As filed with the Securities and Exchange Commission on March 4, 2013

File No. 333-186289

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

x Pre-Effective Amendment No. 1

¨ Post-Effective Amendment No.

ASTON FUNDS

(Exact Name of Registrant as Specified in Charter)

120 North LaSalle Street

Chicago, Illinois 60602

(Address of Principal Executive Offices, including Zip Code)

Registrant’s Telephone Number, including Area Code (312) 268-1400

Copy to:

| | |

(Name and Address of Agent for Service) Kenneth C. Anderson, President Aston Funds 120 North LaSalle Street Chicago, Illinois 60602 | | Copy to: Deborah Bielicke Eades Vedder Price P.C. 222 North LaSalle Street Chicago, Illinois 60601 |

Approximate date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

TITLE OF SECURITIES BEING REGISTERED: Shares of Beneficial Interest (no par value per share) of the Registrant.

No filing fee is required because of reliance on Section 24(f) and an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

, 2013

Dear Fellow Shareholder:

ASTON Small Cap Fund (formerly, ASTON/Veredus Small Cap Growth Fund) (the “Target Fund”), a series of Aston Funds (the “Trust”), a Delaware statutory trust, will hold a Meeting of Shareholders at the offices of the Trust, 120 North LaSalle Street, 25th Floor, Chicago, Illinois 60602 on April 16, 2013 at 9:00 a.m. Central Time (the “Special Meeting”).

The purpose of the Special Meeting is to consider the approval of an Agreement and Plan of Reorganization (and the related transactions) which provides for (i) the transfer of all the assets of the Target Fund to ASTON/LMCG Small Cap Growth Fund (formerly, ASTON Small Cap Growth Fund) (the “Acquiring Fund”) in exchange solely for shares of beneficial interest of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund; and (ii) the distribution by the Target Fund of all the shares of each class of the Acquiring Fund received by the Target Fund to the holders of shares of the corresponding class of the Target Fund in complete liquidation and termination of the Target Fund.

We encourage you to read the Questions and Answers section and the full text of the enclosed Proxy Statement/Prospectus.

The Board of Trustees has approved this proposal and urges you to vote “FOR” the proposal.

YOUR VOTE IS IMPORTANT! Please review the attached Proxy Statement/Prospectus carefully. Enclosed is a proxy card that we ask you to complete, sign, date and return as soon as possible in the postage-paid envelope. You may also vote by telephone or over the Internet using the toll-free telephone number or web address printed on your proxy card.

Effective January 31, 2013, Lee Munder Capital Group, LLC (“LMCG”) was appointed as subadviser to the Target Fund. The enclosed document also provides information about LMCG and the new subadvisory agreement for the Fund between LMCG and Aston Asset Management, LP.

Thank you for your attention and your vote with regard to this important proposal. Please call proxy services at (866) 880-8631 if you need more information. Thank you for your response, and we look forward to serving your future investment needs.

|

| Sincerely, |

|

| Kenneth C. Anderson |

| President |

Important Information for

ASTON Small Cap Fund Shareholders

At a special meeting of shareholders (the “Special Meeting”) of ASTON Small Cap Fund (formerly, ASTON/Veredus Small Cap Growth Fund) (the “Target Fund”), a series of Aston Funds (the “Trust”), you will be asked to vote on an important change affecting your fund. The purpose of the Special Meeting is to allow you to vote on the reorganization of your fund into ASTON/LMCG Small Cap Growth Fund (formerly, ASTON Small Cap Growth Fund) (the “Acquiring Fund”). If the reorganization is approved and completed, you will become a shareholder of the Acquiring Fund. The Target Fund and the Acquiring Fund are referred to herein collectively as the “Funds” and each individually as a “Fund.”

Although we recommend that you read the full text of the enclosed Proxy Statement/Prospectus, for your convenience, below is a brief overview of the proposal presented to shareholders for a vote.

| Q. | Why am I receiving this Proxy Statement/Prospectus? |

| A. | The shareholders of the Target Fund are being asked to approve a reorganization between the Target Fund and the Acquiring Fund pursuant to an Agreement and Plan of Reorganization entered into by the Trust, on behalf of the Target Fund and the Acquiring Fund (the “Agreement”), which is summarized below. |

| Q. | Why has the reorganization been proposed for the Target Fund? |

| A. | The proposed reorganization is intended to consolidate funds that have substantially similar investment objectives and investment policies, and, as of the date of this Proxy Statement/Prospectus, the same subadviser. Although the Acquiring Fund has higher gross operating expenses, the reorganization may result in lower operating expenses after taking into account the lower expense limitation in effect for the Acquiring Fund through February 28, 2014. In addition, the combination of two funds of relatively small sizes may result in economies of scale. |

| Q. | What are the similarities between the investment objectives and principal investment strategies of the Funds? |

| A. | The Target Fund and the Acquiring Fund have substantially similar objectives and principal investment strategies. The Acquiring Fund seeks to provide long-term capital appreciation, and the Target Fund seeks to provide capital appreciation. Under normal conditions, both Funds invest at least 80% of their assets in common stocks and other equity securities of small-cap companies. The Acquiring Fund defines small-cap companies as companies with a market capitalization of less than $3.0 billion at the time of acquisition. The Target Fund defines small-cap companies as those with a market capitalization of less than $2.5 billion at the time of acquisition. |

| Q. | What will happen if shareholders do not approve the reorganization? |

| A. | If the reorganization is not approved by shareholders, the Board of Trustees of the Trust (the “Board”) will take such actions as it deems to be in the best interests of the Target Fund, which may include additional solicitation, continuing to operate the Target Fund as a stand-alone fund or liquidating the Target Fund. |

| Q. | Will Target Fund shareholders receive new shares in exchange for their current shares? |

| A. | Yes. If shareholders approve the reorganization and it is completed, each Target Fund shareholder will receive shares of the Acquiring Fund in an amount equal in total value to the total value of the Target Fund shares surrendered by such shareholder. |

| Q. | Will this reorganization create a taxable event for me? |

| A. | No. The reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes. It is expected that you will recognize no gain or loss for federal income tax purposes as a direct result of the reorganization. |

| Q. | How do total operating expenses compare between the two Funds? |

| A. | The management fee rate is the same for both Funds, and the Funds have the same fee structure with respect to distribution and service fees. As of October 31, 2012, the Target Fund’s total gross expense ratio was lower than the total gross expense ratio of the Acquiring Fund; however, the Acquiring Fund’s net expense ratio was lower as a result of a lower contractual expense cap currently in effect for the Acquiring Fund through February 28, 2014. If the reorganization is completed, the net expense ratio of the combined fund is expected to be lower than the net expense ratio of the Target Fund for both share classes at least through the duration of the contractual fee waiver applicable to the Acquiring Fund, which remains in effect through February 28, 2014. |

| Q. | Who will bear the costs of the reorganization? |

| A. | Generally, each of the Target Fund and the Acquiring Fund will bear its own expenses related to the reorganization (whether or not the reorganization is consummated), including legal and accounting fees and expenses, provided that Aston Asset Management, LP (“Aston”) will reimburse the Funds for expenses in connection with the reorganization to the extent that such expenses cause total operating expenses of a Fund to exceed contractual operating expense caps currently in effect. It is expected that both Funds will be operating at expense levels exceeding their respective contractual expense limitations, thus resulting in Aston reimbursing the Funds for all direct expenses related to the reorganization. The Funds will bear all indirect costs such as brokerage and trading costs in connection with any portfolio repositioning. |

| Q. | When would the reorganization take place? |

| A. | If approved by Target Fund shareholders at the Special Meeting to be held on April 16, 2013, the reorganization would occur on or about April 22, 2013, or as soon as reasonably practicable after shareholder approval is obtained. |

| Q. | Will a proxy firm be engaged for the proxy solicitation? Will Aston contact me? |

| A. | Yes. Georgeson, Inc. d/b/a Computershare Fund Services will be engaged for the proxy solicitation. Shareholders of the Target Fund may be contacted by Aston personnel, in addition to the proxy solicitation firm. |

| Q. | Whom do I call for more information? |

| A. | Please call Computershare Fund Services’ Shareholder Services toll free at (866) 880-8631. |

| Q. | How do I vote my shares? |

| A. | You may vote your shares by Internet, by telephone or by mail, as described below. |

| | By Internet. Log on to the website noted on your proxy card(s), enter the control number printed on the proxy card(s), and follow the simple online instructions. |

By Touch-Tone Phone. Call the toll-free number found on your proxy card(s) and follow the simple instructions.

By Mail. Simply return your signed and dated proxy card(s) in the envelope provided.

| Q. | How does the Board suggest that I vote? |

| A. | After careful consideration, the Board has determined that the reorganization is in the best interests of your Fund and recommends that you vote “FOR” the reorganization. |

| | Your vote is very important. We encourage you as a shareholder to participate in your Fund’s governance by returning your vote as soon as possible. If enough shareholders fail to cast their votes, your Fund may not be able to hold its meeting or the vote on the reorganization, and will be required to incur additional solicitation costs in order to obtain sufficient shareholder participation. |

, 2013

ASTON Small Cap Fund

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 16, 2013

To the Shareholders of ASTON Small Cap Fund:

Notice is hereby given that a special meeting of shareholders of ASTON Small Cap Fund (formerly, ASTON/Veredus Small Cap Growth Fund) (the “Target Fund”), a series of Aston Funds (the “Trust”), a Delaware statutory trust, will be held at the offices of the Trust, 120 North LaSalle Street, 25th Floor, Chicago, Illinois 60602, on April 16, 2013 at 9:00 a.m. Central Time (the “Special Meeting”), for the following purposes:

1. To approve an Agreement and Plan of Reorganization (and the related transactions) which provides for (i) the transfer of all the assets of the Target Fund to ASTON/LMCG Small Cap Growth Fund (formerly, ASTON Small Cap Growth Fund) (the “Acquiring Fund”) in exchange solely for shares of beneficial interest of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund; and (ii) the distribution by the Target Fund of all the shares of each class of the Acquiring Fund received by the Target Fund to the holders of shares of the corresponding class of the Target Fund in complete liquidation and termination of the Target Fund.

2. To transact such other business as may properly come before the Special Meeting including whether or not to adjourn the Special Meeting, and any adjournment or postponement of the Special Meeting.

The Board of Trustees of the Trust has fixed the close of business on January 31, 2013 as the record date for the determination of shareholders entitled to notice of and to vote at the Special Meeting or any adjournment thereof. The persons named as proxies will vote in their discretion on any other business that may properly come before the Special Meeting or any adjournments or postponements thereof.

|

By Order of the Board of Trustees, Gerald F. Dillenburg Senior Vice President and Secretary |

Shareholders are requested to execute and return promptly the accompanying proxy card, which is being solicited by the Board of Trustees of the Trust. You may execute the proxy card using the methods described in the proxy card. Executing the proxy card is important to ensure a quorum at the Special Meeting. Shareholders also have the option to provide their vote by telephone or over the Internet by following the instructions accompanying the proxy card. Proxies may be revoked at any time before they are exercised by submitting a written notice of revocation or a subsequently executed proxy or by attending the Special Meeting and voting in person.

INSTRUCTIONS FOR VOTING

The following general rules apply to voting by mail and will help you properly sign your proxy card. Please read them carefully, because if you do not sign your proxy card properly your vote will be invalidated.

1. Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card.

2. Joint Accounts: Both parties must sign, and the name of each party signing should conform exactly to the name shown in the registration on the proxy card.

