Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | |

ý |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2008 |

OR |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 0-21379

CUBIST PHARMACEUTICALS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| | |

Delaware

(State or Other Jurisdiction of

Incorporation or Organization) | | 22-3192085

(I.R.S. Employer Identification No.) |

65 Hayden Avenue, Lexington, MA 02421

(Address of Principal Executive Offices and Zip Code)

(781) 860-8660

(Registrant's Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of each class | | Name of each exchange on which registered |

|---|

| Common Stock, $0.001 Par Value | | Nasdaq Global Select MarketSM |

| Series A Junior Participating Preferred Stock Purchase Rights | | Nasdaq Global Select MarketSM |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Each Class)

(Name of Each Exchange on Which Registered)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer ý | | Accelerated filer o | | Non-accelerated filer o

(Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the registrant's common stock held by non-affiliates of the registrant as of June 30, 2008 (without admitting that any person whose shares are not included in the calculation is an affiliate) was $887.4 million computed by reference to $17.86, the closing price of our common stock, as reported on the NASDAQ Global Select MarketSM on June 30, 2008. The number of outstanding shares of common stock of Cubist on February 20, 2009, was 57,546,619.

DOCUMENTS INCORPORATED BY REFERENCE

PORTIONS OF THE REGISTRANT'S DEFINITIVE PROXY STATEMENT FOR ITS

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 4, 2009

ARE INCORPORATED BY REFERENCE INTO PART III.

Table of Contents

Cubist Pharmaceuticals, Inc.

Annual Report on Form 10-K

Table of Contents

| | | | |

Item | |

| | Page |

|---|

PART I |

1. | | Business | | 6 |

1A. | | Risk Factors | | 35 |

1B. | | Unresolved Staff Comments | | 61 |

2. | | Properties | | 61 |

3. | | Legal Proceedings | | 61 |

4. | | Submission of Matters to a Vote of Security Holders | | 61 |

| | PART II | | |

5. | | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | 62 |

6. | | Selected Financial Data | | 64 |

7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | 66 |

7A. | | Quantitative and Qualitative Disclosures About Market Risk | | 88 |

8. | | Financial Statements and Supplementary Data | | 90 |

9. | | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | | 130 |

9A. | | Controls and Procedures | | 130 |

9B. | | Other Information | | 130 |

PART III |

10. | | Directors, Executive Officers and Corporate Governance | | 131 |

11. | | Executive Compensation | | 131 |

12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 131 |

13. | | Certain Relationships and Related Transactions, and Director Independence | | 131 |

14. | | Principal Accountant Fees and Services | | 131 |

PART IV |

15. | | Exhibits and Financial Statement Schedule | | 132 |

| | Signatures | | 138 |

2

Table of Contents

FORWARD-LOOKING STATEMENTS

This document contains and incorporates by reference forward-looking statements, including the statements described below. In some cases, these statements can be identified by the use of forward-looking terminology such as "may," "will," "could," "should," "would," "expect," "anticipate," "continue" or other similar words. These statements discuss future expectations, contain projections of results of operations or of financial condition, or state trends and known uncertainties or other forward-looking information. You are cautioned that forward-looking statements are based on current expectations and are inherently uncertain. Actual performance and results of operations may differ materially from those projected or suggested in the forward-looking statements due to certain risks and uncertainties, including the risks and uncertainties described or discussed in the section entitled "Risk Factors" in this Annual Report. The forward-looking statements contained and incorporated herein represent our judgment as of the date of this Annual Report, and we caution readers not to place undue reliance on such statements. The information contained in this Annual Report is provided by us as of the date of this Annual Report, and, except as required by law, we do not undertake any obligation to update any forward-looking statements contained in this document as a result of new information, future events or otherwise.

Forward-looking statements in this Annual Report include, without limitation, statements regarding:

- •

- our expectations regarding our financial performance, including revenues, expenses, gross margins and capital expenditures;

- •

- our expectations regarding the commercialization of CUBICIN® (daptomycin for injection);

- •

- our expectations regarding the strength of our intellectual property portfolio protecting CUBICIN and our plans to file a patent infringement lawsuit in connection with the February 9, 2009, notification to us by Teva Parenteral Medicines, Inc., or Teva, that Teva has submitted an Abbreviated New Drug Application, or ANDA, to the U.S. Food and Drug Administration, or FDA, seeking approval to market a generic version of CUBICIN before the expiration of the patents covering CUBICIN;

- •

- our expectations regarding payments to be received by us under our exclusive agreement with AstraZeneca Pharmaceuticals, LP, or AstraZeneca, for the promotion of MERREM® I.V. (meropenem for injection);

- •

- our ability to secure the manufacture and supply of sufficient amounts of CUBICIN and our drug candidates to meet our development and commercialization needs;

- •

- our expectations regarding our drug candidates, including the development, regulatory review and commercial potential of such drug candidates and the costs and expenses related thereto;

- •

- the continuation of our collaborations and our other significant agreements and our ability to establish and maintain successful manufacturing, supply, sales and marketing, distribution and development collaborations and other arrangements;

- •

- our expected efforts to evaluate product candidates and build our pipeline;

- •

- the liquidity and credit risk of securities, particularly auction rate securities, that we hold as investments;

- •

- the impact of new accounting pronouncements;

- •

- our future capital requirements and our ability to finance our operations;

- •

- our expectations regarding our personnel needs;

3

Table of Contents

- •

- our expectations regarding the payment of dividends; and

- •

- our business strategy and our expectations regarding general business conditions and growth in the biopharmaceutical industry.

Many factors could affect our actual financial results and could cause these actual results to differ materially from those in these forward-looking statements. These factors include the following:

- •

- the level of acceptance of CUBICIN by physicians, patients, third-party payors and the medical community;

- •

- any changes in the current or anticipated market demand or medical need for CUBICIN, including as a result of the economic downturn in the U.S. and around the world;

- •

- any unexpected adverse events related to CUBICIN, particularly as CUBICIN is used in the treatment of a growing number of patients around the world;

- •

- the effectiveness of our sales force and our sales force's ability to access targeted physicians;

- •

- an adverse result in the litigation that we intend to file against Teva to defend and/or assert our patents in connection with Teva's February 2009 notification to us that it has submitted an ANDA to the FDA seeking approval to market a generic version of CUBICIN and the expense and management distraction associated with the litigation;

- •

- whether or not other third parties may seek to market generic versions of our products by filing ANDAs with the FDA and the results of any litigation that we file to defend and/or assert our patents against such third parties;

- •

- competition in the markets in which we and our partners market CUBICIN, including marketing approvals for new products that will be competitive with CUBICIN;

- •

- similar factors with respect to MERREM I.V. in the U.S. as those described above with respect to CUBICIN;

- •

- the effect that the results of ongoing or future clinical trials of CUBICIN may have on its acceptance in the medical community;

- •

- the impact of the results of ongoing or future trials for drug candidates that we are currently developing or may develop in the future;

- •

- the impact of the results of ongoing or future trials for drug candidates that we are currently developing that are being or will be conducted by our collaborators and others for indications that we do not have rights to but are, nonetheless, in human populations and indications that are of relevance to our developmental activities;

- •

- whether we will receive, and the potential timing of, regulatory approvals or clearances to market CUBICIN in countries where it is not yet approved;

- •

- the ability of our third party manufacturers, including our single source provider of CUBICIN active pharmaceutical ingredient, or API, to manufacture sufficient quantities of CUBICIN in accordance with Good Manufacturing Practices and other requirements of the regulatory approvals for CUBICIN and to do so at an acceptable cost;

- •

- our ability to discover, acquire or in-license drug candidates;

- •

- our ability to develop and achieve commercial success, and secure sufficient quantities of supply for such development and commercialization, for our existing and future drug candidates, particularly as we are managing multiple programs and opportunities and continue to seek to maximize the commercial success of CUBICIN and MERREM I.V.;

4

Table of Contents

- •

- our ability to integrate successfully the operations of any business that we may acquire and the potential impact of any future acquisition on our financial results;

- •

- whether the FDA accepts proposed clinical trial protocols in a timely manner for additional studies of CUBICIN or any other drug candidate we seek to initiate or continue testing in clinical trials;

- •

- our ability to conduct successful clinical trials in a timely manner;

- •

- legislative and policy changes in the U.S. and other jurisdictions where our products are sold that may affect the ease of getting a new product or a new indication approved;

- •

- changes in government reimbursement for our or our competitors' products;

- •

- our dependence upon collaborations and alliances, particularly our ability to work effectively with our partners and our partners' ability to meet their obligations and perform effectively under our agreements;

- •

- our ability to finance our operations;

- •

- potential costs resulting from product liability or other third party claims;

- •

- our ability to protect our proprietary technologies; and

- •

- a variety of risks common to our industry, including ongoing regulatory review, public and investment community perception of the industry, statutory or regulatory changes including with respect to federal and state taxation, and our ability to attract and retain talented employees.

