![[infocirc001.jpg]](https://capedge.com/proxy/6-K/0001137171-11-000130/infocirc001.jpg)

INFORMATION CIRCULAR

MANAGEMENT SOLICITATION OF PROXIES

This Information Circular is furnished in connection with the solicitation of proxies by and on behalf of the management of CE Franklin Ltd. (the "Corporation" or "CE Franklin") to be voted at the Annual General Meeting (the "Meeting") of the holders ("Shareholders or CE Franklin Shareholders") of common shares ("Common Shares or CE Franklin Shares") of the Corporation to be held on Wednesday, April 27, 2011 at 2:30 p.m. (Calgary time) in Cardium Rooms A and B at the Calgary Petroleum Club, 319 – 5th Avenue S.W., Calgary, Alberta, and at any adjournment thereof, for the purposes set forth in the accompanying Notice of Meeting. The solicitation is intended to be primarily by mail; however, proxies may also be solicited by telephone, facsimile transmission and other electronic means, or in person. The cost of solicitation will be borne by the Corporation. Except where otherwise stated, the information contained herein is given as of the 7th day of March, 2011.

RECORD DATE

The record date for the determination of CE Franklin Shareholders entitled to receive notice of and to vote at the Meeting is March 9, 2011. CE Franklin Shareholders whose names have been entered in the share register at the close of business on that date will be entitled to receive notice of and to vote at the Meeting, provided that, to the extent a Shareholder transfers the ownership of any of the shareholder's shares after such date and the transferee of those shares establishes ownership of the shares and demands, not later than 10 days before the Meeting, to be included in the list of CE Franklin Shareholders eligible to vote at the Meeting, said transferee will be entitled to vote those shares at the Meeting.

APPOINTMENT AND REVOCATION OF PROXIES

The persons named in the enclosed form of proxy are directors and/or officers of the Corporation and have indicated their willingness to represent as proxy the Shareholders who appoint them. A Shareholder has the right to appoint a nominee other than the persons designated in the enclosed form of proxy to represent him at the Meeting by inserting the name of his chosen nominee (who need not be a Shareholder) in the space provided for that purpose on the form or by completing another proper form of proxy. Such a Shareholder should notify the nominee of his appointment, obtain his consent to act as proxy and instruct him on how the Shareholder's shares are to be voted. In any case, the form of proxy should be dated and executed by the Shareholder or his attorney authorized in writing, a copy of which authorization should accompany the proxy.

A form of proxy will not be valid for the Meeting or any adjournment thereof unless it is completed and deposited at the offices of Computershare Trust Company of Canada, Attention: Proxy Department, 9th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1, fax (866) 249-7775 at least forty eight (48) hours before the time fixed for holding the Meeting or any adjournment thereof (excluding Saturdays, Sundays and statutory holidays in the Province of Alberta).

In addition to revocation in any other manner permitted by law, a registered Shareholder who has given a proxy may revoke it any time before it is exercised by instrument in writing executed by the registered Shareholder or by his attorney authorized in writing and deposited either at the registered office of the Corporation at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof, at which the proxy is to be used, or with the Chairman of the Meeting on the day of the Meeting, or any adjournment thereof, at which the proxy is to be used.

VOTING OF PROXIES

Each Shareholder may instruct his proxy how to vote his shares by completing the blanks on the form of proxy. Shares represented by properly executed forms of proxy will be voted or withheld from voting in accordance with the instructions or choices on any matter made on the forms of proxy on any vote or ballot that may be called for. In the absence of such instructions or choices on any matter, such shares will be voted FOR all matters set out in this Information Circular.

The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to amendments and variations to matters identified in the Notice of Meeting of Shareholders and with respect to any other matters which may properly come before the Meeting. The shares represented by the form of proxy will be voted on such matters in accordance with the best judgment of the person voting such shares. At the time of printing this Information Circular, management knows of no such amendments, variations or other matters to come before the Meeting.

BENEFICIAL CE FRANKLIN SHAREHOLDERS

The information set forth in this section is of significant importance to many CE Franklin Shareholders, as a substantial number of CE Franklin Shareholders do not hold CE Franklin Shares in their own name. CE Franklin Shareholders who do not hold CE Franklin Shares in their own name ("Beneficial Shareholders") should note that only proxies deposited by CE Franklin Shareholders whose names appear on the records of CE Franklin as the registered holders of CE Franklin Shares can be recognized and acted upon at the Meeting. If CE Franklin Shares are listed in an account statement provided to a CE Franklin Shareholder by a broker, then, in almost all cases, those shares will not be registered in the CE Franklin Shareholder's name on the records of the Corporation. Such shares will more likely be registered under the names of the CE Franklin Shareholder's broker or an agent of that broker. In Canada, the majority of such shares are registered under the name of CDS & Co. (the registration name for CDS Clearing and Depositary Services Inc., which acts as nominee for many Canadian brokerage firms). CE Franklin Shares held by brokers or their agents or nominees can only be voted (for or against resolutions) upon the instructions of the Beneficial Shareholder. Without specific instructions, brokers and their agents and nominees are prohibited from voting CE Franklin Shares for the brokers' clients.

If the form of proxy was received by a CE Franklin Shareholder, unsigned, from an intermediary holding CE Franklin Shares on behalf of a CE Franklin Shareholder, the signed proxy must be returned to such intermediary so that the intermediary can vote the CE Franklin Shares on the CE Franklin Shareholder's behalf.

Therefore, Beneficial Shareholders should ensure that instructions respecting the voting of their shares are communicated to the appropriate person. Applicable regulatory policy requires intermediaries/brokers to seek voting instructions from Beneficial Shareholders in advance of shareholders meetings. Every intermediary/broker has its own mailing procedures and provides its own return instructions to clients, which should be carefully followed by Beneficial Shareholders in order to ensure that their shares are voted at the applicable Meeting. The form of proxy supplied to a Beneficial Shareholder by its broker (or the agent of the broker) is similar to the form of proxy provided to registered Shareholders by CE Franklin. However, its purpose is limited to instructing the registered Shareholder (the broker or agent of the broker) how to vote on behalf of the Beneficial Shareholder. The majority of brokers now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. ("Broadridge"). Broadridge typically asks Beneficial Shareholders to return the proxy forms to Broadridge. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at the applicable meeting. A Beneficial Shareholder receiving a Broadridge proxy cannot use that proxy to vote CE Franklin shares directly at the Meeting - the proxy must be returned to Broadridge well in advance of the Meeting in order to have the CE Franklin Shares voted.

Although a Beneficial Shareholder may not be recognized directly at the Meeting for the purposes of voting shares registered in the name of his broker (or agent of the broker), a Beneficial Shareholder may attend at the Meeting as proxyholder for the registered CE Franklin Shareholder and vote the shares in that capacity. Beneficial Shareholders who wish to attend at the Meeting and indirectly vote their shares as proxyholder for the registered Shareholder should enter their own names in the blank space on the instrument of proxy provided to them and return the same to their broker (or the broker's agent) in accordance with the instructions provided by such broker (or agent), well in advance of the Meeting.

Page 2 of 24

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

The board of directors of the Corporation (the "Board") has fixed March 9, 2011 as the record date for determining Shareholders entitled to receive notice of the Meeting. A person shown as a Shareholder of record on March 9, 2011 will be entitled to vote the shares then registered in such Shareholder's name, except to the extent that (a) the Shareholder has transferred the ownership of any of such shares after that date, and (b) the transferee of those shares produces properly endorsed share certificates, or otherwise establishes that the transferee owns the shares and demands not later than ten days before the Meeting that the transferee's name be included in the list of persons entitled to vote at the Meeting, in which case the transferee will be entitled to vote such shares at the Meeting.

As at March 7, 2011, the Corporation had issued and outstanding 17,511,365 Common Shares, each such share entitling the holder to one vote in respect of each share held. To the knowledge of the Corporation's directors and officers, after reasonable inquiry, no person or group of persons beneficially owns, controls or directs, directly or indirectly, Common Shares carrying 10% or more of the voting rights attached to the Common Shares, except as specified below:

| | |

Name |

Number of CE Franklin Shares | Percentage of CE Franklin Shares |

Schlumberger Limited ("Schlumberger") | 9,729,582 | 55.6% |

Fidelity Management & Research Company(1) | 1,775,040 | 10.2% |

Note:

(1)

Based on Form 13G filed with the U.S. Securities and Exchange Commission (the "SEC") on February 11, 2011.