3. All Other Accounts: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example:

| | | | |

| Registration | | Valid Signature |

|

| Corporate Accounts |

| (1) | | ABC Corp. | | ABC Corp. by John Doe, Treasurer |

| (2) | | ABC Corp. | | |

| | John Doe, Treasurer | | John Doe |

| (3) | | ABC Corp. Profit Sharing Plan | | John Doe |

|

| Trust Accounts |

| (1) | | ABC Trust | | Jane B. Doe, Trustee |

| (2) | | Jane B. Doe, Trustee | | |

| | u/t/d 12/28/78 | | Jane B. Doe |

|

| Custodial or Estate Accounts |

| (1) | | John B. Smith, Cust. | | |

| | f/b/o John B. Smith, Jr. UGMA | | John B. Smith |

| (2) | | Estate of John B. Smith | | John B. Smith, Jr., Executor |

Rather than mailing in your proxy, you may vote by telephone or over the Internet using the toll-free telephone number or web address printed on your proxy card. These options require you to input the control number located on your proxy card. After inputting the control number, you may enter your vote on the proposal. You will have an opportunity to review your vote and make any necessary changes before submitting your vote.

Proxy Statement/Prospectus and

Information Statement

Dated , 2013

Relating to the Acquisition of the Assets and Liabilities of

ASTON Small Cap Fund (formerly, ASTON/Veredus Small Cap Growth Fund)

This Proxy Statement/Prospectus is furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board”) of Aston Funds (the “Trust”), a Delaware statutory trust, on behalf of ASTON Small Cap Fund (the “Target Fund”), for use at a special meeting of shareholders of the Target Fund to be held at the offices of the Trust, 120 North LaSalle Street, 25th Floor, Chicago, Illinois 60602 and at any and all adjournments or postponements thereof (the “Special Meeting”). This document also serves as an Information Statement with respect to the appointment of Lee Munder Capital Group, LLC (“LMCG”) as subadviser to the Target Fund, effective as of January 31, 2013.

The purpose of the Special Meeting is to consider the proposed reorganization (the “Reorganization”) of the Target Fund into ASTON/LMCG Small Cap Growth Fund (formerly, ASTON Small Cap Growth Fund) (the “Acquiring Fund”), another series of the Trust. The Target Fund and the Acquiring Fund are referred to herein collectively as the “Funds” and each individually as a “Fund.” Each Fund is a series of the Trust, an open-end, registered management investment company. If shareholders of the Target Fund approve the Reorganization and it is completed, each shareholder of the Target Fund will receive shares of the corresponding class of the Acquiring Fund with the same total value as the total value of the Target Fund shares surrendered by such shareholder. The Board has determined that the Reorganization is in the best interests of the Target Fund.

The address of the principal executive office and telephone number of the Funds and the Trust is 120 North LaSalle Street, 25th Floor, Chicago, Illinois 60602, (312) 268-1400.

The enclosed proxy and this Proxy Statement/Prospectus and Information Statement are first being sent to shareholders of the Target Fund on or about March , 2013. Shareholders of record as of the close of business on January 31, 2013 are entitled to vote at the Special Meeting and any adjournment or postponement thereof with respect to the Reorganization. In reliance on a manager-of-managers exemptive order governing the “manager-of-managers” structure under which the Funds operate, the Target Fund is not seeking your proxy or vote with respect to the appointment of LMCG as subadviser to the Target Fund.

The securities offered by this Proxy Statement/Prospectus have not been approved or disapproved by the Securities and Exchange Commission (“SEC”), nor has the SEC passed upon the accuracy or adequacy of this Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense.

This Proxy Statement/Prospectus explains concisely what you should know before voting on the Reorganization (in effect, investing in Class N and Class I shares of the Acquiring Fund) and constitutes an offering of Class N and Class I shares of beneficial interest, no par value per share, of the Acquiring Fund. Please read it carefully and retain it for future reference.

The following documents have been filed with the SEC and are incorporated into this Proxy Statement/Prospectus by reference:

| | (i) | the Trust’s prospectus dated February 28, 2013 relating to the Acquiring Fund, which accompanies this Proxy Statement/Prospectus; |

| | (ii) | the Trust’s prospectus dated February 28, 2013 relating to the Target Fund; |

| | (iii) | the Statement of Additional Information relating to the proposed Reorganization, dated , 2013 (the “Reorganization SAI”); |

| | (iv) | the Trust’s statement of additional information dated February 28, 2013, as supplemented through the date of this Proxy Statement/Prospectus, relating to the Funds; |

| | (v) | the audited financial statements of the Acquiring Fund contained in the Trust’s Annual Report for the fiscal year ended October 31, 2012; and |

| | (vi) | the audited financial statements of the Target Fund contained in the Trust’s Annual Report for the fiscal year ended October 31, 2012. |

No other parts of the documents referenced above are incorporated by reference herein.

The financial highlights of the Acquiring Fund contained in the Trust’s Annual Report for the fiscal year ended October 31, 2012 are attached as Appendix B to this Proxy Statement/Prospectus.

Copies of the foregoing may be obtained without charge by calling or writing the Funds at the telephone number or address shown below. If you wish to request the Reorganization SAI, please ask for the “Reorganization SAI.” In addition, the Acquiring Fund will furnish, without charge, a copy of its most recent annual report and subsequent semi-annual report to a shareholder upon request. You may request any of the foregoing by calling (800) 992-8151 or by writing to Aston Funds at P.O. Box 9765, Providence, RI 02940.

The Trust is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended, and in accordance therewith files reports and other information with the SEC. Reports, proxy statements, registration statements and other information filed by the Trust (including the Registration Statement relating to the Acquiring Fund on Form N-14 of which this Proxy Statement/Prospectus is a part) may be inspected without charge and copied (for a duplication fee at prescribed rates) at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 or at the SEC’s Northeast Regional Office (3 World Financial Center, New York, New York 10281) or Midwest Regional Office (175 W. Jackson Boulevard, Suite 900, Chicago, Illinois 60604). You may call the SEC at (202) 551-8090 for information about the operation of the Public Reference Room. You may obtain copies of this information, with payment of a duplication fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549. You may also access reports and other information about the Funds on the EDGAR database on the SEC’s Internet site at http://www.sec.gov.

-ii-

TABLE OF CONTENTS

-iii-

TABLE OF CONTENTS

(continued)

-iv-

SYNOPSIS

The following is a summary of, and is qualified by reference to, the more complete information contained in this Proxy Statement/Prospectus and the information attached hereto or incorporated herein by reference, including the Agreement and Plan of Reorganization. If the Reorganization is approved and completed, shareholders of the Target Fund will become shareholders of the Acquiring Fund and will cease to be shareholders of the Target Fund.

Shareholders should read the entire Proxy Statement/Prospectus carefully, together with the Trust’s Prospectus relating to the Acquiring Fund that accompanies this Proxy Statement/Prospectus and is incorporated herein by reference. This Proxy Statement/Prospectus constitutes an offering of Class N and Class I shares of the Acquiring Fund.

Background

Prior to January 31, 2013, the Target Fund and the Acquiring Fund were managed by different subadvisers. Todd-Veredus Asset Management LLC (“Todd-Veredus”) served as the Target Fund’s subadviser and Lee Munder Capital Group, LLC (“LMCG”) served as the Acquiring Fund’s subadviser. During the fourth quarter of 2012, Todd-Veredus notified Aston Asset Management, LP (“Aston” or the “Adviser”) of its decision to terminate the sub-investment advisory agreement with respect to the Fund in connection with its decision to close the investment strategy for the Target Fund as soon as practicable. As a result, Aston recommended, and the Board of Trustees approved, the appointment of LMCG as subadviser to the Target Fund, effective January 31, 2013 (the “Subadviser Change Date”), in order to provide continuity of portfolio management to the Target Fund utilizing a substantially similar investment style, after Todd-Veredus ceased to serve as subadviser. Simultaneously, Aston recommended the reorganization of the Target Fund into the Acquiring Fund because the reorganization would provide the Target Fund’s shareholders with an investment style that is similar to that of the Target Fund. Although the Acquiring Fund has higher gross operating expenses, the consolidation of two substantially similar funds of relatively small sizes may result in a lower total operating expense ratio after taking into account the lower expense limitation in effect for the Acquiring Fund at least through February 28, 2014, and may result in economies of scale, which may subsequently lead to additional shareholder purchases and additional economies of scale.

The Reorganization

This Proxy Statement/Prospectus is being furnished to shareholders of the Target Fund in connection with the proposed combination of the Target Fund with and into the Acquiring Fund pursuant to the terms and conditions of an Agreement and Plan of Reorganization (the “Agreement”), among the Trust, on behalf of the Target Fund and on behalf of the Acquiring Fund, and Aston. The Agreement provides for (i) the transfer of all the assets of the Target Fund to the Acquiring Fund in exchange solely for Class N and Class I shares of beneficial interest, with no par value per share, of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund; and (ii) the distribution by the Target Fund of all the shares of each class of the Acquiring Fund received by the Target Fund to the shareholders of the corresponding class of the Target Fund in complete liquidation and the termination of the Target Fund as soon as practicable following the Closing Date (as defined herein).

If shareholders approve the Reorganization and it is completed, Target Fund shareholders will become shareholders of the Acquiring Fund. The Board has determined that the Reorganization is in the best interests of the Target Fund and that the interests of existing shareholders of each Fund will not be diluted as a result of the Reorganization. The Board unanimously approved the Agreement and the transactions contemplated thereunder at an in-person meeting held on December 13, 2012.

The Board is asking shareholders of the Target Fund to approve the Reorganization at the Special Meeting to be held on April 16, 2013. Approval of the Reorganization requires the affirmative vote of the

1

holders of “a majority of the outstanding voting securities,” as defined by the 1940 Act. See “Voting Information and Requirements” below. The Board recommends that shareholders vote “FOR” the Reorganization.

If shareholders of the Target Fund approve the Reorganization, it is expected that the Reorganization will occur at 8:00 a.m. Central Time on April 22, 2013 (the “Closing Date”), or as soon as practicable thereafter. If the Reorganization is not approved, the Board will take such action as it deems to be in the best interests of the Target Fund. The Closing Date may be delayed and the Reorganization may be abandoned at any time by the mutual agreement of the parties. In addition, either Fund may at its option terminate the Agreement at or before the Closing Date due to (i) a breach by any other party of any representation, warranty or agreement contained in the Agreement to be performed at or before the Closing Date, if not cured within 30 days, (ii) a condition precedent to the obligations of the terminating party that has not been met and reasonably appears will not or cannot be met, or (iii) a determination by the Board that the consummation of the transactions contemplated by the Agreement is not in the best interests of a Fund.

Board of Trustees Recommendation

The Board believes that the proposed Reorganization would be in the best interests of each Fund. In approving the Reorganization and recommending that shareholders of the Target Fund approve the Reorganization, the Board considered a number of factors in reaching its determination, including the following:

| | • | | the appointment of the Acquiring Fund’s subadviser to serve as subadviser to the Target Fund; |

| | • | | the similarities and differences in the Funds’ investment objectives, principal investment strategies and principal risks; |

| | • | | the Funds’ relative sizes and potential for economies of scale; |

| | • | | the investment performance of the Funds; |

| | • | | the relative fees and expense ratios of the Funds, including the contractual expense caps in place for each Fund; |

| | • | | alternatives to the Reorganization; |

| | • | | the anticipated tax-free nature of the Reorganization; |

| | • | | the expected costs of the Reorganization and the extent to which the Funds would bear any such costs; |

| | • | | the effect of the Reorganization on shareholder services and shareholder rights; and |

| | • | | any potential benefits of the Reorganization to Aston and its affiliates as a result of the Reorganization. |

For a more detailed discussion of the Board’s considerations regarding the approval of the Reorganization, see “The Board’s Consideration of the Reorganization.”

