| | OMB APPROVAL |

| | OMB Number: | 3235-0570 |

| | Expires: | August 31, 2011 |

| UNITED STATES | Estimated average burden hours per response. . . . . . . . . . . . . . . . 18.9 |

| SECURITIES AND EXCHANGE COMMISSION | |

| Washington, D.C. 20549 | |

| | | | |

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-07986 |

|

The Alger Institutional Funds |

(Exact name of registrant as specified in charter) |

|

111 Fifth Avenue New York, New York | | 10003 |

(Address of principal executive offices) | | (Zip code) |

|

Mr. Hal Liebes Fred Alger Management, Inc. 111 Fifth Avenue New York, New York 10003 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 212-806-8800 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | April 30, 2009 | |

| | | | | | | | |

ITEM 1. REPORT(S) TO STOCKHOLDERS.

Alger Capital Appreciation Institutional Fund |Alger LargeCap Growth Institutional Fund | Alger MidCap Growth Institutional Fund | Alger SmallCap Growth Institutional Fund |

The Alger

Institutional Funds

| |

|

| |

SEMI-ANNUAL REPORT | |

April 30, 2009 | |

(Unaudited) | |

Table of Contents | |

| |

THE ALGER INSTITUTIONAL FUNDS | |

| |

Letter to Our Shareholders | 1 |

| |

Fund Highlights | 9 |

| |

Portfolio Summary | 13 |

| |

Schedules of Investments | 14 |

| |

Statements of Assets and Liabilities | 38 |

| |

Statements of Operations | 40 |

| |

Statements of Changes in Net Assets | 42 |

| |

Financial Highlights | 44 |

| |

Notes to Financial Statements | 52 |

| |

Additional Information | 62 |

Go Paperless With Alger Electronic Delivery Service

Alger is pleased to provide you with the ability to access regulatory materials online. When documents such as prospectuses and annual and semi-annual reports are available, we’ll send you an e-mail notification with a convenient link that will take you directly to the fund information on our website. To sign up for this free service, simply enroll at www.icsdelivery.com/alger.

Dear Shareholders, | | May 25, 2009 |

We can look at the last six months as the melting away of an illusion; as a time when reality has come painfully back into play. Many philosophers built vast realms of study on the idea that misguided reason can twist reality into something that perhaps suits us in the moment but ultimately only serves to keep us in an illusory state—and, in our current case, wreak havoc on our economy and our confidence.

The housing and credit crises and ensuing financial breakdown began with an illusion based on flawed ideas held by many financial lenders and insurers: the latent belief that growth in the housing market would continue unhampered on its upward trajectory. Underlying the assumption of unimpeded growth was the idea that financial derivatives could not only provide the increase in debt necessary to support the financial system but also manage the associated risk. In the mid-2000s, the illusion grew as more and more lenders extended more and more credit to “subprime” borrowers who, if their circumstances declined, were less and less likely to be able to pay the loans back. Although the practice was based on a belief that growth would continue, experience has shown again and again that the upward trend of growth over time is much more jagged than we like to recall.

When the illusion disintegrated, not only did the borrowers suffer from foreclosures, but the resulting housing crisis created a massive ripple effect that crippled the U.S.’s major financial firms. Along with the weakening of the financial sector, so went credit availability, consumer spending, jobs, and, ultimately, consumer confidence. By the fourth quarter of 2008, the scale of the crisis had ceased to be solely “subprime”—it had gone global. Into the first quarter of 2009, the volatility continued with the Dow Jones Industrial Average(i) climbing as high as 9,034 points and falling as low as 6,547 points.

Toward the end of the first quarter and into the second quarter of the calendar year, economic indicators were struggling to recover. Retail sales fell 1.3% in March and a further 0.4% in April—a larger dip than expected. The Consumer Price Index declined 0.7% on an annual basis in April, only the second year-over-year decline in nearly 54 years following March’s 0.4% drop(ii). Industrial production decreased 0.5% in April after having fallen 1.7% in March(iii). And GDP for the first quarter of 2009 decreased 6.1% compared to the fourth quarter of 2008, which experienced a decline of 6.3%.

Europe did not fare much better. GDP fell 2.5% in the first quarter of 2009 versus the last quarter of 2008, which experienced a decline of 1.5%—the figures were for both the 16-country euro currency zone and the broader 27-country European Union bloc(iv). China is anticipated to fare less poorly, and although its export growth is expected to slow, the country is taking measures to focus on innovation rather than outright cost-efficiency.

Emerging from the Darkness

Plato famously dealt with illusion in what came to be called Plato’s Cave. He described people in a cave whose notion of reality was entirely comprised of shadows projected on a wall. Similarly, one could say that we were in such a cave, deceived by

1

the shadows of easy credit, with no real idea of the hows or whys of what we were seeing.

Now, however, we are beginning to see clearly where things unraveled. Actions are being taken by the Obama administration as well as the housing, financial, and automotive industries to stave off a repetition of the disaster; whether or not those actions will succeed remains to be seen.

What we do know is that, as of the date of this writing, some light has begun to shine in growth investing. In the first quarter, growth funds beat their value rivals by the largest margin in nine years. As of April 28, mid-cap growth funds were up 4.3%, small-cap growth funds were up 0.8%, and large-cap growth funds were up 2.6%, according to investment researcher Morningstar Inc.—a sign that investors are beginning to shed their aversion to risk and test the market.

Then and Now

Much has been made of the similarities between the current downturn and the Great Depression. During the “Roaring Twenties,” people were busy buying automobiles and appliances on credit and eagerly speculating in the stock market, feeding the illusion that the good times would continue to roll.

Then, like now, thought—in terms of easy credit and unimpeded growth—was divorced from reality. Back then, however, government policy either declined to intervene or, worse, intervened in ways that exacerbated rather than alleviated the financial crisis, thus allowing the devastation to spread across the U.S. economy. Things today move much more quickly. The current economy has turned downward faster in a shorter period of time than in any prior period, including the Depression. Fortunately, our government has responded with alacrity and, in a broad sense, moved in the right direction both by injecting massive amounts of liquidity into the financial system and by proactively assuring consumers of the safety of their savings and deposit accounts. As a result, we are likely to emerge faster from this crisis, and certainly much faster than in the 1930s. Government cannot be the only driver of recovery. Today, the depth and breadth of investors in markets across the globe is much stronger than ever before, and their actions will likely speed and strengthen the shape of recovery in both equity and debt markets.

As we have noted in our Alger Market Commentaries (see www.alger.com), companies were quick to respond to the downturn in the second half of 2008 by moving rapidly to cut expenses. At the end of the first quarter of 2009, as we tracked the corporate earnings results of the companies we follow, we discovered a pattern: despite the rapidity of the economic downturn, we saw companies reporting free cash flow of both absolute strength and relative resilience. We expect the continued stabilization of the U.S. economy and company fundamentals to support the market’s rally from March lows.

We are already seeing signs of a bottoming in the housing market in the earliest-hit and hardest-hit areas of the U.S. where declines in foreclosures and short sales have begun to occur. Looking at Orange County, California, home prices increased 2.5% in March from February; sales jumped 27.5% in March from February and 47.4% from last year, according to the California Association of Realtors. The county had about four months of inventory as of May, a level not seen since April 2006. Inventory was at eight months a year ago and peaked at 11 months in 2007.

2

As a lagging indicator, the unemployment rate won’t yield for a while as companies are expected to be slow to add new jobs, but the market can rebound long before the level of employment does. The unemployment rate hit a 25-year high in April, but there were signs of hope as the monthly job loss total for April fell to 539,000, down from 699,000 jobs lost in March and the lowest level in six months—since October, when the economy shed 380,000 jobs.

The Institute for Supply Management’s manufacturing index, a key measure of manufacturing activity, rose for the fourth straight month in April, suggesting the sector may be stabilizing even though the indicator has been at the contraction level for 15 months in a row. And the Consumer Confidence Index, which had posted a slight increase in March, improved considerably in April. The Index now stands at 39.2 (1985=100), up from 26.9 in March.

Apart from the Crowd

Looking forward, we are grounded in a more complete picture of reality—for the overall economy and our firm. Danish philosopher Søren Kierkegaard, too, examined illusion in a way, writing that crowds limit and stifle the unique individual. Like any economic bubble, we can, of course, now say in hindsight that the adjoining crises were a result of exactly this kind of crowd mentality. The resulting economic disaster, while painful, has effectively broken up the crowd, razing the illusion and once again opening the investing field up to new and creative opportunities. There is, after all, a stunning amount of cash on the sidelines. The savings rate is up to 5%, meaning that there is about $500 billion currently being held in cash. As consumer confidence repairs itself, the sidelined cash will be invested. While we believe that the economy will technically be in recession for most of 2009, negative GDP figures will gradually become less severe.

The stock market, however, is a discounting mechanism; investors look forward toward the potential range of economic, sector, and company-specific outcomes in terms of revenues, margins, profits, and growth to assess the value of equity. At Alger, our investment process includes valuation analysis that considers outcomes that are both highly pessimistic and optimistic. Most of the time, we observe stocks selling within ranges that reflect varying but ultimately balanced views between the divergent possibilities.

Occasionally, however, the crowd mentality of the market overwhelms such rational behavior and investors see something entirely different: equities of companies, even the strongest, suddenly priced to fail. We believe the S&P 500 Index(v) lows in March reflected such an event and, thus, we are increasingly confident that those lows will mark the bottom. Because we do not expect the economy—and, in particular, investor sentiment about economic recovery and future growth—to recover in a straight line, we think continued market volatility is likely. The inevitable sell-offs in the stock market that will accompany such uncertain economic progress will offer excellent buying opportunities for patient, long-term investors.

During the last six months, we had limited exposure to the hardest-hit areas of the financial sector, and our performance was largely a result of the market’s broad and indiscriminate decline. Even in the best of times investing is a challenge; however, it is during bad times that an investment firm proves its capability to manage through crisis, focus on improving performance, and not only endure but also improve upon its strengths. Alger investment professionals have remained

3

focused and disciplined in executing upon our consistent investment philosophy and process. Now in 2009, our 45th year in the business of investing, we have successfully passed through many shadowy times and found new opportunities amidst economic and generational change.

Kierkegaard once wrote, “The task must be made difficult, for only the difficult inspires the noble-hearted.” We have perhaps encountered the most difficult task our generation will see, and our firm has come out of it more inspired than ever to deliver exceptional investment results for an exceptional group of individuals and institutions: our clients.

Portfolio Matters

Alger Capital Appreciation Institutional Fund

The Alger Capital Appreciation Institutional Fund returned 0.31% for the six months ended April 30, 2009, compared to the Russell 3000 Growth Index(vi) return of -1.70%.

During the period, the largest portfolio weightings in the Alger Capital Appreciation Institutional Fund were in the Information Technology and Health Care sectors. The largest sector overweight for the period was in Financials. The largest sector underweight for the period was in Industrials. Relative outperformance in the Energy and Information Technology sectors were the most important contributors to performance. Sectors that detracted from the portfolio included Consumer Discretionary and Materials.

