UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08104

| Touchstone Funds Group Trust |

| (Exact name of registrant as specified in charter) |

| 303 Broadway, Suite 1100 |

| Cincinnati, Ohio 45202-4203 |

| (Address of principal executive offices) (Zip code) |

| Jill T. McGruder |

| 303 Broadway, Suite 1100 |

| Cincinnati, Ohio 45202-4203 |

| (Name and address of agent for service) |

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end:September 30

Date of reporting period:September 30, 2019

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

September 30, 2019

Annual Report

Touchstone Funds Group Trust

Touchstone Active Bond Fund

Touchstone Anti-Benchmark® International Core Equity Fund

Touchstone Anti-Benchmark® US Core Equity Fund

Touchstone Credit Opportunities II Fund (formerly known as Touchstone Credit Opportunities Fund)

Touchstone High Yield Fund

Touchstone Impact Bond Fund

Touchstone International ESG Equity Fund (formerly known as Touchstone Premium Yield Equity Fund)

Touchstone Mid Cap Fund

Touchstone Mid Cap Value Fund

Touchstone Sands Capital Select Growth Fund

Touchstone Small Cap Fund

Touchstone Small Cap Value Fund

Touchstone Ultra Short Duration Fixed Income Fund

IMPORTANT NOTE: Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Touchstone Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the shareholder reports from Touchstone Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, annual and semi-annual shareholder reports will be available on the Touchstone Funds’ website (TouchstoneInvestments.com/Resources), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future annual and semi-annual shareholder reports in paper, free of charge. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. To elect to receive paper copies of shareholder reports through the mail or otherwise change your delivery method, contact your financial intermediary or, if you hold your shares directly through Touchstone Funds, visit TouchstoneInvestments.com/Resources/Edelivery or call Touchstone Funds toll-free at 1.800.543.0407. Your election to receive shareholder reports in paper will apply to all Touchstone Funds that you hold through the financial intermediary, or directly with Touchstone.

Table of Contents

This report identifies the Funds’ investments on September 30, 2019. These holdings are subject to change. Not all investments in each Fund performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not occur.

2

Dear Shareholder:

We are pleased to provide you with the Touchstone Funds Group Trust Annual Report. Inside you will find key financial information, as well as manager commentaries for the Funds, for the 12 months ended September 30, 2019.

The post-crisis equity bull market appeared to stall over the trailing 12 months as broad measures of global equities finished near where they started. The period was book-ended by macro-driven negative sentiment in equities during the fourth quarter of 2018 and the third quarter of 2019. After declining into correction territory during the fourth quarter of 2018, central banks, most notably the U.S. Federal Reserve Board (Fed), provided hope of stimulus. The Fed responded with a pause to its monetary policy normalization until shifting to a stimulatory policy stance in the third quarter of 2019 with two cuts in the overnight rate. A chorus of neutral to dovish policy pronouncements and potential for stimulus from other central banks, as well as fiscal and monetary policy stimulus in China, supported a risk rally during the first half of 2019. However, worsening global economic data – combined with a lack of progress toward resolution of the U.S.-China trade war and geopolitical instability in Europe – led to a return of negative sentiment in the period’s final quarter.

In the U.S., mid- and large-capitalization stocks finished with low-to-mid single digit gains while their small-cap brethren, particularly micro-cap stocks, posted negative returns. In terms of style, value-oriented stocks reversed the long run of growth domination in the small- and large-capitalization stocks. However, growth-oriented stocks within the mid-capitalization range significantly outperformed their value-oriented counterparts. Outside the U.S., emerging market and developed market equities exhibited the same peak-trough-recovery pattern as U.S. equities, but finished slightly down in U.S. dollar terms due to dollar strength during the period.

The net effect of the Fed’s rate changes – one hike in the fourth quarter of 2018 and two cuts in the third quarter of 2019 – pushed short-term rates lower while investor demand for safety and yield contributed to lower rates on longer maturities. The result was a significantly flatter yield curve, giving rise to fears throughout the year of a yield curve inversion, which historically has been a leading indicator of recessions. In 2019, these concerns were realized as a brief inversion occurred during the third quarter. Demand for U.S. Treasuries remained strong given the weaker economic environment and relatively high yields compared to many developed sovereign issuers in 2019. The declining rates created a tailwind for longer maturity bonds. Although credit spreads ended the period wider, investor preference for safer yield contributed to outperformance of investment grade over their non-investment grade counterparts.

Periods such as these remind us of the importance of the steady hands of financial professionals, trust in one’s investment strategy and the inherent risks of trying to time the market. Further, we believe that more volatile environments typically create more opportunity for active managers, especially those who are Distinctively Active.

We greatly value your continued support. Thank you for including Touchstone as part of your investment plan.

Sincerely,

Jill T. McGruder

President

Touchstone Funds Group Trust

3

Management’s Discussion of Fund Performance(Unaudited)

Touchstone Active Bond Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Touchstone Active Bond Fund seeks to provide as high a level of current income as is consistent with the preservation of capital. Capital appreciation is a secondary goal. In deciding what securities to buy and sell for the Fund, the overall investment opportunities and risks in different sectors of the debt securities market are analyzed by focusing on maximizing total return and reducing volatility of the Fund’s portfolio. A disciplined sector allocation process is followed in order to build a broadly diversified portfolio of bonds.

Fund Performance

The Touchstone Active Bond Fund (Class A Shares) underperformed its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, for the 12-month period ended September 30, 2019. The Fund’s total return was 9.68 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was 10.30 percent.

Market Environment

In the fourth quarter of 2018, the U.S. Federal Reserve Board (Fed) did not pause with tightening policy, and U.S.-China trade rhetoric intensified after it was hoped that tensions would ease following the G-20 summit. The markets reacted to both of these developments dramatically. The S&P 500® Index declined and risk premiums on non-U.S. Treasury sectors widened significantly.

However, the sell-off at the end of 2018 set the stage for much of the rally over the next nine months. For the first half of 2019, many of the factors that drove the risk-off move in the fourth quarter abated – escalation of the trade war with China, rising interest rates and general fears of a slowdown in global growth – causing credit and equities to recover the majority of losses. The Fed continued to communicate a relatively positive outlook for the U.S. economy, citing a robust labor market, modest wage growth and core inflation well below the 2 percent target.

However, the rally that occurred through the first half of 2019 subsided as tensions flared again between the U.S. and China over trade. As trade dominated headlines, soft economic data out of the eurozone elevated concern as to whether the European Central Bank or individual European governments had the tools necessary to stimulate growth. Likewise, readings on U.S. manufacturing showed signs of slowing coupled with weaker business confidence due to policy and trade uncertainty. All of this sent investors into safe haven assets and sent rates markedly lower. These risks spiked in August and lingered to close the 12-month period.

Portfolio Review

The active management of interest rates was the largest detractor for the period, specifically tactically allocating to treasury inflation protected securities (TIPS). The yield curve flattened throughout the year and the intermediate part of the curve inverted. Interest rates reacted to broader concerns about a slowdown in global growth amid trade uncertainty with China, European weakness and manufacturing weakness in the U.S. which caused investors to shift into U.S. Treasuries. A shorter duration positioning had a negative impact on results given that backdrop.

An overweight allocation to risk assets relative to the U.S. Treasury and Agency-heavy benchmark had a modestly positive impact on performance due to additional return, even as spreads on 10-year BBB-rated Industrials sector bonds were slightly wider over the 12-month period.

