UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08282

Loomis Sayles Funds I

(Exact name of Registrant as specified in charter)

399 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Coleen Downs Dinneen, Esq.

Natixis Distributors, L.P.

399 Boylston Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2810

Date of fiscal year end: September 30

Date of reporting period: September 30, 2009

| Item 1. | Reports to Stockholders. |

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Loomis Sayles Small Cap Growth Fund

Loomis Sayles Small Cap Value Fund

ANNUAL REPORT

SEPTEMBER 30, 2009

FUND AND MANAGER REVIEW

Loomis Sayles Small Cap Growth Fund

Mark F. Burns, CFA

Manager since January 2005

John Slavik, CFA

Manager since April 2005

PORTFOLIO REVIEW

The Fund underperformed its Benchmark, the Russell 2000 Growth Index, during the 12-month period ending September 30, 2009. The majority of the underperformance took place during the second quarter 2009 as the equity markets rebounded off the lows in March. Although the rapid rebound of stocks is positive, quick moves like the one just witnessed often come with a price. That price was a low quality rally that propelled the smallest of the small caps and companies with the most troubled balance sheets and profitability profiles.

Stock selection, which has been a consistent driver of returns for the product, was a detractor in the second quarter and, hence, the 12-month period. From a sector standpoint, the healthcare and consumer discretionary sectors were the most problematic. Partially offsetting this were overweight positions in the energy and technology sectors, with each showing a positive impact from stock selection as well.

Healthcare was the largest detractor to the Fund’s performance, primarily due to the negative macro economic impact on hospital and pharmaceutical budgets. Natus Medical, a medical device company, and ICON Plc., a clinical research provider for pharma companies, were each impacted by this trend. RTI Biologics, a biomedical company, was hurt by discretionary spending on elective surgeries as well as a slower than expected product launch. Each of these holdings were sold from the portfolio as the spending environment remained in question.

Within the consumer discretionary sector, VistaPrint and Gildan Activewear represented the largest performance detractors. VistaPrint, an online supplier of graphic design products for small businesses, fell in the fourth quarter of 2008 after reducing its full-year earnings and revenue forecasts. Gildan Activewear, an apparel manufacturing company, fell in the fourth quarter of 2008, as economic activity contracted and consumer spending plunged. Both stocks were sold.

The technology, consumer staples and energy sectors were among the most positive performers. Within technology, Riverbed Technology and Brocade Communications were among the portfolio’s top performers. Riverbed, which produces appliances to connect computers in wide area networks, advanced late in the period on better-than-expected earnings. Brocade, a company that provides switching solutions for storage area networks, rose dramatically in the second quarter 2009, after the equity markets bottomed in March. Consumer staples holding Green Mountain Coffee Roasters, the company behind the Keurig one-cup coffee brewers, was the largest individual contributor to the Fund’s performance, benefiting from a distribution partnership with Wal-Mart. We sold Riverbed and Green Mountain at a profit. And within the energy sector, the top contributors to performance were Oceaneering and Concho Resources. Oceaneering, an energy service company that supplies the oil and gas industry, rose steadily in the first three quarters of 2009 as demand picked up in-line with the increase in oil prices. Concho, an oil and gas exploration and production company rose in the third quarter of 2009 as commodity prices recovered.

The only significant change we made to the portfolio’s positioning was to substantially increase the technology weighting, in anticipation of an improving economy in the closing quarter of 2009. Technology represented our

FUND FACTS

Symbol | Institutional: LSSIX;

Retail: LCGRX

Objective | Long-term capital growth from investments in common stocks or other equity securities

Strategy | Invests at least 80% of its net assets (plus any borrowings made for investment purposes) in equity securities of companies with market capitalizations that fall within the capitalization range of the Russell 2000 Index or is $3 billion or less at the time of investment. Unlike the Index, the Fund may invest in companies of any size.

Fund Inception Date | 12/31/96

Total Net Assets | $121.0 million

1

largest overweight, and stock selection within this sector became more fruitful due to falling intra-sector correlations. In addition, the sector’s inventory replenishment cycle helped promote strong company fundamentals.

OUTLOOK

As the economic clouds parted this year, investors have grown more confident, leading to improved risk appetites and a dramatic rise in the market. The panic lows of March have been corrected and valuation levels seem to more accurately reflect current improving economic conditions. We believe continued economic improvement will lead to improved, yet bumpy, corporate profit growth, supportive of higher stock prices. The focus now centers on stock selection, as companies with the best business fundamentals and balance sheets are likely to provide the greatest returns.