BUSINESS TO BE ACTED UPON AT THE MEETING

RECEIPT OF DECEMBER 31, 2010 FINANCIAL STATEMENTS

The audited financial statements for the financial year ended December 31, 2010 (the "Financial Statements") of CE Franklin have been mailed to all registered Shareholders and to those Beneficial Shareholders that had requested to receive them. The Financial Statements, together with the annual report of the Corporation for the year ended December 31, 2010 are available on the Canadian System for Electronic Document Analysis and Retrieval ("SEDAR") and can be accessed at www.sedar.com and on the Electronic Data Gathering, Analysis, and Retrieval system at the SEC website at www.sec.gov. No formal action will be taken at the Meeting to approve the Financial Statements, which have already been approved by the Board. If any Shareholders have questions respecting the Financial Statements, the questions may be brought forward at the Meeting.

ELECTION OF DIRECTORS

The Board presently consists of seven directors. It is proposed that seven directors be elected to serve until the next annual meeting of shareholders or until their successors are duly elected, unless their offices are earlier vacated. The term of office of the directors expires upon the end of the next annual meeting of shareholders or upon the election of their successors. The persons designated in the enclosed Form of Proxy, unless instructed otherwise, intend to vote for the election of the nominees set forth below. Management does not contemplate that any of the nominees will be unable to serve as a director; however, if that should occur for any reason prior to the Meeting, the persons designated in the enclosed form of proxy reserve the right to vote for other nominees in their discretion.

Page 3 of 24

Information is given below with respect to each nominee for election as a director.

| | | | | | | | | |

![[infocirc002.jpg]](https://capedge.com/proxy/6-K/0001137171-11-000130/infocirc002.jpg)

| Robert McClinton Age: 61 Calgary, Alberta, Canada Director since: May 2, 2006 Independent Chairman of the Board

| Mr. McClinton, a Chartered Accountant, has been an independent business consultant since April 2005. From September 2007 to October 2008, he served as CFO of CEP International Petroleum Ltd., a private company. Mr. McClinton was a major shareholder and President & CEO of BMP Energy Systems ("BMP") from 1992 to 2005, when BMP was sold to a public company. During the 10 years prior to joining BMP, Mr. McClinton served as director and senior financial officer of Canadian Turbo Inc. He began his career in 1969 with Deloitte & Touche in Northern Ireland. Mr. McClinton is a member of the Alberta and Canadian Institute of Chartered Accountants, and the Institute of Corporate Directors ("ICD"). |

Other Public Board/ Committee Memberships | None |

Board/Committee Membership: | Attendance(1)(3): | Value of Total Compensation Received(4) |

Board of Directors(Chairman)(2) Audit Committee Corporate Governance and Nominating Committee | 6 of 6 5 of 5 4 of 4 | 100% 100% 100% | 2009 2010 | 142,750 140,000 |

Securities Held(5) as at December31, 2010 (at a Market Value of $7.00 per Common Share as at December 31, 2010) |

Year |

Common Shares |

DSUs(6) | Total Market Value of Common Shares and DSUs(9) |

Meets Ownership Requirements(7) |

2009 | Nil | 26,246 | $185,297 | Yes |

2010 | Nil | 33,482 | $234,374 | Yes |

| | | | | | | | | |

![[infocirc004.jpg]](https://capedge.com/proxy/6-K/0001137171-11-000130/infocirc004.jpg)

| Michael J.C. Hogan Age: 54 Calgary, Alberta, Canada Director since: May 2, 2006 Independent

| Mr. Hogan is a business consultant. He is a Professional Engineer and a 30 year veteran of the electric power industry. Mr. Hogan is President and CEO of Enact Power Ltd., which provides business development support to companies pursuing electric power investment in Canada and internationally. From 1995 to 1998, he was President and CEO of SaskPower Commercial Inc., the international development arm of SaskPower. He is a member of the Association of Professional Engineers, Geologists, and Geophysicists of Alberta (APEGGA) and the ICD. Mr. Hogan has also completed the Director Education Program and holds the ICD.D designation. |

Other Public Board/ Committee Memberships | None |

Board/Committee Membership: | Attendance(1)(3): | Value of Total Compensation Received(4) |

Board of Directors Corporate Governance and Nominating Committee (Chair) Compensation Committee Quality, Health, Safety and Environment Committee | 6 of 6 4 of 4 2 of 2(8) 1 of 1(8) | 100% 100% 100% 100% | 2009 2010 | 107,500 109,500 |

Securities Held(5) as at December 31, 2010 (at a Market Value of $7.00 per Common Share as at December 31, 2010) |

Year |

Common Shares |

DSUs(6) | Total Market Value of Common Shares and DSUs(9) |

Meets Ownership Requirements(7) |

2009 | Nil | 25,292 | $178,562 | Yes |

2010 | Nil | 32,528 | $227,696 | Yes |

Page 4 of 24

| | | | | | | | | |

![[infocirc005.jpg]](https://capedge.com/proxy/6-K/0001137171-11-000130/infocirc005.jpg)

| John J. Kennedy Age: 58 Houston, Texas, United States Director since: July 14, 1999 Non-Independent

| Mr. Kennedy is President of Wilson, a distribution unit of Schlumberger. Previously, he was Senior Vice-President and CFO of Smith International, the prior parent of Wilson. Mr. Kennedy has worked in the energy industry for over 30 years in various executive and management positions. He is a member of the board of directors of the Petroleum Equipment Supplier Association and a member of several professional bodies in both the United Kingdom and the United States, including the Energy Institute, the Association of Corporate Treasurers,andthe ICD. |

Other Public Board/ Committee Memberships | None |

Board/Committee Membership: | Attendance(1)(3): | Value of Total Compensation Received(4) |

Board of Directors Compensation Committee Quality, Health, Safety and Environment Committee (Chair) | 6 of 6 3 of 3 2 of 2 | 100% 100% 100% | 2009 2010 | None None |

Securities Held(5) as at December 31, 2010 (at a Market Value of $7.00 per Common Share as at December 31, 2010) |

Year |

Common Shares |

DSUs(6) | Total Market Value of Common Shares and DSUs |

Meets Ownership Requirements(7) |

2009 | Nil | Nil | Nil | N/A |

2010 | Nil | Nil | Nil | N/A |

| | | | | | | | | |

![[infocirc006.jpg]](https://capedge.com/proxy/6-K/0001137171-11-000130/infocirc006.jpg)

| Kjell-Erik Oestdahl Age: 46 Stavanger, Norway Director since: October 28, 2010 Non-Independent | Mr. Oestdahl is Vice-President, Operations of Schlumberger. He holds a Master of Science degree in Electrical Engineering. Mr. Oestdahl joined the Schlumberger group of companies in 1990 as a field engineer in China and has held increasingly senior positions in operations, business development and marketing for Schlumberger Oilfield Services in Europe and North America. Mr. Oestdahl also worked as Chief Procurement Officer of StatoilHydro in 2007-2008. In Canada, he is a member of the ICD. |

Other Public Board/ Committee Memberships | None |

Board/Committee Membership: | Attendance(3): | Value of Total Compensation Received(4) |

Board of Directors Corporate Governance and Nominating Committee | 2 of 2 1 of 1 | 100% 100% | 2010 | None |

Securities Held(5) as at December 31, 2010 (at a Market Value of $7.00 per Common Share as at December 31, 2010) |

Year |

Common Shares |

DSUs(6) | Total Market Value of Common Shares and DSUs |

Meets Ownership Requirements(7) |

2010 | Nil | Nil | Nil | N/A |

| | | | | | | | | |

![[infocirc007.jpg]](https://capedge.com/proxy/6-K/0001137171-11-000130/infocirc007.jpg)

| Bradley J. Thomson Age: 54 Calgary, Alberta, Canada Director since: April 6, 2010 Independent

| Mr. Thomson is a business consultant. He is a Chartered Accountant with over 25 years of diverse experience as a senior executive and corporate director in the energy services industry, including natural gas marketing, trading and transportation, oilfield services, and electricity generation, transmission and telecommunications. From 2004 to 2009 (and from 1994 to 1998), he was a member of the senior executive team of TransCanada Corporation. Mr. Thomson also held senior positions with Northridge Canada Inc. and KPMG LLP ("KPMG"). He is a member of the Alberta and Canadian Institute of Chartered Accountants and the ICD and holds the ICD.D designation. |

Other Public Board/ Committee Memberships | None |

Board/Committee Membership: | Attendance(1)(3): | Value of Total Compensation Received(4) |

Board of Directors Audit Committee Compensation Committee (Chair) | 5 of 5 3 of 3 2 of 2 | 100% 100% 100% | 2010 | 105,000 |

