UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08226

Templeton Global Investment Trust

(Exact name of registrant as specified in charter)

300 S.E. 2nd Street,

Fort Lauderdale, FL 33301-1923

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: (954) 527-7500

Date of fiscal year end: 12/31

Date of reporting period: 6/30/20

| Item 1. | Reports to Stockholders. |

Sign up for electronic delivery at franklintempleton.com/edelivery

Internet Delivery of Fund Reports Unless You Request Paper Copies: Effective January 1, 2021, as permitted by the SEC, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request them from the Fund or your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you have not signed up for electronic delivery, we would encourage you to join fellow shareholders who have. You may elect to receive shareholder reports and other communications electronically from the Fund by calling (800) 632-2301 or by contacting your financial intermediary.

You may elect to continue to receive paper copies of all your future shareholder reports free of charge by contacting your financial intermediary or, if you invest directly with a Fund, calling (800) 632-2301 to let the Fund know of your request. Your election to receive reports in paper will apply to all funds held in your account.

SHAREHOLDER LETTER

Dear Shareholder:

During the six months ended June 30, 2020, global economic growth was impacted by the novel coronavirus (COVID-19) pandemic. Many nations’ efforts to slow the infection rate in March and April severely curtailed global economic activity. Major central banks acted swiftly to maintain financial stability and ease monetary policy. The U.S. Federal Reserve (Fed) issued two emergency rate cuts and revived programs from the Great Recession designed to add liquidity to credit markets. The European Central Bank launched its Pandemic Emergency Purchase Programme, which included many private and public sector securities. In this environment, global developed and emerging market stocks, as measured by the MSCI All Country World Index, posted a -5.99% total return.1 Global government and corporate bonds, as measured by the Bloomberg Barclays Multiverse Index, posted a +2.53% total return.1

We are committed to our long-term perspective and disciplined investment approach as we conduct a rigorous, fundamental analysis of securities with a regular emphasis on investment risk management.

Historically, patient investors have achieved rewarding results by evaluating their goals, diversifying their assets globally and maintaining a disciplined investment program, all hallmarks of the Templeton investment philosophy. We continue to recommend investors consult their financial

advisors and review their portfolios to design a long-term strategy and portfolio allocation that meet their individual needs, goals and risk tolerance.

Templeton Global Balanced Fund’s semiannual report includes more detail about prevailing conditions and a discussion about investment decisions during the period. Please remember all securities markets fluctuate, as do mutual fund share prices.

We thank you for investing with Franklin Templeton, welcome your questions and comments, and look forward to serving your investment needs in the years ahead.

Sincerely,

Alan Bartlett

Chief Investment Officer

Templeton Equity Group

This letter reflects our analysis and opinions as of June 30, 2020, unless otherwise indicated. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

1. Source: Morningstar.

See www.franklintempletondatasources.com for additional data provider information.

| | |

| |

| | | Not FDIC Insured | May Lose Value | No Bank Guarantee |

| | | | |

| | | |

| franklintempleton.com | | Not part of the semiannual report | | 1 |

Contents

|

| Visit franklintempleton.com for fund updates, to access your account, or to find helpful financial planning tools. |

| | | | |

| | | |

2 | | Semiannual Report | | franklintempleton.com |

SEMIANNUAL REPORT

Templeton Global Balanced Fund

This semiannual report for Templeton Global Balanced Fund covers the period ended June 30, 2020.

Your Fund’s Goal and Main Investments

The Fund seeks both income and capital appreciation. Under normal market conditions, the Fund invests in a diversified portfolio of debt and equity securities worldwide. The Fund normally invests at least 25% of its assets in fixed income securities and at least 25% of its assets in equity securities. The Fund’s equity component generally consists of primarily of common stocks of companies from a variety of industries located anywhere in the world, including developing markets, that offer or could offer the opportunity to realize capital appreciation and/or attractive dividend yields. The Fund’s fixed income component primarily consists of developed and developing country government and agency bonds and investment-grade and below investment-grade corporate debt securities that offer the opportunity to realize income.

Performance Overview

The Fund’s Class A shares posted a -12.21% cumulative total return for the six months under review. In comparison, the MSCI All Country World Index (ACWI) posted a -5.99% total return and the Bloomberg Barclays Multiverse Index posted a +2.53% total return.1 For the same period, the Custom 50% MSCI ACWI + 50% Bloomberg Barclays Multiverse Index (Blended Benchmark), posted a -1.44% cumulative total return.1 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 10.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

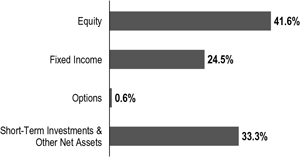

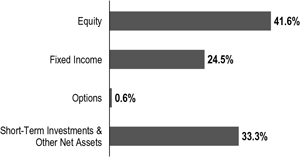

Asset Allocation*

Based on Total Net Assets as of 6/30/20

*Figures represent the net Fund exposure and include certain derivatives held in the portfolio (or their underlying reference assets) or unsettled trades and may not total 100% or may be negative due to rounding, use of any derivatives or other factors.

Economic and Market Overview

Global developed and emerging market equities, as measured by the MSCI ACWI (USD), posted a -5.99% total return during the six months under review.1 Stocks fell sharply in early 2020 as countries around the world implemented lockdown measures in an effort to slow the spread of the novel coronavirus (COVID-19). Global supply chain disruptions, business and personal restrictions, and subdued consumer spending drove many investors to sell equity holdings in favor of perceived safe investments such as government bonds and cash. While global equities, notably in the U.S., rebounded in April and May amid optimism about easing lockdown restrictions, concerns about a second wave of infections hindered equities in June, as investors weighed the possibility of renewed restrictions.

In the U.S., government mandates to mitigate the COVID-19 pandemic severely impacted the economy beginning in March 2020. As a result, the unemployment rate surged to 14.7% in April, as many businesses, particularly those involved in hospitality, retail and travel, announced mass layoffs.2 According to the National Bureau of Economic Research, the longest U.S. economic expansion in history

1. Source: Morningstar. The Fund’s Blended Benchmark was calculated internally and rebalanced monthly.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

2. U.S. Bureau of Labor Statistics

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Consolidated Statement of Investments (SOI). The Consolidated SOI begins on page 20.

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 3 |

TEMPLETON GLOBAL BALANCED FUND

ended in February 2020 as the country slipped into a severe recession. Nonetheless, near period-end, there were signs that a recovery was underway, as jobless claims fell considerably from their peak in early April, retail sales rose sharply in May, and the unemployment rate fell to 11.1% in June.2 Along with optimism about improved treatments and potential vaccines for COVID-19, the positive economic signals contributed to a significant equity rebound in April and May. However, an increase in COVID-19 infections in many states throughout June pressured U.S. stocks.

In the eurozone, some analysts forecasted a significant contraction in 2020, particularly in southern European countries, as the magnitude of the economic disruption caused by the pandemic became apparent. European developed market equities, as measured by the MSCI Europe Index (USD), posted a -12.43% total return for the period.1 To stimulate growth, the European Central Bank implemented a broad bond-buying program, and many countries passed fiscal stimulus measures.

Asian developed and emerging market equities, as measured by the MSCI All Country Asia Index (USD), posted a -5.51% total return during the six-month period.1 The onset of the pandemic brought dramatically slower economic activity in Asia, as businesses halted operations and manufacturing and export activity declined sharply in the region’s major economies. Asian markets generally advanced toward period-end, bolstered by fiscal stimulus measures and economies reopening throughout the region.

