QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

HEALTH NET, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

HEALTH NET,

INC.

NOTICE OF

2003 ANNUAL

MEETING

AND

PROXY

STATEMENT

March 28, 2003

Dear Stockholders:

It is a pleasure to invite you to attend the 2003 Annual Meeting of Stockholders of Health Net, Inc. to be held simultaneously via the Internet at www.health.net and at the company's offices located at 21281 Burbank Boulevard in Woodland Hills, California 91367 on Thursday, May 15, 2003, at 10:00 a.m. (PDT).

Each item of business described in the accompanying Notice of Annual Meeting and Proxy Statement will be discussed during the meeting and stockholders who attend in person will have an opportunity to ask questions. A report on our business operations will be presented at the meeting.

It is important that you vote your shares whether or not you plan to attend the meeting. We urge you to carefully review the Proxy Statement and to vote your choices either via the Internet or on the enclosed card. Please sign, date and return your proxy card in the envelope provided as soon as possible or complete a proxy card over the Internet at www.computershare.com/us/proxy. If you do attend the meeting in person, your proxy can be revoked at your request.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Health Net, Inc. will hold its 2003 Annual Meeting of Stockholders on Thursday, May 15, 2003 at 10:00 a.m. (PDT) simultaneously via the Internet at www.health.net and at the Company's offices at 21281 Burbank Boulevard in Woodland Hills, California 91367, for the following purposes:

- 1.

- To elect ten directors to serve a one-year term until the 2004 Annual Meeting of Stockholders.

- 2.

- To ratify the selection of Deloitte & Touche LLP as Health Net's independent public accountants.

- 3.

- To act upon any other matters that may properly come before the meeting.

The Board of Directors has fixed Thursday, March 20, 2003 as the record date for the determination of the stockholders entitled to notice of, and to vote at, the annual meeting or any adjournment or postponement of the annual meeting.

At the annual meeting, each share of Class A Common Stock, par value $.001 per share, of Health Net represented at the annual meeting will be entitled to one vote on each matter properly brought before the annual meeting. Jay M. Gellert and B. Curtis Westen have been appointed as proxy holders, with full rights of substitution, for the holders of Class A Common Stock.

| |

|

|---|

| | | By Order of the Board of Directors, |

|

|

|

| | | B. Curtis Westen, Esq.

Senior Vice President, General Counsel and Secretary |

March 28, 2003

YOUR VOTE IS IMPORTANT

All stockholders are cordially invited to attend the 2003 Annual Meeting of Stockholders of Health Net, Inc. either in person or via the Internet. However, to ensure your representation at the annual meeting, please mark, sign, date and return the enclosed proxy card as soon as possible in the enclosed self-addressed, postage-paid envelope or, alternatively, fill out the proxy card over the Internet at www.computershare.com/us/proxy. If you attend the annual meeting in person, you may vote at the meeting even if you have previously returned a proxy.

PROXY STATEMENT

General; Voting of Shares

The accompanying proxy is solicited by the Board of Directors of Health Net, Inc. (the "Company," "Health Net," "we," "us" or "our") for use at its 2003 Annual Meeting of Stockholders (the "Annual Meeting") to be held on Thursday, May 15, 2003 at 10:00 a.m. (PDT) simultaneously via the Internet at www.health.net and at the Company's offices at 21281 Burbank Boulevard, Woodland Hills, California 91367, and at any adjournments or postponements thereof. The Company expects to mail this proxy statement and accompanying proxy card beginning on or about March 28, 2003 to give holders of Class A Common Stock, par value $.001 per share ("Class A Common Stock"), of the Company of record on March 20, 2003 (the "Record Date") an opportunity to vote at the Annual Meeting.

The Annual Meeting will be held simultaneously via the Internet and in person. Participation at the Annual Meeting via the Internet will consist of live sound and real-time access to printed material. To attend the Annual Meeting via the Internet, a stockholder should log on to www.health.net on Thursday, May 15, 2003 and follow the instructions provided under the "Investor Relations" section of the site. Stockholders willnot be permitted to vote over the Internet during the Annual Meeting.

Only holders of record of Class A Common Stock at the close of business on the Record Date are entitled to vote at the Annual Meeting. Each share of Class A Common Stock represented at the Annual Meeting is entitled to one vote on each matter properly brought before the Annual Meeting. The Company's by-laws require that the holders of a majority of the total number of shares entitled to vote be present in person or by proxy in order for the business of the Annual Meeting to be transacted. Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting. Attendance at the Annual Meeting over the Internet will not be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting.

In voting, please specify your choices by marking the appropriate spaces on the enclosed proxy card, signing and dating the card and returning it in the accompanying envelope or, alternatively, by completing a proxy card over the Internet at www.computershare.com/us/proxy before 5:00 p.m. (CDT) on May 13, 2003.Voting over the Internet will not be permitted after 5:00 p.m. (CDT) on Tuesday, May 13, 2003. If no directions are given and either the signed card is returned or the Internet proxy card is submitted, then the proxy holders will vote the shares for the election of all listed nominees and in accordance with the directors' recommendations or as stated on the proxy card for the other subjects listed on the proxy card, and at their discretion on any other matters that may properly come before the meeting.

Instructions on how to submit a proxy via the Internet are located on the attachment to the proxy card included with this proxy statement. The Internet voting procedures are designed to authenticate stockholders of the Company by use of a control number located on the attachment to the proxy card included herewith. If you hold your shares through a bank, broker or other holder of record, check the information provided by that entity to determine which voting options are available to you. Please be aware that any costs related to voting over the Internet, such as Internet access charges and telecommunications costs, will be your responsibility.

1

Revocability of Proxies

Any stockholder giving a proxy has the power to revoke it at any time before the proxy is voted. Proxies may be revoked by filing with the Secretary of the Company written notice of revocation bearing a later date than the proxy, by duly executing a subsequently dated proxy relating to the same shares of Class A Common Stock and delivering it to the Secretary of the Company or submitting it electronically via the Internet at www.computershare.com/us/proxy before 5:00 p.m. (CDT) on May 13, 2003, or by attending the Annual Meeting in person and voting such shares during the Annual Meeting. Attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy. Any subsequently dated proxy or written notice revoking a proxy should be sent to the Secretary of Health Net, Inc., at its executive offices at 21650 Oxnard Street, Woodland Hills, California 91367 or if a subsequently dated proxy is submitted electronically, it should be sent via the Internet before 5:00 p.m. (CDT) on May 13, 2003 using the web site at www.computershare.com/us/proxy.

Shares Outstanding

As of the Record Date, the Company had outstanding 117,721,273 shares of Class A Common Stock. Each share of Class A Common Stock is entitled to one vote.

Solicitation

The Company will bear the entire cost of the solicitation of proxies, including preparation, assembly and mailing of this proxy statement, the proxy and any additional materials furnished to stockholders. Proxies may be solicited by directors, officers and a small number of regular employees of the Company personally or by mail, telephone or telegraph, but such persons will not be specially compensated for such service. Copies of solicitation material will be furnished to brokerage houses, fiduciaries and custodians that hold shares of Class A Common Stock of record for beneficial owners for forwarding to such beneficial owners. The Company may also reimburse persons representing beneficial owners for their costs of forwarding the solicitation material to such owners.

Your vote is important. Please return a proxy card (or fill out the Internet proxy) promptly so your shares can be represented, even if you plan to attend the Annual Meeting in person. Highlights of the Annual Meeting and the voting results will be included in the Company's Quarterly Report on Form 10-Q for the second quarter ended June 30, 2003.

2

INTRODUCTION

Health Net, Inc. (together with its subsidiaries, referred to hereinafter as the "Company," "we," "us" or "our") is an integrated managed care organization which administers the delivery of managed health care services. Our health plans and government contracts subsidiaries provide health benefits through our health maintenance organizations ("HMOs"), insured preferred provider organizations ("PPOs") and point-of-service ("POS") plans to approximately 5.4 million individuals in 15 states through group, individual, Medicare, Medicaid and TRICARE programs. Our subsidiaries also offer managed health care products related to behavioral health, dental, vision and prescription drugs. We also offer managed health care product coordination for workers' compensation insurance programs through our employer services group subsidiary. We operate and conduct our HMO and other businesses through our subsidiaries.

The Company was incorporated in 1990. Our current operations are the result of the April 1, 1997 merger transaction (the "FHS Combination") involving Health Systems International, Inc. ("HSI") and Foundation Health Corporation ("FHC"). Pursuant to the Agreement and Plan of Merger (the "Merger Agreement") that evidenced the FHS Combination, FH Acquisition Corp., a wholly-owned subsidiary of HSI, merged with and into FHC and FHC survived as a wholly-owned subsidiary of HSI which changed its name to Foundation Health Systems, Inc. In November 2000, we changed our name from Foundation Health Systems, Inc. to Health Net, Inc.

Prior to the FHS Combination, the Company was the successor to the business conducted by Health Net of California, Inc., now our HMO subsidiary in California, which became a subsidiary of the Company in 1992, and HMO and PPO networks operated by QualMed, Inc. ("QualMed"), which combined with the Company in 1994 to create HSI. FHC was incorporated in Delaware in 1984.

The mailing address of the Company's principal executive offices is 21650 Oxnard Street, Woodland Hills, California 91367, and our Internet web site address is "www.health.net."

PROPOSAL 1—ELECTION OF DIRECTORS

At the annual meeting, stockholders will elect ten directors. The nominees are J. Thomas Bouchard, Governor George Deukmejian, Thomas T. Farley, Gale S. Fitzgerald, Patrick Foley, Jay M. Gellert, Roger F. Greaves, Richard W. Hanselman, Richard J. Stegemeier and Bruce G. Willison. Each director will be elected for a one-year term and will hold office until the 2004 Annual Meeting of Stockholders. Each elected director will continue in office until such director's successor is elected and has been qualified, or until such director's earlier death, resignation or removal.

Health Net's by-laws provide that the persons receiving a plurality of the votes cast, up to the number of directors to be elected, shall be elected. Abstentions will not be counted as votes cast and will have no effect on the vote for directors. Stockholders eligible to vote at the annual meeting do not have cumulative voting rights with respect to the election of directors. Since only ten nominees have been named, proxies cannot be voted for a number of persons greater than ten.

It is expected that the nominees named above will stand for election at the 2003 Annual Meeting of Stockholders, but if any of the nominees declines or is unable to do so, the proxies will be voted for another person or persons designated by the Committee on Directors of the Board of Directors of the Company.

The Board of Directors recommends a vote

FOR each named nominee.

3

Director Nominees

The Company's certificate of incorporation provides for directors to be elected on an annual basis. The certificate of incorporation further provides that the Board of Directors will consist of not less than three nor more than twenty members, the exact number to be determined in accordance with the Company's by-laws. The by-laws provide that the exact number of directors shall be fixed from time to time by the Board of Directors, and the number of members constituting the Board of Directors has been fixed by the Board of Directors at ten.

The Company's by-laws also provide that Directors shall be deemed to have retired and resigned from the Board of Directors effective immediately prior to the first annual meeting of stockholders occurring after such Director attains seventy-two years of age, provided, however, that members of the Board of Directors on February 4, 1999 shall be deemed to have retired and resigned from the Board of Directors effective upon the date of the first annual meeting of stockholders after such Director attains seventy-five years of age; and provided further that the Board of Directors shall have the power to waive the application of such provisions to a given Director on a case-by-case basis after considering all of the applicable facts and circumstances. Pursuant to the foregoing procedures contained in the Company's by-laws, the Company's Board of Directors waived the application of such provisions to Mr. Hanselman and Mr. Stegemeier (each of whom will be seventy-five years of age prior to the Annual Meeting and was a member of the Board of Directors on February 4, 1999) for one year. Although Gov. Deukmejian was a member of the Board of Directors on February 4, 1999, he will not attain age seventy-five until after the upcoming Annual Meeting (so no waiver of these by-law provisions is required at this time).

The ten nominees were designated for election, pursuant to the by-laws, by the Committee on Directors of the Board of Directors of the Company. Each of the nominees has consented to serve as a director if elected. The following table sets forth certain information with respect to the nominees:

Name

| | Principal Occupation or Employment

| | Age

|

|---|

| J. Thomas Bouchard | | Former Senior Vice President, Human Resources of International Business Machines Corporation | | 62 |

Gov. George Deukmejian |

|

Former Partner of Sidley Austin Brown & Wood and former Governor of the State of California |

|

74 |

Thomas T. Farley |

|

Senior Partner of Petersen & Fonda, P.C. |

|

68 |

Gale S. Fitzgerald |

|

Former Chair and Chief Executive Officer of Computer Task Group, Inc. |

|

52 |

Patrick Foley |

|

Former Chairman, President and Chief Executive Officer of DHL Airways, Inc. and Director of various companies |

|

71 |

Jay M. Gellert |

|

President and Chief Executive Officer of the Company |

|

49 |

Roger F. Greaves |

|

Former Co-Chairman of the Board of Directors, Co-President and Co-Chief Executive Officer of the Company and Director of various companies |

|

65 |

Richard W. Hanselman |

|

Chairman of the Board of the Company and Director and Consultant to various companies |

|

75 |

Richard J. Stegemeier |

|

Chairman Emeritus of the Board of Directors of Unocal Corporation |

|

74 |

Bruce G. Willison |

|

Dean of the Anderson School of the University of California at Los Angeles |

|

54 |

Information Concerning Current Members of the Board of Directors and Nominees

Mr. Bouchard became a director of the Company upon consummation of the FHS Combination. Previously, he served as a director of HSI since January 1994, upon consummation of the merger transaction involving H.N. Management Holdings, Inc. and QualMed, Inc. ("QualMed") which created HSI (the "HSI Combination"). Mr. Bouchard served as a director of QualMed from May 1991 until

4

February 1995. From October 1994 to July 2000, Mr. Bouchard served as Senior Vice President, Human Resources of International Business Machines Corporation. From June 1989 until October 1994, Mr. Bouchard served as Senior Vice President & Chief Human Resources Officer of U.S. West, Inc., a diversified global communications company, and prior to that time he was Senior Vice President-Human Resources and Organization for United Technologies Corp. Mr. Bouchard previously served on the Board of Directors of the LPA Labor Policy Association from March 1991 to March 2000. Mr. Bouchard has served as a director of Nordstrom fsb (formerly Nordstrom National Credit Bank) since April 1991, and also currently serves as a director of Manpower, Inc.

Mr. Deukmejian became a director of the Company upon consummation of the FHS Combination. Previously, he served as a director of HSI since January 1994, upon consummation of the HSI Combination. Mr. Deukmejian served as a director of QualMed from April 1992 until February 1995. From February 1991 through June 1999, Mr. Deukmejian was a partner in the law firm of Sidley Austin Brown & Wood, Los Angeles, California. From July 1999 to June 2000, Mr. Deukmejian was senior counsel to Sidley Austin Brown & Wood. Mr. Deukmejian served as Governor of the State of California for two terms, from January 1983 to January 1991. Mr. Deukmejian also served the State of California as Attorney General from 1979 to 1982, as a State Senator from 1967 to 1978 and as a State Assemblyman from 1963 to 1966. Mr. Deukmejian is currently a director of The Keith Companies.

Mr. Farley became a director of the Company upon consummation of the FHS Combination. Previously, he served as a director of HSI since January 1994, upon consummation of the HSI Combination. Mr. Farley served as a director of QualMed from February 1991 until February 1995 and is a senior partner in the law firm of Petersen & Fonda, P.C., Pueblo, Colorado. Mr. Farley was formerly President of the governing board of Colorado State University, the University of Southern Colorado and Ft. Lewis College and Chairman of the Colorado Wildlife Commission. He served as Minority Leader of the Colorado House of Representatives from 1967 to 1975. Mr. Farley was a director of the Public Service Company of Colorado, a public gas and electric company, from 1983 to 1997 and is a director/advisor of Wells Fargo Bank of Pueblo and Sunset. Mr. Farley is a member of the Board of Regents of Santa Clara University, a Jesuit institution, and a director of Colorado Public Radio.

Ms. Fitzgerald became a director of the Company in March 2001. From July 2002 through October 2002, Ms. Fitzgerald served as President and Chief Executive Officer of QP Group, a procurement solutions company. From October 1994 to June 2000, Ms. Fitzgerald served as Chair and Chief Executive Officer of Computer Task Group, Inc. ("CTG"), an international information technology (IT) services firm. Ms. Fitzgerald served as President and Chief Operating Officer of CTG from July 1993 to October 1994, and served as Senior Vice President of CTG's northeast region from 1991 to July 1993. Prior thereto, Ms. Fitzgerald served in various capacities at International Business Machines Corporation ("IBM"), culminating in serving as Vice President of IBM's professional services. Ms. Fitzgerald is a director of Diebold, Inc. Ms. Fitzgerald also served on the Board of Directors of Kaleida Health System in Buffalo, New York from 1995 to 2002, and was Vice Chair from 2000 to 2002. Ms. Fitzgerald served on the Board of Directors of Yipee, a privately-held Internet technology company, from 2001 to 2002, and served on the Advisory Board of the University of Buffalo's School of Management from 1993 to 2001. Ms. Fitzgerald served on the Boards of Directors of the Information Technology Services ("ITS") Division of Information Technology Association of America ("ITAA") and of ITAA from 1998 to 2002, and was Chair of the ITS Board from 1998 to 2002.

Mr. Foley became a director of the Company in April 1997 upon consummation of the FHS Combination. Mr. Foley served as a director of FHC from 1996 until the FHS Combination. Mr. Foley served as Chairman and Chief Executive Officer of DHL Airways, Inc. from September 1988 to July 1999. Mr. Foley is also a director of Continental Airlines, Glenborough Realty Trust, Flextronics International, ProcurePoint Travel Solutions, Inc., V-Commerce, Inc. and New Vine, Inc.

5

Mr. Gellert was elected to the Board of Directors of the Company in February 1999. He became President and Chief Executive Officer of the Company in August 1998. Previously Mr. Gellert served as President and Chief Operating Officer of the Company from May 1997 until August 1998. From April 1997 to May 1997, Mr. Gellert served as Executive Vice President and Chief Operating Officer of the Company. Mr. Gellert served as President and Chief Operating Officer of HSI from June 1996 until March 1997. He served on the Board of Directors of HSI from June 1996 to April 1997. Prior to joining HSI, Mr. Gellert directed Shattuck Hammond Partners Inc.'s strategic advisory engagements in the area of integrated delivery systems development, managed care network formation and physician group practice integration. Prior to joining Shattuck Hammond Partners Inc., Mr. Gellert was an independent consultant, and from 1988 to 1991, he served as President and Chief Executive Officer of Bay Pacific Health Corporation. From 1985 to 1988, he was Senior Vice President and Chief Operating Officer for California Healthcare System. Mr. Gellert has been a director of Ventas, Inc. since August 2001.

Mr. Greaves became a director of the Company in April 1997 upon consummation of the FHS Combination. Mr. Greaves served as a director of HSI from January 1994 until the FHS Combination. Mr. Greaves served as Co-Chairman of the Board of Directors, Co-President and Co-Chief Executive Officer of the Company from January 1994 (upon consummation of the HSI Combination) until March 1995. Prior to January 1994, Mr. Greaves served as Chairman of the Board of Directors, President and Chief Executive Officer of H.N. Management Holdings, Inc. (a predecessor to the Company) since its incorporation in June 1990. Mr. Greaves currently serves as Chairman of the Board of Directors of Health Net of California, Inc. ("HN California"), a subsidiary of the Company. Mr. Greaves also served a prior term as Chairman of the Board of Directors of HN California, and concurrently served as President and Chief Executive Officer of HN California. Prior to joining HN California, Mr. Greaves held various management roles at Blue Cross of Southern California, including Vice President of Human Resources and Assistant to the President, and held various management positions at Allstate Insurance Company from 1962 until 1968. Mr. Greaves is a founding member of (and continues to serve in an advisory capacity to) the Board of Governors of California State University at Long Beach.

Mr. Hanselman became a director of the Company in April 1997 upon consummation of the FHS Combination and became Chairman of the Board of Directors in May 1999. Mr. Hanselman served as a director of FHC from 1990 until the FHS Combination. He has been a corporate director of and consultant to various companies since 1986. Mr. Hanselman is a director of Arvin Meritor, Inc. and of Brass Eagle, Inc., is chairman of a small privately-held company and serves on the Boards of two other privately-held companies.

Mr. Stegemeier became a director of the Company in April 1997 upon consummation of the FHS Combination. Mr. Stegemeier served as a director of FHC from 1993 until the FHS Combination. He is Chairman Emeritus of the Board of Directors of Unocal Corporation and served as Chairman and Chief Executive Officer of Unocal Corporation from July 1988 until his retirement in May 1994. Mr. Stegemeier is currently a director of Montgomery Watson Inc..

Mr. Willison became a director of the Company in December 2000. Since July 1999, Mr. Willison has served as Dean of the Anderson School of the University of California at Los Angeles. From April 1996 to October 1998, Mr. Willison served as President and Chief Operating Officer of H.F. Ahmanson, Inc. (Home Savings of America). Prior thereto, Mr. Willison was Chairman, President and Chief Executive Officer of First Interstate Bank of California from February 1991 to April 1996. Mr. Willison is also a director of Nordstrom, Inc. and Home Store, Inc., and is a trustee of SunAmerica Funds.

6

EXECUTIVE OFFICERS

The following sets forth certain biographical information with respect to the current executive officers of the Company, and all individuals who served as an executive officer of the Company during 2002.

Name

| | Age

| | Position

|

|---|

| Jay M. Gellert | | 49 | | President and Chief Executive Officer |

| Jeffrey Folick | | 55 | | Executive Vice President, Regional Health Plans and Specialty Companies |

| Karin D. Mayhew | | 52 | | Senior Vice President of Organization Effectiveness |

| Timothy J. Moore, M.D | | 46 | | Senior Vice President and Chief Medical Officer |

| Marvin P. Rich | | 57 | | Executive Vice President, Finance and Operations |

| B. Curtis Westen, Esq | | 42 | | Senior Vice President, General Counsel and Secretary |

| Christopher P. Wing | | 45 | | Executive Vice President, Regional Health Plans and Specialty Companies |

| James P. Woys | | 44 | | President of Health Net Federal Services |

| Jeffrey J. Bairstow | | 44 | | Former President of Government and Specialty Services Division |

| Steven P. Erwin | | 59 | | Former Executive Vice President and Chief Financial Officer |

| Cora Tellez | | 53 | | Former President of Health Plans Division |

| Gary S. Velasquez | | 42 | | Former President of Business Transformation and Innovation Services Division |

Mr. Gellert became President and Chief Executive Officer of the Company in August 1998. Previously, Mr. Gellert served as President and Chief Operating Officer of the Company from May 1997 until August 1998. From April 1997 to May 1997, Mr. Gellert served as Executive Vice President and Chief Operating Officer of the Company. Mr. Gellert served as President and Chief Operating Officer of HSI from June 1996 until March 1997. He served on the Board of Directors of HSI from June 1996 to April 1997. Mr. Gellert has been a director of the Company since March 1999. Prior to joining HSI, Mr. Gellert directed Shattuck Hammond Partners Inc.'s strategic advisory engagements in the area of integrated delivery systems development, managed care network formation and physician group practice integration. Prior to joining Shattuck Hammond Partners Inc., Mr. Gellert was an independent consultant, and from 1988 to 1991, he served as President and Chief Executive Officer of Bay Pacific Health Corporation. From 1985 to 1988, Mr. Gellert was Senior Vice President and Chief Operating Officer for California Healthcare System. Mr. Gellert has been a director of Ventas, Inc since August 2001.

Mr. Bairstow became President of the Company's Government and Specialty Services Division in November 1999, and served in such capacity until August 2002, at which time he resigned from all of his officer positions with the Company. Mr. Bairstow served as President of Specialty Services from February 1999 until November 1999. Previously, Mr. Bairstow served as Executive Vice President and Chief Financial Officer of HN California, the Company's California health maintenance organization, from February 1998 until February 1999. Before joining the Company, Mr. Bairstow held the dual position of Chief Operating Officer of America Service Group, Inc. ("ASG"), a provider of managed care services, and President and Chief Executive Officer of the operating subsidiary of ASG from November 1996 to February 1998. Prior to that date, Mr. Bairstow held the position of President of Managed Health Network, Inc., the Company's behavioral health subsidiary, from October 1995 to November 1996. From August 1991 to October 1995 Mr. Bairstow served as Vice President of Finance/Chief Operating Officer of Vendell Healthcare. Prior thereto, Mr. Bairstow served as Senior Vice President for Operations and Vice President for Finance of Park Healthcare Company from August 1986 to August 1991.

7

Mr. Erwin became Executive Vice President and Chief Financial Officer of the Company in March 1998, and served in such capacity until January 28, 2002, at which time he resigned from all of his officer positions with the Company. From 1994 until 1997, he served as Executive Vice President and Chief Financial Officer for U.S. Bancorp, a major superregional bank holding company based in Portland, Oregon. U.S. Bancorp was acquired by First Bank System in 1997. From 1987 to 1994, Mr. Erwin served as Treasurer of Boston-based BayBanks, Inc.. Mr. Erwin is also a member of the Board of Directors and Compensation Committee and Chairman of the Audit Committee of Innoveda, Inc., a Marlborough, Massachusetts-based technology company.

Mr. Folick became Executive Vice President, Regional Health Plans and Specialty Companies of the Company in May 2002. Prior to joining the Company, Mr. Folick was employed by PacifiCare Health Systems, Inc. ("PacifiCare") since 1989 in various capacities, including President, Chief Operating Officer, President and CEO of the Health Plans Division and Executive Vice President. Prior to joining PacifiCare, Mr. Folick held executive positions at Peak of California and CareAmerica Health Plan of California, and has served as chief financial officer of both Valley Presbyterian Hospital and Allegheny County Hospital System.

Ms. Mayhew became Senior Vice President of Organization Effectiveness of the Company in January 2001. Ms. Mayhew served as Senior Vice President of Human Resources of the Company from April 1999 to January 2001. Prior to joining the Company, Ms. Mayhew served as Senior Vice President, Organization Development of Southern New England Telecommunications Company ("SNET"), a northeast regional information, entertainment and telecommunications company based in Connecticut. SNET was acquired by SBC Communications, Inc. in October 1998. Prior thereto, Ms. Mayhew served in various capacities at SNET, including Vice President, Human Resources, since 1972.

Dr. Moore became Senior Vice President and Chief Medical Officer of the Company in January 2001. Dr. Moore served as Senior Vice President and Chief Medical Officer for the Company's northeast operations from November 1998 to January 2001. Before joining the Company, Dr. Moore served as Vice President of Health Systems Integration at Humana Inc. from March 1996 to November 1998. Prior thereto, Dr. Moore served as a clinical consultant for Towers Perrin Integrated Health Systems, a Minneapolis-based international consulting practice.

Mr. Rich became Executive Vice President of Finance and Operations of the Company in January 2002. Mr. Rich served as President of WebMD from September 2000 to September 2001 and as President, Medical Manager and Chief Executive Officer of CareInsight, Inc. from January 2000 to September 2000. Mr. Rich served as Chief Administrative Officer of Oxford Health Plans from March 1998 to December 1999. Mr. Rich also served as Executive Vice President, Finance & Systems of Kmart from 1994 to 1998.

Ms. Tellez became President of the Company's Health Plans Division in January 2001, and served in such capacity until April 2002, at which time she resigned from all of her office positions with the Company. Ms. Tellez served as President of the Company's Western Division from January 2000 to January 2001 and as President of the Company's California Division from November 1998 through December 1999. Formerly, Ms. Tellez served as President and Chair of Prudential Healthcare Plan of California, Inc., responsible for operations in California, Colorado and Arizona. Prior to joining Prudential in 1997, Ms. Tellez served as Senior Vice President and regional Chief Executive Officer of Blue Shield of California.

Mr. Velasquez became President of the Company's Business Transformation and Innovation Services Division in January 2001, and served in such capacity until April 2002, at which time he resigned from all of his office positions with the Company. Mr. Velasquez served as President of the Company's New Ventures Group from November 1999 to January 2001. Mr. Velasquez served as President of the Company's Government Operations Division from consummation of the FHS

8

Combination through November 1999 and as President of the Company's Specialty Services Division from September 1997 through November 1999. Prior to the FHS Combination, Mr. Velasquez served as President and Chief Operating Officer of FHC's California HMO. Prior to this position, Mr. Velasquez served as President and Chief Operating Officer of FHC's managed behavioral health care organization and as President and Chief Operating Officer of Specialty Services for FHC. Prior to joining FHC, Mr. Velasquez served as Chief Financial Officer/General Manager of Managed Health Network, Inc. (now a Company subsidiary). He also served as Vice President, Controller of Equicor.

Mr. Westen became Senior Vice President, General Counsel and Secretary of the Company upon consummation of the FHS Combination. Mr. Westen served as Senior Vice President, General Counsel and Secretary of HSI since April 1995. Mr. Westen also serves as a director of certain subsidiaries of the Company. Mr. Westen has served as Senior Vice President, General Counsel and Secretary of QualMed since February 1994, and served as Vice President of Administration of QualMed from June 1993 until February 1994. Mr. Westen served as Assistant General Counsel and Assistant Secretary of QualMed since joining QualMed in March 1992 until June 1993. From September 1986 until March 1992 Mr. Westen was an attorney with the firm of Lord, Bissell & Brook in Chicago, Illinois.

Mr. Wing became Executive Vice President, Regional Health Plans and Specialty Companies of the Company and President of the Company's California operations in April 2002. Prior to joining the Company, Mr. Wing served for more than eight years with PacifiCare. Most recently, he served as western region president of PacifiCare and president and chief executive officer of PacifiCare of California. He previously served as northwestern region vice president and chief executive officer for PacifiCare of Washington, and also served as president and chief executive officer for PacifiCare of Utah; senior vice president, health services, for PacifiCare of California and vice president/general manager for PacifiCare of California. Before joining PacifiCare in 1994, Mr. Wing held executive positions with several other health care companies, including Blue Cross of California, Lincoln National Life Insurance Company, Prudential Health Care Plan, Inc. and Maxicare Health Plans, Inc.

Mr. Woys became President of Health Net Federal Services in February 2001, and such position became an executive officer position of the Company in May 2002. Mr. Woys served as Chief Operating Officer and President of Health Net Federal Services from November 1999 to February 2001. Mr. Woys served as Chief Operating Officer and Senior Vice President for Foundation Health Federal Services from February 1998 to November 1999. Mr. Woys served as Senior Vice President of Foundation Health Federal Services from January 1995 to February 1998. From January 1990 to January 1995, Mr. Woys served as Vice President and Chief Financial Officer of the Government Division of FHC. Mr. Woys served as Director of Corporate Finance/Tax for FHC from October 1986 to January 1990. Prior to Mr. Woys' employment with FHC, he was employed by Price Waterhouse from 1982 to 1986 and by Arthur Andersen & Co. from 1980 to 1982.

Certain Relationships and Related Party Transactions

The following information relates to transactions during 2002 between the Company and certain directors and executive officers of the Company.

Ms. Tellez, former President of Health Plans Division of the Company, served as a director of California Business Roundtable and The Institute for the Future, each a non-profit entity of which the Company is a member. The Company paid $25,000 in membership dues to each of to these organizations in 2002.

Mr. Foley, a director of the Company, is a director of ProcurePoint Travel Solutions, Inc. ("ProcurePoint"), which provides various "reverse auction" and "closed bid" hotel rate negotiation tools and services. The Company paid $16,000 in fees to ProcurePoint during 2002.

9

Since January 1, 1998, each of the following current and former executive officers of the Company for 2002 received one-time loans from the Company in the amounts indicated in connection with their hire, promotion or relocation: Jeffrey Bairstow ($150,000), Steven Erwin ($125,000), Karin Mayhew ($300,000), Timothy Moore ($50,000), Cora Tellez ($400,000) and B. Curtis Westen ($250,000). The loans accrue interest at the prime rate and each is payable upon demand by the Company in the event of a voluntary termination of employment of the respective officer or termination for Cause (as defined in their respective employment agreements).

With respect to the loans provided to Messrs. Erwin and Westen and to Mmes. Mayhew and Tellez, the principal and interest of the loans is to be forgiven by the Company at varying times after the date of hire, promotion or relocation of the respective officers. A loan will be forgiven prior to such time in the event the respective officer's employment is terminated involuntarily without Cause, voluntarily due to Good Reason following a Change of Control (each as defined in their respective employment agreements), or due to death or disability.

With respect to the loans provided to Messrs. Bairstow and Moore, principal of the loans is to be repaid in various increments from future annual bonuses that may become payable to such individuals; provided that in the event a bonus for a given year is not sufficient to pay such principal amount due, then the portion of such principal amount not so repaid will be carried forward to the following year. In the event that any principal balance remains after five years (for Mr. Bairstow) or after three years (for Mr. Moore), then such remaining principal will become due in full at such time. The principal of such loans is also due in full in the event the individual's employment is terminated for any reason, and in the event a severance payment is due to the individual in connection with such termination, the severance payment will be reduced in an amount sufficient to pay the amount due under the loan.

Income incurred by an officer due to interest on all of such loans (but not the principal) being forgiven is "grossed up" by the Company to cover the income taxes due upon such interest forgiveness. As of March 20, 2003, the remaining principal under each of the loans is as follows: Jeffrey Bairstow ($0), Steven Erwin ($0), Karin Mayhew ($120,000), Timothy Moore ($33,333), Cora Tellez ($0) and B. Curtis Westen ($0).

10

ACTIVITIES OF THE BOARD OF DIRECTORS AND ITS COMMITTEES

Members of the Board of Directors are elected by the holders of Class A Common Stock of the Company and represent the interests of all stockholders. The Board of Directors meets periodically to review significant developments affecting the Company and to act on matters requiring board approval. Although the Board of Directors delegates many matters to others, it reserves certain powers and functions to itself.

The Company's Board of Directors met a total of seven times in 2002. Each member of the Board of Directors of the Company was present for 75% or more of the aggregate number of meetings of such Board of Directors held in 2002 (during the period he/she served as a director) and of all committees of such Board of Directors held in 2002 on which he/she served (during the period he/she served) except for Mr. Foley.

Committees of the Board of Directors

The by-laws of the Company establish the following committees of the Board of Directors: the Audit Committee, the Committee on Directors, the Compensation and Stock Option Committee (the "Compensation Committee") and the Finance Committee. The by-laws further provide that additional committees may be established by resolution adopted by a majority of the Board. In this connection, in December of 2000 the Board of Directors so established the Technology/Infrastructure Committee by resolution, and in October 2002 the Board of Directors so established the Litigation Ad Hoc Committee by resolution. A majority of the Board of Directors selects the directors to serve on the committees of the Board of Directors.

Audit Committee. The Audit Committee of the Board of Directors of the Company currently consists of Messrs. Farley, Stegemeier (Chairman), Fitzgerald and Willison, each of whom is an "independent director" as that term is defined in the New York Stock Exchange Listed Company Manual. Ms. Fitzgerald replaced Gov. Deukmejian as a member of this committee in May 2002. This committee is directed to review the scope, cost and results of the independent audit of the Company's books and records, the results of the annual audit with management and the internal auditors and the adequacy of the Company's accounting, financial and operating controls; to recommend annually to the Board of Directors the selection of the independent auditor; to approve the appointment or removal of the independent auditor; to consider proposals made by the Company's independent auditor for consulting work; to oversee the Company's compliance with certain regulatory programs to deter fraud and abuse; and to report to the Board of Directors, when so requested, on any accounting or financial matters. The Audit Committee operates under a written charter adopted by the Company's Board of Directors. The Company's Audit Committee held eight meetings in 2002.

Committee on Directors. The Committee on Directors of the Board of Directors of the Company currently consists of Messrs. Deukmejian (Chairman), Bouchard, Hanselman and Willison. Mr. Bouchard replaced Mr. Greaves as a member of this committee in May 2002. The Committee on Directors is responsible for reviewing qualifications of individuals suggested as possible candidates for election as directors of the Company. In connection with that responsibility, the Committee on Directors nominated for re-election each of the ten nominees for re-election. The Committee on Directors considers suggestions from many sources, including stockholders, regarding possible candidates for director. Stockholders who wish to propose nominations for directors for consideration at the 2004 Annual Meeting of Stockholders may do so in accordance with the procedures described below under "REQUIREMENTS AND PROCEDURES FOR SUBMISSION OF PROXY PROPOSALS AND NOMINATIONS OF DIRECTORS BY STOCKHOLDERS—Nominations for the Board of Directors." The Company's Committee on Directors held four meetings in 2002.

Compensation and Stock Option Committee. The Compensation Committee currently consists of Messrs. Bouchard (Chairman), Farley, Foley and Greaves. Mr. Greaves replaced Mr. Troubh as a

11

member of this committee in May 2002, as Mr. Troubh relinquished his membership on this committee due to his retirement as a director. Each of such members (other than Mr. Greaves who is a prior executive officer of the Company) is an "outside director" as such term is defined in Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code"). An appropriate sub-committee of the Compensation Committee made up of the members who qualify as "outside directors" under Section 162(m) will take action on all matters that are likely to be subject to Section 162(m) of the Code. The by-laws and the policies of the Board of Directors direct the Compensation Committee: (a) to recommend to the Board of Directors the compensation, including direct regular compensation, stock options or other appropriate incentive plans, and perquisites, if any, of the two most highly compensated Corporate Officers (as defined in the by-laws) of the Company, which recommendations are subject to ratification, modification or rejection by the Board of Directors; (b) to approve the compensation, including direct regular compensation, stock options or other appropriate incentive plans, and perquisites, if any, of up to thirty-five senior officers of the Company and its subsidiaries, including the two Corporate Officers covered in (a) above, which senior officers are designated by the Compensation Committee in consultation with management; (c) to review and approve, on a general policy level basis only, the compensation and benefits architecture for officers and employees other than those covered in (a) and (b) above, based on management's presentation of all relevant factors of proposed actions in totality, and advise the Board of Directors of actions taken, and such compensation and benefit matters shall be deemed within the Compensation Committee's general oversight; (d) to recommend to the Board of Directors corporate-wide policies with respect to direct regular compensation, stock options or other appropriate incentive plans, and perquisites, if any; (e) to administer and implement the Company's stock option or other stock-based and equity-based benefit plans (the "Plans"), including the review and approval of all grants thereunder; (f) to fulfill the purposes of the Plans including, without limitation, through the conditional grant of options and other benefits under the Plans; (g) to recommend to the Board of Directors any revisions or additions to the Plans; (h) to recommend to the Board of Directors appropriate actions with respect to modification, revision or termination of trusteed employee benefit or welfare plans (such as 401(k) or pension plans), with action with respect to such trusteed plans being reserved to the Board of Directors; and (i) to review and report to the Board of Directors, when so requested, on any compensation matter. In 2002, the Company's Compensation Committee held ten meetings.

Finance Committee. The Finance Committee of the Board of Directors of the Company currently consists of Messrs. Deukmejian, Foley, Greaves (Chairman) and Stegemeier. Gov. Deukmejian replaced Ms. Fitzgerald as a member of this committee in May 2002. This committee is directed and empowered to review the Company's investment policies and guidelines; monitor performance of the Company's investment portfolio; in coordination with the Audit Committee, review the Company's financial structure and operations in light of the Company's long-term objectives; and review and recommend to the Board of Directors appropriate action on proposed acquisitions and divestitures. Among other responsibilities, the Committee establishes appropriate authority levels for various officials of the Company with respect to mergers and acquisitions transactions, divestiture transactions and capital expenditures. The Committee also reviews and recommends appropriate action with respect to the Company's short- and long-term debt structure. The Company's Finance Committee held six meetings in 2002.

Technology/Infrastructure Committee. The Board of Directors created the Technology/Infrastructure Committee, which currently consists of Messrs. Foley, Greaves (Chairman) and Willison and Ms. Fitzgerald. The purpose of this committee is to review and consult with management regarding the Company's various technology and infrastructure plans and activities. The Company's Technology/Infrastructure Committee held three meetings in 2002.

Litigation Ad Hoc Committee. The Board of Directors created the Litigation Ad Hoc Committee in October 2002, which currently consists of Messrs. Deukmejian, Greaves, Hanselman and Willison. The purpose of this committee is to review and consult with management regarding certain of the Company's litigation matters, and to authorize the settlement strategy of the Company related thereto. The Company's Litigation Ad Hoc Committee held two meetings in 2002.

12

REPORT OF THE COMPENSATION AND STOCK OPTION COMMITTEE ON

EXECUTIVE COMPENSATION FOR FISCAL YEAR 2002

Introduction and Background

The following report is provided in accordance with the rules of the Securities and Exchange Commission and covers compensation policies applicable to the executive officers of Health Net, Inc. (the "Company") during 2002. The report has been approved by the members of the Compensation and Stock Option Committee of the Board of Directors of the Company (the "Compensation Committee").

During 2002, the Compensation Committee was comprised of all "outside directors" (within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code")) other than Mr. Greaves (who is a prior executive officer of the Company). Messrs. Bouchard (Chairman), Farley, Foley and Troubh served on the Compensation Committee until May 2002 when Mr. Greaves replaced Mr. Troubh on the Committee due to Mr. Troubh's retirement as a member of the Board of Directors. As of the date of this report, the Compensation Committee continues to be comprised of these four members. An appropriate sub-committee of the Compensation Committee made up of the members who qualify as "outside directors" under Section 162(m) will take action on all matters that are likely to be subject to Section 162(m) of the Code. The Chairman of the Board of Directors (Mr. Hanselman) also regularly attends and participates in Compensation Committee meetings, but since he is not a member of the Committee he does not vote on any Committee actions.

Under the Company's by-laws, the Compensation Committee is responsible for recommending to the Board of Directors the compensation levels of the Chief Executive Officer and the most highly compensated officer other than the Chief Executive Officer. The Compensation Committee is also responsible for approving the compensation levels of certain other senior executives, including the "Named Executive Officers" listed below in the Summary Compensation Table. The Compensation Committee is also responsible for the administration of the Company's stock option and other stock-based and equity-based plans.

Our report covers the following topics:

- •

- Role of the Compensation and Stock Option Committee

- •

- Executive Compensation Philosophy and Guiding Principles

- •

- Compensation Components and Market Positioning

- •

- Leadership Development and Succession Planning

- •

- Compensation of the Chief Executive Officer

Role of the Compensation and Stock Option Committee

The Compensation and Stock Option Committee is responsible for developing and administering governance principles with respect to executive compensation and stock option usage. Specific accountabilities include:

- •

- Developing the Company's Executive Compensation Philosophy and the Guiding Principles from which program design and compensation decisions are made

- •

- Ensuring executive compensation is consistent with 1) market practice, 2) business strategy, and 3) business performance

- •

- Approving (or recommending to the Board for approval) compensation levels for the Company's most senior executives identified by the Compensation Committee from time to time.

13

- •

- Facilitating the Company's leadership development and succession planning program

- •

- Evaluating the CEO's performance and compensation

- •

- Administering the Company's stock option program

The Compensation and Stock Option Committee makes every effort to maintain independence and objectivity. The Committee meets in executive session (excluding the CEO) from time to time where discussions and/or decisions regarding CEO pay take place.

The landscape for executive compensation governance and accounting is changing. The Compensation and Stock Option Committee is committed to staying apprised of current issues and emerging trends, and ensuring that Health Net's executive compensation program remains aligned with best practice. To this end, the Committee works with a number of independent advisors and regularly reviews compensation levels, best practices and emerging issues.

Executive Compensation Philosophy and Guiding Principles

Health Net's Executive Compensation Philosophy positions compensation as a strategic management tool that allows the Company to attract, motivate and retain highly qualified executives who are able to maximize value for shareholders.

In seeking to carry out the Philosophy and employ highly qualified executives, the Compensation and Stock Option Committee has developed a set of Guiding Principles that are intended to steer compensation design and administration decisions made by the Board, the Committee and/or Management. Health Net's Executive Compensation Guiding Principles are as follows:

Principle #1—Compensation must be directly aligned with performance

Executive compensation levels should be commensurate with corporate performance and shareholder return. Our annual incentive program incorporates profitability measures that we believe will increase long-term shareholder value. Payments are reduced or not made at all if performance does not meet expectations.

Principle #2—Pay amounts and program design must be competitive with market practice

Understanding competitive market pay levels is instrumental in hiring and keeping qualified executives. Moreover, it is important to understand how best practices change and how comparable organizations deliver compensation. The Committee works with independent advisors to annually review our pay levels relative to market and frequently assesses emerging trends and issues impacting executive compensation.

Health Net's competitive market for executive talent is primarily large managed care organizations. However, where appropriate, Health Net will look to large organizations outside healthcare for executive talent.

Principle #3—Share ownership must be promoted

The personal financial interests of the Company's executives should be directly aligned with those of shareholders. Our compensation and retirement savings programs take this into consideration. More to the point, in 2002, the Committee introduced share ownership guidelines for executives. The guidelines call for the CEO to own shares equal in value to five times annual base salary. Other executives are required to hold between one and three times annual base salary in shares. Participants have four years to comply with the guidelines.

14

Principle #4—Plan affordability and the Company's capacity to pay must always be taken into consideration

The Company's economic situation and profitability must always be taken into consideration when compensation decisions are made. Salary increases, bonus payments and long-term incentive awards will only be made when the Company can afford to do so. Retirement and savings plans funding decisions will also be made within this context.

Compensation Components and Market Positioning

The Committee seeks to have a significant portion of annual compensation at risk, and stock options are used in an attempt to directly align executives' long-term financial interests with the stockholders and advance the interests of the Company by attracting and retaining talented executives. Specifically, each component of pay is described as follows:

Base Salaries

Health Net must manage cash flows and fixed expenses to be financially successful. Thus, base salaries will be positioned at slightly below the median of the competitive market. The CEO's salary is set below the median of the market in order to provide a more highly leveraged incentive program with significant upside opportunity if shareholder returns are substantially improved.

Annual Incentive Compensation

If goals are met, the incentive plans are intended to provide total cash compensation at the 75th percentile of the market for top quartile performance. All executives participate in the annual incentive program, which is based on corporate, unit and individual performance. The goal setting process takes into consideration internal budgets, past performance, market expectations and competitor performance.

It should be noted that the Compensation Committee's policy with respect to the tax deductibility of compensation in excess of $1 million payable to each of the Named Executive Officers is to comply with the requirements of Section 162(m) of the Code applicable to qualified performance-based compensation to the extent such compliance is practicable and in the best interest of the Company and its stockholders.

Long-Term Incentives

Health Net provides a long-term incentive opportunity in the form of stock options. Option grants are positioned to provide total direct compensation at the 75th percentile of the market. Consistent with the Company's philosophy to focus on shareholder return, the Company has issued options in the past with a vesting acceleration feature if the stock price reaches specified trading levels.

In addition to stock options, the Committee has periodically used restricted stock in recruiting circumstances, or to ensure the retention of a key team member. While restricted stock is not a regular component of the executive pay program, it has played an important role when the situation permits.

Benefits/Perquisites

The Company provides benefits focused on ensuring reasonable financial security and making executives whole for benefits lost due to IRS or other restrictions. Long-term wealth accumulation is dependent on stock price appreciation and executives may be eligible to receive supplemental retirement benefits. All benefits and perquisites programs are provided consistent with median market practices as necessary to attract and retain key talent.

15

Severance

Executive Officers are entitled to receive a lump sum payment equal to between one and three times base salary plus, for a period of between one and three years, continued health and welfare benefit coverage upon termination of their employment, such amounts and coverage periods being dependent on the nature of the termination. Under the Company's standard Severance Payment Agreement, terminated executives are precluded from competing with the Company for a period of up to one year post-termination, depending on the applicable circumstances.

In addition, the Company provides benefits for the senior executives in the event of a change in control. Vesting of stock options held by senior executives, including Mr. Gellert, accelerates upon a change in control. If the benefits provided under the Severance Payment Agreement constitute parachute payments under Section 280G of the Internal Revenue Code and are subject to the excise tax imposed by Section 4999 of the Internal Revenue Code, the Named Executive Officers would receive (i) a payment sufficient to pay such excise taxes and (ii) an additional payment sufficient to pay the taxes arising as a result of such payments.

Leadership Development and Succession Planning

The Committee understands that it must see beyond the current management team and ensure that future senior leadership is identified and appropriately developed and groomed. The leadership development and succession planning initiative is an integral component of the Company's strategic plan. It is this Committee's responsibility to facilitate the identification and development of the Company's current and future leadership.

Compensation of the Chief Executive Officer

The Compensation and Stock Option Committee is responsible for evaluating annually the CEO's performance and compensation. All decisions relating to the CEO's pay are made in the context of his performance. The Committee also seeks independent and objective advice on this topic.

The Company's historic reward strategy has been to pay the CEO a base salary at the 25th percentile of the market with greater emphasis on the long-term incentive component. This was primarily due to a critical need to conserve cash. While cash conservation is still important, improved financial performance allows the Committee to bring Mr. Gellert more in line with the overall compensation strategy for other executives of providing a base salary slightly under the market median. This will, of course, be accomplished over a period of several years. Effective August 2002, Mr. Gellert's base salary was increased to $850,000. This re-balancing of the compensation components means that there will be less emphasis on long-term incentives for the CEO (i.e., fewer stock options will be awarded).

Mr. Gellert's target incentive is 125% of base salary. If performance objectives are met and a target incentive is paid, the CEO's cash compensation (base salary plus annual incentive) will fall at the market median. The CEO has the opportunity to earn up to 200% of his salary if performance expectations are significantly exceeded. Incentive plan objectives include pre-tax income, membership growth and employee satisfaction objectives.

In August of 2002, the Company awarded the CEO 325,000 stock options. In determining the number of options to be granted, the Committee considered the advice of independent consultants, internal equity and the CEO's potential to impact shareholder value. Also, the re-balancing of the CEO's compensation components was taken into consideration. His award for 2002 is reduced in value from previous years, and approximates the 25th percentile of long-term incentive awards among a select group of comparable organizations. The options vest 50% in three years and 50% in four years and have a ten-year term.

16

Per the Company's recently adopted ownership guidelines, we note that Mr. Gellert has taken steps to increase his personal holdings of the Company's stock. This year, Mr. Gellert made a market purchase of an additional 10,000 shares of the Company's common stock with personal funds.

In the event of Mr. Gellert's involuntary termination other than for cause or his involuntary (or constructive) termination within two years following a change in control, he would receive a $6 million severance benefit. The Committee has received independent advice on this component and it reflects competitive practice. Mr. Gellert is precluded from competing with the Company for a period of up to one year post-termination under his severance arrangement with the Company.

Overall, the Compensation and Stock Option Committee believes that the Guiding Principles of the Company's executive compensation program will allow the Company to attract, motivate and retain executives who are highly capable and well positioned to create shareholder value. Our emphasis has always been on aligning compensation with performance. This is inherent in our Executive Compensation Philosophy and our Guiding Principles. While specific program features may evolve to remain competitive, we will continue to govern our decisions based on principles of performance, market competitiveness, ownership and affordability.

| |

|

|---|

| | | J. Thomas Bouchard, Chairman

Thomas T. Farley

Patrick Foley

Roger Greaves |

|

|

Dated: March 19, 2003 |

17

Stock Performance Graph

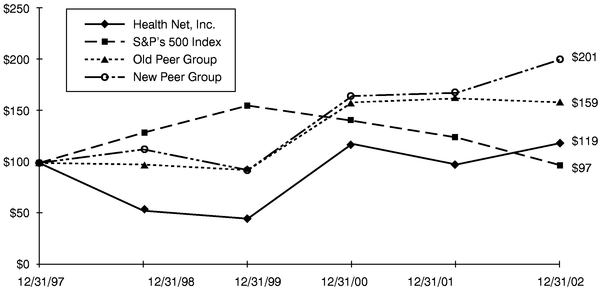

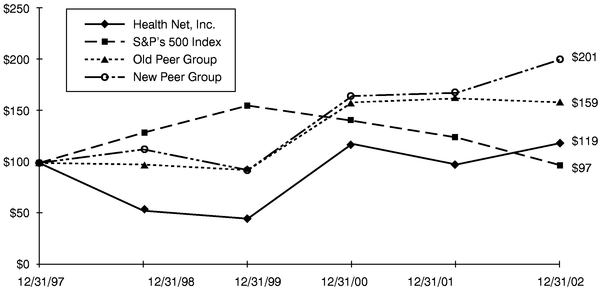

The following graph compares the performance of the Company's Class A Common Stock with the performance of the Standard & Poor's 500 Composite Stock Price Index (the "S&P 500 Index") and two peer group indices (representing both the New Peer Group and the Old Peer Group described below) from December 31, 1997 (the last trading day of 1997) to December 31, 1998, 1999, 2000, 2001 and 2002. The graph assumes that $100 was invested on December 31, 1997 in each of the Class A Common Stock, the S&P 500 Index and the peer group indices, and that all dividends were reinvested.

The Company created a new peer group (the "New Peer Group") index that includes the following companies: Aetna, Inc., Anthem, Inc., Humana, Inc., Oxford Health Plans, Inc., PacifiCare Health Systems, Inc., United Healthcare Corporation and WellPoint Health Networks, Inc. In 2002, the Company changed its peer group by adding Anthem, Inc. and deleting Columbia/HCA Healthcare Corporation and Tenet Healthcare Corporation. These changes were made to ensure the peer group companies are aligned with Health Net in terms of both business market and operational focus.

The peer group reported in Health Net's prior proxy statement (the "Old Peer Group") includes the following companies: Aetna, Inc., Columbia/HCA Healthcare Corporation, Humana, Inc., Oxford Health Plans, Inc., PacifiCare Health Systems, Inc., Tenet Healthcare Corporation, United Healthcare Corporation and WellPoint Health Networks, Inc.

Each of the New Peer Group Index and the Old Peer Group Index weighs the constituent companies' stock performance on the basis of market capitalization at the beginning of the period, except that data for Anthem, Inc. is only included for the period from December 31, 2001 to December 31, 2002 since it did not become a public company until October 2001.

COMPARISON OF CUMULATIVE TOTAL RETURN AMONG HEALTH NET, INC.,

S&P 500 INDEX AND PEER GROUP INDEX

FROM DECEMBER 31, 1997 TO DECEMBER 31, 2002

| | Health Net, Inc

| | S&P's 500 Index

| | Old Peer Group

| | New Peer Group

|

|---|

| December 31, 1997 | | $ | 100 | | $ | 100 | | $ | 100 | | $ | 100 |

| December 31, 1998 | | $ | 53 | | $ | 129 | | $ | 98 | | $ | 113 |

| December 31, 1999 | | $ | 45 | | $ | 156 | | $ | 93 | | $ | 93 |

| December 31, 2000 | | $ | 118 | | $ | 141 | | $ | 159 | | $ | 165 |

| December 31, 2001 | | $ | 98 | | $ | 125 | | $ | 163 | | $ | 168 |

| December 31, 2002 | | $ | 119 | | $ | 97 | | $ | 159 | | $ | 201 |

18

EXECUTIVE COMPENSATION AND OTHER INFORMATION

The following tables and descriptive materials set forth separately, for the fiscal years indicated, each component of compensation paid or awarded to, or earned by, (i) Mr. Gellert, the Chief Executive Officer of the Company during 2002, and (ii) each of the four other most highly compensated executive officers of the Company serving as of the end of the 2002 calendar year (all such persons collectively, the "Named Executive Officers").

SUMMARY COMPENSATION TABLE

| |

| |

| |

| |

| | Long-Term Compensation

| |

| |

|---|

| |

| | Annual Compensation

| | Awards

| | Payouts

| |

| |

|---|

Name and Principal Position with the Company in 2002

| | Year

| | Salary($)

(1)

| | Bonus

($)

| | Other

Annual

| | Restricted

Stock

Awards

$(2)

| | Securities

Underlying

Options/

SARs(#)

| | LTIP

Payouts

($)

| | All Other

Compensation

($)

| |

|---|

Jay M. Gellert

President and Chief Executive Officer | | 2002

2001

2000 | | 754,808

686,923

586,539 | | 700,000

0

0 | | 65,755

69,853

78,348 | (3)

(5)

(7) | 0

0

0 | | 325,000

650,000

500,000 | | 0

0

0 | | 6,256

711

630 | (4)

(6)

(6) |

Marvin P. Rich

EVP, Finance & Health Plan Operations | | 2002

2001

2000 | | 451,923

0

0 | (8)

| 800,000

0

0 | (9)

| 11,133

0

0 | (10)

| 0

0

0 | | 800,000

0

0 | | 0

0

0 | | 5,905

0

0 | (11)

|

Christopher Wing

EVP, Regional Health Plans & Specialty Companies | | 2002

2001

2000 | | 337,500

0

0 | (12)

| 561,450

0

0 | (13)

| 8,767

0

0 | (10)

| 1,056,000

0

0 | (14)

| 350,000

0

0 | | 0

0

0 | | 162

0

0 | (15)

|

B. Curtis Westen

Sr. VP, General Counsel & Secretary | | 2002

2001

2000 | | 448,038

434,769

393,269 | | 308,000

0

186,667 | | 12,000

12,000

12,000 | (10)

(10)

(10) | 132,000

0

0 | (16)

| 100,000

160,000

100,000 | | 0

0

0 | | 8,432

104,889

105,194 | (17)

(18)

(19) |

James Woys

President, Health Net Federal Services | | 2002

2001

2000 | | 308,569

272,654

255,577 | | 240,100

70,125

160,000 | | 12,000

12,000

10,000 | (10)

(10)

(10) | 0

0

0 | | 50,000

58,250

30,000 | | 0

0

0 | | 5,803

5,394

4,878 | (20)

(21)

(22) |

It should be noted that Jeffrey Folick, Executive Vice President, Regional Health Plans & Specialty Companies, joined the Company in this capacity in May 2002. Had Mr. Folick been employed by the Company for the full year, he would have been one of the Named Executive Officers. Mr. Folick had an annual base salary of $500,000 during 2002, and earned an annual cash bonus of $222,775 for the seven month portion of the year he was employed by the Company. He was also granted an option to purchase 500,000 shares of Class A Common Stock at a per share exercise price of $27.59 in 2002, which option vests in various traunches over a five year period, subject to accelerated vesting in the event certain Class A Common Stock closing price thresholds are achieved.

- (1)

- Includes amounts deferred pursuant to the Company's Deferred Compensation Plan and Profit Sharing and 401(k) Plans.

- (2)

- This column shows the market value as of December 31, 2002 of shares of restricted stock granted to each of the Named Executive Officers during 2002. The aggregate holdings and market value of shares of restricted stock held on December 31, 2002 by the Named Executive Officers listed in this table are: Mr. Gellert, no shares; Mr. Rich, no shares; Mr. Wing, 40,000 shares ($1,056,000); Mr. Westen, 5,000 shares ($132,000); and Mr. Woys, no shares. The restrictions on these shares lapse as set forth in the individualized footnotes for this column set forth below. Dividends will be paid on the shares of restricted stock to the same extent (if any) dividends are paid on the Class A Common Stock generally; provided that the Company will hold in escrow any such dividends until all restrictions on such shares have lapsed.

- (3)

- Represents $60,669 paid for housing and travel benefits, including the tax gross-up on such items, $3,000 as an automobile allowance and $2,086 for miscellaneous benefits.

19

- (4)

- Represents matching contributions under the Company's 401(k) Plan of $5,500 and premiums paid by the Company on a life insurance policy of $756.

- (5)

- Represents $56,828 paid for housing and travel benefits, including the tax gross-up on such items, $12,000 as an automobile allowance and $1,025 for miscellaneous benefits.

- (6)

- Represents premiums paid by the Company on a life insurance policy.

- (7)

- Represents $66,348 paid for housing and travel benefits, including the tax gross-up on such items, and $12,000 as an automobile allowance.

- (8)

- Mr. Rich joined the Company in January 2002, and his salary for 2002 therefore does not represent a full year of salary.

- (9)

- Includes a one-time signing bonus of $450,000.

- (10)

- Represents amounts paid as an automobile allowance.

- (11)

- Represents matching contributions under the Company's 401(k) Plan of $5,500 and premiums paid by the Company on a life insurance policy of $405.

- (12)

- Mr. Wing joined the Company in April 2002, and his salary for 2002 therefore does not represent a full year of salary.

- (13)

- Includes a one-time signing bonus of $300,000.

- (14)

- Represents restricted stock award of 40,000 shares valued as of December 31, 2002 at $1,056,000. The 40,000 shares vest as follows: 13,334 on March 25, 2003; 13,333 on either (a) the date the closing sales price of Common Stock for 20 consecutive trading days is equal to or greater than $32 or (b) March 25, 2007; 13,333 on either (a) the date the closing sales price of Common Stock for 20 consecutive trading days is equal to or greater than $37 or (b) March 25, 2007. These are the only shares of restricted stock held by Mr. Wing.

- (15)

- Represents premiums paid by the Company on a life insurance policy of $162.

- (16)

- Represents restricted stock award of 5,000 shares valued as of December 31, 2002 at $132,000. The shares vest in full on August 12, 2005 (three years after the date of grant). These are the only shares of restricted stock held by Mr. Westen.

- (17)

- Represents matching contributions under the Company's 401(k) Plan of $5,500, financial counseling expenses of $235, club membership fees of $2,222 and premiums paid by the Company on a life insurance policy of $475.

- (18)

- Represents matching contributions under the Company's 401(k) Plan of $4,862, loan principal and interest forgiven by the Company, including a tax gross-up of the interest, of $97,385, financial counseling expenses of $766, club membership fees of $1,419 and premiums paid by the Company on a life insurance policy of $457.

- (19)

- Represents matching contributions under the Company's 401(k) Plan of $4,978, loan principal and interest forgiven by the Company, including a tax gross-up of the interest, of $96,406, premiums paid by the Company on a life insurance policy of $423 and miscellaneous benefits of $3,387.

- (20)

- Represents matching contributions under the Company's 401(k) Plan of $5,500 and premiums paid by the Company on a life insurance policy of $303.

- (21)

- Represents matching contributions under the Company's 401(k) Plan of $5,100 and premiums paid by the Company on a life insurance policy of $294.

- (22)

- Represents matching contributions under the Company's 401(k) Plan of $4,606 and premiums paid by the Company on a life insurance policy of $272.

20

Option Grants in 2002

The following table summarizes option grants made in 2002 to the Named Executive Officers of the Company.

OPTION/SAR GRANTS IN LAST FISCAL YEAR

| |

| |

| |

| |

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(b)

|

|---|

Name

| | Number of Securities

Underlying options/SARs

Granted(#)(a)

| | % of Total Options/SARs

Granted to Employees

in Fiscal Year

| | Exercise or

Base Price(a)

($/share)

| | Expiration

Date

| | 5%($)

| | 10%($)

|

|---|

| Jay M. Gellert | | 325,000 | | 6.7 | % | $ | 22.64 | | 8/12/2012 | | 4,627,407 | | 11,726,757 |

| Marvin P. Rich | | 800,000 | | 16.6 | % | $ | 22.01 | | 1/28/2012 | | 11,073,577 | | 28,062,617 |

| Christopher Wing | | 350,000 | | 7.2 | % | $ | 25.86 | | 3/25/2012 | | 5,692,125 | | 14,424,963 |

| B. Curtis Westen | | 100,000 | | 2.1 | % | $ | 22.64 | | 8/12/2012 | | 1,423,817 | | 3,608,233 |

| James Woys | | 50,000 | | 1.0 | % | $ | 22.64 | | 8/12/2012 | | 711,909 | | 1,804,116 |

- (a)