Securities Held(5) as at December 31, 2010 (at a Market Value of $7.00 per Common Share as at December 31, 2010) |

Year |

Common Shares |

DSUs(6) | Total Market Value of Common Shares and DSUs |

Meets Ownership Requirements(7) |

2010 | Nil | 7,236 | $50,652 | Yes |

![[infocirc008.jpg]](https://capedge.com/proxy/6-K/0001137171-11-000130/infocirc008.jpg)

| Keith S. Turnbull Age:61 Calgary, Alberta, Canada Director since: April 6, 2010 Independent

| Mr. Turnbull is a chartered accountant and business consultant. He retired as a Partner from KPMG on December 31, 2009, after nearly 30 years of service. Mr. Turnbull has extensive experience in all aspects of public company accounting and finance matters, including serving as Office Managing Partner at KPMG's Calgary office, where he was responsible for the strategic direction and growth of the Calgary practice, as well its audit, tax and advisory business. Mr. Turnbull is a member of the Alberta and Canadian Institute of Chartered Accountants and the ICD. |

Other Public Board/ Committee Memberships | UNX Energy Corp. |

Board/Committee Membership: | Attendance(1)(3): | Value of Total Compensation Received(4) |

Board of Directors Audit Committee (Chair) Quality, Health, Safety and Environment Committee | 5 of 5 3 of 3 1 of 1 | 100% 100% 100% | 2010 | 108,500 |

Securities Held(5) as at December 31, 2010 (at a Market Value of $7.00 per Common Share as at December 31, 2010) |

Year |

Common Shares |

DSUs(6) | Total Market Value of Common Shares and DSUs |

Meets Ownership Requirements(7) |

2010 | Nil | 7,236 | $50,652 | Yes |

| | | | | | | | | | |

![[infocirc009.jpg]](https://capedge.com/proxy/6-K/0001137171-11-000130/infocirc009.jpg)

| Michael S. West Age: 48 Calgary, Alberta, Canada Director since: January 15, 2002 Non-Independent | Mr. West is President and CEO of CE Franklin. From December 2003 to April 2008, he also served as Chairman of the Board of CE Franklin. Mr. West has held executive positions in the oilfield supply and distribution business for the past 14 years. Prior to joining the oil and gas sector in 1996, he worked for 11 years in various capacities in the automotive aftermarkets industry. Mr. West is a member of the ICD. |

Other Public Board/ Committee Memberships | None |

Board/Committee Membership: | Attendance(1)(3): | Value of Total Compensation Received(4) |

Board of Directors | 6 of 6 | 100% | 2010 | None |

Securities Held(5) as at December 31, 2010 (at a Market Value of $7.00 per Common Share as at December 31, 2010) |

Year | Common Shares |

Options | RSUs/ PSUs(6) | Total Market Value of Common Shares, Options RSUs/PSUs(9) |

Meets Ownership Requirements(7) |

2009 | 37,567 | 249,419 | 82,335 | $730,642 | N/A |

2010 | 66,882 | 249,419 | 119,951 | $1,444,742 | N/A |

Notes:

(2)

Board of Directors meeting attendance includes one strategy meeting of the Board.

(3)

Mr. McClinton was appointed as independent Chairman of CE Franklin in April, 2008. As such, he also serves on the Compensation and on the Quality, Health and Environment committees as ex-officio voting member.

(4)

For details of the 2010 Board and committee meeting attendance, see "Meeting Attendance" on page 19.

(5)

For details of the 2009 and 2010 director compensation, see "Independent Directors Summary Compensation Table" on page 20.

(6)

The number of Common Shares beneficially owned, or controlled or directed by each director as at March 7, 2011 is the same as shown in the respective table as at December 31, 2010. The information as to the number of Common Shares beneficially owned or controlled, not being within the knowledge of the Corporation, has been furnished by the respective nominees.

(7)

For details pertaining to the Restricted Share Units ("RSUs") and the Performance Share Units ("PSUs") and the Deferred Share Unit ("DSU") plans, see pages 13 and 18, respectively.

(8)

For details on the Share Ownership Guidelines, see page 18.

(9)

Mr. Hogan was a member of the Quality, Health, Safety and Environment Committee to April, 2010 and became a member of the Compensation Committee in April 2010.

(10)

The value of the 2009 and 2010 Common Shares, DSUs, RSUs and PSUs was determined using the closing price of the Common Shares on the TSX on December 31, 2009 and 2010, which was $7.06 and $7.00, respectively and the value of the 2009 and 2010 options was calculated by determining the difference between the closing price of the Common shares on the TSX on December 31, 2009 and 2010, respectively, and the exercise price of such options.

Page 6 of 24

APPOINTMENT OF AUDITORS

The persons designated in the enclosed Form of Proxy, unless instructed otherwise, intend to vote for the appointment of PricewaterhouseCoopers LLP, Chartered Accountants, Calgary, Alberta as auditors of the Corporation to hold office until the next annual meeting of Shareholders or until their successors are duly elected or appointed, at a remuneration to be fixed by the board of directors. PricewaterhouseCoopers LLP or its predecessor, Coopers & Lybrand, has been the auditors of the Corporation since February 1993.

The following table summarizes the total fees paid to PricewaterhouseCoopers LLP, the external auditor of the Corporation, for the years ended December 31, 2010 and 2009.

| | |

Year-Ended December 31, | 2010 | 2009 |

Audit fees(1) | $460,000 | $521,850 |

Audit related fees(2) | 30,000 | 15,000 |

All other fees | Nil | Nil |

| $490,000 | $536,850 |

Notes:

(1)

Audit fees include professional services for the audit of the annual financial statements and internal control over financial reporting, review of quarterly financial statements and annual filing documents. The Audit Committee approved 100% of these fees.

(2)

Audit related fees include consultation regarding accounting and financial reporting standards. The Audit Committee approved 100% of these fees.

The Corporation's audit committee policy states all auditing services and non-audit services provided to the Corporation by the Corporation's auditors shall, to the extent and in the manner required by applicable law or regulation, be pre-approved by the Audit Committee of the Corporation.

EXECUTIVE COMPENSATION

Compensation Committee

The Compensation Committee has oversight responsibility in relation to human resources and compensation matters at CE Franklin. The Compensation Committee is composed of two independent directors, being Bradley J. Thomson (Chair) and Michael J.C. Hogan; and John J. Kennedy, who is a representative of Schlumberger, the majority Shareholder of CE Franklin and is independent from management of the Corporation. In addition, Robert McClinton, as independent Board Chair, serves as an ex-officio voting member. The Chair of the Compensation Committee also serves on the Audit Committee, providing a link between compensation and risk management.

As such, a majority of the members of the Compensation Committee are independent. By taking into account the independence of the Schlumberger representative from CE Franklin's management and the alignment of interests between Schlumberger and the minority Shareholders, the Board of Directors believes that all Compensation Committee members are positioned to fulfill their responsibilities objectively and in the interests of all Shareholders.

The Compensation Committee is responsible for, among other matters, formulating and making recommendations to the Board on compensation issues relating to the directors and senior management, including the compensation philosophy and recommending compensation for the President and CEO and the executive officers. The Compensation Committee also recommends to the Board for approval the terms and granting of stock options, RSUs and PSUs to the executive officers and employees of the Corporation. The mandate of the Compensation Committee is posted on the Corporation's website at www.cefranklin.com.

The Compensation Committee met three times during 2010 and held "in-camera" sessions without the presence of management at each meeting. All of the recommendations of the Compensation Committee to the Board have been made unanimously during 2010.

Page 7 of 24

Compensation Consultant

The Compensation Committee engaged Mercer (Canada) Limited ("Mercer") as independent compensation consultant during 2010 to provide analysis and advice on executive compensation matters. This support has consisted of (i) the provision of general market observations with respect to market trends and issues, (ii) the compilation of benchmark market data and the provision of advice on the use of such data, and (iii) attendance at Compensation Committee meetings to review market trends and issues and present market analysis. The decisions made by the Compensation Committee are the responsibility of the Compensation Committee and may reflect factors and considerations other than the information and recommendations provided by Mercer.

The Corporation paid Mercer a fee of $25,053 in respect of services performed in 2010.

