UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

MONACO COACH CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

MONACO COACH CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held May 17, 2006

TO OUR STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the 2006 Annual Meeting of the Stockholders of Monaco Coach Corporation will be held on May 17, 2006 at 2:00 p.m., local time, at our offices located at 91320 Coburg Industrial Way, Coburg, Oregon 97408 for the following purposes:

1. To elect four Class I directors each to serve for a two-year term expiring upon the 2008 Annual Meeting of Stockholders or until their successors are elected.

2. To approve the amended and restated 1993 Stock Plan (formerly known as the 1993 Incentive Stock Option Plan).

3. To transact such other business as may properly come before the meeting and any adjournment or postponement thereof.

The foregoing items of business are more fully described in the proxy statement accompanying this Notice. Stockholders of record at the close of business on March 20, 2006 are entitled to notice of and to vote at the meeting.

All stockholders are cordially invited to attend the meeting in person. However, to ensure your representation at the meeting, you are urged to deliver your proxy by telephone or the Internet or to mark, sign, date and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purpose. Any stockholder attending the meeting may vote in person even if such stockholder has returned a proxy.

| FOR THE BOARD OF DIRECTORS |

| RICHARD E. BOND |

| Secretary |

Coburg, Oregon

April 7, 2006

MONACO COACH CORPORATION

91320 Coburg Industrial Way

Coburg, Oregon 97408

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

General

This proxy statement contains information relating to our Annual Meeting of Stockholders to be held on Wednesday, May 17, 2006 at 2:00 p.m. local time (the “Annual Meeting”), at our offices located at 91320 Coburg Industrial Way, Coburg, Oregon 97408. Our telephone number at that location is (541) 686-8011. The enclosed Proxy is solicited on behalf of our Board of Directors for use at the 2006 Annual Meeting of Stockholders, or at any postponements or adjournment thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders.

These proxy solicitation materials and the Annual Report to Stockholders for the year ended December 31, 2005, including financial statements, were mailed on or about April 7, 2006 to all stockholders entitled to vote at the meeting.

Record Date and Voting Securities

Stockholders of record at the close of business on March 20, 2006, the record date for the meeting, are entitled to notice of and to vote at the meeting. At the record date, 29,682,238 shares of our Common Stock, $0.01 par value, were issued and outstanding.

Each stockholder is entitled to one vote for each share of Common Stock on all matters presented at the Annual Meeting. Stockholders do not have the right to cumulate their votes in the election of directors.

Methods of Voting

Voting by Mail—By signing and returning the proxy card according to the enclosed instructions, you are enabling our Chief Executive Officer, Kay Toolson, and our President, John Nepute, who are named on the proxy card as “proxies or attorneys-in-fact,” to vote your shares at the meeting in the manner you indicate. We encourage you to sign and return the proxy card even if you plan to attend the meeting. In this way, your shares will be voted even if you are unable to attend the meeting.

Voting by Telephone—Specific instructions on how to vote via the telephone are included on the proxy card.

Voting via Internet—Specific instructions on how to vote via the Internet are included on the proxy card.

Your shares will be voted in accordance with the instructions you indicate on the proxy card. If you submit the proxy card but do not indicate your voting instructions, your shares will be voted as follows:

· FOR the election of the nominees for director identified in Proposal One; and

· FOR approval of the amended and restated stock plan in Proposal Two.

Voting in Person at the Meeting—If you plan to attend the 2006 Annual Meeting of Stockholders and vote in person, we will provide you with a ballot at the meeting. If your shares are registered directly in your name, you are considered the stockholder of record and you have the right to vote in person at the meeting. If your shares are held in the name of your broker or other nominee, you are considered the beneficial owner of shares held in your name, but if you wish to vote at the meeting you will need to bring a legal proxy from your broker or other nominee authorizing you to vote these shares.

If you hold shares through a bank, broker, or other record holder, you may vote your shares by following the instructions they have provided you.

Revoking Your Proxy

You may revoke your proxy at any time before it is voted at the 2006 Annual Meeting of Stockholders. In order to do this, you may either:

· sign and return another proxy bearing a later date before the beginning of the 2006 Annual Meeting of Stockholders;

· provide written notice of the revocation to:

Corporate Secretary

Monaco Coach Corporation

91320 Coburg Industrial Way

Coburg, Oregon 97408

prior to the time we take the vote at the 2006 Annual Meeting of Stockholders; or

· attend the 2006 Annual Meeting of Stockholders and request that your proxy be revoked (attendance at the meeting will not by itself revoke a previously granted proxy)

Solicitation of Votes

We will bear the cost of soliciting proxies. In addition, we may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Solicitation of proxies by mail may be supplemented by telephone, telegram, facsimile or personal solicitation by our directors, officers or employees. No additional compensation will be paid to such persons for such services.

Quorum Requirements

A quorum is necessary to hold a valid meeting. The required quorum for the transaction of business at the Annual Meeting is a majority of the votes eligible to be cast by holders of shares of Common Stock, whether in person or by proxy, issued and outstanding on the record date. Abstentions and broker non-votes are counted as present for establishing a quorum for the transaction of business at the Annual Meeting, but neither will be counted as votes cast. A “broker non-vote” occurs when a broker votes on some matters on the proxy card but not on others because the broker does not have authority to do so.

Votes Required for Each Proposal

The vote required for the proposals to be considered at the 2006 Annual Meeting of Stockholders is as follows:

Proposal One—Election of Directors. The four (4) director nominees receiving the highest number of votes, in person or by proxy, will be elected as directors. You may vote either “for” or “withhold” your vote for the director nominees.

Proposal Two—Amendment and Restatement of the 1993 Stock Plan. Amendment and restatement of the 1993 Stock Plan (formerly known as the 1993 Incentive Stock Option Plan) will require the affirmative vote of a majority of the shares present in person or by proxy and entitled to vote at the Annual Meeting.

2

Abstentions and Broker Non-Votes

A properly executed proxy marked “abstain” with respect to any such matter will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote.

Under the rules that govern brokers who have record ownership of shares that are held in “street name” for their clients, the beneficial owners of the shares, brokers have discretion to vote these shares on routine matters but not on non-routine matters. If you hold Common Stock through a broker and you have not given voting instructions to the broker, the broker may be prevented from voting shares on non-routine matters, resulting in a “broker non-vote.” Thus, if you do not otherwise instruct your broker, the broker may turn in a proxy card voting your shares “FOR” routine matters but expressly instructing that the broker is NOT voting on non-routine matters. Broker non-votes are counted for the purpose of determining the presence or absence of a quorum, but are not counted in the tabulation of the voting results with respect to a particular proposal.

