SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | | |

¨ x ¨ | | Preliminary Proxy Statement Definitive Proxy Statement Definitive Additional Materials | | ¨ | | | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | |

| | | |

¨ | | Soliciting Material Pursuant to (S) 240.14a-12 |

METASOLV, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

METASOLV, INC.

5556 Tennyson Parkway

Plano, Texas 75024

April 10, 2006

TO THE STOCKHOLDERS OF METASOLV, INC.

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of MetaSolv, Inc. (the “Company”), which will be held at the Company’s headquarters located at 5556 Tennyson Parkway, Plano, Texas 75024, on Tuesday, May 9, 2006, at 10:00 a.m.

Details of the business to be conducted at the Annual Meeting are given in the attached Proxy Statement and Notice of Annual Meeting of Stockholders.

It is important that your shares be represented and voted at the meeting. WHETHER OR NOT YOU PLAN TO ATTEND the Annual Meeting, please COMPLETE, sign, date and PROMPTLY return the ACCOMPANYING proxy in the ENCLOSED POSTAGE- PAID envelope. Returning the proxy does NOT deprive you of your right to attend the Annual Meeting. If you decide to attend the Annual Meeting and wish to change your proxy vote, you may do so automatically by voting in person at the meeting.

On behalf of the Board of Directors, I would like to express our appreciation for your continued interest in the affairs of the Company. We look forward to seeing you at the Annual Meeting.

Sincerely,

T. Curtis Holmes, Jr.

Chief Executive Officer, President, and Director

|

YOUR VOTE IS IMPORTANT All stockholders are invited to attend the Annual Meeting in person. However, to ensure your representation at the meeting, you are urged to complete, sign, date and return, in the enclosed postage paid envelope, the enclosed Proxy as promptly as possible. Proxies forwarded by or for brokers or fiduciaries should be returned as requested by them. Returning your Proxy will help the Company assure that a quorum will be present at the meeting and avoid the additional expense of duplicate proxy solicitations. You may revoke your Proxy at any time prior to the Annual Meeting. Any stockholder attending the meeting may vote in person even if he or she has returned the Proxy. |

METASOLV, INC.

5556 Tennyson Parkway

Plano, Texas 75024

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

To be held May 9, 2006

The Annual Meeting of Stockholders (the “Annual Meeting”) of MetaSolv, Inc. (the “Company”) will be held at the Company’s headquarters, located at 5556 Tennyson Parkway, Plano, Texas, 75024, on Tuesday, May 9, 2006, at 10:00 a.m. for the following purposes:

1. To elect 2 directors to the Board of Directors to serve until their three-year term expires or until their successors have been duly elected and qualified or until their earlier death, resignation, or removal from office;

2. To ratify the appointment of Grant Thornton LLP as the Company’s independent auditors for 2006; and

3. To transact such other business as may properly come before the meeting or any adjournments or postponements thereof.

The foregoing items of business are more fully described in the attached Proxy Statement.

Only stockholders of record at the close of business on March 20, 2006 are entitled to notice of, and to vote at, the Annual Meeting and at any adjournments or postponements thereof. A list of such stockholders will be available for inspection at the Company’s headquarters located at 5556 Tennyson Parkway, Plano, Texas, during ordinary business hours for the ten-day period prior to the Annual Meeting, and also at the Annual Meeting.

BY ORDER OF THE BOARD OF DIRECTORS,

Jonathan K. Hustis

Executive Vice President—Legal, General

Counsel and Corporate Secretary

Plano, Texas

April 10, 2006

METASOLV, INC.

5556 Tennyson Parkway

Plano, Texas 75024

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

To be held May 9, 2006

These proxy materials are furnished in connection with the solicitation of proxies by the Board of Directors of MetaSolv, Inc., a Delaware corporation (the “Company”), for the Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the Company’s headquarters, located at 5556 Tennyson Parkway, Plano, Texas 75024, on Tuesday, May 9, 2006, at 10:00 a.m., and at any adjournment or postponement of the Annual Meeting. These proxy materials were first mailed to stockholders on or aboutApril 10, 2006.

PURPOSE OF MEETING

The specific proposals to be considered and acted upon at the Annual Meeting are summarized in the accompanying Notice of Annual Meeting of Stockholders. Each proposal is described in more detail in this Proxy Statement.

VOTING RIGHTS AND SOLICITATION OF PROXIES

The Company’s Common Stock, par value $0.005 per share (“Common Stock”), is the only type of security entitled to vote at the Annual Meeting. On March 20, 2006, the record date for determination of stockholders entitled to vote at the Annual Meeting, there were 49,991,733 shares of Common Stock outstanding. Each stockholder of record on March 20, 2006 is entitled to one vote for each share of Common Stock held by such stockholder. Shares of Common Stock may not be voted cumulatively. All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes and abstentions.

Quorum Required

The Company’s bylaws provide that the holders of a majority of the Common Stock issued and outstanding and entitled to vote at the Annual Meeting, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Annual Meeting. Abstentions will be counted as present for the purpose of determining the presence of a quorum.

Broker Voting

Brokers holding shares of record for a customer have the discretionary authority to vote on some matters if they do not receive timely instructions from the customer regarding how the customer wants the shares voted. There are also some matters (“non-discretionary matters”) with respect to which brokers do not have discretionary authority to vote if they do not receive timely instructions from the customer. When a broker does not have discretion to vote on a particular matter and the customer has not given timely instructions on how the broker should vote, what is referred to as a “broker non-vote” results. Any broker non-vote would be counted as present at the meeting for purposes of determining a quorum, but would be treated as not entitled to vote with respect to non-discretionary matters. Therefore, a broker non-vote would not count as a vote in favor of or against such matters and, accordingly, would not affect the outcome of the vote. Brokers will have discretionary authority to vote on Proposals I and II in the absence of timely instructions from their customers. As a result, there should not be any broker non-votes in connection with the meeting.

Votes Required

Proposal 1. Directors are elected by a plurality of the affirmative votes cast by those shares present in person, or represented by proxy, and entitled to vote at the Annual Meeting. The two nominees for director receiving the highest number of affirmative votes will be elected. Abstentions will not be counted toward a nominee’s total. Stockholders may not cumulate votes in the election of directors.

Proposal 2. Ratifying the appointment of Grant Thornton LLP as the Company’s independent auditors for the year 2006 requires the affirmative vote at the Annual Meeting of at least a majority of the outstanding shares of the Company’s Common Stock represented in person or by proxy and entitled to vote on the proposal. Abstentions will have the same effect as votes in opposition to the proposal.

Representatives of Mellon Investor Services will tabulate the vote and act as inspector of the election.

Proxies

Whether or not you are able to attend the Annual Meeting, you are urged to complete and return the enclosed proxy, which is solicited by the Company’s Board of Directors and which will be voted as you direct on your proxy when properly completed. In the event no directions are specified, such proxies will be voted FOR the nominees to the Board of Directors (as set forth in Proposal #1), and FOR Proposal #2, and in the discretion of the proxy holders as to other matters that may properly come before the Annual Meeting. You may also revoke or change your proxy at any time before the Annual Meeting. To do this, you must send a written notice of revocation or another signed proxy with a later date to the Secretary of the Company at the Company’s principal executive offices before the beginning of the Annual Meeting. You may also automatically revoke your proxy by attending the Annual Meeting and voting in person. All shares represented by a valid proxy received prior to the Annual Meeting will be voted.

Solicitation of Proxies

The solicitation of proxies is made by the Company’s Board of Directors. The Company will bear the entire cost of solicitation, including the preparation, assembly, printing, and mailing of this Proxy Statement, the proxy, and any additional soliciting material furnished to stockholders. Copies of solicitation material will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. In addition, the Company may reimburse such persons for their costs of forwarding the solicitation material to such beneficial owners. The original solicitation of proxies by mail may be supplemented by solicitation by telephone, telegram, or other means by directors, officers, employees or agents of the Company. No additional compensation will be paid to these individuals for any such services. Except as described above, the Company does not presently intend to solicit proxies other than by mail.

