SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to Rule 14a-11(c) or rule 14a-12 |

THE PANTRY, INC.

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

THE PANTRY, INC.

1801 Douglas Drive

P.O. Box 1410

Sanford, North Carolina 27330

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MARCH 31, 2004

You are cordially invited to attend the Annual Meeting of Stockholders of The Pantry, Inc. (the “Company”) which will be held on Wednesday, March 31, 2004, at 10:00 a.m. Eastern Standard Time, at the Sheraton Imperial Hotel & Convention Center, 4700 Emperor Blvd., Durham, North Carolina 27703, for the following purposes:

| | • | | To elect nine nominees to serve as directors each for a term of one year or until his successor is duly elected and qualified; |

| | • | | To ratify the appointment of Deloitte & Touche LLP as independent public accountants for the Company and its subsidiaries for the fiscal year ending September 30, 2004; and |

| | • | | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Stockholders of record at the close of business on February 12, 2004, are entitled to notice of and to vote at the Annual Meeting and any and all adjournments or postponements thereof.

Your vote is very important. A proxy card is enclosed for the convenience of those stockholders who do not plan to attend the Annual Meeting in person but desire to have their shares voted. If you do not plan to attend the Annual Meeting, please complete and return the proxy card as soon as possible in the envelope provided for that purpose. If you return your card and later decide to attend the Annual Meeting in person or for any other reason desire to revoke your proxy, you may do so at any time before your proxy is voted.

By Order of the Board of Directors

Daniel J. Kelly

Chief Financial Officer

Sanford, North Carolina

February 27, 2004

THE PANTRY, INC.

1801 Douglas Drive

P.O. Box 1410

Sanford, North Carolina 27330

PROXY STATEMENT

GENERAL INFORMATION

This Proxy Statement and the accompanying proxy card are being mailed to stockholders on or about February 27, 2004, by the Board of Directors of The Pantry, Inc. (the “Company”) in connection with the solicitation of proxies for use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the Sheraton Imperial Hotel & Convention Center, 4700 Emperor Blvd., Durham, North Carolina 27703, on Wednesday, March 31, 2004, at 10:00 a.m. Eastern Standard Time, and at all adjournments or postponements thereof.

The Company will pay all expenses incurred in connection with this solicitation, including postage, printing, handling and the actual expenses incurred by custodians, nominees and fiduciaries in forwarding proxy materials to beneficial owners. In addition to solicitation by mail, certain officers, directors and regular employees of the Company, who will receive no additional compensation for their services, may solicit proxies by telephone, personal communication or other means. The Company has retained Morrow & Co., Inc. to aid in the search for stockholders and delivery of proxy materials. The aggregate fees to be paid to Morrow & Co., Inc. are not expected to exceed $5,000.00. In addition, as part of the services provided to the Company as its transfer agent, Wachovia Bank, N.A. will assist the Company in identifying recordholders.

ANNUAL MEETING

Purposes of Annual Meeting

The principal purposes of the Annual Meeting are to:

| | • | | elect nine directors each for a term of one year or until his successor is duly elected and qualified; |

| | • | | ratify the action of the Audit Committee of the Board of Directors in appointing Deloitte & Touche LLP as independent public accountants for the Company and its subsidiaries for the 2004 fiscal year; and |

| | • | | transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The Board of Directors knows of no other matters other than those stated above to be brought before the Annual Meeting.

Voting

Pursuant to the Company’s Bylaws, the presence in person or by proxy of the holders of a majority in voting power of the outstanding shares of stock entitled to vote at the Annual Meeting will be necessary and sufficient to constitute a quorum for the transaction of business. Once a quorum is established at the Annual Meeting, the vote required to approve each proposal is set forth below:

| | | | |

• | | Proposal 1—“Election of Directors” | | a plurality of the votes cast at the Annual Meeting and entitled to vote thereon |

| | |

• | | Proposal 2—“Ratification of Auditors” and any other matter to properly come before the Annual Meeting | | the affirmative vote of the holders of a majority in voting power of the shares of stock of the Company which are present in person or by proxy and entitled to vote thereon |

1

“Plurality” means that the individuals who receive the largest number of votes cast, even if less than a majority, are elected as directors up to the maximum number of directors to be chosen at the meeting. Consequently, any shares not voted (whether by abstention, broker non-vote or otherwise) will not be included in determining which nominees receive the highest number of votes.

Non-votes by banks, brokerage houses, custodians, nominees and other fiduciaries (“broker non-votes”) and abstentions will be counted for the purpose of determining whether a quorum is present, but broker non-votes will not be included for purposes of determining whether stockholder approval of a matter has been obtained. Because abstentions with respect to any matter are treated as shares present in person or represented by proxy and entitled to vote for the purposes of determining whether that matter has been approved by stockholders, abstentions will have the same effect as negative votes for Proposal 2.

Proxy Cards

If the accompanying proxy card is properly signed and returned to the Company and not revoked, it will be voted in accordance with the instructions contained in the proxy card. If the proxy card is signed and returned, but voting directions are not made, the proxy will be voted in favor of the proposals set forth in the accompanying “Notice of Annual Meeting of Stockholders” and in such manner as the proxyholders named on the enclosed proxy card in their discretion determine upon such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted by:

| | • | | attending the Annual Meeting and voting in person, |

| | • | | delivering a written revocation to the Secretary of the Company or |

| | • | | delivering a proxy in accordance with applicable law bearing a later date to the Secretary of the Company. |

Record Date

The Board of Directors has fixed the close of business on February 12, 2004, as the record date for the determination of stockholders entitled to receive notice of and to vote at the Annual Meeting and all adjournments or postponements thereof. As of the close of business on February 12, 2004, there were 19,801,481 shares of the Company’s common stock outstanding. On all matters to come before the Annual Meeting, each holder of common stock will be entitled to vote at the Annual Meeting and will be entitled to one vote for each share owned.

PRINCIPAL STOCKHOLDERS

The following table sets forth information, as of February 12, 2004, regarding shares of our common stock owned of record or known to us to be beneficially owned by:

| | • | | our Chief Executive Officer and each of our four other most highly compensated executive officers; |

| | • | | all those known by us to beneficially own more than 5% of our outstanding common stock; and |

| | • | | all of our executive officers and directors as a group. |

Except as otherwise indicated:

| | • | | the persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to community property laws, where applicable; and |

| | • | | the address of each of the stockholders listed in this table is as follows: c/o The Pantry, Inc., P.O. Box 1410, 1801 Douglas Drive, Sanford, North Carolina 27330. |

2

The percentages shown below have been calculated based on 19,801,481 total shares of common stock outstanding as of February 12, 2004.

