UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08200

Bridgeway Funds, Inc.

(Exact name of registrant as specified in charter)

5615 Kirby Drive, Suite 518

Houston, Texas 77005-2448

(Address of principal executive offices) (Zip code)

Michael D. Mulcahy, President

Bridgeway Funds, Inc.

5615 Kirby Drive, Suite 518

Houston, Texas 77005-2448

(Name and address of agent for service)

Registrant’s telephone number, including area code:(713) 661-3500

Date of fiscal year end: June 30

Date of reporting period: July 1, 2009 through June 30, 2010

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

| | |

A no-load mutual fund family of domestic funds |

Annual Report June 30, 2010 |

| | |

AGGRESSIVE INVESTORS 1 | | BRAGX |

(Closed to New Investors) | | |

| |

AGGRESSIVE INVESTORS 2 | | BRAIX |

| |

ULTRA-SMALL COMPANY | | BRUSX |

(Open to Existing Investors — Direct Only) | | |

| |

ULTRA-SMALL COMPANY MARKET | | BRSIX |

| |

MICRO-CAP LIMITED | | BRMCX |

| |

SMALL-CAP MOMENTUM | | BRSMX |

| |

SMALL-CAP GROWTH | | BRSGX |

| |

SMALL-CAP VALUE | | BRSVX |

| |

LARGE-CAP GROWTH | | BRLGX |

| |

LARGE-CAP VALUE | | BRLVX |

| |

BLUE CHIP 35 INDEX | | BRLIX |

| |

MANAGED VOLATILITY | | BRBPX |

(formerly Balanced Fund) | | |

| | |

| TABLE OF CONTENTS | |  |

Bridgeway Funds Standardized Returns as of June 30, 2010*

| | | | | | | | | | | | | | | | |

| | | | | | | | | Annualized | | | | | | |

| Fund | | June Qtr.

4/1/10

to 6/30/10 | | Six Months

1/1/10 to

6/30/10 | | 1 Year | | 5 Years | | 10 Years | | Inception

to Date | | Inception

Date | | Gross

Expense

Ratio2 |

Aggressive Investors 1 | | -13.42% | | -9.84% | | 7.51% | | -6.05% | | -1.11% | | 12.12% | | 8/5/1994 | | 0.34% |

Aggressive Investors 2 | | -13.65% | | -11.53% | | 8.54% | | -3.95% | | NA | | 2.16% | | 10/31/2001 | | 1.20% |

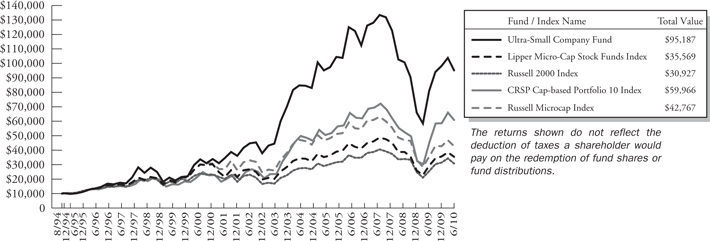

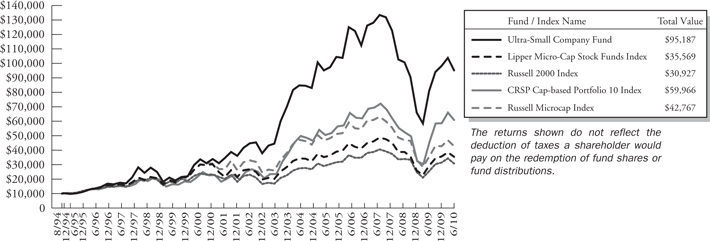

Ultra-Small Company | | -8.46% | | -3.12% | | 17.26% | | -0.49% | | 11.85% | | 15.22% | | 8/5/1994 | | 1.17% |

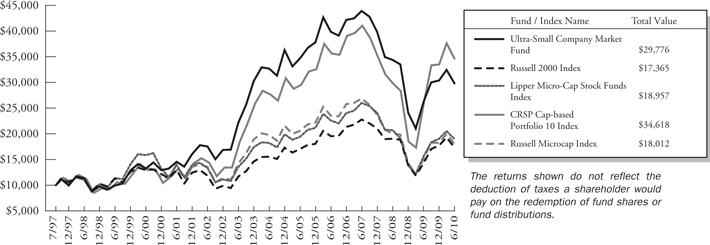

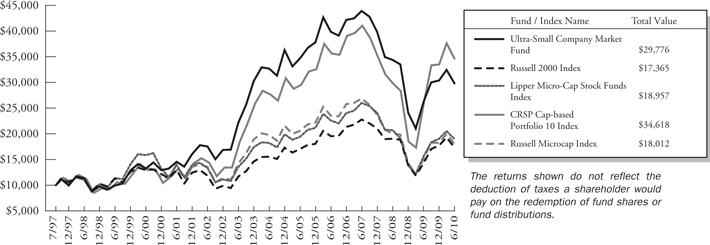

Ultra-Small Co Market | | -8.08% | | -1.93% | | 13.30% | | -2.98% | | 8.44% | | 8.82% | | 7/31/1997 | | 0.79%1 |

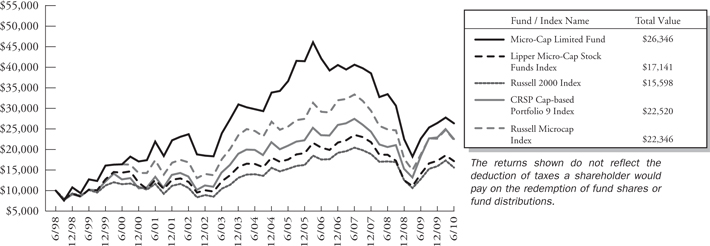

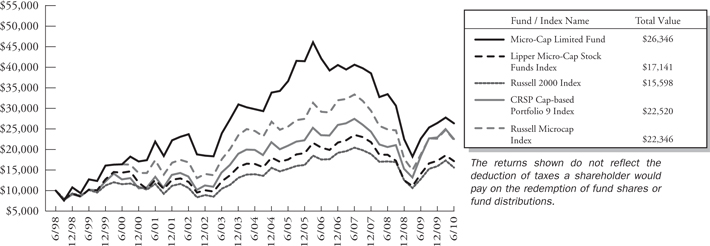

Micro-Cap Limited | | -5.03% | | -0.18% | | 16.44% | | -6.36% | | 4.84% | | 8.41% | | 6/30/1998 | | 0.87% |

Small-Cap Momentum | | NA | | NA | | NA | | NA | | NA | | -6.70%3 | | 5/28/2010 | | 1.29%1 |

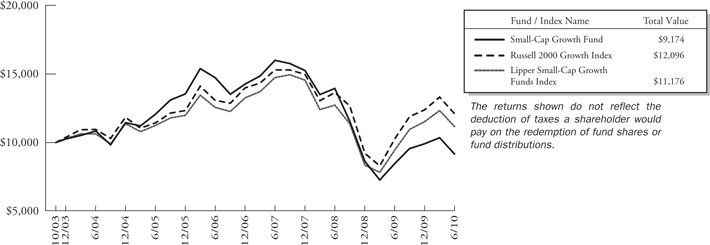

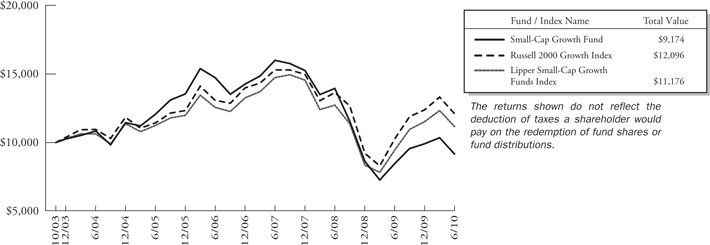

Small-Cap Growth | | -11.43% | | -7.49% | | 8.44% | | -5.34% | | NA | | -1.29% | | 10/31/2003 | | 0.94% |

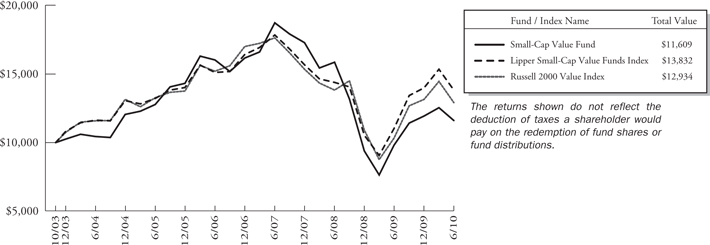

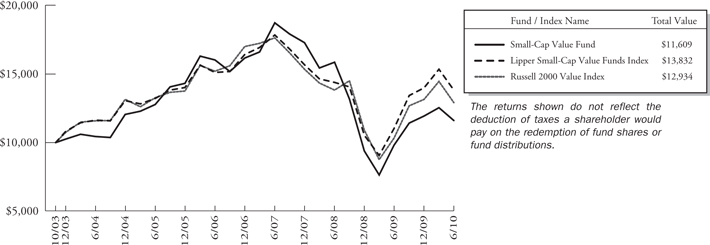

Small-Cap Value | | -7.51% | | -2.80% | | 18.35% | | -1.92% | | NA | | 2.26% | | 10/31/2003 | | 0.92% |

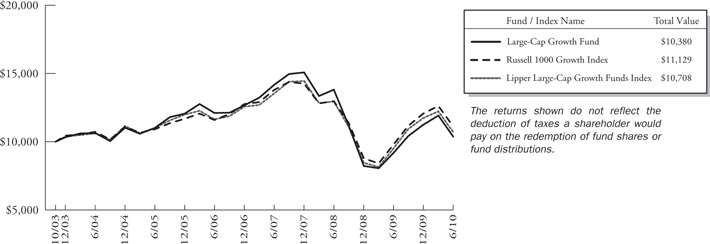

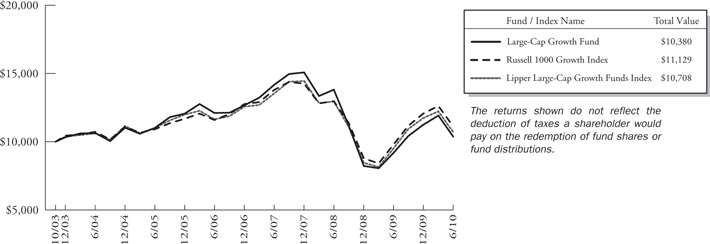

Large-Cap Growth | | -13.00% | | -7.71% | | 12.89% | | -1.15% | | NA | | 0.56% | | 10/31/2003 | | 0.82% |

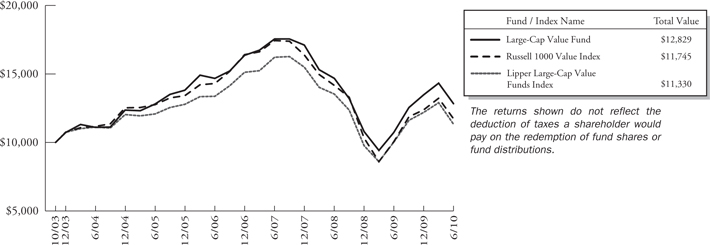

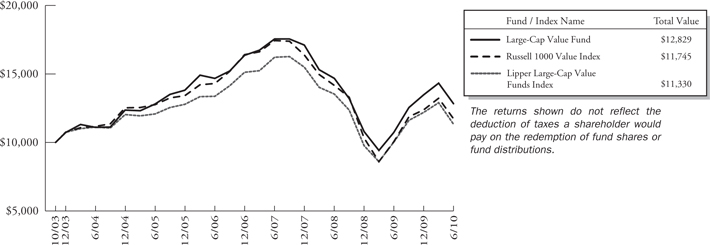

Large-Cap Value | | -10.42% | | -4.90% | | 19.65% | | 0.04% | | NA | | 3.81% | | 10/31/2003 | | 0.98%1 |

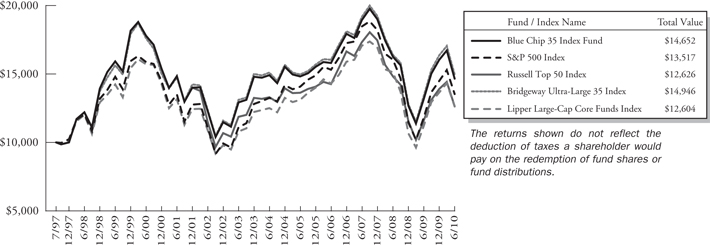

Blue Chip 35 Index | | -12.22% | | -8.58% | | 11.25% | | -0.21% | | -1.91% | | 3.00% | | 7/31/1997 | | 0.25%1 |

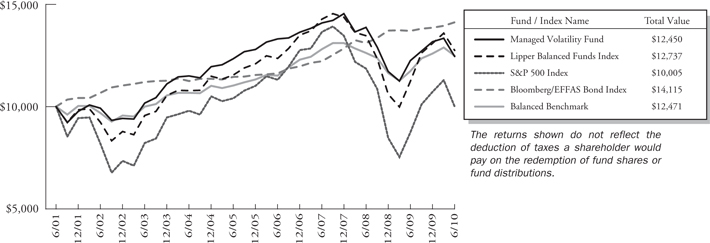

Managed Volatility | | -6.66% | | -5.45% | | 1.67% | | 0.19% | | NA | | 2.46% | | 6/30/2001 | | 1.01%1 |

1 Some of the Funds’ fees were waived or expenses reimbursed otherwise returns would have been lower. The Adviser has contractually agreed to waive fees and/or reimburse expenses. Any material change to this Fund policy would require a vote by shareholders.

2 Expense ratios are as stated in the current prospectus. Please see financials for expense ratios as of June 30, 2010.

3 Return is not annualized.

Bridgeway Funds Returns for Calendar Years 1996 through 2009*

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1996 | | 1997 | | 1998 | | 1999 | | 2000 | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 |

Aggressive Investors 1 | | 32.20% | | 18.27% | | 19.28% | | 120.62% | | 13.58% | | -11.20% | | -18.01% | | 53.97% | | 12.21% | | 14.93% | | 7.11% | | 25.80% | | -56.16% | | 23.98% |

Aggressive Investors 2 | | | | | | | | | | | | | | -19.02% | | 44.01% | | 16.23% | | 18.59% | | 5.43% | | 32.19% | | -55.07% | | 29.84% |

Ultra-Small Company | | 29.74% | | 37.99% | | -13.11% | | 40.41% | | 4.75% | | 34.00% | | 3.98% | | 88.57% | | 23.33% | | 2.99% | | 21.55% | | -2.77% | | -46.24% | | 48.93% |

Ultra-Small Co Market | | | | | | -1.81% | | 31.49% | | 0.67% | | 23.98% | | 4.90% | | 79.43% | | 20.12% | | 4.08% | | 11.48% | | -5.40% | | -39.49% | | 25.95% |

Micro-Cap Limited | | | | | | | | 49.55% | | 6.02% | | 30.20% | | -16.61% | | 66.97% | | 9.46% | | 22.55% | | -2.34% | | -4.97% | | -41.74% | | 17.65% |

Small-Cap Growth | | | | | | | | | | | | | | | | | | 11.59% | | 18.24% | | 5.31% | | 6.87% | | -43.48% | | 15.04% |

Small-Cap Value | | | | | | | | | | | | | | | | | | 17.33% | | 18.92% | | 12.77% | | 6.93% | | -45.57% | | 26.98% |

Large-Cap Growth | | | | | | | | | | | | | | | | | | 6.77% | | 9.33% | | 4.99% | | 19.01% | | -45.42% | | 36.66% |

Large-Cap Value | | | | | | | | | | | | | | | | | | 15.15% | | 11.62% | | 18.52% | | 4.49% | | -36.83% | | 24.92% |

Blue Chip 35 Index | | | | | | 39.11% | | 30.34% | | -15.12% | | -9.06% | | -18.02% | | 28.87% | | 4.79% | | 0.05% | | 15.42% | | 6.07% | | -33.30% | | 26.61% |

Managed Volatility | | | | | | | | | | | | | | -3.51% | | 17.82% | | 7.61% | | 6.96% | | 6.65% | | 6.58% | | -19.38% | | 12.39% |

Performance figures quoted represent past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. To obtain performance current to the most recent month-end, please visit our website at www.bridgeway.com or call 1-800-661-3550. Total return figures include the reimbursement of dividends and capital gains.

This report is submitted for the general information of the shareholders of each Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding a Fund’s risks, objectives, fees and expenses, experience of its management, and other information. Investors should read the prospectus carefully before investing in a Fund. For questions or other Fund information, call 1-800-661-3550 or visit the Funds’ website www.bridgeway.com. Funds are available for purchase by residents of the United States, Puerto Rico, U.S. Virgin Islands and Guam only. Foreside Fund Services, LLC, Distributor.

The views expressed here are exclusively those of Fund management. These views, including those relating to the market, sectors or individual stocks are not meant as investment advice and should not be considered predictive in nature.

| * | Numbers with green highlight indicate periods when the Fund outperformed its primary benchmark. |

| | |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM | |  |

June 30, 2010

Dear Fellow Shareholders,

Our Funds generally followed the trends of the broader market, which broke a four quarter string of positive returns, retreating by double digits in the June quarter. Only three of our eleven Funds beat their primary market benchmark, although our twelfth and newest Fund beat its market benchmark during the initial partial quarter period. Please also note that we changed the name of Bridgeway Balanced Fund to Bridgeway Managed Volatility Fund to better reflect its investment objective and strategy.

A review of the market environment appears on page 2, while the following section on page 3 presents the current picture on the lack of traction that has hurt our relative performance over the last two year period. An encouraging note there: the junk rally aspect (a price surge of the most financially distressed and beat up companies) of the previous four quarters (April 2009 through March 2010), has abated, though not reversed. Stepping back from the details of the recent market, we put the recent market volatility into the context of the prior several decades on page 3. The results may surprise you.

By way of investor education, Bridgeway has been a strong advocate of not chasing hot returns and of learning how to distinguish this emotional tendency in our investment decisions. Page 4 discusses the latest evidence that investors are continuing to chase hot returns, which in the recent environment means the perceived safety of bonds.

Each fiscal year we commit to reporting to shareholders what we think is the worst thing at Bridgeway during the year. This year it was pretty easy to figure out. Details are on page 5. In a rather long and detailed section on pages 5 to 9, we discuss the “state of the union” among investment managers using quantitative methods — the last two years haven’t been pretty —and talk about where Bridgeway fits in and what we’re doing about it.

As always, we appreciate your feedback. We take your comments very seriously and regularly discuss them internally to help in managing our Funds and this company. Please keep your ideas coming — both favorable and critical. They provide us with a vital tool, helping us serve you better.

Sincerely,

Your Investment Management Team

| | | | | | |

| | | |  | | |

| John Montgomery | | | | Dick Cancelmo | | |

| | | |

| | | |  | | |

| Elena Khoziaeva | | | | Michael Whipple | | |

| |  | | | | |

| | Rasool Shaik | | | | |

| | |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

Market Review

The Short Version: The stock market dropped during the quarter as investors struggled with implications of the sovereign debt crisis in Europe and the BP oil disaster in the gulf.

As the second quarter began, the economy continued its trek toward recovery; confidence had returned to corporate boardrooms; and investors were pouring their “cash-on-the sidelines” back into risky assets. Just when all seemed right with the world again, tiny Greece (and huge BP) began dominating the headlines. While market watchers would have expected a collective yawn about an economy whose GDP is smaller than that of Houston’s, soon Spain, Portugal, Ireland, and others across Europe offered similar debt concerns. Threats of sovereign debt defaults rekindled memories of the subprime debacle, and investors feared a new global banking crisis. Meanwhile, the worst oil spill disaster in history unfolded in the Gulf of Mexico. Not even a $20 billion fund for victim compensation could ease the pain caused by the BP oil disaster (which had yet to be plugged at quarter-end). While investors were considering the long-term implications of these critical events, they were greeted by “high frequency flash trades” that prompted the Dow to plunge 1,000 points in less than an hour on May 6, 2010. If sovereign debt and BP were not enough to rattle nerves, the flash crash did the trick.

When the dust settled, the Dow had declined by 10% and suffered its first down quarter since early 2009. The S&P and Nasdaq experienced similar fates, and many global markets fared even worse. Most sectors struggled, commodity-related stocks were among the biggest losers and financials plummeted as well. Gold mining companies reaped the rewards of the new-found bearishness as investors pushed gold to record highs. Oil prices fell steadily during the quarter; traders feared the weakness in Europe would spread and hinder global demand. Shifting to bonds, the benchmark 10-year Treasury dropped 90 bps on flight-to-quality trades, and corporate (and junk) bonds again fell out of favor as companies found new challenges in gaining access to credit.

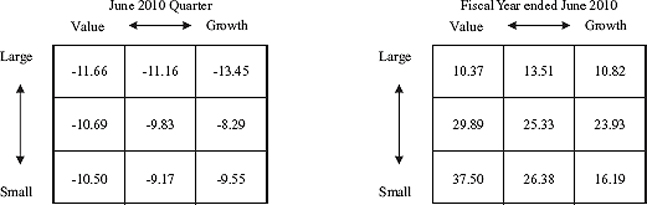

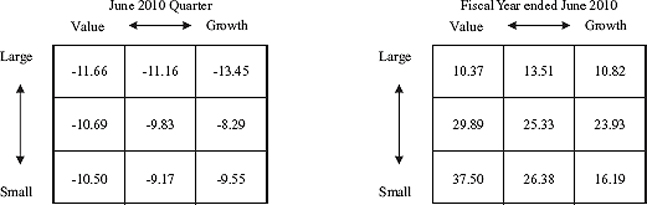

As presented below, each “corner” of the domestic market had more than a nine percent negative return for the quarter ending June 30, 2010. Larger-cap stocks were the weakest market segment, with large-cap growth stocks declining the most, falling 13.45% during the quarter. Mid-cap growth stocks were the “best” performers, dropping only 8.29% during the same period.

Sector returns varied widely during the quarter. Energy, Industrials, and Financial Services were the hardest hit, all declining approximately 12% for the period. Consumer Goods and Telecommunications stocks performed the best, with losses of 4% and 6%, respectively.

| | — | | The tables below are based on stock data from Morningstar. |

| | |

| 2 | | Annual Report | June 30, 2010 |

| | |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

Lack of Traction — Part 5 — the tide has not yet turned, but there are hopeful signs

The Short Version: Our small-, micro-, and ultra-small cap stocks continued to show very significant “lack of traction,” which we see primarily as a disconnect between the underlying fundamental financial health of a company and the relative performance of its stock price.

As explained in each of the shareholder letters this last year, we refer to an unusual market phenomenon whereby the underlying economic health of a company and its stock price diverge. This has not been a favorable environment for a majority of our stock picking models. Long-term, we believe a company’s stock price and its economic results in the marketplace must go hand in hand. We believe this extended period of lack of traction could be due to pumping $700 billion through our economy (the TARP program) in a way that is not driven by normal capital market mechanisms. For example, if the U.S. government rescues companies that would normally suffer severely or go bankrupt, this affects the outcomes of these companies, their stock prices, and their consumers, distributors and suppliers in ways that are much more difficult to predict, based on history.

This phenomenon, which we call a “lack of traction”, was strongest in the June and September quarters of 2009, coming out of the severe bear market. In the December 2009 quarter, we saw some signs that things might be returning to normal, but only among “value” companies (those that are cheap by some financial measures). Similarly, we saw some signs of normality in the March 2010 quarter, but only among the smallest companies in our Funds. This quarter, we also see some positive signs, but as in the December 2009 quarter, only among the companies on the value end of the spectrum.

These are the encouraging signs:

Some of our sidestepping models, ones that tell us to avoid distressed companies that could go bankrupt and those at risk of a precipitous price drop, have stopped working against us — though we would not say that they are actively helping yet. The easiest way to see this is in the performance of our Ultra-Small Company Market Fund, where the sidestepping models are usually (and currently) the primary driver of performance relative to its primary market benchmark.

Unlike the worst relative performance period of 2009, there is now a noticeable difference in the performance between the stock picking models in our most actively managed and higher turnover Funds. Stock picking models on the value end of the spectrum are doing better; those on the growth end are still delivering poorer results.

Not encouraging signs:

Among the companies of the S&P 500 Index, those with the highest levels of debt still outperformed those with the lowest levels of debt, although only by a small margin. At least these are not affecting us like they did in calendar year 2009.

One of the metrics we have followed is the record of companies beating Wall Street estimates. This record still indicates a clear lack of traction. Some of our best performing Funds on a fundamental basis, Funds with the highest percentage of companies beating Wall Street estimates, (e.g. Aggressive Investors 1 and 2 and Small-Cap Value) were among our worst performing Funds relative to their market benchmarks.

The Big Picture on Market Volatility

The Short Version: While it feels as though market volatility is up, historical data indicates we are still within the range of the prior couple of decades over monthly and quarterly periods.

One of the big advantages of Bridgeway’s quantitative investing approach is that it takes emotion out of the stock picking process. As we reflect on how the recent market environment feels to individual investors, however, we realize it could feel as if they are captaining a sailboat adrift in a volatile economic storm. The erratic market winds seem to obscure any investment course that is set. With the crest of each new wave, it’s unclear whether the skies are truly turning blue or we’re merely experiencing false peace as the eye of this economic storm passes. We do know that economic storms come and go; we just don’t know when. And if you can’t stomach this “Dramamine-demanding” volatility by maintaining a long-term perspective, you just might be on the verge of nausea.

We encourage investors in any specific market environment to step back and look at the big picture; and we believe that looking at long-term history is a good way to do that. With respect to longer-term market volatility, it feels as though things have

| | |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

changed; but what does the data actually show? We just completed some research on market volatility since the 1950’s. Here’s what we discovered:

We looked at S&P 500 Index price changes from 1950 to 2009 and computed standard deviations on these returns for daily, monthly and quarterly time periods. What we found was…

| | — | | 2000-2009 was the most volatile decade since 1950 on a daily basis. There is a slight ramp up in the 2005-2009 period as well. |

| | — | | The 80’s were the most volatile decade on a monthly basis, with the 2000-2009 period close behind. |

| | — | | The 70’s were the most volatile decade on a quarterly basis, with the 2000-2009 period close behind. |

Conclusion: There has been an upward trend in volatility since the 50’s and 60’s, yet since the 1970s, volatility over monthly or longer periods is still within range.

While we won’t speculate on why the markets are more volatile today than in the past, we are definitely seeing more volatility. Bridgeway has always encouraged investors to take a longer-term perspective – that is, five years or more – and we still do. Yet, it is difficult for many investors to keep their eyes on that horizon, particularly when their boat is in the trough between waves and visibility is nil.

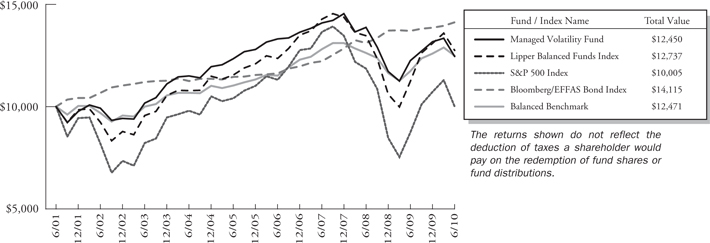

Balanced Fund renamed to Managed Volatility Fund

This past quarter we changed the name of our Balanced Fund to Managed Volatility Fund. The strategy for the Fund has not changed, but we felt the name obscured its real purpose. The fund is not about “balance” per se, but was designed with the objective of providing stock market-like returns at roughly 40% of the volatility. We launched this fund in 2001 as we entered what has become an increasingly volatile market. And now with nine years of experience, we are pleased that the fund has achieved its objective. The name change is one way for us to provide more clarity about its purpose.

Another Form of Chasing Hot Returns

The Short Version: If an investor has strong exposure to stocks just before the worst bear market in eight decades, but immediately thereafter switches to bonds just before a major bout of inflation, he or she will very likely miss out on both ends of the market. In aggregate, it appears that mutual fund investors in America may be doing just that. Bridgeway recommends appropriate diversification, but a static strategy for the long term to help keep emotions from destroying long-term wealth.

In what looks to us like another form of “chasing hot returns,” or more specifically, looking for conservative investments after the horse has left the barn . . .

“Over the past year and a half, investors have poured a net $390 billion into taxable bond funds while pulling $45 billion from U.S. stock funds, according to Morningstar, which opens its 22nd annual conference [this week] in Chicago. . . .” From an article written by Mark Jewel of the Associated Press, June 22, 2010.

If you read our semi-annual report, you know we think one of the biggest investment risks in the next three to five years is inflation risk. This is because, politically, the most feasible way to “pay down” our nation’s war and TARP debt is to inflate our way out. But inflation hits bond funds disproportionately hard. Bonds typically pay a fixed return, the value of which is potentially eroded hugely by inflation. While inflation is also generally bad for stocks in the short term, historically stocks have provided good long-term protection against inflation, since companies inevitably raise the prices of their goods and services in line with the inflated costs of materials and other resources. The bottom line? Some investors were hit hard in the stock market rout of 2008. But if they switch into bond funds just before a bout of inflation, they may be positioning themselves for two back-to-back “hits.”

The article referenced above goes on to say:

The conference agenda reflects the increasing flexibility money managers are seeking as they worry about becoming too dependent on stocks.

| | |

| 4 | | Annual Report | June 30, 2010 |

| | |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

It seems that many money professionals are also looking for solutions to the last downturn, rather than focusing on an appropriate long-term strategy that takes into consideration all kinds of risks. Stock market risk is one; inflation risk is another —a good argument for diversification, which is an appropriate investing principle in all market environments.

The Worst Thing of the Fiscal Year

The Short Version: Underperforming our primary market benchmark with 10 of 11 Funds in a “bounceback” year following the previous year mega-bear market was the worst thing to happen at Bridgeway over the last year. While absolute returns were attractive, our higher quality stocks performed relatively poorly in the “junk rally” and market environment since March 2009.

For the last dozen fiscal years in each annual report, Bridgeway has revealed its “worst thing of the year.” This section has become an important Bridgeway tradition. As a shareholder, you are the owner and “boss,” and we think you have a right to know the negatives as well as the positives. In previous years we have discussed partner loss, trading errors, compliance issues, and Fund performance. This year’s choice for “worst thing” was pretty easy to identify: underperforming our primary market benchmarks in back-to-back fiscal years 2008-09 and 2009-10. The performance sections above and in the individual Fund letters give the details. We are definitely looking forward to the period when “traction” returns to the market and, as is true in any market environment, our research team is working to improve our returns going forward. (See page 7 for more details.)

A Frank Discussion of Quant Firms and Where Bridgeway Fits In

The Short Version: Many quant styles of investing have been out of favor lately, and some of our quantitative competitors have even “pulled the plug” on using models to buy stocks. Bridgeway’s corporate strategy is a contrarian one: we have continued to invest in our quantitative capabilities and have increased research around risk and methodically and incrementally improving our models, a process that was begun well before the downturn of fiscal year ’08-09.

After two fiscal years of relative underperformance by some of our most actively managed funds, and in Bridgeway’s tradition of blunt communications, it’s appropriate to ask some tough questions about our performance (broad picture), our advisory firm’s use of quantitative models, and where Bridgeway fits in, relative to other quantitatively oriented investment equity firms. Ultimately, do we think we will again enjoy the strong relative returns of the fourteen years before fiscal year 2009? Or is the party over?

First, it’s appropriate not to paint all the Bridgeway Funds with the same brush. Aggressive Investors 1 and 2, Small-Cap Value and Growth, Ultra-Small Company and Micro-Cap Limited are the Funds with the most disappointing records over the last two years. Other Funds did better in one or both years. Ultra-Small Company Market provided a nice “cushion” versus its market benchmark in the ’08-’09 downturn, true to its design, but lagged in the bounceback period. Likewise for Market Volatility Fund (formerly Balanced Fund) and Blue Chip 35 Index Fund. Large Cap Value outperformed in both years. Our new Small-Cap Momentum Fund has come out of the blocks in the right direction, relative to its benchmark, but doesn’t yet have even a quarter of performance history. But let’s focus on the funds most driven by our quantitative stock picking models.

Bridgeway had a much better record in the bear market of 2000-2002 and in the 2003 bounceback year. Why was this one (2008 and 2009) different?

The 2000-2002 bear market was driven much more significantly by valuations. The internet and technology rout of 2000-2001 was largely driven by unrealistic expectations of these companies, and a number of our models had increasingly shied away from them as prices rose to unrealistic levels. Our “top-down risk overlay” process also worked well in this period. Huge appreciation in the technology sector in particular caused us to trim these stocks significantly before the rout in 2000. Finally, certain momentum-related factors and models negotiated some of those years pretty well, adding to returns during the relentless market downturn from mid 2000 to late 2002. The valuation metrics then worked well in reverse in 2003. Our models picked up on some of the companies that had become quite cheap, and some multi-factor models that tend to pick up on quick turnaround in profits also did well.

In contrast, we owned some companies with stellar balance sheets and cash flows (“real profits”) in 2008, especially in the energy and materials sectors. Normally, companies with these characteristics would tend to do better in a recession and bear market. In spite of strong fundamentals, however, these companies’ stock prices were hit very hard in the downturn as Wall

| | |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

Street anticipated that demand for their products would vanish in the recession. Whether that actually happened was irrelevant in the second half of 2008, as Wall Street’s anticipation alone pounded these stocks. Our momentum models, which had performed well in the previous bear market, performed poorly in this one. Some large and heavily leveraged (debt-laden) hedge funds were forced to deleverage, causing huge sales of many of these companies. Selling fever fed on itself, and many of the target companies, including some we owned, were pounded mercilessly. Finally, our large deep value model that tends to do well in a downturn (cheaper, larger, and more mature stocks have tended to do better in previous bear markets, since they are not overvalued and have “staying power”) also disappointed in 2008, as everything at the extremes appeared to do poorly.

At this point (late 2008 and early 2009), two factors actually did help, though not enough to reverse the carnage. One thing we worry about, and that our modeling process anticipates, is that we will get “whipsawed” — in other words, that certain technical or growth factors will give sell signals at the height of the downturn, just as a fast moving market turns around. One aspect of our models that worked pretty well is that if a stock gets too cheap by some proprietary measures, they require that we maintain a hold on that stock. This worked pretty well in the last phase of the downturn and into the June quarter of 2009. The second thing that worked was a new risk overlay that we developed after the 2008 downturn. This new risk model identifies sectors or industries that have become “overheated” and thus unusually risky. It would have identified the energy and materials sectors as such, had we been using them in 2008, which we weren’t. But it did come in handy when it identified consumer non-cyclical stocks, notably food and personal product-related companies as much riskier than normal in early calendar 2009. These are the kind of companies investors would tend to flock to in a recession, and we made sure we didn’t overinvest in them, in spite of the fact that they comprised fully half the stock picks of one model. To be clear, neither of these two parts (holding a stock that had been very cheap, and making sure we didn’t over concentrate in a sector that had become risky) of our investment process helped enough to overcome the most dramatic element of the recent market described in the next paragraph.

As described more fully in the “lack of traction” section on page 3, beat up, financially distressed, and penny stock companies led a truly remarkable rally from March 2009 through March 2010. Our models tend in aggregate to avoid such companies. In spite of the fact that our models continued identifying companies with strong and improving company level economics, we were not rewarded with market beating performance.

That’s a lot of details. Isn’t there some “big picture” reason many of Bridgeway’s stock picking models stopped working in fiscal years 2009 and 2010?

We believe that since our models in aggregate are more driven by company level economics, “event driven” markets are not favorable to us. An example on the upside is the market euphoria following the first couple of days of Operation Desert Storm in 1990 when our models were somewhat left behind. An example on the downside is that the quarter following the terrorist attacks of 9/11 was a poor one for our models. Putting this in the context of 2009, if you manipulate the economy by pouring $700 billion of government bailout money through it in a way not dictated by our capitalist system, we believe these events (artificially low interest rates, government purchase of huge amounts of mortgage securities, bailouts of bank, auto, and insurance companies that otherwise would have gone bankrupt, debt incentive programs, etc.) led to a market environment, one some people call a “sentiment driven market,” that is not favorable to our models.

Most “quant” firms suffered on a relative basis in the middle of calendar 2007. What happened at Bridgeway and why?

Many of the investment firms relying on quantitative methods use very short-term signals to buy stocks based on short-term trends. Bridgeway calibrates its models over longer time periods than most of these firms and has a much lower rate of buying and selling stocks. Combined with the fact that we try to keep some independence from what other firms are doing (or else execute it better), we avoided the pitfalls of other “quant shops” in calendar 2007, which was a relatively strong year for us.

Why would an investor want to continue to hold a mutual fund that has underperformed for two or more years?

Avoiding or selling a well-managed fund after a period of underperformance might result in missing the “bounceback.” This is part of the well documented phenomenon of “chasing hot returns,” which we think is the biggest investor education task we face — in times of underperformance or outperformance. This can be seen historically in the fact that the previous worst

| | |

| 6 | | Annual Report | June 30, 2010 |

| | |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

period for Aggressive Investors 1 Fund (it underperformed its market benchmark in calendar 1995, 1997, and 1998) was followed by seven straight years of outperformance. However, we also believe the timing of any turnaround is impossible to forecast and encourage investors who are appropriate for a particular fund to stay invested through the downturns.

Why would an investor invest with a quant firm even in good times? What are the advantages?

Bridgeway believes emotions are “Public Enemy #1” in investing and that statistical models calibrated over long time periods with high quality data — combined with a disciplined process to implement and execute those models — are the best way to take emotion out of the investing process. Other advantages of quant investing are efficiency and potentially lower expenses, the ability to tap lower liquidity stocks in small cap investing, the ability to design a particular investment style with specific and more predictable risk characteristics, having an historical framework to assess risk, and the lack of dependency on a single portfolio manager.

As assets in quant firms have declined, has Bridgeway had to lay off members of its investment management team?

No. We added a member in 2009, another member in 2010, and are currently searching for a third. Our own corporate financial and human resources strategy since inception in 1994 has been to invest during downturns. We did it in the longest running bear market in two generations (2002-2003), and we’re selectively investing in people and systems again. Downturns can be a great time to hire some very talented people. Of course, you must have planned ahead in order to have the resources to do so. Our advisory firm’s low cost and no-debt strategies have enabled us to have those resources.

Did Bridgeway learn anything in the last two years?

Yes. We created a “macro” model of risk, as discussed above. It would have helped in 2008, and it may help in the next downturn.

We continue to search for new variables and models, and we have just completed two years of re-engineering every model at Bridgeway with the highest quality, most recent data available. We also conduct research on risk, timing of sells, transaction costs, and competitive products. We obviously expect these efforts to yield benefits for shareholders in the future. Although these efforts, as well as past performance, are no guarantee of future returns.

From our specific returns in the last two fiscal years, we are faced with the reality that in a financially led market rout and ensuing government bailout, our stock picking models of disparate styles could come together to underperform at the same time. Seeking out models or processes to further diversify this risk is part of the research task at hand. One area of research is using macro-economic indicators to determine when particular variables or models might go in or out of favor.

Did Bridgeway decide to re-engineer its models as a result of the recession, bear market, and performance?

No. We planned out and started this process before the bear market at the beginning of 2008. We strive continually to improve our models and execution in any market environment.

However, we will not make the classic error that we believe some competitors are making, of designing a whole process around the last couple of years of experience. There will most certainly be future bear markets. They will most certainly not look just like the past one, however.

What trends do others see among quantitative investment firms?

Three trends are highlighted in recent industry literature.

First, firms are searching for methods that can statistically associate certain factors (e.g. growth, value, momentum, etc.) with specific economic or market environmental factors. Bridgeway’s previous research in this area indicates that a long-term static strategy is most effective. The closest thing we have to a “macro indicator” is the risk metric described above. However, there is a relatively new window into macroeconomic indicators that we expect to research in the future.

| | |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

Second, firms are no longer publishing their factor (model variable) insights. This is in order to protect their intellectual property and especially to protect their ability to deliver future market beating returns. The problem with this strategy is that it makes the business development of their products more difficult, since investors understandably want to know what’s “under the hood.” Bridgeway has a long standing policy of disclosing overall process (e.g. what kind of factors we use, that we calibrate models over long timeframes, which Funds practice more stringent tax management strategies, etc.), but never specific factors or coefficients. Sometimes the lack of that disclosure keeps an appropriate potential investor from investing, but our criterion in this conversation is answering the question, “What’s in the best long-term interest of current investors?” Bridgeway is ahead of this industry trend.

Third, a “lesson learned” reported at a recent industry conference was, “we need to pay as much attention to the risk management of our business as we do to the risk of the equity investments we make.” With Bridgeway’s policy of no debt on the advisory firm’s balance sheet and a history of retaining for “a rainy day” the substantial profits that we don’t donate to nonprofit work, Bridgeway is significantly out in front of the industry here.

What’s the big picture on quants in the investment management business? Where does Bridgeway fit in?

Our quantitative competitors fall into four categories: those that are

| | 1. | Exiting the quant or investment management business. Profits are way down among quant firms. Some smaller firms don’t have the financial resources to last it out and are closing down or shifting to a fundamental (non-quant) strategy. Some firms are owned by large parent companies that are more committed to short-term profits than to a long-term strategy of unemotional quantitative investing. Bridgeway is fortunate to be independent and financially strong. |

| | 2. | Giving portfolio managers the flexibility to decide when certain factors are in favor. We were astounded to learn of a firm articulating this strategy. This entails discipline in the first (quantitative) part of the process, then giving it all away at the execution stage. |

| | 3. | Research. Any new market environment provides us with the opportunity for additional, rich data. This is definitely true of the recent environment, and we have been adding to our investment team to be able to take strong advantage of it. |

| | 4. | Hiding one’s head in the sand. Pretending the worst bear market since the 1930’s didn’t happen is not in line with a true statistical, unemotional, quantitative process. |

Bridgeway has definitively chosen category three.

In summary, what is Bridgeway doing about the last two years with the poorer performing of its Funds?

We are adding members to the investment management team, rather than laying them off, in order to further strengthen our quantitative capabilities and efficiency. We are selectively strengthening other resources, such as our software systems (a more advanced trade order management system in ’08 and additional capabilities in the “mid-back office” in ’09). We are continuing to invest in our current team members with additional development opportunities. We are hiring a new head of investment operations and structuring a new team to free up investment management time from some support tasks. And we are applying our additional research capacities toward managing risk, fine tuning our current models, looking for new or improved model variables, analyzing ways to better implement the models we have, and pursuing such activities as the macroeconomic modeling discussed above.

I like Bridgeway, but can’t stomach the volatility of Aggressive Investors. Is there a Fund that has had less volatility, one that doesn’t give me the short-term roller coaster ride?

Yes. Managed Volatility Fund (formerly Bridgeway Balanced Fund) is designed to exhibit about 40% of the market’s volatility on a quarterly basis and has delivered well on this since inception. Also, Blue Chip 35 Index is designed to give S&P 500 Index-like returns over the long haul, which has provided some cushion in the vast majority of downturns. Please see the prospectus for more specific information on strategy, risk, and fees. As with any Fund, please make sure it fits appropriately into a long term investment plan in order to avoid the classic mistake of chasing hot returns or investing inappropriately in a conservative Fund after a bear market.

| | |

| 8 | | Annual Report | June 30, 2010 |

| | |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

What does a perfect market environment look like for our very actively managed funds?

A market environment is one that is driven more by fundamental economics at the company level. But our goal is to out- perform in an array of market environments, so we are always striving to broaden our “library” of stock picking models.

How Does Quantitative Investing Help in an Index Fund

The Short Version: Even in its index fund, Bridgeway applies quantitative methods and discipline of execution to avoid emotions that can destroy value.

Bridgeway’s investment philosophy is built on quantitative methods that minimize the role of emotions. For almost all of our Funds (exceptions are Ultra-Small Company Market and Blue Chip 35 Index), this involves building a “library” of models that pick stocks in one or more market niches and with particular statistical characteristics. We then design a Fund using a subset of these models in order to attain a desired risk and return profile in accordance with a Fund’s investment objective, strategy, and risk characteristics, as disclosed in our prospectus. Then, we implement and monitor our Funds to ensure we are staying true to our intentions. Key to all of these steps is our belief in not destroying value by allowing emotions to creep into our process at any point, from model design to Fund management. When we talk about not destroying value, we often think about prudently managing costs. We believe this is so important for our fellow shareholders that cost efficiency is one of Bridgeway’s four business values. (Integrity, long term investment performance, and service are the other three.) There are additional ways that a firm or a manager can destroy value for shareholders, and even our Blue Chip 35 Index Fund provides another, and very interesting, example of how we have been successful in not letting emotion destroy value at Bridgeway.

Blue Chip 35 Index Fund is designed to provide shareholders with long term total return of capital by investing in the ultra-large, high quality segment of the U.S. stock market, the “bluest” of the blue chips. The strategy is implemented using a proprietary index of such companies. We seek to track this index’s holdings and investment returns closely, while scrupulously managing costs. This is one key design of the Fund, but how does this step avoid destroying value?

The underlying index is recomposed (a handful of companies are added into and taken out of the index) every two to three years (with flexibility for takeovers and spin offs) with two major goals in mind: first, to keep the index market capitalization very large, and second, to adequately diversify the fund within the constraint of 35 or 36 holdings. This design seeks to avoid destroying value through cost efficiency by minimizing portfolio turnover and thus, operating costs and capital gains. Yet there is more to it: the statistical re-composition of the index seeks to avoid the downside of human emotions. And human emotion can come shockingly easily into the decision of which companies make up an index. Let’s consider some history to understand the dynamics of how this works.

The very first index portfolio was designed for pension funds, but there was concern that the management company might be sued for including all 500 index stocks in the portfolio. The “prudent man” theory of law suggested that a reasonable man would not include the very worst of the 500 stocks in an investment portfolio. So the portfolio designers excluded twenty companies they thought bore unusually high risk of bankruptcy. Two decades later, someone thought to go back and analyze the success of the decision to avoid the “worst of the worst.” The results were surprising, however. Although a couple of the outperformed the others. Why? Emotion could be the answer.

Another such story is reported by David Dreman in “Contrarian Investment Strategies-The Next Generation” and cites the Dow Jones Industrial Average (DJIA), one of the most highly quoted indexes in the financial media. Selections for companies coming in and out of this index are chosen by committee. In 1939, the Index decided to drop an office equipment supplier for AT&T, which moved up 6 times until 1979. Who was this office equipment supplier? IBM, which over that four decade period moved up 635.2 times before it was re-admitted in 1979. But a stock had to go, and that stock was Chrysler, which appreciated until 1997 by 1324% to IBM’s 82% appreciation, or sixteen times as much. Even a sophisticated committee of very bright people can make mistakes. In fairness, this example was undoubtedly “cherry picked.” Some of the committee’s selections have been much better timed. However, a study last year indicated that in aggregate they have destroyed, not added value. The thought of systematically destroying value sends shivers down the spine of Bridgeway’s research team, and thirteen-plus years out, we sought a process and discipline to avoid this problem with Bridgeway’s own proprietary index. How has this played out after an almost thirteen year track record?

| | |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

Over the thirteen-year history of our Fund, the process of recomposition has in actuality slightly added to, not detracted from our Fund’s returns. Why? We think statistics trump human emotion when it comes to investing. But some of the actual results are related to the discipline of following the process. Here’s a real world example from our own Fund:

In 2005, during an Index re-composition, Google Inc (GOOG) rose for inclusion in the top 35 stocks selected, based on market capitalization. Looking back, this may seem an obvious choice, but in June 2005, Google’s stock offering was less than a year old, seemed much hyped, and appeared quite overvalued. We remember the look of surprise and concern when the statistical choice for inclusion was presented. How could such a young stock, in business less than ten years, appear in the “bluest” of the blue chips already? Could we represent this as a “blue chip” stock, and at any rate, wasn’t it ripe for a fall? In spite of this natural reaction, the portfolio management team chose to stick with our documented process. The outcome? Over the next year, Google was this Fund’s top performer.

| | |

| 10 | | Annual Report | June 30, 2010 |

THIS PAGE INTENTIONALLY LEFT BLANK

| | |

Aggressive Investors 1 Fund MANAGER’S COMMENTARY | |  |

June 30, 2010

Dear Fellow Aggressive Investors 1 Fund Shareholder,

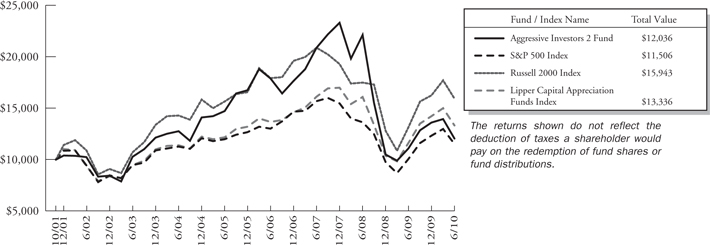

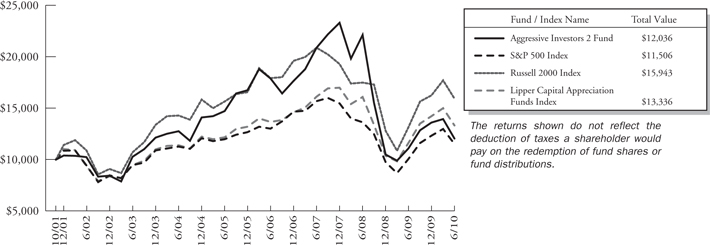

In the June quarter, our Fund declined 13.42%, underperforming our primary market benchmark, the S&P 500 Index (down 11.43%), the Russell 2000 Index of smaller companies (down 9.92%), and our peer benchmark, the Lipper Capital Appreciation Funds Index (down 11.08%). As detailed on page 3, the lack of traction continues to affect our growth leaning models the most severely, while more value leaning models made up some of the difference. This was a poor quarter on an absolute basis and relative basis.

For the fiscal year ended June 30, 2010, our Fund increased 7.51%, trailing the returns of the S&P 500 Index (up 14.43%), the Russell 2000 Index of smaller companies (up 21.48%), and the Lipper Capital Appreciation Funds Index (up 14.86%). Performance details appear below. While we still lead all of our benchmarks since inception, the last two years of returns have taken their toll on performance, including even the five and ten year periods.

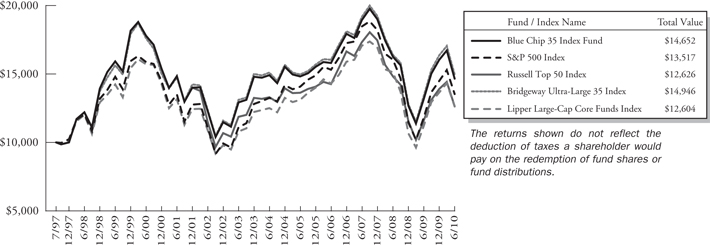

The table below presents our June quarter, one-year, five-year, ten-year and life-to-date financial results according to the formula required by the SEC. See the next page for a graph of performance from inception to June 30, 2010.

| | | | | | | | | | | | | | | |

| | | Jun. Qtr.

4/1/10

to 6/30/10 | | | 1 Year

7/1/09

to 6/30/10 | | | 5 Year

7/1/05

to 6/30/10 | | | 10 Year

7/1/00

to 6/30/10 | | | Life-to-Date

8/5/94 to 6/30/10 | |

| | | | | |

Aggressive Investors 1 Fund | | -13.42 | % | | 7.51 | % | | -6.05 | % | | -1.11 | % | | 12.12 | % |

S&P 500 Index (large companies) | | -11.43 | % | | 14.43 | % | | -0.80 | % | | -1.59 | % | | 7.20 | % |

Lipper Capital Appreciation Funds Index | | -11.08 | % | | 14.86 | % | | 1.85 | % | | -1.06 | % | | 6.60 | % |

Russell 2000 Index (small companies) | | -9.92 | % | | 21.48 | % | | 0.37 | % | | 3.00 | % | | 7.36 | % |

Performance figures quoted in the table above and graph below represent past performance and are no guarantee of future results. Total return figures in the table above include the reinvestment of dividends and capital gains. The table above and the graph below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks with dividends reinvested, while the Russell 2000 Index is an unmanaged, market value weighted index that measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market with dividends reinvested. The Lipper Capital Appreciation Funds Index reflects the record of the 30 largest funds in this category, comprised of more aggressive domestic growth mutual funds, as reported by Lipper, Inc. It is not possible to invest directly in an index. Periods longer than one year are annualized.

According to data from Lipper, Inc. as of June 30, 2010, Aggressive Investors 1 Fund ranked 246th of 285 capital appreciation funds for the twelve months ending June 30, 2010, 218th of 218 over the last five years, 66th of 140 over the last ten years, and 2nd of 54 since inception in August, 1994. Lipper, Inc. is an independent mutual fund rating service that ranks funds in various fund categories by making comparative calculations using total returns.

| | |

| 12 | | Annual Report | June 30, 2010 |

| | |

Aggressive Investors 1 Fund MANAGER’S COMMENTARY (continued) | |  |

Aggressive Investors 1 Fund vs. S&P 500 Index, Lipper Capital Appreciation Funds Index & Russell 2000 Index

from Inception 8/5/94 to 6/30/10

Detailed Explanation of Quarterly Performance — What Worked

The Short Version: In spite of the market decline, some companies in disparate industries overcame the trend. The consumer discretionary and industrial companies helped the most.

Despite the difficulties brought on by such global factors as the European sovereign debt crisis, our models uncovered a number of companies that contributed positive returns to the Fund. Four industrial and three consumer discretionary companies were among the Fund’s best performers list. Combined, these seven stocks returned about three-quarters of a percent to the Fund’s performance, providing some cushion in the quarterly downturn.

These are the ten stocks that performed the best for the Fund during the quarter ended June 30, 2010:

| | | | | | |

| Rank | | Description | | Industry | | % Gain |

1 | | ev3, Inc. | | Health Care Equiptment & Supplies | | 40.2% |

2 | | US Airways Group, Inc. | | Airlines | | 17.1% |

3 | | EMCOR Group, Inc. | | Construction & Engineering | | 16.0% |

4 | | Valassis Communications, Inc. | | Media | | 14.0% |

5 | | Hasbro, Inc. | | Leisure Equipment & Products | | 8.1% |

6 | | EnerNOC, Inc. | | Commercial Services & Supplies | | 5.9% |

7 | | Multi-Fineline Electronix, Inc. | | Electronic Equip., Instruments | | 5.8% |

8 | | Family Dollar Stores, Inc. | | Multiline Retail | | 3.4% |

9 | | Equinix, Inc. | | Internet Software & Services | | 2.4% |

10 | | Acme Packet, Inc. | | Communications Equiptment | | 2.2% |

ev3 manufactures medical devices that allow for small incisions during surgery. In May, its stock reached a 52-week high when the company completed a regulatory filing for a product used in procedures related to cerebral aneurysms. A few weeks later, Covidien PLC, a Dublin, Ireland-based health-care corporation, agreed to acquire ev3 for $2.6 billion, a move aimed at improving global revenue growth. Its share price surged almost 20% in the aftermath of the announcement. Prior to selling the stock in early June, the Fund’s top performer rose over 40% and contributed over 1% to the overall return during the quarter.

Snubbed in the latest airline merger talk (Continental and United Airlines), US Airways claims to be content to go it alone and is not looking for a merger partner at this time. The industry as a whole seems primed for recovery following last year’s

| | |

Aggressive Investors 1 Fund MANAGER’S COMMENTARY (continued) | |  |

recessionary period and the oil hikes of 2008. US Airways announced a nice increase in May revenue as business travel continues to pick up and international bookings have risen. In fact, management recently projected a quarterly profit for the first time since 2007. US Airways was the Fund’s second best performer for the June quarter.

Detailed Explanation of Quarterly Performance — What Didn’t Work

The Short Version: Beating Wall Street expectations didn’t help in the quarter, especially among technology and growth companies.

Lack of traction (page 3) continues to take a toll on the growth leaning stock picking models of this Fund. According to data from Bloomberg, a very strong 89% of our companies reported earnings above Wall Street expectations, versus 82% for our primary market benchmark. Yet, this did not translate into market beating returns. Our Fund stocks with higher exposure to market risk hurt the most, combined with an underweighting of classical conservative sectors: utilities and consumer staples.

These are the ten stocks that performed the worst for the Fund during the quarter ended June 30, 2010:

| | | | | | |

| Rank | | Description | | Industry | | % Loss |

| 1 | | Unisys Corp. | | IT Services | | -47.0% |

| 2 | | Corinthian Colleges, Inc. | | Diversified Consumer Services | | -44.0% |

| 3 | | Pilgrim’s Pride Corp. | | Food Products | | -42.1% |

| 4 | | Teck Resources, Ltd. | | Metals & Mining | | -31.7% |

| 5 | | Diamond Offshore Drilling, Inc. | | Energy Equipment & Services | | -28.7% |

| 6 | | Seagate Technology | | Computers & Peripherals | | -28.6% |

| 7 | | Potash Corp. of Saskatchewan, Inc. | | Chemicals | | -27.7% |

| 8 | | Cinemark Holdings, Inc. | | Media | | -27.4% |

| 9 | | Xerox Corp. | | Office Electronics | | -27.2% |

| 10 | | Barclays PLC | | Commercial Banks | | -26.7% |

Sometimes a global presence hinders a firm’s operations, particularly when foreign governments make decisions beyond management’s control. Unisys Corp. provides outsourced IT services to business enterprises and governments across the globe. Early in the year, Venezuelan President Hugo Chavez took actions to devalue the country’s currency, a move that had a dramatic (negative) impact on multinational companies. The SEC later labeled Venezuela’s economy as “hyperinflationary,” and domestic companies that engaged in operations there were forced to incur a charge to earnings. As a result, Unisys took a hit of $20 million in the first quarter, despite strong operating profits. Its stock price dropped almost 50% in the three-month period, and it was the worst performer in the Fund.

Corinthian Colleges, Inc. (CCI) offers for-profit post-secondary programs in the United States and Canada. In recent times, the industry has been criticized for poor oversight as numerous students incurred significant debt that they are unable to repay (and often without a solid education in return). In April, an official at the Department of Education compared the regulatory environment to that of Wall Street, a harsh reprimand in the aftermath of the financial debacle. In May, the company was downgraded by an analyst who forecast a decline in its enrollment as the government tightened aid requirements to help reduce student loan defaults. Its share price fell almost 50% during the quarter in spite of the fact that the company’s financial results continue to improve. Is the company significantly “oversold?” Our model indicates it may well be.

An interesting footnote to the Corinthian Colleges story highlights the degree to which much of a company’s price continues to be driven by events. On May 17 the company’s stock price soared 14% in the last 15 minutes of trading on the news that U.S. Education Deputy Undersecretary Robert Shireman, a for-profit watchdog, was stepping down.

Detailed Explanation of Fiscal Year Performance — What Worked

The Short Version: Some of the market’s most distressed and battered stocks of the bear market bounced back the most over the last year.

| | |

14 | | Annual Report | June 30, 2010 |

| | |

Aggressive Investors 1 Fund MANAGER’S COMMENTARY (continued) | |  |

We were significantly underrepresented in distressed stocks over the last year, although these were among the market’s best performers. Nevertheless, we held a handful of these stocks, which showed up on our fiscal year best performers list, e.g. BioMed Realty and Aflac. Others, such as our top performer, Cognizant, did reflect strong underlying economic growth. Winners and losers existed in each sector during the past 12 months. Seven sectors were represented on the list of best performers for the year, and they contributed almost six percent to the Fund’s return. In fact, four holdings enjoyed gains of over 50% during the 12-month period.

These are the ten stocks that performed the best for the Fund during the fiscal year ended June 30, 2010:

| | | | | | |

| Rank | | Description | | Industry | | % Gain |

| 1 | | Cognizant Technololgy Solutions Corp. | | IT Services | | 87.5% |

| 2 | | ev3, Inc. | | Health Care Equipment & Supplies | | 79.8% |

| 3 | | BioMed Realty Trust, Inc. | | Real Estate Investment Trusts | | 62.7% |

| 4 | | Coca-Cola Enterprises, Inc. | | Beverages | | 54.7% |

| 5 | | Fifth Third Bancorp | | Commercial Banks | | 42.1% |

| 6 | | EMCOR Group, Inc. | | Construction & Engineering | | 42.0% |

| 7 | | Jo-Ann Stores, Inc. | | Specialty Retail | | 40.8% |

| 8 | | Aflac, Inc. | | Insurance | | 40.7% |

| 9 | | Weingarten Realty Investors | | Real Estate Investment Trusts | | 38.5% |

| 10 | | Equinix, Inc. | | Internet Software & Services | | 37.0% |

Cognizant Technology provides outsourced technology services worldwide. Much of its operations take place in Asian emerging markets, such as India, and its profits are quite high, as it benefits from the lower labor costs. As global firms look for ways to cut expenses in the aftermath of the economic downturn, many have turned to outsourcing certain technology areas. India’s tech sector has surged, even during these challenging times, boosting Cognizant’s earnings beyond Wall Street expectations over the past few quarters. Since Europe is a major market, some analysts fear that future operations may be impacted by the declining value of the euro. In June, Cognizant continued in growth mode and announced that it was acquiring a Paris-based consulting firm, Galileo Performance. Its stock price recently hit an all-time high, rising over 75% during the 12-month period. It was the fund’s top performer for the fiscal year and contributed just over one percent to the overall return.

Detailed Explanation of Fiscal Year Performance — What Didn’t Work

The Short Version: In spite of an up market over three of the last four quarters, there were also significant decliners in a broad array of industries.

Our ten worst performers over the fiscal year period came from ten different industries, although three were related to the information technology sector that also provided the Fund’s top performer. Altogether, these three cost the Fund over two percentage points in return.

These are the ten stocks that performed the worst for the Fund during fiscal year ended June 30, 2010:

| | | | | | |

| Rank | | Description | | Industry | | % Loss |

| 1 | | Pilgrim’s Pride Corp. | | Food Products | | -42.1% |

| 2 | | Corinthian Colleges, Inc. | | Diversified Consumer Services | | -41.8% |

| 3 | | Fuel Systems Solutions, Inc. | | Auto Components | | -38.5% |

| 4 | | Synaptics, Inc. | | Computers & Peripherals | | -37.4% |

| 5 | | Unisys Corp. | | IT Services | | -36.6% |

| 6 | | Fibria Celulose SA | | Paper & Forest Products | | -34.0% |

| 7 | | Cal Dive International, Inc. | | Energy Equipment & Services | | -32.2% |

| 8 | | Xerox Corp. | | Office Electronics | | -27.2% |

| 9 | | Banco Bilbao Vizcaya Argentaria SA | | Commercial Banks | | -25.6% |

| 10 | | Cabot Corp. | | Chemicals | | -24.8% |

| | |

Aggressive Investors 1 Fund MANAGER’S COMMENTARY (continued) | |  |

Overcoming a bankruptcy in the midst of a recession is not an easy task. Pilgrim’s Pride, a producer of processed poultry products, filed for reorganization in late 2008, and Brazil-based JBS acquired a 64% ownership of the company. China indicated that it planned to impose new tariffs on chicken products this past April, a move that was designed to limit US sales of chicken feet, a delicacy in that country. Pilgrim’s Pride reported recent quarterly financials that came in below analysts’ expectations, and its stock price plummeted as a result. Management blamed ongoing restructuring expenses as well as hedging losses incurred during the period. The holding lost over 40% during the period we owned it and cost the fund about a half-percent in return.

Will the country ever become less dependent on the world’s sources of oil? Fuel Systems Solutions certainly hopes so. The company manufactures alternative fuel components and systems that are incorporated in the transportation and industrial industries. While the outlook is bright as carmakers strive to build more fuel efficient vehicles, the company’s share price has declined dramatically since the beginning of the year. In fact, its price decline has followed in step with the European debt crisis that has made headlines over the past few quarters. Italy has long been a key market for Fuel Systems, and some analysts fear a pessimistic outlook for its economy should a “contagion” spread beyond Greece, Spain, and other debt-challenged European markets. Additionally, the Italian government ended an alternative fuel subsidy that had been instrumental in prior revenue gains for Fuel Systems. Its stock price has fallen on these ongoing uncertainties, and the negative returns cost the fund over one percent during the 12-month period.

Top Ten Holdings as of June 30, 2010

The Fund’s top ten holdings comprised six different sectors; only information technology and industrials had more than one company on the list at year-end. The Fund was broadly diversified, and no single holding accounted for greater than 3.4% of net assets. The ten largest positions represented just over 21% of the total assets of the Fund.

| | | | | | |

| Rank | | Description | | Industry | | % of Net

Assets |

| 1 | | Sanmina-SCI Corp. | | Electronic Equip., Instruments & Components | | 3.4% |

| 2 | | DSW, Inc. | | Speciality Retail | | 2.4% |

| 3 | | Veeco Instruments, Inc. | | Semiconductors & Semiconductor | | 2.1% |

| 4 | | Micron Technology, Inc. | | Semiconductors & Semiconductor | | 2.1% |

| 5 | | Align Technology, Inc. | | Health Care Equipment & Supplies | | 2.1% |

| 6 | | W.W. Grainger, Inc. | | Trading Companies & Distributors | | 2.0% |

| 7 | | Cognizant Technology Solutions Corp. | | IT Services | | 1.9% |

| 8 | | Jo-Ann Stores, Inc. | | Speciality Retail | | 1.8% |

| 9 | | Atwood Oceanics, Inc. | | Energy Equipment & Services | | 1.7% |

| 10 | | Cooper Industries PLC | | Electrical Equipment | | 1.6% |

| | Total | | | | 21.1% |

Industry Sector Representation as of June 30, 2010

Information Technology represented almost one-fourth of the Fund’s net assets at the end of the period and comprised the largest allocation disparity within the index. Unfortunately, this volatile sector underperformed during the past three months. Combined, the consumer-related sectors represented in excess of 20% of net assets in both the Fund and the S&P 500 Index. However, we owned more consumer discretionary companies, and the index held more consumer staples.

| | |

16 | | Annual Report | June 30, 2010 |

| | |

Aggressive Investors 1 Fund MANAGER’S COMMENTARY (continued) | |  |

| | | | | | |

| | | % of Portfolio | | % of S&P 500 Index | | Difference |

Consumer Discretionary | | 15.9% | | 10.1% | | 5.8% |

Consumer Staples | | 5.5% | | 11.5% | | -6.0% |

Energy | | 9.8% | | 10.8% | | -1.0% |

Financials | | 16.9% | | 16.3% | | 0.6% |

Health Care | | 7.7% | | 12.1% | | -4.4% |

Industrial | | 11.6% | | 10.4% | | 1.2% |

Information Technology | | 24.4% | | 18.7% | | 5.7% |

Materials | | 7.0% | | 3.4% | | 3.6% |

Telecommunication Services | | 0.0% | | 3.0% | | -3.0% |

Utilities | | 0.0% | | 3.7% | | -3.7% |

Cash | | 1.2% | | 0.0% | | 1.2% |

Total | | 100.0% | | 100.0% | | |

Disclaimer

The views expressed here are exclusively those of Fund management. These views, including those related to market sectors or individual stocks, are not meant as investment advice and should not be considered predictive in nature. Any favorable (or unfavorable) description of a holding applies only as of the quarter-end, June 30, 2010, unless otherwise stated. Security positions can and do change thereafter. Discussions of historical performance do not guarantee and may not be indicative of future performance.

Market volatility can significantly affect short-term performance. The Fund is not an appropriate investment for short-term investors. Investments in the small companies within this multi-cap fund generally carry greater risk than is customarily associated with larger companies. This additional risk is attributable to a number of factors, including the relatively limited financial resources that are typically available to small companies, and the fact that small companies often have comparatively limited product lines. In addition, the stock of small companies tends to be more volatile than the stock of large companies, particularly in the short term and particularly in the early stages of an economic or market downturn. The Fund’s use of options, futures, and leverage can magnify the risk of loss in an unfavorable market, and the Fund’s use of short-sale positions can, in theory, expose shareholders to unlimited loss. Finally, the Fund exposes shareholders to “focus risk,” which may add to Fund volatility through the possibility that a single company could significantly affect total return. Shareholders of the Fund, therefore, are taking on more risk than they would if they invested in the stock market as a whole.

Conclusion

Thank you for your continued investment in Aggressive Investors 1 Fund. We encourage your feedback; your reactions and concerns are extremely important to us.

Sincerely,

Your Investment Management Team

| | |

Bridgeway Aggressive Investors 1 Fund SCHEDULE OF INVESTMENTS | |  |

Showing percentage of net assets as of June 30, 2010

| | | | | | | |

Industry Company | | Shares | | Value | | |

| | | | | | | |

COMMON STOCKS - 98.95% | | |

Aerospace & Defense - 1.02% | | |

Northrop Grumman Corp. | | 17,400 | | $ | 947,256 | | |

Airlines - 3.53% | | |

Delta Air Lines, Inc.* | | 77,800 | | | 914,150 | | |

UAL Corp.*+ | | 51,900 | | | 1,067,064 | | |

US Airways Group, Inc.*+ | | 150,800 | | | 1,298,388 | | |

| | | | | | | |

| | | | | 3,279,602 | | |

Auto Components - 1.07% | | |

TRW Automotive Holdings Corp.* | | 36,200 | | | 998,034 | | |

Automobiles - 1.27% | | |

Ford Motor Co.* | | 117,600 | | | 1,185,408 | | |

Beverages - 1.29% | | |

Brown-Forman Corp., Class B | | 20,900 | | | 1,196,107 | | |

Building Products - 1.02% | | |

Owens Corning* | | 31,700 | | | 948,147 | | |

Capital Markets - 1.19% | | |

Goldman Sachs Group, Inc. (The) | | 8,400 | | | 1,102,668 | | |

Chemicals - 5.31% | | |

Cabot Corp. | | 35,100 | | | 846,261 | | |

Lubrizol Corp. | | 16,400 | | | 1,317,084 | | |

NewMarket Corp. | | 13,900 | | | 1,213,748 | | |

Potash Corp. of | | | | | | | |

Saskatchewan, Inc. | | 10,000 | | | 862,400 | | |

Sherwin-Williams Co. (The) | | 10,100 | | | 698,819 | | |

| | | | | | | |

| | | | | 4,938,312 | | |

Commercial Banks - 3.19% | | |

Barclays PLC - Sponsored ADR | | 29,100 | | | 462,399 | | |

Lloyds Banking Group PLC - ADR+ | | 215,200 | | | 680,032 | | |

M&T Bank Corp. | | 14,200 | | | 1,206,290 | | |

Regions Financial Corp. | | 94,600 | | | 622,468 | | |

| | | | | | | |

| | | | | 2,971,189 | | |

Commercial Services & Supplies - 1.31% | | |

EnerNOC, Inc.*+ | | 38,700 | | | 1,216,728 | | |

Communications Equipment - 1.27% | | |

Acme Packet, Inc.* | | 43,800 | | | 1,177,344 | | |

Computers & Peripherals - 3.30% | | |

Lexmark International, Inc., Class A* | | 30,200 | | | 997,506 | | |

SanDisk Corp.* | | 27,900 | | | 1,173,753 | | |

| | | | | | | |

Industry Company | | Shares | | Value | | |

| | | | | | | |

Computers & Peripherals (continued) | | |

Seagate Technology* | | 68,600 | | $ | 894,544 | | |

| | | | | | | |

| | | | | 3,065,803 | | |

Consumer Finance - 2.12% | | |

Credit Acceptance Corp.* | | 20,800 | | | 1,014,416 | | |

SLM Corp.* | | 92,000 | | | 955,880 | | |

| | | | | | | |

| | | | | 1,970,296 | | |

Diversified Consumer Services - 0.76% | | |

Corinthian Colleges, Inc.*+ | | 71,500 | | | 704,275 | | |

Electrical Equipment - 1.62% | | |

Cooper Industries PLC | | 34,300 | | | 1,509,200 | | |

Electronic Equipment, Instruments & Components - 6.43% | | |

Arrow Electronics, Inc.* | | 39,000 | | | 871,650 | | |

Ingram Micro, Inc., Class A* | | 66,700 | | | 1,013,173 | | |

Sanmina-SCI Corp.* | | 231,700 | | | 3,153,437 | | |

Tech Data Corp.* | | 26,400 | | | 940,368 | | |

| | | | | | | |

| | | | | 5,978,628 | | |

Energy Equipment & Services - 5.60% | | |

Atwood Oceanics, Inc.* | | 62,700 | | | 1,600,104 | | |

Cal Dive International, Inc.* | | 132,100 | | | 772,785 | | |

Diamond Offshore Drilling, Inc.+ | | 16,300 | | | 1,013,697 | | |

National Oilwell Varco, Inc. | | 26,000 | | | 859,820 | | |

Tetra Technologies, Inc.* | | 106,400 | | | 966,112 | | |

| | | | | | | |

| | | | | 5,212,518 | | |

Food & Staples Retailing - 2.19% | | |

Safeway, Inc. | | 49,200 | | | 967,272 | | |

Whole Foods Market, Inc.*+ | | 29,600 | | | 1,066,192 | | |

| | | | | | | |

| | | | | 2,033,464 | | |

Food Products - 0.74% | | |

Pilgrim’s Pride Corp.* | | 104,800 | | | 688,536 | | |

Health Care Equipment & Supplies - 3.19% | | |

Align Technology, Inc.*+ | | 131,700 | | | 1,958,379 | | |

Sirona Dental Systems, Inc.* | | 28,900 | | | 1,006,876 | | |

| | | | | | | |

| | | | | 2,965,255 | | |

Health Care Providers & Services - 1.03% | | |

Quest Diagnostics, Inc. | | 19,300 | | | 960,561 | | |

Insurance - 6.11% | | |

Aflac, Inc. | | 12,500 | | | 533,375 | | |

Genworth Financial, Inc., Class A* | | 74,900 | | | 978,943 | | |

Prudential Financial, Inc. | | 18,600 | | | 998,076 | | |

Travelers Cos., Inc. (The) | | 23,200 | | | 1,142,600 | | |

| | |

18 | | Annual Report | June 30, 2010 |

| | |

Bridgeway Aggressive Investors 1 Fund SCHEDULE OF INVESTMENTS (continued) | |  |

Showing percentage of net assets as of June 30, 2010

| | | | | | | |

Industry Company | | Shares | | Value | | |

Common Stocks (continued) | | |

Insurance (continued) | | |

Unitrin, Inc. | | 47,900 | | $ | 1,226,240 | | |

XL Capital, Ltd., Class A | | 50,400 | | | 806,904 | | |

| | | | | | | |

| | | | | 5,686,138 | | |

Internet Software & Services - 1.00% | | |

United Online, Inc. | | 160,800 | | | 926,208 | | |

IT Services - 3.36% | | |

Cognizant Technology | | | | | | | |

Solutions Corp., Class A* | | 34,800 | | | 1,742,088 | | |

Unisys Corp.* | | 74,883 | | | 1,384,587 | | |

| | | | | | | |

| | | | | 3,126,675 | | |

Leisure Equipment & Products - 1.35% | | |

Hasbro, Inc. | | 30,500 | | | 1,253,550 | | |

Life Sciences Tools & Services - 2.33% | | |

Life Technologies Corp.* | | 24,100 | | | 1,138,725 | | |

Thermo Fisher Scientific, Inc.* | | 20,900 | | | 1,025,145 | | |

| | | | | | | |

| | | | | 2,163,870 | | |

Marine - 0.00% | | |

Kirby Corp.* | | 20 | | | 765 | | |

Media - 2.44% | | |

Cinemark Holdings, Inc. | | 65,200 | | | 857,380 | | |

Valassis Communications, Inc.* | | 44,600 | | | 1,414,712 | | |

| | | | | | | |

| | | | | 2,272,092 | | |

Metals & Mining - 1.71% | | |

Mechel - Sponsored ADR | | 32,600 | | | 591,364 | | |

Teck Resources, Ltd., Class B | | 33,800 | | | 999,804 | | |

| | | | | | | |

| | | | | 1,591,168 | | |

Multiline Retail - 2.35% | | |

Dillard’s, Inc., Class A+ | | 38,600 | | | 829,900 | | |

Family Dollar Stores, Inc. | | 36,100 | | | 1,360,609 | | |

| | | | | | | |

| | | | | 2,190,509 | | |

Office Electronics - 0.94% | | |

Xerox Corp. | | 108,900 | | | 875,556 | | |

Oil, Gas & Consumable Fuels - 4.20% | | |

Comstock Resources, Inc.* | | 36,800 | | | 1,020,096 | | |

ConocoPhillips | | 27,000 | | | 1,325,430 | | |

Exxon Mobil Corp. | | 16,700 | | | 953,069 | | |

Yanzhou Coal Mining Co., Ltd. - Sponsored ADR+ | | 31,900 | | | 610,885 | | |

| | | | | | | |

| | | | | 3,909,480 | | |

| | | | | | | |

Industry Company | | Shares | | Value | | |

| | | | | | | |

Personal Products - 1.31% | | |

Estee Lauder Cos., Inc., Class A (The) | | 21,800 | | $ | 1,214,914 | | |

Pharmaceuticals - 1.15% | | |

Medicis Pharmaceutical Corp., Class A | | 48,800 | | | 1,067,744 | | |

Professional Services - 1.13% | | |

Dun & Bradstreet Corp. | | 15,700 | | | 1,053,784 | | |

Real Estate Investment Trusts (REITs) - 2.07% | | |

BioMed Realty Trust, Inc. | | 64,700 | | | 1,041,023 | | |

Weingarten Realty Investors | | 46,600 | | | 887,730 | | |

| | | | | | | |

| | | | | 1,928,753 | | |

Real Estate Management & Development - 1.07% | | |

Brookfield Properties Corp.+ | | 70,800 | | | 994,032 | | |

Semiconductors & Semiconductor Equipment - 6.54% | | |

Applied Materials, Inc. | | 93,900 | | | 1,128,678 | | |

Cirrus Logic, Inc.* | | 63,000 | | | 996,030 | | |

Micron Technology, Inc.* | | 231,600 | | | 1,966,284 | | |

Veeco Instruments, Inc.* | | 58,200 | | | 1,995,096 | | |

| | | | | | | |

| | | | | 6,086,088 | | |

Software - 1.55% | | |

Longtop Financial Technologies, Ltd. - | | |

Sponsored ADR*+ | | 44,400 | | | 1,438,560 | | |

Specialty Retail - 6.70% | | |

DSW, Inc., Class A*+ | | 100,200 | | | 2,250,492 | | |

Finish Line, Inc., Class A (The) | | 70,000 | | | 975,100 | | |

Jo-Ann Stores, Inc.* | | 44,800 | | | 1,680,448 | | |

Pier 1 Imports, Inc.*# | | 207,400 | | | 1,329,434 | | |

| | | | | | | |

| | | | | 6,235,474 | | |

Thrifts & Mortgage Finance - 1.19% | | |

Hudson City Bancorp, Inc. | | 90,600 | | | 1,108,944 | | |

Trading Companies & Distributors - 2.00% | | |

W.W. Grainger, Inc. | | 18,700 | | | 1,859,715 | | |

| | | | | | | |

TOTAL COMMON STOCKS - 98.95% | | | 92,033,350 | | |

| | | | | | | |

(Cost $93,316,801) | | | | | | | |

| | |

Bridgeway Aggressive Investors 1 Fund SCHEDULE OF INVESTMENTS (continued) | |  |

Showing percentage of net assets as of June 30, 2010

| | | | | | | | | | | | | |

| | | | | Rate^ | | | Shares | | Value | | | |

| |

MONEY MARKET FUND - 1.29% | | | |

BlackRock Fed Fund | | 0.04 | % | | 1,199,868 | | $ | 1,199,868 | | | |

| | | | | | | | | | | | | |

TOTAL MONEY MARKET FUND - 1.29% | | | 1,199,868 | | | |