CORPORATE GOVERNANCE

The Company operates within a comprehensive plan of corporate governance for the purpose of defining responsibilities, setting high standards of professional and personal conduct and achieving compliance with these responsibilities and standards. The Company monitors developments in the area of corporate governance, and the Company is committed to good business practices, transparency in financial reporting and the highest level of corporate governance.

Corporate Governance Guidelines

The Company’s directors and executive management team are governed by MetaSolv, Inc. Corporate Governance Guidelines, published in the Corporate Governance section of the Company’s website atwww.metasolv.com.

2

Corporate Committee Charters

Each of the Company’s three standing board committees (the Governance Committee, Audit Committee, and Compensation Committee) has its own charter, and these are published in the Corporate Governance section of the Company’s website atwww.metasolv.com.

Board and Committee Self-Evaluation

The Board and each of its three standing Committees performs an annual self-evaluation.

Director Independence

Five of our six directors are independent directors. Each of our standing board committees is made up exclusively of independent directors. Director independence is determined under our Corporate Governance Guidelines, and the qualifications include meeting the definition of “independent director” as such term is defined in Rule 4200 of the Nasdaq Marketplace Rules.

Code of Ethics

The Company’s directors, officers and employees are subject to the MetaSolv, Inc. Code of Ethical Business Conduct. Our Chief Executive Officer is also subject to a MetaSolv, Inc. and MetaSolv Software, Inc. Code of Ethics for the Chief Executive Officer. Our Chief Financial Officer and Corporate Controller are also subject to a MetaSolv, Inc. and MetaSolv Software, Inc. Code of Ethics for Senior Financial Officers. All three of these documents are published in the Corporate Governance section of the Company’s website atwww.metasolv.com.

PROPOSAL #1

ELECTION OF DIRECTORS

The Company currently has authorized seven directors to serve on its Board of Directors. In accordance with the terms of the Company’s Certificate of Incorporation, the Board of Directors is divided into three classes: Class I, with directors whose term will expire at the 2006 Annual Meeting; Class II, with directors whose term will expire at the 2007 Annual Meeting; and Class III, with directors whose term will expire at the 2008 Annual Meeting. At the 2006 Annual Meeting, two directors will be elected to serve as Class I directors until the Annual Meeting to be held in 2009 or until such directors’ respective successors are elected and qualified, or until their earlier death, resignation, or removal from office. Based on the recommendation of the Governance Committee, the Board of Directors has selected two nominees as the nominees for Class I. The proxy holders intend to vote all proxies received by them in the accompanying form for the nominees for directors listed below. In the event a nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the present Board of Directors to fill the vacancy. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them for the nominees listed below. As of the date of this Proxy Statement, the Board of Directors is not aware of any nominee who is unable or will decline to serve as a director.

Nominees for Term Ending in 2009

Set forth below is information regarding the nominees, including their ages, the period during which they have served as directors, and information furnished by them as to principal occupations and directorships held by them in corporations whose shares are publicly registered.

| | | | |

Name | | Director Since | | Age |

Royce J. Holland | | 2000 | | 57 |

Terry L. Scott | | 2003 | | 55 |

3

Mr. Holland has served as a director of the Company since May 2000. He has served as chairman of the Company’s Compensation Committee since November, 2000. Mr. Holland has been President and CEO of McLeodUSA, a privately held company providing integrated local, long-distance, data and internet communications services to its customers, and has served as a member of the board of directors of that company, since January 2006. Previously, Mr. Holland co-founded Allegiance Telecom, a telecommunications services provider, in 1997 and served as its Chairman of the Board and Chief Executive Officer from that time until June 2004. Allegiance Telecom filed for bankruptcy on May 14, 2003. Previously, Mr. Holland was at MFS Communications Company, Inc., a communications services provider, as a Co-founder and a Director from its inception in 1988, and also as President from 1990 through the completion of its merger with WorldCom in December 1996. In January 1993, President George Bush appointed Mr. Holland to the National Security Telecommunications Advisory Committee. Mr. Holland is also a director of privately held Bank Street Telecom Funding Corporation. Mr. Holland has over thirty years experience in the telecommunications, independent power and engineering/construction industries.

Mr. Scott has served as a director of the Company and as chairman of its Audit Committee since February 2003. Since March 2004, Mr. Scott has been President, Chief Executive Officer and a director of Airimba Wireless, Inc., a privately held company that is a wireless Internet access service provider. From June 2003 until March 2004, he served as Vice President—Finance and Chief Financial Officer of CMI Holding Company, Inc., a general partner of Chase Medical L.P., a privately held company that develops, manufactures and markets products for the treatment of congestive heart failure. From October 2002 until the sale of the company in December 2004, he also served as an outside director and chairman of the audit committee for Chameleon Technology, Inc., a privately held company that developed intelligent networking software. From November 1995 to August 2002 Mr. Scott served at various times as an independent director and audit committee member for five companies, including Terion, Inc., a privately held wireless application service provider. In addition, from November 1995 to September 1997, he was President and Chief Executive Officer of Terion and from September 1997 to July 1999 he was its Chairman of the Board and Chief Executive Officer. Mr. Scott was with Paging Network, Inc., a wireless paging and text message service provider, from 1981 through 1995 where he held various senior executive positions including serving as its Senior Vice President of Finance and Chief Financial Officer, and then as President and Chief Executive Officer from 1993 to November 1995.

Each of Messrs. Holland and Scott is an “independent director,” as such term is defined in Rule 4200 of The Nasdaq Marketplace Rules.

Recommendation of the Board of Directors Regarding Proposal #1

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES LISTED HEREIN.

PROPOSAL #2

TO RATIFY THE APPOINTMENT OF GRANT THORNTON LLP AS THE COMPANY’S

INDEPENDENT AUDITORS FOR 2006

In accordance with its charter, the Audit Committee of the Board of Directors has selected Grant Thornton LLP (“Grant Thornton”) as the Company’s independent auditors to audit the Company’s consolidated financial statements for 2006 and to render other services required of them.

Stockholders are asked to vote on a proposal to ratify the appointment by the Board’s Audit Committee of Grant Thornton as the Company’s independent auditors for the year 2006. Representatives of Grant Thornton are expected to be present at the Annual Meeting of Stockholders of the Company with the opportunity to make a statement if they so desire and to be available to respond to appropriate questions.

4

The submission of this matter for approval by stockholders is not legally required; however, the Board of Directors and its Audit Committee believe that such submission is consistent with best practices in corporate governance and is an opportunity for stockholders to provide direct feedback to the Board of Directors and its Audit Committee on an important issue of corporate governance. If the stockholders do not approve the selection of Grant Thornton, the Audit Committee may or may not reconsider the selection of such firm as independent auditors.

The Audit Committee has the sole authority and responsibility to retain, evaluate, and, where appropriate, replace the independent auditors. Ratification by the stockholders of the appointment of Grant Thornton does not limit the authority of the Audit Committee to direct the appointment of new independent auditors at any time during the year.

Recommendation of the Board of Directors Regarding Proposal #2

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” PROPOSAL #2 TO RATIFY THE APPOINTMENT OF GRANT THORNTON LLP AS THE COMPANY’S INDEPENDENT AUDITORS FOR 2006.