| | | | | | |

Name and Address of Beneficial Owner

| | Shares of Common Stock Beneficially Owned(1)

| | | Percentage of Class

| |

Freeman Spogli & Co.(2) | | | | | | |

FS Equity Partners III, L.P. | | 5,046,906 | | | 25.5 | % |

FS Equity Partners IV, L.P. | | 2,484,343 | | | 12.6 | % |

FS Equity Partners International, L.P. | | 203,120 | | | 1.0 | % |

Todd W. Halloran | | — | | | — | |

Jon D. Ralph | | — | | | — | |

Charles P. Rullman | | — | | | — | |

Chilton Investment Company, Inc.(3) | | 2,701,415 | | | 13.6 | % |

Peter J. Sodini(4) | | 424,959 | | | 2.1 | % |

Peter M. Starrett(5) | | 73,852 | | | * | |

Joseph A. Krol(6) | | 97,382 | | | * | |

Steven J. Ferreira(7) | | 82,944 | | | * | |

David M. Zaborski(8) | | 51,150 | | | * | |

Hubert E. Yarborough, III(9) | | 22,167 | | | * | |

Byron E. Allumbaugh(10) | | 40,000 | | | * | |

Thomas M. Murnane(11) | | 18,334 | | | * | |

Paul L. Brunswick | | — | | | * | |

Gregory J. Tornberg(12) | | 39,333 | | | * | |

All directors and executive officers as a group (14 individuals)(13) | | 8,596,157 | (14) | | 41.9 | % |

| (1) | | Pursuant to the rules of the Securities and Exchange Commission, certain shares of our common stock which a person has the right to acquire within 60 days of the date shown above pursuant to the exercise of stock options are deemed to be outstanding for the purpose of computing the percentage ownership of such person but are not deemed outstanding for the purpose of computing the percentage ownership of any other person. Such shares are described below as being subject to presently exercisable stock options. |

| (2) | | The business address of Freeman Spogli & Co., FS Equity Partners III, L.P. and FS Equity Partners IV, L.P. is 11100 Santa Monica Boulevard, Suite 1900, Los Angeles, California 90025. The business address of FS Equity Partners International, L.P. is c/o Padget-Brown & Company, Ltd., West Winds Building, Third Floor, Grand Cayman, Cayman Islands, British West Indies. |

| (3) | | Based on an Amendment No. 4 to Schedule 13G filed with the Securities and Exchange Commission on February 13, 2004. The business address of Chilton Investment Company, Inc. is 1266 East Main Street, 7th Floor, Stamford, Connecticut, 06920. |

| (4) | | Includes 402,071 shares of common stock subject to presently exercisable stock options. |

| (5) | | Includes 1,667 shares of common stock subject to presently exercisable stock options. Mr. Starrett’s business address is c/o Freeman Spogli, 11100 Santa Monica Boulevard, Suite 1900, Los Angeles, California 90025. |

| (6) | | Includes 95,792 shares of common stock subject to presently exercisable stock options. |

| (7) | | Includes 82,000 shares of common stock subject to presently exercisable stock options. |

| (8) | | Includes 50,500 shares of common stock subject to presently exercisable stock options. |

| (9) | | Includes 21,667 shares of common stock subject to presently exercisable stock options. |

| (10) | | Includes 15,000 shares of common stock subject to presently exercisable stock options |

| (11) | | Includes 8,334 shares of common stock subject to presently exercisable stock options. |

| (12) | | Includes 39,333 shares of common stock subject to presently exercisable stock options. |

| (13) | | Includes 728,031 shares of common stock subject to presently exercisable stock options. |

| (14) | | Includes 7,734,369 shares of common stock owned by Freeman Spogli, since Messrs. Halloran, Ralph and Rullman are affiliated with those entities. |

3

INFORMATION ABOUT OUR BOARD OF DIRECTORS

General

Our Board of Directors oversees our business and affairs and monitors the performance of management. In accordance with traditional corporate governance principles, our Board of Directors does not involve itself in day-to-day operations. Instead, directors keep themselves informed through, among other things, discussions with our Chief Executive Officer, other key executives and principal external advisers (legal counsel, outside auditors, investment bankers and other consultants), reading reports and other materials that are provided to them and by participating in board and committee meetings. Our directors are elected annually and hold office for a period of one year or until their successors are duly elected and qualified. Our Board of Directors, in its business judgment, has made an affirmative determination that each of Messrs. Yarborough, Murnane, Allumbaugh, Starrett and Brunswick meet the definition of “independent director” as that term is defined in the Nasdaq Marketplace Rules.

There are no family relationships among our directors or executive officers. There are no material proceedings to which any of our directors or executive officers, or any of their associates, is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

To our knowledge, none of our directors or executive officers has been convicted in a criminal proceeding during the last five years (excluding traffic violations or similar misdemeanors), and none of our directors or executive officers was a party to any judicial or administrative proceeding during the last five years (except for any matters that were dismissed without sanction or settlement) that resulted in a judgment, decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

Board Meetings

Our Board of Directors met seven times during fiscal 2003. Each director attended 75% or more of the aggregate of the Board meetings (held during the period for which the director was in office) and committee meetings of the Board of which the director was a member. Going forward, the Company’s independent directors have resolved to hold meetings, separate from management, at least twice a year.

Policy on Attendance at Annual Meetings of Stockholders. The Company does not have a stated policy, but encourages its directors to attend each annual meeting of stockholders. At last year’s annual meeting of stockholders, held on March 25, 2003, seven directors were present and in attendance.

Board Committees

The Board has three standing committees: the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee.

Audit Committee. The Audit Committee was established by our Board of Directors for the purpose of overseeing the accounting and financial reporting processes of the Company and audits of our financial statements. The Audit Committee is responsible for selecting the independent public accountants and reviewing the scope, results and effectiveness of the annual audit and other services provided by our independent public accountants. In addition, the Audit Committee is responsible for reviewing our financial statements and the audit letters provided by our independent public accountants. Finally, the Audit Committee is responsible for reviewing our systems of internal control with management and the independent public accountants.

The members of the Audit Committee for fiscal 2003 were Byron E. Allumbaugh, William M. Webster, III, Hubert E. Yarborough, III and Thomas M. Murnane. In July 2003, Mr. Webster retired from the Board and was replaced by Paul L. Brunswick. Mr. Brunswick has replaced Mr. Webster on the Audit Committee and has

4

assumed the role of Chairman of that committee. Our Board of Directors, in its business judgment, has made an affirmative determination that each of Messrs. Allumbaugh, Yarborough, Murnane and Brunswick (i) are “independent directors” as that term is defined by Nasdaq Marketplace Rules and (ii) satisfies Nasdaq Marketplace Rules relating to financial literacy and experience. Our Board of Directors has also determined that Mr. Brunswick is an “audit committee financial expert” as such term is defined in the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee met nine times during fiscal 2003. For additional information regarding the Audit Committee see “Audit Committee Report” below.

Compensation Committee. The Compensation Committee is responsible for recommending compensation arrangements for officers of the Company and the review of the Company’s compensation plans and policies. The members of the Compensation Committee for fiscal 2003 were Jon D. Ralph, Byron E. Allumbaugh (who the Board has determined, in its business judgment, is an independent director as that term is defined by Nasdaq Marketplace Rules), and Charles P. Rullman, each of whom is a non-employee director. As a result of the recent sale by our largest stockholder of a portion of its holdings of our common stock, the Company is no longer a “Controlled Company” (as such term is defined by Nasdaq Marketplace Rules), so the Board has resolved that, going forward,it will adjust the composition of the Compensation Committee so that its membership will be comprised solely of independent, non-employee directors.

The compensation of our Chief Executive Officer and each of our executive officers for fiscal 2004 was unanimously approved by the Board of Directors, including unanimous approval by the Compensation Committee. During fiscal 2003, Mr. Sodini participated in Board of Director deliberations regarding the compensation of our executive officers. The Compensation Committee met two times in fiscal 2003. For additional information regarding the Compensation Committee see “Compensation Committee Report” below.

Corporate Governance and Nominating Committee. Our Board of Directors has established a Corporate Governance and Nominating Committee to assist the Board in (i) identifying and evaluating individuals qualified to become members of the Board of Directors and recommending qualified individuals for nomination to the Board of Directors and to each of its committees; and (ii) ensuring the highest standards of good corporate governance by, among other things, reviewing and evaluating the Company’s corporate governance policies and procedures and recommending to the Board of Directors any changes to such policies and procedures that it deems necessary. The members of the Corporate Governance and Nominating Committee for fiscal 2003 were Todd W. Halloran (Chairman), Jon D. Ralph and Thomas M. Murnane (who the Board has determined, in its business judgment, is an independent director as that term is defined by Nasdaq Marketplace Rules). The Corporate Governance and Nominating Committee did not meet separately in 2003, but conducted matters during meetings of the full board.