Stockholder Proposals for 2007 Annual Meeting

As a stockholder, you may be entitled to present proposals for action at a forthcoming stockholder meeting. Pursuant to the rules of the Securities and Exchange Commission and our bylaws, stockholder proposals that stockholders intend to present at our 2007 Annual Meeting of Stockholders and desire to have included in our proxy materials relating to such meeting must be received by us no later than December 9, 2006, which is 120 calendar days prior to the anniversary of last year’s proxy statement mailing date, and must be in compliance with applicable laws and regulations (including the regulations of the Securities and Exchange Commission under Rule 14a-8). If the date of next year’s annual meeting is moved more than 30 days before or after the anniversary date of the previous year’s annual meeting, the deadline for inclusion of a proposal in our proxy statement is instead a reasonable time before we begin to print and mail our proxy materials. Proposals should be addressed to:

Corporate Secretary

Monaco Coach Corporation

91320 Coburg Industrial Way

Coburg, Oregon 97408

For stockholder proposals not included in our proxy materials (in accordance with Rule 14a-8) but which stockholders intend to present at our 2007 Annual Meeting of Stockholders, our bylaws provide that the stockholder must have given timely notice thereof in writing to the Secretary of the Company not less than 120 calendar days prior to the anniversary of the date on which we first mailed our proxy materials for our immediately preceding annual meeting of stockholders (as specified in the proxy materials for our immediately preceding annual meeting of stockholders), which for the 2007 Annual Meeting of Stockholders will be December 9, 2006. However, in the event that the annual meeting is called for a date that is not within thirty days of the anniversary of the date on which the immediately preceding annual meeting of stockholders was called, to be timely, notice by the stockholder must be received a reasonable time before the solicitation is made. A stockholder’s notice to our Secretary (to the address noted above) must set forth the information required by our bylaws with respect to each matter the stockholder proposes to bring before the annual meeting.

Other Matters

We know of no other matters to be submitted at the meeting. If any other matters properly come before the meeting or any adjournment or postponement thereof, it is the intention of the persons named in the enclosed form of proxy to vote the shares they represent as the Board of Directors may recommend.

3

PROPOSAL ONE

ELECTION OF DIRECTORS

Nominees to the Board of Directors

Our Board of Directors currently has eight members divided into two classes (Class I and Class II), with the classes serving staggered, two-year terms. Currently there are four directors in Class I and four directors in Class II. The Class I directors are to be elected at the Annual Meeting. Each of the Class II directors will hold office until the 2007 Annual Meeting or until their successors have been duly elected and qualified.

On the recommendation of our Governance Committee, the Board has nominated Kay L. Toolson, L. Ben Lytle, Richard A. Rouse, and Daniel C. Ustian for election as Class I Directors. Each nominee is currently a director. Unless otherwise instructed, the proxy holders will vote the proxies received by them FOR the nominees. In the event that any nominee becomes unable or declines to serve as a director at the time of the Annual Meeting, the proxy holders will vote the proxies for any substitute nominee who is designated by the current Board of Directors to fill the vacancy. It is not expected that any nominee listed below will be unable or will decline to serve as a director.

Certain information about each of the nominees for Class I directors is set forth below. The names of, and certain information about, the four current Class II directors with unexpired terms are also set forth below. All information is as of the record date.

Name | | | | Age | | Principal Occupation | | Director

Since |

Nominees for Class I Directors: | | | | | | |

Kay L. Toolson | | 62 | | Chairman of the Board and Chief Executive Officer | | 1993 |

L. Ben Lytle | | 59 | | Chairman of the Board and Chief Executive Officer of AXIA Health Management, LLC | | 2001 |

Richard A. Rouse | | 60 | | Private Investor | | 1993 |

Daniel C. Ustian | | 55 | | Chairman of the Board, President and Chief Executive Officer of Navistar International Corporation | | 2003 |

Continuing Class II Directors: | | | | | | |

John F. Cogan | | 58 | | Senior Fellow, Hoover Institution;

Professor, Stanford University | | 2005 |

Robert P. Hanafee, Jr. | | 61 | | Private Investor | | 2001 |

Dennis D. Oklak | | 52 | | Chairman of the Board and Chief Executive Officer of Duke Realty Corporation | | 2003 |

Roger A. Vandenberg | | 58 | | President of Cariad Capital, Inc. | | 1993 |

Except as indicated below, each nominee or incumbent director has been engaged in the principal occupation set forth below during the past five years. Michael P. Snell, an executive officer, is the nephew of Director Toolson. Other than this family relationship, there are no family relationships between any directors or executive officers of the Company.

4

Nominees for Class I Directors whose terms expire in 2006

Mr. Toolson has served as our Chief Executive Officer and as the Chief Executive Officer of our predecessor company since 1986 and as Chairman of the Board since 1993. He also served as President from 1986 to October 2000, except for the periods from October 1995 to January 1997 and August 1998 to September 1999. From 1973 to 1986, Mr. Toolson held executive positions with two motor coach manufacturers.

Mr. Lytle has served as a director since October 2001. Mr. Lytle is currently the Chairman of the Board and Chief Executive Officer of AXIA Health Management, LLC, which acquired Healthcare Dimensions, Inc., a provider of physical fitness programs to 1.4 million senior citizens nationwide, in November 2004. Mr. Lytle served as Chairman Emeritus of Wellpoint (fka Anthem, Inc.), one of the largest healthcare management companies in the United States, from January 2005 to February 2006, and served as Chairman of the Board and Non-Executive Director from October 1999 to May 2004. Mr. Lytle served as Chief Executive Officer of Anthem from 1989 through 1999. Before joining Anthem’s predecessor company in 1976, he held positions with LTV Aerospace, an aerospace company, Associates Corp. of North America, a financial services company, and American Fletcher National Bank. Mr. Lytle serves on the boards of Duke Realty Corporation, a real estate investment firm, and he is the Presiding Director of USI, Inc., an insurance broker. Mr. Lytle is also a member of the board of trustees of the American Enterprise Institute, a public policy research organization. Committees: Governance (Chair) and Compensation.

Mr. Rouse has served as a director since July 1993. He is currently a private investor. From 1991 to 1998, Mr. Rouse served as Chairman of Emergency Road Service, Inc., a privately held nationwide roadside assistance company. From 1988 to 1991, he was President of Trailer Life Enterprises, Inc., a publisher and sponsor of recreational vehicle publications and clubs. Committees: Governance and Compensation.

Mr. Ustian has served as a director since June 2003. Mr. Ustian is currently Chairman of the Board, President and Chief Executive Officer of Navistar International Corporation, a manufacturer of commercial trucks and engines. Prior to his present position at Navistar, he was President and Chief Executive Officer, from February 2003, and President and Chief Operating Officer from April 2002, and President of the Engine Group of International Truck and Engine Corporation, Navistar’s principal operating subsidiary, from 1999 to 2002. He also served as Group Vice President and General Manager of Engine & Foundry from 1993 to 1999. Committees: Governance and Compensation (Chair).

Class II Directors whose terms expire in 2007

Mr. Cogan has served as a director since May 2005. Mr. Cogan is currently the Leonard and Shirley Ely Senior Fellow at the Hoover Institution, where he has been a Senior Fellow since 1983. He is also currently a Professor in the Public Policy Program at Stanford University, a position he has held since 1994. Mr. Cogan also serves as a director of Venture Lending & Leasing Funds I, II, and IV and Gilead Sciences Inc., a biopharmaceutical company. Mr. Cogan has also served on numerous congressional and presidential advisory commissions. He is currently a member of California Governor Arnold Schwarzenegger’s Council of Economic Advisors. Most recently, he served on President George W. Bush’s Commission to Strengthen Social Security. He has also served as a member of the U.S. Bipartisan Commission on Health Care (The Pepper Commission), the Social Security Notch Commission, the National Academy of Sciences’ Panel on Poverty and Family Assistance, Congressional Budget Office’s Panel of Economic Advisors, the Congressional Policy Advisory Committee, and California Governor Pete Wilson’s Council of Economic Advisors. Committees: Audit

5

Mr. Hanafee has served as a director since October 2001. Mr. Hanafee held various positions at Gillette Company, a consumer products company, from 1970 until retirement in 2001, including Vice President of Sales and Marketing of the Paper Mate Divisions, Senior Vice President of the North Atlantic Group, and President of the Stationary Products Group. Committees: Governance and Compensation.

