QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

MONACO COACH CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

MONACO COACH CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held May 18, 2005

TO OUR STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the 2005 Annual Meeting of the Stockholders of Monaco Coach Corporation will be held on May 18, 2005 at 1:00 p.m., local time, at our offices located at 606 Nelson's Parkway, Wakarusa, Indiana 46573 for the following purposes:

- 1.

- To elect four Class II directors each to serve for a two-year term expiring upon the 2007 Annual Meeting of Stockholders or until their successors are elected.

- 2.

- To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the 2005 fiscal year.

- 3.

- To transact such other business as may properly come before the meeting and any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Stockholders of record at the close of business on March 21, 2005 are entitled to notice of and to vote at the meeting.

All stockholders are cordially invited to attend the meeting in person. However, to ensure your representation at the meeting, you are urged to deliver your proxy by telephone or the Internet or to mark, sign, date and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purpose. Any stockholder attending the meeting may vote in person even if such stockholder has returned a proxy.

| | | FOR THE BOARD OF DIRECTORS |

|

|

RICHARD E. BOND

Secretary |

Coburg, Oregon

April 8, 2005

MONACO COACH CORPORATION

91320 Industrial Way

Coburg, Oregon 97408

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

General

This Proxy Statement contains information relating to our Annual Meeting of Stockholders to be held on Wednesday, May 18, 2005 at 1:00 p.m. local time (the "Annual Meeting"), at our offices located at 606 Nelson's Parkway, Wakarusa, Indiana 46573. Our telephone number at that location is (574) 862-7211. The enclosed Proxy is solicited on behalf of our Board of Directors for use at the 2005 Annual Meeting of Stockholders, or at any postponements or adjournment thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders.

These proxy solicitation materials and the Annual Report to Stockholders for the year ended January 1, 2005, including financial statements, were mailed on or about April 8, 2005 to all stockholders entitled to vote at the meeting.

Record Date and Voting Securities

Stockholders of record at the close of business on March 21, 2005, the record date for the meeting, are entitled to notice of and to vote at the meeting. At the record date, 29,470,793 shares of our Common Stock, $0.01 par value, were issued and outstanding.

Each stockholder is entitled to one vote for each share of Common Stock on all matters presented at the Annual Meeting. Stockholders do not have the right to cumulate their votes in the election of directors.

Methods of Voting

Voting by Mail—By signing and returning the proxy card according to the enclosed instructions, you are enabling our Chief Executive Officer, Kay Toolson, and our President, John Nepute, who are named on the proxy card as "proxies or attorneys-in-fact," to vote your shares at the meeting in the manner you indicate. We encourage you to sign and return the proxy card even if you plan to attend the meeting. In this way, your shares will be voted even if you are unable to attend the meeting.

Voting by Telephone—Specific instructions on how to vote via the telephone are included on the proxy card.

Voting via Internet—Specific instructions on how to vote via the internet are included on the proxy card.

Your shares will be voted in accordance with the instructions you indicate on the proxy card. If you submit the proxy card but do not indicate your voting instructions, your shares will be voted as follows:

- •

- FOR the election of the nominees for director identified in Proposal One; and

- •

- FOR the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2005.

Voting in Person at the Meeting—If you plan to attend the 2005 Annual Meeting of Stockholders and vote in person, we will provide you with a ballot at the meeting. If your shares are registered directly in your name, you are considered the stockholder of record and you have the right to vote in person at the meeting. If your shares are held in the name of your broker or other nominee, you are considered the beneficial owner of shares held in your name, but if you wish to vote at the meeting you will need to bring a legal proxy from your broker or other nominee authorizing you to vote these shares.

If you hold shares through a bank, broker, or other record holder, you may vote your shares by following the instructions they have provided you.

Revoking Your Proxy

You may revoke your proxy at any time before it is voted at the 2005 Annual Meeting of Stockholders. In order to do this, you may either:

- •

- sign and return another proxy bearing a later date before the beginning of the 2005 Annual Meeting of Stockholders

- •

- provide written notice of the revocation to:

Corporate Secretary

Monaco Coach Corporation

91320 Industrial Way

Coburg, Oregon 97408

Solicitation of Votes

We will bear the cost of soliciting proxies. In addition, we may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Solicitation of proxies by mail may be supplemented by telephone, telegram, facsimile or personal solicitation by our directors, officers or regular employees. No additional compensation will be paid to such persons for such services.

Quorum Requirements

A quorum is necessary to hold a valid meeting. The required quorum for the transaction of business at the Annual Meeting is a majority of the votes eligible to be cast by holders of shares of Common Stock, whether in person or by proxy, issued and outstanding on the record date. Abstentions and broker non-votes are counted as present for establishing a quorum for the transaction of business at the Annual Meeting, but neither will be counted as votes cast. A "broker non-vote" occurs when a broker votes on some matters on the proxy card but not on others because the broker does not have authority to do so.

Votes Required for Each Proposal

The vote required for the proposals to be considered at the 2005 Annual Meeting of Stockholders is as follows:

Proposal One—Election of Directors. The four (4) director nominees receiving the highest number of votes, in person or by proxy, will be elected as directors.

Proposal Two—Ratification of PricewaterhouseCoopers LLP as our Independent Registered Public Accounting Firm. Ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2005 will require the affirmative vote of a majority of the shares present, represented and voting at the 2005 Annual Meeting of Stockholders.

2

You may vote either "for" or "withhold" your vote for the director nominees. You may vote "for," "against," or "abstain" from voting on the proposal to ratify PricewaterhouseCoopers LLP as our independent registered public accounting firm.

Abstentions and Broker Non-Votes

A properly executed proxy marked "abstain" with respect to any such matter will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote.

Under the rules that govern brokers who have record ownership of shares that are held in "street name" for their clients, the beneficial owners of the shares, brokers have discretion to vote these shares on routine matters but not on non-routine matters. If you hold Common Stock through a broker and you have not given voting instructions to the broker, the broker may be prevented from voting shares on non-routine matters, resulting in a "broker non-vote." Thus, if you do not otherwise instruct your broker, the broker may turn in a proxy card voting your shares "FOR" routine matters but expressly instructing that the broker is NOT voting on non-routine matters. Broker non-votes are counted for the purpose of determining the presence or absence of a quorum, but are not counted in the tabulation of the voting results with respect to a particular proposal.

