UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

Form 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the fiscal year ended December 31, 2012 | ||

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the transition period from to | ||

Commission File No. 001-12079

______________________

Calpine Corporation

(A Delaware Corporation)

I.R.S. Employer Identification No. 77-0212977

717 Texas Avenue, Suite 1000, Houston, Texas 77002

Telephone: (713) 830-2000

Not Applicable

(Former Address)

Securities registered pursuant to Section 12(b) of the Act:

Calpine Corporation Common Stock, $0.001 Par Value

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer, “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [X] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | Smaller reporting company [ ] | |

| (Do not check if a smaller reporting company) | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2012, the last business day of the registrant’s most recently completed second fiscal quarter: approximately $5,484 million.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes [X] No [ ]

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: Calpine Corporation: 456,236,512 shares of common stock, par value $0.001, were outstanding as of February 11, 2013.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the documents listed below have been incorporated by reference into the indicated parts of this Report, as specified in the responses to the item numbers involved.

Designated portions of the Proxy Statement relating to the 2013 Annual Meeting of Shareholders are incorporated by reference into Part III (Items 11, 12, 13, 14 and portions of Item 10)

CALPINE CORPORATION AND SUBSIDIARIES

FORM 10-K

ANNUAL REPORT

For the Year Ended December 31, 2012

TABLE OF CONTENTS

| Page | ||

| Item 1. | ||

| Item 1A. | ||

| Item 1B. | ||

| Item 2. | ||

| Item 3. | ||

| Item 4. | ||

| Item 5. | ||

| Item 6. | ||

| Item 7. | ||

| Item 7A. | ||

| Item 8. | ||

| Item 9. | ||

| Item 9A. | ||

| Item 9B. | ||

| Item 10. | ||

| Item 11. | ||

| Item 12. | ||

| Item 13. | ||

| Item 14. | ||

| Item 15. | ||

i

DEFINITIONS

As used in this Report, the following abbreviations and terms have the meanings as listed below. Additionally, the terms “Calpine,” “we,” “us” and “our” refer to Calpine Corporation and its consolidated subsidiaries, unless the context clearly indicates otherwise. The term “Calpine Corporation” refers only to Calpine Corporation and not to any of its subsidiaries. Unless and as otherwise stated, any references in this Report to any agreement means such agreement and all schedules, exhibits and attachments in each case as amended, restated, supplemented or otherwise modified to the date of filing this Report.

| ABBREVIATION | DEFINITION | |

| 2017 First Lien Notes | The $1.2 billion aggregate principal amount of 7.25% senior secured notes due 2017, issued October 21, 2009, of which 10% of the aggregate principal amount was redeemed on November 7, 2012 in connection with the issuance of the 2019 First Lien Term Loan | |

| 2018 First Lien Term Loans | Collectively, the $1.3 billion first lien senior secured term loan dated March 9, 2011 and the $360 million first lien senior secured term loan dated June 17, 2011 | |

| 2019 First Lien Notes | The $400 million aggregate principal amount of 8.0% senior secured notes due 2019, issued May 25, 2010, of which 10% of the aggregate principal amount was redeemed on November 7, 2012 in connection with the issuance of the 2019 First Lien Term Loan | |

| 2019 First Lien Term Loan | The $835 million first lien senior secured term loan, dated October 9, 2012, among Calpine Corporation, as borrower, and the lenders party hereto, and Morgan Stanley Senior Funding, Inc., as administrative agent and Goldman Sachs Credit Partners L.P., as collateral agent | |

| 2020 First Lien Notes | The $1.1 billion aggregate principal amount of 7.875% senior secured notes due 2020, issued July 23, 2010, of which 10% of the aggregate principal amount was redeemed on November 7, 2012 in connection with the issuance of the 2019 First Lien Term Loan | |

| 2021 First Lien Notes | The $2.0 billion aggregate principal amount of 7.50% senior secured notes due 2021, issued October 22, 2010, of which 10% of the aggregate principal amount was redeemed on November 7, 2012 in connection with the issuance of the 2019 First Lien Term Loan | |

| 2023 First Lien Notes | The $1.2 billion aggregate principal amount of 7.875% senior secured notes due 2023, issued January 14, 2011, of which 10% of the aggregate principal amount was redeemed on November 7, 2012 in connection with the issuance of the 2019 First Lien Term Loan | |

| AB 32 | California Assembly Bill 32 | |

| Adjusted EBITDA | EBITDA as adjusted for the effects of (a) impairment charges, (b) major maintenance expense, (c) operating lease expense, (d) unrealized gains or losses on commodity derivative mark-to-market activity, (e) adjustments to reflect only the Adjusted EBITDA from our unconsolidated investments, (f) stock-based compensation expense, (g) gains or losses on sales, dispositions or retirements of assets, (h) non-cash gains and losses from foreign currency translations, (i) gains or losses on the repurchase or extinguishment of debt, (j) Conectiv Acquisition-related costs, (k) Adjusted EBITDA from our discontinued operations and (l) extraordinary, unusual or non-recurring items | |

| AOCI | Accumulated Other Comprehensive Income | |

| Average availability | Represents the total hours during the period that our plants were in-service or available for service as a percentage of the total hours in the period | |

| Average capacity factor, excluding peakers | A measure of total actual generation as a percent of total potential generation. It is calculated by dividing (a) total MWh generated by our power plants, excluding peakers, by (b) the product of multiplying (i) the average total MW in operation, excluding peakers, during the period by (ii) the total hours in the period | |

| Bankruptcy Code | U.S. Bankruptcy Code | |

| Bcf | Billion cubic feet | |

ii

| ABBREVIATION | DEFINITION | |

| Blue Spruce | Blue Spruce Energy Center, LLC, formerly an indirect, wholly-owned subsidiary of Calpine that owned Blue Spruce Energy Center, a 310 MW natural gas-fired, peaking power plant located in Aurora, Colorado, which was sold on December 6, 2010 | |

| Broad River | Broad River Energy LLC, formerly an indirect, wholly-owned subsidiary of Calpine that leases the Broad River Energy Center, an 847 MW natural gas-fired, peaking power plant located in Gaffney, South Carolina, from the BR Owner Lessors | |

| Broad River Entities | Collectively, Broad River and the BR Owner Lessors | |

| BR Owner Lessors | Broad River OL-1, LLC, a Delaware limited liability company, Broad River OL-2, LLC, a Delaware limited liability company, Broad River OL-3, LLC, a Delaware limited liability company, and Broad River OL-4, LLC, a Delaware limited liability company, each of which is an indirect, wholly-owned subsidiary of Calpine, which lease the Broad River Energy Center (i) from Cherokee County, South Carolina and (ii) to Broad River | |

| Btu | British thermal unit(s), a measure of heat content | |

| CAA | Federal Clean Air Act, U.S. Code Title 42, Chapter 85 | |

| CAIR | Clean Air Interstate Rule | |

| CAISO | California Independent System Operator | |

| Calpine BRSP | Calpine BRSP, LLC | |

| Calpine Equity Incentive Plans | Collectively, the Director Plan and the Equity Plan, which provide for grants of equity awards to Calpine non-union employees and non-employee members of Calpine’s Board of Directors | |

| Cap-and-trade | A government imposed emissions reduction program that would place a cap on the amount of emissions that can be emitted from certain sources, such as power plants. In its simplest form, the cap amount is set as a reduction from the total emissions during a base year and for each year over a period of years the cap amount would be reduced to achieve the targeted overall reduction by the end of the period. Allowances or credits for emissions in an amount equal to the cap would be issued or auctioned to companies with facilities, permitting them to emit up to a certain amount of emissions during each applicable period. After allowances have been distributed or auctioned, they can be transferred or traded | |

| CARB | California Air Resources Board | |

| CCFC | Calpine Construction Finance Company, L.P., an indirect, wholly-owned subsidiary of Calpine | |

| CCFC Finance | CCFC Finance Corp. | |

| CCFC Guarantors | Hermiston Power LLC and Brazos Valley Energy LLC, wholly-owned subsidiaries of CCFC | |

