UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08282

Loomis Sayles Funds I

(Exact name of Registrant as specified in charter)

|

| 399 Boylston Street, Boston, Massachusetts 02116 |

| (Address of principal executive offices) (Zip code) |

Russell L. Kane, Esq.

NGAM Distribution, L.P.

399 Boylston Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2822

Date of fiscal year end: September 30

Date of reporting period: September 30, 2016

| Item 1. | Reports to Stockholders. |

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Loomis Sayles Small Cap Growth Fund

Loomis Sayles Small Cap Value Fund

Loomis Sayles Small/Mid Cap Growth Fund

Annual Report

September 30, 2016

LOOMIS SAYLES SMALL CAP GROWTH FUND

| | | | |

| Managers | | Symbols | | |

| Mark F. Burns, CFA® | | Institutional Class | | LSSIX |

| John J. Slavik, CFA® | | Retail Class | | LCGRX |

| | Class N | | LSSNX |

Investment Objective

The Fund’s investment objective is long-term capital growth from investments in common stocks or other equity securities.

Market Conditions

Overall, U.S. equity markets were generally strong for the 12-month period, benefiting from the robust performance off the market bottom in February 2016 and following the two-day Brexit vote-inspired selloff in June. Within the small-cap segment of the market, the smallest companies and the lowest-quality companies (as measured by return on equity) were the strongest performers in the February market rebound. The third quarter of 2016 was a particularly challenging market environment for the fund, as the highest beta (high risk/high reward potential) names significantly outperformed the lowest beta names. Among small-cap stocks, value stocks significantly outperformed growth stocks.

Performance Results

For the 12 months ended September 30, 2016, Institutional Class shares of Loomis Sayles Small Cap Growth Fund returned 6.92%. The fund underperformed its benchmark, the Russell 2000® Growth Index, which returned 12.12%.

Explanation of Fund Performance

Stock selection in the information technology, industrials and healthcare sectors primarily accounted for the fund’s underperformance. Given the fund’s strategy, the market environment during the third quarter of 2016 created a significant headwind.

In terms of individual holdings, the top contributor to fund performance was financials company MarketAxess Holdings. The company continued to steadily gain market share in electronic bond trading, and its earnings grew. In addition, the company remains significantly underpenetrated in the fixed-income market, its biggest market opportunity. In 2016, MarketAxess launched electronic trading for municipal bonds, a market no other firm has been able to penetrate electronically. Following two years of increased investments, MarketAxess is now leveraging those efforts and generating robust incremental margins.

Wix.com, a website development company for small and medium businesses, also was a top-performing holding. The company demonstrated consistently strong revenue growth by converting free users to paid subscribers and retaining their business. The mid-year release of its Artificial Design Intelligence (ADI) platform generated a lot of excitement as an even easier and more intuitive way to create a website, and it’s positioned to aid

1 |

conversion in the future. Another top contributor was technology company Intersil, which announced it was being acquired by Rensas, a Japanese semiconductor company.

A position in Demandware, a software service provider that powers e-commerce for large brands and retailers, was a main detractor. The company was a multi-year holding for the fund, but in late 2015 it experienced slowing revenue due to lower same-store sales growth among existing customers. A sharp selloff in software-as-a-service companies in February 2016 triggered our stop loss, and we sold the position.

In addition, a position in Advisory Board Company, a research and software tools company serving the healthcare and education markets, was a primary detractor. A deceleration of growth in the healthcare segment and a delay in the integration of an education acquisition caused the stock to decline, triggering our stop-loss, and we sold the position.

A position in Restoration Hardware Holdings, a rapidly growing home furnishings retail chain, also weighed on fund performance. The company reported disappointing fourth-quarter 2015 earnings due to elevated promotions and supply chain issues. Furthermore, the company changed its pricing strategy, which created uncertainty about future demand trends. The stock price downturn triggered our stop-loss, and we exited the position.

Outlook

As we look forward, we continue to be focused on the underlying business trends of our existing holdings and potential new additions to ensure revenue and earnings growth trends can remain intact, if not improve.

Slow growth continues to be the name of the game for the U.S. economy. U.S. stocks, particularly small-caps, have had quite a strong run since the market bottom in February, and they may need to take a pause in the near term. Volatility remains subdued; however, macro events that lie ahead, including the U.S. election and the Federal Reserve’s actions, may lead to increasing levels of volatility. Earnings growth may continue to be elusive, with potential for positive trends not all that far off. While the outlook may not be terribly clear, we will not attempt to alter our process.

| 2

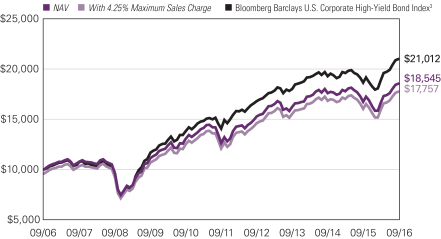

LOOMIS SAYLES SMALL CAP GROWTH FUND

Hypothetical Growth of $100,000 Investment in Institutional Class Shares

September 30, 2006 through September 30, 20162

Top Ten Holdings as of September 30, 2016

| | | | | | |

| | | Security Name | | % of

Net Assets | |

| 1 | | Ultimate Software Group, Inc. (The) | | | 1.63% | |

| 2 | | Guidewire Software, Inc. | | | 1.56% | |

| 3 | | MarketAxess Holdings, Inc. | | | 1.53% | |

| 4 | | Bright Horizons Family Solutions, Inc. | | | 1.47% | |

| 5 | | Euronet Worldwide, Inc. | | | 1.44% | |

| 6 | | MKS Instruments, Inc. | | | 1.42% | |

| 7 | | Monolithic Power Systems, Inc. | | | 1.40% | |

| 8 | | WageWorks, Inc. | | | 1.39% | |

| 9 | | Granite Construction, Inc. | | | 1.34% | |

| 10 | | Cynosure, Inc., Class A | | | 1.32% | |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

3 |

Average Annual Total Returns — September 30, 20162

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | Expense Ratios3 | |

| | | 1 year | | | 5 years | | | 10 years | | | Life of Class N | | | Gross | | | Net | |

| | | | | | | |

Institutional Class

(Inception 12/31/96) | | | 6.92 | % | | | 14.33 | % | | | 9.38 | % | | | — | % | | | 0.94 | % | | | 0.94 | % |

| | | | | | | |

Retail Class

(Inception 12/31/96) | | | 6.61 | | | | 13.99 | | | | 9.09 | | | | — | | | | 1.19 | | | | 1.19 | |

| | | | | | | |

Class N

(Inception 2/1/13) | | | 7.05 | | | | — | | | | — | | | | 10.88 | | | | 0.83 | | | | 0.83 | |

| | | | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | | | | | | | | | |

| Russell 2000® Growth Index1 | | | 12.12 | | | | 16.15 | | | | 8.29 | | | | 11.53 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit loomissayles.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | | Russell 2000® Growth Index is an unmanaged index that measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® companies with higher price-to-book ratios and forecasted growth values. |

| 2 | | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 3 | | As of the most recent prospectus, the investment advisor has contractually agreed to waive fees and/or reimburse expenses (with certain exceptions) once the expense cap of the Fund has been exceeded. This arrangement is set to expire on 1/31/17. When an expense cap has not been exceeded, the Fund may have similar expense ratios. |

| 4

LOOMIS SAYLES SMALL CAP VALUE FUND

| | | | |

| Managers | | Symbols | | |

| Joseph R. Gatz, CFA® | | Institutional Class | | LSSCX |

| Jeffrey Schwartz, CFA® | | Retail Class | | LSCRX |

| | Admin Class | | LSVAX |

| | Class N | | LSCNX |

Investment Objective

The Fund’s investment objective is long-term capital growth from investments in common stocks or other equity securities.

Market Conditions

Stocks generally experienced a sharp downturn from early December through mid-February due to weaker global economic trends, a sharp downturn in oil prices and fears of a premature rate hike from the Federal Reserve (the Fed). Markets recovered steadily off their mid-February lows as global economic fears abated, the Fed delayed further interest rate increases and commodity prices rebounded. Overall, there were significant changes in market leadership during the 12-month period. Growth stock and price momentum leadership in late 2015 gave way to outperformance from higher dividend-yielding utilities and REITs in early 2016. In the final three months of the period, investors showed greater risk tolerance, and small-cap stocks advanced well ahead of large-caps. Technology, healthcare and commodity-sensitive materials stocks outperformed during the final three months, while utilities and REITs lagged. Overall, small-cap stocks generally outperformed large-cap stocks for the entire 12-month period, and small-cap value stocks outperformed small-cap growth stocks.

Performance Results

For the 12 months ended September 30, 2016, Institutional Class shares of Loomis Sayles Small Cap Value Fund returned 16.75%. The fund underperformed its benchmark, the Russell 2000® Value Index, which returned 18.81%.

