As filed with the Securities and Exchange Commission on December 20, 2013

1933 Act File No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

o Pre-Effective Amendment No. 1 o Post-Effective Amendment No.

(Check appropriate box or boxes)

Touchstone Funds Group Trust

(Exact Name of Registrant as Specified in Charter)

513-878-4066

(Area Code and Telephone Number)

303 Broadway, Suite 1100

Cincinnati, OH 45202

(Address of Principal Executive Offices: Number, Street, City, State, Zip Code)

Jill T. McGruder

303 Broadway, Suite 900

Cincinnati, OH 45202

(Name and Address of Agent for Service)

Copies to:

Deborah Bielicke Eades, Esq.

Vedder Price P.C.

222 North LaSalle Street

Chicago, Illinois 60601

(312) 609-7661

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

Shares of beneficial interest, without par value, of the Touchstone Small Cap Value Fund, a series of the Registrant, are being registered. No filing fee is due because Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

It is proposed that this filing will become effective on January 20, 2014 pursuant to Rule 488.

Touchstone Small Company Value Fund

A series of

Touchstone Strategic Trust

303 Broadway, Suite 1100

Cincinnati, Ohio 45202

(800) 543-0407

January 20, 2014

Dear Shareholder:

We have important information concerning your investment in the Touchstone Small Company Value Fund (the “Small Company Fund”), a series of Touchstone Strategic Trust (the “Trust”). As a shareholder of the Small Company Fund, we wish to inform you that the Board of Trustees of the Trust (“the Board”) has approved the reorganization of the Small Company Fund into the Touchstone Small Cap Value Fund (the “Small Cap Value Fund”, and together with the Small Company Fund, the “Funds”), a series of Touchstone Funds Group Trust (the “Reorganization”). The Funds have the same investment goal and management fee, substantially similar investment strategies, and are managed by the same sub-advisor and portfolio manager.

After careful consideration, the Board approved the Reorganization because it eliminates the offering of overlapping funds with the same investment goals and substantially similar investment strategies, and to provide economies of scale for the Funds and their shareholders. The Reorganization does not require shareholder approval. You do not need to take any action regarding your account.

Pursuant to an agreement and plan of reorganization, the Small Company Fund will transfer all of its assets and liabilities to the Small Cap Value Fund. As a result of the Reorganization, you will receive shares of the Small Cap Value Fund, which will have a total value equal to the total value of your shares in the Small Company Fund. The Small Company Fund will then cease operations. The Reorganization is expected to occur on or about March 23, 2014.

We have enclosed a Prospectus/Information Statement that describes the Reorganization in greater detail and contains important information about the Small Cap Value Fund. Please contact the Trust with any questions.

| Sincerely, |

| |

|

|

| |

| Jill T. McGruder |

| President |

| Touchstone Strategic Trust |

QUESTIONS & ANSWERS

We recommend that you read the enclosed Prospectus/Information Statement. In addition to the detailed information in the Prospectus/Information Statement, the following questions and answers provide an overview of key features of the Reorganization.

Q. Why are we sending you the Prospectus/Information Statement?

A. On November 21, 2013, the Board approved the Reorganization of the Small Company Fund into the Small Cap Value Fund. Although the Reorganization does not require your approval, the Prospectus/Information Statement provides you with detailed information about the Reorganization between the Small Company Fund and the Small Cap Value Fund.

Q. What will happen to my existing shares?

A. Immediately after the Reorganization, you will own shares of the Small Cap Value Fund that are equal in value to the shares of the Small Company Fund that you held immediately prior to the closing of the Reorganization (although the number of shares and the net asset value per share may be different). Therefore, your investment with us will not lose any value as a result of the Reorganization, but the Reorganization may result in economies of scale that benefit you.

Q. How do the fees and expenses compare?

A. Each Fund has the same management fee and, for Classes A and C shares, the same 12b-1 fees and sales charges. Class Y and Institutional Class shares of each Fund are not subject to any 12b-1 fees or sales charges.

In addition, each Fund has entered into an expense limitation agreement with Touchstone Advisors, Inc. (“Touchstone Advisors”). Touchstone Advisors has contractually agreed to waive a portion of its fees or reimburse certain Fund expenses in order to limit annual fund operating expenses for each Fund. The expense limitations for each Fund are limited to 1.38%, 2.13%, 1.13%, and 0.98% of average monthly net assets for Classes A, C, and Y shares and Institutional Class shares, respectively. The expense limitation agreement for the Small Company Fund is effective through July 29, 2014. The expense limitation agreement for the Small Cap Value Fund is effective through March 23, 2015. The section entitled “How do the Funds’ fees and expenses compare?” of the Prospectus/Information Statement compares the fees and expenses of the Funds in detail and the section entitled “Comparison of Investment Advisory Fees” provides additional information regarding the expense limitation agreements.

Q. How do the Funds’ investment goals and principal investment strategies compare?

A. Each Fund has the same investment goal and substantially similar principal investment strategies. The section of the Prospectus/Information Statement entitled “How do the Funds’ investment goals and principal investment strategies compare?” describes the investment goal and principal investment strategies of each Fund.

Q. Will I have to pay federal income taxes as a result of the Reorganization?

A. You are not expected to recognize any gain or loss for federal income tax purposes on the exchange of your shares of the Small Company Fund for shares of the Small Cap Value Fund. The Reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes. The section entitled “Material Federal Income Tax Consequences” of the Prospectus/Information Statement provides additional information regarding the federal income tax consequences of the Reorganization.

Q. Who will manage the Small Cap Value Fund after the Reorganization?

A. Both Funds are currently managed by Touchstone Advisors, the investment advisor; DePrince, Race & Zollo, Inc. (“DRZ”), the sub-advisor; and Gregory T. Ramsby, the portfolio manager. Touchstone Advisors, DRZ, and Mr. Ramsby will continue managing the Small Cap Value Fund after the Reorganization. As a result, we do not expect the management of your investment to change. For more information please see the sections of the Prospectus/Information Statement entitled “Who will be the Advisor, Sub-Advisor, and Portfolio Manager of my Fund after the Reorganization?” and “Management of the Funds.”

Q. Will I have to pay any sales load, commission, or other similar fee in connection with the Reorganization?

A. No, you will not pay any sales load, commission, or other similar fee in connection with the Reorganization.

Q. Who will pay for the Reorganization?

A. Touchstone Advisors will pay the costs of the Reorganization.

Q. What if I redeem my shares before the Reorganization takes place?

A. �� If you choose to redeem your shares before the Reorganization takes place, then the redemption will be treated as a normal sale of shares and, generally, will be a taxable transaction and may be subject to any applicable contingent deferred sales charge.

Q. Why is no shareholder action necessary?

A. The Trust’s Declaration of Trust provides that any series may be merged into another fund by a vote of a majority of the Board of the Trust without the approval of shareholders. In addition, the Reorganization of the Small Company Fund into the Small Cap Value Fund satisfies the requisite conditions of Rule 17a-8 under the Investment Company Act of 1940, as amended (the “1940 Act”), such that shareholder approval is not required by the 1940 Act.

Q. When will the Reorganization occur?

A. The Reorganization is expected to occur on or about March 23, 2014.

Q. Who should I contact for more information?

A. You can contact shareholder services at 1.800.543.0407.

PROSPECTUS/INFORMATION STATEMENT

January 20, 2014

Touchstone Strategic Trust

303 Broadway, Suite 1100

Cincinnati, OH 45202

(800) 543-0407

We Are Not Asking You for a Proxy and You Should Not Send Us a Proxy

This Prospectus/Information Statement is being furnished to shareholders of the Touchstone Small Company Value Fund (the “Small Company Fund”), a series of Touchstone Strategic Trust (“TST” or the “Trust”), in connection with an Agreement and Plan of Reorganization (the “Plan”) that has been approved by the Board of Trustees of TST (the “Board”). The Plan provides for the following:

· the transfer of all of the assets of the Small Company Fund to the Touchstone Small Cap Value Fund (the “Small Cap Value Fund” and collectively with the Small Company Fund, the “Funds”), a series of the Touchstone Funds Group Trust (“TFGT”), in exchange for shares of the Small Cap Value Fund (the “Reorganization”);

· the assumption by the Small Cap Value Fund of all of the liabilities of the Small Company Fund;

· the termination of the Small Company Fund subsequent to the distribution of shares of the Small Cap Value Fund to the Small Company Fund’s shareholders in complete liquidation of that Fund; and

· the structuring of the Reorganization as a tax-free reorganization for federal income tax purposes.

The Reorganization is expected to be completed on or about March 23, 2014.

