SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only |

| | | (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

¨ | | Definitive Additional Materials |

¨ | | Soliciting Material Under Rule 14a-12 |

QUAKER CITY BANCORP, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

¨ | | Fee paid previously with preliminary materials: |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Quaker City Bancorp, Inc.

7021 Greenleaf Avenue

Whittier, CA 90602

(562) 907-2200

October 9, 2002

Dear Stockholder:

You are cordially invited to attend the 2002 Annual Meeting of Stockholders (the “Annual Meeting”) of Quaker City Bancorp, Inc. (the “Company”), the holding company for Quaker City Bank (the “Bank”), scheduled to be held on Wednesday, November 20, 2002, at the Whittier Hilton, 7320 Greenleaf Avenue, Whittier, California, at 10:00 a.m. local time. As described in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement, stockholders will be asked to vote on the election of directors for the Company and to approve the Quaker City Bancorp, Inc. 2002 Equity Incentive Plan. Directors and executive officers of the Company will be present at the Annual Meeting to respond to questions that our stockholders may have regarding the business to be transacted.

I urge you to vote your proxy as soon as possible.Your vote is very important, regardless of the number of shares you own. Whether or not you plan to attend the Annual Meeting in person, I urge you to sign, date and return the enclosed proxy card promptly in the accompanying postage prepaid envelope. You may, of course, attend the Annual Meeting and vote in person even if you have previously returned your proxy card.

On behalf of the Board of Directors and all of the employees of the Company and the Bank, I thank you for your continued support.

| Sincerely yours, |

|

|

FREDERIC R. (RICK) McGILL President and Chief Executive Officer |

IMPORTANT: If your Quaker City Bancorp, Inc. shares are held in the name of a brokerage firm or another nominee, only it can execute a proxy on your behalf. To ensure that your shares are voted, please telephone the individual responsible for your account today and obtain instructions on how to direct him or her to execute a proxy on your behalf.

If you have any questions concerning the Proxy Statement or accompanying proxy or if you need any help in voting your stock, please telephone Morrow & Co., Inc. at 1-800-662-5200 today.

|

PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD TODAY. |

|

Quaker City Bancorp, Inc.

7021 Greenleaf Avenue

Whittier, CA 90602

(562) 907-2200

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on November 20, 2002

NOTICE IS HEREBY GIVEN that the 2002 Annual Meeting of Stockholders (the “Annual Meeting”) of Quaker City Bancorp, Inc. (the “Company”), the holding company of Quaker City Bank, will be held on Wednesday, November 20, 2002, at the Whittier Hilton, 7320 Greenleaf Avenue, Whittier, California, at 10:00 a.m. local time, subject to adjournment or postponement by the Board of Directors, for the following purposes:

1. To elect two persons to the Board of Directors to serve until the annual meeting of stockholders to be held in the year 2005 and until their successors are duly elected and qualified;

2. To approve the Quaker City Bancorp, Inc. 2002 Equity Incentive Plan; and

3. To transact such other business as may properly come before the Annual Meeting or any or all adjournments or postponements thereof.

Only holders of record of common stock, par value $.01 per share, of the Company on Monday, September 23, 2002, are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

Prior to the voting thereof, a proxy may be revoked by the person executing such proxy by (i) filing with the Corporate Secretary of the Company, prior to the commencement of the Annual Meeting, either a written notice of revocation or a duly executed proxy bearing a later date, or (ii) by voting in person at the Annual Meeting.

| By order of the Board of Directors |

|

|

KATHRYN M. HENNIGAN Corporate Secretary |

Whittier, California

October 9, 2002

|

YOUR VOTE IS IMPORTANT TO VOTE YOUR SHARES, PLEASE SIGN AND DATE THE ENCLOSED PROXY CARD AND MAIL IT PROMPTLY IN THE ENCLOSED RETURN ENVELOPE. |

|

Quaker City Bancorp, Inc.

7021 Greenleaf Avenue

Whittier, CA 90602

(562) 907-2200

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

November 20, 2002

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the “Board” or the “Board of Directors”) of Quaker City Bancorp, Inc., a Delaware corporation (the “Company”), the holding company of Quaker City Bank (the “Bank”), of proxies for use at the 2002 Annual Meeting of Stockholders of the Company (the “Annual Meeting”) scheduled to be held at the time and place and for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders.

INFORMATION REGARDING VOTING AT THE ANNUAL MEETING

General

At the Annual Meeting, the stockholders of the Company are being asked to consider and to vote upon the election of the two directors nominated by the Company’s Board of Directors to serve until the annual meeting of stockholders to be held in the year 2005 and the approval of the Quaker City Bancorp, Inc. 2002 Equity Incentive Plan (the “2002 Equity Incentive Plan”). For information regarding the proposal relating to the election of directors, see the section of this Proxy Statement entitled “ELECTION OF DIRECTORS.” For information regarding the proposal relating to the approval of the 2002 Equity Incentive Plan, see the section of this Proxy Statement entitled “APPROVAL OF 2002 EQUITY INCENTIVE PLAN.” Shares represented by properly executed proxies received by the Company will be voted at the Annual Meeting in the manner specified therein or, if no instructions are marked on the enclosed proxy card,FOR each of the director nominees identified on such card andFOR approval of the 2002 Equity Incentive Plan. Although management does not know of any matter other than the election of directors and the approval of the 2002 Equity Incentive Plan to be acted upon at the Annual Meeting, unless contrary instructions are given, shares represented by valid proxies will be voted by the persons named on the accompanying proxy card in accordance with their respective best judgment with respect to any other matters that may properly come before the Annual Meeting.

Execution of a proxy will not in any way affect a stockholder’s right to attend the Annual Meeting and vote in person, and any person giving a proxy has the right to revoke it at any time before it is exercised by (i) filing with the Corporate Secretary of the Company, prior to the commencement of the Annual Meeting, a duly executed instrument dated subsequent to such proxy revoking the same or a duly executed proxy bearing a later date, or (ii) attending the Annual Meeting and voting in person.

The mailing address of the principal executive offices of the Company is 7021 Greenleaf Avenue, Whittier, California 90602, and its telephone number is (562) 907-2200. The approximate date on which this Proxy Statement and the enclosed proxy card are first being sent to stockholders is October 10, 2002.

Record Date and Voting

Only stockholders of record on Monday, September 23, 2002 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting. There were outstanding on the Record Date 6,532,368 shares of common stock, par value $.01 per share, of the Company (“Common Stock”) as adjusted for the 25% Common Stock dividends paid to stockholders by the Company on or about May 30, 1997 (the “1997 Stock Dividend”), June 30, 1998 (the “1998 Stock Dividend”), and June 28, 2002 (the “2002 Stock Dividend” and, together with the 1997 Stock Dividend and 1998 Stock Dividend, the “Stock Dividends”). All information set forth herein

regarding beneficial ownership of Common Stock, as well as numbers of shares and exercise prices of outstanding awards under Company equity incentive plans has been adjusted, to the extent applicable, for the effect of the Stock Dividends. Each share of outstanding Common Stock is entitled to one vote on each matter to be voted on at the Annual Meeting.

As provided in the Company’s certificate of incorporation, holders of Common Stock who beneficially own in excess of 10% of the outstanding shares of Common Stock (the “Limit”) are not entitled to any vote with respect to the shares held in excess of the Limit. A person or entity is deemed to beneficially own shares owned by an affiliate of, as well as persons acting in concert with, such person or entity. The Company’s certificate of incorporation authorizes the Board of Directors (i) to make all determinations necessary to implement and apply the Limit, including determining whether persons or entities are acting in concert, and (ii) to demand that any person who is reasonably believed to beneficially own stock in excess of the Limit supply information to the Company to enable the Board to implement and apply the Limit.

The presence, in person or by proxy, of the holders of at least a majority of the total number of shares of Common Stock entitled to vote (after subtracting any shares held in excess of the Limit pursuant to the Company’s certificate of incorporation) is necessary to constitute a quorum at the Annual Meeting. In the event that there are not sufficient votes for a quorum at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit the further solicitation of proxies.