Explanation of Fund Performance

Portfolio strategy was consistent with our long-standing approach, employing our broad resources and rigorous research to identify individual companies and securities we believe are inefficiently priced. The fund’s relative performance was strong during the first half of the 12-month period, largely due to stock selection in the consumer discretionary, real estate investment trust (REIT), healthcare and consumer staples sectors. As markets accelerated higher during the second half of the period, fund returns were strong but lagged the index. Stock selection metrics deteriorated as markets strengthened and investors favored higher risk positions. Selection was weakest in market-leading sectors such as technology and materials, and among REITs.

5 |

The fund’s industrials and information technology sectors made the largest positive absolute contributions to performance for the 12-month period. The industrials sector outperformed the benchmark, and our overweight allocation and security selection within the sector led to outperformance relative to the benchmark’s industrial holdings. Information technology was among the strongest-performing sectors in the benchmark for the year, contributing to our favorable absolute return.

The top individual stock contributor was John Bean Technologies, a leading provider of food processing equipment and airport-related equipment. The company reported strong earnings and raised guidance throughout the year, as global demand for food processing equipment remained strong, profit margins steadily improved, and strategic acquisitions expanded the company’s addressable market.

U.S. Silica Holdings also was a main contributor. Our initial investment in the company, which is a leading provider of silica used in energy, industrial and specialty markets, was well timed, near the bottom point of the energy sector selloff in early 2016. We believe the company is well positioned for further recovery in the oilfield services industry. We also believe two recent acquisitions further strengthen the company’s market position and reach.

Littelfuse, a manufacturer of components and circuit protection devices for use in the automotive, electronics and general industrial markets, was a leading contributor. The company reported improving revenue, margin expansion and solid earnings growth throughout the period. The company announced two larger product line acquisitions, which we believe should contribute positively to future results.

All portfolio sectors generated a positive return during the period, but the contributions from materials and utilities were small, and had smaller weightings within the portfolio.

Although technology sector performance was strong in the benchmark, our technology holdings lagged the sector, contributing to the fund’s relative underperformance. In particular, VeriFone Systems and Zebra Technologies generated disappointing performance, offsetting a strong contribution from Advanced Energy Industries.

The materials sector was the strongest-performing sector in the benchmark, rebounding substantially off the February market bottom. Many of the most commodity-sensitive, highly levered materials companies led the rebound, and our stock selection in the sector lagged.

Sector allocation detracted from relative performance. While modest overweights in the outperforming technology and industrials sectors aided fund performance, underweights in utilities and REITs, both of which outperformed the benchmark, detracted from fund performance. Given the highly regulated nature of utilities and the tax-advantaged mandate for REITs to return nearly all free cash flow to shareholders via dividends, we typically find fewer opportunities within these sectors that meet our specific strategy and investment criteria. An overweight allocation in the consumer discretionary sector also detracted from fund performance.

| 6

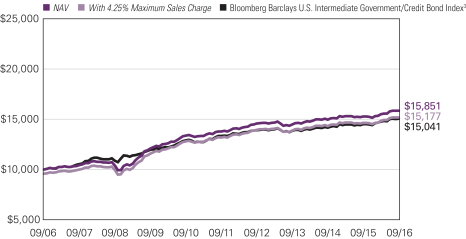

LOOMIS SAYLES SMALL CAP VALUE FUND

In terms of individual holdings, Libbey Inc. and Metaldyne Performance Group were the primary detractors for the period. Libbey, a manufacturer of glass tableware for the restaurant and retail industries, generates about 40% of revenues outside the U.S. and was hurt by the translation effect of a stronger U.S. dollar relative to other local currencies where its products are sold. The company also experienced increased competition in certain markets during the third quarter of 2015. The company lowered financial guidance as a result of these two factors. During the second quarter of 2016, we eliminated the holding on a thesis break; Libbey’s new CEO, hired in January, announced his intention to redefine Libbey as a consumer products company rather than an industrial manufacturer.

Metaldyne Performance Group is an automotive supplier focused on casting and forging complex metal parts primarily used for power-train and safety-critical components of the vehicle. We reduced our position in the stock near its all-time high during the quarter ending December 31, 2015. In January, we were surprised when management issued a cautious outlook for 2016 despite broader strength in the automotive markets, and we eliminated the position.

Outlook

With major U.S. equity indices at or very close to record highs, the bull market remains intact. However, it is now the second-longest bull market since the 1930s. Bull markets do not die of old age; typically, they struggle when intervening macroeconomic events such as rising inflation cause central banks to tighten monetary policy for an extended period. Currently, we believe the Fed may raise interest rates by 25 basis points by year-end, but all signs point to a very slow, deliberate tightening cycle. These measured expectations have helped prolong the business cycle and hence the rally in stock prices. If we are right that equity earnings are poised to move back to a growth mode later this year and in 2017, we think balanced equity performance across the market cap spectrum and across growth and value styles could result.

7 |

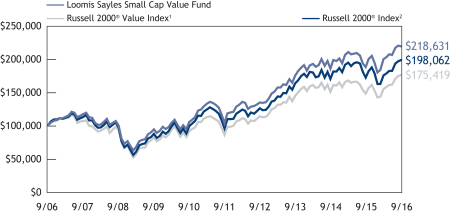

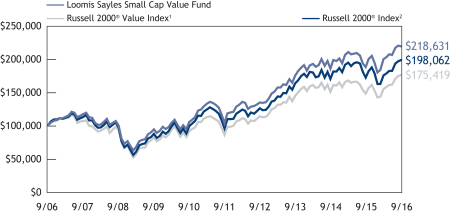

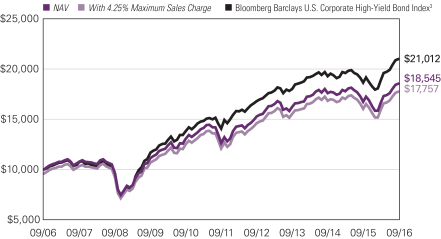

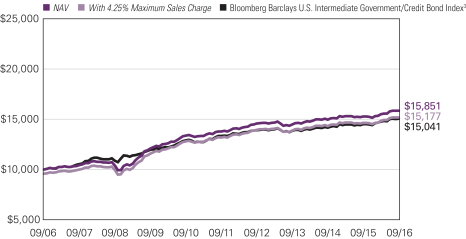

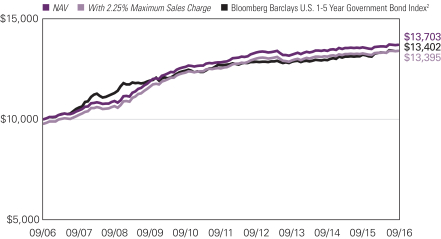

Hypothetical Growth of $100,000 Investment in Institutional Class Shares

September 30, 2006 through September 30, 20163

See notes to chart on page 9.

Top Ten Holdings as of September 30, 2016

| | | | | | |

| | | Security Name | | % of

Net

Assets | |

| 1 | | Littelfuse, Inc. | | | 1.54% | |

| 2 | | Retail Opportunity Investments Corp. | | | 1.35% | |

| 3 | | Cathay General Bancorp | | | 1.34% | |

| 4 | | Post Holdings, Inc. | | | 1.30% | |

| 5 | | KAR Auction Services, Inc. | | | 1.25% | |

| 6 | | Wintrust Financial Corp. | | | 1.22% | |

| 7 | | ALLETE, Inc. | | | 1.16% | |

| 8 | | First Financial Bancorp | | | 1.14% | |

| 9 | | Signature Bank | | | 1.14% | |

| 10 | | IBERIABANK Corp. | | | 1.13% | |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

| 8

LOOMIS SAYLES SMALL CAP VALUE FUND

Average Annual Total Returns — September 30, 20163

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | Expense Ratios4 | |

| | | 1 year | | | 5 years | | | 10 years | | | Life of Class N | | | Gross | | | Net | |

| | | | | | | |

| Institutional Class (Inception 5/13/91) | | | 16.75 | % | | | 16.29 | % | | | 8.14 | % | | | — | % | | | 0.99 | % | | | 0.97 | % |

Retail Class

(Inception 12/31/96) | | | 16.47 | | | | 15.99 | | | | 7.87 | | | | — | | | | 1.24 | | | | 1.22 | |

Admin Class

(Inception 1/2/98) | | | 16.19 | | | | 15.71 | | | | 7.59 | | | | — | | | | 1.47 | | | | 1.45 | |

Class N

(Inception 2/1/13) | | | 16.84 | | | | — | | | | — | | | | 11.04 | | | | 0.90 | | | | 0.90 | |

| | | |

| Comparative Performance | | | | | | | | | |

| Russell 2000® Value Index1 | | | 18.81 | | | | 15.45 | | | | 5.78 | | | | 9.63 | | | | | | | | | |

| Russell 2000® Index2 | | | 15.47 | | | | 15.82 | | | | 7.07 | | | | 10.60 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit loomissayles.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | | Russell 2000® Value Index is an unmanaged index that measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values. |

| 2 | | Russell 2000® Index is an unmanaged index that measures the performance of the small-cap segment of the U.S. equity universe. |

| 3 | | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4 | | As of the most recent prospectus, the investment advisor has contractually agreed to waive fees and/or reimburse expenses (with certain exceptions) once the expense cap of the Fund has been exceeded. This arrangement is set to expire on 1/31/17. When an expense cap has not been exceeded, the Fund may have similar expense ratios. |

9 |

LOOMIS SAYLES SMALL/MID CAP GROWTH FUND

| | | | |

| Managers | | Symbols | | |

| Mark F. Burns, CFA® | | Institutional Class | | LSMIX |

| John J. Slavik, CFA® | | | | |

Investment Objective

The Fund’s investment objective is long-term capital growth from investments in common stocks or other equity securities.