Mr. Oklak has served as a director since February 2003. Mr. Oklak has been Chairman of the Board and Chief Executive Officer since April 2005 and also a Director since April 2004, of Duke Realty Corporation, one of the largest real estate investment trusts in the United States. From 1986 through April 2005, Mr. Oklak served in various other positions with Duke Realty Corporation, including President, Chief Operating Officer, Co-Chief Operating Officer, Executive Vice President and Chief Administrative Officer and Senior Vice President and Treasurer. Prior to joining Duke Realty Corporation, Mr. Oklak was with Deloitte & Touche, a public accounting firm. Committees: Audit (Chair).

Mr. Vandenberg has served as a director since March 1993. He currently serves as the President of Cariad Capital, Inc., a private equity investment business, which he founded in 1992. Mr. Vandenberg also serves as a director of Wellman, Inc., a polyester fiber manufacturer. From 1986 to December 2002, Mr. Vandenberg served as a Managing Director of Narragansett Capital, Inc., a private investment firm, as general partner of Narragansett Capital Partners - -A and -B, L.P., related venture capital funds, and as a general partner of Narragansett First Fund, a venture capital fund. From May 1999 to March 2000, Mr. Vandenberg served as President of EFD, Inc., a manufacturer and seller of fluid dispensing and dispensing components. Committees: Audit.

Vote Required

The four nominees receiving the highest number of votes of the shares entitled to be voted shall be elected as directors. Votes withheld from any director will be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the meeting, but have no other legal effect upon election of directors under Delaware law.

The Board of Directors has unanimously approved Kay L. Toolson, L. Ben Lytle, Richard A. Rouse, and Daniel C. Ustian as its nominees and recommends that stockholders vote “FOR” the election of these nominees as Class I Directors.

6

PROPOSAL TWO

APPROVAL OF THE AMENDED AND RESTATED 1993 STOCK PLAN

The stockholders are being asked to approve the amendment and restatement of the 1993 Stock Plan, formerly known as the 1993 Incentive Stock Option Plan (the “Incentive Plan”). The Board has approved the amendment and restatement of the Incentive Plan, subject to approval by our stockholders at the Annual Meeting. If the stockholders approve the amendment and restatement of the Incentive Plan, it will replace the current version of the Company’s 1993 Stock Plan and the Company’s 1993 Director Option Plan (the “Director Plan”). If the Incentive Plan is approved, no further awards will be made under the Director Plan, but it will continue to govern awards previously granted thereunder. If the stockholders do not approve the Incentive Plan, the current Incentive Plan and Director Plan will remain in effect through the remainder of their respective terms. Approval of the Incentive Plan requires the affirmative vote of the holders of a majority of the shares of the Company’s common stock that are present in person or by proxy and entitled to vote at the Annual Meeting.

The Board of Directors (the “Board”) believes that long-term incentive compensation programs align the interests of management, employees and the stockholders to create long-term stockholder value. The Board believes that plans such as the Incentive Plan increase the Company’s ability to achieve this objective, especially by allowing for several different forms of long-term incentive awards, which the Board believes will help the Company to recruit, reward, motivate and retain talented personnel. The recent changes in the equity compensation accounting rules, which became effective for the Company beginning with the first quarter of 2006, also make it important for the Company to have greater flexibility under its employee equity incentive plan. As the new equity compensation accounting rules come into effect for all companies, competitive equity compensation practices may change materially, especially as they pertain to the use of equity compensation vehicles other than stock options.

Changes Being Made to the Plan

The following is a summary of some of the key changes being made to the Incentive Plan:

· The stockholders are being asked to approve an increase to the number of shares of common stock authorized for issuance under the Incentive Plan from 3,257,813 shares to 5,457,813 shares plus any shares which have been reserved under the Director Plan, but that, as of the date of stockholder approval of the Incentive Plan, have not been issued pursuant to any awards granted thereunder and are not subject to any outstanding awards granted thereunder. Additional shares would have been required for the Plan regardless of the Plan changes.

· The Incentive Plan currently allows for the grant of stock options, stock purchase rights (through which awards of restricted stock can be made), and restricted stock units. In addition to awards of stock options, restricted stock, and restricted stock units, the amended and restated Incentive Plan would permit the award of stock appreciation rights, performance units, performance shares, dividend equivalents, and other stock awards as determined by the administrator of the Incentive Plan.

· The Company recognizes that depleting the Incentive Plan’s share reserve by only the net shares issued pursuant to the grant of a stock-settled stock appreciation right potentially makes the Incentive Plan more costly to its stockholders. Accordingly, each share subject to a stock-settled stock appreciation right at the time of grant will count as a full share against the Incentive Plan share reserve, rather than only the net shares issued upon exercise of the stock appreciation right. Shares used to pay the tax and exercise price of an award will not become available for future grant or sale under the Incentive Plan.

7

· The amended and restated Incentive Plan provides that the per share exercise price of a nonstatutory stock option will be no less than 100% of the fair market value per share on the date of grant.

· The amended and restated Incentive Plan provides that the administrator generally may not modify or amend an option or stock appreciation right to reduce the exercise price of such option or stock appreciation right after it has been granted, nor may the administrator cancel any outstanding option or stock appreciation right and replace it with a new option or stock appreciation right with a lower exercise price, unless, in either case, such action is approved by the Company’s stockholders.

· Under the provisions of the amended and restated Incentive Plan, an outside director may choose to receive his or her annual retainer for service as an outside director in a combination of shares of Company common stock and cash or in a combination of restricted stock/restricted stock units and cash.

· The Incentive Plan has been amended to add limitations to the number of shares that are granted on an annual basis through individual awards. Additionally, specific performance criteria have been added to the Incentive Plan so that the administrator may establish performance objectives upon achievement of which certain awards will vest or be issued, which in turn will allow the Company to receive income tax deductions under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). If the performance goals are not met, no restricted stock unit awards will be made to the Section 162(m) participants.

The Board believes strongly that the approval of the Incentive Plan is essential to the Company’s continued success. In particular, the Company believes that its employees are its most valuable assets and that the awards permitted under the Incentive Plan are vital to the Company’s ability to attract and retain outstanding and highly skilled individuals in the extremely competitive labor markets in which it competes. Such awards also are crucial to the Company’s ability to motivate employees to achieve the Company’s goals. All compensation plans are market based.

Vote Required; Recommendation of the Board of Directors

The approval of the amended and restated Incentive Plan requires the affirmative vote of a majority of the shares present, in person or by proxy and entitled to vote at the Annual Meeting.

The Board of Directors unanimously recommends voting “FOR” the approval of the Amended and Restated 1993 Stock Plan and the number of shares reserved for issuance thereunder.

Summary of the Amended and Restated 1993 Stock Plan.

The following is a summary of the principal features of the Incentive Plan and its operation. The summary is qualified in its entirety by reference to Incentive Plan itself set forth in Appendix A.

The Incentive Plan provides for the grant of the following types of incentive awards: (i) stock options, (ii) restricted stock, (iii) restricted stock units, (iv) stock appreciation rights (v) performance shares and performance units, (vi) dividend equivalents and (vii) and other stock awards. Each of these is referred to individually as an “Award.” Those who will be eligible for Awards under the Incentive Plan include employees, directors and consultants who provide services to the Company and its affiliates. As of March 24, 2006, approximately 5,900 employees, directors and consultants would be eligible to participate in the Incentive Plan.

