QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

ý |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Cubist Pharmaceuticals, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

CUBIST PHARMACEUTICALS, INC.

65 Hayden Avenue

Lexington, MA 02421

NOTICE OF 2004 ANNUAL MEETING OF STOCKHOLDERS

TO THE STOCKHOLDERS OF CUBIST PHARMACEUTICALS, INC.:

NOTICE IS HEREBY GIVEN that the 2004 Annual Meeting of Stockholders of Cubist Pharmaceuticals, Inc. will be held at our corporate offices, 65 Hayden Avenue, Lexington, MA 02421, on Thursday, June 10, 2004, at 8:30 A.M., local time, for the following purposes:

- 1.

- To elect three Class II directors to hold office for a three-year term and until their successors have been duly elected and qualified.

- 2.

- To consider and vote upon a proposal to amend our corporate charter to increase the number of authorized shares from 50,000,000 shares to 150,000,000 shares.

- 3.

- To consider and vote upon a proposal to amend and restate the Amended and Restated 2002 Directors' Stock Option Plan.

- 4.

- To transact such other business as may properly come before the annual meeting or any adjournments or postponements thereof.

The Board of Directors has fixed April 12, 2004, as the record date for the determination of stockholders entitled to notice of, and to vote at, the annual meeting. Accordingly, only stockholders of record at the close of business on April 12, 2004, will be entitled to notice of, and to vote at, such meeting or any adjournments thereof.

To ensure your representation at the annual meeting, however, you are urged to vote by proxy by following one of these steps as promptly as possible:

- (a)

- Vote via telephone (toll-free) in the United States or Canada (see instructions on the enclosed proxy card);

- (b)

- Vote via the internet (see instructions on the enclosed proxy card); or

- (c)

- Complete, date, sign and return the enclosed proxy card (a postage-prepaid envelope is enclosed).

The Internet and telephone voting procedures are designed to authenticate shareholders' identities, to allow shareholders to vote their shares, and to confirm that their instructions have been properly recorded. Specific instructions to be followed by any registered shareholder interested in voting via the Internet or telephone are set forth on the enclosed proxy card and must be completed by 11:59 p.m. on June 9, 2004. Your shares cannot be voted unless you date, sign, and return the enclosed proxy card, vote via the internet or telephone, or attend the annual meeting in person. Regardless of the number of shares you own, your careful consideration of, and vote on, the matters before the shareholders is important.

April 15, 2004

NOTE: THE BOARD OF DIRECTORS SOLICITS THE EXECUTION AND PROMPT RETURN OF THE ACCOMPANYING PROXY. WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE ANNUAL MEETING, PLEASE VOTE VIA THE INTERNET OR TELEPHONE, OR COMPLETE, DATE, SIGN AND MAIL THE ACCOMPANYING PROXY CARD AND PROMPTLY RETURN IT IN THE PRE-ADDRESSED ENVELOPE PROVIDED FOR THAT PURPOSE. IF YOU ATTEND THE ANNUAL MEETING, YOU MAY WITHDRAW ANY PROXY GIVEN BY YOU AND VOTE YOUR SHARES IN PERSON.

CUBIST PHARMACEUTICALS, INC.

65 Hayden Avenue

Lexington, MA 02421

PROXY STATEMENT

GENERAL INFORMATION

Proxy Solicitation

This proxy statement is furnished to the holders of the common stock, $.001 par value per share, of Cubist Pharmaceuticals, Inc. in connection with the solicitation of proxies on behalf of our Board of Directors for use at the 2004 Annual Meeting of Stockholders to be held on June 10, 2004, or at any adjournment or postponement of such meeting. The purposes of the annual meeting and the matters to be acted upon are set forth in the accompanying Notice of 2004 Annual Meeting of Stockholders. The Board of Directors knows of no other business that will come before the annual meeting.

This proxy statement and proxies for use at the annual meeting will be first mailed to stockholders on or about April 15, 2004, and such proxies will be solicited chiefly by mail, but additional solicitations may be made by telephone or telegram by our officers or regular employees. We may enlist the assistance of brokerage houses in soliciting proxies. We shall bear all solicitation expenses, including costs of preparing, assembling and mailing proxy material.

Voting and Revocability of Proxy

Registered shareholders can vote their shares via (1) a toll-free telephone call from the U.S. or Canada, (2) the Internet, or (3) by mailing their signed proxy card. The telephone and Internet voting procedures are designed to authenticate shareholders' identities, to allow shareholders to vote their shares, and to confirm that their instructions have been properly recorded. We have been advised by counsel that the procedures that have been put in place are consistent with the requirements of applicable law. Specific instructions to be followed by any registered shareholder interested in voting via telephone or the Internet are set forth on the enclosed proxy card.

Stockholders may revoke the authority granted by their execution of proxies at any time before the effective exercise of such authority by filing with our Secretary a written revocation or a duly executed proxy bearing a later date or by voting in person at the annual meeting. Shares represented by executed and unrevoked proxies will be voted in accordance with the choice or instructions specified thereon. If no specifications are given, the proxies intend to vote the shares represented thereby to (i) approve Proposal No. 1 to elect the nominees to the Board of Directors, (ii) approve Proposal No. 2 to amend our corporate charter to increase the number of authorized shares of common stock from 50,000,000 to 150,000,000, and (iii) approve Proposal No. 3 to amend and restate the Amended and Restated 2002 Directors' Stock Option Plan, all as set forth in the accompanying Notice of 2004 Annual Meeting of Stockholders and in accordance with their best judgment on any other matters that may properly come before the annual meeting.

Record Date and Voting Rights

Only stockholders of record at the close of business on April 12, 2004, are entitled to notice of, and to vote at, the annual meeting, or any adjournment or postponement of such meeting. On

March 1, 2004, we had outstanding 40,145,270 shares of common stock, each of which is entitled to one vote upon the matters to be presented at the annual meeting. The presence, in person or by proxy, of a majority of the issued and outstanding shares of common stock will constitute a quorum for the transaction of business at the annual meeting. Votes withheld from any nominee, abstentions, and broker "non-votes" are counted as present or represented for purposes of determining the presence or absence of a quorum for the annual meeting. A broker "non-vote" occurs when a nominee holding shares for a beneficial owner does not vote on one or more proposals because the nominee does not have discretionary voting power and has not received instructions from the beneficial owner.

In the election of directors, the affirmative vote of a plurality of the shares of common stock present or represented and entitled to vote at the annual meeting, in person or by proxy, is required for the election of each of the nominees. Abstentions and broker "non-votes" will have no effect on the voting outcome with respect to the election of directors. To increase the amount of authorized shares of common stock under our charter and to amend and restate the Amended and Restated 2002 Directors' Stock Option Plan, the affirmative vote of the holders of a majority of shares entitled to vote at the annual meeting, in person or by proxy, is required. Abstentions have the practical effect of a vote against these proposals. Although counted as present for the purpose of determining a quorum, broker "non-votes" are not counted for any purpose in determining whether a matter has been approved.

2

PRINCIPAL STOCKHOLDERS

The following table sets forth certain information with respect to each person known to us to be the beneficial owner of more than 5% of the issued and outstanding common stock as of March 1, 2004 (unless another date is specified in the footnotes below). As of March 1, 2004, 40,145,270 shares of common stock were outstanding.

| | Amount and Nature of

Beneficial Ownership

| |

|

|---|

Name and Address of Beneficial Owner

| | Outstanding

Shares

| | Right to

Acquire

| | Total

Number

| | Percentage

of Class

|

|---|

Mazama Capital Management Inc.(1)

One S.W. Columbia, Suite 1500

Portland, Oregon 97258 | | 4,807,668 | | — | | 4,807,668 | | 12.69% |

T. Rowe Price Associates, Inc.(2)

100 East Pratt Street

Baltimore, Maryland 212202-1009 | | 3,995,000 | | — | | 3,995,000 | | 9.9% |

Arnold H. Snider (Deerfield Management)(3)

780 Third Avenue, 37th Floor

New York, New York 10017 | | 2,500,500 | | — | | 2,500,500 | | 5.44% |

With respect to the foregoing table, you should note that:

- (1)

- The information reported is based on a Schedule 13G/A, containing current ownership information as of December 31, 2003, filed with the SEC by Mazama Capital Management, Inc. or Mazama. Mazama, an investment adviser, has sole voting power with respect to 2,560,925 shares and sole dispositive power with respect to 4,807,668 shares.