DIRECTORS

Set forth below is information regarding the continuing directors of the Company, including their ages, the period in which they have served as directors, and information furnished by them as to principal occupations and directorships held by them in corporations whose shares are publicly registered.

| | | | | | |

Name | | Director Since | | Term Ending | | Age |

Lawrence J. Bouman | | 2000 | | 2007 | | 59 |

T. Curtis Holmes, Jr. | | 2001 | | 2007 | | 44 |

John E. Berndt | | 2002 | | 2008 | | 65 |

John W. White | | 1998 | | 2008 | | 67 |

Mr. Bouman has served as a director of the Company since November 2000. Since January 1999, Mr. Bouman has served as a technology advisor and independent consultant to several private communications and technology companies. From June 1998 to January 1999, Mr. Bouman served as a member of the acquisition transition team following Qwest Communications International, Inc.’s acquisition of LCI International. From October 1995 to June 1998, Mr. Bouman was Senior Vice President and Chief Technology Officer of LCI International, Inc., a communications services provider. Prior to 1995, Mr. Bouman held several senior positions with MCI Telecommunications Corporation. From September 2001 to June 2003 Mr. Bouman served as a director of Broadwing, Inc., a communications services provider.

Mr. Holmes has served as our President and Chief Executive Officer since August 2003. He served as President and Chief Operating Officer from January 2001 to July 2003. He has served as a director since May 2001. From December 1996 to December 2000, Mr. Holmes served as Vice President and General Manager of the Intelligent Network Unit of Lucent Technologies, Inc., where his responsibilities included strategic planning, product marketing, product management, and development and deployment of enhanced services applications. From July 1994 to December 1996, Mr. Holmes served as Applications Group Director for Operations Support Systems for Lucent Technologies/AT&T Network Systems.

Mr. Berndt has served as Chairman of the Board of Directors since June 2004, and as a director of the Company since May 2002. Mr. Berndt retired from Sprint Corporation on September 30, 2000. From 1998 to September 2000, Mr. Berndt was President of Sprint International, an operating unit of Sprint Corporation. From 1997 to 1998, Mr. Berndt was President of Fluor Daniel Telecom, an operating company of Fluor Daniel, Inc. Mr. Berndt was President of AT&T New Business Development/Multimedia Ventures from 1993 until the spin-off

5

of Lucent Technologies from AT&T occurred in 1996. Mr. Berndt serves as Chairman of the Board of Directors of Telular Corporation, a designer, developer and manufacturer of products for the cellular fixed wireless telecommunications industry, and from February 2005 until August 2005 he served as interim CEO and President of that company. He is Chairman of the Board of Thunderbird, the Garvin School of International Management.

Mr. White has served as a director of the Company since December 1998. He served as Lead Outside Director from July 2003 until April 2004. Mr. White also served as Chairman of the Company’s Board of Directors from August 1999 until July 2003. He was Vice President and Chief Information Officer for Compaq Computer, a developer and marketer of computer hardware and software, from February 1994 to October 1998, where he served as a member of the executive management team, overseeing Compaq’s worldwide information systems activities. Prior to February 1994, Mr. White was President of the Information Technology Group and Chief Information Officer for Texas Instruments. Mr. White serves as a director and member of the Compensation Committee of Citrix Systems, Inc., a company listed on the Nasdaq National Market and a provider of server-based computing solutions.

Each of Messrs. Berndt, Bouman, and White is an “independent director,” as such term is defined in Rule 4200 of The Nasdaq Marketplace Rules.

The members of the Audit Committee of the Board of Directors are Messrs. Berndt, Scott and White. The Board of Directors has designated Terry L. Scott as the Company’s Audit Committee financial expert. Mr. Scott is an independent director as defined in Item 7(d)(3)(iv) of Schedule 14A under the Securities and Exchange Act of 1934.

Board of Directors and Committee Meetings During 2005

During 2005, the Board of Directors held 7 meetings and acted by written consent on 2 occasions. For the fiscal year, each of the directors during the term of his tenure attended or participated in at least 75% of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings held by all committees of the Board of Directors on which each such director served. Under the policies of the Board, the Company’s directors are expected to attend regular Board meetings and Board committee meetings. There is no Company policy regarding director’s attendance at annual stockholder meetings. All of the Company’s directors attended the 2005 Annual Meeting of Stockholders. The Board of Directors has three standing committees, the Audit Committee, the Compensation Committee and the Governance Committee (formerly the Nominating Committee).

During 2005, the Audit Committee of the Board of Directors held 7 meetings and acted by written consent on 1 occasion. The Audit Committee reviews, acts on and reports to the Board of Directors with respect to various auditing and accounting matters, including the selection of the Company’s independent accountants, the scope of the annual audits, fees to be paid to the independent accountants, the performance of the Company’s independent accountants and the accounting practices of the Company. The members of the Audit Committee are Messrs. Berndt, Scott and White. The Board of Directors has designated Terry L. Scott as the Company’s Audit Committee financial expert. Mr. Scott is an independent director as defined in the Securities and Exchange Act of 1934, as are Mr. Berndt and Mr. White. The Board of Directors has adopted a written charter for the Audit Committee, a copy of which is available through the Corporate Governance section of the Company’s website atwww.metasolv.com. Each member of the Audit Committee is an “independent director,” in accordance with the requirements of Exchange Act Rule 10A-3, and as such term is defined in Rule 4200 of The Nasdaq Marketplace Rules and applicable law, including the Sarbanes-Oxley Act of 2002.

During 2005, the Compensation Committee held 4 meetings. The Compensation Committee is responsible for (i) establishing compensation programs designed to attract, motivate and retain key executives responsible for the Company’s success; (ii) administering and maintaining such programs in a manner that will benefit the long-term interests of the Company and its stockholders; and (iii) determining the compensation of the Company’s Chief Executive Officer and other executive officers. The members of the Compensation Committee are Messrs. Bouman

6

and Holland. The Board of Directors has adopted a written charter for the Compensation Committee, a copy of which is available through the Corporate Governance section of the company’s website atwww.metasolv.com. Each member of the Compensation Committee is an “independent director,” as such term is defined in Rule 4200 of The Nasdaq Marketplace Rules and applicable law, including the Sarbanes-Oxley Act of 2002.

During 2005, the Governance Committee held 4 meetings. The Governance Committee is responsible for (i) making nominations to fill vacancies on the Board of Directors, (ii) making recommendations to the Board of Directors regarding board policies and structure, (iii) overseeing the development and periodic review of corporate governance guidelines for the Company, (iv) director compensation, (v) leading the Board of Directors in its annual performance review and (vi) other issues of corporate governance. The members of the Governance Committee are Messrs. Berndt, Bouman and White. Each member of the Governance Committee is an “independent director,” in accordance with the requirements of Exchange Act Rule 10A-3, and as such term is defined in Rule 4200 of The Nasdaq Marketplace Rules and applicable law, including the Sarbanes-Oxley Act of 2002. The Board of Directors has adopted a written charter for the Governance Committee, a copy of which is available through the Corporate Governance section of the Company’s website atwww.metasolv.com. The Governance Committee will consider nominations by stockholders of persons for election to the Board upon adequate written notice to the Company’s Secretary. To be adequate, the nomination notice must be delivered in writing to the Secretary, not less than 60 days nor more than 90 days prior to the first anniversary of the preceding year’s Annual Meeting, and must be directed to: Governance Committee, c/o Jonathan K. Hustis (Corporate Secretary), MetaSolv, Inc., 5556 Tennyson Parkway, Plano, TX 75024 USA. The Governance Committee reviews candidates for director nominees in the context of the current composition of the Board of Directors, the operating requirements of the Company and the long-term interests of the stockholders. In conducting this assessment, the Governance Committee considers experience, diversity, age, skills and such other factors as it deems appropriate given the current needs of the Board of Directors and the Company. Certain specific minimum qualifications relating to persons to be considered for a position on the Board of Directors have been adopted by the Committee and can be reviewed in the MetaSolv, Inc. Corporate Governance Guidelines, a copy of which is available through the Corporate Governance section of the Company’s website atwww.metasolv.com. The Governance Committee uses the same criteria for evaluating candidates nominated by stockholders as it does for those proposed by other Board members, management and search companies.

