UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-08030

Name of Registrant: Royce Micro-Cap Trust, Inc.

Address of Registrant: 745 Fifth Avenue

New York, NY 10151

| Name and address of agent for service: | John E. Denneen, Esquire |

| | 745 Fifth Avenue

New York, NY 10151 |

Registrant's telephone number, including area code: (212) 508-4500

Date of fiscal year end: December 31

Date of reporting period: January 1, 2017 – December 31, 2017

Item 1. Reports to Shareholders.

| | | DECEMBER 31, 2017 |

| | | |

| | | |

| | | |

| | | 2017 Annual |

| | | Review and Report to Stockholders |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | Royce Global Value Trust |

| | | | |

| | | Royce Micro-Cap Trust |

| | | | |

| | | Royce Value Trust |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | roycefunds.com |  |

| | | | |

| | | | |

| | | | |

A Few Words on Closed-End Funds

Royce & Associates, LP manages three closed-end funds: Royce Global Value Trust, which invests primarily in companies with headquarters outside of the United States, Royce Micro-Cap Trust, which invests primarily in micro-cap securities; and Royce Value Trust, which invests primarily in small-cap securities. A closed-end fund is an investment company whose shares are listed and traded on a stock exchange. Like all investment companies, including open-end mutual funds, the assets of a closed-end fund are professionally managed in accordance with the investment objectives and policies approved by the fund’s Board of Directors. A closed-end fund raises cash for investment by issuing a fixed number of shares through initial and other public offerings that may include shelf offerings and periodic rights offerings. Proceeds from the offerings are invested in an actively managed portfolio of securities. Investors wanting to buy or sell shares of a publicly traded closed-end fund after the offerings must do so on a stock exchange, as with any publicly traded stock. Shares of closed-end funds frequently trade at a discount to their net asset value. This is in contrast to open-end mutual funds, which sell and redeem their shares at net asset value on a continuous basis.

A Closed-End Fund Can Offer Several Distinct Advantages

| • | A closed-end fund does not issue redeemable securities or offer its securities on a continuous basis, so it does not need to liquidate securities or hold uninvested assets to meet investor demands for cash redemptions. |

| | |

| • | In a closed-end fund, not having to meet investor redemption requests or invest at inopportune times can be effective for value managers who attempt to buy stocks when prices are depressed and sell securities when prices are high. |

| | |

| • | A closed-end fund may invest in less liquid portfolio securities because it is not subject to potential stockholder redemption demands. This is potentially beneficial for Royce-managed closed-end funds, with significant investments in small- and micro-cap securities. |

| | |

| • | The fixed capital structure allows permanent leverage to be employed as a means to enhance capital appreciation potential. |

| | |

| • | Royce Micro-Cap Trust and Royce Value Trust distribute capital gains, if any, on a quarterly basis. Each of these Funds has adopted a quarterly distribution policy for its common stock. |

We believe that the closed-end fund structure can be an appropriate investment for a long-term investor who understands the benefits of a more stable pool of capital.

Why Dividend Reinvestment Is Important

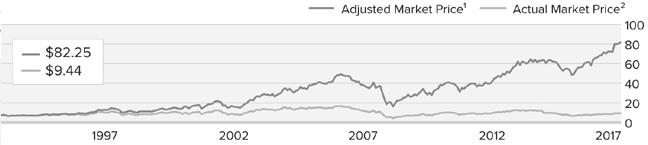

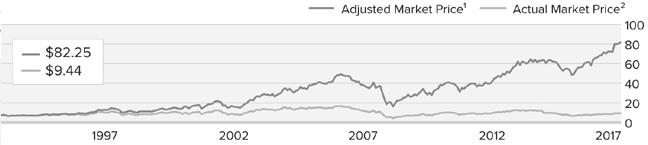

A very important component of an investor’s total return comes from the reinvestment of distributions. By reinvesting distributions, our investors can maintain an undiluted investment in a Fund. To get a fair idea of the impact of reinvested distributions, please see the charts on pages 62 and 63. For additional information on the Funds’ Distribution Reinvestment and Cash Purchase Options and the benefits for stockholders, please see page 64 or visit our website at www.roycefunds.com.

Managed Distribution Policy

The Board of Directors of each of Royce Micro-Cap Trust and Royce Value Trust has authorized a managed distribution policy (“MDP”). Under the MDP, Royce Micro-Cap Trust and Royce Value Trust pay quarterly distributions at an annual rate of 7% of the average of the prior four quarter-end net asset values, with the fourth quarter being the greater of these annualized rates or the distribution required by IRS regulations. With each distribution, the Fund will issue a notice to its stockholders and an accompanying press release that provides detailed information regarding the amount and composition of the distribution (including whether any portion of the distribution represents a return of capital) and other information required by a Fund’s MDP. You should not draw any conclusions about a Fund’s investment performance from the amount of distributions or from the terms of a Fund’s MDP. A Fund’s Board of Directors may amend or terminate the MDP at any time without prior notice to stockholders; however, at this time there are no reasonably foreseeable circumstances that might cause the termination of any of the MDPs.

| This page is not part of the 2017 Annual Report to Stockholders |

| Table of Contents | | | |

| | | | |

| | | | |

| Annual Review | | | |

| | | | |

| Letter to Our Stockholders | | 2 | |

| | | | |

| Performance | | 7 | |

| | | | |

| | | | |

| Annual Report to Stockholders | | | |

| | | | |

| Royce Global Value Trust | | | |

| | | | |

Managers’ Discussions of Fund Performance | | 8 | |

| | | | |

Schedule of Investments | | 10 | |

| | | | |

Other Financial Statements | | 15 | |

| | | | |

| Royce Micro-Cap Trust | | | |

| | | | |

Managers’ Discussion of Fund Performance | | 24 | |

| | | | |

Schedule of Investments | | 26 | |

| | | | |

Other Financial Statements | | 31 | |

| | | | |

| Royce Value Trust | | | |

| | | | |

Managers’ Discussion of Fund Performance | | 42 | |

| | | | |

Schedule of Investments | | 44 | |

| | | | |

Other Financial Statements | | 50 | |

| | | | |

| History Since Inception | | 62 | |

| | | | |

| Distribution Reinvestment and Cash Purchase Options | | 64 | |

| | | | |

| Directors and Officers | | 65 | |

| | | | |

| Notes to Performance and Other Important Information | | 66 | |

| | | | |

| Results of Stockholders Meetings | | 67 | |

| This page is not part of the 2017 Annual Report to Stockholders |

Letter to Our Stockholders

A GOOD YEAR, A PUZZLING PATTERN

A good year for equities, 2017 also looked a little strange at first...

| It was a terrific year for stocks in 2017 up and down the asset class scale and across much of the globe. Yet it was also a seemingly odd year, and it played out much differently than we thought it would. A second consecutive year of double-digit returns for small-cap stocks, with the Russell 2000 Index gaining 14.6% in 2017,1 was more than welcome, of course, even as returns also defied what we would have anticipated against the backdrop of a rapidly growing domestic economy and a rebounding global one. While large-cap’s relatively higher returns in 2017 made sense to us in this context, we also expected that small-cap would draw the bulk of its strength from cyclicals and value stocks in this healthy environment. So we were surprised to see certain growth and defensive stocks take the lead early in 2017 after lagging—in some cases significantly—in 2016, a year that marked its own significant (and in our view favorable) leadership reversals to cyclicals and value. Over the last three years, then, we have transitioned from |

2015’s very narrow, growth-led market to 2016’s broader move driven by cyclicals and value stocks to 2017, in which growth reasserted leadership while value lagged significantly.

It was a terrific year for stocks in 2017 up and down the asset class scale and across much of the globe.

At first, we chalked up this apparent oddity to the market’s long history of refusing to behave in a logical fashion, at least over the short term. As we parsed the data more closely, however, we were able to more accurately decode what happened. First, the advantages enjoyed by growth stocks and defensives within the Russell 2000 came disproportionately from Health Care, which rose 35.5% in 2017, making it by far the best-performing sector within the small-cap index. Rising more than 50%, biotechnology was particularly strong, bouncing back from a corrective phase |

| 1 | It was also the first calendar year since its 1978 inception in which the small-cap index posted a return between 6% and 16%. |

| 2 | This page is not part of the 2017 Annual Report to Stockholders |

LETTER TO OUR STOCKHOLDERS

in 2016 while pharmaceuticals also made an impressive recovery, climbing 37.2%. In aggregate, five of the six industry groups that comprise the Health Care sector in the Russell 2000 outpaced the overall index in 2017.

Following Health Care, however, were four sectors in more cyclical areas, each of which also beat the small-cap index: Consumer Discretionary (+15.6%), Industrials (+19.8%), Information Technology (+17.4%), and Materials (+16.7%). Among the index’s largest sectors, tech is also arguably its most diverse, embracing a mix of cyclical growth and value companies. Two of its more growth-oriented industries—Internet software & services (+28.4%) and software (+27.3%)—did very well while two of its more cyclical industries—electronic equipment, instruments & components (+23.9%) and semiconductors & semiconductor equipment (+15.2%)—also had index-beating returns in 2017. |

