UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08228

(Exact name of registrant as specified in charter)

1055 Maitland Center Commons, Maitland, FL 32751

(Address of principal executive offices) (Zip code)

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219-8000

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 846-7526

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Stockholders.

(a)

Timothy Plan US Small Cap Core ETF

Ticker: TPSC Exchange: NYSE

Annual Shareholder Report — December 31, 2024

The annual shareholder report contains important information about Timothy Plan US Small Cap Core ETF (the "Fund") for the period of January 1, 2024 to December 31, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at etf.timothyplan.com. You may also request more information by calling 800.846.7526 or visiting timothyplan.com/contact-us.

What were the Fund's costs for the last year

(based on a hypothetical $10,000 investment)

| FUND NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Timothy Plan US Small Cap Core ETF | $55 | 0.52% |

|---|

How did the Fund perform last year? What affected the Fund’s performance?

The Timothy Plan Small Cap Core ETF (TPSC) seeks a rules-based approach that combines Biblically Responsible Investing (BRI) criteria with volatility weighting in an effort to outperform traditional indexing strategies. The rules-based volatility weighting methodology weights stocks based on volatility, so each stock in the portfolio has an equal contribution to overall risk.

In 2024, TPSC returned 11.57% NAV, underperforming the Russell 3000 Index, which returned 23.81%.

An underweight in Healthcare combined with positive stock selection contributed to relative performance. An underweight to Information Technology along with stock selection within the sector was a detractor to relative performance.

The top three largest contributors to performance were FTAI Aviation, Sprouts Farmers Market, and Brinker International. The largest stock detractors during the quarter were Adient PLC, Par Pacific Holdings, and Jack in the Box.

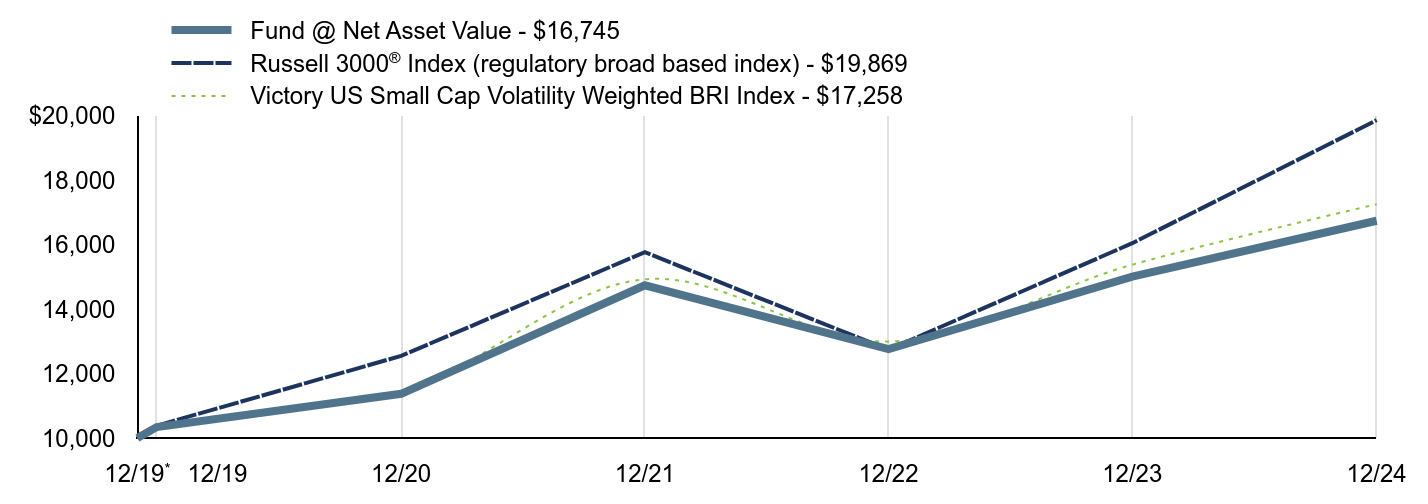

Growth of a $10,000 Investment

The graph reflects investment growth of a hypothetical investment of $10,000 in the Fund. The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

| Fund @ Net Asset Value - $16,745 | Russell 3000® Index (regulatory broad based index) - $19,869 | Victory US Small Cap Volatility Weighted BRI Index - $17,258 |

|---|

12/19Footnote Reference* | $10,000 | $10,000 | $10,000 |

|---|

| 12/19 | $10,339 | $10,381 | $10,344 |

|---|

| 12/20 | $11,372 | $12,550 | $11,444 |

|---|

| 12/21 | $14,740 | $15,770 | $14,928 |

|---|

| 12/22 | $12,757 | $12,741 | $12,996 |

|---|

| 12/23 | $15,008 | $16,049 | $15,382 |

|---|

| 12/24 | $16,745 | $19,869 | $17,258 |

|---|

| Footnote | Description |

Footnote* | Inception date for the Timothy Plan US Small Cap Core ETF is 12/2/2019. |

AVERAGE ANNUAL TOTAL RETURN

| 1 Year | 5 Year | Since Inception |

|---|

| Fund @ Net Asset Value | 11.57%Footnote Reference | 10.12%Footnote Reference | 10.68%Footnote Reference |

|---|

Russell 3000® IndexFootnote Reference1 | 23.81% | 13.86% | 14.47% |

|---|

Victory US Small Cap Volatility Weighted BRI IndexFootnote Reference2 | 12.20% | 10.78% | 11.34% |

|---|

| Footnote | Description |

Footnote | High double-digit returns are attributable, in part, to unusually favorable market conditions and may not be repeated or consistently achieved in the future. |

Footnote1 | The unmanaged Russell 3000® Index is a market-capitalization-weighted index that measures the performance of the 3,000 largest U.S. stocks by market capitalization and covers 98% of the investable U.S. equity universe. |

Footnote2 | Victory US Small Cap Volatility Weighted BRI Index is an unmanaged, volatility weighted index created by the Fund's Sub-Advisor. A volatility weighted index assigns percentage values to each security in the index based on the volatility of that security in the market. The Index eliminates companies that do not satisfy the proprietary Biblically Responsible Investing ("BRI") filtering criteria. |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

| Net Assets | $169,765,980 |

|---|

| Number of Portfolio Holdings | 461 |

|---|

| Net Investment Advisory Fees | $706,972 |

|---|

| Portfolio Turnover Rate | 44% |

|---|

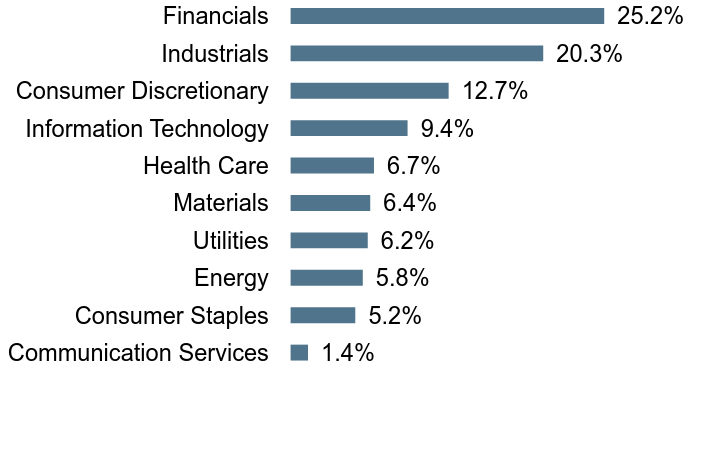

Graphical Presentation of Holdings

(as of 12/31/2024)

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference

| Value | Value |

|---|

| Communication Services | 1.4% |

| Consumer Staples | 5.2% |

| Energy | 5.8% |

| Utilities | 6.2% |

| Materials | 6.4% |

| Health Care | 6.7% |

| Information Technology | 9.4% |

| Consumer Discretionary | 12.7% |

| Industrials | 20.3% |

| Financials | 25.2% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference

| DT Midstream, Inc. | 0.5% |

| IDACORP, Inc. | 0.4% |

| Grand Canyon Education, Inc. | 0.4% |

| Spire, Inc. | 0.4% |

| TXNM Energy, Inc. | 0.4% |

| Federated Hermes, Inc. | 0.4% |

| Madison Square Garden Sports Corp. | 0.4% |

| New Jersey Resources Corp. | 0.4% |

| MDU Resources Group, Inc. | 0.4% |

| The Hanover Insurance Group, Inc. | 0.4% |

* Does not include futures contracts, money market instruments, and short-term investments.

Utilize the Full Financials link below to refer to the Schedule of Portfolio Investments for a complete list of securities.

There were no material fund changes during the year ended December 31, 2024.

Additional information about the Fund is available on etf.timothyplan.com including:

Full Financial Statements

Prospectus

Fund Holdings

Proxy Voting

Contact us at 800.846.7526 or visit timothyplan.com/contact-us.

Timothy Plan US Large/Mid Cap Core ETF

Ticker: TPLC Exchange: NYSE

Annual Shareholder Report — December 31, 2024

The annual shareholder report contains important information about Timothy Plan US Large/Mid Cap Core ETF (the "Fund") for the period of January 1, 2024 to December 31, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at etf.timothyplan.com. You may also request more information by calling 800.846.7526 or visiting timothyplan.com/contact-us.

What were the Fund's costs for the last year

(based on a hypothetical $10,000 investment)

| FUND NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Timothy Plan US Large/Mid Cap Core ETF | $55 | 0.52% |

|---|

How did the Fund perform last year? What affected the Fund’s performance?

The Timothy Plan US Large/Mid Cap Core ETF (TPLC) seeks a rules-based approach that combines Biblically Responsible Investing (BRI) criteria with volatility weighting in an effort to outperform traditional indexing strategies. The rules-based volatility weighting methodology weights stocks based on volatility, so each stock in the portfolio has an equal contribution to overall risk.

In 2024, TPLC returned 13.12% NAV, underperforming the S&P 500® Index (the “Index”), which returned 25.02%.

An underweight in Real Estate contributed to relative performance, with stock selection in the Energy sector also contributing. An underweight and stock selection in Information Technology was a detractor to relative performance.

The top three largest contributors to performance were Vistra, AppLovin Corp., and Howmet Aerospace. The largest stock detractors to performance during the year were Celanese Corporation, Five Below Inc., and Dollar Tree, Inc.