Compensation of Directors

Meeting Fees. In general, non-employee directors receive $1,500 for each Board of Directors meeting attended in person, and for each standing committee meeting attended in person (other than on a Board of Directors meeting day) and $300 per meeting attended by teleconference. However, Audit Committee members are paid as follows for the quarterly committee meetings at which the financial results press release is approved, the 10-Q is approved, the 10-K is approved, and the Committee meets with and hears from the independent auditors concerning Statement of Auditing Standards No. 61: $1,500 to the Chairman of the Audit Committee for such meeting, and $750 to each member of the Committee for such meeting, regardless of whether attendance is in person or by teleconference, and regardless of whether it occurs on a regular Board of Directors meeting day. All directors are reimbursed for reasonable expenses incurred by them in attending Board of Directors and committee meetings.

Retainer Fees. In addition to the meeting fees, non-employee directors also receive an annual retainer for service on the Board of Directors and for service as the chairman of the board or any standing board committee. Each non-employee director may elect to receive the annual retainer, which is paid quarterly, in either cash ($15,000 annually), or restricted stock of the Company ($20,000 annually in restricted stock). The chairman of the Board of Directors and the chairman of the Audit Committee each receive an additional annual retainer, paid quarterly, which they may elect to receive in either cash ($7,500 annually), or restricted stock of the Company ($9,000 annually in restricted stock); and any director serving as the chairman of any other standing committee of the Board of Directors receives an additional annual retainer, paid quarterly, which they may elect to receive in either cash ($5,000 annually), or restricted stock of the Company ($6,500 annually in restricted stock). Restricted

7

stock granted to non-employee directors will have a price equal to the fair market value of the Common Stock of the Company on the date of grant and will vest one year following the date of grant.

Long-Term Incentive Plan Option Grants. Each non-employee director is also granted a one-time option to purchase up to 30,000 shares of Common Stock under the Company’s Long-Term Incentive Plan on the date he or she is first elected to the Board of Directors (applicable to non-employee directors first elected in 2003 and later). A non-employee director is granted an additional option to purchase up to 15,000 shares of Common Stock under the Long-Term Incentive Plan for each successive year that he or she serves as a member of the Board of Directors. Each option will have an exercise price equal to the fair market value of the Common Stock on the date of grant, will have a term to be determined by the Governance Committee of the Board of Directors and will generally terminate within a specified time, as set forth in the Long-Term Incentive Plan, following the date the option holder ceases to be a director. With respect to the option grant of 30,000 shares upon a non-employee director’s initial election to the Board of Directors, 15,000 of the shares are immediately vested and the remaining 15,000 shares vest in equal monthly installments over the director’s first 12 months of service. With respect to the option grant of 15,000 shares for each successive year that a non-employee director serves as a member of the Board of Directors, the shares vest in equal monthly installments over the 12 months following such grant.

Stockholder Communications with the Board of Directors

The Company’s Board of Directors has adopted a formal process by which stockholders may communicate with the Board. Stockholders who wish to communicate with the Board may do so by sending written communications addressed to the Board of Directors of MetaSolv, Inc., at 5556 Tennyson Parkway, Plano, TX 75024 U.S.A., attention of Jonathan K. Hustis (Corporate Secretary). The Company’s process for handling stockholder communications with the Board has been approved by the independent directors of the Company.

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 20, 2006, certain information with respect to shares beneficially owned by (i) each person who is known by the Company to be the beneficial owner of more than five percent of the Company’s outstanding shares of Common Stock, (ii) each of the Company’s directors and the executive officers named in the Summary Compensation Table and (iii) all current directors and executive officers as a group. Unless otherwise indicated, each person named below has an address in care of the Company’s principal executive offices. Beneficial ownership has been determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934. Under this rule, certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option or warrant) within sixty days of the date as of which the information is provided. In computing the percentage ownership of any person, the number of shares outstanding is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of such acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the following table does not necessarily reflect the person’s actual voting power at any particular date. Applicable percentage ownership as of March 20, 2006 is based upon 49,991,733 shares of Common Stock outstanding.

| | | | | |

| | | Shares Beneficially Owned

as of March 20, 2006 | |

Beneficial Owner | | Number of

Shares | | Percentage of

Class | |

Brookside Capital Partners Fund, L.P. (1) | | 5,084,358 | | 9.98 | % |

Private Capital Management, L.P. (2) | | 4,572,652 | | 9.15 | % |

FMR Corp. (3) | | 2,681,007 | | 5.36 | % |

William N. Sick, Jr. | | 4,144,609 | | 8.29 | % |

Business Resources International, Inc. (4) | | | | | |

Bonanza Master Fund, Ltd. (5) | | 3,100,000 | | 6.10 | % |

Michael J. Watters (6) | | 2,768,969 | | 5.54 | % |

T. Curtis Holmes, Jr. (7) | | 516,647 | | 1.02 | % |

Glenn A. Etherington (8) | | 670,970 | | 1.33 | % |

Sam L. Kelley (9) | | 478,297 | | * | |

Phillip C. Thrasher (10) | | 396,952 | | * | |

Jonathan K. Hustis (11) | | 552,844 | | 1.10 | % |

Michael J. Cullen (12) | | 450,563 | | * | |

Royce J. Holland (13) | | 82,500 | | * | |

Lawrence J. Bouman (14) | | 112,652 | | * | |

John W. White (15) | | 109,627 | | * | |

John E. Berndt (16) | | 122,135 | | * | |

Terry L. Scott (17) | | 76,900 | | * | |

All directors and executive officers as a group (11 persons) (18) | | 3,570,087 | | 6.73 | % |

| (1) | The address of Brookside Capital Partners Fund, L.P. is 111 Huntington Avenue, Boston, Massachusetts 02199. Information with respect to such beneficial ownership was obtained from a Schedule 13G filed with the Securities and Exchange Commission that reflects shares beneficially owned by Brookside Capital Partners Fund, L.P. (“Brookside”) as of December 31, 2005, as well as independent verification of such information with Brookside. Domenic Ferrante, as the sole managing member of Brookside Capital Management, LLC (“BCM”), BCM, as the sole general partner of Brookside Capital Investors, L.P. (“BCI”), and BCI, as the sole general partner of Brookside, may each be deemed to share voting or investment control over the shares. Beneficial ownership includes 928,291 shares issuable upon the exercise of warrants to purchase shares of the Company’s Common Stock. Beneficial ownership does not include 905,042 shares of Common Stock issuable upon the exercise of warrants held by Brookside that would |

9

| | cause Brookside’s beneficial ownership of Common Stock to exceed 9.99%. Pursuant to the terms of the warrants the number of warrant shares that Brookside may acquire upon exercise of the warrants is limited to insure that following such exercise the total number of shares of Common Stock beneficially owned by Brookside does not exceed 9.999%. |

| (2) | The address of Private Capital Management, L.P. is 8889 Pelican Bay Blvd., Naples, Florida 34108. Information with respect to such beneficial ownership was obtained from a Schedule 13G filed with the Securities and Exchange Commission and reflects shares beneficially owned by Private Capital Management, L.P. as of December 31, 2005. |

| (3) | The address of FMR Corp. is 82 Devonshire Street, Boston, Massachusetts 02109. Information with respect to such beneficial ownership was obtained from a Schedule 13G filed with the Securities and Exchange Commission and reflects shares beneficially owned by FMR Corp. as of December 31, 2005. |

| (4) | Consists of 1,236,752 shares held directly by Mr. Sick, 2,333,967 shares held by Business Resources International, Inc., 229,536 shares held by Jill Melanie Sick 1991 Trust, 229,536 shares held by David Louis Sick 1991 Trust, and 114,818 shares held by Louis Pitchlyn Williams 1992 Trust. The address of William N. Sick, Jr. is 565 Sheridan Road, Winnetka, Illinois 60093. Information with respect to such beneficial ownership was obtained from a Form 5 and a Schedule 13G filed with the Securities and Exchange Commission and reflects shares beneficially owned by William M. Sick, Jr. as of December 31, 2004. |

