As filed with the Securities and Exchange Commission on April 4, 2013

1933 Act File No. 333-186970

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

x Pre-Effective Amendment No. 1 o Post-Effective Amendment No.

(Check appropriate box or boxes)

Touchstone Funds Group Trust

(Exact Name of Registrant as Specified in Charter)

513-878-4066

(Area Code and Telephone Number)

303 Broadway, Suite 1100

Cincinnati, OH 45202

(Address of Principal Executive Offices: Number, Street, City, State, Zip Code)

Jill T. McGruder

303 Broadway, Suite 900

Cincinnati, OH 45202

(Name and Address of Agent for Service)

Copies to:

John Ford, Esq.

Pepper Hamilton LLP

Two Logan Square

Eighteenth and Arch Streets

Philadelphia, PA 19103

215-981-4009

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

Title of Securities Being Registered: Class Y and Class Z shares of beneficial interest, par value of $0.01 per share, of the Touchstone Ultra Short Duration Fixed Income Fund, a series of the Registrant. No filing fee is due because Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

It is proposed that the filing will become effective on April 4, 2013, or as soon as practicable thereafter.

April 4, 2013

Touchstone Funds Group Trust

Touchstone Short Duration Fixed Income Fund

Dear Shareholder:

The Prospectus/Proxy Statement that accompanies this letter describes a proposed reorganization of the Touchstone Short Duration Fixed Income Fund (the “Short Fund”), a series of Touchstone Funds Group Trust (the “Trust”), into the Touchstone Ultra Short Duration Fixed Income Fund (the “Ultra Short Fund”), a separate series of the Trust (the “Reorganization”). You are being asked to vote on this proposal. The Board of Trustees (the “Board”) of the Trust has approved the proposal and recommends that you vote FOR the proposal.

The Prospectus/Proxy Statement contains important details about the Ultra Short Fund’s investment objective, policies, management, and costs. I urge you to take the time to review it carefully. The Ultra Short Fund’s investment goal is identical to that of the Short Fund. Your vote is important no matter how many shares you own. I would like to answer some initial basic questions about the proposed Reorganization.

Why are you doing this?

Prospects for future growth of the Short Fund are limited given its comparative under-performance and relatively low asset levels. Without the Reorganization it will not be economically practicable for Touchstone Advisors, Inc. (“Touchstone Advisors” or the “Advisor”) to continue to serve as the investment advisor to the Short Fund.

What will happen to my existing shares?

If shareholders of the Short Fund approve the Reorganization, your shares of the that Fund will be exchanged for shares of the Ultra Short Fund. Therefore, in exchange for Class Y shares and Class Z shares of the Short Fund that you own at the time of the Reorganization, you will receive Class Y shares and Class Z shares, respectively, of the Ultra Short Fund. The shares of the Ultra Short Fund that you receive following the Reorganization will have an aggregate net asset value equal to the aggregate net asset value of your shares of the Short Fund immediately prior to the Reorganization so that there will be no change in the value of your investment as a result of the Reorganization.

How will the fees compare?

Set forth below is a comparison of the expenses of the Class Y and Class Z shares of the Short Fund (as of September 30, 2012) and Class Y and Class Z shares of the Ultra Short Fund (as of September 30, 2012). The Total Annual Fund Operating Expenses of the Short Fund are higher than those of the Ultra Short Fund. Touchstone Advisors, the investment advisor to each Fund, has contractually agreed to waive a portion of its fees or reimburse certain Fund expenses through January 29, 2014 for the Short Fund and through May 19, 2014 for the Ultra Short Fund.

TSF-1846-1304

The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for each Fund is presented below.

| | Short

Duration

Fixed Income

Fund

Class Y | | Ultra

Short

Duration

Fixed

Income

Fund

Class Y | | Short Duration

Fixed Income

Class Z | | Ultra

Short

Duration

Fixed

Income

Fund

Class Z | |

Management Fees | | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % |

Total Other Expenses | | 0.45 | % | 0.30 | % | 0.69 | % | 0.48 | % |

Acquired Fund Fees & Expenses | | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % |

Total Annual Fund Operating Expenses | | 0.71 | % | 0.56 | % | 0.95 | % | 0.74 | % |

Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement | | 0.50 | % | 0.45 | % | 0.75 | % | 0.70 | % |

Will I have to pay federal income taxes as a result of the Reorganization?

Shareholders are not expected to recognize gain or loss for federal income tax purposes on the exchange of their shares for shares of the Touchstone Ultra Short Duration Fixed Income Fund. The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization.

What are my choices?

On the enclosed proxy card you have three options. You may vote YES, as the Board and management of the Trust recommends. You may vote NO. Or you may ABSTAIN. An abstention vote is not a neutral response; it is the equivalent of a No vote. Approval of the Reorganization requires the affirmative vote of the holders of a “majority of the outstanding voting securities” of the Short Fund. The term “majority of the outstanding voting securities,” as defined in the Investment Company Act of 1940 and as used in this Prospectus/Proxy Statement, means: the affirmative vote of the lesser of (i) 67% of the voting securities of the Short Fund present at a meeting if more than 50% of the outstanding voting securities of the Short Fund are present in person or by proxy or (ii) more than 50% of the outstanding voting securities of the Short Fund. If the shareholders of the Short Fund do not approve the Plan, the Board may consider other possible courses of action in the best interest of shareholders.

Shares will be voted at a Special Meeting of Shareholders to be held at 10:00 a.m. Eastern Time, on May 13, 2013, at the offices of the Trust, 303 Broadway, Suite 1100, Cincinnati, Ohio, 45202. If you attend the meeting, you may vote your shares in person. If you do not expect to attend the meeting, please complete, date, sign, and return the enclosed proxy card in the enclosed postage paid envelope. Or you may follow the instructions on your proxy card to call in your vote or vote through the Internet.

If you have any questions about the proxy card, please call the Trust at 1-800-543-0407. If we do not receive your vote within a few days, you may be contacted by AST Fund Solutions, our proxy solicitor, who will remind you to vote.

Thank you for considering the proposal carefully.

Sincerely,

Jill T. McGruder

President

Touchstone Funds Group Trust

TOUCHSTONE FUNDS GROUP TRUST

303 BROADWAY, SUITE 1100

CINCINNATI, OHIO 45202

Touchstone Short Duration Fixed Income Fund

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held on May 13, 2013

To the Shareholders of the Touchstone Short Duration Fixed Income Fund:

NOTICE IS HEREBY GIVEN THAT a Special Meeting of the Shareholders of the Touchstone Short Duration Fixed Income Fund of the Touchstone Funds Group Trust, will be held at the offices of the Touchstone Funds Group Trust, 303 Broadway, Suite 1100, Cincinnati, OH, 45202 on May 13, 2013 at 10:00 a.m. Eastern Time and any adjournments thereof (the “Special Meeting”) for the following purpose:

To consider and act upon an Agreement and Plan of Reorganization (the “Plan”) providing for the acquisition of all of the assets of the Touchstone Short Duration Fixed Income Fund (the “Short Fund”) by the Touchstone Ultra Short Duration Fixed Income Fund (the “Ultra Short Fund”), a series of the Touchstone Funds Group Trust, in exchange for shares of the Ultra Short Fund and the assumption by the Ultra Short Fund of the liabilities of the Short Fund. The Plan also provides for pro rata distribution of shares of the Ultra Short Fund to shareholders of the Short Fund in liquidation and subsequent termination of the Short Fund.

The Board of Trustees has fixed the close of business on March 29, 2013 as the record date for determination of shareholders entitled to notice of and to vote at the Special Meeting.

| By order of the Board of Trustees |

| |

|

|

| |

| Jill T. McGruder |

| President |

| Touchstone Funds Group Trust |

April 4, 2013

SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE SPECIAL MEETING ARE REQUESTED TO COMPLETE, SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED ENVELOPE, WHICH NEEDS NO POSTAGE IF MAILED IN THE UNITED STATES. SHAREHOLDERS MAY ALSO VOTE BY TELEPHONE OR VOTE THROUGH THE INTERNET. INSTRUCTIONS FOR THE PROPER EXECUTION OF THE PROXY ARE SET FORTH IMMEDIATELY FOLLOWING THIS NOTICE OR, WITH RESPECT TO TELEPHONE OR INTERNET VOTING, ON THE PROXY CARD. IT IS IMPORTANT THAT YOU VOTE PROMPTLY.