Stockholder Proposals for 2006 Annual Meeting

As a stockholder you may be entitled to present proposals for action at a forthcoming stockholder meeting. Pursuant to the rules of the Securities and Exchange Commission and our bylaws, stockholder proposals that stockholders intend to present at our 2006 Annual Meeting of Stockholders and desire to have included in our proxy materials relating to such meeting must be received by us no later than December 9, 2005, which is 120 calendar days prior to the anniversary of this year's Proxy Statement mailing date, and must be in compliance with applicable laws and regulations (including the regulations of the Securities and Exchange Commission under Rule 14a-8). If the date of next year's annual meeting is moved more than 30 days before or after the anniversary date of this year's annual meeting, the deadline for inclusion of a proposal in our proxy statement is instead a reasonable time before we begin to print and mail our proxy materials. Proposals should be addressed to:

Corporate Secretary

Monaco Coach Corporation

91320 Industrial Way

Coburg, Oregon 97408

Other Matters

We know of no other matters to be submitted at the meeting. If any other matters properly come before the meeting or any adjournment or postponement thereof, it is the intention of the persons named in the enclosed form of Proxy to vote the shares they represent as the Board of Directors may recommend.

3

PROPOSAL ONE

ELECTION OF DIRECTORS

Nominees to the Board of Directors

Our Board of Directors currently has eight members who are divided into two classes (Class I and Class II) with the classes serving staggered, two-year terms. Currently there are four directors in Class I and four directors in Class II. Each of the Class I directors will hold office until the 2006 Annual Meeting or until their successors have been duly elected and qualified. The Class II directors are to be elected at the Annual Meeting.

One of the current Class II directors, Carl E. Ring Jr., has advised us that he does not intend to stand for re-election. On the recommendation of our Governance Committee, the Board has nominated John F. Cogan, Robert P. Hanafee, Jr., Dennis D. Oklak, and Roger A. Vandenberg for election as Class II Directors. Mr. Cogan was recommended to the Governance Committee for consideration by Director L. Ben Lytle. Each nominee, other than Mr. Cogan, is currently a director. Unless otherwise instructed, the proxy holders will vote the proxies received by them FOR the nominees. In the event that any nominee becomes unable or declines to serve as a director at the time of the Annual Meeting, the proxy holders will vote the proxies for any substitute nominee who is designated by the current Board of Directors to fill the vacancy. It is not expected that any nominee listed below will be unable or will decline to serve as a director.

Certain information about each of the nominees for Class II directors is set forth below. The names of, and certain information about, the four current Class I directors with unexpired terms are also set forth below. All information is as of the record date.

Name

| | Age

| | Principal Occupation

| | Director

Since

|

|---|

| Nominees for Class II Directors: | | | | | | |

John F. Cogan |

|

58 |

|

Senior Fellow, Hoover Institution; Professor, Stanford University |

|

— |

Robert P. Hanafee, Jr. |

|

60 |

|

Private Investor |

|

2001 |

Dennis D. Oklak |

|

51 |

|

Chief Executive Officer of Duke Realty Corporation |

|

2003 |

Roger A. Vandenberg |

|

57 |

|

President of Cariad Capital, Inc. |

|

1993 |

Continuing Class I Directors: |

|

|

|

|

|

|

Kay L. Toolson |

|

61 |

|

Chairman of the Board and Chief Executive Officer |

|

1993 |

L. Ben Lytle |

|

58 |

|

Chairman Emeritus of Wellpoint (fka Anthem, Inc.) and Chairman and Chief Executive Officer of AXIA Health Management, LLC |

|

2001 |

Richard A. Rouse |

|

59 |

|

Private Investor |

|

1993 |

Daniel C. Ustian |

|

54 |

|

Chairman of the Board, President and Chief Executive Officer of Navistar International Corporation |

|

2003 |

Except as indicated below, each nominee or incumbent director has been engaged in the principal occupation set forth below during the past five years. Michael P. Snell, an executive officer, is the nephew of Director Toolson. Other than this family relationship, there are no family relationships between any directors or executive officers of the Company.

4

Mr. Cogan is currently the Leonard and Shirley Ely Senior Fellow at the Hoover Institution and has been a Professor in the Public Policy Program at Stanford University since 1979. Mr. Cogan also serves as a director of Venture Lending & Leasing Funds I, II, and IV. Mr. Cogan has also served on numerous congressional and presidential advisory commissions. He is currently a member of California Governor Arnold Schwarzenegger's Council of Economic Advisors. Most recently, he served on President George W. Bush's Commission to Strengthen Social Security. He has also served as a member of the U.S. Bipartisan Commission on Health Care (The Pepper Commission), the Social Security Notch Commission, the National Academy of Sciences' Panel on Poverty and Family Assistance, Congressional Budget Office's Panel of Economic Advisors, the Congressional Policy Advisory Committee, and California Governor Pete Wilson's Council of Economic Advisors.

Mr. Hanafee has served as a director since October 2001. Mr. Hanafee held various positions at Gillette Company, a consumer products company, from 1970 until retirement in 2001, including Vice President of Sales and Marketing of the Paper Mate Divisions, Senior Vice President of the North Atlantic Group, and President of the Stationary Products Group.Committees: Governance and Compensation.

Mr. Oklak has served as a director since February 2003. Mr. Oklak is currently Chief Executive Officer and since April 2004 also a Director, of Duke Realty Corporation, one of the largest real estate investment trusts in the United States. From 1986 through March 2004, Mr. Oklak served in various other positions with Duke Realty Corporation, including President, Chief Operating Officer, Co-Chief Operating Officer, Executive Vice President and Chief Administrative Officer and Senior Vice President and Treasurer. Prior to joining Duke Realty Corporation, Mr. Oklak was with Deloitte & Touche, a public accounting firm.Committees: Audit (Chair).

Mr. Vandenberg has served as a director since March 1993. He currently serves as the President of Cariad Capital, Inc., a private equity investment business, which he founded in January 1992. Mr. Vandenberg also serves as a director of Wellman, Inc., a polyester fiber manufacturer. From 1986 to December 2002, Mr. Vandenberg served as a Managing Director of Narragansett Capital, Inc., a private investment firm, as general partner of Narragansett Capital Partners -A and -B, L.P., related venture capital funds, and as a general partner of Narragansett First Fund, a venture capital fund. From May 1999 to March 2000, Mr. Vandenberg served as President of EFD, Inc., a manufacturer and seller of fluid dispensing and dispensing components.Committees: Audit.

Mr. Toolson has served as our Chief Executive Officer and as the Chief Executive Officer of our predecessor company since 1986 and as Chairman since 1993. He also served as President from 1986 to October 2000, except for the periods from October 1995 to January 1997 and August 1998 to September 1999. From 1973 to 1986, Mr.��Toolson held executive positions with two motor coach manufacturers.

