UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07332 and 811-08162

Name of Fund: BlackRock Funds III

BlackRock ACWI ex-US Index Fund

BlackRock Bond Index Fund

BlackRock Cash Funds: Institutional

BlackRock Cash Funds: Prime

BlackRock Cash Funds: Government

BlackRock Cash Funds: Treasury

BlackRock CoreAlpha Bond Fund

LifePath® Retirement Portfolio

LifePath 2020 Portfolio®

LifePath® 2025 Portfolio

LifePath 2030 Portfolio®

LifePath® 2035 Portfolio

LifePath 2040 Portfolio®

LifePath® 2045 Portfolio

LifePath® 2050 Portfolio

LifePath® 2055 Portfolio

LifePath® Index Retirement Portfolio

LifePath® Index 2020 Portfolio

LifePath® Index 2025 Portfolio

LifePath® Index 2030 Portfolio

LifePath® Index 2035 Portfolio

LifePath® Index 2040 Portfolio

LifePath® Index 2045 Portfolio

LifePath® Index 2050 Portfolio

LifePath® Index 2055 Portfolio

BlackRock Russell 1000® Index Fund

BlackRock S&P 500 Stock Fund

Master Investment Portfolio

Active Stock Master Portfolio

ACWI ex-US Index Master Portfolio

Bond Index Master Portfolio

CoreAlpha Bond Master Portfolio

International TILTS Master Portfolio

LifePath® Retirement Master Portfolio

LifePath 2020 Master Portfolio®

LifePath® 2025 Master Portfolio

LifePath 2030 Master Portfolio®

LifePath® 2035 Master Portfolio

LifePath 2040 Master Portfolio®

LifePath® 2045 Master Portfolio

LifePath® 2050 Master Portfolio

LifePath® 2055 Master Portfolio

LifePath® Index Retirement Master Portfolio

LifePath® Index 2020 Master Portfolio

LifePath® Index 2025 Master Portfolio

LifePath® Index 2030 Master Portfolio

LifePath® Index 2035 Master Portfolio

LifePath® Index 2040 Master Portfolio

LifePath® Index 2045 Master Portfolio

LifePath® Index 2050 Master Portfolio

LifePath® Index 2055 Master Portfolio

Government Money Market Master Portfolio

Money Market Master Portfolio

Prime Money Market Master Portfolio

Russell 1000® Index Master Portfolio

S&P 500 Stock Master Portfolio

Treasury Money Market Master Portfolio

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Funds III and Master Investment Portfolio, 55 East 52nd Street, New York, NY 10055

Registrants’ telephone number, including area code: (800) 537-4942

Date of fiscal year end: 12/31/2013

Date of reporting period: 12/31/2013

Item 1 – Report to Stockholders

2

DECEMBER 31, 2013

| | | | | | |

ANNUAL REPORT | | | | | |  |

BlackRock ACWI ex-US Index Fund | of BlackRock Funds III

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

| | | | | | |

| | | | | | | |

| 2 | | BLACKROCK ACWI ex-US INDEX FUND | | DECEMBER 31, 2013 | | |

Risk assets (such as equities) powered higher in 2013, for the most part unscathed by ongoing political and economic uncertainty. While monetary policy was the main driving force behind the rally in risk assets, it was also the main culprit for the bouts of volatility during the year.

Equity markets rallied right out of the gate in January with cash pouring back in from the sidelines after a potential US fiscal crisis (i.e., the “fiscal cliff”) was averted with a last-minute tax deal. Key indicators signaling modest but broad-based improvements in the world’s major economies and a calming in Europe’s debt troubles fostered an aura of comfort for investors. Global economic momentum slowed in February, however, and the pace of the rally moderated. In the months that followed, US stocks outperformed international stocks, as the US showed greater stability than most other regions. Slow but positive growth was sufficient to support corporate earnings, while uncomfortably high unemployment reinforced expectations that the Federal Reserve would continue its aggressive monetary stimulus program. International markets experienced higher levels of volatility given a resurgence of political instability in Italy, a banking crisis in Cyprus and a generally poor outlook for European economies. Emerging markets significantly lagged the rest of the world as growth in these economies fell short of expectations.

Financial markets were rattled in May when Fed Chairman Bernanke mentioned the possibility of reducing — or “tapering” — the central bank’s asset purchase programs — comments that were widely misinterpreted as signaling an end to the Fed’s zero-interest-rate policy. US Treasury yields rose sharply, triggering a steep sell-off across fixed income markets. (Bond prices move in the opposite direction of yields.) Equity prices also suffered as investors feared the implications of a potential end of a program that had greatly supported the markets. Risk assets rebounded in late June, however, when the Fed’s tone turned more dovish, and improving economic indicators and better corporate earnings helped extend gains through most of the summer.

The fall was a surprisingly positive period for most asset classes as the Fed defied market expectations with its decision to delay tapering. Easing of political tensions that had earlier surfaced in Egypt and Syria and the re-election of Angela Merkel as Chancellor of Germany also boosted investor sentiment. Higher volatility returned in late September when the US Treasury Department warned that the national debt would soon breach its statutory maximum. The ensuing political brinksmanship led to a partial government shutdown, roiling global financial markets through the first half of October, but the rally quickly resumed when politicians engineered a compromise to reopen the government and extend the debt ceiling, at least temporarily.

The remainder of the year was generally positive for stock markets in the developed world, although investors continued to grapple with uncertainty about when and how much the Fed would scale back on stimulus. On the one hand, persistent weak growth and low inflation provided significant latitude for monetary policy decisions and investors were encouraged by dovish comments from Fed Chair-to-be Janet Yellen. On the other hand, US housing and manufacturing reports had begun to signal fundamental improvement in the economy. The long-awaited taper announcement ultimately came in mid-December. The Fed reduced the amount of its monthly asset purchases, but at the same time, extended its time horizon for maintaining low short-term interest rates. Markets reacted positively as this move signaled the Fed’s perception of real improvement in the economy and investors felt relief from the tenacious anxiety that had gripped them throughout the year.

Accommodative monetary policy and the avoidance of major risks made 2013 a strong year for most equity markets. US stocks were the strongest performers for the six- and 12-month periods ended December 31. In contrast, emerging markets were weighed down by uneven growth and structural imbalances. Rising US Treasury yields led to a rare annual loss in 2013 for Treasury bonds and other high-quality fixed income sectors including tax-exempt municipals and investment grade corporate bonds. High yield bonds, to the contrary, generated gains driven by income-oriented investors seeking yield in the low-rate environment. Short-term interest rates remained near zero, keeping yields on money market securities near historical lows.

At BlackRock, we believe investors need to think globally and extend their scope across a broader array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit www.blackrock.com for further insight about investing in today’s world.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

“While monetary policy was the main driving force behind the rally in risk assets, it was also the main culprit for the bouts of volatility during the year.”

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of December 31, 2013 | |

| | | 6-month | | | 12-month | |

US large cap equities

(S&P 500® Index) | | | 16.31 | % | | | 32.39 | % |

US small cap equities

(Russell 2000® Index) | | | 19.82 | | | | 38.82 | |

International equities

(MSCI Europe, Australasia, Far East Index) | | | 17.94 | | | | 22.78 | |

Emerging market equities (MSCI Emerging Markets Index) | | | 7.70 | | | | (2.60 | ) |

3-month Treasury bill

(BofA Merrill Lynch

3-Month US Treasury Bill Index) | | | 0.03 | | | | 0.07 | |

US Treasury securities

(BofA Merrill Lynch

10-Year US Treasury Index) | | | (3.10 | ) | | | (7.83 | ) |

US investment grade

bonds (Barclays US Aggregate Bond Index) | | | 0.43 | | | | (2.02 | ) |

Tax-exempt municipal

bonds (S&P Municipal Bond Index) | | | 0.00 | | | | (2.55 | ) |

US high yield bonds

(Barclays US Corporate High Yield 2% Issuer Capped Index) | | | 5.94 | | | | 7.44 | |

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| | | | | | | |

| | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | 3 |

| | |

| Fund Summary as of December 31, 2013 | | |

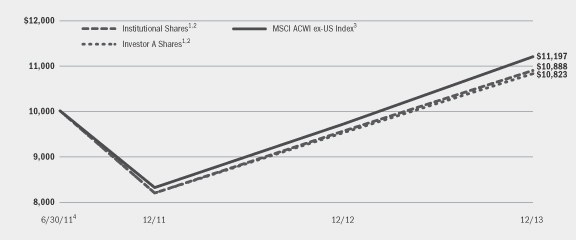

BlackRock ACWI ex-US Index Fund’s (the “Fund”), investment objective is to match the performance of the MSCI All Country World ex-US Index (the “MSCI ACWI ex-US Index”) in US dollars with net dividends as closely as possible before the deduction of Fund expenses.

| | |

| Portfolio Management Commentary | | |

How did the Fund perform?

| Ÿ | | For the 12 months ended December 31, 2013, the Fund’s Institutional Shares returned 13.94%, Investor A Shares returned 13.63% and Class K Shares returned 13.96%. The benchmark MSCI ACWI ex-US Index returned 15.29% for the same period. |

| Ÿ | | Returns for the Fund’s respective share classes differ from the benchmark index based on individual share-class expenses. The Fund invests all of its assets in the MSCI ACWI ex-US Index Master Portfolio (the “Master Portfolio”), a series of Master Investment Portfolio. |

Describe the market environment.