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and avoid the time and expense to the Touchstone Funds Group Trust in validating your vote if you fail to sign your proxy card properly.

1. Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card.

2. Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration on the proxy card.

3. All Other Accounts: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example:

Registration | | Valid Signature |

| | | | |

Corporate Accounts | | |

| | | | |

(1) | | ABC Corp. | | ABC Corp. |

| | | | |

(2) | | ABC Corp. | | John Doe, Treasurer |

| | | | |

(3) | | ABC Corp.

c/o John Doe, Treasurer | | John Doe |

| | | | |

(4) | | ABC Corp. Profit Sharing Plan | | John Doe, Trustee |

| | |

Trust Accounts | | |

| | | | |

(1) | | ABC Trust | | Jane B. Doe, Trustee |

| | | | |

(2) | | Jane B. Doe, Trustee

u/t/d 12/28/78 | | Jane B. Doe |

| | | | |

Custodial or Estate Accounts | | |

| | | | |

(1) | | John B. Smith, Cust.

f/b/o John B. Smith, Jr. UGMA | | John B. Smith |

| | | | |

(2) | | Estate of John B. Smith | | John B. Smith, Jr., Executor |

PROSPECTUS/PROXY STATEMENT

Acquisition of Assets and Liabilities of

TOUCHSTONE SHORT DURATION FIXED INCOME FUND

a series of

Touchstone Funds Group Trust

303 Broadway, Suite 1100

Cincinnati, Ohio 45202

(800) 543-0407

By And In Exchange For Shares of

TOUCHSTONE ULTRA SHORT DURATION FIXED INCOME FUND

a series of

Touchstone Funds Group Trust

303 Broadway, Suite 1100

Cincinnati, Ohio 45202

(800) 543-0407

April 4, 2013

This Prospectus/Proxy Statement is being furnished in connection with the proposed Agreement and Plan of Reorganization (the “Plan”) which will be submitted to shareholders of the Touchstone Short Duration Fixed Income Fund (the “Short Fund”) for consideration at a Special Meeting of Shareholders of Touchstone Funds Group Trust (the “Trust”) to be held on May 13, 2013 at 10:00 a.m. Eastern Time at the offices of the Trust, 303 Broadway, Suite 1100, Cincinnati, OH, 45202, and any adjournments (the “Meeting”). The statement of additional information, dated April 4, 2013, which relates to this Prospectus/Proxy Statement and the Reorganization (defined below), is available upon request and without charge by calling the Trust at (800) 543-0407, by writing to the Trust at P.O. Box 9878, Providence, RI 02940, or by downloading a copy from www.TouchstoneInvestments.com.

GENERAL

The Board of Trustees (the “Board”) of the Trust has approved the proposed reorganization of the Short Fund into the Touchstone Ultra Short Duration Fixed Income Fund (the “Ultra Short Fund”), a separate series of the Trust. Each Fund is an open-end management investment company. The Short Fund and the Ultra Short Fund are sometimes referred to in this Prospectus/Proxy Statement individually as a “Fund” and collectively as the “Funds”.

In the reorganization, all of the assets of the Short Fund will be transferred to the Ultra Short Fund in exchange for Class Y and Class Z shares of the Ultra Short Fund and the assumption by the Ultra Short Fund of all the liabilities of the Short Fund (the “Reorganization”). If the Reorganization is approved by shareholders of the Short Fund, shares of the Ultra Short

Fund will be distributed to shareholders of the Short Fund in liquidation of the Short Fund, and the Short Fund will be terminated as a series of the Trust. If you own Class Y shares of the Short Fund you will receive Class Y shares of the Ultra Short Fund. If you own Class Z shares of the Short Fund you will receive Class Z shares of the Ultra Short Fund. The total value of your investment will not change as a result of the Reorganization. You will not incur any sales loads or similar transaction charges as a result of the Reorganization. The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization.

Because you, as a shareholder of the Short Fund, are being asked to approve transactions that will result in you holding shares of the Ultra Short Fund, this Proxy Statement also serves as a Prospectus for the Ultra Short Fund. This Prospectus/Proxy Statement, which you should retain for future reference, contains important information about the Ultra Short Fund that you should know before voting or investing. Please read it carefully. Additional information concerning the Short Fund and the Ultra Short Fund is contained in the documents described below, all of which have been filed with the Securities and Exchange Commission (the “SEC”) and all of the documents described below are incorporated herein by reference (legally considered to be part of this Prospectus/Proxy Statement):

Information about the Short Fund: | | How to Obtain this Information: |

| | |

Annual Report of the Touchstone Funds Group Trust relating to the Fund for the year ended September 30, 2012 | | Copies are available upon request and without charge if you: · Write to the Touchstone Funds Group Trust at P.O. Box 9878, Providence, RI 02940; or · Call (800) 543-0407 toll-free. · Download from www.TouchstoneInvestments.com. |

Information about the Ultra Short Fund: | | How to Obtain this Information: |

| | |

Prospectus of the Touchstone Funds Group Trust relating to the Fund dated January 30, 2013 as may be amended (the “Ultra Short Fund Prospectus”), which accompanies this Prospectus/Proxy Statement Statement of Additional Information of the Touchstone Funds Group Trust relating to the Fund dated January 30, 2013 as may be amended (the “Trust’s SAI”) Annual Report of the Touchstone Funds Group Trust relating to the Fund for the fiscal year ended September 30, 2012 | | A copy is available upon request and without charge if you: · Write to the Touchstone Funds Group Trust at P.O. Box 9878, Providence, RI 02940; or · Call (800) 543-0407 toll-free. · Download from www.TouchstoneInvestments.com. |

You can also obtain copies of any of these documents without charge on the EDGAR database on the SEC’s Internet site at http://www.sec.gov. Copies are available for a fee by electronic request at the following e-mail address: publicinfo@sec.gov, or from the Public Reference Section, Securities and Exchange Commission, Washington, D.C. 20549-1520.

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT DETERMINED THAT THE INFORMATION IN THIS PROSPECTUS/PROXY STATEMENT IS ACCURATE OR ADEQUATE, NOR HAS IT APPROVED OR DISAPPROVED THESE SECURITIES. ANYONE WHO TELLS YOU OTHERWISE IS COMMITTING A CRIMINAL OFFENSE.

An investment in the Ultra Short Fund:

· is not a deposit of, or guaranteed by, any bank

· is not insured by the FDIC, the Federal Reserve Board or any other government agency

· is not endorsed by any bank or government agency

· involves investment risk, including possible loss of your original investment

TABLE OF CONTENTS

SUMMARY | 2 |

Why is the Reorganization being proposed? | 2 |

What are the key features of the Reorganization? | 2 |

After the Reorganization, what shares will I own? | 2 |

How will the Reorganization affect me? | 3 |

How does the Board recommend that I vote? | 3 |

How do the Funds’ investment goals and principal investment strategies compare? | 3 |

How do the Funds’ investment limitations compare? | 5 |

How do the Funds’ fees and expenses compare? | 8 |

How do the Funds’ performance records compare? | 12 |

Will I be able to purchase, redeem, and exchange shares and receive distributions the same way? | 14 |

Who will be the Advisor, Sub-Advisor, and Portfolio Manager of my Fund after the Reorganization? What will the advisory fees be after the Reorganization? | 14 |

Will the Ultra Short Fund have the same service providers as the Short Fund? | 17 |