| |

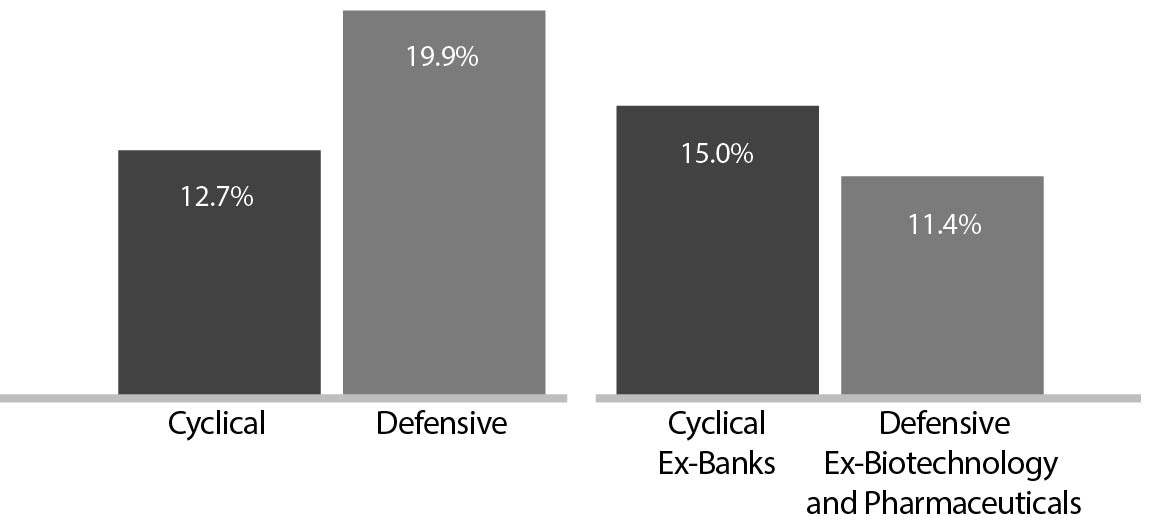

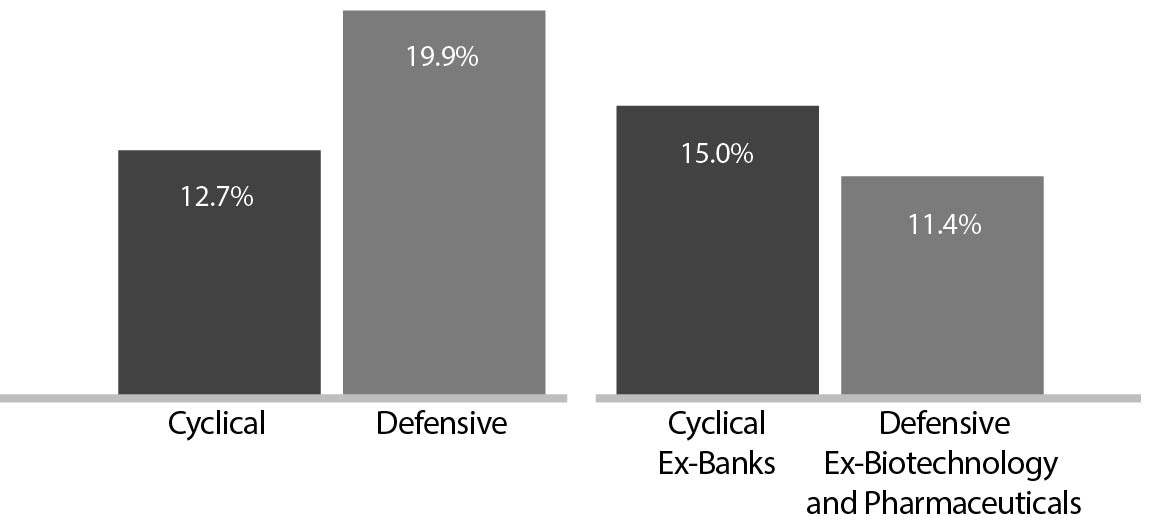

| What, then, contributed most to the odd disparity in small-cap results between cyclicals and defensives, value and growth? An underwhelming, low single-digit performance from banks was arguably the major factor. Slotted in the Financials sector, banks had a weighting just shy of 11% in the Russell 2000 at year-end, larger than six of the 11 sectors in the index, which gives their performance a meaningful impact. (In the Russell 2000 Value Index, their weighting was just shy of 20% at year-end— larger than any other sector in the style index.) Anemic returns for small-cap banks thus played a major role in relative disadvantages for both cyclicals and value. We find the following illustration especially revealing: defensives were up 20.0% in 2017 versus 12.7% for cyclicals. With banks, biotechnology, and pharmaceuticals excluded, however, cyclicals showed better absolute and relative performance—up 15.0% versus 11.4% for defensives. |

| |

A Different Picture Emerges Ex-Outliers

2017 Russell 2000 Cyclical vs Defensive Sector Returns |

|

| |

| Cyclical and Defensive are defined as follows: Cyclical, Consumer Discretionary, Energy, Financials, Industrials. Defensive: Consumer Staples, Health Care, Real Estate, Telecommunication Services, Utilities. |

| |

We think this outlier—excluding comparison goes a long way toward explaining why results for cyclicals versus defensives and value versus growth at first glance looked so strange in a period of economic acceleration.

ARE SMALL-CAPS POISED FOR ANOTHER SHIFT?

After an encouraging 4Q17, can small-cap cyclicals take the lead going forward?

Being narrower, growth-led markets typically create challenges for active managers, who tend to embrace a wider swath of companies. So it was not surprising that results for domestic active small-cap strategies were more varied, and we were pleased to see a number of market-beating performances for a select number of approaches. No doubt, the intertwined effect of strong absolute and relative results for certain cyclical sectors and vibrant global economic growth was the dominant factor. So while active strategies faced crosscurrents during the year as investors revisited more speculative issues, they were also bolstered by the expanding global economy. |

Going forward, we expect investors to increasingly focus on individual company attributes, especially cyclical exposure and company-specific risks. Our view is that this performance pattern should extend into 2018.

| This page is not part of the 2017 Annual Report to Stockholders | 3 |

| |

| Equity Indexes as of December 31, 2017 (%) | | | | | | | | | | |

| | | 1-YR | | 3-YR | | 5-YR | | 10-YR |

| |

| Russell 2000 | | | 14.65 | | | | 9.96 | | | | 14.12 | | | | 8.71 | |

| |

| Russell 2000 Value | | | 7.84 | | | | 9.55 | | | | 13.01 | | | | 8.17 | |

| |

| Russell 2000 Growth | | | 22.17 | | | | 10.28 | | | | 15.21 | | | | 9.19 | |

| |

| S&P 500 | | | 21.83 | | | | 11.41 | | | | 15.79 | | | | 8.50 | |

| |

| Russell 1000 | | | 21.69 | | | | 11.23 | | | | 15.71 | | | | 8.59 | |

| |

| Nasdaq Composite | | | 28.24 | | | | 13.38 | | | | 17.98 | | | | 10.04 | |

| |

| Russell Midcap | | | 18.52 | | | | 9.58 | | | | 14.96 | | | | 9.11 | |

| |

| Russell Microcap | | | 13.17 | | | | 8.91 | | | | 14.29 | | | | 7.68 | |

| |

| Russell Global ex-U.S. Small Cap | | | 30.49 | | | | 11.27 | | | | 9.25 | | | | 3.89 | |

| |

| Russell Global ex-U.S. Large Cap | | | 27.47 | | | | 8.09 | | | | 7.17 | | | | 2.09 | |

| |

| For details on The Royce Funds’ performance in the period, please turn to the Managers’ Discussions that begin on page 8. Past performance is no guarantee of future results. |

This raises the question of when and how—even if—the market’s response to the quickening pace of global growth will mark a more pronounced shift to cyclicals. A clue may have been found in a reversal that occurred in the fourth quarter, when small-cap cyclicals enjoyed higher returns than defensives, which is typically the case in a growing economy. After trailing through the first three quarters of 2017, small-cap cyclicals advanced 3.9% while defensive stocks were up 1.9% (and the Russell 2000 was up 3.3%). Going forward, we expect investors to increasingly focus on individual company attributes, especially cyclical exposure and company-specific risks. Our view is that this performance pattern should extend into 2018.

WHEN IT COMES TO SMALL-CAP, IT’S THE COMPANIES, NOT THE INDEXES

Its high valuation makes the Russell 2000 Index look risky, but numerous opportunities can still be found in small-cap

Based on this view, we believe the opportunity for small-cap investors is not the index itself or the broader asset class as a whole—it’s in select companies in the asset class. In a similar vein, we think that investors should lower their expectations for overall small-cap returns—which is why we believe selectivity has been so critical of late, and why we are increasingly convinced that it will remain so in 2018. Both the lofty state of small-cap valuations at the end of 2017 and recent performance patterns suggest that returns are unlikely to stay as elevated as they have been—for |

the index, growth stocks, and defensives in particular, but not necessarily for certain cyclical small-caps. We suspect that success over the next few years will hinge on making careful selections and maintaining discipline—in essence, the time-honored argument for the importance of active small-cap management.

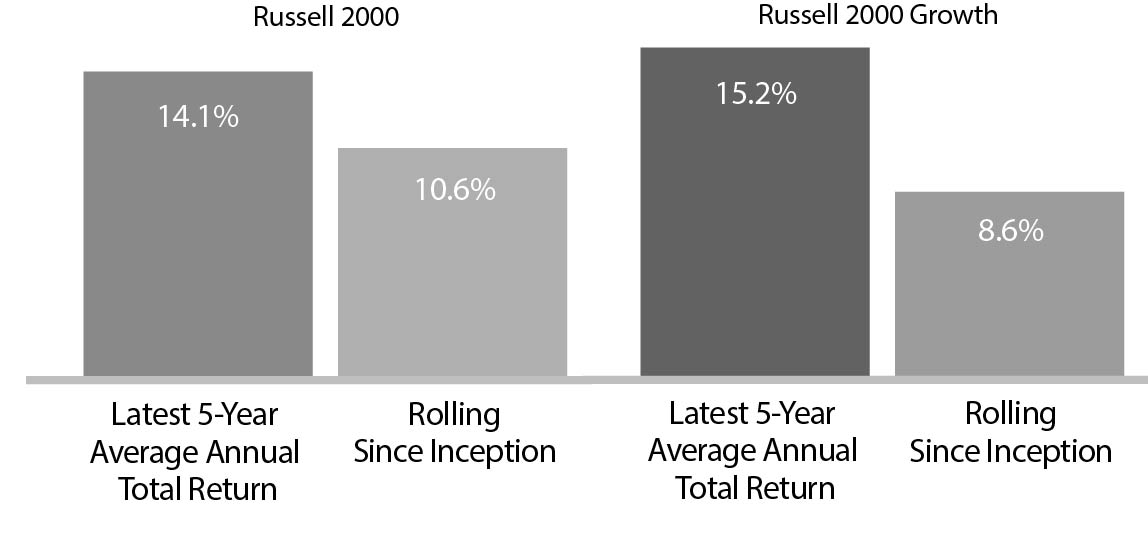

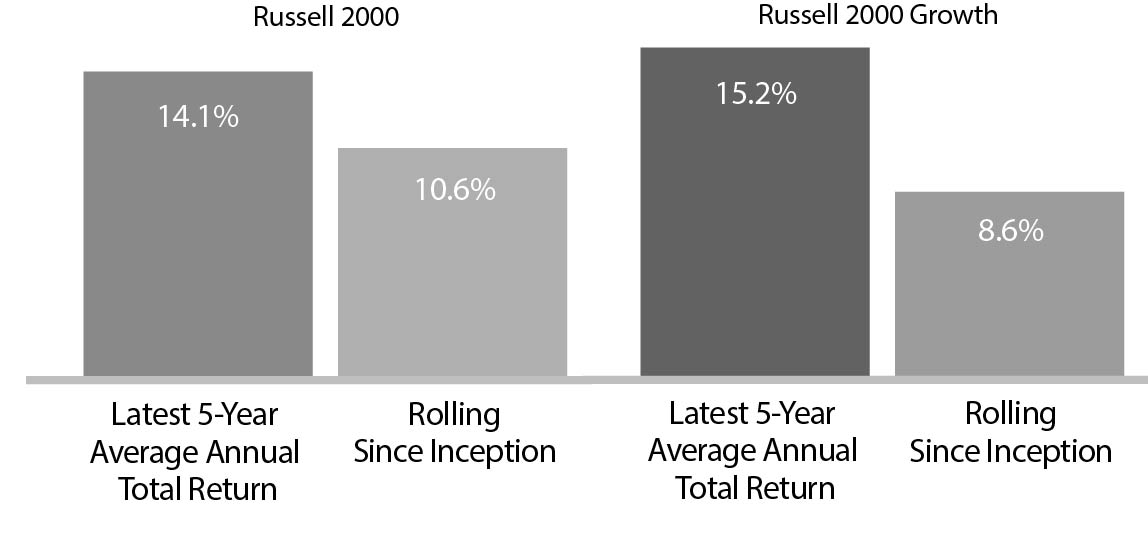

A look at five-year results for the Russell 2000 and Russell 2000 Growth best clarifies our thinking, as both exceeded their long-term averages. The small-cap index’s 14.1% five-year average annual total return for the period ended December 31, 2017 ran appreciably higher than its 10.6% monthly rolling five-year average since inception (12/31/78). The spread was even more pronounced for growth—a 15.2% five-year average annual total return for the same period versus its 8.6% monthly rolling five-year average since inception. These higher-than-average returns simply do not look sustainable to us over the long run. To be sure, while we are optimistic about the prospects for select small-cap companies, we remain firm believers in reversion to the mean for the index. |

| |

| |

| Latest Returns Much Higher Than History |

|

For context, we invite investors to consider how the metrics for the Russell 2000 stack up compared to a fundamentally strong small-cap business with positive earnings and healthy cash flows from operations. At the end of 2017, more than 34% of the companies in the small-cap index had no earnings compared to only 25% at the end of 2007. The index in aggregate also had higher leverage than it did 10 years ago: at the end of 2017, the weighted average long-term debt to capital ratio2 for the Russell |

| 2 Long-term debt to capital is calculated by dividing a company’s long-term debt by its total capital. |

| 4 | This page is not part of the 2017 Annual Report to Stockholders |

LETTER TO OUR STOCKHOLDERS

2000 was 35% versus 29% at the end of 2007. Add to all this the fact that small-caps have not seen a pullback greater than 6.4% for nearly two years dating back to the last small-cap trough on February 11, 2016, and the Russell 2000 looks very risky to us, especially compared to the opportunities to be found in individual small-cap businesses. From our perspective as small-cap specialists, all of this makes a small-cap correction look increasingly likely in 2018. Financially sound companies with growing earnings and modest valuations look far better positioned to us for the kind of lower-return market we are anticipating. Our expectation for annual small-cap returns falls in the 5-7% range over the intermediate term. It’s also worth noting that five-year periods in the zone of 5-10% for the small-cap index have been those with the biggest outperformance spread for active managers.

