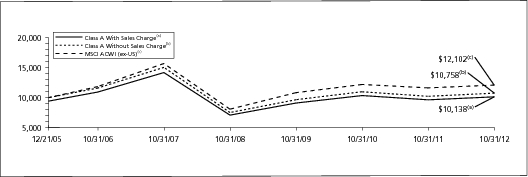

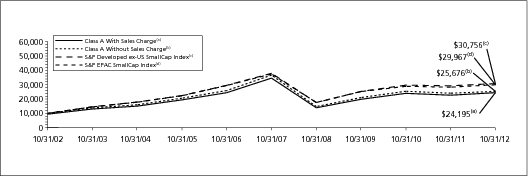

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING International Value Choice Fund against the index indicated. The index is unmanaged and has no cash in its portfolio, imposes no sales charge and incurs no operating expenses. An investor cannot invest directly in the index. The Fund’s performance is shown both with and without the imposition of sales charges.

The graph and performance table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

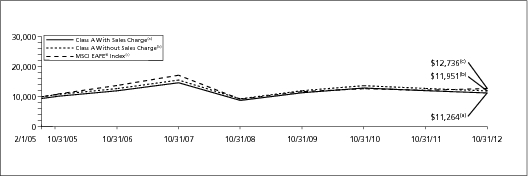

It is important to note that the Fund has a limited operating history. Performance over a longer period of time may be more meaningful than short-term performance.

ING INTERNATIONAL VALUE FUND | PORTFOLIO MANAGERS’ REPORT

|

| | Geographic Diversification

as of October 31, 2012

(as a percentage of net assets) |

| | | Japan | | | | | 22.3 | % |

| | | United Kingdom | | | | | 20.3 | % |

| | | France | | | | | 10.2 | % |

| | | Netherlands | | | | | 7.6 | % |

| | | Germany | | | | | 6.1 | % |

| | | Switzerland | | | | | 5.3 | % |

| | | Italy | | | | | 4.7 | % |

| | | United States | | | | | 2.5 | % |

| | | Canada | | | | | 2.2 | % |

| | | Hong Kong | | | | | 2.0 | % |

| | | Countries between 0.0%–1.6%ˆ | | | | | 15.2 | % |

| | | Assets in Excess of Other Liabilities* | | | | | 1.6 | % |

| | | Net Assets | | | | | 100.0 | % |

| | | |

| | * | Includes short-term investments. |

| | ˆ | Includes 17 countries, which each represents 0.0%–1.6% of net assets. |

| | | |

| | Portfolio holdings are subject to change daily. |

ING International Value Fund (“International Value” or the “Fund”) seeks long-term capital appreciation. The Fund’s assets are managed by three sub-advisers — Brandes Investment Partners, L.P. (“Brandes”), ING Investment Management Co. LLC (“ING IM”) and del Rey Global Investors, LLC (“del Rey”) (each a “Sub-Adviser and collectively, the “Sub-Advisers”). Each manages a portion (“Sleeve”) of the Fund’s assets that is allocated to the Sub-Adviser. The following people are responsible for the day-to-day operations of the Fund: Glenn R. Carlson, CFA, Chief Executive Officer, Brent V. Woods, CFA, Managing Director — Investments, Amelia Maccoun Morris, CFA, Director — Investments, W. James Brown, CFA, Director — Investments, Brent Fredberg, Director — Investments and Jeffrey Germain, CFA, Senior Analyst, comprise the voting members of Brandes’ Large Cap Investment Committee; Martin Jansen, David Rabinowitz and Joseph Vultaggio are the Portfolio Managers for the portion of the Fund that is managed by ING IM; and Paul J. Hechmer is the Portfolio Manager for the portion of the Fund that is managed by del Rey.

Performance: For the year ended October 31, 2012, the Fund’s Class A shares, excluding sales charges, provided a total return of 1.20% compared to the MSCI Europe, Australasia and Far East® Index (“MSCI EAFE® Index”), which returned 4.61% for the same period.

Portfolio Specifics: Brandes Sleeve — The Sleeve underperformed its benchmark by approximately 404 basis points for the fiscal year. An allocation to companies in Brazil, a country not in the benchmark, hurt relative performance as all but one of the holdings, including electric power company Electrobras, energy corporation Petrobras and telecommunications companies TIM Participacoes and Telefonica Brasil, delivered negative absolute returns. Declines in holdings in Japan — seven of the ten worst performers on a relative basis during the period were in Japan — also contributed to the underperformance. Bolstering relative returns were holdings in the United Kingdom and the Netherlands, most notably insurer Aegon.

A significant overweight to and holdings in the telecommunication services sector, as well as holdings in the information technology and financials sectors weighed heavily on relative returns. Within telecommunications, diversified telecommunications companies in Europe, including France Telecom, the Sleeve’s worst performer on a relative basis, Telecom Italia and Spain’s Telefonica all detracted from performance. In information technology, Japanese consumer electronics company FUJIFILM and semiconductor manufacturer ROHM Co. were the weakest performers. Some of the losses were mitigated by holdings in the materials and consumer discretionary sectors, including Mexican building materials producer CEMEX, the Sleeve’s best performer on an absolute basis, British media company ITV PLC and multiline retailer Marks & Spencer Group.

ING IM Sleeve — The Sleeve underperformed its benchmark by approximately 24 basis points on a net of fee basis, but outperformed prior to the deduction of fees and expenses due to strong security selection, which was primarily centered among industrials, energy and information technology. Some of these gains were offset by detractions from security selection in consumer staples and an overweight to information technology. Strong selection was most evident in Europe, particularly France and the Netherlands. By contrast, weak selection in Australia detracted from results. Among the top individual contributors to performance were Koninklijke Philips Electronics N.V., Hannover Rueckversicherung AG and Prudential PLC. Koninklijke Philips Electronics N.V., a provider of healthcare, consumer lifestyle and lighting products, rose in the wake of better than expected earnings. Hannover Rueckversicherung AG, a reinsurance company, strengthened on increased reinsurance revenue and lower claims. Prudential PLC, a composite insurance company, experienced improved profitability from its Asian operations.

Among the largest individual detractors from performance were Iluka Resources Ltd., Tokyo Electron Ltd., and NTT DoCoMo Inc. Iluka Resources Ltd., a miner of mineral sands, was hurt by a sharper than expected slowdown in Chinese housing construction. Tokyo Electron Ltd., a manufacturer of semiconductor production equipment, saw its prospects diminish due to pressure in the semiconductor space, as well the headwind from a stronger currency. NTT DoCoMo Inc., a Japanese provider of mobile communications, suffered from declining profitability in its home market.

del Rey Sleeve — The Sleeve underperformed its benchmark by approximately 896 basis points during the period. This was caused by a weak first half performance, which was offset somewhat by a stronger second half.

For the Sleeve’s fiscal year, information technology and materials weighed, as Nokia, the beleaguered Finnish handset manufacturer, and gold mining stocks hurt performance. Being underweight one of the top performing sectors, financials, also detracted. This was counteracted to some degree by strong performances in utilities, telecommunications, and energy. In particular, Nexen surged after the Chinese state-owned oil company CNOOC Ltd. announced a takeover offer for the company. Consumer discretionary stocks also contributed, with Home Retail, the British retailer, and Magna International, the Canadian auto parts manufacturer, performing particularly well.

Regionally, Japan hurt this year’s performance, as holdings in the region were hit by the lingering effects of the Japanese earthquake and ensuing tsunami, the strong yen, and the most recent territorial dispute with China. Offsetting this somewhat were strong performances from our Chinese positions, namely Huaneng Power, the Chinese utility, and China Mobile.

18

PORTFOLIO MANAGERS’ REPORT | ING INTERNATIONAL VALUE FUND

|

Current Strategy and Outlook: Brandes Sleeve — The Sleeve continues to have a meaningful overweight to companies domiciled in Japan, the Netherlands, and the telecommunications services sector, while maintaining a meaningful underweight to Germany, Australia, and the industrials sector.

While the uncertainty that engulfed investors around the globe last year seems to be gradually subsiding, the current environment still makes many investors wary of investing in equities. This has caused many companies trading at low multiples of book value, earnings and cash flows to become even cheaper. Europe is a perfect example as the gap between the price-to-book ratio of the cheapest 20% of companies and the price-to-book ratio of the average company in developed continental Europe remains wide. The same is true in Japan. Historically, wide spreads of this nature have resulted in strong subsequent returns for value stocks relative to growth stocks.

Top Ten Holdings

as of October 31, 2012*

(as a percentage of net assets) |

| Sanofi-Aventis | | | | | 2.4 | % |

| Siemens AG | | | | | 1.7 | % |

| Royal Dutch Shell PLC — Class A | | | | | 1.7 | % |

| ENI S.p.A. | | | | | 1.7 | % |

| GlaxoSmithKline PLC | | | | | 1.7 | % |

| Novartis AG | | | | | 1.5 | % |

| Total S.A. | | | | | 1.5 | % |

| Vodafone Group PLC | | | | | 1.4 | % |

| Tesco PLC | | | | | 1.4 | % |

| Roche Holding AG — Genusschein | | | | | 1.4 | % |

| | |

| * Excludes short-term investments. |

| | |

| Portfolio holdings are subject to change daily. | |

We believe that despite the extent and duration of the volatility and doubt surrounding the outlook for global stock markets, these factors help drive prices of fundamentally sound companies below what they could truly be worth — and this opportunity augurs well for long-term investors focused on attractively priced companies.