AVERAGE ANNUAL TOTAL RETURNS

Periods Ended September 30, 2009

| | | | | | | | | | |

| 1 Year | | | 5 Years | | | 10 Years | | | Since

Inception | |

Loomis Sayles Small Cap Growth: Institutional | |

| -11.40 | % | | 5.26 | % | | -3.01 | % | | 2.08 | % |

Loomis Sayles Small Cap Growth: Retail | |

| -11.66 | | | 5.01 | | | -3.27 | | | 1.82 | |

Russell 2000 Growth Index(c) | |

| -6.32 | | | 2.91 | | | 1.10 | | | 2.49 | |

Russell 2000 Index(c) | |

| -9.55 | | | 2.41 | | | 4.88 | | | 5.45 | |

Lipper Small-Cap Growth Funds Index(c) | |

| -3.75 | | | 2.01 | | | 2.47 | | | 3.82 | |

| | | | | | | | |

Gross expense ratio (before reductions and reimbursements)* |

| Institutional: 1.01% | | Retail: 1.42% |

Net expense ratio (after reductions and reimbursements)* |

| Institutional: 1.00% | | Retail: 1.25% |

* As stated in the most recent prospectus

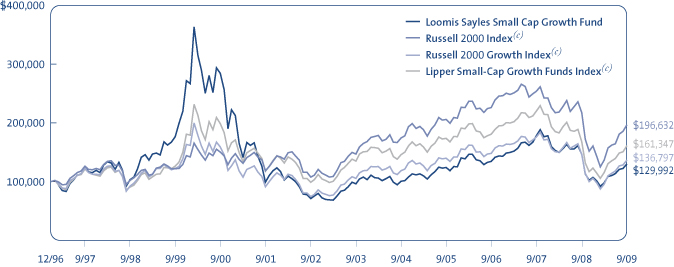

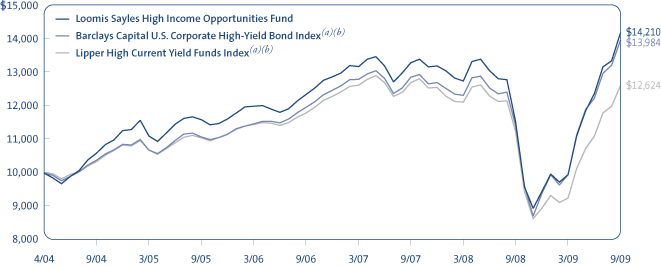

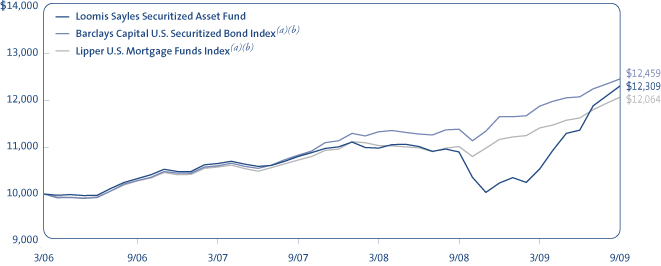

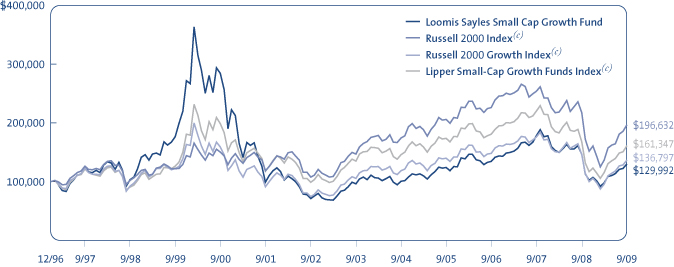

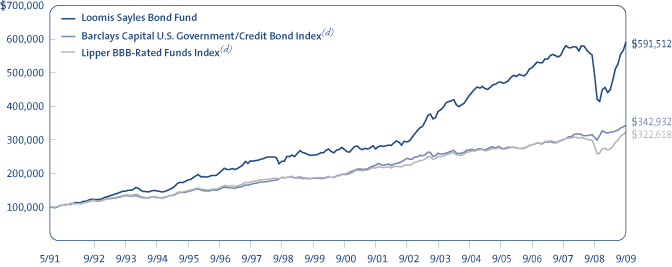

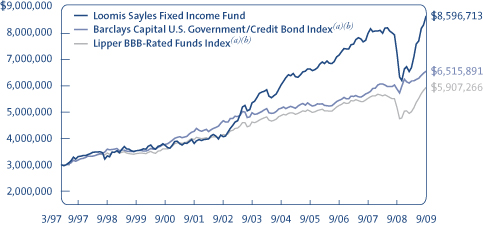

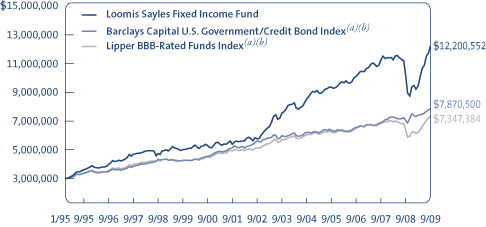

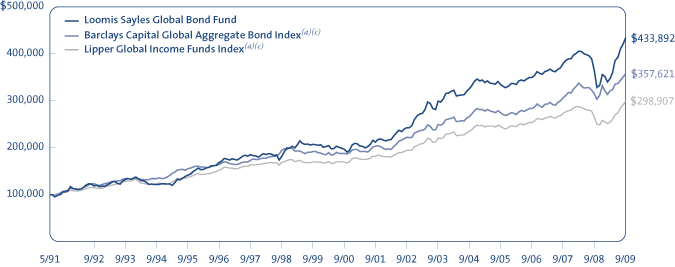

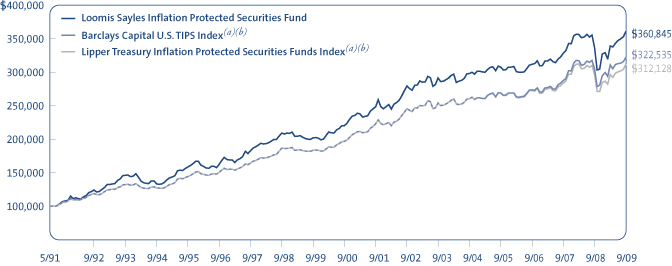

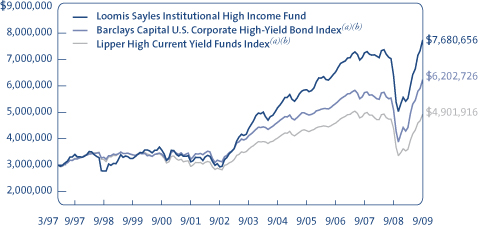

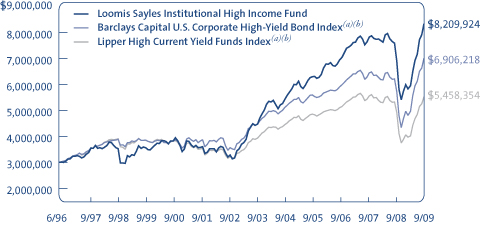

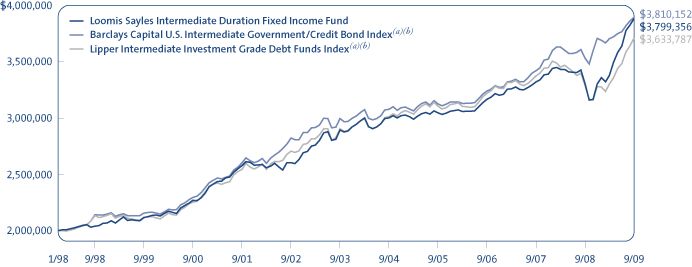

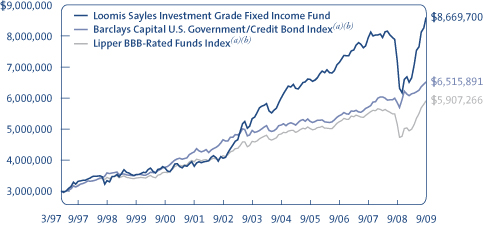

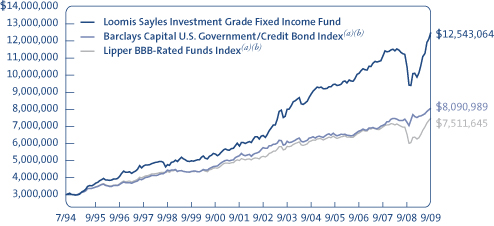

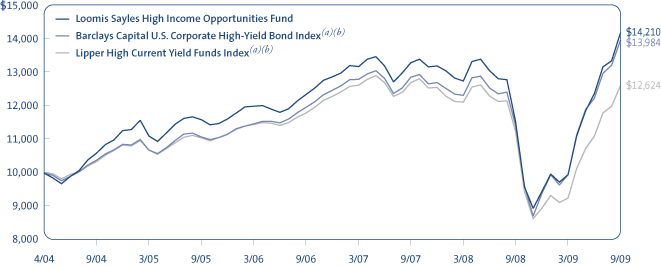

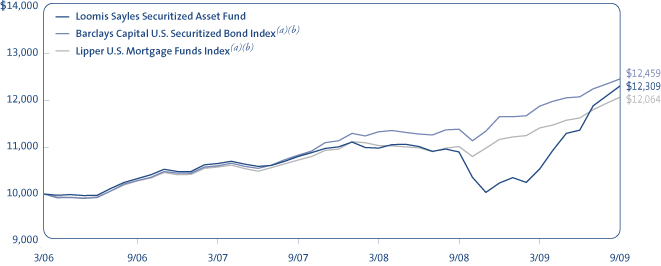

CUMULATIVE PERFORMANCE

Inception to September 30, 2009(a)(b)

Data quoted reflects past performance and cannot guarantee future results. Average annual total returns assume reinvestment of dividends and capital gains distributions. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. For performance current to the most recent month end, please visit www.loomissayles.com. Current performance may be higher or lower than quoted.

Returns do not reflect the taxes that a shareholder would pay on fund distributions or the redemption of shares. Periods of less than one year are not annualized. Performance data reflects certain fee reductions and reimbursements, if any, without which performance would be lower.

(a) Cumulative performance is shown for the Institutional Class of Shares. Performance of the Retail Class would be lower due to higher fees. (b) The mountain chart is based on the initial investment minimum of $100,000 for the Institutional Class. (c) See page 5 for a description of the Indices.

WHAT YOU SHOULD KNOW

Small- and mid-cap stocks may be more volatile than larger, more established companies. The secondary market for these stocks may be less liquid, which could adversely impact the Fund’s value. Growth funds involve increased risks, in part, because the value of the underlying securities is based on future expectations that may or may not be met.

The Fund can invest a significant percentage of assets in foreign securities and the value of the fund shares can be adversely affected by changes in currency exchange rates, political, and economic developments. In emerging markets these risks can be significant. The Fund is subject to currency risk, which is the risk that fluctuations in exchange rates between the US dollar and foreign currencies may cause the value of a Fund’s investments to decline. Fund shares should be viewed as a long-term investment.

2

FUND AND MANAGER REVIEW

Loomis Sayles Small Cap Value Fund

Joseph Gatz, CFA

Manager since January 2000

Daniel Thelen, CFA

Manager since April 2000

PORTFOLIO REVIEW

The Fund outperformed its Benchmark, the Russell 2000 Value Index, for the fiscal year ended September 30, 2009, primarily due to strong stock selection in the financial services sector.

The Fund’s higher quality orientation proved to be fairly defensive during the dramatic stock market selloff late in 2008 and early in 2009, and stock selection was favorable. Our cautious view on the fundamentals of bank stocks, which we underweighted, and our significant weighting in non-credit-sensitive financial data service companies, resulted in solid relative performance in financial services. PHH Corp., a provider of outsourced mortgage and fleet management services, was the Fund’s top contributor for the year. Twelve months ago, the stock was severely depressed due to PHH’s dependence on the capital markets to fund its business. As financing concerns slowly lifted, the high-quality, lower-risk nature of PHH’s business showed through. Three consecutive positive earnings surprises and a management change driven by activist shareholders also inspired investors.

Our holdings in consumer stocks were heavily weighted toward less-economically sensitive business services and media companies, which held up reasonably well versus the retail, apparel and restaurant segments.

Consumer staples, technology, materials and processing detracted slightly, but no individual sector had a large negative impact on the Fund’s relative performance. In the consumer staples sector, Spartan Stores, a Midwest grocery retailer, was among the largest detractors, declining on concerns about reduced economic activity in key states. The technology and materials sectors performed exceptionally well during the market rally. Overall, our stock selection in technology lagged, but an above-average weighting helped, while our underweight in materials detracted while our stock selection was positive.

As the market rebounded from its low in March of 2009, leadership was concentrated among the smallest market cap, higher-risk stocks. These stocks were the hardest hit during the market downturn, but they were among the first to reverse course on early signs of an economic bottom. The low-quality nature of the rally resulted in our portfolio being somewhat out of phase with the market. Nevertheless, several changes we made, including the addition of attractively valued basic materials, technology and industrial stocks in the spring of 2009, helped the Fund maintain its lead on the index.

OUTLOOK

As the economic clouds parted, investors have grown more confident, risk appetites have improved, and the market has risen dramatically. Much of what had been oversold has recovered, and valuation levels seem reasonable relative to current economic conditions. We believe continued economic improvement will support higher prices, but the recovery pace and pattern is apt to be bumpy. We believe determining appropriate valuations will be instrumental, while a focus on individual stock selection is likely to be especially important in this market environment.

FUND FACTS

Symbol | Institutional: LSSCX;

Retail: LSCRX; Admin: LSVAX

Objective | Long-term capital growth from investments in common stocks or other equity securities

Strategy | Invests at least 80% of its net assets (plus any borrowings made for investment purposes) in equity securities of companies with market capitalizations that fall within the capitalization range of the Russell 2000 Index or is $3 billion or less at the time of investment. Unlike the Index, the Fund may invest in companies of any size.

Fund Inception Date | 5/13/91

Class Inception Date | Institutional: 5/13/91

Retail: 12/31/96

Admin: 1/2/98

Total Net Assets | $967.9 million

3

AVERAGE ANNUAL TOTAL RETURNS

Periods Ended September 30, 2009

| | | | | | | | | | |

| 1 Year | | | 5 Years | | | 10 Years | | | Since Fund

Inception(a)(b) | |

Loomis Sayles Small Cap Value: Institutional | |

| -5.42 | % | | 4.29 | % | | 8.70 | % | | 11.95 | % |

Loomis Sayles Small Cap Value: Retail | |

| -5.66 | | | 4.03 | | | 8.44 | | | 11.76 | |

Loomis Sayles Small Cap Value: Admin | |

| -5.93 | | | 3.75 | | | 8.15 | | | 11.41 | |

Russell 2000 Value Index(c) | |

| -12.61 | | | 1.78 | | | 8.05 | | | 10.97 | |

Russell 2000 Index(c) | |

| -9.55 | | | 2.41 | | | 4.88 | | | 8.63 | |

Lipper Small-Cap Core Funds Index(c) | |

| -4.09 | | | 2.86 | | | 6.61 | | | N/A | |

| | | | | | | | |

Gross expense ratio (before reductions and reimbursements)* |

| Institutional: 0.90% | | Retail: 1.27% | | Admin: 1.69% |

Net expense ratio (after reductions and reimbursements)* |

| Institutional: 0.90% | | Retail: 1.15% | | Admin: 1.41% |

* As stated in the most recent prospectus

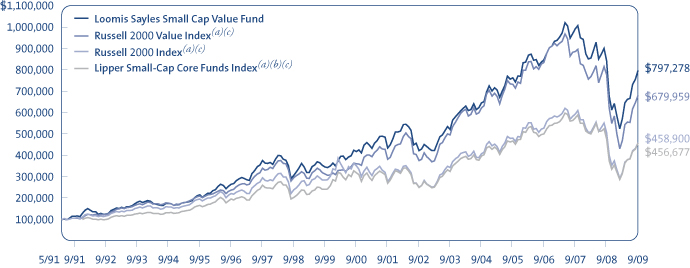

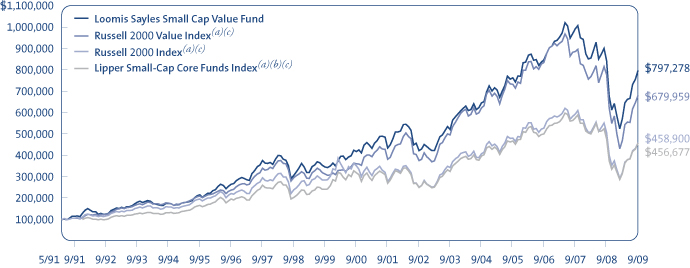

CUMULATIVE PERFORMANCE

Inception to September 30, 2009(d)(e)

Data quoted reflects past performance and cannot guarantee future results. Average annual total returns assume reinvestment of dividends and capital gains distributions. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. For performance current to the most recent month end, please visit www.loomissayles.com. Current performance may be higher or lower than quoted.

