UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08194

FINANCIAL INVESTORS TRUST

(Exact name of Registrant as specified in charter)

1290 Broadway, Suite 1000, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Brendan Hamill, Secretary

Financial Investors Trust

1290 Broadway, Suite 1000

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: April 30

Date of reporting period: April 30, 2024 – October 31, 2024

| Item 1. | Reports to Stockholders. |

| (a) | Report of Shareholders. |

OCTOBER 31, 2024

SEMI-ANNUAL

SHAREHOLDER REPORT

DISCIPLINED GROWTH INVESTORS FUND

This semi-annual shareholder report contains important information about Disciplined Growth Investors Fund for the period of May 1, 2024 to October 31, 2024.

You can find additional information about the Fund at www.DGIfund.com. You can also request this information by contacting us at

1-855-DGI-FUND (344 3863) or dgi@alpsinc.com.

WHAT WERE THE FUND'S COST FOR THE SIX MONTHS?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 Investment | Cost Paid as a percentage of a $10,000 Investment |

|---|

| Disciplined Growth Investors Fund | $39 | 0.78% |

HOW DID THE FUND PERFORM LAST YEAR?

The DGI Fund returned 35.08% for the twelve months ended October 31, 2024. Stocks in the Fund returned 46.16% and bonds returned 9.80%. For comparison, The S&P 500 index increased 38.02%.

Stock selection drove Fund performance. Supermicro (SMCI) contributed 15.98% to the Fund’s overall performance and was the largest contributor by a significant margin. We trimmed the position during January and February 2024 which resulted in the capital gains we distributed to shareholders in July. Other top contributing stocks were Arista Networks (+2.67%,) Garmin (+2.16%), Royal Caribbean (+1.92%), and Intuitive Surgical (+1.59%). The five largest detractors were Viasat (-0.57%), Coterra Energy (-0.29%), Progyny(-0.29%), MSC Industrial (-0.21%), and Power Integrations (-0.21%).

Overall, 19 stocks contributed positively to the Fund’s total return and 19 detracted (had negative returns).

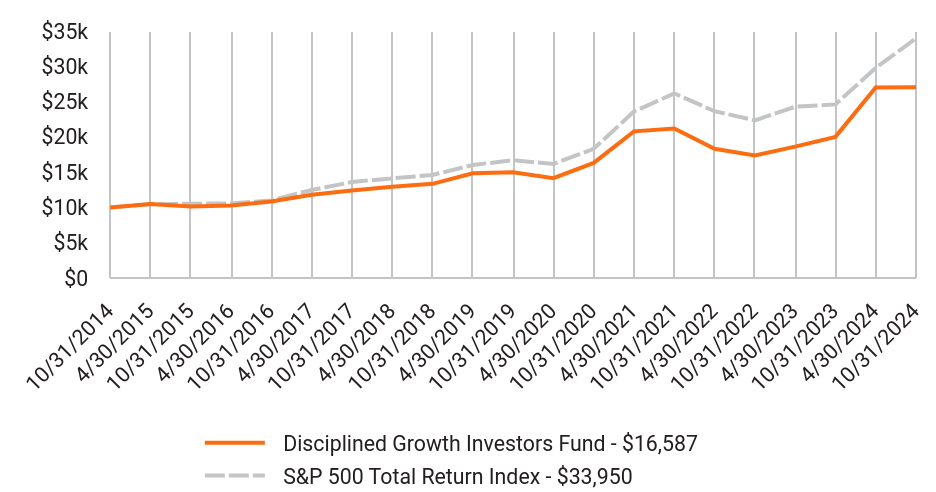

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Disciplined Growth Investors Fund - $16,587 | S&P 500 Total Return Index - $33,950 |

|---|

| 10/31/2014 | $10,000 | $10,000 |

| 4/30/2015 | $10,467 | $10,440 |

| 10/31/2015 | $10,111 | $10,520 |

| 4/30/2016 | $10,253 | $10,566 |

| 10/31/2016 | $10,835 | $10,994 |

| 4/30/2017 | $11,786 | $12,459 |

| 10/31/2017 | $12,401 | $13,593 |

| 4/30/2018 | $12,936 | $14,112 |

| 10/31/2018 | $13,341 | $14,591 |

| 4/30/2019 | $14,843 | $16,016 |

| 10/31/2019 | $14,983 | $16,681 |

| 4/30/2020 | $14,132 | $16,154 |

| 10/31/2020 | $16,301 | $18,301 |

| 4/30/2021 | $20,774 | $23,582 |

| 10/31/2021 | $21,193 | $26,155 |

| 4/30/2022 | $18,310 | $23,632 |

| 10/31/2022 | $17,372 | $22,334 |

| 4/30/2023 | $18,616 | $24,262 |

| 10/31/2023 | $19,997 | $24,599 |

| 4/30/2024 | $26,985 | $29,760 |

| 10/31/2024 | $27,012 | $33,950 |

AVERAGE ANNUAL TOTAL RETURNS

| Disciplined Growth Investors Fund | 1 Year | 5 Year | 10 Year |

|---|

| Disciplined Growth Investors Fund | 35.08% | 12.51% | 10.45% |

| S&P 500 Total Return Index | 38.02% | 15.27% | 13.00% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Call 1-855-344-3863 for current month-end performance.

- Total Net Assets$527,641,275

- # of Portfolio Holdings138

- Portfolio Turnover Rate8%

- Advisory Fees Paid$2,113,550

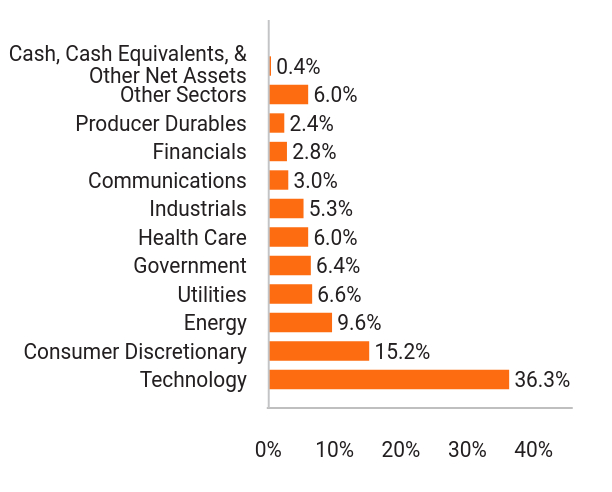

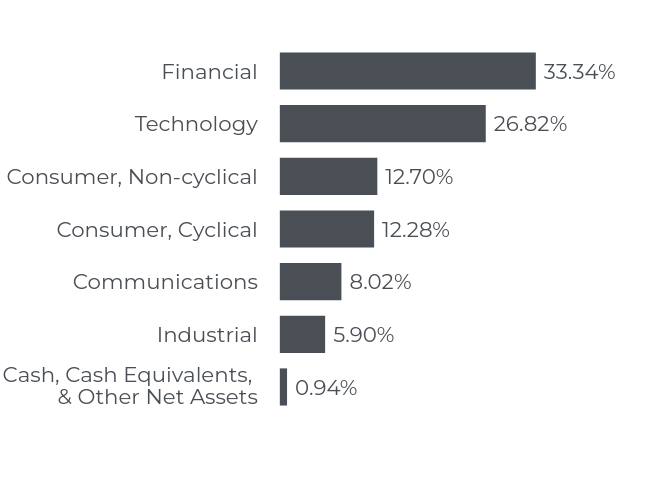

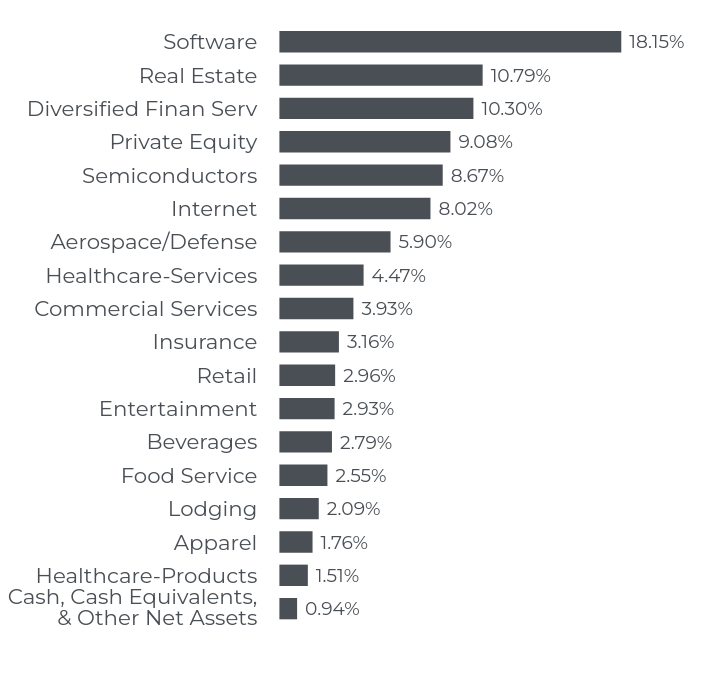

WHAT DID THE FUND INVEST IN?

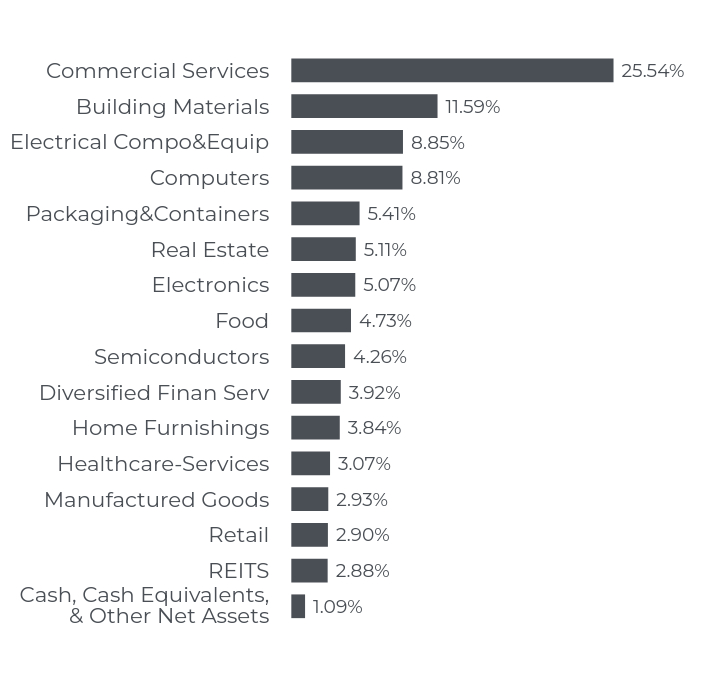

INDUSTRY SECTOR ALLOCATION

| Value | Value |

|---|

| Technology | 36.3% |

| Consumer Discretionary | 15.2% |

| Energy | 9.6% |

| Utilities | 6.6% |

| Government | 6.4% |

| Health Care | 6.0% |

| Industrials | 5.3% |

| Communications | 3.0% |

| Financials | 2.8% |

| Producer Durables | 2.4% |

| Other Sectors | 6.0% |

| Cash, Cash Equivalents, & Other Net Assets | 0.4% |

| Top 10 | Top 10 |

|---|

| U.S. Treasury Note | 5.2% |

| Arista Networks, Inc. | 4.4% |

| Plexus Corp. | 4.3% |

| Pure Storage, Inc. | 3.7% |

| Garmin, Ltd. | 3.6% |

| Super Micro Computer, Inc. | 2.8% |

| Akamai Technologies, Inc. | 2.7% |

| Intuitive Surgical, Inc. | 2.6% |

| Royal Caribbean Cruises, Ltd. | 2.6% |

| InterDigital, Inc. | 2.5% |

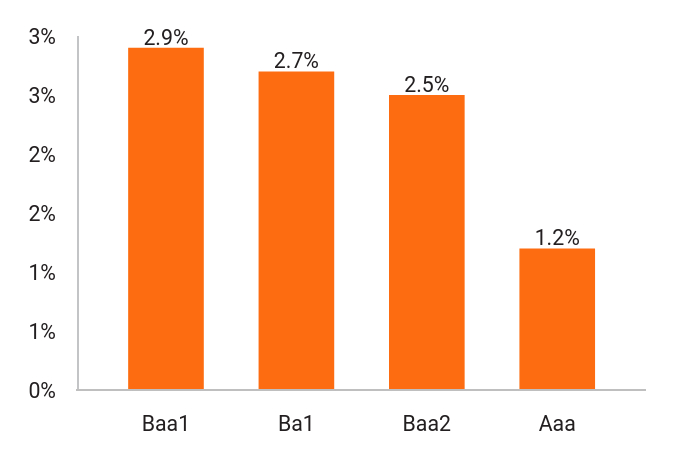

FIXED INCOME: QUALITY STRUCTURE

| Value | Value |

|---|

| Baa1 | 2.9% |

| Ba1 | 2.7% |

| Baa2 | 2.5% |

| Aaa | 1.2% |

| Value | Value |

|---|

| Common Stock | 70.0% |

| Corporate Bond | 23.2% |

| Government Bond | 6.4% |

| Cash, Cash Equivalents, & Other Net Assets | 0.4% |

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.dgifund.com/geeks-lawyers/literature-forms.

DISCIPLINED GROWTH INVESTORS FUND

OCTOBER 31, 2024

SEMI-ANNUAL SHAREHOLDER REPORT

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 1-855-DGI-Fund (344-3863).

Contact Us

1-855-DGI-FUND (344-3863)

Distributor, ALPS Distributors, Inc.

EMERALD FINANCE & BANKING INNOVATION FUND

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

This semi-annual shareholder report shareholder report contains important information about Emerald Finance & Banking Innovation Fund - A for the period of May 1, 2024 to October 31, 2024.

You can find additional information about the Fund at https://www.emeraldmutualfunds.com/literature/emerald-finance-banking-innovation-fund. You can also request this information by contacting us at (855) 828-9909.

WHAT WERE THE FUND’S COST FOR LAST SIX-MONTHS?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 Investment | Cost Paid as a percentage of a $10,000 Investment |

|---|

| Emerald Finance & Banking Innovation Fund - A | $140 | 1.85% |

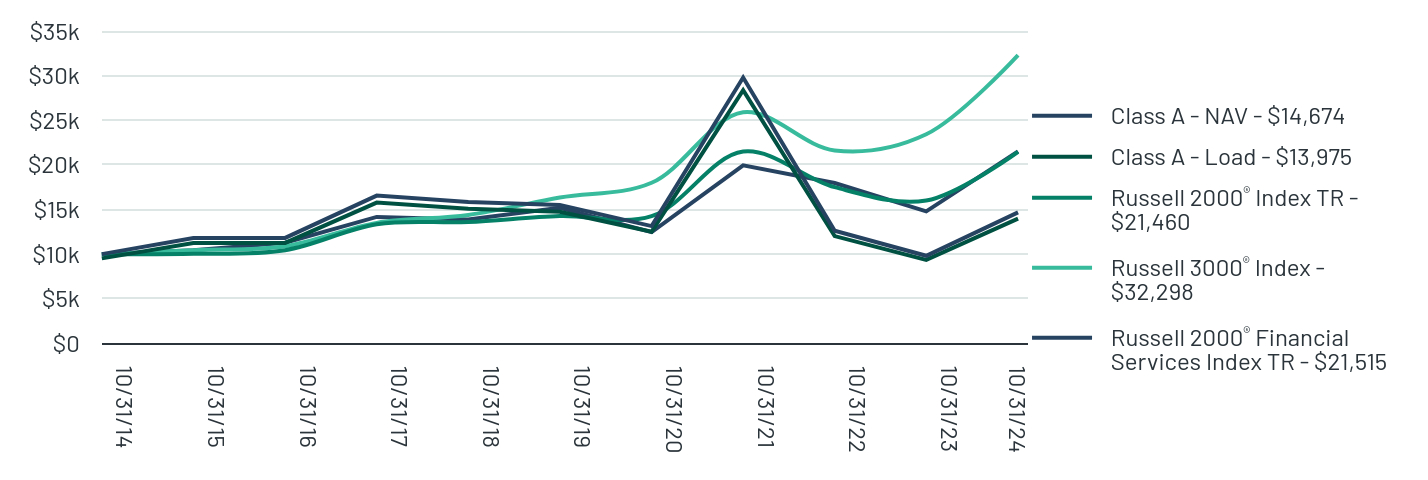

HOW DID THE FUND PERFORM LAST 10 YEARS?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Class A - NAV - $14,674 | Class A - Load - $13,975 | Russell 2000® Index TR - $21,460 | Russell 3000® Index - $32,298 | Russell 2000® Financial Services Index TR - $21,515 |

|---|

| 10/31/24 | $14,674 | $13,975 | $21,460 | $32,298 | $21,515 |

| 10/31/23 | $9,817 | $9,349 | $16,006 | $23,429 | $14,790 |

| 10/31/22 | $12,622 | $12,020 | $17,506 | $21,617 | $17,968 |

| 10/31/21 | $29,785 | $28,367 | $21,490 | $25,894 | $19,953 |

| 10/31/20 | $13,142 | $12,516 | $14,251 | $17,995 | $12,460 |

| 10/31/19 | $15,494 | $14,756 | $14,270 | $16,337 | $15,183 |

| 10/31/18 | $15,844 | $15,090 | $13,603 | $14,395 | $13,869 |

| 10/31/17 | $16,562 | $15,773 | $13,355 | $13,504 | $14,169 |

| 10/31/16 | $11,818 | $11,255 | $10,446 | $10,892 | $11,287 |

| 10/31/15 | $11,810 | $11,248 | $10,034 | $10,449 | $10,431 |

| 10/31/14 | $10,000 | $9,524 | $10,000 | $10,000 | $10,000 |

Average Annual Total Returns

| Class A | 1 Year | 5 Year | 10 Year |

|---|

| Class A - NAV | 49.48% | -1.08% | 3.91% |

| Class A - Load | 42.37% | -2.04% | 3.40% |

Russell 2000® Index TR | 34.07% | 8.50% | 7.94% |

Russell 3000® Index | 37.86% | 14.60% | 12.44% |

Russell 2000® Financial Services Index TR | 45.46% | 7.22% | 7.96% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call (855) 828-9909 for current month-end performance.

- Total Net Assets$51,004,169

- # of Portfolio Holdings73

- Portfolio Turnover Rate57%

- Advisory Fees Paid$246,442

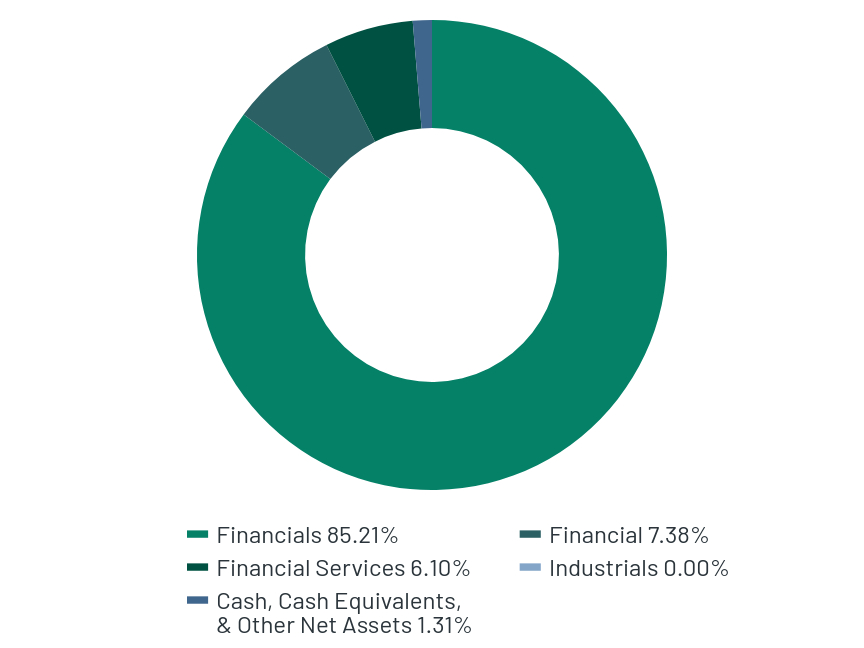

WHAT DID THE FUND INVEST IN?

| Value | Value |

|---|

| Financials | 85.21% |

| Financial | 7.38% |

| Financial Services | 6.10% |

| Industrials | 0.00% |

| Cash, Cash Equivalents, & Other Net Assets | 1.31% |

| Top 10 | % TNA |

|---|

| Northeast Bancorp | 4.70% |

| Metropolitan Bank Holding Corp. | 4.19% |

| Axos Financial, Inc. | 4.15% |

| Kinsale Capital Group, Inc. | 3.38% |

| Skyward Specialty Insurance Group, Inc. | 3.35% |

| Western Alliance Bancorp | 2.93% |

| LendingTree, Inc. | 2.81% |

| Finwise Bancorp | 2.80% |

| Mechanics Bank/Walnut Creek CA | 2.75% |

| First Internet Bancorp | 2.31% |

| Total % of Top 10 Holdings | 33.37% |

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.emeraldmutualfunds.com/literature/emerald-finance-banking-innovation-fund.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent (855) 828-9909.

