UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement | | | |

¨ | | Definitive Additional Materials | | | | |

¨ | | Soliciting Material Under Rule 14a-12 | | | | |

QUAKER CITY BANCORP, INC.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | ¨ | Fee paid previously with preliminary materials: |

| | ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | Quaker City Bancorp, Inc. | | |

| | 7021 Greenleaf Avenue | | |

| | Whittier, CA 90602 | | |

| | (562) 907-2200 | | |

October 9, 2003

Dear Stockholder:

You are cordially invited to attend the 2003 Annual Meeting of Stockholders (the “Annual Meeting”) of Quaker City Bancorp, Inc. (the “Company”), the holding company for Quaker City Bank (the “Bank”), scheduled to be held on Wednesday, November 19, 2003, at the Radisson Hotel Whittier (formerly, the Whittier Hilton), 7320 Greenleaf Avenue, Whittier, California, at 10:00 a.m. local time. As described in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement, stockholders will be asked to vote on the election of directors for the Company. Directors and executive officers of the Company will be present at the Annual Meeting to respond to questions that our stockholders may have regarding the business to be transacted.

I urge you to vote your proxy as soon as possible. Your vote is very important, regardless of the number of shares you own. Whether or not you plan to attend the Annual Meeting in person, I urge you to sign, date and return the enclosed proxy card promptly in the accompanying postage prepaid envelope. You may, of course, attend the Annual Meeting and vote in person even if you have previously returned your proxy card.

On behalf of the Board of Directors and all of the employees of the Company and the Bank, I thank you for your continued support.

Sincerely yours, |

|

FREDERIC R. (RICK) McGILL |

President and Chief Executive Officer |

IMPORTANT: If your Quaker City Bancorp, Inc. shares are held in the name of a brokerage firm or another nominee, only it can execute a proxy on your behalf. To ensure that your shares are voted, please telephone the individual responsible for your account today and obtain instructions on how to direct him or her to execute a proxy on your behalf.

If you have any questions concerning the Proxy Statement or accompanying proxy card or if you need any help in voting your stock, please telephone Morrow & Co., Inc. at 1-800-662-5200 today.

PLEASE SIGN, DATE AND RETURN

THE ENCLOSED PROXY CARD TODAY.

Quaker City Bancorp, Inc.

7021 Greenleaf Avenue

Whittier, CA 90602

(562) 907-2200

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on November 19, 2003

NOTICE IS HEREBY GIVEN that the 2003 Annual Meeting of Stockholders (the “Annual Meeting”) of Quaker City Bancorp, Inc. (the “Company”), the holding company of Quaker City Bank, will be held on Wednesday, November 19, 2003, at the Radisson Hotel Whittier (formerly, the Whittier Hilton), 7320 Greenleaf Avenue, Whittier, California, at 10:00 a.m. local time, subject to adjournment or postponement by the Board of Directors, for the following purposes:

1. To elect three persons to the Board of Directors to serve until the annual meeting of stockholders to be held in the year 2006 and until their successors are duly elected and qualified; and

2. To transact such other business as may properly come before the Annual Meeting or any or all adjournments or postponements thereof.

Only holders of record of common stock, par value $.01 per share, of the Company on Monday, September 22, 2003, are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

Prior to the voting thereof, a proxy may be revoked by the person executing such proxy by (i) filing with the Corporate Secretary of the Company, prior to the commencement of the Annual Meeting, either a written notice of revocation or a duly executed proxy bearing a later date, or (ii) by attending the Annual Meeting and voting in person.

By order of the Board of Directors |

|

KATHRYN M. HENNIGAN |

Corporate Secretary |

Whittier, California

October 9, 2003

YOUR VOTE IS IMPORTANT.

TO VOTE YOUR SHARES, PLEASE SIGN AND DATE THE ENCLOSED PROXY CARD AND MAIL

IT PROMPTLY IN THE ENCLOSED RETURN ENVELOPE.

Quaker City Bancorp, Inc.

7021 Greenleaf Avenue

Whittier, CA 90602

(562) 907-2200

PROXY STATEMENT

2003 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on November 19, 2003

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the “Board” or the “Board of Directors”) of Quaker City Bancorp, Inc., a Delaware corporation (the “Company”), the holding company of Quaker City Bank (the “Bank”), of proxies for use at the 2003 Annual Meeting of Stockholders of the Company (the “Annual Meeting”) scheduled to be held at the time and place and for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders.

INFORMATION REGARDING VOTING AT THE ANNUAL MEETING

General

At the Annual Meeting, the stockholders of the Company are being asked to consider and to vote upon the election of the three directors nominated by the Company’s Board of Directors to serve until the annual meeting of stockholders to be held in the year 2006. For information regarding the proposal relating to the election of directors, see the section of this Proxy Statement entitled “ELECTION OF DIRECTORS.” Shares represented by properly executed proxies received by the Company prior to the Annual Meeting will be voted at the Annual Meeting in the manner specified therein or, if no instructions are marked on the enclosed proxy card,FOR each of the director nominees identified on such card. Although management does not know of any matter other than the election of directors to be acted upon at the Annual Meeting, unless contrary instructions are given, shares represented by valid proxies will be voted by the persons named on the accompanying proxy card in accordance with their respective best judgment with respect to any other matters that may properly come before the Annual Meeting.

Execution of a proxy will not in any way affect a stockholder’s right to attend the Annual Meeting and vote in person, and any person giving a proxy has the right to revoke it at any time before it is exercised by (i) filing with the Corporate Secretary of the Company, prior to the commencement of the Annual Meeting, a duly executed instrument dated subsequent to such proxy revoking the same or a duly executed proxy bearing a later date, or (ii) attending the Annual Meeting and voting in person.

The mailing address of the principal executive offices of the Company is 7021 Greenleaf Avenue, Whittier, California 90602, and its telephone number is (562) 907-2200. The approximate date on which this Proxy Statement and the accompanying Notice of Annual Meeting of Stockholders and proxy card are first being sent to stockholders is October 10, 2003.

Record Date and Voting

Only stockholders of record on Monday, September 22, 2003 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting. There were outstanding on the Record Date 6,307,540 shares of common stock, par value $.01 per share, of the Company (“Common Stock”) as adjusted for the 25% Common Stock dividends paid to stockholders by the Company on or about May 30, 1997 (the “1997 Stock Dividend”), June 30, 1998 (the “1998 Stock Dividend”), and June 28, 2002 (the “2002 Stock Dividend” and, together with the 1997 Stock Dividend and 1998 Stock Dividend, the “Stock Dividends”). All information set forth herein regarding beneficial ownership of Common Stock, as well as numbers of shares and exercise prices of outstanding awards

under Company equity incentive plans has been adjusted, to the extent applicable, for the effect of the Stock Dividends. Each share of outstanding Common Stock is entitled to one vote on each matter to be voted on at the Annual Meeting.

As provided in the Company’s amended and restated certificate of incorporation, holders of Common Stock who beneficially own in excess of 10% of the outstanding shares of Common Stock (the “Limit”) are not entitled to any vote with respect to the shares held in excess of the Limit. A person or entity is deemed to beneficially own shares owned by an affiliate of, as well as persons acting in concert with, such person or entity. The Company’s amended and restated certificate of incorporation authorizes the Board of Directors (i) to make all determinations necessary to implement and apply the Limit, including determining whether persons or entities are acting in concert, and (ii) to demand that any person who is reasonably believed to beneficially own shares of Common Stock in excess of the Limit supply information to the Company to enable the Board to implement and apply the Limit.

The presence, in person or by proxy, of the holders of at least a majority of the total number of shares of Common Stock entitled to vote (after subtracting any shares held in excess of the Limit pursuant to the Company’s amended and restated certificate of incorporation) is necessary to constitute a quorum at the Annual Meeting. In the event that there are not sufficient votes for a quorum at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit the further solicitation of proxies.

Abstentions and broker non-votes are counted for the purpose of determining the presence or absence of a quorum for the transaction of business. With regard to the election of directors, votes may be cast in favor or withheld; votes that are withheld will be excluded entirely from the vote and will have no effect. Abstentions are counted in tabulations of the votes cast on proposals presented to stockholders other than the election of directors, thus having the effect of a negative vote, whereas broker non-votes are not counted for purposes of determining whether a proposal has been approved. Directors will be elected by a plurality of the votes of the shares of Common Stock present in person or represented by proxy and entitled to vote on the election of directors. Approval of any stockholder proposals that properly come before an annual meeting requires the affirmative vote of a majority of the shares of Common Stock present, in person or represented by proxy, at the annual meeting and entitled to vote on the subject matter. Shares held in excess of the Limit will not be counted for either the purpose of determining the presence or absence of a quorum or whether a proposal has been approved.