Emerging market stocks, as measured by the MSCI

Emerging Markets Index (USD), posted a -9.67% total return due primarily to the COVID-19 pandemic.1 A sharp decrease in prices for oil and other natural resources also hurt emerging market economies reliant on these exports. In the last quarter of the reporting period, however, investor optimism led to a stock rally, particularly in emerging market countries that had successfully lowered infection rates.

The novel coronavirus (COVID-19) pandemic profoundly impacted economies and global financial markets during the six-month period. Lockdown orders from governments trying to “flatten the curve” (i.e., stem the rate of infection) brought entire countries, regions and continents to an economic standstill in March and April. The speed and pervasiveness of the economic shocks were unprecedented. There is no historical comparison for the magnitude of aggregate demand that was destroyed, nor the magnitude of job losses in such a compressed timescale.

Risk aversion rapidly escalated to crisis levels and deepened throughout March, driving correlations to 1.0 across multiple

asset classes as investors shed risk and moved into perceived safe havens. Credit markets experienced substantial price volatility, with the lower-rated credit tiers bearing the brunt of the selloffs. Sovereign bond yields declined in higher-rated countries but rose in more vulnerable ones as volatility escalated. The yield on the 10-year U.S. Treasury (UST) note quickly dropped from 2.00% at the start of the period to a low of 0.54% on March 9. It finished the six-month period at 0.66%, 134 basis points (bps) lower that where it began. The yield on the 10-year German Bund dropped 27 bps further into negative territory during the period, finishing at -0.46%.

The U.S. Federal Reserve (Fed) responded quickly to the deepening crisis with two emergency rate cuts in March, the second of which dropped the federal funds target rate 100 bps to the zero bound that was used during the 2008 global financial crisis (GFC). The Fed also cut reserve requirements and encouraged financial institutions to borrow directly from the discount window. Growing liquidity strains throughout financial markets prompted the Fed to re-start liquidity programs that had been created during the GFC, such as the Commercial Paper Funding Facility and the Primary Dealer Credit Facility.

On March 23, the Fed took its financial market interventions beyond the scope of the GFC programs by creating corporate lending programs, and announcing its intentions to support lending to small- and medium-sized businesses through the newly created Main Street Business Lending Program. The Fed also pledged to buy unlimited government bonds, abandoning the previous quantitative easing targets it had announced a week earlier on March 15.

The heightened demand for U.S. dollars (USD) around the world also led the Fed to expand its liquidity swaps program with foreign central banks beyond the five banks in its standing facility including the European Central Bank (ECB), Bank of Japan (BOJ), Bank of England, Bank of Canada and Swiss National Bank. The swap program was expanded on March 19 to include the Reserve Bank of Australia, Reserve Bank of New Zealand, Danmarks Nationalbank, Norges Bank, Sveriges Riksbank, Bank of Korea, Monetary Authority of Singapore, Banco de Mexico and Banco Central do Brasil. The program enables a foreign central bank to borrow USD directly from the Fed to lend to its own local institutions, facilitating the flow of the world’s reserve currency. The USD notably strengthened from mid-March to mid-May before broadly weakening over the final six weeks of the period.

On the U.S. fiscal side, Congress passed the Coronavirus Aid, Relief, and Economic Security Act on March 26, a

| | | | |

| | | |

4 | | Semiannual Report | | franklintempleton.com |

TEMPLETON GLOBAL BALANCED FUND

USD$2.2 trillion fiscal relief program designed to provide loans to businesses, income support and unemployment benefits to individuals, and funding for hospitals and public health services. It was the largest economic relief bill in U.S. history and was designed as a stopgap for social distancing policies.

On March 18, ECB President Christine Lagarde unveiled the €750 billion Pandemic Emergency Purchase Programme (PEPP) in an unscheduled mid-week announcement. Lagarde commented that, “there are no limits to our commitment to the euro. We are determined to use the full potential of our tools, within our mandate.” PEPP appeared geared to support the more vulnerable states, as the program has unprecedented flexibility to buy a wide range of eligible securities, including Greek and Italian sovereign debt, as well as corporate commercial paper.

In the second quarter of 2020, global financial markets began to rebound from the extreme lows in March, as central banks and governments deployed massive monetary and fiscal measures to respond to the crisis. Regional economies began to incrementally reopen and improving economic data appeared to bolster optimism that the worst of the economic shocks had passed. Credit spreads tightened in many sectors during the second quarter, returning to levels last seen in early March and late February.

However, sharp resurgences in COVID-19 cases in several regions, including the U.S., Latin America and China amongst others, prompted governments to return to shutdown policies in June. Though several economic measures improved in May and June, the stronger figures reflected a rebound from the extreme low points in March and April, and were not trends that could be extrapolated into the upcoming months, in our assessment.

Unprecedented interventions from the Fed and central banks around the world widened the disconnect between financial markets and real economies during the period. In our opinion, central bank efforts to bolster liquidity in financial markets have been effective, but they do not replace lost revenues or cure insolvencies; they only deepen the debt burdens. We expected corporate bankruptcies to be the next challenge policymakers will have to face, as business insolvencies appeared likely to worsen with each passing month of stifled economic activity. We saw risks for an upcoming second leg down in financial markets.

Rallies in risk assets during the final months of the period appeared to underappreciate the ongoing economic damage and the risks for successive waves of infections that could further suppress economic activity going forward, in our view.

Massive unemployment, deepening economic hardship and growing insolvencies will not be fully remedied by partial reopenings or government interventions alone. The longer that economic activity remains suppressed and the longer that workers go without incomes, the more entrenched the economic damage will become.

On the policy front, the Fed maintained its monetary stance at its April and June meetings, and reaffirmed its commitment to using its “full range of tools to support the U.S. economy.” The updated dot plot survey in June indicated that Fed officials expected rates to remain unchanged through 2022. The Fed also updated its projections for U.S. GDP (gross domestic product) growth to -6.5% for 2020 and +5.0% for 2021. It also projected unemployment to be 9.3% at the end of 2020. Fed Chair Jay Powell commented at the end of June during testimony to the House financial services committee that, “the path forward for the economy is extraordinarily uncertain and will depend in large part on our success in containing the virus.” He also continued to emphasize the importance of fiscal support for workers. Powell also indicated that yield curve control was not in imminent consideration and likely not an appropriate tool for U.S. financial markets. In previous comments, he had also ruled out the potential for negative policy rates.

In Europe, the European Commission proposed a €750 billion financing program in May that would deliver up to €500 billion in grants and €250 billion in loans to member states in need of financial support. The program was still in policy discussions at the end of June. On the monetary side, the ECB increased the size of the PEPP by €600 billion to €1.35 trillion at its June 4 policy meeting. Italian bonds rallied on the news, as did the euro, which appreciated 1.2% against the USD in the month of June. The ECB also updated its growth forecast for the eurozone in 2020 to -8.7%, which would be the largest contraction in the post-war era. In May, Lagarde acknowledged that a recovery to previous GDP levels would take at least two to three years.