5

Mr. Lytle has served as a director since October 2001. Mr. Lytle is currently the Chairman and Chief Executive Officer of AXIA Health Management, LLC, which acquired Healthcare Dimensions, Inc., a provider of physical fitness programs to 1.4 million senior citizens nationwide, in November 2004. Mr. Lytle is also currently Chairman Emeritus of Wellpoint (fka Anthem, Inc.), one of the largest healthcare management companies in the United States. Mr. Lytle served as Chief Executive Officer of Anthem from 1989 through 1999. Before joining Anthem's predecessor company in 1976, he held positions with LTV Aerospace, an aerospace company, Associates Corp. of North America, a financial services company, and American Fletcher National Bank. Mr. Lytle serves on the boards of Duke Realty Corporation, a real estate investment firm, and he is the Presiding Director of USI, Inc., an insurance broker. Mr. Lytle is also a member of the board of trustees of the American Enterprise Institute, a public policy research organization.Committees: Governance (Chair) and Compensation.

Mr. Rouse has served as a director since July 1993. He is currently a private investor. From 1991 to 1998, Mr. Rouse served as Chairman of Emergency Road Service, Inc., a privately held nationwide roadside assistance company. From 1988 to 1991, he was President of Trailer Life Enterprises, Inc., a publisher and sponsor of recreational vehicle publications and clubs.Committees: Governance and Compensation.

Daniel C. Ustian has served as a director since June 2003. Mr. Ustian is currently Chairman of the Board, President and Chief Executive Officer of Navistar International Corporation, a manufacturer of commercial trucks and engines. Prior to his present position at Navistar, he was President and Chief Executive Officer, from February 2003, and President and Chief Operating Officer from April 2002, and President of the Engine Group of International Truck and Engine Corporation, Navistar's principal operating subsidiary, from 1999 to 2002. He also served as Group Vice President and General Manager of Engine & Foundry from 1993 to 1999.Committees: Governance and Compensation (Chair).

Vote Required

The four nominees receiving the highest number of votes of the shares entitled to be voted shall be elected as directors. Votes withheld from any director will be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the meeting, but have no other legal effect upon election of directors under Delaware law.

The Board of Directors has unanimously approved John F. Cogan, Robert P. Hanafee, Jr., Dennis D. Oklak, and Roger A. Vandenberg as its nominees and recommends that stockholders vote "FOR" the election of these nominees as Class II Directors.

6

PROPOSAL TWO—RATIFICATION OF

APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has selected PricewaterhouseCoopers LLP, an independent registered public accounting firm, to audit our financial statements for the fiscal year ending December 31, 2005, and recommends that the stockholders vote for ratification of such appointment. In the event of a negative vote on such ratification, the Audit Committee will reconsider its selection. No representative of PricewaterhouseCoopers LLP is expected to be present at the Annual Meeting of Stockholders.

Fees to PricewaterhouseCoopers LLP for Fiscal Years 2004 and 2003

The following table presents fees for professional services rendered by PricewaterhouseCoopers, LLP ("PwC") for the audit of our annual financial statements for fiscal years 2004 and 2003 and fees billed for audit-related services, tax services and all other services rendered by PwC for these periods:

| | 2004

| | 2003

|

|---|

| Audit-fees(1) | | $ | 817,000 | | $ | 309,144 |

| Audit-related fees(2) | | | 42,257 | | | 56,191 |

| Tax Fees(3) | | | 0 | | | 1,000 |

| All other fees(4) | | | 12,543 | | | 14,900 |

| | |

| |

|

| | Total Fees: | | $ | 871,800 | | $ | 381,235 |

| | |

| |

|

- (1)

- Audit Fees—These are fees for professional services performed by PwC for auditing our annual financial statements and reviewing our quarterly financial statements, and services that are normally provided in connection with statutory and regulatory filings or engagements. In 2004, audit fees also includes fees for professional services performed by PwC for the audits of management's assessment of the effectiveness of internal control over financial reporting. These fees in 2004 were $525,000.

- (2)

- Audit-Related Fees—These are fees for the assurance and related services performed by PwC that are reasonably related to the performance of the audit or review of the Company's financial statements. For 2003 and 2004, this consisted primarily of employee benefit plan audits.

- (3)

- Tax Fees—These are fees for professional services performed by PwC with respect to tax compliance, tax advice and tax planning. We have now engaged another firm to perform these services for us.

- (4)

- All Other Fees—These are fees for permissible services performed by PwC that do not fall within the above categories. For 2004 and 2003, these services consisted of consultation regarding compliance with the North American Free Trade Agreement.

All services provided by PwC were pre-approved by the Audit Committee, which concluded that the provision of such services by PwC was compatible with the maintenance of that firm's independence in the conduct of its auditing functions. The Audit Committee's current practice is to consider and approve in advance all proposed audit and non-audit services to be provided by our independent auditors.

Vote Required

The affirmative vote of a majority of the shares of our Common Stock present or represented and voting at the 2005 Annual Meeting of Stockholders will be required to ratify PricewaterhouseCoopers LLP as our independent registered public accounting firm.

The Board of Directors unanimously recommends voting "FOR" the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2005.

7

CORPORATE GOVERNANCE

Board of Directors and Committee Meetings

Our Board of Directors held four meetings during 2004. Each of our directors attended 75% or more of the meetings of the Board and the committees on which he served in 2004. Our directors are expected, absent of exceptional circumstances, to attend all Board meetings and meetings of committees on which they serve, and are also expected to attend our Annual Meeting of Stockholders. Last year seven of our eight directors attended the 2004 Annual Meeting of Stockholders.

Our Board of Directors has summarized its corporate governance practices in theCorporate Governance Guidelines for Monaco Coach Corporation, a copy of which is available on our Investor Relations website at http://www.monaco-online.com/ir. The Board currently has three committees: an Audit Committee, a Compensation Committee and a Governance Committee. Each committee has a written charter approved by the Board of Directors outlining the principal responsibilities of the committee. These charters are also available on our Investor Relations website.

The purpose of our Audit Committee is to oversee our accounting and financial reporting processes and audits of our financial statements and internal control over financial reporting. Our Audit Committee also assists the Board in the oversight and monitoring of (i) the integrity of our financial statements, (ii) our compliance with legal and regulatory requirements, (iii) the independent auditor's qualifications and independence, and (iv) the performance of our internal audit function and our independent auditors. In addition, the Audit Committee's duties and responsibilities include reviewing and pre-approving any audit and non-audit services, reviewing, approving and monitoring ourCode of Ethics for Executive Officers and establishing procedures for receiving, retaining and treating complaints regarding accounting, internal accounting controls or auditing matters. The report of the Audit Committee for fiscal 2004 is included in this proxy statement.