5

Table of Contents

PART I

ITEM 1. BUSINESS

Cubist Pharmaceuticals, Inc., which we refer to as "we", "Cubist" or the "Company," was incorporated as a Delaware corporation in 1992. We completed our initial public offering in 1996 and our shares are listed on the NASDAQ Global Select Market, where our symbol is CBST. Our principal offices are located at 65 Hayden Avenue, Lexington, Massachusetts. Our telephone number is 781-860-8660, and our website address iswww.cubist.com.

Corporate Overview and Business Strategy

We are a biopharmaceutical company focused on the research, development and commercialization of pharmaceutical products that address unmet medical needs in the acute care environment. Such products are used primarily in hospitals but also may be used in acute care settings including home-infusion and hospital outpatient clinics.

We have been profitable for ten consecutive quarters as of December 31, 2008. Our net income for the twelve months ended December 31, 2008, was $169.8 million, or $3.00 and $2.56 per basic and diluted share, respectively, as compared to our net income for the twelve months ended December 31, 2007, which was $48.1 million, or $0.87 and $0.83 per basic and diluted share, respectively. Our net income for the full year 2008 was significantly impacted by a tax benefit related to a reversal of our valuation allowance for a significant portion of our deferred tax assets which resulted in a benefit to income tax expense of approximately $127.8 million, and an other-than-temporary impairment charge of $49.2 million related to our investment in auction rate securities. As of December 31, 2008, we had a total of $417.9 million in cash, cash equivalents and long-term investments, as compared to $398.2 million in cash, cash equivalents and long-term investments as of December 31, 2007.

We derive substantially all of our revenues from CUBICIN® (daptomycin for injection), an intravenous, or I.V., antibiotic, which we developed and launched in the U.S. in November 2003. Our net revenues from worldwide product sales of CUBICIN for the twelve months ended December 31, 2008, were $422.1 million, as compared to $290.4 million in the twelve months ended December 31, 2007. CUBICIN is currently the only marketed once-daily, bactericidal, I.V. antibiotic with activity against methicillin-resistantStaphylococcus aureus, orS. aureus, also known as MRSA. CUBICIN is approved in the U.S. for the treatment of complicated skin and skin structure infections, or cSSSI, caused byS. aureus, and certain other Gram-positive bacteria and forS. aureus bloodstream infections (bacteremia), including right-sided infective endocarditis, or RIE, caused by methicillin-susceptible and methicillin-resistant isolates. On February 9, 2009, we received a Paragraph IV Certification Notice Letter from Teva Parenteral Medicines, Inc., or Teva, notifying us that it has submitted an Abbreviated New Drug Application, or ANDA, to the U.S. Food and Drug Administration, or FDA, seeking approval to market a generic version of CUBICIN. Teva's notice letter advised that it is seeking FDA approval to market daptomycin for injection prior to the expiration of U.S. Patent Nos. 6,468,967 and 6,852,689, which expire on September 24, 2019, and U.S. Patent No. RE39,071, which expires on June 15, 2016. Each of these patents are listed in the FDA's list of "Approved Drug Products with Therapeutic Equivalence Evaluations," also known as the Orange Book. The notice letter further stated that Teva is asserting that claims in the referenced patents are not infringed and/or invalid. We plan to file a patent infringement lawsuit against Teva in response to the ANDA filing. By statute, if we initiate such a lawsuit against Teva within 45 days of receiving the notice letter, then the FDA would be automatically precluded from approving Teva's ANDA for 30 months (or such shorter or longer period as ordered by the court because either party failed to expedite the lawsuit), or until a district court decision finding the patents invalid or not infringed, whichever occurs earlier. Once the lawsuit is filed, the 30-month stay period will begin as of February 9, 2009, the date we were notified of the filing. We

6

Table of Contents

are confident in our intellectual property portfolio protecting CUBICIN, including the patents listed in the Orange Book.

Since its U.S. launch, CUBICIN also has received similar regulatory approvals in many markets outside the U.S., including the European Union, or EU. We currently commercialize CUBICIN on our own in the U.S. and have established marketing agreements with other companies for commercialization of CUBICIN in all countries outside the U.S. Other markets where CUBICIN has an approved label for cSSSI caused by certain Gram-positive bacteria and forS. aureus blood stream infections include Argentina, Canada, India, Israel, Korea and Taiwan.

In July 2008, we entered into an exclusive agreement with AstraZeneca Pharmaceuticals, LP, an indirect wholly-owned subsidiary of AstraZeneca PLC, or AstraZeneca, to promote and provide other support in the U.S. for MERREM® I.V. (meropenem for injection), an established broad spectrum (carbapenem class) I.V. antibiotic. Under the agreement, we promote and support MERREM I.V. using our existing U.S. acute care sales and medical affairs organizations. AstraZeneca provides marketing and commercial support for MERREM I.V. The agreement establishes a baseline annual payment by AstraZeneca to us of $20.0 million (which was prorated for 2008), to be adjusted up or down based on actual U.S. sales of MERREM I.V. exceeding or falling short of an established annual baseline sales amount. For 2008, sales of MERREM I.V. exceeded the annual baseline sales amount in the U.S. We recognize revenues related to this agreement as service revenues in our Consolidated Statement of Operations. Our service revenues from MERREM I.V. for the twelve months ended December 31, 2008, were $9.4 million. This amount does not include the additional payment we expect to receive for MERREM I.V. sales exceeding the 2008 baseline sales amount. This additional payment represents our percentage of the gross profit on MERREM I.V. sales exceeding the annual baseline sales amount. We currently expect additional revenues for 2008 sales to be approximately $4.5 million, which will be recorded in our consolidated financial statements as service revenues in the quarter ending March 31, 2009, during which time we expect to receive the payment.

We have focused our product pipeline building efforts on opportunities that leverage our acute-care discovery, development, regulatory, and commercialization expertise. In April 2008, we entered into a license and collaboration agreement with Dyax Corp., or Dyax, pursuant to which we obtained an exclusive license for the development and commercialization in North America and Europe of the I.V. formulation of ecallantide for the prevention of blood loss during surgery. As a potent plasma kallikrein inhibitor, ecallantide has the potential to be an important therapy in reducing blood loss and inflammation in multiple surgical indications. We are studying ecallantide initially as a potential treatment for the prevention of blood loss during on-pump cardiothoracic surgery, or CTS, which includes coronary artery bypass graft, or CABG, and heart valve and replacement procedures. We recently began a Phase 2 dose-ranging trial, which we have named CONSERV™ 1, assessing three different doses of ecallantide, in CTS patients at relatively low risk of bleeding. We also expect soon to begin a second Phase 2 trial, CONSERV 2, using the highest of these three doses in CTS patients undergoing procedures associated with a higher risk of bleeding.

In December 2008, we submitted an Investigational New Drug Application, or IND, with the FDA for each of the following two drug candidates: CB-182,804, in development as I.V. antibiotic therapy for multi-drug-resistant Gram-negative infections; and CB-183,315, in development as oral antibiotic therapy forClostridium difficile associated diarrhea, or CDAD. An IND is the filing stage preparatory to clinical trials. In late January, we were notified by the FDA that we could proceed to clinical trials for both candidates. In February 2009, we began dosing humans in Phase 1 clinical trials of CB-183,315 and CB-182,804. In addition, among our programs in preclinical evaluation is CB-183,872, a compound that we are studying as a potential therapy for the treatment of infections caused by the hepatitis C virus, or HCV. We expect to decide by mid-year 2009 if we will progress this program to IND filing.