COMPENSATION DISCUSSION AND ANALYSIS

General

The purpose of this Compensation Discussion and Analysis is to provide information about the Corporation's philosophy, objectives and processes regarding compensation for the President and CEO, the Vice-President and CFO and the other three most highly compensated executive officers of CE Franklin (each a "Named Executive Officer" or a "NEO" and collectively the "Named Executive Officers" or "NEOs). For the period ended December 31, 2010, the Corporation had the following five NEOs:

Michael S. West

President and CEO

W. Mark Schweitzer

Vice-President and CFO

Merv Day

Senior Vice-President, Business Development

James E. Baumgartner

Vice-President, Commercial Strategies

Timothy M. Ritchie

Vice-President, Sales

The Compensation Committee has reviewed, discussed and recommended the Compensation Discussion and Analysis to be included in this Information Circular. The Compensation Committee believes that it understands the long-term implications of the Corporation's executive compensation plans. Compensation philosophy and programs are reviewed by the Compensation Committee on an annual basis to (a) assess their competiveness, (b) be satisfied that they continue to meet the Corporation's compensation objectives, and (c) improve its overall ability to recruit, retain, and motivate high-performing employees in light of changing market conditions, the Corporation's growth profile and its evolving strategies and goals. The Compensation Committee is satisfied that the Corporation's current executive compensation programs and levels of compensation are aligned with CE Franklin's performance and reflect competitive market practices.

Compensation Principles and Objectives

The objectives of the Corporation's compensation program are to (a) align the executives' interests with those of Shareholders; (b) provide market based compensation that is sufficient to attract, retain and reward a high calibre management team; (c) provide the opportunity to earn total compensation that is commensurately above or below average when the Corporation's performance varies from expectations; and (d) generate company-wide collaboration and superior performance results.

Compensation Program Design

The Corporation utilizes a "pay-for-performance" approach to compensation. Actual rewards are directly linked to the business goals and results of the Corporation. These include financial and non-financial performance measures which are aligned with Shareholder interests.

Page 8 of 24

All elements of the Corporation's compensation plan are intended to attract, retain and align executive performance to Shareholder's interests and to meet CE Franklin's compensation principles and objectives, as stated above. The compensation plan is composed of:

Ø

base salary and benefits;

Ø

short-term cash bonus plan; and

Ø

mid-term and long-term incentive plans.

Mid and long-term incentive plans are comprised of share-based compensation, thereby directly aligning executive interests with those of Shareholders.

The Corporation provides a significant proportion of pay at risk through short-term cash bonus and medium and long-term incentives. The actual compensation mix varies by executive level. Generally, the higher the level of responsibility, the greater the proportion of total target compensation that is variable or at risk.

For 2010, approximate target compensation components for the executive officers consisted of:

| | | | |

| Fixed Compensation | Variable or "At Risk" Compensation |

Position |

Base Salary |

Short-Term Cash Bonus | Medium and Long-Term Incentives | Total Pay At-Risk |

CEO | 30% | 25% | 45% | 70% |

Vice President and CFO | 35% | 20% | 45% | 65% |

Other NEOs | 50% | 20% | 30% | 50% |

Benchmarking Data and Review Process

The total compensation level and plan design versus marketplace as defined by a peer group is reviewed for each position by Mercer through a bi-annual executive total compensation analysis, or as required due to marketplace or job design changes. On an annual basis, compensation levels and plan design are reviewed by the Compensation Committee in the fall. Total compensation levels are generally targeted at the peer group median and adjusted for experience and scope of responsibility of the particular NEO. Formulaic elements of the plan can be adjusted as required to achieve responsible and sustainable executive compensation. Changes or adjustments to plan design are identified to enable management to prepare a proposed Executive Compensation Plan for the coming year, to be approved by the Board in December.

The peer group is comprised of Canadian industrial suppliers, Calgary-based organizations of comparable size and region-specific retailers in local and national markets. This data is augmented, as required, with survey and/or proxy data from other public, comparably sized organizations in the oil and gas industry for executive positions. Compensation data from CE Franklin's direct competitors is not publicly available. As part of the bi-annual executive total compensation analysis conducted in the fall of 2008 and 2010, the Corporation's executive peer group, as recommended by Mercer, currently includes 14 companies:

Mullen Transportation Inc.

Marsulex Inc.

Wajax Ltd.

Badger Daylighting Inc.

Trican Oilwell Services Company Ltd.

Peak Energy Services Ltd.

North American Energy Partners

Pure Energy Services Ltd.

Calfrac Well Services Ltd.

Essential Energy Services Ltd.

ATS Automation

Total Energy Services Ltd.

Newalta Income Fund

Black Diamond Group Ltd.

The CEO annually assesses the individual performance and development of each executive officer and recommends the appropriate compensation target levels for each individual. Total compensation target levels for the coming year are established based on:

Ø

individual performance and contribution;

Ø

strategic value to the Corporation's future plans and compensation history; and

Ø

relative level of total compensation compared to marketplace.

Page 9 of 24

The Compensation Committee reviews these recommendations and recommends to the Board the approval of the total compensation package for the NEOs. For the CEO, the Compensation Committee receives and reviews the results of the performance assessment established by the Corporate Governance and Nominating Committee and supported by the Board. The Compensation Committee then recommends to the Board for their review, discussion and approval, the compensation package payable to the CEO. For 2010, the CEO performance was assessed against the following financial and operational targets and key objectives:

| |

Financial/Operational Targets | earnings per share ("EPS"), accounts receivable and inventory efficiency, return on net assets ("RONA")(1) and safety measures, based on annual business plan, budget and safety reports. |

Key Objectives | on progress made with respect to strategic initiatives, as established by the five year strategic plan. |

on leadership performance, including management team development and succession planning. |

Note:

In general, the achievement of financial and operational targets is given more significant weighting than the realization of key objectives.

(1)

RONA is defined as annual net income before interest and income tax expenses, divided by average month-end total assets excluding cash, less liabilities, revolving term bank debt and other financial liabilities, and future income tax assets and liabilities.

Elements of 2010 Executive Compensation

During 2010, the Corporation's compensation arrangements for senior executives, including the NEOs consisted of a combination of (a) base salary, (b) short-term incentives (cash bonus), and (c) mid-term and long-term incentives.

Base Salaries

Base salaries are reviewed annually. Actual salary levels reflect general market conditions, peer group base compensation generally targeted at the median, level of responsibility, experience, expertise and accountability within the Corporation, as well as subjective factors such as the executive's performance in a variety of areas, including leadership, commitment and ability to motivate others. Base salaries are also compared to other employees and senior executives to assess internal equity. Base compensation levels have been unchanged since 2007. In January of 2008, in support of the Corporation's business plan, each senior executive volunteered to take a $10,000 base salary roll back ($30,000 for the CEO) to reduce operating expenses and retain staff in light of the challenging industry demand profile, then anticipated to prevail for 2008. In early 2009, salaries were re-instated to levels prior to the 2008 roll back. In April of 2009, to mitigate the effects of the economic downturn, CE Franklin established a furlough program, requiring all employees, including the NEO's, to take one day off per month without pay. The furlough program created employee cost consciousness, saved labour costs and united the Corporation in its effort to preserve jobs and maintain customer service. The impact of the furlough program on the 2009 base salaries for the NEO's resulted in a reduction of approximately 3.8%. The furlough program was completed in April, 2010. Other than for merit increases, base salaries remained frozen for 2010, in response to the challenging economic environment.

Perquisites and Personal Benefits:Benefit plans provided by the Corporation include group life, health and medical, pension (RRSP) contributions and other benefits that are available to all salaried employees to support their health and well-being. These plans are reviewed periodically to ensure that they continue to meet the needs of the Corporation's employees and that benefits remain competitive. Perquisites are applied according to business need and marketplace comparison of job class compensation plan matching, provided they are cost effective and assist employees in carrying out their duties effectively.

Short-Term Cash Bonus Plan

Since 2005, EPS, inventory turns and accounts receivable days sales outstanding ("DSO") have been the central measures used to determine payouts under the Short-Term Cash Bonus Plan ("STIP") for the executive officers. Safety and other measures have periodically been included to achieve specific results. These measures have been central to the STIP, as they are critical measures which indicate CE Franklin's performance.

Page 10 of 24

For 2010, the following STIP measures and weightings were established:

Ø

50% linked to EPS performance

Ø

25% linked to inventory turn(1) performance

Ø

12.5% linked to DSO(1) performance

Ø

12.5% linked to Safety performance

Note:

(1)

Inventory turns are calculated using cost of goods sold for the quarter on an annualized basis compared to the period end inventory balance. DSO is calculated using average sales per day for the quarter compared to the period end accounts receivable balance.

