SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | | |

¨ x ¨ | | Preliminary Proxy Statement DefinitiveProxy Statement DefinitiveAdditional Materials | | ¨ | | | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | |

| | | |

¨ | | SolicitingMaterial Pursuant to (S) 240.14a-11(c) or (S) 240.14a-12 |

METASOLV, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

METASOLV, INC.

5556 Tennyson Parkway

Plano, Texas 75024

April 13, 2005

TO THE STOCKHOLDERS OF METASOLV, INC.

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of MetaSolv, Inc. (the “Company”), which will be held at the Company’s headquarters located at 5556 Tennyson Parkway, Plano, Texas 75024, on Tuesday, May 10, 2005, at 10:00 a.m.

Details of the business to be conducted at the Annual Meeting are given in the attached Proxy Statement and Notice of Annual Meeting of Stockholders.

It is important that your shares be represented and voted at the meeting. WHETHER OR NOT YOU PLAN TO ATTEND the Annual Meeting, please COMPLETE, sign, date and PROMPTLY return the ACCOMPANYING proxy in the ENCLOSED POSTAGE- PAID envelope. Returning the proxy does NOT deprive you of your right to attend the Annual Meeting. If you decide to attend the Annual Meeting and wish to change your proxy vote, you may do so automatically by voting in person at the meeting.

On behalf of the Board of Directors, I would like to express our appreciation for your continued interest in the affairs of the Company. We look forward to seeing you at the Annual Meeting.

Sincerely,

/s/ T. Curtis Holmes, Jr.

T. Curtis Holmes, Jr.

Chief Executive Officer, President, and Director

|

| |

YOUR VOTE IS IMPORTANT All stockholders are invited to attend the Annual Meeting in person. However, to ensure your representation at the meeting, you are urged

to complete, sign, date and return, in the enclosed postage paid envelope, the enclosed Proxy as promptly as possible. Returning your

Proxy will help the Company assure that a quorum will be present at the meeting and avoid the additional expense of duplicate proxy

solicitations. You may revoke your Proxy at any time prior to the Annual Meeting. Any stockholder attending the meeting may vote in

person even if he or she has returned the Proxy. |

METASOLV, INC.

5556 Tennyson Parkway

Plano, Texas 75024

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held May 10, 2005

The Annual Meeting of Stockholders (the “Annual Meeting”) of MetaSolv, Inc. (the “Company”) will be held at the Company’s headquarters, located at 5556 Tennyson Parkway, Plano, Texas, 75024, on Tuesday, May 10, 2005, at 10:00 a.m. for the following purposes:

1. To elect 2 directors to the Board of Directors to serve until their three-year term expires or until their successors have been duly elected and qualified or until their earlier death, resignation, or removal from office;

2. To amend the Company’s Employee Stock Purchase Plan (the “ESPP”) to increase the number of shares subject to the ESPP by 2,500,000 shares;

3. To ratify the appointment of Grant Thornton LLP as the Company’s independent auditors for 2005; and

4. To transact such other business as may properly come before the meeting or any adjournments or postponements thereof.

The foregoing items of business are more fully described in the attached Proxy Statement.

Only stockholders of record at the close of business on March 31, 2005 are entitled to notice of, and to vote at, the Annual Meeting and at any adjournments or postponements thereof. A list of such stockholders will be available for inspection at the Company’s headquarters located at 5556 Tennyson Parkway, Plano, Texas, during ordinary business hours for the ten-day period prior to the Annual Meeting, and also at the Annual Meeting.

BY ORDER OF THE BOARD OF DIRECTORS,

/s/ Jonathan K. Hustis

Jonathan K. Hustis

Executive Vice President—Legal, General

Counsel and Corporate Secretary

Plano, Texas

April 13, 2005

METASOLV, INC.

5556 Tennyson Parkway

Plano, Texas 75024

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

To be held May 10, 2005

These proxy materials are furnished in connection with the solicitation of proxies by the Board of Directors of MetaSolv, Inc., a Delaware corporation (the “Company”), for the Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the Company’s headquarters, located at 5556 Tennyson Parkway, Plano, Texas 75024, onTuesday, May 10, 2005, at 10:00 a.m., and at any adjournment or postponement of the Annual Meeting. These proxy materials were first mailed to stockholders on or aboutApril 13, 2005.

PURPOSE OF MEETING

The specific proposals to be considered and acted upon at the Annual Meeting are summarized in the accompanying Notice of Annual Meeting of Stockholders. Each proposal is described in more detail in this Proxy Statement.

VOTING RIGHTS AND SOLICITATION OF PROXIES

The Company’s Common Stock, par value $0.005 per share (“Common Stock”), is the only type of security entitled to vote at the Annual Meeting. On March 31, 2005, the record date for determination of stockholders entitled to vote at the Annual Meeting, there were 41,629,541 shares of Common Stock outstanding. Each stockholder of record on March 31, 2005 is entitled to one vote for each share of Common Stock held by such stockholder. Shares of Common Stock may not be voted cumulatively. All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

Quorum Required

The Company’s bylaws provide that the holders of a majority of the Common Stock issued and outstanding and entitled to vote at the Annual Meeting, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes will be counted as present for the purpose of determining the presence of a quorum.

Votes Required

Proposal 1. Directors are elected by a plurality of the affirmative votes cast by those shares present in person, or represented by proxy, and entitled to vote at the Annual Meeting. The two nominees for director receiving the highest number of affirmative votes will be elected. Abstentions and broker non-votes will not be counted toward a nominee’s total. Stockholders may not cumulate votes in the election of directors.

Proposal 2. Amending the Company’s Employee Stock Purchase Plan (the “ESPP”) to increase the number of shares subject to the ESPP by 2,500,000 shares, requires the affirmative vote at the Annual Meeting of at least a majority of the outstanding shares of the Company’s Common Stock represented in person or by proxy and entitled to vote on the proposal. Abstentions and broker non-votes will not be counted as having been voted on the proposal. As a result, abstentions and broker non-votes will have the same effect as votes in opposition to the proposal.

Proposal 3. Ratifying the appointment of Grant Thornton LLP as the Company’s independent auditors for the year 2005 requires the affirmative vote at the Annual Meeting of at least a majority of the outstanding shares of the Company’s Common Stock represented in person or by proxy and entitled to vote on the proposal. Abstentions and broker non-votes will not be counted as having been voted on the proposal. As a result, abstentions and broker non-votes will have the same effect as votes in opposition to the proposal.

Representatives of Mellon Investor Services will tabulate the vote and act as inspector of the election.

Proxies

Whether or not you are able to attend the Annual Meeting, you are urged to complete and return the enclosed proxy, which is solicited by the Company’s Board of Directors and which will be voted as you direct on your proxy when properly completed. In the event no directions are specified, such proxies will be voted FOR the nominees to the Board of Directors (as set forth in Proposal #1), FOR Proposal #2, FOR Proposal #3, and in the discretion of the proxy holders as to other matters that may properly come before the Annual Meeting. You may also revoke or change your proxy at any time before the Annual Meeting. To do this, you must send a written notice of revocation or another signed proxy with a later date to the Secretary of the Company at the Company’s principal executive offices before the beginning of the Annual Meeting. You may also automatically revoke your proxy by attending the Annual Meeting and voting in person. All shares represented by a valid proxy received prior to the Annual Meeting will be voted.

Solicitation of Proxies

The solicitation of proxies is made by the Company’s Board of Directors. The Company will bear the entire cost of solicitation, including the preparation, assembly, printing, and mailing of this Proxy Statement, the proxy, and any additional soliciting material furnished to stockholders. Copies of solicitation material will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. In addition, the Company may reimburse such persons for their costs of forwarding the solicitation material to such beneficial owners. The original solicitation of proxies by mail may be supplemented by solicitation by telephone, telegram, or other means by directors, officers, employees or agents of the Company. No additional compensation will be paid to these individuals for any such services. Except as described above, the Company does not presently intend to solicit proxies other than by mail.