2

Shareholder Information

The Funds have identical procedures for purchasing, exchanging and selling/redeeming shares, and for making distributions. Both Funds offer Class N and Class I shares. The classes of each Fund have the same investment eligibility criteria. See “Comparison of the Funds” below for a more detailed discussion.

Material Federal Income Tax Consequences of the Reorganization

The Reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes. If the Reorganization so qualifies, neither the Target Fund nor its shareholders will recognize any gain or loss as a direct result of the transfers contemplated by the Reorganization. Prior to the Closing Date, the Target Fund will declare a distribution to its shareholders, which together with all previous distributions, will have the effect of distributing to shareholders all its net investment income and realized net capital gains (after reduction by any available capital loss carryforwards), if any, through the Closing Date. Such distribution will be taxable to the Target Fund’s shareholders for federal income tax purposes. As a result of the change in subadviser effective on the Subadviser Change Date, the Target Fund will experience greater than normal portfolio turnover while LMCG repositions the portfolio. A majority of the securities in the Target Fund may be sold between the Subadviser Change Date and the Closing Date as a result of LMCG implementing its investment strategy. Such portfolio turnover will occur whether or not the Reorganization is consummated. Any income or losses realized by the Target Fund as a result of such portfolio turnover may increase or decrease the net investment income and net capital gain to be distributed by the Target Fund. Portfolio turnover as a direct result of the Reorganization is expected to be less than 5% of the assets of the Target Fund. For a more detailed discussion of the federal income tax consequences of the Reorganization, please see “The Proposed Reorganization—Material Federal Income Tax Consequences” below.

COMPARISON OF THE FUNDS

Investment Objectives

The investment objectives of the Funds are substantially similar. The investment objective of the Target Fund is to provide capital appreciation, and the investment objective of the Acquiring Fund is to provide long-term capital appreciation. The investment objective of each Fund is fundamental and may not be changed without shareholder approval.

Investment Strategies

The Target Fund and the Acquiring Fund have substantially similar principal investment strategies. The similarities and differences of the principal investment strategies of the Funds are:

| | | | | | | | |

Target Fund | | | | Acquiring Fund |

| • | | Under normal circumstances, the Fund invests at least 80% of its assets in common stock and other equity securities of small-cap companies. The Fund defines a small-cap company as one having a market capitalization of less than $2.5 billion at the time of acquisition. | | | | • | | Under normal circumstances, the Fund invests at least 80% of its assets in common stock and other equity securities of small-cap companies. The Fund defines a small-cap company as one having a market capitalization of less than $3.0 billion at the time of acquisition. |

3

| | | | | | | | |

Target Fund | | | | Acquiring Fund |

| • | | The Fund seeks to invest in growth stocks of small-cap companies whose earnings are growing, or are expected to grow, at an accelerating rate. | | | | • | | The portfolio manager seeks to achieve above average risk-adjusted returns by identifying unrecognized growth potential. |

| | | | |

| • | | The portfolio managers look for inefficiencies in the market caused by inaccurate expectations (e.g., positive earnings surprises, estimate revisions). The focus is on companies that have expanding unit volume growth; expanding profit margin potential; high or improving cash flow return on investment; and large markets with high barriers to entry. | | | | • | | The portfolio manager utilizes a fundamental bottom-up security selection process to identify characteristics such as: revenue growth, margin expansion, surprise potential and strong balance sheets. |

| | | | |

| • | | The Fund may also invest in equity securities outside the small-cap range. The Fund may invest in exchange-traded funds (“ETFs”), publicly traded partnerships and foreign securities (directly and indirectly through depositary receipts). | | | | • | | The Fund may also invest in mid-cap stocks, including companies with a market capitalization up to $10 billion at the time of acquisition. |

| | | | |

| • | | Sector exposure is a residual of the investment process and the Fund may, from time to time, have exposure to a single sector or group of related sectors that react similarly to market, economic or other events. | | | | | | |

Comparison of Principal Investment Strategies

The investment objectives and principal investment strategies of the Funds are substantially similar. However, there are some differences. Each Fund invests at least 80% of its assets in small-cap companies under normal circumstances. However, the Target Fund defines a small-cap company as one having a market capitalization of less than $2.5 billion at the time of acquisition and the Acquiring Fund defines a small-cap company as one having a market capitalization of less than $3.0 billion at the time of acquisition. Both Funds seek to invest in companies with growth potential. Prior to the Subadviser Change Date, the subadvisers to the Target Fund and the Acquiring Fund were different and each subadviser had different investment processes for selecting securities. However, as of the Subadviser Change Date, the Funds have the same subadviser, and as a result, there is a significant degree of overlap between the portfolio holdings of the Funds as of the date of this Proxy Statement/Prospectus.

While each Fund may invest in companies outside of the small-cap range, the Acquiring Fund may only invest in companies with market capitalization of up to $10 billion. Both Funds may invest in ETFs, publicly-traded partnerships and foreign securities, but the Target Fund may do so as a principal strategy.

The Reorganization may result in one-time brokerage costs for the Target Fund to the extent it is necessary for the Target Fund to sell securities prior to the Reorganization so that the Acquiring Fund’s portfolio immediately following the Reorganization remains in compliance with its investment policies and restrictions. As a result of the subadviser change described above, however, it is expected that the Target Fund will have commenced repositioning its portfolio as of the Subadviser Change Date and will have sold a material portion of its portfolio as of the date of this Proxy Statement/Prospectus. The repositioning of the portfolio by LMCG is expected to be completed prior to the Closing Date and such portfolio turnover will take place whether or not the Reorganization is consummated. Any portfolio sales that occur prior to the Reorganization, whether as a result of the subadviser change or the Reorganization,

4

may result in taxable distributions to Target Fund shareholders. See “The Proposed Reorganization—Material Federal Income Tax Consequences” below.

Risk Factors

In evaluating the Reorganization, you should consider carefully the risks of the Acquiring Fund. Investing in a mutual fund involves risk, including the risk that you could lose money by investing in a fund. For a complete description of the risks of an investment in the Acquiring Fund, see the section in the Acquiring Fund’s Prospectus entitled “Principal Risks.”

Because the Funds have substantially similar investment strategies, the principal risks of each Fund are substantially similar. The principal risks of investing in the Acquiring Fund are described below.

Growth Style Risk. Growth investing involves buying stocks that have relatively high price-to-earnings ratios. Growth stocks may be more volatile than other stocks because they are generally more sensitive to investor perceptions and market moves. During periods of growth stock underperformance, the Fund’s performance may suffer.

Liquidity Risk. When there is no willing buyer and investments cannot be readily sold at the desired time or price, the Fund may need to accept a lower price or may not be able to sell the security at all. An inability to sell securities can adversely affect the Fund’s value or prevent the Fund from being able to take advantage of other investment opportunities. Less liquid securities are more difficult to dispose of at their recorded values and are subject to increased spreads and volatility.

Manager Risk. The performance of the Fund is dependent upon the investment adviser’s skill in selecting managers and the portfolio manager’s skill in making appropriate investments. As a result, the Fund may underperform its benchmark or its peers.

Market Risk. The Fund’s share price can move down in response to stock market conditions, changes in the economy or changes in a particular company’s stock price. An individual stock may decline in value even when the value of stocks in general is rising.

Portfolio Turnover Risk. Frequent trading of the Fund’s portfolio holdings may result in a higher than average level of capital gains, including short-term gains, and will result in greater transaction costs to the Fund. To the extent distributions to shareholders are made from net short-term capital gains (i.e. net capital gain on securities held or treated as held by the Fund for one year or less minus any net capital losses on securities held or treated as held by the Fund for more than one year), the distributions will be taxed at ordinary income rates for federal income tax purposes, rather than at the lower long-term capital gains rates. Greater transaction costs and higher expenses as a result of portfolio turnover can negatively impact the Fund’s performance.

Small-Cap and Mid-Cap Company Risks. Investing in securities of small-cap and mid-cap companies may involve greater risks than investing in securities of larger, more established issuers. Small-cap and mid-cap companies generally have limited product lines, markets and financial resources. Their securities may trade less frequently and in more limited volume than the securities of larger, more established companies. Also, small-cap and mid-cap companies are typically subject to greater changes in earnings and business prospects than larger companies. As a result, their stock prices may experience greater volatility and may decline significantly in market downturns.

An investment in the Target Fund is also subject to each of the foregoing principal risks. In addition, principal risks of investing in the Target Fund include risks associated with investments in other

5

investment companies, foreign securities and publicly-traded partnerships, as well as sector concentration risk.

Fundamental Investment Restrictions

The Funds have substantially similar fundamental investment restrictions that cannot be changed without shareholder approval. In addition, each Fund is a diversified fund. As diversified funds, each Fund, with respect to 75% of its assets, may not invest more than 5% of its total assets in the securities of any one issuer (other than securities issued by other investment companies or by the U.S. government, its agencies, instrumentalities or authorities) and may not purchase more than 10% of the outstanding voting securities of any one issuer.

Fees and Expenses

The table below provides information about the fees and expenses attributable to each class of shares of the Funds, and the pro forma fees and expenses of the combined fund following the Reorganization. Total Annual Fund Operating Expenses reflect the fees and expenses for the Funds as of their fiscal year ended October 31, 2012, and the pro forma fees and expenses are based on the amounts shown in the table for each Fund, assuming that the Reorganization occurred at the beginning of the most recently completed fiscal year (i.e., on November 1, 2011).

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | | | | |

| | | Target

Fund | | Acquiring

Fund | | Combined

Fund Pro

Forma1 |

Management Fees | | | | | | |

Class N | | 1.00% | | 1.00% | | 1.00% |

Class I | | 1.00% | | 1.00% | | 1.00% |

Distribution and Service (12b-1) Fees | | | | | | |

Class N | | 0.25% | | 0.25% | | 0.25% |

Class I | | — | | — | | — |

Other Expenses | | | | | | |

Class N | | 0.58% | | 1.61% | | 0.79% |

Class I | | 0.58% | | 1.61% | | 0.79% |

Acquired Fund Fees and Expenses | | | | | | |

Class N | | 0.00% | | 0.01% | | 0.01% |

Class I | | 0.00% | | 0.01% | | 0.01% |

Total Annual Fund Operating Expenses | | | | | | |

Class N | | 1.83% | | 2.87% | | 2.05% |

Class I | | 1.58% | | 2.62% | | 1.80% |

Less Fee Waiver and/or Expense Reimbursement2 | | | | | | |

Class N | | (0.34)% | | (1.51)%3 | | (0.69)% |

Class I | | (0.34)% | | (1.51)%3 | | (0.69)% |

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | | | | | | |

Class N | | 1.49% | | 1.36% | | 1.36% |

Class I | | 1.24% | | 1.11% | | 1.11% |

| 1 | Gross pro forma expenses include the expenses to be charged to the Funds in connection with the Reorganization. However, it is expected that both Funds will be operating at expense levels exceeding their respective contractual expenses caps, thus resulting in the Adviser reimbursing the Funds for all direct expenses related to the Reorganization. See “The Proposed Reorganization—Reorganization Expenses” for additional information about these expenses. |

| 2 | The Adviser is contractually obligated to waive management fees and/or reimburse ordinary operating expenses, not including investment-related costs (such as brokerage commissions), interest, taxes, extraordinary expenses and |