Market Conditions

U.S. equity markets were generally strong for the 12-month period, benefitting from the robust performance off the market bottom in February 2016 and following the two-day Brexit vote-inspired selloff in June. Within the small/mid-cap segment of the market, the smallest companies and the lowest-quality companies (as measured by return on equity) were the strongest performers in the February market rebound. The third quarter of 2016 was a particularly challenging market environment for the fund, as the highest beta (high risk/high reward potential) names significantly outperformed the lowest beta names. Among small/mid-cap stocks, value stocks significantly outperformed growth stocks.

Performance Results

For the 12 months ended September 30, 2016, Institutional Class shares of Loomis Sayles Small/Mid Cap Growth Fund returned 7.51%. The Fund underperformed its benchmark, the Russell 2500™ Growth Index, which returned 11.02%.

Explanation of Fund Performance

Stock selection in the information technology and consumer discretionary sectors and an underweight position in the materials sector primarily accounted for the fund’s underperformance. Given the fund’s strategy, the market environment during the third quarter of 2016 created a significant headwind.

In terms of individual holdings, the top contributor to fund performance was financials company MarketAxess Holdings. The company continued to steadily gain market share in electronic bond trading, and its earnings grew. In addition, the company remains significantly underpenetrated in the fixed-income trading market, its biggest market opportunity. In 2016, MarketAxess launched electronic trading for municipal bonds, a market no other firm has been able to penetrate electronically. Following two years of increased investments, MarketAxess is now leveraging those efforts and generating robust incremental margins.

In addition, a position in Parsley Energy, an energy exploration company with a compelling acreage position in the Permian Basin, was a top contributor. The company’s prudent management team has kept leverage low and effectively managed the business through the commodity price downturn in 2015. We believe valuation remains reasonable

| 10

LOOMIS SAYLES SMALL/MID CAP GROWTH FUND

relative to current production. The business continues to generate positive cash, and we believe it is well positioned to continue to expand its asset base and production levels for the foreseeable future, all while generating positive cash flow and maintaining low leverage.

Drew Industries, a leading provider of components to the RV industry, also was a main contributor. The stock advanced due to several factors, including favorable industry trends, growing revenues, diversification of the business and strong incremental margin performance given the high fixed-cost nature of the business.

A position in Virtusa, an information technology services and consulting company, was a main detractor. After several years of demonstrating above-industry growth and improving margins, the company acquired another technology services company with low growth and poor profitability. Despite the potential value of the combined entity, results have been disappointing, and we exited the position.

SPS Commerce, a provider of cloud-based supply chain management software, was a primary detractor. The stock declined after SPS reported its sales force contracted in the fourth quarter of 2015 due to a competitive hiring environment and a poorly structured compensation plan. The selloff was brief, and the stock recovered quickly, but the decline triggered our stop-loss and we did not benefit during the recovery. We repurchased the stock.

Palo Alto Networks, a networking security company, also detracted from performance. After a strong upward move in the stock during 2014 and the first half of 2015, elevated expectations and difficult comparisons created concerns about slowing revenue growth. These concerns were exacerbated by industry data showing a firewall spending surge in 2015 that was unlikely to repeat in 2016. The elevated valuation and high share turnover led us to sell the stock, especially given the volatile market conditions at the time of the sale in late January 2016.

Outlook

As we look forward, we continue to be focused on the underlying business trends of our existing holdings and potential new additions to ensure that revenue and earnings growth trends can remain intact, if not improve.

Slow growth continues to be the name of the game for the U.S. economy. U.S. stocks, particularly small-caps, have had quite a strong run since the market bottom in February, and they may need to take a pause in the near term. Volatility remains subdued; however, macro events that lie ahead, including the U.S. election and the Fed’s actions, may lead to increasing levels of volatility. Earnings growth may continue to be elusive, with potential for positive trends not all that far off. While the outlook may not be terribly clear, we will not attempt to alter our process.

11 |

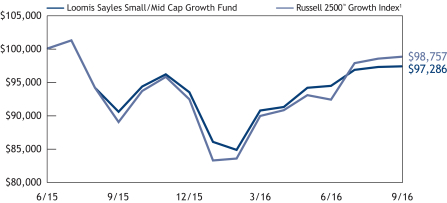

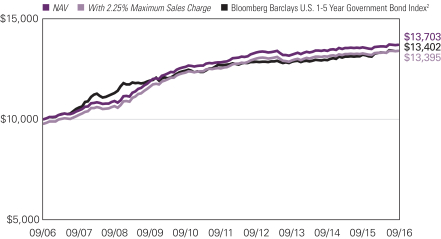

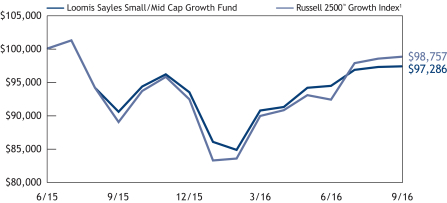

Hypothetical Growth of $100,000 Investment in Institutional Class Shares

June 30, 2015 (inception) through September 30, 20162

See notes to chart on page 13.

Top Ten Holdings as of September 30, 2016

| | | | | | |

| | | Security Name | | % of

Net

Assets | |

| 1 | | WellCare Health Plans, Inc. | | | 1.98% | |

| 2 | | TransDigm Group, Inc. | | | 1.91% | |

| 3 | | Ultimate Software Group, Inc. (The) | | | 1.73% | |

| 4 | | Acuity Brands, Inc. | | | 1.72% | |

| 5 | | Guidewire Software, Inc. | | | 1.65% | |

| 6 | | Nord Anglia Education, Inc. | | | 1.59% | |

| 7 | | B/E Aerospace, Inc. | | | 1.57% | |

| 8 | | Vail Resorts, Inc. | | | 1.53% | |

| 9 | | Blackbaud, Inc. | | | 1.51% | |

| 10 | | Cantel Medical Corp. | | | 1.51% | |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

| 12

LOOMIS SAYLES SMALL/MID CAP GROWTH FUND

Average Annual Total Returns — September 30, 20162

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | Expense Ratios3 | |

| | | 1 year | | | Life of

Fund | | | Gross | | | Net | |

| | | | | |

| Institutional Class (Inception 6/30/15) | | | 7.51 | % | | | -2.16 | % | | | 2.84 | % | | | 0.85 | % |

| | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | |

| Russell 2500TM Growth Index1 | | | 11.02 | | | | -0.99 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit loomissayles.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | | Russell 2500TM Growth Index is an unmanaged index that measures the performance of the small-to-mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500TM companies with higher price-to-book ratios and higher forecasted growth values. |

| 2 | | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 3 | | As of the most recent prospectus, the investment advisor has contractually agreed to waive fees and/or reimburse expenses (with certain exceptions) once the expense cap of the Fund has been exceeded. This arrangement is set to expire on 1/31/17. When an expense cap has not been exceeded, the Fund may have similar expense ratios. |

1623917.2.1

13 |

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the Funds are actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

All investing involves risk, including the risk of loss. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

Additional Index Information

This document may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with Natixis Global Asset Management or any of its related or affiliated companies (collectively “NGAM”) and does not sponsor, endorse or participate in the provision of any NGAM services, funds or other financial products.

The index information contained herein is derived from third parties and is provided on an “as is” basis. The user of this information assumes the entire risk of use of this information. Each of the third party entities involved in compiling, computing or creating index information disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to such information.

Proxy Voting Information

A description of the Funds’ proxy voting policies and procedures is available without charge upon request, by calling Loomis Sayles at 800-633-3330; on the Funds’ website, at www.loomissayles.com, and on the Securities and Exchange Commission’s (SEC’s) website at www.sec.gov. Information about how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on the Funds’ website and the SEC’s website.