| CCFC Notes | The $1.0 billion aggregate principal amount of 8.0% Senior Secured Notes due 2016 issued May 19, 2009, by CCFC and CCFC Finance | |

| CDHI | Calpine Development Holdings, Inc., an indirect, wholly-owned subsidiary of Calpine | |

| CEHC | Conectiv Energy Holding Company, LLC, a wholly-owned subsidiary of Conectiv | |

| CES | Calpine Energy Services, L.P. | |

iii

| ABBREVIATION | DEFINITION | |

| CFTC | U.S. Commodities Futures Trading Commission | |

| Chapter 11 | Chapter 11 of the U.S. Bankruptcy Code | |

CO2 | Carbon dioxide | |

| COD | Commercial operations date | |

| Cogeneration | Using a portion or all of the steam generated in the power generating process to supply a customer with steam for use in the customer's operations | |

| Commodity expense | The sum of our expenses from fuel and purchased energy expense, fuel transportation expense, transmission expense, RGGI compliance and other environmental costs and realized settlements from our marketing, hedging and optimization activities including natural gas transactions hedging future power sales, but excludes the unrealized portion of our mark-to-market activity | |

| Commodity Margin | Non-GAAP financial measure that includes power and steam revenues, sales of purchased power and physical natural gas, capacity revenue, REC revenue, sales of surplus emission allowances, transmission revenue and expenses, fuel and purchased energy expense, fuel transportation expense, RGGI compliance and other environmental costs, and realized settlements from our marketing, hedging and optimization activities including natural gas transactions hedging future power sales, but excludes the unrealized portion of our mark-to-market activity and other revenues | |

| Commodity revenue | The sum of our revenues from power and steam sales, sales of purchased power and physical natural gas, capacity revenue, REC revenue, sales of surplus emission allowances, transmission revenue and realized settlements from our marketing, hedging and optimization activities, but excludes the unrealized portion of our mark-to-market activity | |

| Company | Calpine Corporation, a Delaware corporation, and its subsidiaries | |

| Conectiv | Conectiv, LLC, a wholly-owned subsidiary of PHI | |

| Conectiv Acquisition | The acquisition of all of the membership interests in CEHC pursuant to the Conectiv Purchase Agreement on July 1, 2010, whereby we acquired all of the power generation assets of Conectiv from PHI, which included 18 operating power plants and York Energy Center that was under construction and achieved COD on March 2, 2011, with 4,491 MW of capacity | |

| Conectiv Purchase Agreement | Purchase Agreement by and among PHI, Conectiv, CEHC and NDH dated as of April 20, 2010 | |

| Corporate Revolving Facility | The $1.0 billion aggregate amount revolving credit facility credit agreement, dated as of December 10, 2010, among Calpine Corporation, Goldman Sachs Bank USA, as administrative agent, Goldman Sachs Credit Partners L.P., as collateral agent, the lenders party thereto and the other parties thereto | |

| CPUC | California Public Utilities Commission | |

| Creed | Creed Energy Center, LLC | |

| Director Plan | The Amended and Restated Calpine Corporation 2008 Director Incentive Plan | |

| Dodd-Frank Act | The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 | |

| EBITDA | Net income (loss) attributable to Calpine before net (income) loss attributable to the noncontrolling interest, interest, taxes, depreciation and amortization | |

| Effective Date | January 31, 2008, the date on which the conditions precedent enumerated in the Plan of Reorganization were satisfied or waived and the Plan of Reorganization became effective | |

iv

| ABBREVIATION | DEFINITION | |

| EIA | Energy Information Administration of the U.S. Department of Energy | |

| EPA | U.S. Environmental Protection Agency | |

| Equity Plan | The Amended and Restated Calpine Corporation 2008 Equity Incentive Plan | |

| ERCOT | Electric Reliability Council of Texas | |

| EWG(s) | Exempt wholesale generator(s) | |

| Exchange Act | U.S. Securities Exchange Act of 1934, as amended | |

| FASB | Financial Accounting Standards Board | |

| FDIC | U.S. Federal Deposit Insurance Corporation | |

| FERC | U.S. Federal Energy Regulatory Commission | |

| First Lien Credit Facility | Credit Agreement, dated as of January 31, 2008, as amended by the First Amendment to Credit Agreement and Second Amendment to Collateral Agency and Intercreditor Agreement, dated as of August 20, 2009, among Calpine Corporation, as borrower, certain subsidiaries of the Company named therein, as guarantors, the lenders party thereto, Goldman Sachs Credit Partners L.P., as administrative agent and collateral agent, and the other agents named therein | |

| First Lien Notes | Collectively, the 2017 First Lien Notes, the 2019 First Lien Notes, the 2020 First Lien Notes, the 2021 First Lien Notes and the 2023 First Lien Notes | |

| First Lien Term Loans | Collectively, the 2018 First Lien Term Loans and the 2019 First Lien Term Loan | |

| FRCC | Florida Reliability Coordinating Council | |

| Freestone | Freestone Energy Center, a 994 MW natural gas-fired, combined-cycle power plant located near Fairfield, Texas | |

| GE | General Electric International, Inc. | |

| GEC | Collectively, Gilroy Energy Center, LLC, Creed and Goose Haven | |

| Geysers Assets | Our geothermal power plant assets, including our steam extraction and gathering assets, located in northern California consisting of 15 operating power plants and one plant not in operation | |

| GHG(s) | Greenhouse gas(es), primarily carbon dioxide (CO2), and including methane (CH4), nitrous oxide (N2O), sulfur hexafluoride (SF6), hydrofluorocarbons (HFCs) and perfluorocarbons (PFCs) | |

| Goose Haven | Goose Haven Energy Center, LLC | |

| Greenfield LP | Greenfield Energy Centre LP, a 50% partnership interest between certain of our subsidiaries and a third party which operates the Greenfield Energy Centre, a 1,038 MW natural gas-fired, combined-cycle power plant in Ontario, Canada | |

| Heat Rate(s) | A measure of the amount of fuel required to produce a unit of power | |

v

| ABBREVIATION | DEFINITION | |

| Hg | Mercury | |

| IOUs | Investor Owned Utilities | |

| IRC | Internal Revenue Code | |

| IRS | U.S. Internal Revenue Service | |

| ISO(s) | Independent System Operator(s) | |

| ISO-NE | ISO New England | |

| ISRA | Industrial Site Recovery Act | |

| KIAC | KIAC Partners, an indirect, wholly-owned subsidiary of Calpine that leases our Kennedy International Airport Power Plant, a 121 MW natural gas-fired, combined-cycle power plant located at John F. Kennedy International Airport in New York | |

| KWh | Kilowatt hour(s), a measure of power produced, purchased or sold | |

| LIBOR | London Inter-Bank Offered Rate | |

| Los Esteros Project Debt | Credit Agreement dated August 23, 2011, between Los Esteros Critical Energy Facility, LLC, as borrower, and the lenders named therein | |

| LTSA(s) | Long-Term Service Agreement(s) | |

| Market Heat Rate(s) | The regional power price divided by the corresponding regional natural gas price | |

| MISO | Midwest ISO | |

| MMBtu | Million Btu | |

| MRO | Midwest Reliability Organization | |

| MW | Megawatt(s), a measure of plant capacity | |

| MWh | Megawatt hour(s), a measure of power produced, purchased or sold | |

| NAAQS | National Ambient Air Quality Standards | |

| NDH | New Development Holdings, LLC, an indirect, wholly-owned subsidiary | |

| NDH Project Debt | The $1.3 billion senior secured term loan facility and the $100 million revolving credit facility issued on July 1, 2010, under the credit agreement, dated as of June 8, 2010, among NDH, as borrower, Credit Suisse AG, as administrative agent, collateral agent, issuing bank and syndication agent, Credit Suisse Securities (USA) LLC, Citigroup Global Markets Inc. and Deutsche Bank Securities Inc., as joint book-runners and joint lead arrangers, Credit Suisse AG, Citibank, N.A., and Deutsche Bank Trust Company Americas, as co-documentation agents and the lenders party thereto repaid on March 9, 2011 | |