- (2)

- The information reported is based on a Schedule 13G, containing ownership information as of December 31, 2003, filed with the SEC by T. Rowe Price Associates or T. Rowe Price. These securities are owned by various individual and institutional investors which T. Rowe Price serves as investment adviser with power to direct investments and/or sole power to vote the securities. For purposes of the reporting requirements of the Securities Exchange Act of 1934, T. Rowe Price is deemed to be a beneficial owner of such securities; however, T. Rowe Price expressly disclaims that it is, in fact, the beneficial owner of such securities.

- (3)

- The information reported is based on a Schedule 13G/A, containing ownership information as of December 31, 2003, filed with the SEC by Deerfield Capital, L.P., Deerfield Partners, L.P, Deerfield Management Company, Deerfield International Limited and Arnold H. Snider. Mr. Snider has shared voting and dispositive power with respect to the shares. Mr. Snider is President of Snider Management Company, the General Partner of Deerfield Management Company. Mr. Snider is also the President of Snider Capital Corp., the General Partner of Deerfield Capital, L.P.

3

MANAGEMENT STOCKHOLDERS

The following table sets forth information as of March 1, 2004, as reported to us, with respect to the beneficial ownership of the common stock by each of our executive officers and directors, and by all executive officers and directors as a group. Beneficial ownership is determined in accordance with the rules and regulations of the SEC. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock subject to options held by that person that are currently exercisable or exercisable within 60 days of March 1, 2004, are deemed outstanding. These shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Except as indicated below and pursuant to applicable community property laws, each stockholder named in the table has sole voting and investment power with respect to the shares set forth opposite such stockholder's name. Shares included below under "Right to Acquire" represent shares subject to outstanding stock options currently exercisable or exercisable within 60 days of March 1, 2004.

| | Number of Shares

Beneficially Owned

| |

|

|---|

| | Percentage

of Shares

Beneficially

Owned

|

|---|

Name

| | Outstanding

Shares

| | Right to

Acquire

| | Total

Number

|

|---|

| Michael W. Bonney(1) | | 62,603 | | 165,624 | | 228,227 | | * |

| Barry I. Eisenstein, MD | | 9,306 | | 20,062 | | 29,368 | | * |

| Oliver S. Fetzer, PhD, MBA | | 1,552 | | 41,812 | | 43,364 | | * |

| Christopher D.T. Guiffre, JD, MBA | | 4,677 | | 65,061 | | 69,738 | | * |

| David W.J. McGirr, MBA | | 738 | | 32,249 | | 32,987 | | * |

| Robert J. Perez, MBA | | 429 | | 10,062 | | 10,491 | | * |

| Francis P. Tally, MD | | 96,249 | | 95,892 | | 192,141 | | * |

| Scott M. Rocklage PhD(2) | | 184,237 | | 618,482 | | 802,719 | | 1.9 |

| Kenneth M. Bate, MBA | | — | | — | | — | | * |

| Susan B. Bayh, JD | | 1,519 | | 34,062 | | 35,581 | | * |

| John K. Clarke, MBA(3) | | 71,935 | | 48,400 | | 120,335 | | * |

| David W. Martin, Jr., MD | | 16,381 | | 47,700 | | 64,081 | | * |

| Walter R. Maupay, MBA(4) | | 18,857 | | 46,300 | | 65,157 | | * |

| J. Matthew Singleton MBA, CPA | | — | | — | | — | | * |

| All directors and executive officers as a group (14 persons) | | 468,483 | | 1,225,706 | | 1,694,189 | | 4.1 |

- *

- Less than 1% of the issued and outstanding shares of common stock.

- (1)

- Mr. Bonney holds a portion of his shares with joint voting and investment power with Mrs. Alison G. Bonney.

- (2)

- A portion of the shares attributable to Dr. Rocklage are held in trust for the benefit of his children.

- (3)

- A portion of the shares attributable to Mr. Clarke are held in trust for the benefit of his children.

- (4)

- Mr. Maupay holds a portion of his shares with joint voting and investment power with Ms. Margaret Maupay.

4

EXECUTIVE COMPENSATION

Summary Compensation Table

The table below sets forth compensation information for the fiscal years ended December 31, 2003, 2002, and 2001 with respect to our former Chief Executive Officer, our current Chief Executive Officer, and our four most highly paid executive officers who were serving in such capacity at the end of 2003. We refer to these officers as our named executive officers.

| |

| | Annual Compensation

| | Long-Term

Compensation Awards

| |

|

|---|

Name and

Principal Position

| | Year

| | Salary($)(1)

| | Bonus($)(2)

| | Restricted

Stock

Awards($)

| | Securities

Underlying

Options(#)

| | All Other

Compensation

($)(3)(4)

|

|---|

Michael W. Bonney(5)

President & Chief Executive Officer | | 2003

2002

2001 | | $

$

$ | 346,910

296,538

— | | $

$

$ | 136,461

100,800

— | | $

$

$ | —

—

— | | 310,000

190,000 | | $

$

$ | 11,956

8,996

— |

Scott M. Rocklage, PhD(6)

Chairman |

|

2003

2002

2001 |

|

$

$

$ |

445,128

410,000

387,000 |

|

$

$

$ |

220,000

150,000

245,313 |

|

$

$

$ |

—

—

— |

|

—

200,000

100,000 |

|

$

$

$ |

446,984

8,133

8,383 |

Barry I. Eisenstein, MD(7)

Senior Vice President,

Research and Development |

|

2003

2002

2001 |

|

$

$

$ |

278,526

—

— |

|

$

$

$ |

132,570

—

— |

|

$

$

$ |

—

—

— |

|

80,500

—

— |

|

$

$

$ |

10,540

—

— |

Oliver S. Fetzer, PhD, MBA(8)

Senior Vice President &

Chief Business Officer |

|

2003

2002

2001 |

|

$

$

$ |

353,856

148,756

— |

|

$

$

$ |

99,750

30,989

— |

|

$

$

$ |

—

—

— |

|

18,500

110,000

— |

|

$

$

$ |

10,552

7,029

— |

David W.J. McGirr, MBA(9)

Senior Vice President &

Chief Financial Officer |

|

2003

2002

2001 |

|

$

$

$ |

303,846

40,490

— |

|

$

$

$ |

89,250

—

— |

|

$

$

$ |

—

—

— |

|

15,500

00,000

— |

|

$

$

$ |

10,552

333

— |

Francis P. Tally, MD(10)

Senior Vice President,

Scientific Affairs &

Chief Scientific Officer |

|

2003

2002

2001 |

|

$

$

$ |

226,769

267,000

267,472 |

|

$

$

$ |

78,475

102,506

60,753 |

|

$

$

$ |

—

—

— |

|

13,000

30,000

15,000 |

|

$

$

$ |

20,067

18,007

16,657 |

- (1)

- Salary includes amounts contributed to our 401(k) Plan and not included as taxable income in accordance with IRS rules. Salary increases for 2003 were paid in Cubist common stock.

- (2)

- Bonuses reported for years 2001 and 2002 were earned in the year reported but paid in January of the following year. For example, the 2002 bonus reported for Dr. Rocklage of $150,000 was earned during fiscal year 2002 and paid in January 2003. Bonuses reported for 2003 were paid in December 2003, with the exception of Dr. Rocklage's 2003 bonus, which was paid in January of 2004.

- (3)

- All other compensation includes (i) long-term disability insurance premiums paid by Cubist, (ii) Cubist's matching contributions under our 401(k) Plan, and (iii) a company bonus that was distributed to all employees.

- (4)

- Drs. Rocklage and Tally have additional long-term disability policies.

5

- (5)

- Mr. Bonney's employment at Cubist commenced on January 3, 2002. Mr. Bonney's 2002 bonus, less applicable withholdings, was paid in Cubist common stock.