STIP payouts for all measures were capped at two times target STIP percentage of salary for each NEO (subject to an overall maximum STI payout for all employees of 20% of before-tax profit). The target EPS for 2010 at $0.69 was at budget and a graduated payout band of plus or minus 30% of target was established. For DSO and inventory turns, the graduated payout band was set at plus or minus 10% of budget. Safety performance was based 50% on total reportable injury rate ("TRIR") and 50% on driver fault vehicle accident measurements.

The Corporation's basic EPS for 2010 at $0.34 was 51% below the 2010 target of $0.69. Inventory turn target of 4.4 corporate-wide turns was not met at 4.2 turns. DSO performance at 54.7 did not meet the target of 53.7 days. The safety performance target of TRIR ≤ 1.2 was exceeded at 1.0 and driver fault vehicle accident rate of ≤ 8 was exceeded at 4.

The 2010 STIP payout for each NEO paid in February of 2011 was based on this program. The payout compared to target for NEOs was approximately 37%. (See "Summary Compensation Table"). The NEOs continue to be eligible for the STIP program, which is reviewed by the Compensation Committee on an annual basis with targets established based on the Corporation's annual operating objectives and business plans.

Mid-term and Long-term Incentives: Option-based and Share-based Awards

In late 2008, the option and share-based plans were redeveloped by management with the assistance of Mercer, based on the recommendations of the Compensation Committee and approved by the Board of Directors in January, 2009. The Corporation's mid and long-term incentive plans ("LTIP") are comprised of (a) stock options ("Options"), (b) restricted share unit ("RSU") awards, and (c) performance share unit ("PSU") awards which are focused on medium and long-term performance, retention and alignment of executive's interests with those of the Shareholders.

Annual option and share-based target awards for each executive, including the NEOs (other than for the CEO) are established by the CEO based on (a) principles of external competitiveness, (b) strategic contribution [the executive's performance] in the prior year, and (c) recognition of future potential. Target awards are reviewed and recommended to the Board for approval by the Compensation Committee. The CEO's option and share-based awards are determined by the Compensation Committee after consideration of the performance evaluation report received from the Corporate Governance and Nominating Committee. The Compensation Committee further considers, among such other factors as they may deem relevant, the Corporation's performance, Shareholder returns and the value of similar incentive awards to CEOs at comparable companies.

Option-based Awards

In 2008, the Compensation Committee reviewed stock option grant practices, including exercise price valuations and volatility measures. Based on the Black-Scholes valuation model, volatility was set using three years of monthly or weekly closing prices, depending on the date of grant, from the American Stock Exchange (the "AMEX"), where the majority of the Corporation's trading then occurred. Based on Mercer's recommendations and generally accepted practice for fair valuation, during 2008 the volatility cap of 50% was maintained. For 2008 Option grants, the Black-Scholes valuation model for stock options was applied in determining the appropriate stock-based grant. Previous grants of stock-based awards are not taken into consideration when determining the current year's grant. With respect to exercise price, the Corporation had, for simplicity, used the closing price on the date of grant and amended the Option plan to adopt a ten day volume weighted average price as a preferred fair value approach.

Page 11 of 24

In January 2009, the Option plan was further amended by (a) revising the maximum number of Common Shares reserved for issuance under the Option plan to 10% of the issued and outstanding Common Shares, independent of shares reserved for issuance under any other compensation arrangement; and (b) including a provision for the granting of an election to Option plan participants to have the Corporation settle their vested options in return for cash or shares (collectively, the "2009 Amendments"). The 2009 Amendments were approved by Shareholders on April 28, 2009 together with all unallocated options under the Option plan until April 28, 2012.

In December 2010, the practice of providing an election to Option plan participants to have the Corporation settle their vested options in return for cash was stopped, and the Option plan was amended by adding provisions that provide for withholding of income tax owing on option exercise, in response to certain provisions contained in the Federal Government's 2010 budget (the "2010 Amendments").

For a summary of the terms of the Option plan, see "Option Plan" below.

No Options were granted in 2010 or in 2009 to preserve shareholder value. The Option plan was temporarily suspended, due to extremely volatile market conditions, with the Corporation's stock trading below the book value of its assets, making the valuation of Options difficult. The LTIP portion for 2010 and 2009 consisted of RSU and PSU awards, governed by the terms of the Corporation's Share Unit Plan. See "Share-based Awards" below.

Option Plan Summary: The Option plan was established on September 14, 1993 and was amended on November 21, 1994, October 24, 1995, September 10, 1996, February 12, 1998, April 30, 1998, May 1, 2001, May 3, 2005, May 2, 2007, July 24, 2008, January 29, 2009 and December14, 2010. The 2009 and 2010 Amendments are described above. The Option plan provides that the Board may grant Options, subject to the terms of the Option plan, to employees, officers or directors of the Corporation and its subsidiaries and to officers or employees of affiliates (as defined in the Business Corporation Act (Alberta)) with whom the Corporation conducts business (collectively, the "Eligible Participants"). Under the terms of the Option plan:

1.

Options may be granted in such numbers and with such vesting provisions as the Board of Directors may determine;

2.

the exercise price of options shall not be less than the ten (10) day volume weighted average trading price of the Common Shares traded through the facilities of the NASDAQ (or an equivalent United States based Stock Exchange) or the TSX trading on the last trading day preceding the grant date, as expressed in both U.S. dollars and Canadian dollar equivalents at such date;

3.

the maximum term for options is ten years;

4.

the options are not transferable or assignable other than in the event of the death of the optionee;

5.

the aggregate number of Common Shares reserved for issuance pursuant to options granted to any one person, when combined with any other share compensation arrangement, may not exceed 5% of the outstanding Common Shares (on a non-diluted basis);

6.

vesting of options may be accelerated at the discretion of the Board of Directors; in the event that an optionholder ceases to be an Eligible Participant such options shall cease and terminate on the sixtieth day following the date that such optionholder ceased to be an Eligible Participant, unless otherwise determined by the Board with respect to any particular optionee (and unless the termination was for cause, in which case the Board of Directors may determine that such options shall terminate immediately), and in the event of the death of a holder of options, such options shall be exercisable until the earlier of six months following the death of the holder and the expiry of such options, and in the event of a sale of the Corporation or all or substantially all of its assets or the liquidation or dissolution or merger, amalgamation, consolidation or absorption with or into any other corporation or if any person, firm corporation of related or affiliated persons, firms, corporations make a general offer to any or all of the Shareholders of the Corporation to acquire more than 50% of all of the outstanding Common Shares of the Corporation then the Board of Directors may provide for early exercise or termination or other adjustments of the options;

Page 12 of 24

7.

the aggregate number of Common Shares that may be reserved for issuance under the Option Plan must not exceed 10% of the number of Common Shares, on a non-diluted basis, outstanding at that time;

8.

at the time of exercise, Eligible Participants may elect that the Corporation purchase each of their vested options for a price (the "Purchase Price") equal to the difference between the 10-day weighted average closing price of the Common Shares at the time of exercise and the exercise price for each option being purchased; and

9.

the Board has the right to amend or discontinue the terms and conditions of the Option plan subject to the prior consent of any applicable regulatory bodies, including the TSX. Under the Option plan, the Board has the ability to make amendments to the Option plan or a specific option grant without further approval of Shareholders to the extent that such amendments cure an ambiguity, error or omission; are necessary to comply with applicable laws or requirements; are in respect of administrative or eligibility matters; change the terms of the Options including a change in pricing (other than to insiders) and vesting provisions; change termination provisions (so long as the change does not entail an extension beyond the original expiry date); or are amendments of a housekeeping nature.

Share-based Awards

In January 2009, the Corporation established what it considers a medium-term incentive program ("MTI"), consisting of PSU awards, valued at a target percentage of total compensation within market ranges for similar positions, earned through a first year corporate performance measure and time vested over a period of three years from the date of grant. The MTI was first implemented for 2009 and has been created to focus and reward senior executives for multi-year goals and objectives within a one to three year time horizon. These objectives are not always well served by annual cash flow and earnings measures and are expected to produce results faster than long-term objectives (three to seven year time horizons).

The total number of PSUs granted is established one year following the declaration of the target unit award amount by multiplying the target unit award amount by a performance multiplier. The second PSU target units were awarded on February 16, 2010. The 2010 performance measure, approved by the Board on January 28, 2010, consists of RONA targets, based on historical analysis of the Corporation's RONA performance.

For 2010, the following MTI payout ranges were established:

Ø

Less than

5%

- no payout

Ø

Threshold

5%

-.25 times targeted payout

Ø

Target

11.9%

- 1 times targeted payout

Ø

Cap

30%

- 2 times targeted payout

On February 2, 2011, the Board approved the 2010 performance multiplier of 42%, based on the 2010 RONA performance. Accordingly, PSUs earned for 2010 were granted on February 2, 2011, by multiplying the target unit awards set on February 16, 2010 by the 2010 performance multiplier.

