Filed pursuant to Rule 424(b)(5)

Registration No. 333-272573

The information in this pricing supplement is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. This pricing supplement and the accompanying prospectus supplement and prospectus are not an offer to sell these securities, nor are they soliciting an offer to buy these securities in any state where the offer or sale of securities is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 26, 2024

PRELIMINARY PRICING SUPPLEMENT

(To Prospectus dated June 9, 2023

and Prospectus Supplement dated June 16, 2023)

Senior Medium-Term Notes, Series S

$

% Fixed-to-Floating Rate Senior

Notes due , 2035

This pricing supplement describes the series of our fixed-to-floating rate senior notes that will be issued under our medium-term note program, Series S. In this pricing supplement, we refer to our % fixed-to-floating rate senior notes due , 2035 as the “notes.” This pricing supplement supplements the terms and conditions in the prospectus, dated June 9, 2023 (the “Base Prospectus”), as supplemented by the prospectus supplement dated June 16, 2023 (the “Prospectus Supplement” and, together with the Base Prospectus, including all documents incorporated by reference, the “Prospectus”), which should be read together with this pricing supplement. The notes are unsecured and rank equally with all of our other unsecured and senior indebtedness outstanding from time to time. We do not intend to list the notes on any securities exchange.

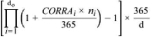

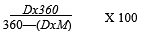

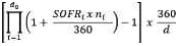

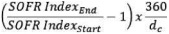

The notes will mature on , 2035 and will be issued in minimum denominations of $2,000 and any larger amount that is a whole multiple of $1,000. Interest on the notes will accrue from , 2024. We will initially pay interest on the notes semiannually in arrears on and of each year, beginning , 2024, and ending on , 2034 (the “Fixed Rate Period”) at a fixed rate per annum equal to %. Beginning on , 2034, we will pay interest on the notes quarterly in arrears on , , , and , and at the maturity date (the “Floating Rate Period”) at a floating rate per annum equal to Compounded SOFR, calculated based on the Compounded Index Rate (as such terms are defined in the Prospectus), plus a spread of %. Interest will be paid to the persons in whose name the notes are registered at the close of business on the 15th calendar day prior to each interest payment date, whether or not a business day. Interest on the notes will be computed on the basis of a 360-day year of twelve 30-day months during the Fixed Rate Period. Interest on the notes will be computed on the basis of a 360-day year and actual number days in each interest period (or any other relevant period) during the Floating Rate Period. We have the option to redeem the notes, at the applicable times and at the applicable redemption price set forth under “Supplemental Information Concerning Description of Notes—Optional Redemption.” If the maturity date or an interest payment date during the Fixed Rate Period for the notes is not a business day, we will pay principal, premium, if any, and interest for the notes on the next business day, and no interest will accrue from and after the maturity date or interest payment date. If an interest payment date during the Floating Rate Period for the notes is not a business day, we will pay principal, premium, if any, and interest for the notes on the next business day, provided that if that business day falls in the next succeeding calendar month, such interest payment date will be the immediately preceding business day and in any such case the payment of interest due on such postponed or brought forward interest payment date will include interest accrued to but excluding such postponed or brought forward interest payment date. The notes are not subject to repayment at the option of the holder at any time prior to maturity and will not be subject to any sinking fund.

Investing in the notes involves risk. See “Risk Factors” beginning on page S-6 of the accompanying prospectus supplement for certain information relevant to an investment in the notes, and the discussion of risk factors contained in our annual, quarterly and current reports filed with the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, the (“Exchange Act”) which are incorporated by reference into the Prospectus and this pricing supplement.

The notes are not savings accounts, deposits or other obligations of any of our bank or non-bank subsidiaries and are not insured or guaranteed by the Federal Deposit Insurance Corporation (the “FDIC”) or any other governmental agency.

None of the SEC, any state securities commission, the Board of Governors of the Federal Reserve System or any other regulatory body have approved or disapproved of the notes or passed upon the adequacy or accuracy of the Prospectus and this pricing supplement. Any representation to the contrary is a criminal offense.

| | | | | | | | |

| | | Per Note | | | Total | |

Public Offering Price(1) | | | % | | | $ | | |

Underwriting Discount | | | % | | | $ | | |

Proceeds (before expenses) to KeyCorp(1) | | | % | | | $ | | |

(1) Plus accrued interest, if any, from , 2024, if settlement occurs after that date.

One of the underwriters for this offering, KeyBanc Capital Markets Inc., is our affiliate. For more information, see “Supplemental Information Concerning the Plan of Distribution (Conflicts of Interest)” on the last page of this pricing supplement.

We expect to deliver the notes to investors through the book-entry delivery system of The Depository Trust Company and its direct participants on or about , 2024.

Joint Book-Running Managers

| | | | | | |

| KeyBanc Capital Markets | | RBC Capital Markets | | Citigroup | | Morgan Stanley |

February , 2024