Two other points are worth emphasizing. The first is to offer a seemingly counterintuitive word of caution about the expanding global economy. As excited as we are about the current period of synchronized global growth, we have also observed that Main Street and Wall Street do not always walk hand in hand. Market cycles and economic cycles are different animals. As economic news continues to improve, there is no guarantee that the market will match its pace. Ultimately, we see global growth as a positive for stocks. But the market may well deviate from what the economy is doing in the months ahead (which is fairly typical) as investors try to sort things out after an almost 10-year bull market for large-caps and a nearly two-year upswing for small-caps.

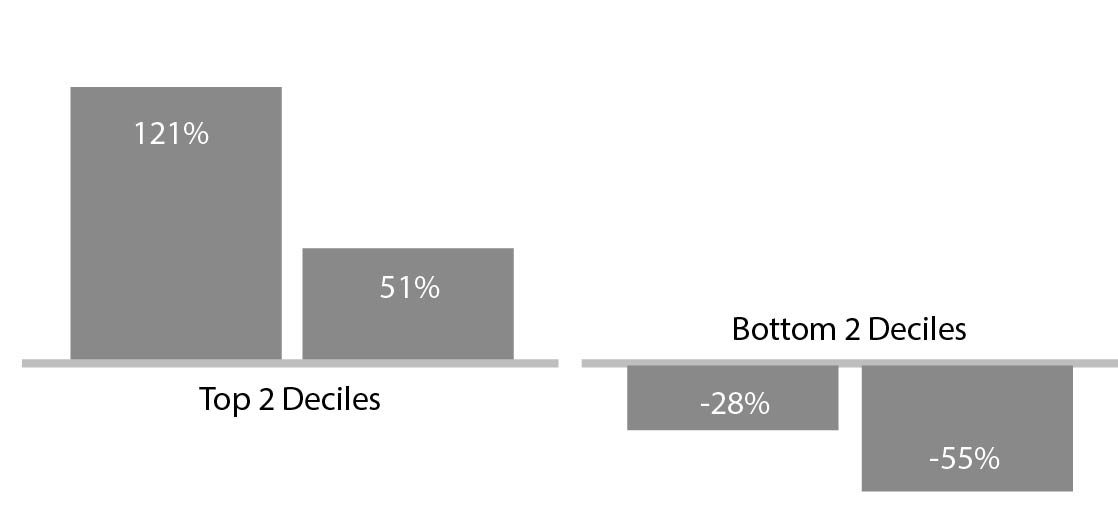

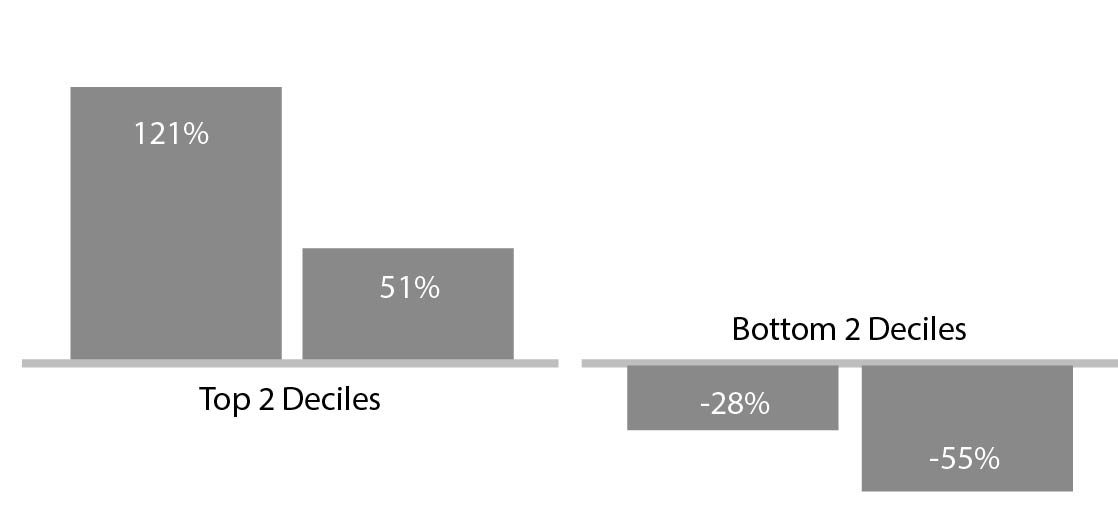

Our second point is to highlight the enormity and diversity of the U.S. small-cap universe. This goes beyond the more than 2,200 |

| publicly traded companies with market capitalizations between $100 million and $3 billion. It also pertains to performance and valuation. For example, the top two deciles of the Russell 2000 were up 121% and 51% in 2017, while the bottom two fell 55% and 28%. Given such wide dispersion, we believe that we can always find long-term opportunities. |

| |

| |

| Divergence: Russell 2017 Returns |

|

THE SMALL-CAP OPPORTUNITY:

GLOBAL GROWTH IN CYCLICALS

We see leadership coming from small-caps in economically sensitive industries that blend profitability, relatively attractive valuation, and global exposure

As confidence in the economy solidifies, the mounting importance of earnings growth or recovery should benefit cyclicals—small-caps in particular—as it has in the past. Cyclicals have historically done best in exactly the kind of economic environment in which we now find ourselves. Valuations for small-cap cyclicals also look more attractive relative to defensives. Moreover, it seems that the end has come for the extended, 30-year bull market for bonds. Being far less yield sensitive, cyclicals should face fewer headwinds as rates rise. |

| Ultimately, we see global growth as a positive for stocks. But the market may well deviate from what the economy is doing in the months ahead (which is fairly typical) as investors try to sort things out after an almost 10-year bull market for large-caps and a nearly two-year upswing for small-caps. |

| This page is not part of the 2017 Annual Report to Stockholders | 5 |

LETTER TO OUR STOCKHOLDERS

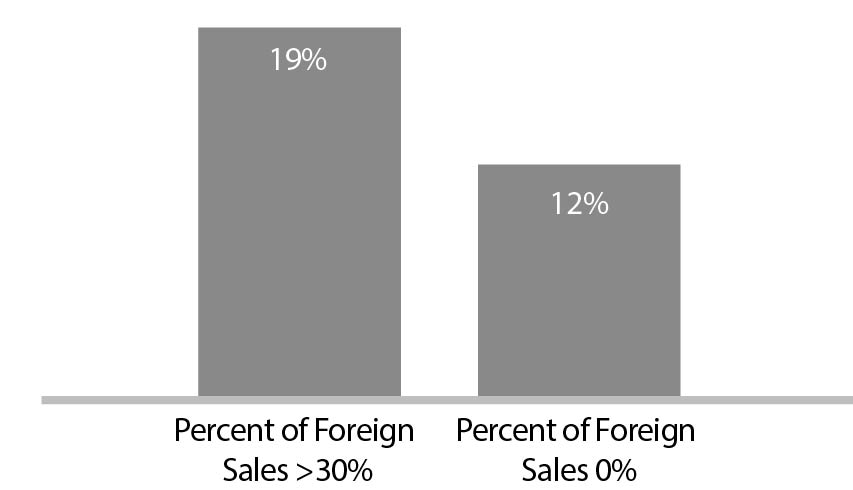

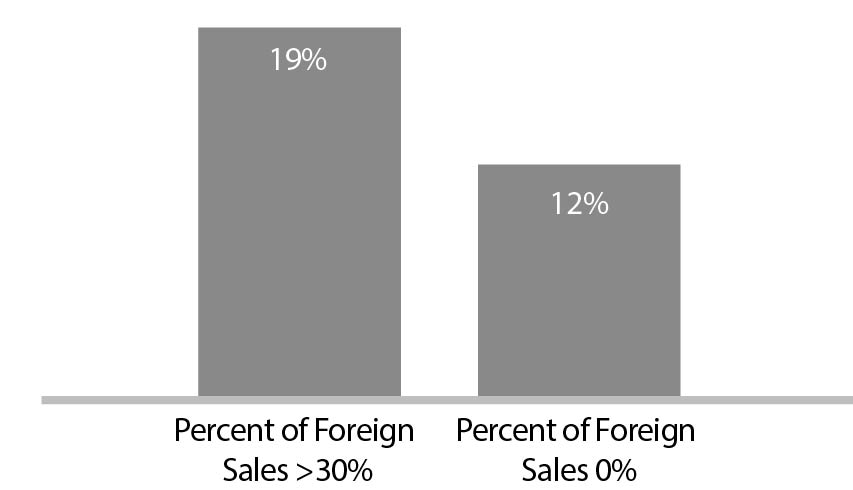

2017 Russell 2000

Returns by Percent

of Foreign Sales |  |

We think investors should be focusing on these matters rather than tax cuts or high valuations for indexes. While the reduced corporate tax rate is an undeniable benefit for small-caps, its positive effect is only lasting insofar as it encourages productive capital investment and allocation (the key, in our view, to creating additional growth beyond the reduced rate). As small-cap specialists, we see the accelerating global economy as the more significant development. Indeed, its effects can already be seen when one looks more closely at 2017’s returns. Companies in the Russell 2000 with no foreign sales were up 12% while those with foreign sales of 30% or greater advanced 19%. |

| So we enter 2018 with a measured confidence, charting a middle course between bullishness and bearishness. Our expectation is for positive small-cap returns that are nonetheless likely to be lower than their long-term historical average. We believe that small-cap performance will be driven by three factors: a preference for profitability, relatively lower valuations for both cyclicals and value stocks, and burgeoning economic strength at home and abroad. Together, these support the leadership case for small-cap companies with global exposure in cyclical industries that also possess quality in the form of high returns on invested capital. Russell 2000 companies with the highest ROIC did quite well in 2017, in fact. These kinds of businesses look best positioned to benefit from increasing economic growth—even in the event of a pullback. With selectivity and discipline being the keys, we see the opportunity for disciplined and select active small-cap strategies to shine in 2018. |

| |  | |  |

| Charles M. Royce | | Christopher D. Clark | | Francis D. Gannon |

| Chairman, | | Chief Executive Officer and | | Co-Chief Investment Officer, |

| Royce & Associates, LP | | Co-Chief Investment Officer,

Royce & Associates, LP | | Royce & Associates, LP |

| | | | | |

| January 31, 2018 | | | | |

| 6 | This page is not part of the 2017 Annual Report to Stockholders |

Performance

| |

| |

NAV Average Annual Total Returns

As of December 31, 2017 (%) |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | 1-YR | | 3-YR | | 5-YR | | 10-YR | | 15-YR | | 20-YR | | 25-YR | | 30-YR | | SINCE