Among the most important relative contributors to the portfolio during the six months ended April 30, 2009, were Apple Inc., Transocean Ltd., Google Inc. (ClA), Chesapeake Energy Corp., and Marvell Technology Group Ltd.. Conversely, detracting from overall results on a relative basis were Satyam Computer Services Ltd. (ADS), Gildan Activewear Inc., Abbott Laboratories, Covidien Ltd., and Activision Blizzard Inc.

Alger LargeCap Growth Institutional Fund

The Alger LargeCap Growth Institutional Fund returned -0.46% for the fiscal year ended April 30, 2009, compared with a return of -1.54% for the Russell 1000 Growth Index(vii).

During the period, the largest portfolio weightings in the Alger LargeCap Growth Institutional Fund were in the Information Technology and Consumer Staples sectors. The largest sector overweight for the period was in Financials. The largest sector underweight for the period was in Industrials. Relative outperformance in the Energy and Health Care sectors were the most important contributors to performance. Sectors that detracted from the portfolio included Industrials and Financials.

Among the most important relative contributors to the portfolio during the six months ended April 30, 2009, were Weatherford International Ltd., Wyeth, Research In Motion Ltd., QUALCOMM Inc., and Walgreen Co. Conversely, detracting from overall results on a relative basis were McDermott International Inc., General Electric Co., Devon Energy Corp., JPMorgan Chase & Co., and Freeport-McMoRan Copper & Gold Inc.

4

Alger MidCap Growth Institutional Fund

For the six months ended April 30, 2009, the Alger MidCap Growth Institutional Fund returned - -1.32%, compared to the Russell MidCap Growth Index(viii) with a return of 2.70%.

During the period, the largest portfolio weightings in the Alger MidCap Growth Institutional Fund were in the Information Technology and Health Care sectors. The largest sector overweight for the period was in Information Technology. The largest sector underweight for the period was in Industrials. Relative outperformance in the Energy and Financials sectors were the most important contributors to performance. Sectors that detracted from the portfolio included Information Technology and Health Care.

Among the most important relative contributors to the portfolio during the six months ended April 30, 2009, were Chico’s FAS Inc., Mylan Inc., SPX Corp., Optimer Pharmaceuticals Inc., and Hansen Natural Corp. Conversely, detracting from overall results on a relative basis were Satyam Computer Services Ltd. (ADS), Gildan Activewear Inc., McDermott International Inc., United Therapeutics Corp., and Tessera Technologies Inc.

Alger SmallCap Growth Institutional Fund

The Alger SmallCap Growth Institutional Fund returned 2.10% for the six months ended April 30, 2009, compared to the Russell 2000 Growth Index(ix), which returned -3.78%.

During the period, the largest portfolio weightings in the Alger SmallCap Growth Institutional Fund were in the Information Technology and Health Care sectors. The largest sector overweight for the period was in Information Technology. The largest sector underweight for the period was in Industrials. Relative outperformance in the Industrials and Health Care sectors were the most important contributors to performance. Sectors that detracted from the portfolio included Telecommunications Services and Consumer Staples.

Among the most important relative contributors to the portfolio during the six months ended April 30, 2009, were Optimer Pharmaceuticals Inc., AECOM Technology Corp., VistaPrint Ltd., priceline.com Inc., and URS Corp. Conversely, detracting from overall results on a relative basis were Tenet Healthcare Corp., Icon PLC (ADS), Microsemi Corp., Ann Taylor Stores Corp., and International Coal Group Inc.

| Respectfully submitted, |

|

|

| Daniel C. Chung |

| Chief Investment Officer |

(i) | The Dow Jones Industrial Average is an index of common stocks comprised of major industrial companies and assumes reinvestment of dividends. It is frequently used as a general measure of stock market performance. |

5

(ii) | Labor Department |

(iii) | Federal Reserve |

(iv) | EU statistics office |

(v) | Standard & Poor’s 500 Index is an index of the 500 largest and most profitable companies in the United States. |

(vi) | The Russell 3000 Growth Index is an unmanaged index designed to measure the performance of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. |

(vii) | The Russell 1000 Growth Index is an unmanaged index designed to measure the performance of the largest 1,000 companies in the Russell 3000 Index with higher price-to-book ratios and higher forecasted growth values. The Russell 3000 Index measures the performance of the 3000 largest U.S. companies based on the total market capitalization, which represents 98% of the U.S. Equity Market. |

(viii) | The Russell Midcap Growth Index is an unmanaged index designed to measure the performance of the 800 smallest companies in the Russell 1000 Index with higher price-to-book ratios and higher forecasted growth values. |

(ix) | The Russell 2000 Growth Index is an unmanaged index designed to measure the performance of the 2,000 smallest companies in the Russell 3000 Index with higher price-to-book ratios and higher forecasted growth values. |

Investors cannot invest directly in an index. Index performance does not reflect the deduction for fees, expenses or taxes.

This report and the financial statements contained herein are submitted for the general information of shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Funds unless proceeded or accompanied by an effective prospectus for the Funds. Funds returns represent the fiscal six-month period return of Class I shares. The performance data quoted represents past performance, which is not an indication or guarantee of future results.

Standardized performance results can be found on the following page. The investment return and principal value of an investment in a fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, visit us at www.alger.com, or call us at (800) 992-3863.

The views and opinions of the Funds’ management in this report are as of the date of the Shareholders letter and are subject to change at any time subsequent to this date. There is no guarantee that any of the assumptions that formed the basis for the opinions stated herein are accurate or that they will materialize. Moreover, the information forming the basis for such assumptions is from sources believed to be reliable; however, there is no guarantee that such information is accurate. Any securities mentioned, whether owned in a fund or otherwise, are considered in the context of the construction of an overall portfolio of securities and therefore reference to them should not be construed as a recommendation or offer to purchase or sell any such security. Inclusion of such securities in a fund and transactions in such securities, if any, may be for a variety of reasons, including without limitation, in response to cash flows, inclusion in a benchmark, and risk control. The reference to a specific security should also be understood in such context and not viewed as a statement that the security is a significant holding in a portfolio. Please refer to the Schedules of Investments for each fund that is included in this report for a complete list of fund holdings as of April 30, 2009. Securities mentioned in the Shareholders letter, if not found in the Schedule of Investments, may have been held by the Funds during the six-month fiscal period.

6

A Word About Risk

Growth stocks tend to be more volatile than other stocks as the price of growth stocks tends to be higher in relation to their companies’ earnings and may be more sensitive to market, political and economic developments. Investing in the stock market involves gains and losses and may not be suitable for all investors. Stocks of small and mid-sized companies are subject to greater risk than stocks of larger, more established companies owing to such factors as limited liquidity, inexperienced management, and limited financial resources. Funds that participate in leveraging, such as the Capital Appreciation Institutional Fund, are subject to the risk that borrowing money to leverage will exceed the returns for securities purchased or that the securities purchased may actually go down in value; thus, the Funds’ net asset value can decrease more quickly than if the Funds had not borrowed. For a more detailed discussion of the risks associated with these Funds, please see the Funds’ Prospectus.

Before investing, carefully consider a fund’s investment objective, risks, charges, and expenses. For a prospectus containing this and other information about The Alger Institutional Funds call us at (800) 992-3863 or visit us at www.alger.com. Read it carefully before investing. Fred Alger & Company, Incorporated, Distributor. Member NYSE Euronext, SIPC.

NOT FDIC INSURED. NOT BANK GUARANTEED. MAY LOSE VALUE.

7

FUND PERFORMANCE AS OF 3/31/09 (Unaudited)

AVERAGE ANNUAL TOTAL RETURNS

| | 1 | | 5 | | 10 | | SINCE | |

| | YEAR | | YEARS | | YEARS | | INCEPTION | |

Alger Capital Appreciation Class I | | | | | | | | | |

(Inception 11/8/93) | | (34.99 | )% | 0.67 | % | (1.42 | )% | 8.90 | % |

Alger Capital Appreciation Class R | | | | | | | | | |

(Inception 1/27/03) | | (35.34 | )% | 0.15 | % | n/a | | 5.57 | % |

Alger LargeCap Growth Class I | | | | | | | | | |

(Inception 11/8/93) | | (39.22 | )% | (5.57 | )% | (4.66 | )% | 4.89 | % |

Alger LargeCap Growth Class R | | | | | | | | | |

(Inception 1/27/03) | | (39.55 | )% | (6.05 | )% | n/a | | 0.41 | % |

Alger MidCap Growth Class I | | | | | | | | | |

(Inception 11/8/93) | | (49.10 | )% | (6.27 | )% | 1.36 | % | 9.51 | % |

Alger MidCap Growth Class R | | | | | | | | | |

(Inception 1/27/03) | | (49.34 | )% | (6.74 | )% | n/a | | 1.45 | % |

Alger SmallCap Growth Class I | | | | | | | | | |

(Inception 11/8/93) | | (36.12 | )% | (2.00 | )% | (2.45 | )% | 6.01 | % |

Alger SmallCap Growth Class R | | | | | | | | | |

(Inception 1/27/03) | | (36.43 | )% | (2.45 | )% | n/a | | 5.25 | % |

8

ALGER CAPITAL APPRECIATION INSTITUTIONAL FUND

Fund Highlights Through April 30, 2009 (Unaudited)

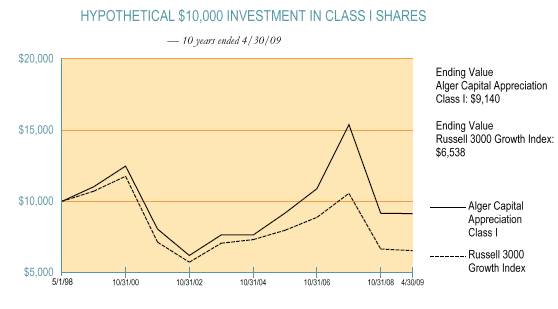

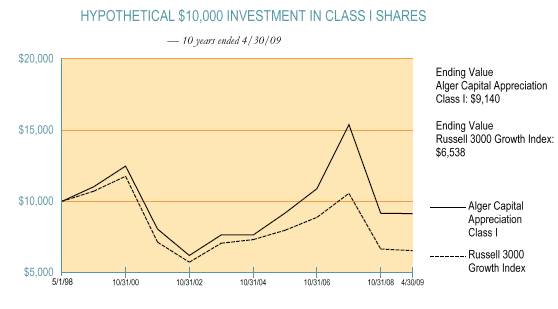

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Capital Appreciation Institutional Class I shares and the Russell 3000 Growth Index (an unmanaged index of common stocks) for the ten years ended April 30, 2009. Figures for the Alger Capital Appreciation Institutional Class I shares and the Russell 3000 Growth Index include reinvestment of dividends. Performance for the Alger Capital Appreciation Institutional Class R shares may vary from the results shown above due to differences in expenses the class bears.

