- VIAV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Viavi Solutions (VIAV) DEF 14ADefinitive proxy

Filed: 1 Oct 04, 12:00am

| UNITED STATES | OMB APPROVAL |

| SECURITIES AND EXCHANGE OMMISSION | OMB Number: 3235-00595 |

| Washington, D.C. 20549 | Expires: February 28, 2006 |

| SCHEDULE 14A | Estimated average burden hours per response......... 12.75 |

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant x | |

| Filed by a Party other than the Registrant o | |

| Check the appropriate box: | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to Rule §240.14a-12 |

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| 1. | Title of each class of securities to which transaction applies: | |

| 2. | Aggregate number of securities to which transaction applies: | |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4. | Proposed maximum aggregate value of transaction: | |

| 5. | Total fee paid: | |

| SEC 1913 (03-04) Persons who are to respond to the Collection of information contained in this form are not required to respond unless the form displays a currently valid OMB cotrol number. | ||

| o | Fee paid previously with preliminary materials. | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| 1. | Amount Previously Paid: | |

| 2. | Form, Schedule or Registration Statement No.: | |

| 3. | Filing Party: | |

| 4. | Date Filed: | |

JDS UNIPHASE CORPORATION

1768 Automation Parkway

San Jose, California 95131

(408) 546-5000

Notice of Annual Meeting of Stockholders

and Proxy Statement

Letter to Stockholders

2004 Annual Report

| YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE OR VOTE TELEPHONE OR ELECTRONICALLY VIA THE INTERNET. |

CONSIDERING REGISTERING ELECTRONICALLY FOR STOCKHOLDER MATERIALS?

JDS UNIPHASE CORPORATION

1768 Automation Parkway

San Jose, California 95131

(408) 546-5000

October 1, 2004

Dear Stockholder:

JDS UNIPHASE CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 16, 2004

TIME | 8:30 a.m., Pacific Standard Time, on November 16, 2004 | ||

LOCATION | JDS Uniphase Corporation 1768 Automation Parkway San Jose, California 95131 (408)546-5000 | ||

PROPOSALS | 1. | To elect three Class I directors to serve until the 2007 annual meeting of stockholders and until their successors are elected and qualified. | |

| 2. | To ratify the appointment of Ernst & Young LLP as JDS Uniphase Corporation’s Independent Registered Accounting Firm for the fiscal year ending June 30, 2005. | ||

| 3. | To consider such other business as may properly come before the annual meeting and any adjournment or postponement thereof. | ||

| These items of business are more fully described in the proxy statement which is attached and made a part hereof. | |||

RECORD DATE | You are entitled to vote at the 2004 annual meeting of stockholders (the “Annual Meeting”) and any adjournment or postponement thereof if you were a stockholder at the close of business on September 15, 2004. | ||

VOTING | Your vote is important. Whether or not you expect to attend the Annual Meeting, you are urged to vote promptly to ensure your representation and the presence of a quorum at the Annual Meeting. You may vote your shares by using the Internet or the telephone. Instructions for using these services are set forth on the enclosed proxy card. You may also vote your shares by marking, signing, dating and returning the proxy card in the enclosed postage-prepaid envelope. If you send in your proxy card and then decide to attend the Annual Meeting to vote your shares in person, you may still do so. Your proxy is revocable in accordance with the procedures set forth in the proxy statement. | ||

San Jose, California

October 1, 2004

JDS UNIPHASE CORPORATION

1768 Automation Parkway

San Jose, California 95131

(408) 546-5000

____________________

PROXY STATEMENT

____________________

GENERAL INFORMATION

Why am I receiving these proxy materials?

What proposals will be voted on at the Annual Meeting?

| 1. | To elect three Class I directors to serve until the 2007 annual meeting of stockholders and until their successors are elected and qualified; |

| 2. | To ratify the appointment of Ernst & Young LLP as the Company’s Independent Registered Public Accounting Firm (hereinafter referred to as “independent auditors”) for the fiscal year ending June 30, 2005; and |

| 3. | To consider such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

What are the recommendations of the Company’s Board of Directors?

What is the record date and what does it mean?

What shares can I vote?

Company (the “Trustee”), the holder of the Company’s special voting share (“Special Voting Share”), is entitled to one vote for each exchangeable share of JDS Uniphase Canada Ltd., a subsidiary of the Company (“Exchangeable Shares”), outstanding as of the record date (other than Exchangeable Shares owned by the Company and its affiliates). Holders of Common Stock and the Special Voting Share are collectively referred to as “Stockholders.” Votes cast with respect to Exchangeable Shares will be voted through the Special Voting Share by the Trustee as directed by the holders of Exchangeable Shares, except votes cast with respect to Exchangeable Shares whose holders request to vote directly in person as proxy for the Trustee at the Annual Meeting.

What is the voting requirement to approve each of the proposals?

How do I vote my shares?

| • | by mailing the enclosed proxy card; |

| • | over the telephone by calling a toll-free number; or |

| • | electronically, using the Internet. |

| • | by mailing the enclosed voting instruction card to the Trustee. |

Who will tabulate the votes?

2

Is my vote confidential?

What are the quorum and voting requirements?

Can I change my vote after submitting my proxy?

| • | submitting another proxy card bearing a later date; |

| • | sending a written notice of revocation to the Company’s Corporate Secretary at 1768 Automation Parkway, San Jose, California, 95131; |

| • | submitting new voting instructions via telephone or the Internet; or |

| • | attending AND voting in person at the Annual Meeting. |

3

procedure for delivering a proxy, including the place for depositing the instructions and the manner for revoking the proxy.

Who is paying for this proxy solicitation?

How can I find out the voting results?

How do I receive electronic access to proxy materials for the current and future annual meetings?

How can I avoid having duplicate copies of the proxy statements sent to my household?

4

document to any Stockholder who contacts the Company’s investor relations department at (408) 546-5000 requesting such copies. If a Stockholder is receiving multiple copies of the proxy statement and annual report at the Stockholder’s household and would like to receive a single copy of those documents for a Stockholder’s household in the future, Stockholders should contact their broker, other nominee record holder, or the Company’s investor relations department to request mailing of a single copy of the proxy statement and annual report.

When are stockholder proposals due for next year’s annual meeting?

5

PROPOSAL 1

ELECTION OF DIRECTORS

| Class | Directors | Term Expiration | ||

|---|---|---|---|---|

| I | Bruce D. Day, Martin A. Kaplan and Kevin J. Kennedy, Ph.D. | 2004 Annual Meeting of Stockholders | ||

| II | Robert E. Enos and Peter A. Guglielmi | 2006 Annual Meeting of Stockholders | ||

| III | Richard T. Liebhaber and Casimir S. Skrzypczak | 2005 Annual Meeting of Stockholders |

Class I Nominees for Three-Year Terms That Will Expire in 2007

Bruce D. Day Age 48 | Mr. Day became a member of the Company’s Board of Directors in July 1999 upon the closing of the merger with JDS FITEL Inc. (“JDS FITEL”) and served as a member of the JDS FITEL Board of Directors from 1996 until July 1999. Since 1991, Mr. Day has been Vice President, Corporate Development of Rogers Communications Inc. and is principally involved in mergers, acquisitions, divestitures, taxation and pensions for Rogers Communications Inc. and its subsidiaries. | |

Martin A. Kaplan Age 67 | Mr. Kaplan has been a member of the Company’s Board of Directors since May 1998. Mr. Kaplan has served as the Chairman of the Board since May 2000. From May 1995 until his retirement in May 2000, Mr. Kaplan was Executive Vice President of Pacific Telesis and was responsible for coordinating integration plans following the merger of SBC Communications, Inc. and Pacific Telesis Group. From 1993 to 1995, he was Chief Technology, Quality and Re-Engineering Officer for Pacific Bell. Mr. Kaplan also is a director of Tekelec, Superconductor Technologies and Redback Networks. | |

Kevin J. Kennedy, Ph.D. Age 48 | Dr. Kennedy became a member of the Company’s Board in November 2001, and upon the retirement of Dr. Jozef Straus, became Chief Executive Officer of the Company on September 1, 2003. From August 2001 to September 2003, Dr. Kennedy was the Chief Operating Officer of Openwave Systems, Inc. Prior to joining Openwave Systems Inc. Dr. Kennedy served seven years at Cisco Systems, Inc., most recently as Senior Vice President of the Service Provider Line of Business and Software Technologies Division, and 17 years at Bell Laboratories. Dr. Kennedy is a director of Quantum Corporation, Rambus Corporation, Openwave Systems, Inc., and Freescale Semiconductor, Inc. |

