UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

£ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE

SECURITIES EXCHANGE ACT OF 1934

OR

T ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2009

OR

£ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from __________ to ______________

OR

£ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934 Date of event requiring this shell company report

Commission file number 0-22216

CANADIAN ZINC CORPORATION

(Exact name of Registrant as specified in its charter)

Not applicable

(Translation of Company’s name into English)

(Jurisdiction of incorporation or organization)

650 West Georgia Street, Suite 1710, Vancouver, British Columbia, V6B 4N9

(Address of principal executive offices)

John Kearney

650 West Georgia Street, Suite 1710, Vancouver, British Columbia, V6B 4N9

Tel: (604) 688-2001

(Name, Telephone, E-mail and/or facsimile number and Address of Company Contact Person)

Securities to be registered pursuant to Section 12(b) of the Act: Not applicable

Securities to be registered pursuant to Section 12(g) of the Act:

Common Shares without par value

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Not applicable

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report:

118,900,563 Common Shares, without par value, as at December 31, 2009

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 12 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer £ | Accelerated filer T | Non-accelerated filer £ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP £ | International Financial Reporting Standards as issued by the International Accounting Standards Board £ | Other T |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

TABLE OF CONTENTS

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING ESTIMATES OF MEASURED, INDICATED OR INFERRED RESOURCES

CONVENTION

MEASUREMENT CONVERSION INFORMATION

GLOSSARY OF NAMES AND TERMS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Cautionary Note to U.S. Investors Concerning Estimates of Measured, Indicated or Inferred Resources

This Annual Report has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. Canadian mining terms in this Annual Report on Form 20-F are defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in the United States Securities and Exchange Commission (“SEC”) Industry Guide 7 under the United States Securities Act of 1933, as amended, which permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

Certain terms are used in this Annual Report, such as “measured,” “indicated,” and “inferred” “resources,” which are defined in and required by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted in reports and registration statements filed with the SEC.

U.S. Investors should note that Canadian Zinc Corporation DOES NOT currently disclose any SEC Industry Guide 7 mineral reserves with regard to its mineral deposits at the Prairie Creek Mine site.

Cautionary Note to Investors concerning estimates of Measured and Indicated Resources

This document uses the terms “measured resources” and “indicated resources.” Investors are advised that while those terms are recognized and required by Canadian regulations, the SEC does not recognize them.

Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves.

Cautionary Note to Investors concerning estimates of Inferred Resources

This document uses the term “inferred resources.” Investors are advised that while those terms are recognized and required by Canadian regulations, the SEC does not recognize them. “Inferred Resources” have significant uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.

Investors are cautioned not to assume that all or part of an inferred resource exists, or is economically or legally mineable.

Accordingly, information contained in this Annual Report and the documents incorporated by reference herein contain descriptions of the Company’s mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder. U.S. investors are urged to consider closely the disclosure in this Annual Report.

Convention

The terms “Canadian Zinc,” the “Company,” “we,” “us” and “our” as used in this Annual Report on Form 20-F, or “Annual Report,” refer to Canadian Zinc Corporation, a corporation organized under the laws of the province of British Columbia, Canada, except where the context requires otherwise.

References throughout this Annual Report to a fiscal year refer to the fiscal year ended on December 31 of that year. “Fiscal 2009,” for example, refers to the fiscal year ended December 31, 2009.

The Company’s financial statements are prepared in Canadian dollars and in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”). These accounting principles conform in all material respects to accounting principles generally accepted in the United States of America (“U.S. GAAP”), except as disclosed in Note 20 to the financial statements for the fiscal year ended December 31, 2009. All references to “dollars” or “$” in this Annual Report are to Canadian dollars (“CDN”) and all references to “U.S. Dollars” or “US$” are to the currency of the United States of America. Solely for the convenience of the reader, this Annual Report contains translations of certain Canadian dollar amounts i nto U.S. Dollar amounts at specified rates.

Measurement Conversion Information

In this Annual Report, metric measures are used with respect to mineral properties described herein. For ease of reference, the following conversion factors are provided:

1 mile = 1.6093 kilometres

1 metric ton (tonne) = 2,205 pounds

1 foot - 0.305 metres

1 troy ounce = 31.103 grams

1 acre = 0.4047 hectare

1 imperial gallon = 4.546 litres

1 long ton = 2,240 pounds

1 imperial gallon = 1.2010 U.S. gallons

Glossary of Names and Terms

“Deposit” -- A mineralized body which has been physically delineated by sufficient drilling, trenching, and/or underground work, and found to contain a sufficient average grade of a commodity, metal or metals to warrant further exploration and/or development expenditures. Such a deposit does not qualify as a commercially mineable ore body or as containing reserves of ore, unless final legal, technical, and economic factors are resolved.

“Net Profits” -- Profits resulting from metal production from the property, less deduction of certain limited costs including smelting, refining, transportation and insurance costs.

“Ore” -- A natural aggregate of one or more minerals which, at a specified time and place, may be mined and sold at a profit or from which some part may be profitably separated.

“Reclamation” -- The restoration of land and the surrounding environment of a mining site after the metal is extracted.

“Ton” -- Short ton (2,000 lbs.). 1 Ton equals 0.907185 Metric Tons.

“Tonne (t)” -- Metric ton (1,000 kilograms). 1 Tonne equals 1.10231 Tons.

National Instrument 43-101 Definitions

National Instrument 43-101 requires mining companies to disclose reserves and resources using the subcategories of proven reserves, probable reserves, measured resources, indicated resources and inferred resources. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

A “mineral reserve” is the economically mineable part of a measured or indicated resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allows for losses that may occur when the material is mined. A “proven mineral reserve” is the economically mineable part of a measured resource for which quantity, grade or quality, densities, shape and physical characterist ics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. A “probable mineral reserve” is the economically mineable part of an indicated mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit.