Quarterly Portfolio Schedules

The Funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

UNDERSTANDING YOUR FUND’S EXPENSES

As a mutual fund shareholder you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. Certain exemptions may apply. These costs are described in more detail in the Funds’ prospectus. The following examples are intended to help you understand the ongoing costs of investing in the Funds and help you compare these with the ongoing costs of investing in other mutual funds.

| 14

The first line in the table of each Fund shows the actual amount of Fund expenses you would have paid on a $1,000 investment in the Fund from April 1, 2016 through September 30, 2016. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.6) and multiply the result by the number in the Expenses Paid During Period column as shown below for your class.

The second line in the table of each Fund provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the Funds to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs. Therefore, the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

Loomis Sayles Small Cap Growth Fund

| | | | | | | | | | | | |

| Institutional Class | | Beginning

Account Value

4/1/2016 | | | Ending

Account Value

9/30/2016 | | | Expenses Paid

During Period*

4/1/2016 – 9/30/2016 | |

Actual | | | $1,000.00 | | | | $1,085.80 | | | | $4.90 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.30 | | | | $4.75 | |

| | | |

Retail Class | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,084.20 | | | | $6.20 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.05 | | | | $6.01 | |

| | | |

Class N | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,086.00 | | | | $4.33 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.85 | | | | $4.19 | |

* Expenses are equal to the Fund’s annualized expense ratio: 0.94%, 1.19% and 0.83% for Institutional Class, Retail Class and Class N, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 366 (to reflect the half-year period). | |

15 |

Loomis Sayles Small Cap Value Fund

| | | | | | | | | | | | |

Institutional Class | | Beginning

Account Value

4/1/2016 | | | Ending

Account Value

9/30/2016 | | | Expenses Paid

During Period*

4/1/2016 – 9/30/2016 | |

Actual | | | $1,000.00 | | | | $1,095.30 | | | | $4.71 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.50 | | | | $4.55 | |

| | | |

Retail Class | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,094.20 | | | | $6.02 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.25 | | | | $5.81 | |

| | | |

Admin Class | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,092.70 | | | | $7.32 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,018.00 | | | | $7.06 | |

| | | |

Class N | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,095.90 | | | | $4.35 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.85 | | | | $4.19 | |

* Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 0.90%, 1.15%, 1.40% and 0.83% for Institutional Class, Retail Class, Admin Class and Class N, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 366 (to reflect the half-year period). | |

Loomis Sayles Small/Mid Cap Growth Fund

| | | | | | | | | | | | |

Institutional Class | | Beginning

Account Value

4/1/2016 | | | Ending

Account Value

9/30/2016 | | | Expenses Paid

During Period*

4/1/2016 – 9/30/2016 | |

Actual | | | $1,000.00 | | | | $1,072.80 | | | | $4.40 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.75 | | | | $4.29 | |

* Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement) of 0.85%, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 366 (to reflect the half-year period). | |

| 16

BOARD APPROVAL OF THE EXISTING ADVISORY AGREEMENTS

The Board of Trustees of the Trusts (the “Board”), including the Independent Trustees, considers matters bearing on each Fund’s advisory agreement (collectively, the “Agreements”) at most of its meetings throughout the year. Each year, usually in the spring, the Contract Review Committee of the Board meets to review the Agreements to determine whether to recommend that the full Board approve the continuation of the Agreements, typically for an additional one-year period. After the Committee has made its recommendation, the full Board, including the Independent Trustees, determines whether to approve the continuation of the Agreements. The Loomis Sayles Small/Mid Cap Growth Fund was not included in the most recent annual review as the Fund’s initial board-approved advisory agreement is in effect until July 1, 2017.

In connection with these meetings, the Trustees receive materials that the Funds’ investment adviser (the “Adviser”) believes to be reasonably necessary for the Trustees to evaluate the Agreements. These materials generally include, among other items, (i) information on the investment performance of the Funds and the performance of peer groups and categories of funds and the Funds’ performance benchmarks, (ii) information on the Funds’ advisory fees and other expenses, including information comparing the Funds’ expenses to the fees charged to institutional accounts with similar strategies managed by the Adviser, if any, and to those of peer groups of funds and information about applicable expense caps and/or fee “breakpoints,” (iii) sales and redemption data in respect of the Funds, (iv) information about the profitability of the Agreements to the Adviser and (v) information obtained through the completion by the Adviser of a questionnaire distributed on behalf of the Trustees. The Board, including the Independent Trustees, also considers other matters such as (i) the Adviser’s financial results and/or financial condition, (ii) each Fund’s investment objective and strategies and the size, education and experience of the Adviser’s investment staff and its use of technology, external research and trading cost measurement tools, (iii) arrangements in respect of the distribution of the Funds’ shares and the related costs, (iv) the procedures employed to determine the value of the Funds’ assets, (v) the allocation of the Funds’ brokerage, if any, including, if applicable, allocations to brokers affiliated with the Adviser and the use of “soft” commission dollars to pay Fund expenses and to pay for research and other similar services, (vi) the resources devoted to, and the record of compliance with, the Funds’ investment policies and restrictions, policies on personal securities transactions and other compliance policies, (vii) information about amounts invested by the Funds’ portfolio managers in the Funds or in similar accounts that they manage and (viii) the general economic outlook with particular emphasis on the mutual fund industry. Throughout the process, the Trustees are afforded the opportunity to ask questions of and request additional materials from the Adviser.

In addition to the materials requested by the Trustees in connection with their annual consideration of the continuation of the Agreements, the Trustees receive materials in advance of each regular quarterly meeting of the Board that provide detailed information about the Funds’ investment performance and the fees charged to the Funds for advisory

17 |

and other services. This information generally includes, among other things, an internal performance rating for each Fund based on agreed-upon criteria, graphs showing each Fund’s performance and fee differentials against each Fund’s peer group/category, performance ratings provided by a third-party, total return information for various periods, and third-party performance rankings for various periods comparing a Fund against similarly categorized funds. The portfolio management team for each Fund or other representatives of the Adviser make periodic presentations to the Contract Review Committee and/or the full Board, and Funds identified as presenting possible performance concerns may be subject to more frequent board presentations and reviews. In addition, each quarter the Trustees are provided with detailed statistical information about each Fund’s portfolio. The Trustees also receive periodic updates between meetings.

The Board most recently approved the continuation of the Agreements at its meeting held in June 2016. The Agreements were continued for a one-year period for the Funds. In considering whether to approve the continuation of the Agreements, the Board, including the Independent Trustees, did not identify any single factor as determinative. Individual Trustees may have evaluated the information presented differently from one another, giving different weights to various factors. Matters considered by the Trustees, including the Independent Trustees, in connection with their approval of the Agreements included, but were not limited to, the factors listed below.

The nature, extent and quality of the services provided to the Funds under the Agreements. The Trustees considered the nature, extent and quality of the services provided by the Adviser and its affiliates to the Funds and the resources dedicated to the Funds by the Adviser and its affiliates.

The Trustees considered not only the advisory services provided by the Adviser to the Funds, but also the monitoring and oversight services provided by NGAM Advisors, L.P. (“NGAM Advisors”). They also considered the administrative services provided by NGAM Advisors and its affiliates to the Funds. For each Fund, the Trustees also considered the benefits to shareholders of investing in a mutual fund that is part of a family of funds that offers shareholders the right to exchange shares of one type of fund for shares of another type of fund, and provides a variety of fund and shareholder services.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the nature, extent and quality of services provided supported the renewal of the Agreements.

Investment performance of the Funds and the Adviser. As noted above, the Trustees received information about the performance of the Funds over various time periods, including information that compared the performance of the Funds to the performance of peer groups and categories of funds and the Funds’ respective performance benchmarks. In addition, the Trustees also reviewed data prepared by an independent third party that analyzed the performance of the Funds using a variety of performance metrics, including metrics that also measured the performance of the Funds on a risk adjusted basis.

With respect to each Fund, the Board concluded that the Fund’s performance or other relevant factors supported the renewal of the Agreement relating to that Fund. In the case

| 18

of the Loomis Sayles Small Cap Value Fund, the performance of which lagged that of a relevant peer group median and/or category median of funds for certain (although not necessarily all) periods , the Board concluded that other factors relevant to performance supported renewal of the relevant Agreement. These factors included one or more of the following: (1) that the underperformance was attributable, to a significant extent, to investment decisions by the Adviser that were reasonable and consistent with the Fund’s investment objective and policies ; (2) that the Fund’s more recent performance was competitive when compared to relevant performance benchmarks or peer groups; and (3) that the Fund’s long-term performance was competitive when compared to relevant performance benchmarks or peer groups.

The Trustees also considered the Adviser’s performance and reputation generally, the performance of the fund family generally, and the historical responsiveness of the Adviser to Trustee concerns about performance and the willingness of the Adviser to take steps intended to improve performance.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the performance of the Funds and the Adviser supported the renewal of the Agreements.