6

THE BOARD RECOMMENDS A VOTEFOR THE ELECTION

TO THE BOARD OF EACH OF THE NOMINEES NAMED ABOVE

Class II Directors Whose Terms Will Expire in 2006

Robert E. Enos Age 65 | Mr. Enos became a member of the Company’s Board in July 1999 upon the closing of the merger with JDS FITEL and was previously a member of the JDS FITEL Board of Directors from 1996 until July 1999. Mr. Enos was the Vice President, Product Line Management, Cable Group and the Vice President, Transmission Network Division of Northern Telecom Limited from 1992 to 1994 and from 1989 to 1992, respectively. Mr. Enos retired from Northern Telecom Limited in 1994. | |

Peter A. Guglielmi Age 60 | Mr. Gulielmi has been a member of the Company’s Board since May 1998. Mr. Guglielmi retired as Executive Vice President of Tellabs, Inc. in 2000, where he served as its Chief Financial Officer since 1988. From 1993 to 1997, he was also President of Tellabs International, Inc. Prior to joining Tellabs, Mr. Guglielmi was Vice President of Finance and Treasurer of Paradyne Corporation for five years. |

Class III Directors Whose Terms Will Expire in 2005

Richard T. Liebhaber Age 69 | Mr. Liebhaber became a member of the Company’s Board in November 2001. Mr. Liebhaber retired as Executive Vice President and Chief Technology Officer of MCI Communications, Inc. (“MCI”) in 1995. Prior to joining MCI in 1985, Mr. Liebhaber was IBM’s director of Business Policy and Development after serving in engineering, manufacturing, product test, service and marketing positions. Mr. Liebhaber is also a director of ECI Telecom Ltd., ILOG S.A. and Avici Systems, Inc. | |

Casimir S. Skrzypczak Age 63 | Mr. Skrzypczak has been a member of the Company’s Board of Directors since July 1997. Since July 2001, Mr. Skrzypczak has been a general partner in Global Asset Capital Investment. From October 1999 to July 2001, Mr. Skrzypczak was Senior Vice President at Cisco Systems, Inc. Mr. Skrzypczak served as Corporate Vice President and Group President of Professional Services at Telcordia Technologies, Inc. from July 1997 to October 1999. Earlier, Mr. Skrzypczak was President, NYNEX Science & Technology and Vice President, Network & Technology Planning for NYNEX. Mr. Skrzypczak has served as a trustee of Polytechnic University since 1987 and is chairman of its Education Committee. Mr. Skrzypczak also serves as a director of Sirenza Microdevices Inc., ECI Telecom Ltd. and Webex Communications, Inc. |

7

Board Committees and Meetings

| Director | Audit | Compensation | Corporate Development | Governance | |||

|---|---|---|---|---|---|---|---|

| Bruce D. Day | Chair | X | |||||

| Robert E. Enos | X | Chair | |||||

| Peter A. Guglielmi | X | X | |||||

| Martin A. Kaplan | X | X | X | ||||

Kevin J. Kennedy2 | X | ||||||

| Richard T. Liebhaber | X | Chair | X | ||||

| Casimir S. Skrzypczak | X | Chair | X |

| 1 | In fiscal 2001, the Company changed its year-end from a fiscal year ending on June 30 to a 52-week fiscal year ending on the Saturday closest to June 30. The Company’s fiscal 2004 year ended on July 3, 2004, whereas fiscal 2003 and 2002 ended on June 28, 2003 and June 29, 2002, respectively. For comparative presentation purposes, all accompanying tables and notes have been shown as ended on June 30. |

| 2 | Effective September 1, 2003, Dr. Kennedy resigned as a member of the Compensation Committee and as chair for the Corporate Development Committee. Dr. Kennedy will continue as a member of the Corporate Development Committee. |

8

purchase plans and equity incentive plans. The Compensation Committee chairman reports on the Compensation Committee’s actions and recommendations at Board meetings. In addition, the Compensation Committee has the authority to engage the services of outside advisors, experts and others to provide assistance as needed. All members of the Compensation Committee are “independent” as that term is defined in Rule 4200 of the Marketplace Rules of the Nasdaq Stock Market, Inc. A copy of the Compensation Committee charter can be viewed at the Company’s website onwww.jdsu.com.

Communication between Stockholders and Directors

9

sufficient to communicate questions, comments and observations that could be useful to the Board. However, stockholders wishing to formally communicate with the Board of Directors may send communications directly to the Chairman of the Board, c/o JDS Uniphase Corporation, 1768 Automation Parkway, San Jose, California 95131.

Director Compensation

Relationships Among Directors or Executive Officers

Certain Relationships and Related Transactions

10

Company’s Common Stock at a price of $3.52 per share upon his assuming the chair of the Corporate Development Committee.

Compensation Committee Interlocks and Insider Participation

Executive Officers

| Executive Officer | Age | Position | ||

|---|---|---|---|---|

| Kevin J. Kennedy, Ph.D. | 48 | Co-Chairman and Chief Executive Officer | ||

| Ronald C. Foster | 54 | Executive Vice President and Chief Financial Officer | ||

| Roy Bie | 47 | Vice President, Flex Products | ||

| George C. Christensen | 49 | Senior Vice President, Lasers, Optics and Displays | ||

| Christopher S. Dewees | 40 | Senior Vice President and General Counsel | ||

| David Gudmundson | 43 | Senior Vice President, Business Development and Corporate Marketing | ||

| Stan Lumish, Ph.D. | 48 | Senior Vice President and Chief Technology Officer | ||

| Mark S. Sobey, Ph.D. | 44 | Senior Vice President, Sales | ||

| Debora Shoquist | 50 | Senior Vice President, Operations | ||

| Thomas Znotins, Ph.D. | 50 | Vice President, Subsystems |

11

employed as Vice President of Operations at Egghead Software Corporation from 1995 until 1996. Mr. Foster held various finance positions with Hewlett Packard Corporation (“HP”) from 1985 until 1995, culminating in his service as Group Controller for HP’s Computer Manufacturing and Distribution Group. Prior to HP, Mr. Foster held various finance and operations related positions in the forest products industry. Mr. Foster also serves as a director of Micron Technology, Inc. Mr. Foster holds an M.B.A. degree from the University of Chicago and a B.A. in Economics from Whitman College.

12

13

PROPOSAL 2

RATIFICATION OF INDEPENDENT AUDITORS

Audit and Non-Audit Fees

| Fiscal 2004 | Fiscal 2003 | |||||

|---|---|---|---|---|---|---|

Audit Fees(1) | $ | 3,498,244 | $ | 2,460,000 | ||

Audit-Related Fees(2) | 186,703 | 510,000 | ||||

Tax Fees(3) | 743,091 | 1,350,000 | ||||

All Other Fees(4) | 17,129 | — | ||||

| Total | $ | 4,445,167 | $ | 4,320,000 | ||

| (1) | Audit Fees related to professional services rendered in connection with the audit of the Company’s annual financial statements, quarterly review of financial statements included in the Company’s Forms 10-Q, and audit services provided in connection with other statutory and regulatory filings. |

| (2) | Audit-Related Fees include professional services related to the audit of the Company’s financial statements and consultation on accounting standards or transactions. |

| (3) | Tax Fees include $587,737 for professional services rendered in connection with tax compliance and preparation relating to the Company’s expatriate program, tax audits and international tax compliance; and $155,354 for tax consulting and planning services. |

| (4) | All Other Fees include $4,225 of certain secretarial and directorship services that were not pre-approved by the Audit Committee. |

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

14

THE BOARD RECOMMENDS A VOTEFOR THE RATIFICATION

OF THE APPOINTMENT OF ERNST & YOUNG LLP

AS THE COMPANY’S INDEPENDENT AUDITORS

FOR THE YEAR ENDING JUNE 30, 2005

15

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

| Number of Shares Beneficially Owned | |||||||

|---|---|---|---|---|---|---|---|

| Name | Number | Percentage | |||||

Directors and Named Executive Officers | |||||||

Jozef Straus, Ph.D.(1) | 11,429,167 | * | |||||

Joseph C. Zils(2) | 987,976 | * | |||||

Donald E. Bossi, Ph.D(3) | 858,112 | * | |||||

Stan Lumish, Ph.D(4) | 669,758 | * | |||||

Kevin J. Kennedy, Ph.D.(5) | 631,388 | * | |||||

Martin A. Kaplan(6) | 561,989 | * | |||||

Robert E. Enos(7) | 537,683 | * | |||||

Mark S. Sobey, Ph.D(8) | 510,387 | * | |||||

Bruce D. Day(9) | 470,539 | * | |||||

Casmir S. Skrzypczak(10) | 335,778 | * | |||||

Peter A. Guglielmi(11) | 316,029 | * | |||||

Ronald C. Foster(12) | 262,500 | * | |||||

Richard T. Liebhaber(13) | 84,417 | * | |||||

All directors and executive officers as a group (19 persons)(14) | 18,676,446 | 1.3 | % | ||||

| * | Less than 1%. |

| (1) | Includes 11,426,077 shares subject to stock options currently exercisable or exercisable within 60 days of August 15, 2004. |

| (2) | Includes 956,816 shares subject to stock options currently exercisable or exercisable within 60 days of August 15, 2004. |

| (3) | Includes (i) 805,184 shares subject to stock options currently exercisable or exercisable within 60 days of August 15, 2004, and (ii) 20,000 shares subject to further vesting restrictions. |

| (4) | Includes 669,139 shares subject to stock options currently exercisable or exercisable within 60 days of August 15, 2004. |

| (5) | Includes 551,888 shares subject to stock options currently exercisable or exercisable within 60 days of August 15, 2004. |