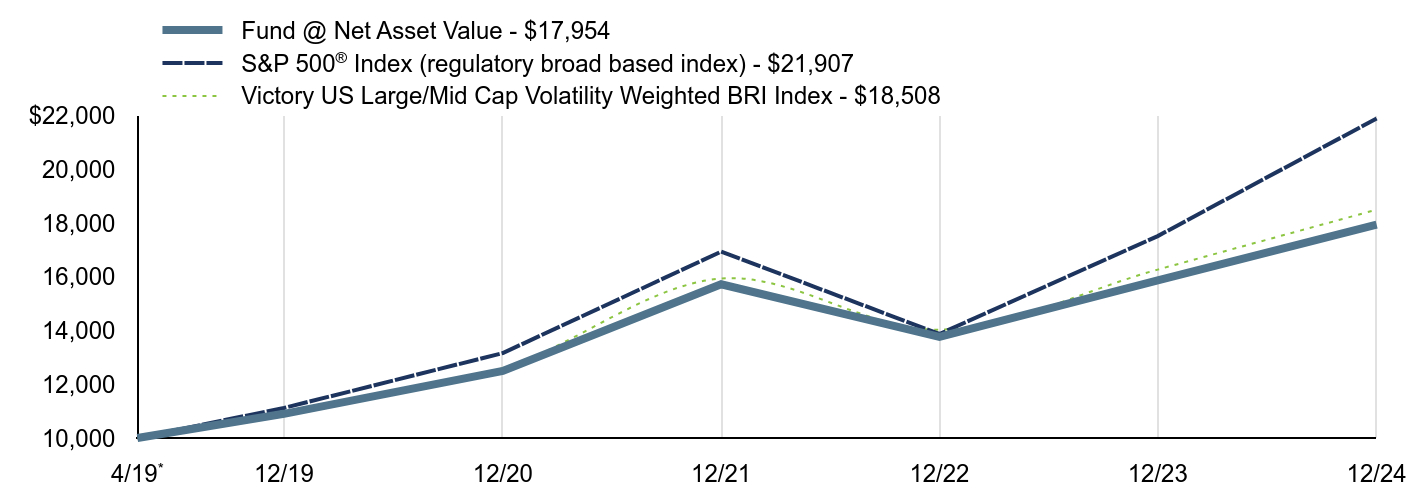

Growth of a $10,000 Investment

The graph reflects investment growth of a hypothetical investment of $10,000 in the Fund. The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

| Fund @ Net Asset Value - $17,954 | S&P 500® Index (regulatory broad based index) - $21,907 | Victory US Large/Mid Cap Volatility Weighted BRI Index - $18,508 |

|---|

4/19Footnote Reference* | $10,000 | $10,000 | $10,000 |

|---|

| 12/19 | $10,901 | $11,119 | $10,939 |

|---|

| 12/20 | $12,500 | $13,165 | $12,605 |

|---|

| 12/21 | $15,728 | $16,944 | $15,942 |

|---|

| 12/22 | $13,765 | $13,876 | $14,038 |

|---|

| 12/23 | $15,871 | $17,523 | $16,275 |

|---|

| 12/24 | $17,954 | $21,907 | $18,508 |

|---|

| Footnote | Description |

Footnote* | Inception date for the Timothy Plan US Large/Mid Cap Core ETF is 4/30/2019. |

AVERAGE ANNUAL TOTAL RETURN

| 1 Year | 5 Year | Since Inception |

|---|

| Fund @ Net Asset Value | 13.12%Footnote Reference | 10.49%Footnote Reference | 10.87%Footnote Reference |

|---|

S&P 500® IndexFootnote Reference1 | 25.02% | 14.53% | 14.83% |

|---|

Victory US Large/Mid Cap Volatility Weighted BRI IndexFootnote Reference2 | 13.72% | 11.09% | 11.47% |

|---|

| Footnote | Description |

Footnote | High double-digit returns are attributable, in part, to unusually favorable market conditions and may not be repeated or consistently achieved in the future. |

Footnote1 | The unmanaged S&P 500® Index is a market-capitalization-weighted index that measures the performance of the common stocks of 500 leading U.S. companies. |

Footnote2 | The universe for the Victory US Large/Mid Cap Volatility Weighted BRI Index begins with the largest U.S. companies by market capitalization with positive earnings in each of the four most recent quarters. The Index eliminates companies that do not satisfy the proprietary Biblically Responsible Investing ("BRI") filtering criteria. |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

| Net Assets | $267,798,092 |

|---|

| Number of Portfolio Holdings | 287 |

|---|

| Net Investment Advisory Fees | $1,252,267 |

|---|

| Portfolio Turnover Rate | 25% |

|---|

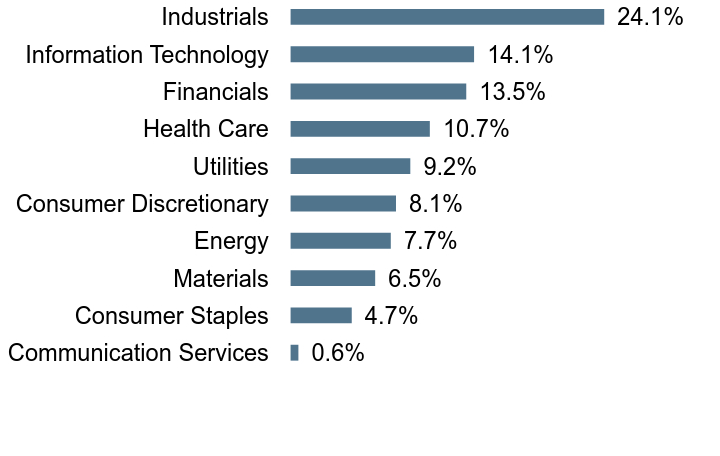

Graphical Presentation of Holdings

(as of 12/31/2024)

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference

| Value | Value |

|---|

| Communication Services | 0.6% |

| Consumer Staples | 4.7% |

| Materials | 6.5% |

| Energy | 7.7% |

| Consumer Discretionary | 8.1% |

| Utilities | 9.2% |

| Health Care | 10.7% |

| Financials | 13.5% |

| Information Technology | 14.1% |

| Industrials | 24.1% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference

| NiSource, Inc. | 0.7% |

| Republic Services, Inc. | 0.6% |

| Atmos Energy Corp. | 0.6% |

| Entergy Corp. | 0.6% |

| Kinder Morgan, Inc. | 0.6% |

| VeriSign, Inc. | 0.6% |

| Intercontinental Exchange, Inc. | 0.6% |

| Cheniere Energy, Inc. | 0.6% |

| Evergy, Inc. | 0.6% |

| Illinois Tool Works, Inc. | 0.6% |

* Does not include futures contracts, money market instruments, and short-term investments.

Utilize the Full Financials link below to refer to the Schedule of Portfolio Investments for a complete list of securities.

There were no material fund changes during the year ended December 31, 2024.

Additional information about the Fund is available on etf.timothyplan.com including:

Full Financial Statements

Prospectus

Fund Holdings

Proxy Voting

Contact us at 800.846.7526 or visit timothyplan.com/contact-us.

Timothy Plan High Dividend Stock ETF

Ticker: TPHD Exchange: NYSE

Annual Shareholder Report — December 31, 2024

The annual shareholder report contains important information about Timothy Plan High Dividend Stock ETF (the "Fund") for the period of January 1, 2024 to December 31, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at etf.timothyplan.com. You may also request more information by calling 800.846.7526 or visiting timothyplan.com/contact-us.

What were the Fund's costs for the last year

(based on a hypothetical $10,000 investment)

| FUND NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Timothy Plan High Dividend Stock ETF | $55 | 0.52% |

|---|

How did the Fund perform last year? What affected the Fund’s performance?

The Timothy Plan High Dividend Stock ETF (TPHD) seeks a rules-based approach that combines Biblically Responsible Investing (BRI) criteria with volatility weighting in an effort to outperform traditional indexing strategies. The rules-based volatility weighting methodology weights stocks based on volatility, so each stock in the portfolio has an equal contribution to overall risk.

In 2024, TPHD returned 11.99% NAV, underperforming the S&P 500® Index, which returned 25.02%.

An underweight in Healthcare contributed to relative performance. An overweight to Energy was a detractor to relative performance. Stock selection in the Information Technology sector contributed to relative performance.

The top three largest contributors to performance were Vistra Corp., Targa Resources Corp., and Kinder Morgan Inc. The largest stock detractors during the year were Celanese Corporation, Huntington Ingalls Industries, and Franklin Resources Inc.

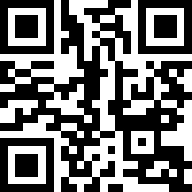

Growth of a $10,000 Investment

The graph reflects investment growth of a hypothetical investment of $10,000 in the Fund. The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

| Fund @ Net Asset Value - $16,533 | S&P 500® Index (regulatory broad based index) - $21,907 | Victory US Large Cap High Dividend Volatility Weighted BRI Index - $17,039 |

|---|

4/19Footnote Reference* | $10,000 | $10,000 | $10,000 |

|---|

| 12/19 | $10,900 | $11,119 | $10,937 |

|---|

| 12/20 | $10,773 | $13,165 | $10,859 |

|---|

| 12/21 | $13,799 | $16,944 | $13,987 |

|---|

| 12/22 | $13,540 | $13,876 | $13,813 |

|---|

| 12/23 | $14,763 | $17,523 | $15,134 |

|---|

| 12/24 | $16,533 | $21,907 | $17,039 |

|---|

| Footnote | Description |

Footnote* | Inception date for the Timothy Plan High Dividend Stock ETF is 4/30/2019. |

AVERAGE ANNUAL TOTAL RETURN

| 1 Year | 5 Year | Since Inception |

|---|

| Fund @ Net Asset Value | 11.99%Footnote Reference | 8.69% | 9.27% |

|---|

S&P 500® IndexFootnote Reference1 | 25.02% | 14.53% | 14.83% |

|---|

Victory US Large Cap High Dividend Volatility Weighted BRI IndexFootnote Reference2 | 12.59% | 9.27% | 9.85% |

|---|

| Footnote | Description |

Footnote | High double-digit returns are attributable, in part, to unusually favorable market conditions and may not be repeated or consistently achieved in the future. |

Footnote1 | The unmanaged S&P 500® Index is a market-capitalization-weighted index that measures the performance of the common stocks of 500 leading U.S. companies. |