This Prospectus/Information Statement, which you should read carefully and retain for future reference, concisely presents the information that you should know about the Funds and the Reorganization. A Statement of Additional Information (“SAI”) dated January 20, 2014 relating to this Prospectus/Information Statement and the Reorganization has been filed with the U.S. Securities and Exchange Commission (the “SEC”) and is incorporated by reference into this Prospectus/Information Statement.

Additional information concerning the Small Company Fund and the Small Cap Value Fund is contained in the documents described below, all of which have been filed with the SEC. Each document is incorporated by reference into this Prospectus/Information Statement (meaning that they are legally considered to be part of this Prospectus/Information Statement) only insofar as they related to the Small Company Fund and the Small Cap Value Fund. No other parts of such documents are incorporated by reference herein.

Information about the Small Company Fund and the Small Cap Value Fund: | | How to Obtain this Information: |

| | |

Prospectuses 1. Prospectus relating to the Touchstone Small Company Value Fund dated July 30, 2013 (previously filed on EDGAR, Accession No. 0001104659-13-057352). 2. Prospectus relating to the Touchstone Small Cap Value Fund dated January 30, 2013, as amended, which accompanies this Prospectus/Information Statement (previously filed on EDGAR, Accession No. 0001104659-13-005222). | | A copy of the Touchstone Small Cap Value Fund Prospectus is being mailed with the Prospectus/Information Statement. You may obtain copies of the SAIs, Annual Reports, or Semi-Annual Report, without charge, upon request by: · Writing to Touchstone Strategic Trust or Touchstone Funds Group Trust, at P.O. Box 9878, Providence, RI 02940; or · Calling (800) 543-0407 toll-free; or |

Statements of Additional Information (“SAIs”) 1. SAI relating to the Touchstone Small Company Value Fund dated July 30, 2013, as amended (previously filed on EDGAR, Accession No. 0001104659-13-057352). 2. SAI relating to the Touchstone Small Cap Value Fund dated January 30, 2013, as amended (previously filed on EDGAR, Accession No. 0001104659-13-005222). | | · Downloading a copy from https://www.touchstoneinvestments.com/home/formslit/. |

| | |

Annual Reports 1. Annual Report relating to the Touchstone Small Company Value Fund dated March 31, 2013 (previously filed on EDGAR, Accession No. 0001144204-13-032838). 2. Annual Report relating to the Touchstone Small Cap Value Fund dated September 30, 2013 (previously filed on EDGAR, Accession No. 0001144204-13-065116). | | |

| | |

Semi-Annual Report 1. Semi-Annual Report (unaudited) relating to the Touchstone Small Company Value Fund dated September 30, 2013 (previously filed on EDGAR, Accession No. 0001144204-13-065061). | | |

You can also obtain copies of any of the above-referenced documents without charge on the EDGAR database on the SEC’s Internet site at http://www.sec.gov. Copies are available for a fee by electronic request at the following E-mail address: publicinfo@sec.gov, or from the Public Reference Section, Securities and Exchange Commission, Washington, D.C. 20549-1520.

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT DETERMINED THAT THE INFORMATION IN THIS PROSPECTUS/INFORMATION STATEMENT IS ACCURATE OR ADEQUATE, NOR HAS IT APPROVED OR DISAPPROVED THESE SECURITIES. ANYONE WHO TELLS YOU OTHERWISE IS COMMITTING A CRIMINAL OFFENSE.

An investment in the Funds:

· is not a deposit of, or guaranteed by, any bank

· is not insured by the FDIC, the Federal Reserve Board or any other government agency

· is not endorsed by any bank or government agency

· involves investment risk, including possible loss of your original investment

TABLE OF CONTENTS

SUMMARY | 3 |

What are the Reasons for the Reorganization? | 3 |

What are the key features of the Reorganization? | 3 |

After the Reorganization, what shares of the Small Cap Value Fund will I own? | 3 |

How do the Funds’ investment goal and principal investment strategies compare? | 4 |

How do the Funds’ fees and expenses compare? | 4 |

How do the Funds’ performance records compare? | 9 |

Will I be able to purchase, redeem, and exchange shares the same way? | 10 |

Will I be able to receive distributions the same way? | 10 |

Who will be the Advisor, Sub-Advisor, and Portfolio Manager of my Fund after the Reorganization? | 11 |

Will the Small Cap Value Fund have the same service providers as the Small Company Fund? | 11 |

What will be the primary federal income tax consequences of the Reorganization? | 11 |

Will there be any repositioning costs? | 11 |

COMPARISON OF PRINCIPAL STRATEGIES AND RISKS | 11 |

Principal Strategies | 11 |

Principal Risks | 12 |

INFORMATION ABOUT THE REORGANIZATION | 14 |

Reasons for the Reorganization | 14 |

Agreement and Plan of Reorganization | 15 |

Description of the Securities to be Issued | 16 |

Material Federal Income Tax Consequences | 16 |

Pro Forma Capitalization | 18 |

THE FUND’S MANAGEMENT | 19 |

Investment Advisor | 19 |

Sub-Advisor and Portfolio Manager | 20 |

Investment Advisory Fees | 20 |

Small Cap Value Fund’s Advisory and Sub-Advisory Agreement Approval | 20 |

Expense Limitation Agreement | 20 |

CHOOSING A CLASS OF SHARES | 21 |

Class A Shares | 21 |

Class C Shares | 21 |

Class Y Shares | 22 |

Institutional Class Shares | 22 |

Buying and Selling Fund Shares | 22 |

Exchange Privileges of the Funds | 22 |

Distribution Policy | 23 |

1

DISTRIBUTION AND SHAREHOLDER SERVICING ARRANGEMENTS | 23 |

INFORMATION ON SHAREHOLDERS’ RIGHTS | 23 |

FINANCIAL STATEMENTS AND EXPERTS | 25 |

LEGAL MATTERS | 25 |

ADDITIONAL INFORMATION | 25 |

FINANCIAL HIGHLIGHTS | 25 |

EXHIBIT A: AGREEMENT AND PLAN OF REORGANIZATION | A-1 |

EXHIBIT B: FUNDAMENTAL INVESTMENT LIMITATIONS | B-1 |

EXHIBIT C: CONTROL PERSONS AND PRINCIPAL HOLDERS OF SECURITIES | C-1 |

2

SUMMARY

This section summarizes the primary features of the Reorganization. It may not contain all of the information that is important to you. To understand the Reorganization, you should read this entire Prospectus/Information Statement and the exhibits. This summary is qualified in its entirety by reference to the additional information contained elsewhere in this Prospectus/Information Statement, SAI, and the Plan, which is attached to this Prospectus/Information Statement as Exhibit A.

What are the Reasons for the Reorganization?

The Reorganization is designed to eliminate the offering of overlapping funds with the same investment goal and management fee, substantially similar investment strategies, and that are managed by the same sub-advisor and portfolio manager. The Reorganization may lead to potential efficiencies and economies of scale for shareholders. At a meeting held on November 21, 2013, the Board of TST and TGFT, including those Trustees who are not “interested persons”, as such term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”) (the “Independent Trustees”), determined that the Reorganization was in the best interests of shareholders of the Funds and the interests of existing shareholders of the Funds will not be diluted as a result of the Reorganization. Therefore, the Board of TST and TGFT approved the Reorganization. For more information, please see the section entitled “Reasons for the Reorganization.”

What are the key features of the Reorganization?

The Plan sets forth the key features of the Reorganization. The Plan provides for the following:

· the transfer of all the assets of the Small Company Fund to the Small Cap Value Fund in exchange for shares of the Small Cap Value Fund;

· the assumption by the Small Cap Value Fund of all the liabilities of the Small Company Fund;

· the termination of the Small Company Fund subsequent to the distribution of shares of the Small Cap Value Fund to the Small Company Fund’s shareholders in complete liquidation of the Small Company Fund; and

· the structuring of the Reorganization as a tax-free reorganization for federal income tax purposes.

The Reorganization is expected to be completed on or about March 23, 2014.

After the Reorganization, what shares of the Small Cap Value Fund will I own?

Each Fund is a series of a registered open-end management investment company (i.e., a mutual fund). The following table shows the share classes of the Small Cap Value Fund that will be issued to each corresponding share class of the Small Company Fund.

Funds and Share Classes

Touchstone Small Company Value Fund, a series of TST | | Touchstone Small Cap Value Fund, a series of TFGT |

Class A Class C Class Y Institutional Class | | Class A Class C Class Y Institutional Class |

The Small Cap Value Fund shares you receive will have the same total value as your shares of the Small Company Fund as of the close of business on the day immediately prior to the Reorganization.

3

How do the Funds’ investment goal and principal investment strategies compare?