Abstentions and broker non-votes are counted for the purpose of determining the presence or absence of a quorum for the transaction of business. With regard to the election of directors, votes may be cast in favor or withheld; votes that are withheld will be excluded entirely from the vote and will have no effect. Abstentions are counted in tabulations of the votes cast on proposals presented to stockholders other than the election of directors, thus having the effect of a negative vote, whereas broker non-votes are not counted for purposes of determining whether a proposal has been approved. Directors will be elected by a plurality of the votes of the shares of Common Stock present in person or represented by proxy and entitled to vote on the election of directors. Approval of the 2002 Equity Incentive Plan and any stockholder proposals that properly come before an annual meeting require the affirmative vote of a majority of the shares of Common Stock present, in person or represented by proxy, at the Annual Meeting and entitled to vote on the subject matter. Shares held in excess of the Limit will not be counted for either the purpose of determining the presence or absence of a quorum or whether a proposal has been approved.

Solicitation

The cost of preparing, assembling and mailing the Notice of Annual Meeting of Stockholders, this Proxy Statement and the enclosed proxy card will be paid by the Company. Following the mailing of this Proxy Statement, directors, officers and other employees of the Company may solicit proxies by mail, telephone, telegraph or personal interview. Such persons will receive no additional compensation for such services. Brokerage houses and other nominees, fiduciaries and custodians nominally holding shares of Common Stock of record will be requested to forward proxy soliciting material to the beneficial owners of such shares, and will be reimbursed by the Company for their reasonable charges and expenses in connection therewith. In addition, the Company has retained proxy solicitor Morrow & Co., Inc. (“Morrow & Co.”) to assist in the solicitation of proxies. Morrow & Co. may solicit proxies by mail, telephone, telegraph and personal solicitation, and will request brokerage houses and other nominees, fiduciaries and custodians nominally holding shares of Common Stock of record to forward proxy soliciting material to the beneficial owners of such shares. For these services, the Company will pay Morrow & Co. a fee estimated not to exceed $6,000, plus reimbursement for reasonable out-of-pocket expenses.

The date of this Proxy Statement is October 9, 2002.

2

DIRECTORS AND EXECUTIVE OFFICERS

Directors

The following table sets forth certain information, except where otherwise indicated, as of June 30, 2002 with respect to the directors of the Company and the Bank. Each of the directors of the Company serves a three-year term and approximately one-third of the directors are elected at each annual stockholders’ meeting. The Bank continues to have a classified board, approximately one-third of the members of which are elected each year to serve three-year terms.

Name of Director

| | Age

| | First Became Director of Bank

| | Term as Bank Director Expires

| | First Became Director of Company

| | Term as Company Director Expires

| | Positions Held with the Company and the Bank

|

| J.L. Thomas | | 66 | | 1975 | | 2003 | | 1993 | | 2003 | | Director and Chairman of the Board |

| Frederic R. McGill | | 55 | | 1995 | | 2004 | | 1995 | | 2004 | | Director, President and Chief Executive Officer |

| David S. Engelman | | 64 | | 1999 | | 2002 | | 1999 | | 2002 | | Director |

| Alfred J. Gobar | | 69 | �� | 1992 | | 2004 | | 1993 | | 2004 | | Director |

| Wayne L. Harvey | | 64 | | 1981 | | 2003 | | 1993 | | 2003 | | Director |

| David K. Leichtfuss | | 57 | | 1991 | | 2002 | | 1993 | | 2002 | | Director |

| Edward L. Miller | | 65 | | 1985 | | 2003 | | 1993 | | 2003 | | Director |

| D.W. Ferguson(1) | | 86 | | 1952 | | N/A | | 1993 | | N/A | | Director Emeritus |

| (1) | | D.W. Ferguson retired as Director Emeritus of the Boards of the Company and the Bank in December, 2001. During his tenure as Director Emeritus of the Boards of the Company and the Bank, Mr. Ferguson did not participate in or influence any voting matters. Mr. Ferguson passed away on September 2, 2002. |

Set forth below is certain information concerning the principal occupation and business experience of each of the directors during the past five years.

J.L. Thomas is Chairman of the Company and the Bank. Mr. Thomas served as President and Chief Executive Officer of the Company since its formation in 1993 until July, 1996. Mr. Thomas joined the Bank in 1961, and was elected to the Board of Directors in 1975. Mr. Thomas served as Chief Operating Officer of the Bank from 1976 to 1982, and became its President and Chief Executive Officer in 1982, serving in that capacity until July, 1996. Mr. Thomas also serves as the Chairman of the Board of Directors of Quaker City Financial Corp., a wholly owned subsidiary of the Bank (“QCFC”), and of Quaker City Neighborhood Development, Inc., a wholly owned subsidiary of the Company (“QCND”).

Frederic R. (Rick) McGill served as Executive Vice President and Chief Operating Officer of the Company since its formation in 1993, serving in that capacity until July, 1996. Mr. McGill joined the Bank in 1991 as Executive Vice President and Chief Operating Officer. Mr. McGill was appointed President and elected to the Board of Directors of the Company and the Bank in 1995, and was appointed Chief Executive Officer effective July 1, 1996. Prior to joining the Bank, Mr. McGill was an independent financial consultant specializing in mortgage banking. Mr. McGill has over 30 years of experience in the banking industry. Mr. McGill has also served as the Chief Executive Officer of QCFC since 1991 and of QCND since July 1, 1996.

3

David S. Engelman, a private investor, served as Chairman, Chief Executive Officer and President of UnionFed Financial Corporation from 1991 until 1997 and held the same positions at its subsidiary, Union Federal Bank. Mr. Engelman is a director of Fleetwood Enterprises, Inc., and from February, 2002 until September, 2002, he served as its Chief Executive Officer and President on an interim basis. Mr. Engelman also serves as a director of MGIC Investment Corporation and Mortgage Guaranty Insurance Corporation, and is a former director of Long Beach Financial Corporation where he served from 1997 until 1999. Mr. Engelman was appointed a director of the Company and the Bank effective September, 1999. Mr. Engelman is the Chairman of the Bank’s Philanthropy Committee.

Alfred J. Gobar, retired, was previously the President and Chairman of AJGA, Inc., an economics consulting firm, and had held such positions from 1990 until 2000. Prior to 1990, Mr. Gobar served as President and Chairman of Alfred Gobar Associates, Inc., a family-owned economics consulting firm. Mr. Gobar has been a director of the Bank since 1992 and of the Company since its formation in 1993.

Wayne L. Harvey, retired, was previously the Managing Partner of Harvey & Parmelee, certified public accountants, and was with such firm from 1958 until 1998. Mr. Harvey has been a director of the Bank since 1981 and of the Company since its formation in 1993. Mr. Harvey is the Chairman of the Audit Committee and the Nominating Committee of the Company’s Board.

David K. Leichtfuss is the President of Broadview Mortgage Corp., a mortgage banking company that specializes in residential permanent financing, and has been with such company since 1988. Mr. Leichtfuss has been a director of the Bank since 1991 and of the Company since its formation in 1993.

Edward L. Miller is a partner of the law firm of Bewley, Lassleben & Miller and has been associated with such firm since 1963. Mr. Miller has been a director of the Bank since 1985 and of the Company since its formation in 1993. Mr. Miller is the Chairman of the Compensation Committee of the Company’s Board.

Committees of the Board of Directors

The Company’s Board of Directors has a standing Audit Committee, Nominating Committee and Compensation Committee.

The Audit Committee held five meetings during fiscal year 2002, and currently consists of Messrs. Harvey (Chairman), Miller and Engelman. The Audit Committee’s responsibilities are generally to assist the Board in fulfilling its legal and fiduciary responsibilities relating to accounting, audit and reporting policies and practices of the Company, the Bank and their subsidiaries. The Audit Committee also, among other things, oversees the Company’s financial reporting process; recommends to the Board the engagement of the Company’s independent auditors; monitors and reviews the quality and activities of the Company’s internal audit function and those of its independent auditors; and monitors the adequacy of the Company’s operating and internal controls as reported by management and internal auditors. The Board has adopted a written charter for the Audit Committee. The members of the Audit Committee are independent directors as defined under the National Association of Securities Dealers’ (“NASD”) current listing standards.