PERFORMANCE COMPARISON AS OF 4/30/09

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | SINCE | |

| | 1 YEAR | | 5 YEARS | | 10 YEARS | | INCEPTION | |

Class I (Inception 11/8/93) | | (32.96 | )% | 3.47 | % | (0.89 | )% | 9.50 | % |

Russell 3000 Growth Index | | (31.47 | )% | (2.33 | )% | (4.16 | )% | 4.86 | % |

| | | | | | | | | |

Class R (Inception 1/27/03) | | (33.32 | )% | 2.94 | % | n/a | | 7.05 | % |

Russell 3000 Growth Index | | (31.47 | )% | (2.33 | )% | n/a | | 2.74 | % |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on fund distributions or on the redemption of fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For performance current to the most recent month end, visit us at www.alger.com or call us at (800) 992-3863.

9

ALGER LARGECAP GROWTH INSTITUTIONAL FUND

Fund Highlights Through April 30, 2009 (Unaudited)

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger LargeCap Growth Institutional Class I shares and the Russell 1000 Growth Index (an unmanaged index of common stocks) for the ten years ended April 30, 2009. The figures for the Alger LargeCap Growth Institutional Class I shares and the Russell 1000 Growth Index include reinvestment of dividends. Performance for the Alger LargeCap Growth Institutional Class R shares may vary from the results shown above due to differences in expenses the class bears.

PERFORMANCE COMPARISON AS OF 4/30/09

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | SINCE | |

| | 1 YEAR | | 5 YEARS | | 10 YEARS | | INCEPTION | |

Class I (Inception 11/8/93) | | (37.52 | )% | (3.08 | )% | (3.88 | )% | 5.43 | % |

Russell 1000 Growth Index | | (31.56 | )% | (2.38 | )% | (4.40 | )% | 5.09 | % |

| | | | | | | | | |

Class R (Inception 1/27/03) | | (37.80 | )% | (3.56 | )% | n/a | | 1.75 | % |

Russell 1000 Growth Index | | (31.56 | )% | (2.38 | )% | n/a | | 2.54 | % |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on fund distributions or on the redemption of fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For performance current to the most recent month end, visit us at www.alger.com or call us at (800) 992-3863.

10

ALGER MIDCAP GROWTH INSTITUTIONAL FUND

Fund Highlights Through April 30, 2009 (Unaudited)

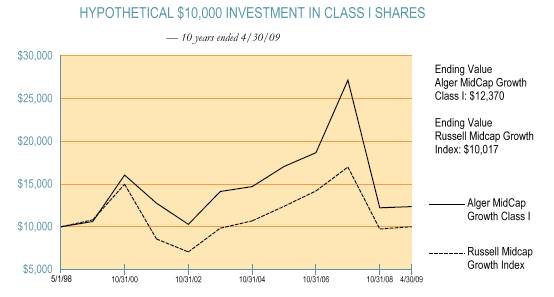

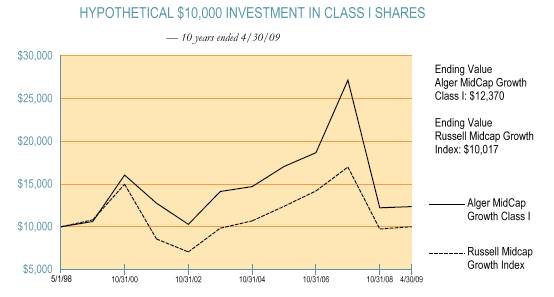

The chart above illustrates the growth in value of a hypothetical $10,000 investment made in the Alger MidCap Growth Institutional Class I shares and the Russell Midcap Growth Index (an unmanaged index of common stocks) for the ten years ended April 30, 2009. Figures for the Alger MidCap Growth Institutional Class I shares and the Russell Midcap Growth Index include reinvestment of dividends. Performance for the Alger MidCap Growth Institutional Class R shares may vary from the results shown above due to differences in expenses the class bears.

PERFORMANCE COMPARISON AS OF 4/30/09

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | SINCE | |

| | 1 YEAR | | 5 YEARS | | 10 YEARS | | INCEPTION | |

Class I (Inception 11/8/93) | | (46.31 | )% | (3.02 | )% | 2.15 | % | 10.26 | % |

Russell Midcap Growth Index | | (35.66 | )% | (0.76 | )% | 0.02 | % | 5.99 | % |

| | | | | | | | | |

Class R (Inception 1/27/03) | | (46.59 | )% | (3.49 | )% | n/a | | 3.27 | % |

Russell Midcap Growth Index | | (35.66 | )% | (0.76 | )% | n/a | | 5.66 | % |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on fund distributions or on the redemption of fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For performance current to the most recent month end, visit us at www.alger.com or call us at (800) 992-3863.

11

ALGER SMALLCAP GROWTH INSTITUTIONAL FUND

Fund Highlights Through April 30, 2009 (Unaudited)

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger SmallCap Growth Institutional Class I shares and the Russell 2000 Growth Index (an unmanaged index of common stocks) for the ten years ended April 30, 2009. The figures for the Alger SmallCap Growth Institutional Class I shares and the Russell 2000 Growth Index include reinvestment of dividends. Performance for the Alger SmallCap Growth Institutional Class R shares may vary from the results shown above due to differences in expenses the class bears.

PERFORMANCE COMPARISON AS OF 4/30/09

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | SINCE | |

| | 1 YEAR | | 5 YEARS | | 10 YEARS | | INCEPTION | |

Class I (Inception 11/8/93) | | (32.41 | )% | 0.87 | % | (1.72 | )% | 6.69 | % |

Russell 2000 Growth Index | | (30.36 | )% | (1.67 | )% | (1.06 | )% | 2.98 | % |

| | | | | | | | | |

Class R (Inception 1/27/03) | | (32.71 | )% | 0.41 | % | n/a | | 6.93 | % |

Russell 2000 Growth Index | | (30.36 | )% | (1.67 | )% | n/a | | 5.54 | % |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on fund distributions or on the redemption of fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For performance current to the most recent month end, visit us at www.alger.com or call us at (800) 992-3863

12

PORTFOLIO SUMMARY*

April 30, 2009 (Unaudited)

| | CAPITAL | | LARGECAP | | MIDCAP | | SMALLCAP | |

| | APPRECIATION | | GROWTH | | GROWTH | | GROWTH | |

| | INSTITUTIONAL | | INSTITUTIONAL | | INSTITUTIONAL | | INSTITUTIONAL | |

SECTORS | | FUND | | FUND | | FUND | | FUND | |

Consumer Discretionary | | 10.2 | % | 8.2 | % | 18.0 | % | 14.9 | % |

Consumer Staples | | 11.6 | | 14.9 | | 4.8 | | 3.8 | |

Energy | | 7.2 | | 8.4 | | 7.7 | | 6.0 | |

Financials | | 6.0 | | 4.3 | | 7.3 | | 6.3 | |

Health Care | | 17.8 | | 14.9 | | 19.4 | | 22.3 | |

Industrials | | 9.3 | | 9.2 | | 9.4 | | 12.4 | |

Information Technology | | 29.6 | | 31.3 | | 27.0 | | 26.3 | |

Materials | | 4.8 | | 3.3 | | 3.4 | | 1.6 | |

Telecommunication Services | | 1.2 | | 0.7 | | 2.4 | | 1.9 | |

Utilities | | 1.2 | | 0.0 | | 1.0 | | 1.3 | |

Short-Term Investments and Net Other | | | | | | | | | |

Assets | | 1.1 | | 4.8 | | (0.4 | ) | 3.2 | |

| | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % |

* Based on net assets for each Fund.

