QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

CUBIST PHARMACEUTICALS, INC. |

(Name of Registrant as Specified In Its Charter) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

CUBIST PHARMACEUTICALS, INC.

65 Hayden Avenue

Lexington, MA 02421

NOTICE OF 2003 ANNUAL MEETING OF STOCKHOLDERS

TO THE STOCKHOLDERS OF CUBIST PHARMACEUTICALS, INC.:

NOTICE IS HEREBY GIVEN that the 2003 Annual Meeting of Stockholders of Cubist Pharmaceuticals, Inc. will be held at our corporate offices, 65 Hayden Avenue, Lexington, MA 02421, on Tuesday, June 10, 2003, at 9:00 A.M., local time, for the following purposes:

- 1.

- To elect two Class I directors to hold office for a three-year term and until their successors have been duly elected and qualified.

- 2.

- To amend and restate the 2002 Directors' Stock Option Plan.

- 3.

- To transact such other business as may properly come before the annual meeting or any adjournments or postponements thereof.

The Board of Directors has fixed April 15, 2003, as the record date for the determination of stockholders entitled to notice of, and to vote at, the annual meeting. Accordingly, only stockholders of record at the close of business on April 15, 2003, will be entitled to notice of, and to vote at, such meeting or any adjournments thereof.

To ensure your representation at the annual meeting, however, you are urged to vote by proxy by following one of these steps as promptly as possible:

- (a)

- Vote via telephone (toll-free) in the United States or Canada (see instructions on the enclosed proxy card);

- (b)

- Vote via the internet (see instructions on the enclosed proxy card); or

- (c)

- Complete, date, sign and return the enclosed proxy card (a postage-prepaid envelope is enclosed).

The Internet and telephone voting procedures are designed to authenticate shareholders' identities, to allow shareholders to vote their shares, and to confirm that their instructions have been properly recorded. Specific instructions to be followed by any registered shareholder interested in voting via the Internet or telephone are set forth on the enclosed proxy card and must be completed by 11:59 p.m. on June 9, 2003. Your shares cannot be voted unless you date, sign, and return the enclosed proxy card, vote via the internet or telephone, or attend the annual meeting in person. Regardless of the number of shares you own, your careful consideration of, and vote on, the matters before the shareholders is important.

April 25, 2003

NOTE: THE BOARD OF DIRECTORS SOLICITS THE EXECUTION AND PROMPT RETURN OF THE ACCOMPANYING PROXY. WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE ANNUAL MEETING, PLEASE VOTE VIA THE INTERNET OR TELEPHONE, OR COMPLETE, DATE, SIGN AND MAIL THE ACCOMPANYING PROXY CARD AND PROMPTLY RETURN IT IN THE PRE-ADDRESSED ENVELOPE PROVIDED FOR THAT PURPOSE. IF YOU ATTEND THE ANNUAL MEETING, YOU MAY WITHDRAW ANY PROXY GIVEN BY YOU AND VOTE YOUR SHARES IN PERSON.

CUBIST PHARMACEUTICALS, INC.

65 Hayden Avenue

Lexington, MA 02421

PROXY STATEMENT

GENERAL INFORMATION

Proxy Solicitation

This proxy statement is furnished to the holders of the common stock, $.001 par value per share, of Cubist Pharmaceuticals, Inc. in connection with the solicitation of proxies on behalf of our Board of Directors for use at the 2003 Annual Meeting of Stockholders to be held on June 10, 2003, or at any adjournment or postponement of such meeting. The purposes of the annual meeting and the matters to be acted upon are set forth in the accompanying Notice of 2003 Annual Meeting of Stockholders. The Board of Directors knows of no other business that will come before the annual meeting.

This proxy statement and proxies for use at the annual meeting will be first mailed to stockholders on or about April 25, 2003, and such proxies will be solicited chiefly by mail, but additional solicitations may be made by telephone or telegram by our officers or regular employees. We may enlist the assistance of brokerage houses in soliciting proxies. We shall bear all solicitation expenses, including costs of preparing, assembling and mailing proxy material.

Voting and Revocability of Proxy

Registered shareholders can vote their shares via (1) a toll-free telephone call from the U.S. or Canada, (2) the Internet, or (3) by mailing their signed proxy card. The telephone and Internet voting procedures are designed to authenticate shareholders' identities, to allow shareholders to vote their shares, and to confirm that their instructions have been properly recorded. We have been advised by counsel that the procedures that have been put in place are consistent with the requirements of applicable law. Specific instructions to be followed by any registered shareholder interested in voting via telephone or the Internet are set forth on the enclosed proxy card.

Stockholders may revoke the authority granted by their execution of proxies at any time before the effective exercise of such authority by filing with our Secretary a written revocation or a duly executed proxy bearing a later date or by voting in person at the annual meeting. Shares represented by executed and unrevoked proxies will be voted in accordance with the choice or instructions specified thereon. If no specifications are given, the proxies intend to vote the shares represented thereby to approve Proposal No. 1 to elect the nominees to the Board of Directors and Proposal No. 2 to amend the 2002 Directors' Stock Option Plan, all as set forth in the accompanying Notice of 2003 Annual Meeting of Stockholders and in accordance with their best judgment on any other matters that may properly come before the annual meeting.

Record Date and Voting Rights

Only stockholders of record at the close of business on April 15, 2003, are entitled to notice of, and to vote at, the annual meeting, or any adjournment or postponement of such meeting. We had outstanding on April 15, 2003, 29,535,883 shares of common stock, each of which is entitled to one vote upon the matters to be presented at the annual meeting. The presence, in person or by proxy, of a

majority of the issued and outstanding shares of common stock will constitute a quorum for the transaction of business at the annual meeting. Votes withheld from any nominee, abstentions, and broker "non-votes" are counted as present or represented for purposes of determining the presence or absence of a quorum for the annual meeting. A broker "non-vote" occurs when a nominee holding shares for a beneficial owner does not vote on one or more proposals because the nominee does not have discretionary voting power and has not received instructions from the beneficial owner.

In the election of directors, the affirmative vote of a plurality of the shares of common stock present or represented and entitled to vote at the annual meeting, in person or by proxy, is required for the election of each of the nominees. Abstentions and broker "non-votes" will have no effect on the voting outcome with respect to the election of directors. The affirmative vote of the holders of a majority of the shares of common stock present or represented and entitled to vote at the annual meeting, in person or by proxy, is necessary for approval of the proposal to amend the 2002 Directors' Stock Option Plan. Abstentions have the practical effect of a vote against these proposals. Although counted as present for the purpose of determining a quorum, broker "non-votes" are not counted for any purpose in determining whether a matter has been approved.

PRINCIPAL STOCKHOLDERS

The following table sets forth certain information with respect to each person known to us to be the beneficial owner of more than 5% of the issued and outstanding common stock as of April 15, 2003 (unless another date is specified in the footnotes below). As of April 15, 2003, 29,535,883 shares of common stock were outstanding.

| | Amount and Nature of

Beneficial Ownership

| |

|

|---|

Name and Address of Beneficial Owner

| | Outstanding

Shares

| | Right to

Acquire

| | Total

Number

| | Percentage

of Class

|

|---|

Mazama Capital Management Inc.(1)

One S.W. Columbia, Suite 1500

Portland, Oregon 97258 | | 5,433,621 | | 0 | | 5,433,621 | | 18.36% |

Delaware Management Holdings(2)

2005 Market Street

Philadelphia, Pennsylvania 19103 | | 2,946,612 | | 0 | | 2,946,612 | | 10.32% |

Arnold H. Snider (Deerfield Management)(3)

780 Third Avenue, 37th Floor

New York, New York 10017 | | 2,500,500 | | 0 | | 2,500,500 | | 8.75% |

Pioneer Global Asset Management S.p.A.(4)

60 State Street

Boston, Massachusetts 02109 | | 1,429,339 | | 0 | | 1,429,339 | | 5.00% |

With respect to the foregoing table, you should note that:

- (1)

- The information reported is based on information received directly from Mazama Capital Management, Inc. or Mazama on April 8, 2003. Mazama, an investment adviser, has sole voting power with respect to 2,877,725 shares and sole dispositive power with respect to 5,433,621 shares. Mazama has confirmed that it became the beneficial owner of more than 15% of Cubist's

2

outstanding common stock inadvertently and, pursuant to the terms of Cubist's Rights Agreement, as amended to date, has agreed to divest a sufficient number of shares of common stock so that Mazama will hold less than 15% of Cubist's outstanding common stock as promptly as reasonably practicable, in light of the volume of trading in Cubist's common stock from time to time as the divestiture proceeds and the interest of Cubist in having an orderly public market in its common stock, in a manner intended to not adversely affect the trading price of Cubist's common stock.