16

| (6) | Includes (i) 539,166 shares subject to stock options currently exercisable or exercisable within 60 days of August 15, 2004, (ii) 11,363 shares subject to further vesting restrictions, (iii) 1,600 shares held by Mr. Kaplan’s children, and (iv) 260 shares held by Mr. Kaplan’s spouse. |

| (7) | Includes (i) 438,940 shares subject to stock options currently exercisable or exercisable within 60 days of August 15, 2004, (ii) 12,000 shares issuable upon exchange of the Exchangeable Shares of JDS Uniphase Canada Ltd., and (iii) 11,363 shares subject to further vesting restrictions. |

| (8) | Includes (i) 490,000 shares subject to stock options currently exercisable or exercisable within 60 days of August 15, 2004, and (ii) 20,000 shares subject to further vesting restrictions. |

| (9) | Includes (i) 438,940 shares subject to stock options currently exercisable or exercisable within 60 days of August 15, 2004, (ii) 12,200 shares issuable upon exchange of the Exchangeable Shares of JDS Uniphase Canada Ltd., and (iii) 11,363 shares subject to further vesting restrictions. |

| (10) | Includes (i) 327,916 shares subject to stock options currently exercisable or exercisable within 60 days of August 15, 2004, and (ii) 11,363 shares subject to further vesting restrictions. |

| (11) | Includes 281,166 shares subject to stock options currently exercisable or exercisable within 60 days of August 15, 2004, and (ii) 11,363 shares subject to further vesting restrictions. |

| (12) | Includes 262,500 shares subject to stock options currently exercisable or exercisable within 60 days of August 15, 2004. |

| (13) | Includes (i) 11,363 shares subject to further vesting restrictions held by Liebhaber & Associates, Inc., of which Mr. Liebhaber is President and Director, and (ii) 60,804 shares subject to stock options currently exercisable or exercisable within 60 days of August 15, 2004. |

| (14) | Includes (i) 18,162,060 shares subject to stock options currently exercisable or exercisable within 60 days of August 15, 2004, (ii) 138,178 shares subject to further vesting restrictions, (iii) 24,200 shares issuable upon exchange of the Exchangeable Shares of JDS Uniphase Canada Ltd., and (iv) indirect holdings attributable to executive officers in the amount of 1,860 shares. |

17

EXECUTIVE COMPENSATION

Summary Compensation Table

| Annual Compensation | Long-Term Compensation | All Other Compensation ($)(4) | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position | Fiscal Year(1) | Salary($)(2) | Bonus and Commission($)(3) | Restricted Stock Awards | Securities Underlying Options(#) | |||||||||||

Kevin J. Kennedy, Ph.D.(5) | 2004 | $403,846 | — | — | 3,000,000 | $870,096 | (6) | |||||||||

| Chief Executive Officer | ||||||||||||||||

Jozef Straus, Ph.D.(7) | 2004 | 548,503 | (US) | $44,748 | (US) | — | 750,000 | |||||||||

| Founder Emeritus and | 734,994 | (CDN) | 59,962 | (CDN) | — | — | — | |||||||||

| Advisor to the Chief | 2003 | 544,440 | (US) | — | 750,000 | 4,812 | (US) | |||||||||

| Executive Officer | 734,994 | (CDN) | 6,502 | (CDN) | ||||||||||||

| 2002 | 505,763 | (US) | — | — | 1,400,000 | 4,591 | (US) | |||||||||

| 743,471 | (CDN) | — | 6,750 | (CDN) | ||||||||||||

Ronald C. Foster(8) | 2004 | 356,730 | 5,321 | — | 680,000 | 5,166 | ||||||||||

| Executive Vice President and | 2003 | 114,423 | — | — | 500,000 | 33,781 | (9) | |||||||||

| Chief Financial Officer | ||||||||||||||||

| Mark S. Sobey, Ph.D. | 2004 | 246,654 | 31,009 | 97,800 | (10) | 450,000 | 1,500 | |||||||||

| Senior Vice President, Sales | 2003 | 242,000 | — | — | 150,000 | 3,600 | ||||||||||

| 2002 | 207,293 | — | — | 140,000 | 3,400 | |||||||||||

Joseph C. Zils(11) | 2004 | 282,423 | 37,419 | — | 150,000 | 1,500 | ||||||||||

| Vice President and Corporate Advisor | 2003 | 274,234 | — | — | 275,000 | 3,600 | ||||||||||

| 2002 | 245,192 | 25,010 | — | 297,000 | 3,400 | |||||||||||

Donald E. Bossi, Ph.D.(12) | 2004 | 254,808 | 7,122 | 97,800 | (10) | 450,000 | 1,918 | |||||||||

| Senior Vice President, | 2003 | 245,195 | — | — | 250,000 | 3,600 | ||||||||||

| Transmission Products | 2002 | 223,629 | — | — | 225,000 | 3,706 | ||||||||||

| Stan Lumish, Ph.D. | 2004 | 228,107 | 7,039 | — | 275,000 | 1,219 | ||||||||||

| Senior Vice President and | 2003 | 242,308 | — | — | 225,000 | 3,077 | ||||||||||

| Chief Technology Officer | 2002 | 204,230 | — | — | 155,000 | 3,069 | ||||||||||

| (1) | Compensation reported for fiscal years ending June 30, 2004, 2003 and 2002. |

| (2) | The compensation information for Dr. Straus for the fiscal year ending June 30, 2004 has been converted from Canadian dollars to U.S. dollars based upon an average foreign exchange rate which was CDN $1.34 = U.S. $1.00. This currency conversion causes Dr. Straus’ reported salary to fluctuate from year-to-year because of the conversion of Canadian dollars to U.S. dollars. |

| (3) | Bonus and commission include amounts in the year earned, rather than in the year in which such bonus amount was paid or is to be paid. |

18

| (4) | Represents contributions made by the Company to (i) Mr. Foster, Mr. Zils, Dr. Bossi, and Dr. Lumish under its 401(k) plan, and (ii) Dr. Straus under the Company’s group retirement savings plan for Canadian employees. |

| (5) | Dr. Kennedy joined the Company as an employee on September 1, 2003. |

| (6) | Represents new hire bonus of $500,000 and stock purchase bonus of $370,096. |

| (7) | Dr. Straus resigned from his position as Co-Chairman and Chief Executive Officer effective September 1, 2003. |

| (8) | Mr. Foster joined the Company in February 2003. |

| (9) | Represents new hire bonus of $30,000. |

| (10) | Reflects the dollar value of awards of 20,000 shares of restricted common stock, calculated by multiplying the closing market price of the Company’s Common Stock on the date of grant ($4.89) by the number of shares of restricted common stock awarded. Restricted common stock awards generally become fully vested on the fifth year anniversary of the date of grant, subject to acceleration upon the achievement of certain specified Company performance targets. |

| (11) | Effective April 4, 2004, Mr. Zils ceased being an executive officer of the Company. |

| (12) | Dr. Bossi ceased being an executive officer of the Company on September 4, 2004. |

Employment Contracts, Termination of Employment and Change in Control Arrangements

19

for fiscal year 2004 pursuant to the Kennedy Agreement will not be considered earned and payable until the sooner of (y) achievement by the Company of certain financial performance objectives, or (z) the termination of Dr. Kennedy’s employment. Effective August 4, 2004 the Kennedy Agreement was further amended (“the Second Kennedy Amendment”) to provide that, notwithstanding the terms of the Kennedy Agreement, Dr. Kennedy’s base annual salary shall remain at $500,000 until such time as the Company achieves certain financial milestones, at which time Dr. Kennedy’s base annual salary shall be increased to $575,000 retroactive to September 1, 2004.