6

| | acquired fund fees and expenses, through February 28, 2014, to the extent that operating expenses exceed the rates set forth above, as a percentage of each Fund’s average daily net assets with respect to each Fund (the “Operating Expense Limit”). Prior to February 28, 2014, the arrangement may be amended or terminated for a class only by a vote of the Board of Trustees of the Trust. |

| 3 | For a period of up to three years from the fiscal year end during which an amount was waived or reimbursed, the Adviser is entitled to be reimbursed by the Acquiring Fund for fees waived and expenses reimbursed from commencement of operations through the completion of the first three full fiscal years to the extent that the Fund’s Total Annual Operating Expenses for a class, not including investment-related costs (such as brokerage commissions), interest, taxes, extraordinary expenses and acquired fund fees and expenses, remains at or below the Operating Expense Limit after such reimbursement. |

Example

The example below is intended to help you compare the cost of investing in each Fund and the pro forma cost of investing in the combined fund. The example shows the operating expenses you would incur as a shareholder if you invested $10,000 in a Fund over the time periods shown and you redeem all your shares at the end of those periods. The example assumes that the average annual return was 5%, operating expenses remained the same, and expenses were capped for one year in each period. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | |

| | | Target

Fund | | Acquiring

Fund | | Combined

Fund Pro

Forma |

1 Year | | | | | | |

Class N | | $ 152 | | $ 138 | | $ 138 |

Class I | | $ 126 | | $ 113 | | $ 113 |

3 Years | | | | | | |

Class N | | $ 543 | | $ 746 | | $ 576 |

Class I | | $ 466 | | $ 671 | | $ 499 |

5 Years | | | | | | |

Class N | | $ 959 | | $1,380 | | $1,040 |

Class I | | $ 828 | | $1,255 | | $ 910 |

10 Years | | | | | | |

Class N | | $2,120 | | $3,086 | | $2,324 |

Class I | | $1,850 | | $2,842 | | $2,059 |

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect a Fund’s performance. During the most recent fiscal year for which audited financial statements are available, the Funds had the following portfolio turnover rates:

| | | | |

Fund | | Fiscal Year End | | Rate |

Target Fund | | 10/31/12 | | 158.83% |

Acquiring Fund | | 10/31/12 | | 168.05% |

After the Reorganization is completed, the portfolio manager of the Acquiring Fund may, in his discretion, sell securities acquired from the Target Fund. To the extent that the portfolio manager chooses to sell a significant percentage of such securities, the Acquiring Fund’s portfolio turnover rate and brokerage costs may be higher than they otherwise would have been.