INCEPTION | | INCEPTION

DATE |

| |

| Royce Global Value Trust | | 31.07 | | 12.04 | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | | 7.50 | | 10/17/13 |

| |

| Royce Micro-Cap Trust | | 17.67 | | 8.21 | | 13.65 | | 7.75 | | 11.51 | | 9.84 | | N/A | | N/A | | 11.09 | | 12/14/93 |

| |

| Royce Value Trust | | 19.38 | | 11.63 | | 13.47 | | 7.18 | | 10.79 | | 9.45 | | 10.73 | | 11.53 | | 10.83 | | 11/26/86 |

| |

INDEX | | | | | | | | | | | | | | | | | | | | |

| |

| Russell Global Small Cap Index | | 23.33 | | 10.54 | | 10.94 | | 5.43 | | 11.34 | | 7.97 | | N/A | | N/A | | N/A | | N/A |

| |

| Russell Microcap Index | | 13.17 | | 8.91 | | 14.29 | | 7.68 | | 10.34 | | N/A | | N/A | | N/A | | N/A | | N/A |

| |

| Russell 2000 Index | | 14.65 | | 9.96 | | 14.12 | | 8.71 | | 11.17 | | 7.89 | | 9.54 | | 10.46 | | N/A | | N/A |

| |

Important Performance and Risk Information

All performance information in this Review and Report reflects past performance, is presented on a total return basis, net of the Fund’s investment advisory fee, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when sold. Current performance may be higher or lower than performance quoted. Current month-end performance may be obtained at www.roycefunds.com. The Funds are closed-end registered investment companies whose respective shares of common stock may trade at a discount to the net asset value. Shares of each Fund’s common stock are also subject to the market risk of investing in the underlying portfolio securities held by each Fund. Certain immaterial adjustments were made to the net assets of Royce Micro-Cap Trust at 12/31/12, as well as 12/31/14 and of Royce Value Trust at 12/31/16, for financial reporting purposes, and as a result the total return based on that net asset value differs from the adjusted net asset value and total return reported in the Financial Highlights. All indexes referenced are unmanaged and capitalization-weighted. Each index’s returns include net reinvested dividends and/or interest income. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The Russell 2000 Index is an index of domestic small-cap stocks that measures the performance of the 2,000 smallest publicly traded U.S. companies in the Russell 3000 Index. The Russell Microcap Index includes 1,000 of the smallest securities in the small-cap Russell 2000 Index, along with the next smallest eligible securities as determined by Russell. The Russell Global Small Cap Index is an unmanaged, capitalization-weighted index of global small-cap stocks. The performance of an index does not represent exactly any particular investment, as you cannot invest directly in an index. Index returns include net reinvested dividends and/or interest income. Royce Value, Micro-Cap and Global Value Trust shares of common stock trade on the NYSE. Royce Fund Services, Inc (“RFS”) is a member of FINRA and files certain material with FINRA on behalf of each Fund. RFS is not an underwriter or distributor of any of the Funds.

This page is not part of the 2017 Annual Report to Stockholders | 7

| MANAGERS’ DISCUSSION |

| Royce Global Value Trust (RGT) |

|

Chuck Royce

David Nadel

Chris Flynn |

| |

FUND PERFORMANCE

A strong absolute and relative showing in 2017 gave Royce Global Value Trust (“RGT”) an advantage over its unleveraged benchmark, the Russell Global Small Cap Index, for the one- and three-year periods ended December 31, 2017 on both a net asset value (“NAV”) and market price basis. The Fund advanced 31.1% on an NAV basis and 36.0% based on market price in 2017, in both instances substantially ahead of the Russell Global Small Cap Index, which rose 23.3% for the same period. 2017 was a terrific year for stocks up and down the asset class scale and across much of the globe, and we were pleased to see the portfolio more than fully participate. |

| WHAT WORKED... AND WHAT DIDN’T |

Nine of the Fund’s 11 equity sectors finished 2017 in the black. Only Energy detracted—and did so modestly—while Utilities was essentially flat. Industrials and Information Technology led by wide margins, followed by more-than-respectable contributions from Financials and Health Care. Relative to the benchmark, the portfolio’s advantage came overwhelmingly from stock selection, primarily in Financials, Information Technology, and Industrials. The first of these sectors saw the greatest relative edge come from holdings in capital markets and consumer finance while in Information Technology the electronic equipment, instruments & components and IT services groups had the biggest impact. In Industrials, trading companies & distributors and commercial services & supplies showed the best relative strength. Conversely, ineffective stock selection in Materials hurt relative performance, as did the portfolio’s cash position.

At the industry level, two groups dominated results on an absolute basis—the aforementioned capital markets and electronic equipment, instruments & components—while the IT services (Information Technology) and health care equipment & supplies (Health Care) industries also made noteworthy positive contributions. The impact of detractors at this same level was comparably very light, with oil, gas & consumable fuels (Energy), technology hardware, storage & peripherals (Information Technology), insurance (Financials), and communications equipment (Information Technology) detracting most. Those countries making the greatest positive impact in 2017 were the U.S., the United Kingdom, Japan, and Germany while South Africa and Puerto Rico detracted most.

The top contributor at the position level was Indian consumer finance company, Bajaj Finance. Its shares were lifted by its strong position in India’s nascent credit markets, which we believe have a long runway for growth given the nation’s fast-growing middle class and its low household debt to GDP ratio. Bajaj has also benefited from successfully cross selling services across its many locations. Cognex Corporation is the market leader in machine vision technology, which captures and analyzes visual information to automate tasks that previously relied on human eyesight and is thus a major driver of industrial and process automation. The firm has just begun to move into key end markets, such as consumer electronics, while adoption is expanding to other industries, including a fast-growing logistics segment. With ever-evolving proprietary technology and an unmatched global corps of engineers serving customers, the firm looks poised to sustain its well-above-average ROIC and compound its business value into the future. |

| |

| The top detractor at the position level was South Africa’s EOH Holdings, Africa’s largest independent information-technology provider, with leading positions in business process outsourcing and SAP implementation across the continent. We were attracted to its rare combination of attractive valuation, strong market position, high growth, and conservative balance sheet. However, we sold our shares when unexplained insider selling and the threat of customer losses compounded the effects of well-publicized accounting and corruption scandals engulfing even some of the blue-chip denizens of South African business. We had more confidence in the turnaround potential of CIRCOR International, which makes an array of valves and provides related flow control products and services. Valve sales to the domestic land-based oil industry improved when the price of oil rallied in the second half of the year, but could not offset the sales declines to large offshore project customers where investments are only now showing signs of bottoming and pricing is intense. We think it can eventually benefit from a recovery in energy prices and the further integration of a recent acquisition, which diversifies its end markets and brings higher margins, differentiated products, and aftermarket service revenue streams, factors that led us to add shares in 2017. |

| | | | | |

| | Top Contributors to Performance

For 2017 (%)1 | | | |

| | | | | |

| | Bajaj Finance | | 0.98 | |

| | | |

| | Cognex Corporation | | 0.97 | |

| | | |

| | SEI Investments | | 0.75 | |

| | | |

| | Relo Group | | 0.74 | |

| | | |

| | Vakrangee | | 0.71 | |

| | | |

| | 1 Includes dividends | | | |

| | | | | |

| | | | | |

| | Top Detractors from Performance

For 2017 (%)2 | | | |

| | | | | |

| | EOH Holdings Limited | | -0.28 | |

| | | |

| | CIRCOR International | | -0.26 | |

| | | |

| | MBIA | | -0.25 | |

| | | |

| | World Fuel Services | | -0.20 | |

| | | |

| | Diebold Nixdorf | | -0.18 | |

| | | |

| | 2 Net of dividends | | | |

| | | | | |

| CURRENT POSITIONING AND OUTLOOK |

| We have a more positive outlook for international stocks and are more cautious on domestic issues, which makes the Fund’s global flexibility particularly timely. While guarded about prospective U.S. small-cap index returns, we are also optimistic about the portfolio’s potential as it leans towards three factors that we believe will be rewarded going forward—cyclicals, global exposure, and—in many cases—high profitability. In this environment, we see the opportunity for the Fund to continue outperforming in the years ahead. |

| 8 | 2017 Annual Report to Stockholders |

| PERFORMANCE AND PORTFOLIO REVIEW | | SYMBOLS MARKET PRICE RGT NAV XRGTX |

| Performance |

| Average Annual Total Return (%) Through 12/31/17 |

| | | JUL-DEC 20171 | | 1-YR | | 3-YR | | SINCE INCEPTION (10/17/13) |

| |

| RGT (NAV) | | 12.89 | | 31.07 | | 12.04 | | 7.50 |

| |

| 1 Not Annualized | | | | | | | | |

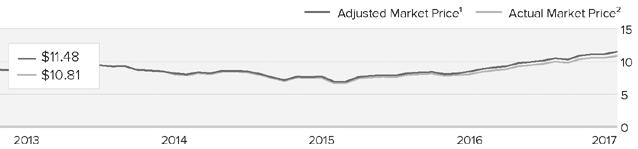

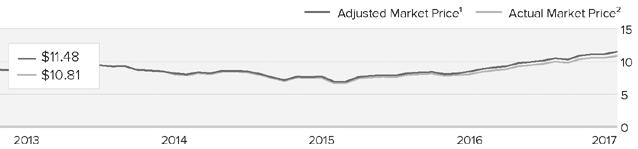

Market Price Performance History Since Inception (10/17/13)Cumulative Performance of Investment1

| | | 1-YR | | 5-YR | | 10-YR | | 15-YR | | 20-YR | | SINCE INCEPTION (10/17/13) |

| |

| RGT | | 36.0% | | N/A | | N/A | | N/A | | N/A | | 28.0% |

| |

| 1 | Reflects the cumulative performance experience of a continuous common stockholder who purchased one share at inception ($8.975 IPO) and reinvested all distributions. |

| 2 | Reflects the actual month-end market price movement of one share as it has traded on NYSE and, prior to 12/1/03, on the Nasdaq. |

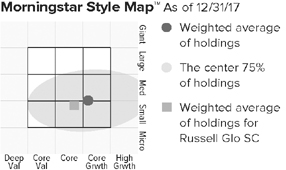

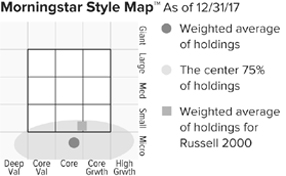

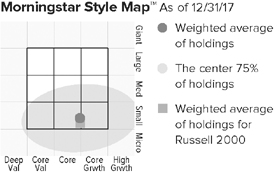

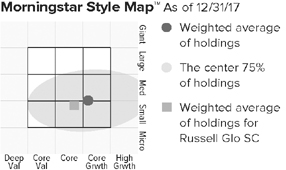

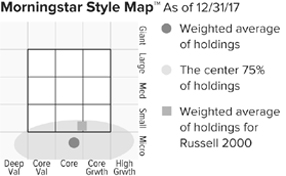

The Morningstar Style Map is the Morningstar Style Box™ with the center 75% of fund holdings plotted as the Morningstar Ownership Zone™. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 66 for additional information. |