ING IM Sleeve — In our opinion, international developed stocks are attractively priced. However, the continuing sovereign debt crisis in Europe and a global growth slowdown are key risks to our short-term outlook. Central banks are easing monetary policy to offset these negative forces, but markets are likely to remain volatile in the coming months before — as we anticipate — the growth outlook improves in the first half of 2013. In our view, the Sleeve is well diversified across different geographic regions, sectors and industries; we continue to favor well-capitalized stocks with unrecognized value.

del Rey Sleeve — Notwithstanding the recent market rally, the global economy continues to face considerable challenges, most notably the ongoing crisis in the Euro region, the slump in Chinese investment, and of course, the impending U.S. fiscal cliff. In our last letter, we commented that the resulting second quarter weakness in the markets was allowing us to become incrementally more aggressive in the Sleeve as better and more opportunities were becoming available. While the temporary dip in the markets during the second quarter did grant us some buying opportunities, the rally’s quick resumption in the third quarter means that our overall Sleeve composition has not changed dramatically. We remain moderately defensively positioned, albeit less so than in earlier periods.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Fund is based only on the outlook of its portfolio managers through the end of this period, and may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

19

ING INTERNATIONAL VALUE FUND | PORTFOLIO MANAGERS’ REPORT

|

Average Annual Total Returns for the Periods Ended October 31, 2012

|

|

|---|

| | | | 1 Year

| | 5 Year

| | 10 Year

| | Since Inception

of Class W

July 20, 2009

|

|---|

| | | | | | | | | | | | | | | | | | |

| | | | | (4.66 | )% | | | (8.35 | )% | | | 6.67 | % | | | — | |

| | | | | (4.49 | )% | | | (8.18 | )% | | | 6.55 | % | | | — | |

| | | | | (0.47 | )% | | | (7.88 | )% | | | 6.57 | % | | | — | |

| | | | | 1.57 | % | | | (6.93 | )% | | | 7.71 | % | | | — | |

| | | | | 1.49 | % | | | — | | | | — | | | | 2.17 | % |

| | | | | | | | | | | | | | | | | | |

| | | | | 1.20 | % | | | (7.26 | )% | | | 7.30 | % | | | — | |

| | | | | 0.45 | % | | | (7.92 | )% | | | 6.55 | % | | | — | |

| | | | | 0.51 | % | | | (7.88 | )% | | | 6.57 | % | | | — | |

| | | | | 1.57 | % | | | (6.93 | )% | | | 7.71 | % | | | — | |

| | | | | 1.49 | % | | | — | | | | — | | | | 2.17 | % |

| | | | | 4.61 | % | | | (5.81 | )% | | | 7.73 | % | | | 5.10 | %(4) |

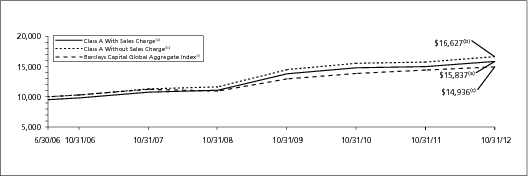

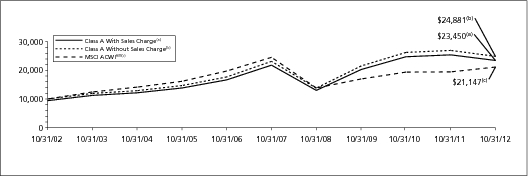

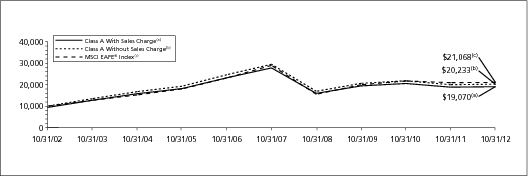

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING International Value Fund against the index indicated. The Index is unmanaged and has no cash in its portfolio, imposes no sales charge and incurs no operating expenses. An investor cannot invest directly in the index. The Fund’s performance is shown both with and without the imposition of sales charges.

The graph and performance table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of the fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

(1) | | Reflects deduction of the maximum Class A sales charge of 5.75%. |

(2) | | Reflects deduction of the Class B deferred sales charge of 5% and 2%, respectively, for the 1 year and 5 year returns. |

(3) | | Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return. |

(4) | | Since inception performance for the index is shown from August 1, 2009. |

20

PORTFOLIO MANAGERS’ REPORT

| ING RUSSIA FUND |

| | Sector Diversification

as of October 31, 2012

(as a percentage of net assets) |

| | | Energy | | | | | 42.5 | % |

| | | Financials | | | | | 17.0 | % |

| | | Materials | | | | | 15.3 | % |

| | | Telecommunications | | | | | 9.3 | % |

| | | Consumer Staples | | | | | 6.7 | % |

| | | Utilities | | | | | 5.1 | % |

| | | Information Technology | | | | | 1.4 | % |

| | | Health Care | | | | | 1.1 | % |

| | | Industrials | | | | | 1.0 | % |

| | | Consumer Discretionary | | | | | 0.5 | % |

| | | Assets in Excess of Other Liabilities* | | | | | 0.1 | % |

| | | Net Assets | | | | | 100.0 | % |

| | | |

| | * | Includes short-term investments. |

| | | |

| | Portfolio holdings are subject to change daily. |

ING Russia Fund (“Russia” or the “Fund”) seeks long-term capital appreciation through investment primarily in equity securities of Russian companies. The Fund is managed by Angus Alexander Robertson and Nathan Griffiths, Portfolio Managers, of ING Investment Management Advisors B.V. — the Sub-Adviser.

Performance: For the year ended October 31, 2012, the Fund’s Class A shares, excluding sales charges, provided a total return of (6.21)% compared to the Russia Trading System (“RTS”) Index and the MSCI Russia 10/40 Index, which returned (5.15)% and (5.92)%, respectively, for the same period.

Portfolio Specifics: The fiscal period proved disappointing for the Russian equity market. Russia was buffeted heavily by domestic political uncertainty and continued doubt around the global economy. Despite pronouncements that it was again unsuitable for investing, Russia strongly outperformed global and emerging markets between January and March 2012, as the global growth outlook grew more optimistic. Russia sold off heavily, though, as the euro crisis again dominated the investment environment. The rally from the June lows coincided with expectations of a third round of quantitative easing, by the U.S. Federal Reserve and the European Central Bank’s promise to buy sovereign bonds of euro zone members. The equity market remained vulnerable to risk appetite, however, and the recovery petered out by period-end as the domestic environment weakened.

The Fund outperformed its benchmarks before the deduction of fees and operating expenses, but lagged net of fees and expenses. Sector allocation was the main contributor to performance. Stock selection in materials and telecommunication services contributed the most. In contrast, selection in consumer staples and energy detracted the most.

The top three individual stock contributors were all underweight positions. InterRao and Rushydro suffered from utility sector uncertainty. OJSC Rostelecom came under pressure because of doubts about its ability to execute a mobile strategy. Transneft JSC was the biggest detractor as speculation of improved corporate governance saw the stock rally strongly. Having held a long-term underweight position in the stock due to heavy capital expenditure commitments, we moved to overweight as we concluded that free cash flow will become positive in 2013. Federal Grid Co. also detracted as government involvement in the utility sector saw all stocks suffer.

Top Ten Holdings

as of October 31, 2012

(as a percentage of net assets) |

| Sberbank | | | | | 10.6 | % |

| Lukoil OAO ADR | | | | | 10.3 | % |

| Gazprom OAO | | | | | 7.1 | % |

| Mobile Telesystems OJSC ADR | | | | | 5.7 | % |

| Transneft | | | | | 5.3 | % |

| Rosneft Oil Co. GDR | | | | | 5.0 | % |

| Magnit OAO | | | | | 4.9 | % |

| Uralkali GDR | | | | | 4.7 | % |

| NovaTek OAO GDR | | | | | 4.4 | % |

| Tatneft ADR | | | | | 4.1 | % |

| |

| Portfolio holdings are subject to change daily. | |

The overweight allocation to consumer staples was a major contributor as the food retail sector benefited from domestic income growth and food inflation. The underweight position in utilities also benefited, as the government reneged upon commitments to provide adequate returns on investment. In contrast, an underweight position in energy proved negative after strong performance at the start of the period due to rising oil prices.

Current Outlook and Strategy: Although we believe valuations are cheap across much of the market, in some areas we see a deteriorating earnings outlook while elsewhere we see the potential for structural improvements. Companies exposed to Western European economies and global trade cycles, and those with heavy capital programs, seem particularly unattractive to us at this moment. The focus of the Fund remains long-term investments that we believe are less exposed to the business cycle. While the global environment will continue to impact the Russian equity market, we believe there are long-term structural trends at play in Russia that provide attractive growth potential.

Though political uncertainty hurt the Russian market during the period, we hope that the realities of a budget no longer in surplus and public discontent with the status quo will accelerate political transformation. If this were to happen, the Russian equity market could undergo a significant re-rating from its current lowly valuation. In this respect it is potentially a major milestone that the government is mandating state-owned companies to pay out 25% of net income in dividends. Not only will this raise the payout ratio of the Russian market but enforce capital discipline on companies most associated with corruption. Such companies have often proved the worst value destroyers and as such have been poor investments; higher dividends alone are insufficient reason to invest. We do, however, see attractive opportunities and have added certain stocks selectively.

Current Fund positioning includes a sizable underweight in utilities. Within the energy sector we favor oil stocks over gas. Despite increases in domestic gas tariffs, we believe the domestic market is moving into surplus due to production growth from independent companies, which is likely to undercut Gazprom’s prices. In addition, weak European demand should pressure export volumes downward. On the other hand, we believe that the tax regime for oil companies is now settled, and with oil prices well supported the sector has the potential for upward re-rating. We prefer precious metals within the materials sector due to the ongoing currency debasement in the Western world. Also, we continue to like the consumer staples sector for its high growth potential and sustainable margins.

| * | | Effective May 8, 2012, Nathan Griffiths replaced Remco Vergeer as a portfolio manager to the Fund. |

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Fund is based only on the outlook of its portfolio managers through the end of this period, and may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

21

ING RUSSIA FUND

| PORTFOLIO MANAGERS’ REPORT |

Average Annual Total Returns for the Periods Ended October 31, 2012

|

|

|---|

| | | | 1 Year

| | 5 Year

| | 10 Year

| | Since Inception

of Class I

September 30, 2009

| | Since Inception

of Class W

August 5, 2011

|

|---|

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | (11.59 | )% | | | (8.65 | )% | | | 15.84 | % | | | — | | | | — | |

| | | | | (6.01 | )% | | | — | | | | — | | | | 3.82 | % | | | — | |

| | | | | (5.99 | )% | | | — | | | | — | | | | — | | | | (16.31 | )% |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | (6.21 | )% | | | (7.56 | )% | | | 16.52 | % | | | — | | | | — | |

| | | | | (6.01 | )% | | | — | | | | — | | | | 3.82 | % | | | — | |

| | | | | (5.99 | )% | | | — | | | | — | | | | — | | | | (16.31 | )% |

| | | | | (5.15 | )% | | | (6.88 | )% | | | 16.59 | % | | | 6.48 | %(2) | | | (20.00 | )%(3) |

MSCI Russia 10/40 IndexSM | | | | | (5.92 | )% | | | (5.86 | )% | | | N/A | | | | 5.65 | %(2) | | | (20.99 | )%(3) |

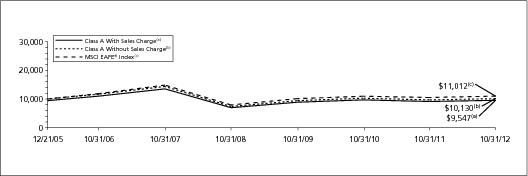

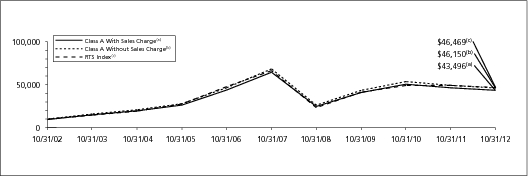

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Russia Fund against the indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charge and incurs no operating expenses. An investor cannot invest directly in an index. The Fund’s performance is shown both with and without the imposition of sales charges.

