Exhibit 99.1

Press Release

Triad Guaranty Inc. Reports First Quarter Results

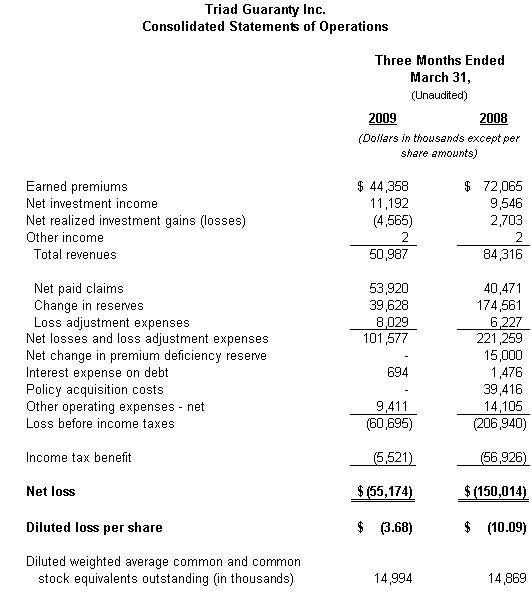

WINSTON-SALEM, N.C., May 15, 2009 -- Triad Guaranty Inc. (NASDAQ GS: TGIC) today reported a net loss for the quarter ended March 31, 2009 of $55.2 million compared to a net loss of $122.2 million for the fourth quarter of 2008 and a net loss of $150.0 million for the first quarter of 2008. The 2009 first quarter diluted loss per share was $3.68 compared to a diluted loss per share of $8.16 for the 2008 fourth quarter and $10.09 for the first quarter of 2008.

Ken Jones, President and CEO, said, “During the first quarter of 2009, risk in default continued to increase as the combination of the recession and declines in home prices impacted our insured portfolio. While there were indications during the quarter that risk in default growth could be slowing on a monthly basis, we expect the challenging environment will continue for the foreseeable future. Although the growth in risk in default during the first quarter increased slightly from the fourth quarter of 2008, our incurred losses, and net loss, were substantially lower. During the first quarter, we realized significant benefits from the stop loss structures provided by our Modified Pool contracts and we continued to recognize benefits from our lender captive reinsurance programs in the Primary business line. The increased benefits from the risk-sharing structures were the primary reason for the decline in incurred losses, but the reported losses also benefited from a change to our reserve factors to incorporate updated expectations for future rescissions of loans currently in default. As a company in run-off, our primary focus remains the efficient and effective servicing of our insured portfolio, particularly with respect to loss management. Although we are pleased with the decline in incurred losses during the first quarter, we continue to operate in historically unprecedented times and the uncertainty regarding the deepening recession, continued declining home prices, and rising unemployment rates, among other considerations, could further adversely impact our future results of operations and financial condition.”

Total insurance in force declined to $60.5 billion at March 31, 2009, a 3.4% drop from December 31, 2008 and a 10.6% decline from March 31, 2008. Our persistency rates have been very high over the past year as reduced credit availability and declining home prices limited the opportunities for borrowers to refinance existing mortgages. As credit becomes more available and home prices stabilize, however, we expect that our persistency rates and the related premium revenue will be negatively affected.

Total revenues grew to $50.9 million for the first quarter of 2009 from $41.4 million in the fourth quarter of 2008 and declined from $84.3 million for the first quarter of 2008. Earned premiums were lower for the first quarter of 2009 and the fourth quarter of 2008 as compared to the first quarter of 2008, primarily due to a non-cash accrual for premium refunds of $16.9 million and $13.5 million, respectively, related to expected premium refunds on rescissions. There was no accrual for premium refunds for expected rescissions in the first quarter of 2008. Non-cash impairment losses on invested assets of $5.6 million and $18.9 million for the first quarter of 2009 and the fourth quarter of 2008, respectively, also reduced revenue in those quarters. There were no investment impairments in the first quarter of 2008.