7

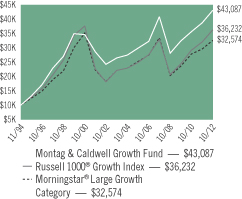

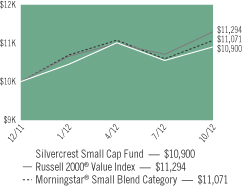

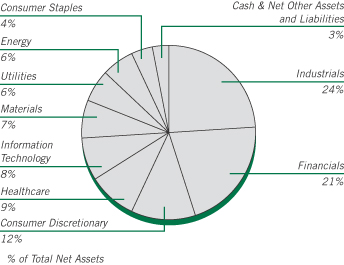

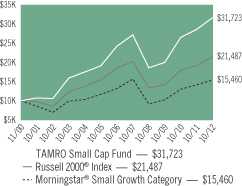

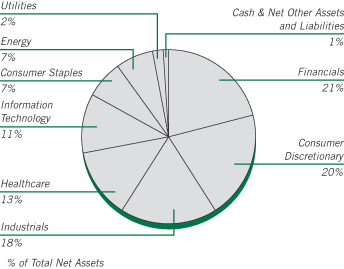

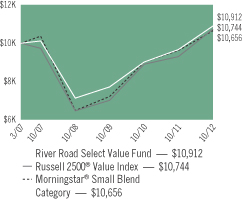

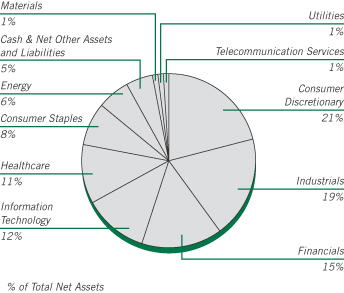

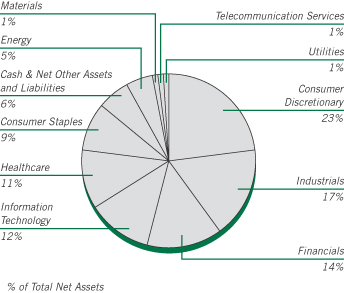

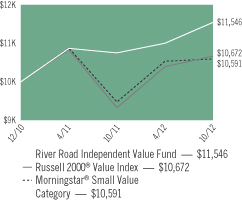

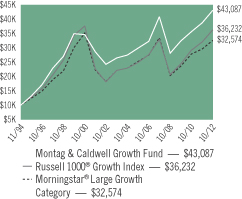

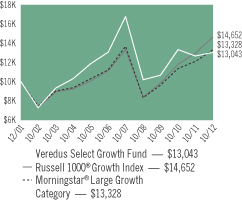

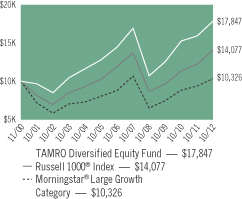

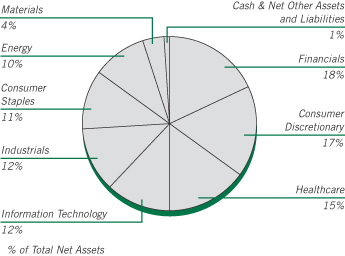

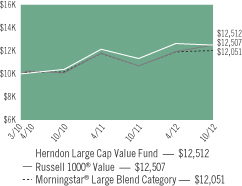

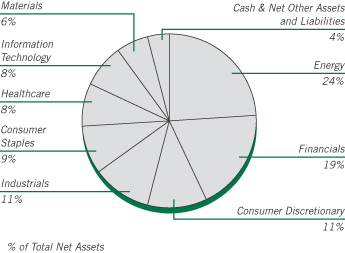

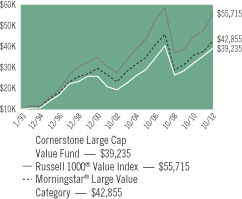

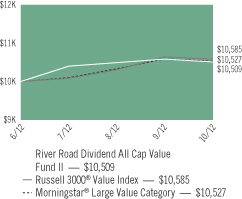

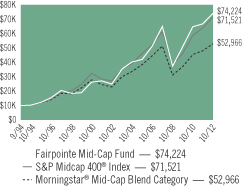

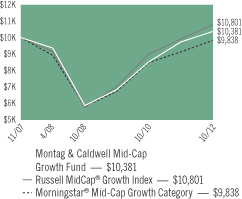

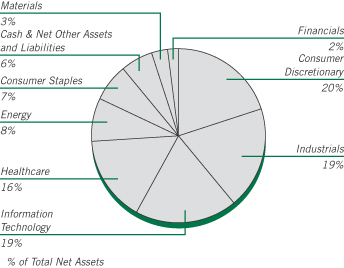

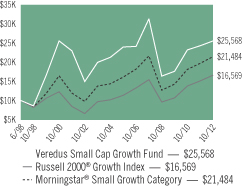

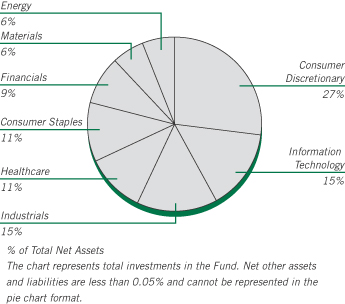

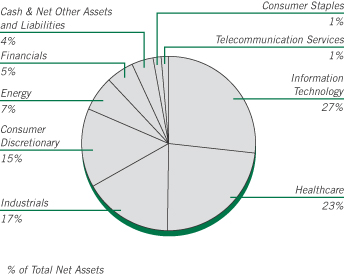

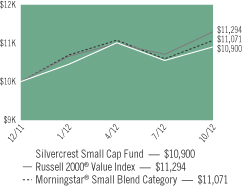

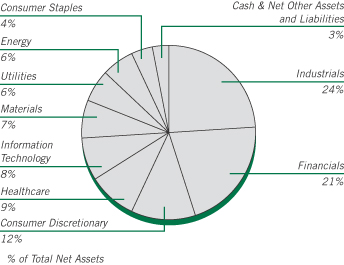

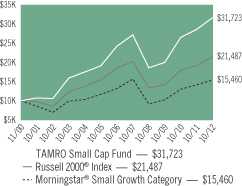

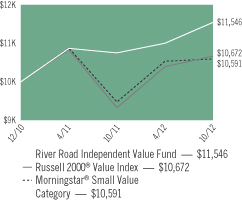

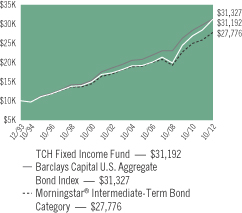

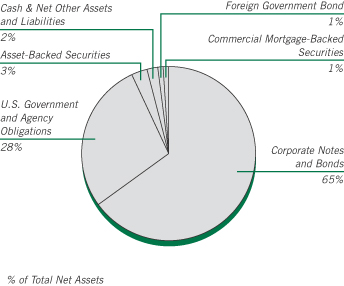

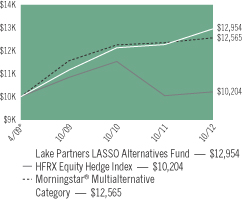

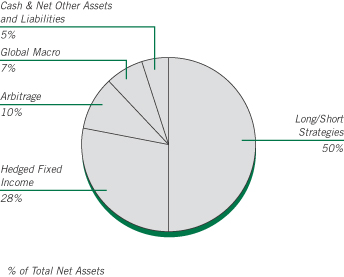

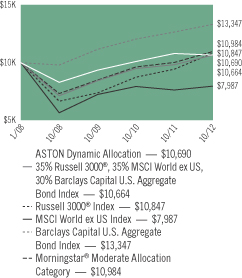

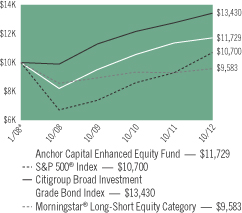

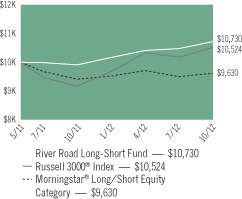

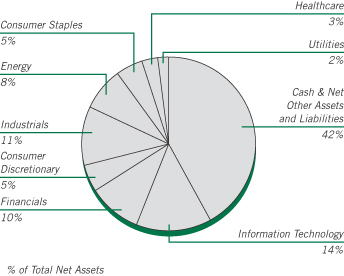

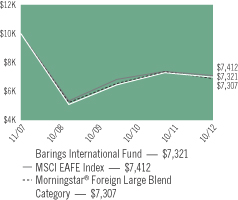

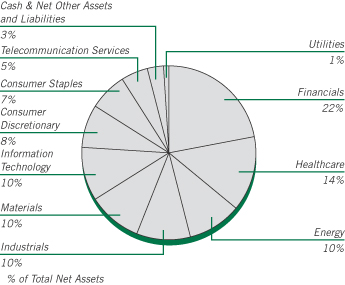

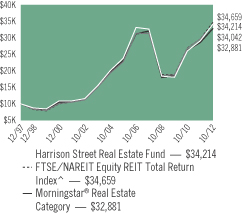

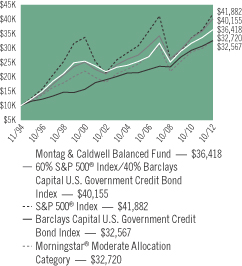

Performance Information

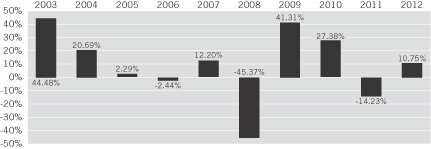

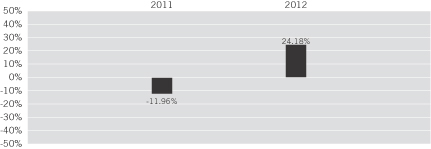

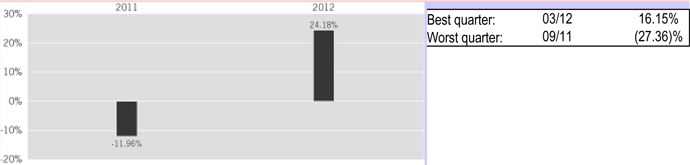

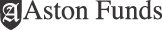

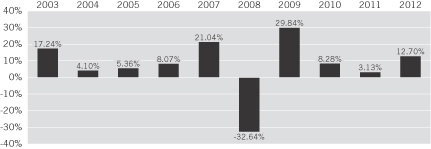

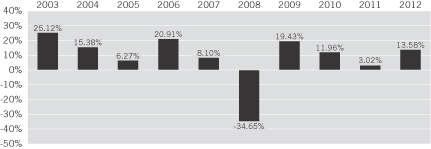

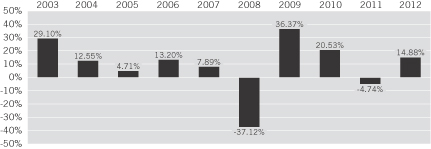

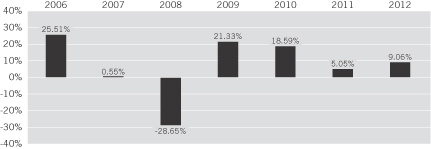

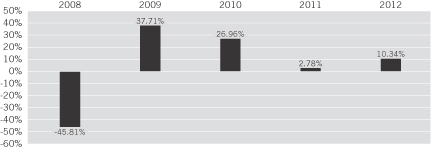

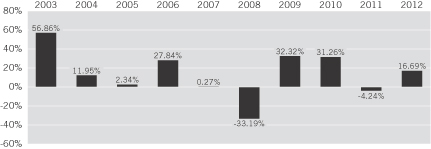

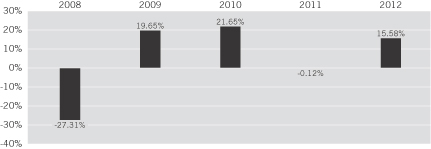

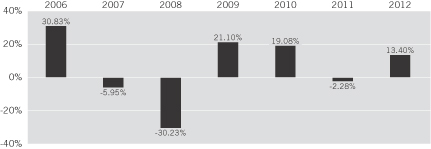

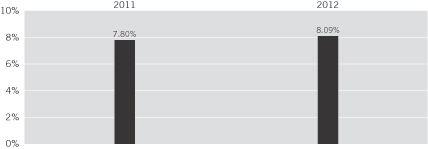

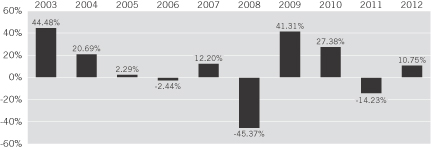

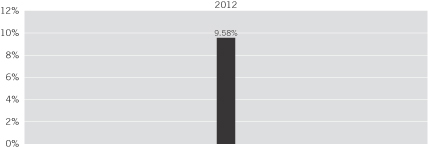

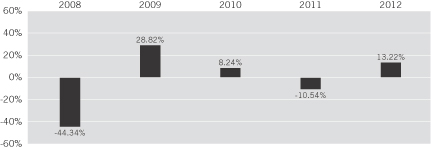

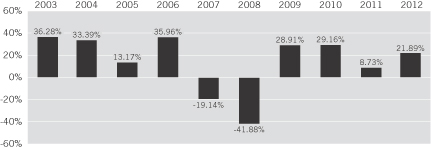

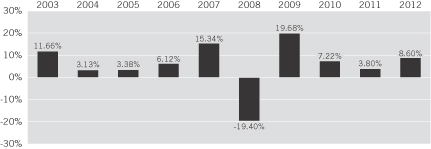

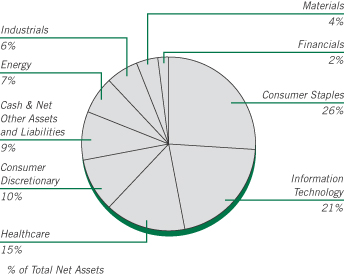

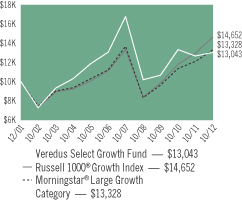

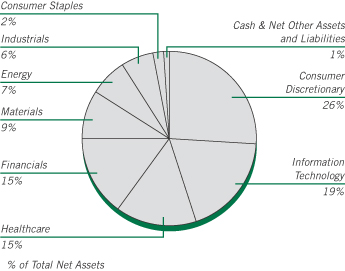

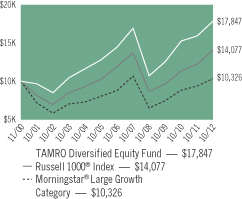

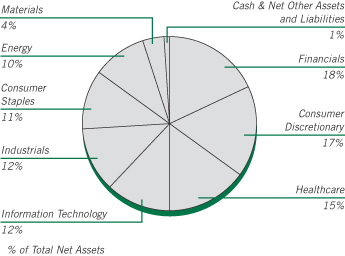

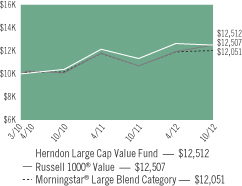

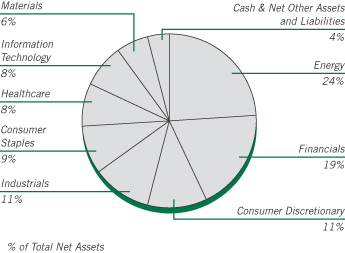

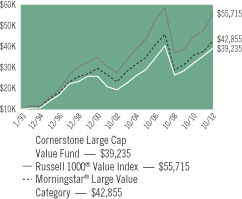

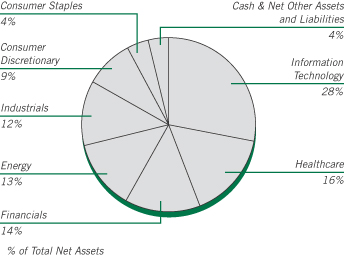

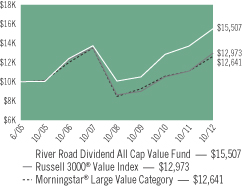

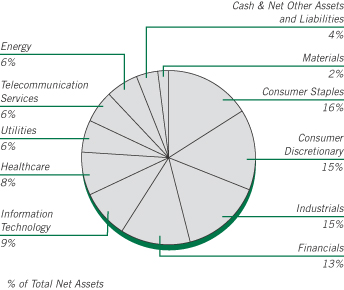

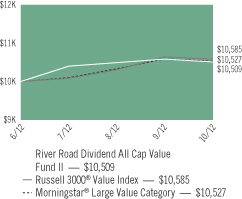

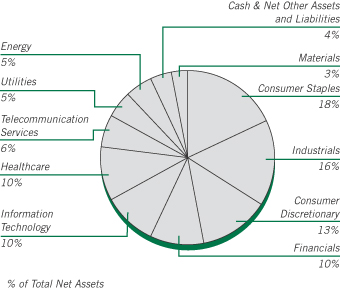

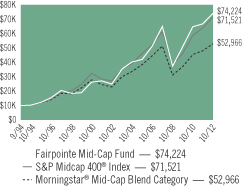

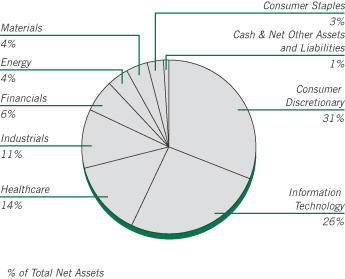

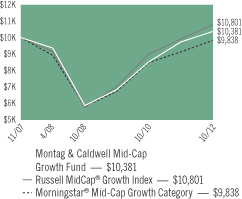

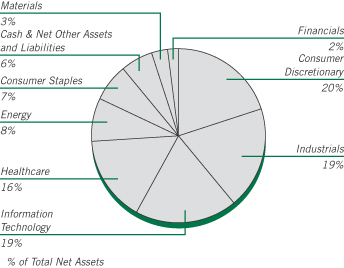

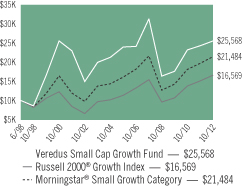

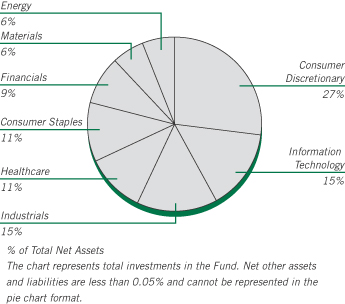

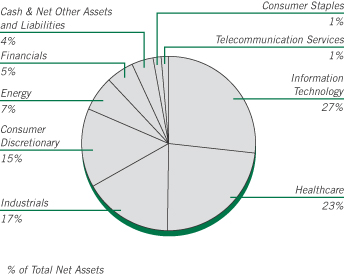

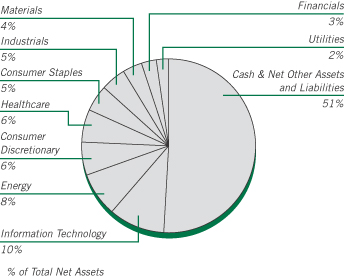

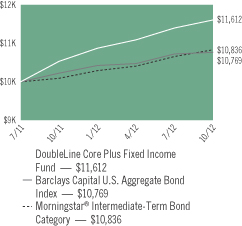

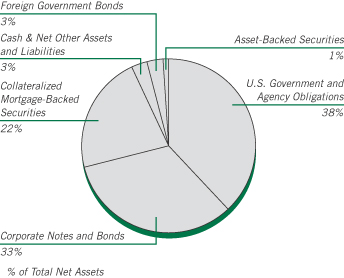

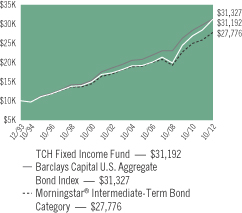

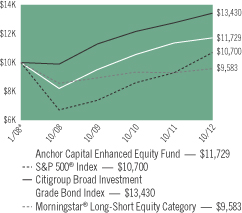

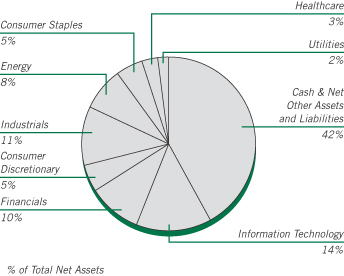

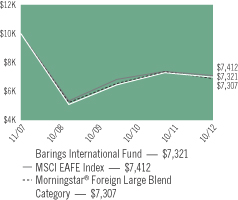

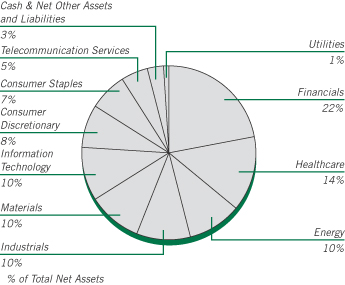

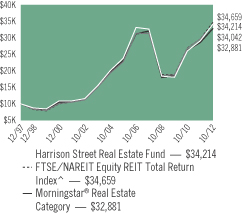

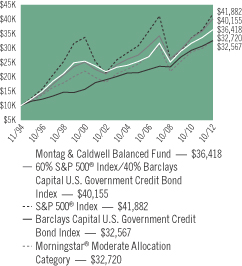

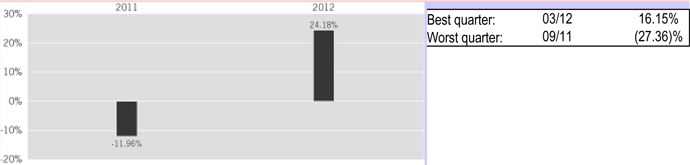

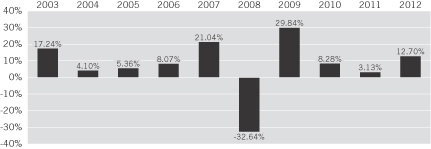

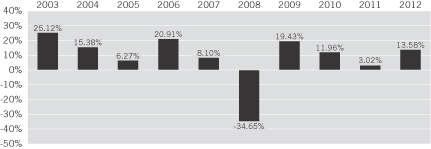

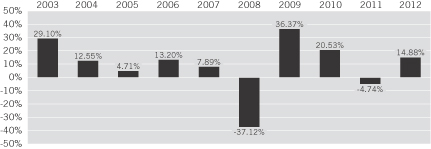

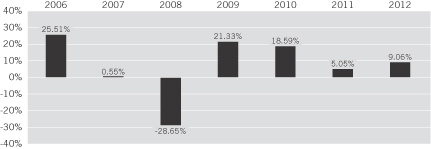

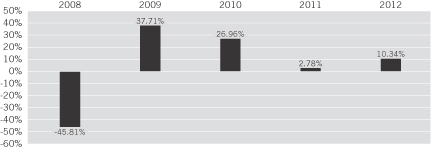

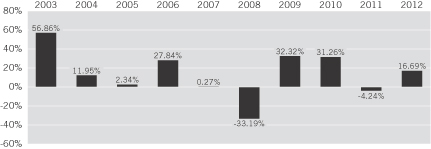

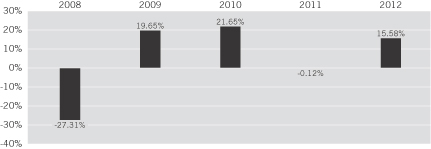

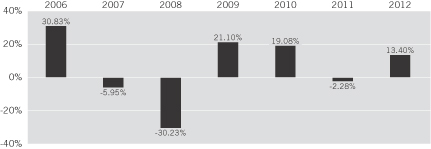

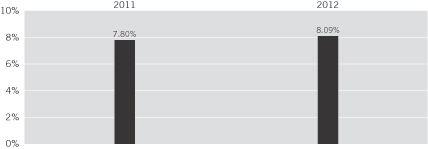

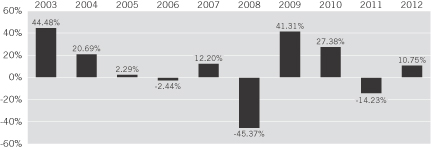

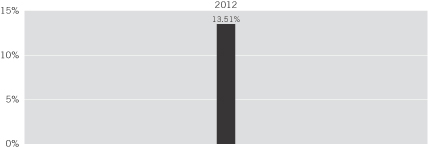

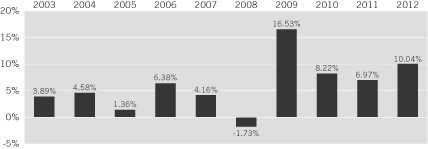

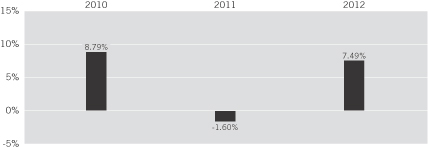

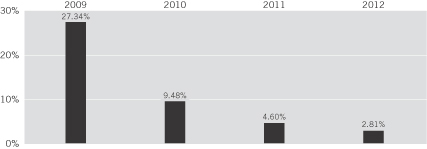

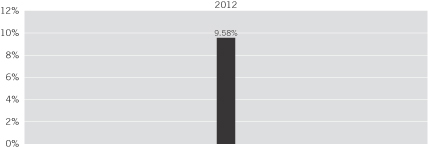

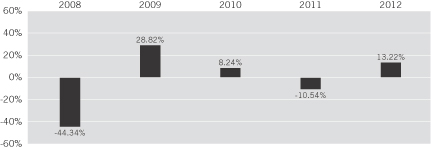

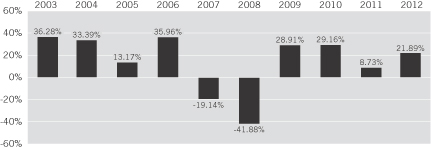

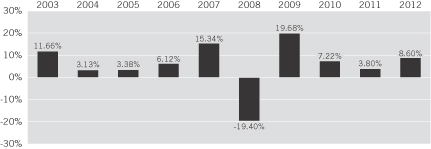

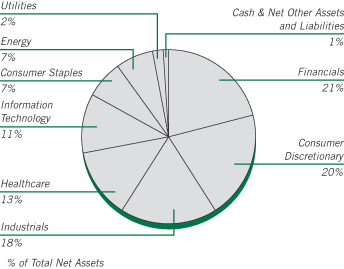

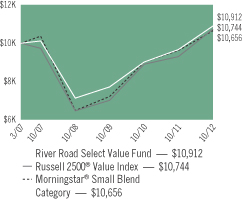

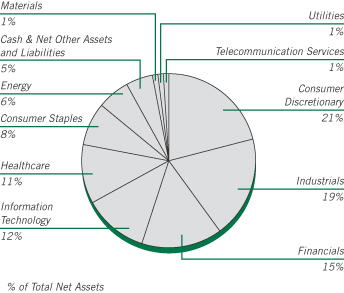

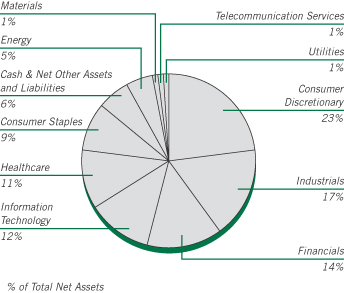

A comparison of the total returns of the Funds for the periods ended December 31, 2012, based on historical fees and expenses for each period, is set forth in the charts and tables below.

