UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number | | 811-08200 |

BRIDGEWAY FUNDS, INC.

|

| (Exact name of registrant as specified in charter) |

| | |

5615 Kirby Drive, Suite 518 Houston, Texas | | 77005-2448 |

| (Address of principal executive offices) | | (Zip code) |

Bridgeway Funds, Inc.

5615 Kirby Drive, Suite 518

Houston, Texas 77005-2448

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (713) 661-3500

Date of fiscal year end: June 30

Date of reporting period: June 30, 2008

| Item 1. | Reports to Stockholders. |

| | |

| | A no-load mutual fund family of domestic funds |

| | |

| |

| | Annual Report June 30, 2008 |

| | | | |

| | |

| | AGGRESSIVE INVESTORS 1 | | BRAGX |

| | (Closed to New Investors) | | |

| | |

| | AGGRESSIVE INVESTORS 2 | | BRAIX |

| | |

| | ULTRA-SMALL COMPANY | | BRUSX |

| | (Closed) | | |

| | |

| | ULTRA-SMALL COMPANY MARKET | | BRSIX |

| | |

| | MICRO-CAP LIMITED | | BRMCX |

| | (Closed to New Investors) | | |

| | |

| | SMALL-CAP GROWTH | | BRSGX |

| | |

| | SMALL-CAP VALUE | | BRSVX |

| | |

| | LARGE-CAP GROWTH | | BRLGX |

| | |

| | LARGE-CAP VALUE | | BRLVX |

| | |

| | BLUE CHIP 35 INDEX | | BRLIX |

| | |

| | BALANCED | | BRBPX |

TABLE OF CONTENTS

Bridgeway Funds Standardized Returns as of June 30, 2008*

| | | | | | | | | | | | | | | |

| | | | | Annualized | | | | | |

| | | June Qtr. | | 1 Year | | 5 Years | | 10 Years | | Inception to Date | | Inception

Date | | Gross

Expense

Ratio | |

| Fund | | 4/1/08

to 6/30/08 | | | | | | |

Aggressive Investors 1 | | 7.73% | | 3.51% | | 14.63% | | 17.11% | | 19.41% | | 8/5/1994 | | 1.69% | |

Aggressive Investors 2 | | 11.61% | | 5.88% | | 16.57% | | | | 12.66% | | 10/31/2001 | | 1.19% | |

Ultra-Small Company | | -1.84% | | -24.59% | | 10.93% | | 14.93% | | 18.08% | | 8/5/1994 | | 1.06% | |

Ultra-Small Co Market | | -1.67% | | -21.72% | | 9.18% | | 11.68% | | 11.97% | | 7/31/1997 | | 0.65% | |

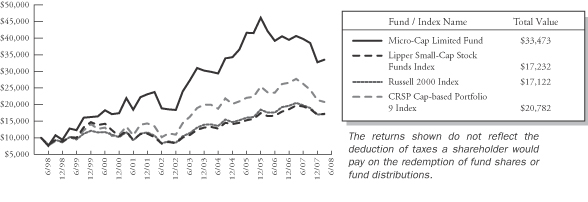

Micro-Cap Limited | | 2.32% | | -17.58% | | 6.93% | | 12.84% | | 12.84% | | 6/30/1998 | | 0.79% | |

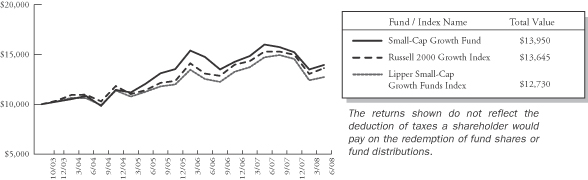

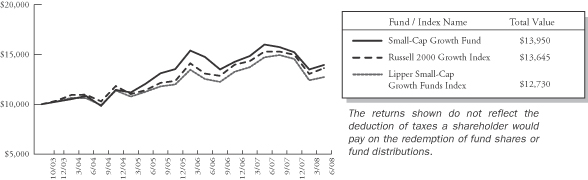

Small-Cap Growth | | 3.26% | | -12.87% | | | | | | 7.40% | | 10/31/2003 | | 0.88% | |

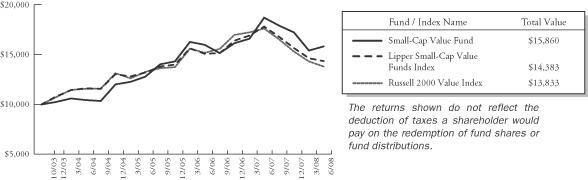

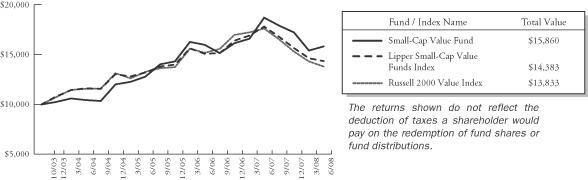

Small-Cap Value | | 2.65% | | -15.37% | | | | | | 10.39% | | 10/31/2003 | | 0.84% | |

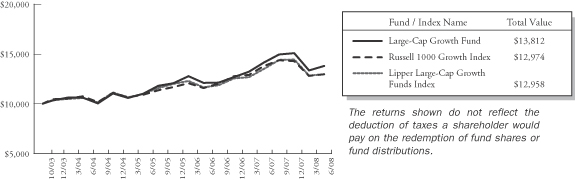

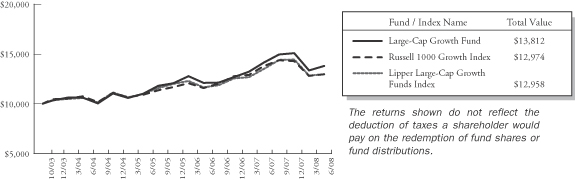

Large-Cap Growth | | 3.54% | | -2.50% | | | | | | 7.17% | | 10/31/2003 | | 0.73% | |

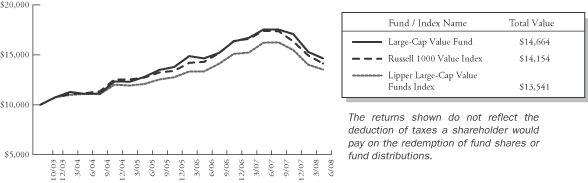

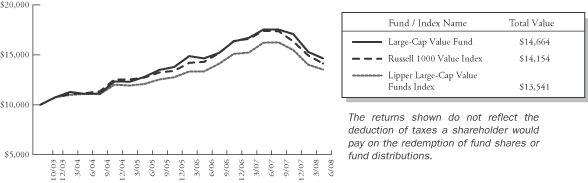

Large-Cap Value | | -4.22% | | -16.46% | | | | | | 8.55% | | 10/31/2003 | | 0.74% | |

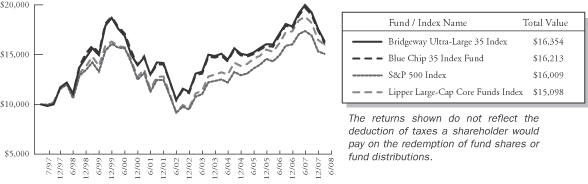

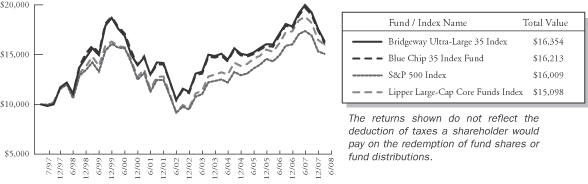

Blue Chip 35 Index | | -6.85% | | -14.28% | | 4.63% | | 2.88% | | 4.53% | | 7/31/1997 | | 0.30% | 1 |

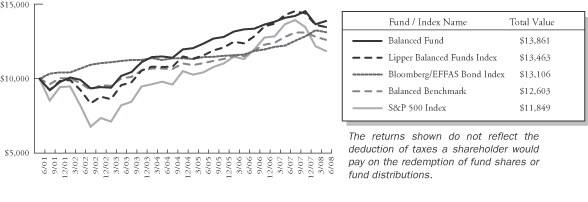

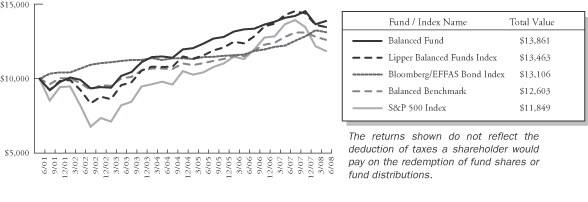

Balanced | | 1.62% | | -1.57% | | 6.37% | | | | 4.77% | | 6/30/2001 | | 0.93% | |

1 Some of the Fund’s fees were waived or expenses reimbursed otherwise returns would have been lower. The Adviser has contractually agreed to waive fees and/or reimburse expenses such that the total operating expenses of the Fund do not exceed 0.15%. Any material change to this Fund policy would require a vote by shareholders.