In Japan, monetary policy responses to the crisis focused more on ensuring businesses had ample access to capital through various loan programs than on lowering the cost of capital. At its April 27 meeting, the BOJ quadrupled the size of its corporate debt purchases. It also announced that it would remove quantitative easing caps. On the price stability front, deflation returned during the period, despite years of persistent efforts from the BOJ to drive inflation higher. Core inflation dropped to -0.2% year-over-year in April and May. The BOJ offered no indications on whether the return of deflation would alter monetary policy in the months ahead,

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 5 |

TEMPLETON GLOBAL BALANCED FUND

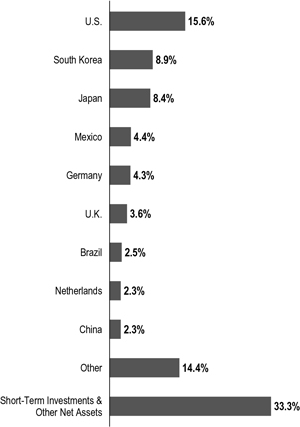

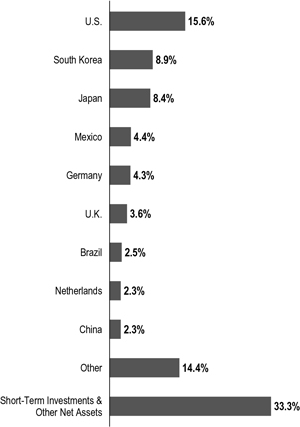

Geographic Composition*

Based on Total Net Assets as of 6/30/20

*Figures represent the net Fund exposure and include certain derivatives held in the portfolio (or their underlying reference assets) and may not total 100% or may be negative due to rounding, use of any derivatives or other factors.

but it remained a concern that officials continued to monitor. The BOJ kept overnight interest rates at -0.1% and the yield target on the 10-year Japanese government bond at 0.0% throughout the period.

Nearly every country in the world declared some form of fiscal response to the crisis, with most countries pursuing programs that went beyond the measures they deployed during the GFC. Debt-to-GDP ratios rose significantly in just about every country. On the monetary front, many central banks aggressively cut policy rates during the peaks in financial market volatility in March, but paused on making additional cuts in April, similar to the approaches taken by the Fed and the ECB. Several central banks returned to rate cuts in May and June, with many indicating they intended to respond with additional accommodation as needed. During the period, Brazil cut its policy rate by 225 bps to 2.25%, Mexico by 225 bps to 5.00%, Colombia by 175 bps to 2.50%, India by 115 bps to 4.00%, Indonesia by 75 bps to 4.25%, South Korea by 75 bps to 0.50%, Australia by 50 bps to

0.25%, Norway by 150 bps to 0.00%, Canada by 150 bps to 0.25% and the United Kingdom by 65 bps to 0.10%.

Investment Strategy

We search for undervalued or out-of-favor debt and equity securities and for equity securities that offer or may offer current income. When choosing equity securities for the Fund, we use a fundamental research, value-oriented, long-term approach, focusing on the market price of a security relative to our evaluation of the company’s long-term earnings, asset value and cash flow potential, as reflected by various metrics. Because this is a global fund, we analyze global economic trends to identify global macro trends (for example, regions with strong economic growth), and evaluate market inefficiencies to identify investment opportunities stemming from market mispricings.

When choosing fixed income investments for the Fund, we perform an independent analysis of the securities being considered for the Fund’s portfolio, rather than relying principally on their ratings assigned by rating agencies, as well as an assessment of the potential impacts of material environmental, social and governance (ESG) factors on the long-term risk and return profile of a country. In our analysis of corporate debt securities, we consider a variety of factors, including a company’s experience and managerial strength; responsiveness to changes in interest rates and business conditions; debt maturity schedules and borrowing requirements; a company’s changing financial condition and market recognition of the change; and a security’s relative value based on such factors as anticipated cash flow, interest or dividend coverage, asset coverage and earnings prospects. With respect to sovereign debt securities, we consider market, political and economic conditions, and evaluate interest and currency exchange rate changes and credit risks. We regularly enter into currency-related transactions involving certain derivative instruments, including currency and cross currency forwards, but we may also use other derivative instruments, to provide a hedge against risks associated with other securities held in the Fund or to implement a currency investment strategy. The use of these derivative transactions may allow the Fund to obtain net long or net short exposures to selected currencies, interest rates, countries, durations or credit risks, and may be used for hedging or investment purposes.

Manager’s Discussion

Despite unprecedented support measures from global central banks and policymakers, macroeconomic conditions remain far from normal. We have never experienced such a precarious market situation and believe global stock market

| | | | |

| | | |

6 | | Semiannual Report | | franklintempleton.com |

TEMPLETON GLOBAL BALANCED FUND

valuations are severely disconnected from underlying challenges. In response, we have tried to diversify away from risks created by policy interventions and de-correlate our portfolio from an increasingly volatile market.

Equity

Global equities, as measured by the MSCI ACWI Index, declined during the six months under review, weighed down by coronavirus concerns and economic uncertainty. However, markets rebounded strongly in the last few months of the period on promises of unlimited policy stimulus and optimism about economic re-openings. It was a challenging six months for value investors such as Templeton, with value stocks significantly underperforming growth stocks.

In this environment, the equity portion underperformed its benchmark index for the period, primarily due to stock selection and an underweighting in the information technology (IT) sector and stock selection in the communication services sector. An underweighting in the energy sector also detracted from relative performance.

In IT, Japanese electronic components manufacturer Kyocera detracted from relative results. The company’s shares declined on continued concerns about demand prospects in end markets for the firm’s automotive and industrial components. Kyocera has remained sensitive to global GDP trends due to the diversity of its customer base, though segments such as electronic devices and ceramics stand to benefit from secular growth trends like the adoption of 5G and increasing content demand, which may offset cyclicality elsewhere. Ultimately, we believe the key to unlocking the company’s value is the more efficient use of its balance sheet, which is overcapitalized in cash and investments. Since the retirement of the company’s founder two years ago, a more shareholder-friendly management team has taken over and explicitly targeted higher returns on equity. We believe this bodes well for the prospects of better long-term returns and is not adequately reflected in Kyocera’s share price.

In communications services, Luxembourg-based satellite operator SES detracted from relative performance. The company reported weaker-than-expected fourth-quarter results and lowered 2020 fiscal year revenue and earnings guidance due to lower-than-expected revenue growth in the video business and slowing growth in its networks business. Management also cut the dividend by half, citing the need to protect its investment-grade debt rating. We exited the position during the period to invest in what we viewed to be more compellingly valued opportunities.

Top Five Equity Holdings

6/30/20

| | |

Company Sector/Industry, Country | | % of Total

Net Assets |

| |

Bayer AG Pharmaceuticals, Germany | | 1.8% |

| |

Samsung Electronics Co. Ltd. Technology Hardware, Storage & Peripherals, South Korea | | 1.6% |

| |

Dollar Tree Inc. Multiline Retail, U.S. | | 1.5% |

| |

AIA Group Ltd. Insurance, Hong Kong | | 1.4% |

| |

Berkshire Hathaway Inc. Diversified Financial Services, U.S. | | 1.4% |

In energy, Husky Energy and Royal Dutch Shell were significant relative detractors, and both positions were sold during the period. The confluence of a pandemic-related demand shock with a supply shock stemming from the Saudi-Russian price war was unexpected, and we used associated volatility to reduce exposure to energy stocks, having found higher quality and more stable cyclical exposure in other sectors.

In contrast, stock selection and underweightings in consumer staples and utilities contributed to relative performance, along with an overweight in materials.

The consumer staples sector has traded at a premium despite low margins, fierce competition and poor pricing power, making value opportunities highly specific and idiosyncratic. Traditionally defensive consumer staples stocks such as U.S. grocer Kroger was a key relative contributor, benefiting from consumer stockpiling ahead of an extended period of stay-at-home social distancing measures.