As a result of the recent sale by our largest stockholder of a portion of its holdings of our common stock, the Company is no longer a “Controlled Company” (as such term is defined by Nasdaq Marketplace Rules), so the Board has resolved that, going forward, it will adjust the composition of the Corporate Governance and Nominating Committee so that its membership will be comprised solely of independent directors.

The Corporate Governance and Nominating Committee acts under a written charter (a copy of which has been affixed to this Proxy Statement as Appendix A) specifying its scope and purpose, which includes among other things, to:

| | • | | assist the Board in identifying, interviewing and recruiting qualified director candidates; |

| | • | | annually present to the Board of Directors a list of individuals recommended for nomination to the Board at the annual meeting of stockholders based on the Committee’s review of those qualifications the Committee deems necessary for services as a member of the Board; |

| | • | | monitor the independence of the Board; |

| | • | | adopt (and periodically review) a code of business conduct and ethics to ensure continued compliance with applicable legal and Nasdaq standards and corporate best practices; |

5

| | • | | periodically review the public reporting and disclosure policies and procedures established by the Company; |

| | • | | monitor and evaluate the work of the Company’s disclosure committee; and |

| | • | | develop and implement (and periodically review) legal compliance policies and procedures for reporting evidence of material violations of securities laws, as required by the Sarbanes-Oxley Act and SEC regulations promulgated thereto; |

The Corporate Governance and Nominating Committee identifies, investigates and recommends prospective directors to the Board with the goal of creating a balance of knowledge, experience and diversity. Candidates for director nominees are reviewed in the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Corporate Governance and Nominating Committee considers diversity, age, skills, and such other factors as it deems appropriate given the current needs of the Board and the Company, to maintain a balance of knowledge, experience and capability. The Corporate Governance and Nominating Committee believes that candidates for director should have certain minimum qualifications, including being able to read and understand basic financial statements, having business experience, and having high moral character, however the committee retains the right to modify these minimum qualifications from time to time. The Corporate Governance and Nominating Committee recommended the slate of directors proposed for election at the Annual Meeting, which was unanimously approved by the Board of Directors, including unanimous approval by the independent directors of the Board of Directors.

The policy of the Corporate Governance and Nominating Committee (and the Board of Directors generally) is to consider written nominations of candidates for election to the Board of Directors properly submitted by stockholders, however it does not actively solicit such nominations. Pursuant to the Company’s Bylaws, stockholders must comply with certain procedures in connection with any nominations to the Board of Directors, which are summarized below under “Procedure for Nominations of Directors.” The Corporate Governance and Nominating Committee does not intend to alter the manner in which it evaluates candidates, including the criteria set forth above, based on whether the candidate is recommended by a stockholder or otherwise.

Procedure for Nominations of Directors

The Company’s Bylaws provide procedures for the nomination of directors. The Bylaws provide that nominations for the election of directors may only be made by the Board of Directors or, if certain procedures are followed, by any stockholder of the Company who is entitled to vote generally in elections of directors. Any stockholder of record entitled to vote generally in the election of directors may nominate one or more persons for election as directors at a meeting of stockholders only if written notice of such stockholder’s intent to make such nomination or nominations has been delivered to the Secretary of the Company at the principal executive offices of the Company not later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the first anniversary of the preceding year’s annual meeting (provided, however, that in the event that the date of the annual meeting is more than 30 days before or more than 70 days after such anniversary date, notice by the stockholder must be so delivered not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made by the Company). Each such notice of a stockholder’s intent to nominate a director must set forth certain information as specified in the Company’s Bylaws.

Stockholder Communications

Our stockholders may communicate directly with the members of the Board of Directors or the individual chairmen of standing Board committees by writing directly to those individuals at the following address: The Pantry, Inc., 1801 Douglas Drive, Sanford, North Carolina 27330. The Company’s general policy is to forward, and not to intentionally screen, any mail received at the Company’s corporate office that is sent directly to an individual unless the Company believes the communication may pose a security risk.

6

Compensation Committee Interlocks and Insider Participation

The members of the compensation committee of our board of directors during fiscal 2003 were Messrs. Allumbaugh, Ralph and Rullman. Messrs. Ralph and Rullman are principals in Freeman Spogli, which is our largest stockholder and which has certain business relationships with the Company described under “Certain Relationships and Related Transactions” below.

Additional Corporate Governance Matters

The Company has adopted a Code of Business Conduct and Ethics (our “Code of Ethics”) that applies to its employees, officers and directors. Our Code of Ethics (a copy of which has been affixed to this Proxy Statement as Appendix B) is available free of charge upon written request to the attention of Corporate Secretary, The Pantry, Inc., 1801 Douglas Drive, Sanford, North Carolina 27330 (telephone: 919-774-6700).

PROPOSAL 1: ELECTION OF DIRECTORS

The Board of Directors has approved the nomination of the following nine directors for election at the Annual Meeting to serve for a period of one year or until the election and qualification of their successors: Todd W. Halloran, Jon D. Ralph, Charles P. Rullman, Peter J. Sodini, Peter M. Starrett, Hubert E. Yarborough, III, Byron E. Allumbaugh, Thomas M. Murnane and Paul L. Brunswick. All of the nominees are currently serving on the Board of Directors of the Company. In July 2003, Mr. Brunswick was appointed to the Board of Directors to replace Mr. William M. Webster, III, who retired from the Board. Mr. Brunswick was recommended to the Board of Directors by our CEO and certain of our non-management directors. It is intended that proxies will be voted in favor of all of the nominees.

The Board of Directors has no reason to believe that the persons named above as nominees will be unable or will decline to serve if elected. In the event of death or disqualification of any nominee or the refusal or inability of any nominee to serve as a director, proxies voted for that nominee may be voted with discretionary authority for a substitute or substitutes as shall be designated by the Board of Directors.

The following table and accompanying biographies provide information on our nominees for election to the Board of Directors at the Annual Meeting:

| | | | | | |

Name

| | Age

| | Year First Elected Director

| | Position with our Company

|

Peter J. Sodini | | 62 | | 1995 | | President, Chief Executive Officer and Director |

Todd W. Halloran | | 41 | | 1995 | | Director |

Jon D. Ralph | | 39 | | 1995 | | Director |

Charles P. Rullman | | 55 | | 1995 | | Director |

Peter M. Starrett | | 56 | | 1999 | | Director |

Hubert E. Yarborough, III | | 59 | | 1999 | | Director |

Byron E. Allumbaugh | | 72 | | 2002 | | Director |

Thomas M. Murnane | | 56 | | 2002 | | Director |

Paul L. Brunswick | | 64 | | 2003 | | Director |

Peter J. Sodini has served as our President and Chief Executive Officer since June 1996 and served as our Chief Operating Officer from February 1996 until June 1996. Mr. Sodini was Chief Executive Officer and a director of Purity Supreme, Inc. from December 1991 through February 1996. Prior to 1991, Mr. Sodini held executive positions at several supermarket chains including Boys Markets, Inc. and Piggly Wiggly Southern, Inc. Mr. Sodini has served as a director since November 1995.

7

Todd W. Halloran has served as a director since November 1995. Mr. Halloran joined Freeman Spogli in 1995 and became a Principal in 1998. From 1990 to 1995, Mr. Halloran was a Vice President and Associate at Goldman, Sachs & Co., where he worked in the Principal Investment Area and the Mergers and Acquisitions Department. Mr. Halloran is also a director of Galyan’s Trading Company, Inc.

Jon D. Ralph has served as a director since November 1995. Mr. Ralph joined Freeman Spogli in 1989 and became a Principal in 1998. Prior to joining Freeman Spogli, Mr. Ralph spent three years at Morgan Stanley & Co. where he served as an analyst in the Investment Banking Division. Mr. Ralph is also a director of Hudson Respiratory Care Inc. and River Holding Corp.

