UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08228

The Timothy Plan

(Exact name of registrant as specified in charter)

1055 Maitland Center Commons, Maitland, FL 32751

(Address of principal executive offices) (Zip code)

Art Ally, The Timothy Plan

1055 Maitland Center Commons, Maitland, FL 32751

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-846-7526

Date of fiscal year end: 9/30

Date of reporting period:9/30/19

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Registrant’s audited annual financial reports transmitted to shareholders pursuant to Rule30e-1 under the Investment Company Act of 1940 are as follows:

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website, www.timothyplan.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically or to continue receiving paper copies of shareholder reports, which are available free of charge, by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by following the instructions included with paper Funds documents that have been mailed to you.

1

September 30, 2019

Dear Shareholder,

As you review the details on the following pages, you will see that we started out this fiscal year where most of our funds endured a very large downturn (in the markets) in the 4th quarter, 2018. Pundits searched for valid reasons causing the decline, but as the markets have since demonstrated, there really was little except what we believe were fear and hype behind the decline. Consequently, I am pleased to report that we more than recovered the losses during the first nine months of 2019. Hence, ourone-year performance over the past fiscal year(10-1-18 thru9-30-19) varies among our funds from slightly down to fairly strongly up. Among our better performers were our fixed-income oriented funds along with our international funds and our Defensive Strategies Fund. All of that simply underscores the wisdom of asset allocation since different market segments perform differently over differing periods.

The positive returns we experienced thus far in 2019 are, we believe, in large part the result of our country’s leadership and the positivepro-business agenda President Trump is pursuing. These changes have given us a positive long-term view of our economy and, therefore the equity markets. Even though we experienced periodic short-term volatility, we fully expect the market trend to continue upward. Nevertheless, Timothy Partners, Ltd, (the “Advisor”) continued (and will continue) to take a conservative approach to the markets as we believe our shareholders prefer a preservation of principal course to that of chasing returns. I do need to reiterate, however, that, in the capital markets in general and our funds in particular, returns can never be guaranteed.

For more complete information about the individual funds, please read each of thesub-advisors’ annual review letters in the pages that follow. They more fully detail the various factors that impacted this fiscal year’s performance along with their economic outlook for the coming year.

Although we cannot guarantee any actual outcome, I remain confident that all of oursub-advisors are, in our opinion, among the best in the industry and they each continue to honor our overall policy to manage their respective funds both in accordance with our screening restrictions and with a continued conservative bias.

Finally, I would once again like to thank you for your moral convictions that led you to becoming part of the Timothy Plan Family.

Yours in Christ,

Arthur D. Ally

President

2

| | |

| |

Timothy Plan Aggressive Growth Fund Letter from the Manager – September 30, 2019 | |

|

| | | |

This time last year we wrote about an accelerating economy in the trailing12-month period, as GDP grew over 3% due to the positive effects of the corporatetax-rate cut and increased government defense spending. A year later, the growth rate of the U.S. economy is losing speed, leading many to question whether we can even stay at a “muddle-through” growth rate of1.0- 1.75%, or fall victim to a recession. The biggest issue currently is that, due largely to the trade war, confidence is plummeting and corporate America remains wary of investing in the face of escalating trade tensions. The manufacturing sector is already in a recession, as evidenced by September’s ISM (Institute for Supply Management) reading of 47.8, the lowest level since June of 2009. Any reading below 50 indicates contraction. On the other hand, the consumer – at 70%+ of our economy – is a more important gauge, and we can be much more optimistic on that front. The unemployment rate recently fell to a fresh50-year low of 3.5%, and we are currently in the midst of an amazing 108 consecutive months of job growth, the longest streak in history. Wages are growing at a reasonable clip of about 3%, as inflation continues to be very tame. The consumer balance sheet has also benefited fromde-leveraging since the financial crisis, and aggregate household net worth has now surpassed $100 trillion, though it can be argued that the benefits of the rising stock market and higher home prices, are enjoyed primarily by the upper-income cohort.

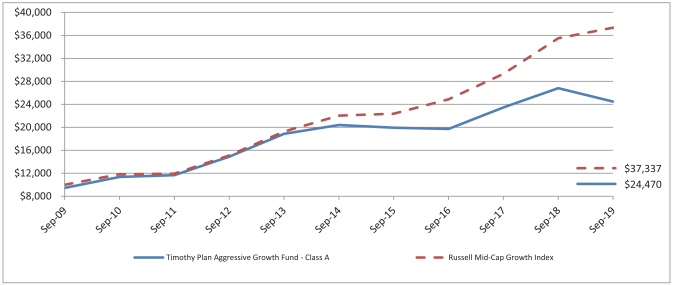

The Fund returned-3.84 percent in the September 2019 quarter, 16.63 percent year to date, and - 7.31 percent over the last 12 months. This compares to the Russell Midcap Growth Index that returned-0.68 percent in the past quarter, 25.23 percent year to date, and 5.2 percent over the last 12 months.

The underperformance over the past 12 months was driven by weak stock selection in the consumer discretionary and the industrial sectors. Our largest stock underperformer in the consumer discretionary sector was Farfetch [FTCH], which suffered after missing its sales projections and having significant senior management turnover. Within the industrial sector, our investment in Insperity [NSP] proved to be disappointing. Insperity is a Professional Employer Organization [PEO] that provides outsourced human resources services to its clients. While the company missed earnings expectations modestly, investors are more concerned that the current economic slowdown will adversely affect Insperity in the future.

The largest outperformers over the past 12 months were primarily investments in the healthcare sector, specifically medical device companies. Insulet [PODD] had significant gains after they reported strong sales and earnings growth as their insulin pump systems are becoming more widely adopted both the in the US and Europe. While historically only type 1 diabetics have used these pump systems, now with greater insurance coverage and technology advances, type 2 diabetics are beginning to adopt these systems as well. Another top performer was Edwards Lifesciences [EW]. Edwards also exceeded investors’ expectations driven by strong growth of their cardiovascular devices, specifically their transcatheter aortic valve replacements [TAVR]. We are optimistic that sales growth should further accelerate going forward after recent clinical data showed that a wider group oflow-risk patients would also benefit from the use of TAVR.

We are monitoring the macro economic data as investors are concerned that the current slowdown in the manufacturing segment extends into the services / consumer-driven segment of the economy. That data had led to investors overweighting sectors that had minimal industrial exposure [healthcare and technology], and underweighting sectors that had exposure to the global economic slowdown. However, over the past month, we are seeing some signals from the markets that perhaps valuations in the industrial segments have become overly compressed, with several sectors trading at10-year-low valuations. While it is difficult to justify investing in many of these sectors based on current fundamentals, we are closely watching both the economic and corporate earnings data to see if the recent rotation into more cyclical segments of the economy is justified. It is in everyone’s interest to see some resolution in the ongoing litany of new global tariffs. Perhaps pressure ahead of the 2020 elections will lead to a partial resolution or ceasefire on this front.

3

We continue to find compelling investment opportunities, particularly in the Real Estate and medical device industries. Given the dramatically lower interest rates seen globally, REITs as an asset class should continue to be in favor to investors due their attractive dividend yield. We remain focused on generating alpha and producing the strongest investment results over the long run. We thank you for your continuing support and investment.

Chartwell Investment Partners, LLC

4

The Timothy Plan International Fund

Letter from The Manager - September 30, 2019

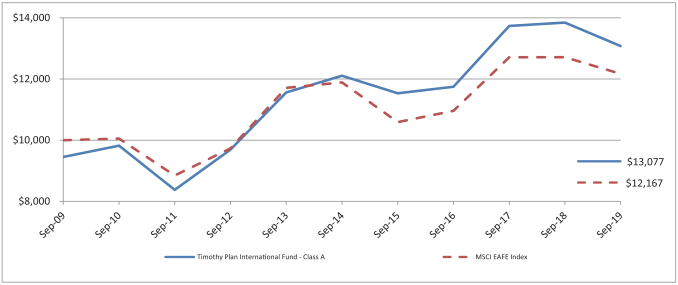

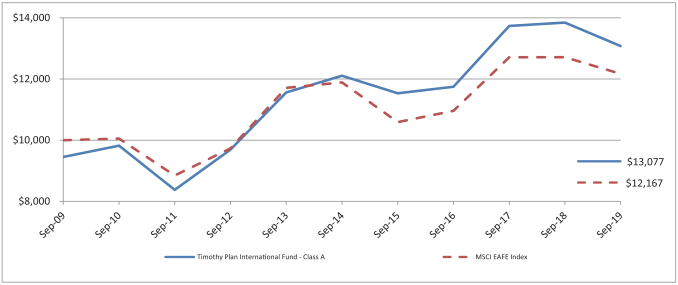

While calendar year 2019 has brought good absolute and relative performance for the Timothy International Fund versus the MSCI EAFE index, the last twelve months proved more challenging due to the market plunge in the 4th quarter of 2018. Sector allocation was tough due to underweights to more defensive sectors such as Utilities, Real Estate, and Consumer Staples which held up much better in the stock selloff in late 2018. The Fund’s overweight to Technology and underweight to the Materials sector helped but were not enough to offset the sharp declines in stocks in late 2018. Stock selection was a bit more balanced for the portfolio with very good selection in the Financials, Technology, and Industrials sectors but offset by negative selection in Health Care, Energy, and Consumer Discretionary. In Health Care, strong performance from British medical device company Smith & Nephew was offset by poor performance from German dialysis provider Fresenius Medical Care. In Industrials, French toll road operator Vinci and Hong-Kong based tools manufacturer Techtronic performed well. From a country standpoint the Fund benefited from its underweight to Japan and good stock selection there but was hurt from its underweight to defensive Switzerland and detrimental stock selection in France where auto parts company Valeo fell on concerns over weakness in the global auto cycle and Europe-specific auto manufacturing disruptions.