- (6)

- Dr. Rocklage's 2002 bonus, less applicable withholdings, was paid in Cubist common stock. Dr. Rocklage served as our Chief Executive Officer until June 10, 2003, and continued as an employee until December 31, 2003. Dr. Rocklage's 2003 "All Other Compensation" figure also includes a one-time special recognition award in the amount of $440,000 pursuant to a transition agreement.

- (7)

- Dr. Eisenstein's employment at Cubist commenced on January 6, 2003. Dr. Eisenstein's 2003 bonus includes a one-time sign-on bonus in the amount of $75,000 that was paid in January 2003.

- (8)

- Dr. Fetzer's employment at Cubist commenced on July 29, 2002. Dr. Fetzer's 2002 bonus, less applicable withholdings, was paid in Cubist common stock.

- (9)

- Mr. McGirr's employment at Cubist commenced on November 11, 2002.

- (10)

- Dr. Tally's 2002 bonus, less applicable withholdings, was paid in Cubist common stock. Dr. Tally's 2002 bonus includes $25,000 for his receipt of the 2002 Chairman's Award.

Option Grants in Last Fiscal Year

The following table sets forth information regarding grants of stock options under our 1993 Amended and Restated Stock Option Plan and our Amended and Restated 2000 Equity Incentive Plan to the named executive officers during the fiscal year ended December 31, 2003.

Name

| | Number of

Securities

Underlying

Options

Granted

(Shares)(1)

| | Percent

of Total

Options

Granted to

Employees in

Fiscal 2003

| | Exercise

or Base

Price

| | Expiration

Date

| | Grant Date

Present

Value(2)

|

|---|

| Michael W. Bonney | | 203,986

46,014

60,000 | | 8.84

2.00

2.60 | %

%

% | $

$

$ | 8.23

8.23

12.61 | | 2/26/2013

2/26/2013

12/12/2013 | | $

$ | 1,106,522

249,603

498,684 |

| Scott M. Rocklage, PhD | | — | | — | | | — | | — | | | — |

| Barry I. Eisenstein, MD | | 80,000

500 | | 3.47

0.02 | %

% | $

$ | 6.36

13.26 | | 2/3/2013

9/12/2013 | | $

$ | 335,352

4,370 |

| Oliver S. Fetzer, PhD, MBA | | 500

18,000 | | 0.02

0.78 | %

% | $

$ | 13.26

12.61 | | 9/12/2013

12/12/2013 | | $

$ | 4,370

149,605 |

| David W.J. McGirr, MBA | | 500

15,000 | | 0.02

0.65 | %

% | $

$ | 13.26

12.61 | | 9/12/2013

12/12/2013 | | $

$ | 4,370

124,671 |

| Francis P. Tally, MD | | 500

12,500 | | 0.02

0.54 | %

% | $

$ | 13.26

12.61 | | 9/12/2013

12/12/2013 | | $

$ | 4,370

103,893 |

- (1)

- Each option is exercisable in 16 equal quarterly installments and has a maximum term of 10 years from the date of grant, subject to earlier termination in the event of the optionee's cessation of service with Cubist. The options are exercisable during the holder's lifetime only by the holder and they are exercisable by the holder only while the holder is an employee of Cubist and for certain limited periods of time thereafter in the event of termination of employment. Pursuant to a

6

transition agreement, all of Dr. Rocklage's then unvested options as of December 31, 2003 vested on December 31, 2003, and will be exercisable until December 31, 2006.

- (2)

- Based on the Black-Scholes pricing model suggested by the Securities and Exchange Commission. The estimated values under that model are based on arbitrary assumptions as to variables such as stock price volatility, projected future dividend yield and interest rates, discounted for lack of marketability and potential forfeiture due to vesting schedule. The estimated values above use the following significant assumptions: volatility—65.4%; dividend yield—0%; the average life of the options—7 years; risk-free interest rate—3.5% (yield to maturity of 7-year treasury note at grant date). The actual value, if any, an executive may realize will depend on the excess of the stock price over the exercise price on the date the option is exercised. There is no assurance that the value realized by an executive will be at or near the value estimated using a modified Black-Scholes model.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth information with respect to the stock options exercised during the fiscal year ended December 31, 2003, and the unexercised stock options held at the end of such fiscal year by the named executive officers.

| |

| |

| | Number of Securities Underlying

Unexercised Options at

December 31, 2003

| | Value of Unexercised

In-the-Money Options at

December 31, 2003(1)

|

|---|

Name

| | Shares Acquired

on Exercise

| | Value Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Michael W. Bonney | | — | | $ | 0.00 | | 124,999 | | 375,001 | | $ | 243,840 | | $ | 933,460 |

| Scott M. Rocklage, PhD | | — | | $ | 0.00 | | 618,482 | | — | | $ | 2,701,270 | | $ | — |

| Barry I. Eisenstein, MD | | — | | $ | 0.00 | | 15,031 | | 65,469 | | $ | 87,600 | | $ | 379,600 |

| Oliver S. Fetzer, PhD, MBA | | — | | $ | 0.00 | | 33,781 | | 94,719 | | $ | 117,950 | | $ | 266,350 |

| David W.J. McGirr, MBA | | — | | $ | 0.00 | | 25,031 | | 90,469 | | $ | 55,500 | | $ | 166,500 |

| Francis P. Tally, MD | | — | | $ | 0.00 | | 89,142 | | 38,595 | | $ | 385,167 | | $ | 64,424 |

- (1)

- Based on the difference between the exercise price of each option and the last reported sales price of our common stock on the NASDAQ-NMS on December 31, 2003 of $12.20.

7

Equity Compensation Plans

The following table provides information as of December 31, 2003, relating to our equity compensation plans pursuant to which grants of options, restricted stock, restricted stock units or other rights to acquire shares may be granted from time to time:

Plan Category

| | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

| | Weighted-average exercise

price of outstanding options,

warrants and rights

| | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column)

| |

|---|

| Equity compensation plans approved by security holders(1)(2) | | 6,085,833 | | $ | 16.75 | | 784,400 | |

Equity compensation plans not approved by security holders |

|

41,366 |

(3) |

$ |

30.92 |

(4) |

467,501 |

(5) |

Total |

|

6,127,199 |

|

$ |

16.85 |

|

1,251,901 |

|

- (1)

- Consists of the 1993 Amended and Restated Stock Option Plan (1993 Plan), the Amended and Restated 2000 Equity Incentive Plan (2000 Equity Incentive Plan), the Amended and Restated 2002 Directors' Stock Option Plan and the 1997 Employee Stock Purchase Plan. The 1993 Plan terminated pursuant to its own terms on May 6, 2003.

- (2)

- The 2000 Equity Incentive Plan includes an evergreen formula pursuant to which the maximum number of shares of our common stock that shall be made available for sale under the Equity Incentive Plan shall be 1,630,000 shares as of June 13, 2002 plus an annual increase to be added on January 1 of each year, beginning on January 1, 2003 until and including January 1, 2006, equal to five percent (5%) of the total number of shares of common stock and stock equivalents issued and outstanding as of the close of business on the immediately preceding December 31.

- (3)

- Includes 31,063 stock options outstanding under the 2001 United Kingdom Stock Option Plan (UK Option Plan) The UK Option Plan was adopted to encourage stock ownership by our employees in the United Kingdom. Options granted under the UK Option Plan have been approved under the Income and Corporation Taxes Act of 1988 of the United Kingdom. Such options receive favored tax treatment in the United Kingdom. Also includes 9,763 stock option outstanding under the TerraGen Discovery Inc. Employee Stock Option Plan (TerraGen Plan), which were assumed as part of the acquisition of TerraGen Discovery Inc. in October 2000. Options under the TerraGen Plan became exercisable for shares of Cubist common stock upon consummation of the acquisition, but remain subject to the TerraGen Plan. No awards have been made under the TerraGen Plan since the date of the acquisition.

- (4)

- The outstanding options under the UK Option Plan have a weighted average exercise price of $24.07 per share. The outstanding options under the TerraGen Plan have a weighted average exercise price of $53.08 per share.

- (5)

- As part of our decision to cease operations in the United Kingdom, we terminated the UK Option Plan and will therefore not be issuing the remaining 467,501 options that were previously available under the UK Option Plan.