The Compensation Committee held two meetings during fiscal year 2002, and currently consists of Messrs. Miller (Chairman), Harvey and Engelman. The Compensation Committee is authorized to review salaries and compensation, including noncash benefits, of directors, officers and other employees of the Company, and to recommend to the Board salaries, remuneration and other forms of additional compensation and benefits as it deems necessary. In July, 1996, the Board established a subcommittee of the Compensation Committee, currently made up of two non-employee directors, Messrs. Engelman and Harvey, whose principal responsibility is to administer for purposes of Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules promulgated thereunder, the equity incentive plans of the Company with respect to certain transactions by executive officers and directors of the Company.

4

In November, 2001, a Nominating Committee of the Company’s Board of Directors was established and currently consists of Messrs. Harvey (Chairman), Gobar and Engelman. The purpose of the Nominating Committee is to select nominees for election as directors. The Nominating Committee held no meetings during fiscal year 2002 and held its first meeting on September 19, 2002, in anticipation of the Annual Meeting. The candidates for election at this Annual Meeting were nominated by the Nominating Committee, which nominations were ratified by the Board of Directors. In accordance with Section 6 of Article I of the Company’s bylaws (a copy of which is available upon request to the Corporate Secretary of the Company), stockholder nominations for election of directors may be voted on at an annual meeting only if such nominations are made pursuant to written notice timely given to the Corporate Secretary accompanied by certain information. To be timely, a stockholder’s written notice must be delivered to or mailed and received at the principal executive offices of the Company not less than 90 days prior to the date of the annual meeting, provided that, in the event that less than 100 days’ notice or prior disclosure of the date of the annual meeting is given or made to stockholders, a stockholder’s notice will be timely if received not later than the tenth day following the day on which such notice of the date of the annual meeting is mailed or such public disclosure is made. Such stockholder’s notice must set forth with respect to each director nominee all of the information relating to such person that is required to be disclosed in solicitations for elections of directors under the rules of the Securities and Exchange Commission (“SEC”) and the stockholder’s name and address, as they appear on the Company’s books, and the number of shares of Common Stock owned by the stockholder giving the notice.

Meetings of the Board of Directors

During fiscal year 2002, there were ten meetings of the Board of Directors of the Company. All directors attended at least 75% of the meetings of the Board of Directors, and all members of the committees attended at least 75% of the meetings of those committees during the term of their service on such committees during fiscal year 2002.

Compensation of Directors

Directors’ Fees. The Company does not currently pay directors’ fees. The directors of the Bank each receive a monthly retainer fee of $2,000; beginning July, 2002, the monthly retainer was increased to $2,200. In addition, the monthly retainer for the Chairman of the Board was increased to $3,000, effective July, 2002. During fiscal year 2002, non-employee directors of the Bank were paid $300 for their attendance at each meeting of each committee on which they served. The $500 monthly retainer paid to the Audit Committee Chairman for general services in addition to attendance at meetings was increased to $600, effective July 1, 2002, due to the increased level of responsibility.

Directors’ Options. In 1993, the Company adopted a stock option plan for directors who are not officers or employees of the Company or its affiliates. See “COMPENSATION AND OTHER INFORMATION—Non-Employee Directors’ Option Plan,” below. In 1997, the Company adopted a plan for employees and directors that provides for the grant of awards (“Awards”) in the form of stock options (including incentive stock options and nonqualified stock options), restricted stock, stock appreciation rights, stock payments, dividend equivalents, stock bonuses, stock sales, phantom stock, and other stock-based benefits. See “COMPENSATION AND OTHER INFORMATION—1997 Stock Incentive Plan,” below. The 1997 Stock Incentive Plan was amended and restated in September, 2002 (together with any predecessor plan as in effect at the time of any prior Award, the “1997 Stock Incentive Plan”). In June 2000, 2001, and 2002, grants of 5,000 nonqualified stock options with vesting on the first anniversary of the option grant date were made to each of the non-employee directors, which options were granted at exercise prices of $15.125, $29.000 and $31.152 per share, respectively. From October, 2000 to June, 2002, the Chairman of the Board received a quarterly grant of 1,250 nonqualified stock options (1,563 nonqualified stock options as adjusted for the 2002 Stock Dividend), valued at the closing market price of the Common Stock as reported on the Nasdaq National Market on the first business day of the quarter. Beginning July 1, 2002, the number of stock options to be granted to the Chairman of the Board on a quarterly basis was increased to 1,565.

5

The Board of Directors of the Company has adopted the 2002 Equity Incentive Plan and is presenting the 2002 Equity Incentive Plan to the Company’s stockholders for approval. See “APPROVAL OF 2002 EQUITY INCENTIVE PLAN,” below.

Executive Officers

Set forth below are the executive officers of the Company, together with the positions currently held by those persons, as of June 30, 2002. The executive officers serve at the pleasure of the Company’s Board of Directors; however, the Company has entered into an employment agreement with Mr. McGill, which agreement is described under “COMPENSATION AND OTHER MATTERS—Employment Agreements and Change of Control Arrangements.”

Name

| | Age

| | Position (1)

|

| Elizabeth A. Conrado | | 50 | | Senior Vice President, Single Family Lending of the Bank |

| Kathryn M. Hennigan | | 51 | | Senior Vice President, Administrative Services and Corporate Secretary |

| Hank H. Kadowaki | | 55 | | Senior Vice President, Income Property Lending of the Bank |

| Frederic R. McGill | | 55 | | President, Chief Executive Officer and Director |

| Jerrold Perisho | | 50 | | Senior Vice President, In-Store Banking of the Bank |

| Harold L. Rams | | 56 | | Senior Vice President, Capital Markets of the Bank |

| Karen A. Tannheimer | | 43 | | Senior Vice President, Loan Service of the Bank |

| Robert C. Teeling | | 52 | | Senior Vice President, Retail Banking of the Bank |

| Dwight L. Wilson | | 54 | | Senior Vice President, Treasurer and Chief Financial Officer |

| (1) | | Unless otherwise indicated, the indicated position is with the Company and the Bank. |

Set forth below is certain information concerning the business experience during the past five years of each of the individuals named above (for information concerning Mr. McGill see “—Directors” above).

Elizabeth A. Conrado joined the Bank in February, 2002 as Senior Vice President, Single Family Lending. Prior to joining the Bank, Ms. Conrado was Vice President, Mortgage Lending Division of Kinecta Federal Credit Union from March, 2000 to October, 2001, and Regional Manager, Nationwide Credit Unions of Countrywide Home Loans from January, 1999 to January, 2000. Prior to joining Countrywide Home Loans, Ms. Conrado held various executive positions with BankAmerica Mortgage for approximately ten years, the last of which was as Assistant Vice President, Wholesale Acquisition Officer from January, 1995 to December, 1998.

Kathryn M. Hennigan has served as Senior Vice President, Administrative Services and Corporate Secretary of the Company since its formation in 1993. Ms. Hennigan joined the Bank in 1992 as the Human Resource Manager. Ms. Hennigan was promoted to Senior Vice President, Administrative Services and Corporate Secretary of the Bank in January, 1993. Prior to joining the Bank, Ms. Hennigan held various management and administrative positions, including principal for seven years at a senior high school in Fullerton, California.

Hank H. Kadowaki joined the Bank in 1994 as Major Loan Manager, and was promoted to Senior Vice President, Income Property Lending of the Bank in April, 1998. Prior to joining the Bank, Mr. Kadowaki had over fifteen years experience in commercial and multifamily lending.

Jerrold S. Perisho joined the Bank in May, 2000 as Senior Vice President, In-Store Banking. Prior to joining the Bank, Mr. Perisho was executive director of the Whittier Boys & Girls Club from December, 1992 to April, 2000. Mr. Perisho has over ten years of experience in credit union management.

6

Harold L. Rams joined the Bank in 1975 and currently serves as Senior Vice President, Capital Markets. Mr. Rams previously held the position of Senior Vice President, Single Family Lending from February, 1980 to February, 2002. Mr. Rams has over 30 years of experience in the banking industry.

Karen A. Tannheimer joined the Bank in 1983 as Loan Service Supervisor. Ms. Tannheimer served in such capacity until 1986 when she left the Bank for a position with a computer services company. Ms. Tannheimer attained the position of Supervisor–Systems Analysis Group before leaving the computer services company to rejoin the Bank in June, 1992 as Senior Vice President, Loan Service. Ms. Tannheimer will be resigning from her position with the Bank, effective October 30, 2002.