The international markets were sent on a tailspin in the 4th quarter of 2018 on uncertainty over Federal Reserve monetary policy, theUS-China trade war, unending Brexit risks, Italian politics, and concerns of slowing global economic growth. This calendar year has been a bit of a roller coaster for the markets overall with increased volatility but thus far has experienced a nice rebound in equity prices. Global central banks have stepped in to offer “whatever it takes” with the Federal Reserve, the European Central Bank, and the Bank of Japan all focused on maintaining or increasing monetary stimulus. Bond yields plummeted during the year which saw the German yield curve all the way to 30 years plunge into negative territory, an unprecedented occurrence. TheUS-China trade war remains a concern as markets await some kind of truce there. Concerns still abound for economic growth as we enter into 2020 but the European and Japanese economics could provide positive momentum as they slowly rebound out of their recent slump in spite of a new consumption tax in Japan that will lead to short term pressures late in 2019.

Relative and absolute valuations remain attractive for international equities while any sign of dollar weakness or Europe and/or Japan closing the economic growth gap with the U.S. could see some renewed optimism for international equity outperformance. We remain committed to a consistent investment approach dedicated to finding long-term investments for shareholders and thank you for your continued investment in the Fund.

Eagle Global Advisors, LLC

5

| | |

Timothy Plan Large/Mid Cap Growth Fund Letter from the Manager – September 30, 2019 | |  |

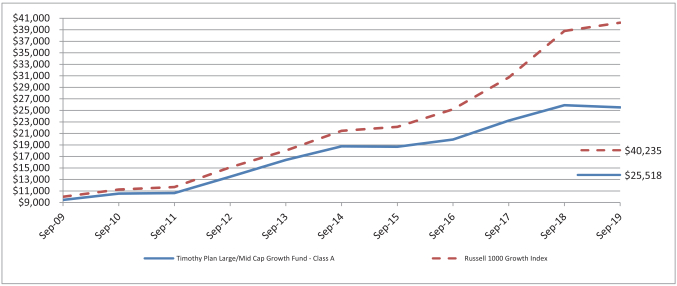

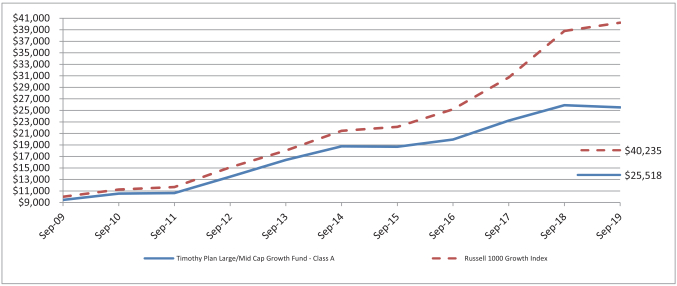

This time last year we wrote about an accelerating economy in the trailing12-month period, as GDP grew over 3% (though it was later revised down to +2.5%), due in part to the positive effects of the corporatetax-rate cut. A year later, the growth rate of the U.S. economy is losing speed (and Europe has already precipitously slowed), leading many to question whether we can even stay at a “muddle-through” growth rate of1.0-1.75% or fall victim to a recession. The biggest issue currently is that, due largely to the trade war, confidence is plummeting and corporate America remains wary of investing in the face of escalating trade tensions. The manufacturing sector is already in a mini-recession, as evidenced by September’s ISM (Institute for Supply Management) reading of 47.8 (below 50 indicates contraction), the lowest level since June of 2009. On the other hand, the consumer – at 70%+ of our economy – is a more important gauge, and we can be much more sanguine on that front. The unemployment rate recently fell to a fresh50-year low of 3.5%, and we are currently in the midst of an amazing 108 consecutive months of job growth, the longest streak in history. Wages are growing at a reasonable clip of about 3%, as inflation continues to be very tame. The consumer balance sheet has also benefited fromde-leveraging since the financial crisis, and aggregate household net worth has now surpassed $100 trillion, though it can be argued that the benefits of this (booming stock market and rising home prices) are enjoyed primarily by the upper-income cohort.

Unlike recent years, for this12-month period, there was not a meaningful spread in performance between growth and value stocks, however, size was impactful to the Fund’s relative performance. Due to the restrictions, we can’t own many of thelarge-cap growth stocks in the benchmark, hence, the Fund’s weighted market cap is significantly smaller than that of the R1G. By way of illustration of the size effect, the Russell top 200 market cap stocks were up 4.1% in the period, the Russell 2000 (small stocks) fell 8.9%, and the Russell Microcap (smallest) index was down 16%.

The Fund underperformed the Russell 1000 Growth Index, rising 0.2%, vs. +3.7% for the benchmark. Sector allocation was a net negative, primarily from our underweight of Real Estate (best-performing sector) and our overweight of Energy (worst-performing sector). Combined, these effects cost the fund 150 basis points. Stock selection was a negative within Industrials, as Fortive fell 18%, and Caterpillar dropped 15%; cyclical stocks did not fare well in the past year due to concerns over tariffs and a slowing economy. In the same vein, trucker J.B. Hunt was down 15%. In Financials, two bank positions – SVB Financial and East West Bancorp (down 34% and 21% respectively) – had negative impacts on the fund; the falling interest-rate environment was generally not good for banks during the period (they were down 26% in the benchmark). Other detractors across various sectors included ConocoPhillips (- 25%), NVIDIA(-38%), and Sarepta Therapeutics(-53%). Sarepta had soared 71% in the prior12-month period, on the heels of an exceptional commercial launch of the drug Ingrezza, after presenting promising gene-therapy data for the treatment of Duchenne Muscular Dystrophy (DMD). However, in August they received a surprising decision from the FDA in which the agency denied approval of Sarepta’s drug Golodirsen in DMD. Given the prior approval of a similar drug Sarepta has on the market, Exondys 51, there were expectations of an approval. NVDA was also coming off a big prior year – when it was up 58%; more recently, however, its growth in both gaming and chips for the data-center end market have slowed. Turning to positive impacts, stock selection in Consumer Staples was buoyed by spice-company McCormick, which rose 20%, and Costco, up 24%. Both of these companies are well-positioned relative to consumer trends and preferences. In Technology, although not being able to own Microsoft (+23%) was a headwind, we had good results from several of our positions: tech reseller CDW was up 40%, as it continues toout-grow its industry; cyber-security company Rapid7 +23%; software company ServiceNow +30% (outperforming Microsoft); and NXP Semiconductors +29%. In Healthcare, animal-health company Zoetis rose 37% as it continues to produce consistentmid-teens earnings growth (and has had 5 consecutive quarters of positive earnings surprises).

6

For the portfolio, there has been no change to our time-tested,bottom-up fundamental approach to managing large andmid-cap growth investments. As an overview, the Fund remains well diversified by issuers and sectors, as all areas of the economy are impacted by broad macroeconomic trends. We have recently taken some weight out of the economically-sensitive areas of our holdings, as the tariffs (and global economic slowdown) make these stocks vulnerable. We also cut back on stocks that could be negatively impacted by lower interest rates, as that trend seems to be in place for the foreseeable future. Healthcare is an area of interest for purchase candidates, as the political rhetoric around “Medicare for All” and drug pricing has created some opportunities. We thank you for your continuing support and investment.

Chartwell Investment Partners, LLC

7

September 30, 2019

Dear Timothy PlanLarge/Mid-Cap Growth Fund Shareholder:

On May 1, 2019, Timothy Plan added two new Exchange Traded Funds to our diversified product line: Timothy PlanLarge-Cap Core (TPLC) and Timothy Plan High Dividend Stock (TPHD). These are both smart beta index funds traded on the New York Stock Exchange. Since TPLC fits nicely into the investment objective of ourLarge/Mid-Cap Growth Fund, we incorporated this particular ETF into the holdings of this fund so that:

| | • | | Approximately 20% of the fund is now invested in TPLC |

| | • | | And the remainder of the fund continues to be actively managed by our long-timesub-advisor, Chartwell Investment Partners. |

In addition to greatly increasing the diversification of the holdings in this fund, we believe this addition should have the positive effect of lowering our expense ratio over both the near and longer term.

ETFs are passively managed investment vehicles, with Timothy ETFs being reflections of biblically responsible investment (BRI) indices that were developed specifically to accommodate the BRI space. As stated above, the ETFs were not incorporated into the portfolio until May, following the 2018sell-off, and although the market was choppy, the ETF was a positive contributor, although the Fund overall had a slightly negative return of-1.54% for the fiscal year. We suggest you look to Chartwell’sSub-Advisor’s letter for the Fund for more information and future market outlook.

As you know, no one can guarantee future performance. However, the one thing that I can assure you of is every one of oursub-advisors is doing their very best and our team here at Timothy is working very hard to provide you an investment in which you can feel comfortable.

Sincerely,

Arthur D. Ally

President

8

LETTER FROM THE MANAGER

September 30, 2019

TIMOTHY PLAN SMALL CAP VALUE FUND

We are pleased to provide you with our report for the Timothy Plan Small Cap Value Fund for the twelve months ending September 30, 2019 and would like to thank you for entrusting your assets with us.