The graph and performance table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

(1) | | Reflects deduction of the maximum Class A sales charge of 5.75%. |

(2) | | Since inception performance for the index is shown from October 1, 2009. |

(3) | | Since inception performance for the index is shown from August 1, 2011. |

| | Redemptions on shares held less than 365 days are subject to a redemption fee of 2% of the redemption proceeds. |

22

SHAREHOLDER EXPENSE EXAMPLES (UNAUDITED)

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, redemption fees, and exchange fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2012 to October 31, 2012. Each Fund’s expenses are shown without the imposition of any sales charges or fees. Expenses would have been higher if such charges were included.

Actual Expenses

The left section of the table shown below, “Actual Fund Return,” provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The right section of the table shown below, “Hypothetical (5% return before expenses),” provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the hypothetical lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | Actual Fund Return

|

| Hypothetical (5% return before expenses)

|

|

|---|

| | | | Beginning

Account

Value

May 1,

2012

| | Ending

Account

Value

October 31,

2012

| | Annualized

Expense

Ratio

| | Expenses Paid

During the

Period Ended

October 31,

2012*

| | Beginning

Account

Value

May 1,

2012

| | Ending

Account

Value

October 31,

2012

| | Annualized

Expense

Ratio

| | Expenses Paid

During the

Period Ended

October 31,

2012*

|

|---|

ING Diversified International Fund** |

| | | | $ | 1,000.00 | | | $ | 1,001.10 | | | | 0.50 | % | | $ | 2.52 | | | $ | 1,000.00 | | | $ | 1,022.62 | | | | 0.50 | % | | $ | 2.54 | |

| | | | | 1,000.00 | | | | 996.60 | | | | 1.25 | | | | 6.27 | | | | 1,000.00 | | | | 1,018.85 | | | | 1.25 | | | | 6.34 | |

| | | | | 1,000.00 | | | | 996.60 | | | | 1.25 | | | | 6.27 | | | | 1,000.00 | | | | 1,018.85 | | | | 1.25 | | | | 6.34 | |

| | | | | 1,000.00 | | | | 1,002.20 | | | | 0.25 | | | | 1.26 | | | | 1,000.00 | | | | 1,023.88 | | | | 0.25 | | | | 1.27 | |

| | | | | 1,000.00 | | | | 1,000.00 | | | | 0.50 | | | | 2.51 | | | | 1,000.00 | | | | 1,022.62 | | | | 0.50 | | | | 2.54 | |

| | | | | 1,000.00 | | | | 1,000.00 | | | | 0.75 | | | | 3.77 | | | | 1,000.00 | | | | 1,021.37 | | | | 0.75 | | | | 3.81 | |

| | | | | 1,000.00 | | | | 1,002.30 | | | | 0.25 | | | | 1.26 | | | | 1,000.00 | | | | 1,023.88 | | | | 0.25 | | | | 1.27 | |

| * | | Expenses are equal to each Fund’s respective annualized expense ratios multiplied by the average account value over the period, multiplied by 184/366 to reflect the most recent fiscal half-year. |

| ** | | The annualized expense ratios do not include expenses of underlying funds. |

23

SHAREHOLDER EXPENSE EXAMPLES (UNAUDITED) (CONTINUED)

| | | | Actual Fund Return

|

| Hypothetical (5% return before expenses)

|

|

|---|

| | | | Beginning

Account

Value

May 1,

2012

| | Ending

Account

Value

October 31,

2012

| | Annualized

Expense

Ratio

| | Expenses Paid

During the

Period Ended

October 31,

2012*

| | Beginning

Account

Value

May 1,

2012

| | Ending

Account

Value

October 31,

2012

| | Annualized

Expense

Ratio

| | Expenses Paid

During the

Period Ended

October 31,

2012*

|

|---|

|

| | | | $ | 1,000.00 | | | $ | 1,026.70 | | | | 0.90 | % | | $ | 4.58 | | | $ | 1,000.00 | | | $ | 1,020.61 | | | | 0.90 | % | | $ | 4.57 | |

| | | | | 1,000.00 | | | | 1,022.20 | | | | 1.65 | | | | 8.39 | | | | 1,000.00 | | | | 1,016.84 | | | | 1.65 | | | | 8.36 | |

| | | | | 1,000.00 | | | | 1,023.00 | | | | 1.65 | | | | 8.39 | | | | 1,000.00 | | | | 1,016.84 | | | | 1.65 | | | | 8.36 | |

| | | | | 1,000.00 | | | | 1,028.30 | | | | 0.60 | | | | 3.06 | | | | 1,000.00 | | | | 1,022.12 | | | | 0.60 | | | | 3.05 | |

| | | | | 1,000.00 | | | | 1,027.20 | | | | 0.90 | | | | 4.59 | | | | 1,000.00 | | | | 1,020.61 | | | | 0.90 | | | | 4.57 | |

| | | | | 1,000.00 | | | | 1,025.50 | | | | 1.15 | | | | 5.86 | | | | 1,000.00 | | | | 1,019.36 | | | | 1.15 | | | | 5.84 | |

| | | | | 1,000.00 | | | | 1,027.60 | | | | 0.65 | | | | 3.31 | | | | 1,000.00 | | | | 1,021.87 | | | | 0.65 | | | | 3.30 | |

ING Global Value Choice Fund |

| | | | $ | 1,000.00 | | | $ | 1,005.30 | | | | 1.51 | % | | $ | 7.61 | | | $ | 1,000.00 | | | $ | 1,017.55 | | | | 1.51 | % | | $ | 7.66 | |

| | | | | 1,000.00 | �� | | | 1,001.80 | | | | 2.26 | | | | 11.37 | | | | 1,000.00 | | | | 1,013.77 | | | | 2.26 | | | | 11.44 | |

| | | | | 1,000.00 | | | | 1,001.60 | | | | 2.26 | | | | 11.37 | | | | 1,000.00 | | | | 1,013.77 | | | | 2.26 | | | | 11.44 | |

| | | | | 1,000.00 | | | | 1,005.70 | | | | 1.26 | | | | 6.35 | | | | 1,000.00 | | | | 1,018.80 | | | | 1.26 | | | | 6.39 | |

| | | | | 1,000.00 | | | | 1,006.80 | | | | 1.26 | | | | 6.36 | | | | 1,000.00 | | | | 1,018.80 | | | | 1.26 | | | | 6.39 | |

ING Index Plus International Equity Fund |

| | | | $ | 1,000.00 | | | $ | 1,020.60 | | | | 1.15 | % | | $ | 5.84 | | | $ | 1,000.00 | | | $ | 1,019.36 | | | | 1.15 | % | | $ | 5.84 | |

| | | | | 1,000.00 | | | | 1,015.30 | | | | 1.90 | | | | 9.62 | | | | 1,000.00 | | | | 1,015.58 | | | | 1.90 | | | | 9.63 | |

| | | | | 1,000.00 | | | | 1,015.50 | | | | 1.90 | | | | 9.63 | | | | 1,000.00 | | | | 1,015.58 | | | | 1.90 | | | | 9.63 | |

| | | | | 1,000.00 | | | | 1,023.20 | | | | 0.68 | | | | 3.46 | | | | 1,000.00 | | | | 1,021.72 | | | | 0.68 | | | | 3.46 | |

| | | | | 1,000.00 | | | | 1,019.50 | | | | 1.15 | | | | 5.84 | | | | 1,000.00 | | | | 1,019.36 | | | | 1.15 | | | | 5.84 | |

| | | | | 1,000.00 | | | | 1,022.00 | | | | 0.90 | | | | 4.57 | | | | 1,000.00 | | | | 1,020.61 | | | | 0.90 | | | | 4.57 | |

ING International Small Cap Fund |

| | | | $ | 1,000.00 | | | $ | 983.30 | | | | 1.74 | % | | $ | 8.67 | | | $ | 1,000.00 | | | $ | 1,016.39 | | | | 1.74 | % | | $ | 8.82 | |

| | | | | 1,000.00 | | | | 980.20 | | | | 2.39 | | | | 11.90 | | | | 1,000.00 | | | | 1,013.12 | | | | 2.39 | | | | 12.09 | |

| | | | | 1,000.00 | | | | 980.10 | | | | 2.39 | | | | 11.90 | | | | 1,000.00 | | | | 1,013.12 | | | | 2.39 | | | | 12.09 | |

| | | | | 1,000.00 | | | | 986.20 | | | | 1.26 | | | | 6.29 | | | | 1,000.00 | | | | 1,018.80 | | | | 1.26 | | | | 6.39 | |

| | | | | 1,000.00 | | | | 983.90 | | | | 1.64 | | | | 8.18 | | | | 1,000.00 | | | | 1,016.89 | | | | 1.64 | | | | 8.31 | |

| | | | | 1,000.00 | | | | 985.30 | | | | 1.39 | | | | 6.94 | | | | 1,000.00 | | | | 1,018.15 | | | | 1.39 | | | | 7.05 | |