Footnote2 | The Victory US Large Cap High Dividend Volatility Weighted BRI Index is comprised of the 100 highest dividend yielding stocks from the Victory US Large/Mid Cap Volatility Weighted BRI Index with positive earnings in each of the four most recent quarters. The universe of the Index begins with the largest US companies by market capitalization with positive earnings in each of the four most recent quarters. The Index eliminates companies that do not satisfy the proprietary Biblically Responsible Investing ("BRI") filtering criteria. |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

| Net Assets | $238,131,671 |

|---|

| Number of Portfolio Holdings | 101 |

|---|

| Net Investment Advisory Fees | $1,219,635 |

|---|

| Portfolio Turnover Rate | 34% |

|---|

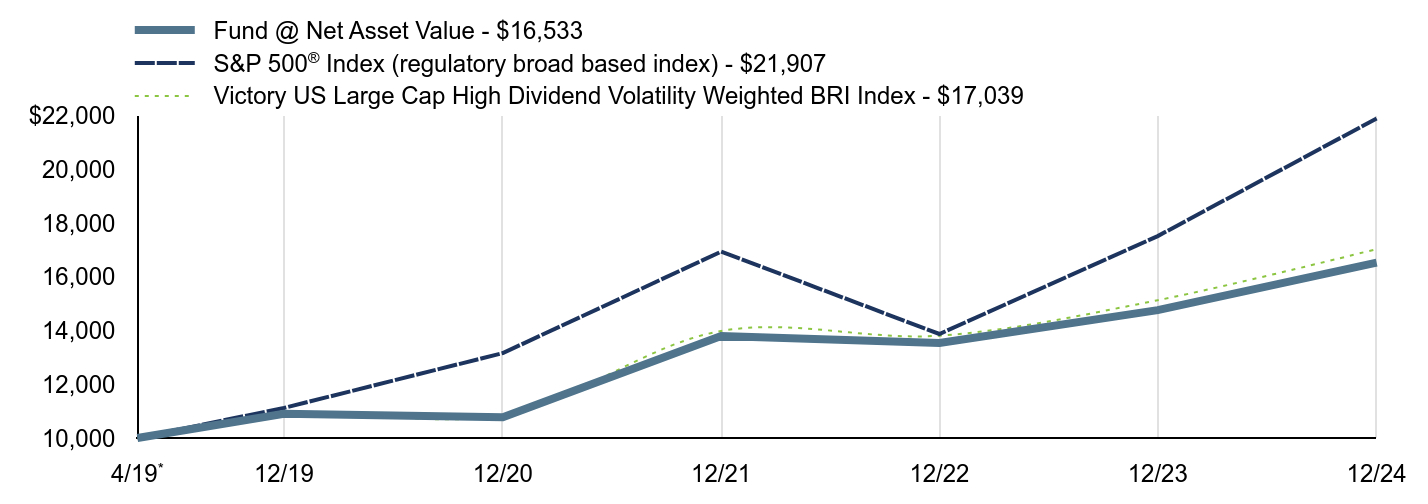

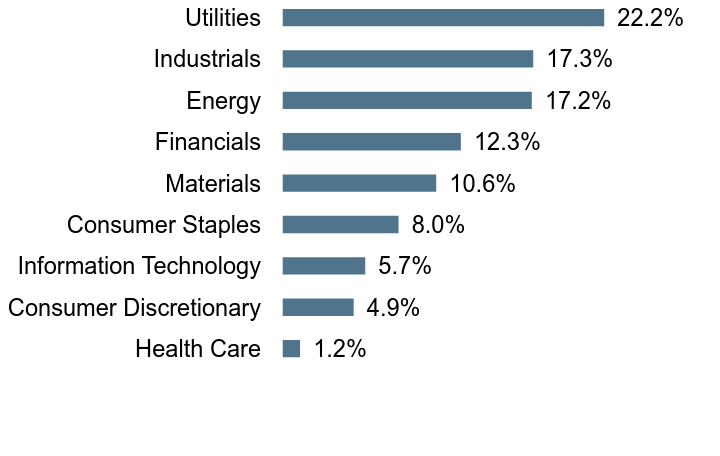

Graphical Presentation of Holdings

(as of 12/31/2024)

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference

| Value | Value |

|---|

| Health Care | 1.2% |

| Consumer Discretionary | 4.9% |

| Information Technology | 5.7% |

| Consumer Staples | 8.0% |

| Materials | 10.6% |

| Financials | 12.3% |

| Industrials | 17.3% |

| Energy | 17.3% |

| Utilities | 22.1% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference

| NiSource, Inc. | 1.6% |

| Atmos Energy Corp. | 1.6% |

| Entergy Corp. | 1.5% |

| Kinder Morgan, Inc. | 1.5% |

| Evergy, Inc. | 1.4% |

| Illinois Tool Works, Inc. | 1.4% |

| Ameren Corp. | 1.4% |

| Alliant Energy Corp. | 1.4% |

| The Williams Cos., Inc. | 1.4% |

| CMS Energy Corp. | 1.4% |

* Does not include futures contracts, money market instruments, and short-term investments.

Utilize the Full Financials link below to refer to the Schedule of Portfolio Investments for a complete list of securities.

There were no material fund changes during the year ended December 31, 2024.

Additional information about the Fund is available on etf.timothyplan.com including:

Full Financial Statements

Prospectus

Fund Holdings

Proxy Voting

Contact us at 800.846.7526 or visit timothyplan.com/contact-us.

Timothy Plan International ETF

Ticker: TPIF Exchange: NYSE

Annual Shareholder Report — December 31, 2024

The annual shareholder report contains important information about Timothy Plan International ETF (the "Fund") for the period of January 1, 2024 to December 31, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at etf.timothyplan.com. You may also request more information by calling 800.846.7526 or visiting timothyplan.com/contact-us.

What were the Fund's costs for the last year

(based on a hypothetical $10,000 investment)

| FUND NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Timothy Plan International ETF | $63 | 0.62% |

|---|

How did the Fund perform last year? What affected the Fund’s performance?

The Timothy Plan International ETF (TPIF) seeks a rules-based approach that combines Biblically Responsible Investing (BRI) criteria with volatility weighting in an effort to outperform traditional indexing strategies. The rules-based volatility weighting methodology weights stocks based on volatility, so each stock in the portfolio has an equal contribution to overall risk.

In 2024, TPIF returned 2.77% NAV, underperforming the MSCI EAFE Index (the “Index”), which returned 3.82%.

An overweight in the Healthcare sector was a contributor to relative performance. An overweight in the Materials sector was a detractor to relative performance.

At the country level, stock selection in Japan was a detractor to relative performance. An overweight to Canada contributed to relative performance.

The top three largest contributors to performance were Mitsubishi Heavy Industries, Rheinmetall, and Hitachi. The largest stock detractors during the year were Oriental Land Co., Edenred SA, and Neste Corporation.

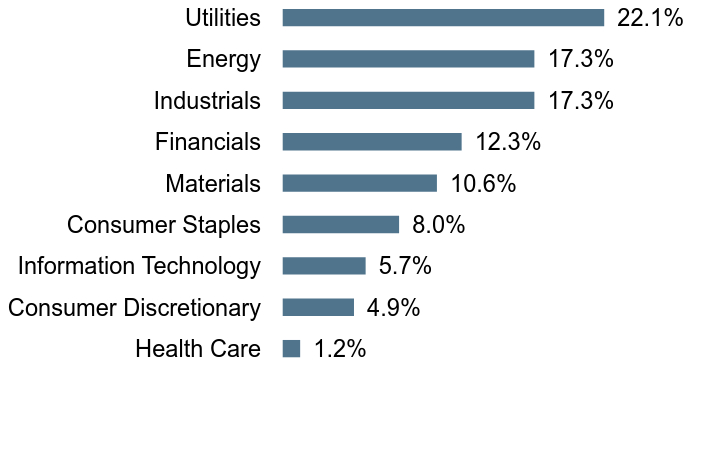

Growth of a $10,000 Investment

The graph reflects investment growth of a hypothetical investment of $10,000 in the Fund. The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

| Fund @ Net Asset Value - $12,063 | MSCI EAFE Index (regulatory broad based index) - $13,051 | Victory International Volatility Weighted BRI Index - $12,478 |

|---|

12/19Footnote Reference* | $10,000 | $10,000 | $10,000 |

|---|

| 12/19 | $10,325 | $10,360 | $10,339 |

|---|

| 12/20 | $11,116 | $11,169 | $11,221 |

|---|

| 12/21 | $12,266 | $12,427 | $12,419 |

|---|

| 12/22 | $10,083 | $10,631 | $10,245 |

|---|

| 12/23 | $11,738 | $12,570 | $12,054 |

|---|

| 12/24 | $12,063 | $13,051 | $12,478 |

|---|

| Footnote | Description |

Footnote* | Inception date for the Timothy Plan International ETF is 12/2/2019. |

AVERAGE ANNUAL TOTAL RETURN

| 1 Year | 5 Year | Since Inception |

|---|

| Fund @ Net Asset Value | 2.77% | 3.16% | 3.76% |

|---|

MSCI EAFE IndexFootnote Reference1 | 3.82% | 4.73% | 5.38% |

|---|

Victory International Volatility Weighted BRI IndexFootnote Reference2 | 3.52% | 3.83% | 4.46% |

|---|

| Footnote | Description |

Footnote1 | The MSCI EAFE Index is an equity index that captures large-cap and mid-cap representation across Developed markets countries around the world. The index reflects the reinvestment of dividends paid on the stocks constituting the index, net of withholding taxes. |

Footnote2 | The universe for the Victory International Volatility Weighted BRI Index begins with the largest developed international companies by market capitalization with positive earnings in each of the four most recent quarters. The Index eliminates companies that do not satisfy the proprietary Biblically Responsible Investing ("BRI") filtering criteria. |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

| Net Assets | $112,124,993 |

|---|

| Number of Portfolio Holdings | 362 |

|---|

| Net Investment Advisory Fees | $668,453 |

|---|

| Portfolio Turnover Rate | 35% |

|---|

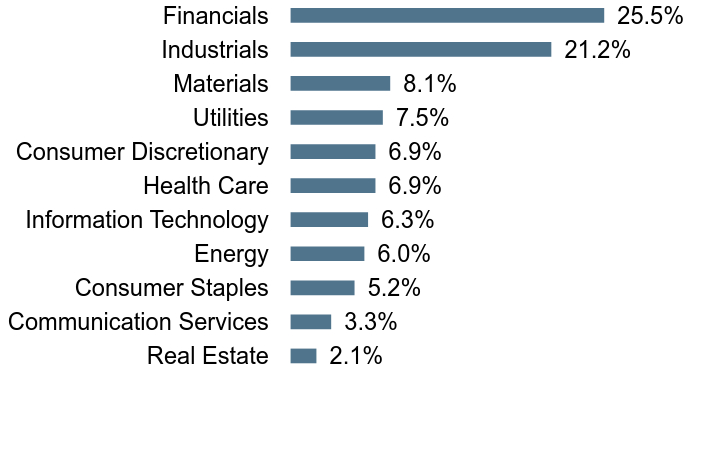

Graphical Presentation of Holdings

(as of 12/31/2024)

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference

| Value | Value |

|---|

| Real Estate | 2.1% |

| Communication Services | 3.3% |

| Consumer Staples | 5.2% |

| Energy | 6.0% |

| Information Technology | 6.3% |

| Health Care | 6.9% |

| Consumer Discretionary | 6.9% |

| Utilities | 7.5% |

| Materials | 8.1% |

| Industrials | 21.2% |

| Financials | 25.5% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference

| Hydro One Ltd. | 0.6% |

| London Stock Exchange Group PLC | 0.6% |

| United Overseas Bank Ltd. | 0.6% |

| Fortis, Inc. | 0.5% |

| Waste Connections, Inc. | 0.5% |

| Metro, Inc. | 0.5% |

| Oversea-Chinese Banking Corp. Ltd. | 0.5% |

| Pembina Pipeline Corp. | 0.5% |

| DBS Group Holdings Ltd. | 0.5% |

| Wolters Kluwer NV | 0.5% |

* Does not include futures contracts, money market instruments, and short-term investments.

Utilize the Full Financials link below to refer to the Schedule of Portfolio Investments for a complete list of securities.

There were no material fund changes during the year ended December 31, 2024.

Additional information about the Fund is available on etf.timothyplan.com including:

Full Financial Statements

Prospectus

Fund Holdings

Proxy Voting

Contact us at 800.846.7526 or visit timothyplan.com/contact-us.

Timothy Plan US Large/Mid Cap Core Enhanced ETF

Ticker: TPLE Exchange: NYSE

Annual Shareholder Report — December 31, 2024

The annual shareholder report contains important information about Timothy Plan US Large/Mid Cap Core Enhanced ETF (the "Fund") for the period of January 1, 2024 to December 31, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at etf.timothyplan.com. You may also request more information by calling 800.846.7526 or visiting timothyplan.com/contact-us.

What were the Fund's costs for the last year

(based on a hypothetical $10,000 investment)

| FUND NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Timothy Plan US Large/Mid Cap Core Enhanced ETF | $55 | 0.52% |

|---|

How did the Fund perform last year? What affected the Fund’s performance?

The Timothy Plan US Large/Mid Cap Core Enhanced ETF (TPLE) seeks a rules-based approach that combines Biblically Responsible Investing (BRI) criteria with volatility weighting in an effort to outperform traditional indexing strategies. The rules-based volatility weighting methodology weights stocks based on volatility, so each stock in the portfolio has an equal contribution to overall risk. In addition, the fund seeks to manage risk during times of significant market decline by employing a rules-based mathematical formula to reduce exposure in the equity markets by moving to cash equivalents.

In 2024, TPLE returned 13.18% NAV, underperforming the S&P 500® Index (the “Index”), which returned 25.02%.

As a result of tactical allocation, the portfolio was invested in 100% equities for the year.

An underweight in Real Estate contributed to relative performance, with stock selection in the Energy sector also contributing. An underweight and stock selection in Information Technology was a detractor to relative performance.

The top three largest contributors to performance were Vistra, AppLovin Corp., and Howmet Aerospace. The largest stock detractors to performance during the year were Celanese Corporation, Five Below Inc., and Dollar Tree, Inc.

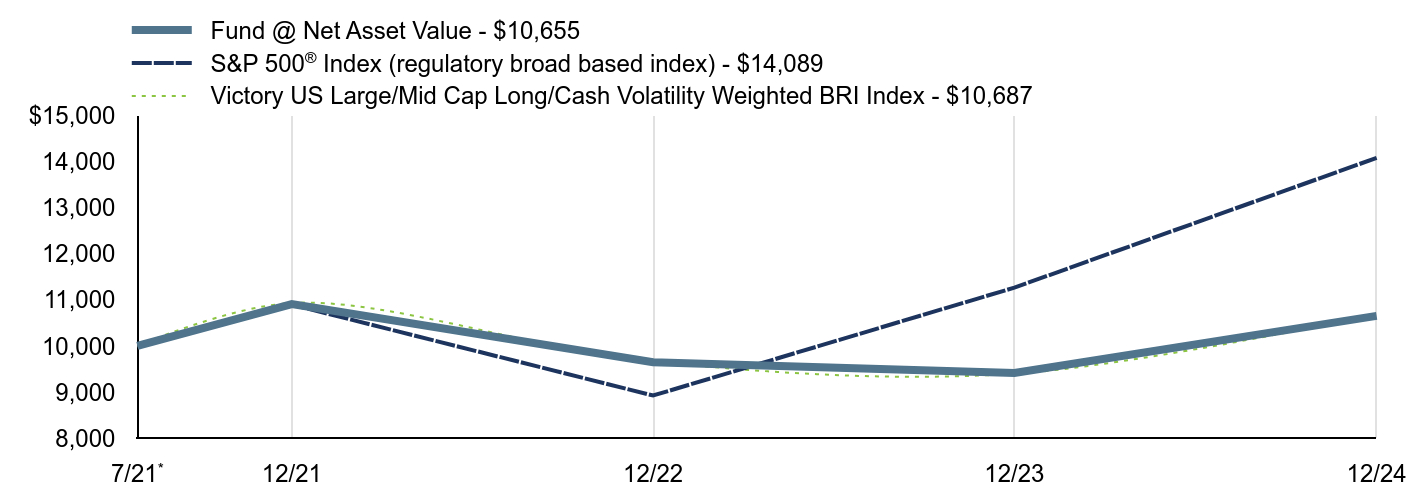

Growth of a $10,000 Investment

The graph reflects investment growth of a hypothetical investment of $10,000 in the Fund. The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

| Fund @ Net Asset Value - $10,655 | S&P 500® Index (regulatory broad based index) - $14,089 | Victory US Large/Mid Cap Long/Cash Volatility Weighted BRI Index - $10,687 |

|---|

7/21Footnote Reference* | $10,000 | $10,000 | $10,000 |

|---|

| 12/21 | $10,909 | $10,897 | $10,935 |

|---|

| 12/22 | $9,646 | $8,923 | $9,660 |

|---|

| 12/23 | $9,414 | $11,269 | $9,397 |

|---|

| 12/24 | $10,655 | $14,089 | $10,687 |

|---|

| Footnote | Description |

Footnote* | Inception date for the Timothy Plan US Large/Mid Cap Core Enhanced ETF is 7/28/2021. |

AVERAGE ANNUAL TOTAL RETURN

| 1 Year | Since Inception |

|---|

| Fund @ Net Asset Value | 13.18%Footnote Reference | 1.87% |

|---|

S&P 500® IndexFootnote Reference1 | 25.02% | 10.52% |

|---|

Victory US Large/Mid Cap Long/Cash Volatility Weighted BRI IndexFootnote Reference2 | 13.72% | 1.96% |

|---|

| Footnote | Description |

Footnote | High double-digit returns are attributable, in part, to unusually favorable market conditions and may not be repeated or consistently achieved in the future. |

Footnote1 | The unmanaged S&P 500® Index is a market-capitalization-weighted index that measures the performance of the common stocks of 500 leading U.S. companies. |

Footnote2 | The universe for the Victory US Large/Mid Cap Long/Cash Volatility Weighted BRI Index begins with the largest U.S. companies by market capitalization with positive earnings in each of the four most recent quarters. The Index eliminates companies that do not satisfy the proprietary Biblically Responsible Investing ("BRI") filtering criteria. |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

| Net Assets | $70,383,119 |

|---|

| Number of Portfolio Holdings | 288 |

|---|

| Net Investment Advisory Fees | $362,057 |

|---|

| Portfolio Turnover Rate | 29% |

|---|

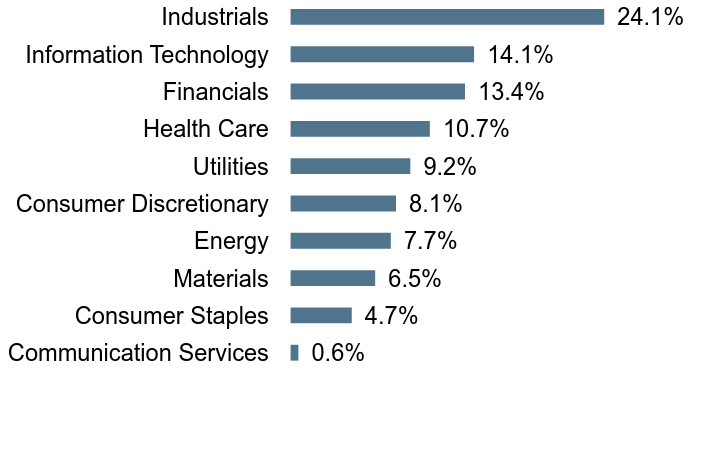

Graphical Presentation of Holdings

(as of 12/31/2024)

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference

| Value | Value |

|---|

| Communication Services | 0.6% |

| Consumer Staples | 4.7% |

| Materials | 6.5% |

| Energy | 7.7% |

| Consumer Discretionary | 8.1% |

| Utilities | 9.2% |

| Health Care | 10.7% |

| Financials | 13.4% |

| Information Technology | 14.1% |

| Industrials | 24.1% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference

| NiSource, Inc. | 0.7% |

| Republic Services, Inc. | 0.6% |

| Atmos Energy Corp. | 0.6% |

| Entergy Corp. | 0.6% |

| Kinder Morgan, Inc. | 0.6% |

| VeriSign, Inc. | 0.6% |

| Intercontinental Exchange, Inc. | 0.6% |

| Cheniere Energy, Inc. | 0.6% |

| Evergy, Inc. | 0.6% |

| Illinois Tool Works, Inc. | 0.6% |

* Does not include futures contracts, money market instruments, and short-term investments.

Utilize the Full Financials link below to refer to the Schedule of Portfolio Investments for a complete list of securities.

There were no material fund changes during the year ended December 31, 2024.

Additional information about the Fund is available on etf.timothyplan.com including:

Full Financial Statements

Prospectus

Fund Holdings

Proxy Voting

Contact us at 800.846.7526 or visit timothyplan.com/contact-us.

Timothy Plan High Dividend Stock Enhanced ETF

Ticker: TPHE Exchange: NYSE

Annual Shareholder Report — December 31, 2024

The annual shareholder report contains important information about Timothy Plan High Dividend Stock Enhanced ETF (the "Fund") for the period of January 1, 2024 to December 31, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at etf.timothyplan.com. You may also request more information by calling 800.846.7526 or visiting timothyplan.com/contact-us.

What were the Fund's costs for the last year

(based on a hypothetical $10,000 investment)

| FUND NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Timothy Plan High Dividend Stock Enhanced ETF | $55 | 0.52% |

|---|

How did the Fund perform last year? What affected the Fund’s performance?

The Timothy Plan High Dividend Stock Enhanced ETF (TPHE) seeks a rules-based approach that combines Biblically Responsible Investing (BRI) criteria with volatility weighting in an effort to outperform traditional indexing strategies. The rules-based volatility weighting methodology weights stocks based on volatility, so each stock in the portfolio has an equal contribution to overall risk. In addition, the fund seeks to manage risk during times of significant market decline by employing a rules-based mathematical formula to reduce exposure in the equity markets by moving to cash equivalents.

In 2024, TPHE returned 12.01% NAV, underperforming the S&P® 500 Index, which returned 25.02%.

As a result of tactical allocation, the portfolio was invested in 100% equities for the year.

An underweight in Healthcare contributed to relative performance. An overweight to Energy was a detractor to relative performance. Stock selection in the Information Technology sector contributed to relative performance.

The top three largest contributors to performance were Vistra Corp., Targa Resources Corp., and Kinder Morgan Inc. The largest stock detractors during the year were Celanese Corporation, Huntington Ingalls Industries, and Franklin Resources Inc.

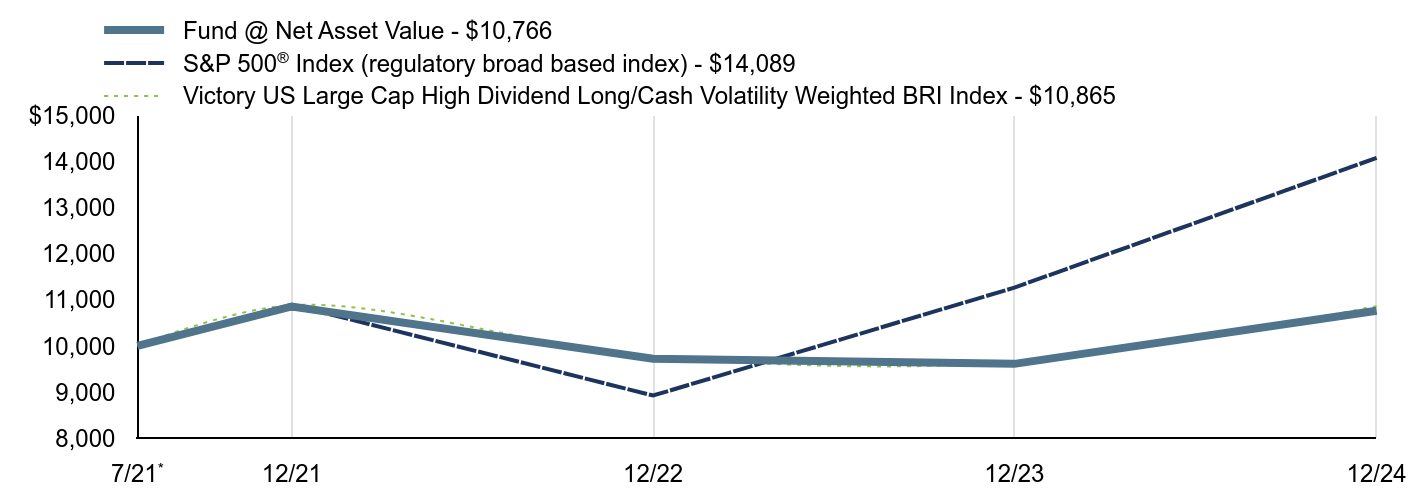

Growth of a $10,000 Investment

The graph reflects investment growth of a hypothetical investment of $10,000 in the Fund. The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

| Fund @ Net Asset Value - $10,766 | S&P 500® Index (regulatory broad based index) - $14,089 | Victory US Large Cap High Dividend Long/Cash Volatility Weighted BRI Index - $10,865 |

|---|

7/21Footnote Reference* | $10,000 | $10,000 | $10,000 |

|---|

| 12/21 | $10,859 | $10,897 | $10,887 |

|---|

| 12/22 | $9,725 | $8,923 | $9,773 |

|---|

| 12/23 | $9,612 | $11,269 | $9,650 |

|---|

| 12/24 | $10,766 | $14,089 | $10,865 |

|---|

| Footnote | Description |

Footnote* | Inception date for the Timothy Plan High Dividend Stock Enhanced ETF is 7/28/2021. |

AVERAGE ANNUAL TOTAL RETURN

| 1 Year | Since Inception |

|---|

| Fund @ Net Asset Value | 12.01%Footnote Reference | 2.18% |

|---|

S&P 500® IndexFootnote Reference1 | 25.02% | 10.52% |

|---|

Victory US Large Cap High Dividend Long/Cash Volatility Weighted BRI IndexFootnote Reference2 | 12.59% | 2.45% |

|---|

| Footnote | Description |

Footnote | High double-digit returns are attributable, in part, to unusually favorable market conditions and may not be repeated or consistently achieved in the future. |

Footnote1 | The unmanaged S&P 500® Index is a market-capitalization-weighted index that measures the performance of the common stocks of 500 leading U.S. companies. |

Footnote2 | The Victory Large Cap High Dividend Volatility Long/Cash Weighted BRI Index is comprised of the 100 highest dividend yielding stocks from the Victory US Large/Mid Cap Volatility Weighted BRI Index with positive earnings in each of the four most recent quarters. The universe for the Index begins with the largest US companies by market capitalization with positive earnings in each of the four most recent quarters. The Index eliminates companies that do not satisfy the proprietary Biblically Responsible Investing ("BRI") filtering criteria. |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

| Net Assets | $64,550,447 |

|---|

| Number of Portfolio Holdings | 102 |

|---|

| Net Investment Advisory Fees | $350,498 |

|---|

| Portfolio Turnover Rate | 39% |

|---|

Graphical Presentation of Holdings

(as of 12/31/2024)

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference

| Value | Value |

|---|

| Health Care | 1.2% |

| Consumer Discretionary | 4.9% |

| Information Technology | 5.7% |

| Consumer Staples | 8.0% |

| Materials | 10.6% |

| Financials | 12.3% |

| Energy | 17.2% |

| Industrials | 17.3% |

| Utilities | 22.2% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference

| NiSource, Inc. | 1.6% |

| Atmos Energy Corp. | 1.6% |

| Entergy Corp. | 1.5% |

| Kinder Morgan, Inc. | 1.5% |

| Evergy, Inc. | 1.4% |

| Illinois Tool Works, Inc. | 1.4% |

| Ameren Corp. | 1.4% |

| Alliant Energy Corp. | 1.4% |

| The Williams Cos., Inc. | 1.4% |

| CMS Energy Corp. | 1.4% |

* Does not include futures contracts, money market instruments, and short-term investments.

Utilize the Full Financials link below to refer to the Schedule of Portfolio Investments for a complete list of securities.

There were no material fund changes during the year ended December 31, 2024.

Additional information about the Fund is available on etf.timothyplan.com including:

Full Financial Statements

Prospectus

Fund Holdings

Proxy Voting

Contact us at 800.846.7526 or visit timothyplan.com/contact-us.

Timothy Plan Market Neutral ETF

Ticker: TPMN Exchange: NYSE

Annual Shareholder Report — December 31, 2024

The annual shareholder report contains important information about Timothy Plan Market Neutral ETF (the "Fund") for the period of January 1, 2024 to December 31, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at etf.timothyplan.com. You may also request more information by calling 800.846.7526 or visiting timothyplan.com/contact-us.

What were the Fund's costs for the last year

(based on a hypothetical $10,000 investment)

| FUND NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Timothy Plan Market Neutral ETF | $65 | 0.65% |

|---|

How did the Fund perform last year? What affected the Fund’s performance?

The Timothy Plan Market Neutral ETF (TPMN) pursues its investment objective by implementing a proprietary, "market neutral" investment strategy designed to seek income from its investments while maintaining a low correlation to the foreign and domestic equity and bond markets. The fund is actively managed, meaning that the Sub-Advisor may make changes to the Fund's portfolio at any time. The Fund uses a multi-strategy approach. First, it seeks income from long positions in foreign and domestic dividend producing equity securities of any market capitalization size that satisfy the Biblically Responsible Investing ("BRI") filtering criteria. Second, the Fund seeks to offset market risk by selling short high-correlating equity index futures contracts, such as the S&P 500® Index, Russell 2000® or MSCI EAFE + Emerging Markets Indexes, or exchange-traded funds ("ETFs") that track such indexes.

In 2024, TPMN returned 1.39% NAV, outperforming the Bloomberg U.S. Aggregate Bond Index (the “Index”), which returned 1.25%.

The Fund’s total return was driven by a positive contribution from the Global High Dividend Long/Short Portfolio which was enough to offset the negative contribution of Overlay Strategy. Cash has been a positive contributor. In the Global High Dividend Long/Short Portfolio, all sleeves were positive contributors. In the Overlay Strategy, gains from the Nasdaq 100 Index long futures were not enough to offset the negative return of the S&P 500 Index short position, resulting in a negative total contribution.

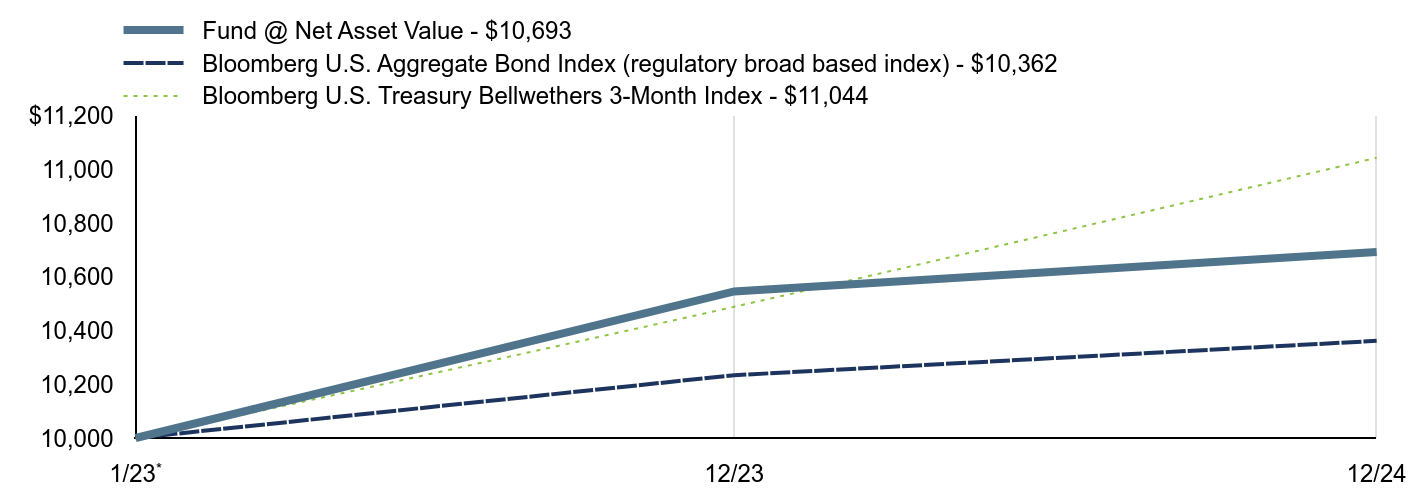

Growth of a $10,000 Investment

The graph reflects investment growth of a hypothetical investment of $10,000 in the Fund. The graph and table total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, or redemption of shares.

| Fund @ Net Asset Value - $10,693 | Bloomberg U.S. Aggregate Bond Index (regulatory broad based index) - $10,362 | Bloomberg U.S. Treasury Bellwethers 3-Month Index - $11,044 |

|---|

1/23Footnote Reference* | $10,000 | $10,000 | $10,000 |

|---|

| 12/23 | $10,546 | $10,234 | $10,489 |

|---|

| 12/24 | $10,693 | $10,362 | $11,044 |

|---|

| Footnote | Description |

Footnote* | Inception date for the Timothy Plan Market Neutral ETF is 1/24/2023. |

AVERAGE ANNUAL TOTAL RETURN

| 1 Year | Since Inception |

|---|

| Fund @ Net Asset Value | 1.39% | 3.52% |

|---|

Bloomberg U.S. Aggregate Bond IndexFootnote Reference1 | 1.25% | 1.86% |

|---|

Bloomberg U.S. Treasury Bellwethers 3-Month IndexFootnote Reference2 | 5.29% | 5.27% |

|---|

| Footnote | Description |

Footnote1 | The unmanaged Bloomberg U.S. Aggregate Bond Index measures the investment grade, USD-denominated, fixed rate taxable bond market. The index includes Treasurys, government-related and corporate securities, and asset backed securities. |

Footnote2 | The unmanaged Bloomberg U.S. Treasury Bellwethers 3-Month Index represents the total return received by investors of 3-month U.S. Treasury securities. |

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

| Net Assets | $41,703,293 |

|---|

| Number of Portfolio Holdings | 300 |

|---|

| Net Investment Advisory Fees | $257,351 |

|---|

| Portfolio Turnover Rate | 35% |

|---|

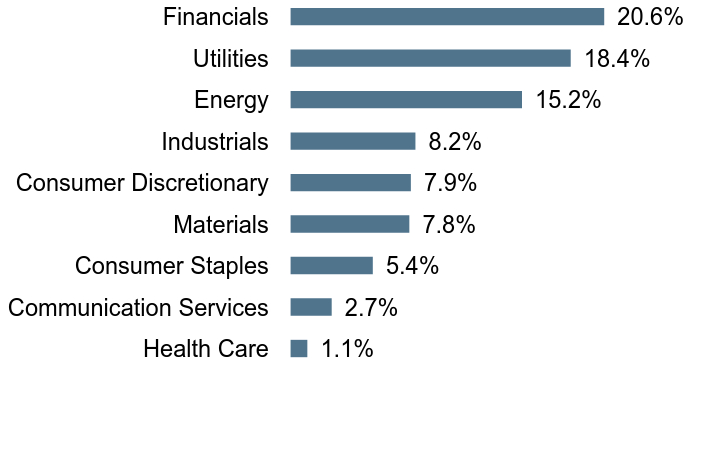

Graphical Presentation of Holdings

(as of 12/31/2024)

Top SectorsFootnote Reference* (% of Net Assets)Footnote Reference

| Value | Value |

|---|

| Health Care | 1.1% |

| Communication Services | 2.7% |

| Consumer Staples | 5.4% |

| Materials | 7.8% |

| Consumer Discretionary | 7.9% |

| Industrials | 8.2% |

| Energy | 15.2% |

| Utilities | 18.4% |

| Financials | 20.6% |

Top 10 HoldingsFootnote Reference* (% of Net Assets)Footnote Reference

| TXNM Energy, Inc. | 0.8% |

| DT Midstream, Inc. | 0.7% |

| ACS Actividades de Construccion y Servicios SA | 0.7% |

| Keyera Corp. | 0.7% |

| Pembina Pipeline Corp. | 0.6% |

| Spire, Inc. | 0.6% |

| Intesa Sanpaolo SpA | 0.6% |

| NiSource, Inc. | 0.6% |

| ANZ Group Holdings Ltd. | 0.6% |

| Mediobanca Banca di Credito Finanziario SpA | 0.6% |

* Does not include futures contracts, money market instruments, and short-term investments.

Utilize the Full Financials link below to refer to the Schedule of Portfolio Investments for a complete list of securities.

There were no material fund changes during the year ended December 31, 2024.

Additional information about the Fund is available on etf.timothyplan.com including:

Full Financial Statements

Prospectus

Fund Holdings

Proxy Voting

Contact us at 800.846.7526 or visit timothyplan.com/contact-us.

(b) Not applicable.

Item 2. Code of Ethics.

As of the end of the period covered by this report, the Registrant has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the Registrant or a third party (the “Code of Ethics”). During the period covered by this report, there were no amendments, nor did the Registrant grant any waivers, including any implicit waivers, from any provision of the Code of Ethics. The Code of Ethics is attached hereto as Exhibit 19(a)(1) of this Form.

Item 3. Audit Committee Financial Expert.

The Registrant’s Board of Trustees has determined that the Registrant has at least one “audit committee financial expert” (as defined in Item 3 of Form N-CSR) serving on its audit committee. Dale Bissonette is an “audit committee financial expert” and is “independent” (as each term is defined in Item 3 of Form N-CSR).

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees. Fees for audit services provided to the Registrant were $92,250 and $92,250 for the fiscal years ended December 31, 2024 and 2023, respectively.

(b) Audit-Related Fees. The aggregate fees billed in each of the last two fiscal years for audit-related services by the principal accountant that are reasonably related to the performance of the audit of the Registrant’s financial statements and are not reported under paragraph (a) of this item were $0 and $0 for the fiscal years ended December 31, 2024 and 2023, respectively. The fees, paid by the Registrant, were payment for the principal accountant performing work relating to assurance and related services.

(c) Tax Fees. Fees for tax services, which consisted of income and excise tax compliance services, were $21,000 and $21,000 for the fiscal years ended December 31, 2024, and 2023, respectively.

(d) All Other Fees. Fees for other services totaled $0 and $0 for the fiscal years ended December 31, 2024, and 2023, respectively.

(e) (1) The Registrant’s Audit Committee has adopted Pre-Approval Policies and Procedures. The Audit Committee must pre-approve all audit services and non-audit services that the principal accountant provides to the Registrant. The Audit Committee must also pre-approve any engagement of the principal accountant to provide non-audit services to the Registrant’s investment adviser, or any affiliate of the adviser that provides ongoing services to the Registrant, if such non-audit services directly impact the Registrant’s operations and financial reporting.

(2) 100% of services described in items (b) were pre-approved by the Audit Committee pursuant to Rule 2 01(c)(7)(i)(c) of Regulation S-X for the fiscal years ended December 31, 2024, and 2023

(f) Not applicable

(g) The aggregate fees billed by the principal accountant for non-audit services to the Registrant, the Registrant’s investment adviser and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant were $21,000 and $21,000 for the years ended December 31, 2024 and 2023, respectively.

(h) The Registrant’s Audit Committee has considered whether the provision of non-audit services that were rendered to the Registrant’s investment adviser, and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal auditor’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

The Registrant is a listed issuer as defined in Rule 10A-3 under the Exchange Act and has a separately-designated standing audit committee established in accordance with Section

3(a)(58)(A) of the Exchange Act. The Registrant’s audit committee members are Mr. Dale Bissonette, Mr. John Mulder, Mr. Scott Preissler and Mr. Richard Copeland.

Item 6. Investments.

(a) The Schedule of Investments as of the close of the reporting period are included as part of the report to shareholders filed under Item 7 of the Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Other Information.

(a)

ANNUAL

Full

Financials

December

31,

2024

Listed

and

traded

on:

The

New

York

Stock

Exchange

Ticker

Symbol

TIMOTHY

PLAN

US

SMALL

CAP

CORE

ETF

TPSC

TIMOTHY

PLAN

US

LARGE/MID

CAP

CORE

ETF

TPLC

TIMOTHY

PLAN

HIGH

DIVIDEND

STOCK

ETF

TPHD

TIMOTHY

PLAN

INTERNATIONAL

ETF

TPIF

TIMOTHY

PLAN

US

LARGE/MID

CAP

CORE

ENHANCED

ETF

TPLE

TIMOTHY

PLAN

HIGH

DIVIDEND

STOCK

ENHANCED

ETF

TPHE

TIMOTHY

PLAN

MARKET

NEUTRAL

ETF

TPMN

•

NOT

FDIC

INSURED

•NO

BANK

GUARANTEE

•

MAY

LOSE

VALUE

•

INVESTMENTS

INVOLVE

RISK

•

PRINCIPAL

LOSS

IS

POSSIBLE

Schedule

of

Portfolio

Investments

3

Statements

of

Assets

and

Liabilities

33

Statements

of

Operations

37

Statements

of

Changes

in

Net

Assets

41

Financial

Highlights

45

Notes

to

Financial

Statements

52

Report

of

Independent

Registered

Public

Accounting

Firm

63

Other

Information

(Unaudited)

65

Schedule

of

Portfolio

Investments

December

31,

2024

Timothy

Plan

US

Small

Cap

Core

ETF

See

notes

to

financial

statements.

SECURITY

DESCRIPTION

SHARES

VALUE

($)

Common

Stocks

(99.7%)

Communication

Services

(

1

.4

%

):

Cable

One,

Inc.

782

283,178

Cogent

Communications

Holdings,

Inc.

4,175

321,767

Integral

Ad

Science

Holding

Corp.(a)

17,188

179,443

Iridium

Communications,

Inc.

10,252

297,513

Madison

Square

Garden

Entertainment

Corp.(a)

11,095

394,982

Madison

Square

Garden

Sports

Corp.(a)

2,863

646,122

United

States

Cellular

Corp.(a)

3,571

223,973

2,346,978

Consumer

Discretionary

(

12

.7

%

):

Academy

Sports

&

Outdoors,

Inc.

6,006

345,525

Acushnet

Holdings

Corp.

6,614

470,123

Adient

PLC(a)

14,065

242,340

Adtalem

Global

Education,

Inc.(a)

3,855

350,227

Arhaus,

Inc.

19,515

183,441

Asbury

Automotive

Group,

Inc.(a)

1,506

366,003

Atmus

Filtration

Technologies,

Inc.

9,206

360,691

Boot

Barn

Holdings,

Inc.(a)

1,760

267,203

Brinker

International,

Inc.(a)

3,418

452,167

Brunswick

Corp.

4,296

277,865

Carter's,

Inc.

7,198

390,060

Carvana

Co.(a)

716

145,606

Cava

Group,

Inc.(a)

1,594

179,803

Cavco

Industries,

Inc.(a)

787

351,183

Century

Communities,

Inc.

3,145

230,717

Champion

Homes,

Inc.(a)

2,948

259,719

Chewy,

Inc.,

Class

A(a)

6,304

211,121

Columbia

Sportswear

Co.

6,492

544,874

Dillard's,

Inc.,

Class

A

807

348,414

Dorman

Products,

Inc.(a)

3,232

418,706

Dream

Finders

Homes,

Inc.,

Class

A(a)

6,093

141,784

Dutch

Bros,

Inc.,

Class

A(a)

7,626

399,450

Fox

Factory

Holding

Corp.(a)

4,854

146,931

Frontdoor,

Inc.(a)

7,618

416,476

Garrett

Motion,

Inc.(a)

40,424

365,029

Graham

Holdings

Co.,

Class

B

541

471,709

Grand

Canyon

Education,

Inc.(a)

4,416

723,341

Green

Brick

Partners,

Inc.(a)

4,188

236,580

Group

1

Automotive,

Inc.