The costs of the services to be provided and profits to be realized by the Adviser and its affiliates from their respective relationships with the Funds. The Trustees considered the fees charged to the Funds for advisory services as well as the total expense levels of the Funds. This information included comparisons (provided both by management and also by an independent third party) of the Funds’ advisory fees and total expense levels to those of their peer groups and information about the advisory fees charged by the Adviser to comparable accounts (such as institutional separate accounts), as well as information about differences in such fees and the reasons for any such differences. In considering the fees charged to comparable accounts, the Trustees considered, among other things, management’s representations about the differences between managing mutual funds as compared to other types of accounts, including the additional resources required to effectively manage mutual fund assets and the greater regulatory costs associated with the management of such assets. In evaluating each Fund’s advisory fee, the Trustees also took into account the demands, complexity and quality of the investment management of such Fund and the need for the Adviser to offer competitive compensation and the potential need to expend additional resources to the extent the Funds grow in size. The Trustees considered that over the past several years, management had made recommendations regarding reductions in advisory fee rates, implementation of advisory fee breakpoints and the institution of advisory fee waivers and expense caps for various funds in the fund family. They noted that both of the Funds in this report have expense caps in place, and they considered the amounts waived or reimbursed by the Adviser for the Loomis Sayles Small Cap Value Fund. The Trustees also considered that the Loomis Sayles Small Cap Growth Fund’s current expenses are below the cap.

The Trustees also considered the compensation directly or indirectly received by the Adviser and its affiliates from their relationships with the Funds. The Trustees reviewed information provided by management as to the profitability of the Adviser and its

19 |

affiliates’ relationships with the Funds, and information about the allocation of expenses used to calculate profitability. They also reviewed information provided by management about the effect of distribution costs and changes in asset levels on Adviser profitability, including information regarding resources spent on distribution activities. When reviewing profitability, the Trustees also considered information about court cases in which adviser compensation or profitability were issues, the performance of the relevant Funds, the expense levels of the Funds, and whether the Adviser had implemented breakpoints and/or expense caps with respect to such Funds.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the advisory fee charged to each of the Funds was fair and reasonable, and that the costs of these services generally and the related profitability of the Adviser and its affiliates in respect of their relationships with the Funds supported the renewal of the Agreements.

Economies of Scale. The Trustees considered the existence of any economies of scale in the provision of services by the Adviser and whether those economies are shared with the Funds through breakpoints in their investment advisory fees or other means, such as expense waivers or caps. The Trustees also discussed with management the factors considered with respect to the implementation of breakpoints in investment advisory fees or expense waivers or caps for certain funds. Management explained that a number of factors are taken into account in considering the implementation of breakpoints or an expense cap for a fund, including, among other things, factors such as a fund’s assets, the projected growth of a fund, projected profitability and a fund’s fees and performance. With respect to economies of scale, the Trustees noted that although neither Fund’s management fee was subject to breakpoints, each Fund’s management fee and overall net expense ratio was at or below the median fee for a peer group of funds and that each Fund was subject to an expense cap or waiver. In considering these issues, the Trustees also took note of the costs of the services provided (both on an absolute and a relative basis) and the profitability to the Adviser and its affiliates of their relationships with the Funds, as discussed above.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the extent to which economies of scale were shared with the Funds supported the renewal of the Agreements.

The Trustees also considered other factors, which included but were not limited to the following:

| • | | the effect of recent market and economic events on the performance, asset levels and expense ratios of each Fund. |

| • | | whether each Fund has operated in accordance with its investment objective and the Fund’s record of compliance with its investment restrictions, and the compliance programs of the Funds and the Adviser. They also considered the compliance-related resources the Adviser and its affiliates were providing to the Funds. |

| 20

| • | | the nature, quality, cost and extent of administrative and shareholder services performed by the Adviser and its affiliates, both under the Agreements and under separate agreements covering administrative services. |

| • | | so-called “fallout benefits” to the Adviser, such as the engagement of affiliates of the Adviser to provide distribution, administrative and brokerage services to the Funds, and the benefits of research made available to the Adviser by reason of brokerage commissions (if any) generated by the Funds’ securities transactions. The Trustees also considered the benefits to the parent company of NGAM Advisors from the retention of the Adviser. The Trustees considered the possible conflicts of interest associated with these fallout and other benefits, and the reporting, disclosure and other processes in place to disclose and monitor such possible conflicts of interest. |

| • | | the Trustees’ review and discussion of the Funds’ advisory arrangements in prior years, and management’s record of responding to Trustee concerns raised during the year and in prior years. |

Based on their evaluation of all factors that they deemed to be material, including those factors described above, and assisted by the advice of independent counsel, the Trustees, including the Independent Trustees, concluded that each of the existing Agreements should be continued through June 30, 2017.

21 |

Portfolio of Investments – as of September 30, 2016

Loomis Sayles Small Cap Growth Fund

| | | | | | | | |

| Shares | | | Description | | Value (†) | |

|

| | Common Stocks – 96.8% of Net Assets | |

| |

| | | | Aerospace & Defense – 1.0% | |

| | 262,976 | | | Hexcel Corp. | | $ | 11,649,837 | |

| | | | | | | | |

| | | | Auto Components – 1.7% | |

| | 176,397 | | | Dorman Products, Inc.(b) | | | 11,271,768 | |

| | 82,866 | | | Drew Industries, Inc. | | | 8,122,526 | |

| | | | | | | | |

| | | | | | | 19,394,294 | |

| | | | | | | | |

| | | | Banks – 4.2% | | | | |

| | 238,013 | | | Chemical Financial Corp. | | | 10,503,514 | |

| | 234,695 | | | Pinnacle Financial Partners, Inc. | | | 12,692,305 | |

| | 291,177 | | | PrivateBancorp, Inc. | | | 13,370,848 | |

| | 314,876 | | | Renasant Corp. | | | 10,589,280 | |

| | | | | | | | |

| | | | | | | 47,155,947 | |

| | | | | | | | |

| | | | Biotechnology – 2.5% | | | | |

| | 311,716 | | | Genomic Health, Inc.(b) | | | 9,014,827 | |

| | 632,176 | | | Ironwood Pharmaceuticals, Inc.(b) | | | 10,038,955 | |

| | 492,458 | | | Lexicon Pharmaceuticals, Inc.(b) | | | 8,898,716 | |

| | | | | | | | |

| | | | | | | 27,952,498 | |

| | | | | | | | |

| | | | Building Products – 2.2% | | | | |

| | 278,380 | | | Apogee Enterprises, Inc. | | | 12,440,802 | |

| | 216,763 | | | Trex Co., Inc.(b) | | | 12,728,324 | |

| | | | | | | | |

| | | | | | | 25,169,126 | |

| | | | | | | | |

| | | | Capital Markets – 2.5% | | | | |

| | 362,036 | | | Financial Engines, Inc. | | | 10,756,090 | |

| | 104,116 | | | MarketAxess Holdings, Inc. | | | 17,240,568 | |

| | | | | | | | |

| | | | | | | 27,996,658 | |

| | | | | | | | |

| | | | Commercial Services & Supplies – 1.5% | | | | |

| | 372,069 | | | Healthcare Services Group, Inc. | | | 14,726,491 | |

| | 47,349 | | | Team, Inc.(b) | | | 1,548,786 | |

| | | | | | | | |

| | | | | | | 16,275,277 | |

| | | | | | | | |

| | | | Construction & Engineering – 2.2% | | | | |

| | 303,105 | | | Granite Construction, Inc. | | | 15,076,443 | |

| | 475,474 | | | Primoris Services Corp. | | | 9,794,764 | |

| | | | | | | | |

| | | | | | | 24,871,207 | |

| | | | | | | | |

| | | | Distributors – 1.3% | | | | |

| | 149,143 | | | Pool Corp. | | | 14,096,996 | |

| | | | | | | | |

| | | | Diversified Consumer Services – 3.7% | |

| | 247,256 | | | Bright Horizons Family Solutions, Inc.(b) | | | 16,538,954 | |

| | 292,362 | | | Grand Canyon Education, Inc.(b) | | | 11,808,501 | |

| | 602,657 | | | Nord Anglia Education, Inc.(b) | | | 13,125,869 | |

| | | | | | | | |

| | | | | | | 41,473,324 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 22