4

Management’s Discussion of Fund Performance(Unaudited) (Continued)

Strong security selection within investment grade credit and securitized assets was the largest contributor. Within investment grade credit, capital goods, energy and real estate investment trusts (REITS) were the top contributing industries, while within securitized assets Agency Fixed-Rate Mortgage-Backed Securities (MBS) and Non-Agency Commercial MBS were top contributors.

Outlook

We believe the level of interest rates primarily reflects the changing economic outlook and rate path of the Fed, and reflects the uncertainty surrounding trade policy, global economic outlook and tighter financial conditions. In the near term, downward pressure on interest rates should continue to persist in a slow global growth and low yield environment, likely with higher volatility. The front-end of the curve is likely to outperform from here given the level of rates amid this backdrop. The general risks to lower interest rates include higher than expected growth and an acceleration in inflation. The primary risk to lower rates is that the trade disputes get resolved in a friendly fashion and growth is able to return to trend. The Fund is positioned slightly long duration and curve neutral versus the benchmark. We view TIPS as somewhat attractive as a long-term risk/reward trade from a breakeven basis.

We believe the biggest concern going forward is the further escalation of the trade dispute between the U.S. and China, and the elevation of uncertainty surrounding the potential fallout and impact on the global economy. In addition, we believe the risk of further weakness in business confidence and investing will eventually spill over into labor markets and effect consumer spending.

The Fund continues to have a modest allocation to U.S. dollar denominated emerging markets debt as the additional yield the sector offers remains attractive relative to investment grade credit and high yield.

Certain securitized sectors offer attractive risk/reward profiles, particularly within the Asset-Backed Securities (ABS) and Non-Agency MBS sectors, for higher quality securities. We are also comfortable with the space given it is closely related to the health of the consumer, which continues to be strong.

5

Management’s Discussion of Fund Performance(Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Active Bond Fund - Class A* and the

Bloomberg Barclays U.S. Aggregate Bond Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares and Institutional Class shares was October 3, 1994, October 3, 1994, April 12, 2012, and April 12, 2012, respectively. Class Y shares’ and Institutional Class shares’ performance was calculated using the historical performance of Class A shares for the periods prior to April 12, 2012. The returns have been restated for sales loads and fees applicable to Class Y and Institutional Class shares. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 2.04% of the NAV (or 2.00% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. investment grade, fixed rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and ten years.

6

Management’s Discussion of Fund Performance(Unaudited)

Touchstone Anti-Benchmark® International Core Equity Fund

Sub-Advised by TOBAM S.A.S.

Investment Philosophy

TOBAM’s methodology seeks to enhance the diversification of portfolio holdings to reduce market bias and potentially improve risk-adjusted returns. TOBAM’s process selects individual stocks and their weights in an effort to reduce the correlations between individual holdings. This enables the creation of portfolios that seek to mitigate the inherent concentration risks associated with capitalization-weighted benchmarks. The lower correlations have the potential to provide a differentiated source of value than other methods of diversification. This quantitative approach creates fully invested, long-only portfolios that do not use leverage, and are designed to help guard against structural biases.

Fund Performance

The Touchstone Anti-Benchmark®International Core Equity Fund (Class Y Shares) underperformed its benchmark, the MSCI EAFE Index, since the Fund’s November 19, 2018 inception through the period ended September 30, 2019. The Fund’s return was 2.13 percent compared to the 7.19 percent return of the MSCI EAFE Index.

Market Environment

The Fund was launched in the middle of the fourth quarter of 2018, in a declining equity market environment as global growth concerns and trade tensions weighed on investors. In contrast, the first three quarters of 2019 were marked by a strong rebound in equity markets, however, during the third quarter of 2019 there was a pause in the year–to-date rise of equity markets following concerns regarding U.S.-China trade tensions.

Long term inflation expectations continued to be subdued for the Eurozone and spot inflation rates remained low as well. European central bankers loosened monetary policy and restarted quantitative easing. Illustrative of this loose monetary environment in the Eurozone was that the entirety of the German yield curve turned negative.

Portfolio Review

TOBAM analyzes the Fund’s relative performance vs. the benchmark by looking at the main benchmark holdings and how they performed over the period, since the Fund is a long-only portfolio, fully invested, without leverage that does not invest in off benchmark stocks. By maximizing diversification, the Fund seeks a portfolio where risk is contributed homogeneously by all the risk factors available in the investment universe.

The Fund’s underweight to the largest market capitalization stocks relative to the benchmark and overweighting the lowest market capitalization stocks represented a performance headwind during the period.

Over the period, the Fund’s Financials, Energy, Consumer Discretionary and Materials exposures positively contributed to performance relative to the benchmark. The Communication Services, Consumer Staples, Health Care, Industrials, and Utilities sectors all detracted from performance relative to the benchmark.

Outlook and Conclusion

TOBAM’s Anti-Benchmark®strategy does not forecast market activity but simply seeks to maximize diversification. Thus, it does not include fundamental analysis of individual stocks, countries, sectors, economic environments or factors. No discretionary tactical or strategic asset allocation decisions are made with respect to specific regions, sectors or industries. TOBAM’s investment process consists of maximizing diversification from a bottom-up perspective. Securities are solely bought or sold in relation to their potential relative diversification benefits within the portfolio. A security will be completely sold when it no longer provides the most marginal diversification among all available stocks in the universe, and others purchased when they begin to provide more marginal

7

Management’s Discussion of Fund Performance(Unaudited) (Continued)

diversification. TOBAM’s patented Anti-Benchmark® approach is designed to avoid explicit and implicit biases in terms of sector, style, market cap and other statistical measures. For this reason, we apply as few constraints as possible and do not rely on any given view or forecast, in order to avoid unwanted systematic exposures. The Fund’s portfolio reflects even risk contributions from all independent effective risk factors in the investment universe, which may include sector and country factors.

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Anti-Benchmark®International Core Equity Fund - Class Y* and the

MSCI EAFE Index

| * | The chart above represents performance of Class Y shares only, which will vary from the performance of Institutional Class shares based on the difference in fees paid by the shareholders in the different classes. The inception date of the Fund was November 19, 2018. The returns of the index listed above are based on the inception date of the Fund. |

| ** | Not Annualized. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

The MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding U.S. and Canada.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI.

8

Management’s Discussion of Fund Performance(Unaudited)

Touchstone Anti-Benchmark®US Core Equity Fund

Sub-Advised by TOBAM S.A.S.

Investment Philosophy

TOBAM’s methodology seeks to enhance the diversification of portfolio holdings to reduce market bias and potentially improve risk-adjusted returns. TOBAM’s process selects individual stocks and their weights in an effort to reduce the correlations between individual holdings. This enables the creation of portfolios that seek to mitigate the inherent concentration risks associated with capitalization-weighted benchmarks. The lower correlations have the potential to provide a differentiated source of value than other methods of diversification. This quantitative approach creates fully invested, long-only portfolios that do not use leverage, and are designed to help guard against structural biases.

Fund Performance

The Touchstone Anti-Benchmark®US Core Equity Fund (Class Y Share) underperformed its benchmark, the Russell 1000® Index, since the Fund’s November 19, 2018 inception through the period ended September 30, 2019. The Fund’s return was 6.57 percent compared to the 10.65 percent return of the benchmark.

Market Environment

The Fund was launched in the middle of the fourth quarter of 2018, in a declining equity market environment as global growth concerns and trade tensions weighed on investors. Small caps declined the most. Fundamentals for the U.S. economy were nonetheless positive, with an unemployment rate at all-time lows (below 4 percent), a gross domestic product (GDP) growth expected to be 3 percent, and core inflation slightly below the 2 percent target. Late in the period, the third quarter of 2019, there was a pause in the year-to-date rise of equity markets following concerns regarding U.S.-China trade tensions.