The Audit Committee of the Board of Directors currently consists of Directors Oklak, Ring and Vandenberg, and held eight meetings during 2004. We expect that Mr. Cogan will be appointed to the Audit Committee to succeed Mr. Ring if he is elected to the Board of Directors at the Annual Meeting. None of the Audit Committee members is an employee of Monaco Coach Corporation and all of them are independent within the meaning of the rules of the SEC and the listing standards of the NYSE. Mr. Oklak serves as the Chair of the Audit Committee. The Board has designated Mr. Oklak as an "Audit Committee financial expert" within the meaning of the rules of the SEC and the Board has determined that he has accounting and related financial management expertise within the meaning of the listing standards of the NYSE.

The purpose of our Compensation Committee is to determine salaries, incentives and other forms of compensation for executive officers and other employees, to administer our various incentive compensation and benefit plans, and to provide oversight and guidance to management regarding general compensation goals and guidelines. The report of the Compensation Committee for fiscal 2004 is included in this proxy statement. The Compensation Committee of the Board of Directors currently consists of Directors Hanafee, Lytle, Rouse and Ustian, and held four meetings during the last fiscal year. Mr. Ustian has served as the Chair of the Compensation Committee since February 2005 when he succeeded Mr. Ring in that capacity. Mr. Hanafee also joined the Compensation Committee in February 2005, succeeding Mr. Vandenberg. Each member of the Compensation Committee is independent within the meaning of the listing standards of the NYSE.

8

The purpose of our Governance Committee is to identify, evaluate and recommend nominees for the Board of Directors, evaluate the composition, organization and governance of the Board of Directors and its committees and develop and recommend to the Board appropriate corporate governance principles and policies. The Governance Committee also supervises the Board's annual review of director independence and the performance self-assessments of the Board and each of the committees. The Governance Committee currently consists of Directors Lytle, Hanafee, Rouse and Ustian, and held three meetings during the last fiscal year. Mr. Lytle serves as the Chair of the Governance Committee. Each member of the Governance Committee is independent within the meaning of the listing standards of the NYSE.

Stockholder Communications to Directors

Stockholders may communicate directly with our non-management directors by sending a letter addressed to:

Corporate Secretary

Monaco Coach Corporation

606 Nelson's Parkway

Wakarusa, Indiana 46573

Richard Bond, our Senior Vice President, Chief Administrative Officer and Corporate Secretary will ensure that a summary of all communications received is provided to the Board of Directors at its regularly scheduled meetings. Where the nature of a communication warrants, Mr. Bond may decide to obtain the more immediate attention of the appropriate committee of the Board of Directors or a non-management director, management or independent advisors, as Mr. Bond considers appropriate. Mr. Bond may decide, in the exercise of his judgment, whether a response to any stockholder communication is necessary.

Policy for Director Recommendations and Nominations

The Governance Committee considers candidates for Board membership suggested by Board members, management and our stockholders. The policy of the Governance Committee is to consider recommendations for candidates to the Board of Directors from any stockholder holding, as of the date the recommendation is submitted, not less than one percent (1%) of the then outstanding shares of our common stock continuously for at least twelve (12) months prior to such date. The Governance Committee will consider a director candidate recommended by our stockholders in the same manner as a nominee recommended by a Board member, management or other sources.

In addition, a stockholder may nominate a person directly for election to the Board of Directors at an Annual Meeting of Stockholders provided the stockholder meets the requirements set forth in our Bylaws.

Where the Governance Committee has either identified a prospective nominee or determines that an additional or replacement director is required, the Governance Committee may take such measures that it considers appropriate in connection with its evaluation of a director candidate, including candidate interviews, inquiry of the person or persons making the recommendation or nomination, engagement of an outside search firm to gather additional information, or reliance on the knowledge of the members of the Governance Committee, the Board or management. In its evaluation of director candidates, including the members of the Board of Directors eligible for re-election, the Governance Committee considers a number of factors, including:

- •

- The current size and composition of the Board of Directors and the needs of the Board of Directors and the respective committees of the Board

9

- •

- Such factors as judgment, independence, character and integrity, age, area of expertise, diversity of experience, length of service, and potential conflicts of interest

The Governance Committee has also specified the following minimum qualifications that it believes must be met by a nominee for a position on the Board:

- •

- The highest personal and professional ethics and integrity

- •

- Proven achievement and competence in the nominee's field and the ability to exercise sound business judgment

- •

- Skills that are complementary to those of the existing Board

- •

- The ability to assist and support management and make significant contributions to the Company's success

- •

- An understanding of the fiduciary responsibilities that is required of a member of the Board and the commitment of time and energy necessary to diligently carry out those responsibilities

- •

- A willingness of the prospective nominee to meet the minimum equity interest holding guideline set out in ourCorporate Governance Guidelines

After completing its evaluation, the Governance Committee makes a recommendation to the full Board as to the persons who should be nominated to the Board, and the Board determines the nominees after considering the recommendation and report of the Governance Committee.

Director Independence

In November 2003, the Board adoptedStandards of Independence for the Board of Directors. These guidelines for determining director independence are intended to be consistent with the NYSE's director independence standards and are available on our Investor Relations website at http://www.monaco-online.com/ir. Consistent with the standards that were adopted, the Board has reviewed the independence of our directors and considered whether any director had any relationship with Monaco Coach Corporation or management that would compromise his ability to exercise independent judgment in carrying out his responsibilities. The Board has affirmatively determined that directors L. Ben Lytle, Richard A. Rouse, Daniel C. Ustian, Robert P. Hanafee, Jr., Dennis D. Oklak, Carl E. Ring, Jr., Roger A. Vandenberg, and John F. Cogan, who has been nominated to our Board, are independent within the meaning of the NYSE director independence standards.

Presiding Director

In October 2002, the Board created the position of Presiding Director. The primary responsibility of the Presiding Director is to preside over executive sessions of the Board in which management and management directors do not participate, to work with the Chairman of the Board and the committee chairs in establishing the agendas for board and committee meetings and to perform such other duties as the Board may from time to time delegate to him in order to help it fulfill its responsibilities. Robert P. Hanafee, Jr. serves as our Presiding Director.

10

Code of Business Conduct and Code of Ethics for Officers

Our Board has adopted aCode of Business Conduct that is applicable to all of our employees, officers and directors. OurCode of Business Conduct is intended to ensure our employees act in accordance with high ethical standards based on respect for the dignity of each individual and a commitment to honesty and fairness. In addition, we have in place aCode of Ethics for Executive Officers that applies to our Chief Executive Officer, our Chief Financial Officer and certain other officers and this code is intended to deter wrongdoing and promote ethical conduct among our executives and to ensure all of our public disclosure is full, fair and accurate. Both theCode of Business Conduct and theCode of Ethics for Executive Officers are available on our Investor Relations website at http://www.monaco-online.com/ir. If necessary, we intend to post amendments to, or waivers from, these Codes for our executive officers and directors on our website.