What will be the primary federal tax consequences of the Reorganization? | 17 |

Will there be any repositioning costs? | 17 |

RISKS | 17 |

Are the risk factors for the Funds similar? | 17 |

What are the primary risks of investing in each Fund? | 17 |

Are there any other risks of investing in each Fund? | 20 |

INFORMATION ABOUT THE REORGANIZATION | 20 |

Reasons for the Reorganization | 20 |

Agreement and Plan of Reorganization | 22 |

Description of the Securities to be Issued | 23 |

Federal Income Tax Consequences | 23 |

Pro Forma Capitalization | 25 |

Distribution of Shares | 25 |

Purchase and Redemption Procedures | 26 |

Exchange Privileges | 26 |

Dividend Policy | 26 |

INFORMATION ON SHAREHOLDERS’ RIGHTS | 27 |

Form of Organization | 27 |

Capitalization | 27 |

Shareholder Liability | 27 |

Shareholder Meetings and Voting Rights | 27 |

Liquidation | 28 |

Liability and Indemnification of Trustees | 28 |

VOTING INFORMATION CONCERNING THE MEETING | 29 |

Shareholder Information | 30 |

Control Persons and Principal Holders of Securities | 31 |

FINANCIAL STATEMENTS AND EXPERTS | 32 |

LEGAL MATTERS | 33 |

ADDITIONAL INFORMATION | 33 |

ADDITIONAL INFORMATION ABOUT THE FUNDS | 33 |

Buying and Selling Fund Shares | 33 |

Payments to Broker-Dealers and Other Financial Intermediaries | 33 |

CHOOSING A CLASS OF SHARES | 34 |

DISTRIBUTION AND SHAREHOLDER SERVICING ARRANGEMENTS | 34 |

INVESTING WITH TOUCHSTONE | 34 |

Purchasing Your Shares | 34 |

Opening an Account | 35 |

Investing in the Funds | 35 |

Pricing of Purchases | 37 |

Adding to Your Account | 37 |

Purchases with Securities | 38 |

Automatic Investment Options | 38 |

Selling Your Shares | 39 |

Signature Guarantees | 41 |

Market Timing Policy | 41 |

Receiving Sale Proceeds | 42 |

Pricing of Fund Shares | 43 |

DISTRIBUTION AND TAXES | 44 |

Tax Information | 44 |

OTHER BUSINESS | 46 |

FINANCIAL HIGHLIGHTS | 47 |

EXHIBIT A - AGREEMENT AND PLAN OF REORGANIZATION | A-1 |

1

SUMMARY

This section summarizes the primary features and consequences of the Reorganization. It may not contain all of the information that is important to you. To understand the Reorganization, you should read this entire Prospectus/Proxy Statement and the exhibits.

This summary is qualified in its entirety by reference to the additional information contained elsewhere in this Prospectus/Proxy Statement, the Ultra Short Fund Prospectus, the Trust’s SAI and a form of the Agreement and Plan of Reorganization (the “Plan”), which is attached to this Prospectus/Proxy Statement as Exhibit A.

Why is the Reorganization being proposed?

Touchstone Advisors, Inc. (“Touchstone Advisors” or the “Advisor”) believes that the Short Fund’s prospects for future growth are limited given its comparative under-performance. In addition, the Advisor believes that the Short Fund currently lacks the asset levels needed to effectively distribute the Fund. Therefore, the Advisor does not anticipate the Short Fund’s asset levels increasing materially. The Management Fees for the two Funds are the same, but the Total Annual Fund Operating Expenses of the Short Fund are higher than those of the Ultra Short Fund. The Ultra Short Fund has received higher Morningstar ratings as well as superior rankings versus its respective Morningstar category peers as compared with the Short Fund for the one-, three-, five-, and ten-year periods ended December 31, 2012. The Board of the Trust believes that the Reorganization is in the best interests of the Short Fund’s shareholders.

What are the key features of the Reorganization?

The Plan sets forth the key features of the Reorganization. A description of the Reorganization is set out in the Plan, a form of which is attached as Exhibit A. The Plan generally provides for the following:

· the transfer of all of the assets of the Short Fund to the Ultra Short Fund in exchange for shares of the Ultra Short Fund;

· the assumption by the Ultra Short Fund of all of the liabilities of the Short Fund;

· the termination of the Short Fund subsequent to the distribution of shares of the Ultra Short Fund to the Short Fund’s shareholders in complete liquidation of the Short Fund; and

· the structuring of the Reorganization as a tax-free reorganization for federal income tax purposes.

The Reorganization is expected to be completed on or about May 20, 2013.

After the Reorganization, what shares will I own?

Shareholders owning Class Y shares of the Short Fund will own Class Y shares of the Ultra Short Fund. Shareholders owning Class Z shares of the Short Fund will own Class Z shares of the Ultra Short Fund. The new shares you receive will have the same total value as

2

your shares of the Short Fund as of the close of business on the day immediately prior to the Reorganization.

How will the Reorganization affect me?

It is anticipated that the Reorganization will benefit you for the reasons stated below, although no assurance can be given that the Reorganization will result in any such benefits. After the Reorganization, operating efficiencies may be achieved by the Ultra Short Fund because it will have a greater level of combined assets than the Short Fund. As of January 31, 2013, the Short Fund and the Ultra Short Fund’s total net assets were approximately $99 million and $599 million, respectively. The Reorganization could lead to operating efficiencies and lower operating costs for the Funds’ shareholders due to the Ultra Short Fund having lower Total Annual Fund Operating Expenses than those of the Short Fund.

After the Reorganization, the Short Fund will cease to exist and the value of your shares will depend on the performance of the Ultra Short Fund. Neither the Funds nor the shareholders will bear any costs of the Meeting, this proxy solicitation, or any adjourned session. All of the costs of the Reorganization will be paid by Touchstone Advisors.

Like the Short Fund, the Ultra Short Fund will declare investment income, if any, daily and distribute it monthly to its shareholders. The Ultra Short Fund will distribute net realized capital gains, if any, at least annually. These dividends and distributions will continue to be reinvested in the same class of shares of the Ultra Short Fund you receive in the Reorganization or, if you have so elected, distributed in cash or invested in other funds of the Trust.

Although Touchstone Advisors is the advisor to both Funds, the Funds do have different sub-advisors. The Ultra Short Fund is sub-advised by Fort Washington Investment Advisors, Inc. (“Fort Washington”), an affiliate of Touchstone Advisors, while the Short Fund is sub-advised by Longfellow Investment Management Co. (“Longfellow”) (together with Fort Washington, the “Sub-Advisors”). After the Reorganization, the Ultra Short Fund will continue to be sub-advised by Fort Washington.

THE BOARD RECOMMENDS THAT YOU VOTE FOR THE PROPOSED REORGANIZATION.

How does the Board recommend that I vote?

The Board of the Trust, including the Trustees who are not “interested persons” (the “Disinterested Trustees”), as such term is defined in the 1940 Act, have concluded that the Reorganization would be in the best interest of the shareholders of the Short Fund and that their interests will not be diluted in value as a result of the Reorganization. Accordingly, the Board has submitted the Plan for the approval of shareholders of the Short Fund and recommend a vote for the Reorganization.

The Board has also approved the Plan on behalf of the Ultra Short Fund.

How do the Funds’ investment goals and principal investment strategies compare?

The investment goal of each Fund is identical. Both Funds seek maximum total return consistent with the preservation of capital. The investment goal of each Fund is non-

3

fundamental, which means that it may be changed by vote of the Board without shareholder approval.

In addition, the investment strategies of each Fund are substantially similar. Under each Fund’s principal investment strategy, each Fund invests at least 80% of its assets in fixed-income securities. Each Fund invests in a diversified portfolio of investment-grade debt securities that are identical, except that the Ultra Short Fund’s principal investments also include commercial mortgage-backed securities, municipal bonds and certain cash equivalent securities.

Under normal market conditions, the Short Fund seeks to maintain an effective duration between one and three years, while the Ultra Short Fund seeks to maintain an effective duration of one year or less. Effective duration is a measure of a security’s price volatility or the risk associated with changes in interest rates. For example, assume the Fund purchases a Company W&S bond at 100% of par and the bond yields 8%. If the bond price increases to 101.5% of par when yields fall 0.10% (10 basis points) and the price falls to 99.5% of par when yields rise by 0.10% (10 basis points), then the bond’s effective duration is 10.00. This means that for every 1.00% (100 basis point) change in interest rates, the bond’s price will change by 10.00%. The lower the effective duration, the lower the risk associated with changes in interest rates.

