SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT (NO. )

UNDER

THE SECURITIES ACT OF 1933

Pre-Effective Amendment No.

Post-Effective Amendment No.

MASSMUTUAL SELECT FUNDS

(Exact Name of Registrant as Specified in Declaration of Trust)

1295 State Street, Springfield, Massachusetts 01111

(413) 788-8411

Name and Address of Agent for Service

Andrew M. Goldberg, Esq.

Assistant Secretary

MassMutual Select Funds

1295 State Street

Springfield, Massachusetts 01111

Copy to:

Timothy W. Diggins, Esq.

Ropes & Gray LLP

One International Place

Boston, MA 02110

TITLE OF SECURITIES BEING REGISTERED:

Class S, Y, L, A and N Shares of the MassMutual Select Blue Chip Growth Fund, a series of the Registrant.

Approximate date of proposed public offering: As soon as practicable after this Registration Statement becomes effective.

It is proposed that this filing will become effective on October 14, 2007 pursuant to Rule 488.

An indefinite amount of the Registrant’s securities has been registered under the Securities Act of 1933 pursuant to Rule 24f-2 under the Investment Company Act of 1940. In reliance upon such Rule, no filing fee is being paid at this time.

MASSMUTUAL SELECT FUNDS

1295 State Street

Springfield, Massachusetts 01111

Acquisition of MassMutual Select Growth Equity Fund by MassMutual Select Blue Chip Growth Fund

PROSPECTUS/INFORMATION STATEMENT

October 14, 2007

The Board of Trustees (“Trustees”) of the MassMutual Select Funds (“Select Funds” or the “Trust”) are distributing this Prospectus/Information Statement in connection with the merger of the MassMutual Select Growth Equity Fund (“Growth Equity Fund”) into the MassMutual Select Blue Chip Growth Fund (“Blue Chip Growth Fund” and, together with the Growth Equity Fund, the “Funds”) (the “Merger”). This Prospectus/Information Statement is being delivered to shareholders of record as of August 31, 2007 on or about October 18, 2007.

The Trust is distributing this Prospectus/Information Statement solely for your information in connection with action to be taken by Massachusetts Mutual Life Insurance Company (“MassMutual”) (in its capacity as the majority shareholder of the Growth Equity Fund, the “Majority Shareholder”). The Majority Shareholder anticipates approving the Merger by written consent on or about a date that is 20 days following the date of this Prospectus/Information Statement, or as soon thereafter as practicable. THE TRUSTEES ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND A PROXY.

The Funds are diversified series of the Trust and are located at 1295 State Street, Springfield, Massachusetts 01111; 1-888-309-3539. As a result of the Merger, each shareholder of the Growth Equity Fund will receive shares of the Blue Chip Growth Fund equal in value at the date of the exchange to the value of the shareholder’s Growth Equity Fund shares. This Prospectus/Information Statement explains concisely what you should know regarding the Merger and about the Blue Chip Growth Fund. Please read this Prospectus/Information Statement and keep it for future reference.

This document is required under the federal securities laws and is provided solely for informational purposes.

The following documents have been filed with the Securities and Exchange Commission (the “SEC”) and are incorporated into this Prospectus/Information Statement by reference to the extent they contain information about the Growth Equity Fund or Blue Chip Growth Fund:

(i) the prospectus of the Select Funds, dated April 2, 2007, and supplemented July 16, 2007 (the “Select Prospectus”);

(ii) the statement of additional information of the Select Funds, dated April 2, 2007 (the “Select SAI”);

(iii) the Report of Independent Registered Public Accounting Firm and financial statements included in the Select Funds’ Annual Report to Shareholders for the fiscal year ended December 31, 2006; and

(iv) the financial statements included in the Select Funds’ Semi-Annual Report to Shareholders for the period ended June 30, 2007.

Shareholders may obtain free copies of any of the above, request other information about the Funds, or make shareholder inquiries, by calling toll-free at 1-888-309-3539, or by writing to the Trust at 1295 State Street, Springfield, Massachusetts 01111-0111.

You may review and copy information about the Funds, including the statement of additional information, at the SEC’s public reference room in Washington, D.C. You may call the SEC at 1-202-942-8090 for information about the operation of the public reference room. You may obtain copies of this information, with

1

payment of a duplication fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, Washington, D.C. 20549-0102. You may also access reports and other information about the Funds on the EDGAR database on the SEC’s Internet site at http://www.sec.gov.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION NOR HAS THE SECURITIES AND EXCHANGE COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS/INFORMATION STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS NOT CONTAINED IN THIS PROSPECTUS/INFORMATION STATEMENT IN CONNECTION WITH THE OFFER MADE BY THIS PROSPECTUS/INFORMATION STATEMENT AND, IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATIONS MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY MASSMUTUAL SELECT FUNDS. THIS PROSPECTUS/INFORMATION STATEMENT DOES NOT CONSTITUTE AN OFFERING BY MASSMUTUAL SELECT FUNDS IN ANY JURISDICTION IN WHICH SUCH OFFERING MAY NOT LAWFULLY BE MADE.

2

TABLE OF CONTENTS

3

I. Synopsis

The following provides an overview of key points regarding the Merger. This information is qualified in its entirety by the remainder of the Prospectus/Information Statement, which contains additional information and further details regarding the Merger.

1. Overview of the Merger

The Trustees of the Growth Equity Fund unanimously approved the Merger on behalf of the Growth Equity Fund, subject to the approval of a majority of the Fund’s shareholders. The Majority Shareholder of the Growth Equity Fund has indicated that it will approve the Merger, which will be accomplished pursuant to an Agreement and Plan of Reorganization (the “Agreement”), attached hereto as Exhibit 1. After the Majority Shareholder approves the Merger, pursuant to the Agreement, all of the assets of the Growth Equity Fund will be transferred to the Blue Chip Growth Fund in exchange for shares of the Blue Chip Growth Fund (the “Merger Shares”) with a value equal to the value of the Growth Equity Fund’s assets net of liabilities, and for the assumption by the Blue Chip Growth Fund of all of the liabilities of the Growth Equity Fund. Immediately following the transfer, the Merger Shares received by the Growth Equity Fund will be distributed to its shareholders, pro rata, with the holders of each class of shares receiving shares of the same class of the Blue Chip Growth Fund in accordance with such shareholders’ percentage ownership interest in such class of shares of the Growth Equity Fund on the closing date, which is anticipated to be on or about November 16, 2007. The Growth Equity Fund will then be liquidated and dissolved.

It is intended that, as a result of the Merger, each shareholder of the Growth Equity Fund will receive, without paying any sales charges and on a tax-free basis (for federal income tax purposes), a number of full and fractional Class S, Y, L, A or N shares, as the case may be, of the Blue Chip Growth Fund with an aggregate net asset value equal to the aggregate net asset value of the Class S, Y, L, A or N shares of the Growth Equity Fund held by such shareholder immediately prior to the closing of the Merger.

By approving the Agreement, the Majority Shareholder of the Growth Equity Fund is approving the Merger, including the liquidation and dissolution of the Growth Equity Fund.

2. Rationale for the Merger

MassMutual, the investment adviser to the Trust (in such capacity, the “Adviser”), believes the Merger offers shareholders of the Growth Equity Fund the opportunity to invest in a larger fund with similar investment policies to those of the Growth Equity Fund, and a greater potential to achieve economies of scale. In addition, MassMutual believes the Merger will provide shareholders of the Growth Equity Fund access to a new sub-adviser that has a strong track record of consistent performance.

The Trustees of the Growth Equity Fund have carefully considered MassMutual’s recommendations. Following a review of the anticipated benefits and costs of the merger to the shareholders of the Growth Equity Fund, the Trustees of the Growth Equity Fund, including the Trustees who are not “interested persons” of the Select Funds or MassMutual (as such term is defined in the Investment Company Act of 1940, as amended, (the “1940 Act”) (the “Independent Trustees”)), unanimously determined that the merger is in the best interest of the shareholders of the Growth Equity Fund. For a discussion of the Trustees’ deliberations, see “Information about the Merger—Trustees’ Considerations Relating to the Merger.”