A “mineral resource” is a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. A “measured mineral resource” is that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence suffi cient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. An “indicated mineral resource” is that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic

viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. Mineral resources that are not mineral reserves do not have demonstrated economic viability. An “inferred mineral resource” is that part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropr iate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

A “feasibility study” is a comprehensive study of a mineral deposit in which all geological, engineering, legal, operating, economic, social, environmental and other relevant factors are considered in sufficient detail that it could reasonably serve as the basis for a final decision by a financial institution to finance the development of the deposit for mineral production. A “preliminary feasibility study” or “pre-feasibility study” is a comprehensive study of the viability of a mineral project that has advanced to a stage where the mining method, in the case of underground m ining, or the pit configuration, in the case of an open pit, has been established, and which, if an effective method of mineral processing has been determined, includes a financial analysis based on reasonable assumptions of technical, engineering, operating, economic factors and the evaluation of other relevant factors which are sufficient for a qualified person, acting reasonably, to determine if all or part of the mineral resource may be classified as a mineral reserve. “Cut-off grade” means (a) in respect of mineral resources, the lowest grade below which the mineralized rock currently cannot reasonably be expected to be economically extracted, and (b) in respect of mineral reserves, the lowest grade below which the mineralized rock currently cannot be economically extracted as demonstrated by either a preliminary feasibility study or a feasibility study. Cut-off grades vary between deposits depending upon the amenability of ore to mineral extraction and upon costs of production and metal prices.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements that are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and under Canadian securities laws that involve a number of risks and uncertainties. Such statements are based on the Company’s current expectations, estimates and projections about the industry, management’s beliefs and certain assumptions made by it. We use words such as “expect,” “anticipate,” “project,” “believe,” “plan,” “intend,” “seek,” “should,” “estimate,” “future” and other similar expressions to identify forward-looking statements. The Company’s actual results could differ materially and adversely fro m those expressed in any forward-looking statements as a result of various factors.

Statements about planned/proposed mine operations, anticipated future operating descriptions included in the Company’s Project Description Report (filed for permitting requirements), expected completion dates of pre-feasibility or feasibility studies, future cost estimates, expectations around the process for obtaining operating permits, the expected completion of acquisitions/transactions, the impact on the Company of future accounting standards, discussions of risks and uncertainties, anticipated commencement dates of mining or metal production operations, projected quantities of future metal production and anticipated production rates, operating efficiencies, costs and expenditures, business development efforts, the need for additional capital and the Company's production capacity are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Therefore, the Company's actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors. You should not place undue reliance on these forward-looking statements.

Information relating to the magnitude or quality of mineral deposits is deemed to be forward-looking information. The reliability of such information is affected by, among other things, uncertainty involving geology of mineral deposits; uncertainty of estimates of their size or composition; uncertainty of projections relating to costs of production or estimates of market prices for the mineral; the possibility of delays in mining activities; changes in plans with respect to exploration, development projects or capital expenditures; and various other risks including those relating to health, safety and environmental matters.

The Company cautions that the list of factors set forth above is not exhaustive. Some of the risks, uncertainties and other factors which negatively affect the reliability of forward-looking information are discussed in the Company's public filings with the Canadian securities regulatory authorities, including its most recent annual report, quarterly reports, material change reports and press releases, and with the United States Securities and Exchange Commission (the “SEC”). In particular, your attention is directed to the risks detailed in “Item 3.D.--Key Information--Risk Factors” and similar discussions in the Company's other SEC and Canadian filings concerning some of the important risk factors that may affect its business, results of operations and financial conditions.� 60; You should carefully consider those risks, in addition to the other information in this Annual Report and in the Company's other filings and the various public disclosures before making any business or investment decisions involving the Company and its securities.

The Company undertakes no obligation to revise or update any forward-looking statement, or any other information contained or referenced in this Annual Report to reflect future events and circumstances for any reason, except as required by law. In addition, any forecasts or guidance provided by the Company are based on the beliefs, estimates and opinions of the Company’s management as at the date of this Annual Report and, accordingly, they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except as required by law, the Company undertakes no obligation to update such projections if management’s beliefs, esti mates or opinions, or other factors should change.

| IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

| A. | Directors and senior management |

Not applicable.

Not applicable.

Not applicable.

| OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| B. | Method and expected timetable |

Not applicable.

A. Selected Financial Data

The following table sets forth our selected financial data of the Company. This selected financial data is derived from the Company’s audited financial statements and notes thereto as at December 31, 2009, 2008, 2007, 2006 and 2005. The Company’s financial statements have been prepared in accordance with Canadian GAAP, which differs in certain respects from U.S. GAAP; a discussion of the differences between Canadian GAAP and U.S. GAAP is contained in Note 20 to the audited financial statements. The selected financial data provided below is not necessarily indicative of the future results of operations or financial performance of the Company. The Company has not paid any dividends on its common shares and it does not expect to pay dividends in the foreseeable future. The selected financial data set forth below should be read in conjunction with “Item 5--Operating and Financial Review and Prospects,” and the financial statements and the notes thereto and other financial information which appear elsewhere in this Annual Report.

Selected Financial Data

(CDN$ in thousands, except share and per share data)

| | Year ended December 31, | |

| | 2009 | | 2008 | | 2007 | | 2006 | | | 2005 | |

| Amounts in accordance with Canadian GAAP: | | | | | | | | | | | |

| Net (loss) | $ | (611 | ) | $ | (4,228 | ) | $ | (9,483 | ) | $ | (7,723 | ) | | $ | (3,504 | ) |

| Basic and diluted (loss) per share | | (0.005 | ) | | (0.04 | ) | | (0.08 | ) | | (0.08 | ) | | | (0.05 | ) |

| Total assets | | 29,152 | | | 29,521 | | | 34,391 | | | 35,272 | | | | 21,204 | |

| Net assets | | 27,513 | | | 27,848 | | | 31,909 | | | 33,428 | | | | 19,854 | |

| Net working capital | | 22,476 | | | 22,557 | | | 27,432 | | | 29,143 | | | | 16,040 | |

| Capital stock | | 65,583 | | | 65,621 | | | 65,964 | | | 59,365 | | | | 43,067 | |

| Contributed surplus | | 8,668 | | | 8,354 | | | 7,844 | | | 6,479 | | | | 1,479 | |

| Dividends declared (per share) | $ | 0.00 | | $ | 0.00 | | $ | 0.00 | | $ | 0.00 | | | $ | 0.00 | |

| Weighted average number of common shares outstanding – basic and diluted | | 118,915,812 | | | 120,440,062 | | | 113,429,078 | | | 94,734,979 | | | | 71,378,444 | |

| Number of common shares outstanding | | 118,900,563 | | | 118,969,063 | | | 120,213,962 | | | 107,590,212 | | | | 79,747,212 | |

| | | | | | | | | | | | | | | | | |

| Amounts in accordance with U.S. GAAP: | | | | | | | | | | | | | | | | |

| Net (loss) | $ | (611 | ) | $ | (4,228 | ) | $ | (10,439 | ) | $ | (9,486 | ) | | $ | (3,504 | ) |

| Basic and diluted (loss) per share | | (0.005 | ) | | (0.04 | ) | | (0.09 | ) | | (0.10 | ) | | | (0.05 | ) |

| Total assets | | 29,152 | | | 29,521 | | | 34,391 | | | 35,272 | | | | 21,204 | |

| Net assets | | 27,513 | | | 27,848 | | | 31,909 | | | 31,897 | | | | 19,854 | |

| Net working capital | | 22,476 | | | 22,557 | | | 27,432 | | | 29,143 | | | | 16,040 | |

| Capital stock | | 68,302 | | | 68,340 | | | 68,683 | | | 57,834 | | | | 43,067 | |

| Contributed surplus | | 8,668 | | | 8,354 | | | 7,844 | | | 6,479 | | | | 1,479 | |

| Dividends declared (per share) | $ | 0.00 | | $ | 0.00 | | $ | 0.00 | | $ | 0.00 | | | $ | 0.00 | |

| Weighted average number of common shares outstanding – basic and diluted | | 118,915,812 | | | 120,440,062 | | | 113,429,078 | | | 94,734,979 | | | | 71,378,444 | |

| Number of common shares outstanding | | 118,900,563 | | | 118,969,063 | | | 120,213,962 | | | 107,590,212 | | | | 79,747,212 | |

See “Item 5.A.--Operating Results--Comparison of Canadian GAAP and United States GAAP as applicable to the Company’s operations” for comments on the reconciliation of Canadian and United States Generally Accepted Accounting Principles in this Annual Report.