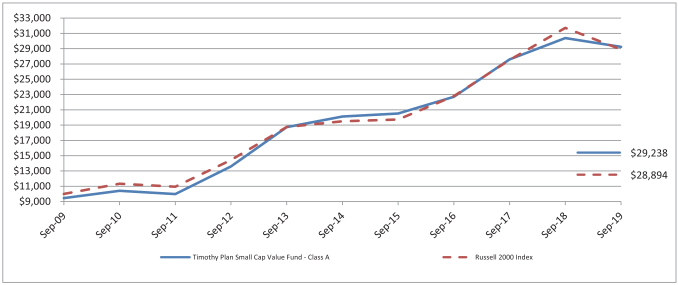

Looking back, equity markets began the last twelve months with a harshsell-off over fears of slowing global growth, continued pressures from the trade dispute between the U.S. and China, and a potential policy error by the Federal Reserve in over-tightening monetary policy. None of these fears were new to investors, but they culminated into a broad market decline across all of the sectors and market capitalizations. As fears abated, markets rallied with larger caps regaining their losses and then some while smaller cap stocks remain in negative territory. Economic data has moderated over the last year, with the most recent Gross Domestic Product (GDP) figure showing just 2 percent growth and other indicators, like the Institute of Supply Management’s (ISM) Manufacturing Purchasing Managers Index (PMI) have fallen into contraction territory. The Federal Reserve has entirely reversed course, with expectations for rate hikes to continue as the calendar year turned have morphed into several rate cuts with the potential for more in the future. This added support has certainly been well-received by investors, though expectations remain for challenging growth conditions more broadly. Little progress has been made on the trade negotiations underway with China, sapping business confidence and adding to the uncertainty. While corporate profits have been resilient, investments in capital expenditures have failed to materialize as fast as hoped due to these concerns and companies continue to return record levels of cash to shareholders in the form of dividends and buybacks. While the U.S. muddles through, the rest of the world has seen challenging economic conditions, though, some signs may be emerging for a potential rebound in the coming quarters. There remains a high degree of concern globally regarding future growth and disruptions from these macroeconomic factors in the future.

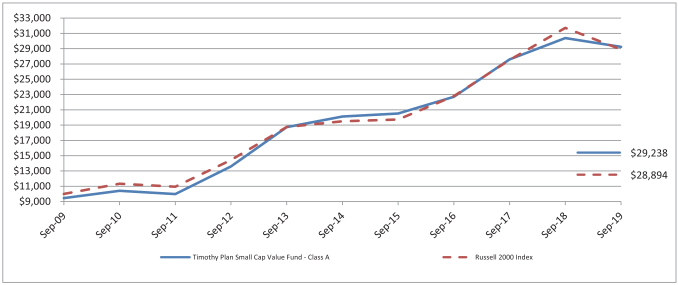

For the twelve months ending September 30, 2019, the Timothy Plan Small Cap Value Fund produced a net return of - 2.57%, while the Russell 2000 Index produced a return of-8.86%. Positive stock selection was seen broadly across most sectors as higher-quality businesses were strongly preferred by the market. This was particularly true within Health Care and Consumer Staples, the top relative contributors. Energy performed poorly, both in a relative and absolute sense, as an overweight weighed heavily on relative performance. An underweight to Information Technology, despite positive selection, also detracted from relative performance.

Installed Building Products recovered strongly in the spring after investors’ concerns regarding their ability to pass through increased costs for the insulation they install were assuaged with further tailwinds from the strong U.S. housing market. UniFirst saw the market reward their reacceleration in earnings growth as strong demand for their uniform rental services continued to rise from employment growth in their serviced industries. Lattice Semiconductor rallied as their strong product pipeline and improving gross margins continued to exceed investor expectations as their chips are well suited for edge and internet of things (IoT) applications. Novanta remained a solid execution story as management’s efforts to reshape their portfolio towards higher-growth areas like medical over the last several years delivered strong sales and earnings growth once again. CONMED saw strength in the organic growth in their core areas of orthopedics and general surgery. Their recent acquisition performed above expectations and new sports medicine products look promising to bolster growth in the future.

Falling crude oil prices over concerns of oversupply and lower demand growth weighed heavily on a number of names including Callon Petroleum, Penn Virginia, and SRC Energy. Penn Virginia also struggled after walking away from a potential merger with another exploration and production company as some deal-related investors rotated out of the shares. Interface continued to execute as topline growth led to strong earnings growth, however, a challenging environment in terms of future commercial remodel activity in the U.S. and Europe weighed on shares. Children’s Place remains positioned to capitalize on the bankruptcy of a large competitor, Gymboree, however, the near-term environment remains highly promotional hurting their sales and margins.

The Small Cap Value team is focused on seekingwell-run companies with growth prospects that are underappreciated by the marketplace. We look for companies with above average growth and strong balance sheets that generate positive cash flows. As economic growth continues to remain positive, we feel our companies are well positioned to achieve higher earnings and have the potential to provide superior relative returns.

We thank you for your continued confidence in the Westwood process and investment teams and we look forward to serving your investment needs through the years ahead.

Westwood Management Corporation

9

LETTER FROM THE MANAGER

September 30, 2019

TIMOTHY PLAN LARGE/MID CAP VALUE FUND

We are pleased to provide you with our report for the Timothy Plan Large/Mid Cap Value Fund for the twelve months ending September 30, 2019 and would like to thank you for entrusting your assets with us.

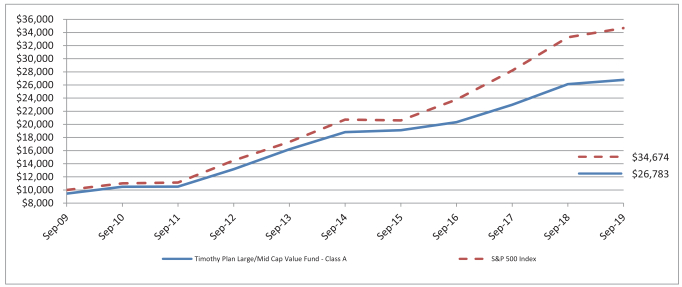

Looking back, equity markets began the last twelve months with a harshsell-off over fears of slowing global growth, continued pressures from the trade dispute between the U.S. and China, and a potential policy error by the Federal Reserve in over-tightening monetary policy. None of these fears were new to investors, but they culminated into a broad market decline across all of the sectors and market capitalizations. As fears abated, markets rallied with larger caps regaining their losses and then some while smaller cap stocks remain in negative territory. Economic data has moderated over the last year, with the most recent Gross Domestic Product (GDP) figure showing just 2 percent growth and other indicators, like the Institute of Supply Management’s (ISM) Manufacturing Purchasing Managers Index (PMI) have fallen into contraction territory. The Federal Reserve has entirely reversed course, with expectations for rate hikes to continue as the calendar year turned have morphed into several rate cuts with the potential for more in the future. This added support has certainly been well-received by investors, though expectations remain for challenging growth conditions more broadly. Little progress has been made on the trade negotiations underway with China, sapping business confidence and adding to the uncertainty. While corporate profits have been resilient, investments in capital expenditures have failed to materialize as fast as hoped due to these concerns and companies continue to return record levels of cash to shareholders in the form of dividends and buybacks. While the U.S. muddles through, the rest of the world has seen challenging economic conditions, though, some signs may be emerging for a potential rebound in the coming quarters. There remains a high degree of concern globally regarding future growth and disruptions from these macroeconomic factors in the future.

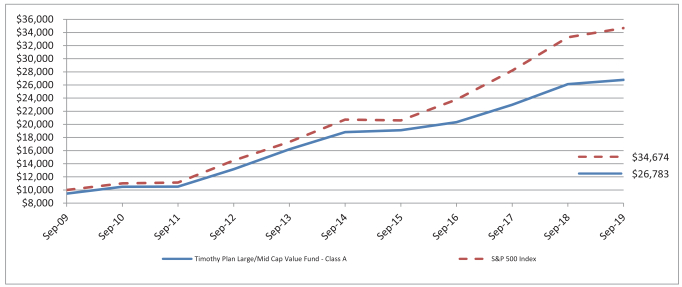

For the twelve months ending September 30, 2019, the Timothy Plan Large/Mid Cap Value Fund produced a net return of 3.85%, while the S&P 500 Index produced a return of 4.25%. While absolute returns have remained positive despite compressing from their recent highs, relative performance faced some headwinds. Notable positives included better stock selection within Health Care and Communication Services while our exposure and selection within Energy, the worst performing sector, weighed heavily on relative performance as did less favorable selection in Financials.

Several areas saw strong stock selection, particularly in Health Care, as high-quality medical device companies were less impacted by the political headlines suggesting the possibility of‘Medicare-for-All’. STERIS and DENTSPLY SIRONA saw strong performance on the back of continued execution of their respective growth and cost initiatives. DENTSPLY, in particular, saw a strong rebound despite the persistent headwinds in the dental market. Within Communication Services, Cable One remains the lone contributor. Their strategy to shift towards high-speed data customers and away from video subscribers has continued to deliver strong growth in margins and free cash flow. Management continues to target the longer-term increase in broadband penetration, along with the completion of a facility upgrade, to further grow their free cash flow. KLA Corp. remains committed to their long-term operating model as their recent investor day highlighted the potential for their semiconductor process control segment to outgrow an already healthy 6 percent growing end market. This should further enhance their superior free cash flow and margin profile founded on product leadership and services offering. CMS Energy rallied as investors looked for stable, steady income as interest rates declined and their consistent execution fit the profile. Their upcoming long-term capital plan provides significant visibility into the company’s ability to consistently deliver above-average returns and earnings growth.

The Fund’s exposure to Energy was the most notable headwind, as the sector experienced significant declines during the period. Falling commodity prices, as expectations for global crude oil demand growth moderated, pressured a number of stocks within the oil patch including EOG Resources and Diamondback Energy. While many companies’ execution remained strong, the 25 percent plus decline in crude prices proved challenging to overcome, however, both continue to focus on generating improved returns over absolute growth and are well-positioned in the lower crude price environment. Similarly, Financials saw less favorable selection and faced broad macroeconomic pressures. The decline in interest rates weighed heavily on banks given their net interest margin or spread between their cost of deposits and what they earn on loans. TCF Financial closed their acquisition of Chemical Financial and continues to work through the integration with potentially meaningful cost savings coming in the next several quarters. Western Alliance posted strong fundamentals, given the backdrop, and management reiterated their ability to adjust their operations to respond to the current environment. PerkinElmer declined as growth slowed within their industrial segment, particularly in China. Management noted that they faced some headwinds as customers switched to domestic manufacturers in China, even as demand moderated in the food safety testing arena.