The following table describes the investment goal and principal investment strategies of the Short Fund and the Ultra Short Fund.

| | Short Fund | | Ultra Short Fund |

| | | | |

Investment Goal | | Maximum total return consistent with the preservation of capital. | | Maximum total return consistent with the preservation of capital. |

| | | | |

Principal Investment Strategies | | The Fund invests, under normal market conditions, at least 80% of its assets in fixed-income securities. This is a non-fundamental investment policy that can be changed by the Fund upon 60 days prior notice to shareholders. The Fund invests in a diversified portfolio of securities of different maturities including U.S. Treasury securities, U.S. government agency securities, securities of U.S. government-sponsored enterprises, corporate bonds, mortgage-backed securities, and asset-backed securities. The Fund invests only in investment-grade debt securities and does not invest in non-investment grade (i.e. “high yield”) debt securities. Investment grade debt securities are those having a rating of BBB-/Baa3 or higher from a major rating agency or, if a rating is not | | The Fund invests, under normal market conditions, at least 80% of its assets in fixed-income securities. This is a non-fundamental investment policy that can be changed by the Fund upon 60 days prior notice to shareholders. The Fund invests in a diversified portfolio of securities of different maturities including U.S. Treasury securities, U.S. government agency securities, securities of U.S. government-sponsored enterprises, corporate bonds, mortgage-backed securities, commercial mortgage-backed securities, asset-backed securities, municipal bonds, and cash equivalent securities including repurchase agreements and commercial paper. The Fund invests only in investment-grade debt securities and does not invest in non-investment grade (i.e. |

4

| | available, deemed to be of comparable quality by the sub-advisor, Longfellow. In selecting investments for the Fund, Longfellow chooses fixed-income securities that it believes are attractively priced relative to the market or to similar instruments. While the Fund may invest in securities of any maturity, Longfellow seeks to maintain an effective duration for the Fund between one and three years under normal market conditions. A sector or security holding may be reduced if it becomes overvalued or if there is a change in the underlying fundamentals. Longfellow may sell a security if another security is more attractive. | | “high yield”) debt securities. Investment grade debt securities are those having a rating of BBB-/Baa3 or higher from a major rating agency or, if a rating is not available, deemed to be of comparable quality by the sub-advisor, Fort Washington. In selecting investments for the Fund, Fort Washington chooses fixed-income securities that it believes are attractively priced relative to the market or to similar instruments. In addition, Fort Washington considers the “effective duration” of the Fund’s entire portfolio. Effective duration is a measure of a security’s price volatility or the risk associated with changes in interest rates. While the Fund may invest in securities with any maturity or duration, Fort Washington seeks to maintain an effective duration for the Fund of one year or less under normal market conditions. |

How do the Funds’ investment limitations compare?

The investment limitations of the Funds are identical. The Funds’ fundamental investment limitation cannot be changed without the consent of the holders of a majority of that Fund’s outstanding shares. The term “majority of the outstanding shares” means the vote of (i) 67% or more of a Fund’s shares present at a meeting, if more than 50% of the outstanding shares of a Fund are present or represented by proxy, or (ii) more than 50% of a Fund’s outstanding shares, whichever is less. The following table compares the fundamental investment limitations of the Ultra Short Fund and the Short Fund.

5

| | Short Fund | | Ultra Short Fund |

| | | | |

Diversification | | With respect to 75% of the Fund’s assets: (i) purchase securities of any issuer (except securities issued or guaranteed by the United States government, its agencies or instrumentalities and repurchase agreements involving such securities) if, as a result, more than 5% of the total assets of the Fund would be invested in the securities of such issuer; or (ii) acquire more than 10% of the outstanding voting securities of any one issuer. | | With respect to 75% of the Fund’s assets: (i) purchase securities of any issuer (except securities issued or guaranteed by the United States government, its agencies or instrumentalities and repurchase agreements involving such securities) if, as a result, more than 5% of the total assets of the Fund would be invested in the securities of such issuer; or (ii) acquire more than 10% of the outstanding voting securities of any one issuer. |

| | | | |

Concentration | | Invest more than 25% of the Fund’s assets in securities issued by companies in a single industry or related group of industries. | | Invest more than 25% of the Fund’s assets in securities issued by companies in a single industry or related group of industries. |

| | | | |

Borrowing Money | | The Fund may not borrow money in an amount exceeding 33 1/3% of the value of its total assets, provided that, for purposes of this limitation, investment strategies which either obligate a Fund to purchase securities or require a fund to segregate assets are not considered to be borrowings. Asset coverage of at least 300% is required for all borrowings, except where the Fund has borrowed money for temporary purposes in amounts not exceeding 5% of its total assets. Each Fund will not purchase securities while its borrowings exceed 5% of its total assets. | | The Fund may not borrow money in an amount exceeding 33 1/3% of the value of its total assets, provided that, for purposes of this limitation, investment strategies which either obligate a Fund to purchase securities or require a fund to segregate assets are not considered to be borrowings. Asset coverage of at least 300% is required for all borrowings, except where the Fund has borrowed money for temporary purposes in amounts not exceeding 5% of its total assets. Each Fund will not purchase securities while its borrowings exceed 5% of its total assets. |

| | | | |

Underwriting | | The Fund may not Act as an underwriter of securities of other issuers except as it may be deemed an underwriter in selling a portfolio security. | | The Fund may not Act as an underwriter of securities of other issuers except as it may be deemed an underwriter in selling a portfolio security. |

6

Loans | | The Fund may not make loans to other persons except through the lending of its portfolio securities, provided that this limitation does not apply to the purchase of debt securities and loan participations and/or engaging in direct corporate loans or repurchase agreements in accordance with its investment objectives and policies. The loans cannot exceed 33 1/3% of a Fund’s assets. A Fund may also make loans to other investment companies to the extent permitted by the 1940 Act or any exemptions therefrom which may be granted to the Fund by the SEC. For example, at a minimum, a Fund will not make any such loans unless all requirements regarding common control and ownership of Fund shares are met. | | The Fund may not make loans to other persons except through the lending of its portfolio securities, provided that this limitation does not apply to the purchase of debt securities and loan participations and/or engaging in direct corporate loans or repurchase agreements in accordance with its investment objectives and policies. The loans cannot exceed 33 1/3% of a Fund’s assets. A Fund may also make loans to other investment companies to the extent permitted by the 1940 Act or any exemptions therefrom which may be granted to the Fund by the SEC. For example, at a minimum, a Fund will not make any such loans unless all requirements regarding common control and ownership of Fund shares are met. |

| | | | |

Real Estate and Commodities | | The Fund may not purchase or sell real estate, physical commodities, or commodities contracts, except that each Fund may purchase (i) marketable securities issued by companies which own or invest in real estate (including REITs), commodities, or commodities contracts; and (ii) commodities contracts relating to financial instruments, such as financial futures contracts and options on such contracts. The Fund may not invest in interests in oil, gas, or other mineral exploration or development programs and oil, gas or mineral leases. | | The Fund may not purchase or sell real estate, physical commodities, or commodities contracts, except that each Fund may purchase (i) marketable securities issued by companies which own or invest in real estate (including REITs), commodities, or commodities contracts; and (ii) commodities contracts relating to financial instruments, such as financial futures contracts and options on such contracts. The Fund may not invest in interests in oil, gas, or other mineral exploration or development programs and oil, gas or mineral leases. |

| | | | |

Senior Securities | | The Fund may no issue senior securities as defined in the 1940 Act except as permitted by rule, regulation or order of the SEC. | | The Fund may no issue senior securities as defined in the 1940 Act except as permitted by rule, regulation or order of the SEC. |

In addition to the fundamental limitations listed above, both Funds provide the following descriptions of certain provisions of the 1940 Act, which may assist investors in understanding the above policies and restrictions:

7

1. Diversification. Under the 1940 Act, a diversified investment management company, as to 75% of its total assets, may not purchase securities of any issuer (other than securities issued or guaranteed by the U.S. Government, its agents or instrumentalities or securities of other investment companies) if, as a result, more than 5% of its total assets would be invested in the securities of such issuer, or more than 10% of the issuer’s outstanding voting securities would be held by the fund.

2. Borrowing. The 1940 Act allows a fund to borrow from any bank (including pledging, mortgaging or hypothecating assets) in an amount up to 33 1/3% of its total assets (not including temporary borrowings not in excess of 5% of its total assets).

3. Underwriting. Under the 1940 Act, underwriting securities involves a fund purchasing securities directly from an issuer for the purpose of selling (distributing) them or participating in any such activity either directly or indirectly. Under the 1940 Act, a diversified fund may not make any commitment as underwriter, if immediately thereafter the amount of its outstanding underwriting commitments, plus the value of its investments in securities of issuers (other than investment companies) of which it owns more than 10% of the outstanding voting securities, exceeds 25% of the value of its total assets.

4. Lending. Under the 1940 Act, a fund may only make loans if expressly permitted by its investment policies. The Fund’s current investment policy on lending is as follows: the Fund may not make loans if, as a result, more than 33 1/3% of its total assets would be lent to other parties, except that the Fund may: (i) purchase or hold debt instruments in accordance with its investment objective and policies; (ii) enter into repurchase agreements that are collateralized fully; and (iii) engage in securities lending as described in its Statement of Additional Information.