To replace the Options typically awarded as part of the LTIP program, the Corporation granted PSUs and RSUs for 2010. The PSUs and RSUs were granted pursuant to the terms of the Share Unit Plan. See "Share Unit Plan" below. For 2010 RSU and PSU awards to each NEO, see "Summary Compensation Table".

Share Unit Plan Summary: RSUs and PSUs entitle the holder thereof to receive, upon exercise by the holder, but at the election of the Corporation: (i) a number of Common Shares equal to the number of mature RSUs or PSUs then held; or (ii) a payment from the Corporation equal to the closing price per Common Share of a stock exchange on which the Common Shares are then listed for trading for each mature RSU or PSU then held. Pursuant to the Share Unit Plan, the number of RSUs and PSUs that may be issued in any given year is subject to certain restrictions. The number of RSUs and PSUs granted is to be determined at the discretion of the Board of Directors at the time of the granting of the RSUs and PSUs, as is the term and vesting policies. There may not be issued any RSUs or PSUs exceeding 10% of the outstanding issue from time to time and no one eligible RSU or PSU recipient can receive RSUs and/or PSUs entitling the eligible recipient to acquire more than 5% of the total Common Shares by way of the granting of RSUs and/or PSUs. There may not be issued to any one insider and such insider's associates, within a one-year period, a number of RSUs and/or PSUs of the Corporation exceeding 5% of the issued and outstanding Common Shares.

Page 13 of 24

All RSUs and PSUs awarded to date vest over a three year period (33.3 percent each at the end of the first, second and third anniversary following the award date). Vested RSUs and PSUs may be exercised at any time by providing the requisite notice to the Corporation up to December 31st in the year that is three years after the date of the award.

To date, the Corporation has funded all RSU and PSU exercises with Common Shares purchased in the open market. It is the Corporation's intention to continue to fund future RSU and PSU exercises through open-market purchases of Common Shares.

Performance Graph

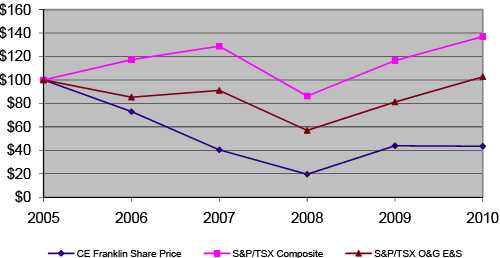

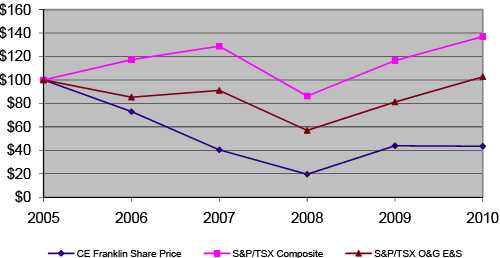

The following graph compares the yearly change in the Corporation's cumulative total Shareholder return on its Common Shares as listed on the TSX based on an initial fixed investment of $100 with the cumulative return on S&P/TSX Composite Total Return Index ("S&P/TSX Composite") and the S&P/TSX Oil and Gas Equipment and Services sub-index ("S&P/TSX O&G E&S").

| | | | | | |

| Dec. 31/05 | Dec. 31/06 | Dec. 31/07 | Dec. 31/08 | Dec. 31/09 | Dec. 31/10 |

CE Franklin | 100 | 73.0 | 40.4 | 19.6 | 43.9 | 43.5 |

S&P/TSX Composite | 100 | 117.3 | 128.8 | 86.3 | 116.5 | 137.0 |

S&P/TSX O&G E&S | 100 | 85.3 | 91.1 | 57.0 | 81.2 | 102.7 |

The total compensation received by the NEOs over the periods reflected in the above Performance Graph, has generally tracked fluctuations in CE Franklin's Shareholder return over such periods, as share-based awards form a significant portion of executive compensation. In this manner, as the Corporation's share price increases or decreases, the value of share-based compensation awards fluctuate similarly. Additionally, the performance metrics used to determine STIP and PSU awards are aligned with CE Franklin's business performance which, over time, are expected to have an impact on the value of the Corporation's Common Shares.

Page 14 of 24

SUMMARY COMPENSATION TABLE

The following table sets forth the compensation information for the NEOs for services rendered to the Corporation for the three years ended December 31, 2010.

| | | | | | | | |

Name and Principal Position |

Year |

Salary(1) ($) |

PSU Awards(2) ($) |

RSU Awards(3) ($) |

Option Awards(4) ($) |

Non Equity Incentive Plan Compen-sation/ Annual Incentive Plans(5) ($) |

All Other Compen-sation(6) ($) |

Total Compen-sation ($) |

Michael S. West President and CEO | 2010 2009 2008 | 413,538 405,000 390,000 | 126,000 102,000 --- | 300,000 300,000 --- | --- --- 600,000 | 122,682 140,000 546,000 | 11,000 10,496 10,000 | 973,220 957,496 1,546,000 |

W. Mark Schweitzer Vice-President, and CFO | 2010 2009 2008 | 295,385 290,000 290,000 | 84,000 68,000 --- | 200,000 200,000 --- | --- --- 225,000 | 65,723 75,000 203,000 | 14,769 14,481 10,000 | 659,877 647,481 728,000 |

Merv Day Sr. Vice-President Business Development | 2010 2009 2008(7) | 212,885 217,000 63,510 | 31,500 25,500 --- | 75,000 75,000 --- | --- --- --- | 32,862 49,000 39,375 | 10,644 8,221 --- | 362,891 374,721 102,885 |

James E. Baumgartner Vice-President Commercial Strategies | 2010 2009 2008 | 206,769 203,000 200,000 | 22,260 17,850 --- | 53,000 52,500 --- | --- --- 100,000 | 30,671 48,000 140,000 | 10,388 10,137 10,002 | 323,088 331,487 450,002 |

Timothy M. Ritchie Vice-President, Sales | 2010 2009 2008(8) | 186,954 189,000 165,000 | 31,500 25,500 --- | 75,000 75,000 --- | --- --- 90,000 | 28,626 43,000 115,500 | 11,217 11,353 9,902 | 333,297 343,853 380,402 |

Notes:

(1)

The furlough program was completed in April 2010 and base salaries otherwise remained frozen for 2010. The 2009 salaries reflect the impact of (a) the early 2009 re-instatement of salaries to levels prior to the 2008 roll back and (b) the furlough program (See "Base Salaries").

(2)

The 2010 target PSU awards were set on February 16, 2010 at fair value of $6.51 per unit and subsequently multiplied by a performance multiplier of 42%, based on actual 2010 RONA performance, to calculate the value of PSU awards earned for 2010 (See "Share-based Awards").

(3)

The 2010 RSU awards were granted on February 16, 2010 at fair value of $6.51 per unit.

(4)

The option awards recorded for 2008 in this table were granted on December 11, 2007 and made to reward 2008 compensation.

(5)

Annual incentive bonus amounts are disclosed in the year in which they are earned, not in the year in which they were paid.

(6)

Consists of employer contributions towards a group registered retirement pension and savings plan (See "Retirement Benefits").

(7)

Mr. Day was appointed Senior Vice-President, Business Development effective September 15, 2008.

(8)

Mr. Ritchie was appointed Vice-President, Sales in November 2008, and previously held the position of Vice-President, IT Projects.