Solicitation

The cost of preparing, assembling and mailing the Notice of Annual Meeting of Stockholders, this Proxy Statement and the enclosed proxy card will be paid by the Company. Following the mailing of this Proxy Statement, directors, officers and other employees of the Company may solicit proxies by mail, telephone, telegraph, facsimile, e-mail or personal interview. Such persons will receive no additional compensation for such services. Brokerage houses and other nominees, fiduciaries and custodians nominally holding shares of Common Stock of record will be requested to forward proxy soliciting material to the beneficial owners of such shares, and will be reimbursed by the Company for their reasonable charges and expenses in connection therewith. In addition, the Company has retained proxy solicitor Morrow & Co., Inc. (“Morrow & Co.”) to assist in the solicitation of proxies. Morrow & Co. may solicit proxies by mail, telephone, telegraph, facsimile, e-mail and personal solicitation, and will request brokerage houses and other nominees, fiduciaries and custodians nominally holding shares of Common Stock of record to forward proxy soliciting material to the beneficial owners of such shares. For these services, the Company will pay Morrow & Co. a fee estimated not to exceed $6,000, plus reimbursement for reasonable out-of-pocket expenses.

The date of this Proxy Statement is October 9, 2003.

2

DIRECTORS AND EXECUTIVE OFFICERS

Directors

The following table sets forth certain information, except where otherwise indicated, as of June 30, 2003 with respect to the directors of the Company and the Bank. Each of the directors of the Company serves a three-year term and approximately one-third of the directors are elected at each annual meeting of stockholders. The Bank continues to have a classified board, approximately one-third of the members of which are elected each year to serve three-year terms.

Name of Director

| | Age

| | First

Became

Director of

Bank

| | Term as

Bank

Director

Expires

| | First

Became

Director

of

Company

| | Term as

Company

Director

Expires

| | Positions Held with the Company and the Bank

|

J.L. Thomas | | 67 | | 1975 | | 2003 | | 1993 | | 2003 | | Director and Chairman of the Board |

Frederic R. McGill | | 56 | | 1995 | | 2004 | | 1995 | | 2004 | | Director, President and Chief Executive Officer |

David S. Engelman | | 65 | | 1999 | | 2005 | | 1999 | | 2005 | | Director |

Alfred J. Gobar | | 70 | | 1992 | | 2004 | | 1993 | | 2004 | | Director |

Wayne L. Harvey | | 65 | | 1981 | | 2003 | | 1993 | | 2003 | | Director |

David K. Leichtfuss | | 58 | | 1991 | | 2005 | | 1993 | | 2005 | | Director |

Edward L. Miller | | 66 | | 1985 | | 2003 | | 1993 | | 2003 | | Director |

Set forth below is certain information concerning the principal occupation and business experience of each of the directors during the past five years.

J.L. Thomas is Chairman of the Company and the Bank. Mr. Thomas served as President and Chief Executive Officer of the Company since its formation in 1993 until July, 1996. Mr. Thomas joined the Bank in 1961, and was elected to the Board of Directors in 1975. Mr. Thomas served as Chief Operating Officer of the Bank from 1976 to 1982, and became its President and Chief Executive Officer in 1982, serving in that capacity until July, 1996. Mr. Thomas also serves as the Chairman of the Board of Directors of Quaker City Financial Corp., a wholly owned subsidiary of the Bank (“QCFC”), and of Quaker City Neighborhood Development, Inc., a wholly owned subsidiary of the Company (“QCND”).

Frederic R. (Rick) McGill served as Executive Vice President and Chief Operating Officer of the Company since its formation in 1993, serving in that capacity until July, 1996. Mr. McGill joined the Bank in 1991 as Executive Vice President and Chief Operating Officer. Mr. McGill was appointed President and elected to the Board of Directors of the Company and the Bank in 1995, and was appointed Chief Executive Officer effective July 1, 1996. Prior to joining the Bank, Mr. McGill was an independent financial consultant specializing in mortgage banking. Mr. McGill has over 30 years of experience in the banking industry. Mr. McGill has also served as the Chief Executive Officer of QCFC since 1991 and of QCND since July 1, 1996.

3

David S. Engelman, a private investor, served as Chairman, Chief Executive Officer and President of UnionFed Financial Corporation from 1991 until 1997 and held the same positions at its subsidiary, Union Federal Bank. Mr. Engelman is a director of Fleetwood Enterprises, Inc., and from February, 2002 until September, 2002, he served as its Chief Executive Officer and President on an interim basis. Mr. Engelman also serves as a director of MGIC Investment Corporation and Mortgage Guaranty Insurance Corporation, and is a former director of Long Beach Financial Corporation where he served from 1997 until 1999. Mr. Engelman was appointed a director of the Company and the Bank effective September, 1999. Mr. Engelman is the Chairman of the Bank’s Philanthropy Committee.

Alfred J. Gobar, retired, was previously the President and Chairman of AJGA, Inc., an economics consulting firm, and had held such positions from 1990 until 2000. Prior to 1990, Mr. Gobar served as President and Chairman of Alfred Gobar Associates, Inc., a family-owned economics consulting firm. Mr. Gobar has been a director of the Bank since 1992 and of the Company since its formation in 1993. Mr. Gobar is the Chairman of the Bank’s Loan Committee.

Wayne L. Harvey, retired, was previously the Managing Partner of Harvey & Parmelee, certified public accountants, and was with such firm from 1958 until 1998. Mr. Harvey has been a director of the Bank since 1981 and of the Company since its formation in 1993. Mr. Harvey is the Chairman of the Company’s Audit and Nominating Committees.

David K. Leichtfuss is the President of Broadview Mortgage Corp., a mortgage banking company that specializes in residential permanent financing, and has been with such company since 1988. Mr. Leichtfuss has been a director of the Bank since 1991 and of the Company since its formation in 1993.

Edward L. Miller is a partner of the law firm of Bewley, Lassleben & Miller, LLP and has been associated with such firm since 1963. Mr. Miller has been a director of the Bank since 1985 and of the Company since its formation in 1993. Mr. Miller is the Chairman of the Compensation Committee of the Company’s Board.

Committees of the Board of Directors

The Company’s Board of Directors has a standing Audit Committee, Compensation Committee and Nominating Committee.

The Audit Committee held six meetings during fiscal 2003, and currently consists of Messrs. Harvey (Chairman), Miller and Engelman. The Audit Committee’s responsibilities are generally to assist the Board in fulfilling its legal and fiduciary responsibilities relating to accounting, audit and reporting policies and practices of the Company, the Bank and their subsidiaries. In addition, among other things, the Audit Committee’s responsibilities are to oversee the Company’s accounting and financial reporting processes, report the results of its activities to the Company’s Board of Directors, approve the selection of the Company’s independent auditors, review the Company’s periodic filings with the management and independent auditors prior to filing, and review and respond to any matters raised by the independent auditors in their management letter. The Board has adopted a written charter for the Audit Committee, which was amended and restated by the Board on July 16, 2003, a copy of which is attached to this Proxy Statement as Appendix A. Each of the members of the Audit Committee is independent as defined under the National Association of Securities Dealers’ (“NASD”) current listing standards. The Company’s Board of Directors has designated Mr. Harvey as the audit committee financial expert, as defined under Item 401(h) of Regulation S-K. Mr. Harvey is independent as that term is used in Item 7(d)(3)(iv) of Schedule 14A promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The Compensation Committee held four meetings during fiscal 2003, and currently consists of Messrs. Miller (Chairman), Harvey and Engelman. The Compensation Committee is authorized to review salaries and compensation, including noncash benefits, of directors, officers and other employees of the Company, and to recommend to the Board salaries, remuneration and other forms of additional compensation and benefits as it

4

deems necessary. In July, 1996, the Board established a subcommittee of the Compensation Committee, currently made up of two non-employee directors, Messrs. Engelman and Harvey, whose principal responsibility is to administer for purposes of Section 16 of the Exchange Act, and the rules promulgated thereunder, the equity incentive plans of the Company with respect to certain transactions by executive officers and directors of the Company. Each of the members of the Compensation Committee is an independent director as defined under the NASD current listing standards.

The Nominating Committee held one meeting during fiscal 2003. Additionally, the Nominating Committee held a meeting on September 17, 2003, in anticipation of the Annual Meeting. The Nominating Committee currently consists of Messrs. Harvey (Chairman), Gobar and Engelman. The purpose of the Nominating Committee is to select nominees for election as directors. The candidates for election at the Annual Meeting were nominated by the Nominating Committee, which nominations were ratified by the Board of Directors. In accordance with Section 6 of Article I of the Company’s bylaws (a copy of which is available upon request to the Corporate Secretary of the Company), stockholder nominations for election of directors will be considered by the Nominating Committee and may be voted on at an annual meeting only if such nominations are made pursuant to written notice timely given to the Corporate Secretary accompanied by certain information. To be timely, a stockholder’s written notice must be delivered to, or mailed to and received at, the principal executive offices of the Company not less than 90 days prior to the date of the annual meeting, provided that, in the event that less than 100 days’ notice or prior disclosure of the date of the annual meeting is given or made to stockholders, a stockholder’s notice will be timely if received not later than the tenth day following the day on which such notice of the date of the annual meeting is mailed or such public disclosure is made. Such stockholder’s notice must set forth with respect to each director nominee all of the information relating to such person that is required to be disclosed in solicitations for elections of directors under the rules of the Securities and Exchange Commission (“SEC”) and the stockholder’s name and address, as they appear on the Company’s books, and the number of shares of Common Stock owned by the stockholder giving the notice.

Meetings of the Board of Directors

During fiscal 2003, there were ten meetings of the Board of Directors of the Company. Each director attended at least 75% of the meetings of the Board of Directors and the committees of the Board of Directors on which such director served during fiscal 2003.

Compensation of Directors

Directors’ Fees.The Company does not currently pay directors’ fees. The directors of the Bank each receive a monthly retainer fee of $2,200; beginning July, 2003, the monthly retainer was increased to $2,500. The monthly retainer for the Chairman of the Board was increased to $3,000, effective July, 2002, and will remain at that level during fiscal 2004. During fiscal 2003, non-employee directors were paid $300 for their attendance at each meeting of each committee on which they served; beginning July, 2003, the committee meeting fees for non-employee directors were increased to $400 per meeting. The $600 monthly retainer paid to the Audit Committee Chairman for general services in addition to attendance at meetings was increased to $1,000, effective July 1, 2003, due to the increased level of responsibility.

Directors’ Options.In 1993, the Company adopted a stock option plan for directors who are not officers or employees of the Company or its affiliates. See “COMPENSATION AND OTHER INFORMATION—Outside Directors’ Option Plan,” below. In 1997, the Company adopted a plan for employees and directors that provides for the grant of awards (“Awards”) in the form of stock options (including incentive stock options and nonqualified stock options), restricted stock, stock appreciation rights, stock payments, dividend equivalents, stock bonuses, stock sales, phantom stock, and other stock-based benefits. See “COMPENSATION AND OTHER INFORMATION—1997 Stock Incentive Plan,” below. The 1997 Stock Incentive Plan was amended and restated in September, 2002 (together with any predecessor plan as in effect at the time of any prior Award, the “1997 Stock

5

Incentive Plan”). In June 2000, 2001, and 2002, grants of 5,000 nonqualified stock options (6,250 nonqualified stock options in each of June, 2000, 2001, and 2002, as adjusted for the 2002 Stock Dividend) with vesting on the first anniversary of the option grant date were made to each of the non-employee directors, which options were granted at exercise prices of $12.10, $23.20, and $31.15 per share, respectively. From October, 2000 to June, 2002, the Chairman of the Board received a quarterly grant of 1,250 nonqualified stock options (1,563 nonqualified stock options as adjusted for the 2002 Stock Dividend), valued at the closing market price of the Common Stock as reported on the Nasdaq National Market System on the first business day of the quarter. Beginning July 1, 2002 and for fiscal 2004, the number of stock options to be granted to the Chairman of the Board on a quarterly basis was increased to 1,565.

In 2002, the Company adopted a plan for employees and directors that provides for the grant of Awards. See “COMPENSATION AND OTHER INFORMATION—2002 Equity Incentive Plan,” below. In June, 2003, grants of 5,000 nonqualified stock options with vesting on the first anniversary of the option grant date were made to each of the non-employee directors, which options were granted at the exercise price of $41.21 per share.

Executive Officers

Set forth below are the names of the executive officers of the Company, together with the positions held by those persons, as of June 30, 2003. The executive officers serve at the pleasure of the Company’s Board of Directors; however, the Company has entered into an employment agreement with Mr. McGill, which agreement is described under “COMPENSATION AND OTHER INFORMATION—Employment Agreements and Change in Control Arrangements.”

Name

| | Age

| | Position (1)

|

Elizabeth A. Conrado | | 51 | | Senior Vice President, Single Family Lending of the Bank |

Kathryn M. Hennigan | | 52 | | Senior Vice President, Administrative Services and Corporate Secretary |

Hank H. Kadowaki | | 56 | | Senior Vice President, Income Property Lending of the Bank |

Frederic R. McGill | | 56 | | President, Chief Executive Officer and Director |

Jerrold S. Perisho | | 51 | | Senior Vice President, In-Store Banking of the Bank |

Harold L. Rams | | 57 | | Senior Vice President, Capital Markets of the Bank |

Robert C. Teeling | | 53 | | Senior Vice President, Retail Banking of the Bank |

Teresa A. Thompson | | 45 | | Senior Vice President, Loan Service of the Bank |

Dwight L. Wilson | | 55 | | Senior Vice President, Treasurer and Chief Financial Officer |

| (1) Unless | otherwise indicated, the position is with both the Company and the Bank. |

Set forth below is certain information concerning the business experience during the past five years of each of the individuals named above (for information concerning Mr. McGill see “—Directors” above).

Elizabeth A. Conrado joined the Bank in February, 2002 as Senior Vice President, Single Family Lending. Prior to joining the Bank, Ms. Conrado was Vice President, Mortgage Lending Division of Kinecta Federal Credit Union from March, 2000 to October, 2001, and Regional Manager, Nationwide Credit Unions of Countrywide Home Loans from January, 1999 to January, 2000. Prior to joining Countrywide Home Loans, Ms. Conrado held various executive positions with BankAmerica Mortgage for approximately 10 years, the last of which was as Assistant Vice President, Wholesale Acquisition Officer from January, 1995 to December, 1998.

Kathryn M. Hennigan has served as Senior Vice President, Administrative Services and Corporate Secretary of the Company since its formation in 1993. Ms. Hennigan joined the Bank in 1992 as the Human Resource Manager. Ms. Hennigan was promoted to Senior Vice President, Administrative Services and Corporate

6

Secretary of the Bank in January, 1993. Prior to joining the Bank, Ms. Hennigan held various management and administrative positions, including principal for seven years at a senior high school in Fullerton, California.

Hank H. Kadowaki joined the Bank in 1994 as Major Loan Manager, and was promoted to Senior Vice President, Income Property Lending of the Bank in April, 1998. Prior to joining the Bank, Mr. Kadowaki had over 15 years experience in commercial and multifamily lending.

Jerrold S. Perisho joined the Bank in May, 2000 as Senior Vice President, In-Store Banking. Prior to joining the Bank, Mr. Perisho was executive director of the Whittier Boys & Girls Club from December, 1992 to April, 2000. Mr. Perisho has over 10 years of experience in credit union management.

Harold L. Rams joined the Bank in 1975 and currently serves as Senior Vice President, Capital Markets. Mr. Rams previously held the position of Senior Vice President, Single Family Lending from February, 1980 to February, 2002. Mr. Rams has over 30 years of experience in the banking industry.

Robert C. Teeling joined the Bank in 1991 as the Senior Vice President, Retail Banking. Prior to joining the Bank, Mr. Teeling had over 20 years of experience in retail banking with various savings and loan associations in the southern California area.

Teresa A. Thompson joined the Bank in November, 2002 as Senior Vice President, Loan Service. Prior to joining the Bank, Ms. Thompson was Vice President, Loan Operations Manager at Southern Pacific Bank in Torrance, California from July, 1999 to November, 2002. Ms. Thompson has over 20 years of experience in mortgage lending and loan servicing management.

Dwight L. Wilson has served as Senior Vice President, Treasurer and Chief Financial Officer of the Company since its formation in 1993. Mr. Wilson joined the Bank in 1976 as the Assistant Controller and held that position until 1979. Mr. Wilson served as the Controller of the Bank from 1979 to 1985. Since 1985, Mr. Wilson has been the Treasurer and Chief Financial Officer of the Bank and QCFC.

7

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth the shares of Common Stock beneficially owned as of September 22, 2003, the Record Date, by each director (and director nominee), by the Chief Executive Officer and the four most highly compensated executive officers of the Company and/or the Bank who were serving as executive officers at June 30, 2003 (the “Named Executive Officers”) and by all directors and executive officers of the Company as a group.

Name and Address (1)

| | Title of Position (2)

| | Shares of Common

Stock Beneficially

Owned (3)(4)

| | Percentage

of Class (5)

| |

| J.L. Thomas (6) | | Chairman of the Board | | 123,557 | | 1.95 | % |

| Frederic R. McGill (7) | | President and Chief Executive Officer | | 260,517 | | 4.02 | % |

| David S. Engelman (8) | | Director | | 13,125 | | * | |

| Alfred J. Gobar (9) | | Director | | 196,612 | | 3.11 | % |

| Wayne L. Harvey (10) | | Director | | 125,347 | | 1.98 | % |

| David K. Leichtfuss (11) | | Director | | 72,365 | | 1.14 | % |

| Edward L. Miller (12) | | Director | | 177,036 | | 2.80 | % |

| Dwight L. Wilson (13) | | Senior Vice President, Treasurer and Chief Financial Officer | | 68,952 | | 1.09 | % |

| Harold L. Rams (14) | | Senior Vice President, Capital Markets of the Bank | | 51,007 | | * | |

| Kathryn M. Hennigan (15) | | Senior Vice President, Administrative Services and Corporate Secretary | | 72,473 | | 1.14 | % |

| Hank H. Kadowaki (16) | | Senior Vice President, Income Property Lending of the Bank | | 60,342 | | * | |

| All directors and executive officers as a group (15 persons) (17) | | | | 1,278,299 | | 18.86 | % |

| * | Does not exceed 1.0% of the Company’s voting securities. |

| (1) | The address of each person is c/o Quaker City Bancorp, Inc., 7021 Greenleaf Avenue, Whittier, California 90602. |

| (2) | Titles are for both the Company and the Bank unless otherwise indicated. |

| (3) | Each person effectively exercises sole (or shares with a spouse or other immediate family member) voting and dispositive power as to shares reported. |

| (4) | All shares beneficially owned have been adjusted for the Stock Dividends. |

| (5) | Percentage of class is based upon 6,307,540 shares of Common Stock outstanding as of the Record Date. |

| (6) | Includes 39,384 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan, and 1,565 shares subject to currently exercisable options granted under the 2002 Equity Incentive Plan. |

| (7) | Includes 22,281 allocated shares under the Employee Stock Ownership Plan (the “ESOP”), and 167,708 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

| (8) | Includes 3,857 shares subject to options granted under the 1993 Stock Option Plan for Outside Directors (the “Outside Directors’ Option Plan”), which options are all currently exercisable, and 7,393 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

| (9) | Includes 5,000 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

| (10) | Includes 25,313 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

| (11) | Includes 25,313 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

8

| (12) | Includes 25,313 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan, and 44,390 shares held by three irrevocable trusts for the benefit of Mr. Miller’s grandchildren, the beneficial ownership of which shares Mr. Miller disclaims. Mr. Miller and his wife, Mary O. Miller, are the trustees of all three trusts. |

| (13) | Includes 20,574 allocated shares under the ESOP, 2,722 shares subject to options granted under the 1993 Management Option Plan, which options are all currently exercisable, and 31,375 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

| (14) | Includes 19,372 allocated shares under the ESOP, and 25,125 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

| (15) | Includes 17,403 allocated shares under the ESOP, and 31,375 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

| (16) | Includes 12,560 allocated shares under the ESOP, and 43,875 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan. |

| (17) | Includes 109,262 allocated shares under the ESOP, 3,857 shares subject to options granted under the Outside Directors’ Option Plan, which options are all currently exercisable, 2,722 shares subject to options granted under the 1993 Management Option Plan, which options are all currently exercisable, 459,609 shares subject to currently exercisable options granted under the 1997 Stock Incentive Plan, and 3,232 shares subject to currently exercisable options granted under the 2002 Equity Incentive Plan. |

9

COMPENSATION AND OTHER INFORMATION

Summary Compensation Table

The following table sets forth the compensation paid by the Company, including any of its subsidiaries, to the Named Executive Officers for their service during the fiscal years ended June 30, 2003, 2002, and 2001.

Name and Principal Position

| | Annual Compensation (1)

| | Long Term

Compensation

Awards

| | All Other

Compensation ($)

| |

| | Fiscal

Year

| | Salary ($)

| | Bonus ($)

| | Securities

Underlying

Options (#)

| |

Frederic R. McGill President and Chief Executive Officer | | 2003

2002

2001 | | $ $ $ | 345,000 320,000 295,000 | | $ $ $ | 192,682 217,600 196,175 | | 19,000

17,500 — | | $ $ $ | 130,348 114,479 97,862 | (2) |

| | | | | |

Dwight L. Wilson Senior Vice President, Treasurer and Chief Financial Officer | | 2003

2002

2001 | | $ $ $ | 168,000 160,024 150,900 | | $ $ $ | 55,118 61,834 57,221 | | 9,900

9,750 — | | $ $ $ | 52,079 45,635 26,479 | (2) |

| | | | | |

Kathryn M. Hennigan Senior Vice President, Administrative Services and Corporate Secretary | | 2003

2002

2001 | | $ $ $ | 147,125 137,500 122,500 | | $ $ $ | 50,476 53,130 46,452 | | 8,700

9,750 — | | $ $ $ | 20,569 20,688 17,602 | (2) |

| | | | | |

Harold L. Rams Senior Vice President, Capital Markets of the Bank | | 2003

2002

2001 | | $ $ $ | 135,450 126,150 126,150 | | $ $ $ | 47,153 50,259 47,836 | | 7,950

9,750 — | | $ $ $ | 32,468 35,437 18,268 | (2) |

| | | | | |

Hank H. Kadowaki Senior Vice President, Income Property Lending of the Bank | | 2003

2002

2001 | | $ $ $ | 134,820 126,000 116,700 | | $ $ $ | 45,850 49,065 44,252 | | 8,100

9,750 — | | $ $ $ | 18,244 17,561 16,843 | (2) |

| (1) | Under “Annual Compensation,” the column titled “Salary” includes deferred compensation and the column titled “Bonus” consists of payments earned under the Bank’s Incentive Compensation Plan in the reported fiscal year. |

| (2) | Includes the following contributions to the designated plans by the Bank on behalf of the Named Executive Officers (all amounts are for plan year January 1 – December 31, 2002): |

| | (a) | matching contributions under the Bank’s 401(k) Plan of $3,851, $4,534, $1,720, $2,659 and $1,695 for Mr. McGill, Mr. Wilson, Ms. Hennigan, Mr. Rams and Mr. Kadowaki, respectively; |

| | (b) | $5,474, $5,474, $5,349, $4,975 and $4,912 representing the cost of the shares allocated under the ESOP, including forfeitures, for the benefit of Mr. McGill, Mr. Wilson, Ms. Hennigan, Mr. Rams and Mr. Kadowaki, respectively; |

10

| | (c) | contributions under the Quaker City Bank Employees Retirement Income Plan of $31,561, $42,071, $11,634, $24,056 and $9,743 to the accounts of Mr. McGill, Mr. Wilson, Ms. Hennigan, Mr. Rams and Mr. Kadowaki, respectively; and |

| | (d) | the value of benefits accrued under the Bank’s non-qualified benefit plan of $89,462, $0, $1,866, $778 and $1,894 for Mr. McGill, Mr. Wilson, Ms. Hennigan, Mr. Rams and Mr. Kadowaki, respectively. |

Stock Options

The following table sets forth the number of grants of stock options by the Company during fiscal 2003 to the Named Executive Officers. All shares of Common Stock reserved under the 1993 Management Option Plan are subject to outstanding options and no shares remain available under the 1993 Management Option Plan for future option grants. On July 27, 2002, the 1997 Stock Incentive Plan expired and, as of such date, the Company was not permitted to grant any further Awards in respect of the 1,616 shares of Common Stock that remained available for issuance thereunder. As of June 30, 2003, 208,333 shares of Common Stock remained available for issuance under the 2002 Equity Incentive Plan.

Option/SAR Grants in Last Fiscal Year

| | | Individual Grants

| | Potential Realizable Value at

Assumed Annual Rates of

Stock Price Appreciation

for Option Term

|

| | | Number of Securities Underlying | | % of Total Options/SARs Granted to | | | Exercise or Base | | | |

Name

| | Options/SARs

Granted (#)

| | Employees in

Fiscal Year

| | | Price ($/Sh)

| | Expiration Date

| | 5% ($)

| | 10% ($)

|

| | | | | | |

Frederic R. McGill | | 19,000 | | 22.70 | % | | $ | 41.21 | | 06/19/13 | | $ | 493,240 | | $ | 1,244,880 |

Dwight L. Wilson | | 9,900 | | 11.83 | % | | $ | 41.21 | | 06/19/13 | | $ | 257,004 | | $ | 648,648 |

Kathryn M. Hennigan | | 8,700 | | 10.39 | % | | $ | 41.21 | | 06/19/13 | | $ | 225,852 | | $ | 570,024 |

Harold L. Rams | | 7,950 | | 9.50 | % | | $ | 41.21 | | 06/19/13 | | $ | 206,382 | | $ | 520,884 |

Hank H. Kadowaki | | 8,100 | | 9.68 | % | | $ | 41.21 | | 06/19/13 | | $ | 210,276 | | $ | 530,712 |

The following table sets forth the number of shares of Common Stock covered by options granted under the 1993 Management Option Plan, the 1997 Stock Incentive Plan, and the 2002 Equity Incentive Plan held by the Named Executive Officers at June 30, 2003. The Named Executive Officers do not hold any options granted under the Outside Directors’ Option Plan. The form of Awards that could have been granted under the 1997 Stock Incentive Plan and may be granted under the 2002 Equity Incentive Plan includes stock options, restricted stock, stock appreciation rights, stock payments, dividend equivalents, stock bonuses, stock sales, phantom stock and other stock-based benefits. The following table also sets forth the value of unexercised options granted under the 1993 Management Option Plan, the 1997 Stock Incentive Plan, and the 2002 Equity Incentive Plan that were in-the-money at June 30, 2003. Options are “in-the-money” if the fair market value of the shares covered thereby is greater than the option exercise price.

11

Aggregated Option/SAR Exercises in Last Fiscal Year

and Fiscal Year-End Option/SAR Values

Name

| | Shares

Acquired

On

Exercise

(#)

| | Value

Realized ($)

| | Number of Securities

Underlying Unexercised

Options At Fiscal Year-End (#)

| | Value of Unexercised In-the-Money Options At

Fiscal Year-End ($) (1)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Frederic R. McGill | | 54,369 | | $ | 1,555,309 | | 167,709 | | 30,666 | | $ | 4,742,154 | | $ | 183,088 |

Dwight L. Wilson | | 33,500 | | $ | 1,045,525 | | 40,097 | | 16,399 | | $ | 1,182,546 | | $ | 103,394 |

Kathryn M. Hennigan | | 41,582 | | $ | 1,303,290 | | 31,375 | | 15,199 | | $ | 853,290 | | $ | 102,938 |

Harold L. Rams | | — | | | — | | 25,125 | | 14,449 | | $ | 673,978 | | $ | 102,653 |

Hank H. Kadowaki | | — | | | — | | 43,875 | | 14,599 | | $ | 1,193,790 | | $ | 102,710 |

| (1) | The values of unexercised in-the-money options set forth in the table have been calculated, in accordance with requirements promulgated by the SEC, by determining the difference between the fair market value of the underlying Common Stock at fiscal year-end and the exercise price of the options. |

Employment Agreements and Change in Control Arrangements

In connection with the conversion of the Bank from mutual to stock form in December, 1993 (the “Conversion”) and the commencement of operations by the Company as the holding company thereof, the Bank and the Company entered into employment agreements with Messrs. Thomas and McGill. Mr. Thomas’ employment agreements with the Bank and the Company terminated on September 25, 2000, his sixty-fifth birthday. The Bank and the Company also entered into change in control agreements, which are two-year agreements, with Messrs. Wilson, Rams and Kadowaki, and with Ms. Hennigan. The employment agreements and change in control agreements were entered into with the intent of ensuring that the Bank and the Company would be able to maintain a stable and competent management base after the Conversion. The continued success of the Bank and the Company depends to a significant degree on the skills and competence of these individuals.

Employment Agreements with Mr. McGill

Mr. McGill’s employment agreements with the Bank and the Company provide for an initial three-year term. Commencing on the first anniversary date and continuing on each anniversary date thereafter, the Board of Directors of the Bank may extend the employment agreement with the Bank for an additional year such that the remaining term shall be the amount of the original term unless written notice of non-renewal is given by the Board of Directors of the Bank after conducting a performance evaluation of Mr. McGill. Effective June 30, 2003, the Bank’s Board extended Mr. McGill’s employment agreement until June 30, 2006. With respect to his employment agreement with the Company, commencing on the date of execution of the employment agreement with the Company, the term of the employment agreement for Mr. McGill extends, unless earlier terminated, one day each day until such time as the Company’s Board of Directors or Mr. McGill elects not to extend the term of the employment agreement by giving written notice to the other party, in which case the term of the employment agreement will be fixed and will end on the third anniversary date of the written notice.

12

The employment agreements with the Bank and the Company provide that Mr. McGill will receive an annual base salary of $370,000, which base salary will be reviewed annually by the Board of the Bank. In addition to the base salary, the employment agreements provide for, among other things, disability pay, participation in stock benefit plans and other fringe benefits applicable to executive personnel.

The employment agreements provide for termination by the Bank or the Company for cause at any time. In the event the Bank or the Company chooses to terminate Mr. McGill’s employment for reasons other than for cause or for disability, or in the event of his resignation from the Bank and the Company upon (i) failure to re-elect Mr. McGill to his current offices; (ii) a material change in his functions, duties or responsibilities, or relocation of his principal place of employment, or a material reduction in benefits or perquisites; (iii) liquidation or dissolution of the Bank or the Company; or (iv) a breach of the employment agreement by the Bank or the Company, Mr. McGill or, in the event of death, his beneficiary, would be entitled to receive an amount equal to the aggregate of (a) the amount of the remaining salary payments that he would have earned if he continued his employment with the Bank or Company during the remaining unexpired term of the employment agreement at his defined base salary on the date he was terminated; (b) the average of the amount of bonus and any other cash compensation paid to him during the term of the employment agreement times the remaining number of years of the employment agreement and any fraction thereof, and (c) an amount equal to the average of the annual contributions that were made on Mr. McGill’s behalf to any employee benefit plan of the Company or Bank during the term of the employment agreement times the remaining number of years of the employment agreement and any fraction thereof.

If termination of employment follows a “change in control” of the Bank or the Company, as defined in the employment agreement, Mr. McGill or, in the event of death, his beneficiary, would be entitled to an aggregate payment from the Bank and the Company equal to the greater of: (i) the payments due for the remaining term of the agreement; or (ii) three times Mr. McGill’s average annual compensation for the three preceding taxable years, including bonuses and any other cash compensation paid or to be paid to Mr. McGill during such years, and the amount of any contributions made or to be made to any employee benefit plan. The Bank and the Company would also continue his health and disability coverage for the remaining unexpired term of the employment agreements to the extent allowed by the plans or policies maintained by the Company or Bank from time to time. Payments to Mr. McGill under the Bank’s employment agreements are guaranteed by the Company in the event that payments or benefits are not paid by the Bank. The employment agreements also provide for reduced benefits to Mr. McGill upon termination of employment due to disability and further provide that the Bank and Company shall indemnify him to the fullest extent allowable under federal and Delaware law. In the event of a change in control, based upon fiscal 2003 salary and bonus, Mr. McGill would receive approximately $1,695,846 in severance payments in addition to other cash and noncash benefits provided under the employment agreements.

Change in Control Agreements

The change in control agreements with the Bank and the Company provide for a two-year term for Messrs. Wilson, Rams and Kadowaki, and Ms. Hennigan (each, an “Executive”). Commencing on the first anniversary date and continuing on each anniversary thereafter, the change in control agreements may be extended by the Board of Directors of the Bank for a year so that the remaining terms shall be two years. Effective June 30, 2003, the Bank’s Board extended the term of the change in control agreements with each Executive until June 30, 2005. Commencing on the date of execution of the change in control agreement with the Company, the term of the change in control agreement extends for one day each day until such time as the Board of Directors of the Company or the Executive elects not to extend the term of the change in control agreement by giving written notice to the other party, in which case the term of the change in control agreement will be fixed and will end on the second anniversary date of the written notice. Each change in control agreement provides that at any time following a change in control of the Company or the Bank, if the Company or the Bank terminates the Executive’s employment for any reason other than cause, the Executive or, in the event of death, the Executive’s beneficiary would be entitled to receive an aggregate payment from the Bank and the Company equal to two times the Executive’s average annual salary for the two preceding taxable years, including bonuses and any other cash

13

compensation paid or to be paid to the Executive during such years and the amount of any contributions made or to be made to any employee benefit plan. The Bank and the Company would also continue the Executive’s life, health and disability coverage for the remaining unexpired term of the Executive’s change in control agreement to the extent allowed by the plans or policies maintained by the Company or Bank from time to time. Payments to the Executive under the Bank’s change in control agreements are guaranteed by the Company in the event that payments or benefits are not paid by the Bank. If a change in control occurs, based upon fiscal 2003 salary and bonus, the amounts payable to Messrs. Wilson, Rams, and Kadowaki, and Ms. Hennigan, pursuant to the change in control agreements would be approximately $463,036, $378,751, $374,822, and $409,915, respectively, in addition to other cash and noncash benefits provided for under the change in control agreements.

The change in control agreements and the employment agreements contain a provision to the effect that in the event of a change in control, the aggregate payments under the agreements shall not constitute an excess parachute payment under either Section 280G or Section 4999 of the Internal Revenue Code of 1986, as amended (the “Code”) (Section 280G denies a deduction for such excess amounts to the employer, and Section 4999 imposes an excise tax on the recipient with respect to such excess amounts). Such provision provides that the payments under the agreements shall be reduced to one dollar below the amount that would cause them to constitute excess parachute payments under either Section 280G or Section 4999.

Change in Control Provisions in Equity Incentive Plans

Each of the 1993 Management Option Plan, the 1997 Stock Incentive Plan, and the 2002 Equity Incentive Plan contains a change in control provision. The definition of “change in control” is the same in both the 1993 Management Option Plan and the 1997 Stock Incentive Plan. The “change in control” definition in the 2002 Equity Incentive Plan is comparable to that of the other two plans; however, the 2002 Equity Incentive Plan has more limited triggers and higher trigger thresholds.

The Company’s 1993 Management Option Plan provides that, to the extent not previously exercisable, options granted under the 1993 Management Option Plan become exercisable upon a change in control. All outstanding unexercised options under the 1993 Management Option Plan are currently exercisable. No shares of Common Stock remain available under the 1993 Management Option Plan for future option grants.

The 1997 Stock Incentive Plan and the 2002 Equity Incentive Plan each also contains a change in control provision. Pursuant to such provision in each plan, as of the effective time and date of any change in control (as defined in such plan), the 1997 Stock Incentive Plan or the 2002 Equity Incentive Plan, as applicable, and any then outstanding Awards granted thereunder (whether or not vested) shall automatically terminate unless (i) provision is made in writing in connection with such transaction for the continuance of such plan and for the assumption of such Awards, or for the substitution for such Awards of new awards covering the securities of a successor entity or an affiliate thereof, with appropriate adjustments as to the number and kind of securities and exercise prices or other measurement criteria, in which event the 1997 Stock Incentive Plan or the 2002 Equity Incentive Plan, as applicable, and such outstanding Awards will continue or be replaced, as the case may be, in the manner and under the terms so provided; or (ii) the Board otherwise provides in writing for such adjustments as it deems appropriate in the terms and conditions of the then-outstanding Awards (whether or not vested), including without limitation (a) accelerating the vesting of outstanding Awards, and/or (b) providing for the cancellation of Awards and their automatic conversion into the right to receive the securities, cash or other consideration that a holder of the shares underlying such Awards would have been entitled to receive upon consummation of such change in control had such shares been issued and outstanding immediately prior to the effective time of the change in control (net of the appropriate option exercise prices). If the 1997 Stock Incentive Plan or the 2002 Equity Incentive Plan, as applicable, and the respective Awards terminate by reason of the occurrence of a change in control without provision for any of the actions described in clause (i) or (ii) of the immediately preceding sentence, then any holder of outstanding Awards will have the right, at such time immediately prior to the consummation of the

14

change in control as the Board designates, to exercise or receive the full benefit of such Awards to the full extent not theretofore exercised, including any installments which have not yet become vested.

Defined Benefit Plan

The Bank maintains the Quaker City Bank Employees Retirement Income Plan, a non-contributory defined benefit pension plan (“Defined Benefit Plan”) qualified under the Employment Retirement Income Security Act of 1974, as amended (“ERISA”). Employees become eligible to participate in the Defined Benefit Plan upon attaining the age of 21 and completing one year of service during which they have served a minimum of 1,000 hours. Until December 31, 1999, the Plan was an income replacement retirement plan. The benefits were based on years of service and the three consecutive years of employment during which the participant earned the highest compensation. Contributions were intended to provide not only for benefits attributed to service to date, but also for those expected to be earned in the future. Effective December 31, 1993, the Plan was frozen for benefit service accrued, and employees hired after November 30, 1992 did not participate in the Plan.

Effective January 1, 2000, the Board of Directors approved the conversion of the Defined Benefit Plan into a “Cash Balance Plan.” Under the provisions of the Cash Balance Plan, a cash balance account is established for each participant at plan entry and increased over time with pay and interest credits. Pay credits are equal to 5.0% of eligible pay and are credited to each participant’s cash balance account annually. Interest credits are based on ten-year Treasury Note rates and are credited to a participant’s cash balance account quarterly. At termination of employment, a participant (if vested) becomes entitled to a monthly annuity payable for life (or over a joint lifetime with his or her beneficiary) at retirement. The Cash Balance Plan is intended to be an ERISA-qualified plan, and the Bank has filed for IRS approval.

Estimated annual benefits payable at normal retirement age, expressed as a single life annuity, to each of the Named Executive Officers under the Cash Balance Plan are as follows:

Name

| | Estimated Annual Benefit

|

Frederic R. McGill | | $ | 25,900 |

Dwight L. Wilson | | | 71,900 |

Kathryn M. Hennigan | | | 26,200 |

Harold L. Rams | | | 57,400 |

Hank H. Kadowaki | | | 14,700 |

401(k) Plan

Effective July 1, 1997, the Bank implemented a 401(k) Plan. Employees become eligible to participate in the 401(k) Plan upon attaining the age of 21 and completing one year of service during which they have served a minimum of 1,000 hours. The 401(k) Plan is an ERISA-qualified plan under which employees may annually defer, on a pretax basis, up to the lesser of 15% of their base salary or the IRS limitation on employee deferrals ($12,000 for 2003). The Bank currently contributes on a matching basis 40% of the first 5% of the employees’ contributions to participants’ accounts in the 401(k) Plan.

Employee Stock Ownership Plan

At the time of Conversion, the Company established an ESOP for all employees who are age 21 or older and have completed one year of service with the Bank during which they have served a minimum of 1,000 hours. The ESOP is internally leveraged and borrowed $3.1 million from the Company to purchase 10% of the outstanding shares of the Common Stock of the Company issued in the Conversion. The loan will be repaid from the Bank’s discretionary contributions to the ESOP as well as with any cash dividends payable in respect of any

15

unallocated shares held by the ESOP. In conjunction with the conversion of the Bank’s income replacement Defined Benefit Plan into a Cash Balance Plan effective January 1, 2000, and the inclusion of all eligible employees as participants in the Cash Balance Plan, the Board of Directors approved an amendment to the ESOP loan agreement and promissory note which allows the loan underlying the ESOP to be amortized over a longer period of time. ESOP participants will receive essentially the same benefit, but the length of time by which the benefit will be earned will be extended from September, 2003 to December, 2004. At June 30, 2003 and 2002, the outstanding balance on the loan was $349,000 and $582,000, respectively. Shares purchased with the loan proceeds are held in a suspense account for allocation among participants as the loan is repaid. Contributions to the ESOP and shares released from the suspense account are allocated among participants on the basis of compensation, as described in the plan, in the year of allocation. Benefits generally become 100% vested after five years of vesting service. Vesting will accelerate upon retirement, death or disability of the participant or in the event of a change in control of the Bank or the Company. Forfeitures will be reallocated among remaining participating employees, in the same proportion as contributions. Benefits may be payable upon death, retirement, early retirement, disability or separation from service. Since the annual contributions are discretionary, the benefits payable under the ESOP cannot be estimated.

Retirement Benefit Equalization Plan

Until December 31, 1999, the Bank maintained a nonqualified Supplemental Executive Retirement Plan (“SERP”) for certain employees and their beneficiaries whose benefits from the Bank’s Defined Benefit Plan were reduced by reason of the annual limitation on benefits and contributions imposed by Section 415 of the Code and the limitations imposed on compensation taken into consideration in the determination of benefits under the Defined Benefit Plan due to Section 401(a)(17) of the Code. The SERP provided additional benefits to participants to ensure that they received an aggregate annual benefit from the Defined Benefit Plan, the ESOP and Social Security of an amount equal to 65% of such participants’ final average compensation at age 65.

In conjunction with the conversion of the Bank’s Defined Benefit Plan into a Cash Balance Plan effective January 1, 2000, the SERP was converted into a Retirement Benefit Equalization Plan (“RBEP”) for certain employees. J.L. Thomas’ benefit remains under the SERP, and is $93,180 per year, payable through December 31, 2005. The RBEP is a supplemental plan to the Cash Balance Plan, 401(k) Plan, and ESOP, and is intended to provide certain covered employees with the total amount of retirement income that they would otherwise receive under these plans if not for legislated ceilings in compliance with certain sections of the Code which limit retirement benefits payable from qualified plans. Under the provisions of the RBEP, a cash balance account is established for each participant at plan entry and increased over time with contribution and interest credits. The opening account balance for each participant was equal to their liability held under the SERP. Contribution credits are equal to the amounts not contributed under the qualified plans due to IRS limitations and are credited to each participant’s cash balance account annually. Interest credits are based on ten-year Treasury Note rates and are credited to a participant’s cash balance account quarterly.

The approximate allocation under the RBEP for plan year January 1, 2002 through December 31, 2002 for the Named Executive Officers is as follows:

Name

| | Estimated

Allocation

|

Frederic R. McGill | | $ | 89,462 |

Dwight L. Wilson | | | 0 |

Kathryn M. Hennigan | | | 1,866 |

Harold L. Rams | | | 778 |

Hank H. Kadowaki | | | 1,894 |

16

Outside Directors’ Option Plan

Outside, non-employee directors (“Outside Directors”) of the Company and the Bank are eligible to receive stock options under the Outside Directors’ Option Plan. The purpose of the Outside Directors’ Option Plan is to promote the growth and profitability of the Company and the Bank by providing an incentive in the form of stock options to Outside Directors of outstanding competence to achieve long-term objectives of the Company and the Bank by encouraging their acquisition of an equity interest in the Company. The Outside Directors’ Option Plan authorized the granting of nonqualified stock options for a total of 202,149 shares of Common Stock to Outside Directors. There are no shares of Common Stock remaining available for future option grants under the Outside Directors’ Option Plan.

1993 Management Option Plan

The 1993 Management Option Plan provided for the grant of stock options to senior executives, offering them the possibility of future gains, depending on the executive’s continued employment by the Company or the Bank and the long-term price appreciation of the Company’s Common Stock. All 2,722 shares of Common Stock reserved under the 1993 Management Option Plan are subject to outstanding options and no shares remain available under the 1993 Management Option Plan for future option grants.

1997 Stock Incentive Plan

The 1997 Stock Incentive Plan provides for the grant of Awards in the form of stock options (including incentive stock options and nonqualified stock options), restricted stock, stock appreciation rights, stock payments, dividend equivalents, stock bonuses, stock sales, phantom stock and other stock-based benefits. Persons eligible to receive an Award under the 1997 Stock Incentive Plan include directors, officers, employees, consultants, and advisors of the Company and its affiliated entities. An amendment to the 1997 Stock Incentive Plan was approved by the stockholders at the Company’s 1999 Annual Meeting of Stockholders. The amendment increased the number of shares of Common Stock reserved for issuance under the 1997 Stock Incentive Plan from 233,000 shares to 560,465 shares (700,582, as adjusted for the 2002 Stock Dividend). Each of the options granted to date under the 1997 Stock Incentive Plan expires 10 years following the date of grant. On July 27, 2002, the 1997 Stock Incentive Plan expired and, as of such date, the Company is not permitted to grant any further Awards thereunder.

2002 Equity Incentive Plan

The 2002 Equity Incentive Plan provides for the grant of Awards in the form of stock options (including incentive stock options and nonqualified stock options), performance awards, restricted stock, stock appreciation rights, stock payments, dividend equivalents, stock bonuses, stock sales, phantom stock and other stock-based benefits. The persons eligible to receive an Award under the 2002 Equity Incentive Plan include directors, officers, employees, consultants and advisors of the Company and its affiliated entities. On June 30, 2003, 208,333 shares of Common Stock remained available for issuance under the 2002 Equity Incentive Plan.

17

Equity Compensation Plan Information

The following table summarizes information relating to securities authorized for issuance under the Company’s equity compensation plans as of June 30, 2003. The table provides information for each of the following equity compensation plans: the Company’s Outside Directors’ Option Plan, the Company’s 1993 Management Option Plan, the Company’s 1997 Stock Incentive Plan, and the Company’s 2002 Equity Incentive Plan.

| | | (a) | | (b) | | (c) | |

Plan Category

| | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding

options, warrants

and rights

| | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a))

| |

Equity compensation plans approved by security holders: | | | | | | | | |

Outside Directors’ Option Plan | | 3,857 | | $ | 31.152 | | 0 | |

1993 Management Option Plan | | 8,722 | | $ | 3.840 | | 0 | |

1997 Stock Incentive Plan | | 585,184 | | $ | 17.531 | | 0 | (1) |

2002 Equity Incentive Plan | | 118,395 | | $ | 40.647 | | 208,033 | |

Equity compensation plans not approved by security holders | | None | | | N/A | | N/A | |

Total | | 716,158 | | $ | 21.259 | | 208,033 | |

| (1) | On July 27, 2002, the 1997 Stock Incentive Plan expired and, as of such date, the Company was not permitted to grant any further Awards thereunder. |

Compensation Committee Interlocks and Insider Participation

The Company’s Compensation Committee consists of Messrs. Miller (Chairman), Engelman and Harvey. None of such members is, or formerly was, an officer or employee of the Company or any of its subsidiaries and none had any relationship with the Company requiring disclosure herein under applicable rules. In addition, to the Company’s knowledge, no executive officer of the Company serves as a director or a member of the compensation committee of another entity.

18

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Administration

The compensation program is administered by the Compensation Committee of the Company’s Board of Directors, which is composed of at least two Outside Directors. The Chairman of the Board, the Chief Executive Officer and the Senior Vice President, Administrative Services, serve as advisors to the Compensation Committee. Following review and approval by the Compensation Committee, all issues pertaining to employment-related contracts are submitted to the full Board of Directors for approval.

The following is the Compensation Committee report addressing the compensation of the Company’s executive officers for fiscal 2003.

Philosophy

The goals and objectives of the executive compensation policies remain the same as in previous years. The Compensation Committee’s executive compensation policies are designed to provide competitive levels of compensation that integrate pay with the Company’s annual and long-term performance goals, reward above average corporate performance, recognize individual initiative and achievements and assist the Company in attracting and retaining qualified executives. Targeted levels of executive compensation are set at levels the Compensation Committee believes to be consistent with others in the financial services industry, with executives’ compensation packages increasingly being weighted toward programs contingent upon the Company’s long-term (three years or more) performance. As a result, the executives’ actual compensation levels in any particular year may be above or below those of the Company’s competitors, depending upon the Company’s performance.

The Company’s compensation strategy continues to support the concept of pay-for-performance, associating the goal of variable pay for variable performance. A mix of compensation elements, with an emphasis on tying long-term incentives to corporate performance, is designed to meet this goal. The mix of compensation elements varies between executive levels within the organization, with compensation opportunities of senior executives relying more heavily on annual and long-term incentive compensation.

With regard to Section 162(m) of the Code, which limits the deductibility of certain executive officer compensation in excess of $1,000,000, the Company intends to take all necessary steps to cause the compensation paid to executive officers to be deductible by the Company.

Performance to Date

The Company’s compensation strategy is based on the philosophy that Company executives should be compensated within competitive norms for their level of responsibility within the organization. The Company has determined the competitive marketplace for different executive levels within the organization. Generally, the competitive marketplace for senior executives has been defined as financial institutions with assets between $916 million and $4.2 billion that are located in the western United States.

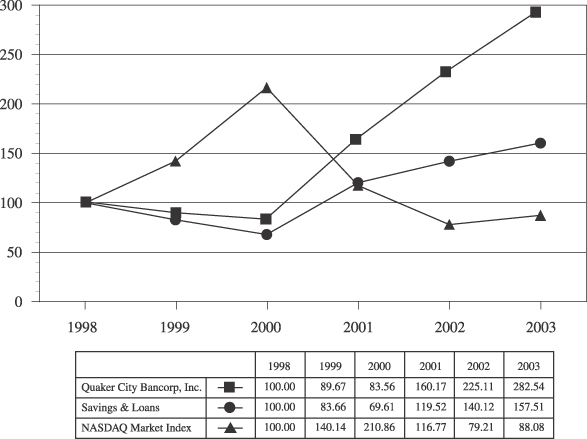

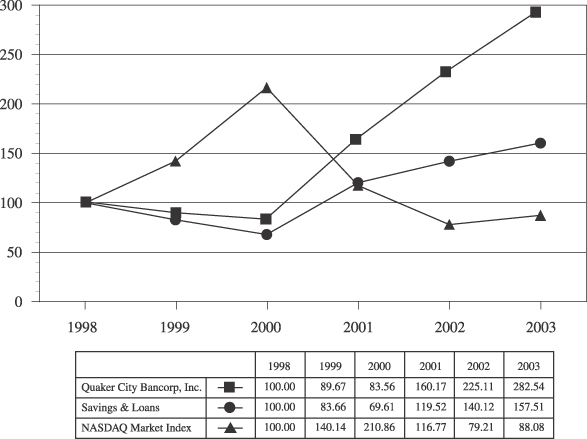

It should be noted that the Company wishes to compare itself on a broader basis for corporate performance purposes, and thus the peer group referenced above for comparison purposes in regard to cash compensation is not identical to that used in the Stock Price Performance Graph which appears immediately after this report. See “STOCK PRICE PERFORMANCE GRAPH,” below.

The Compensation Committee conducted its annual review of officers’ base salary levels in June, 2002. As a result of the Compensation Committee review, senior executives received raises ranging from 5.0% to 7.0% for

19

fiscal 2003. These raises in base salaries reflected the impact of increased job responsibilities and improved performance.

In the spring of 1999, a competitive review of the current cash compensation program (base salary and short-term incentive cash compensation) for Company executives was performed by an independent outside consulting firm, Wm. M. Mercer, Inc. The findings of such review were used by the Compensation Committee in its executive salary reviews for fiscal years 2000 and 2001. The Compensation Committee retained independent consulting firm Aon Consulting, Inc. to perform a new independent review of the executive cash compensation program in the spring of 2001, the results of which were used for executive salary reviews for fiscal years 2002 and 2003. In the spring of 2003, the Compensation Committee retained independent consulting firm JLR Associates to undertake a competitive review of the cash compensation program for Company executives, the findings of which formed the basis for its executive salary review for fiscal 2004.

Annual incentive compensation for the Chief Executive Officer was based solely on corporate goals. For fiscal 2003, the target incentive for the Chief Executive Officer was 50% of base salary. For fiscal 2003, these goals pertained to performance in the following areas: net profit, asset quality, operating expense ratios, regulatory and compliance ratings and quality of customer service. In addition, a profitability threshold required for any corporate bonus award continues to be an integral part of the incentive compensation plan. Incentive compensation for fiscal 2003 for other executive officers of the Company, with a target of 30% of base salary, was based 80% upon corporate and 20% upon personal goal achievement. The annual incentive program also included a profitability threshold necessary for the payment of any bonus based on corporate goals. In July, 2003, executive officers received bonuses approved by the Board of Directors based on both management objectives and their personal goal achievement, as applicable, during fiscal 2003.

The third part of executive compensation is the long-term compensation program, including incentive stock options, nonqualified stock options and stock grants. Stock options have been granted under the Company’s 1993 Management Option Plan, the 1997 Incentive Stock Plan, and the 2002 Equity Incentive Plan. The purpose of these plans is to encourage management stability as well as stock ownership of the Company.

Under the 1993 Management Option Plan, senior executives received stock options which offer them the possibility of future gains, depending on the executive’s continued employment by the Company or the Bank and the long-term price appreciation of the Company’s Common Stock. At the Conversion, senior executive officers were granted options under the 1993 Management Option Plan that vested over a period of three years, with one-third becoming exercisable on each of January 1, 1995, 1996, and 1997. All shares of Common Stock reserved under the 1993 Management Option Plan are subject to outstanding options and no shares remain available under the 1993 Management Option Plan for future option grants. Under the first grant under the 1997 Stock Incentive Plan, senior executive officers then-employed by the Company, except for Mr. Kadowaki, received nonqualified stock options which vested over a period of three years, with one-third becoming exercisable on each of July 7, 1998, 1999, and 2000. Mr. Kadowaki received nonqualified stock options upon his appointment in April, 1998 as Senior Vice President, Income Property Lending of the Bank. One-third of Mr. Kadowaki’s nonqualified stock options became exercisable on each of April 21, 1999, 2000 and 2001. On May 20, 1999, senior executive officers received nonqualified stock options which vested over a period of three years, with one-third becoming exercisable on each of May 20, 2000, 2001 and 2002. An amendment to the 1997 Stock Incentive Plan was approved by the stockholders at the Company’s 1999 Annual Meeting of Stockholders. The amendment increased the number of shares of Common Stock reserved for issuance under the 1997 Stock Incentive Plan from 233,000 shares (291,250, as adjusted for the 1998 Stock Dividend) to 560,465 shares (700,582, as adjusted for the 2002 Stock Dividend).

Mr. Perisho received nonqualified stock options upon being hired in May, 2000 as Senior Vice President, In-Store Banking of the Bank. One-third of Mr. Perisho’s nonqualified stock options became exercisable on each of April 20, 2001, 2002 and 2003. In June, 2000, a grant of nonqualified stock options was made to Mr. McGill.

20

For further information regarding this grant, see the section of this report entitled “Chief Executive Officer Compensation,” below. During fiscal 2001, no senior executives received stock option grants.

On January 17, 2002, senior executive officers then-employed by the Company, except for Mr. McGill, received nonqualified stock options which vest over a period of three years, with one-third becoming exercisable on each of January 17, 2003, 2004 and 2005. In February, 2002 and June, 2002, grants of nonqualified stock options were made to Mr. McGill. For further information regarding these grants, see the section of this report entitled “Chief Executive Officer Compensation,” below. Ms. Conrado received nonqualified stock options upon being hired in February, 2002 as Senior Vice President, Single Family Lending of the Bank. One-third of Ms. Conrado’s nonqualified stock options become exercisable on each of February 21, 2003, 2004 and 2005. In June, 2002, senior executive officers received nonqualified stock options which vest over a period of three years, with one-third becoming exercisable on each of June 25, 2003, 2004, and 2005. On July 27, 2002, the 1997 Stock Incentive Plan expired and, as of such date, the Company is not permitted to grant any further Awards thereunder.

Awards under the 2002 Equity Incentive Plan may be granted in the form of stock options, restricted stock, stock appreciation rights, stock payments, dividend equivalents, stock bonuses, stock sales, phantom stock and/or other stock based benefits. Pursuant to the terms of the 2002 Equity Incentive Plan, no one eligible person may be granted Awards with respect to more than 100,000 shares of Common Stock in any one calendar year.