ING International Value Choice Fund |

| | | | $ | 1,000.00 | | | $ | 1,007.70 | | | | 1.56 | % | | $ | 7.87 | | | $ | 1,000.00 | | | $ | 1,017.29 | | | | 1.56 | % | | $ | 7.91 | |

| | | | | 1,000.00 | | | | 1,004.40 | | | | 2.31 | | | | 11.64 | | | | 1,000.00 | | | | 1,013.52 | | | | 2.31 | | | | 11.69 | |

| | | | | 1,000.00 | | | | 1,003.30 | | | | 2.31 | | | | 11.63 | | | | 1,000.00 | | | | 1,013.52 | | | | 2.31 | | | | 11.69 | |

| | | | | 1,000.00 | | | | 1,008.80 | | | | 1.35 | | | | 6.82 | | | | 1,000.00 | | | | 1,018.35 | | | | 1.35 | | | | 6.85 | |

| | | | | 1,000.00 | | | | 1,009.90 | | | | 1.31 | | | | 6.62 | | | | 1,000.00 | | | | 1,018.55 | | | | 1.31 | | | | 6.65 | |

ING International Value Fund |

| | | | $ | 1,000.00 | | | $ | 1,014.60 | | | | 1.61 | % | | $ | 8.15 | | | $ | 1,000.00 | | | $ | 1,017.04 | | | | 1.61 | % | | $ | 8.16 | |

| | | | | 1,000.00 | | | | 1,010.60 | | | | 2.31 | | | | 11.67 | | | | 1,000.00 | | | | 1,013.52 | | | | 2.31 | | | | 11.69 | |

| | | | | 1,000.00 | | | | 1,011.00 | | | | 2.31 | | | | 11.68 | | | | 1,000.00 | | | | 1,013.52 | | | | 2.31 | | | | 11.69 | |

| | | | | 1,000.00 | | | | 1,016.70 | | | | 1.17 | | | | 5.93 | | | | 1,000.00 | | | | 1,019.25 | | | | 1.17 | | | | 5.94 | |

| | | | | 1,000.00 | | | | 1,015.70 | | | | 1.31 | | | | 6.64 | | | | 1,000.00 | | | | 1,018.55 | | | | 1.31 | | | | 6.65 | |

|

| | | | $ | 1,000.00 | | | $ | 934.00 | | | | 2.14 | % | | $ | 10.40 | | | $ | 1,000.00 | | | $ | 1,014.38 | | | | 2.14 | % | | $ | 10.84 | |

| | | | | 1,000.00 | | | | 934.10 | | | | 1.96 | | | | 9.53 | | | | 1,000.00 | | | | 1,015.28 | | | | 1.96 | | | | 9.93 | |

| | | | | 1,000.00 | | | | 934.90 | | | | 1.89 | | | | 9.19 | | | | 1,000.00 | | | | 1,015.63 | | | | 1.89 | | | | 9.58 | |

| * | | Expenses are equal to each Fund’s respective annualized expense ratios multiplied by the average account value over the period, multiplied by 184/366 to reflect the most recent fiscal half-year. |

24

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Shareholders and Board of Trustees

ING Mutual Funds and ING Mayflower Trust

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments or summary portfolios of investments, as indicated, of ING Diversified International Fund, ING Global Bond Fund, ING Global Value Choice Fund, ING Index Plus International Equity Fund, ING International Small Cap Fund, ING International Value Choice Fund, and ING Russia Fund, each a series of ING Mutual Funds, and ING International Value Fund, a series of ING Mayflower Trust, as of October 31, 2012, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years or periods in the five-year period then ended. These financial statements and financial highlights are the responsibility of management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2012, by correspondence with the custodian, transfer agent, and brokers, or by other appropriate auditing procedures when replies from brokers were not received. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the aforementioned funds as of October 31, 2012, and the results of their operations, the changes in their net assets, and the financial highlights for the periods specified in the first paragraph above, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

December 20, 2012

25

STATEMENTS OF ASSETS AND LIABILITIES AS OF OCTOBER 31, 2012

| | | | ING

Diversified

International

Fund

| | ING

Global

Bond

Fund

| | ING

Global

Value Choice

Fund

| | ING

Index Plus

International

Equity Fund

|

|---|

| | | | | | | | | | | | | | | | | | |

Investments in securities at fair value+* | | | | $ | 4,471,700 | | | $ | 729,778,672 | | | $ | 171,237,728 | | | $ | 54,846,728 | |

Investments in affiliated underlying funds** | | | | | 92,548,723 | | | | — | | | | — | | | | — | |

Short-term investments at fair value*** | | | | | — | | | | 41,255,640 | | | | 15,326,588 | | | | 1,361,000 | |

Short-term investments at amortized cost | | | | | — | | | | 77,987,438 | | | | — | | | | — | |

Total Investments at fair value | | | | | 97,020,423 | | | | 849,021,750 | | | | 186,564,316 | | | | 56,207,728 | |

| | | | | 97,167 | | | | 2,470,316 | | | | — | | | | — | |

Cash collateral for futures | | | | | — | | | | 2,764,562 | | | | — | | | | 56,525 | |

Receivable for derivatives collateral (Note 2) | | | | | — | | | | 7,530,000 | | | | — | | | | — | |

Foreign currencies at value**** | | | | | — | | | | 285,713 | | | | — | | | | 7,841 | |

| | | | | | | �� | | | | | | | | | | | |

Investments in affiliated underlying funds sold | | | | | 55,834 | | | | — | | | | — | | | | — | |

Investments securities sold | | | | | — | | | | 48,933,876 | | | | 1,245,523 | | | | — | |

Investment securities sold on a delayed-delivery or when-issued basis | | | | | — | | | | 29,257,808 | | | | — | | | | — | |

| | | | | 6,098 | | | | 1,872,168 | | | | 38,062 | | | | 17,125 | |

| | | | | — | | | | 1,801 | | | | 345,713 | | | | 172,578 | |

| | | | | — | | | | 7,670,001 | | | | — | | | | — | |

| | | | | — | | | | — | | | | — | | | | 126,967 | |

Unrealized appreciation on forward foreign currency contracts | | | | | — | | | | 15,056,820 | | | | — | | | | — | |

Upfront payments paid on OTC swap agreements | | | | | — | | | | 205,465 | | | | — | | | | — | |

Unrealized appreciation on OTC swap agreements | | | | | — | | | | 23,142 | | | | — | | | | — | |

| | | | | 15,161 | | | | 59,034 | | | | 21,961 | | | | 11,466 | |

Reimbursement due from manager | | | | | 6,300 | | | | 29,022 | | | | — | | | | 24,416 | |

| | | | | 97,200,983 | | | | 965,181,478 | | | | 188,215,575 | | | | 56,624,646 | |

| | | | | | | | | | | | | | | | | | |

Payable for investment securities purchased | | | | | — | | | | 80,455,359 | | | | 1,092,945 | | | | — | |

Payable for investment securities purchased on a delayed-delivery or when-issued basis | | | | | — | | | | 54,393,877 | | | | — | | | | — | |

Payable for fund shares redeemed | | | | | 251,558 | | | | 1,039,872 | | | | 819,893 | | | | 68,901 | |

Payable for foreign cash collateral for futures***** | | | | | — | | | | 186,409 | | | | — | | | | — | |

Payable upon receipt of securities loaned | | | | | — | | | | — | | | | 8,310,696 | | | | — | |

Unrealized depreciation on forward foreign currency contracts | | | | | — | | | | 11,560,519 | | | | — | | | | — | |

Unrealized depreciation on OTC swap agreements | | | | | — | | | | 8,501,863 | | | | — | | | | — | |

Payable for investment management fees | | | | | — | | | | 258,685 | | | | 166,893 | | | | 26,447 | |

Payable for administrative fees | | | | | 8,308 | | | | 64,670 | | | | 15,740 | | | | 4,808 | |

Payable for shareholder service and distribution fees | | | | | 41,609 | | | | 141,514 | | | | 67,634 | | | | 10,187 | |

Payable to custodian due to bank overdraft | | | | | — | | | | — | | | | — | | | | 4,618 | |

| | | | | 540 | | | | 3,483 | | | | 1,827 | | | | 420 | |

Payable for derivatives collateral (Note 2) | | | | | — | | | | 4,198,000 | | | | — | | | | — | |

Other accrued expenses and liabilities | | | | | 166,854 | | | | 178,792 | | | | 158,291 | | | | 126,692 | |

Written options, at fair valueˆ | | | | | — | | | | 217,804 | | | | — | | | | — | |

| | | | | 468,869 | | | | 161,200,847 | | | | 10,633,919 | | | | 242,073 | |

| | | | $ | 96,732,114 | | | $ | 803,980,631 | | | $ | 177,581,656 | | | $ | 56,382,573 | |

NET ASSETS WERE COMPRISED OF: | | | | | | | | | | | | | | | | | | |

| | | | $ | 255,505,558 | | | $ | 791,647,158 | | | $ | 239,120,939 | | | $ | 125,499,396 | |

Undistributed (distributions in excess of) net investment income | | | | | 343,923 | | | | (3,407,671 | ) | | | 678,384 | | | | 2,410,014 | |

Accumulated net realized loss | | | | | (163,717,567 | ) | | | (1,102,932 | ) | | | (37,756,854 | ) | | | (80,882,464 | ) |