Number of Shares of Common Stock Available Under the Incentive Plan. The maximum aggregate number of shares that may be awarded and sold under the Incentive Plan is 5,457,813 shares plus any shares which have been reserved under the Director Plan, but that, as of the date of stockholder approval of the Incentive Plan, have not been issued pursuant to any awards granted thereunder and are not subject

8

to any outstanding awards granted thereunder. The shares may be authorized, but unissued, or reacquired common stock.

If the Company declares a stock dividend or engages in a reorganization or other change in its capital structure, including a merger, the Board will have the discretion to adjust (i) the number of shares available for issuance under the Incentive Plan, (ii) the number and price of shares subject to outstanding Awards, and (iii) the number of shares specified as per-person limits on Awards, as appropriate, to reflect the change.

Administration of the Incentive Plan. The Board, or a committee of directors or of other individuals satisfying applicable laws and appointed by the Board, will administer the Incentive Plan. To make grants to certain of the Company’s officers and key employees, the members of the committee must qualify as “non-employee directors” under Rule 16b-3 of the Securities Exchange Act of 1934, and as “outside directors” under Section 162(m) of the Code (so that the Company can receive a federal tax deduction for certain compensation paid under the Incentive Plan). Subject to the terms of the Incentive Plan, the Board or its committee has the sole discretion to select the employees, consultants, and directors who will receive Awards, determine the terms and conditions of Awards, and to interpret the provisions of the Incentive Plan and outstanding Awards. Notwithstanding the foregoing, the Board or committee may not modify or amend an option or stock appreciation right to reduce the exercise price of that Award after it has been granted or to cancel any outstanding option or stock appreciation right and replace it with a new option or stock appreciation right with a lower exercise price unless such action is approved by the Company’s stockholders. The Board or other committee administering the Incentive Plan is referred to below as the “Administrator.”

Options. The Administrator is able to grant nonstatutory stock options and incentive stock options under the Incentive Plan. The Administrator determines the number of shares subject to each option, although the Incentive Plan provides that a participant may not receive options for more than 750,000 shares in any fiscal year, except in connection with his or her initial service as an employee, in which case he or she may be granted an option to purchase up to an additional 1,000,000 shares.

The Administrator determines the exercise price of options granted under the Incentive Plan, provided the exercise price must be at least equal to the fair market value of the Company’s common stock on the date of grant. In addition, the exercise price of an incentive stock option granted to any participant who owns more than 10% of the total voting power of all classes of the Company’s outstanding stock must be at least 110% of the fair market value of the common stock on the grant date.

The term of an option may not exceed 10 years, except that, with respect to any participant who owns 10% of the voting power of all classes of the Company’s outstanding capital stock, the term of an incentive stock option may not exceed five years.

After a termination of service with the Company, a participant will be able to exercise the vested portion of his or her option for the period of time stated in the Award agreement. If no such period of time is stated in the participant’s Award agreement, the participant will generally be able to exercise his or her option for (i) three months following his or her termination for reasons other than death or disability, and (ii) twelve months following his or her termination due to death or disability. In the event of the participant’s retirement, the option will become fully vested and will be exercisable for twelve months following his or her termination due to retirement. In no event may an option be exercised later than the expiration of its term.

Restricted Stock. Awards of restricted stock are rights to acquire or purchase shares of Company common stock, which vest in accordance with the terms and conditions established by the Administrator in its sole discretion. For example, the Administrator may set restrictions based on the achievement of specific performance goals; provided, however, that shares of restricted stock generally will not vest more rapidly than one-third of the total number of shares of restricted stock subject to an award each year from

9

the date of grant, unless the Administrator determines that the Award is to vest upon the achievement of performance criteria and the period for measuring such performance will cover at least twelve months. Notwithstanding the foregoing, the Administrator, in its sole discretion, may provide at the time of or following the date of grant for accelerated vesting for an Award of restricted stock upon or in connection with a change in control or upon the or in connection with a participant’s termination of service, including, without limitation, due to death, disability or retirement.

The Award agreement will generally grant the Company a right to repurchase or reacquire the shares upon the termination of the participant’s service with the Company for any reason (including death or disability). The Administrator will determine the number of shares granted pursuant to an Award of restricted stock, but no participant will be granted a right to purchase or acquire more than 200,000 shares of restricted stock during any fiscal year, except that a participant may be granted up to an additional 300,000 shares of restricted stock in connection with his or her initial employment with the Company or its affiliates.

Restricted Stock Units. Awards of restricted stock units result in a payment to a participant only if the vesting criteria the Administrator establishes are satisfied. For example, the Administrator may set restrictions based on the achievement of specific performance goals. Upon satisfying the applicable vesting criteria, the participant will be entitled to the payout specified in the Award agreement; provided, however, that restricted stock units generally will not vest more rapidly than one-third of the total number of restricted stock units subject to an award each year from the date of grant, unless the Administrator determines that the Award is to vest upon the achievement of performance criteria and the period for measuring such performance will cover at least twelve months. Notwithstanding the foregoing, the Administrator, in its sole discretion, may provide at the time of or following the date of grant for accelerated vesting for an Award of restricted stock units upon or in connection with a change in control or upon the or in connection with a participant’s termination of service, including, without limitation, due to death, disability or retirement. The Administrator, in its sole discretion, may pay earned restricted stock units in cash, shares, or a combination thereof. Restricted stock units that are fully paid in cash will not reduce the number of shares available for grant under the Incentive Plan. On the date set forth in the Award agreement, all unearned restricted stock units will be forfeited to the Company.

The Administrator determines the number of restricted stock units granted to any participant, but during any fiscal year of the Company, no participant may be granted more than 200,000 restricted stock units during any fiscal year, except that the participant may be granted up to an additional 300,000 restricted stock units in connection with his or her initial employment to the Company or its affiliates.

Stock Appreciation Rights. The Administrator will be able to grant stock appreciation rights, which are the rights to receive the appreciation in fair market value of common stock between the exercise date and the date of grant. The Company can pay the appreciation in either cash or shares of common stock. Stock appreciation rights will become exercisable at the times and on the terms established by the Administrator, subject to the terms of the Incentive Plan. The Administrator, subject to the terms of the Incentive Plan, will have complete discretion to determine the terms and conditions of stock appreciation rights granted under the Incentive Plan, provided, however, that the exercise price will not be less than 100% of the fair market value of a share on the date of grant. The term of a stock appreciation right may not exceed ten years. No participant will be granted stock appreciation rights covering more than 750,000 shares during any fiscal year, except that a participant may be granted stock appreciation rights covering up to an additional 1,000,000 shares in connection with his or her initial service as an employee with the Company or its affiliates.

After termination of service with the Company, a participant will be able to exercise the vested portion of his or her stock appreciation right for the period of time stated in the Award agreement. If no such period of time is stated in a participant’s Award agreement, a participant will generally be able to exercise his or her stock appreciation right for (i) three months following his or her termination for reasons

10

other than cause, death, or disability, and (ii) twelve months following his or her termination due to death or disability. In the event of the participant’s retirement, the stock appreciation right will become fully vested and will be exercisable for twelve months following his or her termination due to retirement. In no event will a stock appreciation right be exercised later than the expiration of its term.

