In May 2004, upon recommendation from the Compensation Committee, the Board of Directors approved changes to the outside Directors’ compensation plan effective July 1, 2004 and attached as Exhibit A to our Governance Principles which is available on our website atwww.spherion.com under the Corporate Governance tab found in the Investor Relations section. Such changes were based on advice and recommendation from the Compensation

Committee’s independent compensation consultant, Frederic W. Cook & Co., Inc. Recommendations were based on peer company reviews and the changes adopted resulted in the elimination of stock option grants to non-employee directors, an increase in the amount of DSUs awarded to directors, and an increase in the retainers paid to committee chairpersons.

Non-employee directors receive an annual retainer. The annual retainer is determined by the Board each year and is effective for a twelve-month period commencing on July 1stof such year. The Board may designate the manner in which the annual retainer shall be payable including, but not limited to, in cash, in shares of our Common Stock or in any combination thereof, and may permit up to 100% of the annual retainer to be deferred and paid to the directors in the form of DSUs. The annual retainer payable to each non-employee director is currently set at $35,000.

Our Chairman receives an additional annual retainer in the amount of $100,000 payable in cash, DSUs or stock options, at the election of the Board. In 2004, the Board elected to pay the Chairman in DSUs, granting him 10,000 DSUs. In addition, the Compensation Committee of the Board of Directors approved a one-time grant of DSUs to the Chairman in an amount equal to $125,000 based on the value of the underlying Common Stock as of the closing price on July 1, 2004. This grant was in recognition of his significant workload during 2004 due to the absence of an active Chief Executive Officer. In addition, the Chairperson of the Compensation Committee and the Chairperson of the Nominating Committee each receive an additional annual retainer in the amount of $10,000, payable in cash. The Chairperson of the Audit Committee receives an additional annual retainer in the am ount of $20,000, payable in cash.

Additionally, non-employee directors are compensated at the rate of $2,000 per Board meeting attended and $1,500 per Committee meeting attended, each payable in cash. Attendance fees are not paid for Board or Committee meetings that, in the judgment of the Chairperson thereof, are not of sufficient length or significance to warrant an attendance fee. Directors are reimbursed for expenses incurred by them in connection with our business.

Each non-employee director is entitled to receive an annual grant of DSUs in an amount equal to $50,000 based on the value of the underlying Common Stock, vesting on the first anniversary of the date of grant. Five thousand (5,000) DSUs were granted to each non-employee director on July 1, 2004 and will vest on July 1, 2005. In addition, Messrs. Morrison and Victory participate in certain of our health benefit plans for which they pay the entire premium.

Non-employee members of the Board of Directors are required to meet certain stock ownership guidelines. Each are required to own and hold a minimum of 10,000 shares of our Common Stock. Vested DSUs count toward this requirement. All of our current directors have already met the stock ownership requirement, except for Ms. Szostak who just joined the Board a few weeks before the date of this proxy statement. New directors have two years from the time of election to the Board to meet this goal.

What are the standing committees of the Board?

The standing committees of the Board include: the Audit Committee, the Compensation Committee, the Corporate Governance Committee, the Nominating Committee and the Executive Committee. The following table sets forth Committee memberships as of the date of this Proxy Statement.

| | | | | | | | | | | | | | | | | | | | | |

Director

| | Audit

Committee

| | Compensation

Committee

| | Corporate

Governance

Committee

| | Nominating

Committee

| | Executive

Committee

|

| Steven S. Elbaum | | | | | | | | | | | ** | | | | | | | | ** | |

| William F. Evans | | | ** | | | | | | | | * | | | | | | | | | |

| James J. Forese | | | * | | | | * | | | | * | | | | | | | | * | |

| Roy G. Krause | | | | | | | | | | | | | | | | | | | * | |

| J. Ian Morrison | | | | | | | ** | | | | * | | | | * | | | | | |

| David R. Parker | | | * | | | | | | | | * | | | | * | | | | * | |

| Anne Szostak | | | | | | | | | | | * | | | | | | | | | |

| A. Michael Victory | | | | | | | * | | | | * | | | | ** | | | | * | |

* Member

** Chair

10

The functions of the Audit Committee and its activities during fiscal year ended December 31, 2004 (“Fiscal 2004”) are described below in theAudit Committee Report. The Committee met twelve times during Fiscal 2004. All members of the Audit Committee are “independent” within the meaning of the listing standards of the New York Stock Exchange (“NYSE”) and meet financial literacy and management expertise requirements. Chairman William F. Evans has been designated by the Board as an “audit committee financial expert” within the meaning of Item 401(h) of Regulation S-K under the Securities Exchange Act of 1934. The charter of the Audit Committee is available on our website at www.spherion.com under the Corporate Governance tab found in the Investor Relations section.

All members of the Compensation Committee are “independent” within the meaning of the listing standards of the NYSE. The Compensation Committee grants stock and equity-linked awards, determines and approves, in consultation with the other independent directors, the Chief Executive Officer’s (“CEO”) annual compensation, evaluates the performance and approves the compensation of our executive officers including our Named Executive Officers , administers our equity-based plans, and reviews and makes recommendations to the Board concerning compensation for directors and approval of compensation plans requiring stockholder approval. The Compensation Committee held three meetings during Fiscal 2004. The charter of the Compensation Committee is available on our website at www.spherion.com under the Corporate Governance tab found in the Investor Relations section.

The Corporate Governance Committee is comprised of all of the independent, non-employee directors and meets regularly in executive session without the presence of the CEO or other management. These executive sessions are presided over by the Committee’s Chairman who is selected annually by the Board of Directors. The primary functions of the Corporate Governance Committee include reviewing and recommending to the Board: (i) roles and compositions of the various Board committees; (ii) evaluation of the performance of the Board; and (iii) evaluation of the senior management. This Committee held six meetings (one of which was uncompensated) during Fiscal 2004. The charter of the Corporate Governance Committee is available on our website at www.spherion.com under the Corporate Governance tab found in the Investor Relations section.

The Nominating Committee, whose primary function is to identify and recommend nominees for election as directors, held two meetings (one of which was uncompensated) during Fiscal 2004. All members of the Nominating Committee are “independent” within the meaning of the listing standards of the NYSE. The charter of the Nominating Committee is available on our website at www.spherion.com under the Corporate Governance tab found in the Investor Relations section.