CORPORATE GOVERNANCE

The Company operates within a comprehensive plan of corporate governance for the purpose of defining responsibilities, setting high standards of professional and personal conduct and achieving compliance with these responsibilities and standards. The Company monitors developments in the area of corporate governance, and the Company is committed to good business practices, transparency in financial reporting and the highest level of corporate governance.

Corporate Governance Guidelines

The Company’s directors and executive management team are governed by MetaSolv, Inc. Corporate Governance Guidelines, published in the Corporate Governance section of the Company’s website atwww.metasolv.com.

Corporate Committee Charters

Each of the Company’s three standing board committees (the Governance Committee, Audit Committee, and Compensation Committee) has its own charter, and these are published in the Corporate Governance section of the Company’s website atwww.metasolv.com.

2

Board and Committee Self-Evaluation

The Board and each of its three standing Committees performs an annual self-evaluation.

Director Independence

Five of our six directors are independent directors. Each of our standing board committees is made up exclusively of independent directors. Director independence is determined under our Corporate Governance Guidelines, and the qualifications include meeting the definition of “independent director” as such term is defined in Rule 4200 of the Nasdaq Marketplace Rules.

Code of Ethics

The Company’s directors, officers and employees are subject to the MetaSolv, Inc. Code of Ethical Business Conduct. Our Chief Executive Officer is subject to a MetaSolv, Inc. and MetaSolv Software, Inc. Code of Ethics for the Chief Executive Officer. Our Chief Financial Officer and Corporate Controller are subject to a MetaSolv, Inc. and MetaSolv Software, Inc. Code of Ethics for Senior Financial Officers. All three of these documents are published in the Corporate Governance section of the Company’s website atwww.metasolv.com.

PROPOSAL #1

ELECTION OF DIRECTORS

The Company currently has authorized seven directors to serve on its Board of Directors. In accordance with the terms of the Company’s Certificate of Incorporation, the Board of Directors is divided into three classes: Class I, with directors whose term will expire at the 2006 Annual Meeting; Class II, with directors whose term will expire at the 2007 Annual Meeting; and Class III, with directors whose term will expire at the 2005 Annual Meeting. At the 2005 Annual Meeting, two directors will be elected to serve as Class III directors until the Annual Meeting to be held in 2008 or until such directors’ respective successors are elected and qualified, or until their earlier death, resignation, or removal from office. The Board of Directors has selected two nominees as the nominees for Class III. The proxy holders intend to vote all proxies received by them in the accompanying form for the nominees for directors listed below. In the event a nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the present Board of Directors to fill the vacancy. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them for the nominees listed below. As of the date of this Proxy Statement, the Board of Directors is not aware of any nominee who is unable or will decline to serve as a director.

Nominees for Term Ending in 2008

Set forth below is information regarding the nominees, including their ages, the period during which they have served as directors, and information furnished by them as to principal occupations and directorships held by them in corporations whose shares are publicly registered.

| | | | |

Name

| | Director Since

| | Age

|

John E. Berndt | | 2002 | | 64 |

John W. White | | 1998 | | 66 |

Mr. Berndt has served as Chairman of the Board of Directors since June 2004, and as a director of the Company since May 2002. Mr. Berndt retired from Sprint Corporation on September 30, 2000. From 1998 to September 2000, Mr. Berndt was President of Sprint International, an operating unit of Sprint Corporation. From 1997 to 1998, Mr. Berndt was President of Fluor Daniel Telecom, an operating company of Fluor Daniel, Inc.

3

Mr. Berndt was President of AT&T New Business Development/Multimedia Ventures from 1993 until the spin-off of Lucent Technologies from AT&T occurred in 1996. Mr. Berndt serves as Chairman of the Board of Directors and interim President and CEO of Telular Corporation, a designer, developer and manufacturer of products for the cellular fixed wireless telecommunications industry and as a director of Calence, Inc., a privately held communications networking consulting company. He is Chairman of the Board of Thunderbird, the Garvin School of International Management.

Mr. White has served as a director of the Company since December 1998. He served as Lead Outside Director from July 2003 until April 2004. Mr. White also served as Chairman of the Company’s Board of Directors from August 1999 until July 2003. He was Vice President and Chief Information Officer for Compaq Computer, a developer and marketer of computer hardware and software, from February 1994 to October 1998, where he served as a member of the executive management team, overseeing Compaq’s worldwide information systems activities. Prior to February 1994, Mr. White was President of the Information Technology Group and Chief Information Officer for Texas Instruments. Mr. White serves as a director and member of the Compensation Committee of Citrix, a provider of server-based computing solutions. He also serves as a director of Siebel Systems, Inc., a provider of business applications software.

Recommendation of the Board of Directors Regarding Proposal #1

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES LISTED HEREIN.

PROPOSAL #2

TO AMEND THE COMPANY’S EMPLOYEE STOCK PURCHASE PLAN (THE “ESPP”)

TO INCREASE THE NUMBER OF SHARES SUBJECT TO THE ESPP

BY 2,500,000 SHARES

The stockholders are being asked to approve an amendment to the ESPP to increase the number of shares of Common Stock issuable thereunder by 2,500,000 shares to a total of 4,940,332 shares of Common Stock. The ESPP was adopted by our Board of Directors on August 24, 1999, and has been approved by our stockholders. The ESPP was amended by our Board of Directors on November 5, 2002. Under the ESPP terms as originally adopted in 1999, 600,000 shares were issuable under the ESPP, and under those terms the number of securities offered through the ESPP have increased as of each January 1 by 1% of the Company’s outstanding common stock, for a period of five years, up to a total of 2,440,332 shares issuable. The ESPP and the right of participants to make purchases thereunder is intended to meet the requirements of an “employee stock purchase plan” as defined in Section 423 of the Internal Revenue Code of 1986, as amended (the “Code”).

Purpose

The purpose of the ESPP is to enable our eligible employees to acquire an ownership interest in the Company by purchasing Common Stock through payroll deductions.

Securities Offered

The securities issuable under the ESPP are the Company’s authorized but unissued or reacquired Common Stock, which participants may purchase through “Rights” granted in accordance with the terms of the ESPP. Under the ESPP terms as originally adopted in 1999, 600,000 shares were issuable under the ESPP, and under those terms the number of securities offered through the ESPP have increased as of each January 1 by 1% of the Company’s outstanding common stock, for a period of five years, up to a total of 2,440,332 shares issuable. If this Proposal is approved, the maximum number of shares that may be used in the aggregate under the ESPP will

4

increase to 4,940,332, subject to adjustment in the event of stock splits or dividends, recapitalization and other similar changes affecting our Common Stock. If any Right granted under the ESPP expires or terminates for any reason without being exercised in full or ceases for any reason to be exercisable in whole or in part, the unpurchased shares subject thereto shall again be available for Rights to be granted under the ESPP. As of March 31, 2005, 1,996,637 shares of Common Stock have been issued pursuant to the ESPP and 443,395 shares were available for future issuance. If the proposed amendment receives stockholder approval 2,943,395 shares will be available for future issuance under the ESPP.

Administration

The Compensation Committee of our Board of Directors (the “Committee”) oversees the operation of the ESPP. The Committee shall have full power to construe and interpret the ESPP and the Rights granted under the ESPP, and to establish and amend rules and regulations for its administration. The Committee also shall have full authority to correct any defect or reconcile any inconsistency in the ESPP, and its decisions shall be final, conclusive and binding. The Committee shall have the discretion to modify the terms of the ESPP with respect to participants who reside outside the United States or who are employed by one of our subsidiaries that has been formed under the laws of any foreign country, if a modification is necessary to conform to the requirements of local laws.