| (5) | The address of Bonanza Master Fund, Ltd. (“Bonanza”) is 300 Crescent Court, Suite 1740, Dallas, Texas 75201. Information with respect to such beneficial ownership was obtained from a Schedule 13G filed with the Securities and Exchange Commission that reflects shares beneficially owned by Bonanza as of December 31, 2005, as well as independent verification of such information with Bonanza. Bonanza Fund Management LLC is the General Partner of Bonanza. Bernay Box has sole voting control over Bonanza Fund Management LLC. Beneficial ownership includes 833,333 shares issuable upon the exercise of warrants to purchase shares of the Company’s Common Stock that were not reported on Schedule 13G. |

| (6) | Consists of shares held by The Watters’ Children Trust, the Michael and Carole Watters Charitable Remainder Trust and MCDA International Partnership, Ltd. The address of Mr. Watters is 101 E. Park Blvd., Suite 600, Plano, Texas 75024. Information with respect to such beneficial ownership was obtained from a Schedule 13G filed with the Securities and Exchange Commission and reflects shares beneficially owned by Mr. Watters as of December 31, 2005. |

| (7) | Consists of (i) 79,980, shares owned by Mr. Holmes and (ii) 436,667 shares subject to stock options held by Mr. Holmes that are exercisable within 60 days of March 20, 2006. |

| (8) | Consists of (i) 97,699 shares owned by Mr. Etherington and (ii) 573,271 shares subject to stock options held by Mr. Etherington that are exercisable within 60 days of March 20, 2006. |

| (9) | Consists of (i) 18,069 shares owned by Mr. Kelley and (ii) 460,226 shares subject to stock options held by Mr. Kelley that are exercisable within 60 days of March 20, 2006. |

| (10) | Consists of (i) 12,785 shares owned by Mr. Thrasher and (ii) 384,167 shares subject to stock options held by Mr. Thrasher that are exercisable within 60 days of March 20, 2006. |

| (11) | Consists of (i) 129,427 shares owned by Mr. Hustis and (ii) 423,417 shares subject to stock options held by Mr. Hustis that are exercisable within 60 days of March 20, 2006. |

| (12) | Consists of (i) 48,896 shares owned by Mr. Cullen and (ii) 401,667 shares subject to stock options held by Mr. Cullen that are exercisable within 60 days of March 20, 2006. |

| (13) | Consists of 82,500 shares subject to stock options held by Mr. Holland that are exercisable within 60 days of March 20, 2006. |

| (14) | Consists of (i) 40,152 shares owned by Mr. Bouman and (ii) 72,500 shares subject to stock options held by Mr. Bouman that are exercisable within 60 days of March 20, 2006. |

10

| (15) | Consists of (i) 5,460 shares owned by Mr. White and (ii) 104,167 shares subject to stock options held by Mr. White that are exercisable within 60 days of March 20, 2006. |

| (16) | Consists of (i) 39,635 shares owned by Mr. Berndt and (ii) 82,500 shares subject to stock options held by Mr. Berndt that are exercisable within 60 days of March 20, 2006. |

| (17) | Consists of (i) 5,450 shares owned by Mr. Scott, (ii) 10,200 shares owned by Mr. Scott’s wife and (iii) 61,250 shares subject to stock options held by Mr. Scott that are exercisable within 60 days of March 20, 2006. |

| (18) | Consists of (i) 487,753 shares owned by all directors and executive officers as a group and (ii) 3,082,334 shares subject to stock options that are exercisable within 60 days of March 20, 2006. |

COMPENSATION COMMITTEE REPORT

Responsibilities and Composition of the Committee.

The Compensation Committee of the Company’s Board of Directors (the “Committee”) is responsible for (i) establishing compensation programs designed to attract, motivate and retain key executives responsible for the Company’s success; (ii) administering and maintaining such programs in a manner that will benefit the long-term interests of the Company and its stockholders; and (iii) determining the compensation of the Company’s Chief Executive Officer and other executive officers. The Committee also makes recommendations to senior management with respect to the Company’s compensation policies and practices generally. The Committee is composed of two directors, currently Mr. Holland and Mr. Bouman. The members of the Committee are “independent directors” (as defined under Nasdaq rules), as well as “outside directors” (as defined in Section 162(m) of the Internal Revenue Code of 1986, as amended). Neither of these directors has ever served as an employee of the Company.

This report describes the philosophy that underlies the Company’s executive compensation program. It also describes the details of each element of the program, as well as the rationale for compensation paid to the Company’s Chief Executive Officer and its executive officers in general.

For the 2005 fiscal year, the process used by the Committee in determining executive officer compensation levels was based on the subjective judgment of the Committee. However, the recommendations of the Company’s Chief Executive Officer were considered by the Committee when making the final compensation decisions concerning each other officer.

Compensation Philosophy and Objectives.

The Committee believes that the Company’s executive officer compensation should be determined according to a competitive framework and based on overall financial results, individual contributions and teamwork that help build value for the Company’s stockholders. Within this overall philosophy, the Committee bases the compensation program on the following principles.

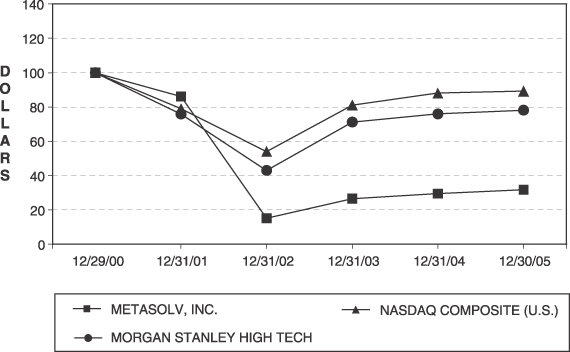

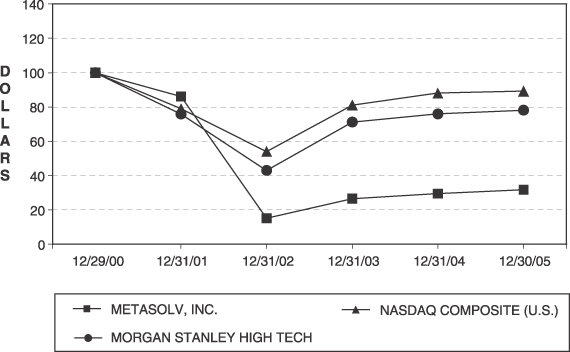

Compensation levels for executive officers are benchmarked to the outside market, using published industry data relevant to the officers’ positions. Compensation benchmarks are determined by referring to information regarding software companies with comparable revenue levels. The Company obtained salary information on these companies through Culpepper & Associates, Inc. and William M. Mercer, independent organizations that provide comprehensive salary survey data for U.S. high technology and software companies. The benchmark companies against whom the Committee gauged the Company’s executive compensation may occasionally overlap those contained in the Morgan Stanley High Tech Index, which was used for comparison in the stock performance graph. The Committee, however, does not consider other companies’ performance in awarding executive compensation. Nor does the Committee refer to the Morgan Stanley High Tech Index as a guide for such compensation. Rather, the Committee examines several factors when setting salaries for executive officers, including:

| | • | | The compensation of officers at software and technology companies generally; |

11

| | • | | The revenues of comparable software companies; |

| | • | | The geographic location of the comparable companies; |

| | • | | Whether the comparable companies are publicly or privately held; and |

| | • | | The job responsibilities of the officers in the comparable companies. |

The total compensation opportunity is targeted to be competitive with the compensation offered by comparable companies. The Company targets its executives’ compensation opportunity at a chosen percentile ranking within the compensation statistics available for these companies, and the percentile ranking chosen is based on competitive considerations, as well as performance expectations and objectives. The Committee considers it essential to the vitality of the Company that the total compensation opportunity for executive officers remains competitive with similar companies in order to attract and retain the talent needed to manage and build the Company’s business.

Compensation is tied to performance. A significant part of the total compensation opportunity is at risk, to be earned only if specific goals are met.

Incentive compensation is designed to reinforce the achievement of both short-and long-term corporate objectives.

Compensation of Executive Officers Generally.

The Company’s executive compensation program is designed to link executive pay to Company performance and to provide an incentive to executives to manage the Company with a principal view to enhancing stockholder value.

Generally, the Company’s executive compensation program makes a significant portion of each executive’s cash compensation contingent upon improvement in the Company’s results of operations, with the potential to earn exceptional rewards for exceptional performance. Targets for improved results in operations may be categorized as growth, profitability, cash flow or other target categories. The program is designed to provide compensation for meeting and exceeding internal goals, and to provide incentives to increase the market value of the Common Stock. The program also is designed to attract and retain talented executives who are essential to the Company’s long-term success within a highly competitive industry that demands unique talents, skills and capabilities.

Compensation criteria are evaluated at least annually to ensure they are appropriate and consistent with the business objectives that are important in meeting the Company’s earnings per share, operating profit, cash flow and revenue goals, and in enhancing stockholder value. The Company’s executive compensation policies and programs are intended to (i) provide rewards contingent upon Company and individual performance, (ii) link executive compensation to sustainable increases in stockholder value, (iii) promote teamwork among executives and other Company employees, and (iv) effect retention of a strong management team.

The primary components of the Company’s executive compensation program are salary, performance bonuses, restricted stock, restricted stock units, and stock options.

Base Salary. The Committee reviews the salary of each of its executive officers annually. The Committee’s review takes into consideration the Company’s revenue, earnings per share and operating profits, and the duties and expected performance of each executive. In making salary recommendations or decisions, the Committee exercises its discretion and judgment based on the foregoing criteria, without applying a specific formula to determine the weight of each factor considered. The Committee also considers equity and fairness when comparing base salaries of executives.

12

Incentive Bonuses. The Company has established a bonus system for executive officers based on financial performance criteria, which may include revenue growth, profitability, operating cash flow and percentage performance compared to established targets. During fiscal 2005, executive officers could earn annual bonuses targeted between 50% and 89% of their respective base salaries. Bonuses payable, if any, are paid semi-annually and are contingent upon the attainment of six-month objectives determined by the Committee. Other senior managers have similar bonus arrangements. Bonuses are typically determined based on the achievement of certain financial and operational goals for the Company which may include:

| | • | | improvement of contracted sales backlog; |

| | • | | achievement of departmental objectives; and |

| | • | | achievement of individual objectives |

Incentive bonuses earned during fiscal 2005 were paid to two Named Executive Officers, Sam L. Kelley and Phillip C. Thrasher, based on their achievements measured in proportion to certain individual target objectives.

Equity Compensation. The Committee believes that grants to executive officers and other key employees of restricted stock, restricted stock units, stock options, and other forms of equity compensation are important methods of enhancing long-term profitability and stockholder value. The Committee views the MetaSolv, Inc. Long-Term Incentive Plan as a vehicle to attract and retain experienced employees and to align the employee’s economic incentives with those of the Company’s stockholders. Under the Long-Term Incentive Plan, the Committee may grant restricted stock, restricted stock units, stock options, other forms of equity compensation, and performance awards that include awards of equity compensation in the event specified performance goals are achieved, to executive officers who are expected to contribute materially to the Company’s future success. In determining the size of restricted stock, restricted stock unit, option and other equity grants, the Committee focuses primarily on the Company’s performance and the perceived role of each executive in accomplishing such performance objectives, as well as the satisfaction of individual performance objectives. In addition, the Committee examines the option holdings of the executives and the competitive market for qualified executives. The Committee’s primary objectives in granting awards are the retention of its executives and incentive creation for officers to improve the Company’s performance.

The Committee intends to continue using restricted stock, restricted stock units, stock options, other forms of equity compensation, and performance awards that include equity compensation as the primary long-term incentive for the Company’s executive officers. Because they generally provide rewards to executives to the extent the executive remains with the Company, and to the extent that the Company’s stock price increases after restricted stock or other equity awards are granted, the Committee feels that stock options and other equity awards granted under the Long-Term Incentive Plan are an appropriate means to provide executives with incentives to remain with the Company, and that closely align their interests with those of stockholders, thereby encouraging them to promote the ongoing success of the Company.

Policy on Deductibility of Compensation.

It is the responsibility of the Committee to address the provisions of Section 162(m) of the Internal Revenue Code which, except in the case of “performance-based compensation” and certain other types of compensation, limits to $1,000,000 per person the amount of the Company’s federal income tax deduction for compensation paid to the Chief Executive Officer and the other four most highly paid executive officers. In that regard, the Committee must determine whether any actions with respect to Section 162(m) should be taken by the Company. In fiscal 2005, the Company did not pay its executive officers compensation that would not be deductible as a

13

result of the Section 162(m) deductibility limit. The Company expects that the compensation paid to executive officers in fiscal 2006 will qualify for income tax deductibility under Section 162(m) of the Internal Revenue Code. The Committee will take appropriate action when it is warranted in the future.

Chief Executive Officer Compensation.

The Chief Executive Officer’s salary, bonus and long-term awards follow the policies set forth above. For 2005 Mr. Holmes was paid base salary in the amount of $341,000. He received $3,000 in matching contributions under the Company’s 401(k) Plan. Mr. Holmes’ salary was not linked to any set corporate or personal performance goals. Mr. Holmes also received $16,256 in cash under the Company’s Corporate Bonus Plan, which compensation was linked entirely to achievement measured against pre-defined corporate revenue and performance goals.

The foregoing report has been approved by all of the members of the Committee.

THE COMPENSATION COMMITTEE

Royce J. Holland, Chairman

Lawrence J. Bouman

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Neither of the members of the Compensation Committee during 2005, Lawrence J. Bouman or Royce J. Holland, is currently or has been, at any time since the formation of the Company, an officer or employee of the Company or any of its subsidiaries. No executive officer of the Company served, during fiscal year 2005, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of the Company’s Board of Directors or Compensation Committee.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process. The Company’s independent auditors are responsible for expressing an opinion on the conformity of our audited financial statements to generally accepted accounting principles.

In this context, the Audit Committee has reviewed and discussed with management and the independent auditors the audited financial statements. The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). In addition, the Audit Committee has received from the independent auditors the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discussed with them their independence from the Company and its management.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in the Company’s Annual Report on SEC Form 10-K for the year ended December 31, 2005, for filing with the Securities and Exchange Commission.

THE AUDIT COMMITTEE

John E. Berndt

Terry L. Scott, Chairman

John W. White

14

CHANGE IN PRINCIPAL ACCOUNTANT FIRM

On April 5, 2005, the Audit Committee notified Grant Thornton LLP that it was being engaged to serve as the Company’s independent public accountants for 2005, and notified KPMG LLP (“KPMG”) that it had been dismissed as the Company’s independent public accountants, effective immediately. The appointment of Grant Thornton and the dismissal of KPMG were approved by the Audit Committee.

KPMG’s audit reports on the Company’s financial statements as of and for the years ended December 31, 2004 and 2003 did not contain an adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. The audit report of KPMG on management’s assessment of internal control over financial reporting as of December 31, 2004 did not contain an adverse opinion or disclaimer of opinion and was not qualified or modified as to uncertainty, audit scope or accounting principles. KPMG’s audit report on the effectiveness of internal control over financial reporting as of December 31, 2004, expressed an opinion that MetaSolv, Inc. did not maintain effective internal control over financial reporting as of December 31, 2004 because of the effect of a material weakness on the achievement of the objectives of the control criteria and contains an explanatory paragraph that states that internal controls over financial reporting related to the accounting for estimated income tax exposures and foreign income taxes did not operate effectively as of December 31, 2004, but such report was not qualified or modified as to uncertainty, audit scope or accounting principles.

In connection with the audits of the two years ended December 31, 2004, and the subsequent interim period from January 1, 2005 through April 5, 2005, the effective date of KPMG’s dismissal, there were no disagreements between the Company and KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which, if not resolved to the satisfaction of KPMG, would have caused KPMG to make reference to the subject matter of such disagreements in connection with its audit report. Except as described in the next paragraph, none of the “reportable events” described in Item 304(a)(1)(v) of Regulation S-K promulgated by the Securities and Exchange Commission (the “SEC”) pursuant to the Securities Exchange Act of 1934, as amended, have occurred during the two years ended December 31, 2004, or from December 31, 2004 through the effective date of KPMG’s termination.

As disclosed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2004, the Company, in conjunction with KPMG, determined that it had a material weakness that caused the Company’s internal control over financial reporting to not be effective as of December 31, 2004. The deficiency constituting the material weakness was that, as of December 31, 2004, the Company did not employ personnel with adequate expertise in matters related to the accounting for estimated income tax exposures and foreign income taxes. The deficiency did not result in a material misstatement in the Company’s 2004 financial statements. The Audit Committee discussed the material weakness with KPMG, and the Company has authorized KPMG to respond fully to the inquiries of Grant Thornton concerning the material weakness. Additionally, KPMG reported a significant deficiency in internal control to the audit committee of the board of directors of MetaSolv, Inc. The significant deficiency related to income tax disclosures in the notes to the Company’s consolidated financial statements, and the deficiency was not deemed to be a material weakness.

During the two years ended December 31, 2004, and from December 31, 2004 through the engagement of Grant Thornton as the Company’s independent accountant, neither the Company nor anyone on its behalf has consulted Grant Thornton with respect to any accounting or auditing issues involving the Company. In particular, there was no discussion with the Company regarding the application of accounting principles to a specified transaction, the type of audit opinion that might be rendered on the financial statements, or any matter that was either (i) the subject of a disagreement with KPMG on accounting principles or practices, financial statement disclosure or auditing scope or procedure which, if not resolved to the satisfaction of KPMG, would have caused KPMG to make reference to the subject matter of such disagreement in connection with its report, or (ii) a “reportable event” as described in Item 304(a)(1)(v) of Regulation S-K promulgated by the SEC.

15

The Company provided KPMG with a copy of the foregoing disclosures. KPMG provided the Company with a letter regarding the disclosures, which was addressed to the SEC and dated April 11, 2005, and which was attached as an exhibit to the Company’s Form 8-K disclosure filed April 11, 2005, including the following text:

“We were previously principal accountants for MetaSolv, Inc. and, under the date of March 28, 2005, we reported on the consolidated financial statements of MetaSolv, Inc. as of December 31, 2004 and 2003 and for the three-year period ended December 31, 2004. On April 5, 2005, our appointment as principal accountants was terminated. We have read MetaSolv, Inc.’s statements included under Item 4.01 of its Form 8-K dated April 11, 2005, and we agree with such statements, except we are not in a position to agree or disagree with MetaSolv, Inc.’s statements that (1) on April 5, 2005, the Audit Committee of the Board of Directors of MetaSolv, Inc. notified Grant Thornton LLP (“Grant Thornton”) that it was being engaged to serve as the Company’s independent public accountants effective immediately; (2) the appointment of Grant Thornton and the dismissal of KPMG were approved by the Audit Committee; (3) or the statements made by the Company in the fifth paragraph under Item 4.01 of such Form 8-K.”

FEES PAID TO INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMS

Fees Paid

Fees for all services provided by Grant Thornton LLP in 2005 and KPMG LLP in 2004, the Company’s independent auditors for years 2005 and 2004, respectively, are as follows:

Audit Fees. Fees for services for years 2005 and 2004 related to the annual financial statement audits, review of and assistance with quarterly and annual financial statements filed in the periodic reports on Form 10-Q and Form 10-K with the Securities and Exchange Commission (“SEC”), consents related to such reports filed with the SEC, audits of internal control over financial reporting as required by the Sarbanes-Oxley Act of 2002, and statutory audits approximated $509,813 and $742,000 respectively.

Audit-Related Fees. Fees for audit-related services for years 2005 and 2004, primarily related to audits of financial statements of certain employee benefit plans, acquisition due diligence assistance, regulatory filings, the review of registration statements and the issuance of consents, and internal control related services (including assistance with compliance required by Sarbanes-Oxley Act of 2002) approximated $32,100 and $26,000 respectively.

Tax Fees. Fees for tax services for 2004, which included tax compliance services (other than those related to Audit Fees) were approximately $105,000. Tax services in 2005 were provided by Ernst and Young LLP.

All Other Fees. Fees for other services in 2005 approximated $2,200 for assistance with the liquidation of a subsidiary in Europe. There were no fees for services in 2004 other than as described above.

Guidelines of the MetaSolv, Inc. Audit Committee for Pre-Approval of Independent Auditor Services

The Audit Committee of the Company’s Board of Directors (the “Audit Committee”) has adopted the following pre-approval policies and procedures regarding the engagement of the Company’s independent auditor to perform services for the Company, and the Audit Committee approved all services performed in 2005 by Grant Thornton LLP and its related entities, in accordance with the Company’s guidelines:

For audit services (including statutory audit engagements as required under local country laws), the independent auditor will provide the Audit Committee with an engagement letter during the January-March quarter of each year, or such other time as is determined by the Chair of the Audit Committee, outlining the scope of the audit services proposed to be performed during the fiscal year. If agreed to by the Audit Committee, this engagement letter will be formally accepted by the Audit Committee at either its February or April Audit Committee meeting, or at such other time as may be determined by the Chair of the Audit Committee.

16

The independent auditor will submit to the Audit Committee for approval an audit services fee proposal after acceptance of the engagement letter.

For non-audit services, Company management will submit to the Audit Committee for approval (during July or October of each fiscal year, or at such time as may be determined by the Chair of the Audit Committee) the list of non-audit services that it recommends the Audit Committee engage the independent auditor to provide for the fiscal year. Company management and the independent auditor will each confirm to the Audit Committee that each non-audit service on the list is permissible under all applicable legal requirements, and that it does not jeopardize the auditor’s independence. In addition to the list of planned non-audit services, a budget estimating non-audit service spending for the fiscal year will be provided. The Audit Committee will approve both the list of permissible non-audit services and the budget for such services. The Audit Committee will be informed routinely as to the non-audit services actually provided by the independent auditor pursuant to this pre-approval process.

To ensure prompt handling of unexpected matters, the Audit Committee delegates to the Chair of the Audit Committee the authority to amend or modify the list of approved permissible non-audit services and fees. The Chair of the Audit Committee will report action taken to the Audit Committee at the next Audit Committee meeting.

The independent auditor must ensure that all audit and non-audit services provided to the Company have been approved by the Audit Committee. The Company’s Controller will be responsible for tracking all independent auditor fees against the budget for such services and shall report at least annually to the Audit Committee.

In accordance with the Company’s pre-approval policies and procedures set forth above, prior to the engagement of the Company’s independent auditors, the Audit Committee approves the engagement and the terms of such engagement. The Audit Committee approves all audit and non-audit services provided by the Company’s independent auditors prior to their engagement or commencement of such services, except for the provision of certain services (other than audit, review or attest services) for which pre-approval is not required, in part because the aggregate of the fees billed for such services is no more than 5% of the total amount of fees paid by the Company to its independent auditors and such services are approved by the Audit Committee prior to the completion of the audit. For the year ended December 31, 2005, none of the audit-related fees, none of the tax fees and $2,200 of all other fees were approved by the Audit Committee pursuant to the exception to pre-approval for certain de minimis services described above. In addition, for the year ended December 31, 2004, none of the audit-related fees, none of the tax fees and none of all other fees (of which there were none) were approved by the Audit Committee pursuant to the exception to pre-approval for certain de minimis services described above.

