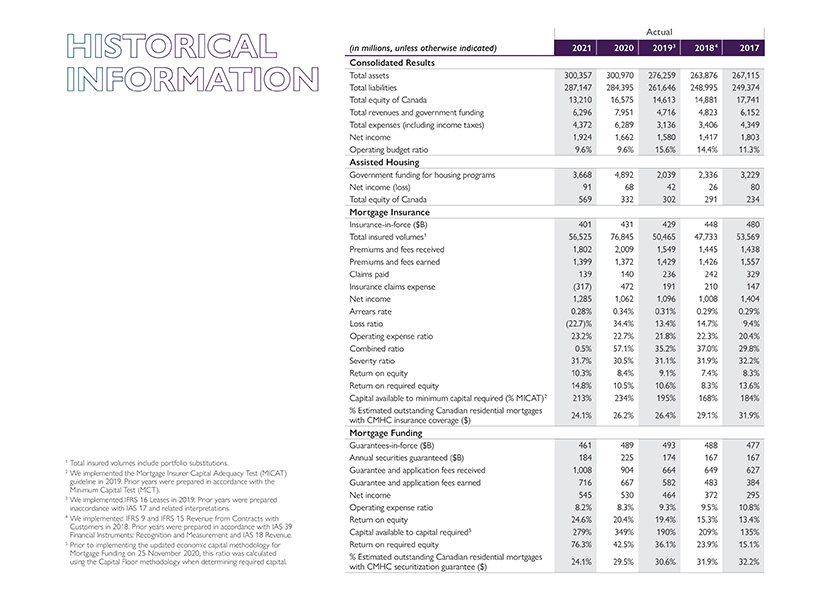

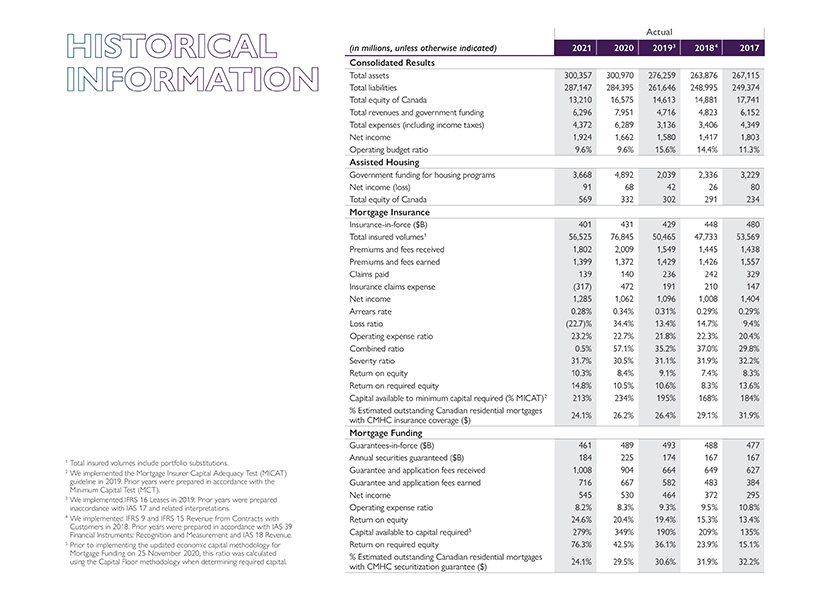

HISTORICAL INFORMATION 1 Total insured volumes include portfolio substitutions. 2 We implemented the Mortgage Insurer Capital Adequacy Test (MICAT) guideline in 2019. Prior years were prepared in accordance with the Minimum Capital Test (MCT). 3We implemented IFRS 16 Leases in 2019. Prior years were prepared inaccordance with IAS 17 and related interpretations. 4We implemented IFRS 9 and IFRS 15 Revenue from Contracts with Customers in 2018. Prior years were prepared in accordance with IAS 39 Financial Instruments: Recognition and Measurement and IAS 18 Revenue. 5Prior to implementing the updated economic capital methodology for Mortgage Funding on 25 November 2020, this ratio was calculated using the Capital Floor methodology when determining required capital. Actual (in millions, unless otherwise indicated)2021202020193201842017 Consolidated Results Total assets300,357300,970276,259263,876267,115 Total liabilities287,147284,395261,646248,995249,374 Total equity of Canada13,21016,57514,61314,88117,741 Total revenues and government funding6,2967,9514,7164,8236,152 Total expenses (including income taxes)4,3726,2893,1363,4064,349 Net income1,9241,6621,5801,4171,803 Operating budget ratio9.6%9.6%15.6%14.4%11.3% Assisted Housing Government funding for housing programs3,6684,8922,0392,3363,229 Net income (loss)9168422680 Total equity of Canada569332302291234 Mortgage Insurance Insurance-in-force ($B)401431429448480 Total insured volumes156,52576,84550,46547,73353,569 Premiums and fees received1,8022,0091,5491,4451,438 Premiums and fees earned1,3991,3721,4291,4261,557 Claims paid139140236242329 Insurance claims expense(317)472191210147 Net income1,2851,0621,0961,0081,404 Arrears rate0.28%0.34%0.31%0.29%0.29% Loss ratio(22.7)%34.4%13.4%14.7%9.4% Operating expense ratio23.2%22.7%21.8%22.3%20.4% Combined ratio0.5%57.1%35.2%37.0%29.8% Severity ratio31.7%30.5%31.1%31.9%32.2% Return on equity10.3%8.4%9.1%7.4%8.3% Return on required equity14.8%10.5%10.6%8.3%13.6% Capital available to minimum capital required (% MICAT)2213%234%195%168%184% % Estimated outstanding Canadian residential mortgages with CMHC insurance coverage ($)24.1%26.2%26.4%29.1%31.9% Mortgage Funding Guarantees-in-force ($B)461489493488477 Annual securities guaranteed ($B)184225174167167 Guarantee and application fees received1,008904664649627 Guarantee and application fees earned716667582483384 Net income545530464372295 Operating expense ratio8.2%8.3%9.3%9.5%10.8% Return on equity24.6%20.4%19.4%15.3%13.4% Capital available to capital required5279%349%190%209%135% Return on required equity76.3%42.5%36.1%23.9%15.1% % Estimated outstanding Canadian residential mortgages with CMHC securitization guarantee ($)24.1%29.5%30.6%31.9%32.2%

| | | | | | |

| 2021 Annual Report | | HISTORICAL INFORMATION | | | 155 | |