Exchange Rates

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in Canadian dollars (“CDN”).

Since June 1, 1970, the Government of Canada has permitted a floating exchange rate to determine the value of the Canadian dollar against the U.S. dollar. The high and low exchange rates, the average rates (average of the exchange rates on the last day of each month during the period), and the end of the period rates for Canadian dollars, expressed in U.S. dollars, from January 1, 2005 to December 31, 2009 were as follows:

| | U.S. DOLLARS PER $1.00 (CDN.) |

| | Years ended December 31 |

| | 2009 | 2008 | 2007 | 2006 | 2005 |

| High | 0.9748 | 1.0241 | 1.0852 | 0.9105 | 0.8682 |

| Low | 0.7698 | 0.7731 | 0.8435 | 0.8531 | 0.7876 |

| Average | 0.8757 | 0.9381 | 0.9303 | 0.8817 | 0.8254 |

| End of Period | 0.9515 | 0.8210 | 1.0088 | 0.8581 | 0.8598 |

The high and low exchange rates for Canadian dollars, expressed in U.S. dollars for each of the most recent six months were as follows:

| | U.S. DOLLARS PER $1.00 (CDN.) |

| | Monthly |

| | November ‘09 | December ‘09 | January ‘10 | February ‘10 | March ‘10 | April ‘10 |

| High | 0.9565 | 0.9580 | 0.9771 | 0.9611 | 0.9898 | 1.0012 |

| Low | 0.9278 | 0.9343 | 0.9352 | 0.9307 | 0.9601 | 0.9827 |

The exchange rate on May 12, 2010 was 0.9806.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons For The Offer and Use of Proceeds

Not applicable.

D. Risk Factors

The following is a discussion of those distinctive or special characteristics of the Company’s operations and industry which may have a material impact on, or constitute risk factors in respect of, the Company’s future financial performance. This discussion is also described in Section 4 of the Company’s Annual Information Form dated March 26, 2010 filed as Exhibit 15.1 hereto and incorporated herein by reference.

Political and Legislative

Canadian Zinc conducts its operations in the Mackenzie Valley in the Northwest Territories of Canada in an area which is claimed by the Dehcho First Nations as their traditional territory. The Dehcho have not settled their land claim with the Federal Government of Canada. The Dehcho and the Federal Government both claim legal title to this territory and legal title to the land remains in dispute. The Company’s operations are potentially subject to a number of political, legislative and other risks. Canadian Zinc is not able to determine the impact of political, legislative or other risks on its business or its future financial position.

Canadian Zinc’s operations are exposed to various levels of political, legislative and other risks and uncertainties. These risks and uncertainties include, but are not limited to, cancellation, renegotiation or nullification of existing leases, claims, permits and contracts; expropriation or nationalization of property; changes in laws or regulations; changes in taxation laws or policies; royalty and tax increases or claims by governmental, Aboriginal or other entities; retroactive tax or royalty claims and changing political conditions; government mandated social expenditures; governmental regulations or policies that favour or require the awarding of contracts to local or Aboriginal contractors or require contractors to employ residents of, or purchase supplies from, a particular jurisdiction or area; or that require that an operating project have a local joint venture partner, which may require to be subsidized; and other risks arising out of sovereignty or land claims over the area in which Canadian Zinc’s operations are conducted.

The mining, processing, development and mineral exploration activities of Canadian Zinc are subject to extensive federal, territorial and local laws and regulations, including various laws governing prospecting, development, production, taxes, labour standards and occupational health, mine safety, toxic substances, land use, water use and other matters. Such laws and regulations are subject to change and can become more stringent and costly over time. No assurance can be given that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner which could limit or curtail exploration, production or development. Amendments to current laws and regulations governing operations and activities of exploration and mining, or more stringent implementation t hereof, could have a substantial adverse impact on Canadian Zinc Corporation.

In 1998 - 2000 there was a major change to the legislative and regulatory framework and regulations in the Mackenzie Valley. There can be no assurance that these laws and regulations will not change in the future in a manner that could have an adverse effect on the Company’s activities and/or its financial condition.

In relation to Northwest Territories specifically, a number of policy and social issues exist which increase Canadian Zinc’s political and legislative risk. The Government of Canada is facing legal and political issues, such as land claims and social issues, all of which may impact future operations. This political climate increases the risk of the Government making changes in the future to its position on issues such as mining rights and land tenure, which in turn may adversely affect Canadian Zinc’s operations. Future government actions cannot be predicted, but may impact the operation and regulation of the Prairie Creek mine. Changes, if any, in Government policies, or shifts in local political attitude in the Northwest Territories may adversely affect Canadian Zinc’s operations or business.

Canadian Zinc’s exploration, development and production activities may be substantially affected by factors beyond Canadian Zinc’s control, any of which could materially adversely affect Canadian Zinc’s

financial position or results of operations. The occurrence of these various factors and uncertainties cannot be accurately predicted. The Company is not able to determine the impact of these risks on its business.

Permitting, Environmental and Other Regulatory Requirements

The operations of Canadian Zinc require licences and permits from various governmental and regulatory authorities. Canadian Zinc believes that it is presently complying in all material respects with the terms of its current licences and permits. However, such licences and permits are subject to change in various circumstances. Canadian Zinc does not hold all necessary licences and permits under applicable laws and regulations for the operation of the Prairie Creek mine. There can be no guarantee Canadian Zinc will be able to obtain or maintain all necessary licences and permits as are required to explore and develop its properties, commence construction or operation of mining facilities or properties under exploration or development, or to obtain them within a reasonable time.

The Prairie Creek Project is located in an environmentally sensitive and remote area in the Mackenzie Mountains of the Northwest Territories, within the watershed of the South Nahanni River. The South Nahanni River is considered to be of global significance, is highly valued as a wilderness recreation river and is a designated World Heritage Site. The South Nahanni River flows through the Nahanni National Park Reserve.