Eligible Participants

All of the employees of the Company and, if designated by our Board of Directors, of our subsidiaries, whose customary employment exceeds twenty (20) hours per week, are eligible to participate in the ESPP. An employee may not be granted a Right under the ESPP if (i) he owns, immediately after the grant of the Right, 5% or more of the combined voting power or value of all classes of our stock or any of our subsidiaries, or (ii) Rights under the ESPP or any other plans qualified under Section 423 of the Code, would result during any calendar year in the purchase of shares having an aggregate fair market value of more than $25,000. As of February 24, 2005, 479 full time employees of the Company were eligible to participate in the ESPP. As of February 24, 2005, 145 current employees of the Company and its subsidiaries were electing to participate in the ESPP (approximately 30% of the Company’s eligible employees).

An eligible employee may become a participant in the ESPP on the first Offering Date coincident with or next following the employee’s first day of employment or, if the Committee so determines on a uniform basis, the first day of any calendar month coincident with or next following an employee’s first day of employment. For purposes of the ESPP, “Offering Date” is defined as the date on which the Committee grants an eligible employee the option to purchase shares of Common Stock, which date generally will be the 15th day of November or of May of each year. The “Offering Period” is the period beginning on the Offering Date and ending on such date as the Committee may from time to time select, subject to the limitations of Section 423 of the Code. A request to begin payroll deductions will be effective on the next Offering Date (or, if the Committee so determines, on the first day of the next calendar month), provided that the authorization form is delivered to the Committee no later than fifteen (15) days prior to the first day of such Offering Period (or calendar month, if applicable). A participant may elect to have deductions made from pay on each payday at a whole number percentage rate of 1% to 15% of the compensation that the participant is entitled to receive. The deduction rate will continue in effect through the first date shares are purchased and each succeeding purchase date. The deduction rate may be reduced at any time during any Offering Period by filing an authorization form with the Committee, which will become effective as soon as reasonably practicable. The rate of payroll deduction may be increased by similarly filing an authorization form which will become effective as of the first day of the next succeeding Offering Date so long as it is delivered to the Committee fifteen (15) or more days prior to the next Offering Date.

An employee’s right to purchase shares of Common Stock under the ESPP will vest on the last day of the Offering Period provided that the Committee, sets a limit on the number of shares that an employee is able to

5

purchase during the Offering Period. If the Committee does not set such a limit then an employee’s right to purchase shares of Common Stock vests on either the date any performance conditions established by the Committee are satisfied or the date it becomes certain that there are a sufficient number of shares of Common Stock available for delivery under the ESPP. In either case, prior to the vesting date the Board of Directors has the authority to terminate an Offering Period and return all contributions to employees.

Purchase of Shares

The amount withheld from a participant’s compensation will be credited to a book account, which will be used to purchase shares of our Common Stock periodically, generally once every six months (on the last business day before the 15th day of November or of May of each year). Any cash dividends paid on shares of Common Stock held in the participant’s account will be added to the balance in its account and used to purchase additional Common Stock. Except as provided below, the Company will pay any administrative or commission expenses incurred, or fees charged on purchases of Common Stock. The purchase price of the Common Stock to be purchased with payroll deductions will be equal to the lesser of 85% (or such other amount as the Committee shall authorize, but in no event less than 85%) of (i) the fair market value of the Common Stock on the Offering Date (or, if later, on the date an authorization form becomes effective in accordance with the terms of the ESPP) or (ii) the fair market value of a share on the date the shares are purchased; provided, however, that if a participant enters the ESPP on a date other than on Offering Date, the amount set forth in clause (i) shall not be less than the fair market value of a share of Common Stock on the Offering Date. The fair market value of the Common Stock on a given date shall be determined by the Committee based upon the reported closing sales price of the Common Stock on the NASDAQ national market system on such date. However, for purposes of the first Offering Date, the fair market value was the initial price of a share to the public as set forth in the final prospectus included in the Company’s registration statement on Form S-1 as filed with the Securities and Exchange Commission for the initial public offering of our Common Stock.

If the limit (4,940,332, assuming the proposed amendment to the ESPP is approved by stockholders) on the number of shares of Common Stock available to be purchased under the ESPP is reached, then the last purchase of Common Stock shall be allocated among the participants pro rata based upon the number of shares that would have been purchased under the ESPP without this limitation.

A statement is delivered to the participant periodically showing the aggregate number of shares in the account, the number of shares purchased on the most recent purchase date and the price per share paid for such shares, the amount of cash remaining in the account and such other relevant information as determined by the Committee.

As of February 24, 2005, participants had purchased an aggregate of 1,996,937 shares of Common Stock under the ESPP at a weighted average of percentage price of $4.40 per share.

Withdrawal or Termination

A participant may elect to withdraw any cash or shares credited to an account at any time (subject to any limitations imposed by any applicable state or federal securities laws). The Company will deliver Common Stock so requested at such regular times as we or our transfer agent determine. If delivery is requested at other than the normal transfer date, the participant requesting the transfer shall pay the costs associated with the transfer. The Company pays all the cash deposits in an account promptly after receipt of the notice of withdrawal, without interest. Shares of Common Stock to be delivered to a participant are registered in his or her name, or if directed in writing to the Committee, in a designate’s name, and are delivered as soon as practicable after the request for withdrawal. If a participant wishes to sell the shares in an account instead of receiving a distribution of shares, he or she may notify the Committee to sell the shares. The participant bears all the commission costs associated with such a sale. The Company pays all the administrative costs associated with such a sale (other than costs arising from a sale occurring at a time that differs from the prearranged dates we, or our transfer agent, set for making such sales).

6

The participant may stop participating in the ESPP at any time by notifying the Committee. When the notice is received by the Committee, he or she receives a distribution of all accumulated payroll deductions, without interest, and no further payroll deductions will be made, except upon the filing of a new authorization form.

The participant must be employed by the Company or one of our subsidiaries on the date the Common Stock is purchased in order to participate in that purchase. If he or she is ineligible to participate in the ESPP at any time, payroll deductions made that have not been used to purchase shares of Common Stock are returned within sixty (60) days after the determination of ineligibility. No interest will be paid on any payroll deductions made at any time.

Transferability of Rights

Rights may not be transferred except by will or the laws of descent and distribution. Only the participant may exercise Rights during his or her lifetime. All shares of Common Stock purchased and left in an account shall, however, be subject to his or her absolute control.

Adjustments and Amendments To, and Termination of the ESPP

In the event the Company pays a stock dividend or makes a distribution of shares, or splits up, combines, reclassifies or substitutes other securities for its outstanding shares of Common Stock, the Committee is to make an appropriate adjustment to the number of shares subject to outstanding Rights and the purchase prices thereof.

The Board of Directors may amend the ESPP in any respect except that the maximum number of shares available for purchase may not be increased (except upon stock splits and dividends, combinations and similar events) and the class of eligible employees and rate of compensation deductions may not be modified without stockholder approval. The Board of Directors may terminate the ESPP at any time. However, no termination or amendment will affect the Rights of participants previously granted without such participants’ consent.

Federal Income Tax Consequences

The ESPP is designed to qualify as an employee stock purchase plan under the provisions of Sections 421 and 423 of the Code. Neither the grant nor the purchase of Rights under the ESPP will have a tax impact on participants or on us. If an employee disposes of the Common Stock acquired upon the purchase of his Right after at least two years from the date of grant and one year from the date of purchase, then the employee must treat as ordinary income the lesser of (i) the amount, if any, by which the fair market value of the Common Stock at the time of disposition exceeds the purchase price paid, or (ii) the amount, if any, by which the fair market value of the Common Stock at the date of grant exceeds the purchase price paid. Such recognition of compensation income upon disposition shall have the effect of increasing the basis of the shares in the employee’s hands by an amount equal to the amount of compensation income recognized. Any gain in addition to this amount will be treated as a long-term capital gain. If an employee holds Common Stock at the time of his or her death, the holding period requirements are automatically deemed to have been satisfied and ordinary income will be realized by the estate, in the amount discussed above, upon the sale or other disposition of the Common Stock. We will not be allowed a deduction if the holding period requirements are satisfied or deemed satisfied.

If an employee disposes of the Common Stock before the expiration of the later of two years from the date of grant and one year from the date of purchase, then the employee must treat as ordinary income the excess of the fair market value of the Common Stock on the date of purchase over the purchase price. Any additional gain will be treated as long-term capital gain. We may deduct an amount equal to the ordinary income recognized by the employee.

The rules governing taxation of stock purchase plans are complex, and this statement of the federal income tax consequences does not address any state tax considerations.

7

The Plan is not qualified under Section 401(a) of the Code, and the Company does not consider it subject to any provisions of the Employee Retirement Income Security Act of 1974.

Purchase Plan Benefits

Since purchase rights are subject to discretion, including an employee’s decision not to participate in the ESPP, awards under the ESPP for the current year are not determinable. No Rights have been granted with respect to the additional 2,500,000 shares for which approval is requested. The following table sets forth information with respect to purchases of Common Stock by certain executive officers, all current executive officers as a group and all other employees as a group during the last fiscal year ended December 31, 2004.

| | | | | |

Name of Individual or Identity of Group and Position

| | Number of Shares

Purchased under ESPP

| | Dollar Value (1)

|

T. Curtis Holmes, Jr. President and Chief Executive Officer | | 10,000 | | $ | 12,610 |

Anthony Finbow Managing Director, EMEA | | — | | | — |

Glenn Etherington Chief Financial Officer | | 2,877 | | $ | 3,628 |

Sam Kelley Executive Vice President—Services | | — | | | — |

Phillip Thrasher Executive Vice President—Americas and Asia Pacific Sales | | — | | | — |

All current executive officers as a group (7 persons) | | 22,877 | | $ | 28,848 |

All other employees as a group | | 476,573 | | $ | 540,533 |

| (1) | | Fair market value on the date of purchase, minus the purchase price. |

Recommendation of the Board of Directors Regarding Proposal #2

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” PROPOSAL #2 TO AMEND THE COMPANY’S EMPLOYEE STOCK PURCHASE PLAN.

PROPOSAL #3

TO RATIFY THE APPOINTMENT OF GRANT THORNTON LLP AS THE COMPANY’S INDEPENDENT AUDITORS FOR 2005

In accordance with its charter, the Audit Committee of the Board of Directors has selected Grant Thornton LLP as the Company’s independent auditors to audit the Company’s consolidated financial statements for 2005 and to render other services required of them.

On April 5, 2005, the Audit Committee of the Board of Directors of the Company notified Grant Thornton LLP (“Grant Thornton”) that it was being engaged to serve as the Company’s independent auditors, and notified KPMG LLP (“KPMG”) that it had been dismissed as the Company’s independent auditors, effective immediately. The appointment of Grant Thornton and the dismissal of KPMG were approved by the Audit Committee.

KPMG performed audits of the Company’s consolidated financial statements for the two years ended December 31, 2003 and December 31, 2004. KPMG’s reports on the Company’s financial statements did not contain an adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

8

In connection with the audits of the two years ended December 31, 2004, and the subsequent interim period from January 1, 2005 through April 5, 2005, the effective date of KPMG’s dismissal, there were no disagreements between the Company and KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which, if not resolved to the satisfaction of KPMG, would have caused KPMG to make reference to the subject matter of such disagreements in connection with its report. Except as described in the next paragraph, none of the “reportable events” described in Item 304(a)(1)(v) of Regulation S-K promulgated by the Securities and Exchange Commission (the “SEC”) pursuant to the Securities Exchange Act of 1934, as amended, have occurred during the two years ended December 31, 2004, or from December 31, 2004 through the effective date of KPMG’s termination.

As disclosed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2004, the Company, in conjunction with KPMG, determined that it had a material weakness that caused the Company’s internal control over financial reporting to not be effective as of December 31, 2004. The deficiency constituting the material weakness was that, as of December 31, 2004, the Company did not employ personnel with adequate expertise in matters related to the accounting for estimated income tax exposures and foreign income taxes. The deficiency did not result in a material misstatement in the Company’s 2004 financial statements. The Audit Committee discussed the material weakness with KPMG, and the Company has authorized KPMG to respond fully to the inquiries of Grant Thornton concerning the material weakness.

During the two years ended December 31, 2004, and from December 31, 2004 through the engagement of Grant Thornton as the Company’s independent accountant, neither the Company nor anyone on its behalf has consulted Grant Thornton with respect to any accounting or auditing issues involving the Company. In particular, there was no discussion with the Company regarding the application of accounting principles to a specified transaction, the type of audit opinion that might be rendered on the financial statements, or any matter that was either (i) the subject of a disagreement with KPMG on accounting principles or practices, financial statement disclosure or auditing scope or procedure which, if not resolved to the satisfaction of KPMG, would have caused KPMG to make reference to the subject matter of such disagreement in connection with its report, or (ii) a “reportable event” as described in Item 304(a)(1)(v) of Regulation S-K promulgated by the SEC.

The Company provided KPMG with a copy of the foregoing disclosures. A letter from KPMG has been requested, to confirm the foregoing disclosures.

Stockholders are asked to vote on a proposal to ratify the appointment by the Board’s Audit Committee of Grant Thornton as the Company’s independent auditors for the year 2005. Representatives of Grant Thornton are expected to be present at the Annual Meeting of Stockholders of the Company with the opportunity to make a statement if they so desire and to be available to respond to appropriate questions. Representatives of KPMG are not expected to be present at the Annual Meeting of Stockholders of the Company.

The submission of this matter for approval by stockholders is not legally required; however, the Board of Directors and its Audit Committee believe that such submission is consistent with best practices in corporate governance and is an opportunity for stockholders to provide direct feedback to the Board of Directors and its Audit Committee on an important issue of corporate governance. If the stockholders do not approve the selection of Grant Thornton, the Audit Committee may or may not reconsider the selection of such firm as independent auditors.

The Audit Committee has the sole authority and responsibility to retain, evaluate, and, where appropriate, replace the independent auditors. Ratification by the stockholders of the appointment of Grant Thornton does not limit the authority of the Audit Committee to direct the appointment of new independent auditors at any time during the year.

Recommendation of the Board of Directors Regarding Proposal #3

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” PROPOSAL #3 TO RATIFY THE APPOINTMENT OF GRANT THORNTON LLP AS THE COMPANY’S INDEPENDENT AUDITORS FOR 2005.

9

DIRECTORS

Set forth below is information regarding the continuing directors of the Company, including their ages, the period in which they have served as directors, and information furnished by them as to principal occupations and directorships held by them in corporations whose shares are publicly registered.

| | | | | | |

Name

| | Director Since

| | Term Ending

| | Age

|

Lawrence J. Bouman | | 2000 | | 2007 | | 58 |

Royce Holland | | 2000 | | 2006 | | 56 |

T. Curtis Holmes, Jr. | | 2001 | | 2007 | | 43 |

Terry L. Scott | | 2003 | | 2006 | | 54 |

Mr. Bouman has served as a director of the Company since November 2000. Since January 1999, Mr. Bouman has served as a technology advisor and independent consultant to several private communications and technology companies. From June 1998 to January 1999, Mr. Bouman served as a member of the acquisition transition team following Qwest Communications International, Inc.’s acquisition of LCI International. From October 1995 to June 1998, Mr. Bouman was Senior Vice President and Chief Technology Officer of LCI International, Inc., a communications services provider. Prior to 1995, Mr. Bouman held several senior positions with MCI Telecommunications Corporation. From September 2001 to June 2003 Mr. Bouman served as a director of Broadwing, Inc., a communications services provider. From September 1999 to October 2000, Mr. Bouman served as a director of Net-Tel, a competitive local exchange carrier.