8

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

Under the terms of a transition agreement, dated February 25, 2003, Dr. Rocklage, our Chairman, resigned as Chief Executive Officer of Cubist effective June 10, 2003, the date of our 2003 Annual Meeting of Stockholders. Dr. Rocklage remained an employee of Cubist until December 31, 2003, and received his full salary and bonus through that date. In addition, he received a one-time Special Recognition Award of $440,000 in January 2004. Under the terms of the transition agreement, Dr. Rocklage's then unvested stock options vested on December 31, 2003, and will remain exercisable until December 31, 2006. None of our other executive officers has entered into an employment agreement.

We have provided retention letters to certain of our executive officers. Under the terms of these retention letters, each of Mr. Bonney, Dr. Eisenstein, Dr. Fetzer, Mr. Guiffre, Mr. McGirr, and Dr. Tally is entitled to severance pay in an amount equal to twelve months of his then-current annual base salary if his employment is terminated by us without cause (as defined in the retention letter) or terminated by the executive officer for good reason (as defined in the retention letter). If such termination occurs within twenty-four months after a change-in-control, then the executive officer's unvested options granted prior to the change-in-control, if any, will become vested.

The Board of Directors and Committees of the Board

The Board of Directors held seven meetings, two of which were telephonic meetings, and took action by written consent on fifteen occasions during fiscal year 2003. There were five Audit Committee meetings, seven Compensation Committee meetings, and six Corporate Governance Committee meetings in fiscal year 2003. Except for Kenneth Bate (who joined the Board in June of 2003), no incumbent director attended fewer than 75% of the total number of meetings of the Board of Directors plus meetings of any committees on which he or she served during fiscal year 2003. It has been the practice of the Board of Directors to hold a meeting on the same date and at the same location as the Annual Meeting of Stockholders. The entire Board of Directors attended the 2003 Annual Meeting of Stockholders either in person or by telephone.

The Board of Directors has three standing committees: the Audit Committee, the Compensation Committee, and the Corporate Governance Committee.

Audit Committee

The Board of Directors has an Audit Committee, which met five times during 2003. The functions of the Audit Committee are as set forth in the Amended and Restated Audit Committee Charter which can be viewed on the Company's website at www.cubist.com or in the Company's filings with the Securities and Exchange Commission. The members of the Audit Committee are all independent as defined Rule 4200(a)(15) of the National Association of Securities Dealers' listing standards, including the "financial experts" as defined in Regulation S-K of the Securities Act of 1933, as amended. The members of the Audit Committee during 2003 were Mr. John Clarke, Dr. Barry Bloom (until his resignation from the Board in June 2003), Dr. John Zabriskie (until June 2003), Mr. J. Matthew Singleton (starting in June 2003) and Mr. Kenneth Bate (starting in June 2003). For 2004, the Audit Committee members are Mr. Clarke, Mr. Bate, and Mr. Singleton. The Board has determined that Messrs. Bate and Singleton are "financial experts".

9

The Audit Committee is required to pre-approve the audit and non-audit services performed by the independent auditors in order to assure that the provision of such services do not impair the auditor's independence. Unless a type of service to be provided has received general pre-approval from the Audit Committee, it will require specific pre-approval in each instance by the Audit Committee. Any proposed services exceeding pre-approved cost levels also require specific pre-approval by the Audit Committee.

REPORT OF THE AUDIT COMMITTEE(1)

In fulfilling its oversight responsibilities, the Audit Committee reviewed the Company's audited year-end financial statements with management and the independent auditors. The Committee discussed with the independent auditors the matters to be discussed by Statement of Auditing Standards No. 61. In addition, the Committee received from the independent auditors, written disclosure and the letter required by Independence Standards Board Standard No. 1 and the information required under Regulation S-X rule 2-07 of the Securities Act of 1933, as amended. The Committee also discussed with the independent auditors the auditors' independence from management and the Company, including a review of audit and non-audit fees and the matters covered by the written disclosures and letter provided by the independent auditors.

The Committee discussed with Cubist's independent auditors the overall scope and plans for their audits. The Committee meets with the independent auditors, with and without management present, to discuss the results of their audits and reviews, their evaluations of Cubist and its personnel, the Company's internal controls, and the overall quality of the Company's financial reporting. The Committee also meets with the internal auditors, with and without management present. The Committee held five meetings during fiscal year 2003.

Based on the reviews and discussions referred to above, the Committee reviewed and recommended to the Board of Directors that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2003, for filing with the Securities and Exchange Commission.

The Board of Directors has adopted a written charter for the Audit Committee, which can be viewed on the Company's website at www.cubist.com or in the Company's filings with the Securities and Exchange Commission.

| March 15, 2004 | | Audit Committee

John Clarke, Chairman

Kenneth Bate

J. Matthew Singleton |

- (1)

- Notwithstanding anything to the contrary set forth in any of Cubist's previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this Proxy Statement, in whole or in part, the Report of the Audit Committee shall not be incorporated by reference into any such filings.

10

Compensation Committee

The Board of Directors has a Compensation Committee, which met seven times during 2003. The functions of the Compensation Committee are as set forth in the Compensation Committee Charter, which can be viewed on the Company's website at www.cubist.com or in the Company's filings with the Securities and Exchange Commission. The members of the Compensation Committee are all independent, as defined in the National Association of Securities Dealers' listing standards. The members of the Compensation Committee for 2003 were Dr. David Martin, Mr. Walter Maupay, and Dr. John Zabriskie (until his resignation from the Board in November 2003). For 2004, the Compensation Committee Members are Dr. Martin, Mr. Maupay, and Mr. J. Matthew Singleton.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee, as constituted during 2003, was a former or current officer or employee of Cubist.

11

COMPENSATION COMMITTEE REPORT

ON EXECUTIVE OFFICER COMPENSATION(1)

Compensation Philosophy and Objectives

Our compensation philosophy for executive officer compensation strives to reward the value created and protected for shareholders, while furthering our short-and long-term strategic goals by aligning compensation with the achievement of business objectives and the individual's performance. We believe that short- and long-term compensation should be structured so as to motivate and reward high levels of performance and that it should be geared to both attract and retain qualified executive officers. Accordingly, we utilize a pay for performance compensation philosophy for executive officer compensation that consists of three primary components, which are used in conjunction with one another to achieve the objectives of our compensation philosophy. The primary components are: base salaries, annual bonuses, and grants of stock options.

In evaluating our executive officers' performance, we generally follow the process outlined below:

- •

- Prior to the beginning of each fiscal year, we set corporate goals and objectives, which are reviewed with, and ultimately approved by, the full Board of Directors. Shortly after our corporate goals and objectives are approved by our Board, we set goals and objectives for each of our executive officers. These goals and objectives are used at the end of each year to measure executive officer performance.

- •

- At year-end, the Compensation Committee meets with Mr. Bonney. This meeting is a comprehensive review of performance, including performance against corporate goals and objectives set the prior year. Mr. Bonney's salary increase, bonus amount, and stock option grant are set, all commensurate with his performance and Cubist's performance. In addition, the Compensation Committee considers compensation packages of chief executives of similar companies.

- •

- At year-end, Mr. Bonney evaluates the performance of the remainder of Cubist's executive officers, including their performance against their goals and objectives set the prior year. Mr. Bonney recommends to the Compensation Committee a salary increase, bonus amount, and stock option grant, all commensurate with performance and compensation packages of comparable executive officers of similar companies.

Compensation for Fiscal 2003

Report on Chief Executive Officer Compensation

In February 2003, the Compensation Committee and the Board set Mr. Bonney's annual base salary at $350,000 effective June 10, 2003, the date on which Mr. Bonney was promoted to CEO. This increase represented a $20,000 increase or approximately 6% over his base salary prior to being promoted to CEO and a 16% increase over his 2002 base salary. In December 2003, the Compensation Committee, with the concurrence of the Board, set Mr. Bonney's salary for 2004 at $350,000. The Compensation Committee has performed comprehensive review of the compensation paid to chief executive officers of other companies and has concluded this salary positions Mr. Bonney fairly within the range of base salaries paid to other chief executive officers of comparable companies.

12

In December 2003, the Compensation Committee, with the concurrence of the Board, authorized a bonus for Mr. Bonney in the amount of $136,461. Mr. Bonney's bonus target for 2004 is 50% of his base salary.

In December 2003, the Compensation Committee, with the concurrence of the Board, authorized a stock option grant for Mr. Bonney in the amount of 60,000 options.

Report On Executive Compensation

In December 2003, the Compensation Committee authorized, base salary increases for the six executive officers other than Mr. Bonney, ranging from 0 to 10%. The increases were determined after reviewing company, group, and individual performance, including performance against goals and objectives set for the year and also against salaries of similar positions in comparable companies.

In December 2003, the Compensation Committee authorized bonuses in the aggregate amount of $461,515 for the six executive officers other than Mr. Bonney. Individual bonuses for these executive officers ranged from $57,750 to $99,750. The bonus target for each of these executive officers in 2004 is 40% of base salary.

In December 2003, the Compensation Committee authorized stock option grants in the aggregate amount of 60,500 for the six executive officers other than Mr. Bonney. Individual stock option grants for these executive officers ranged from 0 to 18,000 options.

Conclusion

The Compensation Committee believes that the total 2003-related compensation of the Chief Executive Officer and the other executive officers, as described above, is reflective of the Company's pay-for-performance compensation philosophy and is fair and within the range of compensation for executive officers in similar positions at comparable companies.

| March 15, 2004 | | Compensation Committee

David Martin, Chairman

Walter Maupay

J. Matthew Singleton |

- (1)

- Notwithstanding anything to the contrary set forth in any of Cubist's previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this Proxy Statement, in whole or in part, the Compensation 0Committee Report on Executive Compensation shall not be incorporated by reference into any such filings.

13

Corporate Governance Committee

The Board of Directors has a Corporate Governance Committee, which met six times during 2003 fiscal year. The functions of the Corporate Governance Committee are as set forth in the Corporate Governance Committee Charter, which can be viewed on the Company's website at www.cubist.com or in the Company's filings with the Securities and Exchange Commission. The members of the Corporate Governance Committee are all independent, as defined in the National Association of Securities Dealers' listing standards. The members of the Corporate Governance Committee during 2003 were Susan Bayh, Esq., Mr. Walter Maupay, Dr. Barry Bloom (until his resignation from the Board in June 2003), and Dr. John Zabriskie (starting in June 2003 and until his resignation from the Board in November 2003).

The Corporate Governance Committee requires that directors possess the highest personal and professional ethics, integrity and values, and are committed to representing the long-term interests of our stockholders. Directors must have an inquisitive and objective perspective, practical wisdom and mature judgment. We endeavor to have a board representing diverse experience at policy-making levels in business, education and technology, and in areas that are relevant to our activities. Directors must be willing to devote sufficient time to carrying out their duties and responsibilities effectively, and should be committed to serve on the board for an extended period of time.

In addition to considering candidates suggested by stockholders, the Corporate Governance Committee considers potential candidates recruited by the Company or recommended by current directors, company officers, employees and others. The Corporate Governance Committee considers all candidates in the same manner regardless of the source of the recommendation.

Nominations of persons for election to the Board of Directors may be made at a meeting of stockholders (a) by or at the direction of the Board of Directors or (b) by any stockholder who is a stockholder of record at the time of giving of notice for the election of directors at the annual meeting and who complies with the notice procedures set forth below. Such nominations, other than those made by or at the direction of the Board of Directors, shall be made pursuant to timely notice in writing to the Secretary of Cubist Pharmaceuticals, Inc., at 65 Hayden Avenue, Lexington, Massachusetts 02421. To be timely, a stockholder's notice shall be delivered to or mailed and received at our principal executive offices not less than 90 days nor more than 120 days prior to the annual meeting;provided, however, that if less than 100 days' notice or prior public disclosure of the date of the annual meeting is given or made to stockholders, notice by the stockholder to be timely must be so received not later than the close of business on the seventh day following the day on which such notice of the date of the annual meeting or such public disclosure was made.

The stockholder's notice shall set forth (a) as to each person whom the stockholder proposes to nominate for election or reelection as a director, all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (including such person's written consent to being named in the proxy statement as a nominee and to serving as a director if elected) and (b) as to the stockholder giving the notice (i) the name and address, as they appear on the books of Cubist, of such stockholder and (ii) the class and number of shares of Cubist that are beneficially owned by such stockholder. In addition to the requirements set forth above, a stockholder shall also comply with all applicable requirements of the Securities Exchange

14

Act of 1934, as amended, and the rules and regulations thereunder. The nominees for the 2004 Annual Meeting of Stockholders were nominated by the Corporate Governance Committee and recommended by the Board of Directors. Cubist did not receive any stockholder nominations this year.

Stockholders may send general communications to our Board, including shareholder proposals, or concerns about Cubist's conduct, and our employees may send communications to our Board regarding complaints about the company's accounting, internal accounting controls or auditing matters. These communications may be sent to any director, non-employee director or to member of the Audit Committee, care of: Secretary, Cubist Pharmaceuticals, Inc., 65 Hayden Avenue, Lexington, Massachusetts, 02421. All communications unless otherwise indicated in such communication, will be reviewed by the Secretary and submitted to the Board or individual directors as appropriate or as directed.

15

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Nominees for Election as Directors

Our Board of Directors is divided into three classes, with one class of directors elected each year for a three-year term of office at the annual meeting of stockholders. All directors of a class hold their positions until the annual meeting of stockholders at which their terms of office expire and until their successors have been duly elected and qualified.

The term of office of the Class II directors will expire at the annual meeting on June 10, 2004. The Board of Directors has nominated Michael W. Bonney, Susan B. Bayh, and Walter R. Maupay for re-election as Class II directors to hold office until the annual meeting of stockholders to be held in 2007 and until their respective successors have been duly elected and qualified. In the event that either of the nominees shall be unable or unwilling to serve as a director, the Board of Directors shall reserve discretionary authority to vote for a substitute or substitutes. The Board of Directors has no reason to believe that either of the nominees will be unable or unwilling to serve. Proxies cannot be voted for any persons other than the nominees.

The affirmative vote of a plurality of the shares of common stock present at the annual meeting, in person or by proxy, is required for the election of each of the Class II directors. Unless authority to do so is withheld, the persons named in each proxy will vote the shares represented thereby "FOR" the election of the nominees.

Information as to Directors and Nominees for Director

The names of our directors (including the nominees for reelection as Class II directors at the annual meeting) and certain information regarding each director is listed below.

Name

| | Age

| | Position(s) Held

| | Director

Since

| | Term

Expires

| | Class of

Director

|

|---|

| Scott M. Rocklage, PhD | | 49 | | Chairman | | 1994 | | 2005 | | III |

| Kenneth M. Bate, MBA(1)(3) | | 53 | | Director | | 2003 | | 2006 | | I |

| Susan B. Bayh, JD(3)* | | 44 | | Director | | 2000 | | 2004 | | II |

| Michael W. Bonney | | 45 | | Director | | 2003 | | 2004 | | II |

| John K. Clarke, MBA(1)* | | 50 | | Director | | 1992 | | 2005 | | III |

| David W. Martin, Jr., MD(2)* | | 63 | | Director | | 1997 | | 2006 | | I |

| Walter R. Maupay, MBA(2)(3) | | 65 | | Director | | 1999 | | 2004 | | II |

| J. Matthew Singleton, MBA, CPA(1)(2) | | 51 | | Director | | 2003 | | 2005 | | III |

- (1)

- Member of Audit Committee

- (2)

- Member of Compensation Committee

- (3)

- Member of Corporate Governance Committee

- *

- Committee Chairman

16

Dr. Rocklage has served as one of our directors since July of 1994 and was elected Chairman of the Board of Directors in March 2000. From July 1994 to June 2003, Dr. Rocklage served as our Chief Executive Officer. He served as our President from July 1994 to March 2001. From 1990 to 1994, Dr. Rocklage served as President and Chief Executive Officer of Nycomed Salutar, Inc., a diagnostic imaging company. From 1992 to 1994, he also served as President and Chief Executive Officer and Chairman of Nycomed Interventional, Inc., a medical device company. From 1986 to 1990, he served in various positions at Nycomed Salutar, Inc. and was responsible for designing and implementing research and development programs that resulted in three drug products in human clinical trials, including the approved drugs Omniscan and Teslascan. Dr. Rocklage currently serves as a director of Symyx Therapeutics, Inc., a drug discovery and development company, Miikana Therapeutics, Inc., a biopharmaceutical company, and is a venture partner at 5AM Ventures, a venture capital fund. He received his B.S. in Chemistry from the University of California, Berkeley and his Ph.D. in Chemistry from the Massachusetts Institute of Technology.