The Funds have the same investment goal and substantially similar principal investment strategies. Although there are some differences in how the Funds’ principal investment strategies are described in their respective prospectuses, their principal investment strategies are substantially similar. Each Fund also has the same fundamental investment limitations, which are set forth in Exhibit B.

Each Fund’s investment goal is to seek long-term capital growth. Each Fund invests, under normal market conditions, at least 80% of its net assets (including borrowings for investment purposes) in equity securities of small capitalization companies. These are non-fundamental investment policies that can be changed by a Fund upon 60-days’ notice to shareholders. For the Small Company Fund equity securities consist of common stock; for the Small Cap Value Fund, equity securities consist of common and preferred stock. The Funds define a small capitalization company as having a market capitalization of no more than $2 billion at the time of initial purchase.

In selecting securities, the Funds’ sub-advisor, DePrince, Race & Zollo, Inc. (“DRZ”), seeks to invest in companies that have the potential for growth and that appear to be trading below their perceived value. DRZ employs a multi-step, “bottom up” investment process. Initially, DRZ screens the investible universe for small capitalization companies that pay a dividend. DRZ then applies various valuation multiples such as price-to-earnings, price-to-book, and price-to-cash flow, to find companies that it believes are trading at the low end of their historical relative valuation levels. DRZ then conducts fundamental analysis to identify an imminent catalyst that may lead to future price appreciation (e.g., a new product cycle, management focus on return on invested capital, management changes, restructuring, improving financial or operating conditions, or an industry-pricing cycle). DRZ establishes relative price targets for the remaining stocks that have identifiable catalysts. Finally, DRZ filters the results to choose companies that it believes have the potential for growth and appear to be trading below their perceived value. DRZ considers selling a security when the security’s yield falls below an acceptable limit established by DRZ, when the valuation is no longer attractive, or the fundamentals of the company or sector deteriorate.

The Funds may invest in securities of foreign companies that may be headquartered in or doing a substantial portion of their business overseas. The Funds will typically hold 65 to 80 securities and may engage in frequent and active trading of securities as a part of their principal investment strategy.

How do the Funds’ fees and expenses compare?

Comparative Fee Tables. The following tables allow you to compare the various fees and expenses that you may pay for buying and holding shares of each Fund. The tables also show the various costs and expenses that investors in the Small Company Fund will bear as shareholders of the Small Cap Value Fund. Pro forma expense levels project anticipated expense levels, but actual expenses may be greater or less than those shown. The shareholder transaction expenses presented below show the maximum sales charge (load) on purchases of Fund shares as a percentage of offering price. Small Company Fund shareholders will not pay any front-end sales charge on any shares of the Small Cap Value Fund received as part of the Reorganization, but any CDSC holding period will carry over. Information regarding sales charge discounts for which you may qualify with respect to future purchases of Class A shares of the Small Cap Value Fund is included in the section entitled “Description of Share Classes of the Funds” below. Expense ratios reflect annual fund operating expenses for the 12 months ended September 30, 2013 for the Small Company Fund and for the most recent fiscal year ended September 30, 2013 for the Small Cap Value Fund. Pro forma numbers are estimated as if the Reorganization had been completed as of September 30, 2013 and do not include the estimated costs of the Reorganization. Neither the Funds nor the shareholders will bear any Reorganization costs.

4

| | Touchstone Small

Company Value

Fund

Class A | | Touchstone Small

Cap Value Fund

Class A | | Touchstone Small Cap

Value Fund after

Reorganization

(pro forma combined)

Class A | |

Shareholder Fees (fees paid directly from your investment) |

Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) | | 5.75 | % | 5.75 | % | 5.75 | % |

Maximum Deferred Sales (Load) (as a % of original purchase price or the amount redeemed, whichever is less) | | 1.00 | %(1) | 1.00 | %(1) | 1.00 | %(1) |

Wire Redemption Fee | | Up to $15 | | Up to $15 | | Up to $15 | |

Annual Fund Operating Expenses (expenses that you pay each year as a % of the value of your investment) |

Management Fees | | 0.90 | % | 0.90 | %(2) | 0.90 | % |

Distribution or Service (12b-1) Fees | | 0.25 | % | 0.25 | % | 0.25 | % |

Other Expenses | | 1.56 | % | 0.60 | % | 0.59 | % |

Total Annual Fund Operating Expenses | | 2.71 | % | 1.75 | % | 1.74 | % |

Fee Waivers or Expense Reimbursement(3) | | -1.33 | % | -0.37 | % | -0.36 | % |

Total Annual Fund Operating Expenses After Fee Waiver or Expense Reimbursement | | 1.38 | % | 1.38 | % | 1.38 | % |

(1) If a shareholder purchases $1 million or more of Class A shares and therefore does not pay initial sales charges, then a CDSC of up to 1.00% may apply if those Class A shares are redeemed within 12 months after initial purchase. You should contact your financial intermediary to determine whether you are subject to the CDSC.

(2) Effective May 23, 2013, the advisory fee payable by the Fund was reduced to 0.90% on the Fund’s average daily net assets.

(3)Touchstone Advisors, Inc. and TST and TFGT, as applicable, have entered into an expense limitation agreement whereby Touchstone Advisors has contractually agreed to waive a portion of its fees or reimburse certain Fund expenses (excluding dividend expenses relating to short sales, interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, the cost of “Acquired Fund Fees and Expenses,” if any, and other extraordinary expenses not incurred in the ordinary course of business) in order to limit annual fund operating expenses for each Fund to 1.38% of average monthly net assets for Class A shares. The expense limitation agreement for the Small Company Fund is effective through July 28, 2014. The expense limitation agreement for the Small Cap Value Fund is effective through March 23, 2015. Each agreement can be terminated by a vote of the Board of Trustees of TST or TFGT, as applicable, if it deems the termination to be beneficial to the Fund’s shareholders. The terms of Touchstone Advisors’ contractual expense limitation agreement provide that Touchstone Advisors is entitled to recoup, subject to approval by the Board, such amounts waived or reimbursed for a period of up to three years from the year in which Touchstone Advisors reduced its compensation or assumed expenses for a Fund. No recoupment will occur unless a Fund’s operating expenses are below the expense limitation amount. See the discussion entitled “Expense Limitation Agreements with respect to the Funds” in this Prospectus/Information Statement for more information.

5

| | Touchstone Small

Company Value

Fund

Class C | | Touchstone Small

Cap Value Fund

Class C | | Touchstone Small Cap

Value Fund after

Transaction

(pro forma combined)

Class C | |

Shareholder Fees (fees paid directly from your investment) | |

Maximum Deferred Sales (Load) (as a % of original purchase price or the amount redeemed, whichever is less) | | 1.00 | % | 1.00 | % | 1.00 | % |

Wire Redemption Fee | | Up to $15 | | Up to $15 | | Up to $15 | |

Annual Fund Operating Expenses (expenses that you pay each year as a % of the value of your investment) | |

Management Fees | | 0.90 | % | 0.90 | %(1) | 0.90 | % |

Distribution or Service (12b-1) Fees | | 1.00 | % | 1.00 | % | 1.00 | % |

Other Expenses | | 1.81 | % | 3.26 | % | 1.88 | % |

Total Annual Fund Operating Expenses | | 3.71 | % | 5.16 | % | 3.78 | % |

Fee Waivers or Expense Reimbursement(2) | | -1.58 | % | -3.03 | % | -1.65 | % |

Total Annual Fund Operating Expenses After Fee Waiver or Expense Reimbursement | | 2.13 | % | 2.13 | % | 2.13 | % |

(1)Effective May 23, 2013, the advisory fee payable by the Fund was reduced to 0.90% on the Fund’s average daily net assets.

(2)Touchstone Advisors, Inc. and TST and TFGT, as applicable, have entered into an expense limitation agreement whereby Touchstone Advisors has contractually agreed to waive a portion of its fees or reimburse certain Fund expenses (excluding dividend expenses relating to short sales, interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, the cost of “Acquired Fund Fees and Expenses,” if any, and other extraordinary expenses not incurred in the ordinary course of business) in order to limit annual fund operating expenses for each Fund to 2.13% of average monthly net assets for Class C shares. The expense limitation agreement for the Small Company Fund is effective through July 28, 2014. The expense limitation agreement for the Small Cap Value Fund is effective through March 23, 2015. Each agreement can be terminated by a vote of the Board of TST or TGFT, as applicable, if it deems the termination to be beneficial to the Fund’s shareholders. The terms of Touchstone Advisors’ expense limitation agreement provide that Touchstone Advisors is entitled to recoup, subject to approval by the Board, such amounts waived or reimbursed for a period of up to three years from the year in which Touchstone Advisors reduced its compensation or assumed expenses for a Fund. No recoupment will occur unless a Fund’s operating expenses are below the expense limitation amount. See the discussion entitled “Expense Limitation Agreements with respect to the Funds” in this Prospectus/Information Statement for more information.