- (2)

- The information reported is based on a Schedule 13G/A, dated December 31, 2002, filed with the SEC by Delaware Management Holdings, Inc. or DMH. DMH, a holding company, has sole voting power with respect to 2,931,938 shares, sole dispositive power with respect to 2,936,912 shares and shared dispositive power with respect to 9,700 shares. DMH is the parent corporation of Delaware Management Business Trust, an investment adviser, which owns 2,803,533 of the total shares held by DMH.

- (3)

- The information reported is based on a Schedule 13G/A, dated December 31, 2002, filed with the SEC by Deerfield Capital, L.P., Deerfield Partners, L.P, Deerfield Management Company, Deerfield International Limited and Arnold H. Snider. Mr. Snider has shared voting and dispositive power with respect to the shares. Mr. Snider is President of Snider Management Company, the General Partner of Deerfield Management Company. Mr. Snider is also the President of Snider Capital Corp., the General Partner of Deerfield Capital, L.P.

- (4)

- The information reported is based on a Schedule 13G/A, dated December 31, 2002 filed with the SEC by Pioneer Global Asset Management S.p.A or Pioneer. Pioneer, an investment adviser, has sole voting and dispositive power with respect to the shares.

3

MANAGEMENT STOCKHOLDERS

The following table sets forth information as of April 15, 2003, as reported to us, with respect to the beneficial ownership of the common stock by each of our directors and each of our executive officers, and by all directors and executive officers as a group. Beneficial ownership is determined in accordance with the rules and regulations of the SEC. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock subject to options held by that person that are currently exercisable or exercisable within 60 days of April 15, 2003, are deemed outstanding. These shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Except as indicated below and pursuant to applicable community property laws, each stockholder named in the table has sole voting and investment power with respect to the shares set forth opposite such stockholder's name. Shares included below under "Right to Acquire" represent shares subject to outstanding stock options currently exercisable or exercisable within 60 days of April 15, 2003.

| | Number of Shares

Beneficially Owned

| |

|

|---|

| | Percentage

of Shares

Beneficially

Owned

|

|---|

Name

| | Outstanding

Shares

| | Right to

Acquire

| | Total

Number

|

|---|

| Scott M. Rocklage, PhD(1) | | 240,237 | | 409,732 | | 649,969 | | 2.2% |

| Susan B. Bayh, JD | | 1,519 | | 31,250 | | 32,769 | | * |

| Barry M.Bloom, PhD | | 22,393 | | 40,112 | | 62,505 | | * |

| John K. Clarke, MBA(2) | | 71,935 | | 46,117 | | 118,052 | | * |

| David W. Martin, Jr., MD | | 16,381 | | 45,400 | | 61,781 | | * |

| Walter R. Maupay, MBA(3) | | 18,857 | | 44,000 | | 62,857 | | * |

| John L. Zabriskie, PhD | | 19,706 | | 39,813 | | 59,519 | | * |

| Michael W. Bonney(4) | | 60,863 | | 69,999 | | 130,862 | | * |

| Barry I. Eisenstein, MD | | 6,235 | | 5,000 | | 86,235 | | * |

| Oliver S. Fetzer, PhD, MBA | | 2,393 | | 20,000 | | 71,768 | | * |

| Christopher D.T. Guiffre, JD, MBA | | 8,250 | | 33,125 | | 41,375 | | * |

| David W.J. McGirr, MBA | | 0 | | 12,500 | | 12,500 | | * |

| Francis P. Tally, MD | | 114,079 | | 80,361 | | 194,440 | | * |

| All directors and executive officers as a group (13 persons) | | 582,848 | | 876,784 | | 1,584,632 | | 5.4% |

- *

- Less than 1% of the issued and outstanding shares of common stock.

- (1)

- A portion of the shares attributable to Dr. Rocklage are held in trust for the benefit of his children.

- (2)

- A portion of the shares attributable to Mr. Clarke are held in trust for the benefit of his children.

- (3)

- Mr. Maupay holds a portion of his shares with joint voting and investment power with Ms. Margaret Maupay.

- (4)

- Mr. Bonney holds a portion of his shares with joint voting and investment power with Mrs. Alison G. Bonney.

4

EXECUTIVE COMPENSATION

Summary Compensation Table

The table below sets forth compensation information for the fiscal years ended December 31, 2002, 2001, and 2000 with respect to our Chief Executive Officer, our four most highly paid executive officers who were serving in such capacity at the end of 2002, and two other former executive officers for whom disclosure would have been provided as one of the four most highly paid executive officers but for the fact that they were not serving as executive officers at the end of 2002. We refer to these officers as our named executive officers.

| |

| | Annual Compensation

| | Long-Term

Compensation Awards

| |

|

|---|

Name and

Principal Position

| | Year

| | Salary($)(1)

| | Bonus($)(2)

| | Restricted

Stock

Awards($)

| | Securities

Underlying

Options(#)

| | All Other

Compensation

($)(3)

|

|---|

Scott M. Rocklage, PhD(4)

Chairman & Chief Executive Officer | | 2002

2001

2000 | | $

$

$ | 400,000

375,000

323,500 | | $

$

$ | 150,000

245,313

212,500 | | $

$

$ | —

—

— | | 200,000

100,000

75,000 | | $

$

$ | 8,133

8,383

8,363 |

Michael W. Bonney(5)

President & Chief Operating Officer |

|

2002

2001

2000 |

|

$

|

296,538

—

— |

|

$

|

100,800

—

— |

|

$

$

$ |

—

—

— |

|

190,000

—

— |

|

$

|

8,996

—

— |

Francis P. Tally, MD(6)

Executive Vice President,

Chief Scientific Officer |

|

2002

2001

2000 |

|

$

$

$ |

256,323

263,000

247,775 |

|

$

$

$ |

102,506

60,753

37,662 |

|

$

$

$ |

—

—

— |

|

30,000

15,000

25,000 |

|

$

$

$ |

18,007

16,657

16,856 |

Christopher D.T. Guiffre, JD, MBA(7)

Vice President,

General Counsel & Secretary |

|

2002

2001

2000 |

|

$

|

202,500

—

— |

|

$

|

106,306

—

— |

|

$

$

$ |

—

—

— |

|

10,000

100,000

— |

|

$

|

9,000

—

— |

Oliver S. Fetzer, PhD, MBA(8)

Senior Vice President,

Corporate Development &

Chief Business Officer |

|

2002

2001

2000 |

|

$

|

148,756

—

— |

|

$

|

30,989

—

— |

|

$

$

$ |

—

—

— |

|

110,000

—

— |

|

$

|

7,029

—

— |

Robert J. McCormack, PhD(9)

Senior Vice President,

Drug Development |

|

2002

2001

2000 |

|

$

$

$ |

261,826

215,000

190,000 |

|

$

$

$ |

17,469

62,407

24,759 |

|

$

$

$ |

—

—

— |

|

28,125

40,000

100,000 |

|

$

$ |

—

750

566 |

Alan D. Watson, PhD, MBA(10)

Senior Vice President,

Corporate Development |

|

2002

2001

2000 |

|

$

$

$ |

59,152

215,000

205,333 |

|

$

$ |

—

31,390

33,881 |

|

$

$

$ |

—

—

— |

|

5,000

20,000

5,000 |

|

$

$ |

—

8,400

8,135 |

- (1)

- Salary includes amounts deferred pursuant to our 401(k) Plan.

- (2)

- Unless otherwise stated, bonuses reported are earned in the year reported but paid in January of the following year. For example, the 2002 bonus reported for Dr. Rocklage of $150,000 was earned during fiscal year 2002 and paid in January 2003.

5

- (3)

- All other compensation includes (i) long-term disability insurance premiums paid by Cubist, (ii) Cubist's matching contributions under our 401(k) Plan, and (iii) annual company-wide bonus distribution.