The Prairie Creek mine is encircled by the newly expanded Nahanni National Park Reserve. However, an area of approximately 300 square kilometres immediately surrounding the Prairie Creek Mine is specifically excluded from the Park. In 2009 new legislation entitled “An Act to Amend the Canada National Parks Act to enlarge Nahanni National Park Reserve of Canada” was enacted, which also authorized the Minister of Environment to enter into leases, licences of occupation or easements over Nahanni Park lands for the purposes of a mining access road leading to the Prairie Creek Mine Area, including the sites of storage and other facilities connected with that road. The Company will require permits from the Minister of Environment and / or t he Parks Canada Agency for the purposes of accessing the Prairie Creek Mine Area. There can be no guarantee the Company will be able to obtain or maintain all necessary permits or to obtain them within a reasonable time or on acceptable terms.

The Company has experienced long delays in obtaining permits to date. The Company anticipates continuing difficulties and delays with its permitting activities and may face some opposition or legal challenges from certain interests.

Canadian Zinc’s activities are subject to extensive federal, provincial, territorial and local laws and regulations governing environmental protection and employee health and safety. Canadian Zinc is required to obtain governmental permits and provide bonding requirements under federal and territorial water and mine regulations. All phases of Canadian Zinc’s operations are subject to environmental regulation. These regulations mandate, among other things, the maintenance of water and air quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner, which will require stricter standards and enforcement, increased fines and penalties for non-compliance, and more stringent environm ental assessments of proposed projects. There is no assurance that future changes in environmental regulation, if any, will not adversely affect Canadian Zinc’s operations.

Environmental laws and regulations are complex and have tended to become more stringent over time. These laws are continuously evolving. Any changes in such laws, or in the environmental conditions at Prairie Creek, could have a material adverse effect on Canadian Zinc’s financial condition, liquidity or results of operations. Canadian Zinc is not able to determine the impact of any future changes in environmental laws and regulations on its future financial position due to the uncertainty surrounding the ultimate form such changes may take. The Company does not currently consider that its expenditures required to maintain ongoing environmental monitoring obligations at the Prairie Creek mine are material to the results and financial condition of the Company. However, these costs could become material in the future and would be reported in the Company’s public filings at that time.

Although Canadian Zinc makes provision for reclamation costs, it cannot be assured that these provisions will be adequate to discharge its obligations for these costs. As environmental protection laws and administrative policies change, Canadian Zinc will revise the estimate of its total obligations and may be obliged to make further provisions or provide further security for mine reclamation cost. The ultimate amount of reclamation to be incurred for existing and past mining interests is uncertain. Additional discussion on the impact of reclamation costs is included in this Annual Report at “Item 4.D.--Property, Plants and Equipment--11. Environmental Considerations--Environmental Obligations.”

Existing and possible future environmental legislation, regulations and actions could cause additional expense, capital expenditures, restrictions and delays in the activities of the Company, the extent of which cannot be predicted. Before production can commence on the Prairie Creek Property the Company must obtain regulatory approval, permits and licences and there is no assurance that such approvals will be obtained. No assurance can be given that new rules and regulations will not be enacted or made, or that existing rules and regulations will not be applied, in a manner which could limit or curtail production or development.

Regulatory approvals and permits are currently, and will in the future be, required in connection with Canadian Zinc’s operations. To the extent such approvals are required and not obtained, Canadian Zinc may be curtailed or prohibited from proceeding with planned exploration or development of its mineral properties or from continuing its mining operations.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. The Company may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Failure to comply with applicable environmental and health and safety laws can result in injunctions, damages, suspension or revocation of permits and imposition of penalties. There can be no assurance that Canadian Zinc has been or will be at all times in complete compliance with all such laws, regulations and permits, or that the costs of complying with current and future environmental and health and safety laws and permits will not materially adversely affect Canadian Zinc’s business, results of operations or financial condition. Environmental hazards may exist on the properties on which Canadian Zinc holds interests which are unknown to Canadian Zinc at present and which have been caused by previous owners or operators of the properties.

Amendments to current laws, regulations and permits governing operations and activities of mining and exploration companies, or more stringent implementation thereof, could have a material adverse impact on Canadian Zinc Corporation and cause increases in exploration expenses, capital expenditures or production costs or require abandonment or delays in the development of mining properties.

The Prairie Creek project has, on numerous occasions, experienced significant delays in obtaining permits and licences necessary for the conduct of its operations. If at any time in the future permits essential to operations are not obtained, or not obtained in a timely manner, or exemptions not granted, there is a risk that the Prairie Creek mine may not be able to operate.

Metal Prices and Market Sentiment

The market price of metals and minerals is volatile and cannot be controlled. Metal prices have fluctuated widely, particularly in recent years. If the price of metals and minerals should drop significantly, as occurred in late 2008, the economic prospects for the Prairie Creek Project could be significantly reduced or rendered uneconomic. There is no assurance that, even if commercial quantities of ore are delineated, a profitable market may exist for the sale of products, including concentrates from that ore. Factors beyond the control of the Company may affect the marketability of any minerals discovered or concentrates produced. The

marketability of minerals is affected by numerous other factors beyond the control of the Company, including quality issues, impurities, government regulations, royalties, allowable production and importing and exporting of minerals, the effect of which cannot be accurately predicted. Factors tending to affect the price of metals include:

| | • The relative strength of the U.S. dollar against other currencies; |

| | • Government monetary and fiscal policies; |

| | • Expectations of the future rate of global monetary inflation and interest rates; |

| | • General economic conditions and the perception of risk in capital markets; |

| | • Political conditions including the threat of terrorism or war; |

| | • Investment and industrial demand; and |

| | • Global production and inventory stocks. |

The effects of these factors, individually or in aggregate, on the prices of zinc, lead and/or silver is impossible to predict with accuracy. Fluctuations in metal prices may adversely affect Canadian Zinc’s financial performance and results of operations. Further, if the market price of zinc, lead and/or silver falls or remains depressed, Canadian Zinc may experience losses or asset write-downs and may curtail or suspend some or all of its exploration, development and mining activities.

Furthermore, sustained low metal prices can halt or delay the development of new projects; reduce funds available for mineral exploration and may result in the recording of a write-down of mining interests due to the determination that future cash flows would not be expected to recover the carrying value.

Metal prices fluctuate widely and are affected by numerous factors beyond Canadian Zinc’s control such as the sale or purchase of such commodities by various central banks and financial institutions, interest rates, exchange rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand, and the political and economic conditions of major mineral and metal producing countries throughout the world. Future production from Canadian Zinc’s mining properties is dependent on mineral prices that are adequate to make these properties economic. The prices of metals have fluctuated widely in recent years, and future or continued serious price declines could cause continued development of and commercial production from Canadian Zin c’s properties to be impracticable. Depending on the price of metal, cash flow from mining operations may not be sufficient and Canadian Zinc could be forced to discontinue production and may lose its interest in, or may be forced to sell, its properties.