Mr. Holland has served as a director of the Company since May 2000. Mr. Holland co-founded Allegiance Telecom, a telecommunications services provider, in 1997 and served as its Chairman of the Board and Chief Executive Officer from that time until June 2004. Allegiance Telecom filed for bankruptcy on May 14, 2003. Previously, Mr. Holland was at MFS Communications Company, Inc., a communications services provider, as a Co-founder and a Director from its inception in 1988, and also as President from 1990 through the completion of its merger with WorldCom in December 1996. In January 1993, President George Bush appointed Mr. Holland to the National Security Telecommunications Advisory Committee. Mr. Holland has over thirty years experience in the telecommunications, independent power and engineering/construction industries.

Mr. Holmes has served as our President and Chief Executive Officer since August 2003. He served as President and Chief Operating Officer from January 2001 to July 2003. He has served as a director since May 2001. From December 1996 to December 2000, Mr. Holmes served as Vice President and General Manager of the Intelligent Network Unit of Lucent Technologies, Inc., where his responsibilities included strategic planning, product marketing, product management, and development and deployment of enhanced services applications. From July 1994 to December 1996, Mr. Holmes served as Applications Group Director for Operations Support Systems for Lucent Technologies/AT&T Network Systems.

Mr. Scott has served as a director of the Company since February 2003. Since March 2004, Mr. Scott has been President, Chief Executive Officer and a director of Airimba Wireless, Inc., a wireless Internet access service provider. From June 2003 until March 2004, he served as Vice President – Finance and Chief Financial Officer of CMI Holding Company, Inc., a general partner of Chase Medical L.P., a privately held company that develops, manufactures and markets products for the treatment of congestive heart failure. From October 2002 until December 2004, upon the sale of the company, he also served as an outside director and chairman of the audit committee for Chameleon Technology, Inc., a privately held company that developed intelligent networking software. From November 1995 to August 2002 Mr. Scott served at various times as an independent director and audit committee member for five companies, including Terion, Inc., a wireless application service provider. In addition, from November 1995 to September 1997, he was President and Chief Executive Officer of Terion and from September 1997 to July 1999 he was its Chairman of the Board and Chief Executive Officer. Mr. Scott was with Paging Network, Inc. from 1981 through 1995 where he held various senior executive positions including serving as its Senior Vice President of Finance and Chief Financial Officer, and then as President and Chief Executive Officer from 1993 to November 1995.

10

Each of Messrs. Berndt, Bouman, Holland, Scott and White is an “independent director,” as such term is defined in Rule 4200 of The Nasdaq Marketplace Rules.

Board of Directors Meetings and Committees

During 2004, the Board of Directors held 6 meetings and acted by written consent on 2 occasions. For the fiscal year, each of the directors during the term of his tenure attended or participated in at least 75% of the aggregate of (i) the total number of meetings or actions by written consent of the Board of Directors and (ii) the total number of meetings held by all committees of the Board of Directors on which each such director served. Under the policies of the Board, the Company’s directors are expected to attend regular Board meetings and Board committee meetings. There is no Company policy regarding director’s attendance at annual stockholder meetings. All of the Company’s directors except John W. White attended the 2004 Annual Meeting of Stockholders. The Board of Directors has three standing committees, the Audit Committee, the Compensation Committee and the Governance Committee (formerly the Nominating Committee).

During 2004, the Audit Committee of the Board of Directors held 10 meetings. The Audit Committee reviews, acts on and reports to the Board of Directors with respect to various auditing and accounting matters, including the selection of the Company’s independent accountants, the scope of the annual audits, fees to be paid to the independent accountants, the performance of the Company’s independent accountants and the accounting practices of the Company. The members of the Audit Committee are Messrs. Berndt, Scott and White. The Board of Directors has designated Terry L. Scott as the Company’s Audit Committee financial expert. Mr. Scott is an independent director as defined in the Securities and Exchange Act of 1934. The Board of Directors has adopted a written charter for the Audit Committee, a copy of which is available through the Corporate Governance section of the Company’s website atwww.metasolv.com. Each member of the Audit Committee is an “independent director,” in accordance with the requirements of Exchange Act Rule 10A-3, and as such term is defined in Rule 4200 of The Nasdaq Marketplace Rules and applicable law, including the Sarbanes-Oxley Act of 2002.

During 2004, the Compensation Committee held 5 meetings. The Compensation Committee is responsible for (i) establishing compensation programs designed to attract, motivate and retain key executives responsible for the Company’s success; (ii) administering and maintaining such programs in a manner that will benefit the long-term interests of the Company and its stockholders; and (iii) determining the compensation of the Company’s Chief Executive Officer and other executive officers. The members of the Compensation Committee are Messrs. Bouman and Holland. The Board of Directors has adopted a written charter for the Compensation Committee, a copy of which is available through the Corporate Governance section of the company’s website atwww.metasolv.com. Each member of the Compensation Committee is an “independent director,” as such term is defined in Rule 4200 of The Nasdaq Marketplace Rules and applicable law, including the Sarbanes-Oxley Act of 2002.

During 2005, the Governance Committee held 4 meetings. The Governance Committee is responsible for (i) making nominations to fill vacancies on the Board of Directors, (ii) making recommendations to the Board of Directors regarding board policies and structure, (iii) overseeing the development and periodic review of corporate governance guidelines for the Company, (iv) director compensation, (v) leading the Board of Directors in its annual performance review and (vi) other issues of corporate governance. The members of the Governance Committee are Messrs. Berndt, Bouman and White. Each member of the Governance Committee is an “independent director,” in accordance with the requirements of Exchange Act Rule 10A-3, and as such term is defined in Rule 4200 of The Nasdaq Marketplace Rules and applicable law, including the Sarbanes-Oxley Act of 2002. The Board of Directors has adopted a written charter for the Governance Committee, a copy of which is available through the Corporate Governance section of the Company’s website atwww.metasolv.com. The Governance Committee will consider nominations by stockholders of persons for election to the Board of upon adequate written notice to the Company’s Secretary. To be adequate, the nomination notice must be delivered in writing to the Secretary not less than 60 days nor more than 90 days prior to the first anniversary of the preceding year’s Annual Meeting, and must be directed to: Governance Committee, c/o Jonathan K. Hustis (Corporate

11

Secretary), MetaSolv, Inc., 5556 Tennyson Parkway, Plano, TX 75024 USA. The Governance Committee reviews candidates for director nominees in the context of the current composition of the Board of Directors, the operating requirements of the Company and the long-term interests of the stockholders. In conducting this assessment, the Governance Committee considers experience, diversity, age, skills and such other factors as it deems appropriate given the current needs of the Board of Directors and the Company. Certain specific minimum qualifications relating to persons to be considered for a position on the Board of Directors have been adopted by the Committee and can be reviewed in the MetaSolv, Inc. Corporate Governance Guidelines, a copy of which is available through the Corporate Governance section of the Company’s website atwww.metasolv.com. The Governance Committee uses the same criteria for evaluating candidates nominated by stockholders as it does for those proposed by other Board members, management and search companies.

Director Compensation

Non-employee directors receive $1,500 for each Board of Directors meeting attended in person, and for each standing committee meeting attended in person (other than on a Board of Directors meeting day) and $300 per meeting attended by teleconference. All directors are reimbursed for reasonable expenses incurred by them in attending Board of Directors and committee meetings.