20

terminated by the Company other than for cause (as that term is defined in the Sobey Change of Control Agreement) or by him for good reason (as that term is defined in the Sobey Change of Control Agreement), conditioned upon Dr. Sobey executing and delivering to the Company a release of claims reasonably acceptable to the Company. Prior to a change of control, the Company or Dr. Sobey may terminate the Sobey Change of Control Agreement for convenience upon delivery of a written notice to the other.

21

Stock Option Grants in Last Fiscal Year

| Individual Grants | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number of Securities Underlying Options Granted(1) | % of Total Options Granted to Employees in Fiscal 2004(2) | Exercise Price per Share(3) | Expiration Date | Potential Realizable Value at Assumed Annual Rate of Stock Price Appreciation for Option Term(4)(5) | ||||||||

| Name | 5% | 10% | ||||||||||

| Kevin J. Kennedy, Ph.D. | 2,000,000 | 4.01% | $3.45 | 08/31/11 | $3,294,443 | $7,890,763 | ||||||

| 1,000,000 | 2.01% | 4.35 | 03/21/14 | 2,214,445 | 6,102,782 | |||||||

| Jozef Straus, Ph.D. | 750,000 | 1.51% | 2.95 | 07/29/11 | 1,000,966 | 2,449,806 | ||||||

| Ronald C. Foster | 300,000 | 0.60% | 2.95 | 07/29/11 | 400,386 | 979,922 | ||||||

| 380,000 | 0.76% | 4.35 | 03/21/14 | 841,489 | 2,319,057 | |||||||

| Mark S. Sobey, Ph.D. | 150,000 | 0.30% | 2.95 | 07/29/11 | 200,193 | 489,961 | ||||||

| 300,000 | 0.60% | 4.35 | 03/11/14 | 815,821 | 2,072,053 | |||||||

| Joseph C. Zils | 150,000 | 0.30% | 2.95 | 07/29/11 | 200,193 | 489,961 | ||||||

| Donald E. Bossi. Ph.D. | 150,000 | 0.30% | 2.95 | 07/29/11 | 200,193 | 489,961 | ||||||

| 300,000 | 0.60% | 4.35 | 03/11/14 | 815,821 | 2,072,053 | |||||||

| Stan Lumish, Ph.D. | 125,000 | 0.25% | 2.95 | 07/29/11 | 166,828 | 408,301 | ||||||

| 150,000 | 0.30% | 4.35 | 03/11/14 | 407,910 | 1,036,02 | |||||||

| (1) | Except in the event of a change in control of the Company, options granted become exercisable at the rate of 25% of the shares subject thereto one year from the grant date and as to approximately 6.25% of the shares subject to the option at the end of each three-month period thereafter such that the option is fully exercisable four years from the grant date. |

| (2) | Based on a total of 49,829,040 options granted to the Company’s employees in fiscal 2004, including the Named Executive Officers. |

| (3) | The exercise price per share of options granted represented the fair market value of the underlying shares of Common Stock on the date the options were granted. |

| (4) | The potential realizable is calculated based upon the term of the option at its time of grant. It is calculated assuming that the stock price on the date of grant appreciates at the indicated annual rate, compounded annually for the entire term of the option, and that the option is exercised and sold on the last day of its term for the appreciated stock price. |

| (5) | Stock price appreciation of 5% and 10% is assumed pursuant to the rules promulgated by the SEC and does not represent the Company’s prediction of the future stock price performance. |

22

Aggregated Stock Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

| Shares Acquired on Exercise | Value Realized(1) | Number of Securities Underlying Unexercised Options at June 30, 2004 | Value of Unexercised In-the-Money Options at June 30, 2004(2) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||

| Kevin J. Kennedy, Ph.D. | 0 | $0 | 47,444 | 3,005,556 | $ | 16,887 | $200,000 | |||||||

| Jozef Straus, Ph.D. | 0 | $0 | 11,085,452 | 1,862,500 | 67,500 | 562,500 | ||||||||

| Ronald C. Foster | 0 | $0 | 156,250 | 1,023,750 | 115,625 | 434,375 | ||||||||

| Mark S. Sobey, Ph.D. | 0 | $0 | 422,500 | 632,500 | 45,000 | 165,000 | ||||||||

| Joseph C. Zils | 0 | $0 | 871,691 | 483,251 | 86,156 | 229,344 | ||||||||

| Donald E. Bossi, Ph.D. | 0 | $0 | 723,919 | 735,651 | 83,811 | 218,687 | ||||||||

| Stan Lumish, Ph.D. | 0 | $0 | 597,499 | 523,751 | 74,812 | 191,187 | ||||||||

| (1) | The value realized upon the exercise of stock options represents the positive spread between the exercise price of stock options and the fair market value of the shares subject to such options on the exercise date. |

| (2) | The value of “in-the-money” stock options represents the positive spread between the exercise price of stock options and the fair market value of the shares subject to such options on July 3, 2004, which was $3.55 per share. |

23

EQUITY COMPENSATION PLANS

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Equity compensation plans approved by security holders(1)(2) | 29,767,096 | 4.24 | 143,548,159 | |||||||||

Equity compensation plans not approved by security holders(3) | 94,235,533 | 15.15 | 10,671,689 | |||||||||

| Total/Weighted Ave./Total | 124,002,629 | 12.53 | 154,219,848 | |||||||||

| (1) | Represents shares of the Company’s Common Stock issuable upon exercise of options and restricted stock units outstanding under the following equity compensation plan: 2003 Equity Incentive Plan. |

| (2) | Represents shares of the Company’s Common Stock authorized for future issuance under the following equity compensation plan: Amended and Restated 1998 Employee Stock Purchase Plan. |

| (3) | Represents shares of the Company’s Common Stock issuable upon exercise of options outstanding or authorized for future issuance under the following equity compensation plans: Amended and Restated 1993 Flexible Stock Incentive Plan, 1996 Non-Qualified Stock Option Plan, and Amended and Restated 1999 Canadian Employee Stock Purchase Plan. |

| (4) | As of June 30, 2004, options and rights to purchase an aggregate of 20,595,299 shares of the Company’s Common Stock at a weighted average exercise price of $31.14 were outstanding under the following equity compensation plans, which options and rights were assumed in connection with the following merger and acquisition transactions: Uniphase Telecommunications, Inc. 1995 Flexible Stock Incentive Plan; JDS FITEL 1994 and 1996 Stock Option Plans; Broadband Communications Products, Inc. 1992 Key Employee Incentive Stock Option Plan; EPITAXX, Inc. Amended and Restated 1996 Employee, Director and Consultant Stock Option Plan; Optical Coating Laboratory, Inc. 1993, 1995, 1996, 1998 and 1999 Incentive Compensation Plans; Cronos Integrated Microsystems, Inc. 1999 Stock Plan; E-TEK Dynamics, Inc. 1997 Equity Incentive Plan, and 1998 Stock Plan; Optical Process Automation, Inc. 2000 Stock Option and Incentive Plan, 2000 Series B Preferred Stock Option Plan; SDL, Inc. 1995 Stock Option Plan; 1992 SDL-Spectra Diode Stock Option Plan; and Epion Corporation 1996 Stock Option Plan. No further grants or awards will be made under the assumed equity compensation plans, and the options outstanding under the assumed plans are not reflected in the table above. |

Amended and Restated 1993 Flexible Stock Incentive Plan

24

Company’s Stockholders in both 1995 and 1996. The 1993 Plan has subsequently been amended and restated by the Board of Directors without approval of the Company’s Stockholders.

1996 Non-Qualified Stock Option Plan

Amended and Restated 1999 Canadian Employee Stock Purchase Plan

25

Canadian ESPP limits purchase rights to a maximum of (i) $25,000 worth of stock (determined at the fair market value of the shares at the time the purchase right is granted) in any calendar year, and (ii) 20,000 shares in any Purchase Period.

REPORT OF COMPENSATION COMMITTEE

26

total compensation be dependent upon Company performance and stock price appreciation rather than base salary.

27

Company’s executive officers. The equity incentive awards granted in fiscal 2004 to each of the current executive officers named in the Summary Compensation Table is indicated in the Long-Term Compensation Awards column.