7

Table of Contents

In addition to these pipeline programs, in January 2009, we entered into a collaboration agreement with Alnylam Pharmaceuticals, Inc., or Alnylam, for the development and commercialization of Alnylam's RNA interference, or RNAi, therapeutics as potential therapy for the treatment of respiratory syncytial virus, or RSV, infection, an area of high unmet medical need. The RSV-specific RNAi therapeutic program on which we are collaborating with Alnylam includes ALN-RSV01, which is currently in Phase 2 clinical development for the treatment of RSV infection in adult lung transplant patients, as well as several other potent and specific second generation RNAi-based RSV inhibitors in pre-clinical studies.

Products and Pipeline Programs

The following table summarizes important information about our products and pipeline programs. More detailed descriptions of each of our products and pipeline programs follows the table.

| | | | | | | | |

Products,

Compound or

Program | | Commercial

Indication(s)/or

Therapeutic Area

of Study | | Marketing

Alliances or

Development

Collaborations | | U.S. Status | | Ex-U.S. Status |

|---|

CUBICIN

|

|

In the U.S., approved for cSSSI caused by certain Gram-positive bacteria including MRSA; and complicated bloodstream infections caused byS. aureus (MRSA and MSSA). |

|

U.S.—none.

Outside U.S.—Multiple development and marketing partners, including Novartis, AstraZeneca AB, Banyu (a subsidiary of Merck), and Sepracor. |

|

In market:

Approved by FDA and launched in 2003; expanded label approved in 2006. |

|

Approved in 57 countries outside the U.S for one or more indications; launches ongoing. |

MERREM I.V | | In the U.S., approved for cSSSI and intra-abdominal infections caused by certain susceptible Gram-positive and Gram-negative bacteria; bacterial meningitis in pediatric patients >3 months of age. | | U.S.—we promote MERREM I.V. for AstraZeneca in U.S. hospitals. | | In market:

Launched in 1996; we began promoting MERREM I.V. in July 2008. | | AstraZeneca commercializes MERREM I.V. outside the U.S.; we have no involvement in MERREM I.V. outside the U.S. |

Ecallantide | | Licensed by Cubist in the field of prevention of blood loss during surgery; initial indication being sought is on-pump CTS. | | In-licensed from Dyax in North America and EU; Dyax has worldwide rights to ecallantide for non-surgical indications and for surgical indications outside of North America/EU. | | In the clinic:

Two Phase 2 studies in CTS in progress. | | N/A |

8

Table of Contents

| | | | | | | | |

Products,

Compound or

Program | | Commercial

Indication(s)/or

Therapeutic Area

of Study | | Marketing

Alliances or

Development

Collaborations | | U.S. Status | | Ex-U.S. Status |

|---|

ALN-RSV program | | Cubist/Alnylam developing for RSV. | | Worldwide (except for Asia) collaboration with Alnylam;

North America—

50:50 collaboration; Outside North America—

exclusive license.

Alnylam's partner, Kyowa Hakko Kirin Co., Ltd., has the rights to this program in Asia. | | In the clinic and advancing preclinical candidates:

ALN-RSV01 now in Phase 2 for adult lung transplant patients; multiple 2nd generation preclinical RNAi RSV compounds. | | N/A |

CB-182,804 | | Being developed for various infections caused by multi-drug-resistant Gram-negative bacteria. | | None | | In the clinic:

IND accepted; Phase 1 study began in February 2009. | | N/A |

CB-183,315 | | Being developed for CDAD. | | None | | In the clinic:

IND accepted; Phase 1 study began in February 2009. | | N/A |

CB-183,872 | | Being studied for infections caused by HCV. | | None | | Preclinical | | N/A |

Our Flagship Product: CUBICIN

CUBICIN has been on the market in the U.S. since November 2003 and, as of December 31, 2008, has been used in the treatment of an estimated 640,000 patients in the U.S. We believe that CUBICIN provides important advantages over existing antibiotic therapies in its approved indications, including:

- •

- its rapid bactericidal properties demonstratedin vitro;

- •

- its mechanism of action;

- •

- once-daily dosing regimen; and

- •

- established safety profile.

CUBICIN's spectrum of activity includes strains of Gram-positive pathogens that are both susceptible and resistant to other antibiotic therapies. In May 2006, CUBICIN received the first approval by the FDA for the treatment ofS. aureus bloodstream infections in more than 20 years. The FDA based its approval on results from our prospective, randomized, and controlled registration trial of CUBICIN for the treatment ofS. aureus bacteremia and endocarditis, which is the only such trial ever undertaken.

Antibiotic Agents for Serious Infections

Antibacterial therapies work by inhibiting specific critical processes in a bacterial pathogen. Such therapies can be either static—inhibiting growth of the pathogen—or bactericidal—causing the death of

9

Table of Contents

the pathogen. Many antibiotics in use today were developed and introduced into the market from the 1950s to the 1980s. Most of these were developed from existing classes of drugs such as semi-synthetic penicillins, cephalosporins, macrolides, quinolones and carbapenems. Only two new antibiotics from new chemical classes have been introduced to the market in the past 35 years—Zyvox®, a static agent which is known generically as linezolid and is from the oxazolidinones chemical class, and our lipopeptide product, CUBICIN, a bactericidal agent known generically as daptomycin.

The increasing prevalence of drug-resistant bacterial pathogens has led to increased mortality rates, prolonged hospitalizations, and increased healthcare costs. The resistant organisms have emerged from both the Gram-positive and Gram-negative classes of bacteria. Gram-positive bacteria are differentiated from Gram-negative bacteria by the differences in the structure of the bacterial envelope. Gram-positive bacteria possess a single cellular membrane and a thick cell wall component, whereas Gram-negative bacteria possess a double cellular membrane with a thin cell wall component. These cellular structures greatly affect the ability of an antibiotic to penetrate the bacterium and reach its target site.

Examples of drug-resistant Gram-positive bacterial pathogens include:

- •

- MRSA (methicillin-resistant Staphylococcus aureus):S. aureus, often referred to simply as "staph," are bacteria commonly carried on the skin or in the nose of healthy people. In some cases,S. aureus can cause an infection, and these bacteria are among the most common causes of skin infections in the U.S. These infections can be minor (such as pimples or boils) which can be treated in many cases without antibiotics (by draining an abscess for example). However,S. aureus bacteria can also cause more serious infections (such as post-surgical wound infections, pneumonia, and infections of the bloodstream and of the bone and joints). Over the past 50 years, treatment of these infections has become more difficult due to the prevalence of MRSA, that is,S. aureus that have become resistant to various antibiotics, including commonly used penicillin-related antibiotics. As reported by the U.S. Centers for Disease Control and Prevention, or the CDC, and others, more than 60% ofS. aureus isolates in the U.S. have been found to be methicillin-resistant.

The practical definition of resistance for a pathogen is when the minimum inhibitory concentration, or MIC value, exceeds a pre-specified limit for that specific antibiotic. Vancomycin has been the standard of care for patients who have serious MRSA infections. However, several strains of staphylococci, such as GISA (glycopeptides intermediateStaphylococcus aureus, vancomycin MIC = 4 - 8 µg/ml), and VRSA (vancomycin-resistantStaphylococcus aureus, vancomycin MIC >/= 16 µg/ml), have developed reduced susceptibility or resistance to vancomycin. In recognition of the issues with vancomycin susceptibility, the FDA, in May 2008, approved lower susceptibility criteria (MIC </=2 mcg/mL as susceptible) for vancomycin againstS. aureus. In addition, recent published reports document a poor clinical success rate for vancomycin therapy against someS. aureus isolates with a vancomycin MIC of 1.0 to 2.0 µg/ml.