In addition to adversely affecting Canadian Zinc’s reserve or resource estimates and its financial condition, declining commodity prices can impact operations by requiring a reassessment of the feasibility of a particular project. The need to conduct such a reassessment may cause substantial delays or may interrupt operations until the reassessment can be completed.

Currency fluctuations may affect the costs that Canadian Zinc incurs at its operations. Zinc, lead and silver are sold throughout the world based principally on the U.S. dollar price, but operating expenses are incurred in currencies other than the U.S. dollar. Appreciation of the Canadian dollar against the U.S. dollar increases the cost of production in U.S. dollar terms at mines located in Canada.

The development of the Company’s properties will depend upon the Company’s ability to obtain financing through private placement financing, public financing, the joint venturing of projects, bank financing or other means. There is no assurance that the Company will be successful in obtaining the required financing, or if available, that the terms of such financing will be favorable or acceptable to the Company.

Securities of junior and small-cap companies have experienced substantial volatility in the past, often based on factors unrelated to the financial performance or prospects of the companies involved. These factors include macroeconomic developments in North America and global and market perceptions of the attractiveness of particular industries. The share price of Canadian Zinc is likely to be significantly affected by short-term

changes in metal prices. Other factors unrelated to Canadian Zinc’s performance that may have an effect on the price of its shares include the following: the extent of analytical coverage available to investors concerning Canadian Zinc’s business may be limited if investment banks with research capabilities do not follow the Company’s securities; lessening in trading volume and general market interest in the Company’s securities may affect an investor’s ability to trade significant numbers of common shares; the size of Company’s public float may limit the ability of some institutions to invest in the Company’s securities; and a substantial decline in the price of the common shares that persists for a significant period of time could cause the Company’s securities to be deliste d from an exchange, further reducing market liquidity.

As a result of any of these factors, the market price of the Company’s shares at any given point in time may not accurately reflect Canadian Zinc’s long-term value. Securities class action litigation often has been brought against companies following periods of volatility in the market price of their securities. Canadian Zinc may in the future be the target of similar litigation. Securities litigation could result in substantial costs and damages and divert management’s attention and resources.

The development and exploration of Canadian Zinc’s current or future properties, will require substantial additional financing. Failure to obtain sufficient financing will result in delaying or indefinite postponement of exploration, development or production on Canadian Zinc’s properties or even a loss of property interest. There can be no assurance that additional capital or other types of financing will be available when needed or that, if available, the terms of such financing will be favourable to Canadian Zinc.

Exploration and Development

The business of exploring for minerals and mining involves a high degree of risk. There is no assurance the Company’s mineral exploration activities will be successful. Few properties that are explored are ultimately developed into producing mines. In exploring and developing its mineral deposits the Company is subjected to an array of complex economic factors and technical considerations. Unusual or unexpected formations, formation pressures, power outages, labour disruptions, flooding, explosions, cave-ins, landslides, environmental hazards, and the inability to obtain suitable or adequate machinery, equipment or labour are other risks involved in the conduct of exploration and development programs. Such risks could materially adversely affect the business or the financial performance of the Company.

There is no certainty that the expenditures made by Canadian Zinc towards the search and evaluation of mineral deposits will result in discoveries of commercial quantities of ore. The exploration for and development of mineral deposits involves significant risks which even a combination of careful evaluation, experience and knowledge may not eliminate. Major expenses may be required to locate and establish mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. It is impossible to ensure that the exploration or development programs planned by Canadian Zinc will result in a profitable commercial mining operation. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the part icular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices which are highly cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in Canadian Zinc not receiving an adequate return on invested capital.

A specific risk associated with the Prairie Creek Property is its remote location. Mining, processing, development and exploration activities depend, to one degree or another, on adequate infrastructure. Reliable roads, bridges, power sources and water supply are important factors, which affect capital and operating costs. Unusual or infrequent weather phenomena, government or other interference in the maintenance or provision of such infrastructure could adversely affect Canadian Zinc’s operations, financial condition and results of operations.

The development plan for the Prairie Creek Project is based upon a Project Description Report prepared internally by the Company, with the assistance of outside consultants, in 2008. A Project Description Report is

not a Feasibility Study. The Project Description Report outlined the plan for the development of the Prairie Creek Project based on the historical development and existing infrastructure at the Prairie Creek Property and on the Resource Estimation in the 2007 NI 43-101 Technical Report. The Resource Estimation in the Technical Report does not constitute mineable reserves. The historical development was carried out principally in 1980 to 1982 and the infrastructure, including the mill, was constructed in the same period based on a feasibility study prepared by Kilborn Engineering (Pacific) Limited in 1980. The Kilborn feasibility study is outdated and cannot be relied upon. The existing infrastructure, including the mill, buildings, camp etc. is over twenty-five years old and, alth ough it has been held under care and maintenance, it has lain idle for more than twenty-five years and was never operated. There is significant risk attaching to the proposed operation of aged equipment.

Mining operations generally involve a high degree of risk. Canadian Zinc’s mining operations will be subject to all the hazards and risks normally encountered in the development and production of minerals, including unusual and unexpected geologic formations, seismic activity, rock bursts, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. Mining and milling operations are subject to hazards such as equipment failure or failure of retaining dams around tailings disposal areas, which may result in environmental pollution and consequent liability.

Uncertainty in the Estimation of Mineral Resources

U.S. Investors should note that Canadian Zinc Corporation DOES NOT currently disclose any SEC Industry Guide 7 mineral reserves with regard to its mineral deposits at the Prairie Creek Mine site.

This document uses the terms “measured resources,” “indicated resources,” and “inferred resources.” Investors are advised that while those terms are recognized and required by Canadian regulations, the SEC does not recognize them.

The figures for Mineral Resources contained in this document are estimates only and no assurance can be given that the anticipated tonnages and grades will be achieved, that the indicated level of recovery will be realized or that Mineral Resources can be mined or processed profitably. There are numerous uncertainties inherent in estimating Mineral Resources, including many factors beyond Canadian Zinc Corporation’s control. Such estimation is a subjective process, and the accuracy of any resource estimate is a function of the quantity and quality of available data and of the assumptions made and judgments used in engineering and geological interpretation. In addition, there can be no assurance that mineral or metal recoveries in small scale laboratory tests will be duplicated in larger scale tes ts under on-site conditions or during production.

Inferred mineral resources do not have demonstrated economic viability. Due to the uncertainty which may attach to inferred mineral resources, there is no assurance that inferred mineral resources will be upgraded to measured and indicated mineral resources as a result of continued exploration.