13

THE ALGER INSTITUTIONAL FUNDS |

ALGER CAPITAL APPRECIATION INSTITUTIONAL FUND

Schedule of Investments (Unaudited) April 30, 2009

| | SHARES | | VALUE | |

COMMON STOCKS—98.0% | | | | | |

AEROSPACE & DEFENSE—5.6% | | | | | |

BE Aerospace Inc. * | | 1,030,800 | | $ | 11,122,332 | |

General Dynamics Corp. | | 88,600 | | 4,577,962 | |

Lockheed Martin Corp. | | 157,600 | | 12,376,328 | |

| | | | 28,076,622 | |

AIR FREIGHT & LOGISTICS—0.3% | | | | | |

United Parcel Service Inc., Cl. B | | 31,900 | | 1,669,646 | |

| | | | | |

APPAREL RETAIL—0.5% | | | | | |

Gap Inc., /The | | 165,100 | | 2,565,654 | |

| | | | | |

APPLICATION SOFTWARE—1.0% | | | | | |

Net 1 UEPS Technologies Inc. * | | 29,200 | | 481,800 | |

Solera Holdings Inc. * | | 151,500 | | 3,457,230 | |

Synopsys Inc. * | | 46,800 | | 1,019,304 | |

| | | | 4,958,334 | |

ASSET MANAGEMENT & CUSTODY BANKS—0.5% | | | | | |

AllianceBernstein Holding LP | | 50,800 | | 890,016 | |

Invesco Ltd. | | 124,200 | | 1,828,224 | |

| | | | 2,718,240 | |

AUTOMOBILE MANUFACTURERS—0.3% | | | | | |

Honda Motor Co., Ltd. | | 52,683 | | 1,523,435 | |

| | | | | |

BIOTECHNOLOGY—3.7% | | | | | |

Alexion Pharmaceuticals Inc. * | | 51,000 | | 1,704,420 | |

Biogen Idec Inc. * | | 57,600 | | 2,784,384 | |

Celgene Corp. * | | 156,400 | | 6,681,408 | |

Cephalon Inc. * | | 85,400 | | 5,603,094 | |

Genzyme Corp. * | | 32,900 | | 1,754,557 | |

| | | | 18,527,863 | |

CABLE & SATELLITE—0.4% | | | | | |

DIRECTV Group Inc., /The* | | 78,600 | | 1,943,778 | |

| | | | | |

CASINOS & GAMING—0.7% | | | | | |

Las Vegas Sands Corp.* | | 467,100 | | 3,652,722 | |

| | | | | |

COMMUNICATIONS EQUIPMENT—3.6% | | | | | |

Cisco Systems Inc. * | | 302,300 | | 5,840,436 | |

Corning Inc. | | 33,600 | | 491,232 | |

Nice Systems Ltd. #* | | 33,300 | | 852,813 | |

Qualcomm Inc. | | 179,400 | | 7,592,208 | |

Research In Motion Ltd. * | | 45,800 | | 3,183,100 | |

| | | | 17,959,789 | |

COMPUTER & ELECTRONICS RETAIL—0.6% | | | | | |

Best Buy Co., Inc. | | 84,500 | | 3,243,110 | |

| | | | | |

COMPUTER HARDWARE—6.8% | | | | | |

Apple Inc. * | | 133,800 | | 16,836,055 | |

Hewlett-Packard Co. | | 259,300 | | 9,329,614 | |

International Business Machines Corp. | | 79,000 | | 8,153,590 | |

| | | | 34,319,259 | |

| | | | | | |

14

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

COMPUTER STORAGE & PERIPHERALS—1.1% | | | | | |

EMC Corp.* | | 420,600 | | $ | 5,270,118 | |

| | | | | |

CONSTRUCTION & ENGINEERING—0.1% | | | | | |

Foster Wheeler AG* | | 23,400 | | 503,802 | |

| | | | | |

DATA PROCESSING & OUTSOURCED SERVICES—3.2% | | | | | |

Mastercard Inc. | | 73,500 | | 13,483,575 | |

Visa Inc., Cl. A | | 35,700 | | 2,319,072 | |

| | | | 15,802,647 | |

DISTILLERS & VINTNERS—0.2% | | | | | |

Central European Distribution Corp.* | | 54,400 | | 1,218,560 | |

| | | | | |

DIVERSIFIED METALS & MINING—0.3% | | | | | |

Cia Vale do Rio Doce# | | 91,700 | | 1,513,967 | |

| | | | | |

DRUG RETAIL—3.5% | | | | | |

CVS Caremark Corp. | | 552,400 | | 17,555,272 | |

| | | | | |

EDUCATION SERVICES—0.5% | | | | | |

ITT Educational Services Inc.* | | 26,100 | | 2,630,097 | |

| | | | | |

ELECTRIC UTILITIES—0.5% | | | | | |

Northeast Utilities | | 130,100 | | 2,734,702 | |

| | | | | |

ELECTRICAL COMPONENTS & EQUIPMENT—0.3% | | | | | |

General Cable Corp.* | | 49,500 | | 1,343,430 | |

| | | | | |

FERTILIZERS & AGRICULTURAL CHEMICALS—0.4% | | | | | |

Mosaic Co., /The | | 54,900 | | 2,220,705 | |

| | | | | |

FOOD RETAIL—1.6% | | | | | |

Kroger Co., /The | | 370,300 | | 8,005,886 | |

| | | | | |

FOOTWEAR—0.3% | | | | | |

NIKE Inc., Cl. B | | 27,600 | | 1,448,172 | |

| | | | | |

GOLD—0.5% | | | | | |

Goldcorp Inc. | | 83,500 | | 2,297,920 | |

| | | | | |

HEALTH CARE EQUIPMENT—1.4% | | | | | |

Covidien Ltd. | | 143,640 | | 4,737,247 | |

Insulet Corp. * | | 133,500 | | 767,625 | |

Medtronic Inc. | | 38,700 | | 1,238,400 | |

Varian Medical Systems Inc. * | | 14,400 | | 480,528 | |

| | | | 7,223,800 | |

HEALTH CARE FACILITIES—0.8% | | | | | |

Community Health Systems Inc. * | | 47,700 | | 1,089,468 | |

Universal Health Services Inc., Cl. B | | 61,600 | | 3,104,640 | |

| | | | 4,194,108 | |

HEALTH CARE SERVICES—0.4% | | | | | |

Medco Health Solutions Inc.* | | 41,200 | | 1,794,260 | |

| | | | | |

HEALTH CARE SUPPLIES—1.1% | | | | | |

Inverness Medical Innovations Inc.* | | 173,400 | | 5,599,086 | |

| | | | | |

HOME ENTERTAINMENT SOFTWARE—0.5% | | | | | |

Activision Blizzard Inc. * | | 62,600 | | 674,202 | |

| | | | | | |

15

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

HOME ENTERTAINMENT SOFTWARE—(CONT.) | | | | | |

Nintendo Co., Ltd. # | | 54,526 | | $ | 1,834,800 | |

| | | | 2,509,002 | |

HOME IMPROVEMENT RETAIL—1.0% | | | | | |

Lowe’s Companies, Inc. | | 222,600 | | 4,785,900 | |

| | | | | |

HOMEBUILDING—0.5% | | | | | |

KB Home | | 44,000 | | 795,080 | |

Toll Brothers Inc. * | | 89,500 | | 1,813,270 | |

| | | | 2,608,350 | |

HOTELS RESORTS & CRUISE LINES—0.2% | | | | | |

Carnival Corp. | | 45,100 | | 1,212,288 | |

| | | | | |

HOUSEWARES & SPECIALTIES—0.2% | | | | | |

Newell Rubbermaid Inc. | | 46,700 | | 488,015 | |

Tupperware Brands Corp. | | 27,700 | | 693,331 | |

| | | | 1,181,346 | |

HYPERMARKETS & SUPER CENTERS—1.0% | | | | | |

Wal-Mart Stores Inc. | | 96,200 | | 4,848,480 | |

| | | | | |

INDUSTRIAL CONGLOMERATES—2.2% | | | | | |

Tyco International Ltd. | | 454,700 | | 10,803,672 | |

| | | | | |

INDUSTRIAL MACHINERY—0.8% | | | | | |

SPX Corp. | | 87,300 | | 4,030,641 | |

| | | | | |

INTEGRATED OIL & GAS—0.8% | | | | | |

Total SA# | | 82,600 | | 4,106,872 | |

| | | | | |

INTEGRATED TELECOMMUNICATION SERVICES—0.8% | | | | | |

AT&T Inc. | | 141,800 | | 3,632,916 | |

| | | | | |

INTERNET RETAIL—1.6% | | | | | |

Amazon.com Inc. * | | 6,000 | | 483,120 | |

Expedia Inc. * | | 529,400 | | 7,205,134 | |

| | | | 7,688,254 | |

INTERNET SOFTWARE & SERVICES—4.7% | | | | | |

eBay Inc. * | | 227,300 | | 3,743,631 | |

Google Inc., Cl. A * | | 15,600 | | 6,177,132 | |

IAC/InterActiveCorp. * | | 484,600 | | 7,763,292 | |

Netease.com #* | | 129,000 | | 3,893,220 | |

Yahoo! Inc. * | | 151,800 | | 2,169,222 | |

| | | | 23,746,497 | |

INVESTMENT BANKING & BROKERAGE—1.4% | | | | | |

Goldman Sachs Group Inc., /The | | 24,200 | | 3,109,700 | |

Morgan Stanley | | 150,200 | | 3,550,728 | |

