UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

HEALTH NET, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

HEALTH NET,

INC.

NOTICE OF

2004 ANNUAL

MEETING

AND

PROXY

STATEMENT

Preliminary Copy

March , 2004

Dear Stockholders:

It is a pleasure to invite you to attend the 2004 Annual Meeting of Stockholders of Health Net, Inc. to be held at the company’s offices located at 21281 Burbank Boulevard in Woodland Hills, California 91367 on Thursday, May 13, 2004, at 10:00 a.m. (Pacific daylight time). For your convenience, we are offering a live webcast of the annual meeting on our Internet web site, www.health.net.

Each item of business described in the accompanying Notice of Annual Meeting and Proxy Statement will be discussed during the annual meeting. In addition, a report on our business operations will be presented at the meeting. Stockholders who attend the annual meeting will have an opportunity to ask questions at the meeting; those who participate in the live webcast may submit questions during the meeting via the Internet.

It is important that you vote your shares whether or not you plan to attend the annual meeting. We urge you to carefully review the proxy statement and to vote your choices either on the enclosed proxy card or via the Internet. Please sign and date your proxy card and return it in the envelope provided as soon as possible or complete a proxy card over the Internet at www.computershare.com/us/proxy. If you do attend the annual meeting in person, your proxy can be revoked at your request.

We look forward to your attendance at the annual meeting.

Sincerely,

Jay M. Gellert

President and Chief Executive

Officer

Preliminary Copy

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Health Net, Inc. will hold its 2004 Annual Meeting of Stockholders on Thursday, May 13, 2004 at 10:00 a.m. (Pacific daylight time) at the Company’s offices at 21281 Burbank Boulevard in Woodland Hills, California 91367, for the following purposes:

| | 1. | To elect nine directors to serve for a term of one year or until the 2005 Annual Meeting of Stockholders. |

| | 2. | To adopt an amended and restated Certificate of Incorporation that eliminates Health Net’s Class B Convertible Common Stock, $.001 par value per share, and refers to the single remaining class of Health Net common stock as “Common Stock” rather than “Class A Common Stock.” |

| | 3. | To ratify the selection of Deloitte & Touche LLP as Health Net’s independent public accountants. |

| | 4. | To transact such other business as may be properly brought before the meeting or any adjournment or postponement thereof. |

The Board of Directors has fixed Friday, March 19, 2004 as the record date for the determination of the stockholders entitled to notice of, and to vote at, the annual meeting or any adjournment or postponement of the annual meeting.

At the annual meeting, each share of Class A Common Stock, $.001 par value per share, of Health Net represented at the annual meeting will be entitled to one vote on each matter properly brought before the annual meeting. Jay M. Gellert and B. Curtis Westen have been appointed as proxy holders, with full rights of substitution, for the holders of Class A Common Stock.

By Order of the Board of Directors,

B. Curtis Westen, Esq.

Senior Vice President, General Counsel and Secretary

March , 2004

YOUR VOTE IS IMPORTANT

All stockholders are cordially invited to attend the 2004 Annual Meeting of Stockholders of Health Net, Inc. in person. However, to ensure your representation at the annual meeting, please mark, sign and date the enclosed proxy card and return it as soon as possible in the enclosed self-addressed, postage-paid envelope or, alternatively, fill out a proxy card over the Internet at www.computershare.com/us/proxy. If you attend the annual meeting in person, you may vote at the meeting even if you have previously returned a proxy.

Preliminary Copy

PROXY STATEMENT

General; Voting of Shares

The accompanying proxy is solicited by the Board of Directors of Health Net, Inc. (the “Company,” “Health Net,” “we,” “us” or “our”) for use at its 2004 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Thursday, May 13, 2004 at 10:00 a.m. (Pacific daylight time) at the Company’s offices at 21281 Burbank Boulevard, Woodland Hills, California 91367, and at any adjournments or postponements thereof. The Company expects to mail this proxy statement and accompanying proxy card beginning on or about March 26, 2004 to holders of record of the Company’s Class A Common Stock, $.001 par value per share (“Class A Common Stock”), on March 19, 2004 (the “Record Date”).

We are offering a live webcast of the Annual Meeting on our Internet web site, www.health.net. The webcast of the Annual Meeting will consist of live sound, real-time access to printed material and the ability of stockholders to submit questions during the question and answer period. To participate in the webcast of the Annual Meeting, a stockholder should log on to www.health.net on Thursday, May 13, 2004 shortly before 10:00 a.m. (Pacific daylight time) and follow the instructions provided under the “Investor Relations” section of the web site. Stockholders willnot be permitted to vote over the Internet during the Annual Meeting.

Only holders of record of Class A Common Stock at the close of business on the Record Date are entitled to vote at the Annual Meeting. Each share of Class A Common Stock represented at the Annual Meeting is entitled to one vote on each matter properly brought before the Annual Meeting. The Company’s bylaws require that the holders of a majority of the total number of shares entitled to vote be present in person or by proxy in order for the business of the Annual Meeting to be transacted. Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting. Participation by a stockholder in the live webcast of the Annual Meeting will not be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting.

In voting, please specify your choices either by marking the appropriate spaces on the enclosed proxy card, signing and dating the card and returning it in the accompanying envelope or, alternatively, by completing a proxy card over the Internet at www.computershare.com/us/proxy before1:00 a.m. (Central daylight time) on May 13, 2004.Voting over the Internet will not be permitted after 1:00 a.m. (Central daylight time) on Thursday, May 13, 2004. If no directions are given and either the signed card is returned or the Internet proxy card is submitted, then the proxy holders will vote the shares for the election of all listed nominees and in accordance with the directors’ recommendations or as stated on the proxy card for the other subjects listed on the proxy card, and in their discretion on any other business that may be properly brought before the meeting or any adjournment or postponement thereof.

Instructions on how to submit a proxy via the Internet are located on the attachment to the proxy card included with this proxy statement. The Internet voting procedures are designed to authenticate stockholders of the Company by use of a control number located on the attachment to the proxy card included herewith. If you hold your shares through a bank, broker or other holder of record, check the information provided by that entity to determine which voting options are available to you. Please be aware that any costs related to voting over the Internet, such as Internet access charges and telecommunications costs, will be your responsibility.

1

Revocability of Proxies

Any stockholder giving a proxy has the power to revoke it at any time before the proxy is voted. A proxy may be revoked by filing with the Secretary of the Company written notice of revocation bearing a later date than the proxy, by duly executing a subsequently dated proxy relating to the same shares of Class A Common Stock and delivering it to the Secretary of the Company or submitting it electronically via the Internet at www.computershare.com/us/proxy before 1:00 a.m. (Central daylight time) on May 13, 2004, or by attending the Annual Meeting in person and voting such shares during the Annual Meeting. Attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy. Any subsequently dated proxy or written notice revoking a proxy should be sent to the Secretary of Health Net, Inc., at its executive offices at 21650 Oxnard Street, Woodland Hills, California 91367 or if a subsequently dated proxy is submitted electronically, it should be sent via the Internet before 1:00 a.m. (Central daylight time) on May 13, 2004 using the web site at www.computershare.com/us/proxy.

Shares Outstanding

As of the Record Date, the Company had outstanding shares of Class A Common Stock. Each share of Class A Common Stock is entitled to one vote.

Solicitation

The Company will bear the entire cost of the solicitation of proxies, including preparation, assembly and mailing of this proxy statement, the proxy and any additional materials furnished to stockholders. Proxies may be solicited by directors, officers and a small number of regular employees of the Company personally or by mail, telephone or telegraph, but such persons will not be specially compensated for such service. Copies of solicitation material will be furnished to brokerage houses, fiduciaries and custodians that hold shares of Class A Common Stock of record for beneficial owners for forwarding to such beneficial owners. The Company may also reimburse persons representing beneficial owners for their costs of forwarding the solicitation material to such owners.