3. Comparison of the investment objectives, principal investment strategies and policies of the Growth Equity Fund with those of the Blue Chip Growth Fund

The investment objectives of the Funds are similar. The Growth Equity Fund seeks long-term growth of capital and future income as its fundamental objective, while the Blue Chip Growth Fund seeks growth of capital

4

over the long term as its fundamental objective. While there are differences in the investment process, Grantham, Mayo, Van Otterloo & Co. LLC (“GMO”), the sub-adviser to the Growth Equity Fund, and T. Rowe Price Associates, Inc. (“T. Rowe Price”), the sub-adviser to the Blue Chip Growth Fund, each seek to identify high quality growth stocks and to construct a broadly diversified portfolio. Although the principal investment strategies of the Funds are similar, there are differences. For example, the Growth Equity Fund seeks to achieve its objective by normally investing at least 80% of its net assets in the common stocks and securities convertible into common stocks of companies which GMO believes offer prospects for long-term growth. GMO uses fundamental investment principles and quantitative applications to provide broad exposure to the large capitalization growth sector of the U.S. equity market. The Blue Chip Growth Fund seeks to achieve its objective by normally investing at least 80% of its net assets in the common stocks of large and medium-sized blue chip growth companies. T. Rowe Price believes bottom-up, fundamental research is key to identifying successful long-term investments. Please see the table below for more information comparing the investment objectives and strategies of the Funds.

This table shows the investment objective and principal investment strategies of each Fund. For more detail regarding the investment objective, strategies and policies of the Blue Chip Growth Fund, see Appendix B.

| | |

GROWTH EQUITY FUND | | BLUE CHIP GROWTH FUND |

Investment Objectives |

| This Fund seeks long-term growth of capital and future income. | | This Fund seeks growth of capital over the long term. |

Principal Investment Strategies |

The Fund seeks to achieve its objective by normally investing at least 80% of its net assets in the common stocks and securities convertible into common stocks of companies which the Fund’s Sub-Adviser, Grantham, Mayo, Van Otterloo & Co. LLC (“GMO”), believes offer prospects for long-term growth. GMO uses proprietary research and multiple quantitative models to identify stocks it believes are undervalued and stocks in the growth universe it believes have improving fundamentals. Generally, these stocks are trading at prices below what GMO believes to be their intrinsic value. GMO also uses proprietary techniques to adjust the portfolio for factors such as stock selection discipline, industry and sector weight, and market capitalization. The factors considered by GMO and the models may change over time. The Fund intends to be fully invested, and generally will not take temporary defensive positions through investment in cash and high quality money market instruments. In pursuing its investment strategy, the Fund may (but is not obligated to) use a wide variety of exchange-traded and over-the-counter derivative instruments, including options, futures, and swap contracts to (i) hedge equity exposure; (ii) replace | | The Fund seeks to achieve its objective by normally investing at least 80% of net assets in the common stocks of large and medium-sized blue chip growth companies. These are firms that, in the view of the Fund’s Sub-Adviser, T. Rowe Price Associates, Inc. (“T. Rowe Price”), are well established in their industries and have the potential for above-average earnings growth. The Sub-Adviser focuses on companies with leading market position, seasoned management, and strong financial fundamentals. The investment approach reflects the Sub-Adviser’s belief that solid company fundamentals (with emphasis on strong growth in earnings per share or operating cash flow) combined with a positive industry outlook will ultimately reward investors with strong investment performance. Some of the companies targeted will have good prospects for dividend growth. In pursuing its investment objective, the Fund’s Sub-Adviser has the discretion to purchase some securities that do not meet its normal investment criteria, as described above, when it perceives an unusual opportunity for gain. These special situations might arise when the Fund’s Sub-Adviser believes a security could increase in value for a variety of reasons, including a change in management, an extraordinary corporate event, or a temporary imbalance in the supply of or demand for the securities. |

5

| | |

| direct investing (e.g., creating equity exposure through the use of futures contracts or other derivative instruments); and (iii) manage risk by implementing shifts in investment exposure. | | While most assets will be invested in U.S. common stocks, other securities may also be purchased, including foreign stocks, futures, and options, in keeping with Fund objectives. The Fund’s investments in foreign securities are limited to 20% of its total assets. The Fund may sell securities for a variety of reasons, such as to secure gains, limit losses, or redeploy assets into more promising opportunities. |

The Growth Equity Fund and the Blue Chip Growth Fund each has adopted certain “fundamental” policies, which cannot be changed without the approval of a majority of the outstanding voting securities of the applicable Fund, as such term is defined in the 1940 Act; other investment policies can be changed without shareholder approval (“non-fundamental” policies). The Funds generally have similar investment policies, but there are differences. The table below compares the fundamental investment policies of the Funds. See Appendix A for a discussion of the Funds’ non-fundamental investment policies.

| | |

GROWTH EQUITY FUND | | BLUE CHIP GROWTH FUND |

Diversification |

The Trust may not, on behalf of the Fund, purchase any security (other than U.S. Treasury securities or U.S. Government Securities) if as a result, with respect to 75% of the Fund’s assets, more than 5% of the value of the total assets (determined at the time of investment) of the Fund would be invested in the securities of a single issuer. The Trust may not, on behalf of the Fund, purchase any security (other than securities issued, guaranteed or sponsored by the U.S. Government or its agencies or instrumentalities) if, as a result, the Fund would hold more than 10% of the outstanding voting securities of an issuer. This restriction is applicable to 75% of the assets of the Fund. | | The Fund may not with respect to 75% of the Fund’s total assets, purchase the securities of any issuer (other than securities issued or guaranteed by the U.S. Government or any of its agencies or instrumentalities, or securities of other investment companies) if, as a result, (a) more than 5% of the Fund’s total assets would be invested in the securities of that issuer, or (b) the Fund would hold more than 10% of the voting securities of that issuer. |

Borrowing |

| The Trust may not, on behalf of the Fund, borrow money, except from banks for temporary or emergency purposes not in excess of one-third of the value of the Fund’s assets, except that the Fund may enter into reverse repurchase agreements or roll transactions. For purposes of calculating this limitation, entering into portfolio lending agreements shall not be deemed to constitute borrowing money. The Fund would not make any additional investments while its borrowings exceeded 5% of its assets. | | The Fund may not borrow money, except that the Fund may borrow money for temporary or emergency purposes (not for leveraging or investment) in an amount not exceeding 33 1/3 of its total assets (including the amount borrowed) less liabilities (other than borrowings). Any borrowings that come to exceed this amount will be reduced within three days (not including Sundays and holidays) to the extent necessary to comply with the 33 1/3% limitation. |

Senior Securities |

| The Trust may not, on behalf of the Fund, issue senior securities (as defined in the 1940 Act) except for securities representing indebtedness not prevented by the above-referenced restriction on borrowing. | | The Fund may not issue senior securities, except as permitted under the Investment Company Act of 1940, as amended. |

6

| | |

Short Sales |

| The Trust may not, on behalf of the Fund, make short sales, except for sales “against-the-box.” | | None. |

Underwriting |

| The Trust may not, on behalf of the Fund, act as an underwriter, except to the extent that, in connection with the disposition of portfolio securities, the Fund may be deemed an underwriter under applicable laws. | | The Fund may not underwrite securities issued by others, except to the extent that the Fund may be considered an underwriter within the meaning of the Securities Act of 1933 in the disposition of restricted securities or in connection with investments in other investment companies. |

Real Estate |

| The Trust may not, on behalf of the Fund, invest in oil, gas or other mineral leases, rights, royalty contracts or exploration or development programs, real estate or real estate mortgage loans. This restriction does not prevent the Fund from purchasing readily marketable securities secured or issued by companies investing or dealing in real estate and by companies that are not principally engaged in the business of buying and selling such leases, rights, contracts or programs. | | The Fund may not purchase or sell real estate unless acquired as a result of ownership of securities or other instruments (but this shall not prevent the Fund from investing in securities or other instruments backed by real estate or securities of companies engaged in the real estate business). |

Commodities |

| The Trust may not, on behalf of the Fund, purchase physical commodities or commodity contracts (except futures contracts, including but not limited to contracts for the future delivery of securities and futures contracts based on securities indices). | | The Fund may not purchase or sell physical commodities unless acquired as a result of ownership of securities or other instruments (but this shall not prevent the Fund from purchasing or selling options and futures contracts or from investing in securities or other instruments backed by physical commodities). |

Lending |

The Trust may not, on behalf of the Fund, make loans other than by investing in obligations in which the Fund may invest consistent with its investment objective and policies and other than repurchase agreements and loans of portfolio securities. The Trust may not, on behalf of the Fund, pledge, mortgage or hypothecate assets taken at market to an extent greater than 15% of the total assets of the Fund except in connection with permitted transactions in options, futures contracts and options on futures contracts, reverse repurchase agreements and securities lending. | | The Fund may not lend any security or make any loan if, as a result, more than 33 1/3% of its total assets would be lent to other parties, but this limitation does not apply to purchases of debt securities or to repurchase agreements, or to acquisitions of loans, loan participations or other forms of debt instruments. |

7

| | |

Concentration |

| The Trust may not, on behalf of the Fund, acquire securities of issuers in any one industry (as determined by the Board of Trustees of the Trust) if as a result 25% or more of the value of the total assets | | The Fund may not purchase the securities of any issuer (other than securities issued or guaranteed by the U.S. government or any of its agencies or instrumentalities), if, as a result, more than 25% of |

of the Fund would be invested in such industry, with the following exception: (a) There is no limitation for securities issued or guaranteed by the U.S. government or its agencies and instrumentalities. | | the Fund’s total assets would be invested in companies whose principal business activities are in the same industry. |

Pooled Funds |

| None. | | The Fund may, notwithstanding any other fundamental policy or limitation, invest all of its assets in the securities of a single open-end management investment company managed by the Fund’s sub-adviser or an affiliate or successor with substantially the same fundamental investment objective, policies and limitations as the Fund. |

Comparison of Fees and Expenses of the Funds and Estimated Fees and Expenses Following the Merger

The following tables are intended to help you compare the fees and expenses of the Growth Equity Fund and the Blue Chip Growth Fund and to analyze the estimated expenses that MassMutual expects the combined Fund to bear in the first year following the Merger. The tables show the fees and expenses that each of the Funds incurred for its most recent fiscal year ended December 31, 2006, as well as the pro forma fees and expenses that MassMutual expects the Blue Chip Growth Fund would have incurred during the twelve months ended December 31, 2006, assuming consummation of the Merger as of January 1, 2006. Shareholders of the Growth Equity Fund will not pay a sales charge in connection with the Merger, although contingent deferred sales charges will continue to apply. For purposes of determining the contingent deferred sales charge applicable to Growth Equity Fund shareholders as a result of the Merger, the amount of time that the shareholder held his or her Growth Equity Fund shares will be added, or tacked, to the length of time the shareholder held Blue Chip Growth Fund shares acquired in the Merger.

Shareholder Fees (fees paid directly from your investment)

| | | | |

| | | Maximum Sales

Charge (Load)

on purchases (as a

% of offering price) | | Maximum Deferred Sales

Charge (Load) (as a % of

the lower of the original

offering price or

redemption proceeds) |

Growth Equity Fund | | | | |

Class S | | NONE | | NONE |

Class Y | | NONE | | NONE |

Class L | | NONE | | NONE |

Class A | | 5.75% | | NONE(1) |

Class N | | NONE | | 1.00%(2) |

| | |

Blue Chip Growth Fund | | | | |

Class S | | NONE | | NONE |

Class Y | | NONE | | NONE |

Class L | | NONE | | NONE |

Class A | | 5.75% | | NONE(1) |

Class N | | NONE | | 1.00%(2) |

8

| | | | |

| | | Maximum Sales

Charge (Load)

on purchases (as a

% of offering price) | | Maximum Deferred Sales

Charge (Load) (as a % of

the lower of the original

offering price or

redemption proceeds) |

| | |

Blue Chip Growth Fund (pro forma combined) | | | | |

Class S | | NONE | | NONE |

Class Y | | NONE | | NONE |

Class L | | NONE | | NONE |

Class A | | 5.75% | | NONE(1) |

Class N | | NONE | | 1.00%(2) |

Annual Fund Operating Expenses

(expenses that are deducted from Fund assets) (% of average net assets)

| | | | | | | | | | | | | | | | | |

| | | Management

Fees | | | Distribution

and Service

(Rule 12b-1)

Fees | | Other

Expenses(3) | | | Total Annual

Fund Operating

Expenses(4) | | | Less Expense

Reimbursement | | | Net Fund

Expenses(7) | |

Growth Equity Fund | | | | | | | | | | | | | | | | | |

Class S | | 0.68 | % | | NONE | | 0.11 | % | | 0.79 | % | | NONE | | | 0.79 | % |

Class Y | | 0.68 | % | | NONE | | 0.17 | % | | 0.85 | % | | NONE | | | 0.85 | % |

Class L | | 0.68 | % | | NONE | | 0.32 | % | | 1.00 | % | | NONE | | | 1.00 | % |

Class A | | 0.68 | % | | 0.25% | | 0.32 | % | | 1.25 | % | | NONE | | | 1.25 | % |

Class N | | 0.68 | % | | 0.50% | | 0.37 | % | | 1.55 | % | | NONE | | | 1.55 | % |

Blue Chip Growth Fund | | | | | | | | | | | | | | | | | |

Class S | | 0.70 | % | | NONE | | 0.19 | % | | 0.89 | % | | (0.10% | )(5) | | 0.79 | % |

Class Y | | 0.70 | % | | NONE | | 0.30 | % | | 1.00 | % | | (0.10% | )(5) | | 0.90 | % |

Class L | | 0.70 | % | | NONE | | 0.44 | % | | 1.14 | % | | (0.10% | )(5) | | 1.04 | % |

Class A | | 0.70 | % | | 0.25% | | 0.44 | % | | 1.39 | % | | (0.10% | )(5) | | 1.29 | % |

Class N | | 0.70 | % | | 0.50% | | 0.49 | % | | 1.69 | % | | (0.10% | )(5) | | 1.59 | % |

| | | | |

Blue Chip Growth Fund (pro forma combined) | | | | | | | | | | | | |

Class S | | 0.65 | % | | NONE | | 0.18 | % | | 0.83 | % | | (0.07% | ) | | 0.76 | %(6) |

Class Y | | 0.65 | % | | NONE | | 0.31 | % | | 0.96 | % | | (0.14% | ) | | 0.82 | %(6) |

Class L | | 0.65 | % | | NONE | | 0.43 | % | | 1.08 | % | | (0.10% | ) | | 0.98 | %(6) |

Class A | | 0.65 | % | | 0.25% | | 0.43 | % | | 1.33 | % | | (0.14% | ) | | 1.19 | %(6) |

Class N | | 0.65 | % | | 0.50% | | 0.48 | % | | 1.63 | % | | (0.12% | ) | | 1.51 | %(6) |

| (1) | A contingent deferred sales charge may apply to shares redeemed within 18 months of purchase from initial investments of $1 million or more. |

| (2) | Applies to shares redeemed within 18 months of purchase. |

| (3) | Other Expenses include Acquired Fund fees and expenses, which represent approximate expenses borne indirectly by the Fund in its most recent fiscal year through investments in other pooled investment vehicles. The amount of Acquired Fund fees and expenses may change in the coming year due to a number of factors including, among others, a change in allocation of the Fund’s investments among other pooled investment vehicles. |

| (4) | Because Total Annual Fund Operating Expenses include Acquired Fund fees and expenses, they may not correspond to the ratios of expenses to average daily net assets shown in the “Financial Highlights” tables in the Fund’s prospectus, which reflect the operating expenses of the Fund and do not include Acquired Fund fees and expenses. |

| (5) | The expenses in the above table reflect a written agreement by MassMutual to waive .10% of the management fee of the Blue Chip Growth Fund through March 31, 2008. The agreement cannot be terminated unilaterally by MassMutual. |

9

| (6) | The expenses in the above table reflect a written agreement by MassMutual to cap the fees and expenses of the Blue Chip Growth Fund (other than extraordinary litigation and legal expenses, or other non-recurring or unusual expenses), excluding Acquired Fund fees and expenses, through March 31, 2010 to the extent that Net Fund Expenses would otherwise exceed 0.76%, 0.82%, 0.98%, 1.19% and 1.51% for Classes S, Y, L, A and N, respectively. The agreement cannot be terminated unilaterally by MassMutual. |

| (7) | Employee benefit plans which invest in the Fund through MassMutual separate investment accounts may pay additional charges under their group annuity contract or services agreement. Investors who purchase shares directly from the Fund may also be subject to charges imposed in their administrative services or other agreement with MassMutual or MassMutual affiliate. None of these charges are deducted from Fund assets. |

Examples

These examples are intended to help you compare the cost of investing in the Growth Equity Fund with the cost of investing in the Blue Chip Growth Fund both for the fiscal year set forth above and on a pro forma basis, and also allow you to compare this with the cost of investing in other mutual funds. The examples assume that you invest $10,000 in each share class of the Funds for the time periods indicated and then, except as shown for Class N shares, redeem all of your shares at the end of those periods. For Class A shares, the examples include the initial sales charge. The examples also assume that your investment earns a 5% return each year and that the Funds’ operating expenses are exactly as described in the preceding table and assume reinvestment of all dividends and distributions. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | | | | | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