In addition to the meeting fees, non-employee directors also receive an annual retainer for service on the Board of Directors and for service as the chairman of the board or any standing board committee. Each non-employee director may elect to receive the annual retainer, which is paid quarterly, in either cash ($15,000 annually), or restricted stock of the Company ($20,000 annually in restricted stock). The chairman of the Board of Directors and the chairman of the Audit Committee each receive an additional annual retainer, paid quarterly, which they may elect to receive in either cash ($7,500 annually), or restricted stock of the Company ($9,000 annually in restricted stock); and any director serving as the chairman of any other standing committee of the Board of Directors receives an annual retainer, paid quarterly, which they may elect to receive in either cash ($5,000 annually), or restricted stock of the Company ($6,500 annually in restricted stock). Restricted stock granted to non-employee directors will have a price equal to the fair market value of the Common Stock of the Company on the date of grant and will vest one year following the date of grant.

Each non-employee director is also granted a one-time option to purchase up to 30,000 shares of Common Stock under the Company’s Long-Term Incentive Plan on the date he or she is first elected to the Board of Directors (applicable to non-employee directors first elected in 2003 and later). A non-employee director is granted an additional option to purchase up to 15,000 shares of Common Stock under the Long-Term Incentive Plan for each successive year that he or she serves as a member of the Board of Directors. Each option will have an exercise price equal to the fair market value of the Common Stock on the date of grant, will have a term to be determined by the Governance Committee and will generally terminate within a specified time, as defined in the Long-Term Incentive Plan, following the date the option holder ceases to be a director. With respect to the option grant of 30,000 shares upon a non-employee director’s initial election to the Board of Directors, 15,000 of the shares are immediately vested and the remaining 15,000 vest in equal monthly installments over the director’s first 12 months of service. With respect to the option grant of 15,000 shares for each successive year that a non-employee director serves as a member of the Board of Directors, the shares vest in equal monthly installments over the 12 months following such grant.

Stockholder Communications with the Board of Directors

The Company’s Board of Directors has adopted a formal process by which stockholders may communicate with the Board. Stockholders who wish to communicate with the Board may do so by sending written communications addressed to the Board of Directors of MetaSolv, Inc., at 5556 Tennyson Parkway, Plano, TX 75024 U.S.A., attention of Jonathan K. Hustis (Corporate Secretary). The Company’s process for handling stockholder communications with the Board has been approved by the independent directors of the Company.

12

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of February 28, 2005, certain information with respect to shares beneficially owned by (i) each person who is known by the Company to be the beneficial owner of more than five percent of the Company’s outstanding shares of Common Stock, (ii) each of the Company’s directors and the executive officers named in the Summary Compensation Table and (iii) all current directors and executive officers as a group. Unless otherwise indicated, each person named below has an address in care of the Company’s principal executive offices. Beneficial ownership has been determined in accordance with Rule 13d-3 under the Exchange Act. Under this rule, certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option or warrant) within sixty days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of such acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the following table does not necessarily reflect the person’s actual voting power at any particular date. Applicable percentage of ownership as of February 28, 2005 is based upon 41,609,356 shares of Common Stock outstanding.

| | | | | |

| | | Shares Beneficially Owned

as of February 28, 2005

| |

Beneficial Owner

| | Number of Shares

| | Percentage of Class

| |

Private Capital Management, L.P. (1) | | 5,005,730 | | 12.03 | % |

FMR Corp. (2) | | 3,653,000 | | 8.78 | % |

William N. Sick, Jr. | | 4,144,609 | | 9.96 | % |

Business Resources International, Inc. (3) | | | | | |

Michael J. Watters (4). | | 2,768,969 | | 6.65 | % |

T. Curtis Holmes, Jr. (5) | | 1,104,462 | | 2.59 | % |

Glenn A. Etherington (6) | | 696,060 | | 1.65 | % |

Anthony Finbow (7) | | 108,750 | | * | |

Sam L. Kelley (8) | | 466,624 | | 1.11 | % |

Phillip C. Thrasher (9) | | 334,468 | | * | |

Royce W. Holland (10). | | 97,500 | | * | |

Lawrence J. Bouman (11) | | 117,634 | | * | |

John W. White (12). | | 89,167 | | * | |

John E. Berndt (13) | | 111,172 | | * | |

Terry L. Scott (14) | | 61,900 | | * | |

All directors and executive officers as a group (12 persons) (14) | | 4,174,034 | | 9.22 | % |

| (1) | | The address of Private Capital Management, L.P. is 8889 Pelican Bay Blvd., Naples, Florida 34108. Information with respect to such beneficial ownership was obtained from a Schedule 13G filed with the Securities and Exchange Commission and reflects shares beneficially owned by Private Capital Management, L.P. as of December 31, 2004. |

| (2) | | The address of FMR Corp. is 82 Devonshire Street, Boston, Massachusetts 02109. Information with respect to such beneficial ownership was obtained from a Schedule 13G filed with the Securities and Exchange Commission and reflects shares beneficially owned by FMR Corp. as of December 31, 2004. |

| (3) | | Consists of 1,236,752 shares held directly by Mr. Sick, 2,333,967 shares held by Business Resources International, Inc., 229,536 shares held by Jill Melanie Sick 1991 Trust, 229,536 shares held by David Louis Sick 1991 Trust, and 114,818 shares held by Louis Pitchlyn Williams 1992 Trust. The address of William N. Sick, Jr. is 565 Sheridan Road, Winnetka, Illinois 60093. Information with respect to such beneficial |

13

| | ownership was obtained from a Form 5 and a Schedule 13G filed with the Securities and Exchange Commission and reflects shares beneficially owned by William M. Sick, Jr. as of December 31, 2004. |

| (4) | | Consists of shares held by The Watters’ Children Trust, the Michael and Carole Watters Charitable Remainder Trust and MCDA International Partnership, Ltd. The address of Mr. Watters is 101 E. Park Blvd., Suite 600, Plano, Texas 75024. Information with respect to such beneficial ownership was obtained from a Schedule 13G filed with the Securities and Exchange Commission and reflects shares beneficially owned by Mr. Watters as of December 31, 2004. |

| (5) | | Consists of (i) 98,212, shares owned by Mr. Holmes and (ii) 1,006,250 shares subject to stock options held by Mr. Holmes that are exercisable within 60 days of February 28, 2005. |

| (6) | | Consists of (i) 110,706 shares owned by Mr. Etherington and (ii) 585,354 shares subject to stock options held by Mr. Etherington that are exercisable within 60 days of February 28, 2005. |

| (7) | | Consists of 108,750 shares subject to stock options held by Mr. Finbow that are exercisable within 60 days of February 28, 2005. |

| (8) | | Consists of (i) 22,230 shares owned by Mr. Kelley and (ii) 444,394 shares subject to stock options held by Mr. Kelley that are exercisable within 60 days of February 28, 2005. |

| (9) | | Consists of (i) 18,218 shares owned by Mr. Thrasher and (ii) 316,250 shares subject to stock options held by Mr. Thrasher that are exercisable within 60 days of February 28, 2005. |

| (10) | | Consists of 97,500 shares subject to stock options held by Mr. Holland that are exercisable within 60 days of February 28, 2005. |

| (11) | | Consists of (i) 30,134 shares owned by Mr. Bouman and (ii) 87,500 shares subject to stock options held by Mr. Bouman that are exercisable within 60 days of February 28, 2005. |

| (12) | | Consists of 89,167 shares subject to stock options held by Mr. White that are exercisable within 60 days of February 28, 2005. |

| (13) | | Consists of (i) 28,672 shares owned by Mr. Berndt and (ii) 82,500 shares subject to stock options held by Mr. Berndt that are exercisable within 60 days of February 28, 2005. |

| (14) | | Consists of (i) 5,450 shares owned by Mr. Scott (ii) 10,200 shares owned by Mr. Scott’s wife and (iii) 46,250 shares held by Mr. Scott that are exercisable within 60 days of February 28, 2005. |

| (15) | | Consists of (i) 532,509 shares owned by all directors and executive officers as a group and (ii) 3,641,525 shares subject to stock options that are exercisable within 60 days of February 28, 2005. |

COMPENSATION COMMITTEE REPORT

Responsibilities and Composition of the Committee

The Compensation Committee of the Company’s Board of Directors (the “Committee”) is responsible for (i) establishing compensation programs designed to attract, motivate and retain key executives responsible for the Company’s success; (ii) administering and maintaining such programs in a manner that will benefit the long-term interests of the Company and its stockholders; and (iii) determining the compensation of the Company’s Chief Executive Officer and other executive officers. The Committee also makes recommendations to senior management with respect to the Company’s compensation policies and practices generally. The Committee is composed of two directors, currently Mr. Holland and Mr. Bouman. The members of the Committee are “independent directors” (as defined under Nasdaq rules), as well as “outside directors” (as defined in Section 162(m) of the Internal Revenue Code of 1986, as amended). Neither of these directors has ever served as an employee of the Company.