28

from the $1 million limitation. The Board has required that at least two thirds of all awards to covered employees under the 2003 Plan contain criteria under which the vesting of such awards is tied to achievement of specified performance milestones.

| 1 | Dr. Kennedy resigned as a member of the Compensation Committee on September 1, 2003. |

29

REPORT OF THE AUDIT COMMITTEE

Review with Management

Review and Discussions with Independent Auditors

30

Conclusion

31

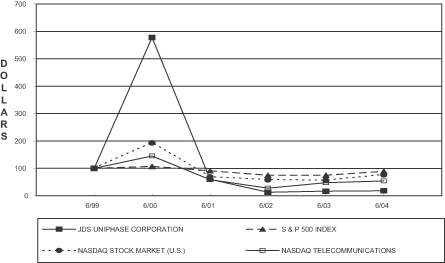

STOCK PERFORMANCE GRAPH

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG JDS UNIPHASE CORPORATION

*$100 invested on 6/30/99 in stock or index-including reinvestment of dividends. Fiscal year ending June 30.

| June 30, | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | |||||||

| JDS Uniphase Corporation | $100 | $578 | $60 | $12 | $17 | $18 | ||||||

| S&P 500 Index | 100 | 107 | 91 | 75 | 75 | 89 | ||||||

| Nasdaq Stock Market (U.S.) | 100 | 192 | 69 | 58 | 56 | 76 | ||||||

| Nasdaq Telecommunications Index | 100 | 146 | 58 | 28 | 48 | 54 | ||||||

32

CODE OF BUSINESS CONDUCT

BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

OTHER MATTERS

ANNUAL REPORT ON FORM 10-K AND ANNUAL REPORT TO STOCKHOLDERS

October 1, 2004

San Jose, California

33

APPENDIX A

2004 ANNUAL REPORT

| ||

| JDS Uniphase Corporation 1768 Automation Parkway San Jose, CA 95131 USA Tel 408 546-5000 Fax 408 546-4300 www.jdsu.com | ||

October 1, 2004

Dear Shareholder,

| · | we initiated a number of practices to improve corporate governance: separating the roles of Chairman and Chief Executive Officer, consolidating into one headquarters, revising our compensation practices to better align employee and shareholder interests, and imposing limitations on equity awards to the top five executives; |

| · | we renewed our commitment to our customers and, by linking compensation to customer satisfaction and product quality, began to drive that commitment firmly into our company culture. In addition, for the first time, we established a critical accounts team dedicated to the delivery of customer satisfaction, acting as a triage function similar to what is found in an emergency room. Through these efforts, our customer satisfaction has already improved in-line with our internal goals; |

| · | we progressed in our evolution to more highly integrated products in both our communications and our commercial and consumer businesses; |

| · | our investment in high growth markets continues to enable new achievements in our display business, including traction in customer orders for our leading digital light engines for large screen, high definition televisions; |

| · | our most highly integrated communications offerings to date, agile networking devices and OEM development circuit packs, gained traction and are positioned to accelerate in fiscal 2005; and |

| · | we made important changes to the company’s leadership, welcoming several accomplished executives to the management team. Though their tenure with the company has been short, our new Vice President of Operations, Vice President of Corporate Development and Marketing, and others have already implemented significant operational, structural, and strategic improvements throughout the company. These hires were crucial in enabling the company to centralize its key operational functions for improved operational focus. |

Fiscal 2004 Results

Strategy

| · | establishing closer and more sustainable partnerships with our customers through a more highly integrated product offering. In short, we would like to move to a model where we are supplying assembled sub-systems, rather than individual components, to more of our customers: for example, circuit packs rather than components in our communications business, and light engines rather than components in our commercial and consumer business. We believe that, over time, these products will provide improved time to revenue for our portfolio of investments while delivering higher gross margins; |

| · | introducing innovative, new products that bring improved gross margins; |

| · | driving continued operational improvements through a relentless focus on achieving excellence in our manufacturing processes, customer interactions, and research and design processes; |

| · | reducing manufacturing costs through the expansion of our partnerships with contract manufacturers, the restructure of assets where appropriate, and the transition of internal product manufacturing to lower cost locations; |

| · | continuing to expand sales outside of North America in order to enlarge our revenue opportunity and disperse risk over a global market; |

| · | leveraging our optical technology leadership into adjacent markets offering expanded market opportunities and improved time to revenue; and |

| · | executing on carefully selected, digestible acquisitions and surgical divestitures designed to fortify and enhance our position as a market leader, expand our addressable market, and take advantage of opportunities to improve our profitability. Recent acquisitions, such as E2O Communications, strengthening our datacom presence, and Advanced Digital Optics, fortifying our display business, have demonstrated our capacity to successfully integrate complimentary technologies into the JDS Uniphase family. |

Growth Drivers

| · | growing demand for broadband, driven by consumer demand for higher quality, faster, and integrated content (internet, voice, music, pictures, etc.); |

| · | service provider investment in new and upgraded networks to support demand for bandwidth-intensive services; |

| · | growth of outsourcing by telecom original equipment manufacturers (OEMs); and |

| · | strong competition between the major service provider segments, cable, telephone carrier, satellite and wireless, to provide “triple play” (voice, video and data) content service to consumers over broadband networks. |

| · | demand for improved visual display experiences driving growth of large screen, high definition televisions. JDS Uniphase is a leading supplier of optical components used in projection displays and is gaining traction as supplier of light engines for rear projection displays; and |

| · | global explosion of counterfeit merchandise leading to growing investment in brand protection initiatives. JDS Uniphase’s security pigments already protect more than 90 currencies around the world, and our proprietary color-shifting technology protects a number of leading pharmaceutical brands. |

Building Tomorrow’s JDS Uniphase

Sincerely yours,

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 10-K

For Annual and Transition Reports Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

(Mark One)

[X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED JUNE 30, 2004* |

or

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO . |

Commission File Number: 0-22874

______________________

JDS UNIPHASE CORPORATION

(Exact name of Registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 94-2579683 (I.R.S. Employer Identification No. | ||

1768 Automation Parkway, San Jose, California (Address of principal executive offices) | 95131 (Zip code) | ||

Registrant’s telephone number, including area code:

(408) 546-5000

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common stock, par value of $.001 per share

(Title of class)

____________________

DOCUMENTS INCORPORATED BY REFERENCE

__________

| * | Our fiscal year ended formally on July 3, 2004. For more information see Note 1 to Consolidated Financial Statements for information regarding Registrant’s fiscal year. |

A-2

TABLE OF CONTENTS

| PART I | ||||

| ITEM 1. | BUSINESS | A-5 | ||

| ITEM 2. | PROPERTIES | A-30 | ||

| ITEM 3. | LEGAL PROCEEDINGS | A-31 | ||

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS | A-32 | ||

| PART II | ||||

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | A-33 | ||

| ITEM 6. | SELECTED FINANCIAL DATA | A-34 | ||

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | A-35 | ||

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | A-56 | ||

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | A-58 | ||

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | A-114 | ||

| ITEM 9A. | CONTROLS AND PROCEDURES | A-114 | ||

| PART III | ||||

| ITEM 10. | DIRECTORS AND EXECUTIVE OFFICERS OF THE REGISTRANT | A-114 | ||

| ITEM 11. | EXECUTIVE COMPENSATION | A-114 | ||

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | A-114 | ||

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | A-114 | ||

| PART IV | ||||

| ITEM 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | A-115 | ||

| ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES, AND REPORTS ON FORM 8-K: | A-115 | ||

| SIGNATURES | ||||

| Exhibit Index | A-121 | |||

| EXHIBIT 3.5 | ||||

| EXHIBIT 10.18 | ||||

| EXHIBIT 10.19 | ||||

| EXHIBIT 10.20 | ||||

| EXHIBIT 10.21 | ||||

| EXHIBIT 10.22 | ||||

| EXHIBIT 10.23 | ||||

| EXHIBIT 10.24 | ||||

| EXHIBIT 10.25 | ||||

| EXHIBIT 10.26 | ||||

| EXHIBIT 21.1 | ||||

| EXHIBIT 23.1 | ||||

| EXHIBIT 31.1 | A-124 | |||

| EXHIBIT 31.2 | A-125 | |||

| EXHIBIT 32.1 | A-126 | |||

| EXHIBIT 32.2 | A-127 |

A-3

FORWARD-LOOKING STATEMENTS

A-4

PART I

ITEM 1. BUSINESS

General

A-5

to the SEC. All such filings on our Investor Relations web site are available free of charge. The SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Industry Environment

Communications

Commercial and Consumer

A-6

Entertainment

| • | The emergence of High-Definition content, rapid adoption of DVDs and on-line gaming, and increased use of digital distribution of films and video — Consumers have quickly come to appreciate the impact that higher resolution formats have on the entertainment experience. Among other things, content providers and both satellite and cable television service providers are rapidly increasing supply of high-definition (HD) material that can provide up to 5 times higher resolution than traditional formats. |

| • | Regulations for broadcast and reception for digital TV content — As of July 1, 2004, television manufacturers are mandated by the U.S. Federal Communications Commission to integrate 50% of ATSC (Advanced Television System Committee) standards for digital tuning into all sets measuring 36 inches and larger, and 100 percent of those a year later. Next year, the mandate extends to 50% of sets measuring 25 inches through 35 inches, growing to 100% in 2006. And by July 1, 2007, all sets and video devices that normally carry analog tuning are required to integrate terrestrial ATSC tuning. |

| • | Migration from scheduled to on-demand content delivery — television programming is undergoing a transformation from scheduled programming, tightly managed by the content providers, to on-demand consumption, driven by consumer demand for greater flexibility as to when and where content is experienced. This in turn, is expected to drive further growth of consumed content. |