Returns do not reflect the taxes that a shareholder would pay on fund distributions or the redemption of shares. Periods of less than one year are not annualized. Performance data reflects certain fee reductions and reimbursements, if any, without which performance would be lower.

(a) Performance shown for periods prior to the inception date of the Retail Class (12/31/96) and Admin Class (1/02/98) represents the performance of the Institutional Class of shares during the periods shown, adjusted to reflect current levels of 12b-1 fees payable by the respective Classes. Since index performance data is not available coincident with the Fund’s inception date, the beginning value of the index is the value as of the month end closest to the Fund’s inception date. (b) The Lipper Small-Cap Core Funds Index performance data is not available prior to January 1, 1992. (c) See page 5 for a description of the Indices. (d) Cumulative performance is shown for the Institutional Class of Shares. Performance of the Retail and Admin Classes would be lower due to higher fees and expenses. (e) The mountain chart is based on the initial investment minimum of $100,000 for the Institutional Class.

WHAT YOU SHOULD KNOW

Value stocks may fall out of favor with investors and underperform the overall equity market during any given period. Small- and mid-cap stocks may be more volatile than larger, more established companies. The secondary market for these stocks may be less liquid, which could adversely impact the Fund’s value.

The Fund can invest a significant percentage of assets in foreign securities and the value of the fund shares can be adversely affected by changes in currency exchange rates, political, and economic developments. In emerging markets these risks can be significant. The Fund is subject to currency risk, which is the risk that fluctuations in exchange rates between the US dollar and foreign currencies may cause the value of a Fund’s investments to decline. Fund shares should be viewed as a long-term investment.

4

ADDITIONAL INFORMATION

Index Definitions

Indexes are unmanaged and do not have expenses that affect results, unlike mutual funds. Index returns are adjusted for the reinvestment of capital gain distributions and income dividends. It is not possible to invest directly in an index.

Lipper Small-Cap Core Funds Index is an equally weighted index of typically the 30 largest mutual funds within the small-cap core funds investment objective.

Lipper Small-Cap Growth Funds Index is an equally weighted index of typically the 30 largest mutual funds within the small-cap growth funds investment objective.

Source: Lipper, Inc.

Russell 2000 Growth Index is an index comprised of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values.

Russell 2000 Index is an index comprised of the 2,000 smallest companies in the Russell 3000 Index (a broad market index), representing approximately 10% of the Russell 3000 total market capitalization.

Russell 2000 Value Index is an index comprised of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

Proxy Voting Information

A description of the Funds’ proxy voting policies and procedures is available without charge, upon request, (i) by calling Loomis Sayles at 800-633-3330; (ii) on the Funds’ website, www.loomissayles.com, and (iii) on the SEC’s website, www.sec.gov. Information about how the Funds voted proxies relating to portfolio securities during the 12 months ended June 30, 2009 is available on (i) the Funds’ website and (ii) the SEC’s website.

Quarterly Portfolio Schedules

The Funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

UNDERSTANDING YOUR FUND’S EXPENSES

As a mutual fund shareholder you incur two types of costs: (1) transaction costs, including redemption fees and certain exchange fees; and (2) ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other Fund expenses. These costs are described in more detail in the Funds’ prospectus. The examples below are intended to help you understand the ongoing costs of investing in the Funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table of each Fund shows the actual amount of Fund expenses you would have paid on a $1,000 investment in the Fund from April 1, 2009 through September 30, 2009. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual fund returns and expenses. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.6) and multiply the result by the number in the Expenses Paid During the Period column as shown below for your class.

The second line in the table of each Fund provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

5

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs. Therefore, the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

Loomis Sayles Small Cap Growth Fund

| | | | | | |

Institutional Class | | Beginning

Account Value

4/1/2009 | | Ending

Account Value

9/30/2009 | | Expenses Paid

During Period*

4/1/2009 – 9/30/2009 |

Actual | | $1,000.00 | | $1,323.40 | | $5.82 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,020.05 | | $5.06 |

| | | |

Retail Class | | | | | | |

Actual | | $1,000.00 | | $1,321.90 | | $7.28 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,018.80 | | $6.33 |

* Expenses are equal to the Fund’s annualized expense ratio (after fee reduction/reimbursement): 1.00%, and 1.25% for Institutional and Retail Class, respectively, multiplied by the average account value over the period multiplied by the number of days in the most recent fiscal half-year, divided by 365 (to reflect the half-year period). |

Loomis Sayles Small Cap Value Fund

| | | | | | |

Institutional Class | | Beginning

Account Value

4/1/2009 | | Ending

Account Value

9/30/2009 | | Expenses Paid

During Period*

4/1/2009 – 9/30/2009 |

Actual | | $1,000.00 | | $1,396.90 | | $5.41 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,020.56 | | $4.56 |

| | | |

Retail Class | | | | | | |

Actual | | $1,000.00 | | $1,395.40 | | $6.91 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,019.30 | | $5.82 |

| | | |

Admin Class | | | | | | |

Actual | | $1,000.00 | | $1,392.70 | | $8.40 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,018.05 | | $7.08 |

* Expenses are equal to the Fund’s annualized expense ratio (after fee reduction/reimbursement): 0.90%, 1.15% and 1.40% for Institutional, Retail and Admin Class, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 365 (to reflect the half-year period). |

6

BOARD APPROVAL OF THE EXISTING ADVISORY AGREEMENTS

The Board of Trustees, including the Independent Trustees, considers matters bearing on each Fund’s advisory agreement (collectively, the “Agreements”) at most of its meetings throughout the year. Each year, usually in the spring, the Contract Review and Governance Committee of the Board meets to review the Agreements to determine whether to recommend that the full Board approve the continuation of the Agreements, typically for an additional one-year period. After the Committee has made its recommendation, the full Board, including the Independent Trustees, determines whether to approve the continuation of the Agreements.

In connection with these meetings, the Trustees receive materials that the Funds’ investment adviser (the “Adviser”) believes to be reasonably necessary for the Trustees to evaluate the Agreements. These materials generally include, among other items, (i) information on the investment performance of the Funds and the performance of peer groups of funds and the Funds’ performance benchmarks, (ii) information on the Funds’ advisory fees, and other expenses, including information comparing the Funds’ expenses to those of peer groups of funds and information about applicable expense caps and fee “breakpoints,” (iii) sales and redemption data in respect of the Funds, (iv) information about the profitability of the Agreements to the Funds’ Adviser and (v) information obtained through the completion of a questionnaire by the Adviser (the Trustees are consulted as to the information requested through that questionnaire). The Board of Trustees, including the Independent Trustees, also consider other matters such as (i) the Adviser’s financial results and financial condition, (ii) each Fund’s investment objective and strategies and the size, education and experience of the Adviser’s respective investment staffs and their use of technology, external research and trading cost measurement tools, (iii) arrangements in respect of the distribution of the Funds’ shares and the related costs, (iv) the procedures employed to determine the value of the Funds’ assets, (v) the allocation of the Funds’ brokerage, if any, including, if applicable, allocations to brokers affiliated with the Adviser and the use of “soft” commission dollars to pay Fund expenses and to pay for research and other similar services, (vi) the resources devoted to, and the record of compliance with, the Funds’ investment policies and restrictions, policies on personal securities transactions and other compliance policies, (vii) information about amounts invested by the Funds’ portfolio managers in the Funds or in similar accounts that they manage and (viii) the general economic outlook with particular emphasis on the mutual fund industry. Throughout the process, the Trustees are afforded the opportunity to ask questions of and request additional materials from the Adviser.

In addition to the materials requested by the Trustees in connection with their annual consideration of the continuation of the Agreements, the Trustees receive materials in advance of each regular quarterly meeting of the Board of Trustees that provide detailed information about the Funds’ investment performance and the fees charged to the Funds for advisory and other services. This information generally includes, among other things, an internal performance rating for each Fund based on agreed-upon criteria, graphs showing each Fund’s performance and fee differentials against each Fund’s peer group of funds, performance ratings provided by a third-party, total return information for various periods, and third-party performance rankings for various periods comparing a Fund against its peer group. The portfolio management team for each Fund or other representatives of the Adviser make periodic presentations to the Contract Review and Governance Committee and/or the full Board of Trustees, and Funds identified as presenting possible performance concerns may be subject to more frequent board presentations and reviews. In addition, each quarter the Trustees are provided with detailed statistical information about each Fund’s portfolio.

The Board of Trustees most recently approved the continuation of the Agreements at their meeting held in June, 2009. The Agreements were continued for a one-year period for the Funds. In considering whether to approve the continuation of the Agreements, the Board of Trustees, including the Independent Trustees, did not identify any single factor as determinative. Individual Trustees may have evaluated the information presented differently from one another, giving different weights to various factors. Matters considered by the Trustees, including the Independent Trustees, in connection with their approval of the Agreements included the factors listed below.

The nature, extent and quality of the services provided to the Funds under the Agreements. The Trustees considered the nature, extent and quality of the services provided by the Adviser and its affiliates to the Funds and the resources dedicated to the Funds by the Adviser and its affiliates, including recent or planned investments by the Adviser in additional personnel or other resources. They considered the need for the Adviser to offer competitive compensation in order to attract and retain capable personnel. They also considered the administrative services provided by Natixis Advisors and its affiliates to the Funds.

For each Fund, the Trustees also considered the benefits to shareholders of investing in a mutual fund that is part of a family of funds that offers shareholders the right to exchange shares of one type of fund for shares of another type of fund, and provides a variety of fund and shareholder services.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the nature, extent and quality of services provided supported the renewal of the Agreements.

Investment performance of the Funds and the Adviser. As noted above, the Trustees received information about the performance of the Funds over various time periods, including information which compared the performance of the Funds to the performance of peer

7

groups of funds and the Funds’ respective performance benchmarks. In addition, the Trustees also reviewed data prepared by an independent third party which analyzed the performance of the Funds using a variety of performance metrics, including metrics which also measured the performance of the Funds on a risk adjusted basis.

With respect to each Fund, the Board concluded that the Fund’s performance or other relevant factors supported the renewal of the Agreement relating to that Fund.

The Trustees also considered the Adviser’s performance and reputation generally, the Funds’ performance as a fund family generally (as noted by certain financial publications), and the historical responsiveness of the Adviser to Trustee concerns about performance and the willingness of the Adviser to take steps intended to improve performance.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the performance of the Funds and the Adviser supported the renewal of the Agreements.

The costs of the services to be provided and profits to be realized by the Adviser and its affiliates from their respective relationships with the Funds. The Trustees considered the fees charged to the Funds for advisory services as well as the total expense levels of the Funds. This information included comparisons (provided both by management and also by an independent third party) of the Funds’ advisory fees and total expense levels to those of their peer groups and information about the advisory fees charged by the Adviser to comparable accounts. In considering the fees charged to comparable accounts, the Trustees considered, among other things, management’s representations about the differences between managing mutual funds as compared to other types of accounts, including the additional resources required to effectively manage and the greater regulatory costs associated with the management of mutual fund assets. In evaluating each Fund’s advisory fee, the Trustees also took into account the demands, complexity and quality of the investment management of such Fund. The Trustees considered that over the past several years, management had made recommendations regarding the institution of expense caps. They noted that all of the Loomis Sayles Funds in this report have expense caps in place, and they considered the amounts waived or reimbursed by the Adviser under these caps.