Growth Equity Fund | | | | | | | | | | | | |

Class S | | $ | 81 | | $ | 252 | | $ | 439 | | $ | 978 |

Class Y | | $ | 87 | | $ | 271 | | $ | 471 | | $ | 1,049 |

Class L | | $ | 102 | | $ | 318 | | $ | 552 | | $ | 1,225 |

Class A | | $ | 695 | | $ | 949 | | $ | 1,222 | | $ | 1,999 |

Class N (assuming redemption at end of each period) | | $ | 261 | | $ | 490 | | $ | 845 | | $ | 1,845 |

Class N (no redemption) | | $ | 158 | | $ | 490 | | $ | 845 | | $ | 1,845 |

| | | | |

Blue Chip Growth Fund | | | | | | | | | | | | |

Class S | | $ | 81 | | $ | 274 | | $ | 483 | | $ | 1,087 |

Class Y | | $ | 92 | | $ | 308 | | $ | 543 | | $ | 1,216 |

Class L | | $ | 106 | | $ | 352 | | $ | 618 | | $ | 1,377 |

Class A | | $ | 699 | | $ | 980 | | $ | 1,283 | | $ | 2,139 |

Class N (assuming redemption at end of each period) | | $ | 265 | | $ | 523 | | $ | 908 | | $ | 1,989 |

Class N (no redemption) | | $ | 162 | | $ | 523 | | $ | 908 | | $ | 1,989 |

| | | | |

Blue Chip Growth Fund (pro forma combined) | | | | | | | | | | | | |

Class S | | $ | 78 | | $ | 247 | | $ | 443 | | $ | 1,009 |

Class Y | | $ | 84 | | $ | 271 | | $ | 497 | | $ | 1,146 |

Class L | | $ | 100 | | $ | 319 | | $ | 571 | | $ | 1,295 |

Class A | | $ | 689 | | $ | 940 | | $ | 1,230 | | $ | 2,055 |

Class N (assuming redemption at end of each period) | | $ | 257 | | $ | 485 | | $ | 858 | | $ | 1,907 |

Class N (no redemption) | | $ | 154 | | $ | 485 | | $ | 858 | | $ | 1,907 |

Historic investment performance of the Funds

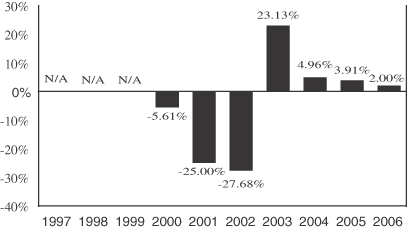

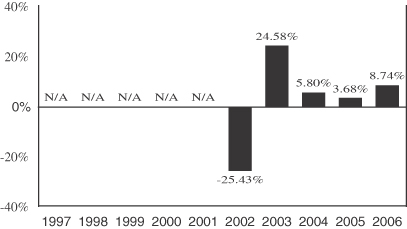

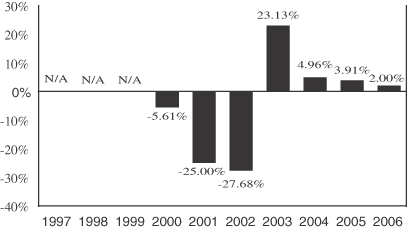

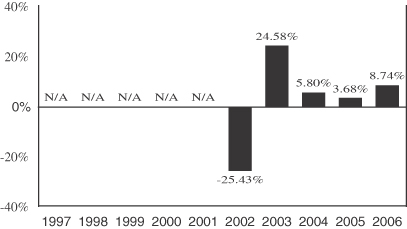

The charts and tables below provide some indication of the risks of investing in the Growth Equity Fund and the Blue Chip Growth Fund by showing changes in each Fund’s performance from year to year, and by comparing each Fund’s returns with those of a broad measure of market performance. The first chart shows

10

changes in the performance of the Growth Equity Fund’s Class S Shares; and the second chart shows changes in the performance of the Blue Chip Growth Fund’s Class S Shares. Sales charges and taxes are not reflected in the returns in these bar charts. If sales charges and taxes were reflected, the returns would be lower than those shown. Class S shares represent an investment in the same portfolio of securities as Class Y, L, A and N shares. Annual returns would differ to the extent the different classes do not have the same expenses as Class S shares.

Past performance is not necessarily an indication of future results. It is possible to lose money on an investment in either of the Funds. Neither Fund may achieve its investment objective. Each Fund’s performance after the period shown may differ significantly from its performance during such period. No assurance can be given that the Blue Chip Growth Fund will achieve any particular level of performance after the Merger.

Annual Performance(1)

Growth Equity Fund—Class S Shares

During the periods shown above, the highest quarterly return for the Fund was 14.88% for the quarter ended June 30, 2003 and the lowest quarterly return was -21.36% for the quarter ended September 30, 2001.

Year-to-date performance through June 30, 2007 was 5.19% for the Growth Equity Fund’s Class S shares.

Blue Chip Growth Fund—Class S Shares

| (1) | Performance shown does not reflect fees that may be paid by investors for administrative services or group annuity contract charges. |

11

During the periods shown above, the highest quarterly return for the Fund was 13.21% for the quarter ended June 30, 2003 and the lowest quarterly return was -16.12% for the quarter ended September 30, 2002.

Year-to-date performance through June 30, 2007 was 8.78% for the Blue Chip Growth Fund’s Class S shares.

Average Annual Total Returns(1)

(for the periods ended December 31, 2006)

The table is intended to show the risk of investing in the Growth Equity Fund by comparing the Fund’s returns with a broad measure of market performance over different time periods. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown for only Class S and after-tax returns for other classes will vary.

Growth Equity Fund

| | | | | | | | | |

| | | One

Year | | | Five

Years | | | Since

Inception

(5/3/99) | |

Return Before Taxes—Class S | | 2.00 | % | | -0.19 | % | | -1.24 | % |

Return After Taxes on Distributions—Class S | | 1.90 | % | | -0.24 | % | | -1.66 | % |

Return After Taxes on Distributions and Sale of Fund Shares—Class S | | 1.43 | % | | -0.16 | % | | -1.25 | % |

Return Before Taxes—Class Y | | 1.88 | % | | -0.26 | % | | -1.32 | % |

Return Before Taxes—Class L | | 1.80 | % | | -0.40 | % | | -1.44 | % |

Return Before Taxes—Class A(2) | | -4.33 | % | | -1.82 | % | | -2.44 | % |

Return Before Taxes—Class N(2) | | 0.27 | % | | -0.95 | % | | -2.00 | % |

| | | | | | | | | |

Russell 1000® Growth Index(3) | | 9.07 | % | | 2.69 | % | | -1.63 | % |

S&P 500® Index(4)(5) | | 15.78 | % | | 6.19 | % | | 2.41 | % |

12

The table below to intended to show the risk of investing in the Blue Chip Growth Fund by comparing the Fund’s returns with a broad measure of market performance over different time periods. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown for only Class S and after-tax returns for other classes will vary.

Blue Chip Growth Fund

| | | | | | | | | |

| | | One

Year | | | Five

Years | | | Since

Inception (6/1/01) | |

Return Before Taxes—Class S | | 8.74 | % | | 2.07 | % | | 0.15 | % |

Return After Taxes on Distributions—Class S | | 8.69 | % | | 2.02 | % | | 0.10 | % |

Return After Taxes on Distributions and Sale of Fund Shares—Class S | | 5.74 | % | | 1.76 | % | | 0.12 | % |

Return Before Taxes—Class Y | | 8.64 | % | | 1.93 | % | | 0.02 | % |

Return Before Taxes—Class L | | 8.52 | % | | 1.81 | % | | -0.10 | % |

Return Before Taxes—Class A(2) | | 1.99 | % | | 0.36 | % | | -1.42 | % |

Return Before Taxes—Class N(2) | | 6.96 | % | | 1.24 | % | | -0.68 | % |

| | | | | | | | | |

Russell 1000 Growth Index(3) | | 9.07 | % | | 2.69 | % | | 0.62 | % |

S&P 500 Index(4)(5) | | 15.78 | % | | 6.19 | % | | 3.99 | % |

| (1) | Performance shown does not reflect fees that may be paid by investors for administrative services or group annuity contract charges. |

| (2) | Performance for Class A shares of the Fund reflects any applicable sales charge. Performance for Class N shares of the Fund prior to December 31, 2002 is based on Class A shares, adjusted to reflect Class N expenses, and also reflects any applicable sales charge. |

(3) | The Russell 1000® Growth Index is an unmanaged index consisting of those Russell 1000 securities (representing the 1000 largest U.S. companies based on market capitalization) with greater than average growth orientation that tend to exhibit higher price-to-book ratios and forecasted growth values than securities in the value universe. The Index does not incur expenses or reflect any deduction for taxes and cannot be purchased directly by investors. |

(4) | The S&P 500® Index is a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies. The Index does not incur expenses or reflect any deduction for taxes and cannot be purchased directly by investors. |

| (5) | Going forward, the Fund’s performance will be compared to the Russell 1000 Growth Index rather than the S&P 500 Index because the Russell 1000 Growth Index more closely represents the Fund’s investment strategy. The Fund will retain the S&P 500 Index as its supplemental benchmark for performance comparisons. |

It is expected that Blue Chip Growth Fund will be the accounting successor in the Merger; therefore, its historical performance would carry over to the combined Fund for accounting purposes after the Merger.

Investment Adviser and Sub-Advisers

MassMutual and GMO serve as the investment adviser and sub-adviser, respectively, to the Growth Equity Fund. MassMutual and T. Rowe Price serve as the investment adviser and sub-adviser, respectively, to the Blue Chip Growth Fund. Upon completion of the Merger, MassMutual and T. Rowe Price will continue to serve as the investment adviser and sub-adviser, respectively, to the Blue Chip Growth Fund. Larry J. Puglia will continue to serve as the portfolio manager for the Blue Chip Growth Fund. Please see “Additional Information about the Blue Chip Growth Fund” in Appendix B and the SAI.

13

Shareholder Information Regarding Share Classes, Dividends, Purchases and Redemptions

Shareholders of the Growth Equity Fund will receive Class S, Y, L, A or N shares of the Blue Chip Growth Fund, respectively, in return for their Class S, Y, L, A or N shares of the Growth Equity Fund. Shareholder policies and procedures, including exchange rights and distribution, purchase and redemption procedures, are identical for the two Funds. Please see “Additional Information about the Blue Chip Growth Fund” in Appendix B and the SAI.

Federal income tax consequences of the Merger

For federal income tax purposes, the merger of the Growth Equity Fund into the Blue Chip Growth Fund, although not free from doubt, is expected to be a tax-free reorganization. Accordingly, no gain or loss is expected to be recognized by the Growth Equity Fund or its shareholders directly as a result of the merger. At any time before the consummation of the merger, a shareholder may redeem shares, likely resulting in recognition of gain or loss to such shareholder for federal income tax purposes. Certain other tax consequences are discussed below under “Information about the Merger—Federal Income Tax Consequences.”

II. Principal Risks of an Investment in the Blue Chip Growth Fund and Comparison to Risks of Investing in the Growth Equity Fund

Because the Funds have similar investment objectives and strategies, the risks of an investment in the Blue Chip Growth Fund are generally similar to the risks of an investment in the Growth Equity Fund. The main risks that could adversely affect the value of the Blue Chip Growth Fund’s shares and the total return on your investment include:

Market Risk. Market risk arises since stock prices can fall for any number of factors, including general economic and market conditions, real or perceived changes in the prospects of the security’s issuer, changing interest rates and real or perceived economic and competitive industry conditions. The Blue Chip Growth Fund maintains substantial exposure to equities and does not attempt to time the market. Because of this exposure, the possibility that stock market prices in general will decline over short or even extended periods subjects this Fund to unpredictable declines in the value of its shares, as well as periods of poor performance. Market risk also includes specific risks affecting the companies whose shares are purchased by the Blue Chip Growth Fund, such as management performance, financial leverage, industry problems and reduced demand for the issuer’s goods or services.

Credit Risk. This is the risk that the issuer or the guarantor of a debt security, or the counterparty to a derivatives contract or securities loan, will be unable or unwilling to make timely principal and/or interest payments, or to otherwise honor its obligations. There are varying degrees of credit risk, which are often reflected in credit ratings.

Management Risk. The Blue Chip Growth Fund is subject to management risk because the Fund is an actively managed investment portfolio. Management risk is the chance that poor security selection will cause the Blue Chip Growth Fund to underperform other funds with similar investment objectives. T. Rowe Price manages the Blue Chip Growth Fund according to the traditional methods of active investment management, which involves the buying and selling of securities based upon economic, financial and market analysis and investment judgment. T. Rowe Price applies its investment techniques and risk analyses in making investment decisions for the Blue Chip Growth Fund, but there can be no guarantee that it will produce the desired result.

Derivative Risk. The Blue Chip Growth Fund may, but will not necessarily, use derivatives, which are financial contracts whose values depend upon, or are derived from, the value of an underlying asset, reference rate or index. Derivatives may relate to stocks, bonds, interest rates, currencies, credit exposures, currency exchange rates, commodities, related indexes or other assets. The use of derivative instruments may involve risks

14

different from, or greater than, the risks associated with investing directly in securities and other more traditional investments. Derivatives are subject to a number of potential risks. Derivative products are highly specialized instruments that may require investment techniques and risk analyses different from those associated with stocks and bonds. The use of a derivative requires an understanding not only of the underlying instrument or index but also of the derivative itself, without the benefit of observing the performance of the derivative under all possible market conditions. (For example, successful use of a credit default swap may require, among other things, an understanding of both the credit of the company to which it relates and of the way the swap is likely to respond to changes in various market conditions and to factors specifically affecting the company.) The use of derivatives involves the risk that a loss may be sustained as a result of the failure of another party to the contract (typically referred to as a “counterparty”) to make required payments or otherwise to comply with the contract’s terms. Derivative transactions can create investment leverage and may be highly volatile. When a fund uses a derivative instrument, it could lose more than the principal amount invested. Since the values of derivatives are calculated and derived from the values of other assets, reference rates, or indexes, there is greater risk that derivatives will be improperly valued. Derivatives also involve the risk that changes in the value of the derivative may not correlate perfectly with the relevant assets, rates or indexes they are designed to hedge or to track closely, and the risk that a derivative transaction may not have the effect the fund’s investment adviser anticipated. Also, suitable derivative transactions may not be available in all circumstances, and there can be no assurance that a fund will engage in these transactions to reduce exposure to other risks when that would be beneficial. A liquid secondary market may not always exist for the fund’s derivative positions at any time. If a derivative transaction is particularly large or if the relevant market is illiquid (as is the case with many privately negotiated derivatives), it may not be possible to initiate a transaction or liquidate a position at an advantageous price. Use of derivatives may increase the amount of taxes payable by shareholders. Although the use of derivatives is intended to enhance a fund’s performance, it may instead reduce returns and increase volatility.

Growth Company Risk. Market risk is also particularly pronounced for “growth” companies. The prices of growth company securities may fall to a greater extent than the overall equity markets (represented by the S&P 500 Index) due to changing economic, political or market factors. Growth company securities tend to be more volatile in terms of price swings and trading volume. The Blue Chip Growth Fund generally has the greatest exposure to this risk. Growth companies, especially technology related companies, have seen dramatic rises and falls in stock valuations. The Blue Chip Growth Fund has the risk that the market may deem its stock prices over-valued, which could cause steep and/or volatile price swings. Also, since investors buy these stocks because of their expected superior earnings growth, earnings disappointments often result in sharp price declines.

Leveraging Risk. When a fund borrows money or otherwise leverages its portfolio, the value of an investment in that fund will be more volatile and all other risks will tend to be compounded. The Blue Chip Growth Fund may take on leveraging risk by investing collateral from securities loans, by using derivatives and by borrowing money to repurchase shares or to meet redemption requests. Leveraging may increase the assets on which the investment adviser’s fee is based.

In addition, the Blue Chip Growth Fund is subject to the following principal risks, which are not principal risks of the Growth Equity Fund;

Foreign Investment Risk. Funds investing in foreign securities may experience more rapid and extreme changes in value than funds which invest solely in U.S. companies. This is because the securities markets of many foreign countries are relatively small, with a limited number of companies representing a small number of industries. In addition, foreign companies are usually not subject to the same degree of regulation as U.S. companies. Reporting, accounting and auditing standards of foreign countries differ, in some cases significantly, from U.S. standards. Also, nationalization, expropriation or confiscatory taxation, currency blockage, political changes or diplomatic developments could adversely affect a fund’s non-U.S. investments. In the event of nationalization, expropriation or other confiscation, a fund could lose its entire investment. Economic downturns in certain regions, such as Southeast Asia, can also adversely affect other countries whose economies appear to be unrelated.

15

The Blue Chip Growth Fund may also invest in foreign securities known as American Depositary Receipts (“ADRs”), Global Depositary Receipts (“GDRs”) and European Depositary Receipts (“EDRs”). ADRs, GDRs and EDRs represent securities or a pool of securities of an underlying foreign or, in the case of GDRs and EDRs, U.S. or non-U.S. issuer. They are subject to many of the same risks as foreign securities. ADRs, GDRs and EDRs are more completely described in the Statement of Additional Information.

Currency Risk. The Blue Chip Growth Fund is subject to currency risk to the extent that it invests in securities of foreign companies that are traded in, and receive revenues in, foreign currencies. Currency risk is caused by uncertainty in foreign currency exchange rates. Fluctuations in the value of the U.S. dollar relative to foreign currencies may enhance or diminish returns that a U.S. investor would receive on foreign investments. The Blue Chip Growth Fund may, but will not necessarily, engage in foreign currency transactions in order to protect against fluctuations in the value of holdings denominated in or exposed to other currencies. Those currencies can decline in value relative to the U.S. dollar, or, in the case of hedging positions, the U.S. dollar can decline in value relative to the currency hedged. The Blue Chip Growth Fund’s investment in foreign currencies may increase the amount of ordinary income recognized by the Fund.

III. Information about the Merger

General. The Merger will be effected pursuant to an Agreement and Plan of Reorganization between the Funds. The form of the Agreement is attached to this Prospectus/Information Statement as Exhibit 1.

Although the term “merger” is used for ease of reference, the transaction is structured as a transfer of all of the assets of the Growth Equity Fund to the Blue Chip Growth Fund in exchange for the assumption by the Blue Chip Growth Fund of all of the liabilities of the Growth Equity Fund and for the issuance and delivery to the Growth Equity Fund of shares of each class of the Blue Chip Growth Fund equal in aggregate value to the net value of the assets attributable to shares of the corresponding class of the Growth Equity Fund transferred to the Blue Chip Growth Fund.

After receipt of the Merger Shares, the Growth Equity Fund will distribute the Merger Shares of each class to its shareholders of the corresponding class, in proportion to their existing shareholdings, in complete liquidation of the Growth Equity Fund, and the legal existence of the Growth Equity Fund will be terminated. Each shareholder of the Growth Equity Fund will receive a number of full and fractional Merger Shares equal in value at the date of the exchange to the aggregate value of the shareholder’s Growth Equity Fund shares.

Prior to the date of the transfer, the Growth Equity Fund will declare a distribution to shareholders that will have the effect of distributing to shareholders all of its remaining investment company income (computed without regard to the deduction for dividends paid) and net realized capital gains, if any, through the date of the transfer.

The Trustees of the Growth Equity Fund have voted unanimously to approve the Merger and to recommend that shareholders also approve the Merger. Because MassMutual, the holder of a majority of the outstanding shares of the Growth Equity Fund has indicated that it will approve the Merger by written consent, no shareholder proxies will be solicited.

The investment restrictions of the Growth Equity Fund will be temporarily amended to the extent necessary to effect the transactions contemplated by the Agreement.

Agreement and Plan of Reorganization. The Merger will be governed by the Agreement, which provides that the Blue Chip Growth Fund will acquire all of the assets of the Growth Equity Fund in exchange for the assumption by the Blue Chip Growth Fund of all of the liabilities of the Growth Equity Fund and for the issuance of Merger Shares equal in value to the value of the transferred assets net of assumed liabilities, all as of the Exchange Date (anticipated to be November 16, 2007, or such other date as may be agreed upon by the parties

16

(the “Valuation Time”)). The following discussion of the Agreement is qualified in its entirety by the full text of the Agreement.

The Growth Equity Fund will sell all of its assets to the Blue Chip Growth Fund, and in exchange, the Blue Chip Growth Fund will assume all of the liabilities of the Growth Equity Fund and deliver to the Growth Equity Fund a number of full and fractional Merger Shares of each class having an aggregate net asset value equal to the value of the assets of the Growth Equity Fund attributable to shares of the corresponding class of shares of the Growth Equity Fund, less the value of the liabilities of the Growth Equity Fund assumed by the Blue Chip Growth Fund attributable to shares of such class of the Growth Equity Fund.

Immediately following the Exchange Date, the Growth Equity Fund will distribute pro rata to its shareholders of record as of the close of business on the Exchange Date the full and fractional Merger Shares received by the Growth Equity Fund, with Merger Shares of each class being distributed to holders of shares of the corresponding class of the Growth Equity Fund. As a result of the transaction, shareholders of each class of the Growth Equity Fund will receive a number of Merger Shares of the corresponding class of the Blue Chip Growth Fund equal in aggregate value at the Exchange Date to the value of the Growth Equity Fund shares of the corresponding class held by the shareholder. This distribution will be accomplished by the establishment of accounts on the share records of the Blue Chip Growth Fund in the name of such Growth Equity Fund shareholder, each account representing the respective number of full and fractional Merger Shares of each class due such shareholder. New certificates for Merger Shares will not be issued.

The consummation of the Merger is subject to the conditions set forth in the Agreement, any one of which may be waived. The Agreement may be terminated and the Merger abandoned at any time, before or after approval by the shareholders of the Growth Equity Fund, prior to the Exchange Date, by mutual consent of the Blue Chip Growth Fund and the Growth Equity Fund or, if any condition set forth in the Agreement has not been fulfilled and has not been waived by the party entitled to its benefits, by such party.

Except for the trading costs associated with the liquidation described above, the fees and expenses for the Merger and related transactions are estimated to be $160,000, all of which will be paid by the Funds to the extent they do not exceed the anticipated benefit of the Merger to the Funds. The expenses will be divided between the two Funds based on the anticipated benefit to each Fund. Any expenses that exceed the benefit to the Funds will be paid by the Adviser.

Trustees’ Considerations Relating to the Merger. At a meeting of the Board of Trustees of Growth Equity Fund and Blue Chip Growth Fund held on May 9, 2007, the Trustees, including the Independent Trustees, considered whether to approve the Merger on behalf of each Fund. As part of their review process, the Trustees reviewed materials provided by the Adviser and were represented by independent legal counsel to the Independent Trustees. The Trustees reviewed and considered information with respect to, among other things, the Funds’ respective investment objectives and policies, management fees, distribution fees and other operating expenses, historical performance and asset size also was considered by the Trustees. In addition, the Trustees considered that because shareholders of the Growth Equity Fund and the Blue Chip Growth Fund would benefit from the Merger, the costs of the Merger were expected to be paid by the Funds.

The Trustees considered that the Growth Equity Fund and the Blue Chip Growth Fund have similar investment objectives and investment strategies. The Growth Equity Fund, with its current sub-adviser, GMO, has underperformed relative to its peers over the one-, three- and five-year periods. The Trustees also considered the performance history of the Blue Chip Growth Fund, of which T. Rowe Price has served as sub-adviser since February 16, 2006.

The Trustees received information that showed that, as of June 30, 2007, the Growth Equity Fund was expected to have approximately $521 million in net assets and the Blue Chip Growth Fund was expected to have approximately $533 million in net assets. The Board considered that merging the Funds is expected to result in a larger fund, having combined assets over $1 billion. MassMutual expects that shareholders of both Funds will

17

receive the benefit of a lowered effective management fee, while still being invested in a fund with the same or similar investment objective and investment policies. In addition, MassMutual has agreed to cap the fees and expenses of the combined Fund until March 31, 2010, as described under “Synopsis—Comparison of Fees and Expenses of the Funds and Estimated Fees and Expenses Following the Merger.” (At current asset levels, the total fees and expenses of the combined Fund would exceed those of the Growth Equity Fund, in the absence of the expense cap.)

The Trustees considered that the procedures for purchases, exchanges and redemptions of shares of both Funds are the same and that both Funds offer the same investor services and options to shareholders.

The Trustees also considered the terms and conditions of the merger, including that there would be no sales charge imposed in effecting the merger and that the merger is expected to be structured as a tax-free reorganization for federal income tax purposes. Shareholders are not expected to recognize any gain or loss for federal income tax purposes directly as a result of the merger. The Trustees concluded that Growth Equity Fund’s participation in the transaction was in the best interests of the Growth Equity Fund and that the merger would not result in a dilution of the interests of existing shareholders of the Growth Equity Fund.

After consideration of the above factors, other considerations, and such information as the Trustees of the Growth Equity Fund deemed relevant, the Trustees, including the Independent Trustees, unanimously approved the Merger and the Agreement voted to recommend its approval by the shareholders of the Growth Equity Fund.

The Trustees also determined that the Merger was in the best interests of the Blue Chip Growth Fund and its shareholders and that no dilution would result to those shareholders. The Trustees on behalf of the Blue Chip Growth Fund, including the Independent Trustees, unanimously approved the Merger and the Agreement.

Description of the Merger Shares. Merger Shares will be issued to the Growth Equity Funds’ shareholders in accordance with the procedures under the Agreement as described above. The Merger Shares are Class S, Class Y, Class L, Class A and Class N shares of the Blue Chip Growth Fund. The Growth Equity Funds’ shareholders receiving Merger Shares will not pay an initial sales charge on such shares. Each class of Merger Shares has the same characteristics as shares of the corresponding class of the Growth Equity Fund. Your Merger Shares will be subject to a contingent deferred sales charge to the same extent that your Growth Equity Fund shares were so subject. In other words, your Merger Shares will be treated as having been purchased on the date you purchased your Growth Equity Fund shares and for the price you originally paid. For more information on the characteristics of each class of Merger Shares, please see “Additional Information about the Blue Chip Growth Fund” in Appendix B and the SAI.

Under Massachusetts law, shareholders could, under certain circumstances, be held personally liable for the obligations of the Growth Equity Fund or the Blue Chip Growth Fund. However, the Select Funds’ Agreement and Declaration of Trust disclaims shareholder liability for acts or obligations of the Select Funds and requires that notice of such disclaimer be given in each agreement, obligation, or instrument entered into or executed by the Select Funds or their Trustees. The Agreement and Declaration of Trust provides for indemnification out of fund property for all loss and expense of any shareholder held personally liable for the obligations of the Select Funds. Thus, the risk of a shareholder incurring financial loss on account of shareholder liability should be limited to circumstances in which Select Funds would be unable to meet their obligations. The likelihood of such circumstances is remote.

Federal Income Tax Consequences. As a condition to the obligation of the Growth Equity Fund and the Blue Chip Growth Fund to consummate the Merger, each Fund will receive a tax opinion from Ropes & Gray LLP, counsel to the Select Funds (which opinion will be based on certain factual representations made by officers of the Select Funds and certain customary assumptions), to the effect that, on the basis of the existing provisions of the Internal Revenue Code of 1986, as amended (the “Code”), current administrative rules and court decisions, while the matter is not free from doubt, generally for federal income tax purposes, except as noted below:

18

| | (i) | the acquisition by the Blue Chip Growth Fund of substantially all of the assets of the Growth Equity Fund solely in exchange for Merger Shares and the assumption by the Blue Chip Growth Fund of all of the liabilities of the Growth Equity Fund followed by the distribution by the Growth Equity Fund to its shareholders of Merger Shares in complete liquidation of the Growth Equity Fund, all pursuant to the Agreement, will constitute a reorganization within the meaning of Section 368(a) of the Code, and the Growth Equity Fund and the Blue Chip Growth Fund will each be a “party to a reorganization” within the meaning of Section 368(b) of the Code; |

| | (ii) | under Section 361 of the Code, no gain or loss will be recognized by the Growth Equity Fund upon the transfer of the Growth Equity Fund’s assets to the Blue Chip Growth Fund in exchange for Merger Shares and the assumption of the Growth Equity Fund’s liabilities by the Blue Chip Growth Fund or upon the distribution of the Merger Shares by the Growth Equity Fund to its shareholders in liquidation of the Growth Equity Fund; |

| | (iii) | under Section 354 of the Code, no gain or loss will be recognized by shareholders of the Growth Equity Fund on the distribution of Merger Shares to them in exchange for their shares of the Growth Equity Fund; |

| | (iv) | under Section 358 of the Code, the aggregate tax basis of the Merger Shares received by the Growth Equity Fund’s shareholders will be the same as the aggregate tax basis of the Growth Equity Fund’s shares exchanged therefor; |

| | (v) | under Section 1223(1) of the Code, a Growth Equity Fund shareholder’s holding periods in the Merger Shares received by such shareholder pursuant to the Agreement will include the holding periods for the Growth Equity Fund shares exchanged therefor, provided that at the time of the reorganization the Growth Equity Fund’s shares are held by such shareholder as a capital asset; |

| | (vi) | under Section 1032 of the Code, no gain or loss will be recognized by the Blue Chip Growth Fund upon the receipt of assets of the Growth Equity Fund pursuant to the Agreement in exchange for Merger Shares and the assumption by the Blue Chip Growth Fund of the liabilities of the Growth Equity Fund; |

| | (vii) | under Section 362(b) of the Code, the Blue Chip Growth Fund’s tax basis in the assets of the Growth Equity Fund transferred to it pursuant to the Agreement will be the same as the tax basis of such assets in the hands of the Growth Equity Fund immediately prior to the transfer; |

| | (viii) | under Section 1223(2) of the Code, the Blue Chip Growth Fund’s holding period in the assets of the Growth Equity Fund will include the Growth Equity Fund’s holding period in such assets; and |

| | (ix) | the Blue Chip Growth Fund will succeed to and take into account the items of the Growth Equity Fund described in Section 381(c) of the Code, subject to the conditions and limitations specified in Sections 381, 382, 383 and 384 of the Code and Regulations thereunder. |

Ropes & Gray LLP will express no view with respect to the effect of the reorganization on any transferred asset as to which any unrealized gain or loss is required to be recognized at the end of the taxable year (or on the termination or transfer thereof, without reference to whether such a termination or transfer would otherwise be a taxable transaction) under federal income tax principles.

The consummation of the Merger will terminate the taxable year of the Growth Equity Fund. Prior to the consummation of the Merger, the Growth Equity Fund will, and the Blue Chip Growth Fund may, declare a distribution to shareholders, which together with all previous distributions, will have the effect of a distribution to shareholders of all of its investment company taxable income (computed without regard to the deduction for dividends paid) and net realized capital gains, if any, through the consummation of the Merger. This distribution to shareholders will accelerate the recognition of gain or loss to shareholders of the Growth Equity Fund.

19

This description of the federal income tax consequences of the Merger is made without regard to the particular facts and circumstances of any shareholder. Shareholders are urged to consult their own tax advisers as to the specific consequences to them of the Merger, including the applicability and effect of state, local and other tax laws.

Additional Tax Considerations. As of July 31, 2007, the Growth Equity Fund had $117,976,377 in capital loss carryforwards. Capital loss carryforwards are used to reduce the amount of realized capital gains that a Fund is required to distribute to its shareholders in order to avoid paying taxes on undistributed capital gain.

If the Merger occurs, the tax attributes of the Blue Chip Growth Fund and the Growth Equity Fund, including any capital loss carryforwards that could have been used by each Fund to offset its future realized capital gains, will be shared by the surviving combined Fund.

Blue Chip Growth Fund’s ability to utilize the pre-Merger losses of Growth Equity Fund to offset post-Merger gains of the combined Fund is expected to be substantially limited as a result of the Merger due to the application of loss limitation rules under federal tax law. Under applicable tax laws, the ability of the Blue Chip Growth Fund, as the surviving combined Fund, to use the Growth Equity Fund’s pre-Merger capital loss carryforwards to offset future realized capital gains will likely be subject to an annual limitation. Other tax rules would prohibit the use for five years following the Merger of one Fund’s pre-Merger capital losses (including both loss carryforwards and “built-in losses” (i.e., net unrealized losses)) against the other Fund’s “built-in gains” (i.e., net unrealized gains). The effect of these limitations will depend on the amount of losses and “built-in gains” in each Fund at the time of the Merger.

By way of example, if the Merger had occurred on July 31, 2007, the combined Fund would have had net losses (i.e., capital loss carryforwards as of the end of the last fiscal year as adjusted by year-to-date realized gains or losses) of 2.59% of its net assets available to reduce capital gains, whereas absent the Merger, the Growth Equity Fund would have net losses equal to 15.78% of its net assets available to reduce capital gains. As a result of this and the spreading of the losses remaining available over a larger asset base, former Growth Equity Fund shareholders may well have received taxable distributions of capital gains from Blue Chip Growth Fund at times when distributions, if any, of capital gains from Growth Equity Fund would have been offset by capital losses if the Merger had not occurred.

The tax principles described above will remain true; their application and, at a minimum, the specific percentages noted above will change prior to the Merger, including, because of market developments and shareholder activity in the Funds. The application of these rules may accelerate taxable gain distributions to shareholders of the combined Fund.

A substantial portion of the portfolio assets of the Growth Equity Fund may be sold in connection with the Merger. The actual tax impact of such sales will depend on the difference between the prices at which the portfolio assets are sold and basis of the selling Fund in the assets. If the assets are sold by the Growth Equity Fund before the Merger, any capital gains recognized in these sales on a net basis, as reduced by any available capital losses, including in the form of carryforwards, will be distributed to the Growth Equity Fund’s shareholders as capital-gain dividends (to the extent of net realized long-term capital gains distributed) and/or ordinary dividends (to the extent of net realized short-term capital gains distributed) during or with respect to the year of sale, and such distributions will be taxable to such shareholders. If the assets are sold after the Merger, any capital gains will be distributed to shareholders of the Blue Chip Growth Fund, including existing shareholders and shareholders of the Growth Equity Fund who become shareholders of the Blue Chip Growth Fund as a result of the Merger. If the portfolio assets are sold by the Blue Chip Growth Fund after the Merger, capital gains from the sales will likely be offset to a substantially lesser degree by capital loss carryforwards than if the assets are sold by the Growth Equity Fund before the Merger, due to the loss limitation rules described above. Management of the Funds has not determined whether the sale will occur before or after the Merger.

20

Existing and Pro Forma Capitalization. The following table shows, on an unaudited basis, the capitalization of the Growth Equity Fund and the Blue Chip Growth Fund as of June 30, 2007, and on a pro forma combined basis, giving effect to the acquisition of assets at net asset value as of that date:

| | | | | | | | | |

(Unaudited) | | Growth Equity Fund | | Blue Chip

Growth Fund | | Pro Forma

Combined* |

Net assets (000’s omitted) | | $ | 452,594 | | $ | 558,670 | | $ | 1,011,264 |

Class S | | $ | 151,948 | | $ | 112,068 | | $ | 264,016 |

Class Y | | $ | 60,134 | | $ | 31,331 | | $ | 91,465 |

Class L | | $ | 171,353 | | $ | 364,559 | | $ | 535,912 |

Class A | | $ | 69,093 | | $ | 47,834 | | $ | 116,927 |

Class N | | $ | 66 | | $ | 2,878 | | $ | 2,944 |

| | | |

Shares outstanding (000’s omitted) | | | 52,359 | | | 52,122 | | | 94,348 |

Class S | | | 17,439 | | | 10,400 | | | 24,501 |

Class Y | | | 6,926 | | | 2,920 | | | 8,525 |

Class L | | | 19,880 | | | 34,004 | | | 49,986 |

Class A | | | 8,106 | | | 4,522 | | | 11,054 |

Class N | | | 8 | | | 276 | | | 282 |

| | | |

Net asset value per share | | | | | | | | | |

Class S | | $ | 8.71 | | $ | 10.78 | | $ | 10.78 |

Class Y | | $ | 8.68 | | $ | 10.73 | | $ | 10.73 |

Class L | | $ | 8.62 | | $ | 10.72 | | $ | 10.72 |

Class A | | $ | 8.52 | | $ | 10.58 | | $ | 10.58 |

Class N | | $ | 8.38 | | $ | 10.43 | | $ | 10.43 |

| * | Assuming consummation of the Merger on June 30, 2007, and for informational purposes only. |

The capitalization of the Funds and, consequently, the pro forma capitalization of the combined Fund, are likely to be different at the effective time of completion of the Merger as a result of market movements and daily share purchase and redemption activities, as well as the effect of other ongoing operations of the Funds prior to completion of the Merger.

Unaudited pro forma combining financial statements of the Funds giving effect to the Merger of the Growth Equity Fund and the Blue Chip Growth Fund, as of June 30, 2007, and for the 12-month period then ended, are included in the SAI. Because the Agreement provides that the Blue Chip Growth Fund will be the surviving Fund following the Merger, the pro forma combining financial statements reflect the transfer of the assets and liabilities of the Growth Equity Fund to the Blue Chip Growth Fund, as contemplated by the Agreement.

IV. No Shareholder Proxies Will Be Solicited

Approval of the Merger requires the approval of not only a majority of the Growth Equity Fund’s Trustees, but also a “majority of the outstanding voting securities” (as defined in the 1940 Act) of the Growth Equity Fund. Under the Select Funds’ Declaration of Trust, shareholders are entitled to one vote for each dollar (or a proportionate fractional vote for each fraction of a dollar) of net asset value per share of each series or class for each share held, and separate classes vote together as one group on matters, such as the Merger, that affect classes equally. As of August 31, 2007, there were 43,029,705.826 shares of record of the Growth Equity Fund entitled to vote, of which MassMutual, through its separate accounts, owned approximately 33,065,678.136, or approximately 76.84% of the Fund. MassMutual has indicated that, on or about November 16, 2007, it will execute a Consent of Majority Shareholder approving the Merger. Since MassMutual, the holder of record of more than a majority of the outstanding shares of the Growth Equity Fund as of August 31, 2007, the record date, has indicated that it will consent to the Merger, no shareholder proxies will be solicited in connection with the Merger and no meeting of shareholders will be held.

21

As of August 31, 2007, the Growth Equity Fund had the following shares outstanding:

| | |

Growth Equity Fund | | Number of Shares Outstanding |

Class S | | 16,661,217.919 |

Class Y | | 3,328,265.452 |

Class L | | 16,935,039.555 |

Class A | | 6,097,321.417 |

Class N | | 7,861.483 |

Share Ownership. As of August 31, 2007, the officers and Trustees of the Funds as a group beneficially owned less than 1% of the outstanding shares of the Growth Equity Fund and the Blue Chip Growth Fund.

To the best of the knowledge of the Funds, the following shareholders owned of record 5% or more of the outstanding shares of the Growth Equity Fund and the Blue Chip Growth Fund as of August 31, 2007 (those persons who beneficially own more than 25% of a particular class of shares may be deemed to control such class):

| | | | | | |

Class | | Shareholder Name and Address | | Actual | | Percentage Owned Assuming Completion of Merger(1) |

Growth Equity Fund | | | | | | |

| | | | | | |

S | | MassMutual | | 54.88% | | [ ]% |

| | 1295 State Street | | | | |

| | Springfield, MA 01111 | | | | |

S | | MassMutual | | 11.59% | | [ ]% |

| | Select Destination Retirement 2020 Fund

1295 State Street

Springfield, MA 01111 | | | | |

S | | MassMutual | | 16.35% | | [ ]% |

| | Select Destination Retirement 2030 Fund

1295 State Street

Springfield, MA 01111 | | | | |

S | | MassMutual | | 10.10% | | [ ]% |

| | Select Destination Retirement 2040 Fund

1295 State Street

Springfield, MA 01111 | | | | |

Y | | MassMutual | | 93.88% | | [ ]% |

| | 1295 State Street | | | | |

| | Springfield, MA 01111 | | | | |

L | | MassMutual | | 90.49% | | [ ]% |

| | 1295 State Street | | | | |

| | Springfield, MA 01111 | | | | |

L | | Taynik & Co. | | 9.03% | | [ ]% |

| | c/o State Street Bank and Trust Company

P.O. Box 9130, FPG 90

Boston, MA 02117 | | | | |

A | | MassMutual | | 89.63% | | [ ]% |

| | 1295 State Street | | | | |

| | Springfield, MA 01111 | | | | |

22

| | | | | | |

Class | | Shareholder Name and Address | | Actual | | Percentage Owned Assuming Completion of Merger(1) |

N | | MassMutual | | 100% | | 100% |

| | 1295 State Street | | | | |

| | Springfield, MA 01111 | | | | |

| | | |

Blue Chip Growth Fund | | | | | | |

| | | | | | |

S | | MassMutual | | 57.67% | | [ ]% |

| | 1295 State Street | | | | |

| | Springfield, MA 01111 | | | | |

S | | MassMutual Select Destination Retirement 2020 Fund | | 11.45% | | [ ]% |

| | 1295 State Street | | | | |

| | Springfield, MA 01111 | | | | |

S | | MassMutual Select Destination Retirement 2030 Fund | | 16.06% | | [ ]% |

| | 1295 State Street | | | | |

| | Springfield, MA 01111 | | | | |

S | | MassMutual Select Destination Retirement 2040 Fund | | 9.92% | | [ ]% |

| | 1295 State Street | | | | |

| | Springfield, MA 01111 | | | | |

Y | | MassMutual | | 85.56% | | [ ]% |

| | 1295 State Street | | | | |

| | Springfield, MA 01111 | | | | |

Y | | Taynik & Co. | | 9.20% | | [ ]% |

| | c/o State Street Bank and Trust Company | | | | |

| | P.O. Box 9130, FPG 90 | | | | |

| | Boston, MA 02117 | | | | |

Y | | Jupiter & Co. | | 5.24% | | [ ]% |

| | c/o State Street Bank and Trust Company | | | | |

| | P.O. Box 9130, FPG 90 | | | | |

| | Boston, MA 02117 | | | | |

L | | MassMutual | | 99.22% | | [ ]% |

| | 1295 State Street | | | | |

| | Springfield, MA 01111 | | | | |

A | | MassMutual | | 86.27% | | [ ]% |

| | 1295 State Street | | | | |

| | Springfield, MA 01111 | | | | |

N | | MassMutual | | 100% | | 100% |

| | 1295 State Street | | | | |

| | Springfield, MA 01111 | | | | |

| (1) | Percentage owned on August 31, 2007 assuming completion of Merger. |

23

Appendix A

OTHER COMPARISONS BETWEEN THE FUNDS