|

| Top 10 Positions | | |

| % of Net Assets | | |

| | | |

| SEI Investments | | 1.9 |

| |

| Kirby Corporation | | 1.7 |

| |

| TGS-NOPEC Geophysical | | 1.7 |

| |

| FLIR Systems | | 1.5 |

| |

| VZ Holding | | 1.5 |

| |

| Lazard Cl. A | | 1.3 |

| |

| Ashmore Group | | 1.2 |

| |

| Clarkson | | 1.1 |

| |

| Spirax-Sarco Engineering | | 1.1 |

| |

| USS | | 1.1 |

| |

|

| Portfolio Sector Breakdown | | |

| % of Net Assets | | |

| | | |

| Industrials | | 25.6 |

| |

| Information Technology | | 18.4 |

| |

| Financials | | 16.7 |

| |

| Materials | | 11.1 |

| |

| Health Care | | 9.9 |

| |

| Consumer Discretionary | | 8.4 |

| |

| Energy | | 3.3 |

| |

| Consumer Staples | | 2.8 |

| |

| Real Estate | | 2.3 |

| |

| Telecommunication Services | | 0.2 |

| |

| Utilities | | 0.1 |

| |

| Cash and Cash Equivalents, Net of Outstanding Line of Credit | | 1.2 |

| |

|

| Calendar Year Total Returns (%) | | |

| | | |

| YEAR | | RGT |

| |

| 2017 | | 31.1 |

| |

| 2016 | | 11.1 |

| |

| 2015 | | -3.4 |

| |

| 2014 | | -6.2 |

| |

|

Portfolio Country Breakdown1,2

% of Net Assets | | |

| | | |

| |

| United States | | 27.5 |

| |

| United Kingdom | | 12.0 |

| |

| Japan | | 9.3 |

| |

| Canada | | 8.5 |

| |

| Switzerland | | 4.1 |

| |

| Australia | | 3.8 |

| |

| France | | 3.7 |

| |

| India | | 3.4 |

| |

| Germany | | 3.3 |

| |

| 1 Represents countries that are 3% or more of net assets. |

| 2 Securities are categorized by the country of their headquarters. |

|

| Portfolio Diagnostics | | |

| | | |

| Fund Net Assets | | $131 million |

| |

| Number of Holdings | | 348 |

| |

| 2017 Annual Turnover Rate | | 34% |

| |

| Net Asset Value | | $12.48 |

| |

| Market Price | | $10.81 |

| |

| Average Market Capitalization1 | | $1,933 million |

| |

| Weighted Average P/E Ratio2,3 | | 22.2x |

| |

| Weighted Average P/B Ratio2 | | 2.9x |

| |

| Active Share4 | | 97% |

| |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (7% of portfolio holdings as of 12/31/17). |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

| Important Performance and Risk Information All performance information reflects past performance, is presented on a total return basis, net of the Fund’s investment advisory fee, and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Current performance may be higher or lower than performance quoted. Returns as of the most recent month-end may be obtained at www.roycefunds.com. The market price of the Fund’s shares will fluctuate, so that shares may be worth more or less than their original cost when sold. The Fund invests primarily in securities of small- and mid-cap companies, which may involve considerably more risk than investments in securities of larger-cap companies. The Fund’s broadly diversified portfolio does not ensure a profit or guarantee against loss. From time to time, the Fund may invest a significant portion of its net assets in foreign securities, which may involve political, economic, currency and other risks not encountered in U.S. investments. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2017. |

| 2017 Annual Report to Stockholders | 9 |

| |

| Schedule of Investments | | | | | | | | |

| Common Stocks – 98.8% | | | | | | | | |

| | | | SHARES | | | | VALUE | |

| |

| | | | | | | | | |

| AUSTRALIA – 3.8% | | | | | | | | |

ALS | | | 155,000 | | | $ | 844,746 | |

Austal | | | 43,700 | | | | 61,786 | |

†Bravura Solutions | | | 395,449 | | | | 533,811 | |

Cochlear | | | 5,500 | | | | 734,261 | |

†Decmil Group | | | 60,000 | | | | 60,972 | |

†Eureka Group Holdings 1 | | | 175,000 | | | | 43,539 | |

†Hansen Technologies | | | 335,000 | | | | 1,031,112 | |

†HT&E | | | 110,400 | | | | 161,803 | |

Imdex 1 | | | 103,100 | | | | 84,750 | |

IPH | | | 260,000 | | | | 1,114,946 | |

NetComm Wireless 1 | | | 13,350 | | | | 12,484 | |

Seeing Machines 1 | | | 2,171,489 | | | | 164,892 | |

†Tassal Group | | | 48,300 | | | | 141,362 | |

| |

| Total (Cost $4,291,516) | | | | | | | 4,990,464 | |

| |

| | | | | | | | | |

| AUSTRIA – 0.8% | | | | | | | | |

Mayr-Melnhof Karton | | | 7,500 | | | | 1,102,357 | |

| |

| Total (Cost $893,160) | | | | | | | 1,102,357 | |

| |

| | | | | | | | | |

| BELGIUM – 0.1% | | | | | | | | |

†Agfa-Gevaert 1 | | | 15,200 | | | | 70,885 | |

†Greenyard | | | 2,700 | | | | 65,120 | |

| |

| Total (Cost $123,771) | | | | | | | 136,005 | |

| |

| | | | | | | | | |

| BRAZIL – 2.1% | | | | | | | | |

†B3 | | | 32,847 | | | | 225,163 | |

†Construtora Tenda 1 | | | 20,000 | | | | 120,380 | |

†Direcional Engenharia 1 | | | 14,000 | | | | 23,765 | |

†International Meal Company Alimentacao | | | 25,000 | | | | 65,045 | |

Minerva | | | 26,250 | | | | 84,186 | |

†MRV Engenharia e Participacoes | | | 21,700 | | | | 98,229 | |

OdontoPrev | | | 225,000 | | | | 1,076,219 | |

T4F Entretenimento | | | 50,400 | | | | 111,355 | |

TOTVS | | | 108,000 | | | | 972,174 | |

| |

| Total (Cost $2,398,739) | | | | | | | 2,776,516 | |

| |

| | | | | | | | | |

| CANADA – 8.5% | | | | | | | | |

Agnico Eagle Mines 2 | | | 5,000 | | | | 230,900 | |

AGT Food and Ingredients | | | 4,300 | | | | 68,793 | |

†Aimia 1 | | | 35,000 | | | | 104,137 | |

†Calfrac Well Services 1 | | | 26,100 | | | | 124,167 | |

Canaccord Genuity Group | | | 92,000 | | | | 424,503 | |

†Centric Health 1 | | | 221,800 | | | | 91,755 | |

Computer Modelling Group | | | 108,000 | | | | 824,821 | |

†Corsa Coal 1 | | | 99,200 | | | | 161,782 | |

E-L Financial | | | 1,200 | | | | 777,861 | |

Exco Technologies | | | 24,000 | | | | 193,604 | |

FirstService Corporation | | | 10,300 | | | | 720,176 | |

Franco-Nevada Corporation 2 | | | 10,200 | | | | 815,490 | |

Genworth MI Canada | | | 13,000 | | | | 449,881 | |

Gluskin Sheff + Associates | | | 23,000 | | | | 304,654 | |

†Hudbay Minerals | | | 7,400 | | | | 65,120 | |

†Leucrotta Exploration 1 | | | 27,700 | | | | 37,903 | |

Magellan Aerospace | | | 9,400 | | | | 157,115 | |

Major Drilling Group International 1 | | | 188,500 | | | | 1,058,719 | |

Morneau Shepell | | | 50,000 | | | | 887,033 | |

†North American Energy Partners | | | 31,882 | | | | 157,816 | |

Pan American Silver 2,3 | | | 31,800 | | | | 494,808 | |

†Rocky Mountain Dealerships | | | 7,100 | | | | 77,383 | |

Sandstorm Gold 1 | | | 10,000 | | | | 49,900 | |

Solium Capital 1 | | | 69,000 | | | | 598,878 | |

Sprott | | | 520,600 | | | | 1,010,552 | |

†Supremex | | | 18,500 | | | | 66,376 | |

Total Energy Services | | | 2,500 | | | | 29,554 | |

†Wajax Corporation | | | 3,400 | | | | 66,729 | |

Western Forest Products | | | 50,150 | | | | 97,747 | |

Winpak | | | 25,000 | | | | 930,788 | |

| |

| Total (Cost $10,916,771) | | | | | | | 11,078,945 | |

| |

| | | | | | | | | |

| CHILE – 0.1% | | | | | | | | |

†SMU 1 | | | 318,400 | | | | 96,234 | |

| |

| Total (Cost $85,780) | | | | | | | 96,234 | |

| |

| | | | | | | | | |

| CHINA – 1.4% | | | | | | | | |

China Communications Services | | | 203,400 | | | | 136,045 | |

†China Lesso Group Holdings | | | 130,900 | | | | 84,766 | |

Chinasoft International | | | 130,900 | | | | 86,752 | |

†Delong Holdings 1 | | | 67,000 | | | | 132,553 | |

Fufeng Group | | | 275,100 | | | | 179,556 | |

Hopefluent Group Holdings | | | 50,000 | | | | 21,947 | |

†Hua Hong Semiconductor | | | 58,000 | | | | 122,743 | |

TravelSky Technology | | | 300,000 | | | | 899,032 | |

†Xingda International Holdings | | | 160,500 | | | | 56,876 | |

Xtep International Holdings | | | 295,800 | | | | 115,471 | |

| |

| Total (Cost $1,399,684) | | | | | | | 1,835,741 | |

| |

| | | | | | | | | |

| DENMARK – 1.0% | | | | | | | | |

Chr. Hansen Holding | | | 5,500 | | | | 515,822 | |

Coloplast Cl. B | | | 4,000 | | | | 317,184 | |

Columbus | | | 26,200 | | | | 62,419 | |

†DFDS | | | 1,200 | | | | 64,008 | |

Zealand Pharma 1 | | | 24,000 | | | | 328,519 | |

| |

| Total (Cost $1,042,617) | | | | | | | 1,287,952 | |

| |

| | | | | | | | | |

| EGYPT – 0.1% | | | | | | | | |

†Egyptian Financial Group-Hermes Holding | | | | | | | | |

Company | | | 70,800 | | | | 93,975 | |

†Oriental Weavers | | | 82,300 | | | | 77,209 | |

| |

| Total (Cost $172,777) | | | | | | | 171,184 | |

| |

| | | | | | | | | |

| FINLAND – 0.0% | | | | | | | | |

†Ferratum | | | 1,300 | | | | 47,432 | |

| |

| Total (Cost $37,828) | | | | | | | 47,432 | |

| |

| | | | | | | | | |

| FRANCE – 3.7% | | | | | | | | |

Bigben Interactive 1 | | | 5,000 | | | | 82,601 | |

HighCo | | | 8,100 | | | | 47,503 | |

Interparfums | | | 13,500 | | | | 558,931 | |

Manutan International | | | 450 | | | | 48,315 | |

Neurones | | | 25,500 | | | | 880,548 | |

Rothschild & Co | | | 33,000 | | | | 1,207,840 | |

Synergie | | | 1,400 | | | | 73,648 | |

Thermador Groupe | | | 9,500 | | | | 1,293,798 | |

Vetoquinol | | | 8,000 | | | | 580,948 | |

| |

| Total (Cost $2,899,952) | | | | | | | 4,774,132 | |

| |

| | | | | | | | | |

| GEORGIA – 0.1% | | | | | | | | |

BGEO Group | | | 2,400 | | | | 115,015 | |

| |

| Total (Cost $72,732) | | | | | | | 115,015 | |

| |

| 10 | 2017 Annual Report to Stockholders | | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| |

