UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-08228 | |||||||

The Timothy Plan | ||||||||

| (Exact name of registrant as specified in charter) | ||||||||

1055 Maitland Center Commons, Maitland, FL 32751 | ||||||||

| (Address of principal executive offices) (Zip code) | ||||||||

Art Ally, The Timothy Plan | ||||||||

| 1055 Maitland Center Commons, Maitland, FL 32751 | ||||||||

| (Name and address of agent for service) | ||||||||

| Registrant’s telephone number, including area code: | 800-846-7526 | |||||||

| Date of fiscal year end: 9/30 | ||||||||

| Date of reporting period: 9/30/15 | ||||||||

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Registrant’s audited annual financial reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 are as follows:

September 30, 2015

Dear Shareholder,

As you review the details on the following pages, you will see that most of our funds experienced slightly negative performance over the past fiscal year (10-1-14 thru 9-30-15). Of course this has been a particularly turbulent period in the capital markets where, upon review, you can see that nearly all of our funds were, at least, fairly competitive with our various benchmark indices that represent fairly broad segments of the capital markets.

As I write this, we remain concerned that the year ahead could be as turbulent as the past year has been so we continue to remain conservatively cautious. Although we cannot guarantee any actual outcome, I remain confident that all of our sub-advisors are, in our opinion, among the best in the industry and they each continue to honor our overall policy to manage their respective funds both in accordance with our screening restrictions and with a conservative bias.

Please find each of our sub-advisors’ annual review letters along with their economic outlook in the pages that follow.

Finally, I would once again like to thank you for your moral convictions that led you to becoming part of the Timothy Plan Family.

Yours in Christ,

Arthur D. Ally

President

1

Aggressive Growth Fund Letter from the Manager – September 30, 2015 |  |

We wrote in this letter last year that, “volatility in energy markets and the normalization of interest rates could well provide the script for the year to come.” The energy volatility certainly came to pass: Brent Crude was $95 on 9/30/14, bottomed at $45 in January ’15, bounced back up to $70 in May, made a lower low of $42 in August, and then finally recovered some to $49 at quarter-end. Demand for crude actually surprised to the upside, especially given the economic slowdown in many emerging markets, but supply stayed stubbornly high, providing a downward bias to the commodity. Consequently, the Energy sector in the S&P500 was down about 30% for the full-year period. As to the normalization of rates, the story remains the same – the Fed is in a holding pattern – claiming to be “data-dependent” – and still concerned that inflation has been almost non-existent. While labor-market conditions have significantly improved, global uncertainty was cited by Chair Yellen in her last press conference as another reason to stay accommodative (leaving some to wonder how many mandates the Fed really has these days). Reported U.S. GDP growth had a wide range over the past year (+0.6% to +3.9%), but the bigger picture is that growth has only been slightly above 2% for the entire period since the financial crisis. Additionally under the heading of “the more things change, the more they stay the same,” both Greece and China were sources of turmoil to financial markets. Greece defaulted on payments due to the IMF, had a referendum vote that rejected bailout conditions from their European creditors, but in the end accepted the terms. China – like so many other emerging markets – has seen its economy contract, but in contrast to other countries that can weaken their currencies to spur exports, the yuan was pegged to the dollar. Hence, in August they decided to let it float (to a certain degree); this rattled markets, especially since there was little additional commentary as to future expectations. Volatility in U.S. equity markets, along with credit spreads, spiked in the third quarter of 2015, and in late August/early September the S&P500 dropped about 12% from its July high. There was some recovery before the quarter closed, but we’ll go out on a limb and predict that heightened volatility is here for the foreseeable future.

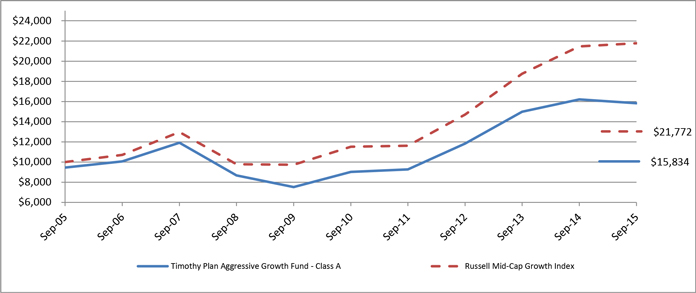

The Timothy Plan Aggressive Growth Fund’s performance was -2.35% (Class A) over the last 12 months ended September 30, 2015, while the return of the benchmark, the Russell Mid Cap Growth Index, was +1.45% for the same period. Cash was 31% of the portfolio at 9/30/15 and averaged 11% over the last two quarters. The cash was additive to performance during that period, adding 1.4% to returns, as the RMG index was down 9.1% for those six months.

For the portfolio, there has been no change to our time-tested, bottom up fundamental approach to managing large and mid-cap growth investments. As an overview, the portfolio remains well diversified by issuers and by sectors as all areas of the economy have been impacted by broad macroeconomic trends. We have investments that blend growth potential with durability for an environment that will reward the former if conditions continue to improve and appreciate the latter if they don’t. Applying our model to the current environment with all the threats to stability – financial and geopolitical – we remain committed to our growth mandates but with a responsible eye toward valuation and risk. Above all, three factors remain central to our management of the portfolio: Growth, Valuation, & Execution. And we are particularly keen on Execution, which can be the “last mile” connecting financial forecasts to investment outcomes.

Chartwell Investment Partners, LLC

2

Letter From The Manager

The Timothy Plan International Fund

September 30, 2015

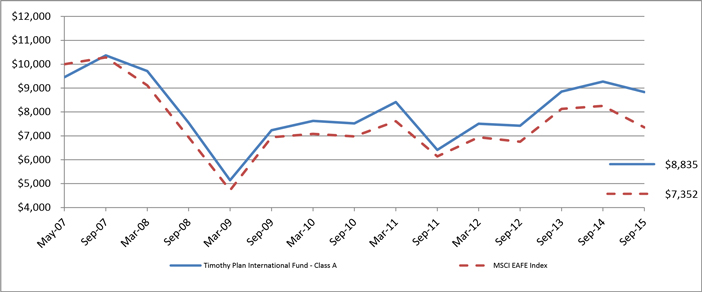

Although the last twelve months were difficult ones for global equities, The Timothy Plan International Fund (the “Fund”) performed well relative to the MSCI EAFE index performance during this time period.

Volatility was back in equity markets as diverging monetary conditions from the U.S. to Europe and Japan increased investor anxiety during this period. China’s economic slowdown also led to significant declines for global trade values, commodity markets, and emerging market equities and currencies. The decision from the People’s Bank of China to devalue the RMB currency was an unexpected curveball for equity and currency markets leading to significant volatility. As the euro zone has joined the quantitative easing party and Europe appears to have successfully navigated Greek debt negotiations, European equities performed better even though also succumbing to the volatility of global markets. The sharp decline in commodity prices during this period also led to significant declines for prices of companies in the Materials and Energy sectors. Japan provided a bit of self-help stories during the year as the government there pressures the corporate sector to focus more on ROE and shareholder-friendly capital allocation while at the same time pushing for better wage increases going forward to support private consumption.

The outperformance of the Fund relative to the EAFE index was due to a combination of strong sector allocation and stock selection. The Fund had good sector allocation in 7 of the 10 sectors with the strongest contribution coming from the overweight in the outperforming Consumer Discretionary sector and underweight to underperforming Energy and Materials sectors. The only meaningful negative sector attribution occurred as a result of an underweight to the Consumer Staples sector which outperformed due to its safer haven status in a difficult market. Strong stock selection occurred in 8 of the 10 sectors with significant outperformance from stock picks in the Consumer Discretionary sector. Stock picks in the Energy and Industrials sectors proved less than stellar though. Of note in the Consumer Discretionary sector was the portfolio’s holdings in the auto parts sectors helped performance as car sales continued to positively surprise and as sector consolidation has driven better margins with Fund holdings of note Valeo SA in France and Magna International in Canada. Other notable outperformers included Sekisui House benefitting from rising housing activity in Japan and Techtronic Industries from Hong Kong benefitting from improved sales of its products at U.S. home improvement stores and continued strong execution on margins.

Leading up to the last months of this year, the Fund raised cash above normal levels due to very elevated macro and market risks. While we ended the fiscal year with high cash levels, we expect to reduce these cash levels accordingly as opportunities present themselves. International equities remain attractive and we believe the European Central Bank and Bank of Japan will remain quite accommodative leading to additional support for equity markets in Europe and Japan. We thank you for your continued investment in the Fund.