Fluctuation in metal prices, results of drilling, metallurgical testing and production and the evaluation of mine plans subsequent to the date of any estimate may require revision of any such resource or reserve estimate. The volume and grade of resources mined and processed and recovery rates may not be the same as currently anticipated. Any material reductions in estimates of Mineral Resources, or of Canadian Zinc’s ability to extract these Mineral Resources, could have a material adverse effect on Canadian Zinc’s results of operations and financial condition.

Mineral reserve and mineral resource estimates are imprecise and depend partly on statistical inferences drawn from drilling and other data which may prove to be unreliable. Future production could differ dramatically from mineral resource estimates for many reasons including the following:

| | • Mineralization or formations could be different from those predicted by drilling, sampling and similar examinations; |

| | • Declines in the market price of metals may render the mining of some or all of Canadian Zinc’s mineral resources uneconomic; |

| | • Increases in operating mining costs and processing costs could adversely affect mineral reserves or resources; and |

| | • The grade of mineral reserves or resources may vary significantly from time to time and there can be no assurance that any particular level of metal may be recovered from the mineral reserves or resources. |

Any of these factors may require Canadian Zinc to reduce its mineral reserve or mineral resources estimates.

Insurance and Uninsured Risks

Canadian Zinc’s business is subject to a number of risks and hazards generally, including adverse environmental conditions, industrial accidents, labour disputes, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods and earthquakes. Such occurrences could result in damage to mineral properties or production facilities, personal injury or death, environmental damage to Canadian Zinc’s properties or the properties of others, delays in mining, monetary losses and possible legal liability.

Although Canadian Zinc maintains insurance to protect against certain risks in such amounts as it considers reasonable, its insurance will not cover all the potential risks associated with the Company’s mining operations. Canadian Zinc may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution or other hazards as a result of exploration and production is not generally available to Canadian Zinc or to other companies in the mining industry on acceptable terms. In particular, the Company is not insured for environmental liability or earthquake damage.

Canadian Zinc might also become subject to liability for pollution or other hazards which may not be insured against, or which Canadian Zinc may elect not to insure against, because of premium costs or other reasons. Losses from these events may cause Canadian Zinc to incur significant costs that could have a material adverse effect upon its financial performance and results of operations.

Key Executives and Conflicts of Interest

Canadian Zinc is dependent on the services of key executives, including the President and Chief Executive Officer and the Vice President of Exploration and Chief Operating Officer of the Company, and a small number of other skilled and experienced executives and personnel. Due to the relatively small size of the Company, the loss of these persons or Canadian Zinc’s inability to attract and retain additional highly skilled or experienced employees may adversely affect its business and future operations.

Certain of the directors and officers of the Company also serve as directors and/or officers of, or have significant shareholdings in, other companies involved in natural resource exploration and development and consequently there exists the possibility for such directors and officers to be in a position of conflict. Two directors of Canadian Zinc also serve as directors of Vatukoula Gold Mines Plc (a United Kingdom based company that is listed on AIM and of which Canadian Zinc currently holds approximately 17% of the issued shares). Any decision made by any of such directors and officers involving Canadian Zinc will be made in accordance with their duties and obligations to deal fairly and in good faith with a view to the best interests of the Company and its shareholders. In addition, each of the dir ectors is required to declare and refrain from

voting on any matter in which such directors may have a conflict of interest in accordance with the procedures set forth in the Business Corporations Act (British Columbia) and other applicable laws.

To the extent that such other companies may participate in ventures in which Canadian Zinc may participate, the directors of Canadian Zinc may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation. In the event that such a conflict of interest arises at a meeting of the Company’s directors, a director who has such a conflict will abstain from voting for the approval of such participation or such terms.

From time to time several companies may collectively participate in the acquisition, exploration and development of natural resource properties thereby allowing for their participation in larger programs, permitting involvement in a greater number of programs and reducing financial exposure in respect of any one program. It may also occur that a particular company will assign all or a portion of its interest in a particular program to another of these companies due to the financial position of the company making the assignment. Under the laws of the Province of British Columbia, the directors of the Company are required to act honestly, in good faith and in the best interests of the Company. In determining whether or not Canadian Zinc will participate in a particular program and the interest therein to be acquire d by it, the directors will primarily consider the degree of risk to which the Company may be exposed and its financial position at that time.

Title Matters

Mining leases and surface leases issued to the Company by the Federal Government have been surveyed but other parties may dispute the Company’s title to its mining properties. The mining claims in which the Company has an interest have not been surveyed and, accordingly, the precise location of the boundaries of the claims and ownership of mineral rights on specific tracts of land comprising the claims may be in doubt. These claims have not been converted to lease, and are, accordingly, subject to regular compliance with assessment work requirements.

Failure to comply strictly with applicable laws, regulations and local practices relating to mineral right applications and tenure, could result in loss, reduction or expropriation of entitlements.

While the Company has investigated its title to all its mining leases, surface leases and mining claims and, to the best of its knowledge, title to all properties is in good standing, this should not be construed as a guarantee of title and title may be affected by undetected defects. The validity and ownership of mining property holdings can be uncertain and may be contested. There are currently a number of pending Aboriginal or Native title or Treaty or traditional land ownership claims relating to Northwest Territories. The Company’s properties at Prairie Creek are subject to Aboriginal or Native land claims. Title insurance generally is not available, and Canadian Zinc’s ability to ensure that it has obtained secure title to individual mineral properties or mining concessions may be severely constrained. Canadian Zinc’s mineral properties may be subject to prior unregistered liens, agreements, transfers or claims, including Native land claims, and title may be affected by, among other things, undetected defects. No assurances can be given that there are no title defects affecting such properties.

Competition

The mining industry is competitive in all of its phases. There is aggressive competition within the mining industry for the discovery and acquisition of properties considered to have commercial potential. Canadian Zinc faces strong competition from other mining companies in connection with the acquisition of properties, mineral claims, leases and other mineral interests as well as for the recruitment and retention of qualified employees and other personnel. Many of these companies have greater financial resources, operational experience and technical capabilities than Canadian Zinc. As a result of this competition, Canadian Zinc may be unable to maintain or acquire attractive mining properties on terms it considers acceptable or at all. Consequently, Canadian Zinc’s operations and financial condi tion could be materially adversely affected.