German power utility E.ON led relative contributors in the utilities sector. E.ON’s transition from a diversified and geographically dispersed operation into a focused European utility is nearing completion, and the company should benefit over time from a stable regulatory environment and lower interest costs once debt is refinanced. In our analysis, synergies from the firm’s acquisition of power distribution company Innogy (not a Fund holding) are yet to be realised and should create economies of scale and support profitability over our long-term investment horizon. Overall, the firm offers a relatively high dividend yield supported by regulated earnings, while also having the potential to become a higher-growth utility once the benefits of the Innogy integration materialize.

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 7 |

TEMPLETON GLOBAL BALANCED FUND

In materials, U.S.-based copper miner Freeport-McMoRan contributed to relative returns. The firm rallied strongly after copper prices recovered to pre-crisis levels and investors reacted positively to an announced austerity plan, which includes capital expenditure reductions, executive pay cuts and a suspension of the dividend.

Regionally, stock selection and an overweight in Asia detracted significantly from relative performance. No regions contributed to relative performance during the period, but stock selection in Germany, the Netherlands and France did help results.

It is important to recognize the effect of currency movements on the Fund’s performance. In general, if the value of the U.S. dollar goes up compared with a foreign currency, an investment traded in that foreign currency will go down in value because it will be worth fewer U.S. dollars. This can have a negative effect on Fund performance. Conversely, when the U.S. dollar weakens in relation to a foreign currency, an investment traded in that foreign currency will increase in value, which can contribute to Fund performance. For the six months ended June 30, 2020, the U.S. dollar rose in value relative to most currencies. As a result, the Fund’s performance was negatively affected by the portfolio’s investment primarily in securities with non-U.S. currency exposure.

Top Five Fixed Income Holdings*

6/30/20

| | |

Issue/Issuer | | % of Total

Net Assets |

| |

Korea Treasury Bond | | 7.3% |

| |

Government of Mexico | | 4.0% |

| |

U.S. Treasury Note | | 3.9% |

| |

Nota do Tesouro Nacional | | 2.2% |

| |

Government of Ghana | | 1.8% |

*Does not include cash and cash equivalents.

Fixed Income

The fixed income sleeve of the strategy was structured around four key pillars during the reporting period: (1) maintaining high liquidity through elevated cash balances and risk-adjusted position weights; (2) holding long exposures to perceived safe-haven assets such as the Japanese yen, Swiss franc, Norwegian krone and Swedish krona; (3) targeting appropriate risk-adjusted returns in a select subset of emerging markets; and (4) underweighting overvalued developed fixed income markets, notably longer-term USTs. The strategy continued to emphasize select duration exposures in countries that have attractive

risk-adjusted yields, resilient economic fundamentals and prudent fiscal and monetary policies. Several emerging markets continued to offer significantly higher yields than those available in the developed markets. The strategy entered the reporting period in a de-risked state as the investment team saw elevated global financial market risks that it believed were significantly underappreciated by markets. While the team was not explicitly anticipating the COVID-19 crisis or the collapse in oil prices in the first quarter of 2020, it was concerned that overvalued risk assets were vulnerable to a geopolitical, economic or financial market shock. The team adjusted the risk-sizing of various positions and hedged (using currency forwards) a substantial amount of local-currency emerging market beta risk through proxy hedges (net-negative Australian dollar) and direct hedges (Indian rupee, South Korean won, Mexican peso and Brazilian real). The team also continued to broadly avoid credit sectors, which it believed were overvalued leading up to the crisis and increasingly vulnerable to insolvencies as the economic crisis progressed. The strategy also maintained negative duration exposure to longer-term USTs before the COVID-19 crisis erupted in March 2020, as the team believed that inflation pressures, rising deficit spending and surging levels of debt issuance were significantly underpriced in the longer-term range of the U.S. Treasury yield curve. The team unwound its net-negative positioning in longer-term USTs into curve steepening in March. The strategy continued to hold safe-haven assets that it had previously added in the third quarter of 2019, notably the Japanese yen, Swiss franc, Swedish krona and Norwegian krone. These positions were intended to hedge against global financial market risks associated with rising geopolitical tensions as well as price distortions from ongoing loose monetary policies across the developed world. The strategy also continued to hold a net-negative position in the euro to hedge against broad-based USD strength and unresolved structural risks across Europe, and a net-negative position in the Australian dollar to hedge against broad emerging market risks. During the period, the team used forward currency exchange contracts and currency options to actively manage currencies, and used interest-rate swaps to tactically manage duration exposures.

During the period, the Fund’s negative absolute performance was primarily due to currency positions. Interest-rate strategies contributed to absolute results, while overall credit exposures had a largely neutral effect. Among currencies, positions in Latin America (the Brazilian real and Argentine peso) and Asia ex-Japan (Indonesian rupiah) detracted from absolute performance. The Fund maintained a defensive approach regarding interest rates in developed markets,

| | | | |

| | | |

8 | | Semiannual Report | | franklintempleton.com |

TEMPLETON GLOBAL BALANCED FUND

while holding duration exposures in select emerging markets. Select duration exposures in Latin America (Mexico and Argentina) Africa (Ghana) and Asia (India) contributed to absolute results, while negative duration exposure to USTs during the first quarter detracted.

On a relative basis, the Fund underperformed its fixed income benchmark due to currency positions, followed by interest-rate strategies. Overall credit exposures had a largely neutral effect on relative results. Among currencies, overweighted positions in Latin America (the Brazilian real and Argentine peso) and Asia ex-Japan (Indonesian rupiah) detracted from relative performance, as did overweighted positions in northern European currencies (the Norwegian krone). Underweighted duration exposure in the U.S. detracted from relative performance, as did select underweighted duration exposures in Europe. However, select overweighted duration exposures in Latin America (Mexico and Argentina), Africa (Ghana) and Asia ex-Japan (India) contributed to relative results.

Thank you for your continued participation in Templeton Global Balanced Fund. We look forward to serving your future investment needs.

Michael Hasenstab, Ph.D.

Co-Lead Portfolio Manager

Warren Pustam, CFA

Co-Lead Portfolio Manager

Herbert J. Arnett, Jr.

Portfolio Manager

The foregoing information reflects our analysis, opinions and portfolio holdings as of June 30, 2020, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

CFA® is a trademark owned by CFA Institute.

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 9 |

TEMPLETON GLOBAL BALANCED FUND

Performance Summary as of June 30, 20201

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 6/30/201

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%. Class A: 5.50% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| | | | | | | | |

| Share Class | |

| Cumulative

Total Return |

2 | |

| Average Annual

Total Return |

3 |

| |

| | |

A4 | | | | | | | | |

6-Month | | | -12.21% | | | | -17.17% | |

| |

| | |

1-Year | | | -10.69% | | | | -15.73% | |

| |

| | |

5-Year | | | -5.28% | | | | -2.19% | |

| |

| | |

10-Year | | | +50.26% | | | | +3.58% | |

| |

| | |

Advisor | | | | | | | | |

6-Month | | | -12.36% | | | | -12.36% | |

| |

| | |

1-Year | | | -10.42% | | | | -10.42% | |

| |

| | |

5-Year | | | -4.33% | | | | -0.88% | |

| |

| | |

10-Year | | | +54.35% | | | | +4.44% | |

| |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 11 for Performance Summary footnotes.

| | | | |

| | | |

10 | | Semiannual Report | | franklintempleton.com |

TEMPLETON GLOBAL BALANCED FUND

PERFORMANCE SUMMARY

Distributions (1/1/20–6/30/20)

| | |

| Share Class | | Net Investment

Income |

| |

A | | $0.0309 |

| |

A1 | | $0.0309 |

| |

C | | $0.0211 |

| |

C1 | | $0.0252 |

| |

R | | $0.0287 |

| |

R6 | | $0.0356 |

| |

Advisor | | $0.0341 |

Total Annual Operating Expenses5

| | | | | | |

| Share Class | | With Fee

Waiver | | | Without Fee

Waiver |

| | |

A | | | 1.22% | | | 1.25% |

| | |

Advisor | | | 0.97% | | | 1.00% |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments; investments in emerging markets involve heightened risks related to the same factors. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. The risks associated with higher yielding, lower rated debt securities include higher risk of default and loss of principal. The markets for a particular security or instrument or type of security or instrument are or may become relatively illiquid. Reduced liquidity will have an adverse impact on the security’s value and on the Fund’s ability to sell such securities or instruments when necessary to meet the Fund’s liquidity needs or in response to a specific market event. The Fund’s investment in derivative securities, such as swaps, financial futures and option contracts, and use of foreign currency techniques involve special risks as such may not achieve the anticipated benefits and/or may result in losses to the Fund. Unexpected events and their aftermaths, such as the spread of deadly diseases; natural, environmental or man-made disasters; financial, political or social disruptions; terrorism and war; and other tragedies or catastrophes, can cause investor fear and panic, which can adversely affect the economies of many companies, sectors, nations, regions and the market in general, in ways that cannot necessarily be foreseen. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has a fee waiver associated with any investment it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 4/30/21. Fund investment results reflect the fee waiver; without this waiver, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Prior to 9/10/18, these shares were offered at a higher initial sales charge of 5.75%; thus actual returns would have differed. Total returns with sales charges have been restated to reflect the current maximum initial sales charge of 5.50%. Effective 9/27/11, Class A shares closed to new investors, were renamed Class A1 Shares, and a new Class A with different expense structure became available. Class A performance shown has been calculated as follows: (a) for periods prior to 9/27/11 a restated figure is used based on Class A1 performance and including the Rule 12b-1 rate differential between Class A and A1, and (b) for periods after 9/27/11, actual Class A performance is used, reflecting all charges and fees applicable to that class.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 11 |

TEMPLETON GLOBAL BALANCED FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual (actual return after expenses) | | | | Hypothetical (5% annual return before expenses) | | | | |

Share

Class | | Beginning

Account

Value 1/1/20 | | | | Ending

Account

Value 6/30/20 | | Expenses Paid During Period

1/1/20–6/30/201, 2 | | | | Ending

Account

Value 6/30/20 | | Expenses Paid During

Period

1/1/20–6/30/201, 2 | | | | Net

Annualized

Expense

Ratio2 |

| A | | $1,000 | | | | $877.90 | | $5.74 | | | | $1,018.75 | | $6.17 | | | | 1.23% |

| A1 | | $1,000 | | | | $874.80 | | $5.73 | | | | $1,018.75 | | $6.17 | | | | 1.23% |

| C | | $1,000 | | | | $870.20 | | $9.21 | | | | $1,015.02 | | $9.92 | | | | 1.98% |

| C1 | | $1,000 | | | | $872.60 | | $7.59 | | | | $1,016.76 | | $8.17 | | | | 1.63% |

| R | | $1,000 | | | | $877.50 | | $6.68 | | | | $1,017.75 | | $7.17 | | | | 1.43% |

| R6 | | $1,000 | | | | $876.50 | | $4.06 | | | | $1,020.54 | | $4.37 | | | | 0.87% |

| Advisor | | $1,000 | | | | $876.40 | | $4.57 | | | | $1,019.99 | | $4.92 | | | | 0.98% |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 182/366 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| | | | |

| | | |

12 | | Semiannual Report | | franklintempleton.com |

TEMPLETON GLOBAL INVESTMENT TRUST

Consolidated Financial Highlights

Templeton Global Balanced Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2020 (unaudited) | | | | | | | | | | | | | | | Year Ended March 31, 2016 | |

| | | Year Ended December 31, | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016a | |

| | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Per share operating performance (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $ 2.84 | | | | $ 2.77 | | | | $ 3.17 | | | | $ 2.91 | | | | $ 2.72 | | | | $ 3.13 | |

| | | | | | |

Income from investment operationsb: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomec | | | 0.03 | | | | 0.11 | | | | 0.10 | | | | 0.09 | | | | 0.07 | | | | 0.08 | |

| | | | | | |

Net realized and unrealized gains (losses) | | | (0.38 | ) | | | 0.08 | | | | (0.38 | ) | | | 0.25 | | | | 0.15 | | | | (0.32 | ) |

| | | | | | |

Total from investment operations | | | (0.35 | ) | | | 0.19 | | | | (0.28 | ) | | | 0.34 | | | | 0.22 | | | | (0.24 | ) |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | (0.03 | ) | | | (0.12 | ) | | | (0.12 | ) | | | (0.08 | ) | | | (0.03 | ) | | | (0.09 | ) |

| | | | | | |

Net realized gains | | | — | | | | — | | | | — | | | | — | | | | — | | | | (0.08 | ) |

| | | | | | |

Total distributions | | | (0.03 | ) | | | (0.12 | ) | | | (0.12 | ) | | | (0.08 | ) | | | (0.03 | ) | | | (0.17 | ) |

| | | | | | |

Net asset value, end of period | | | $ 2.46 | | | | $ 2.84 | | | | $ 2.77 | | | | $ 3.17 | | | | $ 2.91 | | | | $ 2.72 | |

| | | | | | |

Total returnd | | | (12.21)% | | | | 6.96% | | | | (9.44)% | | | | 12.18% | | | | 7.97% | | | | (7.74)% | |

| | | | | | |

Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expenses before waiver and payments by affiliates and expense reduction | | | 1.29% | | | | 1.22% | | | | 1.19% | | | | 1.17% | | | | 1.16% | | | | 1.11% | |

| | | | | | |

Expenses net of waiver and payments by affiliates and expense reduction | | | 1.23% | | | | 1.19% | f | | | 1.16%f | | | | 1.14%f | | | | 1.15%f | | | | 1.10%f | |

| | | | | | |

Net investment income | | | 2.28% | | | | 3.81% | | | | 3.17% | | | | 2.82% | | | | 3.28% | | | | 2.55% | |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (000’s) | | | $346,525 | | | | $465,915 | | | | $557,604 | | | | $745,957 | | | | $780,810 | | | | $987,949 | |

| | | | | | |

Portfolio turnover rate | | | 44.23% | | | | 26.62% | | | | 45.92% | | | | 34.25% | | | | 16.66% | | | | 44.25% | |

aFor the period April 1, 2016 to December 31, 2016.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year, except for non-recurring expenses, if any.

fBenefit of expense reduction rounds to less than 0.01%.

| | | | |

| | | |

| franklintempleton.com | | The accompanying notes are an integral part of these consolidated financial statements. | Semiannual Report | | 13 |

TEMPLETON GLOBAL INVESTMENT TRUST

CONSOLIDATED FINANCIAL HIGHLIGHTS

Templeton Global Balanced Fund (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2020 (unaudited) | | | | | | | | | | | | | | | Year Ended March 31, 2016 | |

| | | Year Ended December 31, | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016a | |

| | | | | | |

Class A1 | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Per share operating performance (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $ 2.84 | | | | $ 2.77 | | | | $ 3.18 | | | | $ 2.91 | | | | $ 2.72 | | | | $ 3.13 | |

| | | | | | |

Income from investment operationsb: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomec | | | 0.03 | | | | 0.11 | | | | 0.10 | | | | 0.09 | | | | 0.07 | | | | 0.08 | |

| | | | | | |

Net realized and unrealized gains (losses) | | | (0.38 | ) | | | 0.08 | | | | (0.39 | ) | | | 0.26 | | | | 0.15 | | | | (0.32 | ) |

| | | | | | |

Total from investment operations | | | (0.35 | ) | | | 0.19 | | | | (0.29 | ) | | | 0.35 | | | | 0.22 | | | | (0.24 | ) |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | (0.03 | ) | | | (0.12 | ) | | | (0.12 | ) | | | (0.08 | ) | | | (0.03 | ) | | | (0.09 | ) |

| | | | | | |

Net realized gains | | | — | | | | — | | | | — | | | | — | | | | — | | | | (0.08 | ) |

| | | | | | |

Total distributions | | | (0.03 | ) | | | (0.12 | ) | | | (0.12 | ) | | | (0.08 | ) | | | (0.03 | ) | | | (0.17 | ) |

| | | | | | |

Net asset value, end of period | | | $ 2.46 | | | | $ 2.84 | | | | $ 2.77 | | | | $ 3.18 | | | | $ 2.91 | | | | $ 2.72 | |

| | | | | | |

Total returnd | | | (12.52)% | | | | 7.33% | | | | (9.45)% | | | | 12.18% | | | | 7.97% | | | | (7.76)% | |

| | | | | | |

Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expenses before waiver and payments by affiliates and expense reduction | | | 1.29% | | | | 1.22% | | | | 1.19% | | | | 1.17% | | | | 1.16% | | | | 1.11% | |

| | | | | | |

Expenses net of waiver and payments by affiliates and expense reduction | | | 1.23% | | | | 1.19%f | | | | 1.16%f | | | | 1.14%f | | | | 1.15%f | | | | 1.10%f | |

| | | | | | |

Net investment income | | | 2.28% | | | | 3.81% | | | | 3.17% | | | | 2.82% | | | | 3.28% | | | | 2.55% | |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (000’s) | | | $192,516 | | | | $252,990 | | | | $285,358 | | | | $293,488 | | | | $319,161 | | | | $370,212 | |

| | | | | | |

Portfolio turnover rate | | | 44.23% | | | | 26.62% | | | | 45.92% | | | | 34.25% | | | | 16.66% | | | | 44.25% | |

aFor the period April 1, 2016 to December 31, 2016.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year, except for non-recurring expenses, if any.

fBenefit of expense reduction rounds to less than 0.01%.

| | | | |

| | | |

14 | | Semiannual Report | The accompanying notes are an integral part of these consolidated financial statements. | | franklintempleton.com |

TEMPLETON GLOBAL INVESTMENT TRUST

CONSOLIDATED FINANCIAL HIGHLIGHTS

Templeton Global Balanced Fund (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2020 (unaudited) | | | | | | | | | | | | | | | Year Ended March 31, 2016 | |

| | | Year Ended December 31, | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016a | |

| | | | | | |

Class C | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Per share operating performance (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $ 2.82 | | | | $ 2.75 | | | | $ 3.16 | | | | $ 2.90 | | | | $ 2.70 | | | | $ 3.12 | |

| | | | | | |

Income from investment operationsb: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomec | | | 0.02 | | | | 0.09 | | | | 0.08 | | | | 0.06 | | | | 0.05 | | | | 0.05 | |

| | | | | | |

Net realized and unrealized gains (losses) | | | (0.38 | ) | | | 0.08 | | | | (0.40 | ) | | | 0.26 | | | | 0.16 | | | | (0.31 | ) |

| | | | | | |

Total from investment operations | | | (0.36 | ) | | | 0.17 | | | | (0.32 | ) | | | 0.32 | | | | 0.21 | | | | (0.26 | ) |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | (0.02 | ) | | | (0.10 | ) | | | (0.09 | ) | | | (0.06 | ) | | | (0.01 | ) | | | (0.08 | ) |

| | | | | | |

Net realized gains | | | — | | | | — | | | | — | | | | — | | | | — | | | | (0.08 | ) |

| | | | | | |

Total distributions | | | (0.02 | ) | | | (0.10 | ) | | | (0.09 | ) | | | (0.06 | ) | | | (0.01 | ) | | | (0.16 | ) |

| | | | | | |

Net asset value, end of period | | | $ 2.44 | | | | $ 2.82 | | | | $ 2.75 | | | | $ 3.16 | | | | $ 2.90 | | | | $ 2.70 | |

| | | | | | |

Total returnd | | | (12.98)% | | | | 6.55% | | | | (10.23)% | | | | 11.03% | | | | 7.74% | | | | (8.68)% | |

| | | | | | |

Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expenses before waiver and payments by affiliates and expense reduction | | | 2.04% | | | | 1.97% | | | | 1.94% | | | | 1.92% | | | | 1.89% | | | | 1.86% | |

| | | | | | |

Expenses net of waiver and payments by affiliates and expense reduction | | | 1.98% | | | | 1.94%f | | | | 1.91%f | | | | 1.89%f | | | | 1.88%f | | | | 1.85%f | |

| | | | | | |

Net investment income | | | 1.53% | | | | 3.06% | | | | 2.42% | | | | 2.07% | | | | 2.55% | | | | 1.80% | |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (000’s) | | | $97,136 | | | | $139,231 | | | | $203,587 | | | | $317,374 | | | | $340,265 | | | | $464,899 | |

| | | | | | |

Portfolio turnover rate | | | 44.23% | | | | 26.62% | | | | 45.92% | | | | 34.25% | | | | 16.66% | | | | 44.25% | |

aFor the period April 1, 2016 to December 31, 2016.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year, except for non-recurring expenses, if any.

fBenefit of expense reduction rounds to less than 0.01%.

| | | | |

| | | |

| franklintempleton.com | | The accompanying notes are an integral part of these consolidated financial statements. | Semiannual Report | | 15 |

TEMPLETON GLOBAL INVESTMENT TRUST

CONSOLIDATED FINANCIAL HIGHLIGHTS

Templeton Global Balanced Fund (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2020 (unaudited) | | | | | | | | | | | | | | | Year Ended March 31, 2016 | |

| | | Year Ended December 31, | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016a | |

| | | | | | |

Class C1 | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Per share operating performance (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $ 2.84 | | | | $ 2.77 | | | | $ 3.17 | | | | $ 2.91 | | | | $ 2.72 | | | | $ 3.13 | |

| | | | | | |

Income from investment operationsb: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomec | | | 0.02 | | | | 0.10 | | | | 0.09 | | | | 0.08 | | | | 0.06 | | | | 0.06 | |

| | | | | | |

Net realized and unrealized gains (losses) | | | (0.37 | ) | | | 0.08 | | | | (0.39 | ) | | | 0.25 | | | | 0.15 | | | | (0.31 | ) |

| | | | | | |

Total from investment operations | | | (0.35 | ) | | | 0.18 | | | | (0.30 | ) | | | 0.33 | | | | 0.21 | | | | (0.25 | ) |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | (0.03 | ) | | | (0.11 | ) | | | (0.10 | ) | | | (0.07 | ) | | | (0.02 | ) | | | (0.08 | ) |

| | | | | | |

Net realized gains | | | — | | | | — | | | | — | | | | — | | | | — | | | | (0.08 | ) |

| | | | | | |

Total distributions | | | (0.03 | ) | | | (0.11 | ) | | | (0.10 | ) | | | (0.07 | ) | | | (0.02 | ) | | | (0.16 | ) |

| | | | | | |

Net asset value, end of period | | | $ 2.46 | | | | $ 2.84 | | | | $ 2.77 | | | | $ 3.17 | | | | $ 2.91 | | | | $ 2.72 | |

| | | | | | |

Total returnd | | | (12.74)% | | | | 6.82% | | | | (9.88)% | | | | 11.71% | | | | 7.62% | | | | (8.07)% | |

| | | | | | |

Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expenses before waiver and payments by affiliates and expense reduction | | | 1.69% | | | | 1.62% | | | | 1.59% | | | | 1.57% | | | | 1.56% | | | | 1.51% | |

| | | | | | |

Expenses net of waiver and payments by affiliates and expense reduction | | | 1.63% | | | | 1.59%f | | | | 1.56%f | | | | 1.54%f | | | | 1.55%f | | | | 1.50%f | |

| | | | | | |

Net investment income | | | 1.88% | | | | 3.41% | | | | 2.77% | | | | 2.42% | | | | 2.88% | | | | 2.15% | |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (000’s) | | | $16,207 | | | | $27,765 | | | | $62,418 | | | | $173,079 | | | | $202,929 | | | | $233,840 | |

| | | | | | |

Portfolio turnover rate | | | 44.23% | | | | 26.62% | | | | 45.92% | | | | 34.25% | | | | 16.66% | | | | 44.25% | |

aFor the period April 1, 2016 to December 31, 2016.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year, except for non-recurring expenses, if any.

fBenefit of expense reduction rounds to less than 0.01%.

| | | | |

| | | |

16 | | Semiannual Report | The accompanying notes are an integral part of these consolidated financial statements. | | franklintempleton.com |

TEMPLETON GLOBAL INVESTMENT TRUST

CONSOLIDATED FINANCIAL HIGHLIGHTS

Templeton Global Balanced Fund (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2020 (unaudited) | | | | | | | | | | | | | | | Year Ended March 31, 2016 | |

| | | Year Ended December 31, | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016a | |

| | | | | | |

Class R | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Per share operating performance (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $ 2.85 | | | | $ 2.78 | | | | $ 3.18 | | | | $ 2.92 | | | | $ 2.72 | | | | $ 3.14 | |

| | | | | | |

Income from investment operationsb: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomec | | | 0.03 | | | | 0.10 | | | | 0.09 | | | | 0.08 | | | | 0.06 | | | | 0.07 | |

| | | | | | |

Net realized and unrealized gains (losses) | | | (0.38 | ) | | | 0.08 | | | | (0.38 | ) | | | 0.25 | | | | 0.16 | | | | (0.32 | ) |

| | | | | | |

Total from investment operations | | | (0.35 | ) | | | 0.18 | | | | (0.29 | ) | | | 0.33 | | | | 0.22 | | | | (0.25 | ) |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | (0.03 | ) | | | (0.11 | ) | | | (0.11 | ) | | | (0.07 | ) | | | (0.02 | ) | | | (0.09 | ) |

| | | | | | |

Net realized gains | | | — | | | | — | | | | — | | | | — | | | | — | | | | (0.08 | ) |

| | | | | | |

Total distributions | | | (0.03 | ) | | | (0.11 | ) | | | (0.11 | ) | | | (0.07 | ) | | | (0.02 | ) | | | (0.17 | ) |

| | | | | | |

Net asset value, end of period | | | $ 2.47 | | | | $ 2.85 | | | | $ 2.78 | | | | $ 3.18 | | | | $ 2.92 | | | | $ 2.72 | |

| | | | | | |

Total returnd | | | (12.25)% | | | | 6.66% | | | | (9.67)% | | | | 11.84% | | | | 8.11% | | | | (8.24)% | |

| | | | | | |

Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expenses before waiver and payments by affiliates and expense reduction | | | 1.49% | | | | 1.47% | | | | 1.44% | | | | 1.42% | | | | 1.41% | | | | 1.36% | |

| | | | | | |

Expenses net of waiver and payments by affiliates and expense reduction | | | 1.43% | | | | 1.44%f | | | | 1.41%f | | | | 1.39%f | | | | 1.40%f | | | | 1.35%f | |

| | | | | | |

Net investment income | | | 2.08% | | | | 3.56% | | | | 2.92% | | | | 2.57% | | | | 3.03% | | | | 2.30% | |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (000’s) | | | $1,832 | | | | $2,348 | | | | $2,778 | | | | $4,944 | | | | $5,487 | | | | $6,498 | |

| | | | | | |

Portfolio turnover rate | | | 44.23% | | | | 26.62% | | | | 45.92% | | | | 34.25% | | | | 16.66% | | | | 44.25% | |

aFor the period April 1, 2016 to December 31, 2016.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year, except for non-recurring expenses, if any.

fBenefit of expense reduction rounds to less than 0.01%.

| | | | |

| | | |

| franklintempleton.com | | The accompanying notes are an integral part of these consolidated financial statements. | Semiannual Report | | 17 |

TEMPLETON GLOBAL INVESTMENT TRUST

CONSOLIDATED FINANCIAL HIGHLIGHTS

Templeton Global Balanced Fund (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2020 (unaudited) | | | | | | | | | | | | | | | Year Ended March 31, 2016 | |

| | | Year Ended December 31, | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016a | |

| | | | | | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Per share operating performance (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $ 2.85 | | | | $ 2.78 | | | | $ 3.18 | | | | $ 2.92 | | | | $ 2.73 | | | | $ 3.14 | |

| | | | | | |

Income from investment operationsb: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomec | | | 0.03 | | | | 0.12 | | | | 0.11 | | | | 0.09 | | | | 0.08 | | | | 0.08 | |

| | | | | | |

Net realized and unrealized gains (losses) | | | (0.38 | ) | | | 0.08 | | | | (0.38 | ) | | | 0.26 | | | | 0.15 | | | | (0.31 | ) |

| | | | | | |

Total from investment operations | | | (0.35 | ) | | | 0.20 | | | | (0.27 | ) | | | 0.35 | | | | 0.23 | | | | (0.23 | ) |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | (0.04 | ) | | | (0.13 | ) | | | (0.13 | ) | | | (0.09 | ) | | | (0.04 | ) | | | (0.10 | ) |

| | | | | | |

Net realized gains | | | — | | | | — | | | | — | | | | — | | | | — | | | | (0.08 | ) |

| | | | | | |

Total distributions | | | (0.04 | ) | | | (0.13 | ) | | | (0.13 | ) | | | (0.09 | ) | | | (0.04 | ) | | | (0.18 | ) |

| | | | | | |

Net asset value, end of period | | | $ 2.46 | | | | $ 2.85 | | | | $ 2.78 | | | | $ 3.18 | | | | $ 2.92 | | | | $ 2.73 | |

| | | | | | |

Total returnd | | | (12.35)% | | | | 7.32% | | | | (9.09)% | | | | 12.56% | | | | 8.35% | | | | (7.44)% | |

| | | | | | |

Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expenses before waiver and payments by affiliates and expense reduction | | | 0.99% | | | | 0.92% | | | | 0.89% | | | | 0.84% | | | | 0.81% | | | | 0.81% | |

| | | | | | |

Expenses net of waiver and payments by affiliates and expense reduction | | | 0.87% | | | | 0.84%f | | | | 0.82%f | | | | 0.77%f | | | | 0.79%f | | | | 0.75%f | |

| | | | | | |

Net investment income | | | 2.64% | | | | 4.16% | | | | 3.51% | | | | 3.19% | | | | 3.64% | | | | 2.90% | |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (000’s) | | | $4,509 | | | | $6,080 | | | | $7,933 | | | | $11,254 | | | | $752 | | | | $1,089 | |

| | | | | | |

Portfolio turnover rate | | | 44.23% | | | | 26.62% | | | | 45.92% | | | | 34.25% | | | | 16.66% | | | | 44.25% | |

aFor the period April 1, 2016 to December 31, 2016.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year, except for non-recurring expenses, if any.