- (4)

- Dr. Rocklage's bonus, less applicable withholdings, was paid in Cubist common stock.

- (5)

- Mr. Bonney's employment at Cubist commenced on January 3, 2002. Mr. Bonney's bonus, less applicable withholdings, was paid in Cubist common stock

- (6)

- Dr. Tally's 2002 bonus, less applicable withholdings, was paid in Cubist common stock. Dr. Tally's 2002 bonus includes $25,000 for his receipt of the 2002 Chairman's Award. Dr. Tally's 2001 bonus reflects an additional amount that was earned in 2001 but paid in 2002 following the date of the 2002 Proxy Statement.

- (7)

- Mr. Guiffre's employment commenced on December 17, 2001. Mr. Guiffre's bonus, less applicable withholdings, was paid in Cubist common stock. Mr. Guiffre's bonus also includes loan forgiveness in the amount of $50,000.

- (8)

- Dr. Fetzer's employment at Cubist commenced on July 29, 2002. Dr. Fetzer's bonus, less applicable withholdings, was paid in Cubist common stock.

- (9)

- Dr. McCormack's employment terminated on December 18, 2002. Dr. McCormack's 2001 bonus reflects an additional amount that was earned in 2001 but paid in 2002 following the date of the 2002 Proxy Statement.

- (10)

- Dr. Watson's employment terminated on March 15, 2002. Dr. Watson also received consulting fees following his termination in the amount of $150,000 and a payment of $200,000 in connection with the termination of his employment.

6

Option Grants in Last Fiscal Year

The following table sets forth information regarding grants of stock options under our 1993 Amended and Restated Stock Option Plan and our Amended and Restated 2000 Equity Incentive Plan to the named executive officers during the fiscal year ended December 31, 2002.

Name

| | Number of

Securities

Underlying

Options

Granted

(Shares)(1)

| | Percent

of Total

Options

Granted to

Employees in

Fiscal 2002

| | Exercise

or Base

Price

| | Expiration

Date

| | Grant Date

Present

Value(2)

|

|---|

| Scott M. Rocklage, PhD | | 100,000

100,000 | | 4.81

4.81 | %

% | $

$ | 35.32

7.58 | | 1/3/12

8/9/12 | | $

$ | 2,650,182

568,596 |

| Michael W. Bonney | | 150,000

40,000 | | 7.22

1.93 | %

% | $

$ | 35.32

7.58 | | 1/3/12

8/9/12 | | $

$ | 3,975,235

227,439 |

| Francis P. Tally, MD | | 10,000

20,000 | | 0.48

0.96 | %

% | $

$ | 35.32

7.58 | | 1/3/12

8/9/12 | | $

$ | 265,018

113,719 |

| Christopher D.T. Guiffre, JD, MBA | | 10,000 | | 0.48 | % | $ | 7.58 | | 8/9/12 | | $ | 56,860 |

| Oliver S. Fetzer, PhD, MBA | | 100,000

10,000 | | 4.81

0.48 | %

% | $

$ | 8.70

8.70 | | 8/1/12

12/13/12 | | $

$ | 652,630

65,769 |

| Robert J. McCormack, PhD | | 46,875 | | 2.26 | % | $ | 35.32 | | 3/18/03 | | $ | 1,275,670 |

| Alan D. Watson, PhD, MBA | | 5,000 | | 0.24 | % | $ | 35.32 | | 3/15/03 | | $ | 147,067 |

- (1)

- Except for Dr. Rocklage's options, each option is exercisable in 16 equal quarterly installments and has a maximum term of 10 years from the date of grant, subject to earlier termination in the event of the optionee's cessation of service with Cubist. The options are exercisable during the holder's lifetime only by the holder and they are exercisable by the holder only while the holder is an employee of Cubist and for certain limited periods of time thereafter in the event of termination of employment. Pursuant to a transition agreement, all of Dr. Rocklage's unvested options as of December 31, 2003 will vest on December 31, 2003, and will be exercisable until December 31, 2006.

- (2)

- Based on the Black-Scholes pricing model suggested by the Securities and Exchange Commission. The estimated values under that model are based on arbitrary assumptions as to variables such as stock price volatility, projected future dividend yield and interest rates, discounted for lack of marketability and potential forfeiture due to vesting schedule. The estimated values above use the following significant assumptions: volatility—100%; dividend yield—0%; the average life of the options—7 years; risk-free interest rate—yield to maturity of 10-year treasury note at grant date—4.5%. The actual value, if any, an executive may realize will depend on the excess of the stock price over the exercise price on the date the option is exercised. There is no assurance that the value realized by an executive will be at or near the value estimated using a modified Black-Scholes model.

7

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth information with respect to the stock options exercised during the fiscal year ended December 31, 2002, and the unexercised stock options held at the end of such fiscal year by the named executive officers.

| |

| |

| | Number of Securities Underlying

Unexercised Options at

December 31, 2002

| | Value of Unexercised

In-the-Money Options at

December 31, 2002(1)

|

|---|

Name

| | Shares Acquired

on Exercise

| |

|

|---|

| | Value Realized

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Scott M. Rocklage, PhD | | 16,518 | | $ | 192,847 | | 357,856 | | 260,626 | | $ | 1,210,994 | | $ | 83,527 |

| Michael W. Bonney | | | | $ | 0.00 | | 30,625 | | 159,375 | | $ | 1,625 | | $ | 24,375 |

| Francis P. Tally, MD | | 20,000 | | $ | 212,482 | | 69,017 | | 45,720 | | $ | 154,565 | | $ | 23,645 |

| Christopher D.T. Guiffre, JD, MBA | | | | $ | 0.00 | | 25,625 | | 84,375 | | $ | 406 | | $ | 6,094 |

| Oliver S. Fetzer, PhD, MBA | | | | $ | 0.00 | | 6,250 | | 93,750 | | $ | 0.00 | | $ | 0.00 |

| Robert J. McCormack, PhD | | | | $ | 0.00 | | 85,272 | | 0 | | $ | 0.00 | | $ | 0.00 |

| Alan D. Watson, PhD, MBA | | 38,000 | | $ | 345,565 | | 70,125 | | 0 | | $ | 168,316 | | $ | 0.00 |

- (1)

- Based on the difference between the exercise price of each option and the last reported sales price of our common stock on the NASDAQ-NMS on December 31, 2002 of $8.23.

Equity Compensation Plans

The following table provides information as of December 31, 2002, relating to our equity compensation plans pursuant to which grants of options, restricted stock, restricted stock units or other rights to acquire shares may be granted from time to time:

Plan Category

| | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

| | Weighted-average exercise

price of outstanding options,

warrants and rights

| | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column)

| |

|---|

| Equity compensation plans approved by security holders (1) | | 4,957,110 | | $ | 20.66 | | 1,120,623 | (2)(3) |

Equity compensation plans not approved by security holders (4)(5)(6) |

|

51,364 |

|

$ |

31.79 |

|

587,518 |

|

Total |

|

5,008,474 |

|

$ |

20.77 |

|

1,708,141 |

|

- (1)

- Consists of the 1993 Amended and Restated Stock Option Plan (1993 Plan), the Amended and Restated 2000 Equity Incentive Plan (2000 Equity Incentive Plan), the 2002 Directors' Stock Option Plan and the 1997 Employee Stock Purchase Plan.

- (2)

- The 1993 Plan includes an evergreen formula pursuant to which the maximum number of shares of our common stock that shall be made available for sale under the 1993 Plan shall be 4,000,000

8

shares plus an annual increase to be added on January 1 of each year equal to fifteen percent (15%) of the difference between (i) the total number of shares of common stock and stock equivalents (other than stock options under the 1993 Plan) issued and outstanding as of the close of business on December 31 of the immediately preceding year and (ii) the total number of shares and stock equivalents (other than stock options under the 1993 Plan) issued and outstanding as of the close of business on December 31 of the year prior to such immediately preceding year. The 1993 Plan terminates pursuant to its own terms on May 6, 2003.

- (3)

- The 2000 Equity Incentive Plan includes an evergreen formula pursuant to which the maximum number of shares of our common stock that shall be made available for sale under the Equity Incentive Plan shall be 1,630,000 shares plus an annual increase to be added on January 1 of each year, beginning on January 1, 2003 until and including January 1, 2006, equal to five percent (5%) of the total number of shares of common stock and stock equivalents issued and outstanding as of the close of business on the immediately preceding December 31.