Acquisitions

From time to time Canadian Zinc undertakes evaluations of opportunities to acquire additional mining assets and businesses (or parts thereof). Any resultant acquisitions may be significant in size, may change the scale of Canadian Zinc’s business, and may expose Canadian Zinc to new geographic, political, operating financial and geological risks. Canadian Zinc’s success in its acquisition activities depends on its ability to identify suitable acquisition candidates, to acquire them on acceptable terms, and integrate their operations successfully with those of Canadian Zinc. Any acquisition would be accompanied by risks, such as a significant decline in metal prices; the ore body proving to be below expectations; the difficulty of assimilating the operation and personnel; the potential disru ption of Canadian Zinc’s ongoing business; the inability of management to maximize the financial and strategic position of Canadian Zinc through the successful integration of acquired assets and businesses; the maintenance of uniform standards, control, procedures and policies; the impairment of relationships with employees, customers and contractors as a result of any integration of new management personnel; and the potential unknown liabilities associated with acquired assets and business. In addition Canadian Zinc may need additional capital to finance an acquisition. Debt financing related to any acquisition will expose Canadian Zinc to the risk of leverage, while equity financing may cause existing shareholders to suffer dilution. There can be no assurance that Canadian Zinc would be successful in overcoming these risks or any other problems encountered in connection with such acquisitions.

Vatukoula Gold Mines Plc (“VGM”)

As discussed in this Annual Report at “Item 4.B--Business Overview”, the Company has acquired an interest in Vatukoula Gold Mines Plc (“VGM”), which operates the Vatukoula Gold Mine in Fiji. Operations in Fiji add increased risks to the Company’s business affairs. Fiji has experienced political unrest and there may, at times, be challenges to foreign owned companies. In Fiji, VGM expenditures are made in Fijian dollars and revenues are in U.S. dollars. The parent company in the VGM group is based in the United Kingdom and reports in Pounds Sterling. The impact of foreign exchange fluctuations may have a material impact on the results of operations of VGM. As VGM is operating a working gold mine, it is exposed to risk from changes in commodi ty prices (notably gold) and also the price of oil on the world markets. Adverse changes in these prices could have a material impact on the operations of VGM.

Requirements of the Sarbanes-Oxley Act

Since 2007, the Company has documented and tested its internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (“SOX”). As of December 31, 2009, SOX requires an annual assessment by management of the effectiveness of the Company’s internal control over financial reporting and an attestation by the Company’s independent auditors addressing internal controls over financial reporting.

Due to its size, its limited staff resources and financial constraints, the Company is exposed to certain potential deficiencies in its internal controls over financial reporting. If the Company fails to maintain the adequacy of its internal control over financial reporting, as such standards are modified, supplemented, or amended from time to time, the Company may not be able to ensure that it can conclude on an ongoing basis that it has effective internal controls over financial reporting in accordance with Section 404 of SOX. The Company’s failure to satisfy the requirements of Section 404 of SOX on an ongoing, timely basis could result in the loss of investor confidence in the reliability of its financial statements, which in turn could harm the Company’s business and negatively impact the trading price of its common shares. In addition, any failure to implement required new or improved controls, or difficulties encountered in their implementation, could impact the Company’s operating results or cause it to fail to meet its reporting obligations. Future acquisitions (if any) may provide the Company with challenges in implementing the required processes, procedures and controls in the acquired operations. Acquired companies may not have disclosure controls and procedures or internal control over financial reporting that are as thorough or effective as those required by securities laws currently applicable to the Company.

No evaluation can provide complete assurance that the Company’s internal control over financial reporting will detect or uncover all failures of persons within the Company to disclose material information otherwise required to be reported. The effectiveness of the Company’s controls and procedures could also be limited by simple errors or faulty judgments. In addition, as the Company continues to develop, the challenges involved in implementing appropriate internal controls over financial reporting will increase and will require that the Company continue to enhance its internal controls over financial reporting. Although the Company will be required to devote substantial time and will incur substantial costs, as necessary, in an effort to ensure ongoing compliance, the Company cannot be cer tain that it will be successful in continuing to comply with Section 404 of SOX.

Dividend Policy

No dividends have been paid by the Company to date. The Company anticipates that it will retain all future earnings and other cash resources for the future operation and development of its business and the Company does not intend to declare or pay any cash dividends in the foreseeable future. Payment of any future dividends will be at the discretion of the Company’s board of directors after taking into account many factors, including the Company’s operating results, financial condition and current and anticipated cash needs.

History of Losses and No Assurance of Profitable Operations

The Company has incurred losses since inception of $46.738 million through December 31, 2009. The Company’s properties are all in the exploration or development stages and the Company has no revenues from mining operations since incorporation. There can be no assurance that the Company will be able to operate profitably during future periods. If the Company is unable to operate profitably during future periods, and is not successful in obtaining additional financing, the Company could be forced to cease its exploration and development plans as a result of lacking sufficient cash resources.

Shareholder Dilution

As of the date hereof, the Company had share purchase options outstanding allowing the holders of these options to purchase 8,790,000 common shares. Directors and officers of the Company hold 6,800,000 of these share purchase options and 1,990,000 share purchase options are held by employees and service providers of the Company. As of December 31, 2009 and the date hereof, there were 118,900,563 common shares outstanding; the exercise of all of the existing share purchase options would result in percentage ownership dilution to the existing shareholders.

Potential Future Equity Financings

The Company has used equity financing in order to meet its needs for capital and may engage in equity financings during future periods. Subsequent issuances of equity securities or securities convertible into or exchangeable or exercisable for equity securities would result in further percentage ownership dilution to existing shareholders and could depress the price of the Company’s shares.

Enforcement of Foreign Judgments

Canadian Zinc is organized under the law of, and headquartered in, British Columbia, Canada, and none of its directors and officers are citizens or residents of the United States. In addition, all of its assets are located outside the United States. As a result, it may be difficult or impossible for an investor to (i) enforce in courts outside the United States judgments against the Company and its directors and officers obtained in United States courts based upon the civil liability provisions of United States federal securities law or (ii) bring in courts outside the United States an original action against the Company and/or its directors and officers to enforce liabilities based upon such United States securities laws.

Foreign Private Issuer Status

The Company is a “foreign private issuer” as defined in Rule 3b-4 under the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”). Equity securities of the Company are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3 of the Exchange Act. Therefore, the Company is not required to file a Schedule 14A proxy statement in relation to the annual meeting of shareholders. The submission of proxy and annual meeting of shareholder information on Form 6-K may result in shareholders having less complete and timely information in connection with shareholder actions. The exemption from Section 16 rules regarding reports of beneficial ownership a nd purchases and sales of common shares by insiders and restrictions on insider trading in the Company’s securities may result in shareholders having less data and there being fewer restrictions on insiders’ activities in the Company’s securities.