Performance Units and Performance Shares. The Administrator will be able to grant performance units and performance shares, which are Awards that will result in a payment to a participant only if the performance goals or other vesting criteria the Administrator may establish are achieved or the Awards otherwise vest. The Administrator will establish performance or other vesting criteria in its discretion, which, depending on the extent to which they are met, will determine the number and/or the value of performance units and performance shares to be paid out to participants; provided, however, that performance units or shares generally will not vest more rapidly than one-third of the total number of performance units or shares subject to an award each year from the date of grant, unless the Administrator determines that the Award is to vest upon the achievement of performance criteria and the period for measuring such performance will cover at least twelve months. Notwithstanding the foregoing, after the grant of performance units or shares, the Administrator, in its sole discretion, may reduce or waive any performance objectives or other vesting provisions for such performance units or shares.

During any fiscal year, no participant will receive more than 200,000 performance units or shares, except that a participant may be granted performance units or shares covering up to an additional 300,000 performance units or shares in connection with his or her initial employment with the Company. Performance units and performance shares will have an initial value equal to the fair market value of a share of the Company’s common stock on the date of grant.

Dividend Equivalents. The Administrator may, in its discretion, include in any award agreement a dividend equivalent right entitling the participant, once the Award becomes vested, to receive amounts equal to the dividends that would be paid, during the time any such Award is outstanding, on the shares of our common stock covered by such Award as if such shares were then outstanding. The participant of a dividend equivalent right will have only the rights of a general unsecured creditor until payment of such amount is made as specified in the applicable Award agreement.

Performance Goals. The granting or vesting of Awards of restricted stock, restricted stock units, performance shares, performance units and other incentives under the Incentive Plan may be made subject to the attainment of performance goals relating to one or more business criteria within the meaning of Section 162(m) of the Code and may provide for a targeted level or levels of achievement including: cash position; earnings before interest and taxes; earnings before interest, taxes, depreciation and amortization; earnings per share; net income; operating cash flow; operating income; return on assets; return on equity; return on net assets; return on sales; revenue and total shareholder return. The performance goals may differ from participant to participant and from Award to Award and may be used to measure the performance of the Company as a whole or a business unit of the Company and may be measured relative to a peer group or index.

Transferability of Awards. Awards granted under the Incentive Plan are generally not transferable, and all rights with respect to an Award granted to a participant generally will be available during a participant’s lifetime only to the participant.

Election to Receive Annual Retainer in Restricted Stock/Restricted Stock Units. Each director who is not an employee of the Company (an “Outside Director”) will be entitled to select one of the following alternative means of payment for the value of the amount he or she receives for serving as an Outside Director during a fiscal year (the “Annual Retainer”): (i) an amount between 10 - 50% of the value of his or her Annual Retainer in the form of the Company’s common stock and the balance in cash, or (ii) an amount between 10 - 50% of the value of his or her Annual Retainer in the form of the restricted stock/restricted stock units and the balance in a cash payment.

11

Change of Control. In the event of a change of control of the Company, each outstanding Award will be assumed or an equivalent option or right substituted by the successor corporation or a parent or subsidiary of the successor corporation. In the event that the successor corporation, or the parent or subsidiary of the successor corporation, refuses to assume or substitute for the Award, the participant will fully vest in and have the right to exercise all of his or her outstanding options or stock appreciation rights, including shares as to which such Awards would not otherwise be vested or exercisable, all restrictions on restricted stock will lapse, and, with respect to restricted stock units, performance shares and performance units, all performance goals or other vesting criteria will be deemed achieved at maximum performance levels and all other terms and conditions met. In addition, if an option or stock appreciation right becomes fully vested and exercisable in lieu of assumption or substitution in the event of a change of control, the Administrator will notify the participant in writing or electronically that the option or stock appreciation right will be fully vested and exercisable for a period of time determined by the Administrator in its sole discretion, and the option or stock appreciation right will terminate upon the expiration of such period.

Amendment and Termination of the Incentive Plan. The Administrator will have the authority to amend, alter, suspend or terminate the Incentive Plan, except that stockholder approval will be required for any amendment to the Incentive Plan to the extent required by any applicable laws. No amendment, alteration, suspension or termination of the Incentive Plan will impair the rights of any participant, unless mutually agreed otherwise between the participant and the Administrator and which agreement must be in writing and signed by the participant and the Company. The Incentive Plan will terminate in March 2012, unless the Board terminates it earlier.

Awards Granted to Employees, Consultants, and Directors

On March 20, 2006, the Compensation Committee of the Board of Directors granted the awards shown in the following table. The restricted stock units granted to Messrs. Toolson and Nepute and all of the performance share awards are subject to stockholder approval of the amended and restated Incentive Plan.

Name of Individual or Group | | Number of

Restricted Stock

Units Granted(1) | | Value of

Restricted

Stock Units | | Number

of Performance

Shares Granted(2) | | Value of

Performance

Shares | |

Kay L. Toolson | | | 52,124 | | | $ | 675,006 | | | 104,248 | | | $ | 1,350,012 | |

John W. Nepute | | | 20,571 | | | 266,394 | | | 41,142 | | | 532,789 | |

P. Martin Daley | | | 11,961 | | | 154,895 | | | 23,922 | | | 309,790 | |

Richard E. Bond | | | 6,714 | | | 86,946 | | | 13,428 | | | 173,893 | |

Michael P. Snell | | | 6,594 | | | 85,392 | | | 13,188 | | | 170,785 | |

All executive officers, as a group | | | 138,683 | | | 1,795,945 | | | 275,366 | | | 3,565,990 | |

All directors who are not executive officers, as a group(3) | | | 0 | | | 0 | | | 0 | | | 0 | |

All employees who are not executive officers, as a group | | | 90,476 | | | 1,171,664 | | | 54,452 | | | 705,153 | |

| | | | | | | | | | | | | | | |

(1) Awards of restricted stock units generally vest subject to a participant’s continued employment with us or one of our affiliates. Awards of restricted stock units granted to our Chief Executive Officer and President, however, will vest only if we achieve certain performance objectives based on return on equity.

(2) Performance shares will be earned based on achieving target levels of total shareholder return and return on net assets. The performance share awards granted in 2006 are in excess of what the Company believes would normally be awarded in a single year. Although the normal performance cycle for these awards will be three years, the transition to the new program was initiated by

12

establishing two concurrent performance cycles, a two-year cycle for 2006 and 2007 and a three-year cycle for 2006 through 2008. The intent of the concurrent cycles is to increase the employee retention effect of the awards by starting with a shorter performance horizon for the initial award. Based on market data, the Compensation Committee determined that long-term incentives for the Company’s management had historically been below market.

(3) The Company anticipates that awards will be made to outside directors later this year, subject to stockholder approval of the Incentive Plan. The terms and nature of any such awards have not been determined.

Federal Tax Aspects

The following paragraphs are a summary of the general federal income tax consequences to U.S. taxpayers and the Company of Awards granted under the Incentive Plan. Tax consequences for any particular individual may be different.

Nonstatutory Stock Options. No taxable income is reportable when a nonstatutory stock option with an exercise price equal to the fair market value of the underlying stock on the date of grant is granted to a participant. Upon exercise, the participant will recognize ordinary income in an amount equal to the excess of the fair market value (on the exercise date) of the shares purchased over the exercise price of the option. Any taxable income recognized in connection with an option exercise by an employee of the Company is subject to tax withholding by the Company. Any additional gain or loss recognized upon any later disposition of the shares would be capital gain or loss.