While infections caused by MRSA previously had been associated mostly with hospital and long-term care settings, the incidence of community-acquired MRSA, or CA-MRSA, infections has been increasing rapidly. Of great concern to the infectious disease community and public health authorities, such as the CDC, is the fact that CA-MRSA infections show up in otherwise healthy individuals—not fitting the traditional profile for an "at risk" patient such as a frequent user of the healthcare system who is more likely to be exposed to MRSA infections. As a result, individuals contracting an MRSA infection outside of the healthcare system can be misdiagnosed and receive inappropriate initial therapy. Such patients can get more seriously ill and require hospitalization. The infectious disease community is also concerned because CA-MRSA strains have been more virulent than the strains traditionally found in hospitals. These CA-MRSA

10

Table of Contents

Susceptibility ofS.aureus to CUBICIN

The most recently published surveillance data continue to show that CUBICIN is a potent agent against isolates ofS. aureus that are both susceptible and resistant to other antibiotics. In a study entitled "Evaluation of thein vitro activity of daptomycin against 19615 clinical isolates of Gram-positive cocci collected in North American hospitals (2002 - 2005)" published in the April 2007 edition of the Diagnostic Microbiology and Infectious Diseases, or DMID, daptomycin demonstrated excellentin vitro activity against a wide range of Gram-positive pathogens and resistance to vancomycin or methicillin did not compromise the activity of daptomycin against any tested species.

Case reports ofS. aureus isolates that exceed the approved susceptibility range for daptomycin (those with a reported daptomycin MIC of greater than 1 µg/mL) have been published in the literature or presented at scientific meetings. In each of these cases, clinical failure was associated with an elevated daptomycin MIC. A majority of these reports describe patients with deep-seated infections or the presence of intravascular/prosthetic material. These patients often have numerous co-morbidities, usually compounded by an undrained focus of infection or hardware that was not removed.

Surveillance monitoring to assess the potency of CUBICIN is ongoing. 2008 surveillance data, presented in poster form at an infectious disease conference in October 2008, but not yet published, has findings consistent with the data from the 2007 DMID study.

Clinical Development of CUBICIN

We continue to undertake research which can add to the medical knowledge about CUBICIN. In particular, we are studying higher dosing of CUBICIN for serious infections requiring treatment of longer duration. We also conduct post-marketing research agreed to with the FDA, such as the study of CUBICIN in renal-compromised patients and in children. Studies currently underway include:

- •

- The study of CUBICIN at 6 mg/kg and at 8 mg/kg for 6 weeks versus standard of care therapy (either vancomycin or teicoplanin) in the treatment of prosthetic joint infections, or PJI. We currently expect enrollment in the study to continue through 2009 and to make data available from this study in 2010;

11

Table of Contents

- •

- The study of CUBICIN at 10 mg/kg for 28 days versus standard of care therapy (either vancomycin or teicoplanin) in the treatment of MRSA bacteremia;

- •

- A cSSSI safety and efficacy study in renal-compromised patients for which a protocol was submitted to the FDA in December 2008;

- •

- A cSSSI safety and efficacy study in 7 to 17 year olds and a pharmacokinetics study in 2 to 6 year olds; and

- •

- The study of CUBICIN at 6 mg/kg, with and without gentamicin, for the treatment of infective endocarditis.

CUBICIN in the U.S. Market

We recorded $414.7 million, $285.1 million and $189.5 million in U.S. net product sales of CUBICIN in 2008, 2007 and 2006, respectively. We market CUBICIN to more than 2,000 U.S. institutions (hospitals and outpatient acute care settings), that account for approximately 83% of the total market opportunity for I.V. antibiotics to treat serious Gram-positive infections in the U.S. As of December 31, 2008, CUBICIN had approximately a 10% share of this market. Our sales and marketing efforts are led by our in-house marketing team and our acute care sales force, which included approximately 164 clinical business manager positions, or CBMs, as of February 1, 2009. Our U.S. acute care sales organization also includes small numbers of regional business directors, or RBDs, who manage our CBMs, senior sales directors, who manage the RBDs, and regional access managers, whose primary objective is to sell CUBICIN in the U.S. to outpatient acute care settings, such as home infusion and dialysis markets. On February 9, 2009, we received a Paragraph IV Certification Notice Letter from Teva notifying us that it has submitted an ANDA to the FDA seeking approval to market a generic version of CUBICIN. Teva's notice letter advised that it is seeking FDA approval to market daptomycin for injection prior to the expiration of U.S. Patent Nos. 6,468,967, 6,852,689 and RE39,071. The notice letter further stated that Teva is asserting that claims in the referenced patents are not infringed and/or invalid. We plan to file a patent infringement lawsuit against Teva in response to the ANDA filing. By statute, if we initiate such a lawsuit against Teva within 45 days of receiving the notice letter, then the FDA would be automatically precluded from approving Teva's ANDA for 30 months (or such shorter or longer period as ordered by the court because either party failed to expedite the lawsuit), or until a district court decision finding the patents invalid or not infringed, whichever occurs earlier. Once the lawsuit is filed, the 30-month stay period will begin as of February 9, 2009, the date we were notified of the filing.

We sell CUBICIN in the U.S. in accordance with a drop-ship program under which orders are processed through wholesalers but shipments are sent directly to our end users. This provides us with greater visibility into end-user ordering and reordering trends. We outsource many of our supply chain activities, including: (i) manufacturing and supplying CUBICIN API; (ii) converting CUBICIN API into its finished, vialed and packaged formulation; (iii) managing warehousing and distribution of CUBICIN to our customers; and (iv) performing the order processing, order fulfillment, shipping, collection and invoicing services related to our U.S. CUBICIN product sales.

Competition in the U.S.

The competition in the market for therapeutic products that address serious Gram-positive bacterial infections is significant. In particular, vancomycin has been a widely used and well known antibiotic for over 40 years and is sold in a relatively inexpensive generic form. Vancomycin is marketed generically by Abbott Laboratories, Shionogi & Co., Ltd. and others. CUBICIN also faces competition in the U.S. from commercially available drugs such as Zyvox®, marketed by Pfizer, Inc., or Pfizer, Synercid®, marketed by King Pharmaceuticals, Inc., and Tygacil®, marketed by Wyeth, which has agreed to be acquired by Pfizer, as announced in January 2009.

12

Table of Contents

In November 2008, an FDA Antiinfective Drug Advisory Committee, or AIDAC, meeting was held to discuss pending New Drug Applications, or NDAs, for three antibiotics: telavancin, filed by Theravance, Inc., or Theravance; oritavancin, filed by Targanta Therapeutics Corporation, or Targanta, which was acquired by The Medicines Company in late February 2009; and iclaprim, filed by Arpida Ltd., or Arpida. The NDAs for each of these agents sought approval for the treatment of cSSSI. The AIDAC voted in favor of approval of telavancin subject to certain recommendations regarding certain safety issues. In late January 2009, Theravance submitted an NDA for telavancin as a potential therapy for hospital-acquired pneumonia, or HAP, based on the positive results of the telavancin HAP Phase 3 trial announced in December 2007. In late February 2009, Theravance announced that it had received a Complete Response letter from the FDA outlining requirements for approval of telavancin for the treatment of cSSSI. The Complete Response letter requires a Risk Evaluation and Mitigation Strategy and a boxed warning related to the risk of teratogenicity (the ability to cause birth defects). The Complete Response letter also requested data on patients with certain renal risk factors from the cSSSI and HAP studies, revisions to the draft label, and a customary safety update. No additional clinical trials are required. The AIDAC, in November 2008, also voted against approval of oritavancin and iclaprim based on the data submitted in their respective NDAs. In December 2008, the FDA issued a complete response letter to Targanta's NDA indicating that an additional Phase 3 trial would be required to gain U.S. approval for oritavancin. In January 2009, the FDA issued a complete response letter to Arpida's iclaprim NDA, indicating that it did not demonstrate the efficacy of iclaprim for treatment of cSSSI within an acceptable non-inferiority margin. The FDA also is reviewing ceftobiprole, a broad spectrum agent with MRSA activity (NDA submitted in May 2007 by a division of Johnson & Johnson which licensed worldwide rights to ceftobiprole from Basilea Pharmaceutica, Ltd., or Basilea). In September 2008, Johnson & Johnson announced that its Complete Response (to the Approvable Letter received by Johnson & Johnson in March 2008) was accepted in September 2008 as a Class 2 Complete Response. In late February 2009, Basilea announced that as a result of FDA inspections at investigator sites and of Johnson & Johnson, the FDA suggested that Johnson & Johnson have additional clinical site audits performed. Basilea also announced that additional audits are anticipated to occur in the first half of 2009 with a Complete Response submission foreseen in the second half of this year, and that it has filed claims in arbitration against Johnson & Johnson and affiliated companies related to delays in approval of ceftobiprole. Telavancin and ceftobiprole may be approved and marketed in the near future and could compete with CUBICIN. Oritavancin and iclaprim, as well as other antibiotics in clinical development, could compete with CUBICIN, if approved by the appropriate regulatory agencies, in future years.