- (4)

- Includes 128,818 shares issued under the 2002 Stock In-Lieu of Cash Compensation Plan, which was adopted to allow us to conserve cash by issuing shares of Cubist common stock to directors and employees in lieu of cash that would otherwise be paid in connection with board compensation for October 1, 2002 to December 31, 2002, employee bonuses for 2002, and employee salary increases for 2003. These shares have a weighted average exercise price of $7.24 per share. Cubist adopted this plan in December of 2002 without stockholder approval because it is a broad-based plan, as defined by Nasdaq guidelines.

- (5)

- Includes 35,688 stock options outstanding under the 2001 United Kingdom Stock Option Plan (UK Option Plan). The UK Option Plan was adopted to encourage stock ownership by our employees in the United Kingdom. Options granted under the UK Option Plan have been approved under the Income and Corporation Taxes Act of 1988 of the United Kingdom. Such options receive favored tax treatment in the United Kingdom. The outstanding options under the UK Option Plan have a weighted average exercise price of $23.82 per share.

- (6)

- Includes 15,676 stock options outstanding under the TerraGen Discovery Inc. Employee Stock Option Plan (TerraGen Plan), which were assumed as part of the acquisition of TerraGen Discovery Inc. in October 2000. Options under the TerraGen Plan became exercisable for shares of Cubist common stock upon consummation of the acquisition, but remain subject to the TerraGen Plan. The outstanding options under the TerraGen Plan have a weighted average exercise price of $49.93 per share. No awards have been made under the TerraGen Plan since the date of the acquisition.

9

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

Dr. Rocklage, our Chairman and Chief Executive Officer, is employed pursuant to an employment agreement. Under the terms of the original employment agreement, dated June 20, 1994, Dr. Rocklage's annual base salary was set at $175,000 subject to annual review and increase by the Board of Directors, and he is entitled to a performance bonus upon our achievement of certain milestones for each fiscal year that have been mutually agreed upon by Dr. Rocklage and the Compensation Committee prior to the commencement of that particular fiscal year. Dr. Rocklage received a base salary in 2002 of $400,000 and a performance bonus of $150,000, paid in January 2003 in Cubist common stock. Under the terms of a transition agreement, dated February 25, 2003, Dr. Rocklage resigned as Chief Executive Officer, effective June 10, 2003, the date of our Annual Meeting of Stockholders. He will continue to serve as Chairman of the Board of Directors. Dr. Rocklage will remain an employee of Cubist until December 31, 2003, and will receive his full salary and bonus through that date. In addition, he will receive a one-time Special Recognition Award of $440,000 in January 2004. Under the terms of the transition agreement, Dr. Rocklage's unvested stock options will vest on December 31, 2003, and remain exercisable until December 31, 2006.

None of our other executive officers has entered into an employment agreement.

We have provided retention letters to certain of our executive officers. Under the terms of these retention letters, each of Mr. Bonney, Dr. Eisenstein, Dr. Fetzer, Mr. Guiffre, Mr. McGirr, and Dr. Tally is entitled to severance pay in an amount equal to twelve months of his then-current annual base salary if his employment is terminated by us without cause (as defined in the retention letter) or terminated by the executive officer for good reason (as defined in the retention letter). If such termination occurs within twenty-four months after a change-in-control, then the executive officer's unvested options granted prior to the change-in-control, if any, will become vested.

The Board of Directors and Committees of the Board

The Board of Directors held 9 meetings, including 4 telephonic meetings, and took action by written consent on 5 occasions during fiscal year 2002. There were 5 Audit Committee meetings, 6 Compensation Committee meetings, and 2 Corporate Governance Committee meetings in fiscal year 2002. No incumbent director attended fewer than 75% of the total number of meetings of the Board of Directors plus meetings of any committees on which he or she served during fiscal year 2002.

The Board of Directors has three standing committees: the Audit Committee, the Compensation Committee, and the Corporate Governance Committee.

Audit Committee

The Board of Directors has an Audit Committee, which met 5 times during the 2002 fiscal year. The functions of the Audit Committee are as set forth in the Amended and Restated Audit Committee Charter, a copy of which is attached as Appendix A to this Proxy Statement. The members of the Audit Committee are all independent, as defined in the National Association of Securities Dealers' listing standards. Members of the Audit Committee during the 2002 fiscal year were John Zabriskie, John Clarke, Barry Bloom and Susan Bayh (Mr. Clarke and Ms. Bayh joined the Audit Committee when Dr. Paul Schimmel resigned from the Board of Directors and the Audit Committee). For 2003, the Audit Committee members are John Clarke, Barry Bloom and John Zabriskie.

10

REPORT OF THE AUDIT COMMITTEE(1)

In fulfilling its oversight responsibilities, the Audit Committee reviewed the Company's audited year-end financial statements with management and the independent auditors. The Committee discussed with the independent auditors the matters to be discussed by Statement of Auditing Standards No. 61. In addition, the Committee received from the independent auditors, written disclosure and the letter required by Independence Standards Board Standard No. 1. The Committee also discussed with the independent auditors the auditors' independence from management and the company, including the matters covered by the written disclosures and letter provided by the independent auditors.

The Committee discussed with Cubist's independent auditors the overall scope and plans for their audits. The Committee meets with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of Cubist, the internal controls, and the overall quality of the financial reporting. The Committee held 5 meetings during fiscal year 2002.

Based on the reviews and discussions referred to above, the Committee reviewed, and the Board of Directors approved, the audited financial statements included in the Annual Report on Form 10-K for the year ended December 31, 2002 for filing with the Securities and Exchange Commission.

The Board of Directors has adopted a written charter for the Audit Committee. A copy of that charter is included with this proxy statement.

| April 15, 2003 | | Audit Committee

John Zabriskie

Susan Bayh

Barry Bloom

John Clarke |

- (1)

- Notwithstanding anything to the contrary set forth in any of Cubist's previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this Proxy Statement, in whole or in part, the Report of the Audit Committee shall not be incorporated by reference into any such filings.

Compensation Committee

The Board of Directors has a Compensation Committee, which met 6 times during the 2002 fiscal year. The functions of the Compensation Committee are as set forth in the Compensation Committee Charter, a copy of which is attached as Appendix B to this Proxy Statement. The members of the Compensation Committee are all independent, as defined in the National Association of Securities Dealers' listing standards.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee during the 2002 fiscal year were Mr. John Clarke, Dr. David Martin, and Mr. Walter Maupay. Except for Mr. Clarke, who acted as interim President and CEO from the Company's founding until June of 1994 but who has never taken a salary from Cubist, no member of the Compensation Committee, as constituted during 2002, was a former or current

11

officer or employee of Cubist. For 2003, the members of the Compensation Committee are David Martin, Walter Maupay, and John Zabriskie.

COMPENSATION COMMITTEE REPORT

ON EXECUTIVE OFFICER COMPENSATION(1)

Compensation Philosophy and Objectives

Our compensation philosophy for executive officer compensation is to reflect the value created and protected for shareholders, while furthering our short- and long-term strategic goals and values by aligning compensation with business objectives and individual performance. Short- and long-term compensation should motivate and reward high levels of performance and be geared to attract and retain qualified executive officers. Accordingly, our executive officer compensation consists of three primary components intended to further our overall compensation philosophy to achieve our compensation objectives. The components include: base salary, annual bonuses, and grants of stock options.

In evaluating our executive officers' performance, we generally follow the process outlined below:

- •

- Prior to or shortly after the beginning of each fiscal year, we set company goals and objectives, which are reviewed with, and ultimately approved by, the full Board of Directors. Dr. Rocklage reports to the Board on Cubist's progress toward the achievement of these goals and objectives throughout the year at Board meetings and at other times as necessary.

- •

- Once a year, generally in December, the Compensation Committee meets with Dr. Rocklage. This meeting is a comprehensive review of performance, including performance against goals and objectives set the prior year as well as a review of Dr. Rocklage's full compensation package against compensation packages of chief executive officers of similar companies. Dr. Rocklage's salary increase, bonus amount, and stock option grant are set, all commensurate with performance. In 2002, Dr. Rocklage's stock options were granted in August along with the majority of Cubist employees.