Portfolio of Investments – as of September 30, 2016

Loomis Sayles Small Cap Growth Fund – continued

| | | | | | | | |

| Shares | | | Description | | Value (†) | |

|

| | Common Stocks – continued | |

| | |

| | | | Diversified Telecommunication Services – 2.3% | | | | |

| | 342,998 | | | Cogent Communications Holdings, Inc. | | $ | 12,625,756 | |

| | 1,245,759 | | | ORBCOMM, Inc.(b) | | | 12,769,030 | |

| | | | | | | | |

| | | | | | | 25,394,786 | |

| | | | | | | | |

| | | | Electrical Equipment – 1.0% | | | | |

| | 307,766 | | | Generac Holdings, Inc.(b) | | | 11,171,906 | |

| | | | | | | | |

| | | | Electronic Equipment, Instruments & Components – 1.8% | | | | |

| | 131,843 | | | IPG Photonics Corp.(b) | | | 10,857,271 | |

| | 316,456 | | | Orbotech Ltd.(b) | | | 9,370,262 | |

| | | | | | | | |

| | | | | | | 20,227,533 | |

| | | | | | | | |

| | | | Energy Equipment & Services – 0.7% | | | | |

| | 145,035 | | | Dril-Quip, Inc.(b) | | | 8,084,251 | |

| | | | | | | | |

| | | | Food Products – 2.0% | | | | |

| | 713,013 | | | Amplify Snack Brands, Inc.(b) | | | 11,550,810 | |

| | 327,515 | | | Snyder’s-Lance, Inc. | | | 10,997,954 | |

| | | | | | | | |

| | | | | | | 22,548,764 | |

| | | | | | | | |

| | | | Health Care Equipment & Supplies – 8.2% | | | | |

| | 292,046 | | | Cynosure, Inc., Class A(b) | | | 14,876,823 | |

| | 225,532 | | | Inogen, Inc.(b) | | | 13,509,367 | |

| | 338,574 | | | Insulet Corp.(b) | | | 13,861,220 | |

| | 168,892 | | | Integra LifeSciences Holdings Corp.(b) | | | 13,942,035 | |

| | 83,557 | | | Merit Medical Systems, Inc.(b) | | | 2,029,599 | |

| | 215,262 | | | Neogen Corp.(b) | | | 12,041,756 | |

| | 91,601 | | | Nevro Corp.(b) | | | 9,562,228 | |

| | 512,681 | | | Wright Medical Group NV(b) | | | 12,576,065 | |

| | | | | | | | |

| | | | | | | 92,399,093 | |

| | | | | | | | |

| | | | Health Care Providers & Services – 4.6% | | | | |

| | 193,934 | | | Acadia Healthcare Co., Inc.(b) | | | 9,609,430 | |

| | 358,086 | | | AMN Healthcare Services, Inc.(b) | | | 11,412,201 | |

| | 151,750 | | | Amsurg Corp.(b) | | | 10,174,837 | |

| | 413,304 | | | Ensign Group, Inc. (The) | | | 8,319,810 | |

| | 317,404 | | | HealthEquity, Inc.(b) | | | 12,013,741 | |

| | | | | | | | |

| | | | | | | 51,530,019 | |

| | | | | | | | |

| | | | Health Care Technology – 3.0% | | | | |

| | 320,168 | | | Evolent Health, Inc., Class A(b) | | | 7,882,536 | |

| | 257,841 | | | Medidata Solutions, Inc.(b) | | | 14,377,214 | |

| | 280,118 | | | Press Ganey Holdings, Inc.(b) | | | 11,316,767 | |

| | | | | | | | |

| | | | | | | 33,576,517 | |

| | | | | | | | |

| | | | Hotels, Restaurants & Leisure – 3.6% | | | | |

| | 348,528 | | | Chuy’s Holdings, Inc.(b) | | | 9,737,872 | |

See accompanying notes to financial statements.

23 |

Portfolio of Investments – as of September 30, 2016

Loomis Sayles Small Cap Growth Fund – continued

| | | | | | | | |

| Shares | | | Description | | Value (†) | |

|

| | Common Stocks – continued | |

| | |

| | | | Hotels, Restaurants & Leisure – continued | | | | |

| | 157,359 | | | Popeyes Louisiana Kitchen, Inc.(b) | | $ | 8,362,057 | |

| | 206,889 | | | Texas Roadhouse, Inc. | | | 8,074,878 | |

| | 93,451 | | | Vail Resorts, Inc. | | | 14,660,593 | |

| | | | | | | | |

| | | | | | | 40,835,400 | |

| | | | | | | | |

| | | | Household Durables – 2.4% | | | | |

| | 209,575 | | | Installed Building Products, Inc.(b) | | | 7,517,455 | |

| | 221,898 | | | iRobot Corp.(b) | | | 9,759,074 | |

| | 131,843 | | | Universal Electronics, Inc.(b) | | | 9,817,030 | |

| | | | | | | | |

| | | | | | | 27,093,559 | |

| | | | | | | | |

| | | | Internet & Direct Marketing Retail – 0.6% | | | | |

| | 178,292 | | | Wayfair, Inc., Class A(b) | | | 7,019,356 | |

| | | | | | | | |

| | | | Internet Software & Services – 7.1% | |

| | 287,859 | | | 2U, Inc.(b) | | | 11,022,121 | |

| | 210,523 | | | Benefitfocus, Inc.(b) | | | 8,404,078 | |

| | 293,468 | | | Criteo S.A., Sponsored ADR(b) | | | 10,303,661 | |

| | 146,773 | | | Envestnet, Inc.(b) | | | 5,349,876 | |

| | 147,563 | | | LogMeIn, Inc. | | | 13,338,220 | |

| | 448,852 | | | Q2 Holdings, Inc.(b) | | | 12,864,098 | |

| | 426,752 | | | Quotient Technology, Inc.(b) | | | 5,680,069 | |

| | 309,346 | | | Wix.com Ltd.(b) | | | 13,434,897 | |

| | | | | | | | |

| | | | | | | 80,397,020 | |

| | | | | | | | |

| | | | IT Services – 4.3% | | | | |

| | 128,762 | | | EPAM Systems, Inc.(b) | | | 8,924,494 | |

| | 198,831 | | | Euronet Worldwide, Inc.(b) | | | 16,270,341 | |

| | 208,785 | | | ExlService Holdings, Inc.(b) | | | 10,405,844 | |

| | 368,514 | | | InterXion Holding NV(b) | | | 13,347,577 | |

| | | | | | | | |

| | | | | | | 48,948,256 | |

| | | | | | | | |

| | | | Life Sciences Tools & Services – 2.8% | | | | |

| | 318,668 | | | Accelerate Diagnostics, Inc.(b) | | | 8,686,890 | |

| | 234,221 | | | INC Research Holdings, Inc., Class A(b) | | | 10,441,572 | |

| | 227,823 | | | PRA Health Sciences, Inc.(b) | | | 12,874,278 | |

| | | | | | | | |

| | | | | | | 32,002,740 | |

| | | | | | | | |

| | | | Machinery – 3.0% | | | | |

| | 177,266 | | | Astec Industries, Inc. | | | 10,612,915 | |

| | 98,191 | | | Middleby Corp. (The)(b) | | | 12,138,372 | |

| | 146,536 | | | RBC Bearings, Inc.(b) | | | 11,207,073 | |

| | | | | | | | |

| | | | | | | 33,958,360 | |

| | | | | | | | |

| | | | Oil, Gas & Consumable Fuels – 2.1% | | | | |

| | 132,870 | | | Diamondback Energy, Inc.(b) | | | 12,827,270 | |

See accompanying notes to financial statements.