Charles P. Rullman has served as a director since November 1995. Mr. Rullman joined Freeman Spogli in 1995 as a Principal. From 1992 to 1995, Mr. Rullman was a General Partner of Westar Capital, a private equity investment firm specializing in middle market transactions. Prior to joining Westar, Mr. Rullman spent twenty years at Bankers Trust Company and its affiliate, BT Securities Corporation, where he was a Managing Director and Partner. Mr. Rullman is also a director of Hudson Respiratory Care Inc. and River Holding Corp.

Peter M. Starrett has served as a director since January 1999. Since August 1998, Mr. Starrett has served as President of Peter Starrett Associates, a retail advisory firm, and has served as a consultant to Freeman Spogli. Prior to August 1998, Mr. Starrett was President of Warner Bros. Studio Stores Worldwide and had been employed by Warner Bros. since May 1990. Mr. Starrett is also a director of Pacific Sunwear of California, Inc., AFC Enterprises, Inc., Galyan’s Trading Company, Inc. and Guitar Center, Inc.

Hubert E. Yarborough, III has served as a director since September 1999. Mr. Yarborough currently is the President of The Yarborough Group of South Carolina, LLC, a national governmental relations firm. Prior to joining that firm, Mr. Yarborough was a shareholder in the McNair Law Firm where his practice primarily involved representing clients before the South Carolina General Assembly, state regulatory and administrative agencies, the South Carolina Congressional delegation and various Federal regulatory agencies.

Byron E. Allumbaugh has served as a director since March 2002. Currently, Mr. Allumbaugh is a business consultant working with public and private companies. From 1976 to 1997, he served as Chairman and Chief Executive Officer of Ralphs Supermarkets based in Southern California. Currently, Mr. Allumbaugh is a director of CKE Restaurants, Inc., Galyan’s Trading Company, Inc. and The Penn Traffic Company.

Thomas M. Murnane has served as a director since October 2002. Mr. Murnane retired as a partner of PricewaterhouseCoopers, LLP in 2002. He served in various capacities in his tenure with that firm since 1980, including Director of the firm’s Retail Strategy Consulting Practice, Director of Overall Strategy Consulting for the East Region of the United States, and most recently, Global Director of Marketing and Brand Management for PwC Consulting. Mr. Murnane currently provides consulting services and is also a director of Finlay Enterprises, Inc., Pacific Sunwear of California, Inc. and Captaris, Inc.

Paul L. Brunswickhas served as a director since July 2003. Currently, Mr. Brunswick is President of General Management Advisory, a provider of financial and business consulting services. Mr. Brunswick was the Vice President and Chief Financial Officer of GoodMark Foods, Inc., a company in the meat snack business, from 1992 until 1999. Currently, Mr. Brunswick is a director of Waste Industries USA, Inc. and Lonesource, Inc.

The Board of Directors recommends that stockholders vote FOR the election of these nominees.

8

COMPENSATION

Director Compensation

Independent directors receive a $10,000 annual retainer. They also receive $2,500 for each Board meeting they attend, $1,000 for each committee meeting they attend, and $1,000 for each committee meeting at which they act as chairperson. Currently, our independent directors who receive such payments are Messrs. Yarborough, Allumbaugh, Murnane, Starrett and Brunswick. During fiscal 2003, Mr. Webster also received such payments. Our other directors do not receive any compensation for their service on our Board of Directors. All directors are reimbursed for their reasonable out-of-pocket expenses in connection with their attendance at meetings.

Executive Compensation

The following table summarizes annual and long-term compensation paid or accrued by the Company for services rendered for the fiscal years indicated by the Company’s Chief Executive Officer and the Company’s four other most highly compensated executive officers whose total salary and bonus exceeded $100,000 individually during the year ended September 25, 2003 (collectively, the “named executive officers”):

| | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | | Long-Term Compensation Awards

| | |

Name and Principal Position

| | Fiscal

Year

| | Salary

| | Bonus

| | Other Annual Compensation(1)

| | | Securities Underlying Options/SARs

| | All Other Compensation(2)

|

Peter J. Sodini President and Chief Executive Officer | | 2003

2002

2001 | | $

| 572,308

549,327

515,000 | | $

| 400,000

250,000

150,000 | | $

| —

52,623

— | (3)

(4)

(3) | | 70,000

28,000

60,000 | | $

| 6,000

5,500

4,000 |

| | | | | | |

Joseph A. Krol Vice President, Operations | | 2003

2002

2001 | |

| 234,885

211,538

205,000 | |

| 130,000

95,000

60,000 | |

| —

—

— | (3)

(3)

(3) | | 50,000

18,000

30,000 | |

| 5,910

5,285

4,135 |

| | | | | | |

Steven J. Ferreira Senior Vice President, Administration | | 2003

2002

2001 | |

| 228,692

207,308

179,616 | |

| 130,000

85,000

60,000 | |

| —

44,070

— | (3)

(5)

(3) | | 50,000

23,000

38,000 | |

| 4,887

4,827

4,678 |

| | | | | | |

David M. Zaborski Vice President, Merchandise Marketing | | 2003

2002

2001 | |

| 170,236

162,115

145,962 | |

| 95,000

60,000

50,000 | |

| —

—

— | (3)

(3)

(3) | | 35,000

14,000

25,000 | |

| 2,987

2,750

3,187 |

| | | | | | |

Gregory J. Tornberg Vice President,

Gasoline Marketing | | 2003

2002

2001 | |

| 131,200

126,885

106,877 | |

| 75,000

45,000

40,000 | |

| —

16,517

— | (3)

(6)

(3) | | 30,000

14,000

14,000 | |

| 1,762

1,269

1,513 |

| (1) | | Consists primarily of executive perquisites (medical, life, vehicle and tax services) and relocation reimbursements. |

| (2) | | Consists of matching contributions to our Retirement Savings Plan. |

| (3) | | Perquisites and other personal benefits received did not exceed the lesser of $50,000 or 10% of salary and bonus compensation for the named executive officer. |

| (4) | | Includes $35,570 for the personal use of a Company automobile. |

| (5) | | Includes reimbursement of $34,607 for relocation expenses. |

| (6) | | Includes reimbursement of $7,776 in medical expenses and of $7,378 in relocation expenses. |

9

Option Grants in Last Fiscal Year

The following table reflects stock options granted during the past fiscal year to the named executive officers pursuant to our 1999 Stock Option Plan (the “1999 Plan,” which along with our 1998 Stock Option Plan sometimes collectively referred to herein as the “stock option plans”). No stock appreciation rights were granted to the named executive officers during fiscal 2003. All options expire seven years from the date of grant or, if sooner, 90 days after termination of employment:

| | | | | | | | | | | | | | | | | |

| | | Individual Grants

| | | | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation for

Option Term(1)

|

Name

| | Number of Securities Underlying Options Granted(#)

| | | Percent of Total Options Granted to Employees in Fiscal Year(2)

| | | Exercise or Base Price per Share

| | Expiration Date 11/13/2009

| |

| | | | | | 5%

| | 10%

|

Peter J. Sodini | | 70,000 | (3) | | 16.3 | % | | $ | 1.70 | | 11/13/2009 | | $ | 48,445 | | $ | 112,889 |

Joseph A. Krol | | 50,000 | (3) | | 11.6 | % | | $ | 1.70 | | 11/13/2009 | | | 34,604 | | | 80,641 |

Steven J. Ferreira | | 50,000 | (3) | | 11.6 | % | | $ | 1.70 | | 11/13/2009 | | | 34,604 | | | 80,641 |

David M. Zaborski | | 35,000 | (3) | | 8.1 | % | | $ | 1.70 | | 11/13/2009 | | | 24,222 | | | 56,449 |

Gregory J. Tornberg | | 30,000 | (3) | | 7.0 | % | | $ | 1.70 | | 11/13/2009 | | | 20,762 | | | 48,385 |

| (1) | | Potential realizable value of grant is calculated assuming that the market price of the underlying security appreciates at annualized rates of 5% and 10%, respectively, over the respective term of the grant. The assumed annual rates of appreciation of 5% and 10% would result in the price of our common stock increasing to $2.39 and $3.31 per share, respectively. |

| (2) | | Options to purchase an aggregate of 430,000 shares were granted to employees during fiscal 2003. |

| (3) | | Non-qualified stock options granted November 13, 2002. Shares subject to the options granted vest over three years, with 33.3% of such shares vesting on November 13 of each year beginning November 13, 2003. |

Option Exercises in Last Fiscal Year and Fiscal Year-end Option Value

The following table sets forth information with respect to option exercises by the named executive officer for the fiscal year ended September 25, 2003 and held by them as of that date:

| | | | | | | | | | | | |

| | | Shares Acquired On Exercise(#)

| | Value Realized($)

| | Number of Securities Underlying Unexercised Options at September 25, 2003(#)

| | Value of Unexercised In-the-Money Options at September 25, 2003($)(1)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Peter J. Sodini | | — | | — | | 349,405 | | 108,666 | | 372,000 | | 708,867 |

Joseph A. Krol | | — | | — | | 63,125 | | 72,000 | | 37,600 | | 496,600 |

Steven J. Ferreira | | — | | — | | 45,000 | | 78,000 | | 47,973 | | 514,787 |

David M. Zaborski | | — | | — | | 25,834 | | 52,666 | | 29,600 | | 352,900 |

Gregory J. Tornberg | | — | | — | | 20,000 | | 44,000 | | 27,253 | | 308,627 |

| (1) | | These values are based upon the difference between the exercise price and the closing price per share on September 25, 2003 of $10.32. |

10

Executive Employment Contracts

We have entered into employment agreements with our Chief Executive Officer and each of our other executive officers that provide for certain severance payments upon a change of control of our company.

Peter J. Sodini. We entered into an employment agreement with Mr. Sodini on October 1, 1997. The agreement was subsequently amended to provide that the term shall expire on September 30, 2006. The agreement provides for:

| | • | | an annual base salary of $475,000 (subject to annual adjustment by the board of directors); |

| | • | | participation in any of our benefit programs; and |

| | • | | participation in an incentive bonus program that provides for a payout of a minimum of 25% of base salary upon the achievement of goals determined by the board of directors (this bonus arrangement is not tied to specific objectives—principal factors considered by the board of directors are increases in earnings per share, EBITDA improvement, comparable sales growth, acquisition quality and future outlook). |

Pursuant to the terms of the agreement, if we terminate Mr. Sodini prior to a “change in control” with just cause, Mr. Sodini shall be entitled to his then effective compensation and benefits through the last day of his actual employment. If Mr. Sodini is terminated because of death or disability, we will pay to the estate of Mr. Sodini, in the case of his death, or to Mr. Sodini, in the case of his disability, one year’s pay less amounts paid under any disability plan.

If Mr. Sodini is terminated by us prior to a “change in control” without just cause, he will be entitled to amounts due him on the effective termination date, severance pay equal to his then current monthly salary for a period of 18 months and continued medical insurance coverage during the severance payment period (unless he is able to procure medical insurance coverage from a subsequent employer).

If Mr. Sodini’s employment is terminated without “cause” or for “good reason” following a “change in control,” then Mr. Sodini is entitled to salary continuation and benefits for 24 months.

For purposes of Mr. Sodini’s employment agreement, the terms below have the following meanings:

“Change in control” occurs if:

| | • | | a change in control, of a nature that would be required to be disclosed in our proxy statement, occurs, whether or not we are required to so disclose it in our proxy statement; |

| | • | | any “person” (which could include two or more persons acting as a partnership, limited partnership, syndicate or other group), other than The Pantry, a trustee or other fiduciary holding securities under one of our employee benefit plans or a company owned by our stockholders becomes the “beneficial owner” (as defined under the federal securities laws) of securities representing more than 50% of our combined voting power; |

| | • | | any person, other than our existing stockholders, becomes the beneficial owner of more than 50% of our outstanding voting securities; |

| | • | | we consummate certain mergers or consolidations; or |

| | • | | we are liquidated or we sell or dispose of all or substantially all of our assets. |

“Good reason” includes:

| | • | | a reduction in Mr. Sodini’s annual base salary; |

| | • | | an adverse alteration in the nature of his position or responsibilities; |

| | • | | moving Mr. Sodini’s employment base more than 25 miles from its current location; or |

| | • | | a good faith determination by Mr. Sodini that as a result of the change in control, he is not able to discharge his duties effectively. |

11

“Cause” includes:

| | • | | a willful and continued failure to perform; |

| | • | | engaging in conduct that injures us; and |

| | • | | being convicted of a felony or any crime of moral turpitude. |

Mr. Sodini’s agreement contains covenants prohibiting Mr. Sodini, through the period ending on the later of 18 months after termination or such time as he no longer receives severance benefits from us, from competing with us or soliciting our employees for employment.

Other Executive Officers. We have also entered into employment agreements with each of Messrs. Ferreira, Kelly, Krol, Zaborski and Tornberg. The agreements are for one year terms, ending on April 30, 2004, but renew for successive one-year terms unless either party gives the other notice of non-renewal or the agreement is otherwise terminated. If any of the above listed executive officers is terminated without “cause” prior to a “change in control,” he would receive salary continuation for 12 months or until such time as he engages in other employment, after which he would receive the difference, if any, between his previous salary with us and his new salary.

If the executive officer’s employment is terminated without cause or for “good reason” following a “change in control”, he would receive salary continuation and health insurance for a period of 24 months from the termination date or until such time he engages in other employment, after which he would receive the difference, if any, between his previous salary with us and his new salary.

For purposes of our employment agreements with each of the above named officers, the terms below have the following meanings:

A “change in control” occurs if:

| | • | | any “person” (which could include two or more persons acting as a partnership, limited partnership, syndicate or other group), other than The Pantry, a trustee or other fiduciary holding securities under one of our employee benefit plans or a company owned by our stockholders becomes the “beneficial owner” (as defined under the federal securities laws) of securities representing more than 50% of our outstanding voting power; |

| | • | | any person, other than our existing stockholders, becomes the beneficial owner of more than 50% of our outstanding voting securities; |

| | • | | we consummate certain mergers or consolidations; or |

| | • | | we are liquidated or we sell or dispose of all or substantially all of our assets. |

“Good reason” includes:

| | • | | a reduction in annual base salary; |

| | • | | an adverse alteration in the nature of the executive officer’s position or responsibility; |

| | • | | moving the executive officer more than 50 miles from his current location; |

| | • | | the failure to pay the executive officer any portion of his current compensation or compensation under any deferred compensation program within seven days of the due date; or |

| | • | | the failure to provide the executive officer with benefits substantially similar to those enjoyed by him under any of our plans that he was participating in at the time of a change in control. |

12

“Cause” means:

| | • | | willful and continued failure to perform his duties; |

| | • | | conduct demonstrably and materially injurious to us; or |

| | • | | conviction of or entry of plea of guilty ornolo contendre to any crime involving moral turpitude or any felony. |

Each agreement with the above-named officers contains a covenant prohibiting such officer through the period ending on the later of 12 months after termination or such time as he no longer receives severance benefits from us, from competing with us or soliciting our employees for employment.

Equity Compensation Plan Information

We maintain our stock option plans, pursuant to which we may grant equity awards to eligible persons. The following table sets forth aggregate information regarding our compensation plans in effect as of September 25, 2003:

| | | | | | | |

| | | (a) | | (b) | | (c) |

| | | |

Plan Category

| | Number of Securities to be Issued Upon Exercise of Outstanding Options

| | Weighted-Average Exercise Price of Outstanding Options

| | Number of Securities Available for Future Issuances Under Equity Compensation Plans (excluding Securities reflected in Column(a))

|

Equity compensation plans approved by security holders | | 1,305,892 | | $ | 6.85 | | 3,401,613 |

Equity compensation plans not approved by security holders | | N/A | | | N/A | | N/A |

| | |

| |

|

| |

|

Total | | 1,305,892 | | $ | 6.85 | | 3,401,613 |

| | |

| |

|

| |

|

The following descriptions of our stock option plans are a summary of the material terms and provisions of the respective plans and are not intended to be complete. Such descriptions are qualified in their entirety by reference to the full text of each such plan, a copy of each of which has been filed with the Securities and Exchange Commission and is available at the SEC’s website http://www.sec.gov.

Stock Option Plans. We adopted the 1998 Stock Option Plan in January 1998. The 1998 Stock Option Plan provides for the grant of incentive stock options and nonqualified stock options, as appropriate, to our officers, employees, consultants and members of the Board of Directors. An aggregate of 1,275,000 shares of common stock have been reserved for issuance under the 1998 Stock Option Plan as of February 12, 2004. Options to acquire 320,892 shares of common stock are outstanding under the 1998 Stock Option Plan with exercise prices no less than the fair market value of our common stock on the date of grant. In January 2003, our board of directors terminated the 1998 Stock Option Plan, but its provisions continue to govern options to purchase common stock, which were outstanding as of the date of termination.

On June 3, 1999, we adopted the 1999 Plan with provisions similar to the 1998 Stock Option Plan, providing for the grant of incentive stock options and non-qualified stock options to our officers, directors, employees and consultants. Up to 3,825,000 shares of our common stock initially were reserved for issuance under the 1999 Plan. In connection with the termination of the 1998 Stock Option Plan in January 2003, our board of directors amended the 1999 Plan to increase the number of shares of common stock that may be used under the 1999 Plan by 882,505 shares, which was the number of shares that remained available for issuance under the 1998 Stock Option Plan at that time. As amended, up to 4,707,505 shares of our common stock are reserved for issuance under the 1999 Plan. Options to acquire 1,103,804 shares of common stock are outstanding

13

under the 1999 Plan as of February 12, 2004 with exercise prices no less than the fair market value of our common stock on the date of grant.

Each of the stock option plans are administered by our Board of Directors or a committee of our Board of Directors. The exercise price of options granted under the 1999 Plan is no less than the fair market value of our common stock on the date of grant. Options granted under the 1999 Plan generally vest in equal annual installments over a three-year period, and may be exercised, in whole or in part, to the extent vested. Options granted under the 1999 Plan generally have terms of up to seven years. Additionally, the terms and conditions of awards under the plans may differ from one grant to another.

Freeman Spogli has the right to require the sale of shares purchased under the stock option plans in the event it sells all of its holdings of our common stock. Similarly, under certain circumstances, a purchaser of shares under our stock subscription plan may be forced to sell all of the shares purchased under such plan if Freeman Spogli finds a third party buyer for all or part of the shares of common stock held by Freeman Spogli.

Compensation Committee Report

The Compensation Committee of our Board of Directors develops, oversees and reviews the general compensation plans and policies of the Company and recommends the individual compensation arrangements for our Chief Executive Officer and each of our executive officers, including the named executive officers. The Compensation Committee also administers the stock option plans. As a result of the recent sale by our largest stockholder of a portion of its holdings of our common stock, the Company is no longer a “Controlled Company” (as that term is defined by Nasdaq Marketplace Rules), so the Board of Directors has resolved that, going forward, it will adjust the composition of the Compensation Committee so that its membership will be comprised solely of independent, non-employee directors.

Our Executive Compensation Program

The Compensation Committee is committed to designing and implementing a program of executive compensation that will contribute to the achievement of our business objectives. We have an executive compensation program which we believe:

| | • | | fulfills our business and operating needs, comports with our general human resource strategies and enhances shareholder value; |

| | • | | enables us to attract, motivate and retain the executive talent essential to the achievement of our short-term and long-term business objectives; |

| | • | | rewards executives for accomplishment of pre-defined business goals and objectives; and |

| | • | | provides rewards consistent with gains in stockholder wealth so that executives will be financially advantaged when stockholders are similarly financially advantaged. |

In implementing our executive compensation program, we attempt to provide compensation opportunities that are generally comparable to those provided by similar companies in the convenience store, grocery and general retail industries. This “peer group” is not the same group used for the industry comparison in the performance graph found in the “Comparison of Cumulative Total Return” section below; rather, it reflects the industry groups with which we compete for personnel.

Elements of Executive Compensation

Our executive compensation program has four key components:

| | • | | annual performance awards; |

| | • | | long-term incentive awards; and |

14

These components combine fixed and variable elements to create a total compensation package that provides some income predictability while linking a significant portion of compensation to corporate, business unit and individual performance.

Base Salary

Base salary represents the fixed component of our executive compensation program. Base salaries are set within ranges, which are targeted around the competitive norm for similar executive positions in similar companies in the convenience store, grocery and general retail industries. Individual salaries may be above or below the competitive norm, depending on the executive’s experience and performance. We consider the following factors in approving adjustments to salary levels for our executive officers:

| | • | | the relationship between current salary and appropriate internal and external salary comparisons; |

| | • | | the average size of salary increases being granted by competitors; |

| | • | | whether the responsibilities of the position have changed during the preceding year; and |

| | • | | the individual executive’s performance as reflected in the overall manner in which his assigned role is carried out. |

Annual Performance Award

Annual performance awards are granted pursuant to our executive compensation plan and are intended to serve two primary functions. First, annual incentives permit us to compensate officers directly if we achieve specific financial performance targets. Second, annual incentives also serve to reward executives for performance on those activities that are most directly under their control and for which they are held accountable.

At the beginning of each year, we set specific performance goals for the Company, each business unit and each individual executive. Performance awards are proportionately increased or decreased from the target to reflect performance levels that exceed or fall below expectations. For fiscal 2003, we determined the best criteria for measurement of our performance was cash flow and pre-tax earnings. Business unit and individual performance goals are based on each individual executive’s responsibilities and his respective contribution to our financial targets, including strategic initiatives, innovation, departmental effectiveness and personnel management.

The annual performance award is discretionary and the Compensation Committee has the authority to approve, reduce or entirely eliminate annual performance awards. Annual performance awards are cash-based and are paid at the end of each fiscal year. Generally, annual performance award amounts increase as financial measures increase above the levels originally set by the Compensation Committee.

Long-Term Incentive Awards

Long-term incentive awards are granted pursuant to the stock option plans and are intended to align the interests of executive officers and other key employees with those of our stockholders, reward executives for maximizing stockholder value and facilitate the retention of key employees.

The size of an individual’s stock option award is based primarily on individual performance and the individual’s responsibilities and position with the Company. These options are granted with an exercise price equal to the fair market value of our common stock on the date of grant, therefore, the stock options have value only if our common stock price appreciates from the value on the date the options were granted. This feature is intended to focus executives on the enhancement of stockholder value over the long-term and to encourage equity ownership in the Company. These options vest and become exercisable in three equal, annual, installments beginning on the first anniversary of the date of grant. The stock option plans are discretionary plans; however, it has been the Compensation Committee’s practice generally to award options annually.

15

Benefits

Benefits offered to executives serve a different purpose than do the other elements of executive compensation. In general, they are designed to provide a safety net of protection against the financial catastrophes that can result from illness, disability or death and to provide a reasonable level of retirement income. Benefits offered to executives are largely those that are offered to the general employee population, with some variation primarily to promote tax efficiency.

Chief Executive Officer (“CEO”) Compensation

Mr. Peter J. Sodini’s compensation for the fiscal year ended September 25, 2003, was determined in accordance with the above plans and policies taking into account his employment agreement with the Company. During fiscal 2003, Mr. Sodini also earned $400,000 in annual performance awards.

Mr. Sodini’s employment agreement provides for his participation in an incentive bonus program (with a minimum payout of 25% of base salary upon the achievement of goals determined by the board of directors, and other perquisites). Mr. Sodini’s bonus arrangement is not tied to specific objectives. Principal factors considered by the Board of Directors are increases in earnings per share, EBITDA improvement, comparable sales growth, acquisition quality and future outlook.

Policy With Respect to $1 Million Deduction Limit

We have not awarded any compensation that is non-deductible under Section 162(m) of the Internal Revenue Code. That section imposes a $1 million limit on the U.S. corporate income tax deduction a publicly-held company may claim for compensation paid to the named executive officers unless certain requirements are satisfied. An exception to this limitation is available for “performance-based” compensation, as defined under Section 162(m). Compensation received as a result of the exercise of stock options may be considered performance-based compensation if certain requirements of Section 162(m) are satisfied. In the event that the Compensation Committee considers approving compensation in the future which would exceed the $1 million deductibility threshold, the Compensation Committee will consider what actions, if any, should be taken to make such compensation deductible.

Conclusion

The Compensation Committee believes that these executive compensation policies and programs effectively promote our interests and enhance stockholder value.

Submitted by the Company’s Compensation Committee

Byron E. Allumbaugh

Jon D. Ralph

Charles P. Rullman

16

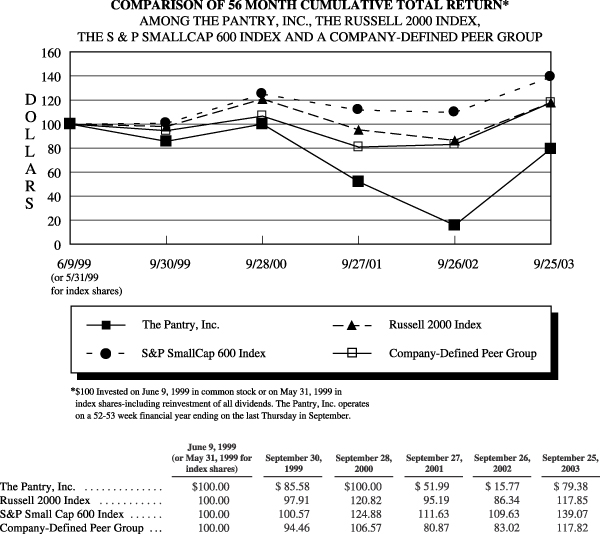

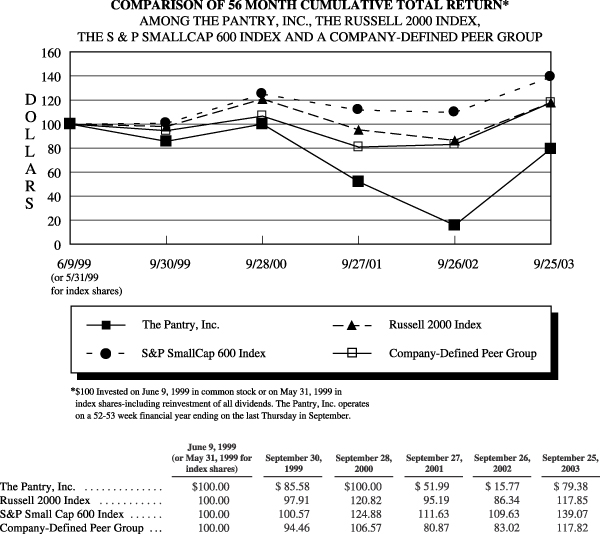

Comparison Of Cumulative Total Return

The following graph compares the cumulative total stockholder return on our common stock since June 9, 1999, the effective date of our initial public offering, through September 25, 2003, with the cumulative total return for the same period on the S&P SmallCap 600 Index, the Russell 2000 Index and a Company-Defined Peer Group. The graph assumes that at the beginning of the period indicated, $100 was invested in our common stock and the stock of the companies comprising the SmallCap 600 Index, the Russell 2000 Index and the Company-Defined Peer Group and that all dividends were reinvested. The Company-Defined Peer Group is composed of the common stock of the following issuers:

| | • | | Casey’s General Stores, Inc.; |

| | • | | Dairy Mart Convenience Stores, Inc. (includes both Series A and Series B common stock); and |

The stockholder return shown on the graph below is not necessarily indicative of future performance and we will not make or endorse any predictions as to future stockholder returns.

17

Audit Committee Report

The Audit Committee is composed of Paul L. Brunswick (Chairman), Byron E. Allumbaugh, Hubert E. Yarborough, III and Thomas M. Murnane and operates under an amended and restated written charter (a copy of which was included as an appendix to the Company’s 2003 Proxy Statement and which was amended and restated by the Board of Directors in October 2002—the original written charter was adopted in March 2000). The role of the Audit Committee is to assist the Board of Directors in overseeing the Company’s financial reporting process.

In the performance of its oversight function, the Audit Committee has met and held discussions with management of the Company, who represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles. The Audit Committee has reviewed and discussed the consolidated financial statements with both management and the independent public accountants. The Audit Committee also discussed with the independent public accountants matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees), as currently in effect.

The Company’s independent public accountants also provided to the Audit Committee the written disclosures required by the current version of Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed their independence with the independent public accountants. In connection with that, the Audit Committee has considered whether the provision of non-auditing services (and the aggregate fees billed for these services) in fiscal 2003 by Deloitte & Touche LLP to the Company is compatible with maintaining the independent public accountants’ independence.

The members of the Audit Committee are not professionally engaged in the practice of auditing or accounting and are not experts in the fields of accounting or auditing, including in respect of auditor independence. Management is responsible for the Company’s internal controls and the financial reporting process. The Company’s independent public accountants are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted auditing standards and to issue a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes, including the Company’s system of internal controls and the preparation of its consolidated financial statements, and members of the Audit Committee rely without independent verification on the information provided to them and on the representations made by management and the independent public accountants. The Audit Committee also hires and sets the compensation for the Company’s independent public accountants.

The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions with management and the independent public accountants do not assure that the Company’s financial statements are presented in accordance with generally accepted accounting principles, that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards or that the Company’s independent accountants are in fact “independent.”

Based upon the reports and discussions described in this report, and subject to the limitations on the role and responsibilities of the Audit Committee referred to above and in the amended and restated Audit Committee charter, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 25, 2003, filed with the Securities and Exchange Commission. The Audit Committee also retained Deloitte & Touche LLP as the Company’s independent public accountants for the 2004 fiscal year.

Submitted by the Company’s Audit Committee

Paul L. Brunswick—Chairman

Byron E. Allumbaugh

Hubert E. Yarborough, III

Thomas M. Murnane

18

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Stock Subscription Plan

The Company’s 1998 stock subscription plan permits our employees, including directors and executive officers, and our consultants to purchase up to an aggregate of 158,100 shares of common stock at a purchase price equal to the fair market value on the date of purchase. The purchase price for all common stock purchased under the Company’s stock subscription plan was $11.27 per share and was paid in cash and/or the delivery to the Company of a secured promissory note payable to the Company or one of its subsidiaries. As of December 9, 2003, the Company has issued 134,436 shares of common stock, net of subsequent repurchases of 6,273 shares, to 38 employees under the stock subscription plan.

The Company has the right to repurchase shares purchased under this plan upon an employee’s termination of employment. This right terminates with respect to each share on the first anniversary of the purchase date for such share. In addition, Freeman Spogli has the right to require the sale of all shares purchased under the stock subscription plan in the event it sells all of its holdings of our common stock.

No shares were purchased by our Chief Executive Officer or any of our other four most highly compensated officers during the last fiscal year pursuant to the stock subscription plan; however, in connection with previous purchases of our common stock under the stock subscription plan, Mr. Sodini was indebted to the Company for $100,100 plus interest at a rate of 8.5% per annum. During fiscal 2003, this promissory note was repaid in full.

Registration Rights Agreements

The Company has entered into a registration rights agreement with Freeman Spogli and Mr. Sodini. The registration rights agreement obligates the Company:

| | • | | on up to three occasions at the request of holders of at least 50% of the common stock held by the parties to the agreement, to register the resale of all common stock held by the requesting holders; |

| | • | | at any time to register the resale of shares of common stock having a value of more than $5 million at the request of any party; and |

| | • | | at any time, to allow any party to include shares in any registration of common stock by us. |

In addition, the Company has entered into a separate registration rights agreement with Freeman Spogli granting demand and piggyback registration rights with respect to the common stock issuable upon exercise of warrants to purchase shares of our common stock held by Freeman Spogli. The warrants were exercised in full in a cashless exercise on December 9, 2003 for 1,607,855 shares of our common stock.

Other

The Company has adopted a policy that it will not enter into any material transaction in which a Company director, officer or stockholder has a direct or indirect financial interest unless the transaction is reviewed and approved by the Company’s Audit Committee in accordance with applicable Nasdaq Marketplace Rules.

PROPOSAL 2: RATIFICATION OF APPOINTMENT

OF INDEPENDENT PUBLIC ACCOUNTANTS

The Board of Directors was responsible for selecting the Company’s independent public accountants in prior fiscal years. As a result of recent legislation, the Audit Committee is now solely responsible for selecting the Company’s independent public accountants.

The Audit Committee has selected Deloitte & Touche LLP as the Company’s independent public accountants for fiscal year 2004. Although stockholder approval is not required to appoint Deloitte & Touche LLP as the independent public accountants for the Company and its subsidiaries, the Company believes that

19

submitting the appointment of Deloitte & Touche LLP to its stockholders for ratification is a matter of good corporate governance. If the stockholders do not ratify this appointment, such appointment will be reconsidered by the Audit Committee. The proxy will be voted as specified, and if no specification is made, the proxy will be cast “For” this proposal.

During the Company’s fiscal year ended September 25, 2003, there were no disagreements with Deloitte & Touche LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which if not resolved to their satisfaction would have caused them to make reference to the subject matter of the disagreements in connection with their opinion.

The audit report of Deloitte & Touche LLP on the consolidated financial statements of the Company for the years ended September 25, 2003, and September 26, 2002, did not contain any adverse opinion or disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles.

A representative of Deloitte & Touche LLP will be present at the Annual Meeting and will be afforded an opportunity to make a statement and to respond to questions.

Audit Firm Fee Summary

During fiscal year 2003, the Company retained its independent public accountants, Deloitte & Touche LLP, to provide services in the following categories and amounts:

| | | | | | |

| | | Fiscal 2003

| | Fiscal 2002

|

Audit | | $ | 375,112 | | $ | 370,700 |

Audit Related | | $ | 60,038 | | $ | 50,169 |

Tax Fees | | $ | 585,593 | | $ | 567,906 |

All Other Fees | | $ | 91,110 | | $ | 20,953 |

| | |

|

| |

|

|

Total | | $ | 1,111,853 | | $ | 1,009,728 |

Audit Fees. This category includes the aggregate fees billed for professional services rendered for the audits of the Company’s consolidated financial statements for fiscal years 2003 and 2002, for the reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q during fiscal 2003 and 2002, and for services that are normally provided by the independent public accountants in connection with statutory and regulatory filings or engagements for the relevant fiscal years.

Audit-Related Fees. This category includes the aggregate fees billed in each of the last two fiscal years for assurance and related services by the independent public accountants that are reasonably related to the performance of the audits or reviews of the financial statements and are not reported above under “Audit Fees,” and generally consist of fees for, accounting consultation and audits of employee benefit plans.

Tax Fees. This category includes the aggregate fees billed in each of the last two fiscal years for professional services rendered by the independent public accountants for tax compliance, tax planning and tax advice. Fees for tax compliance services totaled $386,694 and $370,615 in 2003 and 2002, respectively. Tax compliance services consisted of assistance with (i) federal, state and local income tax returns, (ii) requests for technical advice from taxing authorities, (iii) tax audits and appeals, and (iv) in fiscal 2003, property tax returns.

Fees for tax planning and advice services totaled $198,899 and $197,291 in 2003 and 2002, respectively. Tax planning and advice consisted of tax advice related to structuring certain proposed mergers, acquisitions and disposals, alteration of employee benefit plans, qualifying tax hedges and trade discounts.

All Other Fees. This category includes the aggregate fees billed in each of the last two fiscal years for products and services provided by the independent public accountants that are not reported above under “Audit Fees,” “Audit-Related Fees,” or “Tax Fees.”

20

The Audit Committee has considered the compatibility of the non-audit services performed by and fees paid to Deloitte & Touche LLP in fiscal 2003 and determined that such services and fees were compatible with the independence of the public accountants. During fiscal year 2003, Deloitte & Touche LLP did not utilize any personnel in connection with the audit other than its full-time, permanent employees.

Policy for Approval of Audit and Nonaudit Services. The Audit Committee has adopted, and the Board of Directors has ratified, an Interim Policy Regarding the Approval of Audit and Nonaudit Services Provided by the Independent Auditor (the “Approval Policy”), which describes the procedures and the conditions pursuant to which the Audit Committee may grant general pre-approval for services proposed to be performed by the Company’s independent public accountants.

All services provided by the Company’s independent public accountants, both audit and non-audit, must be pre-approved by the Audit Committee. The Audit Committee may delegate to one or more designated member(s) of the Audit Committee, who satisfies the definition of “independent director” under Nasdaq Marketplace Rules (the “Designated Member”), the authority to grant pre-approvals of “permitted services” (which are defined as those that are not specifically prohibited by the Approval Policy), or classes of permitted services, to be provided by the independent public accountants. The Approval Policy describes the types of classes of permitted services (e.g., annual audit services or tax consulting services) that may be pre-approved by the Audit Committee of a Designated Member. The pre-approval of audit and nonaudit services may be given at any time up to a year before commencement of the specified service. The decisions of the Designated Member to pre-approve a permitted service are required to be reported to the Audit Committee at its regularly scheduled meetings.

In determining whether to approve a particular audit or permitted non-audit service, the Audit Committee will consider, among other things, whether such service is consistent with maintaining the independence of the independent public accountant. The Audit Committee will also consider whether the independent public accountant is best positioned to provide the most effective and efficient service to the Company and whether the service might be expected to enhance the Company’s ability to manage or control risk or improve audit quality.

The Board of Directors recommends that the stockholders vote FOR the ratification of the appointment of Deloitte & Touche LLP for fiscal year 2004.

SECTION 16(a)

BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company’s executive officers, directors and 10% beneficial owners to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Based on a review of the report forms that were filed, the Company believes that during fiscal 2003 all filing requirements applicable to its executive officers, directors and 10% beneficial owners were complied with, except that Mr. Brunswick failed to timely file a Form 3 upon his appointment to the Board of Directors, Mr. Kelly failed to timely file a Form 4 covering one transaction, Mr. Tornberg failed to timely file a Form 4 covering one transaction, Mr. Murnane failed to timely file a Form 4 covering one transaction, Mr. Allumbaugh failed to timely file a Form 4 covering one transaction, Mr. Starrett failed to timely file a Form 4 covering one transaction, Mr. Yarborough failed to timely file a Form 4 covering one transaction and Mr. Webster failed to timely file a Form 4 covering one transaction.

21