Robert C. Teeling joined the Bank in 1991 as the Senior Vice President, Retail Banking. Prior to joining the Bank, Mr. Teeling had over 20 years of experience in retail banking with various savings and loan associations in the southern California area.

Dwight L. Wilson has served as Senior Vice President, Treasurer and Chief Financial Officer of the Company since its formation in 1993. Mr. Wilson joined the Bank in 1976 as the Assistant Controller and held that position until 1979. Mr. Wilson served as the Controller of the Bank from 1979 to 1985. Since 1985, Mr. Wilson has been the Treasurer and Chief Financial Officer of the Bank and QCFC.

7

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth the shares of Common Stock beneficially owned as of September 23, 2002, the Record Date, by each director (and director nominee), by the Chief Executive Officer and the four most highly compensated executive officers of the Company and/or the Bank who were serving as executive officers at June 30, 2002 (the “Named Executive Officers”) and by all directors and executive officers of the Company as a group.

Name and Address (1)

| | Title of Position (2)

| | Shares of Common Stock Beneficially Owned (3)(4)

| | Percent of Class (5)

| |

| J.L. Thomas (6) | | Chairman of the Board | | 163,054 | | 2.48 | % |

| Frederic R. McGill (7) | | President and Chief Executive Officer | | 284,341 | | 4.22 | % |

| David S. Engelman (8) | | Director | | 20,625 | | * | |

| Alfred J. Gobar (9) | | Director | | 193,752 | | 2.96 | % |

| Wayne L. Harvey (10) | | Director | | 138,748 | | 2.11 | % |

| David K. Leichtfuss (11) | | Director | | 67,168 | | 1.02 | % |

| Edward L. Miller (12) | | Director | | 175,844 | | 2.68 | % |

| Dwight L. Wilson (13) | | Senior Vice President, Treasurer and Chief Financial Officer | | 96,877 | | 1.47 | % |

| Harold L. Rams (14) | | Senior Vice President, Capital Markets of the Bank | | 60,218 | | * | |

| Kathryn M. Hennigan (15) | | Senior Vice President, Administrative Services and Corporate Secretary | | 99,831 | | 1.51 | % |

| Hank H. Kadowaki (16) | | Senior Vice President, Income Property Lending of the Bank | | 55,814 | | * | |

| All directors and executive officers as a group (15 persons) (17) | | | | 1,446,674 | | 20.27 | % |

| * | | Does not exceed 1.0% of the Company’s voting securities. |

| (1) | | The address of each person is c/o Quaker City Bancorp, Inc., 7021 Greenleaf Avenue, Whittier, California 90602. |

| (2) | | Titles are for both the Company and the Bank unless otherwise indicated. |

| (3) | | Each person effectively exercises sole (or shares with spouse or other immediate family member) voting and dispositive power as to shares reported. |

| (4) | | All shares beneficially owned have been adjusted for the Stock Dividends. |

| (5) | | Percentage of class is based upon 6,532,368 shares of Common Stock outstanding as of the Record Date. |

| (6) | | Includes 32,819 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

| (7) | | Includes 20,854 allocated shares under the Employee Stock Ownership Plan (the “ESOP”), 36,869 shares subject to options granted under the 1993 Incentive Stock Option Plan (the “1993 Management Option Plan”), which options are all currently exercisable, and 161,459 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

| (8) | | Includes 6,250 shares subject to options granted under the 1993 Stock Option Plan for Outside Directors (the “Outside Directors’ Option Plan”), which options are all currently exercisable, and 12,500 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

| (9) | | Includes 6,250 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

| (10) | | Includes 15,001 shares subject to options granted under the Outside Directors’ Option Plan, which options are all currently exercisable, and 20,313 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

8

| (11) | | Includes 30,322 shares subject to options granted under the Outside Directors’ Option Plan, which options are all currently exercisable, and 20,313 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

| (12) | | Includes 11,572 shares subject to options granted under the Outside Directors’ Option Plan, which options are all currently exercisable, and 20,313 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. Includes 39,716 shares held by three irrevocable trusts for the benefit of Mr. Miller’s grandchildren, the beneficial ownership of which shares Mr. Miller disclaims. Mr. Miller and his wife, Mary O. Miller, are the trustees of all three trusts. |

| (13) | | Includes 19,147 allocated shares under the ESOP, 37,222 shares subject to options granted under the 1993 Management Option Plan, which options are all currently exercisable, and 28,125 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

| (14) | | Includes 18,076 allocated shares under the ESOP, and 21,875 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

| (15) | | Includes 16,010 allocated shares under the ESOP, 36,582 shares subject to options granted under the 1993 Management Option Plan, which options are all currently exercisable, and 28,125 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

| (16) | | Includes 11,280 allocated shares under the ESOP, and 40,625 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

| (17) | | Includes 112,216 allocated shares under the ESOP, 63,145 shares subject to options granted under the Outside Directors’ Option Plan, which options are all currently exercisable, 110,673 shares subject to options granted under the 1993 Management Option Plan, which options are all currently exercisable, and 432,405 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

9

COMPENSATION AND OTHER INFORMATION

Summary Compensation Table

The following table sets forth the compensation paid by the Company, including any of its subsidiaries, to the Named Executive Officers for their service during the fiscal years ended June 30, 2002, 2001, and 2000.

| | | Annual Compensation (1)

| | Long Term Compensation

| | | |

Name and Principal Position

| | Fiscal Year

| | Salary ($)

| | Bonus ($)

| | Awards

| | All Other Compensation ($)

| |

| | | | | Securities Underlying Options (#) (3)

| |

| Frederic R. McGill | | 2002 | | $ | 320,000 | | $ | 217,600 | | 17,500 | | $ | 114,479 | (2) |

| President and | | 2001 | | $ | 295,000 | | $ | 196,175 | | — | | $ | 97,862 | |

| Chief Executive Officer | | 2000 | | $ | 275,000 | | $ | 154,000 | | 31,250 | | $ | 9,112 | |

|

| Dwight L. Wilson | | 2002 | | $ | 160,024 | | $ | 61,834 | | 9,750 | | $ | 45,635 | (2) |

| Senior Vice President, | | 2001 | | $ | 150,900 | | $ | 57,221 | | — | | $ | 26,479 | |

| Treasurer and Chief | | 2000 | | $ | 143,700 | | $ | 46,386 | | — | | $ | 9,536 | |

| Financial Officer | | | | | | | | | | | | | | |

|

| Harold L. Rams | | 2002 | | $ | 126,150 | | $ | 50,259 | | 9,750 | | $ | 35,437 | (2) |

| Senior Vice President, | | 2001 | | $ | 126,150 | | $ | 47,836 | | — | | $ | 18,268 | |

| Capital Markets of the Bank | | 2000 | | $ | 121,300 | | $ | 39,156 | | — | | $ | 8,530 | |

|

| Kathryn M. Hennigan | | 2002 | | $ | 137,500 | | $ | 53,130 | | 9,750 | | $ | 20,688 | (2) |

| Senior Vice President, | | 2001 | | $ | 122,500 | | $ | 46,452 | | — | | $ | 17,602 | |

| Administrative Services and | | 2000 | | $ | 115,600 | | $ | 38,009 | | — | | $ | 8,190 | |

| Corporate Secretary | | | | | | | | | | | | | | |

|

| Hank H. Kadowaki | | 2002 | | $ | 126,000 | | $ | 49,065 | | 9,750 | | $ | 17,561 | (2) |

| Senior Vice President, | | 2001 | | $ | 116,700 | | $ | 44,252 | | — | | $ | 16,843 | |

| Income Property Lending | | 2000 | | $ | 110,100 | | $ | 36,861 | | — | | $ | 7,684 | |

| of the Bank | | | | | | | | | | | | | | |

| (1) | | Under “Annual Compensation,” the column titled “Salary” includes deferred compensation and the column titled “Bonus” consists of payments earned under the Bank’s Incentive Compensation Plan in the reported fiscal year. |

| (2) | | Includes the following contributions to the designated plans by the Bank on behalf of the Named Executive Officers (all amounts are for plan year January 1–December 31, 2001): |

| | (a) | | matching contributions under the Bank’s 401(k) Plan of $4,200, $4,200, $2,459, $2,351, and $2,428 for Messrs. McGill, Wilson, Rams, and Kadowaki, and Ms. Hennigan, respectively; |

| | (b) | | $5,675, $5,675, $5,675, $5,528, and $5,675 representing the cost of the shares allocated under the ESOP, including forfeitures, for the benefit of Messrs. McGill, Wilson, Rams, and Kadowaki, and Ms. Hennigan, respectively; |

| | (c) | | contributions under the Quaker City Bank Employees Retirement Income Plan of $11,842, $23,894, $25,253, $8,721, and $9,809 to the accounts of Messrs. McGill, Wilson, Rams, and Kadowaki, and Ms. Hennigan, respectively; and |

