UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | | | |

| | |

| [X] | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | | |

| For the fiscal year ended December 31, 2009 |

| | |

| [ ] | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | | |

| For the transition period from to |

Commission File No. 001-12079

Calpine Corporation

(A Delaware Corporation)

I.R.S. Employer Identification No. 77-0212977

717 Texas Avenue, Suite 1000, Houston, Texas 77002

Telephone: (713) 830-8775

Not Applicable

(Former Address)

Securities registered pursuant to Section 12(b) of the Act:

Calpine Corporation Common Stock, $.001 Par Value

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | |

Large accelerated filer [X] | | Accelerated filer [ ] |

Non-accelerated filer [ ] | | Smaller reporting company [ ] |

(Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2009, the last business day of the registrant’s most recently completed second fiscal quarter: approximately $2,018 million.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes [X] No [ ]

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: Calpine Corporation: 442,890,684 shares of common stock, par value $.001, were outstanding as of February 22, 2010.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the documents listed below have been incorporated by reference into the indicated parts of this report, as specified in the responses to the item numbers involved.

Designated portions of the Proxy Statement relating to the 2010 Annual Meeting of Shareholders are incorporated by reference into Part III (Items 11, 12, 13, 14 and portions of Item 10)

CALPINE CORPORATION AND SUBSIDIARIES

FORM 10-K

ANNUAL REPORT

For the Year Ended December 31, 2009

TABLE OF CONTENTS

i

DEFINITIONS

As used in this Report, the following abbreviations and terms have the meanings as listed below. Additionally, the terms “Calpine,” “we,” “us” and “our” refer to Calpine Corporation and its consolidated subsidiaries, unless the context clearly indicates otherwise. For clarification, for the period from December 20, 2005, through February 7, 2008, such terms do not include the Canadian Debtors and other foreign subsidiaries that were deconsolidated as of the Petition Date. The term “Calpine Corporation” refers only to Calpine Corporation and not to any of its subsidiaries. Unless and as otherwise stated, any references in this Report to any agreement means such agreement and all schedules, exhibits and attachments in each case as amended, restated, supplemented or otherwise modified to the date of filing this Report.

| | |

ABBREVIATION | | DEFINITION |

| Acadia PP | | Acadia Power Partners, LLC |

| Adjusted EBITDA | | EBITDA as adjusted for the effects of (a) impairment charges, (b) reorganization items, (c) major maintenance expense, (d) operating lease expense, (e) any non-cash realized gains on derivatives and any unrealized gains or losses on commodity derivative mark-to-market activity, (f) adjustments to reflect only the Adjusted EBITDA from our unconsolidated investments, (g) claim settlement income, (h) stock-based compensation expense (income), (i) non-cash gains or losses on sales or dispositions of assets, (j) non-cash gains and losses from intercompany foreign currency translations, (k) any gains or losses on the repurchase or extinguishment of debt and (l) any other extraordinary, unusual or non-recurring items |

| Aircraft Services | | Aircraft Services Corporation, an affiliate of General Electric Capital Corporation |

| AOCI | | Accumulated Other Comprehensive Income |

| Aries Power Plant | | MEP Pleasant Hill, LLC |

| Auburndale | | Auburndale Holdings, LLC |

| Average availability | | Represents the total hours during the period that our plants were in-service or available for service as a percentage of the total hours in the period |

Average capacity factor (excluding peakers) | | The average capacity factor (excluding peakers) is a measure of total actual generation as a percent of total potential generation. It is calculated by dividing (a) total MWh generated by our power plants (excluding peakers) by (b) the product of multiplying (i) the average total MW in operation during the period by (ii) the total hours in the period |

| Bankruptcy Code | | U.S. Bankruptcy Code |

| BLM | | Bureau of Land Management of the U.S. Department of the Interior |

| Blue Spruce | | Blue Spruce Energy Center LLC |

| Btu | | British thermal unit(s), a measure of heat content |

| CAA | | Federal Clean Air Act, U.S. Code Title 42, Chapter 85 |

| CAISO | | California ISO |

| CalGen | | Calpine Generating Company, LLC |

ii

| | |

ABBREVIATION | | DEFINITION |

| CalGen Secured Debt | | Collectively the: CalGen First Lien Debt comprised of (a) $235,000,000 First Priority Secured Floating Rate Notes Due 2009, (b) $600,000,000 First Priority Secured Institutional Term Loans Due 2009, and (c) $200,000,000 First Priority Revolving Loans issued on or about March 23, 2004; CalGen Second Lien Debt comprised of (a) $640,000,000 Second Priority Secured Floating Rate Notes Due 2010, and (b) $100,000,000 Second Priority Secured Institutional Term Loans Due 2010; and CalGen Third Lien Debt. In each case, issued by CalGen or CalGen and CalGen Finance Corp. and repaid on March 29, 2007 |

| CalGen Third Lien Debt | | Together, the $680,000,000 Third Priority Secured Floating Rate Notes Due 2011, issued by CalGen and CalGen Finance Corp.; and the $150,000,000 11 1/2% Third Priority Secured Notes Due 2011, issued by CalGen and CalGen Finance Corp., in each case repaid on March 29, 2007 |

| Calpine Debtors | | The U.S. Debtors and the Canadian Debtors |

| Calpine Equity Incentive Plans | | Collectively, the MEIP and the DEIP, which provide for grants of equity awards to Calpine employees and non-employee members of Calpine’s Board of Directors |

| Canadian Court | | The Court of Queen’s Bench of Alberta, Judicial District of Calgary |

| Canadian Debtors | | The subsidiaries and affiliates of Calpine Corporation that were granted creditor protection under the CCAA in the Canadian Court |

| Canadian Effective Date | | February 8, 2008, the date on which the Canadian Court ordered and declared that the Canadian Debtors’ proceedings under the CCAA were terminated |

| Canadian Settlement Agreement | | Settlement Agreement dated as of July 24, 2007, by and between Calpine Corporation, on behalf of itself and its U.S. subsidiaries, Calpine Canada Energy Ltd., Calpine Canada Power Ltd., Calpine Canada Energy Finance ULC, Calpine Energy Services Canada Ltd., Calpine Canada Resources Company, Calpine Canada Power Services Ltd., Calpine Canada Energy Finance II ULC, Calpine Natural Gas Services Limited, 3094479 Nova Scotia Company, Calpine Energy Services Canada Partnership, Calpine Canada Natural Gas Partnership, Calpine Canadian Saltend Limited Partnership and HSBC Bank USA, National Association, as successor indenture trustee |

| Cap-and-trade | | A government imposed GHG emissions reduction program that would place a cap on the amount of GHG emissions that can be emitted from certain sources, such as power plants. In its simplest form, the cap amount is set as a reduction from the total emissions during a base year and for each year over a period of years the cap amount would be reduced to achieve the targeted overall reduction by the end of the period. Allowances or credits for emissions in an amount equal to the cap would be issued or auctioned to companies with facilities, permitting them to emit up to a certain amount of GHG during each applicable period. After allowances have been distributed or auctioned, they can be transferred, or traded |

| Cash Collateral Order | | Second Amended Final Order of the U.S. Bankruptcy Court Authorizing Use of Cash Collateral and Granting Adequate Protection, dated February 24, 2006 as modified by orders of the U.S. Bankruptcy Court dated June 21, 2006, July 12, 2006, October 25, 2006, November 15, 2006, December 20, 2006, December 28, 2006, January 17, 2007, and March 1, 2007 |

iii

| | |

ABBREVIATION | | DEFINITION |

| CCAA | | Companies’ Creditors Arrangement Act (Canada) |

| CCFC | | Calpine Construction Finance Company, L.P. |

| CCFC Finance | | CCFC Finance Corp. |

| CCFC Guarantors | | Hermiston Power LLC and Brazos Valley Energy LLC, wholly owned subsidiaries of CCFC |