Teva notified us on February 9, 2009, that it has submitted an ANDA to the FDA seeking approval to market a generic version of CUBICIN before the expiration of the patents covering CUBICIN. We plan to file a patent infringement lawsuit against Teva in response to the ANDA filing. By statute, if we initiate such a lawsuit against Teva within 45 days of receiving the notice letter, then the FDA would be automatically precluded from approving Teva's ANDA for 30 months (or such shorter or longer period as ordered by the court because either party failed to expedite the lawsuit), or until a district court decision finding the patents invalid or not infringed, whichever occurs earlier. If Teva's ANDA is ultimately approved by the FDA and Teva launches a generic version of CUBICIN, which could occur after the district court proceeding if the district court rules in favor of Teva or before the completion of the district court proceeding if the 30-month statutory stay (as shortened or lengthened by the court) has expired and Teva decides to launch prior to the district court decision, then we would face competition in the U.S. from a generic version of CUBICIN.

Our International Marketing Partners for CUBICIN

CUBICIN is being introduced and commercialized in markets outside the U.S. through alliances we have entered into with other companies. Novartis AG, or Novartis, through a subsidiary, is responsible for regulatory filings, sales, marketing and distribution costs in Europe, Australia,

13

Table of Contents

New Zealand, India, and certain Central American, South American and Middle Eastern countries; AstraZeneca AB is responsible for the development and commercialization of CUBICIN in China as well as more than one hundred additional countries; and Merck & Co., Inc., or Merck, through its wholly owned subsidiary, Banyu Pharmaceutical Co., Ltd., is responsible for the development and commercialization of CUBICIN in Japan. Other international partners for CUBICIN include Medison Pharma, Ltd., for Israel, Sepracor, Inc., successor-in-interest to Oryx Pharmaceuticals, Inc., for Canada, TTY BioPharm for Taiwan, and Kuhnil Pharma Co., Ltd. for Korea. As of December 31, 2008, CUBICIN had received regulatory approval in 58 countries and was being marketed in 25 countries, including the U.S. In 2008, our total international revenue for CUBICIN, primarily based on sales by Novartis in the EU, was $7.4 million. To date, EU sales have grown more slowly than U.S. sales due primarily to lower overall MRSA rates in the hospital and community, an additional glycopeptide competitor (teicoplanin), which is not approved in the U.S., the evolving commercialization strategy and mix of resources that Novartis has been using to commercialize CUBICIN, as well as other factors.

Each partner is responsible for seeking regulatory approvals to market CUBICIN in its territory. We are responsible for manufacturing and supplying CUBICIN to our partners in exchange for a transfer price and, in the case of Novartis, a possible additional royalty. Unless terminated earlier, in accordance with its terms, our license agreement with Novartis' subsidiary expires on the later of: (a) expiration of the last-to-expire of the CUBICIN patents owned by Cubist or jointly-owned by Cubist and Novartis' subsidiary; (b) the date on which there no longer exists a claim of a pending CUBICIN patent application owned by Cubist or jointly-owned by Cubist and Novartis' subsidiary; and (c) the earlier of: (i) generic daptomycin sales reaching 30% of the total market share for all daptomycin sales in Novartis's territory, and (ii) June 30, 2020.

MERREM I.V.

We promote and provide other support for MERREM I.V. in the U.S. under our July 2008 Commercial Services Agreement with AstraZeneca. MERREM I.V. is an established I.V. broad spectrum carbapenem antibiotic for the treatment of serious, hospital-acquired infections. MERREM I.V. was launched in 1996 by AstraZeneca and is approved in the U.S. for cSSSI and intra-abdominal infections caused by certain susceptible Gram-positive and Gram-negative bacteria. MERREM I.V. also is indicated for the treatment of bacterial meningitis in children (3 months of age or older) caused by certain susceptible bacteria. According to our calculations, the market for carbapenem therapy has grown by 5.5% in treatment days for the 12 months ended June 2008. As reported by AstraZeneca, there has been steady revenue growth for MERREM I.V, in the U.S. over the last two years. AstraZeneca has reported that it generated annual worldwide revenues of $897.0 million, $773.0 million and $604.0 million from MERREM I.V. in 2008, 2007 and 2006, respectively.

We are obligated under the agreement to provide certain levels of support with respect to MERREM I.V., including requirements related to sales calls to physicians, specified priority of presentation of MERREM I.V. relative to other products, and a minimum number of sales representatives and clinical science directors. The agreement includes a baseline annual payment to us to be adjusted up or down based on actual sales. We recognize revenues related to this agreement over each annual period of performance based on the estimated minimum annual payment amount that we can receive under the agreement. The amount of revenue recognized is assessed at the end of each quarterly period to reflect actual performance against the annual baseline sales amount. In 2008, we recognized service revenues from AstraZeneca of $9.4 million based on the achievement of agreed upon target revenue requirements for sales since the inception of our agreement. We also earn a percentage of the gross profit on sales exceeding the annual baseline sales amount. The payment for any such sales over the baseline amount will be recognized in the quarter in which AstraZeneca provides us with its annual sales report. Because sales of MERREM I.V. in 2008 exceeded the annual

14

Table of Contents

baseline sales amount in the U.S., we expect to receive additional revenues for 2008 sales of approximately $4.5 million, which will be recorded in our financial statements as service revenues in the quarter ending March 31, 2009, during which time we expect to receive the payment.

The composition of matter patent for MERREM I.V. in the U.S. extends through June 2010. However, the term of the agreement extends through December 31, 2012, unless earlier terminated. Annual sales targets may be adjusted if certain events occur during the term of the agreement that could impact sales of MERREM I.V. The agreement includes standard termination provisions for material breaches by, and bankruptcy, insolvency or changes in control of, the other party. The agreement may also be terminated by AstraZeneca if sales fall below certain agreed-upon thresholds, by us if AstraZeneca conducts certain activities competitive with MERREM I.V. in the U.S., or by either party: (i) without cause effective no earlier than January 1, 2010, (ii) in the event that we cease to promote CUBICIN, (iii) if AstraZeneca withdraws MERREM I.V. from the market or decides or is required to restrict approved indications for MERREM I.V., (iv) in the case of certain price controls on MERREM I.V. imposed by governmental entities, or (v) in the event of certain failures of supply of MERREM I.V. by AstraZeneca. The agreement also terminates automatically upon a termination or reduction to non-exclusive of AstraZeneca's right to market MERREM I.V. in the U.S. pursuant to an agreement between AstraZeneca's affiliate, AstraZeneca UK Limited, and Sumitomo Pharmaceuticals Co., Limited. The agreement also includes certain restrictions on our rights to market, promote, sell and engage in certain other activities with respect to competing products during the term of the agreement and for three months thereafter.