14

This report describes the philosophy that underlies the cash and equity-based components of the Company’s executive compensation program. It also describes the details of each element of the program, as well as the rationale for compensation paid to the Company’s Chief Executive Officer and its executive officers in general.

For the 2004 fiscal year, the process used by the Committee in determining executive officer compensation levels was based on the subjective judgment of the Committee. However, the recommendations of the Company’s Chief Executive Officer were considered by the Committee when making the final compensation decisions concerning each other officer.

Compensation Philosophy and Objectives

The Committee believes that the Company’s executive officer compensation should be determined according to a competitive framework and based on overall financial results, individual contributions and teamwork that help build value for the Company’s stockholders. Within this overall philosophy, the Committee bases the compensation program on the following principles:

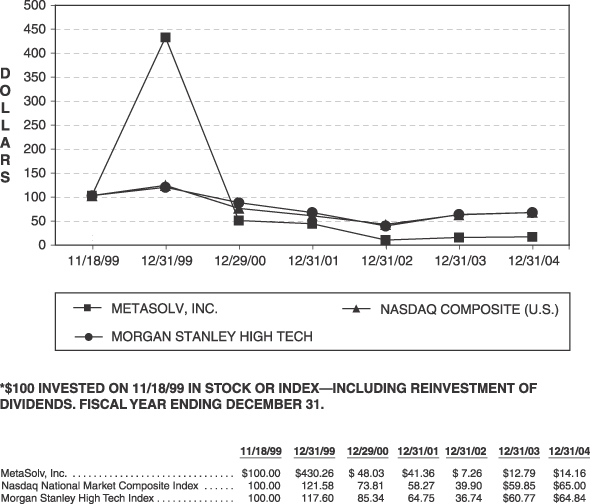

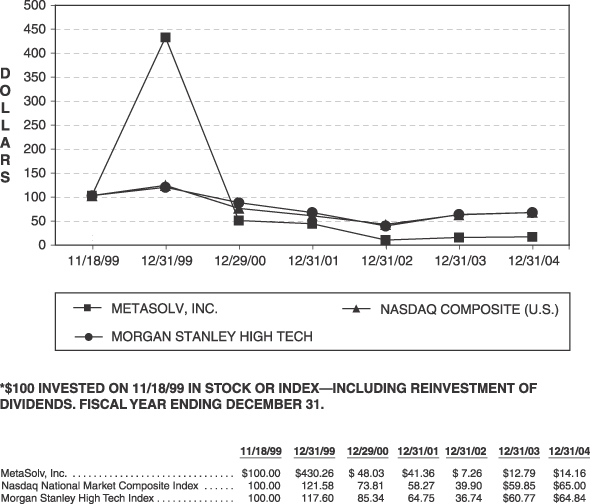

| | • | | Compensation levels for executive officers are benchmarked to the outside market, using published industry data relevant to the officers’ positions. Compensation decisions are made by referring to information regarding two groups of companies: companies with which the Company is expected to compete for executive talent; and companies within the industry groups with which the Company can expect to compete for investors. The Company obtained salary information on these companies through Culpepper & Associates, Inc. and William M. Mercer, independent organizations that provide comprehensive salary survey data for U.S. high technology and software companies. The benchmark companies against whom the Committee gauged the Company’s executive compensation may occasionally overlap those contained in the Morgan Stanley Index, which was used for comparison in the stock performance graph. The Committee, however, does not consider other companies’ performance in awarding executive compensation. Nor does the Committee refer to the Morgan Stanley Index as a guide for such compensation. Rather, the Committee examines several factors when setting salaries for executive officers, including: |

| | • | | the compensation of officers at software and technology companies generally; |

| | • | | the revenues of comparable software companies; |

| | • | | the geographic location of the comparable companies; |

| | • | | whether the comparable companies are publicly or privately held; and |

| | • | | the job responsibilities of the officers in the comparable companies. |

| | • | | The total compensation opportunity is targeted to be competitive with the compensation offered by these companies. The Committee considers it essential to the vitality of the Company that the total compensation opportunity for executive officers remains competitive with similar companies in order to attract and retain the talent needed to manage and build the Company’s business. |

| | • | | Compensation is tied to performance. A significant part of the total compensation opportunity is at risk, to be earned only if specific goals are met. |

| | • | | Incentive compensation is designed to reinforce the achievement of both short-and long-term corporate objectives. |

Compensation of Executive Officers Generally

The Company’s executive compensation program is designed to link executive pay to Company performance and to provide an incentive to executives to manage the Company with a principal view to enhancing stockholder value.

15

Generally, the Company’s executive compensation program makes a significant portion of each executive’s cash compensation contingent upon growth and improvement in the Company’s results of operations, with the potential to earn exceptional rewards for exceptional performance. More specifically, the program is designed to provide compensation for meeting and exceeding internal goals and to provide incentives to increase the market value of the Common Stock. The program also is designed to attract and retain talented executives who are essential to the Company’s long-term success within a highly competitive industry that demands unique talents, skills and capabilities.

Compensation criteria are evaluated annually to ensure they are appropriate and consistent with the business objectives that are important in meeting the Company’s earnings per share, operating profit, cash flow and revenue goals, and in enhancing stockholder value. The Company’s executive compensation policies and programs are intended to (i) provide rewards contingent upon Company and individual performance, (ii) link executive compensation to sustainable increases in stockholder value, (iii) promote teamwork among executives and other Company employees, and (iv) effect retention of a strong management team.

The primary components of the Company’s executive compensation program are salary, performance bonuses, restricted stock, and stock options.

Base Salary. The Committee reviews the salary of each of its executive officers annually. The Committee’s review takes into consideration the Company’s revenue, earnings per share and operating profits and the duties and performance of each executive. In making salary recommendations or decisions, the Committee exercises its discretion and judgment based on the foregoing criteria, without applying a specific formula to determine the weight of each factor considered. The Committee also considers equity and fairness when comparing base salaries of executives.

Incentive Bonuses. The Company has established a bonus system for executive officers based on financial performance criteria, including revenue growth, profitability, operating cash flow and percentage performance compared to established targets. During fiscal 2004, executive officers could earn annual bonuses targeted between 50% and 89% of their respective base salaries. Bonuses payable, if any, are paid semi-annually and are contingent upon the attainment of six-month objectives determined by the Committee. Other senior managers have similar bonus arrangements. Bonuses are typically determined based on the achievement of certain financial and operational goals for the Company including:

| | • | | improvement of contracted sales backlog; |

| | • | | achievement of departmental objectives; and |

| | • | | achievement of individual objectives |

Incentive bonuses earned during fiscal 2004 were paid to two executive officers, based on their achievements measured in proportion to certain individual target objectives.