| CCFC New Notes | | The $1.0 billion aggregate principal amount of 8.0% Senior Secured Notes due 2016 issued May 19, 2009, by CCFC and CCFC Finance |

| CCFC Old Notes | | The $415 million total aggregate principal amount of Second Priority Senior Secured Floating Rate Notes Due 2011 issued by CCFC and CCFC Finance, comprising $365 million aggregate principal amount issued August 14, 2003, and $50 million aggregate principal amount issued September 25, 2003, and redeemed on June 18, 2009 |

| CCFC Refinancing | | The issuance of the CCFC New Notes on May 19, 2009, pursuant to Rule 144A and Regulation S under the Securities Act, and the related transactions including repayment of the CCFC Term Loans and the redemption of the CCFC Old Notes and CCFCP Preferred Shares |

| CCFC Term Loans | | The $385 million First Priority Senior Secured Institutional Term Loans due 2009 borrowed by CCFC under the Credit and Guarantee Agreement, dated as of August 14, 2003, among CCFC, the guarantors party thereto, and Goldman Sachs Credit Partners L.P., as sole lead arranger, sole bookrunner, administrative agent and syndication agent, and repaid on May 19, 2009 |

| CCFCP | | CCFC Preferred Holdings, LLC |

| CCFCP Preferred Shares | | The $300 million of six-year redeemable preferred shares due 2011 issued by CCFCP and redeemed on or before July 1, 2009 |

| CDWR | | California Department of Water Resources |

| CES | | Calpine Energy Services, L.P. |

| CFTC | | U.S. Commodities Futures Trading Commission |

| Chapter 11 | | Chapter 11 of the Bankruptcy Code |

| CO2 | | Carbon dioxide |

| Cogeneration | | Using a portion or all of the steam generated in the power generating process to supply a customer with steam for use in the customer’s operations |

| Commodity Collateral Revolver | | Commodity Collateral Revolving Credit Agreement, dated as of July 8, 2008, among Calpine Corporation as borrower, Goldman Sachs Credit Partners L.P., as payment agent, sole lead arranger and sole bookrunner, and the lenders from time to time party thereto |

| Commodity expense | | The sum of our expenses from fuel and purchased energy expense, fuel transportation expense, transmission expense and cash settlements from our marketing, hedging and optimization activities that are included in our mark-to-market activity in fuel and purchased energy expense, but excludes the unrealized portion of our mark-to-market activity |

iv

| | |

ABBREVIATION | | DEFINITION |

| Commodity Margin | | Non-GAAP financial measure that includes power and steam revenues, sales of purchased power and natural gas, capacity revenue, REC revenue, sales of surplus emission allowances, transmission revenue and expenses, fuel and purchased energy expense, RGGI compliance costs, and cash settlements from our marketing, hedging and optimization activities that are included in mark-to-market activity, but excludes the unrealized portion of our mark-to-market activity and other revenues |

| Commodity revenue | | The sum of our revenues from power and steam sales, sales of purchased power and natural gas, capacity revenue, REC revenue, sales of surplus emission allowances, transmission revenue, and cash settlements from our marketing, hedging and optimization activities that are included in our mark-to-market activity in operating revenues but excludes the unrealized portion of our mark-to-market activity |

| Company | | Calpine Corporation, a Delaware corporation, and subsidiaries |

| Confirmation Order | | The order of the U.S. Bankruptcy Court entitled “Findings of Fact, Conclusions of Law, and Order Confirming Sixth Amended Joint Plan of Reorganization Pursuant to Chapter 11 of the Bankruptcy Code,” entered December 19, 2007, confirming the Plan of Reorganization pursuant to section 1129 of the Bankruptcy Code |

| Convertible Senior Notes | | Collectively, Calpine Corporation’s 4% Contingent Convertible Notes Due 2006, Contingent Convertible Notes Due 2014, 7 3/4% Contingent Convertible Notes Due 2015 and 4 3/4% Contingent Convertible Senior Notes Due 2023, all of which were terminated and settled with reorganized Calpine Corporation common stock on the Effective Date |

| CPUC | | California Public Utilities Commission |

| Creed | | Creed Energy Center, LLC |

| Deer Park | | Deer Park Energy Center Limited Partnership |

| DEIP | | Calpine Corporation 2008 Director Incentive Plan, which provides for grants of equity awards to non-employee members of Calpine’s Board of Directors |

| DIP | | Debtor-in-possession |

| DIP Facility | | The Revolving Credit, Term Loan and Guarantee Agreement, dated as of March 29, 2007, among Calpine Corporation, as borrower, certain of Calpine Corporation’s subsidiaries, as guarantors, the lenders party thereto, and Credit Suisse, as administrative agent and collateral agent, and the other agents, arrangers and bookrunners named therein |

| Disclosure Statement | | Disclosure Statement for the U.S. Debtors’ Joint Plan of Reorganization Pursuant to Chapter 11 of the Bankruptcy Code filed by the U.S. Debtors with the U.S. Bankruptcy Court on June 20, 2007, as amended, modified or supplemented through the filing of this Report pursuant to the Plan of Reorganization |

| EBITDA | | Earnings before interest, taxes, depreciation and amortization |

| Effective Date | | January 31, 2008, the date on which the conditions precedent enumerated in the Plan of Reorganization were satisfied or waived and the Plan of Reorganization became effective |

| EIA | | Energy Information Administration of the U.S. Department of Energy |

v

| | |

ABBREVIATION | | DEFINITION |

Emergence Date Market Capitalization | | The weighted average trading price of Calpine Corporation’s common stock over the 30-day period following the date on which it emerged from Chapter 11 bankruptcy protection, as defined in and calculated pursuant to Calpine Corporation’s amended and restated certificate of incorporation and reported in its Current Report on Form 8-K filed with the SEC on March 25, 2008 |

| EPA | | U.S. Environmental Protection Agency |

| ERCOT | | Electric Reliability Council of Texas |

| EWG(s) | | Exempt wholesale generator(s) |

| Exchange Act | | U.S. Securities Exchange Act of 1934, as amended |

| FDIC | | U.S. Federal Deposit Insurance Corporation |

| FERC | | U.S. Federal Energy Regulatory Commission |

| First Lien Credit Facility | | Credit Agreement, dated as of January 31, 2008, as amended by the First Amendment to Credit Agreement and Second Amendment to Collateral Agency and Intercreditor Agreement, dated as of August 20, 2009, among Calpine Corporation, as borrower, certain subsidiaries of the Company named therein, as guarantors, the lenders party thereto, Goldman Sachs Credit Partners L.P., as administrative agent and collateral agent, and the other agents named therein |

| First Lien Facilities | | Together, our First Lien Credit Facility and $300 million Bridge Loan Agreement dated January 31, 2008 repaid on March 6, 2008 |

| First Lien Notes | | $1.2 billion aggregate principal amount of 7 1/4% senior secured notes due 2017 issued October 21, 2009, in exchange for a like principal amount of term loans under the First Lien Credit Facility |

| First Priority Notes | | 9 5/8% First Priority Senior Secured Notes Due 2014, repaid in May and June 2006 |

| FRCC | | Florida Reliability Coordinating Council |

| Fremont | | Fremont Energy Center, LLC |

| GAAP | | Generally accepted accounting principles |

| GE | | General Electric International, Inc. |

| GEC | | Collectively, Gilroy Energy Center, LLC, Creed and Goose Haven |

| Geysers Assets | | Our geothermal power plant assets, including our steam extraction and gathering assets, located in northern California consisting of 15 operating power plants and one plant not in operation |

| GHG(s) | | Greenhouse gas(es), primarily CO2, and including methane (CH4), nitrous oxide (N2O), sulfur hexafluoride (SF6), hydrofluorocarbons (HFCs) and perfluorocarbons (PFCs) |

| Gilroy | | Calpine Gilroy Cogen, L.P. |

| Goose Haven | | Goose Haven Energy Center, LLC |

| Greenfield LP | | Greenfield Energy Centre LP |

| Heat Rate(s) | | A measure of the amount of fuel required to produce a unit of power |

