UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08194

FINANCIAL INVESTORS TRUST

(Exact name of Registrant as specified in charter)

1290 Broadway, Suite 1000, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Michael Lawlor, Esq., Secretary

Financial Investors Trust

1290 Broadway, Suite 1000

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: April 30

Date of reporting period: May 1, 2023 – October 31, 2023

Item 1. Reports to Stockholders.

(a) Report of Shareholders.

TABLE OF CONTENTS

SEMI-ANNUAL REPORT

| SHAREHOLDER LETTER | 1 |

| PERFORMANCE UPDATE | 4 |

| DISCLOSURE OF FUND EXPENSES | 6 |

| PORTFOLIO OF INVESTMENTS | 7 |

| STATEMENT OF ASSETS AND LIABILITIES | 19 |

| STATEMENT OF OPERATIONS | 20 |

| STATEMENTS OF CHANGES IN NET ASSETS | 21 |

| FINANCIAL HIGHLIGHTS | 22 |

| NOTES TO FINANCIAL STATEMENTS | 24 |

| ADDITIONAL INFORMATION | 31 |

| LIQUIDITY RISK MANAGEMENT PROGRAM | 32 |

| PRIVACY POLICY | 33 |

Disciplined Growth Investors’ goal is to communicate clearly and transparently with our clients and mutual fund shareholders. It is mutually beneficial when our shareholders understand how we invest, what we are currently thinking and forecasting, and the specific investment decisions we have made. Our views and opinions regarding the investment prospects of our portfolio holdings and the Fund are “forward looking statements” which may or may not be accurate over the long term. While we believe we have a reasonable basis for these forecasts and have confidence in our investment team’s views, actual results may differ materially from those we anticipate. Information provided in this report should not be considered a recommendation to purchase or sell any particular security.

You can identify forward looking statements as those including words such as “believe”, “expect”, “anticipate”, “forecast”, and similar statement. We cannot assure future performance. These forward-looking statements are made only as-of the date of this report. Following the publication of this report, we will not update any of the forward-looking statements included here.

This material must be preceded or accompanied by a prospectus. Please read the prospectus carefully before investing.

| OCTOBER 31, 2023 | DGINV.COM |

| The Disciplined Growth Investors Fund | Shareholder Letter |

| | October 31, 2023 (Unaudited) |

October 31st marked The DGI Fund’s fiscal year midway point. For the last six months, The Fund returned 7.42%. Stocks in the Fund were up 11.74%% while bonds declined 3.38%.

Since the Fund’s Inception (8/12/2011-10/31/2023), the DGI Fund has returned 10.31% (annualized). The stocks and bonds in the fund have returned annualized rates of 13.61% and 1.81%, respectively, in the same span.

For the remainder of this letter, we will focus on calendar year 2023 to-date and longer periods, as those hold more interesting and meaningful narratives than the last six months.

Calendar year 2022 presented the largest downturn since the Fund opened in 2011. Both in the Fund and in broad market indexes, stocks and bonds declined simultaneously for the first time since 1969.1 2023 has been a much different story, especially for equities. 2023 has also been a good example of how the stock market and the economy can act differently.

Coming into 2023, there was broad concern of an economic recession. Prices were continuing to increase, albeit less sharply than in 2022 and 2021. The consumer’s purchasing power was significantly eroded since the start of 2021. Rising interest rates caused a slight cooling in the housing market and likely negatively impacted private equity markets. With more interest rate hikes, bond prices fell through most of 2023. Banks struggled to absorb the pace of rate changes, with some well-publicized bank failures in March and many other bank stocks shedding value. Yet the stock market maintained an upward climb, with some hiccups in August, September, and October.

For the year-to-date, the Fund increased 14.97%, with stocks up 21.29% and bonds down slightly, returning -0.16%. Performance in stocks was both broad based and driven by a single holding. Of the 44 stocks in the Fund, 31 have increased in value thus far in the year, while 13 have posted negative performance. Super Micro Computer alone added 10.63% to the Fund’s total return. The stock is also the largest holding of The DGI Fund, at 12.03% of assets (10/31/23).

Super Micro Computer (SMCI)

The Fund’s initial purchase of SMCI was over 10 years ago. We were attracted to the way the founder had developed the company. He founded the company over thirty years ago with no venture capital money. His company has never had layoffs, has never done an acquisition and has never had a fiscal year during which the company lost money. By the time we invested, his company was generating annual sales of around $700 million.

For the first nine years the Fund held SMCI, the stock made no meaningful progress and faced some challenges. We were impressed with the reaction and transparency demonstrated by the senior management of Super Micro around these issues, and felt they were serious about becoming a major server company. The CEO’s behavior backed this view, as he cut his pay to just $1 per year and agreed to a 100% performance-based incentive program which would only pay if SMCI’s revenue and share price increased substantially.

Revenue growth came first. In 2022, Super Micro’s quarterly revenue growth was 50% or higher each quarter. This was quickly followed by expansion in profit margins – both gross and operating profits. SMCI’s operating profit margin ranged between 1.1% and 6.8% from 2020 through mid-2022. In the last three quarters of 2022, it was above 10% and has remained above pre-2022 highs during 2023.

The stock price has reflected this progress, increasing 190.85% in the calendar year-to-date.

| Semi-Annual Report | October 31, 2023 | 1 |

| The Disciplined Growth Investors Fund | Shareholder Letter |

| | October 31, 2023 (Unaudited) |

In addition to feeling good about a stock working well for us and our clients, Super Micro is encouraging to us as corporate governance is one key item in our research process. Management alignment with fundamental financial progress is something we believe is important to sustained growth.

At this point, SMCI is in a unique position in the Fund. It is the largest holding and we are keenly aware of the high allocation, yet we believe it still holds significant potential. We have trimmed the position slightly at times to manage allocation risk. That said, we are primarily focused on continuing to develop our understanding of the depth and durability of the long-term competitive advantage for SMCI and the size of their addressable market. Today, the company is generating annual revenues of about $7 billion. We believe their addressable market is around $60 billion and may well grow to $100 billion over the next decade. It is rare for a company to be both the performance leader and low-cost provider in an industry, but Super Micro appears to be executing on exactly those seemingly contradictory fronts.

A Mixed Bag for Bonds

The bond portfolio in The DGI Fund has contended with a mixture of price declines and increased yields on new purchases. The painful part, we believe, is likely mostly in the rear-view mirror. When interest rates increase, prices of existing bonds fall. For anyone not previously familiar with this dynamic, 2022 and 2023 have provided an uncomfortable primer.

On March 16, 2022, the U.S. Federal Reserve undertook the first of eight interest rate increases. Prior to the increases, the baseline Fed Funds rate was 0.25%. As of 10/31/23, it was 5.50%. The pace of the increase was nearly unprecedented in recent history. As a result, bonds in the Fund have returned -5.16% since the start of March 2022. That encapsulates the pain.

The forward-looking environment seems more favorable. At the start of March of 2022, the DGI Fund’s bond portfolio sported a yield to maturity of 2.29%. Today, that is at 6.03%, the highest such figure since we opened The DGI Fund in 2011.

The broad consensus forecast is that interest rates are likely to decline one to two years from now. We have no specific interest rate forecast, but given the improvement in yields available, our outlook for bonds is optimistic.

We entered 2023 optimistic about the Fund’s prospects, especially the equity portion. While this optimism has generally been validated so far, we still hold that view. Portfolio companies are executing well on a fundamental level. We believe stocks in the Fund are priced to offer forward returns above our hurdle rate.

New Purchases and Complete Sales

In the last six months, we did not add any new stocks to The DGI Fund or make any complete sales. We increased the position sizes of existing holdings Floor & Décor and Generac and trimmed the position sizes in Landstar System and Super Micro Computer.

Sincerely,

Frederick Martin, CFA – Portfolio Manager

Rob Nicoski, CPA* – Portfolio Manager

Nick Hansen, CFA, CAIA – Portfolio Manager

Jason Lima, CFA – Portfolio Manager

| 2 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Shareholder Letter |

| | October 31, 2023 (Unaudited) |

| 1 | As measured by the S&P 500 Index’s calendar year returns and the Bloomberg Aggregate US Government/Credit Bond Index. |

The Barclay’s Government & Corporate Credit index includes both corporate (publicly-issued, fixed-rate, nonconvertible, investment grade, dollar-denominated, SEC-registered, corporate dept.) and government (Treasury Bond index, Agency Bond index, 1-3 Year Government index, and the 20+-Year treasury) indexes, including bonds with maturities up to ten years.

The S&P 500® Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in the Index.

Asset class-specific performance is before fees. The Fund’s single fee – the management fee – is paid from the Fund’s holding of cash. Total Fund net-of-fees performance is presented in this letter, later in this annual report, and is updated monthly on the Fund’s website, www.dgifund.com.