| | | | 6,660,428 | |

IT CONSULTING & OTHER SERVICES—1.2% | | | | | |

Cognizant Technology Solutions Corp., Cl. A* | | 245,500 | | 6,085,945 | |

| | | | | |

LEISURE PRODUCTS—0.3% | | | | | |

Gildan Activewear Inc.* | | 116,200 | | 1,330,490 | |

| | | | | | |

16

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

LIFE SCIENCES TOOLS & SERVICES—2.1% | | | | | |

Icon PLC #* | | 239,700 | | $ | 3,796,848 | |

Life Technologies Corp. * | | 109,300 | | 4,076,890 | |

Thermo Fisher Scientific Inc. * | | 74,200 | | 2,602,936 | |

| | | | 10,476,674 | |

MANAGED HEALTH CARE—2.3% | | | | | |

Aetna Inc. | | 68,400 | | 1,505,484 | |

WellPoint Inc. * | | 237,700 | | 10,164,052 | |

| | | | 11,669,536 | |

METAL & GLASS CONTAINERS—2.6% | | | | | |

Crown Holdings Inc. * | | 294,900 | | 6,502,545 | |

Owens-Illinois Inc. * | | 279,000 | | 6,804,810 | |

| | | | 13,307,355 | |

MOVIES & ENTERTAINMENT—1.0% | | | | | |

Regal Entertainment Group, Cl. A | | 250,200 | | 3,267,612 | |

Walt Disney Co., /The | | 70,200 | | 1,537,380 | |

| | | | 4,804,992 | |

MULTI-UTILITIES—0.7% | | | | | |

Veolia Environnement# | | 112,000 | | 3,058,720 | |

| | | | | |

OIL & GAS DRILLING—1.2% | | | | | |

Transocean Ltd.* | | 90,500 | | 6,106,940 | |

| | | | | |

OIL & GAS EQUIPMENT & SERVICES—0.8% | | | | | |

Weatherford International Ltd.* | | 253,100 | | 4,209,053 | |

| | | | | |

OIL & GAS EXPLORATION & PRODUCTION—3.7% | | | | | |

Chesapeake Energy Corp. | | 453,100 | | 8,930,601 | |

Newfield Exploration Co. * | | 43,100 | | 1,343,858 | |

Nexen Inc. | | 424,700 | | 8,111,770 | |

| | | | 18,386,229 | |

OIL & GAS REFINING & MARKETING—0.5% | | | | | |

NuStar Energy LP | | 46,900 | | 2,363,291 | |

| | | | | |

OIL & GAS STORAGE & TRANSPORTATION—0.2% | | | | | |

Magellan Midstream Holdings LP | | 25,200 | | 499,968 | |

Plains All American Pipeline LP | | 12,100 | | 512,314 | |

| | | | 1,012,282 | |

OTHER DIVERSIFIED FINANCIAL SERVICES—0.8% | | | | | |

BM&F BOVESPA SA | | 823,800 | | 3,369,115 | |

JPMorgan Chase & Co. | | 14,900 | | 491,700 | |

| | | | 3,860,815 | |

PACKAGED FOODS & MEATS—1.1% | | | | | |

General Mills Inc. | | 113,100 | | 5,733,039 | |

| | | | | |

PAPER PACKAGING—0.1% | | | | | |

Temple-Inland Inc. | | 39,600 | | 472,824 | |

| | | | | |

PHARMACEUTICALS—5.1% | | | | | |

Abbott Laboratories | | 378,800 | | 15,852,780 | |

Allergan Inc. | | 21,900 | | 1,021,854 | |

Bristol-Myers Squibb Co. | | 71,300 | | 1,368,960 | |

| | | | | | |

17

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

PHARMACEUTICALS—(CONT.) | | | | | |

Johnson & Johnson | | 18,900 | | $ | 989,604 | |

Shire PLC # | | 13,300 | | 495,691 | |

Teva Pharmaceutical Industries Ltd. # | | 10,900 | | 478,401 | |

Wyeth | | 118,500 | | 5,024,400 | |

| | | | 25,231,690 | |

PROPERTY & CASUALTY INSURANCE—0.9% | | | | | |

Travelers Cos. Inc., /The | | 105,400 | | 4,336,156 | |

| | | | | |

PUBLISHING—1.4% | | | | | |

McGraw-Hill Cos. Inc., /The | | 227,800 | | 6,868,170 | |

| | | | | |

REAL ESTATE SERVICES—0.1% | | | | | |

Mack-Cali Realty Corp. | | 21,200 | | 569,432 | |

| | | | | |

REGIONAL BANKS—0.1% | | | | | |

Keycorp | | 87,900 | | 540,585 | |

| | | | | |

RESTAURANTS—0.7% | | | | | |

McDonald’s Corp. | | 44,600 | | 2,376,734 | |

Wendy’s/Arby’s Group Inc. | | 263,700 | | 1,318,500 | |

| | | | 3,695,234 | |

SEMICONDUCTORS—3.7% | | | | | |

Atheros Communications Inc. * | | 267,743 | | 4,610,534 | |

Broadcom Corp., Cl. A * | | 105,800 | | 2,453,502 | |

Marvell Technology Group Ltd. * | | 403,200 | | 4,427,136 | |

National Semiconductor Corp. | | 133,300 | | 1,648,921 | |

ON Semiconductor Corp. * | | 639,800 | | 3,467,716 | |

Taiwan Semiconductor Manufacturing Co., Ltd. # | | 174,800 | | 1,847,636 | |

| | | | 18,455,445 | |

SOFT DRINKS—0.9% | | | | | |

Coca-Cola Co., /The | | 98,800 | | 4,253,340 | |

| | | | | |

SPECIALIZED FINANCE—1.0% | | | | | |

NYSE Euronext | | 217,600 | | 5,041,792 | |

| | | | | |

SPECIALTY CHEMICALS—0.8% | | | | | |

Albemarle Corp. | | 36,400 | | 976,248 | |

Lubrizol Corp. | | 46,700 | | 2,018,374 | |

Rockwood Holdings Inc. * | | 85,600 | | 1,052,880 | |

| | | | 4,047,502 | |

STEEL—0.1% | | | | | |

AK Steel Holding Corp. | | 24,500 | | 318,745 | |

| | | | | |

SYSTEMS SOFTWARE—3.8% | | | | | |

Microsoft Corp. | | 803,900 | | 16,287,014 | |

Symantec Corp. * | | 160,000 | | 2,760,000 | |

| | | | 19,047,014 | |

THRIFTS & MORTGAGE FINANCE—1.2% | | | | | |

People’s United Financial Inc. | | 120,600 | | 1,883,772 | |

TFS Financial Corp. | | 360,100 | | 4,223,973 | |

| | | | 6,107,745 | |

| | | | | | |

18

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

TOBACCO—3.3% | | | | | |

Philip Morris International Inc. | | 459,950 | | $ | 16,650,190 | |

| | | | | |

WIRELESS TELECOMMUNICATION SERVICES—0.4% | | | | | |

American Tower Corp., Cl. A* | | 70,300 | | 2,232,728 | |

| | | | | |

TOTAL COMMON STOCKS

(Cost $518,891,419) | | | | 490,603,583 | |

| | | | | |

CONVERTIBLE PREFERRED STOCK—0.6% | | | | | |

PHARMACEUTICALS—0.6% | | | | | |

Mylan Inc., 6.50%, 11/15/10(a)

(Cost $2,297,731) | | 3,254 | | 2,772,408 | |

| | | | | |

| | PRINCIPAL | | | |

| | AMOUNT | | | |

CONVERTIBLE CORPORATE BONDS—0.3% | | | | | |

LIFE SCIENCES TOOLS & SERVICES—0.3% | | | | | |

Invitrogen Corp., 3.25%, 6/15/25

(Cost $1,294,309) | | 1,474,000 | | 1,486,898 | |

| | | | | |

SHORT-TERM INVESTMENTS—1.7% | | | | | |

TIME DEPOSITS—1.7% | | | | | |

Citibank London, 0.03%, 5/01/09

(Cost $8,455,712) | | 8,455,712 | | 8,455,712 | |

| | | | | |

Total Investments

(Cost $530,939,171)(b) | | 100.6 | % | 503,318,601 | |

Liabilities in Excess of Other Assets | | (0.6 | ) | (3,043,911 | ) |

| | | | | |

NET ASSETS | | 100.0 | % | $ | 500,274,690 | |

* | Non-income producing security. |

# | American Depositary Receipts. |

(a) | These securities are required to be converted on the date listed; they generally may be converted prior to this date at the option of the holder. |

(b) | At April 30, 2009, the net unrealized depreciation on investments, based on cost for federal income tax purposes of $559,601,060 amounted to $56,282,459 which consisted of aggregate gross unrealized appreciation of $29,985,674 and aggregate gross unrealized depreciation of $86,268,133. |

See Notes to Financial Statements.

19

(This page has been intentionally left blank)