The bar charts show how the performance of the Class N shares of each Fund has varied from year to year for the periods shown. Class N shares and Class I shares are invested in the same portfolio of securities, so the annual returns would differ only to the extent that the classes have different expenses. The annual returns of the Class I shares would be higher than the returns of the Class N shares due to 12b-1 fees paid with respect to Class N shares. This information may help illustrate the risks of investing in the Funds. The Funds make updated performance information available on the Funds’ website, www.astonfunds.com, or by calling 800-992-8151. As with all mutual funds, past performance (before and after taxes) does not guarantee future performance.

8

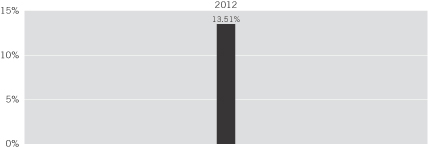

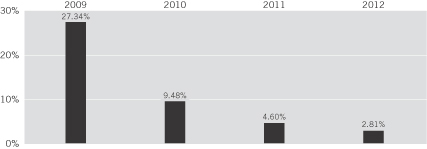

Target Fund*

Class N Annual Total Return

| * | During the periods shown in the chart, Todd-Veredus Asset Management LLC or Veredus Asset Management LLC served as subadviser to the Fund. Accordingly, returns may have differed had the current subadviser been in place. |

During the periods shown in the bar chart, the Target Fund’s highest and lowest calendar quarter returns were 30.94% and -28.07%, respectively, for the quarters ended September 30, 2009 and September 30, 2011.

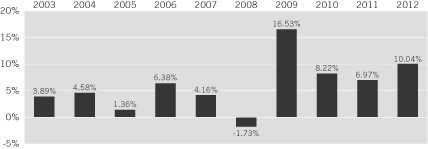

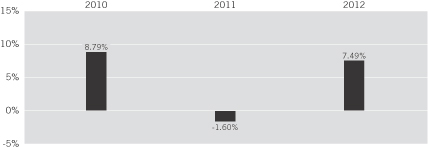

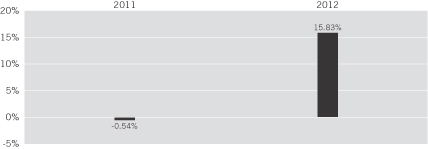

Acquiring Fund*

Class N Annual Total Return

| * | The Acquiring Fund commenced operations November 3, 2010. Prior to February 17, 2012, another firm served as subadviser to the Fund. However, the same portfolio manager has been in place since the Fund’s inception. |

During the periods shown in the bar chart, the Acquiring Fund’s highest and lowest calendar quarter returns were 16.15% and -27.36%, respectively, for the quarters ended March 31, 2012 and September 30, 2011.

9

The following tables indicate how each Fund’s average annual returns for different calendar periods compared to the returns of a broad-based securities market index.

| | | | | | | | |

| | | Average Annual Total Returns for the

Periods Ended December 31, 2012* |

Target Fund | | 1 Year | | 5 Years | | 10 Years | | Since

Inception |

Class N Shares (Inception 6/30/98) | | | | | | | | |

Return Before Taxes | | 10.75% | | (1.35)% | | 6.19% | | 6.71% |

Return After Taxes on Distributions | | 10.75% | | (1.38)% | | 5.36% | | 5.40% |

Return After Taxes on Distributions and Sale of Fund Shares | | 6.99% | | (1.16)% | | 5.21% | | 5.33% |

Class I (Inception 10/05/01) | | | | | | | | |

Return Before Taxes | | 11.11% | | (1.09)% | | 6.48% | | 1.12% |

Russell 2000 Growth Index (Reflects no deduction for taxes, expenses or fees. Index return for Class I shares, since inception, computed from September 30, 2001, is 7.44%.) | | 14.59% | | 3.49% | | 9.80% | | 3.80% |

| * | From the inception of the Fund through January 31, 2013, Todd-Veredus Asset Management LLC or Veredus Asset Management LLC served as subadviser to the Fund. Accordingly, returns may have differed had the current subadviser been in place. |

| | | | |

| | | Average Annual Total Returns for the

Periods Ended December 31, 2012** |

Acquiring Fund | | 1 Year | | Since Inception |

Class N Shares (Inception 11/03/10) | | | | |

Return Before Taxes | | 24.18% | | 9.09% |

Return After Taxes on Distributions | | 21.31% | | 7.92% |

Return After Taxes on Distributions and Sale of Fund Shares | | 16.07% | | 7.16% |

Class I (Inception 6/01/11) | | | | |

Return Before Taxes | | 24.43% | | (1.43)% |

Russell 2000 Growth Index (Reflects no deduction for taxes, expenses or fees. Index return since inception for Class N shares is computed from October 31, 2010. Index return for Class I shares, since inception, computed from May 31, 2011, is 0.16%.) | | 14.59% | | 10.81% |

| ** | Prior to February 17, 2012, a different investment manager served as subadviser to the Fund. However, the portfolio manager of the Fund has been in place since the Fund’s inception. |

Investment Adviser and Subadviser

Aston Asset Management, LP serves as investment adviser to the Funds. Aston is a majority-owned and independently managed indirect subsidiary of Affiliated Managers Group, Inc. (“AMG”). A wholly-owned subsidiary of AMG, Manor LLC, serves as the General Partner of Aston, and senior management and key employees of Aston have an equity interest in Aston. Aston commenced operations on December 1, 2006 and converted to a Delaware limited partnership on April 15, 2010 in connection with AMG’s acquisition of a controlling interest in Aston. As of December 31, 2012, Aston had approximately $11.5 billion in assets under management.

Lee Munder Capital Group, LLC (“LMCG”), 200 Clarendon Street, 28th Floor, Boston, Massachusetts 02116, has served as the subadviser to the Acquiring Fund since February 17, 2012 and to the Target Fund since January 31, 2013. LMCG was founded in August 2000. LMCG is majority-owned

10

by Convergent Capital Management, LLC. As of December 31, 2012, LMCG had approximately $5.0 billion in assets under management.

Mr. Andrew Morey, CFA, lead portfolio manager of LMCG’s small- and small/mid-cap investment strategies has served as the Acquiring Fund’s portfolio manager since its inception and as the Target Fund’s portfolio manager since January 31, 2013. Mr. Morey joined LMCG in February 2012. Mr. Morey has 20 years of investment management experience, and prior to joining LMCG, he served as portfolio manager at Crosswind Investments, LLC for Crosswind’s small- and small/mid-cap investment strategies. Previously, Mr. Morey was the founder and portfolio manager of Tartan Partners, LLC from 2005 to 2007. Prior to Tartan Partners, Mr. Morey worked at State Street Research & Management as a portfolio manager, and at Gabelli & Co. as a research analyst. Mr. Morey holds the Chartered Financial Analyst designation.

For a complete description of the advisory services provided to the Acquiring Fund, see the section of the Trust’s Prospectus entitled “Management of the Funds” and the sections of the Trust’s Statement of Additional Information entitled “Investment Adviser” and “Subadvisers.” Additional information about the portfolio manager compensation structure, other accounts managed by the portfolio manager and the portfolio manager’s ownership of securities in the Funds is provided in the Trust’s Statement of Additional Information.

Advisory and Other Fees

For the services provided and the expenses assumed pursuant to the Investment Advisory Agreement with Aston, Aston receives a management fee from each Fund based on the Fund’s average daily net assets, computed daily and payable monthly, at the following annual rates:

| | |

Fund | | Management Fee |

ASTON Small Cap Fund | | 1.00% |

ASTON/LMCG Small Cap Growth Fund | | 1.00% |

For the services provided pursuant to the Sub-Investment Advisory Agreement with LMCG with respect to the Acquiring Fund and the Target Fund, Aston pays LMCG a fee computed daily and payable monthly. The sub-advisory fee rate is 50% of the applicable advisory fee less any fee waivers and expense reimbursements and certain payments to third-party intermediaries.

Aston has entered into an Expense Reimbursement Agreement with the Trust, on behalf of the Acquiring Fund, through February 28, 2014, under which Aston will waive its fees or reimburse the Fund’s expenses to the extent that the Fund’s annual operating expense ratio, not including interest, taxes, investment-related costs (such as brokerage commissions), extraordinary expenses and acquired fund fees and expenses, exceeds 1.10% for Class I shares and 1.35% for Class N shares. In connection with the Expense Reimbursement Agreement for each class of shares, the Acquiring Fund has agreed that for a period of up to three years from the end of the fiscal year end in which such amount was waived or reimbursed, the Adviser is entitled to be reimbursed by the Fund for fees waived and expenses reimbursed from the commencement of operations of the class of shares through the completion of the Fund’s first three full fiscal years of that class to the extent that the Fund’s expense ratio with respect to that class (not including interest, taxes, other investment-related costs (such as brokerage commissions), extraordinary expenses and acquired fund fees and expenses) remains at or below the applicable operating expense cap after such reimbursement.

In addition, Aston has entered into an Expense Limitation Agreement with the Trust, on behalf of the Target Fund, through February 28, 2014 under which Aston will waive its fees or reimburse the

11

Fund’s expenses to the extent that the Fund’s annual operating expense ratio, not including interest, taxes, investment-related costs (such as brokerage commissions), extraordinary expenses and acquired fund fees and expenses, exceeds 1.24% for Class I shares and 1.49% for Class N shares.

The Board has adopted plans of distribution (the “Plans”) pursuant to Rule 12b-1 under the 1940 Act, which permit the Class N shares of each Fund to pay certain expenses associated with the distribution of its shares and the provision of shareholder services. Class I shares are not subject to Rule 12b-1 fees.

Under the Plans, each Fund is authorized to pay an annual rate not exceeding 0.25% of the Fund’s average daily net assets for Class N shares. From this amount, the Trust’s distributor may make payments to financial institutions and intermediaries such as banks, savings and loan associations, insurance companies, investment counselors, broker-dealers, and the distributor’s affiliates and subsidiaries as compensation for services, reimbursement of expenses incurred in connection with distribution assistance or the provision of shareholder services. The Plans for Class N shares are characterized as reimbursement plans and are directly tied to expenses incurred by the distributor; therefore, the payments the distributor receives during any year may not exceed its actual expenses.

Trustees and Officers

Both Funds are series of the Trust and, as a result, have the same Board and the same officers. The management of each Fund, including general oversight of the duties performed by Aston under the Investment Advisory Agreement for each Fund, is the responsibility of the Board. The Board currently is composed of nine trustees (each, a “Trustee”), seven of whom are not “interested persons” (as that term is defined in the 1940 Act). The names and business addresses of the Trustees and officers of the Funds and their principal occupations and other affiliations during the past five years are set forth under “Trustees and Officers of the Trust” in the Statement of Additional Information for the Trust incorporated herein by reference.

Purchase and Sale of Fund Shares

Each Fund offers Class N and Class I shares. You may purchase, exchange, or redeem shares of the Funds on any business day, which is any day the New York Stock Exchange is open for trading. You may purchase, exchange or redeem shares of each Fund through a financial representative or directly from the Fund. Each Fund’s initial and subsequent investment minimums generally are as follows, although each Fund may reduce or waive the minimums in some cases:

| | | | | | | | |

| | | Class N | | | Class I |

| | | |

ASTON/LMCG Small Cap Growth Fund | | Regular Accounts | | | $2,500 | | | Institutional Accounts $1 Million |

| | Individual Retirement Accounts | | | $500 | | | |

| | Education Savings Accounts | | | $500 | | | |

| | Custodial Accounts for Minors | | | $500 | | | |

| | | |

ASTON Small Cap Fund | | Regular Accounts | | | $2,500 | | | Institutional Accounts $1 Million |

| | Individual Retirement Accounts | | | $500 | | | |

| | Education Savings Accounts | | | $500 | | | |

| | Custodial Accounts for Minors | | | $500 | | | |

For a complete description of purchase, redemption and exchange options, see the section of the Trust’s Prospectus entitled “Shareholder Information” and the section of the Trust’s Statement of Additional Information entitled “Redemptions-In-Kind.”

12

Tax Information

The Funds’ distributions are generally taxable as ordinary income or capital gains for federal income purposes, unless you are investing through a tax-deferred account such as a 401(k) or individual retirement account. Distributions on investments made through tax-deferred vehicles, such as 401(k) plans or IRAs, may be taxed later upon withdrawal of assets from those plans or accounts.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of a Fund through a broker-dealer or another financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

THE PROPOSED REORGANIZATION

The proposed Reorganization will be governed by the Agreement, a form of which is attached as Appendix A. The following discussion of the Agreement is qualified in its entirety by the full text of the Agreement.

The Board has determined that the proposed Reorganization is in the best interests of each Fund and that the interests of shareholders of each Fund will not be diluted as a result of the transactions contemplated by the Agreement.

The Agreement provides that the closing of the Reorganization will take place at 8:00 a.m. Central Time on the Closing Date. At the closing, the Target Fund will transfer all its assets to the Acquiring Fund, and in exchange, the Acquiring Fund will assume all the liabilities of the Target Fund and deliver to the Target Fund a number of full and fractional shares of the Acquiring Fund having an aggregate value equal to the value of the assets of the Target Fund less the liabilities of the Target Fund assumed by the Acquiring Fund. On or as soon after the Closing Date as is practicable, the Target Fund will distribute in complete liquidation of the Target Fund, pro rata to its Class N and Class I shareholders, all Class N and Class I shares of the Acquiring Fund received by the Target Fund. This distribution will be accomplished by the transfer of Acquiring Fund shares credited to the account of the Target Fund on the books of the Acquiring Fund to open accounts on the share records of the Acquiring Fund in the name of the Target Fund shareholders, and representing the respective pro rata number of Acquiring Fund shares due such shareholders. All issued and outstanding shares of the Target Fund will simultaneously be canceled on the books of the Target Fund. The Acquiring Fund shall not issue certificates representing Acquiring Fund shares in connection with such transfer.

The aggregate net asset value of Acquiring Fund shares received by the Target Fund in the Reorganization will equal, as of the close of regular trading on the New York Stock Exchange on the business day immediately prior to the Closing Date, the aggregate net asset value of Target Fund shares held by Target Fund shareholders.

The consummation of the Reorganization is subject to the terms and conditions of, and the representations and warranties being true as set forth in, the Agreement. The Agreement may be terminated by the mutual agreement of the parties to the Reorganization, and such termination may be effected by the Trust’s President without further action by the Board. In addition, either the Acquiring Fund or the Target Fund may at its option terminate the Agreement at or before the Closing Date due to (a) a breach by any other party to the Reorganization of any representation, warranty or agreement

13

contained therein to be performed at or before the Closing Date, if not cured within 30 days; (b) a condition precedent to the obligations of the terminating party has not been met and it reasonably appears that it will not or cannot be met; or (c) a determination by the Board that the consummation of the transactions contemplated therein with respect to the Reorganization is not in the best interests of the Acquiring Fund or the Target Fund.

The Target Fund will, within a reasonable period of time before the Closing Date, furnish the Acquiring Fund with a list of the Target Fund’s portfolio securities and other investments. The Acquiring Fund will, within a reasonable period of time before the Closing Date, furnish the Target Fund with a list of the securities, if any, on the Target Fund’s list referred to above that do not conform to the Acquiring Fund’s investment objective, policies and restrictions. The Target Fund, if requested by the Acquiring Fund, will dispose of securities on such Acquiring Fund’s list before the Closing Date. In addition, if it is determined that the portfolios of the Target Fund and the Acquiring Fund, when aggregated, would contain investments exceeding certain percentage limitations imposed upon the Acquiring Fund with respect to such investments, the Target Fund, if requested by the Acquiring Fund, will dispose of a sufficient amount of such investments as may be necessary to avoid violating such limitations as of the Closing Date. Notwithstanding the foregoing, nothing herein will require the Target Fund to dispose of any investments or securities if, in the reasonable judgment of the Board or the Adviser, such disposition would adversely affect the status of the Reorganization as a “reorganization” for federal income tax purposes or would otherwise not be in the best interests of the Target Fund.

