0000915802 fit:C000200957Member 2022-01-31 0000915802 fit:ALPSCoreCommodityManagementCompleteCommodities174StrategyFundClassIBloombergCommodityTotalReturnIndexMember 2019-01-31 0000915802 fit:C000093015Member fit:FortisHealthcareLtdMember 2024-10-31 0000915802 fit:C000093017Member fit:CommunicationServicesMember 2024-10-31 0000915802 fit:ALPSGlobalOpportunityFundInvestorSharesMorningstarDevelopedMarketsIndexMember 2023-03-31 0000915802 fit:ALPSGlobalOpportunityFundClassIRedRocksGlobalListedPrivateEquityIndexMember 2016-10-31 0000915802 fit:RiverFrontAssetAllocationGrowthampIncomeInvestorSharesBloombergUSAggregateBondIndexMember 2019-04-30 0000915802 fit:RiverFrontAssetAllocationGrowthampIncomeClassCBloombergUSAggregateBondIndexMember 2016-04-30 0000915802 fit:RiverFrontAssetAllocationGrowthampIncomeClassIBloombergUSAggregateBondIndexMember 2024-03-31 0000915802 fit:ALPSSmithShortDurationBondFundClassIBloomberg13YearUSGovernmentCreditIndexMember 2018-08-31 0000915802 fit:ALPSSmithCreditOpportunitiesFundClassIBloombergUSCorporateHYBondIndexMember 2020-09-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08194

FINANCIAL INVESTORS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1000, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Brendan Hamill, Secretary

Financial Investors Trust

1290 Broadway, Suite 1000

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: October 31

Date of reporting period: November 1, 2023 - October 31, 2024

Item 1. Reports to Stockholders.

| (a) | Report of Shareholders. |

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund - Investor Shares | FINANCIAL INVESTORS TRUST |

JCRAX | |

This annual shareholder report contains important information about ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund (the "Fund" or "JCRAX") for the period of November 1, 2023 to October 31, 2024 (the "Period"). You can find additional information about the Fund at https://www.alpsfunds.com/mutual-funds/jcrix. You can also request this information by contacting us at 866-759-5679.

This report describes changes to the Fund that occurred during the reporting period.

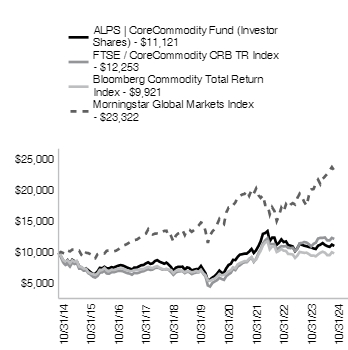

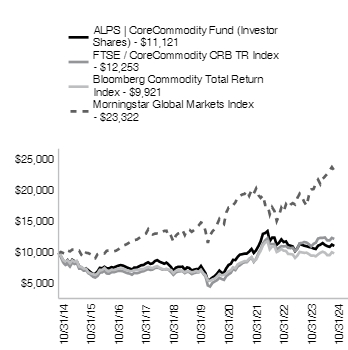

The ALPS | CoreCommodity Management Complete Commodities® Strategy Fund Investor Class shares, net of fees, returned 0.36% at net asset value (NAV) for the 12 months ending October 31, 2024. The Fund outperformed the Bloomberg Commodity Total Return Index (the "BCOM") by 1.54% over the period.

Top Contributors to relative performance

Within the energy sector, the Fund's deferred positioning in natural gas and exposure to energy equities was additive to relative performance.

Within the industrial metals sector, an overweight to copper, aluminum, and zinc and the inclusion of industrial metals equities was additive to relative performance.

Within agriculture, an underweight to staple crops (corn, soybeans, wheat) and the inclusion of agriculture equities was additive to relative performance.

Detractors from relative performance

Within precious metals, an underweight to gold detracted from relative performance.

Within livestock, an underweight to each constituent and deferred positioning in lean hogs and live cattle detracted from relative performance.

The Fund's past performance is not a good predictor of the Fund's future performance. The chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or sale of Fund shares.

| 10/31/2014 | 10000 | 10000 | 10000 | 10000 |

| 11/30/2014 | 9456 | 9353 | 9593 | 10155 |

| 12/31/2014 | 8787 | 8456 | 8861 | 9983 |

| 01/31/2015 | 8483 | 8047 | 8566 | 9841 |

| 02/28/2015 | 8828 | 8240 | 8786 | 10379 |

| 03/31/2015 | 8305 | 7791 | 8335 | 10246 |

| 04/30/2015 | 8891 | 8439 | 8813 | 10530 |

| 05/31/2015 | 8661 | 8207 | 8575 | 10531 |

| 06/30/2015 | 8619 | 8354 | 8723 | 10293 |

| 07/31/2015 | 7803 | 7450 | 7797 | 10359 |

| 08/31/2015 | 7657 | 7433 | 7725 | 9670 |

| 09/30/2015 | 7207 | 7127 | 7461 | 9322 |

| 10/31/2015 | 7479 | 7195 | 7428 | 10030 |

| 11/30/2015 | 7186 | 6714 | 6889 | 9959 |

| 12/31/2015 | 6872 | 6481 | 6676 | 9780 |

| 01/31/2016 | 6590 | 6136 | 6564 | 9176 |

| 02/29/2016 | 6611 | 6008 | 6457 | 9126 |

| 03/31/2016 | 6998 | 6279 | 6704 | 9812 |

| 04/30/2016 | 7584 | 6799 | 7275 | 9967 |

| 05/31/2016 | 7510 | 6857 | 7261 | 9982 |

| 06/30/2016 | 7751 | 7095 | 7561 | 9913 |

| 07/31/2016 | 7510 | 6671 | 7175 | 10353 |

| 08/31/2016 | 7490 | 6643 | 7048 | 10383 |

| 09/30/2016 | 7699 | 6870 | 7269 | 10449 |

| 10/31/2016 | 7626 | 6871 | 7233 | 10255 |

| 11/30/2016 | 7793 | 6985 | 7330 | 10356 |

| 12/31/2016 | 7943 | 7106 | 7462 | 10584 |

| 01/31/2017 | 8027 | 7092 | 7472 | 10868 |

| 02/28/2017 | 7964 | 7043 | 7488 | 11168 |

| 03/31/2017 | 7797 | 6872 | 7289 | 11298 |

| 04/30/2017 | 7619 | 6723 | 7179 | 11477 |

| 05/31/2017 | 7472 | 6656 | 7083 | 11719 |

| 06/30/2017 | 7315 | 6476 | 7070 | 11780 |

| 07/31/2017 | 7640 | 6774 | 7230 | 12096 |

| 08/31/2017 | 7619 | 6713 | 7259 | 12138 |

| 09/30/2017 | 7828 | 6802 | 7248 | 12389 |

| 10/31/2017 | 8006 | 6975 | 7403 | 12643 |

| 11/30/2017 | 8048 | 7042 | 7369 | 12896 |

| 12/31/2017 | 8309 | 7224 | 7589 | 13110 |

| 01/31/2018 | 8480 | 7365 | 7740 | 13814 |

| 02/28/2018 | 8223 | 7246 | 7606 | 13241 |

| 03/31/2018 | 8319 | 7309 | 7559 | 12982 |

| 04/30/2018 | 8684 | 7568 | 7754 | 13113 |

| 05/31/2018 | 8835 | 7612 | 7864 | 13145 |

| 06/30/2018 | 8577 | 7532 | 7589 | 13063 |

| 07/31/2018 | 8427 | 7324 | 7427 | 13431 |

| 08/31/2018 | 8255 | 7278 | 7296 | 13555 |

| 09/30/2018 | 8427 | 7373 | 7435 | 13589 |

| 10/31/2018 | 8094 | 7230 | 7275 | 12538 |

| 11/30/2018 | 7697 | 6894 | 7234 | 12728 |

| 12/31/2018 | 7101 | 6454 | 6736 | 11822 |

| 01/31/2019 | 7610 | 6842 | 7103 | 12771 |

| 02/28/2019 | 7732 | 6974 | 7174 | 13118 |

| 03/31/2019 | 7743 | 7026 | 7162 | 13256 |

| 04/30/2019 | 7776 | 7060 | 7131 | 13693 |

| 05/31/2019 | 7300 | 6733 | 6892 | 12890 |

| 06/30/2019 | 7666 | 6963 | 7077 | 13711 |

| 07/31/2019 | 7544 | 6880 | 7029 | 13745 |

| 08/31/2019 | 7157 | 6576 | 6866 | 13411 |

| 09/30/2019 | 7289 | 6725 | 6947 | 13692 |

| 10/31/2019 | 7389 | 6849 | 7087 | 14077 |

| 11/30/2019 | 7389 | 6849 | 6906 | 14424 |

| 12/31/2019 | 7882 | 7213 | 7254 | 14924 |

| 01/31/2020 | 7268 | 6621 | 6720 | 14736 |

| 02/29/2020 | 6710 | 6206 | 6382 | 13530 |

| 03/31/2020 | 5493 | 4742 | 5564 | 11608 |

| 04/30/2020 | 5660 | 4564 | 5479 | 12870 |

| 05/31/2020 | 6029 | 5151 | 5716 | 13471 |

| 06/30/2020 | 6241 | 5375 | 5847 | 13886 |

| 07/31/2020 | 6643 | 5598 | 6180 | 14594 |

| 08/31/2020 | 7134 | 5969 | 6598 | 15479 |

| 09/30/2020 | 6810 | 5787 | 6377 | 14998 |

| 10/31/2020 | 6766 | 5640 | 6467 | 14670 |

| 11/30/2020 | 7503 | 6238 | 6694 | 16519 |

| 12/31/2020 | 8052 | 6540 | 7027 | 17323 |

| 01/31/2021 | 8254 | 6790 | 7212 | 17269 |

| 02/28/2021 | 8869 | 7423 | 7678 | 17716 |

| 03/31/2021 | 8847 | 7210 | 7514 | 18166 |

| 04/30/2021 | 9351 | 7787 | 8136 | 18952 |

| 05/31/2021 | 9721 | 8018 | 8359 | 19232 |

| 06/30/2021 | 9799 | 8319 | 8513 | 19446 |

| 07/31/2021 | 9877 | 8502 | 8670 | 19542 |

| 08/31/2021 | 9900 | 8506 | 8644 | 20031 |

| 09/30/2021 | 10224 | 8925 | 9074 | 19239 |

| 10/31/2021 | 10639 | 9267 | 9309 | 20162 |

| 11/30/2021 | 10001 | 8546 | 8628 | 19618 |

| 12/31/2021 | 10426 | 9061 | 8932 | 20406 |

| 01/31/2022 | 11114 | 9949 | 9717 | 19344 |

| 02/28/2022 | 11830 | 10496 | 10322 | 18911 |

| 03/31/2022 | 13084 | 11519 | 11214 | 19294 |

| 04/30/2022 | 13208 | 12037 | 11678 | 17773 |

| 05/31/2022 | 13524 | 12370 | 11857 | 17778 |

| 06/30/2022 | 11899 | 11392 | 10579 | 16244 |

| 07/31/2022 | 12464 | 11447 | 11030 | 17386 |

| 08/31/2022 | 12464 | 11410 | 11040 | 16773 |

| 09/30/2022 | 11307 | 10569 | 10145 | 15158 |

| 10/31/2022 | 11665 | 10832 | 10347 | 16070 |

| 11/30/2022 | 12188 | 11093 | 10630 | 17312 |

| 12/31/2022 | 11760 | 11053 | 10370 | 16696 |

| 01/31/2023 | 11863 | 11111 | 10319 | 17867 |

| 02/28/2023 | 11273 | 10821 | 9834 | 17369 |

| 03/31/2023 | 11170 | 10781 | 9814 | 17810 |

| 04/30/2023 | 11052 | 10840 | 9740 | 18052 |

| 05/31/2023 | 10299 | 10310 | 9191 | 17833 |

| 06/30/2023 | 10727 | 10687 | 9562 | 18864 |

| 07/31/2023 | 11465 | 11563 | 10161 | 19574 |

| 08/31/2023 | 11302 | 11605 | 10083 | 19024 |

| 09/30/2023 | 11170 | 11764 | 10013 | 18243 |

| 10/31/2023 | 11081 | 11680 | 10039 | 17647 |

| 11/30/2023 | 10963 | 11418 | 9813 | 19273 |

| 12/31/2023 | 10892 | 11056 | 9549 | 20258 |

| 01/31/2024 | 10724 | 11471 | 9587 | 20330 |

| 02/29/2024 | 10633 | 11632 | 9446 | 21177 |

| 03/31/2024 | 11166 | 12326 | 9759 | 21841 |

| 04/30/2024 | 11334 | 12436 | 10022 | 21116 |

| 05/31/2024 | 11594 | 12437 | 10197 | 21957 |

| 06/30/2024 | 11289 | 12501 | 10040 | 22372 |

| 07/31/2024 | 11090 | 12028 | 9635 | 22806 |

| 08/31/2024 | 10983 | 12031 | 9640 | 23345 |

| 09/30/2024 | 11350 | 12427 | 10108 | 23884 |

| 10/31/2024 | 11121 | 12253 | 9921 | 23322 |

| ALPS | CoreCommodity Fund - Investor - NAV | 0.36% | 8.52% | 1.07% |

| Morningstar Global Markets Index# | 32.16% | 10.63% | 8.84% |

| Bloomberg Commodity Total Return Index | -1.18% | 6.96% | -0.08% |

| FTSE / CoreCommodity CRB TR Index | 4.91% | 12.34% | 2.05% |

For the most current month-end performance data, please call 1-866-759-5679.

| Net Assets | $940,528,649 |

| Number of Portfolio Holdings | 55 |

| Portfolio Turnover Rate | 72% |

| Total Advisory Fees Paid | $9,426,269 |

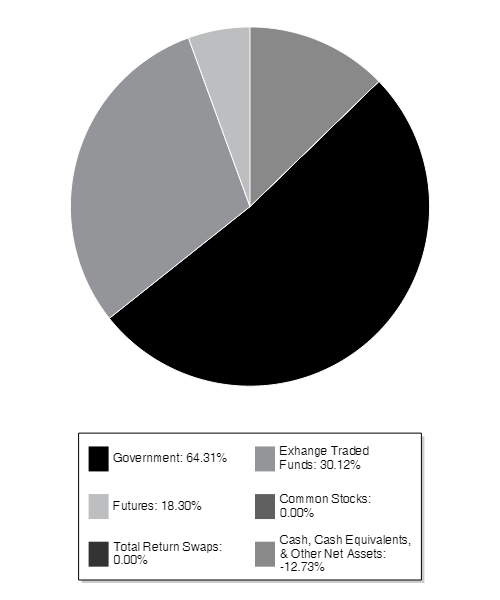

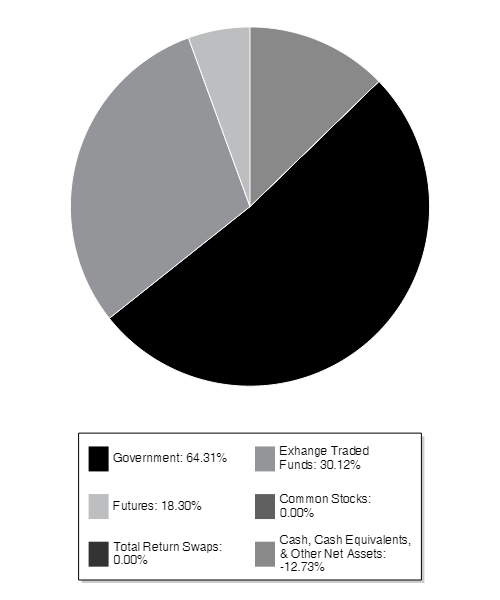

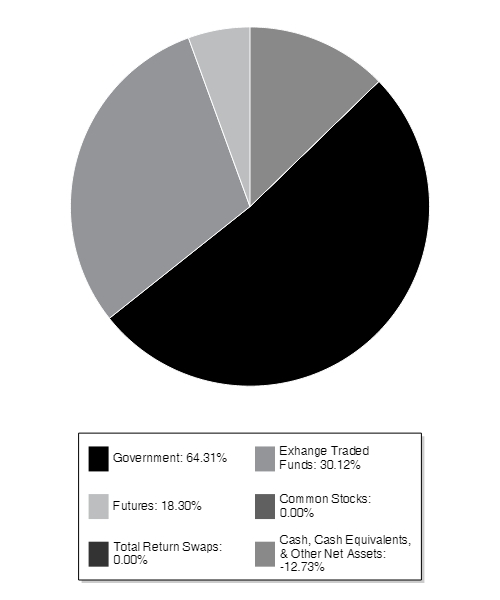

| Government | 64.31% |

| Exhange Traded Funds | 30.12% |

| Futures | 18.30% |

| Common Stocks | 0.00% |

| Total Return Swaps | 0.00% |

| Cash, Cash Equivalents, & Other Net Assets | -12.73% |

| |

** | As a percentage of net assets. |

Holdings are subject to change

This is a summary of certain changes to the Fund since April 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://www.alpsfunds.com/mutual-funds/jcrix or upon request at 866-759-5679.