Commercial and Defense

| • | analysis of anomalies in human genome sequencing to discover cures to genetic diseases; |

| • | growth in the semiconductor market; |

| • | need for lasers and instrumentation that offer innovative, non-invasive, effective measurement and analysis for biomedical and healthcare; and |

| • | remote sensing in environmental, including bio hazard detection, applications growth. |

A-7

Consumer

Restructuring Programs

| • | We have consolidated manufacturing, research and development, sales and administrative facilities through building and site closures. As of June 30, 2004, 29 sites and buildings in North America, Europe and Asia-Pacific have been closed. The process involves consolidating product lines, standardizing on global product designs, and transferring manufacturing to fewer locations. The 29 sites closed were as follows: | ||

| North America: | Asheville, North Carolina; Columbus, Ohio; Eatontown, New Jersey; Freehold, New Jersey; Gloucester, Massachusetts; Horsham, Pennsylvania; Manteca, California; Ottawa, Ontario (two sites); Piscataway, New Jersey; Raleigh, North Carolina; Richardson, Texas; Rochester, New York; San Jose, California (two sites); Toronto, Ontario; Victoria, British Columbia. | ||

| Europe | Arnhem, Netherlands; Bracknell, United Kingdom; Eindhoven, Netherlands; Hillend, United Kingdom; Oxford, United Kingdom; Plymouth, United Kingdom; Torquay, United Kingdom; Waghaeusel-Kirrlach, Germany; Witham, United Kingdom. | ||

| Asia-Pacific: | Shunde, China; Sydney, Australia; Taipei, Taiwan. | ||

A-8

| • | We have centralized many administrative functions such as information technology, human resources and finance to take advantage of synergies, economies of scale and common processes and controls. |

Acquisitions

| • | E2O Communications, Inc.; and |

| • | the optical communication business from Ditech Communications, Inc. |

Acquisition of E2O Communications

Acquisition of the optical business of Ditech Communications

Operating Segments and Products

A-9

Communications Products:

A-10

A-11

They offer a low cost alternative for enabling DWDM and CWDM networking and new wavelength services such as Ethernet and SAN. Hardware and software products new this year to the WaveReady™ network edge access product line include the WSH-540LX and WSH-550SX DWDM optical regenerators for converting 1360 nm to 15xx DWDM wavelengths, The WaveReady 2010 Gigabit Ethernet extender that increases maximum interconnect distance to 67 miles, the WaveReady 3100 rack-mount platform and the WaveReady Node Manager, an intuitive graphical interface for use with the communications module to provide fault and status management functions.

Commercial and Consumer Products:

Entertainment:

Optics:

A-12

Document Authentication and Brand Protection

Product Differentiation

Laser Products:

A-13

Competitive Environment

Strategy

Communications

Commercial & Defense

A-14

Consumer

| • | Customer-driven execution. We are committed to working closely with our customers from initial product design through to manufacturing and delivery. We strive to engage with our customers at the early stages of development to provide them with their entire component, module or subsystem needs. Ensuring that our sales, customer support, product marketing and development efforts are organized and executed to maximize effectiveness in our customer interactions continues to be a fundamental aspect of our strategy. |

| • | Maintaining technology leadership. We believe that our technology and product leadership is an important competitive advantage. Driven by current and anticipated demand, we will continue to invest in new technologies and products that offer our customers increased efficiency, higher performance, improved functionality, and/or higher levels of integration. |

| • | Vertical Integration. In response to cost saving initiatives, enterprises are increasingly focusing on core competences and choosing to outsource manufacturing that was previously performed in-house. As a result of these two trends, a growing number of our customers are demanding more highly integrated products across our markets, for example, integrated circuit packs rather than individual components in the communications business, and integrated light engines for large-screen televisions rather than individual components in the consumer business. Higher levels of integration offer the opportunity for higher revenues, and improved margins over time. |

| • | Structuring our manufacturing capabilities for increased efficiency and quality improvement. Between 2001 and 2004, we consolidated 41 manufacturing locations to 14, inclusive of our mergers and acquisitions activity during the period. We remain committed to streamlining our manufacturing operations and reducing costs by using lower-cost contract manufacturers where appropriate, and by situating our factories in lower-cost locations capable of consistently meeting our customers’ quality and performance requirements. For example, we are moving the manufacture of many of our established communications products to our facility in Shenzhen, China. |

| • | Pursuing complementary strategic relationships. Complementary and digestible acquisitions can expand our addressable markets and strengthen our competitive position. As part of our growth strategy, we continue to critically assess opportunities to develop strategic relationships, including acquisitions and investments, with other businesses. |

| • | Developing our people. Our management and employees have formed a culture of innovation, passion, adaptability and resilience that has proven its strength through extreme changes in the market. We are focused on retaining key contributors, developing our people and nurturing this level of commitment. |

Sales and Marketing

A-15

Scientific-Atlanta. Our customers in our commercial and consumer markets include Agilent, Applied Biosystems, Eastman Kodak, Hitachi, KLA Tencor, Mitsubishi, SICPA, Sony, Texas Instruments and Toshiba.

Research and Development

Manufacturing

A-16

| Location | Products | |

|---|---|---|

NORTH AMERICA: | ||

| Canada: | ||

| Ottawa | Wavelength blockers, equalizers, waveguide modules, dispersion compensation modules, custom modules, circuit packs, optical performance monitors and instrumentation and control products | |

| United States: | ||

| Commerce, CA | Packaging labels for both security and non-security applications | |

| Melbourne, FL | Transceivers and transponders | |

| Mountain Lakes, NJ | Precision glass manufacturing | |

| Rochester, MN | Optical transceivers | |

| San Jose, CA | High power pump lasers, source lasers, and waveguides | |

| Santa Rosa, CA | Optical display and projection products, light interference pigments for security and decorative applications, gas and solid state lasers, laser subsystems and thin film filters, | |

| Ewing, NJ | Photodetectors, receiver products, erbium doped fiber amplifiers (EDFA), optical amplifiers and source lasers | |

| Bloomfield, CT | Lithium niobate modulators, wavelength lockers and electronic drivers for telecommunications | |

REST OF WORLD: | ||

| China: | ||

| Beijing | Light interference pigments for security applications | |

| Fuzhou | Neodymium-doped yttrium vanadate (YVO4), display components and specialty optics | |

| Shenzhen | Variety of standard optical components and modules | |

| Singapore | Transceivers | |

| Indonesia | Transceivers |

Sources and Availability of Raw Materials

Patents and Proprietary Rights

Backlog

A-17

will often reflect orders shipped in the same quarter in which they are received, our backlog at any particular date is not necessarily indicative of actual revenue or the level of orders for any succeeding period.

Employees

Risk Factors

We have continuing concerns regarding the manufacture, quality and distribution of our products. These concerns are heightened as our markets stabilize and our volumes and new product offerings increase.

| • | Our continuing cost reduction programs, which include site consolidations, product transfers (internally and to contract manufacturers) and employee reductions, require the re-establishment and re-qualification of complex manufacturing lines, as well as modifications to systems, planning and operational infrastructure. During this process, we have experienced, and continue to experience, additional costs, and delays in re-establishing volume production levels, supply chain interruptions, planning difficulties and systems integration problems. |

| • | Recent increases in demand for our products, in the midst of our cost reduction programs, have strained our execution abilities as well as those of our suppliers, as we are experiencing capacity, workforce and materials constraints, enhanced by concerns associated with product and operational transfers. |

| • | Recently, we have commenced a series of new product programs and introductions, particularly in our circuit pack, communications and display components, light engine and commercial laser businesses, which due to the untested and untried nature of the relevant products and their manufacture and their increased complexity, exposes us to product quality risk, internally and with our materials suppliers. Among other things, one of our light engine customers recently announced delays in its display program due in part to yield, quality and volume problems with our light engine. While we are working diligently to resolve these problems, we cannot predict when all of these concerns will be resolved or the impact of these concerns on our customers and our light engine program. |

A-18

to respond to these execution challenges. We are currently losing additional revenue opportunities due to these concerns. We are also, in the short-term, diverting resources from research and development and other functions to assist with resolving these matters. If we do not improve our performance in all of these areas, our operating results will be harmed, the commercial viability of new products may be challenged and our customers may choose to reduce their purchases of our products and purchase additional products from our competitors.

If our customers do not qualify our manufacturing lines for volume shipments, our operating results could suffer

We could incur significant costs to correct defective products

If our contract manufacturers fail to deliver quality products at reasonable prices and on a timely basis, our results of operations and financial conditions could be harmed

A-19

We must improve our cost structure to achieve long-term profitability

If our new product offerings fail in the market, our business will suffer

Stability concerns affecting many of our key suppliers could impair the quality, cost or availability of many of our important products, harming our revenue, profitability and customer relations

A-20

to impact, our ability to meet customer expectations. If we do not identify and implement long-term solutions to our supply chain concerns, our customer relationships and business will materially suffer.

Recent signs of market stability are not necessarily indicative of long-term growth

The recent economic downturn has had and will likely continue to have long-term implications for our markets.

The communications equipment industry has extremely long product development cycles requiring us to incur product development costs without assurances of an acceptable investment return

Our success depends on sustained recovery and long-term growth in our markets

If the Internet does not continue to grow as expected, our communications business will suffer.

A-21

We are increasingly depending on stability and growth in non-communications markets.

Our business and financial condition could be harmed by our long-term growth strategy

Our financial results could be affected by potential changes in the accounting rules governing the recognition of stock-based compensation expense

Our sales are dependent upon a few key customers

A-22

or in the aggregate, for a high percentage of our total net revenues. Dependence on a limited number of customers exposes us to the risk that order reductions from any one customer can have a material adverse effect on periodic revenue.

One of our products is dependent upon a single customer for a majority of sales.

Any failure to remain competitive would harm our operating results

If we fail to attract and retain key personnel, our business could suffer.

Certain of our non-telecommunications products are subject to governmental and industry regulations, certifications and approvals.

A-23

We face risks related to our international operations and revenue

| • | our ability to comply with the customs, import/export and other trade compliance regulations of the countries in which we do business, together with any unexpected changes in such regulations; |

| • | difficulties in establishing and enforcing our intellectual property rights; |

| • | tariffs and other trade barriers; |

| • | political, legal and economic instability in foreign markets, particularly in those markets in which we maintain manufacturing and research facilities; |

| • | difficulties in staffing and management; |

| • | language and cultural barriers; |

| • | seasonal reductions in business activities in the countries where our international customers are located; |

| • | integration of foreign operations; |

| • | longer payment cycles; |

| • | greater difficulty in accounts receivable collection; |

| • | currency fluctuations; and |

| • | potential adverse tax consequences. |

We are increasing manufacturing operations in China, which expose us to risks inherent in doing business in China

A-24

relating to taxation, import and export tariffs, environmental regulations, land use rights, intellectual property and other matters. Moreover, the enforceability of applicable existing Chinese laws and regulations is uncertain. These concerns are exacerbated for foreign businesses, such as ours, operating in China. Our business could be materially harmed by any changes to the political, legal or economic climate in China or the inability to enforce applicable Chinese laws and regulations.

We may incur unanticipated costs and liabilities, including costs under environmental laws and regulations.

Our business and operations would suffer in the event of a failure of our information technology infrastructure

A-25

If we have insufficient proprietary rights or if we fail to protect those we have, our business would be materially harmed

We may not obtain the intellectual property rights we require.

Our products may be subject to claims that they infringe the intellectual property rights of others.

Our intellectual property rights may not be adequately protected.

A-26

are or may be developed, manufactured or sold, including Europe, Asia-Pacific or Latin America, may not protect our products and intellectual property rights to the same extent as the laws of the United States.

We face certain litigation risks that could harm our business

A-27

We recently sold $475.0 million of senior convertible notes, which significantly increased our leverage, and may cause our reported earnings per share to be more volatile because of the conversion contingency features of these notes.

Our rights plan and our ability to issue additional preferred stock could harm the rights of our common stockholders

A-28

imposed upon any wholly unissued shares of undesignated preferred stock and to fix the number of shares constituting any series and the designation of such series, without the consent of our stockholders. The preferred stock could be issued with voting, liquidation, dividend and other rights superior to those of the holders of common stock.

Some anti-takeover provisions contained in our charter and under Delaware laws could hinder a takeover attempt

A-29

ITEM 2. PROPERTIES

| Leased Properties: | ||||||

| Location | Square footage | Location | Square footage | |||

NORTH AMERICA: | EUROPE: | |||||

| Canada: | Italy: | |||||

| Ottawa(1) | 139,580 | Monza | 1,000 | |||

| United States: | France: | |||||

| Allentown, PA | 11,274 | Les Ulis | 3,800 | |||

| Bloomfield, CT | 60,000 | Grenoble | 10,226 | |||

| Calabasas, CA | 12,238 | Germany | ||||

| Camarillo, CA (1) | 23,046 | Eching | 8,712 | |||

| Commerce, CA | 27,136 | Netherlands: | ||||

| Ewing Township, NJ | 132,300 | Eindhoven (1) | 137,094 | |||

| Horsham, PA(1) | 126,500 | |||||

| Milpitas, CA | 69,702 | REST OF WORLD: | ||||

| Mountain Lakes, NJ | 20,000 | China: | ||||

| Nashua, NH (1) | 2,611 | Beijing | 75,347 | |||

| Norwood, MA (1) | 20,800 | Fuzhou | 224,656 | |||

| Parsippany, NJ | 2,000 | Hong Kong | 770 | |||

| Piscataway, NJ(1) | 132,650 | Shenzhen | 419,395 | |||

| San Jose, CA | 396,922 | Japan: | ||||

| Santa Clara, CA(1) | 46,338 | Tokyo | 859 | |||

| Santa Rosa, CA | 71,339 | Taiwan | ||||

| Windsor, CT(1) | 165,000 | Taipai | 3,960 | |||

| Indonesia | ||||||

| Bintin | 23,682 | |||||

| Singapore | 16,777 | |||||

Total leased square footage: | 2,385,714 | |||||

| Owned Properties: | ||||||

| Location | Square footage | Location | Square footage | |||

NORTH AMERICA: | EUROPE: | |||||

| Canada: | United Kingdom: | |||||

| Ottawa (2) | 948,900 | Plymouth(1) | 114,473 | |||

| United States: | ||||||

| Bloomfield, CT | 24,000 | REST OF WORLD: | ||||

| Columbus, OH(1) | 50,000 | China: | ||||

| Rochester, MN | 40,500 | Fuzhou | 152,360 | |||

| Santa Rosa, CA | 659,017 | |||||

| Raleigh, NC (1) | 178,000 | |||||

| Melbourne, FL | 105,000 | |||||

Total owned square footage: | 2,272,250 | |||||

Total leased and owned square footage: | 4,657,964 |

| (1) | Operations have ceased at these properties, and we are in the process of vacating additional properties as part of our Global Realignment Program. |

| (2) | This property is actively being marketed and has been classified in our financial statements as “held for sale.” See “Note 13. Reduction of Other Long-Lived Assets” of the Notes to Consolidated Financial Statements |

A-30

ITEM 3. LEGAL PROCEEDINGS

Pending Litigation

The Securities Class Actions:

The Derivative Actions:

The ERISA Actions:

The Shareholder Inspection Demands

A-31

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

A-32

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

| High | Low | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Fiscal 2004: | ||||||||||

| Fourth Quarter | $ | 4.48 | $ | 2.98 | ||||||

| Third Quarter | 5.73 | 3.88 | ||||||||

| Second Quarter | 4.02 | 3.13 | ||||||||

| First Quarter | 4.20 | 2.85 | ||||||||

Fiscal 2003: | ||||||||||

| Fourth Quarter | $ | 4.28 | $ | 2.86 | ||||||

| Third Quarter | 3.28 | 2.53 | ||||||||

| Second Quarter | 3.41 | 1.62 | ||||||||

| First Quarter | 3.84 | 1.87 | ||||||||

A-33

ITEM 6. SELECTED FINANCIAL DATA

| Years Ended June 30, | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2004 | 2003 (6) | 2002 (1) | 2001 (2)(3) | 2000 (4) | ||||||||||||||||