| NERC | North American Electric Reliability Council | |

| NOL(s) | Net operating loss(es) | |

NOX | Nitrogen oxides | |

| NPCC | Northeast Power Coordinating Council | |

| NYISO | New York ISO | |

vi

| ABBREVIATION | DEFINITION | |

| NYMEX | New York Mercantile Exchange | |

| NYSE | New York Stock Exchange | |

| OCI | Other Comprehensive Income | |

| OMEC | Otay Mesa Energy Center, LLC, an indirect, wholly-owned subsidiary that owns the Otay Mesa Energy Center, a 608 MW natural gas-fired, combined-cycle power plant located in San Diego county, California | |

| OTC | Over-the-Counter | |

| PG&E | Pacific Gas & Electric Company | |

| PHI | Pepco Holdings, Inc. | |

| PJM | PJM Interconnection is a RTO that coordinates the movement of wholesale electricity in all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia | |

| Plan of Reorganization | Sixth Amended Joint Plan of Reorganization Pursuant to Chapter 11 of the Bankruptcy Code filed by the U.S. Debtors with the U.S. Bankruptcy Court on December 19, 2007, as amended, modified or supplemented | |

| PPA(s) | Any term power purchase agreement or other contract for a physically settled sale (as distinguished from a financially settled future, option or other derivative or hedge transaction) of any power product, including power, capacity and/or ancillary services, in the form of a bilateral agreement or a written or oral confirmation of a transaction between two parties to a master agreement, including sales related to a tolling transaction in which the purchaser provides the fuel required by us to generate such power and we receive a variable payment to convert the fuel into power and steam | |

| PUCT | Public Utility Commission of Texas | |

| PUHCA 2005 | U.S. Public Utility Holding Company Act of 2005 | |

| PURPA | U.S. Public Utility Regulatory Policies Act of 1978 | |

| QF(s) | Qualifying facility(ies), which are cogeneration facilities and certain small power production facilities eligible to be “qualifying facilities” under PURPA, provided that they meet certain power and thermal energy production requirements and efficiency standards. QF status provides an exemption from the books and records requirement of PUHCA 2005 and grants certain other benefits to the QF | |

| REC(s) | Renewable energy credit(s) | |

| Report | This Annual Report on Form 10-K for the year ended December 31, 2012, filed with the SEC on February 12, 2013 | |

| Reserve margin(s) | The measure of how much the total generating capacity installed in a region exceeds the peak demand for power in that region | |

| RFC | Reliability First Corporation | |

| RGGI | Regional Greenhouse Gas Initiative | |

| Risk Management Policy | Calpine's policy applicable to all employees, contractors, representatives and agents which defines the risk management framework and corporate governance structure for commodity risk, interest rate risk, currency risk and other risks | |

vii

| ABBREVIATION | DEFINITION | |

| RMR Contract(s) | Reliability Must Run contract(s) | |

| Rocky Mountain | Rocky Mountain Energy Center, LLC, formerly an indirect, wholly-owned subsidiary of Calpine that owned Rocky Mountain Energy Center, a 621 MW natural gas-fired, combined-cycle power plant located in Keenesburg, Colorado, which was sold on December 6, 2010 | |

| RPS | Renewable Portfolio Standards | |

| RTO(s) | Regional Transmission Organization(s) | |

| Russell City Project Debt | Credit Agreement dated June 24, 2011, between Russell City Energy Company, LLC, as borrower, and the lenders named therein | |

| SEC | U.S. Securities and Exchange Commission | |

| Securities Act | U.S. Securities Act of 1933, as amended | |

| SERC | Southeastern Electric Reliability Council | |

SO2 | Sulfur dioxide | |

| South Point | South Point Energy Center, a 530 MW natural gas-fired, combined-cycle power plant located in Mohave Valley, Arizona | |

| Spark Spread(s) | The difference between the sales price of power per MWh and the cost of fuel to produce it | |

| SPP | Southwest Power Pool | |

| Steam Adjusted Heat Rate | The adjusted Heat Rate for our natural gas-fired power plants, excluding peakers, calculated by dividing (a) the fuel consumed in Btu reduced by the net equivalent Btu in steam exported to a third party by (b) the KWh generated. Steam Adjusted Heat Rate is a measure of fuel efficiency, so the lower our Steam Adjusted Heat Rate, the lower our cost of generation | |

| TCEQ | Texas Commission on Environmental Quality | |

| TRE | Texas Reliability Entity, Inc. | |

| U.S. Bankruptcy Court | U.S. Bankruptcy Court for the Southern District of New York | |

| U.S. Debtor(s) | Calpine Corporation and each of its subsidiaries and affiliates that filed voluntary petitions for reorganization under Chapter 11 of the Bankruptcy Code in the U.S. Bankruptcy Court, which matter was jointly administered in the U.S. Bankruptcy Court under the caption In re Calpine Corporation, et al., Case No. 05-60200 (BRL) and was dismissed on December 19, 2011 | |

| U.S. GAAP | Generally accepted accounting principles in the U.S. | |

| VAR | Value-at-risk | |

| VIE(s) | Variable interest entity(ies) | |

| WECC | Western Electricity Coordinating Council | |

| Whitby | Whitby Cogeneration Limited Partnership, a 50% partnership interest between certain of our subsidiaries and a third party which operates the Whitby 50 MW natural gas-fired, simple-cycle cogeneration power plant located in Ontario, Canada | |

viii

| ABBREVIATION | DEFINITION | |

| WP&L | Wisconsin Power & Light Company | |

| York Energy Center | 565 MW dual fuel, combined-cycle generation power plant (formerly known as the Delta Project) located in Peach Bottom Township, Pennsylvania which achieved COD on March 2, 2011 | |

ix

Forward-Looking Statements

In addition to historical information, this Report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and Section 21E of the Exchange Act. Forward-looking statements may appear throughout this Report, including without limitation, the “Management's Discussion and Analysis” section. We use words such as “believe,” “intend,” “expect,” “anticipate,” “plan,” “may,” “will,” “should,” “estimate,” “potential,” “project” and similar expressions to identify forward-looking statements. Such statements include, among others, those concerning our expected financial performance and strategic and operational plans, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and that a number of risks and uncertainties could cause actual results to differ materially from those anticipated in the forward-looking statements. Such risks and uncertainties include, but are not limited to:

| • | Financial results that may be volatile and may not reflect historical trends due to, among other things, fluctuations in prices for commodities such as natural gas and power, changes in U.S. macroeconomic conditions, fluctuations in liquidity and volatility in the energy commodities markets and our ability to hedge risks; |

| • | Laws, regulation and market rules in the markets in which we participate and our ability to effectively respond to changes in laws, regulations or market rules or the interpretation thereof including those related to the environment, derivative transactions and market design in the regions in which we operate; |

| • | Our ability to manage our liquidity needs and to comply with covenants under our First Lien Notes, Corporate Revolving Facility, First Lien Term Loans, CCFC Notes and other existing financing obligations; |

| • | Risks associated with the operation, construction and development of power plants including unscheduled outages or delays and plant efficiencies; |

| • | Risks related to our geothermal resources, including the adequacy of our steam reserves, unusual or unexpected steam field well and pipeline maintenance requirements, variables associated with the injection of wastewater to the steam reservoir and potential regulations or other requirements related to seismicity concerns that may delay or increase the cost of developing or operating geothermal resources; |

| • | The unknown future impact on our business from the Dodd-Frank Act and the rules to be promulgated thereunder; |

| • | Competition, including risks associated with marketing and selling power in the evolving energy markets; |

| • | The expiration or early termination of our PPAs and the related results on revenues; |

| • | Future capacity revenues may not occur at expected levels; |

| • | Natural disasters, such as hurricanes, earthquakes and floods, acts of terrorism or cyber attacks that may impact our power plants or the markets our power plants serve and our corporate headquarters; |

| • | Disruptions in or limitations on the transportation of natural gas, fuel oil and transmission of power; |

| • | Our ability to manage our customer and counterparty exposure and credit risk, including our commodity positions; |

| • | Our ability to attract, motivate and retain key employees; |

| • | Present and possible future claims, litigation and enforcement actions; and |

| • | Other risks identified in this Report. |

Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. Many of these factors are beyond our ability to control or predict. Our forward-looking statements speak only as of the date of this Report. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

Where You Can Find Other Information

Our website is www.calpine.com. Information contained on our website is not part of this Report. Information that we furnish or file with the SEC, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to or exhibits included in these reports are available for download, free of charge, on our website soon after such reports are filed with or furnished with the SEC. Our SEC filings, including exhibits filed therewith, are also available at the SEC’s website at www.sec.gov. You may obtain and copy any document we furnish or file with the SEC at the SEC’s public reference room at 100 F Street, NE, Room 1580, Washington, D.C. 20549. You may obtain information on the

1

operation of the SEC’s public reference facilities by calling the SEC at 1-800-SEC-0330. You may request copies of these documents, upon payment of a duplicating fee, by writing to the SEC at its principal office at 100 F Street, NE, Room 1580, Washington, D.C. 20549.

2

PART I

| Item 1. | Business |

BUSINESS AND STRATEGY

Business

We are a premier wholesale power producer with operations throughout the U.S. We measure our success by delivering long-term shareholder value. We accomplish this through our focus on operational excellence, effectively executing our hedging strategy, our customer origination program and completing our growth capital projects on schedule and on budget. We are one of the largest power generators in the U.S. measured by power produced. We own and operate primarily natural gas-fired and geothermal power plants in North America and have a significant presence in major competitive wholesale power markets in California, Texas and the Mid-Atlantic region of the U.S. Since our inception in 1984, we have been a leader in environmental stewardship. We have invested in clean power generation to become a recognized leader in developing, constructing, owning and operating an environmentally responsible portfolio of power plants. Our portfolio is primarily comprised of two types of power generation technologies: natural gas-fired combustion turbines, which are primarily efficient combined-cycle plants, and renewable geothermal conventional steam turbines. We are among the world’s largest owners and operators of industrial gas turbines as well as cogeneration power plants. Our Geysers Assets located in northern California represent the largest geothermal power generation portfolio in the U.S. and produced approximately 18% of all renewable energy in the state of California during 2011. We sell wholesale power, steam, capacity, renewable energy credits and ancillary services to our customers, which include utilities, independent electric system operators, industrial and agricultural companies, retail power providers, municipalities, power marketers and others. We purchase natural gas and fuel oil as fuel for our power plants and engage in related natural gas transportation and storage transactions. We also purchase electric transmission rights to deliver power to our customers. Additionally, consistent with our Risk Management Policy, we enter into natural gas and power physical and financial contracts to hedge certain business risks and optimize our portfolio of power plants.

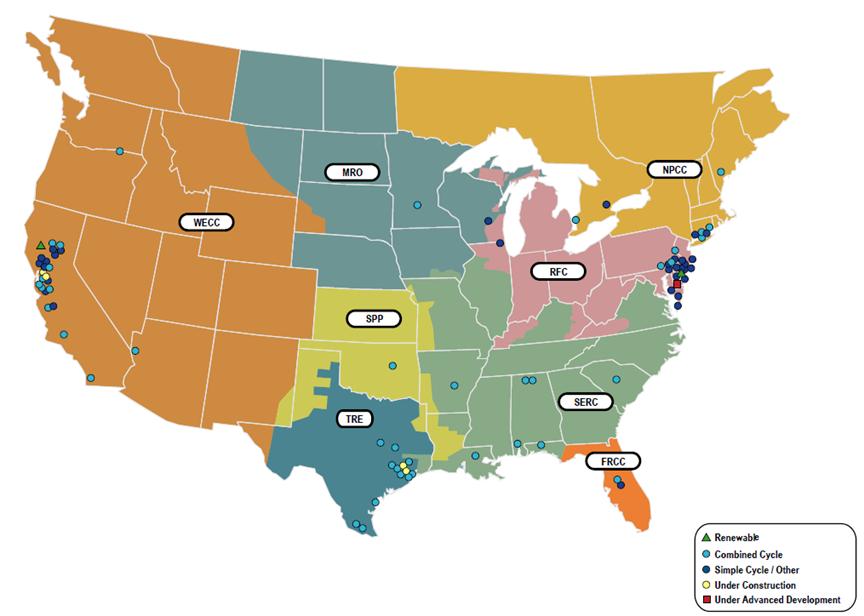

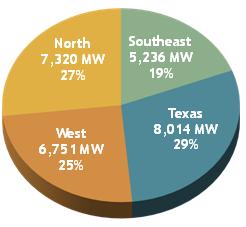

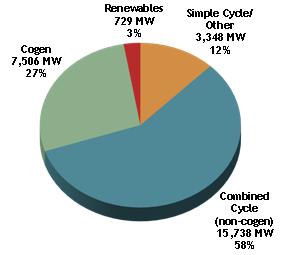

Our portfolio, including partnership interests, consists of 92 power plants, including 4 under construction (1 new power plant and 3 expansions of existing power plants), located throughout 20 states in the U.S. and Canada, with an aggregate generation capacity of 27,321 MW and 1,163 MW under construction. Our fleet, including projects under construction, consists of 74 combustion turbine-based plants, 2 fossil steam-based plants, 15 geothermal turbine-based plants and 1 photovoltaic solar plant. In 2012, our fleet of power plants produced approximately 116 billion KWh of electric power for our customers. In addition, we are one of the largest consumers of natural gas in North America. In 2012, we consumed 867 Bcf or approximately 9% of the total estimated natural gas consumed for power generation in the U.S. We believe that having scale and geographic diversity is important in our business. Scale provides us the opportunity to have meaningful regulatory input, an ability to leverage our procurement efforts for better pricing, terms and conditions on our goods and services, and allows us to develop and offer a wide array of products and services to our customers. Geographic diversity helps us manage weather, regulatory and regional economic differences across our markets.

The environmental profile of our power plants reflects our commitment to environmental leadership and stewardship. We have invested the necessary capital to develop a power generation portfolio that has substantially lower air pollutant emissions compared to our competitors’ power plants using other fossil fuels, such as coal. In addition, we strive to preserve our nation’s valuable water and land resources. To condense steam, our combined-cycle power plants use cooling towers with a closed water cooling system or air cooled condensers and do not employ “once-through” water cooling, which uses large quantities of water from adjacent waterways, negatively impacting aquatic life. Since our plants are modern and efficient and utilize clean burning natural gas, we do not require large areas of land for our power plants nor do we require large specialized landfills for the disposal of coal ash or nuclear plant waste. We believe that we will be less adversely impacted by Cap-and-trade limits, carbon taxes or required environmental upgrades as a result of future potential regulation or legislation addressing GHG, other air pollutant emissions such as mercury, as well as water use or emissions, compared to our competitors who use other fossil fuels or older, less efficient technologies.

Our principal offices are located in Houston, Texas with regional offices in Dublin, California and Wilmington, Delaware, an engineering, construction and maintenance services office in Pasadena, Texas and government affairs offices in Washington D.C., Sacramento, California and Austin, Texas. We operate our business through a variety of divisions, subsidiaries and affiliates.

Strategy

Our goal is to be recognized as the premier wholesale power company in the U.S. as measured by our employees, shareholders, customers and regulators as well as the communities in which our facilities are located. We seek to achieve sustainable

3

growth through financially disciplined power plant development, construction, acquisition, operation and ownership. Our strategy to achieve this is reflected in the four major initiatives described below:

| 1. | Focus on Becoming the Premier Operating Company — Our objective is to be the “best-in-class” in regards to certain operational performance metrics, such as safety, availability, reliability, efficiency and cost management. |

| • | We produced approximately 116 billion KWh of electricity in 2012, 23% more than the same period in 2011 (includes generation from power plants owned but not operated by us and our share of generation from our unconsolidated power plants). |

| • | Our entire fleet achieved a forced outage factor of 1.6% in 2012, our lowest on record and an improvement of 36% from 2011. |

| • | Our entire fleet achieved an impressive starting reliability of 98.3% in 2012. |

| • | During 2012, our outage services subsidiary completed 11 major inspections and 19 hot gas path inspections. |

| • | For the past twelve consecutive years, our Geysers Assets have reliably generated approximately 6 million MWh per year and, in 2012, achieved an exceptional availability factor of approximately 97%. |

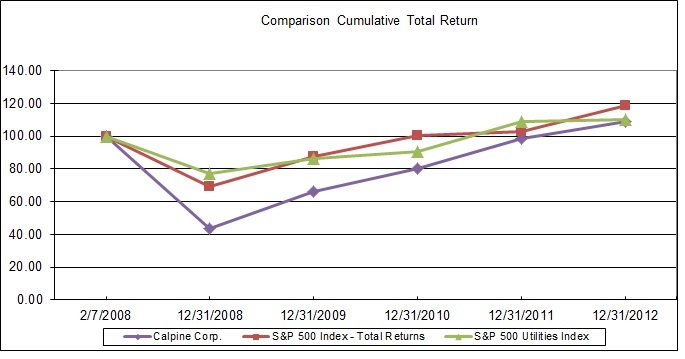

| 2. | Focus on Enhancing Shareholder Value — We continue to make significant progress to deliver financially disciplined growth, to enhance shareholder value through our capital allocation and share repurchases and to set the foundation for continued growth and success. Given our strong cash flow from operations, we are committed to remaining financially disciplined in our capital allocation decisions. The year ended December 31, 2012 was marked by the following accomplishments: |

| • | As of the filing of this Report, we have completed our previously announced $600 million share repurchase program, having repurchased a total of 35,568,833 shares of our outstanding common stock at an average price paid of $16.87 per share. In February 2013, our Board of Directors authorized the repurchase of an additional $400 million in shares of our common stock, bringing the cumulative authorization total to $1.0 billion. |

| • | During the first quarter of 2012, we terminated our legacy interest rate swaps formerly hedging our First Lien Credit Facility for a payment of approximately $156 million which eliminated our exposure from these instruments to further declines in interest rates. |

| • | On October 9, 2012, we issued our 2019 First Lien Term Loan and used the proceeds to reduce our overall cost of debt and simplify our capital structure by redeeming a portion of our First Lien Notes and repaying project debt. |

| • | On November 7, 2012, we completed the purchase of a modern, natural gas-fired, combined-cycle power plant with a nameplate capacity of 800 MW located in Bosque County, Texas for approximately $432 million which increased capacity in our Texas segment. |

| • | On December 27, 2012, we, through our indirect, wholly-owned subsidiary Calpine Power Company, completed the sale of 100% of our ownership interest in each of the Broad River Entities for approximately $423 million. This transaction resulted in the disposition of our Broad River power plant, an 847 MW natural gas-fired, peaking power plant located in Gaffney, South Carolina, and includes a five year consulting agreement with the buyer. We expect to use the sale proceeds for our capital allocation activities and for general corporate purposes. |

| • | On December 31, 2012, we completed the sale of Riverside Energy Center, LLC to WP&L for approximately $402 million. We expect to use the sale proceeds for our capital allocation activities and for general corporate purposes. |

| 3. | Focus on Leveraging our Three Scale Regions — Our goal is to continue to grow our generation presence in core markets with an emphasis on expansions or modernizations of existing power plants. We intend to take advantage of favorable opportunities to continue to design, develop, acquire, construct and operate the next generation of highly efficient, operationally flexible and environmentally responsible power plants where such investment meets our rigorous financial hurdles, particularly if power contracts and financing are available and attractive returns are expected. Likewise, we will actively seek divestiture opportunities on our non-core assets if those opportunities meet our financial expectations. In addition, we believe that modernizations and expansions to our current assets offer proven and financially disciplined opportunities to improve our operations, capacity and efficiencies. Our significant projects under construction, organic growth initiatives and modernization activities are discussed below. |

West:

| • | Russell City Energy Center — Construction at our Russell City Energy Center continues to move forward. Upon completion, this project will bring on line approximately 429 MW of net interest baseload capacity (464 MW with peaking capacity) representing our 75% share. Construction is ongoing and COD is expected in the summer of 2013. Upon completion, the Russell City Energy Center is contracted to deliver its full output to PG&E under a ten-year PPA. |

4

| • | Los Esteros Critical Energy Facility — During 2009, we and PG&E negotiated a new PPA to replace the existing California Department of Water Resources contract and facilitate the modernization of our Los Esteros Critical Energy Facility from a 188 MW simple-cycle generation power plant to a 309 MW combined-cycle generation power plant, which will also increase the efficiency and environmental performance of the power plant by lowering the Heat Rate. Construction is ongoing and COD is expected in the summer of 2013. |

Texas:

| • | Channel and Deer Park Expansions — In September and November 2011, we filed air permit applications with the TCEQ and the EPA to expand the baseload capacity of the Deer Park and Channel Energy Centers by approximately 260 MW each. We received air permit approvals from the TCEQ for our Deer Park and Channel expansion projects in September and October 2012, respectively, and from the EPA in November 2012. Construction on these expansion projects commenced in the fourth quarter of 2012. We expect COD during the summer of 2014 for these expansions and are currently evaluating funding sources including, but not limited to, nonrecourse financing, corporate financing or internally generated funds. |

North:

| • | Garrison Energy Center — We are actively permitting 618 MW of new combined-cycle capacity at a development site secured by a long-term lease with the City of Dover. For the first phase (309 MW), we have executed the Interconnection Services Agreement and the Interconnection Construction Services Agreement with PJM. For the second phase (309 MW), we have completed a feasibility study and are currently conducting a system impact study. Environmental permitting, site development planning and development engineering are underway and the first phase’s capacity cleared PJM’s 2015/2016 base residual auction. We received the air permit and executed a preliminary notice to proceed for the engineering, procurement and construction agreement during the first quarter of 2013. We expect COD for the first phase by the summer of 2015 and are currently evaluating funding sources including, but not limited to, nonrecourse financing, corporate financing or internally generated funds. |

All Segments:

| • | Turbine Modernization — We continue to move forward with our turbine modernization program. Through December 31, 2012, we have completed the upgrade of eleven Siemens and eight GE turbines totaling over 200 MW and have committed to upgrade approximately three additional turbines. |

| 4. | Focus on Customer-Oriented Origination Business — We continue to focus on providing products and services that are beneficial to our customers. A summary of certain significant contracts entered into or approved in 2012 is as follows: |

| • | We entered into a new twenty-year PPA with Western Farmers Electric Cooperative to provide 160 MW of power generated by our Oneta Energy Center, commencing in June 2014. The capacity under contract will increase in increments, up to a maximum of 280 MW in years 2019 through 2035. |

| • | We entered into a new five-year PPA with Southwestern Public Service Company, a subsidiary of Xcel Energy, to provide an additional 200 MW of power generated by our Oneta Energy Center commencing on June 1, 2014. |

| • | We entered into a new five-year resource adequacy contract with PG&E for approximately 280 MW of combined heat and power capacity from our Los Medanos Energy Center commencing in the summer 2013. |

| • | We entered into a new seven-year resource adequacy contract with Southern California Edison Company (“SCE”) for approximately 280 MW of combined heat and power capacity from our Los Medanos Energy Center and a new five-year resource adequacy contract with SCE for approximately 120 MW of combined heat and power capacity from our Gilroy Cogeneration Plant, both commencing in January 2014. |

| • | We amended an existing PPA with Dow Chemical Company for an incremental energy sale of up to approximately 158,000 MWh per year of energy from our Los Medanos Energy Center which runs through February 2025. |

| • | We entered into a new fifteen-year PPA with American Electric Power Service Corporation, as agent for Public Service Company of Oklahoma, to provide 260 MW of energy, capacity and ancillary services from our Oneta Energy Center commencing in June 2016. |

| • | We entered into a new ten-year PPA with the Tennessee Valley Authority to provide the full output of power generated by our Decatur Energy Center, a natural gas-fired, combined-cycle power plant that can generate up to 795 MW, commencing in January 2013. |

5

THE MARKET FOR POWER

Our Power Markets and Market Fundamentals

The power industry represents one of the largest industries in the U.S. and impacts nearly every aspect of our economy, with an estimated end-user market of approximately $364 billion in power sales in 2012 according to the EIA. Historically, vertically integrated power utilities with monopolies over franchised territories dominated the power generation industry in the U.S. Over the last 25 years, industry trends and regulatory initiatives, culminating with the deregulation trend of the late 1990’s and early 2000’s, provided opportunities for wholesale power producers to compete to provide power. Although different regions of the country have very different models and rules for competition, the markets in which we operate have some form of wholesale market competition. California (included in our West segment), Texas and the Mid-Atlantic (included in our North segment), which are the markets in which we have our largest presence, have emerged as among the most competitive wholesale power markets in the U.S. We also operate, to a lesser extent, in the competitive ISO-NE, NYISO and MISO markets. We produce several products for sale to our customers.

| • | First, we are a wholesale provider of power to utilities, independent electric system operators, industrial or agricultural companies, retail power providers, municipalities, and power marketers. Our power sales occur in several different product categories including baseload (around the clock generation), intermediate (generation typically more expensive than baseload and utilized during higher demand periods to meet shifting demand needs), and peaking capacity (most expensive variable cost and utilized during the highest demand periods), for which the latter is provided by some of our stand-alone peaking power plants/units and from our combined-cycle power plants by using technologies such as steam injection or duct firing additional burners in the heat recovery steam generators. Many of our units have operated more frequently as baseload units at times when low natural gas prices have driven their production costs below those of some competing coal-fired units. |

| • | Second, we provide capacity for sale to retail power providers. In various markets, retail power providers are required to demonstrate adequate resources to meet their power sales commitments. To meet this obligation, they procure a market product known as capacity from power plant owners or resellers. Most electricity market administrators have acknowledged that an energy only market does not provide sufficient revenues to enable existing merchant generators to recover all of their costs or to encourage the construction of new power plants. Capacity auctions have been implemented in the northeast, the Mid-Atlantic and some midwest regional markets to address this issue. California has a bilateral capacity program. Texas does not presently have a capacity market, nor a requirement for retailers to ensure adequate resources. |

| • | Third, we sell RECs from our Geysers Assets in northern California, as well as from our small solar power plant in New Jersey. California has an RPS that requires load serving entities to have RECs for a certain percentage of their demand for the purpose of guaranteeing a certain level of renewable generation in the state. Because geothermal is a renewable source of energy, we receive a REC for each MWh we produce and are able to sell our RECs to load serving entities. New Jersey has a solar specific RPS which enables us to sell RECs from our Vineland Solar Energy Center. |

| • | Fourth, our cogeneration power plants produce steam for sale to customers for use in industrial or heating, ventilation and air conditioning operations. |

| • | Fifth, we provide ancillary service products to wholesale power markets. These products include the right for the purchaser to call on our generation to provide flexibility to the market and support operation of the electric grid. As an example, we are sometimes paid to reserve a portion of capacity at some of our power plants that could be deployed quickly should there be an unexpected increase in load or to assure reliability due to fluctuations in the supply of power from variable renewable resources such as wind and solar generation. These ramping characteristics are becoming increasingly necessary in markets where intermittent renewables have large penetrations. |

In addition to the five products above, we are buyers and sellers of environmental allowances and credits, including those under RGGI, the federal Acid Rain and CAIR programs and emission reduction credits under the federal Nonattainment New Source Review program. We also participate in CO2 emissions credit markets related to California’s AB 32 GHG reduction program.

Although all of the products mentioned above contribute to our financial performance and are the primary components of our Commodity Margin, the most important is our sale of wholesale power. We utilize long-term customer contracts for our power and steam sales where possible. For power that is not sold under customer contracts, we use our hedging program throughout the markets in which we participate.

6

For sales of power from our natural gas-fired fleet into the short-term or spot markets, we attempt to maximize our operations when the market Spark Spread is positive. Assuming economic behavior by market participants, generating units generally are dispatched in order of their variable costs, with lower cost units being dispatched first and units with higher costs dispatched as demand, or “load,” grows beyond the capacity of the lower cost units. For this reason, in a competitive market, the price of power typically is related to the variable operating costs of the marginal generator, which is the last unit to be dispatched in order to meet demand. The market factors that most significantly impact our operations are reserve margins, the price and supply of natural gas and competing fuels such as coal and oil, weather patterns and natural events, our operating Heat Rate, availability factors, and regulatory and environmental pressures as further discussed below.

Reserve Margins

Reserve margin, a measure of excess generation capacity in a market, is a key indicator of the competitive conditions in the markets in which we operate. For example, a reserve margin of 15% indicates that supply is 115% of expected peak power demand under normal weather conditions. Holding other factors constant, lower reserve margins typically lead to higher power prices because the less efficient capacity in the region is needed more often to satisfy power demand or voluntary or involuntary load shedding measures are taken. Markets with tight demand and supply conditions often display price spikes and improved bilateral contracting opportunities. Typically, the market price impact of reserve margins, as well as other supply/demand factors, is reflected in the Market Heat Rate, calculated as the local market power price divided by the local natural gas price.

During the last decade, the supply and demand fundamentals in many regional markets have been negatively impacted by the combination of new generation coming on line and a general decline in weather normalized load growth rates due to the economic recession. Although uncertainty exists and there are key regional differences at a macro level, continued economic recovery and thus, corresponding load recovery, with the lack of broad new power plant investments in our key markets should lead to lower reserve margins and higher Market Heat Rates. Reserve margins by NERC regional assessment area for each of our segments are listed below:

2012(1) | |||

| West: | |||

| WECC | 19.7 | % | |

| Texas: | |||

| TRE | 13.5 | % | |

| North: | |||

| NPCC | 21.5 | % | |

| MISO | 28.7 | % | |

| PJM | 30.6 | % | |

| Southeast: | |||

| SERC | 32.2 | % | |

| SPP | 22.7 | % | |

| FRCC | 27.8 | % | |

___________

| (1) | Data source is NERC weather-normalized estimates for 2012 |

The Price and Supply of Natural Gas

Approximately 95% of our generating capability’s fuel requirements are met with natural gas. We have approximately 725 MW of baseload capacity from our Geysers Assets and our expectation is that the steam reservoir at our Geysers Assets will be able to supply economic quantities of steam for the foreseeable future as our steam flow decline rates have become very small over the past several years. We also have approximately 596 MW of capacity from power plants where we purchase fuel oil to meet these generation requirements, but do not expect fuel oil requirements to be material to our portfolio of power plant assets. Additionally, we have 4 MW of capacity from solar power generation technology with no fuel requirement.

We procure natural gas from multiple suppliers and transportation and storage sources. Although availability is generally not an issue, localized shortages (especially in extreme weather conditions in and around the population centers), transportation availability and supplier financial stability issues can and do occur.

Lower gas prices over the past four years have had a significant impact on power markets. Beginning in 2009, there was a significant decrease in NYMEX Henry Hub natural gas prices from a range of $6/MMBtu — $13/MMBtu during 2008 to an

7

average natural gas price of $4.38/MMBtu, $4.03/MMBtu, and $2.83/MMBtu during 2010, 2011 and 2012, respectively. Natural gas prices in some parts of the country for parts of 2010, 2011 and 2012 were low enough that modern, combined-cycle, natural gas-fired generation became less expensive on a marginal basis than coal-fired generation. The result was that natural gas displaced coal as a less expensive generation resource resulting in what the industry describes as coal-to-gas switching, the effects of which can be seen in our increased generation volumes in 2012.

The availability of non-conventional natural gas supplies, in particular shale natural gas, has been the primary driver of reduced natural gas prices in the last few years. Access to significant deposits of shale natural gas has altered the natural gas supply landscape in the U.S. and could have a longer-term and profound impact on both the outright price of natural gas and the historical regional natural gas price relationships (basis differentials). The U.S. Department of Energy estimates that shale natural gas production has the potential of 3 trillion to 4 trillion cubic feet per year and may be sustainable for decades with enough natural gas to supply the U.S. for the next 90 years. Accordingly, there is an emerging view that lower priced natural gas will be available for the medium to long-term future.

The price of natural gas, economic growth and environmental regulations affect our Commodity Margin and liquidity. The impact of changes in natural gas prices differs according to the time horizon and regional market conditions and depends on our hedge levels and other factors discussed below.

Much of our generating capacity is located in California (included in our West segment), Texas and the Mid-Atlantic (included in our North segment) where natural gas-fired units set power prices during many hours. When natural gas is the price-setting fuel, increases in natural gas prices may increase our unhedged Commodity Margin because our combined-cycle power plants in those markets are more fuel-efficient than conventional natural gas-fired technologies and peaking power plants. Conversely, decreases in natural gas prices may decrease our unhedged Commodity Margin. In these instances, our cost of production advantage relative to less efficient natural gas-fired generation is diminished on an absolute basis.

In 2012, given very low natural gas prices, natural gas-fired, combined-cycle units in many markets were frequently cheaper to dispatch than coal-fired power plants. When coal-fired electricity production costs exceed natural gas-fired production costs, coal-fired units tend to set power prices. In these hours, lower natural gas prices tend to increase our Commodity Margin, since our production costs fall while power prices remain constant (depending on our hedge levels and holding other factors constant).

Where we operate under long-term contracts, changes in natural gas prices can have a neutral impact on us in the short-term. This tends to be the case where we have entered into tolling agreements under which the customer provides the natural gas and we convert it to power for a fee, or where we enter into indexed-based agreements with a contractual Heat Rate at or near our actual Heat Rate for a monthly payment.

Changes in natural gas prices or power prices may also affect our liquidity. During periods of high or volatile natural gas prices, we could be required to post additional cash collateral or letters of credit.

Despite these short-term dynamics, over the long-term, we expect lower natural gas prices to encourage new combined-cycle gas turbine power plant investment, thus enhancing the competitiveness of our modern, natural gas-fired fleet by making investment in other technologies such as coal, nuclear, or renewables less economic.

Weather Patterns and Natural Events

Weather generally has a significant short-term impact on supply and demand for power and natural gas. Historically, demand for and the price of power is higher in the summer and winter seasons when temperatures are more extreme, and therefore, our unhedged revenues and Commodity Margin could be negatively impacted by relatively cool summers or mild winters. Additionally, a disproportionate amount of our total revenue is usually realized during the summer months of our third fiscal quarter. We expect this trend to continue in the future as U.S. demand for power generally peaks during this time.

Operating Heat Rate and Availability

Our fleet is modern and more efficient than the average generation fleet; accordingly, we run more and earn incremental margin in markets where less efficient natural gas units frequently set the power price. In such cases, our unhedged Commodity Margin is positively correlated with how much more efficient our fleet is than our competitors’ fleets and with higher natural gas prices. Efficient operation of our fleet creates the opportunity to capture Commodity Margin. However, unplanned outages during periods when Commodity Margin is positive can result in a loss of that opportunity. We measure our fleet performance based on our operating Heat Rate and availability factors. The higher our availability factor, the better positioned we are to capture Commodity Margin. The lower our operating Heat Rate compared to the Market Heat Rate, the more favorable the impact on our Commodity Margin.

8

Regulatory and Environmental Pressures

We believe that, on a net basis, we will be favorably impacted by current regulatory and environmental trends, including those described below, given the characteristics of our power plant portfolio:

| • | Environmental pressures continue to increase for coal-fired power generation as state and federal agencies enact rules to reduce air emissions of certain pollutants such as SO2, NOX, GHG, Hg and acid gases, restrict the use of once-through cooling, and provide for stricter standards for managing coal combustion residuals. Some of the regions in which we operate include older, less efficient fossil-fuel power plants that emit much higher amounts of GHG, SO2, NOX, Hg and acid gases, which we anticipate will be negatively impacted by current and future air emissions, water and waste regulations and legislation both at the state and federal levels. The estimated capacity for fossil-fueled plants which are older than 50 years and the total estimated capacity for fossil-fueled plants by NERC region are as follows: |

| Generating Capacity Older Than 50 years | Total Generating Capacity | |||||||

| West: | ||||||||

| WECC | 8,450 | MW | 132,258 | MW | ||||

| Texas: | ||||||||

| TRE | 2,801 | MW | 82,552 | MW | ||||

| North: | �� | |||||||

| NPCC | 6,445 | MW | 57,559 | MW | ||||

| MRO | 4,489 | MW | 45,869 | MW | ||||

| RFC | 25,034 | MW | 197,354 | MW | ||||

| Southeast: | ||||||||

| SERC | 27,935 | MW | 235,483 | MW | ||||

| SPP | 4,811 | MW | 59,961 | MW | ||||

| FRCC | 1,233 | MW | 59,569 | MW | ||||

| Total | 81,198 | MW | 870,605 | MW | ||||

• | An increase in power generated from renewable sources could lead to an increased need for flexible power that many of our power plants provide to protect the reliability of the grid and premium compensation for that flexibility; however, risks also exist that renewables have the ability to lower overall wholesale prices which could negatively impact us. Significant economic and reliability concerns for renewable generation have been raised, but we expect that renewable market penetration will continue to be assisted by state-level renewable portfolio standards and federal tax incentives. |

| • | The regulators in our core markets remain committed to the competitive wholesale power model, particularly in Texas and PJM where they continue to focus on market design and rules to assure the long-term viability of competition and the benefits to customers that justify competition. |

| • | Utilities are increasingly focused on demand side management – managing the level and timing of power usage through load curtailment, dispatching generators located at commercial or industrial sites, and “smart grid” technologies that may improve the efficiencies, dispatch usage and reliability of electric grids. Scrutiny of demand side resources has increased in recent months as system operators evaluate their reliability (especially at high levels of penetration) and environmental authorities deal with the implications of relying on smaller, less environmentally efficient generation sources during periods of peak demand when air quality is already challenged. |

| • | Environmental permitting requirements for new power plants and transmission lines are becoming increasingly onerous. |

We believe these trends are positive for our fleet. For a discussion of federal, state and regional legislative and regulatory initiatives and how they might affect us, see “— Governmental and Regulatory Matters.”

It is very difficult to predict the continued evolution of our markets due to the uncertainty of the following:

| • | number of market participants, both in terms of physical presence as well as contribution toward financial market liquidity; |

| • | amount of power available in the market; |

9

| • | fluctuations in power supply due to planned and unplanned outages of generators; |

| • | fluctuations in power demand due to weather and other factors; |

| • | cost of fuel, which could be impacted by the efficiency of generation technology and fluctuations in fuel supply or interruptions in natural gas transportation; |

| • | relative ease or difficulty of developing, permitting and constructing new power plants; |

| • | availability and cost of power transmission; |

| • | potential growth of demand side management; |

| • | creditworthiness and other risks associated with counterparties; |

| • | bidding behavior of market participants; |

| • | regulatory and ISO guidelines and rules; |

| • | structure of commercial products; and |

| • | ability to optimize the market’s mix of alternative sources of power such as renewable and hydroelectric power. |

Competition

Wholesale power generation is a capital-intensive, commodity-driven business with numerous industry participants. We compete against other independent power producers, power marketers and trading companies, including those owned by financial institutions, retail load aggregators, municipalities, retail power providers, cooperatives and regulated utilities to supply power and power-related products to our customers in major markets in the U.S. and Canada. In addition, in some markets, we compete against some of our customers.

In markets with centralized ISOs, such as California, Texas and the Mid-Atlantic, our natural gas-fired power plants compete directly with all other sources of power. The EIA estimates that in 2012, 30% of the power generated in the U.S. was fueled by natural gas and that approximately 56% of power generated in the U.S. was produced by coal and nuclear facilities, which generated approximately 37% and 19%, respectively. The EIA estimates that the remaining 14% of power generated in the U.S. was fueled by hydroelectric, fuel oil and other energy sources. We are subject to complex and stringent energy, environmental and other governmental laws and regulations at the federal, state and local levels in connection with the development, ownership and operation of our power plants. Federal and state legislative and regulatory actions continue to change. The federal government is continuing to take further action on many air pollutant emissions such as NOX, SO2, Hg and acid gases as well as on once-through cooling and coal ash disposal. Although we cannot predict the ultimate effect any future environmental legislation or regulations will have on our business, as a clean energy provider, we believe that we are well positioned for almost any increase in environmental rule stringency. We are actively participating in these debates at the federal, regional and state levels. For a further discussion of the environmental and other governmental regulations that affect us, see “— Governmental and Regulatory Matters.”

With new environmental regulations, the proportion of power generated by natural gas and other low emissions resources is expected to increase because older coal-fired power plants will be required to install costly emissions control devices, limit their operations or be retired. Meanwhile, the federal government and many states are considering or have already mandated that certain percentages of power delivered to end users in their jurisdictions be produced from renewable resources, such as geothermal, wind and solar energy.

Competition from other sources of power, such as nuclear energy and renewables, could increase in the future, but likely at a lower rate than had been previously expected. The nuclear incident in March 2011 at the Fukushima Daiichi nuclear power plant introduced substantial uncertainties around new nuclear power plant development in the U.S. In addition, the combination of emerging air emissions regulations, federal and state financial incentives and RPS requirements for renewables and their impact of expected increased investment in cleaner sources of generation will be somewhat counteracted by a lower natural gas price environment, which, should it persist, makes new investment in these types of power generation generally uneconomical. Thus, it is doubtful that generation from new nuclear power plants and renewable sources will be available in the quantities needed to meet future energy demand. Beyond economic issues, there are concerns over the reliability and adequacy of transmission infrastructure to transmit certain renewable generation from its source to where it is needed. Consequently, long-term, natural gas units are likely still needed as baseload and “back-up” generation.

We believe our ability to compete will be driven by the extent to which we are able to accomplish the following:

| • | provide affordable, reliable services to our customers; |

| • | maintain excellence in operations; |

| • | achieve and maintain a lower cost of production, primarily by maintaining unit availability and efficiency; |

10

| • | accurately assess and effectively manage our risks; and |

| • | benefit from future environmental regulation and legislation. |

MARKETING, HEDGING AND OPTIMIZATION ACTIVITIES

Our commercial hedging and optimization strategies are designed to maximize our risk-adjusted Commodity Margin by leveraging our knowledge, experience and fundamental views on natural gas and power. Additionally, we seek strong bilateral relationships with load serving entities that can benefit us and our customers.

The majority of our risk exposures arise from our ownership and operation of power plants. Our primary risk exposures are Spark Spread, power prices, natural gas prices, capacity prices, locational price differences in both power and natural gas, natural gas transportation, electric transmission, REC prices, carbon prices in California and other emissions credit prices. In addition to the direct risk exposure to commodity prices, we also have general market risks such as risk related to performance of our counterparties and customers and plant operating performance risk. We also have a small exposure to Canadian exchange rates due to our partial ownership of Greenfield LP and Whitby located in Canada, which are under long term contracts, and minimal fuel oil exposure which are not currently material to our operations. As such, we have currently elected not to hedge our Canadian exchange rate or fuel oil exposure.

We produced approximately 116 billion KWh of electricity in 2012 across North America (primarily in the U.S.). We are one of the largest consumers of natural gas in North America having consumed approximately 867 Bcf during 2012. The four primary power markets in which we conduct our operations are Texas, California, PJM and the Southeast. The Texas, California and PJM markets have a centralized market for which power demand and prices are determined on a spot basis (day ahead and real time), and the Southeast market is a bilateral market. Most of the power generated by our power plants is sold to entities such as independent electric system operators, utilities, municipalities and cooperatives, as well as to retail power providers, commercial and industrial end users, financial institutions, power trading and marketing companies and other third parties.

We actively manage our risk exposures with a variety of physical and financial instruments with varying time horizons. These instruments include PPAs, tolling arrangements, Heat Rate swaps and options, load sales, steam sales, buying and selling standard physical products, buying and selling exchange traded instruments, gas transportation and storage arrangements, electric transmission service and other contracts for the sale and purchase of power products. We utilize these instruments to maximize the risk-adjusted returns for our Commodity Margin.

At any point in time, the relative quantity of our products hedged or sold under longer-term contracts is determined by the availability of forward product sales opportunities and our view of the attractiveness of the pricing available for forward sales. Historically, we have economically hedged a portion of our expected generation and natural gas portfolio mostly through power and natural gas forward physical and financial transactions; however, we currently remain susceptible to significant price movements for 2013 and beyond. When we elect to enter into these transactions, we are able to economically hedge a portion of our Spark Spread at pre-determined generation and price levels.

We conduct our hedging and optimization activities within a structured risk management framework based on controls, policies and procedures. We monitor these activities through active and ongoing management and oversight, defined roles and responsibilities, and daily risk measurement and reporting. Additionally, we seek to manage the associated risks through diversification, by controlling position sizes, by using portfolio position limits, and by entering into offsetting positions that lock in a margin. We also are exposed to commodity price movements (both profits and losses) in connection with these transactions. These positions are included in and subject to our consolidated risk management portfolio position limits and controls structure. Our future hedged status and marketing and optimization activities are subject to change as determined by our commercial operations group, Chief Risk Officer, senior management and Board of Directors. For control purposes, we have VAR limits that govern the overall risk of our portfolio of power plants, energy contracts, financial hedging transactions and other contracts. Our VAR limits, transaction approval limits and other risk related controls, are dictated by our Risk Management Policy which is approved by our Board of Directors and by a committee comprised of members of our senior management and administered by our Chief Risk Officer's organization. The Chief Risk Officer's organization is segregated from the commercial operations unit and reports directly to our Audit Committee and Chief Financial Officer. Our Risk Management Policy is primarily designed to provide us with a degree of protection from significant downside commodity price risk exposure to our cash flows.

In order to simplify our reporting, we elected to discontinue the application of hedge accounting treatment during the first quarter of 2012 for all commodity derivatives, including the remaining commodity derivatives previously accounted for as cash flow hedges. Accordingly, prospective changes in fair value from the date of this election are reflected in unrealized mark-to-market activity on our Consolidated Statements of Operations and could create more volatility in our earnings. The fair value of our commodity derivative instruments residing in AOCI during the previous application of hedge accounting was reclassified

11

to earnings during 2012 as the related economic transactions affected earnings or the forecasted transaction became probable of not occurring.

We have historically used interest rate swaps to adjust the mix between our fixed and variable rate debt. To the extent eligible, our interest rate swaps have been designated as cash flow hedges, and changes in fair value are recorded in OCI to the extent they are effective with gains and losses reclassified into earnings in the same period during which the hedged forecasted transaction affects earnings. The reclassification of unrealized losses from AOCI into earnings and the changes in fair value and settlements subsequent to the reclassification date of the interest rate swaps formerly hedging our First Lien Credit Facility is presented separately from interest expense as loss on interest rate derivatives on our Consolidated Statements of Operations. See Note 8 of the Notes to Consolidated Financial Statements for further discussion of our derivative instruments.

Seasonality and weather can have a significant impact on our results of operations and are also considered in our hedging and optimization activities. Most of our power plants are located in regional power markets where the greatest demand for power occurs during the summer months, which coincides with our third fiscal quarter. Depending on existing contract obligations and forecasted weather and power demands, we may maintain either a larger or smaller open position on fuel supply and committed generation during the summer months in order to protect and enhance our Commodity Margin accordingly.

SEGMENT AND SIGNIFICANT CUSTOMER INFORMATION

See Note 16 of the Notes to Consolidated Financial Statements for a discussion of financial information by reportable segment and sales in excess of 10% of our annual consolidated revenues to one of our customers.

12

DESCRIPTION OF OUR POWER PLANTS

Geographic Diversity Dispatch Technology

13

Power Plants in Operation at December 31, 2012

We own 92 power plants, including 4 under construction (1 new power plant and 3 expansions of existing power plants), with an aggregate generation capacity of approximately 27,321 MW and 1,163 MW under construction.

Natural Gas-Fired Fleet