Eagle Global Advisors, LLC

3

Large/Mid Cap Growth Fund Letter from the Manager – September 30, 2015 |  |

We wrote in this letter last year that, “volatility in energy markets and the normalization of interest rates could well provide the script for the year to come.” The energy volatility certainly came to pass: Brent Crude was $95 on 9/30/14, bottomed at $45 in January ’15, bounced back up to $70 in May, made a lower low of $42 in August, and then finally recovered some to $49 at quarter-end. Demand for crude actually surprised to the upside, especially given the economic slowdown in many emerging markets, but supply stayed stubbornly high, providing a downward bias to the commodity. Consequently, the Energy sector in the S&P500 was down about 30% for the full-year period. As to the normalization of rates, the story remains the same – the Fed is in a holding pattern – claiming to be “data-dependent” – and still concerned that inflation has been almost non-existent. While labor-market conditions have significantly improved, global uncertainty was cited by Chair Yellen in her last press conference as another reason to stay accommodative (leaving some to wonder how many mandates the Fed really has these days). Reported U.S. GDP growth had a wide range over the past year (+0.6% to +3.9%), but the bigger picture is that growth has only been slightly above 2% for the entire period since the financial crisis. Additionally under the heading of “the more things change, the more they stay the same,” both Greece and China were sources of turmoil to financial markets. Greece defaulted on payments due to the IMF, had a referendum vote that rejected bailout conditions from their European creditors, but in the end accepted the terms. China – like so many other emerging markets – has seen its economy contract, but in contrast to other countries that can weaken their currencies to spur exports, the yuan was pegged to the dollar. Hence, in August they decided to let it float (to a certain degree); this rattled markets, especially since there was little additional commentary as to future expectations. Volatility in U.S. equity markets, along with credit spreads, spiked in the third quarter of 2015, and in late August/early September the S&P500 dropped about 12% from its July high. There was some recovery before the quarter closed, but we’ll go out on a limb and predict that heightened volatility is here for the foreseeable future.

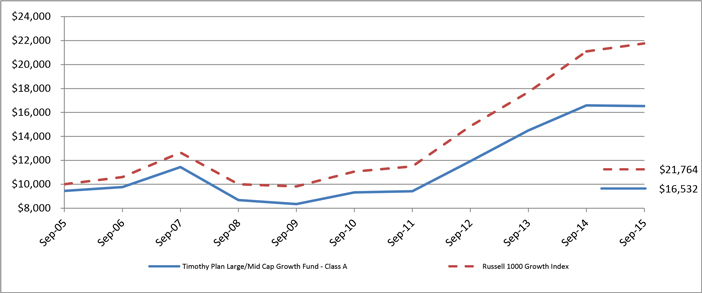

The Timothy Plan Large/Mid Cap Growth Fund’s performance decreased 0.35% (Class A) over the last 12 months ended September 30, 2015, while the return of the benchmark, the Russell 1000 Growth Index, was up 3.17% for the same period. Cash was 30% of the portfolio at 9/30/15 and averaged 17% over the last two quarters. The cash was additive to performance during that period, adding 0.9% to returns, as the R1G index was down 5.2% for those six months.

For the portfolio, there has been no change to our time-tested, bottom up fundamental approach to managing large and mid-cap growth investments. As an overview, the portfolio remains well diversified by issuers and by sectors as all areas of the economy have been impacted by broad macroeconomic trends. We have investments that blend growth potential with durability for an environment that will reward the former if conditions continue to improve and appreciate the latter if they don’t. Applying our model to the current environment with all the threats to stability – financial and geopolitical – we remain committed to our growth mandates but with a responsible eye toward valuation and risk. Above all, three factors remain central to our management of the portfolio: Growth, Valuation, & Execution. And we are particularly keen on Execution, which can be the “last mile” connecting financial forecasts to investment outcomes.

Chartwell Investment Partners, LLC

4

LETTER FROM THE MANAGER

September 30, 2015

TIMOTHY PLAN LARGE/MID-CAP VALUE FUND

We are pleased to provide you with our report for the Timothy Plan Large/Mid-Cap Value Fund for the twelve months ended September 30, 2015 and would like to thank you for entrusting your assets with us.

The past twelve months have been challenging for the equity markets as many themes have weighed on investor sentiment. A sell-off in commodities gained momentum as recessionary fears deepened and crude oil fell below US$50 per barrel for the first time in ten years. The sustainability of global growth was once again in question following the critical Fed policy decision to leave rates unchanged, signaling a lack of confidence in outlook and concerns regarding the impact of a China growth slowdown.

For the twelve months ended September 30, 2015, the Timothy Plan Large/Mid-Cap Value Fund produced a return of 1.59% (Class A), while the S&P 500 Index produced a return of -0.61%. Security selection in Technology, Health Care and Utilities aided relative performance. Furthermore, the portfolio’s higher cash position served as a cushion against market volatility and contributed positively to relative performance.

The Technology sector was again a strong performer for the fund and many of the top performers were in this sector. Top performers in the Technology sector included Skyworks Solutions, Avago Technologies and Amdocs Limited. The “Internet of Things” trend continues to benefit Skyworks Solutions and Amdocs has posted strong quarters with better-than-expected guidance. The company generates and returns significant amounts of cash flow to shareholders through buybacks and dividends. Shares of C.R. Bard, J.M. Smucker, McCormick & Company and Dr Pepper Snapple Group were looked on favorably by investors due to their defensive growth characteristics. J.M. Smucker has posted better-than-expected earnings results with solid organic sales growth and strong free cash flow conversion. Management expects significant synergies from the Big Heart Pet Brands acquisition, and the core coffee business saw nice improvement from the prior quarter. McCormick & Company’s management team made positive comments at a sell-side conference that helped shares rally ahead of its earnings results in early October.

Security selection in Producer Durables and Financial Services was the largest detractor to relative performance in the period. Individual detractors to performance included Energy companies Oasis Petroleum, Occidental Petroleum and EOG Resources, which have fallen with crude oil and natural gas prices. Other underperforming securities included Flowserve, Garmin and B/E Aerospace which are levered to economic growth.

The Westwood team remains focused on high-quality business trading at a discount to intrinsic value. Market returns had been bolstered by a Fed-centric market focused on unprecedented monetary stimulus rather than fundamentals pushing valuations to the upper end of historical averages. As the economic cycle matures and the FOMC prepares to start tightening monetary policy with higher interest rates, investors will likely turn their focus back to fundamentals and corporate profits will become the key driver of future returns. We will continue to leverage our intensive research driven process to identify securities with company-specific opportunities and visible earnings growth that provide attractive risk adjusted returns for the portfolio. As has always been our practice, we look to invest in companies with conservative balance sheets, robust free cash flow generation, and high returns as these characteristics help protect capital in a downside scenario. Given the above-average market returns over the past few years, we are mindful of the potential for downside risk and are focusing on opportunities which we feel have measurable and limited potential for loss.

We thank you for your continued confidence in the Westwood process and investment teams and we look forward to serving your investment needs through the years ahead.

Westwood Management Corporation

5

LETTER FROM THE MANAGER

September 30, 2015

TIMOTHY PLAN SMALL-CAP VALUE FUND

We are pleased to provide you with our report for the Timothy Plan Small Cap Value Fund for the twelve months ended September 30, 2015 and would like to thank you for entrusting your assets with us.

The past twelve months have been challenging for the equity markets as many themes have weighed on investor sentiment. A sell-off in commodities gained momentum as recessionary fears deepened and crude oil fell below US$50 per barrel for the first time in ten years. The sustainability of global growth was once again in question following the critical Fed policy decision to leave rates unchanged, signaling a lack of confidence in outlook and concerns regarding the impact of a China growth slowdown.

For the twelve months ended September 30, 2015, the Timothy Plan Small Cap Value Fund produced a return of 1.9% (Class A), while the Russell 2000 Index produced a return of 1.25%. Small caps, however, have outperformed their large cap counterparts over this time period. Security selection was the primary driver of relative outperformance and centered in the Materials, Consumer Discretionary and Health Care sectors. The portfolio’s higher cash position served as a cushion against market volatility and also contributed positively to relative performance.

Security selection in Energy and Health Care detracted from relative performance. Energy was the largest declining sector with several holdings, including Bonanza Creek Energy, Rex Energy and CONE Midstream Partners, producing returns over 50% for the last 12 months. Holdings in this sector, while strong fundamentally sound operators have fallen along with crude oil and natural gas prices.

The Small Cap Value team is focusing on well-run companies with growth prospects that are underappreciated by the marketplace. We look for companies with above average growth and strong balance sheets that are generating good cash flows and superior relative returns. As economic growth continues, we feel our companies are positioned to achieve higher earnings and our portfolio should perform well.

We thank you for your continued confidence in the Westwood process and investment teams and we look forward to serving your investment needs through the years ahead.

Westwood Management Corporation

6

TIMOTHY PLAN FIXED INCOME MANAGER’S COMMENTARY SEPTEMBER 2015

BARROW, HANLEY, MEWHINNEY & STRAUSS

The Timothy Plan Fixed Income Fund invests in the broad U.S. investment grade bond market as defined by the Barclays Capital U.S. Aggregate Bond Index which began the last 12 months with a yield of 2.36% and ended at 2.31% on September 30, 2015. This modest change in yield does not explain the underlying volatility in the market.

The U.S. Treasury (UST) 10 year rate started the year at 2.49%. Slowing global growth and lower inflation had global central banks engaged in massive monetary stimulus. These global concerns led to demand for UST bonds as a safe haven driving their yields sharply lower with the UST 10 year at 1.64% by January 31st the low rate for the year. However, as the U.S. economy showed strength in 2Q15 more investors became convinced the Federal Reserve would finally raise rates and the UST 10 year rose to 2.35% by June 30th. As the Federal Reserve continued to delay increasing rates the UST 10 year settled down to 2.04% by September 30, 2015 for a decline of 0.45% for the year. Even with the decline in UST rates they remain well above their developed market sovereign peers.