THE ALGER INSTITUTIONAL FUNDS | ALGER LARGECAP GROWTH INSTITUTIONAL FUND

Schedule of Investments (Unaudited) April 30, 2009

| | SHARES | | VALUE | |

COMMON STOCKS—95.2% | | | | | |

AEROSPACE & DEFENSE—3.9% | | | | | |

Boeing Co., /The | | 8,500 | | $ | 340,425 | |

General Dynamics Corp. | | 7,500 | | 387,525 | |

Lockheed Martin Corp. | | 10,700 | | 840,271 | |

| | | | 1,568,221 | |

AIR FREIGHT & LOGISTICS—1.0% | | | | | |

United Parcel Service Inc., Cl. B | | 7,400 | | 387,316 | |

| | | | | |

APPAREL RETAIL—0.8% | | | | | |

Gap Inc., /The | | 19,550 | | 303,807 | |

| | | | | |

ASSET MANAGEMENT & CUSTODY BANKS—1.0% | | | | | |

BlackRock Inc. | | 1,300 | | 190,476 | |

Invesco Ltd. | | 14,550 | | 214,176 | |

| | | | 404,652 | |

BIOTECHNOLOGY—3.9% | | | | | |

Amgen Inc. * | | 3,350 | | 162,375 | |

Biogen Idec Inc. * | | 4,800 | | 232,032 | |

Celgene Corp. * | | 11,450 | | 489,144 | |

Genzyme Corp. * | | 5,500 | | 293,315 | |

Gilead Sciences Inc. * | | 7,700 | | 352,660 | |

| | | | 1,529,526 | |

CABLE & SATELLITE—0.3% | | | | | |

Comcast Corp., Cl. A | | 6,850 | | 100,558 | |

| | | | | |

COAL & CONSUMABLE FUELS—0.5% | | | | | |

Consol Energy Inc. | | 6,150 | | 192,372 | |

| | | | | |

COMMUNICATIONS EQUIPMENT—5.3% | | | | | |

Cisco Systems Inc. * | | 49,100 | | 948,611 | |

Qualcomm Inc. | | 16,550 | | 700,396 | |

Research In Motion Ltd. * | | 6,300 | | 437,850 | |

| | | | 2,086,857 | |

COMPUTER & ELECTRONICS RETAIL—0.6% | | | | | |

GameStop Corp., Cl. A* | | 7,900 | | 238,264 | |

| | | | | |

COMPUTER HARDWARE—7.5% | | | | | |

Apple Inc. * | | 9,850 | | 1,239,425 | |

Hewlett-Packard Co. | | 28,550 | | 1,027,229 | |

International Business Machines Corp. | | 6,900 | | 712,149 | |

| | | | 2,978,803 | |

COMPUTER STORAGE & PERIPHERALS—1.2% | | | | | |

EMC Corp.* | | 39,050 | | 489,297 | |

| | | | | |

CONSTRUCTION & FARM MACHINERY & HEAVY TRUCKS—1.7% | | | | | |

Caterpillar Inc. | | 6,350 | | 225,933 | |

Deere & Co. | | 10,600 | | 437,356 | |

| | | | 663,289 | |

DATA PROCESSING & OUTSOURCED SERVICES—2.8% | | | | | |

Mastercard Inc. | | 3,550 | | 651,248 | |

Visa Inc., Cl. A | | 3,100 | | 201,376 | |

Western Union Co., /The | | 15,200 | | 254,600 | |

| | | | 1,107,224 | |

| | | | | | |

21

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

DIVERSIFIED CHEMICALS—0.7% | | | | | |

El Du Pont de Nemours & Co. | | 10,350 | | $ | 288,765 | |

| | | | | |

DRUG RETAIL—3.3% | | | | | |

CVS Caremark Corp. | | 22,550 | | 716,639 | |

Walgreen Co. | | 18,600 | | 584,598 | |

| | | | 1,301,237 | |

FERTILIZERS & AGRICULTURAL CHEMICALS—1.7% | | | | | |

Monsanto Co. | | 4,700 | | 398,983 | |

Potash Corporation of Saskatchewan Inc. | | 2,650 | | 229,199 | |

| | | | 628,182 | |

FOOD RETAIL—0.9% | | | | | |

Kroger Co., /The | | 16,750 | | 362,135 | |

| | | | | |

FOOTWEAR—0.9% | | | | | |

NIKE Inc., Cl. B | | 6,750 | | 354,173 | |

| | | | | |

GENERAL MERCHANDISE STORES—0.6% | | | | | |

Target Corp. | | 6,100 | | 251,686 | |

| | | | | |

GOLD—0.9% | | | | | |

Barrick Gold Corp. | | 4,900 | | 142,590 | |

Goldcorp Inc. | | 8,300 | | 228,416 | |

| | | | 371,006 | |

HEALTH CARE EQUIPMENT—3.1% | | | | | |

Baxter International Inc. | | 2,700 | | 130,950 | |

Boston Scientific Corp. * | | 20,600 | | 173,246 | |

Covidien Ltd. | | 12,500 | | 412,249 | |

Stryker Corp. | | 6,350 | | 245,809 | |

Zimmer Holdings Inc. * | | 6,250 | | 274,938 | |

| | | | 1,237,192 | |

HOME ENTERTAINMENT SOFTWARE—2.9% | | | | | |

Activision Blizzard Inc. * | | 31,800 | | 342,486 | |

Electronic Arts Inc. * | | 16,550 | | 336,793 | |

Nintendo Co., Ltd. # | | 14,150 | | 476,147 | |

| | | | 1,155,426 | |

HOTELS RESORTS & CRUISE LINES—1.1% | | | | | |

Carnival Corp. | | 10,000 | | 268,800 | |

Marriott International Inc., Cl. A | | 6,550 | | 154,318 | |

| | | | 423,118 | |

HOUSEHOLD PRODUCTS—1.2% | | | | | |

Procter & Gamble Co., /The | | 9,500 | | 469,680 | |

| | | | | |

HYPERMARKETS & SUPER CENTERS—2.1% | | | | | |

Costco Wholesale Corp. | | 3,250 | | 157,950 | |

Wal-Mart Stores Inc. | | 13,300 | | 670,320 | |

| | | | 828,270 | |

INDUSTRIAL CONGLOMERATES—1.3% | | | | | |

Tyco International Ltd. | | 21,150 | | 502,524 | |

| | | | | |

INTEGRATED OIL & GAS—3.0% | | | | | |

Chevron Corp. | | 5,800 | | 383,380 | |

Exxon Mobil Corp. | | 6,250 | | 416,688 | |

| | | | | | |

22

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

INTEGRATED OIL & GAS—(CONT.) | | | | | |

Petroleo Brasileiro SA # | | 5,200 | | $ | 174,564 | |

Total SA # | | 4,050 | | 201,366 | |

| | | | 1,175,998 | |

INTEGRATED TELECOMMUNICATION SERVICES—0.7% | | | | | |

AT&T Inc. | | 11,100 | | 284,382 | |

| | | | | |

INTERNET RETAIL—0.7% | | | | | |

Amazon.com Inc.* | | 3,250 | | 261,690 | |

| | | | | |

INTERNET SOFTWARE & SERVICES—4.8% | | | | | |

eBay Inc. * | | 29,950 | | 493,277 | |

Google Inc., Cl. A * | | 2,463 | | 975,273 | |

Yahoo! Inc. * | | 29,500 | | 421,555 | |

| | | | 1,890,105 | |

INVESTMENT BANKING & BROKERAGE—0.8% | | | | | |

Goldman Sachs Group Inc., /The | | 1,150 | | 147,775 | |

Morgan Stanley | | 6,750 | | 159,570 | |

| | | | 307,345 | |

IT CONSULTING & OTHER SERVICES—1.2% | | | | | |

Cognizant Technology Solutions Corp., Cl. A* | | 18,550 | | 459,855 | |

| | | | | |

LIFE SCIENCES TOOLS & SERVICES—0.9% | | | | | |

Thermo Fisher Scientific Inc.* | | 10,300 | | 361,324 | |

| | | | | |

MANAGED HEALTH CARE—0.6% | | | | | |

UnitedHealth Group Inc. | | 9,250 | | 217,560 | |

| | | | | |

MOVIES & ENTERTAINMENT—1.3% | | | | | |

Regal Entertainment Group, Cl. A | | 19,450 | | 254,017 | |

Viacom Inc., Cl. B * | | 13,850 | | 266,474 | |

| | | | 520,491 | |

OIL & GAS DRILLING—1.2% | | | | | |

Transocean Ltd.* | | 7,147 | | 482,280 | |

| | | | | |

OIL & GAS EQUIPMENT & SERVICES—0.6% | | | | | |

Weatherford International Ltd.* | | 14,500 | | 241,135 | |

| | | | | |

OIL & GAS EXPLORATION & PRODUCTION—3.1% | | | | | |

Anadarko Petroleum Corp. | | 11,750 | | 505,954 | |

Chesapeake Energy Corp. | | 22,700 | | 447,417 | |

Nexen Inc. | | 13,600 | | 259,760 | |

| | | | 1,213,131 | |

OTHER DIVERSIFIED FINANCIAL SERVICES—0.2% | | | | | |

Bank of America Corp. | | 9,050 | | 80,817 | |

| | | | | |

PACKAGED FOODS & MEATS—1.1% | | | | | |

General Mills Inc. | | 3,500 | | 177,415 | |

Kraft Foods Inc., Cl. A | | 11,600 | | 271,440 | |

| | | | 448,855 | |

PHARMACEUTICALS—6.4% | | | | | |

Abbott Laboratories | | 20,650 | | 864,202 | |

Allergan Inc. | | 6,250 | | 291,625 | |

Bristol-Myers Squibb Co. | | 7,400 | | 142,080 | |

Johnson & Johnson | | 11,850 | | 620,466 | |

| | | | | | |

23

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

PHARMACEUTICALS—(CONT.) | | | | | |

Novartis AG # | | 3,450 | | $ | 130,790 | |

Wyeth | | 11,250 | | 477,000 | |

| | | | 2,526,163 | |

PROPERTY & CASUALTY INSURANCE—0.6% | | | | | |

Travelers Cos. Inc., /The | | 5,600 | | 230,384 | |

| | | | | |

RAILROADS—1.3% | | | | | |

Burlington Northern Santa Fe Corp. | | 7,800 | | 526,344 | |

| | | | | |

RESTAURANTS—1.9% | | | | | |

McDonald’s Corp. | | 8,450 | | 450,300 | |

Starbucks Corp. * | | 22,450 | | 324,627 | |

| | | | 774,927 | |

SEMICONDUCTORS—2.5% | | | | | |

Broadcom Corp., Cl. A * | | 11,400 | | 264,366 | |

Intel Corp. | | 31,400 | | 495,492 | |

Taiwan Semiconductor Manufacturing Co., Ltd. # | | 21,600 | | 228,312 | |

| | | | 988,170 | |

SOFT DRINKS—2.9% | | | | | |

Coca-Cola Co., /The | | 14,550 | | 626,378 | |

PepsiCo Inc. | | 10,150 | | 505,064 | |

| | | | 1,131,442 | |

SPECIALIZED FINANCE—1.7% | | | | | |

CME Group Inc. | | 1,412 | | 312,546 | |

NYSE Euronext | | 16,250 | | 376,512 | |

| | | | 689,058 | |

SYSTEMS SOFTWARE—3.1% | | | | | |

Microsoft Corp. | | 59,500 | | 1,205,470 | |

| | | | | |

TOBACCO—3.4% | | | | | |

Altria Group Inc. | | 34,200 | | 558,486 | |

Philip Morris International Inc. | | 21,450 | | 776,490 | |

| | | | 1,334,976 | |

TOTAL COMMON STOCKS

(Cost $43,926,569) | | | | 37,575,482 | |

| | | | | |

| | PRINCIPAL | | | |

| | AMOUNT | | | |

SHORT-TERM INVESTMENTS—4.1% | | | | | |

TIME DEPOSITS—4.1% | | | | | |

Wells Fargo Grand Cayman, 0.03%, 5/1/09 | | 117,190 | | 117,190 | |

Citibank London, 0.03%, 5/1/09 | | 1,500,000 | | 1,500,000 | |

| | | | | |

TOTAL TIME DEPOSITS

(Cost $1,617,190) | | | | 1,617,190 | |

| | | | | |

Total Investments

(Cost $45,543,759)(a) | | 99.3 | % | 39,192,672 | |

Other Assets in Excess of Liabilities | | 0.7 | | 263,927 | |

| | | | | |

NET ASSETS | | 100.0 | % | $ | 39,456,599 | |

24

* | Non-income producing security. |

# | American Depositary Receipts. |

(a) | At April 30, 2009, the net unrealized depreciation on investments, based on cost for federal income tax purposes of $46,519,958 amounted to $7,327,286 which consisted of aggregate gross unrealized appreciation of $1,495,667 and aggregate gross unrealized depreciation of $8,822,953. |

See Notes to Financial Statements.