Page 15 of 24

INCENTIVE PLAN AWARDS

Outstanding Share-based Awards and Option-based Awards

| | | | | | |

| Option-based Awards | Share-based Awards (RSUs and PSUs) |

Name |

Number of Securities Underlying Unexercised Options (#) |

Option Exercise Price ($) |

Option Expiration Date |

Value of Unexercised In-the-Money Options(1) ($) | Number of Shares or Units of Shares that have not Vested (#) | Market or Payout Value of Share-based Awards that have not Vested(2) ($) |

Michael S. West | 17,472 41,991 189,956 | 4.60 10.90 6.50 | 01/11/2015 01/31/2017 12/11/2014 | 136,911 | RSU: 82,184 PSU: 31,629 | 796,691 |

W. Mark Schweitzer | 52,428 58,255 71,232 | 10.30 10.30 6.50 | 08/13/2017 08/13/2017 12/11/2014 | 35,616 | RSU: 54,789 PSU: 21,085 | 531,118 |

Merv Day

| Nil | N/A | N/A | Nil | RSU: 20,546 PSU: 7,907 | 199,171 |

James E. Baumgartner | 27,609 28,139 24,522 26,203 6,996 31,656 | 3.50 3.49 2.70 4.60 10.90 6.50 | 01/01/2012 12/13/2012 12/12/2013 01/11/2015 01/31/2017 12/11/2014 | 379,559 | RSU: 14,459 PSU: 5,567 | 140,182 |

Timothy M. Ritchie | 28,139 41,824 28,823 6,996 28,492 | 3.49 2.70 4.60 10.90 6.50 | 12/13/2012 12/12/2013 01/11/2015 01/31/2017 12/11/2014 | 362,032 | RSU: 20,546 PSU: 7,907 | 199,171 |

Notes:

(1)

The value of unexercised In-the-Money Options at December 31, 2010 was calculated by determining the difference between the closing price of the Common Shares on the TSX on December 31, 2010, which was $7.00 and the exercise price of such options.

(2)

Consists of RSU and PSU Share-based awards. The value of the RSUs and PSUs was determined using the closing price of the Common Shares on the TSX on December 31, 2010 which was $7.00.

Incentive Plan Awards - Value Vested or Earned During 2010

| | | |

Name |

Option-based Awards – Value Vested During 2010(1)($) | Share-based Awards -(RSUs and PSUs) Value Vested During 2010(2)($) |

Non-equity Incentive Plan Compensation Payout during the Year(3) ($) |

Michael S. West | 47,489 | 221,193 | 122,682 |

W. Mark Schweitzer | 17,808 | 120,553 | 65,723 |

Merv Day | N/A | 37,740 | 32,862 |

James E. Baumgartner | 7,914 | 38,119 | 30,671 |

Timothy M. Ritchie | 7,123 | 49,445 | 28,626 |

Notes:

(1)

The value vested during 2010 for Option-based Awards represents the aggregate dollar value that would have been realized if the options had been exercised on the vesting date.

(2)

The value vested during 2010 for RSUs and PSUs represents the aggregate dollar value realized or that would have been realized if the RSUs and PSUs had been exercised on the vesting date.

(3)

Paid in February 2011 for annual STIP bonus earned in 2010.

RETIREMENT BENEFITS

The Corporation does not have a defined benefit or a defined contribution pension plan. It has a group registered retirement savings plan ("RRSP") which matches executives' personal contributions up to 5% of their salary or 6% for employees with greater than 10 years service. The Corporation's contributions are owned by the employee with no vesting conditions. The Corporation's contributions are stopped for one year in the event of employee withdraws from the group RRSP.

Page 16 of 24

TERMINATION AND CHANGE OF CONTROL BENEFITS

Employment Contracts

The Corporation has entered into employment contracts with the President and CEO and the Vice President and CFO (the "Employment Contracts") that provide for payment of 24 months salary, benefits and bonus and immediate vesting of Options, RSUs and PSUs if employment is terminated by the Corporation for any reason, other than cause, or in the event of a change of control or constructive dismissal. If employment is terminated for cause, no payments are made.

Pursuant to the terms of the Employment Contracts, a change of control occurs upon the acquisition of more than 50% of the voting shares of the Corporation; the liquidation, dissolution or winding-up of the Corporation or the sale of all or substantially all of its assets; the Board of Directors being replaced; the Corporation's shares ceasing to be listed on a stock exchange in North America; and any determination by the Board of Directors that a change of control has occurred. Constructive dismissal occurs when there has been an adverse change in the executive's position, title, status, duties, responsibilities or overall compensation (including participation in bonus, stock option or other incentive plans or a material reduction in employment benefits); an assignment of duties and responsibilities inconsistent with the executive's status and position; a required relocation of the executive outside of Calgary, Alberta; or any breach by the Corporation of the Employment Contract.

Other NEO's have employment agreements subject to Alberta labour standards and generally accepted employment practices and no other termination or change of control provisions.

Incremental payments, assuming that such triggering event took place on December 31, 2010, are estimated to be:

| | |

Incremental Payments | President and CEO(1) | Vice-President and CFO |

Salary | $840,000 | $600,000 |

Loss of Benefit | 126,000 | 90,000 |

Bonus(2) | 539,123 | 229,149 |

Unvested Options | 23,745 | 8,904 |

Unvested RSUs and PSUs | 796,691 | 531,118 |

Total Incremental Payments | $2,325,559 | $1,459,171 |

Notes:

(1)

In case of the President and CEO's death, his estate will be entitled to receive the incremental amount shown under the bonus column below.

(2)

Bonus based on two times average of the annual bonus over preceding three years.

DIRECTOR COMPENSATION

Each independent director of the Corporation who is not an officer or employee of the Corporation or of Schlumberger, the Corporation's majority shareholder, receives annual Board and Committee retainers, prorated for partial services, and meeting fees. The independent directors are also compensated through the granting of DSUs pursuant to the Corporation's DSU plan. Additionally, the Corporation reimburses directors for out-of-pocket travel expenses.

The objectives of the Corporation's compensation program for independent Board members are to attract and retain highly qualified Board members through providing market competitive compensation which appropriately recognizes the strategic contribution, risks and liabilities faced by Board members and aligns the interests of Board members and Shareholders. The Board, through the Compensation Committee, annually reviews independent director compensation and makes appropriate recommendations for approval to the Board.

In March 2009, Mercer was engaged by the Compensation Committee to review the Corporation's director compensation levels relative to publicly disclosed compensation levels of Canadian and US traded organizations. Director compensation levels were benchmarked against Canadian and US peer groups.

Page 17 of 24

The Canadian peer group was comprised of the same 17 publically traded organizations as the 2009 executive compensation peer group. In addition, a US peer group, consisting of 11 comparably-sized publicly traded US organizations from the oil & gas equipment and service industry included:

Matrix Service Company

Ion Geophysical Corp.

Allis-Chalmers Energy Inc.

Gulf Island Fabrication Inc.

PHI Inc.

Englobal Corp.

GE Okinetics Inc.

Superior Well Services Inc.

Dawson Geophysical Co.

T-3 Energy Services Inc.

Trico Marine Services Inc.

Given the North American nature of the Corporation with respect to its ownership, American stock exchange listing and SEC registration, it was considered appropriate to adopt a blended Canadian and American director compensation package. The Compensation Committee used the data regarding the Canadian and American peer groups as a frame of reference and applied judgement in making the 2009 director compensation recommendations to the Board in light of the difficult economic environment, resulting in a downward adjustment to levels that had not increased since 2006.

In January 2010, it was determined that the Board compensation survey be conducted on a bi-annual basis and to keep independent director compensation levels flat for 2010, due to prevailing economic circumstances. Accordingly, no changes were made to the director compensation levels for 2010.

2010 Annual Independent Director Compensation Levels

| |

Item | Annual Compensation ($) |

Board Chair Cash Retainer | 60,000 |

Board Chair DSU Grant | 50,000 |

Board Member Retainer | 30,000 |

Board Member DSU Grant | 50,000 |

Audit Committee Chair Retainer | 15,000 |

Other Committee Chair Retainer | 10,000 |

Board and Committee Meeting Fees (per meeting attended) | 1,500 |

On an annual basis, Board members may elect to receive all or a portion of their annual cash retainer in the form of DSUs.

DSU Plan Awards: Effective May 2, 2006, the Corporation adopted the DSU Plan. Under the terms of the DSU plan, DSUs entitle the holder thereof to receive upon exercise by the holder, but at the election of the Corporation: (i) a number of Common Shares equal to the number of mature DSUs then held; or (ii) a payment from the Corporation equal to the weighted average trading price of the Common Shares on the TSX for that date and the nine trading days immediately preceding that date. DSUs vest on the date of grant and can only be redeemed when the director resigns from the Board. It is the Corporation's intention to resource DSU exercises either through open-market purchases of Common Shares or in cash.

Share Ownership Guidelines for Independent Directors:In March of 2006, the Board approved share ownership guidelines for independent directors. These guidelines provide that independent directors be required to hold a multiple of four times their annual retainer measured on the basis of investment cost, with such holdings to be accumulated over five years of becoming a director. All of the current independent directors meet these requirements.

Page 18 of 24

Board and Committee Meetings Held in 2010

| |

Meeting | Total Number of Meetings Held in 2010 |

Board of Directors | 5 |

Strategy Meeting of the Board of Directors | 1 |

Audit Committee | 5 |

Compensation Committee | 3 |

Corporate Governance and Nominating Committee | 4 |

Quality, Health, Safety, and Environment Committee | 2 |

Meeting Attendance

The Board and committee meeting attendance rate in 2010 was 100%.

