UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08200

Bridgeway Funds, Inc.

(Exact name of registrant as specified in charter)

20 Greenway Plaza, Suite 450

Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Michael D. Mulcahy, President

Bridgeway Funds, Inc.

20 Greenway Plaza, Suite 450

Houston, Texas 77046

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 661-3500

Date of fiscal year end: June 30

Date of reporting period: July 1, 2012 through June 30, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

| | | | | | |

| |

| | A no-load mutual fund family of domestic funds |

| | | |

| | Annual Report | | | | |

| | | |

| | June 30, 2013 | | | | |

| | | |

| | AGGRESSIVE INVESTORS 1 | | BRAGX | | |

| | | |

| | ULTRA-SMALL COMPANY | | BRUSX | | |

| | (Open to Existing Investors — Direct Only) | | | | |

| | | |

| | ULTRA-SMALL COMPANY MARKET | | BRSIX | | |

| | | |

| | SMALL-CAP MOMENTUM | | BRSMX | | |

| | | |

| | SMALL-CAP GROWTH | | BRSGX | | |

| | | |

| | SMALL-CAP VALUE | | BRSVX | | |

| | | |

| | LARGE-CAP GROWTH | | BRLGX | | |

| | | |

| | BLUE CHIP 35 INDEX | | BRLIX | | |

| | | |

| | MANAGED VOLATILITY | | BRBPX | | |

| | | |

| | | | | | |

| | | |

| | www.bridgeway.com | | | | |

| | | |

| | | | | | |

| | |

| TABLE OF CONTENTS | |  |

Bridgeway Funds Standardized Returns as of June 30, 2013* (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Annualized | | | | | | | | | | |

| Fund | | Quarter | | | Six Months | | | 1 Year | | | 5 Years | | | 10 Years | | | Inception

to Date | | | Inception

Date | | | Gross

Expense

Ratio2 | | | Net

Expense

Ratio2 | |

Aggressive Investors 1 | | | 3.40% | | | | 17.87% | | | | 31.92% | | | | -2.53% | | | | 5.71% | | | | 13.16% | | | | 8/5/1994 | | | | 1.33%3 | | | | NA3 | |

Ultra-Small Company | | | 8.61% | | | | 29.73% | | | | 42.85% | | | | 10.67% | | | | 10.80% | | | | 16.07% | | | | 8/5/1994 | | | | 1.25% | | | | 1.25% | |

Ultra-Small Co Market | | | 8.35% | | | | 23.52% | | | | 29.95% | | | | 8.52% | | | | 8.85% | | | | 10.87% | | | | 7/31/1997 | | | | 0.95%1 | | | | 0.87%1 | |

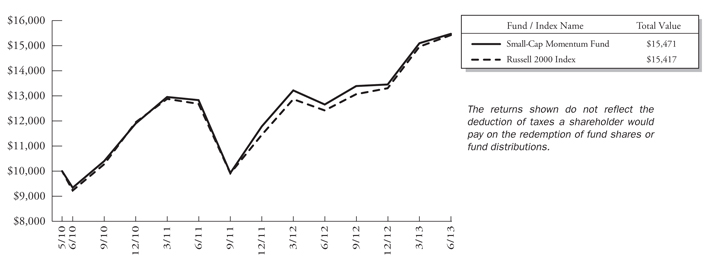

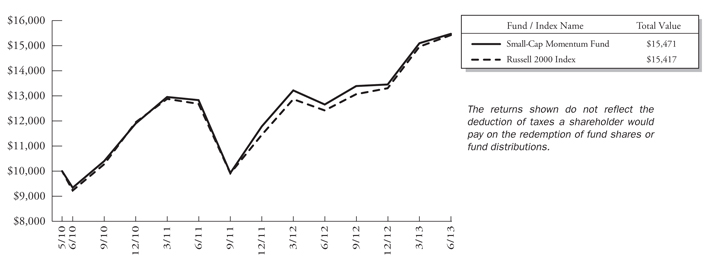

Small-Cap Momentum | | | 2.44% | | | | 15.00% | | | | 22.31% | | | | NA | | | | NA | | | | 15.17% | | | | 5/28/2010 | | | | 5.76%1 | | | | 0.93%1 | |

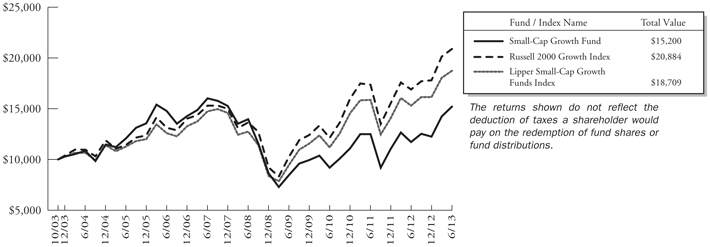

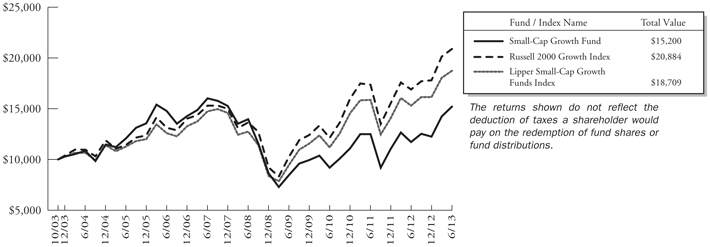

Small-Cap Growth | | | 6.71% | | | | 24.26% | | | | 29.92% | | | | 1.73% | | | | NA | | | | 4.43% | | | | 10/31/2003 | | | | 1.08%1 | | | | 0.94%1 | |

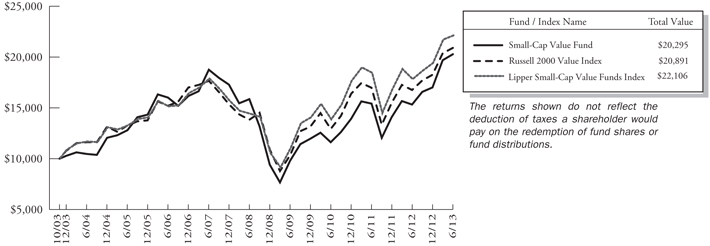

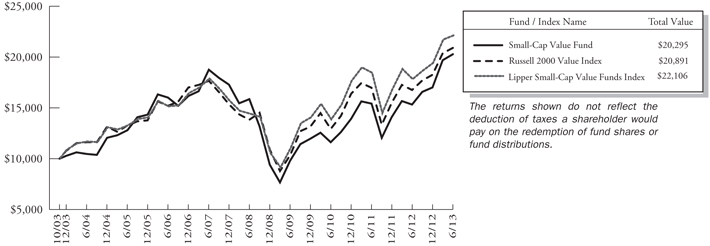

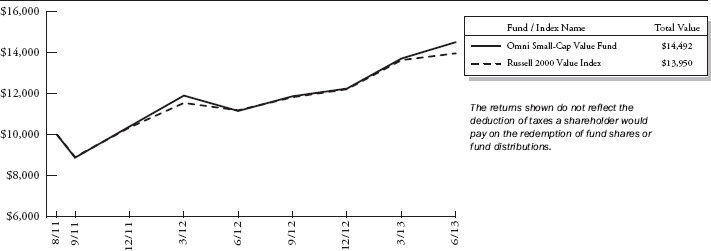

Small-Cap Value | | | 3.11% | | | | 19.24% | | | | 32.49% | | | | 5.06% | | | | NA | | | | 7.60% | | | | 10/31/2003 | | | | 0.99%1 | | | | 0.94%1 | |

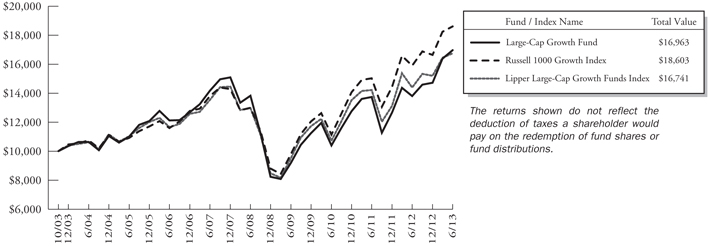

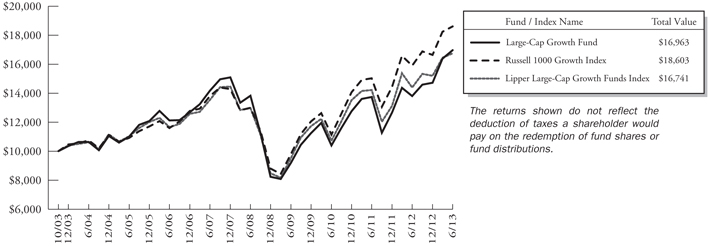

Large-Cap Growth | | | 3.58% | | | | 15.33% | | | | 23.06% | | | | 4.20% | | | | NA | | | | 5.62% | | | | 10/31/2003 | | | | 0.92%1 | | | | 0.84%1 | |

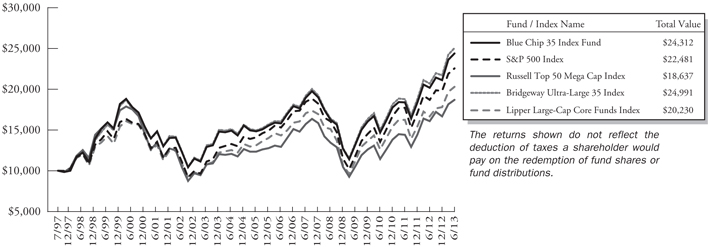

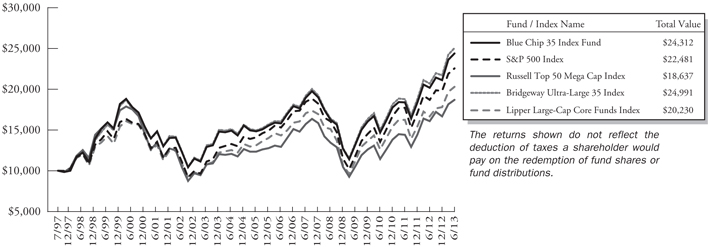

Blue Chip 35 Index | | | 3.34% | | | | 15.40% | | | | 20.89% | | | | 8.44% | | | | 6.52% | | | | 5.74% | | | | 7/31/1997 | | | | 0.29%1 | | | | 0.15%1 | |

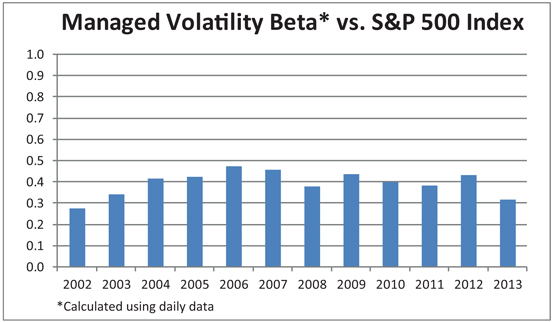

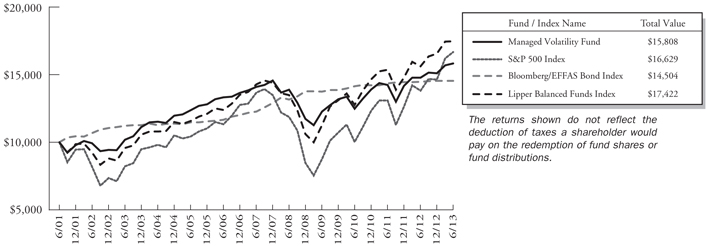

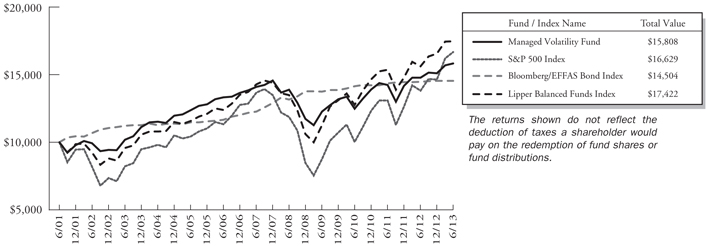

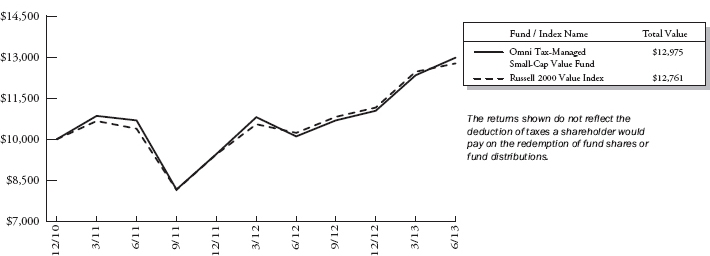

Managed Volatility | | | 0.95% | | | | 4.94% | | | | 7.23% | | | | 2.66% | | | | 4.50% | | | | 3.89% | | | | 6/30/2001 | | | | 1.44%1 | | | | 0.95%1 | |

Bridgeway Funds Returns for Calendar Years 1999 through 2012* (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1999 | | | 2000 | | | 2001 | | | 2002 | | | 2003 | | | 2004 | | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

Aggressive Investors 1 | | | 120.62 | % | | | 13.58 | % | | | -11.20 | % | | | -18.01 | % | | | 53.97 | % | | | 12.21 | % | | | 14.93 | % | | | 7.11 | % | | | 25.80 | % | | | -56.16 | % | | | 23.98 | % | | | 17.82 | % | | | -10.31 | % | | | 21.58 | % |

Ultra-Small Company | | | 40.41 | % | | | 4.75 | % | | | 34.00 | % | | | 3.98 | % | | | 88.57 | % | | | 23.33 | % | | | 2.99 | % | | | 21.55 | % | | | -2.77 | % | | | -46.24 | % | | | 48.93 | % | | | 23.55 | % | | | -14.64 | % | | | 24.49 | % |

Ultra-Small Co Market | | | 31.49 | % | | | 0.67 | % | | | 23.98 | % | | | 4.90 | % | | | 79.43 | % | | | 20.12 | % | | | 4.08 | % | | | 11.48 | % | | | -5.40 | % | | | -39.49 | % | | | 25.95 | % | | | 24.86 | % | | | -7.86 | % | | | 19.83 | % |

Small-Cap Momentum | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | -0.92 | % | | | 14.18 | % |

Small-Cap Growth | | | | | | | | | | | | | | | | | | | | | | | 11.59 | % | | | 18.24 | % | | | 5.31 | % | | | 6.87 | % | | | -43.48 | % | | | 15.04 | % | | | 11.77 | % | | | -0.63 | % | | | 11.05 | % |

Small-Cap Value | | | | | | | | | | | | | | | | | | | | | | | 17.33 | % | | | 18.92 | % | | | 12.77 | % | | | 6.93 | % | | | -45.57 | % | | | 26.98 | % | | | 16.55 | % | | | 1.05 | % | | | 20.99 | % |

Large-Cap Growth | | | | | | | | | | | | | | | | | | | | | | | 6.77 | % | | | 9.33 | % | | | 4.99 | % | | | 19.01 | % | | | -45.42 | % | | | 36.66 | % | | | 13.34 | % | | | -0.71 | % | | | 16.21 | % |

Blue Chip 35 Index | | | 30.34 | % | | | -15.12 | % | | | -9.06 | % | | | -18.02 | % | | | 28.87 | % | | | 4.79 | % | | | 0.05 | % | | | 15.42 | % | | | 6.07 | % | | | -33.30 | % | | | 26.61 | % | | | 10.60 | % | | | 3.17 | % | | | 15.20 | % |

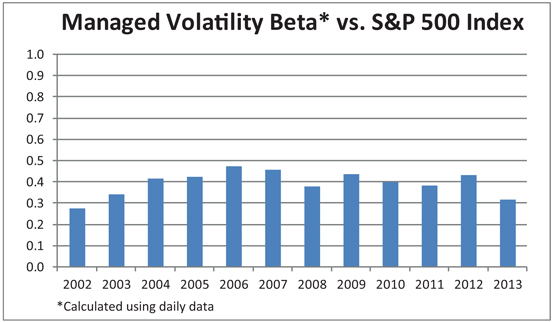

Managed Volatility | | | | | | | | | | | | | | | -3.51 | % | | | 17.82 | % | | | 7.61 | % | | | 6.96 | % | | | 6.65 | % | | | 6.58 | % | | | -19.38 | % | | | 12.39 | % | | | 5.41 | % | | | 1.94 | % | | | 6.46 | % |

Performance figures quoted represent past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than original cost. To obtain performance current to the most recent month-end, please visit www.bridgeway.com or call 1-800-661-3550. Total return figures include the reinvestment of dividends and capital gains.

1 Some of the Funds’ fees were waived or expenses reimbursed; otherwise, returns would have been lower. The Adviser has contractually agreed to waive fees and/or reimburse expenses. Any material change to this Fund policy would require a vote by shareholders.

2 Expense ratios are as stated in the current prospectus. Please see financial highlights for expense ratios as of June 30, 2013.

3 The management fee included in the gross expense ratio for the Aggressive Investors 1 Fund has been restated to reflect only the base management fee payable under the Fund’s performance-based management fee structure. The total actual management fee for the fiscal year ended June 30, 2012 was -0.47%. The actual total management fee for the prior fiscal year was negative due to the negative performance adjustment of the investment management fee under the Fund’s performance-based management fee structure.

* Numbers highlighted in green indicate periods when the Fund outperformed its primary benchmark.

This report is submitted for the general information of the shareholders of each Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding a Fund’s risks, objectives, fees and expenses, experience of its management, and other information. Investors should read the prospectus carefully before investing in a Fund. For questions or other Fund information, call 1-800-661-3550 or visit the Funds’ website at www.bridgeway.com. Funds are available for purchase by residents of the United States, Puerto Rico, U.S. Virgin Islands and Guam only. Foreside Fund Services, LLC, Distributor.

The views expressed here are exclusively those of Fund management. These views, including those relating to the market, sectors or individual stocks are not meant as investment advice and should not be considered predictive in nature.

| | | | |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM | | |  | |

June 30, 2013

Dear Fellow Shareholders,

Domestic equity markets performed positively during the latest quarter and last twelve months ended June 30, 2013. The Bridgeway Funds performed within design expectations, guided by our statistically driven, evidence-based investment approach. Please see the enclosed letters for a detailed explanation of each Fund’s performance during the quarter and fiscal year. We hope you find it helpful.

See page 2 for an update to our ongoing dialogue on macro-driven markets, followed on page 3 by a discussion of long-term investing, supported by the work of Dr. Jeremy Siegel, Professor of Finance at the Wharton School of the University of Pennsylvania.

Each fiscal year we commit to reporting to shareholders what we think was the “worst thing” at Bridgeway that year. In fiscal year 2013, it was difficult to come up with a “worst thing” because so much went well this year. A Bridgeway shareholder offered us feedback that led us to the “worst thing.” Details are on page 4.

Bridgeway Capital Management just celebrated its 20th anniversary. See page 5 for highs and lows as shared by Bridgeway’s founder, John Montgomery.

One of the strongest parts of our culture is a commitment to community and world change. On page 7, Dick Cancelmo shares his experience as a member of the volunteer executive panel for the Prison Entrepreneurship Program.

As always, we appreciate your feedback. We take your comments very seriously and regularly discuss them internally to help in managing our Funds and this company. Please keep your ideas coming — both favorable and critical. They provide us with a vital tool, helping us to serve you better.

Sincerely,

Your Investment Management Team

| | | | |

| |  | |  |

| John Montgomery | | Christine L. Wang | | Michael Whipple |

| | |

| |  | | |

| Elena Khoziaeva | | Dick Cancelmo | | |

| | |

1 | | Annual Report | June 30, 2013 |

| | |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

Market Review

The Short Version: The domestic equity markets rose in the second quarter of 2013. The positive market momentum that started in November of 2012 continued through April and May, with the S&P 500 Index closing above 1,600 and the Dow closing above 15,000 for the first time. In June, the Dow closed roughly 3.2% below its record high set in May. The quarter ended with the S&P 500 Index and the Dow up approximately 2.9%.

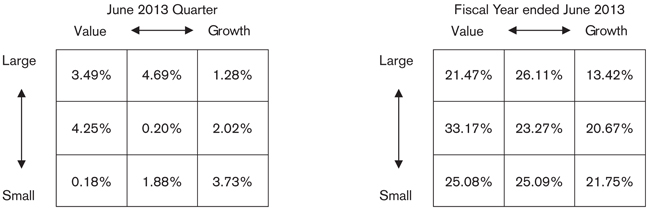

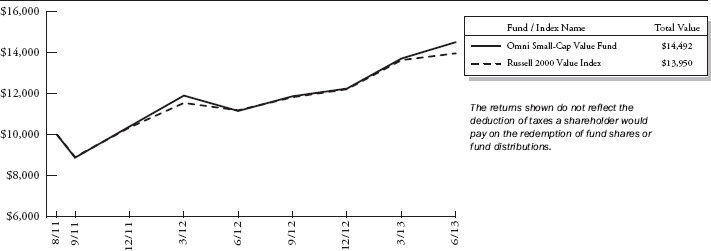

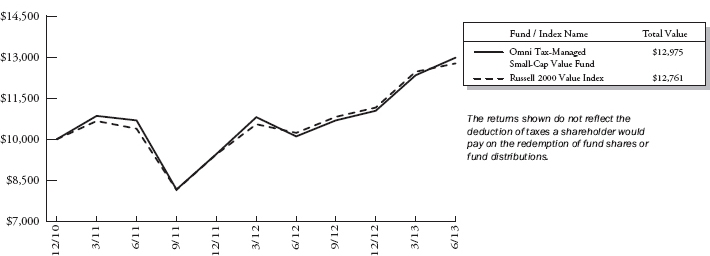

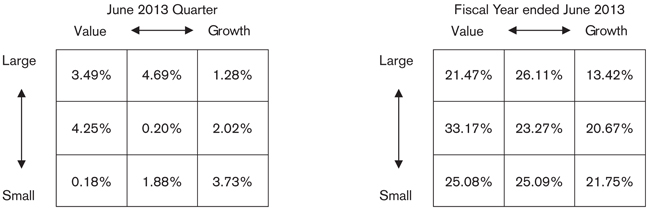

Returns across U.S. equity style boxes, as defined by Morningstar, were mixed for the quarter, with large-cap value and small-cap growth as the stronger “corners.” Large-cap core led the way, up 4.69%, while small-cap value was the laggard, up 0.18%. Value slightly outperformed growth, and large-cap stocks were favored over small-cap stocks.

Quarterly sector performance for the S&P 500 Index was mixed. Financials led the way, gaining approximately seven percent, followed by Consumer Discretionary, up over six percent, and Health Care, up close to four percent. Utilities, Materials, and Energy stocks fared the worst and were the only sectors in negative territory. Utilities were down almost three percent, Materials fell approximately two percent, and Energy was down less than one percent.

Following are the stock market “style box” returns from Morningstar for the quarter and year:

Macro-Driven Markets — An Update

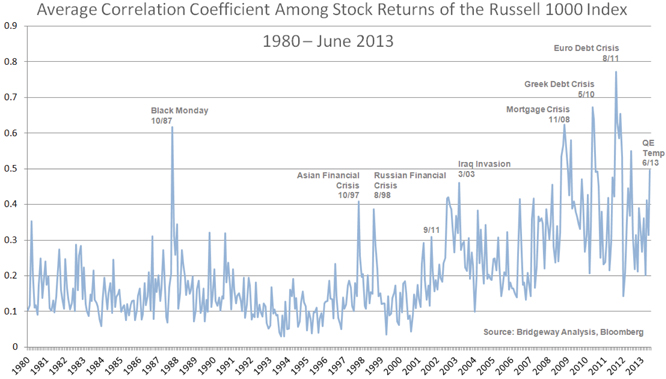

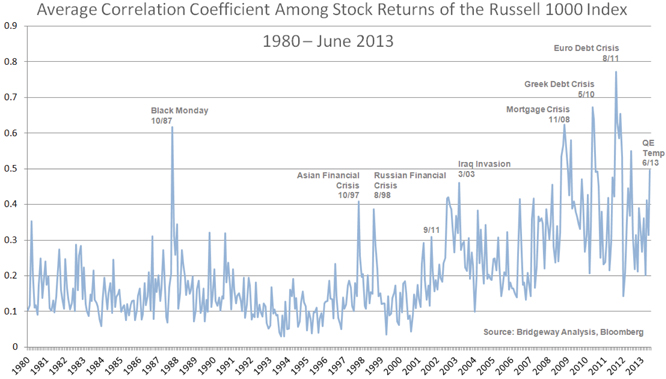

The Short Version: As reported a number of times over the last five years, macro-driven markets have been unfavorable to our models and to Select Funds with a strong growth component (Aggressive Investors 1, Ultra-Small Company, Large-Cap Growth, and Small-Cap Growth). This quarter, specifically in the month of June, these Funds were once again put to the test with a high correlation spike, statistical evidence of a macro-driven market. We passed this test with flying colors, evidence that incorporating additional data and incremental model improvements have helped.

High correlation markets are markets in which individual stock prices tend to move proportionally in tandem — statistically, we define these as time periods when stock correlations reach 0.5 or higher. We call these “macro-driven markets,” markets within which investors focus on macroeconomic events, such as the European debt crisis or actions of the Federal Reserve Board, rather than the economic health of individual companies. Thus, in a macro-driven market, good news at Company XYZ is less likely to favorably impact its stock price than in most market environments. Macro-driven markets are unfavorable to our more growth leaning models in particular, since our models focus on data at the company rather than at a national or world level.

Five of the eight macro-driven markets since 1940 have occurred in the last five years. In the month of June, our Funds were put to the test once again as stock correlations climbed to the 0.50 level. We passed the test. While two of our growth leaning funds (Aggressive Investors 1 and Ultra-Small Company) did trail their primary market benchmarks in June, as expected, all four (Aggressive Investors 1, Ultra-Small Company, Small-Cap Growth, and Large-Cap Growth) did outperform for the full June quarter and fiscal year. The incremental model improvements of the last five years plus the addition of high correlation

| | |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

market environments in our calibration dataset seem to have helped, as hoped and expected. No one knows whether macro-driven markets will continue at the current pace or return to the former level of once every two or three decades. However, we are pleased with our performance in the most two recent spikes of correlation.

Long-Term Investing

The Short Version: In 1994, Dr. Jeremy Siegel, Professor of Finance at the Wharton School of the University of Pennsylvania, wrote the first edition of Stocks for the Long Run. He subsequently updated this book in 1998, 2002 and 2008, continuing to document the benefits of investing in equities over the long term, relative to bonds. With the volatility of the equity markets these days, commentators either declare him a genius (when the equity markets are up) or misguided (when the equity markets are down). However, these responses are based on the whims of the current market and not long-term data and evidence that more appropriately supports the key point Dr. Siegel is making: If you are a patient, long-term investor, by remaining in stocks over the long-term, you can have greater returns with less risk than bonds or cash.

Dr. Siegel’s research shows that stocks give higher returns with less risk than bonds if you measure risk over longer time periods, such as 10 years and beyond. Recent critics will pick the market low of 2008 to prove Dr. Siegel “wrong” for a single 10-, 20- and 30-year period. However, since investors don’t generally invest all their money on a single day and take it all out on a single day - and on days that just happen to coincide with the dates picked by the critics - this criticism isn’t very helpful. Dr. Siegel’s data and conclusions are still valid for people who invest across multiple time periods and with a plan.

Unfortunately, we have allowed the media to focus our eyes on risk as defined by what is happening in the market today, this month or this year. For long-term investors, such as those saving for retirement in 25+ years, this short-term movement is mostly irrelevant and can cause you to destroy value and incur greater risk of jeopardizing your retirement savings.

Data presented by the Investment Company Institute shows that investors repeatedly mis-time their investments, buying after market upticks and selling after the market declines. However, if you are 25 to 45 years old, you need to consider Dr. Siegel’s data and evidence. What happens in the market today, this month, this quarter or even this year, is mathematically not that important if you implement a multi-year investment plan that keeps the long-term in proper perspective.

| | |

3 | | Annual Report | June 30, 2013 |

| | |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

A May 31, 2013 article in the Wall Street Journal highlighted a group of investors who were invested 100% in stocks. Were these investors crazy? While we don’t advocate exposure to only one asset class, our answer to this question is, no, they were not crazy. What these investors had in common was not a gambler’s mentality but a proper perspective on risk, returns and time frames, as presented by Dr. Siegel. They understood that what happens over any one short-term period is not that relevant if you have a plan that invests and rebalances regularly.

At Bridgeway, we regularly write about the importance of having an investment plan. In these seemingly turbulent times, a plan that reflects your stage in life, your tolerance for risk, and your cash/income needs is more essential than ever. And, if retirement is 25+ years away, your plan should keep you properly exposed to equities. Incidentally, Dr. Siegel’s book is available in PDF online for free and is recommended reading.

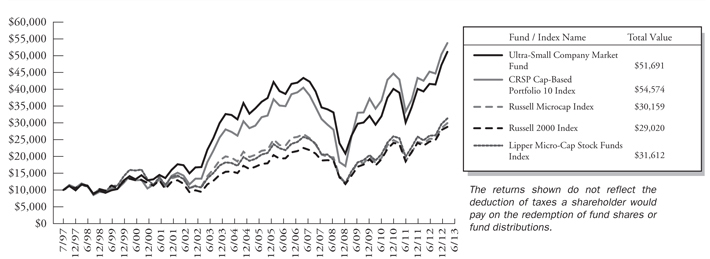

The Worst Thing of the Fiscal Year

The Short Version: Continuing a Bridgeway tradition of disclosing the worst thing of the fiscal year . . . The Bridgeway Ultra-Small Company Market Fund distributed approximately 16% of the Fund’s NAV – the largest percentage of any Fund in the history of Bridgeway – in long term capital gains in 2012. Generally speaking, a higher distribution means that taxable shareholders pay more taxes, which is bad. However, these gains were distributed during a period in which the Fund appreciated 18.20% (the primary market benchmark was up 18.18%). Since this Fund invests only in ultra-small companies and continually “harvests” stocks that have significantly outgrown our size objective, the act of selling larger, highly appreciated stocks generates capital gains for the Fund. We attempt to keep the tax burden low by working hard to generate only gains that are long-term, and thus tax-advantaged. While we would not change our investment or accounting decisions if we could go back, we think we could have better communicated to investors.

In each annual report for the last fifteen fiscal years, Bridgeway has revealed its “worst thing of the year.” This section has become an important Bridgeway tradition. As a shareholder, you are the owner and “boss,” and we think you have a right to know the negatives as well as the positives. In previous years we have discussed company turnover, trading errors, compliance issues, and specific periods of the performance of one or more of our Funds. Part of our firm’s culture is transparency (we’re the only Fund firm we know of that addresses this topic in an annual report), and we work hard to address problems and not repeat mistakes. “Worst things” fall into two categories: a) mistakes we made that we want to learn from and b) bad things beyond our control. The worst thing in fiscal year 2013 has characteristics of both.

By way of disclosure, in fiscal year 2013, it was difficult to come up with a “worst thing” because so much went well this year. While we celebrate this, there’s always something at the trailing edge of not good. A Bridgeway shareholder suggested that a taxable gain this large was not good and that we communicated it poorly. We agree that a large distribution hurts — though we wouldn’t change any investment or accounting decisions on this if we could go back — and further agree we could have communicated better. So let’s dissect the part we don’t control (not a mistake) from the part we do control.

The part we don’t control is that our primary market benchmark was up 18.18% in the Fund’s excise tax year (November 2011 to October 2012), the period of time when the gains were realized. During the same period, the Fund was up 18.20%, and distributed a capital gain of approximately 16% of the Fund’s NAV. So, while large, the capital gains distribution was still smaller in percentage terms than our strong performance, something we would like to repeat. We work hard to keep capital gains long-term in nature, so that taxable shareholder accounts generally pay the lower, long-term rate. While it is possible to not sell our most highly appreciated stocks in any one year, we eventually do since our main objective is to approximate the return of the CRSP 10 Index of ultra-small stocks.

The part we could have done better was communication. While we routinely disclose estimated distributions on our web site prior to the distribution date (this allows investors to decide if they want to invest more before or after the distribution date), we could have highlighted this better. And while our December 2012 semi-annual report financial statements disclosed the distribution, we could have written this explanation in that report, rather than waiting until this letter, a half year later. Our apologies; we intend to do better in the future. Thanks to the shareholder who took the time to point this out; it’s much appreciated.

| | |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

20 Years at Bridgeway — highs and lows (by Bridgeway’s founder)

The Short Version: Bridgeway Capital Management just celebrated its 20th anniversary. Here are some ruminations by its founder, John Montgomery.

July 12th marked Bridgeway Capital Management’s 20th birthday. That means it’s also my 20th anniversary at Bridgeway. I’ve never worked in any other place for a single decade, let alone two. Something to ponder. So I thought I would . . . .

In my household we play a game called “highs and lows.” Basically, each member around the dinner table shares one or two high and low points from their day or week. Or in the case of my rather international family, it might have been three months since we have last seen each other, so we may be sharing the highs and lows of a several month period. Let me play highs and lows for the last 20 years at Bridgeway.

Some highs: First, I love the people I work with. They are amazing. Bright, creative, committed, diverse, and fun. I wake up in the morning looking forward to the work I get to do and the people I get to do it with. Sometimes I chuckle sheepishly that anyone would actually pay me to do this job. On the other hand, and by way of fiduciary duty, it’s a deep responsibility as well as a privilege.

Second, is you. It’s an extreme honor to me that you entrust your money into our care. I will never take that trust for granted. You give us an outlet to exercise the gifts in financial management that we have honed over two decades at Bridgeway. Working hard on your investments also empowers others through our mission and philanthropic work.

Third, as an engineer, I celebrate two decades of execution in accordance with design. One of our first two mutual funds, Bridgeway Ultra-Small Company Fund, has the highest returns of any diversified mutual fund since inception. It also has outsize risk in accordance with its asset class. For any of our Funds, more important than the specific returns or rankings is that they do what we say they’ll do. We can’t guarantee that, but we work very hard to achieve it through design, execution, and accountability by way of performance attribution and Board oversight. When we are unable to achieve that, such as during the very negative impact of the high correlation markets of 2008-2011 on some of our growth leaning Funds, our investment research process is designed to be self correcting by exploring statistically what happened and adding that data to our calibration database. Thus, Aggressive Investors 1 Fund, for example, has now navigated two high correlation spikes (June quarter 2012 and June quarter 2013); in a way I believe is acceptable should these historically rare market environments continue. This self correction is something, I believe, that is not likely with non-quantitative, “gut and instinct” based investment processes.

And now a low: too many of our shareholders redeemed in the downturn following June of 2008. Many of them invested in fixed income and missed much of the equity appreciation of the last 4+ years. We’ve written about this in more detail in previous letters. It’s the problem of chasing hot returns and selling after a downturn — thus, buying high and selling low, rather than holding on for the long term. It’s destructive and life-changing, and we have to do better. This may sound like I’m blaming others. I’m not; many have a hand in creating and reinforcing this very common investor behavior. We are working on an effective means to further educate investors on the appropriate use of our highly volatile Funds (since investors tend to buy and sell them more).

Behavioral Finance at the University of Virginia (Bridgeway’s Chief Investment Officer goes back to school)

Last April, I took three days to engage in a course on behavioral finance sponsored by the CFA Institute and the University of Virginia’s Darden School of Business. It was an awesome course, giving an overview of the very young field, I won’t say science, of behavioral finance. This field of study is both interesting to me and important to our work at Bridgeway. Here are some of my thoughts on the topic:

My first behavioral finance insight. The year was 1984. The room was a class at Harvard’s graduate school of business. The course: investment management. The class: about 50 students, many of whom were destined for Wall Street. We had just finished a case study that included a very attractive — and rare — track record of an investment management firm “beating the market.” The professor’s final question was, “Who in this room thinks that when they get out of business school and are managing money professionally, that they will be able to beat this track record?” 80% of the hands in the room were raised. My

| | |

5 | | Annual Report | June 30, 2013 |

| | |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

thought was, if 80% of the people in this room think they can beat the market, but statistically less than 20% can, that should create a big advantage for a well-designed investment process based on statistics and a lot of historical data — taking advantage of human irrationality. Out of these thoughts grew the first seeds of Bridgeway’s investment management process. In 1984 I was completely unaware of behavioral finance. But I did start doing research on the application of quantitative methods to investing. Fast forward 29 years . . .

What is behavioral finance?

This is one of my favorite definitions:

There have been many studies that have documented long-term historical phenomena in securities markets that contradict the efficient market hypothesis and cannot be captured plausibly in models based on perfect investor rationality. Behavioral finance attempts to fill the void. Investopedia.com

Simply stated, the efficient market hypothesis asserts that all information is already incorporated into the price of a security. A corollary is that it is therefore not possible to beat the market on a risk adjusted basis consistently or over the long haul.

Are markets efficient? Is the efficient markets hypothesis true?

I believe our markets are very efficient over time, and that it is extremely perilous to try to “beat the market.” There are a few problems with this, however. A major one is that it invites the question, “What is the market?” Does it mean holding a portfolio of all world investments in proportion to their total market weight? Is holding only U.S. stocks an active “bet” on the U.S. economy? Is an equal weighted portfolio of stocks a “bet” against the largest stocks? Should investors ignore their own risk tolerance in favor of holding stocks and bonds in the same proportion that they represent in the broader economy? I believe the answer to each of these questions is “no.” BUT, I still think timing the market is a perilous activity. That’s different from having a well conceived plan for investing in a diversified way, based on historical data, and implementing this plan through thick and thin, especially when it feels least comfortable to do so.

Where does that leave Bridgeway? Are our various funds actively managed, seeking to beat the market?

This is not how I think about them. Relative to Fund strategy design (including target risk) and primary market benchmark, the adviser seeks with each Fund to:

a. take advantage of documented, sometimes irrational, investor behavior

b. “tilt” the portfolio to certain documented risk factor exposures, such as size or valuation

c. take advantage of portfolio construction techniques, for example, rebalancing and security weighting that may increase returns or decrease risk

d. not destroy value, for example, by poor trading execution or ignoring tax consequences that cost nothing in pre-tax returns

The first category, item a, is the reason for Bridgeway’s interest in behavioral finance. Certain historical patterns of behavior create opportunities to not follow the same patterns (sometimes referred to as “anomalies”) of other investors, sometimes taking advantage of that behavior. In a future letter I’ll give several examples of behavioral anomalies.

Strongest takeaway from this seminar:

Humility. And healthy skepticism. Sometimes what looks like an anomaly or risk factor, is not.

| | |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) | |  |

Lowest personal grade:

Trading simulation. OK, I wasn’t at the bottom of the class, but I wasn’t in the top. To be an average trader is analogous to being an average ballet dancer (among all the people in a city, not all the people in a ballet corps). If you’re like me, you probably wouldn’t want to get on a stage in front of a roomful of people who paid to watch a dancer. I don’t trade at Bridgeway. I’m particularly not well suited for it. Just as important as knowing what you’re good at is knowing what you’re not good at.

One of my favorite quotes from a competitor:

We like to think we invest rationally, but the field of behavioral finance has shown there are social, emotional, and even cognitive factors that can affect our investing decisions. By becoming aware of these unconscious tendencies, we have a better chance of meeting our long-term investing goals. Franklin Templeton Funds.

Transformative Change

Prison Entrepreneurship Program — authored by Dick Cancelmo

In my mind happiness and the pursuit of satisfaction in life evolves around a common theme of People, Places and Purpose. Little did I know that prison could be a Place to evoke happiness until I participated in the Prison Entrepreneurship Program or PEP. This very well run and successful program transforms “inmates and executives by unlocking human potential through entrepreneurial passion, education and mentoring.” One of the outcomes of PEP’s mission is that it tackles a tremendous problem in Texas prisons: that 25% of prisoners return to jail within 3 years. PEP’s 700+ graduates have a recidivism rate of less than 5% since PEP started operations in 2004. In addition, the employment rate for graduates within 90 days of release is 100%, with more than 120 businesses launched from the program.

Three Bridgeway Partners, Kai Liu, Cindy Griffin and Tammira Philippe, have been active in this program for several years. They organized a small group of Partners, family members and a business associate to see what PEP was all about. Recently, we went to the Cleveland Correctional Center just north of Houston and spent the better part of the day in prison. We participated in “Pitch Day,” an exercise where select prisoners “pitch” business plans for their hopeful post-prison businesses. As members of the volunteer executive panels, we offered insight, suggestions and encouragement to this group of men.

When we arrived at the Cleveland Correctional Center, the first thing that was obvious was that there are very few things that differentiate us from the inmates in the program. If it weren’t for luck or grace or whatever you choose to call it, any of us could be the ones on the other side. Secondly, they were very well prepared for this event after spending many hours of hard work studying an outstanding curriculum. Third, they were incredibly articulate, passionate, friendly and thankful for our help, and more importantly the help of the dedicated leaders of PEP who have given these men the tremendous gift of Purpose.

Perhaps the experience was best summed up by Matt Hall, our business associate who joined us – “I’m very cognizant of what gives me energy and of activities that are energy thieves. If I think about how I feel after being away on a ten day vacation and compare that feeling to one day at PEP, there’s no question that PEP is the winner. Three weeks later, I’m still energized by the men of PEP.”

PEP’s success in reducing recidivism rates and changing lives has been growing. They hope to soon include all inmates at the Cleveland Correctional Center, which would double the program size. Check out PEP for yourself - http:// www.prisonentrepreneurship.org/.

| | |

7 | | Annual Report | June 30, 2013 |

| | |

Aggressive Investors 1 Fund MANAGER’S COMMENTARY (Unaudited) | |  |

June 30, 2013

Dear Fellow Aggressive Investors 1 Fund Shareholder,

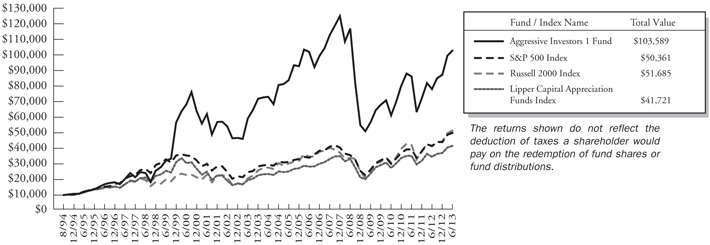

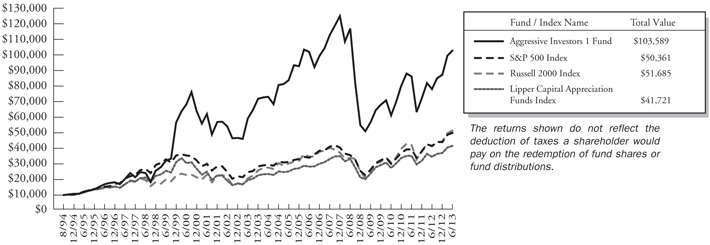

For the quarter ended June 30, 2013, our Fund appreciated 3.40%, outperforming our primary market benchmark, the S&P 500 Index (+2.91%), the Russell 2000 Index (+3.08%), and our peer benchmark, the Lipper Capital Appreciation Funds Index (+2.18%). In June we experienced a high correlation spike — a historically rare and unfriendly environment for our Fund. Our Fund has now navigated two high correlation spikes (the other in June 2012) much better than the previous ones (2008, 2010, 2011), as discussed on page 2. We are pleased with the results.

For the fiscal year ending June 30, 2013, our Fund appreciated 31.92%, strongly outperforming our primary benchmark, the S&P 500 Index (+20.60%), our peer benchmark, the Lipper Capital Appreciation Index (+20.06%) and the Russell 2000 Index (+24.21%). We are very pleased with both the relative and absolute returns for the one year period. We continue to lead our primary benchmark for the fifteen-year and life-to-date periods, but we still have ground to make up for the five and ten year periods.

The table below presents our June quarter, one-year, five-year, ten-year and inception-to-date financial results. See the next page for a graph of performance since inception.

Standardized Returns as of June 30, 2013

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Annualized | |

| | | Quarter | | | 1 Year | | | 5 Years | | | 10 Years | | | Since Inception

(8/5/94) | |

| | | | | |

Aggressive Investors 1 Fund | | | 3.40% | | | | 31.92% | | | | -2.53% | | | | 5.71% | | | | 13.16% | |

S&P 500 Index | | | 2.91% | | | | 20.60% | | | | 7.01% | | | | 7.30% | | | | 8.91% | |

Russell 2000 Index | | | 3.08% | | | | 24.21% | | | | 8.77% | | | | 9.53% | | | | 9.08% | |

Lipper Capital Appreciation Funds Index | | | 2.18% | | | | 20.06% | | | | 4.58% | | | | 7.83% | | | | 7.84% | |

Performance figures quoted in the table above and the graph on the next page represent past performance and are no guarantee of future results. Total return figures in the table above and the graph on the next page include the reinvestment of dividends and capital gains. The table above and the graph on the next page do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions, based on the average of 500 widely held common stocks with dividends reinvested. The Russell 2000 Index is an unmanaged, market value weighted index that measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market with dividends reinvested. The Lipper Capital Appreciation Funds Index reflects the record of the 30 largest funds in the category of more aggressive domestic growth mutual funds, as reported by Lipper, Inc. It is not possible to invest directly in an index. Periods longer than one year are annualized.

According to data from Lipper, Inc. as of June 30, 2013, Aggressive Investors 1 Fund ranked 19th of 281 capital appreciation funds for the twelve months ending June 30, 2013, 219th of 230 over the last five years, 127th of 163 over the last ten years, and 2nd of 51 since inception in August, 1994. Lipper, Inc. is an independent mutual fund rating service that ranks funds in various fund categories by making comparative calculations using total returns.

| | |

Aggressive Investors 1 Fund MANAGER’S COMMENTARY (Unaudited) (continued) | |

|

Aggressive Investors 1 Fund vs. S&P 500 Index, Russell 2000 Index & Lipper Capital Appreciation Funds Index

from Inception 8/5/94 to 6/30/13

Detailed Explanation of Quarterly Performance

The Short Version: In a quarter where overall volatility went up, and in spite of the high correlation spike in June, we outperformed our primary market benchmark. The Fund’s current “tilt” toward higher beta (measure of market risk) stocks helped in the June quarter market environment.

We outperformed our primary benchmark by approximately 0.5% for the quarter ended June 30, 2013. It was a period in which there was an increase in volatility, along with a spike in correlation at the end of the quarter. As expected, we did slightly underperform in the month of June when these correlations were the highest, but this was less of a decline than in past spikes, and the outperformance from the other two months more than made up for it — an excellent result. We believe that incorporating four high correlation spikes since 2008 into our database, as well as the ongoing process of model refinements, have helped improve the Fund’s navigation through such historically unfavorable high correlation markets.

The Fund continues to be overweighted in the Consumer Discretionary sector, one of the best performing sectors in the June quarter (it returned approximately 6.9% versus a 2.9% S&P 500 Index return) and underweighted in the lagging Utilities sector, which also had a positive effect on the Fund’s performance. Fund holdings in the Information Technology and Consumer Staples sectors added to the Fund’s strong returns as well. Our models continued to successfully identify stocks that show strong company financial health, adding around 2.8% to overall absolute returns.

Detailed Explanation of Fiscal Year Performance

The Short Version: For the fiscal year ended June 30, 2013, we outperformed our primary benchmark by 11.32%. Our current positioning, favoring smaller size, higher leverage, and higher beta (market risk) companies, helped in the market environment of the fiscal year. Our stocks performed well across a broad spectrum of our quantitative models during the low/mid-correlation environment of the first three fiscal year quarters.

The fiscal year ended June 30, 2013 contained a high-correlation spike, an environment traditionally unfavorable to our growth models. However, as discussed in the quarterly commentary above, we fared better during this recent quarter than during previous spikes. The other three quarters had historically normal market correlation, which contributed to the Fund outperforming our primary market benchmark for the year by more than eleven percent.

| | |

9 | | Annual Report | June 30, 2013 |

| | |

Aggressive Investors 1 Fund MANAGER’S COMMENTARY (Unaudited) (continued) | |  |

As is usual, our larger universe of stocks (those from which we select companies for the Fund) and non-market cap weighting tends to give us a small-cap bias compared to the S&P 500 Index. Throughout the fiscal year, this proved to be beneficial, especially in the December quarter of 2012. The Fund’s Consumer Discretionary holdings shined for the fiscal year, adding almost four percent to the Fund’s performance relative to the primary market benchmark. Although the Financial sector was the best performing sector in the S&P 500 Index, the Fund’s overweighting of non-bank financial stocks did not help performance. The Fund’s above-market exposure to strongly performing high beta and more highly leveraged companies did add significantly to our positive results.

Top Ten Holdings as of June 30, 2013

| | | | | | | | |

| Rank | | Description | | Industry | | % of Net

Assets | |

1 | | PulteGroup, Inc. | | Household Durables | | | 1.8% | |

2 | | Lumber Liquidators Holdings, Inc. | | Specialty Retail | | | 1.8% | |

3 | | Western Digital Corp. | | Computers & Peripherals | | | 1.8% | |

4 | | Gap, Inc. (The) | | Specialty Retail | | | 1.7% | |

5 | | Pilgrim’s Pride Corp. | | Food Products | | | 1.7% | |

6 | | Ryland Group, Inc. (The) | | Household Durables | | | 1.5% | |

7 | | Seagate Technology PLC | | Computers & Peripherals | | | 1.5% | |

8 | | Tesoro Corp . | | Oil, Gas & Consumable Fuels | | | 1.3% | |

9 | | Delphi Automotive PLC | | Auto Components | | | 1.3% | |

10 | | AAR Corp. | | Aeorspace & Defense | | | 1.3% | |

| | Total | | | | | 15.7% | |

Industry Sector Representation as of June 30, 2013

| | | | | | | | | | | | |

| | | % of Net Assets | | | % of S&P 500

Index | | | Difference | |

Consumer Discretionary | | | 18.6% | | | | 12.2% | | | | 6.4% | |

Consumer Staples | | | 8.4% | | | | 10.5% | | | | -2.1% | |

Energy | | | 10.0% | | | | 10.5% | | | | -0.5% | |

Financials | | | 17.3% | | | | 16.7% | | | | 0.6% | |

Health Care | | | 7.3% | | | | 12.7% | | | | -5.4% | |

Industrials | | | 11.7% | | | | 10.2% | | | | 1.5% | |

Information Technology | | | 17.5% | | | | 17.8% | | | | -0.3% | |

Materials | | | 4.8% | | | | 3.3% | | | | 1.5% | |

Telecommunication Services | | | 1.7% | | | | 2.8% | | | | -1.1% | |

Utilities | | | 2.2% | | | | 3.3% | | | | -1.1% | |

Cash & Other Assets | | | 0.5% | | | | 0.0% | | | | 0.5% | |

Total | | | 100.0% | | | | 100.0% | | | | | |

Disclaimer

The views expressed here are exclusively those of Fund management. These views, including those related to market sectors or individual stocks, are not meant as investment advice and should not be considered predictive in nature. Any favorable (or unfavorable) description of a holding applies only as of the quarter end, June 30, 2013, unless otherwise stated. Security positions can and do change thereafter. Discussions of historical performance do not guarantee and may not be indicative of future performance.

Market volatility can significantly affect short-term performance. The Fund is not an appropriate investment for short-term investors. Investments in the small companies within this multi-cap fund generally carry greater risk than is customarily associated with larger companies. This additional risk is attributable to a number of factors, including the relatively limited financial resources that are typically available to small companies and the fact that small companies often have comparatively limited

| | |

Aggressive Investors 1 Fund MANAGER’S COMMENTARY (Unaudited) (continued) | |  |

product lines. In addition, the stock of small companies tends to be more volatile than the stock of large companies, particularly in the short term and particularly in the early stages of an economic or market downturn. The Fund’s use of options, futures, and leverage can magnify the risk of loss in an unfavorable market, and the Fund’s use of short-sale positions can, in theory, expose shareholders to unlimited loss. Finally, the Fund exposes shareholders to “focus risk,” which may add to Fund volatility through the possibility that a single company could significantly affect total return. Shareholders of the Fund, therefore, are taking on more risk than they would if they invested in the stock market as a whole.

Conclusion

Thank you for your continued investment in Aggressive Investors 1 Fund. We encourage your feedback; your reactions and concerns are extremely important to us.

Sincerely,

The Investment Management Team

| | |

11 | | Annual Report | June 30, 2013 |

| | |

Bridgeway Aggressive Investors 1 Fund SCHEDULE OF INVESTMENTS | |  |

Showing percentage of net assets as of June 30, 2013

| | | | | | | | |

| Industry Company | | Shares | | | Value | |

COMMON STOCKS - 99.54% | |

Aerospace & Defense - 2.40% | | | | | |

AAR Corp. | | | 129,800 | | | $ | 2,853,004 | |

Precision Castparts Corp. | | | 10,900 | | | | 2,463,509 | |

| | | | | | | | |

| | | | | | | 5,316,513 | |

| |

Airlines - 2.33% | | | | | |

Delta Air Lines, Inc.* | | | 125,800 | | | | 2,353,718 | |

SkyWest, Inc. | | | 207,700 | | | | 2,812,258 | |

| | | | | | | | |

| | | | | | | 5,165,976 | |

| |

Auto Components - 2.35% | | | | | |

Delphi Automotive PLC | | | 57,100 | | | | 2,894,399 | |

Lear Corp. | | | 38,200 | | | | 2,309,572 | |

| | | | | | | | |

| | | | | | | 5,203,971 | |

| |

Automobiles - 1.06% | | | | | |

Toyota Motor Corp. - Sponsored ADR | | | 19,400 | | | | 2,340,804 | |

| |

Biotechnology - 1.98% | | | | | |

Amgen, Inc. | | | 22,100 | | | | 2,180,386 | |

Gilead Sciences, Inc.* | | | 42,800 | | | | 2,191,788 | |

| | | | | | | | |

| | | | | | | 4,372,174 | |

| |

Chemicals - 5.87% | | | | | |

Albemarle Corp. | | | 36,300 | | | | 2,261,127 | |

CF Industries Holdings, Inc. | | | 12,178 | | | | 2,088,527 | |

Ecolab, Inc. | | | 28,000 | | | | 2,385,320 | |

Kraton Performance Polymers, Inc.* | | | 41,700 | | | | 884,040 | |

LyondellBasell Industries NV | | | 36,700 | | | | 2,431,742 | |

OM Group, Inc.* | | | 32,300 | | | | 998,716 | |

Sherwin-Williams Co. (The) | | | 11,000 | | | | 1,942,600 | |

| | | | | | | | |

| | | | | | | 12,992,072 | |

| |

Commercial Banks - 0.98% | | | | | |

Bank of Montreal+ | | | 37,300 | | | | 2,164,519 | |

| |

Computers & Peripherals - 4.12% | | | | | |

Apple, Inc. | | | 4,800 | | | | 1,901,184 | |

Seagate Technology PLC | | | 72,900 | | | | 3,268,107 | |

Western Digital Corp. | | | 63,500 | | | | 3,942,715 | |

| | | | | | | | |

| | | | | | | 9,112,006 | |

| |

Consumer Finance - 2.02% | |

Discover Financial Services | | | 47,700 | | | | 2,272,428 | |

SLM Corp. | | | 96,000 | | | | 2,194,560 | |

| | | | | | | | |

| | | | | | | 4,466,988 | |

| | | | | | | | |

| Industry Company | | Shares | | | Value | |

| | | | | | | | |

Diversified Consumer Services - 0.97% | |

H&R Block, Inc. | | | 77,000 | | | $ | 2,136,750 | |

|

Diversified Financial Services - 1.97% | |

Citigroup, Inc. | | | 45,300 | | | | 2,173,041 | |

Moody’s Corp. | | | 35,900 | | | | 2,187,387 | |

| | | | | | | | |

| | | | | | | 4,360,428 | |

|

Diversified Telecommunication Services - 1.03% | |

Verizon Communications, Inc. | | | 45,200 | | | | 2,275,368 | |

| |

Electric Utilities - 1.09% | | | | | |

Entergy Corp. | | | 34,600 | | | | 2,410,928 | |

| |

Electrical Equipment - 0.98% | | | | | |

Rockwell Automation, Inc. | | | 26,200 | | | | 2,178,268 | |

|

Electronic Equipment, Instruments & Components - 2.32% | |

Corning, Inc. | | | 167,900 | | | | 2,389,217 | |

Plexus Corp.* | | | 92,100 | | | | 2,752,869 | |

| | | | | | | | |

| | | | | | | 5,142,086 | |

| |

Energy Equipment & Services - 1.01% | | | | | |

Exterran Holdings, Inc.* | | | 79,700 | | | | 2,241,164 | |

| |

Food & Staples Retailing - 3.72% | | | | | |

Kroger Co. (The) | | | 80,800 | | | | 2,790,832 | |

Rite Aid Corp.*+ | | | 911,600 | | | | 2,607,176 | |

Safeway, Inc. | | | 120,000 | | | | 2,839,200 | |

| | | | | | | | |

| | | | | | | 8,237,208 | |

| |

Food Products - 4.72% | | | | | |

Flowers Foods, Inc. | | | 101,250 | | | | 2,232,562 | |

Ingredion, Inc. | | | 33,600 | | | | 2,204,832 | |

Kellogg Co. | | | 36,700 | | | | 2,357,241 | |

Pilgrim’s Pride Corp.* | | | 243,900 | | | | 3,643,866 | |

| | | | | | | | |

| | | | | | | 10,438,501 | |

|

Health Care Equipment & Supplies - 1.17% | |

Medtronic, Inc. | | | 50,500 | | | | 2,599,235 | |

|

Health Care Providers & Services - 4.15% | |

DaVita HealthCare Partners, Inc.* | | | 20,700 | | | | 2,500,560 | |

HCA Holdings, Inc. | | | 57,800 | | | | 2,084,268 | |

MWI Veterinary Supply, Inc.* | | | 18,600 | | | | 2,292,264 | |

Tenet Healthcare Corp.* | | | 50,000 | | | | 2,305,000 | |

| | | | | | | | |

| | | | | | | 9,182,092 | |

| | |

Bridgeway Aggressive Investors 1 Fund SCHEDULE OF INVESTMENTS (continued) | |  |

Showing percentage of net assets as of June 30, 2013

| | | | | | | | |

| Industry Company | | Shares | | | Value | |

Common Stocks (continued) | | | | | | | | |

Hotels, Restaurants & Leisure - 1.10% | | | | | |

Texas Roadhouse, Inc. | | | 96,900 | | | | $ 2,424,438 | |

| |

Household Durables - 6.29% | | | | | |

Hovnanian Enterprises, Inc., Class A*+ | | | 297,000 | | | | 1,666,170 | |

PulteGroup, Inc.* | | | 212,900 | | | | 4,038,713 | |

Ryland Group, Inc. (The)+ | | | 83,200 | | | | 3,336,320 | |

Sony Corp. - Sponsored ADR | | | 115,100 | | | | 2,438,969 | |

Whirlpool Corp. | | | 21,300 | | | | 2,435,868 | |

| | | | | | | | |

| | | | | | | 13,916,040 | |

| |

Insurance - 8.63% | | | | | |

Allstate Corp. (The) | | | 50,700 | | | | 2,439,684 | |

Arch Capital Group, Ltd.* | | | 49,900 | | | | 2,565,359 | |

Axis Capital Holdings, Ltd. | | | 59,200 | | | | 2,710,176 | |

First American Financial Corp. | | | 89,200 | | | | 1,965,968 | |

Genworth Financial, Inc., Class A* | | | 220,700 | | | | 2,518,187 | |

MetLife, Inc. | | | 56,000 | | | | 2,562,560 | |

Prudential Financial, Inc. | | | 31,900 | | | | 2,329,657 | |

Stewart Information Services Corp. | | | 77,000 | | | | 2,016,630 | |

| | | | | | | | |

| | | | | | | 19,108,221 | |

| |

IT Services - 6.65% | | | | | |

Accenture PLC, Class A | | | 35,900 | | | | 2,583,364 | |

Alliance Data Systems Corp.* | | | 14,500 | | | | 2,624,935 | |

Computer Sciences Corp. | | | 46,000 | | | | 2,013,420 | |

FleetCor Technologies, Inc.* | | | 29,000 | | | | 2,357,700 | |

Unisys Corp.* | | | 118,100 | | | | 2,606,467 | |

Western Union Co. (The)+ | | | 148,500 | | | | 2,540,835 | |

| | | | | | | | |

| | | | | | | 14,726,721 | |

| |

Leisure Equipment & Products - 1.03% | | | | | |

Hasbro, Inc.+ | | | 50,600 | | | | 2,268,398 | |

| |

Machinery - 2.81% | | | | | |

ITT Corp. | | | 77,300 | | | | 2,273,393 | |

Oshkosh Corp.* | | | 38,600 | | | | 1,465,642 | |

Snap-on, Inc. | | | 27,700 | | | | 2,475,826 | |

| | | | | | | | |

| | | | | | | 6,214,861 | |

| |

Media - 1.23% | | | | | |

Time Warner Cable, Inc. | | | 24,200 | | | | 2,722,016 | |

| |

Office Electronics - 1.08% | | | | | |

Xerox Corp. | | | 264,700 | | | | 2,400,829 | |

| |

Oil, Gas & Consumable Fuels - 6.97% | | | | | |

CVR Energy, Inc. | | | 41,600 | | | | 1,971,840 | |

| | | | | | | | |

| Industry Company | | Shares | | | Value | |

| | | | | | | | |

Oil, Gas & Consumable Fuels (continued) | | | | | |

Delek US Holdings, Inc. | | | 85,200 | | | | $ 2,452,056 | |

HollyFrontier Corp. | | | 41,500 | | | | 1,775,370 | |

Marathon Petroleum Corp. | | | 40,000 | | | | 2,842,400 | |

Stone Energy Corp.* | | | 61,000 | | | | 1,343,830 | |

Tesoro Corp. | | | 56,300 | | | | 2,945,616 | |

Valero Energy Corp. | | | 60,500 | | | | 2,103,585 | |

| | | | | | | | |

| | | | | | | 15,434,697 | |

| |

Professional Services - 1.18% | | | | | |

Huron Consulting Group, Inc.* | | | 56,500 | | | | 2,612,560 | |

|

Real Estate Investment Trusts (REITs) - 3.72% | |

American Tower Corp. | | | 28,600 | | | | 2,092,662 | |

Geo Group, Inc. (The) | | | 61,900 | | | | 2,101,505 | |

Weingarten Realty Investors | | | 65,600 | | | | 2,018,512 | |

Weyerhaeuser Co. | | | 70,700 | | | | 2,014,243 | |

| | | | | | | | |

| | | | | | | 8,226,922 | |

| |

Road & Rail - 1.99% | | | | | |

Avis Budget Group, Inc.* | | | 70,100 | | | | 2,015,375 | |

Hertz Global Holdings, Inc.* | | | 95,900 | | | | 2,378,320 | |

| | | | | | | | |

| | | | | | | 4,393,695 | |

|

Semiconductors & Semiconductor Equipment - 3.35% | |

Amkor Technology, Inc.*+ | | | 526,100 | | | | 2,214,881 | |

Cree, Inc.* | | | 40,000 | | | | 2,554,400 | |

Magnachip Semiconductor Corp.* | | | 144,900 | | | | 2,647,323 | |

| | | | | | | | |

| | | | | | | 7,416,604 | |

| |

Specialty Retail - 4.63% | | | | | |

Gap, Inc. (The) | | | 89,000 | | | | 3,713,970 | |

Lumber Liquidators Holdings, Inc.*+ | | | 51,500 | | | | 4,010,305 | |

O’Reilly Automotive, Inc.* | | | 22,500 | | | | 2,533,950 | |

| | | | | | | | |

| | | | | | | 10,258,225 | |

| |

Trading Companies & Distributors - 0.92% | | | | | |

MRC Global, Inc.* | | | 73,900 | | | | 2,041,118 | |

|

Wireless Telecommunication Services - 1.72% | |

Cellcom Israel, Ltd.+ | | | 155,000 | | | | 1,430,650 | |

SBA Communications Corp., Class A* | | | 32,100 | | | | 2,379,252 | |

| | | | | | | | |

| | | | | | | 3,809,902 | |

| | | | | | | | |

TOTAL COMMON STOCKS - 99.54% | | | | | | | 220,312,298 | |

| | | | | | | | |

(Cost $190,263,292) | | | | | | | | |

| | |

13 | | Annual Report | June 30, 2013 |

| | |

Bridgeway Aggressive Investors 1 Fund SCHEDULE OF INVESTMENTS (continued) | |  |

Showing percentage of net assets as of June 30, 2013

| | | | | | | | | | |

| | | Rate^ | | Shares | | | Value | |

MONEY MARKET FUND - 0.00% | |

BlackRock FedFund | | 0.01% | | | 2,760 | | | | $2,760 | |

| | | | | | | | | | |

TOTAL MONEY MARKET FUND - 0.00% | | | | 2,760 | |

| | | | | | | | | | |

(Cost $ 2,760) | | | | | | | | | | |

| |

TOTAL INVESTMENTS - 99.54% | | | | $220,315,058 | |

(Cost $190,266,052) | | | | | | | | | | |

Other Assets in Excess of Liabilities - 0.46% | | | | 1,021,747 | |

| | | | | | | | | | |

NET ASSETS - 100.00% | | | | $221,336,805 | |

| | | | | | | | | | |

* Non-income producing security. | |

^ Rate disclosed as of June 30, 2013. | |

+ This security or a portion of the security is out on loan as of June 30, 2013. Total loaned securities had a value of $8,951,730 at June 30, 2013. | |

| ADR - American Depositary Receipt | |

| PLC - Public Limited Company | |

Summary of inputs used to value the Fund’s investments as of 06/30/2013 is as follows (See Note 2 in Notes to Financial Statements):

| | | | | | | | | | | | | | | | |

| | | Valuation Inputs | |

| | | | Investment in Securities (Value) | |

| | | Level 1 Quoted Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Total | |

Common Stocks | | | $220,312,298 | | | | $ — | | | | $ — | | | | $220,312,298 | |

Money Market Fund | | | — | | | | 2,760 | | | | — | | | | 2,760 | |

| | | | | | | | | | | | | | | | |

TOTAL | | | $220,312,298 | | | | $2,760 | | | | $ — | | | | $220,315,058 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

| | |

| Ultra-Small Company Fund | |  |

| MANAGER’S COMMENTARY (Unaudited) | |

June 30, 2013

Dear Fellow Ultra-Small Company Fund Shareholder,

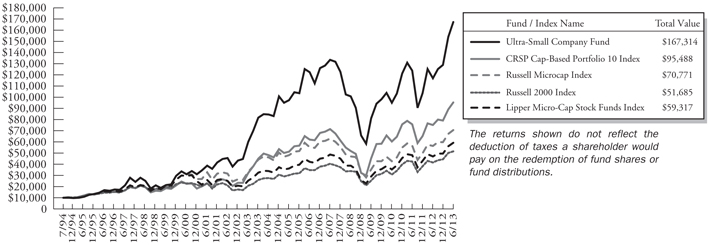

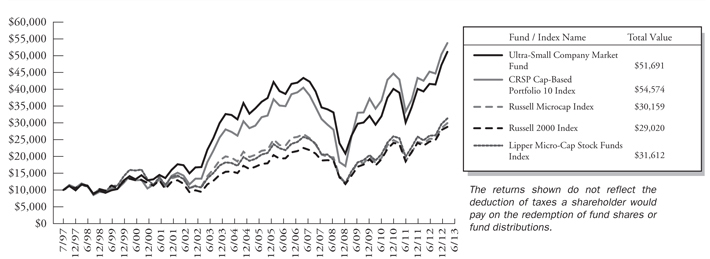

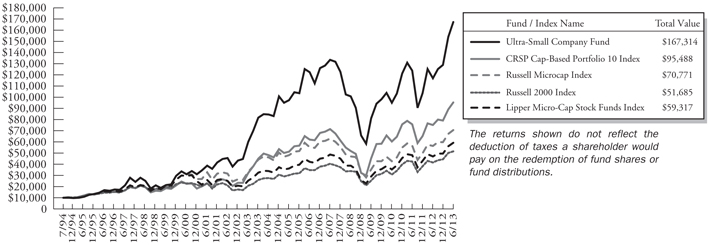

For the quarter ended June 30, 2013, our Fund appreciated 8.61%, outperforming our primary market benchmark, the CRSP Cap-Based Portfolio 10 Index (+7.17%), our peer benchmark, the Lipper Micro-Cap Stock Funds Index (+5.81%), the Russell Microcap Index (+5.10%) and the Russell 2000 Index (+3.08%). We are pleased with the results.

For the fiscal year ended June 30, 2013, our Fund appreciated 42.85%, strongly outperforming each of our performance benchmarks: our primary market benchmark, the CRSP Cap-Based Portfolio 10 Index (+26.96%), our peer benchmark, the Lipper Micro-Cap Stock Funds Index (+26.30%), the Russell Microcap Index (+25.38%), and the Russell 2000 Index (+24.21%). It feels good to have a clean sweep for these shorter time periods and since inception. We still have some ground to make up relative to our performance benchmarks in the five- and ten-year periods, primarily due to the “penny stock” and “junk rally” effects of 2009.

The table below presents our June quarter, one-year, five-year, ten-year and inception-to-date financial results. See the next page for a graph of performance since inception.

Standardized Returns as of June 30, 2013

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Annualized | |

| | | Quarter | | | 1 Year | | | 5 Years | | | 10 Years | | | Since Inception

(8/5/94) | |

| | | | | |

Ultra-Small Company Fund | | | 8.61% | | | | 42.85% | | | | 10.67% | | | | 10.80% | | | | 16.07% | |

CRSP Cap-Based Portfolio 10 Index | | | 7.17% | | | | 26.96% | | | | 12.93% | | | | 11.47% | | | | 12.61% | |

Russell Microcap Index | | | 5.10% | | | | 25.38% | | | | 8.53% | | | | 7.81% | | | | N/A | |

Russell 2000 Index | | | 3.08% | | | | 24.21% | | | | 8.77% | | | | 9.53% | | | | 9.08% | |

Lipper Micro-Cap Stock Funds Index | | | 5.81% | | | | 26.30% | | | | 8.84% | | | | 8.84% | | | | N/A | |

Performance figures quoted in the table above and the graph on the next page represent past performance and are no guarantee of future results. Total return figures in the table above and the graph on the next page include the reinvestment of dividends and capital gains. The table above and the graph on the next page do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The CRSP Cap-Based Portfolio 10 Index is an unmanaged index of 1,052 of the smallest publicly traded U.S. stocks (with dividends reinvested), as reported by the Center for Research on Security Prices. The Russell Microcap Index is an unmanaged, market value weighted index that measures performance of 1,000 of the smallest securities in the Russell 2000 Index. The Russell 2000 Index is an unmanaged, market value weighted index that measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market with dividends reinvested. The Lipper Micro-Cap Stock Funds Index is an index of micro-cap funds compiled by Lipper, Inc. It is not possible to invest directly in an index. Periods longer than one year are annualized.

According to data from Lipper, Inc. as of June 30, 2013, Ultra-Small Company Fund ranked 1st of 67 micro-cap funds for the twelve months ending June 30, 2013, 19th of 48 over the last five years, 8th of 31 over the last ten years, and 1st of 8 since inception in August, 1994. These long-term numbers and the graph on the next page give two snapshots of our long-term success. Lipper, Inc. is an independent mutual fund rating service that ranks funds in various fund categories by making comparative calculations using total returns.

| | |

15 | | Annual Report | June 30, 2013 |

| | |

Ultra-Small Company Fund MANAGER’S COMMENTARY (Unaudited) (continued) | |  |

Ultra-Small Company Fund vs. CRSP Cap-Based Portfolio 10 Index, Russell Microcap Index**, Russell 2000 Index & Lipper Micro-Cap Stock Funds Index* from Inception 7/31/94 to 6/30/13

| | * | The Lipper Micro-Cap Stock Funds Index began on 12/31/1995, and the line graph for the Index begins at the same value as the Fund on that date. |

| | ** | The Russell Microcap Index began on 6/30/2000, and the line graph for the Index begins at the same value as the Fund on that date. |

Detailed Explanation of Quarterly Performance

The Short Version: Our Fund’s current stronger weighting of deeper value stocks helped in the current quarter. Many of these stocks appeared in the Consumer Discretionary sector, which was a particularly strong sector for our Fund. We are pleased that the Fund’s outperformance occurred despite a spike in correlation (see page 2), an environment not usually favorable to our Fund.

The Consumer Discretionary sector was a highlight for the quarter and significantly contributed to the Fund’s positive relative performance. Not only did the Fund’s overweighting in this sector clearly help (the Consumer Discretionary sector returned more than 15% compared to the benchmark’s return of just over six percent), but the Fund’s stronger exposure to value stocks in this sector helped significantly. In total, more than one percent of the Fund’s outperformance can be attributed to the Consumer Discretionary sector.

Design features of the Fund, such as our overweighting of value and momentum stocks, proved to be beneficial this quarter. The high correlation spike in June did hurt our Fund somewhat during this month, as expected, but recent changes (including incorporating data from 2008 through 2011) allowed the Fund to navigate this market better than it has in the past. We are encouraged that the one percent underperformance in June was more than offset by the outperformance of the previous two months.

A primary determinant of our performance relative to most other funds relates to the size of the companies in which we invest. Our investment strategy is to approximate the long-term returns of the CRSP Cap-Based Portfolio 10 Index of ultra-small companies by investing in ultra-small stocks. As shown in the table on the next page, smaller companies (particularly those in the 9th and 10th decile) strongly outperformed large companies for the quarter ended June 30, 2013.

| | |

Ultra-Small Company Fund MANAGER’S COMMENTARY (Unaudited) (continued) | |  |

| | | | | | | | | | | | | | | | | | | | |

| CRSP Decile1 | | Quarter | | | 1 Year | | | 5 Years | | | 10 Years | | | 87.5 Years | |

| 1 (ultra-large) | | | 2.89% | | | | 19.56% | | | | 6.62% | | | | 6.65% | | | | 9.16% | |

| 2 | | | 3.81% | | | | 26.08% | | | | 8.49% | | | | 10.30% | | | | 10.50% | |

| 3 | | | 1.64% | | | | 26.63% | | | | 8.74% | | | | 10.43% | | | | 10.89% | |

| 4 | | | 3.29% | | | | 30.86% | | | | 10.84% | | | | 11.44% | | | | 10.91% | |

| 5 | | | 3.26% | | | | 29.49% | | | | 11.50% | | | | 12.25% | | | | 11.55% | |

| 6 | | | 4.17% | | | | 29.55% | | | | 10.73% | | | | 10.81% | | | | 11.37% | |

| 7 | | | 5.52% | | | | 27.30% | | | | 13.20% | | | | 11.85% | | | | 11.62% | |

| 8 | | | 5.98% | | | | 30.18% | | | | 13.74% | | | | 12.11% | | | | 11.64% | |

| 9 | | | 7.78% | | | | 27.76% | | | | 13.03% | | | | 10.27% | | | | 11.60% | |

| 10 (ultra-small) | | | 7.17% | | | | 26.96% | | | | 12.93% | | | | 11.47% | | | | 13.28% | |

| 1 | Performance figures are as of the period ended June 30, 2013. The CRSP Cap-Based Portfolio Indexes are unmanaged indexes of the publicly traded U.S. stocks with dividends reinvested, grouped by market capitalization, as reported by the Center for Research in Security Prices. Past performance is no guarantee of future results. |

Detailed Explanation of Fiscal Year Performance

The Short Version: The Fund boasted an outperformance of almost sixteen percent for the year, relative to our primary market benchmark, the CRSP Cap-Based Portfolio 10 Index. Stocks within the Consumer Discretionary sector and greater exposure to higher liquidity stocks contributed most significantly to this exceptional outperformance.

For the fiscal year ended June 30, 2013, the Fund handily beat the CRSP Cap-Based Portfolio 10 Index, the Fund’s primary benchmark. Surprising to some, perhaps, this was not our best fiscal year relative performance. When our ultra-small stock models “kick in,” they can really kick in. The flip side: they can also underperform, as they did in fiscal years 2009 and 2010. This is truly a fund for long term investors.

Ultra-small stocks with highest liquidity made the most significant impact on the Fund’s positive relative returns this fiscal year. This was a year that went against the grain. In a majority of years, less liquid (harder to trade) ultra-small stocks outperform the pack. Every stock category gets its day in the sun in a given year, and this was the year for high liquidity stocks. Specifically, the stocks in the highest 10% of trading volume (liquidity) returned more than 135% on average for the year, compared to just over 25% for the benchmark. Weighting this decile over three times more than the benchmark gave a huge boost to the Fund’s relative performance.

The Consumer Discretionary sector was the strongest performing sector for the fiscal year, adding around 13% to the Fund’s return. In fact, half of our best performing stocks came from this sector.

| | |

17 | | Annual Report | June 30, 2013 |

| | |

Ultra-Small Company Fund MANAGER’S COMMENTARY (Unaudited) (continued) | |  |

Top Ten Holdings as of June 30, 2013

| | | | | | | | | | | | |

| Rank | | | | | | Description | | Industry | | % of Net

Assets | |

1 | | | | | | Addus HomeCare Corp | | Health Care Providers & Services | | | 2.3% | |

2 | | | | | | Nautilus, Inc. | | Leisure Equipment & Products | | | 2.3% | |

3 | | | | | | CalAmp Corp | | Communications Equipment | | | 2.0% | |

4 | | | | | | HCI Group, Inc. | | Insurance | | | 1.8% | |

5 | | | | | | Christopher & Banks Corp. | | Specialty Retail | | | 1.8% | |

6 | | | | | | Hutchinson Technology, Inc. | | Computers & Peripherals | | | 1.7% | |

7 | | | | | | Ducommun, Inc. | | Aerospace & Defense | | | 1.7% | |

8 | | | | | | Bon-Ton Stores, Inc. (The) | | Multiline Retail | | | 1.6% | |

9 | | | | | | YRC Worldwide, Inc. | | Road & Rail | | | 1.6% | |

10 | | | | | | Gray Television, Inc. | | Media | | | 1.6% | |

| | | | | | Total | | | | | 18.4% | |

Industry Sector Representation as of June 30, 2013

| | | | | | |

| | | % of Net Assets | | % of CRSP 10 Index | | Difference |

Consumer Discretionary | | 22.2% | | 16.2% | | 6.0% |

Consumer Staples | | 3.8% | | 3.8% | | 0.0% |

Energy | | 5.7% | | 7.0% | | -1.3% |

Financials | | 18.6% | | 24.9% | | -6.3% |

Health Care | | 10.7% | | 12.2% | | -1.5% |

Industrials | | 18.3% | | 13.6% | | 4.7% |

Information Technology | | 14.2% | | 16.6% | | -2.4% |

Materials | | 2.8% | | 2.5% | | 0.3% |

Telecommunication Services | | 2.5% | | 2.2% | | 0.3% |

Utilities | | 0.0% | | 1.0% | | -1.0% |

Cash & Other Assets | | 1.2% | | 0.0% | | 1.2% |

Total | | 100.0% | | 100.0% | | |

Disclaimer

The views expressed here are exclusively those of Fund management. These views, including those related to market sectors or individual stocks, are not meant as investment advice and should not be considered predictive in nature. Any favorable (or unfavorable) description of a holding applies only as of the quarter end, June 30, 2013, unless otherwise stated. Security positions can and do change thereafter. Discussions of historical performance do not guarantee and may not be indicative of future performance.

The Fund is subject to very high, above market risk (volatility) and is not an appropriate investment for short-term investors. Investments in ultra-small companies generally carry greater risk than is customarily associated with larger companies and even “small companies” for various reasons, such as narrower markets (fewer investors), limited financial resources and greater trading difficulty.

| | |

Ultra-Small Company Fund MANAGER’S COMMENTARY (Unaudited) (continued) | |  |

Conclusion

Ultra-Small Company Fund remains closed to new investors. We encourage your feedback; your reactions and concerns are important to us.

Sincerely,

The Investment Management Team

| | |

19 | | Annual Report | June 30, 2013 |

| | |

Bridgeway Ultra-Small Company Fund SCHEDULE OF INVESTMENTS | |  |

Showing percentage of net assets as of June 30, 2013

| | | | | | | | |

| Industry Company | | Shares | | | Value | |

COMMON STOCKS - 98.76% | | | | | |

Aerospace & Defense - 1.66% | | | | | | | | |

Ducommun, Inc.* | | | 103,100 | | | | $2,191,906 | |

| | |

Airlines - 1.24% | | | | | | | | |

Republic Airways Holdings, Inc.* | | | 144,800 | | | | 1,640,584 | |

| | |

Auto Components - 0.77% | | | | | | | | |

Strattec Security Corp. | | | 8,900 | | | | 332,504 | |

Tower International, Inc.* | | | 34,600 | | | | 684,734 | |

| | | | | | | | |

| | | | | | | 1,017,238 | |

| | |

Biotechnology - 1.73% | | | | | | | | |

AVEO Pharmaceuticals, Inc.* | | | 440,000 | | | | 1,100,000 | |

China Biologic Products, Inc.*+ | | | 6,900 | | | | 158,355 | |

Vanda Pharmaceuticals, Inc.*+ | | | 126,500 | | | | 1,022,120 | |

| | | | | | | | |

| | | | | | | 2,280,475 | |

| | |

Building Products - 1.50% | | | | | | | | |

China Ceramics Co., Ltd. | | | 29,500 | | | | 61,065 | |

Patrick Industries, Inc.* | | | 50,700 | | | | 1,054,053 | |

PGT, Inc.* | | | 100,000 | | | | 867,000 | |

| | | | | | | | |

| | | | | | | 1,982,118 | |

| | |

Capital Markets - 2.65% | | | | | | | | |

Calamos Asset Management, Inc., Class A | | | 76,100 | | | | 799,050 | |

FBR & Co.* | | | 36,400 | | | | 919,464 | |

Manning & Napier, Inc. | | | 32,500 | | | | 577,200 | |

Oppenheimer Holdings, Inc., Class A | | | 4,428 | | | | 84,309 | |

Solar Senior Capital, Ltd. | | | 60,500 | | | | 1,113,805 | |

| | | | | | | | |

| | | | | | | 3,493,828 | |

| | |

Chemicals - 2.10% | | | | | | | | |

American Pacific Corp.* | | | 44,900 | | | | 1,272,915 | |

Chase Corp. | | | 9,700 | | | | 216,892 | |

Gulf Resources, Inc.*+ | | | 195,100 | | | | 226,316 | |

Landec Corp.* | | | 79,800 | | | | 1,054,158 | |

| | | | | | | | |

| | | | | | | 2,770,281 | |

| | |

Commercial Banks - 4.14% | | | | | | | | |

C&F Financial Corp.+ | | | 6,700 | | | | 373,391 | |

Center Bancorp, Inc. | | | 18,300 | | | | 232,227 | |

Farmers Capital Bank Corp.* | | | 20,000 | | | | 433,800 | |

Fidelity Southern Corp.* | | | 22,100 | | | | 273,377 | |

| | | | | | | | |

| Industry Company | | Shares | | | Value | |

| | | | | | | | |

Commercial Banks (continued) | | | | | | | | |

Heritage Financial Corp. | | | 30,200 | | | | $ 442,430 | |

Independent Bank Corp.* | | | 67,500 | | | | 424,575 | |

Intervest Bancshares Corp., Class A*+ | | | 56,500 | | | | 377,420 | |

Metro Bancorp, Inc.* | | | 38,700 | | | | 775,161 | |

Middleburg Financial Corp. | | | 2,100 | | | | 40,110 | |

Monarch Financial Holdings, Inc. | | | 24,500 | | | | 265,335 | |

National Bankshares, Inc.+ | | | 1,600 | | | | 56,848 | |

Old Line Bancshares, Inc. | | | 1,600 | | | | 21,104 | |

Old Second Bancorp, Inc.*+ | | | 42,700 | | | | 235,704 | |

Park Sterling Corp.* | | | 75,000 | | | | 443,250 | |

Premier Financial Bancorp, Inc. | | | 905 | | | | 10,896 | |

Renasant Corp. | | | 13,700 | | | | 333,458 | |

Suffolk Bancorp* | | | 17,400 | | | | 284,316 | |

Trico Bancshares | | | 21,000 | | | | 447,930 | |

| | | | | | | | |

| | | | | | | 5,471,332 | |

| |

Commercial Services & Supplies - 2.29% | | | | | |

A.T. Cross Co., Class A* | | | 1,955 | | | | 33,137 | |

ARC Document Solutions, Inc.* | | | 200,000 | | | | 800,000 | |

Casella Waste Systems, Inc., Class A* | | | 159,000 | | | | 685,290 | |

Ceco Environmental Corp. | | | 35,700 | | | | 439,110 | |

Cenveo, Inc.*+ | | | 502,800 | | | | 1,070,964 | |

| | | | | | | | |

| | | | | | | 3,028,501 | |

| |

Communications Equipment - 5.77% | | | | | |

Anaren, Inc.* | | | 30,500 | | | | 699,670 | |

Aviat Networks, Inc.* | | | 303,700 | | | | 795,694 | |

CalAmp Corp.* | | | 176,900 | | | | 2,582,740 | |

Gilat Satellite Networks, Ltd.*+ | | | 52,600 | | | | 291,404 | |

KVH Industries, Inc.* | | | 31,000 | | | | 412,610 | |

Mitel Networks Corp.*+ | | | 34,800 | | | | 133,632 | |

Sierra Wireless, Inc.* | | | 87,600 | | | | 1,121,280 | |

Tessco Technologies, Inc. | | | 49,100 | | | | 1,296,240 | |

UTStarcom Holdings Corp.*+ | | | 110,466 | | | | 293,840 | |

| | | | | | | | |

| | | | | | | 7,627,110 | |

| |

Computers & Peripherals - 3.14% | | | | | |

Concurrent Computer Corp. | | | 172,100 | | | | 1,316,565 | |

Hutchinson Technology, Inc.* | | | 469,300 | | | | 2,219,789 | |

Novatel Wireless, Inc.* | | | 153,900 | | | | 607,905 | |

| | | | | | | | |

| | | | | | | 4,144,259 | |

| | |

Bridgeway Ultra-Small Company Fund SCHEDULE OF INVESTMENTS (continued) | |  |

Showing percentage of net assets as of June 30, 2013

| | | | | | | | |

| Industry Company | | Shares | | | Value | |

Common Stocks (continued) | | | | | | | | |

Construction & Engineering - 1.64% | |

Argan, Inc. | | | 65,000 | | | | $1,014,000 | |

Orion Marine Group, Inc.* | | | 95,500 | | | | 1,154,595 | |

| | | | | | | | |

| | | | | | | 2,168,595 | |

| |

Construction Materials - 0.19% | |

U.S. Concrete, Inc.* | | | 15,000 | | | | 246,300 | |

| |

Consumer Finance - 1.49% | |

Consumer Portfolio Services, Inc.* | | | 267,300 | | | | 1,961,982 | |

| |

Diversified Consumer Services - 1.00% | |

Carriage Services, Inc. | | | 36,100 | | | | 611,895 | |

Corinthian Colleges, Inc.* | | | 316,700 | | | | 709,408 | |

| | | | | | | | |

| | | | | | | 1,321,303 | |

| |

Diversified Financial Services - 0.60% | |

Gain Capital Holdings, Inc. | | | 126,100 | | | | 795,691 | |

| |

Diversified Telecommunication Services - 2.26% | |

Alaska Communications Systems Group, Inc. | | | 290,000 | | | | 487,200 | |

Fairpoint Communications, Inc.*+ | | | 175,000 | | | | 1,461,250 | |

HickoryTech Corp. | | | 24,900 | | | | 264,687 | |

Lumos Networks Corp. | | | 45,500 | | | | 778,050 | |

| | | | | | | | |

| | | | | | | 2,991,187 | |

| |

Electrical Equipment - 1.06% | |

Coleman Cable, Inc. | | | 41,000 | | | | 740,460 | |

Lihua International, Inc.*+ | | | 115,800 | | | | 556,998 | |

Orion Energy Systems, Inc.* | | | 42,000 | | | | 104,160 | |

| | | | | | | | |

| | | | | | | 1,401,618 | |

| |

Electronic Equipment, Instruments & Components - 1.84% | |

Agilysys, Inc.* | | | 41,800 | | | | 471,922 | |

PC Connection, Inc. | | | 48,500 | | | | 749,325 | |

PCM, Inc.* | | | 33,700 | | | | 323,520 | |

Perceptron, Inc. | | | 111,700 | | | | 881,313 | |

| | | | | | | | |

| | | | | | | 2,426,080 | |

| |

Energy Equipment & Services - 0.52% | |

Global Geophysical Services, Inc.* | | | 50,172 | | | | 236,812 | |

North American Energy Partners, Inc.* | | | 105,100 | | | | 444,573 | |

| | | | | | | | |

| | | | | | | 681,385 | |

| |

Food & Staples Retailing - 1.62% | |

Nash Finch Co. | | | 53,400 | | | | 1,175,334 | |

Susser Holdings Corp.* | | | 20,100 | | | | 962,388 | |

| | | | | | | | |

| | | | | | | 2,137,722 | |

| | | | | | | | |

| Industry Company | | Shares | | | Value | |

| | | | | | | | |

Food Products - 1.40% | |

John B. Sanfilippo & Son, Inc. | | | 49,700 | | | | $1,001,952 | |

Omega Protein Corp.* | | | 93,600 | | | | 840,528 | |

SkyPeople Fruit Juice, Inc.* | | | 3,282 | | | | 6,400 | |

| | | | | | | | |

| | | | | | | 1,848,880 | |

|

Health Care Equipment & Supplies - 1.39% | |

CryoLife, Inc. | | | 105,300 | | | | 659,178 | |

Fonar Corp.* | | | 9,900 | | | | 64,944 | |

Kewaunee Scientific Corp. | | | 10,000 | | | | 126,500 | |