Change to Principal Investment Strategy and Principal Risks: With respect to the Commodity Equity Investments portion of its portfolio, the Fund will now invest primarily through underlying exhange-traded funds (ETFs) as oppossed to making such investments directly. The following are now Principal Risks of the Fund: Affiliated ETF Risk and ETF Investment Risk.

If you wish to view additional information about the Fund, including but not limited to the Fund's prospectus, financial information, holdings, and proxy voting information, please visit https://www.alpsfunds.com/mutual-funds/jcrix.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 866-759-5679.

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund - Class A | FINANCIAL INVESTORS TRUST |

JCCSX | |

This annual shareholder report contains important information about ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund (the "Fund" or "JCCSX") for the period of November 1, 2023 to October 31, 2024 (the "Period"). You can find additional information about the Fund at https://www.alpsfunds.com/mutual-funds/jcrix. You can also request this information by contacting us at 866-759-5679.

This report describes changes to the Fund that occurred during the reporting period.

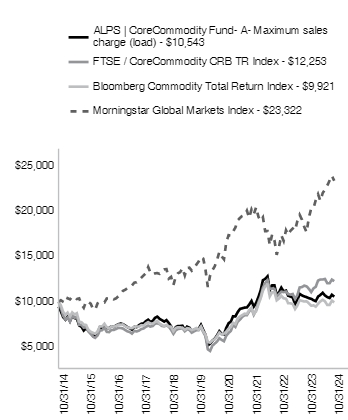

The ALPS | CoreCommodity Management Complete Commodities® Strategy Fund Class A shares, net of fees, returned 0.49% at net asset value (NAV) for the 12 months ending October 31, 2024. The Fund outperformed the Bloomberg Commodity Total Return Index (the "BCOM") by 1.67% over the period.

Top Contributors to relative performance

Within the energy sector, the Fund's deferred positioning in natural gas and exposure to energy equities was additive to relative performance.

Within the industrial metals sector, an overweight to copper, aluminum, and zinc and the inclusion of industrial metals equities was additive to relative performance.

Within agriculture, an underweight to staple crops (corn, soybeans, wheat) and the inclusion of agriculture equities was additive to relative performance.

Detractors from relative performance

Within precious metals, an underweight to gold detracted from relative performance.

Within livestock, an underweight to each constituent and deferred positioning in lean hogs and live cattle detracted from relative performance.

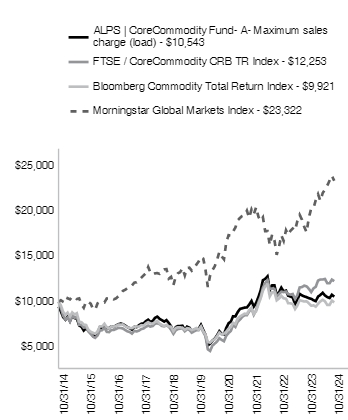

The Fund's past performance is not a good predictor of the Fund's future performance. The chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or sale of Fund shares.

| 10/31/2014 | 9447 | 10000 | 10000 | 10000 |

| 11/30/2014 | 8933 | 9353 | 9593 | 10155 |

| 12/31/2014 | 8300 | 8456 | 8861 | 9983 |

| 01/31/2015 | 8014 | 8047 | 8566 | 9841 |

| 02/28/2015 | 8340 | 8240 | 8786 | 10379 |

| 03/31/2015 | 7846 | 7791 | 8335 | 10246 |

| 04/30/2015 | 8399 | 8439 | 8813 | 10530 |

| 05/31/2015 | 8182 | 8207 | 8575 | 10531 |

| 06/30/2015 | 8142 | 8354 | 8723 | 10293 |

| 07/31/2015 | 7372 | 7450 | 7797 | 10359 |

| 08/31/2015 | 7233 | 7433 | 7725 | 9670 |

| 09/30/2015 | 6808 | 7127 | 7461 | 9322 |

| 10/31/2015 | 7065 | 7195 | 7428 | 10030 |

| 11/30/2015 | 6789 | 6714 | 6889 | 9959 |

| 12/31/2015 | 6492 | 6481 | 6676 | 9780 |

| 01/31/2016 | 6225 | 6136 | 6564 | 9176 |

| 02/29/2016 | 6245 | 6008 | 6457 | 9126 |

| 03/31/2016 | 6611 | 6279 | 6704 | 9812 |

| 04/30/2016 | 7164 | 6799 | 7275 | 9967 |

| 05/31/2016 | 7095 | 6857 | 7261 | 9982 |

| 06/30/2016 | 7322 | 7095 | 7561 | 9913 |

| 07/31/2016 | 7095 | 6671 | 7175 | 10353 |

| 08/31/2016 | 7075 | 6643 | 7048 | 10383 |

| 09/30/2016 | 7273 | 6870 | 7269 | 10449 |

| 10/31/2016 | 7204 | 6871 | 7233 | 10255 |

| 11/30/2016 | 7362 | 6985 | 7330 | 10356 |

| 12/31/2016 | 7504 | 7106 | 7462 | 10584 |

| 01/31/2017 | 7583 | 7092 | 7472 | 10868 |

| 02/28/2017 | 7523 | 7043 | 7488 | 11168 |

| 03/31/2017 | 7365 | 6872 | 7289 | 11298 |

| 04/30/2017 | 7197 | 6723 | 7179 | 11477 |

| 05/31/2017 | 7059 | 6656 | 7083 | 11719 |

| 06/30/2017 | 6910 | 6476 | 7070 | 11780 |

| 07/31/2017 | 7217 | 6774 | 7230 | 12096 |

| 08/31/2017 | 7197 | 6713 | 7259 | 12138 |

| 09/30/2017 | 7395 | 6802 | 7248 | 12389 |

| 10/31/2017 | 7563 | 6975 | 7403 | 12643 |

| 11/30/2017 | 7603 | 7042 | 7369 | 12896 |

| 12/31/2017 | 7849 | 7224 | 7589 | 13110 |

| 01/31/2018 | 8011 | 7365 | 7740 | 13814 |

| 02/28/2018 | 7768 | 7246 | 7606 | 13241 |

| 03/31/2018 | 7859 | 7309 | 7559 | 12982 |

| 04/30/2018 | 8204 | 7568 | 7754 | 13113 |

| 05/31/2018 | 8346 | 7612 | 7864 | 13145 |

| 06/30/2018 | 8102 | 7532 | 7589 | 13063 |

| 07/31/2018 | 7960 | 7324 | 7427 | 13431 |

| 08/31/2018 | 7798 | 7278 | 7296 | 13555 |

| 09/30/2018 | 7960 | 7373 | 7435 | 13589 |

| 10/31/2018 | 7646 | 7230 | 7275 | 12538 |

| 11/30/2018 | 7271 | 6894 | 7234 | 12728 |

| 12/31/2018 | 6708 | 6454 | 6736 | 11822 |

| 01/31/2019 | 7189 | 6842 | 7103 | 12771 |

| 02/28/2019 | 7304 | 6974 | 7174 | 13118 |

| 03/31/2019 | 7314 | 7026 | 7162 | 13256 |

| 04/30/2019 | 7346 | 7060 | 7131 | 13693 |

| 05/31/2019 | 6907 | 6733 | 6892 | 12890 |

| 06/30/2019 | 7241 | 6963 | 7077 | 13711 |

| 07/31/2019 | 7126 | 6880 | 7029 | 13745 |

| 08/31/2019 | 6771 | 6576 | 6866 | 13411 |

| 09/30/2019 | 6886 | 6725 | 6947 | 13692 |

| 10/31/2019 | 6980 | 6849 | 7087 | 14077 |

| 11/30/2019 | 6980 | 6849 | 6906 | 14424 |

| 12/31/2019 | 7446 | 7213 | 7254 | 14924 |

| 01/31/2020 | 6866 | 6621 | 6720 | 14736 |

| 02/29/2020 | 6349 | 6206 | 6382 | 13530 |

| 03/31/2020 | 5189 | 4742 | 5564 | 11608 |

| 04/30/2020 | 5357 | 4564 | 5479 | 12870 |

| 05/31/2020 | 5695 | 5151 | 5716 | 13471 |

| 06/30/2020 | 5906 | 5375 | 5847 | 13886 |

| 07/31/2020 | 6275 | 5598 | 6180 | 14594 |

| 08/31/2020 | 6739 | 5969 | 6598 | 15479 |

| 09/30/2020 | 6444 | 5787 | 6377 | 14998 |

| 10/31/2020 | 6402 | 5640 | 6467 | 14670 |

| 11/30/2020 | 7098 | 6238 | 6694 | 16519 |

| 12/31/2020 | 7617 | 6540 | 7027 | 17323 |

| 01/31/2021 | 7807 | 6790 | 7212 | 17269 |

| 02/28/2021 | 8389 | 7423 | 7678 | 17716 |

| 03/31/2021 | 8368 | 7210 | 7514 | 18166 |

| 04/30/2021 | 8834 | 7787 | 8136 | 18952 |

| 05/31/2021 | 9193 | 8018 | 8359 | 19232 |

| 06/30/2021 | 9267 | 8319 | 8513 | 19446 |

| 07/31/2021 | 9341 | 8502 | 8670 | 19542 |

| 08/31/2021 | 9363 | 8506 | 8644 | 20031 |

| 09/30/2021 | 9669 | 8925 | 9074 | 19239 |

| 10/31/2021 | 10071 | 9267 | 9309 | 20162 |

| 11/30/2021 | 9458 | 8546 | 8628 | 19618 |

| 12/31/2021 | 9860 | 9061 | 8932 | 20406 |

| 01/31/2022 | 10510 | 9949 | 9717 | 19344 |

| 02/28/2022 | 11199 | 10496 | 10322 | 18911 |

| 03/31/2022 | 12370 | 11519 | 11214 | 19294 |

| 04/30/2022 | 12500 | 12037 | 11678 | 17773 |

| 05/31/2022 | 12786 | 12370 | 11857 | 17778 |

| 06/30/2022 | 11264 | 11392 | 10579 | 16244 |

| 07/31/2022 | 11785 | 11447 | 11030 | 17386 |

| 08/31/2022 | 11785 | 11410 | 11040 | 16773 |

| 09/30/2022 | 10705 | 10569 | 10145 | 15158 |

| 10/31/2022 | 11030 | 10832 | 10347 | 16070 |

| 11/30/2022 | 11538 | 11093 | 10630 | 17312 |

| 12/31/2022 | 11119 | 11053 | 10370 | 16696 |

| 01/31/2023 | 11216 | 11111 | 10319 | 17867 |

| 02/28/2023 | 10659 | 10821 | 9834 | 17369 |

| 03/31/2023 | 10561 | 10781 | 9814 | 17810 |

| 04/30/2023 | 10464 | 10840 | 9740 | 18052 |

| 05/31/2023 | 9739 | 10310 | 9191 | 17833 |

| 06/30/2023 | 10157 | 10687 | 9562 | 18864 |

| 07/31/2023 | 10854 | 11563 | 10161 | 19574 |

| 08/31/2023 | 10687 | 11605 | 10083 | 19024 |

| 09/30/2023 | 10575 | 11764 | 10013 | 18243 |

| 10/31/2023 | 10492 | 11680 | 10039 | 17647 |

| 11/30/2023 | 10380 | 11418 | 9813 | 19273 |

| 12/31/2023 | 10313 | 11056 | 9549 | 20258 |

| 01/31/2024 | 10154 | 11471 | 9587 | 20330 |

| 02/29/2024 | 10054 | 11632 | 9446 | 21177 |

| 03/31/2024 | 10558 | 12326 | 9759 | 21841 |

| 04/30/2024 | 10731 | 12436 | 10022 | 21116 |

| 05/31/2024 | 10975 | 12437 | 10197 | 21957 |

| 06/30/2024 | 10687 | 12501 | 10040 | 22372 |

| 07/31/2024 | 10500 | 12028 | 9635 | 22806 |

| 08/31/2024 | 10399 | 12031 | 9640 | 23345 |

| 09/30/2024 | 10759 | 12427 | 10108 | 23884 |

| 10/31/2024 | 10543 | 12253 | 9921 | 23322 |

| ALPS | CoreCommodity Fund - Class A - NAV** | 0.49% | 8.60% | 1.10% |

| ALPS | CoreCommodity Fund - Class A -Maximum sales charge (load)*^ | -5.06% | 7.37% | 0.53% |

| Morningstar Global Markets Index# | 32.16% | 10.63% | 8.84% |

| Bloomberg Commodity Total Return Index | -1.18% | 6.96% | -0.08% |

| FTSE / CoreCommodity CRB TR Index | 4.91% | 12.34% | 2.05% |

For the most current month-end performance data, please call 1-866-759-5679.

| Net Assets | $940,528,649 |

| Number of Portfolio Holdings | 55 |

| Portfolio Turnover Rate | 72% |

| Total Advisory Fees Paid | $9,426,269 |

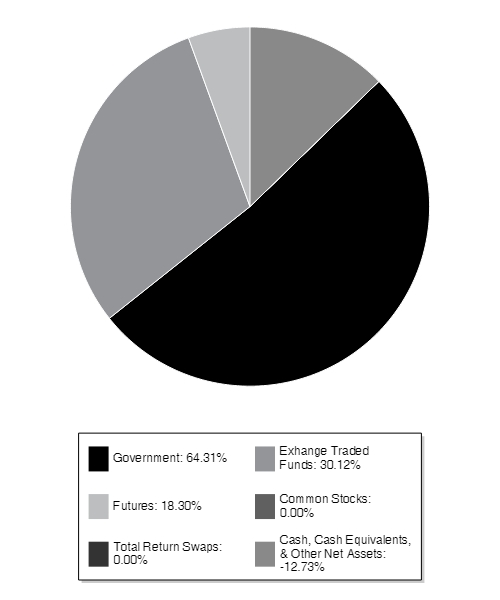

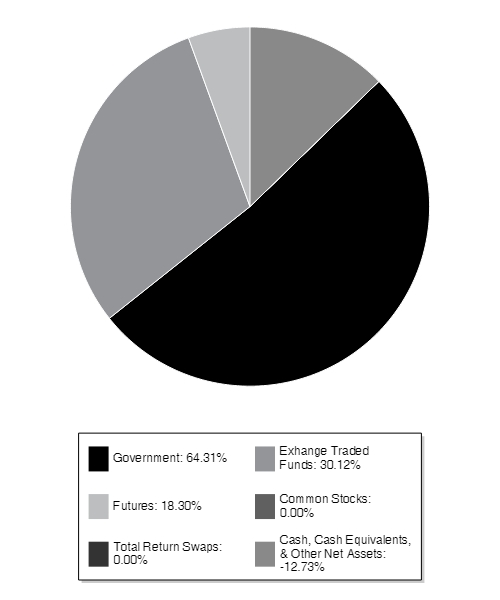

| Government | 64.31% |

| Exhange Traded Funds | 30.12% |

| Futures | 18.30% |

| Common Stocks | 0.00% |

| Total Return Swaps | 0.00% |

| Cash, Cash Equivalents, & Other Net Assets | -12.73% |

| |

** | As a percentage of net assets. |

Holdings are subject to change

This is a summary of certain changes to the Fund since April 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://www.alpsfunds.com/mutual-funds/jcrix or upon request at 866-759-5679.

Change to Principal Investment Strategy and Principal Risks: With respect to the Commodity Equity Investments portion of its portfolio, the Fund will now invest primarily through underlying exhange-traded funds (ETFs) as oppossed to making such investments directly. The following are now Principal Risks of the Fund: Affiliated ETF Risk and ETF Investment Risk.

If you wish to view additional information about the Fund, including but not limited to the Fund's prospectus, financial information, holdings, and proxy voting information, please visit https://www.alpsfunds.com/mutual-funds/jcrix.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 866-759-5679.

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund - Class C | FINANCIAL INVESTORS TRUST |

JCRCX | |

This annual shareholder report contains important information about ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund (the "Fund" or "JCRCX") for the period of November 1, 2023 to October 31, 2024 (the "Period"). You can find additional information about the Fund at https://www.alpsfunds.com/mutual-funds/jcrix. You can also request this information by contacting us at 866-759-5679.

This report describes changes to the Fund that occurred during the reporting period.

The ALPS | CoreCommodity Management Complete Commodities® Strategy Fund Class C shares, net of fees, returned -0.31% at net asset value (NAV) for the 12 months ending October 31, 2024. The Fund outperformed the Bloomberg Commodity Total Return Index (the "BCOM") by 0.87% over the period.

Top Contributors to relative performance

Within the energy sector, the Fund's deferred positioning in natural gas and exposure to energy equities was additive to relative performance.

Within the industrial metals sector, an overweight to copper, aluminum, and zinc and the inclusion of industrial metals equities was additive to relative performance.

Within agriculture, an underweight to staple crops (corn, soybeans, wheat) and the inclusion of agriculture equities was additive to relative performance.