Well-being matters With our aspiration, we like to think that nothing else is more important. For that reason, a range of well-being programs, benefits, leave options and resources continued to be made available to all throughout 2021. Among them was a non-medical COVID-19 leave for a period of three months or more where the first week was paid at 100%. Response to COVID-19 and worksite reintegration Guided by the importance we place on the health and safety of our employees and by our Results Only Work Environment", we developed a three-phase, evidence-based approach to worksite reintegration. Appropriate measures were put in place to safely reintegrate employees to our offices while limiting any health risks. We remained agile and adapted our plan to reflect our steadfastness in the broader responsibility to support public health measures and be part of the solution. Vaccination policy and strategy and implementation status CMHC's Vaccination Policy took effect on 15 November 2021 and is fully aligned with the Government of Canada's vaccine requirements. It is in accordance with the Privacy Act, the Canadian Human Rights Act, and the Canada Labour Code. The Policy introduced mandatory vaccination measures as a condition of employment to support the health and safety of CMHC's workforce and the communities we serve. "I am grateful and honoured that CMHC gave me the opportunity to do what was right for my family during the pandemic. I came back even more motivated and energized to work toward our 2030 aspiration. Proud to be on the CMHC team!" - Soula Tsiakopoulos Specialist, Financial Planning and Analysis

Well-being matters With our aspiration, we like to think that nothing else is more important. For that reason, a range of well-being programs, benefits, leave options and resources continued to be made available to all throughout 2021. Among them was a non-medical COVID-19 leave for a period of three months or more where the first week was paid at 100%. Response to COVID-19 and worksite reintegration Guided by the importance we place on the health and safety of our employees and by our Results Only Work Environment", we developed a three-phase, evidence-based approach to worksite reintegration. Appropriate measures were put in place to safely reintegrate employees to our offices while limiting any health risks. We remained agile and adapted our plan to reflect our steadfastness in the broader responsibility to support public health measures and be part of the solution. Vaccination policy and strategy and implementation status CMHC's Vaccination Policy took effect on 15 November 2021 and is fully aligned with the Government of Canada's vaccine requirements. It is in accordance with the Privacy Act, the Canadian Human Rights Act, and the Canada Labour Code. The Policy introduced mandatory vaccination measures as a condition of employment to support the health and safety of CMHC's workforce and the communities we serve. "I am grateful and honoured that CMHC gave me the opportunity to do what was right for my family during the pandemic. I came back even more motivated and energized to work toward our 2030 aspiration. Proud to be on the CMHC team!" - Soula Tsiakopoulos Specialist, Financial Planning and Analysis