Corporate bonds also exhibited rate volatility but moved in the opposite direction as yield spreads increased 0.53% by September 30th. Credit quality was threatened by a dramatic increase in M&A along with company managements’ shareholder friendly actions like debt financed share buy backs. Energy credits were challenged by the significant decline in the price of oil and other types of commodity oriented companies were also under pressure. Similarly GNMA MBS yield spreads increased by 0.54% ending the year close to their highest level. Structural changes in the GNMA mortgage program led to increased prepayments which hurt returns and drove spreads higher.

The Timothy Fixed Income Fund A shares returned 1.08% over the 12 months ended September 30, 2015 with income partially offset from lower prices. The Barclays Capital U.S. Aggregate Bond Index was 2.94% over the trailing 12 months. The portfolio overweight in investment grade corporate bonds detracted from results as yield spreads increased especially in Energy and Basic Industry holdings. Results were aided by UST holdings returning over 5% and a slight underweight in MBS was beneficial last year. We are keeping a close watch on the timing of the Fed’s first policy-rate increase and what they decide to do to unwind a balance sheet four times larger than ever before. Looking ahead the portfolio is positioned with modestly less interest rate risk than the market, an over-weight in corporate bonds with yield spreads at the most attractive level in three years, and a slight overweight in GNMA MBS. We remain focused on generating income consistent with a prudent level of risk.

BARROW, HANLEY, MEWHINNEY & STRAUSS

7

TIMOTHY PLAN HIGH YIELD BOND FUND MANAGER’S COMMENTARY SEPTEMBER

2015

BARROW, HANLEY, MEWHINNEY & STRAUSS

The Timothy Plan High Yield Bond Fund invests primarily in BB and B rated High Yield (HY) bonds. Our benchmark for the HY market is the Barclays BA/B High Yield index which began the last 12 months yielding 5.51% and ended at 7.09% on September 30, 2015. High Yield market yields began rising in 4Q14 led by Energy companies under pressure from declining oil prices and ended at 6.49%. A “relief rally” in oil prices during 1Q15 helped move prices higher and rates lower so that by June 30th the HY market’s yield was 5.81%. However, 3Q15 saw significant with HY rates up 1.28% to 7.09% by quarter’s end. Yields were initially led higher by the energy sector as oil prices renewed their decline, but as global economic concerns increased other sectors were impacted especially Basic Industry. Technical factors also contributed to the rapid rise in rates as mutual fund and ETF HY investors became net sellers.

By September 30th the yield of the HY market was at the highest level since 2Q12 generating negative 3Q15 returns. Higher yields in part reflect concern for default rates moving higher in the future. Fitch recently reported that while the HY market default rates are up to 2.7% from 2.2% they remain significantly lower than their long term average. HY market yields are still primarily skewed higher by just a few out of favor industry groups. For example, the HY Energy sector yield spread above U.S. Treasury bonds was 823 basis points compared to 499 basis points for the entire HY market ex-energy. Removing this one industry lowers the yield 0.41% for the Barclays BA/B index ex-energy.

The Timothy Plan High Yield Bond Fund (A shares) in this difficult environment generated a total return of -4.88% over the 12 months ended September 30, 2015. Barclays Ba/B (3% cap) High Yield Index total return was -2.09%. The portfolio’s overweight in Energy and Basic Industries detracted from results. Holdings in Consumer Cyclicals and Non-Cyclicals were additive to returns. We continue to hold Energy names especially MLP issues that we believe are less impacted by the price of the oil. Looking ahead, with HY yields at the highest level since 2Q12 and an improved U.S. economy we believe the HY market should have a better year, but we are keeping a close watch on upticks in the default rate. The portfolio remains focused on generating a high level of income consistent with a reasonable level of risk.

BARROW, HANLEY, MEWHINNEY & STRAUSS

8

September 30, 2015

Dear Shareholder,

The Timothy Plan Defensive Strategies Fund has been designed and managed to do what its name implies, i.e. hedge against a possible scenario of hyper-inflation which could result from our nation’s leadership’s proven unwillingness to address our core problems of too much spending, too much taxation and too many onerous government regulations. We have, therefore, built in the flexibility to either adjust to a possible risk of extreme deflation with the ability to convert our inflation sensitive assets to cash and fixed income securities that should perform well during a deflationary environment or to a more normal, traditional investment strategy. As I stated in last year’s report, although we will do our very best to be successful, we cannot guarantee results in any of these scenarios.

I would also like to point out that, since there does not exist an appropriate benchmark index with which to compare our performance, we have created a blended index comprised of roughly 1/3 each of U.S. Government TIPs, FTSE NAREIT Equity Index and Dow Jones UBS Commodity Index.

I am also pleased to report that, effective this year, we have added physical gold and silver bullion (custodied at Brinks, New York) to our diversified holdings.

While no one can predict future events, I remain confident that our sub-advisors (i.e. money management firms that manage the various sleeves of this Fund) are, in our opinion, among the best in the industry and they each continue to honor our overall policy that they manage their respective Fund sleeve both in accordance with our screening restrictions and with a conservative bias.

Finally, I would once again like to thank you for your moral convictions that led you to become part of the Timothy Plan Family.

Yours in Christ,

Arthur D. Ally

Fund Advisor

9

TIMOTHY PLAN DEFENSIVE STRATEGIES FUND TIPS MANAGER’S COMMENTARY SEPTEMBER 2015

BARROW, HANLEY, MEWHINNEY & STRAUSS

The Timothy Plan Defensive Strategies Fund has an allocation of U.S. Treasury Inflation Protected Securities (TIPS) designed to help protect assets from higher rates of inflation. Over the past 12 months ended September 30th, 2015 Global economic growth slowed especially Chinese and emerging market economies. Economic weakness led to tepid inflation data from slumping commodity prices. Investors’ future inflation expectations declined in this environment leading to weak returns for TIPS securities. We measure investors’ inflation expectations as the difference between the U.S. Treasury 10 year and the U.S. TIPS 10 year. This “breakeven rate” of inflation is what would be required to make these two securities have the same yield. The “breakeven rate” of inflation started at 1.97% but declined over 12 months to 1.43%.

While the Core CPI (ex food and energy) was up 1.9% over the past 12 months, TIPS use a different inflation measure. The All Urban Non-Seasonally adjusted CPI was up only 0.2% as this inflation measure used in TIPS calculations included declining oil and commodity prices. Over the long term these inflation measurements should narrow. The U.S. TIPS market generated a -0.83% total return as reported by Barclays over the past 12 months. TIPS returns were lowered by an inflation benchmark up only 0.2% and investors’ lower inflation expectations.

The TIPS allocation we manage held 10 to 20% in investment grade corporate bonds and GNMA mortgages for their higher nominal yield, and the portfolio will hold these positions until the TIPS inflation measure increases. Looking ahead, we are concerned about the potential impact on inflation from Global central banks engaging in massive monetary stimulus and the extreme size of the Federal Reserve’s balance sheet. The primary goal of the TIPS allocation continues to be protection from rising inflation rates.

BARROW, HANLEY, MEWHINNEY & STRAUSS

10

September 30, 2015

Dear Strategic Growth Fund Shareholder:

The Timothy Plan Strategic Growth Fund (the “Fund”) is simply an asset allocation fund that invests in a number of Timothy Plan underlying funds. Although the allocation percentages will vary somewhat from time to time as a result of changing economic conditions, the allocation based on net assets at September 30, 2015 was as follows:

| ● | Large/Mid-Cap Growth Fund | 9.00% | ● | Small-Cap Value Fund | 3.50% | |||||||||||

| ● | Large/Mid-Cap Value Fund | 9.00% | ● | Aggressive Growth Fund | 3.25% | |||||||||||

| ● | International Fund | 10.50% | ● | High-Yield Bond Fund | 8.50% | |||||||||||

| ● | Defensive Strategies Fund | 25.50% | ● | Israel Common Values | 2.75% | |||||||||||

| ● | Emerging Markets Fund | 3.25% | ● | Growth & Income | 9.25% | |||||||||||

| ● | Cash | 15.50% | ||||||||||||||

I am pleased to report that performance was, in our opinion, somewhat respectable – albeit a little negative – over the past twelve months and reasonably comparable to the fund’s market benchmark - the Dow Jones Global Moderately Aggressive Portfolio Index. We plan to continue to manage this fund conservatively as we attempt to adjust to (what could be) rapidly changing economic conditions.

We continue to realize that the volatility and uncertainty of the markets may have been unsettling for many investors; however all our sub-advisors expect this pattern to continue into 2016 and, as a result, they are committed to manage their various funds with a definite conservative bias.

As you know, no one can guarantee future performance. However, the one thing that I can assure you of is that every one of our sub-advisors is doing their very best and our team here at Timothy is working very hard to provide you an investment with which you can feel comfortable.

Sincerely,

Arthur D. Ally

Fund Advisor

11

September 30, 2015

Dear Conservative Growth Fund Shareholder:

The Timothy Plan Conservative Growth Fund (the “Fund”) is simply an asset allocation fund that invests in a number of Timothy Plan underlying funds. Although the allocation percentages will vary somewhat from time to time as a result of changing economic conditions, the allocation based on net assets at September 30, 2015 was as follows:

● | Large/Mid-Cap Growth Fund | 4.50% | ● | Small-Cap Value Fund | 3.00% | |||||||||||

● | Large/Mid-Cap Value Fund | 5.00% | ● | Aggressive Growth Fund | 1.00% | |||||||||||

● | International Fund | 6.00% | ● | High-Yield Bond Fund | 4.50% | |||||||||||

● | Defensive Strategies Fund | 22.50% | ● | Israel Common Values Fund | 2.00% | |||||||||||

● | Emerging Markets Fund | 1.50% | ● | Growth & Income Fund | 7.25% | |||||||||||

● | Fixed Income Fund | 22.50% | ● | Cash | 20.25% | |||||||||||

I am pleased to report that performance was, in our opinion, somewhat respectable – albeit a little negative –over the past twelve months and reasonably comparable to the fund’s market benchmark - the Dow Jones Global Moderate Portfolio Index. We plan to continue to manage this fund conservatively as we attempt to adjust to (what could be) rapidly changing economic conditions.