Detractors from relative performance

Within precious metals, an underweight to gold detracted from relative performance.

Within livestock, an underweight to each constituent and deferred positioning in lean hogs and live cattle detracted from relative performance.

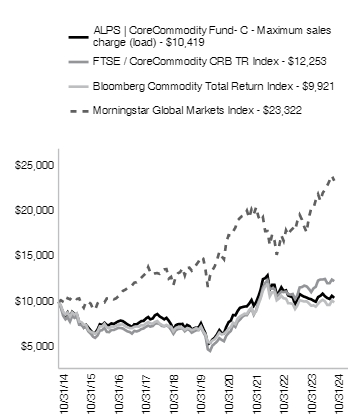

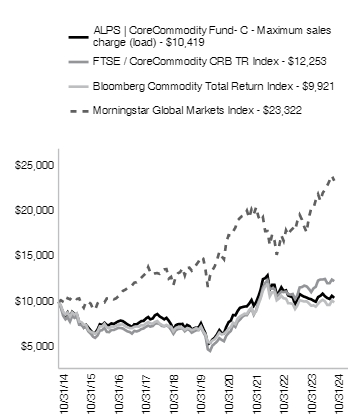

The Fund's past performance is not a good predictor of the Fund's future performance. The chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or sale of Fund shares.

| 10/31/2014 | 10000 | 10000 | 10000 | 10000 |

| 11/30/2014 | 9457 | 9353 | 9593 | 10155 |

| 12/31/2014 | 8775 | 8456 | 8861 | 9983 |

| 01/31/2015 | 8466 | 8047 | 8566 | 9841 |

| 02/28/2015 | 8818 | 8240 | 8786 | 10379 |

| 03/31/2015 | 8285 | 7791 | 8335 | 10246 |

| 04/30/2015 | 8871 | 8439 | 8813 | 10530 |

| 05/31/2015 | 8637 | 8207 | 8575 | 10531 |

| 06/30/2015 | 8594 | 8354 | 8723 | 10293 |

| 07/31/2015 | 7764 | 7450 | 7797 | 10359 |

| 08/31/2015 | 7625 | 7433 | 7725 | 9670 |

| 09/30/2015 | 7167 | 7127 | 7461 | 9322 |

| 10/31/2015 | 7433 | 7195 | 7428 | 10030 |

| 11/30/2015 | 7135 | 6714 | 6889 | 9959 |

| 12/31/2015 | 6816 | 6481 | 6676 | 9780 |

| 01/31/2016 | 6539 | 6136 | 6564 | 9176 |

| 02/29/2016 | 6550 | 6008 | 6457 | 9126 |

| 03/31/2016 | 6933 | 6279 | 6704 | 9812 |

| 04/30/2016 | 7508 | 6799 | 7275 | 9967 |

| 05/31/2016 | 7433 | 6857 | 7261 | 9982 |

| 06/30/2016 | 7668 | 7095 | 7561 | 9913 |

| 07/31/2016 | 7423 | 6671 | 7175 | 10353 |

| 08/31/2016 | 7401 | 6643 | 7048 | 10383 |

| 09/30/2016 | 7604 | 6870 | 7269 | 10449 |

| 10/31/2016 | 7529 | 6871 | 7233 | 10255 |

| 11/30/2016 | 7689 | 6985 | 7330 | 10356 |

| 12/31/2016 | 7827 | 7106 | 7462 | 10584 |

| 01/31/2017 | 7913 | 7092 | 7472 | 10868 |

| 02/28/2017 | 7849 | 7043 | 7488 | 11168 |

| 03/31/2017 | 7678 | 6872 | 7289 | 11298 |

| 04/30/2017 | 7497 | 6723 | 7179 | 11477 |

| 05/31/2017 | 7359 | 6656 | 7083 | 11719 |

| 06/30/2017 | 7199 | 6476 | 7070 | 11780 |

| 07/31/2017 | 7508 | 6774 | 7230 | 12096 |

| 08/31/2017 | 7487 | 6713 | 7259 | 12138 |

| 09/30/2017 | 7678 | 6802 | 7248 | 12389 |

| 10/31/2017 | 7849 | 6975 | 7403 | 12643 |

| 11/30/2017 | 7881 | 7042 | 7369 | 12896 |

| 12/31/2017 | 8138 | 7224 | 7589 | 13110 |

| 01/31/2018 | 8302 | 7365 | 7740 | 13814 |

| 02/28/2018 | 8051 | 7246 | 7606 | 13241 |

| 03/31/2018 | 8138 | 7309 | 7559 | 12982 |

| 04/30/2018 | 8488 | 7568 | 7754 | 13113 |

| 05/31/2018 | 8630 | 7612 | 7864 | 13145 |

| 06/30/2018 | 8378 | 7532 | 7589 | 13063 |

| 07/31/2018 | 8225 | 7324 | 7427 | 13431 |

| 08/31/2018 | 8051 | 7278 | 7296 | 13555 |

| 09/30/2018 | 8214 | 7373 | 7435 | 13589 |

| 10/31/2018 | 7887 | 7230 | 7275 | 12538 |

| 11/30/2018 | 7494 | 6894 | 7234 | 12728 |

| 12/31/2018 | 6913 | 6454 | 6736 | 11822 |

| 01/31/2019 | 7397 | 6842 | 7103 | 12771 |

| 02/28/2019 | 7510 | 6974 | 7174 | 13118 |

| 03/31/2019 | 7521 | 7026 | 7162 | 13256 |

| 04/30/2019 | 7544 | 7060 | 7131 | 13693 |

| 05/31/2019 | 7093 | 6733 | 6892 | 12890 |

| 06/30/2019 | 7431 | 6963 | 7077 | 13711 |

| 07/31/2019 | 7307 | 6880 | 7029 | 13745 |

| 08/31/2019 | 6936 | 6576 | 6866 | 13411 |

| 09/30/2019 | 7060 | 6725 | 6947 | 13692 |

| 10/31/2019 | 7150 | 6849 | 7087 | 14077 |

| 11/30/2019 | 7150 | 6849 | 6906 | 14424 |

| 12/31/2019 | 7621 | 7213 | 7254 | 14924 |

| 01/31/2020 | 7019 | 6621 | 6720 | 14736 |

| 02/29/2020 | 6485 | 6206 | 6382 | 13530 |

| 03/31/2020 | 5304 | 4742 | 5564 | 11608 |

| 04/30/2020 | 5463 | 4564 | 5479 | 12870 |

| 05/31/2020 | 5815 | 5151 | 5716 | 13471 |

| 06/30/2020 | 6020 | 5375 | 5847 | 13886 |

| 07/31/2020 | 6394 | 5598 | 6180 | 14594 |

| 08/31/2020 | 6860 | 5969 | 6598 | 15479 |

| 09/30/2020 | 6553 | 5787 | 6377 | 14998 |

| 10/31/2020 | 6508 | 5640 | 6467 | 14670 |

| 11/30/2020 | 7212 | 6238 | 6694 | 16519 |

| 12/31/2020 | 7729 | 6540 | 7027 | 17323 |

| 01/31/2021 | 7923 | 6790 | 7212 | 17269 |

| 02/28/2021 | 8515 | 7423 | 7678 | 17716 |

| 03/31/2021 | 8492 | 7210 | 7514 | 18166 |

| 04/30/2021 | 8959 | 7787 | 8136 | 18952 |

| 05/31/2021 | 9323 | 8018 | 8359 | 19232 |

| 06/30/2021 | 9391 | 8319 | 8513 | 19446 |

| 07/31/2021 | 9459 | 8502 | 8670 | 19542 |

| 08/31/2021 | 9482 | 8506 | 8644 | 20031 |

| 09/30/2021 | 9778 | 8925 | 9074 | 19239 |

| 10/31/2021 | 10176 | 9267 | 9309 | 20162 |

| 11/30/2021 | 9550 | 8546 | 8628 | 19618 |

| 12/31/2021 | 9949 | 9061 | 8932 | 20406 |

| 01/31/2022 | 10601 | 9949 | 9717 | 19344 |

| 02/28/2022 | 11297 | 10496 | 10322 | 18911 |

| 03/31/2022 | 12475 | 11519 | 11214 | 19294 |

| 04/30/2022 | 12588 | 12037 | 11678 | 17773 |

| 05/31/2022 | 12886 | 12370 | 11857 | 17778 |

| 06/30/2022 | 11339 | 11392 | 10579 | 16244 |

| 07/31/2022 | 11850 | 11447 | 11030 | 17386 |

| 08/31/2022 | 11850 | 11410 | 11040 | 16773 |

| 09/30/2022 | 10757 | 10569 | 10145 | 15158 |

| 10/31/2022 | 11070 | 10832 | 10347 | 16070 |

| 11/30/2022 | 11581 | 11093 | 10630 | 17312 |

| 12/31/2022 | 11155 | 11053 | 10370 | 16696 |

| 01/31/2023 | 11247 | 11111 | 10319 | 17867 |

| 02/28/2023 | 10682 | 10821 | 9834 | 17369 |

| 03/31/2023 | 10575 | 10781 | 9814 | 17810 |

| 04/30/2023 | 10468 | 10840 | 9740 | 18052 |

| 05/31/2023 | 9734 | 10310 | 9191 | 17833 |

| 06/30/2023 | 10147 | 10687 | 9562 | 18864 |

| 07/31/2023 | 10834 | 11563 | 10161 | 19574 |

| 08/31/2023 | 10666 | 11605 | 10083 | 19024 |

| 09/30/2023 | 10544 | 11764 | 10013 | 18243 |

| 10/31/2023 | 10452 | 11680 | 10039 | 17647 |

| 11/30/2023 | 10330 | 11418 | 9813 | 19273 |

| 12/31/2023 | 10261 | 11056 | 9549 | 20258 |

| 01/31/2024 | 10103 | 11471 | 9587 | 20330 |

| 02/29/2024 | 9992 | 11632 | 9446 | 21177 |

| 03/31/2024 | 10499 | 12326 | 9759 | 21841 |

| 04/30/2024 | 10641 | 12436 | 10022 | 21116 |

| 05/31/2024 | 10879 | 12437 | 10197 | 21957 |

| 06/30/2024 | 10594 | 12501 | 10040 | 22372 |

| 07/31/2024 | 10404 | 12028 | 9635 | 22806 |

| 08/31/2024 | 10293 | 12031 | 9640 | 23345 |

| 09/30/2024 | 10641 | 12427 | 10108 | 23884 |

| 10/31/2024 | 10419 | 12253 | 9921 | 23322 |

| ALPS | CoreCommodity Fund - Class C - NAV | -0.31% | 7.82% | 0.41% |

| ALPS | CoreCommodity Fund - Class C - Maximim deferred sales charge** | -1.28% | 7.82% | 0.41% |

| Morningstar Global Markets Index# | 32.16% | 10.63% | 8.84% |

| Bloomberg Commodity Total Return Index | -1.18% | 6.96% | -0.08% |

| FTSE / CoreCommodity CRB TR Index | 4.91% | 12.34% | 2.05% |

For the most current month-end performance data, please call 1-866-759-5679.

| Net Assets | $940,528,649 |

| Number of Portfolio Holdings | 55 |

| Portfolio Turnover Rate | 72% |

| Total Advisory Fees Paid | $9,426,269 |

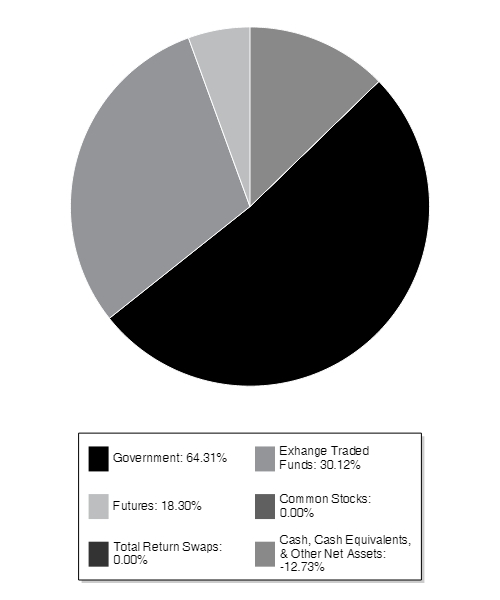

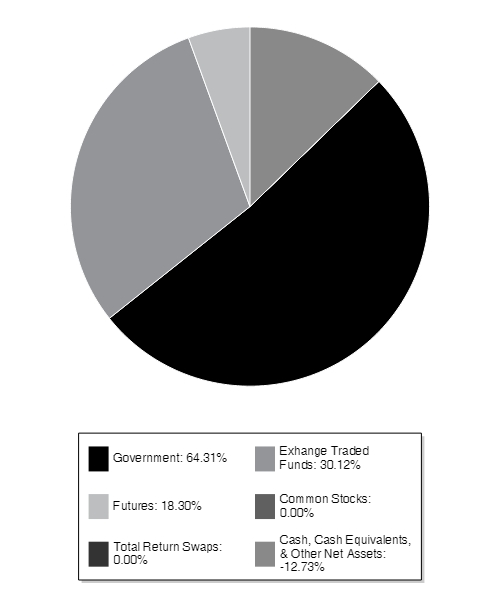

| Government | 64.31% |

| Exhange Traded Funds | 30.12% |

| Futures | 18.30% |

| Common Stocks | 0.00% |

| Total Return Swaps | 0.00% |

| Cash, Cash Equivalents, & Other Net Assets | -12.73% |

| |

** | As a percentage of net assets. |

Holdings are subject to change

This is a summary of certain changes to the Fund since April 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://www.alpsfunds.com/mutual-funds/jcrix or upon request at 866-759-5679.

Change to Principal Investment Strategy and Principal Risks: With respect to the Commodity Equity Investments portion of its portfolio, the Fund will now invest primarily through underlying exhange-traded funds (ETFs) as oppossed to making such investments directly. The following are now Principal Risks of the Fund: Affiliated ETF Risk and ETF Investment Risk.

If you wish to view additional information about the Fund, including but not limited to the Fund's prospectus, financial information, holdings, and proxy voting information, please visit https://www.alpsfunds.com/mutual-funds/jcrix.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 866-759-5679.

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund - Class I | FINANCIAL INVESTORS TRUST |

JCRIX | |

This annual shareholder report contains important information about ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund (the "Fund" or "JCRIX") for the period of November 1, 2023 to October 31, 2024 (the "Period"). You can find additional information about the Fund at https://www.alpsfunds.com/mutual-funds/jcrix. You can also request this information by contacting us at 866-759-5679.

This report describes changes to the Fund that occurred during the reporting period.

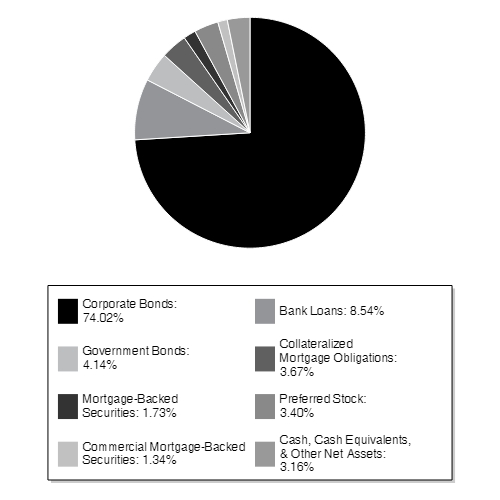

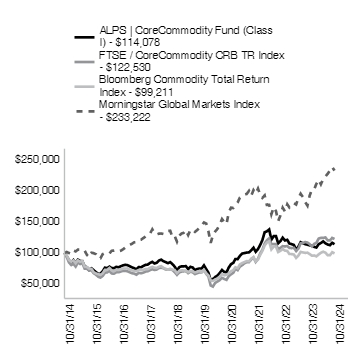

The ALPS | CoreCommodity Management Complete Commodities® Strategy Fund Class I shares, net of fees, returned 0.67% at net asset value (NAV) for the 12 months ending October 31, 2024. The Fund outperformed the Bloomberg Commodity Total Return Index (the "BCOM") by 1.85% over the period.

Top Contributors to relative performance

Within the energy sector, the Fund's deferred positioning in natural gas and exposure to energy equities was additive to relative performance.

Within the industrial metals sector, an overweight to copper, aluminum, and zinc and the inclusion of industrial metals equities was additive to relative performance.

Within agriculture, an underweight to staple crops (corn, soybeans, wheat) and the inclusion of agriculture equities was additive to relative performance.

Detractors from relative performance

Within precious metals, an underweight to gold detracted from relative performance.

Within livestock, an underweight to each constituent and deferred positioning in lean hogs and live cattle detracted from relative performance.