10

| | (d) | | the value of benefits accrued under the Bank’s non-qualified benefit plan of $92,762, $11,866, $2,050, $961, and $2,776 for Messrs. McGill, Wilson, Rams, and Kadowaki, and Ms. Hennigan, respectively. |

| (3) | | Share numbers have been adjusted for the 2002 Stock Dividend. |

Stock Options

The following table sets forth the number of grants of stock options by the Company during fiscal year 2002 to the Named Executive Officers. All shares of Common Stock reserved under the 1993 Management Option Plan are subject to outstanding options and no shares remain available under the 1993 Management Option Plan for future option grants. As of June 30, 2002, 3,181 shares (adjusted for the 2002 Stock Dividend) of Common Stock remained available for future Award grants under the 1997 Stock Incentive Plan. On July 27, 2002, the 1997 Stock Incentive Plan expired and, as of such date, the Company is not permitted to grant any further awards in respect of the 1,616 shares (adjusted for the 2002 Stock Dividend) of Common Stock that remained available for issuance thereunder.

Option/SAR Grants in Last Fiscal Year

| | | Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term

|

Name

| | Number of Securities Underlying Options/SARs Granted (#) (1)

| | % of Total Options/SARs Granted to Employees in Fiscal Year

| | | Exercise or Base Price ($/Sh)

| | Expiration Date

| | 5% ($)

| | 10% ($)

|

| Frederic R. McGill | | 12,500 | | 11.81 | % | | $ | 24.660 | | 02/21/12 | | $ | 194,250 | | $ | 490,125 |

| | | 5,000 | | 4.73 | % | | $ | 31.152 | | 06/25/12 | | $ | 98,150 | | $ | 247,650 |

|

| Dwight L. Wilson | | 6,250 | | 5.91 | % | | $ | 23.520 | | 01/17/12 | | $ | 92,625 | | $ | 233,750 |

| | | 3,500 | | 3.31 | % | | $ | 31.152 | | 06/25/12 | | $ | 68,705 | | $ | 173,355 |

|

| Harold L. Rams | | 6,250 | | 5.91 | % | | $ | 23.520 | | 01/17/12 | | $ | 92,625 | | $ | 233,750 |

| | | 3,500 | | 3.31 | % | | $ | 31.152 | | 06/25/12 | | $ | 68,705 | | $ | 173,355 |

|

| Kathryn M. Hennigan | | 6,250 | | 5.91 | % | | $ | 23.520 | | 01/17/12 | | $ | 92,625 | | $ | 233,750 |

| | | 3,500 | | 3.31 | % | | $ | 31.152 | | 06/25/12 | | $ | 68,705 | | $ | 173,355 |

|

| Hank H. Kadowaki | | 6,250 | | 5.91 | % | | $ | 23.520 | | 01/17/12 | | $ | 92,625 | | $ | 233,750 |

| | | 3,500 | | 3.31 | % | | $ | 31.152 | | 06/25/12 | | $ | 68,705 | | $ | 173,355 |

| (1) | | Number of shares of Common Stock underlying exercisable options has been adjusted for the Stock Dividends. |

The following table sets forth the number of shares of Common Stock covered by options granted under the 1993 Management Option Plan and under the 1997 Stock Incentive Plan held by the Named Executive Officers at June 30, 2002. The Named Executive Officers do not hold any options granted under the 1993 Directors’ Option Plan. Awards under the 1997 Stock Incentive Plan may be granted in the form of stock options, restricted stock, stock appreciation rights, stock payments, dividend equivalents, stock bonuses, stock sales, phantom stock and other stock-based benefits. The following table also sets forth the value of unexercised

11

options granted under the 1993 Management Option Plan and the 1997 Stock Incentive Plan that were in-the-money at June 30, 2002. Options are “in-the-money” if the fair market value of the shares covered thereby is greater than the option exercise price.

Aggregated Option/SAR Exercises in Last Fiscal

Year and Fiscal Year-End Option/SAR Values(1)

| | | Shares Acquired On Exercise(#)

| | Value Realized($)

| | Number of Securities Underlying Unexercised Options At Fiscal

Year-End(#)(2)

| | Value of Unexercised In-the-Money Options At Fiscal Year-End($)(3)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| Frederic R. McGill | | 34,350 | | $ | 1,024,160 | | 205,828 | | 27,916 | | $ | 4,566,598 | | $ | 334,981 |

| Dwight L. Wilson | | 12,550 | | $ | 395,970 | | 70,347 | | 9,750 | | $ | 1,802,636 | | $ | 67,044 |

| Harold L. Rams | | — | | | — | | 21,875 | | 9,750 | | $ | 439,225 | | $ | 67,044 |

| Kathryn M. Hennigan | | 13,650 | | $ | 441,342 | | 69,707 | | 9,750 | | $ | 1,783,886 | | $ | 67,044 |

| Hank H. Kadowaki | | — | | | — | | 40,625 | | 9,750 | | $ | 800,525 | | $ | 67,044 |

| (1) | | No free-standing stock appreciation rights (“SARs”) are issuable under the Company’s 1993 Management Option Plan. |

| (2) | | Number of shares of Common Stock underlying exercisable options has been adjusted for the Stock Dividends. |

| (3) | | The values of unexercised in-the-money options set forth in the table have been calculated, in accordance with requirements promulgated by the SEC, by determining the difference between the fair market value of the underlying Common Stock at fiscal year-end and the exercise price of the options (as adjusted for the Stock Dividends). |

Employment Agreements and Change in Control Arrangements

In connection with the conversion of the Bank from mutual to stock form in December, 1993 (the “Conversion”) and the commencement of operations by the Company as the holding company thereof, the Bank and the Company entered into employment agreements with Messrs. Thomas and McGill. Mr. Thomas’ employment agreements with the Bank and the Company terminated on September 25, 2000, his sixty-fifth birthday. The Bank and the Company also entered into change in control agreements, which are two-year agreements, with Messrs. Wilson, Rams, and Kadowaki, and with Ms. Hennigan. The employment agreements and change in control agreements were entered into with the intent of ensuring that the Bank and the Company will be able to maintain a stable and competent management base after the Conversion. The continued success of the Bank and the Company depends to a significant degree on the skills and competence of these individuals.

12

Employment Agreements with Mr. McGill

Mr. McGill’s employment agreements with the Bank and the Company provide for an initial three-year term. Commencing on the first anniversary date and continuing on each anniversary date thereafter, the Board of Directors of the Bank may extend the employment agreement with the Bank for an additional year such that the remaining term shall be the amount of the original term unless written notice of non-renewal is given by the Board of Directors of the Bank after conducting a performance evaluation of Mr. McGill. Effective June 30, 2002, the Bank’s Board extended Mr. McGill’s employment agreement until June 30, 2005. With respect to his employment agreement with the Company, commencing on the date of execution of the employment agreement with the Company, the term of the employment agreement for Mr. McGill extends, unless earlier terminated, one day each day until such time as the Company’s Board of Directors or Mr. McGill elects not to extend the term of the employment agreement by giving written notice to the other party, in which case the term of the employment agreement will be fixed and will end on the third anniversary date of the written notice.

The employment agreements with the Bank and the Company provide that Mr. McGill will receive an annual base salary of $345,000, which base salary will be reviewed annually by the Board of the Bank. In addition to the base salary, the employment agreements provide for, among other things, disability pay, participation in stock benefit plans and other fringe benefits applicable to executive personnel.

