UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

TERRESTAR CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it is determined) |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary proxy materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement no.: |

TerreStar Corporation

12010 Sunset Hills Road, 9th Floor

Reston, VA 20190

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of TerreStar Corporation to be held at 11:00 a.m., local time, on October 16, 2008 at 12010 Sunset Hills Road, 9th Floor, Reston, Virginia 20190.

The formal notice of the annual meeting and proxy statement are attached to this letter. This material contains information concerning the business to be conducted at the meeting and the nominees for election as directors.

Even if you are unable to attend the meeting in person, it is important that your shares be represented. Whether or not you plan to attend the annual meeting, please complete, date, sign and return the enclosed proxy card. You may revoke your proxy at any time before it is exercised by giving written notice to, or filing a duly executed proxy bearing a later date with the Secretary of the Company, or by voting in person at the meeting.

Sincerely,

William Freeman

Chairman of the Board

TerreStar Corporation

12010 Sunset Hills Road, 9th Floor

Reston, VA 20190

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To our Stockholders:

The 2008 Annual Meeting of Stockholders (the “Annual Meeting”) of TerreStar Corporation (“TerreStar” or the “Company”) will be held at 11:00 a.m., local time, on October 16, 2008 at 12010 Sunset Hills Road, 9th Floor, Reston, Virginia 20190. At the Annual Meeting, stockholders will act on the following matters:

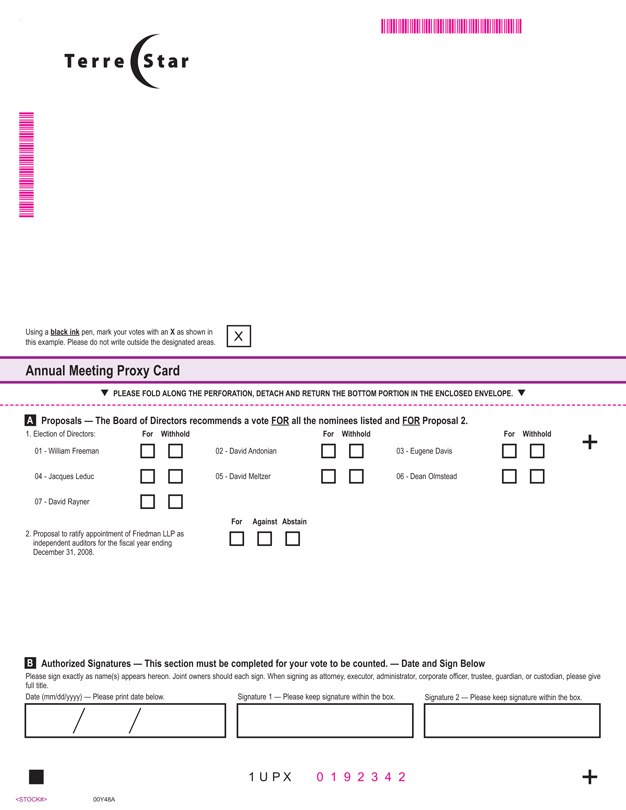

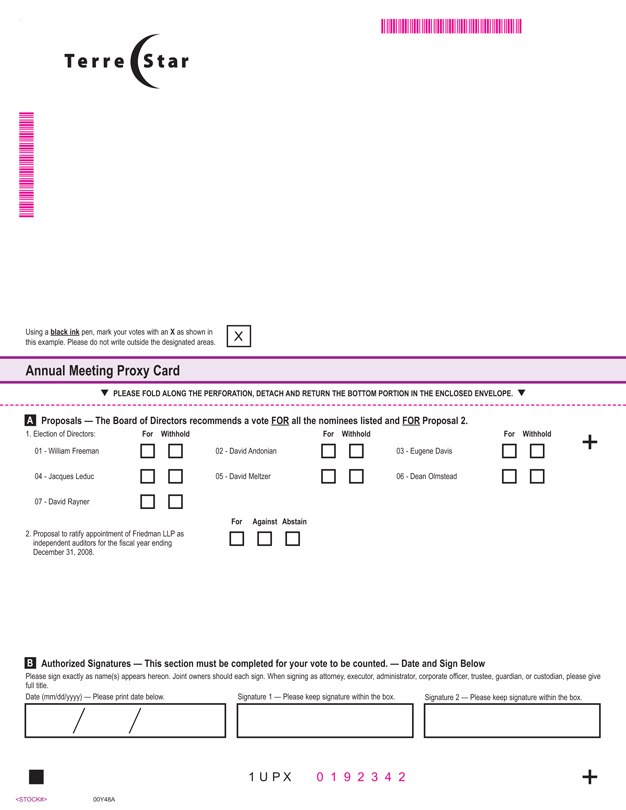

| | 1. | Election of seven directors to hold office until the next annual stockholders’ meeting or until their respective successors are duly elected or appointed; |

| | 2. | Ratification of the appointment of Friedman LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2008; and |

| | 3. | Any other matters that properly come before the meeting or any postponements or adjournments thereof. |

IMPORTANT

STOCKHOLDERS WHO DO NOT EXPECT TO ATTEND IN PERSON ARE URGED TO COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE TO ENSURE ITS ARRIVAL IN TIME FOR THE ANNUAL MEETING. PLEASE USE THE ENCLOSED POSTAGE-PAID ENVELOPE.

These items are fully described in the Proxy Statement which is part of this notice. We have not received notice of other matters that may be properly presented at the Annual Meeting.

Holders of record of TerreStar’s common stock at the close of business on August 29, 2008 will be entitled to notice of and to vote at the Meeting or any adjournments or postponements thereof. A list of such stockholders will be available at the Company’s headquarters, 12010 Sunset Hills Road, 9th Floor, Reston, Virginia 20190, for examination during normal business hours by any stockholder for any purpose germane to the meeting for a period of ten days prior to the Annual Meeting. The list will also be available at the Annual Meeting and may be inspected by any stockholder who is present.

Regardless of the number of shares of TerreStar Corporation common stock you hold, as a stockholder your vote is important and the Board of Directors of the Company strongly encourages you to exercise your right to vote. To ensure our vote is recorded promptly, please vote as soon as possible, even if you plan to attend the Annual Meeting.

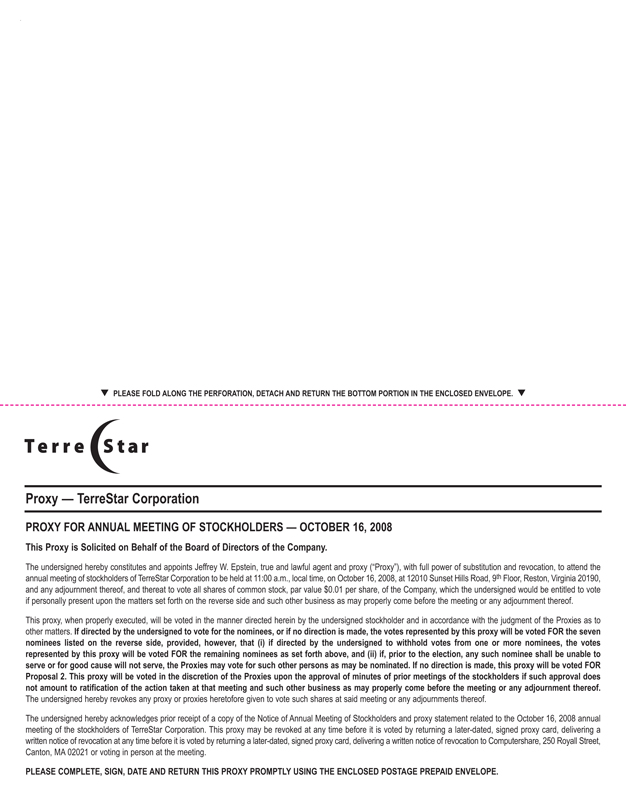

By order of the Board of Directors,

Jeffrey W. Epstein

President, General Counsel and Secretary

Reston, VA

September 10, 2008

TerreStar Corporation

12010 Sunset Hills Road, 9th Floor

Reston, VA 20190

PROXY STATEMENT FOR 2008 ANNUAL MEETING OF STOCKHOLDERS

We are providing this proxy statement and the accompanying proxy card to you in connection with the solicitation on behalf of our Board of Directors of proxies to be voted at the 2008 Annual Meeting of Stockholders (the “Annual Meeting”) of TerreStar Corporation (“TerreStar,” “we,” “us,” or the “Company”) to be held on October 16, 2008, beginning at 11:00 a.m., local time, at 12010 Sunset Hills Road, 9th Floor, Reston, Virginia 20190 and at any postponements or adjournments thereof. This proxy statement and the enclosed proxy are first being mailed to the Company’s stockholders on or about September 10, 2008.