Director Compensation

Each of our directors who are not employees received a total of $50,000 in compensation in fiscal 2004, and will receive a total of $50,000 in fiscal 2005, for service on the Board of Directors and any committee thereof. The directors are also reimbursed for certain expenses in connection with attendance at board and committee meetings. In addition, non-employee directors are able to elect to receive a portion of their annual cash retainer in either common stock or an option to purchase common stock. For fiscal year 2004, directors Hanafee, Lytle, Oklak and Ustian received 1,030 shares each of Common Stock in lieu of a portion of their cash retainer.

Each non-employee director is also currently entitled to participate in our Director Stock Plan. Each eligible non-employee director is automatically granted an option to purchase 8,000 shares of Common Stock on the date on which the optionee first becomes a director of the Company. Thereafter each optionee is automatically granted an additional option to purchase 4,000 shares of Common Stock on September 30 of each year if, on such date, the optionee has served as a director of the Company for at least six months. Each initial option grant vests over five years at the rate of 20% per year. Each subsequent option grant vests in full on the fifth anniversary of its date of grant. The exercise price of each option is the fair market value of the Common Stock as determined by the closing price reported by the New York Stock Exchange on the date of grant.

Director Rouse provides occasional consulting services to the Company without charge. Mr. Rouse is included in our standard health care plans, and received benefits totaling $5,258 in 2004.

11

REPORT OF THE AUDIT COMMITTEE

The information contained in the following report shall not be deemed to be "soliciting material" or to be filed with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates it by reference into such filing.

The following is the Audit Committee's report submitted to the Board of Directors for the fiscal year ended January 1, 2005.

The Audit Committee of the Board of Directors has:

- •

- reviewed and discussed the Company's audited financial statements for the fiscal year ended January 1, 2005 with the Company's management

- •

- reviewed and discussed with the Company's management the process designed to achieve compliance with Section 404 of the Sarbanes-Oxley Act of 2002

- •

- discussed with PricewaterhouseCoopers LLP, the Company's independent registered public accounting firm, the materials required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees)

- •

- reviewed the written disclosures and the letter from PricewaterhouseCoopers LLP required by Independence Standards Board No. 1 (Independence Discussions with Audit Committees) and has discussed with PricewaterhouseCoopers LLP its independence

- •

- considered whether the provision of non-audit services as noted under Proposal Two is compatible with maintaining the independence of PricewaterhouseCoopers LLP and has determined that such provision of non-audit services is compatible.

Based on the foregoing review and discussion, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended January 1, 2005.

| | | AUDIT COMMITTEE |

|

|

Dennis D. Oklak, Chair

Roger A. Vandenberg

Carl E. Ring, Jr. |

12

REPORT OF THE COMPENSATION COMMITTEE

The information contained in the following report shall not be deemed to be "soliciting material" or to be filed with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates it by reference into such filing.

Introduction

The Compensation Committee of the Board of Directors was established in July 1993 and is comprised solely of independent directors. The Compensation Committee is responsible for determining salaries, incentives and other forms of compensation for executive officers and other employees and administers various incentive compensation and benefit plans. With respect to the compensation of the Chief Executive Officer, the Committee reviews and approves the various elements of the Chief Executive Officer's compensation. With respect to other executive officers, the Compensation Committee reviews the recommendations for such individuals presented by the Chief Executive Officer and approves or modifies the compensation packages for such individuals. Base salary levels for executive officers are generally established at or near the start of each fiscal year, and final bonuses for executive officers are determined at the end of each fiscal year based upon such individual's performance and the Company's performance.

Executive Compensation

Our compensation program consists of two principal components: cash-based compensation, both fixed and variable, and equity-based compensation. These two principal components are intended to attract, retain, motivate and reward executives who are expected to manage both short-term and long-term success.

Cash-based Compensation

Executive officers receive cash compensation in the form of annual salaries and bonus payments. A principal goal of the Compensation Committee is to tie a substantial part of each executive officer's cash compensation to our corporate performance, and to reward executive officers for our success. In 2004, executive officers (other than Kay Toolson, our Chief Executive Officer) were eligible to receive, as a group, a bonus from a pool of 4.4% of the amount by which our earnings for fiscal 2004, before deducting interest, tax, depreciation and amortization expenses (EBITDA), exceeded 12% of our stockholders' equity at the beginning of fiscal 2004. The amount of the pool was $1,971,158. One half of a quarterly allocation, other than the amount allocated to the Chief Executive Officer (as described below), was paid to participants in the pool, other than the Chief Executive Officer, after the end of each quarter. At the discretion of the Committee, the participants, other than the Chief Executive Officer, are eligible for the remaining amount after the year-end, based on EBITDA achieved by the Company for the fiscal year. The allocation of the bonus pool, other than the amount allocated to the Chief Executive Officer, is recommended by the Chief Executive Officer for approval by the Compensation Committee and is based on subjective factors, including the achievement by each participant in the pool of defined objectives and the particular contributions of each participant to revenue and profitability. The Committee also considers the compensation of similarly situated executives in the Company's peer group in the recreational vehicle industry. The Chief Executive Officer also recommends to the Compensation Committee the performance objectives for each executive officer for the ensuing year.

13

Equity-based Compensation

The Compensation Committee administers an option program pursuant to which members of management, including executive officers, may receive annual option grants from a pool of shares set aside by the Compensation Committee. The purpose of the option program is to provide additional incentive to executives and other key employees to work to maximize long-term return to our stockholders. The Chief Executive Officer provides a recommendation to the Compensation Committee regarding the allocation of the option pool and the Compensation Committee determines the allocation of shares to the Chief Executive Officer. In granting stock options to executive officers, the Chief Executive Officer and the Committee consider a number of subjective factors, including the executive's position and responsibilities, such executive's individual performance, the number of options held (if any) and other factors that they may deem relevant. Options generally vest over a five-year period to encourage the optionholders to remain an employee. The exercise price of options is the market price on the date of grant, ensuring that the option will acquire value only to the extent that the price of the Company's common stock increases relative to the market price at the date of grant. In 2004, the Compensation Committee set aside a pool of 173,800 shares for grants to management, of which options to purchase 75,500 shares were granted to the executive officers.

Chief Executive Officer Compensation

The Compensation Committee generally uses the same factors and criteria described above for compensation decisions regarding our Chief Executive Officer. During 2004, Mr. Toolson received a base salary of $233,500 for serving as our Chief Executive Officer. As a participant in our Executive Variable Compensation Plan, which was originally adopted in 1999 and re-approved at the 2004 Annual Meeting, Mr. Toolson was eligible to receive a bonus for fiscal 2004 equal to 3.0% of EBITDA in excess of 12% of stockholders' equity at the beginning of fiscal 2004. This bonus totaled $1,343,971. The Compensation Committee has the discretion to reduce this bonus as it sees fit.