Bridgeway Funds Returns for Calendar Years 1995 through 2007*

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1995 | | 1996 | | 1997 | | 1998 | | 1999 | | 2000 | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 |

Aggressive Investors 1 | | 27.10% | | 32.20% | | 18.27% | | 19.28% | | 120.62% | | 13.58% | | -11.20% | | -18.01% | | 53.97% | | 12.21% | | 14.93% | | 7.11% | | 25.80% |

Aggressive Investors 2 | | | | | | | | | | | | | | | | -19.02% | | 44.01% | | 16.23% | | 18.59% | | 5.43% | | 32.19% |

Ultra-Small Company | | 39.84% | | 29.74% | | 37.99% | | -13.11% | | 40.41% | | 4.75% | | 34.00% | | 3.98% | | 88.57% | | 23.33% | | 2.99% | | 21.55% | | -2.77% |

Ultra-Small Co Market | | | | | | | | -1.81% | | 31.49% | | 0.67% | | 23.98% | | 4.90% | | 79.43% | | 20.12% | | 4.08% | | 11.48% | | -5.40% |

Micro-Cap Limited | | | | | | | | | | 49.55% | | 6.02% | | 30.20% | | -16.61% | | 66.97% | | 9.46% | | 22.55% | | -2.34% | | -4.97% |

Small-Cap Growth | | | | | | | | | | | | | | | | | | | | 11.59% | | 18.24% | | 5.31% | | 6.87% |

Small-Cap Value | | | | | | | | | | | | | | | | | | | | 17.33% | | 18.92% | | 12.77% | | 6.93% |

Large-Cap Growth | | | | | | | | | | | | | | | | | | | | 6.77% | | 9.33% | | 4.99% | | 19.01% |

Large-Cap Value | | | | | | | | | | | | | | | | | | | | 15.15% | | 11.62% | | 18.52% | | 4.49% |

Blue Chip 35 Index | | | | | | | | 39.11% | | 30.34% | | -15.12% | | -9.06% | | -18.02% | | 28.87% | | 4.79% | | 0.05% | | 15.42% | | 6.07% |

Balanced | | | | | | | | | | | | | | | | -3.51% | | 17.82% | | 7.61% | | 6.96% | | 6.65% | | 6.58% |

Performance figures quoted represent past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. To obtain performance current to the most recent month-end, please visit our website at www.bridgeway.com or call 1-800-661-3550. Total return figures include the reimbursement of dividends and capital gains.

This report is submitted for the general information of the shareholders of each Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding a Fund’s risks, objectives, fees and expenses, experience of its management, and other information. Investors should read the prospectus carefully before investing in a Fund. For questions or other Fund information, call 1-800-661-3550 or visit the Funds’ website www.bridgeway.com. Funds are available for purchase by residents of the United States, Puerto Rico, U.S. Virgin Islands and Guam only. Foreside Fund Services, LLC, Distributor.

The views expressed here are exclusively those of Fund management. These views including those relating to the market, sectors or individual stocks are not meant as investment advice and should be not considered predictive in nature.

| * | Numbers with green highlight indicate periods when the Fund outperformed its primary benchmark. |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM

June 30, 2008

Dear Fellow Shareholders,

Fighting the trend of the broader market averages, seven of our eleven Funds ended the June 2008 quarter with positive returns. Nine Funds beat their primary market benchmarks as detailed on the facing page (market beating returns are in green). For the full fiscal year ending in June, the same nine Funds beat their primary market benchmark, although only Aggressive Investors 1 Fund and Aggressive Investors 2 Fund had a positive one-year return as the market tumbled in the environment of a credit crisis, inflation, and economic pull-back. While negative returns don’t feel good, we aim to be fully invested for the long haul, so we are generally pleased when and where we are able to provide some “cushion” in a downturn.

More details of the market in the June quarter are provided in the section following this letter. On page 2 we also provide an overview of Bridgeway’s “hot button” issue: ways investors can “destroy value” even while being generally invested in market-beating mutual funds. We’re especially impressed with two communications from a shareholder on what she learned by investing in our Funds during the current decade (page 3). As part of a section covering the current fad (ok, it could be with us for some time to come) of “target date funds,” Bridgeway discloses what we think about when we come to market with a new fund. If you’re interested in how we think and what goes on behind the scenes at Bridgeway, you probably won’t want to miss this section starting on page 4. One of our shareholders asked a handful of insightful questions about our quantitative models, and we share our answers on page 5. (No, we’re not disclosing the “secret sauce,” but we are trying to provide some insight for how our investment management team does what it does.) An icon of investing and model of integrity in business, Sir John Templeton, died last quarter at age 95. John’s tribute to Sir John is on page 6. Recent news articles have reported very basic statistics on fund ownership by portfolio managers. Mike Mulcahy, President of Bridgeway Funds, conducted a much more detailed study for Bridgeway staff and reports the impressive results on page 6. Each fiscal year we report the worst thing that happened at Bridgeway. You are our owner and boss, and we think you have the right to know the good (everybody discloses) and the bad (most firms sweep this under the carpet). If the worst thing is not clear, our staff votes on it. This year has an interesting twist. See page 8. The Adviser to our Funds celebrated 15 years along with John’s 15 years at Bridgeway on July 1, 2008. On page 8 Mike wrote a tribute to John and his vision (but didn’t give him a vote on whether to include this section in Bridgeway’s report.)

As always, we appreciate your feedback. We take your comments very seriously and regularly discuss them internally to help in managing our Funds and this company. Please keep your ideas coming—both favorable and critical. They provide us with a vital tool helping us serve you better.

Sincerely,

Your investment team

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued)

Market Review

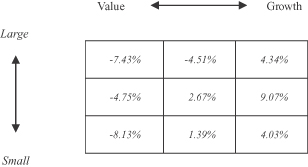

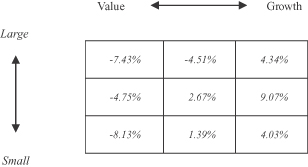

The Short Version: In the midst of a decline for the broader market averages, value companies (those that are cheaper on the basis of certain economic measures) were hardest hit across the board of all size companies. The stocks of growth companies (those growing at a faster rate) actually had a positive return for the quarter ending June 30, 2008.

It seems that each area of the “style box” eventually gets its day in the sun. Growth stocks, which had lagged the market every calendar year from 2000 through 2006, actually had a significant positive quarterly return, even as most stocks declined. Many of the companies hardest hit in the credit crisis “hailed’ from the value end of the spectrum, and this contributed to the style box results below. (Data from Morningstar for the quarter ended June 30, 2008):

Staying Put

The Short Version: For those of you who read each of our shareholder letters, you may have recognized a common theme around several related issues. In particular, we consistently encourage our investors: a) not to “chase hot returns” (buy funds that look strong recently and dump ones that have done poorly), b) not to try to time the market, c) not to base long-term investment decisions on short-term events. In this letter we thought we’d pull these together, given unusually strong opportunities in this market environment to get off track.

One of the saddest things we see some of our shareholders do is appropriately pick a given Bridgeway Fund to meet their investment objectives, but to time the entry and exit of our Funds so as to “destroy value” by buying after a market and/or Fund run up, and selling after a decline. This drives us nuts. Here is some hard data evidence about why.

Not chasing hot returns. Page i of our annual report gives all the details on performance of our Funds over various time periods. One would then think that individual investors in those Funds have also done as well. While anyone who has invested, with dividend reinvested, over the full time period reported has actually achieved these audited results—in aggregate these returns are frequently over-inflated! These are the actual returns, and over the long haul they have been very attractive. One would think that, since individual investors in those Funds have done as well. While anyone who has invested over the full time period reported and who has reinvested Fund dividends has actually achieved these audited results—in aggregate these returns are frequently overinflated! Did you read that correctly? Bridgeway, which prides itself on straightforward, blunt, and honest communications, is inflating its returns? Let’s dig a little deeper.

This over-inflation has to do with the timing of actual shareholder returns. Let’s say 100 shareholders invest $10,000 each in a fictitious “Skyrocket Fund” at the beginning of year one. Let’s also assume that the total return that first year is 50%, or 25% more than the market. Skyrocket Fund appears in performance tables and is written up as a “top performer.” There’s a nice story in Buy this Fund magazine about a hot shot portfolio manager who is very articulate about why he or she chose such great stocks. The adviser to Skyrocket Fund knows a marketing opportunity when they see it and takes out advertising, which rather conspicuously reports year one returns. (Fund companies as a whole have actually gotten better about this practice, but there are still many versions of it.) Furthermore, they ante up large fees to ensure “shelf space” with a brokerage firm that assures Skyrocket Fund will get some much needed exposure. On the basis of this performance, press coverage, advertisements, and new “distribution channel,” 1,000 new investors each buy $20,000 (they are more confident than the earlier investors, because the fund now has a track record) at the beginning of year two. That year, the market declines 10%, but Skyrocket Fund declines 20%. Frustrated and disappointed, the 1,000 new investors realize they made the wrong decision and sell at the end of the second year. The Fund is no longer in performance charts and no journalist wants to write about it, so there are no new investors at the beginning of year three. This is the year the market recovers 11% (the long term historical average) and Skyrocket Fund does the same.

| | |

| 2 | | Annual Report | June 30, 2008 |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued)

Under this scenario, the first investors enjoyed a 33% total return, not too shabby for a three-year period. The second round of investors suffered a 20% loss (and missed the third year recovery). Skyrocket Fund reports three-year returns of 33% cumulative (or 10.03% per year)—beating the 25% return of the market—but the average shareholder still suffered a significant decline. The only way to ensure the full three-year period returns is to stay invested for the full three-year period. (To be fair, if Skyrocket Fund had declined three years in a row, the second year shareholders would have suffered less; so mathematically, staying in longer doesn’t necessarily mean better returns, just the actual returns for the fund for the period). Sound far fetched? Let’s look at some actual numbers from Bridgeway.

For the last five-year period from June 2003 to June 2008, Bridgeway Aggressive Investors 2 Fund appreciated 16.57% per year, much better than the S&P 500 Index, which appreciated 7.58% per year. However, according to Morningstar, the average shareholder return was only 11.39% per year—more than 5% poorer than the record of this Fund itself. Unfortunately, this statistic is predictable. In a more aggressive fund that does well over the long haul, way too many investors will squander a big portion of the fund’s return by buying and selling, rather than staying put. By comparison, people are much less likely to sell a closed fund when performance is off. Our sister Fund, Aggressive Investors 1 (which is closed to new investors) returned 14.63% over the same five-year time period (not quite as high as Aggressive Investors 2 Fund). Nevertheless, because the investors mostly stayed put, the average investor’s return was actually higher than those in the “better performing” sister Fund, and was within one percentage point of the actual, reported Fund returns. We can’t tell you the best time to buy (or sell) our Funds. We never know returns before the fact. But we do know that human emotion tends to work against you, and our most successful investors tend to be the ones who have been with us over the long haul.

Not timing the market. Bridgeway got a wonderful letter from a shareholder, Denise Di Salvo, about lessons learned by “market timing:”

| | | This is just to let you know that I learned my lesson in 2000, when I bailed & shouldn’t have. Been there, done that, so now I leave it to you to make the great decisions & look for buying opportunities. I’m not really that worried. |

I, John, have my own “lessons learned,” which cost me money at the time, but now seem like cheap lessons. I wrote Denise back for more details. Here’s what she said:

| | | In 2000 I did not understand how much of the market is based on emotion. All of these waves rolling around on top. Underneath all the froth are some things that are going to remain unaffected, like good companies with solid business plans & a need & ability to pay for that particular product or service in the marketplace. The rest is all hysteria. |

| | | This was a painful & expensive lesson. I yanked my money out of Bridgeway Aggressive Investors 1 Fund at the bottom & proceeded to watch the NAV recover over the next few years. This was far more painful than any 300-point drop in the Dow. It is far and away the stupidest thing I have ever done, but it earned me the dubious title of “seasoned investor.” |

| | | I did not understand that at biddy-bottom it feels as though prices have nowhere to go but down. Just like at tippy-top, it feels like they have nowhere to go but up. To my mind, this might be more definitive of a top and bottom than any other measure. It makes me think that when projections are being made for another precipitous drop in, say, the housing market, we are by definition closer to the bottom than one may think. |

| | | Anyway, I hope some of these thoughts can help other investors relax & stay focused on the number of shares they have rather than the NAV. |

Not basing long-term decision on short-term events. Matching up your investment needs with the investment objective of your fund (and especially the investment time horizon) is crucial. Stock market instruments are by definition long-term investments. If you use our stock market-based Funds, our assumption is that you are investing for the long haul. Our prospectus says in eleven places that our Funds are not appropriate investments for short-term investors, those trying to time the market, or those who would panic during a major market or Fund correction. Likewise with events: as one investor recently said that with all the talk of credit crises, soaring energy costs, deficits, and inflation, isn’t it clear that the stock market direction is down?

Of course, We’d love to use recent events to predict the direction of the stock market. We’ve even spent some time in prior years trying to model this, and the modeling is fraught with problems. Our conclusion: don’t time our Funds, don’t time the

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued)

market, and don’t think—even if you did know the direction of the economy (and your name is Ben Bernanke)—that you could productively predict the direction of the market. In short, you could adopt John’s sister’s investment philosophy, the “Rip Van Winkle” principle: “Get a long-term plan, put it in place for the long term, then fall asleep until something changes or it’s getting closer to time to spend the money.”

Opportunities and Problems of Target Date Funds

The Short Version: Target date funds seem like an attractive way to simplify the decision of how to allocate investment funds among the major alternatives (e.g., stocks, bonds, and cash) within a mutual fund structure. Unfortunately, used at “face value,” they are an oversimplification that may get an investor off the best track for the long haul due to their simplified “one size fits all” approach.

Target date funds (ones with asset allocations designed around the date that a person is targeted to retire) currently attract the largest inflows of new money of any mutual fund segment. You might be interested to know then, why Bridgeway isn’t planning to offer a target date fund.

As background, it’s helpful to know what we think about when designing a new fund. Bridgeway never offers a fund simply because there is a “market,” and our advisory firm can make money by offering it. Our high standards for a new fund include the following five factors:

| | 1) | it must meet a legitimate investing need (such as diversification, or attractive asset class returns, or favorable risk characteristics), |

| | 2) | it must be an attractive way (or part of a statistically “optimal” way) to achieve that legitimate investing need, |

| | 3) | it must be “in sync” with our four business values (integrity, performance, cost efficiency, and service), |

| | 4) | we must be able to look at a lot of historical data, so we can model what returns might look like in a downturn, and |

| | 5) | we must believe we have a “leg up” on the competition. |

While we think we are up to the task of competition among target date funds (the fifth criterion), our current analysis of the second criterion indicates target date funds pose significant limitations at the individual investor level.

To understand why this is so, it is helpful to understand how target date funds got started and became so popular. The answer, according to a recent article in the New York Times (“You’re on Autopilot,” July 13, 2008), concerns company liability in corporate retirement plans. It turns out that one of the biggest investing mistakes we investors make is not getting around to saving and investing. To address that problem, companies have looked for ways within defined contribution retirement plans to automatically enroll their employees. But then the question is, “could a company be sued for the investment choices they make on behalf of their employees, especially if those investments did poorly?” According to the article,

| | | The Labor Department’s effort to answer [this] question set off the current boom in target-date funds. The department issued a regulation last year saying that employers could not be held liable for 401(k) [retirement plan] losses if they had taken care to enroll their workers in investment funds that had diversified portfolios and reflected the number of years before the employees would retire. |

We believe companies’ push to get employees’ funds invested quickly is a noble one and that diversification is an extremely important part of any investment program. We disagree, however, with the interpretation that target date funds are in all cases the best solution for both the employer and retirement plan participant. The defining element of how risky a person’s investments should be allocated (i.e., how much is invested in stocks, bonds, and cash—the defining focus of the various target date funds) is not the date of their retirement, but rather a combination of a) when they will actually need to spend that money (the investment time horizon), b) their withdrawal rate (what percentage of their investment nest egg they will need to spend each year) at that time and c) their tolerance for short term risk (swings in account valuation). Thus, a 60 year old employee, who through a combination, let’s say, of relatively modest lifestyle and alternative resources, only plans to spend 2% of their 401(k) plan assets each year in retirement, can afford to be in the same target date fund (with respect to risk and investment allocation) as a 25 year old. The target date fund concept is a way around the conundrum of how a company can invest a large number of employees’ retirement funds with the only information at hand (age), but it generally doesn’t address the real underlying investment needs and risks of the individual investor. (One size doesn’t fit all!)

| | |

| 4 | | Annual Report | June 30, 2008 |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued)

In our next letter, we’ll propose two alternative ways to approach a plan for investment allocation in a retirement fund—considering the three (admittedly more complex) criteria of investment horizon, withdrawal rate, and risk tolerance.

Conversation with a Shareholder on our “Quant” models

The Short Version: Bridgeway uses quantitative models to pick stocks in our actively managed Funds. Since these models focus on longer timeframes, they tend to be more stable than strategies you may read about in the press. Thus, our investment process looks the same in radically different market environments, which is just one more way we can keep emotions out. Another “upside” to our process is that we’re not dependent on any one person for the operation or implementation of our models.

The following are questions asked recently by a shareholder: (along with our replies):

| | 1) | Do you ever revise the quantitative models on the basis of which you manage the funds? In other words, are you using the same model today as you did 1, 2, 5 or more years ago? We don’t use just one model, and yes, we do revise them. However, they are relatively stable, due to the modeling process we use. Last year we added two models to our library and now use 17 at Bridgeway across the sum total of our funds. We recently “reengineered” two of the early Bridgeway models and made only minor changes. |

| | 2) | If you do not revise the models, then do you believe that the market does not “fundamentally” change. ever? There are different modeling strategies; ours are designed for use in divergent market environments. Our process looks exactly the same in a bull or bear market. We view the markets from the standpoint of risk. The kinds of risk may change, e.g., the risk of nuclear war did not exist eight decades ago (higher risk now). The Federal Reserve is more successful with economic interventions (lower risk now). Bank insurance was not as prevalent eight decades ago (higher risk then). Derivative instruments were largely absent (lower risk then). Risk principles of diversification and stress testing are just as relevant in any time period. We say the economy and the market may significantly change over time, but not the principles of risk on which our models are based. Therefore, we count on their working over the long haul in many different (even “new”) market environments. Some of our Funds are old enough to get some picture of our success along these lines, at least historically. |

| | 3) | Is it possible that certain forces (e.g., electronic trading, more widespread dissemination of information) might actually cause fundamental changes? Yes. |

| | 4) | If so, do you worry that the models might need tweaking? We’re continually doing research to “stay ahead of the curve.” But we think we have less to worry about than, say, many hedge funds which rely on fewer models, short-term trends, and leverage (debt). |

| | 5) | If you do revise the models, then how do I, as a shareholder, find out about it? Generally, you won’t, at least not on a “real time” basis. It’s our intention to report some major changes in shareholder letters, as long as we feel it won’t damage our future returns by divulging too much to competitors—we’re always trying to protect our investors’ returns in this regard. Recent changes (but I would say these are much more incremental than major) are: a) we’ve added to our resources (both human and data) to expand our investment research capabilities, b) we’ve begun a methodical process to reengineer the earlier models, and c) we’re focusing some current research on looking for ways to dampen short-term risk without giving up expected returns. |

| | 6) | Conventional advice says that fund shareholders should monitor changes in fund management. I would certainly sit up and take notice if John Montgomery were no longer fund manager. A change from using Bridgeway Capital Management as the adviser for Bridgeway Funds would require the approval of shareholders, so you would know if the advisory firm changed (or John’s majority ownership of it). However, if John (or any other member of the investment team) were suddenly “out of the loop” for whatever reason, nothing about the operation of the models would change as a result. As a matter of fact, we think much less would change at Bridgeway than at most “fundamental” shops, where managers are given more leeway to implement their personal investment views. We have a formal backup plan for each member of the investment management team, and our models are well documented, we intentionally rotate roles and we operate without members to assure more continuity. |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued)

| | | To put it bluntly, we think that much more so than most other fund companies, nothing would change about the investment management process of your funds. Four people are trained on the operation of our models, and we expect the remaining three would keep cranking as they currently are. |

| | 7) | But since a ‘quant’ fund is managed largely by the model, shouldn’t I be concerned if the model is substantially revised? We don’t expect dramatic, wholesale changes. Our team’s confidence is in the modeling process, however, so any new model has to meet the same standards of “vetting” that our old ones do. As a matter of fact, with increased resources for data, tools, and staff, we hope there is reason for increased confidence. Of course, each shareholder will have to decide for him- or herself. |

| | 8) | Don’t get me wrong, I am very happy with being a Bridgeway shareholder for the last 5+ years, but these questions have been nagging me for a while. Great that you’re a long term shareholder! These are the shareholders who have done the best with Bridgeway, keeping cool and holding through downturns with money they have invested for the long haul. We can make no representations about the future, but we don’t see any current structural change that would cause us to modify our own investing strategy, personally or corporately. |

Fund Founder and Philanthropist John Templeton Dies at Age 95 in early July

It’s unusual that we would highlight the founder of a competing fund company, but John Templeton was an extraordinary man. John Montgomery had the privilege of meeting him in his office a little over four years ago. Here are some notes from that meeting:

| | ¡ | | I was struck by a graph of total returns of his fund for the two plus decades he was portfolio manager; it was an encouragement to aim for long-term results. |

| | ¡ | | At age 91, he was terribly sharp and said he was the busiest he had ever been. |

| | ¡ | | He demonstrated self awareness, broad perspective, and humility. |

| | ¡ | | He noted instances in his life and career where strength was born out of severe adversity. |

| | ¡ | | For every dollar he spent on himself or his family, he donated nine (a “reverse tithe”). |

| | ¡ | | He had already accomplished two of my life goals: celebrating a 50th wedding anniversary and giving away $100 million annually. |

Our condolences go to his family members and colleagues. He was truly a gifted, generous, and extraordinary man, leaving a very important and significant footprint behind in our industry and through the work of Templeton Foundation.

Fund Managers “Eating Their Own Cooking” (the next three sections by Mike Mulcahy)

The Short Version: While it is good that shareholders consider whether their fund manager is investing alongside their own shareholders, a simple absolute number of dollars invested per fund may not be the best metric and certainly shouldn’t be the only one. In this section, we help you “look under the hood” at Bridgeway.

In this past quarter, Morningstar, the mutual fund rating and investment research company, released their study on how much managers invest in their own funds. A requirement of the Securities & Exchange Commission is that managers must disclose their holdings in each fund annually. This report is typically done in the Statement of Additional Information, (Bridgeway’s most recent SAI is available on our website www.bridgeway.com) and displays holdings in a range of values.

What looks like a rather shocking statistic, Morningstar discovered 46% of domestic stock fund managers were not invested in their own funds! That certainly is not “eating their own cooking.” But, is that good or bad? Probably mostly bad, but an accurate judgment requires more information. (In fairness, Morningstar acknowledges this is not a one size fits all statistic, any more than the magnitude of an expense ratio taken out of context.)

Here are several things you may want to consider as you review this metric against any funds you may hold:

| | ¡ | | What is the investment style of the fund, and is it an appropriate investment for the managers to have a large part of their investable assets in it? For example, if the fund is a municipal bond fund, it may not make sense for the manager |

| | to be invested, particularly if he or she doesn’t live in that state. Or an aggressive fund may not be appropriate for someone who has near-term cash needs. |

| | |

| 6 | | Annual Report | June 30, 2008 |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued)

| | ¡ | | How many funds does the person manage? If the manager works on multiple funds, is it possible for the manager to make significant investments in each? |

| | ¡ | | Is the amount invested increasing or decreasing? This information is possible to get but requires some digging. This trend could give an idea of what the manager is thinking. |

| | ¡ | | How much of the manager’s investable assets are in the funds he or she manages? Unfortunately, this metric is not available. But THAT would be more telling than just how much money is invested. Someone with $10s of millions of dollars in net worth who only has $100,000 in the fund doesn’t seem to have his or her interests aligned with yours. But a manager with $200,000 in net worth probably does. |

What you probably don’t want to see as an investor are token investments. Instead, you want a manager who “feels your pain” and is interested in success of the fund—and you.

Why do I bring this up? Well, Bridgeway did not score as well as we would have liked on the Morningstar study (see www.morningstar.com for details), and we did get a question from a shareholder as a result. So, like Paul Harvey would say, I am here to tell you the “rest of the story.”

We recently surveyed the partners at Bridgeway Capital Management (that is, all full-time staff members) to measure their commitment to the Funds. There are 26 partners. (The results below reflect 23 data points as we excluded 3 partners who had been here less than 3 months). So, we are looking at a pool larger than just the investment management team. What did we find?

| | — | Average number of funds invested: 4.9 per partner |

| | — | Most popular funds: Aggressive Investors 2 with 96% of partners invested, Aggressive Investor 1 (78%) and Ultra-Small Company (74%). |

| | — | Least popular funds: Small-Cap Growth (17%), Small Cap-Value (17%) and Large-Cap Growth (22%). |

Clearly there is a bent toward “aggressive” in our partner pool.

We also asked: “What percentage of your estimated investable assets is in Bridgeway Funds?”—This is an important metric, and one we really believe reflects commitment.

| | — | All 23 partners invested in at least 1 Bridgeway Fund. |

| | — | On average, partners reported that 66% of their investable assets were in Bridgeway Funds. |

| | — | For partners that have been here more than 5 years, that number increases to 75%. |

| | — | For partners on the investment management team…69% |

| | — | For partners that are officers and directors…. 76% |

We don’t have any industry data to compare but believe this IS a strong commitment.

Finally, we asked “Are you committed to further investments in the Bridgeway Funds?” The answer was not surprising: 100% are planning more investment.

In regards to the portfolio managers specifically and the Morningstar study results, here are some points for you to ponder about Bridgeway:

| | ¡ | | We subscribe to a 7 to 1 total compensation cap with Bridgeway Capital Management. That means no one makes more than 7x the lowest compensated full-time person at Bridgeway. So unlike some firms who have outrageously high salaries for their “top” people, Bridgeway’s are much more conservative. In fact, salaries and trends are disclosed in the SAI annually. |

| | ¡ | | Three of our investment management team members (Rasool, Elena and Michael)—being very candid—are not in the stage of life to have large investable assets. Each is in the 30-40 age range and is supporting young and growing families. They are committed and are building positions. This is where following trend is important. |

| | ¡ | | Our investment team members are involved with up to 11 funds. Unlike fundamental shops that typically align a manager with 1 or 2 funds, our team works on up to 11. For the team to make significant investment in a large number of funds will take time. |

[GRAPHIC]

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued)

| | ¡ | | Bridgeway Capital Management and our Bridgeway Foundation both maintain significant positions in the funds, which do not get captured in these surveys. The Adviser’s investments are disclosed in the SAI. |

We are proud of our commitment to the Funds by the entire staff of Bridgeway. Maybe it doesn’t show up in the numbers captured by the Morningstar study, but it is there.

The Worst Thing of the Year

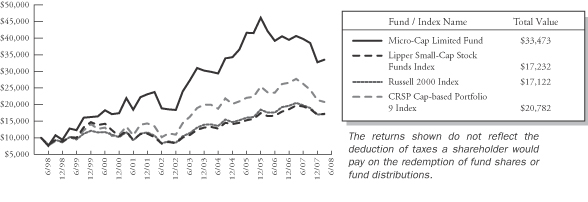

The Short Version: Micro-Cap Limited Fund continues to lag its market benchmark over a three-year period (by 2.65% per year) and over a five-year period (by 0.70% per year). At most fund companies we suspect beating a market benchmark by 7.39% in the last year and by 5.25% per year for the last ten years would be enough to put it in the “outright winner” column. At Bridgeway, our standards are a bit different. We designed Micro-cap Limited Fund to keep up with our Aggressive Investors Fund(s) over the long haul (and with “diversifying” timing) but it hasn’t come close to doing so in the Fund’s first decade. We’re also not satisfied with our consistency of relative performance with this Fund. Thus, the performance record of Micro-cap Limited Fund got the most votes for “worst thing in fiscal year 2008” among our staff at a recent full-staff meeting, and we’re presenting the case here to you.

In each annual report, Bridgeway reveals its “worst thing of the year.” This section has become an important Bridgeway tradition within each annual report. As a shareholder, you are the owner and “boss,” and we think you have a right to know the negatives as well as the positives. In previous years we have discussed company turnover, trading errors, and compliance issues, among other things. This year we selected our three- and five-year track record for Micro-Cap Limited Fund as the worst thing.

Bluntly, Micro-Cap Limited Fund’s three-year record lags its market benchmark, and by our standards, that stinks, and ditto for our five-year record. This puts more than a dent in our excitement of celebrating the ten year anniversary of our Fund on June 30, 2008. The Adviser seeks to beat each Fund’s market and peer benchmarks over the long term—periods of three years and more. Informally, we want to be in the top 5% of our peer group over the long haul—but even in the ten year timeframe Micro-Cap Limited Fund falls out of this range. (see page 50 for more details.)

For seven quarters in a row from December 2005 until June 2007, this Fund underperformed its market benchmark, which contributed to the lagging five-year period. Since the fall of 2006, the investment management team has evaluated the nine models used for this Fund with renewed vigor. These models span the spectrum in orientation from value to growth to technical. The conclusion: we found no reason to change course. In spite of seven quarters lagging the market, perhaps the thing we are most proud of is that we stuck to the discipline of our process and didn’t succumb to the strong human tendency to change direction when things didn’t look good. This (changing course when something current feels bad) works in some other areas of life (picture sticking your hand in a fire), but it can lead to a travesty in investing. Without this kind of discipline, it is unlikely that your investment management team could have delivered a “cushion” of 7.39% (on a relative basis) in the most recently completed fiscal year, a time corresponding to the first bear market since 2002.

We do take long-term underperformance seriously. So far, periods of extended underperformance haven’t happened too often. (Past performance is no guarantee of future returns, however.) No actively-managed Bridgeway Fund has lagged its benchmark at any quarter end over a five-year period since our first Funds hit their five-year anniversary. While we cannot know the future of Micro-Cap Limited Fund, we do know that we are not making any major changes, except through our disciplined modeling process—and this is where we want to focus significant energy. And the “worst” part is that it has had such an extended period of underperformance—but it’s not a “dud” because at one point, it was the “bomb”.

15 Years in the Making (and Many More to Go)

The Short Version: In July, Bridgeway celebrated the founding of Bridgeway Capital Management, the investment adviser to Bridgeway Funds. This section was written by Mike Mulcahy, a Bridgeway partner, and is a celebration of John Montgomery, the founder of Bridgeway, and the vision he created.

In 1991, an unassuming, spectacle-wearing, flute-playing man running budgets and operations for Houston’s transportation company (METRO) was tossed the proverbial once-in-a-lifetime offer by his legal and tax firm. After Glenn H. Johnson

| | |

| 8 | | Annual Report | June 30, 2008 |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued)

reviewed John’s personal investment track record and returns, he unknowingly started John on the journey of founding Bridgeway Capital Management, the adviser to the Bridgeway Funds, by making the comment “We do a lot of tax returns, and I’ve never seen returns like these; if you ever consider investing professionally, I will be your client and bring you others.” Some years later in 1993 after intensive research (as is John’s unrelenting nature) Bridgeway Capital Management was formed and the idea for Bridgeway Funds was firmly planted.

John founded Bridgeway on a set of ideals, which not only haven’t wavered but have grown stronger through the years, and have been essential to our growth and success to date.

| | • | | He wanted to build a firm based on integrity. Not just in name but visible in all that we do. The so-called markers or flags that investors see regularly are reminders that we really take integrity seriously. |

| | • | | He wanted to create funds with long-term performance that would be among the top 5% of their peers. No fund would be launched that wasn’t diligently scrutinized, back-tested, and scrubbed for the potential of long-term performance. |

| | • | | He wanted service that reflected a commitment to and respect of people. Friendly, honest and open. |

| | • | | He wanted us to be cost efficient as reflected in our expense ratios, so that more money remains in the hands of investors. |

Aside from these four pillars of Bridgeway’s mission statement (which you can read more about at www.bridgeway.com) there were some incredible ideals in the founding of Bridgeway that have come to life in amazing ways over the first 15 years. These include such visions as:

| | • | | Building an organization that was highly participative, empowering, relatively flat, and intensely respectful and loving of each other and our community around us. An organization committed to the development and success of “partners” where everyone is an owner and acts like an owner of the company. No titles. Salary caps. Equity participation. Everyone leads, everyone follows. Not dependent on any one person. A new kind of—rather, a better—organization. |

| | • | | Committing an amazing 50% of after-tax profits of the Adviser to charitable causes. As John jokingly says, “It’s more fun to give away money while you are alive than dead.” (A truism we wish everyone would adopt.) It’s a great ideal that has truly been transformational to the partners of Bridgeway and, more importantly, organizations and people around the world addressing some of the world’s most depressing, repressive and daunting challenges and where we have been able to come along side with our time, talent and treasures. (See our foundation website for more information, www.bridgewayfoundation.com). |

This is Bridgeway. Who we are and who we are becoming is a reflection of one man’s unpolished, raw vision which time, our partners, friends, investors and the markets are helping to refine, shape and shine into something of emerging beauty that is truly a different and better place to work.

Thank you, John, for the vision, the willingness to take a chance and for never giving up the dream. Happy 15!

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY

June 30, 2008

Dear Fellow Aggressive Investors 1 Fund Shareholder,

Our Fund bounced back strongly in the June quarter, outperforming all our market and peer benchmarks. Aggressive Investors 1 increased by an impressive 7.73%, trouncing our primary market index (the S&P 500 Index—down 2.73%), our peer benchmark (the Lipper Capital Appreciation Funds Index—up 4.54%), and the Russell 2000 Index of small companies (up 0.58%) for the three-month period. This was our best quarter relative to our primary market benchmark in five years and our fifth best quarter since inception 14 years ago. We are quite pleased.

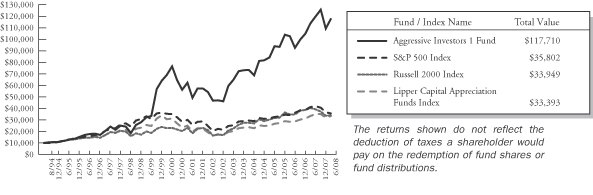

Likewise, our Fund performed well for the full fiscal year on both an absolute and relative return basis, outperforming each of its benchmarks. For the 12-months ending June 30, 2008, the Fund rose by 3.51% while each of the indexes closed in negative territory: S&P 500 (-13.12%), Lipper Capital Appreciation Funds Index (-0.16%), and Russell 2000 Index (-16.19%). While we welcome such strong results during these shorter-term quarterly and 12-month time horizons, we strive to achieve excellent consistent returns over the long term. We are pleased to report that Aggressive Investors 1 Fund has rewarded our shareholders with double-digit returns and outperformed each of its benchmarks over the past five and ten years as well as since inception in August 1994 (where we have ranked first among our peers according to Lipper research as detailed below). Our strategies stay constant and consistent in both good times and bad, in both strong and weak markets, during both “the sky is the limit” and “the sky is falling” investor environments. Such long-term results always will remain the key objective of our firm. The information below bears out our historical success in these areas.

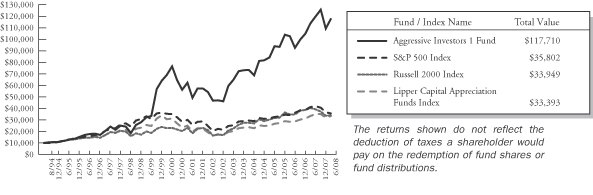

The table below presents our June quarter, one-year, five-year, ten-year and life-to-date financial results according to the formula required by the SEC. See the next page for a graph of performance from inception to June 30, 2008.

| | | | | | | | | | |

| | | June Qtr. 4/1/08

to 6/30/08 | | 1 Year 7/1/07

to 6/30/08 | | 5 Year 7/1/03

to 6/30/08 | | 10 Year 7/1/98

to 6/30/08 | | Life-to-Date 8/5/94 to 6/30/08 |

| | | | | |

Aggressive Investors 1 Fund | | 7.73% | | 3.51% | | 14.63% | | 17.11% | | 19.41% |

S&P 500 Index (large companies) | | -2.73% | | -13.12% | | 7.58% | | 2.88% | | 9.61% |

Lipper Capital Appreciation Funds Index | | 4.54% | | -0.16% | | 11.19% | | 4.53% | | 9.06% |

Russell 2000 Index (small companies) | | 0.58% | | -16.19% | | 10.29% | | 5.53% | | 9.19% |

Performance figures quoted in the table above and graph below represent past performance and are no guarantee of future results. The table above and the graph below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks with dividends reinvested, while the Russell 2000 Index is an unmanaged, market value weighted index, that measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market with dividends reinvested. The Lipper Capital Appreciation Funds Index reflects the record of the 30 largest funds in this category, comprised of more aggressive domestic growth mutual funds, as reported by Lipper, Inc. It is not possible to invest directly in an index. Periods longer than one year are annualized.

According to data from Lipper, Inc. as of June 30, 2008, Aggressive Investors 1 Fund ranked 33rd of 296 capital appreciation funds for the twelve months ending June 30, 2008, 28th of 218 over the last five years, 3rd of 120 over the last ten years, and 1st of 59 since inception in August, 1994. These long-term numbers and the following graph give two snapshots of our long-term success. Lipper, Inc. is an independent mutual fund rating service that ranks funds in various fund categories by making comparative calculations using total returns

| | |

| 10 | | Annual Report | June 30, 2008 |

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY (continued)

Aggressive Investors 1 Fund vs. S&P 500 Index & Lipper Capital Appreciation Funds Index & Russell 2000 Index Inception (8/5/94) to 6/30/08

Detailed Explanation of Quarterly Performance—What Worked Well

The Short Version: These days, a lump of coal in the old holiday stocking actually would be a pretty good thing (ok, its 97 degrees in August in Bridgeway’s hometown of Houston). Commodities like coal continued to surge during the past quarter, and companies within industries that deal with natural resources and related products performed best over the three-month period. Our top performer list is comprised entirely of energy, basic materials, and industrial companies, most of which engage in some commodities-driven operations. These ten performers contributed over 13% to the return of the Fund over the three-month period.

These are the ten best performers for the quarter ended June 30, 2008:

| | | | | | |

| Rank | | Description | | Industry | | % Gain |

| 1 | | Alpha Natural Resources Inc | | Coal | | 74.2% |

| 2 | | National Oilwell Varco Inc | | Oil & Gas Services | | 52.0% |

| 3 | | CF Industries Holdings Inc | | Chemicals | | 47.5% |

| 4 | | Potash Corp of Saskatchewan | | Chemicals | | 47.3% |

| 5 | | Bucyrus International Inc | | Machinery-Construction & Mining | | 43.7% |

| 6 | | Mosaic Co | | Chemicals | | 41.0% |

| 7 | | Terra Industries Inc | | Chemicals | | 38.9% |

| 8 | | Petroleo Brasileiro SA ADR | | Oil & Gas | | 38.7% |

| 9 | | Flir Systems Inc | | Electronics | | 34.8% |

| 10 | | Flowserve Corp | | Machinery-Diversified | | 31.0% |

| | | | | | | |

Alpha Natural Resources was the Fund’s top performer and contributed over three percent to the overall return of the Fund. The company is the leading domestic exporter of metallurgical coal, which is used in the production of steel. With demand for coal (and steel) skyrocketing in emerging markets like China and India, Alpha Resources reported that its earnings tripled in the first-quarter, and some analysts predict soaring profitability through at least 2010. High natural gas prices and the weak dollar contributed to the strong global demand, which helped push the company’s stock price to an all-time high in late June.

Bucyrus International manufactures mining equipment used to extract resources like coal, copper, iron, and other minerals. Coal and copper mining companies represent its two largest customer bases. A consistent story during the quarter, higher commodities prices derived from growing international demand escalated the need for such specialized equipment; replacement parts and repairs accounted for over half of the company’s sales in the most recent quarter. In May, Lehman Brothers initiated coverage at “overweight,” and the stock price hit a 52-week high shortly thereafter. However, our own “overweighting” (See the top ten holdings on page 14) resulted from following our models’ analysis, not any broker’s recommendation. For the quarter, Bucyrus contributed over a percentage point to the overall return of the Fund.

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY (continued)

Detailed Explanation of Quarterly Performance—What Didn’t Work

The Short Version: While the Fund did not suffer much from the ill-effects of the downturn in financial-related companies this past quarter, four consumer-oriented firms were among those on the list of worst performers. Of note, food companies struggled from the rising costs of grains and other commodities; additionally, retailers recognized less traffic (both in stores and online), as consumers grew more cautious given the weaker domestic economic environment. Combined, the four consumer companies lost two and a half percent during the three-month period.

These are the ten stocks that performed the worst in the quarter ended June 30, 2008:

| | | | | | |

| Rank | | Description | | Industry | | % Loss |

| 1 | | Chiquita Brands International Inc | | Food | | -32.6% |

| 2 | | Turkcell Iletisim Hizmet AS ADR | | Telecommunications | | -29.9% |

| 3 | | Owens-Illinois Inc | | Packaging & Containers | | -26.1% |

| 4 | | NewMarket Corp | | Chemicals | | -23.5% |

| 5 | | Garmin Ltd | | Electronics | | -23.5% |

| 6 | | Amtrust Financial Services Inc | | Insurance | | -22.3% |

| 7 | | Fresh Del Monte Produce Inc | | Food | | -21.4% |

| 8 | | GameStop Corp | | Retail | | -20.8% |

| 9 | | Sigma Designs Inc | | Semiconductors | | -19.5% |

| 10 | | Intuitive Surgical Inc | | Healthcare-Products | | -16.9% |

| | | | | | | |

Chiquita Brands distributes bananas and other produce across the U.S. and abroad. Late in the quarter, blaming bad weather in Central America and Ecuador, management warned that higher costs will lead to a significant loss in the third quarter. The company has not been able to pass along these escalating costs to consumers and previously strong markets in Europe have been slowing as of late. (Apparently, as banana prices rise, healthy eaters seek out alternative sources for their potassium!) After the warning, its stock price plummeted by 28% in one day, which represents the majority of the loss for the quarter. Chiquita was the Fund’s poorest performer for the three-months, and we sold it after quarter end.

Owens-Illinois is the largest glass manufacturer in the world and sells containers and related products throughout North and South America, Asia, and Europe. The company produced excellent fundamental results as of late, including four straight quarters of better than expected earnings reports. Indeed, our Fund had a sizable gain in the stock coming into the June quarter. However, after hitting an all-time high in April, Owens-Illinois took a step back and lost over 25% of its value during the quarter. While the company has benefited from strong international demand (70% of its revenue comes from overseas), management warned about the effects that rising energy and raw material costs may have on future sales. The company cost the Fund just less than two percent for the three-month period.

Detailed Explanation of Fiscal Year Performance—What Worked Well

The Short Version: The four top performers during the fiscal year are all chemical-related stocks, further proof that companies engaged in commodities-driven industries have reaped tremendous benefits during the run-up in prices over the past twelve months. In fact, our three best performers each doubled in value during the period and contributed over 10% to the return of the Fund.

| | |

| 12 | | Annual Report | June 30, 2008 |

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY (continued)

These are the ten best performers for the fiscal year ended June 30, 2008:

| | | | | | |

| Rank | | Description | | Industry | | % Gain |

| 1 | | Potash Corp of Saskatchewan | | Chemicals | | 193.2% |

| 2 | | Mosaic Co | | Chemicals | | 140.1% |

| 3 | | CF Industries Holdings Inc | | Chemicals | | 106.7% |

| 4 | | Terra Industries Inc | | Chemicals | | 92.4% |

| 5 | | Research In Motion Ltd | | Computers | | 85.2% |

| 6 | | Alpha Natural Resources Inc | | Coal | | 74.2% |

| 7 | | National Oilwell Varco Inc | | Oil & Gas Services | | 70.2% |

| 8 | | priceline.com Inc | | Internet | | 68.0% |

| 9 | | Mobile Telesystems OJSC ADR | | Telecommunications | | 55.5% |

| 10 | | Bucyrus International Inc | | Machinery-Construction & Mining | | 52.4% |

| | | | | | | |

Our top performing stock, Potash Corp. of Saskatchewan, nearly tripled in price during the past twelve months and represented almost four percent of the Fund’s return. The Canadian-based company produces and markets fertilizer and related products across the globe. As the population in many emerging markets become more affluent, demand for different foods and other materials has increased dramatically, thus, enhancing the farmers’ needs for fertilizer. Additionally, natural disasters like the floods that devastated the Midwest earlier in the year also contributed to the shrinking supply (and rising demand) for grains, foods, and other products—all benefiting our Fund’s performance.

Three other top performers (Mosaic, CF Industries, and Terra Industries) are also chemical-related, and their stories have some similarities to Potash Corp. Outside of that industry, priceline.com was another excellent performer. The online travel company actually benefited from the ailing economy, as travelers sought out any and all discounts and promotions for their trips. When Captain Kirk…aka William Shatner…talks, people listen (though a few Bridgeway traders are more partial to Captain Picard in The Next Generation). The company’s tag line “name your own price” attracted consumers and business travelers alike to its sight in search of discounted flights, hotels, rental cars, and full packages, as priceline.com outperformed its key competitors: Orbitz and Expedia. For the summer, its management initiated a new creative promotion called “Sunshine Guaranteed.” Travelers who book through the website can get refunds should poor weather conditions ruin vacation plans.

Detailed Explanation of Fiscal Year Performance—What Didn’t Work

The Short Version: While financials received much of the negative headlines over the past twelve months, the weaker economy impacted companies within other (non-commodities-related) sectors as well, including technology and consumer non-cyclicals. The five poorest performing stocks declined at least 50%, and together they cost the Fund over 4% in return.

These are the ten stocks that performed the worst for the fiscal year ended June 30, 2008:

| | | | | | |

| Rank | | Description | | Industry | | % Loss |

| 1 | | WellCare Health Plans Inc | | Healthcare-Services | | -77.5% |

| 2 | | Sigma Designs Inc | | Semiconductors | | -63.3% |

| 3 | | Garmin Ltd | | Electronics | | -54.7% |

| 4 | | Synaptics Inc | | Computers | | -52.2% |

| 5 | | Perini Corp | | Engineering & Construction | | -51.5% |

| 6 | | Apollo Group Inc | | Commercial Services | | -44.3% |

| 7 | | Sunpower Corp | | Energy-Alternate Sources | | -43.1% |

| 8 | | Onyx Pharmaceuticals Inc | | Pharmaceuticals | | -41.4% |

| 9 | | Turkcell Iletisim Hizmet AS ADR | | Telecommunications | | -40.5% |

| 10 | | Sun Microsystems Inc | | Computers | | -38.4% |

| | | | | | | |

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY (continued)

WellCare Health Plans was our Fund’s worst performer for the fiscal year. This managed care provider offers government-sponsored healthcare and prescription drug programs through Medicare and Medicaid. In late October 2007, federal officials began investigating the company for fraud-related claims. The company’s stock price plummeted over 70% in one day on the news of the investigation. Additionally, reports surfaced that corporate execs had sold a sizable number of shares in advance of the decline, prompting concerns about insider trading and other illegal activities. We had only owned this stock a brief period when this news came out, and we sold shortly thereafter. Fortunately, as a smaller diversifying position, it cost the Fund less than a percentage point of return.

Chip-maker Sigma Designs is a leading manufacturer of digital solutions for home entertainment products, particularly high definition (HD) televisions and DVDs. The company holds a considerable market share advantage in providing chips for Sony’s Blu-Ray devices. During the year, management disclosed a significant error in its ordering system that resulted in its shipping products in excess of actual demand. As a result, the problem prompted the company to reduce its future sales forecasts, and several analysts lowered their price targets. Sigma Designs was the second worst-performing holding and cost the Fund just over a percentage point during the fiscal year.

Top Ten Holdings as of June 30, 2008

Commodities were a consistent theme among the Fund’s top holdings, as companies related to chemicals, coal, energy, and mining highlighted the list. Six of our largest positions at fiscal year end were also among our top quarterly performers: Mosaic, Alpha Natural Resources, Potash Corp., CF Industries, Bucyrus International, and National Oilwell Varco. The top ten holdings represented just under half of the overall net assets of the Fund, which represents more concentration in a smaller number of stocks and in more related industries than we have seen in quite a while.

| | | | | | |

| Rank | | Description | | Industry | | Percent of

Net Assets |

| 1 | | Mosaic Co | | Chemicals | | 8.0% |

| 2 | | Alpha Natural Resources Inc | | Coal | | 7.3% |

| 3 | | Potash Corp of Saskatchewan | | Chemicals | | 6.5% |

| 4 | | Owens-Illinois Inc | | Packaging & Containers | | 5.1% |

| 5 | | CF Industries Holdings Inc | | Chemicals | | 4.2% |

| 6 | | Bucyrus International Inc | | Machinery-Construction & Mining | | 4.1% |

| 7 | | Intuitive Surgical Inc | | Healthcare-Products | | 3.8% |

| 8 | | Compass Minerals International Inc | | Mining | | 3.7% |

| 9 | | Invitrogen Corp | | Biotechnology | | 3.1% |

| 10 | | National Oilwell Varco Inc | | Oil & Gas Services | | 2.6% |

| | | | | | | |

| | | | | | 48.4% |

| | |

| 14 | | Annual Report | June 30, 2008 |

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY (continued)

Industry Sector Representation as of June 30, 2008

Our Fund’s concentration in basic materials greatly contributed to the June quarter success. This overweighting along with good stock selection in the sector added over seven percent to the return. Conversely, we were underweighted in financials and avoided much of the hardships faced by companies engaged in subprime lending, mortgage-related securities investing, and other ramifications of the ongoing credit crisis, which saved the Fund more than two percentage points relative to our primary market benchmark.

| | | | | | |

| | | % of Portfolio | | % S&P 500 Index | | Difference |

Basic Materials | | 30.0% | | 3.9% | | 26.1% |

Communications | | 3.1% | | 11.0% | | -7.9% |

Consumer, Cyclical | | 4.6% | | 7.1% | | -2.5% |

Consumer, Non-cyclical | | 13.6% | | 20.6% | | -7.0% |

Energy | | 17.0% | | 16.3% | | 0.7% |

Financial | | 1.6% | | 14.0% | | -12.4% |

Industrial | | 19.9% | | 11.5% | | 8.4% |

Technology | | 6.7% | | 11.6% | | -4.9% |

Utilities | | 0.0% | | 3.9% | | -3.9% |

Diversified | | 0.0% | | 0.1% | | -0.1% |

Cash | | 3.5% | | 0.0% | | 3.5% |

| | | | | | | |

Total | | 100.0% | | 100.0% | | |

Disclaimer

The following is a reminder from the friendly folks at your Fund who worry about liability. The views expressed here are exclusively those of Fund management. These views, including those of market sectors or individual stocks, are not meant as investment advice and should not be considered predictive in nature. Any favorable (or unfavorable) description of a holding applies only as of the quarter end, June 30, 2008, unless otherwise stated. Security positions can and do change thereafter. Discussions of historical performance do not guarantee and may not be indicative of future performance.

Market volatility can significantly affect short-term performance. The Fund is not an appropriate investment for short-term investors. Investments in the small companies within this multi-cap fund generally carry greater risk than is customarily associated with larger companies. This additional risk is attributable to a number of factors, including the relatively limited financial resources that are typically available to small companies, and the fact that small companies often have comparatively limited product lines. In addition, the stock of small companies tends to be more volatile than the stock of large companies, particularly in the short term and particularly in the early stages of an economic or market downturn. The Fund’s use of options, futures, and leverage can magnify the risk of loss in an unfavorable market, and the Fund’s use of short-sale positions can, in theory, expose shareholders to unlimited loss. Finally, the Fund exposes shareholders to “focus risk” which may add to Fund volatility through the possibility that a single company could significantly affect total return. Shareholders of the Fund, therefore, are taking on more risk than they would if they invested in the stock market as a whole.

Conclusion

Thank you for your continued investment in Aggressive Investors 1 Fund. We encourage your feedback; your reactions and concerns are important to us.

Sincerely,

Your Investment Management Team

Bridgeway Aggressive Investors 1 Fund

SCHEDULE OF INVESTMENTS

Showing percentage of net assets as of June 30, 2008

| | | | | | | |

| Industry | | Company | | Shares | | Value |

|

COMMON STOCKS - 96.48% |

Aerospace/Defense - 0.88% |

| | Lockheed Martin Corp. | | 30,100 | | $ | 2,969,666 |

|

Apparel - 1.32% |

| | Warnaco Group, Inc.* | | 101,200 | | | 4,459,884 |

|

Banks - 0.85% |

| | US Bancorp+ | | 103,800 | | | 2,894,982 |

|

Biotechnology - 5.22% |

| | Invitrogen Corp.* | | 259,700 | | | 10,195,822 |

| | OSI Pharmaceuticals, Inc.* | | 181,700 | | | 7,507,844 |

| | | | | | | |

| | | | | | | 17,703,666 |

|

Chemicals - 24.15% |

| | CF Industries Holdings, Inc.+ | | 91,600 | | | 13,996,480 |

| | Dow Chemical Co. | | 82,300 | | | 2,873,093 |

| | Monsanto Co. | | 28,000 | | | 3,540,320 |

| | Mosaic Co.* | | 184,000 | | | 26,624,800 |

| | NewMarket Corp. | | 50,500 | | | 3,344,615 |

| | Potash Corp. of Saskatchewan, Inc. | | 95,100 | | | 21,737,007 |

| | Syngenta AG - ADR | | 37,900 | | | 2,452,130 |

| | Terra Industries, Inc.+ | | 146,370 | | | 7,223,359 |

| | | | | | | |

| | | | | | | 81,791,804 |

|

Coal - 7.22% |

| | Alpha Natural Resources, Inc.*+ | | 234,400 | | | 24,445,576 |

|

Computers - 3.78% |

| | Apple, Inc.* | | 21,300 | | | 3,566,472 |

| | Research In Motion, Ltd.* | | 26,800 | | | 3,132,920 |

| | Western Digital Corp.* | | 176,500 | | | 6,094,545 |

| | | | | | | |

| | | | | | | 12,793,937 |

|

Electrical Components & Equipment - 1.24% |

| | GrafTech International, Ltd.* | | 156,400 | | | 4,196,212 |

|

Electronics - 1.23% |

| | FLIR Systems, Inc.* | | 103,200 | | | 4,186,824 |

|

Engineering & Construction - 1.20% |

| | ABB, Ltd. - ADR* | | 143,400 | | | 4,061,088 |

|

Food - 0.04% |

| | Chiquita Brands International, Inc.*+ | | 8,600 | | | 130,462 |

| | | | | | | |

| Industry | | Company | | Shares | | Value |

|

|

Healthcare - Products - 4.65% |

| | Intuitive Surgical, Inc.* | | 46,800 | | $ | 12,607,920 |

| | St. Jude Medical, Inc.* | | 76,700 | | | 3,135,496 |

| | | | | | | |

| | | | | | | 15,743,416 |

|

Insurance - 0.78% |

| | AmTrust Financial Services, Inc. | | 209,400 | | | 2,638,440 |

|

Internet - 2.18% |

| | Priceline.com, Inc.*+ | | 64,000 | | | 7,389,440 |

|

Iron/Steel - 2.28% |

| | AK Steel Holding Corp. | | 50,600 | | | 3,491,400 |

| | Mechel Open Joint Stock Co. - ADR+ | | 85,300 | | | 4,225,762 |

| | | | | | | |

| | | | | | | 7,717,162 |

|

Machinery - Construction & Mining - 4.08% |

| | Bucyrus International, Inc., Class A+ | | 189,200 | | | 13,815,384 |

|

Machinery - Diversified - 3.34% |

| | AGCO Corp.*+ | | 57,300 | | | 3,003,093 |

| | Flowserve Corp. | | 33,100 | | | 4,524,770 |

| | Gardner Denver, Inc.* | | 66,600 | | | 3,782,880 |

| | | | | | | |

| | | | | | | 11,310,743 |

|

Media - 0.93% |

| | Walt Disney Co. | | 101,100 | | | 3,154,320 |

|

Mining - 3.61% |

| | Compass Minerals International, Inc. | | 152,000 | | | 12,245,120 |

|

Office Furnishing - 1.00% |

| | Herman Miller, Inc. | | 136,100 | | | 3,387,529 |

|

Oil & Gas - 5.00% |

| | CNOOC, Ltd. - ADR | | 13,100 | | | 2,273,374 |

| | ConocoPhillips | | 36,700 | | | 3,464,113 |

| | EOG Resources, Inc. | | 23,500 | | | 3,083,200 |

| | Petroleo Brasileiro S.A. - ADR | | 68,400 | | | 4,844,772 |

| | Transocean, Inc. | | 21,400 | | | 3,261,146 |

| | | | | | | |

| | | | | | | 16,926,605 |

|

Oil & Gas Services - 3.72% |

| | FMC Technologies, Inc.* | | 51,600 | | | 3,969,588 |

| | National Oilwell Varco, Inc.* | | 97,200 | | | 8,623,584 |

| | | | | | | |

| | | | | | | 12,593,172 |

| | |

| 16 | | Annual Report | June 30, 2008 |

Bridgeway Aggressive Investors 1 Fund

SCHEDULE OF INVESTMENTS (continued)

Showing percentage of net assets as of June 30, 2008

| | | | | | | |

| Industry | | Company | | Shares | | Value |

|

Common Stocks (continued) |

Packaging & Containers - 5.04% |

| | Owens-Illinois, Inc.* | | 409,600 | | $ | 17,076,224 |

|

Pharmaceuticals - 3.65% |

| | Bristol-Myers Squibb Co. | | 174,300 | | | 3,578,379 |

| | Express Scripts, Inc.* | | 50,600 | | | 3,173,632 |

| | Medco Health Solutions, Inc.* | | 68,200 | | | 3,219,040 |

| | Novo Nordisk A/S - Sponsored ADR | | 36,200 | | | 2,389,200 |

| | | | | | | |

| | | | | | | 12,360,251 |

|

Pipelines - 1.07% |

| | The Williams Cos., Inc. | | 89,700 | | | 3,615,807 |

|

Retail - 2.25% |

| | Aeropostale, Inc.* | | 91,600 | | | 2,869,828 |

| | Costco Wholesale Corp.+ | | 33,200 | | | 2,328,648 |

| | Tiffany & Co. | | 60,000 | | | 2,445,000 |

| | | | | | | |

| | | | | | | 7,643,476 |

|

Semiconductors - 0.99% |

| | Amkor Technology, Inc.* | | 321,500 | | | 3,346,815 |

|

Software - 1.92% |

| | Microsoft Corp. | | 115,900 | | | 3,188,409 |

| | Oracle Corp.* | | 157,500 | | | 3,307,500 |

| | | | | | | |

| | | | | | | 6,495,909 |

|

Transportation - 2.86% |

| | CH Robinson Worldwide, Inc. | | 53,900 | | | 2,955,876 |

| | CSX Corp. | | 49,700 | | | 3,121,657 |

| | Kirby Corp.* | | 20 | | | 960 |

| | Ryder System, Inc. | | 52,600 | | | 3,623,088 |

| | | | | | | |

| | | | | | | 9,701,581 |

| | | | | | | |

| |

TOTAL COMMON STOCKS - 96.48% | | | 326,795,496 |

| | | | | | | |

(Cost $250,679,171) | | | |

| | | | | |

| |

PURCHASED CALL OPTIONS - 0.18% | | | |

| | |

| Company | | Number

of Contracts | | Value |

Southwestern Energy Co.

Expiring September, 2008 at $42.50 | | 800 | | $ | 624,000 |

| | | | | |

| |

TOTAL PURCHASED CALL OPTIONS - 0.18% | | | 624,000 |

| | | | | |

(Cost $480,679) | | | | | |

| | | | | | | |

|

MONEY MARKET FUNDS - 0.35% |

| | | |

| | | Rate^ | | Shares | | Value |

BlackRock Temp Cash Liquidity Fund Institutional Shares #21 | | 2.61% | | 1,170,513 | | $ | 1,170,513 |

| | | | | | | |

| |

TOTAL MONEY MARKET FUNDS - 0.35% | | | 1,170,513 |

| | | | | | | |

(Cost $1,170,513) | | | |

| |

TOTAL INVESTMENTS - 97.01% | | $ | 328,590,009 |

(Cost $252,330,363) | | | |

Other Assets in Excess of Liabilities - 2.99% | | | 10,124,881 |

| | | | | | | |

NET ASSETS - 100.00% | | $ | 338,714,890 |

| | | | | | | |

| * | Non Income Producing Security. |

| + | This security or a portion of the security is out on loan at June 30, 2008. Total loaned securities had a market value of $53,026,296 at June 30, 2008. |

| ^ | Rate disclosed is as of June 30, 2008. |

| ADR | - American Depositary Receipt |

See Notes to Financial Statements.

Aggressive Investors 2 Fund

MANAGER’S COMMENTARY

June 30, 2008

Dear Fellow Aggressive Investors 2 Fund Shareholder,

Our Fund bounced back strongly in the June quarter, outperforming all our market and peer benchmarks. Aggressive Investors 2 increased by an impressive 11.61%, trouncing our primary market index (the S&P 500 Index—down 2.73%), our peer benchmark (the Lipper Capital Appreciation Funds Index—up 4.54%), and the Russell 2000 Index of small companies (up 0.58%) for the three-month period. This was our best quarter relative to our primary market benchmark in five years and our second best quarter relative to our primary market benchmark since inception six and a half years ago. We are quite pleased.

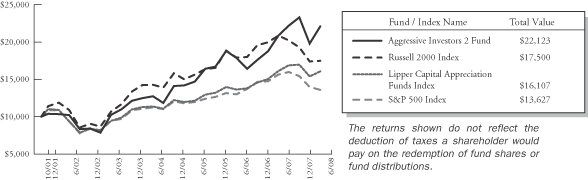

Likewise, our Fund outperformed all of its benchmarks for the full fiscal year on both an absolute and relative return basis. For the twelve months ending June 30, 2008, the Fund appreciated 5.88%, while each of the indexes closed in negative territory: S&P 500 (-13.12%), Lipper Capital Appreciation Funds Index (-0.16%), and Russell 2000 Index (-16.19%). While we welcome such strong results during these shorter-term quarterly and twelve month time horizons, we strive to achieve excellent consistent returns over the long term. We are pleased to report that Aggressive Investors 2 Fund has rewarded our shareholders with double-digit returns and outperformed each of its benchmarks over the past five years as well as since inception in October, 2001. Our strategies stay constant and consistent in both good times and bad, in both strong and weak markets, during both “the sky is the limit” and “the sky is falling” investor environments. Such long-term results always will remain the key objective of our firm. The information below bears out our longer term success in these areas.

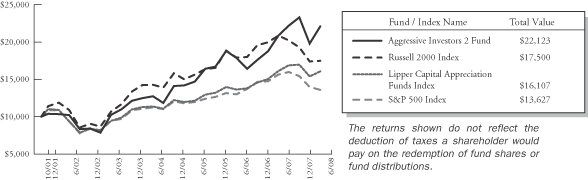

The table below presents our June quarter, one-year, five-year and life-to-date financial results, according to the formula required by the SEC. See the next page for a graph of performance from inception to June 30, 2008.

| | | | | | | | |

| | | June Qtr.

4/1/08

to 6/30/08 | | 1 Year

7/1/07

to 6/30/08 | | 5 Year

7/1/03

to 6/30/08 | | Life-to-Date

10/31/01 to 6/30/08 |

| | | | |

Aggressive Investors 2 Fund | | 11.61% | | 5.88% | | 16.57% | | 12.66% |

S&P 500 Index (large companies) | | -2.73% | | -13.12% | | 7.58% | | 4.75% |

Lipper Capital Appreciation Funds Index | | 4.54% | | -0.16% | | 11.19% | | 7.41% |

Russell 2000 Index (small companies) | | 0.58% | | -16.19% | | 10.29% | | 8.76% |

Performance figures quoted in the table above and graph below represent past performance and are no guarantee of future results. The table above and the graph below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks with dividends reinvested, while the Russell 2000 Index is an unmanaged, market value weighted index, that measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market with dividends reinvested. The Lipper Capital Appreciation Funds Index reflects the record of the 30 largest funds in this category, comprised of more aggressive domestic growth mutual funds, as reported by Lipper, Inc. It is not possible to invest directly in an index. Periods longer than one year are annualized.

According to data from Lipper, Inc. as of June 30, 2008, Aggressive Investors 2 Fund ranked 23rd of 296 capital appreciation funds for the twelve months ending June 30, 2008, 15th of 218 over the last five years, and 12th of 198 since inception in October, 2001. Lipper, Inc. is an independent mutual fund rating service that ranks funds in various fund categories by making comparative calculations using total returns.

| | |

| 18 | | Annual Report | June 30, 2008 |

Aggressive Investors 2 Fund

MANAGER’S COMMENTARY (continued)

Aggressive Investors 2 Fund vs. S&P 500 Index & Lipper Capital Appreciation Funds Index & Russell 2000 Index 10/31/01 to 6/30/08

Detailed Explanation of Quarterly Performance—What Worked Well