MERREM I.V. faces competition in the U.S. from commercially available drugs such as Primaxin® I.V., marketed by Merck, as well as Doribax™, marketed by Ortho-McNeil, a Johnson & Johnson company. Primaxin I.V. was initially approved by the FDA in 1986 and is a widely used and well known antibiotic. In December 2008, a bulletin on the website of the American Society of Health System Pharmacists referenced a shortage of Primaxin I.V. that was being addressed by Merck. Doribax was approved by the FDA in October 2007 for two indications (complicated intraabdominal infections and complicated urinary tract infections, including pyelonephritis). Ortho-McNeil is pursuing additional indications for Doribax. In August 2008, the FDA issued a Complete Response letter to Ortho-McNeil outlining the actions necessary to address outstanding issues with the supplemental NDA for use of Doribax in patients with nosocomial pneumonia, including ventilator-associated pneumonia.

Our Product Pipeline

We are building a pipeline of acute care therapies through licensing and collaboration agreements as well as by progressing compounds into clinical development that we have developed internally.

In April 2008, we entered into a license and collaboration agreement with Dyax, pursuant to which we obtained an exclusive license for the development and commercialization of the I.V. form of Dyax's ecallantide compound for the prevention of blood loss during surgery in North America and Europe. We are studying ecallantide initially in CTS, which includes CABG and heart valve and replacement procedures. We recently began a Phase 2 dose-ranging placebo-controlled trial assessing three different doses of ecallantide in CTS patients undergoing primary on-pump CABG at relatively low risk of bleeding, and expect soon to begin a Phase 2 dose-ranging active-control trial assessing a high dose of ecallantide in CTS patients undergoing procedures associated with a higher risk of bleeding. The prevention of blood loss during CTS is an area of significant unmet medical need, particularly since aprotinin (previously marketed as Trasylol® by Bayer Healthcare Pharmaceuticals) was withdrawn from the U.S. market in November 2007. In October 2008, we announced positive top-line results from the ecallantide on-pump CTS Phase 2 clinical trial known as Kalahari™ 1, which was terminated in June 2008, after the enrollment of 69 patients, so that we could focus resources on the design and initiation of the Phase 2 dose-ranging clinical trials. Top-line data from Kalahari 1 showed that for patients treated with ecallantide, transfusion volume decreased by 25% and 65% at the trial's low and high doses, respectively (assessed at the 12 hour time point), and that the drug was well tolerated.

15

Table of Contents

Pursuant to the terms of our agreement with Dyax, we paid Dyax a $15.0 million upfront payment in April 2008 and an additional $2.5 million payment on December 31, 2008, both of which are included in research and development expense for the twelve months ended December 31, 2008. We are responsible for all further development costs associated with ecallantide in the licensed indications for our territory. If certain clinical, regulatory and sales milestones are met, we could become obligated to pay Dyax up to an additional $214.0 million in milestone payments. We also would be obligated to pay Dyax tiered royalties based on any future sales of ecallantide by us. The agreement provides an option for Dyax to retain certain U.S. co-promotion rights. Dyax retains exclusive rights to ecallantide in all other indications, including for its hereditary angioedema program. Except under certain circumstances, Dyax will supply us with ecallantide for our development and commercialization efforts. The agreement may be terminated by us without cause on prior notice to Dyax, and by either party in the event of a breach of specified provisions of the agreement by the other party.

In January 2009, we entered into a collaboration agreement with Alnylam for the development and commercialization of RNAi therapeutics as potential therapy for the treatment of RSV infection, an area of high unmet medical need. The RSV-specific RNAi therapeutic program includes ALN-RSV01, which is currently in Phase 2 clinical development for the treatment of RSV infection in adult lung transplant patients, as well as several other potent and specific second generation RNAi-based RSV inhibitors in pre-clinical studies. RNAi is a natural process of gene silencing that occurs in organisms ranging from plants to mammals. RNAi therapeutics target the cause of diseases by potently silencing specific messenger ribonucleic acids, or mRNAs, thereby preventing disease-causing proteins from being made. RSV is a highly contagious virus that causes infections in both the upper and lower respiratory tract. RSV infects nearly every child at least once by the age of two years and is a major cause of hospitalization due to respiratory infection in children and people with compromised immune systems, and others. RSV infection typically results in cold-like symptoms but can lead to more serious respiratory illnesses such as croup, pneumonia, bronchiolitis, and in extreme cases, death. RSV infection in the pediatric and adult populations accounts for more than 300,000 hospitalizations per year in the U.S. In addition, RSV infection in infants has been linked to the development of childhood asthma. As a result, there is a significant need for novel therapeutics for patients who become infected with RSV.

Our agreement with Alnylam is structured as a 50/50 co-development and profit share arrangement in North America, and a milestone- and royalty-bearing license arrangement in the rest of the world outside of Asia, where ALN-RSV is partnered with Kyowa Hakko Kirin Co., Ltd. The development of licensed products in North America will be governed by a joint steering committee comprised of an equal number of representatives from each party. We have the sole right to commercialize licensed products in North America with costs associated with such activities and any resulting profits or losses to be split equally between us and Alnylam. For the rest of the world, excluding Asia, we have sole responsibility for any required additional development of licensed products, at our cost, and the sole right to commercialize such products. Upon signing the agreement, we made a $20.0 million upfront payment to Alnylam. We also have an obligation to make milestone payments to Alnylam if certain specified development and sales events are achieved in the rest of the world, excluding Asia. These development and sales milestones payments could total up to $82.5 million. In addition, if licensed products are successfully developed in the rest of the world, excluding Asia, we will be required to pay Alnylam double digit royalties on net sales of such products in such territory, if any, subject to offsets under certain circumstances. Upon achievement of certain development milestones, Alnylam will have the right to convert the North American co-development and profit sharing arrangement into a royalty-bearing license with development and sales milestones payments to be paid by us to Alnylam which could total up to an aggregate of $130.0 million if certain specified development and sales events are achieved in North America and depending upon the timing of the conversion by Alnylam and the

16

Table of Contents

regulatory status of a collaboration product at the time of conversion. If Alnylam makes the conversion to a royalty-bearing license with respect to North America, then North America becomes part of the existing royalty territory (i.e. the rest of the world, excluding Asia). Unless terminated earlier in accordance with the agreement, the agreement expires on a country-by-country and licensed product-by-licensed product basis: (a) with respect to the royalty territory, upon the latest to occur of: (i) the expiration of the last-to-expire Alnylam patent covering a licensed product, (ii) the expiration of the Regulatory-Based Exclusivity Period (as defined in the agreement), and (iii) ten years from first commercial sale in such country of such licensed product by us or our affiliates or sublicensees; and (b) with respect to North America, if Alnylam has not converted North America into the royalty territory, upon the termination of the agreement by us upon specified prior written notice.

Alnylam estimates that its fundamental RNAi patents covered under the agreement will expire both in and outside of the U.S. generally between 2016 and 2025. Allowed claims covering ALN-RSV01 in the U.S. would expire in 2026. These patent rights are subject to any potential patent term extensions and/or supplemental protection certificates extending such term extensions in countries where such extensions may become available. In addition, more patent filings relating to the collaboration may be made in the future. We have the right to terminate the agreement at any time on three months prior written notice prior to acceptance for filing of the first application for regulatory approval of a licensed product or on nine months prior written notice after acceptance for filing of the first application for regulatory approval. Either party may terminate the agreement in the event the other party fails to cure a material breach or upon patent-related challenges by the other party. During the term of the agreement, neither party nor its affiliates may develop, manufacture or commercialize anywhere in the world, outside of Asia, a therapeutic or prophylactic product that specifically targets RSV, except for licensed products developed, manufactured or commercialized pursuant to the agreement.

In December 2008, we submitted two INDs to the FDA to indicate our intention to begin clinical trials for CB-182,804 and for CB-183,315. In late January 2009, we were notified by the FDA that we could proceed with clinical trials for both compounds. In February 2009, we began Phase 1 studies of CB-182,804 and CB-183,315.

CB-182,804 is in development for the treatment of multi-drug-resistant, or MDR, Gram-negative infections. CB-182,804 is a novel, proprietary, I.V. administered Gram-negative antibiotic that has demonstratedin vitro efficacy and rapid bactericidal activity against the key MDR Gram-negative pathogens, includingP. aeruginosa, E. coli, K. pnuemoniae, and A. baumannii. In animal models, CB-182,804 was shown to be effective against lung, kidney, bloodstream and thigh infections against all MDR Gram-negative strains tested.