1,043

439,604

Harley-Davidson,

Inc.

8,818

265,686

Hilton

Grand

Vacations,

Inc.(a)

9,800

381,710

Installed

Building

Products,

Inc.

1,066

186,816

KB

Home

4,099

269,386

Kontoor

Brands,

Inc.

4,628

395,277

Laureate

Education,

Inc.(a)

27,424

501,585

La-Z-Boy,

Inc.

7,836

341,415

LCI

Industries

2,579

266,643

LGI

Homes,

Inc.(a)

2,246

200,792

Life

Time

Group

Holdings,

Inc.(a)

11,500

254,380

SECURITY

DESCRIPTION

SHARES

VALUE

($)

Consumer

Discretionary

(12.7%):

(continued)

Lucky

Strike

Entertainment

Corp.

19,249

192,682

M/I

Homes,

Inc.(a)

1,769

235,189

Mister

Car

Wash,

Inc.(a)

45,462

331,418

Modine

Manufacturing

Co.(a)

1,400

162,302

Ollie's

Bargain

Outlet

Holdings,

Inc.(a)

3,286

360,573

OneSpaWorld

Holdings

Ltd.

22,098

439,750

Patrick

Industries,

Inc.

4,088

339,631

Phinia,

Inc.

7,213

347,450

Polaris,

Inc.

4,366

251,569

RH(a)

534

210,177

Sonic

Automotive,

Inc.,

Class

A

5,748

364,136

Steven

Madden

Ltd.

9,706

412,699

Strategic

Education,

Inc.

3,475

324,634

Stride,

Inc.(a)

5,721

594,584

The

Buckle,

Inc.

8,639

438,948

The

Cheesecake

Factory,

Inc.

8,785

416,760

The

Wendy's

Co.

25,988

423,604

Topgolf

Callaway

Brands

Corp.(a)

25,208

198,135

Tri

Pointe

Homes,

Inc.(a)

8,515

308,754

United

Parks

&

Resorts,

Inc.(a)

6,685

375,630

Upbound

Group,

Inc.

12,452

363,225

Valvoline,

Inc.(a)

10,963

396,641

Visteon

Corp.(a)

4,226

374,931

Winnebago

Industries,

Inc.

6,110

291,936

Worthington

Enterprises,

Inc.

8,493

340,654

YETI

Holdings,

Inc.(a)

6,031

232,254

21,528,648

Consumer

Staples

(

5

.2

%

):

Cal-Maine

Foods,

Inc.

5,592

575,529

Central

Garden

&

Pet

Co.,

Class

A(a)

13,305

439,730

Edgewell

Personal

Care

Co.

14,581

489,922

Energizer

Holdings,

Inc.

14,923

520,663

Flowers

Foods,

Inc.

27,715

572,592

Freshpet,

Inc.(a)

2,249

333,099

Grocery

Outlet

Holding

Corp.(a)

17,507

273,284

Interparfums,

Inc.

2,795

367,570

J

&

J

Snack

Foods

Corp.

2,389

370,606

Lancaster

Colony

Corp.

2,404

416,229

National

Beverage

Corp.

8,208

350,235

PriceSmart,

Inc.

5,482

505,276

Seaboard

Corp.

162

393,605

Spectrum

Brands

Holdings,

Inc.

4,324

365,335

Sprouts

Farmers

Market,

Inc.(a)

2,940

373,586

The

Andersons,

Inc.

7,661

310,424

The

Chefs'

Warehouse,

Inc.(a)

8,678

427,999

The

Simply

Good

Foods

Co.(a)

13,496

526,074

Utz

Brands,

Inc.

22,325

349,609

WD-40

Co.

1,796

435,853

Weis

Markets,

Inc.

7,216

488,668

8,885,888

Energy

(

5

.8

%

):

Archrock,

Inc.

16,291

405,483

Schedule

of

Portfolio

Investments

-

continued

December

31,

2024

Timothy

Plan

US

Small

Cap

Core

ETF

See

notes

to

financial

statements.

SECURITY

DESCRIPTION

SHARES

VALUE

($)

Energy

(5.8%):

(continued)

Atlas

Energy

Solutions,

Inc.

15,225

337,690

Cactus,

Inc.,

Class

A

5,031

293,609

California

Resources

Corp.

5,414

280,932

CNX

Resources

Corp.(a)

11,757

431,129

CONSOL

Energy,

Inc.

2,595

276,835

Crescent

Energy

Co.,

Class

A

22,165

323,831

CVR

Energy,

Inc.

12,982

243,283

Dorian

LPG

Ltd.

8,638

210,508

DT

Midstream,

Inc.

7,985

793,949

Excelerate

Energy,

Inc.,

Class

A

12,473

377,308

Gulfport

Energy

Corp.(a)

2,801

515,944

Helmerich

&

Payne,

Inc.

8,633

276,429

International

Seaways,

Inc.

7,797

280,224

Kinetik

Holdings,

Inc.

9,143

518,499

Kodiak

Gas

Services,

Inc.

10,512

429,205

Kosmos

Energy

Ltd.(a)

57,232

195,733

Liberty

Energy,

Inc.

14,812

294,611

Magnolia

Oil

&

Gas

Corp.,

Class

A

16,062

375,530

Northern

Oil

&

Gas,

Inc.

9,304

345,737

Oceaneering

International,

Inc.(a)

10,688

278,743

Patterson-UTI

Energy,

Inc.

34,422

284,326

Peabody

Energy

Corp.

12,650

264,891

SM

Energy

Co.

6,749

261,591

Talos

Energy,

Inc.(a)

25,920

251,683

Tidewater,

Inc.(a)

3,527

192,962

Valaris

Ltd.(a)

5,717

252,920

Viper

Energy,

Inc.

7,485

367,289

World

Kinect

Corp.

14,119

388,414

9,749,288

Financials

(

25

.2

%

):

Affiliated

Managers

Group,

Inc.

2,822

521,844

Ameris

Bancorp

6,501

406,768

Artisan

Partners

Asset

Management,

Inc.,

Class

A

9,842

423,698

Assured

Guaranty

Ltd.

5,529

497,665

Atlantic

Union

Bankshares

Corp.

10,358

392,361

Axis

Capital

Holdings

Ltd.

6,813

603,768

Axos

Financial,

Inc.(a)

4,964

346,735

BancFirst

Corp.

3,753

439,777

Bank

of

Hawaii

Corp.

6,042

430,432

Bank

OZK

7,361

327,785

BankUnited,

Inc.

8,775

334,942

Banner

Corp.

6,231

416,044

BGC

Group,

Inc.,

Class

A

35,826

324,584

BOK

Financial

Corp.

4,283

455,925

Bread

Financial

Holdings,

Inc.

5,014

306,155

Cadence

Bank

11,379

392,007

Cathay

General

Bancorp

8,989

427,966

City

Holding

Co.

4,228

500,933

CNO

Financial

Group,

Inc.

13,223

492,028

Cohen

&

Steers,

Inc.

3,977

367,236

Columbia

Banking

System,

Inc.

9,994

269,938

Community

Financial

System,

Inc.

6,331

390,496

SECURITY

DESCRIPTION

SHARES

VALUE

($)

Financials

(25.2%):

(continued)

CVB

Financial

Corp.

19,370

414,712

Donnelley

Financial

Solutions,

Inc.(a)

6,485

406,804

Enova

International,

Inc.(a)

4,226

405,189

Enterprise

Financial

Services

Corp.

7,213

406,813

Euronet

Worldwide,

Inc.(a)

4,703

483,656

EVERTEC,

Inc.

11,580

399,857

FB

Financial

Corp.

7,719

397,606

Federal

Agricultural

Mortgage

Corp.,

Class

C

2,000

393,900

Federated

Hermes,

Inc.

15,744

647,236

First

Bancorp

7,780

342,087

First

Bancorp

Puerto

Rico

22,219

413,051

First

Commonwealth

Financial

Corp.

24,129

408,263

First

Financial

Bancorp

16,743

450,052

First

Financial

Bankshares,

Inc.

9,973

359,527

First

Hawaiian,

Inc.

19,656

510,073

First

Interstate

BancSystem,

Inc.,

Class

A

11,532

374,444

First

Merchants

Corp.

10,636

424,270

FirstCash

Holdings,

Inc.

3,807

394,405

FNB

Corp.

32,136

474,970

Fulton

Financial

Corp.

21,554

415,561

Genworth

Financial,

Inc.(a)

69,430

485,316

Glacier

Bancorp,

Inc.

6,893

346,166

Goosehead

Insurance,

Inc.,

Class

A(a)

2,257

241,996

Hamilton

Lane,

Inc.,

Class

A

2,235

330,892

Hancock

Whitney

Corp.

7,285

398,635

Hilltop

Holdings,

Inc.

14,116

404,141

Home

Bancshares,

Inc.

17,106

484,100

Independent

Bank

Corp.

5,769

370,312

International

Bancshares

Corp.

6,864

433,530

Jackson

Financial,

Inc.,

Class

A

3,096

269,600

Kemper

Corp.

6,869

456,376

Lakeland

Financial

Corp.

5,540

380,930

Lazard,

Inc.

6,944

357,477

Live

Oak

Bancshares,

Inc.

5,884

232,712

Merchants

Bancorp

6,419

234,101

Mercury

General

Corp.

5,801

385,650

MGIC

Investment

Corp.

19,824

470,027

Moelis

&

Co.,

Class

A

5,276

389,791

Mr.

Cooper

Group,

Inc.(a)

4,580

439,726

Navient

Corp.

25,978

345,248

NBT

Bancorp,

Inc.

8,373

399,894

NMI

Holdings,

Inc.(a)

12,981

477,182

Northwest

Bancshares,

Inc.

34,600

456,374

OFG

Bancorp

10,684

452,147

Palomar

Holdings,

Inc.(a)

3,168

334,509

Park

National

Corp.

2,193

375,946

Pathward

Financial,

Inc.

6,298

463,407

Payoneer

Global,

Inc.(a)

30,000

301,200

PennyMac

Financial

Services,

Inc.

3,728

380,778

Piper

Sandler

Cos.

1,409

422,630

PJT

Partners,

Inc.,

Class

A

3,046

480,689

Schedule

of

Portfolio

Investments

-

continued

December

31,

2024

Timothy

Plan

US

Small

Cap

Core

ETF

See

notes

to

financial

statements.

SECURITY

DESCRIPTION

SHARES

VALUE

($)

Financials

(25.2%):

(continued)

PROG

Holdings,

Inc.

5,564

235,135

Provident

Financial

Services,

Inc.

17,652

333,093

Radian

Group,

Inc.

13,698

434,501

Renasant

Corp.

11,977

428,178

Rocket

Cos.,

Inc.,

Class

A(a)

13,504

152,055

Ryan

Specialty

Holdings,

Inc.

