SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | | Preliminary Proxy Statement |

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

¨ | | Definitive Additional Materials |

¨ | | Soliciting Material Pursuant to Rule 14a-11(c) or rule 14a-12 |

THE PANTRY, INC.

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

¨ | | Fee paid previously with preliminary materials. |

¨ Check | | box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

THE PANTRY, INC.

1801 Douglas Drive

P.O. Box 1410

Sanford, North Carolina 27330

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MARCH 25, 2003

You are cordially invited to attend the Annual Meeting of Stockholders of The Pantry, Inc. (the “Company”) which will be held on Tuesday, March 25, 2003, at 10:00 a.m. Eastern Standard Time, at the Sheraton Imperial Hotel & Convention Center,4700 Emperor Blvd., Durham, North Carolina 27703, for the following purposes:

| | (1) | | To elect nine nominees to serve as directors each for a term of one year or until his successor is duly elected and qualified; |

| | (2) | | To approve the Company’s 1999 Stock Option Plan, including an amendment thereto increasing the number of shares available for grant under the plan by 882,505 shares; |

| | (3) | | To ratify the appointment of Deloitte & Touche LLP as independent public accountants for the Company and its subsidiaries for the fiscal year ending September 25, 2003; and |

| | (4) | | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Stockholders of record at the close of business on January 24, 2003, are entitled to notice of and to vote at the Annual Meeting and any and all adjournments or postponements thereof.

It is desirable that your shares of stock be represented at the meeting, regardless of the number of shares you may hold. Whether or not you plan to attend the meeting in person, please complete and return the enclosed proxy in the envelope provided. If you attend the meeting you may revoke your proxy and vote in person.

By Order of the Board of Directors

Daniel J. Kelly

Chief Financial Officer

Sanford, North Carolina

February 10, 2003

THE PANTRY, INC.

1801 Douglas Drive

P.O. Box 1410

Sanford, North Carolina 27330

PROXY STATEMENT

GENERAL INFORMATION

Proxy Solicitation

This Proxy Statement and the accompanying proxy card are being mailed to stockholders on or about February 10, 2003, by the Board of Directors of The Pantry, Inc. (the “Company”) in connection with the solicitation of proxies for use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the Sheraton Imperial Hotel & Convention Center, 4700 Emperor Blvd., Durham, North Carolina 27703, on Tuesday, March 25, 2003, at 10:00 a.m. Eastern Standard Time, and at all adjournments or postponements thereof.

The Company will pay all expenses incurred in connection with this solicitation, including postage, printing, handling and the actual expenses incurred by custodians, nominees and fiduciaries in forwarding proxy materials to beneficial owners. In addition to solicitation by mail, certain officers, directors and regular employees of the Company, who will receive no additional compensation for their services, may solicit proxies by telephone, personal communication or other means. The Company has retained Morrow & Co., Inc. to aid in the search for stockholders and delivery of proxy materials. The aggregate fees to be paid to Morrow & Co., Inc. are not expected to exceed $5,000.00.In addition, as part of the services provided to the Company as its transfer agent, First Union National Bank will assist the Company in identifying recordholders.

ANNUAL MEETING

Purposes of Annual Meeting

The principal purposes of the Annual Meeting are to:

| | • | | elect nine directors each for a term of one year or until his successor is duly elected and qualified; |

| | • | | approve the Company’s 1999 Stock Option Plan, including an amendment thereto increasing the number of shares available for grant under the plan by 882,505 shares; |

| | • | | ratify the action of the Audit Committee of the Board of Directors in appointing Deloitte & Touche LLP as independent public accountants for the Company and its subsidiaries for the 2003 fiscal year; and |

| | • | | transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The Board of Directors knows of no other matters other than those stated above to be brought before the Annual Meeting.

Voting Rights

If the accompanying proxy card is properly signed and returned to the Company and not revoked, it will be voted in accordance with the instructions contained in the proxy card. If the proxy card is signed and returned, but voting directions are not made, the proxy will be voted in favor of the proposals set forth in the accompanying “Notice of Annual Meeting of Stockholders” and in such manner as the proxyholders named on the enclosed proxy card in their discretion determine upon such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

1

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted by:

| | • | | attending the Annual Meeting and voting in person, |

| | • | | delivering a written revocation to the Secretary of the Company or |

| | • | | delivering a proxy in accordance with applicable law bearing a later date to the Secretary of the Company. |

The Board of Directors has fixed the close of business on January 24, 2003, as the record date for the determination of stockholders entitled to receive notice of and to vote at the Annual Meeting and all adjournments or postponements thereof. As of the close of business on January 17, 2003, there were 18,107,597 shares of the Company’s common stock outstanding. On all matters to come before the Annual Meeting, each holder of common stock will be entitled to vote at the Annual Meeting and will be entitled to one vote for each share owned.

PRINCIPAL STOCKHOLDERS

The following table sets forth information, as of January 17, 2003, regarding shares of Company common stock owned of record or known to the Company to be beneficially owned by:

| | • | | our Chief Executive Officer and each other “named executive officer” (as such term is defined below), |

| | • | | all those known by us to beneficially own more than 5% of the Company’s outstanding common stock, and |

| | • | | all of our executive officers and directors as a group. |

Except as otherwise indicated:

| | • | | the persons named in the table have sole voting and investment power with respect to all shares of Company common stock shown as beneficially owned by them, subject to community property laws, where applicable, and |

| | • | | the address of each of the stockholders listed in this table is as follows: c/o The Pantry, Inc., P.O. Box 1410, 1801 Douglas Drive, Sanford, North Carolina 27331. |

2

The percentages shown below have been calculated based on 18,107,597 total shares of Company common stock outstanding as of January 17, 2003.

Name and Address of Beneficial Owner

| | Shares of Common Stock Beneficially Owned(1)

| | Percentage of Class

| |

| Freeman Spogli & Co.(2) | | 14,161,538 | | 69.2 | % |

| Todd W. Halloran(2) | | — | | — | |

| Jon D. Ralph(2) | | — | | — | |

| Charles P. Rullman(2) | | — | | — | |

| Chilton Investment Company, Inc.(3) | | 2,420,100 | | 13.4 | % |

| Peter J. Sodini(4) | | 417,492 | | 2.3 | % |

| Peter M. Starrett(5) | | 72,185 | | * | |

| Joseph A. Krol(6) | | 71,999 | | * | |

| Douglas Sweeney | | 7,974 | | * | |

| Steven J. Ferreira(7) | | 54,438 | | * | |

| David M. Zaborski(8) | | 26,484 | | * | |

| William M. Webster, III | | — | | — | |

| Hubert E. Yarborough, III(9) | | 20,500 | | * | |

| Byron E. Allumbaugh | | 25,000 | | * | |

| Thomas M. Murnane | | 10,000 | | * | |

| All directors and executive officers as a group (14 individuals)(10) | | 14,879,636 | | 70.7 | % |

| (1) | | Pursuant to the rules of the Securities and Exchange Commission, certain shares of the Company’s common stock which a person has the right to acquire within 60 days of the date shown above pursuant to the exercise of stock options are deemed to be outstanding for the purpose of computing the percentage ownership of such person but are not deemed outstanding for the purpose of computing the percentage ownership of any other person. Such shares are described below as being subject to presently exercisable stock options. |