The Westwood team remains focused on seeking high-quality companies trading at a discount to intrinsic value. In the face of growing concerns over global growth, particularly here in the U.S., the market has seen a distinct pivot towards higher-quality franchises with strong balance sheets and cash generation. Concurrently, the fall in interest rates as investors seek

10

out stability and income along with the Federal Reserve’s pivot towards cutting rates has helped hold equities near their recent highs. The Fed began the year expecting to hike rates while reducing their balance sheet; now, the Fed expects to grow its balance sheet modestly while lowering rates. Fiscal policies, particularly the tax cuts, have seen some of their positive effects offset by the ongoing trade dispute with China. These uncertainties have weighed heavily on business confidence, with some spillover beginning to manifest in the consumer arena and limited the incentive for companies to invest in capital expenditures. Returns amongst those businesses better positioned to weather volatility and those who can’t have widened as of late. In total, the overall impact to the investing landscape should provide additional opportunities to active managers as dispersion of returns increases and correlations between stocks decrease. We continue to leverage our intensive research-driven process to identify securities with company-specific opportunities and visible earnings growth. As has always been our practice, we look to invest in companies with conservative balance sheets, robust free cash flow generation, and high returns as we believe those characteristics among others help provide attractive risk-adjusted returns for the portfolio. Given the above-average market returns over the past few years, we are mindful of the potential for downside risk and are focusing on opportunities which we feel have measurable and limited potential for loss should volatility rise.

We thank you for your continued confidence in the Westwood process and investment teams and we look forward to serving your investment needs through the years ahead.

Westwood Management Corporation

11

September 30, 2019

Dear Timothy PlanLarge/Mid-Cap Value Fund Shareholder:

On May 1, 2019, Timothy Plan added two new Exchange Traded Funds to our diversified product line: Timothy PlanLarge-Cap Core (TPLC) and Timothy Plan High Dividend Stock (TPHD). These are both smart beta index funds traded on the New York Stock Exchange. Since both of these fit nicely into the investment objective of ourLarge/Mid-Cap Value Fund, we incorporated them into the holdings of this fund so that:

| | • | | 10% of the fund is invested in TPLC |

| | • | | 10% of the fund is invested in TPHD |

| | • | | And 80% of the fund continues to be actively managed by our long-timesub-advisor, Westwood Capital Management. |

In addition to greatly increasing the diversification of the holdings in this fund, we believe this addition should have the positive effect of lowering our expense ratio over both the near and longer term.

ETFs are passively managed investment vehicles, with Timothy ETFs being reflections of biblically responsible investment (BRI) indices that were developed specifically to accommodate the BRI space. As stated above, the ETFs were not incorporated into the portfolio until May, following the 2018sell-off, and although the market was choppy, the ETFs were both minor contributors to the Fund’s positive return of 2.54% for the fiscal year. We suggest you look to Westwood’sSub-Advisor’s letter for the Fund for more information and future market outlook.

As you know, no one can guarantee future performance. However, the one thing that I can assure you of is every one of oursub-advisors is doing their very best and our team here at Timothy is working very hard to provide you an investment in which you can feel comfortable.

Sincerely,

Arthur D. Ally

President

12

Letter from the Manager

September 30, 2019

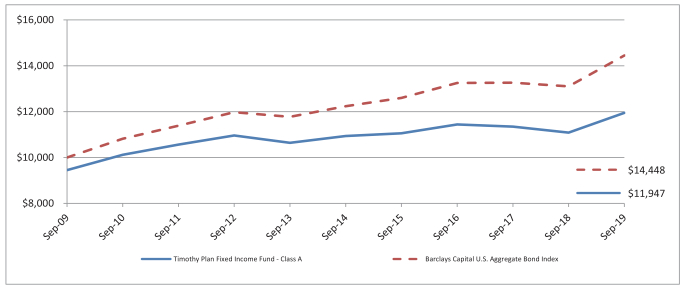

Timothy Plan Fixed Income Fund

The fiscal year ended September 30, 2019 saw a decline in yields as the Federal Reserve (Fed) began cutting rates due to U.S.-China Trade issues and signs of slowing economic growth. The Timothy Plan Fixed Income Fund invests in the broad U.S. investment grade bond market benchmarked to the Bloomberg Barclays Aggregate index which began the last 12 months with a 3.45% yield and ended at 2.11%.

The U.S. Treasury (UST)10-year fell after starting the fiscal period at 3.06%, peaking at 3.24% in November, and ending at 1.67%. By comparison, the2-year rate declined slightly less starting at 2.82% and ending the last 12 months at 1.63% or 1.19% lower. The2- and10-year UST yield curve inverted during the12-month period with the narrowest differential reaching-4 basis points; 1.42% versus 1.46%, respectively. The inversion reversed and maintained a difference of +5 basis points by the end of September 30, 2019. The2- and10-year inversion is the mostoft-cited harbinger of an economic slowdown since it has preceded the last eleven U.S. recessions. Undoubtedly, U.S. economic growth has slowed as GDP fell to a 2.3% year-over-year rate from 3.2%12-months prior. Consequently, the Fed reversed its hawkish stance in 2019 and by fiscal year end had cut interest rates twice.

Investment Grade (IG) Credit spreads started the last 12 months at 143 basis points and narrowed to 109 by the end of September 2019. The narrowing was a result of supply/demand dynamics that included a year-over-year decline in gross supply through the first half of 2019. In addition, foreign buying of IG Credit remerged due to anemic yields in Europe and developed Asia. The Mortgage Backed Securities (MBS) sector struggled during the period as lower UST yields sparked a wave of mortgage refinancing.

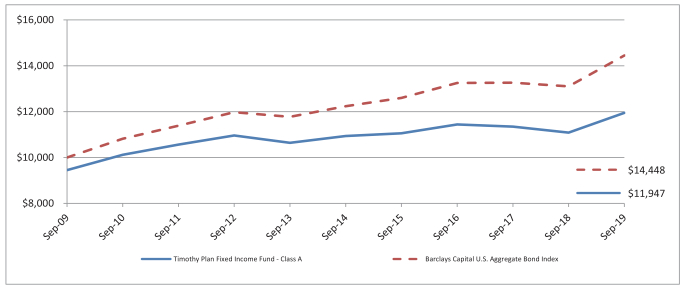

The Timothy Fixed Income Fund A shares returned 7.76% over the12-months ended September 30, 2019 which was below the Bloomberg Barclays Aggregate index at 10.30%. The overweight to Utilities added value as the sector performed better than all other major sectors and the overall index. Underweight to the Financial sector and security selection in Technology also added to results. Detracting from results was our security selection in Industrials as holdings lagged their counterparts in the sector. The portfolio’s MBS holdings generated returns below their counterparts in the index which also hurt performance. The portfolio is positioned with less interest rate risk than the market, an over-weight in corporate bonds and GNMA MBS for yield. We remain focused on generating income consistent with a prudent level of risk.

BARROW, HANLEY, MEWHINNEY & STRAUSS

13

Letter from the Manager

September 30, 2019

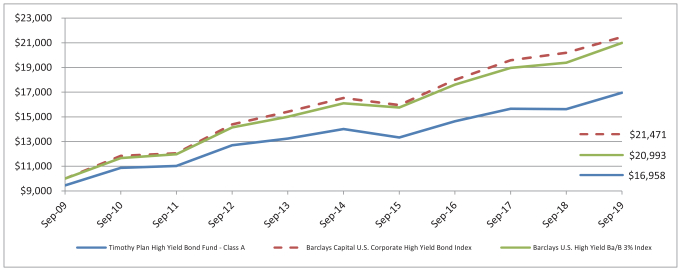

Timothy Plan High Yield Bond Fund

The fiscal year ended September 30, 2019 saw a decline in High Yield rates as investor’s continued to search for yield and income. The Timothy Plan High Yield Bond Fund invests primarily in BB and B rated High Yield (HY) bonds with a benchmark of the Bloomberg Barclays BA/B HY* index which began the last 12 months yielding 5.68% and ended at 4.77%. Over the period, the HY market posted a return of 8.31% and trailed investment grade credit bonds. Performance of the index was led by higher quality Ba rated credits.

The primary influence on performance has been favorable technicals, particularly low yields in overseas markets and low default rates. Low yields overseas make the U.S. more attractive, on a relative basis, and has resulted in the demand for higher yielding securities. During the first nine months of 2019, U.S. HY mutual funds received net inflows of $15.5B and Exchange Traded Funds also had positive flows. On a trailing1-year basis, the HY default rate remained near historic lows at 1.62%.

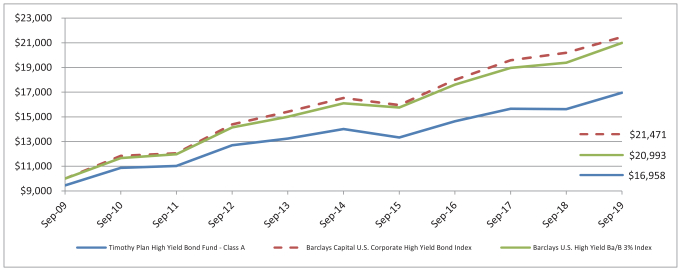

The Timothy Plan High Yield Bond Fund A shares generated a total return of 8.50% over the 12 months ended September 30, 2019 while the Bloomberg Barclays Ba/B HY* index returned 8.31%. Security selection in Energy, Capital Goods and Basic Industries benefited performance. Overweight to Utilities also helped performance as the sector generated the highest nominal return of any other major sector in the index. Detracting from performance was our security selection in Electric issuers as our holdings lagged their counterparts in the index. The portfolio remains focused on generating a higher level of carry income consistent with a reasonable level of risk.