Examples of resistant Gram-negative pathogens are:

- •

- Pan-resistantPseudomonas aeruginosa:P. aeruginosa is a major cause of opportunistic infections among immunocompromised patients. Multi-drug resistance is increasingly observed in clinical isolates reflecting both their innate resistance (limited permeability of theP. aeruginosa outer membrane) along with acquisition of resistance mechanisms. It is now commonplace for a burn patient to develop an infection with a pan-resistant organism—resistant to B-lactams, fluoroquinolones, tetracycline, chloramphenicol, macrolides, trimethoprim/sulfa, and aminoglycosides.

- •

- ESBL positive Gram-negatives: Extended-spectrum B-lactamases (ESBLs) are plasmid-mediated bacterial enzymes that result from genetic mutations of native B-lactamases such that they confer resistance to a broader group of antibiotics including third-generation cephalosporins. Since the first ESBL positive strain was recognized approximately 20 years ago, these

17

Table of Contents

CB-183,315 is in development as therapy for CDAD. The recent increase in severity of CDAD, due to newer strains that produce higher levels of toxins, has exposed shortcomings in the standard of care therapy, including reduced susceptibility and recurrence rates of greater than 20% for standard of care therapy. CB-183,315 is a potent, oral, cidal lipopeptide with rapidin vitro bactericidal activity againstC. difficile, an opportunistic anaerobic Gram-positive bacterium that causes CDAD.

- •

- Clostridium difficile:C. difficile is an opportunistic anaerobic Gram-positive bacterium causing the most commonly diagnosed form of hospital-acquired, or nosocomial, diarrhea—CDAD. Recent years have witnessed the emergence of a hypervirulent strain ofC. difficile that produces much higher levels of toxins. This strain also demonstrates high level resistance to fluoroquinolones which may have contributed to its spread throughout the U.S., Canada, the United Kingdom, the Netherlands and Belgium. Physicians have noted an increase in incidence and mortality rates as well as increases in numbers of patients requiring emergency colectomy (removal of all or part of the colon) or admission to intensive care units.

Our preclinical development pipeline includes CB-183,872, a compound in development for the treatment of infections caused by HCV. We plan to decide whether we will proceed with an IND filing for this compound in the first half of 2009.

Our Research and Development Expenditures

Our research and development expenditures, which include research related to CUBICIN, were $126.7 million, $85.2 million and $57.4 million in 2008, 2007 and 2006, respectively. Based on our ongoing investments in CUBICIN, and the progression of our product pipeline programs, we expect that our expenditures in research and development will increase again in 2009.

Our Significant Customers

Revenues from Cardinal Health, Inc. accounted for approximately 28%, 32% and 33% of all revenues for the years ended December 31, 2008, 2007 and 2006, respectively. Revenues from Amerisource Bergen Drug Corporation accounted for approximately 28%, 30% and 32% of all revenues for the years ended December 31, 2008, 2007 and 2006, respectively. Revenues from McKesson Corporation accounted for approximately 20%, 20% and 21% of all revenues for the years ended December 31, 2008, 2007 and 2006, respectively.

Our Intellectual Property Portfolio

We seek to protect our novel compounds, cloned targets, expressed proteins, assays, organic synthetic processes, screening technology and other technologies by, among other things, filing, or causing to be filed on our behalf, patent applications. Except as specifically noted below, the patent rights described below may be subject to potential patent term extensions and/or supplemental protection certificates extending such term extensions in countries where such extensions may become available. In addition, more patent filings relating to the product and product candidates described below may be made in the future.

18

Table of Contents

To date, Cubist and its subsidiaries own or co-own 26 issued U.S. patents, 28 pending U.S. patent applications, 42 issued foreign patents and approximately 178 pending foreign patent applications. Not included in these totals are the patents and patent applications which Cubist has exclusively licensed.

CUBICIN:

We have acquired and exclusively licensed technology from Eli Lilly and Company, or Eli Lilly, related to the composition, manufacture, and use of daptomycin, the active ingredient in CUBICIN. To date, under our license agreement with Eli Lilly, we have made payments to Eli Lilly of $1.15 million for milestones, which were paid in Cubist common stock, and approximately $91.1 million for royalties on sales of CUBICIN, which were paid in cash. Unless terminated earlier in accordance with its terms, our license agreement with Eli Lilly expires on the later of: (a) the expiration of the last-to-expire of the patents assigned or licensed under the agreement; or (b) the end of the tenth year from the date of first sale of CUBICIN in any of the U.S., Canada, Japan, the United Kingdom, Germany, France, Italy, Spain, Switzerland, Netherlands or Belgium in which know-how royalties are due under the agreement.

The primary composition of matter patent covering daptomycin in the U.S. has expired; however, currently there are five issued U.S. patents owned by Cubist that cover the drug product, manufacture, and/or administration or use of daptomycin. These patents and their expiration dates are as follows:

| | |

Patent No. | | Expiration Date |

|---|

6,852,689 | | September 2019 |

6,696,412 | | November 2020 |

6,468,967 | | September 2019 |

RE39,071 | | June 2016 |

4,885,243 | | August 2010 |

On February 9, 2009, we received a Paragraph IV Certification Notice Letter from Teva notifying us that it has submitted an ANDA to the FDA seeking approval to market a generic version of CUBICIN. Teva's notice letter advised that it is seeking FDA approval to market daptomycin for injection prior to the expiration of U.S. Patent Nos. 6,468,967, 6,852,689 and RE39,071. The notice letter further stated that Teva is asserting that claims in the referenced patents are not infringed and/or invalid. We plan to file a patent infringement lawsuit against Teva in response to the ANDA filing. By statute, if we initiate such a lawsuit against Teva within 45 days of receiving the notice letter, then the FDA would be automatically precluded from approving Teva's ANDA for 30 months (or such shorter or longer period as ordered by the court because either party failed to expedite the lawsuit), or until a district court decision finding the patents invalid or not infringed, whichever occurs earlier. Once the lawsuit is filed, the 30-month stay period will begin as of February 9, 2009, the date we were notified of the filing.

In addition, we have also filed a number of patent applications in our name relating to the composition, manufacture, administration and/or use of daptomycin and/or other lipopeptides. The patent term extension in the U.S. for CUBICIN was applied to U.S. Patent no. 4,885,243.

Ecallantide for CTS:

We have exclusively licensed from Dyax rights to ecallantide (a biologic). The composition of matter patent in the U.S. is U.S. Patent no. 7,276,480.

ALN-RSV compounds:

We have exclusively licensed from Alnylam rights to RSV01 and backup compounds Alnylam has developed or will develop under the collaboration between our companies. Alnylam estimates that its fundamental RNAi patents covered under the agreement will expire both in and outside of the U.S.

19

Table of Contents

generally between 2016 and 2025. Allowed claims covering ALN-RSV01 in the U.S. would expire in 2026.

CB-182,804 for infections caused by Gram-negative bacteria:

We have exclusively licensed from a third party technology related to the composition of matter of CB-182,804 and its manufacture and use and have utilized the third party to perform certain of the research activities for CB-182,804. The composition of matter provisional patent application, which we have exclusively licensed, is pending and, if a patent is issued in the U.S. it would expire no earlier than December 2029.

CB-183,315 for infections caused by Clostridium difficile bacteria:

We own the rights related to the composition of matter of CB-183,315 and its manufacture and use. The composition of matter provisional patent application is pending and, if a patent is issued in the U.S., it would expire no earlier than December 2029.

CB-183,872 for infections caused by the Hepatitis C virus:

We own the rights related to the composition of matter of CB-183,872 (a biologic) and its manufacture and use through our acquisition of Illumigen Biosciences, Inc. The composition of matter patent application, which we own, is pending and, if a patent is issued in the U.S. we expect it would expire no earlier than May 2026.