Net unrealized appreciation (depreciation) | | | | | 4,600,200 | | | | 16,844,076 | | | | (24,460,813 | ) | | | 9,355,627 | |

| | | | $ | 96,732,114 | | | $ | 803,980,631 | | | $ | 177,581,656 | | | $ | 56,382,573 | |

| | | | | | | | | | | | | | | | | | |

| + Including securities loaned at value | | | | $ | — | | | $ | — | | | $ | 7,969,306 | | | $ | — | |

| * Cost of investments in securities | | | | $ | 4,581,626 | | | $ | 708,632,654 | | | $ | 195,687,701 | | | $ | 45,472,335 | |

| ** Cost of investments in affiliated underlying funds | | | | $ | 87,838,597 | | | $ | — | | | $ | — | | | $ | — | |

| *** Cost of short-term investments | | | | $ | — | | | $ | 41,189,110 | | | $ | 15,326,588 | | | $ | 1,361,000 | |

| **** Cost of foreign currencies | | | | $ | — | | | $ | 291,388 | | | $ | — | | | $ | 7,823 | |

| ***** Cost of payable for foreign cash collateral for futures | | | | $ | — | | | $ | 186,409 | | | $ | — | | | $ | — | |

| ˆ Premiums received on written options | | | | $ | — | | | $ | 1,010,367 | | | $ | — | | | $ | — | |

See Accompanying Notes to Financial Statements

26

STATEMENTS OF ASSETS AND LIABILITIES AS OF OCTOBER 31, 2012 (CONTINUED)

| | | | ING

Diversified

International

Fund

| | ING

Global

Bond

Fund

| | ING

Global

Value Choice

Fund

| | ING

Index Plus

International

Equity Fund

|

|---|

| | | | | | | | | | | | | | | | | | |

| | | | $ | 46,504,207 | | | $ | 219,276,390 | | | $ | 82,688,287 | | | $ | 6,600,300 | |

| | | | | unlimited | | | | unlimited | | | | unlimited | | | | unlimited | |

| | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | 5,195,945 | | | | 18,860,103 | | | | 3,126,883 | | | | 834,423 | |

Net asset value and redemption price per share | | | | $ | 8.95 | | | $ | 11.63 | | | $ | 26.44 | | | $ | 7.91 | |

Maximum offering price per share (5.75%)(1) | | | | $ | 9.50 | | | $ | 11.93 | (2) | | $ | 28.05 | | | $ | 8.39 | |

| |

| | | | | | | | | | | | | | | | | | |

| | | | $ | 7,795,455 | | | $ | 1,586,741 | | | $ | 3,256,483 | | | $ | 284,246 | |

| | | | | unlimited | | | | unlimited | | | | unlimited | | | | unlimited | |

| | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | 873,888 | | | | 137,805 | | | | 114,561 | | | | 35,655 | |

Net asset value and redemption price per share† | | | | $ | 8.92 | | | $ | 11.51 | | | $ | 28.43 | | | $ | 7.97 | |

| |

| | | | | | | | | | | | | | | | | | |

| | | | $ | 27,902,869 | | | $ | 109,381,211 | | | $ | 52,627,761 | | | $ | 932,717 | |

| | | | | unlimited | | | | unlimited | | | | unlimited | | | | unlimited | |

| | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | 3,135,080 | | | | 9,464,015 | | | | 2,133,490 | | | | 118,461 | |

Net asset value and redemption price per share† | | | | $ | 8.90 | | | $ | 11.56 | | | $ | 24.67 | | | $ | 7.87 | |

| |

| | | | | | | | | | | | | | | | | | |

| | | | $ | 9,953,490 | | | $ | 437,620,009 | | | $ | 30,701,461 | | | $ | 12,016,674 | |

| | | | | unlimited | | | | unlimited | | | | unlimited | | | | unlimited | |

| | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | 1,115,198 | | | | 37,762,968 | | | | 1,150,187 | | | | 1,513,181 | |

Net asset value and redemption price per share | | | | $ | 8.93 | | | $ | 11.59 | | | $ | 26.69 | | | $ | 7.94 | |

| |

| | | | | | | | | | | | | | | | | | |

| | | | $ | 3,833,426 | | | $ | 4,116,980 | | | $ | n/a | | | $ | 36,545,642 | |

| | | | | unlimited | | | | unlimited | | | | n/a | | | | unlimited | |

| | | | $ | — | | | $ | — | | | $ | n/a | | | $ | — | |

| | | | | 431,993 | | | | 360,637 | | | | n/a | | | | 4,655,074 | |

Net asset value and redemption price per share | | | | $ | 8.87 | | | $ | 11.42 | | | $ | n/a | | | $ | 7.85 | |

| |

| | | | | | | | | | | | | | | | | | |

| | | | $ | 95,664 | | | $ | 275,860 | | | $ | n/a | | | $ | n/a | |

| | | | | unlimited | | | | unlimited | | | | n/a | | | | n/a | |

| | | | $ | — | | | $ | — | | | $ | n/a | | | $ | n/a | |

| | | | | 10,817 | | | | 23,761 | | | | n/a | | | | n/a | |

Net asset value and redemption price per share | | | | $ | 8.84 | | | $ | 11.61 | | | $ | n/a | | | $ | n/a | |

| |

| | | | | | | | | | | | | | | | | | |

| | | | $ | 647,003 | | | $ | 31,723,440 | | | $ | 8,307,664 | | | $ | 2,994 | |

| | | | | unlimited | | | | unlimited | | | | unlimited | | | | unlimited | |

| | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | 72,713 | | | | 2,780,105 | | | | 311,266 | | | | 378 | |

Net asset value and redemption price per share | | | | $ | 8.90 | | | $ | 11.41 | | | $ | 26.69 | | | $ | 7.91 | |

| |

| | | | | | | | | | | | | | | | | | |

(1) Maximum offering price is computed at 100/94.25 of net asset value. On purchases of $100,000 or more, the offering price is reduced. |

(2) Maximum offering price is 2.50% and is computed at 100/97.50 of net asset value. On purchases of $100,000 or more, the offering price is reduced. |

† Redemption price per share may be reduced for any applicable contingent deferred sales charges. |

See Accompanying Notes to Financial Statements

27

STATEMENTS OF ASSETS AND LIABILITIES AS OF OCTOBER 31, 2012

| | | | ING

International

Small Cap

Fund

| | ING

International

Value Choice

Fund

| | ING

International

Value Fund

| | ING

Russia

Fund

|

|---|

| | | | | | | | | | | | | | | | | | |

Investments in securities at fair value+* | | | | $ | 237,048,043 | | | $ | 22,714,166 | | | $ | 474,776,654 | | | $ | 244,109,043 | |

Short-term investments at fair value** | | | | | 2,354,582 | | | | 203,586 | | | | 7,624,498 | | | | 14,079,810 | |

Total Investments at fair value | | | | | 239,402,625 | | | | 22,917,752 | | | | 482,401,152 | | | | 258,188,853 | |

| | | | | 3,001,730 | | | | — | | | | 356,238 | | | | 2,165,823 | |

Foreign currencies at value*** | | | | | 933,146 | | | | — | | | | — | | | | 321,427 | |

| | | | | | | | | | | | | | | | | | |

Investments securities sold | | | | | 2,344,644 | | | | 138,342 | | | | 2,234,440 | | | | 211,930 | |

| | | | | 37,792 | | | | 629 | | | | 122,267 | | | | 36,097 | |

| | | | | 634,021 | | | | 70,675 | | | | 2,397,305 | | | | 230,576 | |

| | | | | 19,139 | | | | — | | | | — | | | | — | |

| | | | | 267,149 | | | | 17,471 | | | | 2,204,197 | | | | — | |

| | | | | 26,940 | | | | 11,092 | | | | 23,135 | | | | 19,200 | |

Reimbursement due from manager | | | | | — | | | | 9,979 | | | | — | | | | — | |

| | | | | 246,667,186 | | | | 23,165,940 | | | | 489,738,734 | | | | 261,173,906 | |

| |

| | | | | | | | | | | | | | | | | | |

Payable for investment securities purchased | | | | | 1,778,317 | | | | 65,453 | | | | 2,150,223 | | | | 840,819 | |

Payable for fund shares redeemed | | | | | 564,319 | | | | 12,891 | | | | 2,895,579 | | | | 1,129,374 | |

Payable upon receipt of securities loaned | | | | | 1,722,019 | | | | — | | | | 700,066 | | | | 14,079,810 | |

Payable for investment management fees | | | | | 201,301 | | | | 17,990 | | | | 422,608 | | | | 268,981 | |

Payable for administrative fees | | | | | 20,646 | | | | 1,999 | | | | 41,530 | | | | 21,518 | |

Payable for shareholder service and distribution fees | | | | | 43,948 | | | | 6,635 | | | | 135,410 | | | | 51,848 | |

Payable to custodian due to foreign currency overdraft**** | | | | | — | | | | — | | | | 305,746 | | | | — | |

| | | | | 1,275 | | | | 135 | | | | 2,817 | | | | 1,309 | |

Other accrued expenses and liabilities | | | | | 162,131 | | | | 36,516 | | | | 501,202 | | | | 418,772 | |

| | | | | 4,493,956 | | | | 141,619 | | | | 7,155,181 | | | | 16,812,431 | |

| | | | $ | 242,173,230 | | | $ | 23,024,321 | | | $ | 482,583,553 | | | $ | 244,361,475 | |

| |

NET ASSETS WERE COMPRISED OF: | | | | | | | | | | | | | | | | | | |

| | | | $ | 508,805,937 | | | $ | 42,340,181 | | | $ | 1,470,980,819 | | | $ | 292,718,839 | |

Undistributed net investment income | | | | | 4,269,957 | | | | 365,448 | | | | 11,361,011 | | | | 973,892 | |

Accumulated net realized loss | | | | | (284,943,090 | ) | | | (18,555,421 | ) | | | (965,218,112 | ) | | | (100,262,420 | ) |

Net unrealized appreciation (depreciation) | | | | | 14,040,426 | | | | (1,125,887 | ) | | | (34,540,165 | ) | | | 50,931,164 | |

| | | | $ | 242,173,230 | | | $ | 23,024,321 | | | $ | 482,583,553 | | | $ | 244,361,475 | |

| |

| | | | | | | | | | | | | | | | | | |

| + Including securities loaned at value | | | | $ | 1,621,307 | | | $ | — | | | $ | 650,310 | | | $ | 13,619,804 | |

| * Cost of investments in securities | | | | $ | 222,991,398 | | | $ | 23,837,336 | | | $ | 509,403,588 | | | $ | 193,181,646 | |

| ** Cost of short-term investments | | | | $ | 2,354,582 | | | $ | 203,586 | | | $ | 7,624,498 | | | $ | 14,079,810 | |

| *** Cost of foreign currencies | | | | $ | 925,780 | | | $ | — | | | $ | — | | | $ | 317,659 | |

| **** Cost of foreign currency overdraft | | | | $ | — | | | $ | — | | | $ | 306,120 | | | $ | — | |