| 24

Portfolio of Investments – as of September 30, 2016

Loomis Sayles Small Cap Growth Fund – continued

| | | | | | | | |

| Shares | | | Description | | Value (†) | |

|

| | Common Stocks – continued | |

| | |

| | | | Oil, Gas & Consumable Fuels – continued | | | | |

| | 160,676 | | | PDC Energy, Inc.(b) | | $ | 10,774,932 | |

| | | | | | | | |

| | | | | | | 23,602,202 | |

| | | | | | | | |

| | | | Pharmaceuticals – 2.8% | | | | |

| | 199,147 | | | Dermira, Inc.(b) | | | 6,735,152 | |

| | 193,697 | | | Medicines Co. (The)(b) | | | 7,310,125 | |

| | 424,996 | | | Nektar Therapeutics(b) | | | 7,301,431 | |

| | 414,963 | | | Supernus Pharmaceuticals, Inc.(b) | | | 10,262,035 | |

| | | | | | | | |

| | | | | | | 31,608,743 | |

| | | | | | | | |

| | | | Professional Services – 1.4% | | | | |

| | 257,525 | | | WageWorks, Inc.(b) | | | 15,685,848 | |

| | | | | | | | |

| | | | Real Estate Management & Development – 0.5% | |

| | 212,814 | | | HFF, Inc., Class A | | | 5,892,820 | |

| | | | | | | | |

| | | | Semiconductors & Semiconductor Equipment – 6.3% | |

| | 324,987 | | | Inphi Corp.(b) | | | 14,140,184 | |

| | 511,733 | | | Intersil Corp. | | | 11,222,305 | |

| | 322,459 | | | MKS Instruments, Inc. | | | 16,035,886 | |

| | 196,698 | | | Monolithic Power Systems, Inc. | | | 15,834,189 | |

| | 230,667 | | | Silicon Laboratories, Inc.(b) | | | 13,563,220 | |

| | | | | | | | |

| | | | | | | 70,795,784 | |

| | | | | | | | |

| | | | Software – 7.5% | | | | |

| | 207,679 | | | Blackbaud, Inc. | | | 13,777,425 | |

| | 604,947 | | | Callidus Software, Inc.(b) | | | 11,100,778 | |

| | 190,695 | | | FleetMatics Group PLC(b) | | | 11,437,886 | |

| | 293,784 | | | Guidewire Software, Inc.(b) | | | 17,621,164 | |

| | 508,731 | | | RingCentral, Inc., Class A(b) | | | 12,036,576 | |

| | 89,896 | | | Ultimate Software Group, Inc. (The)(b) | | | 18,373,843 | |

| | | | | | | | |

| | | | | | | 84,347,672 | |

| | | | | | | | |

| | | | Specialty Retail – 1.7% | |

| | 149,775 | | | Monro Muffler Brake, Inc. | | | 9,161,737 | |

| | 624,854 | | | Tile Shop Holdings, Inc.(b) | | | 10,341,333 | |

| | | | | | | | |

| | | | | | | 19,503,070 | |

| | | | | | | | |

| | | | Textiles, Apparel & Luxury Goods – 1.7% | |

| | 163,678 | | | Columbia Sportswear Co. | | | 9,287,090 | |

| | 297,339 | | | Steven Madden Ltd.(b) | | | 10,276,036 | |

| | | | | | | | |

| | | | | | | 19,563,126 | |

| | | | | | | | |

| | | | Thrifts & Mortgage Finance – 1.0% | |

| | 435,344 | | | Essent Group Ltd.(b) | | | 11,584,504 | |

| | | | | | | | |

| | | | Trading Companies & Distributors – 1.6% | |

| | 230,983 | | | Beacon Roofing Supply, Inc.(b) | | | 9,717,455 | |

See accompanying notes to financial statements.

25 |

Portfolio of Investments – as of September 30, 2016

Loomis Sayles Small Cap Growth Fund – continued

| | | | | | | | |

| Shares | | | Description | | Value (†) | |

|

| | Common Stocks – continued | |

| |

| | | | Trading Companies & Distributors – continued | |

| | 227,823 | | | SiteOne Landscape Supply, Inc.(b) | | $ | 8,185,680 | |

| | | | | | | | |

| | | | | | | 17,903,135 | |

| | | | | | | | |

| | |

| | | | Total Common Stocks

(Identified Cost $879,197,130) | | | 1,091,709,628 | |

| | | | | | | | |

| | |

| Principal

Amount |

| | | | | | |

|

| | Short-Term Investments – 3.0% | |

| $ | 34,249,644 | | | Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 9/30/2016 at 0.030% to be repurchased at $34,249,730 on 10/03/2016 collateralized by $34,550,000 U.S. Treasury Note, 1.500% due 3/31/2023 valued at $34,938,688 including accrued interest (Note 2 of Notes to Financial Statements)(Identified Cost $34,249,644) | | | 34,249,644 | |

| | | | | | | | |

| | |

| | | | Total Investments – 99.8%

(Identified Cost $913,446,774)(a) | | | 1,125,959,272 | |

| | | | Other assets less liabilities—0.2% | | | 1,826,692 | |

| | | | | | | | |

| | | | Net Assets – 100.0% | | $ | 1,127,785,964 | |

| | | | | | | | |

| |

| | (†) | | | See Note 2 of Notes to Financial Statements. | |

| | (a) | | | Federal Tax Information: | |

| | | | At September 30, 2016, the net unrealized appreciation on investments based on a cost of $913,910,875 for federal income tax purposes was as follows: | |

| | | | Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | | $ | 225,493,195 | |

| | | | Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | | | (13,444,798 | ) |

| | | | | | | | |

| | | | Net unrealized appreciation | | $ | 212,048,397 | |

| | | | | | | | |

| | (b) | | | Non-income producing security. | |

| |

| | ADR | | | An American Depositary Receipt is a certificate issued by a custodian bank representing the right to receive securities of the foreign issuer described. The values of ADRs may be significantly influenced by trading on exchanges not located in the United States. | |

See accompanying notes to financial statements.

| 26

Portfolio of Investments – as of September 30, 2016

Loomis Sayles Small Cap Growth Fund – continued

Industry Summary at September 30, 2016

| | | | |

Health Care Equipment & Supplies | | | 8.2 | % |

Software | | | 7.5 | |

Internet Software & Services | | | 7.1 | |

Semiconductors & Semiconductor Equipment | | | 6.3 | |

Health Care Providers & Services | | | 4.6 | |

IT Services | | | 4.3 | |

Banks | | | 4.2 | |

Diversified Consumer Services | | | 3.7 | |

Hotels, Restaurants & Leisure | | | 3.6 | |

Machinery | | | 3.0 | |

Health Care Technology | | | 3.0 | |

Life Sciences Tools & Services | | | 2.8 | |

Pharmaceuticals | | | 2.8 | |

Capital Markets | | | 2.5 | |

Biotechnology | | | 2.5 | |

Household Durables | | | 2.4 | |

Diversified Telecommunication Services | | | 2.3 | |

Building Products | | | 2.2 | |

Construction & Engineering | | | 2.2 | |

Oil, Gas & Consumable Fuels | | | 2.1 | |

Food Products | | | 2.0 | |

Other Investments, less than 2% each | | | 17.5 | |

Short-Term Investments | | | 3.0 | |

| | | | |

Total Investments | | | 99.8 | |

Other assets less liabilities | | | 0.2 | |

| | | | |

Net Assets | | | 100.0 | % |

| | | | |

See accompanying notes to financial statements.

27 |

Portfolio of Investments – as of September 30, 2016

Loomis Sayles Small Cap Value Fund

| | | | | | | | |

| Shares | | | Description | | Value (†) | |

|

| | Common Stocks – 98.2% of Net Assets | |

| |

| | | | Aerospace & Defense – 2.1% | |

| | 258,206 | | | Aerojet Rocketdyne Holdings, Inc.(b) | | $ | 4,539,261 | |

| | 257,814 | | | BWX Technologies, Inc. | | | 9,892,323 | |

| | 272,965 | | | DigitalGlobe, Inc.(b) | | | 7,506,538 | |

| | | | | | | | |

| | | | | | | 21,938,122 | |

| | | | | | | | |

| | | | Auto Components – 1.9% | |

| | 136,200 | | | Cooper Tire & Rubber Co. | | | 5,178,324 | |

| | 183,745 | | | Fox Factory Holding Corp.(b) | | | 4,220,623 | |

| | 311,349 | | | Horizon Global Corp.(b) | | | 6,205,185 | |

| | 63,951 | | | Tenneco, Inc.(b) | | | 3,726,425 | |

| | | | | | | | |

| | | | | | | 19,330,557 | |

| | | | | | | | |

| | | | Banks – 17.1% | |

| | 420,939 | | | BancorpSouth, Inc. | | | 9,765,785 | |

| | 160,341 | | | Bank of the Ozarks, Inc. | | | 6,157,094 | |

| | 258,326 | | | Bryn Mawr Bank Corp. | | | 8,263,849 | |

| | 450,864 | | | Cathay General Bancorp | | | 13,877,594 | |

| | 217,763 | | | Chemical Financial Corp. | | | 9,609,881 | |

| | 533,038 | | | CVB Financial Corp. | | | 9,386,799 | |

| | 541,604 | | | First Financial Bancorp | | | 11,828,631 | |

| | 193,155 | | | First Financial Bankshares, Inc. | | | 7,038,568 | |

| | 411,049 | | | Home BancShares, Inc. | | | 8,553,930 | |

| | 173,656 | | | IBERIABANK Corp. | | | 11,655,791 | |

| | 168,106 | | | LegacyTexas Financial Group, Inc. | | | 5,317,193 | |

| | 247,775 | | | PacWest Bancorp | | | 10,632,025 | |

| | 177,536 | | | Pinnacle Financial Partners, Inc. | | | 9,601,147 | |

| | 284,947 | | | Popular, Inc. | | | 10,890,674 | |

| | 156,062 | | | Prosperity Bancshares, Inc. | | | 8,566,243 | |

| | 99,750 | | | Signature Bank(b) | | | 11,815,387 | |

| | 123,418 | | | Texas Capital Bancshares, Inc.(b) | | | 6,778,117 | |

| | 255,353 | | | Triumph Bancorp, Inc.(b) | | | 5,066,204 | |

| | 226,625 | | | Wintrust Financial Corp. | | | 12,593,551 | |

| | | | | | | | |

| | | | | | | 177,398,463 | |

| | | | | | | | |

| | | | Beverages – 0.9% | |

| | 664,437 | | | Cott Corp. | | | 9,468,227 | |

| | | | | | | | |

| | | | Building Products – 2.4% | |

| | 87,946 | | | Apogee Enterprises, Inc. | | | 3,930,307 | |

| | 153,765 | | | Armstrong World Industries, Inc.(b) | | | 6,353,570 | |

| | 70,344 | | | Gibraltar Industries, Inc.(b) | | | 2,613,279 | |

| | 111,434 | | | Masonite International Corp.(b) | | | 6,927,852 | |

| | 74,254 | | | Patrick Industries, Inc.(b) | | | 4,597,808 | |

| | | | | | | | |

| | | | | | | 24,422,816 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 28