BARROW, HANLEY, MEWHINNEY & STRAUSS

*Bloomberg Barclays US High Yield Ba/B 3% Issuer Cap Index

14

Letter from the Manager

September 30, 2019

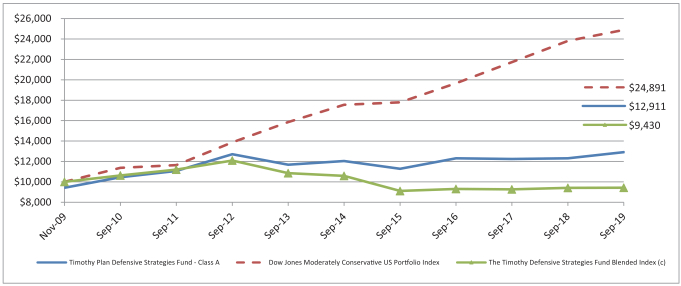

Timothy Plan Defensive Strategies Fund – TIPS

Over the past 12 months, ended September 30, 2019, economic momentum slowed as GDP growth fell and inflation remained subdued. The Timothy Defensive Strategies Fund has an allocation of U.S. Treasury Inflation Protected Securities (TIPS) designed to help protect assets from higher rates of inflation.

Investors’ future inflation expectations reached a high in late 2018 but subsequently fell during the12- month period. We measure investors’ inflation expectations as the difference between the U.S. Treasury 10 year and the U.S. TIPS 10 year. This “breakeven rate” of inflation is what would be required to make these two securities have the same yield. The “breakeven rate” of inflation rose to a high of 2.17% in October 2018 and eventually declined to a low of 1.51% by the end of September 2019. TIPS securities generated a return of 7.13%, as reported by Bloomberg Barclays, for the 12 months ended September 30th.

The TIPS allocation we manage held 5 to 10% in investment grade corporate bonds for their higher nominal yield. Inflation has remained relatively subdued but going forward the potential of higher inflation exists as central banks have reengaged in monetary stimulus and the unemployment rate remains low which could potentially trigger higher wages. The primary goal of the TIPS allocation continues to be protection from rising inflation rates.

BARROW, HANLEY, MEWHINNEY & STRAUSS

15

| | |

| | 2005 Market St. |

| | Philadelphia, PA 19103-7094 |

The Timothy Plan Defensive Strategies Fund

Real Estate Sleeve (the “Portfolio”)

Annual Manager Letter: 12 months ended September 30, 2019

During the last twelve months stock and bond volatility significantly increased. This was highlighted in December, when the Federal Reserve appeared to make a policy mistake raising rates while credit spreads widened and inflation expectations fell. The Federal Reserve, which had been on a steady path of continual interest rate increases, suddenly reversed course and has now cut the Federal Funds rate three times in the last nine months. Global growth continues to slow, and many central banks, including the U.S. are searching for a way to increase growth and inflation expectations. The US continues to be the strongest market globally, despite its slowing economy. Europe continues to struggle from the continual delay in Brexit, as well poor demographics. The Emerging markets have had a difficult year due to slowing growth and protests in Hong Kong.

REITs outperformed significantly rallying over 19% during this period. During times of uncertainty, REITs can perform quite well as investors search for safety, which many REITs offer matching long-term income with long term debt. During much of the last year, the yield curve flattened and then inverted. Often this can signal a slowdown in the economy. While growth has slowed, we have yet to see evidence of a recession, but it certainly bears watching given the length of the recovery. September proved to be a very interesting month as value outperformed growth significantly for the first time in a few years. What was interesting is this occurred during a period when the yield curve began to steepen, which could be signaling a potential return to global growth in 2020. Should this occur, we would expect the more discounted real estate names to perform quite well. While certainly not as discounted as they were a year ago, we still believe the REITs can perform well in the low growth, low yield world.

For the twelve months ended September 30, 2019, the Timothy Plan Defensive Fund Real Estate Sleeve generated a gross return of 19.79% versus the FTSE NAREIT Equity REITs Index return of 18.48%. Strong allocation drove performance while stock selection was a negative. Stock selection was primarily attributable to one security, Brookdale Senior Living. Data Centers, Towers, Apartments, and Manufactured Homes lead the returns. All have strong consistent growth. Data Centers and Towers benefit from the increased use of data connectivity and the deployment of 5G. Apartments and Manufactured Homes both benefit from the desire for lower cost housing and flexibility. During times of uncertainty investors were willing to pay a higher multiple for stocks that offer consistent growth, which greatly benefited these sectors which saw significant multiple expansion over the last twelve months. In addition, our underweight to Lodging was a significant contributor. Lodging continues to suffer from supply and price transparency. In our view, there is too much supply being delivered in many markets across the country making a difficult environment even more challenging, as such we remain underweight. The biggest detractors were in Office and Healthcare. In Office, our exposure to some NYC office companies hurt performance. While the stocks remain discounted the NYC office market has become more difficult over the last year as the city has changed zoning restrictions in certain areas, leading to increased supply risk. As such, despite the discounted valuations we have further

16

reduced our exposure due to limited catalysts to unlock the embedded value. In the Healthcare sector, Brookdale Senior Living, lagged the index. Brookdale, a senior living operator experienced a softer 2019 than we had expected due to some supply and the stock lagged. The industry now appears to have bottomed as supply has started to significantly fall. Demand has also increased, and we are hopeful the combination of lower supply and strong demand will significantly improve the company’s valuation.

Real estate stocks continue to deliver on their merits of higher than average yield and good dividend growth. Importantly, some sectors should see trough fundamentals in 2019 which will set up for a stronger 2020 and 2021. We believe retail, while still a challenging market should see less bankruptcies and thus FFO growth should improve as the year progresses. Senior housing appears to finally be bottoming and could set up for very strong growth the next few years. The sectors that have been the most challenged, with the exception of malls, appear to be turning operationally. As these stocks are discounted there may be some interesting investment opportunities.

17

Important Information:

Investing involves risk, including possible loss of principal.

The FTSE NAREIT Equity REITs Index measures the performance of all publicly traded equity real estate investment trusts (REITs) traded on U.S. exchanges, excluding timber and infrastructure REITs.

All third-party trademarks are the property of their respective owners.

Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index.

The views expressed represent the investment team’s assessment of the account and market environment as of September 30, 2019 and should not be considered a recommendation to buy, hold, or sell any security, and should not be relied on as research or investment advice. Holdings are as of September 30, 2019 and subject to change.

Past performance is no guarantee of future results.

Unless otherwise noted, the source of statistical information used in this document was FactSet.

Because this Strategy expects to hold a concentrated fund of a limited number of securities, the fund’s risk is increased because each investment has a greater effect on the Strategy’s overall performance.

REIT investments are subject to many of the risks associated with direct real estate ownership, including changes in economic conditions, credit risk, and interest rate fluctuations.

International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations.

Additional information regarding the firm’s policies and procedures for calculating and reporting performance results is available upon request. A complete list and description of composites managed is available upon request. The above information is not intended and should not be construed as a presentation of information regarding any mutual fund.

Macquarie Investment Management (MIM) is the marketing name for the following registered investment advisers: Macquarie Investment Management Business Trust, Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, Macquarie Capital Investment Management LLC and Macquarie Investment Management Europe S.A.

Other than Macquarie Bank Limited (MBL), none of the entities noted are authorised deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise.

© 2019 Macquarie Group Limited

18

Annual Letter from the Manager

We are pleased to provide you with our annual report for the Timothy Plan Defensive Strategies Fund Commodity Sleeve (the Portfolio) for the twelve months ending September 30, 2019. The CoreCommodity sleeve of the Timothy Defensive Fund fell (17.73%) on a gross basis. Commodities broadly fell over these twelve months with the Bloomberg Commodity Total Return Index falling (6.57%). The Portfolio had positive contributions to performance from precious metals, although energy, industrial metals, and agriculture detracted from performance.

Metals & Mining

Industrial metal commodity futures were modestly down for the period with the Bloomberg Industrial Metals Subindex Total Return falling (2.1%). The best performing base metal was Nickel, rising more than 37% over the period, as Indonesia implemented an export ban on nickel ore earlier than expected. Aluminum was the worst performing base metal, falling(-17%) for the year. The Portfolio’s industrial metal holdings performed worse than the commodity futures, falling (12%) for the period. The Portfolio’s largest industrial metal holdings as of September 30th were Rio Tinto (RIO US), Teck Resources (TECK/B CN), and BHP Group (BHP US).

Precious metal futures finished a strong year up, with the Bloomberg Precious Metals Subindex Total Return rising 20.5%. Timothy’s precious metal miners outperformed, rallying 36% over the same time period. The Portfolio’s largest precious metal holdings as of September 30th were Newmont Goldcorp (NEM US), Iamgold (IAG US), and Franco-Nevada Corp (FNV US).

Energy

Energy was the worst performing sector for the prior year, with the Bloomberg Energy Subindex Total Return falling (21.6%). The Portfolio’s energy holdings were also the worst performing sector, falling (37%) for the period. Crude oil prices fell approximately (26%) in both Brent and WTI futures. The Portfolio’s largest energy holdings as of September 30th were Suncor Energy (SU CN), ConocoPhillips (COP US), and EOG Resources (EOG US).

Agriculture

Over the past year agricultural commodities, as proxied by the Bloomberg Commodity Agriculture and Livestock Subindex Total Return, fell nearly (5.0%). Over the same period the Portfolio’s agricultural holdings were roughly flat, rising almost 1%, providing additional relative outperformance. Of primary agricultural futures, Kansas City wheat fell the most in the preceding twelve months, declining (18.8%). Over the same period, corn prices, rose nearly 9%. The Portfolio’s largest agriculture holdings as of September 30th were Deere & Company (DE US), American Water Works Co (AWK US), and Kubota Corp (6326 JP).