6

| | Touchstone Small

Company Value

Fund

Class Y | | Touchstone Small

Cap Value Fund

Class Y | | Touchstone Small Cap

Value Fund after

Transaction

(pro forma combined)

Class Y | |

Shareholder Fees (fees paid directly from your investment) | | | | | | | |

Wire Redemption Fee | | Up to $15 | | Up to $15 | | Up to $15 | |

Annual Fund Operating Expenses (expenses that you pay each year as a % of the value of your investment) | |

Management Fees | | 0.90 | % | 0.90 | %(1) | 0.90 | % |

Other Expenses | | 0.83 | % | 2.52 | % | 0.85 | % |

Total Annual Fund Operating Expenses | | 1.73 | % | 3.42 | % | 1.75 | % |

Fee Waivers or Expense Reimbursement(2) | | -0.60 | % | -2.29 | % | -0.62 | % |

Total Annual Fund Operating Expenses After Fee Waiver or Expense Reimbursement | | 1.13 | % | 1.13 | % | 1.13 | % |

(1)Effective May 23, 2013, the advisory fee payable by the Fund was reduced to 0.90% on the Fund’s average daily net assets.

(2)Touchstone Advisors, Inc. and TST and TFGT, as applicable, have entered into an expense limitation agreement whereby Touchstone Advisors has contractually agreed to waive a portion of its fees or reimburse certain Fund expenses (excluding dividend expenses relating to short sales, interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, the cost of “Acquired Fund Fees and Expenses,” if any, and other extraordinary expenses not incurred in the ordinary course of business) in order to limit annual fund operating expenses for each Fund to 1.13% of average monthly net assets for Class Y shares. The expense limitation agreement for the Small Company Fund is effective through July 28, 2014. The expense limitation agreement for the Small Cap Value Fund is effective through March 23, 2015. Each agreement can be terminated by a vote of the Board of TST or TFGT, as applicable, if it deems the termination to be beneficial to the Fund’s shareholders. The terms of Touchstone Advisors’ expense limitation agreement provide that Touchstone Advisors is entitled to recoup, subject to approval by the Board, such amounts waived or reimbursed for a period of up to three years from the year in which Touchstone Advisors reduced its compensation or assumed expenses for a Fund. No recoupment will occur unless a Fund’s operating expenses are below the expense limitation amount. See the discussion entitled “Expense Limitation Agreements with respect to the Funds” in this Prospectus/Information Statement for more information.

| | Touchstone Small

Company Value

Fund

Institutional Class | | Touchstone Small

Cap Value Fund

Institutional Class | | Touchstone Small Cap

Value Fund after

Transaction

(pro forma combined)

Institutional Class | |

Shareholder Fees (fees paid directly from your investment) | | | | | | | |

Wire Redemption Fee | | Up to $15 | | Up to $15 | | Up to $15 | |

Annual Fund Operating Expenses (expenses that you pay each year as a % of the value of your investment) | | | | | | | |

Management Fees | | 0.90 | % | 0.90 | %(1) | 0.90 | % |

Other Expenses | | 0.44 | | 0.90 | % | 0.40 | % |

Total Annual Fund Operating Expenses | | 1.34 | % | 1.80 | % | 1.30 | % |

Fee Waivers or Expense Reimbursement(2) | | -0.36 | % | -0.82 | % | -0.32 | % |

Total Annual Fund Operating Expenses After Fee Waiver or Expense Reimbursement | | 0.98 | % | 0.98 | % | 0.98 | % |

(1)Effective May 23, 2013, the advisory fee payable by the Fund was reduced to 0.90% on the Fund’s average daily net assets.

(2) Touchstone Advisors, Inc. and TST and TFGT, as applicable, have entered into an expense limitation agreement whereby Touchstone Advisors has contractually agreed to waive a portion of its fees or reimburse certain Fund expenses (excluding dividend expenses relating to short sales, interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, the cost of “Acquired Fund Fees and Expenses,” if any, and other extraordinary expenses not incurred in the ordinary course

7

of business) in order to limit annual fund operating expenses for each Fund to 0.98% of average monthly net assets for Institutional Class shares. The expense limitation agreement for the Small Company Fund is effective through July 28, 2014. The expense limitation agreement for the Small Cap Value Fund is effective through March 23, 2015. Each agreement can be terminated by a vote of the Board of TST or TFGT, as applicable, if it deems the termination to be beneficial to the Fund’s shareholders. The terms of Touchstone Advisors’ contractual waiver agreement provide that Touchstone Advisors is entitled to recoup, subject to approval by the Board, such amounts waived or reimbursed for a period of up to three years from the year in which Touchstone Advisors reduced its compensation or assumed expenses for a Fund. No recoupment will occur unless a Fund’s operating expenses are below the expense limitation amount. See the discussion entitled “Expense Limitation Agreements with respect to the Funds” in this Prospectus/Information Statement for more information.

Expense Examples. The examples are intended to help you compare the cost of investing in the Small Company Fund versus the Small Cap Value Fund and the Small Cap Value Fund (Pro Forma Combined), assuming the Reorganization takes place. The examples assume that you invest $10,000 for the time periods indicated and then, except as indicated, redeem all of your shares at the end of those periods. The examples also assume that your investment has a 5% return each year and that the operating expenses remain the same. For the Small Company Value Fund the example also assumes that the expense limitations remain in effect for the for the remainder of the contractual period, which expires on July 28, 2014, and then gross expenses are used for the period of July 29, 2013 through January 1, 2015. For the Small Cap Value Fund the Small Cap Value Fund (Pro Forma Combined), the expense example assumes that the expense limitations remain in effect for a period of one year. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | Assuming Redemption | | Assuming No Redemption | |

Classes | | 1

Year | | 3

Years | | 5

Years | | 10

Years | | 1

Year | | 3

Years | | 5

Years | | 10

Years | |

Class A | | | | | | | | | | | | | | | | | |

Small Company Value Fund | | $ | 768 | | $ | 1,306 | | $ | 1,869 | | $ | 3,392 | | $ | 768 | | $ | 1,306 | | $ | 1,869 | | $ | 3,392 | |

Small Cap Value Fund | | $ | 707 | | $ | 1,059 | | $ | 1,435 | | $ | 2,487 | | $ | 707 | | $ | 1,059 | | $ | 1,435 | | $ | 2,487 | |

Small Cap Value Fund after Reorganization

(Pro Forma Combined) | | $ | 708 | | $ | 1,060 | | $ | 1,434 | | $ | 2,485 | | $ | 708 | | $ | 1,060 | | $ | 1,434 | | $ | 2,485 | |

Class C | | | | | | | | | | | | | | | | | |

Small Company Value Fund | | $ | 391 | | $ | 1,058 | | $ | 1,846 | | $ | 3,905 | | $ | 291 | | $ | 1,058 | | $ | 1,846 | | $ | 3,905 | |

Small Cap Value Fund | | $ | 316 | | $ | 1,276 | | $ | 2,333 | | $ | 4,959 | | $ | 216 | | $ | 1,276 | | $ | 2,333 | | $ | 4,959 | |

Small Cap Value Fund after Reorganization

(Pro Forma Combined) | | $ | 316 | | $ | 1,003 | | $ | 1,809 | | $ | 3,911 | | $ | 216 | | $ | 1,003 | | $ | 1,809 | | $ | 3,911 | |

Class Y | | | | | | | | | | | | | | | | | |

Small Company Value Fund | | $ | 144 | | $ | 514 | | $ | 908 | | $ | 2,014 | | $ | 144 | | $ | 514 | | $ | 908 | | $ | 2,014 | |

Small Cap Value Fund | | $ | 115 | | $ | 837 | | $ | 1,581 | | $ | 3,548 | | $ | 115 | | $ | 837 | | $ | 1,581 | | $ | 3,548 | |

Small Cap Value Fund after Reorganization

(Pro Forma Combined) | | $ | 116 | | $ | 492 | | $ | 893 | | $ | 2,014 | | $ | 116 | | $ | 492 | | $ | 893 | | $ | 2,014 | |

Institutional Class | | | | | | | | | | | | | | | | | |

Small Company Value Fund | | $ | 117 | | $ | 406 | | $ | 716 | | $ | 1,597 | | $ | 117 | | $ | 406 | | $ | 716 | | $ | 1,597 | |

Small Cap Value Fund | | $ | 100 | | $ | 486 | | $ | 898 | | $ | 2,049 | | $ | 100 | | $ | 486 | | $ | 898 | | $ | 2,049 | |

Small Cap Value Fund after Reorganization

(Pro Forma Combined) | | $ | 100 | | $ | 381 | | $ | 683 | | $ | 1,540 | | $ | 100 | | $ | 381 | | $ | 683 | | $ | 1,540 | |

Portfolio Turnover. Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the Expense Example, affect the Funds’ performance. As of each Fund’s most recent fiscal year end, the portfolio turnover rate for the Small Company Fund and Small Cap Value Fund was 155% and 98%, respectively. The Small Company Fund’s portfolio turnover rate was 48% for the semi-annual report period ended September 30, 2013.

