As filed with the Securities and Exchange Commission on May 30, 2017

File No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

¨Pre-Effective Amendment No. __ ¨ Post-Effective Amendment No. __

(Check appropriate box or boxes)

Touchstone Funds Group Trust

(Exact Name of Registrant as Specified in Charter)

(800) 638-8194

(Area Code and Telephone Number)

303 Broadway, Suite 1100

Cincinnati, Ohio 45202

(Address of Principal Executive Offices: Number, Street, City, State, Zip Code)

Jill T. McGruder

303 Broadway, Suite 1100

Cincinnati, Ohio 45202

(Name and Address of Agent for Service)

Copies to:

Deborah Bielicke Eades, Esq.

Vedder Price P.C.

222 North LaSalle Street

Chicago, Illinois 60601

(312) 609-7661

Renee M. Hardt, Esq.

Vedder Price P.C.

222 North LaSalle Street

Chicago, Illinois 60601

(312) 609-7616

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

Shares of beneficial interest, $0.01 par value per share, of the Touchstone Active Bond Fund and Touchstone Ultra Short Duration Fixed Income Fund, each a series of the Registrant, are being registered. No filing fee is due because Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Sentinel GROUP funds, INC.

One National Life Drive

Montpelier, Vermont 05604

800-282-3863

June [•], 2017

Dear Shareholder:

The Board of Directors of Sentinel Group Funds, Inc., a Maryland corporation (“Sentinel Funds”), has called a joint special meeting of shareholders (the “Special Meeting”) of the series of Sentinel Funds listed in the table below under the heading Target Funds (each a “Target Fund” and collectively, the “Target Funds”) to be held at the offices of Sentinel Funds, One National Life Drive, Montpelier, Vermont 05604, on August 23, 2017 at 11:00 a.m., Eastern time. The purpose of the Special Meeting is to vote on an important proposal that affects your investment in your Target Fund.

On April 18, 2017, Sentinel Asset Management, Inc. (“Sentinel”) entered into an agreement to sell its mutual fund asset management business to Touchstone Advisors, Inc. (“Touchstone Advisors”), investment advisor to the Touchstone family of mutual funds and an indirect, wholly-owned subsidiary of Western & Southern Mutual Holding Company (the “Transaction”). Currently, Touchstone Advisors’ retail mutual fund platform includes 35 separate mutual funds that are managed by Touchstone Advisors and sub-advised by various institutional investment managers (the “Touchstone Funds”).

In connection with Sentinel’s decision to exit the mutual fund asset management business, Sentinel recommended and the Board of Directors of Sentinel Funds approved an Agreement and Plan of Reorganization with respect to each Target Fund pursuant to which the Target Fund would be reorganized (each, a “Reorganization” and collectively, the “Reorganizations”) into a corresponding Touchstone Fund as set forth in the table below under the heading Acquiring Funds (each, an “Acquiring Fund” and collectively, the “Acquiring Funds”).

| Target Funds | | Acquiring Funds |

| | | |

| Sentinel Government Securities Fund | | Touchstone Active Bond Fund, a series of Touchstone Funds Group Trust |

| Sentinel Total Return Bond Fund | | Touchstone Active Bond Fund, a series of Touchstone Funds Group Trust |

| Sentinel Low Duration Bond Fund | | Touchstone Ultra Short Duration Fixed Income Fund, a series of Touchstone Funds Group Trust |

| Sentinel Multi-Asset Income Fund | | Touchstone Flexible Income Fund, a series of Touchstone Strategic Trust |

| Sentinel Sustainable Core Opportunities Fund | | Touchstone Sustainability and Impact Equity Fund, a series of Touchstone Strategic Trust |

| Sentinel Balanced Fund | | Touchstone Balanced Fund, a newly created series of Touchstone Strategic Trust |

| Sentinel Common Stock Fund | | Touchstone Large Cap Focused Fund, a newly created series of Touchstone Strategic Trust |

| Sentinel International Equity Fund | | Touchstone International Equity Fund, a newly created series of Touchstone Strategic Trust |

| Sentinel Small Company Fund | | Touchstone Small Company Fund, a newly created series of Touchstone Strategic Trust |

The Board of Directors of Sentinel Funds believes that the proposed Reorganizations are in the best interests of the Target Funds and recommends that you vote FOR the proposed Reorganization of your Target Fund.

We have enclosed a Joint Proxy Statement/Prospectus that describes each Reorganization proposal in greater detail, as well as important information about the Acquiring Funds. Your vote is extremely important, so please read the entire Joint Proxy Statement/Prospectus. Please contact our proxy solicitor, Broadridge Financial Solutions, Inc., at 855-928-4492 with any questions.

Thank you for your consideration of this important proposal.

| | Sincerely, |

| | |

| | Lisa F. Muller

Secretary, Sentinel Group Funds, Inc. |

sentinel GROUP FUNDs, INC.

One National Life Drive

Montpelier, Vermont 05604

800-282-3863

NOTICE OF JOINT SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON AUGUST 23, 2017

To the Shareholders:

Notice is hereby given that a joint special meeting of shareholders of the series of Sentinel Group Funds, Inc., a Maryland corporation, identified in the table below (each, a “Target Fund” and collectively, the “Target Funds”) will be held at the offices of Sentinel Group Funds, Inc., One National Life Drive, Montpelier, Vermont 05604, on August 23, 2017 at 11:00 a.m., Eastern time, and any adjournment or postponement thereof (the “Special Meeting”).

At the Special Meeting, shareholders of each Target Fund will be asked to consider a proposal to approve an Agreement and Plan of Reorganization (the “Plan”) between Touchstone Strategic Trust or Touchstone Funds Group Trust, as applicable, on behalf of the applicable series thereof identified in the table below (each, an “Acquiring Fund” and collectively, the “Acquiring Funds”) and Sentinel Group Funds, Inc., on behalf of the applicable Target Fund, providing for (i) the transfer of all the assets of the Target Fund to the Acquiring Fund in exchange solely for shares of the Acquiring Fund as set forth in the table below and the assumption by the Acquiring Fund of the liabilities (other than certain excluded liabilities) of the Target Fund, as described in the Plan; (ii) the pro rata distribution, by class, to the Target Fund’s shareholders of the shares of the Acquiring Fund as set forth in the table below; and (iii) the termination of the Target Fund (each, a “Reorganization” and collectively, the “Reorganizations”).

Target Funds and Share Classes | | Acquiring Funds and Corresponding Share

Classes |

| Sentinel Government Securities Fund | | Touchstone Active Bond Fund |

| Class A | | Class A |

| Class C | | Class C |

| Class I | | Class Y |

| Sentinel Total Return Bond Fund | | Touchstone Active Bond Fund |

| Class A | | Class A |

| Class C | | Class C |

| Class I | | Class Y |

| Class R3 | | Class A |

| Class R6 | | Class Y |

| Sentinel Low Duration Bond Fund | | Touchstone Ultra Short Duration Fixed Income Fund |

| Class A | | Class A |

| Class I | | Class Y |

| Class S | | Class S |

| Sentinel Multi-Asset Income Fund | | Touchstone Flexible Income Fund |

| Class A | | Class A |

| Class C | | Class C |

| Class I | | Class Y |

Target Funds and Share Classes | | Acquiring Funds and Corresponding Share

Classes |

| Sentinel Sustainable Core Opportunities Fund | | Touchstone Sustainability and Impact Equity Fund |

| Class A | | Class A |

| Class I | | Class Y |

| Sentinel Balanced Fund | | Touchstone Balanced Fund |

| Class A | | Class A |

| Class C | | Class C |

| Class I | | Class Y |

| Sentinel Common Stock Fund | | Touchstone Large Cap Focused Fund |

| Class A | | Class A |

| Class C | | Class C |

| Class I | | Class Y |

| Class R6 | | Institutional Class |

| Sentinel International Equity Fund | | Touchstone International Equity Fund |

| Class A | | Class A |

| Class C | | Class C |

| Class I | | Class Y |

| Sentinel Small Company Fund | | Touchstone Small Company Fund |

| Class A | | Class A |

| Class C | | Class C |

| Class I | | Class Y |

| Class R6 | | Class R6 |

The Board of Directors of Sentinel Group Funds, Inc. has fixed the close of business on June 21, 2017 as the record date for determination of shareholders entitled to notice of and eligible to vote at the Special Meeting.

Please complete, sign, date and return your proxy card in the postage paid return envelope or otherwise vote promptly regardless of the number of shares owned.

Even if you expect to attend the Special Meeting, shareholders are requested to complete, sign, date and return the enclosed proxy card in the enclosed envelope, which needs no postage if mailed in the United States. Shareholders may also authorize a proxy by telephone or via the Internet. Instructions for the proper execution of the proxy card are set forth immediately following this notice or, with respect to telephone or Internet voting, on the proxy card. It is important that you vote promptly.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting to be held on August 23, 2017: The Notice of Joint Special Meeting of Shareholders, Joint Proxy Statement/Prospectus, annual and semi-annual reports and form of proxy are available on the Internet at www.sentinelinvestments.com. For more information, shareholders may contact Sentinel Funds at P.O. Box 55929-5929, Boston, Massachusetts 02205 or 1-800-282-3863.

| | Sincerely, |

| | |

| | Lisa F. Muller

Secretary, Sentinel Group Funds, Inc. |

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and avoid the time and expense in validating your vote if you fail to sign your proxy card properly.

1. Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card.

2. Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration on the proxy card.

3. All Other Accounts: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example:

Registration | | Valid Signature |

| Corporate Accounts | | |

| (1) ABC Corp. | | ABC Corp. |

| (2) ABC Corp | | John Doe, Treasurer |

| (3) ABC Corp. c/o John Doe, Treasurer | | John Doe |

| (4) ABC Corp. Profit Sharing Plan | | John Doe, Trustee |

| Trust Accounts | | |

| (1) ABC Trust | | Jane B. Doe, Trustee |

| (2) Jane B. Doe, Trustee u/t/d 12/28/78 | | Jane B. Doe |

| Custodial or Estate Accounts | | |

| (1) John B. Smith, Cust. f/b/o John B. Smith, Jr. UGMA | | John B. Smith |

| (2) Estate of John B. Smith | | John B. Smith, Jr., Executor |

Every shareholder’s vote is important!

Please complete, sign, date and return your

proxy card today!

Your proxy vote is important!

The information contained in this Joint Proxy Statement/Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Joint Proxy Statement/Prospectus is not an offer to sell these securities, and it is not a solicitation of an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION,

DATED MAY 30, 2017

joint PROXY STATEMENT

of

Sentinel GROUP funds, INC.

One National Life Drive

Montpelier, Vermont 05604

800-282-3863

and

JOINT PROSPECTUS

OF

TOUCHSTONE STRATEGIC TRUST

and

TOUCHSTONE FUNDS GROUP TRUST

303 Broadway, Suite 1100

Cincinnati, Ohio 45202

800.543.0407

June [•], 2017

This Joint Proxy Statement/Prospectus is being furnished to shareholders of the series of Sentinel Group Funds, Inc., a Maryland corporation (“Sentinel Funds”), listed below (each a “Target Fund” and collectively, the “Target Funds”). The Board of Directors of Sentinel Funds (the “Sentinel Funds Board”) has called a joint special meeting of shareholders of the Target Funds to be held at the offices of Sentinel Funds, One National Life Drive, Montpelier, Vermont 05604, on August 23, 2017 at 11:00 a.m., Eastern time, and any adjournment or postponement thereof (the “Special Meeting”). This Joint Proxy Statement/Prospectus and the enclosed proxy are first being sent to shareholders of the Target Funds on or about [•], 2017.

Shareholders of record of each Target Fund as of the close of business on June 21, 2017 (the “Record Date”) are entitled to notice of and eligible to vote at the Special Meeting. At the Special Meeting, shareholders of each Target Fund will be asked to consider a proposal to approve an Agreement and Plan of Reorganization (the “Plan”) between Touchstone Strategic Trust or Touchstone Funds Group Trust, as applicable, on behalf of the applicable series thereof identified in the table below (each, an “Acquiring Fund” and collectively, the “Acquiring Funds”), and Sentinel Funds, on behalf of the applicable Target Fund, providing for (i) the transfer of all the assets of the Target Fund to the Acquiring Fund in exchange solely for shares of the Acquiring Fund as set forth in the table below and the assumption by the Acquiring Fund of the liabilities (other than certain excluded liabilities) of the Target Fund, as described in the Plan; (ii) the pro rata distribution, by class, to the Target Fund’s shareholders of such shares of the Acquiring Fund; and (iii) the termination of the Target Fund (each, a “Reorganization” and collectively, the “Reorganizations”).

The following table shows each Target Fund and the corresponding Acquiring Fund, as well as the share class of the Acquiring Fund that will be issued to holders of each share class of the Target Fund.