5. Senior Securities. Senior securities may include any obligation or instrument issued by a fund evidencing indebtedness. The 1940 Act generally prohibits funds from issuing senior securities, although it does not treat certain transactions as senior securities, such as certain borrowings, short sales, reverse repurchase agreements, firm commitment agreements and standby commitments, with appropriate earmarking or segregation of assets to cover such obligation.

How do the Funds’ fees and expenses compare?

The Short Fund currently offers two classes of shares: Class Y and Class Z. The Ultra Short Fund currently offers five classes of shares: Class A, Class C, Class Y, Institutional Class, and Class Z. The Short Fund Class Y shareholders will receive Class Y shares of the Ultra Short Fund while the Short Fund Class Z shareholders will receive Class Z shares of the Ultra Short Fund.

The following tables allow you to compare the various fees and expenses that you may pay for buying and holding shares of each of the Funds. The tables also show the various costs and expenses that investors in the Short Fund will bear as shareholders of the Ultra Short Fund. Pro forma expense levels shown should not be considered an actual representation of future expenses or performance. Such pro forma expense levels project anticipated levels but actual expenses may be greater or less than those shown.

8

The fees and expenses for the shares of the Short Fund and the Ultra Short Fund set forth in the following tables and in the examples are based on the expenses for the Short Fund and the Ultra Short Fund as of September 30, 2012.

Shareholder Fees (fees paid directly from your investment)

| | Short Fund

Class Y | | Ultra Short Fund

Class Y | | Ultra Short Fund

Class Y Pro

Forma After

Reorganization | |

Wire Redemption Fee | | Up to $15 | | Up to $15 | | Up to $15 | |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| | Short Fund

Class Y | | Ultra Short Fund

Class Y | | Ultra Short Fund

Class Y Pro

Forma After

Reorganization | |

Management Fees | | 0.25 | % | 0.25 | % | 0.25 | % |

Total Other Expenses | | 0.45 | % | 0.30 | % | 0.31 | % |

Acquired Fund Fees and Expenses | | 0.01 | % | 0.01 | % | 0.01 | % |

Total Annual Fund Operating Expenses | | 0.71 | % | 0.56 | % | 0.57 | % |

Fee Waiver and/or Expense Reimbursement | | (0.21 | )%(1) | (0.11 | )%(1) | (0.12 | )%(1) |

Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement | | 0.50 | % | 0.45 | % | 0.45 | % |

(1) Touchstone Advisors and the Trust have entered into an expense limitation agreement whereby Touchstone Advisors has contractually agreed to waive a portion of its fees or reimburse certain Fund expenses in order to limit annual fund operating expenses to 0.49% and 0.44% for the Short Fund and Ultra Short Fund, respectively. The expense limitation for the Short Fund will remain in effect until at least January 29, 2014. The expense limitation for the Ultra Short Fund will remain in effect until at least May 19, 2014. Both expense limitations can be terminated by a vote of the Board of Trustees of each Fund if they deem the termination to be beneficial to the shareholders.

9

Shareholder Fees (fees paid directly from your investment)

| | Short Fund

Class Z | | Ultra Short Fund

Class Z | | Ultra Short Fund

Class Z Pro Forma

After

Reorganization | |

Wire Redemption Fee | | Up to $15 | | Up to $15 | | Up to $15 | |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| | Short Fund

Class Z | | Ultra Short Fund

Class Z | | Ultra Short Fund

Class Z Pro Forma

After

Reorganization | |

Management Fees | | 0.25 | % | 0.25 | % | 0.25 | % |

Total Other Expenses | | 0.69 | % | 0.48 | % | 0.48 | % |

Acquired Fund Fees and Expenses | | 0.01 | % | 0.01 | % | 0.01 | % |

Total Annual Fund Operating Expenses | | 0.95 | % | 0.74 | % | 0.74 | % |

Fee Waiver and/or Expense Reimbursement | | (0.20 | )%(1) | (0.04 | )%(1) | (0.04 | )%(1) |

Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement | | 0.75 | % | 0.70 | % | 0.70 | % |

(1) Touchstone Advisors and the Trust have entered into an expense limitation agreement whereby Touchstone Advisors has contractually agreed to waive a portion of its fees or reimburse certain Fund expenses in order to limit annual fund operating expenses to 0.74% and 0.69% for the Short Fund and Ultra Short Fund, respectively. The expense limitation for the Short Fund will remain in effect until at least January 29, 2014. The expense limitation for the Ultra Short Fund will remain in effect until at least May 19, 2014. Both expense limitations can be terminated by a vote of the Board of Trustees of each Fund if they deem the termination to be beneficial to the shareholders.

The examples are intended to help you compare the cost of investing in the Short Fund versus the Ultra Short Fund and the Ultra Short Fund (Pro Forma), assuming the Reorganization takes place. The examples assume that you invest $10,000 for the time periods indicated and then, except as indicated, redeem all of your shares at the end of those periods. The examples also assume that your investment has a 5% return each year and that the operating expenses remain the same. The examples also assume that all expense limitations remain in effect for a one year period. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

10

Examples of Fund Expenses

| | Short Fund | |

| | | | | | | | | |

| | One Year | | Three Years | | Five Years | | Ten Years | |

Class Y | | $ | 51 | | $ | 206 | | $ | 374 | | $ | 863 | |

| | | | | | | | | | | | | |

| | Ultra Short Fund | |

| | | | | | | | | |

| | One Year | | Three Years | | Five Years | | Ten Years | |

Class Y | | $ | 46 | | $ | 168 | | $ | 302 | | $ | 691 | |

| | | | | | | | | | | | | |

| | Ultra Short Fund Pro Forma After Reorganization | |

| | | | | | | | | |

| | One Year | | Three Years | | Five Years | | Ten Years | |

Class Y | | $ | 46 | | $ | 170 | | $ | 306 | | $ | 700 | |

| | | | | | | | | | | | | |

| | Short Fund | |

| | | | | | | | | |

| | One Year | | Three Years | | Five Years | | Ten Years | |

Class Z | | $ | 77 | | $ | 283 | | $ | 506 | | $ | 1,148 | |

| | | | | | | | | | | | | |

| | Ultra Short Fund | |

| | | |

| | One Year | | Three Years | | Five Years | | Ten Years | |

Class Z | | $ | 72 | | $ | 233 | | $ | 408 | | $ | 915 | |

| | | | | | | | | | | | | |

| | Ultra Short Fund Pro Forma After Reorganization | |

| | | |

| | One Year | | Three Years | | Five Years | | Ten Years | |

Class Z | | $ | 72 | | $ | 233 | | $ | 408 | | $ | 915 | |

| | | | | | | | | | | | | |

Portfolio Turnover: Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the Example, affect the Funds’ performance. During the period ended September 30, 2012, the Ultra Short Fund’s and the Short Fund’s portfolio turnover rates were 169% and 42%, respectively, of the average value of their portfolios.

11

How do the Funds’ performance records compare?

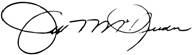

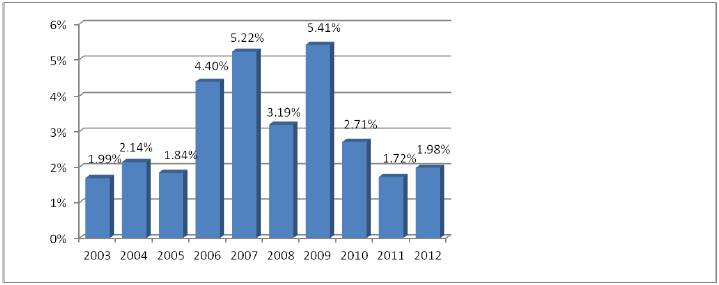

Year-by-Year Total Return (%)

The bar charts and performance tables below illustrate some of the risks of investing in the Funds by showing changes in the Funds’ performance from year to year (before taxes) and by showing how each Fund’s average annual total returns for 1 year, 5 years, and 10 years compare with a broad measure of market performance (the Barclays Capital 1-3 Year U.S. Treasury Index for the Short Fund and the BoA Merrill Lynch Three-Month U.S. Treasury Bill Index and BoA Merrill Lynch 1-Year Treasury Note Index for the Ultra Short Fund). The bar charts do not reflect any sales charges, which would reduce your return. The Funds’ past performance (before and after taxes) does not necessarily indicate how each Fund will perform in the future. Updated performance is available at no cost by visiting www.TouchstoneInvestments.com or by calling 1.800.543.0407.