25

THE ALGER INSTITUTIONAL FUNDS | ALGER MIDCAP GROWTH INSTITUTIONAL FUND

Schedule of Investments (Unaudited) April 30, 2009

| | SHARES | | VALUE | |

COMMON STOCKS—98.9% | | | | | |

AEROSPACE & DEFENSE—0.9% | | | | | |

BE Aerospace Inc.* | | 704,790 | | $ | 7,604,684 | |

| | | | | |

APPAREL RETAIL—1.3% | | | | | |

Chico’s FAS Inc. * | | 447,300 | | 3,417,372 | |

TJX Cos Inc. | | 245,500 | | 6,866,635 | |

| | | | 10,284,007 | |

APPLICATION SOFTWARE—3.7% | | | | | |

Ansys Inc. * | | 87,800 | | 2,425,036 | |

Informatica Corp. * | | 555,400 | | 8,830,860 | |

Intuit Inc. * | | 215,700 | | 4,989,141 | |

Salesforce.com Inc. * | | 58,000 | | 2,482,980 | |

Solera Holdings Inc. * | | 206,800 | | 4,719,176 | |

Taleo Corp., Cl. A * | | 215,200 | | 2,584,552 | |

TIBCO Software Inc. * | | 576,290 | | 3,642,153 | |

| | | | 29,673,898 | |

ASSET MANAGEMENT & CUSTODY BANKS—2.4% | | | | | |

AllianceBernstein Holding LP | | 173,200 | | 3,034,464 | |

Invesco Ltd. | | 503,700 | | 7,414,464 | |

Northern Trust Corp. | | 176,600 | | 9,599,976 | |

| | | | 20,048,904 | |

BIOTECHNOLOGY—5.2% | | | | | |

Alexion Pharmaceuticals Inc. * | | 218,100 | | 7,288,902 | |

Biogen Idec Inc. * | | 94,800 | | 4,582,632 | |

Celgene Corp. * | | 153,300 | | 6,548,976 | |

Cephalon Inc. * | | 90,000 | | 5,904,900 | |

Genzyme Corp. * | | 83,200 | | 4,437,056 | |

Metabolix Inc. * | | 1,126,960 | | 8,902,984 | |

OSI Pharmaceuticals Inc. * | | 140,800 | | 4,726,656 | |

| | | | 42,392,106 | |

CASINOS & GAMING—1.5% | | | | | |

Las Vegas Sands Corp.* | | 1,554,200 | | 12,153,844 | |

| | | | | |

COMMERCIAL PRINTING—0.5% | | | | | |

Warnaco Group Inc., /The* | | 132,200 | | 3,812,648 | |

| | | | | |

COMMUNICATIONS EQUIPMENT—2.1% | | | | | |

Brocade Communications Systems Inc. * | | 745,800 | | 4,310,724 | |

F5 Networks Inc. * | | 81,700 | | 2,227,959 | |

Research In Motion Ltd. * | | 89,600 | | 6,227,200 | |

Starent Networks Corp. * | | 209,900 | | 4,141,327 | |

| | | | 16,907,210 | |

COMPUTER & ELECTRONICS RETAIL—1.6% | | | | | |

Best Buy Co., Inc. | | 78,100 | | 2,997,478 | |

GameStop Corp., Cl. A * | | 318,300 | | 9,599,928 | |

| | | | 12,597,406 | |

COMPUTER HARDWARE—2.0% | | | | | |

Apple Inc.* | | 125,400 | | 15,779,082 | |

| | | | | |

COMPUTER STORAGE & PERIPHERALS—1.2% | | | | | |

Data Domain Inc. * | | 226,200 | | 3,750,396 | |

| | | | | | |

26

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

COMPUTER STORAGE & PERIPHERALS—(CONT.) | | | | | |

NetApp Inc. * | | 333,800 | | $ | 6,108,540 | |

| | | | 9,858,936 | |

DATA PROCESSING & OUTSOURCED SERVICES—2.4% | | | | | |

Affiliated Computer Services Inc., Cl. A * | | 230,500 | | 11,151,590 | |

Mastercard Inc. | | 46,500 | | 8,530,425 | |

| | | | 19,682,015 | |

DIVERSIFIED REITS—0.5% | | | | | |

Vornado Realty Trust | | 77,600 | | 3,793,864 | |

| | | | | |

EDUCATION SERVICES—2.2% | | | | | |

Corinthian Colleges Inc. * | | 637,800 | | 9,822,120 | |

ITT Educational Services Inc. * | | 81,500 | | 8,212,755 | |

| | | | 18,034,875 | |

ELECTRIC UTILITIES—0.6% | | | | | |

Northeast Utilities | | 252,100 | | 5,299,142 | |

| | | | | |

ELECTRICAL COMPONENTS & EQUIPMENT—1.8% | | | | | |

AMETEK Inc. | | 179,400 | | 5,778,474 | |

First Solar Inc. * | | 22,300 | | 4,176,567 | |

General Cable Corp. * | | 171,900 | | 4,665,366 | |

| | | | 14,620,407 | |

ENVIRONMENTAL & FACILITIES SERVICES—0.5% | | | | | |

Covanta Holding Corp.* | | 300,500 | | 4,240,055 | |

| | | | | |

FOOD RETAIL—0.3% | | | | | |

Whole Foods Market Inc. | | 136,000 | | 2,819,280 | |

| | | | | |

FOOTWEAR—1.4% | | | | | |

Iconix Brand Group Inc.* | | 820,200 | | 11,696,052 | |

| | | | | |

GENERAL MERCHANDISE STORES—0.7% | | | | | |

Dollar Tree Inc.* | | 135,900 | | 5,754,006 | |

| | | | | |

GOLD—0.3% | | | | | |

Yamana Gold Inc. | | 330,600 | | 2,615,046 | |

| | | | | |

HEALTH CARE EQUIPMENT—2.0% | | | | | |

Covidien Ltd. | | 235,600 | | 7,770,088 | |

Insulet Corp. * | | 871,000 | | 5,008,250 | |

Intuitive Surgical Inc. * | | 24,800 | | 3,564,504 | |

| | | | 16,342,842 | |

HEALTH CARE FACILITIES—2.0% | | | | | |

Community Health Systems Inc. * | | 198,400 | | 4,531,456 | |

Universal Health Services Inc., Cl. B | | 91,200 | | 4,596,480 | |

VCA Antech Inc. * | | 270,100 | | 6,757,902 | |

| | | | 15,885,838 | |

HEALTH CARE SERVICES—2.7% | | | | | |

DaVita Inc. * | | 92,500 | | 4,289,225 | |

Express Scripts Inc. * | | 269,300 | | 17,227,121 | |

| | | | 21,516,346 | |

HEAVY ELECTRICAL EQUIPMENT—1.0% | | | | | |

Vestas Wind Systems A/S* | | 122,300 | | 8,082,696 | |

| | | | | | |

27

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

HOME ENTERTAINMENT SOFTWARE—2.7% | | | | | |

Activision Blizzard Inc. * | | 659,000 | | $ | 7,097,430 | |

Nintendo Co., Ltd. # | | 315,530 | | 10,617,585 | |

Rosetta Stone Inc. * | | 147,500 | | 4,417,625 | |

| | | | 22,132,640 | |

HOMEBUILDING—1.7% | | | | | |

KB Home | | 320,300 | | 5,787,821 | |

Meritage Homes Corp. * | | 197,700 | | 4,114,137 | |

NVR Inc. * | | 7,800 | | 3,941,886 | |

| | | | 13,843,844 | |

HOTELS RESORTS & CRUISE LINES—0.9% | | | | | |

Carnival Corp. | | 269,600 | | 7,246,848 | |

| | | | | |

HOUSEHOLD PRODUCTS—1.0% | | | | | |

Church & Dwight Co., Inc. | | 146,000 | | 7,943,860 | |

| | | | | |

INDUSTRIAL GASES—1.6% | | | | | |

Praxair Inc. | | 170,000 | | 12,683,700 | |

| | | | | |

INDUSTRIAL MACHINERY—2.3% | | | | | |

Clarcor Inc. | | 332,800 | | 10,343,424 | |

SPX Corp. | | 168,000 | | 7,756,560 | |

| | | | 18,099,984 | |

INTERNET RETAIL—2.3% | | | | | |

Expedia Inc. * | | 1,067,900 | | 14,534,119 | |

Shutterfly Inc. * | | 381,500 | | 4,887,015 | |

| | | | 19,421,134 | |

INTERNET SOFTWARE & SERVICES—5.1% | | | | | |

eBay Inc. * | | 650,000 | | 10,705,500 | |

IAC/InterActiveCorp. * | | 495,389 | | 7,936,132 | |

Netease.com #* | | 63,900 | | 1,928,502 | |

Omniture Inc. * | | 336,945 | | 4,151,162 | |

Vignette Corp. * | | 532,000 | | 4,394,320 | |

VistaPrint Ltd. * | | 161,300 | | 5,540,655 | |

Yahoo! Inc. * | | 481,100 | | 6,874,919 | |

| | | | 41,531,190 | |

IT CONSULTING & OTHER SERVICES—2.1% | | | | | |

Cognizant Technology Solutions Corp., Cl. A* | | 688,600 | | 17,070,394 | |

| | | | | |

LIFE SCIENCES TOOLS & SERVICES—2.0% | | | | | |

Charles River Laboratories International Inc. * | | 153,500 | | 4,244,275 | |

Icon PLC #* | | 741,198 | | 11,740,576 | |

| | | | 15,984,851 | |

MANAGED HEALTH CARE—0.7% | | | | | |

Aetna Inc. | | 245,800 | | 5,410,058 | |

| | | | | |

METAL & GLASS CONTAINERS—0.8% | | | | | |

Crown Holdings Inc. * | | 132,400 | | 2,919,420 | |

Silgan Holdings Inc. | | 75,600 | | 3,514,644 | |

| | | | 6,434,064 | |

MOVIES & ENTERTAINMENT—0.7% | | | | | |

Regal Entertainment Group, Cl. A | | 416,400 | | 5,438,184 | |

| | | | | | |

28

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

MULTI-UTILITIES—0.4% | | | | | |

Veolia Environnement# | | 105,300 | | $ | 2,875,743 | |

| | | | | |

OIL & GAS DRILLING—0.7% | | | | | |

Transocean Ltd.* | | 89,200 | | 6,019,216 | |

| | | | | |

OIL & GAS EQUIPMENT & SERVICES—0.7% | | | | | |

Smith International Inc. | | 221,100 | | 5,715,435 | |

| | | | | |

OIL & GAS EXPLORATION & PRODUCTION—5.2% | | | | | |

Chesapeake Energy Corp. | | 300,700 | | 5,926,797 | |

Concho Resources Inc. * | | 135,100 | | 3,704,442 | |

Denbury Resources Inc. * | | 132,500 | | 2,157,100 | |

Linc Energy Ltd. * | | 1,776,908 | | 3,276,790 | |

Newfield Exploration Co. * | | 200,800 | | 6,260,944 | |

Nexen Inc. | | 421,500 | | 8,050,650 | |

Plains Exploration & Production Co. * | | 206,500 | | 3,896,655 | |

Quicksilver Resources Inc. * | | 1,015,600 | | 8,256,828 | |

| | | | 41,530,206 | |

OIL & GAS REFINING & MARKETING—0.7% | | | | | |

NuStar Energy LP | | 31,600 | | 1,592,324 | |

Sunoco Inc. | | 148,400 | | 3,934,084 | |

| | | | 5,526,408 | |

OTHER DIVERSIFIED FINANCIAL SERVICES—0.7% | | | | | |

BM&F BOVESPA SA | | 1,452,487 | | 5,940,272 | |

| | | | | |

PACKAGED FOODS & MEATS—2.9% | | | | | |

Flowers Foods Inc. | | 228,300 | | 5,273,730 | |

General Mills Inc. | | 198,500 | | 10,061,965 | |

Ralcorp Holdings Inc. * | | 131,100 | | 7,493,676 | |

| | | | 22,829,371 | |

PHARMACEUTICALS—4.8% | | | | | |

Allergan Inc. | | 66,800 | | 3,116,888 | |

Ardea Biosciences Inc. * | | 141,500 | | 1,746,110 | |

Auxilium Pharmaceuticals Inc. * | | 241,100 | | 5,521,190 | |

Optimer Pharmaceuticals Inc. * | | 617,674 | | 8,628,906 | |

Perrigo Co. | | 222,800 | | 5,774,976 | |

Shire PLC # | | 105,700 | | 3,939,439 | |

Teva Pharmaceutical Industries Ltd. # | | 243,500 | | 10,687,215 | |

| | | | 39,414,724 | |

PROPERTY & CASUALTY INSURANCE—0.4% | | | | | |

Travelers Cos. Inc., /The | | 69,100 | | 2,842,774 | |

| | | | | |

PUBLISHING—0.8% | | | | | |

McGraw-Hill Cos. Inc., /The | | 201,500 | | 6,075,225 | |

| | | | | |

REAL ESTATE SERVICES—0.1% | | | | | |

Mack-Cali Realty Corp. | | 34,200 | | 918,612 | |

| | | | | |

RESEARCH & CONSULTING SERVICES—1.2% | | | | | |

FTI Consulting Inc.* | | 179,200 | | 9,834,496 | |

| | | | | |

RESTAURANTS—1.7% | | | | | |

McCormick & Schmick’s Seafood Restaurants Inc. * | | 544,950 | | 3,858,246 | |

| | | | | | |

29

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

RESTAURANTS—(CONT.) | | | | | |

Starbucks Corp. * | | 660,800 | | $ | 9,555,168 | |

| | | | 13,413,414 | |