In 2004, the Compensation Committee also granted Mr. Toolson an option to purchase 10,000 shares of Common Stock.

Tax Deductibility of Executive Compensation

The Internal Revenue Code limits the federal income tax deductibility of compensation paid to our Chief Executive Officer and to each of the other four most highly compensated executive officers. For this purpose, compensation can include, in addition to cash compensation, the difference between the exercise price of stock options and the value of the underlying stock on the date of exercise. Under this legislation, the Company may deduct such compensation with respect to any of these individuals only to the extent that during any fiscal year such compensation does not exceed $1 million or meets certain other conditions (such as stockholder approval). Our policy is to qualify, to the extent reasonable, our executive officers' compensation for deductibility under applicable tax laws. However, the Compensation Committee believes that its primary responsibility is to provide a compensation program that will attract, retain and reward the executive talent necessary for our success. Consequently, the Compensation Committee recognizes that the loss of a tax deduction may be necessary in some circumstances. In 1999 and in 2004, our stockholders approved the Executive Variable Compensation Plan under which bonuses may be paid to participating executive officers. The Executive Variable Compensation Plan, which provides for performance-based compensation, is intended to be exempt from the deduction limits under Section 162(m) of the Internal Revenue Code.

14

Summary

The Compensation Committee believes that its compensation program to date has been fair and motivating, and has been successful in attracting and retaining qualified employees and in linking compensation directly to our success. The Compensation Committee intends to review this program on an ongoing basis to evaluate its continued effectiveness.

| | | THE COMPENSATION COMMITTEE* |

|

|

Carl E. Ring, Jr., Chair

Roger A. Vandenberg

L. Ben Lytle

Richard A. Rouse |

* As of February 2005, the Compensation Committee consisted of Directors Ring (Chair), Vandenberg, Lytle, and Rouse. At that time, Mr. Ustian succeeded Mr. Ring as Chair, and Mr. Hanafee succeeded Mr. Vandenberg.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee of the Board of Directors who served on the Committee in 2004 or who presently serves on the Committee has interlocking relationships as defined by the Securities and Exchange Commission.

15

EXECUTIVE COMPENSATION

Executive Compensation Tables

The table below sets forth information for the three most recently completed fiscal years concerning the compensation of the Chief Executive Officer of the Company and the five other most highly compensated executive officers in fiscal 2004 (the "Named Executive Officers"):

Summary Compensation Table

| | Annual Compensation

| | Long-Term

Compensation

|

|---|

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | Securities

Underlying

Options (#)

|

|---|

Kay L. Toolson

Chief Executive Officer and Chairman | | 2004

2003

2002 | | $

| 233,500

228,000

224,400 | | $

| 1,343,971

650,240

1,827,000 | | 10,000

10,000

10,000 |

John W. Nepute

President |

|

2004

2003

2002 |

|

|

160,800

156,100

153,000 |

|

|

419,900

257,000

571,000 |

|

9,000

9,000

9,000 |

Richard E. Bond

Senior Vice President, Chief Administrative Officer and Secretary |

|

2004

2003

2002 |

|

|

133,000

129,100

126,500 |

|

|

232,000

151,150

340,000 |

|

6,000

6,000

6,000 |

Martin W. Garriott

Vice President, Oregon Manufacturing |

|

2004

2003

2002 |

|

|

99,600

96,700

94,800 |

|

|

263,250

165,500

365,000 |

|

6,000

6,000

6,000 |

Irvin M. Yoder

Vice President, Indiana Manufacturing |

|

2004

2003

2002 |

|

|

99,600

96,700

94,800 |

|

|

263,250

167,000

374,000 |

|

6,000

6,000

6,000 |

Michael P. Snell

Vice President of Sales and Marketing |

|

2004

2003

2002 |

|

|

97,500

94,600

92,700 |

|

|

260,500

210,700

352,044 |

(1)

(1)

(1) |

6,000

6,000

6,000 |

- (1)

- Includes sales commissions earned by Mr. Snell in the amounts of $150,000 in fiscal years 2004, 2003, and 2002.

16

Option Grants

The following table sets forth certain information with respect to stock option grants to the Named Executive Officers during the fiscal year ended January 1, 2005. In accordance with the rules of the SEC, also shown below is the potential realizable value over the term of the option (the period from the grant date to the expiration date) based on assumed rates of stock appreciation from the option exercise price of 5% and 10%, compounded annually. These amounts are based on certain assumed rates of appreciation and do not represent the Company's estimate of future stock price. Actual gains, if any, on stock option exercises will be dependent on the future performance of the Common Stock.

Option Grants in Last Fiscal Year

| | # of Individual Grants(1)

| | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation for

Option Term

|

|---|

| | Number of

Securities

Underlying

Options

Granted (#)

| |

| |

| |

|

|---|

| | % of Total

Options

Granted to

Employees

| |

| |

|

|---|

Name

| | Exercise

Price

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Kay L. Toolson | | 10,000 | | 5.75 | | $ | 26.80 | | 3/31/2014 | | $ | 168,544 | | $ | 427,123 |

| John W. Nepute | | 9,000 | | 5.18 | | $ | 26.80 | | 3/31/2014 | | | 151,689 | | | 384,411 |

| Richard E. Bond | | 6,000 | | 3.45 | | $ | 26.80 | | 3/31/2014 | | | 101,126 | | | 256,274 |

| Martin W. Garriott | | 6,000 | | 3.45 | | $ | 26.80 | | 3/31/2014 | | | 101,126 | | | 256,274 |

| Irvin M. Yoder | | 6,000 | | 3.45 | | $ | 26.80 | | 3/31/2014 | | | 101,126 | | | 256,274 |

| Michael P. Snell | | 6,000 | | 3.45 | | $ | 26.80 | | 3/31/2014 | | | 101,126 | | | 256,274 |

- (1)

- These options were granted pursuant to the Company's 1993 Incentive Stock Plan. These options have terms of 10 years and vest over five years at the rate of 20% of the shares subject to the options at the end of each anniversary following the date of grant of such options.