Consolidated Statement of Operations Data: | ||||||||||||||||||||

| Net revenue | $ | 635.9 | $ | 675.9 | $ | 1,098.2 | $ | 3,232.8 | $ | 1,430.4 | ||||||||||

| Amortization of goodwill and other intangibles | 16.0 | 19.8 | 1,308.7 | 5,387.0 | 896.9 | |||||||||||||||

| Acquired in-process research and development | 2.6 | 0.4 | 25.3 | 393.2 | �� | 360.7 | ||||||||||||||

| Reduction of goodwill and other long-lived assets | 51.8 | 393.6 | 5,979.4 | 50,085.0 | — | |||||||||||||||

| Restructuring charges | 11.5 | 121.3 | 260.0 | 264.3 | — | |||||||||||||||

| Loss from operations | (180.3 | ) | (900.7 | ) | (8,284.0 | ) | (56,347.4 | ) | (865.1 | ) | ||||||||||

| Net loss | (115.5 | ) | (933.8 | ) | (8,738.3 | ) | (56,121.9 | ) | (904.7 | ) | ||||||||||

| Net loss per share-basic and diluted | $ | (0.08 | ) | $ | (0.66 | ) | $ | (6.50 | ) | $ | (51.40 | ) | $ | (1.27 | ) | |||||

| June 30, | ||||||||||||||||||||

| 2004 | 2003 | 2002 (1) | 2001 (2)(3) | 2000 (4)(5) | ||||||||||||||||

Consolidated Balance Sheet Data: | ||||||||||||||||||||

| Working capital | $ | 1,515.7 | $ | 1,091.8 | $ | 1,374.8 | $ | 2,187.8 | $ | 1,325.7 | ||||||||||

| Total assets | 2,421.5 | 2,137.8 | 3,004.5 | 12,245.4 | 26,389.1 | |||||||||||||||

| Long-term obligations | 473.1 | 16.3 | 8.9 | 18.0 | 61.2 | |||||||||||||||

| Total stockholders’ equity | $ | 1,571.1 | $ | 1,671.1 | $ | 2,471.4 | $ | 10,706.5 | $ | 24,778.6 | ||||||||||

| (1) | We acquired IBM’s optical transceiver business on December 28, 2001 in a transaction accounted for as a purchase. The Consolidated Statement of Operations for fiscal 2002 included the results of operations of the optical transceiver business subsequent to December 28, 2001 and the Consolidated Balance Sheet as of June 30, 2002 included the financial position of the optical transceiver business. |

| (2) | We acquired SDL on February 13, 2001 in a transaction accounted for as a purchase. The Consolidated Statement of Operations for fiscal 2001 included the results of operations of SDL subsequent to February 13, 2001 and the Consolidated Balance Sheet as of June 30, 2001 included the financial position of SDL. |

| (3) | On February 13, 2001, we completed the sale of our Zurich, Switzerland subsidiary to Nortel for 65.7 million shares of Nortel common stock valued at $1,953.3 million. After adjusting for the net costs of the assets sold and for the expenses associated with the divestiture, we realized a gain of $1,770.2 million from the transaction. We subsequently sold 41.0 million shares of Nortel common stock for total proceeds of $659.2 million, resulting in a realized loss of $559.1 million during fiscal 2001. |

| (4) | We acquired OCLI on February 4, 2000 in a transaction accounted for as a purchase. The Consolidated Statement of Operations for fiscal 2000 included the results of operations of OCLI subsequent to February 4, 2000 and the Consolidated Balance Sheet as of June 30, 2000 included the financial position of OCLI. |

| (5) | We acquired E-TEK on June 30, 2000 in a transaction accounted for as a purchase. The Consolidated Balance Sheet as of June 30, 2000 included the financial position of E-TEK. |

| (6) | Commencing July 1, 2002, in accordance with SFAS 142, we no longer amortize goodwill, but test for impairment of goodwill on an annual basis and at any other time if events occur or circumstances indicate that the carrying amount of goodwill may not be recoverable. Fiscal years 2002, 2001 and 2000 include goodwill amortization as a component of the expense for amortization of goodwill and other intangibles. |

A-34

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Adjustments to Previously Announced FY 2004 Fourth-Quarter and Annual Results

| Three Months Ended June 30, 2004 | Year Ended June 30, 2004 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Net loss announced on July 28, 2004 | $ | (24.3 | ) | $ | (118.1 | ) | ||||

| Adjustment: | ||||||||||

| Reduction of income taxes payable liability | 2.6 | 2.6 | ||||||||

| Reported net loss in Annual Report on Form 10-K | $ | (21.7 | ) | $ | (115.5 | ) | ||||

| Net loss per share announced on July 28, 2004 — basic and diluted | $ | (0.02 | ) | $ | (0.08 | ) | ||||

| Reported net loss per share in Annual Report on Form 10-K — basic and diluted | $ | (0.02 | ) | $ | (0.08 | ) | ||||

Our Industries and Developments

Our Communications Group markets consist generally of:

| • | Enterprise and storage equipment providers such as Cisco, Sun Microsystems and Hewlett-Packard. |

| • | The telecommunications carriers: the regional Bell companies, or “RBOCS”; the long distance carriers, such as AT&T and MCI; international counterparts, such as British Telecom and Deutsche Telecom; and, to a growing extent, emerging carriers in the rest of the world. |

| • | System and equipment providers to the communications network carriers: principally Nortel, Lucent, Alcatel, Ciena, and Cisco |

| • | Cable service providers such as Comcast and Time Warner. |

| • | System and equipment providers to the cable service providers, such as Scientific Atlanta. |

Our Commercial and Consumer Products Group markets consist generally of:

| • | Display products, with customers such as Texas Instruments, optical components and modules and front surface mirrors used in rear projection and plasma displays. |

A-35

| • | Custom Optics: medical/environmental instrumentation, high precision coated products, optical sensors for aerospace and defense applications and optical filters for medical instruments. |

| • | Light Interference Pigment products, with customers such as SICPA, color shifting utilized in security products and decorative surface treatments. Pigments are used in security products to inhibit counterfeiting of currencies and other valuable documents. |

| • | Lasers: lasers subsystems are used in biotechnology, graphic arts and imaging, semiconductor processing, material processing and other laser based applications and markets. |

Recent Accounting Pronouncements

EITF No. 03-1:

SFAS No. 150:

A-36

FASB Interpretation No. 46R:

Critical Accounting Policies

Revenue Recognition:

A-37

protection or stock rotation is not recognized until the products are sold through to end customers. Generally, revenue associated with contract cancellation payments from customers is not recognized until we receive payment for such charges.

Allowances for Doubtful Accounts:

Investments:

Inventory Valuation:

A-38

Goodwill Valuation:

Long-lived asset valuation (property, plant and equipment and intangible assets):

Long-lived assets held and used

Long-lived assets held for sale

Deferred Taxes:

A-39

Warranty Accrual:

Restructuring Accrual:

A-40

Results of Operations

| Years Ended June 30, | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2004 | 2003 | 2002 | |||||||

| Net revenue | 100.0 | % | 100.0 | % | 100.0 | % | |||

| Cost of sales | 77.1 | 91.8 | 106.6 | ||||||

| Gross profit (loss) | 22.9 | 8.2 | (6.6 | ) | |||||

| Operating expenses: | |||||||||

| Research and development | 15.7 | 22.7 | 23.2 | ||||||

| Selling, general and administrative | 22.8 | 39.5 | 34.8 | ||||||

| Amortization of goodwill | — | — | 85.4 | ||||||

| Amortization of other intangibles | 2.5 | 2.9 | 33.8 | ||||||

| Acquired in-process research and development | 0.4 | 0.1 | 2.3 | ||||||

| Reduction of goodwill | — | 33.5 | 397.1 | ||||||

| Reduction of other long-lived assets | 8.1 | 24.9 | 147.4 | ||||||

| Restructuring charges | 1.8 | 17.9 | 23.7 | ||||||

| Total operating expenses | 51.3 | 141.5 | 747.7 | ||||||

| Loss from operations | (28.4 | ) | (133.3 | ) | (754.3 | ) | |||

| Interest and other income, net | 3.6 | 4.8 | 4.4 | ||||||

| Gain (loss) on sale of subsidiaries’ assets | — | (0.3 | ) | — | |||||

| Gain on sale of investments | 6.5 | 0.6 | 1.4 | ||||||

| Reduction in fair value of investments | (0.6 | ) | (6.7 | ) | (20.6 | ) | |||

| Loss on equity method investments | (1.3 | ) | (1.3 | ) | (5.0 | ) | |||

| Loss before income taxes and cumulative effect of an accounting change | (20.2 | ) | (136.2 | ) | (774.1 | ) | |||

| Income tax expense (benefit) | (2.5 | ) | 2.0 | 21.6 | |||||

| Loss before cumulative effect of an accounting change | (17.7 | ) | (138.2 | ) | (795.7 | ) | |||

| Cumulative effect of an accounting change | (0.5 | ) | — | — | |||||

| Net loss | (18.2 | )% | (138.2 | )% | (795.7 | )% | |||

Results of Operations

| 2004 | 2003 | Change* | Percentage Change | 2003 | 2002 | Change** | Percentage Change | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net revenue | $635.9 | $675.9 | $(40.0) | (6)% | $675.9 | $1,098.2 | $(422.3) | (38)% |