SECURITY & ALARM SERVICES—1.2% | | | | | |

Geo Group Inc., /The* | | 570,300 | | 9,484,089 | |

| | | | | |

SEMICONDUCTORS—3.6% | | | | | |

Altera Corp. | | 358,700 | | 5,850,397 | |

Atheros Communications Inc. * | | 432,535 | | 7,448,253 | |

Broadcom Corp., Cl. A * | | 289,200 | | 6,706,548 | |

Marvell Technology Group Ltd. * | | 655,700 | | 7,199,586 | |

ON Semiconductor Corp. * | | 318,100 | | 1,724,102 | |

| | | | 28,928,886 | |

SOFT DRINKS—0.6% | | | | | |

Hansen Natural Corp.* | | 118,300 | | 4,821,908 | |

| | | | | |

SPECIALIZED FINANCE—1.0% | | | | | |

NYSE Euronext | | 347,100 | | 8,042,307 | |

| | | | | |

SPECIALIZED REITS—0.6% | | | | | |

Host Hotels & Resorts Inc. | | 587,300 | | 4,516,337 | |

| | | | | |

SPECIALTY CHEMICALS—0.7% | | | | | |

Albemarle Corp. | | 136,000 | | 3,647,520 | |

Nalco Holding Co. | | 124,500 | | 2,031,840 | |

| | | | 5,679,360 | |

SPECIALTY STORES—0.9% | | | | | |

PetSmart Inc. | | 307,000 | | 7,024,160 | |

| | | | | |

SYSTEMS SOFTWARE—1.6% | | | | | |

Red Hat Inc. * | | 112,600 | | 1,944,602 | |

Symantec Corp. * | | 621,300 | | 10,717,425 | |

| | | | 12,662,027 | |

TECHNOLOGY DISTRIBUTORS—0.5% | | | | | |

Mellanox Technologies Ltd.* | | 377,480 | | 3,850,296 | |

| | | | | |

THRIFTS & MORTGAGE FINANCE—1.6% | | | | | |

People’s United Financial Inc. | | 411,400 | | 6,426,068 | |

TFS Financial Corp. | | 527,900 | | 6,192,267 | |

| | | | 12,618,335 | |

WIRELESS TELECOMMUNICATION SERVICES—1.6% | | | | | |

American Tower Corp., Cl. A * | | 237,300 | | 7,536,648 | |

SBA Communications Corp. * | | 202,065 | | 5,092,038 | |

| | | | 12,628,686 | |

TOTAL COMMON STOCKS

(Cost $869,254,611) | | | | 797,928,227 | |

| | | | | | |

| | PRINCIPAL | | | |

| | AMOUNT | | | |

CORPORATE BONDS—0.3% | | | | | |

CASINOS & GAMING—0.3% | | | | | |

Wynn Las Vegas, LLC / Wynn Las Vegas Capital Corp., 0.06%, 12/1/14

(Cost $2,545,577) | | 3,096,000 | | 2,631,600 | |

30

| | PRINCIPAL | | | |

| | AMOUNT | | VALUE | |

CONVERTIBLE CORPORATE BONDS —1.2% | | | | | |

OIL & GAS DRILLING—0.4% | | | | | |

Transocean Inc., 1.50%, 12/15/37 | | $ | 3,929,000 | | $ | 3,378,940 | |

| | | | | |

WIRELESS TELECOMMUNICATION SERVICES—0.8% | | | | | |

SBA Communications Corp., 4.00%, 10/1/14(a) | | 5,922,000 | | 6,121,868 | |

| | | | | |

TOTAL CONVERTIBLE CORPORATE BONDS

(Cost $9,956,183) | | | | 9,500,808 | |

| | | | | |

SHORT-TERM INVESTMENTS—0.4% | | | | | |

TIME DEPOSITS—0.4% | | | | | |

Citibank London, 0.03%, 5/01/09

(Cost $3,464,196) | | 3,464,196 | | 3,464,196 | |

| | | | | |

Total Investments

(Cost $885,220,567)(b) | | 100.8 | % | 813,524,831 | |

Liabilities in Excess of Other Assets | | (0.8 | ) | (6,479,426 | ) |

| | | | | |

NET ASSETS | | 100.0 | % | $ | 807,045,405 | |

| | | | | | | |

* | Non-income producing security. |

# | American Depositary Receipts. |

(a) | Pursuant to Securities and Exchange Commission Rule 144A, these securities may be sold prior to their maturity only to qualified institutional buyers. These securities are deemed to be liquid and represent 0.8%, of the net assets of the Fund. |

(b) | At April 30, 2009, the net unrealized depreciation on investments, based on cost for federal income tax purposes of $967,206,742 amounted to $153,681,911 which consisted of aggregate gross unrealized appreciation of $44,720,633 and aggregate gross unrealized depreciation of $198,402,544. |

See Notes to Financial Statements.

31

THE ALGER INSTITUTIONAL FUNDS | ALGER SMALLCAP GROWTH INSTITUTIONAL FUND

Schedule of Investments (Unaudited) April 30, 2009

| | SHARES | | VALUE | |

COMMON STOCKS—96.8% | | | | | |

AEROSPACE & DEFENSE—2.2% | | | | | |

BE Aerospace Inc. * | | 478,005 | | $ | 5,157,674 | |

Esterline Technologies Corp. * | | 240,675 | | 6,341,785 | |

Orbital Sciences Corp. * | | 312,250 | | 4,827,385 | |

| | | | 16,326,844 | |

AIRLINES—1.0% | | | | | |

Airtran Holdings Inc.* | | 1,032,490 | | 7,175,806 | |

| | | | | |

APPAREL RETAIL—2.9% | | | | | |

Aeropostale Inc. * | | 274,350 | | 9,319,669 | |

Chico’s FAS Inc. * | | 561,300 | | 4,288,332 | |

Childrens Place Retail Stores Inc., /The * | | 128,200 | | 3,646,008 | |

J Crew Group Inc. * | | 228,550 | | 3,933,346 | |

| | | | 21,187,355 | |

APPLICATION SOFTWARE—6.5% | | | | | |

Ansys Inc. * | | 234,286 | | 6,470,979 | |

Concur Technologies Inc. * | | 207,150 | | 5,607,551 | |

Informatica Corp. * | | 424,700 | | 6,752,730 | |

Pegasystems Inc. | | 397,350 | | 6,941,705 | |

Solera Holdings Inc. * | | 352,400 | | 8,041,767 | |

Taleo Corp., Cl. A * | | 696,900 | | 8,369,768 | |

TIBCO Software Inc. * | | 968,680 | | 6,122,058 | |

VanceInfo Technologies Inc. #* | | 102,050 | | 812,318 | |

| | | | 49,118,876 | |

ASSET MANAGEMENT & CUSTODY BANKS—0.4% | | | | | |

AllianceBernstein Holding LP | | 187,150 | | 3,278,868 | |

| | | | | |

BIOTECHNOLOGY—5.1% | | | | | |

Alexion Pharmaceuticals Inc. * | | 265,050 | | 8,857,970 | |

Allos Therapeutics Inc. * | | 896,100 | | 5,493,093 | |

Cubist Pharmaceuticals Inc. * | | 163,250 | | 2,709,950 | |

Myriad Genetics Inc. * | | 183,300 | | 7,110,207 | |

OSI Pharmaceuticals Inc. * | | 180,250 | | 6,050,993 | |

Seattle Genetics Inc. * | | 464,800 | | 4,290,104 | |

United Therapeutics Corp. * | | 56,415 | | 3,543,426 | |

| | | | 38,055,743 | |

CASINOS & GAMING—2.1% | | | | | |

Bally Technologies Inc. * | | 200,100 | | 5,238,618 | |

Penn National Gaming Inc. * | | 277,400 | | 9,437,148 | |

| | | | 14,675,766 | |

COMMUNICATIONS EQUIPMENT—4.0% | | | | | |

Brocade Communications Systems Inc. * | | 864,550 | | 4,997,099 | |

F5 Networks Inc. * | | 196,700 | | 5,364,009 | |

Nice Systems Ltd. #* | | 324,655 | | 8,314,415 | |

Polycom Inc. * | | 215,305 | | 4,013,285 | |

Starent Networks Corp. * | | 356,400 | | 7,031,772 | |

| | | | 29,720,580 | |

COMPUTER STORAGE & PERIPHERALS—0.9% | | | | | |

Synaptics Inc.* | | 201,725 | | 6,552,028 | |

| | | | | | |

32

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

CONSTRUCTION & ENGINEERING—2.1% | | | | | |

Aecom Technology Corp. * | | 293,550 | | $ | 7,553,042 | |

URS Corp. * | | 185,705 | | 8,182,162 | |

| | | | 15,735,204 | |

DATA PROCESSING & OUTSOURCED SERVICES—3.2% | | | | | |

NeuStar Inc., Cl. A * | | 254,760 | | 4,842,988 | |

TeleTech Holdings Inc. * | | 650,250 | | 8,628,817 | |

VenFone Holdings Inc. * | | 458,045 | | 3,439,918 | |

Wright Express Corp. * | | 302,535 | | 6,922,001 | |

| | | | 23,833,724 | |

DISTILLERS & VINTNERS—1.1% | | | | | |

Central European Distribution Corp.* | | 370,800 | | 8,305,920 | |

| | | | | |

DISTRIBUTORS—1.3% | | | | | |

LKQ Corp.* | | 550,590 | | 9,349,018 | |

| | | | | |

EDUCATION SERVICES—1.4% | | | | | |

American Public Education Inc. * | | 104,250 | | 3,753,000 | |

Corinthian Colleges Inc. * | | 454,650 | | 7,001,610 | |

| | | | 10,754,610 | |

ELECTRIC UTILITIES—1.3% | | | | | |

ITC Holdings Corp. | | 218,385 | | 9,506,299 | |

| | | | | |

ELECTRICAL COMPONENTS & EQUIPMENT—0.8% | | | | | |

SunPower Corp., Cl. A * | | 59,800 | | 1,637,324 | |

SunPower Corp., Cl. B * | | 55,700 | | 1,412,552 | |

Woodward Governor Co. | | 154,500 | | 3,083,820 | |

| | | | 6,133,696 | |

ENVIRONMENTAL & FACILITIES SERVICES—1.1% | | | | | |

Waste Connections Inc.* | | 323,500 | | 8,339,830 | |

| | | | | |

FOOD RETAIL—0.9% | | | | | |

Whole Foods Market Inc. | | 326,750 | | 6,773,528 | |

| | | | | |

FOOTWEAR—1.3% | | | | | |

Iconix Brand Group Inc.* | | 703,875 | | 10,037,258 | |

| | | | | |

HEALTH CARE DISTRIBUTORS—1.0% | | | | | |

Owens & Minor Inc. | | 146,850 | | 5,092,758 | |

PharMerica Corp. * | | 118,950 | | 2,170,838 | |

| | | | 7,263,596 | |

HEALTH CARE EQUIPMENT—4.3% | | | | | |

Hologic Inc. * | | 286,650 | | 4,259,619 | |

Insulet Corp. * | | 376,700 | | 2,166,025 | |

Masimo Corp. * | | 252,150 | | 7,287,135 | |

NuVasive Inc. * | | 228,000 | | 8,641,200 | |

Thoratec Corp. * | | 290,900 | | 8,453,554 | |

Wright Medical Group Inc. * | | 92,900 | | 1,277,375 | |

| | | | 32,084,908 | |

HEALTH CARE FACILITIES—1.2% | | | | | |

Community Health Systems Inc.* | | 405,200 | | 9,254,768 | |

| | | | | |

HEALTH CARE SERVICES—0.5% | | | | | |

Gentiva Health Services Inc.* | | 215,400 | | 3,431,322 | |

| | | | | | |

33

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

HEALTH CARE SUPPLIES—1.6% | | | | | |

Immucor Inc. * | | 211,000 | | $ | 3,437,190 | |

Inverness Medical Innovations Inc. * | | 272,300 | | 8,792,567 | |

| | | | 12,229,757 | |

HOUSEWARES & SPECIALTIES—0.8% | | | | | |

Tupperware Brands Corp. | | 247,950 | | 6,206,189 | |

| | | | | |

INDUSTRIAL MACHINERY—2.6% | | | | | |

Actuant Corp., Cl. A | | 501,360 | | 6,146,674 | |

Clarcor Inc. | | 229,100 | | 7,120,427 | |

RBC Bearings Inc. * | | 320,440 | | 5,928,140 | |

| | | | 19,195,241 | |

INTERNET RETAIL—1.8% | | | | | |

NetFlix Inc. * | | 115,500 | | 5,233,305 | |

priceline.com Inc. * | | 84,260 | | 8,180,803 | |

| | | | 13,414,108 | |

INTERNET SOFTWARE & SERVICES—4.4% | | | | | |

GSI Commerce Inc. * | | 597,822 | | 8,495,051 | |

Omniture Inc. * | | 254,805 | | 3,139,198 | |

SkillSoft PLC. #* | | 1,053,050 | | 8,866,681 | |

Vignette Corp. * | | 398,550 | | 3,292,023 | |

VistaPrint Ltd. * | | 264,090 | | 9,071,491 | |

| | | | 32,864,444 | |

INVESTMENT BANKING & BROKERAGE—1.7% | | | | | |

GFI Group Inc. | | 326,750 | | 1,333,140 | |