General Economic Conditions

The unprecedented events in global financial markets since 2008 have had a profound impact on the global economy. Many industries, including the mining industry, are impacted by these market conditions. Some of the key impacts of the financial market turmoil include contraction in credit markets resulting in a widening of credit risk, devaluations and high volatility in global equity, commodity, foreign exchange and precious metal markets, and a lack of market liquidity. A continued or worsened slowdown in the financial markets or other economic conditions, including but not limited to, consumer spending, employment rates, business conditions, inflation, fuel and energy costs, consumer debt levels, lack of available credit, the state of the financial mark ets, interest rates, and tax rates may adversely affect the Company’s growth and profitability. Specifically:

| | · | the global credit/liquidity crisis could impact the cost and availability of financing and the Company’s overall liquidity; |

| | · | the volatility of metal prices may impact the Company’s revenues, profits and cash flow; |

| | · | volatile energy prices, commodity and consumables prices and currency exchange rates impact potential production costs; and |

| | · | the devaluation and volatility of global stock markets impacts the valuation of the Company’s equity securities |

These factors could have a material adverse effect on our financial condition and results of operations.

U.S. Tax Matters

United States income tax legislation contains rules governing passive foreign investment companies (“PFIC”), which can have significant tax effects on US Holders of foreign corporations. A US Holder who holds stock in a foreign corporation during any year in which such corporation qualifies as a PFIC is subject to United States federal income taxation under one of two alternative tax regimes at the election of each such US Holder. The U.S. federal income tax consequences to a U.S. Holder of the acquisition, ownership, and disposition of Common Shares will depend on whether such U.S. Holder makes an election to treat the Company as a “qualified electing fund” or “QEF” under Section 1295 of the Code (a “QEF Election̶ 1;) or a mark-to-market election under Section 1296 of the Code (a “Mark-to-Market Election”). See “Item 10E Taxation--Certain United States Federal Income Tax Consequences” for a detailed discussion of material United States federal income tax consequences for U.S. Shareholders.

Penny Stock Rules

The Company’s stock is a penny stock. The SEC has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. The Company’s securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors.” The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC, which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer m ust make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. The Company believes that the penny stock rules discourage investor interest in and limit the marketability of its common stock in the United States.

| INFORMATION ON THE COMPANY |

A. History and Development of the Company

General Information. The Company was incorporated in British Columbia, Canada, on December 16, 1965 under the Companies Act of British Columbia and the name “Pizza Patio Management Ltd.” The Company changed its name to “San Andreas Resources Corporation” on August 29, 1991 and to “Canadian Zinc Corporation” on May 25, 1999. The Company currently exists under the Business Corporations Act (British Columbia). On June 16, 2004, the Company’s shareholders adopted new Articles to bring the Company’s Charter docum ents up to date and into conformity with the new Business Corporations Act (British Columbia).

The Company's principal place of business (which is also the registered office) is located at Suite 1710, 650 West Georgia Street, Vancouver, British Columbia, Canada V6B 4N9. The office telephone number is (604) 688-2001.

The Company’s common shares trade on the Toronto Stock Exchange (“TSX”) in Toronto, Ontario, Canada, under the symbol “CZN” and on the OTC Bulletin Board in the United States under the symbol “CZICF.” Canada is the place of domicile for the Company. The Company’s fiscal year end is December 31 in each year.

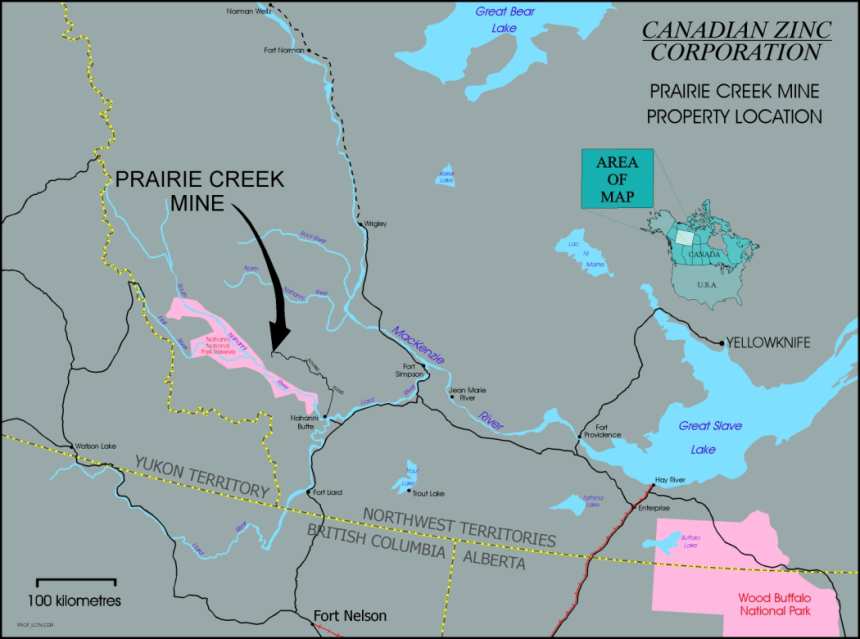

The Company is engaged in the business of exploration and, when warranted, development of natural resource properties. The Company’s principal focus is exploration and development the Prairie Creek Property and adjacent mineral land claims (a zinc/lead/silver property) located approximately 500 kilometres west of Yellowknife in the Northwest Territories, Canada.

For the purposes of the United States regulatory requirements and United States Generally Accepted Accounting Principles the Company is considered to be an exploration stage enterprise.

Acquisition of interest in Prairie Creek Property. Pursuant to an August 23, 1991 Option Agreement, the Company entered into an option to acquire a 60% interest in the Prairie Creek Property (“Prairie Creek”) from Nanisivik Mines Ltd. (an unaffiliated third party) (“Nanisivik”). Subsequently, pursuant to a March 29, 1993 Asset Purchase Agreement that superseded the Option Agreement, the Company acquired a 100% interest in Prairie Creek, and a 60% interest in the plant and equipment, subject to a net smelter royalty of 2%, in favour of Titan Pacific Resources Ltd. (“Titan”) with a maximum payout of $8.2 million.

The purchase price for the mineral interests was $3.25 million paid between 1993 and 1995 in full, in cash and shares. The purchase price was allocated $2.75 million to the land and $0.5 million to the plant and equipment.

In January 2004, the Company completed an agreement with Titan to purchase Titan's interest in Prairie Creek. Under the Agreement, the Company acquired the outstanding 40% interest in the physical plant and equipment at Prairie Creek, which it did not already own, and also repurchased the 2% net smelter royalty interest with a face value of $8.2 million. The consideration was the issue to Titan of 300,000 common shares and 250,000 share purchase warrants exercisable at $1.25 per share until June 22, 2005. The transaction simplified and consolidated the Company's 100% royalty free ownership interest of the Prairie Creek Property.

Summary of recent equity financing activities. The Company relies on equity financings to fund its financial commitments. Over the past five years the following, in overview, has occurred:

- 2005: The Company raised $5.4 million through the private placement of shares and the exercise of share purchase warrants.

- 2006: The Company raised $22 million (net of share issue costs) through the private placement of shares and the exercise of share purchase warrants and employee stock options.