fBenefit of expense reduction rounds to less than 0.01%.

| | | | |

| | | |

18 | | Semiannual Report | The accompanying notes are an integral part of these consolidated financial statements. | | franklintempleton.com |

TEMPLETON GLOBAL INVESTMENT TRUST

CONSOLIDATED FINANCIAL HIGHLIGHTS

Templeton Global Balanced Fund (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2020 (unaudited) | | | | | | | | | | | | | | | Year Ended March 31, 2016 | |

| | | Year Ended December 31, | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016a | |

| | | | | | |

Advisor Class | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Per share operating performance (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $ 2.85 | | | | $ 2.78 | | | | $ 3.19 | | | | $ 2.92 | | | | $ 2.73 | | | | $ 3.14 | |

| | | | | | |

Income from investment operationsb: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomec | | | 0.03 | | | | 0.12 | | | | 0.11 | | | | 0.10 | | | | 0.08 | | | | 0.08 | |

| | | | | | |

Net realized and unrealized gains (losses) | | | (0.38 | ) | | | 0.08 | | | | (0.39 | ) | | | 0.26 | | | | 0.14 | | | | (0.31 | ) |

| | | | | | |

Total from investment operations | | | (0.35 | ) | | | 0.20 | | | | (0.28 | ) | | | 0.36 | | | | 0.22 | | | | (0.23 | ) |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | (0.03 | ) | | | (0.13 | ) | | | (0.13 | ) | | | (0.09 | ) | | | (0.03 | ) | | | (0.10 | ) |

| | | | | | |

Net realized gains | | | — | | | | — | | | | — | | | | — | | | | — | | | | (0.08 | ) |

| | | | | | |

Total distributions | | | (0.03 | ) | | | (0.13 | ) | | | (0.13 | ) | | | (0.09 | ) | | | (0.03 | ) | | | (0.18 | ) |

| | | | | | |

Net asset value, end of period | | | $ 2.47 | | | | $ 2.85 | | | | $ 2.78 | | | | $ 3.19 | | | | $ 2.92 | | | | $ 2.73 | |

| | | | | | |

Total returnd | | | (12.36)% | | | | 7.57% | | | | (9.19)% | | | | 12.42% | | | | 8.22% | | | | (7.52)% | |

| | | | | | |

Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expenses before waiver and payments by affiliates and expense reduction | | | 1.04% | | | | 0.97% | | | | 0.94% | | | | 0.92% | | | | 0.91% | | | | 0.86% | |

| | | | | | |

Expenses net of waiver and payments by affiliates and expense reduction | | | 0.98% | | | | 0.94%f | | | | 0.91%f | | | | 0.89%f | | | | 0.90%f | | | | 0.85%f | |

| | | | | | |

Net investment income | | | 2.53% | | | | 4.06% | | | | 3.42% | | | | 3.07% | | | | 3.53% | | | | 2.80% | |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (000’s) | | | $81,569 | | | | $141,277 | | | | $207,346 | | | | $246,044 | | | | $212,161 | | | | $299,226 | |

| | | | | | |

Portfolio turnover rate | | | 44.23% | | | | 26.62% | | | | 45.92% | | | | 34.25% | | | | 16.66% | | | | 44.25% | |

aFor the period April 1, 2016 to December 31, 2016.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year, except for non-recurring expenses, if any.

fBenefit of expense reduction rounds to less than 0.01%.

| | | | |

| | | |

| franklintempleton.com | | The accompanying notes are an integral part of these consolidated financial statements. | Semiannual Report | | 19 |

TEMPLETON GLOBAL INVESTMENT TRUST

Consolidated Statement of Investments, June 30, 2020 (unaudited)

Templeton Global Balanced Fund

| | | | | | | | | | | | |

| | | Industry | | | Shares | | | Value | |

| |

| | | |

Common Stocks 41.6% | | | | | | | | | | | | |

China 2.3% | | | | | | | | | | | | |

a Alibaba Group Holding Ltd. | | | Internet & Direct Marketing Retail | | | | 159,600 | | | $ | 4,306,584 | |

a Baidu Inc., ADR | | | Interactive Media & Services | | | | 65,300 | | | | 7,828,817 | |

b Xiabuxiabu Catering Management China Holdings Co. Ltd. | | | Hotels, Restaurants & Leisure | | | | 4,711,000 | | | | 4,673,048 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 16,808,449 | |

| | | | | | | | | | | | |

Denmark 0.9% | | | | | | | | | | | | |

AP Moeller-Maersk A/S, B | | | Marine | | | | 5,511 | | | | 6,458,294 | |

| | | | | | | | | | | | |

| | | |

France 1.2% | | | | | | | | | | | | |

a ArcelorMittal SA | | | Metals & Mining | | | | 493,831 | | | | 5,230,125 | |

a Dassault Aviation SA | | | Aerospace & Defense | | | | 4,354 | | | | 3,994,428 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 9,224,553 | |

| | | | | | | | | | | | |

Germany 4.3% | | | | | | | | | | | | |

Bayer AG | | | Pharmaceuticals | | | | 183,073 | | | | 13,568,805 | |

Bayerische Motoren Werke AG | | | Automobiles | | | | 76,462 | | | | 4,880,949 | |

E.ON SE | | | Multi-Utilities | | | | 831,401 | | | | 9,383,752 | |

Siemens AG | | | Industrial Conglomerates | | | | 35,741 | | | | 4,214,816 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 32,048,322 | |

| | | | | | | | | | | | |

Hong Kong 1.6% | | | | | | | | | | | | |

AIA Group Ltd. | | | Insurance | | | | 1,119,600 | | | | 10,476,702 | |

Value Partners Group Ltd. | | | Capital Markets | | | | 2,550,000 | | | | 1,299,912 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 11,776,614 | |

| | | | | | | | | | | | |

India 1.0% | | | | | | | | | | | | |

Housing Development Finance Corp. Ltd. | | | Thrifts & Mortgage Finance | | | | 314,236 | | | | 7,302,663 | |

| | | | | | | | | | | | |

| | | |

Ireland 0.9% | | | | | | | | | | | | |

a Ryanair Holdings PLC, ADR | | | Airlines | | | | 96,000 | | | | 6,368,640 | |

| | | | | | | | | | | | |

| | | |

Japan 8.2% | | | | | | | | | | | | |

Hosokawa Micron Corp. | | | Machinery | | | | 31,700 | | | | 1,678,977 | |

Isuzu Motors Ltd. | | | Automobiles | | | | 432,400 | | | | 3,929,364 | |

Japan Airlines Co. Ltd. | | | Airlines | | | | 153,000 | | | | 2,760,965 | |

Kirin Holdings Co. Ltd. | | | Beverages | | | | 170,200 | | | | 3,587,773 | |

Komatsu Ltd. | | | Machinery | | | | 102,100 | | | | 2,091,061 | |

Kyocera Corp. | |

| Electronic Equipment, Instruments

& Components |

| | | 98,300 | | | | 5,365,662 | |

Nippon Television Holdings Inc. | | | Media | | | | 434,600 | | | | 4,707,142 | |

Seria Co. Ltd. | | | Multiline Retail | | | | 225,800 | | | | 8,053,547 | |

Sony Corp. | | | Household Durables | | | | 32,300 | | | | 2,229,673 | |