We continue to realize that the volatility and uncertainty of the markets may have been unsettling for many investors; however all our sub-advisors expect this pattern to continue into 2016 and, as a result, they are committed to manage their various funds with a definite conservative bias.

As you know, no one can guarantee future performance. However, the one thing that I can assure you of is that every one of our sub-advisors is doing their very best and our team here at Timothy is working very hard to provide you an investment with which you can feel comfortable.

Yours in Christ,

Arthur D. Ally

Fund Advisor

12

Letter From The Manager

Timothy Plan Israel Common Values Fund

September 30, 2015

Israel’s economy bounced back nicely after the weakness caused by Operation Protective Edge. Strong private consumption throughout most of the year supported the economy as strong wage growth and employment levels led to rising income levels in the country. While the private sector provided a nice tailwind, continued weak trade and a relatively strong shekel dented corporate performance and economic activity for the export sector. The Bank of Israel maintained its highly accommodative monetary policy throughout the year, lowering interest rates to 0.10%. Increased episodes of violence toward year end as well as uncertainty related to the Iran nuclear deal continues to place some pressure on economic activity and equity prices.

The Timothy Plan Israel Common Values Fund (the “Fund”) performed strongly in the first half of the year but succumbed to weaker equity markets with the global selloff in the third calendar quarter of 2015. The Fund’s overweight allocation to the Information Technology sector was positive but was partly offset from negative stock selection in that sector. Negative stock selection in the Energy and Telecom Services sector for the year also dented relative performance. In Energy, the negative developments coming from the antitrust government agency against the industry dented hopes of a start to the development of the Leviathan field while weak oil and gas prices also contributed to the weaker performance. The new parliamentary elections held earlier in 2015 led to a razor thin coalition for Benjamin Netanyahu. The Prime Minister was able to form this coalition with more business-friendly factions but also some more polarizing figures that may lead to new political wrangling in the coming year.

The Fund ended the year with higher than average cash levels as elevated macro, market, and geopolitical risks surfaced. We expect to diligently reinvest this cash into the opportunities afforded the Fund from the innovation of Israeli companies. Although near term economic performance may be dented from increased episodes of violence in the country, we see increased signs of better global trade conditions in the coming year and continued accommodative monetary policy providing a nice tailwind for Israel’s economy. We thank you for your continued investment in the Fund.

Eagle Global Advisors, LLC

13

LETTER FROM THE MANAGER

September 30, 2015

Timothy Plan Emerging Markets Fund (the “Fund”)

We will discuss sector-, country- and stock-specific factors that affected the Fund’s performance and describe changes in the Fund’s composition during the 12 months ended September 30th, 2015. In addition, we will share insight into how the Fund is currently positioned for the future.

The Markets

The last year proved to be a continuation of challenging conditions for emerging markets. News on China’s slowing economic growth intensified worries on its ramifications to the global economy. The renminbi devaluation, although relatively minor, generated fears of potential spillovers to other emerging countries. In late August, the Shanghai Composite and the Shenzhen Composite indices lost a combined $1.2 trillion in market capitalization over the course of four days, putting a stop to their upward trajectory that started in late 2014. The selloff prompted the People’s Bank of China to cut its interest rate and lower reserve requirement for banks—in the hope of easing market concerns about the slowdown.

Meanwhile, investor sentiment took a turn for the worse in Brazil as the country continued to face political and economic challenges, including falling commodity prices and rising inflation. The Brazilian real lost over 20% (vs. the U.S. dollar), making it one of the worst-performing currencies in the quarter. The MSCI Brazil Index fell over 30% in the last three months and more than 40% year to date (in U.S. dollar terms). Despite the general market decline, Brazil remains home to select companies with what we view as attractive valuations and appealing long-term prospects.

Another headwind during the year was oil prices, which continued to drop due to a weak outlook for the global economy and continued high supply from major oil producers. Uncertainties surrounding the world economy also compelled the Federal Reserve to keep U.S. interest rates unchanged in its September meeting, causing questions about the potential rate-hike timing to remain.

The Fund

Year to date through September 30, 2015, the Brandes Emerging Markets Equity Strategy underperformed the MSCI Emerging Markets Index, which declined 21.21%.

Holdings in Brazil, namely Petrobras, Sabesp and Banco do Brasil, were the main detractors for the nine-month period. As was the case for the quarter, Copa Holdings, POSCO, and XL Axiata negatively impacted returns for the year. Moreover, while our underweight to Chinese companies aided returns in the quarter, it weighed on performance relative to the benchmark for the year to date.

Contributors during the period included holdings in Russia, led by Sberbank. Austria-based Erste Bank and Hong Kong’s Yue Yuen also helped performance.

14

Outlook

In the midst of significant volatility in emerging markets, our strategy weighting has not changed dramatically in the quarter. As noted, we added to a number of our positions in Brazil, and the country remained the strategy’s largest overweight as of September 30, 2015.

Although the Chinese equity market—as represented by the MSCI China Index—declined over 20% in the quarter, it has still been one of the better-performing emerging markets in recent years. We remained cautious on the valuations of many China-based companies and continued to hold a significant underweight at quarter end, especially since we did not own any Chinese financials, which made up approximately 40% of the benchmark’s China allocation.

The past year has not only been difficult for the Brandes Emerging Markets Equity Strategy, but for value investing in emerging markets in general. For the 12 months ended September 30, 2015, the MSCI Emerging Markets Value Index underperformed the MSCI Emerging Markets Growth Index by 6.6%, representing one of the worst relative performances for value investing since the inception of both indices in 1997.

In our opinion, current valuation levels for the MSCI Emerging Markets Index, such as price-to-book and price-to-cash flow ratios, indicate that emerging markets is one of the most undervalued asset classes. As of September 30, 2015, the Brandes Emerging Markets Equity Strategy presented attractive valuations vs. the benchmark—with 0.7x price-to-book ratio vs. 1.4x for the MSCI Emerging Markets Index.

Looking ahead, we believe company fundamentals, while seemingly obscured by the market’s preoccupation with volatility, will eventually gain investor recognition. In the current market environment, we hold the view that selectivity, discipline and a focus on margin of safety remain paramount as we invest in companies worthy of inclusion in the Brandes Emerging Markets Equity Strategy.

As always, thank you for your business and continued trust.

This material is intended for informational purposes only. The information provided in this material should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any security transactions, holdings, or sectors discussed were or will be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance discussed herein. Portfolio holdings and allocations are subject to change at any time. Strategies discussed herein are subject to change at any time by the investment manager in its discretion due to market conditions or opportunities. Market conditions may impact performance.

International and emerging markets investing is subject to certain risks such as currency fluctuation and social and political changes, differences in financial reporting standards and less stringent regulation of securities markets which may result in greater share price volatility; such risks are increased when investing in emerging markets. Additional risks associated with emerging markets investing include smaller-sized markets, liquidity risks, and less established legal, political, social, and business systems to

15

support securities markets. Some emerging markets countries may have fixed or managed currencies that are not free-floating against the U.S. dollar. Certain of these currencies have experienced, and may experience in the future, substantial fluctuations or a steady devaluation relative to the U.S. dollar. The foregoing reflects the thoughts and opinions of Brandes Investment Partners® exclusively and is subject to change without notice.

Brandes Investment Partners® is a registered trademark of Brandes Investment Partners, L.P. in the United States and Canada.

Index Guide

The MSCI Emerging Markets Index with gross dividends measures equity market performance of emerging markets.

Brandes Investment Partners, L.P.

11988 El Camino Real | Suite 600 | P.O. Box 919048 | San Diego, CA 92191-9048

858.755.0239 | 800.237.7119 | Fax 858.755.0916

www.brandes.com | info@brandes.com

16

LETTER FROM THE MANAGER

September 30, 2015

Timothy Plan Growth and Income Fund

We are pleased to provide you our annual report for the Timothy Plan Growth and Income Fund (the “Fund”) for the period ending September 30, 2015. Like you, our company and some officers continue to hold corporate retirement and personal assets in the fund. We certainly thank you for entrusting your assets with us.

For the year starting 1 October 2014 through 30 September 2015, the Fund returned -3.75% (Class A). During the past year, large and small capitalization stock indices experienced a lot of volatility but not much return. The Utility and Consumer Cyclical sectors were the top performers while the Industrial and Energy sectors did the worst. Two top contributors were Vonage, which is a telecommunications provider, and Footlocker, which sells shoes and apparel.

We continue to see divergences in the indices and underlying stock returns. For example, even though the S&P 500 was down 6.94% over the past three months, the median stock in our database was down 10.89%. Value stocks, those with inexpensive valuation ratios, continued to underperform growth stocks but we expect this to reverse as it has in the past.