Market Outlook

The Timothy Plan Defensive Strategy Fund Commodity Sleeve currently utilizes a diversified portfolio of natural resource equities that is intended to capture commodity price movements. We believe that many global commodities remain attractively priced relative to their marginal production costs. To the extent commodities rally as prices normalize to historic average premiums above these levels, we expect the Portfolio to perform positively.

|

| CoreCommodity Management, LLC 680 Washington Boulevard Stamford, CT 06901 Tel: 203.708.6500 www.CoreCommodityllc.com |

19

September 30, 2019

Dear Shareholder,

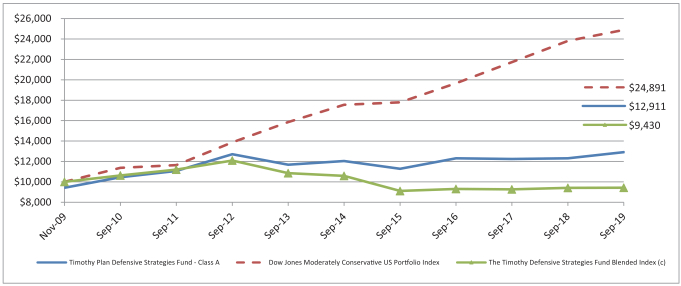

The Defensive Strategies Fund was designed and is managed to do what its name implies, hedge against a possible scenario of hyper-inflation which could result from our Congress’s proven unwillingness to address our core problems of too much spending and too much debt. The Fund was also designed withbuilt-in flexibility that allows it to be adjusted to address a possible risk of extreme deflation, with the ability to convert the inflation sensitive assets to cash and fixed income securities during a deflationary environment, and to be adjusted to a more normal, traditional investment strategy.

The Fund’s portfolio is comprised of four inflation sensitive investment sleeves: commodities (commodity company stocks and ETF’s), real estate (in the form of REITs), precious metals (primarily gold bullion), and TIPs (Treasury Inflation Protected Bonds), with the balance in cash. Timothy Partners, Ltd. (the “Advisor”) is responsible for setting the percentages of the Fund that will be allocated to each investment sleeve. Differentsub-advisors manage the holdings in each sleeve. Even with continued low inflation over the past year, the Fund experienced a respectable 4.92% total return for the fiscal year ended September 30, 2019. For a more complete description of the elements that impacted Fund performance and the outlook for the future, please read the varioussub-advisors’ reports in the pages that follow.

I would like to point out that, since there does not exist an appropriate benchmark index with which to compare our performance, we have created a blended index comprised of roughly 33% each of U.S. Government TIPs, FTSE NAREIT Equity Index and Dow Jones UBS Commodity Index. We believe the blend offers a fairly accurate reflection and comparison of the composition of the Fund. For the fiscal year ended September 30, 2019, the blended index had a total return of 0.22%.

While no one can predict future events, I remain confident that oursub-advisors (i.e. money management firms that manage the various sleeves of this Fund) are, in our opinion, among the best in the industry, and they each continue to honor our overall policy that they manage their respective Fund sleeve both in accordance with our screening restrictions and with a conservative bias. As I stated in last year’s report, although we will do our very best to be successful, we cannot guarantee results in any of these scenarios.

Finally, I would once again like to thank you for your moral convictions that led you to become part of the Timothy Plan Family.

Yours in Christ,

Arthur D. Ally

Fund Advisor

20

September 30, 2019

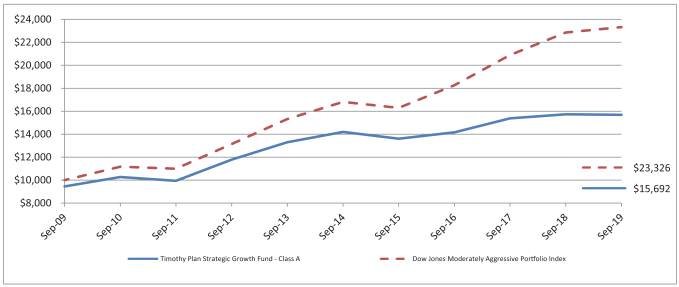

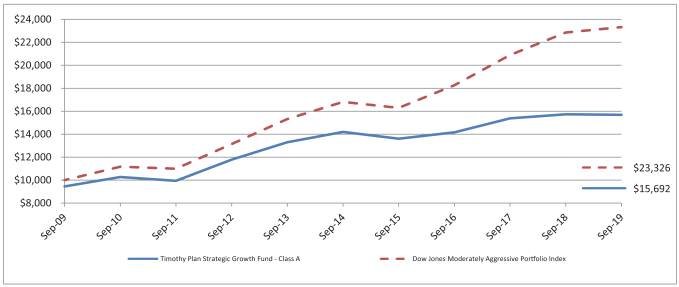

Dear Timothy Plan Strategic Growth Fund Shareholder:

Asset allocation has normally been, and we believe it continues to be, a very prudent approach to investing. As a review, your Timothy Plan Strategic Growth investment is a compilation of many of Timothy’s underlying funds (including two of our new ETF’s) and, as such, your performance is directly related to the performance of those underlying funds. Although the fourth quarter of 2018 experienced a fairly substantial decline, the underlying funds recovered nicely, allowing the Strategic Growth Fund to post only a slightly negative 0.26%end-of-fiscal year return. Throughout the down-turn, we maintained a constant allocation model that we believe provided for less volatile fluctuations than might otherwise have been expected. In 2019 and into 2020, we have a fairly positive outlook for the economy. As a result, we have adjusted our positions in the underlying funds to the allocations shown below:

| | | | |

• Large-Cap Core ETF | | | 17.00 | % |

• High Dividend Stock ETF | | | 8.50 | % |

• Small-Cap Value Fund | | | 4.00 | % |

• Aggressive Growth Fund | | | 3.00 | % |

• International Fund | | | 19.50 | % |

• High-Yield Bond Fund | | | 5.50 | % |

• Defensive Strategies Fund | | | 8.00 | % |

• Fixed Income Fund | | | 19.50 | % |

• Israel Common Values Fund | | | 5.00 | % |

• Emerging Markets Fund | | | 7.00 | % |

• Cash | | | 3.00 | % |

We understand that the fourth quarter market decline in 2018, followed by a very positive first three quarters of 2019, may be unsettling for some investors. Please understand that our #1 concern was (and continues to be) preservation of principal and, even though we want to participate in the markets’ strong upward trend, we will attempt to adjust the allocation above to changing market conditions.

As you know, no one can guarantee future performance. However, the one thing that I can assure you of is every one of thesub-advisors of the under-lying funds is doing their very best, and our team here at Timothy is working very hard to provide you an investment in which you can feel comfortable. For a commentary on each fund, please see the managers’ comments in this report.

Sincerely,

Arthur D. Ally

President

21

September 30, 2019

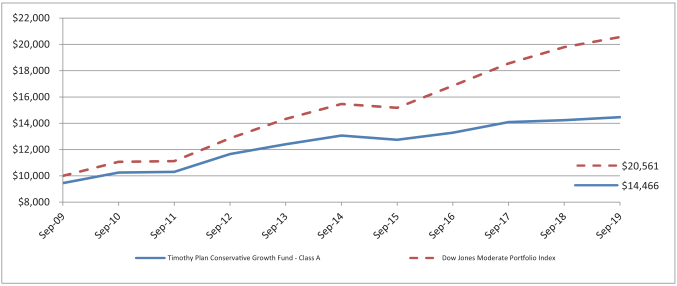

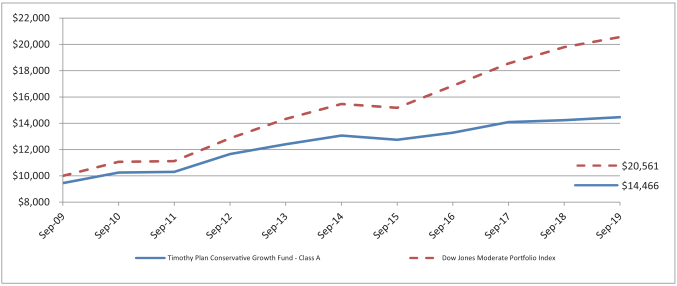

Dear Timothy Plan Conservative Growth Fund Shareholder:

Asset allocation has normally been, and we believe it continues to be, a very prudent approach to investing. As a review, your Timothy Plan Conservative Growth investment is a compilation of many of Timothy’s underlying funds (including two of our new ETF’s) and, as such, your performance is directly related to the performance of those underlying funds. Although the fourth quarter of 2018 experienced a fairly substantial decline, the underlying funds recovered nicely, allowing the Conservative Growth Fund to post anend-of-fiscal year return positive 1.6% return. Throughout the down-turn, we maintained a conservative allocation model that we believe provided for less volatile fluctuations than might otherwise have been expected. In 2019 and into 2020, we maintain a fairly positive outlook for the economy. As a result, we have adjusted our positions in the underlying funds to the allocations shown below:

| | | | | | | | |

| | • Large-Cap Core ETF | | | 14.00 % | | | |

| | • High Dividend Stock ETF | | | 6.00 % | | | |

| | • Small-Cap Value Fund | | | 3.00 % | | | |

| | • Aggressive Growth Fund | | | 2.00 % | | | |

| | • International Fund | | | 10.50 % | | | |

| | • High-Yield Bond Fund | | | 5.50 % | | | |

| | • Defensive Strategies Fund | | | 7.00 % | | | |

| | • Fixed Income Fund | | | 39.50 % | | | |

| | • Israel Common Values Fund | | | 3.50 % | | | |

| | • Emerging Markets Fund | | | 4.50 % | | | |

| | • Cash | | | 5.00 % | | | |

Even though the Portfolio has been designed to be conservatively allocated, we understand that the fourth quarter market decline in 2018 followed by a very positive first three quarters of 2019 may be unsettling for some investors. Please understand that our #1 concern was (and continues to be) preservation of principal and, even though we want to participate in the markets’ strong upward trend, we will attempt to adjust our allocation above to changing market conditions.

As you know, no one can guarantee future performance. However, the one thing that I can assure you of is every one of oursub-advisors is doing their very best and our team here at Timothy is working very hard to provide you an investment in which you can feel comfortable. For a commentary on each fund, please see the managers’ comments in this report.