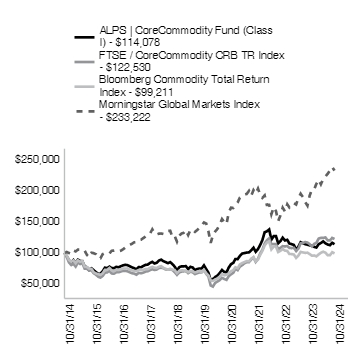

The Fund's past performance is not a good predictor of the Fund's future performance. The chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or sale of Fund shares.

| 10/31/2014 | 100000 | 100000 | 100000 | 100000 |

| 11/30/2014 | 94671 | 93533 | 95930 | 101553 |

| 12/31/2014 | 87932 | 84557 | 88613 | 99834 |

| 01/31/2015 | 84885 | 80471 | 85657 | 98406 |

| 02/28/2015 | 88457 | 82400 | 87863 | 103793 |

| 03/31/2015 | 83204 | 77907 | 83350 | 102459 |

| 04/30/2015 | 89088 | 84392 | 88128 | 105299 |

| 05/31/2015 | 86881 | 82074 | 85750 | 105310 |

| 06/30/2015 | 86461 | 83541 | 87230 | 102934 |

| 07/31/2015 | 78267 | 74499 | 77969 | 103594 |

| 08/31/2015 | 76796 | 74327 | 77252 | 96701 |

| 09/30/2015 | 72279 | 71268 | 74612 | 93221 |

| 10/31/2015 | 75115 | 71946 | 74279 | 100304 |

| 11/30/2015 | 72068 | 67145 | 68889 | 99595 |

| 12/31/2015 | 68917 | 64808 | 66764 | 97795 |

| 01/31/2016 | 66080 | 61364 | 65642 | 91764 |

| 02/29/2016 | 66395 | 60080 | 64575 | 91263 |

| 03/31/2016 | 70283 | 62787 | 67042 | 98119 |

| 04/30/2016 | 76166 | 67988 | 72748 | 99665 |

| 05/31/2016 | 75430 | 68572 | 72613 | 99821 |

| 06/30/2016 | 77847 | 70952 | 75612 | 99125 |

| 07/31/2016 | 75430 | 66712 | 71748 | 103531 |

| 08/31/2016 | 75220 | 66433 | 70483 | 103825 |

| 09/30/2016 | 77426 | 68704 | 72689 | 104489 |

| 10/31/2016 | 76796 | 68707 | 72335 | 102554 |

| 11/30/2016 | 78372 | 69852 | 73300 | 103562 |

| 12/31/2016 | 79920 | 71062 | 74620 | 105835 |

| 01/31/2017 | 80761 | 70919 | 74722 | 108675 |

| 02/28/2017 | 80236 | 70428 | 74878 | 111675 |

| 03/31/2017 | 78553 | 68718 | 72887 | 112980 |

| 04/30/2017 | 76765 | 67225 | 71786 | 114771 |

| 05/31/2017 | 75293 | 66558 | 70833 | 117186 |

| 06/30/2017 | 73716 | 64760 | 70698 | 117797 |

| 07/31/2017 | 77081 | 67739 | 72297 | 120959 |

| 08/31/2017 | 76765 | 67134 | 72588 | 121377 |

| 09/30/2017 | 78868 | 68021 | 72478 | 123887 |

| 10/31/2017 | 80656 | 69745 | 74034 | 126432 |

| 11/30/2017 | 81077 | 70420 | 73693 | 128958 |

| 12/31/2017 | 83740 | 72243 | 75894 | 131098 |

| 01/31/2018 | 85575 | 73648 | 77400 | 138141 |

| 02/28/2018 | 82985 | 72456 | 76063 | 132413 |

| 03/31/2018 | 83956 | 73087 | 75590 | 129819 |

| 04/30/2018 | 87625 | 75680 | 77543 | 131126 |

| 05/31/2018 | 89136 | 76124 | 78640 | 131452 |

| 06/30/2018 | 86654 | 75317 | 75890 | 130629 |

| 07/31/2018 | 85143 | 73245 | 74270 | 134310 |

| 08/31/2018 | 83417 | 72779 | 72959 | 135551 |

| 09/30/2018 | 85143 | 73733 | 74355 | 135892 |

| 10/31/2018 | 81798 | 72298 | 72752 | 125385 |

| 11/30/2018 | 77805 | 68938 | 72339 | 127278 |

| 12/31/2018 | 71747 | 64544 | 67358 | 118224 |

| 01/31/2019 | 76975 | 68425 | 71027 | 127710 |

| 02/28/2019 | 78198 | 69738 | 71744 | 131181 |

| 03/31/2019 | 78309 | 70259 | 71618 | 132558 |

| 04/30/2019 | 78643 | 70600 | 71314 | 136926 |

| 05/31/2019 | 73971 | 67332 | 68919 | 128898 |

| 06/30/2019 | 77531 | 69632 | 70766 | 137115 |

| 07/31/2019 | 76418 | 68799 | 70294 | 137452 |

| 08/31/2019 | 72525 | 65758 | 68661 | 134112 |

| 09/30/2019 | 73860 | 67255 | 69467 | 136924 |

| 10/31/2019 | 74861 | 68495 | 70871 | 140767 |

| 11/30/2019 | 74861 | 68487 | 69058 | 144242 |

| 12/31/2019 | 79858 | 72130 | 72537 | 149241 |

| 01/31/2020 | 73680 | 66206 | 67202 | 147359 |

| 02/29/2020 | 68064 | 62057 | 63816 | 135296 |

| 03/31/2020 | 55709 | 47425 | 55643 | 116084 |

| 04/30/2020 | 57506 | 45642 | 54787 | 128697 |

| 05/31/2020 | 61101 | 51508 | 57161 | 134715 |

| 06/30/2020 | 63347 | 53745 | 58468 | 138859 |

| 07/31/2020 | 67390 | 55983 | 61804 | 145941 |

| 08/31/2020 | 72445 | 59695 | 65983 | 154789 |

| 09/30/2020 | 69187 | 57868 | 63774 | 149985 |

| 10/31/2020 | 68738 | 56401 | 64672 | 146700 |

| 11/30/2020 | 76263 | 62380 | 66945 | 165192 |

| 12/31/2020 | 81830 | 65399 | 70272 | 173225 |

| 01/31/2021 | 83971 | 67900 | 72120 | 172692 |

| 02/28/2021 | 90171 | 74232 | 76784 | 177156 |

| 03/31/2021 | 90058 | 72100 | 75135 | 181659 |

| 04/30/2021 | 95130 | 77870 | 81364 | 189522 |

| 05/31/2021 | 98962 | 80185 | 83586 | 192315 |

| 06/30/2021 | 99751 | 83185 | 85134 | 194458 |

| 07/31/2021 | 100540 | 85016 | 86699 | 195420 |

| 08/31/2021 | 100878 | 85056 | 86441 | 200309 |

| 09/30/2021 | 104147 | 89252 | 90743 | 192386 |

| 10/31/2021 | 108430 | 92675 | 93088 | 201615 |

| 11/30/2021 | 101893 | 85463 | 86281 | 196182 |

| 12/31/2021 | 106249 | 90610 | 89322 | 204059 |

| 01/31/2022 | 113305 | 99490 | 97166 | 193437 |

| 02/28/2022 | 120637 | 104959 | 103218 | 189105 |

| 03/31/2022 | 133504 | 115190 | 112142 | 192938 |

| 04/30/2022 | 134887 | 120369 | 116785 | 177726 |

| 05/31/2022 | 137931 | 123703 | 118569 | 177782 |

| 06/30/2022 | 121468 | 113920 | 105790 | 162438 |

| 07/31/2022 | 127140 | 114474 | 110303 | 173861 |

| 08/31/2022 | 127278 | 114100 | 110400 | 167730 |

| 09/30/2022 | 115519 | 105686 | 101447 | 151581 |

| 10/31/2022 | 119116 | 108323 | 103467 | 160700 |

| 11/30/2022 | 124649 | 110931 | 106301 | 173116 |

| 12/31/2022 | 120132 | 110531 | 103699 | 166960 |

| 01/31/2023 | 121168 | 111114 | 103188 | 178666 |

| 02/28/2023 | 115243 | 108213 | 98343 | 173693 |

| 03/31/2023 | 114206 | 107806 | 98140 | 178099 |

| 04/30/2023 | 113021 | 108396 | 97402 | 180518 |

| 05/31/2023 | 105319 | 103100 | 91911 | 178330 |

| 06/30/2023 | 109763 | 106874 | 95622 | 188640 |

| 07/31/2023 | 117317 | 115630 | 101607 | 195744 |

| 08/31/2023 | 115688 | 116052 | 100827 | 190240 |

| 09/30/2023 | 114206 | 117640 | 100127 | 182426 |

| 10/31/2023 | 113318 | 116800 | 100392 | 176469 |

| 11/30/2023 | 112281 | 114185 | 98132 | 192728 |

| 12/31/2023 | 111475 | 110557 | 95492 | 202580 |

| 01/31/2024 | 109791 | 114709 | 95871 | 203299 |

| 02/29/2024 | 108719 | 116323 | 94463 | 211773 |

| 03/31/2024 | 114231 | 123259 | 97588 | 218414 |

| 04/30/2024 | 116069 | 124360 | 100215 | 211162 |

| 05/31/2024 | 118672 | 124367 | 101974 | 219573 |

| 06/30/2024 | 115609 | 125013 | 100405 | 223723 |

| 07/31/2024 | 113619 | 120277 | 96352 | 228057 |

| 08/31/2024 | 112547 | 120314 | 96398 | 233446 |

| 09/30/2024 | 116375 | 124268 | 101084 | 238845 |

| 10/31/2024 | 114078 | 122530 | 99211 | 233222 |

| ALPS | CoreCommodity Fund - Class I - NAV | 0.67% | 8.79% | 1.33% |

| Morningstar Global Markets Index# | 32.16% | 10.63% | 8.84% |

| Bloomberg Commodity Total Return Index | -1.18% | 6.96% | -0.08% |

| FTSE / CoreCommodity CRB TR Index | 4.91% | 12.34% | 2.05% |

For the most current month-end performance data, please call 1-866-759-5679.

| Net Assets | $940,528,649 |

| Number of Portfolio Holdings | 55 |

| Portfolio Turnover Rate | 72% |

| Total Advisory Fees Paid | $9,426,269 |

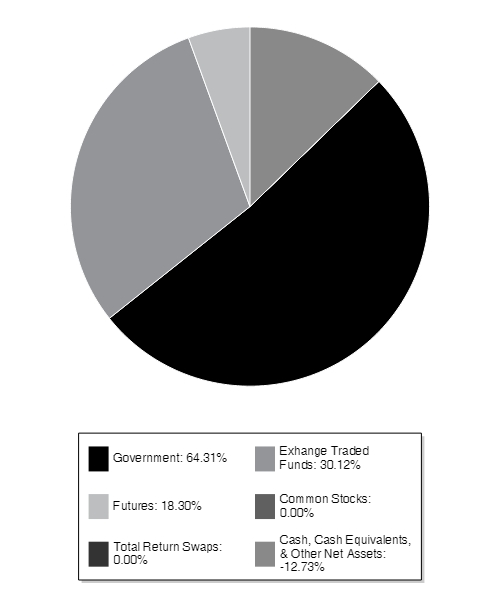

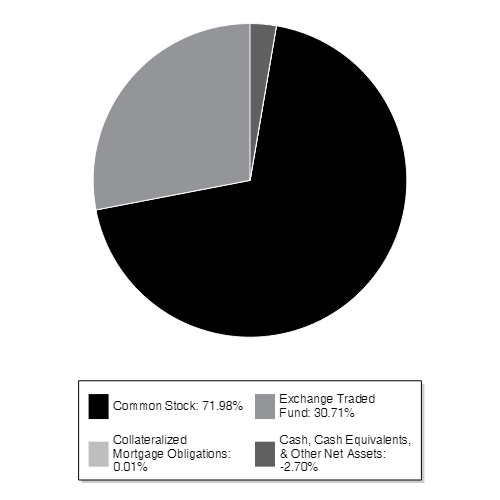

| Government | 64.31% |

| Exhange Traded Funds | 30.12% |

| Futures | 18.30% |

| Common Stocks | 0.00% |

| Total Return Swaps | 0.00% |

| Cash, Cash Equivalents, & Other Net Assets | -12.73% |

| |

** | As a percentage of net assets. |

Holdings are subject to change

This is a summary of certain changes to the Fund since April 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://www.alpsfunds.com/mutual-funds/jcrix or upon request at 866-759-5679.

Change to Principal Investment Strategy and Principal Risks: With respect to the Commodity Equity Investments portion of its portfolio, the Fund will now invest primarily through underlying exhange-traded funds (ETFs) as oppossed to making such investments directly. The following are now Principal Risks of the Fund: Affiliated ETF Risk and ETF Investment Risk.

If you wish to view additional information about the Fund, including but not limited to the Fund's prospectus, financial information, holdings, and proxy voting information, please visit https://www.alpsfunds.com/mutual-funds/jcrix.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 866-759-5679.

ALPS | Kotak India ESG Fund - Investor Shares | FINANCIAL INVESTORS TRUST |

INDAX | |

This annual shareholder report contains important information about ALPS | Kotak India ESG Fund (the "Fund" or "INDAX") for the period of November 1, 2023 to October 31, 2024 (the "Period"). You can find additional information about the Fund at https://www.alpsfunds.com/mutual-funds/indix. You can also request this information by contacting us at 866-759-5679.

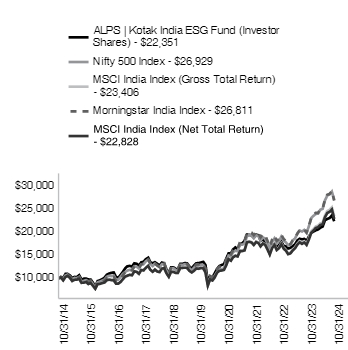

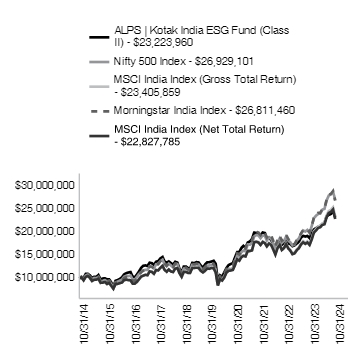

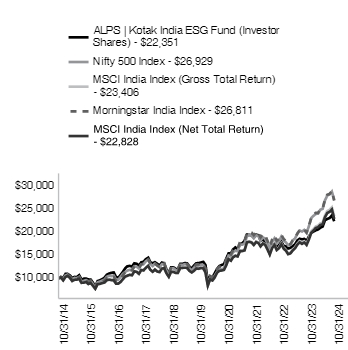

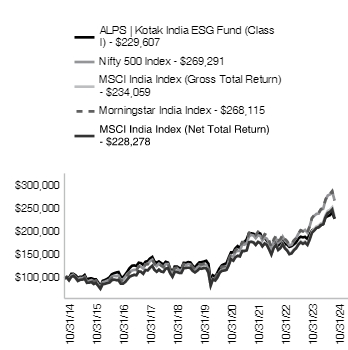

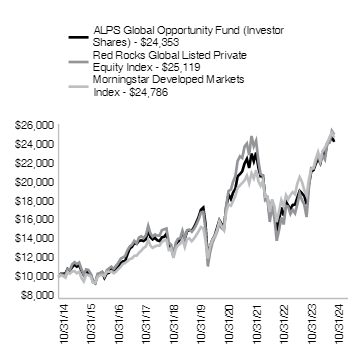

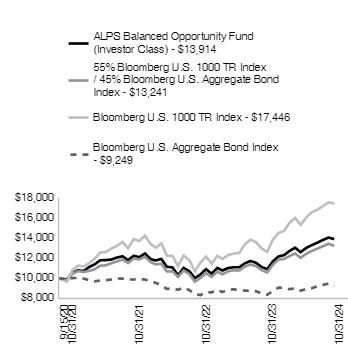

For the twelve months ended October 31, 2024, the ALPS | Kotak India ESG Fund Investor Class shares increased by 23.87%. The Fund underperformed the MSCI India Index -net of fees, which was up 32.69%.

Geopolitical concerns, US elections outcome, China recovery and earnings moderation in India corporations led global equity markets to correct from highs in October 2024, which also impacted the Fund's performance.

Top 5 additions to the Fund: Cognizant Technology, Ultratech Cement, Uno Minda, Thermax and Ashok Leyland

Top 5 exits from the Fund: Infosys, Hindustan Unilever, Persistent Systems, Maruti Suzuki India and Bajaj Finance

What contributed and detracted to/from performance?