Credit markets benefited from yield scarcity as more than $14 trillion in bonds traded in negative yield territory globally.

Portfolio Review

TOBAM analyzes the Fund’s relative performance vs. the benchmark by looking at the main benchmark holdings and how they performed over the period, since the Fund is a long-only portfolio, fully invested, without leverage that does not invest in off benchmark stocks. By maximizing diversification, the Fund seeks a portfolio where risk is contributed homogeneously by all the risk factors available in the investment universe.

The Fund’s underweight to the largest market capitalization stocks relative to the benchmark and overweighting the lowest market capitalization stocks represented a performance headwind during the period.

Over the period, the Fund’s Financials, Energy, Real Estate, Utilities, and Materials exposures positively contributed to performance relative to the benchmark. The Communication Services, Consumer Staples, Consumer Discretionary, Industrials, and Information Technology sectors all detracted from performance relative to the benchmark.

Outlook and Conclusion

TOBAM’s Anti-Benchmark®strategy does not forecast market activity but simply seeks to maximize diversification. Thus, it does not include fundamental analysis of individual stocks, countries, sectors, economic environments or factors. No discretionary tactical or strategic asset allocation decisions are made with respect to specific regions, sectors or industries. TOBAM’s investment process consists of maximizing diversification from a bottom-up perspective. Securities are solely bought or sold in relation to their potential relative diversification benefits within the portfolio. A security will be completely sold when it no longer provides the most marginal diversification among all available stocks in the universe, and others purchased when they begin to provide more marginal

9

Management’s Discussion of Fund Performance(Unaudited) (Continued)

diversification. TOBAM’s patented Anti-Benchmark® approach is designed to avoid explicit and implicit biases in terms of sector, style, market cap and other statistical measures. For this reason, we apply as few constraints as possible and do not rely on any given view or forecast, in order to avoid unwanted systematic exposures. The Fund’s portfolio reflects even risk contributions from all independent effective risk factors in the investment universe, which may include sector and country factors.

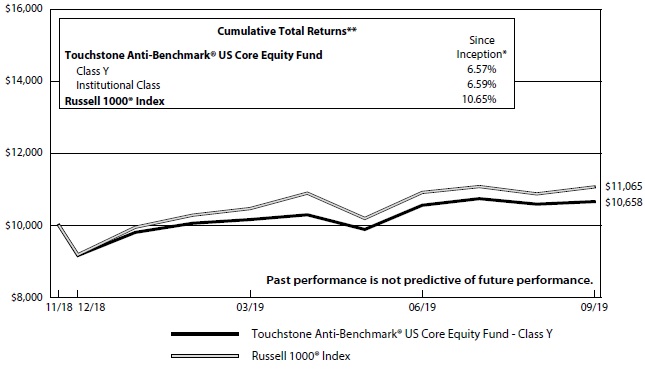

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Anti-Benchmark®US Core Equity Fund - Class Y* and the

Russell 1000® Index

| * | The chart above represents performance of Class Y shares only, which will vary from the performance of Institutional Class shares based on the difference in fees paid by the shareholders in the different classes. The inception date of the Fund was November 19, 2018. The returns of the index listed above are based on the inception date of the Fund. |

| ** | Not Annualized. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000® Index.

The Frank Russell Company (FRC) is the source and owner of the data contained or reflected in this material and all trademarks and copyrights related thereto. The material may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a Touchstone Investments presentation of the data, and FRC is not responsible for the formatting or configuration of this material or for any inaccuracy in the presentation thereof.

10

Management’s Discussion of Fund Performance(Unaudited)

Touchstone Credit Opportunities II Fund*

Sub-Advised by Ares Capital Management II LLC

Investment Philosophy

The Touchstone Credit Opportunities II Fund employs a flexible investment approach by allocating assets among core investments and opportunistic investments as market conditions change. It invests in several broad investment categories, including high yield bonds, bank loans, special situations, structured credit and hedges.

Fund Performance

The Touchstone Credit Opportunities II Fund (Class A Shares) outperformed its benchmark, the ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index, for the 3-month period ended September 30, 2019. The Fund’s total return was 1.40 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was 0.56 percent.

Market Environment

Investors continued to grapple with dovish rhetoric from global central banks, ongoing U.S.-China trade negotiations, uncertainty following the dramatic shift in interest rates, and heightened concerns over weaker economic indicators. The U.S. Federal Reserve Board (Fed) continued with their accommodative approach by cutting rates in July and September while the European Central Bank cut rates in September and relaunched quantitative easing. Trade negotiations continued throughout the quarter and shaped market sentiment. Economic data releases seemed to confirm a late cycle backdrop as gross domestic product (GDP) figures in the U.S. and Europe pointed to deceleration and the ISM Purchasing Manager’s Index (PMI) highlighted cracks in the U.S. economy. Fear pushed government yields down globally. The dollar amount of negative yielding debt increased to $15 trillion by quarter-end, an increase of 67 percent in 2019 and nearly double the five-year average of $8 trillion. Meanwhile, positive, long-end rates moved decidedly lower in the U.S. and resulted in an inversion of the U.S. Treasury curve. While these events contributed to episodic volatility, corporate credit markets generated positive returns.

While both the high yield and bank loans asset classes lagged investment grade bonds, performance was relatively stable as investment grade returns lagged their sub-investment grade peers in July and September. The technical environment in high yield remained positive as coupon reinvestment, inflows and rising stars offset new issuance and fallen angels. Bank loan technicals remained constructive as collateralized loan obligation (CLO) issuance remained steady, new issuance light, and repayments provided a balance against continued retail outflows. High yield returns were driven by a mix of price and coupon, while the quarter was a coupon-only environment for bank loans. A sign of late cycle sentiment; high credit quality led the way in both markets while CCC-rated securities posted negative returns. Default rates and expectations remained below historical averages, although we have witnessed an uptick recently, largely attributable to weakness in the Energy sector. Dispersion on a single-name basis within high yield continued to increase, as the percentage of bonds trading near index levels steadily declined.

Portfolio Review

The Touchstone Credit Opportunities Fund was reorganized into the Touchstone Credit Opportunities II Fund after the close of business on September 6, 2019 with the performance record for Touchstone Credit Opportunities Fund becoming the history of Touchstone Credit Opportunities II Fund as a reflection of the Credit Opportunities Strategy’s continuity. The Touchstone Credit Opportunities II Fund changed its investment goal and principal investment strategy, and appointed Ares as sub-advisor in mid-May 2019. Fund assets were transitioned into the Credit Opportunities Strategy over the course of May and June 2019.

11

Management’s Discussion of Fund Performance(Unaudited) (Continued)

Both the high yield and bank loan allocations contributed to returns. The bank loan allocation faced a headwind from holdings in the Energy and retail sectors, but still was additive to results. Allocations to structured products and equity detracted. Negative contributions from the structured products allocation were largely technical while idiosyncratic news affected the equity allocation. Single-name shorts contributed modestly to performance.