See Accompanying Notes to Financial Statements

28

STATEMENTS OF ASSETS AND LIABILITIES AS OF OCTOBER 31, 2012 (CONTINUED)

| | | | ING

International

Small Cap

Fund

| | ING

International

Value Choice

Fund

| | ING

International

Value Fund

| | ING

Russia

Fund

|

|---|

| | | | | | | | | | | | | | | | | | |

| | | | $ | 81,948,237 | | | $ | 18,558,722 | | | $ | 185,195,129 | | | $ | 235,621,954 | |

| | | | | unlimited | | | | unlimited | | | | unlimited | | | | unlimited | |

| | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | 2,210,338 | | | | 2,017,734 | | | | 17,798,578 | | | | 7,494,572 | |

Net asset value and redemption price per share | | | | $ | 37.07 | | | $ | 9.20 | | | $ | 10.41 | | | $ | 31.44 | |

Maximum offering price per share (5.75%)(1) | | | | $ | 39.33 | | | $ | 9.76 | | | $ | 11.05 | | | $ | 33.36 | |

| |

| | | | | | | | | | | | | | | | | | |

| | | | $ | 1,887,773 | | | $ | 325,110 | | | $ | 634,539 | | | $ | n/a | |

| | | | | unlimited | | | | unlimited | | | | unlimited | | | | n/a | |

| | | | $ | — | | | $ | — | | | $ | — | | | $ | n/a | |

| | | | | 48,252 | | | | 35,741 | | | | 60,537 | | | | n/a | |

Net asset value and redemption price per share | | | | $ | 39.12 | | | $ | 9.10 | | | $ | 10.48 | | | $ | n/a | |

| |

| | | | | | | | | | | | | | | | | | |

| | | | $ | 20,350,728 | | | $ | 2,642,299 | | | $ | 101,301,106 | | | $ | n/a | |

| | | | | unlimited | | | | unlimited | | | | unlimited | | | | n/a | |

| | | | $ | — | | | $ | — | | | $ | — | | | $ | n/a | |

| | | | | 589,802 | | | | 291,336 | | | | 10,061,933 | | | | n/a | |

Net asset value and redemption price per share | | | | $ | 34.50 | | | $ | 9.07 | | | $ | 10.07 | | | $ | n/a | |

| |

| | | | | | | | | | | | | | | | | | |

| | | | $ | 100,952,305 | | | $ | 1,425,363 | | | $ | 195,303,770 | | | $ | 8,675,093 | |

| | | | | unlimited | | | | unlimited | | | | unlimited | | | | unlimited | |

| | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | 2,718,063 | | | | 154,998 | | | | 18,806,872 | | | | 273,141 | |

Net asset value and redemption price per share | | | | $ | 37.14 | | | $ | 9.20 | | | $ | 10.38 | | | $ | 31.76 | |

| |

| | | | | | | | | | | | | | | | | | |

| | | | $ | 1,573,406 | | | $ | n/a | | | $ | n/a | | | $ | n/a | |

| | | | | unlimited | | | | n/a | | | | n/a | | | | n/a | |

| | | | $ | — | | | $ | n/a | | | $ | n/a | | | $ | n/a | |

| | | | | 42,811 | | | | n/a | | | | n/a | | | | n/a | |

Net asset value and redemption price per share | | | | $ | 36.75 | | | $ | n/a | | | $ | n/a | | | $ | n/a | |

| |

| | | | | | | | | | | | | | | | | | |

| | | | $ | 35,460,781 | | | $ | 72,827 | | | $ | 149,009 | | | $ | 64,428 | |

| | | | | unlimited | | | | unlimited | | | | unlimited | | | | unlimited | |

| | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | 803,851 | | | | 7,911 | | | | 14,359 | | | | 2,031 | |

Net asset value and redemption price per share | | | | $ | 44.11 | | | $ | 9.21 | | | $ | 10.38 | | | $ | 31.72 | |

| |

| | | | | | | | | | | | | | | | | | |

(1) Maximum offering price is computed at 100/94.25 of net asset value. On purchases of $50,000 or more, the offering price is reduced. |

† Redemption price per share may be reduced for any applicable contingent deferred sales charges. |

See Accompanying Notes to Financial Statements

29

STATEMENTS OF OPERATIONS FOR THE YEAR ENDED OCTOBER 31, 2012

| | | | ING

Diversified

International

Fund

| | ING

Global

Bond

Fund

| | ING

Global

Value Choice

Fund

| | ING

Index Plus

International

Equity Fund

|

|---|

| | | | | | | | | | | | | | | | | | |

Dividends from affiliated underlying funds | | | | $ | 2,104,235 | | | $ | — | | | $ | — | | | $ | — | |

Dividends, net of foreign taxes withheld* | | | | | — | | | | 12,400 | | | | 8,716,065 | | | | 3,230,687 | |

Interest, net of foreign taxes withheld* | | | | | — | | | | 30,674,196 | | | | — | | | | 390 | |

Securities lending income, net | | | | | — | | | | — | | | | 94,594 | | | | — | |

| | | | | 2,104,235 | | | | 30,686,596 | | | | 8,810,659 | | | | 3,231,077 | |

| | | | | | | | | | | | | | | | | | |

Investment management fees | | | | | — | | | | 2,786,663 | | | | 3,262,789 | | | | 461,780 | |

Distribution and service fees: | | | | | | | | | | | | | | | | | | |

| | | | | 129,151 | | | | 529,096 | | | | 365,780 | | | | 17,129 | |

| | | | | 87,061 | | | | 18,156 | | | | 43,546 | | | | 3,147 | |

| | | | | 325,112 | | | | 1,000,622 | | | | 908,876 | | | | 9,659 | |

| | | | | 9,273 | | | | 10,198 | | | | — | | | | 91,407 | |

| | | | | 446 | | | | 776 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | |

| | | | | 89,211 | | | | 165,055 | | | | 224,236 | | | | 17,129 | |

| | | | | 14,495 | | | | 1,416 | | | | 6,693 | | | | 787 | |

| | | | | 57,445 | | | | 78,209 | | | | 139,329 | | | | 2,415 | |

| | | | | 17,767 | | | | 98,843 | | | | 88,081 | | | | 10,943 | |

| | | | | 6,102 | | | | 3,183 | | | | — | | | | 91,407 | |

| | | | | 172 | | | | 135 | | | | — | | | | — | |

| | | | | 1,457 | | | | 21,052 | | | | 25,365 | | | | 7 | |

Administrative service fees | | | | | 108,029 | | | | 696,657 | | | | 365,430 | | | | 83,959 | |

Shareholder reporting expense | | | | | 61,485 | | | | 95,145 | | | | 67,950 | | | | 14,665 | |

| | | | | 102,474 | | | | 158,066 | | | | 113,983 | | | | 92,272 | |

| | | | | 20,532 | | | | 99,085 | | | | 72,390 | | | | 25,427 | |

Custody and accounting expense | | | | | 25,278 | | | | 299,625 | | | | 339,173 | | | | 107,225 | |

| | | | | 3,241 | | | | 20,900 | | | | 10,963 | | | | 2,519 | |

| | | | | 14,430 | | | | 40,598 | | | | 40,390 | | | | 7,008 | |

| | | | | 82 | | | | 3,373 | | | | 13,151 | | | | 1,166 | |

| | | | | 1,073,243 | | | | 6,126,853 | | | | 6,088,125 | | | | 1,040,051 | |

Net waived and reimbursed fees | | | | | (244,615 | ) | | | (205,867 | ) | | | (173,501 | ) | | | (248,446 | ) |

Brokerage commission recapture | | | | | — | | | | — | | | | (125,298 | ) | | | — | |

| | | | | 828,628 | | | | 5,920,986 | | | | 5,789,326 | | | | 791,605 | |

| | | | | 1,275,607 | | | | 24,765,610 | | | | 3,021,333 | | | | 2,439,472 | |

REALIZED AND UNREALIZED GAIN (LOSS): | | | | | | | | | | | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | | | | | | | | | | | |

| | | | | (442,638 | ) | | | 13,191,506 | | | | (34,747,981 | ) | | | (2,282,706 | ) |

Capital gain distributions from affiliated underlying funds | | | | | 180,357 | | | | — | | | | — | | | | — | |

Capital gain distributions from unaffiliated underlying funds | | | | | — | | | | — | | | | 133 | | | | — | |

Foreign currency related transactions | | | | | — | | | | (12,264,578 | ) | | | (84,549 | ) | | | (66,052 | ) |

| | | | | — | | | | 8,405,748 | | | | — | | | | 361,998 | |

| | | | | — | | | | (20,509,389 | ) | | | — | | | | — | |

| | | | | — | | | | 3,150,527 | | | | — | | | | — | |

| | | | | (262,281 | ) | | | (8,026,186 | ) | | | (34,832,397 | ) | | | (1,986,760 | ) |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | | | | | | | | | | | |

| | | | | — | | | | 15,862,350 | | | | (7,523,856 | ) | | | 3,055,318 | |

Affiliated underlying funds | | | | | 3,400,195 | | | | — | | | | — | | | | — | |

Foreign currency related transactions | | | | | — | | | | 4,073,964 | | | | 25,343 | | | | 37,642 | |

| | | | | — | | | | (743,452 | ) | | | — | | | | (218,858 | ) |

| | | | | — | | | | 1,813,888 | | | | — | | | | — | |

| | | | | — | | | | 521,404 | | | | — | | | | — | |

Net change in unrealized appreciation (depreciation) | | | | | 3,400,195 | | | | 21,528,154 | | | | (7,498,513 | ) | | | 2,874,102 | |

Net realized and unrealized gain (loss) | | | | | 3,137,914 | | | | 13,501,968 | | | | (42,330,910 | ) | | | 887,342 | |