Target Funds and Share Classes | | Acquiring Funds and Corresponding Share

Classes |

| Sentinel Government Securities Fund | | Touchstone Active Bond Fund, a series of Touchstone Funds Group Trust |

| Class A | | Class A |

| Class C | | Class C |

| Class I | | Class Y |

| Sentinel Total Return Bond Fund | | Touchstone Active Bond Fund, a series of Touchstone Funds Group Trust |

| Class A | | Class A |

| Class C | | Class C |

| Class I | | Class Y |

| Class R3 | | Class A |

| Class R6 | | Class Y |

| Sentinel Low Duration Bond Fund | | Touchstone Ultra Short Duration Fixed Income Fund, a series of Touchstone Funds Group Trust |

| Class A | | Class A |

| Class I | | Class Y |

| Class S | | Class S |

| Sentinel Multi-Asset Income Fund | | Touchstone Flexible Income Fund, a series of Touchstone Strategic Trust |

| Class A | | Class A |

| Class C | | Class C |

| Class I | | Class Y |

| Sentinel Sustainable Core Opportunities Fund | | Touchstone Sustainability and Impact Equity Fund, a series of Touchstone Strategic Trust |

| Class A | | Class A |

| Class I | | Class Y |

| Sentinel Balanced Fund | | Touchstone Balanced Fund, a newly created series of Touchstone Strategic Trust |

| Class A | | Class A |

| Class C | | Class C |

| Class I | | Class Y |

| Sentinel Common Stock Fund | | Touchstone Large Cap Focused Fund, a newly created series of Touchstone Strategic Trust |

| Class A | | Class A |

| Class C | | Class C |

| Class I | | Class Y |

| Class R6 | | Institutional Class |

| Sentinel International Equity Fund | | Touchstone International Equity Fund, a newly created series of Touchstone Strategic Trust |

| Class A | | Class A |

| Class C | | Class C |

| Class I | | Class Y |

Target Funds and Share Classes | | Acquiring Funds and Corresponding Share

Classes |

| Sentinel Small Company Fund | | Touchstone Small Company Fund, a newly created series of Touchstone Strategic Trust |

| Class A | | Class A |

| Class C | | Class C |

| Class I | | Class Y |

| Class R6 | | Class R6 |

The Reorganizations are expected to be completed on October 13, 2017, or as soon as practicable thereafter.

Each Target Fund and each Acquiring Fund is a series of a registered open-end management investment company (mutual funds). The following Acquiring Funds are each currently operating mutual funds: Touchstone Active Bond Fund, Touchstone Ultra Short Duration Fixed Income Fund, Touchstone Flexible Income Fund and Touchstone Sustainability and Impact Equity Fund (each, an “Operating Fund” and collectively, the “Operating Funds”). Touchstone Balanced Fund, Touchstone Large Cap Focused Fund, Touchstone International Equity Fund and Touchstone Small Company Fund (each, a “Shell Fund” and collectively, the “Shell Funds”) are each newly organized series of Touchstone Strategic Trust that have been created solely for the purpose of completing the applicable Reorganization and will not commence operations prior to the closing of the Reorganization. Touchstone Strategic Trust and Touchstone Funds Group Trust are sometimes referred to in this Joint Proxy Statement/Prospectus individually as an “Acquiring Trust” and collectively as the “Acquiring Trusts.” The Board of Trustees of each Acquiring Trust is comprised of the same individual board members (the “Touchstone Funds Board”). The Target Funds and the Acquiring Funds are sometimes referred to in this Joint Proxy Statement/Prospectus individually as a “Fund” and collectively as the “Funds.”

This Joint Proxy Statement/Prospectus, which you should read carefully and retain for future reference, presents the information that you should know about the Funds and the Reorganizations. This document also serves as a prospectus for the offering and issuance of the shares of each Acquiring Fund to be issued in the Reorganizations. Statements of Additional Information (“SAIs”) dated [•], 2017 relating to this Joint Proxy Statement/Prospectus and the Reorganizations have been filed with the U.S. Securities and Exchange Commission (the “SEC”) and are incorporated by reference into this Joint Proxy Statement/Prospectus (meaning that they are legally considered to be part of this Joint Proxy Statement/Prospectus).

Additional information concerning the Target Funds and the Operating Funds is contained in the documents described below, all of which have been filed with the SEC. Each document is incorporated by reference into this Joint Proxy Statement/Prospectus only insofar as it relates to the Target Funds and the Operating Funds. No other parts of such documents are incorporated by reference herein. Because the Shell Funds have not yet commenced operations as of the date of this Joint Proxy Statement/Prospectus, no prospectuses, SAIs or annual or semi-annual reports are available for the Shell Funds at this time.

Information About the Target Funds: | | How to Obtain this Information: |

| Prospectus, dated March 30, 2017, as supplemented through the date of this Joint Proxy Statement/Prospectus (File Nos. 811-00214; 002-10685) | | On file with the SEC (www.sec.gov) (Accession No. 0001144204-17-017719 filed March 30, 2017) |

| Statement of Additional Information, March 30, 2017, as supplemented through the date of this Joint Proxy Statement/Prospectus (File Nos. 811-00214; 002-10685) | | On file with the SEC (www.sec.gov) (Accession No. 0001144204-17-017719 filed March 30, 2017) |

| Annual Report for Sentinel Group Funds, Inc., for the fiscal year ended November 30, 2016 (File Nos. 811-00214; 002-10685) | | On file with the SEC (www.sec.gov) (Accession No. 0001144204-17-006110 filed February 6, 2017) |

Information About the Operating Funds: | | How to Obtain this Information: |

| Prospectus for Touchstone Strategic Trust, dated July 30, 2016, as supplemented through the date of this Joint Proxy Statement/Prospectus (File Nos. 811-03651; 002-80859) | | On file with the SEC (www.sec.gov) (Accession No. 0000711080-16-000093 filed July 28, 2016) |

| Statement of Additional Information for Touchstone Strategic Trust, dated July 30, 2016, as supplemented through the date of this Joint Proxy Statement/Prospectus (File Nos. 811-03651; 002-80859) | | On file with the SEC (www.sec.gov) (Accession No. 0000711080-16-000093 filed July 28, 2016) |

| Annual Report for Touchstone Strategic Trust, for the fiscal year ended March 31, 2017 (File Nos. 811-03651; 002-80859) | | On file with the SEC (www.sec.gov) (Accession No.__________) |

| Prospectus for Touchstone Funds Group Trust, dated January 30, 2017, as supplemented through the date of this Joint Proxy Statement/Prospectus (File Nos. 811-08104; 033-70958) | | On file with the SEC (www.sec.gov) (Accession No. 0000914243-17-000005 filed January 27, 2017) |

| Statement of Additional Information for Touchstone Funds Group Trust, dated January 30, 2017, as supplemented through the date of this Joint Proxy Statement/Prospectus (File Nos. 811-08104; 033-70958) | | On file with the SEC (www.sec.gov) (Accession No. 0000914243-17-000005 filed January 27, 2017) |

| Annual Report for Touchstone Funds Group Trust, for the fiscal year ended September 30, 2016 (File Nos. 811-08104; 033-70958) | | On file with the SEC (www.sec.gov) (Accession No. 0001144204-16-137153 filed November 30, 2016) |

| Semi-Annual Report for Touchstone Funds Group Trust, for the period ended March 31, 2017 (File Nos. 811-08104; 033-70958) | | On file with the SEC (www.sec.gov) (Accession No.__________) |

| Annual Report for Touchstone Investment Trust for the fiscal year ended September 30, 2016 (File Nos. 811-02538; 002-52242 | | On file with the SEC (www.sec.gov) (Accession No. 0001144204-16-137138 filed November 30, 2016) |

You can also obtain copies of any of the above-referenced documents without charge on the EDGAR database on the SEC’s Internet site at http://www.sec.gov. Copies are available for a fee by electronic request at the following e-mail address: publicinfo@sec.gov, or from the Public Reference Section, Securities and Exchange Commission, Washington, D.C. 20549-1520. Copies of above-referenced documents relating to the Target Funds may also be obtained upon oral or written request without charge by calling 800.282.3863, on the Target Funds’ website at www.sentinelinvestments.com or by writing to Sentinel Investments at P.O. Box 55929, Boston, Massachusetts 02205. Copies of above-referenced documents relating to the Acquiring Funds may also be obtained upon oral or written request without charge by calling 800.543.0407, on the Acquiring Funds’ website at TouchstoneInvestments.com or by writing to Touchstone Strategic Trust or Touchstone Funds Group Trust, as applicable, at P.O. Box 9878, Providence, Rhode Island 02940.

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT DETERMINED THAT THE INFORMATION IN THIS JOINT PROXY STATEMENT/PROSPECTUS IS ACCURATE OR ADEQUATE, NOR HAS IT APPROVED OR DISAPPROVED THESE SECURITIES. ANYONE WHO TELLS YOU OTHERWISE IS COMMITTING A CRIMINAL OFFENSE.

An investment in the Acquiring Funds:

| · | is not a deposit of, or guaranteed by, any bank |

| · | is not insured by the FDIC, the Federal Reserve Board or any other government agency |

| · | is not endorsed by any bank or government agency |

| · | involves investment risk, including possible loss of your original investment |

TABLE OF CONTENTS

TABLE OF CONTENTS

(continued)

Synopsis: Background and General Summary

These questions and answers provide a brief overview of the key features of the Reorganizations and other matters typically of concern to shareholders considering a proposed combination of mutual funds. These questions and answers are qualified in their entirety by the more detailed information contained in the remainder of this Joint Proxy Statement/Prospectus, which you should read carefully and retain for future reference. The description of the Reorganizations is qualified by reference to the full texts of the Agreements and Plans of Reorganization. A form of Agreement and Plan of Reorganization is attached as Exhibit A to this Joint Proxy Statement/Prospectus.

| Q. | What is being proposed? |

| A. | Sentinel Asset Management, Inc. (“Sentinel”), the current investor advisor of your Fund, informed the Sentinel Funds Board of its intent to exit the mutual fund advisory business. Sentinel engaged an investment bank to help identify parties interested in acquiring Sentinel’s mutual fund advisory business. As a result of that search, Sentinel entered into an agreement to sell its mutual fund advisory business to Touchstone Advisors, Inc. (“Touchstone Advisors”), investment advisor to the Touchstone family of mutual funds (the “Transaction”). In connection with the Transaction, Sentinel recommended and the Sentinel Funds Board approved the integration of each of the Target Funds into the Touchstone family of mutual funds (the “Touchstone Funds”). At the Joint Special Meeting of Shareholders, shareholders of each Target Fund are being asked to vote on a proposal to reorganize their Fund into a Touchstone Fund with a similar investment goal and principal investment policies (each, a “Reorganization” and collectively, the “Reorganizations”). |

| Q. | What is the recommendation of the Sentinel Funds Board? |

| A. | At a meeting held on April 24, 2017, the Sentinel Funds Board determined that each Reorganization was in the best interests of the applicable Target Fund and its shareholders. Based on information provided by Sentinel and Touchstone Advisors, the Sentinel Funds Board believes that the Reorganizations will provide shareholders with access to a larger and more diverse family of mutual funds managed by Touchstone Advisors and that the larger distribution platform of the Touchstone family of funds may provide opportunities for asset growth. If realized, these asset growth opportunities may result in greater efficiencies and economies of scale, which in turn could lead to lower overall costs over time. In addition, each Reorganization will provide Target Fund shareholders with an opportunity to continue their investment in a Touchstone Fund with an investment goal and principal investment policies similar to those of the Target Fund through a tax-free reorganization of the Target Fund into the corresponding Acquiring Fund. The Board of Directors of Sentinel Funds recommends that shareholders of each Target Fund approve the Reorganization of their Fund. |

See “Information About the Reorganizations—Sentinel Funds Board Approval of the Reorganizations” for additional information regarding the Sentinel Funds Board’s considerations.

| Q. | How do the fees and expenses of the Funds compare? |

| A. | Touchstone Advisors has contractually agreed to waive fees and reimburse expenses in order to maintain the total annual operating expense ratio for each class of shares of each Acquiring Fund offered hereby to an amount no greater than the total annual operating expense ratio of the corresponding class of shares of the corresponding Target Fund for the fiscal year ended November 30, 2016 (after giving effect to any expense limitation in effect for the Target Fund). This contractual expense limitation will remain in place for a period of at least two years from the closing date of the Reorganization. Absent this expense limitation, and after giving effect to existing Touchstone expense limitation arrangements, the pro forma total annual fund operating expense ratio of certain classes of the Acquiring Funds in the Reorganizations involving each of Sentinel Sustainable Core Opportunities Fund, Sentinel Balanced Fund, Sentinel Common Stock Fund, Sentinel International Equity Fund and Sentinel Small Company Fund would be higher than the total annual fund operating expense ratio before any waivers and reimbursements of the corresponding class of the corresponding Target Fund. Additional information regarding the pro forma fees and expenses for the Funds involved in each Reorganization can be found under the Synopsis for your |

Target Fund’s Reorganization. Additional information regarding expense limitation agreements can be found under “The Funds’ Management—Expense Limitation Agreement.”