Bond prices were also volatile but provided positive returns during the past year. This is one reason why we continue to advocate a balanced portfolio approach. We are also continuing to favor high quality bonds over lower quality bonds. They tend to hold up better in times of uncertainty.

One major contributor to market volatility was the Federal Reserve’s well publicized debate regarding when to raise short term interest rates. Surprisingly, our research shows stocks have typically done well in the early stages of Fed tightening. However, we will continue to watch our indicators for guidance.

This fund has two main objectives, growth and income but also preserving capital in declining markets. We have been managing similar assets for over 40 years. We will adjust equity and fixed income levels according to our risk analysis. We do this on a weekly basis. We see opportunities for small capitalization stocks going forward as they typically have less exposure to international economies and more opportunities for growth.

We don’t think interest rates will surge higher, but we think the best returns in bonds are probably behind us. At the same time, if stocks suffer another setback, having bonds in the portfolio should help. We think volatility will continue but if our research works well, this actually could give us opportunities to take advantage of these moves.

We thank you for your trust in the James Investment Research Inc., we are grateful for the opportunity to serve you.

James Investment Research Inc.

17

Fund Performance - (Unaudited)

September 30, 2015

Aggressive Growth Fund

| Fund/Index | 1 Year

Total Return |

5 Year

Average

Annual Return |

10 Year

Average

Annual Return | |||||

Timothy Aggressive Growth Fund - Class A (With Sales Charge) | (7.68)% | 10.63% | 4.70% | |||||

Russell Mid-Cap Growth Index | 1.45% | 13.58% | 8.09% | |||||

Timothy Aggressive Growth Fund - Class C * | (3.95)% | 11.07% | 4.51% | |||||

Russell Mid-Cap Growth Index | 1.45% | 13.58% | 8.09% | |||||

Timothy Aggressive Growth Fund - Class I | (2.10)% | N/A | 3.54% | (a) | ||||

Russell Mid-Cap Growth Index | 1.45% | 13.58% | 7.66% | (a) |

| (a) | For the period August 1, 2013 (commencement of investment in accordance with objective) to September 30, 2015. |

| * | With Maximum Deferred Sales Charge |

Timothy Plan Aggressive Growth Fund vs. Russell Mid-Cap Growth Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s Class A shares and the Russell Mid-Cap Growth Index on September 30, 2005 and held through September 30, 2015. The Russell Mid-Cap Growth Index is a widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

18

Fund Performance - (Unaudited)

September 30, 2015

International Fund

| Fund/Index | 1 Year

Total Return |

5 Year

Average

Annual Return | Average

Annual Return

Since Inception | |||||||

Timothy International Fund - Class A (With Sales Charge) | (9.99)% | 2.10% | (1.46 | )% | (a) | |||||

MSCI EAFE Index | (10.92)% | 1.05% | (3.59 | )% | (a) | |||||

Timothy International Fund - Class C * | (6.25)% | 2.49% | (1.55 | )% | (a) | |||||

MSCI EAFE Index | (10.92)% | 1.05% | (3.59 | )% | (a) | |||||

Timothy International Fund - Class I | (4.39)% | N/A | 1.14 | % | (b) | |||||

MSCI EAFE Index | (10.92)% | 1.05% | (2.62 | )% | (b) | |||||

| (a) | For the period May 3, 2007 (commencement of investment in accordance with objective) to September 30, 2015. |

| (b) | For the period August 1, 2013 (commencement of investment in accordance with objective) to September 30, 2015. |

| * | With Maximum Deferred Sales Charge |

Timothy Plan International Fund vs. MSCI EAFE Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s Class A shares and the MSCI EAFE Index on May 3, 2007 and held through September 30, 2015. The MSCI EAFE Index is a widely recognized unmanaged index of equity prices and is representative of equity market performance of developed countries, excluding the U.S. and Canada. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

19

Fund Performance - (Unaudited)

September 30, 2015

Large/Mid Cap Growth Fund

| Fund/Index | 1 Year

Total Return |

5 Year

Average

Annual Return | 10 Year

Average

Annual Return | |||||||||

Timothy Large/Mid Cap Growth Fund - Class A (With Sales Charge) | (5.79)% | 10.87% | 5.16 | % | ||||||||

Russell 1000 Growth Index | 3.17% | 14.47% | 8.09 | % | ||||||||

Timothy Large/Mid Cap Growth Fund - Class C * | (2.01)% | 11.27% | 4.93 | % | ||||||||

Russell 1000 Growth Index | 3.17% | 14.47% | 8.09 | % | ||||||||

Timothy Large/Mid Cap Growth Fund - Class I | (0.10)% | N/A | 6.83 | % | (a | ) | ||||||

Russell 1000 Growth Index | 3.17% | 14.47% | 10.63 | % | (a | ) | ||||||

| (a) | For the period August 1, 2013 (commencement of investment in accordance with objective) to September 30, 2015. |

| * | With Maximum Deferred Sales Charge |

Timothy Plan Large/Mid Cap Growth Fund vs. Russell 1000 Growth Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s Class A shares and the Russell 1000 Growth Index on September 30, 2005 and held through September 30, 2015. The Russell 1000 Growth Index is a widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

20

Fund Performance - (Unaudited)

September 30, 2015

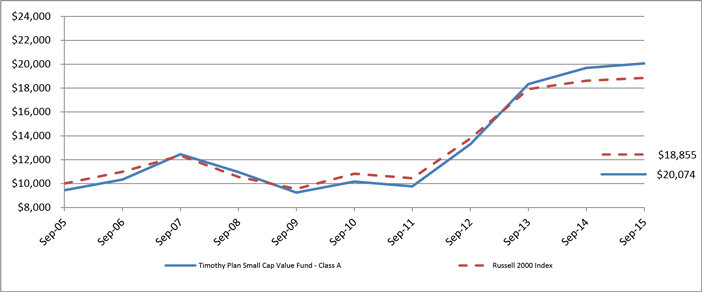

Small Cap Value Fund

| Fund/Index | 1 Year

Total Return |

5 Year

Average

Annual Return |

10 Year

Average

Annual Return | |||

Timothy Small Cap Value Fund - Class A (With Sales Charge) | (3.65)% | 13.26% | 7.22% | |||

Russell 2000 Index | 1.25% | 11.73% | 6.55% | |||

Timothy Small Cap Value Fund - Class C * | 0.39% | 13.69% | 7.03% | |||

Russell 2000 Index | 1.25% | 11.73% | 6.55% | |||

Timothy Small Cap Value Fund - Class I | 2.18% | N/A | 6.00% (a) | |||

Russell 2000 Index | 1.25% | 11.73% | 3.12% (a) |

| (a) | For the period August 1, 2013 (commencement of investment in accordance with objective) to September 30, 2015. |

| * | With Maximum Deferred Sales Charge |

Timothy Plan Small Cap Value Fund vs. Russell 2000 Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s Class A shares and the Russell 2000 Index on September 30, 2005 and held through September 30, 2015. The Russell 2000 Index is a widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

21

Fund Performance - (Unaudited)

September 30, 2015

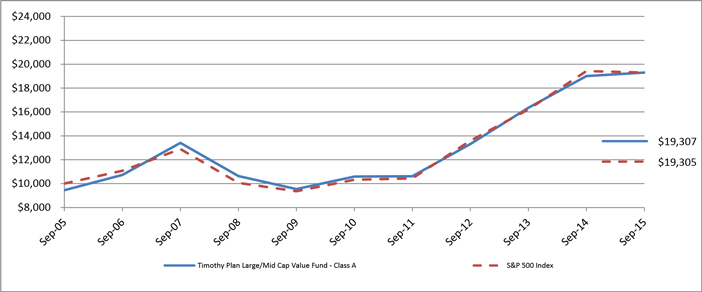

Large/Mid Cap Value Fund

| Fund/Index | 1 Year

Total Return |

5 Year

Average

Annual Return |

10 Year

Average

Annual Return | |||

Timothy Large/Mid Cap Value Fund - Class A (With Sales Charge) | (3.99)% | 11.49% | 6.80% | |||

S&P 500 Index | (0.61)% | 13.34% | 6.80% | |||

Timothy Large/Mid Cap Value Fund - Class C * | (0.09)% | 11.91% | 6.61% | |||

S&P 500 Index | (0.61)% | 13.34% | 6.80% | |||

Timothy Large/Mid Cap Value Fund - Class I | 1.81% | N/A | 8.01% (a) | |||

S&P 500 Index | (0.61)% | 13.34% | 7.82% (a) |

| (a) | For the period August 1, 2013 (commencement of investment in accordance with objective) to September 30, 2015. |

| * | With Maximum Deferred Sales Charge |

Timothy Plan Large/Mid Cap Value Fund vs. S&P 500 Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s Class A shares and the S&P 500 Index on September 30, 2005 and held through September 30, 2015. The S&P 500 Index is a widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

22

Fund Performance - (Unaudited)