The attendance record for each director for all Board and committee meetings held for the financial year ended December 31, 2010 is set out below. In addition, directors have a standing invitation to attend those committee meetings on which they do not serve as a member. However, directors are not being paid for such attendance and such attendance is not reflected in the following attendance record.

| | | | | | |

| Board of Directors(1) | Committees of the Board(1) |

Name of Director |

Board |

Strategy |

Audit |

Compensation | Corporate Governance and Nominating |

Quality, Health, Safety, and Environment |

David A. Dyck(3) | 2 of 2 | N/A | 2 of 2 | 1 of 1 | N/A | N/A |

Michael J.C. Hogan(6) | 5 of 5 | 1 of 1 | N/A | 2 of 2 | 4 of 4 | 1 of 1 |

John J. Kennedy | 5 of 5 | 1 of 1 | N/A | 3 of 3 | N/A | 2 of 2 |

Robert McClinton(2) | 5 of 5 | 1 of 1 | 5 of 5 | N/A | 4 of 4 | N/A |

Donald McKenzie(5) | 5 of 5 | 1 of 1 | N/A | N/A | 3 of 3 | 2 of 2 |

Kjell-Erik Oestdahl(5) | 2 of 2 | N/A | N/A | N/A | 1 of 1 | N/A |

Victor J. Stobbe(3) | 2 of 2 | N/A | 2 of 2 | 1 of 1 | N/A | N/A |

Bradley J. Thomson(4) | 4 of 4 | 1 of 1 | 3 of 3 | 2 of 2 | N/A | N/A |

Keith S. Turnbull(4) | 4 of 4 | 1 of 1 | 3 of 3 | N/A | N/A | 1 of 1 |

Michael S. West | 5 of 5 | 1 of 1 | N/A | N/A | N/A | N/A |

Attendance Rate | 100% | 100% | 100% | 100% | 100% | 100% |

Notes:

(1)

At each meeting of the Board of Directors and the committees, in-camera sessions without management are held.

(2)

As independent Chairman of the Board, Mr. McClinton has been appointed as ex-officio voting member on those committees he does not serve as a member.

(3)

Messrs. Dyck and Stobbe retired from the Board on April 27, 2010.

(4)

Messrs. Thomson and Turnbull joined the Board on April 6, 2010.

(5)

Mr. McKenzie resigned from and Mr. Oestdahl joined the Board on October 28, 2010.

(6)

Mr. Hogan was a member of the Quality, Health, Safety and Environment Committee to April, 2010 and became a member of the Compensation Committee in April 2010.

Since January 1, 2011 and to date, one Board meeting and one meeting each of the Audit Committee, the Compensation Committee, the Corporate Governance and Nominating Committee and the Quality, Health, Safety and Environment Committee were held at which all directors and all committee members, as applicable, were in attendance, except for Mr. Oestdahl who was not in attendance at the meetings of the Corporate Governance and Nominating Committee and the Quality, Health, Safety and Environment Committee.

Page 19 of 24

Independent Directors Summary Compensation Table

The following table sets forth the compensation provided to independent directors for the year ended December 31, 2010. Compensation provided to independent directors for the year ended 2009 is provided for comparative purposes.

| | | | | | |

Name | Fees Earned ($) 2009 2010 | Share (DSU) Awards ($) 2009 2010(4)(5) | Total ($) 2009 2010 |

David A. Dyck(1) | 64,250 | 7,500 | 50,000 | --- | 114,250 | 7,500 |

Michael J.C. Hogan | 57,500 | 59,500 | 50,000 | 50,000 | 107,500 | 109,500 |

Robert McClinton(2) | 92,750 | 90,000 | 50,000 | 50,000 | 142,750 | 140,000 |

Victor J. Stobbe(1) | 69,250 | 7,500 | 50,000 | --- | 119,250 | 7,500 |

Bradley J. Thomson(3) | --- | 55,000 | --- | 50,000 | --- | 105,000 |

Keith S. Turnbull(3) | --- | 58,500 | --- | 50,000 | --- | 108,500 |

Total | 283,750 | 278,000 | 200,000 | 200,000 | 483,750 | 478,000 |

Notes:

(1)

Messrs. Dyck and Stobbe retired from the Board on April 27, 2010.

(2)

Mr. McClinton serves as independent Chairman of the Board. Amounts include fees paid for committee meetings attended as ex-officio voting member.

(3)

Messrs. Thomson and Turnbull joined the Board on April 6, 2010.

(4)

DSUs vest on the date of grant and can only be redeemed when the director resigns from the Board.For the total number of DSUs held by each independent director as at December 31, 2010, see "Election of Directors."

(5)

Messrs. Dyck and Stobbe, who served since 2004 and 2003, respectively, retired from the Board on April 27, 2010. Mr. Dyck received the payout value of his 23,330 DSUs in Common Shares on July 7, 2010 and Mr. Stobbe received the payout value of his 25,728 DSUs in cash on May 20, 2010, in accordance with the payout provisions of the DSU Plan. The payout value of Messrs. Dyck's and Stobbe's DSU was equal to $6.93 and $6.91, respectively, which represents the average closing price of Common Shares on the TSX for the ten trading days following May 3, 2010 and April 29, 2010, respectively.

Directors' and Officers' Liability Insurance

The Corporation maintains a policy of directors' and officers' liability insurance, the premium for which in 2010 was $165,000 which amount is paid by the Corporation. The policy has a limit of $25,000,000 and has a $500,000 deductible for the Corporation in Canada and a U.S. $500,000 deductible in the U.S. with respect to judgements, settlements and defence costs for indemnifiable losses.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

As at December 31, 2010, the following table sets forth information with respect to the Corporation's compensation plans under which equity securities are authorized for issuance.

| | | |

Plan Category | Number of Common Shares to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of Common Shares remaining available for future issuance under equity compensation plans |

Equity compensation plans approved by Shareholders |

1,073,442 |

$6.01 |

673,932 |

Equity compensation plans not approved Shareholders(1) |

451,713 |

N/A(1) |

- |

Total | 1,525,155 | $6.01 | 673,932 |

Note:

(1)

The RSUs, DSUs and PSUs have not been approved by security holders and do not have an exercise price attached. For a description of the material terms of the Share Unit Plans, see "Executive Compensation". It is the Corporation's intention, upon exercise of outstanding options, to settle option obligations by issuance of Common Shares from treasury.

As of March 7, 2011, there were 1,027,189 options outstanding, representing approximately 6% of the issued and outstanding Common Shares.

Page 20 of 24

INDEBTEDNESS OF DIRECTORS AND SENIOR OFFICERS

No directors, executive officers, employees and former directors, executive officers, or employees, nor any of their associates or affiliates were indebted to the Corporation during 2010.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

John J. Kennedy and Kjell-Erik Oestdahl are directors of the Corporation. Mr. Kennedy is President and a director of Wilson, a wholly owned subsidiary of Schlumberger (which holds 9,729,582Common Shares representing approximately 55.6% of the issued and outstanding CE Franklin Shares) and Mr. Oestdahl is Vice-President, Operations of Schlumberger. Prior to the completion of the Schlumberger merger with Smith International ("Smith") in August of 2010, Wilson was a wholly owned subsidiary of Smith and Donald McKenzie, who resigned as a director of the Corporation on October 28, 2010 was Advisor to the CEO, President and COO of Smith. During 2010, the Corporation purchased inventory in the ordinary course of business, and at market rates, from affiliates of Smith and Schlumberger.

CORPORATE GOVERNANCE

The following describes the Corporation's governance practices with reference to National Policy 58-201Corporate Governance Guidelines("NP 58-201") and National Instrument 58-101 ("Disclosure of Corporate Governance Practices").

CE Franklin's Board has ultimate responsibility for the way in which the Corporation is managed, including overseeing the conduct of the business of the Corporation and supervising management, which is responsible for the day-to-day conduct of the business. Pursuant to the Board's Terms of Reference, a copy of which is attached hereto as Schedule A, the Board's fundamental objectives are to:

·

enhance and preserve long-term shareholder value;

·

ensure the Corporation meets its obligations on an ongoing basis; and

·

ensure the Corporation operates in a reliable and safe manner.

The Board is responsible for strategic planning, identifying and controlling the principal risks of the Corporation, succession planning, developing communications policies, and internal control and management systems. The Board discharges its responsibilities directly and through committees.