The Trustees also considered the compensation directly or indirectly received by the Adviser and its affiliates from their relationships with the Funds. The Trustees reviewed information provided by management as to the profitability of the Adviser and its affiliates’ relationships with the Funds, and information about the allocation of expenses used to calculate profitability. They also reviewed information provided by management about the effect of distribution costs and changes in asset levels on Adviser profitability, including information regarding resources spent on distribution activities. When reviewing profitability, the Trustees also considered information about court cases in which adviser profitability was an issue, the performance of the relevant Funds, the expense levels of the Funds, and whether the Adviser had implemented breakpoints and/or expense caps with respect to such Funds.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the advisory fee charged to each of the Funds were fair and reasonable, and that the costs of these services generally and the related profitability of the Adviser and its affiliates in respect of their relationships with the Funds supported the renewal of the Agreements.

Economies of Scale. The Trustees considered the existence of any economies of scale in the provision of services by the Adviser and whether those economies are shared with the Funds through breakpoints in their investment advisory fees or other means, such as expense waivers or caps. The Trustees noted that although each Fund’s management fee was not subject to breakpoints, each Fund’s management fee was below the median fee for a peer group of funds and that each of the Funds was subject to an expense cap. In considering these issues, the Trustees also took note of the costs of the services provided (both on an absolute and a relative basis) and the profitability to the Adviser and its affiliates of their relationships with the Funds, as discussed above.

After reviewing these and related factors, the Trustees considered, within the context of their overall conclusions regarding each of the Agreements, that the extent to which economies of scale were shared with the Funds supported the renewal of the Agreements.

The Trustees also considered other factors, which included but were not limited to the following:

| • | | the effect of recent market and economic turmoil on the performance, asset levels and expense ratios of each Fund. |

| • | | whether each Fund has operated in accordance with its investment objective and the Fund’s record of compliance with its investment restrictions, and the compliance programs of the Funds and the Adviser. They also considered the compliance-related resources the Adviser and its affiliates were providing to the Funds. |

| • | | the nature, quality, cost and extent of administrative and shareholder services performed by the Adviser and its affiliates, both under the Agreements and under separate agreements covering administrative services. |

| • | | so-called “fallout benefits” to the Adviser, such as the engagement of affiliates of the Adviser to provide distribution, administrative and brokerage services to the Funds, and the benefits of research made available to the Adviser by reason of brokerage commissions |

8

| | generated by the Funds’ securities transactions. The Trustees also considered the fact that Natixis Advisors’ parent company benefits from the retention of an affiliated Adviser. The Trustees considered the possible conflicts of interest associated with these fallout and other benefits, and the reporting, disclosure and other processes in place to disclose and monitor such possible conflicts of interest. |

| • | | the Trustees’ review and discussion of the Funds’ advisory arrangements in prior years, and management’s record of responding to Trustee concerns raised during the year and in prior years. |

Based on their evaluation of all factors that they deemed to be material, including those factors described above, and assisted by the advice of independent counsel, the Trustees, including the Independent Trustees, concluded that each of the existing Agreements should be continued through June 30, 2010.

9

PORTFOLIO OF INVESTMENTS – as of September 30, 2009

Loomis Sayles Small Cap Growth Fund

| | | | | | | |

| | | | | Shares | | Value (†) |

| | | | | | | |

| | | |

| COMMON STOCKS – 97.4% of Net Assets | | | | | | | |

| | | |

| Aerospace & Defense – 2.0% | | | | | | | |

Applied Signal Technology, Inc. | | | | 49,537 | | $ | 1,152,726 |

Hexcel Corp.(b) | | | | 105,827 | | | 1,210,661 |

| | | | | | | |

| | | | | | | 2,363,387 |

| | | | | | | |

| Biotechnology – 4.8% | | | | | | | |

Alexion Pharmaceuticals, Inc.(b) | | | | 24,335 | | | 1,083,881 |

AMAG Pharmaceuticals, Inc.(b) | | | | 18,395 | | | 803,494 |

Incyte Corp. Ltd.(b) | | | | 134,691 | | | 909,164 |

Isis Pharmaceuticals, Inc.(b) | | | | 48,621 | | | 708,408 |

Onyx Pharmaceuticals, Inc.(b) | | | | 26,280 | | | 787,612 |

Regeneron Pharmaceuticals, Inc.(b) | | | | 38,595 | | | 744,883 |

Theravance, Inc.(b) | | | | 49,374 | | | 722,835 |

| | | | | | | |

| | | | | | | 5,760,277 |

| | | | | | | |

| Building Products – 0.6% | | | | | | | |

Trex Company, Inc.(b) | | | | 43,079 | | | 784,038 |

| | | | | | | |

| Capital Markets – 4.0% | | | | | | | |

Evercore Partners, Inc., Class A | | | | 39,517 | | | 1,154,687 |

Greenhill & Co., Inc. | | | | 15,206 | | | 1,362,153 |

Penson Worldwide, Inc.(b) | | | | 101,355 | | | 987,198 |

Stifel Financial Corp.(b) | | | | 24,809 | | | 1,362,014 |

| | | | | | | |

| | | | | | | 4,866,052 |

| | | | | | | |

| Commercial Banks – 0.9% | | | | | | | |

Signature Bank(b) | | | | 39,300 | | | 1,139,700 |

| | | | | | | |

| Commercial Services & Supplies – 2.7% | | | | | | | |

EnerNOC, Inc.(b) | | | | 33,665 | | | 1,116,331 |

Tetra Tech, Inc.(b) | | | | 34,066 | | | 903,771 |

Waste Connections, Inc.(b) | | | | 41,807 | | | 1,206,550 |

| | | | | | | |

| | | | | | | 3,226,652 |

| | | | | | | |

| Communications Equipment – 6.1% | | | | | | | |

Brocade Communications Systems, Inc.(b) | | | | 136,465 | | | 1,072,615 |

Ciena Corp.(b) | | | | 76,816 | | | 1,250,565 |

DG FastChannel, Inc.(b) | | | | 57,594 | | | 1,206,018 |

F5 Networks, Inc.(b) | | | | 30,599 | | | 1,212,638 |

Harris Stratex Networks, Inc., Class A(b) | | | | 133,587 | | | 935,109 |

Starent Networks Corp.(b) | | | | 24,485 | | | 622,409 |

Tellabs, Inc.(b) | | | | 152,621 | | | 1,056,137 |

| | | | | | | |

| | | | | | | 7,355,491 |

| | | | | | | |

| Construction & Engineering – 3.2% | | | | | | | |

Dycom Industries, Inc.(b) | | | | 48,292 | | | 593,992 |

MasTec, Inc.(b) | | | | 88,794 | | | 1,078,847 |

Northwest Pipe Co.(b) | | | | 32,778 | | | 1,099,046 |

Orion Marine Group, Inc.(b) | | | | 53,846 | | | 1,105,997 |

| | | | | | | |

| | | | | | | 3,877,882 |

| | | | | | | |

| Diversified Consumer Services – 2.6% | | | | | | | |

Grand Canyon Education, Inc.(b) | | | | 54,021 | | | 963,194 |

Lincoln Educational Services Corp.(b) | | | | 43,145 | | | 987,158 |

New Oriental Education & Technology Group, Inc., Sponsored ADR(b) | | | | 15,413 | | | 1,239,976 |

| | | | | | | |

| | | | | | | 3,190,328 |

| | | | | | | |

See accompanying notes to financial statements.

10

PORTFOLIO OF INVESTMENTS – as of September 30, 2009

Loomis Sayles Small Cap Growth Fund – continued

| | | | | | | |

| | | | | Shares | | Value (†) |

| | | | | | | |

| | | |

| COMMON STOCKS – continued | | | | | | | |

| | | |

| Diversified Financial Services – 1.1% | | | | | | | |

MSCI, Inc.(b) | | | | 43,457 | | $ | 1,287,196 |

| | | | | | | |

| Diversified Telecommunication Services – 0.7% | | | | | | | |

Neutral Tandem, Inc.(b) | | | | 39,069 | | | 889,210 |

| | | | | | | |

| Electric Utilities – 0.9% | | | | | | | |

ITC Holdings Corp. | | | | 23,444 | | | 1,065,530 |

| | | | | | | |

| Electronic Equipment Instruments & Components – 1.7% | | | | | | | |

Cogent, Inc.(b) | | | | 75,903 | | | 766,620 |

IPG Photonics Corp.(b) | | | | 84,502 | | | 1,284,431 |

| | | | | | | |

| | | | | | | 2,051,051 |

| | | | | | | |

| Energy Equipment & Services – 1.8% | | | | | | | |

Oceaneering International, Inc.(b) | | | | 22,494 | | | 1,276,535 |

Tesco Corp.(b) | | | | 118,041 | | | 941,967 |

| | | | | | | |

| | | | | | | 2,218,502 |

| | | | | | | |

| Food Products – 1.0% | | | | | | | |

Diamond Foods, Inc. | | | | 36,383 | | | 1,154,069 |

| | | | | | | |

| Health Care Equipment & Supplies – 5.7% | | | | | | | |

DexCom, Inc.(b) | | | | 111,199 | | | 881,808 |

Electro-Optical Sciences, Inc.(b) | | | | 83,497 | | | 799,901 |

ev3, Inc.(b) | | | | 98,341 | | | 1,210,578 |

Insulet Corp.(b) | | | | 70,731 | | | 794,309 |

Masimo Corp.(b) | | | | 27,525 | | | 721,155 |

ResMed, Inc.(b) | | | | 27,301 | | | 1,234,005 |

Volcano Corp.(b) | | | | 71,493 | | | 1,202,513 |

| | | | | | | |

| | | | | | | 6,844,269 |

| | | | | | | |

| Health Care Providers & Services – 3.9% | | | | | | | |

Bio-Reference Labs, Inc.(b) | | | | 30,245 | | | 1,040,428 |

Catalyst Health Solutions, Inc.(b) | | | | 39,449 | | | 1,149,939 |

Genoptix, Inc.(b) | | | | 31,013 | | | 1,078,632 |

IPC The Hospitalist Co.(b) | | | | 47,249 | | | 1,485,981 |

| | | | | | | |

| | | | | | | 4,754,980 |

| | | | | | | |

| Health Care Technology – 4.6% | | | | | | | |

athenahealth, Inc.(b) | | | | 33,504 | | | 1,285,548 |

MedAssets, Inc.(b) | | | | 87,426 | | | 1,973,205 |

Phase Forward, Inc.(b) | | | | 69,545 | | | 976,412 |

SXC Health Solutions Corp.(b) | | | | 29,522 | | | 1,381,334 |

| | | | | | | |

| | | | | | | 5,616,499 |

| | | | | | | |

| Hotels, Restaurants & Leisure – 3.4% | | | | | | | |

Bally Technologies, Inc.(b) | | | | 22,083 | | | 847,325 |

BJ’s Restaurants, Inc.(b) | | | | 66,567 | | | 997,839 |

Buffalo Wild Wings, Inc.(b) | | | | 26,996 | | | 1,123,304 |

Panera Bread Co., Class A(b) | | | | 21,618 | | | 1,188,990 |

| | | | | | | |

| | | | | | | 4,157,458 |

| | | | | | | |

| Household Durables – 0.7% | | | | | | | |

Tempur-Pedic International, Inc.(b) | | | | 41,834 | | | 792,336 |

| | | | | | | |

| Internet Software & Services – 2.9% | | | | | | | |

Constant Contact, Inc.(b) | | | | 55,782 | | | 1,073,804 |

DealerTrack Holdings, Inc.(b) | | | | 64,691 | | | 1,223,307 |

GSI Commerce, Inc.(b) | | | | 65,172 | | | 1,258,471 |

| | | | | | | |

| | | | | | | 3,555,582 |

| | | | | | | |

See accompanying notes to financial statements.

11

| | | | | | | |

| | | | | Shares | | Value (†) |

| | | | | | | |

| | | |

| COMMON STOCKS – continued | | | | | | | |

| | | |

| IT Services – 1.0% | | | | | | | |

CyberSource Corp.(b) | | | | 72,744 | | $ | 1,212,642 |

| | | | | | | |

| Machinery – 2.4% | | | | | | | |

Bucyrus International, Inc. | | | | 37,170 | | | 1,323,995 |

Energy Recovery, Inc.(b) | | | | 113,226 | | �� | 658,975 |

Wabtec Corp. | | | | 24,156 | | | 906,575 |

| | | | | | | |

| | | | | | | 2,889,545 |

| | | | | | | |

| Media – 0.8% | | | | | | | |

Imax Corp.(b) | | | | 109,125 | | | 1,026,866 |

| | | | | | | |

| Oil, Gas & Consumable Fuels – 3.6% | | | | | | | |

Arena Resources, Inc.(b) | | | | 34,249 | | | 1,215,840 |

Comstock Resources, Inc.(b) | | | | 40,734 | | | 1,632,619 |

Concho Resources, Inc.(b) | | | | 39,901 | | | 1,449,204 |

| | | | | | | |

| | | | | | | 4,297,663 |

| | | | | | | |

| Pharmaceuticals – 2.8% | | | | | | | |

Cypress Bioscience, Inc.(b) | | | | 89,420 | | | 730,561 |

Eurand NV(b) | | | | 61,004 | | | 923,601 |

Inspire Pharmaceuticals, Inc.(b) | | | | 132,042 | | | 689,259 |

Nektar Therapeutics(b) | | | | 107,520 | | | 1,047,245 |

| | | | | | | |

| | | | | | | 3,390,666 |

| | | | | | | |

| Professional Services – 3.4% | | | | | | | |

ICF International, Inc.(b) | | | | 49,755 | | | 1,508,572 |

IHS, Inc., Class A(b) | | | | 26,827 | | | 1,371,664 |

Monster Worldwide, Inc.(b) | | | | 69,059 | | | 1,207,151 |

| | | | | | | |

| | | | | | | 4,087,387 |

| | | | | | | |

| Semiconductors & Semiconductor Equipment – 8.0% | | | | | | | |

Cavium Network, Inc.(b) | | | | 51,068 | | | 1,096,430 |

Cymer, Inc.(b) | | | | 27,488 | | | 1,068,184 |

Hittite Microwave Corp.(b) | | | | 29,990 | | | 1,103,032 |

Lam Research Corp.(b) | | | | 39,276 | | | 1,341,668 |

Netlogic Microsystems, Inc.(b) | | | | 26,610 | | | 1,197,450 |

Power Integrations, Inc. | | | | 31,450 | | | 1,048,229 |

Silicon Laboratories, Inc.(b) | | | | 30,373 | | | 1,408,092 |

Varian Semiconductor Equipment Associates, Inc.(b) | | | | 42,555 | | | 1,397,506 |

| | | | | | | |

| | | | | | | 9,660,591 |

| | | | | | | |

| Software – 10.4% | | | | | | | |

ArcSight, Inc.(b) | | | | 26,049 | | | 627,000 |

Ariba, Inc.(b) | | | | 106,804 | | | 1,238,927 |

Blackboard, Inc.(b) | | | | 37,436 | | | 1,414,332 |

Concur Technologies, Inc.(b) | | | | 30,254 | | | 1,202,899 |

DemandTec, Inc.(b) | | | | 99,033 | | | 874,461 |

Informatica Corp.(b) | | | | 71,552 | | | 1,615,644 |

Nice Systems Ltd., ADR(b) | | | | 36,344 | | | 1,106,311 |

Sourcefire, Inc.(b) | | | | 31,449 | | | 675,210 |

Tyler Technologies, Inc.(b) | | | | 71,400 | | | 1,220,226 |

Ultimate Software Group, Inc.(The)(b) | | | | 44,226 | | | 1,270,171 |

VanceInfo Technologies, Inc., ADR(b) | | | | 70,084 | | | 1,362,433 |

| | | | | | | |

| | | | | | | 12,607,614 |

| | | | | | | |

See accompanying notes to financial statements.

12

PORTFOLIO OF INVESTMENTS – as of September 30, 2009

Loomis Sayles Small Cap Growth Fund – continued

| | | | | | | | |

| | | | | Shares | | Value (†) |

| | | | | | | | |

| | | |

| COMMON STOCKS – continued | | | | | | | | |

| | | |

| Specialty Retail – 5.5% | | | | | | | | |

DSW, Inc., Class A(b) | | | | | 79,768 | | $ | 1,273,895 |

hhgregg, Inc.(b) | | | | | 50,874 | | | 861,806 |

Hibbett Sports, Inc.(b) | | | | | 48,253 | | | 879,652 |

Lumber Liquidators, Inc.(b) | | | | | 60,874 | | | 1,320,357 |

Monro Muffler Brake, Inc. | | | | | 38,606 | | | 1,227,285 |

Ulta Salon, Cosmetics & Fragrance, Inc.(b) | | | | | 65,485 | | | 1,081,157 |

| | | | | | | | |

| | | | | | | | 6,644,152 |

| | | | | | | | |

| Textiles, Apparel & Luxury Goods – 4.2% | | | | | | | | |

Fuqi International, Inc.(b) | | | | | 28,478 | | | 833,836 |

Lululemon Athletica, Inc.(b) | | | | | 37,268 | | | 847,847 |

Phillips-Van Heusen Corp. | | | | | 33,081 | | | 1,415,536 |

Under Armour, Inc., Class A(b) | | | | | 44,737 | | | 1,245,030 |

Volcom, Inc.(b) | | | | | 43,410 | | | 715,397 |

| | | | | | | | |

| | | | | | | | 5,057,646 |

| | | | | | | | |

| | | |

| TOTAL COMMON STOCKS | | | | | | | | |

(Identified Cost $98,475,238) | | | | | | | | 117,825,261 |

| | | | | | | | |

| | | |

| | | | | Principal Amount | | |

| | | |

| SHORT-TERM INVESTMENTS – 1.5% | | | | | | | | |

| Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 9/30/09 at 0.000% to be repurchased at $1,818,320 on 10/01/09 collateralized by $1,840,000 Federal Home Loan Bank, 3.030% due 5/05/14 valued at $1,856,100 including accrued interest (Note 2f of Notes to Financial Statements) (Identified Cost $1,818,320) | | | | $ | 1,818,320 | | | 1,818,320 |

| | | | | | | | |

| | | |

| TOTAL INVESTMENTS – 98.9% | | | | | | | | |

(Identified Cost $100,293,558)(a) | | | | | | | | 119,643,581 |

Other assets less liabilities—1.1% | | | | | | | | 1,391,350 |

| | | | | | | | |

| | | |

| NET ASSETS – 100.0% | | | | | | | $ | 121,034,931 |

| | | | | | | | |

| | |

(†) See Note 2a of Notes to Financial Statements. | | | | | | |

(a) Federal Tax Information: | | | | | | |

At September 30, 2009, the net unrealized appreciation on investments based on a cost of $101,035,882 for federal income tax purposes was as follows: | | | |

Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | | $ | 21,141,029 |

Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | | | (2,533,330) |

| | | | | | | | |

Net unrealized appreciation | | $ | 18,607,699 |

| | | | | | | | |

| (b) | Non-income producing security. |

| ADR | An American Depositary Receipt (ADR) is a certificate issued by a custodian bank representing the right to receive securities of the foreign issuer described. The values of ADRs are significantly influenced by trading on exchanges not located in the United States. |

See accompanying notes to financial statements.

13

INDUSTRY SUMMARY AT SEPTEMBER 30, 2009 (Unaudited)

| | | |

Software | | 10.4 | % |

Semiconductors & Semiconductor Equipment | | 8.0 | |

Communications Equipment | | 6.1 | |

Health Care Equipment & Supplies | | 5.7 | |

Specialty Retail | | 5.5 | |

Biotechnology | | 4.8 | |

Health Care Technology | | 4.6 | |

Textiles, Apparel & Luxury Goods | | 4.2 | |

Capital Markets | | 4.0 | |

Health Care Providers & Services | | 3.9 | |

Oil, Gas & Consumable Fuels | | 3.6 | |

Hotels, Restaurants & Leisure | | 3.4 | |

Professional Services | | 3.4 | |

Construction & Engineering | | 3.2 | |

Internet Software & Services | | 2.9 | |

Pharmaceuticals | | 2.8 | |

Commercial Services & Supplies | | 2.7 | |

Diversified Consumer Services | | 2.6 | |

Machinery | | 2.4 | |

Aerospace & Defense | | 2.0 | |

Other Investments, less than 2% each | | 11.2 | |

Short-Term Investments | | 1.5 | |

| | | |

Total Investments | | 98.9 | |

Other assets less liabilities | | 1.1 | |

| | | |

Net Assets | | 100.0 | % |

| | | |

See accompanying notes to financial statements.

14

PORTFOLIO OF INVESTMENTS – as of September 30, 2009

Loomis Sayles Small Cap Value Fund

| | | | | | | |

| | | | | Shares | | Value (†) |

| | | | | | | |

| | | |

| COMMON STOCKS – 95.4% of Net Assets | | | | | | | |

| | | |

| Aerospace & Defense – 1.1% | | | | | | | |

Ducommun, Inc. | | | | 209,460 | | $ | 3,960,889 |

Teledyne Technologies, Inc.(b) | | | | 195,386 | | | 7,031,942 |

| | | | | | | |

| | | | | | | 10,992,831 |

| | | | | | | |

| Air Freight & Logistics – 0.8% | | | | | | | |

Atlas Air Worldwide Holdings, Inc.(b) | | | | 236,556 | | | 7,562,695 |

| | | | | | | |

| Auto Components – 0.5% | | | | | | | |

Goodyear Tire & Rubber Co. (The)(b) | | | | 298,466 | | | 5,082,876 |

| | | | | | | |

| Building Products – 0.8% | | | | | | | |

Armstrong World Industries, Inc.(b) | | | | 220,314 | | | 7,592,020 |

| | | | | | | |

| Capital Markets – 2.9% | | | | | | | |

Fifth Street Finance Corp. | | | | 349,872 | | | 3,824,101 |

Investment Technology Group, Inc.(b) | | | | 217,478 | | | 6,071,986 |

JMP Group, Inc. | | | | 161,713 | | | 1,562,148 |

Legg Mason, Inc. | | | | 160,379 | | | 4,976,560 |

Stifel Financial Corp.(b) | | | | 214,727 | | | 11,788,512 |

| | | | | | | |

| | | | | | | 28,223,307 |

| | | | | | | |

| Chemicals – 3.0% | | | | | | | |

Calgon Carbon Corp.(b) | | | | 270,934 | | | 4,017,951 |

Ferro Corp. | | | | 613,965 | | | 5,464,288 |

Koppers Holdings, Inc. | | | | 195,239 | | | 5,788,836 |

LSB Industries, Inc.(b) | | | | 187,459 | | | 2,918,737 |

Minerals Technologies, Inc. | | | | 42,169 | | | 2,005,558 |

Olin Corp. | | | | 244,931 | | | 4,271,597 |

RPM International, Inc. | | | | 243,744 | | | 4,506,827 |

| | | | | | | |

| | | | | | | 28,973,794 |

| | | | | | | |

| Commercial Banks – 5.8% | | | | | | | |

Bank of the Ozarks, Inc. | | | | 246,487 | | | 6,539,300 |

First Horizon National Corp.(b) | | | | 417,991 | | | 5,530,027 |

Glacier Bancorp, Inc. | | | | 228,082 | | | 3,407,545 |

Hancock Holding Co. | | | | 85,415 | | | 3,209,042 |

IBERIABANK Corp. | | | | 188,834 | | | 8,603,277 |

Metro Bancorp, Inc.(b) | | | | 119,404 | | | 1,453,147 |

Prosperity Bancshares, Inc. | | | | 228,423 | | | 7,946,836 |

Signature Bank(b) | | | | 292,081 | | | 8,470,349 |

Southwest Bancorp, Inc. | | | | 261,402 | | | 3,670,084 |

Sterling Bancshares, Inc. | | | | 941,772 | | | 6,884,353 |

| | | | | | | |

| | | | | | | 55,713,960 |

| | | | | | | |

| Commercial Services & Supplies – 5.5% | | | | | | | |

ABM Industries, Inc. | | | | 391,160 | | | 8,230,006 |

American Ecology Corp. | | | | 150,555 | | | 2,815,378 |

Brink’s Co. (The) | | | | 181,717 | | | 4,890,004 |

McGrath Rentcorp | | | | 147,833 | | | 3,144,408 |

Rollins, Inc. | | | | 833,861 | | | 15,718,280 |

Standard Parking Corp.(b) | | | | 497,373 | | | 8,699,054 |

Team, Inc.(b) | | | | 164,327 | | | 2,785,343 |

Waste Connections, Inc.(b) | | | | 248,909 | | | 7,183,514 |

| | | | | | | |

| | | | | | | 53,465,987 |

| | | | | | | |

See accompanying notes to financial statements.

15

| | | | | | | |

| | | | | Shares | | Value (†) |

| | | | | | | |

| | | |

| COMMON STOCKS – continued | | | | | | | |

| | | |

| Communications Equipment – 3.5% | | | | | | | |

ADC Telecommunications, Inc.(b) | | | | 447,285 | | $ | 3,730,357 |

ADTRAN, Inc. | | | | 236,180 | | | 5,798,219 |

Anaren, Inc.(b) | | | | 169,713 | | | 2,885,121 |

Avocent Corp.(b) | | | | 234,036 | | | 4,743,910 |

Brocade Communications Systems, Inc.(b) | | | | 336,187 | | | 2,642,430 |

CommScope, Inc.(b) | | | | 198,099 | | | 5,929,103 |

Harris Stratex Networks, Inc., Class A(b) | | | | 369,589 | | | 2,587,123 |

Tekelec(b) | | | | 343,013 | | | 5,635,703 |

| | | | | | | |

| | | | | | | 33,951,966 |

| | | | | | | |

| Computers & Peripherals – 0.3% | | | | | | | |

Intevac, Inc.(b) | | | | 197,385 | | | 2,652,854 |

| | | | | | | |

| Construction & Engineering – 0.4% | | | | | | | |

MYR Group, Inc.(b) | | | | 173,109 | | | 3,650,869 |

| | | | | | | |

| Construction Materials – 0.4% | | | | | | | |

Eagle Materials, Inc. | | | | 126,011 | | | 3,601,394 |

| | | | | | | |

| Consumer Finance – 0.9% | | | | | | | |

Dollar Financial Corp.(b) | | | | 519,036 | | | 8,314,957 |

| | | | | | | |

| Containers & Packaging – 1.2% | | | | | | | |

Myers Industries, Inc. | | | | 209,271 | | | 2,253,849 |

Rock-Tenn Co., Class A | | | | 191,835 | | | 9,037,347 |

| | | | | | | |

| | | | | | | 11,291,196 |

| | | | | | | |

| Distributors – 0.2% | | | | | | | |

Core-Mark Holding Co., Inc.(b) | | | | 61,813 | | | 1,767,852 |

| | | | | | | |

| Diversified Consumer Services – 0.4% | | | | | | | |

Hillenbrand, Inc. | | | | 215,015 | | | 4,379,856 |

| | | | | | | |

| Diversified Financial Services – 1.1% | | | | | | | |

PHH Corp.(b) | | | | 520,467 | | | 10,326,065 |

| | | | | | | |

| Electric Utilities – 2.7% | | | | | | | |

ALLETE, Inc. | | | | 242,848 | | | 8,152,407 |

ITC Holdings Corp. | | | | 147,590 | | | 6,707,965 |

Portland General Electric Co. | | | | 211,598 | | | 4,172,713 |

UIL Holdings Corp. | | | | 257,628 | | | 6,798,803 |

| | | | | | | |

| | | | | | | 25,831,888 |

| | | | | | | |

| Electrical Equipment – 1.9% | | | | | | | |

Baldor Electric Co. | | | | 146,966 | | | 4,018,051 |

Encore Wire Corp. | | | | 163,553 | | | 3,653,774 |

GrafTech International Ltd.(b) | | | | 257,042 | | | 3,778,517 |

II-VI, Inc.(b) | | | | 272,341 | | | 6,928,355 |

| | | | | | | |

| | | | | | | 18,378,697 |

| | | | | | | |

| Electronic Equipment Instruments & Components – 1.3% | | | | | | | |

Littelfuse, Inc.(b) | | | | 137,304 | | | 3,602,857 |

Methode Electronics, Inc. | | | | 270,494 | | | 2,345,183 |

TTM Technologies, Inc.(b) | | | | 321,945 | | | 3,692,709 |

Vishay Intertechnology, Inc.(b) | | | | 412,997 | | | 3,262,676 |

| | | | | | | |

| | | | | | | 12,903,425 |

| | | | | | | |

See accompanying notes to financial statements.

16

PORTFOLIO OF INVESTMENTS – as of September 30, 2009

Loomis Sayles Small Cap Value Fund – continued

| | | | | | | |

| | | | | Shares | | Value (†) |

| | | | | | | |

| | | |

| COMMON STOCKS – continued | | | | | | | |

| | | |

| Energy Equipment & Services – 2.1% | | | | | | | |

Hornbeck Offshore Services, Inc.(b) | | | | 182,127 | | $ | 5,019,420 |

Lufkin Industries, Inc. | | | | 58,027 | | | 3,085,876 |

Oceaneering International, Inc.(b) | | | | 158,835 | | | 9,013,886 |

Seahawk Drilling, Inc.(b) | | | | 106,646 | | | 3,315,624 |

| | | | | | | |

| | | | | | | 20,434,806 |

| | | | | | | |

| Food & Staples Retailing – 0.5% | | | | | | | |

Spartan Stores, Inc. | | | | 359,274 | | | 5,076,542 |

| | | | | | | |

| Food Products – 2.5% | | | | | | | |

Darling International, Inc.(b) | | | | 506,580 | | | 3,723,363 |

Flowers Foods, Inc. | | | | 231,281 | | | 6,080,377 |

J & J Snack Foods Corp. | | | | 201,646 | | | 8,709,091 |

Ralcorp Holdings, Inc.(b) | | | | 99,353 | | | 5,809,170 |

| | | | | | | |

| | | | | | | 24,322,001 |

| | | | | | | |

| Gas Utilities – 1.1% | | | | | | | |

UGI Corp. | | | | 424,507 | | | 10,638,145 |

| | | | | | | |

| Health Care Equipment & Supplies – 1.7% | | | | | | | |

Medical Action Industries, Inc.(b) | | | | 261,297 | | | 3,153,855 |

Teleflex, Inc. | | | | 156,254 | | | 7,548,630 |

West Pharmaceutical Services, Inc. | | | | 144,562 | | | 5,870,663 |

| | | | | | | |

| | | | | | | 16,573,148 |

| | | | | | | |

| Health Care Providers & Services – 1.4% | | | | | | | |

CorVel Corp.(b) | | | | 93,798 | | | 2,663,863 |

MEDNAX, Inc.(b) | | | | 119,792 | | | 6,578,977 |

MWI Veterinary Supply, Inc.(b) | | | | 109,983 | | | 4,393,821 |

| | | | | | | |

| | | | | | | 13,636,661 |

| | | | | | | |

| Hotels, Restaurants & Leisure – 2.4% | | | | | | | |

Bob Evans Farms, Inc. | | | | 181,897 | | | 5,285,927 |

California Pizza Kitchen, Inc.(b) | | | | 251,170 | | | 3,923,276 |

Dover Downs Gaming & Entertainment, Inc. | | | | 301,983 | | | 1,721,303 |

Isle of Capri Casinos, Inc.(b) | | | | 347,414 | | | 4,096,011 |

Penn National Gaming, Inc.(b) | | | | 122,555 | | | 3,389,871 |

Wyndham Worldwide Corp. | | | | 286,963 | | | 4,683,236 |

| | | | | | | |

| | | | | | | 23,099,624 |

| | | | | | | |

| Household Durables – 1.3% | | | | | | | |

Jarden Corp. | | | | 197,326 | | | 5,538,941 |

Leggett & Platt, Inc. | | | | 374,547 | | | 7,266,212 |

| | | | | | | |

| | | | | | | 12,805,153 |

| | | | | | | |

| Industrial Conglomerates – 0.3% | | | | | | | |

Raven Industries, Inc. | | | | 123,702 | | | 3,306,554 |

| | | | | | | |

| Insurance – 6.5% | | | | | | | |

American Physicians Capital, Inc. | | | | 107,020 | | | 3,083,246 |

Aspen Insurance Holdings Ltd. | | | | 256,449 | | | 6,788,205 |

Hanover Insurance Group, Inc. (The) | | | | 134,037 | | | 5,539,749 |

HCC Insurance Holdings, Inc. | | | | 334,373 | | | 9,145,102 |

Navigators Group, Inc.(b) | | | | 116,894 | | | 6,429,170 |

ProAssurance Corp.(b) | | | | 102,409 | | | 5,344,726 |

See accompanying notes to financial statements.

17

| | | | | | | |

| | | | | Shares | | Value (†) |

| | | | | | | |

| | | |

| COMMON STOCKS – continued | | | | | | | |

| | | |

| Insurance – continued | | | | | | | |

Reinsurance Group of America, Inc. | | | | 139,456 | | $ | 6,219,738 |

RLI Corp. | | | | 113,569 | | | 5,994,172 |

W.R. Berkley Corp. | | | | 272,454 | | | 6,887,637 |

Zenith National Insurance Corp. | | | | 235,235 | | | 7,268,761 |

| | | | | | | |

| | | | | | | 62,700,506 |

| | | | | | | |

| Internet & Catalog Retail – 0.7% | | | | | | | |

HSN, Inc.(b) | | | | 434,171 | | | 7,068,304 |

| | | | | | | |

| Internet Software & Services – 0.3% | | | | | | | |

United Online, Inc. | | | | 395,892 | | | 3,182,972 |

| | | | | | | |

| IT Services – 3.5% | | | | | | | |

Broadridge Financial Solutions, Inc. | | | | 465,213 | | | 9,350,781 |

Global Payments, Inc. | | | | 124,931 | | | 5,834,278 |

Lender Processing Services, Inc. | | | | 217,332 | | | 8,295,563 |

SRA International, Inc., Class A(b) | | | | 200,139 | | | 4,321,001 |

Wright Express Corp.(b) | | | | 214,667 | | | 6,334,823 |

| | | | | | | |

| | | | | | | 34,136,446 |

| | | | | | | |

| Life Sciences Tools & Services – 0.6% | | | | | | | |

Mettler-Toledo International, Inc.(b) | | | | 61,157 | | | 5,540,213 |

| | | | | | | |

| Machinery – 4.3% | | | | | | | |

Actuant Corp., Class A | | | | 476,590 | | | 7,654,036 |

Albany International Corp., Class A | | | | 342,706 | | | 6,648,496 |

Altra Holdings, Inc.(b) | | | | 333,302 | | | 3,729,649 |

Colfax Corp.(b) | | | | 165,357 | | | 1,757,745 |

Dynamic Materials Corp. | | | | 183,577 | | | 3,664,197 |

John Bean Technologies Corp. | | | | 370,402 | | | 6,730,204 |

Middleby Corp. (The)(b) | | | | 36,509 | | | 2,008,360 |

Tennant Co. | | | | 103,930 | | | 3,020,206 |

Wabtec Corp. | | | | 169,822 | | | 6,373,420 |

| | | | | | | |

| | | | | | | 41,586,313 |

| | | | | | | |

| Marine – 0.2% | | | | | | | |

Kirby Corp.(b) | | | | 63,554 | | | 2,340,058 |

| | | | | | | |

| Media – 3.4% | | | | | | | |

Alloy, Inc.(b) | | | | 244,628 | | | 1,656,131 |

Arbitron, Inc. | | | | 192,310 | | | 3,992,356 |

Dolan Media Co.(b) | | | | 293,924 | | | 3,524,149 |

John Wiley & Sons, Inc. Class A | | | | 249,879 | | | 8,690,792 |

Live Nation, Inc.(b) | | | | 922,972 | | | 7,559,141 |

Scholastic Corp. | | | | 293,584 | | | 7,145,834 |

| | | | | | | |

| | | | | | | 32,568,403 |

| | | | | | | |

| Metals & Mining – 1.3% | | | | | | | |

Horsehead Holding Corp.(b) | | | | 356,270 | | | 4,175,484 |

Reliance Steel & Aluminum Co. | | | | 190,083 | | | 8,089,933 |

| | | | | | | |

| | | | | | | 12,265,417 |

| | | | | | | |

| Multi-Utilities & Unregulated Power – 0.5% | | | | | | | |

NorthWestern Corp. | | | | 193,268 | | | 4,721,537 |

| | | | | | | |

See accompanying notes to financial statements.

18

PORTFOLIO OF INVESTMENTS – as of September 30, 2009

Loomis Sayles Small Cap Value Fund – continued

| | | | | | | |

| | | | | Shares | | Value (†) |

| | | | | | | |

| | | |

| COMMON STOCKS – continued | | | | | | | |

| | | |

| Oil, Gas & Consumable Fuels – 3.6% | | | | | | | |

Arena Resources, Inc.(b) | | | | 169,513 | | $ | 6,017,712 |

Berry Petroleum Co., Class A | | | | 187,881 | | | 5,031,453 |

Comstock Resources, Inc.(b) | | | | 196,822 | | | 7,888,626 |

Mariner Energy, Inc.(b) | | | | 360,308 | | | 5,109,167 |

Penn Virginia Corp. | | | | 485,007 | | | 11,111,510 |

| | | | | | | |

| | | | | | | 35,158,468 |

| | | | | | | |

| Paper & Forest Products – 0.6% | | | | | | | |

Clearwater Paper Corp.(b) | | | | 80,429 | | | 3,324,130 |

Deltic Timber Corp. | | | | 45,984 | | | 2,104,688 |

| | | | | | | |

| | | | | | | 5,428,818 |

| | | | | | | |

| Personal Products – 0.5% | | | | | | | |

Alberto-Culver Co. | | | | 182,486 | | | 5,051,212 |

| | | | | | | |

| Pharmaceuticals – 2.3% | | | | | | | |

Endo Pharmaceuticals Holdings, Inc.(b) | | | | 270,162 | | | 6,113,766 |

Obagi Medical Products, Inc.(b) | | | | 385,567 | | | 4,472,577 |

Perrigo Co. | | | | 358,879 | | | 12,198,297 |

| | | | | | | |

| | | | | | | 22,784,640 |

| | | | | | | |

| Real Estate Management & Development – 1.0% | | | | | | | |

Forestar Group, Inc.(b) | | | | 548,186 | | | 9,417,836 |

| | | | | | | |

| REITs – 4.7% | | | | | | | |

American Campus Communities, Inc. | | | | 363,085 | | | 9,748,832 |

Capstead Mortgage Corp. | | | | 673,066 | | | 9,362,348 |

Chimera Investment Corp. | | | | 1,535,216 | | | 5,864,525 |

Digital Realty Trust, Inc. | | | | 174,840 | | | 7,991,937 |

National Retail Properties, Inc. | | | | 219,320 | | | 4,708,800 |

Potlatch Corp. | | | | 268,691 | | | 7,644,259 |

| | | | | | | |

| | | | | | | 45,320,701 |

| | | | | | | |

| Road & Rail – 1.1% | | | | | | | |

Con-way, Inc. | | | | 101,024 | | | 3,871,240 |

Genesee & Wyoming, Inc., Class A(b) | | | | 187,345 | | | 5,680,300 |

Saia, Inc.(b) | | | | 75,742 | | | 1,217,931 |

| | | | | | | |

| | | | | | | 10,769,471 |

| | | | | | | |

| Semiconductors & Semiconductor Equipment – 3.8% | | | | | | | |

Applied Micro Circuits Corp.(b) | | | | 203,481 | | | 2,032,775 |

Atmel Corp.(b) | | | | 902,712 | | | 3,782,363 |

Cohu, Inc. | | | | 251,428 | | | 3,409,364 |

Entegris, Inc.(b) | | | | 1,061,734 | | | 5,255,584 |

ON Semiconductor Corp.(b) | | | | 740,740 | | | 6,111,105 |

Semtech Corp.(b) | | | | 229,275 | | | 3,899,968 |

Teradyne, Inc.(b) | | | | 584,253 | | | 5,404,340 |

TriQuint Semiconductor, Inc.(b) | | | | 942,042 | | | 7,272,564 |

| | | | | | | |

| | | | | | | 37,168,063 |

| | | | | | | |

| Software – 2.2% | | | | | | | |

Informatica Corp.(b) | | | | 132,523 | | | 2,992,369 |

MicroStrategy, Inc., Class A(b) | | | | 43,617 | | | 3,120,360 |

Progress Software Corp.(b) | | | | 156,761 | | | 3,550,637 |

See accompanying notes to financial statements.

19

| | | | | | | | |

| | | | | Shares | | Value (†) |

| | | | | | | | |

| | | |

| COMMON STOCKS – continued | | | | | | | | |

| | | |

| Software – continued | | | | | | | | |

Quest Software, Inc.(b) | | | | | 272,667 | | $ | 4,594,439 |

Sybase, Inc.(b) | | | | | 174,940 | | | 6,805,166 |

| | | | | | | | |

| | | | | | | | 21,062,971 |

| | | | | | | | |

| | | |

| Specialty Retail – 2.3% | | | | | | | | |

Genesco, Inc.(b) | | | | | 166,373 | | | 4,004,598 |

Jo-Ann Stores, Inc.(b) | | | | | 200,926 | | | 5,390,845 |

Sally Beauty Holdings, Inc.(b) | | | | | 1,127,717 | | | 8,018,068 |

Sonic Automotive, Inc., Class A | | | | | 471,078 | | | 4,946,319 |

| | | | | | | | |

| | | | | | | | 22,359,830 |

| | | | | | | | |

| Textiles, Apparel & Luxury Goods – 2.7% | | | | | | | | |

Carter’s, Inc.(b) | | | | | 388,247 | | | 10,366,195 |

FGX International Holdings Ltd.(b) | | | | | 275,446 | | | 3,842,472 |

Fossil, Inc.(b) | | | | | 248,694 | | | 7,075,344 |

Movado Group, Inc. | | | | | 320,326 | | | 4,654,337 |

| | | | | | | | |

| | | | | | | | 25,938,348 |

| | | | | | | | |

| Thrifts & Mortgage Finance – 0.9% | | | | | | | | |

Washington Federal, Inc. | | | | | 286,005 | | | 4,822,044 |

Westfield Financial, Inc. | | | | | 407,901 | | | 3,454,922 |

| | | | | | | | |

| | | | | | | | 8,276,966 |

| | | | | | | | |

| Water Utilities – 0.4% | | | | | | | | |

Middlesex Water Co. | | | | | 272,189 | | | 4,104,610 |

| | | | | | | | |

| | | |

| TOTAL COMMON STOCKS | | | | | | | | |

(Identified Cost $821,166,230) | | | | | | | | 923,503,226 |

| | | | | | | | |

| | | |

| | | | | Principal Amount | | |

| | | |

| SHORT-TERM INVESTMENTS – 4.0% | | | | | | | | |

| Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 9/30/2009 at 0.000% to be repurchased at $38,153,199 on 10/01/2009 collateralized by $38,725,000 Federal National Mortgage Association, 3.000% due 1/13/2014 with a value of $38,918,625 including accrued interest (Note 2f of Notes to Financial Statements) (Identified Cost $38,153,198) | | | | $ | 38,153,198 | | | 38,153,198 |

| | | | | | | | |

| | | |

| TOTAL INVESTMENTS – 99.4% | | | | | | | | |

(Identified Cost $859,319,428)(a) | | | | | | | | 961,656,424 |

Other assets less liabilities—0.6% | | | | | | | | 6,245,617 |

| | | | | | | | |

| | | |

| NET ASSETS – 100.0% | | | | | | | $ | 967,902,041 |

| | | | | | | | |

| |

(†) See Note 2a of Notes to Financial Statements. | | | |

(a) Federal Tax Information:

At September 30, 2009, the net unrealized appreciation on investments based on a cost of $868,593,394 for federal income tax purposes was as follows: | | | |

Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | | $ | 136,082,101 |

Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | | | (43,019,071) |

| | | | | | | | |

Net unrealized appreciation | | $ | 93,063,030 |

| | | | | | | | |

| (b) | Non-income producing security. |

| REITs | Real Estate Investment Trusts |

See accompanying notes to financial statements.

20

PORTFOLIO OF INVESTMENTS – as of September 30, 2009

Loomis Sayles Small Cap Value Fund – continued

INDUSTRY SUMMARY AT SEPTEMBER 30, 2009 (Unaudited)

| | | |

Insurance | | 6.5 | % |

Commercial Banks | | 5.8 | |

Commercial Services & Supplies | | 5.5 | |

REITs | | 4.7 | |

Machinery | | 4.3 | |

Semiconductors & Semiconductor Equipment | | 3.8 | |

Oil, Gas & Consumable Fuels | | 3.6 | |

IT Services | | 3.5 | |

Communications Equipment | | 3.5 | |

Media | | 3.4 | |

Chemicals | | 3.0 | |

Capital Markets | | 2.9 | |

Textiles, Apparel & Luxury Goods | | 2.7 | |

Electric Utilities | | 2.7 | |

Food Products | | 2.5 | |

Hotels, Restaurants & Leisure | | 2.4 | |

Pharmaceuticals | | 2.3 | |

Specialty Retail | | 2.3 | |

Software | | 2.2 | |

Energy Equipment & Services | | 2.1 | |

Other Investments, less than 2% each | | 25.7 | |

Short-Term Investments | | 4.0 | |

| | | |

Total Investments | | 99.4 | |

Other assets less liabilities | | 0.6 | |

| | | |

Net Assets | | 100.0 | % |

| | | |

See accompanying notes to financial statements.

21

STATEMENTS OF ASSETS AND LIABILITIES

September 30, 2009

| | | | | | | | |

| | | Small Cap

Growth Fund | | | Small Cap

Value Fund | |

| | | | | | | | |

Assets | | | | | | | | |

Investments at cost | | $ | 100,293,558 | | | $ | 859,319,428 | |

Net unrealized appreciation | | | 19,350,023 | | | | 102,336,996 | |

| | | | | | | | |

Investments at value | | | 119,643,581 | | | | 961,656,424 | |

Receivable for Fund shares sold | | | 223,084 | | | | 923,560 | |

Receivable for securities sold | | | 3,006,329 | | | | 9,038,272 | |

Dividends and interest receivable | | | — | | | | 1,397,261 | |

Receivable from investment adviser (Note 5) | | | 7,976 | | | | 14,259 | |

| | | | | | | | |

Total Assets | | | 122,880,970 | | | | 973,029,776 | |

| | | | | | | | |

| | |

| Liabilities | | | | | | | | |

Payable for securities purchased | | | 1,588,658 | | | | 3,865,585 | |

Payable for Fund shares redeemed | | | 88,698 | | | | 416,831 | |

Management fees payable (Note 5) | | | 73,145 | | | | 584,910 | |

Administrative fees payable (Note 5) | | | 4,787 | | | | 38,275 | |

Deferred Trustees’ fees (Note 5) | | | 46,961 | | | | 110,532 | |

Service and distribution fees payable (Note 5) | | | 519 | | | | 3,693 | |

Other accounts payable and accrued expenses | | | 43,271 | | | | 107,909 | |

| | | | | | | | |

Total Liabilities | | | 1,846,039 | | | | 5,127,735 | |

| | | | | | | | |

Net Assets | | $ | 121,034,931 | | | $ | 967,902,041 | |

| | | | | | | | |

Net Assets consist of: | | | | | | | | |

Paid-in capital | | $ | 341,683,551 | | | $ | 1,072,244,798 | |

Accumulated net investment income (loss)/Undistributed net investment income | | | (46,961 | ) | | | 1,177,091 | |

Accumulated net realized loss on investments | | | (239,951,682 | ) | | | (207,856,844 | ) |

Net unrealized appreciation on investments | | | 19,350,023 | | | | 102,336,996 | |

| | | | | | | | |

Net Assets | | $ | 121,034,931 | | | $ | 967,902,041 | |

| | | | | | | | |

| | |

| Net Asset Value and Offering Price | | | | | | | | |

Institutional Class | | | | | | | | |

Net assets | | $ | 45,556,734 | | | $ | 506,323,696 | |

| | | | | | | | |

Shares of beneficial interest | | | 3,934,994 | | | | 24,506,094 | |

| | | | | | | | |

Net asset value, offering and redemption price per share | | $ | 11.58 | | | $ | 20.66 | |

| | | | | | | | |

Retail Class | | | | | | | | |

Net assets | | $ | 75,478,197 | | | $ | 387,383,082 | |

| | | | | | | | |

Shares of beneficial interest | | | 6,731,158 | | | | 18,927,367 | |

| | | | | | | | |

Net asset value, offering and redemption price per share | | $ | 11.21 | | | $ | 20.47 | |

| | | | | | | | |

Admin Class | | | | | | | | |

Net assets | | $ | — | | | $ | 74,195,263 | |

| | | | | | | | |

Shares of beneficial interest | | | — | | | | 3,688,760 | |

| | | | | | | | |

Net asset value, offering and redemption price per share | | $ | — | | | $ | 20.11 | |

| | | | | | | | |

See accompanying notes to financial statements.

22

STATEMENTS OF OPERATIONS

For the Year Ended September 30, 2009

| | | | | | | | |

| | | Small Cap

Growth Fund | | | Small Cap

Value Fund | |

| | | | | | | | |

Investment Income | | | | | | | | |

Dividends | | $ | 295,838 | | | $ | 11,236,026 | |

Interest | | | 2,346 | | | | 21,623 | |

Securities lending income (Note 2) | | | 7,998 | | | | 49,006 | |

| | | | | | | | |

| | | 306,182 | | | | 11,306,655 | |

| | | | | | | | |

| | |

| Expenses | | | | | | | | |

Management fees (Note 5) | | | 713,999 | | | | 5,985,483 | |

Distribution fees—Retail Class (Note 5) | | | 148,197 | | | | 820,762 | |

Service and distribution fees—Admin Class (Note 5) | | | — | | | | 298,932 | |

Trustees’ fees and expenses (Note 5) | | | 8,260 | | | | 14,692 | |

Administrative fees (Note 5) | | | 47,922 | | | | 402,025 | |

Custodian fees and expenses | | | 23,264 | | | | 38,599 | |

Transfer agent fees and expenses—Institutional Class (Note 5) | | | 20,269 | | | | 350,319 | |

Transfer agent fees and expenses—Retail Class (Note 5) | | | 132,724 | | | | 677,633 | |

Transfer agent fees and expenses—Admin Class (Note 5) | | | — | | | | 250,517 | |

Audit and tax services fees | | | 39,839 | | | | 68,062 | |

Registration fees | | | 42,142 | | | | 91,928 | |

Shareholder reporting expenses | | | 20,466 | | | | 151,299 | |

Legal fees | | | 3,439 | | | | 29,518 | |

Miscellaneous expenses | | | 10,376 | | | | 43,289 | |

| | | | | | | | |

Total expenses | | | 1,210,897 | | | | 9,223,058 | |

Less fee reduction and/or expense reimbursement (Note 5) | | | (110,702 | ) | | | (920,783 | ) |

| | | | | | | | |

Net expenses | | | 1,100,195 | | | | 8,302,275 | |

| | | | | | | | |

Net investment income (loss) | | | (794,013 | ) | | | 3,004,380 | |

| | | | | | | | |

| | |

| Net Realized and Unrealized Gain (Loss) on Investments | | | | | | | | |

Net Realized Loss on: | | | | | | | | |

Investments | | | (34,962,361 | ) | | | (157,922,333 | ) |

| Net Change in Unrealized Appreciation (Depreciation) on: | | | | | | | | |

Investments | | | 21,890,105 | | | | 76,497,968 | |

| | | | | | | | |

Net realized and unrealized loss on investments | | | (13,072,256 | ) | | | (81,424,365 | ) |

| | | | | | | | |

| | |

| Net Decrease in Net Assets Resulting from Operations | | $ | (13,866,269 | ) | | $ | (78,419,985 | ) |

| | | | | | | | |

See accompanying notes to financial statements.

23

STATEMENTS OF CHANGES IN NET ASSETS

Small Cap Growth Fund

| | | | | | | | |

| | | Year Ended

September 30, 2009 | | | Year Ended

September 30, 2008 | |

From Operations: | | | | | | | | |

Net investment loss | | $ | (794,013 | ) | | $ | (584,280 | ) |

Net realized loss on investments | | | (34,962,361 | ) | | | (6,171,517 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 21,890,105 | | | | (10,322,096 | ) |

| | | | | | | | |

Net decrease in net assets resulting from operations | | | (13,866,269 | ) | | | (17,077,893 | ) |

| | | | | | | | |

From Distributions to Shareholders: | | | | | | | | |

Net Investment Income: | | | | | | | | |

Institutional Class | | | — | | | | — | |

Retail Class | | | — | | | | — | |

Capital Gains: | | | | | | | | |

Institutional Class | | | — | | | | — | |

Retail Class | | | — | | | | — | |

| | | | | | | | |

Total distributions | | | — | | | | — | |