Top contributors to relative performance

Top detractors from relative performance

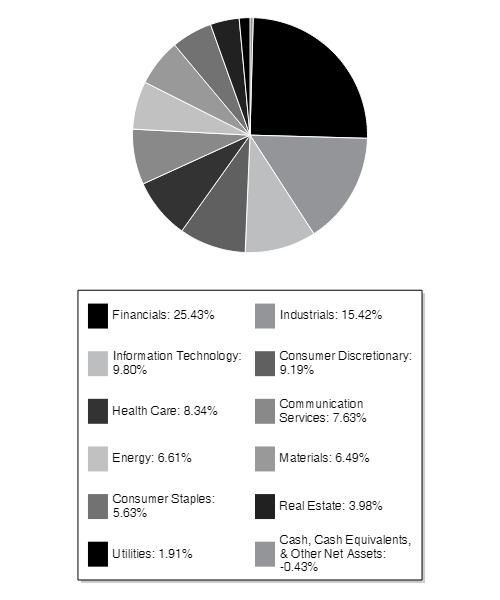

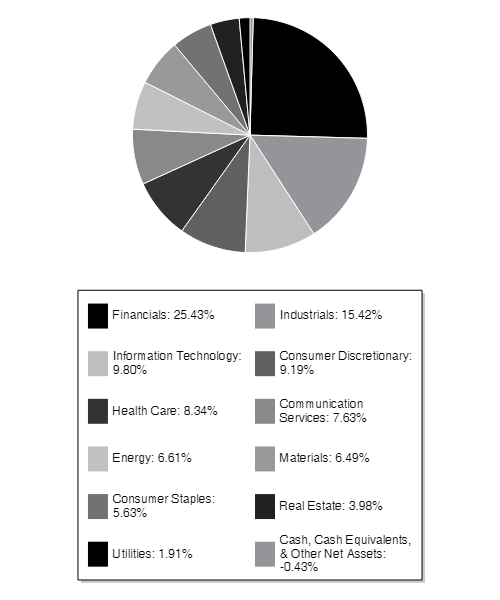

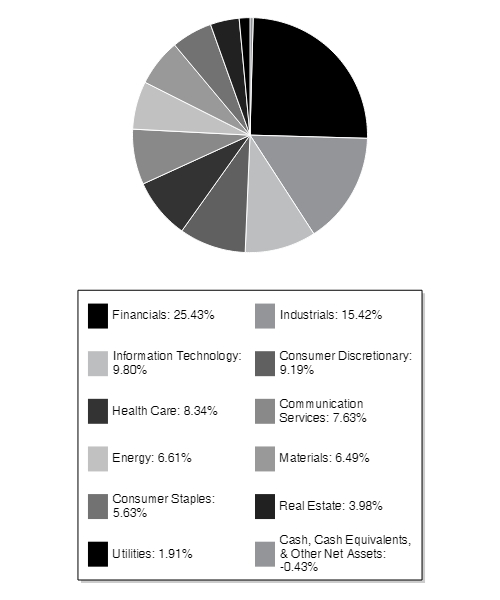

There were notable reductions in the Fund's holdings within the Financials, Information Technology, and Consumer Staples sectors and an increase in the Fund's holdings within the Industrials, Communication Services, and Real Estate Sectors.

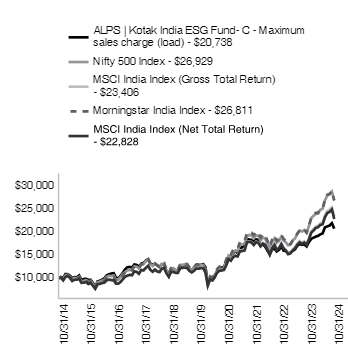

The Fund's past performance is not a good predictor of the Fund's future performance. The chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or sale of Fund shares.

| 10/31/2014 | 10000 | 10000 | 10000 | 10000 | 10000 |

| 11/30/2014 | 10295 | 10207 | 10160 | 10214 | 10160 |

| 12/31/2014 | 10053 | 9845 | 9555 | 9760 | 9555 |

| 01/31/2015 | 10938 | 10611 | 10313 | 10524 | 10313 |

| 02/28/2015 | 10938 | 10793 | 10505 | 10661 | 10505 |

| 03/31/2015 | 10599 | 10311 | 10070 | 10258 | 10070 |

| 04/30/2015 | 10045 | 9769 | 9412 | 9717 | 9412 |

| 05/31/2015 | 10290 | 10071 | 9678 | 10014 | 9678 |

| 06/30/2015 | 10251 | 10024 | 9706 | 9991 | 9706 |

| 07/31/2015 | 10662 | 10299 | 9879 | 10218 | 9879 |

| 08/31/2015 | 9682 | 9323 | 9011 | 9272 | 9011 |

| 09/30/2015 | 9903 | 9425 | 9052 | 9332 | 9052 |

| 10/31/2015 | 9927 | 9601 | 9194 | 9553 | 9194 |

| 11/30/2015 | 9745 | 9347 | 8755 | 9204 | 8755 |

| 12/31/2015 | 9712 | 9449 | 8970 | 9405 | 8969 |

| 01/31/2016 | 9009 | 8695 | 8352 | 8679 | 8352 |

| 02/29/2016 | 8150 | 7966 | 7734 | 7960 | 7734 |

| 03/31/2016 | 9393 | 9117 | 8746 | 9052 | 8746 |

| 04/30/2016 | 9539 | 9272 | 8787 | 9167 | 8787 |

| 05/31/2016 | 9795 | 9488 | 8952 | 9294 | 8952 |

| 06/30/2016 | 10105 | 9704 | 9071 | 9484 | 9071 |

| 07/31/2016 | 10754 | 10320 | 9586 | 10055 | 9586 |

| 08/31/2016 | 11010 | 10535 | 9697 | 10249 | 9697 |

| 09/30/2016 | 11165 | 10459 | 9608 | 10209 | 9608 |

| 10/31/2016 | 11257 | 10590 | 9561 | 10283 | 9561 |

| 11/30/2016 | 10279 | 9744 | 8848 | 9509 | 8848 |

| 12/31/2016 | 10114 | 9693 | 8841 | 9460 | 8841 |

| 01/31/2017 | 10743 | 10316 | 9226 | 9948 | 9226 |

| 02/28/2017 | 11345 | 10925 | 9770 | 10602 | 9770 |

| 03/31/2017 | 12122 | 11351 | 10355 | 11288 | 10355 |

| 04/30/2017 | 12594 | 11668 | 10554 | 11641 | 10554 |

| 05/31/2017 | 12668 | 11824 | 10740 | 11738 | 10740 |

| 06/30/2017 | 12539 | 11810 | 10656 | 11714 | 10656 |

| 07/31/2017 | 13233 | 12582 | 11477 | 12525 | 11477 |

| 08/31/2017 | 13131 | 12492 | 11391 | 12487 | 11390 |

| 09/30/2017 | 12761 | 12106 | 10970 | 12106 | 10970 |

| 10/31/2017 | 13446 | 13030 | 11779 | 13031 | 11779 |

| 11/30/2017 | 13575 | 13057 | 11696 | 13060 | 11696 |

| 12/31/2017 | 14133 | 13689 | 12267 | 13709 | 12267 |

| 01/31/2018 | 14448 | 14027 | 12690 | 14060 | 12690 |

| 02/28/2018 | 13495 | 13111 | 11839 | 13182 | 11839 |

| 03/31/2018 | 13219 | 12640 | 11414 | 12688 | 11414 |

| 04/30/2018 | 13476 | 13167 | 11884 | 13231 | 11884 |

| 05/31/2018 | 13124 | 12766 | 11457 | 12737 | 11457 |

| 06/30/2018 | 12771 | 12363 | 11346 | 12455 | 11345 |

| 07/31/2018 | 13390 | 13057 | 12084 | 13173 | 12085 |

| 08/31/2018 | 13229 | 13059 | 12201 | 13276 | 12201 |

| 09/30/2018 | 11886 | 11638 | 11090 | 11839 | 11090 |

| 10/31/2018 | 11171 | 10957 | 10316 | 11094 | 10316 |

| 11/30/2018 | 12371 | 12109 | 11386 | 12219 | 11386 |

| 12/31/2018 | 12372 | 12190 | 11371 | 12268 | 11371 |

| 01/31/2019 | 12026 | 11754 | 11152 | 11918 | 11152 |

| 02/28/2019 | 11924 | 11713 | 11156 | 11885 | 11156 |

| 03/31/2019 | 13135 | 12914 | 12185 | 13057 | 12185 |

| 04/30/2019 | 13104 | 12865 | 12253 | 13025 | 12254 |

| 05/31/2019 | 13287 | 13053 | 12280 | 13137 | 12280 |

| 06/30/2019 | 13236 | 12981 | 12246 | 13081 | 12246 |

| 07/31/2019 | 12555 | 12200 | 11608 | 12404 | 11608 |

| 08/31/2019 | 12097 | 11685 | 11268 | 12010 | 11268 |

| 09/30/2019 | 12768 | 12308 | 11615 | 12458 | 11615 |

| 10/31/2019 | 13247 | 12713 | 12117 | 12996 | 12117 |

| 11/30/2019 | 13277 | 12753 | 12049 | 12983 | 12049 |

| 12/31/2019 | 13411 | 12929 | 12233 | 13162 | 12233 |

| 01/31/2020 | 13545 | 12855 | 12136 | 13132 | 12136 |

| 02/29/2020 | 12885 | 11905 | 11253 | 12178 | 11253 |

| 03/31/2020 | 9277 | 8703 | 8425 | 8976 | 8425 |

| 04/30/2020 | 10452 | 9988 | 9785 | 10405 | 9785 |

| 05/31/2020 | 10143 | 9714 | 9516 | 10114 | 9513 |

| 06/30/2020 | 11071 | 10533 | 10164 | 10948 | 10159 |

| 07/31/2020 | 12009 | 11362 | 11231 | 11971 | 11214 |

| 08/31/2020 | 12648 | 12048 | 11627 | 12509 | 11606 |

| 09/30/2020 | 12865 | 11982 | 11700 | 12548 | 11678 |

| 10/31/2020 | 13050 | 12139 | 11840 | 12753 | 11809 |

| 11/30/2020 | 14246 | 13703 | 12865 | 14028 | 12828 |

| 12/31/2020 | 15380 | 14917 | 14177 | 15401 | 14135 |

| 01/31/2021 | 15380 | 14676 | 13848 | 15140 | 13806 |

| 02/28/2021 | 16215 | 15628 | 14577 | 16083 | 14528 |

| 03/31/2021 | 16679 | 15969 | 14911 | 16490 | 14858 |

| 04/30/2021 | 16287 | 15860 | 14775 | 16416 | 14720 |

| 05/31/2021 | 17380 | 17336 | 16063 | 17845 | 15867 |

| 06/30/2021 | 17575 | 17253 | 15956 | 17843 | 15885 |

| 07/31/2021 | 18101 | 17529 | 16106 | 18089 | 16022 |

| 08/31/2021 | 19451 | 19038 | 17870 | 19731 | 17775 |

| 09/30/2021 | 19390 | 19376 | 17983 | 20051 | 17882 |

| 10/31/2021 | 19276 | 19248 | 17845 | 19901 | 17739 |

| 11/30/2021 | 18823 | 18663 | 17307 | 19336 | 17201 |

| 12/31/2021 | 19438 | 19286 | 17956 | 20062 | 17843 |

| 01/31/2022 | 19308 | 19168 | 17712 | 19788 | 17599 |

| 02/28/2022 | 18143 | 18181 | 17009 | 18833 | 16895 |

| 03/31/2022 | 18361 | 18842 | 17632 | 19537 | 17512 |

| 04/30/2022 | 17806 | 18554 | 17339 | 19290 | 17219 |

| 05/31/2022 | 16891 | 17531 | 16341 | 18097 | 16216 |

| 06/30/2022 | 16010 | 16369 | 15248 | 16849 | 15122 |

| 07/31/2022 | 17240 | 17862 | 16678 | 18394 | 16532 |

| 08/31/2022 | 17414 | 18640 | 17372 | 19200 | 17211 |

| 09/30/2022 | 16772 | 17659 | 16277 | 18118 | 16105 |

| 10/31/2022 | 17174 | 18062 | 16701 | 18482 | 16518 |

| 11/30/2022 | 17925 | 19006 | 17574 | 19404 | 17375 |

| 12/31/2022 | 16983 | 18145 | 16612 | 18510 | 16424 |

| 01/31/2023 | 16916 | 17759 | 16120 | 17977 | 15933 |

| 02/28/2023 | 16430 | 17113 | 15388 | 17262 | 15205 |

| 03/31/2023 | 16585 | 17271 | 15568 | 17412 | 15381 |

| 04/30/2023 | 16950 | 18152 | 16219 | 18211 | 16022 |

| 05/31/2023 | 17348 | 18635 | 16699 | 18696 | 16489 |

| 06/30/2023 | 18177 | 19614 | 17493 | 19683 | 17263 |

| 07/31/2023 | 18553 | 20342 | 18021 | 20392 | 17778 |

| 08/31/2023 | 18409 | 20115 | 17687 | 20175 | 17440 |

| 09/30/2023 | 18520 | 20456 | 17994 | 20532 | 17732 |

| 10/31/2023 | 18044 | 19847 | 17463 | 19895 | 17204 |

| 11/30/2023 | 19039 | 21250 | 18637 | 21294 | 18354 |

| 12/31/2023 | 19831 | 23005 | 20149 | 23026 | 19841 |

| 01/31/2024 | 20120 | 23517 | 20636 | 23676 | 20320 |

| 02/29/2024 | 20375 | 23924 | 21209 | 24150 | 20876 |

| 03/31/2024 | 20559 | 23988 | 21382 | 24157 | 21046 |

| 04/30/2024 | 20929 | 24841 | 21878 | 24968 | 21533 |

| 05/31/2024 | 21184 | 25032 | 22044 | 25135 | 21686 |

| 06/30/2024 | 22570 | 26833 | 23596 | 26980 | 23194 |

| 07/31/2024 | 22836 | 27915 | 24541 | 28071 | 24116 |

| 08/31/2024 | 23033 | 28141 | 24812 | 28268 | 24369 |

| 09/30/2024 | 23610 | 28756 | 25344 | 28872 | 24884 |

| 10/31/2024 | 22351 | 26929 | 23406 | 26811 | 22828 |

| ALPS | Kotak India ESG Fund - Investor - NAV | 23.87% | 11.03% | 8.38% |

| MSCI India Index (Net Total Return)#*** | 32.69% | 13.50% | 8.60% |

| Morningstar India Index | 34.76% | 15.59% | 10.37% |

| MSCI India Index (Gross Total Return)**** | 34.03% | 14.07% | 8.88% |

| Nifty 500 Index | 35.69% | 16.20% | 10.41% |

For the most current month-end performance data, please call 1-866-759-5679.