Manufacturing and Supply Agreements

CUBICIN:

We outsource many of our supply chain activities, including: (i) manufacturing CUBICIN API; (ii) converting CUBICIN API into its finished, vialed and packaged formulation; (iii) managing warehousing and distribution of CUBICIN to our customers; and (iv) performing the order processing, order fulfillment, shipping, collection and invoicing services related to our CUBICIN product sales in the U.S.

In September 2001, we entered into a manufacturing and supply agreement with ACS Dobfar SpA, or ACS, pursuant to which ACS manufactures and supplies us API for CUBICIN, on an exclusive basis, for commercial purposes. ACS is the sole provider of our commercial supply of CUBICIN API. Pursuant to our agreement with ACS, ACS currently stores some CUBICIN API at its facilities in Italy. We are also required to purchase at least one thousand kilograms of CUBICIN API in each calendar year until the expiration of the agreement on December 31, 2015, unless the agreement is terminated earlier in accordance with its terms. ACS also manufactures API for our clinical trials of CUBICIN. We expect that ACS's substantial fermentation and purification plant capacity can meet all of our anticipated needs for CUBICIN API for at least the next several years.

In April 2000, we entered into an agreement with Hospira, Inc., or Hospira, formerly the core global hospital products business of Abbott Laboratories. Under this agreement, Hospira currently converts API into our finished, vialed formulation of CUBICIN. Under the original agreement with Hospira, Hospira had certain development obligations to assist us in obtaining an approved NDA covering CUBICIN. Hospira has no further development obligations under the agreement and we have paid Hospira approximately $0.6 million in milestone payments as full payment for its performance of these obligations. Under an amendment to this agreement, which we entered into with Hospira in June 2008, Hospira has additional development obligations relating to: (a) the validation of a second facility where Hospira will be able to provide fill/finish services for CUBICIN; (b) the validation of a new vial size for the supply by Hospira of CUBICIN vials; and (c) our ability to have Hospira provide us with

20

Table of Contents

packaging and labeling services for CUBICIN. We are paying Hospira to perform these development obligations, but there are no milestone payments associated with the services.

In September 2003, we entered into a packaging services agreement with Catalent Pharma Solutions, LLC, or Catalent, the successor-in-interest to Cardinal Health PTS, LLC, or Cardinal Health, pursuant to which Catalent packages and labels the finished CUBICIN product that is produced by Hospira. We also have an additional services agreement with Oso Biopharmaceuticals Manufacturing, LLC, or Oso, successor-in-interest to an agreement that we originally entered into in August 2004 with Cardinal Health, to provide fill/finish as well as packaging services for the finished CUBICIN product at Oso's Albuquerque, New Mexico, facility.

In June 2003, we entered into a services agreement with Integrated Commercialization Solutions, Inc., or ICS, under which ICS exclusively manages our CUBICIN warehousing and inventory program and distributes finished product to our customers. ICS also provides us with order processing, order fulfillment, shipping, collection and invoicing services in support of the direct ship model we have employed since the launch of CUBICIN in the U.S. Our agreement with ICS was amended and restated in July 2006, but the services provided have remained substantially the same.

In September 2001, Cubist entered into a services agreement with PPD Development, LLC, or PPD, pursuant to which PPD originally provided various clinical, laboratory, GMP and other research and testing services. In December 2006, we received approval from the FDA to begin release testing of CUBICIN at our Lexington, Massachusetts, facility. We now perform the testing for the U.S. market that was previously performed at PPD.

Pipeline Programs:

Ecallantide: Under our agreement with Dyax, Dyax, except under certain circumstances, is responsible for supplying drug substance for the development and commercialization of ecallantide. For our Phase 2 clinical trials, drug product also will be provided by Dyax. We use "drug substance" to refer to the active ingredient of a product and "drug product" to refer to the final, finished form of the product, ready for packaging and labeling. Dyax currently utilizes third party suppliers to supply such drug substance and product. Following our Phase 2 clinical trials, we will be responsible for turning ecallantide drug substance into drug product.

ALN-RSV01: Under our agreement with Alnylam, Alnylam is responsible for providing drug substance and drug product during development and commercialization of ALN-RSV01.

CB-182,804 and CB-183,315: We are responsible for providing or acquiring adequate supplies of drug substance and drug product for the development of these pipeline candidates. We are currently using third party suppliers to supply us with drug substance and drug product for these product candidates.

Government Regulation

Overview

Our current and contemplated activities and the products and processes that will result from such activities are subject to substantial government regulation.

U.S.—FDA Process

Pre-Clinical Testing: Before testing of any compounds with potential therapeutic value in human subjects may begin in the U.S., stringent government requirements for pre-clinical data must be satisfied. Pre-clinical testing includes bothin vitro (in an artificial environment outside of a living

21

Table of Contents

organism) andin vivo (within a living organism) laboratory evaluation and characterization of the safety and efficacy of a drug and its formulation.

Investigational New Drug application (IND): Pre-clinical testing results obtained from studies in several animal species, as well as fromin vitro studies, are submitted to the FDA as part of an IND application, and are reviewed by the FDA prior to the commencement of human clinical trials. These pre-clinical data must provide an adequate basis for evaluating both the safety and the scientific rationale for the initial clinical studies in human volunteers. Unless the FDA objects to an IND, the IND becomes effective 30 days following its receipt by the FDA. Once trials have commenced, the FDA may stop the trials by placing them on "clinical hold" because of concerns about, for example, the safety of the product being tested.

Clinical Trials: Clinical trials involve the administration of the drug to healthy human volunteers or to patients under the supervision of a qualified investigator pursuant to an FDA-reviewed protocol. Human clinical trials are typically conducted in three sequential phases, although the phases may overlap with one another. Clinical trials must be conducted under protocols that detail the objectives of the study, the parameters to be used to monitor safety, and the efficacy criteria, if any, to be evaluated. Each protocol must be submitted to the FDA as part of the IND. Each clinical trial must be conducted under the auspices of an Institutional Review Board, or IRB, at the institution that is conducting the trial that considers, among other things, ethical factors, the safety of human subjects, the possible liability of the institution and the informed consent disclosure, which must be made to participants in the clinical trial.

Phase 1 Clinical Trials: Phase 1 clinical trials represent the initial administration of the investigational drug to a small group of healthy human subjects or, more rarely, to a group of select patients with the targeted disease or disorder. The goal of Phase 1 clinical trials is typically to test for safety, dose tolerance, absorption, bio-distribution, metabolism, excretion and clinical pharmacology and, if possible, to gain early evidence regarding efficacy.

Phase 2 Clinical Trials: Phase 2 clinical trials involve a small sample of the actual intended patient population and seek to assess the efficacy of the drug for specific targeted indications, to determine dose response and the optimal dose range and to gather additional information relating to safety and potential adverse effects.

Phase 3 Clinical Trials: Once an investigational drug is found to have some efficacy and an acceptable safety profile in the targeted patient population, Phase 3 clinical trials are initiated to establish further clinical safety and efficacy of the investigational drug in a broader sample of the general patient population at geographically dispersed study sites in order to determine the overall risk-benefit ratio of the drug and to provide an adequate basis for product labeling. The Phase 3 clinical development program consists of expanded, large-scale studies of patients with the target disease or disorder to obtaindefinitive statistical evidence of the efficacy and safety of the proposed product and dosing regimen.

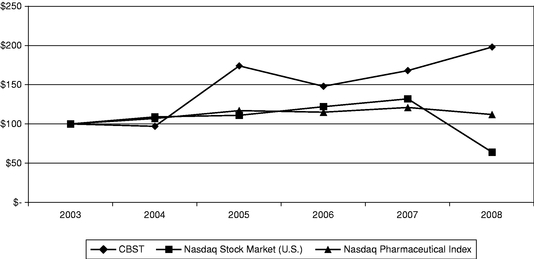

All of the phases of clinical studies must be conducted in conformance with the FDA's bioresearch monitoring regulations and Good Clinical Practices, which are ethical and scientific quality standards for conducting, recording, and reporting clinical trials to assure that the rights, safety, and well-being of trial participants are protected.