Net losses and loss adjustment expenses were $101.6 million for the first quarter of 2009, compared to $178.1 million for the fourth quarter of 2008 and $221.3 million for the first quarter of 2008. These year-over-year and sequential declines reflect the increased benefit from captive reinsurance programs and stop loss provisions contained in our Modified Pool contracts. For the first quarter of 2009, we recognized benefits of $97.4 million from risk-sharing structures, compared with $66.7 million in the fourth quarter of 2008 and $20.1 million in the first quarter of 2008. Paid losses for the first quarter of 2009 totaled $53.9 million, which reflected ceded cash recoveries on previously paid claims of $10.2 million from captive reinsurers. Paid claims were $69.4 million for the fourth quarter of 2008, including less than $1 million of ceded paid recoveries from captive reinsurance programs, and $40.1 million for the first quarter of 2008 with no ceded paid recoveries. We anticipate that paid losses will grow substantially in future quarters due to the expiration of the public and private foreclosure moratoriums previously in place. The change in reserves of $39.6 million during the first quarter of 2009 was significantly less than the $106.1 million change in the fourth quarter of 2008 and the $174.9 million change in the first quarter of 2008, again due primarily to the benefits of risk-sharing structures. Additionally, and as noted above, we adjusted our reserve factors in the first quarter of 2009 to incorporate updated expectations for future rescissions of loans currently in default.

Expenses were up moderately for the first quarter of 2009 as compared to the fourth quarter of 2008 due primarily to increased legal costs, and down significantly compared to the first quarter of 2008 due to the significantly reduced personnel costs from our transition into run-off. In addition, we wrote off the unamortized balance of the deferred acquisition cost asset in the first quarter of 2008 and no longer have any deferred acquisition cost amortization expense, which also contributed to the lower total expenses in the first quarter of 2009 as compared to the first quarter of 2008. Due to the existence of significant net operating loss carry forwards at March 31, 2009 and the probability of continued operating losses, the tax benefit recorded for the first quarter of 2009 reflects only the positive change in the valuation allowance established for the net deferred tax asset.

On March 31, 2009, the Illinois Director of Insurance issued a corrective order affecting our main insurance subsidiary, Triad Guaranty Insurance Corporation (“Triad”). Effective no earlier than June 1, 2009, all valid claims under Triad’s mortgage guaranty insurance policies will be paid 60% in cash and 40% by the creation of a deferred payment obligation (“DPO”) payable to the insured. The DPO will accrue a carrying charge based on the investment yield earned by our investment portfolio. Payments of the carrying charge and the DPO will be subject to our future financial performance and will require the approval of the Illinois Director. Under U.S. generally accepted accounting principles, the DPOs, when issued, and the related accrued interest, will be recorded as liabilities.

We have updated the supplemental information for the 2009 first quarter results related to product differentiation, risk structures, additional portfolio characteristics and performance on our web site at www.triadguaranty.com. The supplemental information can be found under “Investors” and then under “Webcasts and Presentations” by the title “Supplemental Information – First Quarter 2009”.

(Relevant Triad Guaranty Inc. financial and statistical information follows)

Triad Guaranty Inc.'s wholly owned subsidiary, Triad Guaranty Insurance Corporation, is a nationwide mortgage insurer pursuing a voluntary run-off of its existing in-force book of business. For more information, please visit the Company's web site at www.triadguaranty.com.

Certain of the statements contained in this release are "forward-looking statements" and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements include estimates and assumptions related to economic, competitive, regulatory, operational and legislative developments. These forward-looking statements are subject to change, uncertainty and circumstances that are, in many instances, beyond our control and they have been made based upon our current expectations and beliefs concerning future developments and their potential effect on us. Actual developments and their results could differ materially from those expected by us, depending on the outcome of a number of factors, including our ability to operate our business in run-off, the possibility of general economic and business conditions that are different than anticipated, legislative, regulatory, and other similar developments, changes in interest rates, employment rates, the housing market, the mortgage industry and the stock market, as well as the relevant factors described under "Risk Factors" and in the “Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995” in our Annual Report on Form 10-K for the year ended December 31, 2008 and in other reports and statements filed with the Securities and Exchange Commission. Forward-looking statements are based upon our current expectations and beliefs concerning future events and we undertake no obligation to update or revise any forward-looking statements to reflect the impact of circumstances or events that arise after the date the forward-looking statements are made.

SOURCE: | Triad Guaranty Inc. |

CONTACT: | Bob Ogburn, Vice President and Treasurer, at 336.723.1282 ext. 1167 or bogburn@tgic.com |