Mr. Bate has served as one of our directors since June 2003. Since July 2003, Mr. Bate has served as Executive Vice President, Head of Commercial Operations and Chief Financial Officer of Millennium Pharmaceuticals Inc. From December 2002 to July 2003, Mr. Bate served as Senior Vice President and Chief Financial Officer of Millennium Pharmaceuticals, Inc. Prior to that, he was a founding partner of JSB Partners, LP, a firm providing banking and advisory services to biopharmaceutical and life sciences companies from July 1999 to December 2002. From 1997 to 1999, Mr. Bate served as Senior Managing Director and Chief Executive Officer of MPM Capital, LP, a venture capital company. Mr. Bate served at Biogen, Inc. as Vice President of Sales and Marketing from 1993 to 1996 and as Chief Financial Officer from 1990 to 1993. Mr. Bate received a B.A. in Chemistry from Williams College and an MBA from the Wharton School at the University of Pennsylvania.

Ms. Bayh has served as one of our directors since June 2000. Since 1994, Ms. Bayh has served as the Commissioner of the International Joint Commission, a bi-national organization between the United States and Canada focusing on environmental issues of the Great Lakes. Ms. Bayh served as an attorney in Eli Lilly's Pharmaceutical Division handling federal regulatory issues for marketing and medical clients from 1989 to 1994. From 1984 to 1989, Ms. Bayh practiced law, focusing on litigation, utility and corporate law, and antitrust at the law firms of Gibson, Dunn & Crutcher LLP and Barnes & Thornburg LLP. She is also a director of Anthem, Inc., (a Blue Cross/Blue Shield company), Dendreon, Inc., a biotechnology company, Curis, Inc., a biotechnology company, Dyax, Inc., a biopharmaceutical company, Emmis Communications, a diversified media company, Golden State Foods, a food distribution company, and E-Bank, an internet banking subsidiary of E-Trade Securities LLC. Ms. Bayh has a B.A. from the University of California at Berkeley and a J.D. from the University of Southern California Law Center.

Mr. Bonney has served as our President & Chief Executive Officer and as a member of the Board of Directors since June 2003. From January 2002 to June 2003, he served as our President & Chief Operating Officer. From 1995 to 2001, he held various positions of increasing responsibility at Biogen, Inc., a biopharmaceutical company, including Vice President, Sales and Marketing from 1999 to 2001. While at Biogen, Mr. Bonney built the commercial infrastructure for the launch of Avonex. Prior to that, Mr. Bonney held various positions of increasing responsibility in sales, marketing and strategic

17

planning at Zeneca Pharmaceuticals, ending his eleven-year career there serving as National Business Director. Mr. Bonney received a BA in Economics from Bates College

Mr. Clarke has served as one of our directors since our incorporation and as Chairman of the Board of Directors from our incorporation to March 2000. From 1992 to 1994, Mr. Clarke served as our acting President and Chief Executive Officer. Since 1982, he has been a general partner of DSV Management in Princeton, New Jersey, the general partner of DSV Partners IV, a venture capital firm. Mr. Clarke is also the Managing General Partner of Cardinal Partners, a venture capital firm. He is a director of numerous privately held companies. Mr. Clarke received his B.A. in Biology and Economics from Harvard College and his MBA from The Wharton School of the University of Pennsylvania.

Dr. Martin has served as one of our directors since October 1997. Since 2003, he has been Chairman and Chief Executive Officer of GangaGen, Inc., a biotechnology company. From July 1997 until April 2003, Dr. Martin served as President, Chief Executive Officer and a founder of Eos Biotechnology, Inc., a biotechnology company. From 1995 to 1996, Dr. Martin was President and Chief Executive Officer of Lynx Therapeutics, Inc., a biotechnology company. During 1994, Dr. Martin served as Senior Vice President of Chiron Corporation, a biopharmaceutical company. From 1991 to 1993, Dr. Martin served as Executive Vice President of DuPont Merck Pharmaceutical Company. From 1983 to 1990, Dr. Martin was Vice President and then Senior Vice President of Research and Development at Genentech, Inc., a biotechnology company. Prior to 1983, Dr. Martin was a Professor of Medicine, Professor of Biochemistry and an Investigator of the Howard Hughes Medical Institute at the University of California San Francisco. Dr. Martin is also a Director of Varian Medical Systems, Inc., a medical equipment and software supplier. Dr. Martin received his M.D. from Duke University.

Mr. Maupay has served as one of our directors since June 1999. From January 1995 to June 1995, Mr. Maupay served as Group Executive of Calgon Vestal Laboratories, a division of Merck & Co. From 1988 to 1995, Mr. Maupay served as President of Calgon Vestal Laboratories. From 1984 to 1988, Mr. Maupay served as Vice President, Healthcare at Calgon Vestal Laboratories. Mr. Maupay is a director of Life Medical Sciences, Inc., a medical device company, Kensey Nash Corporation, a medical device company, PolyMedica Corporation, a healthcare distribution company, and Triosyn, Inc., an infection control medical device company. Mr. Maupay received his Bachelor of Science in Pharmacy from Temple University and his MBA from Lehigh University.

Mr. Singleton has served as one of our directors since June 2003. From 2000 to the present, he has served as Chief Financial and Administrative Officer of CitationShares, LLC, a joint venture of Cessna Aircraft Company and TAG Aviation USA, Inc. From 1994 to 1997, Mr. Singleton served as a Managing Director, Executive Vice President and Chief Administrative Officer of CIBC World Markets, an investment banking firm. Previous to that, he served in a variety of roles from 1974 until 1994 at Arthur Andersen & Co., a public accounting firm, ending his tenure there as Partner-In-Charge of the Metro New York Audit and Business Advisory Practice. During 1980 and 1981, he served as a Practice Fellow at the Financial Accounting Standards Board. Mr. Singleton also serves as a director of Salomon Asset Reinvestment Company. He received an AB in Economics from Princeton University and an MBA from New York University. Mr. Singleton is a Certified Public Accountant.

18

Compensation of Directors

Mr. Bonney is a director and one of our full-time officers; he receives no additional compensation for serving on the Board of Directors. No other director is an officer. In 2003, we paid each of the non-employee directors (other than Dr. Rocklage, our Chairman, who receives two times the standard non-employee director fees and two times the number of options awarded to other non-employee directors) a fee of $3,000 for each meeting of the Board of Directors that he or she attended in person, $1,000 for each meeting of the Board of Directors that he or she attended by phone, and $1,000 for each committee meeting he or she attended, whether in person or by phone. In addition, committee chairmen received an additional $1,000 for each meeting chaired, and each was reimbursed for expenses in connection with his or attendance at board of committee meetings. In 2004, non-employee directors shall be paid in accordance with the same fee structure that was in place for 2003. The following table sets forth the aggregate fees paid to each of our non-employee directors in 2003:

Name

| | Position(s) Held

| | Aggregate Fees

in 2003

|

|---|

| Scott M. Rocklage, PhD | | Chairman | | $ | 10,000 |

| Kenneth M. Bate, MBA | | Director | | $ | 5,000 |

| Susan B. Bayh, JD | | Director | | $ | 26,000 |

| Barry M. Bloom | | Director | | $ | 7,000 |

| John K. Clarke, MBA | | Director | | $ | 28,000 |

| David W. Martin, Jr., MD | | Director | | $ | 24,000 |

| Walter R. Maupay, MBA | | Director | | $ | 24,000 |

| J. Matthew Singleton, MBA, CPA | | Director | | $ | 13,000 |

| John L. Zabriskie | | Director | | $ | 23,000 |

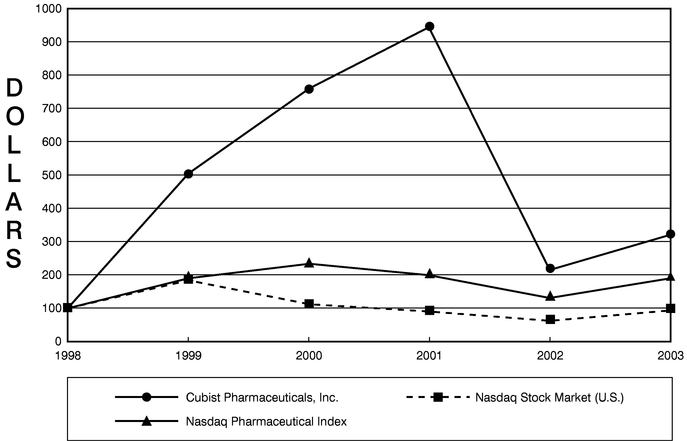

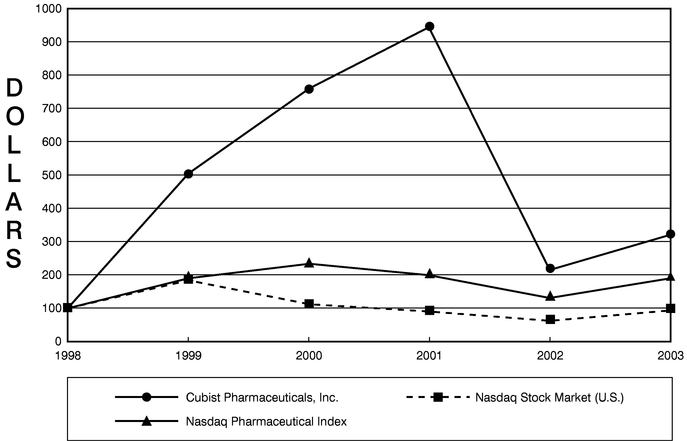

Pursuant to our 2002 Directors' Stock Option Plan, upon first joining the Board of Directors, each director who is not one of our officers or employees automatically is granted a stock option exercisable for 10,000 shares of common stock at fair market value, and each time that he or she is serving as a director on the close of business on the date of an annual meeting of stockholders, such director is automatically granted on such business day a stock option in an amount previously determined by the Board. The current amount set by the Board of Directors for such annual grants is either (a) 10,000 shares of common stock at fair market value if Cubist's common stock underperforms the Nasdaq Pharmaceutical Index for the preceding calendar year or (b) 12,500 shares of common stock at fair market value if Cubist's common stock outperforms the Nasdaq Pharmaceutical Index for the preceding calendar year. None of our directors has a consulting agreement with Cubist.

19

PROPOSAL NO. 2

APPROVAL OF AMENDMENT TO THE RESTATED CERTIFICATE OF INCORPORATION

TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

Introduction

We are seeking stockholder approval to amend Article IV of our Amended and Restated Certificate of Incorporation, to increase the number of authorized shares of common stock from 50,000,000 to 150,000,000, and make the necessary corresponding change to increase our authorized capital stock to 155,000,000 shares in light of the already authorized aggregate 5,000,000 shares of preferred stock.

If the required vote is obtained at the Annual Meeting, we will file an amendment with the Secretary of State of the State of Delaware to increase the number of authorized shares of common stock from 50,000,000 to 150,000,000, and make the necessary corresponding change to increase the authorized capital stock to 155,000,000 shares.

Background

Our Board of Directors, subject to stockholder approval, adopted and approved an amendment to Article IV of the Amended and Restated Certificate of Incorporation to increase the number of shares of common stock authorized for issuance from 50,000,000 shares to 150,000,000 shares, and to make the necessary corresponding change to increase our authorized capital stock to 155,000,000 in light of the already authorized aggregate 5,000,000 shares of preferred stock. There is no proposal to increase the number of shares of preferred stock that we are authorized to issue.

As of March 1, 2004, the number of shares of our common stock issued or reserved for issuance totaled approximately 50,000,000 shares, which is the number of shares of common stock currently authorized. Therefore, in order for us to have a sufficient number of shares available for future issuance, we require approval of this Proposal No. 2.

Reasons for Amendment

In 1999, we increased the number of shares of common stock authorized for issuance from 30,000,000 to 50,000,000 in expectation of additional capital needs and an increased employee base. We have not increased this amount nor have we proposed to increase this amount until this Annual Meeting. Since 1999, Cubist has transformed itself from a research and development organization into a commercial biopharmaceutical company. During such time, we have funded our operations through various equity and debt financings and we have rewarded our employees, in part, with stock options. Since 1999, we have increased our number of employees and completed multiple private and public financings, including a secondary public offering and a convertible debt financing. In 2003, we received regulatory approval for and commercially launched Cubicin™. As a result, we issued stock to Eli Lilly & Company, or Eli Lilly, for the payment of milestones under our license agreement with Eli Lilly relating to Cubicin™. In 2003, we also bought down our future royalty obligations to Eli Lilly on sales of Cubicin™ by issuing approximately 723,619 shares of common stock to Eli Lilly. In October of 2003, we issued 529,942 shares of our common stock to Chiron Corporation in connection with entering into a marketing agreement to commercialize Cubicin™ in Europe and other parts of the world. Finally, in 2003 we took advantage of the increasingly favorable market conditions and completed a public equity

20

financing to fund our continued operations, resulting in an issuance of 8,571,410 shares of our common stock.

We expect to continue to enter into strategic partnerships and collaborations for any or all of our drug products and drug candidates. We may need additional capital to fund the research, development and commercialization of such drug products and drug candidates and therefore we may need to issue additional shares of common stock. In addition, we expect to continue to provide incentives for our strong employee base, our management and our Board of Directors through the issuance of stock options, consistent with our past practices. Our Board of Directors believes that the availability of additional shares of common stock will provide us with the flexibility to issue shares for a variety of additional purposes that our board may deem advisable without further action by our stockholders, unless required by law, regulation or stock market rules. These purposes could include, among other things, the use of additional shares for various in-licensing or other business development transactions, public or private financings, acquisitions, our director option plan, various equity compensation and other employee benefit plans for our employees, and other bona fide corporate purposes. Approval of the proposed amendment to our Restated Certificate of Incorporation, as amended, will give us greater flexibility in pursuing these opportunities and will facilitate the attraction and retention of personnel. We expect that the proposed increase in our authorized capital will meet our needs for the next several years as we continue to grow and expand our opportunities with respect to our drug product and all of our drug candidates.

If the amendment is approved, as soon as practicable after the Annual Meeting, we will file an amendment to the Restated Certificate of Incorporation, as amended, with the office of the Delaware Secretary of State to reflect the increase in the authorized number of shares of our common stock. A copy of the Certificate of Amendment to the Amended and Restated Certificate of Incorporation is set forth in Appendix A to this Proxy Statement and is incorporated herein by reference. You are encouraged to read the Certificate of Amendment carefully.

Vote Required

Approval of this proposal requires the affirmative vote of the holders of a majority of outstanding shares of Cubist common stock. Abstentions have the effect of votes against this proposal. Broker "non-votes" will not be counted in determining whether this proposal has been approved.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS

VOTE "FOR" PROPOSAL TWO

21

PROPOSAL NO. 3

RATIFICATION, ADOPTION AND APPROVAL OF

THE AMENDED AND RESTATED 2002 DIRECTORS' STOCK OPTION PLAN

In March 2002, our Board of Directors approved the adoption of the Directors' Stock Option Plan, referred to herein as the Original Directors' Option Plan, subject to stockholder approval, and in June 2002, the Original Directors' Option Plan was ratified and approved by the stockholders. The Original Directors' Option Plan authorized the issuance up to 175,000 shares of common stock.