Contact Us:

Phone: (855) 828-9909

EMERALD FINANCE & BANKING INNOVATION FUND - CLASS A : HSSAX

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

Distributor, ALPS Distributors, Inc.

EMERALD FINANCE & BANKING INNOVATION FUND

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

This semi-annual shareholder report shareholder report contains important information about Emerald Finance & Banking Innovation Fund - C for the period of May 1, 2024 to October 31, 2024.

You can find additional information about the Fund at https://www.emeraldmutualfunds.com/literature/emerald-finance-banking-innovation-fund. You can also request this information by contacting us at (855) 828-9909.

WHAT WERE THE FUND’S COST FOR LAST SIX-MONTHS?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 Investment | Cost Paid as a percentage of a $10,000 Investment |

|---|

| Emerald Finance & Banking Innovation Fund - C | $189 | 2.50% |

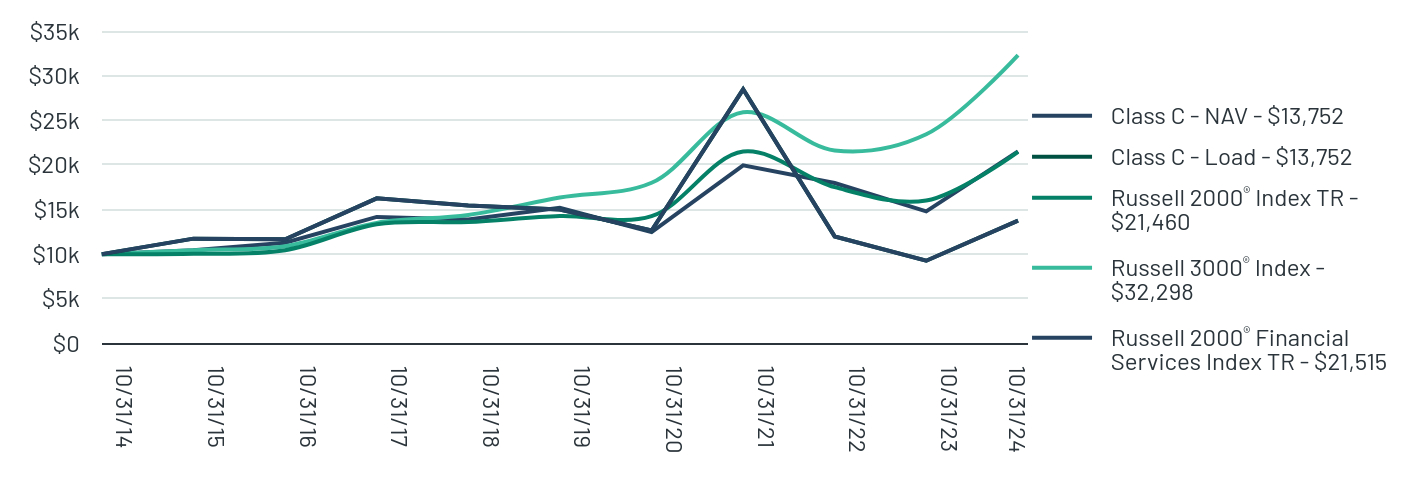

HOW DID THE FUND PERFORM LAST 10 YEARS?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Class C - NAV - $13,752 | Class C - Load - $13,752 | Russell 2000® Index TR - $21,460 | Russell 3000® Index - $32,298 | Russell 2000® Financial Services Index TR - $21,515 |

|---|

| 10/31/24 | $13,752 | $13,752 | $21,460 | $32,298 | $21,515 |

| 10/31/23 | $9,259 | $9,259 | $16,006 | $23,429 | $14,790 |

| 10/31/22 | $11,984 | $11,984 | $17,506 | $21,617 | $17,968 |

| 10/31/21 | $28,469 | $28,469 | $21,490 | $25,894 | $19,953 |

| 10/31/20 | $12,644 | $12,644 | $14,251 | $17,995 | $12,460 |

| 10/31/19 | $14,998 | $14,998 | $14,270 | $16,337 | $15,183 |

| 10/31/18 | $15,442 | $15,442 | $13,603 | $14,395 | $13,869 |

| 10/31/17 | $16,248 | $16,248 | $13,355 | $13,504 | $14,169 |

| 10/31/16 | $11,667 | $11,667 | $10,446 | $10,892 | $11,287 |

| 10/31/15 | $11,735 | $11,735 | $10,034 | $10,449 | $10,431 |

| 10/31/14 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

Average Annual Total Returns

| Class C | 1 Year | 5 Year | 10 Year |

|---|

| Class C - NAV | 48.53% | -1.72% | 3.24% |

| Class C - Load | 47.53% | -1.72% | 3.24% |

Russell 2000® Index TR | 34.07% | 8.50% | 7.94% |

Russell 3000® Index | 37.86% | 14.60% | 12.44% |

Russell 2000® Financial Services Index TR | 45.46% | 7.22% | 7.96% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call (855) 828-9909 for current month-end performance.

- Total Net Assets$51,004,169

- # of Portfolio Holdings73

- Portfolio Turnover Rate57%

- Advisory Fees Paid$246,442

WHAT DID THE FUND INVEST IN?

| Value | Value |

|---|

| Financials | 85.21% |

| Financial | 7.38% |

| Financial Services | 6.10% |

| Industrials | 0.00% |

| Cash, Cash Equivalents, & Other Net Assets | 1.31% |

| Top 10 | % TNA |

|---|

| Northeast Bancorp | 4.70% |

| Metropolitan Bank Holding Corp. | 4.19% |

| Axos Financial, Inc. | 4.15% |

| Kinsale Capital Group, Inc. | 3.38% |

| Skyward Specialty Insurance Group, Inc. | 3.35% |

| Western Alliance Bancorp | 2.93% |

| LendingTree, Inc. | 2.81% |

| Finwise Bancorp | 2.80% |

| Mechanics Bank/Walnut Creek CA | 2.75% |

| First Internet Bancorp | 2.31% |

| Total % of Top 10 Holdings | 33.37% |

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.emeraldmutualfunds.com/literature/emerald-finance-banking-innovation-fund.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent (855) 828-9909.

Contact Us:

Phone: (855) 828-9909

EMERALD FINANCE & BANKING INNOVATION FUND - CLASS C : HSSCX

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

Distributor, ALPS Distributors, Inc.

EMERALD FINANCE & BANKING INNOVATION FUND

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

This semi-annual shareholder report shareholder report contains important information about Emerald Finance & Banking Innovation Fund - Institutional for the period of May 1, 2024 to October 31, 2024.

You can find additional information about the Fund at https://www.emeraldmutualfunds.com/literature/emerald-finance-banking-innovation-fund. You can also request this information by contacting us at (855) 828-9909.

WHAT WERE THE FUND’S COST FOR LAST SIX-MONTHS?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 Investment | Cost Paid as a percentage of a $10,000 Investment |

|---|

| Emerald Finance & Banking Innovation Fund - Institutional | $116 | 1.54% |

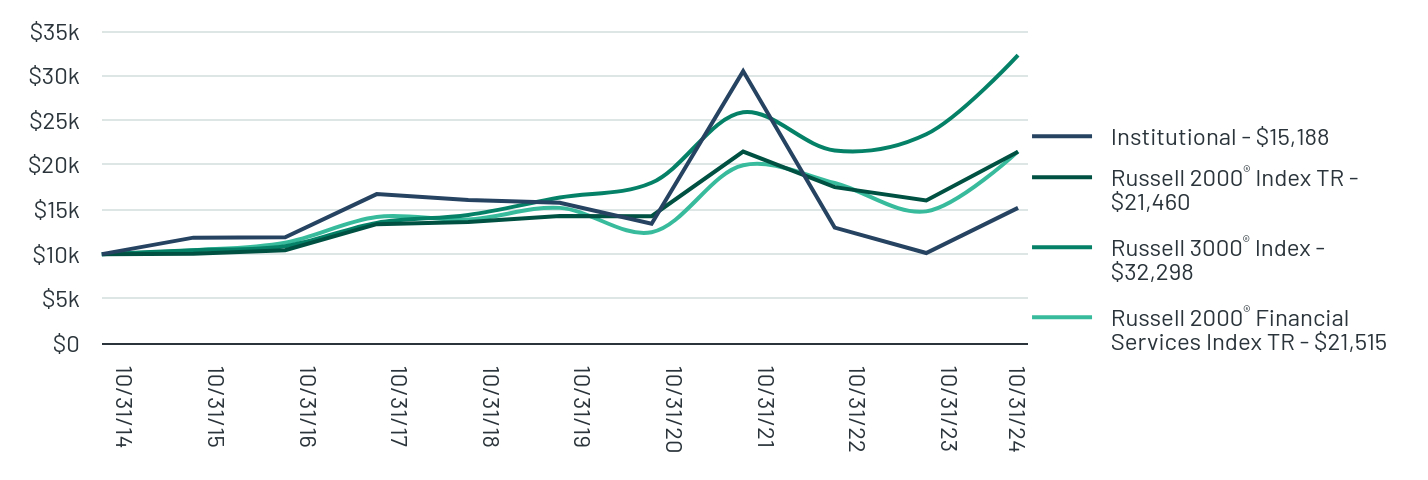

HOW DID THE FUND PERFORM LAST 10 YEARS?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Institutional - $15,188 | Russell 2000® Index TR - $21,460 | Russell 3000® Index - $32,298 | Russell 2000® Financial Services Index TR - $21,515 |

|---|

| 10/31/24 | $15,188 | $21,460 | $32,298 | $21,515 |

| 10/31/23 | $10,126 | $16,006 | $23,429 | $14,790 |

| 10/31/22 | $12,972 | $17,506 | $21,617 | $17,968 |

| 10/31/21 | $30,507 | $21,490 | $25,894 | $19,953 |

| 10/31/20 | $13,412 | $14,251 | $17,995 | $12,460 |

| 10/31/19 | $15,753 | $14,270 | $16,337 | $15,183 |

| 10/31/18 | $16,054 | $13,603 | $14,395 | $13,869 |

| 10/31/17 | $16,725 | $13,355 | $13,504 | $14,169 |

| 10/31/16 | $11,893 | $10,446 | $10,892 | $11,287 |

| 10/31/15 | $11,849 | $10,034 | $10,449 | $10,431 |

| 10/31/14 | $10,000 | $10,000 | $10,000 | $10,000 |

Average Annual Total Returns

| Institutional | 1 Year | 5 Year | 10 Year |

|---|

| Institutional | 50.00% | -0.73% | 4.27% |

Russell 2000® Index TR | 34.07% | 8.50% | 7.94% |

Russell 3000® Index | 37.86% | 14.60% | 12.44% |

Russell 2000® Financial Services Index TR | 45.46% | 7.22% | 7.96% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call (855) 828-9909 for current month-end performance.

- Total Net Assets$51,004,169

- # of Portfolio Holdings73

- Portfolio Turnover Rate57%

- Advisory Fees Paid$246,442

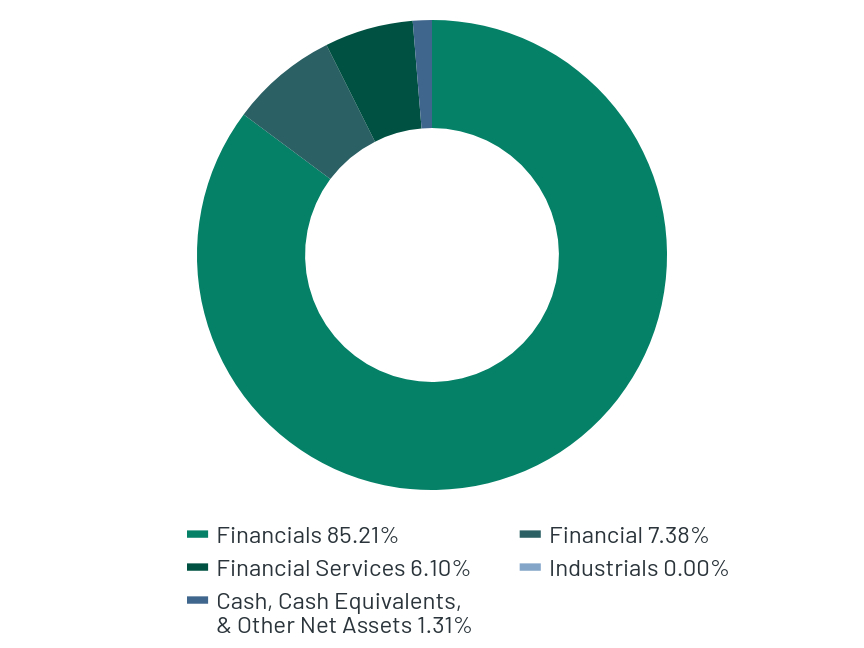

WHAT DID THE FUND INVEST IN?

| Value | Value |

|---|

| Financials | 85.21% |

| Financial | 7.38% |

| Financial Services | 6.10% |

| Industrials | 0.00% |

| Cash, Cash Equivalents, & Other Net Assets | 1.31% |

| Top 10 | % TNA |

|---|

| Northeast Bancorp | 4.70% |

| Metropolitan Bank Holding Corp. | 4.19% |

| Axos Financial, Inc. | 4.15% |

| Kinsale Capital Group, Inc. | 3.38% |

| Skyward Specialty Insurance Group, Inc. | 3.35% |

| Western Alliance Bancorp | 2.93% |

| LendingTree, Inc. | 2.81% |

| Finwise Bancorp | 2.80% |

| Mechanics Bank/Walnut Creek CA | 2.75% |

| First Internet Bancorp | 2.31% |

| Total % of Top 10 Holdings | 33.37% |

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.emeraldmutualfunds.com/literature/emerald-finance-banking-innovation-fund.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent (855) 828-9909.

Contact Us:

Phone: (855) 828-9909

EMERALD FINANCE & BANKING INNOVATION FUND - INSTITUTIONAL : HSSIX

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

Distributor, ALPS Distributors, Inc.

EMERALD FINANCE & BANKING INNOVATION FUND

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

This semi-annual shareholder report shareholder report contains important information about Emerald Finance & Banking Innovation Fund - Investor for the period of May 1, 2024 to October 31, 2024.

You can find additional information about the Fund at https://www.emeraldmutualfunds.com/literature/emerald-finance-banking-innovation-fund. You can also request this information by contacting us at (855) 828-9909.

WHAT WERE THE FUND’S COST FOR LAST SIX-MONTHS?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 Investment | Cost Paid as a percentage of a $10,000 Investment |

|---|

| Emerald Finance & Banking Innovation Fund - Investor | $143 | 1.90% |

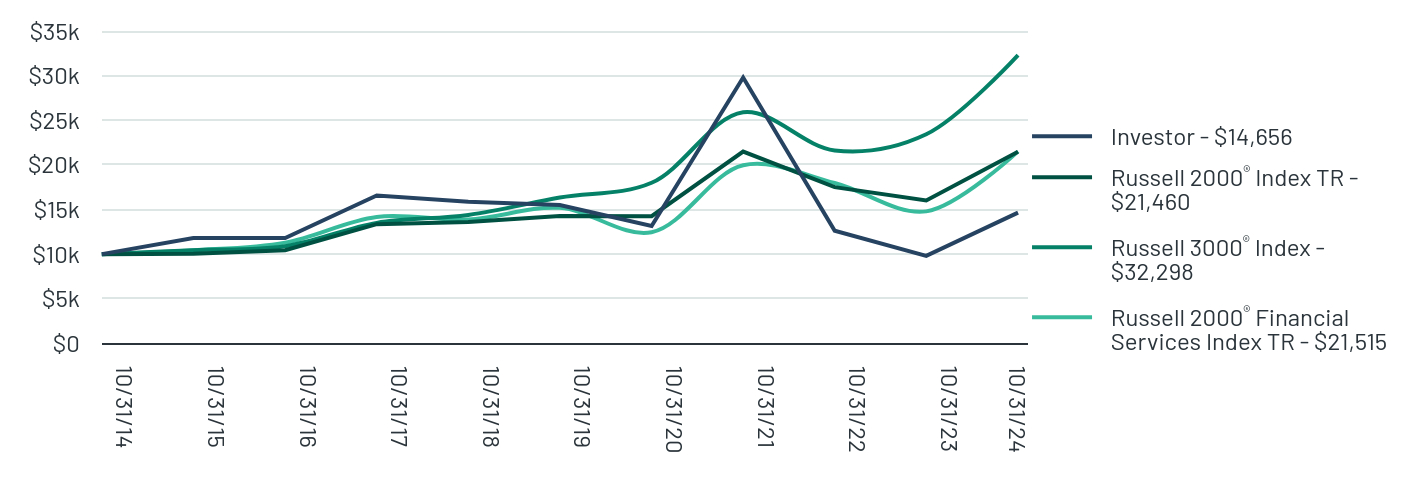

HOW DID THE FUND PERFORM LAST 10 YEARS?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Investor - $14,656 | Russell 2000® Index TR - $21,460 | Russell 3000® Index - $32,298 | Russell 2000® Financial Services Index TR - $21,515 |

|---|

| 10/31/24 | $14,656 | $21,460 | $32,298 | $21,515 |

| 10/31/23 | $9,810 | $16,006 | $23,429 | $14,790 |

| 10/31/22 | $12,618 | $17,506 | $21,617 | $17,968 |

| 10/31/21 | $29,786 | $21,490 | $25,894 | $19,953 |

| 10/31/20 | $13,146 | $14,251 | $17,995 | $12,460 |

| 10/31/19 | $15,503 | $14,270 | $16,337 | $15,183 |

| 10/31/18 | $15,859 | $13,603 | $14,395 | $13,869 |

| 10/31/17 | $16,566 | $13,355 | $13,504 | $14,169 |

| 10/31/16 | $11,814 | $10,446 | $10,892 | $11,287 |

| 10/31/15 | $11,814 | $10,034 | $10,449 | $10,431 |

| 10/31/14 | $10,000 | $10,000 | $10,000 | $10,000 |

Average Annual Total Returns

| Investor | 1 Year | 5 Year | 10 Year |

|---|

| Investor | 49.40% | -1.12% | 3.90% |

Russell 2000® Index TR | 34.07% | 8.50% | 7.94% |

Russell 3000® Index | 37.86% | 14.60% | 12.44% |

Russell 2000® Financial Services Index TR | 45.46% | 7.22% | 7.96% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call (855) 828-9909 for current month-end performance.

- Total Net Assets$51,004,169

- # of Portfolio Holdings73

- Portfolio Turnover Rate57%

- Advisory Fees Paid$246,442

WHAT DID THE FUND INVEST IN?

| Value | Value |

|---|

| Financials | 85.21% |

| Financial | 7.38% |

| Financial Services | 6.10% |

| Industrials | 0.00% |

| Cash, Cash Equivalents, & Other Net Assets | 1.31% |

| Top 10 | % TNA |

|---|

| Northeast Bancorp | 4.70% |

| Metropolitan Bank Holding Corp. | 4.19% |

| Axos Financial, Inc. | 4.15% |

| Kinsale Capital Group, Inc. | 3.38% |

| Skyward Specialty Insurance Group, Inc. | 3.35% |

| Western Alliance Bancorp | 2.93% |

| LendingTree, Inc. | 2.81% |

| Finwise Bancorp | 2.80% |

| Mechanics Bank/Walnut Creek CA | 2.75% |

| First Internet Bancorp | 2.31% |

| Total % of Top 10 Holdings | 33.37% |

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.emeraldmutualfunds.com/literature/emerald-finance-banking-innovation-fund.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent (855) 828-9909.

Contact Us:

Phone: (855) 828-9909

EMERALD FINANCE & BANKING INNOVATION FUND - INVESTOR : FFBFX

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

Distributor, ALPS Distributors, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

This semi-annual shareholder report shareholder report contains important information about Emerald Growth Fund - A for the period of May 1, 2024 to October 31, 2024.

You can find additional information about the Fund at https://www.emeraldmutualfunds.com/literature/emerald-growth-fund. You can also request this information by contacting us at (855) 828-9909.

WHAT WERE THE FUND’S COST FOR LAST SIX-MONTHS?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 Investment | Cost Paid as a percentage of a $10,000 Investment |

|---|

| Emerald Growth Fund - A | $70 | 1.08% |

HOW DID THE FUND PERFORM LAST 10 YEARS?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Class A - NAV - $25,124 | Class A - Load - $23,929 | Russell 2000® Growth Index TR - $21,890 | Russell 3000® Index - $32,298 |

|---|

| 10/31/24 | $25,124 | $23,929 | $21,890 | $32,298 |

| 10/31/23 | $17,841 | $16,993 | $16,037 | $23,429 |

| 10/31/22 | $19,392 | $18,470 | $17,362 | $21,617 |

| 10/31/21 | $25,796 | $24,570 | $23,469 | $25,894 |

| 10/31/20 | $19,033 | $18,128 | $16,951 | $17,995 |

| 10/31/19 | $15,886 | $15,131 | $14,952 | $16,337 |

| 10/31/18 | $14,849 | $14,143 | $14,053 | $14,395 |

| 10/31/17 | $14,238 | $13,561 | $13,495 | $13,504 |

| 10/31/16 | $10,585 | $10,081 | $10,302 | $10,892 |

| 10/31/15 | $10,976 | $10,454 | $10,352 | $10,449 |

| 10/31/14 | $10,000 | $9,525 | $10,000 | $10,000 |

Average Annual Total Returns

| Class A | 1 Year | 5 Year | 10 Year |

|---|

| Class A - NAV | 40.82% | 9.60% | 9.65% |

| Class A - Load | 34.15% | 8.54% | 9.12% |

Russell 2000® Growth Index TR | 36.49% | 7.92% | 8.15% |

Russell 3000® Index | 37.86% | 14.60% | 12.44% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call (855) 828-9909 for current month-end performance.

- Total Net Assets$947,447,405

- # of Portfolio Holdings122

- Portfolio Turnover Rate109%

- Advisory Fees Paid$3,025,851

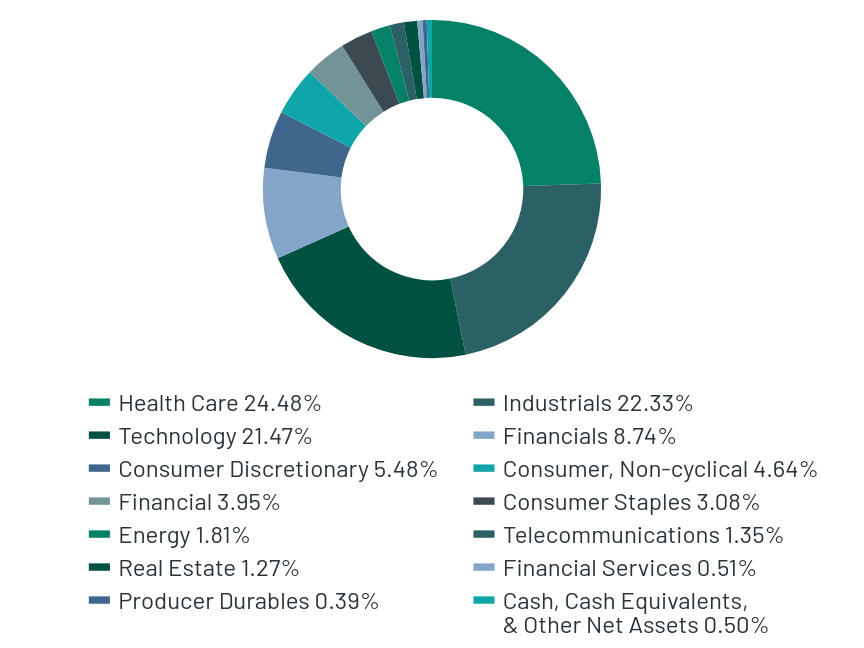

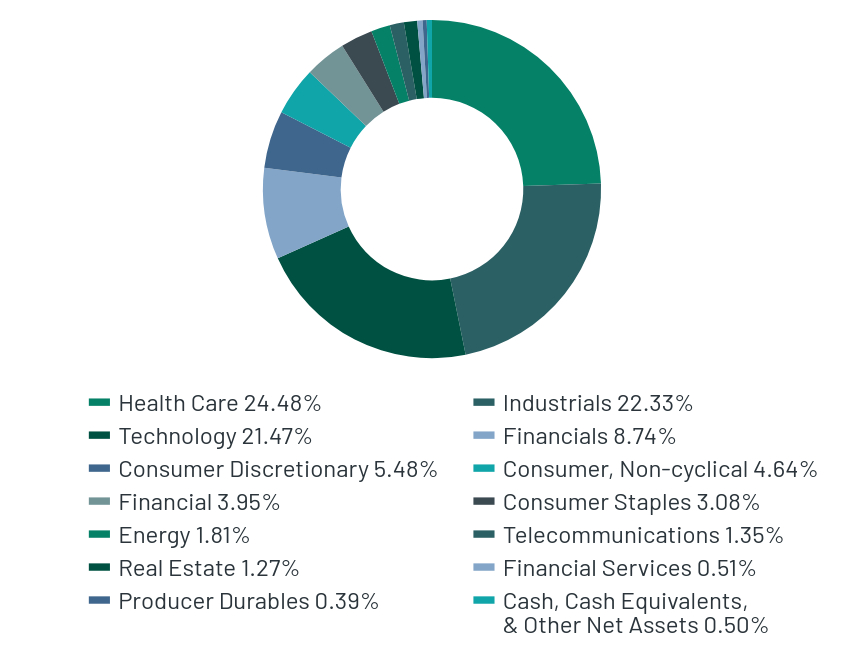

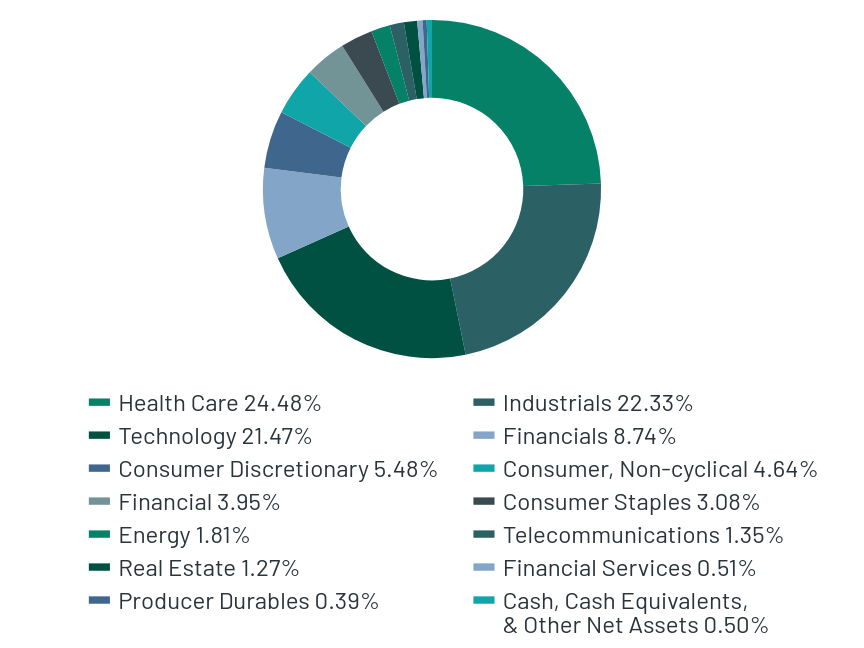

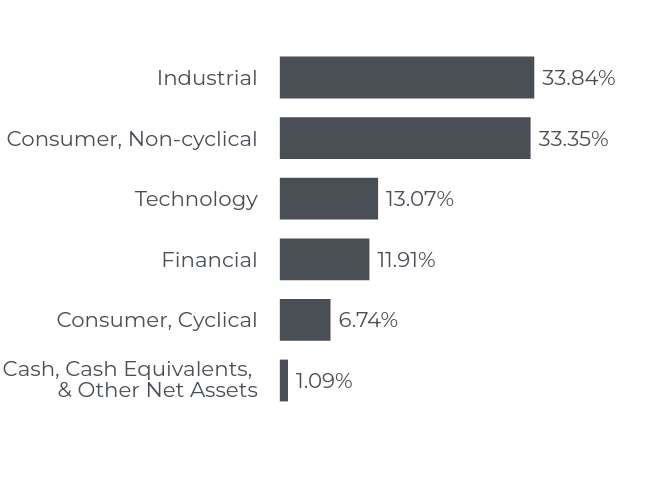

WHAT DID THE FUND INVEST IN?

| Value | Value |

|---|

| Health Care | 24.48% |

| Industrials | 22.33% |

| Technology | 21.47% |

| Financials | 8.74% |

| Consumer Discretionary | 5.48% |

| Consumer, Non-cyclical | 4.64% |

| Financial | 3.95% |

| Consumer Staples | 3.08% |

| Energy | 1.81% |

| Telecommunications | 1.35% |

| Real Estate | 1.27% |

| Financial Services | 0.51% |

| Producer Durables | 0.39% |

| Cash, Cash Equivalents, & Other Net Assets | 0.50% |

| Top 10 | % TNA |

|---|

| F/m Emerald Life Sciences Innovation ETF | 5.25% |

| FTAI Aviation Ltd | 3.06% |

| Freshpet, Inc. | 2.82% |

| Credo Technology Group Holding, Ltd. | 2.55% |

| Q2 Holdings, Inc. | 2.15% |

| AeroVironment, Inc. | 2.02% |

| Palomar Holdings, Inc. | 1.89% |

| Skyward Specialty Insurance Group, Inc. | 1.78% |

| Kratos Defense & Security Solutions, Inc. | 1.77% |

| Varonis Systems, Inc. | 1.76% |

| Total % of Top 10 Holdings | 25.05% |

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.emeraldmutualfunds.com/literature/emerald-growth-fund.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent (855) 828-9909.

Contact Us:

Phone: (855) 828-9909

EMERALD GROWTH FUND - CLASS A : HSPGX

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

Distributor, ALPS Distributors, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

This semi-annual shareholder report shareholder report contains important information about Emerald Growth Fund - C for the period of May 1, 2024 to October 31, 2024.

You can find additional information about the Fund at https://www.emeraldmutualfunds.com/literature/emerald-growth-fund. You can also request this information by contacting us at (855) 828-9909.

WHAT WERE THE FUND’S COST FOR LAST SIX-MONTHS?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 Investment | Cost Paid as a percentage of a $10,000 Investment |

|---|

| Emerald Growth Fund - C | $112 | 1.74% |

HOW DID THE FUND PERFORM LAST 10 YEARS?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Class C - NAV - $23,529 | Class C - Load - $23,529 | Russell 2000® Growth Index TR - $21,890 | Russell 3000® Index - $32,298 |

|---|

| 10/31/24 | $23,529 | $23,529 | $21,890 | $32,298 |

| 10/31/23 | $16,831 | $16,831 | $16,037 | $23,429 |

| 10/31/22 | $18,414 | $18,414 | $17,362 | $21,617 |

| 10/31/21 | $24,649 | $24,649 | $23,469 | $25,894 |

| 10/31/20 | $18,307 | $18,307 | $16,951 | $17,995 |

| 10/31/19 | $15,374 | $15,374 | $14,952 | $16,337 |

| 10/31/18 | $14,466 | $14,466 | $14,053 | $14,395 |

| 10/31/17 | $13,962 | $13,962 | $13,495 | $13,504 |

| 10/31/16 | $10,451 | $10,451 | $10,302 | $10,892 |

| 10/31/15 | $10,905 | $10,905 | $10,352 | $10,449 |

| 10/31/14 | $10,000 | $10,000 | $10,000 | $10,000 |

Average Annual Total Returns

| Class C | 1 Year | 5 Year | 10 Year |

|---|

| Class C - NAV | 39.80% | 8.88% | 8.93% |

| Class C - Load | 38.80% | 8.88% | 8.93% |

Russell 2000® Growth Index TR | 36.49% | 7.92% | 8.15% |

Russell 3000® Index | 37.86% | 14.60% | 12.44% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call (855) 828-9909 for current month-end performance.

- Total Net Assets$947,447,405

- # of Portfolio Holdings122

- Portfolio Turnover Rate109%

- Advisory Fees Paid$3,025,851

WHAT DID THE FUND INVEST IN?

| Value | Value |

|---|

| Health Care | 24.48% |

| Industrials | 22.33% |

| Technology | 21.47% |

| Financials | 8.74% |

| Consumer Discretionary | 5.48% |

| Consumer, Non-cyclical | 4.64% |

| Financial | 3.95% |

| Consumer Staples | 3.08% |

| Energy | 1.81% |

| Telecommunications | 1.35% |

| Real Estate | 1.27% |

| Financial Services | 0.51% |

| Producer Durables | 0.39% |

| Cash, Cash Equivalents, & Other Net Assets | 0.50% |

| Top 10 | % TNA |

|---|

| F/m Emerald Life Sciences Innovation ETF | 5.25% |

| FTAI Aviation Ltd | 3.06% |

| Freshpet, Inc. | 2.82% |

| Credo Technology Group Holding, Ltd. | 2.55% |

| Q2 Holdings, Inc. | 2.15% |

| AeroVironment, Inc. | 2.02% |

| Palomar Holdings, Inc. | 1.89% |

| Skyward Specialty Insurance Group, Inc. | 1.78% |

| Kratos Defense & Security Solutions, Inc. | 1.77% |

| Varonis Systems, Inc. | 1.76% |

| Total % of Top 10 Holdings | 25.05% |

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.emeraldmutualfunds.com/literature/emerald-growth-fund.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent (855) 828-9909.

Contact Us:

Phone: (855) 828-9909

EMERALD GROWTH FUND - CLASS C : HSPCX

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

Distributor, ALPS Distributors, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

This semi-annual shareholder report shareholder report contains important information about Emerald Growth Fund - Institutional for the period of May 1, 2024 to October 31, 2024.

You can find additional information about the Fund at https://www.emeraldmutualfunds.com/literature/emerald-growth-fund. You can also request this information by contacting us at (855) 828-9909.

WHAT WERE THE FUND’S COST FOR LAST SIX-MONTHS?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 Investment | Cost Paid as a percentage of a $10,000 Investment |

|---|

| Emerald Growth Fund - Institutional | $50 | 0.78% |

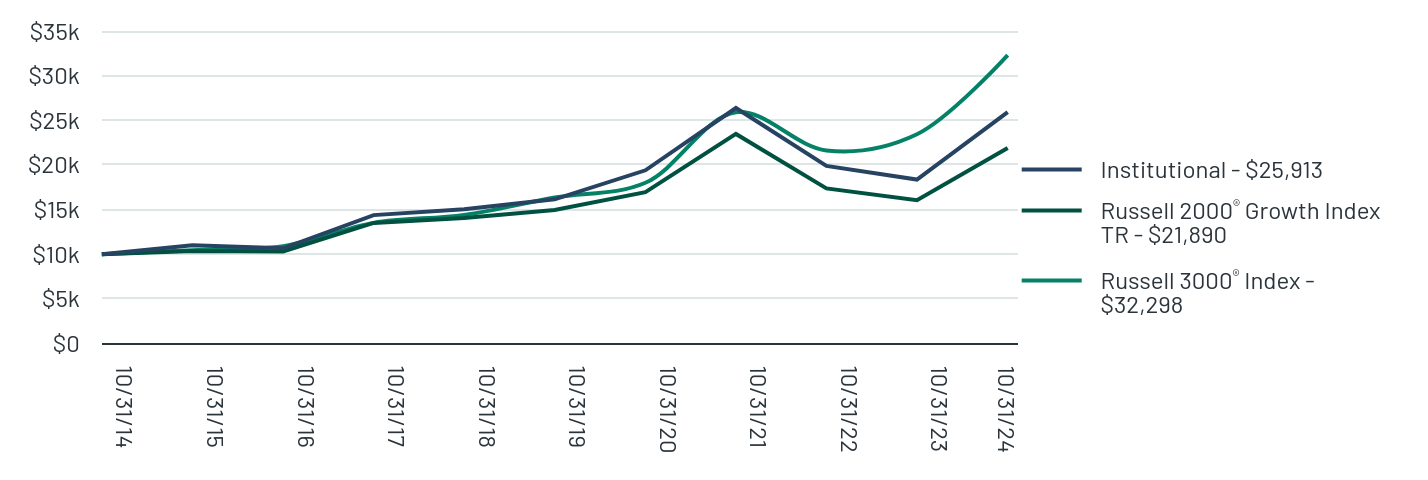

HOW DID THE FUND PERFORM LAST 10 YEARS?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Institutional - $25,913 | Russell 2000® Growth Index TR - $21,890 | Russell 3000® Index - $32,298 |

|---|

| 10/31/24 | $25,913 | $21,890 | $32,298 |

| 10/31/23 | $18,352 | $16,037 | $23,429 |

| 10/31/22 | $19,886 | $17,362 | $21,617 |

| 10/31/21 | $26,373 | $23,469 | $25,894 |

| 10/31/20 | $19,395 | $16,951 | $17,995 |

| 10/31/19 | $16,140 | $14,952 | $16,337 |

| 10/31/18 | $15,035 | $14,053 | $14,395 |

| 10/31/17 | $14,372 | $13,495 | $13,504 |

| 10/31/16 | $10,653 | $10,302 | $10,892 |

| 10/31/15 | $11,007 | $10,352 | $10,449 |

| 10/31/14 | $10,000 | $10,000 | $10,000 |

Average Annual Total Returns

| Institutional | 1 Year | 5 Year | 10 Year |

|---|

| Institutional | 41.21% | 9.93% | 9.99% |

Russell 2000® Growth Index TR | 36.49% | 7.92% | 8.15% |

Russell 3000® Index | 37.86% | 14.60% | 12.44% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call (855) 828-9909 for current month-end performance.

- Total Net Assets$947,447,405

- # of Portfolio Holdings122

- Portfolio Turnover Rate109%

- Advisory Fees Paid$3,025,851

WHAT DID THE FUND INVEST IN?

| Value | Value |

|---|

| Health Care | 24.48% |

| Industrials | 22.33% |

| Technology | 21.47% |

| Financials | 8.74% |

| Consumer Discretionary | 5.48% |

| Consumer, Non-cyclical | 4.64% |

| Financial | 3.95% |

| Consumer Staples | 3.08% |

| Energy | 1.81% |

| Telecommunications | 1.35% |

| Real Estate | 1.27% |

| Financial Services | 0.51% |

| Producer Durables | 0.39% |

| Cash, Cash Equivalents, & Other Net Assets | 0.50% |

| Top 10 | % TNA |

|---|

| F/m Emerald Life Sciences Innovation ETF | 5.25% |

| FTAI Aviation Ltd | 3.06% |

| Freshpet, Inc. | 2.82% |

| Credo Technology Group Holding, Ltd. | 2.55% |

| Q2 Holdings, Inc. | 2.15% |

| AeroVironment, Inc. | 2.02% |

| Palomar Holdings, Inc. | 1.89% |

| Skyward Specialty Insurance Group, Inc. | 1.78% |

| Kratos Defense & Security Solutions, Inc. | 1.77% |

| Varonis Systems, Inc. | 1.76% |

| Total % of Top 10 Holdings | 25.05% |

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.emeraldmutualfunds.com/literature/emerald-growth-fund.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent (855) 828-9909.

Contact Us:

Phone: (855) 828-9909

EMERALD GROWTH FUND - INSTITUTIONAL : FGROX

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

Distributor, ALPS Distributors, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

This semi-annual shareholder report shareholder report contains important information about Emerald Growth Fund - Investor for the period of May 1, 2024 to October 31, 2024.

You can find additional information about the Fund at https://www.emeraldmutualfunds.com/literature/emerald-growth-fund. You can also request this information by contacting us at (855) 828-9909.

WHAT WERE THE FUND’S COST FOR LAST SIX-MONTHS?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 Investment | Cost Paid as a percentage of a $10,000 Investment |

|---|

| Emerald Growth Fund - Investor | $73 | 1.13% |

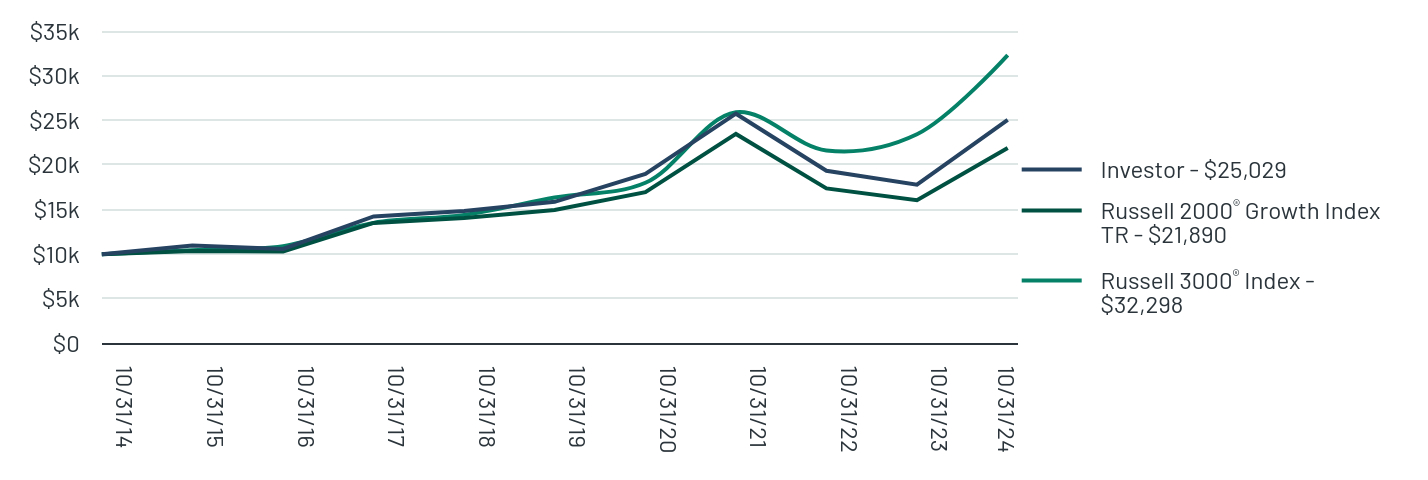

HOW DID THE FUND PERFORM LAST 10 YEARS?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Investor - $25,029 | Russell 2000® Growth Index TR - $21,890 | Russell 3000® Index - $32,298 |

|---|

| 10/31/24 | $25,029 | $21,890 | $32,298 |

| 10/31/23 | $17,781 | $16,037 | $23,429 |

| 10/31/22 | $19,341 | $17,362 | $21,617 |

| 10/31/21 | $25,736 | $23,469 | $25,894 |

| 10/31/20 | $18,995 | $16,951 | $17,995 |

| 10/31/19 | $15,857 | $14,952 | $16,337 |

| 10/31/18 | $14,829 | $14,053 | $14,395 |

| 10/31/17 | $14,223 | $13,495 | $13,504 |

| 10/31/16 | $10,581 | $10,302 | $10,892 |

| 10/31/15 | $10,979 | $10,352 | $10,449 |

| 10/31/14 | $10,000 | $10,000 | $10,000 |

Average Annual Total Returns

| Investor | 1 Year | 5 Year | 10 Year |

|---|

| Investor | 40.76% | 9.56% | 9.61% |

Russell 2000® Growth Index TR | 36.49% | 7.92% | 8.15% |

Russell 3000® Index | 37.86% | 14.60% | 12.44% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call (855) 828-9909 for current month-end performance.

- Total Net Assets$947,447,405

- # of Portfolio Holdings122

- Portfolio Turnover Rate109%

- Advisory Fees Paid$3,025,851

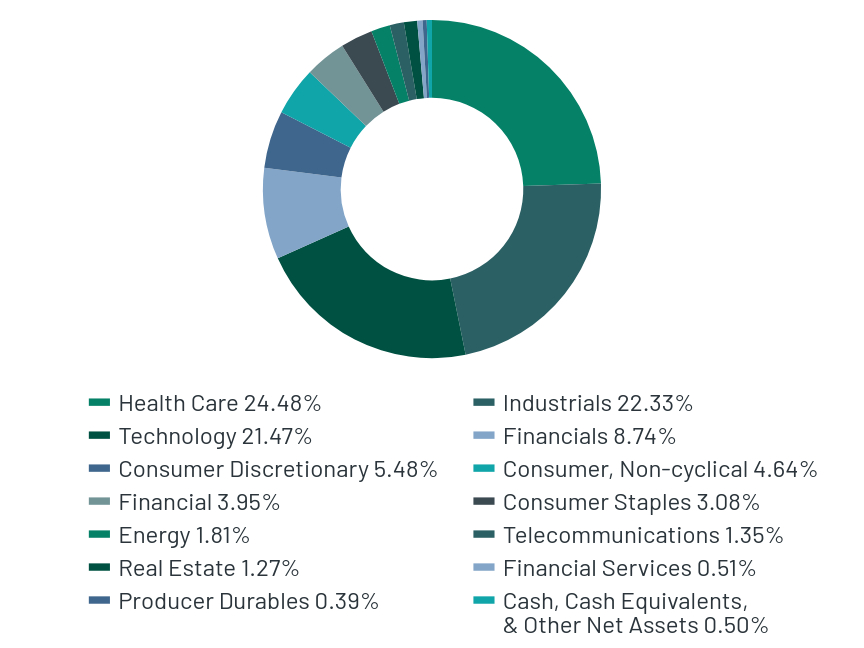

WHAT DID THE FUND INVEST IN?

| Value | Value |

|---|

| Health Care | 24.48% |

| Industrials | 22.33% |

| Technology | 21.47% |

| Financials | 8.74% |

| Consumer Discretionary | 5.48% |

| Consumer, Non-cyclical | 4.64% |

| Financial | 3.95% |

| Consumer Staples | 3.08% |

| Energy | 1.81% |

| Telecommunications | 1.35% |

| Real Estate | 1.27% |

| Financial Services | 0.51% |

| Producer Durables | 0.39% |

| Cash, Cash Equivalents, & Other Net Assets | 0.50% |

| Top 10 | % TNA |

|---|

| F/m Emerald Life Sciences Innovation ETF | 5.25% |

| FTAI Aviation Ltd | 3.06% |

| Freshpet, Inc. | 2.82% |

| Credo Technology Group Holding, Ltd. | 2.55% |

| Q2 Holdings, Inc. | 2.15% |

| AeroVironment, Inc. | 2.02% |

| Palomar Holdings, Inc. | 1.89% |

| Skyward Specialty Insurance Group, Inc. | 1.78% |

| Kratos Defense & Security Solutions, Inc. | 1.77% |

| Varonis Systems, Inc. | 1.76% |

| Total % of Top 10 Holdings | 25.05% |

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.emeraldmutualfunds.com/literature/emerald-growth-fund.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent (855) 828-9909.

Contact Us:

Phone: (855) 828-9909

EMERALD GROWTH FUND - INVESTOR : FFGRX

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

Distributor, ALPS Distributors, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

This semi-annual shareholder report shareholder report contains important information about Emerald Insights Fund - A for the period of May 1, 2024 to October 31, 2024.

You can find additional information about the Fund at https://www.emeraldmutualfunds.com/literature/emerald-insights-fund. You can also request this information by contacting us at (855) 828-9909.

WHAT WERE THE FUND’S COST FOR LAST SIX-MONTHS?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 Investment | Cost Paid as a percentage of a $10,000 Investment |

|---|

| Emerald Insights Fund - A | $88 | 1.35% |

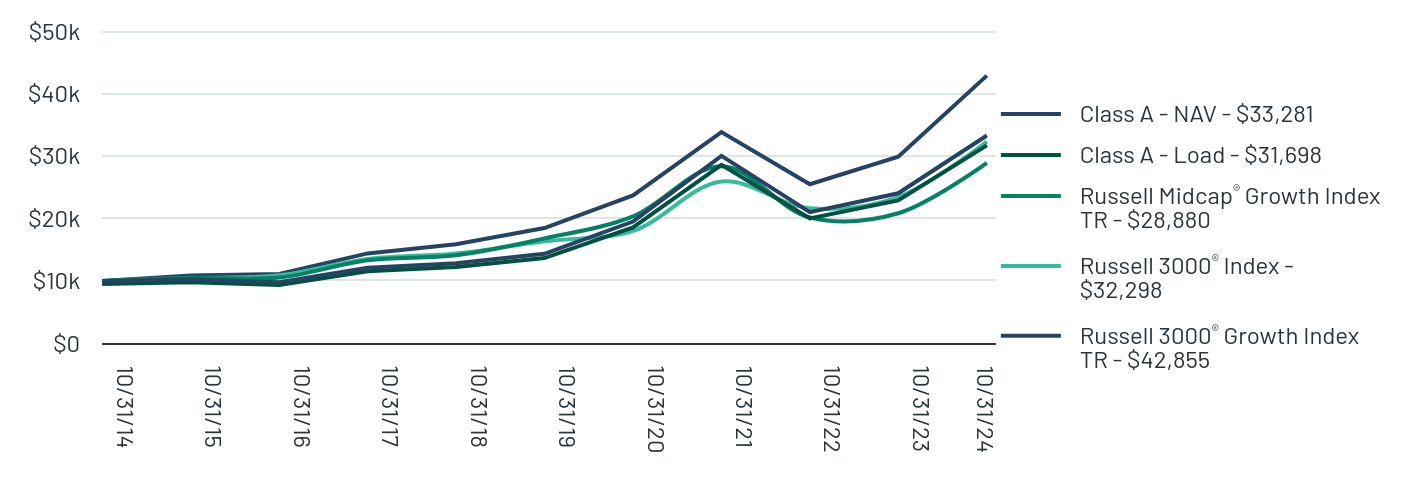

HOW DID THE FUND PERFORM LAST 10 YEARS?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Class A - NAV - $33,281 | Class A - Load - $31,698 | Russell Midcap® Growth Index TR - $28,880 | Russell 3000® Index - $32,298 | Russell 3000® Growth Index TR - $42,855 |

|---|

| 10/31/24 | $33,281 | $31,698 | $28,880 | $32,298 | $42,855 |

| 10/31/23 | $24,024 | $22,881 | $20,826 | $23,429 | $29,880 |

| 10/31/22 | $21,005 | $20,005 | $20,151 | $21,617 | $25,469 |

| 10/31/21 | $30,006 | $28,578 | $28,358 | $25,894 | $33,812 |

| 10/31/20 | $19,498 | $18,571 | $20,339 | $17,995 | $23,675 |

| 10/31/19 | $14,336 | $13,654 | $16,790 | $16,337 | $18,467 |

| 10/31/18 | $12,840 | $12,229 | $14,118 | $14,395 | $15,874 |

| 10/31/17 | $12,106 | $11,530 | $13,301 | $13,504 | $14,405 |

| 10/31/16 | $9,794 | $9,328 | $10,536 | $10,892 | $11,098 |

| 10/31/15 | $10,255 | $9,767 | $10,494 | $10,449 | $10,872 |

| 10/31/14 | $10,000 | $9,524 | $10,000 | $10,000 | $10,000 |

Average Annual Total Returns

| Class A | 1 Year | 5 Year | 10 Year |

|---|

| Class A - NAV | 38.53% | 18.35% | 12.78% |

| Class A - Load | 31.92% | 17.19% | 12.23% |

Russell Midcap® Growth Index TR | 38.67% | 11.46% | 11.19% |

Russell 3000® Index | 37.86% | 14.60% | 12.44% |

Russell 3000® Growth Index TR | 43.42% | 18.34% | 15.66% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call (855) 828-9909 for current month-end performance.

- Total Net Assets$23,113,274

- # of Portfolio Holdings68

- Portfolio Turnover Rate115%

- Advisory Fees Paid$85,448

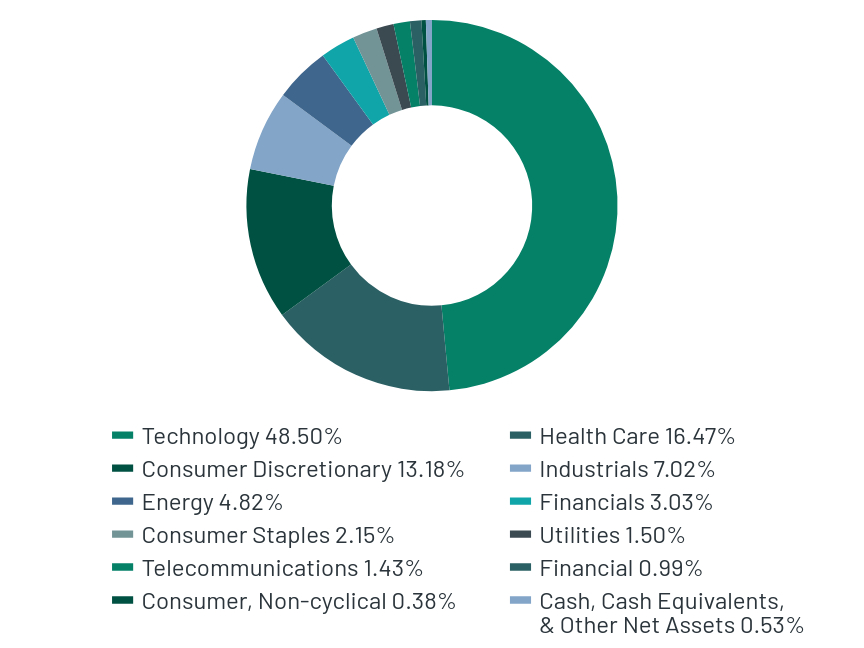

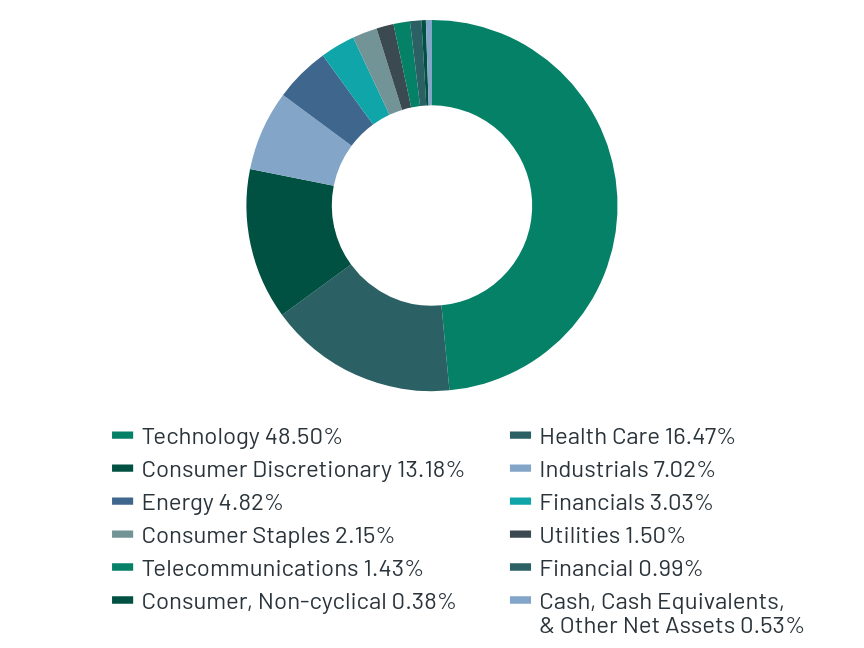

WHAT DID THE FUND INVEST IN?

| Value | Value |

|---|

| Technology | 48.50% |

| Health Care | 16.47% |

| Consumer Discretionary | 13.18% |

| Industrials | 7.02% |

| Energy | 4.82% |

| Financials | 3.03% |

| Consumer Staples | 2.15% |

| Utilities | 1.50% |

| Telecommunications | 1.43% |

| Financial | 0.99% |

| Consumer, Non-cyclical | 0.38% |

| Cash, Cash Equivalents, & Other Net Assets | 0.53% |

| Top 10 | % TNA |

|---|

| NVIDIA Corp. | 12.04% |

| Microsoft Corp. | 9.45% |

| Apple, Inc. | 8.82% |

| Amazon.com, Inc. | 5.67% |

| Alphabet, Inc. | 4.85% |

| Meta Platforms, Inc. | 4.08% |

| Broadcom, Ltd. | 2.79% |

| WaVe Life Sciences, Ltd. | 2.04% |

| Eli Lilly & Co. | 2.02% |

| Insmed, Inc. | 1.79% |

| Total % of Top 10 Holdings | 53.55% |

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.emeraldmutualfunds.com/literature/emerald-insights-fund.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent (855) 828-9909.

Contact Us:

Phone: (855) 828-9909

EMERALD INSIGHTS FUND - CLASS A : EFCAX

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

Distributor, ALPS Distributors, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

This semi-annual shareholder report shareholder report contains important information about Emerald Insights Fund - C for the period of May 1, 2024 to October 31, 2024.

You can find additional information about the Fund at https://www.emeraldmutualfunds.com/literature/emerald-insights-fund. You can also request this information by contacting us at (855) 828-9909.

WHAT WERE THE FUND’S COST FOR LAST SIX-MONTHS?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 Investment | Cost Paid as a percentage of a $10,000 Investment |

|---|

| Emerald Insights Fund - C | $131 | 2.01% |

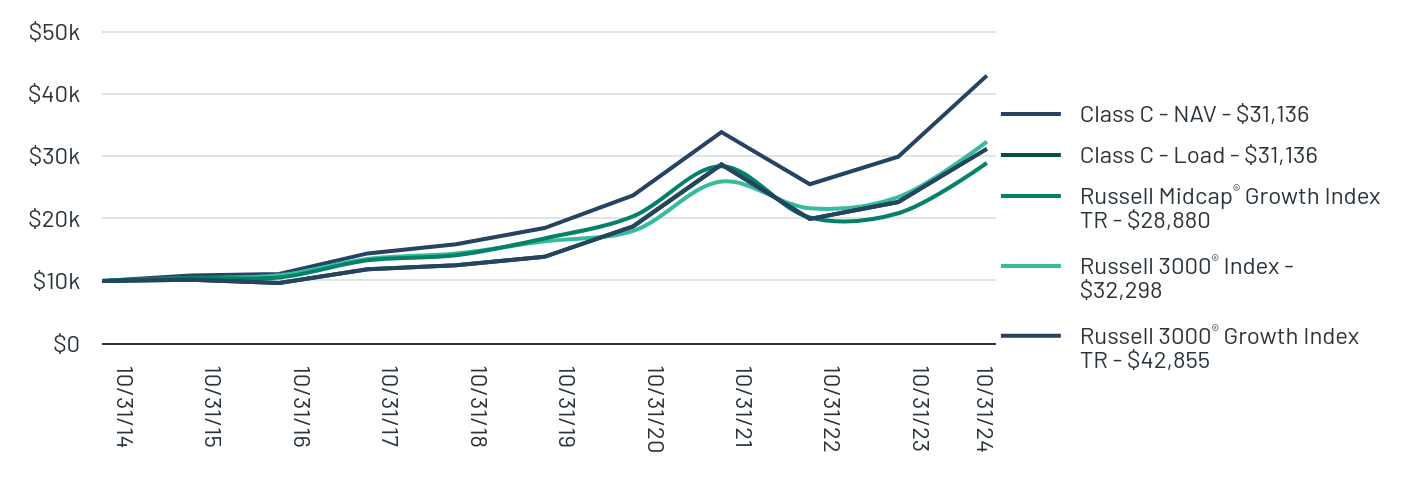

HOW DID THE FUND PERFORM LAST 10 YEARS?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Class C - NAV - $31,136 | Class C - Load - $31,136 | Russell Midcap® Growth Index TR - $28,880 | Russell 3000® Index - $32,298 | Russell 3000® Growth Index TR - $42,855 |

|---|

| 10/31/24 | $31,136 | $31,136 | $28,880 | $32,298 | $42,855 |

| 10/31/23 | $22,621 | $22,621 | $20,826 | $23,429 | $29,880 |

| 10/31/22 | $19,919 | $19,919 | $20,151 | $21,617 | $25,469 |

| 10/31/21 | $28,633 | $28,633 | $28,358 | $25,894 | $33,812 |

| 10/31/20 | $18,735 | $18,735 | $20,339 | $17,995 | $23,675 |

| 10/31/19 | $13,857 | $13,857 | $16,790 | $16,337 | $18,467 |

| 10/31/18 | $12,493 | $12,493 | $14,118 | $14,395 | $15,874 |

| 10/31/17 | $11,855 | $11,855 | $13,301 | $13,504 | $14,405 |

| 10/31/16 | $9,657 | $9,657 | $10,536 | $10,892 | $11,098 |

| 10/31/15 | $10,177 | $10,177 | $10,494 | $10,449 | $10,872 |

| 10/31/14 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

Average Annual Total Returns

| Class C | 1 Year | 5 Year | 10 Year |

|---|

| Class C - NAV | 37.64% | 17.58% | 12.03% |

| Class C - Load | 36.64% | 17.58% | 12.03% |

Russell Midcap® Growth Index TR | 38.67% | 11.46% | 11.19% |

Russell 3000® Index | 37.86% | 14.60% | 12.44% |

Russell 3000® Growth Index TR | 43.42% | 18.34% | 15.66% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call (855) 828-9909 for current month-end performance.

- Total Net Assets$23,113,274

- # of Portfolio Holdings68

- Portfolio Turnover Rate115%

- Advisory Fees Paid$85,448

WHAT DID THE FUND INVEST IN?

| Value | Value |

|---|

| Technology | 48.50% |

| Health Care | 16.47% |

| Consumer Discretionary | 13.18% |

| Industrials | 7.02% |

| Energy | 4.82% |

| Financials | 3.03% |

| Consumer Staples | 2.15% |

| Utilities | 1.50% |

| Telecommunications | 1.43% |

| Financial | 0.99% |

| Consumer, Non-cyclical | 0.38% |

| Cash, Cash Equivalents, & Other Net Assets | 0.53% |

| Top 10 | % TNA |

|---|

| NVIDIA Corp. | 12.04% |

| Microsoft Corp. | 9.45% |

| Apple, Inc. | 8.82% |

| Amazon.com, Inc. | 5.67% |

| Alphabet, Inc. | 4.85% |

| Meta Platforms, Inc. | 4.08% |

| Broadcom, Ltd. | 2.79% |

| WaVe Life Sciences, Ltd. | 2.04% |

| Eli Lilly & Co. | 2.02% |

| Insmed, Inc. | 1.79% |

| Total % of Top 10 Holdings | 53.55% |

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.emeraldmutualfunds.com/literature/emerald-insights-fund.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent (855) 828-9909.

Contact Us:

Phone: (855) 828-9909

EMERALD INSIGHTS FUND - CLASS C : EFCCX

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

Distributor, ALPS Distributors, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

This semi-annual shareholder report shareholder report contains important information about Emerald Insights Fund - Institutional for the period of May 1, 2024 to October 31, 2024.

You can find additional information about the Fund at https://www.emeraldmutualfunds.com/literature/emerald-insights-fund. You can also request this information by contacting us at (855) 828-9909.

WHAT WERE THE FUND’S COST FOR LAST SIX-MONTHS?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 Investment | Cost Paid as a percentage of a $10,000 Investment |

|---|

| Emerald Insights Fund - Institutional | $68 | 1.05% |

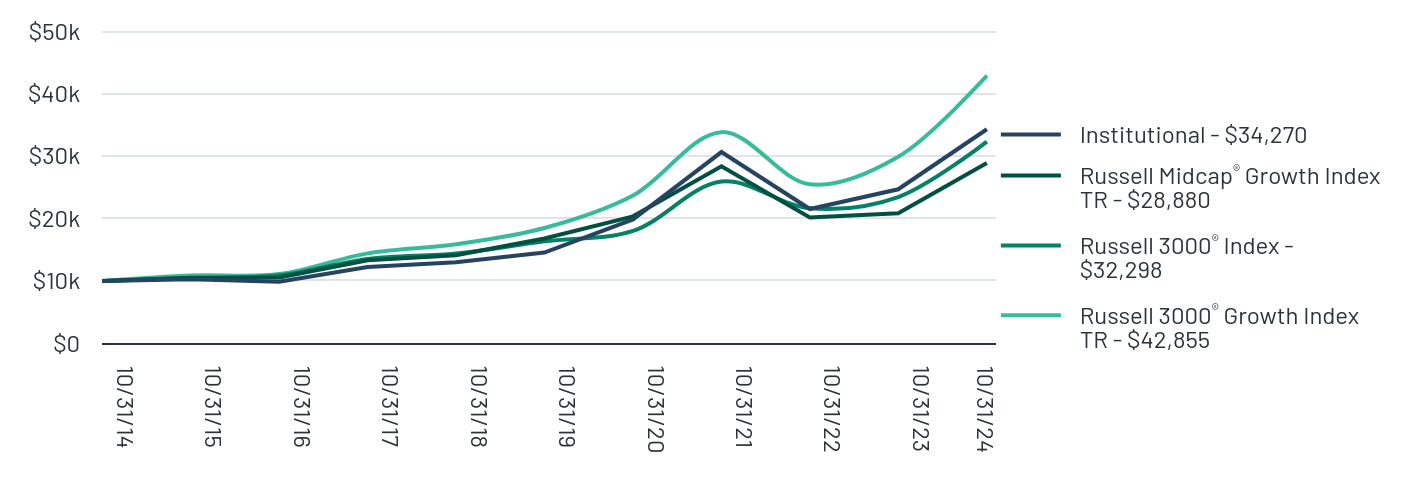

HOW DID THE FUND PERFORM LAST 10 YEARS?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Institutional - $34,270 | Russell Midcap® Growth Index TR - $28,880 | Russell 3000® Index - $32,298 | Russell 3000® Growth Index TR - $42,855 |

|---|

| 10/31/24 | $34,270 | $28,880 | $32,298 | $42,855 |

| 10/31/23 | $24,670 | $20,826 | $23,429 | $29,880 |

| 10/31/22 | $21,503 | $20,151 | $21,617 | $25,469 |

| 10/31/21 | $30,626 | $28,358 | $25,894 | $33,812 |

| 10/31/20 | $19,847 | $20,339 | $17,995 | $23,675 |

| 10/31/19 | $14,539 | $16,790 | $16,337 | $18,467 |

| 10/31/18 | $12,987 | $14,118 | $14,395 | $15,874 |

| 10/31/17 | $12,214 | $13,301 | $13,504 | $14,405 |

| 10/31/16 | $9,853 | $10,536 | $10,892 | $11,098 |

| 10/31/15 | $10,274 | $10,494 | $10,449 | $10,872 |

| 10/31/14 | $10,000 | $10,000 | $10,000 | $10,000 |

Average Annual Total Returns

| Institutional | 1 Year | 5 Year | 10 Year |

|---|

| Institutional | 38.91% | 18.71% | 13.11% |

Russell Midcap® Growth Index TR | 38.67% | 11.46% | 11.19% |

Russell 3000® Index | 37.86% | 14.60% | 12.44% |

Russell 3000® Growth Index TR | 43.42% | 18.34% | 15.66% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call (855) 828-9909 for current month-end performance.

- Total Net Assets$23,113,274

- # of Portfolio Holdings68

- Portfolio Turnover Rate115%

- Advisory Fees Paid$85,448

WHAT DID THE FUND INVEST IN?

| Value | Value |

|---|

| Technology | 48.50% |

| Health Care | 16.47% |

| Consumer Discretionary | 13.18% |

| Industrials | 7.02% |

| Energy | 4.82% |

| Financials | 3.03% |

| Consumer Staples | 2.15% |

| Utilities | 1.50% |

| Telecommunications | 1.43% |

| Financial | 0.99% |

| Consumer, Non-cyclical | 0.38% |

| Cash, Cash Equivalents, & Other Net Assets | 0.53% |

| Top 10 | % TNA |

|---|

| NVIDIA Corp. | 12.04% |

| Microsoft Corp. | 9.45% |

| Apple, Inc. | 8.82% |

| Amazon.com, Inc. | 5.67% |

| Alphabet, Inc. | 4.85% |

| Meta Platforms, Inc. | 4.08% |

| Broadcom, Ltd. | 2.79% |

| WaVe Life Sciences, Ltd. | 2.04% |

| Eli Lilly & Co. | 2.02% |

| Insmed, Inc. | 1.79% |

| Total % of Top 10 Holdings | 53.55% |

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.emeraldmutualfunds.com/literature/emerald-insights-fund.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent (855) 828-9909.

Contact Us:

Phone: (855) 828-9909

EMERALD INSIGHTS FUND - INSTITUTIONAL : EFCIX

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

Distributor, ALPS Distributors, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

This semi-annual shareholder report shareholder report contains important information about Emerald Insights Fund - Investor for the period of May 1, 2024 to October 31, 2024.

You can find additional information about the Fund at https://www.emeraldmutualfunds.com/literature/emerald-insights-fund. You can also request this information by contacting us at (855) 828-9909.

WHAT WERE THE FUND’S COST FOR LAST SIX-MONTHS?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 Investment | Cost Paid as a percentage of a $10,000 Investment |

|---|

| Emerald Insights Fund - Investor | $91 | 1.40% |

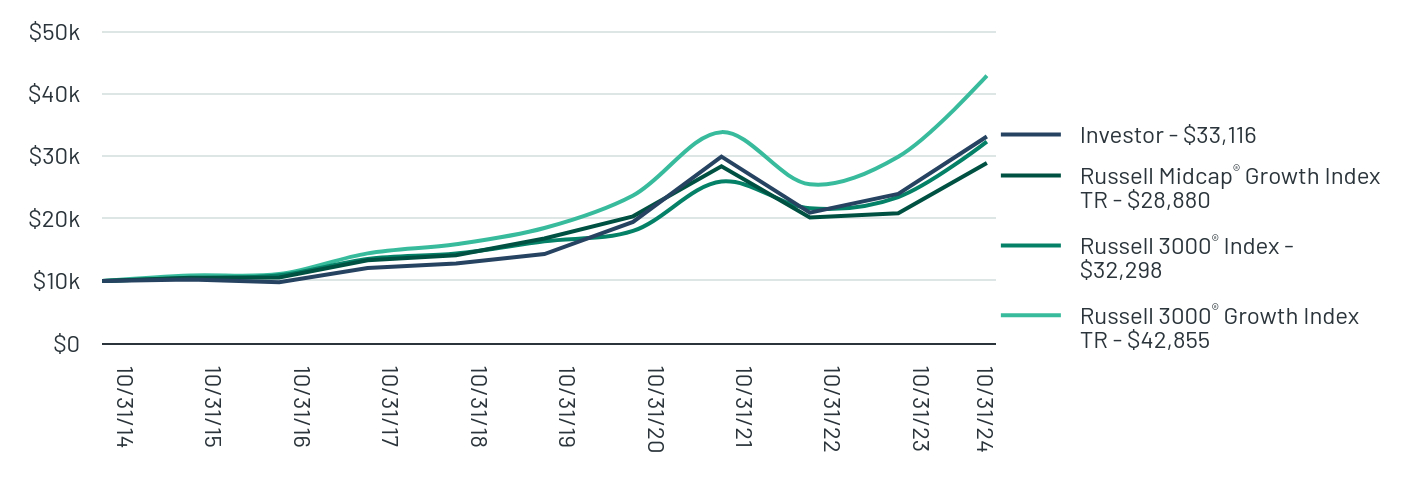

HOW DID THE FUND PERFORM LAST 10 YEARS?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Investor - $33,116 | Russell Midcap® Growth Index TR - $28,880 | Russell 3000® Index - $32,298 | Russell 3000® Growth Index TR - $42,855 |

|---|

| 10/31/24 | $33,116 | $28,880 | $32,298 | $42,855 |

| 10/31/23 | $23,922 | $20,826 | $23,429 | $29,880 |

| 10/31/22 | $20,923 | $20,151 | $21,617 | $25,469 |

| 10/31/21 | $29,894 | $28,358 | $25,894 | $33,812 |

| 10/31/20 | $19,440 | $20,339 | $17,995 | $23,675 |

| 10/31/19 | $14,304 | $16,790 | $16,337 | $18,467 |

| 10/31/18 | $12,804 | $14,118 | $14,395 | $15,874 |

| 10/31/17 | $12,078 | $13,301 | $13,504 | $14,405 |

| 10/31/16 | $9,784 | $10,536 | $10,892 | $11,098 |

| 10/31/15 | $10,245 | $10,494 | $10,449 | $10,872 |

| 10/31/14 | $10,000 | $10,000 | $10,000 | $10,000 |

Average Annual Total Returns

| Investor | 1 Year | 5 Year | 10 Year |

|---|

| Investor | 38.43% | 18.28% | 12.72% |

Russell Midcap® Growth Index TR | 38.67% | 11.46% | 11.19% |

Russell 3000® Index | 37.86% | 14.60% | 12.44% |

Russell 3000® Growth Index TR | 43.42% | 18.34% | 15.66% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call (855) 828-9909 for current month-end performance.

- Total Net Assets$23,113,274

- # of Portfolio Holdings68

- Portfolio Turnover Rate115%

- Advisory Fees Paid$85,448

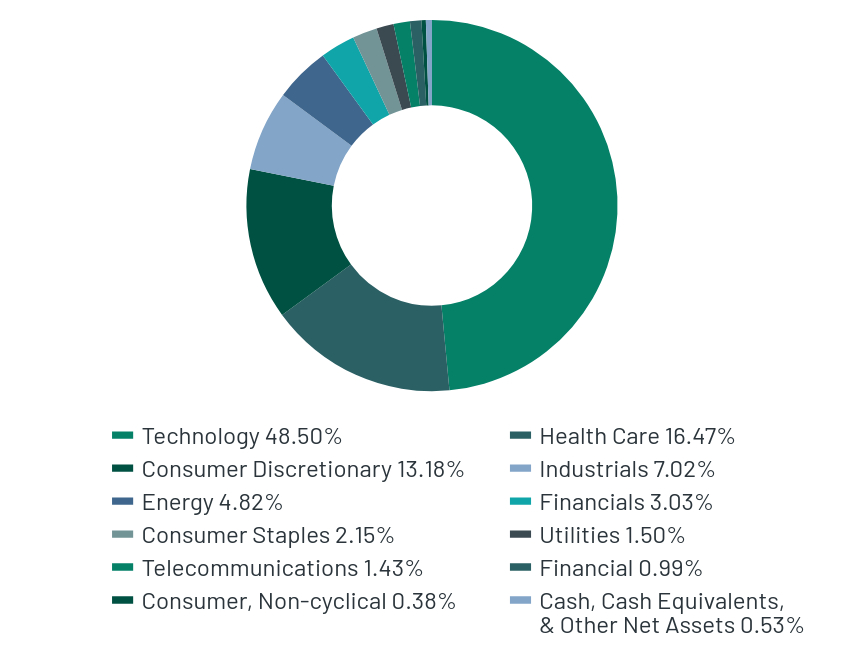

WHAT DID THE FUND INVEST IN?

| Value | Value |

|---|

| Technology | 48.50% |

| Health Care | 16.47% |

| Consumer Discretionary | 13.18% |

| Industrials | 7.02% |

| Energy | 4.82% |

| Financials | 3.03% |

| Consumer Staples | 2.15% |

| Utilities | 1.50% |

| Telecommunications | 1.43% |

| Financial | 0.99% |

| Consumer, Non-cyclical | 0.38% |

| Cash, Cash Equivalents, & Other Net Assets | 0.53% |

| Top 10 | % TNA |

|---|

| NVIDIA Corp. | 12.04% |

| Microsoft Corp. | 9.45% |

| Apple, Inc. | 8.82% |

| Amazon.com, Inc. | 5.67% |

| Alphabet, Inc. | 4.85% |

| Meta Platforms, Inc. | 4.08% |

| Broadcom, Ltd. | 2.79% |

| WaVe Life Sciences, Ltd. | 2.04% |

| Eli Lilly & Co. | 2.02% |

| Insmed, Inc. | 1.79% |

| Total % of Top 10 Holdings | 53.55% |

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.emeraldmutualfunds.com/literature/emerald-insights-fund.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent (855) 828-9909.

Contact Us:

Phone: (855) 828-9909

EMERALD INSIGHTS FUND - INVESTOR : EFCNX

SEMI-ANNUAL SHAREHOLDER REPORT - OCTOBER 31, 2024

Distributor, ALPS Distributors, Inc.

0000915802fit:C000167155Memberus-gaap:RealEstateSectorMember2024-10-31

OCTOBER 31, 2024

SEMI-ANNUAL SHAREHOLDER REPORT

INSTITUTIONAL CLASS : SIGIX

Seafarer Overseas Growth and Income Fund

This semi-annual shareholder report contains important information about the Seafarer Overseas Growth and Income Fund - Institutional Class for the period of May 1, 2024 to October 31, 2024.

You can find additional information about the Fund at www.seafarerfunds.com. You can also request this information by contacting us at 855-732-9220 or seafarerfunds@alpsinc.com.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 Investment | Cost Paid as a Percentage of a $10,000 Investment (annualized) |

|---|

| Seafarer Overseas Growth and Income Fund - Institutional Class | $4 | 0.86% |

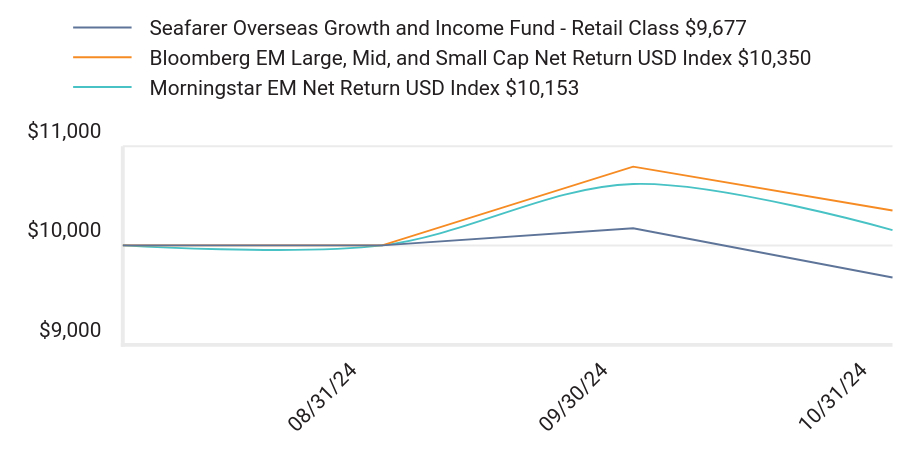

How did the Fund perform over the last six months?

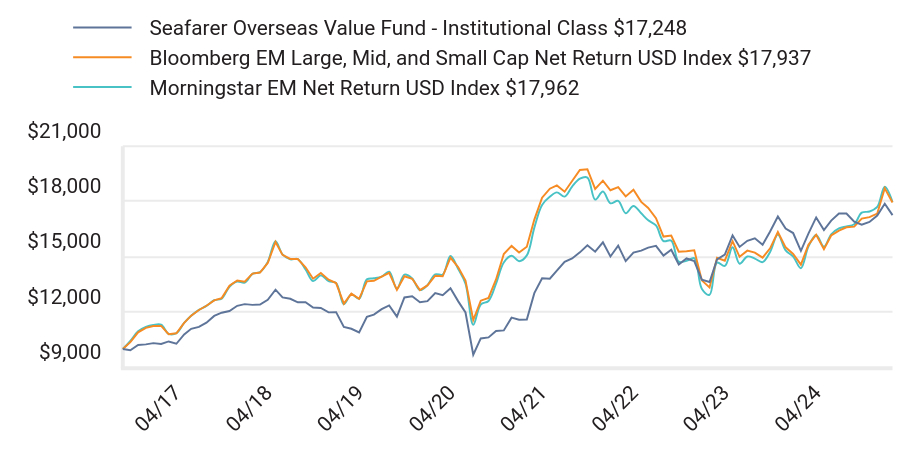

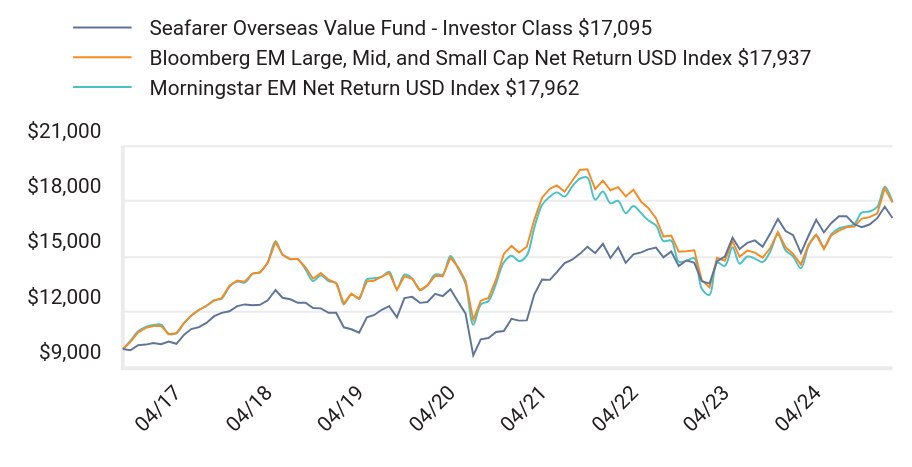

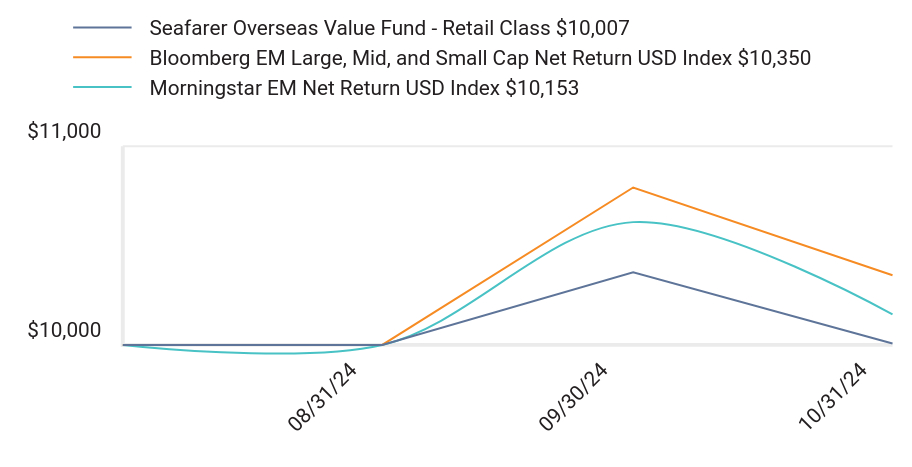

During the semi-annual period (May 1, 2024 to October 31, 2024), the Seafarer Overseas Growth and Income Fund’s Institutional Class returned 2.93%, while the Fund’s benchmark indices, the Bloomberg Emerging Markets Large, Mid, and Small Cap Net Return USD Index and the Morningstar Emerging Markets Net Return USD Index, returned 8.12% and 7.96%, respectively. By way of broader comparison, the S&P 500 Index increased 14.08%.

The Fund began the semi-annual period with a net asset value (NAV) of $12.22 per share. In June, the Fund paid a semi-annual distribution of $0.193 per share. That payment brought the cumulative distribution per share, as measured from the Fund’s inception, to $5.302. The Fund finished the period with a value of $12.38 per share.

Performance during the period can be divided into two distinct periods: all that occurred prior to September 24th, when China’s authorities announced economic stimulus plans, and everything that occurred afterward. Until that day, emerging markets shares moved mostly sideways and slightly higher. The markets were led by Indian shares and semiconductor stocks; the Fund was lifted by corporate financial results. After the China stimulus announcements, Chinese stocks rose markedly, lifting the indices from their doldrums. The Fund profited from its China holdings, but the benchmarks’ greater allocation to China ensured their outperformance for the period.

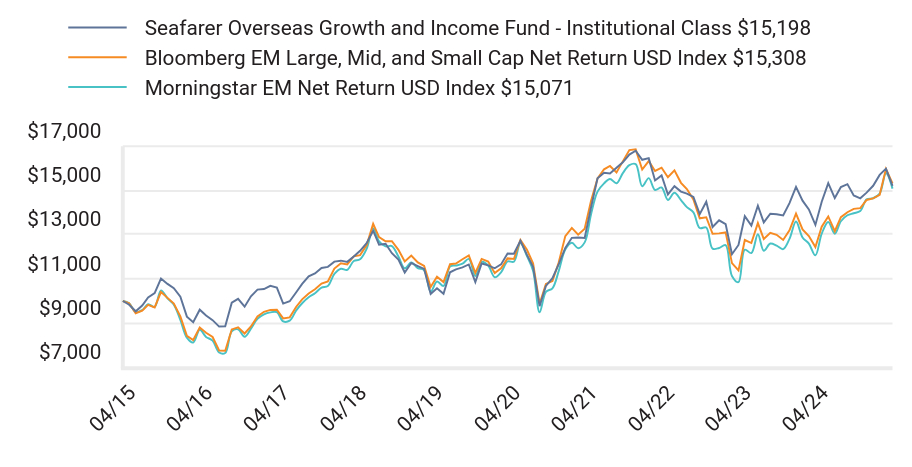

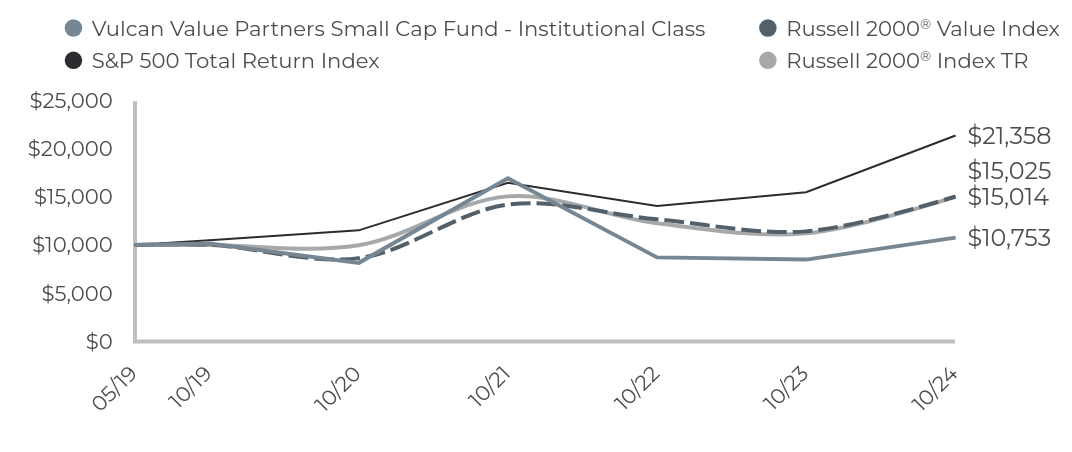

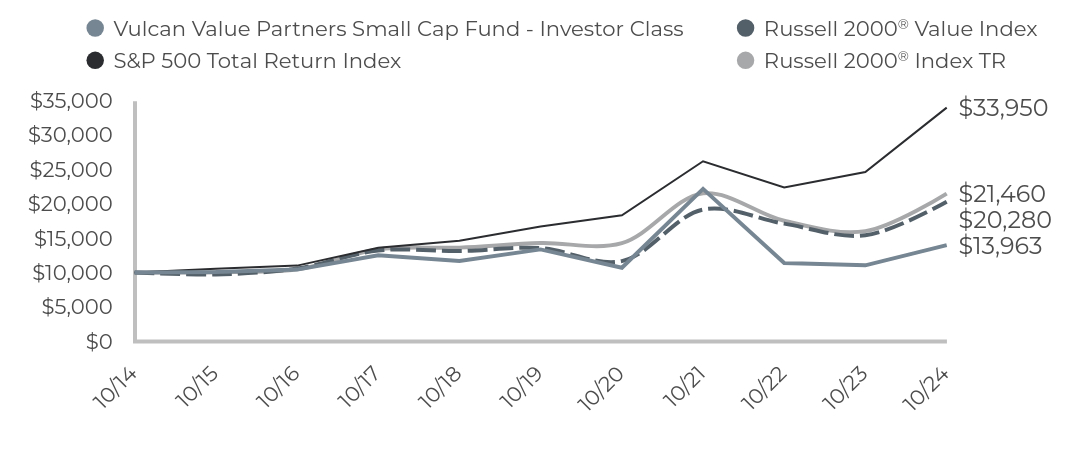

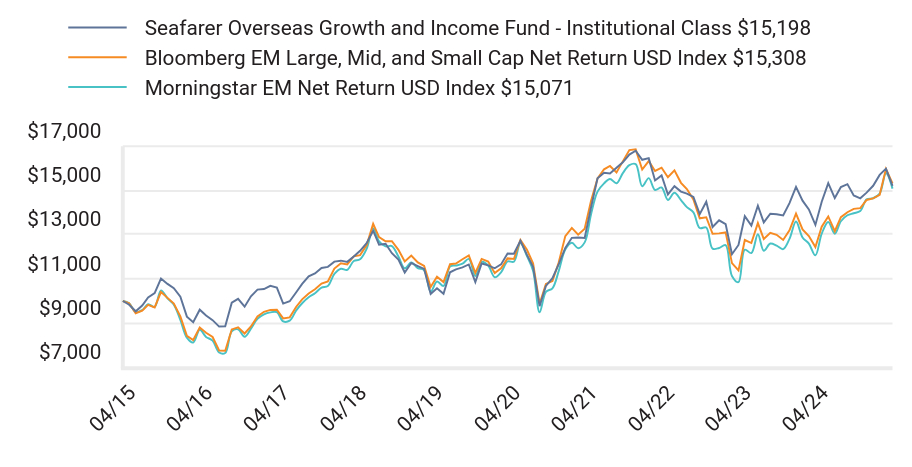

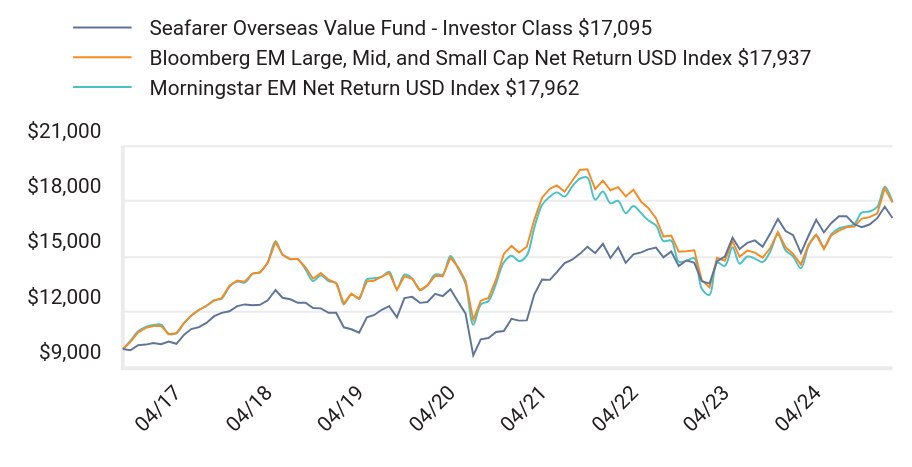

How did the Fund perform over the last 10 years?

Total Return Based on $10,000 Investment

| Seafarer Overseas Growth and Income Fund - Institutional Class $15,198 | Bloomberg EM Large, Mid, and Small Cap Net Return USD Index $15,308 | Morningstar EM Net Return USD Index $15,071 |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 |

| 11/14 | $9,830 | $9,896 | $9,901 |

| 12/14 | $9,535 | $9,446 | $9,492 |

| 01/15 | $9,796 | $9,559 | $9,595 |

| 02/15 | $10,162 | $9,824 | $9,851 |

| 03/15 | $10,353 | $9,711 | $9,734 |

| 04/15 | $11,014 | $10,405 | $10,479 |

| 05/15 | $10,771 | $10,140 | $10,120 |

| 06/15 | $10,578 | $9,886 | $9,834 |

| 07/15 | $10,194 | $9,308 | $9,149 |

| 08/15 | $9,293 | $8,425 | $8,345 |

| 09/15 | $9,040 | $8,240 | $8,128 |

| 10/15 | $9,608 | $8,800 | $8,701 |

| 11/15 | $9,346 | $8,564 | $8,381 |

| 12/15 | $9,137 | $8,376 | $8,212 |

| 01/16 | $8,846 | $7,769 | $7,675 |

| 02/16 | $8,855 | $7,756 | $7,654 |

| 03/16 | $9,921 | $8,718 | $8,632 |

| 04/16 | $10,097 | $8,811 | $8,721 |

| 05/16 | $9,745 | $8,534 | $8,390 |

| 06/16 | $10,211 | $8,850 | $8,755 |

| 07/16 | $10,513 | $9,305 | $9,193 |

| 08/16 | $10,539 | $9,512 | $9,394 |

| 09/16 | $10,682 | $9,597 | $9,485 |

| 10/16 | $10,602 | $9,604 | $9,501 |

| 11/16 | $9,882 | $9,216 | $9,080 |

| 12/16 | $9,990 | $9,261 | $9,113 |

| 01/17 | $10,394 | $9,740 | $9,578 |

| 02/17 | $10,770 | $10,075 | $9,900 |

| 03/17 | $11,111 | $10,337 | $10,170 |

| 04/17 | $11,246 | $10,532 | $10,348 |

| 05/17 | $11,488 | $10,784 | $10,606 |

| 06/17 | $11,540 | $10,886 | $10,677 |

| 07/17 | $11,775 | $11,463 | $11,220 |

| 08/17 | $11,820 | $11,703 | $11,455 |

| 09/17 | $11,766 | $11,649 | $11,405 |

| 10/17 | $12,010 | $12,018 | $11,806 |

| 11/17 | $12,263 | $12,069 | $11,881 |

| 12/17 | $12,608 | $12,510 | $12,349 |

| 01/18 | $13,172 | $13,480 | $13,288 |

| 02/18 | $12,543 | $12,883 | $12,690 |

| 03/18 | $12,580 | $12,695 | $12,464 |

| 04/18 | $12,155 | $12,695 | $12,479 |

| 05/18 | $11,868 | $12,310 | $12,003 |

| 06/18 | $11,288 | $11,784 | $11,474 |

| 07/18 | $11,717 | $12,050 | $11,735 |

| 08/18 | $11,577 | $11,741 | $11,479 |

| 09/18 | $11,446 | $11,581 | $11,390 |

| 10/18 | $10,317 | $10,630 | $10,423 |

| 11/18 | $10,578 | $11,093 | $10,879 |

| 12/18 | $10,323 | $10,853 | $10,679 |

| 01/19 | $11,296 | $11,659 | $11,554 |

| 02/19 | $11,427 | $11,688 | $11,602 |

| 03/19 | $11,517 | $11,882 | $11,681 |

| 04/19 | $11,648 | $12,052 | $11,899 |

| 05/19 | $10,855 | $11,267 | $11,125 |

| 06/19 | $11,691 | $11,897 | $11,766 |

| 07/19 | $11,610 | $11,779 | $11,599 |

| 08/19 | $11,477 | $11,258 | $11,069 |

| 09/19 | $11,651 | $11,474 | $11,294 |

| 10/19 | $12,140 | $11,922 | $11,783 |

| 11/19 | $12,130 | $11,892 | $11,774 |

| 12/19 | $12,717 | $12,753 | $12,614 |

| 01/20 | $12,078 | $12,309 | $12,026 |

| 02/20 | $11,542 | $11,699 | $11,362 |

| 03/20 | $9,770 | $9,875 | $9,493 |

| 04/20 | $10,677 | $10,768 | $10,414 |

| 05/20 | $11,027 | $10,898 | $10,574 |

| 06/20 | $11,668 | $11,749 | $11,358 |

| 07/20 | $12,394 | $12,927 | $12,323 |

| 08/20 | $12,850 | $13,299 | $12,628 |

| 09/20 | $12,861 | $12,994 | $12,381 |

| 10/20 | $12,840 | $13,261 | $12,645 |

| 11/20 | $14,219 | $14,515 | $13,904 |

| 12/20 | $15,540 | $15,526 | $14,936 |

| 01/21 | $15,783 | $15,942 | $15,308 |

| 02/21 | $15,751 | $16,093 | $15,505 |

| 03/21 | $16,015 | $15,804 | $15,314 |

| 04/21 | $16,258 | $16,300 | $15,771 |

| 05/21 | $16,607 | $16,807 | $16,127 |

| 06/21 | $16,779 | $16,843 | $16,179 |

| 07/21 | $16,372 | $15,931 | $15,176 |

| 08/21 | $16,447 | $16,315 | $15,544 |

| 09/21 | $15,440 | $15,869 | $15,009 |

| 10/21 | $15,665 | $16,016 | $15,122 |

| 11/21 | $14,808 | $15,585 | $14,561 |

| 12/21 | $15,178 | $15,894 | $14,886 |

| 01/22 | $14,937 | $15,332 | $14,555 |

| 02/22 | $14,845 | $15,050 | $14,236 |

| 03/22 | $14,696 | $14,580 | $14,002 |

| 04/22 | $13,916 | $13,730 | $13,294 |

| 05/22 | $14,478 | $13,778 | $13,317 |

| 06/22 | $13,339 | $13,032 | $12,361 |

| 07/22 | $13,641 | $13,050 | $12,393 |

| 08/22 | $13,467 | $13,094 | $12,518 |

| 09/22 | $12,111 | $11,707 | $11,131 |

| 10/22 | $12,528 | $11,378 | $10,854 |

| 11/22 | $13,826 | $12,752 | $12,313 |

| 12/22 | $13,403 | $12,616 | $12,163 |

| 01/23 | $14,301 | $13,516 | $13,015 |

| 02/23 | $13,545 | $12,797 | $12,267 |

| 03/23 | $13,935 | $13,080 | $12,595 |

| 04/23 | $13,911 | $12,988 | $12,499 |

| 05/23 | $13,864 | $12,756 | $12,338 |

| 06/23 | $14,418 | $13,188 | $12,801 |

| 07/23 | $15,149 | $13,939 | $13,587 |

| 08/23 | $14,526 | $13,233 | $12,868 |

| 09/23 | $14,130 | $12,928 | $12,589 |

| 10/23 | $13,434 | $12,434 | $12,060 |

| 11/23 | $14,478 | $13,350 | $13,040 |

| 12/23 | $15,321 | $13,814 | $13,567 |

| 01/24 | $14,644 | $13,147 | $13,035 |

| 02/24 | $15,140 | $13,782 | $13,599 |

| 03/24 | $15,273 | $14,006 | $13,868 |

| 04/24 | $14,765 | $14,158 | $13,960 |

| 05/24 | $14,632 | $14,191 | $14,061 |

| 06/24 | $14,891 | $14,560 | $14,584 |

| 07/24 | $15,198 | $14,629 | $14,636 |

| 08/24 | $15,689 | $14,791 | $14,843 |

| 09/24 | $15,971 | $15,961 | $15,760 |

| 10/24 | $15,198 | $15,308 | $15,071 |

Average Annual Total Returns

| Seafarer Overseas Growth and Income Fund | 1 Year | 5 Year | 10 Year |

|---|

| Seafarer Overseas Growth and Income Fund - Institutional Class (Incep. February 15, 2012) | 13.13% | 4.60% | 4.27% |

| Bloomberg EM Large, Mid, and Small Cap Net Return USD Index | 23.11% | 5.13% | 4.35% |

| Morningstar EM Net Return USD Index | 24.97% | 5.05% | 4.19% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call 855-732-9220 for current month-end performance.

| Header | Text |

|---|

| Total Net Assets | $3,320,400,850 |

| # of Portfolio Holdings | 52 |

| Portfolio Turnover Rate | 9% |

| Total Advisory Fees Paid | $12,455,728 |

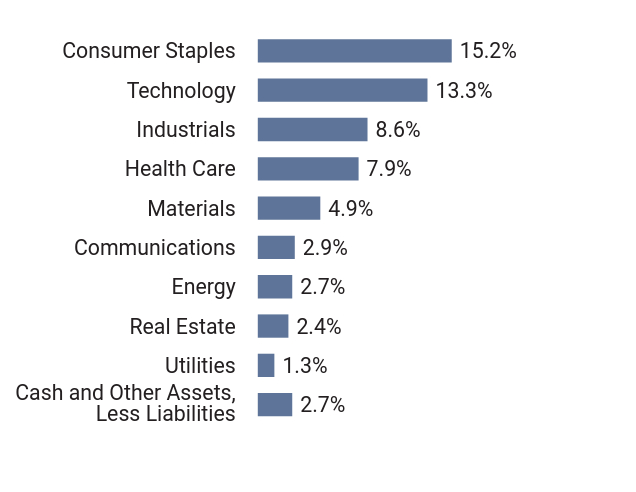

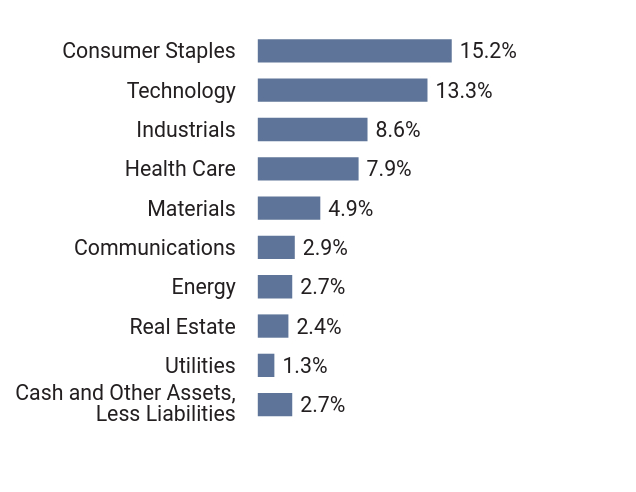

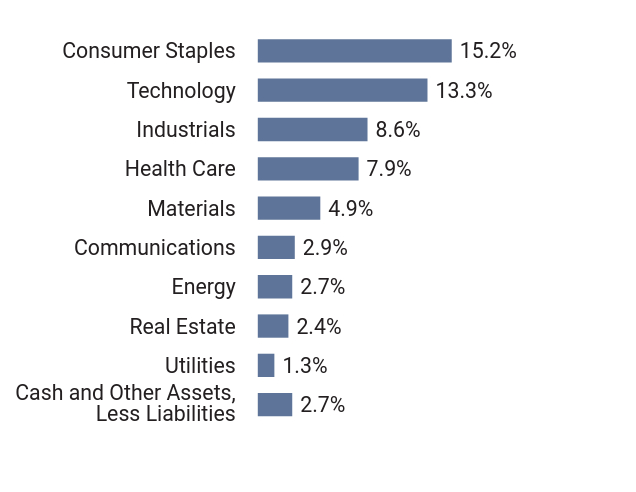

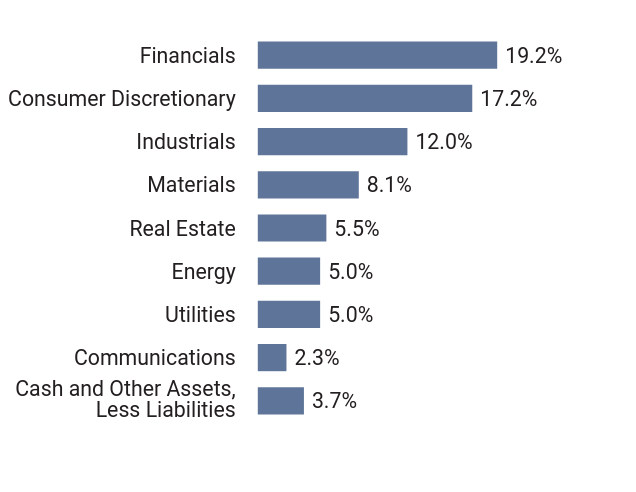

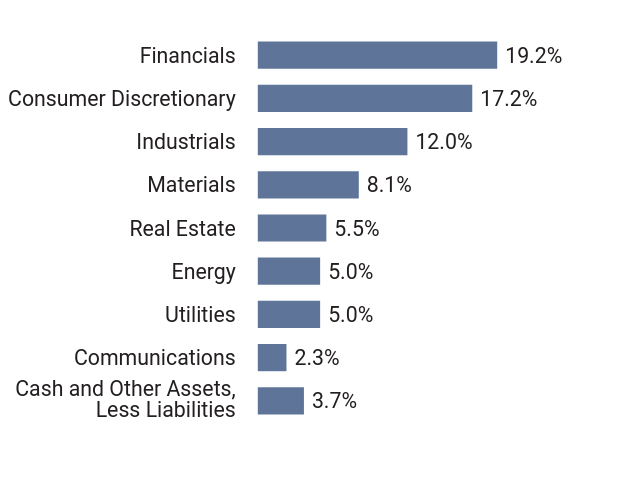

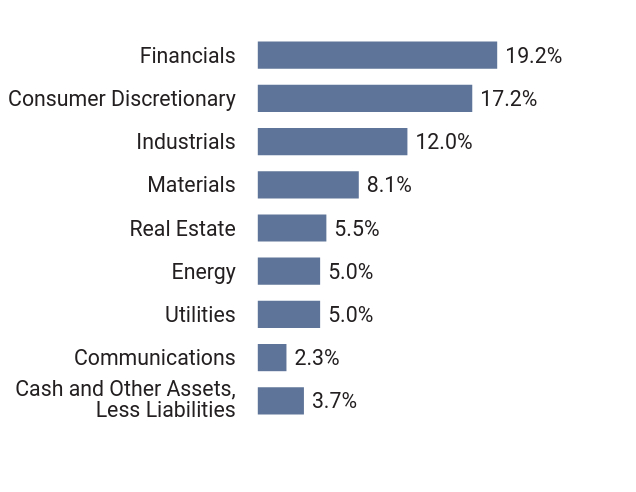

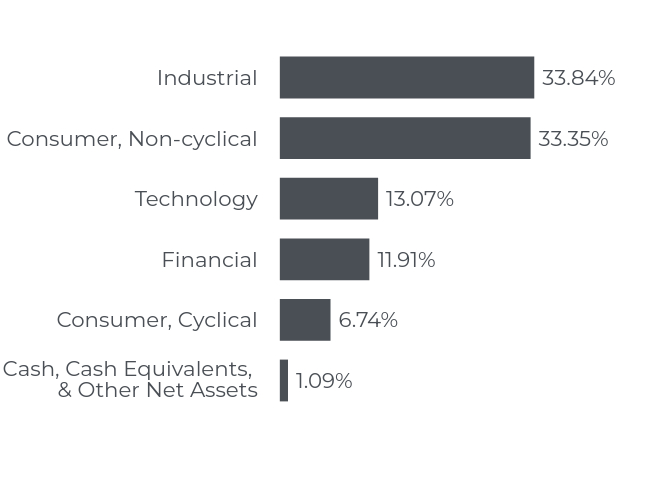

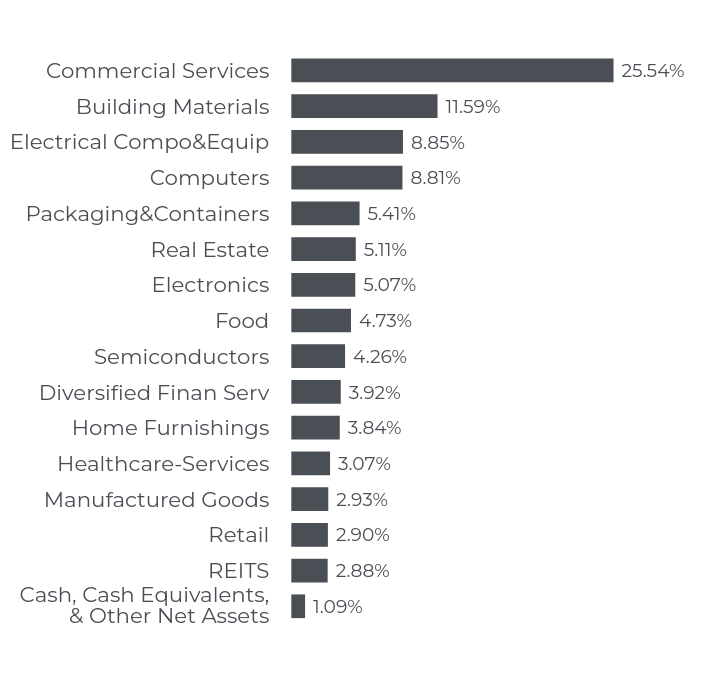

What did the Fund invest in?

Sector Weightings (% of Net Assets)

| Value | Value |

|---|

| Cash and Other Assets, Less Liabilities | 2.7% |

| Utilities | 1.3% |

| Real Estate | 2.4% |

| Energy | 2.7% |

| Communications | 2.9% |

| Materials | 4.9% |

| Health Care | 7.9% |

| Industrials | 8.6% |

| Technology | 13.3% |

| Consumer Staples | 15.2% |

| Consumer Discretionary | 16.6% |

| Financials | 21.5% |

Top Ten Holdings (% of Net Assets)

| Top 10 | Top 10 |

|---|

| Hyundai Mobis Co., Ltd. | 5.7% |

| Samsung Biologics Co., Ltd. | 3.4% |

| Singapore Exchange, Ltd. | 3.1% |

| Sanlam, Ltd. | 3.1% |

| Richter Gedeon Nyrt | 2.9% |

| Bank Central Asia Tbk PT | 2.9% |

| L&T Technology Services, Ltd. | 2.8% |

| Accton Technology Corp. | 2.8% |

| DBS Group Holdings, Ltd. | 2.6% |

| Novatek Microelectronics Corp. | 2.6% |

| Total % of Top 10 Holdings | 31.9% |

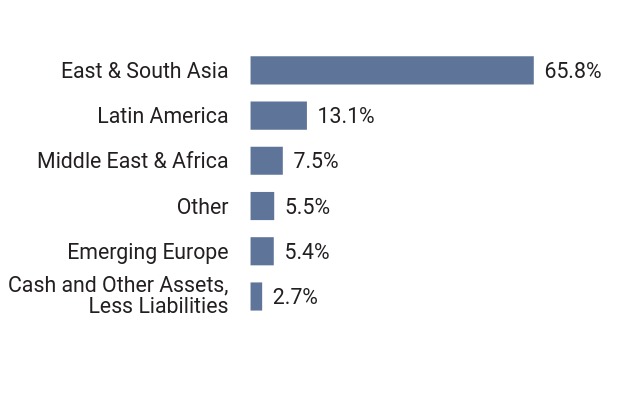

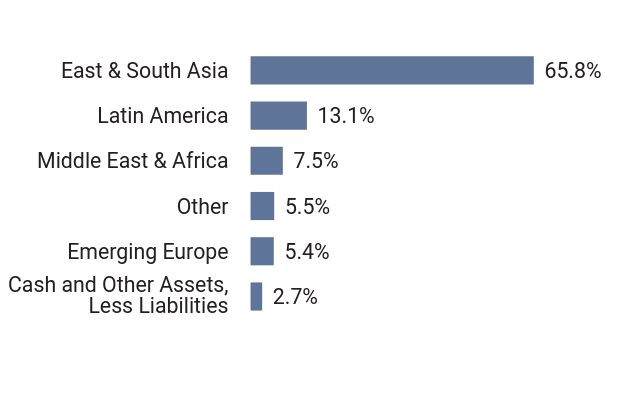

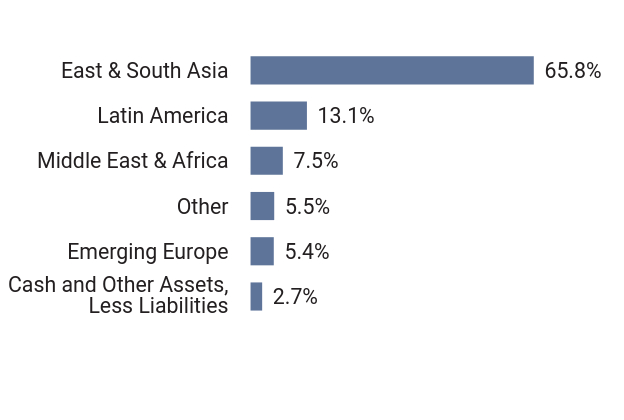

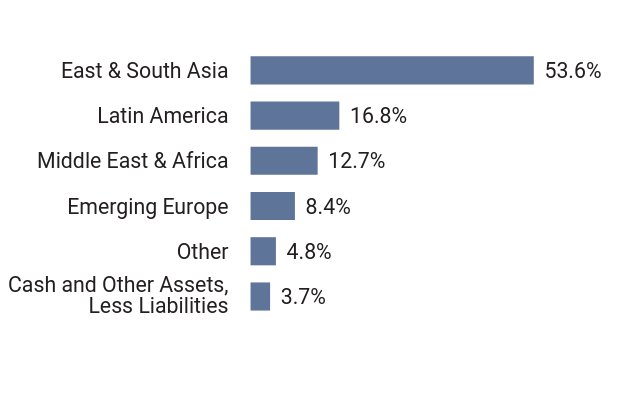

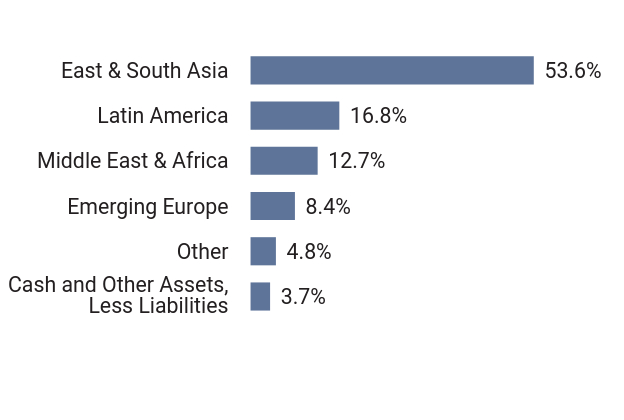

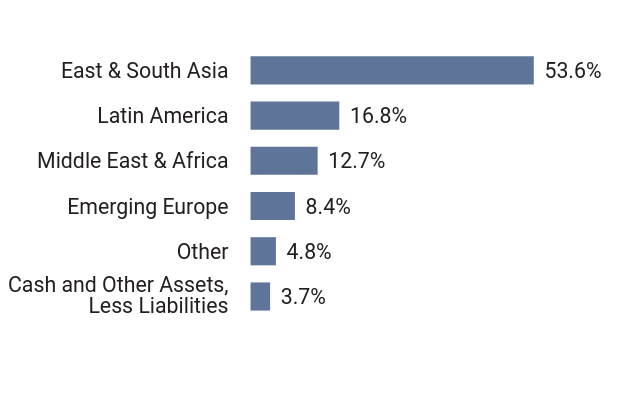

Region Weightings (% of Net Assets)

| Value | Value |

|---|

| Cash and Other Assets, Less Liabilities | 2.7% |

| Emerging Europe | 5.4% |

| Other | 5.5% |

| Middle East & Africa | 7.5% |

| Latin America | 13.1% |

| East & South Asia | 65.8% |

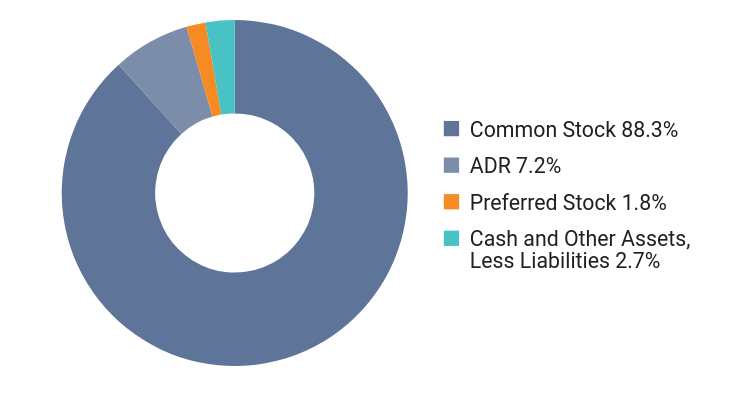

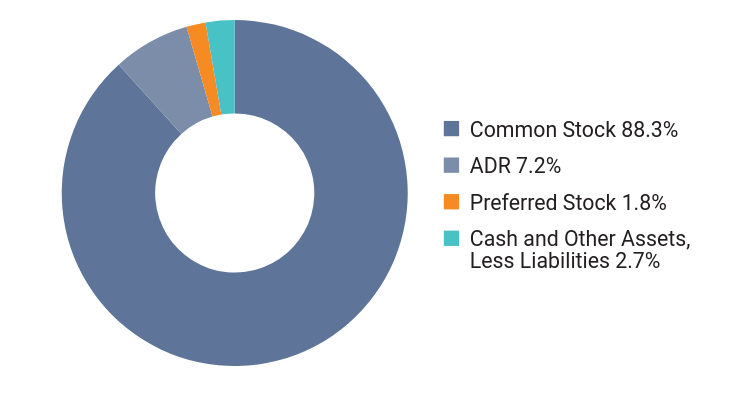

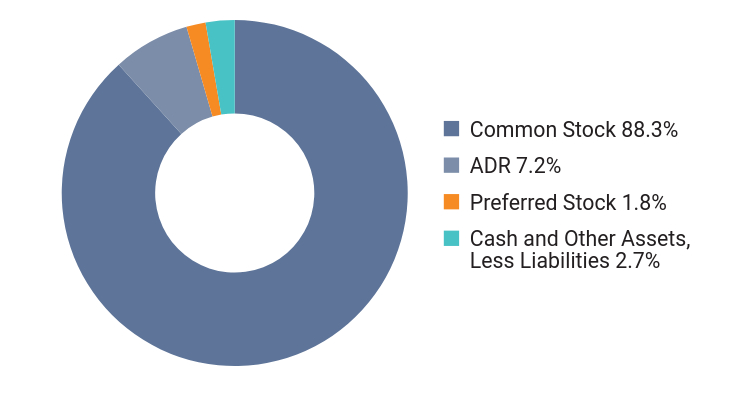

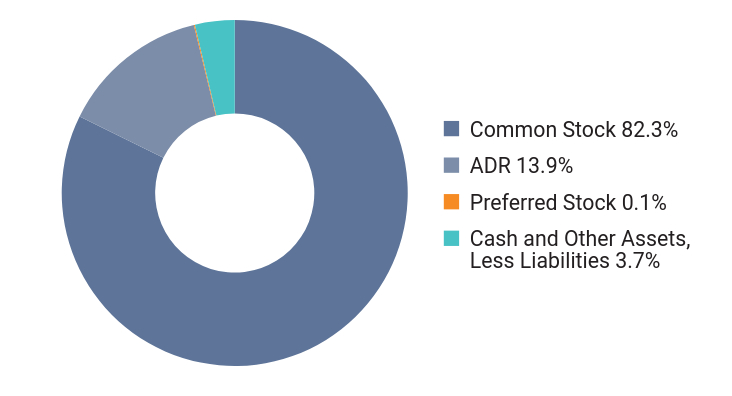

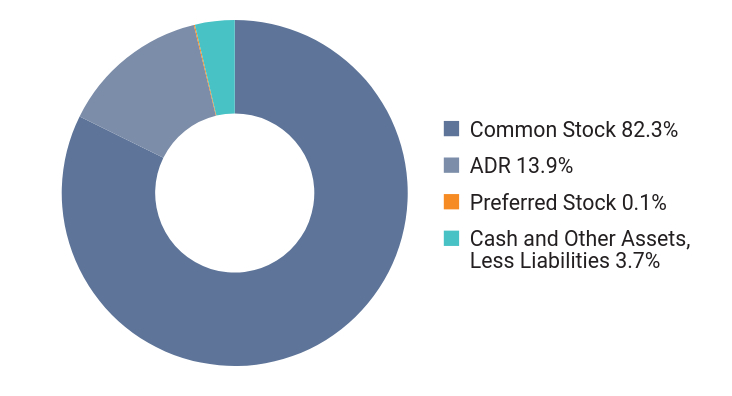

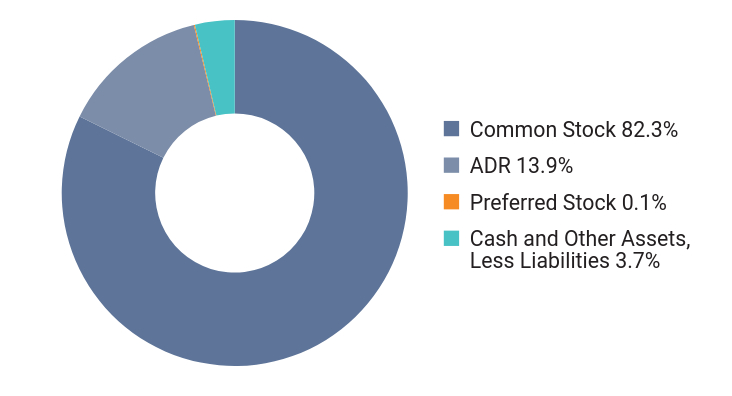

Asset Class Weightings (% of Net Assets)

| Value | Value |

|---|

| Common Stock | 88.3% |

| ADR | 7.2% |

| Preferred Stock | 1.8% |

| Cash and Other Assets, Less Liabilities | 2.7% |

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The Seafarer Funds are not sponsored, endorsed, sold, or promoted by Morningstar, Inc. Morningstar, Inc. makes no representation or warranty, express or implied, to the shareholders of the Funds or any member of the public regarding the advisability of investing in the Funds or the ability of the Morningstar EM Net Return U.S. Dollar Index to track general equity market performance of emerging markets.

Effective August 30, 2024, the Fund launched a Retail Class (SFGRX).

This is a summary of certain changes to the Fund since May 1, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available on August 31, 2025 at www.seafarerfunds.com/literature or upon request at 855-732-9220 or seafarerfunds@alpsinc.com.

Availability of Additional Information

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting www.seafarerfunds.com/literature.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling Investor Services at 855-732-9220.

OCTOBER 31, 2024

SEMI-ANNUAL SHAREHOLDER REPORT

INSTITUTIONAL CLASS : SIGIX

Seafarer Overseas Growth and Income Fund

Investor Services: 855-732-9220

Distributor: ALPS Distributors, Inc.

OCTOBER 31, 2024

SEMI-ANNUAL SHAREHOLDER REPORT

Seafarer Overseas Growth and Income Fund

This semi-annual shareholder report contains important information about the Seafarer Overseas Growth and Income Fund - Investor Class for the period of May 1, 2024 to October 31, 2024.

You can find additional information about the Fund at www.seafarerfunds.com. You can also request this information by contacting us at 855-732-9220 or seafarerfunds@alpsinc.com.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 Investment | Cost Paid as a Percentage of a $10,000 Investment (annualized) |

|---|

| Seafarer Overseas Growth and Income Fund - Investor Class | $5 | 0.96% |

How did the Fund perform over the last six months?

During the semi-annual period (May 1, 2024 to October 31, 2024), the Seafarer Overseas Growth and Income Fund’s Investor Class returned 2.85%, while the Fund’s benchmark indices, the Bloomberg Emerging Markets Large, Mid, and Small Cap Net Return USD Index and the Morningstar Emerging Markets Net Return USD Index, returned 8.12% and 7.96%, respectively. By way of broader comparison, the S&P 500 Index increased 14.08%.

The Fund began the semi-annual period with a net asset value (NAV) of $12.14 per share. In June, the Fund paid a semi-annual distribution of $0.191 per share. That payment brought the cumulative distribution per share, as measured from the Fund’s inception, to $5.192. The Fund finished the period with a value of $12.29 per share.

Performance during the period can be divided into two distinct periods: all that occurred prior to September 24th, when China’s authorities announced economic stimulus plans, and everything that occurred afterward. Until that day, emerging markets shares moved mostly sideways and slightly higher. The markets were led by Indian shares and semiconductor stocks; the Fund was lifted by corporate financial results. After the China stimulus announcements, Chinese stocks rose markedly, lifting the indices from their doldrums. The Fund profited from its China holdings, but the benchmarks’ greater allocation to China ensured their outperformance for the period.

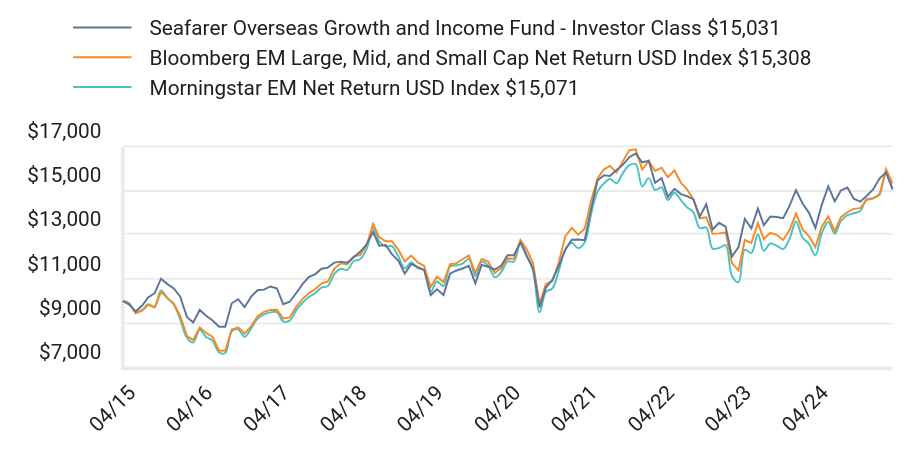

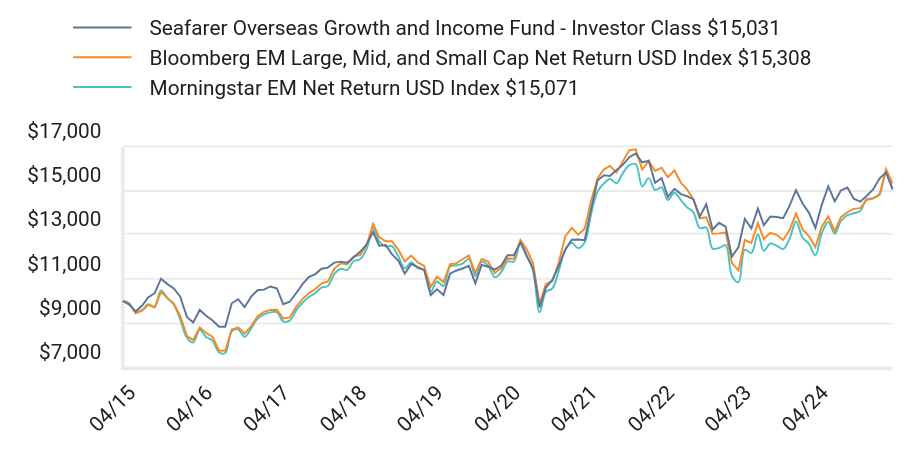

How did the Fund perform over the last 10 years?

Total Return Based on $10,000 Investment

| Seafarer Overseas Growth and Income Fund - Investor Class $15,031 | Bloomberg EM Large, Mid, and Small Cap Net Return USD Index $15,308 | Morningstar EM Net Return USD Index $15,071 |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 |

| 11/14 | $9,839 | $9,896 | $9,901 |

| 12/14 | $9,534 | $9,446 | $9,492 |

| 01/15 | $9,795 | $9,559 | $9,595 |

| 02/15 | $10,161 | $9,824 | $9,851 |

| 03/15 | $10,352 | $9,711 | $9,734 |

| 04/15 | $11,005 | $10,405 | $10,479 |

| 05/15 | $10,762 | $10,140 | $10,120 |

| 06/15 | $10,568 | $9,886 | $9,834 |

| 07/15 | $10,183 | $9,308 | $9,149 |

| 08/15 | $9,282 | $8,425 | $8,345 |

| 09/15 | $9,028 | $8,240 | $8,128 |

| 10/15 | $9,597 | $8,800 | $8,701 |

| 11/15 | $9,335 | $8,564 | $8,381 |

| 12/15 | $9,122 | $8,376 | $8,212 |

| 01/16 | $8,840 | $7,769 | $7,675 |

| 02/16 | $8,840 | $7,756 | $7,654 |

| 03/16 | $9,897 | $8,718 | $8,632 |

| 04/16 | $10,082 | $8,811 | $8,721 |

| 05/16 | $9,721 | $8,534 | $8,390 |

| 06/16 | $10,186 | $8,850 | $8,755 |

| 07/16 | $10,487 | $9,305 | $9,193 |

| 08/16 | $10,514 | $9,512 | $9,394 |

| 09/16 | $10,656 | $9,597 | $9,485 |

| 10/16 | $10,576 | $9,604 | $9,501 |

| 11/16 | $9,857 | $9,216 | $9,080 |

| 12/16 | $9,968 | $9,261 | $9,113 |

| 01/17 | $10,362 | $9,740 | $9,578 |

| 02/17 | $10,739 | $10,075 | $9,900 |

| 03/17 | $11,079 | $10,337 | $10,170 |

| 04/17 | $11,205 | $10,532 | $10,348 |

| 05/17 | $11,456 | $10,784 | $10,606 |

| 06/17 | $11,506 | $10,886 | $10,677 |

| 07/17 | $11,732 | $11,463 | $11,220 |

| 08/17 | $11,777 | $11,703 | $11,455 |

| 09/17 | $11,723 | $11,649 | $11,405 |

| 10/17 | $11,976 | $12,018 | $11,806 |

| 11/17 | $12,220 | $12,069 | $11,881 |

| 12/17 | $12,557 | $12,510 | $12,349 |

| 01/18 | $13,121 | $13,480 | $13,288 |

| 02/18 | $12,493 | $12,883 | $12,690 |

| 03/18 | $12,530 | $12,695 | $12,464 |

| 04/18 | $12,114 | $12,695 | $12,479 |

| 05/18 | $11,818 | $12,310 | $12,003 |

| 06/18 | $11,237 | $11,784 | $11,474 |

| 07/18 | $11,665 | $12,050 | $11,735 |

| 08/18 | $11,526 | $11,741 | $11,479 |

| 09/18 | $11,395 | $11,581 | $11,390 |

| 10/18 | $10,267 | $10,630 | $10,423 |

| 11/18 | $10,528 | $11,093 | $10,879 |

| 12/18 | $10,273 | $10,853 | $10,679 |

| 01/19 | $11,236 | $11,659 | $11,554 |

| 02/19 | $11,366 | $11,688 | $11,602 |

| 03/19 | $11,466 | $11,882 | $11,681 |

| 04/19 | $11,586 | $12,052 | $11,899 |

| 05/19 | $10,795 | $11,267 | $11,125 |

| 06/19 | $11,628 | $11,897 | $11,766 |

| 07/19 | $11,546 | $11,779 | $11,599 |

| 08/19 | $11,414 | $11,258 | $11,069 |

| 09/19 | $11,587 | $11,474 | $11,294 |

| 10/19 | $12,066 | $11,922 | $11,783 |

| 11/19 | $12,066 | $11,892 | $11,774 |

| 12/19 | $12,636 | $12,753 | $12,614 |

| 01/20 | $12,008 | $12,309 | $12,026 |

| 02/20 | $11,473 | $11,699 | $11,362 |

| 03/20 | $9,714 | $9,875 | $9,493 |

| 04/20 | $10,609 | $10,768 | $10,414 |

| 05/20 | $10,959 | $10,898 | $10,574 |

| 06/20 | $11,586 | $11,749 | $11,358 |

| 07/20 | $12,311 | $12,927 | $12,323 |

| 08/20 | $12,767 | $13,299 | $12,628 |

| 09/20 | $12,777 | $12,994 | $12,381 |

| 10/20 | $12,746 | $13,261 | $12,645 |

| 11/20 | $14,123 | $14,515 | $13,904 |

| 12/20 | $15,435 | $15,526 | $14,936 |

| 01/21 | $15,677 | $15,942 | $15,308 |

| 02/21 | $15,646 | $16,093 | $15,505 |

| 03/21 | $15,909 | $15,804 | $15,314 |

| 04/21 | $16,141 | $16,300 | $15,771 |

| 05/21 | $16,489 | $16,807 | $16,127 |

| 06/21 | $16,658 | $16,843 | $16,179 |

| 07/21 | $16,252 | $15,931 | $15,176 |

| 08/21 | $16,327 | $16,315 | $15,544 |

| 09/21 | $15,333 | $15,869 | $15,009 |

| 10/21 | $15,547 | $16,016 | $15,122 |

| 11/21 | $14,702 | $15,585 | $14,561 |

| 12/21 | $15,063 | $15,894 | $14,886 |

| 01/22 | $14,823 | $15,332 | $14,555 |

| 02/22 | $14,731 | $15,050 | $14,236 |

| 03/22 | $14,583 | $14,580 | $14,002 |

| 04/22 | $13,804 | $13,730 | $13,294 |

| 05/22 | $14,365 | $13,778 | $13,317 |

| 06/22 | $13,227 | $13,032 | $12,361 |

| 07/22 | $13,527 | $13,050 | $12,393 |

| 08/22 | $13,354 | $13,094 | $12,518 |

| 09/22 | $12,001 | $11,707 | $11,131 |

| 10/22 | $12,429 | $11,378 | $10,854 |

| 11/22 | $13,701 | $12,752 | $12,313 |

| 12/22 | $13,280 | $12,616 | $12,163 |

| 01/23 | $14,175 | $13,516 | $13,015 |

| 02/23 | $13,421 | $12,797 | $12,267 |

| 03/23 | $13,810 | $13,080 | $12,595 |

| 04/23 | $13,786 | $12,988 | $12,499 |

| 05/23 | $13,739 | $12,756 | $12,338 |

| 06/23 | $14,289 | $13,188 | $12,801 |

| 07/23 | $15,007 | $13,939 | $13,587 |

| 08/23 | $14,397 | $13,233 | $12,868 |

| 09/23 | $13,990 | $12,928 | $12,589 |

| 10/23 | $13,297 | $12,434 | $12,060 |

| 11/23 | $14,337 | $13,350 | $13,040 |

| 12/23 | $15,169 | $13,814 | $13,567 |

| 01/24 | $14,494 | $13,147 | $13,035 |

| 02/24 | $14,988 | $13,782 | $13,599 |

| 03/24 | $15,120 | $14,006 | $13,868 |

| 04/24 | $14,615 | $14,158 | $13,960 |

| 05/24 | $14,482 | $14,191 | $14,061 |

| 06/24 | $14,738 | $14,560 | $14,584 |

| 07/24 | $15,031 | $14,629 | $14,636 |

| 08/24 | $15,533 | $14,791 | $14,843 |

| 09/24 | $15,802 | $15,961 | $15,760 |

| 10/24 | $15,031 | $15,308 | $15,071 |

Average Annual Total Returns

| Seafarer Overseas Growth and Income Fund | 1 Year | 5 Year | 10 Year |

|---|

| Seafarer Overseas Growth and Income Fund - Investor Class (Incep. February 15, 2012) | 13.04% | 4.49% | 4.16% |

| Bloomberg EM Large, Mid, and Small Cap Net Return USD Index | 23.11% | 5.13% | 4.35% |

| Morningstar EM Net Return USD Index | 24.97% | 5.05% | 4.19% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call 855-732-9220 for current month-end performance.

| Header | Text |

|---|

| Total Net Assets | $3,320,400,850 |

| # of Portfolio Holdings | 52 |

| Portfolio Turnover Rate | 9% |

| Total Advisory Fees Paid | $12,455,728 |

What did the Fund invest in?

Sector Weightings (% of Net Assets)

| Value | Value |

|---|

| Cash and Other Assets, Less Liabilities | 2.7% |

| Utilities | 1.3% |

| Real Estate | 2.4% |

| Energy | 2.7% |

| Communications | 2.9% |

| Materials | 4.9% |

| Health Care | 7.9% |

| Industrials | 8.6% |

| Technology | 13.3% |