Option Values

The following table sets forth information with respect to the number and value of securities underlying exercisable and unexercisable options held by each of the Named Executive Officers on January 1, 2005:

Options Exercises in Last Fiscal Year and Fiscal Year-End Option Values

| |

| |

| | Number of Securities

Underlying Unexercised

Options at

Fiscal Year End

| |

| |

|

|---|

| |

| |

| | Value of Unexercised

In-the-Money Options at

Fiscal Year End(1)

|

|---|

Name

| | Shares

Acquired on

Exercise

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Kay L. Toolson | | 5,510 | | $ | 51,121 | | 32,777 | | 33,300 | | $ | 255,464 | | $ | 158,172 |

| John W. Nepute | | 8,657 | | | 196,471 | | 90,752 | | 28,200 | | | 1,189,314 | | | 127,857 |

| Richard E. Bond | | 0 | | | 0 | | 56,775 | | 19,350 | | | 690,854 | | | 89,757 |

| Martin W. Garriott | | 8,265 | | | 178,489 | | 35,907 | | 19,350 | | | 345,682 | | | 89,757 |

| Irvin M. Yoder | | 0 | | | 0 | | 51,095 | | 19,350 | | | 607,574 | | | 89,757 |

| Michael P. Snell | | 5,000 | | | 109,156 | | 25,958 | | 18,750 | | | 234,978 | | | 84,846 |

- (1)

- Value of unexercised options is based on the last reported sale price of the Company's Common Stock on the New York Stock Exchange of $20.57 per share on December 31, 2004 (the last trading day for the fiscal year ended January 1, 2005) minus the exercise price.

17

SECURITY OWNERSHIP

The following table sets forth certain information with respect to beneficial ownership of the Company's Common Stock as of March 11, 2005 (except as otherwise indicated), by: (i) each person who is known by the Company to own beneficially more than five percent of the Common Stock, (ii) each of the Named Executive Officers, (iii) each of the Company's directors, and (iv) all directors and executive officers as a group. Except as indicated in the footnotes to this table, the persons named in the table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them, subject to community property laws where applicable.

Beneficial Owner

| | Number of

Shares(1)

| | Percentage

| |

|---|

Barclays Global Investors, N.A.(2)

45 Fremont Street

San Francisco, CA 94105 | | 4,190,476 | | 14.22 | % |

Westcap Investors(3)

1111 Santa Monica Blvd., Suite 820

Los Angeles, CA 90025 |

|

2,026,815 |

|

6.88 |

% |

Kay L. Toolson(4)

c/o Monaco Coach Corporation

91320 Industrial Way

Coburg, OR 97408 |

|

1,892,536 |

|

6.41 |

% |

Royce & Associates, LLC(5)

1414 Avenue of the Americas

New York, NY 10019 |

|

1,511,400 |

|

5.13 |

% |

Kornitzer Capital Management, Inc.(6)

5420 West 61st Place

Shawnee Mission, KS 66205 |

|

1,493,825 |

|

5.07 |

% |

Roger A. Vandenberg |

|

750,856 |

|

2.55 |

% |

John W. Nepute(4) |

|

248,590 |

|

* |

|

Richard A. Rouse(4) |

|

77,173 |

|

* |

|

Richard E. Bond(4) |

|

70,758 |

|

* |

|

Irvin M. Yoder(4) |

|

68,405 |

|

* |

|

Michael P. Snell(4) |

|

47,819 |

|

* |

|

Martin W. Garriott(4) |

|

43,653 |

|

* |

|

L. Ben Lytle(4) |

|

9,602 |

|

* |

|

Robert P. Hanafee, Jr. |

|

6,484 |

|

* |

|

Dennis D. Oklak(4) |

|

5,855 |

|

* |

|

Daniel C. Ustian(4) |

|

3,257 |

|

* |

|

All directors and executive officers as a group (22 persons)(7) |

|

3,527,176 |

|

11.59 |

% |

- *

- Less than one percent.

18

- (1)

- Applicable percentage of beneficial ownership is based on 29,469,673 shares of Common Stock outstanding as of March 11, 2005 together with applicable options for each stockholder. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission, and includes voting and investment power with respect to shares. Shares of Common Stock subject to options currently exercisable or exercisable within 60 days after March 11, 2005 are deemed outstanding for purposes of computing the percentage ownership of the person holding such options, but are not deemed outstanding for computing the percentage of any other stockholder.

- (2)

- Information based solely on a joint Schedule 13G filed on February 14, 2005 by Barclays Global Investors, N.A., and other reporting persons.

- (3)

- Information based solely on Schedule 13G filed on February 7, 2005.

- (4)

- Includes the number of shares subject to options which are exercisable within 60 days of March 11, 2005 by the following persons: Mr. Toolson (45,077 shares); Mr. Nepute (100,502 shares); Mr. Rouse (19,950 shares); Mr. Bond (63,675 shares); Mr. Yoder (57,995 shares); Mr. Snell (32,408 shares); Mr. Garriott (42,807 shares); Mr. Lytle (4,800 shares); Mr. Oklak (3,200 shares); Mr. Ustian (1,600 shares).

- (5)

- Information based solely on Schedule 13G filed on February 1, 2005.

- (6)

- Information based solely on Schedule 13G filed on February 10, 2005.

- (7)

- Includes 546,277 shares subject to options that are exercisable within 60 days of March 11, 2005.