In December 2002, our Board of Directors approved a change in its compensation structure. The change was designed to attract and retain qualified directors, align directors' interests more closely with those of stockholders, reflect a pay-for-performance philosophy, and facilitate increased activity on the part of the committees of the Board. At our 2003 Annual Meeting of Stockholders, the Original Director's Option Plan was amended and restated (referred to herein as the Amended and Restated Director's Option Plan) to reflect the changes to the compensation structure that were approved by our Board of Directors in March 2002. To enable the Board to continue to attract and retain highly qualified directors and to continue to compensate our directors under our pay-for-performance philosophy, Cubist now seeks approval from its stockholders to increase the authorized shares under the Amended and Restated Directors' Option Plan from 175,000 to 525,000. If this Proposal #3 is adopted, the Amended and Restated Directors' Option Plan will be further amended and restated to reflect the changes referenced above. A copy of the proposed Amended and Restated 2002 Directors' Stock Option Plan, referred to herein as the Directors' Option Plan, is attached as Appendix B to this Proxy Statement. If this Proposal #3 is not adopted, the current Amended and Restated Directors' Option Plan will remain in full force and effect as is and without modification.

Each non-employee director who is elected to the Board of Directors for the first time is automatically granted an option to purchase 10,000 shares of common stock. Each non-employee director who continues to serve as a director at the close of business on the date of the annual meeting of stockholders, is automatically granted an option to purchase a number of shares described below under "Summary of the Directors' Option Plan—Grant and Exercise of Options; Exercise Price." Consequently, the maximum number of shares common stock that may be received by each non-employee director under the Director's Option Plan is indeterminable and is dependent on the number of years such director serves on the Board. No employee of Cubist, including the Chief Executive Officer, will receive any shares of common stock under the Director's Option Plan.

The determination of the price, expiration, and vesting of each option, and the consideration to be received by Cubist upon exercise of each option, is described below. As of March 1, the fair market value of Cubist common stock underlying an option that is granted on such date is $10.40. Unless a non-employee director is elected for the first time during any given year, in which case such director will receive an option to purchase 10,000 shares of common stock, all non-employee directors will receive the same number of options each year to purchase shares of common stock under the Director's Option Plan, and in any event, if this Proposal #3 is adopted, Cubist will not grant options to purchase more than 525,000 shares of common stock to non-employee directors, in the aggregate, during the term of the Director's Option Plan.

22

Summary of the Directors' Option Plan

The following description of certain provisions of the Directors' Option Plan, is intended as a summary of such provisions and does not purport to be a complete statement of such provisions or of the Directors' Option Plan or its operation; and such description is qualified in its entirety by reference to the provisions of the Directors' Option Plan and to the forms of stock option agreements evidencing options granted under the Directors' Option Plan.

Proceeds received by Cubist from the exercise of options under the Directors' Option Plan have been and are to be used for general corporate purposes. The Directors' Option Plan is not subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended.

Purpose. The purpose of the Directors' Option Plan is to promote the recruiting and retention of highly qualified directors, to strengthen commonality of interest between directors and stockholders by encouraging stock ownership by outside directors of Cubist and to provide additional incentive for them to promote the success of Cubist's business. Options granted under the Directors' Option Plan are not incentive stock options.

Administration. The Directors' Option Plan will be administered by the Compensation Committee. Subject to the provisions of the Directors' Option Plan, the Compensation Committee has complete authority to interpret the Directors' Option Plan, to prescribe, amend and rescind rules and regulations relating to it, to determine the terms and provisions of the respective option agreements (which need not be identical), and to make all other determinations deemed necessary or advisable by it for the administration of the Directors' Option Plan).

Eligibility. Only members of Cubist's Board of Directors may be granted options under the Directors' Option Plan.

Shares Subject to the Directors' Option Plan and to Outstanding Options. A total of 525,000 shares of common stock are reserved for issuance under the Directors' Option Plan.

The number of shares of common stock covered by each outstanding option under the Directors' Option Plan and the option exercise price of each such option, as well as the number of shares that may be optioned under the Directors' Option Plan, will be proportionately adjusted for any increase or decrease in the number of outstanding shares of common stock by reason of (i) the subdivision (e.g., split-up) or combination of such shares, (ii) any stock dividend payable in shares of common stock, or (iii) any reclassification of outstanding shares of common stock.

In the event that we are acquired, the Board of Directors shall have the authority to terminate all stock options granted pursuant to the Directors' Option Plan that remain unexercised at the closing of that transaction. In the event of a reclassification or change of the outstanding shares of common stock or in the event of any consolidation or merger of Cubist with or into another company or in the event of any sale or conveyance to another company or entity of the property of Cubist as a whole or substantially as a whole, then each option outstanding immediately prior to such reclassification, change, consolidation, merger, sale or conveyance shall become exercisable for shares of stock or other securities equivalent in kind and value to those shares of stock or other securities that the holder of such option would have received if he or she had exercised such option in full immediately prior to such reclassification, change, consolidation, merger, sale or conveyance and had continued to hold such

23

shares of stock or other securities (together with all other shares, stock and securities that thereafter would have been issued in respect thereof) to the time of the exercise of such option.

Grant and Exercise of Options; Exercise Price. Each non-employee director who is elected to the Board of Directors for the first time during the term of the Directors' Option Plan is automatically granted, pursuant to the terms of the Directors' Option Plan itself, and without any action required by such non-employee director, the Compensation Committee or the Board of Directors, on such director's first election date, an option to purchase 10,000 shares of common stock. In addition, each non-employee director that continues to serve as a director at the close of business on the date of the annual meeting of stockholders, is automatically granted pursuant to the terms of the Directors' Option Plan itself (and without any action required by such non-employee director, the Compensation Committee or the Board of Directors), on such business day, a stock option in an amount previously determined by the Board. The current amount set by the Board of Directors for such annual grants is either (a) 10,000 shares of common stock if Cubist's common stock underperforms the Nasdaq Pharmaceutical Index for the preceding calendar year or (b) 12,500 shares of common stock if Cubist's common stock outperforms the Nasdaq Pharmaceutical Index for the preceding calendar year.

The exercise price of each formula option is equal to the fair market value of the common stock on the applicable grant date, which is deemed to be equal to the closing price of a share of common stock on such date, as reported on the Nasdaq National Market, or if no trades were reported on such date, the closing price of a share of common stock on the most recent trading day preceding such date on which a trade occurred. The term of each formula option is ten years from the applicable grant date. Initial grants are exercisable in three equal installments, with the first installment occurring on the first anniversary of the grant date and the second and third installments occurring on the second and third anniversary of the grant date, respectively. Annual grants to directors shall be immediately exercisable unless otherwise determined by the Compensation Committee.

Method of Exercise. An optionee exercises an option under the Directors' Option Plan by giving written notice of exercise to us, accompanied by (i) a check or bank draft payable to the order of Cubist in an amount equal to the aggregate exercise price for the shares of common stock being purchased by the optionee, (ii) shares of common stock having a fair market value equal to the aggregate exercise price for the shares of common stock being purchased by the optionee, or (iii) if authorized by the Board of Directors, a promissory note payable to us in an amount equal to the aggregate exercise price for the shares of common stock being purchased by the optionee. We will deliver or cause to be delivered to the optionee a certificate for the number of shares then being purchased by such optionee.

Upon exercise of any option by an optionee, we have the right to require such optionee to remit to us an amount sufficient to satisfy federal, state, local, employment or other tax withholding requirements if and to the extent required by law (whether so required to secure for Cubist an otherwise available tax deduction or otherwise) prior to the delivery of any certificate or certificates representing any shares of common stock purchased by such optionee pursuant to such exercise. The Compensation Committee may permit such optionee to satisfy such tax withholding requirements by delivering to us shares of common stock having a fair market value equal to the amount to be withheld.

In lieu of delivering a check, bank draft or other shares of common stock in connection with any exercise of any option, an optionee may, unless prohibited by applicable law, elect to effect payment in

24

connection with such exercise by means of a "cashless" exercise. To effect a cashless exercise, an optionee must include with the written notice of exercise (i) irrevocable instructions to deliver for sale to a registered securities broker acceptable to us a number of shares of common stock subject to the option being exercised sufficient, after brokerage commissions, to cover the aggregate exercise price payable with respect to such shares and, if the optionee further elects, the optionee's withholding obligations, if any, with respect to such exercise, together with (ii) irrevocable instructions to such broker to sell such shares and to remit directly to us such aggregate exercise price and, if the optionee has so elected, the amount of such withholding obligations. We will not be required to deliver to such securities broker any stock certificate for such shares until we have received from the broker such aggregate exercise price and, if the optionee has so elected, the amount of such withholding obligations.