8

How do the Funds’ performance records compare?

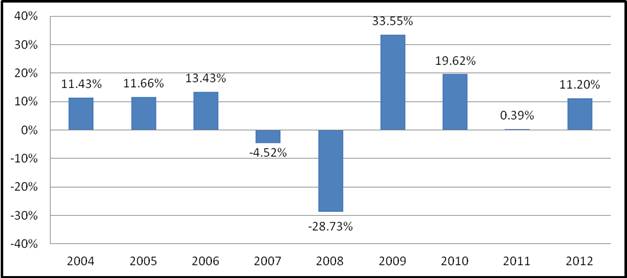

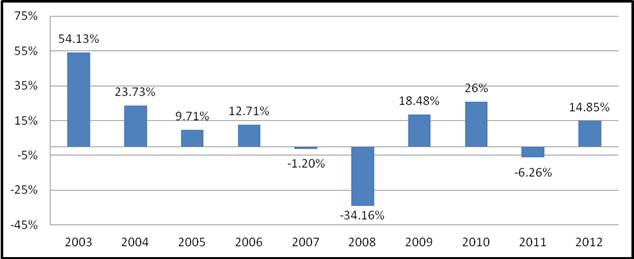

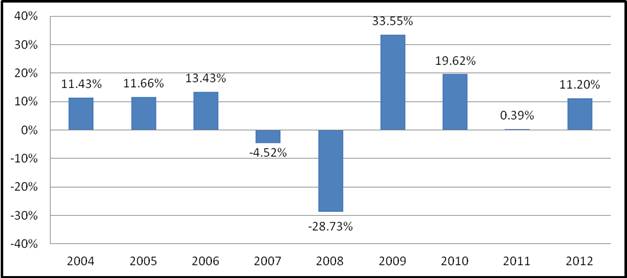

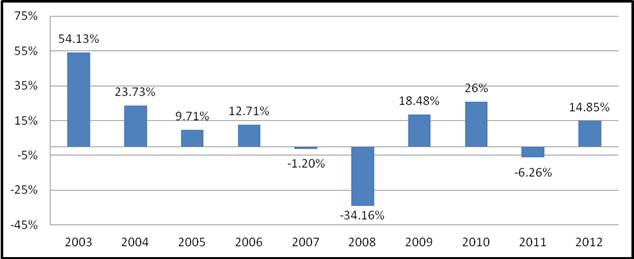

The bar charts and performance tables below illustrate some indication of the risks of investing in the Funds by showing changes in the Funds’ performance from year to year and by comparing the Russell 2000® Index and Russell 2000® Value Index to the Small Company Fund’s average annual total returns for 1 year, 5 years, and since inception and the Small Cap Value Fund’s average annual total returns for 1 year, 5 years, and 10 years. The bar charts do not reflect any sales charges, which would reduce your return. The Funds’ past performance (before and after taxes) does not indicate how the Funds will perform in the future. Updated performance is available at no cost by visiting www.TouchstoneInvestments.com or by calling 1.800.543.0407.

Touchstone Small Company Value Fund — Class A Total Return as of December 31

Best Quarter: 2nd Quarter 2009 26.20% Worst Quarter: 4th Quarter 2008 (27.57)%

The year-to-date return for the Small Company Fund’s Class A shares as of September 30, 2013 is 20.89%.

Touchstone Small Cap Value Fund — Class A shares Total Return as of December 31

Best Quarter: 1st Quarter 2003 18.97% Worst Quarter: 3rd Quarter 2008 (24.10)%

9

The year to date return for the Small Cap Value Fund’s Class A Shares as of September 30, 2013 is 20.69%.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns may differ from those shown and depend on your tax situation. The after-tax returns do not apply to shares held in an IRA, 401(k), or other tax-deferred account. The after-tax returns shown in the table are for each Fund’s Class A shares and after-tax returns for other share classes will vary.

Small Company Fund

Classes A, C, and Y shares began operations on April 1, 2003. Institutional Class shares began operations on September 10, 2012. The Institutional Class shares performance information is calculated using the historical performance of Class Y shares for periods prior to September 10, 2012. Institutional Class shares would have had substantially similar annual returns because the shares are invested in the same portfolio. Annual returns would differ only to the extent that the Classes have different expenses.

Small Cap Value Fund

On June 10, 2011, Class Z shares were converted to Class A shares and performance for periods prior to the date of conversion represents the performance of Class Z shares. Performance in the table below for periods prior to June 10, 2011 has been restated to reflect the impact of the Class A fees and expenses. Classes C and Y shares and Institutional Class shares began operations on March 1, 2011. Classes C and Y shares and Institutional Class shares performance information is calculated using the historical performance of Class A shares for the periods prior to March 1, 2011. Performance for this period for Class C shares has been restated to reflect the impact of the Class C shares fees and expenses.

Average Annual Total Returns

For the period ended December 31, 2012

| | Small Company Fund | | Small Cap Value Fund | |

| | 1 Year | | 5

Years | | Since

Inception

(4/1/03) | | 1 Year | | 5

Years | | 10

Years | |

Class A | | | | | | | | | | | | | |

Return Before Taxes | | 4.82 | % | 3.68 | % | 8.57 | % | 14.85 | % | 1.10 | % | 9.42 | % |

Return After Taxes on Distributions | | 0.85 | % | 2.53 | % | 6.70 | % | 14.54 | % | 0.96 | % | 8.67 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | 5.57 | % | 2.78 | % | 6.77 | % | 10.05 | % | 0.92 | % | 8.03 | % |

Class C | | | | | | | | | | | | | |

Return Before Taxes | | 9.58 | % | 4.15 | % | 8.42 | % | 19.95 | % | 1.54 | % | 9.25 | % |

Class Y | | | | | | | | | | | | | |

Return Before Taxes | | 11.51 | % | 5.19 | % | 9.52 | % | 22.08 | % | 2.44 | % | 10.14 | % |

Institutional Class | | | | | | | | | | | | | |

Return Before Taxes | | 11.66 | % | 5.22 | % | 9.54 | % | 22.38 | % | 2.47 | % | 10.16 | % |

| | 1 year | | 5 years | | 10 years | |

Russell 2000 Value Index

(reflects no deductions for fees, expenses or taxes) | | 18.05 | % | 3.55 | % | 9.50 | % |

Russell 2000 Index

(reflects no deductions for fees, expenses or taxes) | | 16.35 | % | 3.56 | % | 9.72 | % |

Will I be able to purchase, redeem, and exchange shares the same way?

Yes, after the Reorganization you will be able to purchase, redeem, and exchange shares of the Small Cap Value Fund the same way that you purchase, redeem, and exchange shares of the Small Company Fund. For more information, see the section entitled “Purchases, Redemptions, Exchanges of Shares and Dividend Policy,” below.

Will I be able to receive distributions the same way?

Yes, after the Reorganization you will be able to receive distributions the same way. Like the Small Company Fund, the Small Cap Value Fund intends to annually distribute to its shareholders substantially all of its income and capital gains. After the Reorganization, any income and capital gains will be reinvested in the class of shares of the

10

Small Cap Value Fund you receive in the Reorganization or, if you have so elected, distributed in cash. For more information, see the section entitled “Purchases, Redemptions, Exchanges of Shares and Dividend Policy.”

Who will be the Advisor, Sub-Advisor, and Portfolio Manager of my Fund after the Reorganization?

For each Fund, Touchstone Advisors, DRZ, and Gregory T. Ramsby serve as the investment advisor, sub-advisor, and portfolio manager respectively. After the Reorganization, each will continue in its current capacity. For additional information regarding Touchstone Advisors, DRZ, and Mr. Ramsby, please see the section entitled “Management of the Funds”.

Will the Small Cap Value Fund have the same service providers as the Small Company Fund?

The Funds currently have the same service providers. Upon completion of the Reorganization, the Small Cap Value Fund will continue to engage its existing service providers, as set forth in the chart below.

| | Service Providers |

Principal Underwriter | | Touchstone Securities, Inc. |

Administrator | | Touchstone Advisors, Inc. |

Sub-Administrator | | BNY Mellon Investment Servicing (US) Inc. |

Transfer Agent | | BNY Mellon Investment Servicing (US) Inc. |

Custodian | | Brown Brothers Harriman & Co. |

Independent Registered Public Accounting Firm | | Ernst & Young LLP |

For additional information regarding the service providers to the Funds, please see each Fund’s SAI.

What will be the primary federal income tax consequences of the Reorganization?

The transaction is expected to qualify as a tax-free reorganization for federal income tax purposes. If the Reorganization qualifies, then generally no gain or loss will be recognized by the Funds or their respective shareholders as a direct result of the Reorganization. As a condition to the closing of the Reorganization, the Funds will each receive an opinion from the law firm of Vedder Price P.C. that the Reorganization qualifies as a tax-free reorganization within the meaning of section 368(a) of the United States Internal Revenue Code of 1986, as amended (the “Code”). The opinion, however, is not binding on the Internal Revenue Service (the “IRS”) or any court and thus does not preclude the IRS or a court from taking a contrary position. See “Material Federal Income Tax Consequences” for more information on the federal income tax consequences of the Reorganization.

Will there be any repositioning costs?

Because the Small Company Fund and the corresponding Small Cap Value Fund have the same investment goal, substantially similar investment strategies, and are managed by the same portfolio manager, no material repositioning costs are expected to be incurred by either Fund as a result of the Reorganization.

COMPARISON OF PRINCIPAL STRATEGIES AND RISKS

The principal strategies and risks of each Fund are substantially similar, as shown in the following tables. For more information on the risks associated with Funds, see each Fund’s SAI.

Principal Strategies

SMALL COMPANY FUND | | SMALL CAP VALUE FUND |

Under normal circumstances, the Fund invests at least 80% of its assets in equity securities of small-cap companies. This is a non-fundamental investment policy that can be changed by the Fund upon 60-days prior notice to shareholders. For purposes of the Fund, a small capitalization company has a market capitalization of no more than $2 billion at the time of initial purchase. Equity securities consist of common stock and preferred stock. The Fund’s sub-advisor, DePrince, Race & Zollo, Inc. (“DRZ” or “Sub-Advisor”), seeks to invest in companies | | The Fund invests, under normal market conditions, at least 80% of its assets in common stocks of companies with small market capitalizations that the sub-advisor, DePrince, Race & Zollo, Inc. (“DRZ” or “Sub-Advisor”), believes have the potential for growth and that appear to be trading below their perceived value. This is a non-fundamental investment policy that can be changed by the Fund upon 60-days prior notice to shareholders. For purposes of the Fund, a small capitalization company has a market capitalization of no more than $2 billion at the time of initial purchase. |

11

that it believes have the potential for growth and that appear to be trading below their perceived value. DRZ employs a multi-step, “bottom-up” investment process. Initially, DRZ screens the investible universe for small capitalization companies that pay a dividend. DRZ then applies various valuation multiples such as price-to-earnings, price-to-book and price-to-cash flow, to find companies that it believes are trading at the low end of their historical relative valuation levels. DRZ then conducts fundamental analysis to identify an imminent catalyst (e.g., a new product cycle, management focus on return on invested capital, management changes, restructuring, improving financial or operating conditions, or an industry-pricing cycle), that it believes may lead to future price appreciation. DRZ establishes relative price targets for the remaining stocks that have identifiable catalysts. Finally, DRZ filters the results to choose companies that it believes have the potential for growth and appear to be trading below their perceived value. DRZ considers selling a security when, in DRZ’s opinion, the security’s yield falls below an acceptable limit, when the valuation is no longer attractive or the fundamentals of the company or sector deteriorate. Most of these companies are based in the U.S., but in some instances may be foreign companies. Non-U.S. issuer or foreign companies (or issuers) are companies that: (i) are organized under the laws of; (ii) maintain their principal place of business in; (iii) have the principal trading market for their securities in; (iv) derive at least 50% of revenues or profits from operation in; or (v) have at least 50% of their assets in, foreign countries. The Fund will typically hold 65 to 80 securities. The Fund may engage in frequent and active trading of securities as a part of its principal investment strategy. | | DRZ employs a multi-step, “bottom-up” investment process. Initially, DRZ screens the investible universe for small market capitalization companies that pay a dividend. DRZ then applies various valuation multiples such as price-to-earnings, price-to-book and price-to-cash flow, to find companies that it believes are trading at the low end of their historical relative valuation levels. DRZ then conducts rigorous fundamental analysis to identify an imminent catalyst which it believes may lead to future price appreciation. DRZ establishes relative price targets for the remaining stocks that have identifiable catalysts. Finally, DRZ filters the results to choose stocks that it believes have the potential for growth and appear to be trading below their perceived value. DRZ considers selling a security when its yield falls below the acceptable limit, when the valuation is no longer attractive or the fundamentals of the company or sector deteriorate. The Fund invests in securities of companies operating in a broad range of industries. Most of these companies are based in the U.S., but in some instances may be headquartered in or doing a substantial portion of their business overseas. The Fund will typically hold 65 to 80 securities. The Fund may engage in frequent and active trading of securities as a part of its principal investment strategy. |

Principal Risks

Each Fund’s share price will fluctuate. You could lose money on your investment in each Fund, and each Fund could return less than other investments. As with any mutual fund, there is no guarantee that either Fund will achieve its investment goal. Each Fund is subject to the principal risks listed below.

PRINCIPAL

RISK | | SMALL COMPANY FUND | | SMALL CAP VALUE FUND |

Equity Securities Risk | | The Fund is subject to the risk that stock prices will fall over short or extended periods of time. Individual companies may report poor results or be negatively affected by industry or economic trends and developments. The prices of securities issued by these companies may suffer a decline in response to such developments which could result in a decline in the value of the Fund’s shares. | | Identical. |

12

Small-Cap Risk | | The Fund is subject to the risk that small capitalization stocks may underperform other types of stocks or the equity markets as a whole. Stocks of smaller companies may be subject to more abrupt or erratic market movements than stocks of larger, more established companies. Small companies may have limited product lines or financial resources, or may be dependent upon a small or inexperienced management group. In addition, small-cap stocks typically are traded in lower volume, and their issuers typically are subject to greater degrees of changes in their earnings and prospects. | | Identical. |

| | | | |

Foreign Securities Risk | | Investing in foreign securities poses additional risks since political and economic events unique in a country or region will affect those markets and their issuers. These events will not necessarily affect the U.S. economy or similar issuers located in the United States. In addition, investments in foreign securities are generally denominated in foreign currency. As a result, changes in the value of those currencies compared to the U.S. dollar may affect (positively or negatively) the value of the Fund’s investments. There are also risks associated with foreign accounting standards, government regulation, market information, and clearance and settlement procedures. Foreign markets may be less liquid and more volatile than U.S. markets and offer less protection to investors. | | Investing in foreign securities poses additional risks since political and economic events unique in a country or region will affect those markets and their issuers. These events will not necessarily affect the U.S. economy or similar issuers located in the United States. In addition, investments in foreign securities are generally denominated in foreign currency. As a result, changes in the value of those currencies compared to the U.S. dollar may affect (positively or negatively) the value of the Fund’s investments. These currency movements may happen separately from, or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. There is a risk that foreign securities may not be subject to accounting standards or governmental supervision comparable to U.S. companies and that less public information about their operations may exist. There is risk associated with the clearance and settlement procedures in non-U.S. markets, which may be unable to keep pace with the volume of securities transactions and may cause delays. Foreign markets may be less liquid and more volatile than U.S. markets and offer less protection to investors. Over-the-counter securities may also be less liquid than exchange-traded securities. |

| | | | |

Portfolio Turnover Risk | | Frequent and active trading may result in greater expenses to the Fund, which may lower the Fund’s performance and may generate more taxable short-term gains for shareholders. | | Identical. |

13

Preferred Stock Risk | | Preferred stock represents an equity or ownership interest in an issuer that pays dividends at a specified rate and that has precedence over common stock in the payment of dividends. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of bonds take precedence over the claims of those who own preferred and common stock. If interest rates rise, the fixed dividend on preferred stocks may be less attractive, causing the price of preferred stocks to decline. Preferred stock may have mandatory sinking fund provisions, as well as provisions allowing the stock to be called or redeemed prior to its maturity, which can have a negative impact on the stock’s price when interest rates decline. | | None. |

| | | | |

Management Risk | | The Advisor engages one or more sub-advisors to make investment decisions on its behalf for a portion or all of the Fund. There is a risk that the Advisor may be unable to identify and retain sub-advisors who achieve superior investment returns relative to other similar sub-advisors. The value of your investment may decrease if the Sub-Advisor’s judgment about the attractiveness, value or market trends affecting a particular security, issuer, industry or sector or about market movements is incorrect. | | Touchstone Advisors, Inc., the advisor (the “Advisor”), engages one or more sub-advisors to make investment decisions on its behalf for a portion or all of the Fund. There is a risk that the Advisor may be unable to identify and retain sub-advisors who achieve superior investment returns relative to other similar sub-advisors. The value of your investment may decrease if the sub-advisor’s judgment about the attractiveness, value or market trends affecting a particular security, issuer, industry or sector or about market movements is incorrect. |

| | | | |

Value Investing Risk: | | A value-oriented investment approach is subject to the risk that a security believed to be undervalued does not appreciate in value as anticipated or experiences a decline in value. | | Identical. |

INFORMATION ABOUT THE REORGANIZATION

Reasons for the Reorganization

The Reorganization is designed to eliminate the offering of overlapping funds with the same investment goal, substantially similar investment strategies, and the same sub-advisor and portfolio manager. The Reorganization may lead to potential efficiencies and economies of scale for shareholders. At a meeting held on November 21, 2013, the Board of TST and TGFT, including the Independent Trustees, determined that the Reorganization was in the best interests of the Funds and the interests of existing shareholders of the Funds will not be diluted as a result of the Reorganization. Therefore, the Board approved the Reorganization.

In evaluating the Reorganization, the Board requested and reviewed, with assistance of independent legal counsel, materials furnished by Touchstone Advisors, the investment advisor to the Funds. These materials included written information regarding operations and financial conditions of the Funds, principal terms and conditions of the Reorganization, including that the Reorganization is expected to quality as a tax-free reorganization for federal income tax purposes. The Board considered that as of September 30, 2013, the Small Company Fund had net assets of approximately $39.8 million, while the Small Cap Value Fund had net assets of approximately $39.1 million. Accordingly, by merging the Funds, shareholders would enjoy a greater asset base over which fund expenses may be spread. In addition, the Board considered, the following factors among others:

· the terms and conditions of the Reorganization;

· the investment advisory fee and other fees paid by the Funds and the expense ratios of the Funds;

· the advice and recommendation of Touchstone Advisors, including its opinion that the Reorganization would be in the best interests of the Funds;

· the expenses of the Reorganization would not be borne by the Funds’ shareholders;

· the historical investment performance record of the Funds and expected continuity of day-to-day Fund management through DRZ;

14

· the same investment goal and substantially similar investment strategies of the Funds;

· the Small Cap Value Fund’s assumption of all of the liabilities of the Small Company Fund;

· the anticipated benefits to shareholders, including operating efficiencies, that may be achieved from the Reorganization;

· the anticipated federal income tax-free nature of the Reorganization; and

· alternatives available to shareholders of the Small Company Fund, including the ability to redeem their shares.

During their assessment, the Board met with independent legal counsel regarding the legal issues involved. After consideration of the factors noted above, together with other factors and information considered to be relevant, and recognizing that there can be no assurance that any operating efficiencies or other benefits will in fact be realized, the Board concluded that the Reorganization would be in the best interests of the Funds and the interests of existing shareholders would not be diluted as a result of the Reorganization.

Agreement and Plan of Reorganization

The following summary is qualified in its entirety by reference to the Plan, as set forth in Exhibit A.

The Plan provides that all of the assets of the Small Company Fund will be transferred to the Small Cap Value Fund solely in exchange for shares of the Small Cap Value Fund and the assumption by the Small Cap Value Fund of all the liabilities of the Small Company Fund on or about March 23, 2014 or such other date as may be agreed upon by the parties (the “Closing Date”). The class or classes of the Small Cap Value Fund shares that you will receive in connection with the Reorganization will depend on the class or classes of the Small Company Fund shares that you own immediately prior to the closing.

Prior to the Closing Date, the Small Company Fund will endeavor to discharge all of its known liabilities and obligations. The Small Company Fund will prepare an unaudited statement of its assets and liabilities as of 4:00 PM Eastern Time on the Business Day preceding the Closing Date (the “Valuation Date”). At or prior to the Valuation Date, for tax reasons, the Small Company Fund will distribute to its shareholders all of the Small Company Fund’s investment company taxable income (computed without regard to any deduction for dividends paid) for all taxable periods ending on or before the Closing Date, all of the Small Company Fund’s net tax exempt income for all taxable periods ending on or before the Closing Date, and all of its net capital gains realized in all taxable periods ending on or before the Closing Date (after reduction by any available capital loss carryforwards).

BNY Mellon Investment Servicing (US) Inc., the sub-administrator for the Funds, will compute the value of the Small Company Fund’s portfolio of securities. The method of valuation employed will be consistent with the valuation procedures described in the Small Company Fund’s prospectus and statement of additional information or such other valuation procedures as shall be mutually agreed upon by the Funds.

As soon after the closing as practicable, the Small Company Fund will distribute pro rata to its shareholders of record as of the closing the full and fractional shares of the Small Cap Value Fund received by the Small Company Fund. The liquidation and distribution will be accomplished by the establishment of accounts in the names of the Small Company Fund’s shareholders on the Small Cap Value Fund’s share records of its transfer agent. Each account will represent the respective pro rata number of full and fractional shares of the Small Cap Value Fund due to a Small Company Fund’s shareholder. All issued and outstanding shares of the Small Company Fund will be canceled. Shares of the Small Cap Value Fund to be issued will have no preemptive or conversion rights and no share certificates will be issued. After these distributions and the winding up of its affairs, the Small Company Fund will be completely liquidated and terminated.

The Reorganization is subject to the conditions set forth in the Plan. The Plan may be terminated (a) by the mutual agreement of the Small Company Fund and the Small Cap Value Fund; or (b) at or prior to the Closing Date by either party (1) because of a breach by the other of any representation, warranty, or agreement contained in the Plan to be performed at or prior to the Closing Date, if not cured within 30 days, or (2) because a condition in the Plan expressed to be precedent to the obligations of the terminating party has not been met and it reasonably appears that it will not or cannot be met.

Whether or not the Reorganization is consummated, Touchstone Advisors will pay the expenses incurred by the Funds in connection with the Reorganization.

15

Description of the Securities to be Issued

Shareholders of the Small Company Fund as of the closing will receive full and fractional shares of the Small Cap Value Fund in accordance with the procedures provided for in the Plan. The shares of the Small Cap Value Fund to be issued in connection with the Reorganization will be fully paid and non-assessable when issued.

Material Federal Income Tax Consequences

The following discussion summarizes the material U.S. federal income tax consequences of the Reorganization that are applicable to you as a Small Company Fund shareholder. It is based on the Code, applicable U.S. Treasury regulations, judicial authority, and administrative rulings and practice, all as of the date of this Prospectus/Information Statement and all of which are subject to change, including changes with retroactive effect. The discussion below does not address any state, local, or foreign tax consequences of the Reorganization. Your tax treatment may vary depending upon your particular situation. You also may be subject to special rules not discussed below if you are a certain kind of Small Company Fund shareholder, including, but not limited to: an insurance company; a tax-exempt organization; a financial institution or broker-dealer; a person who is neither a citizen nor resident of the United States or an entity that is not organized under the laws of the United States or a political subdivision thereof; a holder of Small Company Fund shares as part of a hedge, straddle, or conversion transaction; a person that does not hold Small Company Fund shares as a capital asset at the time of the Reorganization; or an entity taxable as a partnership for U.S. federal income tax purposes.

The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization under Section 368(a) of the Code. As a condition to the closing of the Reorganization, the Small Company Fund and the Small Cap Value Fund will receive an opinion from the law firm of Vedder Price P.C. substantially to the effect that, on the basis of the existing provisions of the Code, U.S. Treasury regulations issued thereunder, current administrative rules, pronouncements and court decisions, and certain representations, qualifications, and assumptions with respect to the Reorganization, for federal income tax purposes:

(i) The transfer by the Small Company Fund of all its assets to the Small Cap Value Fund solely in exchange for Small Cap Value Fund shares and the assumption by the Small Cap Value Fund of all the liabilities of the Small Company Fund, followed by the pro rata, by class, distribution of all the Small Cap Value Fund shares so received by the Small Company Fund to the Small Company Fund’s shareholders of record in complete liquidation of the Small Company Fund as soon as practicable thereafter, will constitute a “reorganization” within the meaning of Section 368(a) of the Code, and the Small Cap Value Fund and the Small Company Fund will each be “a party to a reorganization,” within the meaning of Section 368(b) of the Code, with respect to the Reorganization.

(ii) No gain or loss will be recognized by the Small Cap Value Fund upon the receipt of all the assets of the Small Company Fund solely in exchange for Small Cap Value Fund shares and the assumption by the Small Cap Value Fund of all the liabilities of the Small Company Fund.

