UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-08228

TIMOTHY PLAN

(Exact name of registrant as specified in charter)

1055 Maitland Center Commons

Maitland, FL 32751

(Address of principal executive offices) (Zip code)

Arthur D. Ally

The Timothy Plan

1055 Maitland Center Commons

Maitland, FL 32751

(Name and address of agent for service)

Copies to:

David D. Jones, Esquire

20770 Hwy 281 N., Suite108-619

San Antonio, TX 78258

and

Benjamin V. Mollozzi, Esquire

225 Pictoria Drive, Suite 450

Cincinnati, Ohio 45246

Registrant’s telephone number, including area code:800-846-7526

Date of fiscal year end: September 30, 2019

Date of reporting period: September 30, 2019

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

*Explanatory Note:

The Registrant is filing this amendment to its FormN-CSR for the period ended September 30, 2019, originally filed with the Securities and Exchange Commission on December 4, 2019 (Accession Number0001193125-19-306003) to amend Item 1 “Reports to Stockholders.” The purpose of this amendment is to replace page 37 of the Annual Report, with the below page 37.

The Timothy Plan

Supplement dated March 4, 2020

to the Annual Report (the “Report”) dated September 30, 2019

This supplement replaces page 37 of the Annual Report for the Timothy PlanDefensive Strategies Fund contained in FormN-CSR, of the Timothy Plan dated September 30, 2019 and filed with the Securities and Exchange Commission(“SEC”) on December 4, 2019.(SEC Accession No. 0001193125-19-306003)

This supplement should be read in conjunction with the original FormN-CSR, Annual Report filed with the SEC on December 4, 2019 and retained for future reference.

The following information replaces, in its entirety, page 37 of theTimothy Plan Annual Report for theDefensive Strategies Fund:

Fund Performance - (Unaudited)

September 30, 2019

Defensive Strategies Fund

| Fund/Index | 1 Year Total Return | 5 Year Total Return | Average Annual Return Since Inception | |||||||

Timothy Defensive Strategies Fund - Class A (With Sales Charge) | (0.88)% | 0.26% | 2.61 | % | (a) | |||||

Dow Jones Moderately Conservative U.S. Portfolio Index | 4.52% | 7.23% | 9.64 | % | (a) | |||||

Timothy Defensive Strategies Fund Blended Index (c) | 5.32% | 1.66% | 3.59 | % | (a) | |||||

Timothy Defensive Strategies Fund - Class C * | 3.06% | 0.62% | 2.46 | % | (a) | |||||

Dow Jones Moderately Conservative U.S. Portfolio Index | 4.52% | 7.23% | 9.64 | % | (a) | |||||

Timothy Defensive Strategies Fund Blended Index (c) | 5.32% | 1.66% | 3.59 | % | (a) | |||||

Timothy Defensive Strategies Fund - Class I | 5.17% | 1.66% | 1.90 | % | (b) | |||||

Dow Jones Moderately Conservative U.S. Portfolio Index | 4.52% | 7.23% | 7.62 | % | (b) | |||||

Timothy Defensive Strategies Fund Blended Index (c) | 5.32% | 1.66% | 1.61 | % | (b) | |||||

| (a) | For the period November 4, 2009 (commencement of investment in accordance with objective) to September 30, 2019. |

| (b) | For the period August 1, 2013 (commencement of investment in accordance with objective) to September 30, 2019. |

| (c) | Change in Fund’s benchmark. The Timothy Defensive Strategies Fund Blended Index reflects an unmanaged portfolio of 33% of the Bloomberg Barclays U.S. Treasury:1-3 years Index, 33% of the Bloomberg Commodity Index Total Return and 34% of the MSCI U.S. REIT Gross (USD) Index. The Timothy Defensive Strategies Fund Blended Index is more suitable for the Fund’s objective. The Dow Jones Moderately Conservative US Portfolio was the Fund’s prior benchmark. The Fund’s performance is compared to both indices in the table above. |

| * | With Maximum Deferred Sales Charge |

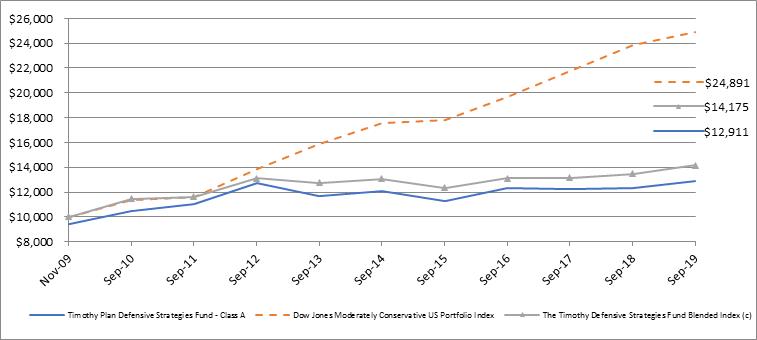

Timothy Plan Defensive Strategies Fund vs. Dow Jones Moderately Conservative U.S. Portfolio Index vs. The Timothy Defensive Strategies Fund Blended Index (c)

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s Class A shares, Dow Jones Moderately Conservative U.S. Portfolio Index and the Timothy Defensive Strategies Fund Blended Index on November 4, 2009 and held through September 30, 2019. The Dow Jones Moderately Conservative U.S. Portfolio Index is a widely recognized unmanaged index of stocks, bonds and cash. Performance figures include the change in value of the asset classes in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused thisSupplement to the Annual Report of the Timothy Plan to be signed on its behalf by the undersigned, thereunto duly authorized.

| Registrant | Timothy Plan | |

| By (Signature and Title) | /s/ Arthur D. Ally

| |

Arthur D. Ally, President/Principle Executive Officer | ||

| Date | 3/4/2020 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, thisSupplement to the Annual Report of the Timothy Plan has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| Registrant | Timothy Plan | |

| By (Signature and Title) | /s/ Arthur D. Ally

| |

Arthur D. Ally, President/Treasurer/ Principle Financial Officer | ||

| Date | 3/4/2020 | |