| Schedule of Investments (continued) | | | | | | | | |

| | | | | | | | | |

| | | | SHARES | | | | VALUE | |

| |

| | | | | | | | | |

| GERMANY – 3.3% | | | | | | | | |

CANCOM | | | 1,350 | | | $ | 112,193 | |

Carl Zeiss Meditec | | | 17,500 | | | | 1,084,791 | |

CompuGroup Medical | | | 8,000 | | | | 523,821 | |

†Deutsche EuroShop | | | 1,700 | | | | 69,203 | |

†Energiekontor | | | 6,200 | | | | 106,037 | |

Fielmann | | | 8,000 | | | | 704,068 | |

†FinTech Group 1 | | | 1,800 | | | | 65,971 | |

HolidayCheck Group 1 | | | 19,150 | | | | 64,132 | |

†JDC Group 1 | | | 7,000 | | | | 81,020 | |

MorphoSys 1 | | | 6,000 | | | | 549,246 | |

mutares | | | 2,500 | | | | 47,683 | |

†PSI Software | | | 2,600 | | | | 57,736 | |

STRATEC Biomedical | | | 9,000 | | | | 697,806 | |

VIB Vermoegen | | | 5,200 | | | | 132,145 | |

| |

| Total (Cost $2,616,679) | | | | | | | 4,295,852 | |

| |

| | | | | | | | | |

| GREECE – 0.1% | | | | | | | | |

Aegean Marine Petroleum Network 2 | | | 1,250 | | | | 5,375 | |

†JUMBO | | | 5,900 | | | | 105,302 | |

Sarantis | | | 2,900 | | | | 43,954 | |

| |

| Total (Cost $151,794) | | | | | | | 154,631 | |

| |

| | | | | | | | | |

| HONG KONG – 1.4% | | | | | | | | |

†Dah Sing Financial Holdings | | | 19,900 | | | | 127,375 | |

HKBN | | | 100,000 | | | | 126,456 | |

I.T | | | 182,900 | | | | 77,947 | |

†International Housewares Retail | | | 380,000 | | | | 75,825 | |

Oriental Watch Holdings | | | 232,950 | | | | 53,053 | |

†Perfect Shape Beauty Technology | | | 600,000 | | | | 96,150 | |

Pico Far East Holdings | | | 376,300 | | | | 149,308 | |

Television Broadcasts | | | 54,000 | | | | 194,651 | |

†Texhong Textile Group | | | 47,600 | | | | 61,770 | |

†Tongda Group Holdings | | | 224,100 | | | | 57,295 | |

Value Partners Group | | | 712,600 | | | | 754,107 | |

†Xinyi Glass Holdings | | | 71,100 | | | | 92,627 | |

| |

| Total (Cost $1,725,861) | | | | | | | 1,866,564 | |

| |

| | | | | | | | | |

| INDIA – 3.4% | | | | | | | | |

Bajaj Finance | | | 50,000 | | | | 1,378,247 | |

†Borosil Glass Works | | | 3,400 | | | | 51,996 | |

CCL Products India | | | 10,600 | | | | 49,786 | |

†Dewan Housing Finance | | | 6,500 | | | | 59,127 | |

†Edelweiss Financial Services | | | 19,300 | | | | 89,714 | |

†Hinduja Global Solutions | | | 3,500 | | | | 49,145 | |

IIFL Holdings | | | 2,750 | | | | 28,899 | |

†Indo Count Industries | | | 42,200 | | | | 82,071 | |

Manappuram Finance | | | 70,100 | | | | 134,633 | |

†Mphasis | | | 2,400 | | | | 27,113 | |

†Multi Commodity Exchange of India | | | 5,300 | | | | 75,775 | |

†NIIT 1 | | | 35,400 | | | | 56,948 | |

†Radico Khaitan | | | 13,900 | | | | 63,872 | |

†Redington India | | | 30,000 | | | | 82,433 | |

SH Kelkar & Company | | | 175,000 | | | | 810,260 | |

†Shriram Transport Finance | | | 2,400 | | | | 55,232 | |

†Vakrangee | | | 100,000 | | | | 655,634 | |

†Vakrangee (Bonus Shares) 1 | | | 100,000 | | | | 656,457 | |

| |

| Total (Cost $2,336,170) | | | | | | | 4,407,342 | |

| |

| | | | | | | | | |

| INDONESIA – 0.5% | | | | | | | | |

†Media Nusantara Citra | | | 378,800 | | | | 35,875 | |

†Mitra Pinasthika Mustika | | | 1,000,000 | | | | 71,507 | |

Selamat Sempurna | | | 5,800,000 | | | | 536,338 | |

| |

| Total (Cost $647,283) | | | | | | | 643,720 | |

| |

| | | | | | | | | |

| IRELAND – 0.6% | | | | | | | | |

Irish Residential Properties REIT | | | 20,000 | | | | 36,149 | |

Keywords Studios | | | 37,500 | | | | 804,977 | |

| |

| Total (Cost $113,998) | | | | | | | 841,126 | |

| |

| | | | | | | | | |

| ISRAEL – 0.7% | | | | | | | | |

†Frutarom Industries | | | 7,500 | | | | 703,945 | |

Nova Measuring Instruments 1,2,3 | | | 5,500 | | | | 142,505 | |

Sarine Technologies | | | 12,850 | | | | 9,606 | |

| |

| Total (Cost $635,614) | | | | | | | 856,056 | |

| |

| | | | | | | | | |

| ITALY – 0.8% | | | | | | | | |

†Anima Holding | | | 7,400 | | | | 52,852 | |

DiaSorin | | | 8,500 | | | | 754,250 | |

†Openjobmetis 1 | | | 11,900 | | | | 183,850 | |

| |

| Total (Cost $573,963) | | | | | | | 990,952 | |

| |

| | | | | | | | | |

| JAPAN – 9.3% | | | | | | | | |

Ai Holdings | | | 45,000 | | | | 1,088,184 | |

†As One | | | 15,000 | | | | 937,542 | |

†Ateam | | | 4,700 | | | | 112,861 | |

C. Uyemura & Co. | | | 1,100 | | | | 83,894 | |

EPS Holdings | | | 2,500 | | | | 56,456 | |

†Financial Products Group | | | 5,700 | | | | 69,150 | |

G-Tekt | | | 3,400 | | | | 69,930 | |

†H.I.S. | | | 1,100 | | | | 39,835 | |

†IDOM | | | 16,800 | | | | 119,037 | |

†Investors Cloud | | | 9,000 | | | | 133,702 | |

Itochu Techno-Solutions | | | 2,900 | | | | 125,697 | |

Kenedix | | | 13,450 | | | | 81,970 | |

Kenko Mayonnaise | | | 1,650 | | | | 59,678 | |

†Kyowa Exeo | | | 5,000 | | | | 129,457 | |

Leopalace21 | | | 11,500 | | | | 89,423 | |

Mandom Corporation | | | 2,800 | | | | 91,514 | |

Meitec Corporation | | | 26,400 | | | | 1,389,867 | |

Nihon Kohden | | | 37,500 | | | | 870,463 | |

Nitto Kohki | | | 3,100 | | | | 78,630 | |

NS Solutions | | | 6,800 | | | | 185,358 | |

†NSD | | | 3,600 | | | | 76,616 | |

Open House | | | 2,400 | | | | 128,882 | |

†Osaka Soda | | | 2,540 | | | | 65,003 | |

Outsourcing | | | 5,500 | | | | 100,161 | |

Pressance | | | 1,850 | | | | 24,684 | |

Relo Group | | | 40,000 | | | | 1,089,485 | |

Ryobi | | | 1,040 | | | | 29,554 | |

Santen Pharmaceutical | | | 55,000 | | | | 863,488 | |

Shimano | | | 3,500 | | | | 492,452 | |

SPARX Group | | | 27,550 | | | | 76,166 | |

Sugi Holdings | | | 17,500 | | | | 892,480 | |

Sun Frontier Fudousan | | | 12,000 | | | | 136,290 | |

Takara Leben | | | 12,600 | | | | 55,638 | |

Tenpos Busters | | | 5,800 | | | | 111,087 | |

Tokai Corporation | | | 4,400 | | | | 100,413 | |

†Tokuyama Corporation | | | 1,980 | | | | 64,389 | |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | | 2017 Annual Report to Stockholders | 11 |