The views of Disciplined Growth Investors, Inc. and information discussed in this commentary are as of the date of this report, are subject to change, and may not reflect the writers’ current views.

The views expressed are those of the Fund’s adviser only, and represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned in this letter. The subject matter contained in this letter has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither Disciplined Growth Investors, Inc. nor the Fund accepts any liability for losses either direct or consequential caused by the use of this information.

The Fund is distributed by ALPS Distributors, Inc.

The Fund is subject to investment risks, including possible loss of the principal amount invested and therefore is not suitable for all investors. The Fund may not achieve its objectives.

Diversification does not eliminate the risk of experiencing investment losses.

Fred Martin is a registered representative of ALPS Distributors, Inc. CFA Institute Marks are trademarks owned by the CFA Institute.

| Semi-Annual Report | October 31, 2023 | 3 |

| The Disciplined Growth Investors Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

Annualized Total Return Performance (for the period ended October 31, 2023)

| | 6 Month | 1 Year | 3 Year | 5 Year | 10 Year | Since Inception* |

| The Disciplined Growth Investors Fund | 7.42% | 15.11% | 7.05% | 8.43% | 8.54% | 10.31% |

| S&P 500® Total Return Index(1) | 1.39% | 10.14% | 10.36% | 11.01% | 11.18% | 13.13% |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please call 1.855.DGI.FUND.

The table does not reflect the deductions of taxes a shareholder would pay on Fund distributions or redemptions of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| * | Fund Inception date of August 12, 2011. |

| (1) | The S&P 500® Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in the Index. |

| 4 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Performance Update |

| | October 31, 2023 (Unaudited) |

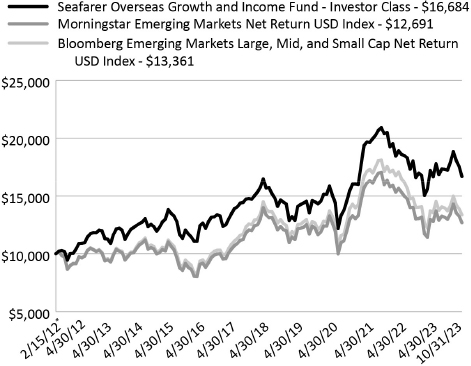

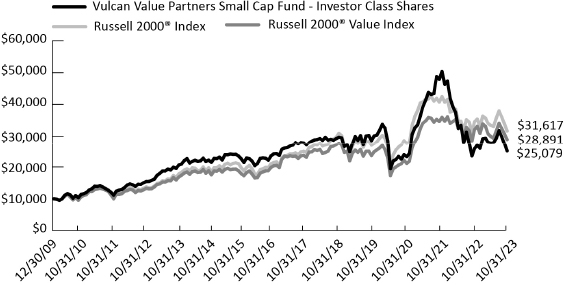

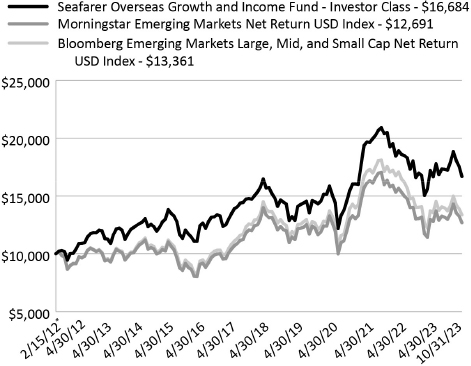

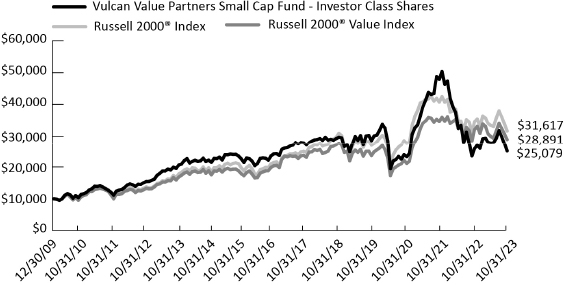

Growth of $10,000 Investment in the Fund (for the period ended October 31, 2023)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

Industry Sector Allocation

(as a % of Net Assets)*

| Technology | 43.71% |

| Consumer Discretionary | 11.25% |

| Energy | 5.59% |

| Industrials | 4.19% |

| Health Care | 3.82% |

| Producer Durables | 2.14% |

| Communications | 0.87% |

| Corporate Bonds | 22.79% |

| Foreign Corporate Bonds | 2.74% |

| Government Bond & Agency Obligations | 2.29% |

| Other Assets in Excess of Liabilities | 0.61% |

Top Ten Holdings

(as a % of Net Assets)*

| Super Micro Computer, Inc. | 12.03% |

| Plexus Corp. | 3.53% |

| Pure Storage, Inc. | 3.45% |

| Akamai Technologies, Inc. | 3.24% |

| Arista Networks, Inc. | 3.14% |

| Microchip Technology, Inc. | 3.06% |

| Power Integrations, Inc. | 2.78% |

| Southwestern Energy Co. | 2.78% |

| Gentex Corp. | 2.71% |

| Coterra Energy, Inc. | 2.64% |

| Top Ten Holdings | 39.36% |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

| Semi-Annual Report | October 31, 2023 | 5 |

| The Disciplined Growth Investors Fund | Disclosure of Fund Expenses |

| | October 31, 2023 (Unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other fund operating expenses. This example is intended to help you understand your ongoing costs (in dollars), of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of May 1, 2023 through October 31, 2023.

Actual Expenses The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account

Value

5/1/2023 | Ending Account

Value

10/31/2023 | Expense Ratio(a) | Expenses Paid During period 5/1/2023 -

10/31/2023(b) |

| Actual | $1,000.00 | $1,000.00 | 0.78% | $ 3.93 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.27 | 0.78% | $ 3.97 |

| (a) | The Fund's expense ratios have been annualized based on the Fund's most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184)/365 (to reflect the half-year period). |

| 6 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| | October 31, 2023 (Unaudited) |

| | | Shares | | | Value

(Note 2) | |

| COMMON STOCKS (71.57%) | | | | | | | | |

| COMMUNICATIONS (0.36%) | | | | | | | | |

| Media (0.36%) | | | | | | | | |

| Take-Two Interactive Software, Inc. (a) | | | 10,349 | | | $ | 1,384,179 | |

| | | | | | | | | |

| TOTAL COMMUNICATIONS | | | | | | | 1,384,179 | |

| | | | | | | | | |

| CONSUMER DISCRETIONARY (8.92%) | | | | | | | | |

| Consumer Discretionary Products (4.93%) | | | | | | | | |

| Gentex Corp. | | | 366,470 | | | | 10,510,360 | |

| Gentherm, Inc. (a) | | | 44,772 | | | | 1,800,730 | |

| LGI Homes, Inc. (a) | | | 36,758 | | | | 3,473,999 | |

| Under Armour, Inc. , Class A(a) | | | 482,930 | | | | 3,308,070 | |

| | | | | | | | 19,093,159 | |

| Consumer Discretionary Services (2.12%) | | | | | | | | |

| Royal Caribbean Cruises, Ltd. (a) | | | 66,644 | | | | 5,646,746 | |

| Strategic Education, Inc. | | | 31,052 | | | | 2,555,890 | |

| | | | | | | | 8,202,636 | |

| | | Shares | | | Value

(Note 2) | |

| CONSUMER DISCRETIONARY (continued) | | | | | | | | |

| Retail & Whsle - Discretionary (1.87%) | | | | | | | | |

| Floor & Decor Holdings, Inc. , Class A(a) | | | 65,962 | | | $ | 5,435,269 | |

| Sleep Number Corp. (a) | | | 98,188 | | | | 1,597,518 | |

| Stitch Fix, Inc. , Class A(a) | | | 62,314 | | | | 204,390 | |

| | | | | | | | 7,237,177 | |

| | | | | | | | | |

| TOTAL CONSUMER DISCRETIONARY | | | | | | | 34,532,972 | |

| | | | | | | | | |

| ENERGY (5.59%) | | | | | | | | |

| Oil & Gas (5.59%) | | | | | | | | |

| Core Laboratories, Inc. | | | 32,247 | | | | 690,731 | |

| Coterra Energy, Inc. | | | 371,382 | | | | 10,213,005 | |

| Southwestern Energy Co. (a) | | | 1,507,524 | | | | 10,748,646 | |

| | | | | | | | 21,652,382 | |

| | | | | | | | | |

| TOTAL ENERGY | | | | | | | 21,652,382 | |

| Semi-Annual Report | October 31, 2023 | 7 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| | October 31, 2023 (Unaudited) |

| HEALTH CARE (3.82%) | | | | | | |

| Health Care (3.82%) | | | | | | |

| Align Technology, Inc. (a) | | | 31,218 | | | | 5,762,531 | |

| Intuitive Surgical, Inc. (a) | | | 27,295 | | | | 7,157,295 | |

| Myriad Genetics, Inc. (a) | | | 119,476 | | | | 1,861,436 | |

| | | | | | | | 14,781,262 | |

| | | | | | | | | |

| TOTAL HEALTH CARE | | | | | | | 14,781,262 | |

| | | | | | | | | |

| INDUSTRIALS (9.79%) | | | | | | | | |

| Industrial Products (6.11%) | | | | | | | | |

| Cognex Corp. | | | 185,508 | | | | 6,676,433 | |

| Generac Holdings, Inc. (a) | | | 28,824 | | | | 2,423,234 | |

| Graco, Inc. | | | 43,784 | | | | 3,255,340 | |

| Proto Labs, Inc. (a) | | | 115,345 | | | | 2,723,296 | |

| Snap-on, Inc. | | | 33,361 | | | | 8,605,136 | |

| | | | | | | | 23,683,439 | |

| Industrial Services (3.68%) | | | | | | | | |

| Alarm.com Holdings, Inc. (a) | | | 131,426 | | | | 6,719,811 | |

| Landstar System, Inc. | | | 31,606 | | | | 5,208,037 | |

| MSC Industrial Direct Co., Inc. , Class A | | | 24,516 | | | | 2,322,891 | |

| | | | | | | | 14,250,739 | |

| | | | | | | | | |

| TOTAL INDUSTRIALS | | | | | | | 37,934,178 | |

| | | | | | | | | |

| TECHNOLOGY (43.09%) | | | | | | | | |

| Software & Tech Services (7.76%) | | | | | | | | |

| Akamai Technologies, Inc. (a) | | | 121,431 | | | | 12,547,465 | |

| Autodesk, Inc. (a) | | | 37,045 | | | | 7,321,204 | |

| Intuit, Inc. | | | 19,113 | | | | 9,459,979 | |

| Paychex, Inc. | | | 6,506 | | | | 722,491 | |

| | | | | | | | 30,051,139 | |

| 8 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| | October 31, 2023 (Unaudited) |

| | | Shares | | | Value

(Note 2) | |

| TECHNOLOGY (continued) | | | | | | | | |

| Tech Hardware & Semiconductors (35.33%) | | | | | | | | |

| Arista Networks, Inc. (a) | | | 60,657 | | | $ | 12,153,843 | |

| Dolby Laboratories, Inc. , Class A | | | 113,187 | | | | 9,161,356 | |

| Garmin, Ltd. | | | 88,200 | | | | 9,043,146 | |

| InterDigital, Inc. | | | 45,019 | | | | 3,387,680 | |

| IPG Photonics Corp. (a) | | | 37,687 | | | | 3,237,313 | |

| Microchip Technology, Inc. | | | 166,007 | | | | 11,834,639 | |

| Plexus Corp. (a) | | | 139,018 | | | | 13,668,250 | |

| Power Integrations, Inc. | | | 155,567 | | | | 10,785,460 | |

| Pure Storage, Inc. , Class A(a) | | | 394,706 | | | | 13,345,010 | |

| Semtech Corp. (a) | | | 45,375 | | | | 633,435 | |

| Super Micro Computer, Inc. (a) | | | 194,531 | | | | 46,584,338 | |

| Viasat, Inc. (a) | | | 163,161 | | | | 3,008,689 | |

| | | | | | | | 136,843,159 | |

| | | | | | | | | |

| TOTAL TECHNOLOGY | | | | | | | 166,894,298 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $204,425,324) | | | | | | $ | 277,179,271 | |

| | | Principal

Amount | | | Value

(Note 2) | |

| CORPORATE BONDS (22.79%) | | | | | | | | |

| COMMUNICATIONS (1.21%) | | | | | | | | |

| Cable & Satellite (0.31%) | | | | | | | | |

| Comcast Corp. | | | | | | | | |

| 2.650% 02/01/2030 | | $ | 1,440,000 | | | $ | 1,195,396 | |

| | | | | | | | | |

| Entertainment Content (0.29%) | | | | | | | | |

| Paramount Global | | | | | | | | |

| 7.875% 07/30/2030 | | | 1,140,000 | | | | 1,122,945 | |

| | | | | | | | | |

| Wireless Telecommunications Services (0.61%) | | | | | | | | |

| AT&T, Inc. | | | | | | | | |

| 4.350% 03/01/2029 | | | 1,280,000 | | | | 1,178,636 | |

| Verizon Communications, Inc. | | | | | | | | |

| 4.329% 09/21/2028 | | | 1,264,000 | | | | 1,177,381 | |

| | | | | | | | 2,356,017 | |

| | | | | | | | | |

| TOTAL COMMUNICATIONS | | | | | | | 4,674,358 | |

| Semi-Annual Report | October 31, 2023 | 9 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| | October 31, 2023 (Unaudited) |

| | | Principal

Amount | | | Value

(Note 2) | |

| CONSUMER DISCRETIONARY (2.30%) | | | | | | | | |

| Airlines (0.29%) | | | | | | | | |

| Southwest Airlines Co. | | | | | | | | |

| 3.450% 11/16/2027 | | $ | 1,244,000 | | | $ | 1,125,418 | |

| | | | | | | | | |

| Automobiles Manufacturing (0.26%) | | | | | | | | |

| General Motors Co. | | | | | | | | |

| 5.400% 10/15/2029 | | | 1,100,000 | | | | 1,033,301 | |

| | | | | | | | | |

| Consumer Services (0.29%) | | | | | | | | |

| Cintas Corp. No 2 | | | | | | | | |

| 6.150% 08/15/2036 | | | 1,120,000 | | | | 1,114,306 | |

| | | | | | | | | |

| Restaurants (0.60%) | | | | | | | | |

| McDonald's Corp., Series MTN | | | | | | | | |

| 6.300% 03/01/2038 | | | 1,121,000 | | | | 1,131,192 | |

| Starbucks Corp. | | | | | | | | |

| 4.000% 11/15/2028 | | | 1,270,000 | | | | 1,180,969 | |

| | | | | | | | 2,312,161 | |

| | | | | | | | | |

| Retail - Consumer Discretionary (0.86%) | | | | | | | | |

| Advance Auto Parts, Inc. | | | | | | | | |

| 3.900% 04/15/2030 | | | 1,394,000 | | | | 1,130,972 | |

| Amazon.com, Inc. | | | | | | | | |

| 5.200% 12/03/2025 | | | 1,035,000 | | | | 1,033,404 | |

| Lowe's Cos., Inc. | | | | | | | | |

| 3.650% 04/05/2029 | | | 1,305,000 | | | | 1,171,074 | |

| | | | | | | | | |

| TOTAL CONSUMER DISCRETIONARY | | | | | | | 8,920,636 | |

| | | | | | | | | |

| CONSUMER STAPLES (0.91%) | | | | | | | | |

| Consumer Products (0.30%) | | | | | | | | |

| Clorox Co. | | | | | | | | |

| 3.100% 10/01/2027 | | | 1,300,000 | | | | 1,179,842 | |

| | | | | | | | | |

| Food & Beverage (0.31%) | | | | | | | | |

| Hormel Foods Corp. | | | | | | | | |

| 1.700% 06/03/2028 | | | 1,400,000 | | | | 1,188,020 | |

| 10 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| | October 31, 2023 (Unaudited) |

| | | Principal

Amount | | | Value

(Note 2) | |

| CONSUMER STAPLES (continued) | | | | | | | | |

| Mass Merchants (0.30%) | | | | | | | | |

| Costco Wholesale Corp. | | | | | | | | |

| 1.600% 04/20/2030 | | $ | 1,480,000 | | | $ | 1,170,617 | |

| | | | | | | | | |

| TOTAL CONSUMER STAPLES | | | | | | | 3,538,479 | |

| | | | | | | | | |

| ENERGY (2.32%) | | | | | | | | |

| Exploration & Production (0.27%) | | | | | | | | |

| ConocoPhillips Co. | | | | | | | | |

| 3.350% 05/15/2025 | | | 1,100,000 | | | | 1,057,807 | |

| | | | | | | | | |

| Integrated Oils (0.30%) | | | | | | | | |

| BP Capital Markets America, Inc. | | | | | | | | |

| 4.893% 09/11/2033 | | | 1,253,000 | | | | 1,147,544 | |

| | | | | | | | | |

| Pipeline (1.45%) | | | | | | | | |

| El Paso Natural Gas Co. LLC | | | | | | | | |

| 7.500% 11/15/2026 | | | 1,000,000 | | | | 1,039,071 | |

| Energy Transfer LP | | | | | | | | |

| 5.250% 04/15/2029 | | | 1,245,000 | | | | 1,181,964 | |

| Enterprise Products Operating LLC | | | | | | | | |

| 3.125% 07/31/2029 | | | 1,355,000 | | | | 1,176,709 | |

| MPLX LP | | | | | | | | |

| 2.650% 08/15/2030 | | | 1,463,000 | | | | 1,156,272 | |

| ONEOK, Inc. | | | | | | | | |

| 6.875% 09/30/2028 | | | 1,062,000 | | | | 1,080,435 | |

| | | | | | | | 5,634,451 | |

| Refining & Marketing (0.30%) | | | | | | | | |

| Phillips 66 | | | | | | | | |

| 2.150% 12/15/2030 | | | 1,498,000 | | | | 1,157,972 | |

| | | | | | | | | |

| TOTAL ENERGY | | | | | | | 8,997,774 | |

| | | | | | | | | |

| FINANCIALS (4.40%) | | | | | | | | |

| Banks (1.16%) | | | | | | | | |

| Regions Financial Corp. | | | | | | | | |

| 1.800% 08/12/2028 | | | 1,465,000 | | | | 1,145,373 | |

| Truist Financial Corp., Series MTN | | | | | | | | |

| 3.875% 03/19/2029 | | | 1,364,000 | | | | 1,166,281 | |

| US Bancorp, Series DMTN | | | | | | | | |

| 3.000% 07/30/2029 | | | 1,416,000 | | | | 1,158,538 | |

| Semi-Annual Report | October 31, 2023 | 11 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| | October 31, 2023 (Unaudited) |

| | | Principal

Amount | | | Value

(Note 2) | |

| FINANCIALS (continued) | | | | | | | | |

| Banks (continued) | | | | | | | | |

| Wachovia Corp. | | | | | | | | |

| 7.574% 08/01/2026 | | $ | 995,000 | | | $ | 1,030,510 | |

| | | | | | | | 4,500,702 | |

| Commercial Finance (0.30%) | | | | | | | | |

| GATX Corp. | | | | | | | | |

| 4.700% 04/01/2029 | | | 1,275,000 | | | | 1,176,155 | |

| | | | | | | | | |

| Consumer Finance (0.56%) | | | | | | | | |

| American Express Co. | | | | | | | | |

| 3.300% 05/03/2027 | | | 1,176,000 | | | | 1,076,656 | |

| Capital One Financial Corp. | | | | | | | | |

| 4.200% 10/29/2025 | | | 1,150,000 | | | | 1,090,918 | |

| | | | | | | | 2,167,574 | |

| Diversified Banks (0.91%) | | | | | | | | |

| Bank of America Corp., Series L | | | | | | | | |

| 4.183% 11/25/2027 | | | 1,280,000 | | | | 1,177,841 | |

| Citigroup, Inc. | | | | | | | | |

| 4.125% 07/25/2028 | | | 1,300,000 | | | | 1,167,479 | |

| JPMorgan Chase & Co. | | | | | | | | |

| 4.125% 12/15/2026 | | | 1,255,000 | | | | 1,186,095 | |

| | | | | | | | 3,531,415 | |

| Financial Services (0.57%) | | | | | | | | |

| Morgan Stanley | | | | | | | | |

| 5.000% 11/24/2025 | | | 1,030,000 | | | | 1,006,689 | |

| Northern Trust Corp. | | | | | | | | |

| 3M US L + 1.131% 05/08/2032 (b) | | | 1,349,000 | | | | 1,186,461 | |

| | | | | | | | 2,193,150 | |

| Life Insurance (0.29%) | | | | | | | | |

| Principal Financial Group, Inc. | | | | | | | | |

| 3.100% 11/15/2026 | | | 1,201,000 | | | | 1,107,996 | |

| | | | | | | | | |

| Real Estate (0.61%) | | | | | | | | |

| Simon Property Group LP | | | | | | | | |

| 2.450% 09/13/2029 | | | 1,440,000 | | | | 1,176,066 | |

| 12 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| | October 31, 2023 (Unaudited) |

| | | Principal

Amount | | | Value

(Note 2) | |

| FINANCIALS (continued) | | | | | | | | |

| Real Estate (continued) | | | | | | | | |

| Welltower OP LLC | | | | | | | | |

| 4.125% 03/15/2029 | | $ | 1,310,000 | | | $ | 1,183,065 | |

| | | | | | | | 2,359,131 | |

| | | | | | | | | |

| TOTAL FINANCIALS | | | | | | | 17,036,123 | |

| | | | | | | | | |

| HEALTH CARE (1.49%) | | | | | | | | |

| Health Care Facilities & Services (0.30%) | | | | | | | | |

| CVS Health Corp. | | | | | | | | |

| 3.250% 08/15/2029 | | | 1,362,000 | | | | 1,177,193 | |

| | | | | | | | | |

| Managed Care (0.31%) | | | | | | | | |

| Elevance Health, Inc. | | | | | | | | |

| 3.650% 12/01/2027 | | | 1,284,000 | | | | 1,183,291 | |

| | | | | | | | | |

| Pharmaceuticals (0.88%) | | | | | | | | |

| AbbVie, Inc. | | | | | | | | |

| 4.250% 11/14/2028 | | | 1,255,000 | | | | 1,181,942 | |

| Astrazeneca Finance LLC | | | | | | | | |

| 1.750% 05/28/2028 | | | 1,400,000 | | | | 1,191,998 | |

| Bristol-Myers Squibb Co. | | | | | | | | |

| 6.800% 11/15/2026 | | | 1,000,000 | | | | 1,046,361 | |

| | | | | | | | 3,420,301 | |

| | | | | | | | | |

| TOTAL HEALTH CARE | | | | | | | 5,780,785 | |

| | | | | | | | | |

| INDUSTRIALS (3.08%) | | | | | | | | |

| Aerospace & Defense (0.87%) | | | | | | | | |

| General Dynamics Corp. | | | | | | | | |

| 3.500% 05/15/2025 | | | 1,100,000 | | | | 1,067,738 | |

| Northrop Grumman Corp. | | | | | | | | |

| 4.400% 05/01/2030 | | | 1,224,000 | | | | 1,129,022 | |

| RTX Corp. | | | | | | | | |

| 7.500% 09/15/2029 | | | 1,085,000 | | | | 1,166,430 | |

| | | | | | | | 3,363,190 | |

| Engineering & Construction (0.18%) | | | | | | | | |

| Fluor Corp. | | | | | | | | |

| 4.250% 09/15/2028 | | | 750,000 | | | | 680,850 | |

| Semi-Annual Report | October 31, 2023 | 13 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| | October 31, 2023 (Unaudited) |

| | | Principal

Amount | | | Value

(Note 2) | |

| INDUSTRIALS (continued) | | | | | | | | |

| Industrial Other (0.30%) | | | | | | | | |

| Emerson Electric Co. | | | | | | | | |

| 2.000% 12/21/2028 | | $ | 1,370,000 | | | $ | 1,161,458 | |

| | | | | | | | | |

| Railroad (0.59%) | | | | | | | | |

| CSX Corp. | | | | | | | | |

| 3.400% 08/01/2024 | | | 1,124,000 | | | | 1,103,632 | |

| Union Pacific Corp. | | | | | | | | |

| 2.400% 02/05/2030 | | | 1,419,000 | | | | 1,166,523 | |

| | | | | | | | 2,270,155 | |

| Transportation & Logistics (0.58%) | | | | | | | | |

| FedEx Corp. | | | | | | | | |

| 2.400% 05/15/2031 | | | 1,468,000 | | | | 1,148,336 | |

| United Parcel Service, Inc. | | | | | | | | |

| 6.200% 01/15/2038 | | | 1,092,000 | | | | 1,118,839 | |

| | | | | | | | 2,267,175 | |

| Waste & Environment Services & Equipment (0.56%) | | | | | | | | |

| Republic Services, Inc. | | | | | | | | |

| 2.300% 03/01/2030 | | | 1,429,000 | | | | 1,159,956 | |

| Waste Management, Inc. | | | | | | | | |

| 7.000% 07/15/2028 | | | 953,000 | | | | 1,016,566 | |

| | | | | | | | 2,176,522 | |

| | | | | | | | | |

| TOTAL INDUSTRIALS | | | | | | | 11,919,350 | |

| | | | | | | | | |

| MATERIALS (0.31%) | | | | | | | | |

| Chemicals (0.31%) | | | | | | | | |

| Dow Chemical Co. | | | | | | | | |

| 7.375% 11/01/2029 | | | 1,108,000 | | | | 1,172,001 | |

| DuPont de Nemours, Inc. | | | | | | | | |

| 4.725% 11/15/2028 | | | 14,000 | | | | 13,387 | |

| | | | | | | | 1,185,388 | |

| | | | | | | | | |

| TOTAL MATERIALS | | | | | | | 1,185,388 | |

| | | | | | | | | |

| UTILITIES (6.77%) | | | | | | | | |

| Utilities (6.77%) | | | | | | | | |

| Ameren Corp. | | | | | | | | |

| 1.750% 03/15/2028 | | | 1,410,000 | | | | 1,181,927 | |

| Appalachian Power Co., Series AA | | | | | | | | |

| 2.700% 04/01/2031 | | | 1,464,000 | | | | 1,154,382 | |

| 14 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| | October 31, 2023 (Unaudited) |

| | | Principal

Amount | | | Value

(Note 2) | |

| UTILITIES (continued) | | | | | | | | |

| Utilities (continued) | | | | | | | | |

| Arizona Public Service Co. | | | | | | | | |

| 2.600% 08/15/2029 | | $ | 1,405,000 | | | $ | 1,192,416 | |

| Black Hills Corp. | | | | | | | | |

| 3.050% 10/15/2029 | | | 1,410,000 | | | | 1,170,140 | |

| CenterPoint Energy, Inc. | | | | | | | | |

| 4.250% 11/01/2028 | | | 1,201,000 | | | | 1,100,298 | |

| CMS Energy Corp. | | | | | | | | |

| 3.450% 08/15/2027 | | | 1,303,000 | | | | 1,193,618 | |

| Commonwealth Edison Co., Series 122 | | | | | | | | |

| 2.950% 08/15/2027 | | | 1,300,000 | | | | 1,179,947 | |

| DTE Electric Co. | | | | | | | | |

| 6.350% 10/15/2032 | | | 1,023,000 | | | | 1,032,394 | |

| Duke Energy Corp. | | | | | | | | |

| 3.400% 06/15/2029 | | | 1,342,000 | | | | 1,176,030 | |

| Eastern Energy Gas Holdings LLC, Series B | | | | | | | | |

| 3.000% 11/15/2029 | | | 939,000 | | | | 784,417 | |

| Interstate Power and Light Co. | | | | | | | | |

| 3.600% 04/01/2029 | | | 1,300,000 | | | | 1,167,080 | |

| National Rural Utilities Cooperative Finance Corp. | | | | | | | | |

| 1.650% 06/15/2031 | | | 1,500,000 | | | | 1,096,983 | |

| Nevada Power Co., Series N | | | | | | | | |

| 6.650% 04/01/2036 | | | 1,330,000 | | | | 1,339,294 | |

| NextEra Energy Capital Holdings, Inc. | | | | | | | | |

| 3.500% 04/01/2029 | | | 1,330,000 | | | | 1,172,561 | |

| NiSource, Inc. | | | | | | | | |

| 2.950% 09/01/2029 | | | 1,325,000 | | | | 1,128,418 | |

| Oncor Electric Delivery Co. LLC | | | | | | | | |

| 3.700% 11/15/2028 | | | 1,289,000 | | | | 1,180,790 | |

| PPL Electric Utilities Corp. | | | | | | | | |

| 6.450% 08/15/2037 | | | 963,000 | | | | 953,046 | |

| Public Service Electric and Gas Co. | | | | | | | | |

| 3.200% 05/15/2029 | | | 1,340,000 | | | | 1,180,851 | |

| Puget Energy, Inc. | | | | | | | | |

| 4.100% 06/15/2030 | | | 1,355,000 | | | | 1,158,721 | |

| Southern Co., Series 21-B | | | | | | | | |

| 1.750% 03/15/2028 | | | 1,415,000 | | | | 1,188,797 | |

| Tampa Electric Co. | | | | | | | | |

| 3.875% 07/12/2024 | | | 1,120,000 | | | | 1,103,929 | |

| WEC Energy Group, Inc. | | | | | | | | |

| 4.750% 01/15/2028 | | | 1,240,000 | | | | 1,186,227 | |

| Semi-Annual Report | October 31, 2023 | 15 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| | October 31, 2023 (Unaudited) |

| | | Principal

Amount | | | Value

(Note 2) | |

| UTILITIES (continued) | | | | | | | | |

| Utilities (continued) | | | | | | | | |

| Xcel Energy, Inc. | | | | | | | | |

| 2.600% 12/01/2029 | | $ | 1,420,000 | | | $ | 1,174,409 | |

| | | | | | | | 26,196,675 | |

| | | | | | | | | |

| TOTAL UTILITIES | | | | | | | 26,196,675 | |

| | | | | | | | | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $97,665,625) | | | | | | $ | 88,249,568 | |

| | | | | | | | | |

| FOREIGN CORPORATE BONDS (2.74%) | | | | | | | | |

| ENERGY (0.90%) | | | | | | | | |

| Exploration & Production (0.31%) | | | | | | | | |

| Canadian Natural Resources, Ltd. | | | | | | | | |

| 3.850% 06/01/2027 | | | 1,280,000 | | | | 1,187,040 | |

| | | | | | | | | |

| Pipeline (0.59%) | | | | | | | | |

| Enbridge, Inc. | | | | | | | | |

| 5.700% 03/08/2033 | | | 1,223,000 | | | | 1,144,116 | |

| TransCanada PipeLines, Ltd. | | | | | | | | |

| 7.250% 08/15/2038 | | | 1,130,000 | | | | 1,162,550 | |

| | | | | | | | 2,306,666 | |

| | | | | | | | | |

| TOTAL ENERGY | | | | | | | 3,493,706 | |

| | | | | | | | | |

| FINANCIALS (0.92%) | | | | | | | | |

| Diversified Banks (0.92%) | | | | | | | | |

| Bank of Nova Scotia | | | | | | | | |

| 4.750% 02/02/2026 | | | 1,225,000 | | | | 1,194,066 | |

| Royal Bank of Canada, Series GMTN | | | | | | | | |

| 4.650% 01/27/2026 | | | 1,229,000 | | | | 1,191,832 | |

| Toronto-Dominion Bank | | | | | | | | |

| 1.200% 06/03/2026 | | | 1,340,000 | | | | 1,188,382 | |

| | | | | | | | | |

| TOTAL FINANCIALS | | | | | | | 3,574,280 | |

| | | | | | | | | |

| HEALTH CARE (0.30%) | | | | | | | | |

| Pharmaceuticals (0.30%) | | | | | | | | |

| Pfizer Investment Enterprises Pte, Ltd. | | | | | | | | |

| 4.450% 05/19/2028 | | | 1,220,000 | | | | 1,166,605 | |

| | | | | | | | | |

| TOTAL HEALTH CARE | | | | | | | 1,166,605 | |

| 16 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| | October 31, 2023 (Unaudited) |

| | | Principal

Amount | | | Value

(Note 2) | |

| INDUSTRIALS (0.31%) | | | | | | | | |

| Railroad (0.31%) | | | | | | | | |

| Canadian Pacific Railway Co. | | | | | | | | |

| 2.900% 02/01/2025 | | $ | 1,250,000 | | | $ | 1,205,348 | |

| | | | | | | | | |

| TOTAL INDUSTRIALS | | | | | | | 1,205,348 | |

| | | | | | | | | |

| MATERIALS (0.31%) | | | | | | | | |

| Metals & Mining (0.31%) | | | | | | | | |

| BHP Billiton Finance USA, Ltd. | | | | | | | | |

| 4.750% 02/28/2028 | | | 1,220,000 | | | | 1,178,421 | |

| | | | | | | | | |

| TOTAL MATERIALS | | | | | | | 1,178,421 | |

| | | | | | | | | |

| TOTAL FOREIGN CORPORATE BONDS | | | | | | | | |

| (Cost $11,343,544) | | | | | | $ | 10,618,360 | |

| | | | | | | | | |

| GOVERNMENT & AGENCY OBLIGATIONS (2.29%) | | | | | | | | |

| U.S. Treasury Bonds | | | | | | | | |

| 2.875% 08/15/2028 | | | 290,000 | | | | 265,514 | |

| U.S. Treasury Notes | | | | | | | | |

| 0.250% 06/15/2024 | | | 3,000,000 | | | | 2,904,463 | |

| 0.250% 08/31/2025 | | | 3,500,000 | | | | 3,205,234 | |

| 4.125% 06/15/2026 | | | 670,000 | | | | 656,705 | |

| 4.250% 05/31/2025 | | | 670,000 | | | | 660,421 | |

| 4.500% 11/15/2025 | | | 1,200,000 | | | | 1,187,016 | |

| | | | | | | | | |

| TOTAL GOVERNMENT & AGENCY OBLIGATIONS | | | | | | | | |

| (Cost $8,955,676) | | | | | | $ | 8,879,353 | |

| | | Yield | | | Shares | | | Value

(Note 2) | |

| SHORT TERM INVESTMENTS (0.31%) | | | | | | | | | | | | |

| MONEY MARKET FUND (0.31%) | | | | | | | | | | | | |

| First American Treasury Obligations | | | | | | | | | | | | |

| Fund, 12/31/2049 | | | 5.270 | %(c) | | | 1,173,314 | | | | 1,173,314 | |

| | | | | | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $1,173,314) | | | | | | | | | | $ | 1,173,314 | |

| Semi-Annual Report | October 31, 2023 | 17 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| | October 31, 2023 (Unaudited) |

| TOTAL INVESTMENTS (99.70%) | | | | | | | | | |

| (Cost $323,563,483) | | | | | | | | | | $ | 386,099,866 | |

| | | | | | | | | | | | | |

| Other Assets In Excess Of Liabilities (0.30%) | | | | | | | | | | | 1,173,036 | |

| | | | | | | | | | | | | |

| NET ASSETS (100.00%) | | | | | | | | | | $ | 387,272,902 | |

| (a) | Non-Income Producing Security. |

| (b) | Floating or variable rate security. The reference rate is described below. The rate in effect as of October 31, 2023 is based on the reference rate plus the displayed spread as of the securities last reset date. |

| (c) | Represents the 7-day yield. |

Common Abbreviations:

LLC - Limited Liability Company

LP - Limited Partnership

Ltd. - Limited

Reference Rates:

3M US L - 3 Month Synthetic LIBOR as of October 31, 2023 was 5.64%

As a result of supervisory guidance and requirements of law, regulated entities have generally ceased investing in LIBOR contracts. Moreover, most LIBOR settings have ceased to be published. Some LIBOR settings continue to be published but only on a temporary, synthetic and non-representative basis. All such synthetic LIBOR settings are expected to be discontinued by September 30, 2024.

For Fund compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percent of net assets.

See Notes to Financial Statements.

| 18 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Statement of Assets and Liabilities |

| | October 31, 2023 (Unaudited) |

| ASSETS | | | |

| Investments, at value | | $ | 386,099,866 | |

| Receivable for investments sold | | | 1,194,664 | |

| Receivable for shares sold | | | 280,000 | |

| Dividends and interest receivable | | | 1,188,573 | |

| Total assets | | | 388,763,103 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for investments purchased | | | 1,108,655 | |

| Payable for shares redeemed | | | 115,591 | |

| Payable to adviser | | | 265,955 | |

| Total liabilities | | | 1,490,201 | |

| NET ASSETS | | $ | 387,272,902 | |

| | | | | |

| NET ASSETS CONSIST OF | | | | |

| Paid-in capital (Note 5) | | $ | 315,724,882 | |

| Distributable Earnings | | | 71,548,020 | |

| NET ASSETS | | $ | 387,272,902 | |

| | | | | |

| INVESTMENTS, AT COST | | $ | 323,563,483 | |

| | | | | |

| PRICING OF SHARES | | | | |

| Net Asset Value, offering and redemption price per share | | $ | 21.79 | |

| Shares of beneficial interest outstanding | | | 17,773,197 | |

See Notes to Financial Statements.

| Semi-Annual Report | October 31, 2023 | 19 |

| The Disciplined Growth Investors Fund | Statement of Operations |

| | | For the Six Months Ended October 31, 2023 (Unaudited) | |

| INVESTMENT INCOME | | | | |

| Dividends | | $ | 927,882 | |

| Interest | | | 2,226,710 | |

| Total investment income | | | 3,154,592 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees (Note 6) | | | 1,600,203 | |

| Total expenses | | | 1,600,203 | |

| NET INVESTMENT INCOME | | | 1,554,389 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | | |

| Net realized gain on investments | | | 10,281,856 | |

| Net change in unrealized appreciation on investments | | | 14,491,327 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 24,773,183 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 26,327,572 | |

See Notes to Financial Statements.

| 20 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| Statements of Changes in Net Assets |

| | | For the Six Months Ended October 31, 2023 (Unaudited) | | | For the Year Ended April 30, 2023 | |

| OPERATIONS | | | | | | | | |

| Net investment income | | $ | 1,554,389 | | | $ | 3,070,654 | |

| Net realized gain/(loss) | | | 10,281,856 | | | | (1,397,790 | ) |

| Net change in unrealized appreciation | | | 14,491,327 | | | | 4,616,078 | |

| Net increase in net assets resulting from operations | | | 26,327,572 | | | | 6,288,942 | |

| | | | | | | | | |

| DISTRIBUTIONS (Note 3) | | | | | | | | |

| From distributable earnings | | | (1,519,362 | ) | | | (8,142,755 | ) |

| Net decrease in net assets from distributions | | | (1,519,362 | ) | | | (8,142,755 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS (Note 5) | | | | | | | | |

| Proceeds from sales of shares | | | 10,464,332 | | | | 29,649,276 | |

| Issued to shareholders in reinvestment of distributions | | | 1,498,568 | | | | 8,078,561 | |

| Cost of shares redeemed | | | (7,795,835 | ) | | | (22,079,671 | ) |

| Net increase from capital share transactions | | | 4,167,065 | | | | 15,648,166 | |

| | | | | | | | | |

| Net increase in net assets | | | 28,975,275 | | | | 13,794,353 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 358,297,627 | | | | 344,503,274 | |

| End of period | | $ | 387,272,902 | | | $ | 358,297,627 | |

| | | | | | | | | |

| OTHER INFORMATION | | | | | | | | |

| Share Transactions | | | | | | | | |

| Issued | | | 444,254 | | | | 1,494,874 | |

| Issued to shareholders in reinvestment of distributions | | | 63,844 | | | | 412,883 | |

| Redeemed | | | (335,219 | ) | | | (1,100,819 | ) |

| Net increase in share transactions | | | 172,879 | | | | 806,938 | |

See Notes to Financial Statements.

| Semi-Annual Report | October 31, 2023 | 21 |

| The Disciplined Growth Investors Fund |

| NET ASSET VALUE, BEGINNING OF PERIOD |

| |

| INCOME FROM OPERATIONS |

| Net investment income(a) |

| Net realized and unrealized gain/(loss) on investments |

| Total from investment operations |

| |

| DISTRIBUTIONS |

| From net investment income |

| From net realized gain on investments |

| Total distributions |

| |

| INCREASE/(DECREASE) IN NET ASSET VALUE |

| |

| NET ASSET VALUE, END OF PERIOD |

| |

| TOTAL RETURN |

| |

| RATIOS AND SUPPLEMENTAL DATA |

| Net assets, end of period (000's) |

| |

| RATIOS TO AVERAGE NET ASSETS |

| Expenses |

| Net investment income |

| |

| PORTFOLIO TURNOVER RATE |

| (a) | Per share numbers have been calculated using the average shares method. |

See Notes to Financial Statements.

| 22 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| Financial Highlights |

| For a share outstanding during the period or years presented |

| For the Six Months Ended October 31, 2023 (Unaudited) | | | For the Year Ended April 30, 2023 | | | For the Year Ended April 30, 2022 | | | For the Year Ended April 30, 2021 | | | For the Year Ended April 30, 2020 | | | For the Year Ended April 30, 2019 | |

| $ | 20.36 | | | $ | 20.51 | | | $ | 25.94 | | | $ | 19.42 | | | $ | 21.15 | | | $ | 19.12 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 0.09 | | | | 0.18 | | | | 0.08 | | | | 0.09 | | | | 0.18 | | | | 0.16 | |

| | 1.43 | | | | 0.14 | | | | (2.84 | ) | | | 8.83 | | | | (1.14 | ) | | | 2.55 | |

| | 1.52 | | | | 0.32 | | | | (2.76 | ) | | | 8.92 | | | | (0.96 | ) | | | 2.71 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | (0.09 | ) | | | (0.17 | ) | | | (0.08 | ) | | | (0.10 | ) | | | (0.17 | ) | | | (0.12 | ) |

| | – | | | | (0.30 | ) | | | (2.59 | ) | | | (2.30 | ) | | | (0.60 | ) | | | (0.56 | ) |

| | (0.09 | ) | | | (0.47 | ) | | | (2.67 | ) | | | (2.40 | ) | | | (0.77 | ) | | | (0.68 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 1.43 | | | | (0.15 | ) | | | (5.43 | ) | | | 6.52 | | | | (1.73 | ) | | | 2.03 | |

| $ | 21.79 | | | $ | 20.36 | | | $ | 20.51 | | | $ | 25.94 | | | $ | 19.42 | | | $ | 21.15 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 7.42 | %(b) | | | 1.67 | % | | | (11.86 | %) | | | 47.00 | % | | | (4.79 | %) | | | 14.74 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| $ | 387,273 | | | $ | 358,298 | | | $ | 344,503 | | | $ | 345,450 | | | $ | 226,591 | | | $ | 240,172 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 0.78 | %(c) | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % |

| | 0.76 | %(c) | | | 0.89 | % | | | 0.32 | % | | | 0.39 | % | | | 0.86 | % | | | 0.80 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 10 | %(b) | | | 26 | % | | | 21 | % | | | 31 | % | | | 29 | % | | | 22 | % |

| Semi-Annual Report | October 31, 2023 | 23 |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

| | October 31, 2023 (Unaudited) |

1. ORGANIZATION

Financial Investors Trust (the “Trust”), a Delaware statutory trust, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (“1940 Act”). The Trust consists of multiple separate portfolios or series. This semi-annual report describes The Disciplined Growth Investors Fund (the “Fund”). The Fund seeks long-term capital growth and as a secondary objective, modest income with reasonable risk.

2. SIGNIFICANT ACCOUNTING POLICIES

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Actual results could differ from those estimates. The Fund is considered an investment company for financial reporting purposes under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Codification Topic 946. The following is a summary of significant accounting policies consistently followed by the Fund in preparation of its financial statements.

Investment Valuation: The Fund generally values its securities based on market prices determined at the close of regular trading on the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern Time, on each day the NYSE is open for trading.

For equity securities and mutual funds that are traded on an exchange, the market price is usually the closing sale or official closing price on that exchange. In the case of equity securities not traded on an exchange, or if such closing prices are not otherwise available, the securities are valued at the mean of the most recent bid and ask prices on such day. Redeemable securities issued by open-end registered investment companies are valued at the investment company’s applicable net asset value, with the exception of exchange-traded open-end investment companies, which are priced as equity securities.

The market price for debt obligations is generally the price supplied by an independent third-party pricing service, which may use a matrix, formula or other objective method that takes into consideration quotations from dealers, market transactions in comparable investments, market indices and yield curves. If vendors are unable to supply a price, or if the price supplied is deemed to be unreliable, the market price may be determined using quotations received from one or more broker–dealers that make a market in the security. Fixed-income obligations, excluding municipal securities, having a remaining maturity of greater than 60 days, are typically valued at the mean between the evaluated bid and ask prices formulated by an independent pricing service. Corporate Bonds, U.S. Government & Agency, and U.S. Treasury Bonds & Notes are valued using market models that consider trade data, quotations from dealers and active market makers, relevant yield curve and spread data, creditworthiness, trade data or market information on comparable securities, and other relevant security specific information. Publicly traded Foreign Government Debt securities and Foreign Corporate Bonds are typically traded internationally in the over-the-counter market and are

| 24 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

| | October 31, 2023 (Unaudited) |

valued at the mean between the bid and asked prices as of the close of business of that market. Mortgage-related and asset-backed securities are valued based on models that consider trade data, prepayment and default projections, benchmark yield and spread data and estimated cash flows of each tranche of the issuer. Publicly traded foreign government debt securities are typically traded internationally in the over-the-counter market and are valued at the mean between the bid and asked prices as of the close of business of that market.

When such prices or quotations are not available, or when Disciplined Growth Investors, Inc. (the “Adviser”) believes that they are unreliable, securities may be priced using fair value procedures established by the Adviser pursuant to Rule 2a-5 under the 1940 Act and approved by and subject to the oversight of the Board of Trustees of the Trust (the “Board” or the “Trustees”).

Fair Value Measurements: Pursuant to Rule 2a-5 under the Investment Company Act of 1940, the Board has appointed the Adviser to serve as the Valuation Designee to perform fair value determinations for investments in the Fund. When such prices or quotations are not available, or when the Valuation Designee believes that they are unreliable, securities may be priced using fair value procedures approved by the Board. The fair valuation policies and procedures (“FV Procedures”) have been adopted by the Board for the fair valuation of portfolio assets held by the Fund in the event that (1) market quotations for the current price of a portfolio security or asset are not readily available, or (2) available market quotations that would otherwise be used to value a portfolio security or asset in accordance with the Fund’s Pricing Procedures appear to be unreliable or not indicative of fair value. The Pricing Procedures reflect certain pricing methodologies (or “logics”) that are not “readily available market quotations” and thus are viewed and treated as fair valuations. The Valuation Designee routinely meets to discuss fair valuations of portfolio securities and other instruments held by the Fund.

The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| | |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Semi-Annual Report | October 31, 2023 | 25 |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

| | October 31, 2023 (Unaudited) |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The following is a summary of each input used to value the Fund as of October 31, 2023:

| Investments in Securities at Value | | Level 1 - Unadjusted Quoted Prices | | | Level 2 - Other Significant Observable Inputs | | | Level 3 - Significant Unobservable Inputs | | | Total | |

| Common Stocks(a) | | $ | 277,179,271 | | | $ | – | | | $ | – | | | $ | 277,179,271 | |

| Corporate Bonds(a) | | | – | | | | 88,249,568 | | | | – | | | | 88,249,568 | |

| Foreign Corporate Bonds(a) | | | – | | | | 10,618,360 | | | | – | | | | 10,618,360 | |

| Government & Agency Obligations | | | – | | | | 8,879,353 | | | | – | | | | 8,879,353 | |

| Short Term Investments | | | 1,173,314 | | | | – | | | | – | | | | 1,173,314 | |

| TOTAL | | $ | 278,352,585 | | | $ | 107,747,281 | | | $ | – | | | $ | 386,099,866 | |

| (a) | For detailed descriptions of the underlying industries, see the accompanying Portfolio of Investments. |

For the six months ended October 31, 2023, the Fund did not have any securities that used significant unobservable inputs (Level 3) in determining fair value. There were no transfers in/out of Level 3 securities during the six months ended October 31, 2023.

Investment Transactions and Investment Income: Investment transactions are accounted for on the date the investments are purchased or sold (trade date). Realized gains and losses from investment transactions are reported on an identified cost basis, which is the same basis the Fund uses for federal income tax purposes. Interest income, which includes accretion of discounts, is accrued and recorded as earned. Dividend income is recognized on the ex-dividend date or for certain foreign securities, as soon as information is available to the Fund.

Trust Expenses: Some expenses of the Trust can be directly attributed to the Fund. Expenses which cannot be directly attributed to the Fund are apportioned among all funds in the Trust based on average net assets of each fund.

Fund Expenses: Expenses that are specific to the Fund are charged directly to the Fund.

Federal Income Taxes: The Fund complies with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and intends to distribute substantially all of their net taxable income and net capital gains, if any, each year so that it will not be subject to excise tax on undistributed income and gains. The Fund is not subject to income taxes to the extent such distributions are made.

As of and during the six months ended October 31, 2023 the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return for

| 26 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

| | October 31, 2023 (Unaudited) |

federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Distributions to Shareholders: The Fund normally pays dividends, if any, quarterly and distributes capital gains, if any, on an annual basis. Income dividend distributions are derived from dividends and other income the Fund receives from its investments, including short term capital gains. Long term capital gain distributions are derived from gains realized when the Fund sells a security it has owned for more than a year. The Fund may make additional distributions and dividends at other times if the portfolio manager believes doing so may be necessary for the Fund to avoid or reduce taxes.

3. TAX BASIS INFORMATION

Tax Basis of Investments: As of October 31, 2023, the aggregate cost of investments, gross unrealized appreciation/(depreciation) and net unrealized appreciation for Federal tax purposes was as follows:

| | | The Disciplined Growth Investors Fund | |

| Gross appreciation | | | | |

| (excess of value over tax cost) | | $ | 106,920,669 | |

| Gross depreciation | | | | |

| (excess of tax cost over value) | | | (44,384,286 | ) |

| Net unrealized appreciation | | $ | 62,536,383 | |

| Cost of investments for income tax purposes | | $ | 323,563,483 | |

Tax Basis of Distributions to Shareholders: The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain was recorded by the Fund.

The tax character of distributions paid during the year ended April 30, 2023, were as follows:

| | | Ordinary Income | | | Long-Term Capital Gain | |

| The Disciplined Growth Investors Fund | | $ | 2,946,749 | | | $ | 5,196,006 | |

The amounts and characteristics of tax basis distributions and composition of distributable earnings/(accumulated losses) are finalized at fiscal year-end. Accordingly, tax basis balances have not been determined as of October 31, 2023.

| Semi-Annual Report | October 31, 2023 | 27 |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

| | October 31, 2023 (Unaudited) |

4. SECURITIES TRANSACTIONS

The cost of purchases and proceeds from sales of securities (excluding short-term securities and U.S. Government Obligations) during the six months ended October 31, 2023, were as follows:

| Fund | | Purchases of Securities | | | Proceeds From Sales of Securities | |

| The Disciplined Growth Investors Fund | | $ | 32,599,298 | | | $ | 28,969,669 | |

Investment transactions in U.S. Government Obligations during the six months ended October 31, 2023 were as follows:

| Fund | | Purchases of Securities | | | Proceeds From Sales of Securities | |

| The Disciplined Growth Investors Fund | | $ | 8,086,115 | | | $ | 9,619,545 | |

The cost of purchases in kind, proceeds from sales in kind along with their realized gain/(loss) included in above transactions during the six months ended October 31, 2023 were as follows:

| Fund | | Purchases | | | Proceeds | | | Net Realized Gain/(Loss) | |

| Disciplined Growth Investors Fund | | $ | 1,388,820 | | | $ | – | | | $ | – | |

5. SHARES OF BENEFICIAL INTEREST

The capitalization of the Trust consists of an unlimited number of shares of beneficial interest with no par value per share. Holders of the shares of the Fund of the Trust have one vote for each share held and a proportionate fraction of a vote for each fractional share. All shares issued and outstanding are fully paid and are transferable and redeemable at the option of the shareholder. Purchasers of the shares do not have any obligation to make payments to the Trust or its creditors (other than the purchase price for the shares or make contributions to the Trust or its creditors solely by reason of the purchasers’ ownership of the shares. Shares have no pre-emptive rights.

6. MANAGEMENT AND RELATED-PARTY TRANSACTIONS

The Adviser, subject to the authority of the Board, is responsible for the overall management and administration of the Fund’s business affairs. The Adviser manages the investments of the Fund in accordance with the Fund’s investment objective, policies and limitations and investment guidelines established jointly by the Adviser and the Trustees. Pursuant to the Advisory Agreement, the Fund pays the Adviser a unitary management fee for the services and facilities it provides payable on a monthly basis at the annual rate of 0.78% of the Fund’s average daily net assets. The management fee is paid on a monthly basis.

Out of the unitary management fee, the Adviser pays substantially all expenses of the Fund, including the cost of transfer agency, custody, fund administration, bookkeeping and pricing

| 28 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

| | October 31, 2023 (Unaudited) |

services, legal, audit and other services, except for interest expenses, brokerage expenses, taxes and extraordinary expenses not incurred in the ordinary course of the Fund’s business. Also included are Trustee fees which were $11,384 for the six months ended October 31, 2023.

Fund Administrator Fees and Expenses

ALPS Fund Services, Inc. (“ALPS”) serves as administrator to the Fund. Pursuant to an Administration Agreement, ALPS provides operational services to the Fund including, but not limited to, fund accounting and fund administration and generally assists in the Fund’s operations. Officers of the Trust are employees of ALPS. The Fund’s administration fee is accrued on a daily basis and paid monthly. The Administrator is also reimbursed for certain out-of-pocket expenses. The administrative fee and out-of-pocket expenses are included in the unitary management fee paid to the Adviser.

Transfer Agent

ALPS serves as transfer, dividend paying and shareholder servicing agent for the Fund. ALPS receives an annual minimum fee, a fee based upon the number of shareholder accounts, and is also reimbursed for certain out-of-pocket expenses. The fee and out-of-pocket expenses are included in the unitary management fee paid to the Adviser.

Compliance Services

ALPS provides services that assist the Trust’s chief compliance officer in monitoring and testing the policies and procedures of the Trust in conjunction with requirements under Rule 38a-1 under the 1940 Act and receives an annual base fee. ALPS is reimbursed for certain out-of-pocket expenses. The fee and out-of-pocket expenses are included in the unitary management fee paid to the Adviser.

Principal Financial Officer

ALPS receives an annual fee for providing principal financial officer services to the Fund. The fee is included in the unitary management fee paid to the Adviser.

Distributor

ALPS Distributors, Inc. (“ADI” or the “Distributor”) (an affiliate of ALPS) acts as the distributor of the Fund’s shares pursuant to a Distribution Agreement with the Trust. Shares are sold on a continuous basis by ADI as agent for the Fund, and ADI has agreed to use its best efforts to solicit orders for the sale of the Fund’s shares, although it is not obliged to sell any particular amount of shares. ADI is not entitled to any compensation for its services as Distributor. ADI is registered as a broker-dealer with the Securities and Exchange Commission.

Trustees

The fees and expenses of the Trustees of the Board are presented in the Statements of Operations

| Semi-Annual Report | October 31, 2023 | 29 |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

| | October 31, 2023 (Unaudited) |

7. INDEMNIFICATIONS

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that may contain general indemnification clauses, which may permit indemnification to the extent permissible under applicable law. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

8. SUBSEQUENT EVENT

Subsequent events after the date of the Statements of Assets and Liabilities have been evaluated through the date the financial Statements were issued.

| 30 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Additional Information |

| | October 31, 2023 (Unaudited) |

1. FUND HOLDINGS

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s Web site at http://www.sec.gov. The Fund’s Form N-PORT reports are also available upon request by calling toll-free (855) 344-3863.

2. FUND PROXY VOTING POLICIES, PROCEDURES AND SUMMARIES

The Fund’s policies and procedures used in determining how to vote proxies and information regarding how the Fund voted proxies relating to portfolio securities during the most recent prior 12-month period ending June 30 are available without charge, (1) upon request, by calling (toll-free) 855-DGI-Fund and (2) on the SEC’s website at http://www.sec.gov.

| Semi-Annual Report | October 31, 2023 | 31 |

| The Disciplined Growth Investors Fund | Liquidity Risk

Management Program |

| | October 31, 2023 (Unaudited) |

The Financial Investors Trust (the “Trust”) has established a liquidity risk management program (the “Program”) to govern the Trust’s approach to managing liquidity risk for each fund in the Trust (each a “Fund”). The Program is overseen by the Liquidity Committee (the “Committee”), a committee comprised of representatives of the Trust’s investment advisers, sub-advisers, and Officers of the Trust. The Trust’s Board of Trustees (the “Board”) has approved the designation of the Committee to oversee the Program.

The Program’s principal objectives include supporting each Fund’s compliance with limits on investments in illiquid assets and mitigating the risk that a Fund will be unable to meet its redemption obligations in a timely manner. The Program also includes a number of elements that support the management and assessment of liquidity risk, including a periodic assessment of factors that influence a Fund’s liquidity and the periodic classification and re-classification of the Fund’s investments into groupings that reflect the Committee’s assessment of their relative liquidity under current market conditions.

At a meeting of the Board held on June 13, 2023, the Trustees received a report from the Committee regarding the design and operational effectiveness of the Program during the calendar year 2022. The Committee determined, and reported to the Board, that the Program is reasonably designed to assess and manage each Fund’s liquidity risk and has operated adequately and effectively to manage each Fund’s liquidity risk since implementation.

The Committee reported that during the period covered by the report, there were no liquidity events that impacted the Funds or their ability to timely meet redemptions without dilution to existing shareholders. Among other things, the Board noted that the Funds are not required to have a highly liquid investment minimum based on their liquidity classifications. The Board further noted that no material changes have been made to the Program since its implementation.

| 32 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Privacy Policy |

| WHO WE ARE | |

| Who is providing this notice? | The Disciplined Growth Investors Fund |

| WHAT WE DO | |

| How does the Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. |

| How does the Fund collect my personal information? | We collect your personal information, for example, when you ● open an account ● provide account information or give us your contact information ● make a wire transfer or deposit money |

| Why can’t I limit all sharing? | Federal law gives you the right to limit only ● sharing for affiliates’ everyday business purposes-information about your creditworthiness ● affiliates from using your information to market to you ● sharing for non-affiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

| DEFINITIONS | |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. |

| Non-affiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies. ● The Fund does not share with non-affiliates so they can market to you. |

| Joint marketing | A formal agreement between non-affiliated financial companies that together market financial products or services to you. ● The Fund does not jointly market. |

| Semi-Annual Report | October 31, 2023 | 33 |

| The Disciplined Growth Investors Fund | Privacy Policy |

| FACTS | WHAT DOES THE FUND DO WITH YOUR PERSONAL INFORMATION? |

| WHY? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| WHAT? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ● Social Security number and account transactions ● Account balances and transaction history ● Wire transfer instructions |

| HOW? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons the Fund chooses to share; and whether you can limit this sharing. |

REASONS WE CAN SHARE YOUR

PERSONAL INFORMATION | DOES THE

FUND SHARE: | CAN YOU LIMIT

THIS SHARING? |

For our everyday business purposes –