19

PERFORMANCE GRAPH

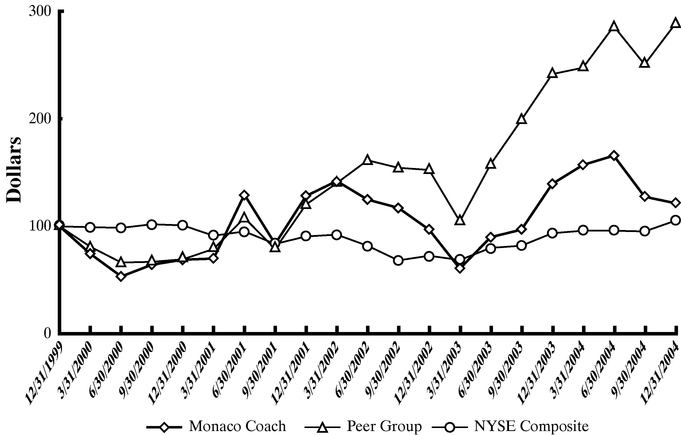

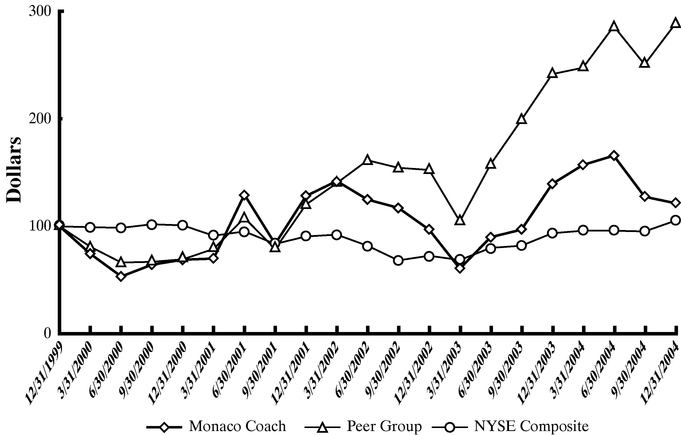

The following line graph shows a comparison of cumulative total stockholder return for our common stock, the New York Stock Exchange Composite Index and a peer group of companies selected by the Company (the "Peer Group"), whose primary business is recreational vehicles. The Peer Group consists of Coachmen Industries, Inc., National RV Holdings, Inc., Fleetwood Enterprises, Inc., Thor Industries, Inc., and Winnebago Industries, Inc. for the full period, and SMC Corp. from December 31, 1999 to August 6, 2001. The graph assumes that $100 was invested on December 31, 1999 at the closing price for our common stock on such date, and that all dividends are reinvested. In accordance with the guidelines of the SEC, the stockholder return for each entity in the Peer Group has been weighted on the basis of market capitalization as of each measurement date set forth in the graph. Historic stock price performance should not be considered indicative of future stock price performance.

TOTAL RETURN TO STOCKHOLDERS

(Assumes $100 Investment on 12/31/1999)

20

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 (the "Exchange Act") requires our executive officers and directors and persons who own more than ten percent of a registered class of our equity securities to file an initial report of ownership on Form 3 and changes in ownership on Form 4 or Form 5 with the SEC and the National Association of Securities Dealers, Inc. Such persons are also required by SEC rules to furnish us with copies of all Section 16(a) forms they file. Based solely on its review of the copies of such forms received by it, or written representations from certain reporting persons, we believe that, during the fiscal year ended January 1, 2005, all filing requirements applicable to its officers, directors and ten percent stockholders were met, except that Director Rouse's transaction was not reported within the two day filing requirement and occurred while the trading window was closed.

| | | FOR THE BOARD OF DIRECTORS |

|

|

RICHARD E. BOND

Secretary |

| April 8, 2005 | | |

21

MONACO COACH CORPORATION

ANNUAL MEETING OF STOCKHOLDERS

THIS PROXY IS SOLICITED ON BEHALF

OF THE BOARD OF DIRECTORS

Wednesday, May 18, 2005

1:00 p.m., local time

606 Nelson's Parkway

Wakarusa, IN 46573

|

|

|

|

MONACO COACH CORPORATION

91320 Industrial Way, Coburg, Oregon 97408 |

|

proxy |

|

The undersigned stockholder of Monaco Coach Corporation, a Delaware corporation (the "Company"), hereby acknowledges receipt of the Notice of Annual Meeting of Stockholders and Proxy Statement, each dated April 8, 2005, and the 2004 Annual Report to Stockholders, and hereby appoints Kay L. Toolson and John W. Nepute, or either of them, proxies and attorneys-in-fact, with full power to each of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the Annual Meeting of Stockholders of Monaco Coach Corporation to be held on May 18, 2005, at 1:00 p.m. local time, at the Company's offices, located at 606 Nelson's Parkway, Wakarusa, IN 46573, and at any adjournment(s) thereof, and to vote all shares of Common Stock which the undersigned would be entitled to vote if then and there personally present, on the matters set forth on the reverse side, and, in their discretion, upon such other matter or matters which may properly come before the meeting and any adjournment(s) thereof.

THIS PROXY WILL BE VOTED AS DIRECTED, OR, IF NO CONTRARY DIRECTION IS INDICATED, WILL BE VOTED FOR THE ELECTION OF THE SPECIFIED NOMINEES AS DIRECTORS, TO RATIFY THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY, AND AS SAID PROXIES DEEM ADVISABLE ON SUCH OTHER MATTERS AS MAY COME BEFORE THE MEETING.

See reverse for voting instructions.

There are three ways to vote your Proxy

Your telephone or Internet vote authorizes the Named Proxies to vote your shares in the same manner as if you marked, signed and returned your proxy card.

VOTE BY PHONE — TOLL FREE — 1-800-560-1965 — QUICK *** EASY *** IMMEDIATE

- •

- Use any touch-tone telephone to vote your proxy 24 hours a day, 7 days a week, until 12:00 noon (CT) on May 17, 2005.

- •

- Please have your proxy card and the last four digits of your Social Security Number or Tax Identification Number available. Follow the simple instructions the voice provides you.

VOTE BY INTERNET — http://www.eproxy.com/mnc/ — QUICK *** EASY *** IMMEDIATE

- •

- Use the Internet to vote your proxy 24 hours a day, 7 days a week, until 12:00 noon (CT) on May 17, 2005.

- •

- Please have your proxy card and the last four digits of your Social Security Number or Tax Identification Number available. Follow the simple instructions to obtain your records and create an electronic ballot.

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we've provided or return it toMonaco Coach Corporation, c/o Shareowner ServicesSM, P.O. Box 64873, St. Paul, MN 55164-0873.

If you vote by Phone or Internet, please do not mail your Proxy Card

Please detatch here

The Board of Directors Recommends a Vote FOR Items 1 and 2.

| 1. | Election of four

Class II directors: | | 01

02 | John F. Cogan

Robert P. Hanafee, Jr. | | 03

04 | Dennis D. Oklak

Roger A. Vandenberg | | o | Vote FOR

all nominees

(except as marked) | | o | Vote WITHHELD

from all nominees |

| (Instructions: To withhold authority to vote for any indicated nominee, write the number(s) of the nominee(s) in the box provided to the right.) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2. | | Proposal to ratify the appointment of PricewaterhouseCoopers LLP as the Independent Registered Public Accounting Firm of the Company for the fiscal year ending December 31, 2005. | | o | For | | o | Against | | o | Abstain |

3. |

|

To transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Address Change? Mark Box | | o | | Indicate changes below: | | Date | |

| | | | | | | |

|

|

|

|

| | |

|

|

|

|

|

|

|

|

|

Signature(s) in Box

Please sign exactly as your name(s) appears on Proxy. If held in joint tenancy, all persons should sign. Trustees, administrators, etc., should include title and authority. Corporations should provide full name of corporation and title of authorized officer signing the proxy. |

QuickLinks

NOTICE OF ANNUAL MEETING OF STOCKHOLDERSPROXY STATEMENTINFORMATION CONCERNING SOLICITATION AND VOTINGPROPOSAL ONE ELECTION OF DIRECTORSPROPOSAL TWO—RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMCORPORATE GOVERNANCEREPORT OF THE AUDIT COMMITTEEREPORT OF THE COMPENSATION COMMITTEEEXECUTIVE COMPENSATIONSECURITY OWNERSHIPPERFORMANCE GRAPHSECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE