UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08282

Loomis Sayles Funds I

(Exact name of Registrant as specified in charter)

888 Boylston Street, Suite 800 Boston, Massachusetts 02199-8197

(Address of principal executive offices) (Zip code)

Russell L. Kane, Esq.

Natixis Distribution, L.P.

888 Boylston Street, Suite 800

Boston, Massachusetts 02199-8197

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2822

Date of fiscal year end: September 30

Date of reporting period: September 30, 2017

Item 1. Reports to Stockholders.

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Loomis Sayles Small Cap Growth Fund

Loomis Sayles Small Cap Value Fund

Loomis Sayles Small/Mid Cap Growth Fund

Annual Report

September 30, 2017

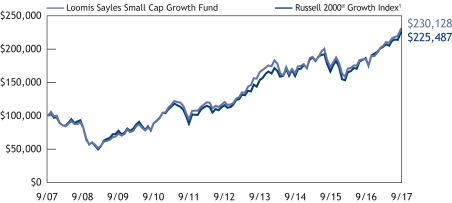

LOOMIS SAYLES SMALL CAP GROWTH FUND

| | | | |

| Managers | | Symbols | | |

| Mark F. Burns, CFA® | | Institutional Class | | LSSIX |

| John J. Slavik, CFA® | | Retail Class | | LCGRX |

| | Class N | | LSSNX |

Investment Objective

The Fund’s investment objective is long-term capital growth from investments in common stocks or other equity securities.

Market Conditions

The period began with significant underperformance by growth stocks in the small-cap segment of the market; factors such as beta (risk/reward potential) also drove early performance trends. These trends shifted during the period as growth and value performed in line with each other and company fundamentals became more influenced by returns.

For the one-year period ended September 30, 2017, most domestic equity markets posted strong returns. Small-cap stocks outperformed their mid-cap and large-cap counterparts.

Almost all sectors in the Russell 2000® Growth Index posted positive returns, with the exception of energy. The biotechnology industry was an area of strength, up almost 34% during the time period.

The divergence in performance between the best and worst-performing sectors was at historic levels; the best sector was up over 50%, while the worst-performing sector was down over 20%.

Performance Results

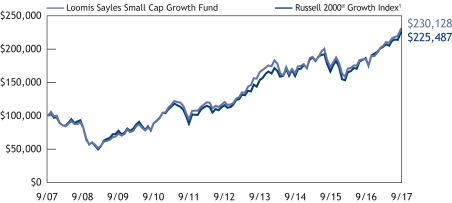

For the 12 months ended September 30, 2017, Institutional Class shares of Loomis Sayles Small Cap Growth Fund returned 24.24% at net asset value. The Fund outperformed its benchmark, the Russell 2000® Growth Index, which returned 20.98%.

Explanation of Fund Performance

Stock selection in the information technology and consumer discretionary sectors primarily accounted for the Fund’s outperformance. An overweight position in the energy sector and stock selection in the telecommunication services and healthcare sectors detracted from relative performance.

On an individual basis, Grand Canyon Education and MKS Instruments were the top contributors to performance. For-profit higher education provider Grand Canyon Education was the top contributor. The company continued to steadily gain share in the education market, offering both a traditional campus and online programs. Enrollment growth in both the campus and online programs has been very strong and continued to accelerate. MKS Instruments is a semiconductor equipment company. The overall environment for semiconductor activity has been very healthy, and the company has

1 |

continued to hold a dominant market position. The company reported record revenues because of their presence within some of the strongest segments of the market and greater-than-expected growth from a recent acquisition.

Another top contributor to performance was fiber laser company IPG Photonics. The company reported growth across multiple products, end markets and geographies as high power fiber lasers have increasingly replaced legacy cutting and welding techniques.

The three largest detractors from performance were Amplify Snack Brands, Evolent Health and Benefitfocus.

Amplify reported disappointing results at the end of 2016. An acquisition distracted management’s attention from its core brand, and the company was therefore not able to execute as well as expected. Sales volumes were weaker than anticipated based on the level of promotional activity. Given the fundamental concerns, the stock was sold from the Fund.

Health care technology company Evolent Health’s shares came under pressure shortly after the 2016 presidential election, amid concerns about the potential impact from the repeal and replacement of the Affordable Care Act. The stock fell sufficiently to trigger our stop-loss risk management criteria and was sold from the Fund.

Benefitfocus, a provider of cloud-based healthcare benefit management solutions, reported solid results but gave disappointing guidance due to a weaker-than-expected private-exchange market. A longer sales process for larger clients also weighed on the company’s outlook. The stock triggered our stop-loss criteria and was sold from the Fund.

Outlook

Small-cap earnings growth has been challenged in 2017, significantly lagging the earnings growth of large-cap stocks. If the improvement in global economic indicators continues to be sustainable, we could see an acceleration of earnings across the board, including in small-caps. Domestically, this could be further accentuated with a lowering of the corporate tax rate. While forecasting global economic conditions and predicting legislative changes are not our daily focus, we believe these factors would provide a favorable backdrop for the strategy.

Our daily focus is the discovery and analysis of secular growth companies that could develop into large and high-quality businesses that create wealth for shareholders. We believe these types of companies are likely to reward investors, particularly in an environment where global growth is steadily improving. Steady global growth allows excess liquidity to drain from the system, which should favor higher-quality companies that have better access to capital. This environment also tends to lead to lower stock correlations, supporting active managers that can use their experience and resources to identify potential winners. As always, we remain focused on underlying business fundamentals and investing in secular growth companies.

| 2

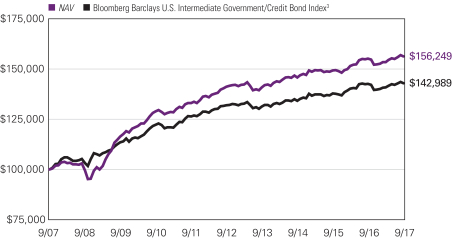

LOOMIS SAYLES SMALL CAP GROWTH FUND

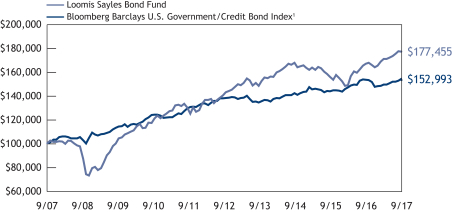

Hypothetical Growth of $100,000 Investment in Institutional Class Shares

September 30, 2007 through September 30, 20172

Top Ten Holdings as of September 30, 2017

| | | | | | |

| Security name | | % of

net assets | |

| 1 | | Medidata Solutions, Inc. | | | 1.53 | % |

| 2 | | Bright Horizons Family Solutions, Inc. | | | 1.52 | % |

| 3 | | Grand Canyon Education, Inc. | | | 1.49 | % |

| 4 | | MKS Instruments, Inc. | | | 1.44 | % |

| 5 | | HealthEquity, Inc. | | | 1.42 | % |

| 6 | | 2U, Inc. | | | 1.41 | % |

| 7 | | SiteOne Landscape Supply, Inc. | | | 1.38 | % |

| 8 | | Insulet Corp. | | | 1.38 | % |

| 9 | | Guidewire Software, Inc. | | | 1.37 | % |

| 10 | | RingCentral, Inc., Class A | | | 1.36 | % |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

3 |

Average Annual Total Returns — September 30, 20172

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Expense Ratios3 | |

| | | 1 year | | | 5 years | | | 10 years | | | Life of

Class N | | | Gross | | | Net | |

| | | | | | | |

Institutional Class

(Inception 12/31/96) | | | 24.24 | % | | | 13.77 | % | | | 8.70 | % | | | — | % | | | 0.95 | % | | | 0.95 | % |

| | | | | | | |

Retail Class

(Inception 12/31/96) | | | 23.93 | | | | 13.47 | | | | 8.41 | | | | — | | | | 1.20 | | | | 1.20 | |

| | | | | | | |

Class N

(Inception 2/1/13) | | | 24.38 | | | | — | | | | — | | | | 13.65 | | | | 0.83 | | | | 0.83 | |

| | | | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | | | | | | | | | |

| Russell 2000® Growth Index1 | | | 20.98 | | | | 14.28 | | | | 8.47 | | | | 13.50 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit loomissayles.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | | Russell 2000® Growth Index is an unmanaged index that measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® companies with higher price-to-book ratios and higher forecasted growth values. |

| 2 | | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 3 | | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense caps set to expire on 01/31/18. When a Fund’s expenses are below the cap, gross and net expense ratios will be the same. See Note 5 of the Notes to Financial Statements for more information about the Fund’s expense caps. |

| 4

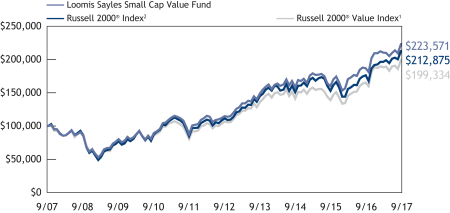

LOOMIS SAYLES SMALL CAP VALUE FUND

| | | | |

| Managers | | Symbols | | |

| Joseph R. Gatz, CFA® | | Institutional Class | | LSSCX |

| Jeffrey Schwartz, CFA® | | Retail Class | | LSCRX |

| | Admin Class | | LSVAX |

| | Class N | | LSCNX |

Investment Objective

The Fund’s investment objective is long-term capital growth from investments in common stocks or other equity securities.

Market Conditions

Equity markets finished the 12 months on a strong note, completing a remarkable period of broad-based gains. The year was characterized by a sharp rotation between small-caps and large-caps and growth and value stocks, as well as a wide performance variation among sectors.

For the period, small-cap stocks outperformed large-cap stocks, and small-cap value stocks closely matched the performance of small-cap growth stocks.

Immediately following the US elections, performance among sectors and asset classes varied substantially. Variation was driven by investor perceptions of which sectors would or would not benefit from improved economic growth, higher interest rates, infrastructure spending, lower regulation, and tax reform.

While initial equity performance favored small-caps and value stocks, market leadership shifted toward large-caps and growth stocks as the year went on. The shift reflected a lack of improvement in economic data and revised expectations about the timing and scope of policy change and reform.

Performance Review

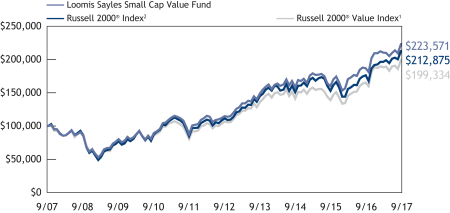

For the 12 months ended September 30, 2017, Institutional Class shares of Loomis Sayles Small Cap Value Fund returned 19.68% at net asset value. The Fund underperformed its benchmark, the Russell 2000® Value Index, which returned 20.55%.

Explanation of Fund Performance

Among contributors to overall return, performance of the consumer discretionary stocks held by the Fund was notably positive, followed by strong stock selection in the materials sector. The Fund’s overweight in the industrials sector added to its gains.

The top three contributors to performance were Marriott Vacations Worldwide, Littelfuse and AdvanSix.

5 |

Marriott Vacations Worldwide, a developer of timeshare ownership properties operating under the Ritz-Carlton and Marriott brand names, continued to report strong quarterly results. Expectations for further consolidation within the timeshare industry led to solid gains in the stock.

Littelfuse manufactures and sells fuses and other circuit protection devices for use in virtually every market that uses electrical energy, ranging from consumer electronics to automobiles, commercial vehicles and industrial equipment. Greater use of electronics in vehicles and the proliferation of mobile battery-powered devices continued to drive demand for circuit protection. The company exceeded earnings forecasts during the year and announced an accretive acquisition.

AdvanSix, spun out of Honeywell in September 2016, is a leading manufacturer of Nylon 6, a synthetic polymer used for engineered plastics, films, fibers, and filaments. These products are used in carpeting, automobile components, clothing, industrial packaging, and electrical components. The combination of anticipated improvements in market conditions after 2017, continuing post-spinoff efficiency gains and product mix improvements helped the stock meaningfully outperform the small-cap market since the Fund purchased it.

Among detractors from overall return, stock selection lagged in the information technology, real estate, industrials and energy sectors. Also, an underweight versus our benchmark in the financial sector detracted from our performance. Cash reserves were quite low throughout the year, but nevertheless underperformed strong equity returns.

The leading individual detractors were Synchronoss Technologies, Inc., QEP Resources, Inc. and Genesco Inc. Synchronoss Technologies, a provider of hosted storage, software and services to the telecommunications industry, suffered a sharp decline during the period. The company pre-announced a first quarter earnings shortfall in late April, as well as the sudden departure of the new CEO and CFO, both of whom had served in their roles for only a few months. Our investment thesis was clearly broken, and we promptly eliminated the holding despite a material decline in the stock price.

QEP Resources, an independent exploration and production company, declined on lower energy commodity prices and a shortfall in oil production volume. The company continued to shift production from gas to oil in anticipation of helping the stock get a higher valuation. We maintained our position due to the management team, the under-appreciated asset base, and the potential monetization of certain assets.

Genesco is a mall-based retailer of footwear and headwear, operating the Journeys, Johnston & Murphy, Schuh and Lids retail brands. While retail in general has been weak, fashion trends have improved for the Journeys store concept (specialty teen). Other brands, such as Lids (headwear), had weak traffic due to soft hat sales. The stock continued to trade at a deeply discounted valuation, and we are maintaining our current position.

| 6

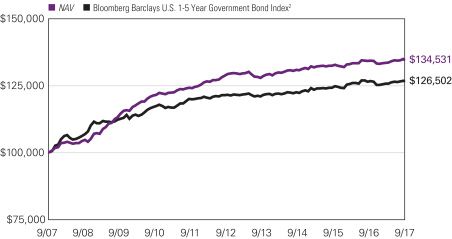

LOOMIS SAYLES SMALL CAP VALUE FUND

Outlook

Our focus will remain on small-cap companies where the stock’s current price and valuation do not accurately reflect our assessment of the underlying value of the corporate enterprise. We believe these types of opportunities are available in all market environments. As always, our investments tend to be misunderstood, overlooked, or in the midst of a “special situation” that has created an investment opportunity. We look for trustworthy and capable management teams with interests aligned with shareholders and fundamentally sound business models with sustainable and understandable advantages leading to growth in value over time. Identifying unique, company-specific catalysts on the horizon to sustain, enhance or highlight the fundamental outlook is key to our investment process.

Hypothetical Growth of $100,000 Investment in Institutional Class Shares

September 30, 2007 through September 30, 20173

Top Ten Holdings as of September 30, 2017

| | | | | | |

| Security name | | % of

net assets | |

| 1 | | Littelfuse, Inc. | | | 1.86 | % |

| 2 | | Employers Holdings, Inc. | | | 1.35 | % |

| 3 | | ALLETE, Inc. | | | 1.28 | % |

| 4 | | Wintrust Financial Corp. | | | 1.24 | % |

| 5 | | Viad Corp. | | | 1.19 | % |

| 6 | | Churchill Downs, Inc. | | | 1.13 | % |

| 7 | | Euronet Worldwide, Inc. | | | 1.12 | % |

| 8 | | AdvanSix, Inc. | | | 1.07 | % |

| 9 | | Liberty Ventures, Series A | | | 1.06 | % |

| 10 | | Cathay General Bancorp | | | 1.06 | % |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

7 |

Average Annual Total Returns — September 30, 20173

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Expense Ratios4 | |

| | | 1 year | | | 5 years | | | 10 years | | | Life of Class N | | | Gross | | | Net | |

| | | | | | | |

| Institutional Class (Inception 5/13/91) | | | 19.68 | % | | | 14.28 | % | | | 8.38 | % | | | — | % | | | 0.99 | % | | | 0.96 | % |

| | | | | | | |

Retail Class

(Inception 12/31/96) | | | 19.38 | | | | 13.99 | | | | 8.11 | | | | — | | | | 1.24 | | | | 1.21 | |

| | | | | | | |

Admin Class

(Inception 1/2/98) | | | 19.10 | | | | 13.71 | | | | 7.84 | | | | — | | | | 1.48 | | | | 1.45 | |

| | | | | | | |

Class N

(Inception 2/1/13) | | | 19.78 | | | | — | | | | — | | | | 12.86 | | | | 0.89 | | | | 0.89 | |

| | | | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | | | | | | | | | |

| Russell 2000® Value Index1 | | | 20.55 | | | | 13.27 | | | | 7.14 | | | | 11.89 | | | | | | | | | |

| Russell 2000® Index2 | | | 20.74 | | | | 13.79 | | | | 7.85 | | | | 12.71 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit loomissayles.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | | Russell 2000® Value Index is an unmanaged index that measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values. |

| 2 | | Russell 2000® Index is an unmanaged index that measures the performance of the small-cap segment of the U.S. equity universe. |

| 3 | | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4 | | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense caps set to expire on 01/31/18. When a Fund’s expenses are below the cap, gross and net expense ratios will be the same. See Note 5 of the Notes to Financial Statements for more information about the Fund’s expense caps. |

| 8

LOOMIS SAYLES SMALL/MID CAP GROWTH FUND

| | | | |

| Managers | | Symbols | | |

| Mark F. Burns, CFA® | | Institutional Class | | LSMIX |

| John J. Slavik, CFA® | | | | |

Investment Objective

The Fund’s investment objective is long-term capital growth from investments in common stocks or other equity securities.

Market Conditions

For the one-year period ended September 30, 2017, most domestic equity markets posted strong returns. Small-cap stocks outperformed their mid-cap and large-cap counterparts.

Growth stocks outperformed value stocks in the Small/Mid-cap segment of the market.

Almost all sectors in the Russell 2500TM Growth Index posted positive returns, with the exception of energy and consumer staples. The biotechnology industry was an area of strength, up almost 24% during the time period.

The divergence in performance between the best and worst-performing sectors was at historic levels; the best sector was up almost 38%, while the worst-performing sector was down over 30%.

Performance Results

For the 12 months ended September 30, 2017, Institutional Class shares of Loomis Sayles Small/Mid Cap Growth Fund returned 26.74% at net asset value. The Fund outperformed its benchmark, the Russell 2500TM Growth Index, which returned 20.07%.

Explanation of Fund Performance

Relative performance was driven by stock selection, with particular strength in the consumer discretionary and information technology sectors.

Among individual stocks, the top contributors to the Fund’s performance were Grand Canyon Education, Align Technology and Coherent.

For-profit higher education provider Grand Canyon Education was the top contributor. The company continued to steadily gain share in the education market, offering both a traditional campus and online programs. Enrollment growth in both the campus and online programs has been very strong and continued to accelerate.

Align Technology designs, markets and manufactures the Invisalign orthodontic system. The company continued to gain market share steadily in an underpenetrated market. Sales volumes have accelerated in the teen market, which is the least penetrated market. International volumes have also been positive.

9 |

Coherent is a laser company whose products are used in the OLED (organic light-emitting diode) manufacturing process, which creates digital displays in devices such as phones, televisions, tablets, and computer monitors. The company reported strong quarterly results during the period and made upward revisions to guidance.

Our overweight position to the energy sector detracted from relative performance. Among individual stocks, Dexcom, Acuity Brands and SPS Commerce were the largest detractors from performance for the 12-month period.

Dexcom declined during the year after the FDA approved a competitor’s glucose monitoring system, creating uncertainty for the company’s competitive landscape.

Acuity Brands, a leading lighting manufacturer and distributor, reported a weak fiscal first quarter. The poor performance came as a result of a slowdown in spending on small projects leading up to the US presidential election.

SPS Commerce, a provider of electronic data interchange and analytics software to retailers and their suppliers, lowered guidance due to two primary factors: an upgrade cycle pushing out deployments of software and a reorganization in its sales group. The negative reaction in the stock triggered our stop-loss risk management criteria, and the position was sold from the portfolio.

Outlook

Small-cap earnings growth has been challenged in 2017, significantly lagging the earnings growth of large-cap stocks. If the improvement in global economic indicators continues to be sustainable, we could see an acceleration of earnings across the board, including in small-caps. Domestically, this could be further accentuated with a lowering of the corporate tax rate. While forecasting global economic conditions and predicting legislative changes are not our daily focus, we believe these factors would provide a favorable backdrop for the strategy.

Our daily focus is the discovery and analysis of secular growth companies that could develop into large and high-quality businesses that create wealth for shareholders. We believe these types of companies are likely to reward investors, particularly in an environment where global growth is steadily improving. Steady global growth allows excess liquidity to drain from the system, which should favor higher-quality companies that have better access to capital. This environment also tends to lead to lower stock correlations, supporting active managers that can use their experience and resources to identify potential winners. As always, we remain focused on underlying business fundamentals and investing in secular growth companies.

| 10

LOOMIS SAYLES SMALL/MID CAP GROWTH FUND

Hypothetical Growth of $1,000,000 investment in Institutional Class Shares2

June 30, 2015 (inception) through September 30, 2017

Top Ten Holdings as of September 30, 2017

| | | | | | |

| Security name | | % of

net assets | |

| 1 | | XPO Logistics, Inc. | | | 1.78 | % |

| 2 | | Grand Canyon Education, Inc. | | | 1.73 | |

| 3 | | Align Technology, Inc. | | | 1.72 | |

| 4 | | HubSpot, Inc. | | | 1.71 | |

| 5 | | Bright Horizons Family Solutions, Inc. | | | 1.66 | |

| 6 | | ICON PLC | | | 1.64 | |

| 7 | | Guidewire Software, Inc. | | | 1.60 | |

| 8 | | CoStar Group, Inc. | | | 1.58 | |

| 9 | | WellCare Health Plans, Inc. | | | 1.58 | |

| 10 | | Trimble, Inc. | | | 1.57 | |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

11 |

Average Annual Total Returns — September 30, 20172

| | | | | | | | | | | | | | | | |

| | | | | | | | | Expense Ratios3 | |

| | | 1 year | | | Life of

Fund | | | Gross | | | Net | |

| | | | | |

| Institutional Class (Inception 6/30/15) | | | 26.74 | % | | | 9.75 | % | | | 1.75 | % | | | 0.85 | % |

| | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | |

| Russell 2500TM Growth Index1 | | | 20.07 | | | | 7.85 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit loomissayles.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | | The Russell 2500TM Growth Index measures the performance of the small-to-mid-cap growth segment of the US equity universe. It includes those Russell 2500 companies with higher growth earning potential as defined by Russell’s leading style methodology. The Russell 2500™ Growth Index is constructed to provide a comprehensive and unbiased barometer of the small-to-mid-cap growth market. The Index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-to-mid-cap opportunity set and that the represented companies continue to reflect growth characteristics. Indices are unmanaged. |

| 2 | | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 3 | | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense caps set to expire on 01/31/18. When a Fund’s expenses are below the cap, gross and net expense ratios will be the same. See Note 5 of the Notes to Financial Statements for more information about the Fund’s expense caps. |

| 12

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the Fund is actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

All investing involves risk, including the risk of loss. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

Additional Index Information

This document may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with Natixis Investment Managers or any of its related or affiliated companies (collectively “Natixis Affiliates”) and does not sponsor, endorse or participate in the provision of any Natixis Affiliates services, funds or other financial products.

The index information contained herein is derived from third parties and is provided on an “as is” basis. The user of this information assumes the entire risk of use of this information. Each of the third party entities involved in compiling, computing or creating index information disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to such information.

Proxy Voting Information

A description of the Funds’ proxy voting policies and procedures is available without charge upon request, by calling Loomis Sayles at 800-633-3330; on the Funds’ website, at www.loomissayles.com, and on the Securities and Exchange Commission’s (SEC’s) website at www.sec.gov. Information about how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on the Funds’ website and the SEC’s website.

Quarterly Portfolio Schedules

The Funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

UNDERSTANDING YOUR FUND’S EXPENSES

As a mutual fund shareholder you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. Certain exemptions may apply. These costs are described in more detail in the Funds’ prospectus. The following examples are intended to help you understand the ongoing costs of investing in the Funds and help you compare these with the ongoing costs of investing in other mutual funds.

13 |

The first line in the table of each Fund shows the actual amount of Fund expenses you would have paid on a $1,000 investment in the Fund from April 1, 2017 through September 30, 2017. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.6) and multiply the result by the number in the Expenses Paid During Period column as shown below for your class.

The second line in the table of each Fund provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the Funds to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs. Therefore, the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

Loomis Sayles Small Cap Growth Fund

| | | | | | | | | | | | |

| Institutional Class | | Beginning

Account Value

4/1/2017 | | | Ending

Account Value

9/30/2017 | | | Expenses Paid

During Period*

4/1/2017 – 9/30/2017 | |

Actual | | | $1,000.00 | | | | $1,123.10 | | | | $5.00 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.36 | | | | $4.76 | |

| | | |

Retail Class | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,121.70 | | | | $6.33 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.10 | | | | $6.02 | |

| | | |

Class N | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,123.80 | | | | $4.37 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.96 | | | | $4.15 | |

* Expenses are equal to the Fund’s annualized expense ratio: 0.94%, 1.19% and 0.82% for Institutional Class, Retail Class and Class N, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). | |

| 14

Loomis Sayles Small Cap Value Fund

| | | | | | | | | | | | |

Institutional Class | | Beginning

Account Value

4/1/2017 | | | Ending

Account Value

9/30/2017 | | | Expenses Paid

During Period*

4/1/2017 – 9/30/2017 | |

Actual | | | $1,000.00 | | | | $1,063.50 | | | | $4.66 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.56 | | | | $4.56 | |

| | | |

Retail Class | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,062.30 | | | | $5.95 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | �� | | $1,019.30 | | | | $5.82 | |

| | | |

Admin Class | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,061.10 | | | | $7.23 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,018.05 | | | | $7.08 | |

| | | |

Class N | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,064.00 | | | | $4.29 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.91 | | | | $4.20 | |

* Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 0.90%, 1.15%, 1.40% and 0.83% for Institutional Class, Retail Class, Admin Class and Class N, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). | |

Loomis Sayles Small/Mid Cap Growth Fund

| | | | | | | | | | | | |

Institutional Class | | Beginning

Account Value

4/1/2017 | | | Ending

Account Value

9/30/2017 | | | Expenses Paid

During Period*

4/1/2017 – 9/30/2017 | |

Actual | | | $1,000.00 | | | | $1,145.10 | | | | $4.57 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.81 | | | | $4.31 | |

* Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement) of 0.85%, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). | |

15 |

BOARD APPROVAL OF THE EXISTING ADVISORY AGREEMENTS

The Board of Trustees of the Trusts (the “Board”), including the Independent Trustees, considers matters bearing on each Fund’s advisory agreement (collectively, the “Agreements”) at most of its meetings throughout the year. Each year, usually in the spring, the Contract Review Committee of the Board meets to review the Agreements to determine whether to recommend that the full Board approve the continuation of the Agreements, typically for an additional one-year period. After the Contract Review Committee has made its recommendation, the full Board, including the Independent Trustees, determines whether to approve the continuation of the Agreements.

In connection with these meetings, the Trustees receive materials that the Funds’ investment adviser (the “Adviser”) believes to be reasonably necessary for the Trustees to evaluate the Agreements. These materials generally include, among other items, (i) information on the investment performance of the Funds and the performance of peer groups and categories of funds and the Funds’ performance benchmarks, (ii) information on the Funds’ advisory fees and other expenses, including information comparing the Funds’ expenses to the fees charged to institutional accounts with similar strategies managed by the Adviser, if any, and to those of peer groups of funds and information about applicable expense caps and/or fee “breakpoints,” (iii) sales and redemption data in respect of the Funds, (iv) information about the profitability of the Agreements to the Adviser and (v) information obtained through the completion by the Adviser of a questionnaire distributed on behalf of the Trustees. The Board, including the Independent Trustees, also considers other matters such as (i) the Adviser’s financial results and financial condition, (ii) each Fund’s investment objective and strategies and the size, education and experience of the Adviser’s investment staff and its use of technology, external research and trading cost measurement tools, (iii) arrangements in respect of the distribution of the Funds’ shares and the related costs, (iv) the allocation of the Funds’ brokerage, if any, including, if applicable, allocations to brokers affiliated with the Adviser and the use of “soft” commission dollars to pay Fund expenses and to pay for research and other similar services, (v) the resources devoted to, and the record of compliance with, the Funds’ investment policies and restrictions, policies on personal securities transactions and other compliance policies, (vi) each Adviser’s policies and procedures relating to, among other things, compliance, trading and best execution, proxy voting and valuation, (vii) information about amounts invested by the Funds’ portfolio managers in the Funds or in similar accounts that they manage and (viii) the general economic outlook with particular emphasis on the mutual fund industry. Throughout the process, the Trustees are afforded the opportunity to ask questions of and request additional materials from the Adviser.

In addition to the materials requested by the Trustees in connection with their annual consideration of the continuation of the Agreements, the Trustees receive materials in advance of each regular quarterly meeting of the Board that provide detailed information about the Funds’ investment performance and the fees charged to the Funds for advisory and other services. This information generally includes, among other things, an internal

| 16

performance rating for each Fund based on agreed-upon criteria, graphs showing each Fund’s performance and fee differentials against each Fund’s peer group/category, performance ratings provided by a third-party, total return information for various periods, and third-party performance rankings for various periods comparing a Fund against similarly categorized funds. The portfolio management team for each Fund or other representatives of the Adviser make periodic presentations to the Contract Review Committee and/or the full Board, and Funds identified as presenting possible performance concerns may be subject to more frequent board presentations and reviews. In addition, each quarter the Trustees are provided with detailed statistical information about each Fund’s portfolio. The Trustees also receive periodic updates between meetings.

The Board most recently approved the continuation of the Agreements at its meeting held in June 2017. The Agreements were continued for a one-year period for the Funds. In considering whether to approve the continuation of the Agreements, the Board, including the Independent Trustees, did not identify any single factor as determinative. Individual Trustees may have evaluated the information presented differently from one another, giving different weights to various factors. Matters considered by the Trustees, including the Independent Trustees, in connection with their approval of the Agreements included, but were not limited to, the factors listed below.

The nature, extent and quality of the services provided to the Funds under the Agreements. The Trustees considered the nature, extent and quality of the services provided by the Adviser and its affiliates to the Funds and the resources dedicated to the Funds by the Adviser and its affiliates.

The Trustees considered not only the advisory services provided by the Adviser to the Funds, but also the monitoring and oversight services provided by Natixis Advisors, L.P. (“Natixis Advisors”). They also considered the administrative services provided by Natixis Advisors and its affiliates to the Funds. For each Fund, the Trustees also considered the benefits to shareholders of investing in a mutual fund that is part of a family of funds that offers shareholders the right to exchange shares of one type of fund for shares of another type of fund, and provides a variety of fund and shareholder services.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the nature, extent and quality of services provided supported the renewal of the Agreements.

Investment performance of the Funds and the Adviser. As noted above, the Trustees received information about the performance of the Funds over various time periods, including information that compared the performance of the Funds to the performance of peer groups and categories of funds and the Funds’ respective performance benchmarks. In addition, the Trustees also reviewed data prepared by an independent third party that analyzed the performance of the Funds using a variety of performance metrics, including metrics that also measured the performance of the Funds on a risk adjusted basis.

The Board noted that, through December 31, 2016, each Fund’s one- and three-year performance, as applicable, stated as percentile rankings within categories selected by the

17 |

independent third-party data provider was as follows (where the best performance would be in the first percentile of its category):

| | | | | | | | |

| | | One-Year | | | Three-Year | |

Loomis Sayles Small Cap Growth Fund | | | 89% | | | | 64% | |

Loomis Sayles Small Cap Value Fund | | | 16% | | | | 20% | |

Loomis Sayles Small/Mid Cap Growth Fund | | | 39% | | | | N/A | |

In the case of each Fund that had performance that lagged that of a relevant peer group median and/or category median for certain (although not necessarily all) periods, the Board concluded that other factors relevant to performance supported renewal of the Agreements. These factors included one or more of the following: (1) that the underperformance was attributable, to a significant extent, to investment decisions (such as security selection or sector allocation) by the Adviser that were reasonable and consistent with the Fund’s investment objective and policies; and (2) that the Fund’s more recent performance, although lagging in certain periods, had shown improvement relative to its category.

The Trustees also considered the Adviser’s performance and reputation generally, the performance of the fund family generally, and the historical responsiveness of the Adviser to Trustee concerns about performance and the willingness of the Adviser to take steps intended to improve performance.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the performance of the Funds and the Adviser supported the renewal of the Agreements.

The costs of the services to be provided and profits to be realized by the Adviser and its affiliates from their respective relationships with the Funds. The Trustees considered the fees charged to the Funds for advisory services as well as the total expense levels of the Funds. This information included comparisons (provided both by management and also by an independent third party) of the Funds’ advisory fees and total expense levels to those of their peer groups and information about the advisory fees charged by the Adviser to comparable accounts (such as institutional separate accounts), as well as information about differences in such fees and the reasons for any such differences. In considering the fees charged to comparable accounts, the Trustees considered, among other things, management’s representations about the differences between managing mutual funds as compared to other types of accounts, including the additional resources required to effectively manage mutual fund assets and the greater regulatory costs associated with the management of such assets. In evaluating each Fund’s advisory fee, the Trustees also took into account the demands, complexity and quality of the investment management of such Fund and the need for the Adviser to offer competitive compensation and the potential need to expend additional resources to the extent the Funds grow in size. The Trustees considered that over the past several years, management had made recommendations regarding reductions in advisory fee rates, implementation of advisory fee breakpoints and the institution of advisory fee waivers and expense caps for various funds in the fund family. They noted that all of the Funds in this report have expense caps in place, and they

| 18

considered the amounts waived or reimbursed by the Adviser for certain Funds that had current expenses above their caps. The Trustees also considered that Loomis Sayles Small Cap Growth Fund’s current expenses are below its cap.

The Trustees also considered the compensation directly or indirectly received by the Adviser and its affiliates from their relationships with the Funds. The Trustees reviewed information provided by management as to the profitability of the Adviser and its affiliates’ relationships with the Funds, and information about the allocation of expenses used to calculate profitability. They also reviewed information provided by management about the effect of distribution costs and changes in asset levels on Adviser profitability, including information regarding resources spent on distribution activities. When reviewing profitability, the Trustees also considered information about court cases in which adviser compensation or profitability were issues, the performance of the relevant Funds, the expense levels of the Funds, and whether the Adviser had implemented breakpoints and/or expense caps with respect to such Funds.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the advisory fee charged to each of the Funds was fair and reasonable, and that the costs of these services generally and the related profitability of the Adviser and its affiliates in respect of their relationships with the Funds supported the renewal of the Agreements.

Economies of Scale. The Trustees considered the existence of any economies of scale in the provision of services by the Adviser and whether those economies are shared with the Funds through breakpoints in their investment advisory fees or other means, such as expense waivers or caps. The Trustees also discussed with management the factors considered with respect to the implementation of breakpoints in investment advisory fees or expense waivers or caps for certain funds. Management explained that a number of factors are taken into account in considering the implementation of breakpoints or an expense cap for a fund, including, among other things, factors such as a fund’s assets, the projected growth of a fund, projected profitability and a fund’s fees and performance. With respect to economies of scale, the Trustees noted that although none of the Funds’ management fees were subject to breakpoints, each Fund’s management fee and overall net expense ratio was below the median fee for a peer group of funds and that each Fund was subject to an expense cap or waiver. In considering these issues, the Trustees also took note of the costs of the services provided (both on an absolute and on a relative basis) and the profitability to the Adviser and its affiliates of their relationships with the Funds, as discussed above.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the extent to which economies of scale were shared with the Funds supported the renewal of the Agreements.

The Trustees also considered other factors, which included but were not limited to the following:

| • | | The effect of recent market and economic events on the performance, asset levels and expense ratios of each Fund. |

19 |

| • | | Whether each Fund has operated in accordance with its investment objective and the Fund’s record of compliance with its investment restrictions, and the compliance programs of the Funds and the Adviser. They also considered the compliance-related resources the Adviser and its affiliates were providing to the Funds. |

| • | | The nature, quality, cost and extent of administrative and shareholder services performed by the Adviser and its affiliates, both under the Agreements and under separate agreements covering administrative services. |

| • | | So-called “fallout benefits” to the Adviser, such as the engagement of affiliates of the Adviser to provide distribution, administrative and brokerage services to the Funds, and the benefits of research made available to the Adviser by reason of brokerage commissions (if any) generated by the Funds’ securities transactions. The Trustees also considered the benefits to the parent company of Natixis Advisors from the retention of the Adviser. The Trustees considered the possible conflicts of interest associated with these fallout and other benefits, and the reporting, disclosure and other processes in place to disclose and monitor such possible conflicts of interest. |

| • | | The Trustees’ review and discussion of the Funds’ advisory arrangements in prior years, and management’s record of responding to Trustee concerns raised during the year and in prior years. |

Based on their evaluation of all factors that they deemed to be material, including those factors described above, and assisted by the advice of independent counsel, the Trustees, including the Independent Trustees, concluded that each of the existing Agreements should be continued through June 30, 2018.

| 20

Portfolio of Investments – as of September 30, 2017

Loomis Sayles Small Cap Growth Fund

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| |

| | Common Stocks – 96.4% of Net Assets | | | | |

| | |

| | | | Aerospace & Defense – 3.3% | | | | |

| | 224,226 | | | Hexcel Corp. | | $ | 12,875,057 | |

| | 211,563 | | | KLX, Inc.(a) | | | 11,198,029 | |

| | 299,395 | | | Mercury Systems, Inc.(a) | | | 15,532,613 | |

| | | | | | | | |

| | | | | | | 39,605,699 | |

| | | | | | | | |

| | | | Auto Components – 3.1% | | | | |

| | 150,405 | | | Dorman Products, Inc.(a) | | | 10,772,006 | |

| | 220,724 | | | Fox Factory Holding Corp.(a) | | | 9,513,204 | |

| | 144,006 | | | Gentherm, Inc.(a) | | | 5,349,823 | |

| | 105,276 | | | LCI Industries | | | 12,196,225 | |

| | | | | | | | |

| | | | | | | 37,831,258 | |

| | | | | | | | |

| | | | Banks – 3.8% | | | | |

| | 220,724 | | | Chemical Financial Corp. | | | 11,535,036 | |

| | 200,113 | | | Pinnacle Financial Partners, Inc. | | | 13,397,565 | |

| | 298,048 | | | Renasant Corp. | | | 12,786,259 | |

| | 110,597 | | | UMB Financial Corp. | | | 8,238,371 | |

| | | | | | | | |

| | | | | | | 45,957,231 | |

| | | | | | | | |

| | | | Beverages – 0.3% | | | | |

| | 69,002 | | | MGP Ingredients, Inc. | | | 4,183,591 | |

| | | | | | | | |

| | | | Biotechnology – 4.2% | | | | |

| | 105,142 | | | Advanced Accelerator Applications S.A., ADR(a) | | | 7,109,702 | |

| | 115,514 | | | Agios Pharmaceuticals, Inc.(a) | | | 7,710,560 | |

| | 354,223 | | | Genomic Health, Inc.(a) | | | 11,367,016 | |

| | 608,355 | | | Ironwood Pharmaceuticals, Inc.(a) | | | 9,593,758 | |

| | 540,037 | | | Lexicon Pharmaceuticals, Inc.(a) | | | 6,637,055 | |

| | 133,566 | | | Prothena Corp. PLC(a) | | | 8,651,070 | |

| | | | | | | | |

| | | | | | | 51,069,161 | |

| | | | | | | | |

| | | | Building Products – 3.0% | | | | |

| | 237,361 | | | Apogee Enterprises, Inc. | | | 11,455,042 | |

| | 124,607 | | | Patrick Industries, Inc.(a) | | | 10,479,449 | |

| | 165,088 | | | Trex Co., Inc.(a) | | | 14,869,476 | |

| | | | | | | | |

| | | | | | | 36,803,967 | |

| | | | | | | | |

| | | | Capital Markets – 2.0% | | | | |

| | 308,690 | | | Financial Engines, Inc. | | | 10,726,977 | |

| | 75,909 | | | MarketAxess Holdings, Inc. | | | 14,005,970 | |

| | | | | | | | |

| | | | | | | 24,732,947 | |

| | | | | | | | |

| | | | Chemicals – 0.9% | | | | |

| | 166,772 | | | Ingevity Corp.(a) | | | 10,418,247 | |

| | | | | | | | |

| | | | Commercial Services & Supplies – 1.1% | | | | |

| | 235,609 | | | Healthcare Services Group, Inc. | | | 12,715,818 | |

| | | | | | | | |

See accompanying notes to financial statements.

21 |

Portfolio of Investments – as of September 30, 2017

Loomis Sayles Small Cap Growth Fund – continued

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| |

| | Common Stocks – continued | | | | |

| | |

| | | | Construction & Engineering – 2.2% | | | | |

| | 233,319 | | | Granite Construction, Inc. | | $ | 13,520,836 | |

| | 450,945 | | | Primoris Services Corp. | | | 13,266,802 | |

| | | | | | | | |

| | | | | | | 26,787,638 | |

| | | | | | | | |

| | | | Consumer Finance – 0.9% | | | | |

| | 214,190 | | | Green Dot Corp., Class A(a) | | | 10,619,540 | |

| | | | | | | | |

| | | | Distributors – 0.9% | | | | |

| | 104,266 | | | Pool Corp. | | | 11,278,453 | |

| | | | | | | | |

| | | | Diversified Consumer Services – 3.0% | | | | |

| | 213,113 | | | Bright Horizons Family Solutions, Inc.(a) | | | 18,372,472 | |

| | 198,833 | | | Grand Canyon Education, Inc.(a) | | | 18,058,013 | |

| | | | | | | | |

| | | | | | | 36,430,485 | |

| | | | | | | | |

| | | | Diversified Telecommunication Services – 2.1% | | | | |

| | 292,458 | | | Cogent Communications Holdings, Inc. | | | 14,301,196 | |

| | 1,019,494 | | | ORBCOMM, Inc.(a) | | | 10,674,102 | |

| | | | | | | | |

| | | | | | | 24,975,298 | |

| | | | | | | | |

| | | | Electrical Equipment – 1.0% | | | | |

| | 262,417 | | | Generac Holdings, Inc.(a) | | | 12,052,813 | |

| | | | | | | | |

| | | | Electronic Equipment, Instruments & Components – 0.9% | | | | |

| | 277,707 | | | II-VI, Inc.(a) | | | 11,427,643 | |

| | | | | | | | |

| | | | Energy Equipment & Services – 1.1% | | | | |

| | 152,291 | | | Dril-Quip, Inc.(a) | | | 6,723,647 | |

| | 419,423 | | | Forum Energy Technologies, Inc.(a) | | | 6,668,826 | |

| | | | | | | | |

| | | | | | | 13,392,473 | |

| | | | | | | | |

| | | | Health Care Equipment & Supplies – 7.3% | | | | |

| | 456,738 | | | AtriCure, Inc.(a) | | | 10,217,229 | |

| | 123,732 | | | Inogen, Inc.(a) | | | 11,766,913 | |

| | 303,167 | | | Insulet Corp.(a) | | | 16,698,438 | |

| | 337,047 | | | Merit Medical Systems, Inc.(a) | | | 14,273,941 | |

| | 137,270 | | | Neogen Corp.(a) | | | 10,632,934 | |

| | 116,727 | | | Penumbra, Inc.(a) | | | 10,540,448 | |

| | 539,451 | | | Wright Medical Group NV(a) | | | 13,955,598 | |

| | | | | | | | |

| | | | | | | 88,085,501 | |

| | | | | | | | |

| | | | Health Care Providers & Services – 4.9% | | | | |

| | 310,913 | | | AMN Healthcare Services, Inc.(a) | | | 14,208,724 | |

| | 340,145 | | | HealthEquity, Inc.(a) | | | 17,204,534 | |

| | 429,594 | | | Teladoc, Inc.(a) | | | 14,241,041 | |

| | 349,845 | | | Tivity Health, Inc.(a) | | | 14,273,676 | |

| | | | | | | | |

| | | | | | | 59,927,975 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 22

Portfolio of Investments – as of September 30, 2017

Loomis Sayles Small Cap Growth Fund – continued

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| |

| | Common Stocks – continued | | | | |

| | |

| | | | Health Care Technology – 1.5% | | | | |

| | 237,832 | | | Medidata Solutions, Inc.(a) | | $ | 18,565,166 | |

| | | | | | | | |

| | | | Hotels, Restaurants & Leisure – 2.2% | | | | |

| | 536,487 | | | Planet Fitness, Inc., Class A | | | 14,474,419 | |

| | 363,046 | | | Wingstop, Inc. | | | 12,071,280 | |

| | | | | | | | |

| | | | | | | 26,545,699 | |

| | | | | | | | |

| | | | Household Durables – 1.8% | | | | |

| | 239,449 | | | Installed Building Products, Inc.(a) | | | 15,516,295 | |

| | 76,785 | | | iRobot Corp.(a) | | | 5,917,052 | |

| | | | | | | | |

| | | | | | | 21,433,347 | |

| | | | | | | | |

| | | | Insurance – 0.8% | | | | |

| | 223,620 | | | Kinsale Capital Group, Inc. | | | 9,653,675 | |

| | | | | | | | |

| | | | Internet Software & Services – 8.3% | | | | |

| | 305,727 | | | 2U, Inc.(a) | | | 17,132,941 | |

| | 284,240 | | | Envestnet, Inc.(a) | | | 14,496,240 | |

| | 156,424 | | | Five9, Inc.(a) | | | 3,738,534 | |

| | 125,820 | | | LogMeIn, Inc. | | | 13,846,491 | |

| | 385,610 | | | Mimecast Ltd.(a) | | | 10,959,036 | |

| | 382,714 | | | Q2 Holdings, Inc.(a) | | | 15,940,038 | |

| | 758,424 | | | Quotient Technology, Inc.(a) | | | 11,869,335 | |

| | 165,829 | | | Wix.com Ltd.(a) | | | 11,914,814 | |

| | | | | | | | |

| | | | | | | 99,897,429 | |

| | | | | | | | |

| | | | IT Services – 4.5% | | | | |

| | 251,303 | | | Blackhawk Network Holdings, Inc.(a) | | | 11,007,071 | |

| | 169,534 | | | Euronet Worldwide, Inc.(a) | | | 16,070,128 | |

| | 314,213 | | | InterXion Holding NV(a) | | | 16,002,868 | |

| | 323,374 | | | WNS Holdings Ltd., ADR(a) | | | 11,803,151 | |

| | | | | | | | |

| | | | | | | 54,883,218 | |

| | | | | | | | |

| | | | Life Sciences Tools & Services – 2.0% | | | | |

| | 347,891 | | | Accelerate Diagnostics, Inc.(a) | | | 7,810,153 | |

| | 209,880 | | | PRA Health Sciences, Inc.(a) | | | 15,986,560 | |

| | | | | | | | |

| | | | | | | 23,796,713 | |

| | | | | | | | |

| | | | Machinery – 4.0% | | | | |

| | 204,424 | | | Albany International Corp., Class A | | | 11,733,938 | |

| | 174,046 | | | Astec Industries, Inc. | | | 9,748,316 | |

| | 144,949 | | | Proto Labs, Inc.(a) | | | 11,639,405 | |

| | 124,944 | | | RBC Bearings, Inc.(a) | | | 15,636,741 | |

| | | | | | | | |

| | | | | | | 48,758,400 | |

| | | | | | | | |

See accompanying notes to financial statements.

23 |

Portfolio of Investments – as of September 30, 2017

Loomis Sayles Small Cap Growth Fund – continued

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| |

| | Common Stocks – continued | | | | |

| | |

| | | | Multiline Retail – 1.2% | | | | |

| | 302,291 | | | Ollie’s Bargain Outlet Holdings, Inc.(a) | | $ | 14,026,302 | |

| | | | | | | | |

| | | | Oil, Gas & Consumable Fuels – 0.6% | | | | |

| | 148,451 | | | PDC Energy, Inc.(a) | | | 7,278,553 | |

| | | | | | | | |

| | | | Pharmaceuticals – 3.0% | | | | |

| | 300,675 | | | Aclaris Therapeutics, Inc.(a) | | | 7,760,422 | |

| | 152,425 | | | Aerie Pharmaceuticals, Inc.(a) | | | 7,407,855 | |

| | 278,178 | | | Dermira, Inc.(a) | | | 7,510,806 | |

| | 353,819 | | | Supernus Pharmaceuticals, Inc.(a) | | | 14,152,760 | |

| | | | | | | | |

| | | | | | | 36,831,843 | |

| | | | | | | | |

| | | | Professional Services – 1.3% | | | | |

| | 251,208 | | | WageWorks, Inc.(a) | | | 15,248,326 | |

| | | | | | | | |

| | | | Semiconductors & Semiconductor Equipment – 4.7% | | | | |

| | 184,621 | | | MKS Instruments, Inc. | | | 17,437,454 | |

| | 130,333 | | | Monolithic Power Systems, Inc. | | | 13,886,981 | |

| | 285,048 | | | Semtech Corp.(a) | | | 10,703,552 | |

| | 182,196 | | | Silicon Laboratories, Inc.(a) | | | 14,557,460 | |

| | | | | | | | |

| | | | | | | 56,585,447 | |

| | | | | | | | |

| | | | Software – 9.0% | | | | |

| | 148,384 | | | Blackbaud, Inc. | | | 13,028,115 | |

| | 515,809 | | | Callidus Software, Inc.(a) | | | 12,714,692 | |

| | 198,025 | | | CommVault Systems, Inc.(a) | | | 12,039,920 | |

| | 213,719 | | | Guidewire Software, Inc.(a) | | | 16,640,161 | |

| | 172,969 | | | HubSpot, Inc.(a) | | | 14,538,044 | |

| | 276,360 | | | RealPage, Inc.(a) | | | 11,026,764 | |

| | 393,760 | | | RingCentral, Inc., Class A(a) | | | 16,439,480 | |

| | 65,671 | | | Ultimate Software Group, Inc. (The)(a) | | | 12,451,222 | |

| | | | | | | | |

| | | | | | | 108,878,398 | |

| | | | | | | | |

| | | | Textiles, Apparel & Luxury Goods – 1.7% | | | | |

| | 158,257 | | | Columbia Sportswear Co. | | | 9,745,466 | |

| | 253,526 | | | Steven Madden Ltd.(a) | | | 10,977,676 | |

| | | | | | | | |

| | | | | | | 20,723,142 | |

| | | | | | | | |

| | | | Thrifts & Mortgage Finance – 1.0% | | | | |

| | 302,157 | | | Essent Group Ltd.(a) | | | 12,237,359 | |

| | | | | | | | |

| | | | Trading Companies & Distributors – 2.8% | | | | |

| | 141,648 | | | Beacon Roofing Supply, Inc.(a) | | | 7,259,460 | |

| | 446,230 | | | BMC Stock Holdings, Inc.(a) | | | 9,527,011 | |

| | 287,541 | | | SiteOne Landscape Supply, Inc.(a) | | | 16,706,132 | |

| | | | | | | | |

| | | | | | | 33,492,603 | |

| | | | | | | | |

| | |

| | | | Total Common Stocks

(Identified Cost $842,542,400) | | | 1,167,131,358 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 24

Portfolio of Investments – as of September 30, 2017

Loomis Sayles Small Cap Growth Fund – continued

| | | | | | | | |

Principal

Amount | | | Description | | Value (†) | |

| |

| | Short-Term Investments – 3.5% | | | | |

| $ | 42,636,661 | | | Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 9/29/2017 at 0.340% to be repurchased at $42,637,869 on 10/02/2017 collateralized by $41,625,000 U.S. Treasury Note, 3.625% due 8/15/2019 valued at $43,491,049 including accrued interest (Note 2 of Notes to Financial Statements) (Identified Cost $42,636,661) | | $ | 42,636,661 | |

| | | | | | | | |

| | |

| | | | Total Investments – 99.9%

(Identified Cost $885,179,061) | | | 1,209,768,019 | |

| | | | Other assets less liabilities—0.1% | | | 1,230,784 | |

| | | | | | | | |

| | | | Net Assets – 100.0% | | $ | 1,210,998,803 | |

| | | | | | | | |

| | (†) | | | See Note 2 of Notes to Financial Statements. | |

| | (a) | | | Non-income producing security. | |

| |

| | ADR | | | An American Depositary Receipt is a certificate issued by a custodian bank representing the right to receive securities of the foreign issuer described. The values of ADRs may be significantly influenced by trading on exchanges not located in the United States. | |

Industry Summary at September 30, 2017

| | | | |

Software | | | 9.0 | % |

Internet Software & Services | | | 8.3 | |

Health Care Equipment & Supplies | | | 7.3 | |

Health Care Providers & Services | | | 4.9 | |

Semiconductors & Semiconductor Equipment | | | 4.7 | |

IT Services | | | 4.5 | |

Biotechnology | | | 4.2 | |

Machinery | | | 4.0 | |

Banks | | | 3.8 | |

Aerospace & Defense | | | 3.3 | |

Auto Components | | | 3.1 | |

Pharmaceuticals | | | 3.0 | |

Building Products | | | 3.0 | |

Diversified Consumer Services | | | 3.0 | |

Trading Companies & Distributors | | | 2.8 | |

Construction & Engineering | | | 2.2 | |

Hotels, Restaurants & Leisure | | | 2.2 | |

Diversified Telecommunication Services | | | 2.1 | |

Capital Markets | | | 2.0 | |

Life Sciences Tools & Services | | | 2.0 | |

Other Investments, less than 2% each | | | 17.0 | |

Short-Term Investments | | | 3.5 | |

| | | | |

Total Investments | | | 99.9 | |

Other assets less liabilities | | | 0.1 | |

| | | | |

Net Assets | | | 100.0 | % |

| | | | |

See accompanying notes to financial statements.

25 |

Portfolio of Investments – as of September 30, 2017

Loomis Sayles Small Cap Value Fund

| | | | | | | | |

| Shares | | | Description | | Value (†) | |

|

| | Common Stocks – 99.2% of Net Assets | |

| | |

| | | | Aerospace & Defense – 1.9% | | | | |

| | 265,079 | | | Aerojet Rocketdyne Holdings, Inc.(a) | | $ | 9,280,416 | |

| | 192,699 | | | BWX Technologies, Inc. | | | 10,794,998 | |

| | | | | | | | |

| | | | | | | 20,075,414 | |

| | | | | | | | |

| | | | Auto Components – 3.3% | | | | |

| | 121,341 | | | Adient PLC | | | 10,191,431 | |

| | 136,200 | | | Cooper Tire & Rubber Co. | | | 5,093,880 | |

| | 102,382 | | | Fox Factory Holding Corp.(a) | | | 4,412,664 | |

| | 339,163 | | | Horizon Global Corp.(a) | | | 5,982,835 | |

| | 89,035 | | | LCI Industries | | | 10,314,705 | |

| | | | | | | | |

| | | | | | | 35,995,515 | |

| | | | | | | | |

| | | | Banks – 17.3% | | | | |

| | 291,869 | | | BancorpSouth, Inc. | | | 9,354,401 | |

| | 122,778 | | | Bank of the Ozarks, Inc. | | | 5,899,483 | |

| | 235,206 | | | Bryn Mawr Bank Corp. | | | 10,302,023 | |

| | 93,559 | | | Carolina Financial Corp. | | | 3,356,897 | |

| | 285,690 | | | Cathay General Bancorp | | | 11,484,738 | |

| | 331,025 | | | CenterState Bank Corp. | | | 8,871,470 | |

| | 189,785 | | | Chemical Financial Corp. | | | 9,918,164 | |

| | 428,530 | | | CVB Financial Corp. | | | 10,357,570 | |

| | 340,783 | | | First Financial Bancorp | | | 8,911,475 | |

| | 150,066 | | | First Financial Bankshares, Inc. | | | 6,782,983 | |

| | 325,784 | | | Home BancShares, Inc. | | | 8,216,273 | |

| | 128,635 | | | IBERIABANK Corp. | | | 10,567,365 | |

| | 145,331 | | | LegacyTexas Financial Group, Inc. | | | 5,801,614 | |

| | 199,619 | | | PacWest Bancorp | | | 10,082,756 | |

| | 124,735 | | | Pinnacle Financial Partners, Inc. | | | 8,351,008 | |

| | 269,947 | | | Popular, Inc. | | | 9,701,895 | |

| | 156,062 | | | Prosperity Bancshares, Inc. | | | 10,257,955 | |

| | 53,627 | | | Signature Bank(a) | | | 6,866,401 | |

| | 114,716 | | | Texas Capital Bancshares, Inc.(a) | | | 9,842,633 | |

| | 289,256 | | | Triumph Bancorp, Inc.(a) | | | 9,328,506 | |

| | 171,079 | | | Wintrust Financial Corp. | | | 13,397,197 | |

| | | | | | | | |

| | | | | | | 187,652,807 | |

| | | | | | | | |

| | | | Beverages – 0.6% | | | | |

| | 439,837 | | | Cott Corp. | | | 6,601,953 | |

| | | | | | | | |

| | | | Building Products – 1.6% | | | | |

| | 87,946 | | | Apogee Enterprises, Inc. | | | 4,244,274 | |

| | 133,662 | | | Armstrong World Industries, Inc.(a) | | | 6,850,177 | |

| | 86,005 | | | Masonite International Corp.(a) | | | 5,951,546 | |

| | | | | | | | |

| | | | | | | 17,045,997 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 26

Portfolio of Investments – as of September 30, 2017

Loomis Sayles Small Cap Value Fund – continued

| | | | | | | | |

| Shares | | | Description | | Value (†) | |

|

| | Common Stocks – continued | |

| | |

| | | | Capital Markets – 1.4% | | | | |

| | 233,795 | | | Donnelley Financial Solutions, Inc.(a) | | $ | 5,040,620 | |

| | 179,068 | | | Stifel Financial Corp. | | | 9,572,975 | |

| | | | | | | | |

| | | | | | | 14,613,595 | |

| | | | | | | | |

| | | | Chemicals – 3.3% | |

| | 292,262 | | | AdvanSix, Inc.(a) | | | 11,617,415 | |

| | 59,157 | | | Ashland Global Holdings, Inc. | | | 3,868,276 | |

| | 103,845 | | | Cabot Corp. | | | 5,794,551 | |

| | 118,904 | | | Ingevity Corp.(a) | | | 7,427,933 | |

| | 105,863 | | | Minerals Technologies, Inc. | | | 7,479,221 | |

| | | | | | | | |

| | | | | | | 36,187,396 | |

| | | | | | | | |

| | | | Commercial Services & Supplies – 3.8% | |

| | 94,019 | | | Clean Harbors, Inc.(a) | | | 5,330,877 | |

| | 238,526 | | | KAR Auction Services, Inc. | | | 11,387,231 | |

| | 218,513 | | | Kimball International, Inc. | | | 4,320,002 | |

| | 135,679 | | | Knoll, Inc. | | | 2,713,580 | |

| | 284,953 | | | LSC Communications, Inc. | | | 4,704,574 | |

| | 211,762 | | | Viad Corp. | | | 12,896,306 | |

| | | | | | | | |

| | | | | | | 41,352,570 | |

| | | | | | | | |

| | | | Communications Equipment – 1.3% | |

| | 174,957 | | | ARRIS International PLC(a) | | | 4,984,525 | |

| | 343,605 | | | Digi International, Inc.(a) | | | 3,642,213 | |

| | 600,447 | | | Viavi Solutions, Inc.(a) | | | 5,680,229 | |

| | | | | | | | |

| | | | | | | 14,306,967 | |

| | | | | | | | |

| | | | Construction & Engineering – 0.6% | |

| | 99,805 | | | MYR Group, Inc.(a) | | | 2,908,318 | |

| | 85,960 | | | Quanta Services, Inc.(a) | | | 3,212,325 | |

| | | | | | | | |

| | | | | | | 6,120,643 | |

| | | | | | | | |

| | | | Construction Materials – 0.6% | |

| | 84,574 | | | U.S. Concrete, Inc.(a) | | | 6,452,996 | |

| | | | | | | | |

| | | | Consumer Finance – 0.6% | |

| | 219,421 | | | PRA Group, Inc.(a) | | | 6,286,412 | |

| | | | | | | | |

| | | | Distributors – 0.6% | |

| | 196,034 | | | Core-Mark Holding Co., Inc. | | | 6,300,533 | |

| | | | | | | | |

| | | | Diversified Consumer Services – 1.2% | |

| | 190,517 | | | Adtalem Global Education, Inc. | | | 6,830,035 | |

| | 525,781 | | | Houghton Mifflin Harcourt Co.(a) | | | 6,335,661 | |

| | | | | | | | |

| | | | | | | 13,165,696 | |

| | | | | | | | |

See accompanying notes to financial statements.

27 |

Portfolio of Investments – as of September 30, 2017

Loomis Sayles Small Cap Value Fund – continued

| | | | | | | | |

| Shares | | | Description | | Value (†) | |

|

| | Common Stocks – continued | |

| |

| | | | Diversified Financial Services – 0.5% | |

| | 310,245 | | | FNFV Group(a) | | $ | 5,320,702 | |

| | | | | | | | |

| | | | Electric Utilities – 1.3% | |

| | 180,009 | | | ALLETE, Inc. | | | 13,912,896 | |

| | | | | | | | |

| | | | Electrical Equipment��– 0.6% | |

| | 265,485 | | | TPI Composites, Inc.(a) | | | 5,930,935 | |

| | | | | | | | |

| | | | Electronic Equipment, Instruments & Components – 5.2% | |

| | 107,123 | | | Belden, Inc. | | | 8,626,615 | |

| | 190,865 | | | II-VI, Inc.(a) | | | 7,854,095 | |

| | 83,204 | | | Kimball Electronics, Inc.(a) | | | 1,801,366 | |

| | 102,732 | | | Littelfuse, Inc. | | | 20,123,144 | |

| | 133,698 | | | Methode Electronics, Inc. | | | 5,662,110 | |

| | 58,638 | | | Rogers Corp.(a) | | | 7,815,273 | |

| | 218,026 | | | Vishay Intertechnology, Inc. | | | 4,098,889 | |

| | | | | | | | |

| | | | | | | 55,981,492 | |

| | | | | | | | |

| | | | Energy Equipment & Services – 2.9% | | | | |

| | 317,535 | | | C&J Energy Services, Inc.(a) | | | 9,516,524 | |

| | 240,094 | | | Natural Gas Services Group, Inc.(a) | | | 6,818,670 | |

| | 326,184 | | | RPC, Inc. | | | 8,086,101 | |

| | 240,166 | | | U.S. Silica Holdings, Inc. | | | 7,461,958 | |

| | | | | | | | |

| | | | | | | 31,883,253 | |

| | | | | | | | |

| | | | Food & Staples Retailing – 0.5% | | | | |

| | 214,629 | | | SpartanNash Co. | | | 5,659,767 | |

| | | | | | | | |

| | | | Food Products – 2.0% | | | | |

| | 318,092 | | | Darling Ingredients, Inc.(a) | | | 5,572,972 | |

| | 20,566 | | | J&J Snack Foods Corp. | | | 2,700,316 | |

| | 102,238 | | | Post Holdings, Inc.(a) | | | 9,024,548 | |

| | 523,103 | | | SunOpta, Inc.(a) | | | 4,550,996 | |

| | | | | | | | |

| | | | | | | 21,848,832 | |

| | | | | | | | |

| | | | Health Care Equipment & Supplies – 1.6% | | | | |

| | 182,748 | | | Halyard Health, Inc.(a) | | | 8,229,142 | |

| | 265,328 | | | Varex Imaging Corp.(a) | | | 8,978,700 | |

| | | | | | | | |

| | | | | | | 17,207,842 | |

| | | | | | | | |

| | | | Health Care Providers & Services – 0.4% | | | | |

| | 82,392 | | | AMN Healthcare Services, Inc.(a) | | | 3,765,314 | |

| | | | | | | | |

| | | | Hotels, Restaurants & Leisure – 3.4% | | | | |

| | 593,376 | | | Caesars Entertainment Corp.(a) | | | 7,921,570 | |

| | 278,250 | | | Carrols Restaurant Group, Inc.(a) | | | 3,032,925 | |

| | 59,259 | | | Churchill Downs, Inc. | | | 12,219,206 | |

| | 19,562 | | | Cracker Barrel Old Country Store, Inc. | | | 2,965,990 | |

| | 89,176 | | | Marriott Vacations Worldwide Corp. | | | 11,105,087 | |

| | | | | | | | |

| | | | | | | 37,244,778 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 28

Portfolio of Investments – as of September 30, 2017

Loomis Sayles Small Cap Value Fund – continued

| | | | | | | | |

| Shares | | | Description | | Value (†) | |

|

| | Common Stocks – continued | |

| | |

| | | | Household Durables – 0.7% | | | | |

| | 77,742 | | | Helen of Troy Ltd.(a) | | $ | 7,533,200 | |

| | | | | | | | |

| | | | Household Products – 0.4% | | | | |

| | 295,958 | | | HRG Group, Inc.(a) | | | 4,619,904 | |

| | | | | | | | |

| | | | Industrial Conglomerates – 0.7% | | | | |

| | 226,336 | | | Raven Industries, Inc. | | | 7,333,286 | |

| | | | | | | | |

| | | | Insurance – 3.9% | | | | |

| | 125,076 | | | Atlas Financial Holdings, Inc.(a) | | | 2,363,936 | |

| | 320,846 | | | Employers Holdings, Inc. | | | 14,582,451 | |

| | 131,997 | | | First American Financial Corp. | | | 6,595,890 | |

| | 154,995 | | | ProAssurance Corp. | | | 8,470,477 | |

| | 71,516 | | | Reinsurance Group of America, Inc., Class A | | | 9,978,627 | |

| | | | | | | | |

| | | | | | | 41,991,381 | |

| | | | | | | | |

| | | | Internet & Direct Marketing Retail – 2.1% | |

| | 310,985 | | | 1-800-Flowers.com, Inc., Class A(a) | | | 3,063,202 | |

| | 81,135 | | | HSN, Inc. | | | 3,168,322 | |

| | 101,668 | | | Liberty Expedia Holdings, Inc., Series A(a) | | | 5,399,588 | |

| | 199,899 | | | Liberty Ventures, Series A(a) | | | 11,504,187 | |

| | | | | | | | |

| | | | | | | 23,135,299 | |

| | | | | | | | |

| | | | Internet Software & Services – 1.2% | |

| | 176,033 | | | CommerceHub, Inc., Series C(a) | | | 3,758,304 | |

| | 81,415 | | | IAC/InterActiveCorp(a) | | | 9,572,776 | |

| | | | | | | | |

| | | | | | | 13,331,080 | |

| | | | | | | | |

| | | | IT Services – 4.0% | |

| | 113,291 | | | Booz Allen Hamilton Holding Corp. | | | 4,235,950 | |

| | 405,978 | | | Conduent, Inc.(a) | | | 6,361,675 | |

| | 107,076 | | | CSG Systems International, Inc. | | | 4,293,748 | |

| | 154,758 | | | DST Systems, Inc. | | | 8,493,119 | |

| | 128,121 | | | Euronet Worldwide, Inc.(a) | | | 12,144,590 | |

| | 72,208 | | | WEX, Inc.(a) | | | 8,103,182 | |

| | | | | | | | |

| | | | | | | 43,632,264 | |

| | | | | | | | |

| | | | Leisure Products – 0.4% | |

| | 245,671 | | | Nautilus, Inc.(a) | | | 4,151,840 | |

| | | | | | | | |

| | | | Life Sciences Tools & Services – 0.6% | |

| | 209,906 | | | VWR Corp.(a) | | | 6,949,988 | |

| | | | | | | | |

| | | | Machinery – 5.8% | |

| | 55,852 | | | Alamo Group, Inc. | | | 5,996,829 | |

| | 155,875 | | | Albany International Corp., Class A | | | 8,947,225 | |