September 30, 2015

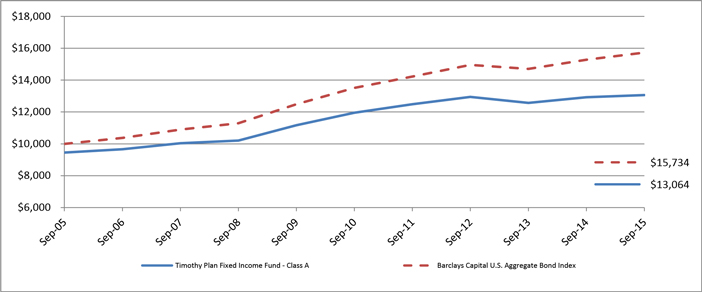

Fixed Income Fund

| Fund/Index | 1 Year

Total Return |

5 Year

Average

Annual Return |

10 Year

Average

Annual Return | |||

Timothy Fixed Income Fund - Class A (With Sales Charge) | (3.45)% | 0.65% | 2.71% | |||

Barclays Capital U.S. Aggregate Bond Index | 2.94% | 3.10% | 4.64% | |||

Timothy Fixed Income Fund - Class C * | (0.62)% | 1.04% | 2.54% | |||

Barclays Capital U.S. Aggregate Bond Index | 2.94% | 3.10% | 4.64% | |||

Timothy Fixed Income Fund - Class I | 1.28% | N/A | 2.47% (a) | |||

Barclays Capital U.S. Aggregate Bond Index | 2.94% | 3.10% | 3.65% (a) |

| (a) | For the period August 1, 2013 (commencement of investment in accordance with objective) to September 30, 2015. |

| * | With Maximum Deferred Sales Charge |

Timothy Plan Fixed Income Fund vs. Barclays Capital U.S. Aggregate Bond Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s Class A shares and the Barclays Capital U.S. Aggregate Bond Index on September 30, 2005 and held through September 30, 2015. The Barclays Capital U.S. Aggregate Bond Index is a widely recognized, unmanaged index of bond prices. Performance figures include the change in value of the bonds in the index and the reinvestment of interest. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

23

Fund Performance - (Unaudited)

September 30, 2015

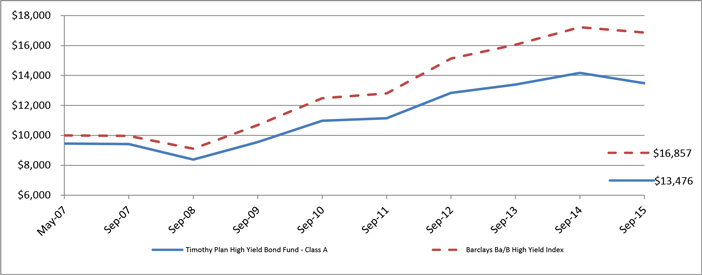

High Yield Bond Fund

| Fund/Index | 1 Year

Total Return |

5 Year

Average

Annual Return |

Average

Annual Return

Since Inception | |||

Timothy High Yield Bond Fund - Class A (With Sales Charge) | (9.18)% | 3.00% | 3.62% (a) | |||

Barclays Ba/B High Yield Index | (2.09)% | 6.19% | 6.41% (a) | |||

Timothy High Yield Bond Fund - Class C * | (6.49)% | 3.38% | 3.53% (a) | |||

Barclays Ba/B High Yield Index | (2.09)% | 6.19% | 6.41% (a) | |||

Timothy High Yield Bond Fund - Class I | (4.62)% | N/A | 0.61% (b) | |||

Barclays Ba/B High Yield Index | (2.09)% | 6.19% | 2.43% (b) |

| (a) | For the period May 7, 2007 (commencement of investment in accordance with objective) to September 30, 2015. |

| (b) | For the period August 1, 2013 (commencement of investment in accordance with objective) to September 30, 2015. |

| * | With Maximum Deferred Sales Charge |

Timothy Plan High Yield Bond Fund vs. Barclays Ba/B High Yield Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s Class A shares and the Barclays Ba/B High Yield Index on May 7, 2007 and held through September 30, 2015. The Barclays Ba/B High Yield Index measures the performance of bonds with Ba or B ratings. Performance figures include the change in value of the bonds in the index and the reinvestment of interest. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

24

Fund Performance - (Unaudited)

September 30, 2015

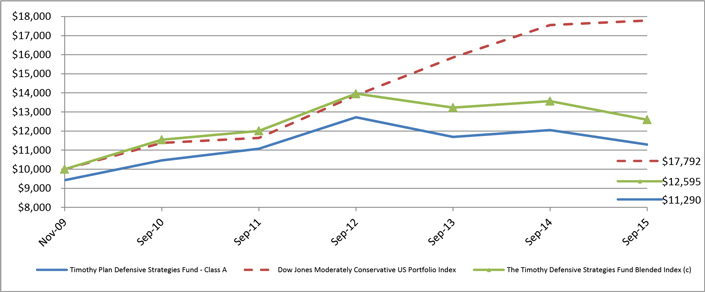

Defensive Strategies Fund

| Fund/Index | 1 Year

Total Return | 5 Year

Total Return |

Average

Annual Return

Since Inception | |||

Timothy Defensive Strategies Fund - Class A (With Sales Charge) | (11.44)% | 0.40% | 2.08% (a) | |||

Dow Jones Moderately Conservative U.S. Portfolio Index | 1.35% | 9.36% | 10.25% (a) | |||

Timothy Defensive Strategies Fund Blended Index (c) | (7.17)% | 1.76% | 3.98% (a) | |||

Timothy Defensive Strategies Fund - Class C * | (7.99)% | 0.79% | 2.34% (a) | |||

Dow Jones Moderately Conservative U.S. Portfolio Index | 1.35% | 9.36% | 10.25% (a) | |||

Timothy Defensive Strategies Fund Blended Index (c) | (7.17)% | 1.76% | 3.98% (a) | |||

Timothy Defensive Strategies Fund - Class I | (6.09)% | N/A | (1.35)% (b) | |||

Dow Jones Moderately Conservative U.S. Portfolio Index | 1.35% | 9.36% | 5.56% (b) | |||

Timothy Defensive Strategies Fund Blended Index (c) | (7.17)% | 1.76% | (2.38)% (b) |

| (a) | For the period November 4, 2009 (commencement of investment in accordance with objective) to September 30, 2015. |

| (b) | For the period August 1, 2013 (commencement of investment in accordance with objective) to September 30, 2015. |

| (c) | The Timothy Defensive Strategies Fund Blended Index reflects an unmanaged portfolio of 33% of the Barclays U.S. TIPs Index, 33% of the FTSE NAREIT ALL REITs Index and 34% of the Dow Jones Commodity Total Return Index. |

| * | With Maximum Deferred Sales Charge |

Timothy Plan Defensive Strategies Fund vs. Dow Jones Moderately Conservative U.S. Portfolio Index vs. The Timothy Defensive Strategies Fund Blended Index (c)

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s Class A shares, Dow Jones Moderately Conservative U.S. Portfolio Index and the Timothy Defensive Strategies Fund Blended Index (c) on November 4, 2009 and held through September 30, 2015. The Dow Jones Moderately Conservative U.S. Portfolio Index is a widely recognized unmanaged index of stocks, bonds and cash. Performance figures include the change in value of the asset classes in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

25

Fund Performance - (Unaudited)

September 30, 2015

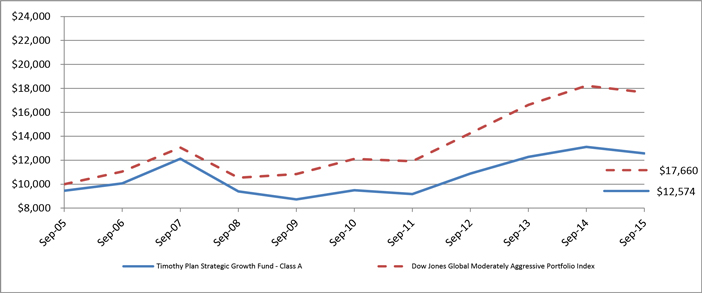

Strategic Growth Fund

| Fund/Index | 1 Year

Total Return |

5 Year

Average

Annual Return |

10 Year

Average

Annual Return | |||

Timothy Strategic Growth Fund - Class A (With Sales Charge) | (9.45)% | 4.59% | 2.32% | |||

Dow Jones Global Moderately Aggressive Portfolio Index | (3.10)% | 7.83% | 5.85% | |||

Timothy Strategic Growth Fund - Class C * | (5.83)% | 4.94% | 2.10% | |||

Dow Jones Global Moderately Aggressive Portfolio Index | (3.10)% | 7.83% | 5.85% |

| * | With Maximum Deferred Sales Charge |

Timothy Plan Strategic Growth Fund vs. Dow Jones Global Moderately Aggressive Portfolio Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s Class A shares and the Dow Jones Global Moderately Aggressive Portfolio Index on September 30, 2005 and held through September 30, 2015. The Dow Jones Global Moderately Aggressive Portfolio Index is a widely recognized index that measures global stocks, bonds and cash which are in turn represented by multiple sub-indexes. Performance figures include the change in value of the investments in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

26

Fund Performance - (Unaudited)

September 30, 2015

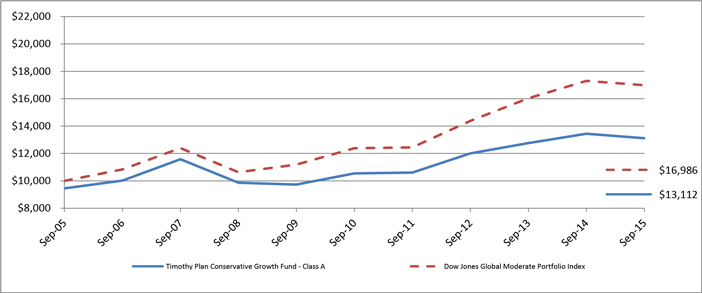

Conservative Growth Fund

| Fund/Index | 1 Year

Total Return |

5 Year

Average

Annual Return |

10 Year

Average

Annual Return | |||

Timothy Conservative Growth Fund - Class A (With Sales Charge) | (7.82)% | 3.28% | 2.75% | |||