Short Duration Fixed Income Fund – Class Z Total Return as of December 31

Best Quarter: 3rd Quarter 2009 +7.77% Worst Quarter: 2nd Quarter 2004 -0.75%

The year-to-date return for the Fund’s Class Z shares as of March 31, 2013 is 0.18%.

12

Ultra Short Duration Fixed Income Fund — Class Z Total Return as of December 31

Best Quarter: 3rd Quarter 2006 1.95% Worst Quarter: 3rd Quarter 2008 -0.24%

The year-to-date return for the Fund’s Class Z shares as of March 31, 2013 is 0.20%.

After-tax returns are calculated using the highest individual federal income tax rate and do not reflect the impact of state and local taxes. Your after-tax returns may differ from those shown and depend on your tax situation. The after-tax returns do not apply to shares held in an IRA, 401(k), or other tax-deferred account. After-tax returns are for Class Z shares only and after tax returns for Class Y shares will vary.

Average Annual Total Return (for the period ended 12/31/2012)

| | 1 Year | | 5 Years | | 10 Years | |

Short Duration Fixed Income Fund — Class Z | | | | | | | |

Return Before Taxes | | 1.98 | % | 2.99 | % | 3.02 | % |

Return After Taxes on Distributions | | 1.32 | % | 1.92 | % | 1.82 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | 1.28 | % | 1.93 | % | 1.87 | % |

Barclays Capital 1-3 Year U.S. Treasury Index | | 0.51 | % | 2.49 | % | 2.83 | % |

Short Duration Fixed Income Fund — Class Y | | | | | | | |

Return Before Taxes | | 2.23 | % | 3.18 | % | 3.11 | % |

| | | | | | | |

| | 1 Year | | 5 Years | | 10 Years | |

Ultra Short Duration Fixed Income Fund — Class Z | | | | | | | |

Return Before Taxes | | 1.82 | % | 1.78 | % | 2.48 | % |

Return After Taxes on Distributions | | 1.07 | % | 0.80 | % | 1.37 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | 1.18 | % | 0.95 | % | 1.47 | % |

BoA Merrill Lynch Three-Month U.S. Treasury Bill Index | | 0.11 | % | 0.52 | % | 1.78 | % |

BoA Merrill Lynch 1-Year Treasury Note Index | | 0.24 | % | 1.42 | % | 2.19 | % |

Ultra Short Duration Fixed Income Fund — Class Y | | | | | | | |

Return Before Taxes | | 1.92 | % | 1.80 | % | 2.49 | % |

13

Will I be able to purchase, redeem, and exchange shares and receive distributions the same way?

The Ultra Short Fund shares are sold in a continuous offering and are offered to the public, and may be purchased through securities dealers or directly from the Funds’ underwriter, Touchstone Securities, Inc. (“Touchstone Securities”). In the proposed Reorganization, the Short Fund shareholders will receive shares of the Ultra Short Fund and will be able to purchase, redeem and exchange shares and receive distributions the same way as they currently do with respect to their shares of the Short Fund.

Who will be the Advisor, Sub-Advisor, and Portfolio Manager of my Fund after the Reorganization? What will the advisory fees be after the Reorganization?

Management of the Funds

The overall management of each Fund is the responsibility of, and is supervised by, the Board of the Trust.

Advisor

Touchstone Advisors is the investment advisor of both Funds. Pursuant to an Investment Advisory Agreement with the Trust, Touchstone Advisors selects each Fund’s sub-advisor, subject to approval by the Board of Trustees. Touchstone Advisors pays the fees to each sub-advisor and monitors each sub-advisor’s investment program. Touchstone Advisors is a wholly-owned subsidiary of Western & Southern Mutual Holding Company (“Western & Southern”). Touchstone Advisors is also responsible for running all of the operations of the Funds, except those that are subcontracted to the sub-advisors, custodian, transfer agent, sub-administrative agent, or other parties.

Facts about Touchstone Advisors:

· As of December 31, 2012, Touchstone Advisors had assets under management of approximately $14.8 billion.

· Touchstone Advisors is located at 303 Broadway, Suite 1100, Cincinnati, Ohio 45202.

For each Fund, Touchstone Advisors has received an order from the SEC that permits it, under certain conditions, to select or change unaffiliated sub-advisors, enter into new sub-advisory agreements, or amend existing sub-advisory agreements without first obtaining shareholder approval. Each Fund must still obtain shareholder approval of any sub-advisory

14

agreement with a sub-advisor affiliated with each Trust or Touchstone Advisors other than by reason of serving as a sub-advisor to one or more funds.

Sub-Advisors

Longfellow is a SEC-registered investment advisor located at 20 Winthrop Square, Boston, MA 02110. Longfellow serves as sub-advisor to the Touchstone Short Duration Fixed Income Fund. As sub-advisor, Longfellow makes investment decisions for the Fund and also ensures compliance with the Fund’s investment policies and guidelines. As of December 31, 2012, Longfellow had approximately $5.3 billion in assets under management.

Fort Washington, an affiliate of Touchstone Advisors, is a SEC-registered investment advisor located at 303 Broadway, Suite 1200, Cincinnati, Ohio 45202. Fort Washington serves as sub-advisor to the Touchstone Ultra Short Duration Fixed Income Fund. As sub-advisor, Fort Washington makes investment decisions for the Fund and also ensures compliance with the Fund’s investment policies and guidelines. As of December 31, 2012, Fort Washington had approximately $44.7 billion in assets under management.

After the Reorganization, Fort Washington will continue to serve as the sub-advisor to the Ultra Short Fund.

Portfolio Management of the Short Fund

Barbara J. McKenna, CFA, Principal and Portfolio Manager, has over 20 years of fixed-income investment experience. Ms. McKenna joined Longfellow in 2005. Prior to joining Longfellow, from 2001 to 2005, Ms. McKenna was a director and senior portfolio manager at State Street Research, responsible for managing $14 billion of institutional fixed-income accounts. As director of corporate bond strategy, she was responsible for directing and leading the implementation of corporate bond strategy across all mandates.

David W. Seeley, CFA, Principal and Portfolio Manager, is one of Longfellow’s founders and has over 25 years of investment experience. Longfellow was founded in 1986.

John E. Villela, CFA, Principal, Portfolio Manager, and Senior Analyst, has over 15 years of investment industry experience. Prior to joining Longfellow in 2005, Mr. Villela was a portfolio analyst at State Street Research & Management Company from 2003 to 2005, where he focused on credit assets and short/intermediate duration accounts. From 1999 to 2003, Mr. Villela was a trader at Standish Mellon Asset Management, specializing in credit, asset backed securities, and government and fixed-income derivatives. He also formerly worked at Lehman Brothers and HSBC Securities, Inc.

Portfolio Management of the Ultra Short Fund

Scott D. Weston, Vice President and Senior Portfolio Manager, joined Fort Washington in September 1999. He is also Fort Washington’s lead sector specialist in mortgage-backed and asset-backed securities. Mr. Weston is a graduate of the University of Utah with a BS in Finance and the University of Cincinnati with an MBA in Finance. He has investment experience dating back to 1992.

Brent A. Miller, CFA, Portfolio Manager, joined Fort Washington in June 2001. He became a portfolio manager in 2008 and was an assistant portfolio manager prior to 2008.

15

Mr. Miller graduated Magna Cum Laude from the University of Evansville with a BS in Mathematics. He has investment experience dating back to 1999.

After the Reorganization, the Fort Washington portfolio managers will continue to serve as the portfolio managers to the Ultra Short Fund. With respect to the Fort Washington portfolio managers, the Trust’s SAI provides additional information about each portfolio manager’s compensation, other accounts managed, and ownership of securities in his managed Fund.

Advisory Fees

For its management and supervision of the daily business affairs of the Short Fund, Touchstone Advisors receives a monthly fee at the annual rate of 0.25% of the Short Fund’s average daily net assets. The annual fee rate paid to Touchstone Advisors by the Fund for the fiscal year ended September 30, 2012, net of advisory fees waived by Touchstone Advisors, if any, was 0.25%. Touchstone Advisors pays sub-advisory fees to the sub-advisor from its advisory fee.

For its management and supervision of the daily business affairs of the Ultra Short Fund, Touchstone Advisors receives a monthly fee at the annual rate of 0.25% of the Ultra Short Fund’s average daily net assets. The annual fee rate paid to Touchstone Advisors by the Fund for the fiscal year ended September 30, 2012, net of advisory fees waived by Touchstone Advisors, if any, was 0.25%. Touchstone Advisors pays sub-advisory fees to the sub-advisor from its advisory fee.

The Trust and Touchstone Advisors have entered into an expense limitation agreement whereby the Short Fund’s total operating expenses (excluding dividend expenses relating to short sales, interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles; the cost of “Acquired Fund Fees and Expenses,” if any; other extraordinary expenses not incurred in the ordinary course of the Fund’s business; and amounts, if any, payable pursuant to a plan adopted in accordance with Rule 12b-1 under the 1940 Act) will be contractually limited until at least January 29, 2014 and will not exceed 0.49% and 0.74% for Class Y shares and Class Z shares, respectively.

The Trust and Touchstone Advisors have also entered into an expense limitation agreement whereby the Ultra Short Fund’s total operating expenses (excluding dividend expenses relating to short sales, interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles; the cost of “Acquired Fund Fees and Expenses,” if any; other extraordinary expenses not incurred in the ordinary course of the Fund’s business; and amounts, if any, payable pursuant to a plan adopted in accordance with Rule 12b-1 under the 1940 Act) will be contractually limited until at least May 19, 2014 and will not exceed 0.44% and 0.69% for Class Y shares and Class Z shares, respectively.

Advisory and Sub-Advisory Agreement Approval

A discussion of the basis for the Board’s approval of the Short Fund’s and the Ultra Short Fund’s advisory and sub-advisory agreements can be found in the Trust’s September 30, 2012 Annual Report.

16

Will the Ultra Short Fund have the same service providers as the Short Fund?

The Funds have the same investment advisor, administrator, accounting agent, transfer agent, and principal underwriter, which will continue in their capacities after the Reorganization. The Funds have different sub-advisors, and the Ultra Short Fund’s current sub-advisor, Fort Washington, will continue to act in such capacity after the Reorganization.

What will be the primary federal tax consequences of the Reorganization?

Prior to or at the completion of the Reorganization, the Ultra Short Fund and the Short Fund will have each received an opinion from the law firm of Pepper Hamilton LLP that the Reorganization intends to qualify as a tax-free reorganization within the meaning of section 368(a) of the United States Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, it is believed that no gain or loss generally will be recognized by the Short Fund or the Ultra Short Fund or their respective shareholders. The amount of the Short Fund’s capital loss carryforwards available to offset capital gains of the Ultra Short Fund in any given year following the Reorganization may be substantially limited and the expiration of these carryforwards will be accelerated by one year as a consequence of the Reorganization. See “Information About the Reorganization-Federal Income Tax Consequences” for more information on the federal tax consequences of the Reorganization.

Will there be any repositioning costs?

Although the Short Fund and the Ultra Short Fund have similar investment goals and investment strategies, it is expected that a portion of the securities held by the Short Fund may be sold after the Reorganization takes place as the Ultra Short Fund’s portfolio managers align or reposition the portfolio with the Ultra Short Fund’s investment strategy. The estimated transaction costs anticipated to be incurred in connection with the sale of such portfolio securities following the Reorganization is $200,000, or approximately a 3 basis point impact on the Ultra Short Fund’s asset base.

RISKS

Are the risk factors for the Funds similar?

Yes. The risk factors are similar due to the identical investment objectives and comparable investment strategies of the Short Fund and the Ultra Short Fund. However, there are some important differences. The Ultra Short Fund has three principal risks that are not principal risks of the Short Fund: Municipal Securities Risk, Repurchase Agreement Risk, and Portfolio Turnover Risk.

What are the primary risks of investing in each Fund?

An investment in each Fund is subject to certain risks. There is no assurance that the investment performance of either the Short Fund or the Ultra Short Fund will be positive or that the Funds will meet their investment objective. You could lose money on your investment in the Funds and the Funds could also return less than other investments. The following discussions highlight the principal risks associated with an investment in each of the Funds.

17

Each Fund is subject to Credit Risk.

The securities in each Fund’s portfolio are subject to the possibility that a deterioration, whether sudden or gradual, in the financial condition of an issuer, or a deterioration in general economic conditions, could cause an issuer to fail to make timely payments of principal or interest, when due. This may cause the issuer’s securities to decline in value.

Each Fund is subject to Prepayment Risk.

The risk that a debt security may be paid off and proceeds invested earlier than anticipated. Prepayment risk is more prevalent during periods of falling interest rates.

Each Fund is subject to Interest Rate Risk.

As interest rates rise, the value of fixed-income securities the Fund owns will likely decrease. Longer-term securities are generally more volatile, so the longer the average maturity or duration of these securities, the greater their price risk. Duration is a measure of the expected life, taking into account any prepayment or call features of the security, of a fixed-income security that is used to determine the price sensitivity of the security for a given change in interest rates. Specifically, duration is the change in the value of a fixed-income security that will result from a 1% change in interest rates, and generally is stated in years. Maturity, on the other hand, is the date on which a fixed-income security becomes due for payment of principal.

Each Fund is subject to Investment-Grade Debt Securities Risk.

Investment-grade debt securities may be downgraded by a Nationally Recognized Statistical Rating Organization (“NRSRO”) to below-investment-grade status, which would increase the risk of holding these securities. Investment-grade debt securities rated in the lowest rating category by an NRSRO involve a higher degree of risk than fixed-income securities in the higher-rating categories. While such securities are considered investment-grade quality and are deemed to have adequate capacity for payment of principal and interest, such securities lack outstanding investment characteristics and have speculative characteristics as well. For example, changes in economic conditions or other circumstances are more likely to lead to a weakened capacity to make principal and interest payments than is the case with higher-grade securities.

Each Fund is subject to Mortgage-Backed Securities Risk.

Mortgage-backed securities are fixed-income securities representing an interest in a pool of underlying mortgage loans. Mortgage-backed securities are sensitive to changes in interest rates, but may respond to these changes differently from other fixed-income securities due to the possibility of prepayment of the underlying mortgage loans. As a result, it may not be possible to determine in advance the actual maturity date or average life of a mortgage-backed security. Rising interest rates tend to discourage refinancing, with the result that the average life and volatility of the security will increase, exacerbating its decrease in market price. When interest rates fall, however, mortgage-backed securities may not gain as much in market value because of the expectation of additional mortgage prepayments that must be reinvested at lower interest rates. Prepayment risk may make it difficult to calculate the average maturity of the Fund’s mortgage-backed securities and, therefore, to assess the volatility risk of the Fund. An unexpectedly high rate of defaults on the mortgages held by a mortgage pool may adversely affect the value of mortgage-backed securities and could result in losses to the Fund. The risk of such defaults is generally higher in the cases of mortgage pools that include subprime mortgages. Subprime mortgages refer to loans made to borrowers with weakened credit histories or with lower capacity to make timely payments on their mortgages.

18

Each Fund is subject to Asset Backed Securities Risk.

Asset-backed securities are fixed-income securities backed by other assets such as credit card, automobile or consumer loan receivables, retail installment loans, or participations in pools of leases. Credit support for these securities may be based on the underlying assets and/or provided through credit enhancements by a third party. Even with a credit enhancement by a third party, there is still risk of loss. There could be inadequate collateral or no collateral for asset-backed securities. The values of these securities are sensitive to changes in the credit quality of the underlying collateral, the credit strength of the credit enhancement, changes in interest rates and, at times, the financial condition of the issuer. Some asset-backed securities also may receive prepayments that can change the securities’ effective durations.

Each Fund is subject to Management Risk.

The Advisor engages one or more sub-advisors to make investment decisions on its behalf for a portion or all of the Fund. There is a risk that the advisor may be unable to identify and retain sub-advisors who achieve superior investment returns relative to other similar sub-advisors. The value of your investment may decrease if the Sub-Advisor’s judgment about the attractiveness, value or market trends affecting a particular security, issuer, industry or sector or about market movements is incorrect.

Each Fund is subject to U.S. Government Agencies Securities Risk.

Certain U.S. Government agency securities are backed by the right of the issuer to borrow from the U.S. Treasury while others are supported only by the credit of the issuer or instrumentality. While the U.S. Government is able to provide financial support to U.S. Government-sponsored agencies or instrumentalities, no assurance can be given that it will always do so. Such securities are neither issued nor guaranteed by the U.S. Treasury.

The Ultra Short Fund is subject to Municipal Securities Risk.

The value of municipal securities may be affected by uncertainties in the municipal market related to legislation or litigation involving the taxation of municipal securities or the rights of municipal securities holders in the event of bankruptcy. In addition, the ongoing issues facing the national economy may negatively impact the economic performance of issuers of municipal securities, and may increase the likelihood that issuers of securities in which the Fund may invest may be unable to meet their obligations. Also, some municipal obligations may be backed by a letter of credit issued by a bank or other financial institution. Adverse developments affecting banks or other financial institutions could have a negative effect on the value of the Fund’s portfolio securities.

The Ultra Short Fund is subject to Repurchase Agreement Risk.

Under all repurchase agreements entered into by the Fund, the Fund’s Custodian or its agent must take possession of the underlying collateral. However, if the counterparty defaults, the Fund could realize a loss on the sale of the underlying security to the extent that the proceeds of sale, including accrued interest, are less than the resale price provided in the agreement including interest. In addition, even though the Bankruptcy Code provides protection for most repurchase agreements, if the seller should be involved in bankruptcy or insolvency proceedings,

19

the Fund may incur delay and costs in selling the underlying security or may suffer a loss of principal and interest if the Fund is treated as an unsecured creditor and is required to return the underlying security to the seller’s estate. Repurchase agreements are considered loans by the Fund.

The Ultra Short Fund is subject to Portfolio Turnover Risk.

The Fund may sell its securities, regardless of the length of time that they have been held, if the sub-advisor determines that it would be in such Fund’s best interest to do so. These transactions will increase the Fund’s “portfolio turnover.” High turnover rates generally result in higher brokerage costs to the Fund and in higher net taxable gain for shareholders, and may reduce the Fund’s returns.

Are there any other risks of investing in each Fund?

Each Fund is subject to Securities Lending Risk.

The Funds may lend their portfolio securities to brokers, dealers and financial institutions under guidelines adopted by the Board of the Trust, including a requirement that the Funds must receive collateral equal to no less than 100% of the market value of the securities loaned. The risk in lending portfolio securities, as with other extensions of credit, consists of possible loss of rights in the collateral should the borrower fail financially. In determining whether to lend securities, a Fund’s securities lending agent will consider all relevant facts and circumstances, including the creditworthiness of the borrower.

Other Risks

Each Fund may invest some or all of its assets in money market instruments or utilize other investment strategies as a temporary defensive measure during, or in anticipation of, adverse market conditions. This strategy may be inconsistent with the Fund’s principal investment goals and strategies, and could result in lower returns and loss of market opportunities.

The Funds have other investment policies, practices, and restrictions. Additional information relating to the Funds’ investment policies, practices, restrictions, and risks is set forth in their prospectuses and the Trust’s SAI.

Although the Funds have identical investment objectives and comparable investment strategies, it is expected that a portion of the securities held by the Short Fund will be sold in connection with the Reorganization in order to comply with the investment policies and practices of the Ultra Short Fund. To the extent such sales occur prior to the Reorganization, the transaction costs will be borne by the Short Fund. To the extent such sales occur following the Reorganization, the transaction costs will be borne by the Ultra Short Fund. Such costs will be ultimately borne by the respective Funds’ shareholders.

INFORMATION ABOUT THE REORGANIZATION

Reasons for the Reorganization

At a regular meeting held on February 21, 2013, the Board of the Trust, including the Disinterested Trustees, considered and approved the Reorganization, determined that the

20

Reorganization was in the best interests of shareholders of the Short Fund and the Ultra Short Fund, and that the interests of existing shareholders of the Funds will not be diluted in value as a result of the transactions contemplated by the Reorganization.

In evaluating the Reorganization, the Board requested and reviewed, with assistance of independent legal counsel, materials furnished by the Advisor. These materials included written information regarding operations and financial conditions of the Funds and principal terms and conditions of the Reorganization, including the intention that the Reorganization be consummated on a tax-free basis for the Short Fund and its shareholders.

The Board noted that the Ultra Short Fund will have identical investment objectives and comparable investment strategies to those of the Short Fund.

The Trustees reviewed the historical performance record of each Fund and also noted that the Ultra Short Fund has received higher Morningstar ratings as well as superior rankings versus its respective Morningstar category peers as compared with the Short Fund for the one-, three-, five-, and ten-year periods ended December 31, 2012. The Board also reviewed year-to-date performance information for the Funds.

The Board was also advised that as of December 31, 2012, the Short Fund had net assets of approximately $91.6 million, while the Ultra Short Fund had net assets of approximately $573.4 million. If the Reorganization is approved, the Funds’ combined assets could lead to operating efficiencies and lower operating costs for the Funds’ shareholders. Accordingly, by reorganizing the Short Fund into the Ultra Short Fund, shareholders would enjoy a greater asset base over which fund expenses may be spread. The Board also reasoned that the Reorganization would likely result in lower expenses to the Short Fund shareholders due to the Ultra Short Fund having lower Total Annual Fund Operating Expenses.

In addition, the Board considered, among other things:

· the terms and conditions of the Reorganization;

· the investment advisory and other fees paid by the Funds and the projected expense ratios of the Ultra Short Fund as compared with those of the Short Fund;

· that the expenses of the Reorganization would not be borne by the Short Fund’s shareholders;

· the investment personnel, expertise, and resources of each sub-advisor;

· the identical investment objectives and comparable investment strategies of the Funds;

· the fact that the Ultra Short Fund will assume all of the liabilities of the Short Fund;

· the fact that the management fee of the Ultra Short Fund is the same as that of the Short Fund;

· the benefits to shareholders, including operating efficiencies, which may be achieved from the Reorganization;

· the anticipated tax-free nature of the Reorganization for the Short Fund and its shareholders; and

21

· alternatives available to shareholders of the Short Fund, including the ability to redeem their shares.

During their consideration of the Reorganization, the Board of the Trust met with counsel to the Disinterested Trustees regarding the legal issues involved.

After consideration of the factors noted above, together with other factors and information considered to be relevant, and recognizing that there can be no assurance that any operating efficiencies or other benefits will in fact be realized, the Board concluded that the Reorganization would be in the best interests of the Short Fund and its shareholders. Consequently, it approved the Plan and directed that the Plan be submitted to shareholders of the Short Fund for approval.

The Board of the Trust, including the Disinterested Trustees, have also approved the Plan on behalf of the Ultra Short Fund.

Agreement and Plan of Reorganization

The following summary is qualified in its entirety by reference to the Plan (the form of which is attached as Exhibit A to this Prospectus/Proxy Statement).

The Plan provides that all of the assets of the Short Fund will be acquired by the Ultra Short Fund in exchange for Class Y shares and Class Z shares of the Ultra Short Fund and the assumption by the Ultra Short Fund of all of the liabilities of the Short Fund immediately prior to the opening of business on May 20, 2013 or such other date as may be agreed upon by the parties (the “Closing Date”). Prior to the Closing Date, the Short Fund will endeavor to discharge all of its known liabilities and obligations. The Short Fund will prepare an unaudited statement of its assets and liabilities as of the close of regular trading on the NYSE, typically 4:00 p.m. Eastern Time, on the business day immediately prior to the Closing Date (the “Valuation Date”).

At or prior to the Valuation Date, for tax reasons, the Short Fund will declare any dividends or distributions which, together with all previous dividends and distributions, shall have the effect of distributing to the Short Fund’s shareholders all of the Short Fund’s investment company taxable income for the taxable period ending on the Closing Date (computed without regard to any deduction for dividends paid), all of the Short Fund’s net tax exempt income, if any, and all of its net capital gains realized in all taxable periods ending on the Closing Date (after reductions for any capital loss carryforward).

The number of full and fractional Class Y and Class Z shares of the Ultra Short Fund to be received by the shareholders of the Short Fund will be determined by multiplying the number of outstanding Class Y and Class Z shares of the Short Fund by a ratio which shall be computed by dividing the net asset value per share of the Class Y and Class Z shares of the Short Fund by the net asset value per share of the Class Y and Class Z shares of the Ultra Short Fund. These computations will take place as of the Valuation Date.

BNY Mellon Investment Servicing (US) Inc., the accounting agent of the Funds, will compute the value of each Fund’s respective portfolio of securities. The method of valuation employed will be consistent with the procedures set forth in the Declaration of Trust, the Funds’ prospectuses, and the Trust’s SAI.

As soon after the Closing Date as conveniently practicable, the Short Fund will liquidate and distribute pro rata to shareholders of record as of the close of business on the Closing Date

22