Equity Compensation. The Committee believes that grants to executive officers and other key employees of restricted stock, stock options, and other forms of equity compensation are important methods of enhancing long-term profitability and stockholder value. The Committee views the Long-Term Incentive Plan as a vehicle to attract and retain experienced employees and to align the employee’s economic incentives with those of the Company’s stockholders. Under the Long-Term Incentive Plan, the Committee may grant restricted stock, stock options, other forms of equity compensation, and performance awards that include awards of equity compensation in the event specified performance goals are achieved, to executive officers who are expected to

16

contribute materially to the Company’s future success. In determining the size of restricted stock option and other equity grants, the Committee focuses primarily on the Company’s performance and the perceived role of each executive in accomplishing such performance objectives, as well as the satisfaction of individual performance objectives. In addition, the Committee examines the option holdings of the executives and the competitive market for qualified executives. The Committee’s primary objectives in granting awards are the retention of its executives and incentive creation for officers to improve the Company’s performance.

The Committee intends to continue using restricted stock, stock options, other forms of equity compensation, and performance awards that include equity compensation as the primary long-term incentive for the Company’s executive officers. Because they generally provide rewards to executives to the extent the executive remains with the Company, and to the extent that the Company’s stock price increases after restricted stock or other equity awards are granted, the Committee feels that stock options and other equity awards granted under the Long-Term Incentive Plan are an appropriate means to provide executives with incentives to remain with the Company, and that closely align their interests with those of stockholders, thereby encouraging them to promote the ongoing success of the Company.

Policy on Deductibility of Compensation

It is the responsibility of the Committee to address the provisions of Section 162(m) of the Internal Revenue Code which, except in the case of “performance-based compensation” and certain other types of compensation, limits to $1,000,000 per person the amount of the Company’s federal income tax deduction for compensation paid to the Chief Executive Officer and the other four most highly paid executive officers. In that regard, the Committee must determine whether any actions with respect to Section 162(m) should be taken by the Company. In fiscal 2004, the Company did not pay its executive officers compensation that would not be deductible as a result of the Section 162(m) deductibility limit. The Company expects that the compensation paid to executive officers in fiscal 2005 will qualify for income tax deductibility under Section 162(m) of the Internal Revenue Code. The Committee will take appropriate action when it is warranted in the future.

Chief Executive Officer Compensation

The Chief Executive Officer’s salary, bonus and long-term awards follow the policies set forth above. For 2004 Mr. Holmes’ base salary was $315,000. He also received $3,000 in matching contributions under the Company’s 401(k) Plan. Mr. Holmes’ salary was not linked to any set corporate or personal performance goals.

The foregoing report has been approved by all of the members of the Committee.

THE COMPENSATION COMMITTEE

Royce J. Holland, Chairman

Lawrence J. Bouman

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Neither of the members of the Compensation Committee is currently or has been, at any time since the formation of the Company, an officer or employee of the Company. No executive officer of the Company serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of the Company’s Board of Directors or Compensation Committee.

Mr. Royce Holland, a director of the Company and member of the Compensation Committee, until February 2004 was a 5% shareholder and until June 2004 was Chairman of the Board and CEO of Allegiance Telecom, a customer of the Company. Purchases by Allegiance from the Company in fiscal year 2004 accounted for approximately $266,000 in revenue to the Company.

17

REPORT OF THE AUDIT COMMITTEE

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process. The Company’s independent auditors are responsible for expressing an opinion on the conformity of our audited financial statements to generally accepted accounting principles.

In this context, the Audit Committee has reviewed and discussed with management and the independent auditors the audited financial statements. The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). In addition, the Audit Committee has received from the independent auditors the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discussed with them their independence from the Company and its management.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in the Company’s Annual Report on SEC Form 10-K for the year ended December 31, 2004, for filing with the Securities and Exchange Commission.

THE AUDIT COMMITTEE

John E. Berndt

Terry L. Scott, Chairman

John W. White

FEES PAID TO INDEPENDENT ACCOUNTANTS

Fees for all services provided by KPMG LLP, the Company’s independent auditors, for years 2004 and 2003 are as follows:

Audit Fees

Fees for services for years 2004 and 2003 related to the annual financial statement audits, review of and assistance with quarterly and annual financial statements filed in the reports 10-Q and 10-K with the SEC, consents related to such reports filed with the SEC, audits of internal controls over financial reporting as required by the Sarbanes-Oxley Act of 2002, and statutory audits approximated $742,00 and $188,000 respectively.

Audit-Related Fees

Fees for audit-related services for years 2004 and 2003, primarily related to audits of financial statements of certain employee benefit plans, acquisition due diligence assistance, regulatory filings, the review of registration statements and the issuance of consents, and internal control related services (including assistance with compliance required by Sarbanes-Oxley Act of 2002) approximated $26,000 and $25,500 respectively.

Tax Fees

Fees for tax services for years 2004 and 2003, which included tax compliance services (other than those related to Audit Fees) in both years, approximated $105,000 and $64,800 respectively.

18

All Other Fees

There were no fees for services in 2004 other than as described above. Fees for other services in 2003 approximated $20,396, which included a stock compensation study.

Pre-Approval of Independent Auditor Services

The Audit Committee has adopted guidelines for pre-approval by that committee of independent auditor services. These guidelines are set out in Appendix A of this proxy statement.

The Audit Committee has considered, in accordance with its charter, whether the independent auditor’s provision of the services described above is compatible with maintaining the independent auditor’s independence.

19

MANAGEMENT COMPENSATION

General

The following table sets forth all compensation awarded or earned during the last three fiscal years by the Company’s Chief Executive Officer, and the four other most highly paid individuals who were executive officers at the end of 2004 (the “Named Executive Officers”):

Summary Compensation Table

| | | | | | | | | | | | | | |

| | | | | Annual Compensation (1)

| | | Long-Term Compensation

|

Name and Principal Position

| | Fiscal

Year

| | Salary

| | | Bonus

| | | Securities Underlying Options (#)

| | Restricted Stock

| | All Other

Compensation

(2)

|

T. Curtis Holmes, Jr. President and Chief Executive Officer | | 2004

2003

2002 | | 315,000

291,667

271,875 |

| | —

48,750

— |

| | 100,000

270,000

215,000 | | 33,112

—

— | | 3,000

3,000

3,000 |

| | | | | | |

Anthony C. Finbow Managing Director, EMEA | | 2004

2003 | | 273,272

224,763 | (3)

| | 83,180

49,039 |

| | 50,000

215,000 | | —

— | | 14,663

11,238 |

| | | | | | |

Glenn A. Etherington Chief Financial Officer | | 2004

2003

2002 | | 230,000

225,000

221,875 |

| | —

31,250

— |

| | 60,000

15,000

170,000 | | 46,000

—

— | | 3,000

3,000

3,000 |

| | | | | | |

Sam L. Kelley Executive Vice President – Services | | 2004

2003

2002 | | 220,000

220,000

212,917 |

| | —

33,000

— |

| | 30,000

15,000

135,00 | | 7,103

—

— | | 3,000

3,000

3,000 |

| | | | | | |

Phillip C. Thrasher Executive Vice President – Americas and Asia Pacific Sales | | 2004

2003

2002 | | 193,875

190,696

190,953 |

| | 60,323

85,747

35,000 |

(4)

(5) | | 30,000

65,000

300,000 | | 11,465

—

— | | 3,000

3,000

— |

| (1) | | The Annual Compensation amounts do not reflect Performance Awards granted under the Long Term Incentive Plan to the Named Executive Officers in 2004, the vesting of which awards was subject to performance criteria that did not occur. |

| (2) | | Represents contributions made by the Company to each of our Named Executive Officers, except Mr. Finbow, under the Company’s 401(k) profit sharing plan. Mr. Finbow’s sum includes pension contributions and payments for private health insurance. |

| (3) | | Mr. Finbow’s annual salary was £150,000 in both 2003 and 2004. The apparent increase is due to currency exchange rate changes between British pounds and U.S. dollars from 2003 to 2004. |

| (4) | | Includes an individual retention bonus in the amount of $50,000, related to the acquisition of the Service Commerce Division of Nortel Networks in February 2002. |