The employment agreements provide for termination by the Bank or the Company for cause at any time. In the event the Bank or the Company chooses to terminate Mr. McGill’s employment for reasons other than for cause or for disability, or in the event of his resignation from the Bank and the Company upon (i) failure to re-elect Mr. McGill to his current offices; (ii) a material change in his functions, duties or responsibilities, or relocation of his principal place of employment, or a material reduction in benefits or perquisites; (iii) liquidation or dissolution of the Bank or the Company; or (iv) a breach of the employment agreement by the Bank or the Company, Mr. McGill or, in the event of death, his beneficiary, would be entitled to receive an amount equal to the aggregate of (a) the amount of the remaining salary payments that he would have earned if he continued his employment with the Bank or Company during the remaining unexpired term of the employment agreement at his defined base salary on the date he was terminated; (b) the average of the amount of bonus and any other cash compensation paid to him during the term of the employment agreement times the remaining number of years of the employment agreement and any fraction thereof, and (c) an amount equal to the average of the annual contributions that were made on Mr. McGill’s behalf to any employee benefit plan of the Company or Bank during the term of the employment agreement times the remaining number of years of the employment agreement and any fraction thereof.

If termination of employment follows a “change in control” of the Bank or the Company, as defined in the employment agreement, Mr. McGill or, in the event of death, his beneficiary, would be entitled to an aggregate payment from the Bank and the Company equal to the greater of: (i) the payments due for the remaining term of the agreement; or (ii) three times Mr. McGill’s average annual compensation for the three preceding taxable years, including bonuses and any other cash compensation paid or to be paid to Mr. McGill during such years, and the amount of any contributions made or to be made to any employee benefit plan. The Bank and the Company would also continue his health and disability coverage for the remaining unexpired term of the employment agreements to the extent allowed by the plans or policies maintained by the Company or Bank from time to time. Payments to Mr. McGill under the Bank’s employment agreements are guaranteed by the Company in the event that payments or benefits are not paid by the Bank. The employment agreements also provide for reduced benefits to Mr. McGill upon termination of employment due to disability and further provide that the Bank and Company shall indemnify him to the fullest extent allowable under federal and Delaware law. In the event of a change in control, based upon fiscal year 2002 salary and bonus, Mr. McGill would receive approximately $1,689,600 in severance payments in addition to other cash and noncash benefits provided under the employment agreements.

13

Change in Control Agreements

The change in control agreements with the Bank and the Company provide for a two-year term for Messrs. Wilson, Rams, and Kadowaki, and Ms. Hennigan (each, an “Executive”). Commencing on the first anniversary date and continuing on each anniversary thereafter, the change in control agreements may be extended by the Board of Directors of the Bank for a year so that the remaining terms shall be two years. Effective June 30, 2002, the Bank’s Board extended the term of the change of control agreements with each Executive until June 30, 2004. Commencing on the date of execution of the change in control agreement with the Company, the term of the change in control agreement extends for one day each day until such time as the Board of Directors of the Company or the Executive elects not to extend the term of the change in control agreement by giving written notice to the other party, in which case the term of the change in control agreement will be fixed and will end on the second anniversary date of the written notice. Each change in control agreement provides that at any time following a change in control of the Company or the Bank, if the Company or the Bank terminates the Executive’s employment for any reason other than cause, the Executive or, in the event of death, the Executive’s beneficiary would be entitled to receive an aggregate payment from the Bank and the Company equal to two times the Executive’s average annual salary for the two preceding taxable years, including bonuses and any other cash compensation paid or to be paid to the Executive during such years and the amount of any contributions made or to be made to any employee benefit plan. The Bank and the Company would also continue the Executive’s life, health and disability coverage for the remaining unexpired term of the Executive’s change in control agreement to the extent allowed by the plans or policies maintained by the Company or Bank from time to time. Payments to the Executive under the Bank’s change in control agreements are guaranteed by the Company in the event that payments or benefits are not paid by the Bank. If a change in control occurs, based upon fiscal year 2002 salary and bonus, the amounts payable to Messrs. Wilson, Rams, and Kadowaki, and Ms. Hennigan, pursuant to the change in control agreements would be approximately $459,668, $365,434, $362,730 and $395,010, respectively, in addition to other cash and noncash benefits provided for under the change in control agreements.

The change in control agreements and the employment agreements contain a provision to the effect that in the event of a change in control, the aggregate payments under the agreements shall not constitute an excess parachute payment under either Section 280G or Section 4999 of the Internal Revenue Code of 1986, as amended (the “Code”) (Section 280G denies a deduction for such excess amounts to the employer, and Section 4999 imposes an excise tax on the recipient with respect to such excess amounts). Such provision provides that the payments under the agreements shall be reduced to one dollar below the amount that would cause them to constitute excess parachute payments under either Section 280G or Section 4999.

Change in Control Provisions in Equity Incentive Plans

Both the 1993 Management Option Plan and the 1997 Stock Incentive Plan contain change in control provisions. The definition of “change in control” is the same in both the 1993 Management Option Plan and the 1997 Stock Incentive Plan.

The Company’s 1993 Management Option Plan provides that to the extent not previously exercisable, options granted under the 1993 Management Option Plan become exercisable upon a change in control. All outstanding unexercised options under the 1993 Management Option Plan are currently exercisable. No shares of Common Stock remain available under the 1993 Management Option Plan for future option grants.

The 1997 Stock Incentive Plan also contains a change in control provision. Pursuant to such provision, as of the effective time and date of any change in control, the 1997 Stock Incentive Plan and any then outstanding Awards granted thereunder (whether or not vested) shall automatically terminate unless (i) provision is made in writing in connection with such transaction for the continuance of the 1997 Stock Incentive Plan and for the assumption of such Awards, or for the substitution for such Awards of new awards covering the securities of a successor entity or an affiliate thereof, with appropriate adjustments as to the number and kind of securities and exercise prices, in which event the 1997 Stock Incentive Plan and such outstanding Awards will continue or be

14

replaced, as the case may be, in the manner and under the terms so provided; or (ii) the Board otherwise provides in writing for such adjustments as it deems appropriate in the terms and conditions of the then-outstanding Awards (whether or not vested), including without limitation (a) accelerating the vesting of outstanding Awards, and/or (b) providing for the cancellation of Awards and their automatic conversion into the right to receive the securities, cash or other consideration that a holder of the shares underlying such Awards would have been entitled to receive upon consummation of such change in control had such shares been issued and outstanding immediately prior to the effective time of the change in control (net of the appropriate option exercise prices). If the 1997 Stock Incentive Plan and the Awards terminate by reason of the occurrence of a change in control without provision for any of the actions described in clause (i) or (ii) of the immediately preceding sentence, then any holder of outstanding Awards will have the right, at such time immediately prior to the consummation of the change in control as the Board designates, to exercise such Awards to the full extent not theretofore exercised, including any installments which have not yet become vested.

Defined Benefit Plan

The Bank maintains the Quaker City Bank Employees Retirement Income Plan, a non-contributory defined benefit pension plan (“Defined Benefit Plan”) qualified under the Employment Retirement Income Security Act of 1974, as amended (“ERISA”). Employees become eligible to participate in the Defined Benefit Plan upon attaining the age of 21 and completing one year of service during which they have served a minimum of 1,000 hours. Until December 31, 1999, the Plan was an income replacement retirement plan. The benefits were based on years of service and the three consecutive years of employment during which the participant earned the highest compensation. Contributions were intended to provide not only for benefits attributed to service to date, but also for those expected to be earned in the future. Effective December 31, 1993, the Plan was frozen for benefit service accrued, and employees hired after November 30, 1992 did not participate in the Plan.

Effective January 1, 2000, the Board of Directors approved the conversion of the Defined Benefit Plan into a “Cash Balance Plan.” Under the provisions of the Cash Balance Plan, a cash balance account is established for each participant at plan entry and increased over time with pay and interest credits. Pay credits are equal to 5.0% of eligible pay and are credited to each participant’s cash balance account annually. Interest credits are based on ten-year Treasury Note rates and are credited to a participant’s cash balance account quarterly. At termination of employment, a participant (if vested) becomes entitled to a monthly annuity payable for life (or over a joint lifetime with his or her beneficiary) at retirement. The Cash Balance Plan is intended to be an ERISA-qualified plan, and the Bank has filed for IRS approval.