The primary function of the Executive Committee is to exercise the authority of the Board during intervals between meetings of the Board, subject to limitations of Delaware law. The Executive Committee held no meetings during Fiscal 2004. The charter of the Executive Committee is available on our website at www.spherion.com under the Corporate Governance tab found in the Investor Relations section.

The Board of Directors has the ability to retain outside advisors as it deems necessary in the performance of its duties. The Board of Directors held ten meetings during Fiscal 2004. All directors attended at least seventy-five percent of the aggregate of (i) the total number of meetings of the Board and (ii) the total number of meetings held by all committees of the Board on which such director served during Fiscal 2004.

We do not have a formal policy regarding attendance by members of the Board of Directors at the annual meeting of stockholders, but we encourage directors to attend and historically, most have done so. All members of the Board of Directors attended the 2004 annual meeting of stockholders.

The Board of Directors has determined that all of its members are “independent” within the meaning of the listing standards of the NYSE, with the exception of Roy G. Krause, who is also our President and Chief Executive Officer.

How does the Board select director nominees?

The Nominating Committee considers candidates for Board membership suggested by its members and other Board members, as well as management and stockholders. The Committee has also retained, from time to time, a

11

third-party executive search firm to identify candidates upon request of the Committee. A stockholder who wishes to recommend a prospective nominee for the Board should notify the Company’s Corporate Secretary in writing with whatever supporting material the stockholder considers appropriate. The Nominating Committee will also consider whether to nominate any person nominated by a stockholder pursuant to the provisions of our Restated By-laws relating to stockholder nominations as described in “Stockholder Proposals” below.

Once the Nominating Committee has identified a prospective nominee, the Committee makes an initial determination as to whether to conduct a full evaluation of the candidate. This initial determination is based on whatever information is provided to the Committee with the recommendation of the prospective candidate, as well as the Committee’s own knowledge of the prospective candidate, which may be supplemented by inquiries to the person making the recommendation or others. The preliminary determination is based primarily on the need for additional Board members to fill vacancies or expand the size of the Board and the likelihood that the prospective nominee can satisfy the evaluation factors described below. If the Committee determines, in consultation with the Chairman of the Board and other Board members as appropriate, that additional consideration is warrante d, it may request the third-party search firm to gather additional information about the prospective nominee’s background and experience and to report its findings to the Committee. The Committee then evaluates the prospective nominee against the standards and qualifications set out in the Charter of the Nominating Committee, including:

| | | | | | |

| | | | • | | the prospective nominee’s ability to dedicate sufficient time, energy and attention to the diligent performance of his or her duties |

| | | | | | |

| | | | • | | the extent to which the prospective nominee contributes to the range of talent, skill and expertise appropriate for the Board |

| | | | | | |

| | | | • | | the prospective nominee’s character and integrity |

| | | | | | |

| | | | • | | the prospective nominee’s ability to be free of any conflict of interest |

The Committee also considers such other relevant factors as it deems appropriate, including the current composition of the Board, the balance of management and independent directors, the need for Audit Committee expertise and the evaluations of other prospective nominees. In connection with this evaluation, the Committee determines whether to interview the prospective nominee, and if warranted, one or more members of the Committee, and others as appropriate, interview prospective nominees in person or by telephone. After completing this evaluation and interview, the Committee makes a recommendation to the full Board as to the persons who should be nominated by the Board, and the Board determines the nominees after considering the recommendation and report of the Committee.

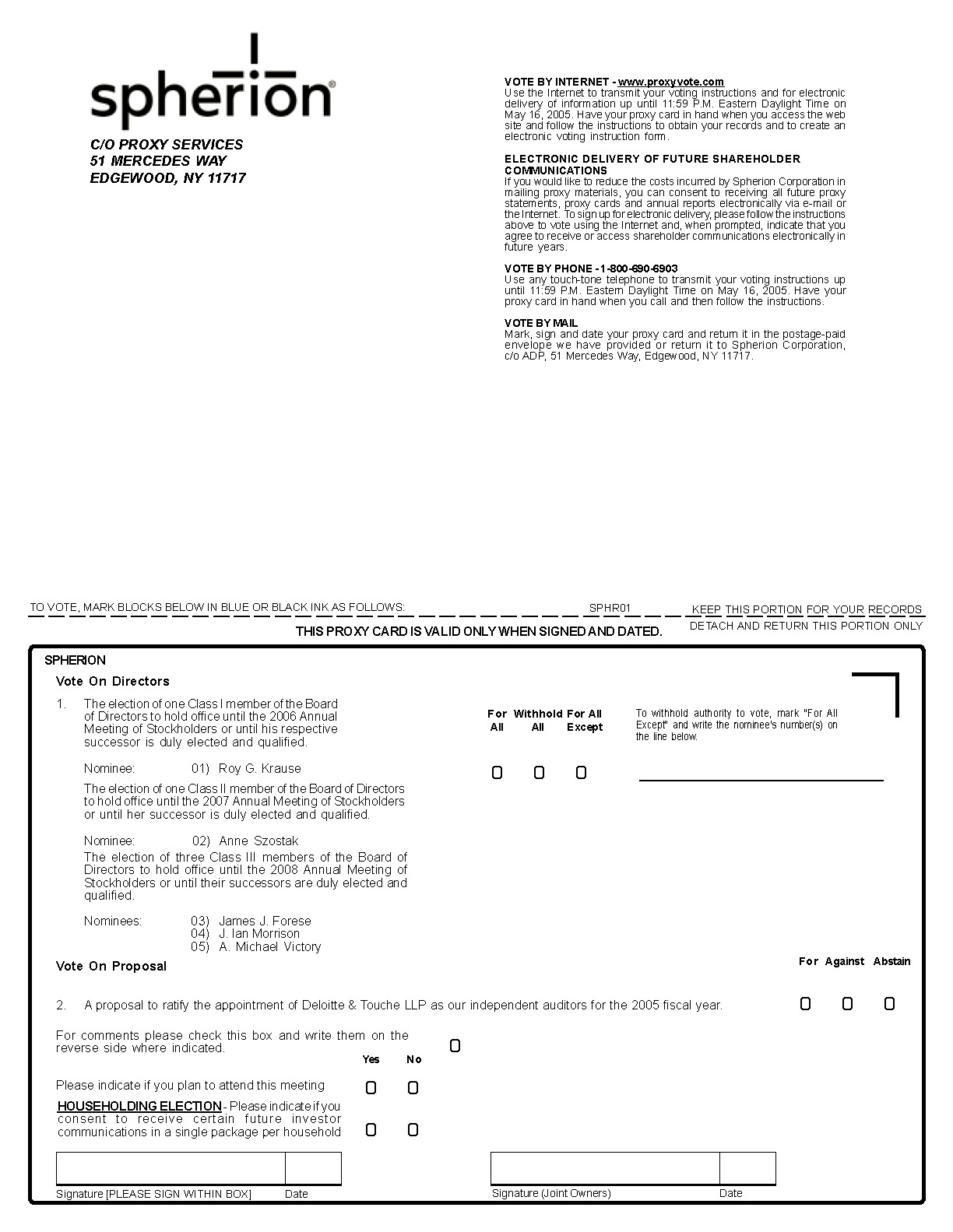

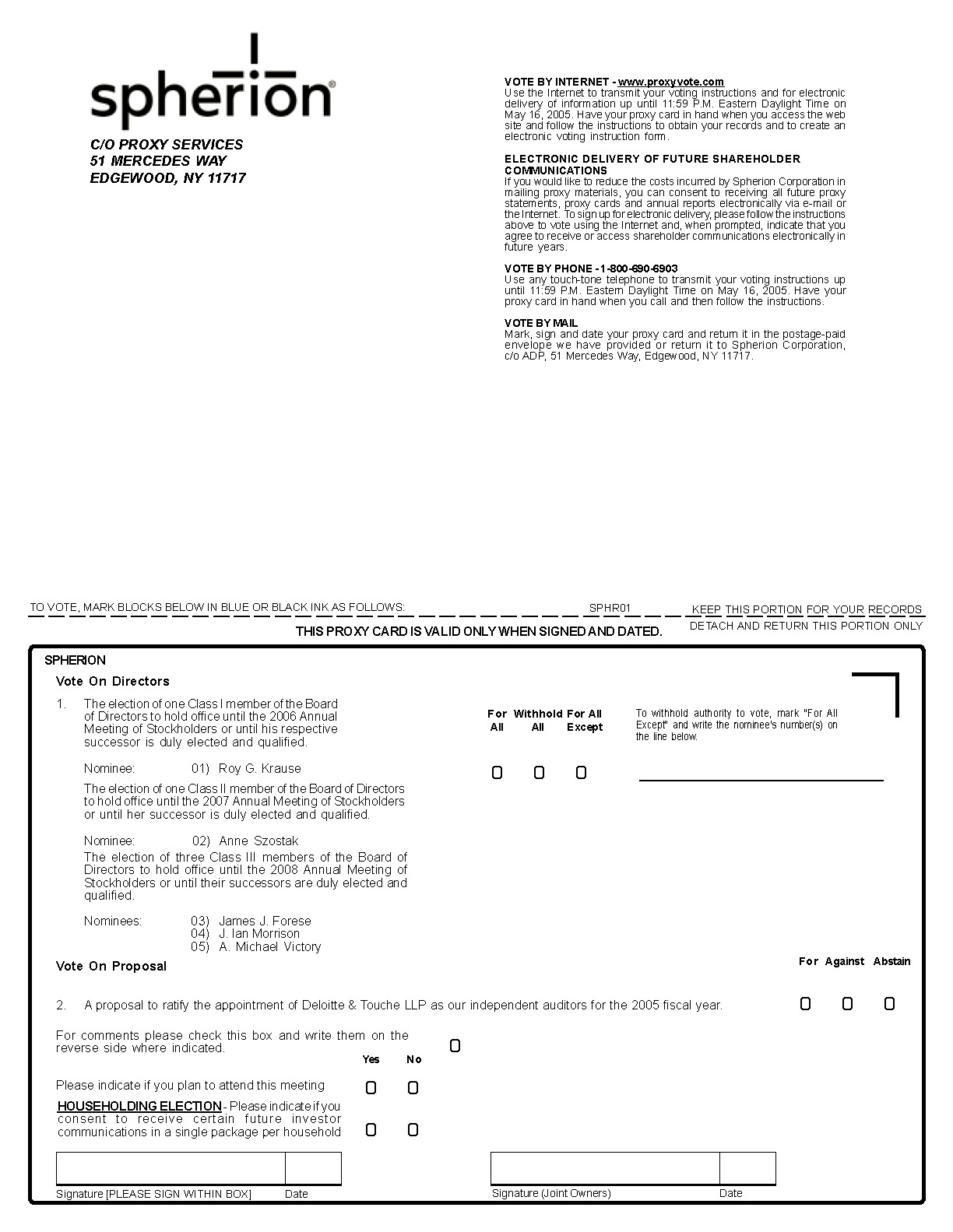

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH NOMINEE FOR CLASS I DIRECTOR, CLASS II DIRECTOR AND CLASS III DIRECTOR. IF YOU COMPLETE THE ENCLOSED PROXY CARD, UNLESS YOU DIRECT TO THE CONTRARY ON THAT CARD, THE SHARES REPRESENTED BY THAT PROXY CARD WILL BE VOTED “FOR” ALL THE NOMINEES.

12

AUDIT COMMITTEE REPORT

The following Report of the Audit Committee of the Board of Directors (the “Audit Committee”) of Spherion does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Spherion filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent Spherion specifically incorporates this Report by reference therein.

The Audit Committee’s purpose is to assist the Board of Directors’ oversight of:

| | | | | |

| | | • | | The integrity of our financial statements; |

| | | | | |

| | | • | | The integrity of our financial reporting process and systems of internal controls regarding finance and accounting; |

| | | | | |

| | | • | | Our compliance with legal and regulatory requirements; |

| | | | | |

| | | • | | The independent auditors’ qualifications, independence and performance; |

| | | | | |

| | | • | | The performance of our internal audit function; and |

| | | | | |

| | | • | | Communication among the independent auditors, management, the internal auditing department, and the Board of Directors. |

A more detailed description of the scope of the Audit Committee’s responsibilities and how they will be carried out is contained in the Audit Committee’s charter which is available on our website at www.spherion.com under the Corporate Governance tab found in the Investor Relations section.

The Audit Committee has implemented procedures to ensure that during the course of each fiscal year it devotes the attention that it deems necessary or appropriate to each of the matters assigned to it under the Audit Committee’s charter. To carry out its responsibilities, the Audit Committee held twelve meetings during Fiscal 2004. The Audit Committee regularly meets in executive sessions with our independent auditors and with our internal auditors, in each case without the presence of our management.

The members of the Audit Committee during Fiscal 2004 were William F. Evans (Chairman), James J. Forese and David R. Parker. Each member of the Audit Committee has certified that he is independent from us as such term is defined in Sections 303.01(B)(2)(a) and (3) of the NYSE’s listing standards and Chairman William F. Evans has been designated by the Board as an “audit committee financial expert” within the meaning of Item 401(h) of Regulation S-K under the Securities Exchange Act of 1934.

In discharging its oversight responsibility as to the audit process, the Audit Committee obtained from our independent auditors, Deloitte & Touche LLP, a formal written statement describing all relationships between the auditors and Spherion that might bear on the auditors’ independence consistent with Independence Standards Board Standard No. 1, as amended, “Independence Discussions with Audit Committees;” discussed with the auditors any relationships that may impact their objectivity and independence; and satisfied itself as to the auditors’ independence. The Audit Committee also discussed with management, the internal auditors and the independent auditors, the quality and adequacy of our internal controls and the internal audit function’s organization and responsibilities. The Audit Committee reviewed with both the independent a nd the internal auditors their audit plans, audit scope and identification of audit risks.

The Audit Committee discussed and reviewed with the independent auditors all communications required by auditing standards generally accepted in the United States of America, including those described in Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees” and, with and without management present, discussed and reviewed the results of the independent auditors’ examination of the financial statements. The Audit Committee also discussed the results of the internal audit examinations.

The Audit Committee reviewed our audited financial statements as of and for the fiscal year ended

13

December 31, 2004, with management and the independent auditors.Management has the responsibility for the preparation of our financial statements and the independent auditors have the responsibility for the examination of those statements.

Based on the above-mentioned review and discussions with management and the independent auditors, the Audit Committee recommended to the Board of Directors that our audited financial statements be included in its Annual Report on Form 10-K for the fiscal year ended December 31, 2004, for filing with the Securities and Exchange Commission.

Date: April 8, 2005

| | | | |

| | | BY THE 2004 AUDIT COMMITTEE, |

| | | | |

| | | William F. Evans, Chairman

James J. Forese

David R. Parker |

AUDIT AND NON-AUDIT FEES

The aggregate fees billed by Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, “Deloitte”), for professional services rendered for Fiscal 2004 and for the year ended December 26, 2003 (“Fiscal 2003”) are set forth below:

| | | | | | | | | |

| | | Fiscal 2004

| | Fiscal 2003

|

| Audit fees | | $ | 1,436,500 | | | $ | 849,000 | |

| Audit-related fees | | | 82,300 | | | | 80,600 | |

| Tax fees* | | | 733,500 | | | | 955,000 | |

| Other fees | | | 27,400 | | | | 34,300 | |

| Total fees | | $ | 2,279,700 | | | $ | 1,918,900 | |

*In Fiscal 2004 and Fiscal 2003, tax fees include $372,000 and $371,000, respectively, for tax compliance and preparation; the remaining tax fees are related to tax planning and advice.

Audit fees for Fiscal 2004 include $700,000 for the required audit of internal controls. Audit-related fees for both years include audits of benefit plans. The Audit Committee has considered and has agreed that the provision of services as described above are compatible with maintaining Deloitte’s independence.

Pre-Approval Policies and Procedures

The Audit Committee pre-approves the engagement of the independent auditor for all professional services. The Audit Committee approved all services performed by Deloitte during Fiscal 2004. The pre-approval process generally involves the full Audit Committee evaluating and approving the particular engagement prior to the commencement of services. However, the Audit Committee has delegated pre-approval authority to Mr. Evans, as Audit Committee Chairperson, for circumstances when it is impractical to hold a meeting of the full Audit Committee. In the event that Mr. Evans pre-approves an engagement, he is then required to report the pre-approval to the full Audit Committee at the next regularly scheduled Audit Committee meeting.

14

EXECUTIVE COMPENSATION

The following table sets forth the aggregate compensation earned during each of our three most recently completed fiscal years by President and Chief Executive Officer Roy G. Krause and the four other most highly compensated executive officers in Fiscal 2004 as well as former Chief Executive Officer Cinda A. Hallman (collectively, the “Named Executive Officers”).

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Annual Compensation

| | Long-Term Compensation (1)

Awards

| | | | |

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Other

Annual

Compen-

sation ($)

| | Restricted

Stock

Award(s)

($)(2)

| | Securities

Underlying

Options (#)(3)

| | | All Other

Compensation($)

|

Roy G. Krause

President and Chief Executive Officer | | | 2004

2003

2002 | | | $ | 495,000

495,000

495,000 | | | $ | 0

250,000

250,000 | | | $ | 144,825

0

541,725 | (4) | | $ | 0

574,425

0 | | | | 0

135,000

275,400 | | | $ | 2,322

2,322

2,322 | (5) |

Byrne K. Mulrooney

President, Staffing Services | | | 2004

2003

2002 | | | $ | 350,000

106,346

N/A | | | $ | 180,469

100,000

N/A | | | $ | 66,093

0

N/A | (6) | | $ | 0

37,462

N/A | | | | 0

152,500

N/A | | | $ | 540

40,077

N/A | (7) |

Eric Archer

President, Professional Services | | | 2004

2003

2002 | | | $ | 299,385

266,731

250,000 | | | $ | 199,853

405,216

83,047 | | | $ | 58,535

0 | (8) | | | 0

299,700

0 | | | | 0

70,000

46,065 | | | $ | 810

810

83,743 | (9) |

Mark W. Smith

Senior Vice President and Chief Financial Officer | | | 2004

2003

2002 | | | $ | 298,461

250,000

250,000 | | | $ | 50,000

0

56,636 | (10) | | $ | 43,447

0 | (11) | | $ | 0

387,700

0 | | | | 0

70,000

69,436 | | | $ | 540

540

311,191 | (12) |

Richard A. Lamond

Senior Vice President and Chief Human Resources Officer | | | 2004

2003

2002 | | | $ | 275,000

275,000

33,846 | | | $ | 25,000

0

0 | (13) | | $ | 0

40,759

0 | | | $ | 0

224,775

0 | | | | 0

52,500

50,000 | | | $ | 2,322

2,322

179 | (14) |

Cinda A. Hallman

Former Chief Executive Officer | | | 2004

2003

2002 | | | $ | 187,966

719,584

775,000 | | | $ | 0

0

0 | | | $ | 0

0

0 | | | $ | 0

0

0 | | | | 0

0

300,000 | | | $ | 4,353,761

2,322

2,322 | (15) |

| | | |

| (1) | | There were no Stock Appreciation Rights or Long-Term Incentive Plan Payouts to the listed individuals during fiscal years 2002, 2003 or 2004. |

| | | |

| (2) | | Represents grants of DSUs. A DSU represents the right to receive a share of Common Stock in the future after meeting service requirements or financial targets. The holder may elect to accept delivery of the common share underlying a DSU upon vesting or defer delivery until the future. Holders are not eligible to receive dividends on DSUs until receipt of the underlying common share. For 2002 grants, DSUs vest over a three-year period in cumulative increments of 33 1/3% per year beginning with the first anniversary of the date of grant. For grants in 2003, DSUs have a three-year cliff vesting based on achievement by us of certain revenue growth rates and earnings targets. There were no DSU grants in Fiscal 2004. The aggregate DSU holdings as of the end of Fiscal 2004 in number of shares and year-end value were 150,300 shares and $1,262,520 for Mr. Krause, of which 68,819 shares and $578,080 was vested and deferred; 37,500 shares and $315,000 for Mr. Mulrooney, of which 0 shares and $0 wa s v ested and deferred; 38,750 shares and $325,500 for Mr. Archer, of which 8,750 shares and $73,500 was vested and deferred; 79,241 shares and $665,624 for Mr. Smith, of which 17,250 and $144,900 was vested and deferred; and 22,500 shares and $189,000 for Mr. Lamond, of which 0 shares and $0 was vested and deferred. Due to Ms. Hallman’s retirement, she had no DSUs at the end of Fiscal 2004. |

15

| | | |

| (3) | | No stock options were granted in Fiscal 2004. Incentive stock options and non-qualified stock options were granted in 2002 and 2003 under the 2000 Plan and predecessor plans at an exercise price equal to the fair market value of the Common Stock on the dates of grant. These options have a ten-year term and become exercisable over a three-year period in cumulative increments of 33-% per year beginning with the first anniversary of the date of grant. |

| | | |

| (4) | | Represents taxes paid by us upon vesting of performance based DSUs. |

| | | |

| (5) | | Represents the imputed economic value of a death benefit provided by us for life insurance for Mr. Krause. |

| | | |

| (6) | | Includes $53,611 for relocation costs paid on behalf of Mr. Mulrooney pursuant to our relocation plan for a job-related relocation. These costs were comprised of temporary living expenses, moving and transition expenses as well as home purchase closing costs. Also includes $12,482 as taxes paid by us for such relocation expenses. |

| | | |

| (7) | | Represents the imputed economic value of a death benefit provided by us for life insurance for Mr. Mulrooney. |

| | | |

| (8) | | Represents taxes paid by us upon vesting of performance based DSUs. |

| | | |

| (9) | | Represents the imputed economic value of a death benefit provided by us for life insurance for Mr. Archer. |

| | | |

| (10) | | Represents a cash incentive payment relating to Mr. Smith’s 2004 performance granted outside of the terms of his 2004 incentive award plan. |

| | | |

| (11) | | Represents taxes paid by us upon vesting of performance based DSUs. |

| | | |

| (12) | | Represents the imputed economic value of a death benefit provided by us for life insurance for Mr. Smith. |

| | | |

| (13) | | Represents a cash incentive payment relating to Mr. Lamond’s 2004 performance granted outside of the terms of his 2004 incentive award plan. |

| | | |

| (14) | | Represents the imputed economic value of a death benefit provided by us for life insurance for Mr. Lamond. |

| | | |

| (15) | | Includes $822 as the imputed economic value of a death benefit provided by us for life insurance for Ms. Hallman; $2,939 as the fair market value of computer equipment transferred to Ms. Hallman and a cash severance payment of $4,350,000, both as part of Ms. Hallman’s retirement in April 2004. In addition, pursuant to the terms of Ms. Hallman’s separation agreement, we provide her with continuation of benefits under our health and welfare benefit plans until March 2007. |

16

The following table sets forth information with respect to the Named Executive Officers concerning the exercise of options during the fiscal year ended December 31, 2004, and unexercised options held as of the end of that year.

AGGREGATED OPTION EXERCISES IN THE FISCAL YEAR ENDED

DECEMBER 31, 2004 AND 2004 YEAR END OPTION VALUES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Shares Acquired on | | Value | | Number of Securities Underlying

Unexercised Options at Year End

(#)(1)

| | Value of Unexercised

In-the-Money Options at

Year End ($)(1)(2)

|

Name

| | Exercise (#)(1)

| | Realized

($)(1)(2)

| | Exercisable

| | | | | | Unexercisable

| | Exercisable

| | | | | | Unexercisable

|

Roy G. Krause

President and Chief Executive Officer | | | 0 | | | $ | 0 | | | | 466,233 | | | | | | | | 131,667 | | | | $382,992 | | | | | | | | $103,751 | |

Byrne K. Mulrooney

President, Staffing Services | | | 0 | | | | 0 | | | | 50,832 | | | | | | | | 101,668 | | | | 36,399 | | | | | | | | 72,801 | |

Eric Archer

President, Professional Services | | | 0 | | | | 0 | | | | 108,148 | | | | | | | | 56,667 | | | | 87,217 | | | | | | | | 24,900 | |

Mark W. Smith

Senior Vice President and Chief Financial Officer | | | 0 | | | | 0 | | | | 128,185 | | | | | | | | 60,001 | | | | 109,832 | | | | | | | | 33,202 | |

Richard A. Lamond

Senior Vice President and Chief Human Resources Officer | | | 0 | | | | 0 | | | | 50,833 | | | | | | | | 51,667 | | | | 68,999 | | | | | | | | 34,501 | |

Cinda A. Hallman (3)

Former Chief Executive Officer | | | 342,372 | | | | 1,336,614 | | | | 357,628 | | | | | | | | 0 | | | | 472,069 | | | | | | | | 0 | |

| | | |

| (1) | | The above table does not include information on DSUs. See Note (3) to the Summary Compensation Table for a description of the terms and other information regarding DSUs. |

| | | |

| (2) | | The value realized on the exercise of options and the value of unexercised in-the-money options at year end are determined by subtracting the exercise price for the options from the fair market value of the shares subject to the options as of the date of exercise or year end, respectively, multiplied by the number of shares. There can be no assurance that the value of “unexercised options” reported above will be realized, and any gains on exercise will depend on the value of our Common Stock on the date of exercise. |

| | | |

| (3) | | In connection with Ms. Hallman’s retirement in April 2004, the vesting of her unexercised stock options was accelerated. Her outstanding options terminate and expire on April 10, 2005. |

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

Our former CEO, Cinda A. Hallman, retired in April 2004. Ms. Hallman’s former employment agreement, a copy of which is filed as an exhibit to our Form 10-Q for the quarter ended March 30, 2001, provided her certain benefits upon her termination. Among other things, Ms. Hallman received a $4,350,000 cash severance payment; accelerated vesting with respect to unexercised stock options and DSUs; and the continuation of benefits under our health and welfare benefit plans until March 2007. In addition, Ms. Hallman agreed to certain non-competition, non-disparagement and confidentiality provisions as well as a full release and settlement of any and all claims against us. The full text of Ms. Hallman’s separation agreement is available as an exhibit to our Form 10-Q for the fiscal quarter ended March 26, 2004.

17

In October 2004, Roy G. Krause was appointed to the office of Chief Executive Officer as well as to the Board of Directors. Mr. Krause has been acting as our President and principal executive officer since July 2003 when Ms. Hallman began her medical leave. Byrne K. Mulrooney serves as President, Staffing Services. Eric Archer serves as President, Professional Services. Mark W. Smith serves as Senior Vice President and Chief Financial Officer. Richard A. Lamond serves as Senior Vice President and Chief Human Resources Officer. Mr. Krause serves in his role pursuant to an employment agreement entered into in May 2001, as amended through March 2005. Messrs. Mulrooney, Archer, Smith and Lamond serve in their respective roles pursuant to employment agreements entered into in November 2003, as amended through March 2005. All of these employment agreements provide for employment at will and, accordingly, may be terminated by either party thereto at any time for any reason. However, the employment agreements provide, among other things, that if we terminate the executive “without cause” (as such term is defined in the agreements), the executive would receive a cash severance payment, payable in a lump sum, in an amount equal to: (i) in the case of Mr. Krause, three times his annual base salary, plus his prorated target annual incentive payment for the year in which termination occurs; (ii) in the case of Messrs. Archer and Smith, one and one-half times the sum of the executive’s annual base salary plus his target annual incentive payment for terminations prior to January 1, 2006, and the executive’s annual base salary plus a prorated target annual incentive payment for terminations after January 1, 2006; and (iii) in the case of Messrs. Mulrooney and Lamond, the executive’s annual base salary plus a prorated target annual incentive payment. All of the employment agreements provide for base salary and annual incentive award targets as determined from time to time at the sole discretion of the Compensation Committee.

We also entered into Change in Control Agreements (the “CIC Agreements”) with Mr. Krause in May 2001 as amended through March 2005, and with Messrs. Mulrooney, Archer, Smith and Lamond in November 2003, as amended through March 2005. The CIC Agreements provide for certain benefits to be paid to these executives upon the occurrence of a Change in Control (as defined in the CIC Agreements), including the waiving of all restrictions and conditions applicable to any awards of restricted stock, and the vesting of stock options and DSUs and certain specified severance payments in the event that the employment of such executive is terminated following a Change in Control. Such severance includes a lump sum cash payment in an amount equal to: (i) three times the sum of the executive’s annual salary plus target annual incentive payment, in the case of Mr. Krau se and (ii) two times the sum of the executive’s annual salary plus target annual incentive payment, in the case of Messrs. Mulrooney, Archer, Smith and Lamond.

In March 2005, the employment agreements and CIC Agreements were amended as a result of changes made to the rules for taxation of deferred compensation. These amendments included (i) modifying the definition of “change in control” to mirror that of the new rules; (ii) changing the severance payment from a twelve month installment payout to a lump sum payout; and (iii) acknowledging that a six month delay in payment of certain deferred compensation upon termination is required for “key employees.”

Copies of the amended employment agreements and the amended CIC Agreements for Messrs. Krause, Mulrooney, Archer, Smith and Lamond, are filed as exhibits to our Form 10-K for the fiscal year ended December 31, 2004.

Compensation Committee Interlocks and Insider Participation

The 2004 Compensation Committee was comprised of J. Ian Morrison (Chairperson), James J. Forese and A. Michael Victory. None of these committee members have ever been an officer or employee of Spherion or any of our subsidiaries and none of our executive officers has served on the Compensation Committee or Board of Directors of any company of which any of our other directors is an executive officer.

18

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The following Report of the Compensation Committee of the Board of Directors (the “Compensation Committee”) of Spherion does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Spherion filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent Spherion specifically incorporates this Report by reference therein.

The Compensation Committee has prepared the following report on executive compensation. This report describes our current executive compensation program including the underlying philosophy of the program and the criteria on which executive compensation is based. This report also describes the compensation paid to our President and Chief Executive Officer, Roy G. Krause, during Fiscal 2004.

During Fiscal 2004, the Compensation Committee was composed entirely of independent outside directors. Their responsibilities include participating in the development and approval of compensation philosophy and policies; recommending to the Board of Directors compensation for the Board of Directors; reviewing and approving corporate goals and objectives with respect to compensation for the CEO; determining and approving, in consultation with the other independent directors, the CEO’s annual compensation, including salary, bonus, incentive and equity compensation; and reviewing and approving the compensation program for our executive officers, including our other Named Executive Officers, after receiving recommendations from the CEO. The Compensation Committee Charter can be found on our website at www.spherion.com under the Corporate Governance tab found in the Investor Relations section.

Other duties include administering our equity-based plans, including the 2000 Plan and the DSU Plan; and approving adoption of compensation plans not requiring stockholder approval and recommending to the Board approval of compensation plans requiring stockholder approval. The Compensation Committee also reviews total compensation for all others designated as subject to Section 16 of the Securities Exchange Act of 1934.

The Compensation Committee has retained the services of an outside consultant, Frederic W. Cook & Co., Inc. to provide information and advice on executive compensation issues.

Compensation Philosophy

Our executive compensation program consists of three main elements:

Base Salary

Base compensation is set to attract and retain qualified management, when combined with the other components of the compensation program.

Incentive Compensation

An opportunity to earn additional variable compensation under the annual incentive plan for yearly business success and individual performance.

Long-Term Incentives

Long-term incentives in the form of stock options and DSUs that will encourage stock ownership, reward executives for increases in stockholder value, and for achieving key performance goals.

The compensation program is designed to contribute to our viability and long-term success by meeting the following objectives:

| | | | | | |

| | | | • | | To attract, retain and motivate experienced and competent managers and professionals who are performance-oriented. |

| | | | | | |

| | | | • | | To reinforce a commitment to take action that will contribute to our long-term success. |

19

| | | | | | |

| | | | • | | To encourage ownership of our Common Stock so that management’s long-term financial interests are closely linked with the long-term interests of our stockholders. |

| | | | | | |

| | | | • | | To compensate fairly for financial and strategic success and the enhancement of stockholder value. |

Competitive Stance

For competitive comparisons, we obtain compensation data on other companies in the temporary service and staffing industry, general industry, service industry and on other growth companies. Industry-specific companies are also used for business-unit presidents. Some of the companies used in the peer group for the total stockholder return graph are included within the temporary service and staffing industry comparison group. Our policy is to offer base salaries that are competitive at the median of companies of similar size within the comparison groups, annual incentive compensation that could pay at median levels if pre-set performance and EPS goals are met and pay at above-median levels if the goals are exceeded, and long-term incentive awards that offer above-median opportunities.

Base Salaries

Base salaries are reviewed annually using competitive compensation information provided by nationally recognized consulting firms. Increases in base salaries are granted after considering relative competitive positions, individual performance and general salary increases within the rest of our organization. During Fiscal 2004, the base salaries for Mr. Archer and Mr. Smith were increased to reflect their expanded roles in Spherion.

Incentive Compensation

The Compensation Committee recommends to the Board target awards and performance measures for the Chief Executive Officer and determines target awards and performance measures for the Chief Executive Officer’s direct reports, including the Named Executive Officers. During Fiscal 2004, the annual incentive awards for all of the Named Executive Officers, except Messrs. Mulrooney and Archer were based 100% on EPS goals. Annual incentive awards for Messrs. Mulrooney and Archer were based 25% on EPS goals, 25% on net operating income targets and 50% on gross profit growth targets.

During Fiscal 2004, the annual incentive award targets for each of our Named Executive Officers were as follows: 70% of annual base salary for Mr. Krause; 75% of base salary for Mr. Mulrooney; 60% of annual base salary for Messrs. Archer, Smith and Lamond. Incentive award plans for Fiscal 2004 for the Named Executive Officers are filed as exhibits to our Form 10-K for the fiscal year ended December 31, 2004.

Annual incentive awards are typically paid after the end of the fiscal year. In Fiscal 2004, the EPS threshold was not met and no annual incentive award was paid to Mr. Krause. The Compensation Committee approved cash incentive payments relating to 2004 performance to Messrs. Smith and Lamond in recognition of their performance and contributions to Spherion. An annual incentive award was earned by and paid to Messrs. Mulrooney and Archer based on their respective achievement of net operating income and gross profit growth targets pursuant to their respective incentive award plans.

Long-Term Incentives

The Compensation Committee views stock options and DSUs as critical elements of the compensation program. However, there were no grants of stock options or DSUs given to executive officers during Fiscal 2004 as we changed the timing of annual grants from December to February. Our form of stock option agreement and all forms of our deferred stock agreement are filed as exhibits to our Form 10-K for the fiscal year ended December 31, 2004.

Change In Control/Employment Agreements

We have Change In Control and Employment Agreements for our top executives. The details of these agreements for the Named Executive Officers are described on page 17.

20

Compliance with Internal Revenue Code Section 162(m)

The Compensation Committee intends that all compensation paid to our executives under our regular plans will be tax-deductible. The Compensation Committee has requested stockholder approval where necessary and has established administrative rules for our plans in order to be in compliance with Internal Revenue Code Section 162(m).

2004 Compensation of our President and CEO

Since Ms. Hallman was on a medical leave of absence in 2004, she was not eligible to participate in an incentive award plan. Ms. Hallman retired in April 2004. The details of Ms. Hallman’s separation may be found on page 17, under the section entitled “Employment Contracts, Termination of Employment and Change-in-Control Arrangements.”

After a comprehensive search process was conducted, Mr. Krause was appointed to the position of Chief Executive Officer in October 2004. Mr. Krause’s annual salary remained $495,000 in Fiscal 2004. Since the EPS threshold was not met, Mr. Krause did not receive an annual incentive bonus for Fiscal 2004. Mr. Krause’s employment agreement and change in control agreement are described on page 18. The Compensation Committee has tallied up all components of Mr. Krause’s compensation and has deemed such to meet standards of reasonableness, as compared to companies of similar size and industry.

| | | |

| | BY THE 2004 COMPENSATION COMMITTEE, |

| | | |

| | J. Ian Morrison, Chairperson

James J. Forese

A. Michael Victory |

Certain Relationships and Related Transactions

We did not have any related party transactions during Fiscal 2004.

Do we have a Code of Ethics?

We have aCode of Business Conduct and Ethics, which is applicable to all of our employees, officers and directors. There is a separateCode of Ethics for Chief Executive Officer and Senior Financial Officers, which is applicable to the principal executive officer, the principal financial officer, the principal accounting officer and the controller. Both theCode of Business Conduct and Ethics and the Code of Ethics for Chief Executive Officer and Senior Financial Officers are available on our website at www.spherion.com under the Corporate Governance tab found in the Investor Relations section. We intend to post amendments or waivers, if any, to theCode of Business Conduct and Ethics (to the extent applicable to our principal executive officer, principal financial officer or principal accounting officer) and waivers to theCode of Ethics for Chief Executive Officer and Senior Financial Officers at this location on our website.

21

PERFORMANCE GRAPH

The following graph sets forth the cumulative total stockholder return on our Common Stock, the cumulative total return of the NYSE composite index and the cumulative total return of our Peer Group Index (the “Peer Group Index”), each for the period beginning December 31, 1999 and ending December 31, 2004. The total cumulative return on investment (change in stock price plus reinvested dividends, if any) for us, the NYSE composite index and the Peer Group Index assumes that a $100 investment was made on December 31, 1999. We have not declared any dividends in the period represented in this performance graph.

The Peer Group Index is comprised of the following publicly traded companies: Kelly Services, Inc.; Manpower Inc.; Robert Half International Inc.; Adecco SA; and MPS Group Inc.

The data for this performance graph was compiled for us by Standard and Poor’s. The stock price performance shown on this graph is not necessarily indicative of future price performance of our Common Stock.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | 12/99

| | 12/00

| | 12/01

| | 12/02

| | 12/03

| | 12/04

|

| Spherion Corporation | | $ | 100.00 | | | $ | 45.71 | | | $ | 39.64 | | | $ | 24.44 | | | $ | 40.12 | | | $ | 33.94 | |

| NYSE Composite Index | | | 100.00 | | | | 101.01 | | | | 91.40 | | | | 72.11 | | | | 92.56 | | | | 105.44 | |

| Peer Group | | | 100.00 | | | | 94.65 | | | | 88.04 | | | | 64.19 | | | | 100.05 | | | | 98.97 | |

22

RATIFICATION OF APPOINTMENT OF AUDITORS

(Item 2 on Proxy Card)

The Audit Committee of our Board of Directors has recommended the appointment of Deloitte & Touche LLP as our independent auditor for the 2005 fiscal year. Services provided to us and our subsidiaries by Deloitte & Touche LLP in Fiscal 2004 are described under“Audit and Non-Audit Fees”on page 14. Deloitte & Touche LLP audited our accounts for Fiscal 2004. Deloitte & Touche LLP has offices or affiliate offices convenient to most of our operations in the United States and other countries and our Audit Committee considers this firm to be well qualified. The Audit Committee is responsible for the appointment, oversight and termination of our independent auditor. We are seeking the ratification of our stockholders of this appointment, although our Audit Committee is not bound by any stockholder action on this matter. If the appoi ntment of Deloitte & Touche LLP as our independent auditor is not ratified by our stockholders, the Audit Committee will reconsider its appointment, but may nevertheless retain Deloitte & Touche LLP. Also, even if the appointment of Deloitte & Touche LLP as our independent auditor is ratified by our stockholders, the Audit Committee may direct the appointment of a different independent auditor at any time during the year if the Audit Committee determines, in its discretion, that such a change would be in our best interests. Representatives of Deloitte & Touche LLP plan to attend the Annual Meeting, will be afforded an opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions by stockholders.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP. IF YOU COMPLETE THE ENCLOSED PROXY CARD, UNLESS YOU DIRECT TO THE CONTRARY ON THAT CARD, THE SHARES REPRESENTED BY THAT PROXY CARD WILL BE VOTED “FOR” THIS PROPOSAL.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires certain of our officers, directors and persons who beneficially own more than ten percent of our Common Stock to file with the SEC and the NYSE initial reports of beneficial ownership of the Common Stock on Form 3 and reports of changes in beneficial ownership of the Common Stock on Form 4 or Form 5. Such persons are also required to furnish us with copies of all such reports filed. Based solely on our review of Forms 3, 4 and 5 and amendments thereto furnished to us with respect to Fiscal 2004, we believe that, during Fiscal 2004, all Section 16(a) filing requirements applicable to such persons were timely satisfied.

STOCKHOLDER COMMUNICATION WITH THE BOARD OF DIRECTORS

Any stockholder who wishes to communicate with the Board of Directors, a committee of the Board, the non-management directors as a group or any member of the Board, may send correspondence to the Corporate Secretary at Spherion Corporation, 2050 Spectrum Boulevard, Fort Lauderdale, Florida, 33309. The Corporate Secretary will submit all stockholder correspondence relating to material matters affecting our company to the Board of Directors, committee of the Board, non-management directors as a group or individual member, as the case may be.

STOCKHOLDER PROPOSALS

As more specifically provided in our Restated By-laws, no business may be brought before an annual meeting unless it is specified in the notice of the meeting or is otherwise brought before the meeting by or at the direction of our Board of Directors or by a stockholder entitled to vote who has delivered proper notice to us not less than 50 days nor more than 75 days prior to the scheduled date of the annual meeting. Accordingly, as our Restated By-laws state that our annual meeting be held on the third Tuesday of May each year, any stockholder proposal to be

23

considered at the 2006 Annual Meeting must be properly submitted to us not earlier than March 2, 2006 nor later than March 27, 2006. Stockholders desiring to suggest qualified nominees for director positions should submit the required information to our Corporate Secretary within the same time period. Detailed information for submitting stockholder proposals or recommendations for director nominees will be provided to you if you make a written request to our Corporate Secretary, 2050 Spectrum Boulevard, Fort Lauderdale, Florida 33309. These requirements are separate from the Securities and Exchange Commission’s requirements that a stockholder must meet in order to have a proposal included in our Proxy Statement. For the 2006 Annual Meeting, under the Commission’s requirements, any stockholder proposals and recommendations for director nominees must be received by our Corporate Secretary no later than December 9, 2005 in order to be included in our 2006 Proxy Statement.

OTHER MATTERS

The Board of Directors knows of no other matters which will be presented at the Annual Meeting, but if other matters do properly come before the Annual Meeting it is intended that the persons named in the proxy will vote as recommended by the Board or, if no recommendation is given, in their own discretion.

The Annual Report to our Stockholders for fiscal year ended December 31, 2004 (the “Annual Report”), and the Annual Report on Form 10-K for the fiscal year ended December 31, 2004 (the “Form 10-K”) are being mailed concurrently with this Proxy Statement to all stockholders of record as of March 24, 2005. In addition, we have provided brokers, dealers, banks, voting trustees and their nominees, at our expense, with additional copies of the Annual Report and the Form 10-K so that such record holders could supply such material to beneficial owners as of March 24, 2005. We submitted to the New York Stock Exchange our CEO Certification, without qualification, in 2004 pursuant to Section 303.A.12(a) of the NYSE Listed Company Manual, and we filed our CEO/CFO Certifications pursuant to Section 302 of the Sarbanes-Oxley Act with the Securities and Exchange Commission as Exhibits to our Form 10-K in 2005. A copy of our Form 10-K, of each of the Charters of our Committees of the Board of Directors, and of our Code of Business Conduct and Ethics and the Code of Ethics for Chief Executive Officer and Senior Financial Officers, will be available without charge upon written request to:

Teri L. Miller

Investor Relations

Spherion Corporation

2050 Spectrum Boulevard

Fort Lauderdale, Florida 33309

| �� | |

| BY ORDER OF THE BOARD OF DIRECTORS, |

| | |

| |  |

| | |

| Lisa G. Iglesias

Secretary |

April 8, 2005

24