The Audit Committee has considered, in accordance with its charter, whether the independent auditor’s provision of the services described above is compatible with maintaining the independent auditor’s independence.

17

EXECUTIVE OFFICER COMPENSATION

Summary Compensation Table

The following table sets forth all compensation awarded or earned during the last three fiscal years by the Company’s Chief Executive Officer, the four other most highly paid individuals who were serving as executive officers at the end of 2005, and one other individual, Sam L. Kelley, whose compensation level during 2005 would have required disclosure had he been serving as an executive officer at the end of 2005 (together, the “Named Executive Officers”):

| | | | | | | | | | | | | | | |

| | | | | Annual Compensation | | | Long-Term Compensation |

| | | | Awards | | Payouts | | |

Name and Principal Position | | Fiscal Year | | Salary

($) | | Bonus ($) | | | Restricted Stock Award(s) ($)(1) | | Securities

Underlying

Options (#) | | LTIP

Payouts

($)(2) | | All Other Compensation ($)(3) |

T. Curtis Holmes, Jr. President and Chief Executive Officer (4) | | 2005

2004

2003 | | 341,250

315,000

291,667 | | 78,475

—

48,750 |

| | 79,000

105,958

— | | 80,000

100,000

270,000 | | 62,923

—

— | | 3,000

3,000

3,000 |

| | | | | | | |

Phillip C. Thrasher Executive Vice President—

Americas and Asia Pacific Sales (5) | | 2005

2004

2003 | | 210,000

193,875

190,696 | | 138,906

60,323

85,747 |

(6) | | 13,600

36,688

— | | 50,000

30,000

65,000 | | 16,371

—

— | | 3,000

3,000

3,000 |

| | | | | | | |

Sam L. Kelley Executive Vice President—Services (7) | | 2005

2004

2003 | | 220,000

220,000

220,000 | | 72,847

—

33,000 |

| | 28,550

22,730

— | | 25,000

30,000

15,000 | | 20,546

—

— | | 3,000

3,000

3,000 |

| | | | | | | |

Glenn A. Etherington Chief Financial Officer (8) | | 2005

2004

2003 | | 255,000

230,000

225,000 | | 36,126

—

31,250 |

| | 38,250

147,200

— | | 50,000

60,000

15,000 | | 57,789

—

— | | 3,000

3,000

3,000 |

| | | | | | | |

Jonathan K. Hustis General Counsel, Executive Vice President—Legal (9) | | 2005

2004

2003 | | 210,000

193,948

190,000 | | 29,590

—

26,250 |

| | 30,950

151,949

— | | 50,000

60,000

15,000 | | 55,332

—

— | | 3,000

3,000

3,000 |

| | | | | | | |

Michael J. Cullen Executive Vice President—

Engineering (10) | | 2005

2004

2003 | | 210,000

197,962

195,000 | | 28,835

—

26,250 |

| | 30,950

73,158

— | | 50,000

30,000

15,000 | | 34,815

—

— | | 3,000

3,000

3,000 |

| (1) | Compensation under restricted stock awards do not reflect Performance Awards granted under the Long Term Incentive Plan to the Named Executive Officers in 2005, the vesting of which awards was subject to performance criteria that did not occur. |

| (2) | Consists of the value of restricted stock awards that vested during 2005. |

| (3) | Represents contributions made by the Company to each of our Named Executive Officers under the Company’s 401(k) profit sharing plan. |

| (4) | As of December 31, 2005 Mr. Holmes held 22,074 shares of unvested restricted stock with a value of $64,015. Vesting of such shares shall occur in near equal installments on each of January 20, 2006 and January 20, 2007, and, to the extent the Company declares a dividend on its outstanding Common Stock, dividends will be paid on such shares of restricted stock. |

| (5) | As of December 31, 2005 Mr. Thrasher held 7,643 shares of unvested restricted stock with a value of $22,165. Vesting of such shares shall occur in near equal installments on each of January 20, 2006 and January 20, 2007, and, to the extent the Company declares a dividend on its outstanding Common Stock, dividends will be paid on such shares of restricted stock. |

| (6) | Includes an individual retention bonus in the amount of $50,000, related to the acquisition of the Service Commerce Division of Nortel Networks in February 2002. |

18

| (7) | As of December 31, 2005 Mr. Kelley held 4,735 shares of unvested restricted stock with a value of $13,732. Vesting of such shares shall occur in near equal installments on each of January 20, 2006 and January 20, 2007, and, to the extent the Company declares a dividend on its outstanding Common Stock, dividends will be paid on such shares of restricted stock. |

| (8) | As of December 31, 2005 Mr. Etherington held 30,666 shares of unvested restricted stock with a value of $88,931. Vesting of such shares shall occur in near equal installments on each of January 20, 2006 and January 20, 2007, and, to the extent the Company declares a dividend on its outstanding Common Stock, dividends will be paid on such shares of restricted stock. |

| (9) | As of December 31, 2005 Mr. Hustis held 31,656 shares of unvested restricted stock with a value of $91,802. Vesting of such shares shall occur in near equal installments on each of January 20, 2006 and January 20, 2007, and, to the extent the Company declares a dividend on its outstanding Common Stock, dividends will be paid on such shares of restricted stock. |

| (10) | As of December 31, 2005 Mr. Cullen held 15,241 shares of unvested restricted stock with a value of $44,199. Vesting of such shares shall occur in near equal installments on each of January 20, 2006 and January 20, 2007, and, to the extent the Company declares a dividend on its outstanding Common Stock, dividends will be paid on such shares of restricted stock. |

Option Grants in Fiscal 2005

The following table sets forth information concerning the stock option grants made to each of the Named Executive Officers in 2005.

| | | | | | | | | | | | | | | | |

| | | Individual Grants | | Potential Realized Value at Assumed Annual Rates

of Stock Price Appreciation

for Option Term(3) |

| | | Number of Securities Underlying Options | | Percentage of Total Options Granted to Employees in | | | Exercise Price Per | | Expiration | |

Name | | Granted(1) | | Fiscal 2005(2) | | | Share | | Date | | 5% | | 10% |

T. Curtis Holmes, Jr. | | 80,000 | | 8.1 | % | | $ | 2.50 | | 2/24/10 | | $ | 55,256 | | $ | 122,102 |

Michael J. Cullen | | 50,000 | | 5.1 | % | | $ | 2.50 | | 2/24/10 | | $ | 34,535 | | $ | 76,314 |

Glenn A. Etherington | | 50,000 | | 5.1 | % | | $ | 2.50 | | 2/24/10 | | $ | 34,535 | | $ | 76,314 |

Sam L. Kelley | | 25,000 | | 2.5 | % | | $ | 2.50 | | 2/24/10 | | $ | 17,268 | | $ | 38,157 |

Jonathan K. Hustis | | 50,000 | | 5.1 | % | | $ | 2.50 | | 2/24/10 | | $ | 34,535 | | $ | 76,314 |

Phillip C. Thrasher | | 50,000 | | 5.1 | % | | $ | 2.50 | | 2/24/10 | | $ | 34,535 | | $ | 76,314 |

| (1) | Shares under option grants listed in the table become exercisable in near equal installments over three years on each of February 24, 2006, 2007 and 2008. The option shares will be fully vested upon the dissolution or liquidation of the Company, or on certain reorganizations where there is no plan to convert or exchange the options into option shares of the surviving entity. In addition, the options vest in connection with a termination of a Named Executive Officer’s employment under certain circumstances. See the discussion under “Employment Contracts and Termination and Change in Control Arrangements” below. Each of the options has a five-year term, subject to earlier termination in the event of the optionee’s cessation of service with the Company. |

| (2) | Based upon options to purchase an aggregate of 983,000 shares of Common Stock granted to employees of the Company in 2005 under the Long-Term Incentive Plan. |