5,854

375,593

S&T

BanCorp,

Inc.

9,214

352,159

Seacoast

Banking

Corp.

of

Florida

14,006

385,585

ServisFirst

Bancshares,

Inc.

3,672

311,165

Shift4

Payments,

Inc.,

Class

A(a)

2,635

273,460

Simmons

First

National

Corp.,

Class

A

16,519

366,391

SiriusPoint

Ltd.(a)

33,107

542,624

SLM

Corp.

19,423

535,686

StepStone

Group,

Inc.,

Class

A

5,527

319,903

Stewart

Information

Services

Corp.

6,375

430,249

Stock

Yards

Bancorp,

Inc.

5,158

369,364

StoneX

Group,

Inc.(a)

5,067

496,414

Synovus

Financial

Corp.

8,186

419,369

Texas

Capital

Bancshares,

Inc.(a)

5,014

392,095

The

Bancorp,

Inc.(a)

5,279

277,834

The

Hanover

Insurance

Group,

Inc.

3,984

616,165

The

Western

Union

Co.

43,270

458,662

Towne

Bank

13,207

449,830

Triumph

Financial,

Inc.(a)

3,895

353,978

UMB

Financial

Corp.

3,708

418,485

United

Bankshares,

Inc.

11,159

419,020

United

Community

Banks,

Inc.

14,035

453,471

Valley

National

Bancorp

28,365

256,987

Virtu

Financial,

Inc.,

Class

A

9,558

341,029

WaFd,

Inc.

10,512

338,907

Walker

&

Dunlop,

Inc.

3,495

339,749

WesBanco,

Inc.

13,079

425,591

White

Mountains

Insurance

Group

Ltd.

276

536,837

WSFS

Financial

Corp.

7,379

392,046

42,824,655

Health

Care

(

6

.7

%

):

ACADIA

Pharmaceuticals,

Inc.(a)

16,820

308,647

Addus

HomeCare

Corp.(a)

3,269

409,769

ADMA

Biologics,

Inc.(a)

10,908

187,072

Alkermes

PLC(a)

11,385

327,433

Astrana

Health,

Inc.(a)

4,978

156,956

Catalyst

Pharmaceuticals,

Inc.(a)

14,735

307,520

CONMED

Corp.

4,424

302,779

Corcept

Therapeutics,

Inc.(a)

5,619

283,142

CorVel

Corp.(a)

3,745

416,669

Doximity,

Inc.,

Class

A(a)

4,593

245,220

Haemonetics

Corp.(a)

5,290

413,043

Halozyme

Therapeutics,

Inc.(a)

6,896

329,698

Harmony

Biosciences

Holdings,

Inc.(a)

8,693

299,126

Integer

Holdings

Corp.(a)

3,179

421,281

Krystal

Biotech,

Inc.(a)

1,040

162,926

SECURITY

DESCRIPTION

SHARES

VALUE

($)

Health

Care

(6.7%):

(continued)

Lantheus

Holdings,

Inc.(a)

1,667

149,130

LeMaitre

Vascular,

Inc.

3,766

346,999

Ligand

Pharmaceuticals,

Inc.(a)

2,540

272,161

MannKind

Corp.(a)

38,357

246,636

Merit

Medical

Systems,

Inc.(a)

5,920

572,582

National

HealthCare

Corp.

3,538

380,547

Option

Care

Health,

Inc.(a)

14,822

343,870

Patterson

Cos.,

Inc.

17,232

531,780

Premier,

Inc.,

Class

A

26,002

551,242

Prestige

Consumer

Healthcare,

Inc.(a)

7,064

551,628

Privia

Health

Group,

Inc.(a)

15,798

308,851

Progyny,

Inc.(a)

11,973

206,534

Protagonist

Therapeutics,

Inc.(a)

5,122

197,709

RadNet,

Inc.(a)

4,093

285,855

Select

Medical

Holdings

Corp.

19,461

366,840

Sotera

Health

Co.(a)

18,740

256,363

Supernus

Pharmaceuticals,

Inc.(a)

9,477

342,688

TG

Therapeutics,

Inc.(a)

8,089

243,479

TransMedics

Group,

Inc.(a)

1,426

88,911

UFP

Technologies,

Inc.(a)

758

185,339

Vericel

Corp.(a)

7,047

386,951

11,387,376

Industrials

(

20

.3

%

):

AAR

Corp.(a)

5,993

367,251

ABM

Industries,

Inc.

8,802

450,486

AeroVironment,

Inc.(a)

1,010

155,429

Air

Lease

Corp.

8,385

404,241

Alamo

Group,

Inc.

2,382

442,838

Albany

International

Corp.

5,765

461,027

Allison

Transmission

Holdings,

Inc.

4,157

449,205

ArcBest

Corp.

2,410

224,901

Arcosa,

Inc.

3,590

347,297

Armstrong

World

Industries,

Inc.

3,390

479,109

ASGN,

Inc.(a)

4,123

343,611

AZZ,

Inc.

4,163

341,033

Blue

Bird

Corp.(a)

4,978

192,300

Boise

Cascade

Co.

2,011

239,027

Brady

Corp.,

Class

A

7,124

526,107

Casella

Waste

Systems,

Inc.(a)

5,344

565,449

CBIZ,

Inc.(a)

5,160

422,243

Chart

Industries,

Inc.(a)

1,794

342,367

Cimpress

PLC(a)

3,072

220,324

Construction

Partners,

Inc.,

Class

A(a)

3,881

343,313

CSW

Industrials,

Inc.

939

331,279

Dycom

Industries,

Inc.(a)

1,913

332,977

Enerpac

Tool

Group

Corp.

12,646

519,624

EnerSys

4,173

385,710

Enpro,

Inc.

2,067

356,454

Esab

Corp.

4,061

487,076

ESCO

Technologies,

Inc.

3,510

467,567

ExlService

Holdings,

Inc.(a)

11,581

513,965

Exponent,

Inc.

2,938

261,776

Schedule

of

Portfolio

Investments

-

continued

December

31,

2024

Timothy

Plan

US

Small

Cap

Core

ETF

See

notes

to

financial

statements.

SECURITY

DESCRIPTION

SHARES

VALUE

($)

Industrials

(20.3%):

(continued)

Federal

Signal

Corp.

4,416

407,994

First

Advantage

Corp.(a)

25,320

474,244

Flowserve

Corp.

8,808

506,636

Franklin

Electric

Co.,

Inc.

4,725

460,451

GATX

Corp.

3,669

568,548

Gibraltar

Industries,

Inc.(a)

4,869

286,784

GMS,

Inc.(a)

4,273

362,479

Granite

Construction,

Inc.

6,032

529,067

Griffon

Corp.

3,904

278,238

H&E

Equipment

Services,

Inc.

5,276

258,313

Hayward

Holdings,

Inc.(a)

20,548

314,179

Herc

Holdings,

Inc.

1,769

334,925

Hillman

Solutions

Corp.(a)

35,657

347,299

HNI

Corp.

8,210

413,538

Huron

Consulting

Group,

Inc.(a)

4,002

497,289

ICF

International,

Inc.

2,662

317,337

IES

Holdings,

Inc.(a)

871

175,036

Insperity,

Inc.

4,201

325,619

JBT

Marel

Corp.

3,772

479,421

Kadant,

Inc.

1,048

361,549

Kennametal,

Inc.

18,267

438,773

Kirby

Corp.(a)

3,331

352,420

Korn

Ferry

5,749

387,770

Kratos

Defense

&

Security

Solutions,

Inc.(a)

11,902

313,975

Leonardo

DRS,

Inc.(a)

13,361

431,694

ManpowerGroup,

Inc.

6,379

368,196

MasTec,

Inc.(a)

2,183

297,194

Masterbrand,

Inc.(a)

17,134

250,328

Matson,

Inc.

2,910

392,384

Maximus,

Inc.

6,689

499,334

MDU

Resources

Group,

Inc.

34,506

621,798

MillerKnoll,

Inc.

11,014

248,806

Moog,

Inc.,

Class

A

1,929

379,704

MSC

Industrial

Direct

Co.,

Inc.

5,333

398,322

Mueller

Industries,

Inc.

5,413

429,576

Mueller

Water

Products,

Inc.,

Class

A

17,569

395,302

MYR

Group,

Inc.(a)

2,090

310,929

OPENLANE,

Inc.(a)

30,158

598,335

Powell

Industries,

Inc.

465

103,067

Primoris

Services

Corp.

5,050

385,820

Resideo

Technologies,

Inc.(a)

13,594

313,342

REV

Group,

Inc.

8,099

258,115

Rush

Enterprises,

Inc.,

Class

A

7,174

393,063

Ryder

System,

Inc.

2,679

420,228

Schneider

National,

Inc.,

Class

B

16,847

493,280

SkyWest,

Inc.(a)

3,717

372,183

SPX

Technologies,

Inc.(a)

2,094

304,719

Standex

International

Corp.

2,310

431,947

Sterling

Infrastructure,

Inc.(a)

1,363

229,597

Tecnoglass,

Inc.

3,233

256,442

Tennant

Co.

4,783

389,958

Terex

Corp.

5,282

244,134

SECURITY

DESCRIPTION

SHARES

VALUE

($)

Industrials

(20.3%):

(continued)

The

Brink's

Co.

4,258

395,015

Trinity

Industries,

Inc.

9,287

325,974

UniFirst

Corp.

2,196

375,714

Valmont

Industries,

Inc.

1,227

376,284

Verra

Mobility

Corp.(a)

15,360

371,405

Vestis

Corp.

11,585

176,555

Vicor

Corp.(a)

5,272

254,743

VSE

Corp.

3,656

347,686

Watts

Water

Technologies,

Inc.,

Class

A

2,313

470,233

Werner

Enterprises,

Inc.

12,906

463,584

Zurn

Elkay

Water

Solutions

Corp.

11,922

444,691

34,385,551

Information

Technology

(

9

.4

%

):

ACI

Worldwide,

Inc.(a)

8,277

429,659

Advanced

Energy

Industries,

Inc.

2,986

345,271

Agilysys,

Inc.(a)

2,638

347,451

Alarm.com

Holdings,

Inc.(a)

7,926

481,901

Allegro

MicroSystems,

Inc.(a)

10,734

234,645

Altair

Engineering,

Inc.,

Class

A(a)

3,883

423,674

Appfolio,

Inc.,

Class

A(a)

1,069

263,744

Axcelis

Technologies,

Inc.(a)

2,210

154,413

Badger

Meter,

Inc.

1,661

352,331

Belden,

Inc.

2,823

317,898

Blackbaud,

Inc.(a)

4,952

366,052

BlackLine,

Inc.(a)

5,406

328,469

Calix,

Inc.(a)

6,671

232,618

Cirrus

Logic,

Inc.(a)

2,400

238,992

Clear

Secure,

Inc.,

Class

A