Dow Jones Global Moderate Portfolio Index | (1.83)% | 6.52% | 5.44% | |||

Timothy Conservative Growth Fund - Class C * | (4.12)% | 3.67% | 2.57% | |||

Dow Jones Global Moderate Portfolio Index | (1.83)% | 6.52% | 5.44% |

| * | With Maximum Deferred Sales Charge |

Timothy Plan Conservative Growth Fund vs. Dow Jones Global Moderate Portfolio Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s Class A shares and the Dow Jones Global Moderate Portfolio Index on September 30, 2005 and held through September 30, 2015. The Dow Jones Global Moderate Portfolio Index is a widely recognized index that measures global stocks, bonds and cash which are in turn represented by multiple sub-indexes. Performance figures include the change in value of the investments in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

27

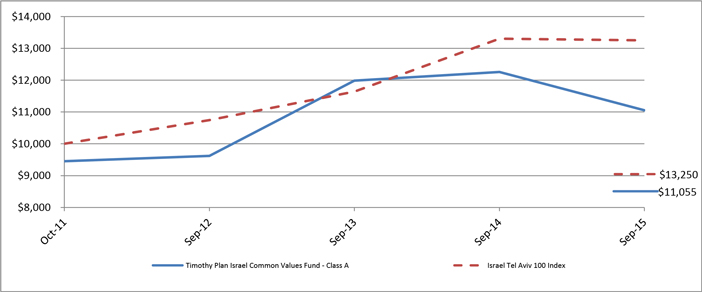

Fund Performance - (Unaudited)

September 30, 2015

Israel Common Values Fund

| Fund/Index | 1 Year

Total Return |

Average

Annual Return

Since Inception | ||

Timothy Israel Common Values Fund - Class A (With Sales Charge) | (14.81)% | 2.56% (a) | ||

Israel Tel Aviv 100 Index | (0.43)% | 7.35% (a) | ||

Timothy Israel Common Values Fund - Class C * | (11.43)% | 3.22% (a) | ||

Israel Tel Aviv 100 Index | (0.43)% | 7.35% (a) | ||

Timothy Israel Common Values Fund - Class I | (9.60)% | (1.82)% (b) | ||

Israel Tel Aviv 100 Index | (0.43)% | 8.09% (b) |

| (a) | For the period October 12, 2011 (commencement of investment in accordance with objective) to September 30, 2015. |

| (b) | For the period August 1, 2013 (commencement of investment in accordance with objective) to September 30, 2015. |

| * | With Maximum Deferred Sales Charge |

Timothy Plan Israel Common Values Fund vs. Israel Tel Aviv 100 Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s Class A shares and the Israel Tel Aviv 100 Index on October 12, 2011 and held through September 30, 2015. The Israel Tel Aviv 100 Index is an unmanaged index of equity prices representing the 100 most highly capitalized companies listed on the Tel Aviv Stock Exchange . Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

28

Fund Performance - (Unaudited)

September 30, 2015

Emerging Markets Fund

| Fund/Index | 1 Year

Total Return |

Average

Annual Return

Since Inception | ||||||

Timothy Emerging Markets Fund - Class A (With Sales Charge) | (37.55)% | (13.58)% | (a) | |||||

MSCI Emerging Markets Index | (21.21)% | (8.17)% | (a) | |||||

Timothy Emerging Markets Fund - Class C * | (35.01)% | (12.50)% | (a) | |||||

MSCI Emerging Markets Index | (21.21)% | (8.17)% | (a) | |||||

Timothy Emerging Markets Fund - Class I | (33.04)% | (14.85)% | (b) | |||||

MSCI Emerging Markets Index | (21.21)% | (8.24)% | (b) | |||||

| (a) | For the period December 3, 2012 (commencement of investment in accordance with objective) to September 30, 2015. |

| (b) | For the period August 1, 2013 (commencement of investment in accordance with objective) to September 30, 2015. |

| * | With Maximum Deferred Sales Charge |

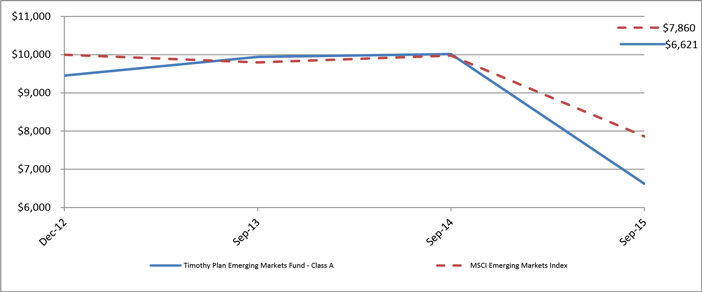

Timothy Plan Emerging Markets Fund vs. MSCI Emerging Markets Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s Class A shares and the MSCI Emerging Markets Index on December 3, 2012 and held through September 30, 2015. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The MSCI Emerging Markets Index consists of the following 21 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

29

Fund Performance - (Unaudited)

September 30, 2015

Growth & Income Fund

| Fund/Index | 1 Year

Total Return |

Average

Annual Return

Since Inception | ||||||

Timothy Growth & Income Fund - Class A (With Sales Charge) | (9.06)% | (0.19)% | (a) | |||||

Timothy Growth & Income Fund Blended Index (b) | 1.24% | 5.23% | (a) | |||||

Timothy Growth & Income Fund - Class C * | (5.37)% | 1.93% | (a) | |||||

Timothy Growth & Income Fund Blended Index (b) | 1.24% | 5.23% | (a) | |||||

Timothy Growth & Income Fund - Class I | (3.50)% | 2.85% | (a) | |||||

Timothy Growth & Income Fund Blended Index (b) | 1.24% | 5.23% | (a) | |||||

| (a) | For the period October 1, 2013 (commencement of investment in accordance with objective) to September 30, 2015. |

| (b) | The Timothy Growth & Income Fund Blended Index reflects an unmanaged portfolio of 50% of the Barclays Intermediate Government/Credit Index and 50% of the Russell 3000 Total Return Index. |

| * | With Maximum Deferred Sales Charge |

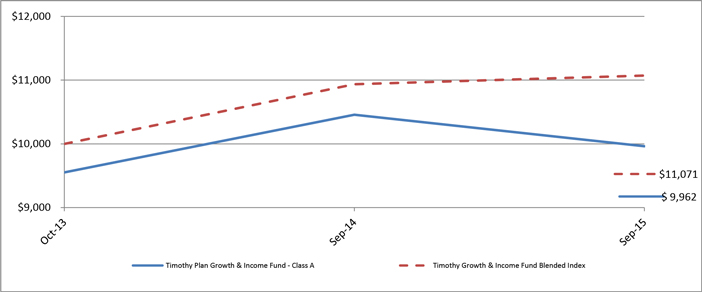

Timothy Growth & Income Fund vs. Timothy Growth & Income Fund Blended Index (b)

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s Class A shares and the Timothy Growth & Income Fund Blended Index on October 1, 2013 and held through September 30, 2015. The Timothy Growth & Income Fund Blended Index reflects an unmanaged portfolio of 50% of the Barclays Intermediate Government/Credit Index and 50% of the Russell 3000 Total Return Index. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

30

Schedule of Investments | Aggressive Growth

As of September 30, 2015

|

| |||||||

| Shares | Fair Value | |||||||

|

| |||||||

COMMON STOCK - 68.5 % | ||||||||

ADVERTISING - 1.0 % | ||||||||

| 11,155 | MDC Partners, Inc. Class A | $ | 205,587 | |||||

|

| |||||||

APPAREL - 1.8 % | ||||||||

| 955 | Carter’s, Inc. | 86,561 | ||||||

| 4,570 | Crocs, Inc. * | 59,067 | ||||||

| 5,640 | Steven Madden Ltd. * | 206,537 | ||||||

|

| |||||||

| 352,165 | ||||||||

|

| |||||||

AUTO PARTS & EQUIPMENT - 0.9 % | ||||||||

| 3,655 | Dorman Products, Inc. * | 186,003 | ||||||

|

| |||||||

BANKS - 6.8 % | ||||||||

| 2,075 | Boston Private Financial Holdings, Inc. | 24,277 | ||||||

| 4,680 | Cardinal Financial Corp. | 107,687 | ||||||

| 156,415 | First BanCorp. * | 556,838 | ||||||

| 2,025 | Hancock Holding Co. | 54,776 | ||||||

| 1,350 | Iberiabank Corp. | 78,583 | ||||||

| 13,130 | Popular, Inc. | 396,920 | ||||||

| 1,975 | PrivateBancorp., Inc. | 75,702 | ||||||

| 3,525 | State Bank Financial Corp. | 72,897 | ||||||

|

| |||||||

| 1,367,680 | ||||||||

|

| |||||||

BIOTECHNOLOGY - 1.5 % | ||||||||

| 1,060 | BioMarin Pharmaceutical, Inc. * | 111,639 | ||||||

| 1,275 | Charles River Laboratories International, Inc. * | 80,988 | ||||||

| 380 | Incyte Corp. * | 41,926 | ||||||

| 1,745 | Isis Pharmaceuticals Inc. * | 70,533 | ||||||

|

| |||||||

| 305,086 | ||||||||

|

| |||||||

COMMERCIAL SERVICES - 15.1 % | ||||||||

| 3,775 | Advisory Board Co. * | 171,914 | ||||||

| 8,340 | Cardtronics, Inc. * | 272,718 | ||||||

| 1,320 | FTI Consulting Inc. * | 54,793 | ||||||

| 4,575 | Grand Canyon Education, Inc. * | 173,804 | ||||||

| 3,485 | INC Research Holdings, Inc. - Cl. A * | 139,400 | ||||||

| 75,910 | Information Services Group, Inc. | 296,808 | ||||||

| 14,430 | KAR Auction Services, Inc. | 512,265 | ||||||

| 9,675 | On Assignment, Inc. * | 357,007 | ||||||

| 13,900 | SEI Investments Co. | 670,397 | ||||||

| 3,120 | Team Health Holdings, Inc. * | 168,574 | ||||||

| 9,430 | TrueBlue, Inc. * | 211,892 | ||||||

|

| |||||||

| 3,029,572 | ||||||||

|

| |||||||

COMPUTERS - 5.1 % | ||||||||

| 5,830 | Cognizant Technology Solutions Corp. - Cl. A * | 365,016 | ||||||

| 3,250 | Electronics For Imaging, Inc. | 140,660 | ||||||

| 4,140 | Manhattan Associates, Inc. * | 257,922 | ||||||

| 1,520 | MAXIMUS, Inc. | 90,531 | ||||||

| 6,280 | WNS Holdings Ltd. (ADR) * | 175,526 | ||||||

|

| |||||||

| 1,029,655 | ||||||||

|

| |||||||

The accompanying notes are an integral part of these financial statements.

31

Schedule of Investments | Aggressive Growth

As of September 30, 2015 (Continued)

|

| |||||||

| Shares | Fair Value | |||||||

|

| |||||||

DISTRIBUTION/WHOLESALE - 2.4 % | ||||||||

| 20,210 | H&E Equipment Services, Inc. | $ | 337,911 | |||||

| 3,690 | HD Supply Holdings, Inc. * | 105,608 | ||||||

| 570 | Pool Corp. | 41,211 | ||||||

|

| |||||||

| 484,730 | ||||||||

|

| |||||||

DIVERSIFIED FINANCIAL SERVICES - 2.9 % | ||||||||

| 25,255 | Cowen Group, Inc. * | 115,163 | ||||||

| 7,230 | E*TRADE Financial Corp. * | 190,366 | ||||||

| 2,875 | Evercore Partners, Inc. - Cl. A | 144,440 | ||||||

| 2,845 | WageWorks, Inc. * | 128,252 | ||||||

|

| |||||||

| 578,221 | ||||||||

|

| |||||||

ELECTRICAL COMPONENTS & EQUIPMENT - 0.2 % | ||||||||

| 1,070 | Belden, Inc. | 49,958 | ||||||

|

| |||||||

| 49,958 | ||||||||

|

| |||||||

ENGINEERING & CONSTRUCTION - 0.5 % | ||||||||

| 860 | SBA Communications Corp. - Cl. A * | 90,077 | ||||||

|

| |||||||

HEALTHCARE - PRODUCTS - 2.3 % | ||||||||

| 3,755 | Globus Medical, Inc. - Cl. A * | 77,578 | ||||||

| 2,065 | LDR Holding Corp. * | 71,305 | ||||||

| 1,315 | Masimo Corp. | 50,707 | ||||||

| 1,860 | NuVasive, Inc. * | 89,689 | ||||||

| 4,200 | NxStage Medical, Inc. * | 66,234 | ||||||

| 570 | Sirona Dental Systems, Inc. * | 53,204 | ||||||

| 4,470 | Spectranetics Corp. * | 52,701 | ||||||

|

| |||||||

| 461,418 | ||||||||

|

| |||||||

HEALTHCARE - SERVICES - 0.4 % | ||||||||

| 1,075 | HCA Holdings, Inc. * | 83,162 | ||||||

|

| |||||||

HOLDING COMPANIES - DIVERSIFIED - 0.3 % | ||||||||

| 525 | Chimerix, Inc. * | 20,055 | ||||||

| 2,990 | Horizon Pharma PLC * | 59,262 | ||||||

|

| |||||||

| 79,317 | ||||||||

|

| |||||||

HOME BUILDERS - 0.4 % | ||||||||

| 1,695 | Lennar Corp. Class A | 81,580 | ||||||

|

| |||||||

HOME FURNISHINGS - 0.3 % | ||||||||

| 600 | Harman International Industries, Inc. | 57,594 | ||||||

|

| |||||||

INSURANCE - 3.0 % | ||||||||

| 8,205 | Assured Guaranty Ltd. | 205,125 | ||||||

| 42,710 | MGIC Investment Corp. * | 395,495 | ||||||

|

| |||||||

| 600,620 | ||||||||

|

| |||||||

LEISURE TIME - 3.1 % | ||||||||

| 12,860 | Brunswick Corp. | 615,866 | ||||||

|

| |||||||

MEDIA - 0.2 % | ||||||||

| 5,625 | Tribune Publishing Co. | 44,100 | ||||||

|

| |||||||

The accompanying notes are an integral part of these financial statements.

32

Schedule of Investments | Aggressive Growth

As of September 30, 2015(Continued)

|

| |||||||

| Shares | Fair Value | |||||||

|

| |||||||

OIL & GAS - 1.3 % | ||||||||

| 1,145 | Carrizo Oil & Gas, Inc. * | $ | 34,968 | |||||

| 3,310 | Diamondback Energy, Inc. * | 213,826 | ||||||

|

| |||||||

| 248,794 | ||||||||

|

| |||||||

OIL & GAS SERVICES - 1.3 % | ||||||||

| 20,045 | Superior Energy Services, Inc. | 253,168 | ||||||

|

| |||||||

PHARMACEUTICALS - 1.6 % | ||||||||

| 5,912 | Akorn, Inc. * | 168,522 | ||||||

| 2,050 | Flamel Technologies SA (ADR) * | 33,435 | ||||||

| 3,925 | PharMerica Corp. * | 111,745 | ||||||

|

| |||||||

| 313,702 | ||||||||

|

| |||||||

RETAIL - 6.1 % | ||||||||

| 1,225 | Advance Auto Parts, Inc. | 232,174 | ||||||

| 2,275 | Bloomin’ Brands, Inc. | 41,360 | ||||||

| 8,325 | Express, Inc. * | 148,768 | ||||||

| 2,975 | Kona Grill, Inc. * | 46,856 | ||||||

| 14,470 | MarineMax, Inc. * | 204,461 | ||||||

| 2,970 | Men’s Wearhouse, Inc. | 126,284 | ||||||

| 6,275 | Sonic Corp. | 144,011 | ||||||

| 3,315 | Tractor Supply Co. | 279,521 | ||||||

|

| |||||||

| 1,223,435 | ||||||||

|

| |||||||

SEMICONDUCTORS - 4.1 % | ||||||||

| 575 | Avago Technologies Ltd. | 71,881 | ||||||

| 655 | Cavium, Inc. * | 40,197 | ||||||

| 22,740 | Cypress Semiconductor Corp. | 193,745 | ||||||

| 3,680 | Integrated Device Technology, Inc. * | 74,704 | ||||||

| 1,000 | IPG Photonics Corp. * | 75,970 | ||||||

| 1,450 | Monolithic Power System, Inc. | 74,240 | ||||||

| 3,305 | NXP Semiconductor NV * | 287,767 | ||||||

|

| |||||||

| 818,504 | ||||||||

|

| |||||||

SOFTWARE - 5.0 % | ||||||||

| 675 | Citrix Systems, Inc. * | 46,764 | ||||||

| 1,640 | Proofpoint, Inc. * | 98,925 | ||||||

| 6,125 | PTC, Inc. * | 194,407 | ||||||

| 3,135 | Qlik Teachnologies, Inc. * | 114,271 | ||||||

| 2,400 | SPS Commerce, Inc. * | 162,936 | ||||||

| 5,355 | SS&C Technologies Holdings, Inc. | 375,064 | ||||||

|

| |||||||

| 992,367 | ||||||||

|

| |||||||

The accompanying notes are an integral part of these financial statements.

33

Schedule of Investments | Aggressive Growth

As of September 30, 2015 (Continued)

|

| |||||||

| Shares | Fair Value | |||||||

|

| |||||||

TRANSPORTATION - 0.9 % | ||||||||

| 3,005 | Old Dominion Freight Line, Inc. * | $ | 183,305 | |||||

|

| |||||||

TOTAL COMMON STOCK (Cost $14,648,299) | 13,735,666 | |||||||

|

| |||||||

MASTER LIMITED PARTNERSHIPS - 1.1 % | ||||||||

| 5,285 | Lazard Ltd. - Cl. A (Cost $271,795) | 228,840 | ||||||

|

| |||||||

REITs - 0.2 % | ||||||||

| 5,675 | Lexington Realty Trust - REIT (Cost $48,843) | 45,967 | ||||||

|

| |||||||

MONEY MARKET FUND - 31.1 % | ||||||||