Increase (decrease) in net assets resulting from operations | | | | $ | 4,413,521 | | | $ | 38,267,578 | | | $ | (39,309,577 | ) | | $ | 3,326,814 | |

| | | | | | | | | | | | | | | | | | |

| | | | $ | — | | | $ | 1,245 | | | $ | 771,600 | | | $ | 250,891 | |

See Accompanying Notes to Financial Statements

30

STATEMENTS OF OPERATIONS FOR THE YEAR ENDED OCTOBER 31, 2012

| | | | ING

International

Small Cap

Fund

| | ING

International

Value Choice

Fund

| | ING

International

Value Fund

| | ING

Russia

Fund

|

|---|

| | | | | | | | | | | | | | | | | | |

Dividends, net of foreign taxes withheld* | | | | $ | 7,343,189 | | | $ | 866,059 | | | $ | 20,686,699 | | | $ | 6,940,527 | |

Interest, net of foreign taxes withheld* | | | | | 52,684 | | | | — | | | | — | | | | 17,748 | |

Securities lending income, net | | | | | 39,294 | | | | — | | | | 10,172 | | | | 242,769 | |

| | | | | 7,435,167 | | | | 866,059 | | | | 20,696,871 | | | | 7,201,044 | |

| |

| | | | | | | | | | | | | | | | | | |

Investment management fees | | | | | 2,549,602 | | | | 269,966 | | | | 5,635,284 | | | | 3,499,951 | |

Distribution and service fees: | | | | | | | | | | | | | | | | | | |

| | | | | 310,242 | | | | 47,498 | | | | 696,684 | | | | 672,252 | |

| | | | | 21,162 | | | | 4,081 | | | | 9,908 | | | | — | |

| | | | | 214,872 | | | | 36,122 | | | | 1,147,231 | | | | — | |

| | | | | 3,741 | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | |

| | | | | 144,681 | | | | 31,289 | | | | 420,419 | | | | 537,924 | |

| | | | | 3,397 | | | | 671 | | | | 1,769 | | | | — | |

| | | | | 35,179 | | | | 5,940 | | | | 208,532 | | | | — | |

| | | | | 39,800 | | | | 5,524 | | | | 88,022 | | | | 30,380 | |

| | | | | 2,520 | | | | — | | | | — | | | | — | |

| | | | | 52,644 | | | | 2,181 | | | | 453 | | | | 60 | |

Administrative service fees | | | | | 254,957 | | | | 26,996 | | | | 563,520 | | | | 279,992 | |

Shareholder reporting expense | | | | | 28,004 | | | | 3,217 | | | | 35,300 | | | | 47,623 | |

| | | | | 97,984 | | | | 73,986 | | | | 82,302 | | | | 59,715 | |

| | | | | 56,920 | | | | 14,644 | | | | 57,277 | | | | 56,901 | |

Custody and accounting expense | | | | | 181,915 | | | | 18,146 | | | | 243,998 | | | | 747,620 | |

| | | | | 7,649 | | | | 810 | | | | 16,906 | | | | 8,400 | |

| | | | | 12,283 | | | | 2,883 | | | | 48,054 | | | | 24,926 | |

| | | | | 379 | | | | 451 | | | | 6,844 | | | | 761 | |

| | | | | 4,017,931 | | | | 544,405 | | | | 9,262,503 | | | | 5,966,505 | |

Net waived and reimbursed fees | | | | | (70,231 | ) | | | (101,938 | ) | | | (311,357 | ) | | | — | |

Brokerage commission recapture | | | | | — | | | | (7,892 | ) | | | (14,780 | ) | | | — | |

| | | | | 3,947,700 | | | | 434,575 | | | | 8,936,366 | | | | 5,966,505 | |

| | | | | 3,487,467 | | | | 431,484 | | | | 11,760,505 | | | | 1,234,539 | |

| |

REALIZED AND UNREALIZED GAIN (LOSS): | | | | | | | | | | | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | | | | | | | | | | | |

| | | | | (890,097 | ) | | | (2,434,613 | ) | | | (57,501,709 | ) | | | (2,260,423 | ) |

Foreign currency related transactions | | | | | 5,454 | | | | (14,188 | ) | | | (126,062 | ) | | | (253,681 | ) |

| | | | | (884,643 | ) | | | (2,448,801 | ) | | | (57,627,771 | ) | | | (2,514,104 | ) |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | | | | | | | | | | | |

| | | | | 10,612,956 | | | | 108,749 | | | | 44,413,167 | | | | (19,717,659 | ) |

Foreign currency related transactions | | | | | 6,402 | | | | 124 | | | | (144,074 | ) | | | 61,435 | |

Net change in unrealized appreciation (depreciation) | | | | | 10,619,358 | | | | 108,873 | | | | 44,269,093 | | | | (19,656,224 | ) |

Net realized and unrealized gain (loss) | | | | | 9,734,715 | | | | (2,339,928 | ) | | | (13,358,678 | ) | | | (22,170,328 | ) |

Increase (decrease) in net assets resulting from operations | | | | $ | 13,222,182 | | | $ | (1,908,444 | ) | | $ | (1,598,173 | ) | | $ | (20,935,789 | ) |

| | | | | | | | | | | | | | | | | | |

| | | | $ | 507,684 | | | $ | 93,106 | | | $ | 2,010,263 | | | $ | 1,239,358 | |

See Accompanying Notes to Financial Statements

31

STATEMENTS OF CHANGES IN NET ASSETS

| | | | ING Diversified International Fund

| | ING Global Bond Fund

| |

|---|

| | | | Year Ended

October 31,

2012

| | Year Ended

October 31,

2011

| | Year Ended

October 31,

2012

| | Year Ended

October 31,

2011

|

|---|

| | | | | | | | | | | | | | | | | | |

| | | | $ | 1,275,607 | | | $ | 1,061,111 | | | $ | 24,765,610 | | | $ | 21,852,387 | |

| | | | | (262,281 | ) | | | 18,677,621 | | | | (8,026,186 | ) | | | 16,073,329 | |

Net change in unrealized appreciation (depreciation) | | | | | 3,400,195 | | | | (28,118,960 | ) | | | 21,528,154 | | | | (32,404,908 | ) |

Increase (decrease) in net assets resulting from operations | | | | | 4,413,521 | | | | (8,380,228 | ) | | | 38,267,578 | | | | 5,520,808 | |

| |

FROM DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | (702,513 | ) | | | (849,416 | ) | | | (2,973,693 | ) | | | (10,319,094 | ) |

| | | | | (25,317 | ) | | | (6,446 | ) | | | (10,812 | ) | | | (123,842 | ) |

| | | | | (95,652 | ) | | | (41,009 | ) | | | (453,531 | ) | | | (3,634,043 | ) |

| | | | | (173,157 | ) | | | (101,208 | ) | | | (4,757,431 | ) | | | (12,386,732 | ) |

| | | | | (47,020 | ) | | | (31,234 | ) | | | (51,069 | ) | | | (182,335 | ) |

| | | | | (1,361 | ) | | | (1,151 | ) | | | (592 | ) | | | (28 | ) |

| | | | | (14,983 | ) | | | (30,647 | ) | | | (379,070 | ) | | | (781,331 | ) |

| | | | | | | | | | | | | | | | | | |

| | | | | — | | | | — | | | | (9,453,922 | ) | | | (1,887,005 | ) |

| | | | | — | | | | — | | | | (77,080 | ) | | | (32,368 | ) |

| | | | | — | | | | — | | | | (3,749,885 | ) | | | (837,018 | ) |

| | | | | — | | | | — | | | | (11,707,244 | ) | | | (2,007,676 | ) |

| | | | | — | | | | — | | | | (159,667 | ) | | | (33,672 | ) |

| | | | | — | | | | — | | | | (3,022 | ) | | | (2 | ) |

| | | | | — | | | | — | | | | (986,134 | ) | | | (135,360 | ) |

| | | | | | | | | | | | | | | | | | |

| | | | | — | | | | (101,282 | ) | | | (2,892,533 | ) | | | — | |

| | | | | — | | | | (16,186 | ) | | | (26,356 | ) | | | — | |

| | | | | — | | | | (58,887 | ) | | | (1,459,959 | ) | | | — | |

| | | | | — | | | | (8,943 | ) | | | (5,236,765 | ) | | | — | |

| | | | | — | | | | (3,222 | ) | | | (60,046 | ) | | | — | |

| | | | | — | | | | (181 | ) | | | (2,655 | ) | | | — | |

| | | | | — | | | | (2,634 | ) | | | (400,311 | ) | | | — | |

| | | | | (1,060,003 | ) | | | (1,252,446 | ) | | | (44,841,777 | ) | | | (32,360,506 | ) |

| |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | | | | | | | |

Net proceeds from sale of shares | | | | | 6,351,082 | | | | 22,363,258 | | | | 509,177,465 | | | | 391,678,723 | |

Reinvestment of distributions | | | | | 865,547 | | | | 1,031,590 | | | | 37,756,214 | | | | 28,050,981 | |

| | | | | 7,216,629 | | | | 23,394,848 | | | | 546,933,679 | | | | 419,729,704 | |

| | | | | (40,900,474 | ) | | | (79,537,970 | ) | | | (371,164,423 | ) | | | (284,914,258 | ) |

Net increase (decrease) in net assets resulting from capital share transactions | | | | | (33,683,845 | ) | | | (56,143,122 | ) | | | 175,769,256 | | | | 134,815,446 | |

Net increase (decrease) in net assets | | | | | (30,330,327 | ) | | | (65,775,796 | ) | | | 169,195,057 | | | | 107,975,748 | |

| |

| | | | | | | | | | | | | | | | | | |

Beginning of year or period | | | | | 127,062,441 | | | | 192,838,237 | | | | 634,785,574 | | | | 526,809,826 | |

| | | | $ | 96,732,114 | | | $ | 127,062,441 | | | $ | 803,980,631 | | | $ | 634,785,574 | |

Undistributed (distributions in excess of) net investment income at end of year or period | | | | $ | 343,923 | | | $ | (3,478 | ) | | $ | (3,407,671 | ) | | $ | 396,522 | |