Incentive Stock Options. No taxable income is reportable when an incentive stock option is granted or exercised (except for purposes of the alternative minimum tax, in which case taxation is the same as for nonstatutory stock options). If the participant exercises the option and then later sells or otherwise disposes of the shares more than two years after the grant date and more than one year after the exercise date, the difference between the sale price and the exercise price will be taxed as capital gain or loss. If the participant exercises the option and then later sells or otherwise disposes of the shares before the end of the two- or one-year holding periods described above, he or she generally will have ordinary income at the time of the sale equal to the fair market value of the shares on the exercise date (or the sale price, if less) minus the exercise price of the option.

Stock Appreciation Rights. No taxable income is reportable when a stock appreciation right with an exercise price equal to the fair market value of the underlying stock on the date of grant is granted to a participant. Upon exercise, the participant will recognize ordinary income in an amount equal to the amount of cash received and the fair market value of any shares received. Any additional gain or loss recognized upon any later disposition of the shares would be capital gain or loss.

Restricted Stock, Restricted Stock Units, Performance Units and Performance Shares. A participant generally will not have taxable income at the time an Award of restricted stock, restricted stock units, performance shares or performance units are granted. Instead, he or she will recognize ordinary income in the first taxable year in which his or her interest in the shares underlying the Award becomes either (i) freely transferable, or (ii) no longer subject to substantial risk of forfeiture. However, the recipient of a restricted stock Award may elect to recognize income at the time he or she receives the Award in an amount equal to the fair market value of the shares underlying the Award (less any cash paid for the shares) on the date the Award is granted.

Dividend Equivalent Awards. A participant generally will recognize ordinary compensation income each time a dividend is paid pursuant to the dividend equivalent rights Award equal to the fair market value of the dividend received. If the dividends are deferred, additional requirements must be met to ensure that the dividend is taxable upon actual delivery of the shares, instead of the grant of the dividend.

13

Tax Effect for the Company. The Company generally will be entitled to a tax deduction in connection with an Award under the Incentive Plan in an amount equal to the ordinary income realized by a participant and at the time the participant recognizes such income (for example, the exercise of a nonstatutory stock option). Special rules limit the deductibility of compensation paid to the Company’s Chief Executive Officer and to each of its four most highly compensated executive officers. Under Section 162(m) of the Code, the annual compensation paid to any of these specified executives will be deductible only to the extent that it does not exceed $1,000,000. However, the Company can preserve the deductibility of certain compensation in excess of $1,000,000 if the conditions of Section 162(m) are met. These conditions include stockholder approval of the Incentive Plan, setting limits on the number of Awards that any individual may receive and for Awards other than certain stock options, establishing performance criteria that must be met before the Award actually will vest or be paid. The Incentive Plan has been designed to permit the Administrator to grant Awards that qualify as performance-based for purposes of satisfying the conditions of Section 162(m), thereby permitting the Company to continue to receive a federal income tax deduction in connection with such Awards.

Section 409A. Section 409A of the Code, which was added by the American Jobs Creation Act of 2004, provides certain new requirements on non-qualified deferred compensation arrangements. These include new requirements with respect to an individual’s election to defer compensation and the individual’s selection of the timing and form of distribution of the deferred compensation. Section 409A also generally provides that distributions must be made on or following the occurrence of certain events (e.g., the individual’s separation from service, a predetermined date, or the individual’s death). Section 409A imposes restrictions on an individual’s ability to change his or her distribution timing or form after the compensation has been deferred. For certain individuals who are officers, Section 409A requires that such individual’s distribution commence no earlier than six months after such officer’s separation from service.

Awards granted under the Incentive Plan with a deferral feature will be subject to the requirements of Section 409A. If an Award is subject to and fails to satisfy the requirements of Section 409A, the recipient of that award may recognize ordinary income on the amounts deferred under the Award, to the extent vested, which may be prior to when the compensation is actually or constructively received. Also, if an Award that is subject to Section 409A fails to comply with Section 409A’s provisions, Section 409A imposes an additional 20% federal income tax on compensation recognized as ordinary income, as well as interest on such deferred compensation. The Internal Revenue Service has not issued final regulations under Section 409A and, accordingly, the requirements of Section 409A (and the application of those requirements to Awards issued under the Incentive Plan) are not entirely clear.

THE FOREGOING IS ONLY A SUMMARY OF THE EFFECT OF FEDERAL INCOME TAXATION UPON PARTICIPANTS AND THE COMPANY WITH RESPECT TO THE GRANT AND EXERCISE OF AWARDS UNDER THE INCENTIVE PLAN. IT DOES NOT PURPORT TO BE COMPLETE, AND DOES NOT DISCUSS THE TAX CONSEQUENCES OF A PARTICIPANT’S DEATH OR THE PROVISIONS OF THE INCOME TAX LAWS OF ANY MUNICIPALITY, STATE OR FOREIGN COUNTRY IN WHICH THE PARTICIPANT MAY RESIDE.

14

CORPORATE GOVERNANCE

Board of Directors and Committee Meetings

Our Board of Directors held seven meetings during 2005. Each of our directors attended 80% or more of the meetings of the Board and the committees on which he served in 2005. Our directors are expected, absent exceptional circumstances, to attend all Board meetings and meetings of committees on which they serve, and are also expected to attend our Annual Meeting of Stockholders. All directors attended the 2005 Annual Meeting of Stockholders.

Our Board of Directors has summarized its corporate governance practices in the Corporate Governance Guidelines for Monaco Coach Corporation, a copy of which is available on our Investor Relations website at http://www.monaco-online.com/ir. The Board currently has three committees: an Audit Committee, a Compensation Committee and a Governance Committee. Each committee has a written charter approved by the Board of Directors outlining the principal responsibilities of the committee. These charters are also available on our Investor Relations website.

Audit Committee

The purpose of our Audit Committee is to oversee our accounting and financial reporting processes and audits of our financial statements and internal control over financial reporting. Our Audit Committee also assists the Board in the oversight and monitoring of (i) the integrity of our financial statements, (ii) our compliance with legal and regulatory requirements, (iii) the independent auditor’s qualifications and independence, and (iv) the performance of our internal audit function and our independent auditors. In addition, the Audit Committee’s duties and responsibilities include reviewing and pre-approving any audit and non-audit services, reviewing, approving and monitoring our Code of Ethics for Executive Officers and establishing procedures for receiving, retaining and treating complaints regarding accounting, internal accounting controls or auditing matters. The report of the Audit Committee for fiscal 2005 is included in this proxy statement.

The Audit Committee of the Board of Directors currently consists of Directors Cogan, Oklak and Vandenberg, and held nine meetings during 2005. None of the Audit Committee members is an employee of Monaco Coach Corporation and all of them are independent within the meaning of the rules of the SEC and the listing standards of the NYSE. Mr. Oklak serves as the Chair of the Audit Committee. The Board has designated Mr. Oklak as an “audit committee financial expert” within the meaning of the rules of the SEC, and the Board has determined that he has accounting and related financial management expertise within the meaning of the listing standards of the NYSE.