Portfolio of Investments – as of September 30, 2016

Loomis Sayles Small Cap Value Fund – continued

| | | | | | | | |

| Shares | | | Description | | Value (†) | |

|

| | Common Stocks – continued | |

| |

| | | | Capital Markets – 1.0% | |

| | 20,114 | | | MarketAxess Holdings, Inc. | | $ | 3,330,677 | |

| | 191,907 | | | Stifel Financial Corp.(b) | | | 7,378,824 | |

| | | | | | | | |

| | | | | | | 10,709,501 | |

| | | | | | | | |

| | | | Chemicals – 1.4% | |

| | 120,054 | | | Cabot Corp. | | | 6,292,030 | |

| | 118,130 | | | Minerals Technologies, Inc. | | | 8,350,610 | |

| | | | | | | | |

| | | | | | | 14,642,640 | |

| | | | | | | | |

| | | | Commercial Services & Supplies – 4.3% | |

| | 94,019 | | | Clean Harbors, Inc.(b) | | | 4,511,032 | |

| | 300,147 | | | KAR Auction Services, Inc. | | | 12,954,345 | |

| | 294,782 | | | Kimball International, Inc. | | | 3,814,479 | |

| | 102,095 | | | Knoll, Inc. | | | 2,332,871 | |

| | 327,274 | | | R.R. Donnelley & Sons Co. | | | 5,144,747 | |

| | 238,745 | | | Viad Corp. | | | 8,802,528 | |

| | 290,843 | | | West Corp. | | | 6,421,813 | |

| | | | | | | | |

| | | | | | | 43,981,815 | |

| | | | | | | | |

| | | | Communications Equipment – 1.8% | |

| | 243,219 | | | ARRIS International PLC(b) | | | 6,890,394 | |

| | 337,076 | | | Calix, Inc.(b) | | | 2,477,509 | |

| | 343,605 | | | Digi International, Inc.(b) | | | 3,917,097 | |

| | 709,626 | | | Viavi Solutions, Inc.(b) | | | 5,244,136 | |

| | | | | | | | |

| | | | | | | 18,529,136 | |

| | | | | | | | |

| | | | Construction & Engineering – 1.6% | |

| | 110,895 | | | Argan, Inc. | | | 6,563,875 | |

| | 170,800 | | | MYR Group, Inc.(b) | | | 5,141,080 | |

| | 183,611 | | | Quanta Services, Inc.(b) | | | 5,139,272 | |

| | | | | | | | |

| | | | | | | 16,844,227 | |

| | | | | | | | |

| | | | Construction Materials – 0.8% | |

| | 221,752 | | | Summit Materials, Inc., Class A(b) | | | 4,113,500 | |

| | 94,184 | | | U.S. Concrete, Inc.(b) | | | 4,338,586 | |

| | | | | | | | |

| | | | | | | 8,452,086 | |

| | | | | | | | |

| | | | Consumer Finance – 0.5% | |

| | 145,279 | | | PRA Group, Inc.(b) | | | 5,017,937 | |

| | | | | | | | |

| | | | Distributors – 0.8% | |

| | 219,700 | | | Core-Mark Holding Co., Inc. | | | 7,865,260 | |

| | | | | | | | |

| | | | Diversified Consumer Services – 0.4% | |

| | 277,662 | | | Houghton Mifflin Harcourt Co.(b) | | | 3,723,447 | |

| | | | | | | | |

| | | | Diversified Financial Services – 0.7% | |

| | 577,201 | | | FNFV Group(b) | | | 7,203,468 | |

| | | | | | | | |

See accompanying notes to financial statements.

29 |

Portfolio of Investments – as of September 30, 2016

Loomis Sayles Small Cap Value Fund – continued

| | | | | | | | |

| Shares | | | Description | | Value (†) | |

|

| | Common Stocks – continued | |

| |

| | | | Electric Utilities – 1.2% | |

| | 200,898 | | | ALLETE, Inc. | | $ | 11,977,539 | |

| | | | | | | | |

| | | | Electrical Equipment – 1.1% | |

| | 45,465 | | | AZZ, Inc. | | | 2,967,501 | |

| | 341,965 | | | Babcock & Wilcox Enterprises, Inc.(b) | | | 5,642,422 | |

| | 34,846 | | | EnerSys | | | 2,410,995 | |

| | | | | | | | |

| | | | | | | 11,020,918 | |

| | | | | | | | |

| | | | Electronic Equipment, Instruments & Components – 5.0% | |

| | 107,123 | | | Belden, Inc. | | | 7,390,416 | |

| | 260,384 | | | II-VI, Inc.(b) | | | 6,335,143 | |

| | 83,204 | | | Kimball Electronics, Inc.(b) | | | 1,153,207 | |

| | 123,871 | | | Littelfuse, Inc. | | | 15,955,823 | |

| | 213,702 | | | Methode Electronics, Inc. | | | 7,473,159 | |

| | 110,650 | | | Rogers Corp.(b) | | | 6,758,502 | |

| | 146,249 | | | VeriFone Systems, Inc.(b) | | | 2,301,959 | |

| | 312,576 | | | Vishay Intertechnology, Inc. | | | 4,404,196 | |

| | | | | | | | |

| | | | | | | 51,772,405 | |

| | | | | | | | |

| | | | Energy Equipment & Services – 2.4% | |

| | 150,461 | | | Bristow Group, Inc. | | | 2,109,463 | |

| | 240,094 | | | Natural Gas Services Group, Inc.(b) | | | 5,903,912 | |

| | 326,184 | | | RPC, Inc.(b) | | | 5,479,891 | |

| | 240,166 | | | U.S. Silica Holdings, Inc. | | | 11,182,129 | |

| | | | | | | | |

| | | | | | | 24,675,395 | |

| | | | | | | | |

| | | | Food & Staples Retailing – 0.8% | |

| | 276,400 | | | SpartanNash Co. | | | 7,993,488 | |

| | | | | | | | |

| | | | Food Products – 2.0% | |

| | 311,985 | | | Darling Ingredients, Inc.(b) | | | 4,214,917 | |

| | 27,071 | | | J&J Snack Foods Corp. | | | 3,224,697 | |

| | 173,768 | | | Post Holdings, Inc.(b) | | | 13,409,677 | |

| | | | | | | | |

| | | | | | | 20,849,291 | |

| | | | | | | | |

| | | | Health Care Equipment & Supplies – 1.8% | |

| | 71,870 | | | Cynosure, Inc., Class A(b) | | | 3,661,058 | |

| | 210,698 | | | Halyard Health, Inc.(b) | | | 7,302,793 | |

| | 162,457 | | | SurModics, Inc.(b) | | | 4,888,331 | |

| | 14,621 | | | Teleflex, Inc. | | | 2,457,059 | |

| | | | | | | | |

| | | | | | | 18,309,241 | |

| | | | | | | | |

| | | | Health Care Providers & Services – 1.2% | |

| | 263,440 | | | PharMerica Corp.(b) | | | 7,394,761 | |

| | 44,442 | | | WellCare Health Plans, Inc.(b) | | | 5,203,714 | |

| | | | | | | | |

| | | | | | | 12,598,475 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 30

Portfolio of Investments – as of September 30, 2016

Loomis Sayles Small Cap Value Fund – continued

| | | | | | | | |

| Shares | | | Description | | Value (†) | |

|

| | Common Stocks – continued | |

| |

| | | | Hotels, Restaurants & Leisure – 3.9% | |

| | 328,250 | | | Carrols Restaurant Group, Inc.(b) | | $ | 4,336,182 | |

| | 76,273 | | | Churchill Downs, Inc. | | | 11,162,554 | |

| | 24,829 | | | Cracker Barrel Old Country Store, Inc. | | | 3,282,890 | |

| | 84,048 | | | Del Frisco’s Restaurant Group, Inc.(b) | | | 1,132,127 | |

| | 142,945 | | | J. Alexander’s Holdings, Inc.(b) | | | 1,448,033 | |

| | 130,415 | | | Marriott Vacations Worldwide Corp. | | | 9,562,028 | |

| | 175,805 | | | Six Flags Entertainment Corp. | | | 9,424,906 | |

| | | | | | | | |

| | | | | | | 40,348,720 | |

| | | | | | | | |