| (2) | | Based on an Amendment No. 2 to Schedule 13D filed with the Securities and Exchange Commission on December 4, 2002. Includes 2,346,000 shares issuable on the exercise of presently exercisable warrants. 9,468,762 shares, 4,311,704 shares and 381,072 shares of common stock are held of record by FS Equity Partners III, L.P. (“FSEP III”), FS Equity Partners IV, L.P. (“FSEP IV”) and FS Equity Partners International, L.P. (“FSEP International”), respectively. As general partner of FS Capital Partners, L.P., which is general partner of FSEP III, FS Holdings, Inc. has the sole power to vote and dispose of the shares owned by FSEP III. As general partner of FS&Co. International, L.P., which is the general partner of FSEP International, FS International Holdings Limited has the sole power to vote and dispose of the shares owned by FSEP International. Bradford M. Freeman, Ronald M. Spogli, J. Frederick Simmons, William M. Wardlaw, John M. Roth and Mr. Rullman are the sole directors, officers and shareholders of FS Holdings, FS International Holdings and Freeman Spogli & Co. (“Freeman Spogli”) and may be deemed to be the beneficial owners of the shares of the common stock and rights to acquire the common stock owned by, FSEP III and FSEP International. As general partner of FSEP IV, FS Capital Partners LLC has the sole power to vote and dispose of the shares owned by FSEP IV. Messrs. Freeman, Spogli, Wardlaw, Rullman, Ralph, Halloran, Roth and Mark J. Doran are the sole directors, officers and beneficial owners of FS Capital Partners and may be deemed to be the beneficial owners of the shares of the common stock and rights to acquire the common stock owned by, FSEP IV. The business address of Freeman Spogli, FSEP III, FSEP IV, FS Capital, FS Holdings and FS Capital Partners and their directors, officers and beneficial owners is 11100 Santa Monica Boulevard, Suite 1900, Los Angeles, California 90025. The business address of FSEP International, FS&Co. International and FS International Holdings is c/o Padget-Brown & Company, Ltd., West Winds Building, Third Floor, Grand Cayman, Cayman Islands, British West Indies. |

| (3) | | Based on an Amendment No. 2 to Schedule 13G filed with the Securities and Exchange Commission on December 22, 2002. The business address of Chilton Investment Company, Inc. is 65 Locust Avenue, 2nd Floor, New Canaan, Connecticut, 06840. |

| (4) | | Includes 349,405 shares of common stock subject to presently exercisable stock options. |

3

| (5) | | Mr. Starrett’s business address is c/o Freeman Spogli & Co. Incorporated, 11100 Santa Monica Boulevard, Suite 1900, Los Angeles, California 90025. |

| (6) | | Includes 63,125 shares of common stock subject to presently exercisable stock options. |

| (7) | | Includes 45,001 shares of common stock subject to presently exercisable stock options. |

| (8) | | Includes 25,834 shares of common stock subject to presently exercisable stock options. |

| (9) | | Includes 20,000 shares of common stock subject to presently exercisable stock options. |

| (10) | | Does not include shares of common stock beneficially owned by Messrs. Sweeney or Flyg who are no longer executive officers. Includes 523,365 shares of common stock subject to presently exercisable stock options. |

INFORMATION ABOUT THE BOARD OF DIRECTORS

Our Board of Directors oversees our business and affairs and monitors the performance of management. In accordance with corporate governance principles, the Board of Directors does not involve itself in day-to-day operations. Instead, directors keep themselves informed through, among other things, discussions with our Chief Executive Officer, other key executives and principal external advisers (legal counsel, outside auditors, investment bankers and other consultants), reading reports and other materials that are provided to them and by participating in board and committee meetings. Our directors are elected annually and hold office for a period of one year or until their successors are duly elected and qualified.

There are no family relationships among the Company’s directors or executive officers. There are no material proceedings to which any of the Company’s directors or executive officers, or any associate of any of the Company’s directors or executive officers, is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

To the Company’s knowledge, none of the Company’s directors or executive officers has been convicted in a criminal proceeding during the last five years (excluding traffic violations or similar misdemeanors), and none of the Company’s directors or executive officers was a party to any judicial or administrative proceeding during the last five years (except for any matters that were dismissed without sanction or settlement) that resulted in a judgment, decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

Board Meetings

The Board of Directors met four times during fiscal 2002. Each director attended 75% or more of the aggregate of the Board meetings (held during the period for which the director was in office) and committee meetings of the Board of which the director was a member.

Compensation of Directors

During fiscal 2002, Messrs. Yarborough, Allumbaugh and Webster received $1,000 per quarter for serving as directors of the Company and $4,000 per quarter for attending Board meetings as compensation for their services as directors of the Company. No other director received any compensation for their service as director of the Company. In addition, all directors are reimbursed for their reasonable out-of-pocket expenses in attending meetings.

Board Committees

The Board has two standing committees, an Audit Committee and a Compensation Committee. The Audit Committee is responsible for selecting the independent public accountants and reviewing the scope, results and effectiveness of the annual audit and other services provided by the Company’s independent public accountants. In addition, the Audit Committee is responsible for reviewing the financial statements of the Company and the

4

audit letters provided by the Company’s independent public accountants. Finally, the Audit Committee is responsible for reviewing with management and the independent auditors the systems of internal control maintained by the Company. The members of the Audit Committee for fiscal 2002 were Byron E. Allumbaugh (Chairman), William M. Webster, III and Hubert E. Yarborough, III. The Audit Committee met four times during fiscal 2002. For additional information regarding the audit committee see “Audit Report “ below.

The Compensation Committee is responsible for the approval of compensation arrangements for officers of the Company and the review of the Company’s compensation plans and policies. The Compensation Committee did not meet during fiscal 2002 but did meet during January 2003.

The Board of Directors determines the compensation of executive officers based in part on the recommendations of the Compensation Committee. During fiscal 2002, Mr. Sodini participated in Board of Director deliberations regarding the compensation of our executive officers.

The Board of Directors does not currently have a nominating committee; rather, the entire Board performs the functions that might be performed by such a committee. While the Board of Directors will consider nominees recommended by stockholders, it has not actively solicited such nominations. Pursuant to our bylaws, stockholders must comply with certain procedures in connection with any nominations to the Board of Directors, which are summarized below under “Procedure for Nominations of Directors.”

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee of the Board of Directors during fiscal 2002 were Messrs. Ralph and Rullman. Messrs. Ralph and Rullman are principals in Freeman Spogli which is the Company’s largest stockholder and which has certain business relationships with the Company described under “Transactions with Affiliates” below.

Procedure for Nominations of Directors

The Company’s Bylaws provide procedures for the nomination of directors. The Bylaws provide that nominations for the election of directors may only be made by the Board of Directors or, if certain procedures are followed, by any stockholder of the Company who is entitled to vote generally in elections of directors. Any stockholder of record entitled to vote generally in the election of directors may nominate one or more persons for election as directors at a meeting of stockholders only if written notice of such stockholder’s intent to make such nomination or nominations has been delivered to the Secretary of the Company at the principal executive offices of the Company not later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the first anniversary of the preceding year’s annual meeting (provided, however, that in the event that the date of the annual meeting is more than 30 days before or more than 70 days after such anniversary date, notice by the stockholder must be so delivered not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made by the Company). Each such notice of a stockholder’s intent to nominate a director must set forth certain information as specified in the Company’s Bylaws.

5

PROPOSAL 1: ELECTION OF DIRECTORS

The Board of Directors has approved the nomination of the following nine directors for election at the Annual Meeting to serve for a period of one year or until the election and qualification of their successors: Todd W. Halloran, Jon D. Ralph, Charles P. Rullman, Peter J. Sodini, Peter M. Starrett, Hubert E. Yarborough, III, William M. Webster, III, Byron E. Allumbaugh and Thomas M. Murnane. All of the nominees are currently serving on the Board of Directors of the Company. It is intended that proxies will be voted in favor of all of the nominees.

The Board of Directors has no reason to believe that the persons named above as nominees will be unable or will decline to serve if elected. In the event of death or disqualification of any nominee or the refusal or inability of any nominee to serve as a director, proxies voted for that nominee may be voted with discretionary authority for a substitute or substitutes as shall be designated by the Board of Directors.

Pursuant to the Company’s Bylaws, the presence in person or by proxy of the holders of a majority in voting power of the outstanding shares of stock entitled to vote at the Annual Meeting will be necessary and sufficient to constitute a quorum. Abstentions and broker nonvotes are counted for purposes of determining the presence or absence of a quorum for the transaction of business. Once a quorum is established at the Annual Meeting, directors will be elected by a plurality of the votes cast at the Annual Meeting and entitled to vote thereon. “Plurality” means that the individuals who receive the largest number of votes cast, even if less than a majority, are elected as directors up to the maximum number of directors to be chosen at the meeting. Consequently, any shares not voted (whether by abstention, broker nonvote or otherwise) will not be included in determining which nominees receive the highest number of votes.

Action on all other matters scheduled to come before the Annual Meeting will be authorized by the affirmative vote of the holders of a majority in voting power of the shares of stock of the Company which are present in person or by proxy and entitled to vote thereon. Abstentions are counted in tabulations of the votes cast on proposals presented to the stockholders, whereas broker nonvotes are not counted for purposes of determining whether a proposal has been approved.

The following sets forth certain information concerning the Company’s nominees for election to the Board of Directors at the Annual Meeting:

Name

| | Age

| | Year First Elected Director

| | Position

|

| Peter J. Sodini | | 61 | | 1995 | | President, Chief Executive Officer and Director |

| Todd W. Halloran | | 40 | | 1995 | | Director |

| Jon D. Ralph (2) | | 38 | | 1995 | | Director |

| Charles P. Rullman (2) | | 54 | | 1995 | | Director |

| Peter M. Starrett | | 54 | | 1999 | | Director |

| Hubert E. Yarborough, III (1) | | 58 | | 1999 | | Director |

| William M. Webster, III(1) | | 69 | | 2001 | | Director |

| Byron E. Allumbaugh (1) | | 71 | | 2002 | | Director |

| Thomas M. Murnane (1) | | 55 | | 2002 | | Director |

| (1) | | Member of Audit Committee |

| (2) | | Member of Compensation Committee |

Peter J. Sodini has served as our President and Chief Executive Officer since June 1996 and served as our Chief Operating Officer from February 1996 until June 1996. Mr. Sodini has served as a director since November 1995.

Todd W. Halloranhas served as a director since November 1995. Mr. Halloran joined Freeman Spogli in 1995 and became a Principal in 1998. Mr. Halloran is also a director of Galyan’s Trading Company, Inc.

6

Jon D. Ralph has served as a director since November 1995. Mr. Ralph joined Freeman Spogli in 1989 and became a Principal in 1998. Mr. Ralph is also a director of Hudson Respiratory Care Inc., River Holding Corp., and Century Maintenance Supply, Inc.

Charles P. Rullman has served as a director since November 1995. Mr. Rullman joined Freeman Spogli in 1995 as a Principal. Mr. Rullman is also a director of Hudson Respiratory Care Inc. and River Holding Corp.

Peter M. Starrett has served as a director since January 1999. Since August 1998, Mr. Starrett has served as President of Peter Starrett Associates, a retail advisory firm, and has served as a consultant to Freeman Spogli. Prior to August 1998, Mr. Starrett was President of Warner Bros. Studio Stores Worldwide and had been employed by Warner Bros. since May 1990. Mr. Starrett is also a director of AFC Enterprises, Inc., Galyan’s Trading Company, Inc. and Guitar Center, Inc.

Hubert E. Yarborough, III has served as a director since September 1999. Mr. Yarborough, formerly a shareholder in the McNair Law Firm, is president of The Yarborough Group of South Carolina, LLC, a national governmental relations firm.

William M. Webster, III has served as a director since May 2001. Mr. Webster has been a private investor for the last several years. Mr. Webster is also Director of Litchfield Company of South Carolina, Inc. and The National Bank of South Carolina.

Byron E. Allumbaugh has served as a director since March 2002. Currently Mr. Allumbaugh is a business consultant working with public and private companies. From 1976 to 1997, he served as Chairman and Chief Executive Officer of Ralphs Supermarkets based in Southern California. Currently, Mr. Allumbaugh is a Director of El Paso Corporation, CKE Restaurants, Inc., Galyan’s Trading Company, Inc. and The Penn Traffic Company.

Thomas M. Murnane has served as a director since October 2002. Mr. Murnane is a recently retired partner of PricewaterhouseCoopers, LLP, who served in various capacities in his tenure with that firm since 1980, including Director of the firm’s Retail Strategy Consulting Practice, Director of Overall Strategy Consulting for the East Region of the U.S., and most recently Global Director of Marketing and Brand Management for PwC Consulting. Mr. Murnane is also a director of Finlay Enterprises, Inc.

The Board of Directors recommends that stockholders vote FOR the election of these nominees.

7

EXECUTIVE COMPENSATION

The following table summarizes annual and long-term compensation paid or accrued by the Company for services rendered for the fiscal years indicated by the Company’s Chief Executive Officer and the Company’s four other most highly compensated executive officers whose total salary and bonus exceeded $100,000 individually during the year ended September 26, 2002 (collectively, the “named executive officers”).

Summary Compensation Table

| | | | | Annual Compensation

| | Long-Term Compensation Awards

| | |

Name and Principal Position

| | Fiscal Year

| | Salary

| | Bonus

| | Other Annual Compensation(a)

| | Securities Underlying Options/SARs

| | All Other Compensation(b)

|

| Peter J. Sodini | | 2002 | | $ | 549,327 | | $ | 250,000 | | $ | 52,623 | | 28,000 | | $ | 5,500 |

| President and Chief | | 2001 | | | 515,000 | | | 150,000 | | | 29,085 | | 60,000 | | | 4,000 |

| Executive Officer | | 2000 | | | 515,000 | | | 250,000 | | | 43,294 | | — | | | 4,000 |

|

| Joseph A. Krol | | 2002 | | | 211,538 | | | 95,000 | | | 6,459 | | 18,000 | | | 5,285 |

| Vice President, | | 2001 | | | 205,000 | | | 60,000 | | | 18,283 | | 30,000 | | | 4,135 |

| Operations | | 2000 | | | 197,308 | | | 80,000 | | | 14,521 | | — | | | 4,621 |

|

| Steven J. Ferreira | | 2002 | | | 207,308 | | | 85,000 | | | 44,070 | | 23,000 | | | 4,827 |

| Senior Vice President, | | 2001 | | | 179,616 | | | 60,000 | | | 10,249 | | 38,000 | | | 4,678 |

| Administration and | | 2000 | | | 157,308 | | | 70,000 | | | 7,639 | | — | | | 4,327 |

| Strategic Planning | | | | | | | | | | | | | | | | |

|

| Douglas Sweeney(c) | | 2002 | | | 197,923 | | | 20,000 | | | 6,992 | | 16,000 | | | 4,844 |

| Vice President, | | 2001 | | | 194,000 | | | 40,000 | | | 3,330 | | 10,000 | | | 4,027 |

| Operations | | 2000 | | | 192,462 | | | 75,000 | | | 3,397 | | — | | | 4,519 |

|

| David M. Zaborski | | 2002 | | | 162,115 | | | 60,000 | | | 7,070 | | 14,000 | | | 2,750 |

| Vice President, | | 2001 | | | 145,962 | | | 50,000 | | | 8,796 | | 25,000 | | | 3,187 |

| Merchandise Marketing | | 2000 | | | 112,116 | | | 55,000 | | | 9,651 | | — | | | 1,285 |

| (a) | | Consists primarily of executive perquisites (medical, life, vehicle and tax services) and relocation reimbursements. |

| (b) | | Consists of matching contributions to the Company’s Retirement Savings Plan. |

| (c) | | Mr. Sweeney resigned as Vice President, Operations, as of September 26, 2002. |

8

Option Grants

OPTION GRANTS IN LAST FISCAL YEAR

The following table reflects stock options granted during the past fiscal year to the named executive officers pursuant to the Company’s 1999 Stock Option Plan (the “1999 Plan,” which along with the Company’s 1998 Stock Option Plan sometimes collectively referred to herein as the “Stock Option Plans”). No stock appreciation rights were granted to the named executive officers during fiscal 2002. All options expire seven years from the date of grant or, if sooner, 90 days after termination of employment:

| | | Individual Grants

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(1)

|

Name

| | Number of Securities Underlying Options Granted(#)

| | Percent of Total Options Granted to Employees in Fiscal Year(2)

| | Exercise or Base Price per Share

| | | 5%

| | 10%

|

| Peter J. Sodini | | 28,000(3) | | 14% | | $ | 5.12 | | 11/26/2008 | | $ | 58,362 | | $ | 136,008 |

| Joseph A. Krol | | 18,000(3) | | 9% | | $ | 5.12 | | 11/26/2008 | | | 37,518 | | | 87,434 |

| Douglas Sweeney | | 16,000(3) | | 8% | | $ | 5.12 | | (4) | | | 33,350 | | | 77,719 |

| Steven J. Ferreira | | 23,000(3) | | 11.5% | | $ | 5.12 | | 11/26/2008 | | | 47,940 | | | 111,721 |

| David M. Zaborski | | 14,000(3) | | 7% | | $ | 5.12 | | 11/26/2008 | | | 29,181 | | | 68,004 |

| (1) | | Potential realizable value of grant is calculated assuming that the market price of the underlying security appreciates at annualized rates of 5% and 10%, respectively, over the respective term of the grant. The assumed annual rates of appreciation of 5% and 10% would result in the price of the Company’s common stock increasing to $7.20 and $9.98 per share, respectively. |

| (2) | | Options to purchase an aggregate of 200,000 shares were granted to employees during fiscal 2002. |

| (3) | | Non-qualified stock options granted November 26, 2001. Shares subject to the options granted vest over three years, with 33.3% of such shares vesting on November 26 of each year beginning November 26, 2002. |

| (4) | | Original stock option granted to expire on November 26, 2008, however, such options expired by their terms 90 days after Mr. Sweeney resigned his position with the Company on September 26, 2002. |

OPTION EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR-END OPTION VALUE

The following table sets forth information with respect to option exercises by the named executive officer for the fiscal year ended September 26, 2002 and held by them as of that date:

| | | Shares Acquired On Exercise(#)

| | Value Realized($)

| | Number of Securities Underlying Unexercised Options at September 26, 2002(#)

| | Value of Unexercised In-the-Money Options at September 26, 2002($)(a)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| Peter J. Sodini | | — | | — | | 320,069 | | 68,002 | | — | | — |

| Joseph A. Krol | | — | | — | | 47,124 | | 38,001 | | — | | — |

| Douglas Sweeney | | — | | — | | 88,243 | | 22,667 | | — | | — |

| Steven J. Ferreira | | — | | — | | 24,665 | | 48,335 | | — | | — |

| David M. Zaborski | | — | | — | | 12,833 | | 30,668 | | — | | — |

| (a) | | These values are based upon the difference between the exercise price and the closing price per share on September 26, 2002 of $2.05. |

9

Executive Employment Contracts

Peter J. Sodini. We entered into an employment agreement with Mr. Sodini on October 1, 1997. The agreement was subsequently amended to provide that the term shall expire on September 30, 2004. The agreement provides for:

| | • | | an annual base salary of $475,000 (subject to annual adjustment by the Board of Directors), |

| | • | | participation in any of our benefit programs and |

| | • | | participation in an incentive bonus program (which provides for a payout of a minimum of 25% upon the achievement of goals determined by the Board of Directors). |

Mr. Sodini’s bonus arrangement is not tied to specific objectives. Principal factors considered by the Board of Directors are increases in earnings per share, EBITDA improvement, comparable sales growth, acquisition quality and future outlook.

Pursuant to the terms of the agreement, if we terminate Mr. Sodini prior to a change in control with just cause, Mr. Sodini shall be entitled to his then effective compensation and benefits through the last day of his actual employment. If Mr. Sodini is terminated because of death or disability, we will pay to the estate of Mr. Sodini, in the case of his death, or to Mr. Sodini, in the case of his disability, one year’s pay less amounts paid under any disability plan. If Mr. Sodini is terminated by us prior to a Change in Control without just cause, Mr. Sodini shall be entitled to amounts due him on the effective termination date, severance pay equal to his then current monthly salary for a period of 18 months (which period coincides with the 18 month non-competition period contained in Mr. Sodini’s employment agreement) and continued medical insurance coverage during the severance payment period (unless Mr. Sodini is able to procure medical insurance coverage from a subsequent employer).

If Mr. Sodini’s employment is terminated without Cause or for Good Reason following a Change in Control, then Mr. Sodini is entitled to salary continuation and benefits for 24 months.

For purposes of Mr. Sodini’s employment agreement, the terms below have the following meanings:

| | • | | A “Change in Control” occurs if: a) any “person” (as such term is defined in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended), other than the Company, trustee or other fiduciary, holding securities under an employee benefit plan of the Company or a company owned, directly or indirectly by the stockholders of the Company becomes the “beneficial owner” (as defined in Rule 13d-3 under the Securities Exchange Act of 1934, as amended), directly or indirectly, of securities of the Company, representing more than 50% of the combined voting power of the Company’s then outstanding securities; b) any person, other than the existing stockholders, becomes the beneficial owner of more than 50% of the Company’s outstanding voting securities; c) certain mergers or consolidations of the Company are consummated; or d) there is a liquidation of the Company, or the sale or disposition of all or substantially all of the Company’s assets. |

| | • | | “Good Reason” includes a reduction in Mr. Sodini’s annual base salary, an adverse alteration in the nature of his position or responsibilities, moving Mr. Sodini’s employment base more than 25 miles from its current location or a good faith determination by Mr. Sodini that as a result of the change in control, he is not able to discharge his duties effectively. |

| | • | | “Just cause” includes a willful and continued failure to perform; engaging in conduct injurious to us; being convicted of a felony or any crime of moral turpitude; and gross negligence or willful misconduct in the performance of his duties. |

This agreement contains covenants prohibiting Mr. Sodini, through the period ending on the later of 18 months after termination or such time as he no longer receives severance benefits from us, from competing with us or soliciting our employees for employment.

10

Other Named Executive Officers. We also entered into employment agreements with each of the named executive officers other than Mr. Sodini. These agreements expired in the first half of calendar 2002. However, the provisions of the agreement which related to severance survived the expiration of the agreements. Therefore, if the executive officer is terminated without Cause prior to a Change in Control, he would receive salary continuation for 12 months or until such time as he engages in other employment, after which he would receive the difference, if any, between his previous salary with us and his new salary. If the executive officer is terminated without Cause or for Good Reason following a Change in Control, he would receive salary continuation and health insurance for a period of 24 months from the termination date or until such time he engages in other employment, after which he would receive the difference, if any, between his previous salary with us and his new salary.

For purposes of our employment agreements with each of the named executive officers other than Mr. Sodini, the terms below have the following meanings:

| | • | | A “Change in Control” would occur if Freeman Spogli and J.P. Morgan Partners, LLC (“J.P. Morgan Partners”) no longer had voting control of the Board of Directors. |

| | • | | “Good Reason” includes: actions by the Company in the 12 months following a Change in Control which prevent the employee from being able to discharge his duties effectively; the assignment to employee of any duties inconsistent with his position immediately prior to the Change in Control or a substantial adverse alteration in the nature or status of his position or responsibilities or the conditions of his employment from those in effect immediately prior to the Change in Control; a reduction in the employee’s annual base salary; requiring the employee to be based outside of the State of North Carolina; the failure to pay to the employee any portion of his current compensation or compensation under any deferred compensation program within seven days of the date such compensation is due; and the failure to continue to provide the employee with benefits substantially similar to those enjoyed by him under any of the Company’s plans in which he was participating at the time of the Change in Control. |

| | • | | “Cause” for termination following a Change in Control means conviction of the employee of, or the entry of a pleading of guilty ornolo contendre by the employee to, any crime involving moral turpitude or any felony. “Cause” for termination prior to a Change in Control means failure to perform, conduct which is injurious to the Company, or the conviction of or entry of a plea of guilty ornolo contendre to any crime involving moral turpitude or any felony. |

Equity Compensation Plan Information

The Company maintains its Stock Option Plans, pursuant to which it may grant equity awards to eligible persons. The 1998 Stock Option Plan is described more fully below under “1998 Stock Option Plan” and the 1999 Stock Option Plan is described more fully below under Proposal 2.

The following table sets forth aggregate information regarding the Company’s compensation plans in effect as of September 26, 2002.

| | | (a) | | ( b) | | (c) |

Plan Category

| | Number of Securities to be Issued Upon Exercise of Outstanding Options

| | Weighted-Average Exercise Price of Outstanding Options

| | Number of Securities Available for Future Issuances Under Equity Compensation Plans (excluding Securities reflected in Column(a))

|

| Equity compensation plans approved by security holders | | 1,125,205 | | | $9.13 | | 3,967,095 |

| Equity compensation plans not approved by security holders | | N/A | | | N/A | | N/A |

| | |

| |

|

| |

|

| Total | | 1,125,205 | | $ | 9.13 | | 3,967,095 |

| | |

| |

|

| |

|

11

1998 Stock Option Plan

We adopted the 1998 Stock Option Plan in January 1998. The 1998 Stock Option Plan provides for the grant of incentive stock options and nonqualified stock options, as appropriate, to our officers, employees, consultants and members of the Board of Directors. An aggregate of 1,275,000 shares of common stock has been reserved for issuance under the 1998 Stock Option Plan. Options to acquire 464,405 shares of common stock have been granted under the 1998 Stock Option Plan with exercise prices ranging from $8.82-$11.27 per share.

The 1998 Stock Option Plan is administered by the Board of Directors or a committee of the Board of Directors. The 1998 Stock Option Plan provides that the administrator may, among other things, select the participants in the plan, determine the number of options which may be granted to such participants, and determine the vesting schedule of the options granted. Options are granted at prices determined by the Board of Directors (or the committee of the Board which administers the plan) and may be exercisable in one or more installments. Additionally, the terms and conditions of awards under the plan may differ from one grant to another. Under the plan, incentive stock options may only be granted to employees with an exercise price at least equal to the fair market value of the related common stock on the date the option is granted. Fair values are based on the most recent common stock sales.

In January 2003, the Board of Directors terminated the 1998 Stock Option Plan, but its provisions continue to govern options to purchase common stock which are outstanding as of the date of termination. Freeman Spogli has the right to require the sale of all shares purchased under the 1998 Stock Option Plan in the event it sells all its holdings of our common stock.

Compensation Committee Report

The Compensation Committee of the Board of Directors develops, oversees and reviews the general compensation plans and policies of the Company and approves the individual compensation arrangements for the Company’s executive officers, including the named executive officers. The Compensation Committee also administers the Stock Option Plans.

Our Executive Compensation Program

The Compensation Committee is committed to designing and implementing a program of executive compensation that will contribute to the achievement of the Company’s business objectives. We have an executive compensation program which we believe:

| | • | | Fulfills our business and operating needs, comports with our general human resource strategies and enhances shareholder value. |

| | • | | Enables us to attract, motivate and retain the executive talent essential to the achievement of our short-term and long-term business objectives. |

| | • | | Rewards executives for accomplishment of pre-defined business goals and objectives. |

| | • | | Provides rewards consistent with gains in stockholder wealth so that executives will be financially advantaged when stockholders are similarly financially advantaged. |

In implementing our executive compensation program, we attempt to provide compensation opportunities that are generally comparable to those provided by similar companies in the convenience store, grocery and general retail industries. This “peer group” is not the same group used for the industry comparison in the performance graph found in the “Comparison of Cumulative Total Return” section of this Proxy Statement; rather, it reflects the industry groups with which the Company competes for personnel.

12

Elements of Executive Compensation

The Company’s executive compensation program has four key components: (i) base salary; (ii) annual performance awards; (iii) long-term incentive awards; and (iv) benefits. These components combine fixed and variable elements to create a total compensation package that provides some income predictability while linking a significant portion of compensation to corporate, business unit and individual performance.

Base Salary

Base salary represents the fixed component of our executive compensation program. Base salaries are set within ranges, which are targeted around the competitive norm for similar executive positions in similar companies in the convenience store, grocery and general retail industries. Individual salaries may be above or below the competitive norm, depending on the executive’s experience and performance. We consider the following factors in approving adjustments to salary levels for our executive officers: (i) the relationship between current salary and appropriate internal and external salary comparisons; (ii) the average size of salary increases being granted by competitors; (iii) whether the responsibilities of the position have changed during the preceding year; and (iv) the individual executive’s performance as reflected in the overall manner in which his assigned role is carried out.

Annual Performance Awards

Annual performance awards are granted pursuant to the Company’s executive compensation plan and are intended to serve two primary functions. First, annual incentives permit the Company to compensate officers directly if the Company achieves specific financial performance targets. Second, annual incentives also serve to reward executives for performance on those activities that are most directly under their control and for which they are held accountable.

At the beginning of each year, specific performance goals are set for the Company, each business unit and each individual executive. Performance awards are proportionately increased or decreased from the target to reflect performance levels that exceed or fall below expectations. For fiscal 2002, we determined the best criteria for measurement of Company performance was cash flow and pre-tax earnings. Business unit and individual performance goals are based on each individual executive’s responsibilities and his respective contribution to the Company’s financial targets, including strategic initiatives, innovation, departmental effectiveness and personnel management.

The annual performance award is discretionary and the Compensation Committee has the authority to approve, reduce or entirely eliminate annual performance awards. Annual performance awards are cash-based and are paid at the end of each fiscal year. Generally, annual performance award amounts increase as financial measures increase above the levels originally set by the Compensation Committee.

Long-Term Incentive Awards

Long-term incentive awards are granted pursuant to the Stock Option Plans and are intended to align the interests of executive officers and other key employees with those of the Company’s stockholders, reward executives for maximizing stockholder value and facilitate the retention of key employees.

The size of an individual’s stock option award is based primarily on individual performance and the individual’s responsibilities and position with the Company. These options are granted with an exercise price equal to the fair market value of the Company’s common stock on the date of grant, therefore, the stock options have value only if the Company’s common stock price appreciates from the value on the date the options were granted. This feature is intended to focus executives on the enhancement of stockholder value over the long-term and to encourage equity ownership in the Company. These options vest and become exercisable in three equal, annual, installments beginning on the first anniversary of the date of grant. The Stock Option Plans are discretionary plans; however, it has been the Compensation Committee’s practice generally to award options annually.

13

Benefits

Benefits offered to executives serve a different purpose than do the other elements of executive compensation. In general, they are designed to provide a safety net of protection against the financial catastrophes that can result from illness, disability or death and to provide a reasonable level of retirement income. Benefits offered to executives are largely those that are offered to the general employee population, with some variation primarily to promote tax efficiency.

Chief Executive Officer (“CEO”) Compensation

Mr. Peter J. Sodini’s compensation for the fiscal year ended September 26, 2002, was determined in accordance with the above plans and policies taking into account his employment agreement with the Company. During fiscal 2002, Mr. Sodini also earned $250,000 in annual performance awards.

Mr. Sodini’s employment agreement provides for his participation in an incentive bonus program (with a minimum payout of 25% upon the achievement of goals determined by the Board of Directors, and other perquisites). Mr. Sodini’s bonus arrangement is not tied to specific objectives. Principal factors considered by the Board of Directors are increases in earnings per share, EBITDA improvement, comparable sales growth, acquisition quality and future outlook.

Policy With Respect to $1 Million Deduction Limit

The Company has not awarded any compensation that is non-deductible under Section 162(m) of the Internal Revenue Code.That section imposes a $1 million limit on the U.S. corporate income tax deduction a publicly-held company may claim for compensation paid to the named executive officers unless certain requirements are satisfied. An exception to this limitation is available for “performance-based” compensation, as defined under Section 162(m). Compensation received as a result of the exercise of stock options may be considered performance-based compensation if certain requirements of Section 162(m) are satisfied.In the event that the Compensation Committee considers approving compensation in the future which would exceed the $1 million deductibility threshold, the Compensation Committee will consider what actions, if any, should be taken to make such compensation deductible.

Conclusion

The Compensation Committee believes that these executive compensation policies and programs effectively promote the Company’s interests and enhance stockholder value.

Submitted by the Company’s Compensation Committee

Jon D. Ralph

Charles P. Rullman

Audit Committee Report

The Audit Committee of the Board of Directors (the “Audit Committee”) is composed of Byron E. Allumbaugh, William M. Webster, III, Hubert E. Yarborough, III and Thomas M. Murnane and operates under an amended and restated written charter (a copy of which is attached to this Proxy Statement as Exhibit A) amended and restated by the Board of Directors in October 2002 (the original written charter was adopted in March 2000). The role of the Audit Committee is to assist the Board of Directors in overseeing the Company’s financial reporting process. The Board of Directors, in its business judgment, has determined that all members of the Audit Committee are “independent directors” as defined by currently applicable Nasdaq Marketplace Rules.

In the performance of its oversight function, the Audit Committee has met and held discussions with management of the Company, who represented to the Audit Committee that the Company’s consolidated financial statements were

14

prepared in accordance with generally accepted accounting principles. The Audit Committee has reviewed and discussed the consolidated financial statements with both management and the independent public accountants. The Audit Committee also discussed with the independent public accountants matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees), as currently in effect.

The Company’s independent public accountants also provided to the Audit Committee the written disclosures required by the current version of Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed their independence with the independent public accountants. In connection with that, the Audit Committee has considered whether the provision of non-auditing services (and the aggregate fees billed for these services) in fiscal 2002 by Deloitte & Touche LLP to the Company is compatible with maintaining the independent public accountants’ independence.

The members of the Audit Committee are not professionally engaged in the practice of auditing or accounting and are not experts in the fields of accounting or auditing, including in respect of auditor independence. Management is responsible for the Company’s internal controls and the financial reporting process. The Company’s independent public accountants are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted auditing standards and to issue a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes, including the Company’s system of internal controls and the preparation of its consolidated financial statements, and members of the Audit Committee rely without independent verification on the information provided to them and on the representations made by management and the independent public accountants. The Audit Committee also hires and sets the compensation for the Company’s independent public accountants.

The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions with management and the independent public accountants do not assure that the Company’s financial statements are presented in accordance with generally accepted accounting principles, that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards or that the Company’s independent accountants are in fact “independent.”

Based upon the reports and discussions described in this report, and subject to the limitations on the role and responsibilities of the Audit Committee referred to above and in the Charter, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 26, 2002, filed with the Securities and Exchange Commission. The Audit Committee also retained Deloitte & Touche LLP as the Company’s independent public accountants for the 2003 fiscal year.

Submitted by the Company’s Audit Committee

Byron E. Allumbaugh—Chairman

William M. Webster, III

Hubert E. Yarborough, III

Thomas M. Murnane

15

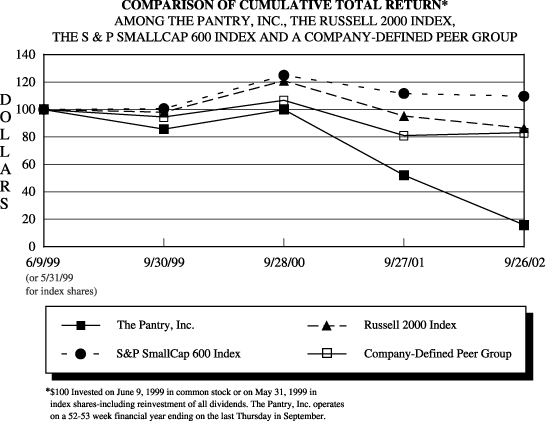

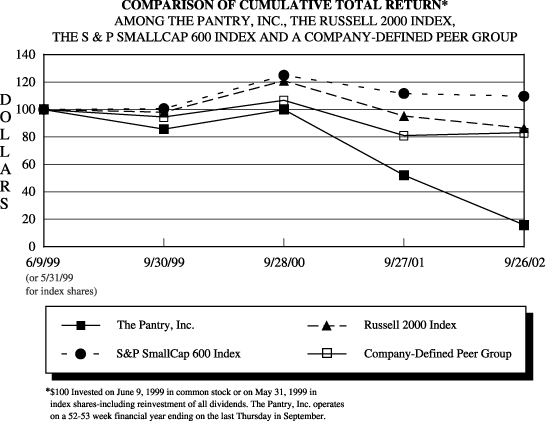

Comparison Of Cumulative Total Return

The following graph compares the cumulative total stockholder return on the Company’s common stock since June 9, 1999, the effective date of the Company’s initial public offering, through September 26, 2002, with the cumulative total return for the same period on the S&P SmallCap 600 Index, the Russell 2000 Index and a Company-Defined Peer Group. The graph assumes that at the beginning of the period indicated, $100 was invested in the Company’s common stock and the stock of the companies comprising the SmallCap 600 Index, the Russell 2000 Index and the Company-Defined Peer Group and that all dividends were reinvested. The Company-Defined Peer Group is composed of the common stock of the following issuers: (i) 7-Eleven, Inc.; (ii) Casey’s General Stores, Inc.; (iii) Dairy Mart Convenience Stores, Inc. (includes both Series A and Series B common stock); and (iv) Uni Marts, Inc. The stockholder return shown on the graph below is not necessarily indicative of future performance and we will not make or endorse any predictions as to future stockholder returns.

| | | June 9, 1999 (or May 31, 1999 for index shares)

| | September 28, 2000

| | September 27, 2001

| | September 26, 2002

|

| The Pantry, Inc. | | $ | 100.00 | | $ | 100.00 | | $ | 51.99 | | $ | 15.77 |

| Russell 2000 Index | | | 100.00 | | | 120.82 | | | 95.19 | | | 86.34 |

| S&P Small Cap 600 Index | | | 100.00 | | | 124.88 | | | 111.63 | | | 109.63 |

| Company-Defined Peer Group | | | 100.00 | | | 106.57 | | | 80.87 | | | 83.02 |

16

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Stock Subscription Plan

In August 1998, we adopted a stock subscription plan that permits our employees, including directors and executive officers, to purchase up to an aggregate of 158,100 shares of common stock at fair market value. The purchase price for all common stock purchased under our stock subscription plan was $11.27 per share and was paid in cash and/or the delivery to us of a secured promissory note payable to us or one of our subsidiaries. As of September 26, 2002, we have issued 134,436 shares of common stock, net of subsequent repurchases of 6,273 shares, to 37 employees under our stock subscription plan.

We have the right to repurchase shares purchased under this plan upon an employee’s termination of employment. This right terminates with respect to each share on the first anniversary of the purchase date for such share. In addition, Freeman Spogli has the right to require the sale of all shares purchased under the stock subscription plan in the event it sells all its holdings of common stock.

No shares were purchased by the named executive officers during the last fiscal year pursuant to the stock subscription plan, however, in connection with previous purchases of our common stock under the stock subscription plan, as of January 24, 2003, Mr. Sodini remains indebted to the Company for an amount equal to $100,100, plus interest at a rate of 8.5% per annum.

Registration Rights Agreement

We have entered into a registration rights agreement with Freeman Spogli, J.P. Morgan Partners and Mr. Sodini obligating us:

| | • | | on up to three occasions at the request of holders of at least 50% of the common stock held by the parties to the agreement, to register the resale of all common stock held by the requesting holders; |

| | • | | at any time to register the resale of shares of common stock having a value of more than $5 million at the request of any party; and |

| | • | | at any time, to allow any party to include shares in any registration of common stock by us. |

Under the registration rights agreement, Freeman Spogli, J.P. Morgan Partners and Mr. Sodini have the right to purchase their pro rata portion of additional shares issued by us.

Severance Arrangements

We have entered into employment agreements with each of the named executive officers which provide for certain severance payments upon a change of control of our company. See “Executive Compensation— Employment Agreements.”

PROPOSAL 2: APPROVAL OF THE COMPANY’S 1999 STOCK OPTION PLAN

General

The Board of Directors adopted our company’s 1999 Stock Option Plan, or the Plan, in June 1999, prior to the effective date of our initial public offering. On January 15, 2003, the Board of Directors amended the Plan to increase the number of shares of common stock of the Company that may be issued under the Plan by 882,505 shares. This number of shares corresponded to the number of shares that had been available for issuance under the Company’s 1998 Stock Option Plan, which the Board of Directors terminated on January 15, 2003, except for the purpose of continuing to govern options to purchase Company common stock remaining outstanding under that plan. As of January 15, 2003,

17

options to purchase 1,019,500 shares had been granted under the Plan. Of these options, none have been exercised, 178,500 have been forfeited and are available for the granting of additional shares and 2,805,500 remain outstanding. If the proposed amendment to the Plan is approved, the total number of shares of common stock authorized for issuance under the Plan will be 4,707,505 (3,825,000 original plus the additional 882,505 under the amendment) and 3,688,005 will be available for future grants of options under the Plan.

The ability to grant stock options has enabled the Company to provide equity compensation to highly qualified employees and other service providers of the Company that is competitive with that of other, similar companies.

Required Vote

Assuming the presence of a quorum, approval of the Plan requires the affirmative vote of the holders of a majority in voting power of the shares of stock of the Company which are present in person or by proxy and entitled to vote thereon. Abstentions are counted in tabulations of the votes cast on proposals presented to the stockholders, whereas broker nonvotes are not counted for purposes of determining whether a proposal has been approved.

The Board of Directors recommends that the shareholders vote FOR the amendment to the 1999 Stock Option Plan.

Description of the 1999 Stock Option Plan

The following description of the Plan is a summary of its material terms and provisions. It is not intended to be a complete description of the Plan, and it is qualified in its entirety by reference to the full text of the Plan, a copy of which has been filed with the SEC and is available at the SEC’s website http://www.sec.gov.

Nature and Purpose

The Plan is intended to further the growth, development and financial success of the Company by providing long-term incentives to certain officers, key employees, consultants and members of the Board of Directors of the Company or its subsidiaries. The Plan authorizes grants of both incentive stock options, or ISOs, and nonqualified stock options, or NSOs. (See “Tax Effects of the Plan” below for information about the tax treatment of ISOs and NSOs.)

The Plan is not subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended, or ERISA. The Plan is not a qualified plan under Section 401 of the Internal Revenue Code of 1986, as amended, or the Code.

Administration

The Compensation Committee of the Board of Directors, or the Committee, administers the Plan. Members of the Committee are appointed by the Board of Directors from among its members and may be removed by the Board of Directors in its discretion. The membership of the Committee may be constituted to enable options to qualify as exempt under Rule 16b-3 under the Securities Exchange Act of 1934, as amended, and as “performance-based compensation” under Section 162(m) of the Code.

The Committee has broad discretion to construe, interpret and administer the Plan, to select the individuals to be granted options, to determine the number of shares to be subject to each option, and to determine the terms, conditions and duration of each option. In its discretion, the Committee may at any time accelerate the vesting and exercisability of outstanding options and may extend the time during which NSOs may be exercised following termination of employment. The Committee may permit statutory withholding obligations to be satisfied by withholding shares upon exercise of options. The Committee’s decisions will be conclusive, final and

18

binding upon all parties. No member of the Committee will be liable for any action or determination made with respect to the Plan or any option granted under the Plan. To the fullest extent permitted by law, the Company will indemnify the members of the Committee against reasonable expenses incurred in connection with any action taken against them with respect to the Plan or any option granted under the Plan.

Shares Reserved for Issuance under the Plan

Up to 3,825,000 shares of common stock are reserved for issuance upon exercise of options granted under the Plan. An individual optionee may be granted options to purchase a maximum of 1,785,000 shares under the Plan. To the extent any shares subject to options under the Plan are not purchased, or are reacquired by the Company at their original purchase price, they will not be counted against the maximum number of shares reserved for issuance under the Plan.

If the outstanding shares of common stock of the Company are exchanged for different securities of the Company through a reorganization, recapitalization or reclassification, or if the number of outstanding shares changes as the result of a stock split, reverse stock split or stock dividend, the Committee will equitably adjust the number and kind of shares that may be purchased upon exercise of options, and the number, exercise price and kind of securities subject to outstanding options granted under the Plan.

Characteristics of Stock Options

The exercise price of options granted under the Plan generally may not be less than 100% of the fair market value of the underlying shares on the date of grant. The Plan provides an exception to this requirement for options granted to employees of an acquired company to replace options previously granted to these employees under the acquired company’s plans.

Each option granted under the Plan will be subject to a written option agreement setting forth the terms and conditions of the option. The option agreement will indicate whether the option is intended to be an ISO or an NSO and may contain a right of first refusal or a repurchase right in favor of the Company. Optionees have no rights as shareholders with respect to shares covered by options until share certificates are issued for shares purchased upon exercise of options.

Options may not be granted under the Plan more than 10 years after the date the Plan was adopted by the Board of Directors. Each option agreement will state the termination date of the option, which will not be more than 10 years from the date the option was granted. All options granted under the Plan will vest over time, and the vesting rate of each option will be determined by the Committee and stated in the applicable option agreement. The termination of the employment or service relationship of the optionee with the Company will not accelerate or otherwise affect the number of shares for which an option may be exercised.

The exercise price of an option may be paid in any form of lawful consideration the Committee may approve, including the surrender of other shares held by the optionee. Options are not transferable and may be exercised only by the optionee, or by a person to whom the optionee’s right to exercise has passed by will or the laws of descent and distribution, or upon the disability of the optionee by designation of the optionee. The Company may withhold for income and employment tax purposes upon the exercise of an option. In the discretion of the Committee, the amount required to be withheld may be paid by a reduction in the number of shares to be issued upon exercise of an option.

Eligibility

The Committee has the exclusive right, subject to applicable law, to determine those persons who will be granted options under the Plan. Subject to the foregoing, any employee of the Company or a subsidiary of the Company, as well as any other person providing services to the Company or a subsidiary, including consultants

19

and directors, may be granted options under the Plan. ISOs may be granted only to employees of the Company or a subsidiary. NSOs may be granted to any service provider of the Company or a subsidiary.

Effect of “Extraordinary Events”

Upon an “Extraordinary Event,” as defined below, the Plan and each outstanding option will terminate. Optionees will have until 10 days before the effective date of the Extraordinary Event to exercise outstanding options to the extent the options are vested and exercisable. An “Extraordinary Event” is (i) the dissolution, liquidation or sale of all or substantially all of the business, properties and assets of the Company, (ii) a reorganization, merger, consolidation, sale or exchange of securities in which the Company either does not survive or the Company survives and any of the stockholders have the opportunity to receive cash, securities and/or other property in exchange for their shares of common stock of the Company, or (iii) the acquisition by any person or group of the beneficial ownership of more than 50% of the Company’s then outstanding shares of common stock.

Termination of the Plan

The Plan will terminate after 10 years or, if sooner, when all shares reserved under the Plan have been issued. At any time, the Board of Directors may terminate the Plan. The termination of the Plan will not affect outstanding options in any way.

Tax Effects of the Plan

The following discussion of the federal income tax consequences of options granted under the Plan is intended only as a summary of the present federal income tax treatment of stock options. These laws are highly technical and are subject to change at any time. This summary does not discuss the tax consequences of an optionee’s death, or the provisions of the income tax laws of any municipality, state or foreign country in which an optionee may reside.

Incentive Stock Options

An optionee recognizes no regular taxable income upon the grant or exercise of an ISO. However, the exercise of an ISO may cause an optionee to be subject to alternative minimum tax (described below). The federal income tax consequences of the sale or other disposition of ISO shares depends upon how long the optionee holds the shares. If the optionee waits to sell or otherwise dispose of ISO shares until the later of (i) two years from the date of the grant of the ISO or (ii) one year after the date of exercise, then any gain or loss is taxed as capital gain or loss according to the rules of sales and exchanges generally. In such a case, the Company is not entitled to a tax deduction.

If an optionee does not wait to sell or otherwise dispose of ISO shares before the end of the holding periods described above, the optionee will recognize ordinary income equal to the lesser of (i) the fair market value of the common stock on the date of exercise minus the exercise price or (ii) the amount realized on the disposition minus the exercise price. The remainder of the optionee’s gain, if any, will be taxable as capital gain. The Company will be entitled to a deduction equal to the amount of ordinary income recognized by the optionee.

The alternative minimum tax consequences of the exercise of ISOs differ from the regular income tax consequences described above. For alternative minimum tax purposes, the difference between the exercise price and the fair market value of the shares upon exercise is a preference item subject to alternative minimum tax.

Nonqualified Stock Options

An optionee recognizes no taxable income upon grant of the NSO. On exercise of an NSO, the optionee will recognize ordinary taxable income equal to the excess of the fair market value of the stock over the exercise

20

price. If the optionee is an employee, the ordinary income he or she recognizes will be considered “wages,” and the Company will be required to withhold for income and employment tax purposes. The Company will be entitled to a tax deduction equal to the ordinary income recognized by the optionee on the exercise of an NSO.

When an optionee sells or otherwise disposes of NSO shares, the optionee’s gain or loss will equal the difference between the sale price and the fair market value of the shares on the date of exercise. Any such gain or loss will be short or long-term capital gain or loss, depending on whether the shares have been held for at least 12 months.

PROPOSAL 3: RATIFICATION OF APPOINTMENT

OF INDEPENDENT PUBLIC ACCOUNTANTS

The Board of Directors was responsible for selecting the Company’s independent public accountants in prior fiscal years. As a result of recent legislation, the Audit Committee is now solely responsible for selecting the Company’s independent public accountants.

The Audit Committee has selected Deloitte & Touche LLP as the Company’s independent public accountants for fiscal year 2003. Although stockholder approval is not required to appoint Deloitte & Touche LLP as the independent public accountants for the Company and its subsidiaries, the Company believes that submitting the appointment of Deloitte & Touche LLP to its stockholders for ratification is a matter of good corporate governance. If the stockholders do not ratify this appointment, such appointment will be reconsidered by the Audit Committee. The proxy will be voted as specified, and if no specification is made, the proxy will be cast “For” this proposal.

During the Company’s fiscal year ended September 26, 2002, there were no disagreements with Deloitte & Touche LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which if not resolved to their satisfaction would have caused them to make reference to the subject matter of the disagreements in connection with their opinion.

The audit report of Deloitte & Touche LLP on the consolidated financial statements of the Company for the years ended September 26, 2002, and September 27, 2001, did not contain any adverse opinion or disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles.

A representative of Deloitte & Touche LLP will be present at the Annual Meeting and will be afforded an opportunity to make a statement and to respond to questions.

Audit Firm Fee Summary

During fiscal year 2002, the Company retained its independent public accountants, Deloitte & Touche LLP, to provide services in the following categories and amounts:

| Audit Fees | | $ | 420,869 |

| Implementation Fees | | $ | 7,503 |

| All Other Fees | | $ | 581,356 |

| Total | | $ | 1,009,728 |

The Board of Directors recommends that the stockholders vote FOR the ratification of the appointment of Deloitte & Touche LLP for fiscal year 2003.

21

SECTION 16(a)

BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our executive officers, directors and 10% beneficial owners to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Based on a review of the report forms that were filed, we believe that during 2001 all filing requirements applicable to our executive officers, directors and 10% beneficial owners were complied with, except that Mr. Thomas M. Murnane failed to timely file a Form 3 upon his appointment to the Board of Directors and a Form 4 disclosing one transaction, Mr. Steven Ferreira failed to timely file a Form 3 upon his appointment to Vice President, Administration and Strategic Planning and two Forms 4 disclosing two transactions, Mr. Peter J. Sodini failed to timely file three Forms 4 disclosing three transactions, and Mr. Joseph J. Duncan failed to timely file two Forms 4 disclosing two transactions. Each of such forms have since been filed with the Securities and Exchange Commission.

SUBMISSION OF STOCKHOLDER PROPOSALS FOR

2004 ANNUAL MEETING OF STOCKHOLDERS

Any proposals which stockholders intend to present for a vote of stockholders at the 2004 Annual Meeting of Stockholders and which such stockholders desire to have included in the Company’s Proxy Statement and form of proxy relating to that meeting must be sent to the Company’s principal executive offices, marked to the attention of the Secretary of the Company, and received by the Company at such offices on or before September 26, 2003, which is 120 calendar days prior to the anniversary of the date of this proxy statement. The determination by the Company of whether it will oppose inclusion of any proposal in its Proxy Statement and form of proxy will be made on a case-by-case basis in accordance with its judgment and the rules and regulations promulgated by the Securities and Exchange Commission. Proposals received after September 26, 2003, will not be considered for inclusion in the Company’s proxy materials for its 2004 Annual Meeting of Stockholders.

In addition, if a stockholder intends to present a matter for a vote at the 2004 Annual Meeting of Stockholders, the stockholder must give advance notice to the Company determined in accordance with the Company’s Bylaws. To be timely, a stockholder’s notice must be received by the Secretary of the Company at the principal executive offices of the Company between November 26, 2003 and December 26, 2003, which is not later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the first anniversary of this year’s annual meeting (provided, however, that in the event that the date of the annual meeting is more than 30 days before or more than 70 days after such anniversary date, notice by the stockholder must be so delivered not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made by the Company) (the “Bylaw Proposal Window”). Each such stockholder’s notice must set forth certain additional information as specified in the Company’s Bylaws, including without limitation:

| | • | | as to each matter the stockholder proposes to bring before the meeting, a brief description of the business desired to be brought before the meeting and the reasons for conducting such business at the meeting, and |

| | • | | the name and record address of the stockholder, the class and number of shares of capital stock of the Company that are beneficially owned by the stockholder, and any material interest of the stockholder in such business. |

Finally, in accordance with SEC rules, if a stockholder gives notice of a proposal after December 27, 2003, which is 45 calendar days prior to the anniversary of the mailing date of this proxy statement (the “Discretionary Vote Deadline”), the Company’s proxy holders will be allowed to use their discretionary voting authority to vote against the stockholder proposal when and if the proposal is raised at the Company’s 2004 Annual Meeting of Stockholders.

22