| |

| Schedule of Investments (continued) | | | | | | | | |

| | | | | | | | | |

| | | | SHARES | | | | VALUE | |

| |

| | | | | | | | | |

| JAPAN (continued) | | | | | | | | |

Trancom | | | 2,400 | | | $ | 168,742 | |

USS | | | 67,500 | | | | 1,427,970 | |

†Yumeshin Holdings | | | 15,300 | | | | 147,537 | |

†Zenkoku Hosho | | | 5,100 | | | | 219,685 | |

| |

| Total (Cost $9,037,116) | | | | | | | 12,083,370 | |

| |

| | | | | | | | | |

| MALAYSIA – 0.1% | | | | | | | | |

CB Industrial Product Holding | | | 151,200 | | | | 67,238 | |

| |

| Total (Cost $70,731) | | | | | | | 67,238 | |

| |

| | | | | | | | | |

| MEXICO – 0.7% | | | | | | | | |

†Becle 1 | | | 200,000 | | | | 321,424 | |

Bolsa Mexicana de Valores | | | 268,700 | | | | 462,034 | |

†Nemak | | | 57,700 | | | | 41,876 | |

Rassini | | | 31,700 | | | | 112,870 | |

| |

| Total (Cost $1,010,617) | | | | | | | 938,204 | |

| |

| | | | | | | | | |

| MONGOLIA – 0.0% | | | | | | | | |

†Mongolian Mining 1 | | | 862,000 | | | | 23,193 | |

| |

| Total (Cost $34,260) | | | | | | | 23,193 | |

| |

| | | | | | | | | |

| NETHERLANDS – 0.2% | | | | | | | | |

†AMG Advanced Metallurgical Group | | | 3,300 | | | | 165,779 | |

†DP Eurasia 1 | | | 24,400 | | | | 70,834 | |

| |

| Total (Cost $166,721) | | | | | | | 236,613 | |

| |

| | | | | | | | | |

| NEW ZEALAND – 1.6% | | | | | | | | |

Fisher & Paykel Healthcare | | | 102,875 | | | | 1,043,223 | |

New Zealand Refining | | | 21,550 | | | | 40,457 | |

†Trade Me Group | | | 300,000 | | | | 1,031,081 | |

| |

| Total (Cost $1,587,857) | | | | | | | 2,114,761 | |

| |

| | | | | | | | | |

| NORWAY – 1.9% | | | | | | | | |

Kongsberg Automotive 1 | | | 63,000 | | | | 90,043 | |

Nordic Semiconductor 1 | | | 10,750 | | | | 54,972 | |

NRC Group | | | 5,450 | | | | 40,821 | |

†Protector Forsikring | | | 8,950 | | | | 98,104 | |

TGS-NOPEC Geophysical | | | 92,500 | | | | 2,188,077 | |

| |

| Total (Cost $2,098,720) | | | | | | | 2,472,017 | |

| |

| | | | | | | | | |

| PERU – 0.1% | | | | | | | | |

†Ferreycorp | | | 93,200 | | | | 73,295 | |

| |

| Total (Cost $56,092) | | | | | | | 73,295 | |

| |

| | | | | | | | | |

| PHILIPPINES – 0.1% | | | | | | | | |

†Pryce Corporation 1 | | | 563,600 | | | | 76,407 | |

†Robinsons Retail Holdings | | | 44,500 | | | | 85,834 | |

| |

| Total (Cost $150,761) | | | | | | | 162,241 | |

| |

| | | | | | | | | |

| POLAND – 0.3% | | | | | | | | |

Warsaw Stock Exchange | | | 33,000 | | | | 445,467 | |

| |

| Total (Cost $459,764) | | | | | | | 445,467 | |

| |

| | | | | | | | | |

| PORTUGAL – 0.1% | | | | | | | | |

†Sonae SGPS | | | 60,000 | | | | 80,897 | |

| |

| Total (Cost $77,642) | | | | | | | 80,897 | |

| |

| | | | | | | | | |

| RUSSIA – 0.3% | | | | | | | | |

Globaltrans Investment GDR | | | 45,500 | | | | 427,257 | |

| |

| Total (Cost $239,644) | | | | | | | 427,257 | |

| |

| | | | | | | | | |

| SINGAPORE – 1.3% | | | | | | | | |

CSE Global | | | 535,150 | | | | 145,955 | |

†Duty Free International | | | 466,600 | | | | 92,453 | |

†Duty Free International (Warrants) 1 | | | 80,440 | | | | 481 | |

Sheng Siong Group | | | 141,800 | | | | 98,033 | |

†Tat Hong Holdings 1 | | | 200,000 | | | | 67,285 | |

XP Power | | | 24,000 | | | | 1,110,975 | |

†Yanlord Land Group | | | 143,000 | | | | 173,184 | |

| |

| Total (Cost $1,206,718) | | | | | | | 1,688,366 | |

| |

| | | | | | | | | |

| SOUTH AFRICA – 0.7% | | | | | | | | |

Adcock Ingram Holdings | | | 12,050 | | | | 56,817 | |

Coronation Fund Managers | | | 59,000 | | | | 351,790 | |

JSE | | | 15,000 | | | | 186,532 | |

†MiX Telematics ADR | | | 11,500 | | | | 146,740 | |

Nampak 1 | | | 77,200 | | | | 101,172 | |

Raubex Group | | | 52,250 | | | | 84,313 | |

| |

| Total (Cost $878,826) | | | | | | | 927,364 | |

| |

| | | | | | | | | |

| SOUTH KOREA – 0.8% | | | | | | | | |

Eugene Technology | | | 4,400 | | | | 86,296 | |

†Hansol Chemical | | | 900 | | | | 60,851 | |

Hanssem | | | 500 | | | | 84,071 | |

†Huchems Fine Chemical | | | 4,200 | | | | 96,240 | |

†Interojo Company | | | 2,958 | | | | 107,355 | |

†KIWOOM Securities | | | 700 | | | | 57,240 | |

Koh Young Technology | | | 2,600 | | | | 199,896 | |

†Loen Entertainment | | | 600 | | | | 63,049 | |

Modetour Network | | | 3,000 | | | | 85,426 | |

Samjin Pharmaceutical | | | 2,800 | | | | 93,693 | |

†SK Materials | | | 500 | | | | 84,033 | |

†Tera Semicon | | | 3,100 | | | | 80,722 | |

| |

| Total (Cost $897,954) | | | | | | | 1,098,872 | |

| |

| | | | | | | | | |

| SPAIN – 0.4% | | | | | | | | |

Atento 2 | | | 49,900 | | | | 506,485 | |

| |

| Total (Cost $501,699) | | | | | | | 506,485 | |

| |

| | | | | | | | | |

| SRI LANKA – 0.1% | | | | | | | | |

†National Development Bank | | | 71,600 | | | | 63,528 | |

†Sunshine Holdings | | | 158,150 | | | | 56,666 | |

| |

| Total (Cost $123,254) | | | | | | | 120,194 | |

| |

| | | | | | | | | |

| SWEDEN – 2.9% | | | | | | | | |

Addtech Cl. B | | | 61,460 | | | | 1,342,561 | |

Bravida Holding | | | 120,000 | | | | 801,170 | |

Byggmax Group | | | 12,200 | | | | 81,737 | |

Dustin Group | | | 8,250 | | | | 81,887 | |

†Hexpol | | | 100,000 | | | | 1,013,586 | |

Hoist Finance | | | 8,800 | | | | 98,859 | |

Knowit | | | 7,000 | | | | 132,469 | |

†Momentum Group 1 | | | 6,300 | | | | 89,439 | |

Proact IT Group | | | 8,100 | | | | 178,282 | |

| |

| Total (Cost $3,160,407) | | | | | | | 3,819,990 | |

| |

| | | | | | | | | |

| SWITZERLAND – 4.1% | | | | | | | | |

Burkhalter Holding | | | 10,000 | | | | 1,302,182 | |

LEM Holding | | | 500 | | | | 847,591 | |

Partners Group Holding | | | 1,800 | | | | 1,233,425 | |

VZ Holding | | | 5,600 | | | | 1,899,445 | |

| |

| Total (Cost $3,539,666) | | | | | | | 5,282,643 | |

| |

| 12 | 2017 Annual Report to Stockholders | | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| |

| Schedule of Investments (continued) | | | | | | | | |

| | | | | | | | | |

| | | | SHARES | | | | VALUE | |

| |

| | | | | | | | | |

| TAIWAN – 1.0% | | | | | | | | |

Egis Technology 1 | | | 12,000 | | | $ | 91,366 | |

Flytech Technology | | | 16,390 | | | | 45,116 | |

†Formosa Laboratories | | | 29,050 | | | | 67,333 | |

Gourmet Master | | | 11,030 | | | | 160,976 | |

Posiflex Technology | | | 8,874 | | | | 40,604 | |

†Sinmag Equipment | | | 20,900 | | | | 119,390 | |

Sitronix Technology | | | 51,400 | | | | 144,746 | |

Sporton International | | | 33,781 | | | | 182,119 | |

Taiwan Paiho | | | 56,400 | | | | 229,287 | |

TCI | | | 16,470 | | | | 159,122 | |

†Tehmag Foods | | | 6,000 | | | | 47,371 | |

| |

| Total (Cost $1,109,346) | | | | | | | 1,287,430 | |

| |

| | | | | | | | | |

| THAILAND – 0.1% | | | | | | | | |

†Beauty Community | | | 57,200 | | | | 36,649 | |

†Erawan Group (The) | | | 130,000 | | | | 34,681 | |

†Forth Smart Service | | | 102,400 | | | | 55,414 | |

†Plan B Media | | | 300,000 | | | | 58,786 | |

| |

| Total (Cost $163,239) | | | | | | | 185,530 | |

| |

| | | | | | | | | |

| TURKEY – 0.2% | | | | | | | | |

†Soda Sanayii | | | 112,200 | | | | 149,155 | |

Tat Gida Sanayi | | | 72,350 | | | | 101,303 | |

| |

| Total (Cost $297,753) | | | | | | | 250,458 | |

| |

| | | | | | | | | |

| UNITED ARAB EMIRATES – 0.1% | | | | | | | | |

†ADES International Holding 1 | | | 5,600 | | | | 75,224 | |

| |

| Total (Cost $75,713) | | | | | | | 75,224 | |

| |

| | | | | | | | | |

| UNITED KINGDOM – 12.0% | | | | | | | | |

Abcam | | | 25,000 | | | | 355,755 | |

†Alliance Pharma | | | 100,000 | | | | 90,542 | |

Ashmore Group | | | 279,000 | | | | 1,525,650 | |

Avon Rubber | | | 3,000 | | | | 49,423 | |

†Berkeley Energia 1 | | | 61,600 | | | | 49,152 | |

†Biffa | | | 23,600 | | | | 83,480 | |

Character Group | | | 5,700 | | | | 34,221 | |

Clarkson | | | 38,100 | | | | 1,471,066 | |

Connect Group | | | 117,650 | | | | 177,755 | |

Consort Medical | | | 61,150 | | | | 963,300 | |

Conviviality | | | 30,800 | | | | 167,531 | |

Diploma | | | 25,000 | | | | 419,840 | |

†DiscoverIE Group | | | 17,500 | | | | 87,112 | |

dotdigital group | | | 117,200 | | | | 164,818 | |

Elementis | | | 200,000 | | | | 777,933 | |

Epwin Group | | | 72,750 | | | | 82,301 | |

Equiniti Group | | | 225,000 | | | | 867,338 | |

Ferroglobe 1 | | | 41,100 | | | | 665,820 | |

Ferroglobe (Warranty Insurance Trust) 1,4 | | | 41,100 | | | | 0 | |

Fidessa Group | | | 20,000 | | | | 683,198 | |

Finsbury Food Group | | | 41,000 | | | | 59,786 | |

†Gattaca | | | 6,000 | | | | 24,684 | |

Hilton Food Group | | | 16,100 | | | | 187,061 | |

ITE Group | | | 375,000 | | | | 919,538 | |

Jupiter Fund Management | | | 36,000 | | | | 305,305 | |

†Macfarlane Group | | | 45,500 | | | | 47,778 | |

Norcros | | | 47,360 | | | | 114,072 | |

Pendragon | | | 139,300 | | | | 53,652 | |

Polypipe Group | | | 60,000 | | | | 318,271 | |

Rank Group | | | 20,000 | | | | 64,947 | |

Real Estate Investors | | | 45,000 | | | | 35,519 | |

†Restore | | | 6,900 | | | | 54,812 | |

†River and Mercantile Group | | | 15,000 | | | | 72,329 | |

Rotork | | | 195,000 | | | | 700,480 | |

†RPC Group | | | 3,000 | | | | 35,488 | |

Severfield | | | 87,200 | | | | 94,292 | |

†SIG | | | 46,400 | | | | 110,301 | |

Spirax-Sarco Engineering | | | 19,000 | | | | 1,437,977 | |

†Staffline Group | | | 2,600 | | | | 36,500 | |

Stallergenes Greer 1 | | | 10,800 | | | | 498,997 | |

†STV Group | | | 17,500 | | | | 76,727 | |

†Topps Tiles | | | 90,000 | | | | 97,114 | |

Victrex | | | 32,500 | | | | 1,157,567 | |

†Wincanton | | | 17,000 | | | | 54,293 | |

Xaar | | | 90,000 | | | | 449,175 | |

| |

| Total (Cost $13,586,516) | | | | | | | 15,722,900 | |

| |

| | | | | | | | | |

| UNITED STATES – 27.5% | | | | | | | | |

Air Lease Cl. A | | | 24,560 | | | | 1,181,090 | |

Brooks Automation 2 | | | 18,100 | | | | 431,685 | |

Century Casinos 1 | | | 5,000 | | | | 45,650 | |

CIRCOR International | | | 18,100 | | | | 881,108 | |

Cognex Corporation | | | 10,748 | | | | 657,348 | |

Coherent 1 | | | 3,000 | | | | 846,660 | |

Copart 1 | | | 19,800 | | | | 855,162 | |

Diebold Nixdorf 2 | | | 28,800 | | | | 470,880 | |

Diodes 1 | | | 20,500 | | | | 587,735 | |

†Dorian LPG 1 | | | 4,475 | | | | 36,784 | |

DST Systems | | | 15,800 | | | | 980,706 | |

EnerSys 2 | | | 11,000 | | | | 765,930 | |

Expeditors International of Washington 2 | | | 13,300 | | | | 860,377 | |

FLIR Systems 2 | | | 42,400 | | | | 1,976,688 | |

Innospec 2 | | | 12,457 | | | | 879,464 | |

Kadant | | | 7,800 | | | | 783,120 | |

KBR 2 | | | 58,700 | | | | 1,164,021 | |

Kirby Corporation 1,2,3 | | | 32,900 | | | | 2,197,720 | |

Lazard Cl. A | | | 32,600 | | | | 1,711,500 | |

Lindsay Corporation | | | 13,700 | | | | 1,208,340 | |

Littelfuse | | | 4,000 | | | | 791,280 | |

ManpowerGroup | | | 8,800 | | | | 1,109,768 | |

MBIA 1,2,3 | | | 80,300 | | | | 587,796 | |

Nanometrics 1,2,3 | | | 35,600 | | | | 887,152 | |

National Instruments 2,3 | | | 15,200 | | | | 632,776 | |

Oaktree Capital Group LLC Cl. A | | | 10,400 | | | | 437,840 | |

Popular | | | 13,100 | | | | 464,919 | |

Quaker Chemical 2,3 | | | 6,069 | | | | 915,145 | |

Raven Industries | | | 40,000 | | | | 1,374,000 | |

Rogers Corporation 1,2,3 | | | 4,800 | | | | 777,216 | |

SEACOR Holdings | | | 20,200 | | | | 933,644 | |

†SEACOR Marine Holdings 1 | | | 20,309 | | | | 237,615 | |

SEI Investments 2 | | | 34,500 | | | | 2,479,170 | |

Sensient Technologies 2,3 | | | 9,500 | | | | 694,925 | |

Signet Jewelers | | | 5,500 | | | | 311,025 | |

Standard Motor Products | | | 11,200 | | | | 502,992 | |

Sun Hydraulics 2 | | | 15,139 | | | | 979,342 | |

Tennant Company 2 | | | 11,600 | | | | 842,740 | |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | | 2017 Annual Report to Stockholders | 13 |

| Royce Global Value Trust | | December 31, 2017 |

| |

| Schedule of Investments (continued) | | | | | | | | |

| | | | | | | | | |

| | | | SHARES | | | | VALUE | |

| |

| | | | | | | | | |

| UNITED STATES (continued) | | | | | | | | |

Valmont Industries | | | 4,500 | | | $ | 746,325 | |

Virtu Financial Cl. A 2 | | | 74,300 | | | | 1,359,690 | |

World Fuel Services | | | 12,000 | | | | 337,680 | |

| |

| Total (Cost $27,056,544) | | | | | | | 35,925,008 | |

| |

| | | | | | | | | |

| URUGUAY – 0.4% | | | | | | | | |

†Arcos Dorados Holdings Cl. A 1 | | | 46,800 | | | | 484,380 | |

†Biotoscana Investments BDR 1 | | | 8,900 | | | | 55,128 | |

| |

| Total (Cost $416,576) | | | | | | | 539,508 | |

| |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| |

| (Cost $101,140,825) | | | | | | | 129,022,745 | |

| |

| | | | | | | | | |

| REPURCHASE AGREEMENT – 7.2% | | | | | | | | |

Fixed Income Clearing Corporation, 0.20% dated 12/29/17, due 1/2/18, maturity value

