March 23, 2007

Via Facsimile and EDGAR Submission

Ryan Rohn, Staff Accountant

Al Pavot, Staff Accountant

Terence O’Brian, Accounting Branch Chief

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E., Mail Stop 7010

Washington, DC 20549-7010

Facsimile No.: (202) 772-9369

Form 10-K for the Fiscal Year Ended August 31, 2006

Filed October 31, 2006

Form 10-Q for the Quarterly Period Ended November 30, 2006

Filed January 16, 2007

File No. 001-12227

Dear Sirs:

This letter is being furnished on behalf of The Shaw Group Inc. in response to the comments of the Staff of the Securities and Exchange Commission contained in a letter dated February 16, 2007 with respect to the above referenced filings. For your convenience we have set forth the text of the Staff’s comments in full followed by our responses. In this letter, references to “Shaw”, “we”, “us” and “our” mean The Shaw Group Inc.

Form 10-K for the Fiscal Year Ended August 31, 2006

Segment Analysis, F&M Segment, page 44

| 1. | We note your disclosure on page 44 under your F&M Segment that beginning April 1, 2006, you are now segmenting the E&C contracts and the revenue from the pipe fabrication portion of the contract will remain in the F&M segment. In consideration that your year end is August 31, please tell us your considerations to ensure consistent presentation of your financial statements in the periods presented in your filing. Please also quantify the materiality of this accounting change. |

Securities and Exchange Commission

March 23, 2007

Page 2 of 27

Management Response: We disclosed that beginning April 1, 2006 we began Segmenting (as that term is defined in AICPA’s Statement of Position 81-1, “Accounting for Performance of Construction-Type and Certain Production-Type Contracts” (SOP 81-1) paragraphs 39-42) our E&C Segment’s contracts that included pipe fabrication being executed by our F&M Reportable Segment (as defined in SFAS 131 paragraph 16). We note that the April 1, 2006 date disclosed was used inadvertently. The date disclosed should have been March 1, 2006 (i.e. the first day of our fiscal third quarter). We will correct this date prospectively in our future filings with the Commission.

As we disclose in our Notes to Consolidated Financial Statements, we recognize revenues on Engineering, Procurement and Construction (“EPC”) contracts on the percentage-of-completion method, primarily based on costs incurred to date compared with total estimated contract costs. Prior to March 1, 2006, we included as a contract cost in our E&C Segment (and, therefore, included in the measurement of progress under the percentage-of-completion method), the revenues recorded in our F&M Segment’s pipe fabrication effort on the related EPC contracts. As disclosed on page 44 of our Form 10-K, we eliminated the revenues and an equal amount of cost of revenues related to the F&M effort in inter-segment revenues, leaving the profit related to the pipe fabrication effort reported in the F&M Segment. Subsequent to March 1, 2006, the revenues and cost of revenues related to the pipe fabrication efforts on our EPC contracts are reported in the F&M Segment. Further, subsequent to March 1, 2006, the F&M Segment pipe fabrication efforts are excluded from the costs incurred and the total estimated costs for measuring progress and recognizing profit in the E&C Segment.

During fiscal 2005, we were executing four contracts reported in our E&C Segment for which significant pipe fabrication was provided by our F&M Segment. During fiscal 2006, we were executing five contracts reported in our E&C Segment for which significant pipe fabrication was provided by our F&M Segment. If we had applied the change described above to these contracts effective September 1, 2005 rather than March 1, 2006, this change would have reduced our consolidated fiscal 2005 revenues by approximately $1.2 million and net income by approximately $740,000 (4.6% of net income for fiscal 2005) or $0.01 per diluted share and increased fiscal 2006 revenues by approximately $265,000 and net income by approximately $165,000 (0.3% of net income for fiscal 2006) or $0.002 per diluted share.

Securities and Exchange Commission

March 23, 2007

Page 3 of 27

| | | | | | |

| | | Fiscal 2005 | | Fiscal 2006 |

Consolidated, as Reported: | | | | | | |

Net Income | | $ | 15,976,000 | | $ | 50,850,000 |

Diluted Shares Outstanding | | | 69,792,000 | | | 80,289,000 |

Diluted Earnings Per Share | | $ | 0.23 | | $ | 0.63 |

| | |

Consolidated, if Adjusted: | | | | | | |

Net Income | | $ | 15,236,000 | | $ | 51,015,000 |

Diluted Shares Outstanding | | | 69,792,000 | | | 80,289,000 |

Diluted Earnings Per Share | | $ | 0.22 | | $ | 0.64 |

The impact of this change on our reported Operating Segments, if the change had been made as of September 1, 2004, would have increased fiscal 2005 revenues in the F&M Segment by approximately $26.1 million (approximately 13.0% of F&M Segment revenues for fiscal 2005) and increased fiscal 2006 revenues in the F&M Segment by approximately $18.2 million (approximately 6.0% of F&M Segment revenues for fiscal 2006). The reported gross profit percentages for the F&M Segment would have decreased by approximately 2.4 percentage points to 18.2% for fiscal 2005 and approximately 1.3 percentage points to 21.1% for fiscal 2006. Revenues for the E&C Segment would have been reduced by the same amounts in the respective periods, representing approximately 2.2% and 1.3% of E&C Segment revenues for the 2005 and 2006 annual periods, respectively.

The table below illustrates the impact of the change in presentation on our F&M Segment.

| | | | | | | | | | | |

| | | Fiscal 2005 | | | Fiscal 2006 | | | % Change | |

F&M, as Reported: | | | | | | | | | | | |

Revenues | | $ | 201,000,000 | | | $ | 300,800,000 | | | 50 | % |

Gross Profit | | | 41,300,000 | | | | 67,300,000 | | | 63 | % |

Gross Profit % | | | 20.5 | % | | | 22.4 | % | | 9 | % |

| | | |

F&M, if Adjusted: | | | | | | | | | | | |

Revenues | | $ | 227,099,989 | | | $ | 318,952,908 | | | 40 | % |

Gross Profit | | | 41,300,000 | | | | 67,300,000 | | | 63 | % |

Gross Profit % | | | 18.2 | % | | | 21.1 | % | | 16 | % |

We reported a 50% increase in revenues in the F&M Segment, comparing fiscal 2005 to fiscal 2006. The impact of the change, if it had been effective for the comparative periods, would have resulted in reporting a 40% increase in revenues in the F&M Segment for the comparative periods. We reported a 1.9 percentage point increase in gross profit percent in the F&M Segment comparing fiscal 2005 to fiscal 2006. The impact of the change, if it had been effective for the comparative periods, would have resulted in reporting a 2.9 percentage point increase in gross profit percentage for the comparative periods in the F&M Segment. Therefore, the change, if adopted earlier, would not have changed the reported trends.

Securities and Exchange Commission

March 23, 2007

Page 4 of 27

While the change did impact the consistency of our presentation, we believe the impacts are not material to users of the consolidated financial statements. Because we believe the effects of the change are not material, we believe revisions to our previously filed reports are not necessary.

Consolidated Statements of Cash Flows, page 71

| 2. | We note the materiality of the “Payments for financed insurance premiums” line item in the annual Statements of Cash Flows. Please clarify for us why these transactions are classified as financing activities instead of as operating activities. Please clarify the structure and business purpose of these transactions. If these dollar amounts reflect cash paid for insurance expenses, then it would appear that the transactions should be classified as operating activities. |

Management Response: We classify our payments of financed insurance premiums as financing activities. The purpose of our “payments for financed insurance premiums” was to finance our annual insurance premium obligation on certain insurance policies over a twelve month period. We financed these obligations through a premium financing company that paid the annual premium on certain insurance contracts on our behalf. We then paid the premium financing company a monthly installment representing principle and interest on the amount financed.

We determined that the financed premium transaction has two components for cash flow consideration:

| | a) | the initial non-cash transaction of recording a pre-paid insurance asset and assuming financed premium liability and |

| | b) | the subsequent monthly cash premium payments and corresponding decreases in the prepaid insurance asset. |

Per SFAS 95, paragraph 32:

“Examples of noncash investing and financing activities are converting debt to equity; acquiring assets by assuming directly related liabilities, such as purchasing a building by incurring a mortgage to the seller; obtaining an asset by entering into a capital lease; obtaining a building or investment asset by receiving a gift; and exchanging noncash assets or liabilities for other noncash assets or liabilities.”

Securities and Exchange Commission

March 23, 2007

Page 5 of 27

Therefore, we disclosed the initial recording of the asset and premium obligation as a noncash financing activity in our consolidated statement of cash flows.

Per SFAS 95, paragraph 20 b., “repayments of amounts borrowed” are considered cash outflows for financing activities. Therefore, we characterized the monthly premium installment payments on the obligation to be payments of principle and interest and classified the payments as financing activities on our consolidated statement of cash flows.

We also recognize it is appropriate and required by SFAS 95 to report the activities related to an event consistently in the statement of cash flows as operating, investing or financing activities in accordance with the predominant nature of the activity.

Per SFAS 95 paragraph 24:

“Certain cash receipts and payments may have aspects of more than one class of cash flows. For example, a cash payment may pertain to an item that could be considered either inventory or a productive asset. If so, the appropriate classification shall depend on the activity that is likely to be the predominant source of cash flows for the item.”

We considered this to be the determining guidance in allowing alternative, acceptable approaches to categorizing certain transactions, including the financed insurance premiums in question. Based upon the nature of the financed insurance premium payments, we determined that the underlying purpose was the financed aspect of the premiums, which was consistent with a financing activity.

We believe the categorization of our financed insurance premiums as either an operating or a financing activity is acceptable per SFAS 95. However, in retrospect and consideration of the nature and business purpose of the transactions, we acknowledge the categorization of the insurance premium payments can alternatively be classified as an operating activity, and we now believe that reflecting the financed insurance premiums as an operating activity is the more appropriate classification. We will make the change prospectively in our filings with the Commission.

Note 15 – Business Segments, Operations by Geographic Region and Major Customers, page 106

| 3. | We note that you currently report four operating segments, Environmental and Infrastructure (E&I), Energy and Chemicals (E&C), Fabrication and Manufacturing (F&M), and Maintenance. In addition we note the following: |

| | • | | You provide services, particularly your E&I segment to distinct types of customers, federal government, state and local government entities, and commercial companies. We note your disclosure on page 15 that for the year ended August 31, 2006, 40% of your total revenues and 80% of E&I segment’s revenues were from U.S. government agencies or entities owned by the U.S. government. |

Securities and Exchange Commission

March 23, 2007

Page 6 of 27

| | • | | We also note your E&I segment provides a variety of services that include the identification of contaminants in soil, air and water and the subsequent design and execution of remedial solutions. Further, you disclose that this segment also provides project and facilities management and other related services for non-environmental construction, watershed restoration, emergency response services and outsourcing of privatization markets. |

| | • | | Your business includes operations outside of the United States which include different areas of the world, with your largest concentrations in the Middle East, Asia/Pacific Rim countries, and the United Kingdom and other European countries. We note as a percentage of income (loss) before provision (benefit) for income taxes as a percentage of revenue, your domestic and foreign amounts have not fluctuated consistently. |

| | • | | Under your Overview section of your website, you present six separate industries that you operate; Energy, Chemicals, Environmental, Infrastructure, Maintenance, and Fabrication and Manufacturing. We also note that operations are conducted through multiple subsidiaries. |

In light of these disclosures, it is unclear to us how you have determined that you have four reportable segments. Please identify for us your operating segments pursuant to paragraph 10 of SFAS 131. As part of your response, please identify your chief operating decision maker and provide us with copies of the relevant financial reports reviewed by your chief operating decision maker during the periods ended August 31, 2005, August 31, 2006, and November 30, 2006.

Management Response: Please note that pursuant to Rule 83 of the Commission’s Rules on Information and Requests (17 C.F.R. § 200.83), we are requesting that the relevant financial reports reviewed by our chief operating decision maker for the periods ended August 31, 2005; August 31, 2006; and November 30, 2006 that we produced be kept confidential. A copy of this letter has been sent to the Freedom of Information Act Officer at the Securities and Exchange Commission in Washington, D.C. Enclosed please find a copy of our letter requesting confidentiality to the Commission’s FOIA Officer. We determined that as of the filing of the Form 10-K for the Fiscal Year Ended August 31, 2006, there were five operating segments and four reportable segments based upon the guidance in SFAS 131 paragraphs 10 – 17. The operating segments consisted of:

| | • | | Environmental and Infrastructure (“E&I”) |

| | • | | Energy and Chemicals (“E&C”) |

| | • | | Nuclear, which is aggregated with E&C to form the E&C reportable segment |

| | • | | Fabrication and Manufacturing (“F&M”) |

Securities and Exchange Commission

March 23, 2007

Page 7 of 27

Identification of Operating Segments as of August 31, 2006

Identification of the CODM

During the time period of September 1, 2005 (the beginning of the 2006 fiscal year) through September 26, 2006 (during the Q4 closing process) our Chief Operating Decision Maker (CODM), based on paragraph 12 of SFAS 131, was determined to be the Chief Operating Officer (COO). The COO met on a monthly basis with the presidents of each of the operating segments to discuss the monthly executive reporting package (ERP). These presidents (Segment Managers per SFAS 131 paragraph 14) were direct reports to the COO who would assess each of the respective segment’s performance and allocate resources among the segments as appropriate.

We provide a diverse portfolio of services; these services are performed by groups skilled in various disciplines and with requisite industry expertise. The CODM has aligned Shaw into five divisions to manage operations based on the type of services provided to clients which are typically dictated by the terms of a contract. Many of these contracts are long term in nature and are performed on a fixed price or cost reimbursable basis.

Information Reviewed by the CODM

As is demonstrated in the ERPs we are providing to you, the metrics we use in reviewing operating performance are not organized by geography, client industry, production methods and processes or classes of customer. The discrete financial information used by the CODM (the ERP) for the period ended August 31, 2006 is divided into the following sections:

|

• Consolidation |

|

• Corporate* |

|

• E&C |

|

• Nuclear |

|

• E&I |

|

• F&M |

|

• Maintenance |

* The corporate section of the ERP (consisting of overhead functions) does not meet the definition of “business activities” as defined in paragraph 10 of SFAS 131. Accordingly, we believe it is appropriate that our corporate activities are not considered an operating segment; however, this information is provided to reconcile the total segment metrics provided in the disclosure to the total consolidated amounts reported. |

|

Within each of the operational sections of the ERP there is income statement information which breaks down activities into further detail. The following table provides a detail of the subgroups for which income statement information is available in the ERPs:

Securities and Exchange Commission

March 23, 2007

Page 8 of 27

Table I.

| | | | |

E&C | | Nuclear | | F&M |

• Power (Fossil Fuels) | | • Nuclear less Shaw UK | | • No additional detail |

• Process | | • Shaw UK | | |

• Technology | | E&I | | Maintenance |

• Consulting | | • Federal Services | | • Power |

• Operations | | • Commercial Services | | • Process |

• Proposals | | • Privatization | | • Construction |

• Construction | | • Strategic Planning | | • Specialty Services |

• E&C International | | • Chief of Operations | | • International Operations |

• E&C Corporate | | • E&I International | | • Maintenance Corporate |

• Other | | • Infrastructure | | |

Of the detail noted above, we consider the following to be “components” because their operations constitute business activities for which there is discrete financial information, as clarified by EITF Topic D-101:

Table II.

| | |

E&C | | Nuclear |

• Power (Fossil Fuels) | | • Nuclear less Shaw UK |

• Process | | • Shaw UK |

• Technology | | |

• Consulting | | Maintenance |

| | • Power |

| E&I | | • Process |

• Federal Services | | • Construction |

• Commercial Services | | • Specialty Services |

• Privatization | | • International Operations |

| | • Maintenance - Corporate |

* Please note that the remaining subgroups (listed in Table I but not included in Table II) generally consist of functional departments which merely support the operations of the business units. Though there is income statement information in the executive financial packages, we do not consider them as true components of the segment because their activities predominantly have the characteristics of cost centers rather than a complete business per EITF Topic D-101.

While the components noted in Table II do generate revenues and incur expenses and may have discrete financial information available which is reviewed by the CODM on a periodic basis, the criteria in paragraphs 13 and 14 of FAS 131 as noted below regarding multiple levels of information have also been considered:

| | • | | The nature of the business activities of each component |

Securities and Exchange Commission

March 23, 2007

Page 9 of 27

| | • | | The existence of managers responsible for each component |

| | • | | Information provided to the board of directors |

Based on the CODM’s ERP for August 31, 2006, the E&C segment and the components detailed therein met at least two of these criteria as follows: 1) there was a single defined segment manager who was responsible to the CODM for the E&C segment as a whole, and 2) the financial reports provided to the board of directors during FY 2006 presents E&C as a whole. Further, the incentives (bonuses) of the segment manager for E&C were based on the performance of E&C as a whole and were not specific or weighted towards any single component within the segment. Thus, we believe that the recognition of E&C as an operating segment is appropriate.

Similarly, the E&I section of the ERP contains income statement information which includes the component business lines within E&I. During most of FY 2006, our CODM was serving as segment manager for our E&I segment while we were performing a search to replace the outgoing E&I president who had previously functioned as segment manager. Functionally, however, we are structured such that there is typically one segment manager who reports to the CODM and whose incentives are dependent on E&I performance as a whole. Financial reports presented to the board of directors also includes E&I metrics as a whole.

An additional level of detail is also available to the CODM with respect to the Maintenance section of the ERP. There is a single segment manager for the Maintenance Group whose incentives depended on the performance of the segment as a whole. This individual also reported directly to the CODM during the 2006 fiscal year. Financial reports presented to the board of directors also include Maintenance metrics as a whole.

Further, the cash flow information and balance sheet information contained in the ERP is provided at the operating segment level for each of E&C, E&I, Maintenance and F&M and is regularly reviewed by the CODM. Other metrics, which have a high degree of importance to the CODM in his assessment of performance, include the return on assets calculation (“ROA”) and the amount of capital expenditures. Since the balance sheets are provided at the reportable segment level these metrics are reviewed for E&C, E&I, F&M and Maintenance as a whole.

Aggregation of Operating Segments into Reportable Segments

The Nuclear and E&C segments were aggregated and titled as the E&C reportable segment as of August 31, 2006. In accordance with SFAS 131, paragraph 17, these two operating segments were aggregated because they have similar products and services (the engineering and construction of power plants); they have similar production processes (the methods for designing and constructing the power plants); they have similar customers (large public utilities); the method used to distribute their products and services are similar (the method of contract execution); and the nature of the regulatory environment is similar (all power plants require a lengthy approval process by some or all

Securities and Exchange Commission

March 23, 2007

Page 10 of 27

of the following governmental agencies: the FERC, the NRC and/or state and local regulatory agencies). We also believe the economic characteristics will be similar, as the permitting, engineering and construction of any type of power plant can take multiple years. We believe this aggregation is consistent with the objectives and principles of SFAS 131.

We noted the following when applying the quantitative thresholds of SFAS 131:

| | • | | The E&C, E&I, F&M and Maintenance operating segments met at least one of the 10% quantitative thresholds noted in paragraph 18 of SFAS 131, respectively. |

| | • | | The Nuclear operating segment itself did not meet any of the 10% quantitative thresholds noted in paragraph 18 of SFAS 131. |

| | • | | The reportable segments of E&C (including Nuclear), E&I, F&M and Maintenance did surpass the 75% consolidated revenue threshold test defined in paragraph 20 of SFAS 131. In fact 100% of our consolidated revenues were reported in our segment disclosures in Note 15 of our Form 10-K for the fiscal year ended August 31, 2006. |

Identification of Operating Segments as of August 31, 2005

Our ERP used by the CODM for the period ending August 31, 2005 contains the same level of detail as the August 31, 2006 ERP. We performed our analysis of the information contained in the ERP used by the CODM for the period ending August 31, 2005 in similar fashion to the analysis of August 31, 2006 ERP noted above. We noted that our reportable segments as disclosed in our Form 10-K for the fiscal year ended August 31, 2005 are consistent with the principles of SFAS 131. These similarities include:

| | • | | The CODM was identified as the COO of Shaw. |

| | • | | The respective presidents of the E&C, E&I, F&M, Maintenance and Nuclear divisions were direct reports of the CODM and were each, functionally, operating segment managers. |

| | • | | Our operating segments were E&C, E&I, F&M, Maintenance and Nuclear, respectively. |

| | • | | Our Nuclear and E&C operating segments were aggregated into the E&C reportable segment. |

Identification of Operating Segments as of November 30, 2006

Our ERP used by the CODM for the period ended November 30, 2006 contains the same level of detail as the August 31, 2006 ERP. We performed our analysis of the information contained in the ERP used by the CODM for the period ending November 30, 2006 in similar fashion to the analysis of August 31, 2006 ERP noted above. We noted that our reportable segments as disclosed in our Form 10-Q for the fiscal year ended November 30, 2006 are consistent with the principles of SFAS 131. We noted the following important factors in our analysis of the ERP used by the CODM for the period ending November 30, 2006:

| | • | | Our Chief Executive Officer (CEO) became the CODM as a result of a change in our corporate structure described below. |

Securities and Exchange Commission

March 23, 2007

Page 11 of 27

| | • | | The respective presidents of the E&C, E&I, F&M, Maintenance and Nuclear divisions were direct reports of the CODM and were each, functionally, operating segment managers. |

| | • | | There is a new section for our Investment in Westinghouse which is disclosed as a segment in our Form 10-Q for the Three Months Ended November 30, 2006. |

| | • | | Our operating segments were E&C, E&I, F&M, Maintenance, Nuclear and Investment in Westinghouse, respectively. |

| | • | | Our Nuclear and E&C operating segments were aggregated into the E&C reportable segment. |

Changes to segments as of the Quarter Ended February 28, 2007

On September 26, 2006, we publicly announced a change in our corporate structure to enhance current resources and position us to achieve better execution. The most significant changes noted in this announcement are as follows:

| | • | | A new division named the Power division will be created which will consist of the Maintenance and Nuclear operating segments as well as the Fossil Fuels (Power) component which were once included in the E&C segment in prior periods. |

| | • | | The E&C division will continue to operate without the Fossil Fuel (Power) component. |

| | • | | There are no changes to the E&I, F&M and Investment in Westinghouse operating segments. |

| | • | | The group presidents will no longer report to the COO. Instead, these individuals will report directly to the CEO and Chairman, who has also assumed the role of COO and is now the CODM. |

Based on this announcement, it is necessary for us to review our disclosures as required by SFAS 131. When the CEO announced the new organization of Shaw, he also became CODM. Though this new management alignment was announced on September 26, 2006 the information in the ERP used for the time period of September 1, 2006 through December 31, 2006 remained the same as those used for the period ended August 31, 2006, thus the segments were reported in the legacy format during the first quarter of the fiscal year 2007 (September 1 through November 30, 2006). During January of 2007, our internal reporting changed to reflect this new alignment. We are currently in the process of reviewing our new executive financial reports used by the CODM to determine if any changes should be made to our segment disclosures in conjunction with the filing of our Form 10-Q for the quarter ended February 28, 2007.

Securities and Exchange Commission

March 23, 2007

Page 12 of 27

Responses to the Observations Made by the SEC Staff

Observation 1: You provide services, particularly your E&I segment to distinct types of customers, federal government, state and local government entities, and commercial companies. We note your disclosure on page 15 that for the year ended August 31, 2006 40% of your total revenues and 80% of E&I segment’s revenues were from U.S. government agencies or entities owned by the U.S. government.

It was noted that our E&I segment’s revenues from U.S. government agencies or entities owned by the U.S. government are 80% of total E&I segment revenues and 40% of total consolidated revenues for the fiscal year ended August 31, 2006. From August 31, 2002 through August 31, 2005, E&I quarterly revenues were fairly consistent and averaged approximately $304 million per quarter. At the beginning of the 2006 fiscal year, we became heavily involved with providing hurricane recovery and restoration work along the U.S. Gulf Coast. These projects significantly increased the work provided by our E&I segment for federal agencies. We provided approximately $962.9 million of services (23% of consolidated revenues) to U.S. government agencies or entities owned by U.S. government agencies during the 2006 fiscal year. Total E&I quarterly revenues during 2006 averaged approximately $530 million. As we continue beyond fiscal 2006 our forecasted revenue from U.S. government agencies is expected to return to historical levels. Further, although there is a “Federal” component within our E&I operating segment which provides services to U.S. government agencies and entities owned by the U.S. government, a centralized group of resources is also used in the performance of contracts for these customers. Our other segments also provide services to U.S. government agencies or entities owned by U.S. government agencies. In 2006 for instance, there was approximately $280 million of E&C and Maintenance segment revenues for services provided to such entities. Also, E&I is managed operationally as a single unit from a resource perspective. For example, the estimating, procurement and logistical functions are centralized by the “Chief of Operations” function. E&I assets and personnel are deployed to projects by the Chief of Operations component depending on the nature of the service provided to the client and the priority for execution of the contract. This approach is used due to the similarities of contracts among the federal, state and local clients (state and local clients are part of the Commercial component).

Observation 2: We also note your E&I segment provides a variety of services that include the identification of contaminants in soil, air and water and the subsequent design and execution of remedial solutions. Further, you disclose that this segment also provides project and facilities management and other related services for non-environmental construction, watershed restoration, emergency response services and outsourcing of privatization markets.

Securities and Exchange Commission

March 23, 2007

Page 13 of 27

It was also noted that our E&I segment provides a variety of services. The ERPs do not contain information relating to the activities noted, and this is discussed in the MD&A section of our Form 10-K. Moreover, the operations of the E&I segment are managed and executed by a common pool of resources which include offices, assets and employees. Thus, under the management approach as prescribed by the FASB, we believe that it is more reasonable that all E&I services are disclosed as within a single operating segment.

Observation 3: Your business includes operations outside of the United States, which include different areas of the world, with your largest concentrations in the Middle East, Asia/Pacific Rim countries, and the United Kingdom and other European countries. We note as a percentage of income (loss) before provision (benefit) for income taxes as a percentage of revenue, your domestic and foreign amounts have not fluctuated consistently.

We respectfully request further explanation of your observation as we could not locate the disclosure which is referenced here. We do not consider geography in our segment disclosures because the information used by the CODM does not reflect this information, except in limited circumstances (i.e. Shaw UK in the Nuclear segment). The information reviewed by the CODM combines information within a given segment by business line or project type. The majority of our foreign work is conducted by the E&C segment. Management reviews results on a project by project basis. Additionally, our projects are managed by that segment whose personnel have the necessary expertise and capacity. For example, our SHARQ ethylene plant construction project in Saudi Arabia is managed by a project team located in our Milton Keynes, UK office while offices in the U.S. and India provide additional project support. Also the project results are reviewed in the ERP, specifically in the E&C gross margin report together with the various other ethylene projects most of which are domestic.

Observation 4: Under your Overview section of your website, you present six separate industries that you operate; Energy, Chemicals, Environmental, Infrastructure, Maintenance, and Fabrication and Manufacturing. We also note that operations are conducted through multiple subsidiaries.

While we do serve clients which operate in various different industries and our operations are in fact carried out through the use of multiple subsidiaries, the information noted on our website is intended to give the reader a high level understanding of the expertise and services we provide to our clients in various industries. This overview is not intended to give an investor insight into the ways that the CODM manages Shaw’s internal resources. Based on the approach to management and the information used by the CODM we believe that the Energy, Chemical, Environmental and Infrastructure industry divisions cannot be supported as respective operating segments under paragraphs 10–15 of FAS 131.

Securities and Exchange Commission

March 23, 2007

Page 14 of 27

Form 10-Q for the Quarterly Period Ended November 30, 2006

Non-GAAP Financial Measures, page 36

| 4. | We note the non-GAAP financial measures presented on page 38 of the November 30, 2006 Form 10-Q. There is a concern over whether readers could be confused by the presentation of a full statement of operations that excludes the operations of the Westinghouse segment. Further it is unclear why this presentation is necessary given the detailed line items on the income statement and given that Westinghouse is apparently a separate operating segment under SFAS 131 (p. 14). Please tell us whether management expects to continue including this non-GAAP presentation in future filings. We may have further comment. |

Management Response: We do expect to continue to include this non-GAAP presentation within MD&A in our future filings with the Commission. We believe this presentation within the referenced MD&A section is valuable to users of the financial statements for the following reasons:

| | • | | Allows for a comparison to our results of operation and financial position before our investment in Westinghouse, enhancing the comparison to previous years’ operating results and financial position. |

| | • | | Relative material amounts of results of operations included in the Investment in Westinghouse Segment. |

| | • | | Shaw’s management cannot control the results of Westinghouse as we can in our other reportable segments. We will measure ourselves and our management on results of operations excluding the Investment in Westinghouse Segment’s results. |

| | • | | Through the exercise of our Put Option Agreement, we can “unwind” our Investment in Westinghouse. |

| | • | | The financial community, as seen in analyst reports, is viewing Shaw’s operating results consistent with this presentation, and our EPS guidance excludes the results from Westinghouse. |

Because the Investment in Westinghouse Segment includes very significant dollar amounts, we believe this presentation helps to explain the complex nature of the Westinghouse transaction and that the users of our financial information will want to be able to easily compare our operating results and financial position consistently between periods. Most importantly, Shaw will measure its own performance by reviewing separately the financial performance and results of (1) Shaw excluding Investment in Westinghouse Segment, and (2) Investment in Westinghouse Segment.

Securities and Exchange Commission

March 23, 2007

Page 15 of 27

We will continue to ensure that our disclosure of this non-GAAP information complies with the Commission’s rules governing non-GAAP disclosures, including Regulation G and Item 10 of Regulation S-K, as applicable.

Note 2 – Acquisition of Westinghouse Investment and Related Agreements, page 11

| 5. | It is not clear whether equity method accounting for the Westinghouse investment is consistent with the guidance in FIN 35. It does not appear that the Registrant has the ability to exercise significant influence over the operating policies of Westinghouse. Please give us an analysis that specifically addresses the following factors: |

| | • | | The risk factor disclosure about the Registrant’s “limited access” to details of the Westinghouse business; |

| | • | | The fact that Toshiba owns 77% of the voting stock of Westinghouse; |

| | • | | The apparent ability of Toshiba to unilaterally appoint the entire Board of Directors of Westinghouse Electric Company and the fact that the Registrant is not represented on the Board; |

| | • | | The apparent ability of Toshiba to unilaterally appoint all principal officers and senior vice presidents of Westinghouse Electric Company; |

| | • | | The provisions in the Shareholder Agreement whereby the Registrant has surrendered its rights to oppose Toshiba’s nominations to the board and Toshiba’s principal officer appointments; |

| | • | | The provisions in the Shareholder Agreement whereby the Registrant has surrendered its rights to vote for the removal of any directors or principal officers appointed by Toshiba, unless requested by Toshiba; |

| | • | | The apparent unilateral ability of Toshiba to appoint the President who will “manage the business and affairs of and exercise the corporate powers of the Company”. |

Management Response:The guidance in FIN 35 clarifies the provisions of APB 18 regarding the application of the equity method of accounting to investments in 50 percent or less of the voting common stock of an investee enterprise. APB 18 requires that the equity method of accounting be “followed by an investor whose investment in voting stock gives it the ability to exercise significant influence over operating and financial policies of an investee.” FIN 35 provides that it is a presumption that the investor has the ability to exercise significant influence over the investee’s operating and financial policies if it owns 20% or more of the voting common stock, “until overcome by predominant evidence to the contrary.”

We own 20% of the voting common stock in the Westinghouse Group (through two Holding Companies), and the following analysis addresses the key areas which we believe support Shaw’s equity method of accounting, addresses the specific points raised by the SEC Staff, and summarizes our position as to why we believe we have significant influence relating to our Investment in Westinghouse.

Securities and Exchange Commission

March 23, 2007

Page 16 of 27

Minority-Protection Rights Influence

Although Toshiba owns 77% of the Westinghouse Group, the Shareholders Agreement provides a minority-protection vote of the Owner Board on all major actions. This minority-protection provision, provided in Section 3.02(f) of the Shareholders Agreement, affords the power that either we or the other voting member, Ishikawajima-Harima Heavy Industries Co., LTD. (IHI), can veto recommended actions by Toshiba.

The following specified actions cannot be taken by the Board of Directors, the Owner Board or any member of the Westinghouse Group without the vote of the Owner Board members holding voting rights at least 1% in excess of the ownership percentage of Toshiba and any affiliate thereof at the time the vote is taken (initially 78%). Thus, Toshiba cannot do the following without either our or IHI’s consent:

| | a) | Issuance of equity securities; |

| | b) | Issuance of equity securities with dividend preferences; |

| | c) | Issuance of equity securities causing a change of control of the Westinghouse Group; |

| | d) | Acquire or dispose of assets or property greater than $10 million other than in ordinary course or identified in budget; |

| | e) | Incurrence of debt greater than $10 million other than in ordinary course of business or one guaranteed by Toshiba or that is already described in relevant budget; |

| | f) | Any dissolution, liquidation or petition for voluntary bankruptcy of the Westinghouse Group; |

| | g) | Any merger, consolidation, restructuring, acquisition, disposition, or similar transaction of the Westinghouse Group whose total exceeds 20% of the then fair market value of the Westinghouse Group’s total consolidated assets; |

| | h) | The settlement of any dispute or litigation or assumption of any obligation or liability with a value greater than $10 million or more, other than in ordinary course of business; |

| | i) | Any material changes to the tax or accounting policies of the Holding Companies or the Westinghouse Group. |

We believe these veto rights, encompassing most of the material actions that might be taken by the Westinghouse Group, gives us significant influence over its financial policies and material business decisions.

Put Option Influence

In connection with and concurrent with our Investment in Westinghouse, we entered into a JPY-denominated Put Option Agreement (the “Put Option”) that provides to us an option to sell all or part of our 20% equity interest in the Westinghouse Group to Toshiba for 97% of the original JPY-equivalent purchase price, approximately 124.68 billion JPY

Securities and Exchange Commission

March 23, 2007

Page 17 of 27

(the equivalent of approximately $1.04 billion at October 16, 2006 exchange rates). We thereby have significant economic influence by virtue of our equivalent $1 billion cash call in the event we are not afforded the opportunity to exercise significant influence over our investment.

Customer Relationship Agreement Influence

Additionally, in connection with our Investment in Westinghouse and related agreements, we executed a Commercial Relationship Agreement (the “CRA”) which provides us with certain exclusive opportunities to participate in projects where we would perform engineering, procurement and construction services on future Westinghouse advanced passive AP 1000 nuclear power plants, along with other commercial opportunities, such as the supply of piping for those units. The term of the CRA is six years, and has renewal provisions. Our opportunities to participate in projects sourced before exercise of the Put Option survives the termination of the CRA. If, upon our exercise of the Put Option, we put more than 5% of our equity interest in the Westinghouse Group to Toshiba, the CRA is terminated.

As can be noted by the termination of the CRA in the event our equity interest drops below 5%, the equity interest is directly related to the CRA and provides us with a significant economic relationship with the Westinghouse Group, and influence on the Westinghouse Group, in providing services to our customers on advanced passive AP 1000 nuclear plants and other projects.

Coordination Office Influence

The interrelationship of the parties and the ability to exercise significant influence can also be evidenced by our rights to participate in the Coordination Office, as set forth in Section 4.06 of the Shareholders Agreement. Westinghouse Electric Company (WEC) will have a Coordination Office. The function of the Coordination Office is 1) supporting creation of synergy between the shareholders business and the Westinghouse Group business; 2) identifying and developing business opportunities for the shareholders in the Westinghouse Group; and 3) managing day-to-day communications with the shareholders. Each shareholder also has the right to send at least one staff to the Coordination Office. We believe the Coordination Office provides us with significant additional influence with respect to our Investment in Westinghouse.

Responses to the Observations Made by the SEC Staff

The risk factor disclosure about the Registrant’s “limited access” to details of the Westinghouse business

Section 5.02 of the Shareholders Agreement provides us access rights. Each shareholder shall have the right, during usual business hours upon reasonable

Securities and Exchange Commission

March 23, 2007

Page 18 of 27

notice, and at such shareholders expense, (1) to visit the offices of the Westinghouse Group; (2) inspect the books and records of the Westinghouse Group, but not at the offices of the Westinghouse Group; and (3) discuss the affairs of the Westinghouse Group with the officers of the Westinghouse Group.

Additionally, Section 5.03(b) provides that no later than 40 days following the end of each fiscal quarter, the Westinghouse Group shall cause to be prepared and furnished to each Shareholder, at the Westinghouse Group’s expense, unaudited consolidated financial statements of the Westinghouse Group including financial notes thereto, comparative figures for the related periods, and certified by the Westinghouse Group as to preparation in accordance with U.S. GAAP.

Upon further consideration, the wording of our risk factor should be adjusted for all subsequent filings. “Access to information relating to Westinghouse is afforded through participation on the Holding Company Board, the Owner Board, regular financial reporting requirements, and access rights provided through the Shareholders Agreement. Such access affords Shaw the opportunity to exercise influence over Westinghouse affairs, but it is not as complete or timely as to what would be afforded in circumstances where Shaw had control of Westinghouse.”

The fact that Toshiba owns 77% of the voting stock of Westinghouse

As noted above, although Toshiba owns 77% of the Westinghouse Group, the Shareholders Agreement provides minority-protection rights through the Owner Board on all major actions. This minority-protection provision, provided in Section 3.02(f) of the Shareholders Agreement, affords the power that either we or the other voting member, IHI, can veto recommended actions by Toshiba. We believe these veto rights, as discussed above, give us significant influence over the Westinghouse Group’s financial policies and material business decisions.

The apparent ability of Toshiba to unilaterally appoint the entire Board of Directors of Westinghouse Electric Company and the fact that the Registrant is not represented on the Board

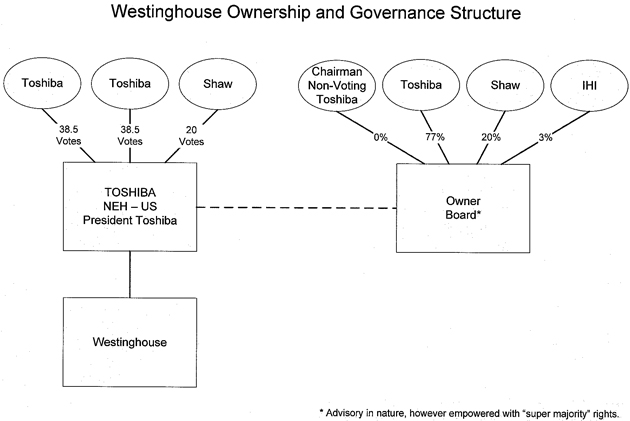

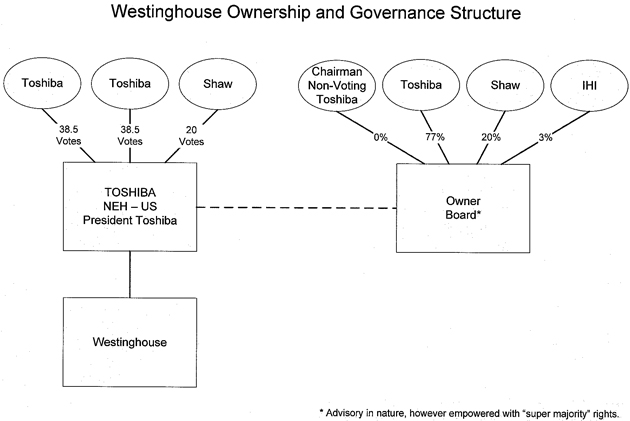

We are represented on the Board of Directors as a 20% voting member of the Holding Companies, which own 100% of the stock of the Westinghouse Group. We are also a 20% voting member on the Owner Board, and as such have minority-protection rights as set forth above. We exercise significant influence over our investment at the Holding Company board level and at the Owner Board level. The diagram provided below sets forth the governance structure and the relationship between the boards and entities:

Securities and Exchange Commission

March 23, 2007

Page 19 of 27

The apparent ability of Toshiba to unilaterally appoint all principal officers and senior vice presidents of Westinghouse Electric Company

We are represented on the Board of Directors as a voting member of the Holding Companies, which own 100% of the stock of the Westinghouse Group. We are also a voting member on the Owner Board, and as such, have minority-protection rights as set forth above. We exercise significant influence over our investment at the Holding Company Board level and at the Owner Board level. As noted, please see the diagram above setting forth the governance structure.

The President of the Holding Companies will notify the other shareholders its designations for officers in advance, in accordance with Section 4.05(b) of the Shareholders Agreement. Further, the Board of Directors and the President “shall duly consider” any opinion or recommendation made by the Owner Board, consistent with Section 3.02 of the Shareholders Agreement. Thereafter, all principal officers and senior vice presidents of Westinghouse Electric Company (WEC) shall be nominated by the WEC Board of Directors based on the designation by the President of the Holding Companies.

The provisions in the Shareholder Agreement whereby the Registrant has surrendered its rights to oppose Toshibas’ nominations to the board and Toshiba’s principal officer appointments

The Shareholders Agreement provides at Section 3.01(c) reciprocal rights, to each shareholder, that it will not vote in favor of the removal from the Board of Directors any Director elected at the request of the other Shareholders unless the Shareholder entitled to nominate such Director shall have consented to such removal in writing. Thus, Toshiba has also surrendered its rights to vote for the removal of any Director appointed by us, unless we so request.

With respect to “principal officer appointments,” Section 4.05 of the Shareholders Agreement vests such powers in the President of the Holding Companies, a Toshiba appointee. We acknowledge this limitation, but we believe we exert our significant influence based on the totality of the factors, including: our board representation at the Holding Companies and the Owner Board levels; our minority-protection rights; our Put option; our CRA; and other factors noted in this analysis.

The provisions in the Shareholder Agreement whereby the Registrant has surrendered its rights to vote for the removal of any directors or principal officers appointed by Toshiba, unless requested by Toshiba

The Shareholders Agreement provides at Section 3.01(c) reciprocal rights, to each shareholder, that it will not vote in favor of the removal from the Board of Directors any

Securities and Exchange Commission

March 23, 2007

Page 20 of 27

Director elected at the request of the other Shareholders unless the Shareholder entitled to nominate such Director shall have consented to such removal in writing. Thus, Toshiba has also surrendered its rights to vote for the removal of any Director appointed by us, unless we so request.

With respect to “principal officer appointments,” Section 4.05 of the Shareholders Agreement vests such powers in the President of the Holding Companies, a Toshiba appointee. We acknowledge this limitation, but we believe we exert our significant influence based on the totality of the factors, including: our board representation at the Holding Companies and the Owner Board levels; our minority-protection rights; our Put option; our CRA; and other factors noted in this analysis.

The apparent unilateral ability of Toshiba to appoint the President who will “manage the business and affairs of and exercise the corporate powers of the Company”

As noted above, Section 3.01(b) of the Shareholders Agreement provides that the Board of Directors of the Holding Companies shall consist of 3 members, two (2) of whom shall be Toshiba, and one by us, provided we maintain an ownership percentage greater than 10%. Our Director shall have the same number of votes as relates to our ownership percentage, which results in 20 votes, or 21%, relative to Toshiba’s 77 votes allowed under the Shareholders Agreement per the current ownership structure. Therefore, we exercise our significant influence at the Holding Companies level and the Owner Board level, where we are a 20% voting member.

It should be noted that the Shareholders Agreement provides a No Inconsistent Actions principle at Section 5.05. Each shareholder agrees it will not “act, for any reason, as a member of a group or in concert with any other persons in connection with the acquisition, disposition, or voting of shares in any manner which is inconsistent with the provision of this agreement”, which serves as legal protection against Toshiba improperly wielding power through collusion of a partner against our interests.

The Shareholders Agreement, Section 3.02(c), provides that each shareholder is entitled to appoint one Owner Board Member. Each Owner Board member has the same number of votes equal to its ownership of stock, per paragraph 3.02(f).

The critical limitation on Toshiba through its appointment of the President, relates to the minority-protection rights vested in the Owner Board. The specific actions limiting the President’s power that provides us with significant influence has been described above in the minority-protection rights section and require our consent with respect to equity issues, material acquisitions/dispositions, material capital expenditures, and settlement of material disputes and litigation.

Securities and Exchange Commission

March 23, 2007

Page 21 of 27

Further, the Owner Board powers under Section 4.03 of the Shareholders Agreement provides that the Owner Board shall be responsible for monitoring the implementation of the annual budget at least once every fiscal quarter. Additionally, the Owner Board is also responsible for monitoring the implementation of the business plan not less often than annually.

Summary Relating to Significant Influence Over Our Investment in Westinghouse

APB 18 provides that the ability to exercise influence may be indicated several ways, such as representation on the board of directors, participation in policy making processes, material intercompany transactions, interchange of managerial personnel, or technological dependency. When viewing all the facts and circumstances of the Westinghouse transaction in totality, we believe we exercise significant influence through:

| | a) | Our voting participation in the Board of Directors of the Holding Companies; |

| | b) | Our voting participation in the Owner Board to the Board of Directors, which has minority-protection rights over major actions of the Westinghouse Group; |

| | c) | The Owner Board approves any material changes to the tax and accounting policies of the Holding Companies and the Westinghouse Group; |

| | d) | The Commercial Relationship Agreement and the Consortium Agreements between Westinghouse and us provide for extensive intercompany transactions. This is evidenced by the recent agreement to build four (4) nuclear plants in China, which we expect to generate billions of dollars in revenues. Our engineering work alone is estimated at $700 million; |

| | e) | The Coordination Office between the Shareholders and Westinghouse is designed and operates to identify mutual opportunities and synergies between the parties; |

| | f) | The technological dependency imbedded in our workforce for the engineering and construction of nuclear plants, which is the impetus for the transactions and the CRA; |

| | g) | Our Put Option, which allows us to Put back our $1 billion investment to Toshiba at our sole discretion, |

Accordingly, our investment of 20% in the Westinghouse transaction, which under APB 18 sets forth a presumption that in the absence of evidence to the contrary, an investor has the ability to exercise of significant influence, is therefore appropriately accounted for under the equity method of accounting. We believe that when applying the guidance in FIN 35, taking into account all the facts and circumstances of the transaction, the presumption in APB 18 of significant influence is not overcome by predominant evidence to the contrary.

Securities and Exchange Commission

March 23, 2007

Page 22 of 27

Note 2 – Acquisition of Westinghouse Investment and Related Agreements, page 11

| 6. | We note the disclosure on page 13 of the November 30, 2006 Form 10-Q about the accounting analysis performed on the Westinghouse put option. Please clarify for us how it was determined that this financial instrument is not required to be measured at fair value under the accounting models referenced in your disclosure. |

Management Response: There does not appear to be any specific relevant GAAP guidance that addresses the accounting for the Put Option. Therefore, we have reviewed certain accounting standards and theories to determine the potential and most appropriate alternatives to account for the Put Option. A summary of analogous US GAAP, together with a brief discussion of the applicability of each of the six theories considered is discussed below.

| | a. | View the Put Option as a derivative instrument and account for it by marking it to fair value with changes reflected in income or loss. This position is consistent with SFAS 133 and is also consistent with the overall stated view of accounting standard policy makers to move toward fair value accounting for all financial instruments. However, the facts of this particular Put Option do not meet the scope of SFAS 133, paragraphs 6-9, as the Put Option does not permit net settlement outside the contract. |

The Put Option is a financial instrument (as defined in SFAS 133 Appendix F), even though it does not meet the scope of SFAS 133, so the most closely analogous US GAAP guidance would appear to be mark-to-market (MTM). MTM accounting for financial instruments is the stated goal of standard setting bodies. MTM gives real-time recognition of changes in value – whether realized or unrealized. MTM should have an offsetting impact to the other components of the overall transaction (i.e., when Westinghouse performs better then expected, the value of the Put Option decreases to offset the positive performance of the investment and vice versa).

However, a fair value model for the Put Option would rely heavily on the fair value of the Commercial Relationship Agreement (an intangible asset described in Note 2) and the underlying Investment in Westinghouse (an equity method investment). Another variable in the fair value model would be the cash flow forecasted for the Investment in Westinghouse. It is difficult to forecast cash flows reliably for valuation purposes.

| | b. | View the Put Option as an intangible asset under SFAS 142 paragraphs 4; 11-14. The Put Option is a legal contract that we acquired as part of the overall transaction and could be viewed as an intangible asset. By analogy to this standard, we would amortize the cost of the Put Option over its useful life – in this case the term of the Put Option which is approximately six years. |

This approach is consistent with cost basis historical accounting and reflects an allocation of the costs in a systematic and rational manner. Amortization provides

Securities and Exchange Commission

March 23, 2007

Page 23 of 27

a conservative accounting treatment to virtually ensure that at no point in the life of the arrangement a loss would need to be recognized. As the Put Option meets the definition of a financial instrument (per a. above), it appears to also meet the definition of a financial asset. SFAS 142 specifically defines intangible assets as “not financial assets.”

| | c. | View the Put Option as an “option” as defined in the 1986 AICPA Issues PaperAccounting for Options (the “Issues Paper”) paragraph 12. The Issues Paper was effectively a survey of existing practices to account for option agreements. The general recommendation of the Issues Paper was that option agreements should be recognized at fair value. However, the recommendations of the Issues Paper were never specifically acted upon, thus implying that all of the accounting practices as surveyed in the Issues Paper could still be appropriate methods. The other methods described in the “survey” are a) value at cost and provide an adjustment to the lower amount of cost or market each period, b) initially record the asset at cost and assess it for impairment each period, and c) initially record the asset at cost and systematically amortize the asset over time. Method c) is the same method as used under SFAS 142 above. |

| | d. | View the Put Option as an equity security classified as available for sale, with unrealized changes in fair value excluded from earnings and reported as a net amount in a separate component of shareholders’ equity until realized (SFAS 115 paragraphs 12-14). The Put Option meets the definition of an equity security, as defined in SFAS 115 Appendix C. However, because the Put Option does not have a “readily determinable fair value” per paragraph 3 of SFAS 115, it does not fall within the scope of this statement. |

| | e. | View the Put Option as an “off-balance sheet” financial instrument. The Put Option could be considered a financial instrument as defined in paragraph 3 of SFAS 107 (which is also the same definition used in SFAS 133 above). Paragraph 25 of SFAS 107 states that “put options on stock” are examples of “custom-tailored” financial instruments. Per paragraph 7, even if the financial instrument is “not recognized in the statement of financial position,” this statement still requires disclosure about the fair value of the financial instrument. Since the Put Option does not meet the scope of SFAS 115 or SFAS 133, it could be considered an instrument outside the asset definition of Concept 5. This view was rejected, primarily because the “value” allocated to this financial instrument at the time of acquisition is material to the users of the financial statements. |

| | f. | The view of immediate expense recognition was also explored. However, this was rejected based on the guidance in SFAS 142, paragraph 12, which provides that an intangible asset shall not be written down or off in the period of acquisition unless it becomes impaired during that period. The Put Option is not impaired at the time of the acquisition. As a result, immediate expense recognition is not warranted. |

Securities and Exchange Commission

March 23, 2007

Page 24 of 27

We have decided to adopt a method which amortizes the allocated cost of the Put Option over its term. This method will result in more conservative accounting and ensure that potential losses are not deferred. The Put Option can be exercised only for the period from 3.5 years to 6 years following its issuance. We have decided to amortize the Put Option over the full term of 6 years. The determination of the estimated useful life to amortize the Put Option over its expected term of six years was also based on the period over which the asset is expected to contribute directly or indirectly to our future cash flows (by analogy to SFAS 142, paragraph 11). The Put Option amortization could also be viewed as additional interest expense related to the favorable interest rate on the debt, as well as the ability to earn a stream of dividend payments from the underlying Investment in Westinghouse over the life of the term.

Note 2 – Acquisition of Westinghouse Investment and Related Agreements, page 11

| 7. | In the quarter ended November 30, 2006, we note that a translation loss was recorded on the Yen-denominated debt. If this was caused by an appreciation of the Yen relative to the Dollar, then please clarify for us why such appreciation did not cause an increase in the fair value of the foreign currency derivative instrument embedded in the Put Option. |

Management Response: The translation loss recorded in the quarter ended November 30, 2006 was caused by the appreciation of the Yen relative to the U.S. dollar from October 16, 2006 to November 30, 2006 (approximately 119.4 to 122.6, respectively). Intuitively, one would expect a Yen-denominated liability to decrease in value (i.e. the long-term bonds) and a Yen-denominated asset to increase in value (i.e. embedded foreign currency derivative). The long-term bonds were translated at the November 30, 2006 spot rate, resulting in a loss for the period. However, the embedded foreign currency derivative is valued based upon a lattice model (as discussed above under comment 6.) in which only one component of ten key assumptions is the month-end spot rate. Another component in the lattice model is the forward foreign exchange rate for Yen to U.S. dollar. The forward foreign currency exchange rate, relative to the spot rate, used for the original fair value determination of the embedded foreign currency derivative as of October 16, 2006, indicated a decline from approximately 119.0 to 94.5 over six years (the estimated life of the embedded foreign currency derivative). Since the relationship between the forward exchange rate and the spot rate declined even more from October 16, 2006 to November 30, 2006, the value of the embedded foreign currency derivative declined in value. As such, there is not a perfect inverse relationship between the translation of the long-term bonds and the change in fair value of the embedded foreign currency derivative, and we accordingly believe our presentation to be appropriate.

Securities and Exchange Commission

March 23, 2007

Page 25 of 27

Note 19 – Unaudited Condensed Consolidating Financial Information, page 29.

| 8. | We note the condensed consolidating financial information in the Form 10-K and 10-Q’s. Please tell us, and disclose in future filings, whether each of the subsidiary guarantors is 100% owned by the parent company issuer. Note that Article 3-10 of Regulation S-X distinguishes between “wholly-owned” and 100% owned. |

Management Response: Each of our subsidiary guarantors is 100% owned (as defined in Rule 3-10 of Regulation S-X). We will revise our disclosure to state “100% owned” in our future filings with the Commission.

Note 19 – Unaudited Condensed Consolidating Financial Information, page 29.

| 9. | Also, please tell us the sources of the parent’s reported operating cash flows given that the parent generates no revenues. |

Management Response: Parent’s reported operating cash flows are primarily due to changes in certain operating assets and liabilities on Parent’s balance sheet. For example, Parent’s balance sheet includes several prepaid assets that are amortized throughout the year, resulting in a change in the prepaid asset account on Parent’s balance sheet. For operating cash flow purposes, the change in the prepaid asset account should be offset by the amortization expense on Parent’s Statement of Cash Flows. However, since we currently allocate all of Parent’s operating expenses to the Guarantor subsidiaries through an intercompany account on the balance sheet, there are no operating expenses remaining on Parent’s books to offset the change in the operating assets and liabilities. We therefore have methodologies in the allocation of operating expenses and the changes in operating assets and liabilities between the Parent’s and Guarantor’s cash flows that result in positive cash flows from operations for the Parent despite the fact that the Parent does not have revenues from operating activities.

For the three months ended November 30, 2006, Consolidated net cash provided by operating activities was $134.8 million, Parent Only net cash provided by operating activities was $9.6 million, and Guarantor Subsidiaries net cash provided by operating activities was $111.0 million. For the three months ended November 30, 2006, net cash flow from all activities was negative on a Consolidated basis. Furthermore, Parent Only and Guarantor Subsidiary net cash flow from all activities was also negative. From a quantitative perspective, for the three months ended November 30, 2006, Parent Only net cash provided by operating activities was only 7.1% of Consolidated net cash provided by operating activities. From a qualitative perspective, had the $9.6 million in operating cash flows resulting from changes in operating assets and liabilities accounts been presented in the Guarantor’s cash flows instead of the Parent’s, both the Parent Only and Guarantor Subsidiaries would still have reported negative overall cash flows for the period.

After further consideration of the Staff’s comment, in future filings we will report all cash flows resulting from changes in operating assets and liabilities in the Guarantor’s

Securities and Exchange Commission

March 23, 2007

Page 26 of 27

cash flows. However, given the quantitative and qualitative considerations mentioned in the preceding paragraph, and given that the Parent Only Statement of Cash Flows is not of primary value to investors since an investor would look to the financial status of the Guarantor Subsidiaries that guaranteed the debt to evaluate the likelihood of payment, we believe the Condensed Consolidating Statement of Cash Flows is fairly presented in all material respects for the three months ended November 30, 2006.

Note 19 – Unaudited Condensed Consolidating Financial Information, page 29.

| 10. | Further, please clarify for us why the November 30, 2006 SFAS 131 data (page 9) reports $284 million of intercompany receivables whereas the November 30, 2006, condensed consolidating Balance Sheets do not reflect an elimination entry approximating that amount. Please tell us how intercompany transactions are classified in the condensed consolidating Statements of Cash Flows. Note the guidance in paragraph 136 of SFAS 95 regarding the classification of intercompany advances and loans. |

Management Response: Of the $284 million of intercompany receivables reported in the SFAS 131 data in our Form 10-Q for the quarterly period ended November 30, 2006, approximately $255 million represents intercompany loans between our subsidiaries that were all reported within the “Guarantor Subsidiaries” column of the Condensed Consolidating Balance Sheets. Hence, these intercompany loans and the related interest receivable and interest payable between Guarantor Subsidiaries are all eliminated within the Guarantor Subsidiaries column on the Condensed Consolidating Balance Sheets in our periodic financial reports. Approximately $24 million of the remaining intercompany receivable balance is eliminated within the Non-Guarantor Subsidiaries column for the same reason above, and approximately $5 million in the Elimination and Consolidation Entries column. Only the $5 million amount in the Elimination and Consolidation Entries column represents the intercompany balances between Guarantor and Non-Guarantor Subsidiaries.

Within the consolidating Statements of Cash Flows on page 32, we present condensed information as permitted by Reg. S-X §210.10-01(a)(4). In addition, we use the indirect method for our statement of cash flows. Although Example 2 in SFAS 95, paragraph 136 in Appendix C Illustrated Examples (page 46), indicates that intercompany receivables and payables are presented on separate line items in the operating activities section of a statement of cash flows presented under the direct method, the indirect method example (page 47) does not; only intercompany profit is eliminated. Furthermore, because we are presenting condensed information, intercompany transactions net to zero within the Eliminations column. For example, if the intercompany dividends in paragraph 136 of SFAS 95 were excluded, then the net impact on cash flows from operating activities would be zero. Since Shaw did not pay intercompany dividends, there is no impact on the net operating activities or the Eliminations column.

Securities and Exchange Commission

March 23, 2007

Page 27 of 27

The Shaw Group Inc. acknowledges that:

| | • | | It is responsible for the adequacy and accuracy of the disclosure in the Form 10-K and Form 10-Q filings; |

| | • | | Staff comments or changes to disclosure in response to staff comments do not foreclose the SEC from taking any action with respect to the 10-K and Form 10-Q filings; and |

| | • | | It may not assert staff comments as a defense in any proceeding initiated by the SEC or any person under the federal securities laws of the United States. |

We would like to discuss both your comments and our analysis at your earliest possible convenience. Please do not hesitate to call me at 225-932-2567. Thank you for your consideration of this matter.

| | |

| | Very truly yours, |

| |

| /s/ | | Robert L. Belk |

| | Chief Financial Officer |

| | The Shaw Group Inc. |

| | |

| cc: | | Gary Graphia |

| | Dirk Wild |

| | Jim Pierson |

| | David Oelman, Vinson & Elkins LLP |

| | Mike Lucki, Ernst & Young LLP |