| Q. | How do the Funds’ investment goals and principal investment strategies compare? |

| A. | Although each Target Fund and the corresponding Acquiring Fund have similar investment goals and principal investment strategies, there are some differences. In addition, the analytical tools, techniques and investment selection process used by the sub-advisors of the Acquiring Funds to select investments may be different from those used by Sentinel. The section of this Joint Proxy Statement/Prospectus entitled “Synopsis” for your Target Fund’s Reorganization describes in detail the differences between the investment goals and principal investment strategies of each Target Fund and the corresponding Acquiring Fund. |

| Q. | Who will manage the Acquiring Funds after the Reorganizations? |

| A. | Touchstone Advisors currently serves as investment advisor to the existing Touchstone Funds and will serve as the investment advisor to each Acquiring Fund. With respect to each Acquiring Fund, Touchstone Advisors will employ a sub-advisor to provide portfolio management services. The sub-advisors are overseen by Touchstone Advisors and by the Touchstone Funds Board. The Target Funds are managed by Sentinel and do not employ sub-advisors. With respect to the Acquiring Funds into which the Sentinel International Equity Fund and Sentinel Small Company Fund will be reorganized, Fort Washington Investment Advisors, Inc. (“Fort Washington”), an affiliate of Touchstone Advisors, has been appointed as sub-advisor, and the current portfolio management teams of those Target Funds are expected to remain in place after the Reorganizations as employees of Fort Washington. For all other Reorganizations, the portfolio management team of the Acquiring Fund will differ from the current portfolio manager(s) of the applicable Target Fund. For more information on Touchstone Advisors and each of the sub-advisors, please see the sections of the Joint Proxy Statement/Prospectus entitled “Synopsis” for your Target Fund’s Reorganization and “The Funds’ Management.” |

| Q. | What will happen to my existing shares? |

| A. | At the closing, your Target Fund will transfer all of its assets to the Acquiring Fund in exchange for (i) the Acquiring Fund’s assumption of the liabilities (other than certain excluded liabilities) of the Target Fund, as described in the Plan, and (ii) newly issued shares of the Acquiring Fund having a value equal to the aggregate net assets of the Target Fund. Immediately after the Reorganization of your Target Fund, you will own shares of the corresponding Acquiring Fund with an aggregate net asset value equal to the aggregate net asset value of the shares of the Target Fund that you held immediately prior to the closing of the Reorganization (although the number of shares and the net asset value per share may be different). |

| Q. | Will I have to pay federal income taxes as a result of my Target Fund’s Reorganization? |

| A. | Each Reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes. Accordingly, shareholders are not expected to recognize any gain or loss for federal income tax purposes as a direct result of the exchange of their Target Fund shares for shares of the corresponding Acquiring Fund in their Target Fund’s Reorganization. However, shareholders may receive a higher level of taxable distributions as a result of the Reorganization. Prior to the closing of each Reorganization, the Target Fund may distribute all of its net investment income and net capital gains, if any. All or a portion of such distribution may be taxable to the shareholders of such Target Fund and will generally be taxed as ordinary income or capital gains for federal income tax purposes, unless the shareholders are tax-advantaged accounts such as an individual retirement account or 401(k) plan (in which case the owners of such accounts may be taxed upon withdrawal of their investment from such accounts). The tax character of such distributions will be the same regardless of whether they are paid in cash or reinvested in additional shares. |

| | |

2

In addition, a significant portion of the portfolio securities of each Target Fund, other than Sentinel International Equity Fund and Sentinel Small Company Fund, are expected to be sold following the Reorganization. To the extent that portfolio investments received by an Acquiring Fund from a Target Fund in a Reorganization are sold after the Reorganization, the Acquiring Fund may recognize gains or losses, which may result in taxable distributions to shareholders holding shares of the Acquiring Fund (including former Target Fund shareholders who hold shares of the Acquiring Fund following the Reorganization). The section of this Joint Proxy Statement/Prospectus entitled “Information About the Reorganizations—Material Federal Income Tax Consequences” provides additional information regarding the federal income tax consequences of the Reorganizations.

| Q. | Will I have to pay any sales load, commission or other similar fee in connection with the Reorganization? |

| A. | No, you will not pay any sales load, commission or other similar fee in connection with the receipt of Acquiring Fund shares in the Reorganization of your Target Fund, and otherwise applicable investment minimums will not apply with regard to your receipt of Acquiring Fund shares in a Reorganization. If you hold Target Fund shares that are subject to contingent deferred sales charges (certain load-waived Class A shares or Class C shares), the Acquiring Funds will look to the date of purchase of your Target Fund shares for purposes of assessing such contingent deferred sales charges. |

| Q. | What if I redeem my shares before the Reorganization of my Target Fund takes place? |

| A. | If you choose to redeem your Target Fund shares before the Reorganization takes place, then the redemption will be treated as a normal sale of shares and, generally, will be a taxable transaction and may be subject to any applicable redemption fee applied by your Target Fund. |

| Q. | How do the distribution policies of the Funds compare? |

| A. | Like the Target Funds, the Acquiring Funds intend to distribute substantially all of their income and capital gains to their shareholders annually. After the Reorganizations, any income and capital gains will be reinvested in the class of shares of the Acquiring Fund you receive in your Target Fund’s Reorganization or, if you have so elected, distributed in cash. For more information, see the section entitled “Share Classes of the Target Funds and Acquiring Funds—Distribution Policy.” |

| Q. | How do I purchase, exchange and redeem shares after the Reorganizations? |

| A. | Shares of the Target Funds may currently be purchased and redeemed in accordance with the policies of the Sentinel Funds family of funds (the “Sentinel Funds”), and you may exchange shares of the Target Funds for shares of other series of Sentinel Funds, subject to applicable policies and procedures. In connection with the Reorganizations, you will become a shareholder of a Fund that is part of the Touchstone family of funds. You will be able to purchase and redeem shares of your Fund in accordance with the policies of the Touchstone Funds. You may also exchange shares of your Acquiring Fund for shares of other Touchstone Funds, including the other Acquiring Funds, subject to applicable policies and procedures. For more information, see the section entitled “Share Classes of the Target Funds and Acquiring Funds—Distribution Policy.” The Sentinel Funds’ policies and procedures applicable to purchases, exchanges and redemptions are generally comparable to those of the Touchstone Funds. |

| Q. | Who will pay the costs of the Reorganizations? |

| A. | Touchstone Advisors and Sentinel or their respective affiliates will pay the costs of the Reorganizations (other than transaction costs related to the purchase or sale of portfolio securities), including the costs relating to the Special Meeting and this Joint Proxy Statement/Prospectus. The costs of the Reorganizations (other than transaction costs related to the purchase or sale of portfolio securities) will not be borne by the Funds or their shareholders. |

3

| Q. | What is the required vote to approve each Reorganization? |

| A. | In order to take action at the Special Meeting, a quorum of shareholders of a Target Fund must be present. The presence in person or by proxy of the shareholders entitled to cast one-third of all the votes entitled to be cast at such meeting shall constitute a quorum for the purpose of voting on the proposal to approve each Reorganization. Approval of each Reorganization requires the affirmative vote of the holders of a majority of the outstanding voting securities, as defined under the 1940 Act. Under Section 2(a)(42) of the 1940 Act, the vote of a majority of outstanding voting securities of a Target Fund means the vote, at the special meeting of the shareholders of such Target Fund duly called (A) of 67% or more of the voting securities present or represented by proxy at such meeting, if the holders of more than 50% of the outstanding voting securities of such Target Fund are present in person or by proxy or (B) of more than 50% of the outstanding voting securities of such Target Fund, whichever is less. |

| Q. | What will happen if shareholders of one or more Target Funds do not approve the Reorganization or the Transaction is not completed? |

| A. | If the shareholders of a Target Fund do not approve the Reorganization, or other closing conditions are not satisfied or waived, the Reorganization of that Target Fund will not be completed and the Sentinel Funds Board will consider other possible courses of action for that Target Fund, including continuing to operate the Target Fund as a stand-alone fund, reorganizing the Target Fund into another mutual fund or liquidating the Target Fund. The closing of each Reorganization is subject to the satisfaction or waiver of all conditions under the Plan and with respect to the closing of the Transaction which include, among other conditions, that (i) shareholder approvals be obtained for Reorganizations of Target Funds representing, at closing, at least a specified amount of assets, and (ii) shareholder approvals be obtained for the Reorganizations of the Sentinel Common Stock Fund and the Sentinel Small Company Fund. If these and any other closing conditions are not met, then Touchstone Advisors is not obligated to close the Transaction, and absent a waiver from Touchstone Advisors, none of the Reorganizations would be consummated. In that event, the Sentinel Funds Board will consider other possible courses of action for the Target Funds. |

| Q. | What will happen to my account options, such as my automatic investment plan? |

| A. | Your current election with respect to automatic investment plans and systematic withdrawal plans and distributions will be automatically enacted on your new account at Touchstone Funds. Your current bank instructions on file with Sentinel Funds also will be enacted on your Touchstone Funds account. |

| Q. | For Class A shares, will my NAV purchase privileges (eligibility for sales load waivers) be converted or do I need to re-enroll? |

| A. | For the majority of shareholders with NAV privileges those elections will carry over and no action will be required to maintain that election. There are some isolated circumstances which may result in changes to NAV privileges. If this affects your account you will receive a separate communication alerting you to this change. |

| Q. | When will the Reorganizations occur? |

| A. | The Reorganizations are expected to be completed on October 13, 2017, or as soon as practicable thereafter. |

| Q. | Whom should I contact for more information? |

| A. | You can contact our proxy solicitor, Broadridge Financial Solutions, Inc., at 1-855-928-4492. |

4

Synopsis: Reorganization of Sentinel Government Securities Fund into

Touchstone Active Bond Fund

What class of shares of the Acquiring Fund will I receive in the Reorganization?

Shareholders of the Sentinel Government Securities Fund will receive shares of the Touchstone Active Bond Fund, as follows:

| Sentinel Government Securities Fund | | Touchstone Active Bond Fund |

| Class A | | Class A |

| Class C | | Class C |

| Class I | | Class Y |

How do the fees and expenses of the Target Fund and the Acquiring Fund compare?

The tables below describe the fees and expenses that you pay if you buy and hold shares of your Sentinel Fund and the pro forma fees and expenses that you may pay if you buy and hold shares of the corresponding Touchstone Fund under the following two scenarios: (i) assuming that only the Reorganization of the Sentinel Government Securities Fund into the Touchstone Active Bond Fund takes place and (ii) assuming that both the Reorganization of the Sentinel Government Securities Fund into the Touchstone Active Bond Fund and the Reorganization of the Sentinel Total Return Bond Fund into the Touchstone Active Bond Fund (which is also described in this Joint Proxy Statement Prospectus) take place. The pro forma expense ratios project anticipated expenses of the Acquiring Fund following the Reorganizations, but actual expenses may be greater or less than those shown. Expenses for the Class A, Class C and Class I shares of the Sentinel Government Securities Fund are based on the operating expenses incurred by each class of shares of the Fund for the fiscal year ended November 30, 2016. Expenses for the Class A, Class C and Class Y shares of the Touchstone Active Bond Fund are based on the operating expenses incurred by each class of shares of the Fund for the 12-month period ended March 31, 2017. The pro forma fees and expenses for the Class A, Class C and Class Y shares of the Touchstone Active Bond Fund reflect the fees and expenses of the Acquiring Fund and assume that the Reorganization(s) had been completed at the beginning of the 12-month period ended March 31, 2017.

No sales charge will be imposed on the Class A shares of the Acquiring Fund received in connection with the Reorganization. In addition, you may qualify for sales charge discounts for Class A shares if you and your family invest, or agree to invest in the future, at least $25,000 or more in the Sentinel Funds or $50,000 or more in the Touchstone Funds. For the Target Fund, more information about these and other discounts is available from your financial professional and in the section entitled “Share Classes” on page 82 of the Target Fund’s prospectus and “How to Purchase Shares and Reduce Sales Charges” on page 44 of the Target Fund’s SAI. For the Acquiring Fund, more information about these and other discounts is available from your financial professional and in the section entitled “Investing with Touchstone—Class A Shares—Letter of Intent” on page [•] of this Joint Proxy Statement/Prospectus and in the Acquiring Fund’s SAI on page [•].

SHAREHOLDER FEES

(fees paid directly from your investment)

| | | Maximum Sales

Charge (Load)

Imposed on

Purchases (as a

percentage of

offering price) | | Maximum

Deferred Sales

Charge (load) (as a

percentage of the

lower of original

purchase price or

redemption

proceeds) | | Wire

Redemption

Fee |

| Sentinel Government Securities Fund – Class A Shares | | 2.25% | | None | | None |

| Touchstone Active Bond Fund – Class A Shares | | 4.75% | | None(2) | | up to $15 |

5

| | | Maximum Sales

Charge (Load)

Imposed on

Purchases (as a

percentage of

offering price) | | Maximum

Deferred Sales

Charge (load) (as a

percentage of the

lower of original

purchase price or

redemption

proceeds) | | Wire

Redemption

Fee |

| Touchstone Active Bond Fund – Class A Shares Pro Forma | | 4.75%(1)(2) | | None(2) | | up to $15 |

| | | | | | | |

| Sentinel Government Securities Fund – Class C Shares | | None | | 1.00%(2) | | None |

| Touchstone Active Bond Fund – Class C Shares | | None | | 1.00%(2) | | up to $15 |

| Touchstone Active Bond Fund – Class C Shares Pro Forma | | None | | 1.00%(2) | | up to $15 |

| | | | | | | |

| Sentinel Government Securities Fund – Class I Shares | | None | | None | | None |

| Touchstone Active Bond Fund – Class Y Shares | | None | | None | | up to $15 |

| Touchstone Active Bond Fund – Class Y Shares Pro Forma | | None | | None | | up to $15 |

| (1) | No sales charge will be imposed on the Class A shares of the Acquiring Fund received in connection with the Reorganization. |

| | |

| (2) | A deferred sales charge of 1% applies to certain redemptions of Class A shares made within twelve months of purchase if the shares were purchased without an initial sales charge as part of an investment of $1 million or more. If you hold load-waived Class A shares or Class C shares of the Target Fund, the Acquiring Fund will look to the date of purchase of your Target Fund shares for purposes of assessing deferred sales charges on shares received in the Reorganization. |

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment)

| | | Sentinel

Government

Securities Fund

(Class A Shares) | | Touchstone

Active

Bond Fund

(Class A

Shares) | | Touchstone

Active

Bond Fund Pro

Forma

(Class A Shares) | | Touchstone Active

Bond Fund Pro

Forma

(Class A Shares)

(both

Reorganizations)(1) |

| Management Fees | | 0.45% | | 0.40% | | 0.40% | | 0.37% |

| Distribution/Service (12b-1) Fees | | 0.20% | | 0.25% | | 0.25% | | 0.25% |

| Other Expenses | | 0.26% | | 0.52% | | 0.36%(2) | | 0.38%(2) |

| Acquired Fund Fees and Expenses(3) | | 0.01% | | 0.01% | | 0.01%(2) | | 0.01%(2) |

| Total Annual Fund Operating Expenses | | 0.92% | | 1.18% | | 1.02% | | 1.01% |

| Fee Waiver | | None | | (0.27%)(4) | | (0.11%)(4)(5) | | (0.10%)(4)(5) |

| Total Annual Fund Operating Expenses After Fee Waiver | | 0.92% | | 0.91% | | 0.91% | | 0.91% |

6

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment)

| | | Sentinel

Government

Securities Fund

(Class C Shares) | | Touchstone

Active

Bond Fund

(Class C

Shares) | | Touchstone

Active

Bond Fund Pro

Forma

(Class C Shares) | | Touchstone Active

Bond Fund Pro

Forma

(Class C Shares)

(both

Reorganizations)(1) |

| Management Fees | | 0.45% | | 0.40% | | 0.40% | | 0.37% |

| Distribution/Service (12b-1) Fees | | 1.00% | | 1.00% | | 1.00% | | 1.00% |

| Other Expenses | | 0.27% | | 0.64% | | 0.38%(2) | | 0.32%(2) |

| Acquired Fund Fees and Expenses(3) | | 0.01% | | 0.01% | | 0.01%(2) | | 0.01%(2) |

| Total Annual Fund Operating Expenses | | 1.73% | | 2.05% | | 1.79% | | 1.70% |

| Fee Waiver | | None | | (0.39%)(4) | | (0.13%)(4)(5) | | (0.04%)(4)(5) |

| Total Annual Fund Operating Expenses After Fee Waiver | | 1.73% | | 1.66% | | 1.66% | | 1.66% |

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment)

| | | Sentinel

Government

Securities Fund

(Class I Shares) | | Touchstone

Active

Bond Fund

(Class Y

Shares) | | Touchstone

Active

Bond Fund Pro

Forma

(Class Y Shares) | | Touchstone Active

Bond Fund Pro

Forma

(Class Y Shares)

(both

Reorganizations)(1) |

| Management Fees | | 0.45% | | 0.40% | | 0.40% | | 0.37% |

| Distribution/Service (12b-1) Fees | | None | | None | | None | | None |

| Other Expenses | | 0.23% | | 0.48% | | 0.35%(2) | | 0.32%(2) |

| Acquired Fund Fees and Expenses(3) | | 0.01% | | 0.01% | | 0.01%(2) | | 0.01%(2) |

| Total Annual Fund Operating Expenses | | 0.69% | | 0.89% | | 0.76% | | 0.70% |

| Fee Waiver | | —(6) | | (0.23%)(4) | | (0.10%)(4)(5) | | (0.04%)(4)(5) |

| Total Annual Fund Operating Expenses After Fee Waiver | | 0.69% | | 0.66% | | 0.66% | | 0.66% |

| (1) | Represents Pro Forma information if both Sentinel Government Securities Fund and Sentinel Total Return Bond Fund reorganize into the Touchstone Active Bond Fund. |

| (2) | Other Expenses and Acquired Fund Fees and Expenses are estimated based on fees and expenses of the Acquiring Fund, assuming the Reorganization(s) had been consummated as of the beginning of the 12-month period ended March 31, 2017. |

| (3) | Acquired Fund Fees and Expenses are expenses indirectly incurred by the Fund through its investments in one or more underlying funds, including money market funds. Because these costs are indirect, the Total Annual Fund Operating Expenses do not correlate to the ratio of expenses to average net assets in the Fund’s most recent annual report. |

| (4) | Touchstone Advisors has agreed to waive a portion of its fees or reimburse certain Fund expenses (excluding dividend and interest expenses relating to short sales; interest; taxes; brokerage commissions and other transaction costs; portfolio transactions and investment related expenses; other expenditures which are capitalized in accordance with U.S. generally accepted accounting principles; the cost of “Acquired Fund Fees and Expenses,” if any; and other extraordinary expenses not incurred in the ordinary course of business) in order to limit annual Fund operating expenses to 0.90%, 1.65%, and 0.65% of average daily net assets for Classes A, C, and Y shares, respectively. This contractual expense limitation is effective through January 29, 2018, but can be |

7

terminated by a vote of the Touchstone Funds Board if it deems the termination to be beneficial to the Fund’s shareholders. The terms of the contractual expense limitation agreement provide that Touchstone Advisors is entitled to recoup, subject to approval by the Touchstone Funds Board, such amounts waived or reimbursed for a period of up to three years from the year in which Touchstone Advisors reduced its compensation or assumed expenses for the Fund. No recoupment will occur unless the Fund’s expenses are below the lesser of the expense limitation amount in effect (a) at the time of the waiver, or (b) at the time of the reimbursement. Additional information regarding the expense limit is provided under the section entitled “The Funds’ Management—Expense Limitation Agreement”.

| (5) | Effective upon consummation of the Reorganization(s), Touchstone Advisors has contractually agreed to waive fees and/or reimburse certain expenses in order to limit total annual fund operating expenses of each class of shares of the Acquiring Fund to 0.90%, 1.65%, and 0.65% of average daily net assets for Classes A, C, and Y shares, respectively. The contractual expense limitation agreement will have the terms described above in Footnote 4 and will remain in effect for at least two years following the closing of the Reorganization(s). Additional information regarding the expense limit is provided under the section entitled “The Funds’ Management—Expense Limitation Agreement”. |

| (6) | Sentinel has contractually agreed to reimburse certain expenses paid by the Class I shares of the Target Funds to the extent necessary to prevent the total annual fund operating expense ratio of the Class I shares of the Target Funds, on an annualized basis, from exceeding the total annual fund operating expense ratio of the Class A shares of the same Fund. This agreement will continue through March 31, 2018. This agreement may be terminated upon 90 days’ notice by a majority of the non-interested directors of the Sentinel Funds. Additional information regarding the expense limit is provided under the section entitled “The Funds’ Management—Expense Limitation Agreement”. |

Expense Examples. The examples below are intended to help you compare the cost of investing in the Target Fund with cost of investing the Acquiring Fund under the following two scenarios (i) assuming that only the Reorganization of the Sentinel Government Securities Fund into the Touchstone Active Bond Fund takes place and (ii) assuming that both the Reorganization of Sentinel Government Securities Fund into Touchstone Active Bond Fund and the Reorganization of Sentinel Total Return Bond Fund (which is also described in this Joint Proxy Statement/Prospectus) take place. The examples assume that you invest $10,000 in each Fund and then either (i) sell all of your shares at the end of each period indicated below or (ii) keep all of your shares at the end of each period indicated below. The examples also assume that your investment has a 5% annual return and that operating expenses (before fee waivers and expense reimbursements) remain the same. This example also assumes that the current expense limitation agreement for the Touchstone Active Bond Fund will remain in place for one year in each period and the expense limitation agreement that takes effect upon closing of the Reorganization(s) will be in place for two years following the closing of the Reorganization(s). Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| If shares are redeemed: | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| Class A Shares | | | | | | | | | | | | | | | | |

| Sentinel Government Securities Fund | | $ | 317 | | | $ | 512 | | | $ | 723 | | | $ | 1,331 | |

| Touchstone Active Bond Fund | | $ | 563 | | | $ | 806 | | | $ | 1,068 | | | $ | 1,816 | |

| Touchstone Active Bond Fund Pro Forma | | $ | 563 | | | $ | 763 | | | $ | 991 | | | $ | 1,644 | |

| Touchstone Active Bond Fund Pro Forma (both Reorganizations) | | $ | 563 | | | $ | 762 | | | $ | 987 | | | $ | 1,635 | |

| Class C Shares | | | | | | | | | | | | | | | | |

| Sentinel Government Securities Fund | | $ | 276 | | | $ | 545 | | | $ | 939 | | | $ | 2,041 | |

| Touchstone Active Bond Fund | | $ | 269 | | | $ | 605 | | | $ | 1,067 | | | $ | 2,348 | |

| Touchstone Active Bond Fund Pro Forma | | $ | 269 | | | $ | 537 | | | $ | 945 | | | $ | 2,083 | |

| Touchstone Active Bond Fund Pro Forma (both Reorganizations) | | $ | 269 | | | $ | 528 | | | $ | 915 | | | $ | 2,002 | |

| Class I Shares/Class Y Shares | | | | | | | | | | | | | | | | |

| Sentinel Government Securities Fund | | $ | 70 | | | $ | 221 | | | $ | 384 | | | $ | 859 | |

| Touchstone Active Bond Fund | | $ | 67 | | | $ | 261 | | | $ | 471 | | | $ | 1,075 | |

| Touchstone Active Bond Fund Pro Forma | | $ | 67 | | | $ | 222 | | | $ | 402 | | | $ | 923 | |

| Touchstone Active Bond Fund Pro Forma (both Reorganizations) | | $ | 67 | | | $ | 216 | | | $ | 382 | | | $ | 863 | |

8

| If shares are not redeemed:(1) | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| Class C Shares | | | | | | | | | | | | | | | | |

| Sentinel Government Securities Fund | | $ | 176 | | | $ | 545 | | | $ | 939 | | | $ | 2,041 | |

| Touchstone Active Bond Fund | | $ | 169 | | | $ | 605 | | | $ | 1,067 | | | $ | 2,348 | |

| Touchstone Active Bond Fund Pro Forma | | $ | 169 | | | $ | 537 | | | $ | 945 | | | $ | 2,083 | |

| Touchstone Active Bond Fund Pro Forma (both Reorganizations) | | $ | 169 | | | $ | 528 | | | $ | 915 | | | $ | 2,002 | |

| (1) | For holders of all other classes, the costs are the same as set forth above. |

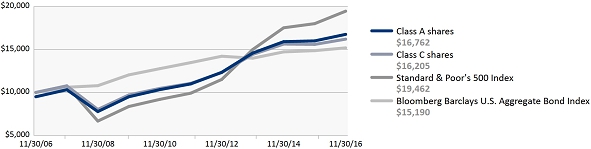

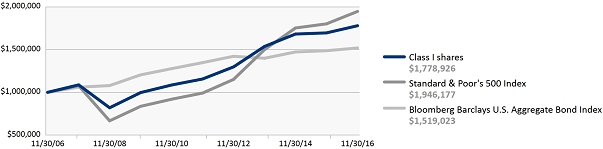

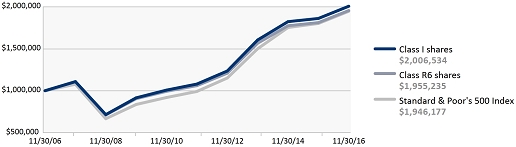

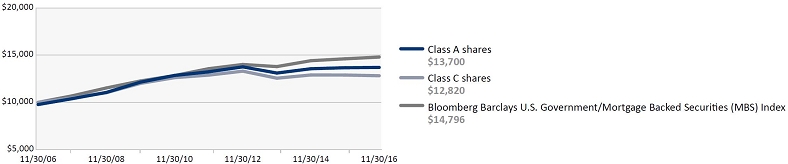

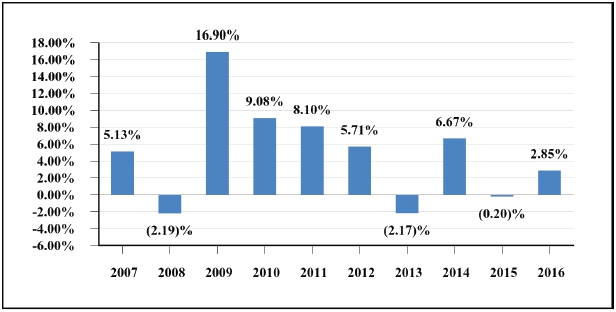

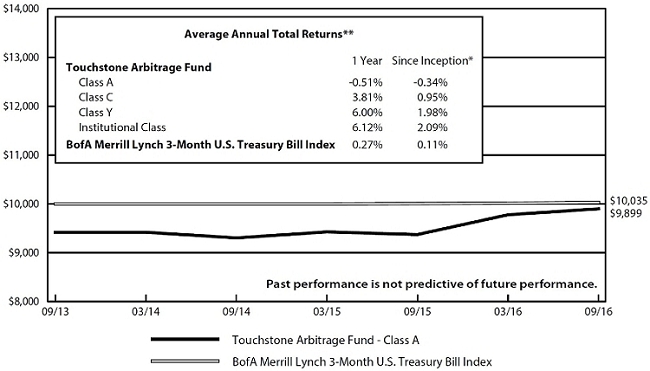

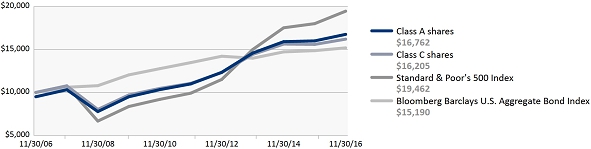

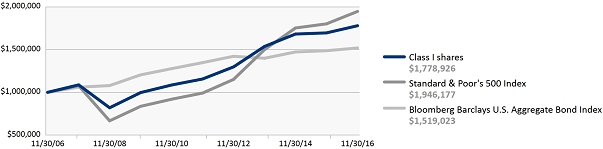

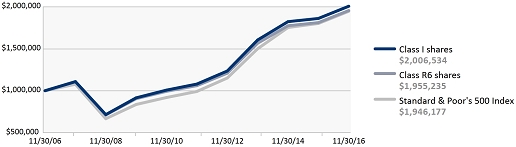

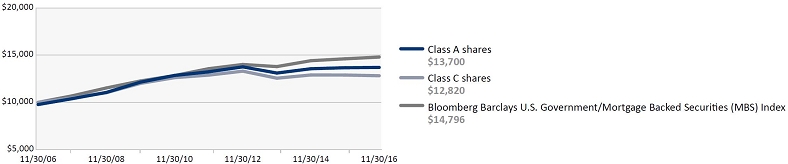

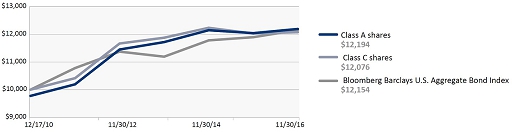

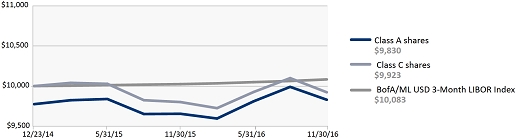

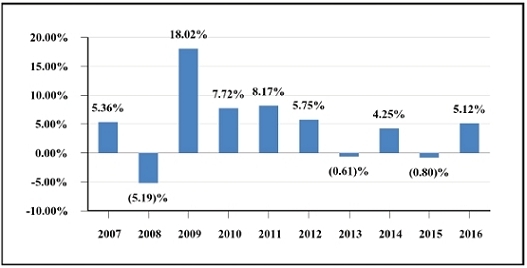

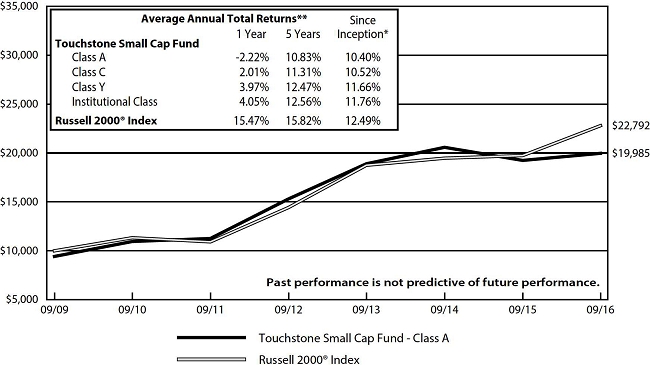

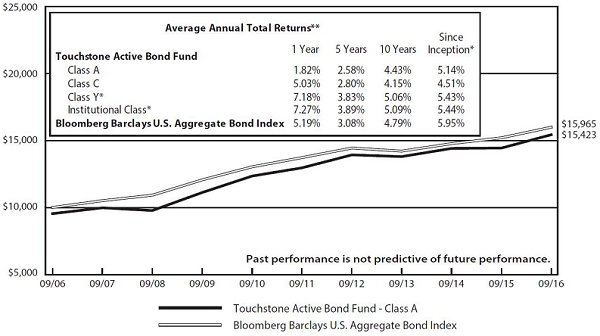

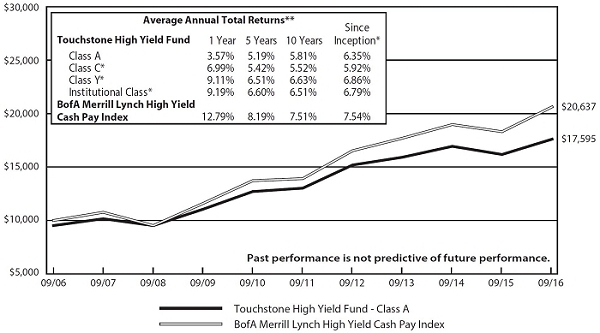

How do the performance records of the Target Fund and the Acquiring Fund compare?

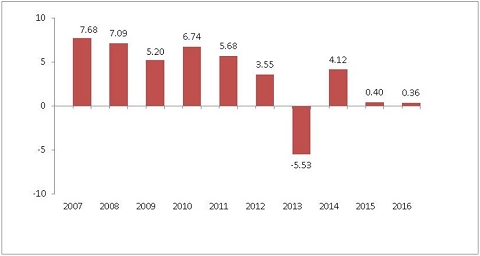

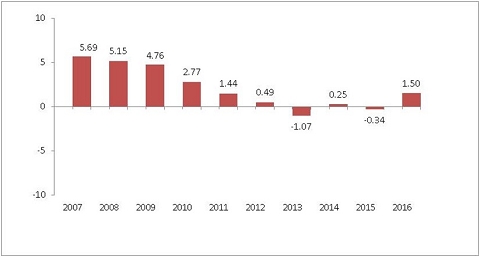

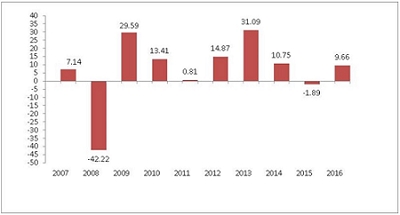

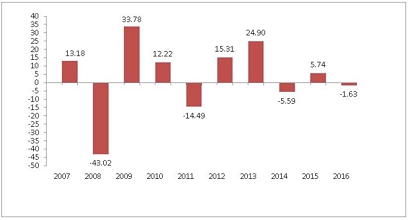

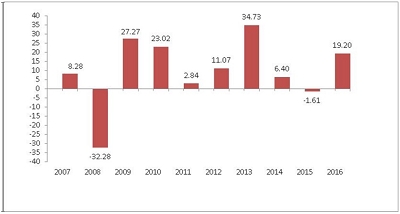

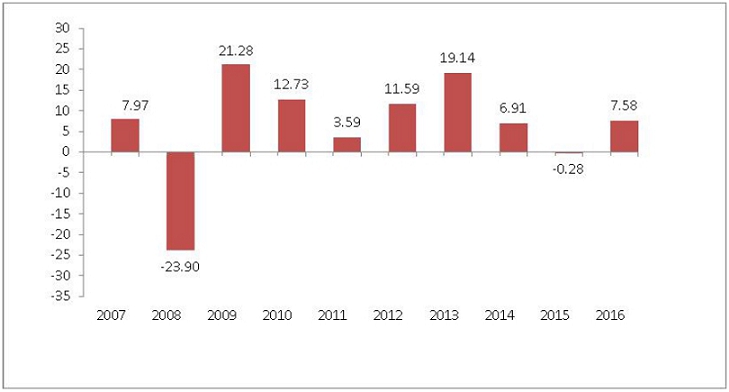

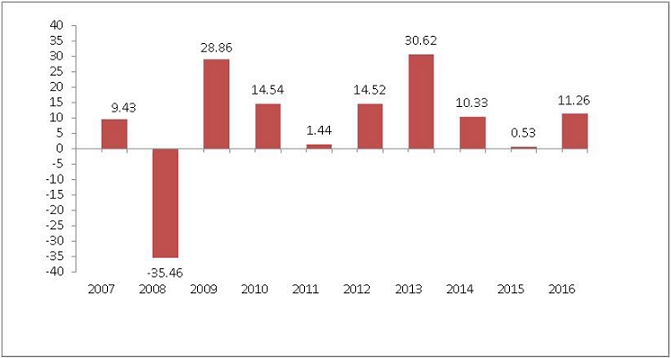

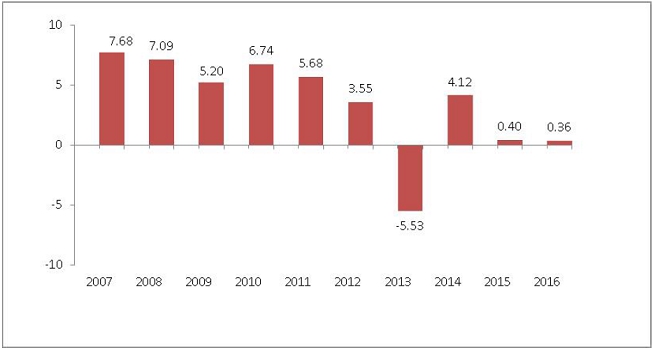

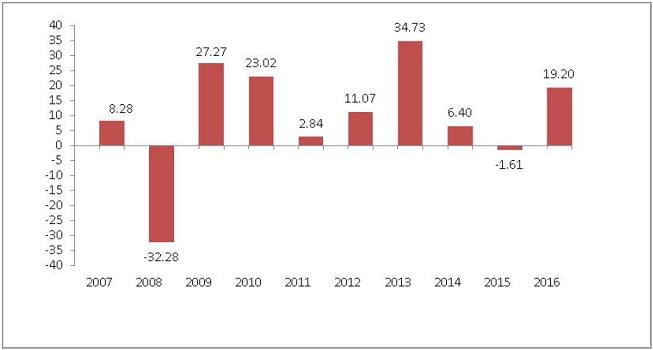

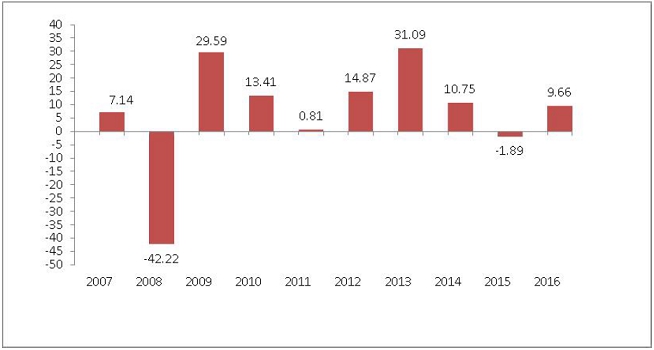

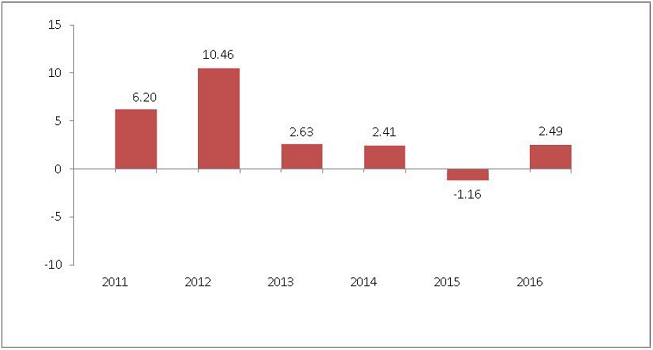

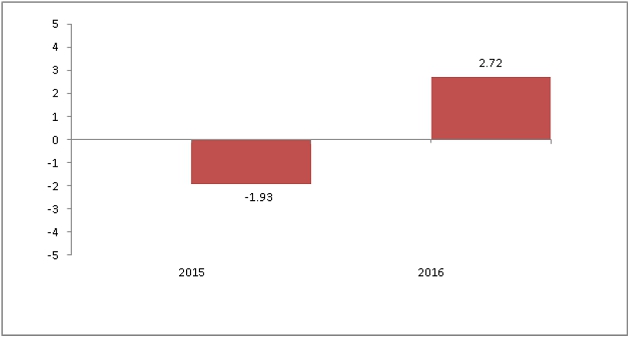

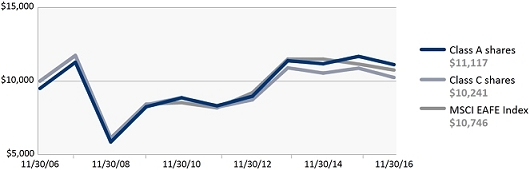

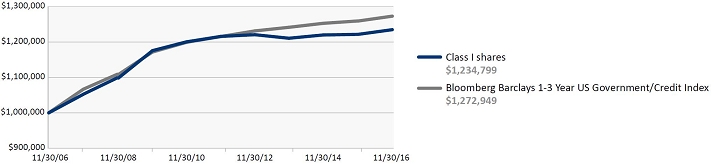

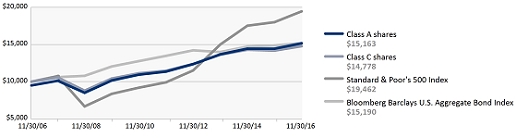

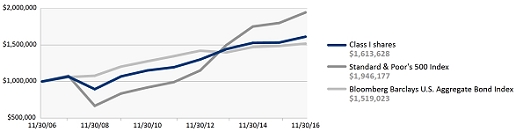

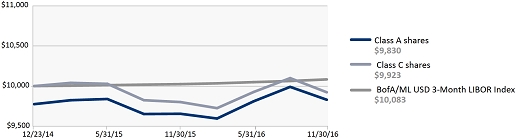

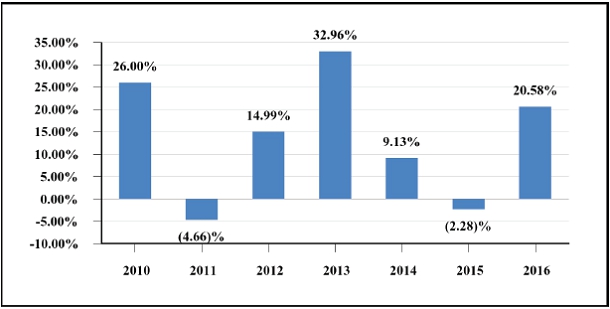

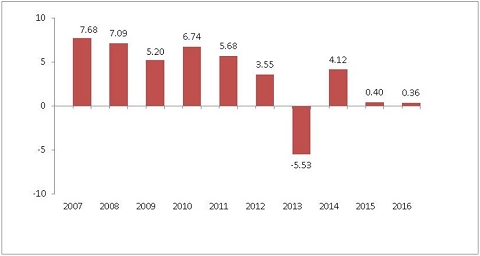

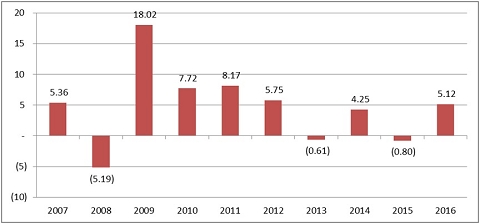

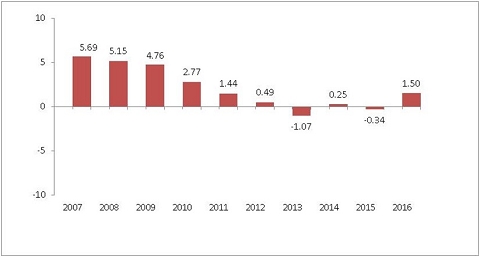

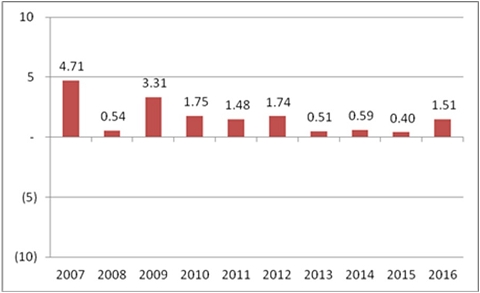

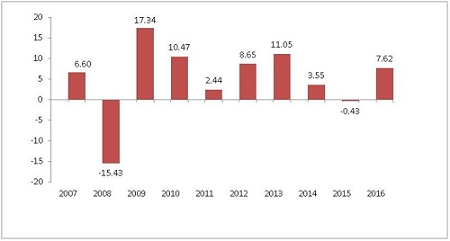

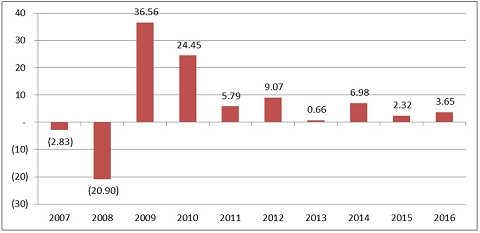

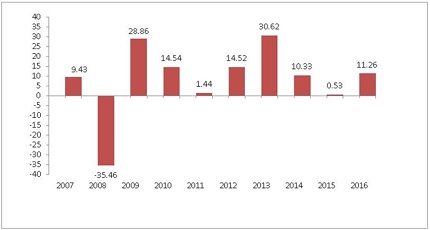

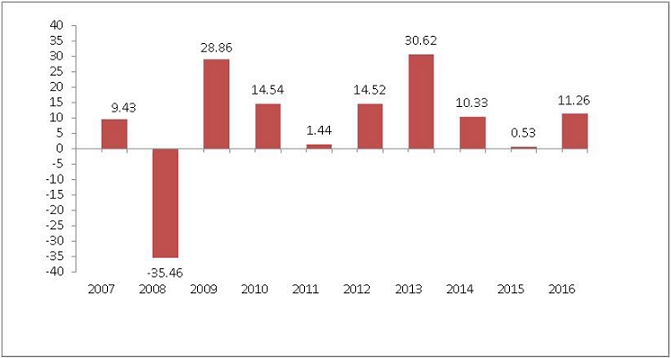

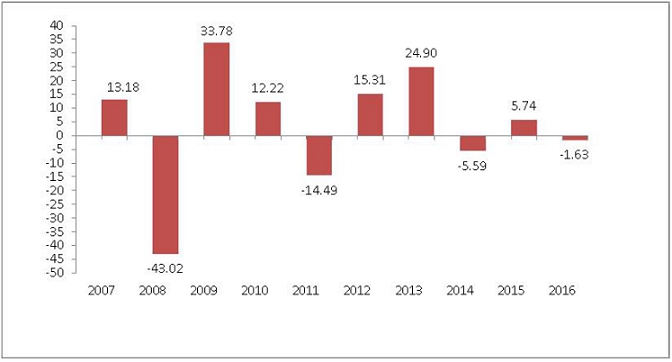

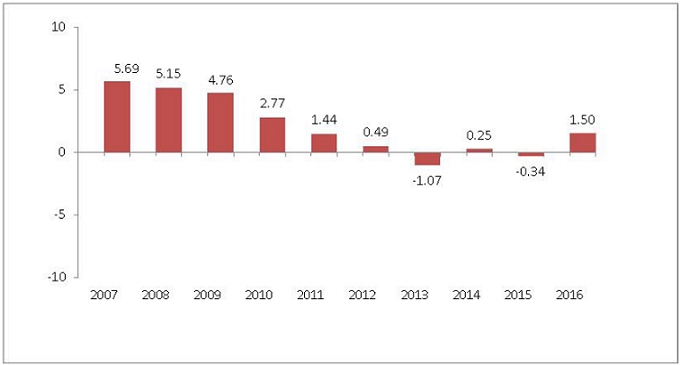

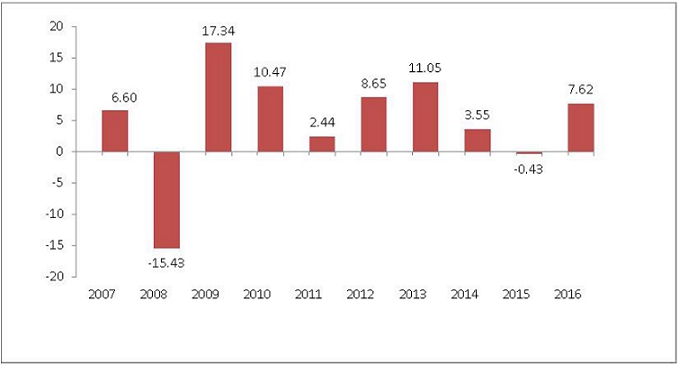

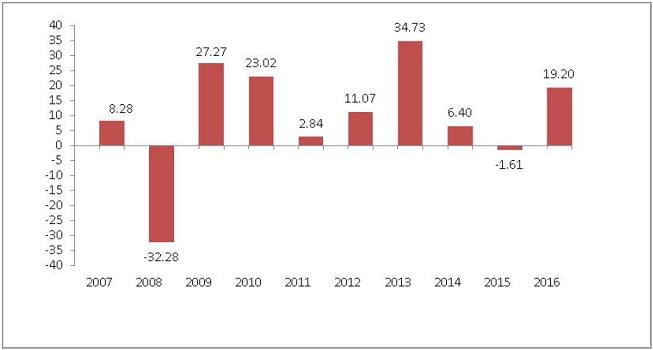

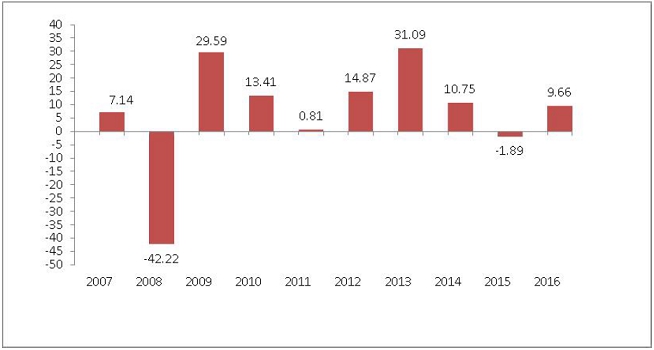

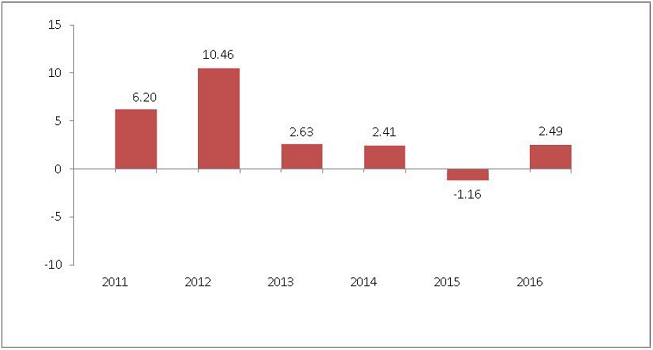

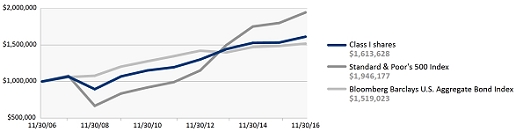

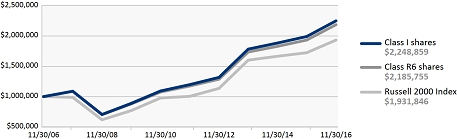

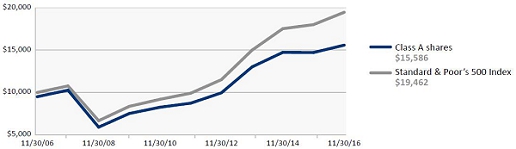

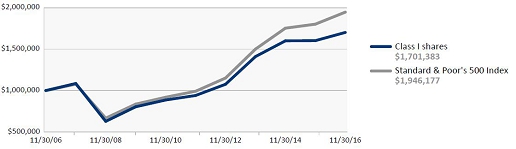

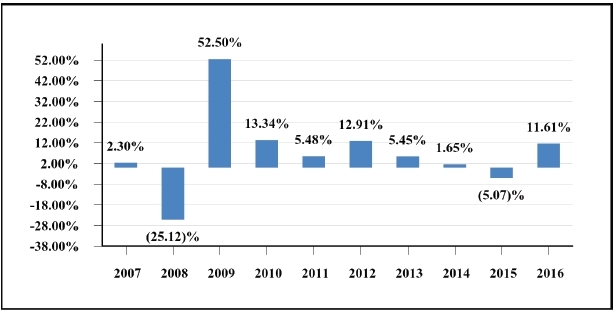

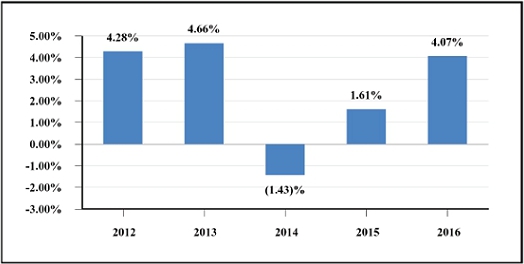

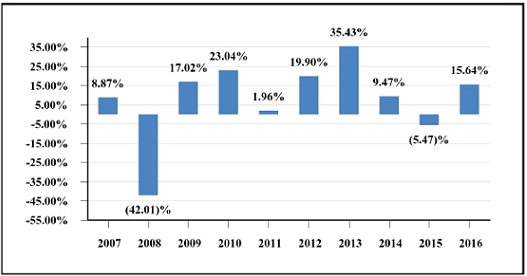

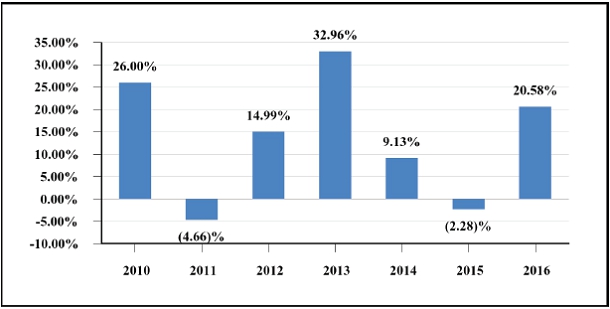

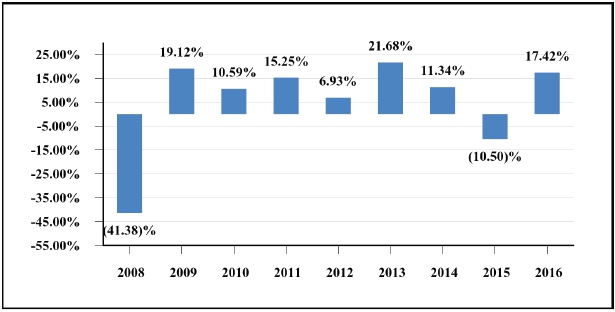

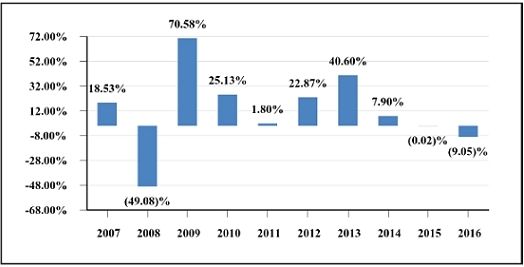

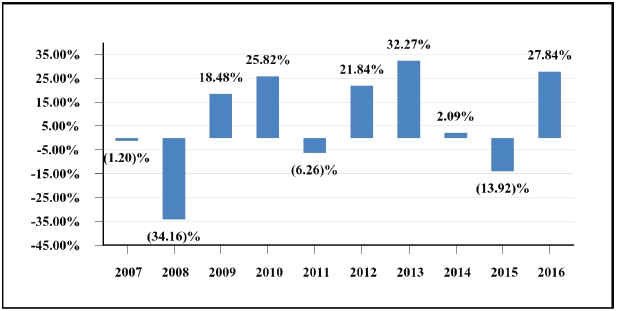

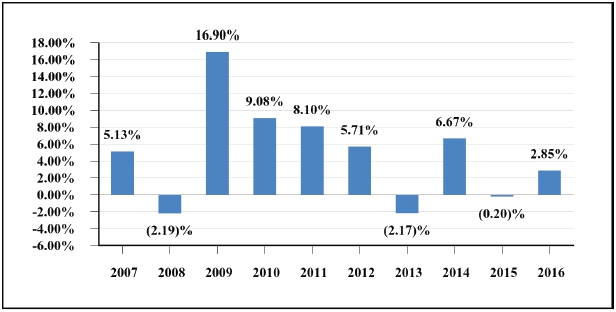

The bar charts and the performance tables below provide some indication of the risks of an investment in each of the Target Fund and the Acquiring Fund by showing how each Fund’s performance has varied from year to year and by showing how each Fund’s average annual returns compare with a broad measure of market performance. Class A returns of the Target Fund shown are based on the 2.25% maximum sales charge currently in effect and are not adjusted to reflect a maximum 4% sales charge in effect from inception through April 10, 2005 and from June 1, 2006 through July 31, 2010. If historical sales charges were reflected, the returns would be lower. Class I share performance of the Target Fund prior to May 4, 2007 (the inception date for the Class I shares) is based on the Target Fund’s Class A share performance, restated to reflect that Class I shares are offered without a sales charge. Past performance of the Target Fund and the Acquiring Fund, before and after taxes, does not necessarily represent how either Fund will perform in the future. Updated performance information for the Target Fund is available on the Target Fund’s website at www.sentinelinvestments.com or by calling 800.282.3863. Updated performance information for the Acquiring Fund is available on the Acquiring Fund’s website at TouchstoneInvestments.com or by calling 800.543.0407.

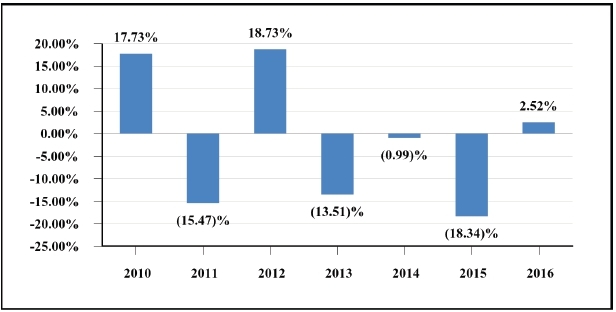

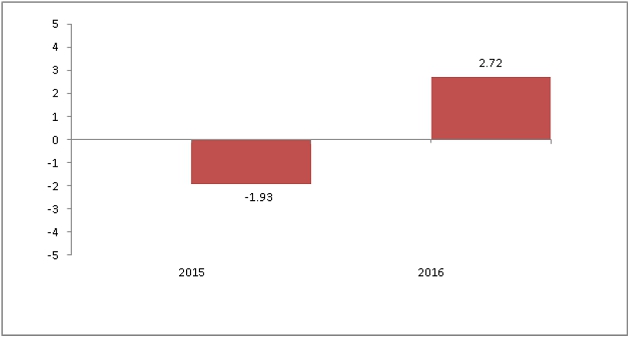

Sentinel Government Securities Fund

| Best Quarter: 2nd Quarter, 2010 4.13% | Worst Quarter: 2nd Quarter, 2013 (2.88%) |

The Sentinel Government Securities Fund’s calendar year-to-date total return for Class A shares as of March 31, 2017 was 0.41%.

9

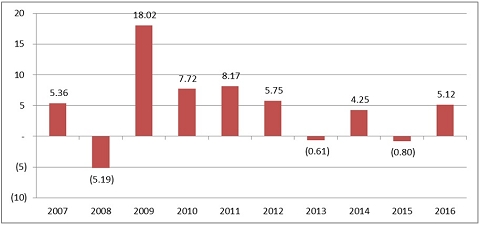

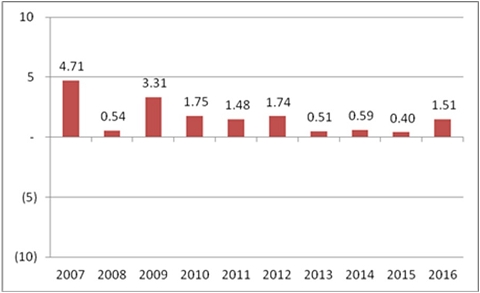

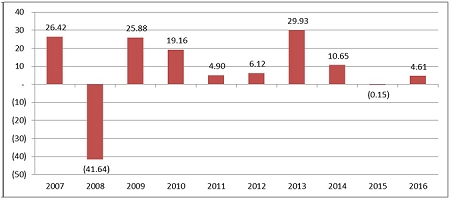

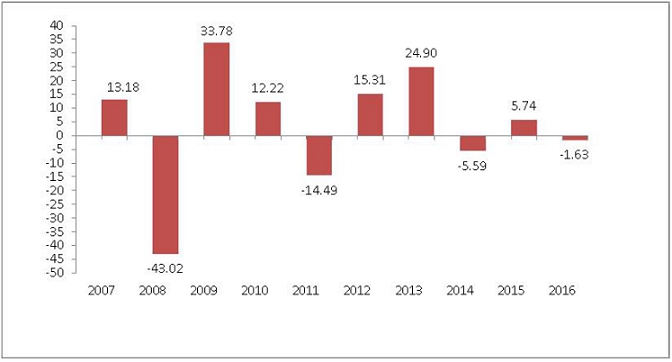

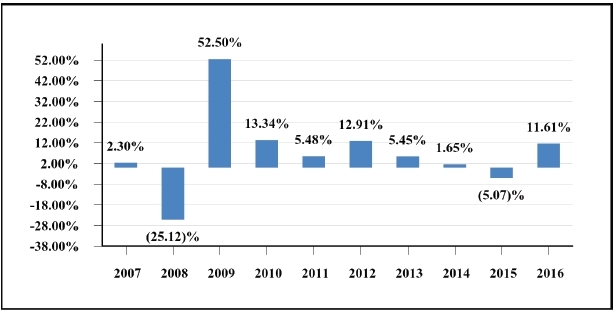

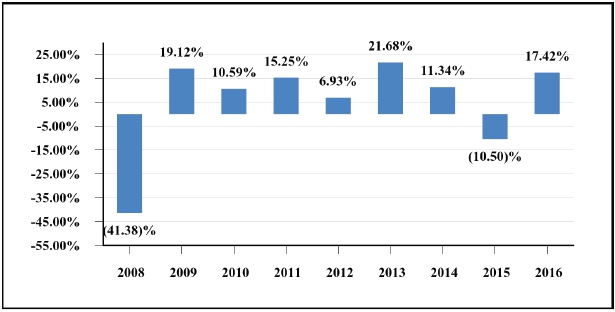

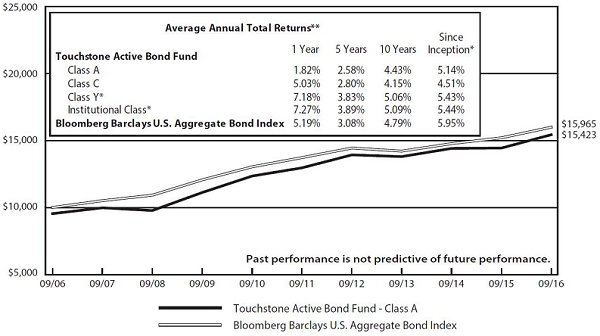

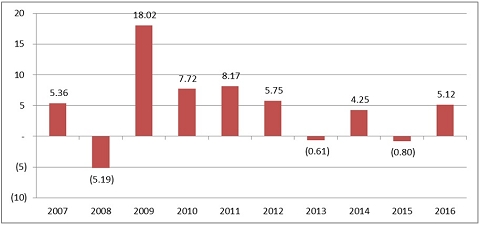

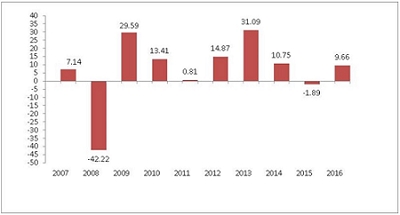

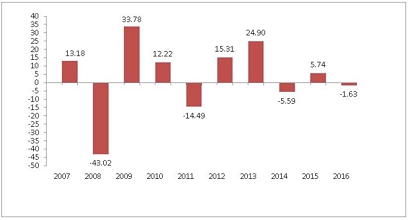

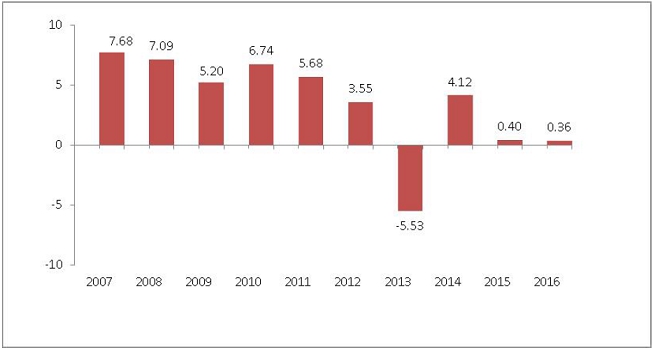

Touchstone Active Bond Fund

| Best Quarter: Third Quarter, 2009 7.14% | Worst Quarter: Third Quarter, 2008 (2.68%) |

The Touchstone Active Bond Fund’s calendar year-to-date total return for Class A shares as of March 31, 2017 was 1.11%.

Average Annual Total Returns

For the periods ended December 31, 2016

| Sentinel Government Securities Fund | | Inception

Date | | 1 Year | | 5 Years | | 10 Years |

| Class A (return before taxes) | | 09/02/1986 | | (1.91%) | | 0.06% | | 3.22% |

| Class A (return after taxes on distributions) | | 09/02/1986 | | (2.97%) | | (1.00%) | | 1.78% |

| Class A (return after taxes on distributions and sale of fund shares) | | 09/02/1986 | | (1.07%) | | (0.40%) | | 1.95% |

| Class C (return before taxes) | | 06/01/2006 | | (1.42%) | | (0.28%) | | 2.56% |

| Class I (return before taxes) | | 05/04/2007 | | 0.67% | | 0.77% | | 3.72% |

| Bloomberg Barclays US Government/Mortgage Backed Securities Index(1) (reflects no deduction for fees, expenses or taxes) | | N/A | | 1.31% | | 1.57% | | 4.04% |

| | | | | | | | | |

| Touchstone Active Bond Fund | | Inception

Date | | 1 Year | | 5 Years | | 10 Years |

| Class A (return before taxes) | | 10/03/1994 | | 0.14% | | 1.70% | | 4.10% |

| Class A (return after taxes on distributions) | | 10/03/1994 | | (1.00%) | | 0.36% | | 2.61% |

| Class A (return after taxes on distributions and sale of fund shares) | | 10/03/1994 | | 0.08% | | 0.72% | | 2.57% |

| Class C (return before taxes) | | 10/03/1994 | | 3.32% | | 1.94% | | 3.83% |

| Class Y (return before taxes) | | 04/12/2012 | | 5.28% | | 2.94% | | 4.73% |

| Bloomberg Barclays US Aggregate Bond Index(2) (reflects no deduction for fees, expenses or taxes) | | N/A | | 2.65% | | 2.23% | | 4.34% |

| (1) | The Bloomberg Barclays US Government/Mortgage Backed Securities Index is a is an unmanaged index comprising U.S. Treasuries and agency debentures with maturities of one year or longer and agency mortgage-backed pass-through securities issued by Government National Mortgage Association (GNMA), Federal National Mortgage Association (FNMA), and Federal Home Loan Mortgage Corporation (FHLMC). |

10

| (2) | The Bloomberg Barclays US Aggregate Bond Index measures the U.S. investment grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities and asset-backed securities. |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. The return after taxes on distributions and sale of Fund shares may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period. If you hold your Fund shares through a tax-advantaged arrangement, such as an individual retirement account or a 401(k) plan, the after-tax returns do not apply to your situation.

How do the investment goals and principal investment strategies of the Funds compare?

The investment goals and principal investment strategies of the Sentinel Government Securities Fund and the Touchstone Active Bond Fund, along with descriptions of certain differences between the Funds’ investment goals and principal investment policies, are set forth in the table below. Although the Funds have similar investment goals and principal strategies, the analytical tools, techniques and investment selection process used by the sub-advisor to the Acquiring Fund may differ from those used by Sentinel.

| | | Sentinel Government

Securities Fund | | Touchstone Active

Bond Fund | | Differences |

| | | | | | | |

| Investment Goal(s): | | The Fund seeks a high level of current income consistent with the preservation of principal. | | The Fund seeks to provide as high a level of current income as is consistent with the preservation of capital. Capital appreciation is a secondary goal. | | The Acquiring Fund has a secondary investment goal of capital appreciation. |

| | | | | | | |

| Principal Investment Strategy: | | The Fund normally invests at least 80% of its net assets in U.S. government securities and related derivatives. The Fund invests mainly in U.S. government bonds. These bonds include direct obligations of the U.S. Treasury, obligations guaranteed by the U.S. government, and obligations of U.S. government agencies and instrumentalities. | | Under normal circumstances, the Fund invests at least 80% of its assets in bonds. Bonds include mortgage-related securities, asset-backed securities, government securities (both U.S. government securities and foreign sovereign debt), and corporate debt securities. | | The Target Fund focuses on investments in U.S. government securities and related derivatives. The Acquiring Fund may invest broadly in bonds, including both government and corporate debt securities. |

| | | | | | | |

| Credit Quality: | | While the Fund invests mainly in U.S. government bonds, the Fund has no stated credit quality policy. | | Up to 30% of the Fund’s total assets may be invested in non-investment-grade debt securities rated as low as B by a Nationally Recognized Statistical Rating Organization. Non-investment-grade debt securities are often referred to as “junk bonds” and are considered speculative. | | The Acquiring Fund may invest in non-investment-grade debt securities. While the Target Fund has no stated credit quality policy, it generally does not invest in non-investment-grade debt securities. |

11

| | | Sentinel Government

Securities Fund | | Touchstone Active

Bond Fund | | Differences |

| | | | | | | |

| Non-U.S. Investments: | | The Fund does not invest in securities of non-U.S. issuers. | | The Fund may invest up to 20% of its total assets in foreign-issued debt securities denominated in either the U.S. dollar or a foreign currency. Foreign-issued debt securities may include debt securities of emerging market countries. | | The Acquiring Fund has exposure to non-U.S. issuers; the Target Fund does not. |

| | | | | | | |

| Derivatives and Other Investments: | | The Fund may use derivative instruments (e.g., exchange-traded derivatives such as futures and options, and other derivatives such as swap agreements, options on swaps and interest rate caps and floors) for investment purposes, such as replicating permitted investments, as long as such investments do not have the effect of leveraging portfolio risks. | | In order to implement its investment strategy, the Fund may invest in mortgage dollar-roll transactions and reverse repurchase agreements, and in derivatives, including forwards, futures contracts, interest rate and credit default swap agreements, and options. | | While there are certain differences, each Fund may invest in a broad range of derivative instruments. The Target Fund has a stated policy that its use of derivatives may not result in leverage. |

| | | | | | | |

| Hedging: | | The Fund may also use derivative instruments in order to hedge various risks, such as interest rate, credit and currency risk. The Fund is not required to use hedging and may choose not to do so. | | The Fund may use mortgage dollar-roll transactions, reverse repurchase agreements and derivatives to gain or hedge market exposure, to adjust the Fund’s duration, to manage interest rate risk, and for any other purposes consistent with the Fund’s investment strategies and limitations. | | While there are certain differences, each Fund may, but is not required to, hedge risks using a variety of derivatives. |

| | | | | | | |

| Active Trading: | | The Fund utilizes an active trading approach, which is expected to result in portfolio turnover greater than 100%. | | The Fund may engage in frequent and active trading as part of its principal investment strategies. | | — |

Additional Information About the Funds’ Principal Investment Policies

Target Fund. The Target Fund is not required to invest set amounts in any of the various types of U.S. government securities set forth in the table above. The Target Fund’s investment advisor, Sentinel, will choose the types of U.S. government securities that it believes will provide capital preservation and the best return with the least risk in light of its analysis of current market conditions and its outlook for interest rates and the economy.

The Target Fund invests substantially in U.S. government mortgage-backed securities (“MBS”) issued and/or guaranteed by the Federal National Mortgage Association (“FNMA” or “Fannie Mae”), the Federal Home Loan Mortgage Corporation (“FHLMC” or “Freddie Mac”) and the Government National Mortgage Association (“GNMA” or “Ginnie Mae”). The Target Fund may also purchase or sell agency MBS on a “to be announced” or “TBA” basis, where the Target Fund buys or sells agency MBS on a forward commitment basis. In a TBA securities transaction, the seller of the agency MBS agrees on a sale price, but does not specify which particular

12

securities will be delivered to the buyer on settlement day. Instead, only a few basic characteristics of the securities are agreed upon, such as the coupon rate and the face value. The Target Fund may engage in short sales of agency MBS that the Target Fund does not own, primarily as part of a TBA swap transaction. A TBA swap transaction involves an agreement to purchase one agency MBS and a simultaneous agreement to sell a different agency MBS.

The Target Fund may sell a security if the security is overvalued on a relative basis compared to other securities available in the market or for duration management purposes. The Target Fund may also sell a security to meet redemptions.

Acquiring Fund. In deciding what securities to buy and sell for the Acquiring Fund, the Acquiring Fund’s sub-advisor, Fort Washington, analyzes the overall investment opportunities and risks in different sectors of the debt securities markets by focusing on maximizing total return while reducing volatility of the Acquiring Fund’s portfolio. Fort Washington follows a disciplined sector allocation process in order to build a diversified portfolio of investments.

How do the principal risks of investing in the Funds compare?

An investment in each Fund is subject to derivatives risk, fixed-income securities risk and portfolio turnover risk. An investment in the Sentinel Government Securities Fund is also subject to short sales risk and TBA securities risk. An investment in the Touchstone Active Bond Fund is also subject to foreign securities risk including emerging markets risk, leverage risk, management risk and mortgage dollar roll risk, as well as additional fixed-income securities risks including non-investment grade debt securities risk. For more information on the Funds’ principal risks, see “Comparison of Principal Risks.”

Who will be the Advisor, Sub-Advisor and Portfolio Managers of my Fund after the Reorganization?

Sentinel is the investment advisor to Sentinel Government Securities Fund. The portfolio managers of Sentinel Government Securities Fund are Jason Doiron and Peter Hassler.

After the Reorganization, Touchstone Advisors will serve as the investment advisor and Fort Washington will serve as the sub-advisor to Touchstone Active Bond Fund. The portfolio managers of Touchstone Active Bond Fund are Timothy J. Policinski and Daniel J. Carter. For additional information regarding the advisor, sub-advisor and portfolio managers listed above, please see the section entitled “The Funds’ Management—Investment Advisor” and “The Funds’ Management—Sub-Advisors and Portfolio Managers.”

What are the portfolio turnover rates of the Funds?

A Fund pays transaction costs, such as brokerage commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect a Fund’s performance. During the fiscal year ended November 30, 2016, the Target Fund’s portfolio turnover rate was 59% of the average value of its portfolio. During the fiscal year ended September 30, 2016, the portfolio turnover rate of the Acquiring Fund was 590% of the average value of its portfolio.

Will there be any repositioning of the portfolio after the Reorganization?

It is expected that a significant portion (approximately two-thirds) of the portfolio investments of the Target Fund may be sold by the Acquiring Fund following the Reorganization. However, the timing of any repositioning and its resulting impact on capital gains distributions in 2017 and beyond is uncertain. The amounts per share of any capital gains distributions resulting from the repositioning will depend on a number of factors, including the proportion of portfolio holdings that are actually sold, the timing of portfolio sales, the performance of the bond market in general, the availability of offsetting capital losses and the scale of purchase and redemption activity in the Funds' shares. The timing of portfolio sales will also be subject to market conditions existing after the closing of the Reorganization. Accordingly, the per share amounts of any capital gains distributions resulting from the repositioning cannot be estimated at this time. Touchstone Advisors publishes estimates of capital gains distributions for the Touchstone Funds on its website (https://www.touchstoneinvestments.com/literature-center/taxplanning.htm), generally in October of each year. The Acquiring Fund will also bear brokerage costs in connection with the repositioning. For illustration purposes only, if the Reorganization had been completed as of March 31, 2017 and the Acquiring Fund had sold on a pro rata basis two-thirds of the investments held in the Target Fund's portfolio as of March 31, 2017, the resulting realized capital gains estimate would be expected to total $0.02 per share of the combined fund and the brokerage commissions would be expected to total approximately $145,000 in the aggregate, or $0.005 per share of the combined fund, based on average commission costs of the Acquiring Fund. Under the same circumstances, if only one-third of the investments held in the Target Fund's portfolio had been repositioned as of March 31, 2017, the resulting realized capital gains and brokerage cost estimates would be reduced by half, to $0.01 and $0.003 per share of the combined fund, respectively.

13

Synopsis: Reorganization of Sentinel Total Return Bond Fund into Touchstone Active Bond Fund

What class of shares of the Acquiring Fund will I receive in the Reorganization?

Shareholders of the Sentinel Total Return Bond Fund will receive shares of the Touchstone Active Bond Fund, as follows:

| Sentinel Total Return Bond Fund | | Touchstone Active Bond Fund |

| Class A | | Class A |

| Class C | | Class C |

| Class I | | Class Y |

| Class R3 | | Class A |

| Class R6 | | Class Y |

How do the fees and expenses of the Target Fund and the Acquiring Fund compare?

The tables below describe the fees and expenses that you pay if you buy and hold shares of your Sentinel Fund and the pro forma fees and expenses that you may pay if you buy and hold shares of the corresponding Touchstone Fund under the following two scenarios (i) assuming that only the Reorganization of the Sentinel Total Return Bond Fund into the Touchstone Active Bond Fund takes places and (ii) assuming that both the Reorganization of the Sentinel Total Return Bond Fund into the Touchstone Active Bond Fund and the Reorganization of the Sentinel Government Securities Fund into the Touchstone Active Bond Fund (which is also described in this Joint Proxy Statement/Prospectus) take place. The pro forma expense ratios project anticipated expenses of the Acquiring Fund following Reorganizations, but actual expenses may be greater or less than those shown. Expenses for the Class A, Class C, Class I, Class R3 and Class R6 shares of the Sentinel Total Return Bond Fund are based on the operating expenses incurred by each class of shares of the Fund for the fiscal year ended November 30, 2016. Expenses for the Class A, Class C and Class Y shares of the Touchstone Active Bond Fund are based on the operating expenses incurred by each class of shares of the Fund for the 12-month period ended March 31, 2017. The pro forma fees and expenses for the Class A, Class C and Class Y shares of the Touchstone Active Bond Fund reflect the fees and expenses of the Acquiring Fund and assume that the Reorganization(s) had been completed at the beginning of the 12-month period ended March 31, 2017.

No sales charge will be imposed on the Class A shares of the Acquiring Fund received in connection with the Reorganization. In addition, you may qualify for sales charge discounts for Class A shares if you and your family invest, or agree to invest in the future, at least $25,000 or more in the Sentinel Funds or $50,000 or more in the Touchstone Funds. For the Target Fund, more information about these and other discounts is available from your financial professional and in the section entitled “Share Classes” on page 82 of the Target Fund’s prospectus and “How to Purchase Shares and Reduce Sales Charges” on page 44 of the Target Fund’s SAI. For the Acquiring Fund, more information about these and other discounts is available from your financial professional and in the section entitled “Investing with Touchstone—Class A Shares—Letter of Intent” on page [•] of this Joint Proxy Statement/Prospectus and in the Acquiring Fund’s SAI on page [•].

SHAREHOLDER FEES

(fees paid directly from your investment)

| | | Maximum Sales

Charge (Load)

Imposed on

Purchases (as a

percentage of

offering price) | | Maximum

Deferred Sales

Charge (load) (as a

percentage of the

lower of original

purchase price or

redemption

proceeds) | | Wire

Redemption

Fee |

| Sentinel Total Return Bond Fund – Class A Shares | | 2.25% | | None | | None |

| Touchstone Active Bond Fund – Class A Shares | | 4.75% | | None | | up to $15 |

14

| | | Maximum Sales

Charge (Load)

Imposed on

Purchases (as a

percentage of

offering price) | | Maximum

Deferred Sales

Charge (load) (as a

percentage of the

lower of original

purchase price or

redemption

proceeds) | | Wire

Redemption

Fee |

| Touchstone Active Bond Fund – Class A Shares Pro Forma | | 4.75%(1)(2) | | None | | up to $15 |

| | | | | | | |

| Sentinel Total Return Bond Fund – Class C Shares | | None | | 1.00%(2) | | None |

| Touchstone Active Bond Fund – Class C Shares | | None | | 1.00%(2) | | up to $15 |

| Touchstone Active Bond Fund – Class C Shares Pro Forma | | None | | 1.00%(2) | | up to $15 |

| | | | | | | |

| Sentinel Total Return Bond Fund – Class I Shares | | None | | None | | None |

| Touchstone Active Bond Fund – Class Y Shares | | None | | None | | up to $15 |

| Touchstone Active Bond Fund – Class Y Shares Pro Forma | | None | | None | | up to $15 |

| | | | | | | |

| Sentinel Total Return Bond Fund – Class R3 Shares | | None | | None | | None |

| Touchstone Active Bond Fund – Class A Shares | | 4.75% | | None | | up to $15 |

| Touchstone Active Bond Fund – Class A Shares Pro Forma | | 4.75%(1)(2) | | None | | up to $15 |

| | | | | | | |