| Net Assets | $396,576,901 |

| Number of Portfolio Holdings | 42 |

| Portfolio Turnover Rate | 75% |

| Total Advisory Fees Paid | $2,056,987 |

| ICICI Bank, Ltd. | 8.76% |

| Reliance Industries, Ltd. | 6.61% |

| Axis Bank, Ltd. | 6.13% |

| HDFC Bank, Ltd. | 4.86% |

| Larsen & Toubro, Ltd. | 4.72% |

| Bharti Airtel, Ltd. | 4.48% |

| Cognizant Technology Solutions Corp. | 3.79% |

| Fortis Healthcare, Ltd. | 3.26% |

| Infosys, Ltd. | 3.22% |

| UltraTech Cement, Ltd. | 3.05% |

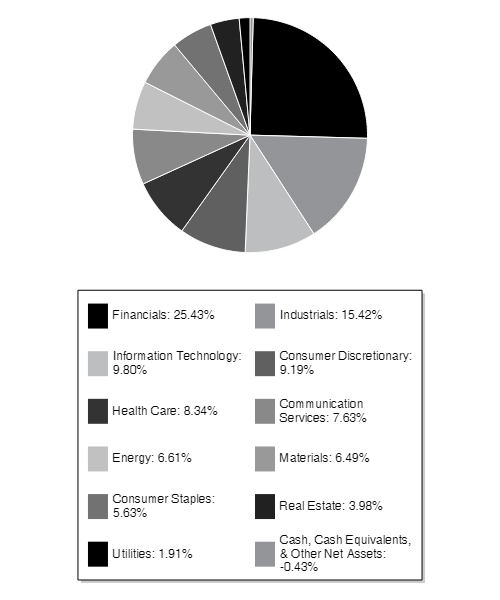

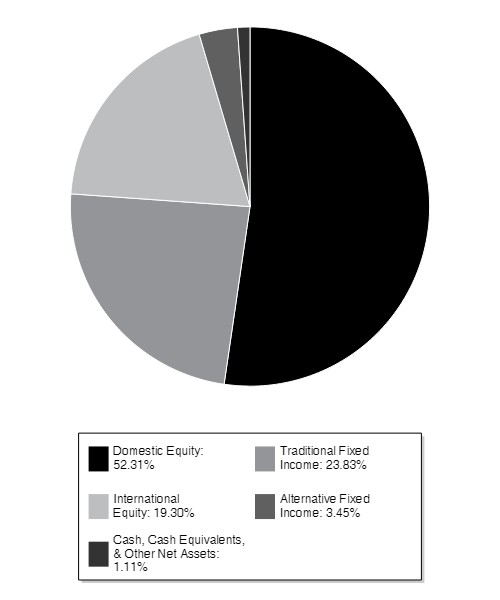

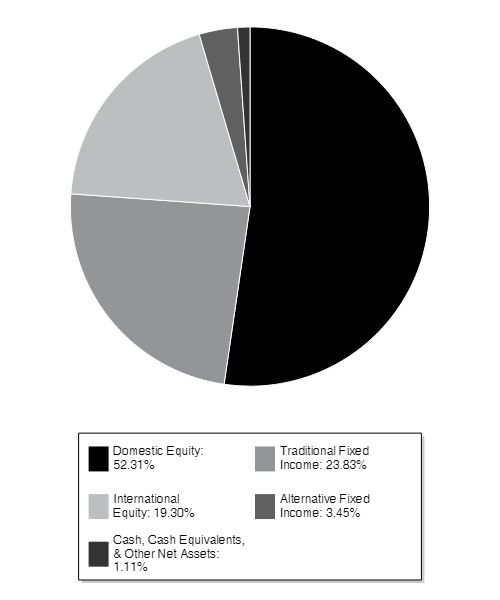

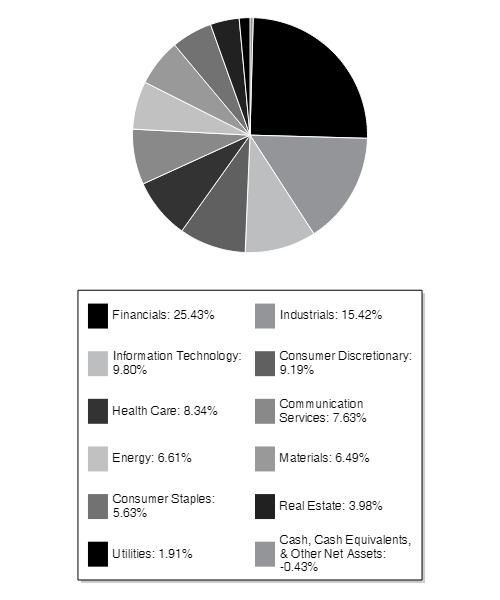

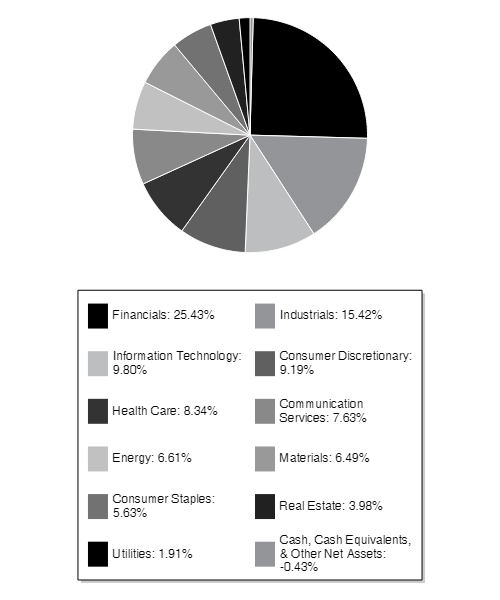

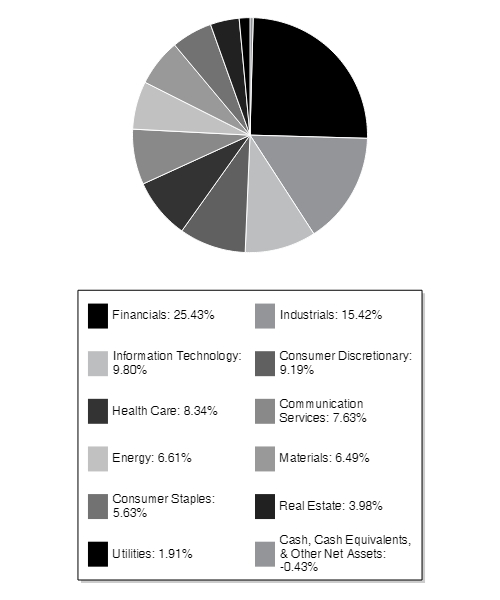

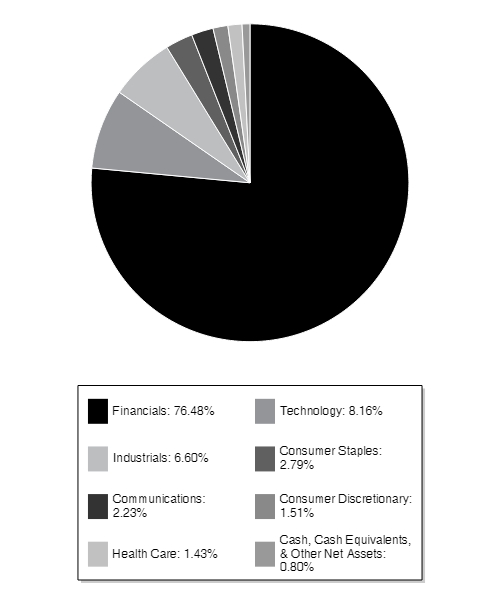

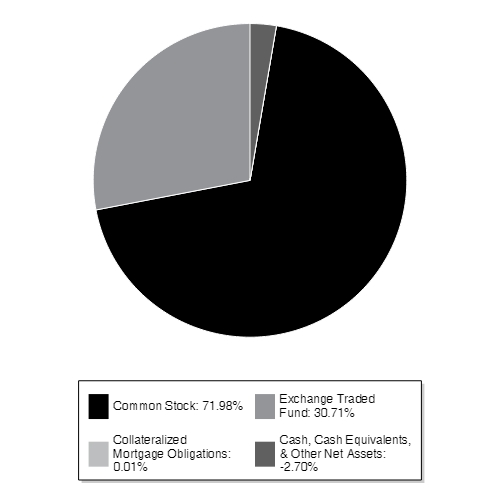

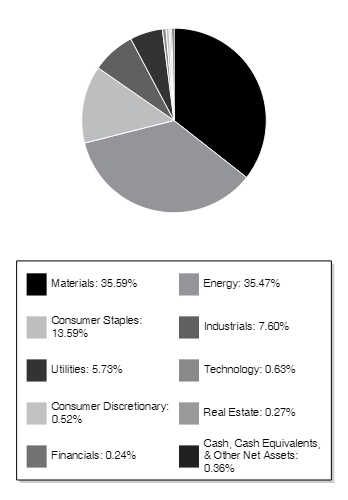

| Financials | 25.43% |

| Industrials | 15.42% |

| Information Technology | 9.80% |

| Consumer Discretionary | 9.19% |

| Health Care | 8.34% |

| Communication Services | 7.63% |

| Energy | 6.61% |

| Materials | 6.49% |

| Consumer Staples | 5.63% |

| Real Estate | 3.98% |

| Utilities | 1.91% |

| Cash, Cash Equivalents, & Other Net Assets | -0.43% |

| |

** | As a percentage of net assets. |

Holdings are subject to change

If you wish to view additional information about the Fund, including but not limited to the Fund's prospectus, financial information, holdings, and proxy voting information, please visit https://www.alpsfunds.com/mutual-funds/indix.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 866-759-5679.

ALPS | Kotak India ESG Fund - Class A | FINANCIAL INVESTORS TRUST |

INAAX | |

This annual shareholder report contains important information about ALPS | Kotak India ESG Fund (the "Fund" or "INAAX") for the period of November 1, 2023 to October 31, 2024 (the "Period"). You can find additional information about the Fund at https://www.alpsfunds.com/mutual-funds/indix. You can also request this information by contacting us at 866-759-5679.

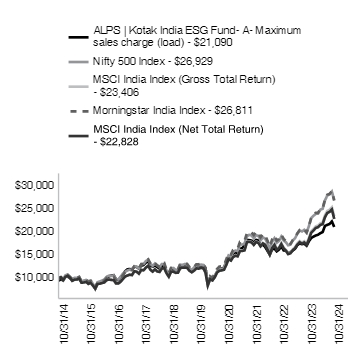

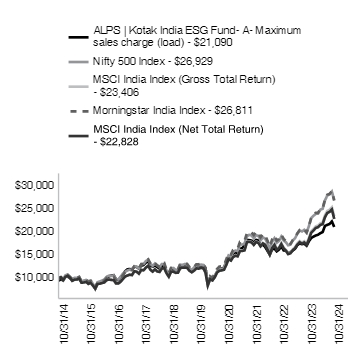

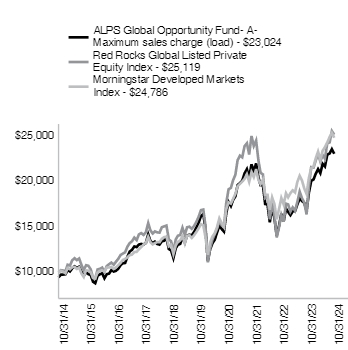

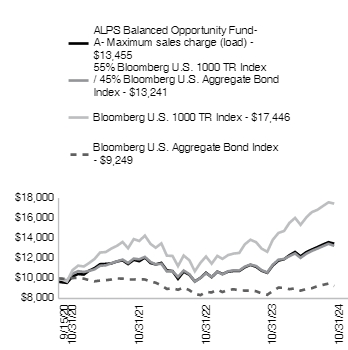

For the twelve months ended October 31, 2024, the ALPS | Kotak India ESG Fund Class A shares increased by 23.85%. The Fund underperformed the MSCI India Index -net of fees, which was up 32.69%.

Geopolitical concerns, US elections outcome, China recovery and earnings moderation in India corporations led global equity markets to correct from highs in October 2024, which also impacted the Fund's performance.

Top 5 additions to the Fund: Cognizant Technology, Ultratech Cement, Uno Minda, Thermax and Ashok Leyland

Top 5 exits from the Fund: Infosys, Hindustan Unilever, Persistent Systems, Maruti Suzuki India and Bajaj Finance

What contributed and detracted to/from performance?

Top contributors to relative performance

Top detractors from relative performance

There were notable reductions in the Fund's holdings within the Financials, Information Technology, and Consumer Staples sectors and an increase in the Fund's holdings within the Industrials, Communication Services, and Real Estate Sectors.

The Fund's past performance is not a good predictor of the Fund's future performance. The chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or sale of Fund shares.

| 10/31/2014 | 9449 | 10000 | 10000 | 10000 | 10000 |

| 11/30/2014 | 9728 | 10207 | 10160 | 10214 | 10160 |

| 12/31/2014 | 9499 | 9845 | 9555 | 9760 | 9555 |

| 01/31/2015 | 10335 | 10611 | 10313 | 10524 | 10313 |

| 02/28/2015 | 10335 | 10793 | 10505 | 10661 | 10505 |

| 03/31/2015 | 10014 | 10311 | 10070 | 10258 | 10070 |

| 04/30/2015 | 9492 | 9769 | 9412 | 9717 | 9412 |

| 05/31/2015 | 9723 | 10071 | 9678 | 10014 | 9678 |

| 06/30/2015 | 9686 | 10024 | 9706 | 9991 | 9706 |

| 07/31/2015 | 10074 | 10299 | 9879 | 10218 | 9879 |

| 08/31/2015 | 9148 | 9323 | 9011 | 9272 | 9011 |

| 09/30/2015 | 9357 | 9425 | 9052 | 9332 | 9052 |

| 10/31/2015 | 9380 | 9601 | 9194 | 9553 | 9194 |

| 11/30/2015 | 9208 | 9347 | 8755 | 9204 | 8755 |

| 12/31/2015 | 9177 | 9449 | 8970 | 9405 | 8969 |

| 01/31/2016 | 8512 | 8695 | 8352 | 8679 | 8352 |

| 02/29/2016 | 7701 | 7966 | 7734 | 7960 | 7734 |

| 03/31/2016 | 8875 | 9117 | 8746 | 9052 | 8746 |

| 04/30/2016 | 9013 | 9272 | 8787 | 9167 | 8787 |

| 05/31/2016 | 9255 | 9488 | 8952 | 9294 | 8952 |

| 06/30/2016 | 9548 | 9704 | 9071 | 9484 | 9071 |

| 07/31/2016 | 10161 | 10320 | 9586 | 10055 | 9586 |

| 08/31/2016 | 10403 | 10535 | 9697 | 10249 | 9697 |

| 09/30/2016 | 10550 | 10459 | 9608 | 10209 | 9608 |

| 10/31/2016 | 10636 | 10590 | 9561 | 10283 | 9561 |

| 11/30/2016 | 9712 | 9744 | 8848 | 9509 | 8848 |

| 12/31/2016 | 9557 | 9693 | 8841 | 9460 | 8841 |

| 01/31/2017 | 10151 | 10316 | 9226 | 9948 | 9226 |

| 02/28/2017 | 10720 | 10925 | 9770 | 10602 | 9770 |

| 03/31/2017 | 11454 | 11351 | 10355 | 11288 | 10355 |

| 04/30/2017 | 11900 | 11668 | 10554 | 11641 | 10554 |

| 05/31/2017 | 11970 | 11824 | 10740 | 11738 | 10740 |

| 06/30/2017 | 11848 | 11810 | 10656 | 11714 | 10656 |

| 07/31/2017 | 12503 | 12582 | 11477 | 12525 | 11477 |

| 08/31/2017 | 12407 | 12492 | 11391 | 12487 | 11390 |

| 09/30/2017 | 12057 | 12106 | 10970 | 12106 | 10970 |

| 10/31/2017 | 12704 | 13030 | 11779 | 13031 | 11779 |

| 11/30/2017 | 12827 | 13057 | 11696 | 13060 | 11696 |

| 12/31/2017 | 13354 | 13689 | 12267 | 13709 | 12267 |

| 01/31/2018 | 13651 | 14027 | 12690 | 14060 | 12690 |

| 02/28/2018 | 12751 | 13111 | 11839 | 13182 | 11839 |

| 03/31/2018 | 12490 | 12640 | 11414 | 12688 | 11414 |

| 04/30/2018 | 12733 | 13167 | 11884 | 13231 | 11884 |

| 05/31/2018 | 12400 | 12766 | 11457 | 12737 | 11457 |

| 06/30/2018 | 12067 | 12363 | 11346 | 12455 | 11345 |

| 07/31/2018 | 12652 | 13057 | 12084 | 13173 | 12085 |

| 08/31/2018 | 12490 | 13059 | 12201 | 13276 | 12201 |

| 09/30/2018 | 11222 | 11638 | 11090 | 11839 | 11090 |

| 10/31/2018 | 10547 | 10957 | 10316 | 11094 | 10316 |

| 11/30/2018 | 11690 | 12109 | 11386 | 12219 | 11386 |

| 12/31/2018 | 11681 | 12190 | 11371 | 12268 | 11371 |

| 01/31/2019 | 11354 | 11754 | 11152 | 11918 | 11152 |

| 02/28/2019 | 11258 | 11713 | 11156 | 11885 | 11156 |

| 03/31/2019 | 12402 | 12914 | 12185 | 13057 | 12185 |

| 04/30/2019 | 12363 | 12865 | 12253 | 13025 | 12254 |

| 05/31/2019 | 12536 | 13053 | 12280 | 13137 | 12280 |

| 06/30/2019 | 12479 | 12981 | 12246 | 13081 | 12246 |

| 07/31/2019 | 11835 | 12200 | 11608 | 12404 | 11608 |

| 08/31/2019 | 11412 | 11685 | 11268 | 12010 | 11268 |

| 09/30/2019 | 12036 | 12308 | 11615 | 12458 | 11615 |

| 10/31/2019 | 12488 | 12713 | 12117 | 12996 | 12117 |

| 11/30/2019 | 12517 | 12753 | 12049 | 12983 | 12049 |

| 12/31/2019 | 12644 | 12929 | 12233 | 13162 | 12233 |

| 01/31/2020 | 12770 | 12855 | 12136 | 13132 | 12136 |

| 02/29/2020 | 12157 | 11905 | 11253 | 12178 | 11253 |

| 03/31/2020 | 8747 | 8703 | 8425 | 8976 | 8425 |

| 04/30/2020 | 9858 | 9988 | 9785 | 10405 | 9785 |

| 05/31/2020 | 9565 | 9714 | 9516 | 10114 | 9513 |

| 06/30/2020 | 10403 | 10533 | 10164 | 10948 | 10159 |

| 07/31/2020 | 11290 | 11362 | 11231 | 11971 | 11214 |

| 08/31/2020 | 11884 | 12048 | 11627 | 12509 | 11606 |

| 09/30/2020 | 12088 | 11982 | 11700 | 12548 | 11678 |

| 10/31/2020 | 12264 | 12139 | 11840 | 12753 | 11809 |

| 11/30/2020 | 13394 | 13703 | 12865 | 14028 | 12828 |

| 12/31/2020 | 14465 | 14917 | 14177 | 15401 | 14135 |

| 01/31/2021 | 14465 | 14676 | 13848 | 15140 | 13806 |

| 02/28/2021 | 15244 | 15628 | 14577 | 16083 | 14528 |

| 03/31/2021 | 15683 | 15969 | 14911 | 16490 | 14858 |

| 04/30/2021 | 15303 | 15860 | 14775 | 16416 | 14720 |

| 05/31/2021 | 16335 | 17336 | 16063 | 17845 | 15867 |

| 06/30/2021 | 16520 | 17253 | 15956 | 17843 | 15885 |

| 07/31/2021 | 17017 | 17529 | 16106 | 18089 | 16022 |

| 08/31/2021 | 18293 | 19038 | 17870 | 19731 | 17775 |

| 09/30/2021 | 18225 | 19376 | 17983 | 20051 | 17882 |

| 10/31/2021 | 18137 | 19248 | 17845 | 19901 | 17739 |

| 11/30/2021 | 17699 | 18663 | 17307 | 19336 | 17201 |

| 12/31/2021 | 18285 | 19286 | 17956 | 20062 | 17843 |

| 01/31/2022 | 18161 | 19168 | 17712 | 19788 | 17599 |

| 02/28/2022 | 17060 | 18181 | 17009 | 18833 | 16895 |

| 03/31/2022 | 17277 | 18842 | 17632 | 19537 | 17512 |

| 04/30/2022 | 16752 | 18554 | 17339 | 19290 | 17219 |

| 05/31/2022 | 15908 | 17531 | 16341 | 18097 | 16216 |

| 06/30/2022 | 15075 | 16369 | 15248 | 16849 | 15122 |

| 07/31/2022 | 16237 | 17862 | 16678 | 18394 | 16532 |

| 08/31/2022 | 16402 | 18640 | 17372 | 19200 | 17211 |

| 09/30/2022 | 15805 | 17659 | 16277 | 18118 | 16105 |

| 10/31/2022 | 16196 | 18062 | 16701 | 18482 | 16518 |

| 11/30/2022 | 16896 | 19006 | 17574 | 19404 | 17375 |

| 12/31/2022 | 16005 | 18145 | 16612 | 18510 | 16424 |

| 01/31/2023 | 15942 | 17759 | 16120 | 17977 | 15933 |

| 02/28/2023 | 15492 | 17113 | 15388 | 17262 | 15205 |

| 03/31/2023 | 15649 | 17271 | 15568 | 17412 | 15381 |

| 04/30/2023 | 15994 | 18152 | 16219 | 18211 | 16022 |

| 05/31/2023 | 16370 | 18635 | 16699 | 18696 | 16489 |

| 06/30/2023 | 17154 | 19614 | 17493 | 19683 | 17263 |

| 07/31/2023 | 17510 | 20342 | 18021 | 20392 | 17778 |

| 08/31/2023 | 17364 | 20115 | 17687 | 20175 | 17440 |

| 09/30/2023 | 17468 | 20456 | 17994 | 20532 | 17732 |

| 10/31/2023 | 17029 | 19847 | 17463 | 19895 | 17204 |

| 11/30/2023 | 17970 | 21250 | 18637 | 21294 | 18354 |

| 12/31/2023 | 18719 | 23005 | 20149 | 23026 | 19841 |

| 01/31/2024 | 18992 | 23517 | 20636 | 23676 | 20320 |

| 02/29/2024 | 19232 | 23924 | 21209 | 24150 | 20876 |

| 03/31/2024 | 19407 | 23988 | 21382 | 24157 | 21046 |

| 04/30/2024 | 19746 | 24841 | 21878 | 24968 | 21533 |

| 05/31/2024 | 19997 | 25032 | 22044 | 25135 | 21686 |

| 06/30/2024 | 21309 | 26833 | 23596 | 26980 | 23194 |

| 07/31/2024 | 21549 | 27915 | 24541 | 28071 | 24116 |

| 08/31/2024 | 21735 | 28141 | 24812 | 28268 | 24369 |

| 09/30/2024 | 22281 | 28756 | 25344 | 28872 | 24884 |

| 10/31/2024 | 21090 | 26929 | 23406 | 26811 | 22828 |

| ALPS | Kotak India ESG Fund - A - NAV** | 23.85% | 11.05% | 8.36% |

| ALPS | Kotak India ESG Fund - A -Maximum sales charge (load)*^ | 17.02% | 9.79% | 7.75% |

| MSCI India Index (Net Total Return)#*** | 32.69% | 13.50% | 8.60% |

| Morningstar India Index | 34.76% | 15.59% | 10.37% |

| MSCI India Index (Gross Total Return)**** | 34.03% | 14.07% | 8.88% |

| Nifty 500 Index | 35.69% | 16.20% | 10.41% |

For the most current month-end performance data, please call 1-866-759-5679.

| Net Assets | $396,576,901 |

| Number of Portfolio Holdings | 42 |

| Portfolio Turnover Rate | 75% |

| Total Advisory Fees Paid | $2,056,987 |

| ICICI Bank, Ltd. | 8.76% |

| Reliance Industries, Ltd. | 6.61% |

| Axis Bank, Ltd. | 6.13% |

| HDFC Bank, Ltd. | 4.86% |

| Larsen & Toubro, Ltd. | 4.72% |

| Bharti Airtel, Ltd. | 4.48% |

| Cognizant Technology Solutions Corp. | 3.79% |

| Fortis Healthcare, Ltd. | 3.26% |

| Infosys, Ltd. | 3.22% |

| UltraTech Cement, Ltd. | 3.05% |

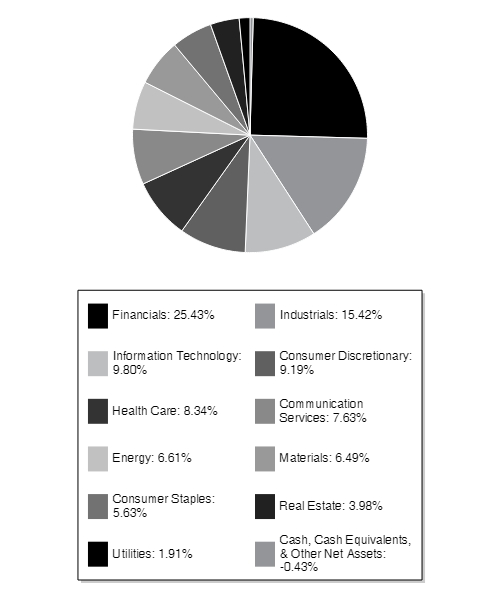

| Financials | 25.43% |

| Industrials | 15.42% |

| Information Technology | 9.80% |

| Consumer Discretionary | 9.19% |

| Health Care | 8.34% |

| Communication Services | 7.63% |

| Energy | 6.61% |

| Materials | 6.49% |

| Consumer Staples | 5.63% |

| Real Estate | 3.98% |

| Utilities | 1.91% |

| Cash, Cash Equivalents, & Other Net Assets | -0.43% |

| |

** | As a percentage of net assets. |

Holdings are subject to change

If you wish to view additional information about the Fund, including but not limited to the Fund's prospectus, financial information, holdings, and proxy voting information, please visit https://www.alpsfunds.com/mutual-funds/indix.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 866-759-5679.

ALPS | Kotak India ESG Fund - Class C | FINANCIAL INVESTORS TRUST |

INFCX | |

This annual shareholder report contains important information about ALPS | Kotak India ESG Fund (the "Fund" or "INFCX") for the period of November 1, 2023 to October 31, 2024 (the "Period"). You can find additional information about the Fund at https://www.alpsfunds.com/mutual-funds/indix. You can also request this information by contacting us at 866-759-5679.

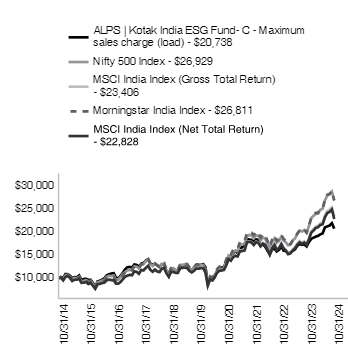

For the twelve months ended October 31, 2024, the ALPS | Kotak India ESG Fund Class C shares increased by 22.83%. The Fund underperformed the MSCI India Index -net of fees, which was up 32.69%.

Geopolitical concerns, US elections outcome, China recovery and earnings moderation in India corporations led global equity markets to correct from highs in October 2024, which also impacted the Fund's performance.

Top 5 additions to the Fund: Cognizant Technology, Ultratech Cement, Uno Minda, Thermax and Ashok Leyland

Top 5 exits from the Fund: Infosys, Hindustan Unilever, Persistent Systems, Maruti Suzuki India and Bajaj Finance

What contributed and detracted to/from performance?

Top contributors to relative performance

Top detractors from relative performance

There were notable reductions in the Fund's holdings within the Financials, Information Technology, and Consumer Staples sectors and an increase in the Fund's holdings within the Industrials, Communication Services, and Real Estate Sectors.

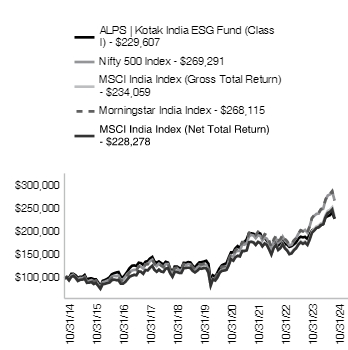

The Fund's past performance is not a good predictor of the Fund's future performance. The chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or sale of Fund shares.

| 10/31/2014 | 10000 | 10000 | 10000 | 10000 | 10000 |

| 11/30/2014 | 10280 | 10207 | 10160 | 10214 | 10160 |

| 12/31/2014 | 10036 | 9845 | 9555 | 9760 | 9555 |

| 01/31/2015 | 10915 | 10611 | 10313 | 10524 | 10313 |

| 02/28/2015 | 10907 | 10793 | 10505 | 10661 | 10505 |

| 03/31/2015 | 10568 | 10311 | 10070 | 10258 | 10070 |

| 04/30/2015 | 10003 | 9769 | 9412 | 9717 | 9412 |

| 05/31/2015 | 10245 | 10071 | 9678 | 10014 | 9678 |

| 06/30/2015 | 10197 | 10024 | 9706 | 9991 | 9706 |

| 07/31/2015 | 10600 | 10299 | 9879 | 10218 | 9879 |

| 08/31/2015 | 9624 | 9323 | 9011 | 9272 | 9011 |

| 09/30/2015 | 9842 | 9425 | 9052 | 9332 | 9052 |

| 10/31/2015 | 9866 | 9601 | 9194 | 9553 | 9194 |

| 11/30/2015 | 9673 | 9347 | 8755 | 9204 | 8755 |

| 12/31/2015 | 9639 | 9449 | 8970 | 9405 | 8969 |

| 01/31/2016 | 8937 | 8695 | 8352 | 8679 | 8352 |

| 02/29/2016 | 8075 | 7966 | 7734 | 7960 | 7734 |

| 03/31/2016 | 9302 | 9117 | 8746 | 9052 | 8746 |

| 04/30/2016 | 9452 | 9272 | 8787 | 9167 | 8787 |

| 05/31/2016 | 9696 | 9488 | 8952 | 9294 | 8952 |

| 06/30/2016 | 9995 | 9704 | 9071 | 9484 | 9071 |

| 07/31/2016 | 10632 | 10320 | 9586 | 10055 | 9586 |

| 08/31/2016 | 10867 | 10535 | 9697 | 10249 | 9697 |

| 09/30/2016 | 11017 | 10459 | 9608 | 10209 | 9608 |

| 10/31/2016 | 11101 | 10590 | 9561 | 10283 | 9561 |

| 11/30/2016 | 10136 | 9744 | 8848 | 9509 | 8848 |

| 12/31/2016 | 9967 | 9693 | 8841 | 9460 | 8841 |

| 01/31/2017 | 10574 | 10316 | 9226 | 9948 | 9226 |

| 02/28/2017 | 11173 | 10925 | 9770 | 10602 | 9770 |

| 03/31/2017 | 11922 | 11351 | 10355 | 11288 | 10355 |

| 04/30/2017 | 12378 | 11668 | 10554 | 11641 | 10554 |

| 05/31/2017 | 12444 | 11824 | 10740 | 11738 | 10740 |

| 06/30/2017 | 12312 | 11810 | 10656 | 11714 | 10656 |

| 07/31/2017 | 12986 | 12582 | 11477 | 12525 | 11477 |

| 08/31/2017 | 12881 | 12492 | 11391 | 12487 | 11390 |

| 09/30/2017 | 12511 | 12106 | 10970 | 12106 | 10970 |

| 10/31/2017 | 13166 | 13030 | 11779 | 13031 | 11779 |

| 11/30/2017 | 13280 | 13057 | 11696 | 13060 | 11696 |

| 12/31/2017 | 13824 | 13689 | 12267 | 13709 | 12267 |

| 01/31/2018 | 14127 | 14027 | 12690 | 14060 | 12690 |

| 02/28/2018 | 13188 | 13111 | 11839 | 13182 | 11839 |

| 03/31/2018 | 12914 | 12640 | 11414 | 12688 | 11414 |

| 04/30/2018 | 13149 | 13167 | 11884 | 13231 | 11884 |

| 05/31/2018 | 12806 | 12766 | 11457 | 12737 | 11457 |

| 06/30/2018 | 12454 | 12363 | 11346 | 12455 | 11345 |

| 07/31/2018 | 13051 | 13057 | 12084 | 13173 | 12085 |

| 08/31/2018 | 12875 | 13059 | 12201 | 13276 | 12201 |

| 09/30/2018 | 11564 | 11638 | 11090 | 11839 | 11090 |

| 10/31/2018 | 10859 | 10957 | 10316 | 11094 | 10316 |

| 11/30/2018 | 12033 | 12109 | 11386 | 12219 | 11386 |

| 12/31/2018 | 12014 | 12190 | 11371 | 12268 | 11371 |

| 01/31/2019 | 11678 | 11754 | 11152 | 11918 | 11152 |

| 02/28/2019 | 11573 | 11713 | 11156 | 11885 | 11156 |

| 03/31/2019 | 12738 | 12914 | 12185 | 13057 | 12185 |

| 04/30/2019 | 12696 | 12865 | 12253 | 13025 | 12254 |

| 05/31/2019 | 12864 | 13053 | 12280 | 13137 | 12280 |

| 06/30/2019 | 12790 | 12981 | 12246 | 13081 | 12246 |

| 07/31/2019 | 12129 | 12200 | 11608 | 12404 | 11608 |

| 08/31/2019 | 11689 | 11685 | 11268 | 12010 | 11268 |

| 09/30/2019 | 12318 | 12308 | 11615 | 12458 | 11615 |

| 10/31/2019 | 12780 | 12713 | 12117 | 12996 | 12117 |

| 11/30/2019 | 12801 | 12753 | 12049 | 12983 | 12049 |

| 12/31/2019 | 12918 | 12929 | 12233 | 13162 | 12233 |

| 01/31/2020 | 13046 | 12855 | 12136 | 13132 | 12136 |

| 02/29/2020 | 12407 | 11905 | 11253 | 12178 | 11253 |

| 03/31/2020 | 8928 | 8703 | 8425 | 8976 | 8425 |

| 04/30/2020 | 10045 | 9988 | 9785 | 10405 | 9785 |

| 05/31/2020 | 9747 | 9714 | 9516 | 10114 | 9513 |

| 06/30/2020 | 10588 | 10533 | 10164 | 10948 | 10159 |

| 07/31/2020 | 11481 | 11362 | 11231 | 11971 | 11214 |

| 08/31/2020 | 12077 | 12048 | 11627 | 12509 | 11606 |

| 09/30/2020 | 12279 | 11982 | 11700 | 12548 | 11678 |

| 10/31/2020 | 12450 | 12139 | 11840 | 12753 | 11809 |

| 11/30/2020 | 13588 | 13703 | 12865 | 14028 | 12828 |

| 12/31/2020 | 14663 | 14917 | 14177 | 15401 | 14135 |

| 01/31/2021 | 14663 | 14676 | 13848 | 15140 | 13806 |

| 02/28/2021 | 15440 | 15628 | 14577 | 16083 | 14528 |

| 03/31/2021 | 15876 | 15969 | 14911 | 16490 | 14858 |

| 04/30/2021 | 15493 | 15860 | 14775 | 16416 | 14720 |

| 05/31/2021 | 16525 | 17336 | 16063 | 17845 | 15867 |

| 06/30/2021 | 16706 | 17253 | 15956 | 17843 | 15885 |

| 07/31/2021 | 17185 | 17529 | 16106 | 18089 | 16022 |

| 08/31/2021 | 18462 | 19038 | 17870 | 19731 | 17775 |

| 09/30/2021 | 18387 | 19376 | 17983 | 20051 | 17882 |

| 10/31/2021 | 18281 | 19248 | 17845 | 19901 | 17739 |

| 11/30/2021 | 17834 | 18663 | 17307 | 19336 | 17201 |

| 12/31/2021 | 18408 | 19286 | 17956 | 20062 | 17843 |

| 01/31/2022 | 18284 | 19168 | 17712 | 19788 | 17599 |

| 02/28/2022 | 17168 | 18181 | 17009 | 18833 | 16895 |

| 03/31/2022 | 17359 | 18842 | 17632 | 19537 | 17512 |

| 04/30/2022 | 16829 | 18554 | 17339 | 19290 | 17219 |

| 05/31/2022 | 15949 | 17531 | 16341 | 18097 | 16216 |

| 06/30/2022 | 15115 | 16369 | 15248 | 16849 | 15122 |

| 07/31/2022 | 16265 | 17862 | 16678 | 18394 | 16532 |

| 08/31/2022 | 16423 | 18640 | 17372 | 19200 | 17211 |

| 09/30/2022 | 15803 | 17659 | 16277 | 18118 | 16105 |

| 10/31/2022 | 16175 | 18062 | 16701 | 18482 | 16518 |

| 11/30/2022 | 16863 | 19006 | 17574 | 19404 | 17375 |

| 12/31/2022 | 15965 | 18145 | 16612 | 18510 | 16424 |

| 01/31/2023 | 15896 | 17759 | 16120 | 17977 | 15933 |

| 02/28/2023 | 15437 | 17113 | 15388 | 17262 | 15205 |

| 03/31/2023 | 15575 | 17271 | 15568 | 17412 | 15381 |

| 04/30/2023 | 15907 | 18152 | 16219 | 18211 | 16022 |

| 05/31/2023 | 16275 | 18635 | 16699 | 18696 | 16489 |

| 06/30/2023 | 17044 | 19614 | 17493 | 19683 | 17263 |

| 07/31/2023 | 17388 | 20342 | 18021 | 20392 | 17778 |

| 08/31/2023 | 17239 | 20115 | 17687 | 20175 | 17440 |

| 09/30/2023 | 17331 | 20456 | 17994 | 20532 | 17732 |

| 10/31/2023 | 16883 | 19847 | 17463 | 19895 | 17204 |

| 11/30/2023 | 17801 | 21250 | 18637 | 21294 | 18354 |

| 12/31/2023 | 18531 | 23005 | 20149 | 23026 | 19841 |

| 01/31/2024 | 18785 | 23517 | 20636 | 23676 | 20320 |

| 02/29/2024 | 19014 | 23924 | 21209 | 24150 | 20876 |

| 03/31/2024 | 19170 | 23988 | 21382 | 24157 | 21046 |

| 04/30/2024 | 19496 | 24841 | 21878 | 24968 | 21533 |

| 05/31/2024 | 19725 | 25032 | 22044 | 25135 | 21686 |

| 06/30/2024 | 21003 | 26833 | 23596 | 26980 | 23194 |

| 07/31/2024 | 21232 | 27915 | 24541 | 28071 | 24116 |

| 08/31/2024 | 21413 | 28141 | 24812 | 28268 | 24369 |

| 09/30/2024 | 21932 | 28756 | 25344 | 28872 | 24884 |

| 10/31/2024 | 20738 | 26929 | 23406 | 26811 | 22828 |

| ALPS | Kotak India ESG Fund - C - NAV | 22.83% | 10.17% | 7.57% |

| ALPS | Kotak India ESG Fund - C - Maximum deferred sales charge** | 21.83% | 10.17% | 7.57% |

| MSCI India Index (Net Total Return)#*** | 32.69% | 13.50% | 8.60% |

| Morningstar India Index | 34.76% | 15.59% | 10.37% |

| MSCI India Index (Gross Total Return)**** | 34.03% | 14.07% | 8.88% |

| Nifty 500 Index | 35.69% | 16.20% | 10.41% |

For the most current month-end performance data, please call 1-866-759-5679.

| Net Assets | $396,576,901 |

| Number of Portfolio Holdings | 42 |

| Portfolio Turnover Rate | 75% |

| Total Advisory Fees Paid | $2,056,987 |

| ICICI Bank, Ltd. | 8.76% |

| Reliance Industries, Ltd. | 6.61% |

| Axis Bank, Ltd. | 6.13% |

| HDFC Bank, Ltd. | 4.86% |

| Larsen & Toubro, Ltd. | 4.72% |

| Bharti Airtel, Ltd. | 4.48% |

| Cognizant Technology Solutions Corp. | 3.79% |

| Fortis Healthcare, Ltd. | 3.26% |

| Infosys, Ltd. | 3.22% |

| UltraTech Cement, Ltd. | 3.05% |

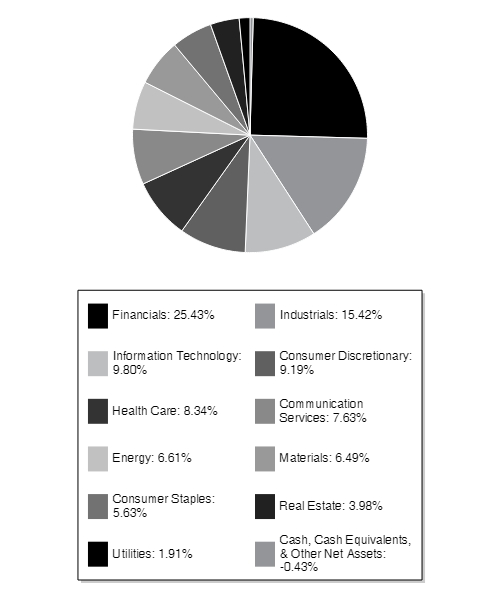

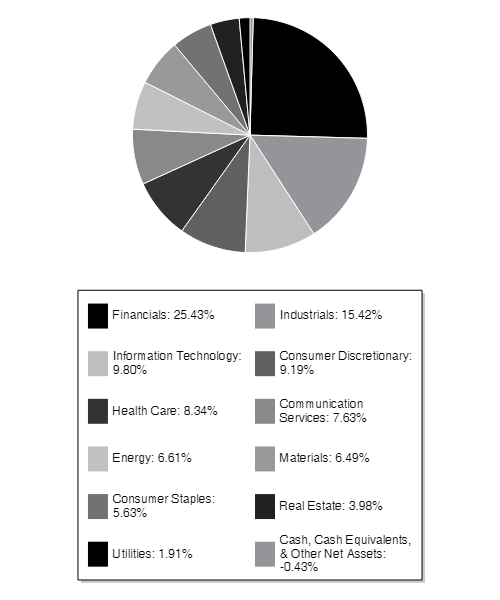

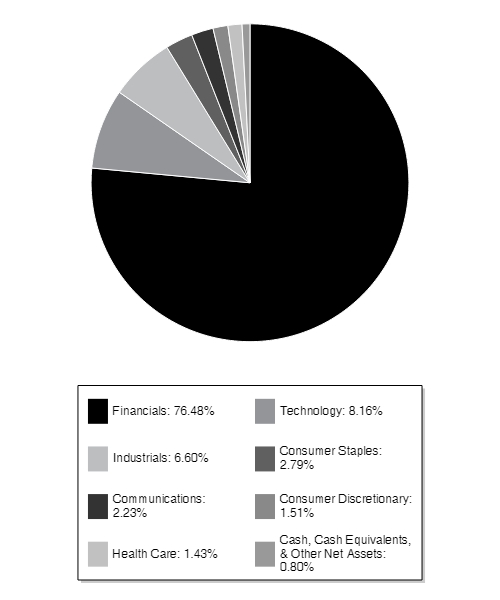

| Financials | 25.43% |

| Industrials | 15.42% |

| Information Technology | 9.80% |

| Consumer Discretionary | 9.19% |

| Health Care | 8.34% |

| Communication Services | 7.63% |

| Energy | 6.61% |

| Materials | 6.49% |

| Consumer Staples | 5.63% |

| Real Estate | 3.98% |

| Utilities | 1.91% |

| Cash, Cash Equivalents, & Other Net Assets | -0.43% |

| |

** | As a percentage of net assets. |

Holdings are subject to change

If you wish to view additional information about the Fund, including but not limited to the Fund's prospectus, financial information, holdings, and proxy voting information, please visit https://www.alpsfunds.com/mutual-funds/indix.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 866-759-5679.

ALPS | Kotak India ESG Fund - Class I | FINANCIAL INVESTORS TRUST |

INDIX | |

This annual shareholder report contains important information about ALPS | Kotak India ESG Fund (the "Fund" or "INDIX") for the period of November 1, 2023 to October 31, 2024 (the "Period"). You can find additional information about the Fund at https://www.alpsfunds.com/mutual-funds/indix. You can also request this information by contacting us at 866-759-5679.

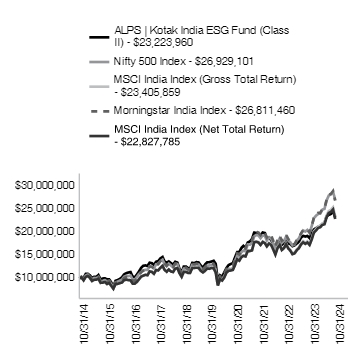

For the twelve months ended October 31, 2024, the ALPS | Kotak India ESG Fund Class I shares increased by 24.18%. The Fund underperformed the MSCI India Index -net of fees, which was up 32.69%.

Geopolitical concerns, US elections outcome, China recovery and earnings moderation in India corporations led global equity markets to correct from highs in October 2024, which also impacted the Fund's performance.

Top 5 additions to the Fund: Cognizant Technology, Ultratech Cement, Uno Minda, Thermax and Ashok Leyland

Top 5 exits from the Fund: Infosys, Hindustan Unilever, Persistent Systems, Maruti Suzuki India and Bajaj Finance

What contributed and detracted to/from performance?

Top contributors to relative performance

Top detractors from relative performance

There were notable reductions in the Fund's holdings within the Financials, Information Technology, and Consumer Staples sectors and an increase in the Fund's holdings within the Industrials, Communication Services, and Real Estate Sectors.

The Fund's past performance is not a good predictor of the Fund's future performance. The chart and the table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or sale of Fund shares.

| 10/31/2014 | 100000 | 100000 | 100000 | 100000 | 100000 |

| 11/30/2014 | 103010 | 102068 | 101600 | 102142 | 101601 |

| 12/31/2014 | 100710 | 98449 | 95546 | 97601 | 95545 |

| 01/31/2015 | 109546 | 106111 | 103134 | 105239 | 103135 |

| 02/28/2015 | 109624 | 107927 | 105051 | 106614 | 105052 |

| 03/31/2015 | 106184 | 103107 | 100702 | 102585 | 100702 |

| 04/30/2015 | 100710 | 97688 | 94116 | 97169 | 94116 |

| 05/31/2015 | 103212 | 100707 | 96779 | 100143 | 96779 |

| 06/30/2015 | 102821 | 100237 | 97064 | 99912 | 97063 |

| 07/31/2015 | 106966 | 102988 | 98787 | 102177 | 98786 |

| 08/31/2015 | 97192 | 93232 | 90111 | 92723 | 90112 |

| 09/30/2015 | 99459 | 94255 | 90521 | 93319 | 90522 |

| 10/31/2015 | 99772 | 96006 | 91943 | 95531 | 91942 |

| 11/30/2015 | 97895 | 93468 | 87552 | 92042 | 87551 |

| 12/31/2015 | 97657 | 94495 | 89695 | 94048 | 89695 |

| 01/31/2016 | 90624 | 86953 | 83522 | 86785 | 83522 |

| 02/29/2016 | 81967 | 79662 | 77341 | 79603 | 77341 |

| 03/31/2016 | 94501 | 91169 | 87457 | 90524 | 87456 |

| 04/30/2016 | 96034 | 92723 | 87872 | 91666 | 87873 |

| 05/31/2016 | 98559 | 94882 | 89523 | 92944 | 89523 |

| 06/30/2016 | 101805 | 97036 | 90712 | 94835 | 90712 |

| 07/31/2016 | 108298 | 103199 | 95860 | 100552 | 95860 |

| 08/31/2016 | 110823 | 105351 | 96971 | 102490 | 96971 |

| 09/30/2016 | 112446 | 104593 | 96083 | 102094 | 96082 |

| 10/31/2016 | 113438 | 105903 | 95609 | 102830 | 95609 |

| 11/30/2016 | 103609 | 97436 | 88479 | 95088 | 88479 |

| 12/31/2016 | 101892 | 96933 | 88409 | 94596 | 88410 |

| 01/31/2017 | 108192 | 103155 | 92257 | 99479 | 92257 |

| 02/28/2017 | 114400 | 109252 | 97704 | 106019 | 97705 |

| 03/31/2017 | 122252 | 113509 | 103546 | 112875 | 103546 |

| 04/30/2017 | 127000 | 116675 | 105544 | 116409 | 105543 |

| 05/31/2017 | 127822 | 118236 | 107397 | 117376 | 107397 |

| 06/30/2017 | 126543 | 118101 | 106557 | 117138 | 106557 |

| 07/31/2017 | 133574 | 125819 | 114767 | 125249 | 114767 |

| 08/31/2017 | 132661 | 124925 | 113905 | 124872 | 113905 |

| 09/30/2017 | 128917 | 121063 | 109704 | 121056 | 109703 |

| 10/31/2017 | 135765 | 130299 | 117791 | 130312 | 117790 |

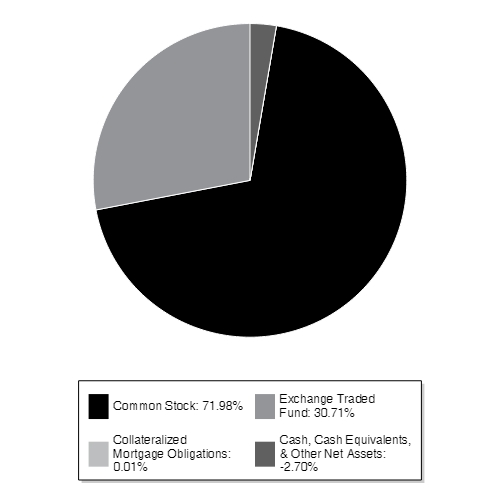

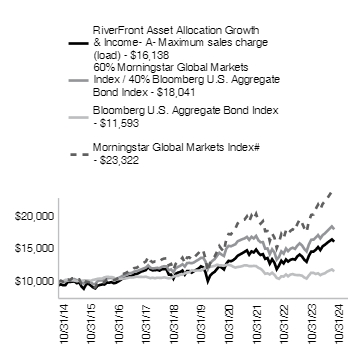

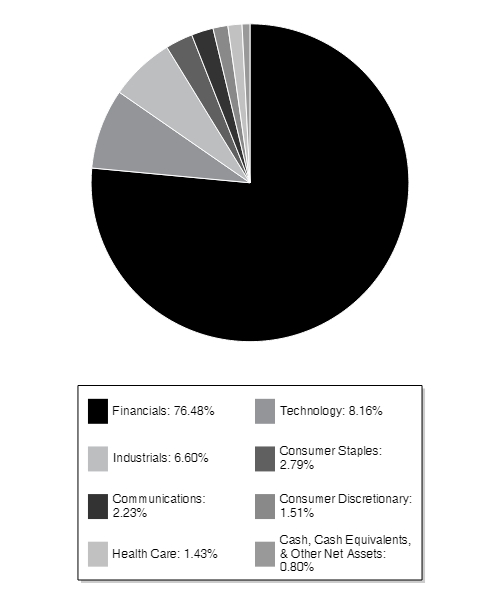

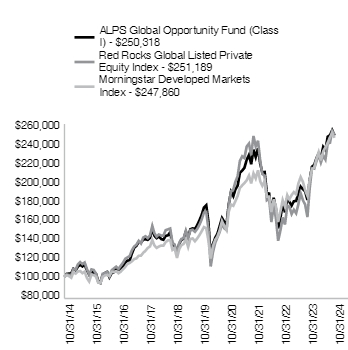

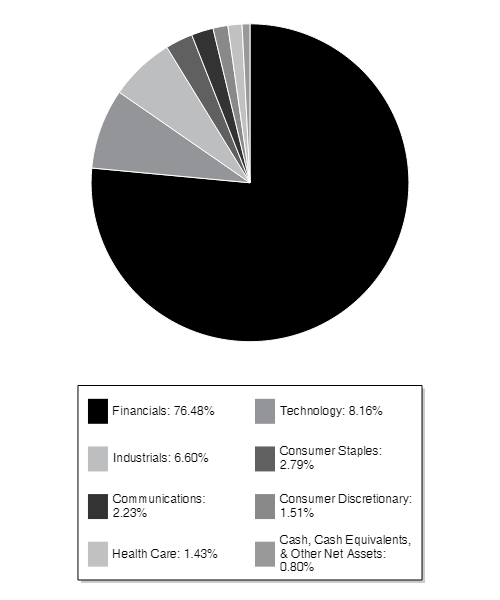

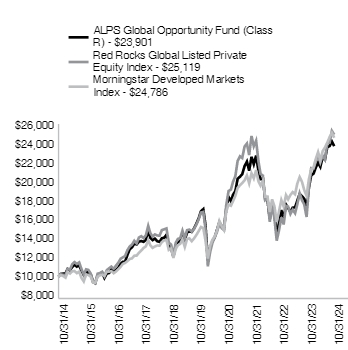

| 11/30/2017 | 137134 | 130569 | 116960 | 130602 | 116960 |