- •

- In December of each year, Dr. Rocklage evaluates the performance of the remainder of Cubist's executive officers, including their performance against their goals and objectives set the prior year and recommends to the Compensation Committee a salary increase, bonus amount, and stock option grant, all commensurate with performance. In 2002, other than Dr. Fetzer whose stock options were granted in December, executive officers' stock options were granted in August along with the majority of Cubist employees.

Compensation for Fiscal 2002

Report on Chief Executive Officer Compensation

In December 2002, the Compensation Committee set Dr. Rocklage's annual base salary at $440,000 effective on January 1, 2003. This increase represented a $40,000 increase or approximately 10.0% over the prior year's base salary. The Compensation Committee performed a comprehensive review of the compensation paid to chief executive officers of other companies and has concluded this increase positions Dr. Rocklage fairly within the range of base salaries paid to other chief executive officers of comparable companies.

12

In December 2002, the Compensation Committee awarded Dr. Rocklage $150,000 in bonus funds, which was paid in Cubist common stock as part of Cubist's 2002 Stock In-Lieu of Cash Compensation Plan, and set an additional $220,000 as the potential bonus amount payable upon achievement of goals for 2003.

In June 2002, the Compensation Committee authorized a company-wide distribution of stock options to employees in August 2002 based on performance. Dr. Rocklage was awarded 100,000 stock options as part of this distribution.

Report On Executive Compensation

In December 2002, Dr. Rocklage recommended and the Compensation Committee accepted base salary increases for the executive officers ranging from 5% to 10%. The increases were determined after reviewing performance, including performance against goals and objectives set for the year and also against salaries of similar positions in comparable companies.

The Compensation Committee also authorized bonuses in the aggregate amount of $265,601 for the five executive officers serving at year-end other than Dr. Rocklage. These bonuses were paid in Cubist common stock as part of Cubist's 2002 Stock In-Lieu of Cash Compensation Plan.

In June 2002, the Compensation Committee authorized a company-wide distribution of stock options to employees in August 2002 based on performance. In December 2002, the Compensation Committee authorized the distribution of stock options on apro rata basis to employees hired before October 1, 2002 who did not receive a stock option grant in August because of their date of hire in 2002. The five executive officers serving at year-end other than Dr. Rocklage were awarded an aggregate of 80,000 stock options as part of these distributions.

Report on Amendment of Options

The following table sets forth information with respect to the stock options (i) amended during the fiscal year ended December 31, 2002, for our named executive officers, and (ii) amended since October 30, 1996, for any of our then executive officers.

Name

| | Date

| | Number Of Securities

Underlying Options

Amended (#)

| | Market Price

Of Stock

At Time Of

Amendment ($)

| | Exercise Price At

Time Of

Amendment ($)

| | New Exercise

Price ($)

| | Length Of Original

Option Term

Remaining At

Date Of

Amendment

|

|---|

| Alan D. Watson, PhD, MBA | | 9/13/99

1/1/00

1/1/01

1/3/02 | | 46,875

2,500

15,000

5,000 | | $

$

$

$ | 20.10

20.10

20.10

20.10 | | $

$

$

$ | 4.50

11.625

29.00

35.32 | | $

$

$

$ | 4.50

11.625

29.00

35.32 | | 7.5 years

7.9 years

8.9 years

9.9 years |

| Robert J. McCormack, PhD | | 7/2/01 | | 18,750 | | $ | 38.21 | | $ | 57.56 | | $ | 35.32 | | 9.0 years |

| George H. Shimer, PhD | | 7/2/01 | | 56,250 | | $ | 38.21 | | $ | 63.38 | | $ | 35.32 | | 8.5 years |

Dr. Watson's options were amended in connection with the termination of his employment to allow for accelerated vesting and extended exercisability; they were not repriced. Dr. McCormack's and

13

Dr. Shimer's options were amended as part of a repricing plan that was made available to all Cubist employees.

Conclusion

The Compensation Committee believes that the total 2002-related compensation of the Chief Executive Officer and the executive officers, as described above, is fair and is within the range of compensation for executive officers in similar positions at comparable companies.

| April 15, 2003 | | Compensation Committee

John Clarke

David Martin

Walter Maupay |

- (1)

- Notwithstanding anything to the contrary set forth in any of Cubist's previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this Proxy Statement, in whole or in part, the Compensation Committee Report on Executive Compensation shall not be incorporated by reference into any such filings.

Corporate Governance Committee

The Board of Directors has a Corporate Governance Committee, which met 2 times during the 2002 fiscal year. The Corporate Governance Committee was established in 2002 and includes, among other things, the functions of its predecessor, the Nominating Committee. The functions of the Corporate Governance Committee are as set forth in the Corporate Governance Committee Charter, a copy of which is attached asAppendix C to this Proxy Statement. The members of the Corporate Governance Committee are all independent, as defined in the National Association of Securities Dealers' listing standards.

In addition to expanding its responsibilities from its former role as a nominating committee to its current role as a committee that is responsible for a comprehensive set of governance issues, and consistent with these additional responsibilities, the Corporate Governance Committee led various corporate governance initiatives in 2002. Among the corporate governance initiatives undertaken by the Board of Directors were three policies that were adopted by the Board of Directors. In 2002, the Board of Directors: (i) amended and restated our Corporate Governance Guidelines which were originally adopted in 1999, a copy of which is attached asAppendix D to this Proxy Statement; (ii) adopted our Code of Conduct and Ethics, a copy of which is attached asAppendix E to this Proxy Statement; and (iii) adopted our Equity Interest Policy, a copy of which is attached asAppendix F to this Proxy Statement.

The Corporate Governance Committee may consider nominees for election to the Board of Directors who are recommended by the stockholders. Nominations of persons for election to the Board of Directors may be made at a meeting of stockholders (a) by or at the direction of the Board of Directors or (b) by any stockholder who is a stockholder of record at the time of giving of notice for the election of directors at the annual meeting and who complies with the notice procedures set forth below. Such nominations, other than those made by or at the direction of the Board of Directors, shall

14

be made pursuant to timely notice in writing to the Secretary of Cubist. To be timely, a stockholder's notice shall be delivered to or mailed and received at our principal executive offices not less than 90 days nor more than 120 days prior to the annual meeting;provided, however, that if less than 100 days' notice or prior public disclosure of the date of the annual meeting is given or made to stockholders, notice by the stockholder to be timely must be so received not later than the close of business on the seventh day following the day on which such notice of the date of the annual meeting or such public disclosure was made.

The stockholder's notice shall set forth (a) as to each person whom the stockholder proposes to nominate for election or reelection as a director, all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (including such person's written consent to being named in the proxy statement as a nominee and to serving as a director if elected) and (b) as to the stockholder giving the notice (i) the name and address, as they appear on the books of Cubist, of such stockholder and (ii) the class and number of shares of Cubist that are beneficially owned by such stockholder. In addition to the requirements set forth above, a stockholder shall also comply with all applicable requirements of the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder.

15

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Nominees for Election as Directors

Our Board of Directors is divided into three classes, with one class of directors elected each year for a three-year term of office at the annual meeting of stockholders. All directors of a class hold their positions until the annual meeting of stockholders at which their terms of office expire and until their successors have been duly elected and qualified. Our Board currently has a vacancy, and we are looking for qualified candidates to fill that vacancy.

The term of office of the Class I directors will expire at the annual meeting on June 10, 2003. The Board of Directors has nominatedDr. David Martin andDr. John Zabriskie for reelection as Class I directors to hold office until the annual meeting of stockholders to be held in 2006 and until their respective successors have been duly elected and qualified. In the event that either of the nominees shall be unable or unwilling to serve as a director, the Board of Directors shall reserve discretionary authority to vote for a substitute or substitutes. The Board of Directors has no reason to believe that either of the nominees will be unable or unwilling to serve. Proxies cannot be voted for any persons other than the nominees.

The affirmative vote of a plurality of the shares of common stock present at the annual meeting, in person or by proxy, is required for the election of each of the Class I directors. Unless authority to do so is withheld, the persons named in each proxy will vote the shares represented thereby "FOR" the election of the nominees.

Information as to Directors and Nominees for Director

The names of our directors (including the nominees for reelection as Class I directors at the annual meeting) and certain information regarding each director is listed below.

Name

| | Age

| | Position(s) Held

| | Director

Since

| | Term

Expires

| | Class of

Director

|

|---|

| Scott M. Rocklage, PhD | | 48 | | Chairman and Chief Executive Officer | | 1994 | | 2005 | | III |

| John K. Clarke, MBA (1)* | | 49 | | Director | | 1992 | | 2005 | | III |

| David W. Martin, Jr., MD (2)* | | 62 | | Director | | 1997 | | 2003 | | I |

| John L. Zabriskie, PhD (1)(2) | | 63 | | Director | | 1999 | | 2003 | | I |

| Barry M. Bloom, PhD (1)(3) | | 74 | | Director | | 1993 | | 2004 | | II |

| Walter R. Maupay, MBA (2)(3) | | 64 | | Director | | 1999 | | 2004 | | II |

| Susan B. Bayh, JD (3)* | | 43 | | Director | | 2000 | | 2004 | | II |

- (1)

- Member of Audit Committee

- (2)

- Member of Compensation Committee

- (3)

- Member of Corporate Governance Committee

- *

- Committee Chairman

16

In February 2003, Cubist announced that Michael W. Bonney will succeed Scott M. Rocklage, Ph.D., as Cubist's Chief Executive Officer at the Company's Annual Meeting of Stockholders on June 10, 2003. Dr. Rocklage, Cubist's current Chairman & CEO, will remain the Company's Chairman.

Dr. Rocklage has served as one of our directors and as our Chief Executive Officer since July 1994. He has served as Chairman of Cubist's Board of Directors since March 2000. He served as our President from July 1994 until March 2001. In June 2003, Mr. Bonney will succeed Dr. Rocklage as CEO of Cubist. Dr. Rocklage will remain as Chairman of the Board of Directors. From 1990 to 1994, Dr. Rocklage served as President and Chief Executive Officer of Nycomed Salutar, Inc., a diagnostic imaging company. From 1992 to 1994, he also served as President and Chief Executive Officer and Chairman of Nycomed Interventional, Inc., a medical device company. From 1986 to 1990, he served in various positions at Nycomed Salutar, Inc. and was responsible for designing and implementing research and development programs that resulted in three drug products in human clinical trials, including the approved drugs Omniscan and Teslascan. Dr. Rocklage currently serves as a director of MDS Proteomics, Inc. He received his B.S. in Chemistry from the University of California, Berkeley and his Ph.D. in Chemistry from the Massachusetts Institute of Technology.

Ms. Bayh has served as one of our directors since June 2000. Since 1994, Ms. Bayh has served as the Commissioner of the International Joint Commission (IJC), a bi-national organization between the United States and Canada focusing on environmental issues of the Great Lakes. Ms. Bayh served as an attorney in Eli Lilly's Pharmaceutical Division handling federal regulatory issues for marketing and medical clients from 1989 to 1994 and, from 1984 until 1989, Ms. Bayh practiced law, focusing on litigation, utility and corporate law, and antitrust. She is also a director of Anthem, Inc., (a Blue Cross/Blue Shield company), Corvas International, Inc., a biotechnology company, Curis, Inc., a biotechnology company, Esperion Therapeutics, a biotechnology company, Emmis Communications, and Golden State Foods. Ms. Bayh has a B.A. from the University of California at Berkeley and a J.D. from the University of Southern California Law Center.

Dr. Bloom has served as a one of our directors since September 1993. Dr. Bloom has more than 40 years experience in the pharmaceutical industry. From 1952 to 1993, Dr. Bloom served in various positions at Pfizer Inc., including Executive Vice President of Research and Development. He is a director of Vertex Pharmaceuticals, Inc., Microbia and Neurogen Corp., biotechnology companies. Dr. Bloom received his S.B. in Chemistry and his Ph.D. in Organic Chemistry from the Massachusetts Institute of Technology.

Mr. Clarke has served as one of our directors since our incorporation and as Chairman of the Board of Directors from our incorporation to March 2000. From 1992 to 1994, Mr. Clarke served as our acting President and Chief Executive Officer. Since 1982, he has been a general partner of DSV Management in Princeton, New Jersey, the general partner of DSV Partners IV. He is a founder and director of Alkermes, Inc. and a director of VISICU, Inc., MedContrax, Inc., Molecular Mining, Inc. and TechRx, Inc. Mr. Clarke is the Managing General Partner for Cardinal Partners, founded in 1997. Mr. Clarke is also the General Partner for DSV Partners. Mr. Clarke has been employed with DSV Partners since 1982. Mr. Clarke received his B.A. in Biology and Economics from Harvard College and his MBA from The Wharton School of the University of Pennsylvania.

Dr. Martin has served as one of our directors since October 1997. From April 2003 to present, Dr. Martin has served as Chairman of GangaGen, Inc., a biotechnology company. From July 1997 until

17

April 2003, Dr. Martin served as President, Chief Executive Officer and a founder of Eos Biotechnology, Inc. Dr. Martin was a Professor of Medicine, Professor of Biochemistry and an Investigator of the Howard Hughes Medical Institute at the University of California San Francisco until 1983 when he became the first Vice President and subsequently Senior Vice President of Research and Development at Genentech, Inc., a position he held until 1990. He was Executive Vice President of DuPont Merck Pharmaceutical Company from 1991 through 1993 and then returned to California in 1994 where he was Senior Vice President of Chiron Corp., a biotechnology company, and President of Chiron Therapeutics. In May 1995, he assumed the position of President and Chief Executive Officer of Lynx Therapeutics, Inc., a biotechnology company, and served until November 1996. Dr. Martin is also a Director of Varian Medical Systems, Inc., a medical equipment and software supplier. Dr. Martin received his M.D. from Duke University.

Mr. Maupay has served as one of our directors since June 1999. Mr. Maupay served as President of Calgon Vestal Laboratories, a division of Merck & Co., Inc. from 1988 to 1995, when it was sold to Bristol-Myers Squibb. From January 1995 until June 1995, Mr. Maupay served as Group Executive of Calgon Vestal Laboratories after the sale to Bristol-Myers Squibb. From 1984 to 1988, Mr. Maupay served as Vice President, Healthcare at Calgon Vestal Laboratories. Mr. Maupay is a director of Life Medical Sciences, Inc., a medical device company, Kensey Nash Corporation, a medical device company, PolyMedica Corporation, a healthcare distribution company, Neshaminy Golf Club, Inc. and Warwick Golf Farm. Mr. Maupay received his Bachelor of Science in Pharmacy from Temple University and his MBA from Lehigh University.

Dr. Zabriskie has served as one of our directors since June 1999. Since 2000, Dr. Zabriskie has been president of Lansing Brown Investments, LLC, an investment firm. Dr. Zabriskie is also Co-Founder and Director of Puretech Ventures, LLC. From July 1997 to July 2000, Dr. Zabriskie served as Chairman of the Board of NEN Life Science Products, Inc., a laboratory supply company. From July 1997 to December 1999, Dr. Zabriskie also served as President and Chief Executive Officer of NEN Life Science Products, Inc. From November 1995 to January 1997, he was President and Chief Executive Officer of Pharmacia & Upjohn, a pharmaceutical company. Dr. Zabriskie is a director of the Kellogg Company, a food products company, and of Biomira Inc., Array Biopharma Inc., MacroChem Corporation and Biosource International, biotechnology companies. From 1994 to November 1995, he served as President, Chief Executive Officer and Chairman of Upjohn Co. Dr. Zabriskie received a B.A. from Dartmouth and his Ph.D. from the University of Rochester.

Compensation of Directors

Dr. Rocklage is Chairman of the Board of Directors and one of our full-time officers; he receives no additional compensation for serving on the Board of Directors. No other director is an officer. Through September 30, 2002, we paid $1,000 to each of Ms. Bayh, Dr. Bloom, Mr. Clarke, Dr. Martin, Mr. Maupay, and Dr. Zabriskie, for each meeting of the Board of Directors he or she attended, and each was reimbursed for expenses in connection with his or her attendance. Commencing on October 1, 2002, non-employee directors received $3,000 for each meeting of the Board of Directors he or she attended in person, $1,000 for each meeting of the Board of Directors he or she attended by phone, and $1,000 for each committee meeting attended, whether in person or by phone. In addition, committee chairmen receive an additional $1,000 for each meeting chaired. All director compensation

18

earned during the period between October 1, 2002, and December 31, 2002, was paid to directors in the form of Cubist common stock as part of Cubist's 2002 Stock In-Lieu of Cash Compensation Plan.

In 2002, we paid John Clarke $10,000 as compensation for attendance as an independent director at meetings of the Board of Directors held in 1999, 2000, and 2001 for which he had previously not been paid. In 2002, we paid Dr. Paul Schimmel, a former Board member, $20,000 in consulting fees, and we reimbursed him for expenses in connection with his attendance at board meetings. Dr. Schimmel did not receive any compensation for attendance at Board Meetings in 2002.

In 2003, Ms. Bayh, Dr. Bloom, Mr. Clarke, Dr. Martin, Mr. Maupay, and Dr. Zabriskie will receive a fee of $3,000 for each meeting of the Board of Directors he or she attends in person, $1,000 for each meeting of the Board of Directors he or she attends by phone, and $1,000 for each committee meeting he or she attends, whether in person or by phone. In addition, committee chairmen will receive an additional $1,000 for each meeting chaired.

Pursuant to our 2002 Directors' Stock Option Plan, upon first joining the Board of Directors, each director who is not one of our officers or employees automatically is granted a stock option exercisable for 15,000 shares of common stock at fair market value, and each time that he or she is serving as a director on the close of business on the date of an annual meeting of stockholders, such director is automatically granted on such business day a stock option exercisable for 10,000 shares of common stock at fair market value. Initial grants are exercisable in twelve quarterly installments, and annual grants are exercisable in full one year after the date of grant. If Proposal #2—Ratification, Adoption, and Approval of the Amended and Restated 2002 Directors' Stock Option Plan—is adopted by the stockholders, each non-employee director will receive a stock option exercisable for 10,000 shares of common stock at fair market value at the time of appointment, and each time that he or she is serving as a director on the close of business on the date of an annual meeting of stockholders, such director would be granted a stock option in an amount previously determined by the Board. The current amount set by the Board of Directors for such annual grants is either (a) 10,000 shares of common stock at fair market value if Cubist's common stock underperforms our peer group index for the preceding calendar year or (b) 12,500 shares of common stock at fair market value if Cubist's common stock outperforms our peer group index for the preceding calendar year.

None of our directors has a consulting agreement with Cubist.

19

PROPOSAL NO. 2

RATIFICATION, ADOPTION AND APPROVAL OF

THE AMENDED AND RESTATED 2002 DIRECTORS' STOCK OPTION PLAN

In March 2002, our Board of Directors approved the adoption of the Directors' Stock Option Plan, referred to herein as the Original Directors' Option Plan, subject to stockholder approval, and in June 2002, the Original Directors' Option Plan was ratified and approved by the stockholders. We may issue up to 175,000 shares of common stock under the Original Directors' Option Plan.

In December of 2002, our Board of Directors approved a change in its compensation structure, retroactive to October 1, 2002. The change was designed to attract and retain qualified directors, align directors' interests more closely with those of stockholders, reflect a pay-for-performance philosophy, and facilitate increased activity on the part of the committees of the Board. The cash portion of such changes are summarized below:

Element

| | Old

| | Current

|

|---|

| Retainer | | | None | | None |

| Board Meetings | | $ | 1,000 | | $3,000 per meeting (in person)

$1,000 per meeting (by phone) |

| Committee Meetings | | $ | 0 | | $1,000 per meeting (in person or by phone) |

| Committee Chairmen | | $ | 0 | | $1,000 per meeting additional |

The changes approved by the Board of Directors included changes to the stock option portion of its compensation structure. Such changes require amendment to the Original Directors' Option Plan and are therefore subject to stockholder approval. Such amendments are summarized below:

Element

| | Current

| | Proposed

|

|---|

| Initial Option Grant | | 15,000 options | | 10,000 options |

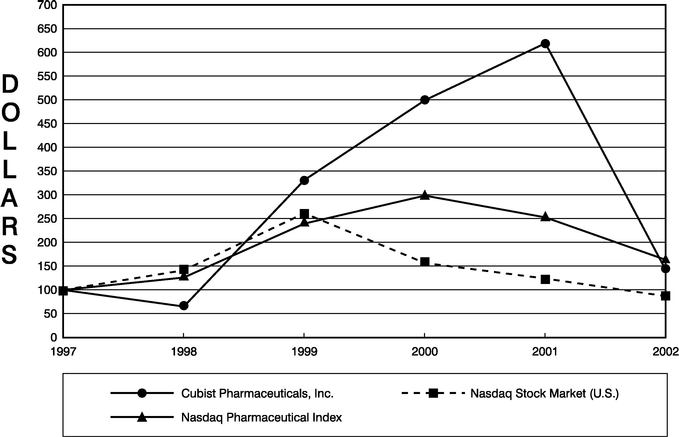

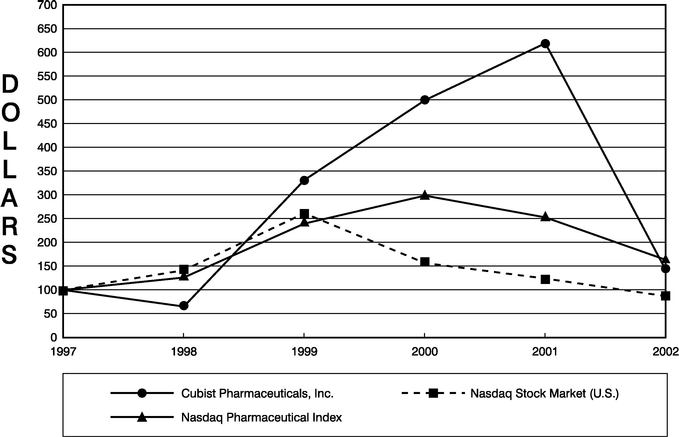

| Annual Option Grant | | 10,000 options | | As determined in advance by the Board. The current amount set by the Board is 10,000 options plus an additional 2,500 options if the Company's common stock outperforms the Nasdaq Pharmaceutical Index (see "Corporate Performance Graph" below) for the preceding calendar year. |

If this Proposal #2 is adopted, the Original Directors' Option Plan will be amended and restated to reflect the changes referenced above. A copy of the proposed Amended and Restated 2002 Directors' Stock Option Plan, referred to herein as the Directors' Option Plan, is attached as Appendix G to this Proxy Statement. If this Proposal #2 is not adopted, the Original Directors' Option Plan will remain in full force and effect as is and without modification.

Summary of the Directors' Option Plan

The following description of certain provisions of the Directors' Option Plan, is intended as a summary of such provisions and does not purport to be a complete statement of such provisions or of the Directors' Option Plan or its operation; and such description is qualified in its entirety by reference

20

to the provisions of the Directors' Option Plan and to the forms of stock option agreements evidencing options granted under the Directors' Option Plan.

Proceeds received by Cubist from the exercise of options under the Directors' Option Plan have been and are to be used for general corporate purposes. The Directors' Option Plan is not subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended.

Purpose. The purpose of the Directors' Option Plan is to promote the recruiting and retention of highly qualified directors, to strengthen commonality of interest between directors and stockholders by encouraging stock ownership by outside directors of Cubist and to provide additional incentive for them to promote the success of Cubist's business. Options granted under the Directors' Option Plan are not incentive stock options.

Administration. The Directors' Option Plan will be administered by the Compensation Committee. Subject to the provisions of the Directors' Option Plan, the Compensation Committee has complete authority to interpret the Directors' Option Plan, to prescribe, amend and rescind rules and regulations relating to it, to determine the terms and provisions of the respective option agreements (which need not be identical), and to make all other determinations deemed necessary or advisable by it for the administration of the Directors' Option Plan).

Eligibility. Only members of Cubist's Board of Directors may be granted options under the Directors' Option Plan.

Shares Subject to the Directors' Option Plan and to Outstanding Options. A total of 175,000 shares of common stock are reserved for issuance under the Directors' Option Plan.

The number of shares of common stock covered by each outstanding option under the Directors' Option Plan and the option exercise price of each such option, as well as the number of shares that may be optioned under the Directors' Option Plan, will be proportionately adjusted for any increase or decrease in the number of outstanding shares of common stock by reason of (i) the subdivision (e.g., split-up) or combination of such shares, (ii) any stock dividend payable in shares of common stock, or (iii) any reclassification of outstanding shares of common stock.

In the event that we are acquired, the Board of Directors shall have the authority to terminate all stock options granted pursuant to the Directors' Option Plan that remain unexercised at the closing of that transaction. In the event of a reclassification or change of the outstanding shares of common stock or in the event of any consolidation or merger of Cubist with or into another company or in the event of any sale or conveyance to another company or entity of the property of Cubist as a whole or substantially as a whole, then each option outstanding immediately prior to such reclassification, change, consolidation, merger, sale or conveyance shall become exercisable for shares of stock or other securities equivalent in kind and value to those shares of stock or other securities that the holder of such option would have received if he or she had exercised such option in full immediately prior to such reclassification, change, consolidation, merger, sale or conveyance and had continued to hold such shares of stock or other securities (together with all other shares, stock and securities that thereafter would have been issued in respect thereof) to the time of the exercise of such option.

Grant and Exercise of Options; Exercise Price. Each non-employee director who is elected to the Board of Directors for the first time during the term of the Directors' Option Plan is automatically granted, pursuant to the terms of the Directors' Option Plan itself, and without any action required by

21

such non-employee director, the Compensation Committee or the Board of Directors, on such director's first election date, an option to purchase 10,000 shares of common stock. In addition, each non-employee director that continues to serve as a director at the close of business on the date of the annual meeting of stockholders, is automatically granted pursuant to the terms of the Directors' Option Plan itself (and without any action required by such non-employee director, the Compensation Committee or the Board of Directors), on such business day, a stock option in an amount previously determined by the Board. The current amount set by the Board of Directors for such annual grants is either (a) 10,000 shares of common stock if Cubist's common stock underperforms the Nasdaq Pharmaceutical Index for the preceding calendar year or (b) 12,500 shares of common stock if Cubist's common stock outperforms our peer group index for the preceding calendar year.

The exercise price of each formula option is equal to the fair market value of the common stock on the applicable grant date, which is deemed to be equal to the closing price of a share of common stock on such date, as reported on the Nasdaq National Market, or if no trades were reported on such date, the closing price of a share of common stock on the most recent trading day preceding such date on which a trade occurred. The term of each formula option is ten years from the applicable grant date. Initial grants are exercisable in three equal installments, with the first installment occurring on the first anniversary of the grant date and the second and third installments occurring on the second and third anniversary of the grant date, respectively. Annual grants to directors shall be immediately exercisable unless otherwise determined by the Compensation Committee.

Method of Exercise. An optionee exercises an option under the Directors' Option Plan by giving written notice of exercise to us, accompanied by (i) a check or bank draft payable to the order of Cubist in an amount equal to the aggregate exercise price for the shares of common stock being purchased by the optionee, (ii) shares of common stock having a fair market value equal to the aggregate exercise price for the shares of common stock being purchased by the optionee, or (iii) if authorized by the Board of Directors, a promissory note payable to us in an amount equal to the aggregate exercise price for the shares of common stock being purchased by the optionee. We will deliver or cause to be delivered to the optionee a certificate for the number of shares then being purchased by such optionee.

Upon exercise of any option by an optionee, we have the right to require such optionee to remit to us an amount sufficient to satisfy federal, state, local, employment or other tax withholding requirements if and to the extent required by law (whether so required to secure for Cubist an otherwise available tax deduction or otherwise) prior to the delivery of any certificate or certificates representing any shares of common stock purchased by such optionee pursuant to such exercise. The Compensation Committee may permit such optionee to satisfy such tax withholding requirements by delivering to us shares of common stock having a fair market value equal to the amount to be withheld.

In lieu of delivering a check, bank draft or other shares of common stock in connection with any exercise of any option, an optionee may, unless prohibited by applicable law, elect to effect payment in connection with such exercise by means of a "cashless" exercise. To effect a cashless exercise, an optionee must include with the written notice of exercise (i) irrevocable instructions to deliver for sale to a registered securities broker acceptable to us a number of shares of common stock subject to the option being exercised sufficient, after brokerage commissions, to cover the aggregate exercise price payable with respect to such shares and, if the optionee further elects, the optionee's withholding obligations, if any, with respect to such exercise, together with (ii) irrevocable instructions to such

22

broker to sell such shares and to remit directly to us such aggregate exercise price and, if the optionee has so elected, the amount of such withholding obligations. We will not be required to deliver to such securities broker any stock certificate for such shares until we have received from the broker such aggregate exercise price and, if the optionee has so elected, the amount of such withholding obligations.

The right of any optionee to exercise an option and the obligation of Cubist to issue shares of common stock upon exercise of such option are subject to compliance with all of the terms of the Directors' Option Plan and the applicable stock option agreement evidencing such option. If any law or applicable regulation of the SEC or other body having jurisdiction shall require us or the optionee to take any action in connection with shares being purchased upon exercise of the option, exercise of the option and delivery of the certificate or certificates for such shares will be postponed until completion of the necessary action, which shall be taken at our expense.

Acceleration of Exercisability. The Compensation Committee may accelerate the exercisability of any option in whole or in part at any time. Moreover, the Directors' Option Plan provides that each outstanding option will immediately become fully exercisable upon a "Change in Corporate Control" of Cubist, as more fully defined in the Directors' Option Plan. A "Change in Corporate Control" includes, among other things, the acquisition by any third party (as hereinafter defined), directly or indirectly, of more than 25% of the common stock outstanding at the time, without the prior approval of our Board of Directors. A "third party" for purposes of the foregoing means any person other than Cubist or a subsidiary or employee benefit plan or trust maintained by Cubist or any of its subsidiaries together with any of such person's "affiliates" and "associates" as defined in Rule 12b-2 under the Exchange Act. The Compensation Committee, however, has the discretion to exclude any event from being deemed a "Change in Corporate Control." If the Board of Directors exercises such discretion, outstanding options shall not accelerate.

Transferability of Options. Options under the Directors' Option Plan are not transferable, except by will or the laws of descent and distribution or except to the extent authorized and permitted by the Compensation Committee. In granting its authorization and permission to any proposed transfer of an option to a third party, the Compensation Committee may impose conditions or requirements that must be satisfied by the transferor or the third party transferee prior to or in connection with such transfer.

Termination of Association with Cubist. If an optionee under the Directors' Option Plan ceases to be a director of Cubist or its subsidiaries for any reason other than death, any option held by such optionee or a permitted transferee of such optionee may only be exercised, if at all, by such optionee or such permitted transferee, as the case may be, at any time within 90 days after such cessation, but only to the extent exercisable at the time of such cessation and in no event after the expiration of the term of such option. If an optionee dies, any option held by such optionee or a permitted transferee of such optionee may be exercised by such optionee, such optionee's executor or administrator or such permitted transferee, as the case may be, at any time within the shorter of the term of such option or 12 months after the date of retirement or death, but only to the extent exercisable at death. Options that are not exercisable at the time of such cessation, or which are so exercisable but are not exercised within the time periods described above, terminate.

In the event that the applicable stock option agreement with respect to any option contains specific provisions governing the effect that any such cessation will have on the exercisability of such option or

23

in the event that the Board of Directors, the Compensation Committee or any other committee of the Board of Directors composed of outside directors that are disinterested on the matter at any time adopt specific provisions governing the effect that any such cessation will have on the exercisability of such option, then such provisions will, to the extent they are inconsistent with the Directors' Option Plan, control and be deemed to supersede any conflicting provisions of the Directors' Option Plan.

Limitation of Rights in Option Stock. An optionee has no rights as a stockholder merely by holding options which have not been exercised for shares of common stock.

Term and Termination of the Directors' Option Plan; Amendment. Options under the Directors' Option Plan may not be granted later than June 30, 2012. The Board of Directors may, at any earlier time, terminate the Directors' Option Plan or make such modifications of the Directors' Option Plan as it shall deem advisable. No termination or amendment of the Directors' Option Plan which (a) reduces the number of shares of stock subject to awards, (b) increases the option price, or (c) changes the vesting schedule, may, without the consent of any recipient of an award under the Directors' Option Plan shall theretofore have been granted, adversely affect the rights of the recipient under such award.

Federal Tax Consequences to Cubist and to the Option Recipient