(iii) No gain or loss will be recognized by the Small Company Fund upon the transfer of all its assets to the Small Cap Value Fund solely in exchange for Small Cap Value Fund shares and the assumption by the Small Cap Value Fund of all the liabilities of the Small Company Fund or upon the distribution (whether actual or constructive) of the Small Cap Value Fund shares so received to the Small Company Fund’s shareholders solely in exchange for such shareholders’ shares of the Small Company Fund in complete liquidation of the Small Company Fund.

(iv) No gain or loss will be recognized by the Small Company Fund’s shareholders upon the exchange, pursuant to the Reorganization, of all their shares of the Small Company Fund solely for Small Cap Value Fund shares.

(v) The aggregate basis of the Small Cap Value Fund shares received by each Small Company Fund shareholder pursuant to the Reorganization will be the same as the aggregate basis of the Small Company Fund shares exchanged therefor by such shareholder.

(vi) The holding period of the Small Cap Value Fund shares received by each Small Company Fund shareholder in the Reorganization will include the period during which the shares of the Small Company Fund exchanged therefore were held by such shareholder, provided such Small Company Fund shares were held as capital assets at the effective time of the Reorganization.

16

(vii) The basis of the assets of the Small Company Fund received by the Small Cap Value Fund will be the same as the basis of such assets in the hands of the Small Company Fund immediately before the effective time of the Reorganization.

(viii) The holding period of the assets of the Small Company Fund received by the Small Cap Value Fund will include the period during which such assets were held by the Small Company Fund.

No opinion will be expressed as to (1) the effect of the Reorganization on the Small Company Fund, the Small Cap Value Fund or any Small Company Fund shareholder with respect to any asset (including without limitation any stock held in a passive foreign investment company as defined in Section 1297(a) of the Code) as to which any unrealized gain or loss is required to be recognized under federal income tax principles (i) at the end of a taxable year or on the termination thereof, or (ii) upon the transfer of such asset regardless of whether such transfer would otherwise be a non-taxable transaction under the Code or (2) any other federal tax issues (except those set forth above) and all state, local or foreign tax issues of any kind.

No private ruling will be sought from the IRS with respect to the federal income tax consequences of the Reorganization. Opinions of counsel are not binding upon the IRS or the courts, are not guarantees of the tax results, and do not preclude the IRS from adopting or taking a contrary position, which may be sustained by a court. If the Reorganization is consummated but the IRS or the courts determine that the Reorganization does not qualify as a tax-free reorganization under the Code and, thus, is taxable, the Small Company Fund would recognize gain or loss on the transfer of its assets to the Small Cap Value Fund and each shareholder of the Small Company Fund would recognize a taxable gain or loss equal to the difference between its tax basis in its Small Company Fund shares and the fair market value of the shares of the Small Cap Value Fund it receives.

Prior to the Reorganization, the Small Company Fund will declare a distribution to its shareholders, which together with all previous distributions, will have the effect of distributing to its shareholders all of the Small Company Fund’s investment company taxable income (computed without regard to the deduction for dividends paid) and realized net capital gain, if any, through the Reorganization. Such distributions will be taxable to shareholders for federal income tax purposes. Even if reinvested in additional shares of the Small Company Fund, which would be exchanged for shares of the Small Cap Value Fund in the Reorganization, such distributions will be taxable for federal income tax purposes.

If portfolio assets of the Small Company Fund are sold prior to the Reorganization, the tax impact of such sales will depend on the holding periods of such assets and the difference between the price at which such portfolio assets are sold and the Small Company Fund’s basis in such assets. Any capital gains recognized in these sales on a net basis (after taking into account any capital loss carryforwards) will be distributed to the Small Company Fund’s shareholders as capital gains (to the extent of net realized long-term capital gain) or ordinary dividends (to the extent of net realized short-term capital gain) during or with respect to the year of sale, and such distributions will be taxable to shareholders.

U.S. federal income tax law permits a regulated investment company to carry forward net capital losses realized during taxable years beginning on or before December 22, 2010, for a period of up to eight taxable years, and, for net capital losses realized during taxable years beginning after December 22, 2010, for an unlimited number of taxable years. A regulated investment company must use capital loss carryforwards generated in taxable years beginning after December 22, 2010 to offset gains arising in taxable years beginning after this date before capital losses carried forward from years beginning on or prior to this date are used.

The Reorganization will cause the tax year of the Small Company Fund to close. After the Reorganization, the Small Cap Value Fund’s ability to use the Small Company Fund’s or the Small Cap Value Fund’s realized and unrealized pre-Reorganization capital losses, if any, may be limited under certain federal income tax rules applicable to reorganizations of this type. Therefore, in certain circumstances, shareholders may pay federal income tax sooner, or may pay more federal income taxes, than they would have had the Reorganization not occurred. The effect of these potential limitations will depend on a number of factors, including the amount of the losses, the amount of gains to be offset, the exact timing of the Reorganization and the amount of unrealized capital gains in the Funds at the time of the Reorganization.

As of March 31, 2013, for U.S. federal income tax purposes the Small Company Fund did not have any capital loss carryforwards. As of September 30, 2013, for U.S. federal income tax purposes the Small Cap Value Fund had capital loss carryforwards with the expiration dates as indicated below:

17

2017 | | 2018 | |

$ | 4,146,671 | | $ | 17,853,429 | |

| | | | | |

As of March 31, 2013, for U.S. federal income tax purposes the Small Company Fund had net unrealized gains of $2,276,422. These figures are likely to change by the date of the Reorganization, and do not reflect the impact of the Reorganization, including, in particular, the application of the loss limitation rules discussed herein.

In addition, shareholders of the Small Company Fund will receive a proportionate share of any taxable income and gains realized by the Small Cap Value Fund and not distributed to its shareholders prior to the Reorganization when such income and gains are eventually distributed by the Small Cap Value Fund. As a result, shareholders of the Small Company Fund may receive a greater amount of taxable distributions than they would have had the Reorganization not occurred.

Tracking Your Basis and Holding Period; State and Local Taxes. After the Reorganization, you will continue to be responsible for tracking the adjusted tax basis and holding period of your shares for federal income tax purposes. However, mutual funds must report cost basis information to you and the IRS when a shareholder sells or exchanges shares acquired on or after January 1, 2012 that are not in a retirement account (“covered shares”). Cost basis reporting by a mutual fund is not required if the shares were acquired in a reorganization and the basis of the acquired shares is determined from the basis of shares that were not covered shares.

This discussion does not address any state or local tax issues and only limited federal tax issues. You are urged and advised to consult your own tax advisors as to the federal, state, local, foreign, and other tax consequences of the Reorganization in light of your individual circumstances, including the applicability and effect of possible changes in any applicable tax laws.

Pro Forma Capitalization

The following table sets forth as of September 30, 2013, for the Reorganization, the total net assets, number of shares outstanding, and net asset value (“NAV”) per share. This information is generally referred to as the “capitalization” of a Fund. The term “pro forma capitalization” means the expected capitalization of the Small Cap Value Fund after it has combined with the Small Company Fund assuming the Reorganization occurred as of September 30, 2013.

| | Touchstone Small

Company Value

Fund* | | Touchstone

Small Cap

Value Fund* | | Pro Forma

Adjustments(1) | | Pro Forma

Combined

Touchstone

Small Cap Value

Fund | |

Net Assets (all classes) | | $ | 39,781,292 | | $ | 39,101,282 | | | | $ | 78,882,574 | |

Class A | | | | | | | | | |

Net assets | | 2,521,758 | | 34,826,120 | | | | 37,347,878 | |

Shares outstanding | | 130,687 | | 1,528,154 | | (20,035 | )(2) | 1,638,806 | |

Net asset value per share | | 19.30 | | 22.79 | | | | 22.79 | |

Class C | | | | | | | | | |

Net assets | | 1,385,983 | | 841,015 | | | | 2,226,998 | |

Shares outstanding | | 77,031 | | 37,191 | | (15,731 | )(2) | 98,491 | |

Net asset value per share | | 17.99 | | 22.61 | | | | 22.61 | |

Class Y | | | | | | | | | |

Net assets | | 6,312,899 | | 769,159 | | | | 7,082,058 | |

Shares outstanding | | 322,318 | | 33,704 | | (45,679 | )(2) | 310,343 | |

Net asset value per share | | 19.59 | | 22.82 | | | | 22.82 | |

Institutional Class | | | | | | | | | |

Net assets | | 29,560,652 | | 2,664,988 | | | | 32,225,640 | |

Shares outstanding | | 1,508,964 | | 116,850 | | (213,013 | )(2) | 1,412,801 | |