$9,331,207 (collateralized by obligations of various U.S. Government Agencies, 0.875%

due 5/15/19, valued at $9,521,062) | | | | | | | | |

| |

| Cost $9,331,000) | | | | | | | 9,331,000 | |

| |

| | | | | | | | | |

| TOTAL INVESTMENTS – 106.0% | | | | | | | | |

| |

| (Cost $110,471,825) | | | | | | | 138,353,745 | |

| |

| | | | | | | | | |

| LIABILITIES LESS CASH AND OTHER ASSETS – (6.0)% | | | | | | | (7,827,563 | ) |

| | | | | | | | |

| | | | | | | | | |

| |

| NET ASSETS – 100.0% | | | | | | $ | 130,526,182 | |

| |

| † | New additions in 2017. |

| 1 | Non-income producing. |

| 2 | All or a portion of these securities were pledged as collateral in connection with the Fund’s revolving credit agreement at December 31, 2017. Total market value of pledged securities at December 31, 2017, was $14,399,588. |

| 3 | At December 31, 2017, a portion of these securities were rehypothecated in connection with the Fund’s revolving credit agreement in the aggregate amount of $5,610,341. |

| 4 | A security for which market quotations are not readily available represents 0.0% of net assets. This security has been valued at its fair value under procedures approved by the Fund’s Board of Directors. This security is defined as a Level 3 security due to the use of significant unobservable inputs in the determination of fair value. See Notes to Financial Statements. |

| | |

| | Securities of Global/International Funds are categorized by the country of their headquarters, with the exception of exchange-traded funds.

Bold indicates the Fund’s 20 largest equity holdings in terms of December 31, 2017, market value. |

| | |

| | TAX INFORMATION: The cost of total investments for Federal income tax purposes was $111,882,790. At December 31, 2017, net unrealized appreciation for all securities was $26,470,955 consisting of aggregate gross unrealized appreciation of $30,869,278 and aggregate gross unrealized depreciation of $4,398,323. The primary causes of the differences between book and tax basis cost are the timing of the recognition of losses on securities sold, investments in publicly traded partnerships and Trusts and mark-to-market of Passive Foreign Investment Companies. |

| 14 | 2017 Annual Report to Stockholders | | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| Royce Global Value Trust | | December 31, 2017 |

| |

| Statement of Assets and Liabilities | | | | |

| | | | | |

| ASSETS: | | | | |

| Investments at value | | $ | 129,022,745 | |

| |

| Repurchase agreements (at cost and value) | | | 9,331,000 | |

| |

| Cash and foreign currency | | | 597 | |

| |

| Receivable for investments sold | | | 555,458 | |

| |

| Receivable for dividends and interest | | | 203,693 | |

| |

| Prepaid expenses and other assets | | | 41,098 | |

| |

| Total Assets | | | 139,154,591 | |

| |

| LIABILITIES: | | | | |

| Revolving credit agreement | | | 8,000,000 | |

| |

| Payable for investments purchased | | | 244,677 | |

| |

| Payable for investment advisory fee | | | 136,108 | |

| |

| Payable for directors’ fees | | | 6,967 | |

| |

| Payable for interest expense | | | 2,351 | |

| |

| Accrued expenses | | | 78,472 | |

| |

| Deferred capital gains tax | | | 159,834 | |

| |

| Total Liabilities | | | 8,628,409 | |

| |

| Net Assets | | $ | 130,526,182 | |

| |

| ANALYSIS OF NET ASSETS: | | | | |

| Paid-in capital - $0.001 par value per share; 10,461,711 shares outstanding (150,000,000 shares authorized) | | $ | 117,980,744 | |

| |

| Undistributed net investment income (loss) | | | (1,199,309 | ) |

| |

| Accumulated net realized gain (loss) on investments and foreign currency | | | (13,980,873 | ) |

| |

| Net unrealized appreciation (depreciation) on investments and foreign currency | | | 27,725,620 | |

| |

| Net Assets (net asset value per share - $12.48) | | $ | 130,526,182 | |

| |

| Investments at identified cost | | $ | 101,140,825 | |

| |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | | 2017 Annual Report to Stockholders | 15 |

| |

| Statement of Changes in Net Assets | | | | | | | | |

| | | | | | | | | |

| | | YEAR ENDED 12/31/17 | | YEAR ENDED 12/31/16 |

| |

| | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | | | | |

| Net investment income (loss) | | $ | 241,105 | | | $ | 651,129 | |

| |

| Net realized gain (loss) on investments and foreign currency | | | 6,555,345 | | | | (1,449,508 | ) |

| |

| Net change in unrealized appreciation (depreciation) on investments and foreign currency | | | 24,156,512 | | | | 10,740,946 | |

| |

| Net increase (decrease) in net assets from investment operations | | | 30,952,962 | | | | 9,942,567 | |

| |

| DISTRIBUTIONS: | | | | | | | | |

| Net investment income | | | (1,145,697 | ) | | | (1,435,789 | ) |

| |

| Net realized gain on investments and foreign currency | | | – | | | | – | |

| |

| Return of capital | | | – | | | | (12,497 | ) |

| |

| Total distributions | | | (1,145,697 | ) | | | (1,448,286 | ) |

| |

| CAPITAL STOCK TRANSACTIONS: | | | | | | | | |

| Reinvestment of distributions | | | 491,130 | | | | 559,946 | |

| |

| Total capital stock transactions | | | 491,130 | | | | 559,946 | |

| |

| Net Increase (Decrease) In Net Assets | | | 30,298,395 | | | | 9,054,227 | |

| |

| NET ASSETS: | | | | | | | | |

| |

| Beginning of year | | | 100,227,787 | | | | 91,173,560 | |

| |

| End of year (including undistributed net investment income (loss) of $(1,199,309) at 12/31/17 and $(672,740) at 12/31/16) | | $ | 130,526,182 | | | $ | 100,227,787 | |

| |

| 16 | 2017 Annual Report to Stockholders | | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| Royce Global Value Trust | | Year Ended December 31, 2017 |

| |

| Statement of Operations | | | | |

| | | | | |

| INVESTMENT INCOME: | | | | |

| INCOME: | | | | |

| Dividends | | $ | 2,315,787 | |

| |

| Foreign withholding tax | | | (143,344 | ) |

| |

| Interest | | | 6,626 | |

| |

| Rehypothecation income | | | 4,306 | |

| |

| Total income | | | 2,183,375 | |

| |

| EXPENSES: | | | | |

| |

| Investment advisory fees | | | 1,450,623 | |

| |

| Interest expense | | | 179,613 | |

| |

| Custody and transfer agent fees | | | 111,286 | |

| |

| Professional fees | | | 66,067 | |

| |

| Stockholder reports | | | 61,312 | |

| |

| Administrative and office facilities | | | 28,644 | |

| |

| Directors’ fees | | | 28,487 | |

| |

| Other expenses | | | 16,360 | |

| |

| Total expenses | | | 1,942,392 | |

| |

| Compensating balance credits | | | (122 | ) |

| |

| Net expenses | | | 1,942,270 | |

| |

| Net investment income (loss) | | | 241,105 | |

| |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | | | | |

| |

| NET REALIZED GAIN (LOSS): | | | | |

| |

| Investments | | | 6,558,027 | |

| |

| Foreign currency transactions | | | (2,682 | ) |

| |

| NET CHANGE IN UNREALIZED APPRECIATION (DEPRECIATION): | | | | |

| |

| Investments and foreign currency translations | | | 24,234,510 | |

| |

| Other assets and liabilities denominated in foreign currency | | | (77,998 | ) |

| |

| Net realized and unrealized gain (loss) on investments and foreign currency | | | 30,711,857 | |

| |

| NET INCREASE (DECREASE) IN NET ASSETS FROM INVESTMENT OPERATIONS | | $ | 30,952,962 | |

| |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | | 2017 Annual Report to Stockholders | 17 |

| Royce Global Value Trust | | Year Ended December 31, 2017 |

| |

| Statement of Cash Flows | | | | |

| | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

| Net increase (decrease) in net assets from investment operations | | $ | 30,952,962 | |

| |

| Adjustments to reconcile net increase (decrease) in net assets from investment operations to net cash provided by operating activities: | | | | |

| |

Purchases of long-term investments | | | (40,717,589 | ) |

| |

Proceeds from sales and maturities of long-term investments | | | 43,446,710 | |

| |

Net purchases, sales and maturities of short-term investments | | | (2,541,000 | ) |

| |

Net (increase) decrease in dividends and interest receivable and other assets | | | (29,607 | ) |

| |

Net increase (decrease) in interest expense payable, accrued expenses and other liabilities | | | 134,385 | |

| |

Net change in unrealized appreciation (depreciation) on investments | | | (24,234,510 | ) |

| |

Net realized gain (loss) on investments and foreign currency | | | (6,555,345 | ) |

| |

| Net cash provided by operating activities | | | 456,006 | |

| |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| |

| Distributions | | | (1,145,697 | ) |

| |

| Reinvestment of distributions | | | 491,130 | |

| |

| Net cash used for financing activities | | | (654,567 | ) |

| |

| INCREASE (DECREASE) IN CASH: | | | (198,561 | ) |

| |

| Cash and foreign currency at beginning of year | | | 199,158 | |

| |

| Cash and foreign currency at end of year | | $ | 597 | |

| |

| 18 | 2017 Annual Report to Stockholders | | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| |

| Financial Highlights |

| This table is presented to show selected data for a share outstanding throughout each year or other indicated period, and to assist stockholders in evaluating the Fund’s performance for the periods presented. |

| | | YEARS ENDED | | PERIOD ENDED |

| | | | | | | |

| | | 12/31/17 | | 12/31/16 | | 12/31/15 | | 12/31/14 | | 12/31/131 |

| |

| Net Asset Value, Beginning of Period | | $ | 9.62 | | | $ | 8.81 | | | $ | 9.25 | | | $ | 10.05 | | | $ | 9.78 | |

| |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.02 | | | | 0.06 | | | | 0.10 | | | | 0.13 | | | | (0.00 | ) |

| |

| Net realized and unrealized gain (loss) on investments and foreign currency | | | 2.96 | | | | 0.90 | | | | (0.43 | ) | | | (0.77 | ) | | | 0.27 | |

| |

| Net increase (decrease) in net assets from investment operations | | | 2.98 | | | | 0.96 | | | | (0.33 | ) | | | (0.64 | ) | | | 0.27 | |

| |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |