[Letterhead of The Shaw Group Inc.]

May 4, 2007

Via Facsimile and EDGAR Submission

Ryan Rohn, Staff Accountant

Al Pavot, Staff Accountant

Terence O’Brien, Accounting Branch Chief

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E., Mail Stop 7010

Washington, DC 20549-7010

Facsimile No.: (202) 772-9369

| | |

| Re: | | The Shaw Group Inc. |

| | Form 10-K for the Fiscal Year Ended August 31, 2006 |

| | Filed October 31, 2006 |

| | Form 10-Q for the Quarterly Period Ended November 30, 2006 |

| | Filed January 16, 2007 |

| | File No. 001-12227 |

Dear Sirs:

This letter is being furnished on behalf of The Shaw Group Inc. in response to additional comments of the Staff of the Securities and Exchange Commission contained in a letter dated April 13, 2007 with respect to the above referenced filings. For your convenience we have set forth the text of the Staff’s comments in italics followed by our responses.

We do not believe that an amended and restated Form 10-K for the fiscal year ended August 31, 2006 would provide significant benefit to the users of our financial statements. However, on April 2, 2007, we reported on Form 8-K that we expected a delay in reporting our second quarter of fiscal year 2007 results of operations on Form 10-Q, and that we expected a restatement of the results of operations for the quarter ended November 30, 2006 on an amended Form 10-Q. Accordingly, we propose that the Staff allows us to resolve the comments below in the amended Form 10-Q for the quarter ended November 30, 2006, and in subsequent periods. In order to obtain your concurrence or comment on this conclusion,we respectfully request a teleconference with the Staff to discuss the contents of this response at your earliest possible convenience. Please do not hesitate to call the undersigned at 225-932-2567. Thank you for your consideration of this matter.

Securities and Exchange Commission

5/4/2007

Page 2

Prior Comment 1

1. It appears that retrospective application of the accounting change is required by paragraph 7 of SFAS 154. We understand that this would cause a 13% and a 6% impact on reported revenues for the F&M segment in fiscal 2005 and fiscal 2006, respectively. We also understand that reported revenues for this segment would reflect a 40% increase over the prior year, versus the 50% increase currently presented. It also appears that there would be a material impact on the interim period data for this segment. Accordingly, it appears that the error is quantitatively material and a restatement is required. The guidance is SAB 99 specifically addresses the relevance of segment data when assessing materiality. Further, the examples and fact patterns used in the SAB consistently describe situations where quantitatively immaterial errors may be considered to be material in light of certain factors. The SAB does not state that quantitatively material errors can be viewed as immaterial. Please amend the form 10K and subsequent form 10-Q to correct the error. Corresponding revisions should be made in MD&A and in notes 22 and 26 to the annual financial statements.

Management Response:We would like to clarify for the Staff that the change in presentation of the F&M segment’s revenues and our change to begin segmenting E&C segment contracts are two separate accounting issues: (1) a change in application of the segmenting provisions for construction-type contracts pursuant to SOP 81-1, and (2) a change in the presentation of the elimination of intersegment revenues between the two aforementioned segments. We believe these two issues should be addressed and considered separately in our SAB 99 analysis. As explained in more detail in this response, the change in F&M revenues is not a result of our decision to change our application of the SOP 81-1 segmenting provisions but rather was a change in how we presented our eliminations of intersegment revenues.

Issue #1—Change in application of the segmenting provisions for construction-type contracts pursuant to SOP 81-1

As previously discussed in our letter to the Staff dated March 23, 2007, beginning March 1, 2006 we began segmenting (as that term is defined in AICPA’s Statement of Position 81-1, “Accounting for Performance of Construction-Type and Certain Production-Type Contracts” (SOP 81-1) paragraphs 39-42) our E&C segment’s contracts that included pipe fabrication being executed by our F&M reportable segment. Prior to March 1, 2006, we included as a contract cost in our E&C segment (and, therefore, included in the measurement of progress under the percentage-of-completion method), the revenues recorded in our F&M segment’s pipe fabrication effort on the related engineering, procurement and construction (“EPC”) contracts. As a result of the change in application of the segmenting provisions of SOP 81-1, subsequent to March 1, 2006, the F&M segment pipe fabrication efforts are excluded from the costs incurred and the total estimated costs for measuring progress and recognizing profit in the E&C segment.

If we had applied the change described above to these contracts effective September 1, 2005 rather than March 1, 2006, this change would have reduced our consolidated fiscal 2005 revenues by approximately $1.2 million (0.04% of revenues for fiscal 2005) and net income by approximately $740,000 (4.6% of net income for fiscal 2005) or $0.01 per

Securities and Exchange Commission

5/4/2007

Page 3

diluted share and increased fiscal 2006 revenues by approximately $265,000 (0.006% of revenues for fiscal 2006) and net income by approximately $165,000 (0.3% of net income for fiscal 2006) or $0.002 per diluted share. This change had no impact on the gross profit or net income of our F&M segment.

We believe this accounting change was quantitatively and qualitatively immaterial to the Shaw consolidated results considered as a whole and the E&C segment’s results. Our change effective March 1, 2006 regarding segmenting contracts should not be confused with the change in how we presented the elimination of intersegment revenues as described below.

Issue #2—Presentation of elimination of F&M intersegment revenues

In a separate but concurrent change, and also beginning March 1, 2006, we began reporting in the F&M segment the revenues and cost of revenues related to the pipe fabrication efforts on our EPC contracts which had previously been included in the results of our E&C segment. We did this by eliminating intersegment revenues between the two segments in the E&C segment instead of in the F&M segment. See illustrations below.

Hypothetical facts for illustrations: E&C and F&M are two reportable segments of The Shaw Group Inc. The E&C segment has a contract to provide EPC services to Customer A for a refining facility. The F&M segment provides pipe fabrication and manufacturing services for the same refining facility. In the execution of the EPC contract with Customer A, the E&C segment engages the F&M segment to provide pipe bending services.

In the most recent reporting period, the E&C and F&M segments had the following results relating to activity on the EPC contract with Customer A:

| | | | | | |

| | | F&M | | E&C |

Revenues | | $ | 100 | | $ | 1,000 |

Cost of revenues | | | 75 | | | 900 |

| | | | | | |

Gross profit | | | 25 | | | 100 |

We could eliminate the appropriate amount of revenues and cost of revenues between the E&C and F&M segments using one of several methods thereby leaving the appropriate amount of consolidated gross profit in our consolidated results.

First, we could eliminate $100 of revenues and cost of revenues between the E&C and F&M segments within the F&M segment by netting F&M’s gross revenues and cost of revenues. This is the method we used prior to March 1, 2006.

Method #1 – Prior to March 1, 2006

| | | | | | | | | | | | | |

| | | F&M | | | E&C | | Elim | | Consol |

Revenues | | $ | — | | | $ | 1,000 | | $ | — | | $ | 1,000 |

Cost of revenues | | | (25 | ) | | | 900 | | | — | | | 875 |

| | | | | | | | | | | | | |

Gross profit | | | 25 | | | | 100 | | | — | | | 125 |

Securities and Exchange Commission

5/4/2007

Page 4

Or, we could eliminate $100 of revenues and cost of revenues between the E&C and F&M segments within the E&C segment by netting E&C’s gross revenues and cost of revenues. This is the method we used subsequent to March 1, 2006.

Method #2 – Subsequent to March 1, 2006

| | | | | | | | | | | | |

| | | F&M | | E&C | | Elim | | Consol |

Revenues | | $ | 100 | | $ | 900 | | $ | — | | $ | 1,000 |

Cost of revenues | | | 75 | | | 800 | | | — | | | 875 |

| | | | | | | | | | | | |

Gross profit | | | 25 | | | 100 | | | — | | | 125 |

Or, we could eliminate $100 of revenues and cost of revenues between the E&C and F&M segments in an eliminations column thereby leaving the E&C and F&M segment revenues and cost of revenues gross.

Method #3 – Gross presentation

| | | | | | | | | |

| | | F&M | | E&C | | Elim | | | Consol |

Revenues | | 100 | | 1,000 | | (100 | ) | | 1,000 |

Cost of revenues | | 75 | | 900 | | (100 | ) | | 875 |

| | | | | | | | | |

Gross profit | | 25 | | 100 | | — | | | 125 |

SFAS 131 states that segment data “shall be the measure reported to the chief operating decision maker (“CODM”) . . . Adjustments or eliminations made in preparing an enterprise’s general–purpose financial statements and allocations of revenues, expenses and gains or losses shall be included in determining reported segment profit or loss only if they are included in the measure of the segments profit or loss that is used by the chief operating decision maker.”

Segment data may be presented in any reasonable manner provided that it is consistent with the information presented to the CODM. During the periods prior to and after March 1, 2006, our CODM used more that one measure of segment profit and loss, i.e., under more than one of the methods of eliminating intersegment revenues illustrated above. Accordingly, we reported our segment data in our periodic filings with the Commission using the measure that we believed was in accordance with the measurement principles most consistent with those used in measuring the corresponding amounts in the enterprise’s consolidated financial statements.

Our change in presenting F&M revenues was driven by our desire to better present the results of the F&M segment and their contribution to the consolidated results rather than the previous view that Shaw revenue and operating income were attributed to the segment which has the contract with the customer. The change in presentation of F&M

Securities and Exchange Commission

5/4/2007

Page 5

segment revenues was solely a change in the way eliminations were included in segment data, and is not a result of an error in application of the segment provisions for construction-type contracts pursuant to SOP 81-1 mentioned in the preceding discussion.

Nevertheless, we now believe that Method #3 above is the clearest presentation, and our CODM would prefer to only review the information in that manner. Therefore, we would propose to recast the prior year’s segment data on a gross basis for all segments consistent with Method #3 illustrated above on a prospective basis. We believe prospective recasting is most appropriate after giving consideration to the fact that for both fiscal years 2006 and 2005, F&M revenues represented only approximately 6% of Shaw’s total consolidated revenues, and also the fact that we will be changing our segments effective December 1, 2006 as discussed below in prior comment #3.

Prior Comment 3

2. Based on the CODM reports that you have provided to us, it appears that there are 3 businesses within your E&C segment that exceed the SFAS 131 10% test and appear to have disparate revenue growth rates and/or profit margins. Please provide for us your analysis of the economic characteristics that support aggregation of these businesses. In addition, please provide us with copies of the new, 2/28/07 CODM reports referenced in your response.

Management Response:You have asked us to present an aggregation analysis relating to businesses within the E&C segment. We believe that Energy and Chemicals (“E&C”) is properly defined as an operating segment in our Form 10-K for the fiscal year ended August 31, 2006. We do not believe an aggregation analysis is appropriate under SFAS 131 due to the language in paragraphs 13, 14 and 18 of the standard.

Considerations of SFAS 131 regarding multiple levels of financial data (para. 13 & 14):

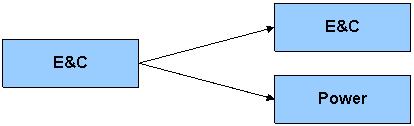

We acknowledge that as of the filing of the Form 10-K for the fiscal year ended August 31, 2006, the E&C operating segment was comprised of the following components because their operations constitutebusiness activities for which there isdiscrete financial information, as clarified by EITF Topic D-101:

Although these components constitute separate businesses, we believe that the criteria in paragraphs 13 and 14 of SFAS 131 as noted below regarding multiple levels of information must be considered:

| | — | | The nature of the business activities of each component |

| | — | | The existence of managers responsible for each component |

Securities and Exchange Commission

5/4/2007

Page 6

| | — | | Information provided to the board of directors |

For the year ended August 31, 2006, the E&C segment and the components detailed therein met at least two of these criteria in that there was (1) a single defined segment manager who was directly responsible to the CODM for the E&C operating segment as a whole, and (2) the financial reports provided to the board of directors during fiscal year 2006 present the E&C segment as a whole.

1. Single segment manager and functional management of the operating segment

The component businesses within E&C were managed as a single unit and by a single segment manager during the year ended August 31, 2006. This segment manager was responsible for the allocation of resources within the E&C operating segment. Functionally, the segment has centralized estimating, engineering, procurement and logistical functions. Also, E&C assets and personnel were deployed to projects from a common resource pool depending on the nature of the service provided to the client and the priority for execution of the contract.

Generally, individual projects are managed by a project manager who is attached to one of the major component business units within E&C (Process, Power, etc.). This project manager will utilize assets and human resources from a common E&C pool to provide the contracted service. Once the contract is completed, the resources and assets are “returned” to the pool of assets and scheduled for deployment in fulfilling another service contract which may be for another component business within the E&C operating segment. The project managers in a given component ultimately report to the managers of the component business unit who in turn report to the E&C segment manager.

Further, the incentives (bonuses) of the E&C operating segment manager, as well as the component managers and service level employees within E&C, were based on the performance of E&C as a whole and were not specifically tied to or weighted toward the performance of any single component within the segment. Thus, under the management approach as prescribed by the FASB, we believe that it is more reasonable that all E&C services are disclosed as within a single operating segment.

2. Internal reporting to the Board of Directors and other metrics used by the CODM

Information is provided to our Board of Directors in two ways, operational reports are presented on a project by project basis for all major projects and financial information is provided at the E&C level. It should also be noted that the financial information which is given to the board reflects the final numbers as presented in our filings.

From an internal reporting perspective, the cash flow and balance sheet information contained in the executive reporting package (“ERP”) is provided at the E&C operating segment level. This information is not available for the component businesses within the E&C operating segment. Also, 66% of E&C indirect costs and 74% of E&C general and administrative costs for the year ended August 31, 2006 were not allocated to the components within the E&C

Securities and Exchange Commission

5/4/2007

Page 7

operating segment. Other metrics, which are of importance to the CODM in his assessment of performance, include the return on assets calculation (“ROA”) and the amount of capital expenditures; both of which are presented on a total E&C operating segment basis and not for the component businesses.

Considerations of SFAS 131 regarding aggregation (para. 18):

Please note that paragraph 18 of SFAS 131 states that, “An enterprise shall report separately information about anoperating segment that meets any of the following quantitative thresholds…”

We believe that the above analysis of the components precludes an aggregation analysis because the component businesses meet the criteria of paragraphs 13 and 14 of FAS 131 whereby component business units may be combined into a single operating segment. Since the component businesses stated above have already been established as a single operating segment, we believe paragraph 18 of SFAS 131 would not be applicable since it applies to the aggregation of operating segments to a reportable segment and not the aggregation of component businesses within an operating segment.

CODM reports as of February 28, 2007:

As requested we have provided a copy of our ERP for the month ended February 28, 2007. Please note that pursuant to Rule 83 of the Commission’s Rules on Information and Requests (17 C.F.R. § 200.83), we are requesting that the relevant financial reports reviewed by our chief operating decision maker for the period ended February 28, 2007 that we produced be kept confidential. A copy of this letter has been sent to the Freedom of Information Act Officer at the Securities and Exchange Commission in Washington, D.C. Enclosed please find a copy of our letter requesting confidentiality to the Commission’s FOIA Officer.

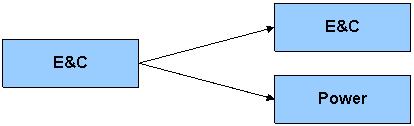

As you may recall from our previous response, we noted that our internal management structure changed during the second quarter of the 2007 fiscal year. This change was announced in a press release that we issued on September 29, 2006. Due to this change we reassessed our segments and have made a preliminary determination, which we are in the process of discussing with our external auditors, that we will present the following segments in our Form 10-Q for the three months ended February 28, 2007:

| | • | | Investment in Westinghouse |

Please note that the previously reported E&C segment will now be separately reported as E&C and Power beginning with our 10-Q filing for the three months ended February 28, 2007 due to our management changes. This prospective change does not alter our belief that our segments were correctly presented in our Form 10-K and Form 10-Q which are

Securities and Exchange Commission

5/4/2007

Page 8

the subject of your comment letter. We have provided the following graphic to illustrate the change in our operating segments.

| | | | | | | | |

| | Reportable Segments as of August 31, 2006 and November 30, 2006 | | | | Reportable Segments as of February 28, 2007 | | |

| | * | The Investment in Westinghouse Segment did not exist prior to November 30, 2006 |

Regarding our prior observation concerning variability in profitability among geographic areas, we noted your income (loss) before provision (benefit) for income taxes disclosure on page 96 and the revenue information disclosed on page 108. However, this may not be relevant to the issue if the CODM does not regularly receive geographic profitability information.

Management Response:Regarding the variability in profitability among geographic areas, we confirm that the CODM does not review such information. Accordingly, geographic areas should not be considered in the determination of our operating segments for the year ended August 31, 2006. However, we do provide geographical information as required by paragraph 38 of SFAS 131.

Securities and Exchange Commission

5/4/2007

Page 9

Prior Comment 5

4. We assume that neither the Shareholders Agreement nor any other applicable contract or law requires that Toshiba give Shaw the ability to vote on the following items:

| | • | | Compensation of Westinghouse management. |

| | • | | Hiring and/or termination of Westinghouse management. |

| | • | | Approving Westinghouse operating budgets. |

| | • | | Approving Westinghouse capital budgets. |

Please advise us if our understanding is correct. These factors would appear inconsistent with the FIN 35 concept of “significant influence over operating policies.”

Management Response:We note your observations, but would like to respond by first highlighting some preliminary overarching thoughts. APB 18 requires that the equity method of accounting be followed by an investor whose investment in voting stock gives it the ability to exercise significant influence over operating and financial policies of an investee. FIN 35 sets forth that when an investor owns 20% or more of the voting stock of an investee, a determination that an investor may be unable to exercise significant influence over the investee’s operating and financial policies requires an evaluation of all the facts and circumstances relating to the investment. It is a presumption that a 20% or more investor has the ability to exercise significant influence over the investee’s operating and financial policies unless overcome by predominant evidence to the contrary. Thus, we believe FIN 35 is the exception to the general rule and is invoked only when, after an evaluation of all the facts and circumstances relating to the investment, there is predominant evidence to the contrary that an investor is unable to exercise significant influence.

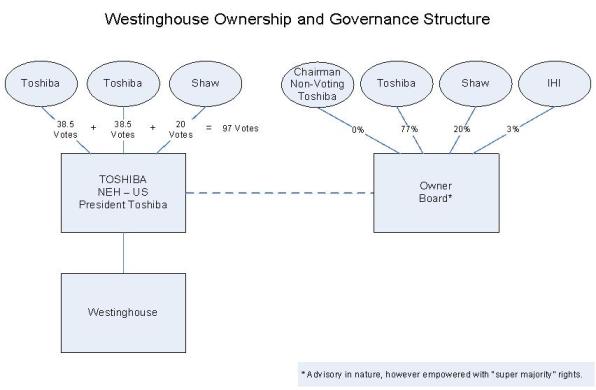

Overview of Sources of Significant Influence:

We believe when viewing all the facts and circumstances of the Westinghouse transaction in their totality, that we are able to exercise significant influence through:

a) Our voting participation on the Board of Directors of the holding companies which is responsible for the corporate governance and management of its investment in the Westinghouse Group;

b) Our voting participation on the Owner’s Board of the Board of Directors, which has minority-protection rights over major actions of the Westinghouse Group as well as approves tax and accounting policies for the Westinghouse Group;

c) The Commercial Relationship Agreement and the Consortium Agreements between Westinghouse and us that provide for extensive intercompany transactions. This is evidenced by the recent agreement to build four (4) nuclear plants in China, which we expect to result in billions of dollars in revenues;

d) The Coordination Office between the Shareholders and Westinghouse is designed and operates to identify mutual opportunities and synergies between the parties;

e) The technological dependency imbedded in our workforce for the engineering and construction of nuclear plants, which is the impetus for the transactions and the Customer Relationship Agreement;

Securities and Exchange Commission

5/4/2007

Page 10

f) Our Put Option, which allows us to put back our $1 billion investment in Westinghouse to Toshiba at our sole discretion.

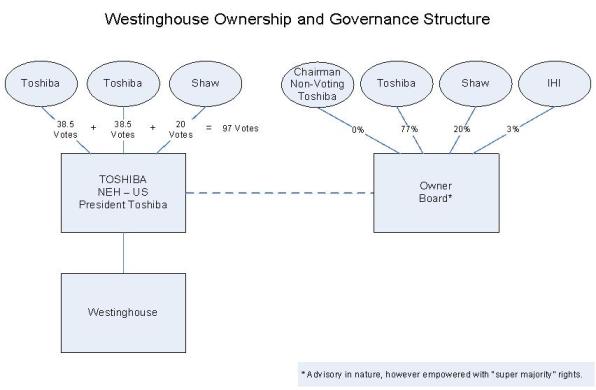

The Shareholders Agreement provides us the ability to approve Westinghouse operating budgets and capital budgets. Toshiba has provided us the ability to vote relating to its operating budget and its capital budget through (1) our membership on the Board of Directors of Toshiba Nuclear Energy Holdings US Inc., where we have 21% voting rights, and (2) our membership on the Owner Board to Toshiba Nuclear Energy Holdings US Inc., where we have 20% voting rights. Our member appointed to Toshiba Nuclear Energy Holdings US Inc. and also appointed to the Owner Board is The Shaw Group Inc. Chairman, Chief Executive Officer, and President, J. M. Bernhard, Jr.

Holding Company Structure:

The holding company structure of our instrument in Westinghouse is set forth below:

Shaw, in making its determination as to whether Shaw had significant influence over operating policies, carefully considered the influence it is able to exert through Toshiba NEH (the holding company for our investment in Westinghouse or “TNEH”) and its Owner Board. As noted below, the Owner Board is charged with monitoring the implementation of the annual budget for Westinghouse on a quarterly basis and Westinghouse’s business plan on a no less than annual basis.

The holding company structure and the Owner Board was designed to facilitate the ability of members to change its ownership interest while affording a forum for new investors to have influence over their investment. Toshiba has publicly stated in a public announcement of their fiscal year end consolidated results dated April 26, 2007 they are in continuing talks with other companies interested in participating in the Westinghouse investment.

Securities and Exchange Commission

5/4/2007

Page 11

Implementation of the Annual Plan:

—Article 4.03(a) of the TNEH Shareholders Agreement provides that the Board of Directors of TNEH shall cause Westinghouse Group to prepare an annual budget and that the Owner Board of TNEH “shall be responsible for the implementation of the annual Budget at least once every fiscal quarter.”

Implementation of the Business Plan:

—Article 4.03(b) of the TNEH Shareholders agreement provides that the Board of Directors of TNEH shall cause the Westinghouse Group to prepare a mid-term business plan which is expected to cover a period of five years, in a manner similar to the preparation of the Annual Budget. The Owner Board of TNEH shall be responsible for monitoring the implementation of the Business Plan not less often than annually.

Evidence of Shaw Exercising Significant Influence over recent Business Plan:

Evidence of Shaw exercising significant influence exists in Shaw’s approval of the five year business plan, which was approved by the Owner Board on February 28, 2007. As part of the approval process for the mid-term business plan of Westinghouse, TNEH requested that the Business Plan be approved by the Owner Board and formally endorsed by the Board of Directors of TNEH, one of whom represents Shaw.

Thus, the Shareholders Agreement provides the mechanism for the Board of Directors of TNEH and the Owner Board of TNEH to cause to be prepared and monitor the annual budget and business plans of Westinghouse Group. By operation, this has been effectuated by Shaw’s written consent to the approval in the Owner Board meeting of February 28, 2007 and in the resolution of the Board of Directors of TNEH.

Compensation, Hiring and/or Termination of Westinghouse Management:

- Article 4.05(a) provides that all decisions as to staffing and personnel matters relating to the Company … shall be made by the President, a Toshiba appointee.

Thus, with respect to Shaw’s ability to vote on the compensation of Westinghouse Management and the hiring and/or termination of Westinghouse Management, the understanding of the Staff is correct. As noted in Article 4.05(b) of the NEH Shareholders Agreement, the President of NEH Holdings will notify the other shareholders in advance. Moreover, we have indirect influence over the compensation of employees through our approval of the Business Plan.

We acknowledged this limitation in our March 23, 2007 response to the Staff on this factor, however, we noted then, and continue to believe, that we exercise our significant influence based on the totality of the factors, including our board representation and voting rights at the Holding Company level, our Owner Board participation and voting rights, our minority-protection rights, our Put Option, our Customer Relationship Agreement, and other factors as noted in the analysis.

Securities and Exchange Commission

5/4/2007

Page 12

Summary:

We continue to believe we have the ability to exercise significant influence over our Westinghouse investment after consideration of all the facts and circumstances as noted above and after consideration of the specific factors identified by the Staff. Based upon our ability to influence operating policies through our voting membership on the Owner Board and the Board of Directors of TNEH, as well as the other relationships described above, and our response to the Staff on March 23, 2007, we continue to believe that we exert significant influence over the operating and financial policies of our investment. We do not believe there is predominant evidence to the contrary, as provided by the FIN 35 exception to the general rule of APB 18, and accordingly, the equity method of accounting as provided in APB 18 is appropriate.

Prior Comment 6

5. Please identify for us the contractual provision that enables Shaw to require the redemption of their shares in the 2 holding companies. Specifically, if the put option agreements are between Toshiba and the holding companies, and if Toshiba has 77% of the voting stock in the holding companies, then it is not clear whether Toshiba has the ability to prevent the holding companies from exercising the put option. Please also clarify for us how it was determined that the guidance in paragraph 12 of SFAS 133 was not relevant to the accounting for the put right. We may have further comment.

Management Response: The Put Option Agreements (“Put Option”) are between our 100% owned subsidiary, Nuclear Energy Holdings LLC (“NEH”), and Toshiba Corp (“Toshiba”). Toshiba has no influence over Shaw’s right to exercise the Put Option. As described in Note 2 of our Form 10-Q for the quarterly period ended November 30, 2006, the Put Option provides us the option to sell all or part of our shares to Toshiba for 97% of our original Japanese Yen (“JPY”)-equivalent purchase price. Specifically, in Section 2.1 of the Put Option (Exhibits 10.2 and 10.3), it states:

“NEH shall have the right and option to sell to Toshiba or its permitted assignee, and upon the exercise of such right and option Toshiba or its permitted assignee shall have the obligation to purchase from NEH, all of the Shares identified in the Put Exercise Notice.”

We analyzed the Put Option as a whole in accordance with SFAS 133 paragraph 6, which states the contract must have all three of the following characteristics:

| | a. | It has one or more underlyings and one or more notional amounts or payment provisions or both. |

We meet this criterion – The underlying is the fixed share price in Yen. The notional amount is the number of shares subject to the put right.

Securities and Exchange Commission

5/4/2007

Page 13

| | b. | It requires no initial net investment or an initial net investment that is smaller than would be required for other types of contracts. |

We may meet this criterion – The purchase price of the Put Option, in total, was $389.7 million. We do not believe this amount is “smaller than would be required” for a similar type of contract; however, there are no quoted market prices for this instrument for comparison purposes. Therefore, we continued to the third criteria.

| | c. | Its terms require or permit net settlement, it can readily be settled net by a means outside the contract, or it provides for delivery of an asset that puts the recipient in a position not substantially different from net settlement. |

We do not meet this criterion – There is no “net settlement” provision as defined under paragraph 9 of SFAS 133, since NEH is required to deliver the actual shares to Toshiba when it exercises the Put Option (per Section 2.5(a) of the Put Option). In addition, the shares of the Toshiba Holding Companies are not marketable securities and are not “readily convertible to cash” as defined in footnote 5 to SFAS 133:

“FAS133, Footnote 5—FASB Concepts Statement No. 5,Recognition and Measurement in Financial Statements of Business Enterprises, states that assets that are readily convertible to cash “have (i) interchangeable (fungible) units and (ii) quoted prices available in an active market that can rapidly absorb the quantity held by the entity without significantly affecting the price” (paragraph 83(a)). For contracts that involve multiple deliveries of the asset, the phrasein an active market that can rapidly absorb the quantity held by the entity should be applied separately to the expected quantity in each delivery.”

Finally, per Article 7 of the Shareholders Agreement, “no Shareholder shall Transfer any of its Shares prior to October 1, 2012, except for Permitted Transfers.” Permitted Transfers are defined in Section 7.02 and only include transfers of all of a Shareholder’s shares to one of its own Affiliates and transfers from Shaw to Toshiba if Shaw exercises its Put Option.

We concluded the Put Option was not a derivative instrument. In addition, we considered the foreign currency component within the Put Option (i.e., the host contract), and reviewed paragraph 12 of SFAS 133 which states, “An embedded derivative instrument shall be separated from the host contract and accounted for as a derivative instrument pursuant to this Statement if and only if all of the following criteria are met:”

| | “a. | The economic characteristics and risks of the embedded derivative instrument are not clearly and closely related to the economic characteristics and risks of the host contract.” |

We meet this criterion – In reviewing the guidance in SFAS 133, paragraph 61. e., we concluded that the right to receive a fixed amount of Yen is not clearly and closely related to the shares of common stock.

| | “b. | The contract (“the hybrid instrument”) that embodies both the embedded derivative instrument and the host contract is not remeasured at fair value under |

Securities and Exchange Commission

5/4/2007

Page 14

| | otherwise applicable generally accepted accounting principles with changes in fair value reported in earnings as they occur.” |

We meet this criterion– We concluded that the Put Option was not a derivative instrument per the analysis above. In addition, the Put Option did not meet any specific generally accepted accounting standard that requires fair value measurement.

| | “c. | A separate instrument with the same terms as the embedded derivative instrument would, pursuant to paragraphs 6–11, be a derivative instrument subject to the requirements of this Statement.” |

We meet this criterion– A separate foreign currency forward exchange contract would meet the definition of a derivative instrument (Example 3 in Appendix B of SFAS 133).

As a result, we concluded that the foreign currency component met the criteria under paragraph 12, and we bifurcated the embedded foreign currency forward exchange contract (the Embedded Derivative disclosed in Note 2 of our Form 10-Q for the quarterly period ended November 30, 2006). The remaining Put Option excluding the foreign currency component continued to not meet the characteristics required by paragraph 6 as described above, primarily because the put right to sell our shares to Toshiba does not contain a “net settlement” provision.

6. Page 11 of the form 10-Q states that Shaw entered into a put option agreement. We assume that this refers to the contracts filed as exhibits 10.2 and 10.3 between NEH and Toshiba. Please advise whether our understanding is correct.

Management Response: The understanding of the Staff is correct. Exhibits 10.2 and 10.3 are the Put Option Agreements between NEH and Toshiba (one agreement for the shares of Toshiba Nuclear Energy Holdings (US) Inc. and one agreement for the shares of Toshiba Nuclear Energy Holdings (UK) Limited).

Prior Comment 7

7. We understand that a lattice model was used to fair value the foreign currency embedded derivative and that a material loss on the asset was recognized despite an appreciation in the value of the Yen. There is a concern that readers may not understand the absence of an inverse relationship between the foreign currency impacts on Yen denominated assets and liabilities. Please revise MD&A to provide an expanded and informative disclosure about the specific factors that generated the substantial foreign currency losses on the Yen-denominated asset of the Yen-denominated debt. If the related gains and losses cannot be expected to directly correlate with changes in the USD to Yen exchange rate, then that fact should be disclosed. The disclosure should also explain to readers management’s view regarding the economic and liquidity impact on the registrant of the recognized gains and losses. If the impact is not deemed material because of a hedging relationship between the

Securities and Exchange Commission

5/4/2007

Page 15

Westinghouse investment/cash flows and the yen-denominated debt/cash flows, then that analysis should be clearly explained.

Management Response: We will revise and expand our MD&A in our restated and amended 10-Q for the quarterly period ended November 30, 2006 to provide more informative disclosures around the specific factors that generate foreign currency translation gains and losses associated with the JPY-denominated bonds and the Embedded Derivative. We will also explain management’s view that the economic and liquidity impact are not deemed material because of an economic hedging relationship between the JPY-equivalent proceeds that would be received from the exercise of the Put Option to settle the JPY-denominated bonds.

Prior Comment 9

8. It appears that the errors contained in your condensed consolidating financial information are quantitatively material to both the parent and guarantor cash flow statements. As such, please amend your Form 10-K for the fiscal year ended August 31, 2006 and your form 10-Q for the quarterly period ended November 30, 2006 accordingly. There is a concern that investors could be misled by a financial statement presentation reporting the issuer’s ability to generate significant positive cash flows.

Management Response:Although we agree that the errors contained in our condensed consolidating financial information are quantitatively material to both the parent guarantor cash flow statements, we believe a restatement is not the most appropriate action because we are in the process of redeeming all outstanding Senior Notes, and these errors have no impact on our consolidated financial statements. Upon completion of this repurchase, as described in more detail below, we will no longer be required to present this information thereby obviating the need for a restatement of this disclosure.

| | • | | Pursuant to a tender offer which commenced on May 5, 2005, approximately $235 million of the 10.75% Senior Notes due March 15, 2010 (the Senior Notes) requiring the condensed consolidating cash flow information were voluntarily redeemed during fiscal 2005. Approximately $15 million of these Senior Notes did not accept the redemption offer and remain outstanding. |

| | • | | The combined Parent plus Guarantor operating cash flows in the aggregate is not misstated, and this is who the investors would look to for repayment. The investor understands that they should not look to the Non-guarantors for repayment. |

| | • | | Pursuant to the Indenture agreement, after March 15, 2007 we may require that the remaining $15 million in Senior Notes be redeemed. As evidenced by our filing on Form 8-K under item 2.04 dated May 3, 2007, we have indeed elected to exercise our option to redeem all of the remaining outstanding Senior Notes. With this election to redeem the outstanding Senior Notes, and upon deposit of the redemption consideration with the Trustee, Shaw’s remaining obligations under the Indenture will be satisfied and the guarantees released. This release will eliminate the requirement |

Securities and Exchange Commission

5/4/2007

Page 16

| | to produce condensed consolidating financial information for the former guarantors of the Senior Notes. |

| | • | | Finally, we would like to make you aware of the potentially significant impact to our ability to timely file required 1934 Act reports if we were to attempt to restate the condensed consolidating financial information. As you are aware, we recently changed auditors from Ernst & Young to KPMG. In the case of a restatement, we have been advised by KPMG that unless they conducted a re-audit KPMG would not be able to opine on those adjustments until they completed our fiscal year 2007 audit. Moreover, E&Y maybe unwilling to re-audit any restatements. In that eventuality, we would be unable to restate any past periods or meet our current reporting obligations. We believe that the cost of failing to provide timely financial reports far outweighs the benefits of restating the condensed consolidating financial information as none of the Senior Notes will be outstanding. |

Accordingly, we would propose eliminating the footnote when we re-file the restated and amended Form 10-Q for the quarter ended November 30, 2006, and, in the event the balance of your comments requires us to re-file our Form 10-K, we would propose eliminating the footnote in that document as well.

9. We remind you that when you file your restated Form 10-K for the fiscal year ended August 31, 2006 and your restated Form 10-Q for the quarter ended November 30, 2006, you should appropriately address the following:

| | • | | an explanatory paragraph in the audit opinion, |

| | • | | full compliance with SFAS 154, paragraph 25 and 26, |

| | • | | fully update all affected portions of the document, including MD&A, selected financial data, and quarterly financial data |

| | • | | Item 9A. disclosures that include the following: |

| | ¡ | | a discussion of the restatement and the facts and circumstances surrounding it, |

| | ¡ | | how the restatement impacted the CEO and CFO’s conclusions regarding the effectiveness of their disclosure controls and procedures, |

| | ¡ | | changes to internal controls over financial reporting, and |

| | ¡ | | anticipated changes to disclosure controls and procedures and/or internal controls over financial reporting to prevent future misstatements of a similar nature. |

Refer to Items 307 and 308(c) of Regulation S-K.

| | • | | updated reports from management and your independent auditors regarding your internal controls over financial reporting. |

| | • | | updated certifications. |

Management Response:We advise the Staff that we did not adopt SFAS 154 until September 1, 2006, thus, we would apply the provisions of paragraphs 25 and 26 of SFAS 154 in our restated and amended Form 10-Q.

Securities and Exchange Commission

5/4/2007

Page 17

We will also update all affected portions of the restated and amended Form 10-Q, and, if necessary, a restated 10-K, including MD&A, selected financial data, and quarterly financial data. In addition, we will include an explanatory statement that fully explains the amendment and the impact on the financial statements.

In our restated and amended Form 10-Q, and, if necessary, a restated and amended Form 10-K, we will update the Item 9A. and/or Item 4 language to discuss the facts and circumstances surrounding the error that led to the restatement, as well as indicate how the restatement impacted the CEO and CFO’s original conclusions regarding the effectiveness of our disclosure controls and procedures in accordance with Item 307 of Regulation S-K. You should also be aware our original Item 9A and Item 4 disclosures in our Form 10-K for the fiscal year ended August 31, 2006 and Form 10-Q for the quarter ended November 30, 2006 indicated that our disclosure controls and procedures were ineffective as of August 31, 2006 and November 30, 2006, respectively.

We will include the required disclosure of any changes in our disclosure controls and procedures and/or internal controls over financial reporting in accordance with Items 307 and 308(c) of Regulation S-K.

We will update the CEO and CFO’s certifications pursuant to Sections 302 and 906 of the Sarbanes-Oxley Act of 2002.

Securities and Exchange Commission

5/4/2007

Page 18

The Shaw Group Inc. acknowledges that:

| | • | | It is responsible for the adequacy and accuracy of the disclosure in the Form 10-K and Form 10-Q filings; |

| | • | | Staff comments or changes to disclosure in response to Staff comments do not foreclose the SEC from taking any action with respect to the 10-K and Form 10-Q filings; and |

| | • | | It may not assert Staff comments as a defense in any proceeding initiated by the SEC or any person under the federal securities laws of the United States. |

|

| Very truly yours, |

|

| /s/ Robert L. Belk |

Robert L. Belk Chief Financial Officer The Shaw Group Inc. |

Dirk Wild

Jim Pierson

David Oelman, Vinson & Elkins LLP

Dennis Whalen, KPMG LLP

Mike Lucki, E&Y LLP