At the close of business on August 29, 2008, the record date for determining the stockholders entitled to notice of and to vote at the meeting, there were outstanding and entitled to vote 122,436,788 shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”). Each share of common stock entitles the holder to one vote on all matters presented at the meeting.

The Common Stock is the only class of our capital stock entitled to vote at the Annual Meeting. As of the record date, there were outstanding 90,000 shares of our Series A Cumulative Convertible Preferred Stock, 318,500 shares of our Series B Cumulative Convertible Preferred Stock, 1 share of our Series C Preferred Stock, 1 share of our Series D Preferred Stock and 1,200,000 shares of our Series E Junior Participating Preferred Stock. None of these shares are entitled to vote at the Annual Meeting.

Management expects that the only matters to be presented for action at the meeting will be the election of directors and the ratification of Friedman LLP as independent auditors.

Our directors, officers and employees may solicit proxies in person or by telephone, mail, electronic mail, facsimile or telegram. We will pay the expenses of soliciting proxies, although we will not pay additional compensation to these individuals for soliciting proxies.

ABOUT THE MEETING

What is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will act upon the matters described in the accompanying notice of meeting, including the election of seven directors and the ratification of Friedman, LLP as our independent auditors. In addition, our management will respond to questions from stockholders.

Who is entitled to vote?

Only holders of record of the Company’s Common Stock at the close of business on the record date, August 29, 2008, are entitled to receive notice of and to vote at the Annual Meeting, or any postponements or adjournments of the meeting. Each holder of common stock is entitled to one vote at the Annual Meeting for each share held by such stockholder.

Who can attend the meeting?

All stockholders as of the record date, or their duly appointed proxies, may attend the Annual Meeting. Cameras, recording devices and other electronic devices will not be permitted at the Annual Meeting.

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the shares of common stock of the Company issued and outstanding on the record date and entitled to vote at the Annual Meeting will constitute a quorum. A quorum is required for business to be conducted at the meeting. As of August 29, 2008, 122,436,788 shares of Common Stock of the Company were outstanding and entitled to vote. If you submit a properly executed proxy card, even if you abstain from voting, then you will be considered for purposes of determining the presence of a quorum at the Annual Meeting. However, abstentions are not counted in the tally of votes FOR or AGAINST a proposal. A WITHHELD vote is treated the same as an abstention. Broker non-votes, which are described below, will also be counted for purposes of determining the presence of a quorum at the Annual Meeting.

How do I vote?

Mark, sign and date each proxy card you receive and return it in the prepaid envelope. Your shares will be voted as you indicate on the proxy card. If a stockholder completes, signs, dates and returns the proxy card by 7:00 p.m., Eastern Daylight Savings Time, on October 15, 2008, his, her or its shares will be voted at the Annual Meeting in accordance with his, her or its instructions. If a stockholder returns a proxy card unsigned, his, her or its vote cannot be counted. If a stockholder signs and dates a proxy card, but does not fill out the voting instructions on the proxy card, the shares represented by the proxy will be voted in accordance with the Board of Directors’ recommendations, as follows:

| | • | | FOR the election of each of the seven nominees to the Board of Directors to hold office until the next annual stockholders’ meeting or until their respective successors have been elected or appointed; and |

| | • | | FOR the ratification of the appointment of the firm of Friedman, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2008. |

In addition, if any other matters come before the Annual Meeting, Jeffrey W. Epstein, our President, General Counsel and Secretary, the named proxy, has discretionary authority to vote on those matters in accordance with his best judgment. The Board of Directors is not currently aware of any other matters that may come before the Annual Meeting.

2

Can I change my vote after I return my proxy card?

Yes. Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised at the meeting. Regardless of the way in which you submitted your original proxy, you may change it by:

| | • | | Returning a later-dated, signed proxy card; |

| | • | | Delivering a written notice of revocation to Computershare, 250 Royall Street, Canton, Massachusetts, 02021; or |

| | • | | Voting in person at the meeting. |

If your shares are held through a broker or other nominee, you will need to contact that institution if you wish to change your voting instructions.

What are the Board’s recommendations?

The Board’s recommendations are set forth after the description of each item in this proxy statement. In summary, the Board recommends a vote:

| | • | | FOR the election of the seven persons nominated to serve as directors to hold office until the next annual stockholders meeting or until their respective successors have been elected or appointed (see Proposal 1); and |

| | • | | FOR ratification of the Audit Committee’s selection of Friedman LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2008 (see Proposal 2). |

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors.

What vote is required to approve each item?

A quorum is required in order to transact any business at the meeting Annual Meeting.

| | • | | Election of Directors. The affirmative vote of a plurality of the shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote is required for the election of the nominees as directors. That is, the nominees receiving the greatest number of votes will be elected. A “WITHHELD” vote will not affect the election of the nominees as directors. |

| | • | | Other Proposal. The affirmative vote of the holders of a plurality of the shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote is required to ratify Friedman LLP as our independent auditors. |

| | • | | Effect of Withheld Votes and Abstentions. In the election of directors, you may withhold your vote. Withheld votes will have no effect on the outcome of the election. You may vote to “abstain” on the other proposal. If you vote to “abstain” on a proposal, your shares will be counted as present at the Annual Meeting for purposes of that proposal and will have the same effect as a vote against that proposal. |

| | • | | Broker-dealers who hold their customer’s shares in street name may, under the applicable rules of the exchange and other self-regulatory organizations of which the broker-dealers are members, sign and submit proxies for such shares and may vote such shares on routine matters, which under such rules typically include the election of directors and ratification of auditors. Broker-dealers may not vote such shares on other matters without specific instructions from the customers who beneficially own such shares. Proxies signed and submitted by broker-dealers which have not been voted on matters described in the previous sentence are referred to as broker non-votes. Broker non-votes on a particular matter are not deemed to be shares present and entitled to vote on such matters. Broker non-votes, if any, will not be counted as votes cast on any proposal. |

3

Who will count the vote?

The Secretary of the Company (or his designee, if applicable) will count the votes and act as the inspectors of election at the Annual Meeting.

What shares are included on my proxy card(s)?

The shares on your proxy card(s) represent ALL of your shares of common stock that the Company’s stock transfer records indicate that you hold. If you hold shares through a broker or other nominee, you will receive a separate voting instruction card for those shares.

What does it mean if I receive more than one proxy card?

If your shares are registered under different names or are in more than one account, you will receive more than one proxy card. To ensure that all your shares are voted, sign and return all proxy cards. We encourage you to have all accounts registered in the same name and address (whenever possible). You can accomplish this by contacting our transfer agent, Computershare, at (781) 575-4593.

How will voting on any other business be conducted?

We currently do not know of any business to be considered at the 2008 annual meeting other than the proposals described in this proxy statement. If any other business is properly presented at the Annual Meeting, your proxy gives authority to Jeffrey W. Epstein, our President, General Counsel and Secretary to vote on such matters at his discretion.

How much did this proxy solicitation cost?

We will bear the entire cost of solicitation, including the preparation, assembly, printing and mailing, of this proxy statement, the proxy and any additional solicitation materials furnished to the stockholders. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. In addition, we may reimburse such persons for their costs in forwarding the solicitation materials to such beneficial owners. The original solicitation of proxies by mail may be supplemented by a solicitation by telephone or other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services. Except as described above, we do not presently intend to solicit proxies other than by mail.

How can I submit a stockholder proposal for the 2009 annual meeting of stockholders?

To be considered for inclusion in our proxy statement and form of proxy for the 2009 annual meeting stockholder proposals must be received at our offices by May 14, 2009 (the date that is 120 days prior to the one year anniversary of the mailing of this proxy statement). Proposals must meet all of the requirements of the SEC and our Amended and Restated Bylaws to be eligible for inclusion in our 2009 proxy materials, and must be submitted in writing delivered or mailed to the Secretary, TerreStar Corporation, 12010 Sunset Hills Road, 9th Floor, Reston, Virginia 20190. Nothing in this paragraph shall be deemed to require the Company to include in its proxy statement and proxy relating to the 2009 annual meeting of stockholders any stockholder proposal which may be omitted from the Company’s proxy materials pursuant to applicable regulations of the SEC in effect at the time such proposal is received.

4

ELECTION OF DIRECTORS

(Proposal 1)

TerreStar’s Amended and Restated Bylaws allow for the Board of Directors to fix the number of directors, and TerreStar’s Board of Directors currently consists of seven members. All of the current members of the Board of Directors have been nominated for election to the Board of Directors to serve until the next annual meeting of stockholders and until their respective successors are elected and qualified or until their earlier resignation or removal.

Approval of the nominees requires the affirmative vote of a plurality of the shares of common stock present in person or represented by proxy at the annual meeting and entitled to vote on the election of the nominees. It is intended that the persons named in the proxy will, unless otherwise instructed, vote for the election of the seven nominees listed below. If for any reason any nominee should not be available for election or able to serve as a director, the persons named in the proxy intend to vote for the election of such substitute nominee for director as the Board of Directors may designate. It is not anticipated that any of the nominees will be unable or unwilling to serve as a director.

The Board of Directors recommends that stockholders vote “FOR” the election of the seven persons nominated to serve as directors.

The following table sets forth, for each nominee for election as a director, his name, title, age and the year in which he first became a director of the Company. The nominees have furnished the information set forth below and elsewhere in this proxy statement concerning them and their security holdings to TerreStar.

| | | | | | |

Name | | Title | | Age | | Began Service |

William Freeman | | Chairman of the Board | | 56 | | 2007 |

David Andonian | | Director | | 51 | | 2006 |

Eugene I. Davis | | Director | | 53 | | 2008 |

Jacques Leduc | | Director | | 45 | | 2006 |

David Meltzer | | Director | | 48 | | 2006 |

Dean Olmstead | | Director | | 53 | | 2008 |

David J. Rayner | | Director | | 51 | | 2008 |

William M. Freeman. Mr. Freeman has served as Chairman of the Board since March 2007 and has served on the Board of Directors since February 2007. Mr. Freeman is currently Chairman of the Board of Arbinet-theexchange, Inc. and has served in that capacity since November 2007. He also served as the President and CEO from November 2007 until September 2008. From May 2004 to February 2005, Mr. Freeman was the Chief Executive Officer of Leap Wireless International, Inc. From January 1994 to January 2004, Mr. Freeman was a senior executive, most recently President—Public Communications Group, at Verizon. Mr. Freeman also serves on the board of directors of the CIT Group, Inc. Mr. Freeman holds a B.A. in Economics from Drew University and an MBA in Finance and Management from Rutgers University. In addition, Mr. Freeman also participated in advanced management programs at Harvard, the Brookings Institute and Rutgers.

David Andonian. Mr. Andonian has served on our Board of Directors since May 2006. Currently, Mr. Andonian is the Founder and managing Partner at Dace Ventures, where he has served since August 2006. Prior to August 2006, Mr. Andonian served as the Chairman of Affinnova, Inc., a marketing services company. From May 2003 to December 2004, Mr. Andonian served as Executive Chairman of the board of directors, and from January 2004 to January 2006, Mr. Andonian served as the Chief Executive Officer of Affinnova, Inc. From December 2002 to April 2003, Mr. Andonian served as an Executive in Residence at Flagship Ventures. From July 2001 to September 2002, Mr. Andonian served as President and Chief Operating Officer at CMGI, an internet marketing and infrastructure provider. At CMGI, he managed domestic and international operations. Prior to joining CMGI, Mr. Andonian held several executive level positions from

5

January, 1996 to November, 1997 with PictureTel Corporation including General Manager of its Personal Systems Division and Vice President of Worldwide Marketing. He began his career in sales at IBM where he spent over fifteen years in various sales, marketing and general management positions including VP of Worldwide Marketing and Brand Management for IBM’s PC Company. Mr. Andonian holds a B.A in Business Management from the Isenberg School of Management at the University of Massachusetts.

Eugene I. Davis.Mr. Davis has served on our Board of Directors since February 2008. Mr. Davis has served as the Chairman and Chief Executive Officer of PIRINATE Consulting Group, L.L.C., a consulting firm specializing in turn-around management, mergers and acquisitions and strategic planning advisory services, since 1999. He served as Chief Operating Officer of Total-Tel USA Communications, Inc., an integrated telecommunications provider, from 1998 to 1999. Mr. Davis served in various capacities including as director, Executive Vice President, President and Vice Chairman of Emerson Radio Corp., a distributor of consumer electronics products, from 1990 to 1997. He served in various capacities including as a director, Chief Executive Officer and Vice Chairman of Sports Supply Group, Inc., a distributor of sporting goods and athletic equipment, from 1996 to 1997. Prior to such time, Mr. Davis was an attorney in private practice. Mr. Davis presently serves as Chairman of the Board of Atlas Air Worldwide Holdings, Inc., Atari, Inc. and Foamex International, Inc. Mr. Davis also serves as a Director of American Commercial Lines, Inc., Delta Air Lines, Inc., Knology, Inc., Medicor Ltd., Rural/Metro Corporation, Silicon Graphics, Inc., Footstar Inc. and Pliant Corporation. Mr. Davis received his B.A. in International Politics from Columbia College, Columbia University, a Masters in International Affairs, International Law and Organization from Columbia University’s School of International Affairs, and a J.D. from Columbia University’s School of Law.

Jacques Leduc. Mr. Leduc has served on our Board of Directors since April 2006. He is a co-founder and managing partner of Trio Capital Inc., a private equity and venture capital firm that he started in January 2006, which invests primarily in telecommunications and new media. He served as Chief Financial Officer of Microcell Telecommunications Inc., a nationwide wireless operator in Canada from February 2001 through November 2004, and as Vice President Finance and Director Corporate Planning from January 1995 to February 2001. Mr. Leduc holds a Masters degree in Business Administration from Ecole des Hautes Etudes Commercials de Montreal and a Bachelors degree in Business Administration from the Universite du Quebec a Montreal.

David Meltzer. Mr. Meltzer has served on our Board of Directors since February 2006. Mr. Meltzer has served as Senior Vice President for International Services for the American Red Cross since July 2005, with overall responsibility for international disaster response activities, international development programs and various international policy matters. From January 2002 to February 2005, Mr. Meltzer served as the General Counsel and Executive Vice President for Regulatory Affairs for Intelsat Global Service Corporation, a wholly-owned subsidiary of Intelsat, Ltd. From July 2001 to September 2001, he served as Vice President and General Counsel of Intelsat Global Services Corporation. From December 1999 to September 2001 he served as Vice President and General Counsel for Intelsat, Ltd. From 1989 to December 1999, Mr. Meltzer served in various other positions with Intelsat, including as Senior Director in the Corporate Restructuring Division. Mr. Meltzer holds a B.A. in International Relations from the University of Pennsylvania and a J.D. from George Washington University National Law Center.

Dean Olmstead. Mr. Olmstead has served on our Board of Directors since February 2008. Mr. Olmstead is the President of Satellite Services for EchoStar Corporation. Before joining EchoStar in January 2008, Mr. Olmstead served as an advisor to Loral Space & Communications on strategic and growth opportunities for its satellite service businesses and served on its board of directors. Additionally, he was President of Arrowhead Global Solutions, President and CEO of SES Americom and held leadership positions with DirecTV Japan, NASA and the U.S. State Department. Mr. Olmstead holds a B.S. in Economics-Mathematics from Western Washington University, an M.A. from Stanford University’s Terman School of Engineering, and also completed Ph.D. studies in Economics at The American University.

David J. Rayner. Mr. Rayner has served on our Board of Directors since February 2008. Mr. Rayner is Chief Administrative Officer of EchoStar Corporation. Prior to that, Mr. Rayner served as Executive Vice

6

President of Installation Services and had previously held the position of Chief Financial Officer of EchoStar Communications Corporation. Before joining EchoStar in December 2004, Mr. Rayner served as Senior Vice President and Chief Financial Officer of Time Warner Telecom in Denver. From February 1997 to May 1998, Rayner served as Vice President of Finance for Time Warner Telecom, and he was Controller for that company from May 1994 to February 1997. From 1982 to 1994, Rayner also held various financial and operational management positions with Time Warner Cable. He received his bachelor’s degree in Accountancy from Northern Illinois University.

Agreements with EchoStar Corporation and Affiliates of Harbinger Capital Partners

On February 5, 2008, we entered into a series of agreements with EchoStar Corporation and certain funds affiliated with Harbinger Capital Partners (“Harbinger”) relating to, among other things, (i) the sale to EchoStar of $50 million 15.0% Senior Secured PIK Notes due 2014, (ii) the sale to EchoStar and Harbinger of $100 million of 6.5% Senior Exchangeable PIK Notes due 2014, exchangeable for our Common Stock at a conversion price of $5.57 per share, and (iii) a commitment by EchoStar and Harbinger to lend us an aggregate of $100 million. In connection with these agreements, we agreed to expand our Board from five to eight members and gave EchoStar and Harbinger the right, depending on their continued stock holdings, to each nominate up to two members of the Board. In February 2008 our Board elected Mr. Davis as a nominee of Harbinger, classified Mr. Freeman, who was an existing Board member, as a Harbinger appointee and elected Messrs. Olmstead and Rayner as nominees of EchoStar. The size of the Board of Directors was reduced to seven members, with one vacancy, upon the resignation of Mr. Brumley in April 2008.

CORPORATE GOVERNANCE

On an annual basis each director and executive officer is obligated to complete a Directors and Officers Questionnaire which requires disclosure of any transactions with the Company in which the director or executive officer, or any member of his or her immediate family, has a direct or indirect material interest. The Board is charged with resolving any conflicts of interest involving the Chief Executive Officer, the Chief Financial Officer or any executive officer of the Company.

Communications with Directors

The Board of Directors maintains a process for stockholders to communicate with the Board of Directors or with individual directors. Stockholders who wish to communicate with the Board of Directors or with individual directors should direct written correspondence to our General Counsel at our principal executive offices located at 12010 Sunset Hills Road, 9th Floor, Reston, Virginia 20190. Any such communication must contain (i) a representation that the stockholder is a holder of record of stock of the Company, (ii) the name and address, as they appear on the Company’s books, of the stockholder sending such communication, and (iii) the class and number of shares of TerreStar that are beneficially owned by such stockholder. The General Counsel will forward such communications to the Board of Directors or the specified individual director to whom the communication is directed unless such communication is unduly hostile, threatening, illegal or similarly inappropriate, in which case the General Counsel has the authority to discard the communication or to take appropriate legal action regarding such communication.

MEETINGS AND COMMITTEES OF THE BOARD

Board Committees and Meetings

The Board of Directors conducts its business through meetings and through its committees. The Board of Directors consisted of six directors at the beginning of 2007. David Grain resigned from the Board in January 2007, William Freeman was elected to the Board in January 2007 and Raymond Steele resigned from the Board in February 2007.

7

Each director is expected to devote sufficient time, energy and attention to ensure diligent performance of his or her duties and to attend all Board, applicable committee and stockholders’ meetings. The Board of Directors met 12 times during 2007. During 2007, each director attended or participated in at least 75% of the aggregate of the meetings held by our Board of Directors and each committee of the Board of Directors on which he served during the period for which he served. Robert Brumley, our former President and Chief Executive Officer, was a member of our Board of Directors during 2007 and was also an employee of TerreStar and TerreStar Networks Inc., our majority owned subsidiary. Mr. Brumley resigned from our Board of Directors in April 2008.

In February 2008 in connection with entering into certain agreements with affiliates of Harbinger Capital Partners and EchoStar Corporation, we agreed to expand the size of the Board of Directors from five to eight members through the additions of Messrs. Davis, Olmstead and Rayner. The size of the Board of Directors was reduced to seven members, with one vacancy, upon the resignation of Mr. Brumley in April 2008. For more information regarding these transactions please see our Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on February 21, 2008.

The Board has three standing committees to facilitate and assist the Board in the execution of its responsibilities. The standing committees of the Board of Directors are: the Audit Committee, the Compensation and Stock Option Committee and the Nominating Committee. In accordance with best practice, all the committees are comprised solely of non-employee, independent directors, as defined by the Marketplace Rules of The Nasdaq Stock Market, Inc. The charter of each committee is available free of charge in print to any stockholder who requests it. The table below shows current membership of each of the standing Board committees:

| | | | |

Audit Committee | | Compensation and Stock Option Committee | | Nominating Committee |

Jacques Leduc* | | David Meltzer* | | David Andonian* |

David Andonian | | David Andonian | | Jacques Leduc |

Eugene I. Davis | | William Freeman | | David Meltzer |

David J. Rayner | | Dean Olmstead | | William Freeman |

| * | Denotes Committee Chairman |

Audit Committee

In 2007, the Audit Committee consisted of Messrs. Leduc, Andonian and Steele until February 2007 and in February 2007 the committee was restructured to consist of Messrs. Leduc, Andonian and Freeman. In April 2008 it was restructured to its present composition. Each member of the Audit Committee is “independent” as defined under the applicable Marketplace Rules of The Nasdaq Stock Market, Inc. The Audit Committee is responsible for reviewing our internal auditing procedures and accounting controls and will consider the selection and independence of our outside auditors. During 2007, the Audit Committee met five times.

Our Board of Directors has determined that Jacques Leduc is the “Audit Committee financial expert” as such term is defined under Item 407 of Regulation S-K and a “financially sophisticated audit committee member” under Rule 4350(d)(A) of the Marketplace Rules of The Nasdaq Stock Market Inc. Stockholders should understand that this designation is a disclosure requirement of the SEC related to Mr. Leduc’s experience and understanding with respect to certain accounting and auditing matters. The designation does not impose on Mr. Leduc any duties, obligations or liability that are greater than are generally imposed on him as a member of the Audit Committee and Board of Directors, and his designation as the Audit Committee financial expert pursuant to this SEC requirement does not affect the duties, obligations or liability of any other member of the Audit Committee or Board of Directors. In making this determination, the Board of Directors considered Mr. Leduc’s educational background, and business experience, which is described above. Our Audit Committee charter is available on our website,www.terrestarcorp.com.

8

Compensation and Stock Option Committee

The Compensation and Stock Option Committee consisted of Mr. Meltzer, Mr. Andonian and Mr. Grain until January 2007 and in February 2007 the committee was restructured to consist of Messrs. Meltzer, Andonian and Freeman. In April 2008 Mr. Olmstead was added to the committee. The Compensation and Stock Option Committee is responsible for reviewing certain of TerreStar’s compensation programs, making recommendations to the Board of Directors with respect to compensation, and administering our stock option plan. During 2007, the Compensation and Stock Option Committee met seven times. Our Compensation and Stock Option Committee charter is available on our website,www.terrestarcorp.com.

Nominating Committee

The Nominating Committee consisted of Messrs. Andonian, Grain, Leduc and Meltzer until January 2007 and in February 2007 the committee was restructured to its present composition. Each member of the Nominating Committee is “independent” as defined under the applicable Marketplace Rules of The Nasdaq Stock Market, Inc. The Nominating Committee is responsible for selecting candidates to stand for election as directors. During 2007, the Nominating Committee met one time. Our Nominating Committee charter is available on our website,www.terrestarcorp.com.

Director Nominations

The Nominating Committee is responsible for selecting candidates to stand for election as directors. The Nominating Committee actively seeks individuals who meet the qualifications established by the Nominating Committee to become members of our Board of Directors, including evaluating persons suggested by stockholders or others, and conducting appropriate inquiries into the backgrounds and qualifications of possible nominees. The Nominating Committee selects those nominees whose attributes it believes would be most beneficial to TerreStar. This assessment includes such issues as experience, integrity, competence, diversity, skills, and dedication in the context of the needs of the Board of Directors. Any stockholder that wishes to propose a candidate should send such candidate to the attention of the Nominating Committee at the address given in the section entitled “Communications with Directors” above.

In February 2008 in connection with entering into certain agreements with affiliates of Harbinger Capital Partners and EchoStar Corporation, we agreed to expand the size of the Board of Directors from five to eight members through the additions of Messrs. Davis, Olmstead and Rayner. The size of the Board of Directors was reduced to seven members, with one vacancy, upon the resignation of Mr. Brumley in April 2008. For more information regarding these transactions please see our Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on February 21, 2008.

Code of Ethics

We have adopted a code of ethics that applies to our principal executive officer, principal financial officer and principal accounting officer. This code of ethics has been approved by our Board of Directors, and has been designed to deter wrongdoing among directors, officers and employees and promote honest and ethical conduct, full, fair, accurate and timely disclosure, compliance with applicable laws, rules and regulations, prompt internal reporting of code violations, and accountability for adherence to our code. Our code of ethics is available on our website, www.terrestar.com.

Independent Director Meetings

The independent members of our Board of Directors meet in conjunction with each regularly scheduled meeting of our Board of Directors and other sessions may be called at the request of the independent directors.

9

Attendance at Annual Meetings

TerreStar does not have a policy regarding the attendance of Board members at annual meetings. No current director attended the 2007 annual meeting of stockholders in person.

Compensation Committee Interlocks and Insider Participation

All members of the Compensation Committee are independent directors, and none of them are past or present employees or officers of the Company or any of our subsidiaries. No member of our Compensation Committee has any relationship with us requiring disclosure under Item 404 of Regulation S-K under the Exchange Act. None of our executive officers has served on a board or compensation committee (or other committee serving an equivalent function) of any other entity, one of whose executive officers serve on our board or our compensation committee.

10

DIRECTOR COMPENSATION

The following chart shows the cash amounts and the value of other compensation paid to each non-employee member of the Board of Directors for their service in 2007. We did not grant non-equity incentive plan awards, restricted stock or any compensation other than the payment of fees and the grant of stock options as shown below.

| | | | | | |

Name (a) | | Fees

Earned

or Paid

in Cash

($)

(b) | | Option

Awards

($)

(d) | | Total

($)

(h) |

David Andonian | | 55,000 | | — | | 55,000 |

William Freeman(1) | | 80,000 | | 181,204 | | 261,204 |

David Grain(2) | | — | | — | | — |

Jacques Leduc | | 50,000 | | — | | 50,000 |

David Meltzer | | 45,000 | | — | | 45,000 |

Raymond Steele(3) | | 114,500 | | — | | 114,500 |

| (1) | Mr. Freeman joined the Board of Directors in January 2007. |

| (2) | Mr. Grain resigned from the Board of Directors in January 2007. |

| (3) | Mr. Steele resigned from the Board of Directors in February 2007. |

In February 2006, the Compensation and Stock Option Committee engaged a compensation consultant to review our Board of Directors compensation. Based on that review, effective January 1, 2006, each non-employee member of the Board of Directors is entitled to an annual retainer of $30,000. In addition, each Chairperson of the Compensation and Stock Option Committee and the Nominating Committee is entitled to an additional retainer of $10,000 per year, and each other member of the Compensation and Stock Option Committee and the Nominating Committee is entitled to an additional retainer of $5,000 per year. Each Chairperson of the Audit Committee is entitled to an additional retainer of $15,000 per year, and each other member of the Audit Committee is entitled to an additional retainer of $10,000 per year. In addition, non-employee members of the Board receive meeting fees of $1,500 for each Board meeting in excess of six per year. Each member of the Compensation and Stock Option Committee or the Nominating Committee receives meeting fees of $2,000 for each committee meeting in excess of three per year, and each member of the Audit Committee receives meeting fees of $2,500 for each meeting in excess of four per year.

Members of the Board of Directors receive an initial grant of 20,000 restricted shares upon joining the Board of Directors and annual grants of 15,000 stock options upon re-election. In 2007, director annual grants were deferred until 2008 and therefore no stock option grants were awarded to directors in 2007.

In May 2007, our Compensation Committee approved a new compensation program for the Chairman of the Board. The Chairman receives an annual retainer of $60,000 and meeting fees of $3,000 for each Board meeting in excess of six per year. No other Board compensation payments changed in 2007.

Raymond Steele retired from the TerreStar Board of Directors in February 2007. In connection with his retirement, the Board of Directors authorized a cash payment to Mr. Steele as if he continued to serve as Chairman of the Board and on the Audit and Compensation Committees through September 2007. In addition, the Board authorized the grant of his two remaining quarterly option grants under the Chairman compensation plan.

11

EXECUTIVE OFFICERS OF TERRESTAR

The following sets forth the biographical information for each of TerreStar’s executive officers as of August 29, 2008.

On April 18, 2008, TerreStar announced the resignations of Robert Brumley, President and CEO, Michael Reedy, Chief Operating Officer, and Doug Sobieski, Chief Marketing Officer. Each of these former executive officers were among our most highly compensated executive officers in 2007 and information regarding these former executive officers is included in the Section titled “Executive Compensation” below.

Jeffrey W. Epstein. Mr. Epstein has served as our President and principal executive officer since April 2008 and as our Senior Vice President, General Counsel and Secretary since September 2006. In addition to his role as President, Mr. Epstein continues to serve as our General Counsel and Secretary. Mr. Epstein served as the General Counsel and Secretary since October 2006 and the Associate General Counsel and Secretary from July 2006 to December 2006 of TerreStar Networks Inc. From October 2003 to July 2006, Mr. Epstein served as Director, Assistant General Counsel, Transactions, for Capital One Financial Corporation. From March 2000 to September 2003, he was an associate at the law firm Piper Rudnick LLP. Mr. Epstein earned a B.A. in Business Administration from the University of Florida, a J.D. from St. Thomas University School of Law and an L.L.M. in Securities and Financial Regulation from Georgetown University Law Center.

Dennis W. Matheson. Mr. Matheson has served as our Chief Technology Officer, Senior Vice President—Satellite Operations since January 2006. Mr. Matheson also has served as a Senior Vice President of TerreStar Global since February 2006. From August 1993 to January 2006, Mr. Matheson served as Chief Technical Officer of Motient Corporation. Mr. Matheson was an executive officer of Motient Corporation at the time it filed for Chapter 11 protection. Mr. Matheson holds a B.S. in Electrical Engineering from Clemson University and an M.S. in Electrical Engineering from the University of Tennessee.

Neil L. Hazard. Mr. Hazard has served as our Executive Vice President, Chief Financial Officer, Treasurer and principal financial officer since September 2006. Mr. Hazard also has served as Chief Financial Officer of TerreStar Global since October 2006 and has served as Chief Financial Officer and Treasurer of TerreStar Networks Inc. since July 2006. In November 2006, TerreStar named Mr. Hazard as its interim Chief Operating Officer. Mr. Hazard retained his titles of Executive Vice President, Chief Financial Officer, Treasurer and principal financial officer of TerreStar. From July 2001 to December 2005, Mr. Hazard served as Chief Operating Officer at Primus Telecommunications Group, where he also served as Chief Financial Officer from February 1996 to October 2004. Mr. Hazard received a B.S. in Engineering from Johns Hopkins University, an M.S. in Computer Systems Management from the University of Maryland and an M.B.A. from the Harvard Business School. He is a Certified Public Accountant and a Certified Management Accountant.

12

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis provides an overview of the combined TerreStar Corporation, or TerreStar, and TerreStar Networks Inc., or Networks, compensation philosophy. For purposes of the following section, except where the context otherwise requires or unless otherwise indicated, the terms “we,” “our” and “us” refer to TerreStar Corporation and its subsidiaries, including Networks.

The following discussion and analysis of compensation arrangements of our named executive officers should be read together with the compensation tables and related disclosures set forth above. This discussion contains forward looking statements that are based on our current plans and expectations regarding future compensation programs. Actual compensation programs that we adopt may differ materially from currently planned programs as summarized in this discussion.

Overview

Our primary business is our ownership of TerreStar Networks and, as of April 22, 2008, we owned approximately 88% of Networks’ outstanding common stock. Over the past year, we experienced a significant change in our management structure and the methodology of our compensation system, which we implemented in May 2007. Our Compensation Committee approved a new compensation structure and implemented this plan during the second quarter of 2007 for TerreStar Networks employees and certain executive officers of TerreStar, who also serve as officers of TerreStar Networks.

In April 2008, we announced a corporate restructuring that led to the departure of three of our executive officers who were among the five most highly compensated executive officers in 2007 as well as one additional officer. In addition, the restructuring led to a headcount reduction of 79 employees, reducing our overall headcount from 178 employees to 99 employees as of April 22, 2008. This restructuring will have a significant impact on our compensation expense in 2008. We expect this reduction to account for savings of approximately 45 percent in base salary expense.

Compensation Committee Members

The Compensation and Stock Option Committee, or the Compensation Committee, is responsible for establishing basic principles related to our compensation programs and for providing oversight of compensation programs and policies for senior executive officers. The Compensation Committee is currently comprised of David Meltzer, David Andonian, Dean Olmstead and William Freeman, all of whom are independent, non-employee directors. The Compensation Committee maintains a practice of meeting prior to regularly scheduled meetings of the Board of Directors and generally holds executive sessions without management present. Mr. Meltzer serves as the Chairman of the Compensation Committee and sets the meetings and agendas. Mr. Olmstead joined the Compensation Committee in April 18, 2008 and therefore was not involved in the compensation decisions discussed in this report.

On May 23, 2007, the Board of Directors approved a Compensation Committee Charter which delegated to the Compensation Committee the responsibilities of reviewing and approving compensation granted to our executive officers and directors. The Compensation Committee has the authority to retain its own compensation consultant and to obtain advice and assistance from internal or external legal, accounting or other advisers as it sees fit. For example, in 2006, the Compensation Committee engaged Strategic Compensation Research Associates, or SCRA, an independent, third-party compensation consultant, to review and assess our compensation practices for our executives and directors. Specifically, SCRA provided recommendations to the Compensation Committee in 2006 with respect to the adoption of the Company’s 2006 Equity Incentive Plan and compensation for the Board of Directors, including the Chairman of the Board.

13

In 2006, the management of TerreStar Networks engaged Mercer as its independent, third-party compensation consultant, to review and provide compensation benchmark analysis and studies to TerreStar Networks’ management in connection with the development of a new compensation structure. Based on the results of Mercer’s benchmark of similarly situated companies, it was determined that the overall compensation of Networks’ employees, particularly at the senior management level, was below market. As discussed above, the compensation structure for TerreStar Networks executives and certain of our executives who also serve as executive officers of both TerreStar Networks and TerreStar was revised to be consistent with our overall compensation philosophy. This new compensation structure was implemented in the second quarter of 2007.

At the request of the Compensation Committee, our Chief Executive Officer, Chief Financial Officer and General Counsel/Secretary regularly participate in Compensation Committee meetings with respect to compensation matters. In addition, the Chief Executive Officer was actively involved in discussions relating to setting the compensation levels for his direct reports, including each of the other executive officers named in the Summary Compensation table below (together, the “NEOs”), as well as assisting in the formation and design of our compensation programs and policies. The Chief Executive Officer was present in Compensation Committee meetings where compensation was determined for other executive officers but he was not present when the Compensation Committee considered and set his compensation. The Compensation Committee reviews and approves compensation components for the Chief Executive Officer and other executive officers including the following components:

| | • | | Cash and equity bonuses, including target amounts; |

| | • | | Other equity or cash compensation; |

| | • | | Employment agreements, severance arrangements, and change in control agreements/provisions, as applicable; and |

| | • | | Any other material benefits, compensation or arrangements. |

During 2007, the Compensation Committee met seven times and acted on the following matters:

| | • | | Employee bonuses for 2007; |

| | • | | Negotiate and enter into employment agreements with executive officers; |

| | • | | Approval of stock option exchange with employees (including executive officers) of TerreStar Networks; and |

| | • | | Approval of compensation for the Chairman of the Board. |

In addition to the above activities, as discussed herein, the Compensation Committee finalized and approved the new compensation structure for employees of Networks and certain executive officers of TerreStar, which was implemented during the second quarter of 2007.

Compensation Philosophy

We design our compensation programs to enable us to attract, retain and motivate executive officers to support and achieve our short-term and long-term strategic goals, and to complement our efforts to develop our integrated next-generation communications system. To the extent possible, the Compensation Committee also believes it is important to seek to foster a stockholder perspective in management by awarding stock options and other equity based awards to align the interests of our executives with those of our stockholders.

The Compensation Committee determines executive officer compensation with respect to each element set forth below based upon an independently conducted analysis of publicly-available compensation data and

14

compensation survey data of comparable companies. The Chief Executive Officer delivers a performance evaluation for each of the other executive officers to the members of the Compensation Committee and makes recommendations on compensation arrangements, including adjustments in base salary, changes in target bonus awards and/or metrics for earning cash incentives and equity grants. Such recommendations are based on competitive market data and a variety of other factors, including individual performance, market competitive pressures, business conditions, the vesting and value of current equity grants, our overall performance and the potential financial impact of implementing the recommendations. The Compensation Committee considers, but is not bound to and does not always accept, the recommendations of the Chief Executive Officer with respect to executive officer compensation. In addition, the Compensation Committee regularly seeks input from independent compensation consultants prior to making any final determinations.

To determine the compensation of our Chief Executive Officer and other executive officers, the Compensation Committee, through consultation with the remaining independent members of the Board of Directors, assesses each officer’s performance and considers competitive market data and other factors described herein.

We believe it is in our stockholders’ best interests to ensure that our executive compensation is competitive with those of other companies of similar size and complexity. The Compensation Committee seeks independent professional assistance and advice from outside consulting firms from time to time in the development and utilization of the competitive market data and the establishment of its executive compensation programs.

Based upon the compensation survey data and publicly-available information, we produced an overall range of competitive market data for the compensation of each of our executive officers.

Elements of Compensation

Base Salary

We target base salary at the median level of the compensation survey data and publicly-available information mentioned above in order to retain and reward executive talent. However, to better support our objective to retain and properly reward executive officers, we also consider other factors, such as duties and responsibilities not typically found in similar positions with comparable companies, prior experience, job performance, tenure, any distinctive value to the organization, and general market conditions. For 2007, each NEO received a cost-of-living adjustment of 4% to their base salary.

In January 2007 and January 2008, the Compensation Committee set each NEO’s base salary as follows:

| | | | |

Name | | 2007

Base Salary($) | | 2008

Base Salary($) |

Robert Brumley | | 550,000 | | 572,000 |

Neil Hazard | | 400,000 | | 416,000 |

Dennis Matheson | | 350,000 | | 364,000 |

Michael Reedy | | 350,000 | | 364,000 |

Doug Sobieski | | 350,000 | | 364,000 |

Cash Incentives

We structure a cash incentive plan, our Bonus Plan, to align the financial incentives of our employees and executive officers with our short-term and long-term operating goals and interests of our stockholders, and to reward exceptional performance. Some of our executive officers currently have employment agreements with Networks and have cash bonus target amounts set forth in such contracts. Each fiscal year, the Compensation Committee approves the structure, performance metrics as well as each metric’s relative weighting under our Bonus Plan. For 2007, the Compensation Committee considered the various goals and milestones established and achieved by Networks and its executive officers and decided to award the bonus targets for achieving these goals.

15

In 2007, the Chief Executive Officer’s annual target bonus was approximately 85% of his annual base salary, or 467,500, and the annual target bonus for our Chief Financial Officer was 60% of his annual base salary, or $240,000. The fiscal 2007 bonuses for our Chief Executive Officer and Chief Financial Officer were based on targets established in their employment agreements. Similar calculations were used for other executive and employee bonuses and were paid out at the end of 2007. We entered into new employment agreements with each of our executive officers in January 2008 that set target bonus amounts for 2008. The cash incentive bonuses are contingent upon the executive and TerreStar achieving specific deliverables or goals that will be agreed to during 2008 by the applicable executive and the Compensation Committee. There will also be an opportunity for each executive to earn more than the target bonus based upon the officer’s success in meeting additional identified performance targets during 2008.

For 2007, the Compensation Committee set each NEO’s target cash bonus and actual cash bonus paid (2007 bonus amounts earned were paid in 2008 for Messrs. Brumley and Hazard) as follows:

| | | | | | |

Name | | 2007

Target Bonus

(% of Base) | | | 2007

Cash Bonus

Earned ($) | |

Robert Brumley | | 85 | % | | 504,083 | (1) |

Neil Hazard | | 60 | % | | 257,667 | (2) |

Dennis Matheson | | 60 | % | | 168,000 | |

Michael Reedy | | 60 | % | | 168,000 | |

Doug Sobieski | | 60 | % | | 168,000 | |

| (1) | Includes $83,333 cash bonus paid to Mr. Brumley in 2007 for services to TerreStar Corporation in 2006 and 2007. |

| (2) | Includes $41,666 cash bonus paid to Mr. Hazard in 2007 for services to TerreStar Corporation in 2006 and 2007. |

Equity Incentives

We provide long-term incentive compensation through the award of stock options under our 2006 Equity Incentive Plan. In connection with the new compensation structure, on May 1, 2007, the Compensation Committee and Board of Directors approved the issuance of approximately 3.8 million non-qualified options to purchase TerreStar common stock to TerreStar Networks employees and to executive officers of TerreStar Networks who also serve as officers of TerreStar. One-third of these options vest each year over three years starting from January 1, 2008 and expiring on January 1, 2017.

In addition, the Board of Directors approved a modification to the TerreStar Corporation Option plan and on May 23, 2007, we cancelled approximately 2.5 million fully vested non-qualified options to purchase Networks common stock in exchange for the issuance of approximately 5.3 million fully vested non-qualified options to purchase TerreStar Corporation common stock to Networks employees and to executive officers of Networks who also serve as officers of TerreStar. These options vested on May 23, 2007 and fifty percent of the options became exercisable on January 1, 2008 and the remaining fifty percent become exercisable on January 1, 2009.

We can also, but have not except to our Board of Directors, award restricted stock and other equity incentives under our 2006 Equity Incentive Plan. These awards generally vest over a number of years or upon the occurrence of certain strategic transactions. Due to the various strategic transactions that we have undertaken over the last several years, many of these shares of restricted stock and stock options have already vested for employees who had received these awards prior to the occurrence of the transactions.

The Compensation Committee regularly reviews our long-term incentive compensation practices. Potential changes include adjusting the mix of equity awards granted, adjusting the vesting schedule of the equity awards, and using other forms of equity and/or non-equity long term incentive compensation with vesting based upon the

16

achievement of performance metrics. Consistent with our philosophy of paying for performance, no executive is entitled to an automatic equity grant. In determining the proper amount and mixture of equity awards granted to each executive officer, we consider a variety of factors, including such executive officer’s contribution to our performance, current equity holdings, ability to influence future performance and relative position within our organization, the competitive market data described above, the relative value of each equity award, the financial impact on our profitability and the dilutive impact to our stockholders.

In addition to the above, the stock options generally have change in control vesting acceleration, forfeiture, transfer restrictions and other customary provisions. In determining which elements of compensation are to be paid, and how they are weighted, we also take into account our compliance with Internal Revenue Code Section 162(m). Section 162(m) of the Internal Revenue Code precludes us from taking a deduction for compensation in excess of $1 million for our executive officers named in the Summary Compensation Table. Certain performance-based compensation is specifically excluded from the deduction limit. Our policy is to qualify, to the extent reasonable, the compensation of our executive officers for deductibility under applicable tax laws. However, the Compensation Committee believes that its primary responsibility is to provide a compensation program to meet our stated objectives and that the loss of a tax deduction may be necessary in some circumstances.

Generally Available Benefit Plans and Executive Perquisites

We do not provide significant perquisites or personal benefits to our NEOs. In 2007, we provided each of our executive officers health care coverage and life insurance coverage that is generally available to all of our salaried employees. Also, we maintain a 401(k) Plan for our employees, including our executive officers, because we wish to encourage our employees to save a portion of their cash compensation, through voluntary deferrals, for their eventual retirement. The executive officers are entitled to participate in the company-sponsored 401(k) Plan on the same terms as all employees. Under our 401(k) Plan, we provide all employees with matching contributions, subject to certain limitations imposed by the Internal Revenue Code of 1986, as amended. Our executive officers do not receive any retirement benefits beyond those generally available to our salaried employees.

Employment Agreements and Change in Control Agreements

We maintain employment agreements with each of our executive officers, effective January 15, 2008. For more information on these employment agreements, please read “Executive Compensation—Narrative to Summary Compensation Table and Plan-Based Awards Table—Employment Agreements” and “Executive Compensation— Potential Payments upon Termination or Change-in-Control” below. These agreements provide for severance compensation to be paid if the employment of the executives is terminated under certain conditions, including, without limitation, his death or disability, following a change in control or for “good reason” or termination by us for any reason other than upon his death or disability, including for “cause,” each as defined in the agreements.

Compensation and Stock Option Committee Interlocks and Insider Participation

In 2007, Messrs. Meltzer, Andonian and Freeman served as members of our Compensation and Stock Option Committee. None of Messrs. Meltzer, Andonian or Freeman was at any time during 2007, or at any other time, an officer or employee of TerreStar Corporation or any of its subsidiaries. Further, none of our executive officers served as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of another entity that has one or more of its executive officers serving as a member of our Board of Directors or Compensation and Stock Option Committee, or other committee performing a similar function, at any time during 2007.

17

COMPENSATION AND STOCK OPTION COMMITTEE REPORT ON

EXECUTIVE COMPENSATION

We, the Compensation Committee of the Board of Directors, have reviewed and discussed this Compensation Discussion and Analysis, or CD&A, as required by Item 402(b) of Regulation S-K with the management of the Company. Based on such review and discussion, we are of the opinion that the executive compensation policies and plans provide appropriate compensation to properly align TerreStar Corporations’ performance and the interests of its stockholders through the use of competitive and equitable executive compensation in a balanced and reasonable manner, for both the short and long-term. Accordingly, we have recommended to the Board of Directors that the CD&A be included as part of this Proxy Statement.

Submitted by the Compensation and Stock Option Committee of the Board of Directors:

David Meltzer, Chairman

David Andonian

William Freeman

Dean Olmstead

18

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table shows the compensation earned for the fiscal year ended December 31, 2007 to our named executive officers, or NEOs, for the year-ended December 31, 2007.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | Salary

($) | | Bonus

($) | | | Stock

Awards

($) | | Option

Awards

($)(1) | | Non-Equity

Incentive Plan

Compensation

($)(2) | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings

($) | | All Other

Compensation

($)(3) | | | Total

($) |

Robert Brumley | | 2007 | | 550,000 | | 83,333 | (5) | | — | | 3,419,388 | | 420,750 | | — | | 43,455 | (6) | | 4,516,926 |

Former President and CEO (4) | | 2006 | | 300,000 | | — | | | — | | 3,201,232 | | 216,000 | | — | | 6,965 | | | 3,724,197 |

| | | | | | | | | |

Neil Hazard | | 2007 | | 400,000 | | 41,666 | (5) | | — | | 1,326,713 | | 216,000 | | — | | 804 | | | 1,985,183 |

Executive Vice President, CFO (7) | | 2006 | | 131,154 | | — | | | — | | 474,000 | | 103,125 | | — | | 20 | | | 708,299 |

| | | | | | | | | |

Dennis Matheson | | 2007 | | 350,000 | | — | | | — | | 310,882 | | 168,000 | | — | | 280 | | | 829,162 |

Chief Technology Officer | | 2006 | | 200,000 | | — | | | — | | 2,401,500 | | 150,000 | | — | | 140 | | | 2,751,640 |

| | | | | | | | | |

Michael Reedy Former | | 2007 | | 350,000 | | — | | | — | | 2,428,816 | | 168,000 | | — | | 168 | | | 2,946,984 |

Chief Operating Officer (8) | | 2006 | | 200,000 | | — | | | — | | 2,198,478 | | 150,000 | | — | | — | | | 2,548,478 |

| | | | | | | | | |

Doug Sobieski Former | | 2007 | | 350,000 | | — | | | — | | 310,882 | | 168,000 | | — | | 430 | | | 829,312 |

Chief Marketing Officer (9) | | 2006 | | 200,000 | | — | | | — | | 2,401,500 | | 150,000 | | — | | 200 | | | 2,751,700 |

| (1) | Each amount reflected in this column is the compensation cost recognized by TerreStar during the applicable year under Statement of Financial Accounting Standard No. 123R (Share-Based Payment) for grants made in 2007 and prior years, disregarding forfeitures. The fair value is estimated on the date of grant using the Black-Scholes option-pricing model. For a discussion of the assumptions underlying the calculation under SFAS 123R see Note 11, Employee Stock Benefit Plans in our Form 10-K for the year ended December 31, 2007. |

| (2) | Represents amounts earned under the Company’s Cash Bonus Plans. |

| (3) | Includes group term life insurance premiums. |

| (4) | Mr. Brumley’s employment with TerreStar terminated in April 2008. |

| (5) | Messrs. Brumley and Hazard were awarded cash bonuses in 2007 for services provided to TerreStar Corporation in 2006 and 2007 when Messrs. Brumley and Hazard also served as executive officers of TerreStar Networks. |

| (6) | Includes group term life insurance premiums of $804 and the Company’s payment of rental expense for a corporate apartment provided for Mr. Brumley in Washington, D.C. during 2007 of $42,651. |

| (7) | Mr. Hazard’s employment began in July 2006. |

| (8) | Mr. Reedy’s employment was terminated in April 2008. |

| (9) | Mr. Sobieski’s employment was terminated in April 2008. |

19

GRANTS OF PLAN-BASED AWARDS FOR FISCAL YEAR 2007

| | | | | | | | | | | | | | | | | |

| | | | | Estimated Future Payouts

Under Non- Equity Incentive

Plan Awards(1) | | | All Other

Stock

Awards:

Number of

Shares of

Stock or

Units

(#)

(i) | | All Other

Option

Awards:

Number of

Securities

Underlying

Options

(#)

(j) | | Exercise

or Base

Price of

Option

Awards

($/Sh)

(k) | | Grant

Date

Fair

Value of

Stock

and

Option

Awards

(2)

(l) |

Name (a) | | Grant Date

(b) | | Threshold

($)

(c) | | Target

($)

(d) | | Max.

($)

(e) | | | | | |

Robert Brumley | | | | 0 | | 467,500 | | (3 | ) | | | | | | | | |

| | 5/1/2007 | | | | | | | | | | | 349,500 | | 11.30 | | 2,334,660 |

| | 5/23/2007 | | | | | | | | | | | 400,500 | | 11.35 | | 2,643,300 |

| | | | | | | | |

Neil Hazard | | | | 0 | | 240,000 | | (3 | ) | | | | | | | | |

| | 5/1/2007 | | | | | | | | | | | 160,000 | | 11.30 | | 1,068,800 |

| | 5/23/2007 | | | | | | | | | | | 356,000 | | 11.35 | | 2,349,600 |

| | | | | | | | |

Dennis Matheson | | | | 0 | | 210,000 | | (3 | ) | | | | | | | | |

| | 5/1/2007 | | | | | | | | | | | 140,000 | | 11.30 | | 935,200 |

| | 5/23/2007 | | | | | | | | | | | 267,000 | | 11.35 | | 1,762,200 |

| | | | | | | | |

Michael Reedy | | | | 0 | | 210,000 | | (3 | ) | | | | | | | | |

| | 5/1/2007 | | | | | | | | | | | 300,200 | | 11.30 | | 2,005,336 |

| | 5/23/2007 | | | | | | | | | | | 267,000 | | 11.35 | | 1,762,200 |

| | | | | | | | |

Doug Sobieski | | | | 0 | | 210,000 | | (3 | ) | | | | | | | | |

| | 5/1/2007 | | | | | | | | | | | 140,000 | | 11.30 | | 935,200 |

| | 5/23/2007 | | | | | | | | | | | 267,000 | | 11.35 | | 1,762,200 |

| (1) | Represents amounts available under 2007 Cash Incentive Plan. Actual amounts paid under the 2007 Cash Incentive Plan to the executive officers are set forth in the Summary Compensation Table under the column “Non-Equity Incentive Plan Compensation.” |

| (2) | For a discussion of the assumptions underlying the calculation under SFAS 123R see Note 11, Employee Stock Benefit Plans in our Form 10-K for the year ended December 31, 2007. |

| (3) | The Compensation Committee may elect to award bonus amounts in amounts in excess of target bonus amounts. |

20

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2007

| | | | | | | | | | | | | | | | | | | |

| | | Option Awards | | Stock Awards |

Name (a) | | Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable

(b) | | Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable

(c) | | | Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options

(#)

(d) | | Option

Exercise

Price

($)

(e) | | Option

Expiration

Date

(f) | | Number

of

Shares

or Units

of Stock

that

Have

Not

Vested

(g) | | Market

Value of

Shares

or Units

of Stock

that

Have

Not

Vested

($)

(h) | | Equity

Incentive

Plan

Awards:

Number

of

Unearned

Shares,

Units or

Other

Rights

that Have

Not

Vested

(#)

(i) | | Equity

Incentive

Plan

Awards:

Market

or Payout

Value of

Unearned

Shares,

Units or

Other

Rights

that Have

Not

Vested

($)

(j) |

Robert Brumley | | | | 349,500 | | | | | 11.30 | | 4/30/2017 | | | | | | | | |

| | | | 400,500 | (1) | | | | 11.35 | | 5/23/2017 | | | | | | | | |

| | | | | | | | | |

Neil Hazard | | | | 160,000 | | | | | 11.30 | | 4/30/2017 | | | | | | | | |

| | | | 356,000 | (1) | | | | 11.35 | | 5/23/2017 | | | | | | | | |

| | | | | | | | | |

Dennis Matheson | | | | 140,000 | | | | | 11.30 | | 4/30/2017 | | | | | | | | |

| | | | 267,000 | (1) | | | | 11.35 | | 5/23/2017 | | | | | | | | |

| | | | | | | | | |

Michael Reedy | | | | 300,200 | | | | | 11.30 | | 4/30/2017 | | | | | | | | |

| | | | 267,000 | (1) | | | | 11.35 | | 5/23/2017 | | | | | | | | |

| | | | | | | | | |

Doug Sobieski | | | | 140,000 | | | | | 11.30 | | 4/30/2017 | | | | | | | | |

| | | | 267,000 | (1) | | | | 11.35 | | 5/23/2017 | | | | | | | | |

| (1) | These options were vested as of December 31, 2007 but were subject to contractual restrictions with respect to their exercise and the sale of the underlying shares of common stock. Those restrictions lapsed with respect to 50% of the shares underlying the option on January 1, 2008 and will lapse as to the remaining 50% of the shares on January 1, 2009. |

21

OPTION EXERCISES AND STOCK VESTED FOR FISCAL YEAR 2007

None of our Named Executive Officers exercised stock options or acquired shares of restricted stock in 2007.

Potential Payments Upon Termination or Change in Control

Consistent with practices within our industry, we also provide certain post-employment termination benefits to our executive officers. We have implemented these programs in order to ensure that we are able to continue to attract and retain top talent, as well as ensure that during the uncertainty associated with a potential change in control the executive officers remain focused on their responsibilities and ensure a maximum return for our stockholders.

On April 16, 2008, we announced the departure of three of our NEO’s, Robert Brumley, Michael Reedy and Doug Sobieski. Please see the information below for a description of the payments made to each of these former NEO’s in connection with their departure.

The following summaries set forth potential payments payable to our NEOs upon termination of employment or a change in control of us under their current employment agreements and our stock plans and other compensation programs. For purposes of the following summaries, dollar amounts are estimates based on salary as of December 31, 2007, benefits paid to the NEOs in 2007 (and any prior years as applicable) and stock and option holdings of the NEOs as of December 31, 2007. The summaries assume a price per share of our common stock of $7.25 per share, which was the closing price per share on December 31, 2007, as reported on the NASDAQ Global Market.

Termination and Change of Control. Each of our NEOs and other executive officers who are still our employees is entitled to certain benefits under his employment agreement upon any of the following:

| | • | | we terminate NEO’s employment for Cause (as defined in each Employment Agreement); |

| | • | | we terminate NEO’s employment as a result of his death or Permanent Disability (as defined in each Employment Agreement); |

| | • | | we terminate the NEO’s employment for reason other than Cause; |

| | • | | NEO terminates his employment for Good Reason (as defined in each Employment Agreement); and |

| | • | | the NEO experiences a Change in Control Position Modification (as defined in each Employment Agreement) within 3 months following a Change of Control (as defined in each Employment Agreement). |

If a NEO’s employment is terminated for Cause, the NEO shall be entitled to all salary and expense reimbursements due to such NEO through the date of his termination.

If a NEO’s employment is terminated as a result of his death or Permanent Disability, the NEO shall be entitled to (i) all salary and expense reimbursements due to such NEO through the date of his termination, (ii) an aggregate amount equal to one-half of the NEO’s then-current annual base salary and target bonus and (iii) all then unvested options held by the NEO shall immediately vest.

If we terminate a NEO’s employment for reason other than Cause or if the NEO terminates his employment for Good Reason, the NEO shall be entitled to (i) all salary and expense reimbursements due to such NEO through the date of his termination, (ii) an aggregate amount equal to NEO’s base salary and target bonus, (iii) all then unvested options held by the NEO shall immediately vest and (iv) we shall pay COBRA premiums on behalf of NEO for a period of not more than 18 months.

In the event a NEO experiences a Change of Control Position Modification within three months of a Change of Control, the NEO shall be entitled to (i) all salary and expense reimbursements due to such NEO through the date of his termination, (ii) an aggregate amount equal to two times NEO’s base salary and target bonus, (iii) all

22

then unvested options held by the NEO shall immediately vest and (iv) we shall pay COBRA premiums on behalf of NEO for a period of not more than 18 months.

Robert Brumley

Robert Brumley was our former President and Chief Executive Officer. His employment was terminated effective April 16, 2008. In connection with his separation from TerreStar, Mr. Brumley entered into an Agreement and General Release (the “Brumley Separation Agreement”). The terms of the Brumley Separation Agreement are as follows: