UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08194

FINANCIAL INVESTORS TRUST

(Exact name of Registrant as specified in charter)

1290 Broadway, Suite 1000, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Michael Lawlor, Esq., Secretary

Financial Investors Trust

1290 Broadway, Suite 1000

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: April 30

Date of reporting period: April 30, 2022 – October 31, 2022

| Item 1. | Reports to Stockholders. |

| (a) | Report of Shareholders. |

| TABLE OF CONTENTS |  |

SEMI-ANNUAL REPORT

| SHAREHOLDER LETTER | 1 |

| PERFORMANCE UPDATE | 5 |

| DISCLOSURE OF FUND EXPENSES | 7 |

| PORTFOLIO OF INVESTMENTS | 8 |

| STATEMENT OF ASSETS AND LIABILITIES | 20 |

| STATEMENT OF OPERATIONS | 21 |

| STATEMENTS OF CHANGES IN NET ASSETS | 22 |

| FINANCIAL HIGHLIGHTS | 24 |

| NOTES TO FINANCIAL STATEMENTS | 26 |

| ADDITIONAL INFORMATION | 33 |

| PRIVACY POLICY | 34 |

Disciplined Growth Investors’ goal is to communicate clearly and transparently with our clients and mutual fund shareholders. It is mutually beneficial when our shareholders understand how we invest, what we are currently thinking and forecasting, and the specific investment decisions we have made. Our views and opinions regarding the investment prospects of our portfolio holdings and the Fund are “forward looking statements” which may or may not be accurate over the long term. While we believe we have a reasonable basis for these forecasts and have confidence in our investment team’s views, actual results may differ materially from those we anticipate. Information provided in this report should not be considered a recommendation to purchase or sell any particular security.

You can identify forward looking statements as those including words such as “believe”, “expect”, “anticipate”, “forecast”, and similar statement. We cannot assure future performance. These forward-looking statements are made only as-of the date of this report. Following the publication of this report, we will not update any of the forward-looking statements included here.

This material must be preceded or accompanied by a prospectus. Please read the prospectus carefully before investing.

| OCTOBER 31, 2022 | DGINV.COM |

| The Disciplined Growth Investors Fund | Shareholder Letter |

October 31, 2022 (Unaudited)

Market Commentary

Investors in both stocks and bonds have experienced the most challenging period since the Fund's inception in 2011 (8/12/11). The last six months, 2022 year-to-date, and going back a full twelve months - all have produced negative returns to stocks and bonds for most investors. However, this same period resulted in important developments for investors as well. The two that stand out to us are a change in stock market leadership and bonds now offering sufficient yields for investors for the first time in The DGI Fund's existence.

A change in market leadership often happens through bear markets. Coming into 2022, the leading stocks for three years or more were big tech companies, software-as-a-service companies, and a few select others. Alongside these real businesses with excessive valuations were speculative “assets” like cryptocurrencies and non-fungible tokens (NFTs). We likely do not need to elaborate on the pain experienced by owners of these speculative assets. The real story, to us, is the overvaluation and subsequent sell off in a narrow portion of the market - which could also be framed as a lack of valuation discipline by many investors heading into 2022.

To illustrate, in just the two years of 2020 and 2021, Tesla stock increased 1163.1% and for a time its market value was greater than all other automakers combined, despite having a tiny fraction of market share and realistically being constrained by economics of its industry. Its stock traded at over a hundred times its annual earnings. Alphabet (Google) stock more than doubled in market value in the same two years. Meta (Facebook), Netflix, and Amazon all increased by over 60% in 2020 and 2021.

As a result, holders of these stocks - including index funds - likely outperformed investors with a more reasonable valuation discipline. That lack of valuation discipline inherent in index funds and rampant with many active investors is coming home to roost. In 2022 through October 31, Meta stock is down 72.3%. That means to get back to even, investors who held it at its peak would have to see over a 350% increase. Netflix’ share price has fallen over 50%. Amazon, Google, and Netflix have lost over 1/3 of their market value as well and may shed more yet.

We have not owned any of these stocks in The DGI Fund, something which you may have noticed on both sides of the increase in valuations and this year's sell off.

Not only have these stock prices fallen, but they were the largest holdings for many investors and have “led” the overall market downturn. The leadership in terms of top performers (individual securities) has begun to shift. While the next group of leading stocks will only be truly visible in hindsight, strong hints are emerging. One emerging group of companies are energy producers, particularly natural gas producers. Significant innovation within the industry combined with global events have driven the cost of producing natural gas down and the market price of it up. We believe this is a sustainable development as alternative energy options such as wind and solar, though growing, are still a tiny portion of total energy consumption and have serious constraints around their potential use. Natural gas and liquified natural gas fill a critical part of on-demand and continuous energy needs. Well-managed companies in that industry that continue to innovate stand to produce outsized growth going forward in our estimation.

The DGI Fund currently owns two natural gas producers in Southwestern Energy (SWN) and Coterra Energy (CTRA).

The second important development has been the increase in bond yields. In the short-term view this may seem a euphemistic way to frame a historically rapid increase in interest rates. Yet for the investor, US Treasury Bond yields (10 year treasuries) being above 4% for the first time in over 11 years1 is significant tailwind. Yields on investment-grade corporate bonds of 5-10 year maturities are higher still, in the 5-7% range. Entering 2022, a 10 year loan to the federal government through a treasury bond offered under 1.5% annual interest. This was insufficient to keep pace even with more normal inflation rates of 2-3%. For us in managing The DGI Fund, corporate bond yields of only 2-4% translated to a very expensive allocation of the portfolio away from higher-return stocks for the sake of some income and protection of principal. While we still see the outlook heavily favoring stocks over bonds, we believe the bond portfolio can finally achieve returns of 4-6% annually for the next seven years versus the under 2% returns bonds have produced in the Fund in the past seven years (the largest bond index has produced negative total returns for the seven years ending 10/31/22).

| Semi-Annual Report | October 31, 2022 | 1 |

| The Disciplined Growth Investors Fund | Shareholder Letter |

October 31, 2022 (Unaudited)

Inflation is, of course, a pernicious phenomenon. We believe inflation will come down to more “normal” long-run levels in the 2-3% range. This may take some time, likely beyond just 2023. However, we do not believe inflation above 3% will be a 7-year or longer issue. Ten year corporate bonds do offer the promise of 5%+ yields, however, as a contractual obligation to the bond holder. So, we believe sufficient yields on bonds will outlive high inflation.

To summarize, 2022 has been a challenging year, yet going forward we think the future is now bright. That is not a forecast of next year’s stock market performance or even the next two to three years. It reflects our view that for the first time in years there are many potentially good stocks at attractive valuations and that bonds offer high enough yields to be investible for the first time in over 11 years. We believe the future will be challenging for index investors and index copycats, but can be rewarding for discerning investors who maintain their valuation discipline and hold high-quality, attractively valued companies through the turbulence.

Our view is still that expected returns for the Fund’s stocks greatly exceed the expected returns on bonds, and it is encouraging that the expected returns for both are higher than in recent years. Because of this, as of the end of the period, the Fund’s allocation to stocks and bonds remains similar to recent years, at approximately 70% stocks, 30% bonds and cash.

Fund Fiscal Year Commentary

In the first half of the fiscal year (5/1/22 to 10/31/22), the DGI Fund’s total return was -5.12%. Performance for longer time frames is available in the Performance Update section of this Annual Report.

In the last six months, stocks in the Fund returned -5.37% while bonds returned -4.20%. In this time frame, the average allocation to stocks was 69.35%, and the average allocation to bonds and cash was 30.65%.

Seventeen stocks posted positive total returns while 30 stocks posted negative total returns. The five stocks that made the greatest positive contribution were Super Micro Computer (+1.90% to the Fund’s performance), Plexus (+0.67%), Coterra Energy (+0.31%), Autodesk (+0.27%), and Viasat (+0.18%). The five stocks that detracted the most from the Fund’s total performance were Under Armour (-0.85%), Algin Technology (-0.80%), Akamai Technology (-0.77%), Cognex (-0.59%), and Garmin (-0.48%). Contribution or detraction for each stock is different from that stock’s total performance. It factors the stock’s total performance and the allocation to that individual stock over the course of the first part of the fiscal year.

| 1 | Since The DGI Fund's inception (8/12/2011), yields on 10-year US Treasury Notes were below 4% until 10/14/2022. |

| 2 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Shareholder Letter |

October 31, 2022 (Unaudited)

No individual bond holding had an impact on the total Fund’s performance of greater than +0.05% or -0.05%. This reflects our intent with the bond portfolio in the Fund; to avoid security-specific risks by widely diversifying across investment-grade bonds.

Portfolio Activity

In the last six months, we added three new stocks to the Fund’s portfolio; Floor & Décor Holdings, Generac, and Semtech. We added to existing positions on several occasions.

Floor & Décor (FND), a hard surface flooring retailer, serves homeowners, professional installers, and commercial customers with an expansive array of options. It stands out with low pricing and a broad selection of in-stock merchandise, including tile, wood, laminate, natural stone, and decorative materials. Floor & Décor’s 166 stores are known for expert help, free design services, and installation accessories. Our initial purchase is based in our view that FND has a compelling business model & successful expansion, and we believe it will continue making market share gains.

Generac (GNRC) designs and manufactures generators and other power generation solutions for both residential and commercial/industrial end-markets. The company competes effectively on attributes such as a broad dealer network, fuel-efficient products, after-market support, product robustness, product breadth, and control/monitoring systems. We purchased an initial position because we believe the company has a significant opportunity to help solve problems resulting from an increasingly unreliable electricity grid and has a proven, profitable business model.

Semtech (SMTC) designs analog and mixed-signal semiconductor products for consumer, enterprise computing, communications, and industrial equipment manufacturers. Its product expertise revolves around the utilization or enablement of low power. Semtech serves original equipment manufacturers and their suppliers in many markets like automotive, industrial, and broadcasting. We took an initial position because we believe Semtech has a healthy culture of innovation, business lines that are on the cusp of accelerating demand, and an attractive high- margin business model.

We made one complete sale of an equity holding, selling S&P Global (SPGI) which came into the Fund when it acquired a prior holding, IHS Markit. After analyzing S&P Global, we decided to sell the position to fund other investments we believe offer better opportunities.

Sincerely,

Frederick Martin, CFA – Portfolio Manager

Rob Nicoski, CPA* – Portfolio Manager

Nick Hansen, CFA, CAIA – Portfolio Manager

Jason Lima, CFA – Portfolio Manager

| Semi-Annual Report | October 31, 2022 | 3 |

| The Disciplined Growth Investors Fund | Shareholder Letter |

October 31, 2022 (Unaudited)

| 1 | Typically bonds with fewer years until maturity will be less price-sensitive to increases in interest rates than bonds with more years until maturity. That means if interest rates rise, you can reasonably expect a bond with more years to maturity to decline more in price than a bond with fewer years until maturity. |

The Barclay’s Government & Corporate Credit index includes both corporate (publicly-issued, fixed-rate, nonconvertible, investment grade, dollar-denominated, SEC-registered, corporate dept.) and government (Treasury Bond index, Agency Bond index, 1-3 Year Government index, and the 20+-Year treasury) indexes, including bonds with maturities up to ten years.

The S&P 500® Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in the Index.

Asset class-specific performance is before fees. The Fund’s single fee – the management fee – is paid from the Fund’s holding of cash. Total Fund net-of-fees performance is presented in this letter, later in this annual report, and is updated monthly on the Fund’s website, www.dgifund.com.

The views of Disciplined Growth Investors, Inc. and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writers’ current views.

The views expressed are those of the Fund’s adviser only, and represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned in this letter. The subject matter contained in this letter has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither Disciplined Growth Investors, Inc. nor the Fund accepts any liability for losses either direct or consequential caused by the use of this information.

The Fund is distributed by ALPS Distributors, Inc.

The Fund is subject to investment risks, including possible loss of the principal amount invested and therefore is not suitable for all investors. The Fund may not achieve its objectives.

Diversification does not eliminate the risk of experiencing investment losses.

Fred Martin is a registered representative of ALPS Distributors, Inc. CFA Institute Marks are trademarks owned by the CFA Institute.

| 4 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Performance Update |

| | October 31, 2022 (Unaudited) |

Annualized Total Return Performance (for the period ended October 31, 2022)

| | 6 month | 1 Year | 3 Year | 5 Year | 10 Year | Since Inception* |

| The Disciplined Growth Investors Fund | -5.12% | | -18.03% | 5.06% | 6.97% | 8.88% | 9.89% |

| S&P 500® Total Return Index(1) | -5.50% | -14.61% | 10.22% | 10.44% | 12.79% | 13.40% |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please call 1.855.DGI.FUND.

The table does not reflect the deductions of taxes a shareholder would pay on Fund distributions or redemptions of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| * | Fund Inception date of August 12, 2011. |

| (1) | The S&P 500® Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in the Index. |

| Semi-Annual Report | October 31, 2022 | 5 |

| The Disciplined Growth Investors Fund | Performance Update |

October 31, 2022 (Unaudited)

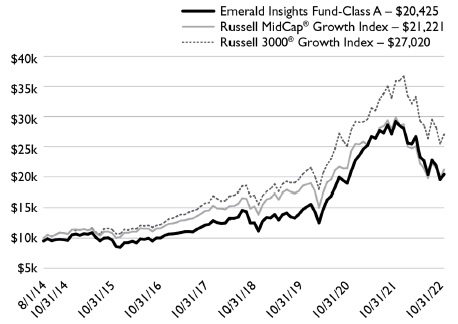

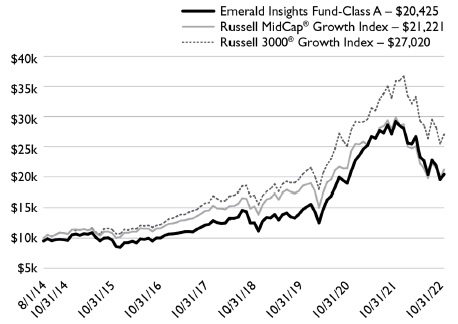

Growth of $10,000 Investment in the Fund (for the period ended October 31, 2022)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

Industry Sector Allocation

(as a % of Net Assets)*

| Technology | 39.31% |

| Consumer Discretionary | 12.44% |

| Energy | 6.62% |

| Industrials | 4.42% |

| Health Care | 4.47% |

| Producer Durables | 2.78% |

| Communications | 0.66% |

| Corporate Bond | 24.99% |

| Government Bond | 3.62% |

| Other Assets in Excess of Liabilities | 0.69% |

Top Ten Holdings

(as a % of Net Assets)*

| Super Micro Computer, Inc. | 5.23% |

| Plexus Corp. | 4.01% |

| Coterra Energy, Inc. | 3.38% |

| Akamai Technologies, Inc. | 3.14% |

| Southwestern Energy Co. | 3.06% |

| Power Integrations, Inc. | 3.04% |

| Microchip Technology, Inc. | 3.00% |

| Gentex Corp. | 2.84% |

| Cognex Corp. | 2.51% |

| Pure Storage, Inc. | 2.47% |

| Top Ten Holdings | 32.68% |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

| 6 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Disclosure of Fund Expenses |

October 31, 2022 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other fund operating expenses. This example is intended to help you understand your ongoing costs (in dollars), of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of May 1, 2022 through October 31, 2022.

Actual Expenses The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account Value 5/1/2022 | Ending Account Value 10/31/2022 | Expense Ratio(a) | Expenses Paid During period

5/1/2022 - 10/31/2022(b) |

| Actual | $1,000.00 | $948.80 | 0.78% | $3.83 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.27 | 0.78% | $3.97 |

| (a) | The Fund's expense ratios have been annualized based on the Fund's most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184)/365 (to reflect the half-year period). |

| Semi-Annual Report | October 31, 2022 | 7 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| October 31, 2022 (Unaudited) |

| | | Shares | | | Value (Note 2) | |

| COMMON STOCKS (70.71%) | | | | | | | | |

| COMMUNICATIONS (0.36%) | | | | | | | | |

| Media (0.36%) | | | | | | | | |

| Take-Two Interactive Software, Inc. (a) | | | 10,156 | | | $ | 1,203,283 | |

| | | | | | | | | |

| TOTAL COMMUNICATIONS | | | | | | | 1,203,283 | |

| | | | | | | | | |

| CONSUMER DISCRETIONARY (10.17%) | | | | | | | | |

| Consumer Discretionary Products (5.65%) | | | | | | | | |

| Gentex Corp. | | | 359,636 | | | | 9,526,757 | |

| Gentherm, Inc. (a) | | | 43,892 | | | | 2,564,171 | |

| LGI Homes, Inc. (a) | | | 36,077 | | | | 3,320,888 | |

| Under Armour, Inc. , Class A(a) | | | 474,075 | | | | 3,531,859 | |

| | | | | | | | 18,943,675 | |

| | | | | | | | | |

| Consumer Discretionary Services (1.67%) | | | | | | | | |

| Royal Caribbean Cruises, Ltd. (a) | | | 65,294 | | | | 3,485,394 | |

| Strategic Education, Inc. | | | 30,479 | | | | 2,103,051 | |

| | | | | | | | 5,588,445 | |

| | | | | | | | | |

| Retail & Whsle - Discretionary (2.85%) | | | | | | | | |

| Floor & Decor Holdings, Inc. , Class A(a) | | | 31,605 | | | | 2,318,859 | |

| Nordstrom, Inc. | | | 78,177 | | | | 1,590,120 | |

| Sleep Number Corp. (a) | | | 96,329 | | | | 2,672,166 | |

| Stitch Fix, Inc. , Class A(a) | | | 60,012 | | | | 240,048 | |

| TJX Cos., Inc. | | | 37,847 | | | | 2,728,769 | |

| | | | | | | | 9,549,962 | |

| | | | | | | | | |

| TOTAL CONSUMER DISCRETIONARY | | | | | | | 34,082,082 | |

| | | | | | | | | |

| ENERGY (6.62%) | | | | | | | | |

| Oil & Gas (6.62%) | | | | | | | | |

| Core Laboratories NV | | | 31,556 | | | | 614,080 | |

| Coterra Energy, Inc. | | | 363,956 | | | | 11,329,950 | |

| Southwestern Energy Co. (a) | | | 1,479,705 | | | | 10,254,356 | |

| | | | | | | | 22,198,386 | |

| | | | | | | | | |

| TOTAL ENERGY | | | | | | | 22,198,386 | |

| 8 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| October 31, 2022 (Unaudited) |

| | | Shares | | | Value (Note 2) | |

| HEALTH CARE (4.47%) | | | | | | | | |

| Health Care (4.47%) | | | | | | | | |

| Align Technology, Inc. (a) | | | 30,650 | | | $ | 5,955,295 | |

| Intuitive Surgical, Inc. (a) | | | 26,769 | | | | 6,597,755 | |

| Myriad Genetics, Inc. (a) | | | 117,097 | | | | 2,428,592 | |

| | | | | | | | 14,981,642 | |

| | | | | | | | | |

| TOTAL HEALTH CARE | | | | | | | 14,981,642 | |

| | | | | | | | | |

| INDUSTRIALS (11.98%) | | | | | | | | |

| Industrial Products (7.36%) | | | | | | | | |

| Cognex Corp. | | | 182,083 | | | | 8,417,697 | |

| Generac Holdings, Inc. (a) | | | 14,193 | | | | 1,645,110 | |

| Graco, Inc. | | | 42,976 | | | | 2,990,270 | |

| Proto Labs, Inc. (a) | | | 113,273 | | | | 4,325,896 | |

| Snap-on, Inc. | | | 32,739 | | | | 7,269,695 | |

| | | | | | | | 24,648,668 | |

| Industrial Services (4.62%) | | | | | | | | |

| Alarm.com Holdings, Inc. (a) | | | 129,070 | | | | 7,594,479 | |

| Landstar System, Inc. | | | 37,708 | | | | 5,890,744 | |

| MSC Industrial Direct Co., Inc. , Class A | | | 24,042 | | | | 1,995,005 | |

| | | | | | | | 15,480,228 | |

| | | | | | | | | |

| TOTAL INDUSTRIALS | | | | | | | 40,128,896 | |

| | | | | | | | | |

| TECHNOLOGY (37.11%) | | | | | | | | |

| Software & Tech Services (9.37%) | | | | | | | | |

| Akamai Technologies, Inc. (a) | | | 119,128 | | | | 10,522,576 | |

| Autodesk, Inc. (a) | | | 36,359 | | | | 7,791,734 | |

| Intuit, Inc. | | | 18,770 | | | | 8,024,175 | |

| Open Text Corp. | | | 94,795 | | | | 2,744,315 | |

| Paychex, Inc. | | | 19,539 | | | | 2,311,659 | |

| | | | | | | | 31,394,459 | |

| Semi-Annual Report | October 31, 2022 | 9 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| October 31, 2022 (Unaudited) |

| | | Shares | | | Value (Note 2) | |

| TECHNOLOGY (continued) | | | | | | | | |

| Tech Hardware & Semiconductors (27.74%) | | | | | | | | |

| Arista Networks, Inc. (a) | | | 59,525 | | | $ | 7,194,192 | |

| Dolby Laboratories, Inc. , Class A | | | 110,942 | | | | 7,415,363 | |

| Garmin, Ltd. | | | 86,462 | | | | 7,612,115 | |

| InterDigital, Inc. | | | 44,156 | | | | 2,202,060 | |

| IPG Photonics Corp. (a) | | | 14,999 | | | | 1,284,814 | |

| Microchip Technology, Inc. | | | 162,979 | | | | 10,062,324 | |

| Plexus Corp. (a) | | | 136,418 | | | | 13,423,531 | |

| Power Integrations, Inc. | | | 152,710 | | | | 10,187,284 | |

| Pure Storage, Inc. , Class A(a) | | | 268,033 | | | | 8,271,498 | |

| Semtech Corp. (a) | | | 44,544 | | | | 1,233,423 | |

| Super Micro Computer, Inc. (a) | | | 251,897 | | | | 17,529,512 | |

| Viasat, Inc. (a) | | | 160,105 | | | | 6,557,901 | |

| | | | | | | | 92,974,017 | |

| | | | | | | | | |

| TOTAL TECHNOLOGY | | | | | | | 124,368,476 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $200,922,059) | | | | | | $ | 236,962,765 | |

| | | Principal Amount | | | Value (Note 2) | |

| CORPORATE BONDS (23.44%) | | | | | | | | |

| COMMUNICATIONS (1.29%) | | | | | | | | |

| Cable & Satellite (0.33%) | | | | | | | | |

| Comcast Corp. | | | | | | | | |

| 4.150% 10/15/2028 | | $ | 1,168,000 | | | $ | 1,096,748 | |

| | | | | | | | | |

| Entertainment Content (0.31%) | | | | | | | | |

| Paramount Global | | | | | | | | |

| 7.875% 07/30/2030 | | | 1,000,000 | | | | 1,040,580 | |

| | | | | | | | | |

| Wireless Telecommunications Services (0.65%) | | | | | | | | |

| AT&T, Inc. | | | | | | | | |

| 4.350% 03/01/2029 | | | 1,151,000 | | | | 1,070,789 | |

| Verizon Communications, Inc. | | | | | | | | |

| 4.329% 09/21/2028 | | | 1,176,000 | | | | 1,103,613 | |

| | | | | | | | 2,174,402 | |

| | | | | | | | | |

| TOTAL COMMUNICATIONS | | | | | | | 4,311,730 | |

| 10 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| October 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value (Note 2) | |

| CONSUMER DISCRETIONARY (2.52%) | | | | | | | | |

| Airlines (0.33%) | | | | | | | | |

| Southwest Airlines Co. | | | | | | | | |

| 3.450% 11/16/2027 | | $ | 1,225,000 | | | $ | 1,100,490 | |

| | | | | | | | | |

| Automobiles Manufacturing (0.30%) | | | | | | | | |

| General Motors Co. | | | | | | | | |

| 5.400% 10/15/2029 | | | 1,100,000 | | | | 1,020,773 | |

| | | | | | | | | |

| Consumer Services (0.33%) | | | | | | | | |

| Cintas Corp. No 2 | | | | | | | | |

| 3.700% 04/01/2027 | | | 1,167,000 | | | | 1,101,027 | |

| | | | | | | | | |

| Restaurants (0.63%) | | | | | | | | |

| McDonald's Corp., Series MTN | | | | | | | | |

| 6.300% 03/01/2038 | | | 966,000 | | | | 995,305 | |

| Starbucks Corp. | | | | | | | | |

| 4.000% 11/15/2028 | | | 1,190,000 | | | | 1,104,566 | |

| | | | | | | | 2,099,871 | |

| Retail - Consumer Discretionary (0.93%) | | | | | | | | |

| Advance Auto Parts, Inc. | | | | | | | | |

| 1.750% 10/01/2027 | | | 1,238,000 | | | | 1,011,897 | |

| Amazon.com, Inc. | | | | | | | | |

| 5.200% 12/03/2025 | | | 1,035,000 | | | | 1,050,655 | |

| Lowe's Cos., Inc. | | | | | | | | |

| 3.650% 04/05/2029 | | | 1,186,000 | | | | 1,067,185 | |

| | | | | | | | 3,129,737 | |

| | | | | | | | | |

| TOTAL CONSUMER DISCRETIONARY | | | | | | | 8,451,898 | |

| | | | | | | | | |

| CONSUMER STAPLES (0.96%) | | | | | | | | |

| Food & Beverage (0.65%) | | | | | | | | |

| Anheuser-Busch InBev Worldwide, Inc. | | | | | | | | |

| 4.000% 04/13/2028 | | | 1,166,000 | | | | 1,102,712 | |

| Tyson Foods, Inc. | | | | | | | | |

| 3.900% 09/28/2023 | | | 1,090,000 | | | | 1,078,697 | |

| | | | | | | | 2,181,409 | |

| Semi-Annual Report | October 31, 2022 | 11 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| October 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value (Note 2) | |

| CONSUMER STAPLES (continued) | | | | | | | | |

| Mass Merchants (0.31%) | | | | | | | | |

| Costco Wholesale Corp. | | | | | | | | |

| 1.600% 04/20/2030 | | $ | 1,280,000 | | | $ | 1,022,749 | |

| | | | | | | | | |

| TOTAL CONSUMER STAPLES | | | | | | | 3,204,158 | |

| | | | | | | | | |

| ENERGY (2.53%) | | | | | | | | |

| Exploration & Production (0.31%) | | | | | | | | |

| ConocoPhillips Co. | | | | | | | | |

| 3.350% 05/15/2025 | | | 1,100,000 | | | | 1,047,466 | |

| | | | | | | | | |

| Integrated Oils (0.33%) | | | | | | | | |

| BP Capital Markets America, Inc. | | | | | | | | |

| 4.234% 11/06/2028 | | | 1,170,000 | | | | 1,102,454 | |

| | | | | | | | | |

| Pipeline (1.58%) | | | | | | | | |

| El Paso Natural Gas Co. LLC | | | | | | | | |

| 7.500% 11/15/2026 | | | 1,000,000 | | | | 1,059,158 | |

| Energy Transfer LP | | | | | | | | |

| 5.250% 04/15/2029 | | | 1,175,000 | | | | 1,102,348 | |

| Enterprise Products Operating LLC | | | | | | | | |

| 3.125% 07/31/2029 | | | 1,216,000 | | | | 1,046,271 | |

| MPLX LP | | | | | | | | |

| 2.650% 08/15/2030 | | | 1,314,000 | | | | 1,035,896 | |

| ONEOK, Inc. | | | | | | | | |

| 6.875% 09/30/2028 | | | 1,047,000 | | | | 1,038,522 | |

| | | | | | | | 5,282,195 | |

| Refining & Marketing (0.31%) | | | | | | | | |

| Phillips 66 | | | | | | | | |

| 2.150% 12/15/2030 | | | 1,337,000 | | | | 1,037,526 | |

| | | | | | | | | |

| TOTAL ENERGY | | | | | | | 8,469,641 | |

| | | | | | | | | |

| FINANCIALS (4.71%) | | | | | | | | |

| Banks (1.25%) | | | | | | | | |

| Regions Financial Corp. | | | | | | | | |

| 1.800% 08/12/2028 | | | 1,344,000 | | | | 1,093,432 | |

| Truist Financial Corp., Series MTN | | | | | | | | |

| 3.875% 03/19/2029 | | | 1,156,000 | | | | 1,028,151 | |

| US Bancorp, Series DMTN | | | | | | | | |

| 3.000% 07/30/2029 | | | 1,217,000 | | | | 1,028,424 | |

| 12 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| October 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value (Note 2) | |

| FINANCIALS (continued) | | | | | | | | |

| Banks (continued) | | | | | | | | |

| Wachovia Corp. | | | | | | | | |

| 7.574% 08/01/2026 | | $ | 980,000 | | | $ | 1,039,090 | |

| | | | | | | | 4,189,097 | |

| Commercial Finance (0.32%) | | | | | | | | |

| GATX Corp. | | | | | | | | |

| 4.700% 04/01/2029 | | | 1,172,000 | | | | 1,080,665 | |

| | | | | | | | | |

| Consumer Finance (0.64%) | | | | | | | | |

| American Express Co. | | | | | | | | |

| 3.300% 05/03/2027 | | | 1,157,000 | | | | 1,048,825 | |

| Capital One Financial Corp. | | | | | | | | |

| 4.200% 10/29/2025 | | | 1,150,000 | | | | 1,092,007 | |

| | | | | | | | 2,140,832 | |

| Diversified Banks (0.93%) | | | | | | | | |

| Bank of America Corp., Series L | | | | | | | | |

| 4.183% 11/25/2027 | | | 1,091,000 | | | | 1,000,255 | |

| Citigroup, Inc. | | | | | | | | |

| 4.125% 07/25/2028 | | | 1,216,000 | | | | 1,095,944 | |

| JPMorgan Chase & Co. | | | | | | | | |

| 4.125% 12/15/2026 | | | 1,081,000 | | | | 1,024,894 | |

| | | | | | | | 3,121,093 | |

| Financial Services (0.63%) | | | | | | | | |

| Morgan Stanley | | | | | | | | |

| 5.000% 11/24/2025 | | | 1,030,000 | | | | 1,028,360 | |

| Northern Trust Corp. | | | | | | | | |

| 3M US L + 1.131% 05/08/2032 (b) | | | 1,227,000 | | | | 1,088,436 | |

| | | | | | | | 2,116,796 | |

| Life Insurance (0.32%) | | | | | | | | |

| Principal Financial Group, Inc. | | | | | | | | |

| 3.100% 11/15/2026 | | | 1,181,000 | | | | 1,074,216 | |

| | | | | | | | | |

| Real Estate (0.62%) | | | | | | | | |

| Simon Property Group LP | | | | | | | | |

| 2.450% 09/13/2029 | | | 1,274,000 | | | | 1,021,583 | |

| Semi-Annual Report | October 31, 2022 | 13 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| October 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value (Note 2) | |

| FINANCIALS (continued) | | | | | | | | |

| Real Estate (continued) | | | | | | | | |

| Welltower, Inc. | | | | | | | | |

| 4.125% 03/15/2029 | | $ | 1,187,000 | | | $ | 1,056,134 | |

| | | | | | | | 2,077,717 | |

| | | | | | | | | |

| TOTAL FINANCIALS | | | | | | | 15,800,416 | |

| | | | | | | | | |

| HEALTH CARE (1.57%) | | | | | | | | |

| Health Care Facilities & Services (0.31%) | | | | | | | | |

| CVS Health Corp. | | | | | | | | |

| 3.250% 08/15/2029 | | | 1,202,000 | | | | 1,043,628 | |

| | | | | | | | | |

| Managed Care (0.33%) | | | | | | | | |

| Elevance Health, Inc. | | | | | | | | |

| 3.650% 12/01/2027 | | | 1,191,000 | | | | 1,100,085 | |

| | | | | | | | | |

| Pharmaceuticals (0.93%) | | | | | | | | |

| AbbVie, Inc. | | | | | | | | |

| 4.250% 11/14/2028 | | | 1,116,000 | | | | 1,051,417 | |

| Astrazeneca Finance LLC | | | | | | | | |

| 1.750% 05/28/2028 | | | 1,212,000 | | | | 1,013,222 | |

| Bristol-Myers Squibb Co. | | | | | | | | |

| 6.800% 11/15/2026 | | | 1,000,000 | | | | 1,064,923 | |

| | | | | | | | 3,129,562 | |

| | | | | | | | | |

| TOTAL HEALTH CARE | | | | | | | 5,273,275 | |

| | | | | | | | | |

| INDUSTRIALS (3.00%) | | | | | | | | |

| Aerospace & Defense (0.63%) | | | | | | | | |

| General Dynamics Corp. | | | | | | | | |

| 3.500% 05/15/2025 | | | 1,100,000 | | | | 1,066,128 | |

| Raytheon Technologies Corp. | | | | | | | | |

| 7.500% 09/15/2029 | | | 955,000 | | | | 1,053,810 | |

| | | | | | | | 2,119,938 | |

| Engineering & Construction (0.19%) | | | | | | | | |

| Fluor Corp. | | | | | | | | |

| 4.250% 09/15/2028 | | | 737,000 | | | | 644,083 | |

| | | | | | | | | |

| Industrial Other (0.33%) | | | | | | | | |

| General Electric Co., Series GMTN | | | | | | | | |

| 3.100% 01/09/2023 | | | 1,100,000 | | | | 1,096,575 | |

| 14 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| October 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value (Note 2) | |

| INDUSTRIALS (continued) | | | | | | | | |

| Railroad (0.64%) | | | | | | | | |

| Burlington Northern Santa Fe LLC | | | | | | | | |

| 3.000%03/15/2023 | | $ | 2,000 | | | $ | 1,986 | |

| CSX Corp. | | | | | | | | |

| 4.250%03/15/2029 | | | 1,108,000 | | | | 1,038,190 | |

| Union Pacific Corp. | | | | | | | | |

| 3.950%09/10/2028 | | | 1,169,000 | | | | 1,100,836 | |

| | | | | | | | 2,141,012 | |

| | | | | | | | | |

| Transportation & Logistics (0.60%) | | | | | | | | |

| FedEx Corp. | | | | | | | | |

| 2.400%05/15/2031 | | | 1,302,000 | | | | 1,012,470 | |

| United Parcel Service, Inc. | | | | | | | | |

| 6.200%01/15/2038 | | | 935,000 | | | | 991,475 | |

| | | | | | | | 2,003,945 | |

| | | | | | | | | |

| Waste & Environment Services & Equipment (0.61%) | | | | | | | | |

| Republic Services, Inc. | | | | | | | | |

| 3.375% 11/15/2027 | | | 1,120,000 | | | | 1,018,477 | |

| Waste Management, Inc. | | | | | | | | |

| 7.000%07/15/2028 | | | 938,000 | | | | 1,015,720 | |

| | | | | | | | 2,034,197 | |

| | | | | | | | | |

| TOTAL INDUSTRIALS | | | | | | | 10,039,750 | |

| | | | | | | | | |

| MATERIALS (0.33%) | | | | | | | | |

| Chemicals (0.33%) | | | | | | | | |

| DuPont de Nemours, Inc. | | | | | | | | |

| 4.725% 11/15/2028 | | | 1,157,000 | | | | 1,107,440 | |

| | | | | | | | | |

| TOTAL MATERIALS | | | | | | | 1,107,440 | |

| | | | | | | | | |

| TECHNOLOGY (0.32%) | | | | | | | | |

| Hardware (0.32%) | | | | | | | | |

| Hewlett Packard Enterprise Co. | | | | | | | | |

| 4.450% 10/02/2023 | | | 1,090,000 | | | | 1,081,566 | |

| | | | | | | | | |

| TOTAL TECHNOLOGY | | | | | | | 1,081,566 | |

| | | | | | | | | |

| UTILITIES (6.21%) | | | | | | | | |

| Utilities (6.21%) | | | | | | | | |

| Ameren Corp. | | | | | | | | |

| 1.750%03/15/2028 | | | 1,237,000 | | | | 1,013,632 | |

| Semi-Annual Report | October 31, 2022 | 15 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| October 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value (Note 2) | |

| UTILITIES (continued) | | | | | | | | |

| Utilities (continued) | | | | | | | | |

| American Electric Power Co., Inc., Series J | | | | | | | | |

| 4.300% 12/01/2028 | | $ | 1,085,000 | | | $ | 1,006,164 | |

| Arizona Public Service Co. | | | | | | | | |

| 2.600%08/15/2029 | | | 1,271,000 | | | | 1,038,640 | |

| Black Hills Corp. | | | | | | | | |

| 3.150%01/15/2027 | | | 1,161,000 | | | | 1,049,132 | |

| CenterPoint Energy, Inc. | | | | | | | | |

| 4.250% 11/01/2028 | | | 1,183,000 | | | | 1,066,474 | |

| CMS Energy Corp. | | | | | | | | |

| 3.450%08/15/2027 | | | 1,108,000 | | | | 1,001,291 | |

| Commonwealth Edison Co., Series 122 | | | | | | | | |

| 2.950%08/15/2027 | | | 1,200,000 | | | | 1,082,055 | |

| DTE Energy Co. | | | | | | | | |

| 2.950%03/01/2030 | | | 1,321,000 | | | | 1,098,836 | |

| Duke Energy Corp. | | | | | | | | |

| 3.400%06/15/2029 | | | 1,254,000 | | | | 1,095,345 | |

| Eastern Energy Gas Holdings LLC, Series B | | | | | | | | |

| 3.000% 11/15/2029 | | | 926,000 | | | | 760,498 | |

| ITC Holdings Corp. | | | | | | | | |

| 4.050%07/01/2023 | | | 1,100,000 | | | | 1,085,361 | |

| National Rural Utilities Cooperative Finance Corp. | | | | | | | | |

| 3.400%02/07/2028 | | | 1,145,000 | | | | 1,047,434 | |

| NextEra Energy Capital Holdings, Inc. | | | | | | | | |

| 3.500%04/01/2029 | | | 1,190,000 | | | | 1,052,131 | |

| NiSource, Inc. | | | | | | | | |

| 2.950%09/01/2029 | | | 1,307,000 | | | | 1,092,511 | |

| PacifiCorp | | | | | | | | |

| 5.250%06/15/2035 | | | 1,085,000 | | | | 1,020,125 | |

| Public Service Electric and Gas Co. | | | | | | | | |

| 3.200%05/15/2029 | | | 1,235,000 | | | | 1,096,378 | |

| Puget Energy, Inc. | | | | | | | | |

| 4.100%06/15/2030 | | | 1,253,000 | | | | 1,093,162 | |

| Southern Co., Series 21-B | | | | | | | | |

| 1.750%03/15/2028 | | | 1,239,000 | | | | 1,012,503 | |

| WEC Energy Group, Inc. | | | | | | | | |

| 1.375% 10/15/2027 | | | 1,243,000 | | | | 1,021,954 | |

| 16 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| October 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value (Note 2) | |

| UTILITIES (continued) | | | | | | | | |

| Utilities (continued) | | | | | | | | |

| Wisconsin Power and Light Co. | | | | | | | | |

| 3.050% 10/15/2027 | | $ | 1,200,000 | | | $ | 1,091,496 | |

| | | | | | | | 20,825,122 | |

| | | | | | | | | |

| TOTAL UTILITIES | | | | | | | 20,825,122 | |

| | | | | | | | | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $89,206,387) | | | | | | $ | 78,564,996 | |

| | | | | | | | | |

| FOREIGN CORPORATE BONDS (1.54%) | | | | | | | | |

| ENERGY (1.23%) | | | | | | | | |

| Exploration & Production (0.30%) | | | | | | | | |

| Canadian Natural Resources, Ltd. | | | | | | | | |

| 3.850%06/01/2027 | | | 1,102,000 | | | | 1,015,295 | |

| | | | | | | | | |

| Integrated Oils (0.31%) | | | | | | | | |

| Shell International Finance BV | | | | | | | | |

| 2.375% 11/07/2029 | | | 1,243,000 | | | | 1,049,028 | |

| | | | | | | | | |

| Pipeline (0.62%) | | | | | | | | |

| Enbridge, Inc. | | | | | | | | |

| 3.700%07/15/2027 | | | 1,191,000 | | | | 1,093,191 | |

| TransCanada PipeLines, Ltd. | | | | | | | | |

| 7.250%08/15/2038 | | | 929,000 | | | | 978,244 | |

| | | | | | | | 2,071,435 | |

| | | | | | | | | |

| TOTAL ENERGY | | | | | | | 4,135,758 | |

| | | | | | | | | |

| FINANCIALS (0.31%) | | | | | | | | |

| Diversified Banks (0.31%) | | | | | | | | |

| Royal Bank of Canada, Series GMTN | | | | | | | | |

| 4.650%01/27/2026 | | | 1,066,000 | | | | 1,029,577 | |

| | | | | | | | | |

| TOTAL FINANCIALS | | | | | | | 1,029,577 | |

| | | | | | | | | |

| TOTAL FOREIGN CORPORATE BONDS | | | | | | | | |

| (Cost $6,048,701) | | | | | | $ | 5,165,335 | |

| | | | | | | | | |

| GOVERNMENT & AGENCY OBLIGATIONS (3.62%) | | | | | | | | |

| U.S. Treasury Bonds | | | | | | | | |

| 2.500%08/15/2023 | | | 160,000 | | | | 157,300 | |

| Semi-Annual Report | October 31, 2022 | 17 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| October 31, 2022 (Unaudited) |

| | | Principal Amount | | | Value (Note 2) | |

| GOVERNMENT & AGENCY OBLIGATIONS (continued) | | | | | | | | |

| U.S. Treasury Notes | | | | | | | | |

| 0.125% 12/31/2022 | | $ | 4,900,000 | | | $ | 4,869,229 | |

| 0.375% 10/31/2023 | | | 1,070,000 | | | | 1,025,327 | |

| 1.500% 03/31/2023 | | | 5,900,000 | | | | 5,833,283 | |

| 2.750% 08/31/2023 | | | 240,000 | | | | 236,503 | |

| | | | | | | | | |

| TOTAL GOVERNMENT & AGENCY OBLIGATIONS | | | | | | | | |

| (Cost $12,252,591) | | | | | | $ | 12,121,642 | |

| | | Yield | | | Shares | | | Value (Note 2) | |

| SHORT TERM INVESTMENTS (0.70%) | | | | | | | | | | | | |

| MONEY MARKET FUND (0.70%) | | | | | | | | | | | | |

| First American Treasury Obligations | | | | | | | | | | | | |

| Fund, 12/31/2049 | | | 2.980 | %(c) | | | 2,341,988 | | | | 2,341,988 | |

| | | | | | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $2,341,988) | | | | | | | | | | $ | 2,341,988 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS (100.01%) | | | | | | | | | | | | |

| (Cost $310,771,726) | | | | | | | | | | $ | 335,156,726 | |

| | | | | | | | | | | | | |

| Liabilities In Excess Of Other Assets (-0.01%) | | | | | | | | | | | (36,021 | ) |

| | | | | | | | | | | | | |

| NET ASSETS (100.00%) | | | | | | | | | | $ | 335,120,705 | |

| (a) | Non-Income Producing Security. |

| (b) | Floating or variable rate security. The reference rate is described below. The rate in effect as of October 31, 2022 is based on the reference rate plus the displayed spread as of the securities last reset date. |

| (c) | Represents the 7-day yield. |

Common Abbreviations:

LLC - Limited Liability Company

LP - Limited Partnership

Ltd. - Limited

| 18 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

| October 31, 2022 (Unaudited) |

For Fund compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percent of net assets.

See Notes to Financial Statements.

| Semi-Annual Report | October 31, 2022 | 19 |

| The Disciplined Growth Investors Fund | Statement of Assets and Liabilities |

October 31, 2022 (Unaudited)

| ASSETS | | | |

| Investments, at value | | $ | 335,156,726 | |

| Receivable for investments sold | | | 1,317,426 | |

| Receivable for shares sold | | | 1,000 | |

| Dividends and interest receivable | | | 985,057 | |

| Total assets | | | 337,460,209 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for investments purchased | | | 2,125,746 | |

| Payable to adviser | | | 213,758 | |

| Total liabilities | | | 2,339,504 | |

| NET ASSETS | | $ | 335,120,705 | |

| | | | | |

| NET ASSETS CONSIST OF | | | | |

| Paid-in capital (Note 5) | | $ | 305,499,035 | |

| Distributable Earnings | | | 29,621,670 | |

| NET ASSETS | | $ | 335,120,705 | |

| | | | | |

| INVESTMENTS, AT COST | | $ | 310,771,726 | |

| | | | | |

| PRICING OF SHARES | | | | |

| Net Asset Value, offering and redemption price per share | | $ | 19.39 | |

| Shares of beneficial interest outstanding | | | 17,286,905 | |

See Notes to Financial Statements.

| 20 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Statement of Operations |

| | | For the Six Months Ended October 31, 2022 (Unaudited) | |

| INVESTMENT INCOME | | | | |

| Dividends | | $ | 1,391,635 | |

| Foreign taxes withheld | | | (7,583 | ) |

| Interest | | | 1,259,426 | |

| Total investment income | | | 2,643,478 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees (Note 6) | | | 1,320,117 | |

| Total expenses | | | 1,320,117 | |

| NET INVESTMENT INCOME | | | 1,323,361 | |

| | | | | |

| REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | | |

| Net realized loss on investments | | | (33,176 | ) |

| Net change in unrealized depreciation on investments | | | (19,043,978 | ) |

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | (19,077,154 | ) |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (17,753,793 | ) |

See Notes to Financial Statements.

| Semi-Annual Report | October 31, 2022 | 21 |

| The Disciplined Growth Investors Fund | Statements of Changes in Net Assets |

| | | For the Six Months Ended October 31, 2022 (Unaudited) | | | For the Year Ended April 30, 2022 | |

| OPERATIONS | | | | | | | | |

| Net investment income | | $ | 1,323,361 | | | $ | 1,128,119 | |

| Net realized gain/(loss) | | | (33,176 | ) | | | 18,922,462 | |

| Net change in unrealized depreciation | | | (19,043,978 | ) | | | (64,699,237 | ) |

| Net decrease in net assets resulting from operations | | | (17,753,793 | ) | | | (44,648,656 | ) |

| | | | | | | | | |

| DISTRIBUTIONS (Note 3) | | | | | | | | |

| From distributable earnings | | | (1,218,159 | ) | | | (36,801,592 | ) |

| Net decrease in net assets from distributions | | | (1,218,159 | ) | | | (36,801,592 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS (Note 5) | | | | | | | | |

| Proceeds from sales of shares | | | 13,420,463 | | | | 60,892,430 | |

| Issued to shareholders in reinvestment of distributions | | | 1,202,216 | | | | 36,008,172 | |

| Cost of shares redeemed | | | (5,033,296 | ) | | | (16,396,837 | ) |

| Net increase from capital share transactions | | | 9,589,383 | | | | 80,503,765 | |

| | | | | | | | | |

| Net decrease in net assets | | | (9,382,569 | ) | | | (946,483 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 344,503,274 | | | | 345,449,757 | |

| End of period | | $ | 335,120,705 | | | $ | 344,503,274 | |

| | | | | | | | | |

| OTHER INFORMATION | | | | | | | | |

| Share Transactions | | | | | | | | |

| Issued | | | 691,786 | | | | 2,611,650 | |

| Issued to shareholders in reinvestment of distributions | | | 60,109 | | | | 1,547,140 | |

| Redeemed | | | (258,370 | ) | | | (681,946 | ) |

| Net increase in share transactions | | | 493,525 | | | | 3,476,844 | |

See Notes to Financial Statements.

| 22 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

Intentionally Left Blank

The Disciplined Growth Investors Fund

| NET ASSET VALUE, BEGINNING OF PERIOD |

| |

| INCOME FROM OPERATIONS |

| Net investment income(a) |

| Net realized and unrealized gain/(loss) on investments |

| Total from investment operations |

| |

| DISTRIBUTIONS |

| From net investment income |

| From net realized gain on investments |

| Total distributions |

| |

| INCREASE/(DECREASE) IN NET ASSET VALUE |

| NET ASSET VALUE, END OF PERIOD |

| |

| TOTAL RETURN |

| |

| RATIOS AND SUPPLEMENTAL DATA |

| Net assets, end of period (000's) |

| |

| RATIOS TO AVERAGE NET ASSETS |

| Expenses |

| Net investment income |

| |

| PORTFOLIO TURNOVER RATE |

| (a) | Per share numbers have been calculated using the average shares method. |

| (c) | In 2018 the Fund's total return consists of a voluntary reimbursement by the advisor for a realized investment loss. Excluding this item, total return would not have been impacted. |

See Notes to Financial Statements.

| 24 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

Financial Highlights

For a share outstanding during the years presented

| For the Six Months Ended October 31, 2022 (Unaudited) | | | For the Year Ended April 30, 2022 | | | For the Year Ended April 30, 2021 | | | For the Year Ended April 30, 2020 | | | For the Year Ended April 30, 2019 | | | For the Year Ended April 30, 2018 | |

| $ | 20.51 | | | $ | 25.94 | | | $ | 19.42 | | | $ | 21.15 | | | $ | 19.12 | | | $ | 18.20 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 0.08 | | | | 0.08 | | | | 0.09 | | | | 0.18 | | | | 0.16 | | | | 0.12 | |

| | (1.13 | ) | | | (2.84 | ) | | | 8.83 | | | | (1.14 | ) | | | 2.55 | | | | 1.64 | |

| | (1.05 | ) | | | (2.76 | ) | | | 8.92 | | | | (0.96 | ) | | | 2.71 | | | | 1.76 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | (0.07 | ) | | | (0.08 | ) | | | (0.10 | ) | | | (0.17 | ) | | | (0.12 | ) | | | (0.12 | ) |

| | – | | | | (2.59 | ) | | | (2.30 | ) | | | (0.60 | ) | | | (0.56 | ) | | | (0.72 | ) |

| | (0.07 | ) | | | (2.67 | ) | | | (2.40 | ) | | | (0.77 | ) | | | (0.68 | ) | | | (0.84 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

| | (1.12 | ) | | | (5.43 | ) | | | 6.52 | | | | (1.73 | ) | | | 2.03 | | | | 0.92 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| $ | 19.39 | | | $ | 20.51 | | | $ | 25.94 | | | $ | 19.42 | | | $ | 21.15 | | | $ | 19.12 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | (5.12 | %)(b) | | | (11.86 | %) | | | 47.00 | % | | | (4.79 | %) | | | 14.74 | % | | | 9.75 | %(c) |

| | | | | | | | | | | | | | | | | | | | | | | |

| $ | 335,121 | | | $ | 344,503 | | | $ | 345,450 | | | $ | 226,591 | | | $ | 240,172 | | | $ | 204,068 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 0.78 | %(d) | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % |

| | 0.78 | %(d) | | | 0.32 | % | | | 0.39 | % | | | 0.86 | % | | | 0.80 | % | | | 0.64 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 16 | %(b) | | | 21 | % | | | 31 | % | | | 29 | % | | | 22 | % | | | 18 | % |

| Semi-Annual Report | October 31, 2022 | 25 |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

October 31, 2022 (Unaudited)

1. ORGANIZATION

Financial Investors Trust (the “Trust”), a Delaware statutory trust, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (“1940 Act”). The Trust consists of multiple separate portfolios or series. This annual report describes The Disciplined Growth Investors Fund (the “Fund”). The Fund seeks long-term capital growth and as a secondary objective, modest income with reasonable risk.

2. SIGNIFICANT ACCOUNTING POLICIES

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Actual results could differ from those estimates. The Fund is considered an investment company for financial reporting purposes under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Codification Topic 946. The following is a summary of significant accounting policies consistently followed by the Fund in preparation of its financial statements.

Investment Valuation: The Fund generally values its securities based on market prices determined at the close of regular trading on the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern Time, on each day the NYSE is open for trading.

For equity securities and mutual funds that are traded on an exchange, the market price is usually the closing sale or official closing price on that exchange. In the case of equity securities not traded on an exchange, or if such closing prices are not otherwise available, the securities are valued at the mean of the most recent bid and ask prices on such day. Redeemable securities issued by open-end registered investment companies are valued at the investment company’s applicable net asset value, with the exception of exchange-traded open-end investment companies, which are priced as equity securities.

The market price for debt obligations is generally the price supplied by an independent third-party pricing service approved by the Board of Trustees of the Trust (the “Board” or the “Trustees”), which may use a matrix, formula or other objective method that takes into consideration quotations from dealers, market transactions in comparable investments, market indices and yield curves. If vendors are unable to supply a price, or if the price supplied is deemed to be unreliable, the market price may be determined using quotations received from one or more broker–dealers that make a market in the security. Fixed-income obligations, excluding municipal securities, having a remaining maturity of greater than 60 days, are typically valued at the mean between the evaluated bid and ask prices formulated by an independent pricing service. Corporate Bonds, U.S. Government & Agency, and U.S. Treasury Bonds & Notes are valued using market models that consider trade data, quotations from dealers and active market makers, relevant yield curve and spread data, creditworthiness, trade data or market information on comparable securities, and other relevant security specific information. Publicly traded Foreign Government Debt securities and Foreign Corporate Bonds are typically traded internationally in the over-the-counter market and are valued at the mean between the bid and asked prices as of the close of business of that market. Mortgage-related and asset-backed securities are valued based on models that consider trade data, prepayment and default projections, benchmark yield and spread data and estimated cash flows of each tranche of the issuer. Publicly traded foreign government debt securities are typically traded internationally in the over-the-counter market and are valued at the mean between the bid and asked prices as of the close of business of that market.

| 26 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

October 31, 2022 (Unaudited)

When such prices or quotations are not available, or when Disciplined Growth Investors, Inc. (the “Adviser”) believes that they are unreliable, securities may be priced using fair value procedures approved by the Board.

Fair Value Measurements: The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

| Semi-Annual Report | October 31, 2022 | 27 |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

October 31, 2022 (Unaudited)

The following is a summary of each input used to value the Fund as of October 31, 2022:

| Investments in Securities at Value | | Level 1 - Unadjusted Quoted Prices | | | Level 2 - Other Significant Observable Inputs | | | Level 3 - Significant Unobservable Inputs | | | Total | |

| Common Stocks(a) | | $ | 236,962,765 | | | $ | – | | | $ | – | | | $ | 236,962,765 | |

| Corporate Bonds(a) | | | – | | | | 78,564,996 | | | | – | | | | 78,564,996 | |

| Foreign Corporate Bonds(a) | | | – | | | | 5,165,335 | | | | – | | | | 5,165,335 | |

| Government & Agency Obligations | | | – | | | | 12,121,642 | | | | – | | | | 12,121,642 | |

| Short Term Investments | | | 2,341,988 | | | | – | | | | – | | | | 2,341,988 | |

| TOTAL | | $ | 239,304,753 | | | $ | 95,851,973 | | | $ | – | | | $ | 335,156,726 | |

| (a) | For detailed descriptions of the underlying industries, see the accompanying Portfolio of Investments. |

For the six months ended October 31, 2022, the Fund did not have any securities that used significant unobservable inputs (Level 3) in determining fair value. There were no transfers in/out of Level 3 securities during the six months ended October 31, 2022.

Investment Transactions and Investment Income: Investment transactions are accounted for on the date the investments are purchased or sold (trade date). Realized gains and losses from investment transactions are reported on an identified cost basis, which is the same basis the Fund uses for federal income tax purposes. Interest income, which includes accretion of discounts, is accrued and recorded as earned. Dividend income is recognized on the ex-dividend date or for certain foreign securities, as soon as information is available to the Fund.

Trust Expenses: Some expenses of the Trust can be directly attributed to the Fund. Expenses which cannot be directly attributed to the Fund are apportioned among all funds in the Trust based on average net assets of each fund.

Fund Expenses: Expenses that are specific to the Fund are charged directly to the Fund.

Federal Income Taxes: The Fund complies with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and intends to distribute substantially all of their net taxable income and net capital gains, if any, each year so that it will not be subject to excise tax on undistributed income and gains. The Fund is not subject to income taxes to the extent such distributions are made.

As of and during the six months ended October 31, 2022, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

| 28 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

October 31, 2022 (Unaudited)

Distributions to Shareholders: The Fund normally pays dividends, if any, quarterly and distributes capital gains, if any, on an annual basis. Income dividend distributions are derived from dividends and other income the Fund receives from its investments, including short term capital gains. Long term capital gain distributions are derived from gains realized when the Fund sells a security it has owned for more than a year. The Fund may make additional distributions and dividends at other times if the portfolio manager believes doing so may be necessary for the Fund to avoid or reduce taxes.

Epidemic and Pandemic Risk: Certain countries have been susceptible to epidemics, most recently COVID-19, which has been designated as a pandemic by world health authorities. The outbreak of such epidemics, together with any resulting restrictions on travel or quarantines imposed, could have a negative impact on the economy and business activity globally (including in the countries in which we invest), and thereby could adversely affect the performance of our investments. Furthermore, the rapid development of epidemics could preclude prediction as to their ultimate adverse impact on economic and market conditions, and, as a result, present material uncertainty and risk with respect to us and the performance of our investments.

Libor Risk: In March 2020, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (“ASU”) No. 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting. The Fund’s investments, payment obligations, and financing terms may be based on floating rates, such as the London Interbank Offered Rate, or “LIBOR,” which is the offered rate for short-term Eurodollar deposits between major international banks. On November 30, 2020, the administrator of LIBOR announced its intention to delay the phase out of the majority of the U.S. dollar LIBOR publications until June 30, 2023. The remainder of LIBOR publications ended at the end of 2021. There remains uncertainty regarding the nature of any replacement rate and the impact of the transition from LIBOR on the Fund’s transactions and the financial markets generally. As such, the potential effect of a transition away from LIBOR on the Fund or the Fund’s investments cannot yet be determined.

3. TAX BASIS INFORMATION

Tax Basis of Investments: As of October 31, 2022, the aggregate cost of investments, gross unrealized appreciation/ (depreciation) and net unrealized appreciation for Federal tax purposes was as follows:

| | | The Disciplined Growth Investors Fund | |

| Gross appreciation | | | | |

| (excess of value over tax cost) | | $ | 65,502,438 | |

| Gross depreciation | | | | |

| (excess of tax cost over value) | | | (41,117,438 | ) |

| Net unrealized appreciation | | $ | 24,385,000 | |

| Cost of investments for income tax purposes | | $ | 310,771,726 | |

| Semi-Annual Report | October 31, 2022 | 29 |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

October 31, 2022 (Unaudited)

Tax Basis of Distributions to Shareholders: The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain was recorded by the Fund.

The tax character of distributions paid during the year ended April 30, 2022, were as follows:

| | | Ordinary Income | | | Long-Term Capital Gain | |

| The Disciplined Growth Investors Fund | | $ | 4,688,850 | | | $ | 32,112,742 | |

The amounts and characteristics of tax basis distributions and composition of distributable earnings/(accumulated losses) are finalized at fiscal year-end. Accordingly, tax basis balances have not been determined as of October 31, 2022.

4. SECURITIES TRANSACTIONS

The cost of purchases and proceeds from sales of securities (excluding short-term securities, and U.S. Government Obligations) during six months ended October 31, 2022, were as follows:

| Fund | | Purchases of Securities | | | Proceeds From Sales of Securities | |

| The Disciplined Growth Investors Fund | | $ | 60,156,176 | | | $ | 33,330,894 | |

Investment transactions in U.S. Government Obligations during the six months ended October 31, 2022 were as follows:

| Fund | | Purchases of Securities | | | Proceeds From Sales of Securities | |

| The Disciplined Growth Investors Fund | | $ | 1,334,635 | | | $ | 18,151,398 | |

The cost of purchases in Kind, proceeds from sales in Kind along with there Realized gains/(loss) included in above transactions during the six months ended October 31, 2022 were as follows:

| Fund | | Purchases | | | Proceeds | | | Net Realized Gain/(Loss) | |

| Disciplined Growth Investors Fund | | $ | 2,684,514 | | | $ | – | | | $ | – | |

5. SHARES OF BENEFICIAL INTEREST

The capitalization of the Trust consists of an unlimited number of shares of beneficial interest with no par value per share. Holders of the shares of the Fund of the Trust have one vote for each share held and a proportionate fraction of a vote for each fractional share. All shares issued and outstanding are fully paid and are transferable and redeemable at the option of the shareholder. Purchasers of the shares do not have any obligation to make payments to the Trust or its creditors (other than the purchase price for the shares or make contributions to the Trust or its creditors solely by reason of the purchasers’ ownership of the shares. Shares have no pre-emptive rights.

| 30 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

October 31, 2022 (Unaudited)

6. MANAGEMENT AND RELATED-PARTY TRANSACTIONS

The Adviser, subject to the authority of the Board, is responsible for the overall management and administration of the Fund’s business affairs. The Adviser manages the investments of the Fund in accordance with the Fund’s investment objective, policies and limitations and investment guidelines established jointly by the Adviser and the Trustees. Pursuant to the Advisory Agreement, the Fund pays the Adviser a unitary management fee for the services and facilities it provides payable on a monthly basis at the annual rate of 0.78% of the Fund’s average daily net assets. The management fee is paid on a monthly basis.

Out of the unitary management fee, the Adviser pays substantially all expenses of the Fund, including the cost of transfer agency, custody, fund administration, bookkeeping and pricing services, legal, audit and other services, except for interest expenses, brokerage expenses, taxes and extraordinary expenses not incurred in the ordinary course of the Fund’s business. Also included are Trustee fees which were $9,043 for the six months ended October 31, 2022.

Fund Administrator Fees and Expenses

ALPS Fund Services, Inc. (“ALPS”) serves as administrator to the Fund. Pursuant to an Administration Agreement, ALPS provides operational services to the Fund including, but not limited to, fund accounting and fund administration and generally assists in the Fund’s operations. Officers of the Trust are employees of ALPS. The Fund’s administration fee is accrued on a daily basis and paid monthly. The Administrator is also reimbursed for certain out-of-pocket expenses. The administrative fee and out-of-pocket expenses are included in the unitary management fee paid to the Adviser.

Transfer Agent

ALPS serves as transfer, dividend paying and shareholder servicing agent for the Fund. ALPS receives an annual minimum fee, a fee based upon the number of shareholder accounts, and is also reimbursed for certain out-of-pocket expenses. The fee and out-of-pocket expenses are included in the unitary management fee paid to the Adviser.

Compliance Services

ALPS provides services that assist the Trust’s chief compliance officer in monitoring and testing the policies and procedures of the Trust in conjunction with requirements under Rule 38a-1 under the 1940 Act and receives an annual base fee. ALPS is reimbursed for certain out-of-pocket expenses. The fee and out-of-pocket expenses are included in the unitary management fee paid to the Adviser.

Principal Financial Officer

ALPS receives an annual fee for providing principal financial officer services to the Fund. The fee is included in the unitary management fee paid to the Adviser.

| Semi-Annual Report | October 31, 2022 | 31 |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

October 31, 2022 (Unaudited)

Distributor

ALPS Distributors, Inc. (“ADI” or the “Distributor”) (an affiliate of ALPS) acts as the distributor of the Fund’s shares pursuant to a Distribution Agreement with the Trust. Shares are sold on a continuous basis by ADI as agent for the Fund, and ADI has agreed to use its best efforts to solicit orders for the sale of the Fund’s shares, although it is not obliged to sell any particular amount of shares. ADI is not entitled to any compensation for its services as Distributor. ADI is registered as a broker-dealer with the Securities and Exchange Commission.

7. INDEMNIFICATIONS

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that may contain general indemnification clauses, which may permit indemnification to the extent permissible under applicable law. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

| 32 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Additional Information |

October 31, 2022 (Unaudited)

1. FUND HOLDINGS

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s Web site at http://www.sec.gov. The Fund’s Form N-PORT reports are also available upon request by calling toll-free (855) 344-3863.

2. FUND PROXY VOTING POLICIES, PROCEDURES AND SUMMARIES

The Fund’s policies and procedures used in determining how to vote proxies and information regarding how the Fund voted proxies relating to portfolio securities during the most recent prior 12-month period ending June 30 are available without charge, (1) upon request, by calling (toll-free) 855-DGI-Fund and (2) on the SEC’s website at http://www.sec.gov.

| Semi-Annual Report | October 31, 2022 | 33 |

| The Disciplined Growth Investors Fund | Privacy Policy |

| WHO WE ARE | |

| Who is providing this notice? | The Disciplined Growth Investors Fund |

| WHAT WE DO | |

| How does the Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. |

| How does the Fund collect my personal information? | We collect your personal information, for example, when you ● open an account ● provide account information or give us your contact information ● make a wire transfer or deposit money |

| Why can’t I limit all sharing? | Federal law gives you the right to limit only ● sharing for affiliates’ everyday business purposes-information about your creditworthiness ● affiliates from using your information to market to you ● sharing for non-affiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

| DEFINITIONS | |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. |

| Non-affiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies. ● The Fund does not share with non-affiliates so they can market to you. |

| Joint marketing | A formal agreement between non-affiliated financial companies that together market financial products or services to you. ● The Fund does not jointly market. |

| 34 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Privacy Policy |

| FACTS | WHAT DOES THE FUND DO WITH YOUR PERSONAL INFORMATION? |

| WHY? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| WHAT? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ● Social Security number and account transactions ● Account balances and transaction history ● Wire transfer instructions |