In terms of individual contributors, the top five positive contributors were all high yield while the bottom five were a mix of high yield and equity. Air Methods Corp. and New Gold Inc. bonds both benefited from positive signs of an operational turnaround. Simmons Foods Inc., The Hillman Group Inc., and JBS USA Holdings Inc. bonds all rallied on strong earnings reports. Reorganization Equity positions, Cumulus Media Inc. and HCA Healthcare Inc., were a modest drag on Fund results though this was partially offset by better performing debt positions from the same issuers. Vine Oil & Gas LP and Rowan Companies Inc. bonds detracted from performance due to the broad weakness in the Energy sector. Frontier Communications Corp. was a modest detractor at the issuer level as the weak high yield bond holding offset contribution from other Frontier securities.

Outlook

As we enter the final quarter of 2019, cracks have started to appear in the strength of the U.S. economy surrounding its resiliency amid prolonged trade tensions with China. A seemingly direct outcome of the continued negotiations has been the recent decline in U.S. manufacturing as the ISM PMI reported its September reading. The September output was the lowest since June 2009 and the second consecutive month of contraction as new exports sunk to the lowest reading in over 10 years. While manufacturing comprises a smaller portion of overall U.S. economic production, September’s ISM Non-Manufacturing Index indicated that weakness may be spreading to the services sector as well. September’s ISM Non-Manufacturing Index continued to reflect economic expansion, though at a declining rate, and a sharp decrease from August’s reading. Moreover, though consumer spending comprises a large majority of the U.S. economy and has benefited recently from the strong labor market, uncertainty over trade negotiations could dampen business investment and curtail hiring going forward. Europe has already shown evidence of slowing growth as euro area economic growth is forecast to slow to roughly 1 percent this year from about 2 percent in 2018, which would result in its worst performance in six years if the projections materialize. The outlook for the euro area economy also took another hit in September as confidence in industry dropped to its lowest level in six years, reflecting the impact of trade uncertainty and worsening unease related to Brexit. As we enter the final stretch of 2019, we expect a higher probability of volatility across global capital markets due to political headlines, underwhelming economic data and potential consequences of Brexit. While we believe this could further perpetuate credit dispersion, we welcome the opportunities that result from an uncertain environment owing to our fundamental approach to investing. We ultimately view any market dislocation as an opportunity to strategically source credit and believe that active managers with flexible capital will be rewarded.

We believe the Fund can continue to serve as an all-weather allocation to sub-investment grade credit and a diversifier to traditional core fixed income allocations. It is our view that the unpredictable nature of the market in the past year underscores the need for an investment strategy like the one utilized in the Fund - flexible guidelines, an agile portfolio construct and a highly selective approach to security selection.

*Prior to September 9, 2019, the performance history is that of the Touchstone Credit Opportunities Fund.

12

Management’s Discussion of Fund Performance(Unaudited) (Continued)

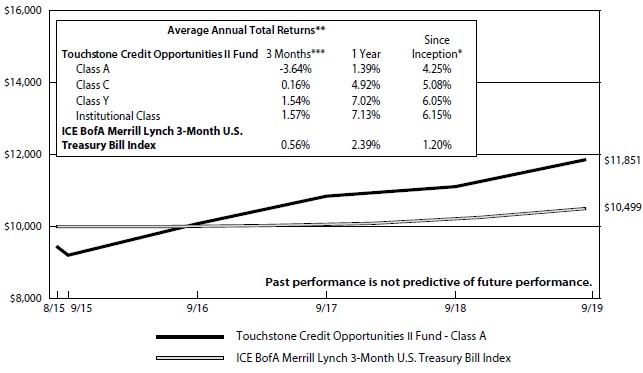

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Credit Opportunities II Fund - Class A* and the

ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of the Fund was August 31, 2015. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

| *** | Not Annualized. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged index of Treasury securities maturing in 90 days that assumes reinvestment of all income.

13

Management’s Discussion of Fund Performance(Unaudited)

Touchstone High Yield Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Touchstone High Yield Fund seeks a high level of income. Capital appreciation is a secondary consideration. The Fund primarily invests in non-investment-grade securities.

Fund Performance

The Touchstone High Yield Fund (Class A Shares) outperformed its benchmark, ICE BofA Merrill Lynch High Yield Cash Pay Index, for the 12-month period ended September 30, 2019. The Fund’s total return was 7.08 percent (calculated excluding the maximum sales charge) while the benchmark’s total return was 6.34 percent.

Market Environment

Over the 12-month period, the high yield market was driven by a handful of larger economic movements that significantly affected the asset class and its returns. Events with the largest impact included economic volatility surrounding political rhetoric, slowing global economic growth and trade policy, particularly between the U.S. and China. The fourth quarter of 2018 was a severe risk-off quarter as concerns over global growth and the pace of the U.S. Federal Reserve Board’s (Fed) interest rate increases mounted. Risk assets rallied in the first quarter of 2019 after the Fed and other major central banks around the world adopted a more dovish stance. The latter half of the last twelve months included large bouts of volatility with more muted returns.

The U.S. Treasury market saw a large and consistent rally for much of the period as yields of all maturity levels declined. In addition to the significant rally in U.S. Treasuries, there were times throughout the period where the U.S. Treasury curve inverted and the market began to worry about a possible recession or the increasing likelihood of one. Investment grade corporate securities with long durations and low spreads benefited the most from the decline in yields. Below-investment grade securities were impacted more severely; their typically shorter duration therefore were less advantaged by the intermediate-to-longer-term U.S. Treasury yield decreases and thus underperformed.

Within High Yield, BB- and B-rated bonds saw their spreads widen modestly while spread widening in CCC-rated bonds was much greater. This created a significant bifurcation of returns with BB- and B-rated bonds significantly outperforming their CCC-rated counterparts.

During the 12-month period, the top performing industries were Supermarkets, Banking, Life Insurance, and Wireless. These are all industries that are non-commodity related, less cyclical, and long in duration. The bottom performing industries were Oil Field Services and Independent Energy. These two industries are the only sizeable industries with a negative return over the twelve-month period. Despite oil staying reasonably range bound, investors have shunned owning this segment of the market over the past year on concerns of recession and increasing default rates.

Portfolio Review

Overall, sector allocation was neutral for the 12-month period. The Fund’s underweight to Independent Energy was the largest positive contributor as Energy was a bottom-performing sector. The Fund’s overweight positions to Food & Beverage and Cable/Satellite were additive as both are large non-cyclical industries that performed well as investors preferred issuers in more defensive sectors. An overweight to Pharmaceuticals and an underweight to Wireless were the two largest detractors.

14

Management’s Discussion of Fund Performance(Unaudited) (Continued)

Security selection positively contributed to performance and was driven by two main factors: an underweight to CCC-rated securities, and not owning several companies that went bankrupt or were trading as if they had defaulted. The largest headwinds to security selection revolved around two themes: the Fund overweight in Energy and an overweight in the Pharmaceuticals industry which was impacted by potential opioid litigation.

Outlook and Conclusion

We expect gross domestic product (GDP) growth to remain positive. Financial conditions are stable, fixed income market liquidity is adequate, credit fundamentals are solid with leverage and coverage at historical levels, there are limited maturities on the horizon and default rates are expected to remain low. This all provides a backdrop whereby we would expect credit markets to perform reasonably well.

We believe the greatest opportunity set for the Fund going forward would be either a continuation of the current environment of low growth mixed with relatively steady monetary policy or a meaningful sell-off in the high yield market. The Fund is positioned to emphasize credit selection over sector allocation as there are few apparent sector allocation opportunities in the current environment. Where there are sector opportunities, we have decided to express our views through quality (BB- versus B-rated) and not necessarily through a large under/overweight to the sector. Lastly, given the higher quality nature of the Fund, we would expect it to perform quite well in an environment where spreads widen significantly and CCC-rated bonds significantly underperform their BB- and B-rated counterparts.