Estimated annual benefits payable at normal retirement age, expressed as a single life annuity, to each of the Named Executive Officers under the Cash Balance Plan are as follows:

Name

| | Estimated Annual Benefit

|

| Frederic R. McGill | | $ | 23,100 |

| Dwight L. Wilson | | | 69,300 |

| Harold L. Rams | | | 58,500 |

| Kathryn M. Hennigan | | | 25,200 |

| Hank H. Kadowaki | | | 14,700 |

401(k) Plan

Effective July 1, 1997, the Bank implemented a 401(k) Plan. Employees become eligible to participate in the 401(k) Plan upon attaining the age of 21 and completing one year of service during which they have served a minimum of 1,000 hours. The 401(k) Plan is an ERISA-qualified plan under which employees may annually defer, on a pretax basis, up to the lesser of 15% of their base salary or the IRS limitation on employee deferrals

15

($11,000 for 2002). The Bank currently contributes on a matching basis 40% of the first 5% of the employees’ contributions to participants’ accounts in the 401(k) Plan.

Employee Stock Ownership Plan

At the time of Conversion, the Company established an ESOP for all employees who are age 21 or older and have completed one year of service with the Bank during which they have served a minimum of 1,000 hours. The ESOP is internally leveraged and borrowed $3.1 million from the Company to purchase 10% of the outstanding shares of the common stock of Quaker City Bancorp, Inc. issued in the Conversion. The loan will be repaid principally from the Bank’s discretionary contributions to the ESOP. In conjunction with the conversion of the Bank’s income replacement Defined Benefit Plan into a Cash Balance Plan effective January 1, 2000, and the inclusion of all eligible employees as participants in the Cash Balance Plan, the Board of Directors approved an amendment to the ESOP loan agreement and promissory note which allows the loan underlying the ESOP to be amortized over a longer period of time. ESOP participants will receive essentially the same benefit, but the length of time by which the benefit will be earned will be extended from September, 2003 to December, 2004. At June 30, 2002 and 2001, the outstanding balance on the loan was $582,000 and $815,000, respectively. Shares purchased with the loan proceeds are held in a suspense account for allocation among participants as the loan is repaid. Contributions to the ESOP and shares released from the suspense account are allocated among participants on the basis of compensation, as described in the plan, in the year of allocation. Benefits generally become 100% vested after five years of vesting service. Vesting will accelerate upon retirement, death or disability of the participant or in the event of a change in control of the Bank or the Company. Forfeitures will be reallocated among remaining participating employees, in the same proportion as contributions. Benefits may be payable upon death, retirement, early retirement, disability or separation from service. Since the annual contributions are discretionary, the benefits payable under the ESOP cannot be estimated.

Retirement Benefit Equalization Plan

Until December 31, 1999, the Bank maintained a nonqualified Supplemental Executive Retirement Plan (“SERP”) for certain employees and their beneficiaries whose benefits from the Bank’s Defined Benefit Plan were reduced by reason of the annual limitation on benefits and contributions imposed by Section 415 of the Code and the limitations imposed on compensation taken into consideration in the determination of benefits under the Defined Benefit Plan due to Section 401(a)(17) of the Code. The SERP provided additional benefits to participants to ensure that they received an aggregate annual benefit from the Defined Benefit Plan, the ESOP and Social Security of an amount equal to 65% of such participants’ final average compensation at age 65.

In conjunction with the conversion of the Bank’s Defined Benefit Plan into a Cash Balance Plan effective January 1, 2000, the SERP was converted into a Retirement Benefit Equalization Plan (“RBEP”) for certain employees. J.L. Thomas’ benefit remains under the SERP, and is $93,180 per year, payable through December 31, 2005. The RBEP is a supplemental plan to the Cash Balance Plan, 401(k) Plan, and ESOP, and is intended to provide certain covered employees with the total amount of retirement income that they would otherwise receive under these plans if not for legislated ceilings in compliance with certain sections of the Internal Revenue Code which limit retirement benefits payable from qualified plans. Under the provisions of the RBEP, a cash balance account is established for each participant at plan entry and increased over time with contribution and interest credits. The opening account balance for each participant was equal to their liability held under the SERP. Contribution credits are equal to the amounts not contributed under the qualified plans due to IRS limitations and are credited to each participant’s cash balance account annually. Interest credits are based on ten-year Treasury Note rates and are credited to a participant’s cash balance account quarterly.

16

The approximate allocation under the RBEP for plan year January 1, 2001 through December 31, 2001 for the Named Executive Officers is as follows:

Name

| | Estimated Allocation

|

| Frederic R. McGill | | $ | 92,762 |

| Dwight L. Wilson | | | 11,866 |

| Harold L. Rams | | | 2,050 |

| Kathryn M. Hennigan | | | 2,766 |

| Hank H. Kadowaki | | | 961 |

Outside Directors’ Option Plan

Outside, non-employee directors (“Outside Directors”) of the Company and the Bank are eligible to receive stock options under the Outside Directors’ Option Plan. The purpose of the Outside Directors’ Option Plan is to promote the growth and profitability of the Company and the Bank by providing an incentive in the form of stock options to Outside Directors of outstanding competence to achieve long-term objectives of the Company and the Bank by encouraging their acquisition of an equity interest in the Company.

The Outside Directors’ Option Plan authorized the granting of nonqualified stock options for a total of 202,149 shares of Common Stock (as adjusted for the Stock Dividends) to Outside Directors. Stock options for an aggregate of 192,043 shares of Common Stock (as adjusted for the Stock Dividends) were granted to the six Outside Directors at the date of the Conversion at an exercise price of $3.84 (as adjusted for the Stock Dividends) per share, which was based on the offering price of the Common Stock in the initial public offering of the Company prior to the Stock Dividends. To the extent options for shares are available for grants under the Outside Directors’ Option Plan, each subsequently elected Outside Director will be granted nonqualified stock options to purchase 5,052 shares of Common Stock (as adjusted for the Stock Dividends) or a number of options to purchase such lesser number of shares as remain in the Outside Directors’ Option Plan. On September 16, 1999, the date on which he first began to serve as an outside director, David S. Engelman received nonqualified stock options to purchase 5,000 shares of Common Stock (6,250, as adjusted for the 2002 Stock Dividend) under the Outside Directors’ Option Plan. If options for sufficient shares are not available to fulfill the grant of options to an Outside Director, and thereafter options become available, such persons shall receive options to purchase an amount of shares of Common Stock, determined by dividing pro rata among such persons the number of options available. There are no shares of Common Stock remaining available for future option grants under the Outside Directors’ Option Plan.

All options initially granted under the Outside Directors’ Option Plan in connection with the Conversion became exercisable January 1, 1995. Options granted to a subsequently elected Outside Director will become exercisable on the first business day of January following that date on which such subsequent Outside Director is qualified and first begins to serve as a Director; provided, however, that in the event of death, disability or retirement of the participant or upon a change in control of the Company or the Bank, all options previously granted would automatically become exercisable. Each option granted under the Outside Directors’ Option Plan expires upon the earlier of ten years following the date of grant, or one year following the date that the Outside Director ceases to be a director.

The Board of Directors of the Company has adopted the Quaker City Bancorp, Inc. 2002 Equity Incentive Plan for certain eligible persons, including directors, officers, employees, consultants and advisors of the Company and its affiliated entities, and is presenting the 2002 Equity Incentive Plan to the Company’s stockholders for approval. See “APPROVAL OF 2002 EQUITY INCENTIVE PLAN,” below.

17

1997 Stock Incentive Plan

The 1997 Stock Incentive Plan provides for the grant of Awards in the form of stock options (including incentive stock options and nonqualified stock options), restricted stock, stock appreciation rights, stock payments, dividend equivalents, stock bonuses, stock sales, phantom stock and other stock-based benefits. Persons eligible to receive an Award under the 1997 Stock Incentive Plan include directors, officers, employees, consultants, and advisors of the Company and its affiliated entities. In July, 1997, certain grants of nonqualified stock options were made to senior executive officers and Outside Directors under the 1997 Stock Incentive Plan, which grants were made subject to stockholder approval of the 1997 Stock Incentive Plan at the Company’s 1997 annual meeting of stockholders. The nonqualified stock options granted have ten-year terms, expiring on July 24, 2007. In April, 1998, Mr. Kadowaki was granted 12,500 (15,625, as adjusted for the 2002 Stock Dividend) nonqualified stock options upon his becoming a senior executive officer, which options have a ten-year term, expiring on April 21, 2008. In May, 1999, certain grants of nonqualified stock options were made to senior executive officers, all of which options have ten-year terms and will expire on May 30, 2009. An amendment to the 1997 Stock Incentive Plan was approved by the stockholders at the Company’s 1999 Annual Meeting of Stockholders. The amendment increased the number of shares of Common Stock reserved for issuance under the 1997 Stock Incentive Plan from 233,000 shares to 560,465 shares (700,582, as adjusted for the 2002 Stock Dividend).

Grants of nonqualified stock options, based on the individual’s salary and length of service, were made to non-executive management of the Bank in December, 1999. The total number of these grants is approximately 30,000 shares (37,500, as adjusted for the 2002 Stock Dividend); all of these options have ten-year terms, and vest in either three or five equal annual installments, depending on length of service. In April, 2000, Mr. Perisho was granted 5,000 (6,250, as adjusted for the 2002 Stock Dividend) nonqualified stock options upon being hired as a senior officer, which options have a ten-year term, expiring on April 20, 2010. In June, 2000, a grant of 25,000 (31,250, as adjusted for the 2002 Stock Dividend) nonqualified stock options, vesting in three equal annual installments, was made to Mr. McGill, and grants of 5,000 (6,250, as adjusted for the 2002 Stock Dividend) nonqualified stock options with vesting on the first anniversary of the option grant date were made to each of the Outside Directors, all of which options were granted at an exercise price equal to the closing sale price of the Common Stock, as reported on the Nasdaq National Market on the date of grant.

During fiscal year 2001, no stock option grants were made to the Chief Executive Officer or to any other senior executive officers. From October, 2000 through June, 2002, Chairman of the Board J.L. Thomas received, as part of the Chairman’s compensation, quarterly grants of 1,250 (1,563, as adjusted for the 2002 Stock Dividend) nonqualified stock options, all of which options are granted at an exercise price equal to the closing sale price of the Common Stock, as reported on the Nasdaq National Market on the date of grant. In June, 2001, grants of nonqualified stock options totaling approximately 40,000 (50,000, as adjusted for the 2002 Stock Dividend) shares were made to non-executive managers of the Bank; individual grants were based on salary and length of service. All of these options have ten-year terms and vest in either three or five equal annual installments, depending on length of service. On June 21, 2001, grants of 5,000 (6,250, as adjusted for the 2002 Stock Dividend) nonqualified stock options with vesting on the first anniversary of the option grant date were made to each of the Outside Directors, all of which options were granted at an exercise price equal to the closing sale price of the Common Stock, as reported on the Nasdaq National market on the date of the grant. On January 17, 2002, grants of 5,000 (6,250, as adjusted for the 2002 Stock Dividend) nonqualified stock options were made to all senior executive officers, except for Mr. McGill, all of which options have ten-year terms and will expire on January 17, 2012. In February, 2002, Mr. McGill was granted 10,000 (12,500, as adjusted for the 2002 Stock Dividend) nonqualified stock options, and Ms. Conrado was granted 5,000 (6,250, as adjusted for the 2002 Stock Dividend) nonqualified stock options upon being hired as a senior officer, all of which options vest in three equal annual installments and were granted at an exercise price equal to the closing sale price of the Common Stock, as reported on the Nasdaq National Market on the date of grant. On June 25, 2002, a grant of 5,000 (adjusted for the 2002 Stock Dividend) nonqualified stock options was made to Mr. McGill, and grants of 3,500 (adjusted for the 2002 Stock Dividend) nonqualified stock options were made to each of the senior

18

executive officers, all of which options vest in three equal annual installments and were granted at an exercise price equal to the closing sale price of the Common Stock, as reported on the Nasdaq National Market on the date of grant. In June, 2002, grants of nonqualified stock options totaling approximately 10,300 (adjusted for the 2002 Stock Dividend) shares were made to non-executive managers of the Bank; all of these options have ten-year terms and vest in three equal annual installments. On June 25, 2002, grants of 5,000 (adjusted for the 2002 Stock Dividend) nonqualified stock options with vesting on the first anniversary of the option grant date were made to each of the Outside Directors, all of which were granted at an exercise price equal to the closing sale price of the Common Stock, as reported on the Nasdaq National Market on the date of grant. As of July, 2002, Chairman of the Board J.L. Thomas’ quarterly stock option grant was increased to 1,565 shares (adjusted for the 2002 Stock Dividend) per quarter. Each of the options granted to date under the 1997 Stock Incentive Plan expires ten years following the date of grant. On July 27, 2002, the 1997 Stock Incentive Plan expired and, as of such date, the Company is not permitted to grant any further awards thereunder.

Compensation Committee Interlocks and Insider Participation

The Company’s Compensation Committee consists of Messrs. Miller (Chairman), Engelman and Harvey. None of such members is, or formerly was, an officer or employee of the Company or any of its subsidiaries and none had any relationship with the Company requiring disclosure herein under applicable rules. In addition, to the Company’s knowledge, no executive officer of the Company serves as a director or a member of the compensation committee of another entity.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Administration

The compensation program is administered by the Compensation Committee of the Company’s Board of Directors, which is composed of at least two outside, non-employee directors. The Chairman of the Board, the Chief Executive Officer and the Senior Vice President, Administrative Services, serve as advisors to the Compensation Committee. Following review and approval by the Compensation Committee, all issues pertaining to employment-related contracts are submitted to the full Board of Directors for approval.

The following is the Compensation Committee report addressing the compensation of the Company’s executive officers for fiscal year 2002.

Philosophy

The goals and objectives of the executive compensation policies remain the same as in previous years. The Compensation Committee’s executive compensation policies are designed to provide competitive levels of compensation that integrate pay with the Company’s annual and long-term performance goals, reward above average corporate performance, recognize individual initiative and achievements and assist the Company in attracting and retaining qualified executives. Targeted levels of executive compensation are set at levels the Compensation Committee believes to be consistent with others in the financial services industry, with executives’ compensation packages increasingly being weighted toward programs contingent upon the Company’s long-term (three years or more) performance. As a result, the executives’ actual compensation levels in any particular year may be above or below those of the Company’s competitors, depending upon the Company’s performance.

The Company’s compensation strategy continues to support the concept of pay-for-performance, associating the goal of variable pay for variable performance. A mix of compensation elements, with an emphasis on tying long-term incentives to corporate performance, is designed to meet this goal. The mix of compensation elements varies between executive levels within the organization, with compensation opportunities of senior executives relying more heavily on annual and long-term incentive compensation.

19

With regard to Section 162(m) of the Code, which limits the deductibility of certain executive officer compensation in excess of $1,000,000, the Company intends to take all necessary steps to cause the compensation paid to executive officers to be deductible by the Company.

Performance to Date

The Company’s compensation strategy is based on the philosophy that Company executives should be compensated within competitive norms for their level of responsibility within the organization. The Company has determined the competitive marketplace for different executive levels within the organization. Generally, the competitive marketplace for senior executives has been defined as financial institutions with assets between $750 million and $1.5 billion that are located in California.

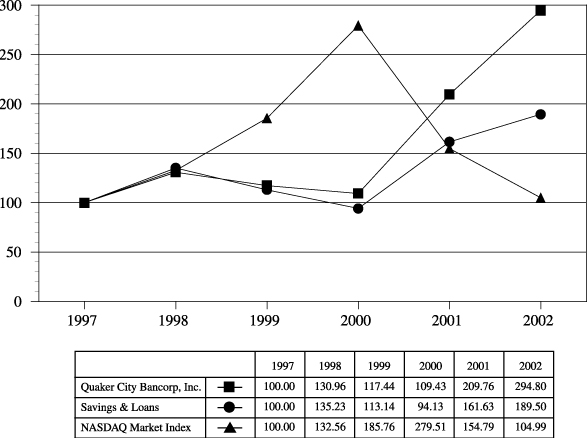

It should be noted that the Company wishes to compare itself on a broader basis for corporate performance purposes, and thus the peer group referenced above for comparison purposes in regard to cash compensation is not identical to that used in the Stock Price Performance Graph which appears immediately after this report. See “STOCK PRICE PERFORMANCE GRAPH,” below.

The Compensation Committee conducted its annual review of officers’ base salary levels in June, 2001. As a result of the Compensation Committee review, senior executives received raises ranging from 6.0% to 12.25% for fiscal year 2002. These raises in base salaries reflected the impact of increased job responsibilities and improved performance.