Sincerely,

Arthur D. Ally

President

22

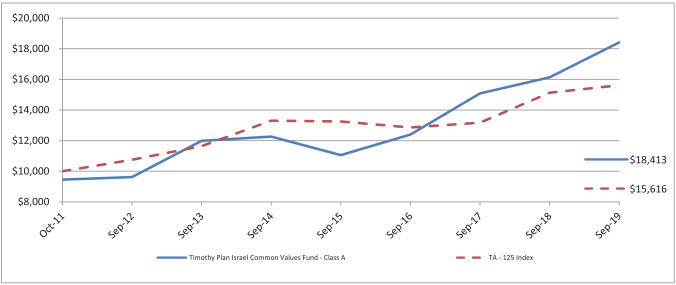

The Timothy Plan Israel Common Values Fund

Letter from The Manager - September 30, 2019

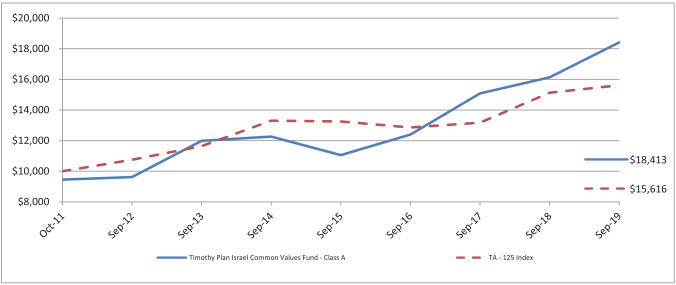

The Timothy Plan Israel Common Values Fund had a really good year over the last twelve months both in absolute terms and relative to Israel’sTA-125 index. Strong stock performance in the Consumer Discretionary, Consumer Staples, Real Estate, and Technology sectors helped absolute performance. Cybersecurity company CyberArk Software (Technology) and Israel’s leading air conditioner systems company Tadiran Holdings (Consumer Discretionary) are a couple of examples of great performers over the last twelve months. Positive sector allocation helped relative performance to the index with underweights to the Health Care, Communications Services, and Materials sectors helping as those three sectors were the worst performing over the last twelve months. An overweight to the Technology sector also aided performance as Tech shares performed well during this period. Stock selection was positive in Health Care and Consumer Discretionary while negative in the Technology sector. The Fund was also helped by the continued appetite for M&A in Israel with foreign companies looking for ways to acquire the entrepreneurial and innovative essence in the country. Among Fund holdings acquired by other companies during the year were Mellanox Technologies (Technology) and Pointer Telocation Ltd (Industrials). The main disappointment for the year was not owning enough of a strong Real Estate sector that benefitted from low interest rates, robust economic growth, and continued immigration into the country leading to strong demand.

The Israeli economy remains on a solid footing with strong consumption on the back of low unemployment levels and strong wage growth. Economists expect the country’s economic growth to remain well underpinned around the 3% level for the foreseeable future. Solid economic growth has led to robust earnings growth supporting equity prices over the last twelve months. The Bank of Israel began to tighten monetary policy in late 2018 but reversed course during 2019 as global central banks shifted to more dovish policies and as inflation disappointed and the shekel appreciated. We believe the Bank of Israel will remain quite accommodative in its monetary policy in the coming year. There remains uncertainty as to who will govern the country going forward but the strong economic prospects and estimates of continued earnings growth help keep investor’s minds on the longer term and not on short term political disruptions.

The Fund continues to invest alongside the innovate spirit of Israeli companies providing ample attractive investment opportunities. A strong domestic economy will continue to support corporate earnings growth over the medium term. We remain committed to a consistent investment approach dedicated to finding long-term investments for shareholders and thank you for your continued investment in the Fund.

Eagle Global Advisors, LLC

23

Letter from the Manager

The Timothy Plan Emerging Markets Equity Fund

September 30, 2019

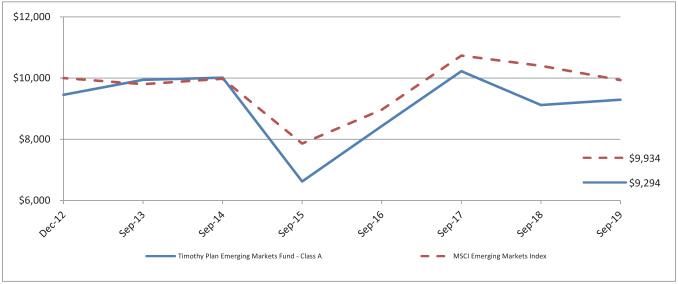

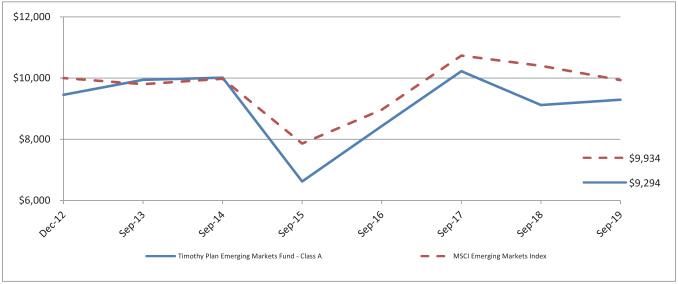

Brandes Investment Partners is pleased to manage the Emerging Markets Fund on behalf of the Timothy Plan. The Timothy Plan Emerging Markets Fund returned 4.3%, outperforming the MSCI Emerging Markets Index, which declined 2.0% for the fiscal year ended September 30, 2019.

Positive Contributors

Holdings in Brazil led performance as the election of right-wing presidential candidate Jair Bolsonaro bolstered the country’s stock market. Bolsonaro, a departure from the left-wing Workers’ Party that had dominated Brazilian politics since 2002, has vowed to deal with Brazil’s fiscal woes and reduce structural impediments to economic growth. Noteworthy contributors included oil & gas firms Petrobras and Petrobras Distribuidora, and electric utility Companhia Paranaense de Energia (Copel). Higher education services provider Estacio Participacoes saw enrollment increase across multiple segments while enrollment forin-person courses remained stable even as tuition prices for that segment climbed. Another notable contributor among our Brazilian holdings was health care services provider Hapvida Participacoes e Investimentos. The market responded positively to Hapvida’s agreement early in the year to buy a local competitor in a bid to expand in Sao Paulo.

Many of the Fund’s holdings in Russia performed well, led by food retailer X5 Retail Group and Sberbank.

X5’s shares rose on margin improvement, helped by continued food inflation in Russia. Holdings in real estate and communication services drove performance. Mexico-based Fideicomiso PLA Administradora Industrial (known as Terrafina), Fibra Uno and Fibra Macquarie Mexico lifted returns as these income-oriented securities benefited from the U.S. Federal Reserve and Bank of Mexico reducing interest rates.

Indonesian holdings Bank Rakyat and one of our communication services holdings, XL Axiata, added value. For XL Axiata, investors welcomed the company’s encouraging earnings growth and favorable outlook. Finally, select financial holdings also aided performance, namely Banco Latinoamericano of Panama.

Performance Detractors

Holdings in Mexico fell amid concerns about possible anti-business policies of newly inaugurated President Andres Manuel Lopez Obrador (Amlo). Late in 2018, Mexico’s currency and bonds declined after Amlo cancelled a $13 billion airport project, igniting worries of a less investment-friendly environment. A subsequent proposal to cap banking fees intensified market concerns. Notable detractors included cement company Cemex, which continued to face a variety of concerns. These include a sharp drop in Mexico’s construction activity this year, fears of a recession in the United States (its biggest market), and a lack of confidence in management’s capital allocation prowess. We believe these issues have been more than accounted for in Cemex’s current share price. Trading at less than book value and a low multiple of forward earnings, the company represents what we see as an attractive value opportunity

Shares of Taiwanese AsusTek Computer declined due to a poor earnings report, driven mainly by greater price competition in the United States and Europe, concerns over the U.S.-China tariff dispute, and margin compression in the component and handset segments. We believe these issues are temporary and cyclical, and more than accounted for in the share price. With the majority of its market value in cash and equity holdings, AsusTek has a solid asset backing to weather its shorter-term challenges, based on our analysis.

Other detractors included India-based electric utility Reliance Infrastructure andBrazil-based regional jet manufacturer Embraer. Embraer has receivedsign-off for its deal with Boeing from most of the required stakeholders, including the Brazilian government and shareholders. The deal is expected to close by the end of 2019, assuming anti-trust regulators approve it. Earlier in the year, Embraer’s shares declined as the company missed revenue and net income forecasts. Nevertheless, our valuation thesis remains positive. We view the deal favorably as it crystalizes the value of Embraer’s commercial segment ahead of any need for regional jet volume recovery, partially mitigating the risks related to the capital expenditure cycle of airlines (Embraer’s customers). The deal also offsets the competitive threat from Airbus/Bombardier and provides a closer relationship with Boeing, which we believe creates an upside potential for both of the company’s remaining segments.

24

Holdings that are domiciled in Argentina or have economic exposure to the country weighed on returns. In August 2019, left-wing populist candidate Alberto Fernandez decisively won Argentina’s primary presidential election over incumbent President Macri, sparking investor concern and a renewed focus on sovereign default risks. For our holding in oil and gas firm YPF, a government-initiated90-day price freeze for key commodities exacerbated negative sentiment. YPF’s management initially estimated a$100-$150 million per month cash flow impact, but lowered it to the $40-$60 million range more recently. We believe that these challenges have been more than factored in YPF’s share price and that the market seems to ascribe minimal value to YPF’s vast shale acreage. We maintained our measured allocation to the company, recognizing the increased risk profile amid the recent developments. Other detractors related to the turmoil in Argentina included Spain-based payment services company Prosegur Cash, which generates the majority of its revenue in Latin America.

Finally, Hong Kong-based retailers Lifestyle International Holdings and Luk Fook Holdings also hurt returns as ongoing demonstrations in Hong Kong hurt sales and tourist spending.

Select Activity

Over the course of the fiscal year, the Emerging Markets Investment Committee initiated several positions for the Fund. Flex Ltd., is one of the world’s largest electronics manufacturing services (EMS) providers, second only to Hon Hai of Taiwan/China. Headquartered in Singapore, Flex provides manufacturing and supply services globally. We have owned Flex several times, and the company has demonstrated the ability to improve its margins to more normalized (higher) levels when it has incurred operational or execution problems that we deemed fixable or that appeared to be more than accounted for in the share price. We feel that is the situation with Flex today, trading at a low multiple of earnings the market seems to be overemphasizing the addressable issues while underappreciating the longer-term positioning of it’s more meaningful businesses.

Keeping in the technology sector, we initiated a new position inmade-to-order chipmaker Taiwan Semiconductor Manufacturing Company (TSMC). TSMC is the world’s dominant semiconductor foundry, controlling slightly more than half of this secularly growing end market. In our view, the company is one of the most attractively valued and sustainable franchises in the global semiconductor industry, and should continue to generate appealing returns on capital and free cash flow going forward.

In addition, we initiated new positions in companies that we know very well as we have owned them in the past, namely Latin American airline Copa Holdings and Austria-domiciled Erste Group Bank, which operates mainly in emerging European countries.

Examples of positions sold include Russian Lukoil and India-based Reliance Infrastructure. A number of recent developments led to a reconsideration of our investment thesis for Reliance Infrastructure and our eventual divestment. Most notably, during the second half of 2018, Reliance sold its Mumbai utility. The utility had been Reliance’s main earnings contributor and was sold to pay down debt. Prior to the sale, our investment case for Reliance Infrastructure was supported by the valuation of its electricity assets. We also anticipated some upside potential from its significant balance of financial assets. However, the disposal of the Mumbai utility meaningfully reduced Reliance’s earnings power and led to a deterioration in the quality of its net asset value (NAV), which now consists primarily of financial holdings and contingent assets. Our loss of confidence in the company, combined with its poor transparency, triggered our decision to exit the position.

Current Positioning

As of September 30, we held our largest country overweights to Brazil and South Korea, while remaining materially underweight to Taiwan, India and China. On a sector basis, our largest overweights were to real estate, consumer discretionary and communication services. Meanwhile, the financial sector continued to represent a significant underweight position, due to our lower exposure to banks in China, Brazil and India. Additionally, we maintained a lower allocation to information technology than did the benchmark.

The valuation discount between value and growth stocks in emerging markets (MSCI EM Value vs. MSCI EM Growth) remains among the highest levels in over 20 years (based onprice-to-forward earnings). While our portfolio is not tilted toward a certain economic outcome (i.e., strong economic growth or a recession), we believe it

25

is well positioned for a value rebound should this valuation dispersion narrow. More than a third of our holdings traded at less than 10x forward earnings at quarter end, while also having strong balance sheets, compelling growth prospects and strong free cash flow.

Thank you for your continued trust.

BRANDES INVESTMENT PARTNERS, L.P.

26

Letter from the Manager

September 30, 2019

Fixed Income Allocation of The Timothy Plan Growth & Income Fund – Inception Date May 14, 2019

The fiscal year ended September 30, 2019 saw a decline in yields as the Federal Reserve (Fed) began cutting rates due to U.S.-China Trade issues and signs of slowing economic growth. The Fixed Income allocation of the Timothy Plan Growth & Income Fund, with an inception date of May 14, 2019, invests in the broad U.S. investment grade bond market benchmarked to the Bloomberg Barclays Aggregate index. At the end of September 30, 2019, the yield on the Fixed Income allocation was 2.20%.

The U.S. Treasury (UST)10-year fell after starting the fiscal period at 3.06%, peaking at 3.24% in November, and ending at 1.67%. By comparison, the2-year rate declined slightly less starting at 2.82% and ending the last 12 months at 1.63% or 1.19% lower. The2- and10-year UST yield curve inverted during the12-month period with the narrowest differential reaching-4 basis points; 1.42% versus 1.46%, respectively. The inversion reversed and maintained a difference of +5 basis points by the end of September 30, 2019. The2- and10-year inversion is the mostoft-cited harbinger of an economic slowdown since it has preceded the last eleven U.S. recessions. Undoubtedly, U.S. economic growth has slowed as GDP fell to a 2.3% year-over-year rate from 3.2%12-months prior. Consequently, the Fed reversed its hawkish stance in 2019 and by fiscal year end had cut interest rates twice.

Investment Grade (IG) Credit spreads started the last 12 months at 143 basis points and narrowed to 109 by the end of September 2019. The narrowing was a result of supply/demand dynamics that included a year-over-year decline in gross supply through the first half of 2019. In addition, foreign buying of IG Credit remerged due to anemic yields in Europe and developed Asia. The Mortgage Backed Securities (MBS) sector struggled during the period as lower UST yields sparked a wave of mortgage refinancing.

Since inception through September 30, 2019, the overweight to Utilities added value as the sector performed better than all other major sectors and the overall index. In addition, security selection in real estate investment trusts (REITS) within Financials also added to results. Detracting from results was our shorter duration positioning in a declining interest rate environment. The portfolio is positioned with less interest rate risk than the market, an over-weight in corporate bonds and GNMA MBS for yield. We remain focused on generating income consistent with a prudent level of risk.

BARROW, HANLEY, MEWHINNEY & STRAUSS

27

September 30, 2019

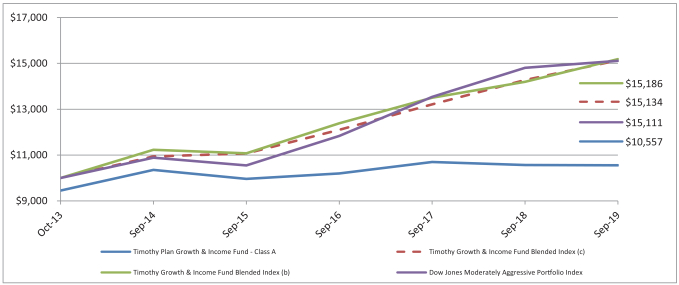

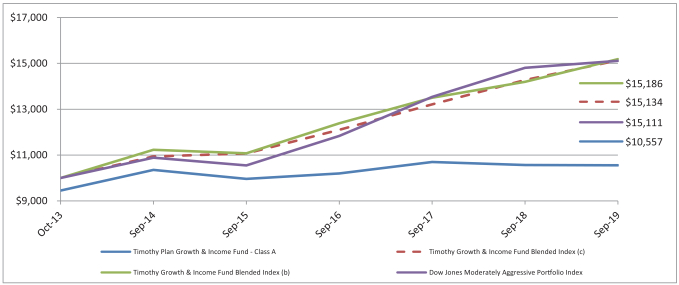

Dear Timothy Plan Growth and Income Fund Shareholder:

On May 1, 2019, Timothy Plan added two new Exchange Traded Funds to our diversified product line: Timothy PlanLarge-Cap Core (TPLC) and Timothy Plan High Dividend Stock (TPHD). These are both smart beta index funds traded on the New York Stock Exchange. Since TPHD fits nicely into the investment objective of our Growth and Income Fund, we incorporated this particular ETF into the holdings of the fund so that:

| | • | Approximately 60% of the fund is now invested in TPHD |

| | • | While the remaining fixed income portion of the fund is now actively managed by our long-time fixed incomesub-advisor, Barrow Hanley. |

This represents (since May 1st) a complete revamping of the management of this fund as approved by shareholders through a proxy vote in April of this year. It is our belief that this management change will result in both better performance and a reduction of this fund’s expense ratio.

ETFs are passively managed investment vehicles, with Timothy ETFs being reflections of biblically responsible investment (BRI) indices that were developed specifically to accommodate the BRI space. As stated above, the ETFs were not incorporated into the portfolio until May, following the 2018sell-off, and although the market was choppy, the ETF was a positive contributor to the Fund, although the Fund overall had a slightly negative return of-0.10% for the fiscal year. We suggest you look to Barrow Hanley’sSub-Advisor’s letter for the Fund for more information and future market outlook.

As you know, no one can guarantee future performance. However, the one thing that I can assure you of is every one of oursub-advisors is doing their very best and our team here at Timothy is working very hard to provide you an investment in which you can feel comfortable.

Sincerely,

Arthur D. Ally

President

28

Fund Performance - (Unaudited)

September 30, 2019

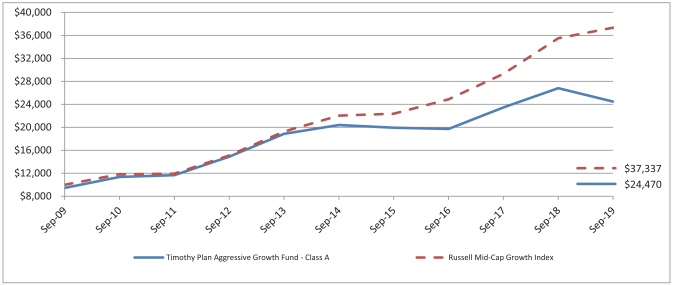

Aggressive Growth Fund

| | | | | | | | |

| Fund/Index | | 1 Year Total Return | | 5 Year Average Annual Return | | 10 Year Average Annual Return | |

Timothy Aggressive Growth Fund - Class A (With Sales Charge) | | (13.75)% | | 2.54% | | | 9.36% | |

RussellMid-Cap Growth Index | | 5.20% | | 11.12% | | | 14.08% | |

Timothy Aggressive Growth Fund - Class C * | | (10.27)% | | 2.93% | | | 9.15% | |

RussellMid-Cap Growth Index | | 5.20% | | 11.12% | | | 14.08% | |

Timothy Aggressive Growth Fund - Class I | | (8.48)% | | 3.96% | | | 4.83% (a) | |

RussellMid-Cap Growth Index | | 5.20% | | 11.12% | | | 11.53% (a) | |

| | (a) | For the period August 1, 2013 (commencement of investment in accordance with objective) to September 30, 2019. |

| | * | With Maximum Deferred Sales Charge |

Timothy Plan Aggressive Growth Fund vs. RussellMid-Cap Growth Index