Compensation Committee

The purpose of our Compensation Committee is to determine salaries, incentives and other forms of compensation for executive officers and other employees, to administer our various incentive compensation and benefit plans, and to provide oversight and guidance to management regarding general compensation goals and guidelines. The report of the Compensation Committee for fiscal 2005 is included in this proxy statement. The Compensation Committee of the Board of Directors currently consists of Directors Hanafee, Lytle, Rouse and Ustian, and held seven meetings during the last fiscal year. Mr. Ustian has served as the Chair of the Compensation Committee since February 2005. Each member of the Compensation Committee is independent within the meaning of the listing standards of the NYSE.

Governance Committee

The purpose of our Governance Committee is to identify, evaluate and recommend nominees for the Board of Directors, evaluate the composition, organization and governance of the Board of Directors and

15

its committees and develop and recommend to the Board appropriate corporate governance principles and policies. The Governance Committee also supervises the Board’s annual review of director independence and the performance self-assessments of the Board and each of the committees. The Governance Committee currently consists of Directors Lytle, Hanafee, Rouse and Ustian, and held three meetings during the last fiscal year. Mr. Lytle serves as the Chair of the Governance Committee. Each member of the Governance Committee is independent within the meaning of the listing standards of the NYSE.

Stockholder Communications to Directors

Stockholders may communicate directly with our non-management directors by sending a letter addressed to:

Corporate Secretary

Monaco Coach Corporation

606 Nelson’s Parkway

Wakarusa, Indiana 46573

Richard Bond, our Senior Vice President, Corporate Secretary and Chief Administrative Officer will ensure that a summary of all communications received is provided to the Board of Directors at its regularly scheduled meetings. Where the nature of a communication warrants, Mr. Bond may decide to obtain the more immediate attention of the appropriate committee of the Board of Directors or a non-management director, management or independent advisors, as Mr. Bond considers appropriate. Mr. Bond may decide, in the exercise of his judgment, whether a response to any stockholder communication is necessary.

Policy for Director Recommendations and Nominations

The Governance Committee considers candidates for Board membership suggested by Board members, management and our stockholders. The policy of the Governance Committee is to consider recommendations for candidates to the Board of Directors from any stockholder holding, as of the date the recommendation is submitted, not less than one percent (1%) of the then outstanding shares of our common stock continuously for at least twelve (12) months prior to such date. The Governance Committee will consider a director candidate recommended by our stockholders in the same manner as a nominee recommended by a Board member, management or other sources.

In addition, a stockholder may nominate a person directly for election to the Board of Directors at an annual meeting of stockholders provided the stockholder meets the requirements set forth in our Bylaws.

Where the Governance Committee has either identified a prospective nominee or determines that an additional or replacement director is required, the Governance Committee may take such measures as it considers appropriate in connection with its evaluation of a director candidate, including candidate interviews, inquiry of the person or persons making the recommendation or nomination, engagement of an outside search firm to gather additional information, or reliance on the knowledge of the members of the Governance Committee, the Board or management. In its evaluation of director candidates, including the members of the Board of Directors eligible for re-election, the Governance Committee considers a number of factors, including:

· The current size and composition of the Board of Directors and the needs of the Board of Directors and the respective committees of the Board and

· Such factors as judgment, independence, character and integrity, age, area of expertise, diversity of experience, length of service, and potential conflicts of interest.

16

The Governance Committee has also specified the following minimum qualifications that it believes must be met by a nominee for a position on the Board:

· The highest personal and professional ethics and integrity;

· Proven achievement and competence in the nominee’s field and the ability to exercise sound business judgment;

· Skills that are complementary to those of the existing Board;

· The ability to assist and support management and make significant contributions to the Company’s success;

· An understanding of the fiduciary responsibilities that is required of a member of the Board and the commitment of time and energy necessary to diligently carry out those responsibilities; and

· A willingness of the prospective nominee to meet the minimum equity interest holding guideline set out in our Corporate Governance Guidelines.

After completing its evaluation, the Governance Committee makes a recommendation to the full Board as to the persons who should be nominated to the Board, and the Board determines the nominees after considering the recommendation and report of the Governance Committee.

Director Independence

In November 2003, the Board adopted Standards of Independence for the Board of Directors. These guidelines for determining director independence are intended to be consistent with the NYSE’s director independence standards and are available on our Investor Relations website at http://www.monaco-online.com/ir. Consistent with the standards that were adopted, the Board has reviewed the independence of our directors and considered whether any director had any relationship with Monaco Coach Corporation or management that would compromise his ability to exercise independent judgment in carrying out his responsibilities.

In addition to considering the NYSE’s director independence standards, the Board identified and evaluated a commercial affiliation relevant to the independence of the directors. Mr. Ustian is the Chairman of the Board, President and Chief Executive Officer of Navistar International Corporation, whose indirect operating subsidiary, Workhorse Custom Chassis Corporation, sells gasoline-powered chassis for motor homes to the Company. After analyzing the amount of the Company’s purchases from Navistar and otherwise considering the relationship, the Board determined that this affiliation did not violate any NYSE director independence standard and was not material to Mr. Ustian’s ability to exercise independent judgment in carrying out his abilities.

As a result, the Board has affirmatively determined that directors L. Ben Lytle, Richard A. Rouse, Daniel C. Ustian, Robert P. Hanafee, Jr., Dennis D. Oklak, Roger A. Vandenberg, and John F. Cogan, are independent within the meaning of the NYSE director independence standards.

Lead Director

In October 2002, the Board created the position of Lead Director (formerly Presiding Director). The primary responsibility of the Lead Director is to preside over executive sessions of the Board in which management and management directors do not participate, to work with the Chairman of the Board and the committee chairs in establishing the agendas for board and committee meetings and to perform such other duties as the Board may from time to time delegate to him in order to help it fulfill its responsibilities. Robert P. Hanafee, Jr. serves as our Lead Director.

17

Code of Business Conduct and Code of Ethics for Officers

Our Board has adopted a Code of Business Conduct that is applicable to all of our employees, officers and directors. Our Code of Business Conduct is intended to ensure our employees act in accordance with high ethical standards based on respect for the dignity of each individual and a commitment to honesty and fairness. In addition, we have in place a Code of Ethics for Executive Officers that applies to our Chief Executive Officer, our Chief Financial Officer and certain other officers and this code is intended to deter wrongdoing and promote ethical conduct among our executives and to ensure all of our public disclosure is full, fair and accurate. Both the Code of Business Conduct and the Code of Ethics for Executive Officers are available on our Investor Relations website at http://www.monaco-online.com/ir. If necessary, we intend to post amendments to, or waivers from, these Codes for our executive officers and directors on our website.

Director Compensation

Each of our directors who are not employees received a total of $50,000 in compensation in fiscal 2005 (except for director Cogan who has only been on the Board since May of 2005 and who received a total of approximately $31,000 in fiscal 2005), and will receive a total of $50,000 in fiscal 2006, for service on the Board of Directors and any committee thereof. The directors are also reimbursed for certain expenses in connection with attendance at board and committee meetings. In addition, non-employee directors are able to elect to receive a portion of their annual cash retainer in either common stock or an option to purchase common stock. For fiscal year 2005, directors Hanafee, Lytle, Oklak and Ustian received 1,644 shares each of Common Stock in lieu of a portion of their cash retainer.

Each non-employee director is also currently entitled to participate in our Director Stock Plan. Under the terms of that plan, each eligible non-employee director is automatically granted an option to purchase 8,000 shares of Common Stock on the date on which the optionee first becomes a director of the Company. Thereafter each optionee is automatically granted an additional option to purchase 4,000 shares of Common Stock on September 30 of each year if, on such date, the optionee has served as a director of the Company for at least six months. Each initial option grant vests over five years at the rate of 20% per year. Each subsequent option grant vests in full on the fifth anniversary of its date of grant. The exercise price of each option is the fair market value of the Common Stock as determined by the closing price reported by the New York Stock Exchange on the date of grant.