In light of high yield’s relatively low spread and yield levels, the Fund is positioning toward the lower portion of our risk range. With the exception of the Energy segment, we believe that the BB- and B-rated segment of the market is fairly valued as fundamentals are solid, economic growth remains positive, and liquidity is available. The Fund maintains a substantially reduced CCC-rated bonds exposure. This defensive stance positions the Fund well in a market in which CCC-rated bonds continue to struggle due to weak economic growth and a persistently risk averse investor base.

15

Management’s Discussion of Fund Performance(Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone High Yield Fund - Class A* and the ICE BofA Merrill Lynch High Yield Cash Pay

Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares and Institutional Class shares was May 1, 2000, May 23, 2000, February 1, 2007, and January 27, 2012, respectively. Class C shares’, Class Y shares’ and Institutional Class shares’ performance was calculated using the historical performance of Class A shares for the periods prior to May 23, 2000, February 1, 2007 and January 27, 2012, respectively. The returns have been restated for sales loads and fees applicable to Class C, Class Y and Institutional Class shares. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 2.04% of the NAV (or 2.00% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

ICE BofA Merrill Lynch High Yield Cash Pay Index is an unmanaged index used as a general measure of market performance consisting of fixed-rate, coupon-bearing bonds with an outstanding par which is greater than or equal to $50 million, a maturity range greater than or equal to one year and must be less than BBB/Baa3 rated but not in default.

16

Management’s Discussion of Fund Performance(Unaudited)

Touchstone Impact Bond Fund

Sub-Advised by EARNEST Partners LLC

Investment Philosophy

The Touchstone Impact Bond Fund seeks current income. Capital appreciation is a secondary goal. The Fund invests primarily in fixed income securities or sectors that are considered undervalued for their risk characteristics.

Fund Performance

The Touchstone Impact Bond Fund (Class A Shares) underperformed its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, for the 12-month period ended September 30, 2019. The Fund’s total return was 9.59 percent (calculated excluding the maximum sales charge) while the benchmark’s total return was 10.30 percent.

Market Environment

The macroeconomic environment reversed course over the 12 months ended September 30, 2019. At the end of September 2018, markets were quite confident that the U.S. Federal Reserve Board (Fed) would continue to raise interest rates. However, trade rhetoric between the U.S. and China increased in the fourth quarter of 2018, sentiment became more negative, interest rates dropped and spreads widened significantly. The yield curve became inverted, as yields on the short-term U.S. Treasury bill were higher than yields on the ten-year U.S. Treasury note. Shortly after New Year’s Day, the Fed indicated that its outlook had changed from two rate hikes over the course of 2019 to zero. This helped restore some investor confidence, but interest rates continued to fall. The trade dispute expanded in the second quarter of 2019, when Japan, South Korea, Europe and Mexico were brought into the fray. This fueled more concerns about economic growth and pushed interest rates ever lower as investors sought out the safety of fixed income.

As gross domestic product (GDP) growth and employment data began to slow, and the threat of trade wars weighed on global and domestic growth, the Fed lowered the federal funds rate in July and followed up with a subsequent cut in September. These cuts marked the end of a rate hiking cycle which began in 2015. However, interest rates at the shorter end of the curve, on the six-month U.S. Treasury bill for example, only declined by a little more than 0.50 percent, leaving much of the yield curve inverted. These rate declines offered a supportive backdrop for fixed income securities.

The yield on Japanese government debt remained in negative territory. All told the amount of negative yielding global debt swelled from $6.4 trillion to $14.9 trillion over the last 12 months. This left global investors scrambling to find means of earning a positive income return on their fixed income investments. For international investors, the cost of currency hedging meant negative yielding global debt placed upward demand on spread products, as investors reached for yield wherever they could find it.

Lower quality bonds were in particularly high demand during the period as BBB-rated securities delivered the strongest levels of outperformance, whereas high-quality AAA-rated securities were the weakest performers. U.S. Agencies performed well as demand was strong across maturities, providing the sector with a tailwind. Agency Multi-Family Mortgage-Backed Securities (MBS) also outperformed. Despite having a similar government backstop, Agency Single-Family MBS did not perform as well. The volatile rate environment weighed heavily on these securities.

The performance of U.S. Investment Grade Credit was highly fragmented. Long bonds underperformed, while intermediate bonds outperformed. The Financials sector performed well across the maturity spectrum within Investment Grade Credit. Industrials were volatile and performance diverged between intermediate and long

17

Management’s Discussion of Fund Performance(Unaudited) (Continued)

issues, but overall outperformed. Utilities underperformed with particular weakness in longer maturity bonds. This was in large part due to PG&E Corp. being removed from the investment grade space due to the liabilities they have incurred after the California wildfires.

Portfolio Review

Due to the Fund’s overweight to spread products, macroeconomic events that shifted the demand profile for these products affected the Fund’s relative returns. Risk sentiment downshifting during the last 12-months created a headwind. The Fund’s overweight to U.S. Agencies and Agency Multi-Family MBS created a small tailwind. Within Investment Grade Credit, the Fund’s overweight to both Utilities and non-corporate credit (e.g. taxable municipals) were the largest detractors of relative performance. Security selection played an important role in performance during the period. Due to the asymmetric return profile fixed income provides, what is not owned is often just as important as what is owned. The Fund did not own PG&E Corp., so the overweight to Utilities did not have the same negative effect on the portfolio as it did on the benchmark. Security selection within U.S. Agencies and Agency Multi-Family MBS also benefited the portfolio.

The Fund does not make any active interest rate bets and, accordingly, the Fund’s effective duration was approximately in line with that of the benchmark at the end of the period. By approximately matching the benchmark’s duration, the Fund’s interest rate risk is effectively equal to that of the benchmark over time. Furthermore, while changes in the yield curve can impact total returns, the Fund attempts to remain approximately curve neutral. With this approach, changes in the yield curve tend to have little effect on the relative performance of the Fund, but given the Fund was only 90 percent of the benchmark’s duration coming into the declining rate environment, the lower duration did detract from performance over the relatively short period. Throughout an investment cycle, these small effects should average approximately zero.

Outlook

Despite the many negative headlines, the economy is still growing, unemployment is low, wages are growing, banks are well capitalized, corporations are reducing debt and household debt service ratios finished near their best levels dating back to 1980. A strong economy is fundamentally positive for spread products. If these items do turn negative, it appears central banks across the globe are prepared to act quickly with easy money policies. This would presumably force already low global yields even lower. The low rate environment could very well drive demand for spread securities from a wide set of investor bases as these investors are starved for yield. If the economy remains on pace, spread sectors should not only perform well due to their higher yield, but could see additional demand as the borrowers continue to make good on their debt obligations. The high quality nature of the Fund would also play an important role in this situation. In any case, our bottom-up fundamental work on these issuers continues to provide us with confidence that the high-quality nature of the portfolio coupled with its spread advantage has the Fund well positioned moving forward. Interest rates are notoriously difficult to forecast. Without being able to predict where interest rates will head next or how much volatility will occur in getting there, we view the additional structure built into the Fund’s portfolio as an important leg for a fixed income portfolio to be able to stand on. As such, we believe the Fund is positioned well and maintains a discipline that balances risk and return objectives.

18

Management’s Discussion of Fund Performance(Unaudited) (Continued)

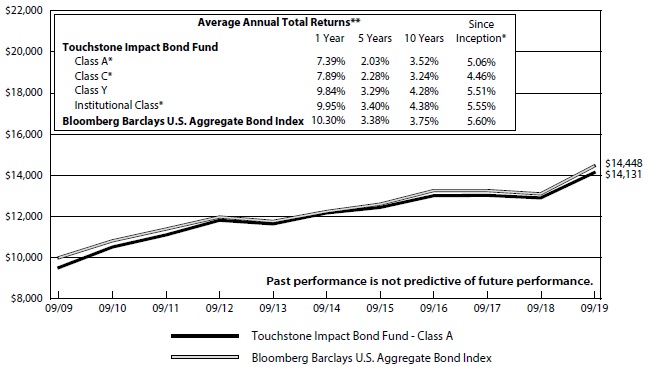

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Impact Bond Fund - Class A* and the

Bloomberg Barclays U.S. Aggregate Bond Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares and Institutional Class shares was August 16, 2010, August 1, 2011, November 15, 1991 and August 1, 2011, respectively. Class A shares’, Class C shares’ and Institutional Class shares’ performance was calculated using the historical performance of Class Y shares for the periods prior to August 16, 2010, August 1, 2011 and August 1, 2011, respectively. The returns have been restated for sales loads and fees applicable to Class A, Class C and Institutional Class shares. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 2.04% of the NAV (or 2.00% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. investment grade, fixed rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and ten years.

19

Management’s Discussion of Fund Performance(Unaudited)

Touchstone International ESG Equity Fund*

Sub-Advised by Rockefeller & Co. LLC

Investment Philosophy

The Touchstone International ESG Equity Fund seeks long-term growth of capital. The Fund primarily invests in equity securities of non-U.S. companies and generally focuses on larger, more established companies. The Fund selects investments based on an evaluation of a company’s sustainability and impact practices which considers environmental, social and governance (ESG) impacts and risks of a company, how well the company manages these impacts and risks and ascertains the company’s willingness and ability to take a leadership position in implementing best practices.

Fund Performance

The Touchstone International ESG Equity Fund (Class A Shares) outperformed its benchmark, the MSCI All Country World ex-USA Index, for the 12-month period ended September 30, 2019. The Fund’s total return was -0.81 percent (calculated excluding the maximum sales charge), while the total return of the benchmark was -1.23 percent.

Market Environment

The markets experienced another roller-coaster ride marked by elevated risk-off sentiment as reflected in the collapse in sovereign bond yields, the outperformance among defensive stock sectors and the underperformance of cyclical sectors. There were a few key developments. The Sino-U.S. trade war escalated further as the U.S. imposed additional tariffs. A drone and missile attack was carried out on Saudi Arabia’s oil field that disrupted the country’s oil production. However, the surge in crude prices turned out to be short-lived as production was restored and the U.S. offered to release oil from its strategic petroleum reserves. The European Central Bank and the U.S. Federal Reserve Board (Fed) cut interest rates, with the former also restarting quantitative easing in November.

Portfolio Review

Prior to the Fund’s manager transition at the end of August 2019, solid stock selection in the Communication Services, Consumer Staples, Information Technology and Real Estate sectors positively contributed to performance. Coca-Cola European Partners PLC (Consumer Staples sector), Crown Castle International Corp. (Real Estate sector) and Texas Instruments Inc. (Information Technology sector) performed well in a volatile equity market, and generally maintained solid earnings. Detractors included most Energy stocks, led by Occidental Petroleum Corp. and Total SA driven by weak oil and natural gas prices. Other detractors included Pfizer Inc. (Health Care sector) which announced weaker earnings guidance for 2019, earlier in the year. Additionally, Pfizer announced the sale of its Upjohn subsidiary to Mylan NV (Health Care sector) in late July, to which the market responded negatively.

In the final month of the 12-month period, contribution from stock selection and sector exposures were relatively neutral. The Fund’s positive stock selection in Industrials, Consumer Discretionary and Materials sectors was offset by selection within the Health Care, Consumer Staples and Financials sectors. Many of the Fund’s holdings are domiciled in countries whose currency depreciated against the U.S. dollar, further detracting from relative returns during the final month.

Outlook

We continue to have a neutral view for the equity market. Synchronized easing around the world and some targeted fiscal stimulus should help raise valuations, but weakening fundamentals are likely to lower earnings expectations. We suspect it will result in a range-bound market for the remainder of 2019.

*Effective August 23, 2019, the Fund changed its name, principal investment strategies, benchmark and sub-advisor. Consequently, prior period performance would have been different if the Fund had not been managed by the prior sub-advisor using that sub-advisor’s equity income strategy.

20

Management’s Discussion of Fund Performance(Unaudited) (Continued)

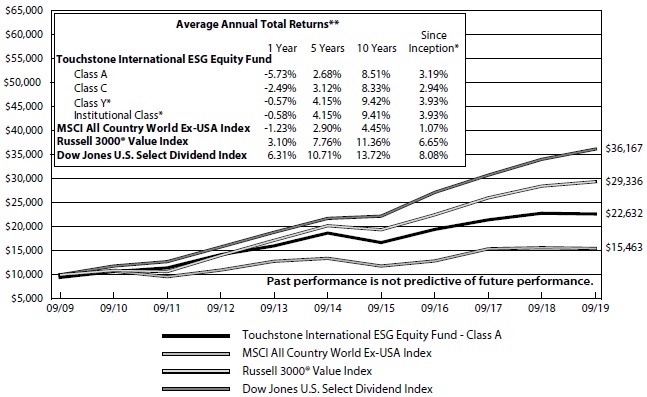

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone International ESG Equity Fund - Class A*, the MSCI All Country World Ex-USA

Index, Russell 3000® Value Index and Dow Jones U.S. Select Dividend Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares and Institutional Class shares was December 3, 2007, December 3, 2007, August 12, 2008 and August 23, 2019, respectively. Class Y shares’ and Institutional Class shares’ performance was calculated using the historical performance of Class A shares for the periods prior to August 12, 2008 and August 23, 2019, respectively. The returns have been restated for sales loads and fees applicable to Class Y and Institutional Class shares. The returns of the indexes listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Notes to Chart

MSCI All Country World Ex-USA Index is an unmanaged capitalization-weighted index composed of companies representative of both developed and emerging markets, excluding the USA.

Russell 3000® Value Index measures the performance of those Russell 3000 companies with lower price-to-book ratios and lower forecasted growth values.

Dow Jones U.S. Select Dividend Index measures 100 leading U.S. dividend-paying companies.

Frank Russell Company (FRC) is the source and owner of the Russell 3000® Value Index data contained or reflected in this material and all trademarks and copyrights related thereto. The material may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a Touchstone

21

Management’s Discussion of Fund Performance(Unaudited) (Continued)

Investments presentation of the data, and FRC is not responsible for the formatting or configuration of this material or for any inaccuracy in the presentation thereof.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI.

22

Management’s Discussion of Fund Performance(Unaudited)

Touchstone Mid Cap Fund

Sub-Advised by The London Company

Investment Philosophy

The Touchstone Mid Cap Fund seeks long-term capital growth by investing primarily in common stocks of mid-cap U.S.-listed companies. The Fund utilizes a bottom-up security selection process that screens potential investments against a proprietary quantitative model for return on capital, earnings-to-enterprise value ratio, and free cash flow yield. Its goal is to purchase financially stable companies that are believed to consistently generate high returns on unleveraged operating capital, are run by shareholder-oriented management and are trading at a discount to their respective private market values.

Fund Performance

The Touchstone Mid Cap Fund (Class A Shares) outperformed its benchmark, the Russell Midcap® Index, for the 12-month period ended September 30, 2019. The Fund’s total return was 15.34 percent (calculated excluding the maximum sales charge) while the benchmark’s total return was 3.19 percent.

Market Environment

U.S. stocks turned in a mixed performance over the trailing 12-month period. Quality and yield factors performed well. Value has led growth for mid-cap companies.

The period was notable for the return of volatility. The year began with concerns over the prospects of increasing rate hikes from the U.S. Federal Reserve Board (Fed). The Fed increased rates in December 2018 after increasing rates by the same amount in September 2018. Concerns over slowing global growth, potentially higher interest rates, and tariffs led to a broad sell off in the fourth quarter of 2018. As the period progressed, the U.S. economy showed solid albeit slowing growth and the market rallied strongly to start the year. Later in the period, investors grew concerned over continued evidence of a slowing economy with the yield curve inverting during the second quarter of 2019. This led to accommodative policy from the Fed, which materialized with two rate cuts in the third quarter of 2019, as the Fed noted weakness in capital spending, as well as exports, as rationale for lowering the rate.

Portfolio Review

During the 12-month period, the Fund benefited from stock selection and sector allocation. At the sector level, an underweight to both Energy and Health Care had a positive impact on relative performance, partially offset by the negative impact of an underweight to the Utilities and Real Estate sectors. Stock selection was most additive in the Industrials and Materials sectors while the Consumer Staples, Information Technology and Communication Services sectors detracted slightly.

Among the individual stocks that contributed to Fund performance were Armstrong World Industries, Inc., Copart, Inc. (both from the Industrials sector), Ball Corporation, (Materials sector), Entegris, Inc. (Information Technology sector), and Dollar Tree Stores, Inc. (Consumer Discretionary sector). Armstrong World Industries, a floor and ceiling building materials producer, performed well during the period as interest rates declined, assuaging fears surrounding the construction end market. Furthermore, Armstrong settled a lawsuit with Rockfon that had claimed anti-competitive measures by Armstrong, so this is one more risk overhang behind them. We continued to like Armstrong’s strong competitive position and economic moat. Copart, a provider of online vehicle auction services, continued to post strong results including top-line growth, margin improvement, and better than expected expense control. The fundamentals and trends remain strong as both volume and pricing grew double-digits. Copart continued to gain share in the market for salvaged vehicles. The company has focused on investing more in its international business, particularly Germany. We believe this should give the company

23

Management’s Discussion of Fund Performance(Unaudited) (Continued)

a long runway for success in the future. Ball Corporation, a manufacturer of metal packing for food and consumer products, has been one of the top performing stocks in the Fund in 2019. The volume tailwinds continued to be impressive in metal can manufacturing, and we continue to have a high degree of confidence in management to execute and allocate capital wisely. Entegris, a maker of integral parts for the manufacturing of semiconductors and disc drives, continued to rally and take share in the specialty materials and filtration products business. The company reaffirmed its full year guidance and we believe the outlook looks positive. Entegris is showing margin improvement and higher sales volumes, improved mix, and the start of realization of cost reductions should help expand margins. The company is well positioned to benefit from increasing materials needed in its material/contamination control business.

Among the individual stocks that detracted from performance were Tiffany & Co. (Consumer Discretionary sector), Energizer Holdings, Inc.(Consumer Staples sector), Citrix Systems Inc., CDK Global Inc. (both Information Technology sector), and Fox Corporation (Communication Services sector). Tiffany, a luxury jewelry producer and retailer, came under pressure ahead of the first quarter earnings release. Bottom-line results came in a bit ahead of expectations, but it was a low quality beat with weak tourist spending weighing on the top-line. Soft tourist spending driven largely by Chinese weakness is expected to continue, and management lowered earnings per share guidance slightly for the full year. The stock was sold in the third quarter of 2019. Energizer Holdings, a portfolio of consumer brands primarily focused on batteries, reported a weak second quarter and the stock declined over 10 percent. The biggest negative in the release was the acquired auto care business, which is driving a reduction to top line guidance for fiscal 2019. While the acquired businesses may be challenged, Energizer’s legacy battery business is still posting good numbers. The stock was also sold in the third quarter. Citrix Systems’, a provider of networking solutions for remote and secure access, stock price lagged in 2019 reflecting weaker than expected revenue growth. We believe some of the revenue weakness reflects the move to more subscription based pricing and may be masking positive changes at the company. Citrix has simplified its product lineup, reduced costs, and moved more business to the cloud. These changes should lead to higher margins, which we believe is not reflected in the stock price today. CDK Global, a provider of technology solutions to auto retailers, is a relatively new Fund holding. It has faced a few noisy quarters given some of the seasonality of the business and negative news around its advertising business, which have negatively impacted the stock. However, the company has shown strong dealer site growth and its core auto software business remains healthy. CDK is gaining operating leverage within the subscription business and operating efficiencies from the business transformation plan. We remain attracted to the high barriers to entry and oligopolistic nature of the industry. Fox Corporation, a news and sports entertainment producer, was added to the Fund during the third quarter. The stock has underperformed so far reflecting concerns around accelerated cord cutting. While we recognize the threat to the business, we believe Fox is better insulated given its focus on sports and live news. We are encouraged by recent NFL viewership trends and Rupert Murdoch’s recent insider buys. We are attracted to FOX’s strong cash flows, solid balance sheet, and history of shareholder returns at the legacy company.

The Fund initiated new positions in Perrigo Co. PLC (Health Care sector), Lamb Weston Holdings Inc. (Consumer Staples sector), CDK Global Inc. (Information Technology sector), Allison Transmission Holdings (Industrials sector), Fox Corporation (Communication Services sector) and HD Supply Holdings Inc. (Industrials sector). Perrigo maintains leading market share (65-70%) in private label over-the-counter drugs in the United States. Backed by a world-class supply chain system, Perrigo’s private label drugs provide tremendous value to major chain stores like Walgreens, CVS, and Walmart since these products provide a higher margin for chain stores than their innovator/branded counterparts (despite being cheaper for consumers). The company generates high teens operating margins along with consistent revenue and cash flow. While a solid business, our investment thesis also relies on new CEO, Murray Kessler, successfully leading the company as he did at both U.S. Smokeless Tobacco Company and Lorillard Tobacco Company. We believe there are a number of potential catalysts that will drive shareholder value in the near- to medium-term. Lamb Weston, a producer of potato products, has

24

Management’s Discussion of Fund Performance(Unaudited) (Continued)

been a long-term holding in another London Company strategy and was added to the Fund after weakness in the stock price mostly tied to concerns around cost pressure and new capacity coming online. We believe the stock is undervalued and do not believe these are material or structural changes. It is a high margin, high return business with an experienced management team. The tight capacity and supply/demand dynamics for the frozen potato market remain favorable. Lamb Weston has been offsetting rising costs with price increases. North America capacity utilization has been over 100% for a few years, so the additional capacity coming online will potentially help alleviate overworked plants but will also be absorbed by the demand. Lastly, Lamb Weston initiated a buyback program for the first time ever in the fourth quarter of 2018, which we view favorably. CDK Global is a provider of integrated information technology and digital marketing solutions to the automotive retail industry, which include dealerships and auto manufacturers. Its core product is the dealership management system (DMS). A DMS provides a centralized, integrated application for dealerships to run effectively. Its functions include everything from inventory management and payroll to vehicle loan process and more. The total cost for a DMS is relatively low. The vast majority of CDK’s revenues are subscription based, i.e. recurring cash flow with 5-year or longer contracts. The company maintains over 40 percent share in this oligopolistic industry with high barriers to entry. CDK maintains a manageable level of net debt with room to optimize the capital structure over time. Allison Transmission Holdings is the world’s leading manufacturer of automatic transmissions for medium- and heavy-duty trucks/buses and military vehicles. Our conviction is due to the company’s particularly wide moat in the automatic transmissions business. In fact, manual transmissions are Allison’s primary competition rather than other manufacturer’s automatic transmissions products. This wide moat leads to attractive margins and returns on capital. The company has the ability to optimize the balance sheet and the stock trades at an attractive valuation. Fox Corporation was created in a spin-off after legacy 21st Century Fox merged with The Walt Disney Company in March of 2019. Fox Corporation owns two of the five most watched television networks (Fox Broadcast and Fox News). The company is focused on news and sports, which command live viewership and large audiences. While viewership among consumers is moving to watching shows on delay, Fox is less susceptible to this risk as the demand for live news and sporting events remains strong. Home Depot Supply is a North American industrial distributor operating in two segments, Facilities Maintenance (FM) and Construction & Industrial (C&I). HDS has the leading position in its respective markets, but only a 5 percent market share in the FM business and 8 percent market share in the C&I business. The FM business has recession-resilient qualities because customers can only defer maintenance, repair, and operations activities to a point, which makes the revenue somewhat recurring in nature. The company’s balance sheet is strong, which gives it the ability to optimize the capital structure, and it trades at an attractive valuation.

The Fund sold its positions in Progressive Corporation (Financials sector), Deckers Outdoor Corporation, Tiffany & Co., Whirlpool Corporation (Consumer Discretionary sector), and Energizer Holdings, Inc. (Consumer Staples sector).

Outlook

Looking ahead, we maintain a mixed view of stocks and expect continued volatility in the months ahead. The key will be the direction of the U.S. economy. On the positive side, the U.S. consumer remains in good shape reflecting a strong labor market, with unemployment near 3.5 percent and average hourly earnings increasing roughly 3.0 percent. This is important as consumer spending represents 70 percent of U.S. gross domestic product (GDP). Low inflation, low interest rates, and a possibly more accommodative Fed are other positive factors. In terms of future growth, we believe the U.S. economy can continue to generate annualized real GDP growth in the 1-2 percent range.

While the consumer side of the economy is solid, there are warning signs in other parts of the economy. The most recent ISM manufacturing survey showed that manufacturing weakness in the U.S. has deepened and broadened. Demand has clearly slowed, negatively impacted by both previously enacted and proposed tariffs as well as weaker exports driven by soft foreign demand. The risk is that the manufacturing slowdown and

25

Management’s Discussion of Fund Performance(Unaudited) (Continued)

impact of tariffs could spill over to the services side of the economy. We are not predicting a recession in the near term, but the odds of a recession have increased in recent months. Another of the risks we see in the market is the increasing amount of corporate leverage, much of which is at the bottom of investment grade. If the economy slows, much of this debt could be downgraded, which would have repercussions well beyond the fixed income markets.

The Fund holds competitively advantaged businesses (judged by return on capital) with stronger balance sheets (lower net debt/EBITDA-earnings before interest, taxes, depreciation and amortization) than the broader market. We believe the Fund is positioned well based on the strength of the companies held and the defensive potential of its portfolio.

26

Management’s Discussion of Fund Performance(Unaudited) (Continued)

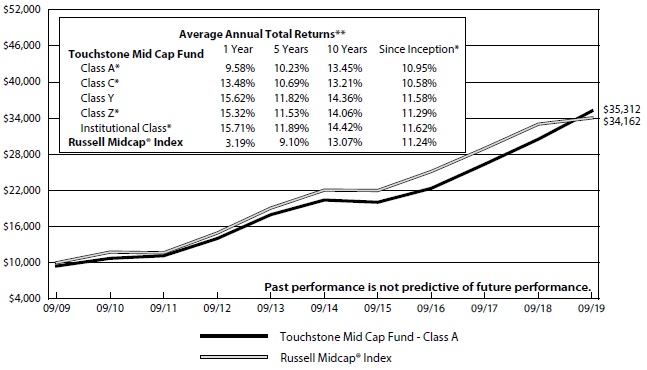

Comparison of the Change in Value of a $10,000 Investment in the Touchstone

Mid Cap Fund - Class A* and the Russell Midcap®Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares, Class Z shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares, Class Z shares and Institutional Class shares was May 14, 2007, May 14, 2007, January 2, 2003, April 24, 2006 and January 27, 2012, respectively. Class A shares’, Class C shares’, Class Z shares’ and Institutional Class shares’ performance was calculated using the historical performance of Class Y shares for the periods prior to May 14, 2007, May 14, 2007, April 24, 2006 and January 27, 2012, respectively. The returns have been restated for sales loads and fees applicable to Class A, Class C, Class Z and Institutional Class shares. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net assets value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares, Class Z shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Notes to Chart

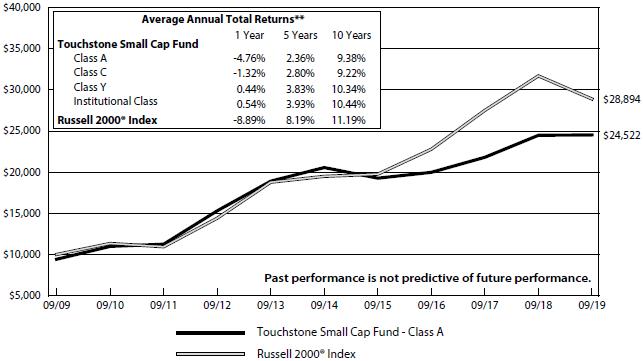

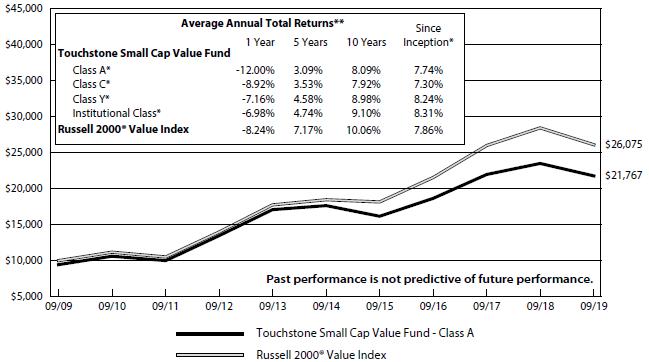

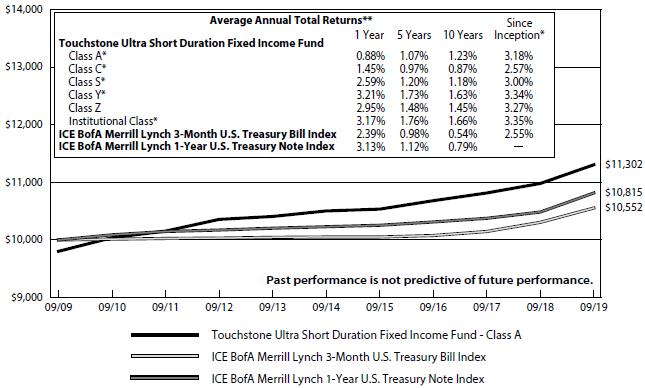

Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000® Index.