Description of Securities to be Issued

The Acquiring Fund has established and designated Class N and Class I shares, no par value per share. The Acquiring Fund is authorized to issue an unlimited number of shares. The number of Acquiring Fund shares to be issued (including fractional shares, if any) in exchange for the Target Fund’s net assets shall be determined with respect to each class by dividing the Target Fund’s net assets with respect to each class of shares of the Target Fund by the net asset value per share of the respective class of Acquiring Fund shares. All shares issued are fully paid and non-assessable, and shareholders have no preemptive or other right to subscribe to any additional shares and no conversion rights. See also “Rights of Shareholders” below.

Service Providers

The Bank of New York Mellon serves as the custodian for the Funds and BNY Mellon Investment Servicing (US) Inc. serves as transfer agent and dividend paying agent for the Funds. Ernst & Young LLP is the Trust’s independent registered public accounting firm.

Material Federal Income Tax Consequences

As a condition to each Fund’s obligation to consummate the Reorganization, each Fund will receive a tax opinion from Vedder Price P.C. (which opinion will be based on certain factual representations and certain customary assumptions and exclusions) substantially to the effect that, on the basis of the existing provisions of the Internal Revenue Code of 1986, as amended (the “Code”), current administrative rules and court decisions, for federal income tax purposes:

| | 1. | The transfer of all the assets of the Target Fund to the Acquiring Fund in exchange solely for Acquiring Fund shares and the assumption by the Acquiring Fund of all the liabilities of the Target Fund, followed by the pro rata distribution to the Target Fund shareholders of all the Acquiring Fund shares received by the Target Fund in complete liquidation of the Target Fund, will constitute a “reorganization” within the meaning of Section 368(a) of the Code, and the Acquiring Fund and the Target Fund will each be a “party to a |

14

| | reorganization” within the meaning of Section 368(b) of the Code with respect to the Reorganization. |

| | 2. | No gain or loss will be recognized by the Acquiring Fund upon the receipt of all the assets of the Target Fund solely in exchange for Acquiring Fund shares and the assumption by the Acquiring Fund of all the liabilities of the Target Fund. |

| | 3. | No gain or loss will be recognized by the Target Fund upon the transfer of all the Target Fund’s assets to the Acquiring Fund solely in exchange for Acquiring Fund shares and the assumption by the Acquiring Fund of all the liabilities of the Target Fund or upon the distribution (whether actual or constructive) of all such Acquiring Fund shares to the Target Fund shareholders solely in exchange for such shareholders’ shares of the Target Fund in complete liquidation of the Target Fund. |

| | 4. | No gain or loss will be recognized by Target Fund shareholders upon the exchange of their Target Fund shares solely for Acquiring Fund shares pursuant to the Reorganization. |

| | 5. | The aggregate basis of the Acquiring Fund shares received by each Target Fund shareholder pursuant to the Reorganization will be the same as the aggregate basis of the Target Fund shares exchanged therefor by such shareholder. The holding period of the Acquiring Fund shares received by each Target Fund shareholder will include the period during which the Target Fund shares exchanged therefor were held by such shareholder, provided such Target Fund shares are held as capital assets at the effective time of the Reorganization. |

| | 6. | The basis of the Target Fund’s assets acquired by the Acquiring Fund will be the same as the basis of such assets to the Target Fund immediately before the Reorganization. The holding period of the assets of the Target Fund in the hands of the Acquiring Fund will include the period during which those assets were held by the Target Fund. |

No opinion will be expressed as to (1) the effect of the Reorganization on (A) the Target Fund, the Acquiring Fund or any Target Fund shareholder with respect to any asset as to which any unrealized gain or loss is required to be recognized under federal income tax principles (i) at the end of a taxable year (or on the termination thereof) or (ii) upon the transfer of such asset regardless of whether such transfer would otherwise be a non-taxable transaction under the Code, or (B) the Target Fund, the Acquiring Fund or any Target Fund shareholder with respect to any stock held in a passive foreign investment company as defined in Section 1297(a) of the Code or (2) any other federal tax issues (except those set forth above) and all state, local or foreign tax issues of any kind.

Prior to the closing of the Reorganization, the Target Fund will declare a distribution to its shareholders, which together with all previous distributions, will have the effect of distributing to shareholders all its net investment income and realized net capital gains (after reduction by any available capital loss carryforwards), if any, through the closing of the Reorganization. This distribution will be taxable to shareholders for federal income tax purposes and may include net capital gains resulting from the sale of portfolio assets discussed below. Additional distributions may be made if necessary. All dividends and distributions will be reinvested in additional shares of the Target Fund unless a shareholder has made an election to receive dividends and distributions in cash. Dividends and distributions are treated the same for federal income tax purposes whether received in cash or additional shares.

To the extent that a portion of the Target Fund’s portfolio assets are sold prior to the Reorganization, the federal income tax effect of such sales would depend on the holding periods of such assets and the difference between the price at which such portfolio assets were sold and the Target Fund’s

15

basis in such assets. Any net capital gains (net long-term capital gain in excess of any net short-term capital loss) recognized in these sales, after the application of any available capital loss carryforwards (capital losses from prior taxable years that may be used to offset future capital gains), would be distributed to the Target Fund’s shareholders as capital gain dividends. Any net short-term capital gains (net short-term capital gain in excess of any net long-term capital loss), after application of any available capital loss carryforwards would be distributed as ordinary dividends. All such distributions would be made during or with respect to the Target Fund’s taxable year in which the sale occurs and would be taxable for federal income tax purposes to shareholders subject to federal income tax. Although the Target Fund is expected to have substantial portfolio turnover as a result of the appointment of LMCG as subadviser effective January 31, 2013, any gains resulting from such sales are expected to be offset by available capital loss carryforwards of the Target Fund.

At October 31, 2012, the Funds had unused capital loss carryforwards available for federal income tax purposes to be applied against future capital gains, if any. If not applied, the capital loss carryforwards would expire as follows:

| | | | |

| | | Acquiring

Fund | | Target Fund |

Expiration Date: | | | | |

October 31, 2016 | | $ — | | $ 2,506,635 |

October 31, 2017 | | — | | 16,347,889 |

Total | | $ — | | $18,854,524 |

For net capital losses arising in taxable years beginning after December 22, 2010 (“post-enactment losses”), a Fund will generally be able to carry forward such capital losses indefinitely. A Fund’s net capital losses from taxable years beginning on or prior to December 22, 2010, however, will remain subject to their current expiration dates and can be used only after the post-enactment losses.

After the Reorganization, the Acquiring Fund’s ability to use the Target Fund’s pre-Reorganization capital losses, if any, may be limited under certain federal income tax rules applicable to reorganizations of this type. Therefore, in certain circumstances, former shareholders of the Target Fund may pay federal income tax sooner, or may pay more federal income taxes, than they would have had the Reorganization not occurred. It is currently estimated that the Acquiring Fund may not be able to utilize approximately $16,600,000 of the capital loss carryforwards set forth above following the Reorganization due to certain federal income tax rules. The effect of these potential limitations will depend on a number of factors, including the amount of the losses, the amount of gains to be offset, the exact timing of the Reorganization and the amount of unrealized capital gains in the Funds at the time of the Reorganization.

In addition, shareholders of the Target Fund will receive a proportionate share of any taxable income and gains realized by the Acquiring Fund and not distributed to its shareholders prior to the Reorganization when such income and gains are eventually distributed by the Acquiring Fund. As a result, shareholders of the Target Fund may receive a greater amount of taxable distributions than they would have had the Reorganization not occurred.

The foregoing is intended to be only a summary of the principal federal income tax consequences of the Reorganization and should not be considered to be tax advice. There can be no assurance that the Internal Revenue Service will concur on all or any of the issues discussed above. The foregoing is made without regard to the particular facts and circumstances of any shareholder. Shareholders are urged to consult their own tax advisers regarding the federal, state and local tax consequences with respect to the foregoing matters and any other considerations which may be applicable to them.

16

Reorganization Expenses

Each Fund will bear the expenses of the Reorganization (whether or not the Reorganization is consummated), including legal and accounting fees and expenses, provided that the Adviser will reimburse the Funds for expenses incurred in connection with the Reorganization, including legal and accounting expenses, to the extent that such expenses cause the total operating expense ratio of a Fund to exceed operating expense caps currently in effect for a Fund. It is expected that both Funds will be operating at expense levels exceeding their respective expense caps, thus resulting in the Adviser reimbursing the Funds for all direct expenses related to the Reorganization.

Notwithstanding the foregoing, expenses will in any event be paid by the party directly incurring such expenses if and to the extent that the payment by the other party of such expenses would result in the disqualification of the Target Fund or the Acquiring Fund, as the case may be, as a regulated investment company for federal income tax purposes.

The Target Fund has engaged Georgeson, Inc. d/b/a Computershare Fund Services to assist in the solicitation of proxies at an estimated cost of $11,000, which is included in the estimate of Reorganization costs.

Rights of Shareholders

Both Funds are organized as series of a Delaware statutory trust. The Target Fund and the Acquiring Fund are both series of the Trust. As such, there are no material differences in the rights of shareholders.

Each issued and outstanding full and fractional share of a Fund is entitled to one full and fractional vote. Shares of a Fund participate equally in regards to dividends, distributions and liquidations with respect to that Fund subject to preferences (such as Rule 12b-1 fees), rights or privileges of any share class. Shareholders have equal non-cumulative voting rights. Class N shares have exclusive voting rights with respect to the Plans for their class. On any matter submitted to a vote of shareholders, shares of each Fund will vote separately except when a vote of shareholders in the aggregate is required by law, or when the Trustees have determined that the matter affects the interests of more than one Fund, in which case the shareholders of all such Funds shall be entitled to vote thereon.

Shareholders have the power to vote only (i) for the election of Trustees, (ii) for the removal of Trustees, and (iii) with respect to such additional matters relating to the Trust as may be required by law, by the Trust Instrument, or as the Trustees may consider desirable.

Capitalization

The following table sets forth the capitalization of the Target Fund and the Acquiring Fund as of October 31, 2012, and the pro forma capitalization of the combined fund as if the Reorganization had occurred on that date. These numbers may differ at the Closing Date.

Capitalization Table as of October 31, 2012 (Unaudited)

| | | | | | | | | | |

| | | Target Fund | | Acquiring

Fund | | Adjustments | | Pro Forma

Combined

Fund | |

Net Assets | | | | | | | | | | |

Class N | | $21,762,975 | | $5,658,602 | | – | | | $27,421,577 | (a) |

Class I | | 2,400,330 | | 754,628 | | – | | | 3,154,958 | (a) |

Total | | $24,163,305 | | $6,413,230 | | – | | | $30,576,535 | (a) |

17

| | | | | | | | | | | | | | | | |

| | | Target Fund | | | Acquiring

Fund | | | Adjustments | | | Pro Forma

Combined

Fund | |

Shares Outstanding | | | | | | | | | | | | | | | | |

Class N | | | 1,670,425 | | | | 495,521 | | | | 235,265(b) | | | | 2,401,211(b) | |

Class I | | | 177,344 | | | | 65,824 | | | | 32,109(b) | | | | 275,277(b) | |

Total | | | 1,847,769 | | | | 561,345 | | | | 267,374(b) | | | | 2,676,488(b) | |

Net Asset Value Per Share | | | | | | | | | | | | | | | | |