See Accompanying Notes to Financial Statements

32

STATEMENTS OF CHANGES IN NET ASSETS

| | | | ING Global Value Choice Fund

| | ING Index Plus International Equity Fund

| |

|---|

| | | | Year Ended

October 31,

2012

| | Year Ended

October 31,

2011

| | Year Ended

October 31,

2012

| | Year Ended

October 31,

2011

|

|---|

| | | | | | | | | | | | | | | | | | |

| | | | $ | 3,021,333 | | | $ | 4,470,605 | | | $ | 2,439,472 | | | $ | 2,130,084 | |

| | | | | (34,832,397 | ) | | | 72,126,776 | | | | (1,986,760 | ) | | | 7,773,885 | |

Net change in unrealized appreciation (depreciation) | | | | | (7,498,513 | ) | | | (72,744,924 | ) | | | 2,874,102 | | | | (10,985,298 | ) |

Increase (decrease) in net assets resulting from operations | | | | | (39,309,577 | ) | | | 3,852,457 | | | | 3,326,814 | | | | (1,081,329 | ) |

| |

FROM DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | (2,085,360 | ) | | | (3,111,531 | ) | | | (172,400 | ) | | | (119,991 | ) |

| | | | | — | | | | (43,014 | ) | | | (4,426 | ) | | | (2,716 | ) |

| | | | | (366,940 | ) | | | (1,315,055 | ) | | | (15,082 | ) | | | (5,994 | ) |

| | | | | (2,716,720 | ) | | | (2,957,286 | ) | | | (1,376,087 | ) | | | (1,354,511 | ) |

| | | | | — | | | | — | | | | (927,783 | ) | | | (609,056 | ) |

| | | | | (288,923 | ) | | | (584,591 | ) | | | (83 | ) | | | — | |

| | | | | | | | | | | | | | | | | | |

| | | | | (20,838,644 | ) | | | — | | | | — | | | | — | |

| | | | | (485,497 | ) | | | — | | | | — | | | | — | |

| | | | | (13,221,207 | ) | | | — | | | | — | | | | — | |

| | | | | (19,281,134 | ) | | | — | | | | — | | | | — | |

| | | | | (2,277,810 | ) | | | — | | | | — | | | | — | |

| | | | | (61,562,235 | ) | | | (8,011,477 | ) | | | (2,495,861 | ) | | | (2,092,268 | ) |

| |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | | | | | | | |

Net proceeds from sale of shares | | | | | 54,481,797 | | | | 389,319,314 | | | | 10,801,680 | | | | 51,836,203 | |

Payment from distribution/payment by affiliate | | | | | 364,932 | | | | — | | | | — | | | | — | |

Reinvestment of distributions | | | | | 36,770,617 | | | | 4,386,066 | | | | 1,596,949 | | | | 1,504,647 | |

| | | | | 91,617,346 | | | | 393,705,380 | | | | 12,398,629 | | | | 53,340,850 | |

| | | | | (453,328,903 | ) | | | (243,707,957 | ) | | | (51,575,951 | ) | | | (93,789,046 | ) |

Net increase (decrease) in net assets resulting from capital share transactions | | | | | (361,711,557 | ) | | | 149,997,423 | | | | (39,177,322 | ) | | | (40,448,196 | ) |

Net increase (decrease) in net assets | | | | | (462,583,369 | ) | | | 145,838,403 | | | | (38,346,369 | ) | | | (43,621,793 | ) |

| |

| | | | | | | | | | | | | | | | | | |

Beginning of year or period | | | | | 640,165,025 | | | | 494,326,622 | | | | 94,728,942 | | | | 138,350,735 | |

| | | | $ | 177,581,656 | | | $ | 640,165,025 | | | $ | 56,382,573 | | | $ | 94,728,942 | |

Undistributed net investment income at end of year or period | | | | $ | 678,384 | | | $ | 4,867,897 | | | $ | 2,410,014 | | | $ | 2,285,357 | |

See Accompanying Notes to Financial Statements

33

STATEMENTS OF CHANGES IN NET ASSETS

| | | | ING International Small Cap Fund

| | ING International Value Choice Fund

| |

|---|

| | | | Year Ended

October 31,

2012

| | Year Ended

October 31,

2011

| | Year Ended

October 31,

2012

| | Year Ended

October 31,

2011

|

|---|

| | | | | | | | | | | | | | | | | | |

| | | | $ | 3,487,467 | | | $ | 4,194,520 | | | $ | 431,484 | | | $ | 729,357 | |

| | | | | (884,643 | ) | | | 44,928,242 | | | | (2,448,801 | ) | | | (265,944 | ) |

Net change in unrealized appreciation (depreciation) | | | | | 10,619,358 | | | | (62,985,420 | ) | | | 108,873 | | | | (4,469,597 | ) |

Increase (decrease) in net assets resulting from operations | | | | | 13,222,182 | | | | (13,862,658 | ) | | | (1,908,444 | ) | | | (4,006,184 | ) |

| |

FROM DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | (1,557,769 | ) | | | (540,772 | ) | | | (562,622 | ) | | | (190,808 | ) |

| | | | | (10,775 | ) | | | (56 | ) | | | (7,167 | ) | | | — | |

| | | | | (230,441 | ) | | | (572 | ) | | | (80,404 | ) | | | (12,953 | ) |

| | | | | (3,055,854 | ) | | | (1,827,105 | ) | | | (122,252 | ) | | | (187,574 | ) |

| | | | | (25,934 | ) | | | (6,464 | ) | | | — | | | | — | |

| | | | | (458,648 | ) | | | (240,091 | ) | | | (1,980 | ) | | | (516 | ) |

| | | | | (5,339,421 | ) | | | (2,615,060 | ) | | | (774,425 | ) | | | (391,851 | ) |

| |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | | | | | | | |

Net proceeds from sale of shares | | | | | 29,267,070 | | | | 79,921,323 | | | | 13,499,438 | | | | 22,439,247 | |

Payment from distribution/payment by affiliate | | | | | 821,983 | | | | 136,362 | | | | — | | | | — | |

Reinvestment of distributions | | | | | 3,263,088 | | | | 1,515,427 | | | | 677,136 | | | | 351,441 | |

| | | | | 33,352,141 | | | | 81,573,112 | | | | 14,176,574 | | | | 22,790,688 | |

| | | | | (106,730,639 | ) | | | (192,605,155 | ) | | | (18,392,169 | ) | | | (35,264,069 | ) |

Net decrease in net assets resulting from capital share transactions | | | | | (73,378,498 | ) | | | (111,032,043 | ) | | | (4,215,595 | ) | | | (12,473,381 | ) |

Net decrease in net assets | | | | | (65,495,737 | ) | | | (127,509,761 | ) | | | (6,898,464 | ) | | | (16,871,416 | ) |

| |

| | | | | | | | | | | | | | | | | | |

Beginning of year or period | | | | | 307,668,967 | | | | 435,178,728 | | | | 29,922,785 | | | | 46,794,201 | |

| | | | $ | 242,173,230 | | | $ | 307,668,967 | | | $ | 23,024,321 | | | $ | 29,922,785 | |

Undistributed net investment income at end of year or period | | | | $ | 4,269,957 | | | $ | 4,023,061 | | | $ | 365,448 | | | $ | 725,238 | |

See Accompanying Notes to Financial Statements

34

STATEMENTS OF CHANGES IN NET ASSETS

| | | | ING International Value Fund

| | ING Russia Fund

| |

|---|

| | | | Year Ended

October 31,

2012

| | Year Ended

October 31,

2011

| | Year Ended

October 31,

2012

| | Year Ended

October 31,

2011

|

|---|

| | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | | $ | 11,760,505 | | | $ | 16,501,957 | | | $ | 1,234,539 | | | $ | (1,256,315 | ) |

| | | | | (57,627,771 | ) | | | (15,527,252 | ) | | | (2,514,104 | ) | | | 1,651,353 | |

Net change in unrealized appreciation (depreciation) | | | | | 44,269,093 | | | | (63,706,978 | ) | | | (19,656,224 | ) | | | (29,282,257 | ) |

Decrease in net assets resulting from operations | | | | | (1,598,173 | ) | | | (62,732,273 | ) | | | (20,935,789 | ) | | | (28,887,219 | ) |

| |

FROM DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | (7,601,085 | ) | | | (10,059,110 | ) | | | — | | | | — | |

| | | | | (20,538 | ) | | | (81 | ) | | | — | | | | — | |

| | | | | (2,495,707 | ) | | | (2,824,431 | ) | | | — | | | | — | |

| | | | | (7,967,223 | ) | | | (9,798,033 | ) | | | — | | | | — | |

| | | | | (9,108 | ) | | | (545,238 | ) | | | — | | | | — | |

| | | | | (18,093,661 | ) | | | (23,226,893 | ) | | | — | | | | — | |

| |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | | | | | | | |

Net proceeds from sale of shares | | | | | 36,063,881 | | | | 158,710,188 | | | | 24,129,463 | | | | 62,067,223 | |

Payment from distribution/payment by affiliate | | | | | 860,591 | | | | 115,624 | | | | — | | | | — | |

Reinvestment of distributions | | | | | 14,532,214 | | | | 18,121,879 | | | | — | | | | — | |

| | | | | 51,456,686 | | | | 176,947,691 | | | | 24,129,463 | | | | 62,067,223 | |

| | | | | — | | | | — | | | | 133,331 | | | | 217,940 | |

| | | | | (252,961,793 | ) | | | (623,758,163 | ) | | | (87,210,483 | ) | | | (131,466,024 | ) |

Net decrease in net assets resulting from capital share transactions | | | | | (201,505,107 | ) | | | (446,810,472 | ) | | | (62,947,689 | ) | | | (69,180,861 | ) |

Net decrease in net assets | | | | | (221,196,941 | ) | | | (532,769,638 | ) | | | (83,883,478 | ) | | | (98,068,080 | ) |

| |

| | | | | | | | | | | | | | | | | | |

Beginning of year or period | | | | | 703,780,494 | | | | 1,236,550,132 | | | | 328,244,953 | | | | 426,313,033 | |

| | | | $ | 482,583,553 | | | $ | 703,780,494 | | | $ | 244,361,475 | | | $ | 328,244,953 | |