| Hg | | Mercury |

| Hillabee | | Hillabee Energy Center, LLC |

| IRC | | Internal Revenue Code |

vi

| | |

ABBREVIATION | | DEFINITION |

| ISO(s) | | Independent System Operator(s) |

| ISO NE | | ISO New England |

| Knock-in Facility | | Letter of Credit Facility Agreement, dated as of June 25, 2008, among Calpine Corporation as borrower and Morgan Stanley Capital Services Inc., as issuing bank which matured on June 30, 2009 |

| KWh | | Kilowatt hour(s), a measure of power produced |

| LIBOR | | London Inter-Bank Offered Rate |

| LSTC | | Liabilities subject to compromise |

| LTSA(s) | | Long-Term Service Agreement(s) |

| Market Capitalization | | As of any date, Calpine Corporation’s then market capitalization calculated using the rolling 30-day weighted average trading price of Calpine Corporation’s common stock, as defined in and calculated in accordance with the Calpine Corporation amended and restated certificate of incorporation |

| Market Heat Rate(s) | | The regional power price divided by the corresponding regional natural gas price |

| MEIP | | Calpine Corporation 2008 Equity Incentive Plan, which provides for grants of equity awards to Calpine employees and non-employee members of Calpine’s Board of Directors |

| Metcalf | | Metcalf Energy Center, LLC |

| MISO | | Midwest ISO |

| MMBtu | | Million Btu |

| MRO | | Midwest Reliability Organization |

| MW | | Megawatt(s), a measure of plant capacity |

| MWh | | Megawatt hour(s), a measure of power produced |

| NERC | | North American Electric Reliability Council |

| NOL(s) | | Net operating loss(es) |

| NOx | | Nitrogen oxide |

| NPCC | | Northeast Power Coordinating Council |

| NYISO | | New York ISO |

| NYMEX | | New York Mercantile Exchange |

| NYSE | | New York Stock Exchange |

| OCI | | Other Comprehensive Income |

| OMEC | | Otay Mesa Energy Center, LLC |

| Original DIP Facility | | The Revolving Credit, Term Loan and Guarantee Agreement, dated as of December 22, 2005, as amended on January 26, 2006, and as amended and restated by the Amended and Restated Revolving Credit, Term Loan and Guarantee Agreement, dated as of February 23, 2006, among Calpine Corporation, as borrower, the guarantors party thereto, the lenders from time to time party thereto, Deutsche Bank Trust Company Americas, as administrative agent for the First Priority Lenders, General Electric Capital Corporation, as Sub-Agent for the Revolving Lenders, Credit Suisse, as administrative agent for the Second Priority Term Lenders and the other agents named therein, refinanced in March 2007 with the DIP Facility |

vii

| | |

ABBREVIATION | | DEFINITION |

| OTC | | Over-the-Counter |

| Panda | | Panda Energy International, Inc., and related party PLC II, LLC |

| PCF | | Power Contract Financing, L.L.C. |

| PCF III | | Power Contract Financing III, LLC |

| Petition Date | | December 20, 2005 |

| PG&E | | Pacific Gas & Electric Company |

| PJM | | Pennsylvania-New Jersey-Maryland Interconnection |

| Plan of Reorganization | | Sixth Amended Joint Plan of Reorganization Pursuant to Chapter 11 of the Bankruptcy Code filed by the U.S. Debtors with the U.S. Bankruptcy Court on December 19, 2007, as amended, modified or supplemented through the filing of this Report |

| Pomifer | | Pomifer Power Funding, LLC, a subsidiary of Arclight Energy Partners Fund I, L.P. |

| PPA(s) | | Any term power purchase agreement or other contract for a physically settled sale (as distinguished from a financially settled future, option or other derivative or hedge transaction) of any power product, including power, capacity and/or ancillary services, in the form of a bilateral agreement or a written or oral confirmation of a transaction between two parties to a master agreement, including sales related to a tolling transaction in which the purchaser provides the fuel required by us to generate such power and we receive a variable payment to convert the fuel into power and steam |

| PSM | | Power Systems Manufacturing, LLC |

| PUCT | | Public Utility Commission of Texas |

| PUHCA 1935 | | U.S. Public Utility Holding Company Act of 1935 |

| PUHCA 2005 | | U.S. Public Utility Holding Company Act of 2005 |

| PURPA | | U.S. Public Utility Regulatory Policies Act of 1978 |

| QF(s) | | Qualifying facility(ies), which are cogeneration facilities and certain small power production facilities eligible to be “qualifying facilities” under PURPA, provided that they meet certain power and thermal energy production requirements and efficiency standards. QF status provides an exemption from PUHCA 2005 and grants certain other benefits to the QF |

| REC(s) | | Renewable energy credit(s) |

| Reserve margin(s) | | The measure of how much the total generating capacity installed in a region exceeds the peak demand for power in that region |

| RFC | | ReliabilityFirstCorporation |

| RGGI | | Regional Greenhouse Gas Initiative |

| RMR Contract(s) | | Reliability Must Run contract(s) |

| RockGen | | RockGen Energy LLC |

| RockGen Owner Lessors | | Collectively, RockGen OL-1, LLC; RockGen OL-2, LLC; RockGen OL-3, LLC and RockGen OL-4, LLC |

| Rosetta | | Rosetta Resources Inc. |

| RPS | | Renewable Portfolio Standards |

| SDG&E | | San Diego Gas & Electric Company |

viii

| | |

ABBREVIATION | | DEFINITION |

| SEC | | U.S. Securities and Exchange Commission |

| Second Circuit | | U.S. Court of Appeals for the Second Circuit |

| Second Priority Debt | | Collectively, Calpine Corporation’s Second Priority Senior Secured Floating Rate Notes Due 2007, 8 1/2% Second Priority Senior Secured Notes Due 2010, 8 3/4% Second Priority Senior Secured Notes Due 2013 and 9 7/8% Second Priority Senior Secured Notes Due 2011 and Second Priority Senior Secured Term Loans Due 2007; all of which were repaid on the Effective Date |

| Securities Act | | U.S. Securities Act of 1933, as amended |

| SERC | | Southeastern Electric Reliability Council |

| SO2 | | Sulfur dioxide |

| Spark spread(s) | | The difference between the sales price of power per MWh and the cost of fuel to produce it |

| SPP | | Southwest Power Pool |

| Steam Adjusted Heat Rate | | The adjusted Heat Rate for our natural gas-fired power plants, excluding peakers, calculated by dividing (a) the fuel consumed in Btu reduced by the net equivalent Btu in steam exported to a third party by (b) the KWh generated. Steam Adjusted Heat Rate is a measure of fuel efficiency, so the lower our Steam Adjusted Heat Rate, the lower our cost of generation |

| Steamboat | | Calpine Steamboat Holdings, LLC, an indirect, wholly owned subsidiary of Calpine Corporation |

Steamboat Amended Credit Facility | | The Amended and Restated Credit Agreement dated November 24, 2009 between Steamboat, as borrower, the lenders named therein, Calyon New York Branch as lead arranger, co-book runner, administrative agent, collateral agent and Security Fund LC issuer and the other agents, bookrunners and agents named therein amending and restating the Credit Agreement, dated as of February 25, 2005, among the parties as defined therein |

| TRE | | Texas Regional Entity |

| ULC I | | Calpine Canada Energy Finance ULC |

| ULC II | | Calpine Canada Energy Finance II ULC |

| Unsecured Notes | | Collectively, Calpine Corporation’s 7 7/8% Senior Notes due 2008, 7 3/4% Senior Notes due 2009, 8 5/8% Senior Notes due 2010 and 8 1/2% Senior Notes due 2011, which constitute a portion of Calpine Corporation’s Unsecured Senior Notes all of which were terminated and settled with Calpine Corporation common stock on the Effective Date |

| Unsecured Senior Notes | | Collectively, Calpine Corporation’s 7 5/8% Senior Notes due 2006, 10 1/2% Senior Notes due 2006, 8 3/4% Senior Notes due 2007, 7 7/8% Senior Notes due 2008, 7 3/4% Senior Notes due 2009, 8 5/8% Senior Notes due 2010 and 8 1/2% Senior Notes due 2011, all of which were terminated and settled with Calpine Corporation common stock on the Effective Date |

| U.S. Bankruptcy Court | | U.S. Bankruptcy Court for the Southern District of New York |

ix

| | |

ABBREVIATION | | DEFINITION |

| U.S. Debtor(s) | | Calpine Corporation and each of its subsidiaries and affiliates that have filed voluntary petitions for reorganization under Chapter 11 of the Bankruptcy Code in the U.S. Bankruptcy Court, which matters are being jointly administered in the U.S. Bankruptcy Court under the captionIn re Calpine Corporation, et al., Case No. 05-60200 (BRL) |

| VAR | | Value-at-risk |

| VIE(s) | | Variable interest entity(ies) |

| WECC | | Western Electricity Coordinating Council |

| Whitby | | Whitby Cogeneration Limited Partnership |

| WP&L | | Wisconsin Power & Light Company |

x

Forward-Looking Statements

In addition to historical information, this Report contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. We use words such as “believe,” “intend,” “expect,” “anticipate,” “plan,” “may,” “will,” “should,” “estimate,” “potential,” “project” and similar expressions to identify forward-looking statements. Such statements include, among others, those concerning our expected financial performance and strategic and operational plans, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and that a number of risks and uncertainties could cause actual results to differ materially from those anticipated in the forward-looking statements. Such risks and uncertainties include, but are not limited to:

| | • | | The uncertain length and severity of the current general financial and economic downturn, the timing and strength of an economic recovery, if any, and their impacts on our business including demand for our power and steam products, the ability of customers, suppliers, service providers and other contractual counterparties to perform under their contracts with us and the cost and availability of capital and credit; |

| | • | | Financial results that may be volatile and may not reflect historical trends due to, among other things, fluctuations in prices for commodities such as natural gas and power, fluctuations in liquidity and volatility in the energy commodities markets and our ability to hedge risks; |

| | • | | Our ability to manage our customer and counterparty exposure and credit risk, including our commodity positions; |

| | • | | Our ability to manage our significant liquidity needs and to comply with covenants under our First Lien Credit Facility, our First Lien Notes and other existing financing obligations; |

| | • | | Competition, including risks associated with marketing and selling power in the evolving energy markets; |

| | • | | Regulation in the markets in which we participate and our ability to effectively respond to changes in laws and regulations or the interpretation thereof including changing market rules and evolving federal, state and regional laws and regulations including those related to GHG emissions and derivative transactions; |

| | • | | Natural disasters, such as hurricanes, earthquakes and floods, or acts of terrorism that may impact our power plants or the markets our power plants serve; |

| | • | | Seasonal fluctuations of our results and exposure to variations in weather patterns; |

| | • | | Disruptions in or limitations on the transportation of natural gas and transmission of power; |

| | • | | Our ability to attract, retain and motivate key employees; |

| | • | | Our ability to implement our business plan and strategy; |

| | • | | Risks related to our geothermal resources, including the adequacy of our steam reserves, unusual or unexpected steam field well and pipeline maintenance requirements, variables associated with the injection of wastewater to the steam reservoir and potential regulations or other requirements related to seismicity concerns that may delay or increase the cost of developing or operating geothermal resources; |

| | • | | Risks associated with the operation, construction and development of power plants including unscheduled outages or delays and plant efficiencies; |

1

| | • | | Present and possible future claims, litigation and enforcement actions; |

| | • | | The expiration or termination of our PPAs and the related results on revenues; and |

| | • | | Other risks identified in this Report. |

Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. Many of these factors are beyond our ability to control or predict. Our forward-looking statements speak only as of the date of this Report. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

Where You Can Find Other Information

Our website is www.calpine.com. Information contained on our website is not part of this Report. Information that we furnish or file with the SEC, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to or exhibits included in these reports are available for download, free of charge, on our website soon after such reports are filed with or furnished to the SEC. Our SEC filings, including exhibits filed therewith, are also available at the SEC’s website at www.sec.gov. You may obtain and copy any document we furnish or file with the SEC at the SEC’s public reference room at 100 F Street, NE, Room 1580, Washington, D.C. 20549-1004. You may obtain information on the operation of the SEC’s public reference facilities by calling the SEC at 1-800-SEC-0330. You may request copies of these documents, upon payment of a duplicating fee, by writing to the SEC at its principal office at 100 F Street, NE, Room 1580, Washington, D.C. 20549-1004.

2

PART I

Item 1. Business

BUSINESS AND STRATEGY

Business

We aspire to be recognized as the premier independent power producer in the U.S. We seek to achieve this objective by delivering operational excellence, effectively executing our hedging strategy, reinvigorating our customer origination program, completing, on schedule and budget, our growth capital projects, and strengthening our balance sheet. We are the largest independent wholesale power company in the U.S. measured by power produced. We own and operate natural gas-fired and geothermal power plants in North America and have a significant presence in major competitive power markets in the U.S., including California and Texas, and to a lesser extent, in the competitive PJM, ISO NE and NYISO markets. Since our inception in 1984, we have been a leader in environmental stewardship and have invested exclusively in clean power generation to become a recognized leader in developing, constructing, owning and operating an environmentally responsible portfolio of power plants. Our portfolio is comprised of two types of power generation technologies: natural gas-fired combustion turbines, which are primarily combined-cycle plants, and renewable geothermal conventional steam turbines. We are among the world’s largest owners and operators of industrial gas turbines as well as cogeneration power plants. Our Geysers Assets located in northern California represent the largest geothermal power generation portfolio in the U.S. and produced approximately 21% of all renewable energy produced in the state of California during 2008. We sell wholesale power, steam, capacity, renewable energy credits and ancillary services to our customers, including utilities, independent electric system operators, industrial and agricultural companies, retail power providers, municipalities, power marketers and others. We purchase natural gas as fuel for our power plants, engage in related natural gas transportation and storage transactions and we purchase electric transmission rights to deliver power to our customers. We also enter into natural gas and power-related commodity and derivative transactions to financially hedge certain business risks and optimize our portfolio of power plants.

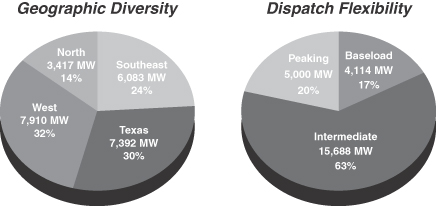

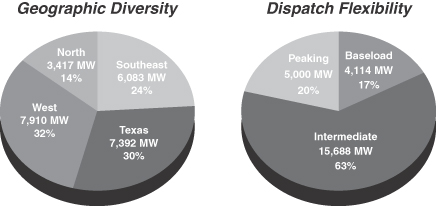

Our portfolio, including partnership interests, consists of 77 operating power plants, located throughout 16 states and Canada, with an aggregate generation capacity of approximately 24,802 MW. In addition, we are actively pursuing the development of our Russell City Energy Center, in which we have a net interest of approximately 400 MW, and an upgrade of 120 MW to our Los Esteros Critical Energy Facility, both located in the San Francisco Bay Area. We also have begun geothermal exploration to increase our generation capability at our Geysers Assets.

The environmental profile of our power plants reflects our commitment to environmental leadership and stewardship. We have invested the necessary capital to develop a power generation portfolio that has the lowest GHG footprint per MWh of any major independent power producer in the U.S. The combination of our Geysers Assets and our high efficiency portfolio of natural gas-fired power plants results in substantially lower emissions of these gases compared to our competitors’ power plants using other fossil fuels, such as coal. In addition, we strive to preserve our nation’s valuable water and land resources. To condense steam, we use cooling towers with a closed water cooling system, or air cooled condensers and do not employ “once-through” water cooling, which uses large quantities of water from adjacent waterways negatively impacting aquatic life. Since our plants are modern and efficient and utilize clean burning natural gas, we do not require large areas of land for our power plants nor do we require large specialized landfills for the disposal of coal ash or nuclear plant waste. We believe that we will be less adversely impacted by cap-and-trade limits, carbon taxes or required environmental upgrades as a result of future potential regulation or legislation addressing GHG, other air emissions, as well as water use or emissions, than compared to our competitors who use other fossil fuels or steam condensation technologies.

We remain focused on increasing our earnings and generating cash flow sufficient to maintain adequate levels of liquidity in order to service our debt, meet our collateral needs and fund our operations and growth. We

3

will continue to pursue opportunities to improve our fleet performance and reduce operating costs. In order to manage our various physical assets and contractual obligations, we will continue to execute commodity hedging agreements within the guidelines of our commodity risk policy. Our fleet of natural gas-fired turbines is the youngest in the U.S. among large independent power producers and utilities, with a weighted average age, based upon MW capacities in operation, of about eight years. As a result, in the near term we do not expect that it will be necessary to invest significant expenditures for environmental retrofits or repowering projects to comply with current or reasonably anticipated GHG, other air emissions or water regulations. Our power plants taken as a whole or by region, have an effective Heat Rate lower than that of our major competitors, which we believe gives us a competitive edge in markets such as Texas, California and some northeastern states where natural gas-fired generation generally sets the market price for power.

We sell a substantial portion of our power and other products under PPAs with a duration greater than one year. The contracted sale of power, steam and capacity from our cogeneration power plants, combustion turbine power plants and geothermal power plants, as well as the sale of renewable energy credits, or RECs, from geothermal power plants, provide a stable source of revenue. Our portfolio also affords us the flexibility to sell power and other products forward for shorter terms or on a merchant basis into the spot markets, where we are able to realize attractive pricing particularly during peak demand periods. Additionally, we sell capacity or similar products to retail power providers, utilities, municipalities and others required to acquire capacity and similar products by regulatory or market rules and we sell ancillary services to independent system operators and utilities to support power transmission system reliability. We believe we have substantially hedged our Commodity Margin for 2010. By contrast, we remain exposed to significant commodity price movements for 2011 and beyond.

Our principal offices are located in Houston, Texas with a regional office in Dublin, California, an engineering office in La Porte, Texas and representative offices in Washington D.C., Sacramento, California and Austin, Texas. We operate our business through a variety of divisions, subsidiaries and affiliates.

Strategy

Our goal is to be recognized as the premier independent power company in the U.S. as measured by our customers, regulators, shareholders and communities in which our power plants reside. We seek to achieve sustainable growth through financially disciplined power plant development, construction, operations and ownership. Our strategy to achieve this is reflected in the six major initiatives described below:

| | 1. | Premier Operating Company — Our objective is to be the “best-in-class” in regards to certain operational performance metrics, such as safety, availability, reliability, efficiency and outage management. Throughout 2009, our plant operating personnel exceeded the first quartile performance for employee lost time incident rate for fossil fuel electric power generation companies with 1,000 or more employees. In addition, for the past nine consecutive years, our Geysers Assets have continued to generate approximately 6 million MWh per year and achieved an exceptional equivalent availability factor of over 97% in 2009. Our natural gas-fired fleet achieved exceptional performance during 2009, with an equivalent forced outage factor of 2.7%, an improvement of 35% over full year 2008. Lastly, we completed 14 major inspections and 13 hot gas path inspections on schedule and on budget during 2009 and completed one of several planned natural gas-fired turbine upgrades and two steam turbine upgrades, which not only added incremental capacity but improved the efficiency of the entire turbines. |

| | 2. | Leader in Environmental Responsibility — Our focus is to utilize our modern, efficient fleet to deliver lower carbon energy solutions. We continue to actively participate in legislative and regulatory processes addressing environmental concerns and support legislative and regulatory action to address GHG and other emissions from fossil fuel generation. We intend to leverage our baseload geothermal expertise to grow our renewable energy portfolio. Our strong and continuing commitment to environmental responsibility and leadership is exemplified by our development of the Russell City Energy Center. On |

4

| | February 4, 2010, we received the Prevention of Significant Deterioration, or PSD, air permit, the final permit necessary, to begin construction of our Russell City Energy Center. Russell City Energy Center is intended to become the first power plant in the U.S. with a federal limit on GHG emissions, and will be designed to operate in a way that produces 25% fewer GHG emissions than the CPUC standard. The power plant will use 100% reclaimed water from the City of Hayward’s Water Pollution Control Facility for cooling and boiler makeup, which will prevent nearly four million gallons of wastewater per day from being discharged into the San Francisco Bay. We initiated and agreed to accept the GHG permit limit and designed the plant to benefit local water resources. |

| | 3. | Leverage our Scale with our Existing Portfolio of Power Plants — Our goal is to continue to grow our presence in our core markets, particularly, our two largest markets, California and Texas, with an emphasis on expansions or upgrades of existing power plants. We will consider selective acquisitions or additions of new capacity supported by long-term hedging programs, including PPAs and natural gas tolling agreements, particularly where limited or non-recourse project financing is available. We intend to take an opportunistic approach to continue to design, develop, construct and operate the next generation of highly efficient, operationally flexible and environmentally responsible power plants. During 2009, we had the following notable achievements related to this initiative: |

| | • | | OMEC, located in San Diego, California, achieved commercial operations on October 3, 2009, adding 608 MW of capacity to our fleet. OMEC is a state-of-the-art, environmentally friendly power plant that operates one of the world’s largest air-cooled condenser thereby minimizing our water usage at the site. OMEC operates under a ten-year tolling agreement with SDG&E. |

| | • | | Under a new ten-year power contract with PG&E, we will modernize and upgrade our Los Esteros Critical Energy Facility to add 120 MW by converting it from simple-cycle (peaking) to combined-cycle technology, increasing the efficiency and environmental performance of the power plant. |

| | • | | We received the Russell City Energy Center PSD air permit. We hope to complete financing and break ground for this new state-of-the-art power plant during 2010 with commercial operations scheduled to begin in 2013. |

| | • | | Turbine Upgrades — During the fourth quarter of 2009, we completed a natural gas-fired turbine upgrade at our Deer Park Energy Center, and have an additional ten natural gas-fired turbine upgrades scheduled. We have also upgraded the steam turbines at our McCabe and Ridgeline geothermal power plants that improved the overall turbine efficiency. We have two additional steam turbine upgrades scheduled for 2011 and 2012, and are considering others. |

| | 4. | Three Scale Regions — We intend to grow our presence in the mid-Atlantic and northeast regions of the U.S. through opportunistic and financially disciplined purchase of existing power plant assets as well as new build projects. We believe this market will result in continued diversification of our asset portfolio, significant near-term growth opportunity and accretive financial strengthening and value. |

| | 5. | Customer-Oriented Origination Business — Our focus is to maximize and stabilize our Commodity Margin through the utilization of physical forward sales and purchases, and financial tools such as collars, swaps and options. During 2009, we reorganized our customer origination function to allow our dedicated group of professionals to more effectively help manage this function. Their charter is to understand our customer’s wants and needs and to rally our organization to develop unique, cost-effective solutions that benefit us and our customers. This effort is beginning to deliver real, tangible results. For example, we entered into new PPAs and amended certain PPAs with PG&E, and also entered into a new PPA with Southern California Edison related to certain of our power plants in California. The amended and new PPAs are all on mutually beneficial terms, many are subject to regulatory approvals and, among other things, provide for the following: |

| | • | | We and PG&E have agreed to an extension of the term and an increase in the volume under the existing contracts for delivery of power from our Geysers Assets. Our Geysers Assets currently |

5

| | provide PG&E 375 MW of power under two contracts. We have agreed to increase the volume to 425 MW through 2017, and from 2018 through the end of 2021, our Geysers Assets will supply PG&E 250 MW of renewable energy. |

| | • | | Our wholly owned subsidiaries, Gilroy Energy Center, LLC, Creed and Goose Haven, have entered into a replacement contract with PG&E, whereby PG&E will have greater dispatch flexibility for all 11 of our peaking units in California through 2017 and for seven of our peaking units through 2021. |

| | • | | We and PG&E negotiated a new agreement to replace the existing CDWR contract and facilitate the upgrade of our Los Esteros Critical Energy Facility from a 188 MW simple-cycle generation power plant to a 308 MW combined-cycle generation power plant. In addition to the increase in capacity, the upgrade will increase the efficiency and environmental performance of the power plant by lowering the Heat Rate. While the upgrade is under construction, we will provide capacity to PG&E from our Gilroy Cogeneration Plant. Upon completion of the upgrade, PG&E will purchase all of the capacity from our Los Esteros Critical Energy Facility for a term of ten years. |

| | • | | We have entered into a new tolling arrangement with PG&E for all of the capacity from our Delta Energy Center from 2011 through 2013. |

| | • | | We executed a resource adequacy agreement for all of the capacity from our Pastoria Energy Center with Southern California Edison for 2012 and 2013. |

| | • | | We executed a contract for 500 MW of capacity from our Morgan Energy Center with the Tennessee Valley Authority through 2011. |

| | • | | We executed a contract for 485 MW of capacity from our Carville Energy Center with Entergy Corporation through May 2012. |

| | • | | We executed a contract for 200 MW of capacity from our Oneta Energy Center with American Electric Power through 2010. |

| | • | | In addition to the suite of products we plan to supply through the agreements described above, our commercial operations team is also identifying creative opportunities to match our capabilities with the needs of our customers. During 2009, we entered into a PPA with the Los Angeles Department of Water and Power to provide integration services of up to 270 MW, leveraging our quick-responding natural gas-fired Hermiston Power Project located in Hermiston, Oregon, as well as its contracted transmission resources in the northwest as back up for wind generated power. |

The last transaction is an indication of the need our customers and more generally the market will have to utilize flexible natural gas-fired generation to assure reliability of supply while integrating intermittent and variable renewable resources, such as wind and solar power, that they are required to procure as part of a renewable energy portfolio.

| | 6. | Continued Strengthening of Our Balance Sheet — We have opportunistically completed several financing transactions for a total of approximately $3.0 billion to improve our flexibility and management of our balance sheet. Significant transactions in 2009 include, but are not limited to, the following: |

| | • | | On November 24, 2009, we amended and extended our Steamboat project debt which extended the maturity date from December 2011 to November 24, 2017. |

| | • | | On December 11, 2009, we amended the letter of credit facility related to our subsidiary, Calpine Development Holdings, Inc., to extend the maturity from January 31, 2010 to December 11, 2012, with an option to increase the letters of credit available from $150 million to $200 million by satisfying certain conditions. |

6

| | • | | On August 20, 2009, we amended our First Lien Credit Facility and related collateral agency and intercreditor agreement in several respects to give us greater flexibility, including allowing us to exchange First Lien Credit Facility term loans for First Lien Notes. |

| | • | | On October 21, 2009, we issued approximately $1.2 billion aggregate principal amount of First Lien Notes in a private placement as a permitted debt exchange pursuant to our First Lien Credit Facility, which retired an aggregate principal amount of term loans under our First Lien Credit Facility equal to the aggregate principal amount of First Lien Notes issued. As a result of the issuance of the First Lien Notes, we were able to extend the maturities of approximately $1.2 billion in debt to 2017, at the same time converting it from a variable to a fixed interest rate. |

| | • | | On May 19, 2009, our wholly owned subsidiaries, CCFC and CCFC Finance, issued approximately $1.0 billion aggregate principal amount of CCFC New Notes in a private placement. The net proceeds were used to repay the CCFC Term Loans, CCFC Old Notes and CCFCP Preferred Shares. As a result of the CCFC Refinancing transactions, we were able to extend the maturities of approximately $1.0 billion of debt by several years, at the same time converting it from a variable to a fixed interest rate and lowering our effective interest rates. |

| | • | | On January 21, 2009, we closed on our Deer Park $156 million senior secured credit facilities, which included a $150 million term facility and a $6 million letter of credit facility. Proceeds received were used to settle an existing commodity contract of approximately $79 million, pay financing and legal fees, fund additional restricted cash and for general corporate purposes. |

THE MARKET FOR POWER

Overview

The power industry represents one of the largest industries in the U.S. and impacts nearly every aspect of our economy, with an estimated end-user market of $357.1 billion in power sales in 2009 based on information published by the EIA. Historically, vertically integrated power utilities with monopolistic control over franchised territories dominated the power generation industry in the U.S. Over the last 25 years, industry trends and regulatory initiatives, culminating with the deregulation trend of the late 1990’s and early 2000’s, provided opportunities for independent wholesale power producers to compete to provide the power needed by customers in many states. Although different regions of the country have very different models and rules of competition, all of the markets in which we operate have some form of wholesale market competition. California (included in our West segment) and Texas, which are two of our largest markets, have emerged as among the most competitive wholesale markets in the U.S. We also operate, to a lesser extent, in the competitive PJM, ISO NE and NYISO markets.

We produce several products for sale to our customers.

| | • | | First, we produce power for sale to utilities, municipalities, retail power providers, independent electric system operators, large end-use industrial or agricultural processing customers or power marketers. |

| | • | | Second, we produce steam for sale to customers for use in industrial or other heating, ventilation and air conditioning operations. |

| | • | | Third, we sell regulatory capacity. In various regional markets, retail power providers are required to demonstrate adequate resources to meet their power sales commitments. To meet this obligation, they procure a market product known as capacity, which allows them to attribute the approved capacity of existing power plants to satisfy the obligation. Electricity market administrators have acknowledged |

7

| | that the markets for generating capacity do not provide sufficient revenues to enable existing merchant generators to recover all of their costs or to encourage new generating capacity to be constructed. Capacity auctions have been implemented in the northeast, mid-Atlantic and some mid-west regional markets to address this issue. California has a bilateral capacity program. Texas does not have a capacity market and there is no concrete proposal under consideration by the regulators. |

| | • | | Fourth, we provide ancillary service products to wholesale power markets. These products include the right for the purchaser to call on our generation units to provide flexibility to the market. As an example, we are sometimes paid to reserve a portion of some capacity at some of our power plants that could be deployed quickly should there be an unexpected increase in load. |

| | • | | Fifth, we sell RECs from our Geysers Assets in northern California. California has an RPS that requires load serving entities to have RECs for a certain percentage of their demand for the purpose of guaranteeing a certain level of renewable generation in the state. Because geothermal is a renewable source of energy, we receive a REC for each MWh we produce and are able to sell our RECs to load serving entities. |

Although all of the products mentioned above contribute to our financial performance, the most important is our sale of wholesale power whether by contract for some term or on a merchant basis into the spot market.

Our Power Market Economics

The market spark spread, sales of RECs, revenues from our steam sales and the results from our marketing, hedging and optimization activities are the primary components of our Commodity Margin and contribute significantly to our financial results. Our Commodity Margin from power and steam sales is largely determined by the pricing associated with our customer contracts. For power that is not sold under customer contracts, the short-term and spot market supply and demand fundamentals determine the sale price for our power. All of our steam production is sold under long-term contracts with industrial customers or steam hosts.

For sales of power from our natural gas-fired fleet into the short-term or spot markets, we attempt to maximize our operations when the market spark spread is positive. Assuming economic behavior by market participants, generating units generally are dispatched in order of their variable costs, with units with lower costs being dispatched first and units with higher costs dispatched as demand, or “load,” grows beyond the capacity of the lower cost units. For this reason, in a competitive market, the price of power typically is related to the variable operating costs of the marginal generator, which is the last unit to be dispatched in order to meet demand. Our fleet is modern and more efficient than the average generation fleet; accordingly, we run more and earn incremental margin in markets in which less efficient natural gas units frequently set the power price. In such cases, our margin is positively correlated with how much more efficient our fleet is than our competitors’ fleets and with higher natural gas prices. Much of our generating capacity is in our West and Texas segments, which are regional markets where natural gas-fired units set prices during most hours, although incremental renewable generation has moderated this dynamic somewhat in off-peak hours over the last year. Due to natural gas prices generally (although not always) being higher than most other input fuels for power production per MMBtu, these regions generally have higher power prices than regions where coal-fired units set power prices. Outside of the California (included in our West segment) and Texas markets (and some northeast markets), other generating technologies, typically coal-fired power plants, tend to set power prices more often, reducing average prices and our Commodity Margin.

Reserve Margins — Reserve margin, a measure of how much excess generation capacity is present in a market, is a key indicator of the competitive conditions in the markets in which we operate. For example, a reserve margin of 15% indicates that supply is 115% of expected peak power demand. Holding other factors constant, lower reserve margins typically lead to higher power prices because the less efficient capacity in the

8

region would be needed to satisfy power demand. Markets with tight demand and supply conditions often display price spikes and improved bilateral contract opportunities. Typically, the market price impact of reserve margins, as well as other supply/demand factors, is reflected in the “Market Heat Rate” calculated as the local market power price divided by the local natural gas price.

Natural Gas Prices and Supply — Our fuel requirements are predominantly met with natural gas. We procure natural gas from multiple suppliers and transportation sources. Although availability is generally not an issue, localized shortages, transportation availability and supplier financial stability issues can and do occur.

In markets where natural gas is often the price-setting fuel, such as in Texas and California, increases in natural gas prices may increase our unhedged Commodity Margin in any given year because our combined-cycle power plants in those markets are more fuel-efficient than conventional gas-fired technologies and peaker power plants. Conversely, decreases in natural gas prices tend to decrease our unhedged Commodity Margin. In other cases, changes in natural gas prices can have a neutral impact on us in the short term, such as where we have entered into tolling agreements under which the customer provides the natural gas and in return we convert it to power for a fee, or where we enter into indexed-based agreements with a contractual Heat Rate at or near our actual Heat Rate for a monthly payment. Changes in natural gas prices may also affect our liquidity as we could be required to post additional cash collateral or letters of credit during periods of increasing natural gas prices. Despite some of these short-term dynamics, over the long run, more moderate natural gas prices may actually enhance the competitiveness of our modern, natural gas-fired fleet by making investment in other technologies such as coal, nuclear, or renewables less economic.

Weather Patterns and Natural Events — Weather could have a significant short-term impact on supply and demand for power and natural gas. Historically, demand for and the price of power is higher in the summer and winter seasons when temperatures are more extreme, and therefore, our revenues and Commodity Margin could be negatively impacted by relatively cool summers or mild winters. Additionally, a disproportionate amount of our total revenue is usually realized during our third fiscal quarter during the summer months. We expect this trend to continue in the future as U.S. demand for power generally peaks during this time.

Operating Heat Rate and Availability — Efficient operation of our fleet creates the opportunity to capture Commodity Margin in a cost effective manner. However, unplanned outages during periods of positive Commodity Margin can result in a loss of that opportunity. We generally measure our fleet performance based on our operating Heat Rate and availability factors. The higher our availability factor, the better positioned we are to capture Commodity Margin. The less natural gas we must consume for each MWh of power generated, the lower our Heat Rate. The lower our operating Heat Rate compared to the Market Heat Rate, the more favorable the impact on our Commodity Margin.

Market Fundamentals

For much of the 1990’s, utilities invested relatively sparingly in new generating capacity. As a result, by the late 1990’s, many regional markets had low reserve margins and were in need of new capacity to meet growing power demand. Prices rose due to capacity shortages, and the emerging merchant power industry responded by constructing significant amounts of new capacity. Between 2000 and 2003, more than 175,000 MW of new generating capacity came “on line” in the U.S. In most regions, these capacity additions far outpaced the growth of demand, resulting in “overbuilt” markets, that is, markets with excess capacity. In the West, for example, approximately 24,000 MW of new generating capacity was added between 2000 and 2003, while demand only increased by approximately 8,000 MW. This surge of generation investment subsided after 2003. Recent investment in new generation capacity over the last several years has occurred, but on a smaller scale.

During 2009, the general supply and demand fundamentals were negatively impacted by the combination of recent new generation investment coming on line and a general decline in weather adjusted load year-over-year due to the economic recession. Lower weather adjusted demand and higher supply would, in a normal

9

weather year, lead to higher reserve margins and lower Market Heat Rates. While Texas and California experienced very hot weather at certain times during 2009, which somewhat compensated for these fundamental demand shifts, this was not the case across the U.S. Although it appears that the load is now returning in several markets with the beginning of an economic recovery, it remains early in the recovery and it remains unclear from current data sources how our future supply and demand fundamentals will be impacted. Reserve margins by NERC region in 2009 for each of our segments are listed below:

| | | |

West: | | | |

WECC | | 28.2 | % |

Texas: | | | |

TRE | | 15.8 | % |

Southeast: | | | |

SERC | | 23.9 | % |

SPP | | 14.7 | % |

North: | | | |

NPCC | | 25.5 | % |

MRO | | 21.8 | % |

RFC | | 27.0 | % |

Lower natural gas prices represent one of the biggest factors impacting the power industry in 2009. Monthly average natural gas prices (NYMEX, Henry Hub) generally fluctuated between $6/MMBtu —$8/MMBtu in 2007 and $6/MMBtu — $13/MMBtu in 2008 with spikes during the months of April through July of $10/MMBtu — $13/MMBtu. In 2009, we experienced a significant decrease in monthly average natural gas prices from a high of $5.35/MMBtu in December 2009 to a low of $3.31/MMBtu in August 2009.

Natural gas prices in some parts of the country in 2009 were low enough that modern combined-cycle natural gas-fired generation became less expensive on a marginal basis than coal-fired generation. The result was that natural gas displaced coal as a less expensive generation resource resulting in what the industry describes as coal-to-gas switching. Owners of modern combined-cycle natural gas-fired fleets, like ours, experienced significantly increased production in the southeast and some other parts of the eastern U.S.

Although some of this lower pricing dynamic can certainly be attributed to the recent economic recession (power load and natural gas demand fell off with the economic recession even while new resources were coming on line), there is a growing school of thought that the availability of non-conventional natural gas supplies, in particular shale gas, could have a longer-term and more profound impact on natural gas markets. The U.S. Department of Energy estimates that shale gas production has the potential of 3 trillion to 4 trillion cubic feet per year and may be sustainable for decades with enough natural gas reserves to supply the U.S. for the next 90 years. Accordingly, there is an emerging view of potentially lower priced natural gas for the medium to long-term future.

In addition to the immediate effects of weather and lower priced natural gas on our supply and demand fundamentals, several other key factors, especially regulatory factors, are emerging that could impact the wholesale power market fundamentals. We believe that we will be favorably impacted by these factors based upon the characteristics of our power plant portfolio. These factors include, but are not limited to:

| | • | | increased penetration of power generated from renewable sources; |

| | • | | increasing environmental pressures on generation, especially pressures on high GHG, NOx and Hg emitting resources. A significant portion of the capacities within the regions we operate include capacities from older, less efficient fossil-fuel power plants that emit much higher amounts of GHG, NOx and Hg which we anticipate will be more negatively impacted by future potential GHG or other |

10

| | air emission legislation. The estimated amounts of MW capacity for plants which are older than 50 years by NERC region are as follows: |

| | |

West: | | |

WECC | | 3,981 MW |

Texas: | | |

TRE | | 1,354 MW |

Southeast: | | |

SERC | | 17,362 MW |

SPP | | 3,581 MW |

North: | | |

NPCC | | 4,543 MW |

MRO | | 3,015 MW |

RFC | | 18,943 MW |

| | • | | an increasing focus in some markets, including California, on limiting the impact of using once-through cooling technology that can be harmful to aquatic life; |

| | • | | an increasing focus by utilities on demand side management – managing the absolute level and timing of power usage such as “smart grid” technologies that improve the efficiencies, dispatch usage and reliability of electric grids; and |

| | • | | increasingly onerous permitting requirements, including those in California, one of our major markets. |

With the exception of demand side management, many of these trends are generally positive for the economic outlook of a modern, flexible natural gas-fired fleet. For a discussion of federal, state and regional legislative and regulatory initiatives and how they might affect us, see “— Governmental and Regulatory Matters.”

Ultimately, it is very difficult to predict the continued evolution of our markets due to the uncertainty of the following:

| | • | | number of market participants buying and selling; |

| | • | | amount of power normally available in the market; |

| | • | | fluctuations in power supply due to planned and unplanned outages of generators; |

| | • | | fluctuations in power demand due to weather and other factors; |

| | • | | cost of fuel used by generators, which could be impacted by the efficiency of generation technology and fluctuations in fuel supply or interruptions in natural gas transportation; |

| | • | | relative ease or difficulty of developing and constructing new power plants; |

| | • | | availability and cost of power transmission; |

| | • | | creditworthiness and other risks associated with counterparties; |

| | • | | bidding behavior of market participants; |

| | • | | regulatory and ISO guidelines and rules; |

11

| | • | | structure of the commercial products transacted; and |

| | • | | ability to optimize the market’s mix of alternative sources of power such as renewable and hydroelectric power. |

Hedging

We seek to actively manage the commodity price risk to our economic performance with a variety of tools, including the use of PPAs and other long-term contracts for the sale of both power and steam. We also pursue other long-term sales opportunities, as well as shorter term market transactions, including bilateral originated sales contracts, and purchase and sale of exchange-traded instruments. We actively monitor key commodity price risks such as Market Heat Rate and natural gas price exposure, as well as other risks related to the value of our generation such as regulatory capacity, REC and emission credit pricing. The relative quantity of our products sold under longer term contracts compared to the quantity subject to shorter term price fluctuations is determined by our need to manage our liquidity, the availability of forward product sales opportunities, and our view of the attractiveness of the pricing available for forward sales. It is our strategy to seek stronger bilateral relationships and longer term contracts with load serving entities that can benefit us and our customers.

We provide more detail on our hedging programs in “— Marketing, Hedging and Optimization Activities” below.

COMPETITION

Wholesale power generation is a capital-intensive, commodity-driven business with numerous industry participants. We compete against other independent power producers, power marketers or trading companies, including those owned by financial institutions, retail load aggregators, municipalities, retail power providers, cooperatives and regulated utilities to supply power and power-related products to our customers in major markets in the U.S. In addition, in some markets, we compete against some of our customers.

In less regulated markets, such as California and Texas, our natural gas-fired power plants compete directly with all other sources of power. Even though most new power plants are fueled by natural gas, the EIA estimates that in 2009 only 24% of the power generated in the U.S. was fueled by natural gas and that approximately 65% of power generated in the U.S. was still produced by coal and nuclear facilities, which generated approximately 45% and 20%, respectively. The EIA estimates that the remaining 11% of power generated in the U.S. was fueled by hydroelectric, fuel oil and other energy sources. We are subject to complex and stringent energy, environmental and other governmental laws and regulations at the federal, state and local levels in connection with the development, ownership and operation of our power plants. Federal and state legislative and regulatory actions continue to change how our business is regulated. The federal government is expected to take action on climate change legislation, as well as other air pollutant emissions, and many states and regions in the U.S. have implemented or are considering implementing regulations to reduce GHG emissions. Although we cannot predict the ultimate effect any future climate change legislation or regulations could have on our business, as a clean energy provider, we believe that we are well positioned on a net basis for potential regulation of GHG emissions. We are actively participating in these debates at the federal, regional and state levels. For a further discussion of the environmental and other governmental regulations that affect us, see “— Governmental and Regulatory Matters.”

As environmental regulations continue to evolve, the proportion of power generated by natural gas and other low emissions resources is expected to increase in most markets. As a result, many of the existing coal-fired power plants will likely have to install costly emission control devices or limit their operations. Meanwhile, the federal government and many states are considering or have already mandated that certain percentages of power delivered to end users in their jurisdictions be produced from renewable resources, such as geothermal, wind and solar energy.

12

Competition from other sources of power, such as nuclear energy and renewables, is expected to increase in the future. The combination of emerging air emissions regulations, federal and state financial incentives and RPS requirements for renewables are expected to result in increased investment in cleaner sources of generation, which could also cause some coal-fired power plants to be retired, thereby allowing a greater proportion of power to be produced by power plants fueled by natural gas, nuclear, wind, solar, hydroelectric, geothermal or other resources that have a less adverse environmental impact. Generation quantities from nuclear power plants and renewable sources are not available in the quantities needed to meet energy demand. There are permitting hurdles, long lead times and general resistance to nuclear generation and there are concerns over the reliability and adequacy of transmission infrastructure to transmit certain renewable generation from its source to where it is needed. Consequently, longer-term, natural gas is still needed as baseload and “back-up” generation.

We believe our ability to compete effectively in our environment will be substantially driven by the extent to which we are able to accomplish the following:

| | • | | maintain excellence in operations; |

| | • | | achieve and maintain a lower cost of production, primarily by maintaining unit availability and efficiency; |

| | • | | benefit from future environmental regulation and legislation; |

| | • | | effectively manage and accurately assess our risk; and |

| | • | | provide reliable service to our customers. |

MARKETING, HEDGING AND OPTIMIZATION ACTIVITIES

The majority of our marketing, hedging and optimization activities are related to risk exposures that arise from our ownership and operation of power plants. Most of the power generated by our power plants is sold, scheduled and settled by our energy marketing unit, which sells to entities such as utilities, municipalities and cooperatives, as well as to retail power providers, commercial and industrial end users, financial institutions, power trading and marketing companies and other third parties. We enter into physical and financial purchase and sale transactions as part of our marketing, hedging and optimization activities. Our marketing, hedging and optimization activities endeavor to protect and enhance our Commodity Margin.

We are one of the largest consumers of natural gas in the U.S. having consumed approximately 650 Bcf (billion cubic feet) during 2009. We employ a variety of market transactions to satisfy most of our natural gas fuel requirements. We enter into long-term, short-term and spot natural gas purchase agreements, as well as storage and transport agreements, to achieve delivery flexibility and to enhance our optimization capabilities. We continually evaluate our natural gas needs, adjusting our natural gas position in an effort to minimize the delivered cost of natural gas, while adjusting for risk within the limitations prescribed in our commodity risk policy.

We are exposed to commodity price volatility in the markets in which our power plants operate. Natural gas prices and power prices are generally correlated in our two primary markets, California and Texas, because power plants using natural gas-fired technology tend to be the marginal or price-setting generation units in these regions. We actively seek to manage the commodity risks of our portfolio, using multiple strategies of buying and selling power or natural gas to manage our spark spread, or selling Heat Rate transactions. We use derivative instruments, which include physical commodity contracts and financial commodity instruments such as OTC and exchange traded swaps, futures, options, forward agreements and instruments that settle on the power price to natural gas price relationships (Heat Rate swaps and options) for the purchase and sale of power, natural gas, and emission allowances to manage commodity price risk and to maximize the risk-adjusted returns from our power

13

and natural gas assets. We also use interest rate swaps to manage the interest rate risk of our variable rate debt. We conduct these hedging and optimization activities within a structured risk management framework based on controls, policies and procedures. We monitor these activities through active and ongoing management, oversight, defined roles and responsibilities, and daily risk measurement and reporting. Additionally, we seek to manage the associated risks through diversification, by controlling position sizes, by using portfolio position limits and by entering into offsetting positions that lock in a margin.