As discussed under Proposal Two, if the amended and restated Incentive Plan is approved by the stockholders, no further options will be granted under the Director Plan and that plan will be terminated. Outside directors would then be eligible to receive awards under the Incentive Plan, although the nature and amount of those awards has not been determined.

Director Rouse provides occasional consulting services to the Company without charge. Mr. Rouse is included in our standard health care plans and received health care benefits totaling $7,959 in 2005.

18

REPORT OF THE AUDIT COMMITTEE

The information contained in the following report shall not be deemed to be “soliciting material” or to be filed with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates it by reference into such filing.

The following is the Audit Committee’s report submitted to the Board of Directors for the fiscal year ended December 31, 2005.

The Audit Committee of the Board of Directors has:

· Reviewed and discussed the Company’s audited financial statements for the fiscal year ended December 31, 2005 with the Company’s management;

· Reviewed and discussed with the Company’s management the process designed to achieve compliance with Section 404 of the Sarbanes-Oxley Act of 2002;

· Discussed with PricewaterhouseCoopers LLP, the Company’s independent registered public accounting firm for 2005, the materials required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees);

· Reviewed the written disclosures and the letter from PricewaterhouseCoopers LLP required by Independence Standards Board No. 1 (Independence Discussions with Audit Committees) and has discussed with PricewaterhouseCoopers LLP its independence; and

· Considered whether the provision of non-audit services is compatible with maintaining the independence of PricewaterhouseCoopers LLP and has determined that such provision of non-audit services is compatible.

Based on the foregoing review and discussion, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005.

| AUDIT COMMITTEE |

| Dennis D. Oklak, Chair |

| Roger A. Vandenberg |

| John F. Cogan |

19

Fees to PricewaterhouseCoopers, LLP for Fiscal Years 2005 and 2004

The following table presents fees for professional services rendered by PricewaterhouseCoopers, LLP for the audit of our annual financial statements for fiscal years 2005 and 2004 and fees billed for audit-related services, tax services and all other services rendered by PricewaterhouseCoopers, LLP for these periods:

| | 2005 | | 2004 | |

Audit-fees(1) | | $ | 737,567 | | $ | 817,000 | |

Audit-related fees(2) | | 25,351 | | 42,257 | |

Tax fees(3) | | 0 | | 0 | |

All other fees(4) | | 19,332 | | 12,543 | |

Total Fees | | $ | 782,250 | | $ | 871,800 | |

(1) Audit fees—These are fees for professional services performed by PricewaterhouseCoopers, LLP in auditing our annual financial statements, reviewing our quarterly financial statements and auditing management’s assessment of the effectiveness of our internal control over financial reporting. These fees also include services that are normally provided in connection with statutory and regulatory filings or engagements.

(2) Audit-related fees—These are fees for the assurance and related services performed by PricewaterhouseCoopers, LLP that are reasonably related to the performance of the audit or review of the Company’s financial statements. For 2004 and 2005, this consisted primarily of employee benefit plan audits.

(3) Tax fees—We have engaged Ernst & Young LLP to perform these services for us.

(4) All other fees—These are fees for permissible services performed by PricewaterhouseCoopers, LLP that do not fall within the above categories. For 2005 and 2004, these services consisted of consultation regarding compliance with responding to an SEC comment letter, research under SFAS 123R and North American Free Trade Agreement.

All services provided by PricewaterhouseCoopers, LLP were pre-approved by the Audit Committee, which concluded that the provision of such services by PricewaterhouseCoopers, LLP was compatible with the maintenance of that firm’s independence in the conduct of its auditing functions. The Audit Committee’s current practice is to consider and approve in advance all proposed audit and non-audit services to be provided by our independent auditors.

20

REPORT OF THE COMPENSATION COMMITTEE

The information contained in the following report shall not be deemed to be “soliciting material” or to be filed with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates it by reference into such filing.

Compensation Committee Charter

Our Board of Directors established the Compensation Committee in 1993. It is comprised solely of independent directors. The Compensation Committee is responsible to the Board of Directors for reviewing and, unless otherwise determined by a majority of the independent directors, approving the compensation program elements, salary levels, incentive compensation and benefit plans for the Chief Executive Officer and for the other executive officers of the Company.

Compensation Philosophy

The Committee’s guiding compensation philosophy is to establish fair and equitable executive compensation practices that attract, motivate and retain key talent. The key objectives of the compensation program are to:

· Align the executive team and stockholders by providing rewards for superior performance and direct consequences for sub-par business results;

· Deliver a significant portion of the overall reward program through equity-based compensation, as the Committee believes this promotes long-term strategic focus and goal accomplishment;

· Tie both short-term and long-term rewards to pre-established financial measures of the business that are linked with individual performance objectives; and

· Provide a total compensation package that, in terms of overall rewards, is market based, competitive with the Company’s peers and promotes the retention of critical talent.

Executive Compensation for 2005

Our compensation program has consisted of two principal components: cash-based compensation, both fixed (base salaries) and variable (annual cash bonus incentives), and equity-based compensation. Historically, executive officers have received a relatively modest portion of their overall compensation in the form of base pay with the potential to earn large cash bonuses. In late 2004, we undertook a study to review the competitiveness of Monaco’s executive pay program and determine how pay practices relate to stockholder value creation. To assist us in completing the study, we engaged the services of a large, internationally recognized executive compensation consulting firm. We requested that the consultant review the current executive pay structure, provide benchmark data, review market best practices, provide recommendations and ultimately assist us with any changes that might be made.

In the initial study, the consultant determined the following:

· Monaco’s executive base salaries were generally positioned well below market competitive levels for similar positions;

· Total pay for executives was highly leveraged—that is, base pay was below market but was offset by the potential for significant annual cash bonus compensation;

· Long-term incentives were significantly below competitive market levels and were delivered through stock option grants with time-based vesting only; and

21

· Monaco’s business as well as the broader industry had evolved significantly over the last several years, warranting a review of our historical pay practices.

Base Salaries and Cash Bonus Incentive Compensation

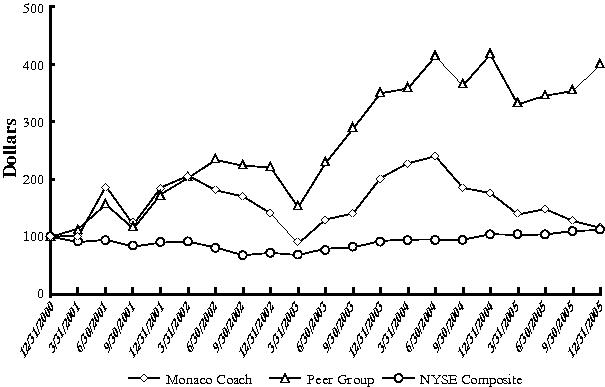

Based on the analysis and on current best practices, the consultant recommended a number of changes to the components of the overall compensation plan—base pay, annual cash bonus pay and long-term awards. After careful consideration and lengthy review, the Compensation Committee and the full Board of Directors adopted the overall compensation plan for executives of the Company. Monaco reported these changes in a Current Report on Form 8-K filed with the Securities and Exchange Commission on April 1, 2005.