| Ÿ | | International equity markets began 2013 with a powerful relief rally after the United States averted the worst of its potential fiscal crisis with a last-minute tax deal. The rally softened in February, however, as global economic momentum slowed. Later in the first quarter, a stalemate presidential election in Italy and a severe banking crisis in Cyprus reminded investors that political and financial instability in Europe continued to pose risks. The ascent of equities persevered as increased global liquidity kept interest rates low and investors turned to riskier asset classes in search of yield. |

| Ÿ | | As the year progressed, the direction of equity markets became increasingly dominated by speculation around the future of monetary policy in response to signals from central banks, particularly the US Federal Reserve. Sluggish global growth, ironically, was often conducive to positive stock market performance as weak economic data reinforced investors’ expectations that major central banks would maintain their accommodative stance. Additionally, the modest pace of economic growth contributed to corporate profit margins as the global recovery was strong enough to support revenues while nearly stagnant wage growth kept costs low. |

| Ÿ | | After peaking in late May, equity markets around the world recoiled when Fed Chairman Bernanke mentioned the possibility of gradually reducing (or “tapering”) monetary stimulus before the end of 2013. Volatility picked up considerably as many investors misinterpreted the Fed’s remarks as signaling the end of low short-term interest rates. However, equities staged a swift mid-summer rebound when the Fed’s tone turned more dovish. Later in the third quarter, mixed economic data drove high volatility as it made investors increasingly anxious about when and how much the Fed would scale back on its monthly asset purchase program. Also concerning was the escalation of the revolution in Egypt and the civil war in Syria, events that fueled higher oil prices, an additional headwind for global growth. |

| Ÿ | | September brought another sharp rally as the Fed defied market expectations with its decision to delay tapering its asset purchase program. On the geopolitical front, the turmoil in Egypt and Syria subsided and the re-election of Angela Merkel as Chancellor of Germany was welcomed as a continuation of the status quo. The equity market advance was interrupted again in late September when the US teetered on breaching the national debt ceiling and political brinksmanship led to a partial government shutdown. The rally quickly resumed in mid-October when politicians engineered a compromise to reopen the government and extend the debt ceiling until early 2014. |

| Ÿ | | As economic indicators improved later in the fall, investors around the world grappled with rising uncertainty around the timing of the anticipated Fed taper. This anxiety was ultimately relieved when the central bank announced the commencement of tapering in mid-December. Investors reacted positively to this policy move as it signaled the Fed’s perception of real improvement in US growth. Sentiment was also buoyed by the extension of the Fed’s expected time horizon for maintaining low short-term interest rates. |

| Ÿ | | Equity markets in all of the developed countries represented in the MSCI EAFE Index moved higher for the year 2013 (in US dollar terms). Markets in Finland (+46.04%) and Ireland (+41.15%) posted the largest gains in the index, followed by Germany (+31.37%), which has substantial representation in the index composition. Japanese equities (+27.16%) climbed higher as a weakening yen benefited the nation’s exporters, which comprise a large portion of the Japanese stock market. (In local currency terms, Japanese stocks soared +54.58%.) Japanese equities are among the heavier country weightings in the MSCI EAFE Index, as are Swiss (+26.61%), French (+26.33%) and UK equities (+20.67%). |

Describe recent portfolio activity.

| Ÿ | | During the period, as changes were made to the composition of the MSCI ACWI ex-US Index, the Master Portfolio purchased and sold securities to maintain its objective of replicating the risks and return of the benchmark index. |

Describe portfolio positioning at period end.

| Ÿ | | The Master Portfolio remains positioned to match the risk characteristics of its benchmark index, irrespective of the market’s future direction. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| | | | | | | |

| 4 | | BLACKROCK ACWI ex-US INDEX FUND | | DECEMBER 31, 2013 | | |

| | |

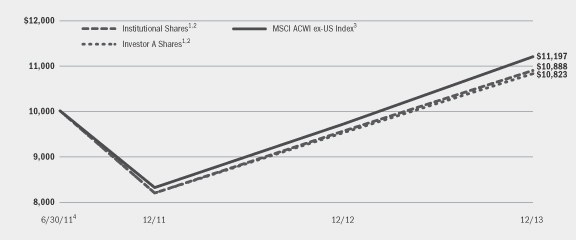

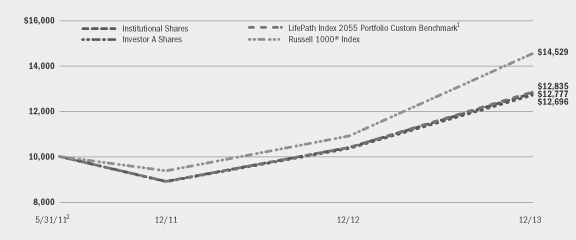

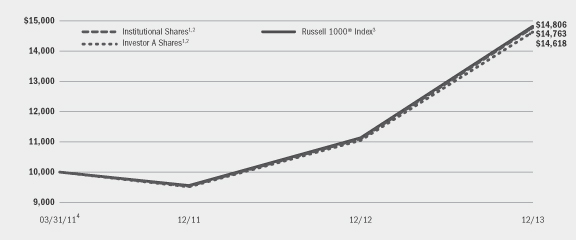

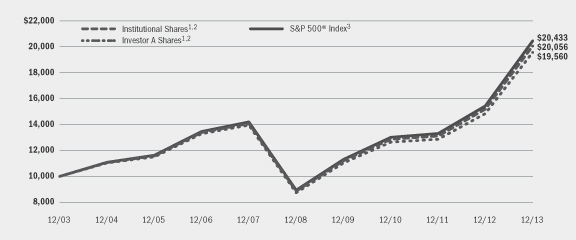

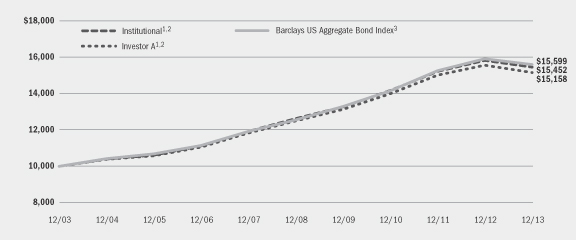

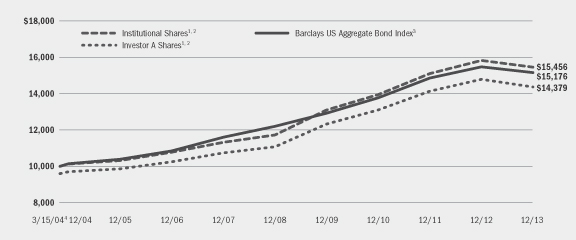

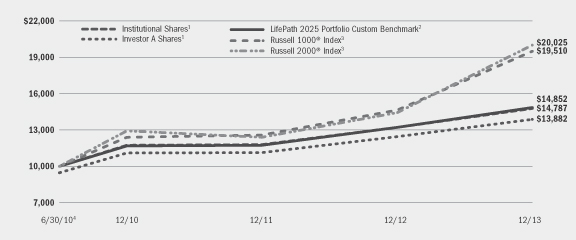

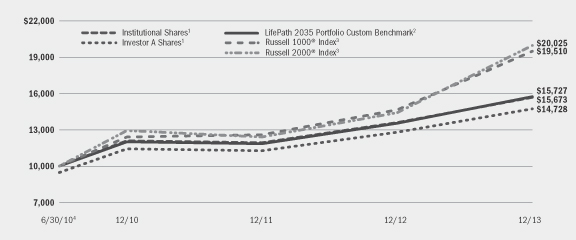

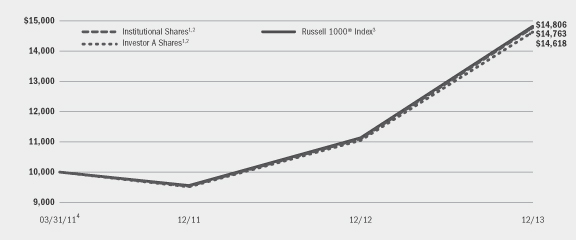

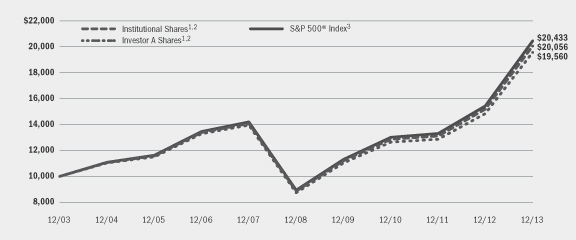

| Total Return Based on a $10,000 Investment | | |

| | 1 | | Assuming transaction costs and other operating expense, including administration fees, if any. |

| | 2 | | The Fund invests all of its assets in the Master Portfolio. The Master Portfolio invests primarily in a non-diversified portfolio of equity securities of companies located in developed and emerging market countries excluding the United States. |

| | 3 | | The Index is a free float-adjusted market capitalization index designed to measure the combined equity market performance of developed and emerging market countries, excluding the United States. |

| | 4 | | Commencement of operations. |

| | | | | | | | |

| Performance Summary for the Period Ended December 31, 2013 | | |

| | | | | | | | | | | | |

| | | 6-Month

Total Returns | | | Average Annual Total Returns | |

| | | | 1 Year | | | Since Inception5 | |

Institutional | | | 15.19 | % | | | 13.94 | % | | | 3.46 | % |

Investor A | | | 15.16 | | | | 13.63 | | | | 3.21 | |

Class K | | | 15.30 | | | | 13.96 | | | | 4.40 | |

MSCI ACWI ex-US Index | | | 15.34 | | | | 15.29 | | | | 4.62 | |

| | 5 | | The Fund commenced operations on June 30, 2011. |

| | | | See “About Fund Performance” on page 6 for a detailed description of share classes, including any related sales charges and fees. |

| | | | Past performance is not indicative of future results. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | Hypothetical7 | | | | |

| | | Beginning

Account Value

July 1, 2013 | | | Ending

Account Value

December 31, 2013 | | | Expenses Paid

During the

Period6 | | | Beginning

Account Value

July 1, 2013 | | | Ending

Account Value

December 31, 2013 | | | Expenses Paid

During the

Period6 | | | Annualized

Expense Ratio | |

Institutional | | $ | 1,000.00 | | | $ | 1,151.90 | | | $ | 1.90 | | | $ | 1,000.00 | | | $ | 1,023.44 | | | $ | 1.79 | | | | 0.35 | % |

Investor A | | $ | 1,000.00 | | | $ | 1,151.60 | | | $ | 3.47 | | | $ | 1,000.00 | | | $ | 1,021.98 | | | $ | 3.26 | | | | 0.64 | % |

Class K | | $ | 1,000.00 | | | $ | 1,153.00 | | | $ | 1.85 | | | $ | 1,000.00 | | | $ | 1,023.49 | | | $ | 1.73 | | | | 0.34 | % |

| | 6 | | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). Because the Fund invests all of its assets in the Master Portfolio, the expense example reflects the net expenses of both the Fund and the Master Portfolio in which it invests. |

| | 7 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | | | See “Disclosure of Expenses” on page 6 for further information on how expenses were calculated. |

| | | | | | |

| | | | | | | |

| | BLACKROCK ACWI ex-US INDEX FUND | | DECEMBER 31, 2013 | | 5 |

| Ÿ | | Institutional and Class K Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. |

| Ÿ | | Investor A Shares are not subject to any sales charge and bear no ongoing distribution fee. These shares are subject to an ongoing service fee of 0.25% per year. |

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month-end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in the performance table on the preceeding page assume reinvestment of all dividends and distributions, if any, at net asset value (“NAV”) on the ex-dividend date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Fund’s administrator waived and/or reimbursed a portion of the Fund’s expenses. Without such waiver and/or reimbursement, the Fund’s performance would have been lower. Dividends paid to each class of shares will vary because of the different levels of administration and distribution fees applicable to each class, which are deducted from the income available to be paid to shareholders.

Shareholders of the Fund may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including administration fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses and other Fund expenses. The expense example on the previous page (which is based on a hypothetical investment of $1,000 invested on July 1, 2013 and held through December 31, 2013) is intended to assist shareholders both in calculating expenses based on an investment in the Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense example provides information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their share class under the heading entitled “Expenses Paid During the Period.”

The expense example also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in the Fund and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the expense example are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical example is useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| | |

Derivative Financial Instruments | | |

The Master Portfolio may invest in various derivative financial instruments, including financial futures contracts and foreign currency exchange contracts, as specified in Note 4 of the Master Portfolio’s Notes to Financial Statements, which may constitute forms of economic leverage. Such derivative financial instruments are used to obtain exposure to a security, index and/or market without owning or taking physical custody of securities or to hedge market, equity or foreign currency exchange rate risks. Derivative financial instruments involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the derivative financial instrument. The Master Portfolio’s ability to use a derivative financial instrument successfully depends on the investment advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may require the Master Portfolio to sell or purchase portfolio investments at inopportune times or for distressed values, may limit the amount of appreciation the Master Portfolio can realize on an investment, may result in lower dividends paid to shareholders or may cause the Master Portfolio to hold an investment that it might otherwise sell. The Master Portfolio’s investments in these instruments are discussed in detail in the Master Portfolio’s Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 6 | | BLACKROCK ACWI ex-US INDEX FUND | | DECEMBER 31, 2013 | | |

| | |

| Statement of Assets and Liabilities | | BlackRock ACWI ex-US Index Fund |

| | | | |

| December 31, 2013 | | | |

| | | | |

| Assets | | | | |

Investments at value — Master Portfolio (cost — $7,597,276) | | $ | 15,189,727 | |

Capital shares sold receivable | | | 31,533 | |

Receivable from administrator | | | 8,624 | |

Prepaid expenses | | | 21,475 | |

| | | | |

Total assets | | | 15,251,359 | |

| | | | |

| | | | |

| Liabilities | | | | |

Contributions payable to the Master Portfolio | | | 25,632 | |

Capital shares redeemed payable | | | 5,901 | |

Income dividends payable | | | 6,905 | |

Registration fees payable | | | 6,767 | |

Printing fees payable | | | 7,476 | |

Transfer agent fees payable | | | 1,396 | |

Service fees payable | | | 10 | |

Professional fees payable | | | 38,334 | |

Other accrued expenses payable | | | 678 | |

| | | | |

Total liabilities | | | 93,099 | |

| | | | |

Net Assets | | $ | 15,158,260 | |

| | | | |

| | | | |

| Net Assets Consist of | | | | |

Paid-in capital | | $ | 10,748,138 | |

Distributions in excess of net investment income | | | (85,553 | ) |

Accumulated net realized loss allocated from the Master Portfolio | | | (3,096,776 | ) |

Net unrealized appreciation/depreciation allocated from the Master Portfolio | | | 7,592,451 | |

| | | | |

Net Assets | | $ | 15,158,260 | |

| | | | |

| | | | |

| Net Asset Value | | | | |

Institutional — Based on net assets of $15,013,239 and 1,491,755 shares outstanding, unlimited number of shares authorized, no par value | | $ | 10.06 | |

| | | | |

Investor A — Based on net assets of $64,871 and 6,448 shares outstanding, unlimited number of shares authorized, no par value | | $ | 10.06 | |

| | | | |

Class K — Based on net assets of $80,150 and 7,781 shares outstanding, unlimited number of shares authorized, no par value | | $ | 10.30 | |

| | | | |

| | | | | | |

| See Notes to Financial Statements. | | | | |

| | | | | | | |

| | BLACKROCK ACWI ex-US INDEX FUND | | DECEMBER 31, 2013 | | 7 |

| | |

| Statement of Operations | | BlackRock ACWI ex-US Index Fund |

| | | | |

| Year Ended December 31, 2013 | | | |

| | | | |

| Investment Income | | | | |

Net investment income allocated from the Master Portfolio: | | | | |

Dividends — unaffiliated | | $ | 340,373 | |

Foreign taxes withheld | | | (41,982 | ) |

Other income — affiliated | | | 8,916 | |

Dividends — affiliated | | | 1,841 | |

Securities lending — affiliated — net | | | 1,155 | |

Income — affiliated | | | 347 | |

Expenses | | | (28,773 | ) |

Fees waived | | | 1,412 | |

| | | | |

Total income | | | 283,289 | |

| | | | |

| | | | |

| Fund Expenses | | | | |

Administration | | | 11,477 | |

Service — Investor A | | | 110 | |

Transfer agent — Institutional | | | 2,611 | |

Transfer agent — Investor A | | | 186 | |

Transfer agent — Class K | | | 84 | |

Professional | | | 42,671 | |

Registration | | | 30,236 | |

Printing | | | 21,059 | |

Miscellaneous | | | 8,418 | |

| | | | |

Total expenses | | | 116,852 | |

Less administration fees waived | | | (11,477 | ) |

Less transfer agent fees waived — Institutional | | | (14 | ) |

Less transfer agent fees waived — Investor A | | | (31 | ) |

Less transfer agent fees waived — Class K | | | (32 | ) |

Less transfer agent fees reimbursed — Institutional | | | (1,474 | ) |

Less transfer agent fees reimbursed — Investor A | | | (133 | ) |

Less transfer agent fees reimbursed — Class K | | | (52 | ) |

Less fees reimbursed by administrator | | | (90,551 | ) |

| | | | |

Total expenses after fees waived and reimbursed | | | 13,088 | |

| | | | |

Net investment income | | | 270,201 | |

| | | | |

| | | | |

| Realized and Unrealized Gain Allocated from the Master Portfolio | | | | |

Net realized gain from investment, financial futures contracts and foreign currency transactions | | | 826,856 | |

Net change in unrealized appreciation/depreciation on investments, financial futures contracts and foreign currency translations | | | 568,944 | |

| | | | |

Total realized and unrealized gain | | | 1,395,800 | |

| | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 1,666,001 | |

| | | | |

| | | | | | |

| See Notes to Financial Statements. | | | | |

| | | | | | | |

| 8 | | BLACKROCK ACWI ex-US INDEX FUND | | DECEMBER 31, 2013 | | |

| | |

| Statements of Changes in Net Assets | | BlackRock ACWI ex-US Index Fund |

| | | | | | | | |

| | | Year Ended December 31, | |

| Increase (Decrease) in Net Assets: | | 2013 | | | 2012 | |

| | | | | | | | |

| Operations | | | | | | | | |

Net investment income | | $ | 270,201 | | | $ | 906,395 | |

Net realized gain (loss) | | | 826,856 | | | | (3,693,070 | ) |

Net change in unrealized appreciation/depreciation | | | 568,944 | | | | 10,461,710 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 1,666,001 | | | | 7,675,035 | |

| | | | | | | | |

| | | | | | | | |

Dividends and Distributions to Shareholders From1 | | | | | | | | |

| Net investment income: | | | | | | | | |

Institutional | | | (287,796 | ) | | | (767,437 | ) |

Investor A | | | (1,049 | ) | | | (1,501 | ) |

Class K | | | (1,578 | ) | | | (182,164 | ) |

| Return of capital: | | | | | | | | |

Institutional | | | — | | | | (175 | ) |

Class K | | | — | | | | (42 | ) |

| | | | | | | | |

Decrease in net assets resulting from dividends and distributions to shareholders | | | (290,423 | ) | | | (951,319 | ) |

| | | | | | | | |

| | | | | | | | |

| Capital Share Transactions | | | | | | | | |

Net increase (decrease) in net assets derived from capital share transactions | | | 4,091,169 | | | | (13,322,040 | ) |

| | | | | | | | |

| | | | | | | | |

| Net Assets | | | | | | | | |

Total increase (decrease) in net assets | | | 5,466,747 | | | | (6,598,324 | ) |

Beginning of year | | | 9,691,513 | | | | 16,289,837 | |

| | | | | | | | |

End of year | | $ | 15,158,260 | | | $ | 9,691,513 | |

| | | | | | | | |

Distributions in excess of net investment income, end of year | | $ | (85,553 | ) | | $ | (65,331 | ) |

| | | | | | | | |

| | 1 | | Determined in accordance with federal income tax regulations. |

| | | | | | |

| See Notes to Financial Statements. | | | | |

| | | | | | | |

| | BLACKROCK ACWI ex-US INDEX FUND | | DECEMBER 31, 2013 | | 9 |

| | |

| Financial Highlights | | BlackRock ACWI ex-US Index Fund |

| | | | | | | | | | | | |

| | | Institutional | |

| | | Year Ended December 31, | | | Period

June 30, 20111

to December 31, 2011 | |

| | | 2013 | | | 2012 | | |

| | | | | | | | | | | | |

| Per Share Operating Performance | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 9.06 | | | $ | 8.13 | | | $ | 10.00 | |

| | | | |

Net investment income2 | | | 0.22 | | | | 0.17 | | | | 0.08 | |

Net realized and unrealized gain (loss) | | | 1.02 | | | | 1.16 | | | | (1.89 | ) |

| | | | |

Net increase (decrease) from investment operations | | | 1.24 | | | | 1.33 | | | | (1.81 | ) |

| | | | |

| Dividends and distributions from:3 | | | | | | | | | | | | |

Net investment income | | | (0.24 | ) | | | (0.40 | ) | | | (0.04 | ) |

Return of capital | | | — | | | | (0.00 | )4 | | | (0.02 | ) |

| | | | |

Total dividends and distributions | | | (0.24 | ) | | | (0.40 | ) | | | (0.06 | ) |

| | | | |

Net asset value, end of period | | $ | 10.06 | | | $ | 9.06 | | | $ | 8.13 | |

| | | | |

| | | | | | | | | | | | |

| Total Investment Return5 | | | | | | | | | | | | |

Based on net asset value | | | 13.94% | | | | 16.61% | | | | (18.05)% | 6 |

| | | | |

| | | | | | | | | | | | |

| Ratios to Average Net Assets7 | | | | | | | | | | | | |

Total expenses8 | | | 1.25% | | | | 0.75% | | | | 2.04% | 9,10 |

| | | | |

Total expenses after fees waived and/or reimbursed8 | | | 0.35% | | | | 0.34% | | | | 0.37% | 9 |

| | | | |

Net investment income8 | | | 2.35% | | | | 1.95% | | | | 1.78% | 9 |

| | | | |

| | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 15,013 | | | $ | 9,602 | | | $ | 46 | |

| | | | |

Portfolio turnover of the Master Portfolio | | | 36% | | | | 42% | | | | 4% | |

| | | | |

| 1 | | Commencement of operations. |

| 2 | | Based on average shares outstanding. |

| 3 | | Determined in accordance with federal income tax regulations. |

| 4 | | Amount is greater than $(0.005) per share. |

| 5 | | Where applicable, assumes the reinvestment of dividends and distributions. |

| 6 | | Aggregate total investment return. |

| 7 | | Includes the Fund’s share of the Master Portfolio’s allocated net expenses and/or net investment income. |

| 8 | | Includes the Fund’s share of the Master Portfolio’s allocated fees waived of 0.01%, 0.08% and 1.14% for the years ended December 31, 2013 and December 31, 2012, and the period ended December 31, 2011, respectively. |

| 10 | | Organization costs were not annualized in the calculation of the expense ratio. If these expenses were annualized, the total expenses would have been 2.08%. |

| | | | | | |

| See Notes to Financial Statements. | | | | |

| | | | | | | |

| 10 | | BLACKROCK ACWI ex-US INDEX FUND | | DECEMBER 31, 2013 | | |

| | |

| Financial Highlights (continued) | | BlackRock ACWI ex-US Index Fund |

| | | | | | | | | | | | |

| | | Investor A | |

| | | Year Ended December 31, | | | Period

June 30, 20111

to December 31, 2011 | |

| | | 2013 | | | 2012 | | |

| | | | | | | | | | | | |

| Per Share Operating Performance | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 9.06 | | | $ | 8.13 | | | $ | 10.00 | |

| | | | |

Net investment income2 | | | 0.21 | | | | 0.19 | | | | 0.08 | |

Net realized and unrealized gain (loss) | | | 1.00 | | | | 1.12 | | | | (1.89 | ) |

| | | | |

Net increase (decrease) from investment operations | | | 1.21 | | | | 1.31 | | | | (1.81 | ) |

| | | | |

| Dividends and distributions from:3 | | | | | | | | | | | | |

Net investment income | | | (0.21 | ) | | | (0.38 | ) | | | (0.04 | ) |

Return of capital | | | — | | | | (0.00 | )4 | | | (0.02 | ) |

| | | | |

Total dividends and distributions | | | (0.21 | ) | | | (0.38 | ) | | | (0.06 | ) |

| | | | |

Net asset value, end of period | | $ | 10.06 | | | $ | 9.06 | | | $ | 8.13 | |

| | | | |

| | | | | | | | | | | | |

| Total Investment Return5 | | | | | | | | | | | | |

Based on net asset value | | | 13.63% | | | | 16.31% | | | | (18.11)% | 6 |

| | | | |

| | | | | | | | | | | | |

| Ratios to Average Net Assets7 | | | | | | | | | | | | |

Total expenses8 | | | 1.91% | | | | 1.88% | | | | 2.30% | 9,10 |

| | | | |

Total expenses after fees waived and/or reimbursed8 | | | 0.64% | | | | 0.63% | | | | 0.62% | 9 |

| | | | |

Net investment income8 | | | 2.21% | | | | 2.18% | | | | 1.74% | 9 |

| | | | |

| | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 65 | | | $ | 39 | | | $ | 20 | |

| | | | |

Portfolio turnover of the Master Portfolio | | | 36% | | | | 42% | | | | 4% | |

| | | | |

| 1 | | Commencement of operations. |

| 2 | | Based on average shares outstanding. |

| 3 | | Determined in accordance with federal income tax regulations. |

| 4 | | Amount is greater than $(0.005) per share. |

| 5 | | Where applicable, assumes the reinvestment of dividends and distributions. |

| 6 | | Aggregate total investment return. |

| 7 | | Includes the Fund’s share of the Master Portfolio’s allocated net expenses and/or net investment income. |

| 8 | | Includes the Fund’s share of the Master Portfolio’s allocated fees waived of 0.01%, 0.16% and 1.14% for the years ended December 31, 2013 and December 31, 2012, and the period ended December 31, 2011, respectively. |

| 10 | | Organization costs were not annualized in the calculation of the expense ratio. If these expenses were annualized, the total expenses would have been 2.36%. |

| | | | | | |

| See Notes to Financial Statements. | | | | |

| | | | | | | |

| | BLACKROCK ACWI ex-US INDEX FUND | | DECEMBER 31, 2013 | | 11 |

| | |

| Financial Highlights (concluded) | | BlackRock ACWI ex-US Index Fund |

| | | | | | | | | | | | |

| | | Class K | |

| | | Year Ended December 31, | | | Period

June 30, 20111

to December 31, 2011 | |

| | | 2013 | | | 2012 | | |

| | | | | | | | | | | | |

| Per Share Operating Performance | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 9.27 | | | $ | 8.13 | | | $ | 10.00 | |

| | | | |

Net investment income2 | | | 0.23 | | | | 0.28 | | | | 0.09 | |

Net realized and unrealized gain (loss) | | | 1.04 | | | | 1.27 | | | | (1.90 | ) |

| | | | |

Net increase (decrease) from investment operations | | | 1.27 | | | | 1.55 | | | | (1.81 | ) |

| | | | |

| Dividends and distributions from:3 | | | | | | | | | | | | |

Net investment income | | | (0.24 | ) | | | (0.41 | ) | | | (0.04 | ) |

Return of capital | | | — | | | | (0.00 | )4 | | | (0.02 | ) |

| | | | |

Total dividends and distributions | | | (0.24 | ) | | | (0.41 | ) | | | (0.06 | ) |

| | | | |

Net asset value, end of period | | $ | 10.30 | | | $ | 9.27 | | | $ | 8.13 | |

| | | | |

| | | | | | | | | | | | |

| Total Investment Return5 | | | | | | | | | | | | |

Based on net asset value | | | 13.96% | | | | 19.25% | | | | (18.04)% | 6 |

| | | | |

| | | | | | | | | | | | |

| Ratios to Average Net Assets7 | | | | | | | | | | | | |

Total expenses8 | | | 1.36% | | | | 1.80% | | | | 1.73% | 9,10 |

| | | | |

Total expenses after fees waived and/or reimbursed8 | | | 0.34% | | | | 0.33% | | | | 0.32% | 9 |

| | | | |

Net investment income8 | | | 2.40% | | | | 3.31% | | | | 2.03% | 9 |

| | | | |

| | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 80 | | | $ | 50 | | | $ | 16,224 | |

| | | | |

Portfolio turnover of the Master Portfolio | | | 36% | | | | 42% | | | | 4% | |

| | | | |

| 1 | | Commencement of operations. |

| 2 | | Based on average shares outstanding. |

| 3 | | Determined in accordance with federal income tax regulations. |

| 4 | | Amount is greater than $(0.005) per share. |

| 5 | | Where applicable, assumes the reinvestment of dividends and distributions. |

| 6 | | Aggregate total investment return. |

| 7 | | Includes the Fund’s share of the Master Portfolio’s allocated net expenses and/or net investment income. |

| 8 | | Includes the Fund’s share of the Master Portfolio’s allocated fees waived of 0.01%, 0.29% and 1.14% for the years ended December 31, 2013 and December 31, 2012, and the period ended December 31, 2011, respectively. |

| 10 | | Organization costs were not annualized in the calculation of the expense ratio. If these expenses were annualized, the total expenses would have been 1.79%. |

| | | | | | |

| See Notes to Financial Statements. | | | | |

| | | | | | | |

| 12 | | BLACKROCK ACWI ex-US INDEX FUND | | DECEMBER 31, 2013 | | |

| | |

| Notes to Financial Statements | | BlackRock ACWI ex-US Index Fund |

1. Organization:

BlackRock ACWI ex-US Index Fund (the “Fund”), a series of BlackRock Funds III (the “Trust”), is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, open-end management investment company. The Trust is organized as a Delaware statutory trust. The Fund seeks to achieve its investment objective by investing substantially all of its assets in ACWI ex-US Index Master Portfolio (the “Master Portfolio”), a series of Master Investment Portfolio (“MIP”), an affiliate of the Fund, which has the same investment objective and strategies as the Fund. The value of the Fund’s investment in the Master Portfolio reflects the Fund’s proportionate interest in the net assets of the Master Portfolio. The performance of the Fund is directly affected by the performance of the Master Portfolio. The percentage of the Master Portfolio owned by the Fund at December 31, 2013 was 2.7%. The financial statements of the Master Portfolio, including the Schedule of Investments, are included elsewhere in this report and should be read in conjunction with the Fund’s financial statements. The Fund offers multiple classes of shares. Institutional and Class K Shares are sold without a sales charge and only to certain eligible investors. Investor A Shares are sold without a sales charge. All classes of shares have identical voting, dividend, liquidation and other rights and are subject to the same terms and conditions, except that Investor A Shares also bear certain expenses related to the shareholder servicing of such shares. Each class has exclusive voting rights with respect to matters relating to its shareholder servicing expenditures.

2. Significant Accounting Policies:

The Fund’s financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“US GAAP”), which may require management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The following is a summary of the significant accounting policies followed by the Fund:

Valuation: US GAAP defines fair value as the price the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The Fund’s policy is to fair value its financial instruments at market value. The Fund records its investment in the Master Portfolio at fair value based on the Fund’s proportionate interest in the net assets of the Master Portfolio. Valuation of securities held by the Master Portfolio is discussed in Note 2 of the Master Portfolio’s Notes to Financial Statements, which are included elsewhere in this report.

Investment Transactions and Investment Income: For financial reporting purposes, contributions to and withdrawals from the Master Portfolio are accounted on a trade date basis. The Fund records daily its proportionate share of the Master Portfolio’s income, expenses and realized and unrealized gains and losses. Realized and unrealized gains and losses are adjusted utilizing partnership tax allocation rules. In addition, the Fund accrues its own expenses. Income, expenses and realized and unrealized gains and losses are allocated daily to each class based on its relative net assets.

Dividends and Distributions: Dividends and distributions paid by the Fund are recorded on the ex-dividend dates, The portion of distributions that exceeds a Fund’s current and accumulated earnings and profits, which are measured on a tax basis, will constitute a non-taxable return of capital. Realized net capital gains can be offset by capital losses carried forward from prior years. However, certain Funds have capital loss carryforwards from pre-2012 tax years that offset realized net capital gains but do not offset current and accumulated earnings and profits. Consequently, if distributions in any tax year are less than the Fund’s current earnings and profits but greater than net investment income and net realized capital gains (taxable income), distributions in excess of taxable income are not treated as non-taxable return of capital, but rather may be taxable to shareholders at ordinary income rates. Under certain circumstances, taxable excess distributions could be significant. See Note 4, Income Tax Information, for the tax character of the Fund’s distributions paid during the period.

Income Taxes: It is the Fund’s policy to comply with the requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Therefore, no federal income tax provision is required.

The Fund files US federal and various state and local tax returns. No income tax returns are currently under examination. The statute of limitations on the Fund’s US federal tax returns remains open for the years ended December 31, 2013 and December 31, 2012, and the period ended December 31, 2011. The statutes of limitations on the Fund’s state and local tax returns may remain open for an additional year depending upon the jurisdiction.

Management has analyzed tax laws and regulations and their application to the Fund’s facts and circumstances and does not believe there are any uncertain tax positions that require recognition of a tax liability.

Other: Expenses directly related to the Fund or its classes are charged to the Fund or class. Other operating expenses shared by several funds are pro rated among those funds on the basis of relative net assets or other appropriate methods. Expenses directly related to the Fund and other shared expenses pro rated to the Fund are allocated daily to each class based on its relative net assets or other appropriate methods.

| | | | | | |

| | | | | | | |

| | BLACKROCK ACWI ex-US INDEX FUND | | DECEMBER 31, 2013 | | 13 |

| | |

| Notes to Financial Statements (continued) | | BlackRock ACWI ex-US Index Fund |

3. Administration Agreement and Other Transactions with Affiliates:

The PNC Financial Services Group, Inc. is the largest stockholder and an affiliate, for 1940 Act purposes, of BlackRock, Inc. (“BlackRock”).

The Trust, on behalf of the Fund, entered into an Administration Agreement with BlackRock Advisors, LLC (“BAL”), an indirect, wholly owned subsidiary of BlackRock, to provide administrative services (other than investment advice and related portfolio activities). For such services, the Fund pays BAL a monthly fee at an annual rate of 0.10% of the average daily value of the Fund’s net assets. The Fund does not pay an investment advisory fee or investment management fee. Effective July 1, 2012, BAL replaced BlackRock Institutional Trust Company, N.A. (“BTC”) as the Fund’s administrator.

BlackRock Fund Advisors (“BFA”), the investment advisor for the Master Portfolio, BAL and previously, BTC, contractually agreed to waive and/or reimburse fees or expenses in order to limit expenses, excluding interest expense, dividend expense, acquired fund fees and expenses and certain other fund expenses, which constitute extraordinary expenses not incurred in the ordinary course of the Fund’s business. The expense limitation as a percentage of average daily net assets is as follows: 0.40% for Institutional Shares, 0.65% for Investor A Shares and 0.35% for Class K Shares. BFA and BAL have agreed not to reduce or discontinue this contractual waiver or reimbursement prior to May 1, 2014, unless approved by the Trust’s Board of Trustees, including a majority of the independent trustees. The Fund may have to repay some of these waivers and reimbursements to BAL and BTC in the following two years. These amounts are shown as or included in administration fees waived, transfer agent fees waived — class specific, transfer agent fees reimbursed — class specific and fees reimbursed by administrator.

If during the Fund’s fiscal year the operating expenses of a share class, that at any time during the prior two fiscal years received a waiver or reimbursement from BFA, BAL or previously BTC, as applicable, are less than the expense limit for that share class, the share class is required to repay BFA, BAL or previously BTC, as applicable, up to the lesser of (a) the amount of fees waived or expenses reimbursed during the prior two fiscal years under the agreement and (b) the amount by which the expense limit for that share class exceeds the operating expenses of the share class for the current fiscal year, provided that: (1) the Fund, of which the share class is a part, has more than $50 million in assets for the fiscal year and (2) BFA, BAL or previously BTC or an affiliate serves as the Fund’s investment advisor or administrator. In the event the expense limit for a share class is changed subsequent to a fiscal year in which BFA, BAL, or previously BTC, as applicable, becomes entitled to reimbursement for fees waived or reimbursed, the amount available to reimburse BFA, BAL or previously BTC, as applicable, shall be calculated by reference to the expense limit for that share class in effect at the time BFA, BAL or previously BTC became entitled to receive such reimbursement, rather than the subsequently changed expense limit for that share class.

For the year ended December 31, 2013, BAL or previously BTC did not recoup any Fund level or class specific waivers and/or reimbursements previously recorded by the Fund.

On December 31, 2013, the Fund level and class specific waiver and/or reimbursements subject to possible future recoupment under the expense limitation agreement are as follows:

| | | | | | | | | | | | | | |

| | | Expiring December 31, | |

| | | 2014 | | | | | 2015 | |

| | | BTC | | | BAL | | | | | BAL | |

Fund level | | $ | 146,981 | | | $ | 110,878 | | | | | $ | 102,028 | |

Institutional | | $ | 9 | | | $ | 375 | | | | | $ | 1,488 | |

Investor A | | $ | 19 | | | $ | 19 | | | | | $ | 164 | |

Class K | | $ | 799 | | | $ | 20 | | | | | $ | 84 | |

The Fund level and class specific waivers and/or reimbursements previously recorded by the Fund, which were subject to recoupment by the Manager, expired on December 31, 2013:

| | | | |

| | | BTC | |

Fund level | | $ | 118,427 | |

Investor A | | $ | 31 | |

Class K | | $ | 1,388 | |

The Trust, on behalf of the Fund, entered into a Distribution Agreement and Investor A Shares Distribution Plan with BlackRock Investments, LLC (“BRIL”), an affiliate of BlackRock. Pursuant to the Distribution Plan and in accordance with Rule 12b-1 under the 1940 Act, the Fund pays BRIL ongoing service fees with respect to Investor A Shares. The fees are accrued daily and paid monthly at an annual rate of 0.25% based upon the average daily net assets of the Investor A Shares.

Pursuant to sub-agreements with BRIL, broker-dealers and BRIL provide shareholder servicing to the Fund. The ongoing service fee compensates BRIL and each broker-dealer for providing shareholder servicing related services to Investor A shareholders.

BAL maintains a call center, which is responsible for providing certain shareholder services to the Fund, such as responding to shareholder inquiries and processing transactions based upon instructions from shareholders with respect to the subscription and redemption of Fund shares. For the year ended December 31, 2013, the Fund reimbursed BAL the following amounts for costs incurred in running the call center, which are included in transfer agent — class specific in the Statement of Operations:

| | | | |

Institutional | | $ | 228 | |

Investor A | | $ | 31 | |

Class K | | $ | 32 | |

| | | | | | |

| | | | | | | |

| 14 | | BLACKROCK ACWI ex-US INDEX FUND | | DECEMBER 31, 2013 | | |

| | | | |

| Notes to Financial Statements (concluded) | | BlackRock ACWI ex-US Index Fund |

Certain officers and/or trustees of the Trust are officers and/or directors of BlackRock or its affiliates. The Fund reimburses the Administrator for a portion of the compensation paid to the Trust’s Chief Compliance Officer.

4. Income Tax Information:

The tax character of distributions paid during the fiscal years ended December 31, 2013 and December 31, 2012 was as follows:

| | | | | | | | |

| | | 12/31/13 | | | 12/31/12 | |

Ordinary income | | $ | 290,423 | | | $ | 951,102 | |

Return of capital | | | — | | | | 217 | |

| | | | |

Total | | $ | 290,423 | | | $ | 951,319 | |

| | | | |

As of December 31, 2013, the tax components of accumulated net earnings were as follows:

| | | | |

Undistributed ordinary income | | $ | 7,699 | |

Undistributed long-term capital gains | | | 314,250 | |

Net unrealized gains1 | | | 4,088,173 | |

| | | | |

Total | | $ | 4,410,122 | |

| | | | |

| | 1 | | The difference between book-basis and tax-basis net unrealized gains was attributable primarily to the timing and recognition of partnership income. |

During the year ended December 31, 2013, the Fund utilized $2,253,335 of its capital loss carryforward.

5. Capital Share Transactions:

Transactions in capital shares for each class were as follows:

| | | | | | | | | | | | | | | | | | |

| | | Year Ended

December 31, 2013 | | | | | Year Ended

December 31, 2012 | |

| | | Shares | | | Amount | | | | | Shares | | | Amount | |

| Institutional | | | | | | | | | | | | | | |

Shares sold | | | 601,760 | | | $ | 5,686,801 | | | | | | 9,459,692 | | | $ | 77,458,398 | |

Shares issued to shareholders in reinvestment of dividends and distributions | | | 30,674 | | | | 287,194 | | | | | | 87,727 | | | | 766,601 | |

Shares redeemed | | | (199,954 | ) | | | (1,927,201 | ) | | | | | (8,493,801 | ) | | | (75,581,211 | ) |

| | | | | | | | | | |

Net increase | | | 432,480 | | | $ | 4,046,794 | | | | | | 1,053,618 | | | $ | 2,643,788 | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Investor A | | | | | | | | | | | | | | | | | | |

Shares sold | | | 4,812 | | | $ | 47,554 | | | | | | 1,873 | | | $ | 15,506 | |

Shares issued to shareholders in reinvestment of dividends | | | 55 | | | | 512 | | | | | | 62 | | | | 548 | |

Shares redeemed | | | (2,761 | ) | | | (26,703 | ) | | | | | (93 | ) | | | (797 | ) |

| | | | | | | | | | |

Net increase | | | 2,106 | | | $ | 21,363 | | | | | | 1,842 | | | $ | 15,257 | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Class K | | | | | | | | | | | | | | | | | | |

Shares sold | | | 2,334 | | | $ | 22,682 | | | | | | 2,170 | | | $ | 17,451 | |

Shares issued to shareholders in reinvestment of dividends and distributions | | | 85 | | | | 813 | | | | | | 76 | | | | 689 | |

Shares redeemed | | | (49 | ) | | | (483 | ) | | | | | (1,991,835 | ) | | | (15,999,225 | ) |

| | | | | | | | | | |

Net increase (decrease) | | | 2,370 | | | $ | 23,012 | | | | | | (1,989,589 | ) | | $ | (15,981,085 | ) |

| | | | | | | | | | |

Total Net Increase (Decrease) | | | 436,956 | | | $ | 4,091,169 | | | | | | (934,129 | ) | | $ | (13,322,040 | ) |

| | | | | | | | | | |

At December 31, 2013, shares owned by affiliates were as follows:

| | | | |

| | | Shares | |

Institutional | | | 2,500 | |

Investor A | | | 2,500 | |

Class K | | | 3,165 | |

6. Subsequent Events:

Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were issued and has determined that there were no subsequent events requiring adjustment or additional disclosure in the financial statements.

| | | | | | |

| | | | | | | |

| | BLACKROCK ACWI ex-US INDEX FUND | | DECEMBER 31, 2013 | | 15 |

| | |

| Report of Independent Registered Public Accounting Firm | | BlackRock ACWI ex-US Index Fund |

To the Board of Trustees of BlackRock Funds III and

the Shareholders of BlackRock ACWI ex-US Index Fund:

In our opinion, the accompanying statement of assets and liabilities and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of BlackRock ACWI ex-US Index Fund (the “Fund”), a series of BlackRock Funds III, at December 31, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

February 24, 2014

| | |

| Important Tax Information (Unaudited) | | |

The following information is provided with respect to the ordinary income distributions paid by the Fund during the taxable year ended December 31, 2013.

| | | | | | | | |

| | | Payable

Dates | | | | |

Qualified Dividend Income for Individuals1 | | | 3/28/2013 | | | | 100.00% | |

| | | 6/28/2013 | | | | 100.00% | |

| | | 9/30/2013 | | | | 100.00% | |

| | | 12/31/2013 | | | | 100.00% | |

Foreign Source Income2 | | | 3/28/2013 | | | | 100.00% | |

| | | 6/28/2013 | | | | 100.00% | |

| | | 9/30/2013 | | | | 100.00% | |

| | | 12/31/2013 | | | | 100.00% | |

Foreign Taxes Paid Per Share3 | | | 3/28/2013 | | | | $0.053090000 | |

| | | 6/28/2013 | | | | $0.106962000 | |

| | | 9/30/2013 | | | | $0.055871000 | |

| | | | 12/31/2013 | | | | $0.053250000 | |

| | 1 | | The Fund hereby designate the percentage indicated above or the maximum amount allowable by law. |

| | 2 | | Expressed as a percentage of distributions grossed up for foreign taxes. |

| | 3 | | The foreign taxes paid represent taxes paid by the Fund on income received by the Fund from foreign sources. Foreign taxes paid may be included in taxable income with an offsetting deduction from gross income or may be taken as a credit for taxes paid to foreign governments. You should consult your tax advisor regarding the appropriate treatment of foreign taxes paid. |

| | | | | | |

| | | | | | | |

| 16 | | BLACKROCK ACWI ex-US INDEX FUND | | DECEMBER 31, 2013 | | |

| | |

| Master Portfolio Information | | ACWI ex-US Index Master Portfolio |

| | |

| Ten Largest Holdings | | Percent of

Long-Term Investments |

| | | | |

iShares India 50 ETF | | | 1 | % |

Nestlé SA, Registered Share | | | 1 | |

HSBC Holdings PLC | | | 1 | |

Roche Holding AG | | | 1 | |

Vodafone Group PLC | | | 1 | |

Novartis AG, Registered Shares | | | 1 | |

Toyota Motor Corp. | | | 1 | |

BP PLC | | | 1 | |

Samsung Electronics Co. Ltd. | | | 1 | |

Royal Dutch Shell PLC | | | 1 | |

| | |

| Geographic Allocation | | Percent of

Long-Term Investments |

| | | | |

United Kingdom | | | 15 | % |

Japan | | | 15 | |

France | | | 7 | |

Canada | | | 7 | |

Switzerland | | | 7 | |

Germany | | | 7 | |

Australia | | | 5 | |

China | | | 4 | |

South Korea | | | 3 | |

Hong Kong | | | 2 | |

Spain | | | 2 | |

Taiwan | | | 2 | |

Sweden | | | 2 | |

Brazil | | | 2 | |

Netherlands | | | 2 | |

Italy | | | 2 | |

South Africa | | | 2 | |

Other1 | | | 14 | |

| | 1 | | Includes holdings within countries that are 1% or less of long-term investments. Please refer to the Schedule of Investments for such countries. |

| | | | | | |

| | | | | | | |

| | BLACKROCK ACWI ex-US INDEX FUND | | DECEMBER 31, 2013 | | 17 |

| | |

Schedule of Investments December 31, 2013 | | ACWI ex-US Index Master Portfolio (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Australia — 5.4% | |

AGL Energy Ltd. (a) | | | 17,258 | | | $ | 231,995 | |

ALS Ltd. | | | 11,241 | | | | 88,685 | |

Alumina Ltd. (b) | | | 74,293 | | | | 73,759 | |

Amcor Ltd. | | | 36,055 | | | | 340,568 | |

AMP Ltd. | | | 87,998 | | | | 345,870 | |

APA Group | | | 24,891 | | | | 133,594 | |

Asciano Ltd. | | | 29,679 | | | | 153,009 | |

ASX Ltd. | | | 5,970 | | | | 196,324 | |

Aurizon Holdings Ltd. | | | 60,946 | | | | 266,184 | |

Australia & New Zealand Banking Group Ltd. | | | 83,234 | | | | 2,402,817 | |

Bank of Queensland Ltd. | | | 8,192 | | | | 89,187 | |

Bendigo and Adelaide Bank Ltd. (a) | | | 12,078 | | | | 126,966 | |

BHP Billiton Ltd. | | | 97,442 | | | | 3,322,082 | |

Boral Ltd. (a) | | | 22,726 | | | | 97,191 | |

Brambles Ltd. | | | 47,351 | | | | 387,944 | |

Caltex Australia Ltd. | | | 3,697 | | | | 66,439 | |

CFS Retail Property Trust | | | 61,764 | | | | 107,511 | |

Coca-Cola Amatil Ltd. | | | 17,129 | | | | 184,267 | |

Cochlear Ltd. (a) | | | 1,677 | | | | 88,357 | |

Commonwealth Bank of Australia | | | 48,903 | | | | 3,407,418 | |

Computershare Ltd. | | | 14,087 | | | | 143,552 | |

Crown Resorts Ltd. | | | 11,987 | | | | 180,857 | |

CSL Ltd. | | | 14,830 | | | | 914,223 | |

Dexus Property Group | | | 149,445 | | | | 134,408 | |

Echo Entertainment Group Ltd. | | | 31,138 | | | | 68,591 | |

Federation Centres Ltd. | | | 41,935 | | | | 87,905 | |

Flight Centre Ltd. | | | 2,028 | | | | 86,370 | |

Fortescue Metals Group Ltd. | | | 45,797 | | | | 239,236 | |

Goodman Group | | | 51,911 | | | | 219,935 | |

GPT Group | | | 51,940 | | | | 157,957 | |

Harvey Norman Holdings Ltd. (a) | | | 13,921 | | | | 39,395 | |

Iluka Resources Ltd. | | | 12,412 | | | | 96,181 | |

Incitec Pivot Ltd. | | | 47,280 | | | | 113,421 | |

Insurance Australia Group Ltd. | | | 68,861 | | | | 358,534 | |

Leighton Holdings Ltd. (a) | | | 4,710 | | | | 68,021 | |

Lend Lease Group | | | 16,969 | | | | 169,346 | |

Macquarie Group Ltd. | | | 8,780 | | | | 430,946 | |

Metcash Ltd. (a) | | | 24,966 | | | | 70,505 | |

Mirvac Group | | | 114,641 | | | | 172,387 | |

National Australia Bank Ltd. | | | 71,206 | | | | 2,222,485 | |

Newcrest Mining Ltd. | | | 22,997 | | | | 161,492 | |

| Common Stocks | | Shares | | | Value | |

Australia (concluded) | |

Orica Ltd. | | | 11,584 | | | $ | 247,709 | |

Origin Energy Ltd. | | | 33,045 | | | | 416,453 | |

Orora Ltd. (b) | | | 39,156 | | | | 40,556 | |

Qantas Airways Ltd. (b) | | | 22,815 | | | | 22,380 | |

QBE Insurance Group Ltd. | | | 36,864 | | | | 380,278 | |

Ramsay Health Care Ltd. | | | 4,015 | | | | 155,386 | |

REA Group Ltd. | | | 1,783 | | | | 60,225 | |

Rio Tinto Ltd. | | | 13,165 | | | | 805,792 | |

Santos Ltd. | | | 29,034 | | | | 380,516 | |

Seek Ltd. (a) | | | 9,862 | | | | 118,565 | |

Sonic Healthcare Ltd. | | | 11,504 | | | | 170,725 | |

SP AusNet | | | 58,496 | | | | 65,139 | |

Stockland | | | 67,584 | | | | 218,507 | |

Suncorp Group Ltd. | | | 39,097 | | | | 458,915 | |

Sydney Airport | | | 34,131 | | | | 115,999 | |

Tabcorp Holdings Ltd. | | | 26,369 | | | | 85,616 | |

Tatts Group Ltd. | | | 40,669 | | | | 112,752 | |

Telstra Corp. Ltd. | | | 132,237 | | | | 620,668 | |

Toll Holdings Ltd. | | | 19,977 | | | | 101,606 | |

Transurban Group | | | 42,625 | | | | 260,669 | |

Treasury Wine Estates Ltd. | | | 18,676 | | | | 80,550 | |

Wesfarmers Ltd. | | | 30,110 | | | | 1,185,519 | |

Westfield Group | | | 62,400 | | | | 563,305 | |

Westfield Retail Trust | | | 95,194 | | | | 252,896 | |

Westpac Banking Corp. | | | 94,141 | | | | 2,729,022 | |

Woodside Petroleum Ltd. | | | 19,887 | | | | 692,634 | |

Woolworths Ltd. | | | 37,893 | | | | 1,147,451 | |

WorleyParsons Ltd. | | | 6,053 | | | | 90,042 | |

| | | | | | | | |

| | | | | | | | 29,825,789 | |

Austria — 0.2% | |

Andritz AG | | | 2,079 | | | | 130,289 | |

Erste Group Bank AG | | | 7,624 | | | | 265,776 | |

IMMOFINANZ AG | | | 27,589 | | | | 127,841 | |

OMV AG | | | 4,701 | | | | 224,992 | |

Raiffeisen Bank International AG (a) | | | 1,162 | | | | 41,031 | |

Telekom Austria AG | | | 7,747 | | | | 58,659 | |

Vienna Insurance Group AG | | | 1,317 | | | | 65,821 | |

Voestalpine AG | | | 3,392 | | | | 163,000 | |

| | | | | | | | |

| | | | | | | | 1,077,409 | |

| | | | | | | | |

| To simplify the listings of portfolio holdings in the Schedule of Investments, the names and descriptions of many of the securities have been abbreviated according to the following list: | | ADR | | American Depositary Receipts | | JPY | | Japanese Yen |

| | AUD | | Australian Dollar | | KRW | | South Korean Won |

| | BRL | | Brazilian Real | | MXN | | Mexican Peso |

| | CAD | | Canadian Dollar | | MYR | | Malaysian Ringgit |

| | CHF | | Swiss Franc | | NOK | | Norwegian Krone |

| | CVA | | Certificaten Van Aandelen (Dutch Certificate) | | NVDR | | Non-Voting Depository Receipts |

| | CZK | | Czech Koruna | | NZD | | New Zealand Dollar |

| | DKK | | Danish Krone | | PHP | | Philippine Peso |

| | EUR | | Euro | | PLN | | Polish Zloty |

| | FKA | | Formerly Known As | | REIT | | Real Estate Investment Trust |

| | GBP | | British Pound | | SEK | | Swedish Krona |

| | GDR | | Global Depositary Receipt | | SGD | | Singapore Dollar |

| | HKD | | Hong Kong Dollar | | TRY | | Turkish Lira |

| | HUF | | Hungarian Forint | | TWD | | Taiwan Dollar |

| | IDR | | Indonesian Rupiah | | USD | | US Dollar |

| | ILS | | Israeli Shekel | | ZAR | | South African Rand |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 18 | | BLACKROCK ACWI ex-US INDEX FUND | | DECEMBER 31, 2013 | | |

| | |

Schedule of Investments (continued) | | ACWI ex-US Index Master Portfolio (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Belgium — 0.9% | |

Ageas | | | 6,464 | | | $ | 275,648 | |

Anheuser-Busch InBev NV | | | 24,356 | | | | 2,589,924 | |

Belgacom SA (a) | | | 4,505 | | | | 133,313 | |

Colruyt SA | | | 2,320 | | | | 129,626 | |

Delhaize Group (a) | | | 3,056 | | | | 181,807 | |

Groupe Bruxelles Lambert SA | | | 2,443 | | | | 224,417 | |

KBC Groep NV | | | 7,555 | | | | 429,543 | |

Solvay SA | | | 1,776 | | | | 281,086 | |

Telenet Group Holding NV | | | 1,521 | | | | 90,760 | |

UCB SA | | | 3,116 | | | | 232,147 | |

Umicore SA | | | 3,417 | | | | 159,658 | |

| | | | | | | | |

| | | | | | | | 4,727,929 | |

Brazil — 2.2% | | | | | | | | |

AES Tiete SA, Preference Shares | | | 3,700 | | | | 29,939 | |

All — America Latina Logistica SA | | | 16,900 | | | | 46,991 | |

AMBEV SA | | | 142,100 | | | | 1,043,201 | |

Anhanguera Educacional Participacoes SA | | | 10,600 | | | | 66,945 | |

Banco Bradesco SA — ADR | | | 21,630 | | | | 292,923 | |

Banco Bradesco SA, Preference Shares | | | 60,290 | | | | 743,387 | |

Banco do Brasil SA | | | 17,500 | | | | 180,990 | |

Banco do Estado do Rio Grande do Sul, Preference Shares | | | 2,900 | | | | 15,488 | |

Banco Santander Brasil SA | | | 28,700 | | | | 170,065 | |

BB Seguridade Participacoes SA | | | 18,000 | | | | 186,924 | |

BM&FBovespa SA | | | 59,200 | | | | 277,525 | |

BR Malls Participacoes SA | | | 10,800 | | | | 78,050 | |

BR Properties SA | | | 5,100 | | | | 40,208 | |

Bradespar SA, Preference Shares | | | 7,900 | | | | 83,981 | |

Braskem SA, Preference ‘A’ Shares (b) | | | 3,300 | | | | 29,374 | |

BRF — Brasil Foods SA | | | 19,600 | | | | 409,155 | |

CCR SA | | | 26,100 | | | | 196,587 | |

Centrais Eletricas Brasileiras SA | | | 11,400 | | | | 28,364 | |

Centrais Eletricas Brasileiras SA, Preference ‘B’ Shares | | | 7,500 | | | | 31,567 | |

CETIP SA — Mercados Organizado | | | 5,104 | | | | 52,354 | |

Cia Brasileira de Distribuicao Grupo Pao de Acucar, Preference Shares | | | 4,400 | | | | 195,657 | |

Cia Energetica de Minas Gerais, Preference Shares | | | 24,613 | | | | 146,160 | |

Cia Energetica de Sao Paulo, Preference ‘B’ Shares | | | 4,000 | | | | 38,012 | |

Cia Paranaense de Energia, Preference ‘B’ Shares | | | 3,400 | | | | 43,998 | |

Cielo SA | | | 10,780 | | | | 299,971 | |

Companhia de Saneamento Basico do Estado de Sao Paulo | | | 9,700 | | | | 108,790 | |

Companhia de Saneamento de Minas Gerais — COPASA | | | 1,900 | | | | 29,959 | |

Companhia Hering SA | | | 5,000 | | | | 63,367 | |

Companhia Siderurgica Nacional SA | | | 21,400 | | | | 130,436 | |

Cosan SA Industria e Comercio | | | 4,200 | | | | 70,461 | |

CPFL Energia SA | | | 6,000 | | | | 48,549 | |

Cyrela Brazil Realty SA | | | 6,700 | | | | 40,894 | |

Duratex SA | | | 10,010 | | | | 55,794 | |

EcoRodovias Infraestrutura e Logistica SA | | | 5,600 | | | | 35,130 | |

EDP — Energias do Brasil SA | | | 9,300 | | | | 44,741 | |

Embraer SA | | | 18,000 | | | | 144,122 | |

Estacio Participacoes SA | | | 9,300 | | | | 80,455 | |

Fibria Celulose SA (b) | | | 6,700 | | | | 78,523 | |

Gerdau SA, Preference Shares | | | 27,000 | | | | 209,889 | |

Hypermarcas SA | | | 11,600 | | | | 86,782 | |

Itau Unibanco Holding SA, Preference Shares | | | 75,530 | | | | 1,003,652 | |

Itausa — Investimentos Itau SA, Preference Shares | | | 82,483 | | | | 311,158 | |

| Common Stocks | | Shares | | | Value | |

Brazil (concluded) | | | | | | | | |

JBS SA | | | 21,100 | | | $ | 78,435 | |

Klabin SA, Preference Shares | | | 13,300 | | | | 69,114 | |

Kroton Educacional SA | | | 5,500 | | | | 91,525 | |

Localiza Rent a Car SA | | | 5,040 | | | | 71,095 | |

Lojas Americanas SA | | | 4,800 | | | | 27,812 | |

Lojas Americanas SA, Preference Shares | | | 9,856 | | | | 65,714 | |

Lojas Renner SA | | | 3,300 | | | | 85,324 | |

M Dias Branco SA | | | 1,200 | | | | 50,864 | |

Marcopolo SA, Preference Shares | | | 18,200 | | | | 39,343 | |

Metalurgica Gerdau SA, Preference Shares | | | 7,600 | | | | 75,380 | |

MRV Engenharia e Participacoes SA | | | 11,900 | | | | 42,521 | |

Multiplan Empreendimentos Imobiliarios SA | | | 2,800 | | | | 59,222 | |

Natura Cosmeticos SA | | | 5,000 | | | | 87,676 | |

Odontoprev SA | | | 9,300 | | | | 38,749 | |

Oi SA, Preference Shares | | | 13,897 | | | | 21,147 | |

Petroleo Brasileiro SA | | | 88,700 | | | | 601,171 | |

Petroleo Brasileiro SA, Preference Shares | | | 128,100 | | | | 927,391 | |

Porto Seguro SA | | | 4,100 | | | | 51,701 | |

Qualicorp SA (b) | | | 7,200 | | | | 68,666 | |

Raia Drogasil SA | | | 4,700 | | | | 29,444 | |

Souza Cruz SA | | | 10,700 | | | | 109,347 | |

Sul America SA | | | 5,738 | | | | 35,971 | |

Suzano Papel e Celulose SA, Preference ‘A’ Shares | | | 10,900 | | | | 42,690 | |

Telefonica Brasil SA, Preference Shares | | | 8,700 | | | | 165,316 | |

Tim Participacoes SA | | | 25,640 | | | | 134,001 | |

Totvs SA | | | 3,300 | | | | 51,698 | |

Tractebel Energia SA | | | 4,600 | | | | 70,075 | |

Transmissora Alianca de Energia Eletrica SA | | | 3,300 | | | | 25,457 | |

Ultrapar Participacoes SA | | | 10,300 | | | | 244,266 | |

Usinas Siderurgicas de Minas Gerais SA, Preference ‘A’ Shares (b) | | | 9,600 | | | | 57,822 | |

Vale SA | | | 40,300 | | | | 609,987 | |

Vale SA, Preference ‘A’ Shares | | | 56,100 | | | | 778,278 | |

WEG SA | | | 6,200 | | | | 81,887 | |

| | | | | | | | |

| | | | | | | | 12,259,607 | |

Canada — 7.1% | |

Agnico Eagle Mines, Ltd. | | | 5,057 | | | | 133,441 | |

Agrium, Inc. | | | 4,404 | | | | 402,859 | |

Alimentation Couche Tard, Inc., Class B | | | 4,175 | | | | 313,955 | |

AltaGas Ltd. | | | 3,476 | | | | 133,412 | |

ARC Resources, Ltd. | | | 9,377 | | | | 261,029 | |

Atco Ltd., Class I | | | 2,185 | | | | 95,977 | |

Athabasca Oil Corp. (b) | | | 11,168 | | | | 68,128 | |

Bank of Montreal | | | 19,541 | | | | 1,302,611 | |

Bank of Nova Scotia (a) | | | 36,450 | | | | 2,279,476 | |

Barrick Gold Corp. | | | 35,436 | | | | 624,154 | |

Baytex Energy Corp. | | | 3,897 | | | | 152,762 | |

BCE, Inc. | | | 7,614 | | | | 329,719 | |

Bell Aliant, Inc. (a) | | | 1,961 | | | | 49,346 | |

BlackBerry, Ltd. (a)(b) | | | 14,305 | | | | 106,387 | |

Bombardier, Inc., Class B | | | 45,491 | | | | 197,424 | |

Brookfield Asset Management Inc., Class A | | | 16,617 | | | | 644,813 | |

Brookfield Office Properties, Inc. | | | 8,350 | | | | 160,751 | |

CAE, Inc. | | | 7,564 | | | | 96,201 | |

Cameco Corp. | | | 11,514 | | | | 238,897 | |

Canadian Imperial Bank of Commerce | | | 12,079 | | | | 1,031,590 | |

Canadian National Railway Co. | | | 25,373 | | | | 1,446,542 | |

Canadian Natural Resources Ltd. | | | 32,770 | | | | 1,108,735 | |

Canadian Oil Sands Ltd. | | | 14,643 | | | | 275,422 | |

Canadian Pacific Railway Ltd. | | | 5,267 | | | | 796,558 | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | BLACKROCK ACWI ex-US INDEX FUND | | DECEMBER 31, 2013 | | 19 |

| | |

Schedule of Investments (continued) | | ACWI ex-US Index Master Portfolio (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Canada (continued) | |

Canadian Tire Corp. Ltd., Class A | | | 2,176 | | | $ | 203,803 | |

Canadian Utilities, Ltd., Class A | | | 3,432 | | | | 115,245 | |

Catamaran Corp. (b) | | | 6,190 | | | | 293,985 | |

Cenovus Energy, Inc. | | | 22,611 | | | | 647,093 | |

CGI Group, Inc., Class A (b) | | | 6,466 | | | | 216,335 | |

CI Financial Corp. | | | 5,090 | | | | 169,387 | |

Crescent Point Energy Corp. | | | 11,567 | | | | 449,177 | |

Dollarama, Inc. | | | 2,058 | | | | 170,898 | |

Eldorado Gold Corp. | | | 22,616 | | | | 128,383 | |

Empire Co., Ltd., Class A (a) | | | 1,672 | | | | 114,242 | |

Enbridge, Inc. | | | 23,646 | | | | 1,033,100 | |

Encana Corp. | | | 22,199 | | | | 400,825 | |

Enerplus Corp. | | | 6,209 | | | | 112,811 | |

Fairfax Financial Holdings, Ltd. | | | 318 | | | | 126,963 | |

Finning International, Inc. | | | 5,061 | | | | 129,354 | |

First Capital Realty, Inc. | | | 2,654 | | | | 44,248 | |

First Quantum Minerals Ltd. | | | 16,954 | | | | 305,483 | |

Fortis, Inc. | | | 6,089 | | | | 174,545 | |

Franco-Nevada Corp. | | | 4,529 | | | | 184,571 | |

George Weston Ltd. | | | 1,554 | | | | 113,377 | |

Gildan Activewear, Inc. | | | 3,492 | | | | 186,098 | |

Goldcorp, Inc. | | | 24,745 | | | | 536,714 | |

Great-West Lifeco, Inc. | | | 9,120 | | | | 281,177 | |

H&R Real Estate Investment Trust | | | 4,412 | | | | 88,884 | |

Husky Energy, Inc. | | | 10,242 | | | | 324,929 | |

IGM Financial, Inc. | | | 3,017 | | | | 159,307 | |

Imperial Oil Ltd. | | | 8,790 | | | | 389,251 | |

Industrial Alliance Insurance & Financial Services, Inc. | | | 2,981 | | | | 131,756 | |

Intact Financial Corp. | | | 3,913 | | | | 255,538 | |

Keyera Corp. | | | 2,323 | | | | 139,806 | |

Kinross Gold Corp. | | | 36,596 | | | | 160,199 | |

Loblaw Cos. Ltd. (a) | | | 3,462 | | | | 138,121 | |

Magna International, Inc. | | | 6,756 | | | | 553,963 | |

Manulife Financial Corp. | | | 55,739 | | | | 1,099,825 | |

MEG Energy Corp. (b) | | | 4,348 | | | | 125,293 | |

Methanex Corp. | | | 2,801 | | | | 165,647 | |

Metro, Inc. | | | 2,844 | | | | 173,759 | |

National Bank of Canada (a) | | | 4,870 | | | | 405,233 | |

New Gold, Inc. (b) | | | 16,854 | | | | 88,217 | |

Onex Corp. | | | 2,763 | | | | 149,172 | |

Open Text Corp. | | | 1,949 | | | | 179,277 | |

Pembina Pipeline Corp. | | | 9,294 | | | | 327,401 | |

Pengrowth Energy Corp. | | | 15,559 | | | | 96,232 | |

Penn West Petroleum Ltd. | | | 14,548 | | | | 121,479 | |

Peyto Exploration & Development Corp. | | | 4,181 | | | | 127,959 | |

Potash Corp. of Saskatchewan, Inc. | | | 26,156 | | | | 862,305 | |

Power Corp. of Canada | | | 10,421 | | | | 313,439 | |

Power Financial Corp. | | | 7,390 | | | | 250,450 | |

RioCan Real Estate Investment Trust | | | 4,337 | | | | 101,132 | |

Rogers Communications, Inc., Class B | | | 10,878 | | | | 492,262 | |

Royal Bank of Canada | | | 43,648 | | | | 2,934,247 | |

Saputo, Inc. | | | 3,754 | | | | 171,011 | |

Shaw Communications, Inc., Class B | | | 11,670 | | | | 283,991 | |

Shoppers Drug Mart Corp. | | | 6,037 | | | | 330,707 | |

Silver Wheaton Corp. (a) | | | 10,891 | | | | 219,922 | |

SNC-Lavalin Group, Inc. | | | 4,286 | | | | 192,825 | |

Sun Life Financial, Inc. | | | 18,336 | | | | 647,650 | |

Suncor Energy, Inc. | | | 45,301 | | | | 1,588,147 | |

Talisman Energy, Inc. | | | 31,357 | | | | 364,565 | |