Your vote is important. Please return a proxy card (or fill out the Internet proxy) promptly so your shares can be represented, even if you plan to attend the Annual Meeting in person. Highlights of the Annual Meeting and the voting results will be included in the Company’s Quarterly Report on Form 10-Q for the second quarter ended June 30, 2004.

2

INTRODUCTION

We are an integrated managed care organization that delivers managed health care services. We operate and conduct our businesses through subsidiaries of Health Net, Inc., which is among the nation’s largest publicly traded managed health care companies. Unless the context otherwise requires, the terms “Company,” “we,” “us,” and “our” refer to Health Net, Inc. and its subsidiaries.

Our health plans and government contracts subsidiaries provide health benefits through our health maintenance organizations (“HMOs”), insured preferred provider organizations (“PPOs”) and point-of-service (“POS”) plans to approximately 5.3 million individuals in 14 states through group, individual, Medicare, Medicaid and TRICARE programs. We also offer managed health care products related to behavioral health and prescription drugs. In addition, we own health and life insurance companies licensed to sell exclusive provider organization (“EPO”), PPO, POS and indemnity products, as well as auxiliary non-health products such as life and accidental death and disability insurance, in 36 states and the District of Columbia.

We were incorporated in 1990. Our current operations are the result of the April 1, 1997 merger transaction (the “FHS Combination”) involving Health Systems International, Inc. (“HSI”) and Foundation Health Corporation (“FHC”). We changed our name to Health Net, Inc. in November 2000. Prior to the FHS Combination, we were the successor to the business conducted by Health Net of California, Inc., now our HMO subsidiary in California and HMO and PPO networks operated by QualMed, Inc. (“QualMed”), which combined with the Company in 1994 to create HSI.

The mailing address of our principal executive office is 21650 Oxnard Street, Woodland Hills, CA 91367, and our Internet web site address is www.health.net.

PROPOSAL 1—ELECTION OF DIRECTORS

At the annual meeting, stockholders will elect nine directors. The nominees are J. Thomas Bouchard, Thomas T. Farley, Gale S. Fitzgerald, Patrick Foley, Jay M. Gellert, Roger F. Greaves, Richard W. Hanselman, Richard J. Stegemeier and Bruce G. Willison. As more fully described below, Gov. George Deukmejian, a current member of the Board of Directors, will be retiring from his position as a director effective on the date of the Annual Meeting. Each director will be elected to hold office for a term of one year or until the 2005 Annual Meeting of Stockholders. Each elected director will continue in office until such director’s successor is elected and has been qualified, or until such director’s earlier death, resignation or removal.

Health Net’s bylaws provide that the persons receiving a plurality of the votes cast, up to the number of directors to be elected, shall be elected. Abstentions will not be counted as votes cast and will have no effect on the vote for directors. Stockholders eligible to vote at the annual meeting do not have cumulative voting rights with respect to the election of directors. Since only nine nominees have been named, proxies cannot be voted for a number of persons greater than nine.

It is expected that the nominees named above will stand for election at the 2004 Annual Meeting of Stockholders, but if any of the nominees declines or is unable to do so, the proxies will be voted for another person or persons designated by the Governance Committee of the Board of Directors of the Company.

The Board of Directors recommends a vote

FOR each named nominee.

3

Director Nominees

The Company’s certificate of incorporation provides for directors to be elected on an annual basis. The certificate of incorporation further provides that the Board of Directors will consist of not less than three nor more than twenty members, the exact number to be determined in accordance with the Company’s bylaws. The bylaws provide that the exact number of directors shall be fixed from time to time by the Board of Directors, and the number of members constituting the Board of Directors has been fixed by the Board of Directors at ten.

The Board of Directors currently consists of ten members. Following Gov. Deukmejian’s retirement the Board will consist of nine members. The Company’s bylaws provide that a Director shall be deemed to have retired and resigned from the Board of Directors effective immediately prior to the first annual meeting of stockholders occurring after such Director attains seventy-two years of age; provided, however, that members of the Board of Directors on February 4, 1999 shall be deemed to have retired and resigned from the Board of Directors effective upon the date of the first annual meeting of stockholders after attaining seventy-five years of age; and provided further that the Board of Directors shall have the power to waive the application of such provisions to a given Director on a case-by-case basis by affirmative vote of two-thirds of the Directors after considering all of the applicable facts and circumstances. The Board of Directors has waived the application of such provisions with respect to Mr. Hanselman and Mr. Stegemeier (each of whom is seventy-five years of age or older and was a member of the Board of Directors on February 4, 1999) for one year.

The Company’s bylaws also provide that a Director who has held office for any period of nine consecutive years after October 14, 2003 shall not be qualified to be elected as a Director at the first annual meeting of stockholders occurring after the end of such ninth consecutive year and shall be deemed to have retired and resigned from the Board of Directors effective immediately upon the completion of such ninth consecutive year in office; provided, however, that the Board of Directors shall have the power to waive the application of such provisions to a given Director on a case-by-case basis by an affirmative vote of two-thirds of the Directors after considering all of the applicable facts and circumstances.

4

The nine nominees were designated for election, pursuant to the bylaws, by the Governance Committee of the Board of Directors of the Company. Each of the nominees has consented to serve as a director if elected. The following table sets forth certain information with respect to the nominees:

NOMINEES

| | | | |

Name

| | Principal Occupation or Employment

| | Age

|

J. Thomas Bouchard | | Former Senior Vice President, Human Resources of International Business Machines Corporation | | 63 |

| | |

Thomas T. Farley | | Senior Partner of Petersen & Fonda, P.C. | | 69 |

| | |

Gale S. Fitzgerald | | Former Chair and Chief Executive Officer of Computer Task Group, Inc. | | 53 |

| | |

Patrick Foley | | Former Chairman, President and Chief Executive Officer of DHL Airways, Inc. and Director of various companies | | 72 |

| | |

Jay M. Gellert | | President and Chief Executive Officer of the Company | | 50 |

| | |

Roger F. Greaves | | Chairman of the Board of the Company, Former Co-President and Co-Chief Executive Officer of the Company and Director of various companies | | 66 |

| | |

Richard W. Hanselman | | Former Chairman of the Board of the Company and Director and Consultant to various companies | | 76 |

| | |

Richard J. Stegemeier | | Chairman Emeritus of the Board of Directors of Unocal Corporation | | 75 |

| | |

Bruce G. Willison | | Dean, UCLA Anderson School of Management | | 55 |

NON-CONTINUING DIRECTOR

| | | | | | |

Name

| | Principal Occupation or Employment

| | Age

| | Existing Term

to Expire

|

Gov. George Deukmejian | | Former Partner of Sidley Austin Brown & Wood and former Governor of the State of California | | 75 | | 2004 |

Information Concerning Current Members of the Board of Directors and Nominees

Mr. Bouchard became a director of the Company upon consummation of the FHS Combination in April 1997. Previously, he served as a director of HSI since January 1994, upon consummation of the merger transaction involving H.N. Management Holdings, Inc. and QualMed, Inc. (“QualMed”) which created HSI (the “HSI Combination”). Mr. Bouchard served as a director of QualMed from May 1991 until February 1995. From October 1994 to July 2000, Mr. Bouchard served as Senior Vice President, Human Resources of International Business Machines Corporation. From June 1989 until October 1994, Mr. Bouchard served as Senior Vice President & Chief Human Resources Officer of U.S. West, Inc., a diversified global communications company, and prior to that time he was Senior Vice President-Human Resources and Organization for United Technologies Corp. Mr. Bouchard has served as a director of Nordstrom fsb (formerly Nordstrom National Credit Bank) since April 1991, and also currently serves as a director of Manpower, Inc., a global staffing company delivering staffing and workforce management solutions.

Mr. Deukmejian became a director of the Company upon consummation of the FHS Combination in April 1997 and will serve in this capacity until his scheduled retirement in May 2004. Previously, he served as a director of HSI since January 1994, upon consummation of the HSI Combination. Mr. Deukmejian served as a director of QualMed from April 1992 until February 1995. From February 1991 through June 1999, Mr. Deukmejian was a partner in the law firm of Sidley Austin Brown & Wood, Los Angeles, California. From July 1999 to June 2000, Mr. Deukmejian was senior counsel to Sidley Austin Brown & Wood. Mr. Deukmejian served as Governor of the State of California for two terms, from January 1983 to January 1991. Mr. Deukmejian also served the State of California as Attorney General from 1979 to 1982, as a State Senator from 1967 to 1978 and as a State Assemblyman from 1963 to 1966. Mr. Deukmejian is currently a director of The Keith Companies.

Mr. Farley became a director of the Company upon consummation of the FHS Combination. Previously, he served as a director of HSI since January 1994, upon consummation of the HSI Combination. Mr. Farley served

5

as a director of QualMed from February 1991 until February 1995 and is a senior partner in the law firm of Petersen & Fonda, P.C., Pueblo, Colorado. Mr. Farley was formerly President of the governing board of Colorado State University, the University of Southern Colorado and Ft. Lewis College and Chairman of the Colorado Wildlife Commission. He served as Minority Leader of the Colorado House of Representatives from 1967 to 1975. Mr. Farley was a director of the Public Service Company of Colorado, a public gas and electric company, from 1983 to 1997 and is a director/advisor of Wells Fargo Bank of Pueblo and Sunset. Mr. Farley is a member of the Board of Regents of Santa Clara University, a Jesuit institution, and a director of Colorado Public Radio.

Ms. Fitzgerald became a director of the Company in March 2001. From July 2002 through October 2002, Ms. Fitzgerald served as President and Chief Executive Officer of QP Group, a procurement solutions company. From October 1994 to June 2000, Ms. Fitzgerald served as Chair and Chief Executive Officer of Computer Task Group, Inc. (“CTG”), an international information technology services firm. Ms. Fitzgerald also served on the Board of Directors of Kaleida Health System in Buffalo, New York from 1995 to 2002, and was Vice Chair from 2000 to 2002, and served on the Advisory Board of the University of Buffalo’s School of Management from 1993 to 2001. Ms. Fitzgerald served on the Boards of Directors of the Information Technology Services (“ITS”) Division of Information Technology Association of America (“ITAA”) and of ITAA from 1992 to 2002, and was Chair of the ITS Board from 1998 to 2002. Ms. Fitzgerald is a director of Diebold, Inc., a company which specializes in providing integrated self-service delivery systems and services. Ms Fitzgerald is also a founding partner and director of TranSpend, Inc. a privately held firm focused on total spend optimization.

Mr. Foley became a director of the Company in April 1997 upon consummation of the FHS Combination. Mr. Foley served as a director of FHC from 1996 until the FHS Combination. Mr. Foley served as Chairman and Chief Executive Officer of DHL Airways, Inc. from September 1988 through July 1999. Mr. Foley is also a director of Glenborough Realty Trust and Flextronics International.

Mr. Gellert was elected to the Board of Directors of the Company in February 1999. He became President and Chief Executive Officer of the Company in August 1998. Previously Mr. Gellert served as President and Chief Operating Officer of the Company from May 1997 until August 1998. From April 1997 to May 1997, Mr. Gellert served as Executive Vice President and Chief Operating Officer of the Company. Mr. Gellert served as President and Chief Operating Officer of HSI from June 1996 until March 1997. He served on the Board of Directors of HSI from June 1996 to April 1997. Prior to joining HSI, Mr. Gellert directed Shattuck Hammond Partners Inc.’s strategic advisory engagements in the area of integrated delivery systems development, managed care network formation and physician group practice integration. Prior to joining Shattuck Hammond Partners Inc., Mr. Gellert was an independent consultant, and from 1988 to 1991, he served as President and Chief Executive Officer of Bay Pacific Health Corporation. From 1985 to 1988, he was Senior Vice President and Chief Operating Officer for California Healthcare System. Mr. Gellert has been a director of Ventas, Inc. since August 2001. Mr. Gellert is currently a director of the American Association of Health Plans.

Mr. Greaves became a director of the Company in April 1997 upon consummation of the FHS Combination and became Chairman of the Board of Directors in January 2004. Mr. Greaves served as a director of HSI from January 1994 until the FHS Combination. Mr. Greaves served as Co-Chairman of the Board of Directors, Co-President and Co-Chief Executive Officer of the Company from January 1994 (upon consummation of the HSI Combination) until March 1995. Prior to January 1994, Mr. Greaves served as Chairman of the Board of Directors, President and Chief Executive Officer of H.N. Management Holdings, Inc. (a predecessor to the Company) since its incorporation in June 1990. Mr. Greaves currently serves as Chairman of the Board of Directors of Health Net of California, Inc. (“HN California”), a subsidiary of the Company. Mr. Greaves also served a prior term as Chairman of the Board of Directors of HN California, and concurrently served as President and Chief Executive Officer of HN California. Prior to joining HN California, Mr. Greaves held various management roles at Blue Cross of Southern California, including Vice President of Human Resources and Assistant to the President, and held various management positions at Allstate Insurance Company from 1962 until 1968. Mr. Greaves serves as an Honorary member of the Board of Trustees of California State University at Long Beach.

6

Mr. Hanselman became a director of the Company in April 1997 upon consummation of the FHS Combination and served as Chairman of the Board of Directors from May 1999 to January 2004. Mr. Hanselman served as a director of FHC from 1990 until the FHS Combination. He has been a corporate director of and consultant to various companies since 1986. Mr. Hanselman is currently a director of Arvin Meritor, Inc. and Honorary Trustee of the Committee for Economic Developments.

Mr. Stegemeier became a director of the Company in April 1997 upon consummation of the FHS Combination. Mr. Stegemeier served as a director of FHC from 1993 until the FHS Combination. He is Chairman Emeritus of the Board of Directors of Unocal Corporation and served as Chairman and Chief Executive Officer of Unocal Corporation from July 1988 until his retirement in May 1994. Mr. Stegemeier is currently a director of Montgomery Watson Inc. He is also the Trustee of the University of Southern California and the University of Missouri Rolla.

Mr. Willison became a director of the Company in December 2000. Since July 1999, Mr. Willison has served as Dean, UCLA Anderson School of Management. From April 1996 to October 1998, Mr. Willison served as President and Chief Operating Officer of H.F. Ahmanson, Inc. (Home Savings of America). Prior thereto, Mr. Willison was Chairman, President and Chief Executive Officer of First Interstate Bank of California from February 1991 to April 1996. Mr. Willison is also a director of Home Store, Inc. and is a trustee of SunAmerica Funds. Since 1991, Mr. Willison has served as the Vice Chair of the United Way of Greater Los Angeles, and since 1996 has been a board member of Operation Hope.

7

EXECUTIVE OFFICERS

The following sets forth certain biographical information with respect to the current executive officers of the Company, and all individuals who served as an executive officer of the Company during 2003.

| | | | |

Name

| | Age

| | Position

|

Jay M. Gellert | | 50 | | President and Chief Executive Officer |

Jeffrey Folick | | 56 | | Executive Vice President, Regional Health Plans and Specialty Companies |

Karin D. Mayhew | | 53 | | Senior Vice President of Organization Effectiveness |

Marvin P. Rich | | 58 | | Executive Vice President, Finance and Operations |

Jonathan Scheff, M.D. | | 52 | | Senior Vice President and Chief Medical Officer |

B. Curtis Westen, Esq. | | 43 | | Senior Vice President, General Counsel and Secretary |

Christopher P. Wing | | 46 | | Executive Vice President, Regional Health Plans and Specialty Companies |

James P. Woys | | 45 | | President of Health Net Federal Services |

Timothy J. Moore, M.D. | | 47 | | Former Senior Vice President and Chief Medical Officer |

Mr. Gellert became President and Chief Executive Officer of the Company in August 1998. Previously, Mr. Gellert served as President and Chief Operating Officer of the Company from May 1997 until August 1998. From April 1997 to May 1997, Mr. Gellert served as Executive Vice President and Chief Operating Officer of the Company. Mr. Gellert served as President and Chief Operating Officer of HSI from June 1996 until March 1997. He served on the Board of Directors of HSI from June 1996 to April 1997. Mr. Gellert has been a director of the Company since March 1999. Prior to joining HSI, Mr. Gellert directed Shattuck Hammond Partners Inc.’s strategic advisory engagements in the area of integrated delivery systems development, managed care network formation and physician group practice integration. Prior to joining Shattuck Hammond Partners Inc., Mr. Gellert was an independent consultant, and from 1988 to 1991, he served as President and Chief Executive Officer of Bay Pacific Health Corporation. From 1985 to 1988, Mr. Gellert was Senior Vice President and Chief Operating Officer for California Healthcare System. Mr. Gellert has been a director of Ventas, Inc. since August 2001. Mr. Gellert is currently a director of the American Association of Health Plans.

Mr. Folick became Executive Vice President, Regional Health Plans and Specialty Companies of the Company in May 2002. Prior to joining the Company, Mr. Folick was employed by PacifiCare Health Systems, Inc. (“PacifiCare”) since 1989 in various capacities, including President, Chief Operating Officer, President and CEO of the Health Plans Division and Executive Vice President. Prior to joining PacifiCare, Mr. Folick held executive positions at Peak of California and CareAmerica Health Plan of California, and has served as chief financial officer of both Valley Presbyterian Hospital and Allegheny County Hospital System.

Ms. Mayhew became Senior Vice President of Organization Effectiveness of the Company in January 2001. Ms. Mayhew served as Senior Vice President of Human Resources of the Company from April 1999 to January 2001. Prior to joining the Company, Ms. Mayhew served as Senior Vice President, Organization Development of Southern New England Telecommunications Company (“SNET”), a northeast regional information, entertainment and telecommunications company based in Connecticut. SNET was acquired by SBC Communications, Inc. in October 1998. Prior thereto, Ms. Mayhew served in various capacities at SNET, including Vice President, Human Resources, since 1972.

Mr. Rich became Executive Vice President of Finance and Operations of the Company in January 2002. Mr. Rich served as President of WebMD from September 2000 to September 2001 and as President, Medical Manager and Chief Executive Officer of CareInsight, Inc. from January 2000 to September 2000. Mr. Rich served as Chief Administrative Officer of Oxford Health Plans from March 1998 to December 1999. Mr. Rich also served as Executive Vice President, Finance & Systems of Kmart from 1994 to 1998.

Dr. Scheffbecame Senior Vice President and Chief Medical Officer of the Company in August 2003. Dr. Scheff served as Senior Vice President and Chief Medical Officer for Health Net Federal Services, Inc., the Company’s federal services subsidiary, from October 1995 toJune 2003. Before joining the federal services

8

group, Dr. Scheff served in positions of increasing responsibility including Senior Vice President of Health Care Operations in Foundation Health Corporation’s California health plan (a predecessor company to Health Net) from January 1992 to October 1995. Prior to that, he was regional medical director with Aetna Health Plans from June 1988 to December 1991. Prior thereto, Dr. Scheff served as medical consultant for Milliman and Robertson.

Mr. Westen became Senior Vice President, General Counsel and Secretary of the Company upon consummation of the FHS Combination. Mr. Westen served as Senior Vice President, General Counsel and Secretary of HSI since April 1995. Mr. Westen also serves as a director of certain subsidiaries of the Company. Mr. Westen served as Senior Vice President, General Counsel and Secretary of QualMed since February 1994, and served as Vice President of Administration of QualMed from June 1993 until February 1994. Mr. Westen served as Assistant General Counsel and Assistant Secretary of QualMed from March 1992 until June 1993. From September 1986 until March 1992 Mr. Westen was an attorney with the firm of Lord, Bissell & Brook in Chicago, Illinois.

Mr. Wing became Executive Vice President, Regional Health Plans and Specialty Companies of the Company and President of the Company’s California operations in April 2002. Prior to joining the Company, Mr. Wing served for more than eight years with PacifiCare. Most recently, he served as western region president of PacifiCare and president and chief executive officer of PacifiCare of California. He previously served as northwestern region vice president and chief executive officer for PacifiCare of Washington, and also served as president and chief executive officer for PacifiCare of Utah; senior vice president, health services, for PacifiCare of California and vice president/general manager for PacifiCare of California. Before joining PacifiCare in 1994, Mr. Wing held executive positions with several other health care companies, including Blue Cross of California, Lincoln National Life Insurance Company, Prudential Health Care Plan, Inc. and Maxicare Health Plans, Inc.

Mr. Woys became President of Health Net Federal Services in February 2001, and such position became an executive officer position of the Company in May 2002. Mr. Woys served as Chief Operating Officer and President of Health Net Federal Services from November 1999 to February 2001. Mr. Woys served as Chief Operating Officer and Senior Vice President for Foundation Health Federal Services from February 1998 to November 1999. Mr. Woys served as Senior Vice President of Foundation Health Federal Services from January 1995 to February 1998. From January 1990 to January 1995, Mr. Woys served as Vice President and Chief Financial Officer of the Government Division of FHC. Mr. Woys served as Director of Corporate Finance/Tax for FHC from October 1986 to January 1990. Prior to Mr. Woys’ employment with FHC, he was employed by Price Waterhouse from 1982 to 1986 and by Arthur Andersen & Co. from 1980 to 1982.

Dr. Moore served as Senior Vice President and Chief Medical Officer of the Company from January 2001 to August 2003 at which time Dr. Moore resigned for the Company. Dr. Moore served as Senior Vice President and Chief Medical Officer for the Company’s northeast operations from November 1998 to January 2001. Before joining the Company, Dr. Moore served as Vice President of Health Systems Integration at Humana Inc. from March 1996 to November 1998. Prior thereto, Dr. Moore served as a clinical consultant for Towers Perrin Integrated Health Systems, a Minneapolis-based international consulting practice.

Certain Relationships and Related Party Transactions

The following information relates to transactions during 2003 between the Company and certain directors and executive officers of the Company.

Mr. Gellert is a director of Miavita, Inc., an Internet health services company in which the Company has made an investment of $2.3 million as of December 31, 2003, and to which the Company paid $250,000 in 2003 in connection with certain agreements the Company has with Miavita, Inc.

Since January 1, 1998, each of the following current and former executive officers of the Company for 2003 received one-time loans from the Company in the amounts indicated in connection with their hire, promotion or relocation: Ms. Mayhew ($300,000), Dr. Moore ($50,000), and Mr. Westen ($250,000). The loans accrue interest at the prime rate and each is payable upon demand by the Company in the event of a voluntary termination of employment of the respective officer or termination for Cause (as defined in their respective employment agreements).

9

Dr. Moore resigned from his position as Senior Vice President and Chief Medical Officer in August 2003 and repaid the outstanding principal amount of his loan concurrent with his resignation.

With respect to the loans provided to Mr. Westen and to Ms. Mayhew, the principal and interest of the loans is to be forgiven by the Company at varying times after the date of hire, promotion or relocation of the respective officers. A loan will be forgiven prior to such time in the event the respective officer’s employment is terminated involuntarily without Cause, voluntarily due to Good Reason following a Change of Control (each as defined in their respective employment agreements), or due to death or disability.

Income incurred by an officer due to interest on all of such loans (but not the principal) being forgiven is “grossed up” by the Company to cover the income taxes due upon such interest forgiveness. As of December 31, 2003, the remaining principal under each of the loans was as follows: Ms. Mayhew, $60,000; and Mr. Westen, $0.

10

ACTIVITIES OF THE BOARD OF DIRECTORS AND ITS COMMITTEES

Members of the Board of Directors are elected by the holders of Class A Common Stock of the Company and represent the interests of all stockholders. The Board of Directors meets periodically to review significant developments affecting the Company and to act on matters requiring board approval. Although the Board of Directors delegates many matters to others, it reserves certain powers and functions to itself.

The Company’s Board of Directors met a total of eight times in 2003. Each member of the Board of Directors of the Company was present for 75% or more of the aggregate number of meetings of such Board of Directors held in 2003 (during the period he/she served as a director) and of all committees of such Board of Directors held in 2003 on which he/she served (during the period he/she served).

The Board of Directors has determined that the following directors of the Company qualify as independent under New York Stock Exchange (“NYSE”) listing standards: J. Thomas Bouchard, Thomas T. Farley, Gale S. Fitzgerald, Patrick Foley, Roger F. Greaves, Richard W. Hanselman, Richard J. Stegemeier and Bruce G. Willison. Under the NYSE listing standards, no director qualifies as independent unless the Board of Directors affirmatively determines that the director has no material relationship with the Company, either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company.

Committees of the Board of Directors

The bylaws of the Company establish the following committees of the Board of Directors: the Audit Committee, the Governance Committee, the Compensation and Stock Option Committee (the “Compensation Committee”) and the Finance Committee. The bylaws further provide that additional committees may be established by resolution adopted by a majority of the Board. In this connection, (i) in December of 2000, the Board of Directors established the Technology/Infrastructure Committee by resolution, and subsequently in May of 2003 consolidated the Technology/Infrastructure Committee and its responsibilities into the Finance Committee, and (ii) in October of 2002, the Board of Directors established the Litigation Ad Hoc Committee by resolution and subsequently renamed it the Ad Hoc Committee. A majority of the Board of Directors selects the directors to serve on the committees of the Board of Directors.

Audit Committee. The Audit Committee of the Board of Directors of the Company currently consists of Ms. Fitzgerald and Messrs. Stegemeier (Chairman), Farley and Willison. Each of Messrs. Stegemeier, Farley, and Willison and Ms. Fitzgerald served on the Audit Committee from January 2003 to December 2003. Each member of the Audit Committee is “independent,” as independence for audit committee members is defined under NYSE listing standards. The Company’s Audit Committee held twelve meetings in 2003.

Although the Board of Directors of the Company has determined that the Company does not currently have an “audit committee financial expert,” as defined under the rules of the Securities and Exchange Commission (the “SEC”), serving on the Audit Committee, the Board of Directors believes that each of the current members of the Audit Committee is fully qualified to carry out all duties and responsibilities of an Audit Committee member and has determined that the current composition of the Audit Committee complies with applicable NYSE listing standards relating to financial literacy and accounting or related financial management expertise. The Company currently does not have an “audit committee financial expert” because the Board of Directors has not yet completed the search and selection process that was initiated during 2003 with the objective of adding to the Board of Directors one or more members who would serve on the Audit Committee and qualify as audit committee financial experts. The Company anticipates that the search and selection process will result in the addition to the Board of Directors of at least one such member during the current fiscal year.

11

The Audit Committee is governed by a charter, a current copy of which is attached to this Proxy Statement as Appendix A and is available on our website atwww.health.net. A copy of the charter is also available in print to stockholders upon request, addressed to the Corporate Secretary. Pursuant to the Audit Committee charter, the Audit Committee is responsible for, among other things:

| | • | appointing, compensating, retaining, terminating and overseeing the work of any independent auditors engaged to prepare or issue an audit report or perform other audit or non-audit services for the Company; |

| | • | preapproving all audit services and permitted non-audit services, including the proposed fees related thereto, to be performed for the Company by the independent auditors; |

| | • | obtaining and reviewing, at least annually, a report from the independent auditors with respect to matters affecting the independent auditors’ internal quality-control procedures, independence and other material issues surrounding the auditing process; |

| | • | reviewing and discussing with the independent auditors their annual audit plan (for annual and quarterly reporting purposes), including the timing and scope of audit activities, and monitoring such plan’s progress and results during the year; |

| | • | reviewing with management and the independent auditors the Company’s practices with respect to, among other things: the Company’s disclosures in its annual audited financial statements and quarterly financial statements; the process surrounding certain accounting estimates; treatment of significant transactions not a part of the Company’s regular operations; significant adjustments to the Company’s financial statements; risk assessment; risk management; and the Company’s critical accounting policies; |

| | • | reviewing and resolving all disagreements, problems or difficulties between the Company’s independent auditors and management regarding financial reporting; |

| | • | reviewing and reporting to the Board on the performance and the independence of the independent auditors; |

| | • | reviewing, on a regular basis, the adequacy and effectiveness of the Company’s accounting and internal control policies and procedures, through inquiry and discussions with management and the independent auditors; |

| | • | reviewing the Audit Committee’s involvement and interaction with the Company’s internal audit function; the services provided by the Company’s internal audit function; and the controls that management has established to protect the integrity of the quarterly reporting process; |

| | • | reviewing the Company’s policies relating to the ethical handling of conflicts of interest and reviewing transactions between the Company and members of management; |

| | • | monitoring compliance with the Company’s Code of Business Conduct, including discussing with management and the independent auditors established standards of conduct and performance, and deviations therefrom; and |

| | • | reviewing with management, at the request of the Board, significant financial matters affecting the Company, whether or not related to a review of quarterly or annual financial statements. |

Governance Committee. The Governance Committee of the Board of Directors of the Company is currently comprised of Messrs. Greaves (Chairman), Bouchard, Deukmejian, Hanselman and Willison. Messrs. Bouchard, Deukmejian, Hanselman and Willison served on the Governance Committee from January 2003 to December 2003. Mr. Greaves was added as an additional member of the Governance Committee in May of 2003 at which time he was appointed Chairman in place of Gov. Deukmejian. Gov. Deukmejian will be resigning from his position on the Governance Committee concurrently with his retirement from the Board of Directors in May 2004. Each of the current five members is “independent” within the meaning of the NYSE listing standards. The Governance Committee held five meetings in 2003. The Governance Committee is governed by a charter, a current copy of

12

which is available on our website at www.health.net. A copy of the charter is also available in print to stockholders upon request, addressed to the Corporate Secretary. Pursuant to the Governance Committee charter, the Governance Committee is responsible for, among other things:

| | • | identifying individuals qualified to serve as directors of the Company, consistent with the criteria established by the Board of Directors; |

| | • | selecting individuals qualified to serve as director nominees at each annual meeting of the Company stockholders; |

| | • | nominating individuals to fill vacancies on the Board of Directors which occur between annual meetings of Company stockholders; |

| | • | recommending individual Board members for designation as members of committees on the Board of Directors; |

| | • | advising the Board of Directors with respect to the Board’s composition, procedures and committees; |

| | • | developing and recommending to the Board of Directors a set of corporate governance principles applicable to the Company and advising the Board of Directors with respect to the corporate governance principles applicable to the Company; and |

| | • | overseeing the evaluation of the Board of Directors and the Company’s management. |

The Governance Committee selects nominees for director on the basis of the nominee’s possession of such knowledge, experience, skills, expertise and diversity so as to enhance the Board’s ability to manage and direct the affairs and business of the Company, including, when applicable, to enhance the ability of the committees of the Board of Directors to fulfill their duties and/or to satisfy any independence requirements imposed by law, regulation,NYSE listing standards and the Company’s bylaws and other corporate governance documents.

The Governance Committee identifies potential director nominees from many sources. The Governance Committee asks current directors and executive officers to notify the Committee if they become aware of persons meeting the criteria described above who may be available to serve on the Board. From time to time, the Governance Committee also engages third party search firms that specialize in identifying director candidates. In addition, the Governance Committee will consider director candidates recommended by stockholders. In considering candidates submitted by stockholders, the Governance Committee will take into consideration the needs of the Board and the qualifications of the candidate. The Governance Committee may also take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held. To have a candidate considered by the Governance Committee, a stockholder must submit the recommendation in writing and include certain information. See “Requirements and Procedures for Submission of Director Candidate Recommendations by Stockholders and Stockholder Proposals” for further information regarding the procedures for recommending a director nominee for consideration by the Governance Committee.

Once a person has been identified by the Governance Committee as a potential candidate, the Governance Committee may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Governance Committee determines that the candidate warrants further consideration, the Chairman of the Governance Committee or another member of the Governance Committee contacts the candidate. Generally, if the person expresses a willingness to be considered and to serve on the Board of Directors, the Governance Committee requests information from the candidate, reviews the person’s accomplishments and qualifications, including in light of any other candidates that the Governance Committee might be considering, and conducts one or more interviews with the candidate. In certain instances, Governance Committee members may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate’s accomplishments. The Governance Committee’s evaluation process does not vary based on whether or not a candidate is recommended by a stockholder, although, as stated above, the Board may take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held.

13

The Company paid a fee to a third party search firm to assist in identifying and evaluating candidates for nomination to the stockholders at this Annual Meeting. One of the new directors up for election at the Annual Meeting was identified through this search firm. In identifying and evaluating candidates, the third party search firm performed the same procedures that the Governance Committee performed in its evaluation of other potential candidates for election to the Board, which procedures are described above.

In connection with this Annual Meeting and in accordance with the above guidelines, the Governance Committee nominated for re-election each of the following nine nominees: Ms. Fitzgerald and Messrs. Bouchard, Farley, Foley, Gellert, Greaves, Hanselman, Stegemeier and Willison.

Compensation and Stock Option Committee. The Compensation Committee currently consists of Messrs. Bouchard (Chairman), Deukmejian, Farley, Foley and Hanselman. Messrs. Bouchard, Farley and Foley served on the Compensation Committee from January 2003 through December 2003. In May 2003, Gov. Deukmejian was added as a member of the Compensation Committee. Gov. Deukmejian will be resigning from his position on the Compensation Committee concurrently with his retirement from the Board of Directors in May 2004. In October 2003, Mr. Greaves resigned from his position on the Compensation Committee and Mr. Hanselman was appointed to serve in his place. Each of the current five members of the Compensation Committee is an “outside director” for Section 162(m) purposes and “independent” within the meaning of NYSE listing standards. In 2003, the Company’s Compensation Committee held eight meetings. The Compensation Committee is governed by a charter, a current copy of which is available on our website at www.health.net. A copy of the charter is also available in print to stockholders upon request, addressed to the Corporate Secretary. Pursuant to the Compensation Committee charter, the Compensation Committee is responsible for, among other things:

| | • | evaluating annually the performance of the Chief Executive Officer and recommending to the Board of Directors the Chief Executive Officer’s compensation levels based on this evaluation; |

| | • | evaluating annually the performance of the second most highly compensated officer of the Company and recommending to the Board of Directors such officer’s compensation level, which recommendation shall be subject to ratification, modification or rejection by the Board of Directors; |

| | • | evaluating annually the performance of up to 35 senior officers (the “Senior Officers”) of the Company, including the “Named Executive Officers” listed below in the Summary Compensation Table, and approving each such officer’s compensation level; |

| | • | reviewing and approving, on a general and policy level basis only, the compensation and benefits of officers, managers and employees other than the Chief Executive Officer and the Senior Officers and advising the Board of Directors of actions taken; |

| | • | reviewing annually the Company’s compensation plans and other employee benefit plans, including incentive-compensation and equity-based plans and, if the Compensation Committee deems it appropriate, adopting, or recommending to the Board of Directors the adoption of, new, or the amendment of existing, plans; |

| | • | reviewing and approving any severance or termination arrangements to be made with any Senior Officer of the Company; |

| | • | reviewing perquisites or other personal benefits to the Company’s Senior Officers and recommending any changes to the Board of Directors; and |

| | • | performing such duties and responsibilities as may be assigned to the Board of Directors or the Compensation Committee under the terms of any compensation or other employee benefit plan, including any incentive-compensation or equity-based plan. |

Finance Committee. The Finance Committee of the Board of Directors currently consists of Ms. Fitzgerald and Messrs. Foley (Chairman), Deukmejian, Hanselman, Stegemeier and Willison. Mr. Hanselman was appointed to serve on the Finance Committee and Mr. Foley was appointed to serve as Chairman of the Finance Committee in December 2003. In addition, Mr. Greaves resigned as a member and Chairman of the Finance

14

Committee. Mr. Greaves served as Chairman of the Finance Committee from January 2003 through December 2003. Messrs. Foley, Deukmejian and Stegemeier served on the Finance Committee from January 2003 through December 2003. Mr. Willison and Ms. Fitzgerald were added as additional members of the Finance Committee in May of 2003. Gov. Deukmejian will be resigning from his position on the Finance Committee concurrently with his retirement from the Board of Directors in May 2004. In 2003, the Company’s Finance Committee held six meetings. The Finance Committee is responsible for, among other things:

| | • | reviewing the Company’s investment policies and guidelines; |

| | • | monitoring the performance of the Company’s investment portfolio; |

| | • | reviewing, in coordination with the Audit Committee, the Company’s financial structure and operations in light of the Company’s long-term objectives; |

| | • | reviewing and recommending to the Board of Directors appropriate action on proposed acquisitions and divestitures; |

| | • | reviewing and consulting with Company’s management regarding the Company’s various technology and infrastructure plans and activities; |

| | • | establishing appropriate authority levels for various officials of the Company with respect to mergers and acquisitions transactions, divestiture transactions and capital expenditures; and |

| | • | reviewing and recommending appropriate action with respect to the Company’s short- and long-term debt structure. |

In May of 2003, the Board of Directors consolidated the Technology/Infrastructure Committee into the Finance Committee and authorized the Finance Committee to assume the responsibilities of the Technology/Infrastructure Committee, including, among other things, reviewing and consulting with management regarding the Company’s various technology and infrastructure plans and activities. The Technology/Infrastructure Committee consisted of the following members upon its consolidation into the Finance Committee, Ms. Fitzgerald and Messrs. Greaves (Chairman), Foley and Willison. The Company’s Technology/Infrastructure Committee held one meeting in 2003 prior to its consolidation into the Finance Committee.

Ad Hoc Committee. The Board of Directors created the Litigation Ad Hoc Committee in October 2002 and subsequently renamed it the Ad Hoc Committee without changing the purpose or responsibilities of the originally named committee. Currently the Ad Hoc Committee consists of Messrs. Hanselman (Chairman), Deukmejian, Greaves and Willison. Each of these four members served on the Ad Hoc Committee from January 2003 to December 2003. Gov. Deukmejian will be resigning from his position on the Ad Hoc Committee concurrently with his retirement from the Board of Directors in May 2004. The purpose of the Ad Hoc Committee is to review and consult with management regarding certain of the Company’s litigation matters, and to authorize the settlement strategy of the Company related thereto. In 2003, the Company’s Ad Hoc Committee held five meetings.

15

REPORT OF THE COMPENSATION AND STOCK OPTION COMMITTEE ON

EXECUTIVE COMPENSATION FOR FISCAL YEAR 2003

Introduction and Background

The following report is provided in accordance with the rules of the Securities and Exchange Commission and covers compensation policies applicable to the executive officers of Health Net, Inc. (“Health Net” or the “Company”) during 2003. The report has been approved by the members of the Compensation and Stock Option Committee of the Board of Directors of the Company (the “Compensation Committee”).

During 2003, the Compensation Committee was comprised of all “outside directors” (within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”)), other than Mr. Greaves who is a prior executive officer of the Company and served on the Compensation Committee from January 2003 through October 2003. Messrs. Bouchard (Chairman), Farley and Foley served on the Compensation Committee from January 2003 through December 2003. In August 2003, Governor Deukmejian was appointed to serve on the Compensation Committee. In October 2003, Mr. Greaves resigned from his position on the Compensation Committee and Mr. Hanselman was appointed to serve in his place. As of the date of this report, the Compensation Committee continues to be comprised of Messrs. Bouchard (Chairman), Farley, Foley and Hanselman and Governor Deukmejian. Each of these five members is an “outside director” for Section 162(m) purposes and “independent” within the meaning of New York Stock Exchange listing standards. When he was Chairman of the Board of Directors Mr. Hanselman regularly attended and participated in Compensation Committee meetings, but since he was not a member of the Committee, he did not vote on any Committee actions. The new Chairman of the Board, Mr. Greaves, has continued this practice and regularly attends Compensation Committee meetings.

Pursuant to the Compensation Committee’s amended and restated charter, a copy of which is posted on the Company’s website, the Compensation Committee is responsible for, among other things:

| | • | evaluating annually the performance of the Chief Executive Officer and recommending to the Board of Directors the Chief Executive Officer’s compensation level based on this evaluation, which recommendation shall be subject to ratification, modification or rejection by the Board of Directors; |

| | • | evaluating annually the performance of the second most highly compensated officer of the Company and recommending to the Board of Directors such officer’s compensation level, which recommendation shall be subject to ratification, modification or rejection by the Board of Directors; |

| | • | evaluating annually the performance of up to 35 senior officers of the Company, including the “Named Executive Officers” listed below in the Summary Compensation Table, and approving each such officer’s compensation level; and |

| | • | reviewing and administering the Company’s stock option and other stock-based and equity-based plans. |

Our report covers the following topics:

| | • | Role of the Compensation Committee |

| | • | Executive Compensation Guiding Principles |

| | • | Guiding Principles in Practice |

| | • | Compensation of the Chief Executive Officer |

Role of the Compensation and Stock Option Committee

The Compensation Committee is responsible for developing and administering guiding principles with respect to executive compensation, including equity-based programs. Specific accountabilities include:

| | • | Developing the Company’s Executive Compensation Guiding Principles that provide the framework for making program design and compensation decisions; |

16

| | • | Ensuring executive compensation is driven by the Company’s financial and operational performance and is consistent with the Company’s business strategy and with the compensation practices of comparable organizations; |

| | • | Approving (or recommending to the Board for approval) compensation levels for the Company’s most senior executives identified by the Compensation Committee from time to time; |

| | • | Evaluating the Chief Executive Officer’s performance and recommending his compensation in light of performance; and |

| | • | Administering the Company’s equity-based compensation programs, including stock options and restricted stock. |

The Compensation Committee makes every effort to maintain independence and objectivity. The Compensation Committee is now composed only of independent directors. The Compensation Committee meets regularly in executive session (excluding the CEO and other employees) where discussions and decisions regarding CEO performance and compensation take place.

The Compensation Committee is committed to staying apprised of current issues and emerging trends, and ensuring that Health Net’s executive compensation program remains aligned with best practice. To this end, the Compensation Committee works with an independent advisor and regularly reviews compensation levels, best practices and emerging issues.

Executive Compensation Guiding Principles

To provide a framework for executive compensation decision-making, the Compensation Committee developed a set of Guiding Principles that are intended to serve as touchstones for design and administration decisions made by the Board, the Compensation Committee and Management. Health Net’s Executive Compensation Guiding Principles are as follows:

Principle #1—Compensation must be directly aligned with performance

Executive compensation levels should be commensurate with corporate performance and shareholder return. Growth and profitability are the foundation for stockholder returns over the long term. Accordingly, Health Net’s management incentive plan incorporates growth and profitability measures. In addition, Health Net believes that its success depends in large part on its employees. The Company conducts an annual employee satisfaction survey to test the Company’s performance as an employer. A portion of the management annual incentive is tied to improving employee satisfaction as measured by select survey items. The Compensation Committee is committed to a strong link between pay for performance – payments are reduced or not made at all if performance does not meet expectations.

Principle #2—Compensation levels and program design features must be competitive with market practice

Understanding competitive market pay levels is instrumental in hiring and keeping qualified executives. Moreover, it is important to understand how best practices change and how comparable organizations deliver compensation. The Compensation Committee works with an independent advisor to annually review compensation levels relative to market and frequently assesses emerging trends and issues affecting executive compensation.

Health Net’s competitive market for executive talent is primarily large managed care organizations. However, where appropriate, Health Net will look to large organizations outside healthcare for executive talent and may adopt practices from other industries where the Compensation Committee deems it appropriate to achieve Health Net’s goals.

Principle #3—Share ownership must be promoted

The personal financial interests of the Company’s executives should be directly aligned with those of stockholders. The Company’s compensation and retirement savings programs take this into consideration. In

17

2002, the Committee introduced share ownership guidelines for executives. The guidelines call for the CEO to own shares equal in value to five times annual base salary. Other executives should hold between one and three times annual base salary in shares. Participants have four years to meet the recommended guidelines.

Principle #4—Plan affordability and the Company’s capacity to pay must always be considered

The cost of any compensation or benefit program must be weighed against the benefits provided to the executives and must be evaluated in light of the Company’s financial condition. Salary increases, annual incentive payments and long-term incentive awards will be made only when the Company can afford to do so. Retirement and savings plans funding decisions will also be made within this context.

Guiding Principles in Practice

The Compensation Committee seeks to have a significant portion of annual compensation at risk. Equity is used to directly align executives’ long-term financial interests with the stockholders and to advance the interests of the Company by attracting and retaining talented executives. Specifically, each component of pay is described as follows:

Base Salaries

Competitiveness, affordability, and individual performance and skills drive base salary decisions.

Annual Incentive Compensation

Health Net has long stressed pay for performance through its annual management incentive plan. Goals are established for corporate, unit and individual performance. The goal setting process takes into consideration internal budgets, past performance, market expectations and competitors’ absolute and relative performance. If goals are not fully met, incentive payments are reduced or even eliminated.

Long-Term Incentives

Health Net aligns executives’ interests with those of the stockholders. The Company has primarily focused on stock options, but has also used restricted stock, which supports retention of key talent and promotes ownership. In managing the equity program, the Compensation Committee closely monitors usage rates and dilution levels.

Benefits/Perquisites

The Company provides benefits focused on ensuring reasonable financial security and making executives whole for benefits lost due to IRS or other restrictions. Long-term wealth accumulation depends primarily on stock price appreciation. Some senior executives may be eligible to receive supplemental retirement benefits. These benefits remain subject to the claims of creditors of the Company. Executives may defer salary and annual incentive payments to facilitate tax planning and personal savings goals. The Company provides competitive perquisites and only where business necessity dictates. All benefits and perquisites programs are provided consistent with median market practices as necessary to attract and retain key talent.

Severance

Executive Officers are entitled to receive a lump sum payment equal to between one and three times base salary. Additionally, for a period of between one and three years, continued health and welfare benefit coverage upon termination of their employment, such amounts and coverage periods being dependent on the nature of the termination. Under the Company’s standard Severance Payment Agreement, terminated executives are precluded from competing with the Company for a period of up to one year post-termination, depending on the applicable circumstances.

18

In addition, the Company provides benefits for the senior executives in the event of a change in control. Vesting of stock options held by senior executives, including Mr. Gellert, accelerates upon a change in control. If the benefits provided under the Severance Payment Agreement constitute parachute payments under Section 280G of the Internal Revenue Code and are subject to the excise tax imposed by Section 4999 of the Internal Revenue Code, the Named Executive Officers would receive (i) a payment sufficient to pay such excise taxes and (ii) an additional payment sufficient to pay the taxes arising as a result of such payments.

Compensation of the Chief Executive Officer

The Compensation Committee is responsible for evaluating annually the CEO’s performance and compensation. All decisions relating to the CEO’s pay are made in the context of his performance. The CEO’s performance evaluation includes key leadership competencies and skills in addition to financial and operation measures. The Compensation Committee also seeks independent and objective advice on this topic.

Effective February 2003, Mr. Gellert’s base salary was increased to $900,000, which continues to be below the market median salary for chief executives of comparable organizations. For 2004, the Compensation Committee decided to maintain Mr. Gellert’s base salary at $900,000.

Mr. Gellert’s target incentive is 125% of base salary. The CEO has the opportunity to earn up to 200% of his salary if performance expectations are significantly exceeded. Incentive plan objectives include pre-tax income, membership growth and employee satisfaction objectives. After reviewing 2003 results, the Compensation Committee determined that the Company did not achieve target level of performance in all categories. Therefore, for 2003 the Compensation Committee decided that there would be no annual incentive plan payment to Mr. Gellert.

In February 2003, the Company awarded Mr. Gellert 325,000 stock options and 130,000 shares of restricted stock. The Compensation Committee split Mr. Gellert’s long term equity award between options and restricted shares to achieve several goals. First, the Committee acknowledges that best practice is moving to a diversity of vehicles. Second, restricted stock is an effective tool to promote retention and ownership. In determining the grant, the Compensation Committee considered the advice of its independent consultant, internal equity and the CEO’s potential to impact shareholder value. The option and restricted stock grants vest 50% in three years and 50% in four years; the options have a ten-year term.

In February 2004, the Compensation Committee decided not to make any equity award to the CEO.

Per the Company’s recently adopted stock ownership guidelines, Mr. Gellert took steps to increase his personal holdings of the Company’s stock to reach full compliance with the guidelines. In 2003, Mr. Gellert exercised options to purchase 500,000 shares of the Company’s common stock with personal funds and held 183,000 of such shares following the exercise.

In the event of Mr. Gellert’s involuntary termination other than for cause or his involuntary (or constructive) termination within two years following a change in control, he would receive a $6 million severance benefit. The Compensation Committee has received independent advice on this component, and the value reflects competitive practice. Mr. Gellert is precluded from competing with the Company for a period of up to one year post-termination under his severance arrangement with the Company.

Deductible Compensation

It should be noted that the Compensation Committee’s policy with respect to the tax deductibility of compensation in excess of $1 million payable to each of the Named Executive Officers is to comply with the requirements of Section 162(m) of the Code applicable to qualified performance-based compensation to the extent such compliance is practicable and in the best interest of the Company and its stockholders. The management incentive plan qualifies as performance-based and therefore, incentive awards under that plan are deductible in full.

19

Leadership Development and Succession Planning

An ongoing leadership development and succession-planning program is an integral component of the Company’s strategic plan. The Company’s Governance Committee has responsibility for the oversight of leadership development and succession planning at Health Net. In that regard, the Governance Committee works closely with the Compensation Committee.

Conclusion

Overall, the Compensation Committee believes that the Guiding Principles of the Company’s executive compensation program will allow the Company to attract, motivate and retain executives who are highly capable and well positioned to create stockholder value. Our emphasis has always been on aligning compensation with performance. While specific program features may evolve to remain competitive, we will continue to govern our decisions based on principles of performance, market competitiveness, ownership and affordability.

J. Thomas Bouchard, Chairman

Gov. George Deukmejian

Thomas T. Farley

Patrick Foley

Richard W. Hanselman

Dated: March 9, 2004

20

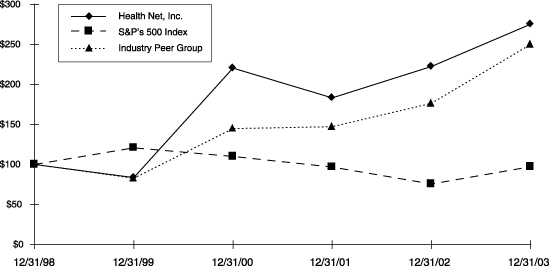

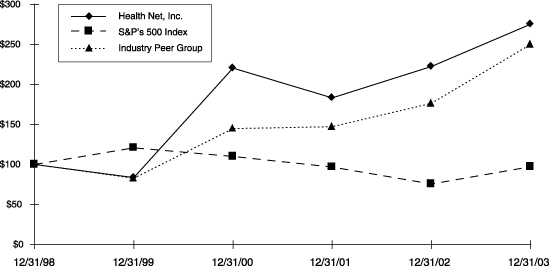

Stock Performance Graph

The following graph compares the performance of the Company’s Class A Common Stock with the performance of the Standard & Poor’s 500 Composite Stock Price Index (the “S&P 500 Index”) and an industry Peer Group Index from December 31, 1998 (the last trading day of 1998) to December 31, 1999, 2000, 2001, 2002 and 2003. The graph assumes that $100 was invested on December 31, 1998 in each of the Class A Common Stock, the S&P 500 Index and the Peer Group Index, and that all dividends were reinvested.

The Company created a Peer Group Index that includes the following companies: Aetna, Inc., Anthem, Inc., Humana, Inc., Oxford Health Plans, Inc., PacifiCare Health Systems, Inc., United Healthcare Corporation and WellPoint Health Networks, Inc. The Peer Group Index weighs the constituent companies’ stock performance on the basis of market capitalization at the beginning of the period, except that data for Anthem, Inc. is only included for the period from December 31, 2001 to December 31, 2003 since it did not become a public company until October 2001.

0

0

COMPARISON OF CUMULATIVE TOTAL RETURN AMONG HEALTH NET, INC.,

S&P 500 INDEX AND PEER GROUP INDEX

FROM DECEMBER 31, 1998 TO DECEMBER 31, 2003

| | | | | | | | | |

| | | Health Net, Inc.

| | S&P’s 500 Index

| | Industry Peer Group

|

December 31, 1998 | | $ | 100.00 | | $ | 100.00 | | $ | 100.00 |

December 31, 1999 | | $ | 83.70 | | $ | 121.00 | | $ | 82.70 |

December 31, 2000 | | $ | 220.50 | | $ | 110.00 | | $ | 145.00 |

December 31, 2001 | | $ | 183.40 | | $ | 97.00 | | $ | 147.30 |

December 31, 2002 | | $ | 222.30 | | $ | 75.50 | | $ | 176.50 |

December 31, 2003 | | $ | 275.40 | | $ | 97.20 | | $ | 250.10 |

21

EXECUTIVE COMPENSATION AND OTHER INFORMATION

The following tables and descriptive materials set forth separately, for the fiscal years indicated, each component of compensation paid or awarded to, or earned by, (i) Mr. Gellert, the Chief Executive Officer of the Company during 2003, and (ii) each of the four other most highly compensated executive officers of the Company serving as of the end of the 2003 calendar year (all such persons, collectively, the “Named Executive Officers”).

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | Long-Term Compensation

| | | |

| | | | | Annual Compensation

| | | Awards

| | Payouts

| | | |

Name and

Principal Position

with the Company

in 2003

| | Year

| | Salary($) (1)

| | | Bonus ($)

| | | Other Annual($)

| | | Restricted Stock Awards $(2)

| | | Securities Underlying Options/ SARs(#)

| | LTIP Payouts ($)

| | All Other Compensation ($)

| |

Jay M. Gellert President and Chief Executive Officer | | 2003

2002

2001 | | 891,731

754,808

686,923 |

| | 0

700,000

0 |

| | 69,565

65,755

69,853 | (3)

(6)

(8) | | 3,127,800

0

0 | (4)

| | 325,000

325,000

650,000 | | 0

0

0 | | 6,941

6,256

711 | (5)

(7)

(9) |

| | | | | | | | |

Marvin P. Rich EVP, Finance & Health Plan Operations | | 2003

2002

2001 | | 520,865

451,923

0 |

(12)

| | 0

800,000

0 |

(13)

| | 12,000

11,133

0 | (10)

(10)

| | 0

0

0 |

| | 150,000

800,000

0 | | 0

0

0 | | 2,066

5,905